- 400+ Sample Business Plans

- WHY UPMETRICS?

Customer Success Stories

Business Plan Course

Strategic Planning Templates

E-books, Guides & More

Entrepreneurs & Small Business

Accelerators & Incubators

Business Consultants & Advisors

Educators & Business Schools

Students & Scholars

AI Business Plan Generator

Financial Forecasting

AI Assistance

Ai Pitch Deck Generator

Strategic Planning

See How Upmetrics Works →

- Sample Plans

Small Business Tools

How to Write Competitive Analysis in a Business Plan (w/ Examples)

Free Competitive Analysis Kit

- Vinay Kevadia

- January 9, 2024

14 Min Read

Every business wants to outperform its competitors, but do you know the right approach to gather information and analyze your competitors?

That’s where competitive analysis steps in. It’s the tool that helps you know your competition’s pricing strategies, strengths, product details, marketing strategies, target audience, and more.

If you want to know more about competitor analysis, this guide is all you need. It spills all the details on how to conduct and write a competitor analysis in a business plan, with examples.

Let’s get started and first understand the meaning of competitive analysis.

What is Competitive Analysis?

A competitive analysis involves collecting information about what other businesses in your industry are doing with their products, sales, and marketing.

Businesses use this data to find out what they are good at, where they can do better, and what opportunities they might have. It is like checking out the competition to see how and where you can improve.

This kind of analysis helps you get a clear picture of the market, allowing you to make smart decisions to make your business stand out and do well in the industry.

Competitive analysis is a section of utmost value for your business plan. The analysis in this section will form the basis upon which you will frame your marketing, sales, and product-related strategies. So make sure it’s thorough, insightful, and in line with your strategic objectives.

Let’s now understand how you can conduct a competitive analysis for your own business and leverage all its varied benefits.

How to Conduct a Competitive Analysis

Let’s break down the process of conducting a competitive analysis for your business plan in these easy-to-follow steps.

It will help you prepare a solid competitor analysis section in your business plan that actually highlights your strengths and opens room for better discussions (and funding).

Let’s begin.

1. Identify Your Direct and Indirect Competitors

First things first — identify all your business competitors and list them down. You can have a final, detailed list later, but right now an elementary list that mentions your primary competitors (the ones you know and are actively competing with) can suffice.

As you conduct more research, you can keep adding to it.

Explore your competitors using Google, social media platforms, or local markets. Then differentiate them into direct or indirect competitors.

Direct competitors

Businesses offering the same products or services, and targeting a similar target market are your direct competitors.

These competitors operate in the same industry and are often competing for the same market share.

Indirect competitors

On the other hand, indirect competitors are businesses that offer different products or services but cater to the same target customers as yours.

While they may not offer identical solutions, they compete for the same customer budget or attention. Indirect competitors can pose a threat by providing alternatives that customers might consider instead of your offerings.

2. Study the Overall Market

Now that you know your business competitors, deep dive into market research. Market research should involve a combination of both primary and secondary research methods.

Primary research

Primary research involves collecting market information directly from the source or subjects. Some examples of primary market research methods include:

- Purchasing competitors’ products or services

- Conducting interviews with their customers

- Administering online surveys to gather customer insights

Secondary research

Secondary research involves utilizing pre-existing gathered information from some relevant sources. Some of its examples include:

- Scrutinizing competitors’ websites

- Assessing the current economic landscape

- Referring to online market databases of the competitors.

Have a good understanding of the market at this point to write your market analysis section effectively.

3. Prepare a Competitive Framework

Now that you have a thorough understanding of your competitors’ market, it is time to create a competitive framework that enables comparison between two businesses.

Factors like market share, product offering, pricing, distribution channel, target markets, marketing strategies, and customer service offer essential metrics and information to chart your competitive framework.

These factors will form the basis of comparison for your competitive analysis. Depending on the type of your business, choose the factors that are relevant to you.

4. Take Note of Your Competitor’s Strategies

Now that you have an established framework, use that as a base to analyze your competitor’s strategies. Such analysis will help you understand what the customers like and dislike about your competitors.

Start by analyzing the marketing strategies, sales and marketing channels, promotional activities, and branding strategies of your competitors. Understand how they position themselves in the market and what USPs they emphasize.

Evaluate, analyze their pricing strategies and keep an eye on their distribution channel to understand your competitor’s business model in detail.

This information allows you to make informed decisions about your strategies, helping you identify opportunities for differentiation and improvement.

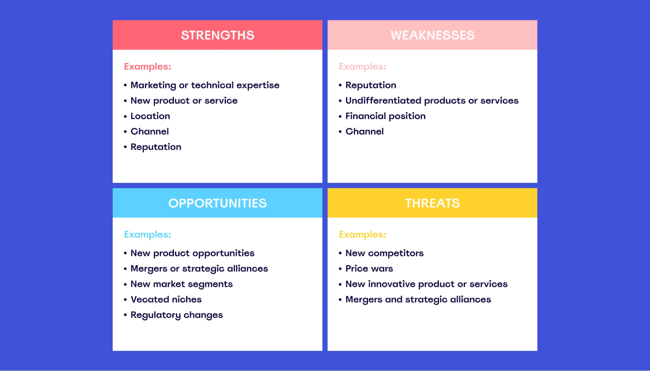

5. Perform a SWOT Analysis of Your Competitors

A SWOT analysis is a method of analyzing the strengths, weaknesses, opportunities, and threats of your business in the competitive marketplace.

While strengths and weaknesses focus on internal aspects of your company, opportunities and threats examine the external factors related to the industry and market.

It’s an important tool that will help determine the company’s competitive edge quite efficiently.

It includes the positive features of your internal business operations. For example, a strong brand, skilled workforce, innovative products/services, or a loyal customer base.

It includes all the hindrances of your internal business operations. For example, limited resources, outdated technology, weak brand recognition, or inefficient processes.

Opportunities

It outlines several opportunities that will come your way in the near or far future. Opportunities can arise as the industry or market trend changes or by leveraging the weaknesses of your competitors.

For example, details about emerging markets, technological advancements, changing consumer trends, profitable partnerships in the future, etc.

Threats define any external factor that poses a challenge or any risk for your business in this section. For example, intense competition, economic downturns, regulatory changes, or any advanced technology disruption.

This section will form the basis for your business strategies and product offerings. So make sure it’s detailed and offers the right representation of your business.

And that is all you need to create a comprehensive competitive analysis for your business plan.

Want to Perform Competitive Analysis for your Business?

Discover your competition’s secrets effortlessly with our user-friendly and Free Competitor Analysis Generator!

How to Write Competitive Analysis in a Business Plan

The section on competitor analysis is the most crucial part of your business plan. Making this section informative and engaging gets easier when you have all the essential data to form this section.

Now, let’s learn an effective way of writing your competitive analysis.

1. Determine who your readers are

Know your audience first, because that will change the whole context of your competitor analysis business plan.

The competitive analysis section will vary depending on the intended audience is the team or investors.

Consider the following things about your audience before you start writing this section:

Internal competitor plan (employees or partners)

Objective: The internal competitor plan is to provide your team with an understanding of the competitive landscape.

Focus: The focus should be on the comparison of the strengths and weaknesses of competitors to boost strategic discussions within your team.

Use: It is to leverage the above information to develop strategies that highlight your strengths and address your weaknesses.

Competitor plan for funding (bank or investors)

Objective: Here, the objective is to reassure the potential and viability of your business to investors or lenders.

Focus: This section should focus on awareness and deep understanding of the competitive landscape to persuade the readers about the future of your business.

