- Remember me Not recommended on shared computers

Forgot your password?

Admissions comparison -- PhD Finance vs. PhD Economics

By rcwlhk June 4, 2008 in PhD in Business

- Reply to this topic

- Start new topic

Recommended Posts

I would really appreciate any input on this topic!

What do you think are the key differences and similarities between admissions in a top tier PhD Finance program vs. a top tier PhD Economics program?

Perhaps I can start by making the following observations:

(1) Clearly, there are close similarities between the core courses between a PhD Finance student and a PhD Economics student. I believe both need to go through the entire micro, macro and metrics sequence.

(2) PhD Finance programs appear to be more competitive. But I would like to add a slight caveat --- while on absolute numbers basis, it does seem so (i.e. 3 - 5 admits per school). But please do correct me if I'm wrong, but it seems the number of applicants to PhD Finance programs are also smaller than that of Economics.

An example (I know there are more schools out there but I just picked one as an illustration. Feel free to give further examples or counter-examples!)

Northwestern Kellogg PhD Finance: 8 Admitted; 196 Applied; 4.08% Yield

Northwestern PhD Economics: 18 - 25 Admitted; 600 Applied; 3.00% - 4.17% Yield

So, it seems that at least for Northwestern, I don't see a significant difference between the yield (admitted / applied ratio) of PhD Finance and PhD Economics programs.

So, in such cases, do absolute numbers matter more than the ratios?

(3) Just going through the profiles of PhD Finance and PhD Economics students, I've noticed the following trends (please correct me if I'm wrong):

-There's a higher proportion of Economics students with Masters degrees and/or previous academic experiences (i.e. research assistant, publication, etc) than their Finance counter parts

-There are many more Math majors going into Economics programs than Finance

-Very few individuals going into Finance programs had a Finance / Business undergraduate training; but a good number of them have MBA's

-Most of those who are admitted to Finance programs had some form of industry work experience (typically in investment banks, consulting firms, hedge funds, etc)

-The strongest observation that I've made is that, it seems there are a plethora of examples of individuals at top tier Finance programs with significant work experience (i.e. 5 years or more) and did not have a math / hard science undergrad / master background. This leads me to wonder --- how many of these admitted individuals have real analysis (which appears to be VERY IMPORTANT in the TM Econ forum), graduate level econ / math / finance courses, and top Finance / Econ professors writing LOR's for them?

That's the end of my observations.

Please do share your opinions and thoughts!

Link to comment

Share on other sites.

I am starting my doctoral studies in Finance this fall. I'll attempt to share all my observations and thoughts based upon your questions.

(1) Clearly, there are close similarities between the core courses between a PhD Finance student and a PhD Economics student. I believe both need to go through the entire micro, macro and metrics sequence.

I don't know about top tier programs but for the following tier, you take micro,macro and metrics sequence relying on your concentrations. Some guys might not necessarily take micro and macro courses. For example, if you have already taken these courses in intermediate level in undergraduate or masters level, you might not take them. Even more to exemplify, most students with Economics courses does not take these courses.

(2) PhD Finance programs appear to be more competitive. But I would like to add a slight caveat --- while on absolute numbers basis, it does seem so (i.e. 3 - 5 admits per school). But please do correct me if I'm wrong, but it seems the number of applicants to PhD Finance programs are also smaller than that of Economics. An example (I know there are more schools out there but I just picked one as an illustration. Feel free to give further examples or counter-examples!) Northwestern Kellogg PhD Finance: 8 Admitted; 196 Applied; 4.08% Yield Northwestern PhD Economics: 18 - 25 Admitted; 600 Applied; 3.00% - 4.17% Yield So, it seems that at least for Northwestern, I don't see a significant difference between the yield (admitted / applied ratio) of PhD Finance and PhD Economics programs. So, in such cases, do absolute numbers matter more than the ratios?

I partly agree and partly disagree with your opinion. The portion that I agree with you is, - no doubt on that- , business schools admit only small numbers per specialization whereas economics departments have more crowded incoming classes. The part that I don't agree with you is that I think PhD Finance programs have more number of applicants and since these programs give full and generous funding and provide better opportunities and options after graduation, these programs are much more competitive. On another perspective, people apply to economics because they think that they are more likely to receive admission letter from econ. departments. Don't be so bothered with numbers. Decide which one you are more interested in.

(3) Just going through the profiles of PhD Finance and PhD Economics students, I've noticed the following trends (please correct me if I'm wrong): -There's a higher proportion of Economics students with Masters degrees and/or previous academic experiences (i.e. research assistant, publication, etc) than their Finance counter parts -There are many more Math majors going into Economics programs than Finance -Very few individuals going into Finance programs had a Finance / Business undergraduate training; but a good number of them have MBA's -Most of those who are admitted to Finance programs had some form of industry work experience (typically in investment banks, consulting firms, hedge funds, etc) -The strongest observation that I've made is that, it seems there are a plethora of examples of individuals at top tier Finance programs with significant work experience (i.e. 5 years or more) and did not have a math / hard science undergrad / master background. This leads me to wonder --- how many of these admitted individuals have real analysis (which appears to be VERY IMPORTANT in the TM Econ forum), graduate level econ / math / finance courses, and top Finance / Econ professors writing LOR's for them? That's the end of my observations.

I have been directly admitted to PhD. Finance from undergraduate. I might be an exceptional example but I already with some guys in the same situation. However, most of the guys, who were planning to go for PhD Finance, had some graduate degrees and extensive work experience somehow. Most of them were above their mid twenties.

Hope this helps!

Thanks for the detailed insight --- especially from a PhD Finance student-to-be!

(1) I wasn't aware that in PhD Finance, there's some flexibility in regards to the economics courses that one is required to take. But that's interesting info!

(2) I don't want to be argumentative or defensive (as I really do appreciate all of your inputs), but I still cannot find the concrete quant data to support that PhD Finance is MUCH MORE competitive than their PhD Economics counterparts.

I'm just adding more data points here (and again, by no means exhaustive):

Figures shown below as: Admits (or enrolled, whatever is available) / Applicants (% Ratio)

Finance: 4 / 75 (5.3%)

Economics: 23 / 178 (12.9%)

http://www.biz.uiowa.edu/phd/Fall07AdmResults.html

Finance: 4 - 6 / 300 (1.3% - 2.0%)

Economics: 30 - 40 / 1000 (3.0% - 4.0%)

NYU > Economics > Graduate Program > Ph.D. Programs > Bulletin

That's all I can find in my 15 min search. But so far, I'd venture to say that it is inconclusive. (But Iowa was definitely very interesting). As well, and I think this has been noted before, very few schools give detailed breakdowns of their business school admits and so, the Finance admit-to-application figures are incredibly difficult to find.

(3) I don't think you touched on this before but would you please comment further? That is, the typical math aptitude of PhD Finance admits. I still can't think of a very good reason to explain why or how some of these people with many years of work experience + a non-math / hard science background can get pass the "math requirements" of the PhD Finance program. Does this hint to the notion that the process is indeed more "random" than PhD Economics? Or perhaps I'm just thinking in a totally different direction.

I also do recognize that the math requirements in corporate finance and asset pricing are vastly different; namely, less math (relatively speaking) in corporate finance and more math in asset pricing (especially theoretical material).

@ Iowa Finance: 4 / 75 (5.3%) Economics: 23 / 178 (12.9%) http://www.biz.uiowa.edu/phd/Fall07AdmResults.html NYU Finance: 4 - 6 / 300 (1.3% - 2.0%) Economics: 30 - 40 / 1000 (3.0% - 4.0%) PhD NYU > Economics > Graduate Program > Ph.D. Programs > Bulletin

Arizona University, Tucson also says that they receive about 40-50 applications annually, and only admit 2 to 4 of them (Finance PhD). The pattern is similar in most schools: Fewer applications in Finance but the chance of enrollment is more slim in Finance then it is in Economics. I explained the reasons elaborately in my post forehead.

