15 Sample Letters of Loan Request from Employer

In today’s dynamic business environment, employees may find themselves in situations where they need to seek financial assistance from their employers.

Whether it’s for an unforeseen medical expense, educational purposes, or a housing loan, the ability to craft a concise and respectful loan request letter is invaluable. This article aims to provide a comprehensive guide on how to structure a loan request to an employer, presenting 15 distinct sample letters that cater to a variety of circumstances.

Sample Letters of Loan Request from Employer

These samples are designed to serve as a blueprint, demonstrating the tone, structure, and key elements that should be included in an effective loan request letter. Each example addresses different scenarios, ensuring that readers have a broad spectrum of templates from which to draw inspiration.

The goal is to equip employees with the necessary tools to communicate their financial needs professionally and succinctly, fostering a constructive dialogue between them and their employers.

Sample Letter 1: Medical Emergency Loan Request

Request for Loan Due to Medical Emergency

Dear [Employer’s Name],

I am writing to request a short-term loan from [Company Name] due to an unexpected medical emergency within my family. Despite having health insurance, the out-of-pocket expenses for [describe medical treatment or surgery] have proven to be a significant financial burden.

I respectfully request a loan of [amount], which I plan to repay through payroll deductions over [specify repayment period]. I have attached the necessary medical documents and a detailed repayment plan for your consideration.

Your understanding and support in this matter would be greatly appreciated.

Sincerely, [Your Name] [Your Job Title]

Sample Letter 2: Educational Loan Request

Request for Educational Support Loan

I am reaching out to request financial assistance in the form of a loan to support my continuing education. As you are aware, I have been pursuing [degree or certification] to further my skills and contribute more effectively to our team.

The total cost of the program is [amount], and I am seeking a loan of [amount] from [Company Name], with a commitment to repay the sum within [time frame]. I believe this investment in my education will not only benefit my personal development but also add value to our team and company.

Thank you for considering my request. I am happy to discuss this further and provide any additional information needed.

Sample Letter 3: Housing Loan Request

Request for Housing Loan

I am writing to formally request a loan for a down payment on a home. After years of saving, I am close to achieving the dream of homeownership but find myself slightly short of the necessary funds.

I respectfully request a loan of [amount], which I propose to repay through monthly deductions from my salary over [time frame]. I believe securing a home will provide me with the stability needed to continue focusing and excelling in my role within [Company Name].

Your support with this personal milestone would be deeply appreciated.

Sample Letter 4: Emergency Financial Assistance Loan Request

Request for Emergency Financial Assistance

I am in a difficult financial situation due to [describe emergency, e.g., a family crisis or unexpected major expense], and I am writing to request a loan from [Company Name] as a means of temporary assistance.

I am seeking a loan of [amount] to address this urgent matter. I am committed to repaying this amount in full over [time frame], through payroll deductions or as per any repayment schedule you deem fit.

I appreciate your consideration of my request during this challenging time.

Sample Letter 5: Vehicle Purchase Loan Request

Request for Loan for Vehicle Purchase

As I currently rely on public transportation to commute to work, which is becoming increasingly unreliable, I am planning to purchase a vehicle to ensure I can maintain my punctuality and dependability at work.

I respectfully request a loan of [amount] from [Company Name] to assist with this purchase. I propose a repayment period of [time frame], with deductions directly from my salary.

Thank you for considering my request to support this necessary investment in my daily commute.

Sample Letter 6: Loan Request for Family Support

Request for Loan to Support Family Needs

I find myself in a challenging position, needing to support my family due to [describe situation, e.g., spouse’s job loss, family illness]. To manage this temporary financial strain, I am requesting a loan from [Company Name].

I am seeking a loan of [amount] with a repayment plan spread over [time frame]. This support would significantly alleviate the current financial pressures my family is facing.

I appreciate your consideration of my situation and am available to discuss this request further.

Sample Letter 7: Personal Development Course Loan Request

Request for Loan for Personal Development Course

I am committed to personal and professional growth and have been accepted into a [describe course or program] that aligns with my role and future career aspirations within [Company Name].

To cover the cost of this program, I am requesting a loan of [amount], which I plan to repay over [time frame] through payroll deductions.

Your support in my pursuit of further development would be greatly appreciated.

Sample Letter 8: Loan Request for Legal Expenses

Request for Loan to Cover Legal Expenses

Due to unexpected legal matters, I am incurring significant expenses that are beyond my current financial capabilities. Thus, I am seeking a loan from [Company Name] to help manage these costs.

I respectfully request a loan of [amount], with a repayment plan to be deducted from my monthly salary over [time frame]. This support would help me navigate through this challenging period with one less burden.

Thank you for considering my request. I am available to discuss this in more detail if required.

Sample Letter 9: Debt Consolidation Loan Request

Request for Loan for Debt Consolidation

To better manage my finances and reduce interest costs, I am seeking a loan for debt consolidation. By consolidating my debts, I aim to have a single, manageable repayment that can be deducted from my salary over a period of [time frame].

I respectfully request a loan of [amount] from [Company Name] for this purpose. I am committed to financial responsibility and believe this step will aid in achieving a more stable financial future.

Your understanding and assistance would be greatly appreciated.

Sample Letter 10: Loan Request for Wedding Expenses

Request for Loan for Wedding Expenses

As an important and joyous occasion in my life approaches, I find myself in need of financial assistance to cover some of the expenses associated with my upcoming wedding.

I am respectfully requesting a loan of [amount] from [Company Name], which I plan to repay through deductions from my salary over [time frame]. This support would mean a great deal to me during this special time.

Thank you for considering my request. I am happy to provide further details or discuss a repayment plan that aligns with company policies.

Sample Letter 11: Loan Request for Home Renovation

Request for Loan for Home Renovation

I am planning to undertake necessary renovations to my home, which will improve living conditions and increase the property’s value. To finance this project, I am requesting a loan from [Company Name].

I seek a loan of [amount] and propose a repayment period of [time frame], with the amount to be deducted from my monthly salary.

Your assistance with this personal investment would be highly appreciated.

Sample Letter 12: Loan Request for Childcare Expenses

Request for Loan for Childcare Expenses

With the recent changes in my family situation, I am faced with unexpected childcare expenses that are crucial for my ability to continue working and providing for my family.

I am requesting a loan of [amount] from [Company Name], to be repaid over [time frame] through payroll deductions. This support would greatly assist me in ensuring reliable care for my children.

Thank you for considering my request. I am available to discuss any details or concerns you may have.

Sample Letter 13: Loan Request for Relocation Expenses

Request for Loan for Relocation Expenses

In light of my recent promotion/transfer, I am in the process of relocating closer to our [new location/office]. This move is essential for me to fulfill my new role effectively. However, the relocation expenses are substantial.

I am requesting a loan of [amount] from [Company Name] to cover these costs, with a plan to repay the amount over [time frame] through my salary.

Your support in this significant career step would be invaluable.

Sample Letter 14: Loan Request for Elderly Care Expenses

Request for Loan for Elderly Care Expenses

As my parents age, their need for specialized care has increased, leading to unexpected financial burdens. To ensure they receive the necessary care, I am seeking a loan from [Company Name].

I respectfully request a loan of [amount], with a repayment plan over [time frame] through salary deductions. This would greatly assist me in providing for my parents’ needs.

Thank you for considering my request and for your support during this time.

Sample Letter 15: Loan Request for Professional Attire

Request for Loan for Professional Attire

To maintain a professional appearance aligned with [Company Name]’s standards, I find myself in need of a wardrobe update. Professional attire represents a significant expense, and thus, I am requesting a loan to cover these costs.

I am seeking a loan of [amount] to be repaid over [time frame] through my salary. This investment in my professional presentation will not only benefit me but also reflect positively on our company.

Your consideration of my request would be greatly appreciated.

Each of these letters is crafted to address specific scenarios, demonstrating the importance of tailoring your request to your personal circumstances while maintaining a professional tone. Remember, the key to a successful loan request is clarity, respect, and a well-thought-out repayment plan that aligns with both your needs and the company’s policies.

Related Posts

Home > Finance > Loans

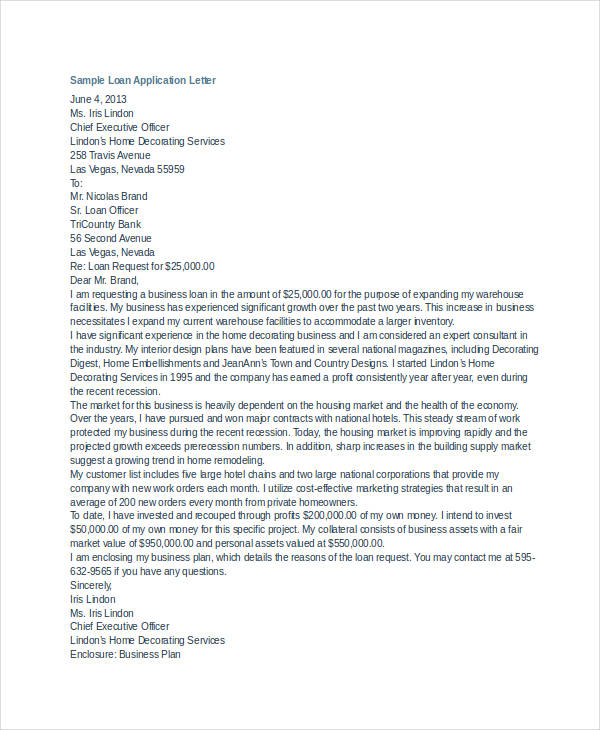

How to Properly Write a Business Loan Request

We are committed to sharing unbiased reviews. Some of the links on our site are from our partners who compensate us. Read our editorial guidelines and advertising disclosure .

Have to submit a business loan request letter as part of your loan application? Not sure how to get started?

We don’t blame you. These kinds of letters aren’t as common as they used to be. While online lenders don’t usually ask for small-business loan requests, some traditional banks and credit unions still do. And if you apply for an SBA business loan (a loan backed by the US Small Business Administration), you’ll need a small-business loan request as part of your loan application package.

No matter which lender you’re applying with, this guide will help you write a strong business loan request letter―and to get the business loan you need.

How to write a business loan request letter

- Start with the easy stuff

- Write a brief summary

- Add information about your business

- Explain your financing needs

- Discuss your repayment plan

- Close the letter

1. Start with the easy stuff

Writing a loan request can feel overwhelming. After all, it’s not an everyday part of being a small-business owner. What do you say when applying for a bank loan? How do you write a business proposal for your loan application? What’s your lender even looking for in a business loan request letter?