Use: It is to showcase your market position and the opportunities that are on the way to your business.

This differentiation is solely to ensure that the competitive analysis serves its purpose effectively based on the specific needs and expectations of the respective audience.

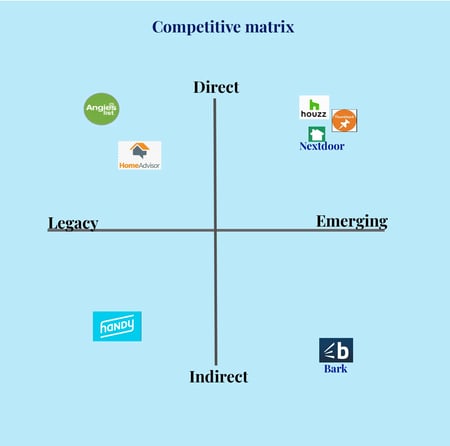

2. Describe and Visualise Competitive Advantage

Remember how we determined our competitive advantage at the time of research. It is now time to present that advantage in your competitive analysis.

Highlight your edge over other market players in terms of innovation, product quality, features, pricing, or marketing strategy. Understanding your products’ competitive advantage will also help you write the products and services section effectively.

However, don’t limit the edge to your service and market segment. Highlight every area where you excel even if it is better customer service or enhanced brand reputation.

Now, you can explain your analysis through textual blocks. However, a more effective method would be using a positioning map or competitive matrix to offer a visual representation of your company’s competitive advantage.

3. Explain your strategies

Your competitor analysis section should not only highlight the opportunities or threats of your business. It should also mention the strategies you will implement to overcome those threats or capitalize on the opportunities.

Such strategies may include crafting top-notch quality for your products or services, exploring the unexplored market segment, or having creative marketing strategies.

Elaborate on these strategies later in their respective business plan sections.

4. Know the pricing strategy

To understand the pricing strategy of your competitors, there are various aspects you need to have information about. It involves knowing their pricing model, evaluating their price points, and considering the additional costs, if any.

One way to understand this in a better way is to compare features and value offered at different price points and identify the gaps in competitors’ offerings.

Once you know the pricing structure of your competitors, compare it with yours and get to know the competitive advantage of your business from a pricing point of view.

Let us now get a more practical insight by checking an example of competitive analysis.

Competitive Analysis Example in a Business Plan

Here’s a business plan example highlighting the barber shop’s competitive analysis.

1. List of competitors

Direct & indirect competitors.

The following retailers are located within a 5-mile radius of J&S, thus providing either direct or indirect competition for customers:

Joe’s Beauty Salon

Joe’s Beauty Salon is the town’s most popular beauty salon and has been in business for 32 years. Joe’s offers a wide array of services that you would expect from a beauty salon.

Besides offering haircuts, Joe’s also offers nail services such as manicures and pedicures. In fact, over 60% of Joe’s revenue comes from services targeted at women outside of hair services. In addition, Joe’s does not offer its customers premium salon products.

For example, they only offer 2 types of regular hair gels and 4 types of shampoos. This puts Joe’s in direct competition with the local pharmacy and grocery stores that also carry these mainstream products. J&S, on the other hand, offers numerous options for exclusive products that are not yet available in West Palm Beach, Florida.

LUX CUTS has been in business for 5 years. LUX CUTS offers an extremely high-end hair service, with introductory prices of $120 per haircut.

However, LUX CUTS will primarily be targeting a different customer segment from J&S, focusing on households with an income in the top 10% of the city.

Furthermore, J&S offers many of the services and products that LUX CUTS offers, but at a fraction of the price, such as:

- Hairstyle suggestions & hair care consultation

- Hair extensions & coloring

- Premium hair products from industry leaders

Freddie’s Fast Hair Salon

Freddie’s Fast Hair Salon is located four stores down the road from J&S. Freddy’s has been in business for the past 3 years and enjoys great success, primarily due to its prime location.

Freddy’s business offers inexpensive haircuts and focuses on volume over quality. It also has a large customer base comprised of children between the ages of 5 to 13.

J&S has several advantages over Freddy’s Fast Hair Salon including:

- An entertainment-focused waiting room, with TVs and board games to make the wait for service more pleasurable. Especially great for parents who bring their children.

- A focus on service quality rather than speed alone to ensure repeat visits. J&S will spend on average 20 more minutes with its clients than Freddy’s.

While we expect that Freddy’s Fast Hair Salon will continue to thrive based on its location and customer relationships, we expect that more and more customers will frequent J&S based on the high-quality service it provides.

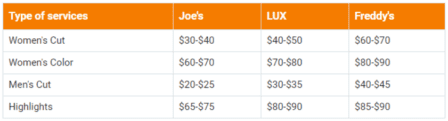

2. Competitive Pricing

John and Sons Barbing Salon will work towards ensuring that all our services are offered at highly competitive prices compared to what is obtainable in The United States of America.

We know the importance of gaining entrance into the market by lowering our pricing to attract all and sundry that is why we have consulted with experts and they have given us the best insights on how to do this and effectively gain more clients soon.

Our pricing system is going to be based on what is obtainable in the industry, we don’t intend to charge more (except for premium and customized services) and we don’t intend to charge less than our competitors are offering in West Palm Beach – Florida.

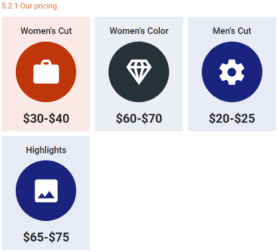

3. Our pricing

- Payment by cash

- Payment via Point of Sale (POS) Machine

- Payment via online bank transfer (online payment portal)

- Payment via Mobile money

- Check (only from loyal customers)

Given the above, we have chosen banking platforms that will help us achieve our payment plans without any itches.

4. Competitive advantage

5. SWOT analysis

Why is a Competitive Environment helpful?

Somewhere we all think, “What if we had no competition?” “What if we were the monopoly?” It would be great, right? Well, this is not the reality, and have to accept the competition sooner or later.

However, competition is healthy for businesses to thrive and survive, let’s see how:

1. Competition validates your idea

When people are developing similar products like you, it is a sign that you are on the right path. Having healthy competition proves that your idea is valid and there is a potential target market for your product and service offerings.

2. Innovation and Efficiency

Businesses competing with each other are motivated to innovate consistently, thereby, increasing their scope and market of product offerings. Moreover, when you are operating in a cutthroat environment, you simply cannot afford to be inefficient.

Be it in terms of costs, production, pricing, or marketing—you will ensure efficiency in all aspects to attract more business.

3. Market Responsiveness

Companies in a competitive environment tend to stay relevant and longer in business since they are adaptive to the changing environment. In the absence of competition, you would start getting redundant which will throw you out of the market, sooner or later.

4. Eases Consumer Education

Since your target market is already aware of the problem and existing market solutions, it would be much easier to introduce your business to them. Rather than focusing on educating, you would be more focused on branding and positioning your brand as an ideal customer solution.

Being the first one in the market is exciting. However, having healthy competition has these proven advantages which are hard to ignore.

A way forward

Whether you are starting a new business or have an already established unit, having a practical and realistic understanding of your competitive landscape is essential to developing efficient business strategies.

While getting to know your competition is essential, don’t get too hung up in the research. Research your competitors to improve your business plan and strategies, not to copy their ideas.

Create your unique strategies, offer the best possible services, and add value to your offerings—that will make you stand out.

While it’s a long, tough road, a comprehensive business plan can be your guide. Using modern business planning software is probably the easiest way to draft your plan.