(3) I don't think you touched on this before but would you please comment further? That is, the typical math aptitude of PhD Finance admits. I still can't think of a very good reason to explain why or how some of these people with many years of work experience + a non-math / hard science background can get pass the "math requirements" of the PhD Finance program. Does this hint to the notion that the process is indeed more "random" than PhD Economics? Or perhaps I'm just thinking in a totally different direction. I also do recognize that the math requirements in corporate finance and asset pricing are vastly different; namely, less math (relatively speaking) in corporate finance and more math in asset pricing (especially theoretical material).

I think schools prefer guys with quantitative analysis. Let's think of an investment banker, or someone who has extensive quantitative skills. And assume that this guy has a masters in Mathematical Finance. This guys knows how the financial sector works, and he is experienced. Excellent choice!! But I don't know about the guys with hard science are enrolled in Finance PhD program. They might have convincing letters of recommendation and a fantastic SOP to convince the faculty about that. Do you imagine a finance faculty, which is interested in enrolling and FUNDING students with no math background. Finance requires some math background, at least at calculus level. I still doubt about guys just enrolled with basic calculus. It is very hard to sustain in Finance PhD without strong quantitative skills. I see the issue as nearly impossible, in my personal judgment.

For my case, I don't have much work experience, just some intern in accounting field, but I am still an undergraduate that has taken Calculus, Mathematical Economics, Statistics, Mathematical Statistics, Econometrics, Applied Econometrics. We can say that I am familiar with Math :) The fact is that you forget math when you do not use it for years.

Hi all, I would really appreciate any input on this topic!

I'm just coming to the end of my first year in a phd finance program, so here's what I've learned so far....

The % admittance to finance vs top econ schools is similar but there's a huge difference in level. Finance programs are much much smaller. That means even if you're really well qualified for a finance program, it is still very likely to get rejected. If you go that route, apply to a lot of schools. I did about 12 & that almost wasn't enough! Once you're in though, they want you to succeed too.

Econ departments have less of a random factor in the admittance part - they figure once you're in they'll see if they like you and if not cut you out in the first couple of years. Once you're in, you also need to do better than other students to stay in.

Depends on the program, but in mine the first year is basically the same as for first year econ students. They have to do macro in the 1st year, whereas it is an elective for us in the 2nd year & we have some finance seminar courses instead, but pretty much if I & an econ student planned our electives right, we could end up both doing exactly the same courses.

(2) PhD Finance programs appear to be more competitive.

The problem is the randomness of the process. To get into finance you need to be good + be very lucky, or apply to a much large number of schools to have a good shot at getting in somewhere.

Business schools are more likely to value some pertinent non-academic work experience on the whole, particularly if it gives you inside knowledge of some area of industry. As far as math ability, in econometrics classes, the finance students tended to usually be towards the top of the distribution in such exams. Econ seems fine with a good knowledge of calculus, maybe some ode's for macro, linear algebra & analysis. If the finance program specializes in asset pricing, they'll probably also be looking for more of the wacky math at admittance - other kinds of analysis, stochastic calc. pde's etc as well.

This leads me to wonder --- how many of these admitted individuals have real analysis (which appears to be VERY IMPORTANT in the TM Econ forum), graduate level econ / math / finance courses, and top Finance / Econ professors writing LOR's for them?

Yes, yes & no in that order at least for me! For other data, I had 3 years of academic research + several years banking industry experience.

That's some very good insight! Thanks a lot!

I'm just coming to the end of my first year in a phd finance program, so here's what I've learned so far.... The % admittance to finance vs top econ schools is similar but there's a huge difference in level. Finance programs are much much smaller. That means even if you're really well qualified for a finance program, it is still very likely to get rejected. If you go that route, apply to a lot of schools. I did about 12 & that almost wasn't enough! Once you're in though, they want you to succeed too. Econ departments have less of a random factor in the admittance part - they figure once you're in they'll see if they like you and if not cut you out in the first couple of years. Once you're in, you also need to do better than other students to stay in. Depends on the program, but in mine the first year is basically the same as for first year econ students. They have to do macro in the 1st year, whereas it is an elective for us in the 2nd year & we have some finance seminar courses instead, but pretty much if I & an econ student planned our electives right, we could end up both doing exactly the same courses. The problem is the randomness of the process. To get into finance you need to be good + be very lucky, or apply to a much large number of schools to have a good shot at getting in somewhere. Business schools are more likely to value some pertinent non-academic work experience on the whole, particularly if it gives you inside knowledge of some area of industry. As far as math ability, in econometrics classes, the finance students tended to usually be towards the top of the distribution in such exams. Econ seems fine with a good knowledge of calculus, maybe some ode's for macro, linear algebra & analysis. If the finance program specializes in asset pricing, they'll probably also be looking for more of the wacky math at admittance - other kinds of analysis, stochastic calc. pde's etc as well. Yes, yes & no in that order at least for me! For other data, I had 3 years of academic research + several years banking industry experience.

Just another question popped into my mind and I hope you could share some insight on this!

With regards to the mathematic skills one needs to get admitted into PhD Finance vs. PhD Economics, what do you think are the key differences? I know you touched on this briefly on your previous post but I'm hoping you could expand on it.

And yes, I do realize that most programs' official prerequisites are just multivariable calculus, linear algebra, statistics and maybe real analysis. But "realistically speaking" (i.e. to have a realistic chance of getting in), what additional math skills do we need here? Specifically what are the differences and similarities for PhD Finance vs. PhD Economics? (i.e. Does Finance prefer candidates to have stochastic calculus whereas it may be not so important in Economics? Conversely, perhaps Economics prefer people to have greater skills in ODE than in Finance?) :grad:

Not knowing the mind of the admissions commitee, I can only venture a guess, but anything that sets you apart from the large stack of applications with very high quantitative scores is a good thing! It would depend somewhat on the program. If you're looking at departments that do theoretical asset pricing then a background in such things would tie in nicely. In general you're much more likely to end up actually using it in a finance program than in economics. For less theoretical or more corporate places, it's not nearly as likely to be a critical decision maker, but again, having something that makes you stand out would be the thing.

On the whole, differences between econ & finance department requirements are probably outweighed by differences due to departmental focus on such things as theory vs empirical focus, as well as idiosyncratic variations due to who comprises the admit commitee that year.

Probably if I had to do the application over again & had the time, I'd do a few extra statistical theory classes, pde's or linear analysis, more because they are useful than anything else. I'd also spend more time getting good LOR's and vet my SOP through more people that know what a phd program is like.

Join the conversation

You can post now and register later. If you have an account, sign in now to post with your account.

× Pasted as rich text. Restore formatting

Only 75 emoji are allowed.

× Your link has been automatically embedded. Display as a link instead

× Your previous content has been restored. Clear editor

× You cannot paste images directly. Upload or insert images from URL.

- Insert image from URL

- Submit Reply

- Existing user? Sign In

- Online Users

- Leaderboard

- All Activity

- Create New...

You're viewing this site as a domestic an international student

You're a domestic student if you are:

- a citizen of Australia or New Zealand,

- an Australian permanent resident, or

- a holder of an Australian permanent humanitarian visa.

You're an international student if you are:

- intending to study on a student visa,

- not a citizen of Australia or New Zealand,

- not an Australian permanent resident, or

- a temporary resident (visa status) of Australia.

Finance vs economics: what you need to know

Careers Published 13 Dec, 2022 · 4-minute read

From household budgeting to international policy, finance and economics impact the daily lives of individuals and communities around the world – in ways you mightn’t even notice. Despite being two distinct disciplines, finance and economics often interconnect and can sometimes appear to be interchangeable.

You may be left wondering how each area of study differs from the other, how they intersect, and why it even matters.

If you’re curious about expanding your career opportunities with postgraduate study in finance, economics, or a unique combination of both, it may be helpful to break down these complex topics and start off with the basics.

What is finance?

Finance can be understood as the management of money. As an area of study, finance looks at wealth, currency, and capital assets, such as property and stocks.

Broadly speaking, finance can be categorised into 3 distinct groups:

- personal finance

- corporate finance

- public finance.

If you work in finance, your job may involve investing, lending, budgeting, and forecasting on behalf of individuals, organisations, or governments. Financial practices can include understanding cash flow, profit, interest rates, relationships with shareholders, risk and return, and creating value.

What is economics?

Economics is a branch of knowledge connected to everyday life in different ways throughout history and societies. It's often concerned with the production, exchange, consumption, and scarcity of wealth and resources.

