Public Economics Research Paper Topics

In this comprehensive guide to public economics research paper topics , students will find an extensive list of subjects to explore within this vital field. The primary aim of this guide is to assist students in selecting and developing research paper topics that align with their interests and contribute to the existing body of knowledge in public economics. In addition, expert advice on how to choose topics, write a research paper, and an introduction to iResearchNet’s writing services ensure that students have all the resources they need for success in their academic endeavors.

Public Economics Research Paper Topics Guide

Public economics, as a branch of economics, focuses on the study of government policies and their impact on the allocation of resources, distribution of income, and overall economic efficiency. This field examines various issues related to public finance, taxation, public goods, welfare programs, and other government interventions in the economy. Given the complexity and importance of public economics, research in this area is essential for shaping effective policies and addressing economic challenges faced by societies around the world.

Academic Writing, Editing, Proofreading, And Problem Solving Services

Get 10% off with 24start discount code.

As a student pursuing a degree in economics or a related field, writing a research paper on public economics can be both challenging and rewarding. Selecting an engaging and relevant topic is a crucial first step in the research and writing process. With numerous public economics research paper topics to choose from, students may find it overwhelming to narrow down their options and identify a subject that aligns with their interests and academic goals.

This guide aims to provide a comprehensive list of public economics research paper topics, organized into ten categories for easy reference. By exploring these topics, students can gain a better understanding of the various aspects of public economics and identify potential research questions that align with their interests and passions. Furthermore, expert advice on how to choose from the multitude of public economics topics and how to write a public economics research paper will help students navigate the research and writing process more effectively.

Finally, for students who may require additional support and guidance, this guide introduces iResearchNet’s writing services. These services offer students the opportunity to order custom public economics research papers, written by expert degree-holding writers, and tailored to their specific needs and requirements.

With this comprehensive guide, students will be well-equipped to tackle the challenges of writing a research paper in public economics, contributing to the ongoing development of knowledge in this important field and enhancing their academic success.

100 Public Economics Research Paper Topics

In this section, you will find an extensive list of public economics research paper topics, divided into ten categories. These topics cover various aspects of public economics, providing a solid foundation for your research and helping you find a subject that aligns with your interests and academic goals.

Public Finance

- The role of fiscal policy in economic growth and stability

- The impact of government debt on economic performance

- Public expenditure and its effect on income distribution

- The efficiency of public spending in promoting economic development

- The relationship between government revenue and economic growth

- Public-private partnerships and their implications for public finance

- The effects of fiscal decentralization on public finance management

- The role of sovereign wealth funds in managing public finances

- The impact of international aid on public finance in developing countries

- Public finance challenges in times of economic crisis

Taxation Policy

- The principles of optimal taxation

- The impact of progressive vs. regressive taxation on income distribution

- The effectiveness of tax incentives in promoting economic growth

- The relationship between corporate taxation and business investment

- The role of value-added tax (VAT) in public revenue generation

- The economic effects of property taxes

- The impact of carbon taxes on environmental sustainability and economic growth

- Tax evasion and avoidance: causes, consequences, and policy responses

- The role of tax competition in shaping international tax policies

- The implications of digitalization for tax policy design

Welfare Economics

- The principles of welfare economics and their application in public policy

- The role of social safety nets in mitigating poverty and inequality

- The effectiveness of unemployment insurance in promoting labor market stability

- The impact of social security systems on savings and consumption behavior

- The economic effects of minimum wage policies

- The role of welfare programs in fostering social cohesion and reducing crime rates

- The challenges of financing and delivering universal healthcare coverage

- The economic implications of population aging for welfare systems

- The impact of immigration on welfare systems in host countries

- The effectiveness of conditional cash transfer programs in reducing poverty

Public Goods and Externalities

- The characteristics and classification of public goods

- The role of government in providing public goods

- The free-rider problem and its implications for public goods provision

- The concept of externalities and their impact on economic efficiency

- The role of government in addressing positive and negative externalities

- The economic rationale for public investment in infrastructure

- The relationship between public goods provision and economic growth

- The role of intellectual property rights in promoting innovation and public goods creation

- The challenges of valuing and pricing public goods

- The role of public goods in fostering regional development and economic integration

Income Redistribution

- The economic rationale for income redistribution policies

- The impact of income redistribution on economic growth and inequality

- The role of progressive taxation in income redistribution

- The effectiveness of transfer programs in reducing income inequality

- The impact of education and skill development policies on income distribution

- The role of labor market policies in promoting income redistribution

- The relationship between income redistribution and social mobility

- The impact of globalization on income distribution and redistribution policies

- The role of international cooperation in addressing global income inequality

- The challenges of designing and implementing effective income redistribution policies

Public Sector Efficiency

- The concept of public sector efficiency and its measurement

- The impact of bureaucratic structures on public sector efficiency

- The role of performance management systems in promoting public sector efficiency

- The relationship between public sector efficiency and economic growth

- The impact of decentralization on public sector efficiency

- The role of public-private partnerships in enhancing public sector efficiency

- The impact of information technology on public sector efficiency

- The role of transparency and accountability in promoting public sector efficiency

- The challenges of reducing corruption and promoting efficiency in the public sector

- The impact of public sector efficiency on trust in government institutions

Health Economics and Public Health Policy

- The economic rationale for government intervention in healthcare markets

- The role of public health insurance in improving health outcomes and reducing health inequalities

- The relationship between healthcare expenditures and economic growth

- The impact of aging populations on healthcare systems and public health policies

- The economic implications of infectious diseases and pandemics for public health policy

- The role of prevention and health promotion in public health policy

- The impact of healthcare reforms on access, quality, and efficiency

- The role of international cooperation in addressing global health challenges

- The implications of digital health technologies for public health policy and healthcare delivery

Education Economics and Public Education Policy

- The economic rationale for government intervention in education markets

- The relationship between education expenditures and economic growth

- The role of public education in promoting income redistribution and social mobility

- The impact of education policies on human capital formation and labor market outcomes

- The challenges of financing and delivering quality education for all

- The role of early childhood education in promoting long-term economic growth

- The impact of education reforms on access, quality, and efficiency

- The role of public-private partnerships in education service delivery

- The implications of digitalization for public education policy and service delivery

- The role of international cooperation in addressing global education challenges

Environmental Economics and Public Environmental Policy

- The economic rationale for government intervention in environmental markets

- The role of environmental taxes and regulations in promoting sustainable development

- The impact of environmental policies on economic growth and welfare

- The relationship between environmental quality and public health outcomes

- The economic implications of climate change for public environmental policy

- The role of international cooperation in addressing global environmental challenges

- The impact of environmental policies on innovation and technological progress

- The challenges of designing and implementing effective environmental policies

- The role of market-based instruments in promoting environmental sustainability

- The implications of the circular economy for public environmental policy

Macroeconomic Policy and Stabilization

- The role of fiscal policy in promoting macroeconomic stability and growth

- The impact of monetary policy on inflation, unemployment, and economic growth

- The effectiveness of fiscal and monetary policy coordination in achieving macroeconomic objectives

- The role of automatic stabilizers in promoting economic stability

- The impact of exchange rate regimes on macroeconomic performance

- The relationship between fiscal sustainability and macroeconomic stability

- The challenges of implementing countercyclical policies in times of economic crisis

- The role of international cooperation in promoting global economic stability

- The impact of financial market regulations on macroeconomic performance

- The implications of digital currencies for monetary policy and macroeconomic stability

With this comprehensive list of public economics research paper topics, you can explore a wide range of subjects within this important field. As you review these topics, consider which ones align with your interests and academic goals, and which ones have the potential to contribute to the existing body of knowledge in public economics. By selecting a topic that you are passionate about, you will be more likely to engage deeply with the research process and produce a high-quality research paper.

