- Skip to main content

- Skip to primary sidebar

- Skip to footer

- QuestionPro

- Solutions Industries Gaming Automotive Sports and events Education Government Travel & Hospitality Financial Services Healthcare Cannabis Technology Use Case AskWhy Communities Audience Contactless surveys Mobile LivePolls Member Experience GDPR Positive People Science 360 Feedback Surveys

- Resources Blog eBooks Survey Templates Case Studies Training Help center

Customer Satisfaction Research: What it is + How to do it?

Customer satisfaction research is essential for businesses looking to build long-term customer relationships. It provides organizations with essential insights into their customers’ thinking and tastes.

Customers who are satisfied with the quality of service are more likely to become loyal customers. In this blog, we will explore customer satisfaction research and how to do it for customer-centric success.

What is customer satisfaction research?

Customer satisfaction research is a systematic process of collecting, analyzing, and interpreting data that allows companies to measure the satisfaction level of customers when purchasing a product or service from their brand.

This research is useful to identify satisfied customers who are loyal defenders of your brand and who are dissatisfied to follow up on their demands.

There are many reasons to measure customer satisfaction. Customer satisfaction research offers great insights, so your team can focus on meeting customer expectations or flagging potential issues that may affect your business growth.

Importance of conducting a satisfaction study

Customer satisfaction research allows business managers and owners to discover that keeping current customers costs less than getting new ones.

One way to collect information about customer satisfaction is by conducting online surveys, which will help you make the necessary changes to improve your business and maintain customer loyalty.

Responding to customer complaints and concerns don’t always mean knowing their needs. Satisfaction surveys allow companies to understand what is working, what needs to be improved, and why.

To provide better customer service, it’s important to understand how they feel and allow them to explain why they feel that way. Only then can you adapt your services and offer an experience that makes you stand out from the competition.

Companies carry out satisfaction studies for different objectives. Among the most important uses of this mechanism are:

- Know what are the areas that need to be improved in the business.

- Know the opinion of customers about your brand.

- Find out what the true needs of customers are.

- Create better customer retention strategies.

- Know if the market strategies that are carried out are working.

- Meet customer expectations.

How to carry out customer satisfaction research?

Customer satisfaction research takes several steps to get a thorough and accurate insight into your customer experiences and perspectives. Here’s a step-by-step method you can follow for carrying out customer satisfaction research:

Step 1: Define Research Objectives

Defining precise and well-structured research objectives is an essential first step in every customer satisfaction research project. These objectives will guide you through the whole research process and ensure that the research remains focused, relevant, and connected with your business goals.

To define research objectives, follow the steps outlined below:

- Identify the Objectives: Start by identifying the overall objectives of your customer satisfaction research.

- Break Down Objectives: Divide the purpose into specific objectives. Each objective should be specific and address a different component of customer satisfaction.

- SMART Criteria: Make sure your objectives are SMART—specific, measurable, attainable, relevant, and time-bound.

- Prioritize: If you have several objectives, prioritize them according to relevance and potential impact.

Step 2: Select Research Methodology

Selecting an appropriate research technique is a vital decision that will define your overall research process. Your approach will influence the type of data you gather, the level of insights you get, and the general validity of your findings. Here are some examples of research methodology.

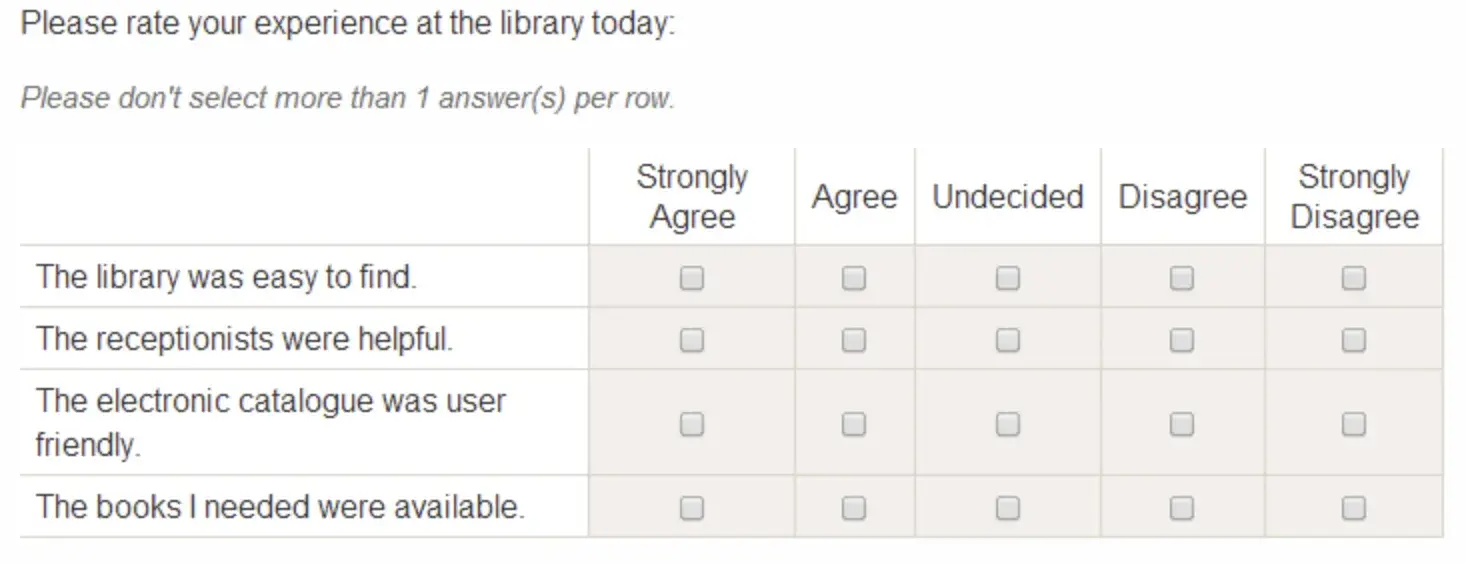

- Surveys: Surveys are a popular and versatile method for collecting data on customer satisfaction. You can gather qualitative and quantitative data through structured questions.

Customer Satisfaction Score (CSAT) is the most straightforward of the customer satisfaction survey methodologies. Surveys are well-suited for measuring customer satisfaction scores, Net Promoter Scores (NPS), and other quantitative metrics.

- Interviews: Interviews will enable you to have in-depth interactions with customers. You can get valuable qualitative insights into customer experiences through phone interviews or in-person chats.

- Focus Groups: In a focus group, a small group of customers shares their experiences, ideas, and impressions in a guided session. This strategy encourages group interactions by allowing participants to respond to each other’s comments.

- Observations: Observational research refers to directly monitoring customers as they interact with your products or services. This strategy will provide you insights into user behavior and reactions in real time.

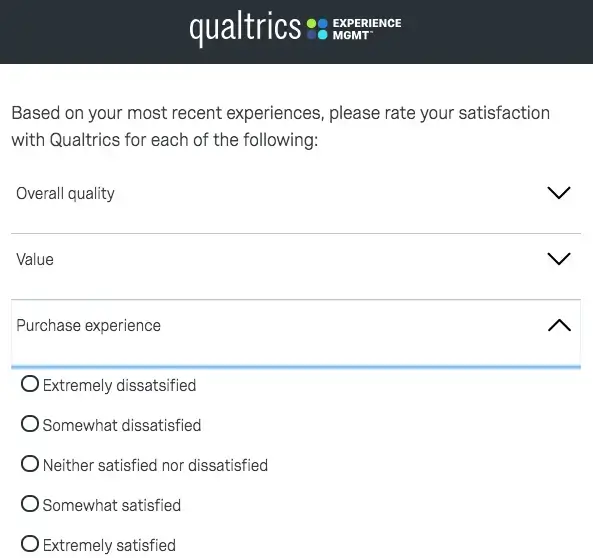

Step 3: Develop Customer Satisfaction Surveys

Developing well-crafted customer satisfaction surveys is an important stage in customer satisfaction research. It serves as the primary tool for gathering customer data and insights.

A well-crafted customer satisfaction survey will ensure that you get relevant and meaningful data. It will also motivate you to make improvements and increase customer satisfaction. You can develop a robust customer satisfaction survey by following the steps below:

- Define Research Objectives: Before developing survey questions, ensure you understand the research objectives. Determine which aspects of customer satisfaction you want to measure and what insights you want to get.

- Choose Question Types: Remember the research objectives when creating customer satisfaction survey questions. Select appropriate question types that align with your research objectives. It will help you to capture different dimensions of customer satisfaction. To quantify responses, include closed-ended questions with Likert scales, multiple-choice options, and ranking scales. Include open-ended questions. It will encourage your customers to provide thorough comments and insights.

- Order and Flow: Organize the survey questions logically, begin with general questions, and then proceed to more specialized and complicated topics. Keep a balance between qualitative and quantitative questions.

- Avoid Leading Questions: Leading questions will unintentionally influence your respondents and compromise the accuracy of their responses. So, avoid including leading questions and design questions that are neutral and unbiased.

