- Search Search Please fill out this field.

Personal Cash Flow Statement

Personal balance sheet, bringing them together, the bottom line.

- Personal Finance

- Budgeting & Savings

Evaluating Your Personal Financial Statement

Tips to help with budget planning and figuring your net worth

:max_bytes(150000):strip_icc():format(webp)/Office2-EbonyHoward-8b4ada1233ed44aca6ef78c46069435d.jpg)

Many individuals look at their bank and credit card statements and are surprised by how much they've spent. One simple method of accounting for income and expenditures is to keep personal financial statements just like the ones used by corporations. Financial statements provide you with an indication of your financial condition and can help with budget planning. There are two types of personal financial statements: the personal cash flow statement and the personal balance sheet .

Key Takeaways

- You can create your own personal financial statements to help with budget planning and to set goals for increasing your net worth.

- Two types of personal financial statements are the personal cash flow statement and the personal balance sheet.

- The personal cash flow statement measures your cash inflows or money you earn and your cash outflows or money you spend. This determines if you have a positive or negative net cash flow.

- A personal balance sheet summarizes your assets and liabilities to calculate your net worth.

A personal cash flow statement measures your cash inflows and outflows to show you your net cash flow for a specific period. Cash inflows generally include:

- Interest from savings accounts

- Dividends from investments

- Capital gains from the sale of financial securities like stocks and bonds

Cash inflow can also include money received from the sale of assets like houses or cars. Your cash inflow essentially consists of anything that brings in money.

Cash outflow represents all your expenses regardless of size. Cash outflows include these types of costs:

- Rent or mortgage payments

- Utility bills

- Entertainment, such as books, movie tickets, and restaurant meals

The purpose of determining your cash inflows and outflows is to find your net cash flow. Your net cash flow is simply the result of subtracting your outflow from your inflow. A positive net cash flow means that you earned more than you spent and you have some money left over from that period. A negative net cash flow shows that you spent more money than you brought in.

A balance sheet is another type of personal financial statement. A personal balance sheet provides an overall snapshot of your wealth at a specific period in time. It's a summary of your assets or what you own and your liabilities or what you owe. It results in your net worth : your assets minus liabilities.

Your Assets

Assets can be classified into three categories:

- Liquid Assets: These are things you own that can easily be sold or turned into cash without losing value. They include checking accounts, money market accounts, savings accounts, and cash. Some people include certificates of deposit (CDs) in this category but the problem with CDs is that most of them charge an early withdrawal fee, causing your investment to lose a little value.

- Large Assets: Large assets include houses, cars, boats, artwork, and furniture. Make sure to use the market value of these items when you're creating a personal balance sheet . You can use recent sales prices of similar items if it's difficult to find a market value.

- Investments: Investments include bonds, stocks, CDs, mutual funds , and real estate. You should record investments at their current market values as well.

Your Liabilities

Liabilities are what you owe. They include current bills, payments still owed on some assets like cars and houses, credit card balances , and other loans.

The "debt avalanche" and the "debt snowball" are two popular methods for paying off liabilities such as credit card debt.

Your Net Worth

Your net worth is the difference between what you own and what you owe. This figure is your measure of wealth because it represents what you own after everything you owe has been paid off. You owe more than you own if you have a negative net worth.

You can increase your net worth by increasing your assets or decreasing your liabilities. You can increase assets by increasing your cash or increasing the value of any asset you own. Just make sure that you don't increase your liabilities along with your assets.

Your assets will increase if you buy a house but your liabilities will also increase if you take out a mortgage on that house. Increasing your net worth through an asset increase will only work if the increase in assets is greater than the increase in liabilities. The same goes for trying to decrease your liabilities. A decrease in what you owe has to be greater than a reduction in assets.

Personal financial statements give you the tools to monitor your spending and increase your net worth. They're not just two separate pieces of information. They work together.

Your net cash flow from the cash flow statement can help you in your quest to increase your net worth. You can apply the money to acquiring assets or paying off liabilities if you have a positive net cash flow in a given period. Applying your net cash flow toward your net worth is a great way to increase assets without increasing liabilities or to decrease liabilities without increasing assets.

What Are Some Examples of Non-Liquid Assets?

Non-liquid assets are those that you can't sell or dispose of quickly if you need cash. Real estate, automobiles, artwork, and jewelry are all non-liquid assets. They can also lose value in the sales process. You might purchase your home for $350,000 and then have to sell it for only $300,000 if you find yourself in an emergency where you have to liquidate assets as quickly as possible to raise cash.

How Much Does the Average American Spend a Year?

The U.S. Bureau of Labor Statistics reported in September 2023 that average annual expenditures per household were $72,967 in 2022. This was up 9% from the year before. Average income before taxes increased only 7.5% during the same timeframe.

How Much Money Should I Have in Savings?

It's been said that you should save six months' worth of living expenses tucked away but the U.S. Securities and Exchange Commission puts a slightly different spin on that. It says you should have six months' worth of income saved. That works out to $30,000 if you earn $60,000 a year.

The SEC also suggests that you might want to consider paying off your high-interest credit card debt to amass some savings rather than invest your money, hoping to earn some. You might find that the amount you're saving on interest is more than a safe investment such as a money market or mutual fund would pay you in a given period.

Approach your finances like a financial advisor during your annual review . If you have a negative cash flow or you want to increase positive net cash flow, the only way to do it is to assess your spending habits and adjust them as necessary. You'll be well on your way to greater financial security if you use your personal financial statements to become more aware of your spending habits and your net worth.

Cornell Law School Legal Information Institute. " Liquid Asset ."

U.S. Bureau of Labor Statistics. " Consumer Expenditures—2022 ."

U.S. Securities and Exchange Commission. " Financial Navigating in the Current Economy: Ten Things to Consider Before You Make Investing Decisions ."

:max_bytes(150000):strip_icc():format(webp)/0-banksavings-951dc516fac84b50a6b6032cceacbcc3.jpg)

- Terms of Service

- Editorial Policy

- Privacy Policy

- Your Privacy Choices

Financial Tips, Guides & Know-Hows

Home > Finance > Personal Financial Statement: Definition, Uses, And Example

Personal Financial Statement: Definition, Uses, And Example

Published: January 7, 2024

Learn about the definition, uses, and example of a personal financial statement in the world of finance. Understand its importance and impact on your financial planning.

- Definition starting with P

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more )

Understanding Personal Financial Statements

When it comes to managing your finances, having a clear understanding of your financial position is essential. This is where personal financial statements come into play. In this article, we’ll explore the definition, uses, and provide an example of a personal financial statement.

Key Takeaways:

- Personal financial statements provide a snapshot of an individual’s financial position.

- These statements are useful for assessing one’s net worth, cash flow, and financial health.

A personal financial statement is a document that summarizes an individual’s financial situation, including their assets, liabilities, income, and expenses. It provides a comprehensive overview of one’s financial health and can be an invaluable tool for making informed financial decisions.

Let’s delve deeper into the various components of a personal financial statement:

Assets refer to items of financial value that an individual owns. This can include cash, savings accounts, investments, real estate, vehicles, and personal belongings. In the personal financial statement, these assets are listed at their current market value. By calculating the total value of assets, one can determine their net worth.

Liabilities

Liabilities encompass the debts and obligations that an individual owes. This can include credit card debt, mortgages, student loans, car loans, and any other outstanding debts. Similar to assets, liabilities are also listed in the personal financial statement, giving a clear picture of one’s overall financial obligations.