Use Upmetrics. Simply enter your business details, answer the strategic questions, and see your business plan come together in front of your eyes.

Build your Business Plan Faster

with step-by-step Guidance & AI Assistance.

Frequently Asked Questions

Is swot analysis a competitive analysis.

SWOT analysis is just a component of a competitive analysis and not the whole competitive analysis. It helps you identify the strengths and weaknesses of your business and determine the emerging opportunities and threats faced by the external environment.

Competitive analysis in reality is a broad spectrum topic wherein you identify your competitors, analyze them on different metrics, and identify your competitive advantage to form competitive business strategies.

What tools can i use for competitor analysis?

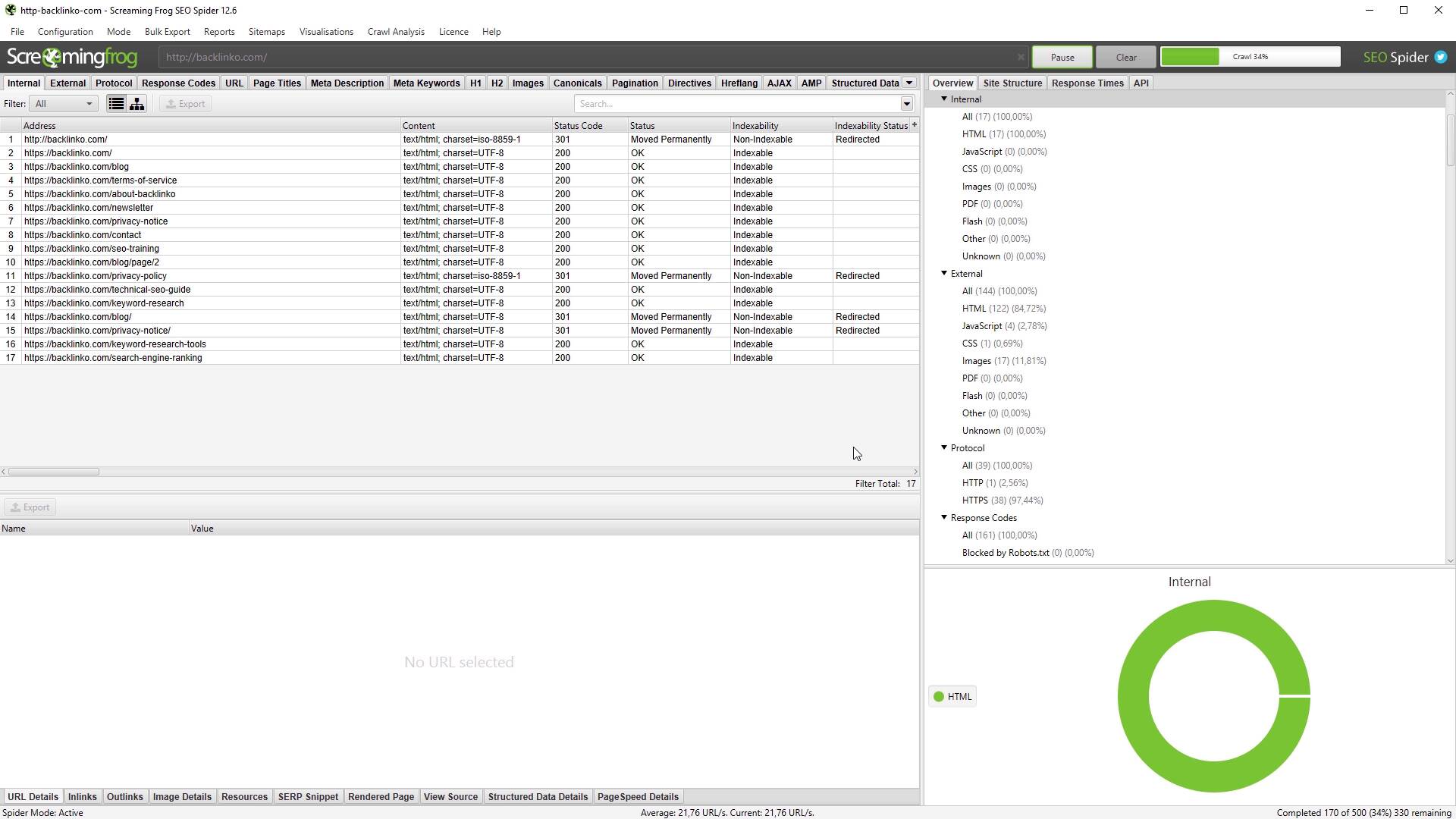

For a thorough competitor analysis, you will require a range of tools that can help in collecting, analyzing, and presenting data. While SEMrush, Google Alerts, Google Trends, and Ahrefs can help in collecting adequate competitor data, Business planning tools like Upmetrics can help in writing the competitors section of your business plan quite efficiently.

What are the 5 parts of a competitive analysis?

The main five components to keep in mind while having a competitor analysis are:

- Identifying the competitors

- Analyzing competitor’s strengths and weaknesses

- Assessing market share and trends

- Examining competitors’ strategies and market positioning

- Performing SWOT analysis

What is the difference between market analysis and competitive analysis?

Market analysis involves a comprehensive examination of the overall market dynamics, industry trends, and factors influencing a business’s operating environment.

On the other hand, competitive analysis narrows the focus to specific competitors within the market, delving into their strategies, strengths, weaknesses, and market positioning.

About the Author

Vinay Kevadiya

Vinay Kevadiya is the founder and CEO of Upmetrics, the #1 business planning software. His ultimate goal with Upmetrics is to revolutionize how entrepreneurs create, manage, and execute their business plans. He enjoys sharing his insights on business planning and other relevant topics through his articles and blog posts. Read more

Related Articles

How to Write a Customer Analysis Section for Your Business Plan

What is SWOT Analysis & How to Conduct it

How to Conduct a PESTLE Analysis Explained with Example

Reach your goals with accurate planning.

No Risk – Cancel at Any Time – 15 Day Money Back Guarantee

Popular Templates

Everything that you need to know to start your own business. From business ideas to researching the competition.

Practical and real-world advice on how to run your business — from managing employees to keeping the books.

Our best expert advice on how to grow your business — from attracting new customers to keeping existing customers happy and having the capital to do it.

Entrepreneurs and industry leaders share their best advice on how to take your company to the next level.

- Business Ideas

- Human Resources

- Business Financing

- Growth Studio

- Ask the Board

Looking for your local chamber?

Interested in partnering with us?

Start » strategy, sizing up the competition: how to conduct competitive research.

Competitive research can reveal trends in the marketplace and gaps in your own business plan.

Competitive research is a crucial part of any good marketing plan. This term may elicit some negative images but competitive research has nothing to do with spying. It has everything to do with paying attention to your competition and what they are doing.

Many people will lose out on business to competitors they have never even heard of simply because they’ve never taken the time to do competitive research. Understanding what your competition is doing will help you position yourself, and your product or service, within the market.

What is competitive research?

Competitive research involves identifying your competitors, evaluating their strengths and weaknesses and evaluating the strengths and weaknesses of their products and services. By looking at your biggest competitors, you can see how your own products and services stack up and what kind of threat they pose to your business. It also helps you identify industry trends you may have been missing.

Four benefits to doing competitive research are:

- Understanding your market . Competitive research can reveal trends in the marketplace that might have otherwise been missed. The ability to identify and predict trends is a huge asset for any business, helping to improve value proposition for customers. This is an important component of competitive research that you should constantly be doing.

