- Global Locations -

Headquarters

Future Market Insights, Inc.

Christiana Corporate, 200 Continental Drive, Suite 401, Newark, Delaware - 19713, United States

616 Corporate Way, Suite 2-9018, Valley Cottage, NY 10989, United States

Future Market Insights

1602-6 Jumeirah Bay X2 Tower, Plot No: JLT-PH2-X2A, Jumeirah Lakes Towers, Dubai, United Arab Emirates

3rd Floor, 207 Regent Street, W1B 3HH London United Kingdom

Asia Pacific

IndiaLand Global Tech Park, Unit UG-1, Behind Grand HighStreet, Phase 1, Hinjawadi, MH, Pune – 411057, India

- Consumer Product

- Food & Beverage

- Chemicals and Materials

- Travel & Tourism

- Process Automation

- Industrial Automation

- Services & Utilities

- Testing Equipment

- Thought Leadership

- Upcoming Reports

- Published Reports

- Contact FMI

Clinical Research Organization Market

Analysis and Review: Clinical Research Organization Market by Service (Drug Discovery Services, Pre-Clinical Services, Clinical Services, Post-Approval Services), by Production (In-House, Outsourced), by Indication (Oncology, CNS, Cardiovascular Diseases, Metabolic Disorders, Immunology, Respiratory, Musculoskeletal Disorders, Hematological Disorders), by End User (Pharmaceutical & Biotechnology Companies, Medical Device Companies, Governments & Private Firms, Academic Institutions, Others) and By Region- Forecast for 2023 – 2033

Market Insights on Clinical Research Organization Market covering sales outlook, demand forecast and up-to-date key trends

- Report Preview

- Request Methodology

Clinical Research Organization Market Snapshot (2023 to 2033)

According to Future Market Insights (FMI) analysis in a recent market survey, the global clinical research organization market was valued at US$ 58.0 Billion in 2022 and is expected to reach US$ 139.6 Billion by 2033.

Market Outlook:

The Clinical Research Organization (CRO) market refers to the industry segment companies and organizations providing clinical research services to pharmaceutical, biotechnology, and medical device companies. It encompasses the commercial activities and financial transactions associated with outsourcing clinical trials and research studies.

The market is driven by the increasing demand for efficient and cost-effective drug development processes. Pharmaceutical and biotech companies often outsource clinical research activities to CROs to leverage their specialized expertise, infrastructure, and resources. This allows the companies to focus on their core competencies, such as drug discovery and marketing, while relying on CROs for the execution of clinical trials.

Don't pay for what you don't need

Customize your report by selecting specific countries or regions and save 30%!

Sales Analysis of Clinical Research Organization Market from 2018 to 2022 Vs Market Outlook for 2023 to 2033

Sales of the market grew at a CAGR of 6.4% between 2018 to 2022.

With a historical forecast of stable growth, the clinical research organization (CRO) industry has seen significant growth in recent years. The rise in demand for outsourced clinical trials from pharmaceutical, biotechnology, and medical device businesses is what is causing this surge.

The clinical research organization (CRO) market is anticipated to maintain its growth trajectory in the upcoming years, according to the projection. The expansion of the CRO market is anticipated to be fueled by an increase in clinical trials, a rise in the need for personalized medication, and the prevalence of chronic diseases. Various clinical trial processes, including patient recruiting and retention, data analysis, and medication discovery, are using these technologies.

Considering this, FMI expects the global clinical research organization market to grow at a CAGR of 8.4% through the forecasted years.

What are the Key Opportunities in the Clinical Research Organization Market?

CROs can provide specialized services for carrying out clinical studies in this field as personalized medicine and targeted medicines gain popularity. This covers the identification of biomarkers, patient screening, and customized trial planning. CROs now have more potential due to the use of real-world data and virtual trials.

Companies with expertise in these fields can provide pharma/biotech firms with specialized services and assistance for real-world research as well as for virtual studies, which can shorten the trial duration and expense. It can also include telemedicine and digital health technology in clinical trials to raise study compliance, increase patient participation, and offer ongoing monitoring. CROs can be assisted in adopting these technologies and incorporating them into clinical trial designs by businesses offering specialised services.

They are now also able to provide specialized services in data analytics and machine learning due to the increased availability of real-time data in clinical trials. To do this, one can employ predictive analytics to foresee dangers, spot trends, and improve study design, which thereby helps in the growth of the global market.

Principal Consultant

Talk to Analyst

Find your sweet spots for generating winning opportunities in this market.

Which Factors Could Possibly Restrain the Growth of the Clinical Research Organization Market?

Ensuring compliance with regulatory regulations is one of the biggest issues for CRO businesses. Navigating through each nation's unique legislation can be time-consuming and expensive. To make sure that all applicable regulations are followed, CROs must have a strong regulatory staff. Companies in the pharma and biotech industries are increasingly looking for CROs that can offer services at a low cost without sacrificing quality or timeliness. To remain competitive, CROs may need to modify their pricing strategies and business models in response to margin concerns.

Large-scale multicenter trials might be difficult to finance since there is sometimes a lack of funding for clinical trials. To maximize the cost-effectiveness of clinical studies, sponsors, researchers, and CROs must collaborate due to the high cost of drug development and growing cost constraints. The capabilities of CROs may also be constrained by a lack of highly skilled workers, including researchers, data administrators, and statisticians. Lack of qualified personnel may cause inefficiencies, delays in hiring and retaining staff, and a general decline in the quality of project outputs.

Country-wise Insights

What makes the usa the dominating country in the clinical research organization market.

The USA clinical research organization market is expected to register 32.0% in the global market in 2022.

There are several life science businesses in the United States, and these businesses are embracing innovations in clinical research. CROs that offer these services are in demand as technological innovations like telemedicine and virtual trials are used more frequently. Drug development efforts by biotech and pharmaceutical firms are increasing in the USA These businesses are turning more and more to CROs for assistance, including access to facilities and programs for current patients, enrollment and recruiting information, personalized protocol design, higher trial completion rates, and lower costs.

Why is China considered a Lucrative Market for Clinical Research Organization Services?

China accounted for around 9.3% market share in 2022 globally.

The clinical research organization (CRO) market in China is expanding due to several factors. The rapidly ageing and expanding Chinese population is a significant contributing element, which has raised demand for cutting-edge medical cures and treatments. Furthermore, recent reforms and laws adopted by the Chinese government have made it simpler to conduct clinical trials and research there.

The government has put in place many steps to hasten the regulatory approval procedure for novel pharmaceuticals and therapies, luring multinational companies to locate their research and development operations in the nation. Additionally, the development of healthcare and rising income levels in China have raised the demand for advanced healthcare services, such as clinical research and triage.

What Makes India an Emerging Market for Clinical Research Organization?

India holds a 7.4% value share in the global market in 2022.

The clinical research organization (CRO) market is expanding in India for a variety of reasons. Large and diversified patient populations are a significant contributing element, which makes India a desirable location for carrying out clinical studies. Due to the country's accessible healthcare services and cheaper cost of living, clinical trials in India are also more economical than in many other nations.

The supportive regulatory environment created by the Indian government, which promotes clinical research activities by streamlining the approval procedure for clinical trials and cutting the time needed to secure regulatory approvals, is another important aspect. More foreign money has also been invested in India's clinical research sector as a result of the rise in medical tourism there.

Get the data you need at a Fraction of the cost

Personalize your report by choosing insights you need and save 40%!

Category-wise Insights

Which service is largely adopted for clinical research organizations.

The post-approval services segment held the major chunk of about 45.7% of the global market by the end of 2022.

A key factor in the expansion of the clinical research organization (CRO) market is post-approval services. Post-approval services are the actions taken after regulatory bodies or authorities have given their clearance for the use of a product or therapy. These services are essential for maintaining the product's safety and effectiveness as well as for carrying out additional studies that could increase the product or therapy's effectiveness.

In order to diversify their service portfolio and give their clients value-added services, several CROs offer post-approval services. Pharmacovigilance, medical monitoring, safety monitoring, data management, statistical analysis, quality assurance, and regulatory compliance are a few examples of the services that may be provided.

Which production type is largely preferred for the clinical research organization market?

The In-house production segment contribute 58.3% share of the global market in 2022.

The term in-house describes a method of conducting all phases of clinical research within a single organization, often comprising study design, data management, monitoring, and statistical analysis. Clinical research organizations (CRO) market development is still mostly fueled by internal clinical research conducted by pharmaceutical and biotech corporations. The in-house methodology has several benefits, including more control over studies, quicker decision-making, and reduced reliance on outside suppliers.

A pharmaceutical or biotech company's ability to quickly and efficiently react to any noteworthy events or changes in the study protocol can be facilitated by in-house clinical research, which provides better control over study data and technological competence.

Which Indication Dominates the Global Market in 2022?

The oncology by indication segment accounted for a revenue share of 23.4% in the global market at the end of 2022.

One of the markets for clinical research organizations (CROs) that is expanding the quickest is oncology, which has had a big impact on the development of the sector. Cancer research is an appealing subject for CROs to concentrate their attention on because it is a complex and fast-developing field of medicine that calls for a high degree of knowledge and resources.

Many variables, such as the rising cancer burden globally, developments in molecular biology and genomics, and the creation of more advanced and novel immuno-oncology medicines, all contribute to the expansion of oncology research and the CRO business. The need for more advanced oncology therapies that can address patients' complicated requirements is growing as cancer rates are expected to keep rising.

Which End User Segment Propels the Market Growth?