As you embark on your research journey, remember that this list is not exhaustive, and there are countless other topics within public economics that could be explored. Use this list as a starting point and feel free to expand upon these topics or explore new areas of interest. The most important thing is to choose a topic that is both relevant to public economics and meaningful to you.

In the following sections, we will provide expert advice on how to choose from the multitude of public economics research paper topics and how to write a public economics research paper. This guidance will help you navigate the research and writing process more effectively, ensuring that you produce a high-quality research paper that contributes to the ongoing development of knowledge in this important field.

How to Choose a Public Economics Topic

Selecting the right topic for your public economics research paper is a critical step in the research and writing process. With countless topics to choose from, it can be overwhelming to narrow down your options and identify the subject that best aligns with your interests and academic goals. In this section, we provide expert advice to help you choose the perfect public economics research paper topic.

- Understand the scope of public economics : Before you begin selecting a topic, it’s essential to have a clear understanding of the breadth and depth of public economics. Familiarize yourself with the key concepts, theories, and policy debates within this field to better understand the range of topics you can explore.

- Identify your interests and passions : Selecting a topic that genuinely interests you is crucial for maintaining motivation throughout the research process. Reflect on the areas of public economics that you find most intriguing, and consider how you can contribute to the existing knowledge in that area. Remember, if you are passionate about a topic, you are more likely to engage deeply with the research and produce a high-quality paper.

- Consult relevant literature and research : Review existing literature and research on public economics to identify knowledge gaps and areas where further research is needed. This can help you determine which topics are under-explored and offer the most significant potential for original contributions.

- Consider the feasibility of the research : When selecting a topic, it’s essential to consider the feasibility of conducting the research within the given timeframe and available resources. Ensure that the topic you choose is not overly broad or complex, and that you can access the necessary data and resources to conduct your research effectively.

- Seek guidance from your instructors or advisors : Don’t hesitate to consult with your instructors, advisors, or peers for guidance on choosing a research topic. They can provide valuable insights and suggestions based on their experience and expertise in the field of public economics.

- Evaluate the relevance of the topic : Ensure that your chosen topic is relevant to the field of public economics and contributes to the existing body of knowledge. Consider the practical implications of your research and how it can be applied to real-world policy challenges.

- Assess the potential for original contribution : Aim to select a topic that allows you to make an original contribution to the field of public economics. This could involve exploring a new aspect of a well-established topic, challenging existing theories or assumptions, or applying existing concepts to a new context.

- Set clear research objectives and questions : Once you have identified a topic, define your research objectives and questions to guide your research process. This will help you stay focused and ensure that your research is well-structured and coherent.

- Be flexible and open to change : Remember that the research process is often iterative, and your initial topic may evolve as you delve deeper into the literature and gather new insights. Be open to refining or revising your research topic as needed to ensure that it remains relevant and feasible.

By following this expert advice, you will be well-equipped to choose a public economics research paper topic that aligns with your interests and academic goals, and has the potential to make a meaningful contribution to the field. In the next section, we will provide guidance on how to write a public economics research paper, ensuring that you have all the tools you need to succeed in your academic endeavors.

How to Write a Public Economics Research Paper

Writing a public economics research paper can be a challenging but rewarding experience. In this section, we provide expert advice on how to approach the writing process, from conducting thorough research to crafting a well-structured and persuasive paper. Follow these steps to ensure that your research paper is a success.

- Conduct thorough research : The foundation of any successful research paper is thorough and comprehensive research. Begin by conducting a literature review to familiarize yourself with the existing body of knowledge on your chosen topic. Identify key theories, empirical findings, and policy debates, and take note of any knowledge gaps or areas of controversy. This will help you establish the context for your research and identify opportunities for original contributions.

- Develop a clear research question and hypothesis : Based on your literature review, formulate a clear and specific research question that your paper will seek to address. Develop a hypothesis that presents a potential answer to this question, and ensure that it is testable and grounded in existing research.

- Design a robust research methodology : To test your hypothesis and answer your research question, you will need to design a research methodology that is appropriate for your chosen topic and research question. This may involve quantitative or qualitative methods, such as econometric analysis, case studies, or comparative analysis. Ensure that your methodology is robust, transparent, and replicable, and that it is clearly explained in your paper.

- Collect and analyze data : With your research methodology in place, collect the necessary data to test your hypothesis and answer your research question. This may involve gathering primary data through surveys or interviews, or accessing secondary data from existing sources, such as government reports or academic databases. Analyze your data using appropriate analytical techniques and tools, and be prepared to critically evaluate your findings.

- Structure your paper effectively : A well-structured paper is crucial for communicating your research findings and arguments clearly and persuasively. Begin with an introduction that outlines the context and importance of your research, presents your research question and hypothesis, and provides an overview of the paper’s structure. Follow this with a literature review that synthesizes existing research on your topic and identifies knowledge gaps. Next, present your research methodology, data, and analysis in a clear and logical manner. Conclude your paper with a discussion of your findings, their implications for public economics theory and policy, and suggestions for future research.

- Write clearly and persuasively : To effectively communicate your research findings and arguments, it’s essential to write in a clear, concise, and persuasive manner. Use clear language and avoid jargon, ensuring that your paper is accessible to a broad audience. Develop a coherent and logical argument that is supported by evidence, and be prepared to address potential counterarguments or alternative explanations.

- Cite your sources correctly : Properly citing your sources is crucial for maintaining academic integrity and giving credit to the work of others. Ensure that you follow the appropriate citation style for your discipline, such as APA, MLA, Chicago/Turabian, or Harvard, and that all sources are accurately and consistently cited throughout your paper.

- Edit and proofread your paper : Before submitting your paper, it’s essential to carefully edit and proofread your work to ensure that it is free of errors and inconsistencies. This includes checking for grammatical and spelling errors, as well as ensuring that your paper flows smoothly and logically. Consider seeking feedback from peers, instructors, or advisors to help you identify areas for improvement and refine your paper.

- Prepare for potential revisions : After submitting your paper, be prepared to make revisions based on feedback from reviewers or instructors. Approach revisions with a constructive mindset, and use the feedback as an opportunity to strengthen your paper and deepen your understanding of your chosen topic.

By following these expert tips and advice, you will be well-equipped to write a high-quality public economics research paper that effectively communicates your research findings and contributes to the existing body of knowledge in this important field. Remember that writing a research paper is an iterative process, and it’s essential to be open to feedback and willing to revise your work as needed.

In addition to these expert tips, it’s essential to manage your time effectively throughout the research and writing process. Break your project into manageable tasks, set realistic deadlines, and create a timeline to help you stay on track. Be sure to allocate sufficient time for each stage of the research process, from conducting a literature review to editing and proofreading your paper.

Writing a public economics research paper can be a challenging and time-consuming endeavor, but it is also an opportunity to deepen your understanding of the field and make a meaningful contribution to the ongoing development of knowledge in public economics. By following these expert tips and advice, you can ensure that your research paper is a success and that you are well-prepared to tackle future academic challenges in the field of public economics.

iResearchNet Writing Services

If you need additional support with your public economics research paper or simply prefer to have a custom paper written by experts, iResearchNet is here to help. Our team of expert degree-holding writers specializes in various fields, including public economics, ensuring that your research paper will be in the hands of professionals who understand the complexities of the subject matter. We are committed to providing you with top-quality custom writing services that cater to your unique needs and requirements.

Our writing services offer a range of features that set us apart from the competition:

- Expert degree-holding writers: Our team consists of highly qualified writers who hold advanced degrees in their respective fields. They possess extensive knowledge and experience in public economics, enabling them to provide well-researched and well-written research papers.

- Custom written works: We create custom-written research papers tailored to your specific needs and requirements. Our writers take your instructions, research question, and any additional information you provide into account to ensure that the final paper is a perfect fit for your academic goals.