As a social science, economics can be used to analyse the behaviour of individuals or groups by looking closer at what makes people act on certain choices. Governments of all countries are advised by economists to implement various policies to run the country well.

Key differences between studying finance and economics

The differences between these 2 distinct fields are important to note – especially when you’re considering which is best suited to your career ambitions.

“By studying finance, you will learn more about how to manage funds available to individuals or firms, while studying economics will give you an opportunity to learn how to apply economics policies and tools to deal with various economic issues like poverty or economic growth to govern a country well.”

- Dr Shino Takayama, UQ School of Economics Senior Lecturer and UQ Master of International Economics and Finance program leader

A finance degree can typically involve practical courses in accounting, financial reporting, quantitative analysis, and corporate finance.

By studying finance, you can gain the knowledge and ability to:

- source suitable investors to borrow money

- create budgets to plan the spending of organisations

- lend funds in the form of a loan for property or other large expenses.

While finance in a lot of ways can be defined by the direct use and management of money, economics considers both material and non-material resources and how the scarcity of resources can impact local or global markets, goods and services, and human behaviour. An economics degree may involve mathematics, statistics, micro and macroeconomics, and a variety of economic theory.

By studying economics, you can learn how to:

- measure the total value of a country’s gross domestic product

- analyse government policies on trade, tax, and investment

- examine the impact of supply and demand when innovating new products.

The Master of International Economics and Finance creates a holistic student journey that develops key innovative skills in both international economics and finance.

Can’t choose between studying finance and economics?

By studying finance and economics and creating a specialty informed by both disciplines, you can equip yourself with a distinctive skillset.

Rameez Tayob found his experience studying UQ’s Master of International Economics and Finance diversified his proficiency across economics and finance on a corporate and international scale.

“Studying a master’s that incorporates both finance and economics has allowed me to see how the various unique concepts in economics and finance overlap in the commercial world,” he says.

“When creating financial models, you can identify predictions that are derived from economic indicators.”

By combining finance and economics in the same master’s degree, the Master of International Economics and Finance taught him the advanced analytical and modelling skills needed to succeed in data analytics, business strategy and risk advisory on a global scale.

Whether you study economics, finance or both, you can rest assured you'll be getting a world-class education here at UQ. We've been ranked the #1 university in the country by the Australian Financial Review in 2023.

My UQ program helped me gain the theoretical knowledge and practical experience to engage with complex issues in society, lead as an industry change maker, and forge a successful career.

Start an economics and finance degree from any discipline

If you’re considering study in a new field outside your existing skillset, Dr Shino Takayama advises a key aspect of the Master of International Economics and Finance is that newly enrolled students don’t need to have any prior knowledge of economics or finance.

“The Master of International Economics and Finance creates a holistic student journey that develops key innovative skills in both international economics and finance,” she says.

“Students in the program experience a flexible learning journey that provides the necessary foundations in economics and hands-on application of economic theory and techniques.”

Shino emphasises the program’s focus on offering strong foundational courses to ensure students can diversify their capabilities, so they’re well positioned for employability.

"The Master of International Economics and Finance aims to enhance existing skills obtained during undergraduate studies and work experience,” Shino says.

“With this degree, a variety of future career paths around the world are open to you, including work in academia, policy and legislation, or corporate environments such as banks, or market research companies.”

Learn how to contribute meaningful insights and innovative solutions in different economies around the world with the UQ Master of International Economics and Finance .

Share this Facebook Twitter LinkedIn Email

Related stories

Postgraduate study in economics and finance is fuelling Diana's drive for success

3-minute read

Why study economics?

5-minute read

What can you do with an economics degree?

14-minute read

Why study the Bachelor of Advanced Finance and Economics?

4-minute read

- The Inventory

Support Quartz

Fund next-gen business journalism with $10 a month

Free Newsletters

The complete guide to getting into an economics PhD program

Back in May, Noah wrote about the amazingly good deal that is the PhD in economics. Why? Because:

- You get a job.

- You get autonomy.

- You get intellectual fulfillment.

- The risk is low.

- Unlike an MBA, law, or medical degree, you don’t have to worry about paying the sticker price for an econ PhD: After the first year, most schools will give you teaching assistant positions that will pay for the next several years of graduate study, and some schools will take care of your tuition and expenses even in the first year. (See Miles’s companion post for more about costs of graduate study and how econ PhD’s future earnings makes it worthwhile, even if you can’t get a full ride.)

Of course, such a good deal won’t last long now that the story is out, so you need to act fast! Since he wrote his post , Noah has received a large number of emails asking the obvious follow-up question: “How do I get into an econ PhD program?” And Miles has been asked the same thing many times by undergraduates and other students at the University of Michigan. So here, we present together our guide for how to break into the academic Elysium called Econ PhD Land:

(Note: This guide is mainly directed toward native English speakers, or those from countries whose graduate students are typically fluent in English, such as India and most European countries. Almost all highly-ranked graduate programs teach economics in English, and we find that students learn the subtle non-mathematical skills in economics better if English is second nature. If your nationality will make admissions committees wonder about your English skills, you can either get your bachelor’s degree at a—possibly foreign—college or university where almost all classes are taught in English, or you will have to compensate by being better on other dimensions. On the bright side, if you are a native English speaker, or from a country whose graduate students are typically fluent in English, you are already ahead in your quest to get into an economics PhD.)

Here is the not-very-surprising list of things that will help you get into a good econ PhD program:

- good grades, especially in whatever math and economics classes you take,

- a good score on the math GRE,

- some math classes and a statistics class on your transcript,

- research experience, and definitely at least one letter of recommendation from a researcher,

- a demonstrable interest in the field of economics.

Chances are, if you’re asking for advice, you probably feel unprepared in one of two ways. Either you don’t have a sterling math background, or you have quantitative skills but are new to the field of econ. Fortunately, we have advice for both types of applicant.

If you’re weak in math…

Fortunately, if you’re weak in math, we have good news: Math is something you can learn . That may sound like a crazy claim to most Americans, who are raised to believe that math ability is in the genes. It may even sound like arrogance coming from two people who have never had to struggle with math. But we’ve both taught people math for many years, and we really believe that it’s true. Genes help a bit, but math is like a foreign language or a sport: effort will result in skill.

Here are the math classes you absolutely should take to get into a good econ program:

- Linear algebra

- Multivariable calculus

Here are the classes you should take, but can probably get away with studying on your own:

- Ordinary differential equations

- Real analysis

Linear algebra (matrices, vectors, and all that) is something that you’ll use all the time in econ, especially when doing work on a computer. Multivariable calculus also will be used a lot. And stats of course is absolutely key to almost everything economists do. Differential equations are something you will use once in a while. And real analysis—by far the hardest subject of the five—is something that you will probably never use in real econ research, but which the economics field has decided to use as a sort of general intelligence signaling device.

If you took some math classes but didn’t do very well, don’t worry. Retake the classes . If you are worried about how that will look on your transcript, take the class the first time “off the books” at a different college (many community colleges have calculus classes) or online. Or if you have already gotten a bad grade, take it a second time off the books and then a third time for your transcript. If you work hard, every time you take the class you’ll do better. You will learn the math and be able to prove it by the grade you get. Not only will this help you get into an econ PhD program, once you get in, you’ll breeze through parts of grad school that would otherwise be agony.

Here’s another useful tip: Get a book and study math on your own before taking the corresponding class for a grade. Reading math on your own is something you’re going to have to get used to doing in grad school anyway (especially during your dissertation!), so it’s good to get used to it now. Beyond course-related books, you can either pick up a subject-specific book (Miles learned much of his math from studying books in the Schaum’s outline series ), or get a “math for economists” book; regarding the latter, Miles recommends Mathematics for Economists by Simon and Blume, while Noah swears by Mathematical Methods and Models for Economists by de la Fuente. When you study on your own, the most important thing is to work through a bunch of problems . That will give you practice for test-taking, and will be more interesting than just reading through derivations.

This will take some time, of course. That’s OK. That’s what summer is for (right?). If you’re late in your college career, you can always take a fifth year, do a gap year, etc.