The pharmaceutical and biotechnology companies hold a share of 45.6% of the global market in 2022.

The market for clinical research organizations (CROs) is expanding mostly due to the efforts of the pharmaceutical and biotechnology industries. These businesses invest a lot of money in the discovery of novel treatments and medications, and they frequently contract out some or all of the clinical research work to CROs to increase productivity and access to funding.

A great deal of financing for clinical research studies-particularly those involving new medicinal compounds-comes from pharmaceutical and biotech corporations. These businesses frequently look to collaborate with CROs who can offer specialized knowledge in research design, data administration, and general project management. Pharmaceutical and biotech companies can shorten the time it takes to develop new drugs by outsourcing clinical trial efforts to CROs and concentrating internal resources on core research and development tasks.

Competitive Landscape

The market's key vendors are concentrating on diversifying their product offerings to strengthen their market share in clinical research organizations and to broaden their presence in developing nations. Pricing strategies, market strategies, technology improvements, regulatory compliance, and acquisition and distribution agreements with other companies to extend their business are the main tactics used by manufacturers to acquire a competitive edge in the market.

For instance:

- In January 2020, Charles River announced a scientific collaboration with Takeda Pharmaceutical Company Limited in order to focus on drug discovery in the four core therapeutic areas that Takeda works on. These four therapeutic areas include oncology, gastroenterology, neuroscience, and rare disease. This collaboration focuses on delivering preclinical candidates.

- In July 2022, Labcorp launched a new test called the neurofilament light chain (NfL) blood test, which will help in the identification and confirmation of neurodegenerative diseases like multiple sclerosis, Alzheimer’s disease, Parkinson’s disease, and others.

Similarly, recent developments have been tracked by the team at Future Market Insights related to companies in the clinical research organization market space, which are available in the full report

Scope of the Clinical Research Organization Report

Key segments covered in clinical research organization industry research, by service:.

- Drug discovery Services

- Pre-clinical Services

- Clinical Services

- Post Approval Services

By Production:

By indication:.

- Cardiovascular Diseases

- Metabolic Disorders

- Respiratory

- Musculoskeletal Disorders

- Hematological Disorders

By End User:

- Pharmaceutical & Biotechnology Companies

- Medical Device Companies

- Governments & Private Firms

- Academic Institutions

- North America

- Latin America

- Middle East and Africa (MEA)

Frequently Asked Questions

How big is the clinical research organization market.

The clinical research organization market is slated to attain US$ 62.43 billion in 2023.

What Might be the Market’s Size by 2033?

The market is expected to attain a value of US$ 139.56 billion by 2033.

Which Opportunities are Emerging in the Market?

Increasing popularity of targeted medicines and personalized medicines are creating opportunities for key players.

Which Factors Pull Back the Market Growth?

Strict regulatory regulations and lack of funding for clinical trials are pulling back the market’s growth.

Who are the Key Players in the CRO Industry?

IQVIA Inc, Parexel International Corporation, and ICON plc. are the key players in the CRO industry.

Table of Content

List of tables, list of charts.

Explore Healthcare Insights

Talk To Analyst

Your personal details are safe with us. Privacy Policy*

- Talk To Analyst -

This report can be customized as per your unique requirement

- Get Free Brochure -

Request a free brochure packed with everything you need to know.

- Customize Now -

I need Country Specific Scope ( -30% )

I am searching for Specific Info.

- Download Report Brochure -

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Report Description

Table of content, methodology.

- Healthcare & Pharmaceuticals

- Clinical Research Organization Market Growth & Trends [2031]

Global Clinical Research Organization (CRO) Market

Segments - By Service (Clinical Research Services, Early Phase Development Services, Laboratory Services, Consulting Services, and Others), By Molecule Type (Small molecules and Biologics), By End-user (Pharmaceutical & Biotechnology Company, Research & Academic Institute, and Others), and Regions (North America, Asia Pacific, Europe, Latin America, Middle East, and Africa) - Global Industry Analysis, Size, Share, Growth, Trends and Forecast 2023-2031

Raksha Sharma

Fact-checked by :

Vineet Pandey

Vishal Golekar

Clinical Research Organization Market Outlook

The global Clinical Research Organization (CRO) market was estimated at USD 80.6 Billion in 2022 and is anticipated to reach USD 220.3 Billion by 2031 , expanding at a CAGR of 12.2% during the forecast period. A clinical research organization (CRO) provides support to the pharmaceuticals, biotechnology, and medical devices industries in the form of research services outsourced on a contract basis. Clinical research organizations (CROs) play a crucial role in the development of pharmaceuticals, medical devices, and therapies. A sponsor (a business, organization, or institution) who wishes to run a clinical trial hires CROs to plan, coordinate, execute, and manage the lifecycle of the clinical trial, safely and efficiently.

CROs have the knowledge, capabilities, processes, and procedures that are needed to develop and run a successful clinical trial while ensuring trial quality and compliance with national and international standards. A CRO serves as the main contact between the sponsor and other stakeholders throughout the trial and communicates with ethics and compliance committees, regulatory personnel, vendors, physicians, and research coordinators.

Macro-economic Factors

Increasing healthcare expenditure.

Healthcare expenditure refers to the amount of money spent on healthcare goods and services, such as medical treatments, hospitalizations, medical equipment, and other healthcare-related expenses. It includes both public and private spending on healthcare, such as expenditure by governments, insurance companies, and individuals. Global spending on health more than doubled in real terms over the past two decades, reaching around US$ 8.5 trillion in 2019, or 9.8% of global GDP. Increasing healthcare spending raises the amount of funds for clinical research and development. This results in a large number of clinical trials and high demand for the services of CROs. High-income countries accounted for nearly 80% of global spending on health, with the US accounting for more than 40% alone.

Regulatory Environment

The regulatory environment has a significant impact on the clinical rese arch organization (CRO) market. Regulatory requirements for conducting clinical trials vary by country and region and considerably affect the demand for the services of CROs, the cost of conducting clinical trials, and the profitability of CROs. Government policies, such as regulations on quality standards, impact the market significantly. For instance, the Drugs and Cosmetics Act (1940) regulates the import, manufacture, and distribution of drugs and ensures that drugs and cosmetics sold are safe, effective, and conform to essential quality standards.

Clinical Research Organization Market Dynamics

Market drivers.

- Rise in the Number of Drug Development Activities

Rising Drug development activities are one of the positive factors for the clinical research organizations (CROs) market. The demand for CRO services increases drastically, as pharmaceuticals and biotechnology companies continue to invest in research and development to bring new drugs to market.

Drug development is a complex and expensive process that involves various steps, that includes drug discovery, preclinical studies, clinical trials, regulatory approval, and others. CROs offer significant cost savings to a large number of pharmaceutical companies by providing economies of scale. Drug development activities are increasing worldwide, which is a primary driving force of clinical research organizations. The demand for clinical trials to test the safety and efficacy of new drugs and medical devices is increasing, as the pharmaceutical industry continues to expand. For instance, in 2022 , Labcorp Drug Development helped to develop 100% of oncology drugs approved by the FDA (The United States Food and Drug Administration).

- Technology Advancement and Outsourcing of Clinical Trials

Outsourcing of clinical trials has become a common practice in the pharmaceutical and biotechnology industries. Clinical trials are complex and require significant resources, including specialized equipment, facilities, and personnel.

Many pharmaceuticals and biotech companies are outsourcing their clinical trial activities to clinical research organizations (CROs) to reduce costs, streamline operations, and improve efficiency. The demand for CROs increases, as more pharmaceutical companies outsource their clinical trials. This is boosting the market for these organizations.

Market Restraint

Regulatory Compliance

Regulatory compliance is an essential aspect of conducting clinical trials, and it is considered to be a significant restraint for the market. CROs are required to comply with strict regulations and guidelines set by regulatory authorities such as the FDA, EMA (The European Medicines Agency), and other national regulatory agencies.

Protecting the rights, safety, and welfare of people who participate in clinical trials is a critical aspect of the regulations set by the FDA. The organization oversees clinical trials to ensure they are designed, conducted, analyzed, and reported according to federal law and good clinical practice (GCP) regulations. Compliance with these regulations is challenging and time-consuming, which makes it difficult for CROs to compete in the market.

Scope of Clinical Research Organization Market Report

The report on the global Clinical Research Organization (CRO) market includes an assessment of the market, trends, segments, and regional markets. Overview and dynamics have also been included in the report.

Clinical Research Organization Market Segmental Outlook

On the basis of Service , the global clinical research organization (CRO) market is segmented into clinical research services, early-phase development services, laboratory services, consulting services, and others. The clinical research services segment is expected to expand at a CAGR of 12.4% from 2023 to 2031 . The clinical research services are further categorized into Phase I, Phase II, Phase III, and Phase IV. The growth of the segment is attributed to the increasing prevalence of chronic diseases and the increasing demand for effective medications & diagnostics products across the globe. Furthermore, various contract research organizations offer a wide range of clinical trial research services and support different areas of medical device & drug development. In 2020 , Parexel and Synairgen plc formed a strategic collaboration for conducting a Phase III study of an Interferon-beta (IFN-beta) treatment for COVID - 19 patients. Such strategic initiatives by CROs are expected to minimize the hindrance and boost the segment.

In terms of molecule type , the global clinical research organization (CRO) market is segmented into small molecules and biologics. The small molecules segment is expected to hold 38.5% share of the market during the forecast period, owing to the increasing number of chronic diseases. According to the British Heart Foundation's statistics in August 2022 , around 7.6 billion people in the UK suffered from some form of heart or cardiovascular disease in 2021 . Such an increase in the number of chronic diseases is expected to increase the demand for treatments, and ultimately the demand for small molecules.