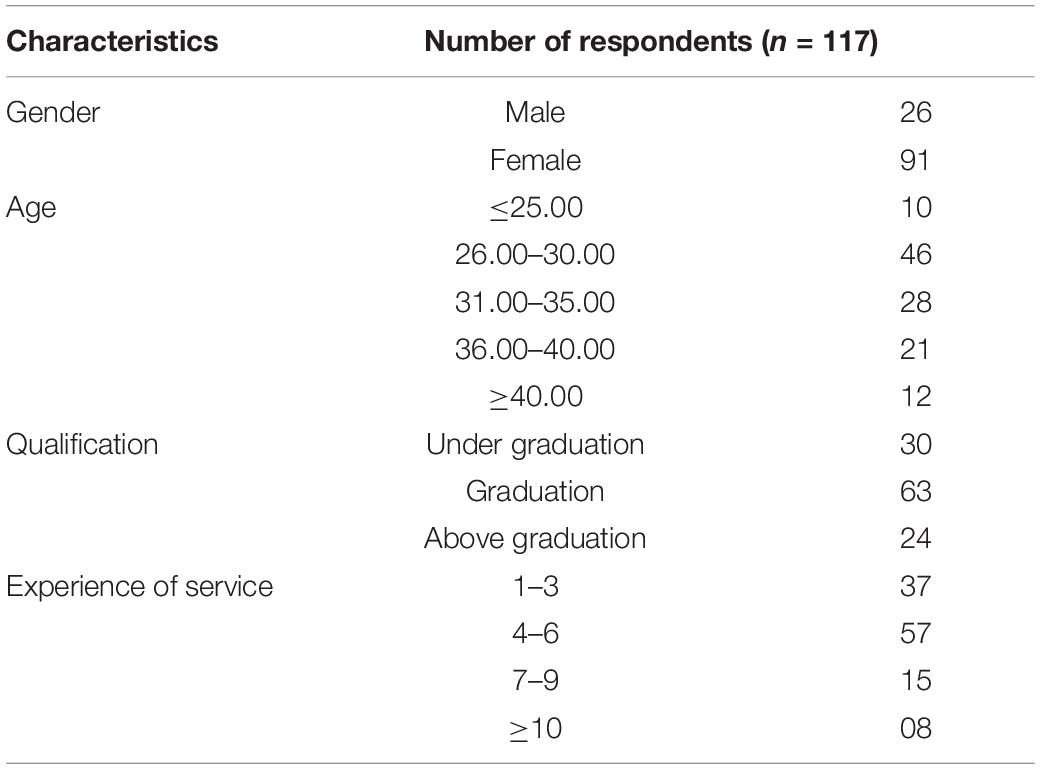

- Incorporate Demographic Questions: Demographic questions (e.g., age, gender, location) will help you to segment responses and analyze satisfaction across different customer segments. So include it.

- Mobile-Friendly Design: Make sure your survey is mobile-friendly and displays properly on different screen sizes.

Step 4: Sampling Strategy

Sampling ensures that the findings are representative of your whole customer base. It will enable you to make correct decisions and judgments. A well-planned sampling method will help you reduce biases and increase your findings’ generalization.

Depending on your research objectives and available resources, you can use a variety of sampling methods . Here are a few common approaches:

- Simple Random Sampling : It ensures that every person in the population has an equal chance of being chosen.

- Stratified Random Sampling : This sampling method divides your population into subgroups based on specified criteria.

- Convenience Sampling : This method selects participants who are easily accessible, such as customers who frequently visit your physical store or online store.

Step 5: Data Collection and Analysis

In this step, you will collect data from your target audience, arrange and evaluate the data systematically, and generate useful insights to make informed decisions.

Use statistical tools to analyze trends, correlations, and distributions for quantitative data. Calculate measures such as averages, percentages, and standard deviations. You can visually represent the findings using graphs, charts, and tables.

Use qualitative analysis tools for qualitative data. Content analysis, thematic analysis, and sentiment analysis are all common methodologies you can use. These strategies will help you identify repeating themes, attitudes, and patterns in open-ended responses.

Step 6: Implement Changes

The implementation phase of customer satisfaction research is where insights and recommendations are implemented. Here, you will turn data-driven findings into real improvements that directly influence the customer experience.

Create a detailed implementation plan for each identified improvement. Implementing changes based on research findings involves careful planning, cooperation, and a dedication to providing greater customer value.

Define specific tasks, time frames, responsible parties, and key performance indicators (KPIs) to measure the effectiveness of each effort. Prioritize the actionable recommendations that are most likely to improve customer satisfaction and retention significantly.

Step 7: Communication and Regular Feedback Loop

Transparency is essential for maintaining trust and credibility with your customers. Share the research’s findings and the responses that were made. Let your customers know that their opinions are taken seriously and have resulted in concrete improvements.

Customer satisfaction will remain a dynamic and changing emphasis of your business strategy if you establish a continual feedback loop. Here are some tips for creating and keeping a consistent feedback loop:

- Scheduled Surveys: Conduct customer satisfaction surveys quarterly, semi-annually, or yearly.

- Incorporate Feedback Mechanisms: Integrate feedback mechanisms into various touchpoints, such as post-purchase follow-up emails, customer service interactions, or feedback forms on your website.

- Feedback Analysis: Analyze the customer feedback you received from each cycle in detail. Identify recurring themes, popular trends, and problem areas.

- Action Planning: Create action plans for additional improvements based on the newly acquired insight.

- Implementation: Implement the suggested modification and changes in every relevant part of your business.

Advantages of carrying out a satisfaction study

Carrying out a satisfaction study has great benefits for your organization:

- Obtain valuable information from customers

Doing customer satisfaction research allows you to obtain information about your customers, determine how happy they are with your company, and correct what is wrong.

- Establish priorities

The satisfaction study results allow you to discover which areas of your business need more attention, such as customer service, the sales closing process, etc.

- Customer retention

If your customers are satisfied with your products, it is possible that they will stay in your business. Maintaining a high level of customer satisfaction is extremely important to the overall success of your organization.

- Maintain your reputation

A satisfaction study allows you to interact with consumers and show them that you care about their needs and opinions. In particular, they offer to improve the customer experience if you make the changes.

- Maintain customer loyalty

If you want to maintain customer loyalty, a satisfaction survey will give you the opportunity to listen to their feedback and improve your brand.

- Get new customers

People feel more confident buying from transparent companies, so post the feedback you get from current customers to show that you allow any kind of feedback and value it.

- An advantage over the competition

There is a lot of competition in the market today, so any advantage you may have needs to be made known. Show current and potential customers the areas in which you excel.

Conducting customer satisfaction research with QuestionPro

One of the best ways to find out the opinion of customers and their needs is through online surveys, which allow you to collect information and perform data analysis to make better business decisions.

With QuestionPro, you can find out how satisfied your customers are by asking a Net Promoter Score question, which will let you know if consumers are promoters or detractors of your brand.

Other types of questions that will help you gather information for your study are:

- Multiple Choice Questions

- Closed questions

- Open text questions

- Order and Ranking Questions

You can track customer satisfaction and measure how happy your existing customers are with your business, brand, and customer initiatives by using QuestionPro’s customer satisfaction survey templates and survey questions. These customer satisfaction survey examples help ensure a higher survey completion and response rate for your market research.

Find out what customers think! Carry out customer satisfaction research and collect the necessary information to improve the consumer experience. Contact us and learn how to measure customer satisfaction using QuestionPro.

LEARN MORE FREE TRIAL

MORE LIKE THIS

Was The Experience Memorable? — Tuesday CX Thoughts

Sep 10, 2024

What Does a Data Analyst Do? Skills, Tools & Tips

Sep 9, 2024

Best Gallup Access Alternatives & Competitors in 2024

Sep 6, 2024

Experimental vs Observational Studies: Differences & Examples

Sep 5, 2024

Other categories

- Academic Research

- Artificial Intelligence

- Assessments

- Brand Awareness

- Case Studies

- Communities

- Consumer Insights

- Customer effort score

- Customer Engagement

- Customer Experience

- Customer Loyalty

- Customer Research

- Customer Satisfaction

- Employee Benefits

- Employee Engagement

- Employee Retention

- Friday Five

- General Data Protection Regulation

- Insights Hub

- Life@QuestionPro

- Market Research

- Mobile diaries

- Mobile Surveys

- New Features

- Online Communities

- Question Types

- Questionnaire

- QuestionPro Products

- Release Notes

- Research Tools and Apps

- Revenue at Risk

- Survey Templates

- Training Tips

- Tuesday CX Thoughts (TCXT)

- Uncategorized

- What’s Coming Up

- Workforce Intelligence

Instant insights, infinite possibilities

How to analyze customer feedback to get better insights

Last updated

16 April 2023

Reviewed by

While continual customer feedback is essential, without a practical and logical way of digesting those findings, it’s unlikely that feedback will lead to actionable changes.

That’s where analysis can help. Customer feedback analysis helps you turn raw customer feedback into a reliable source of knowledge covering paint points, satisfaction levels, usability, loyalty, and more.

- What is customer feedback analysis?

A customer feedback analysis is a process by which to turn customer feedback into actionable insights . Completing a best practice analysis means you’re more likely to deeply understand what your customers want and need from your company. It can also help you attract new customers while retaining your current ones.

A customer feedback analysis typically operates in five main steps:

Collating customer feedback into a readable and understandable report

Analyzing the feedback to deeply understand the messages from your customers

Paying attention to common themes or patterns across the feedback

Deciphering which common issues are the most critical to be solved

Ensuring that you address those issues

- Why analyzing customer feedback is critical

Paying attention to what your customers have to say is one of the most important ways to guarantee long-term business success. Customer feedback is a critical way to understand where issues and clunky aspects arise so that you get the chance to do better for your customers.

While receiving negative feedback can be tricky, in the words of Bill Gates, “[y]our most unhappy customers are your greatest source of learning.”

When customers do provide feedback, it’s essential to react to it and see how you can improve your offering. Doing so can have many positive effects, including:

Business growth . Businesses that react to customer feedback are more likely to stay competitive and continue growing.

Customer experience . Analyzing feedback can streamline areas of friction across products, improving the overall customer experience .

Boosted NPS . The Net Promoter Score (NPS) is a common way of calculating customer loyalty. Participants are more likely to be satisfied if you’re continually improving your products for their benefit.

- The challenge of analyzing customer feedback

While it’s a critical aspect of improving a business, analyzing customer feedback isn’t necessarily straightforward.

Feedback comes from a range of different sources—surveys, social media comments, call center conversations, and more. The broad range of sources means that feedback comes in various forms—written comments, conversational feedback, and scores through surveys. Categorizing, understanding, and acting upon that diverse feedback can be challenging.

The quality of feedback can impact the analysis too. Some people may use complex language when giving feedback. Others may have poor literacy making their point harder to decipher, leaving room for ambiguity or misunderstandings.

To uncover the most relevant and helpful insights, discernment is necessary.

- The difference between insightful and non-insightful data

That discernment means recognizing the difference between data that’s insightful––and therefore helpful to the business––and data that’s non-insightful––and therefore useless.

Non-insightful data is feedback that doesn’t tell you anything new or is irrelevant to your business––such as feedback written by internet trolls or feedback that tells you about an issue that’s already being fixed. What’s more, feedback from random people who are not part of your target audience might be completely useless.