- In-depth research: Our writers conduct thorough research on your chosen topic, making use of relevant and up-to-date sources to provide a comprehensive and accurate analysis of the subject matter.

- Custom formatting: We understand the importance of proper formatting in academic writing. Our writers are well-versed in various citation styles, including APA, MLA, Chicago/Turabian, and Harvard, ensuring that your research paper is formatted correctly and consistently.

- Top quality: We pride ourselves on delivering top-quality research papers that meet the highest academic standards. Our expert writers and editors work together to ensure that your paper is well-researched, well-written, and free of errors.

- Customized solutions: We recognize that every student has unique needs and requirements. Our flexible approach allows us to provide customized solutions that cater to your specific circumstances, including adjusting our services to accommodate tight deadlines or unique research topics.

- Flexible pricing: We offer competitive pricing that takes into account the complexity of the research paper, deadline, and any additional requirements you may have. Our goal is to provide you with high-quality writing services at a price that fits your budget.

- Short deadlines up to 3 hours: If you’re facing a tight deadline, our team of expert writers is here to help. We can accommodate short deadlines up to 3 hours, ensuring that you receive your research paper on time without compromising on quality.

- Timely delivery: We understand the importance of meeting deadlines in the academic world. Our writers work diligently to ensure that your research paper is completed and delivered to you on time, giving you ample time to review and submit your work.

- 24/7 support: Our dedicated customer support team is available 24/7 to assist you with any questions or concerns you may have throughout the research paper writing process. We are committed to providing you with exceptional service and support every step of the way.

- Absolute Privacy: We take your privacy seriously and have implemented strict measures to protect your personal information. Rest assured that your details will be kept confidential, and your completed research paper will not be shared with any third parties.

- Easy order tracking: Our user-friendly order tracking system allows you to monitor the progress of your research paper from the moment you place your order until its completion. This ensures that you are always up to date on the status of your paper and can make any necessary adjustments or provide additional information as needed.

- Money-back guarantee: Your satisfaction is our top priority. If you are not satisfied with the final research paper, we offer a money-back guarantee, giving you peace of mind and assurance in the quality of our services.

By choosing iResearchNet for your public economics research paper needs, you can be confident that you are entrusting your academic success to a team of skilled professionals who are dedicated to helping you achieve your goals. Our commitment to quality, customization, and customer satisfaction sets us apart from other writing services and ensures that your research paper will be a valuable and impactful contribution to the field of public economics.

Whether you need assistance with selecting a topic, conducting research, or crafting a well-structured and persuasive paper, our expert writers are here to support you every step of the way. With our comprehensive writing services, you can focus on your studies and other responsibilities while knowing that your public economics research paper is in good hands.

Don’t hesitate to reach out to iResearchNet for help with your public economics research paper. Our team of expert degree-holding writers is standing by, ready to provide you with the highest quality custom writing services to ensure your academic success. Place your order today and experience the difference that iResearchNet can make in your academic journey.

Order Your Custom Research Paper Today!

In conclusion, writing a public economics research paper can be a rewarding and enlightening experience that deepens your understanding of the field and contributes to the ongoing development of knowledge in this important area. With the comprehensive list of public economics research paper topics provided, expert advice on choosing the right topic, and guidance on how to write a successful research paper, you are well-prepared to tackle your assignment and make a meaningful impact in the world of public economics.

As you embark on this academic journey, remember that iResearchNet is here to support you every step of the way. Our team of expert degree-holding writers is committed to providing top-quality, custom-written research papers tailored to your unique needs and requirements. With our wide range of features, including in-depth research, custom formatting, flexible pricing, and a money-back guarantee, you can trust that your public economics research paper will be in capable hands.

Don’t let the stress and challenges of writing a research paper hold you back from achieving your academic goals. Take advantage of the expertise and support that iResearchNet offers by placing your order today. Whether you need help selecting a topic, conducting research, or crafting the perfect research paper, our team is ready and eager to help you succeed.

Act now and secure the professional assistance you need for your public economics research paper. Visit iResearchNet.com to place your order and take the first step towards academic success in the field of public economics. We look forward to working with you and helping you achieve your goals.

ORDER HIGH QUALITY CUSTOM PAPER

Research Guides

Gould library, econ 270: economics of the public sector.

- Get Started Here

Legislation & Policy Debate

Legislation and policy - state level, interest groups and public policy institutes, non-partisan government reports, national research organizations.

- Finding Journal Articles

- Finding Books, etc.

- Finding Newspapers

- Data & Statistics

- Other Helpful Resources

- The Book of the States Call Number: Online & JK2403 .B62 More information in Catalyst... Published annually by the Council of State Governments, this compendium is the definitive resource for what's happening year-by-year, at a glance but in rich detail all the same, in state legislatures. The library has 1937-current, with the most recent issue in Reference. Also now available online.

- National Conference of State Legislatures An excellent meta level overview of policies and legislation across the 50 states.

- State Agency Databases Project Links to the agency websites for individual states.

The U.S. government researches public policy programs and issues. The Congressional Research Service provides research and analysis to Congress and the Government Accountability Office analyzes the effectiveness of government programs.

Congressional Research Service (CRS) reports are not automatically made public. However, the library has hundreds of CRS reports on file, and various libraries and organizations are making a concerted effort to collect and digitize as many CRS reports as possible.

- In Catalyst , at the Carleton library (search Congressional Research Service as "author")

- CRS Reports from ProQuest Congressional

- CRS Reports at UNT Libraries

- EveryCRSReport.com

- WikiLeaks: Congressional Research Service Reports

Government Accountability Office reports are available both through the library or online.

- In Catalyst , at the Carleton library (search United States. Government Accountability Office as "author")

- GAO.gov (reports 1921 to present)

- GP O (reports to 1989-2008)

- The Brookings Institution This nonpartisan research institute publishes highly useful policy briefs and reports on international affairs.

- The Urban Institute This is a research institution focused on public policy with data and dissemination as part of its mission.

- Pew Research Center The Pew Research Center gives detailed information about the income inequality and more.

- Tax Policy Center A partnership of the Brookings Institution and Urban Institute providing research and statistics on tax policy.

- National Housing Institute

- << Previous: Get Started Here

- Next: Finding Journal Articles >>

- Last Updated: Apr 11, 2024 2:00 PM

- URL: https://gouldguides.carleton.edu/econ270

Questions? Contact [email protected]

Powered by Springshare.

Articles on public sector

Displaying 1 - 20 of 32 articles.

The Alberta government is interfering in public sector bargaining on an unprecedented scale

Jason Foster , Athabasca University ; Bob Barnetson , Athabasca University , and Susan Cake , Athabasca University

The UK public sector is already using AI more than you realise – without oversight it’s impossible to understand the risks

Albert Sanchez-Graells , University of Bristol

A new report from Queensland offers guidance on integrity to all Australian governments

Andrew Podger , Australian National University

‘A lazy cost-saving measure’: the Coalition’s efficiency dividend hike may mean longer wait times and reduced services

Beyond the cabinet reshuffle – what will it take to renew South Africa’s public sector?

Brian Levy , Johns Hopkins University

South Africa’s way forward: abandon old ideas, embrace bold experimentation

Why governments are so bad at implementing public projects

Andrew Graham , Queen's University, Ontario

Why privatizing the VA or other essential health services is a bad idea

Sebastian Jilke , Rutgers University - Newark and Wouter Van Dooren , University of Antwerp

Lack of technical knowledge in leadership is a key reason why so many IT projects fail

Darryl Carlton , Swinburne University of Technology

The EU wants to fight climate change – so why is it spending billions on a gas pipeline?

Aled Jones , Anglia Ruskin University

Lessons learned from imposing performance-related pay on teachers

Simon Burgess , University of Bristol

Business schools have a role to play in fighting corruption in Africa

Tahiru Azaaviele Liedong , University of Bath

A pay rise for prison officers won’t solve the wider crisis within the justice system

Aaron Pycroft , University of Portsmouth

Hard Evidence: are public sector workers due a pay rise?