Regional Outlook

On the basis of region , the global clinical research organization (CRO) market is divided into North America, Europe, Asia Pacific, Latin America, and Middle East & Africa. North America accounted for 40.0% share of the market in 2022 . This is attributed to the presence of major pharmaceutical companies in the region and their widespread drug development activity and excellent healthcare infrastructure. Additionally, several key pharmaceutical companies in the region are outsourcing R&D and clinical trials, due to the changes in competition and reimbursement from generic drugs. This is boosting the Clinical Research Organization (CRO) market in North America.

Key Benefits for Industry Participants & Stakeholders

- In-depth Analysis of the Global Clinical Research Organization (CRO) Market

- Historical, Current, and Projected Market Size in Terms of Value

- Potential & Niche Segments and Regions Exhibiting Promising Growth Covered

- Industry Drivers, Restraints, and Opportunities Covered in the Study

- Recent Industry Trends and Developments

- Competitive Landscape & Strategies of Key Players

- Neutral Perspective on Global Clinical Research Organization (CRO) Market Performance

- Clinical Research Services

- Early Phase Development Services

- Laboratory Services

- Consulting Services

By Molecule Type

- Small molecules

By End-user

- Pharmaceutical & Biotechnology Company

- Research & Academic Institute

- North America

- Asia Pacific

- Latin America

- Middle East & Africa

Key Market Players Profiled in the Report

- Asymchem Laboratories (Tianjin) Co., Ltd

- Charles River Laboratories.

- Dalton Pharma Services

- Eurofins Scientific

- Frontage Holdings Corporation

- Hangzhou Tigermed Consulting Co., Ltd.

- Jubilant Pharmova Limited

- Medpace, Inc.

- Parexel International Corporation

- Pharmaron Beijing Co., Ltd.

- Piramal Enterprises Ltd.

- REPROCELL Inc.

- Sun Pharmaceutical Industries Ltd.

- Syneos Health

- Thermo Fisher Scientific Inc.

- WuXi AppTec

Competitive Landscape

- Manufacturers operating in the global Clinical Research Organization (CRO) market include Asymchem Laboratories (Tianjin) Co., Ltd, Charles River Laboratories., Dalton Pharma Services, Domainex, Eurofins Scientific, Evotec, Frontage Holdings Corporation, Genscript, Hangzhou Tigermed Consulting Co., Ltd., ICON plc, Inotiv, IQVIA Inc, Jubilant Pharmova Limited, LabCorp, Medpace, Inc., Parexel International Corporation, Pharmaron Beijing Co., Ltd., Piramal Enterprises Ltd, REPROCELL Inc., SGS, Sun Pharmaceutical Industries Ltd., Syneos Health, Thermo Fisher Scientific Inc., WuXi AppTec.

- Market players are pursuing key strategies such as acquisitions, collaborations, and geographic expansion to increase their market share.

Purchase Premium Report

- Single User $4200

- Multi User $5200

- Corporate User $6600

- Online License $2999

- Excel Data Pack $2599

Customize This Report

- Ask for Research To Be Focused On Specific Regions or Segments

- Receive Data As Per Your Format and Definition

- Companies Profiled based on Your Requirements

- Breaking Down Competitive Landscape as per Your Requirements

- Any Level of Customization

Our Clients

We needed a highly accurate and precise report, which Growth Market Reports delivered promptly. The company compiled information from a wide array of reliable agencies and sourcess.It is extremely satisfactory to be working with you. Strategy Head of Major Tech Company

We were very pleased to contact Growth Market Reports as they tailored reports precisely as per our requirements. As we are dealing with the aerospace and defense industry, we need reports of high accuracy and substantial quality. Major Player in Defense Industry

Extremely delighted to have a well-crafted report on “Global Packaging Solutions Market Research Report” from your team. Thank you for providing me with all our requirements and for incorporating our suggestions. CMO of Leading Packaging Company from USA

I had a good experience working with Growth Market Reports as they were very open to all constructive changes in the report. I found that the report had its charm embedded with ample of data. Founder and Managing Partner of Major Korean Company

Our company has been working with Growth Market Reports for some years now and we are very happy with the quality of the reports provided by the company.I, on behalf of my organization, would like to thank you for offering professional reports. Global Consulting Firm

Quick Contact

+1 909 414 1393

Growth Market Report

Certified By

FAQ Section

Some frequently asked questions about this report!

1. What is the major end-user of Clinical Research Organization (CRO) that driving the market growth?

The research & academic institute segment held a market share of 33.3% in 2022 and is anticipated to expand at a CAGR of 12.2% during the forecast period. It is typically responsible for scientific research for the advancement of new drugs.

2. Who are the major players operating in the market?

Major manufacturers include IQVIA Inc, LabCorp, Thermo Fisher Scientific Inc., ICON plc, and Syneos Health are among the key players that hold a major chunk of the market.

3. Can I ask for different company profiles?

Additional company profiles are provided on request

4. What are the criteria used for selecting a company profile?

Factors such as competitive strength and market positioning are key areas considered while selecting key companies to be profiled.

5. What are the factors driving the Clinical Research Organization (CRO) market?

The rise in the number of drug development activities, technology advancement and outsourcing of clinical trials are the key driving factors for the market.

6. How big will be the Clinical Research Organization (CRO) market in 2030?

According to this Growth Market Reports report, the Clinical Research Organization (CRO) market is expected to register a CAGR of 12.3 % during the forecast period, 2015-2030, with an anticipated valuation of USD 220.3 Billion by the end of 2030.

7. Which macroeconomic factors affect the market?

Economic Condition, Increasing Healthcare Expenditure, Advancement in Technology, and Regulatory Environment are key macroeconomic factors shaping the market during the forecast period.

8. What is the impact of COVID-19 on the overall market during 2019 -2020?

The pandemic has positive impact on the global Clinical Research Organization (CRO) market. The COVID-19 outbreak spread worldwide, increase in number of clinical research activities has boost the demand of Clinical Research Organization (CRO).

9. What additional data analysis is available in a report?

In addition to market size (in USD Billion), the company market share (in % for the base year 2022), the impact of key regulations, current & future trends, and reimbursement scenario overview: private and public healthcare institutions by region have been provided.

10. What is the base year calculated in the global Clinical Research Organization (CRO) market report and what is the analysis period?

The base year considered for the global Clinical Research Organization (CRO) market report is 2021. The complete analysis period is 2016 to 2031, wherein, 2016 to 2021 are the historic years, and the forecast is provided from 2023 to 2031.

Related Reports

Some other reports from this category!

Drugs for Herpes Labialis (Oral Herpes) Market Trends [2031]

Dengue treatment market size, share & growth report | 2030, mmr vaccine market trends, growth, industry & revenue [2030], acromegaly treatment market size, share & growth report 2031, teenager myopia control market size, share & industry | 2031, cannabidiol (cbd) market share, opportunities, industry 2030, prosthetic joint infections treatment market forecast [2031], cannabis market size, share, growth & industry trends [2031], heart valve replacement market size, share & industry | 2030, ibuprofen market size, share, industry & opportunities 2031.

- Request For Sample

- Clinical Research Organization Market

Clinical Research Organization Market Size, Share, Opportunities, And Trends By Service Type (Early Phase Development Services, Clinical Research Services, Laboratory Services, Regulatory Consulting Services), By Therapeutic Area (Oncology, Clinical Pharmacology, Cardiology, Infectious Disease, Neurology, Gastroenterology & Hepatology, Ophthalmology, Others), By End-user (Pharmaceutical & Biopharmaceutical Companies, Medical Device Companies, Academic Institutes), And By Geography - Forecasts From 2024 To 2029

- Published : Mar 2024

- Report Code : KSI061616785

- Pages : 145

- Description

- Table Of Contents

- Companies Profiled

Offered with this report

Market Data and Estimates in Excel

2 Months of Post Sale Analyst Support

Requirement Specific Customization

The clinical research organization market is anticipated to grow significantly over the forecast period.

The market for clinical research organizations (CROs) has grown significantly due to factors such as the demand for specialized knowledge, growing R&D expenses, and the complexity of clinical trials. Pharmaceutical, biotechnology, and medical device firms can benefit from a variety of services provided by CROs, including data management, regulatory compliance, clinical trial management, and pharmacovigilance. The number of clinical trials that have been outsourced to CROs has increased recently because of their capacity to offer affordable solutions, access to patient populations throughout the world, and proficiency in handling regulatory requirements in various geographic areas. The CRO industry has expanded because of technological breakthroughs like artificial intelligence and electronic data capture, which have improved data analysis capabilities and streamlined trial procedures. The CRO industry is very cutthroat, with both big international companies and specialty suppliers competing for market share. CROs frequently use mergers and acquisitions as a means of growing their service offerings and geographic reach. In the upcoming years, it is anticipated that the CRO market will continue to rise because of the rising demand for novel therapeutics and strict regulatory requirements.

Market Drivers

- The increasing demand for outsourcing is expected to drive the clinical research organization market.

The demand for Clinical Research Organizations to handle clinical trial outsourcing is significantly increasing in the biotechnology and pharmaceutical industries. The need to reduce expenses, shorten the time it takes to create new drugs and get access to specialized knowledge is what is driving this trend. Businesses can reduce operational risk, maximize resource allocation, and concentrate on their core strengths by utilizing the services of CROs.