- Improving your marketing . Your customers care about how your product or service is going to make their lives better. If they are leaving to go to one of your competitors, it’s probably because that company does a better job of explaining the benefits to the customer base, or does in fact provide a better product or service. Competitive research helps you understand why customers choose to buy from you or your competitors and how your competition is marketing their products. Over time, this can help you improve your own marketing programs.

- Identifying market gaps . When you do competitive research, you’re analyzing the strengths and weaknesses of your competitors. You’ll often find that, by looking at the data, there is a segment of the population that is being underserved. This could put your business in a unique position to reach those customers.

- Planning for the future . The most important byproduct of competitive research is that it will help you create a strategic plan for your business. This includes things like improving your product or service, using more strategic pricing strategies, and improving the promotion of your products.

Good competitive research could put your business in a unique position to reach customers who are being underserved.

6 steps to competitive research

It may sound obvious, but the first step is to simply identify who your top competitors are . There are two different types of competitors to identify: direct and indirect.

Direct competitors are targeting the same customer base you’re targeting. They are solving the same problem that you are trying to solve and sell a similar product or service.

Indirect competitors may sell something similar to your product or service but target a different audience, or they may target your same customer base but have a slightly different product or service.

It’s important to understand this segment of your market for two reasons: (1) it could provide you with growth opportunities for your own business, and (2) it could also highlight a threat to your business of which you would otherwise be unaware.

Here are six steps to getting started on competitive research:

Identify main competitors.

The most obvious way to do this is simply by searching your product or service category on the web and seeing what comes up. You can also check websites like Crunchbase or Product Hunt . You may find competitors that you might not have noticed before.

The goal is to cast a wide net and get an idea of who your main competitors are. Another good way to identify direct and indirect competitors is to ask your potential customers what services they are already using.

Analyze competitors' online presence

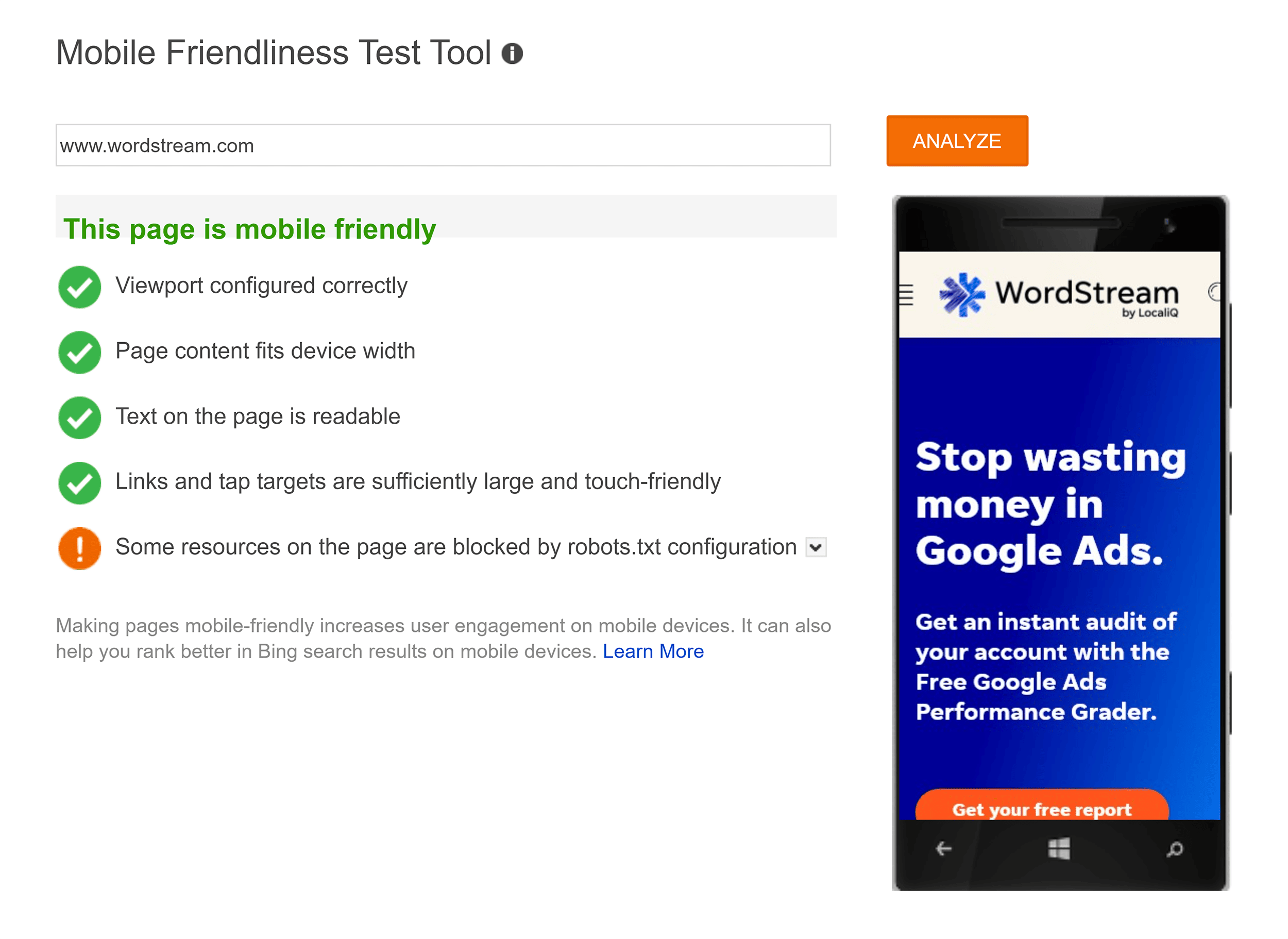

Once you’ve identified your main competitors, you want to look at their website, the type of content they are publishing, and their social media presence. Then, look for any blogs, white papers, and social media content being provided about their products and how to use them. Ask yourself these questions:

- What is the user experience like on their website?

- Is it easy to navigate?

- Do you clearly understand the products or services they offer?

- Is their website mobile-optimized?

- How often do they blog and most importantly, is the quality of their content good?

- What topics do they blog about most frequently?

- What social platforms are they actively using to talk about their products and services?

- Is this content engaging their target audience?

The answers to these questions show you opportunities where you can outperform your competitors. You will want to pay close attention to anything they are doing well that you aren’t doing. This will help give you a better understanding of where you should be focusing your attention and resources.

Gather information

The best way to gather information about your competitors is by acting like one of their customers. Sign up for their email list so you can get an idea of how they communicate.

Also, follow their blog and social media accounts and watch how they interact with their customers online. What kind of experience do customers have with your competitors?

You should consider shopping from them so you can see what their product looks like and what the experience is like from a customer perspective.

Track your findings

Make sure you track your competitors' findings on a spreadsheet; it will help with ongoing monitoring. This isn’t a complicated process, you just need to keep track of what they are doing over time so that you can see how they change everything from pricing to marketing and promotional activities.

You’ll start by dividing your competitors into direct and indirect customer columns. You’ll then track the following information:

- Company name

- Social media sites

- Unique features

- Pros and cons

- Screenshots and additional links

Check online reviews

Try to find as many reviews of your competitors as possible. Read their social media reviews, comments on their blogs, and case studies on their website. If they offer and present Google reviews, read them as well. It’s a good idea to understand not only the good things that your competitors may be doing, but the bad things as well. Include mentions with the Better Business Bureau about them in your research.

How customer-focused are they? This could be an opportunity for you to stand out. And, if they sell a product similar to yours, this will be a good way to find out if a lot of people are interested in it.

Any negative feedback will help you identify areas where you can improve your own product or service.