Alex Bryson , UCL and John Forth , National Institute of Economic and Social Research

Firefighters are fighting fewer fires – but that doesn’t mean we should sack them

James Brooks , University of Huddersfield

Election FactCheck: Has public infrastructure investment fallen 20% under the Coalition?

Marion Terrill , Grattan Institute and Owain Emslie , Grattan Institute

South Africa’s civil servants are the country’s new labour elite

Haroon Bhorat , University of Cape Town ; Karmen Naidoo , University of Cape Town , and Kavisha Pillay , University of Cape Town

Do public sector workers really take more sick leave?

Stephen Bevan , Lancaster University

More women on company boards, but what about the public sector?

Jacqueline Baxter , The Open University

South Africa’s health sector is leaking money: what can be done about it?

Laetitia Rispel , University of the Witwatersrand ; Pieter de Jager , University of the Witwatersrand , and Sharon Fonn , University of the Witwatersrand

Related Topics

- Accountability

- Private sector

- Public sector cuts

- Public service

- Trade unions

- Unemployment

Top contributors

Professor of the Practice of International Development, Johns Hopkins University

Honorary Professor of Public Policy, Australian National University

Associate Tutor, University of Surrey

Research Director at the Centre for Policy Development and PhD Student, Macquarie University

Professor in Public Policy and Management, The Open University

Professor of Industrial Relations, University of Wolverhampton

Associate Professor in Economics, University of Southampton

Associate Professor of Public Policy, Public Services International Research Unit, University of Greenwich

Swiss Post Chair in Management of Network Industries, EPFL – École Polytechnique Fédérale de Lausanne – Swiss Federal Institute of Technology in Lausanne

Professor & Director, Global Sustainability Institute, Anglia Ruskin University

Honorary Fellow in the School of Social and Political Sciences, The University of Melbourne

Senior Research Fellow, National Institute of Labour Studies, Flinders University

Professor of Economics, University of Bristol

Professor, School of Economics, The University of Queensland

- X (Twitter)

- Unfollow topic Follow topic

- 44-207-097-1871

Dissertation Writing Tools

- 1. Complete Dissertation Writing Guide - eBook

- 2. Dissertation Templates Pack

- 3. Research Methodology Handbook

- 4. Academic Writing Checklist

- 5. Citation Style Guide

- 6. Time Management for Dissertation Writing

- 7. Literature Review Toolkit

- 8. Grammar and Style Guide

- 9. Dissertation Proposal Template

- 10.Five Pre-written Full Dissertation Papers

37 Public economics dissertation topics Ideas

Best Public economics dissertation topics examples Public economics dissertation topics focus on policies, finances, taxation, and interventions at government levels. Dissertation topics in public economics have become very popular recently. Topics may include capital gains tax; economic theory of distribution; empirical assessment of the impact of taxation and government spending; and measuring well-being, poverty, and […]

Table of Contents

Best Public economics dissertation topics examples

Public economics dissertation topics focus on policies, finances, taxation, and interventions at government levels. Dissertation topics in public economics have become very popular recently. Topics may include capital gains tax; economic theory of distribution; empirical assessment of the impact of taxation and government spending; and measuring well-being, poverty, and inequality.

Check out our other related posts for economics dissertation topics , political economy , managerial economics , development economics , and agricultural economics .

Best Ideas for Public economics dissertation topics

Major interesting thesis topics in public economics have been enlisted below:

- Historical analysis of public economics: connecting the past with the present ad the future.

- Studying the relationship between public economics and international environmental policy: a descriptive study.

- Correlational analysis of public economics, public finance, and public choice: a systematic analysis.

- Public economics and bureaucracy: a review of empirical evidence.

- Investigating the public economics of renewable electricity generation: a review of the literature.

- Studying the relationship between public economics and social preferences: a quantitative study.

- Behavioral public economics: a review of the empirical evidence.

- Studying the effects of globalization on public policy formulation of X country.

- Comparative analysis of taxation policies in developed and developing countries of the world.

- Importance of healthcare policy in the developed countries of the world: a review of empirical evidence.

- How continuous warfare has affected public policy in X country? An inquiry.

- Studying the effects of globalization on public policy formation: focus on the emerging economies of the world.

- Studying the effects of government expenditure in the field of public economics: a systematic review.

- Focusing on the relationship between public economics and capital taxation.

- Economics of corruption: focus on the role played in the overall domain of public economics.

- Studying the role played by tax avoidance and tax evasion in the field of public economics: a descriptive analysis.

- Studying the effects of crack cocaine markets on young males: focus on X country.

- Focusing on the effects of minimum wages on the high-skilled workers: a quantitative analysis.

- Studying the relationship between climate change and dynamics of policymaking.

- Public economics and COVID-19 pandemic: a systematic analysis.

- Research in the field of public economics: focus on potential opportunities and challenges.

- Investigating the relationship between public economics and corporate social responsibility.

- Investigation of the public economics of annuities with differential mortalities: a descriptive approach.

- Studying the experimental approaches in the field of public economics: a review of empirical evidence.

- Political intergenerational risk-sharing and public economics.

- Studying the effects of television on public policy: an experimental design.

- Wealth accumulation, redistributive taxation, and public goods provision: a correlational analysis.

- Public goods provision, learning and information trap: a review of the literature.

- International public economics: focus on the potential challenges and interventions involved.

- Studying the relationship between property tax compliance and public good provision: a descriptive approach.

- Publicly provided private goods: focus on the political economy perspective.

- Correlational analysis of public economics, public goods, terrorism, and religion.

- Comparative analysis of public economics in the developed and developing countries of the world.

- Ethics in the field of public economics: a review of the empirical evidence.

- Public firms, private firms, and public economics: a statistical analysis.

Public economics (or public sector economics) is the study of government policy through the lens of economic efficiency and justice. The public economy builds on the theory of welfare economics and is ultimately used as a tool to improve the welfare of society.

Above are the best dissertation topics in public economics pick any one of your choices and start writing your dissertation. If still finding some other topics please fill out the form below and get the mini topic proposal on your provided requirements.

Paid Topic Mini Proposal (500 Words)

You will get the topics first and then the mini proposal which includes:

- An explanation why we choose this topic.

- 2-3 research questions.

- Key literature resources identification.

- Suitable methodology including raw sample size and data collection method

- View a Sample of Service

Note: After submiting your order please must check your email [inbox/spam] folders for order confirmation and login details.If email goes in spam please mark not as spam to avoid any communication gap between us.

Get An Expert Dissertation Writing Help To Achieve Good Grades

By placing an order with us, you can get;

- Writer consultation before payment to ensure your work is in safe hands.

- Free topic if you don't have one

- Draft submissions to check the quality of the work as per supervisor's feedback

- Free revisions

- Complete privacy

- Plagiarism Free work

- Guaranteed 2:1 (With help of your supervisor's feedback)

- 2 Instalments plan

- Special discounts

Other Related Posts

- Dissertation Topics in International Relations February 20, 2024 -->

- Unraveling the Essence of Thesis Objectives: A Comprehensive Guide with Examples January 4, 2024 -->

- Software That Can Help You Write A Good Resume October 25, 2023 -->

- Unlock Your Academic Potential with the Right Topics for Dissertation October 12, 2023 -->

- Modern resume writing system to land your dream Job September 25, 2023 -->

- 89+ Best Unique and Informative Speech Topics for Students January 6, 2023 -->

- Employment Law Dissertation Topics January 4, 2023 -->

- 59 Best Environmental Law Dissertation Topics & Examples January 4, 2023 -->

- 03 Unique Dissertation Topics along with 500 words Topic Brief to get approved April 18, 2022 -->

- 37 Monetary economics dissertation topics ideas March 20, 2022 -->

- 39 Economic geography dissertation topics examples March 19, 2022 -->

- 39 Financial Economics Dissertation Topics Ideas March 17, 2022 -->

- 39 Experimental economics dissertation topics Ideas March 16, 2022 -->

- 39 Environmental Economics Dissertation Topics Ideas and Samples March 15, 2022 -->

- 39 Health economics dissertation topics Ideas and Examples March 14, 2022 -->

WhatsApp and Get 35% off promo code now!