Furthermore, outsourcing makes it possible to connect with a worldwide network of researchers and patients, which makes it easier to carry out trials in a variety of geographical locations. All things considered, the growing demand for outsourcing highlights how essential it is to boost productivity and creativity within the drug development ecosystem.

Chronic diseases increase will also drive the market. According to NCBI, 2023, between 2020 and 2050, there will be a 61.11% increase in the number of Americans 50 years of age and older, from 137.25 million to 221.13 million. The number of people 50 years of age and older who have at least one chronic illness is predicted to rise from 71.522 million in 2020 to 142.66 million in 2050, a 99.5% increase. Simultaneously, it is anticipated that the number of people with multimorbidity will rise from 7.8304 million in 2020 to 14.968 million in 2050, a 91.16% increase. According to race, by 2050, non-Hispanic whites (64.6%), non-Hispanic blacks (61.47%), and Hispanics and other races (64.5%) are expected to have one or more chronic illnesses.

- Globalization of clinical trials is expected to boost the market.

Clinical trial globalization is a reflection of a major change in the pharmaceutical and biotechnology sectors toward conducting research across a variety of geographical locations. Regulatory incentives, economic benefits in emerging markets, and access to larger and more diversified patient populations are some of the elements driving this trend. Companies can ensure wider applicability of data, improve variety in research populations, and speed up patient enrollment by expanding trial locations abroad.

Globalization does, however, come with drawbacks, like complicated regulations, disparities in culture, and logistical difficulties. Notwithstanding these obstacles, clinical trials' globalization is nonetheless vital to the advancement of medical research and the enhancement of patients' access to cutting-edge therapies on a global scale.

- Advancing technology is a significant driver for the clinical research organization market.

Technological developments are transforming clinical research by improving patient involvement, data quality, and efficiency. More accurate patient selection, predictive modeling, and real-time trial progress monitoring are made possible by innovations like artificial intelligence, machine learning, and big data analytics. Wearables and remote monitoring tools are examples of digital health technology that enable decentralized trial conduct, enhancing patient convenience and cutting expenses.

Moreover, computerized data capture technologies expedite the process of developing new drugs by streamlining data collecting and processing. All things considered, these technological developments enable researchers to make data-driven choices, maximize trial results, and eventually accelerate the release of safe and efficient treatments onto the market.

IQVIA received recognition for its AI software in June 2023. In order to enable real-world data research, the program, which incorporates natural language processing technology, assists in the analysis of complicated and unstructured patient data, offering distinctive insights into patient care and disease states. What makes the AI software unique is its capacity to offer insights that can be put into practice. It opens up important perspectives on population health, such as the social determinants of health (SDoH), which determine most health outcomes. One of the biggest healthcare systems in Illinois, Northshore-Edward-Elmhurst Health, is using this technology to help doctors identify and screen 56% more at-risk patients based on SDoH, enabling patients in need to receive focused intervention.

Asia Pacific region is expected to grow significantly.

The clinical research organization (CRO) market in Asia-Pacific is expanding significantly as a result of several important factors. The growing incidence of chronic illnesses, growing investments in healthcare infrastructure, and the development of the biotechnology and pharmaceutical industries are the main drivers of this rise. In addition, the area has cheaper operating expenses than Western markets and a sizable and diversified patient base. In nations like China, India, and South Korea, the conduct of clinical trials is further facilitated by regulatory reforms and advantageous government policies.

Consequently, the CRO market has experienced significant expansion, with Asia-Pacific emerging as a major hub for outsourcing clinical research activities. For instance, In November 2021, Based on the encouraging pre-clinical outcomes of LG00034053, a novel medication candidate for the treatment of osteoarthritis, LG Chem declared on the 4th that the company has been granted approval by the Korean Ministry of Food and Drug Safety for the Phase 1b/2 clinical trials.LG Chem aims to expedite the creation of novel medications by creating clinical trials that connect Phases 1 and 2. With the help of this approval, LG Chem will carry out studies at Samsung Medical Center to determine the best dose for patients with mild to moderate knee osteoarthritis (K&L2-3) by assessing factors like safety and tolerability, pharmacokinetics (the process of drug absorption, distribution, metabolism, and excretion), and effectiveness.

Market Restraints

- Increasing competition and consolidation could constraint the market

Demand growth is causing the Clinical Research Organization market to become more competitive and consolidated. As more businesses join the market, the rivalry for talent and contracts gets fiercer, which puts pressure on prices. Consolidation of the sector is fueled by larger CROs acquiring smaller ones to increase capabilities and reach globally. Even while there are advantages like economies of scale, smaller CROs could find it difficult to compete. Players in the CRO sector face a great deal of difficulty in striking a balance between competitiveness and consolidation.

Market Developments

- January 2024- Labcorp, a global leader of innovative and comprehensive laboratory services, and Hawthorne Effect, Inc., a complete clinical trials solution integrating technology, announced a strategic collaboration to advance centralized clinical trial capabilities for sponsors seeking to increase patient diversity and inclusion, decrease site burden, and accelerate enrollment and clinical study timelines.

- October 2023- Through creative and integrated technology-enabled pharmacovigilance (PV) safety services and solutions, IQVIA, a leading global provider of advanced analytics, technology solutions, and clinical research services to the life sciences industry, announced a strategic collaboration with argenx to advance treatment for patients with rare autoimmune diseases.