Insightful data tells you something new or can add weight to a proposal to optimize or release a new feature.

If many customers, for example, are mentioning that the payment aspect of your website is challenging to use, that’s a great case for a more seamless payment feature. As each customer gives this feedback, it proves there’s a real need to prioritize this improvement. If not, your customers could soon drop off.

Insightful data can lead a company to:

Take critical actions, including bug fixes, optimization, new features, and even new product releases

Make changes to the business strategy

Validate (or invalidate) new ideas and plans

How to discern insightful and useless data

Discerning whether data is useful or not can be tricky. These are some questions to ask when sorting data:

Is this feedback authentic?

Do we fully understand what the customer wants to tell us? Should we follow up and ask more questions (instead of making assumptions)?

Does this feedback tell us about a new issue?

Does this feedback add weight to a proposed fix or improvement?

Is this feedback providing us with something new?

Do we know the motivations and reasons behind particular behavior?

Paying attention to these questions as you sort feedback will help ensure you rely on the most insightful data.

Keep in mind that feedback will sometimes be something you may not want to hear. But it’s essential to pay attention to negative comments, as they can help drive business improvements.

- The process: getting actionable insights from customer feedback

Listening to feedback is one thing, but turning it into actionable insights for your business is another. That’s why we recommend these best practice steps to effectively gather, analyze, and act upon comments from customers.

1. Gather customer feedback

Customer feedback can come from a variety of sources.

The most common sources of feedback include:

Customer surveys

Surveys are one of the most common ways to collect customer responses. That’s because they’re a quick, cost-effective way to gather large amounts of data.

Net Promoter Score (NPS)

The NPS is a helpful way of discovering customer satisfaction across the business, not just in one area. The NPS asks participants to rank the likelihood that they would recommend your product or service to someone they know (a friend or colleague). In sum, the NPS provides macro-level insights about the current satisfaction of your customers with your business. To get an actionable insight about your score, you need to include an open-ended follow-up question asking why your customer gave a particular score.

NPS calculator .css-5oqtrw{background:transparent;border:0;color:#0C0020;cursor:pointer;display:-webkit-inline-box;display:-webkit-inline-flex;display:-ms-inline-flexbox;display:inline-flex;font-size:18px;font-weight:600;line-height:40px;outline:0;padding:0;} .css-17ofuq7{-webkit-align-items:center;-webkit-box-align:center;-ms-flex-align:center;align-items:center;background:transparent;border:0;color:inherit;cursor:pointer;-webkit-flex-shrink:0;-ms-flex-negative:0;flex-shrink:0;background:transparent;border:0;color:#0C0020;cursor:pointer;display:-webkit-inline-box;display:-webkit-inline-flex;display:-ms-inline-flexbox;display:inline-flex;font-size:18px;font-weight:600;line-height:40px;outline:0;padding:0;}.css-17ofuq7:disabled{opacity:0.6;pointer-events:none;} .css-7jswzl{-webkit-align-items:center;-webkit-box-align:center;-ms-flex-align:center;align-items:center;display:inline-block;height:28px;-webkit-box-pack:center;-ms-flex-pack:center;-webkit-justify-content:center;justify-content:center;width:28px;-webkit-text-decoration:none;text-decoration:none;}.css-7jswzl svg{height:100%;width:100%;margin-bottom:-4px;}

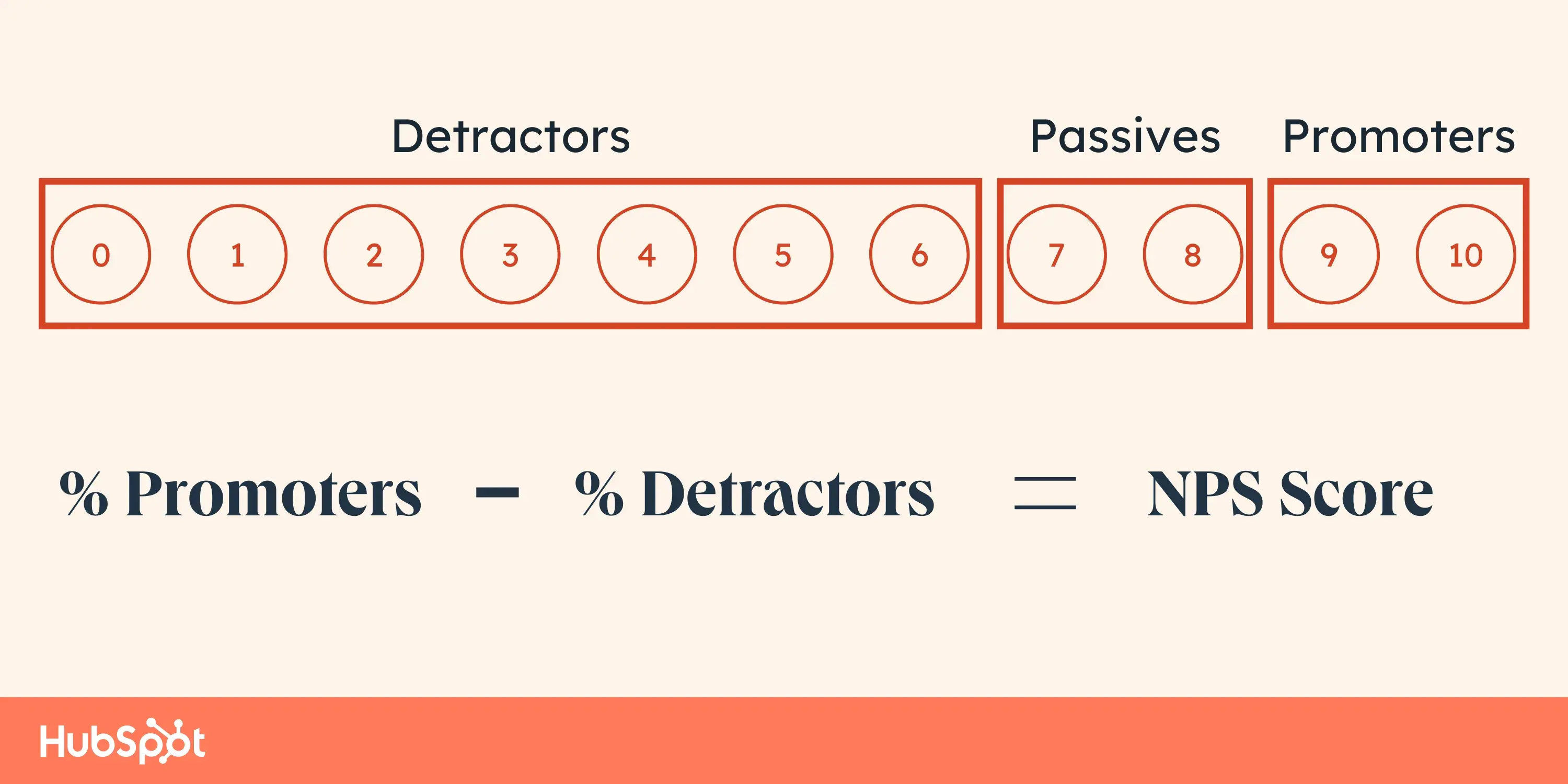

Your Net Promoter Score is calculated by subtracting the percentage of Detractors from the percentage of Promoters.

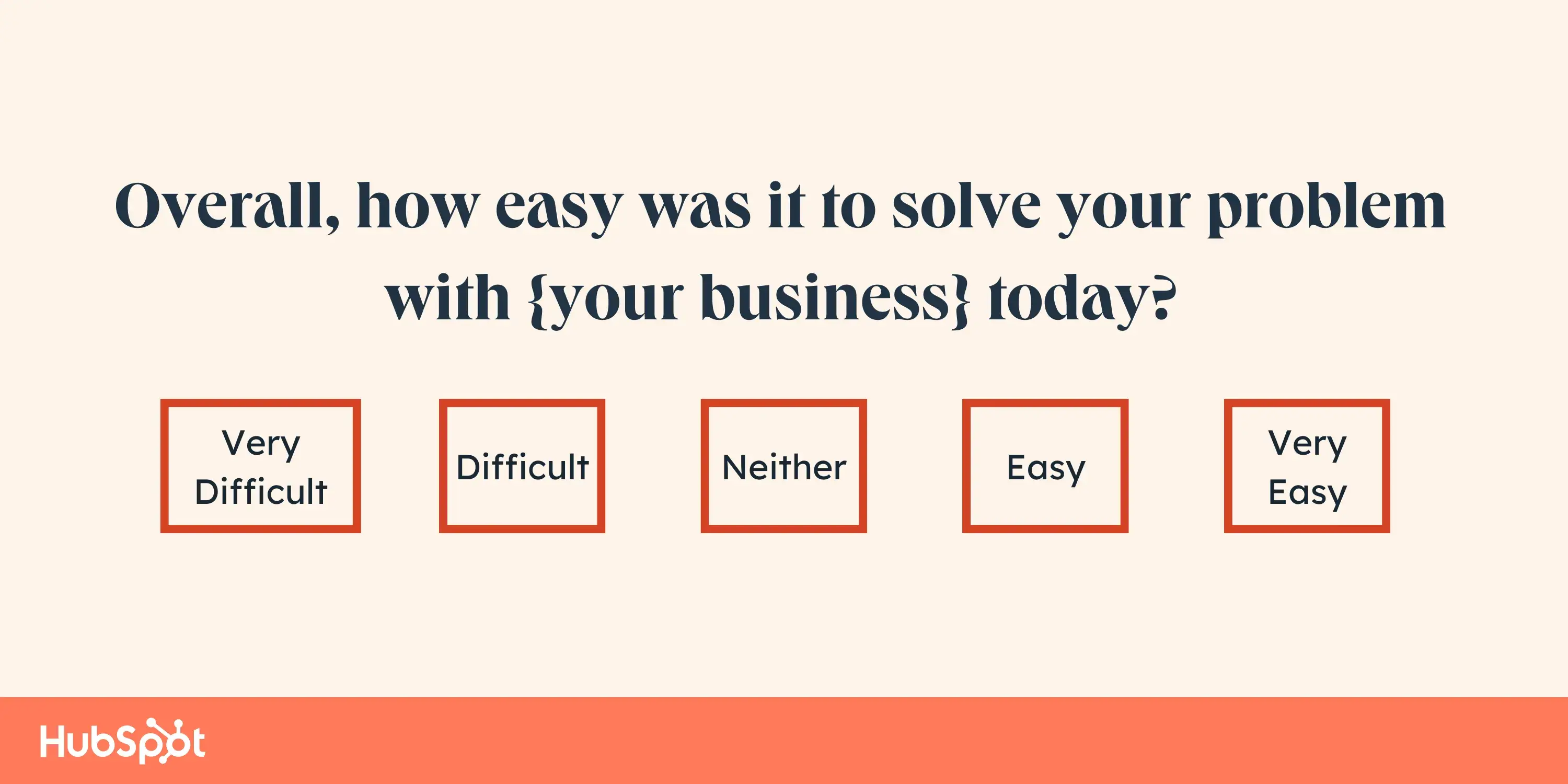

Customer Effort Score Surveys (CES)

The CES is a benchmark that helps you measure the perceived effort customers must put in to achieve a result, whether that’s resolving an issue, fulfilling a task, or getting the information they need.