That’s why we suggest starting your request writing process with the easy bits: formatting.

You’ll want to begin your business loan request with some pretty standardized formatting that includes your contact information, the date, your lender’s contact information, a subject line, and a greeting.

Typically, you’ll want to format the beginning of your small-business loan request roughly like this:

First and last name

Business’s name

Business’s phone number

Business’s address (this one is optional)

Lender name (or loan agent’s name and title, if you have one)

Contact information for your lender or loan agent

Subject line

Obviously you can simply plug in the relevant information for most of this. Easy peasy, right?

You’ll really only have to come up with your own subject line and greeting. But don’t overthink it. Something like this will work just fine for your subject line:

- Re: [Your business’s name] business loan request for [loan amount]

Likewise, keep your greeting simple. “Dear [lender]” or “Dear [loan agent]” will do quite nicely.

Got all that? Then you’re ready to get into the actual loan request.

By signing up I agree to the Terms of Use.

2. Write a brief summary

Before you dive into the meat of your loan request, you should give a brief summary of your letter. Just write a short paragraph that says why you’re writing and what you want.

So you’ll probably want to include the following details:

- Business name

- Business industry

- Desired loan amount

- What you’ll use the loan for

No need to get fancy with this. You’re trying to condense the most important information into one or two sentences.

For example, your summary might look something like this:

- I’m writing to request a [loan amount] loan for my small business in the [industry name] industry, [business name]. With this loan, [business name] would [describe your intended business loan use].

As you can see, you don’t need much detail here. You’re just giving the reader a quick overview of what’s to come.

And now that you’ve given them that preview, it’s time to get more in depth.

Remember, your lender isn’t here to grade your writing. Try to use good spelling, grammar, and punctuation―but don’t stress about crafting beautiful sentences.

3. Add information about your business

Your next section should add more detail about your business. You’ll want to include information like this:

- Business’s legal name (if different than name used)

- Business’s legal structure (LLC, partnership, S corp, sole proprietorship, etc.)

- Business’s purpose

- Business’s age (or date it began operating)

- Annual revenue

- Annual profit (if applicable)

- Number of employees

Now, keep in mind that you’re not trying to give your reader an encyclopedic history of your business. Instead, you’re trying to show that you have a well-established business―one that’s solid enough to deserve a business loan. So focus on relevant details that show your business’s maturity.

You can keep this section as short as a few sentences or as long as a few (brief) paragraphs. Just make sure you leave plenty of room for the next two sections.

4. Explain your financing needs

After discussing your business, it’s time to explain why you need a bank loan.

That means you’ll want to offer some details about how you plan to use your business financing. For example, you can talk about the employees you plan to hire, the building you want to expand, or whatever else you intend to do with your term loan .

Take note, though, that you also need to explain why your loan request makes sense. Because your lender doesn’t really care that you want a loan―it cares whether or not it makes sense to lend to you. You need to convince your lender that you have a good plan for your loan―one that will make it easy to repay the money you borrow.

Try to answer questions like these as you write this section:

- Why should your lender want to approve your loan application?

- What happens to your business if you get your small-business loan?

- What kind of growth will your business loan allow for?

Dig into your business plan and projections to find some good stats. Explain how hiring those additional employees will increase your revenue by a certain percentage or dollar amount. Break down how opening that add-on to your restaurant will allow you to seat a number of additional customers, and how much revenue you expect that to bring in.

The more specific you can get, the better. Because again, you’re trying to convince your lender that you’re borrowing as part of a thoughtful business plan ―not just because you want some cash.

And take your time with this part. In most cases, this section and the next one will form the meat of your business loan request letter.

As a rule, you should keep your business loan request letter to one page.

5. Discuss your repayment plan

By this point, your lender should understand what your business does and why a loan would help it grow. Now you need to prove to your lender that you can repay your small-business loan.

This doesn’t mean you have to show precise calculations breaking down your desired interest rate and monthly payment. (After all, your bank probably hasn’t even committed to a specific interest rate yet.)

Instead, talk about things like your business’s past finances, other existing debts, and any projections can you offer.

So if you have a profitable business, point that out, and discuss how that will free up cash flow to repay your loan. Offer summaries of profit-and-loss statements that show your business has been growing. Tell your lender how you’ll pay off that existing loan within a few months, so they don’t need to worry about it interfering with repayment of your new term loan.

Put simply, this is your chance to convince your lender of your creditworthiness. Especially if you have a slightly low credit score or some other concern, you want to use this section to show that you will absolutely repay your loan.

6. Close the letter

Finally, you can add a few finishing touches.

Usually you should close with a short paragraph or two that refers the reader to any attached documents (like financial statements) and asks them to review your loan application.

You may also want to include a sentence expressing willingness to answer any questions―or just saying you’re looking forward to hearing back.

Then end things with your signature, list any enclosed documents, and you’re done!

Well, sort of.

At this point, we strongly recommend you print off your business loan request letter and read it―out loud, if possible. This will help you catch any errors. Because no, your lender isn’t a writing teacher, but you still want to make a good impression.

Plus, if you make typos on something like your business name or desired loan amount, that inaccuracy could lead to confusion from your lender―slowing down your loan approval process.

Once you’ve proofread your loan request letter, you’re ready to submit it to your lender. With any luck, your thoughtful letter will help convince your lender to give you that loan you want.

Loan proposal letter template

So how do all those steps look when you put them together? Something like this:

First and last name

Business’s name

Business’s phone number

Business’s address (this one is optional)

Date

Lender name (or loan agent’s name and title, if you have one)

Contact information for your lender or loan agent

Subject line

Greeting

This first paragraph should summarize the rest of your letter. Keep it to just a couple sentences.

The next one to three paragraphs add more detail about your business. Include facts about its age, revenue, profit, employees, and other relevant information.

Then explain why you need financing and how you’ll use it to grow your business. This section can be a little longer (but remember your whole letter should fit on one page).

Next, talk about how your business will repay your loan. You may want to mention how financial documents show your business’s financial health, for example.

Finally, close with a short paragraph or two that list any enclosed documents and invite the lender to consider your loan application.

Printed name

List of enclosed financial documents

That’s not so hard, is it? With this basic business loan request letter template, you can easily write your own personalized business loan proposal.

The takeaway

So there you have it―that’s how to properly write a business loan request.

Get your formatting right, include a short summary, talk about your business, explain your loan needs, prove you can repay your loan, and close things off. (And don’t forget to proofread.)

We believe in you. You can write this thing.

And good luck getting your loan application approved!

Don’t just tell your lender you can repay your business loan―make sure you can with our business loan calculator .

Related reading

Best Small Business Loans

- How to Get a Small Business Loan in 7 Simple Steps

- 6 Most Important Business Loan Requirements

- How Long Does It Take To Get a Business Loan?

- Commercial Loan Calculator

At Business.org, our research is meant to offer general product and service recommendations. We don't guarantee that our suggestions will work best for each individual or business, so consider your unique needs when choosing products and services.

5202 W Douglas Corrigan Way Salt Lake City, UT 84116

Accounting & Payroll

Point of Sale

Payment Processing

Inventory Management

Human Resources

Other Services

Best Inventory Management Software

Best Small Business Accounting Software

Best Payroll Software

Best Mobile Credit Card Readers

Best POS Systems

Best Tax Software

Stay updated on the latest products and services anytime anywhere.

By signing up, you agree to our Terms of Use and Privacy Policy .

Disclaimer: The information featured in this article is based on our best estimates of pricing, package details, contract stipulations, and service available at the time of writing. All information is subject to change. Pricing will vary based on various factors, including, but not limited to, the customer’s location, package chosen, added features and equipment, the purchaser’s credit score, etc. For the most accurate information, please ask your customer service representative. Clarify all fees and contract details before signing a contract or finalizing your purchase.

Our mission is to help consumers make informed purchase decisions. While we strive to keep our reviews as unbiased as possible, we do receive affiliate compensation through some of our links. This can affect which services appear on our site and where we rank them. Our affiliate compensation allows us to maintain an ad-free website and provide a free service to our readers. For more information, please see our Privacy Policy Page . |

© Business.org 2024 All Rights Reserved.

Word & Excel Templates

Printable Word and Excel Templates

Loan Application Letter

Applying for the loan requires you to provide a lot of documentation. Some organizations ask you to fill out the loan application form, while in some cases, you have to write a loan application letter to the institute to apply for the loan.

The loan application letter allows you to add all the details that you are required to provide. The letter is written to the loan manager of the company, and he then decides whether he should accept the application or not. The letter should include the personal information of the applicant, and since it is a formal letter, it should be written to the point by avoiding unnecessary details. The lender should follow a standard format while writing the loan application letter. The loan manager should be told about the intended use of the money.

The first paragraph of the letter should state the reason for lending the money. It should be assured in the letter that you will not use this money for any illegal purpose. The date on which the applicant will return the borrowed money should be mentioned in the letter.

You should also include information about you in the letter that can make the reader feel that you are a trustworthy person. Here is a sample letter that can help you learn about the structure and format of the letter.

Loan application letter:

Dear [Recipient’s Name],

It is stated that I am writing this letter to request a loan from the finance office of your company because of some of my very peculiar and essential needs. My mother is seriously ill, and I must get her treated at the hospital, for which I need money. Please accept my loan application and sanction me $2000. I assure you that I will return you the loan from the deductions of my gross salary.

I will be highly grateful for this favor of yours.

I am looking forward to your reply.

[Your Name]

Preview and Details of Template

File: Word ( .doc ) 2003 + and iPad Size: 31 KB

More options

I am writing this letter to get a loan from your bank branch situated in New Jersey. Currently, I am working as a sales executive for ABC Organization and need a $10,000 loan. I am in utmost need of this amount as I have to meet the surgery expenses of my father. I have gone through all the requirements related to the loan process and have enclosed the necessary documents along with this email. Please let me know what other documents I need to send you, and you can call me at any time for further queries. I hope you will give a positive response to my request.

This application is a request to ask for a loan from your organization. I am Christiana Roseland, and I am currently running a bakery in New Jersey. I am planning to open a new branch according to the rising demand of people. For this purpose, I need $70,000/- and I will return the amount in installments. I have thoroughly read the rules and policies for the loan process and hopefully, I will return the entire amount within the given time period and the financial pronouncement has been affixed with this application. Waiting to get positive feedback from you.