Segmentation

- Early phase development services

- Clinical research services

- Laboratory services

- Regulatory consulting services

- Clinical pharmacology

- Infectious disease

- Gastroenterology & Hepatology

- Ophthalmology

- Pharmaceutical & Biopharmaceutical Companies

- Medical Device Companies

- Academic Institutes

- United Kingdom

- Saudi Arabia

- South Korea

1. INTRODUCTION

1.1. Market Overview

1.2. Market Definition

1.3. Scope of the Study

1.4. Market Segmentation

1.5. Currency

1.6. Assumptions

1.7. Base, and Forecast Years Timeline

1.8. Key Benefits to the Stakeholder

2. RESEARCH METHODOLOGY

2.1. Research Design

2.2. Research Processes

3. EXECUTIVE SUMMARY

3.1. Key Findings

3.2. Analyst View

4. MARKET DYNAMICS

4.1. Market Drivers

4.2. Market Restraints

4.3. Porter’s Five Forces Analysis

4.3.1. Bargaining Power of Suppliers

4.3.2. Bargaining Power of Buyers

4.3.3. Threat of New Entrants

4.3.4. Threat of Substitutes

4.3.5. Competitive Rivalry in the Industry

4.4. Industry Value Chain Analysis

4.5. Analyst View

5. CLINICAL RESEARCH ORGANIZATION MARKET BY SERVICE TYPE

5.1. Introduction

5.2. Early phase development services

5.2.1. Market Trends and Opportunities

5.2.2. Growth Prospects

5.2.3. Discovery services

5.2.4. Chemistry, manufacturing & control (CMC)

5.2.5. Preclinical services

5.2.5.1. Pharmacokinetics/Pharmacodynamics (PK/PD)

5.2.5.2. Toxicology services

5.2.5.3. Others

5.3. Clinical research services

5.3.1. Market Trends and Opportunities

5.3.2. Growth Prospects

5.3.3. Phase I

5.3.4. Phase II

5.3.5. Phase III

5.3.6. Phase IV

5.4. Laboratory services

5.4.1. Market Trends and Opportunities

5.4.2. Growth Prospects

5.4.3. Bioanalytical testing services

5.4.4. Analytical testing services

5.4.5. Physical Characterization

5.4.6. Raw Material Testing

5.4.7. Batch Release Testing

5.4.8. Stability Testing

5.4.9. Others

5.5. Regulatory consulting services

5.5.1. Market Trends and Opportunities

5.5.2. Growth Prospects

6. CLINICAL RESEARCH ORGANIZATION MARKET BY THERAPEUTIC AREA

6.1. Introduction

6.2. Oncology

6.2.1. Market Trends and Opportunities

6.2.2. Growth Prospects

6.3. Clinical pharmacology

6.3.1. Market Trends and Opportunities

6.3.2. Growth Prospects

6.4. Cardiology

6.4.1. Market Trends and Opportunities

6.4.2. Growth Prospects

6.5. Infectious disease

6.5.1. Market Trends and Opportunities

6.5.2. Growth Prospects

6.6. Neurology

6.6.1. Market Trends and Opportunities

6.6.2. Growth Prospects

6.7. Gastroenterology & Hepatology

6.7.1. Market Trends and Opportunities

6.7.2. Growth Prospects

6.8. Ophthalmology

6.8.1. Market Trends and Opportunities

6.8.2. Growth Prospects

6.9. Others

6.9.1. Market Trends and Opportunities

6.9.2. Growth Prospects

7. CLINICAL RESEARCH ORGANIZATION MARKET BY END-USER

7.1. Introduction

7.2. Pharmaceutical & Biopharmaceutical Companies

7.2.1. Market Trends and Opportunities

7.2.2. Growth Prospects

7.3. Medical Device Companies

7.3.1. Market Trends and Opportunities

7.3.2. Growth Prospects

7.4. Academic Institutes

7.4.1. Market Trends and Opportunities

7.4.2. Growth Prospects

8. CLINICAL RESEARCH ORGANIZATION MARKET BY GEOGRAPHY

8.1. Introduction

8.2. North America

8.2.1. By Service Type

8.2.2. By Therapeutic Area

8.2.3. By End User

8.2.4. By Country

8.2.4.1. United States

8.2.4.1.1. Market Trends and Opportunities

8.2.4.1.2. Growth Prospects

8.2.4.2. Canada

8.2.4.2.1. Market Trends and Opportunities

8.2.4.2.2. Growth Prospects

8.2.4.3. Mexico

8.2.4.3.1. Market Trends and Opportunities

8.2.4.3.2. Growth Prospects

8.3. South America

8.3.1. By Service Type

8.3.2. By Therapeutic Area

8.3.3. By End User

8.3.4. By Country

8.3.4.1. Brazil

8.3.4.1.1. Market Trends and Opportunities

8.3.4.1.2. Growth Prospects

8.3.4.2. Argentina

8.3.4.2.1. Market Trends and Opportunities

8.3.4.2.2. Growth Prospects

8.3.4.3. Others

8.3.4.3.1. Market Trends and Opportunities

8.3.4.3.2. Growth Prospects

8.4. Europe

8.4.1. By Service Type

8.4.2. By Therapeutic Area

8.4.3. By End User

8.4.4. By Country

8.4.4.1. United Kingdom

8.4.4.1.1. Market Trends and Opportunities

8.4.4.1.2. Growth Prospects

8.4.4.2. Germany

8.4.4.2.1. Market Trends and Opportunities

8.4.4.2.2. Growth Prospects

8.4.4.3. France

8.4.4.3.1. Market Trends and Opportunities

8.4.4.3.2. Growth Prospects

8.4.4.4. Italy

8.4.4.4.1. Market Trends and Opportunities

8.4.4.4.2. Growth Prospects

8.4.4.5. Spain

8.4.4.5.1. Market Trends and Opportunities

8.4.4.5.2. Growth Prospects

8.4.4.6. Others

8.4.4.6.1. Market Trends and Opportunities

8.4.4.6.2. Growth Prospects

8.5. Middle East and Africa

8.5.1. By Service Type

8.5.2. By Therapeutic Area

8.5.3. By End User

8.5.4. By Country

8.5.4.1. Saudi Arabia

8.5.4.1.1. Market Trends and Opportunities

8.5.4.1.2. Growth Prospects

8.5.4.2. UAE

8.5.4.2.1. Market Trends and Opportunities

8.5.4.2.2. Growth Prospects

8.5.4.3. Others

8.5.4.3.1. Market Trends and Opportunities

8.5.4.3.2. Growth Prospects

8.6. Asia Pacific

8.6.1. By Service Type

8.6.2. By Therapeutic Area

8.6.3. By End User

8.6.4. By Country

8.6.4.1. Japan

8.6.4.1.1. Market Trends and Opportunities

8.6.4.1.2. Growth Prospects

8.6.4.2. China

8.6.4.2.1. Market Trends and Opportunities

8.6.4.2.2. Growth Prospects

8.6.4.3. India

8.6.4.3.1. Market Trends and Opportunities

8.6.4.3.2. Growth Prospects

8.6.4.4. South Korea

8.6.4.4.1. Market Trends and Opportunities

8.6.4.4.2. Growth Prospects

8.6.4.5. Taiwan

8.6.4.5.1. Market Trends and Opportunities

8.6.4.5.2. Growth Prospects

8.6.4.6. Thailand

8.6.4.6.1. Market Trends and Opportunities

8.6.4.6.2. Growth Prospects

8.6.4.7. Indonesia

8.6.4.7.1. Market Trends and Opportunities

8.6.4.7.2. Growth Prospects

8.6.4.8. Others

8.6.4.8.1. Market Trends and Opportunities

8.6.4.8.2. Growth Prospects

9. COMPETITIVE ENVIRONMENT AND ANALYSIS

9.1. Major Players and Strategy Analysis

9.2. Market Share Analysis

9.3. Mergers, Acquisitions, Agreements, and Collaborations

9.4. Competitive Dashboard

10. COMPANY PROFILES

10.1. Charles River Laboratories, Inc.

10.2. Laboratory Corporation of America Holdings

10.3. IQVIA

10.4. Pharmaceutical Product Development

10.5. PAREXEL International

10.6. Syneos Health

10.7. ICON plc.

10.8. Medpace

10.9. CTI Clinical Trial and Consulting Services

10.10. QPS Neuropharmacology

Charles River Laboratories, Inc.

Laboratory Corporation of America Holdings

Pharmaceutical Product Development

PAREXEL International

Syneos Health

CTI Clinical Trial and Consulting Services

QPS Neuropharmacology

Related Reports

License Type

Explore custom options available with this study.

- Customize this report

- Buy sections of the study

- Buy country specific report

Subscribe Us

Let us know the industries you are interested in, request free sample.

- Pharmaceuticals

Clinical Research Organization Market

Global Clinical Research Organization Market Size, Trends & Analysis - Forecasts to 2028 By Type (Drug Discovery, Pre-clinical, and Clinical), By Service (Project Management/Clinical Supply Management, Data Management, Regulatory/Medical Affairs, Medical Writing, Clinical Monitoring, Quality Management/ Assurance, Bio-statistics, Investigator Payments, Laboratory, Patient and site Recruitment, Technology, and Others), By Application (Oncology, Cardiovascular, Autoimmune/Inflammation, Central nervous system (CNS), Dermatology, Infectious diseases, Diabetes, Pain, and Others), By End User (Pharmaceutical & Biopharmaceutical Companies, Medical Device Companies, and Others), and By Region (North America, Asia Pacific, Central & South America, Europe, and Middle East and Africa), Competitive Landscape, Company Market Share Analysis, and End User Analysis

- Report Summary

- Table of Content

- Research Methodology

- Customize this research

Global Clinical Research Organization Market Size

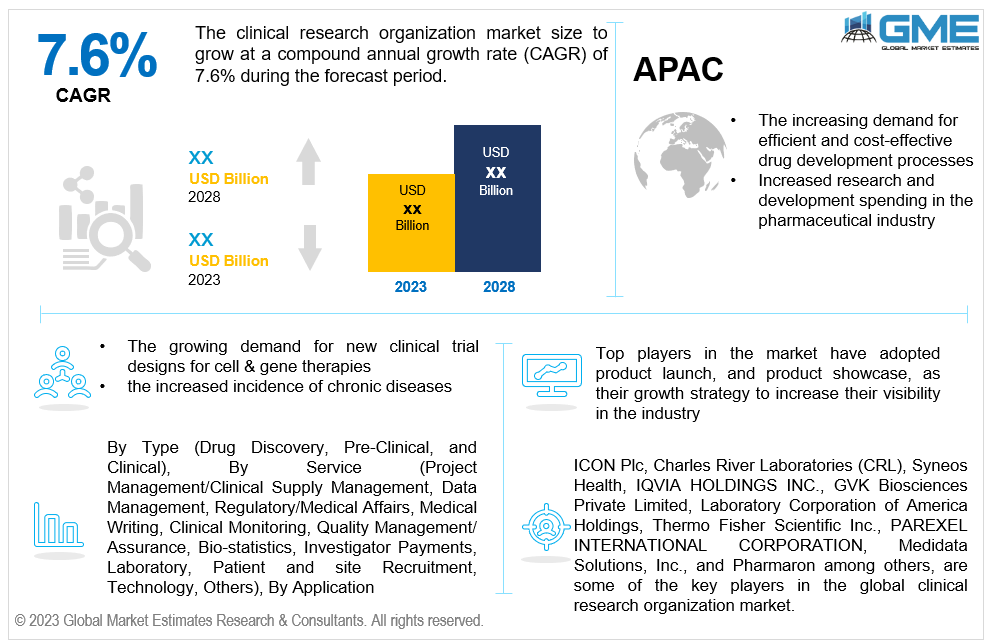

The global clinical research organization market is projected to grow at a CAGR of 7.6% from 2023 to 2028.

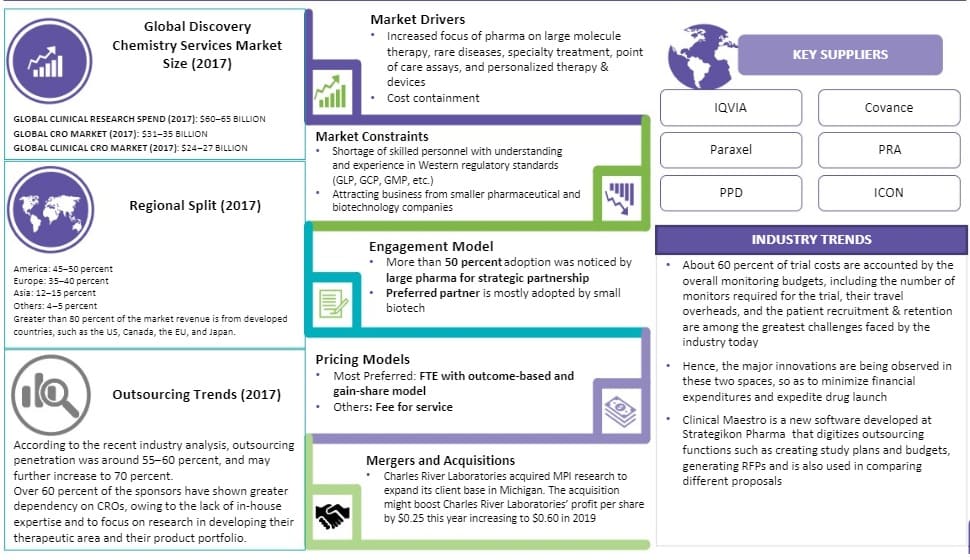

Clinical research organizations (CROs) offer outsourced services to the biotechnology and pharmaceutical sectors. They carry out clinical studies for novel medications and treatments. Drug firms themselves or academic institutions doing the trials can hire CROs. CROs are created to save expenses for businesses creating novel medications and pharmaceuticals for specialized markets. They want to make the medication market entrance and development simpler because it is no longer necessary for huge pharmaceutical corporations to handle everything "in-house”. These organizations offer services that can speed up the whole process of bringing a novel technology or medication to market, from concept creation through FDA marketing approval, without the requirement for the drug's sponsor to keep any people on staff to deliver these services. The pharmaceutical and drug development companies devote a lot of resources and funding to CROs supporting more globally coordinated and collaborative research activities as a result of the growing priority placed on research and development. This is the rationale behind the rising importance of strategic alliances in the value chain for novel medication development.