It’s calculated by asking customers whether a particular interaction was easy. This can lead you to focus on particular processes and collect more evidence about emerging friction points, enabling you to act on the flaws and ultimately streamline processes to be simpler and more satisfying for the customer.

Customer Satisfaction Surveys (CSAT)

The CSAT survey is a key method of measuring customer satisfaction . The survey asks customers how satisfied they are with a certain product, service, or interaction. This means it focuses on one experience and is a helpful way to quickly see whether an isolated process is working well for the users.

Customer reviews

When your customers are talking about your business, it’s a crucial time to be listening. Reviews are critical when it comes to business. A whopping 98% of those surveyed read online reviews for local businesses. That means reviews can be the difference between a customer deciding to use your business or not.

Social media comments

Comments made on social media are also important, especially given that they appear publicly, so in a way, they act like reviews too.

Call center feedback

Call center notes can be very important to understand how people feel when they contact your customer service center. Conversations between customers may reveal some interesting insights.

Chat conversations

Similar to call center feedback, feedback received in live chat can be very useful for seeing trends and themes emerge.

Customer feedback interviews

These allow you to speak directly to your customers, either over the phone or in person, to discover what their pain points are, how your competitors compare, and what their overall experience with your brand is.

2. Categorizing customer feedback

A categorization system is important to digest this large amount of information from multiple sources. Rather than lumping all feedback together, use helpful categories to break it down and turn the feedback into actions.

It can be helpful to place feedback into two main categories:

Type of feedback. First, classify the feedback into types. This means deciding whether it relates to a bug, a feature request, general feedback, a usability issue, or user education.

Feedback theme. Then decide which area of the business the feedback relates to. It could relate to payments, onboarding, the app, sales, marketing, the website, user profiles, or more. This is achieved through conducting a thematic analysis .

This categorization helps to group feedback into manageable sections.

3. Code the feedback

Once feedback is categorized, it’s the best practice to turn feedback into a code that defines what the user is requesting or speaking about.

The code defines exactly what the issue is to make the feedback simple to understand. Say, for example, a customer said they would like to edit their Google documents within your platform. The resulting code could be the “ability to integrate with Google Docs.” Similar feedback that comes through can then fall under this code.

Each piece of feedback should be given a code to ensure it’s ultimately actionable.

4. Analyze feedback codes

Coding feedback can be a complex task. It’s often necessary to go through the codes multiple times to ensure you’ve covered all feedback notes.

A piece of feedback may initially receive just one code. But after going through it once more, you may realize that you need to break the feedback down into two or more codes to cover all requests and comments.

This way, you’ll have a more thorough approach to coding.

5. Score feedback codes

Once you complete the coding process, it’s then useful to see which codes are most popular. Group similar codes together to build an overall picture of which pieces of feedback ought to be actioned more quickly.

Give a score to each piece of feedback. This will help you begin to see patterns and understand what feedback is most common and should therefore be categorized.

6. Provide a summary

Once you’ve collated the feedback and completed the coding process, summarize the analysis into a shareable and digestible document.

You should share this across teams and stakeholders to ensure feedback is listened to, understood, and actionable throughout the business.

- Utilize tools for customer feedback analysis

Collating feedback manually can be a painstaking process––particularly when working with large data sets from multiple sources. Manual processing can also increase the chances of errors.

Making use of tools for customer feedback that are specifically designed for analysis is something many businesses lean into. Tools can fasten the process, increase accuracy, keep all your data and insights in one place, and ensure that feedback is actioned effectively across the business.

Dovetail, for example, allows you to get from data to insights fast. With Dovetail, you can store all feedback in one place while uncovering insights across all kinds of customer touch-points—whether it’s from user interviews, product feedback, or surveys. From there, it’s simple to see patterns, collate insights, and share feedback across your business for fast action.

- Feedback analysis template

To help you start better analyzing customer data, we’re sharing this customer feedback survey analysis template .

Analyze your data to identify common themes and patterns within the responses, which can provide useful information for making informed decisions. This example demonstrates how you can import feedback, tag raw data to capture useful observations, and then transform your findings into actionable insights.

- Analyze feedback for better insights

Customer feedback is a key process to better understand your customers—their needs, wants, and pain points.

Deeply understanding your customers and listening to what they have to say helps you deliver products that are easy to use, satisfying, and ultimately solve the problems they were designed for.

Customer feedback analysis provides a best practice way to gather feedback, categorize it, and turn it into useful actions, all for the benefit of your business––and, importantly, your customers.

Learn more about customer analysis software

What is a customer feedback strategy.

A customer feedback strategy is the process of gathering responses and insights from your customers and then using those to drive positive change across the business.

Which analytics is best for analyzing customer feedback?

There’s no one right way to gain or analyze customer feedback. However, score-based feedback tools such as the NPS and CSAT can be simpler to analyze than other types of open feedback.

When analyzing feedback, consider your business objectives to decide on the right approach for your organization.

What are the limitations of AI in customer feedback analysis?

AI can be very powerful for customer analysis, speeding up the process of gaining insights while increasing accuracy. However, there are limitations. Where there’s little or missing data, the results can be less reliable. The better the data collected, the more relevant and helpful the AI feedback analysis will be.

Should you be using a customer insights hub?

Do you want to discover previous customer research faster?

Do you share your customer research findings with others?

Do you analyze customer research data?

Start for free today, add your research, and get to key insights faster

Editor’s picks

Last updated: 30 April 2024

Last updated: 15 May 2024

Last updated: 20 March 2024

Last updated: 16 March 2024

Last updated: 21 March 2024

Last updated: 13 May 2024

Last updated: 4 July 2024

Last updated: 23 March 2024

Last updated: 18 April 2024

Latest articles

Related topics, .css-je19u9{-webkit-align-items:flex-end;-webkit-box-align:flex-end;-ms-flex-align:flex-end;align-items:flex-end;display:-webkit-box;display:-webkit-flex;display:-ms-flexbox;display:flex;-webkit-flex-direction:row;-ms-flex-direction:row;flex-direction:row;-webkit-box-flex-wrap:wrap;-webkit-flex-wrap:wrap;-ms-flex-wrap:wrap;flex-wrap:wrap;-webkit-box-pack:center;-ms-flex-pack:center;-webkit-justify-content:center;justify-content:center;row-gap:0;text-align:center;max-width:671px;}@media (max-width: 1079px){.css-je19u9{max-width:400px;}.css-je19u9>span{white-space:pre;}}@media (max-width: 799px){.css-je19u9{max-width:400px;}.css-je19u9>span{white-space:pre;}} decide what to .css-1kiodld{max-height:56px;display:-webkit-box;display:-webkit-flex;display:-ms-flexbox;display:flex;-webkit-align-items:center;-webkit-box-align:center;-ms-flex-align:center;align-items:center;}@media (max-width: 1079px){.css-1kiodld{display:none;}} build next, decide what to build next, log in or sign up.

Get started for free

What is Customer Research? Definition, Types, Examples and Best Practices

By Nick Jain

Published on: June 26, 2023

Table of Contents

What is Customer Research?

Customer research is defined as the systematic process of gathering and analyzing information about customers, their behaviors, needs, preferences, and experiences. It involves qualitative and quantitative studies to understand the target audience in order to make informed business decisions and develop effective strategies to meet expectations on customer experience and product/ service demands.

Customer research aims to provide insights into various aspects of the customer journey, including their motivations, purchase behaviors, satisfaction levels, and pain points. It helps organizations gain a deep understanding of their customers, enabling them to tailor their products, services, and marketing efforts to better meet customer expectations.

The key components of customer research typically include the following:

- Research Objectives: Clearly defining the objectives and goals of the research is crucial. This involves determining what specific information or insights the organization aims to gather from customer research. Research objectives help guide the research process and ensure that the collected data is relevant and aligned with the organization’s needs.

- Target Audience Definition: Identifying the target audience or customer segment is essential. This involves determining the specific group of customers or potential customers that the research will focus on. The target audience should be representative of the organization’s customer base or the intended market.

- Research Methodology: Choosing the appropriate research methods and techniques is important to gather relevant data. The methodology may include a combination of quantitative and qualitative observation approaches such as surveys, interviews, focus groups , or data analytics. The chosen methods should align with the research objectives and provide the desired depth and breadth of insights.

- Data Collection: Conducting data collection activities is a core component of customer research. This involves implementing the selected research methods to collect data from the target audience. It may include distributing surveys, conducting interviews or focus groups , observing customer behaviors, or analyzing existing data sources. Proper data collection techniques ensure the accuracy and reliability of the gathered information.

- Data Analysis: Once the data is collected, it needs to be analyzed to extract meaningful insights. Data analysis involves organizing, categorizing, and interpreting the collected data. This may include quantitative research using statistical techniques, such as descriptive statistics or regression analysis, and qualitative research involving the identification of patterns, themes, and trends in the data. The goal is to derive actionable insights that can inform decision-making.