This letter is a request for a loan application to construct a house. I am the managing director at ABC Company, and my monthly salary is not adequate to meet the construction expenses. I will return the due amount according to the company’s rules and policies and will not let you be disappointed. I contacted the admin office to find out the details, and Mr. Jackson has provided me with all the information. If you need additional information, you can ask me at any time. Thank you for taking my request into account.

Dear Madam, I, Darcy Louis, work in the security office of your company. I live in Valley Stream and travel two hours daily to come to the office. I do not have a personal vehicle, and sometimes it creates a lot of difficulties, and I often arrive late to the workplace. I want to apply for a loan because I have to buy a motorcycle. I need $10,000 in this regard. I have chosen a six-month installment plan, and 20% of my salary will be deducted each month. I request that you accept my loan application. I will be grateful to you. Thanking in anticipation.

Dear Sir, I am Dorothy John, and I live in Toronto. I am running a branch of ABC School. The strength of students is increasing with each session, and it is becoming difficult to adjust to the large number of students in a limited space. Therefore, I need to open a new branch adjacent to the current school and construct a new building, but I do not have enough money. I learned about your loan policy and want to apply for it. I have attached the needed documents along with the application. I am hoping to hear a quick response from you.

I am Julia Hughes, and I am writing this message to ask for a loan from your bank. I have an account in your Brooklyn branch, and my account number is [#]. I have a small business marketing in Brooklyn, and I intend to open a new branch in the Netherlands. Hence, it can be a source of ease for hundreds of people. The savings I have and the loan I am asking for will be of great help in expanding my business. Kindly send me an email detailing all the formalities for the loan process. I would like to ask you to send me a confirmation message so I may visit your branch on an immediate basis.

- Letter Requesting Transfer to another Department

- Letter Requesting Promotion Consideration

- Umrah Leave Request Letter to Boss

- Ramadan Office Schedule Announcement Letters/Emails

- Letter to Friend Expressing Support

- Letter to Employer Requesting Mental Health Accommodation

- Letter Requesting Reference Check Information

- Letter Requesting Salary Certificate

- Letter Requesting Recommendation from Previous Employer

- One Hour Off Permission Letter to HR

- Payroll Apology Letter to Employee

- Advice Letter to Subordinate on Effective Communication

- Advice Letter to Subordinate on Time Management

- Letter to Patient for Feedback/Responding Survey/Online Form

- Holiday Cocktail Party Invitation Messages

Verification of employment letter template and guide

Speed up your home loan application by making sure your lender has everything they need..

In this guide

Download this template as a:

Why does my lender need a verification of employment letter, what needs to be included in the letter, will all lenders require a letter to verify my employment, can i provide my lender with a faxed copy or does it need to be the original, how recent does the employment letter need to be, bottom line.

Mortgage guides

We compare the following lenders and brokers

Term length

Mortgage cost by amount

Mortgage calculators

Loan categories

A verification of employment letter is a document provided by your employer that confirms your current employment status and income. Some lenders will need to verify your employment when you apply for a mortgage, line of credit, lease or loan.

- Word document (.docx)

- Google document

- Employer information. Most lenders require your employment letter to be issued on an official company letterhead that contains the company’s name, address, logo and contact details.

- Employment status. The letter should contain information about your employment status, including how many hours you work, your position title and how long you’ve been employed.

- Financial information. The letter should state whether you’re an hourly or salaried employee, how much you make and if you get bonuses.

- Date and signature. Make sure the letter is dated and signed.

Find the best mortgage lender for you Get started

What does a verification of employment letter look like?

New York, NY 10005

To whom it may concern,

I am writing this letter to verify that Laura A. Baxley is currently employed with XYZ Pty Ltd as a Digital Marketing Manager. She has been employed with us since March 2016.

Laura currently works on a full-time basis, averaging 40 hours per week. She earns a salary of $65,000 per year, paid biweekly, plus potential yearly bonuses.

Should you have any questions, please do not hesitate to contact me at (123)456-7890

Kind regards,

(SIGNATURE)

Justin Hamilton

Human Resources Manager

XYZ Pty Ltd

No, but most lenders will require some sort of verification. Aside from a letter, your lender may call or email your employer or give you a form for them to fill out and sign.

What if it’s a phone call?

If your lender lets you know that they’ll be calling your employer to verify your employment, let your boss know to expect the call. It’s also a good idea to ask your employer if they need any information from you and thank them for helping you.

This will vary depending on the lender’s individual policies and eligibility requirements, but most lenders will accept a faxed copy of the employment letter.

Most lenders require the employment letter to be no older than 60 days from the date of receipt, but it can vary from lender to lender. If you have a letter that’s more than a couple of weeks old, ask your lender if you’ll need a copy that’s been signed and dated more recently.

Looking to buy a home? Get started

Most lenders will want to verify your employment. This can involve getting a letter from your employer, having them fill out a form or having your lender call or email them. Whichever option they choose, the process is generally pretty simple.

If you’re just getting started researching the mortgage process, compare home loan lenders to find one that fits your needs.

Belinda Punshon

Belinda Punshon worked for Finder as a writer on home loans and property and as a corporate communications executive. She has a Masters in Advertising, Public Relations and Journalism from the University of New South Wales and a Bachelors in Business from the University of Technology Sydney. See full profile

More guides on Finder

Comparing investment returns vs. mortgage savings.

- ¿Cuánto pagaría por una hipoteca de 400.000 dólares?

- ¿Cuánto pagaría por una hipoteca de 300.000 dólares?

Cornerstone Home Lending offers a standard list of mortgage loans with some portfolio options, but you have to contact a loan officer for rates and fees.

Learn what to look for in a mortgage, what to avoid and what to research if you’re thinking about moving into a retirement community.

Shopping for a new home? Here are seven of the best mortgage lenders in America.

How to successfully transfer your property to someone else.

It’s not just a fairy tale — you can really buy your own castle.

Working out how interest is calculated on a home loan can help you figure out how much you can borrow and how to pay it off sooner.

A change in personal circumstances may make it necessary to remove a name from a property deed. Here’s how to go about it.

Ask a Question

Click here to cancel reply.

How likely would you be to recommend finder to a friend or colleague?

Our goal is to create the best possible product, and your thoughts, ideas and suggestions play a major role in helping us identify opportunities to improve.

Advertiser Disclosure

finder.com is an independent comparison platform and information service that aims to provide you with the tools you need to make better decisions. While we are independent, the offers that appear on this site are from companies from which finder.com receives compensation. We may receive compensation from our partners for placement of their products or services. We may also receive compensation if you click on certain links posted on our site. While compensation arrangements may affect the order, position or placement of product information, it doesn't influence our assessment of those products. Please don't interpret the order in which products appear on our Site as any endorsement or recommendation from us. finder.com compares a wide range of products, providers and services but we don't provide information on all available products, providers or services. Please appreciate that there may be other options available to you than the products, providers or services covered by our service.

We update our data regularly, but information can change between updates. Confirm details with the provider you're interested in before making a decision.

Learn how we maintain accuracy on our site.

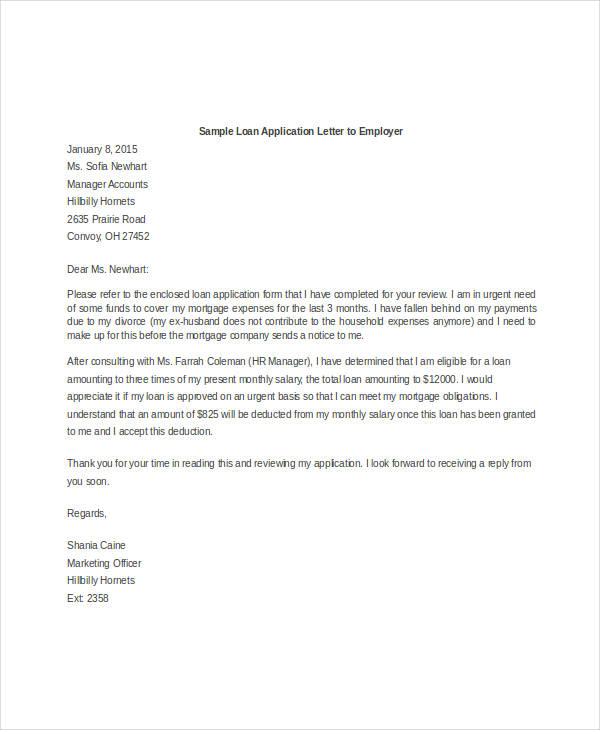

Sample Personal Loan Request Letter to Boss ( in Word Format)

Sometimes employees need personal loans for various purposes like the marriage of self (or) marriage of brother/sister (or) for house reconstruction/renovation or for education etc. Most companies will allow their employees to apply for personal loans, and the due amount will be deducted every month from the salary of the employee.

But to apply for the loan employees need to write an application to the company with a proper reason.

Sample Personal Loan request Letter to Boss (Format 1)

To The Manager, Company Name, Address.

Sub: Application for a personal loan.

Dear Sir/Madam,

With due respect, I am [employee name] , [employee id] working as an [designation] in [department] at [company name] , writing this letter to apply for a personal loan of an amount …………………. Rs due to my marriage/ the marriage of my sister (or) brother/ for construction of my house/ for the education of my children .

I will repay the loan in …. Installments, in each installment you can deduct …………….. Rs from my salary.

I hope you sanction me the loan amount, I shall be grateful to you in this regard.

Thanking you.

Sincerely, Your name. Signature.

Loan Application Letter to Company for Daughter’s Marriage

Sub: Loan application for daughter’s marriage.

I, [your name] have been working in your company as a [designation] for … years, with employee ID XXXX .

I would like to inform you that my daughter’s marriage was fixed and the wedding ceremony will be held on [date] .

But due to my financial conditions, I need some financial assistance from the company.

Therefore I request you to kindly grant me a loan amount of ………………. Rs and the amount can be deducted each month from my salary in …. Installments.

I hope you approve my loan request.

Sincerely, Your name.

Loan Application Letter to Company for Education

From Employee name, Employee ID, Designation, Department.

Sub: Loan application.

I have been working in your company as a [your designation] for the last …. Years. As my son is going for higher studies we need some financial support.

