assignment for benefit of creditors

Primary tabs.

Assignment for the benefit of the creditors (ABC)(also known as general assignment for the benefit of the creditors) is a voluntary alternative to formal bankruptcy proceedings that transfers all of the assets from a debtor to a trust for liquidating and distributing its assets. The trustee will manage the assets to pay off debt to creditors, and if any assets are left over, they will be transferred back to the debtor.

ABC can provide many benefits to an insolvent business in lieu of bankruptcy . First, unlike in bankruptcy proceedings, the business can choose the trustee overseeing the process who might know the specifics of the business better than an appointed trustee. Second, bankruptcy proceedings can take much more time, involve more steps, and further restrict how the business is liquidated compared to an ABC which avoids judicial oversight. Thirdly, dissolving or transferring a company through an ABC often avoids the negative publicity that bankruptcy generates. Lastly, a company trying to purchase assets of a struggling company can avoid liability to unsecured creditors of the failing company. This is important because most other options would expose the acquiring business to all the debt of the struggling business.

ABC has risen in popularity since the early 2000s, but it varies based on the state. California embraces ABC with common law oversight while many states use stricter statutory ABC structures such as Florida. Also, depending on the state’s corporate law and the company’s charter , the struggling business may be forced to get shareholder approval to use ABC which can be difficult in large corporations.

[Last updated in June of 2021 by the Wex Definitions Team ]

- commercial activities

- financial services

- business law

- landlord & tenant

- property & real estate law

- trusts, inheritances & estates

- wex definitions

- assignments benefits creditors abcs basics california

Assignments for the Benefits of Creditors - "ABC's" - The Basics in California

An assignment for the benefit of creditors (“ABC”) is a contract by which an economically troubled entity ("Assignor") transfers legal and equitable title, as well as custody and control, of its assets and property to an independent third party ("Assignee") in trust, who is required to apply the proceeds of sale of the property to the assignor's creditors in accord with priorities established by law.

ABCs are a well-established common law tool and alternative to formal bankruptcy proceedings. The method only makes sense if there are significant assets to liquidate. ABCs are most successful when the Assignor, Assignee and creditors cooperate but can be imposed even if the creditors are not supportive.

Assignors - Rights and Duties

Generally, any debtor – an individual, partnership, corporation or LLC - may make an assignment for the benefit of creditors. Individuals seldom utilize ABCs, though, because there is no discharge of all debts as there would normally occur in a completed bankruptcy filing. Thus, the protection and benefit of the process is quite limited for any personal obligor.

ABCs can benefit individual principals who have personally guaranteed company obligations or have personal liability on tax claims. Once the Assignment Agreement has been executed, a trust is automatically put in place over the assets transferred. The Assignor can neither rescind the contract nor control the proceedings, but the Assignor may be consulted as necessary and appropriate by the Assignee during the liquidation process.

Assets to be Assigned

Assignor may assign any non-exempt real, personal, and/or general intangible property that can be sold or conveyed. Note that such assets as intellectual property, trade names, logos, etc. may be so transferred and sold. When a corporation makes an assignment, all corporate property, tangible and intangible is transferred including accounts, and rights and credits of all kinds, both in law and equity. The assets only can be sold, not the corporation or its stock. Thus the corporation remains existing, albeit without any significant assets left. It becomes, effectively, a shell.

Assets are typically sold without representations or warranties. The sale is free and clear of known liens, claims and encumbrances - with the consent or full payoff of lien holders. Generally, Assignee warrants only that Assignee has title to the assets.

Assignees - Rights and Duties

The Assignee is generally an unrelated professional liquidator selected by the Assignor. The Assignee gathers the Assignor’s assets and sells the Assignor’s right, title and interest in those assets, then distributes the proceeds to Creditors in accordance with statutory priorities.

The Assignee has a fiduciary duty to the Creditors. Assignee’s duties include protecting the assets of the estate, administering them fairly and representing the estate. Assignee is free to enter into contracts to recover assets or liquidated claims, e.g. filing suit or taking other action.

The Assignee may be removed by a court for violations of the Assignment contract or nonfeasance (failure to act appropriately). The Assignee may not give up his/her/its duties without liability or a superior court order until creditors receive distribution of the proceeds of sale of the assets transferred.

Assignee usually prepares the Assignment documents, though the attorney for the Assignor may draft them as well. Often the terms are negotiated at length.

Preferential Claims and Avoidance

Assignee has statutory avoidance powers, similar to those granted to a Chapter 7 bankruptcy trustee. [See Calif. CCP § 493.030 (termination of lien of attachment or temporary protective order), § 1800 et seq. (avoidance of preferential transfers); Calif. Civ.C. § 3439 et seq. (avoidance of fraudulent conveyances)]

Even so, courts may question this right outside a bankruptcy proceeding. There is also disagreement between the Federal Court (Ninth Circuit) and California state courts whether the Bankruptcy Code preempts the assignee's preference avoidance power under California statutory law.

Creditors - Rights and Duties

While not required to consent to an Assignment, secured creditors often must agree in advance since their cooperation frequently affects the liquidation of the assets. Secured creditors are not barred from enforcing their security by such an assignment. The acceptance of an Assignment by unsecured creditors is not necessary, since under common law the proceedings are deemed to benefit them through equality of treatment.

Note that all Creditors must file their claims within the statutory 150-180 day claim filing period.

ABCs in California do not require a public court filing, but most corporations require both board and shareholder approval. Costs and expenses, including the assignee’s fees, legal expenses and costs of administration, are paid first, just as in a Chapter 7 bankruptcy . Because an assignee’s fee is often based on a percentage value of the assigned assets, it can be difficult to procure assignees for smaller estates.

- Assignment Agreement is executed and ratified. Assignor turns over and assigns to Assignee all right, title and interest in the assets being assigned.

- Assignor gives Assignee a complete, certified list of creditors, including addresses and amounts owed.

- Assignee notifies Creditors within 30 days of execution that assignment has been made, provides an estimate of the probable distribution, and provides a claim form for each Creditor to file a claim in the Assignment estate.

- Creditors have 150-180 days from the date of written notice of the assignment to file their claims.

- After claim forms are returned and/or the Bar Date has passed, Assignee reconciles the claims and/or objects to any improper claim amounts.

- After liquidation, Assignee determines distribution amounts. Claim priority is determined first by state statute, then by Bankruptcy Code. First are secured creditors, then follow tax & wage claims.

- Assignee generally informs the IRS that assignment has been made and files notice with local Recorder.

- Assignee immediately searches for any previously undisclosed liens (UCC or real estate) to ensure complete notice to all creditors and interest holders.

- Assignee secures all assets. In limited situations where the business has enough cash, Assignee may continue to operate the business to maintain going-concern value - if no further debt will be incurred.

It normally takes about 12 months to conclude an ABC.

Effects of ABC

An ABC generally is faster and less costly than a bankruptcy proceeding. Parties can often agree and determine what is going to happen prior to execution of the assignment.

However, ABCs do not discharge individual Assignors from their debts, and do not provide for the reorganization of the business. There is no automatic stay, though in practice an ABC results in an informal and/or incomplete automatic stay if the creditors determine that the assets are beyond their reach.

Creditors are able to continue to pursue the Assignor. ABCs often block judgment creditors from attaching assets because the Assignor no longer has title to or interest in the assigned assets. Sometimes the Assignee is willing to allow the judgment if the judgment creditor submits its claim as described above. The assignee may also defend against a claim if the plaintiff is seeking a judgment which is unjustified and not fair to other creditors.

An ABC also provides grounds for filing an involuntary bankruptcy petition within 120 days of assignment.

The Statutes: California Code of Civil Procedure

§§493.010-493.060 “Effect of Bankruptcy Proceedings and General Assignments for the Benefit of Creditors”

§§1800-1802 “Recovery of Preferences and Exempt Property in an Assignment for the Benefit of Creditors”

A Chapter 11 Reorganization can cost hundreds of thousands of dollars and even a business Chapter 7 Liquidation bankruptcy can easily cost tens of thousands or more. The Assignment method, which pays the Assignee normally by a percentage of the assets sold, is cost-efficient but limited in the protection it may afford the Assignor, as described above. Before this method is attempted, competent legal counsel and certified public accountants should be consulted.