When you get to grad school, you will have to take an intensive math course called “math camp” that will take up a good part of your summer. For how to get through math camp itself, see this guide by Jérémie Cohen-Setton .

One more piece of advice for the math-challenged: Be a research assistant on something non-mathy . There are lots of economists doing relatively simple empirical work that requires only some basic statistics knowledge and the ability to use software like Stata. There are more and more experimental economists around, who are always looking for research assistants. Go find a prof and get involved! (If you are still in high school or otherwise haven’t yet chosen a college, you might want to choose one where some of the professors do experiments and so need research assistants—something that is easy to figure out by studying professors’ websites carefully, or by asking about it when you visit the college.)

If you’re new to econ…

If you’re a disillusioned physicist, a bored biostatistician, or a neuroscientist looking to escape that evil Principal Investigator, don’t worry: An econ background is not necessary . A lot of the best economists started out in other fields, while a lot of undergrad econ majors are headed for MBAs or jobs in banks. Econ PhD programs know this. They will probably not mind if you have never taken an econ class.

That said, you may still want to take an econ class , just to verify that you actually like the subject, to start thinking about econ, and to prepare yourself for the concepts you’ll encounter. If you feel like doing this, you can probably skip Econ 101 and 102, and head straight for an Intermediate Micro or Intermediate Macro class.

Another good thing is to read through an econ textbook . Although economics at the PhD level is mostly about the math and statistics and computer modeling (hopefully getting back to the real world somewhere along the way when you do your own research), you may also want to get the flavor of the less mathy parts of economics from one of the well-written lower-level textbooks (either one by Paul Krugman and Robin Wells , Greg Mankiw , or Tyler Cowen and Alex Tabarrok ) and maybe one at a bit higher level as well, such as David Weil’s excellent book on economic growth ) or Varian’s Intermediate Microeconomics .

Remember to take a statistics class , if you haven’t already. Some technical fields don’t require statistics, so you may have missed this one. But to econ PhD programs, this will be a gaping hole in your resume. Go take stats!

One more thing you can do is research with an economist . Fortunately, economists are generally extremely welcoming to undergrad RAs from outside econ, who often bring extra skills. You’ll get great experience working with data if you don’t have it already. It’ll help you come up with some research ideas to put in your application essays. And of course you’ll get another all-important letter of recommendation.

And now for…

General tips for everyone

Here is the most important tip for everyone: Don’t just apply to “top” schools . For some degrees—an MBA for example—people question whether it’s worthwhile to go to a non-top school. But for econ departments, there’s no question. Both Miles and Noah have marveled at the number of smart people working at non-top schools. That includes some well-known bloggers, by the way—Tyler Cowen teaches at George Mason University (ranked 64th ), Mark Thoma teaches at the University of Oregon (ranked 56th ), and Scott Sumner teaches at Bentley, for example. Additionally, a flood of new international students is expanding the supply of quality students. That means that the number of high-quality schools is increasing; tomorrow’s top 20 will be like today’s top 10, and tomorrow’s top 100 will be like today’s top 50.

Apply to schools outside of the top 20—any school in the top 100 is worth considering, especially if it is strong in areas you are interested in. If your classmates aren’t as elite as you would like, that just means that you will get more attention from the professors, who almost all came out of top programs themselves. When Noah said in his earlier post that econ PhD students are virtually guaranteed to get jobs in an econ-related field, that applied to schools far down in the ranking. Everyone participates in the legendary centrally managed econ job market . Very few people ever fall through the cracks.

Next—and this should go without saying— don’t be afraid to retake the GRE . If you want to get into a top 10 school, you probably need a perfect or near-perfect score on the math portion of the GRE. For schools lower down the rankings, a good GRE math score is still important. Fortunately, the GRE math section is relatively simple to study for—there are only a finite number of topics covered, and with a little work you can “overlearn” all of them, so you can do them even under time pressure and when you are nervous. In any case, you can keep retaking the test until you get a good score (especially if the early tries are practice tests from the GRE prep books and prep software), and then you’re OK!

Here’s one thing that may surprise you: Getting an econ master’s degree alone won’t help . Although master’s degrees in economics are common among international students who apply to econ PhD programs, American applicants do just fine without a master’s degree on their record. If you want that extra diploma, realize that once you are in a PhD program, you will get a master’s degree automatically after two years. And if you end up dropping out of the PhD program, that master’s degree will be worth more than a stand-alone master’s would. The one reason to get a master’s degree is if it can help you remedy a big deficiency in your record, say not having taken enough math or stats classes, not having taken any econ classes, or not having been able to get anyone whose name admissions committees would recognize to write you a letter of recommendation.

For getting into grad school, much more valuable than a master’s is a stint as a research assistant in the Federal Reserve System or at a think tank —though these days, such positions can often be as hard to get into as a PhD program!

Finally—and if you’re reading this, chances are you’re already doing this— read some econ blogs . (See Miles’s speculations about the future of the econ blogosphere here .) Econ blogs are no substitute for econ classes, but they’re a great complement. Blogs are good for picking up the lingo of academic economists, and learning to think like an economist. Don’t be afraid to write a blog either, even if no one ever reads it (you don’t have to be writing at the same level as Evan Soltas or Yichuan Wang ); you can still put it on your CV, or just practice writing down your thoughts. And when you write your dissertation, and do research later on in your career, you are going to have to think for yourself outside the context of a class . One way to practice thinking critically is by critiquing others’ blog posts, at least in your head.

Anyway, if you want to have intellectual stimulation and good work-life balance, and a near-guarantee of a well-paying job in your field of interest, an econ PhD could be just the thing for you. Don’t be scared of the math and the jargon. We’d love to have you.

Update: Miles’s colleague Jeff Smith at the University of Michigan amplifies many of the things we say on his blog. For a complete guide, be sure to see what Jeff has to say, too.

📬 Sign up for the Daily Brief

Our free, fast, and fun briefing on the global economy, delivered every weekday morning.

- Assistant Professor / Lecturer

- PhD Candidate

- Senior Researcher / Group Leader

- Researcher / Analyst

- Research Assistant / Technician

- Administration

- Executive / Senior Industry Position

- Mid-Level Industry Position

- Junior Industry Position

- Graduate / Traineeship

- Remote/Hybrid Jobs

- Summer / Winter Schools

- Online Courses

- Professional Training

- Supplementary Courses

- All Courses

- PhD Programs

- Master's Programs

- MBA Programs

- Bachelor's Programs

- Online Programs

- All Programs

- Fellowships

- Postgraduate Scholarships

- Undergraduate Scholarships

- Prizes & Contests

- Financial Aid

- Research/Project Funding

- Other Funding

- All Scholarships

- Conferences

- Exhibitions / Fairs

- Online/Hybrid Conferences

- All Conferences

- Economics Terms A-Z

- Career Advice

- Study Advice

- Work Abroad

- Study Abroad

- Campus Reviews

- Recruiter Advice

- Study Guides - For Students

- Educator Resource Packs

- All Study Guides

- University / College

- Graduate / Business School

- Research Institute

- Bank / Central Bank

- Private Company / Industry

- Consulting / Legal Firm

- Association / NGO

- All EconDirectory

- 📖 INOMICS Handbook

All Categories

All disciplines.