- Findings and Insights: Communicating the research findings and insights is a critical component. This involves summarizing and presenting the results in a clear and understandable manner. The findings should address the research objectives and provide valuable insights into customer behaviors, preferences, needs, or pain points. Visualizations, reports, presentations, or dashboards may be used to effectively convey the information.

- Recommendations: Based on the research findings, recommendations are made to guide business decisions and actions. Recommendations should be practical, actionable, and aligned with the organization’s goals. They may involve suggestions for product improvements, marketing strategies, customer experience enhancements, market segmentation approaches, or any other relevant areas.

- Iteration and Continuous Improvement: Customer research is an iterative process. Organizations should continuously gather customer feedback and update their understanding of customer needs and preferences. The insights gained from research should be regularly incorporated into business strategies and practices. This iterative approach ensures that the organization remains responsive to customer expectations and market changes.

Types of Customer Research

There are various types of customer research that organizations can conduct to gather insights into customer experiences , behavior, and preferences. Some of the common types of customer research include:

- Customer Satisfaction Research

Customer satisfaction research focuses on measuring customer satisfaction levels with a product, service, or overall experience. It often involves surveys or feedback forms to gather customer opinions and perceptions. Customer satisfaction research helps organizations identify areas for improvement, gauge customer loyalty, and track changes in customer satisfaction over time.

- Customer Needs and Preferences Research

This type of research aims to uncover the needs, preferences, and expectations of customers. It helps organizations understand what customers value, what drives their purchasing decisions, and what features or attributes they desire in a product or service. Customer needs and preferences research can involve surveys, interviews, focus groups , or ethnographic research methods.

- Customer Experience (CX) Research

CX research focuses on understanding how users interact with a product, website, or service. It involves observing and analyzing user behaviors, attitudes, and perceptions to identify usability issues, pain points, and opportunities for improvement. The insights gained from CX research help organizations enhance the customer experience and increase satisfaction.

- Brand Perception Research

Brand perception research aims to understand how customers perceive a brand and its reputation in the market. It involves gathering customer feedback on brand awareness, brand image, brand associations, and brand loyalty. Brand perception research helps organizations assess the effectiveness of their branding strategies, identify brand strengths and weaknesses, and make informed decisions to enhance brand positioning.

- Customer Segmentation Research

Customer segmentation research involves grouping customers into distinct segments based on common characteristics, behaviors, or needs. It helps organizations understand their customer base and tailor their marketing strategies and offerings to specific customer segments. Customer segmentation research can involve data analysis, surveys, or clustering techniques to identify meaningful customer segments.

- Competitive Research

Competitive research focuses on analyzing competitors’ strategies, products, and customer experiences . It aims to gain insights into the competitive landscape and identify opportunities for differentiation. Competitive research involves analyzing competitors’ websites, conducting mystery shopping, monitoring social media, and gathering intelligence through industry reports or secondary research.

- Customer Journey Mapping

Customer journey mapping involves visualizing and understanding the end-to-end customer experience across various touchpoints and interactions with a company. It helps organizations identify pain points, gaps, and opportunities for improvement at each stage of the customer journey. Customer journey mapping can be done through a combination of data analysis, customer feedback , and qualitative research methods .

These are just a few examples of the types of customer research organizations can conduct. The choice of research type depends on the specific research objectives, the nature of the industry or market, and the information needed to make informed business decisions.

Learn more: What is Customer Feedback?

How to Conduct Customer Research: 10 Key Steps

Conducting customer research involves a systematic approach to gathering insights about customers and their preferences. Here are the key steps to conduct customer research effectively:

1. Define Research Objectives: Clearly define the specific objectives of your customer research. Determine what information or insights you seek to gather and how you plan to use the research findings. This will guide the entire research process and ensure that it remains focused and aligned with your goals.

2. Identify Target Audience: Identify the specific target audience or customer segment you want to study. Consider factors such as demographics, location, behavior, or any other relevant criteria. The target audience should be representative of your customer base or the market you wish to understand.

3. Choose Research Methods: Select the appropriate research methods (such as quantitative , qualitative research ) and techniques that will help you gather the desired information from your target audience. This may include surveys, interviews, focus groups , observational research (such as quantitative , and qualitative observation ), data analytics, or a combination of these methods. Consider the advantages, limitations, and resource requirements of each method.

4. Develop Research Instruments: Design the research instruments, such as survey questionnaires, interview guides, or discussion protocols, based on your research objectives. Ensure that the instruments are clear, concise, and structured to gather the necessary data. Use validated scales or questions when available and pilot test the instruments to identify any issues or areas for improvement.

5. Recruit Participants: Recruit participants who fit your target audience criteria and are willing to participate in the research. Depending on the research methods chosen, recruitment can be done through various channels such as online panels, customer databases, social media, or targeted advertising. Clearly communicate the purpose and benefits of the research to encourage participation.

6. Conduct Data Collection: Implement the chosen research methods to collect data from your participants. Administer surveys, conduct interviews or focus groups , observe customer behaviors, or analyze existing data sources. Ensure that the data collection process follows ethical guidelines, respects privacy, and maintains data confidentiality.

7. Analyze Data: Once the data is collected, analyze it to derive meaningful insights. Use appropriate data analysis techniques based on the nature of your data and research objectives. This may involve quantitative research and analysis using statistical methods, qualitative research and analysis using thematic coding or content analysis, or a combination of both. Ensure that the data analysis is rigorous, systematic, and aligned with your research objectives.

8. Interpret Findings: Interpret the research findings to gain insights into customer behaviors, preferences, needs, or perceptions. Analyze patterns, trends, and relationships in the data and relate them back to your research objectives. Look for key themes, outliers, or significant findings that can inform your decision-making.

9. Communicate Results: Present the research findings in a clear and concise manner. Prepare reports, presentations, or visualizations that effectively communicate the insights to stakeholders. Tailor the communication format to the needs and preferences of your target audience, ensuring that the findings are easily understandable and actionable.

10. Apply Insights: Apply the insights gained from customer research to inform your business decisions and strategies. Use the findings to enhance product development, refine marketing strategies, improve customer experiences , or address specific pain points. Regularly revisit the research findings and incorporate them into your ongoing business practices.

Remember that customer research is an iterative process. As you implement the insights gained, monitor the outcomes and consider conducting follow-up research to assess the impact and gather further insights. Continuous customer research helps organizations stay informed about evolving customer needs and preferences, enabling them to stay competitive and customer-centric.

Learn more: What is Quantitative Market Research?

Examples of Customer Research Questions

Here are some examples of customer research questions that businesses might ask:

- What factors influenced your decision to purchase our product/service?

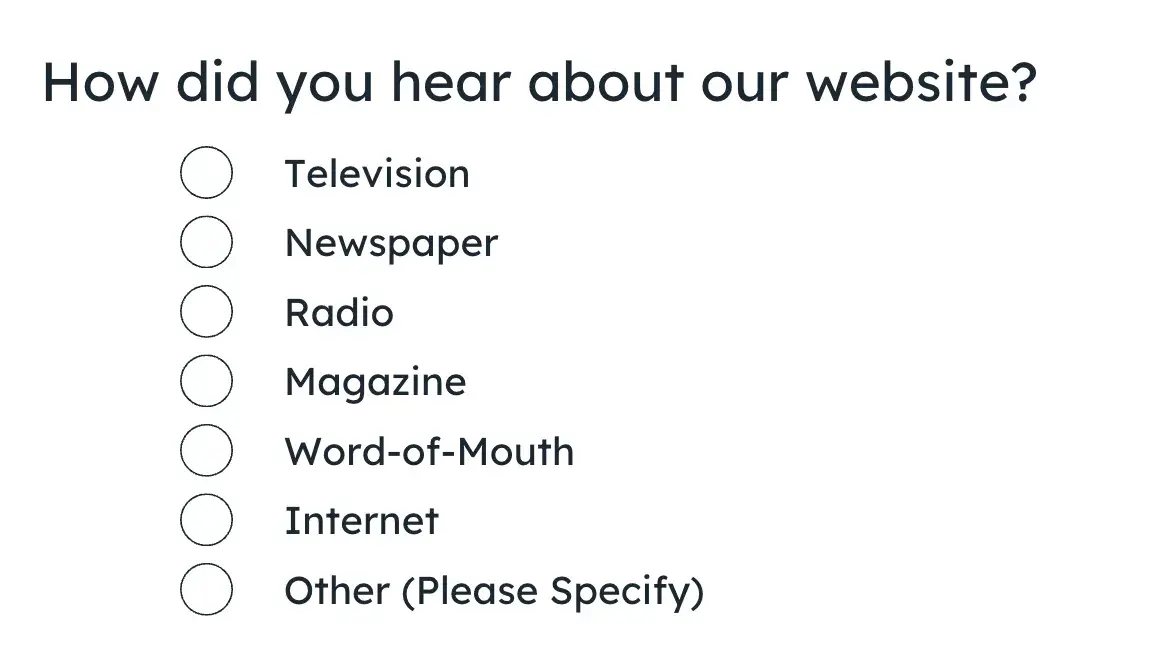

- How did you first hear about our company?

- What specific features or aspects of our product/service do you find most valuable?

- What improvements or enhancements would you like to see in our product/service?

- How likely are you to recommend our product/service to others? Why?

- What obstacles or challenges did you encounter when using our product/service?

- How does our product/service compare to competitors in the market?

- How satisfied are you with the level of customer support you received?

- What are your expectations for pricing and value in relation to our product/service?

- How frequently do you use our product/service, and for what purposes?

These questions can help businesses gain insights into customer preferences, satisfaction levels, purchasing behavior, and areas for improvement. It’s important to tailor the questions to the specific industry, product, or service being researched to gather the most relevant information.

Top 10 Best Practices for Customer Research

When conducting customer research, it’s essential to follow best practices to ensure accurate and valuable insights. Here are some best practices for customer research:

1. Clearly define research objectives

Start by identifying the specific goals and objectives of your customer research. What do you want to learn or achieve through the research? This will guide your research approach and help you focus on the most relevant questions and areas of investigation.