The increasing demand for efficient and cost-effective drug development processes, increased research and development spending in the pharmaceutical industry, and the growing demand for new clinical trial designs for cell & gene therapies are expected to support the growth of the market during the forecast period. Additionally, the market is expanding as a result of the increased incidence of chronic diseases, the high cost of in-house drug research, the focus on rare diseases, and the numerous orphan medications in development.

CROs play a crucial role in clinical trials as they have plenty of opportunities in the fast-expanding therapeutic disciplines of oncology, neurology, cardiology, and vaccines. To increase patient involvement, study compliance, and continuous monitoring, CROs can include telemedicine and digital health technologies in clinical trials, which presents an opportunity for the major players in the global market. However, CROs continue to face a various challenges, such as commoditization, intense competition, and cutting-edge patient engagement models. Due to market segmentation and larger businesses capturing a larger share of the market, smaller CROs are under pressure.

Well-established companies these areas can provide pharmaceutical and biotechnology companies with specialized services and support for both real-world research and virtual studies, which can reduce the length and cost of the trial. They may now also provide specialized services in data analytics and machine learning due to the increasing accessibility of real-time data in clinical trials. To do this, one may use predictive analytics to anticipate risks, identify trends, and enhance research design, which contributes to the expansion of the global market.

Digital therapies are software-based treatments intended to treat or manage medical diseases. CROs have become more involved in the development and assessment of these interventions. To improve patient results, these therapies are frequently utilized in conjunction with conventional pharmacological techniques. CROs were using big data and sophisticated analytics approaches to glean valuable insights from vast amounts of clinical and patient data. This support better decision-making, trend spotting, and trial protocol optimization.

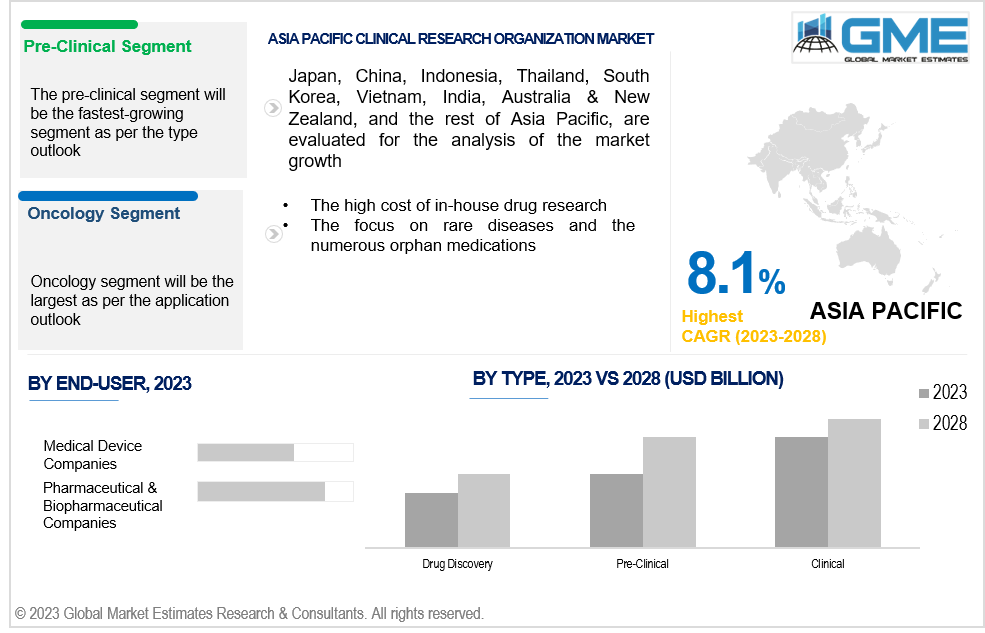

Global Clinical Research Organization Market: By Type

The pre-clinical is expected to be the fastest-growing segment in the market during the forecast period. Leading CROs have amassed a large amount of pre-clinical experience, and CROs are utilizing this expertise to provide highly effective and precise pre-clinical services. Additionally, CROs let small and midsize businesses participate in the difficult drug development process without having to make a substantial investment in capital equipment. Pre-clinical trials are more successful, according to an article by Anju Life Sciences Software that was published in March 2021, due to higher data quality, better safety judgments, lower trial operating expenses, and quicker study execution.

The clinical segment holds the largest share of the market during the forecast period. The segment is expanding due to the rising incidence of chronic diseases and the rising demand for rapid and precise disease diagnostics.

Global Clinical Research Organization Market: By Service

Data management is anticipated to be the fastest-growing segment in the market during the forecast period. To collect data from clinical trial locations, data management entails using electronic data capture (EDC) systems or using alternative data gathering techniques. This can entail making case report forms (CRFs) and guaranteeing that the information gathered conforms with legal requirements.

The project management/clinical supply management segment holds the largest share of the market. Clinical trial design, coordination, and execution are the main goals of these services, which also make sure that clinical supplies are available and managed appropriately. In the CRO industry, project management services entail supervising every component of a clinical study to guarantee its proper execution within specified schedules and financial restrictions. Clinical supply management services prioritize the prompt and effective provision of research medications, medical equipment, and other materials needed for the clinical trial.

Global Clinical Research Organization Market: By Application

The central nervous system (CNS) is anticipated to be the fastest-growing segment in the market during the forecast period. CROs are essential to the management of clinical trials for CNS illnesses including Parkinson's, Alzheimer's, and other similar conditions. They offer knowledge in protocol formulation, location choice, patient recruiting, and trial administration as a whole.

The oncology segment holds the largest share of the market. Preclinical research, clinical trials, and other stages of the drug development process are all supported by a variety of services offered by oncology CROs. Since there are many different medications being developed in the cancer industry, oncology CROs need to have a thorough understanding of the disease process and cutting-edge therapies. Additionally, they must be able to plan and carry out clinical studies that adhere to the exacting requirements of the FDA and other authorities.

Global Clinical Research Organization Market: By End User

The medical device companies is anticipated to be the fastest-growing segment in the market during the forecast period. Clinical trials for new or enhanced medical devices are carried out by CROs on behalf of medical device manufacturers. CROs offer competence in patient recruiting, data management, regulatory compliance, research design, and statistical analysis. They aid manufacturers of medical devices in navigating the challenging world of clinical research and support the efficient and successful conduct of clinical studies.

The pharmaceutical & biopharmaceutical companies segment holds the largest share of the market. Due to the complicated nature of the drug development process, pharmaceutical companies are increasingly depending on CROs for drug research and development services. In order to cut costs and speed up time to market, biotechnology companies are also outsourcing their R&D operations to CROs. Thus, it is anticipated that increasing investment in R&D spending would fuel this segment's growth throughout the forecast period.

Global Clinical Research Organization Market: By Region

Regionally, North America is projected to hold the leading position in the global region in the market. This is due to the region conducting a rising number of clinical trials as well as the existence of several CROs in nations like the United States and Canada. CRO companies are in great demand throughout the region as the desire to outsource R&D operations grows.

Asia Pacific is predicted to have rapid growth during the forecast period. This can be attributed to elements including rising healthcare costs, expanding government funding for clinical research, and an increase in the number of people with chronic illnesses. Clinical trials are being conducted in China at a higher rate thanks to the government's and China's Food and Drug Administration's regulatory flexibility.

Europe market is anticipated to see stable market growth throughout the forecast period due to the favorable reimbursement policies for clinical trials and the rising number of biopharmaceutical businesses.

Global Clinical Research Organization Market Share and Competitor Analysis

Some of the key players in the global clinical research organization market are ICON Plc, Charles River Laboratories (CRL), Syneos Health , IQVIA HOLDINGS INC., GVK Biosciences Private Limited, Laboratory Corporation of America Holdings, Thermo Fisher Scientific Inc., PAREXEL INTERNATIONAL CORPORATION, Medidata Solutions, Inc., and Pharmaron among others..

Please note: This is not an exhaustive list of companies profiled in the report.