- Skip to Content

- Skip to Main Navigation

- Skip to Search

Indiana University Bloomington Indiana University Bloomington IU Bloomington

- High-impact Practices

- Bachelor of Science in Public Affairs (BSPA)

- Bachelor of Science in Environmental Science (BSES)

- Bachelor of Arts in Environmental and Sustainability Studies (BAESS)

- Bachelor of Science in Healthcare Management and Policy (BSHMP)

- Bachelor of Science in Arts Management (BSAM)

- Minors & Certificates

- Advising Staff

- General Ed and Intro

- Topics V450

- Topics V456

- O’Neill Launch

- Director’s Welcome

- Rising Leaders Program

- NextGeneration Leadership Program

- Indiana Leadership Program

- Courses & Faculty

- Estimated Costs

- Student Spotlights

- O'Neill Expo

- Required Internship

- Accelerated Master's Program

- O'Neill + Maurer JD

- Current IU Bloomington Students

- High School Students

- Transfer students

- For Current Students

- For Incoming Students

- Non-O’Neill Funding Opportunities

- Contact & Visit

- Academic & Leadership Programs

- Leadership Seminar Series

- Mission and Goals

- Core Curriculum

- Concentrations

- Washington, D.C. Accelerator Program

- Experiential Requirement

- Components & Concentrations

- Master of Environmental Sustainability (MES)

- Practicum Experience

- Executive Certification

- Master of International Affairs (MIA)

- MPA-MIA Dual Degree

- Experiential Requirements

- Faculty Profiles & Publications

- For Jacobs Students

- For Doctoral Students

- MAAA-MPA Dual Degree

- Additional Dual Degrees

- Certificates

- How to Apply

- Fellowships & Financial Resources

- Prior Professional Experience Benefits

- Peace Corps

- Teach for America

- Military and Veteran Benefits

- Funding for Current Students

- Funding for International Students

- Federal Financial Aid

- Subscribe to our Newsletter

- Virtual Sessions & Webinars

- Experience Day

- Schedule a Visit

- Connect with a Current Student

- O'Neill Visits You

- Why O'Neill?

- Environmental Policy

- Public Finance

- Public Management

- Public Policy Analysis

- Ph.D. in Environmental Science

- Environmental Science Fellowships

- On the Job Market

- Recent Placements

- Current Students

- Dissertations

- Why O’Neill ?

- Our Mission and Goals

- Degree Requirements and Curriculum

- O’Neill Online Week

- Nonprofit Management

- Public & Nonprofit Evaluation

- Tuition & Fees

- Financial Aid

- Meet Our Students

- Meet Our Alumni

- For Professionals

- For Military Students

- Helping You Succeed

- Information Sessions

- Executive Education

- Faculty Directory

- Environmental Research and Policy

- Racial Justice

- Research Areas

- Faculty Research Publications

- Laboratories

- Centers & Initiatives

- Working Research Groups

- Speaker Series

- Hites Prize

- Journals & Books

- Explore Careers & Outcomes

- Register Your Internships

- Internship Funds and Scholarships

- For Employers

- Careers Login

- Life at O’Neill

- Life in Bloomington

- Precollege Programs

- For International Students

- Resilience and Wellbeing Initiative

- O’Neill International

- Leadership Opportunities

- Student Organizations

- Virtual Tour

- Dean’s Welcome

- Strategic Goals and Progress

- About Paul H. O'Neill

- 50th Anniversary

- Environment, Climate, and Sustainability

- Mission, Vision, and Values

- School Profile

- Vietnam Young Leaders Award

- Activate O'Neill

- Support & Resources

- Bloomington & Indianapolis

- Careers at O'Neill

- Administration & Staff Directory

- Dean’s Council

- Get Involved

- Alumni Events

- Alumni Recognition

- Distinguished Alumni Council

- Alumni Board of Directors

- Areas to Support

- Ways to Give

- Our Supporters

- Alumni Communications

Paul H. O’Neill School of Public and Environmental Affairs

- Alumni & Giving

- Faculty & Research

Public Finance & Economics

Our research examines three main themes:

- How the government raises revenue through taxes and borrowing, and on how the government disburses those funds.

- How the government plans, controls, and accounts for such activities through budgeting and accounting, as well as the design and administration of all of these functions.

- The impact of public sector activities on the economic behavior of individuals, firms, nonprofit organizations, and markets, and on economic efficiency.

Faculty Members

David Audretsch

Distinguished Professor; Ameritech Chair of Economic Development; Director, Institute for Development Strategies

Daniel Cole

Sameeksha Desai

Associate Professor; Director, Manufacturing Policy Initiative; Associate Director, Institute for Development Strategies

Denvil Duncan

Associate Professor

Seth Freedman

Bradley T. Heim

Executive Associate Dean, Professor

Craig Johnson

Robert S. Kravchuk

Professor Emeritus

Kerry Krutilla

Professor; Faculty Affiliate, Ostrom Workshop

Visiting Clinical Associate Professor

Antung Anthony Liu

Temirlan T. Moldogaziev

Alberto Ortega

Assistant Professor

Clinton Oster, Jr.

Daniel Preston

Clinical Associate Professor; Director, Master of International Affairs

Kenneth R. Richards

Justin Ross

Professor; Director, Ph.D. Programs in Public Affairs and Public Policy

Barry M. Rubin

Michael Rushton

Kosali Simon

Distinguished Professor; Herman B Wells Endowed Professor; Paul O’Neill Chair; Associate Vice Provost for Health Sciences; Elected member, National Academy of Medicine; Editor, Journal of Health Economics

Anh Ngoc Tran

Nikolaos Zirogiannis

C. Kurt Zorn

Paul H. O’Neill School of Public and Environmental Affairs social media channels

- Give to the O’Neill School

Additional links and resources

Areas of research

Budget, taxes and public investment.

EPI’s work on federal fiscal policy analyzes revenues, spending and deficits, but always within the context of the overall economy. EPI believes that the federal budget is the embodiment of our nation’s priorities, but recognizes that the state of budget balance is simply a tool to meet larger economic goals, not an end-goal in itself.

Child Labor

The Economic Policy Institute’s child labor research examines the role of strong labor standards in ensuring equal economic and educational opportunity for all children. Our work, including ground-breaking research, thought leadership, and advocacy, is focused on assessing the strengths or weaknesses of existing state and federal child labor policies, documenting ongoing coordinated attacks on protections for young workers, and proposing reforms to advance children’s rights to safe, age-appropriate work and fair compensation. As part of this agenda, EPI works in close coordination with partners in the Economic Analysis and Research Network (EARN) and in national child labor coalitions, provides expert analysis to the media and other stakeholders, and seeks to raise awareness through public events.

Economic Growth

EPI’s research on economic growth assesses how policymaking and economic institutions either help or hinder efforts to insure that the U.S. economy is operating at full employment and to generate sustainable growth in average living standards as rapidly as possible.

EPI documents impacts of social and economic inequality on student achievement, and suggests policies, within school and out, to narrow outcome gaps between middle class and disadvantaged students. EPI research refutes false assumptions behind politically inspired attacks on public education, teachers, and their unions.

Green Economics

EPI’s research in this arena focuses on the role that public investment, regulation, and tax policy play in making the economy more sustainable and equitable.