- Scholarships

- All Economics Terms A-Z

- Study-Guides

- All Study-Guides

- EconDirectory

- All 📖 INOMICS Handbook

- INOMICS Salary Report

Is an Economics PhD Worth It? The PhD Pay Premium

Read a summary or generate practice questions using the INOMICS AI tool

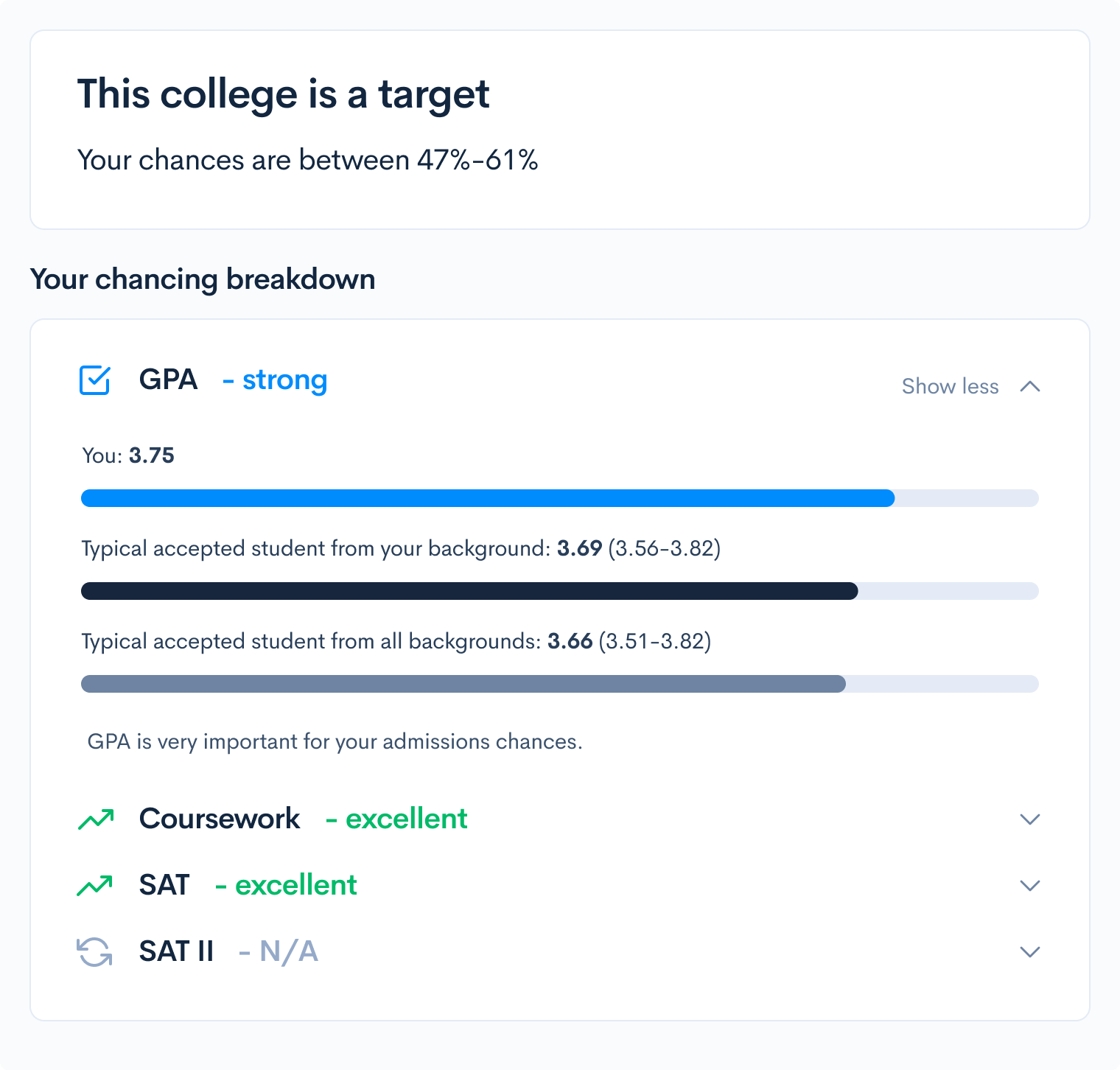

Economics students may often wonder if doing a PhD is the right move for them. After all, you can still get a good job in economics with just a Master’s degree. We’ve covered different angles of this topic before with helpful advice about what degree you’ll need as an economist , asking whether you should do a PhD , and even asking what kinds of economists are paid the most . Thanks to INOMICS Salary Report 2023 data, we can look more closely at the pay benefit for an economics PhD in today’s job market. This will help you decide if doing an economics PhD will be worth it for your own career.

Perhaps unsurprisingly, the typical PhD in economics earns more than the typical economist with “only” a Master’s degree. But how much more? Is doing an economics PhD program worth it in the long term?

Suggested Opportunities

- PhD Program

- Posted 1 day ago

8 fully-funded PhD positions in Economics, Analytics and Decision Sciences (EADS) at the IMT School for Advanced Studies

- Posted 1 week ago

PhD in Economics - University of Torino

Call for gssi phd applications 2024/25.

The short answer: yes. INOMICS Salary Report data shows that in 2023, economics PhDs earned on average 96% more than economists with a Master’s degree. These are worldwide statistics taken from the full breadth of the INOMICS Salary Survey data.

The benefit to doing a PhD in economics varies by region. Figure 1 compares the “earnings premium” that an economics PhD has over economists with a Master’s degree across the world, using 2023 INOMICS Salary Survey data.

Figure 1: Regional Premiums in economics PhD pay compared to a Master’s

Clearly, in most regions acquiring a PhD in economics offers quite the premium. Some results may stand out as surprising, however.

First, in North America in particular, the premium for earning a PhD in economics seems smaller than expected. If a PhD only earns an economist an extra 36% increase in wages, ignoring a PhD and continuing to work might seem like a preferred option in this high-wage region.

In the Caribbean, South & Central America and Africa, PhD earnings are below Master’s earnings. This unexpected result appears to be the case due to the distribution of survey respondents. In both regions, the amount of industry economist respondents is much larger than academic respondents, and Master’s-degree-holding economists outnumber PhD economists in Government, Central & International Bank, and private business roles. These three categories of employer tend to pay more highly than others. This suggests that in these two regions, acquiring a PhD may not be necessary to have a well-compensated industry career. Further, it seems more realistic for Master’s-degree-holding economists to attain high-paying roles in these sectors without a PhD, as opposed to many other regions where a PhD would be considered a requirement.

As the previous discussion just showed, Figure 1 doesn’t account for the different sectors that economists work in. In general, economists who work in industry tend to earn very high wages, while economists who work in academia earn noticeably less until they are finally promoted to a full Professor of Economics. Then, academic economist pay catches up to industry pay. This is a trend noted in multiple editions of the INOMICS Salary Report.

This is particularly true in North America, the highest-paying region on average. Economists working in industry can earn high wages with only a Master’s degree. This is also true of Western Europe & Scandinavia and East Asia & Australasia, the second and third highest-paying regions identified by the Report.

Some other regions of the world feature much more of a premium for PhD economists. Part of the reason for this is clear. Since high-paying regions like Western Europe and Australasia pay higher salaries to begin with due to the higher cost of living, a high pay increase in these regions represents a lower percentage of overall pay.

This fact is supported by the graph; North America is the highest-paying region and features the lowest positive percentage increase in pay for PhDs. Western Europe, which pays the second most on average, features a slightly higher percentage increase. Readers should make no mistake; a 35.6% increase from a base salary of $100,833 (the average Master’s degree economist salary in North America) is a massive increase in pay. Comparably, the almost 120% increase in pay in the Middle East, Central Asia & North Africa region is an increase from an average Master’s degree salary of $17,321 to almost $40,000. In percentage terms, this is obviously enormous, but in cash terms less than the difference in North America.

Additionally, however, the high percentage premium for PhD economists in lower-paying regions may suggest that in these regions (i.e., South Asia, Middle East) there are more opportunities for economists without a PhD to find meaningful employment, so fewer individuals elect to study for a PhD. If this is true, those who do complete a PhD enjoy a high pay premium over their economist peers since economics PhDs are more rare in those regions.

Academic economists need a PhD

Economics students should keep in mind that academic jobs will almost certainly require a PhD in economics. Economics students interested in a career in academia should therefore be strongly encouraged to pursue an economics PhD, regardless of differences in pay. The following Figure 2 shows the pay premium for economists employed at universities, by region:

Figure 2: Regional Premiums in economics PhD pay compared to a Master’s (Academic only)

The pay premiums for economics PhDs tells the story quite clearly: across the board, in every world region, economics PhDs in academia earn much more than their counterparts without a PhD.

Readers might note that this graph is likely skewed because economics PhDs are probably more senior economists than economists without a PhD in academic settings, and likely hold higher-level positions; but this skewness supports the point. Economists interested in a serious career in academia must strongly consider getting a PhD, or have a specific reason to not need one. It is very difficult to earn a Professor of Economics position without a PhD in most of the world. Figure 3 below provides evidence to support this point.