2. Use a mix of qualitative and quantitative methods

Combining qualitative and quantitative research methods can provide a comprehensive understanding of your customers. Qualitative methods , such as interviews or focus groups, offer in-depth insights and allow you to explore customer motivations and experiences. Quantitative methods , like surveys or data analysis, provide statistical data and help you identify patterns and trends.

3. Identify your target audience

Clearly define the characteristics and demographics of your target audience. This will help you select the right participants for your research and ensure that customer feedback represents your customer base accurately.

4. Create unbiased and neutral questions

Formulate questions that are clear, unbiased, and neutral to avoid leading or influencing participants’ responses. Use open-ended questions to encourage participants to provide detailed and honest feedback.

5. Use a variety of data collection methods

Explore various data collection methods to gather customer insights. These can include surveys, interviews, focus groups , social media listening, website analytics, customer feedback forms, or online reviews. Employing multiple methods (such as quantitative research methods , qualitative research methods , etc.) can provide a more comprehensive view of customer opinions and behaviors.

6. Engage with customers at different touchpoints

Interact with customers throughout their journey with your product or service. This can include pre-purchase, purchase, and post-purchase stages. Collect feedback at different touchpoints to understand the entire customer experience and identify areas for improvement.

7. Maintain confidentiality and anonymity

Assure participants that their responses will be kept confidential and anonymous. This encourages honest and unbiased feedback. Respect privacy regulations and data protection guidelines when collecting and storing customer data.

8. Analyze and interpret data systematically

Once you have collected the data, analyze it systematically. Look for patterns, trends, and common themes. Identify key insights and use them to inform your decision-making process. Consider using data visualization techniques to present findings in a clear and concise manner.

9. Continuously iterate and improve

Customer research should be an ongoing process. Regularly revisit your research objectives and update your research methods to reflect changing customer needs and preferences. Continuously gather customer feedback and make improvements based on customer insights.

10. Communicate findings and take action

Share the results of your customer research with relevant stakeholders within your organization. Communicate the key findings, insights, and recommendations. Use the research findings to inform strategic decisions, product development, marketing strategies, and customer support initiatives.

By following these best practices, you can conduct effective customer research that provides valuable insights and helps you better understand and serve your customers.

Learn more: What is Qualitative Research?

Enhance Your Research

Collect feedback and conduct research with IdeaScale’s award-winning software

Most Recent Blogs

Explore the latest innovation insights and trends with our recent blog posts.

Navigating the Complexity of Innovation: Simplifying Idea Management with IdeaScale

How Innovation Management Software is Shaping the Future of Education: 5 Must-Know Reasons

Meet The AI Teaching Assistants that are Transforming Learning at Morehouse College

Exploring How States Are Leveraging AI: Insights from the National Survey

What is User Engagement? Definition, Strategies, Why It Matters, and How to Improve It

Adapting to Change: Using IdeaScale to Navigate Industry Disruptions

What is Business Growth? Definition, Stages, Strategy, and Plan

Empowering Leaders: How IdeaScale Supports Strategic Customer-Focused Decision-Making

I Sent a Survey to AI, and the Results were Brilliant… and Dangerous

Elevate research and feedback with your ideascale community.

IdeaScale is an innovation management solution that inspires people to take action on their ideas. Your community’s ideas can change lives, your business and the world. Connect to the ideas that matter and start co-creating the future.

Copyright © 2024 IdeaScale

Privacy Overview

| Cookie | Duration | Description |

|---|---|---|

| cookielawinfo-checbox-analytics | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Analytics". |

| cookielawinfo-checbox-functional | 11 months | The cookie is set by GDPR cookie consent to record the user consent for the cookies in the category "Functional". |

| cookielawinfo-checbox-others | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Other. |

| cookielawinfo-checkbox-necessary | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookies is used to store the user consent for the cookies in the category "Necessary". |

| cookielawinfo-checkbox-performance | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Performance". |

| viewed_cookie_policy | 11 months | The cookie is set by the GDPR Cookie Consent plugin and is used to store whether or not user has consented to the use of cookies. It does not store any personal data. |

How To Design Customer Satisfaction Surveys That Get Results [+ Templates]

Updated: May 02, 2024

Published: June 15, 2022

On a recent cross-country flight, I made a pitstop in the restroom. On the way out, I was asked to rate my experience by pressing a button — one of four faces ranging from a happy smiley face to a red angry face. My selection was a quick, painless customer satisfaction survey.

Knowing what your customers think and feel makes all the difference when improving your user experience. So, what is a customer satisfaction survey, and what are the best practices for creating one?

![customer satisfaction research report → Free Download: 5 Customer Survey Templates [Access Now]](https://no-cache.hubspot.com/cta/default/53/9d36416b-3b0d-470c-a707-269296bb8683.png)

I took a deep dive, so you don’t have to. Below, I’ll share some knowledge from my personal and professional experience. I’ll also get some other experts to weigh in. Let’s get started.

Table of Contents

What is a customer satisfaction survey?

Why customer satisfaction surveys are important, customer satisfaction survey examples & templates, customer satisfaction question types & survey design, customer satisfaction survey best practices, how to use & implement survey results.

Customer satisfaction surveys gather information on customers’ experiences through a questionnaire. It’s a basic measure of customers’ level of happiness (or unhappiness) with your business.

You might ask respondents if your products or services are useful, your website or app is easy to use, your staff is friendly, or your restroom is clean. Here’s an example of a customer feedback survey from HubSpot:

Going about our lives, we take part in customer surveys almost every day — sometimes multiple times a day — often unknowingly.

For example, if I hop in an Uber to head to my local coffee shop, I’ll get asked to rate my driver after they drop me off. After I’ve ordered my cup of joe, the coffee shop might ask me to rate my drink or the staff member who served it to me.

If companies are asking us to take customer satisfaction surveys so often, they must have some value, right? You bet.

In my career as a marketer and co-founder of Omniscient Digital , I’ve used various types of surveys — from basic one-question surveys to longer questionnaires — to get to the root of customer experiences. Here’s why they matter.

Customer satisfaction surveys are about more than confirming how much your customers love your brand. Let me explain where their real value lies.

.webp)

5 Free Customer Satisfaction Survey Templates

Easily measure customer satisfaction and begin to improve your customer experience.

- Net Promoter Score

- Customer Effort Score

Download Free

All fields are required.

You're all set!

Click this link to access this resource at any time.

1. Customer feedback improves your product and your customer’s overall experience.

From my experience as a marketer, customer feedback is a goldmine of information on more than just satisfaction levels. When customers tell you what they like and don’t like about products or services, you’ll find out what you should definitely keep and what you might want to change.

For a real-world perspective, I talked to Amy Maret , HubSpot’s principal researcher for trends and thought leadership and a former market research manager. According to Maret, satisfaction surveys allow businesses to track their most important relationship — their relationship with customers.

“We see over and over that having an exceptional customer experience is absolutely critical to a business’s success, so being able to see in real-time how your customers are feeling, diagnose potential issues, and act quickly as soon as satisfaction starts trending down is a huge advantage to any organization,” Maret says.

I agree with Maret on the importance of customer relationships, and I think that you can strengthen your relationship by simply listening to customers .

2. Feedback can improve customer retention.

If I don’t know why customers churn, I can’t do much to keep them — or win them back if they’ve already left. Essentially, I can’t know a customer’s thoughts if they don’t tell me.

Take my experience at a new coffee shop. I started going regularly until a barista told me that they had stopped serving oat milk. They offered alternatives, but I wasn’t interested and switched shops.

What’s the lesson? I’m not one to complain over minor things, but had I been given a customer satisfaction survey, I would have mentioned my milk issue.

Maret agrees that businesses should ask if customers are satisfied, but also why. In fact, Maret notes that the best surveys go beyond just measuring KPIs and actually identify which factors impact customer satisfaction.

“As soon as the business sees unsatisfied customers in their survey, they can go deeper into what exactly is causing that dissatisfaction and address those problems directly — which we know from our research leads directly to happier customers that are less likely to churn,” Maret says.

With a well-designed survey given at the right time, you can identify issues and resolve them, helping you increase customer loyalty .

3. Feedback identifies happy customers who can become advocates.

If customers are genuinely happy with your product or service (and not just using it because they can’t find an alternative), they can become an extension of your marketing team — and they do it all for free!

When I moved to a new city, I asked around the office if anyone knew a good place for a haircut. Suddenly, everyone became an advocate for their hairdresser. I got information on everything I needed to know, including prices, personalities, and free extras, like top-tier snacks and drinks.

These recommendations were both honest and enthusiastic, and I found them more convincing than any paid marketing campaign.

If you can identify your brand advocates through customer surveys, you can show your appreciation for them and even incentivize their word-of-mouth marketin g.

4. Customer feedback helps inform decisions.

When it comes down to making important business decisions, you need to get the input of all the important people in the room, and that includes your customers.

From a basic customer survey, I learned that something as simple as a new user interface for a website can annoy previously satisfied customers. As you might imagine, I held urgent discussions with my team to see how we could continue to satisfy loyal customers.

To show you how you can retain customers and have them shout your company’s benefits from the rooftops, I’ll share some customer satisfaction survey examples and templates.

Customer satisfaction surveys come in a few common forms, usually executed using a popular response scale methodology, like:

- Net Promoter Score® (NPS).

- Customer Satisfaction Score (CSAT).

- Customer Effort Score (CES).

Each of these types of customer satisfaction surveys measures something slightly different, so it’s important to consider the specifics if you hope to use the data wisely.

Download for Free

Net Promoter Score (NPS)

The NPS is a popular survey methodology, especially for those in the technology space.

It's rare to see a survey that doesn't use this famous question: “How likely is it that you would recommend this company to a friend or colleague?”

Ask your customers this question with HubSpot's customer feedback software .

Okay, you got me — this first example doesn’t technically ask customers about their level of satisfaction. But, I’ve found that customer satisfaction and willingness to recommend are often directly linked.

If I don’t like a new product/service, I won’t recommend it to friends. Sounds straightforward? Not exactly. When it comes to subjective experience and preferences, things can get a little tricky.

For example, if I watch a new movie that doesn’t appeal to me because it’s too quirky, I might still recommend it to a friend who loves that kind of thing.

So, how does this affect businesses? Well, if you build a great product, you might have a good NPS, even if not every potential customer can benefit from it.