Identify areas for improvement

Now that you’ve taken note of some of the biggest differences between you and your competitors, it’s time to think about how you can use this information to improve your own business results.

Your competitive research should reveal at least one area your business can stand to improve in. This will help you learn how to engage better with your customers and online followers.

Keep in mind that competitive research is never a "one-and-done" event. Ongoing monitoring, such as observing how competitors evolve, is necessary to ensure that you are staying competitive in the marketplace.

Tools for competitive research

Software and technology now make it easier than ever to conduct competitive research. However, there are hundreds of competitive research tools on the market and narrowing down the right software can feel overwhelming.

This is why we’ve done the legwork and narrowed it down for you. Here are four tools you should consider using to conduct your competitive research:

SEMrush : This is one of the best competitive research tools on the market. It contains over 30 tools that can track things like SEO, PPC, keyword research, competitive research, and more. SEMrush will help you discover new competitors, find their best-used keywords, and analyze their ad copy. They have flexible pricing plans depending on your business needs.

SpyFu : This search analytics tool reveals the keywords websites buy on Google. So, once you’ve identified your biggest competitors, you can track every keyword they’ve bought. Plus, you can track every keyword they are ranking for and find the content and backlinks that helped them rank in the first place.

BuzzSumo : BuzzSumo lets you see how your content is matching up to your competitors’ content. You can see which content is shared more frequently on social media compared to others, and you can even schedule alerts on your competitors’ content which will make it easier to continue tracking them.

Owletter : Owletter tracks and analyzes emails sent from a website. This allows you to track your competitors’ email marketing and see what is and isn’t working for them. To get started, you’ll need to sign up to join your competitors’ email list. Then, every time you receive an email, Owletter will take a screenshot, analyze it, and alert you to any useful information.

Competitive research can seem daunting at first but it’s an essential part of running a successful business. When you incorporate the right tools into your research, you may find that it’s not as difficult as you imagined.

On some level, understanding your competitors is just as important as understanding your customers. Your competitors have valuable lessons to teach you and it’s important to regularly monitor their online activity. Doing so will strengthen your business and improve your own value for your customers.

CO— aims to bring you inspiration from leading respected experts. However, before making any business decision, you should consult a professional who can advise you based on your individual situation.

CO—is committed to helping you start, run and grow your small business. Learn more about the benefits of small business membership in the U.S. Chamber of Commerce, here .

Subscribe to our newsletter, Midnight Oil

Expert business advice, news, and trends, delivered weekly

By signing up you agree to the CO— Privacy Policy. You can opt out anytime.

By continuing on our website, you agree to our use of cookies for statistical and personalisation purposes. Know More

Welcome to CO—

Designed for business owners, CO— is a site that connects like minds and delivers actionable insights for next-level growth.

U.S. Chamber of Commerce 1615 H Street, NW Washington, DC 20062

Social links

Looking for local chamber, stay in touch.

What is a Competitive Analysis — and How Do You Conduct One?

Published: April 24, 2024

Every time I work with a new brand, my first order of business is to conduct a competitive analysis.

A competitive analysis report helps me understand the brand’s position in the market, map competitors’ strengths/weaknesses, and discover growth opportunities.

![how to research competition for business plan Download Now: 10 Competitive Analysis Templates [Free Templates]](https://no-cache.hubspot.com/cta/default/53/b3ec18aa-f4b2-45e9-851f-6d359263e671.png)

In this article, I’ll break down the exact steps I follow to conduct competitor analysis and identify ways to one-up top brands in the market.

We’ll cover:

What is competitive analysis?

What is competitive market research, competitive analysis in marketing.

- How To Conduct Competitive Analysis in 5 Steps

How to Do a Competitive Analysis (the Extended Cut)

Competitive product analysis, competitive analysis example, competitive analysis templates.

- Competitive Analysis FAQs

Competitive analysis is the process of comparing your competitors against your brand to understand their core differentiators, strengths, and weaknesses. It’s an in-depth breakdown of each competitor’s market position, sales & marketing tactics, growth strategy, and other business-critical aspects to see what they’re doing right and find opportunities for your business.

Competitive analysis gives you a clearer picture of the market landscape to make informed decisions for your growth.

That said, you have to remember that competitive analysis is an opportunity to learn from others. It isn’t:

- Copying successful competitors to the T.

- Trying to undercut others’ pricing.

- A one-and-done exercise.

Let’s look at how this exercise can help your business before breaking down my 5-step competitive analysis framework.

4 Reasons to Perform Competitive Analysis

If you’re on the fence about investing time and effort in analyzing your competitors, know that it gives you a complete picture of the market and where you stand in it.

Here are four main reasons why I perform a competitive analysis exercise whenever working with a brand for the first time:

- Identify your differentiators. Think of competitor analysis as a chance to reflect on your own business and discover what sets you apart from the crowd. And if you’re only starting out, it helps you brainstorm the best opportunities to differentiate your business.

- Find competitors’ strengths. What are your competitors doing right to drive their growth? Analyzing the ins and outs of an industry leader will tell you what they did well to reach the top position in the market.

- Set benchmarks for success. A competitor analysis gives you a realistic idea of mapping your progress with success metrics. While every business has its own path to success, you can always look at a competitor’s trajectory to assess whether you’re on the right track.

- Get closer to your target audience. A good competitor analysis framework zooms in on your audience. It gives you a pulse of your customers by evaluating what they like, dislike, prefer, and complain about when reviewing competing brands.

The bottom line: Whether you’re starting a new business or revamping an existing one, a competitive analysis eliminates guesswork and gives you concrete information to build your business strategy.

.webp)

10 Free Competitive Analysis Templates

Track and analyze your competitors with these ten free planning templates.

- SWOT Analysis

- Battle Cards

- Feature Comparison

- Strategic Overview

You're all set!

Click this link to access this resource at any time.

Competitive market research is a vital exercise that goes beyond merely comparing products or services. It involves an in-depth analysis of the market metrics that distinguish your offerings from those of your competitors.

A thorough market research doesn't just highlight these differences but leverages them, laying a solid foundation for a sales and marketing strategy that truly differentiates your business in a bustling market.

In the next section, we’ll explore the nuts and bolts of conducting a detailed competitive analysis tailored to your brand.

10 Competitive Analysis Templates

Fill out the form to access the templates., essential aspects to cover in competitive analysis research .

Before we walk through our step-by-step process for conducting competitor analysis, let’s look at the main aspects to include for every competitor:

- Overview. A summary of the company — where it’s located, target market, and target audience.

- Primary offering. A breakdown of what they sell and how they compare against your brand.

- Pricing strategy. A comparison of their pricing for different products with your pricing.

- Positioning. An analysis of their core messaging to see how they position themselves. Customer feedback: A curation of what customers have to say about the brand.

Now, it’s time to learn how to conduct a competitive analysis with an example to contextualize each step.

Every brand can benefit from regular competitor analysis. By performing a competitor analysis, you'll be able to:

- Identify gaps in the market.

- Develop new products and services.

- Uncover market trends.

- Market and sell more effectively.

As you can see, learning any of these four components will lead your brand down the path of achievement.

Next, let's dive into some steps you can take to conduct a comprehensive competitive analysis.

How to Conduct Competitive Analysis in 5 Quick Steps

As a content marketer, I’ve performed a competitive analysis for several brands to improve their messaging, plan their marketing strategy, and explore new channels. Here are the five steps I follow to analyze competitors.

1. Identify and categorize all competitors.

The first step is a simple yet strategic one. You have to identify all possible competitors in your industry, even the lesser-known ones. The goal here is to be aware of all the players in the market instead of arbitrarily choosing to ignore a few.