Figure 3: % of Master’s degree economists in Professor roles by region

Figure 3 shows very clearly that burgeoning economists should expect to earn a PhD if they wish to work as a Professor of Economics in the future. Every world region has very few Professors with just a Master’s degree. Even in South Asia, which has by far the largest representation for Professors with a Master’s degree in our data, only 20% of Professors have a Master’s while 80% have a PhD.

Industry economist roles

It’s clear that academic economists usually need a PhD, but this isn’t necessarily the case in industry. However, readers may be curious to repeat the above breakdowns in industry roles, which can be instructive. Figure 4 thus shows the pay premium for PhD economists in industry roles by region:

Figure 4: Regional Premiums in economics PhD pay compared to a Master’s (Industry only)

Figure 4 shows that PhD economists out-earn Master’s-holding economists in industry jobs by a substantial amount in most regions. The lower industry PhD economist pay compared to Master’s degree economists was already discussed above for Africa and the Caribbean. In summary, Master’s degree holding economists outnumber PhD economists in Government, Central & International Bank, and private business roles in these two regions. Since these three categories of employer tend to pay more highly than others, it may slightly skew the graph in favor of Master’s degree holders. However, this suggests that in these two regions, acquiring a PhD may not be necessary to have a well-compensated industry career.

In North America, part of the reason for a lower than expected premium is likely the fact that in this high-paying region, high base salaries mean that salary increases will be lower percentage-wise. This was discussed above as well. Average years of experience are quite comparable for industry economists in North America (about 12 for Master’s degree holders and 15 for PhD holders), and the employer distribution is relatively balanced.

Figure 4 suggests that industry economists with a Master’s degree in North America ought to consider their career path and whether a PhD is right for them before going back to school. A PhD opens up some employment opportunities in the private sector that aren’t available to Master’s degree holders, and will increase pay, but whether or not that is necessary or desired is likely up to the individual.

Keep in mind that specific non-academic employers – especially governments, central banks like the Federal Reserve, institutions seeking economics researchers, NGOs like the World Bank, and even increasingly consulting firms – are likely to require an econ PhD for some higher-level positions. Be sure to check job listings for economics jobs that you’re interested in to see if a PhD might help you reach them in your career.

Comparing previous years: PhD earnings on the rise again

Using past years of INOMICS survey data, we can examine how the benefit to doing an economics PhD has changed over time. It appears that the premium in pay that economics PhDs enjoy is recovering after a slight dip during the pandemic years. See below Figure 5 below:

Figure 5: How much more PhD economists earn vs. Master’s economists by year, INOMICS data

Figure 5 shows that earnings for economics PhDs are once again rising relative to pay for economists without a PhD. It’s worth noting that pay for economists with both degree types has increased this year. According to the latest INOMICS Salary Report, economists with a Master’s as their highest degree experienced a 3.2% increase in pay on average since 2022, while those with a PhD have experienced a 35.9% increase. This has widened the earnings premium between the two categories from 80% in 2022 to 91% in 2023.

The dip in pay that economists experienced in 2022 may be partially due to the COVID-19 pandemic. And PhD pay is not the only factor that appears to be improving since COVID. The post-pandemic recovery of the economics jobs market has already been discussed by INOMICS, showing that earnings for economists with Master’s and Bachelor’s degrees recovered sharply after the first waves of the pandemic.

So, is doing a PhD in economics right for you? According to the data, in most cases it will be. However, you must weigh the tradeoffs yourself. You may not need a PhD to have a fulfilling career in economics, particularly if you plan to work in a non-governmental and non-central bank role in industry, and particularly in certain countries and regions.

Header image credit: Freepik.de

Currently trending in United States

- (Partially Online)

- Posted 3 weeks ago

Annual Research Conference 2024

- Posted 4 weeks ago

2024 International Conference on Finance for the Common Good

- Research Assistant / Technician Job, PhD Candidate Job

Part-time Research Assistant (50%) in the area of theoretical and quantitative macroeconomics

- economist pay

- economics PhD

- economics jobs

- economics degree

- economist jobs

- Sean McClung

Related Items

Scholarships and Tuition Fee Waivers for PhD in Economics

MSc/PhD in Quantitative Economics - University of Alicante

Featured announcements, 8 fully-funded phd positions in economics, analytics and decision…, part-time research assistant (50%) in the area of theoretical and…, 2024 international conference in finance, accounting and banking …, the economics of poverty and inequality: global challenges in the…, upcoming deadlines.

- May 15, 2024 Double Master in European Financial Markets and Institutions

- May 15, 2024 14th BEST PAPER AWARD ON GENDER ECONOMICS – 2 Prizes Worth € 2,500 each

- May 15, 2024 The 7th International Conference on Economics and Social Sciences (ICESS 2024)

- May 17, 2024 PhD contract in sustainable finance - 2024-2027

- May 18, 2024 Spatial Econometrics Advanced Institute

INOMICS AI Tools

The INOMICS AI can generate an article summary or practice questions related to the content of this article. Try it now!

An error occured

Please try again later.

3 Practical questions, generated by our AI model

For more questions on economics study topics, with practice quizzes and detailed answer explanations, check out the INOMICS Study Guides.

Login to your account

Email Address

Forgot your password? Click here.

- Recently Active

- Top Discussions

- Best Content

By Industry

- Investment Banking

- Private Equity

- Hedge Funds

- Real Estate

- Venture Capital

- Asset Management

- Equity Research

- Investing, Markets Forum

- Business School

- Fashion Advice

- Investment Banking Forum IB

How Hard is Economics vs. Finance?

- Share on Facebook

- Share on Twitter

- Share on LinkedIn

- Share via Email

As a major, which one is harder? Econ seems to apply calculus and other types of math. I've never taken a Finance course so I dont have an idea.

is economics a hard major relative to finance?

The answer to this question depends on the school that you attend and the difficulty of the programs at these respective schools.

That being said, from a conceptual standpoint - finance is more technically focused (learning formulas and processes to solve problems) and economics is focused more on theory and critical thinking. With this in mind, most people can memorize their way through a finance class or even degree while economics will require more conceptual studying and critical thinking. On the economics side, calculus also comes into play which is more difficult than the math that you get into on the finance side which is mainly just algebraic equations at the undergrad level.

You can check out a video about the difference between finance and economics below.

Read More About Economics Degrees on WSO

- How useful is an undergrad Econ degree?

- Economics vs. Finance Major

- Math or Economics Major

- Is Economics a Good Major?

Decided to Pursue a Wall Street Career? Learn How to Network like a Master.

Inside the WSO Finance networking guide, you'll get a comprehensive, all-inclusive roadmap for maximizing your networking efforts (and minimizing embarrassing blunders). This info-rich book is packed with 71 pages of detailed strategies to help you get the most of your networking, including cold emailing templates, questions to ask in interviews, and action steps for success in navigating the Wall Street networking process.

Networking Guide

At my non-target, Finance majors are 72 units (tied for most units in a single major). Econ majors are 50 units. Interpret however you will.

I think so. Finance is more statistics and less theoretical. Econ is also more boring in my opinion.

It varies from school to school, at Illinois, it was about the same. Accy was much tougher as a major.

If you are in a non-target program, I would recommend pairing Econ with a quantitative discipline like engineering. Would set you up extremely well for an MFE program.

I am currently a sophomore majoring in Finance with minor in Accounting, however, I am not sure if it will be the best pairing if I am hoping for a career in IB . I am thinking of switching to Finance major/ Econ minor or Econ major/Finance minor but I don't know which one would be more beneficial. Can anyone give advice?

rbholde: I am currently a sophomore majoring in Finance with minor in Accounting, however, I am not sure if it will be the best pairing if I am hoping for a career in IB . I am thinking of switching to Finance major/ Econ minor or Econ major/Finance minor but I don't know which one would be more beneficial. Can anyone give advice?

Most investment banks require several semesters of Accounting classes. I graduated with a major in Finance and a minor in Economics and I regret not picking Accounting.

PigSooie: rbholde: I am currently a sophomore majoring in Finance with minor in Accounting, however, I am not sure if it will be the best pairing if I am hoping for a career in IB . I am thinking of switching to Finance major/ Econ minor or Econ major/Finance minor but I don't know which one would be more beneficial. Can anyone give advice?