Income and Expenses

The personal financial statement also includes an individual’s income and expenses. Income refers to all sources of money inflow, such as salary, rental income, investments, or any other forms of income. Expenses, on the other hand, encompass all the money outflows, including rent/mortgage payments, utilities, groceries, transportation costs, and other personal expenses. By analyzing this section, one can assess their cash flow and determine if they are living within their means.

Uses of Personal Financial Statements:

- Assessing net worth: By calculating the total value of assets and subtracting liabilities, one can determine their net worth.

- Evaluating financial health: Personal financial statements provide a holistic view of an individual’s financial health, helping identify areas for improvement.

- Applying for loans: Lenders often require personal financial statements when assessing an individual’s creditworthiness.

- Planning for the future: These statements serve as a foundation for setting financial goals and creating a budget.

Example of a personal financial statement:

Let’s take a look at a simple example of a personal financial statement:

Personal Financial Statement of John Doe

- Cash: $10,000

- Savings Account: $20,000

- Investments: $50,000

- Real Estate: $150,000

- Total Assets: $230,000

- Mortgage: $100,000

- Student Loans: $20,000

- Credit Card Debt: $5,000

- Total Liabilities: $125,000

- Salary: $60,000

- Rental Income: $12,000

- Total Income: $72,000

- Monthly Rent/Mortgage: $1,500

- Utilities: $200

- Groceries: $400

- Transportation: $300

- Total Expenses: $2,400

In this example, John Doe’s net worth is calculated by subtracting his liabilities ($125,000) from his assets ($230,000), resulting in a net worth of $105,000. His monthly cash flow can also be determined by subtracting expenses ($2,400) from income ($6,000), resulting in a positive cash flow of $3,600.

Personal financial statements are crucial for managing your finances effectively. By regularly updating and analyzing your personal financial statement, you can gain valuable insights into your financial standing and make informed decisions to achieve your financial goals. Whether you’re applying for a loan, evaluating your financial health, or simply aiming to improve your financial well-being, personal financial statements are an essential tool in your financial toolkit.

Our Review on The Credit One Credit Card

20 Quick Tips To Saving Your Way To A Million Dollars

How Long Can My Son Stay On My Car Insurance

What Is The Purpose Of Having An Accelerated Death Benefit On A Life Insurance Policy?

Latest articles.

Navigating Crypto Frontiers: Understanding Market Capitalization as the North Star

Written By:

Financial Literacy Matters: Here’s How to Boost Yours

Unlocking Potential: How In-Person Tutoring Can Help Your Child Thrive

Understanding XRP’s Role in the Future of Money Transfers

Navigating Post-Accident Challenges with Automobile Accident Lawyers

Related post.

By: • Finance

Please accept our Privacy Policy.

We uses cookies to improve your experience and to show you personalized ads. Please review our privacy policy by clicking here .

- https://livewell.com/finance/personal-financial-statement-definition-uses-and-example/

ACDS PUBLISHING

Understanding Personal Financial Statements: A Comprehensive Guide

Table of content, what’s in this guide, personal balance sheet, how to create a personal balance sheet, calculating and interpreting your net worth, pros of creating a personal balance sheet, personal balance sheet limitations, pro tips on creating and maintaining a personal balance sheet, personal cash flow statement, how to create a personal cash flow statement, calculating and interpreting your net cash flow, pros of creating a personal cash flow statement, personal cash flow statement limitations, pro tips on creating and maintaining a personal cash flow statement, personal balance sheet case study, personal cash flow statement case study, grab your free personal financial statement template here, the bottom line.

Financial literacy isn’t just a skill; it’s a necessity in our complex modern economy. Our financial landscape is filled with many challenges—from managing debt and investments to planning for retirement. A personal financial statement is one key financial document that makes navigating these challenges easy.

Personal financial statements, which comprise a balance sheet and cash flow statement, provide a snapshot of your financial health, allowing you to evaluate your current financial condition, track changes over time, and plan for the future. Imagine seeing, at a glance, areas where you can reduce spending, if your net worth is increasing or decreasing, or if you are on track to meet your financial goals.

That’s the kind of clarity these statements provide. They don’t just contain numbers; they provide insights into your financial health, facilitating better decisions and effective long-term planning. For example, a cash flow statement can reveal if you are spending too much on non-essential items, while a balance sheet can show if your debt is becoming unmanageable.

Additionally, analyzing these statements together provides a broad view of your financial situation, helping you identify potential issues before they become significant problems. For instance, if your cash flow statement shows a consistent surplus, but your balance sheet reveals increasing debt, that might be a sign that you are not using your surplus efficiently to pay down debt.

In this guide, we’ll walk you through the two common types of personal financial statements: the personal balance sheet and the personal cash flow statement. We’ll explain each statement, their typical line items, the benefits of creating them, and their limitations.

Finally, we’ll share some pro tips on creating and maintaining each statement, and we’ll examine two case studies that illustrate how each statement can help individuals make better financial choices. At the end of the guide, you will be able to download a free template to get you started on monitoring your finances.

Let’s dive right in.

In a hurry and can’t read this guide in one go? Download the free PDF version to read whenever you have the chance!

Download Link: Understanding Personal Financial Statements: A Comprehensive Guide

A personal balance sheet provides a snapshot of your financial position at a specific period, typically a month or a year. It outlines what you own (assets), what you owe (liabilities), and the difference between the two, known as your net worth. Assets include your house, car, investments, and savings, while liabilities encompass debts such as your mortgage, car loan, and credit card balances.

For instance, say your assets include a $350,000 house, a $30,000 car, $80,000 in investments, $30,000 in savings, and $10,000 in other assets, totaling $500,000. On the other hand, your liabilities include a $150,000 mortgage, $20,000 car loan, $10,000 credit card debt, $15,000 student loan, and $5,000 in other debts totaling $200,000. In this scenario, your net worth would be $500,000 (Total Assets) – $200,000 (Total Liabilities) = $300,000.

Understanding, creating, and maintaining a personal balance sheet helps you make informed decisions about investments, loans, and other financial matters. For example, by knowing your net worth, you can determine how much debt you can afford for a new home or car, how much you can reasonably invest, or whether you need to focus on paying down existing debt.

A personal balance sheet consists of two major categories: assets and liabilities. You can further divide these categories into subcategories that outline what you own and owe. Let’s briefly examine the typical structure of a personal balance sheet.

“Assets” is the first section on a personal balance sheet, and it covers everything you own that has a monetary value. These include tangible items like your home, car, and personal belongings, as well as intangible items like investments and savings accounts. Essentially, anything you could sell or cash in for money is considered an asset.

Assets are typically categorized into two groups: liquid and non-liquid assets. Let’s briefly examine the types of assets that fall under each group.

Liqui d Assets

“Liquid Assets” is the first category under the “Assets” section. It includes all assets that can be quickly and easily converted into cash without losing much value. Such assets include the following:

- Cash and Cash Equivalents: This subcategory accounts for physical cash, checking accounts, savings accounts, certificates of deposit, and money market accounts, which are investments easily convertible to cash, making them as liquid as cash.

- Liquid Investments: This subcategory covers stocks, bonds, mutual funds, exchange-traded funds, and other liquid investment assets. You can convert these assets to cash relatively quickly without losing much value.

Non-Liq uid Assets

“Non-Liquid Assets” is the second category under the “Assets” section. This subcategory covers all assets that cannot be easily converted into cash or would lose value in the process. Such assets include the following:

- Retirement Accounts: This subcategory includes all forms of retirement funds you have. While the assets within a retirement account (like a 401(k) or an IRA) may be liquid, there are often penalties and tax consequences for withdrawing funds before a certain age. This is why it is usually classified as a non-liquid asset.

- Real Estate: This subcategory covers the market value of your home, rental properties, or any other real estate properties you own.