Founded in 1939, our law firm combines the ability to represent clients in domestic or international matters with the personal interaction with clients that is traditional to a long established law firm.

Read more about our firm

© 2024, Stimmel, Stimmel & Roeser, All rights reserved | Terms of Use | Site by Bay Design

In The (Red)

The Business Bankruptcy Blog

Assignments For The Benefit Of Creditors: Simple As ABC?

Companies in financial trouble are often forced to liquidate their assets to pay creditors. While a Chapter 11 bankruptcy sometimes makes the most sense, other times a Chapter 7 bankruptcy is required, and in still other situations a corporate dissolution may be best. This post examines another of the options, the assignment for the benefit of creditors, commonly known as an "ABC."

A Few Caveats . It’s important to remember that determining which path an insolvent company should take depends on the specific facts and circumstances involved. As in many areas of the law, one size most definitely does not fit all for financially troubled companies. With those caveats in mind, let’s consider one scenario sometimes seen when a venture-backed or other investor-funded company runs out of money.

One Scenario . After a number of rounds of investment, the investors of a privately held corporation have decided not to put in more money to fund the company’s operations. The company will be out of cash within a few months and borrowing from the company’s lender is no longer an option. The accounts payable list is growing (and aging) and some creditors have started to demand payment. A sale of the business may be possible, however, and a term sheet from a potential buyer is anticipated soon. The company’s real property lease will expire in nine months, but it’s possible that a buyer might want to take over the lease.

- A Chapter 11 bankruptcy filing is problematic because there is insufficient cash to fund operations going forward, no significant revenues are being generated, and debtor in possession financing seems highly unlikely unless the buyer itself would make a loan.

- The board prefers to avoid a Chapter 7 bankruptcy because it’s concerned that a bankruptcy trustee, unfamiliar with the company’s technology, would not be able to generate the best recovery for creditors.

The ABC Option . In many states, another option that may be available to companies in financial trouble is an assignment for the benefit of creditors (or "general assignment for the benefit of creditors" as it is sometimes called). The ABC is an insolvency proceeding governed by state law rather than federal bankruptcy law.

California ABCs . In California, where ABCs have been done for years, the primary governing law is found in California Code of Civil Procedure sections 493.010 to 493.060 and sections 1800 to 1802 , among other provisions of California law. California Code of Civil Procedure section 1802 sets forth, in remarkably brief terms, the main procedural requirements for a company (or individual) making, and an assignee accepting, a general assignment for the benefit of creditors:

1802. (a) In any general assignment for the benefit of creditors, as defined in Section 493.010, the assignee shall, within 30 days after the assignment has been accepted in writing, give written notice of the assignment to the assignor’s creditors, equityholders, and other parties in interest as set forth on the list provided by the assignor pursuant to subdivision (c). (b) In the notice given pursuant to subdivision (a), the assignee shall establish a date by which creditors must file their claims to be able to share in the distribution of proceeds of the liquidation of the assignor’s assets. That date shall be not less than 150 days and not greater than 180 days after the date of the first giving of the written notice to creditors and parties in interest. (c) The assignor shall provide to the assignee at the time of the making of the assignment a list of creditors, equityholders, and other parties in interest, signed under penalty of perjury, which shall include the names, addresses, cities, states, and ZIP Codes for each person together with the amount of that person’s anticipated claim in the assignment proceedings.

In California, the company and the assignee enter into a formal "Assignment Agreement." The company must also provide the assignee with a list of creditors, equityholders, and other interested parties (names, addresses, and claim amounts). The assignee is required to give notice to creditors of the assignment, setting a bar date for filing claims with the assignee that is between five to six months later.

ABCs In Other States . Many other states have ABC statutes although in practice they have been used to varying degrees. For example, ABCs have been more common in California than in states on the East Coast, but important exceptions exist. Delaware corporations can generally avail themselves of Delaware’s voluntary assignment statutes , and its procedures have both similarities and important differences from the approach taken in California. Scott Riddle of the Georgia Bankruptcy Law Blog has an interesting post discussing ABC’s under Georgia law . Florida is another state in which ABCs are done under specific statutory procedures . For an excellent book that has information on how ABCs are conducted in various states, see Geoffrey Berman’s General Assignments for the Benefit of Creditors: The ABCs of ABCs , published by the American Bankruptcy Institute .

Important Features Of ABCs . A full analysis of how ABCs function in a particular state and how one might affect a specific company requires legal advice from insolvency counsel. The following highlights some (but by no means all) of the key features of ABCs:

- Court Filing Issue . In California, making an ABC does not require a public court filing. Some other states, however, do require a court filing to initiate or complete an ABC.

- Select The Assignee . Unlike a Chapter 7 bankruptcy trustee, who is randomly appointed from those on an approved panel, a corporation making an assignment is generally able to choose the assignee.

- Shareholder Approval . Most corporations require both board and shareholder approval for an ABC because it involves the transfer to the assignee of substantially all of the corporation’s assets. This makes ABCs impractical for most publicly held corporations.

- Liquidator As Fiduciary . The assignee is a fiduciary to the creditors and is typically a professional liquidator.

- Assignee Fees . The fees charged by assignees often involve an upfront payment and a percentage based on the assets liquidated.

- No Automatic Stay . In many states, including California, an ABC does not give rise to an automatic stay like bankruptcy, although an assignee can often block judgment creditors from attaching assets.

- Event Of Default . The making of a general assignment for the benefit of creditors is typically a default under most contracts. As a result, contracts may be terminated upon the assignment under an ipso facto clause .

- Proof Of Claim . For creditors, an ABC process generally involves the submission to the assignee of a proof of claim by a stated deadline or bar date, similar to bankruptcy. (Click on the link for an example of an ABC proof of claim form .)

- Employee Priority . Employee and other claim priorities are governed by state law and may involve different amounts than apply under the Bankruptcy Code. In California, for example, the employee wage and salary priority is $4,300, not the $10,950 amount currently in force under the Bankruptcy Code.

- 20 Day Goods . Generally, ABC statutes do not have a provision similar to that under Bankruptcy Code Section 503(b)(9) , which gives an administrative claim priority to vendors who sold goods in the ordinary course of business to a debtor during the 20 days before a bankruptcy filing . As a result, these vendors may recover less in an ABC than in a bankruptcy case, subject to assertion of their reclamation rights .

- Landlord Claim . Unlike bankruptcy, there generally is no cap imposed on a landlord’s claim for breach of a real property lease in an ABC.

- Sale Of Assets . In many states, including California, sales by the assignee of the company’s assets are completed as a private transaction without approval of a court. However, unlike a bankruptcy Section 363 sale , there is usually no ability to sell assets "free and clear" of liens and security interests without the consent or full payoff of lienholders. Likewise, leases or executory contracts cannot be assigned without required consents from the other contracting party.

- Avoidance Actions . Most states allow assignees to pursue preferences and fraudulent transfers. However, the U.S. Court of Appeals for the Ninth Circuit has held that the Bankruptcy Code pre-empts California’s preference statute , California Code of Civil Procedure section 1800. Nevertheless, to date the California state courts have refused to follow the Ninth Circuit’s decision and still permit assignees to sue for preferences in California state court . In February 2008, a Delaware state court followed the California state court decisions , refusing either to follow the Ninth Circuit position or to hold that the California preference statute was pre-empted by the Bankruptcy Code. The Delaware court was required to apply California’s ABC preference statute because the avoidance action arose out of an earlier California ABC.

The Scenario Revisited. With this overview in mind, let’s return to our company in distress.

- The prospect of a term sheet from a potential buyer may influence whether our hypothetical company should choose an ABC or another approach. Some buyers will refuse to purchase assets outside of a Chapter 11 bankruptcy or a Chapter 7 case. Others are comfortable with the ABC process and believe it provides an added level of protection from fraudulent transfer claims compared to purchasing the assets directly from the insolvent company. Depending on the value to be generated by a sale, these considerations may lead the company to select one approach over the other available options.

- In states like California where no court approval is required for a sale, the ABC can also mean a much faster closing — often within a day or two of the ABC itself provided that the assignee has had time to perform due diligence on the sale and any alternatives — instead of the more typical 30-60 days required for bankruptcy court approval of a Section 363 sale. Given the speed at which they can be done, in the right situation an ABC can permit a "going concern" sale to be achieved.