1 STRATEGIC INSIGHTS ON NEW REVENUE POCKETS

1.1 Strategic Opportunity & Attractiveness Analysis

1.1.1 Hot Revenue Pockets

1.1.2 Market Attractiveness Score

1.1.3 Revenue Impacting Opportunity

1.1.4 High Growing Region/Country

1.1.5 Competitor Analysis

1.1.6 Consumer Analysis

1.2 Global Market Estimates' View

1.3 Strategic Insights across Business Functions

1.3.1 For Chief Executive Officers

1.3.2 For Chief Marketing Officers

1.3.3 For Chief Strategy Officers

1.4 Evaluate the Potential of your Existing Business Lines vs. New Lines to Enter Into

2 TECHNOLOGICAL TRENDS

2.1 Technological Adoption Rate

2.2 Current Trend Impact Analysis

2.3 Future Trend Impact Analysis

2.4 Data Metrics on Feed Stocks

3 GLOBAL MARKET OUTLOOK

3.1 Market Pyramid Analysis

3.1.1 Introduction

3.1.2 Adjacent Market Opportunities

3.1.3 Ancillary Market Opportunities

3.2 Demand Side Analysis

3.2.1 Market Drivers: Impact Analysis

3.2.2 Market Restraints: Impact Analysis

3.2.3 Market Opportunities: Impact Analysis

3.2.4 Market Challenges: Impact Analysis

3.3 Supply Side Analysis

3.3.1 Porter’s Five Forces Analysis

3.3.1.1 Threat of New Entrants

3.3.1.2 Threat of New Substitutes

3.3.1.3 Bargaining Power of Suppliers

3.3.1.4 Bargaining Power of Buyers

3.3.1.5 Intensity of Competitive Rivalry

3.3.2 SWOT Analysis; By Factor (Political & Legal, Economic, and Technological)

3.3.2.1 Political Landscape

3.3.2.2 Economic Landscape

3.3.2.3 Social Landscape

3.3.2.4 Technology Landscape

3.3.3 Value Chain Analysis

3.3.4 Trend Analysis

3.3.5 Gap Analysis

3.3.6 Cost Analysis

4 GLOBAL CLINICAL RESEARCH ORGANIZATION MARKET, BY TYPE

4.1 Introduction

4.2 Clinical Research Organization Market: Type Scope Key Takeaways

4.3 Revenue Growth Analysis, 2022 & 2028

4.4 Drug Discovery

4.4.1 Drug Discovery Market Estimates and Forecast, 2020-2028 (USD Million)

4.5 Pre-Clinical

4.5.1 Pre-Clinical Market Estimates and Forecast, 2020-2028 (USD Million)

4.6 Clinical

4.6.1 Clinical Market Estimates and Forecast, 2020-2028 (USD Million)

5 GLOBAL CLINICAL RESEARCH ORGANIZATION MARKET, BY SERVICE

5.1 Introduction

5.2 Clinical Research Organization Market: Service Scope Key Takeaways

5.3 Revenue Growth Analysis, 2022 & 2028

5.4 Project Management/Clinical Supply Management

5.4.1 Project Management/Clinical Supply Management Market Estimates and Forecast, 2020-2028 (USD Million)

5.5 Data Management

5.5.1 Data Management Market Estimates and Forecast, 2020-2028 (USD Million)

5.6 Regulatory/Medical Affairs

5.6.1 Regulatory/Medical Affairs Market Estimates and Forecast, 2020-2028 (USD Million)

5.7 Medical Writing

5.7.1 Medical Writing Market Estimates and Forecast, 2020-2028 (USD Million)

5.8 Clinical Monitoring

5.8.1 Clinical Monitoring Market Estimates and Forecast, 2020-2028 (USD Million)

5.9 Quality Management/ Assurance

5.9.1 Quality Management/ Assurance Market Estimates and Forecast, 2020-2028 (USD Million)

5.10 Bio-statistics

5.10.1 Bio-statistics Market Estimates and Forecast, 2020-2028 (USD Million)

5.11 Investigator Payments

5.11.1 Investigator Payments Market Estimates and Forecast, 2020-2028 (USD Million)

5.12 Laboratory

5.12.1 Laboratory Market Estimates and Forecast, 2020-2028 (USD Million)

5.13 Patient and site Recruitment

5.13.1 Patient and site Recruitment Market Estimates and Forecast, 2020-2028 (USD Million)

5.14 Technology

5.14.1 Technology Market Estimates and Forecast, 2020-2028 (USD Million)

5.15 Others

5.15.1 Others Market Estimates and Forecast, 2020-2028 (USD Million)

6 GLOBAL CLINICAL RESEARCH ORGANIZATION MARKET, BY APPLICATION

6.1 Introduction

6.2 Clinical Research Organization Market: Application Scope Key Takeaways

6.3 Revenue Growth Analysis, 2022 & 2028

6.4 Oncology

6.4.1 Oncology Market Estimates and Forecast, 2020-2028 (USD Million)

6.5 Cardiovascular

6.5.1 Cardiovascular Market Estimates and Forecast, 2020-2028 (USD Million)

6.6 Autoimmune/Inflammation

6.6.1 Autoimmune/Inflammation Market Estimates and Forecast, 2020-2028 (USD Million)

6.7 Central nervous system (CNS)

6.7.1 Central nervous system (CNS) Market Estimates and Forecast, 2020-2028 (USD Million)

6.8 Dermatology

6.8.1 Dermatology Market Estimates and Forecast, 2020-2028 (USD Million)

6.9 Infectious diseases

6.9.1 Infectious diseases Market Estimates and Forecast, 2020-2028 (USD Million)

6.10 Diabetes

6.10.1 Diabetes Market Estimates and Forecast, 2020-2028 (USD Million)

6.11.1 Pain Market Estimates and Forecast, 2020-2028 (USD Million)

6.12 Others

6.12.1 Others Market Estimates and Forecast, 2020-2028 (USD Million)

7 GLOBAL CLINICAL RESEARCH ORGANIZATION MARKET, BY END USER

7.1 Introduction

7.2 Clinical Research Organization Market: End User Scope Key Takeaways

7.3 Revenue Growth Analysis, 2022 & 2028

7.4 Pharmaceutical & Biopharmaceutical Companies

7.4.1 Pharmaceutical & Biopharmaceutical Companies Market Estimates and Forecast, 2020-2028 (USD Million)

7.5 Medical Device Companies

7.5.1 Medical Device Companies Market Estimates and Forecast, 2020-2028 (USD Million)

7.6 Others

7.6.1 Others Market Estimates and Forecast, 2020-2028 (USD Million)

8 GLOBAL CLINICAL RESEARCH ORGANIZATION MARKET, BY REGION

8.1 Introduction

8.2 North America Clinical Research Organization Market Estimates and Forecast, 2020-2028 (USD Million)

8.2.1 By Type

8.2.2 By Service

8.2.3 By Application

8.2.4 By End User

8.2.5 By Country

8.2.5.1 U.S. Clinical Research Organization Market Estimates and Forecast, 2020-2028 (USD Million)

8.2.5.1.1 By Type

8.2.5.1.2 By Service

8.2.5.1.3 By Application

8.2.5.1.4 By End User

8.2.5.2 Canada Clinical Research Organization Market Estimates and Forecast, 2020-2028 (USD Million)

8.2.5.2.1 By Type

8.2.5.2.2 By Service

8.2.5.2.3 By Application

8.2.5.2.4 By End User

8.2.5.3 Mexico Clinical Research Organization Market Estimates and Forecast, 2020-2028 (USD Million)

8.2.5.3.1 By Type

8.2.5.3.2 By Service

8.2.5.3.3 By Application

8.2.5.3.4 By End User

8.3 Europe Clinical Research Organization Market Estimates and Forecast, 2020-2028 (USD Million)

8.3.1 By Type

8.3.2 By Service

8.3.3 By Application

8.3.4 By End User

8.3.5 By Country

8.3.5.1 Germany Clinical Research Organization Market Estimates and Forecast, 2020-2028 (USD Million)

8.3.5.1.1 By Type

8.3.5.1.2 By Service

8.3.5.1.3 By Application

8.3.5.1.4 By End User

8.3.5.2 U.K. Presered Flowers Market Estimates and Forecast, 2020-2028 (USD Million)

8.3.5.2.1 By Type

8.3.5.2.2 By Service

8.3.5.2.3 By Application

8.3.5.2.4 By End User

8.3.5.3 France Clinical Research Organization Market Estimates and Forecast, 2020-2028 (USD Million)

8.3.5.3.1 By Type

8.3.5.3.2 By Service

8.3.5.3.3 By Application

8.3.5.3.4 By End User

8.3.5.4 Italy Clinical Research Organization Market Estimates and Forecast, 2020-2028 (USD Million)

8.3.5.4.1 By Type

8.3.5.4.2 By Service

8.3.5.4.3 By Application

8.3.5.4.4 By End User

8.3.5.5 Spain Clinical Research Organization Market Estimates and Forecast, 2020-2028 (USD Million)

8.3.5.5.1 By Type

8.3.5.5.2 By Service

8.3.5.5.3 By Application

8.3.5.5.4 By End User

8.3.5.6 Netherlands Clinical Research Organization Market Estimates and Forecast, 2020-2028 (USD Million)

8.3.5.6.1 By Type

8.3.5.6.2 By Service

8.3.5.6.3 By Application

8.3.5.6.4 By End User

8.3.5.7 Rest of Europe Clinical Research Organization Market Estimates and Forecast, 2020-2028 (USD Million)

8.3.5.7.1 By Type

8.3.5.7.2 By Service

8.3.5.7.3 By Application

8.3.5.7.4 By End User

8.4 Asia Pacific Clinical Research Organization Market Estimates and Forecast, 2020-2028 (USD Million)

8.4.1 By Type

8.4.2 By Service

8.4.3 By Application

8.4.4 By End User

8.4.5 By Country