- Personal Property: This subcategory includes the value of tangible assets such as cars, jewelry, furniture, electronics, collectibles, and other personal belongings. Note that these items should be valued at what they could be sold for now, not what was initially paid for them, as the value of many items depreciates over time, and overvaluing your assets can result in an inflated net worth.

- Business Ownership: If you own a business, the value of your ownership stake is an asset and should be recorded under this subcategory.

- Other Assets: This subcategory accounts for any other assets not included in the preceding subcategories, such as loans you have given to others, tax refunds expected, etc.

Liabilities

“Liabilities” is the second section on your personal balance sheet, and it represents all debts and financial obligations. These can include various forms of debt, such as mortgages, car loans, credit card balances, and personal loans. Essentially, anything you need to pay back to others, whether to a bank, a credit card company, or a friend, is considered a liability.

Just as with assets, liabilities are also usually categorized into two groups: short-term and long-term liabilities. Let’s briefly examine the types of liabilities that fall under each group.

Shor t-Term Liabilities

“Short-Term Liabilities” is the first category under the “Liabilities” section. It includes all debts that are due within a year. Such liabilities include the following:

- Credit Card Balances: This subcategory highlights all you owe to credit card companies.

- Utility Bills: This subcategory covers all your utility bills, such as electricity, water, gas, and internet.

- Medical Bills: This subcategory includes any outstanding bills you owe for medical services or treatments. This can include doctor’s visits, hospital stays, and prescription medications.

- Personal Loans: This subcategory accounts for any loan you take out for personal reasons, such as to cover unexpected expenses or to consolidate debt, and are due within a year.

- Payday Loans: This subcategory covers all short-term loans typically due on your next payday.

- Overdrafts: This subcategory highlights the amount by which withdrawals from your bank account exceed the available balance.

- Taxes Due: This subcategory includes everything you owe to the government in taxes. This can include income, property, and any other taxes due within a year.

- Other Short-Term Liabilities: This subcategory accounts for every other bill or money you owe and is due within a year, such as insurance premiums, subscription services, gym memberships, and contingent liabilities, which are potential liabilities that depend on a future event.

Long-Term Liabil ities

“Long-Term Liabilities” is the second category under the “Liabilities” section. It includes all debts that are due in more than a year. Such liabilities include the following:

- Mortgage: This subcategory covers every mortgage you’ve taken on your home. It is typically the most significant liability for most people and is paid off over many years, often 15 to 30 years.

- Auto Loan: This subcategory includes any car loans you’ve taken out. These loans are typically paid off over a period of 3 to 7 years.

- Student Loans: This subcategory highlights any student loans you’ve taken out, which typically have a 10- to 30-year repayment period.

- Personal Loans: This subcategory accounts for any loan you take out for personal reasons, such as to cover unexpected expenses or to consolidate debt, and are due after a year.

- Pension Liabilities: This subcategory spotlights the amount you owe to your pension plan if you have borrowed against it.

- Long-Term Lease Obligations: This subcategory includes the amount you owe on any long-term lease, such as a car or equipment lease.

- Other Long-Term Liabilities: This subcategory covers any other long-term obligations that do not fit the preceding categories, such as a lawsuit settlement being paid off over time.

“Net Worth” is the final figure on a personal balance sheet. This figure is a clear indicator of your financial health, and you can calculate it using the following formula:

- Net Worth = Total Assets – Total Liabilities

For instance, let’s assume you own a house valued at $350,000, have a car worth $20,000, a retirement account with $50,000, and a savings account with $10,000, putting your total assets at $430,000. Let’s further assume you have a mortgage balance of $200,000 and a car loan of $15,000, putting your total liabilities at $215,000. In this scenario, your net worth would be:

- Net Worth = $430,000 (Total Assets) – $215,000 (Total Liabilities) = $215,000

This positive net worth of $215,000 implies that you own more than you owe, which is the ideal financial position to be in. Suppose your liabilities had exceeded your assets in the preceding scenario. In that case, you’d have a negative net worth, meaning you owe more than you own.

Your net worth is a crucial measure of your financial stability. A high positive net worth implies that you are in a strong financial position and have effectively managed your income, savings, investments, and debts. A negative net worth, on the other hand, signals the need to reevaluate your financial habits to reduce debts and increase assets to avoid financial insolvency.

Understanding your financial situation is crucial for making informed decisions about your future. A personal balance sheet is a valuable tool for gaining this understanding. Here are some key benefits of creating and maintaining this financial statement:

Increased Financial Awareness

Regularly creating and reviewing your balance sheet increases your awareness of your financial situation. This heightened awareness can lead to better financial decisions, such as avoiding unnecessary debt and expenses, making better investment choices, and being more disciplined with savings.

For instance, if you notice that a large portion of your income is spent on dining out and entertainment, this awareness could lead you to make more disciplined spending choices, such as cooking at home or choosing free entertainment options.

Moreover, understanding your financial situation can also lead to psychological benefits. For example, knowing that you have a manageable level of debt and a solid savings plan reduces financial anxiety and increases confidence in your ability to achieve your financial goals. Additionally, this awareness fosters a sense of control over your finances, encourages a more disciplined approach to spending and saving, and promotes a more positive and proactive outlook towards your financial future.

Snapshot of Financial Health

A balance sheet provides a quick, overall view of your financial health by showing your assets and liabilities at a glance, making it easier to identify financial strengths and weaknesses. For example, if your balance sheet reveals that your credit card debt is more than 50% of your total assets, it’s a clear sign that you need to focus on debt reduction. Ignoring this signal could lead to escalating debt, higher interest payments, and a lower credit score.

Conversely, if your balance sheet shows that your assets are three times greater than your liabilities, that implies positive financial strength. You could leverage this strength by investing in higher-yield assets or taking on manageable debt to invest in opportunities with a high return on investment.

However, it is crucial to approach this cautiously and consider the potential risks involved. Do thorough research or consult a financial advisor before making significant financial decisions.

Wealth Tracking

Creating and updating your personal balance sheet regularly helps you monitor your wealth over time. This ongoing tracking lets you see if you’re progressing toward your financial goals and pinpoint areas needing improvement.

For example, if you observe that the value of your stock portfolio has decreased significantly over the past year, this might indicate that your investment strategy needs to be reevaluated. Failing to take action could result in further losses, considerably reducing your overall wealth.

It’s important to factor in economic variables like inflation when assessing your financial growth. A nominal increase in wealth doesn’t always equate to an actual increase in financial well-being. For instance, a 3% increase in your wealth over the past year may seem positive, but if the inflation rate is 5%, your real wealth has actually decreased by 2%. It’s great to see your wealth grow year after year, but it’s essential to ask yourself: does the growth rate outpace or at least keep up with inflation?

Financial Planning

A personal balance sheet is an effective tool for planning financial goals. By knowing your net worth, you can devise better strategies for saving, investing, or debt repayment, helping you make informed decisions to achieve your financial goals. Let’s say you notice that your net worth is decreasing; it might be time to cut expenses, pay down debt, or reconsider large purchases or investments.

For example, if your net worth has decreased by 10% over the past year, you might decide to sell non-essential assets, reduce discretionary spending, or refinance your debt to lower interest rates. Doing a mix of the preceding will help you increase your net worth.

Additionally, a personal balance sheet can help you create a clear and detailed financial plan. For example, by knowing your net worth, you can set realistic savings and investment goals for the next year.

Remember, it is necessary to regularly revisit and adjust your financial plan and goals as your financial situation changes. Factors that may necessitate a change in your plan include a change in income, unexpected expenses, or changes in your financial goals. For example, if you receive a promotion and a salary increase, you may want to adjust your savings and investment goals accordingly. Similarly, if you incur unexpected medical expenses, you may need to adjust your budget and debt repayment plan .