???? lol last time i checked IBs dont have course requirements/pre-reqs? Unless maybe you are working in their accounting department?

Harvard doesnt even have accounting for UGs...

IMO, Economics is tougher intellectually and will also teach you how to think. Finance has an extremely narrow focus and most entry-level jobs or internships will teach you the financial skills you need anyway.

I'm biased of course, but I would encourage you to make the most of your educational opportunities.

Tracer: IMO, Economics is tougher intellectually and will also teach you how to think. Finance has an extremely narrow focus and most entry-level jobs or internships will teach you the financial skills you need anyway. I'm biased of course, but I would encourage you to make the most of your educational opportunities.

Agreed. Econ requires critical thinking where as finance requires more memorization of formulas and rules.

I majored in Financial engineering and econ at a target. Fin engineering was way harder than econ, but the normal finance major was a joke.

Upper-level econ can be very tough. I suspect that generally speaking, econ is harder than finance at the grad level.

What kind of Math do you typically do in a finance course?

The math isn't hard in Finance. It's very simple, there are a ton of formulas. Options and Futures can be difficult for some people, but on the whole Finance is not that hard. It all depends though, I've known some people who were majoring in Acct who found Fin to be harder.

I would suggest you take atleast two accounting courses (Intermediate Acct 1&2). These courses will give all the foundation you'll need when doing financial analysis.

For the people that think finance is a joke major, it sounds to me like you're only familiar with basic corporate finance (which is all theory and almost no mathematical application). Once you break into quant finance, especially at the graduate level, it isn't exactly a walk in the park. I would argue that econ theory, at least at the undergraduate level (I can't comment on anything beyond that) certainly isn't what makes it difficult. If you're going to judge finance, don't just look at the easy parts of it. Also, consider that finance is very poorly taught at the undergraduate level in the US.

ucla: For the people that think finance is a joke major, it sounds to me like you're only familiar with basic corporate finance (which is all theory and almost no mathematical application). Once you break into quant finance, especially at the graduate level, it isn't exactly a walk in the park. I would argue that econ theory, at least at the undergraduate level (I can't comment on anything beyond that) certainly isn't what makes it difficult. If you're going to judge finance, don't just look at the easy parts of it. Also, consider that finance is very poorly taught at the undergraduate level in the US.

The math I did in Industrial Organization and Econometrics is way more complicated than anything I did in an upper level portfolio management course and certainly far more complex than anything I did in IBD . M&A finance as practiced in the real world doesn't get any more complicated than the 4 basic arithmetic functions and the occasional exponent.

Grad-level Econ certainly isn't navelgazing either. There's plenty of statistical analysis in grad level economics as well and a lot of the more complex formulas and tools for analysis in quant finance were developed or are also used by economists, e.g. Black and Scholes were both economists.

Tracer: ucla: For the people that think finance is a joke major, it sounds to me like you're only familiar with basic corporate finance (which is all theory and almost no mathematical application). Once you break into quant finance, especially at the graduate level, it isn't exactly a walk in the park. I would argue that econ theory, at least at the undergraduate level (I can't comment on anything beyond that) certainly isn't what makes it difficult. If you're going to judge finance, don't just look at the easy parts of it. Also, consider that finance is very poorly taught at the undergraduate level in the US.

Luckily my answer isn't confined to purely graduate level finance or econ, which is why it is relevant.

Upper level portfolio management is a joke, how can you compare that to an econometrics course? Get real. Regarding M&A finance, there is a reason bankers are known as monkeys. Again, if you're only going to compare the difficult economics to the easy finance, you're going to bias your answer and give shit advice.

ucla: Tracer: ucla: For the people that think finance is a joke major, it sounds to me like you're only familiar with basic corporate finance (which is all theory and almost no mathematical application). Once you break into quant finance, especially at the graduate level, it isn't exactly a walk in the park. I would argue that econ theory, at least at the undergraduate level (I can't comment on anything beyond that) certainly isn't what makes it difficult. If you're going to judge finance, don't just look at the easy parts of it. Also, consider that finance is very poorly taught at the undergraduate level in the US.

Luckily my answer isn't confined to purely graduate level finance or econ, hence why it's relevant.

Portfolio Management was a 300 level course during undergrad, as were Industrial Organization and Econometrics. We had a really good prof in PM who actually took us through the mathematical derivations of every single formula, including B-S, CAPM , etc.. It was as sophisticated as you could get at the undergrad level, IMO.

I didn't go to Wharton, but looking at the course listings here: http://fnce.wharton.upenn.edu/programs/undergrad_courses.cfm

--and assuming Wharton has a pretty good undergrad finance program, it seems pretty clear to me that ignoring the economics masquerading as finance courses, that PM is as complicated as it gets in undergrad finance. I'm also confident that any econ major w/ no college finance coursework who worked in M&A or Lev Fin for 2 years could sit and pass the final exams in every single course on that page.

As they are currently taught, undergrad econ is definitely harder than undergrad finance.

If the guy wants to be a banker, he might as well take econ and challenge himself and then drop $150 or whatever on the BIWS beginner's modeling course which will teach him all the finance he needs on the job. There's no point dropping thousands of dollars on an undergrad finance education when you can cover the b professionally relevant[/b] material for much less in your spare time.

I genuinely think that it depends on the person. For me, economics was incredibly easy. I'm majoring in finance, but have taken at least six or seven economics classes, and at no point did I find it difficult. To me it was just a lot of what I assumed was common sense. Finance on the other hand was just so vast it was difficult to nail down. Accounting, future cash flows, several different ways to valuate a firm, options and futures markets, foreign currencies and markets, cash flow statements, tons of statistical formulas, etc. I'm not saying economics is easy, but again, I think it depends on the person, and how well they grasp certain material.

Finance and accounting are not difficult or really all that challenging in terms of intellectual rigor, they are more or less memorization of and understanding basic formulas (algebra mostly). Econ has a more calculus applications at the undergrad level and is definitely more of a thinking mans major.

Think I'll go with Finance. The math for Econ is scaring me lol.

I was an econ major and i had a bunch of friends that were finance majors. From what ive seen from their work in comparison with mine, I can say that econ requires more intuitive thinking, while finance is more linear. Interpret that however you like lol.

Econ is definitely much more intellectually rigorous. It requires deeper thinking and thorough understanding of complex material, and then applying that material to novel situations. On the other hand, finance is linear and straight-forward; memorization of a few formulas and basic mathematical skills suffice.

Put it like this. Econ is qualitative with a few key quantitative aspects, while finance is rote and repetitive, quantitative in every way. The proponents of each will say theirs is more challenging.

A Posse Ad Esse: Put it like this. Econ is qualitative with a few key quantitative aspects, while finance is rote and repetitive, quantitative in every way. The proponents of each will say theirs is more challenging.

Bull fucking shit. Utterly incorrect.

Taison: A Posse Ad Esse: Put it like this. Econ is qualitative with a few key quantitative aspects, while finance is rote and repetitive, quantitative in every way. The proponents of each will say theirs is more challenging.

uhhh no. your statement couldnt be further from the truth. (no offense)

The "all of 5 minutes" argument seems to span entire internships and several months into full-time, so I don't buy it.

There is a difference between getting into IB (and getting by in IB) versus crushing IB . And what do you think happens when you interview for buyside , where your ability to get by off of bullshit is largely diminished and you're expected to actually know what you're doing and understand why youre doing it?

Im sure there are a ton of liberal art people who did HBS who are crushing wall street. Last time I checked, HBS is a business school which teaches finance. Liberal arts kids aren't idiots (a persons major has no bearing on their intelligence), but having an additional edge when it comes to knowledge can only help. Why do you think these guys needed to go back to get their MBA ?

Are you still in college or have you just not updated your profile from Prospective IB?

I've done IB for 2.5 years. I know what needs to be known at this point. I was a triple major in college (Econ was one of them, no option for finance). The finance you need to know to do well in an IB non-trading/quant job is so incredibly limited that you can pick it up over a weekend if you're not clueless.

Seriously, if finance were so vital to success in IB , Ivies and other top 20 schools (excepting Wharton, I suppose) would actually offer it as a major.