- Secured creditors with liens against the assets to be sold will either need to be paid off through the sale or will have to consent to release their liens; forced "free and clear" sales generally are not possible in an ABC.

- If the buyer decides to take the real property lease, the landlord will need to consent to the lease assignment. Unlike bankruptcy, the ABC process generally cannot force a landlord or other third party to accept assignment of a lease or executory contract.

- If the buyer decides not to take the lease, or no sale occurs, the fact that only nine months remains on the lease means that this company would not benefit from bankruptcy’s cap on landlord claims. If the company’s lease had years remaining, and if the landlord were unwilling to agree to a lease termination approximating the result under bankruptcy’s landlord claim cap, the company would need to consider whether a bankruptcy filing was necessary to avoid substantial dilution to other unsecured creditor claims that a large, uncapped landlord claim would produce in an ABC.

- If the potential buyer walks away, the assignee would be responsible for determining whether a sale of all or a part of the assets was still possible. In any event, assets would be liquidated by the assignee to the extent feasible and any proceeds would be distributed to creditors in order of their priority through the ABC’s claims process.

- While other options are available and should be explored, an ABC may make sense for this company depending upon the buyer’s views, the value to creditors and other constituencies that a sale would produce, and a clear-eyed assessment of alternative insolvency methods.

Conclusion . When weighing all of the relevant issues, an insolvent company’s management and board would be well-served to seek the advice of counsel and other insolvency professionals as early as possible in the process. The old song may say that ABC is as "easy as 1-2-3," but assessing whether an assignment for the benefit of creditors is best for an insolvent company involves the analysis of a myriad of complex factors.

ABC: Assignments For The Benefit Of Creditors

Contributor

What's an ABC? If you ask ChatGPT, “ABC” is an acronym that can have multiple meanings, depending on the context—for example, referring to the alphabet. But here we are talking about a type of business liquidation process in the United States known as an Assignment for the Benefit of Creditors (“ABC”). An ABC is governed by state law and has long been viewed as an alternative to a liquidation under Chapter 7 of the US Bankruptcy Code. Although the ABC process has existed for more than a century, it now has increased interest in certain market environments due to its speed, flexibility, and comparatively lower expense than a bankruptcy proceeding.

When Does an ABC Make Sense? As a potential buyer, you want to assess potential legal risks if a target's liabilities exceed (or are reasonably expected to exceed) its assets. In such a situation, third parties may later seek to assert that the purchase price you paid for the assets of the target was below fair value and to unwind the transaction or impose continuing liability under successor liability and fraudulent conveyance theories, among others. Unlike a direct asset purchase in such circumstances, in an ABC it's less likely that individual creditors will bring claims against you on fraudulent transfer, successor liability, or other theories because the assets are purchased from an independent fiduciary through a legally recognized wind-down process rather than directly from the distressed company. As a company in distress, you may want to avoid the length and expense of the federal bankruptcy process.

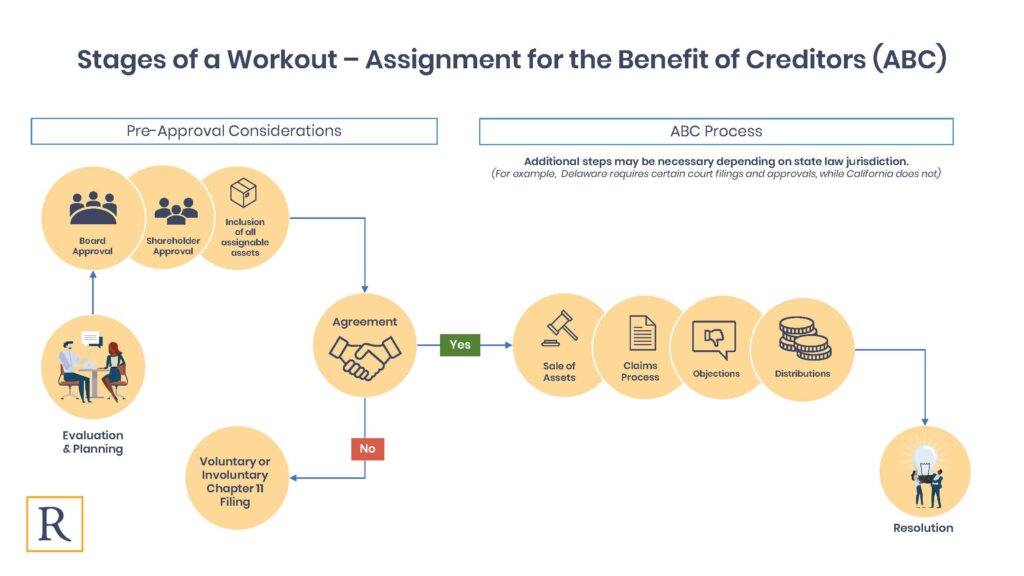

The Basics. The specifics of the ABC process vary by state, but it generally involves four main steps, as follows:

- A company authorizes (through board and any necessary shareholder consent) the shutdown of its operations and assignment of all of its assets to a third-party assignee for the benefit of the company's creditors. The assignee, who is functionally similar to a bankruptcy trustee, is an independent fiduciary selected by the company and typically has experience in insolvency matters, the relevant industry, or both. In many states, such as California, Texas, and Illinois, the ABC process ordinarily is initiated and undertaken with little or no court involvement. Other states, such as Delaware and New York, provide for varying levels of court involvement with the ABC process, though generally substantially less than a bankruptcy proceeding. Once the ABC commences (which includes the appointment of the independent fiduciary), the company's board has no further role in the ABC process.

- The assignee provides notice of the assignment to creditors and other parties in interest and requests submission of claims within a certain time. The time period in which notice must be given and claims must be filed varies by state and is based on specific statutory requirements (such as in California) or, in the absence of specific statutory requirements, may be based on local practice or custom (such as in Delaware and Illinois).

- The assignee liquidates the assets, seeking to maximize the value it obtains. In some cases, the assets are sold as a going concern shortly following commencement of the ABC, pursuant to definitive documentation that has been negotiated with the proposed buyer prior to commencement of the ABC. The liquidation may take other forms as well, such as by sale of certain key assets in bulk and sale of the remaining assets through auctions or other private or public methods.

- The assignee distributes the net proceeds of sale to the company's creditors in accordance with priorities under applicable law.

The Buyer's Perspective. As a potential buyer, you may already be in discussions with the target company prior to the ABC process or you may become involved through the assignee. Although there are some similarities with a Section 363 sale (like a shorter period for due diligence and the potential to lose key personnel through the process), the ABC process differs in several notable respects from a bankruptcy proceeding:

- The commencement of an ABC does not (i) give rise to an automatic stay of collection or enforcement actions against the company or its property, (ii) prevent creditors from attempting to commence an involuntary bankruptcy case against the company, or (iii) invalidate contractual provisions allowing for counterparties to terminate or modify a contract.

- Unlike a sale conducted under Section 363 of the Bankruptcy Code, the assignee generally cannot sell assets “free and clear” of liens and security interests—if you are buying assets subject to a security interest, the secured party will need to be paid in full or agree to release its lien. Some states that provide for judicial approval of a sale, such as Florida and Minnesota, may provide some ability for an assignee to obtain relief similar to a “free and clear” sale order in an ABC process.

- Anti-assignment provisions in leases or contracts cannot be overridden. So, any consents required under contracts that the buyer wants to assume will need to be obtained.

How We Can Help. We have successfully navigated the ABC process for our clients in a variety of states and industries, including technology, finance, chemicals, and manufacturing and maximized the advantages that acquiring assets through an ABC can provide to buyers. Although sales are usually done on an “as-is, where-is” basis, with limited ability to obtain operational or asset-level representations and warranties and without any indemnity rights in favor of the buyer, we have advised buyers in transactions where additional rights have been obtained (without the use of representation and warranty insurance).

Visit us at mayerbrown.com

Mayer Brown is a global legal services provider comprising legal practices that are separate entities (the "Mayer Brown Practices"). The Mayer Brown Practices are: Mayer Brown LLP and Mayer Brown Europe – Brussels LLP, both limited liability partnerships established in Illinois USA; Mayer Brown International LLP, a limited liability partnership incorporated in England and Wales (authorized and regulated by the Solicitors Regulation Authority and registered in England and Wales number OC 303359); Mayer Brown, a SELAS established in France; Mayer Brown JSM, a Hong Kong partnership and its associated entities in Asia; and Tauil & Chequer Advogados, a Brazilian law partnership with which Mayer Brown is associated. "Mayer Brown" and the Mayer Brown logo are the trademarks of the Mayer Brown Practices in their respective jurisdictions.