8.4.5.1 China Clinical Research Organization Market Estimates and Forecast, 2020-2028 (USD Million)

8.4.5.1.1 By Type

8.4.5.1.2 By Service

8.4.5.1.3 By Application

8.4.5.1.4 By End User

8.4.5.2 Japan Clinical Research Organization Market Estimates and Forecast, 2020-2028 (USD Million)

8.4.5.2.1 By Type

8.4.5.2.2 By Service

8.4.5.2.3 By Application

8.4.5.2.4 By End User

8.4.5.3 India Clinical Research Organization Market Estimates and Forecast, 2020-2028 (USD Million)

8.4.5.3.1 By Type

8.4.5.3.2 By Service

8.4.5.3.3 By Application

8.4.5.3.4 By End User

8.4.5.4 South Korea Clinical Research Organization Market Estimates and Forecast, 2020-2028 (USD Million)

8.4.5.4.1 By Type

8.4.5.4.2 By Service

8.4.5.4.3 By Application

8.4.5.4.4 By End User

8.4.5.5 Singapore Clinical Research Organization Market Estimates and Forecast, 2020-2028 (USD Million)

8.4.5.5.1 By Type

8.4.5.5.2 By Service

8.4.5.5.3 By Application

8.4.5.5.4 By End User

8.4.5.6 Malaysia Clinical Research Organization Market Estimates and Forecast, 2020-2028 (USD Million)

8.4.5.6.1 By Type

8.4.5.6.2 By Service

8.4.5.6.3 By Application

8.4.5.6.4 By End User

8.4.5.7 Thailand Clinical Research Organization Market Estimates and Forecast, 2020-2028 (USD Million)

8.4.5.7.1 By Type

8.4.5.7.2 By Service

8.4.5.7.3 By Application

8.4.5.7.4 By End User

8.4.5.8 Indonesia Clinical Research Organization Market Estimates and Forecast, 2020-2028 (USD Million)

8.4.5.8.1 By Type

8.4.5.8.2 By Service

8.4.5.8.3 By Application

8.4.5.8.4 By End User

8.4.5.9 Vietnam Clinical Research Organization Market Estimates and Forecast, 2020-2028 (USD Million)

8.4.5.9.1 By Type

8.4.5.9.2 By Service

8.4.5.9.3 By Application

8.4.5.9.4 By End User

8.4.5.10 Taiwan Clinical Research Organization Market Estimates and Forecast, 2020-2028 (USD Million)

8.4.5.10.1 By Type

8.4.5.10.2 By Service

8.4.5.10.3 By Application

8.4.5.10.4 By End User

8.4.5.11 Rest of Asia Pacific Clinical Research Organization Market Estimates and Forecast, 2020-2028 (USD Million)

8.4.5.11.1 By Type

8.4.5.11.2 By Service

8.4.5.11.3 By Application

8.4.5.11.4 By End User

8.5 Middle East and Africa Clinical Research Organization Market Estimates and Forecast, 2020-2028 (USD Million)

8.5.1 By Type

8.5.2 By Service

8.5.3 By Application

8.5.4 By End User

8.5.5 By Country

8.5.5.1 Saudi Arabia Clinical Research Organization Market Estimates and Forecast, 2020-2028 (USD Million)

8.5.5.1.1 By Type

8.5.5.1.2 By Service

8.5.5.1.3 By Application

8.5.5.1.4 By End User

8.5.5.2 U.A.E. Clinical Research Organization Market Estimates and Forecast, 2020-2028 (USD Million)

8.5.5.2.1 By Type

8.5.5.2.2 By Service

8.5.5.2.3 By Application

8.5.5.2.4 By End User

8.5.5.3 Israel Clinical Research Organization Market Estimates and Forecast, 2020-2028 (USD Million)

8.5.4.3.1 By Type

8.5.4.3.2 By Service

8.5.4.3.3 By Application

8.5.5.3.4 By End User

8.5.5.4 South Africa Clinical Research Organization Market Estimates and Forecast, 2020-2028 (USD Million)

8.5.5.4.1 By Type

8.5.5.4.2 By Service

8.5.5.4.3 By Application

8.5.5.4.4 By End User

8.5.5.5 Rest of Middle East and Africa Clinical Research Organization Market Estimates and Forecast, 2020-2028 (USD Million)

8.5.5.5.1 By Type

8.5.5.5.2 By Service

8.5.5.5.2 By Application

8.5.5.5.4 By End User

8.6 Central & South America Clinical Research Organization Market Estimates and Forecast, 2020-2028 (USD Million)

8.6.1 By Type

8.6.2 By Service

8.6.3 By Application

8.6.4 By End User

8.6.5 By Country

8.6.5.1 Brazil Clinical Research Organization Market Estimates and Forecast, 2020-2028 (USD Million)

8.6.5.1.1 By Type

8.6.5.1.2 By Service

8.6.5.1.3 By Application

8.6.5.1.4 By End User

8.6.5.2 Argentina Clinical Research Organization Market Estimates and Forecast, 2020-2028 (USD Million)

8.6.5.2.1 By Type

8.6.5.2.2 By Service

8.6.5.2.3 By Application

8.6.5.2.4 By End User

8.6.5.3 Chile Clinical Research Organization Market Estimates and Forecast, 2020-2028 (USD Million)

8.6.5.3.1 By Type

8.6.5.3.2 By Service

8.6.5.3.3 By Application

8.6.5.5.4 By End User

8.6.5.4 Rest of Central & South America Clinical Research Organization Market Estimates and Forecast, 2020-2028 (USD Million)

8.6.5.4.1 By Type

8.6.5.4.2 By Service

8.6.5.4.3 By Application

8.6.5.4.4 By End User

9 COMPETITIVE LANDCAPE

9.1 Company Market Share Analysis

9.2 Four Quadrant Positioning Matrix

9.2.1 Market Leaders

9.2.2 Market Visionaries

9.2.3 Market Challengers

9.2.4 Niche Market Players

9.3 Vendor Landscape

9.3.1 North America

9.3.2 Europe

9.3.3 Asia Pacific

9.3.4 Rest of the World

9.4 Company Profiles

9.4.1 ICON Plc

9.4.1.1 Business Description & Financial Analysis

9.4.1.2 SWOT Analysis

9.4.1.3 Products & Services Offered

9.4.1.4 Strategic Alliances between Business Partners

9.4.2 Charles River Laboratories (CRL)

9.4.2.1 Business Description & Financial Analysis

9.4.2.2 SWOT Analysis

9.4.2.3 Products & Services Offered

9.4.2.4 Strategic Alliances between Business Partners

9.4.3 Syneos Health

9.4.3.1 Business Description & Financial Analysis

9.4.3.2 SWOT Analysis

9.4.3.3 Products & Services Offered

9.4.3.4 Strategic Alliances between Business Partners

9.4.4 IQVIA HOLDINGS INC.

9.4.4.1 Business Description & Financial Analysis

9.4.4.2 SWOT Analysis

9.4.4.3 Products & Services Offered

9.4.4.4 Strategic Alliances between Business Partners

9.4.5 Laboratory Corporation of America Holdings

9.4.5.1 Business Description & Financial Analysis

9.4.5.2 SWOT Analysis

9.4.5.3 Products & Services Offered

9.4.5.4 Strategic Alliances between Business Partners

9.4.6 THERMO FISHER SCIENTIFIC INC.

9.4.6.1 Business Description & Financial Analysis

9.4.6.2 SWOT Analysis

9.4.6.3 Products & Services Offered

9.4.6.4 Strategic Alliances between Business Partners

9.4.7 PAREXEL INTERNATIONAL CORPORATION

9.4.7.1 Business Description & Financial Analysis

9.4.7.2 SWOT Analysis

9.4.7.3 Products & Services Offered

9.4.8.4 Strategic Alliances between Business Partners

9.4.8 Medidata Solutions, Inc.

9.4.8.1 Business Description & Financial Analysis

9.4.8.2 SWOT Analysis

9.4.8.3 Products & Services Offered

9.4.9 Pharmaron

9.4.9.1 Business Description & Financial Analysis

9.4.9.2 SWOT Analysis

9.4.9.3 Products & Services Offered

9.4.9.4 Strategic Alliances between Business Partners

9.4.10 GVK Biosciences Private Limited

9.4.10.1 Business Description & Financial Analysis

9.4.10.2 SWOT Analysis

9.4.10.3 Products & Services Offered

9.4.10.4 Strategic Alliances between Business Partners

9.4.11 Other Companies

9.4.11.1 Business Description & Financial Analysis

9.4.11.2 SWOT Analysis

9.4.11.3 Products & Services Offered

9.4.11.4 Strategic Alliances between Business Partners

10 RESEARCH METHODOLOGY

10.1 Market Introduction

10.1.1 Market Definition

10.1.2 Market Scope & Segmentation

10.2 Information Procurement

10.2.1 Secondary Research

10.2.1.1 Purchased Databases

10.2.1.2 GMEs Internal Data Repository

10.2.1.3 Secondary Resources & Third Party Perspectives

10.2.1.4 Company Information Sources

10.2.2 Primary Research

10.2.2.1 Various Service of Respondents for Primary Interviews

10.2.2.2 Number of Interviews Conducted throughout the Research Process

10.2.2.3 Primary Stakeholders

10.2.2.4 Discussion Guide for Primary Participants

10.2.3 Expert Panels

10.2.3.1 Expert Panels Across 30+ Industry

10.2.4 Paid Local Experts

10.2.4.1 Paid Local Experts Across 30+ Industry Across each Region

10.3 Market Estimation

10.3.1 Top-Down Approach

10.3.1.1 Macro-Economic Indicators Considered

10.3.1.2 Micro-Economic Indicators Considered

10.3.2 Bottom Up Approach

10.3.2.1 Company Share Analysis Approach

10.3.2.2 Estimation of Potential Product Sales

10.4 Data Triangulation

10.4.1 Data Collection