I read through Wharton's complete undergrad offering. With the exception of some of the super niche topics, I am confident I could sit for finals in every one of those classes and pass them.

And for the record, HBS is not a finance-heavy school. The finance your typical student learns there is just a condensed version of undergrad finance for career-switchers looking to go into finance.

I have not updated my profile.

First off, I find finance, from an academic perspective, to be extremely interesting. This isn't a field that only offers value because it prepares you for IBD .

You mentioned that you can learn everything you need to in a weekend -- that may be true (probably not), but again, having additional knowledge going into a job can only help. When I interned back in the day, there was a very clear difference between the kids who had taken finance in school and those who had not. The difference did not disappear, even by the end of the internship. Had the gap closed? Sure, but it still existed. Good luck hitting the ground running in a field like restructuring if you've never taken a finance course.

Also, I never said HBS was a finance heavy school. I am quite aware that it is not (whereas Chicago and Wharton are), but it does give a liberal art major a strong intro into finance which is certainly helpful.

On a final note, I absolutely guarantee you would get crushed on anything related to options/futures. Good luck knowing the risk neutral / no arb methods with your IB background. The only things you would easily pass are the things pertaining to corporate finance and valuation . There is a whole lot more to finance than that, which goes back to my initial point. Lets not forget, this entire discussion isn't even relevant to the OP's question.

No one said finance wasn't interesting, well not me anyway. And no one said it was a narrow field as a whole, we're talking undergrad.

As this thread is in the IB forum, it's clearly being started by a kid who wants to do banking some day, so advanced option pricing formulae are irrelevant to his professional goals.

I think it's worth noting that any supposed material advantage a finance major has over an econ major in job performance in IB is limited only to the first few months/years of their careers. After that point, the econ majors catch up in terms of their financial knowledge, and rigorous financial analysis ceases to be part of their job responsibilities. As their careers progress, the econ majors will be better served by the critical thinking skills and fundamental understanding of markets that they learned back as an undergrad. Many of the biggest and most innovative professionals in banking and PE history were econ majors and never studied finance in depth.

Ok to back this argument up slightly...

We started off discussing which major is "harder" (not better). I don't particularly have a strong stance on this because I think the question is incredibly vague. What does "harder" even really mean? In our guts, we feel subjects like sociology/history are easier than mathematics/physics, but it is still quite subjective. Moving away from extremes, we are now looking at econ /finance which are two very closely related fields, and trying to say which is "harder". This makes our discussion incredibly subjective to the point where there isn't a right answer (given the lack of definition of harder, many people are on different pages). At this point, I wanted to correct the fact that the narrow view of corporate finance that you have is NOT representative of "finance" at large in an undergraduate academic setting. Therefore, you pointing out that "finance is easier than econ because you can learn corporate finance in a few days in banking" is a bullshit argument as far as I am concerned (and it is obvious where your bias is...how would you even realize how little you know about the topic unless you've majored in it? I don't know for certain what you majored in, but given your arguments, I highly doubt it is finance).

Now, we've moved away from the argument of which is harder to which is better. Again, this is undefined, but to me, "better" is the subject that will better prepare you for banking (specifically, your analyst stint as that is what is most relevant to prospective students). In my mind, from the perspective of which subject gives you the knowledge to succeed, finance is unequivocally the better major.

We are clashing here because you think "better" isn't what gives you knowledge to begin with, but rather what helps you succeed in the longer run (this is still within the definition of "what will better prepare you for banking" but with a bit more of a distinction between the short/long term). You have the idea that economics teaches you how to critically think in a superior fashion to finance. Overall, this means you're going to give econ more credit in the long run than I would (and finance less credit in the short term because you think the gap is eliminated more quickly than I do).

I don't think your argument holds much weight. We can both agree that finance provides superior "short term" (how short short-term is is certainly subjective, and I think it's longer than you think) knowledge, but we do not both agree about the critical thinking comment. I do not accept your statement that econ teaches you to critically think in a "superior" fashion to finance. My gut tells me that math/philosophy are the only two majors that truly teach you how to critically think, with any sort of applied math subjects being a slightly watered down version of mathematics from a critical thinking perspective (physics, engineering, etc.). Econ/finance are pretty comparable from the math perspective at the undergraduate level, assuming you're comparing quant finance to the more quant fields in econ (like econometrics, which you are). Therefore, I don't think you can objectively state that either subject is superior.

One last thing to note: given the recruiting process for the analyst stint into PE / HF , unless that gap is eliminated extremely quickly (which it really isn't), there will be an advantage to the Wharton kid who already has his shit mastered and can focus on the new stuff. I mean, how much easier is it to understand the mechanics behind a deal when you already know all the quant stuff? How much easier is it to discuss distressed debt opportunities or whatever niche field you're looking at when you've already spent a few semesters studying the theory behind these sorts of events?

TLDR: corp finance (qualitative finance) cannot be compared to econometrics (arguably the most quant portion of undergrad econ). Also, while "better" is subjective, we can both agree finance teaches you more to begin banking but we are at an impasse regarding which teaches you to better think "critically". This is because you are not providing anything to substantiate your comments. Am I supposed to take you at your word that econ is better for critical thinking? Come on now.

based on the unscientific sample below, it would seem that being an econ major puts you at no disadvantage to success in finance over the long term...

Famous Econ Majors:

Bob Diamond http://en.wikipedia.org/wiki/Robert_Diamond

Ken Griffin http://en.wikipedia.org/wiki/Kenneth_C._Griffin

David Tepper http://en.wikipedia.org/wiki/David_Tepper

Steven Cohen http://en.wikipedia.org/wiki/Steven_A._Cohen

Henry Kravis: http://en.wikipedia.org/wiki/Henry_Kravis

Robert Rubin http://en.wikipedia.org/wiki/Robert_Rubin

Jamie Dimon http://en.wikipedia.org/wiki/Jamie_Dimon

Paul Tudor Jones http://en.wikipedia.org/wiki/Paul_Tudor_Jones

Famous Finance Majors:

John Paulson http://en.wikipedia.org/wiki/John_Paulson

Famous English Majors:

Hnery Paulson http://en.wikipedia.org/wiki/Henry_Paulson

+1 for liberal arts...

deal_mkr: based on the unscientific sample below, it would seem that being an econ major puts you at no disadvantage to success in finance over the long term... Famous Econ Majors: Bob Diamond http://en.wikipedia.org/wiki/Robert_Diamond Ken Griffin http://en.wikipedia.org/wiki/Kenneth_C._Griffin David Tepper http://en.wikipedia.org/wiki/David_Tepper Steven Cohen http://en.wikipedia.org/wiki/Steven_A._Cohen Henry Kravis: http://en.wikipedia.org/wiki/Henry_Kravis Robert Rubin http://en.wikipedia.org/wiki/Robert_Rubin Jamie Dimon http://en.wikipedia.org/wiki/Jamie_Dimon Paul Tudor Jones http://en.wikipedia.org/wiki/Paul_Tudor_Jones Famous Finance Majors: John Paulson http://en.wikipedia.org/wiki/John_Paulson Famous English Majors: Hnery Paulson http://en.wikipedia.org/wiki/Henry_Paulson +1 for liberal arts...

Totally forgot Warren Buffett, Econ at UPENN.

Why are they more adaptable and capable? Are people who receive a top-class education in finance not encouraged to think creatively or outside of the box? Econ majors are encouraged to be critical thinkers and finance majors are encouraged to be drones? How is taking a finance major "short sighted towards IBD /PE"? Do you have anything to substantiate your claim other than your opinion?

If nothing else (I assume you won't bother to back up half the shit you've said, because it's opinionated unsubstantiated bullshit), please provide real evidence on how economics is an "education" more than finance. What is it exactly that you think Ben Graham taught? His students were..drones? Incapable of critical thought relative to the average economics student?

A lot of bold claims that you can't back up / substantiate in any way.

As a side note, I find it hilarious that you're comparing math/physics/philosophy with economics. Clearly an econ major haha.

Uhh, Buffett switched schools and graduated from the University of Nebraska. :)

IlliniProgrammer: Uhh, Buffett switched schools and graduated from the University of Nebraska. :)

Score one for the Midwest ha Illini?