I hereby request you to kindly sanction me a loan amount of ………….. Rs and the amount can be deducted each month from my salary in ….. Installments.

We will be really thankful to you in this regard.

Sincerely, Your name, Signature.

Sample Email to Request Personal Loan from Company

Sub: Request for a personal loan due to [reason].

My name is [your name], working as a [your designation] in [department] at [company name] .

I am writing this email to request a personal loan for an amount of ……………….. Rs, because of my marriage/ the marriage of my sister (or) brother/ for construction of my house/ for the education of my children .

I will pay back the loan amount in ….. Installments, in each installment you can deduct ……………… Rs from my monthly salary.

Therefore please approve my loan request.

Regards, Your name. Signature.

Will companies charge interest on personal loans?

It depends on your company loan policy, most companies don’t charge any interest on loans given to their employees.

Is taking a personal loan from the company good?

Yes, it is a good idea. Instead of taking personal loans using credit cards or from banks, it is better to take loans from your office with Zero interest (or) less interest.

Recommended:

- Salary slip request mail to the boss.

- Form 16 in excel format for Ay 2022-23

8 thoughts on “Sample Personal Loan Request Letter to Boss ( in Word Format)”

wow this is well understood and simple love this

10,000 lone

Wow! Very simple and straight to the point. Thanks

Well detailed, Thankyou

Very apt and straight to the point!

its very helpful . love it

Wow! It’s very easy and interesting I love it

Very simple and straight to the point. I love it.

Leave a Comment Cancel reply

Sample Loan Application Letter to Company for Medical Treatment

In this article, I want to share my insights on crafting a compelling loan application letter for medical treatment, drawing from my rich experience. This step-by-step guide, enriched with personal tips and a template, is designed to help you articulate your needs effectively.

Key Takeaways

- Understand the Purpose : Learn why a well-crafted loan application letter can make a difference in securing financial support for medical treatment.

- Personalize Your Story : Discover how sharing your unique medical journey can create a compelling case for your loan request.

- Step-by-Step Guide : Follow a detailed guide to structure your letter effectively, enhancing your chances of approval.

- Use a Template : Get started with a customizable template to streamline your writing process.

- Incorporate Tips : Benefit from personal tips that can strengthen your application based on real-life experiences.

- Engage with Us : Share your experiences or ask for advice in the comments to foster a supportive community.

Step 1: Start with Personal Information

Begin your letter by introducing yourself. Provide your full name, address, contact information, and any relevant account number associated with the company you’re writing to.

- Full Name : Jane Doe

- Address : 123 Main St, Anytown, USA

- Contact Information : (123) 456-7890

- Account Number : 00123456789

Step 2: Address the Letter Appropriately

Research to find out who is in charge of loan approvals within the company. Address the letter directly to this person, if possible. If not, a general salutation can suffice.

- Direct Address : Mr. John Smith, Loan Approval Officer

- General Salutation : To Whom It May Concern

Step 3: State the Purpose of Your Letter

Clearly and succinctly explain that you are requesting a loan for medical treatment. Mention the nature of your medical condition without delving into overly personal details.

Example: “I am writing to request a financial loan for an upcoming surgical procedure that is crucial for my ongoing health.”

Step 4: Detail Your Medical Situation and Financial Need

Trending now: find out why.

This is where you personalize your letter. Describe your medical condition, the treatment required, and why this loan is critical for your health. Include the estimated cost and how it impacts your financial situation.

Step 5: Explain Your Repayment Plan

Demonstrate your commitment to repaying the loan by outlining your repayment plan. This shows the company that you are serious and have thought through your financial responsibility.

Step 6: Attach Supporting Documents

Mention any attached documents, such as medical reports, cost estimates, or proof of income, that can support your application.

Step 7: Conclude with Courtesy and Contact Information

End your letter by thanking the recipient for their consideration. Provide your contact information again, inviting them to reach out if they require further details.

Personal Tips from My Experience

- Empathy Matters : Infuse your writing with a tone of empathy. Remember, you’re not just presenting facts but also telling your story.

- Be Concise : While it’s important to be thorough, ensure your letter is concise and to the point. Avoid unnecessary details.

- Follow Up : Don’t hesitate to follow up after a week or two if you haven’t received a response. Persistence can pay off.

Template for a Loan Application Letter for Medical Treatment

[Your Full Name] [Your Address] [City, State, Zip Code] [Email Address] [Phone Number] [Date]

[Recipient’s Name or “To Whom It May Concern”] [Company’s Name] [Company’s Address] [City, State, Zip Code]

Dear [Recipient’s Name or “To Whom It May Concern”],

I am writing to request a loan for medical treatment that I urgently need. My name is [Your Full Name], and I am undergoing [brief description of medical treatment]. The cost of this treatment is [amount], which is beyond my current financial capabilities without assistance.

[Describe your medical situation and the necessity of the treatment in one or two paragraphs.]

I am committed to repaying this loan and have outlined a repayment plan [describe your repayment plan briefly]. I have attached [list any attached documents] to support my application.

Thank you very much for considering my request. Please feel free to contact me at [your phone number] or [your email address] if you need any more information or have questions.

[Your Signature, if sending a hard copy] [Your Printed Name]

Engage with Us

Have you ever written a loan application letter for medical treatment? Share your experiences or tips in the comments below. Or, if you’re about to write one and have questions, feel free to ask. Let’s support each other in these challenging times.

Frequently Asked Questions (FAQs)

1. What is a loan request letter to an employer?

Answer: A loan request letter to an employer is a document that an employee writes to their employer asking for a loan. It typically includes details about the purpose of the loan, the amount requested, and the employee’s ability to repay the loan.

2. What information should be included in a loan request letter to an employer?

Answer: A loan request letter to an employer should include the employee’s name, job title, and contact information, the purpose of the loan, the amount requested, the expected repayment period, and the employee’s ability to repay the loan.

3. How do I format a loan request letter to an employer?

Answer: A loan request letter to an employer should be formatted like a formal business letter. It should include a heading with the employee’s name and address, a heading with the employer’s name and address, a salutation, a body that explains the purpose of the loan, the amount requested, and the employee’s ability to repay the loan, and a closing and the employee’s signature.

4. What are some reasons why an employer may deny a loan request?

Answer: An employer may deny a loan request if the employee has a poor credit history, if the employee has not been employed with the company for a sufficient amount of time, if the employee has a history of not repaying loans, or if the employer does not offer a loan as a benefit to its employees.

5. What should an employee do if their loan request is denied by their employer?

Answer: If an employee’s loan request is denied by their employer, they should ask for feedback on why the request was denied and try to address any concerns the employer may have. If the employee is still in need of the loan, they may consider other options, such as applying for a loan from a bank or credit union.

Related Articles

Sample request letter for air conditioner replacement: free & effective, goodbye email to coworkers after resignation: the simple way, sample absence excuse letter for work: free & effective, salary negotiation counter offer letter sample: free & effective, formal complaint letter sample against a person: free & effective, medical reimbursement letter to employer sample: free & effective, leave a comment cancel reply.