Advanced Financial Analytics

Creating and maintaining a personal balance sheet makes it easier to calculate and track important personal financial ratios like the debt-to-asset ratio and capitalization ratio. These ratios are crucial for assessing your financial health and stability. For example, the debt-to-asset ratio helps you understand how much of your assets are financed by debt. In contrast, the capitalization ratio helps you understand your financial structure by showing the proportion of debt owed relative to equity owned.

While a personal balance sheet is an indispensable tool for understanding your financial health, planning your financial future, and making informed financial decisions, it’s also important to recognize its limitations. Knowing them helps you better interpret the information your balance sheet provides and understand what additional steps you may need to take to neutralize each limitation. Here are some key limitations of a personal balance sheet:

Doesn't Show Cash Flow

A balance sheet provides a snapshot of your financial situation at a specific point in time but doesn’t show cash flow. A cash flow statement provides a dynamic view of how money is earned and spent over a specific period. This can highlight issues not immediately apparent from the balance sheet, such as a negative cash flow despite a positive net worth. For example, someone might have a high net worth and still have cash flow problems because most of their assets are illiquid (e.g., real estate, long-term investments, etc.). Creating and maintaining a balance sheet and a cash flow statement is a great way to overcome this limitation.

Fluctuating Values

The values of assets and liabilities can fluctuate over time, making the balance sheet a snapshot accurate only at the moment it’s prepared. And this variability can significantly impact your financial planning and decision-making. For example, if you intend to sell some of your stocks, the value of those stocks when preparing the balance sheet may differ from the value at the time of the sale. This discrepancy could result in overestimating or underestimating the sale proceeds in your budget, each having distinct repercussions.

Consider a scenario where you plan to use the sale proceeds to repay debt. If the actual proceeds are lower than anticipated, you may find yourself unable to cover the debt fully, leading to additional interest charges or penalties. For this reason, it’s crucial to update your balance sheet frequently and exercise caution when making financial decisions based on it.

Subjective Asset Valuation

Some assets, like jewelry, art, or antiques, can be difficult to value accurately, making it challenging to create an accurate personal balance sheet. For instance, valuing a piece of art at $12,000 when it’s actually worth $5,000 will inflate your net worth and potentially mislead your financial planning. It’s advisable to consult a professional appraiser for items of significant value to mitigate this limitation.

Dependency on Accurate Data

The effectiveness of a balance sheet depends on the accuracy of the data inputted. Even minor errors in asset or liability values can lead to incorrect conclusions about your financial health. For example, an underestimation of debt by $1000 may seem inconsequential, but when interest is taken into account, the actual value of that debt could be significantly higher over time. This could lead to understating the time and money required to repay that debt.

Creating a personal balance sheet is crucial for anyone interested in managing their finances responsibly. However, the real benefit of a personal balance sheet lies not just in its creation but in regularly updating and using it wisely. Here are some pro tips to help you make the most of your personal balance sheet:

Start with Accurate Information

Gather all your financial documents, such as bank statements, mortgage statements, and credit card bills, before creating your balance sheet. Doing so will help ensure you don’t miss any assets or liabilities.

Categorize Your Assets and Liabilities

Break down your assets and liabilities into categories such as liquid assets (cash, savings), non-liquid assets (real estate, investments), short-term liabilities (credit card debt, other debts due within a year), and long-term liabilities (mortgage, student loans).

Consider Future Liabilities

Include expected future liabilities, such as a child’s college education, a planned home renovation, or future taxes, in your personal balance sheet. Doing so will help make your financial planning more accurate and effective.

For example, let’s say you’re planning for your child’s college education. You can estimate this future liability by researching the current tuition fees of the college your child might attend and its historical growth rate.

Suppose the current tuition fee is $30,000 per year, and historically, the tuition fee has increased by 5% annually. You can estimate that in 10 years, the tuition fee would be approximately $48,890 per year ($30,000 × (1 + 0.05)^10). This estimation will help you plan and save accordingly.

Use Conservative Values

Be conservative when estimating the value of your assets. This means using the lower end of an estimated value range and being cautious when including assets whose value is highly uncertain. Overestimating the value of your assets provides a false sense of financial security and leaves you unprepared for unexpected financial downturns.

Be Thorough

Being conservative matters a lot in creating an accurate personal statement, but so does being thorough. Ensure you include all your assets and liabilities, even if they seem insignificant. Small amounts can add up over time and may affect your financial health more than you realize. Assets and liabilities commonly overlooked include:

- Digital assets like cryptocurrency;

- Intellectual property (e.g., copyrighted material, patents);

- Collectibles (e.g., rare coins, stamps); and

- Prepaid expenses (e.g., prepaid insurance, prepaid rent).

Liabilities:

- Outstanding medical bills;

- Unpaid taxes;

- Personal loans from friends or family; and

- Any accrued interest on existing loans.

Update Regularly

Update your balance sheet at least every quarter or when there is a significant change in your assets or liabilities, such as receiving an inheritance, buying a house, and paying off or incurring a debt. Recording changes in your assets and liabilities is the best way to spot trends you would have otherwise missed. Moreover, doing so helps make your balance sheet more accurate.

Review Past Balance Sheets

While you should update your personal balance sheet at least four times a year, it’s a good idea to monitor it regularly. Set a schedule for reviewing your personal balance sheet, such as monthly or quarterly. Regularly reviewing past balance sheets can help you identify trends, understand how your financial situation has changed, and make more informed decisions about the future.

Use Alongside A Cash Flow Statement

To better understand your financial health, use your personal balance sheet together with a personal cash flow statement. While the balance sheet provides a snapshot of your financial health at a specific point in time, the cash flow statement shows how you earned your money or spent it over a specific period. Using both financial statements will help you identify trends, gain more insights, and make more informed financial decisions.

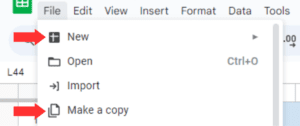

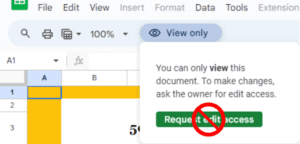

Take Advantage of Tools and Templates

There are various tools and templates available online, such as Microsoft Excel templates, personal finance apps, or online budgeting tools that offer personal balance sheet templates. You can start with a basic template from Microsoft Excel and customize it to include categories specific to your financial situation, like adding a section for digital assets or future liabilities.

Reflect and Act

After creating your balance sheet, reflect on your financial situation. Are you meeting your financial goals? Do you need to adjust your spending or saving habits? Use your balance sheet as a tool for making informed financial decisions.

Seek Professional Help

If you are dealing with a complex financial situation, such as managing investments across multiple platforms, dealing with significant debt, or planning for retirement, it might be beneficial to seek advice from a certified financial planner or wealth manager. A financial planner can help you create a comprehensive financial plan, while a wealth manager can help you manage your investments and optimize for tax efficiency.

A personal cash flow statement tracks how much cash you’re earning and where it’s being spent over a specific period, typically a month or a year. This statement provides valuable insights into how you are managing your cash resources, enabling you to understand your spending patterns and make better financial decisions.

A personal cash flow statement records cash inflows and outflows during a specific period. Think of it as a story of your personal finances from a cash perspective, showing you where your money came from (inflows), where it went (outflows), and the net difference between the two. If your inflows exceed your outflows, then you’ll have a positive cash flow. Conversely, if your outflows exceed your inflows, then you’ll have a negative cash flow.