EPI analyzes the U.S. health care system through the lens of low- and moderate-income families’ living standards, with special attention to employer-sponsored health insurance, the burden of health costs, and disparities in access and outcomes.

Immigration

EPI proposes reforms that would allow the immigration system to respond and adjust to the shifting needs of the U.S. labor market while improving wages and safeguarding labor standards for American and immigrant workers.

Inequality and Poverty

As the United States recovers from the Great Recession, EPI’s research in this area examines the increasing levels of economic inequality in connection with decreasing levels of economic mobility and rising levels of poverty.

Jobs and Unemployment

EPI’s thorough research in this area is as critical as ever and focuses on understanding the intricacies and impact of the slow recovery in the U.S. labor market, including our persistent high unemployment, near-record long-term unemployment, mass underemployment, and weak labor force participation.

Minimum Wage

The minimum wage is a critical labor standard meant to ensure a fair wage for this country’s lowest paid workers. EPI researchers have examined how the minimum wage affects workers and the economy, who benefits from the minimum wage, and how the declining value of the federal minimum wage over time has contributed to the growth in U.S. income inequality.

Race and Ethnicity

EPI’s Program on Race, Ethnicity, and the Economy works to advance policies that ensure racial and ethnic minorities participate fully and benefit equitably as workers in the American economy.

Raising America’s Pay

EPI’s efforts to raise the profile of wage issues and generate ideas for stimulating wage growth are overseen by an advisory board of eminent policymakers, academics, policy experts, and civic engagement leaders. See the list of board members .

The debate over the effect of regulatory changes on employment has intensified in the wake of the Great Recession and the still-high levels of unemployment that are its legacy. But assertions that government regulations are holding back the economy ignore the roots of our economy’s problems, namely the collapse of the housing and financial sectors and inadequate demand. EPI research debunks claims that regulations impede job creation, finding that they can create jobs and confer other critical benefits that outweigh costs. This work is critical to fighting attempts to roll back laws that protect the environment and guarantee worker protections.

EPI’s retirement program examines the inequities in the current system and promotes initiatives that protect Social Security and lead to universal, secure, and adequate retirement policies.

Trade and Globalization

Trade and globalization policies have major effects on the wages and incomes of American workers and on the vitality of American industries such as manufacturing. EPI research identifies the economic benefits accruing to the nation, states, and congressional districts from negotiating better trade agreements and curbing currency manipulation and other unfair trade practices.

Unions and Labor Standards

Strong unions and employee organizing rights foster a vibrant middle class because the protections, rights, and wages that unions secure affect union and nonunion workers alike. Unfortunately, eroded labor standards, weakening unions, changing norms, guestworker policies that undercut wages, and monetary policies that prioritize controlling inflation over lowering unemployment have helped depress wages and erode living standards for all workers. EPI monitors factors that affect American work lives, including unpaid overtime, wage theft, the minimum wage, immigration laws, and collective bargaining rights.

Wages, Incomes, and Wealth

Ensuring that economic growth benefits hard-working Americans in the form of higher wages and rising living standards is the central economic challenge of our time. Unfortunately, wages for most workers grew exceptionally slowly between 1979 and 2012, despite productivity—which essentially measures the economy’s potential for providing rising living standards for all—rising 64%. In other words, most Americans, even those with college degrees, are treading water—despite working more productively (and being better educated) than ever. EPI research demonstrates that wage stagnation, weak income growth, and wealth disparities can be traced to policy decisions that have eroded the bargaining power of low- and middle-wage workers.

Sign up to stay informed

New research, insightful graphics, and event invites in your inbox every week.

Track EPI on Twitter

Patenting as a Public Sector Innovative Response to the Great Recession

- Published: 22 May 2024

Cite this article

- Albert N. Link 1

30 Accesses

Explore all metrics

The literature on innovative responses to periods of economic change has focused on private sector firm behavior. This paper expands the literature by focusing on aspects of the public sector’s response to the Great Recession. The data used relate to patent applications by U.S. federal laboratories. Contrary to previous findings about the private sector’s waning innovation response to the Great Recession, the findings presented show that the U.S. public sector’s post-Great Recession response was positive. Arguments to explain this finding are also presented.

This is a preview of subscription content, log in via an institution to check access.

Access this article

Price includes VAT (Russian Federation)

Instant access to the full article PDF.

Rent this article via DeepDyve

Institutional subscriptions

Similar content being viewed by others

Old Wine in New Bottles: Patenting Propensity

Patent rights, product market reforms, and innovation.

Innovation, Public Policy and Growth: What the Data Say

See https://www.nber.org/research/data/us-business-cycle-expansions-and-contractions .

More specifically, Archibugi et al. ( 2013 , p. 1259) point out that as a result of the economic downturn “innovation is less based on local searching and cumulative processes, and less based on R&D activities within large firms, we [therefore] conclude that the relative importance of behaviours is changing from creative accumulation to creative destruction in the snap shot of the business cycle that the Innobarometer makes it possible to observe.”

Similarly, Babina et al. ( 2023 ) showed for the United States that the Great Recession was associated with a decline in “technological entrepreneurship.”

Joseph Schumpeter (1883–1950) wrote in Capitalism, Socialism and Democracy (1950, p. 82) that “with capitalism we are dealing with an evolutionary process.” Schumpeter continued ( 1950 , p. 84) to write: “capitalism administers existing structures, whereas the relevant problem is how [capitalism] creates and destroys them. It is this process of ‘creative destruction’ that is the essence of capitalism.” In the view of Schumpeter, as interpreted by Hébert and Link ( 2009 , p. 71), creative destruction is: “a process defined by the carrying out of new combinations in production. And it is accomplished by the entrepreneur.”

Investments in R&D are an appropriate metric in aggregate studies, although it might not be the most accurate metric for quantifying innovative inputs in startups or small entrepreneurial firms (Guenther et al., 2023 ). See too footnote 2 above.

The relevant National Science Foundation definitions are: “Research and development (R&D) comprise creative and systematic work undertaken in order to increase the stock of knowledge and to devise new applications of available knowledge. This includes a) activities aimed at acquiring new knowledge or understanding without specific immediate commercial applications or uses (basic research); b) activities aimed at solving a specific problem or meeting a specific commercial objective (applied research); and c) systematic work, drawing on research and practical experience and resulting in additional knowledge, which is directed to producing new products or processes or to improving existing products or processes (development). R&D includes both direct costs such as salaries of researchers as well as administrative and overhead costs clearly associated with the company’s R&D.” See https://www.nsf.gov/statistics/randdef/rd-definitions.pdf .

See Griliches ( 1986 ), and the foundational references therein, regarding the empirical relationship between total factor productivity and basic and applied research activity. It is the research portion of R&D that is the driver of economic growth and development. See also Ardito and Svensson ( 2023 ).

This point is definitely relevant to the public sector, but perhaps not as relevant to the private sector. As Audretsch and Belitski ( 2022 ) argue, there are various knowledge spillover channels especially in private sector entrepreneurial firms. The European Commission ( 2020 ) refers to these channels in terms of knowledge spillover channels ranging from informal networks to formal patenting activity.

Schumpeter ( 1939 , p. 62) described innovative action by an entrepreneur in terms of a production function. He wrote (1939, p. 62): the production function … describes the way in which quantity of product varies if quantities of factors vary. If, instead of quantities of factors, we vary the form of the function, we have an innovation.

As discussed below, the paucity of annual data relevant to the estimation of Eq. (1) has limited the number of lags of Research that could be considered.

To avoid the issue of double counting, Link and Scott ( 2021 ) use a single input in a production function of public sector scientific publications. Link and Scott also reference other studies to justify their single input production function as well as data managers at the National Science Foundation who acknowledge the cost of labor being counted in R&D data.

Data on patent applications are available for FY 2020, but the 2020 datum for each agency was deleted due to possible patent application processing issues related to the Covid-19 pandemic.