Your email address will not be published. Required fields are marked *

Start typing and press enter to search

- Skip to primary navigation

- Skip to main content

- Skip to primary sidebar

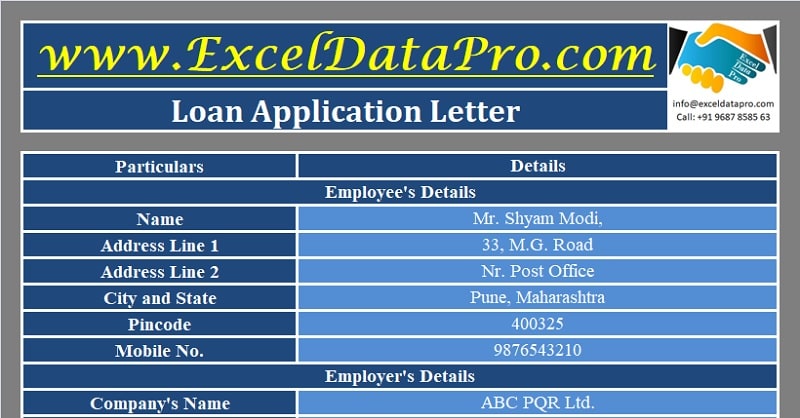

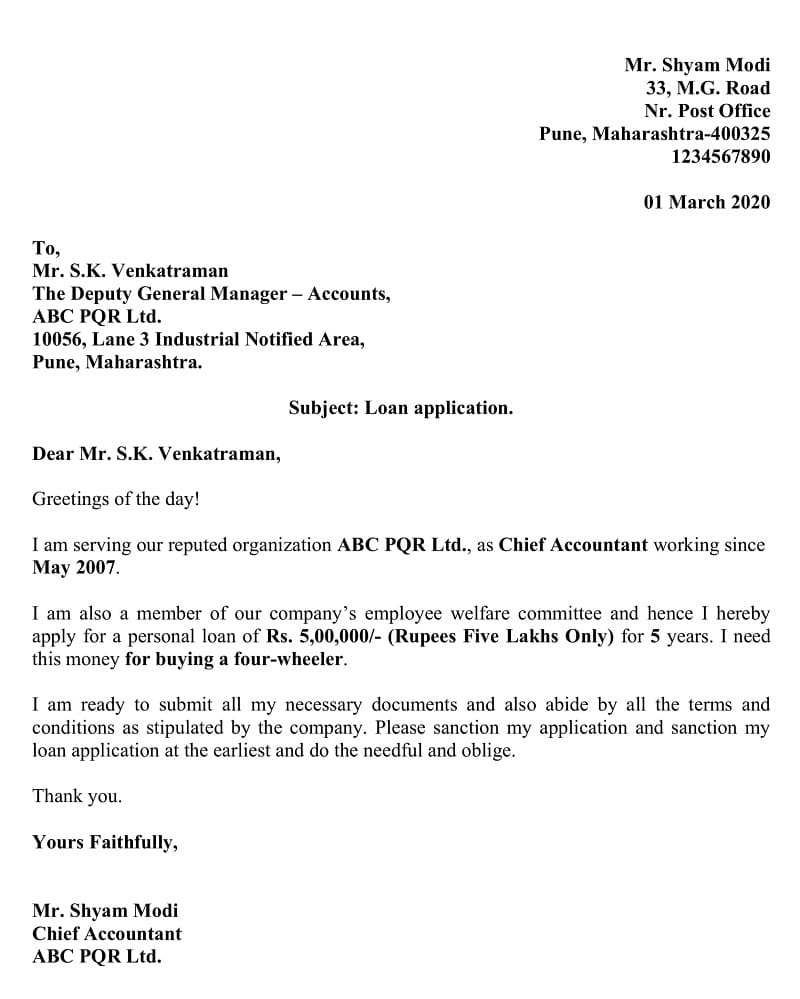

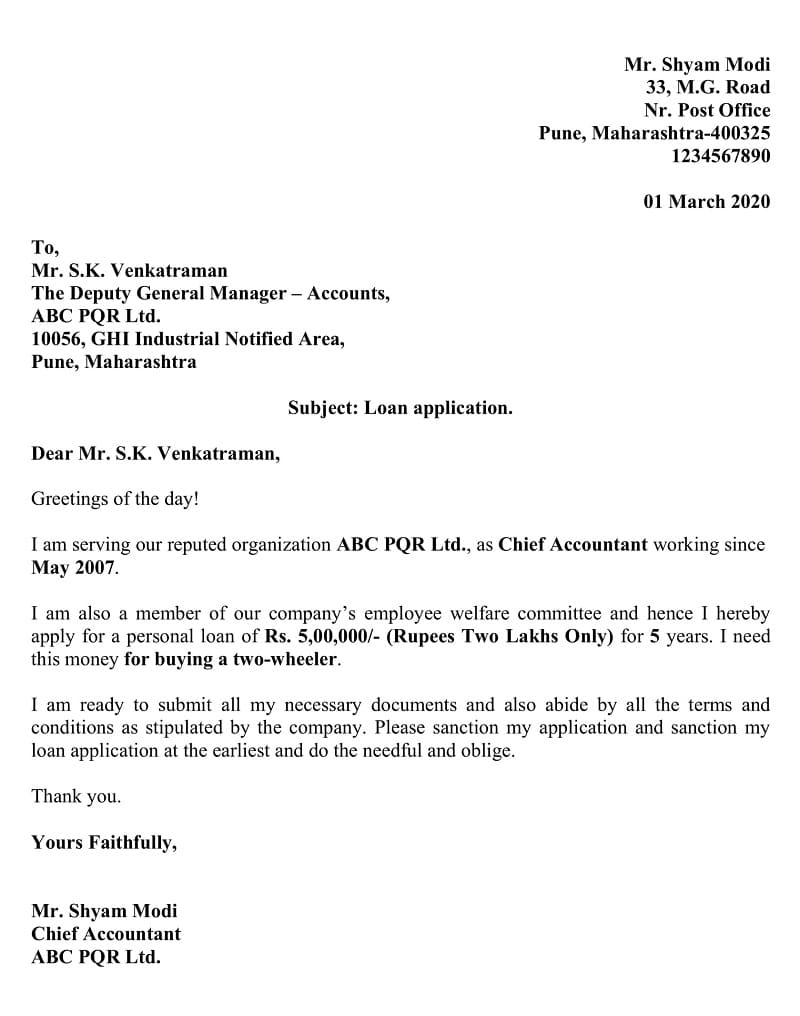

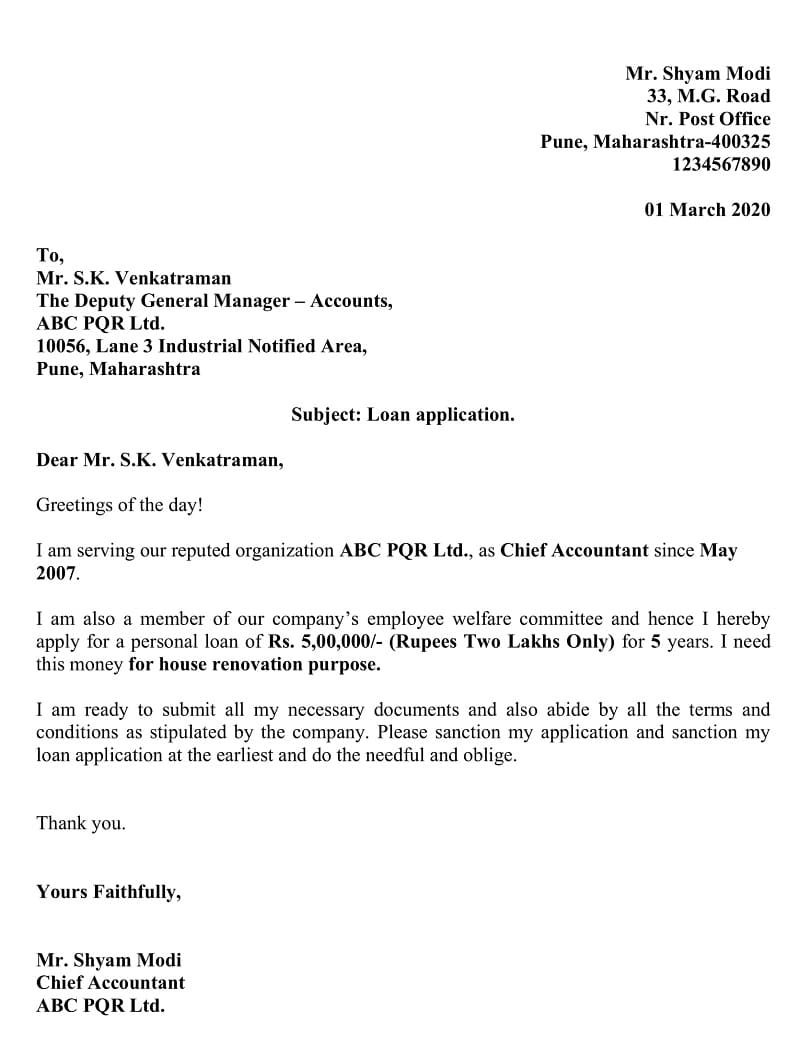

Download Loan Application Letter Excel Template

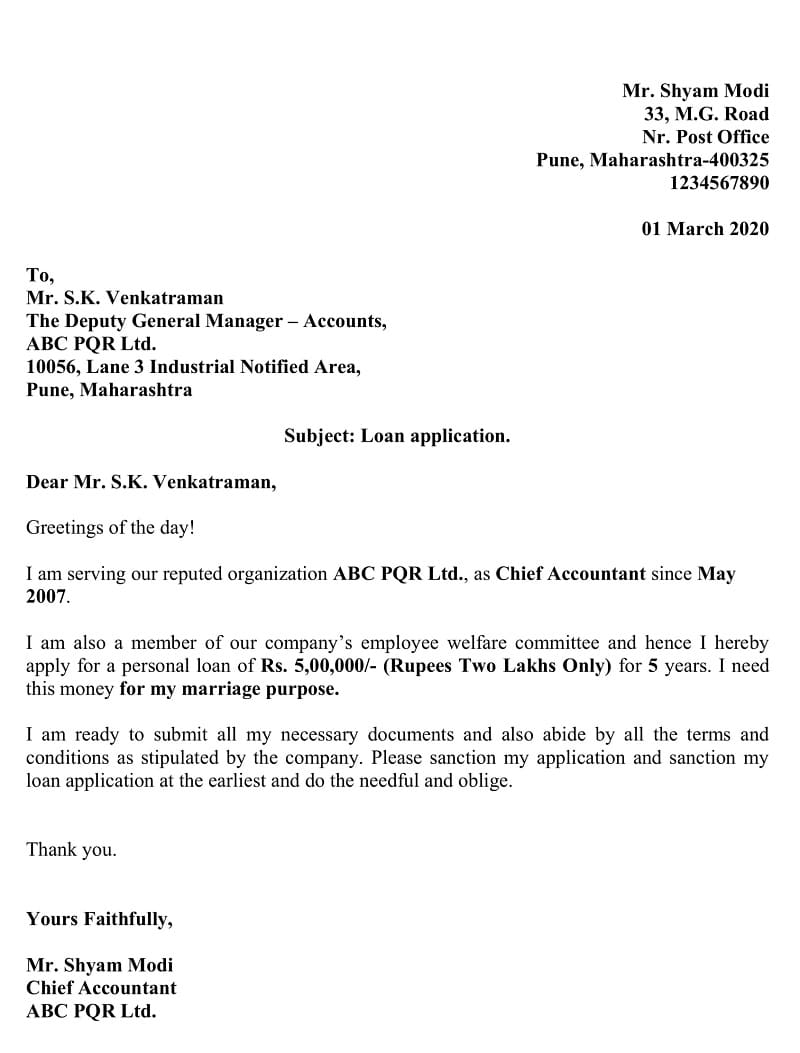

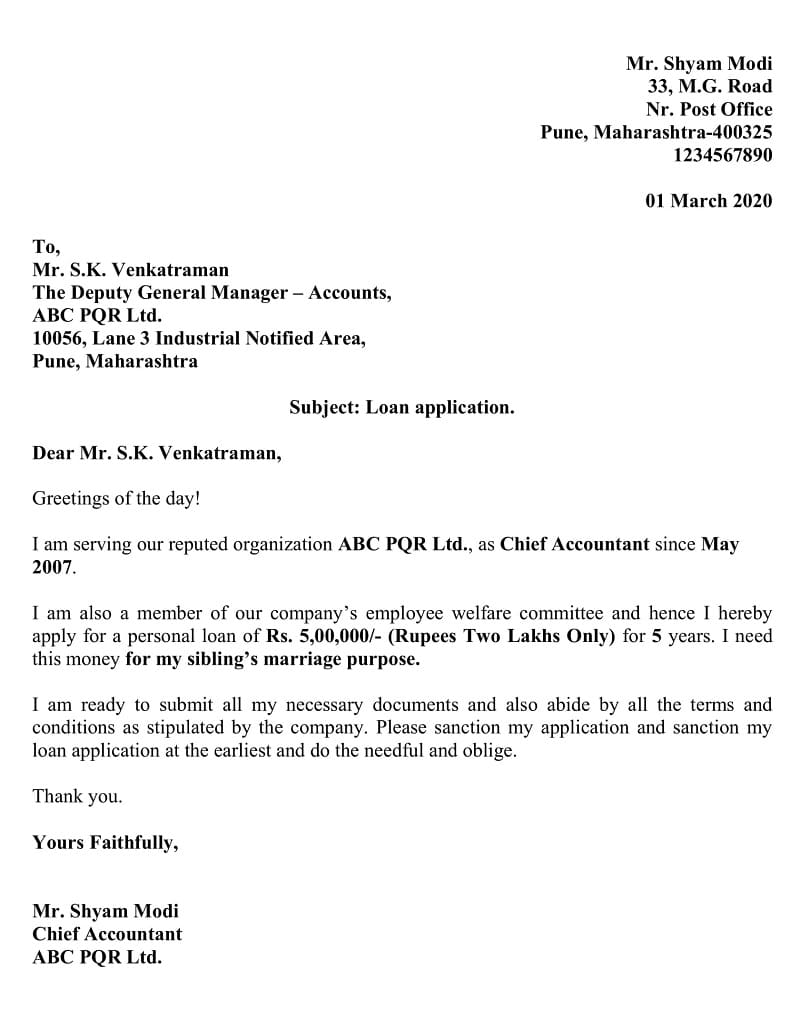

Loan Application Letter is a ready-to-use excel template that helps an individual to request a loan from his/her employer in just a few minutes.