For example, let’s say your monthly cash inflows (salary, freelance work, etc.) are $5,000, and cash outflows (rent, utilities, groceries, etc.) amount to $3,200. In this scenario, your personal cash flow statement for that month would show a surplus of $1800, money you can put towards savings, investment, or other financial goals.

A personal cash flow statement typically consists of two main sections: cash inflows and cash outflows, which can be further divided into various categories and subcategories.

When creating a personal cash flow statement, it is essential to break down your cash inflows and outflows into different line items that track your income sources and expenditures. This detailed breakdown provides a clearer view of your financial situation, helping you identify potential areas for savings or producing additional income.

Let’s briefly examine the typical structure of a personal cash flow statement.

Cash Inflows

“Cash inflows” is the first section on a personal cash flow statement; it covers all the money that comes into your possession during a specific period, usually monthly or yearly. These inflows can include your salary, bonuses, dividends from investments, rental income, money received from selling assets, gifts, or any other sources of income. Essentially, any money you receive or earn is a cash inflow.

Cash Inflows are typically grouped into three categories: earned income, passive income, and other income. Let’s briefly examine the types of cash inflows that fall under each category.

Earned Income

“Earned Income” is the first category under the “Cash Inflows” category. It covers any money you earn by providing a service, working a job, or running a business.

Common types of income under this category include the following:

- Salary/Wages: This line item covers your primary income source, typically earned through employment or self-employment. This is generally the largest portion of your income.

- Bonus/Commissions: This line item includes any additional income from your primary employment beyond your salary or wages.

- Business Income: If you have a side business or gig, such as freelance work or a small online business, include the gross income (i.e., income after business-related expenses are deducted) under this subcategory. For example, if you have a freelance business and earn $10,000 monthly but have $2,000 in business-related expenses (such as advertising, supplies, etc.), you would record $8,000 ($10,000 – $2,000) under this subcategory.

Passiv e Income

“Passive Income” is the second category under the “Cash Inflows” section, and it highlights any cash you earn without active, ongoing effort after the initial groundwork or setup. This category typically contains the following subcategories:

- Investment Income: This subcategory accounts for stock dividends, bond interest payments, rental property income, or any other income you earn from your investments. For example, if you own 100 shares in a company that pays $1 in dividends per share quarterly, you would receive $100 every quarter. This $100 would be recorded under this subcategory.

- Non-Investment Passive Income: This subcategory covers any income from passive ventures or endeavors where capital investment isn’t the primary driver, such as royalties from intellectual property and ad revenue from websites, blogs, or YouTube channels.

Oth er Income

“Other Income” is the third category under the “Cash Inflows” section, and it includes any other money you receive that doesn’t fall under the categories of earned or passive income. Typical subcategories under this category include the following:

- Asset Sales: If you’ve sold any assets like cars, furniture, investments, etc., the cash generated from these sales would be recorded under this subcategory. For example, if you sold a car for $10,000, this amount would be recorded under the “Sale of Assets” subcategory. Similarly, if you sold shares of stock for a total of $5,000, this amount would also be recorded here.

- Miscellaneous Income: This subcategory tracks all miscellaneous income sources like alimony, child support, social security income, lottery winnings, gifts, and inheritance. For example, if you received $500 as a reimbursement from your employer for work-related expenses, $200 as a refund from a returned purchase, and $50 as cashback from your credit card, you would record these amounts under this subcategory.

Cash Outflows

“Cash outflows” is the second section on a personal cash flow statement, and it represents all the money you spend during a specified period, typically monthly or yearly. These outflows include expenses such as rent or mortgage payments, utility bills, groceries, transportation costs, loan repayments, and entertainment.

Essentially, any money you spend is a cash outflow, and unlike cash inflows, which increase your available funds, cash outflows reduce them. Let’s briefly examine the types of cash outflows that fall under this section.

Ess ential Expenses

“Essential Expenses” is the first category under the “Cash Outflows” section. It tracks all necessary costs you incur to maintain your basic standard of living. In other words, this category covers every cash you spend on needs rather than wants. Another way to think about essential expenses is that they are cash you need to spend to survive and function in society. Common types of expenses under this category include the following:

- Housing: This subcategory covers your mortgage or rent payments, maintenance, property tax, and renters’ insurance, among other housing-related costs. If you own a home, you will have property tax expenses; if you rent, you may have renters’ insurance. Accounting for these variations makes your cash outflows more accurate.

- Utilities: This subcategory accounts for basic services vital to everyday living, such as electricity, gas, water, sewer, trash, internet service, and phone bills.

- Food: This subcategory typically includes groceries and other essential food-related expenses, like school lunches for children or meals for elderly family members.

- Transportation: This subcategory highlights car payments, gas, insurance, maintenance, public transit, ride-share costs, vehicle registration, tolls, parking, and all other transportation-related expenses.

- Healthcare: This subcategory covers health insurance premiums, out-of-pocket medical costs, prescriptions, alternative therapies, health supplements, and all other healthcare-related expenses.

- Education: This subcategory includes tuition, textbooks, online courses, professional development, workshops, seminars, conferences, school supplies for kids, tutoring, educational software, and other education-related expenses.

- Essential Personal Care: This subcategory includes clothing, personal grooming, dental care, cosmetics, skincare, and other personal care-related expenses.

- Child Care/Support: This subcategory covers child care costs, school fees, child support payments, and other related expenses.

- Insurance: This subcategory spotlights life insurance, disability insurance, and other insurance-related expenses.

- Taxes Paid: This subcategory covers any additional tax payments you may make, such as estimated tax payments, that are not automatically deducted from your income.

- Miscellaneous Essential Expenses: This subcategory covers essential expenses that don’t fit into the preceding subcategories. These include prescription glasses or contacts, special dietary needs, home safety equipment, professional licensing or certification fees, alimony payments, bank fees, etc.

Non-Essential Expenses

“Non-Essential Expenses” is the second category under the “Cash Outflows” section. All expenses that aren’t necessary for your survival or basic comfort but contribute to your lifestyle and happiness fall under this category. These expenses are typically optional and can be reduced or eliminated if necessary. Common types of non-essential expenses under this category include the following:

- Dining and Entertainment: This subcategory covers cash spent on meals, snacks, and beverages from restaurants, cafes, takeout, and delivery services.

- Luxuries: This subcategory includes any cash spent on things like jewelry, high-end electronics, designer clothing, etc.

- Non-Essential Personal Care: This subcategory accounts for expenses that are not necessary for maintaining basic health and hygiene. These expenses include spa and massage treatments, luxury cosmetics and skincare, tanning, etc.

- Leisure and Entertainment: This subcategory includes a wide range of expenses like gym memberships, subscriptions (like Netflix, Spotify, club memberships, etc.), hobbies, vacations, cultural events, theater, concerts, etc.

- Miscellaneous Non-Essential Expenses: This subcategory accounts for all the expenses that are not crucial for your survival, basic comfort, or regular lifestyle but don’t fit into any existing non-essential expenses subcategories. These include gifts, donations, decor, special occasions, pet-related expenses, books, magazines, etc.

Non-Recurring Expenses

“Non-Recurring Expenses” is the third category under the “Cash Outflows” section. It accounts for essential or non-essential expenses that don’t occur regularly or predictably and don’t fit under preceding categories and subcategories. For example, acquisition of assets, legal fees, or any unexpected expenses like family emergencies. Common types of non-recurring expenses under this category include the following:

- Assets Acquisition: If you’ve bought assets like property, vehicles, or other large purchases, the cash used for these acquisitions would be recorded under this subcategory.