As you find more and more competitors, categorize them into these buckets:

- Direct competitors. These brands offer the same product/service as you to the same target audience. People will often compare you to these brands when making a buying decision. For example, Arcade and Storylane are direct competitors in the demo automation category.

- Indirect competitors. These businesses solve the same problem but with a different solution. They present opportunities for you to expand your offering. For example, Scribe and Whatfix solve the problem of documentation + internal training, but in different ways.

- Legacy competitors. These are established companies operating in your industry for several years. They have a solid reputation in the market and are a trusted name among customers. For example, Ahrefs is a legacy competitor in the SEO industry.

- Emerging competitors. These are new players in the market with an innovative business model and unique value propositions that pose a threat to existing brands. For example, ChatGPT came in as a disruptor in the conversational AI space and outperformed several brands.

Here’s a competitive matrix classifying brands in the community and housing space:

Testing It Out

To help you understand each step clearly, we’ll use the example of Trello and create a competitor analysis report using these steps.

Here’s a table of the main competitors for Trello:

able of the main competitors for Trello:

2. Determine each competitor’s market position.

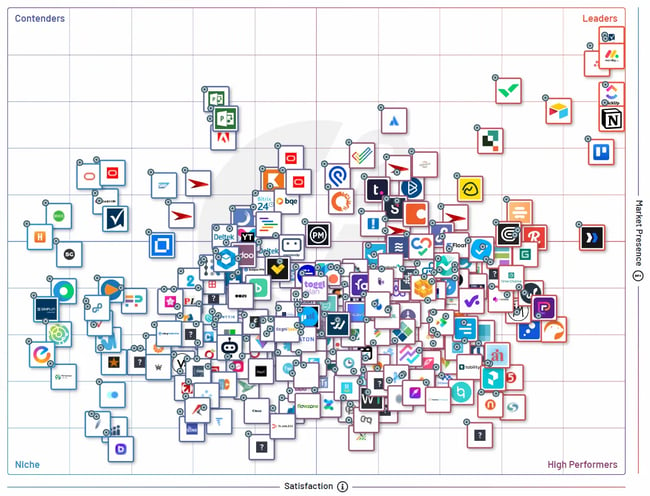

Once you know all your competitors, start analyzing their position in the market. This step will help you understand where you currently stand in terms of market share and customer satisfaction. It’ll also reveal the big guns in your industry — the leading competitors to prioritize in your analysis report.

Plus, visualizing the market landscape will tell you what’s missing in the current state. You can find gaps and opportunities for your brand to thrive even in a saturated market.

To map competitors’ market positions, create a graph with two factors: market presence (Y-axis) and customer satisfaction (X-axis). Then, place competitors in each of these quadrants:

- Niche. These are brands with a low market share but rank high on customer satisfaction. They’re likely targeting a specific segment of the audience and doing it well.

- Contenders. These brands rank low on customer satisfaction but have a good market presence. They might be new entrants with a strong sales and marketing strategy.

- Leaders. These brands own a big market share and have highly satisfied customers. They’re the dominant players with a solid reputation among your audience.

- High performers. These are another category of new entrants scoring high on customer satisfaction but with a low market share. They’re a good alternative for people not looking to buy from big brands.

This visualization will tell you exactly how crowded the market is. But it’ll also highlight ways to gain momentum and compete with existing brands.

Here’s a market landscape grid by G2 documenting all of Trello’s competitors in the project management space. For a leading brand like Trello, the goal would be to look at top brands in two quadrants: “Leaders” and “High Performers.”

Image Source

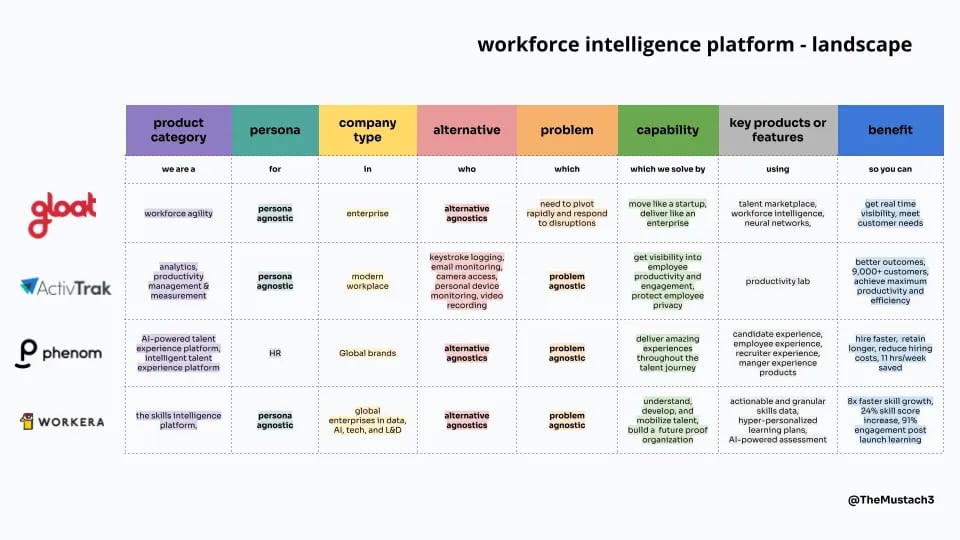

3. Extensively benchmark key competitors.

Step 2 will narrow down your focus from dozens of competitors to the few most important ones to target. Now, it’s time to examine each competitor thoroughly and prepare a benchmarking report.

Remember that this exercise isn’t meant to find shortcomings in every competitor. You have to objectively determine both the good and bad aspects of each brand.

Here are the core factors to consider when benchmarking competitors:

- Quality. Assess the quality of products/services for each competitor. You can compare product features to see what’s giving them an edge over you. You can also evaluate customer reviews to understand what users have to say about the quality of their offering.

- Price. Document the price points for every competitor to understand their pricing tactics. You can also interview their customers to find the value for money from users’ perspectives.

- Customer service. Check how they deliver support — through chat, phone, email, knowledge base, and more. You can also find customer ratings on different third-party platforms.

- Brand reputation. You should also compare each competitor’s reputation in the market to understand how people perceive the brand. Look out for anything critical people say about specific competitors.

- Financial health. If possible, look for performance indicators to assess a brand's financial progress. You can find data on metrics like revenue growth and profit margins.

This benchmarking exercise will involve a combination of primary and secondary research. Invest enough time in this step to ensure that your competitive analysis is completely airtight.