See the data sources in Table 1 .

A re-estimation of the model underlying the finding in column (2) without any controls for the Great Recession (i.e., without the interaction term PostRecession x lnResearch t−1 as an independent variable) shows that the estimated coefficient on lnResearch t−1 is positive and significant ( p = .053), and it could be interpreted to mean that a 10% increase in research expenditures is associated with a 2.21% increase in patent applications. Also, a re-estimation of the model in column (2) using R&D expenditures rather than research expenditures without any controls for the Great Recession show an insignificant coefficient on lnR&D t−1 perhaps due to the inclusion of development expenditures ( D ) that are uncorrelated to new patent applications. These results are available on request from the author.

In a separate specification, agency-specific slope effects during the post Great Recession period were considered. However, the hypothesis of equality in the slope effects across agencies could not be rejected at a conventional level of significance: Wald χ 2 = 5.67 ( p = .129).

See Link ( 2024 ).

This is a point anticipated by Scott ( 2014 ) in his institutional history of Federal Trade Commission’s Line of Business Program.

Akinola, M., Kapadia, C., Lu, J. G., & Mason, M. F. (2019). Incorporating physiology into creativity research and practice: The effects of bodily stress responses on creativity in organizations. Academy of Management Perspectives , 30 , 163–184.

Article Google Scholar

Archibugi, D., Filippetti, A., & Frenz, M. (2013). The impact of the economic crisis on innovation: Evidence from Europe. Technological Forecasting and Social Change , 80 , 1247–1260.

Ardito, L. & Svensson, R. (2023). Sourcing applied and basic knowledge for innovation and commercialization success. Journal of Technology Transfer . https://doi.org/10.1007/s10961-023-10011-3 .

Audretsch, D. B. & Belitski, M. (2022). The knowledge spillover of innovation. Industrial and Corporate Change , 31 , 1329–1357.

Babina, T., Bernstein, A., & Mezzanotti, F. (2023). Financial disruptions and the organization of innovation: Evidence from the Great Depression. Review of Financial Studies . https://doi.org/10.1093/rfs/hhad023 .

Cunningham, J., & Link, A. N. (2022). The returns to publicly funded R&D. Annals of Science and Technology Policy , 6 , 228–314.

Ding, G., Liu, H., Huang, Q. & Gu, J. (2019). Enterprise social networking usage as a moderator of the relationship between work stressors and employee creativity: A multilevel study. Information & Management , 56 , 103165.

European Commission, Joint Research Centre. (2020). Knowledge transfer metrics: Towards a European-wide set of harmonised indicators . Luxembourg Publications Office of the European Union.

Griliches, Z. (1986). Productivity, R&D, and the basic research at the firm level in the 1970’s. American Economic Review , 76 , 141–154.

Google Scholar

Guenther, C., Belitski, M., & Rejeb, N. (2023). Overcoming the ability-willingness paradox in small family firms’ collaborations. Small Business Economics , 60 , 1409–1429.

Hébert, R. F., & Link, A. N. (2009). A history of entrepreneurship . London and New York: Routledge.

Helzer, E. G., & Kim, S. H. (2019). Creativity for workplace well-being. Academy of Management Perspectives , 33 , 134–147.

Link, A. N. (2024). Public sector technology transfer . Cheltenham, U. K. and Northampton, MA, USA: Edward Elgar.

Link, A. N., & Scott, J. T. (2021). Scientific publications at U.S. federal research laboratories. Scientometrics , 126 , 2227–2248.

OECD. (2012). OECD Science, Technology and Industry Outlook 2012 . OECD Publishing. https://doi.org/10.1787/sti_outlook-2012-en .

Schumpeter, J. A. (1939). Business Cycles . McGraw-Hill.

Schumpeter, J. A. (1950). Capitalism, Socialism and Democracy , New York: Harper & Row, 3rd edition.

Scott, J. T. (2014). The U.S. federal trade commission’s line of business program and innovation research. Science and Public Policy , 41 , 438–448.

Scott, J. T. (2023). The digital commercial revolution: U.S. business sales and the entrepreneurial exploitation of information and communications technology. Journal of Technology Transfer . https://doi.org/10.1007/s10961-023-10049-3 .

Download references

Acknowledgements

Thanks to Maksim Belitski and John Scott for very helpful comments and suggestions on earlier versions of this paper.

No extramural funding supported this study.

Author information

Authors and affiliations.

Department of Economics, University of North Carolina at Greensboro, Greensboro, NC, USA

Albert N. Link

You can also search for this author in PubMed Google Scholar

Corresponding author

Correspondence to Albert N. Link .

Ethics declarations

Conflict of interest.

Not applicable.

Additional information

Publisher’s note.

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Springer Nature or its licensor (e.g. a society or other partner) holds exclusive rights to this article under a publishing agreement with the author(s) or other rightsholder(s); author self-archiving of the accepted manuscript version of this article is solely governed by the terms of such publishing agreement and applicable law.

Reprints and permissions

About this article

Link, A.N. Patenting as a Public Sector Innovative Response to the Great Recession. J Technol Transf (2024). https://doi.org/10.1007/s10961-024-10074-w

Download citation

Accepted : 14 February 2024

Published : 22 May 2024

DOI : https://doi.org/10.1007/s10961-024-10074-w

Share this article

Anyone you share the following link with will be able to read this content:

Sorry, a shareable link is not currently available for this article.

Provided by the Springer Nature SharedIt content-sharing initiative

- Federal laboratories

- Great recession

- Policy evaluation

- Technology transfer

JEL Classification

- Find a journal

- Publish with us

- Track your research

Public Economics

The Public Economics Program explores the efficiency and distributional effects of various tax policies and government spending programs, as well as the way that these programs affect the behavior of households and firms.

Program Director

Raj Chetty is the William A. Ackman Professor of Economics at Harvard University, where he also directs Opportunity Insights, a research organization that studies economic mobility. His research focuses on the measurement and explanation of mobility across income and social strata, with particular attention to the role of government policies. He has been an NBER affiliate since 2003.

Featured Program Content

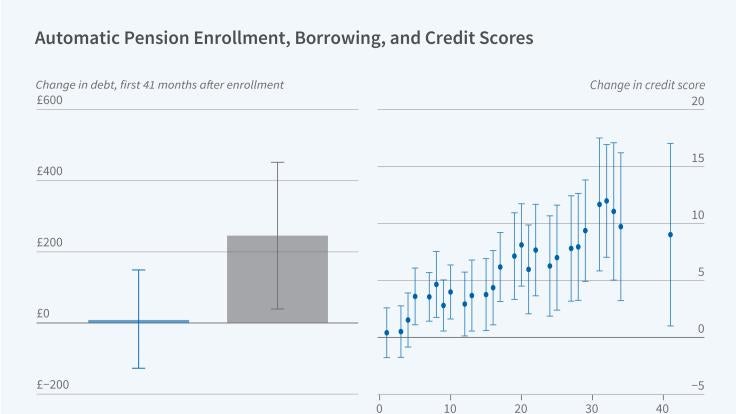

- Authors: John Beshears , Matthew Blakstad , James J. Choi , Christopher Firth , John Gathergood , David Laibson , Richard Notley , Jesal D. Sheth , Will Sandbrook & Neil Stewart et al. (View all)

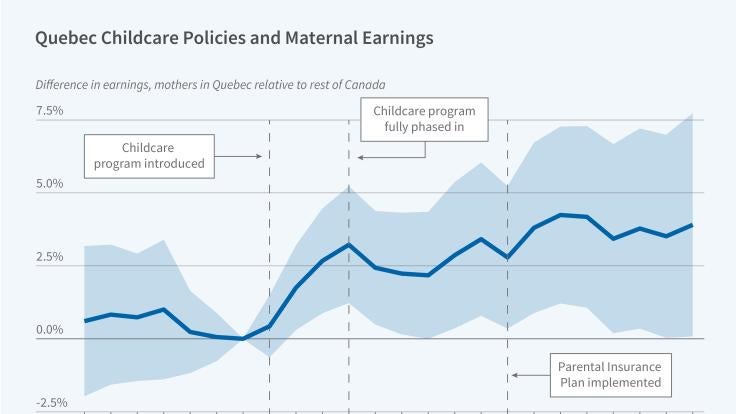

- Authors: Sencer Karademir , Jean-William P. Laliberté & Stefan Staubli

Ways to strengthen and stabilize California’s residential care system

Approximately 3,000 people in California with intellectual and developmental disabilities (I/DD) have complex needs that necessitate intensive behavioral support. These adolescents and adults, many of whom have a co-occurring mental illness, experience chronic instability and are at high risk of institutionalization and incarceration. The specialized group homes where some of them live are a critical part of the state’s safety net.