Just enter your details, company details and your letter is ready. This template consists of a pre-drafted letter and thus there is no need to manually type the letter.

Furthermore, this Loan Application Letter is also available in other formats like Word, PDF, Google Doc, and Open Office Writer format. Just click the download button given below each image. The best part is that all these formats are editable and free to download.

Table of Contents

What is a Loan Application Letter?

An application requesting the employer for financial help in the form of a loan to any personal purpose is called Loan Application Letter. Many companies have eligibility criteria to obtain loans.

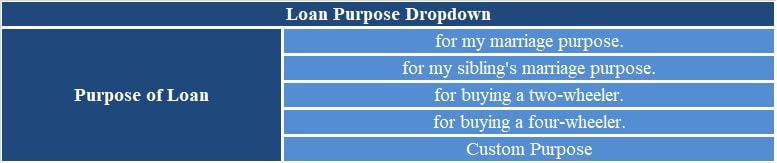

Here are 5 Loan Applications for 5 different purposes. These include the purchase of a car, purchase of a bike, marriage, sibling’s marriage and house renovation.

Financial help in tough times to employees is very encouraging to employees. It is a gesture of humanity as well as shows that the employer’s care for his/her employees. This further helps in reducing the turnover Cost .

Loan Application Letter Excel Template

We have created a simple and easy Loan Application Letter Excel Template with a pre-drafted letter. Just enter your details, employer details, and purpose of obtaining a loan along with the referral to the company policy. Your letter is ready to print.

Click here to download the Loan Application Letter Excel Template.

Additionally, you can download other HR Letter templates like Promotion Request Letter , Resignation Letter , Casual Leave Application , Resume and Cover Letter and much more from our website.

You can also download the Loan Application Letter in PDF, DOC, Open Office or Google Doc format. Just download your desired format and start using it.

Loan Application – Purchasing Car

PDF Word Google Doc Open Office Writer

Loan Application – Purchasing Bike

Loan Application – House Renovation

Loan Application – Own Marriage

Loan Application – Sibling’s Marriage

Once you download the desired format, change the bold text to get your letter ready.

Let us understand the contents of the template in detail and how to use this template.

Contents of Loan Application Letter Excel Template

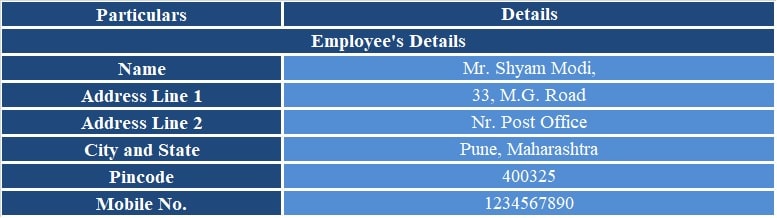

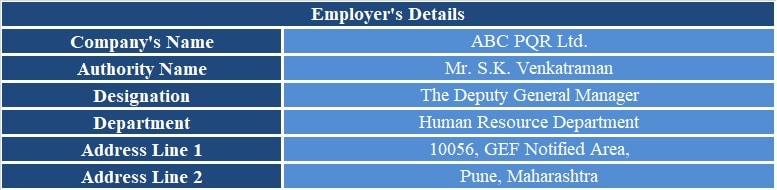

This template consists of 2 sheets: Data Input Sheet and Loan Application Template.

Data Input Sheet

There are 4 sections in the Data Input Sheet: Employee details, Employer details, Loan Details and Loan Purpose.

Employee details consist of:

Name Address Line 1 Address Line 2 City and State Pincode Ph. No.

Employer details include:

Company’s Name Authorized Personnel Name Designation Department Address Line 1 Address Line 2

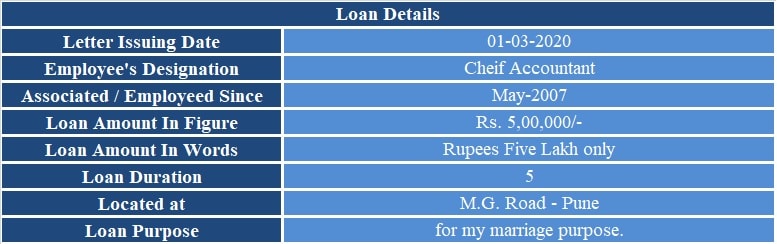

Loan Details section consists of the following heads:

Request Letter Date Employee’s Designation Associated/Employed Since Loan Amount in figures Loan Amount in Words Tenure of Loan Location Loan Purpose

5 generally used loan purposes have been given. These purposes have been used to create the dropdown list. You can also add your custom purpose other than the above mentioned.

Loan Application Template

You can print all 5 types of letters just by entering the details in the Data Input Sheet and selecting any of the 5 purposes from the dropdown list. The cells are linked to the data input sheet and it will automatically fetch the required data.

Printing the letter using the Excel file will look a bit different from Word. The cells have been designated to place the required data. Hence, there will more space near the credentials. We have given other formats for your ease.

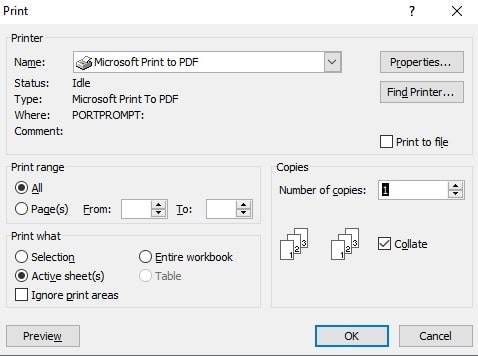

Additionally, to send a pdf version use the inbuilt Microsoft to PDF option available in the print menu. See image below:

Thus, this template can be helpful to individual employees to create a loan application according to your needs in just a few minutes.

We thank our readers for liking, sharing and following us on different social media platforms.

If you have any queries please share in the comment section below. We will be more than happy to assist you.

About Shabbir Bhimani

I have worked in Excel and like to share functional excel templates at ExcelDataPro.

Leave a Reply Cancel reply

Your email address will not be published. Required fields are marked *

Save my name, email, and website in this browser for the next time I comment.

Notify me of follow-up comments by email.

Notify me of new posts by email.

ExcelDataPro

Free Excel Pro Templates

Privacy Overview

- Search Search Please fill out this field.

What Is a Letter of Explanation for a Mortgage?

Why do you need a letter of explanation, how to write a letter of explanation.

- Frequently Asked Questions (FAQs)

The Bottom Line

- Buying a Home

How to Write a Letter of Explanation for a Mortgage

A letter of explanation may help you get approved for a mortgage

:max_bytes(150000):strip_icc():format(webp)/LindsayFrankel-0e50cf9508f64df899aea94f1640c276-2fc39a1b539547cba44e7b84423e2d0f.jpeg)

Wichayada Suwanachun / Getty Images

When you apply for a mortgage, the lender will review information such as your credit history, employment, income, assets, investments, and outstanding debts. But your financial statements, credit report, and tax returns don’t always tell the full story about your financial situation.

A letter of explanation helps clarify any information that might give a lender pause. Learn more about when you might need a letter of explanation for a mortgage application and how to write the letter.

Key Takeaways

- Some mortgage lenders may request a letter of explanation if there is confusion about any details in your financial documents.

- If you’re applying for a government-backed mortgage like an FHA or VA loan, a letter of explanation may be required.

- Even if your lender doesn’t require a letter of explanation, including one may help clarify details in your mortgage application that could otherwise lead to denial.

- You may need to include supporting documentation to give your letter of explanation more credibility.

A letter of explanation, sometimes referred to as an LOX or LOE by mortgage underwriters, is similar to a cover letter for a job application. Just as a cover letter expands on the details in your resume, a mortgage letter of explanation further explains your financial documents. For example, you might need to explain that last year’s income wasn’t typical because you took a sabbatical, or that you missed a payment due to a healthcare emergency.

“A letter of explanation is not a standard or defaulted requirement for a mortgage application,” said Shmuel Shayowitz, president and chief lending officer at Approved Funding, a licensed mortgage bank and direct lender. However, your mortgage lender may request one if your financial information needs clarification. If you’re applying for a government-backed loan, the agency that insures the loan may also require a letter of explanation in certain situations.

Even if it’s not required, it can’t hurt to include a letter of explanation with your mortgage application. “The default for some processors and underwriters is to assume the worst or to err on the side of caution when something is unclear or complicated,” Shayowitz said. “Being proactive with explanation letters can go a long way in helping a loan processor and mortgage underwriter understand something that might be confusing.”

In particular, the following situations merit the inclusion of a letter of explanation.

Erratic Income or Gaps in Employment

Most lenders look for a consistent and reliable income that ensures you can keep up with your mortgage payments. If you were unemployed or did not receive income for more than a month over the last two years, you should include a letter of explanation that details the reason you weren’t working, such as:

- Childbirth or caring for another family member

- Pursuing further education

- Being laid off

- Being self-employed or working in a seasonal industry

- Going out of business or downsizing

If you were able to make regular payments on your debts and support yourself with savings during that time, be sure to mention that in the letter.

Issues on Your Credit Report

If your credit report shows red flags, like missed payments or defaults, bankruptcies , or foreclosures , it’s essential to include a letter of explanation noting what happened and why it’s not likely to reoccur. You’ll also want to include the date of the event, the name of your creditor, and the account number associated with the delinquent debt.