Check out this example of a competitor benchmarking report for workforce intelligence tools:

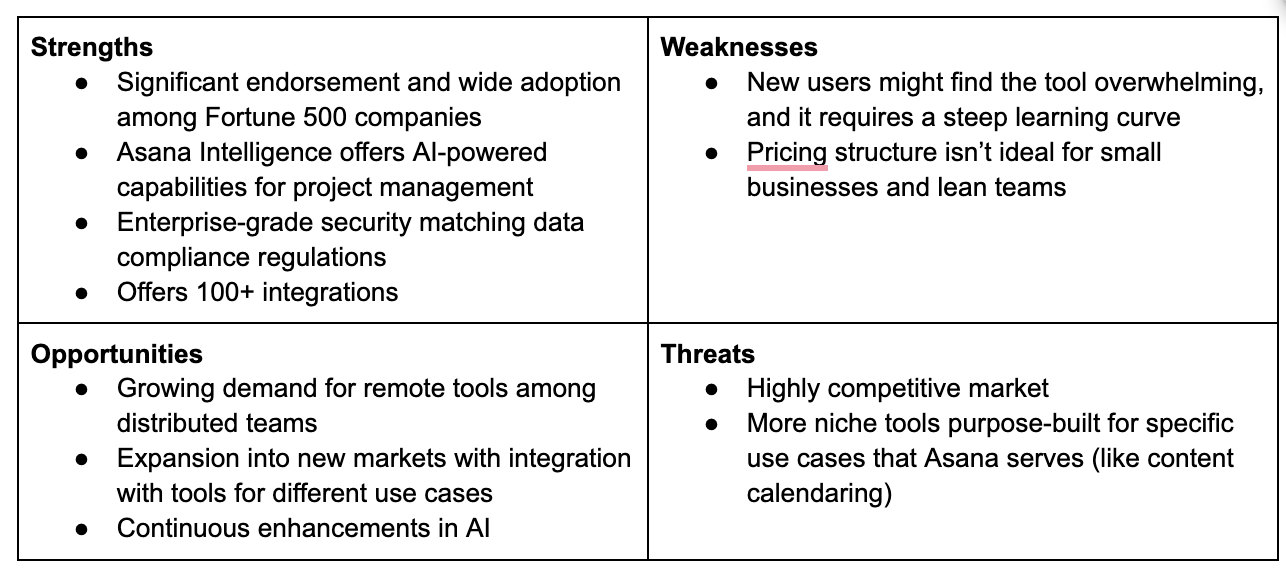

Here’s how I benchmarked Asana based on these criteria using the information I could find:

4. Deep dive into their marketing strategy.

While the first few steps will tell you what you can improve in your core product or service, you also need to find how competitors market their products.

You need to deep-dive into their marketing strategies to learn how they approach buyers. I analyze every marketing channel, then note my observations on how they speak to their audience and highlight their brand personality.

Here are a few key marketing channels to explore:

- Website. Analyze the website structure and copy to understand their positioning and brand voice.

- Email. Subscribe to emails to learn their cadence, copywriting style, content covered, and other aspects.

- Paid ads. Use tools like Ahrefs and Semrush to find if any competitor is running paid ads on search engines.

- Thought leadership. Follow a brand’s thought leadership efforts with content assets like podcasts, webinars, courses, and more.

- Digital PR. Explore whether a brand is investing in digital PR to build buzz around its business and analyze its strategy.

- Social media. See how actively brands use different social channels and what kind of content is working best for them.

- Partnerships. Analyze high-value partnerships to see if brands work closely with any companies and mutually benefit each other.

You can create a detailed document capturing every detail of a competitor’s marketing strategy. This will give you the right direction to plan your marketing efforts.

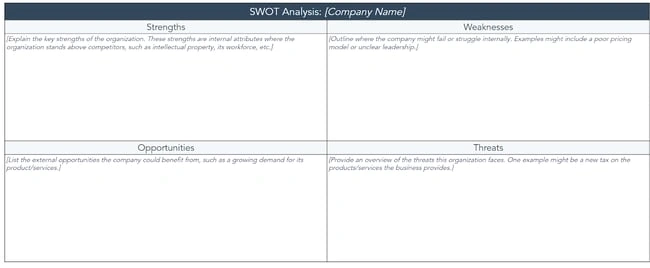

5. Perform a SWOT analysis.

The final step in a competitive analysis exercise is creating a SWOT analysis matrix for each company. This means you‘ll take note of your competitor’s strengths, weaknesses, opportunities, and threats. Think of it as the final step to consolidate all your research and answer these questions:

- What is your competitor doing well?

- Where do they have an advantage over your brand?

- What is the weakest area for your competitor?

- Where does your brand have the advantage over your competitor?

- In what areas would you consider this competitor a threat?

- Are there opportunities in the market that your competitor has identified?

You can use tools like Miro to visualize this data. Once you visually present this data, you’ll get a clearer idea of where you can outgrow each competitor.

Here’s a SWOT analysis matrix I created for Asana as a competitor of Trello:

- Determine who your competitors are.

- Determine what products your competitors offer.

- Research your competitors' sales tactics and results.

- Take a look at your competitors' pricing, as well as any perks they offer.

- Ensure you're meeting competitive shipping costs.

- Analyze how your competitors market their products.

- Take note of your competition's content strategy.

- Learn what technology stack your competitors use.

- Analyze the level of engagement on your competitors' content.

- Observe how they promote marketing content.

- Look at their social media presence, strategies, and go-to platforms.

- Perform a SWOT Analysis to learn their strengths, weaknesses, opportunities, and threats.

To run a complete and effective competitive analysis, use these ten templates, which range in purpose from sales to marketing to product strategy.

Featured Resource: 10 Competitive Analysis Templates

1. Assess your current product pricing.

The first step in any product analysis is to assess current pricing.

Nintendo offers three models of its Switch console: The smaller lite version is priced at $199, the standard version is $299, and the new OLED version is $349.

Sony, meanwhile, offers two versions of its PlayStation 5 console: The standard edition costs $499, and the digital version, which doesn’t include a disc drive, is $399.

2. Compare key features.

Next is a comparison of key features. In the case of our console example, this means comparing features like processing power, memory, and hard drive space.

3. Pinpoint differentiators.

With basic features compared, it’s time to dive deeper with differentiators. While a glance at the chart above seems to indicate that the PS5 is outperforming its competition, this data only tells part of the story.

Here’s why: The big selling point of the standard and OLED Switch models is that they can be played as either handheld consoles or docked with a base station connected to a TV. What’s more, this “switching” happens seamlessly, allowing players to play whenever, wherever.

The Playstation offering, meanwhile, has leaned into market-exclusive games that are only available on its system to help differentiate them from their competitors.

4. Identify market gaps.

The last step in a competitive product analysis is looking for gaps in the market that could help your company get ahead.

When it comes to the console market, one potential opportunity gaining traction is the delivery of games via cloud-based services rather than physical hardware.

Companies like Nvidia and Google have already made inroads in this space, and if they can overcome issues with bandwidth and latency, it could change the market at scale.

How do you stack up against the competition? Where are you similar, and what sets you apart? This is the goal of competitive analysis.

By understanding where your brand and competitors overlap and diverge, you’re better positioned to make strategic decisions that can help grow your brand.

Of course, it’s one thing to understand the benefits of competitive analysis, and it’s another to actually carry out an analysis that yields actionable results. Don’t worry — we’ve got you covered with a quick example.

Sony vs. Nintendo: Not all fun and games.

Let’s take a look at popular gaming system companies Sony and Nintendo.

Sony’s newest offering — the Playstation 5 — recently hit the market but has been plagued by supply shortages.

Nintendo’s Switch console, meanwhile, has been around for several years but remains a consistent seller, especially among teens and children.

This scenario is familiar for many companies on both sides of the coin; some have introduced new products designed to compete with established market leaders, while others are looking to ensure that reliable sales don’t fall.

Using some of the steps listed above, here’s a quick competitive analysis example.

In our example, it’s Sony vs Nintendo, but it’s also worth considering Microsoft’s Xbox, which occupies the same general market vertical.

This is critical for effective analysis; even if you’re focused on specific competitors and how they compare, it’s worth considering other similar market offerings.

PlayStation offers two PS5 versions, digital and standard, at different price points, while Nintendo offers three versions of its console.

Both companies also sell peripherals — for example, Sony sells virtual reality (VR) add-ons, while Nintendo sells gaming peripherals such as steering wheels, tennis rackets, and differing controller configurations.

When it comes to sales tactics and marketing, Sony and Nintendo have very different approaches.