© Copyright 2020. The Mayer Brown Practices. All rights reserved.

This Mayer Brown article provides information and comments on legal issues and developments of interest. The foregoing is not a comprehensive treatment of the subject matter covered and is not intended to provide legal advice. Readers should seek specific legal advice before taking any action with respect to the matters discussed herein.

Insolvency/Bankruptcy/Re-Structuring

United states.

Mondaq uses cookies on this website. By using our website you agree to our use of cookies as set out in our Privacy Policy.

Assignments for the Benefit of Creditors – an often-overlooked state law alternative to Chapter 7 bankruptcy

For some folks the three letters ABC are a reminder of elementary school and singing a song to learn the alphabet. For others, it is a throw back to the early 70’s when the Jackson Five and its lead singer Michael, still with his adolescent high voice, sang a catchy love song. Then there is a select group of people in the world of corporate workouts, liquidations and bankruptcies, who know those three letters to stand for the A ssignment for the B enefit of C reditors – a voluntary state law liquidation process that may arguably offer a hospitable and friendly alternative to federal bankruptcy. This article is a brief summary of this potentially attractive alternative to bankruptcy.

The Assignment for the Benefit of Creditors (“ABC”), also known as a General Assignment, is a state law procedure governed by state statute or common law. Over 30 states have codified statutes, and the remainder of states rely on common law. See Practical Issues in Assignments for the Benefit of Creditors , by Robert Richards & Nancy Ross, ABI Law Review Vol. 17:5 (2009) at p. 6 (listing state statutes). In some states, the statutory authority and common law can coexist. At its most basic, the ABC process involves the transfer of all assets by a financially distressed debtor (the assignor) to an individual or entity (the assignee) with fiduciary obligations who then liquidates the assets and pays creditors. The assignment agreement is essentially a contract involving the transfer and control of property, in trust, to a third party. In some states that have enacted a statute, state courts may supervise the process (and at different levels of involvement depending on the statute). The statutory scheme in other states such as California and Nevada, and in states where common law govern, do not provide for judicial oversight..

ABCs are promoted as less expensive and more flexible than a chapter 7 liquidation and may proceed substantially faster than bankruptcy liquidation. See generally Practical Issues in Assignments for the Benefit of Creditors , ABI Law Review Vol. 17:5 (2009) at p. 8 (citations omitted). In addition, the ABC process may provide four other noteworthy benefits not available in a bankruptcy. First, the liquidating company chooses the assignee, there is no appointment of a random trustee or formal election required like in a bankruptcy. This freedom of choice allows the assignor to evaluate the reputation and experience of proposed assignees, as well as select an assignee with familiarity in the nature of the assignor’s business and/or with more expansive contacts in the industry to facilitate the sale/liquidation. Second, the ABC process generally falls under the radar of the media (particularly in states that do not require court supervision), and the assignor may avoid publicity, often negative, that can be associated with bankruptcy proceedings. Third, with an ABC, the assignee has the ability to sell the assets without the imposition of potentially cumbersome requirements of Section 363 of the Bankruptcy Code, and in some cases, can conduct a sale the same day as the general assignment. Finally, the ABC process generally authorizes the sale of assets free of unsecured creditor debt. In essence, in an ABC, a company buying assets from a distressed business does not acquire the debt of the assignor.

On the down side, ABCs do not provide the protection of the automatic stay that is triggered upon the filing of a bankruptcy petition. In some situations, the debtor entity needs to stop the pursuit of creditors immediately, and a bankruptcy proceeding will supply this relief. Unlike bankruptcy, the sale through an ABC: i) is not free and clear of liens; ii) unexpired leases cannot be assumed and assigned without the consent of the contract counter-party; and iii) insolvency can trigger a default under an unexpired lease or executory contract. See generally Practical Issues in Assignments for the Benefit of Creditors , ABI Law Review Vol. 17:5 (2009) at p. 20. In general, an ABC is not a good choice for debtors that have secured creditors that do not consent because there is no mechanism for using cash collateral or transferring assets free and clear of liens without the secured creditors’ consent. In cases where junior lienholders are out of the money, there is no incentive for those creditors to voluntarily release their liens. In addition, while unsecured creditors do not have to consent to the general assignment for it to be valid, choosing this alternative forum may cause concern for creditors (particularly those used to the transparency of a court-supervised bankruptcy or receivership proceeding) and invite the filing of an involuntary bankruptcy. Therefore, it is prudent to involve major creditors in the process, and perhaps even in the pre-assignment planning. In addition, if an involuntary petition is filed, the assignee could request that the bankruptcy court abstain in order to proceed with the ABC.

Using the ABC state process in lieu of filing for bankruptcy in federal court may result in a more streamlined, efficient liquidation process that is less expensive and likely completed quicker than a federal bankruptcy proceeding. In some jurisdictions, such as New Jersey, workout professionals note anecdotally that corporate clients fare better under this state law alternative rather than the lengthy, more complicated federal bankruptcy proceedings.

Many bankruptcy professionals are unfamiliar with the procedures of ABC and are reluctant to recommend it as a method for liquidating assets and administering claims. This lack of familiarity may be a disservice to potential clients.

[ View source .]

Related Posts

- The More Things Change, The More They Stay The Same? Survival Of Small Businesses Again Dependent On Action From Congress

- Mediation in Bankruptcy: A Glimpse

- In re The Hacienda Company, LLC – Round 2: Bankruptcy Courts May be Available to Non-Operating Cannabis Companies to Liquidate Assets

- PAGA Dischargeable in Bankruptcy?

Latest Posts

- U.S. Justice Department Proposes Loosening Restrictions on Marijuana: What's Next

See more »

DISCLAIMER: Because of the generality of this update, the information provided herein may not be applicable in all situations and should not be acted upon without specific legal advice based on particular situations.

Refine your interests »

Written by:

PUBLISH YOUR CONTENT ON JD SUPRA NOW

- Increased visibility

- Actionable analytics

- Ongoing guidance

Published In:

Fox rothschild llp on:.

"My best business intelligence, in one easy email…"

Our Services

Business advisory.

Turnaround & Restructuring

Appraisals & Valuations

Fiduciary Services

Forensic Accounting

Financial Advisory

Litigation Support

Interim Management

Real Estate Solutions

Corporate trust, what is assignment for the benefit of creditors, explaining an emerging alternative to bankruptcy to resolve distress.

What is an ABC?

Assignment for the benefit of creditors (ABC) is a state law winddown procedure that allows for the orderly winddown of a company. The ABC provides for the appointment of an independent fiduciary representative – known as an assignee. The assignee manages the orderly wind down of the business and monetizes the company’s assets for the benefit of the company’s creditors. The assignee will then distribute the proceeds generated from the sale of the company’s assets to the company’s creditors according to state law.

Important pre-approval considerations :

- The decision must be approved by both the board and shareholders.

- Jurisdiction matters – 35 states have some form of an ABC in its laws. Each state will have different considerations and procedures to follow.

What are the benefits of an ABC?

- Choice: Unlike a receivership or a Chapter 7 Case, the board has the ability to select the assignee.

- Time: A bankruptcy case is a lengthy process with many procedural requirements. Most ABCs are significantly less time-consuming than a bankruptcy case or a receivership.

- Savings: The shortened engagement time for ABCs means billing is leaner – many times, ABCs can provide higher returns.

- Distributions to Creditors: Since the cost of an ABC is usually less than a bankruptcy case or a receivership, the actual return to creditors is usually greater in an ABC than in a bankruptcy case or a receivership. In addition, due to the expedited nature of an ABC, distributions to creditors will usually occur sooner in an ABC than in a bankruptcy case or a receivership.

What else should be considered in ABCs?

ABCs have some key differences from bankruptcies which should be carefully considered. For example, there are no automatic stays or statutory caps for landlord claims or employment claims in ABC. Leases and other executory contracts may be more difficult to assign in an ABC than in a bankruptcy case. In addition, ABCs can only be used for a winddown or sale of the business, not reorganization of the business

Interested in learning more?