Let’s look at how the NPS is measured:

On a rating scale of 0–10, your detractors score you 0–6, passives score you 7 or 8, and promoters score you 9 or 10. Your NPS score is your percentage of promoters minus your percentage of detractors.

For example, if 70% of my respondents are promoters and 20% are detractors, my NPS is +50. If you think +50 sounds disappointing, you might be surprised. According to market research firm B2B International, the average NPS for business-to-business (B2B) firms is +25 to +33.

Customer Satisfaction Score (CSAT)

For me, CSAT is the easiest customer satisfaction survey type to use and respond to.

Usually, it takes the form of a question phrased like, “How satisfied were you with your experience today?” and a corresponding survey scale, which is generally from 1 to 5.

Here’s what these numbers mean.

- 1 = Very unsatisfied

- 2 = Unsatisfied

- 3 = Neutral

- 4 = Satisfied

- 5 = Very satisfied

To get your CSAT score, expressed as a percentage, you’ll need this equation:

(Number of positive responses (4 or 5)/Number of people surveyed) x 100

Opinions differ on this, but I think a good CSAT score is 75% to 85%. Higher is better, but don’t be too worried if you don’t hit a perfect 100% (it’s tricker than you might think).

As someone who has answered countless CSAT surveys and given plenty to customers, I can say that the results are a pretty useful indicator of how a customer feels at that moment, but you need to take the results with a pinch of salt.

For example, if I’m shopping for clothes online and encounter serious issues at the checkout page (no, I don’t want to become a member), I get frustrated. When my payment finally goes through, and I’m asked about my satisfaction level, I might say that it is 1 or 2.

However, when the clothes are delivered quickly and look and fit great, my overall satisfaction level could rise considerably. So, you need to be specific when asking this question (e.g., “How satisfied are you with the checkout experience?”) and get your timing right. (You can easily ask your customers about their satisfaction level with HubSpot’s customer feedback tool .)

In some cases, a simple satisfaction survey won’t give you the answers you’re looking for. Instead, you might want to ask about ease of experience.

Enter the CES.

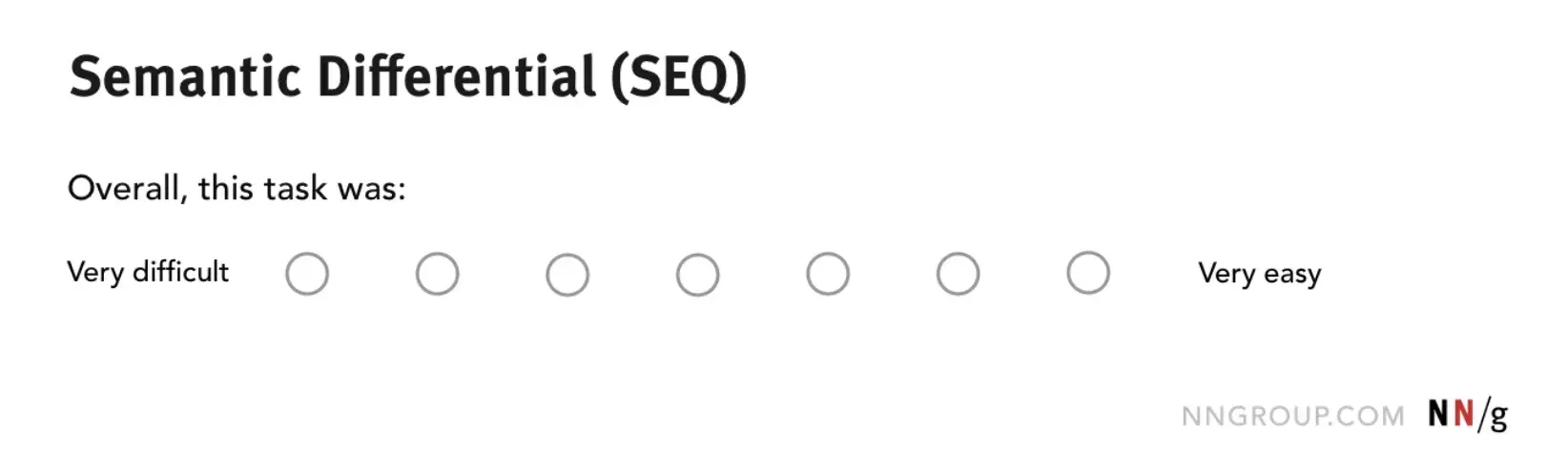

Customer Effort Score (CES)

The CES is a useful metric for measuring a customer’s service experience. Generally, your survey answer options should range from “very difficult” to “very easy.”

I’ve used these CES options to ask customers if they could easily navigate a website to get what they needed and if using an app was challenging.

A few answers of “very difficult” aren’t usually cause for concern, but a high percentage of them means you should consider redesigning your product or service.

Ask your customers this question with HubSpot's customer feedback tool.

It’s impossible to understate the importance of survey design. It’s the foundation your survey is built on, and it can affect everything from response rates to accuracy. If the design is wrong, the data won't be useful to answer your questions about your customers.

With that in mind, I’ll take you through the different types of questions that underpin your survey design.

1. Binary Scale Questions

The first type of survey question is a simple binary distinction:

- “Was your experience satisfying?”

- “Did our product meet expectations?”

- “Did you find what you were looking for?”

The options for all of these are dichotomous, such as yes/no or thumbs up/thumbs down.

I think you’ll agree that the benefit of this survey type lies in its simplicity. When I use this question type, I want a straightforward answer from customers, nothing more.

In some cases, as you lengthen the survey scale, you end up with data you can’t use. As Jared Spool , co-founder of Center Centre , said in a talk , “Anytime you’re enlarging the scale to see higher-resolution data, it’s probably a flag that the data means nothing.”

If I’m finished browsing an ecommerce website and about to exit the page, I often get asked a binary question about my experience. Because it’s easy to answer, I don’t mind doing it, even if I’m in a hurry.

Bear in mind that binary questions have some shortcomings. For example, if a restaurant asks me the binary, “Did you like your meal?” and I answer, “No,” they won’t know if it’s because I found my food too salty, cold, or both.

When to use: I recommend using this question type when you only need a yes/no answer, and there’s no real ambiguity about what the answer means for your business. If you think your target audience could reasonably answer, “Well, kind of,” then choose a different question type.

2. Multiple-Choice Questions

Multiple-choice questions have three or more mutually exclusive answers. These tend to be used to collect categorical variables , like names and labels.

When I’m creating surveys that I’m going to conduct data analysis on later, multiple-choice questions are my go-to. That’s because I can easily segment the data based on different categorical variables to get the valuable insights I need.

Let’s say I have an accounting software company. I can ask respondents what their job title or business industry is when soliciting feedback. Then, when I’m analyzing the data, I can compare the satisfaction scores by job title or industry. I might find that CEOs don’t like the software’s expense, while their finance teams love its functionality.

When to use: I use this question type when I want to glean deep insights from survey responses, and you should, too. However, if you just want basic information from customers and don’t have the time or resources for data analysis, skip this one.

3. Scale Questions

Many popular satisfaction surveys are based on scale questions. For example, the CSAT asks, “How satisfied are you with your experience?” and you rate the experience on a scale of 1 to 5 (a Likert scale ).

You can design scale questions so that they’re answered using numbers (1-5), words (strongly agree), emojis (😀), and more.

Image Source

Like other question types, they’re not without faults. For example, if I ask customers to rate my product and they give it a low score, I’m left guessing why exactly they gave me that score.

When to use: Use Likert scale questions and other scale types when you want a more specific response than a binary answer. They’re generally suitable if you don’t care too much about the reason behind a response.

4. Semantic Differential

Similar to scale questions, semantic differential scales are based on binary statements, such as disagree and agree, but respondents can choose from a wide number of points between them.

That means customers don't have to pick just one or the other — they can choose a point between the two poles that reflects their experience accurately.

Here’s what a semantic differential question looks like in practice:

Say a website owner is testing out a new homepage design. So, they ask visitors a semantic differential question, “Do you like the new website design?” They let respondents answer using two extreme options of “I don’t like it” and “I like it” or multiple unlabelled options in between.

This can give the website owner a good handle on respondents’ actual perceptions of the new design, particularly if there are follow-up questions about specific design elements.

When to use: Use this type of question if you want respondents to be able to interpret the answer continuum as they see fit. This can help you find out their strength of satisfaction or dissatisfaction without introducing bias from labels like “neutral” or “somewhat satisfied.”