According to a new report from Stanford Law School (SLS) and the nonprofit Disability Rights California, reforming certain aspects of these group homes’ operations, and creating additional community-based residences where some individuals with I/DD and complex needs can receive wrap-around care, would stabilize and strengthen the system as a whole.

Alison Morantz, the James and Nancy Kelso Professor of Law at Stanford Law School and a senior fellow at the Stanford Institute for Economic Policy Research (SIEPR), and her coauthors prepared the report in response to the rapid proliferation of specialized group homes serving this population and widespread reports of continuing high levels of unmet need. Morantz is also the founder and director of the Stanford Intellectual and Developmental Disabilities Law and Policy Project (SIDDLAPP), an interdisciplinary program at SLS that focuses on the rights and welfare of individuals with I/DD.

“California policy makers are currently grappling with how to best support individuals in community-based, therapeutic settings that are economically viable and consistent with principles of individual autonomy, equity and community integration,” Morantz said. “Our report is designed to inform the state’s long-range planning to expand opportunities and improve quality of life for individuals with I/DD who require intensive behavioral support.”

In 1969, California became the first state to grant individuals with intellectual and developmental disabilities the right to the services and support they need to live more independent and normal lives, Morantz said. “California remains the only state in which the right of these individuals to be supported in the least restrictive environment is construed as a civil right and an individual entitlement.”

Following interviews with group home administrators and residents, site visits, and analysis of information available in the public domain, Morantz and her co-authors identify in their report a variety of ways that California can improve the quality of care provided by Enhanced Behavioral Support Homes (which offer long-term care) and Community Crisis Homes (which provide short-term care).

The researchers found that almost 70 percent of these homes have had at least one complaint filed against them and about 40 percent have been the subject of a substantiated complaint. “Despite copious regulations, the monitoring of EBS and CC homes is falling short,” they write in the report, titled, Individualizing the Safety Net: Rethinking the Residential Continuum of Care for People with I/DD and Complex Support Needs.

Other key recommendations include:

- Revising home placement processes to be more person-centered;

- Mitigating the adverse effects of labor shortages by loosening eligibility and credentialing requirements for direct-care staff;

- Collecting better data on the adequacy of safety net services and important industry trends;

- Expanding settings, such as Enhanced Supported Living Services, in which a single adult can receive wraparound care in their own home;

- And creating supported single child residences (SSCRs) in which a single child can receive wraparound support instead of being hospitalized, institutionalized, or transferred out of state.

Carly Frieders, a Stanford law student who served as a report editor, said she appreciated the opportunity to further her interest in disability law while informing California policymakers. “It was great to work on a project, while still in law school, that proposes concrete ideas to help people get services in the most supportive and integrated environment possible,” she said.

A version of this story was originally published May 23, 2024 by Stanford Law School.

More News Topics

At what point do we decide ai’s risks outweigh its promise.

- Research Highlight

- Innovation and Technology

Rosenkranz Prize winner investigates impact of price controls on contraceptives

- Awards & Appointments

- Global Development and Trade

California public school enrollment drops again, but transitional kindergarten is up

- Media Mention

- Bibliography

- More Referencing guides Blog Automated transliteration Relevant bibliographies by topics

- Automated transliteration

- Relevant bibliographies by topics

- Referencing guides

Academic literature on the topic 'Public sector economics'

Create a spot-on reference in apa, mla, chicago, harvard, and other styles.

Consult the lists of relevant articles, books, theses, conference reports, and other scholarly sources on the topic 'Public sector economics.'

Next to every source in the list of references, there is an 'Add to bibliography' button. Press on it, and we will generate automatically the bibliographic reference to the chosen work in the citation style you need: APA, MLA, Harvard, Chicago, Vancouver, etc.

You can also download the full text of the academic publication as pdf and read online its abstract whenever available in the metadata.

- Journal articles

- Dissertations / Theses

- Book chapters

- Conference papers

Journal articles on the topic "Public sector economics":

Cebula, Richard J., and Paul G. Hare. "Surveys in Public Sector Economics." Southern Economic Journal 56, no. 4 (April 1990): 1139. http://dx.doi.org/10.2307/1059903.

Mackintosh, Maureen. "Economics of the public sector." Local Economy: The Journal of the Local Economy Policy Unit 5, no. 3 (November 1990): 267–73. http://dx.doi.org/10.1080/02690949008726060.

Britton, Andrew. "Public Sector Borrowing and the Public Sector Balance Sheet." National Institute Economic Review 121 (August 1987): 64–66. http://dx.doi.org/10.1177/002795018712100108.

Fosu, A. K. "Part 2: Public Sector Delivery -- Public Sector Delivery: A Synthesis." Journal of African Economies 13, suppl_1 (July 1, 2004): i137—i141. http://dx.doi.org/10.1093/jae/ejh018.

Gomes, Pedro. "Optimal Public Sector Wages." Economic Journal 125, no. 587 (August 26, 2014): 1425–51. http://dx.doi.org/10.1111/ecoj.12155.

Michie, Jonathan. "Managing the public sector." International Review of Applied Economics 8, no. 3 (January 1994): 333–35. http://dx.doi.org/10.1080/758525164.

Alm, James, and Carolyn J. Bourdeaux. "Applying Behavioral Economics to the Public Sector." Revista Hacienda Pública Espñola 206, no. 3 (September 29, 2013): 91–134. http://dx.doi.org/10.7866/hpe-rpe.13.3.4.

Krueger, Alan B. "Book Review: Labor Economics: Public Sector Payrolls." ILR Review 42, no. 4 (July 1989): 679–81. http://dx.doi.org/10.1177/001979398904200420.

Baker, Keith. "Public Sector Economics20091Richard W. Tesch. Public Sector Economics. Basingstoke: Palgrave Macmillan 2008. Companion web site: www.palgrave.com/economics/tresch/." International Journal of Public Sector Management 22, no. 4 (May 29, 2009): 380. http://dx.doi.org/10.1108/09513550910961646.

Lewis, Alan, and John Cullis. "Preferences, economics and the economic psychology of public sector preference formation." Journal of Behavioral Economics 17, no. 1 (March 1988): 19–33. http://dx.doi.org/10.1016/0090-5720(90)90004-q.

Dissertations / Theses on the topic "Public sector economics":

Leiserson, Gregory Quick. "Essays on the economics of public sector retirement programs." Thesis, Massachusetts Institute of Technology, 2013. http://hdl.handle.net/1721.1/81035.

Tumennasan, Bayar. "Fiscal Decentralization and Corruption in the Public Sector." Digital Archive @ GSU, 2005. http://digitalarchive.gsu.edu/econ_diss/8.

Lopes, Carlos J. "THE PUBLIC SECTOR, MIGRATION, AND HETEROGENEITY." UKnowledge, 2011. http://uknowledge.uky.edu/gradschool_diss/38.