- Property Loss: Expenses related to replacing lost or stolen property not covered by insurance, such as replacing stolen electronics, furniture, or other valuable items, can be recorded here.

- Family Emergencies: Expenses related to unexpected family emergencies, such as travel costs for a family member’s funeral or medical emergency, can be recorded here.

Debt Payments

“Debt Payments” is the fourth category under the “Cash Outflows” section. Any money used to repay the principal and interest on your debts is recorded under this category.

“Savings” is the fifth category under the “Cash Outflows” section. It tracks whatever income is set aside for future use, such as an emergency fund, retirement, or specific financial goals. Common line items under this category include goal-specific savings, emergency funds, retirement accounts, etc.

Investments

“Investments” is the sixth category under the “Cash Outflows” section. It covers any money used to purchase assets with the expectation that they will generate a return in the future. Line items commonly recorded under this category include stocks, bonds, mutual funds, real estate, start-up investments, etc.

Calculating your net cash flow is the final step in creating your personal cash flow statement. Net cash flow is the figure you get after subtracting your total cash outflows from your total cash inflows. It’s a vital indicator of your financial liquidity. You can calculate this figure using the following formula:

- Net Cash Flow = Total Cash Inflows – Total Cash Outflows

To illustrate how to calculate net cash flow, let’s consider the following example. Assume your total cash inflows, which include your salary of $4,000, investment income of $500, and other income sources of $500, come to $5,000 per month. And your total cash outflows, encompassing costs such as housing ($1,500), food ($500), transportation ($400), personal expenses ($400), and debt repayments ($900), sum up to $3,700 per month. In this case, your net cash flow would be:

- Net Cash Flow = $5,000 (Inflows) – $3,700 (Outflows) = $1,300

Your net cash flow is $1,300 in this scenario, indicating a positive cash flow. This means you earn more than you spend, leaving you with excess cash that can be used for savings, investments, or reducing debt.

Interpreting your net cash flow involves understanding what the number means for your financial health. A positive net cash flow indicates a healthy financial situation where you live within your means and have leftover income to allocate towards savings, investments, or debt repayments. This is generally an ideal financial position to be in.

Conversely, if your net cash flow is negative, you spend more than you earn. A negative net cash flow could be due to one-time large expenses or indicate a pattern of overspending. If it’s the former, this may not pose a long-term issue, but if it’s the latter, you may need to reassess your budget and spending habits. Creating a detailed budget, tracking your expenses, and identifying areas where you can cut back or increase your income can help turn a negative net cash flow into a positive one.

To summarize, your net cash flow reveals whether you’re living within your means or overspending. It can serve as a wake-up call to adjust your spending habits or as a green light that you’re on track with your financial plans.

Creating a personal cash flow statement is more than just a financial exercise; it can help you develop a roadmap to your financial freedom. Whether you’re struggling with budgeting, debt, or planning for the future, a personal cash flow statement can provide invaluable insights. Here are some of the key benefits you unlock when you create a personal cash flow statement:

Regularly updating and reviewing your personal cash flow statement not only helps you keep tabs on your financial situation but also increases your awareness of your spending habits. For example, regularly reviewing your personal cash flow statement might help you notice that you’re consistently spending $100 monthly on takeout. Noting this pattern is the first step toward deciding whether this is an area where you can and should cut back.

Interestingly, as you regularly review your personal cash statement, you will become more conscious of your spending decisions in real time, not just when you review your statement.

Enhanced Budgeting

A personal cash flow statement can help you create a more detailed and practical budget by identifying exactly where your money is going. And with a comprehensive cash flow statement, you can easily spot areas where you may need to cut back on your expenses or allocate more funds.

For instance, let’s say you notice that your grocery bill has increased significantly over the last six months. You can delve deeper to understand why and adjust your budget or behavior accordingly. You may decide to allocate more funds to your grocery budget for the following months or find ways to reduce grocery expenses. This real-time feedback loop is invaluable for effective budget management.

Set Achievable Financial Goals

By highlighting your disposable income or the money left over after all cash outflows have been accounted for, a personal cash flow statement can help you set realistic financial goals, both short-term and long-term. This way, you’re not just aiming mindlessly but setting achievable targets.

For instance, if your cash flow statement reveals that you have $300 left each month after essential expenses, setting a goal to save $500 a month would be unrealistic and could leave you frustrated. On the other hand, a realistic goal based on your actual disposable income, such as saving 20% ($60) monthly, can improve your financial self-esteem and encourage you to maintain or improve your financial habits.

Evidently, setting achievable goals not only improves your financial self-esteem but also leads to a sense of accomplishment that motivates you to set and achieve more financial goals.

Effective Debt Management

Effective debt management is critical to eliminating liabilities within the shortest possible time to avoid unnecessary interest payments. A well-structured cash flow statement can reveal non-essential expenses you could cut back on or eliminate to free up funds to fast-track your debt repayment.

Consider this scenario: After creating a monthly cash flow statement, you notice spending $200 on gourmet coffee and $150 on streaming services. Making coffee at home and canceling a few subscriptions could free up $350 monthly or $4,200 annually!

When redirected to your credit card debt, this surplus can significantly reduce your outstanding balance and the interest you’d otherwise accrue, fast-tracking your path to being debt-free. Similar savings can be spotted in areas like dining out, unused gym memberships, or impulse online purchases.

Remember, staying disciplined with your repayment strategy is vital to managing and eliminating debt. Timely repayments free you from debt faster and improve your credit score, opening doors for better financial opportunities in the future.

Deeper Financial Analysis

The insights a personal cash flow statement provides are not limited to tracking income and expenses. By using your cash flow data, you can easily calculate key personal financial ratios. An example of these ratios is the debt-to-income ratio, calculated by dividing total monthly debt payments by total income.

Personal financial ratios are more than just numbers. Despite popular misconceptions, they are performance indicators that can help anyone gauge their financial health and make informed decisions. For example, lenders consider a debt-to-income ratio higher than 0.36 as a red flag. Your ratio exceeding this threshold may result in higher interest rates on loans or make it challenging to secure credit. In such a situation, it’s prudent, therefore, to reduce existing debt before attempting to take on additional debt.

By creating and regularly updating your cash flow statement, you can actively monitor these ratios, spot trends, and make adjustments to reach financial goals more effectively.

While a personal cash flow statement is invaluable for understanding your finances, it has limitations, which, when recognized, can lead to a more accurate interpretation of your data. Here are a few limitations to remember when analyzing a personal cash flow statement.

Doesn't Reflect Future Commitments

A cash flow statement primarily captures present transactions and doesn’t account for upcoming financial obligations like loan repayments or planned investments. For instance, if you’ve recently agreed to a car lease or plan to enroll in a long-term course next year, these commitments won’t appear in your current statement, potentially underestimating future expenses. You can neutralize this limitation by creating a forward-looking budget alongside your cash flow statement.

Doesn't Reflect Total Wealth

A cash flow statement won’t reflect the value of assets such as your home, car, investments, or savings, thus not fully representing your wealth. A balance sheet, on the other hand, provides a snapshot of your assets, liabilities, and net worth, offering a comprehensive view of your overall wealth. As such, it’s important to use your cash flow statement together with a balance sheet to get a complete picture of your current financial health.

Potential for Missed Expenditures

It’s easy to overlook some expenses, especially smaller or infrequent ones, which can make your cash flow statement inaccurate. One way to mitigate this limitation is by meticulously tracking all cash outflows, no matter how small. You can do this by using an expense tracking app, keeping all receipts, or reviewing bank statements.