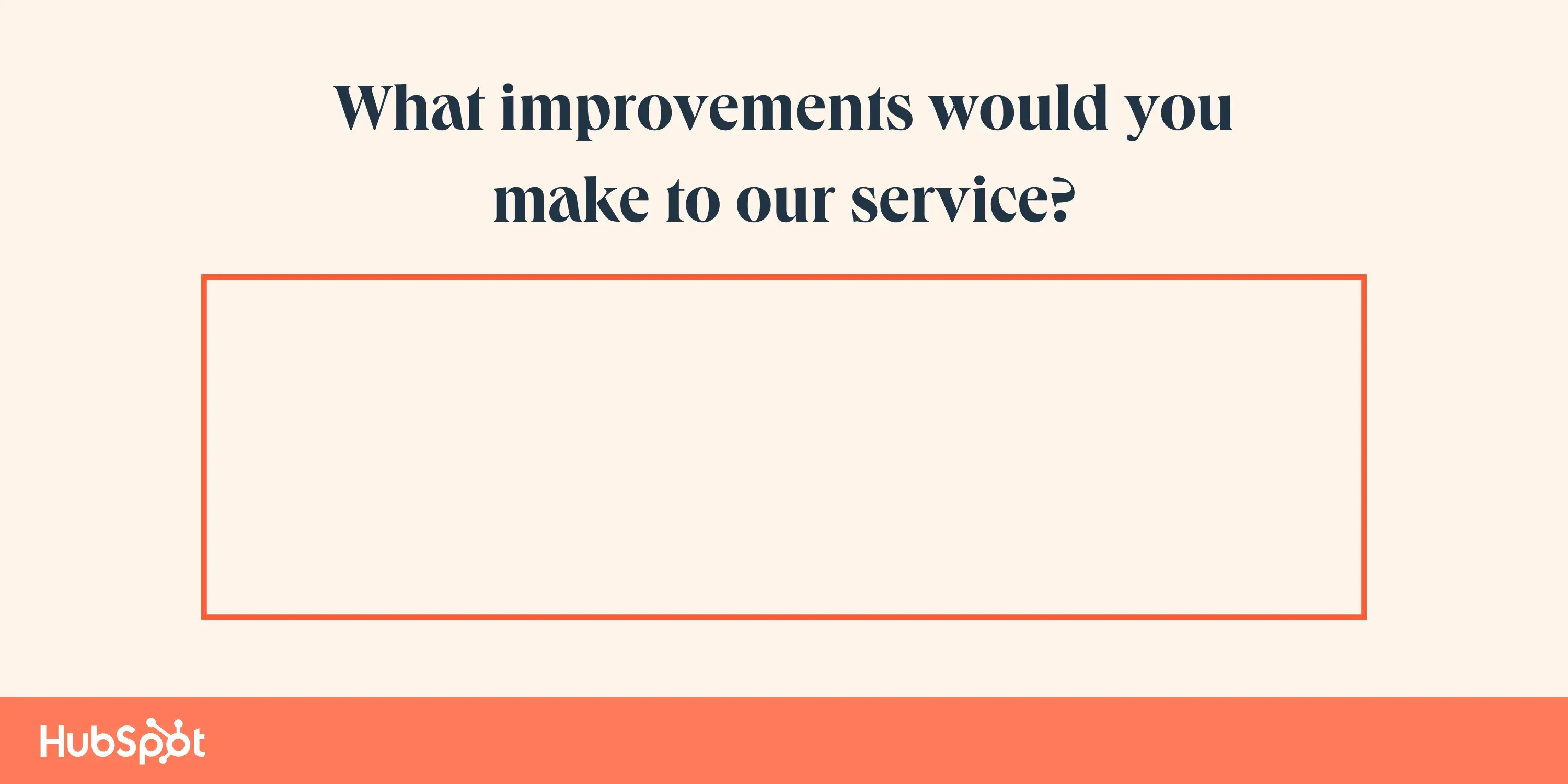

5. Open-Ended Questions

None of the surveys I’ve discussed above tell you the why of an experience — you only get the what. To find out the why, you need qualitative data , which you can get from this type of customer satisfaction survey question.

Maret notes that qualitative questions allow customers to tell you the real why behind their satisfaction, without you having to make assumptions about what matters to them.

“When you want to dig deeper into motivations and underlying factors, it is helpful to hear from customers in their own words. But be careful — too many open-ended questions in one survey can cause respondent fatigue — potentially frustrating your customers and damaging your data quality,” Maret says.

I’ll add to her warning with one of my own: Make sure you’re asking clear questions without letting your bias or expectations slip through.

For example, if you write, “Tell us, in your own words, why our products are so great,” you leave little room for collecting customer feedback that’s critical of your products, and that’s a missed opportunity.

In many of my surveys, I’ll add some open-ended questions to take an in-depth look at customer expectations, customer needs, and more. Often, the insights I get from open-ended questions are the most valuable, but it can take a lot of time and resources to mine these insights.

When to use: Use open-ended questions when you have the time to really dig deep into the answers.

You’ll often see this type of question at the end of a survey with multiple question types — I have found that it helps respondents share thoughts that aren’t covered in other questions.

To bring you closer to creating the most suitable customer satisfaction survey for your business, I’ve collected some tried-and-tested best practices for you to follow.

- Choose the right survey type.

- Choose the right survey questions.

- Send surveys at the right moment in the customer journey.

- Ask for customer feedback regularly.

- Limit the number of survey questions.

- Consider different ways to ask questions.

- Test your survey.

- Follow up with respondents.

1. Choose the right survey type.

If you want quantitative data, I don’t recommend open-ended questions. But there’s nothing stopping you from having a mixed survey type to cover all your bases. If you go this route, I recommend a logical, consistent approach to keep readers on track.

For example, I find that open-ended questions work well at the end of a group of closed questions or as the final section of a survey.

2. Choose the right survey questions.

Remember I said to be careful of your question phrasing? I meant it. Make sure you’re asking the right questions, which should be clear and free from bias.

3. Send surveys at the right moment in the customer journey.

If you measure customer sentiment at the right time, you’ll get actionable results — and a chance to make things right with customers before it’s too late. The correct stage will largely depend on your business type, but in general, you should send out surveys shortly after a purchase.

If you’ve lost a customer, an exit survey can tell you why. But if you spot signs of dissatisfaction and survey customers before they’ve left, you can make a real difference.

For example, I once got negative feedback from a customer just before they were about to switch to a competitor. When I told them I understood their concerns and would work with them to make things right, they appreciated feeling listened to and retained our services.

4. Ask for customer feedback regularly.

By getting regular customer feedback from different touchpoints (e.g., in-app, email surveys, and social media), you can better understand how customers feel about your product/service in the long term.

For example, for complex apps, I recommend checking in with customers early (within the first week post-purchase) in case they are frustrated by technical challenges. You can offer tutorials to help and check in regularly afterward (e.g., monthly or quarterly).

5. Limit the number of survey questions.

If you ask too many questions, your customers might start to answer them on autopilot. This makes surveys a waste of time for them and a waste of time and money for you.

When it comes to survey questions, I always recommend quality over quantity, especially when the results will inform company decisions.

Sticking to around 10-15 questions is a good rule of thumb, but also consider how long the survey will take. For example, I answer binary questions really quickly, but I spend some time mulling over my answers to open-ended questions.

6. Consider different ways to ask questions.

By asking similar questions but in different ways, you can get unexpected but valuable answers from customers. This can tease out customer pain points that they hadn’t considered initially.

For example, “Is the app fast?” and “Is the app slow at times?” can yield different answers.

7. Test your survey.

Don’t just send your survey out without any input from others. I usually get colleagues to read over my questions to check if they hit the mark. Then, I send them to a small group of customers to ensure they’re interpreted correctly before I release them to the masses.

8. Follow up with respondents.

If your survey isn’t anonymous, then check in with customers and reply to their grievances. Address all their points, and try not to get too defensive if you think their responses are inaccurate.

After your customer satisfaction survey is done and dusted, you can’t just put your feet up. Here’s what you need to do:

- If you collect quantitative surveys, clean the data and use analysis software to find out its implications. I generate reports from survey data and use them as slides in company meetings or to show customers we take their feedback seriously.

- For qualitative surveys, read over the results thoroughly and try to identify themes in responses. I’ll constantly take notes on one computer monitor while I’m looking at survey results on another.

- Next, develop a list of recommended actions and group them by priority. For example, if your website can’t accept payments, that’s an urgent concern. But, if a customer has a helpful suggestion that might cost a lot of money to implement, you can discuss it in detail with team members.

- Take any actions necessary, and tell customers about the steps you’ve taken based on their feedback.

To help bring you new insights into implementing satisfaction survey results, I reached out to Simon Bacher , CEO and co-founder of Ling , a language learning app, to find out his team’s approach.

He says the team at Ling analyzes what aspects of gamification users love, such as the app’s banana points system or the badges earned through completing challenges.

“Furthermore, surveys reveal user preferences for different learning styles, enabling us to tailor the gamification experience to better suit their needs. Once we've implemented changes, we track how users engage with the updated features through app analytics and surveys,” Bacher says.

Results Begin with a Survey

Customer satisfaction surveys are generally a great idea, provided you put some thought into designing them, distribute them at the right time and frequency, and — most importantly — do something about what you’ve found out from them.

Customers appreciate the simple act of sharing their thoughts, but in my experience, they won’t be truly satisfied unless a brand’s products or services meet their needs.

I hope these tips on survey design, use, and implementation help you in your efforts to improve your customers’ experience. Many of them have worked for me, but I’m always on the lookout for new ways to improve customer satisfaction.

Net Promoter, Net Promoter System, Net Promoter Score, NPS and the NPS-related emoticons are registered trademarks of Bain & Company, Inc., Fred Reichheld and Satmetrix Systems, Inc.

Editor’s Note: This post was originally published in February 2020 and has been updated for comprehensiveness.

Don't forget to share this post!

Related articles.

![customer satisfaction research report 23 Excellent Customer Satisfaction Survey Examples [+ Templates]](https://www.hubspot.com/hubfs/customer-satisfaction-survey-example_0.webp)

23 Excellent Customer Satisfaction Survey Examples [+ Templates]

What Is Total Quality Management & What’s Its Impact on Customers

What Is Customer Satisfaction Score (CSAT) and How to Measure It?

The Benefits of Customer Feedback, According to Experts

40 Customer Satisfaction Quotes to Inspire You to Make Customers Happy

12 Customer Satisfaction Metrics Worth Monitoring in 2024

Customer Effort Score (CES): What It Is & How to Measure It

Which Industries See the Highest (and Lowest) Customer Satisfaction Levels?

![customer satisfaction research report After Sales Service Strategy: What It Is & Why It's Important [+Examples]](https://www.hubspot.com/hubfs/after-sales-service.jpg)

After Sales Service Strategy: What It Is & Why It's Important [+Examples]

5 free templates for learning more about your customers and respondents.

Service Hub provides everything you need to delight and retain customers while supporting the success of your whole front office

Root out friction in every digital experience, super-charge conversion rates, and optimize digital self-service

Uncover insights from any interaction, deliver AI-powered agent coaching, and reduce cost to serve

Increase revenue and loyalty with real-time insights and recommendations delivered to teams on the ground

Know how your people feel and empower managers to improve employee engagement, productivity, and retention

Take action in the moments that matter most along the employee journey and drive bottom line growth

Whatever they’re are saying, wherever they’re saying it, know exactly what’s going on with your people

Get faster, richer insights with qual and quant tools that make powerful market research available to everyone

Run concept tests, pricing studies, prototyping + more with fast, powerful studies designed by UX research experts

Track your brand performance 24/7 and act quickly to respond to opportunities and challenges in your market

Explore the platform powering Experience Management

- Free Account

- Product Demos

- For Digital

- For Customer Care

- For Human Resources