Resolute’s team of experts include Steve O’Neill , who has more than 35 years of legal experience in ABCs, complex bankruptcy cases, and sale/winddown of companies; and Jeremiah Foster , who has served bankruptcy trustee and liquidating trustee in a variety of ventures.

Please contact us if you would if you’d like to learn more about ABCs or explore your company’s options.

- Download PDF

- Pursuing Assignments for the Benefit of Creditors

- Pursuing Assignments for the Benefit of Creditors Overview

- Bankruptcy and Restructuring

- Security Agreements and UCC Filings in Bankruptcy

- Acquiring Assets from Bankruptcy Estates and Distressed Borrowers

- Workout, Refinancing, and Restructuring Opportunities Outside of Bankruptcy

- Representing Creditors in Bankruptcy Court and Pre-Petition Negotiations

- Debtor-in-Possession Financing and Cash Collateral

- Preventing Debtor Bankruptcy Through Liquidation, Restructuring, and Reorganization

- Proofs of Claim

- Estate Disputes Over the Treatment of Differing Creditor Claims, Transfer Avoidance, Breach of Fiduciary Duty, and Alter Ego Liability

- Reconciling Creditors Committee Interests to Avoid Litigation and Expedite Recovery

- Litigating Parasitic State Court Claims on Behalf of the Estate

- Adversary Proceedings to Set Aside Preference Payments and Fraudulent Transfers

- Creditors’ Committees and Trustees

- Defending Against Involuntary Bankruptcy Petitions

- Advising Insolvent Companies on Fiduciary Duties and Winding Down

- Establishing a Restructuring Agenda

- Recovering from Non-Debtor Entities

- Filing Involuntary Bankruptcy Petitions

- Foreclosure or Repossession During Bankruptcy

- The Impact of Commercial Reorganization on Creditors

- Assigning Bankruptcy Claims to Claims Traders

- Trade Supplier Relations with Financially Distressed Customers

- Creditor’s Committees and Trustees

- Adversary Proceedings in Bankruptcy

- Relief from the Automatic Stay

- Bankruptcy Defense: Fraudulent Transfers and Preferential Payments

What are assignments for the benefit of creditors?

Assignments for the benefit of creditors (ABCs) are an alternative to formal bankruptcy proceedings. Under Florida law, an ABC is a voluntary, out-of-court process where a debtor transfers their assets to an assignee, who then liquidates these assets and distributes the proceeds to the debtor’s creditors.

For example, a struggling business in Florida may pursue an ABC instead of filing for bankruptcy. This choice can be advantageous because it is often faster, less expensive, and less public than a formal bankruptcy filing. The business would transfer its assets to an assignee responsible for selling these assets and distributing the proceeds to the creditors following the priorities established by Florida law.

Need a bankruptcy law advocate? Schedule your consultation today with a top bankruptcy and restructuring attorney.

Which Florida laws and regulations apply to assignments for the benefit of creditors?

The primary source of law governing ABCs in Florida is Chapter 727 of the Florida Statutes . This chapter outlines the process for initiating an ABC, the assignee’s role, and the creditors’ rights. Additionally, the Florida Rules of Civil Procedure may apply to certain aspects of an ABC, such as serving notice to creditors and managing creditor claims.

Federal laws, such as the Bankruptcy Code , generally do not apply to ABCs because they are state law alternatives to bankruptcy. However, it is essential to note that federal laws may still impact an ABC in certain situations, such as when a debtor’s assets are subject to federal tax liens or other federal claims. In these cases, debtors must consult a knowledgeable attorney to navigate the interplay between state and federal laws.

How do assignments for the benefit of creditors connect to the bankruptcy process?

The connection between pursuing an ABC and bankruptcy legal services for debtors lies in their shared goal of providing relief to financially distressed individuals or businesses. Both processes involve the liquidation of assets and the distribution of proceeds to creditors. However, ABCs are generally less formal, less expensive, and more private than bankruptcy filings, making them an attractive option for debtors seeking to avoid the stigma and complexities associated with bankruptcy.

In an ABC, a debtor voluntarily transfers their assets to an assignee who liquidates them and distributes the proceeds to creditors. This process differs from a bankruptcy proceeding, where a court-appointed trustee oversees the operation. Furthermore, while strict federal rules and procedures bind bankruptcy cases, ABCs offer more flexibility, allowing parties to tailor the process to their needs.

When a set of facts is appropriate for bankruptcy services, there are many paths a claimant may take. We are value-based attorneys at Jimerson Birr, which means we look at each action with our clients from the point of view of costs and benefits while reducing liability. Then, based on our client’s objectives, we chart a path to seek appropriate remedies.

To determine whether your unique situation may necessitate litigation or another form of specialized bankruptcy advocacy, please contact our office to set up your initial consultation.

What are the prerequisites for debtors to pursue assignments for the benefit of creditors?

Consider the following:

- Voluntary action: The debtor must willingly initiate an ABC, as this process is a voluntary alternative to bankruptcy.

- Valid assignment: The debtor must properly execute and deliver the assignment to a qualified assignee, who is often an attorney, accountant, or insolvency professional.

- Recording the assignment: The assignee must record the assignment in the county’s public records containing the debtor’s principal place of business.

- Filing notice: The assignee must file a notice of the assignment with the circuit court clerk in the county where the debtor recorded the assignment.

- Notifying creditors: The assignee must provide written notice to all known creditors of the debtor within 20 days of the assignment, informing them about the ABC process and their rights.

By satisfying these requirements, the debtor can effectively pursue an ABC in Florida, which allows for a more personal and flexible approach to resolving financial difficulties compared to bankruptcy.

Please contact our office to set up your initial consultation to see what forms of legal protection and advocacy may be available for your unique situation.

Frequently Asked Questions

- Can a debtor choose any person as an assignee for an ABC?

No, not just anyone can be an assignee. The assignee must be a disinterested person who is not an insider of the debtor and is qualified to manage the debtor’s assets and affairs. Assignees are typically professionals, such as attorneys, accountants, or insolvency experts.

- Does an ABC in Florida prevent creditors from pursuing legal action against the debtor?

Unlike bankruptcy, an ABC does not automatically halt legal actions by creditors. However, creditors may agree to a standstill or moratorium on legal actions while the ABC process is ongoing. This outcome may depend on the specific circumstances and the willingness of the creditors to cooperate.

- How does an ABC affect the debtor’s credit rating?

Although an ABC may be less public and stigmatizing than bankruptcy, it can still harm the debtor’s credit rating. Credit reporting agencies may treat an ABC as a similar event to a default, which can lower the debtor’s credit score and make it more difficult for them to obtain future credit or loans. However, the impact on the credit rating may vary depending on the specific circumstances of the case and the debtor’s credit history before the ABC. Therefore, debtors must work closely with financial advisors and credit counselors to rebuild their credit after an ABC process.

Have more questions about how bankruptcy services could positively impact your business operations and relationships?

Crucially, this overview of assignments for the benefit of creditors does not begin to cover all the laws implicated by this issue or the factors that may compel the application of such laws. Every case is unique, and the laws can produce different outcomes depending on the individual circumstances.

Jimerson Birr attorneys guide our clients to help make informed decisions while ensuring their rights are respected and protected. Our lawyers are highly trained and experienced in the nuances of the law, so they can accurately interpret statutes and case law and holistically prepare individuals or companies for their legal endeavors. Through this intense personal investment and advocacy, our lawyers will help resolve the issue’s complicated legal problems efficiently and effectively.

Having a Jimerson Birr attorney on your side means securing a team of seasoned, multi-dimensional, cross-functional legal professionals. Whether it is a transaction, an operational issue, a regulatory challenge, or a contested legal predicament that may require court intervention, we remain tireless advocates at every step. Being a value-added law firm means putting the client at the forefront of everything we do. We use our experience to help our clients navigate even the most complex problems and come out the other side triumphant.

If you want to understand your case, the merits of your claim or defense, potential monetary awards, or the amount of exposure you face, you should speak with a qualified Jimerson Birr lawyer. Our experienced team of attorneys is here to help. Call Jimerson Birr at (904) 389-0050 or use the contact form to schedule a consultation .