No Rental or Mortgage Payment History

If you have been living with a friend or family member rather than making monthly housing payments for your own place, the homeowner you live with will need to write a letter of explanation. The homeowner should explain that they haven’t charged you rent and include the dates you lived on their property before signing the letter.

Profits or Losses From Farming

If you filed Schedule F with your tax return because you earned or lost income from a farm property, you’re required to include a letter of explanation. Include the address of the farm and clearly state that it is not located on the property you’re buying with the mortgage.

Large Deposits or Withdrawals

If you received a large deposit to your bank account, the lender might think you accepted a gift or a loan from a family member and wonder if your income is sufficient without additional help. A large withdrawal may also indicate to the lender that you’re having financial troubles. There are other reasons for large bank transactions, however. For example, you may have received a bonus from your employer, liquidated investments at an opportune time, or withdrawn funds for a home renovation. Include a letter of explanation that shows why the atypical transaction occurred.

Possible Occupancy Questions

Lenders underwrite vacation homes and investment properties differently from primary residences. It’s illegal to misrepresent your occupancy intentions. If you’re applying for a primary residence mortgage for a property located far from your employer, or if you’re applying for a second home mortgage for a property in close proximity to your primary residence, the lender may think you intend to use it as a rental property.

If you think the lender may have questions about how you intend to use the property, include a letter of explanation.

Address Discrepancies

If any of your documents show a different address, you should include a letter of explanation with a reason for the discrepancy to assure the lender you’re not a victim of identity theft.

“Your explanation letter should be specific, precise, and well-communicated,” said Shayowitz. Avoid general statements about your ability to manage your finances and speak to a specific issue.

For example, if you missed a payment, explain why it happened, point to your otherwise positive payment history, and state when you brought your account back up to date. A statement like “I make every effort to stay on top of my payments” is too vague because it won’t provide the lender with the details they need to make an approval decision.

You may need to attach supporting documentation as well. For example, if you’re buying a home far away from work, you might want to include a letter from your employer that shows your remote work arrangement. If you took out a large withdrawal to pay for landscaping in order to prep your home for sale, include a receipt from the landscaping company. If you missed a payment due to being hospitalized, include medical records.

You’ll also want to include the following elements:

- Your name, address, and phone number

- The lender’s name, address, and phone number

- The mortgage application number

- Your explanation, which should refer to the attached documents that support it

- Your signature and the date

Example of a Letter of Explanation

Today’s Date

Example Lender Lender Address

Loan Application Number

RE: Anna Smith’s Mortgage Application

To Whom It May Concern,

I am writing to explain my gap in employment that occurred between 02/15/2023 and 04/10/2023.

My mother was admitted to the hospital for surgery on 02/09/2023 after a fall. I applied for Family and Medical Leave on 02/10/2023 in order to care for my mother during her recovery. My employer approved FMLA-protected leave on 02/14/2023. I have attached the approval letter from my employer, which grants up to 12 weeks of leave.

During my period of unpaid leave, I relied on sufficient reserves in my savings account as well as my husband’s income to cover my expenses. I didn’t miss any payments on my credit cards or auto loan. I returned to work on 04/11/2023. In the following months, I made several deposits into my Capital One savings account to replenish my reserves.

Anna Smith’s Address Anna Smith’s Phone Number

How Do You Start a Letter of Explanation?

At the top of the letter, include the date, the name of the lender, the lender’s address, and your loan application number. In the next line, write “Re: (Your Name)’s Mortgage Application.” Address the letter to “To Whom It May Concern,” and note which issue you are addressing in the first sentence.

What If Your Mortgage Letter of Explanation Is Rejected?

If your letter of explanation is rejected, you have a few options. If the information you provided wasn’t sufficient, you can write a more detailed letter and include supporting documentation. You can also try applying for a mortgage from a different lender. If you’re struggling to get approved , you may need to resolve whatever problem you’re explaining in the letter before trying again.

How Long Should a Letter of Explanation Be?

A letter of explanation only needs to be long enough to convey the details of the issue you’re explaining. For example, if you missed a payment, you should include the date of the missed payment, the reason you missed it, and how you’ve remedied or plan to remedy the issue. A few sentences may suffice, or your letter may run longer if it’s a complex situation and you need to reference supporting documents.

Is a Letter of Explanation Necessary?

A letter of explanation is not always necessary. If there are no red flags in your financial history, you may be approved without a letter of explanation. But if there are issues that might raise concerns, you’ll want to include a letter of explanation. You’ll also need to write a letter of explanation if the lender requests one, or if it’s required by the government agency backing the mortgage. For example, for all FHA-approved mortgages , the Department of Housing and Urban Development (HUD) requires a letter of explanation from borrowers who have collection accounts or judgments.

A letter of explanation can help your mortgage application process, especially if you have had financial issues you want to clarify. A good letter will address the specific issues and explain why they are not likely to reoccur. Consider consulting a real estate professional for more guidance in writing a letter of explanation that fits your needs.

Chase. " What Documents Are Needed to Apply for a Mortgage? "

Citizens Bank. " How to Write a Letter of Explanation ."

National Association of Mortgage Underwriters. " Best Practices: Letters of Explanation ."

Ally Bank. " How to Write a Letter of Explanation ."

Newcastle Loans. " Principal Residence, Second Home, or Investment Property? "

Griffin Funding. " Letter of Explanation ."

:max_bytes(150000):strip_icc():format(webp)/HowtoWriteaHardshipLetterforaMortgage-14b11d4db04e42839702731c0b9ca8ba.jpg)

- Terms of Service

- Editorial Policy

- Privacy Policy

- Your Privacy Choices

All Formats

13+ Loan Application Letter Templates

Thinking of asking for a loan? Opening up a business and need the extra money to kick your idea into existence? Loan applications form are a standard piece of document that is significant when asking for a sample loan , and in this website, we provide you with ample of application letter templates for loan to choose from and use.

Business Loan Application Letter Template

Car Loan Application Letter Template

Personal Loan Application Letter Template

Loan Forgiveness Application Letter Template

Calamity Loan Application Letter Template

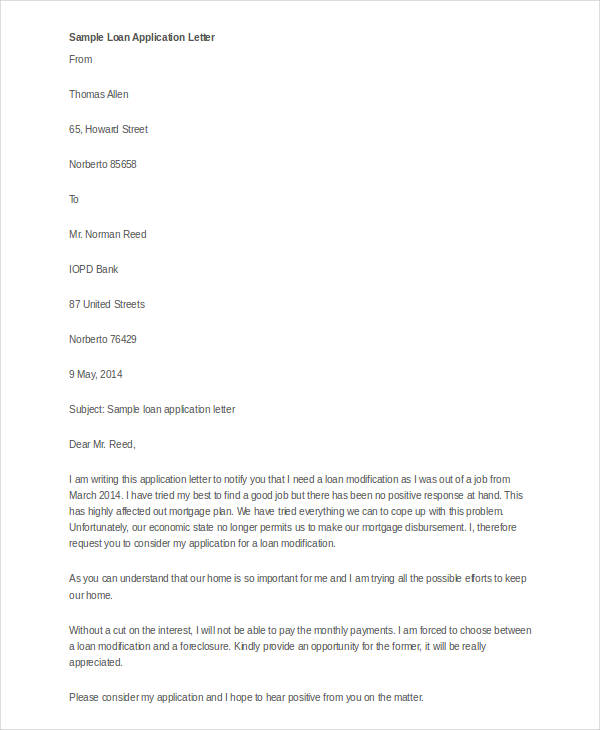

Sample Loan Application Letter Template

Loan Application Letter Templates

What Is a Loan?

How to fill out a loan application, employee loan application letter template.

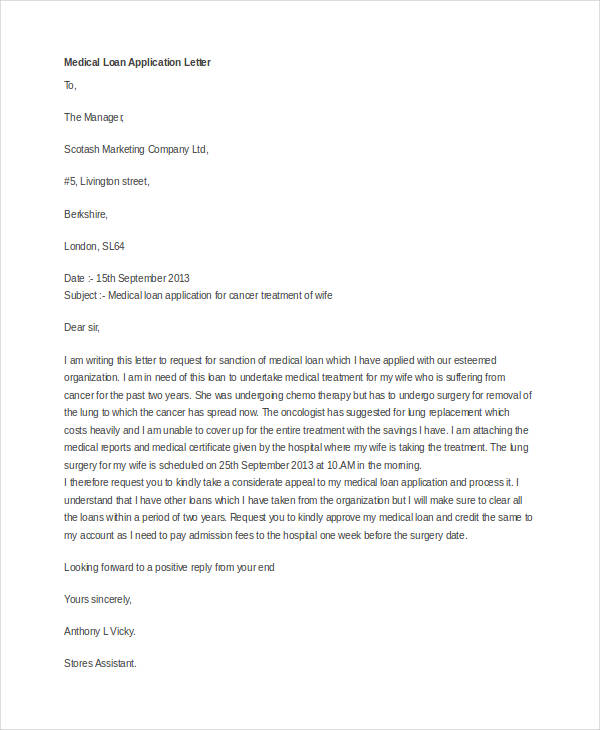

Medical Loan Application Letter Template

Basic Loan Application Letter Template

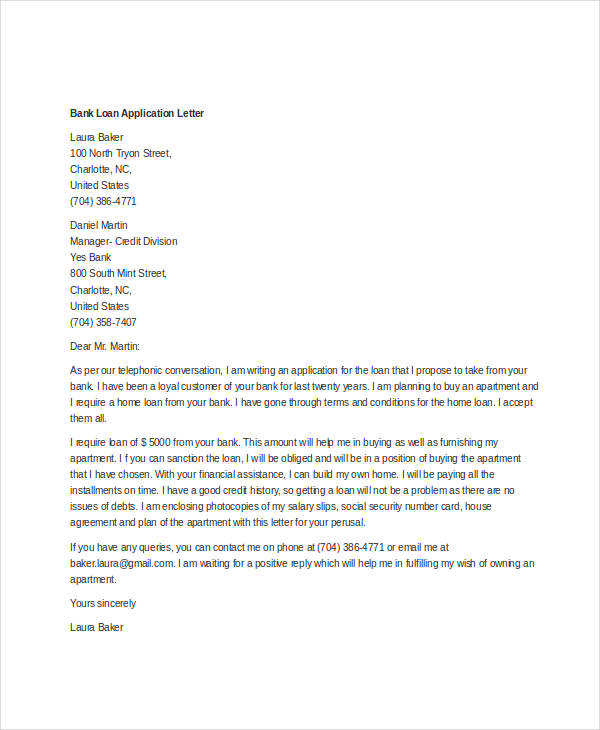

Bank Loan Application Letter Template

Tips before Filling for a Loan

- Why do I need the loan for?