Provide a Snapshot of a Specific Period

A personal cash flow statement only provides a snapshot of your cash inflows and outflows for a specific period, typically a month or a year. It does not reflect changes in your financial situation over time. For instance, if you faced a significant medical expense in January and then maintained a strict budget for the next few months, a cash flow statement for April might not reflect the financial strain you experienced at the start of the year. To track your financial progress, you need to regularly update and review your cash flow statement and compare it with previous periods.

Understanding your cash flow is essential for managing your finances effectively. A personal cash flow statement enables you to identify patterns, plan for the future, and make informed financial decisions. However, to get the most out of your personal cash flow statement, you need to be diligent in its creation and usage. Here are some pro tips for creating and using a personal cash flow statement effectively:

Record Everything

Record all inflows and outflows, no matter how small, to make your cash flow as accurate as possible. Even minor discrepancies can lead to an inaccurate picture of your financial health. For example, small expenses like daily coffee or occasional parking fees are often overlooked. However, a $5 daily coffee adds up to $150 monthly and $1,825 yearly. Assuming your yearly expenses amount to $36,000, you underreport your expenses by ~5% every year.

Use Accurate Time Frames

Make sure the time frame for your cash flow statement matches the time frame for your budget and financial goals. A monthly cash flow statement is appropriate for most people because many expenses and income sources occur on a monthly basis. However, if you have significant irregular expenses or variable income, you may need to review and update your cash flow statement more frequently, such as weekly or bi-weekly.

Be Specific

When noting your expenses, avoid grouping them into overly broad categories to understand your spending patterns better. For example, instead of vaguely listing $150 for “utilities,” you could break it down: $50 for “electricity,” $40 for “water,” $30 for “internet,” and $30 for “gas.” Such granularity can reveal surprising spending habits, like unusually high water cost that prompts leak checks or water conservation efforts.

However, it’s also crucial not to overwhelm your cash flow statement with excessive detail. Excessive details can clutter your statement, making it harder to identify overall trends or patterns quickly. For example, instead of listing “Netflix,” “Hulu,” and “Disney+” separately, group them under “Streaming Services”. The goal is to find a categorization balance that ensures your cash flow statement remains streamlined yet insightful, setting the stage for well-informed financial decisions.

Distinguish Between Essential and Non-Essential Expenses

Distinguishing between essential and non-essential expenses helps you identify areas to cut costs. Essential expenses are the basic costs incurred to maintain a safe and healthy living standard; they cover the fundamental needs required to live and work in modern society. Such expenses include groceries, housing, healthcare, utilities, and transportation. On the other hand, non-essential expenses are costs that enhance your life but aren’t vital for your basic survival. Dining out, vacations, luxury shopping, streaming services, etc., are non-essential expenses.

Note that essential expenses can differ based on individual circumstances and lifestyles. For example, if you work from home, high-speed internet becomes a necessity, whereas someone without remote work might view it as a luxury. It’s essential to recognize that what’s necessary for one person might be a luxury for another. Tailor your cash flow statement to reflect your unique needs and priorities.

Plan for Emergencies

Always ensure that you maintain a financial buffer for emergencies and unexpected expenses. Aim to set aside at least 3-6 months’ worth of living expenses in an easily accessible account. This duration is often optimal as it provides adequate coverage for scenarios like unexpected job losses, sudden medical bills, or major home repairs.

Keep your emergency fund in a high-yield savings account, where your money remains readily accessible and earns interest. You might also consider diversifying your emergency fund by putting a portion in money market accounts or short-term certificates of deposit for potentially higher returns.

Review and Adjust Regularly

Your cash flow statement is a dynamic document that should be reviewed and updated regularly. Regular updates help you stay on top of your finances and make necessary adjustments promptly. Update your cash flow statement as regularly as possible. Monthly updates are standard, but you may want to update more infrequently if your inflows and outflows rarely change.

Identify Areas for Cost Reduction

Make it a habit to regularly review your cash flow statement to pinpoint areas where you can trim expenses. If, for instance, you notice a significant portion of your money goes into dining out, consider cooking at home more often to reduce costs. Similarly, evaluate monthly subscriptions to see if there are any you no longer utilize, or consider cheaper alternatives to recurring expenses, ensuring every dollar is spent wisely.

Identify Opportunities to Increase Income

Review your cash flow statement regularly to identify opportunities for increasing your income. This could include asking for a raise, starting a side hustle, or investing in income-generating assets. For instance, if you have a skill like graphic design, you could begin freelancing and taking on small projects in your free time. Alternatively, investing in income-generating assets like dividend stocks or real estate can also increase your income.

Set Realistic Goals

Setting achievable goals for savings, investments, and debt repayment is crucial. For example, if your monthly income is $3,000, setting a goal to save $1,500 monthly may be unrealistic after accounting for all other expenses. Always consider all your essential expenses before setting aside a savings goal.

Use Technology

Using a financial tracking app or software can help you keep track of expenses and minimize omissions. Many apps like Mint, YNAB, Spendee, and PocketGuard offer features that can help you track your expenses, set budgets, and monitor your investments. Look for an app that allows you to categorize your expenses, set alerts for overspending, and provide a visual representation of your financial health.

Pair With Balance Sheet

Your personal cash flow statement is one part of your financial profile. Pairing it with a balance sheet provides more accurate insights into your financial status, allowing you to identify areas of vulnerability, such as looming debts, and opportunities, like potential investments.

By tracking your monthly net cash flow statement from the cash flow statement and your net worth from the balance sheet, you can strategically plan for future investments, debt repayments, and savings. For instance, if your cash flow statement shows a consistent surplus each month, but your balance sheet reveals high-interest debt, it might be wise to allocate some surplus towards that debt reduction.

Feel free to seek assistance from a financial advisor or planner if creating and managing your cash flow statement seems overwhelming. While a financial advisor can be helpful for anyone, it is especially beneficial for those with more complex financial situations, such as multiple income streams, significant debts, or an extensive investment portfolio. For example, if you have $20,000 in credit card debt, a financial planner can help you develop a plan to pay it off within a realistic timeframe.

Meet Sarah, a 24-year-old recent graduate who has just started her first job as a graphic designer in a reputable advertising agency. Now, with a steady income and eager to start on the right financial footing, she has decided to create a personal balance sheet to gain insight into her financial health.

Sarah has some student loans, a personal loan she took for a family emergency, has been using a credit card for daily expenses, and is living in a rented apartment. Although she had saved some money from part-time jobs during college, she’s unsure how her assets measure up against her debts. She aims to clear her debts, invest more, and contribute more to her retirement fund.

After reading this comprehensive guide on personal financial statements, Sarah decided to create a personal balance sheet to understand her financial status clearly and develop a financial plan.

Creating the Personal Balance Sheet

Sarah sets aside a weekend to organize her financial documents, online accounts, and other financial information to compile a comprehensive list of her assets and liabilities. She then begins by listing all her assets and liabilities meticulously.

LIQUID ASSETS

- Checking Account: $3,200

- Savings Account: $5,500

- Total Liquid Assets: $9,000

NON-LIQUID ASSETS

- Retirement Account (401k): $1,000 (from her new job)

- Investment Portfolio (a diversified set of index funds): $2,700

- Car: $10,000 (current market value)

- Total Non-Liquid Assets: $13,700

- Total Assets: $22,700

LIABILITIES

SHORT-TERM LIABILITIES

- Credit Card Debt (20.93% annual percentage rate): $2,500

- Utility Bills (monthly): $200

- Personal Loan from a Friend (to be repaid within a year): $1,000

- Total Short-Term Liabilities: $3,700

LONG-TERM LIABILITIES

- Student Loans (10-year loan term; 6% fixed interest rate): $25,000

- Car Loan (7-year loan term; 9% annual percentage rate): $8,000

- Total Long-Term Liabilities = $33,000

- Total Liabilities = $36,700

- Net Worth = -$14,000

Interpretation and Action

Upon analyzing her Personal Balance Sheet, Sarah finds herself with a negative net worth, largely because of her student and car loans. She decides to take the following actions:

- Credit Card Payoff: Prioritize paying off her credit card debt first, as it has the highest interest rate (20.93%), and then pay off the car loan next, since it has the second-highest interest rate (9%). To achieve this, she decided to allocate 60% more of her monthly disposable income towards paying off the credit card debt.