We live by our 7 Superior Service Commitments

- Conferring Client-Defined Value

- Efficient and Cost-Effective

- Accessibility

- Delivering an Experience While Delivering Results

- Meaningful and Enduring Partnership

- Exceptional Communication Based Upon Listening

- Accountability to Goals

Assumption, Assignment and Sale of SBA Loans

3 Main Considerations When Obtaining Assignments of Lawsuits or Judgments as a Judgment Collection Tool

Assignment for the Benefit of Creditors: Stay of Litigation

latest Blog Posts

Professional services industry legal blog.

Reasonable and Effective Non-Compete Clauses from the Employer’s Perspective Read More

Join our mailing list.

Call our experienced team., we’re here to help, connect with us., call our experienced team..

An official website of the United States Government

- Kreyòl ayisyen

- Search Toggle search Search Include Historical Content - Any - No Include Historical Content - Any - No Search

- Menu Toggle menu

- INFORMATION FOR…

- Individuals

- Business & Self Employed

- Charities and Nonprofits

- International Taxpayers

- Federal State and Local Governments

- Indian Tribal Governments

- Tax Exempt Bonds

- FILING FOR INDIVIDUALS

- How to File

- When to File

- Where to File

- Update Your Information

- Get Your Tax Record

- Apply for an Employer ID Number (EIN)

- Check Your Amended Return Status

- Get an Identity Protection PIN (IP PIN)

- File Your Taxes for Free

- Bank Account (Direct Pay)

- Payment Plan (Installment Agreement)

- Electronic Federal Tax Payment System (EFTPS)

- Your Online Account

- Tax Withholding Estimator

- Estimated Taxes

- Where's My Refund

- What to Expect

- Direct Deposit

- Reduced Refunds

- Amend Return

Credits & Deductions

- INFORMATION FOR...

- Businesses & Self-Employed

- Earned Income Credit (EITC)

- Child Tax Credit

- Clean Energy and Vehicle Credits

- Standard Deduction

- Retirement Plans

Forms & Instructions

- POPULAR FORMS & INSTRUCTIONS

- Form 1040 Instructions

- Form 4506-T

- POPULAR FOR TAX PROS

- Form 1040-X

- Circular 230

- 5.9.20.1.1 Background

- 5.9.20.1.2 Authority

- 5.9.20.1.3 Responsibilities

- 5.9.20.1.4 Program Management and Review

- 5.9.20.1.5 Program Controls

- 5.9.20.1.6 Terms and Acronyms

- 5.9.20.1.7 Related Resources

- 5.9.20.2.1 SIPA Cases

- 5.9.20.3.1 Federal Deposit Insurance Corporation (FDIC) Receivership Proceedings of Insolvent Financial Institutions

- 5.9.20.4 Assignment for the Benefit of Creditors (ABC)

- 5.9.20.5.1 Corporate Dissolutions - Judicial

- 5.9.20.5.2 Corporate Dissolution - Non-Judicial

- 5.9.20.6 Bulk Sales

Part 5. Collecting Process

Chapter 9. bankruptcy and other insolvencies, section 20. non-bankruptcy insolvencies, 5.9.20 non-bankruptcy insolvencies, manual transmittal.

December 01, 2022

(1) This transmits a new IRM 5.9.20, Bankruptcy and Other Insolvencies, Non-Bankruptcy Insolvencies.

Material Changes

(1) Editorial changes have been made throughout the IRM and citations have been updated.

(2) IRM 5.9.20.1(2): Audience section has been updated to align with names/acronyms of current business units. Clarification on employee use was also added.

(3) IRM 5.9.20.1(3)(4): Policy Owner and Program Owner were updated to align with current business unit names.

(4) IRM 5.9.20.1(5): Primary Stakeholders was updated to align with current business unit names/acronyms.

(5) IRM 5.9.20.1.3(2): Responsibilities was updated to correct IRM link reference and IRM title.

(6) IRM 5.9.20.1.4(1): Program Reports was updated to notate the Business Objects function for the required AIS reports.

(7) IRM 5.9.20.1.4(2)(a)(b): Program Effectiveness was updated to reflect new IRM link references and to change the name from Advisory to CEASO.

(8) IRM 5.9.20.1.5(1): Program Controls was updated to reflect new IRM link references.

(9) IRM 5.9.20.1.5(2): Program Controls was updated to reflect CEASO instead of Advisory. The PALS name was added to the group manager operational guide title.

(10) IRM 5.9.20.1.6(3): Terms and Acronyms updated ReferenceNet Acronym Database web link.

(11) IRM 5.9.20.1.6(4): Acronym table has been added for quick reference.

(12) IRM 5.9.20.1.7(2): Related Resources was updated to add the United States Bankruptcy Code and Rules Booklet.

(13) IRM 5.9.20.2.1(3): Assigned Offices updated to the New York Field Insolvency office for SIPA case routing.

(14) IRM 5.9.20.2.1(10): Payment Posting was updated to reflect the New York Insolvency Field office for payment routing.

(15) IRM 5.9.20.3.1(3): Notification clarified mailing instructions per the Form 56-F’s most recent instructions.

Effect on Other Documents

Effective date.

Kareem Williams Director, Collection Policy Small Business/Self Employed

Program Scope and Objectives

Purpose . This Internal Revenue Manual (IRM) section describes the process and procedures for working non-bankruptcy insolvencies and the types of procedures followed to protect the Government's interest in these proceedings.

Audience . This IRM is designed for use by Specialty Collection Insolvency and Civil Enforcement Advice & Support Operations (CEASO) personnel. Advisors, revenue officers, and other SB/SE employees may also refer to this section. Employees in functions other than SB/SE may refer to this section when working with a taxpayer that has filed an insolvency proceeding.

Policy Owner . The Director of Collection Policy is responsible for issuing policy for the Specialty Collection Insolvency program.

Program Owner . The program owner is Collection Policy, Specialty Collection Insolvency, an organization with the Small Business Self Employed (SB/SE) division.

Primary Stakeholders . The primary stakeholders of this section are SB/SE Collection, Specialty Collection Insolvency and SB/SE Specialty Collection Offers, Liens and CEASO.

Program Goals . The goal of this IRM is to protect the government’s interest and ensure taxpayer rights are protected while processing stockbroker insolvencies, receiverships, assignment for the benefit of creditors, corporate dissolutions and bulk sales.

Internal Revenue Manual (IRM) 5.9, Bankruptcy and Other Insolvencies, contains the Service’s position, procedures, information, instructions, guidance, and references concerning bankruptcy cases, stockbroker insolvencies, receiverships, assignments for the benefit of creditors, corporate dissolutions, and bulk sales.

This IRM specifically addresses the Service’s position, procedures, information, instructions, guidance, and references on the following non-bankruptcy insolvencies: stockbroker insolvencies, receiverships, assignments for the benefit of creditors, corporate dissolutions, and bulk sales.

11 USC 109(b) with 109(d) & (e)

Securities Investor Protection Act (SIPA) of 1970

15 USC 78aaa et seq

IRC 7403(d)

Responsibilities

The Director, Specialty Collection Insolvency and Director, Specialty Collection Offers, Liens and CEASO are responsible for program oversight.

Territory and Frontline managers are responsible for ensuring reviews are completed as required per IRM 1.4.51.17.2, Operational Review, IRM 1.4.51.16.2, EQ Consistency Reviews, IRM 1.4.51.5.2, Reviews (Overview), and IRM 1.4.53, Advisory and Property Appraisal and Liquidation Specialist Group Manager Operational Aid.

Employees are responsible for following the provided guidance to process cases.

Program Management and Review

Program Reports . Reports housed on the Business Objects Enterprise system are used to support the insolvency program. The required AIS reports are described in IRM 5.9.12 , Insolvency Automated Processes, IRM 5.9.16 , Insolvency Case Monitoring, and in IRM 1.4.51.8.3 , Case Management Tools.

Program Effectiveness .

Operational and Program reviews are conducted on a yearly basis. See IRM 1.4.51.17.2, Operational Review, and IRM 1.4.51.17.5, Program Reviews, for more information. Operational Reviews are conducted within the operation and can be obtained by contacting the Director, Specialty Collection Insolvency or Director Specialty Collection Offers, Liens and CEASO. Program Reviews are conducted within Headquarters Collection and can be obtained by contacting the Director, Collection Policy or Director, Specialty Collection Offers, Liens and CEASO.