- How will it help my business?

- How will I spend it?

- Who will manage the loan?

- Start by filling up the basics, such as the type of business, the name, contact numbers, and the legal structures.

- Typically after the application, there will an agreement concerning fees associated with the loan. These should be discussed personally with the lender.

- Be sure to double-check that every question is filled. If anything is amiss, the application might end up with the underwriter and may be delayed.

- Be sure to bring plenty of back up documents when meeting personally the lender. These documents include a resume, a credit report templates, past tax returns, the business plan templates, and balance sheets .

- Do not be afraid to include too much information so that there would be an assurance of confidence from you lender that it is strictly business and is legitimate.

More in Letters

Loan application letter template, simple loan application letter template, loan application letter to employer template, loan application letter for school fees template, loan application letter to bank manager template, loan application letter for house rent template, loan application letter from employee template, loan application request letter to boss template.

- FREE 26+ Covid-19 Letter Templates in PDF | MS Word | Google Docs

- Thank You Letter for Appreciation – 19+ Free Word, Excel, PDF Format Download!

- 69+ Resignation Letter Templates – Word, PDF, IPages

- 12+ Letter of Introduction Templates – PDF, DOC

- 14+ Nurse Resignation Letter Templates – Word, PDF

- 16+ Sample Adoption Reference Letter Templates

- 10+ Sample Work Reference Letters

- 28+ Invitation Letter Templates

- 19+ Rental Termination Letter Templates – Free Sample, Example Format Download!

- 23+ Retirement Letter Templates – Word, PDF

- 12+ Thank You Letters for Your Service – PDF, DOC

- 12+ Job Appointment Letter Templates – Google DOC, PDF, Apple Pages

- 21+ Professional Resignation Letter Templates – PDF, DOC

- 14+ Training Acknowledgement Letter Templates

- 49+ Job Application Form Templates

File Formats

Word templates, google docs templates, excel templates, powerpoint templates, google sheets templates, google slides templates, pdf templates, publisher templates, psd templates, indesign templates, illustrator templates, pages templates, keynote templates, numbers templates, outlook templates.

Home » Letters » Request Letters » Loan Request Letter for Medical Treatment – Request Letter to Employer for Loan for Medical Treatment

Loan Request Letter for Medical Treatment – Request Letter to Employer for Loan for Medical Treatment

Table of Contents:

- Sample Letter

Live Editing Assistance

How to use live assistant, additional template options, download options, share via email, share via whatsapp, copy to clipboard, print letter, sample request letter to employer for loan for medical treatment.

To, ___________ (company name), ___________ (name of the manager), ___________ (address)

Date: __/__/____ (date)

Subject: Requesting loan for medical treatment

Respected Sir/ Madam,

I would like to inform you that my name is _________ (name) and I have been working in your reputed company as a __________ (mention your designation) for last _______ (duration). My employee ID is _________ (mention your employee ID).

I write this letter with utmost respect in order to request you for advance salary/ loan in my name. I need the said amount for the medical treatment of _________ (self/ wife/ son) as ____________ (mention your company). This treatment would cost _________ (mention amount) and needs to be done at the earliest.

I shall be highly obliged if you could help me with the same. In case, you have any queries, you may contact me at ___________ (mention contact number).

Thanking you, ___________ (Signature), ___________ (Name)

Live Preview

The Live Assistant feature is represented by a real-time preview functionality. Here’s how to use it:

- Start Typing: Enter your letter content in the "Letter Input" textarea.

- Live Preview: As you type, the content of your letter will be displayed in the "Live Preview" section below the textarea. This feature converts newline characters in the textarea into <br> tags in HTML for better readability.

The letter writing editor allows you to start with predefined templates for drafting your letters:

- Choose a Template: Click one of the template buttons ("Start with Sample Template 1", "Start with Sample Template 2", or "Start with Sample Template 3").

- Auto-Fill Textarea: The chosen template's content will automatically fill the textarea, which you can then modify or use as is.

Click the "Download Letter" button after composing your letter. This triggers a download of a file containing the content of your letter.

Click the "Share via Email" button after composing your letter. Your default email client will open a new message window with the subject "Sharing My Draft Letter" and the content of your letter in the body.

Click the "Share via WhatsApp" button after you've composed your letter. Your default browser will open a new tab prompting you to send the letter as a message to a contact on WhatsApp.

If you want to copy the text of your letter to the clipboard:

- Copy to Clipboard: Click the "Copy to Clipboard" button after composing your letter.

- Paste Anywhere: You can then paste the copied text anywhere you need, such as into another application or document.

For printing the letter directly from the browser:

- Print Letter: Click the "Print Letter" button after composing your letter.

- Print Preview: A new browser window will open showing your letter formatted for printing.

- Print: Use the print dialog in the browser to complete printing.

- A: Yes, it's common for employees to request loans from their employers for medical treatment in cases of urgent need.

- A: Yes, providing your employee ID helps the employer identify you and process your request more efficiently.

- A: You can express gratitude by using phrases like "I would be deeply grateful" or "Your understanding and assistance would be immensely appreciated."

- A: If your request is approved, follow any instructions provided by your employer regarding the loan disbursement process.

- A: Response times may vary depending on the company's policies and procedures, but it's advisable to follow up if you haven't received a response within a reasonable timeframe.

Incoming Search Terms:

- sample letter of request for loan for medical treatment

- request letter for loan due to medical treatment

By letterskadmin

Related post, contract renewal letter for nurse – sample letter for renewal of contract of nurse, commuted leave application for teachers – sample letter for commuted leave for teacher, food diet chart request letter – sample letter requesting food diet chart, sample job joining application for house job – house job joining application sample, complaint letter to employer about discrimination – complaint letter about discrimination at work, letter to editor complaining about loudspeaker nuisance – write a letter to the editor complaining about loudspeaker nuisance, write a letter to the editor about the noise pollution during the festival, privacy overview.

Getting the Letter of Employment for a Mortgage in Canada

What you should know.

- Most mortgage lenders require your employer to write details about your employment status.

- The purpose is for lenders to understand your job stability and verify your application.

- The letter must include things such as job title, salary, years of employment, and more.

- It is very common and your HR department likely already has a template.

A letter of employment is one of the required documents to get a mortgage in Canada . Lenders want to ensure income stability when qualifying you for a mortgage, and this document provides essential information. In general, lenders want to see salary information , years of employment, type of employment, and more.

We have included all the types of applicable information below and the different requirements from the big six banks. The letter is quite common as most mortgage lenders in Canada require it. Most likely, the human resources department of your company can complete this for you. Otherwise, we have a template available below.

While most lenders require a job letter from your company, some lenders can verify your income through pay stubs, bank statements, or your T1 Tax return.

Mortgage Job Letter Explained

You are more likely to miss mortgage payments if you are unemployed. Banks understand this and want to ensure you have a stable job when assessing your mortgage application. They generally prefer stability and predictability over a high-earning yet risky applicant. For example, mortgage lenders like to see you have spent many years with the same company and have full-time employment in a stable industry.

However, you can still receive a mortgage if you work for a startup or are self-employed. You may have a higher mortgage interest rate. Although there are information requirements listed below, self-employed applicants need to provide additional information shown further in the article.

Information Requirements for a Mortgage Job Letter

- Company Information: Your employment letter should be issued on an official company letterhead with the firm's name, address, logo, and contact information.

- Employment Information: Your job title will be listed on the job letter and how many hours you work and when you began working for this company. A brief description of your job duties may also be included. Make sure this matches what you put on your mortgage application.

- Compensation: The letter also must include your salary information and compensation structure. Full-time, part-time, or contract employment should be mentioned in the job letter.

- Finishing Touches: Your employer must also date and sign the letter. Lenders want to ensure the information is no older than 60 days.

- Pay deductions

- Seasonal pay fluctuations

- Recent income changes

- Overtime income

- Maternity or Paternity leave

- Employment probation

How to Get Your Job Letter Completed

The best way to get your job letter is to ask your employer. Most employers are familiar with this document and can quickly provide you with the information. However, if you work for a smaller company, you can provide a supervisor or manager with the template below. Once the letter is completed, it's best to have your company spokesperson send it directly to your mortgage representative. If you are self-employed, you can skip to the following section as the process is different.

Ensuring Your Job Letter is Accepted

- Include all the required information: job title, start date, salary, employment type.

- Make sure the letter is no older than 60 days. However, 30 days is preferred.

- Ensure the job letter is on company letterhead and signed by an authorized representative.

- Ask your employer to include a brief description of your job duties.

Sample Employment Letter for a Mortgage

To whom it may concern,

We confirm the following details regarding the employment of [Applicant Name] :

- [Applicant Name] works as a [Job Title] for us

- Their gross annual salary is [Annual Salary] , and they work [weekly hours] hours per week

- They are employed on a [full-time, part-time, or contract] basis

- They began working with us on [date of employment]

If you have any more questions, don't hesitate to contact us at [phone number] or [email address] .

[Company Representative Signature]

[Representative Name]

[Representative Job Title]

[Company Name]

What to Do if the Lender Does Not Accept Your Job Letter

If the lender does not accept your job letter, there are a few things you can do. Most likely, your mortgage lender just requires more information about your job. You can ask your employer to write a description of your job duties. You can also try another lender who has different requirements.

Job Letters for Self Employed Mortgage Applicants

If you are a business owner, entrepreneur, or freelancer, you need to apply for a self-employed mortgage in Canada . Although you will still be eligible to receive a mortgage, the process requires more documents, and your interest rate may be higher. It's also important to understand that having many deductions will lower your income, which will affect your maximum mortgage affordability . You will likely need to show the following documents:

- Previous two to three years of Income tax returns.

- Income statement, balance sheet, and statement of cash flows. You may be able to collateralize some of your business assets to receive a lower interest rate.

- Articles of incorporation or proof of licence.

- Six to twelve months of personal and business banking statements.

- Contracts for future projects.

- Capitalization table to show your ownership percentage.

- Up to date Notice of Assessment from the Canada Revenue Agency.

- Proof of GST or HST payments.

The Bottom Line