- Student Loan: Since her student loan has a low single-digit interest rate, Sarah figures there’s no pressing need to rush clearing her student loan. Maintaining her current monthly payment is more financially prudent, especially since student loan interest payments are tax deductible. However, she also knows paying off the loan earlier can save her some interest payments. For that reason, she plans to increase her student loan payments if she gets a chance to do so.

- Emergency Savings: Sarah understands the importance of having an emergency fund. Hence, she decides to save 20% of her disposable income each month until she accumulates a year’s worth of living expenses.

- Retirement Planning: Continue contributing to her 401k to take advantage of her employer’s match and the power of compound interest.

- Investing: Sarah decides to postpone increasing her investment allocation until she has paid off her credit card debt. She understands that it will be challenging to generate real investment returns, seeing as the interest rate on credit card debt exceeds her portfolio’s annualized return.

- Cash Flow Statement: Create a detailed personal cash flow statement to monitor her income and expenses. Doing so will help her identify expenses she can cut back on and allocate more funds toward her debt repayment and savings goals.

Benefits Sarah Gained from Creating a Personal Balance Sheet

- Increased Financial Awareness: By creating her personal balance sheet, Sarah became more aware of her financial situation, which helped her to make informed financial decisions. She decided to prioritize paying off her credit card debt, postpone increasing her investment allocation until her high-interest debts were paid off, and start building an emergency fund. This heightened awareness also reduced her anxiety about her finances and increased her confidence in achieving her financial goals.

- Snapshot of Financial Health: The balance sheet provided Sarah with an overall view of her financial status, revealing that her liabilities significantly exceeded her assets. Her negative net worth was a clear signal that she needed to focus on debt reduction and savings. Identifying this financial weakness allowed her to create a targeted plan to improve her financial health.

- Financial Progress Tracking: By regularly updating her personal balance sheet, Sarah can monitor her wealth over time and see if she is progressing toward her financial goals. For example, as she pays off her debts, she will see a reduction in her liabilities and an increase in her net worth.

- Financial Planning: Creating the personal balance sheet enabled Sarah to begin creating a financial plan. She was able to set realistic goals for saving and debt repayment, giving her a structured path forward.

- Advanced Financial Analytics: Creating a personal balance sheet made it easier for Sarah to calculate and track important personal financial ratios. For example, she could calculate her debt-to-asset ratio and use this information to make informed decisions about debt repayment and borrowing.

Limitations Sarah Overcame

- Doesn’t Show Cash Flow: While the personal balance sheet provided a snapshot of her financial situation, it did not show her cash flow. Recognizing this limitation, Sarah decided to create a detailed personal cash flow statement to monitor her income and expenses. Doing so would help her identify areas where she could cut back and allocate more funds toward her debt repayment and savings goals.

- Fluctuating Values: Sarah understood that the values of assets and liabilities could fluctuate over time. To mitigate this limitation, she decided to update her balance sheet every quarter to ensure that it always reflected her current financial situation.

- Dependency on Accurate Data: Any oversights or inaccuracies could paint an incomplete picture of Sarah’s financial status, potentially leading her to make ill-informed decisions. To overcome this limitation, she meticulously included every asset and liability, no matter how small, and validated the values by checking her bank statements, credit card statements, investment account statements, and other financial records. Additionally, she used financial management apps to automatically pull and consolidate data, further enhancing the accuracy of her balance sheet.

- Subjective Asset Valuation: Knowing that misvaluing her assets can make her balance sheet inaccurate, Sarah used the current market value for her car and checked the most recent statements for her savings and investment accounts.

Pro Tips Sarah Followed

- Regular Updates: Sarah set a reminder to update her Personal Balance Sheet every quarter to track her financial growth and to recalibrate her plans as needed.

- Be Thorough: Sarah included all her assets and liabilities, no matter how small, to ensure her balance sheet was comprehensive.

- Accurate Valuation: As mentioned earlier, Sarah made sure to use the current market value for her car and checked the most recent statements for her savings and investment accounts.

Creating a personal balance sheet was a transformative experience for Sarah. The exercise gave her the information and motivation she needed to take control of her financial future. It provided her with a clear and comprehensive view of her financial situation, enabling her to create a targeted plan to improve her financial health.

Before creating her balance sheet, Sarah often felt overwhelmed by the abstract notion of “net worth” and “financial health.” But after this exercise, these abstract worries solidified into tangible numbers and action points.

Though she started with a negative net worth, Sarah now has a roadmap for eliminating debts and increasing her assets. With a clear roadmap in place, she is now confident in her ability to manage her finances effectively and work towards a secure financial future. This is all thanks to the simple yet enlightening exercise of creating and maintaining her personal balance sheet.

Having already evaluated her net worth via her Personal Balance Sheet, Sarah recognized the importance of tracking her monthly income and expenses. She knows that understanding her cash flows will help her stay on course with her financial goals.

As a recent graduate thrust into the real world with her first job, Sarah was determined not to succumb to the all-too-familiar pitfalls of unchecked spending and minimal savings. Earning a consistent paycheck ($4,500) and living by herself means she has inflows and outflows to monitor closely. And with goals like repaying debts, building an emergency fund, and future investments in mind, it became clear to Sarah that she needed a comprehensive tool to keep tabs on her money.

Creating the Personal Cash Flow Statement

Taking another weekend, Sarah organizes her bank statements, pay stubs, bills, expense-tracking app printouts, and receipts she has accumulated over the past month to compile an accurate cash flow statement. She then begins listing down all sources of cash inflow and outflow.

CASH INFLOWS

- Base Salary from Advertising Agency: $3,420 (after a 24% tax deduction)

FREELANCE INCOME

- Graphic Design Projects: $996

INVESTMENT RETURNS

- Dividends from Index Funds: $35

NON-INVESTMENT PASSIVE INCOME

- Affiliate Marketing from Personal Design Blog: $236

- Ad Revenue from Personal Design Blog: $112

- Sale of Old Laptop: $300

- Total Cash Inflows: $5,099

CASH OUTFLOWS

ESSENTIAL EXPENSES

- Rent: $1,200

- Groceries: $300

- Utilities: $200 (including electricity, water, and internet)

- Gas (for transportation): $120

- Health Insurance (deducted from her salary): $120

- Car Insurance: $90

- Personal Care (haircuts, toiletries): $60

- Public Transportation: $50

- Total Essential Expenses: $2,140

NON-ESSENTIAL EXPENSES

- Dining Out: $250

- Miscellaneous Purchases: $100

- Gym Membership: $50

- Streaming Services (Netflix, Spotify): $25

- Total Non-Essential Expenses: $475

DEBT PAYMENTS

- Student Loan Repayment: $300

- Car Loan Payment: $200

- Credit Card Minimum Payment: $100

- Personal Loan from a Friend: $100

- Total Debt Payments: $700

- Savings Account Contribution: $500

- 401k Contribution: $225 (5% of her gross salary)

- Total Savings: $775

- Investment into Index Funds: $200

- Total Investments: $200

- Total Cash Outflows: $4,140

- Net Cash Flow: $959