National quality reviews conducted on a monthly basis. Consistency reviews are conducted at least annually. See IRM 1.4.51.16.1, NQRS and IRM 1.4.51.16.2, EQ Consistency Reviews, for more information.

Program Controls

Insolvency Managers are required to follow program management procedures and controls addressed in IRM 1.4.51.5.2, Reviews (Overview), IRM 1.4.51.15, Controls, and IRM 1.4.51.16, Quality.

CEASO Managers are required to follow program management procedures and controls addressed in IRM 1.4.53, Advisory and Property Appraisal and Liquidation Specialist Group Manager Operational Aid.

Terms and Acronyms

A glossary of terms used in this IRM can be found in Exhibit 5.9.1-1, Glossary of Common Insolvency Terms.

Common acronyms acceptable for use in the AIS history are listed in Exhibit 5.9.1-2, Acronyms and Abbreviations.

Additional acceptable acronyms and abbreviations are found in the ReferenceNet Acronym Database, which may be viewed at: http://rnet.web.irs.gov/Resources/Acronymdb.aspx.

Acronyms used specifically in this IRM section are listed below:

Related Resources

Procedural guidance on insolvencies can be found throughout IRM 5.9, Bankruptcy and Other Insolvencies.

The United States Bankruptcy Code and Rules Booklet

Automated Insolvency System - User Guide, Document 13219.

http://www.fdic.gov

Stockbroker Insolvencies

Overview. Because stockbrokers are entrusted with the financial investments of their customers, special laws have been enacted to protect the assets of their investors. In conjunction with these special protections, Congress has limited the extent to which stockbrokers may seek bankruptcy protection. Specifically, stockbrokers are prohibited from being a debtor in Chapters 11 and 13 bankruptcies (11 USC 109(d) & (e)). By default the only chapter of bankruptcy for which a stockbroker may be eligible is Chapter 7. (Compare 11 USC 109(b) with 109(d) & (e).) The Field Insolvency operation is fully responsible for working stockbroker insolvencies.

Interstate Commerce. The majority of stockbrokers deal in interstate commerce and, in so doing, are required to be members of the Security Investor Protection Corporation (SIPC) by the Securities Investor Protection Act (SIPA) of 1970, 15 USC 78aaa et seq. Generally, these stockbrokers should not be filing bankruptcy. However, if a determination has been made a broker or brokerage firm's customers' investments do not need protection under SIPA, it may file a Chapter 7 bankruptcy. The discussion of SIPA cases in the subsection below explains procedures to be taken by Field Insolvency caseworkers.

Intrastate Commerce. A broker or dealer whose business is exclusively intra state and who does not use any facility of a national securities exchange may appropriately file a Chapter 7 bankruptcy. Insolvency specialists should handle these cases as they would any other Chapter 7 bankruptcy.

SIPA Actions. SIPC is a private, non-profit, non-governmental corporation to which most registered brokers are required to belong. Assessments against members are deposited into a fund designed to protect customers (i.e., investors doing business with the broker or brokerage) in the event of the financial failure of a SIPA member. If SIPC determines that a member has failed or is in danger of failing and other conditions are met, SIPC may seek liquidation of the firm.

SIPC files an application for a protective decree with the district court as a civil suit where SIPC is listed as one of the plaintiffs in the matter. If a Chapter 7 bankruptcy has been filed, the bankruptcy proceeding is stayed pending the outcome of the SIPC liquidation. See 11 USC 742.

A trustee is appointed to satisfy investors' and other creditors' claims.

Once the SIPC liquidation proceeding is completed, if the broker or brokerage had filed a Chapter 7 previously, the Chapter 7 case is dismissed. 11 USC 742.

SIPC Trustee. After the district court grants the protective decree, it appoints a trustee and the case is removed to the bankruptcy court. SIPA contains special provisions protecting investment customers, but the general provisions of the bankruptcy code also apply to SIPA liquidations. Since the case is opened in the district court and assigned a case number there, the case is not assigned a bankruptcy case number; however, the Bankruptcy Court gives it an adversary number. Insolvency will use the adversary number to load the case onto the Automated Insolvency System (AIS). The duties of the SIPC trustee are similar to those of a Chapter 7 trustee with the additional duties to:

Be responsible for all noticing issues on the case;

Hire any necessary personnel, such as an accountant, to assist in the liquidation process;

Use any member of SIPC to assist in the liquidation proceeding;

Maintain and control customer accounts;

Investigate the debtor and condition of the estate; and

Report any and all findings to the court.

These additional duties do not require approval of the bankruptcy court. (15 USC 78fff-1.)

The SIPC trustee may submit a request to the Service seeking exemption from filing the returns of a brokerage company in a SIPA proceeding, in appropriate circumstances, under the procedures discussed in IRM 5.9.6.14.1(2) , Relief from Filing Requirement.

Assigned Offices. All SIPA cases are handled by the New York Field Insolvency office. When notices pertaining to SIPA proceedings are received by any other Field Insolvency office or by the CIO, those notices must be forwarded to the New York Field Insolvency office as time sensitive mail according to procedures established in IRM 5.9.11.3(4), Specialty Mail Received by the Field.

Initial Insolvency Questions. Usually the Service will not receive any notification of a stockbroker insolvency until SIPC files an application for a protective decree and the case is transferred to the bankruptcy court as an adversarial proceeding. The caseworker must contact the trustee to obtain information such as:

The taxpayer identification number (EIN/SSN)

Other entities involved and their corresponding TINs

Date of the 341 meeting of creditors

If the IRS is named as a creditor

The last date to file a claim

How to be added to creditor matrices, if necessary

Other relevant information or special procedures required by the trustee

Adding the Case to AIS. Field Insolvency will be responsible for loading SIPA cases on to AIS. Because AIS has no database for SIPA cases, they will be added as "RC" (receivership) in the "Chapter" field of the AIS entity screen. The caseworker will use the adversary number with the letters "-AD" following the last digit of the number or following the judge's initials. The "-AD" will identify the case as a SIPA proceeding. The trustee information can be loaded to the AIS Attorney screen.

Manual Processing. The Insolvency Interface Program (IIP) will not process SIPA cases. Field Insolvency caseworkers will be responsible for verifying TINs, reviewing status codes, addressing pending Exam actions (TC 420 ), taking necessary actions to avoid or correct stay violations, and inputting TC 520 cc 84 manually on all periods. If any periods are estimated, a dummy may be required.

Closing code 84 will not establish a dummy module. It may be necessary to establish a dummy mod using cc 81, and change the closing code to 84 after the dummy mod is established.

TFRP Investigation. TFRP investigations will be conducted and assertions will be made as if the case were a Chapter 7 bankruptcy.

Claims. Claims are filed with the trustee rather than with the court. The typical deadline to file a claim is six months from the date of notice. The Automated Proof of Claim (APOC) system will not process SIPA cases. The caseworker will prepare the Service's claim as if it were for a Chapter 7 bankruptcy. When a claim is printed from the AIS claim screen, it will be annotated as a "receivership." The caseworker must white out the "receivership" designation and replace it with "SIPA."

Payment Preference. Customer creditors (see Exhibit 5.9.1-1, Glossary of Common Insolvency Terms) always receive full preference in these liquidation proceedings. The IRS will never be a customer creditor. After distribution is made to customer creditors, distribution toward non-customer claims is treated as if the broker or brokerage had filed a Chapter 7 Asset case (11 USC 726; see 15 USC 78fff(e)).

Payment Posting. The SIPA trustee should be instructed to mail payments to the New York Field Insolvency office to be posted through AIS and sent to the serving Campuses. Payments received by the CIO in error will be posted to the period with the most imminent CSED by the CIO. The CIO will advise the New York Field Insolvency office of payment receipt by phone or secure e-mail. Designated payment code "03" should be used on the payment vouchers.

Stay. Upon SIPC's filing of an application for a protective decree under SIPA, all tax proceedings concerning the broker or brokerage are stayed until the application is dismissed or until the liquidation proceedings are finished. 11 USC 362(a). However, in the case of an individual broker, the stay applies to the commencement or continuation of a proceeding in United States Tax Court for a taxable period ending before the filing of an application for a protective decree under SIPA. Thus, all normal bankruptcy stay procedures must be followed. For instance, receipt of levy payments must be refunded to the SIPC trustee; Notices of Federal Tax Liens filed in violation of the stay must be withdrawn.

Case Closure. After completion of a liquidation proceeding, corporations, limited liability companies, and limited partnerships should be closed as TC 530 cc 10 upon reversal of the TC 520. Individual brokers' cases should be closed as if they were Chapter 7 discharges.

Counsel Guidance. Issues arising from SIPA proceedings that have not been covered in this IRM should be discussed with Counsel.

Receivership Proceedings

Overview . A receivership proceeding is when a state or federal court appoints a fiduciary (receiver) to take control of the assets of a business or individual debtor. A receivership may be established to:

Conserve, preserve, protect, or administer property involved in a legal action;

Prevent fraud or loss of property from fraud;

Prevent mismanagement of property; or

Replace an irresponsible or insolvent assignee where claims are jeopardized in an assignment for benefit of creditors.

Court Jurisdiction. The majority of receivership actions are brought in the state courts because the basis for jurisdiction by federal district courts is limited. The court appointing the receiver has jurisdiction over the assets of the receivership. The court handles all questions pertaining to the preservation, collection, liquidation, and distribution of the assets.

No absolute right to the appointment of a receiver exists. The decision is at the discretion of the court.

US District Courts. The US government can request a federal district court to appoint a receiver as part of a federal tax lien foreclosure action under IRC 7403(d). Such a receivership is usually sought where necessary for the collection, preservation, or orderly liquidation of property being foreclosed.

CSED. The statute for collection of taxes is suspended during the time the taxpayer's assets are in the control or custody of the court plus six months (IRC 6503(b)).

Types of Receiverships. Receiverships are generally classified as either "general" where all of the non-exempt assets of a business or individual debtor are under the court's control, or "limited" where a specific asset or group of assets are under the court's control. The following chart illustrates the difference between a general and a limited receivership.

Receiver. The receiver is considered an officer of the court with fiduciary responsibilities to the court and creditors. The receiver is usually an independent party without an interest in the case. However, a party in interest with special knowledge of the business may be appointed receiver upon agreement of the parties to the suit. The receiver is not personally liable for receivership obligations.

The receiver of a corporation in receivership may submit a request to the Service seeking exemption from filing the returns of the corporation, in appropriate circumstances, under the procedures discussed in IRM 5.9.6.14.1(2), Relief from Filing Requirement

Bankruptcy versus Receivership. The Service generally will not initiate or join in a proceeding to request an involuntary bankruptcy for a taxpayer. However, IRC 7403(d) authorizes the Service to request the appointment of a receiver. Such a receivership is usually sought where necessary for the collection, preservation, or orderly liquidation of property being foreclosed.

Adding the Case to AIS. Caseworkers must add receivership cases to AIS, inputting "RC" in the chapter field on the AIS entity screen. The court-appointed receiver's name, address, and phone number must be added to the AIS attorney table.

Manual Processing. IIP does not process receivership cases, so the caseworker must manually input TC 520 cc 84 on balance due modules. Field Insolvency caseworkers will be responsible for verifying TINs, reviewing status codes, addressing pending Exam actions (TC 420), taking necessary actions to avoid or correct stay violations, and inputting TC 520 cc 84 manually on all periods. If any periods on the proof of claim are estimated, a dummy module may be required.

Closing code 84 will not establish a dummy module. It may be necessary to establish a dummy module using cc 81 and change the closing code to 84 after the dummy module is established.

TFRP Investigation. TFRP investigations will be conducted and assertions made as if the case were a Chapter 7 bankruptcy.

Unfiled Returns. Unfiled returns should be requested from the receiver. The Service should make IRC 6020(b) returns for returns not received by the deadline given to the receiver. This may require issuing a summons for the 6020(b) information.

The IRS can make immediate assessments of unassessed income, estate and gift tax deficiencies pursuant to IRC 6871; Treas. Reg. 301.6871(b)-1(c).

Bar Date. Claims must be filed by the bar date established by the court or the claim may be disallowed.

Proof of Claim. The Automated Proof of Claim (APOC) system does not process Receivership cases. The proof of claim should be filed manually on Form 4490, unless the receiver requests the claim be filed on another form or presented in letter format. Penalties and interest should be computed to the date of the court order establishing the receivership. Schedules of assets and liabilities are not provided to the court and creditors, so secured claims should be filed at full value. The claim should be filed according to the requirements of the court.

Case Files. In addition to AIS documentation, paper files should be kept for receivership cases, including notices, copies of claims, and correspondence sent to or received from the receiver.

Follow-Up Review. After filing a claim, the caseworker must input a one year follow-up on the AIS case to check for distribution. If no distribution has been received by the follow-up date, the caseworker must contact the receiver by phone or ad hoc letter asking about the progress of the distribution and the likelihood of the Service's receiving payment on its claim.

Payment Application. The court determines the formula for the distribution of assets and to which creditors the assets will be distributed. Generally, the assets are paid:

First, to the receiver's administrative creditors, including the receiver.

Then, to pre-appointment creditors and other creditors.

The receiver should be instructed to mail payments to the Field Insolvency office where the case is assigned. The CIO will post payments received in error to the period with the most imminent CSED. The CIO will advise the caseworker of payment receipt by phone or secure email. Designated payment code "03" should be used on the payment vouchers.

Case Closure. Once the receivership proceeding is complete and the creditors have been paid to the extent allowed by the court distribution, the receiver is discharged and the case is closed. Unlike bankruptcy cases, receivership proceedings do not provide a discharge. The IRS may collect any tax claim that remains unpaid once the proceeding ends. IRC 6873. When a business entity has been dissolved under state receivership proceedings or other dissolution actions, and all IRS activity, including addressing any TFRP issues, has concluded the litigation freeze code must be reversed and the modules closed with a TC 530 cc10. When an individual receivership is closed in the court and all IRS activity has concluded, the litigation freeze code should be reversed.

Counsel Guidance. Issues arising from receivership proceedings that have not been covered in this IRM should be discussed with Counsel. In some instances formal intervention by Counsel may be required.

Federal Deposit Insurance Corporation (FDIC) Receivership Proceedings of Insolvent Financial Institutions

Overview. When a financial institution encounters economic distress, the financial institution can be placed into a receivership proceeding pursuant to 12 USC 1821. The receivership proceeding is much like a bankruptcy case. Prior to January 1, 1996, the Resolution Trust Corporation (RTC) was the fiduciary of the insolvent financial institutions. On January 1, 1996, the FDIC took over the responsibility of serving as the fiduciary of failing financial institutions. The FDIC also assumed the responsibility of closing the cases of financial institutions previously administered by the RTC that remained open as of close of business on December 31, 1995. The FDIC has the authority to wind up the financial institution's operations, liquidate the assets, and to pay the claims of creditors from the funds secured from the liquidation of the assets.

Court Jurisdiction. The FDIC receivership is an administrative proceeding. The financial institution's assets are not under the direct control of a court. Therefore, the CSED for the financial institution is not extended during the period that the FDIC is the receiver for the insolvent financial institution.

Notification. Form 56-F, Notice Concerning Fiduciary Relationship of Financial Institution, is the only form the IRS should accept as notice of the FDIC Receivership. In reference toIRC 6402(k) and IRC 6903 , send Form 56-F to the Internal Revenue Service Center where the financial institution for whom the fiduciary is acting files its income tax return. For purposes of IRC 6036, send Form 56-F to the Advisory Group Manager of the area office of the IRS having jurisdiction over the person for whom you are acting. Until the Form 56-F is revised, the Advisory Group Manager should forward the form to:

Internal Revenue Service

Insolvency,

MS 5024 DAL

Dallas, TX 75242

The IRS should not honor an informal notice from the FDIC, such as an email to SBSE Collection employees, as the equivalent of a Form 56-F.

Adding the case to AIS. Caseworkers must add the FDIC receivership cases to AIS, inputting "RC" in the chapter field on the Taxpayer Screen on AIS. For easy identification of the FDIC cases, the caseworker must select "FDIC" from the drop down menu in the "Classification" field on the Taxpayer Screen when adding the case to AIS. The name of the failed financial institution should be added in the "Last Name" field on the Taxpayer Screen. The" First Name" field should show c/o FDIC. The address should be the address of the FDIC location administering the case. The FDIC information may be found using cc ENMOD on IDRS or from lines 9 through 13 of the Form 56-F.