In part thanks to the recent semiconductor shortage, Sony has driven up demand via scarcity — very low volumes of PS5 consoles remain available. Nintendo, meanwhile, has adopted a broader approach by targeting families as its primary customer base.

This effort is bolstered by the Switch Lite product line, which is smaller and less expensive, making it a popular choice for children.

The numbers tell the tale : Through September 2021, Nintendo sold 14.3 million consoles, while Sony sold 7.8 million.

Sony has the higher price point: Their standard PS5 sells for $499, while Nintendo’s most expensive offering comes in at $349. Both offer robust digital marketplaces and the ability to easily download new games or services.

Here, the key differentiators are flexibility and fidelity. The Switch is flexible — users can dock it with their television and play it like a standard console or pick it up and take it anywhere as a handheld gaming system.

The PS5, meanwhile, has superior graphics hardware and processing power for gamers who want the highest-fidelity experience.

5. Analyze how your competitors market their products.

If you compare the marketing efforts of Nintendo and Sony, the difference is immediately apparent: Sony’s ads feature realistic in-game footage and speak to the exclusive nature of their game titles.

The company has managed to secure deals with several high-profile game developers for exclusive access to new and existing IPs.

Nintendo, meanwhile, uses brightly lit ads showing happy families playing together or children using their smaller Switches while traveling.

6. Analyze the level of engagement on your competitor's content.

Engagement helps drive sales and encourage repeat purchases.

While there are several ways to measure engagement, social media is one of the most straightforward: In general, more followers equates to more engagement and greater market impact.

When it comes to our example, Sony enjoys a significant lead over Nintendo: While the official Playstation Facebook page has 38 million followers, Nintendo has just 5 million.

Competitive analysis is complex, especially when you’re assessing multiple companies and products simultaneously.

To help streamline the process, we’ve created 10 free templates that make it possible to see how you stack up against the competition — and what you can do to increase market share.

Let’s break down our SWOT analysis template. Here’s what it looks like:

Don't forget to share this post!

Related articles.

25 Tools & Resources for Conducting Market Research

Market Research: A How-To Guide and Template

![how to research competition for business plan SWOT Analysis: How To Do One [With Template & Examples]](https://blog.hubspot.com/hubfs/marketingplan_20.webp)

SWOT Analysis: How To Do One [With Template & Examples]

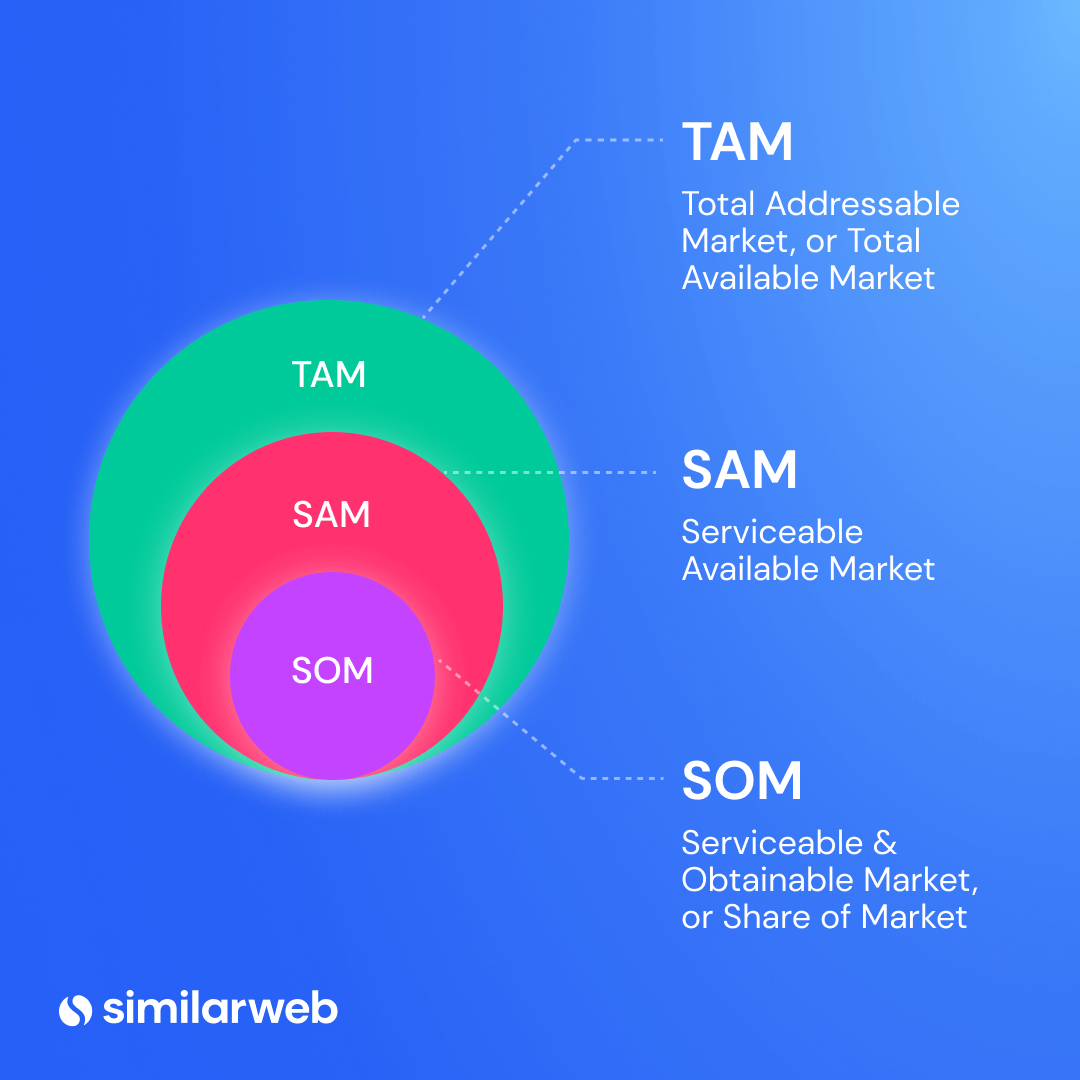

TAM SAM SOM: What Do They Mean & How Do You Calculate Them?

![how to research competition for business plan How to Run a Competitor Analysis [Free Guide]](https://blog.hubspot.com/hubfs/Google%20Drive%20Integration/how%20to%20do%20a%20competitor%20analysis_122022.jpeg)

How to Run a Competitor Analysis [Free Guide]

![how to research competition for business plan 5 Challenges Marketers Face in Understanding Audiences [New Data + Market Researcher Tips]](https://blog.hubspot.com/hubfs/challenges%20marketers%20face%20in%20understanding%20the%20customer%20.png)

5 Challenges Marketers Face in Understanding Audiences [New Data + Market Researcher Tips]

Causal Research: The Complete Guide

Total Addressable Market (TAM): What It Is & How You Can Calculate It

What Is Market Share & How Do You Calculate It?

![how to research competition for business plan 3 Ways Data Privacy Changes Benefit Marketers [New Data]](https://blog.hubspot.com/hubfs/how-data-privacy-benefits-marketers_1.webp)

3 Ways Data Privacy Changes Benefit Marketers [New Data]

10 free templates to help you understand and beat the competition.

Marketing software that helps you drive revenue, save time and resources, and measure and optimize your investments — all on one easy-to-use platform

.css-s5s6ko{margin-right:42px;color:#F5F4F3;}@media (max-width: 1120px){.css-s5s6ko{margin-right:12px;}} AI that works. Coming June 5, Asana redefines work management—again. .css-1ixh9fn{display:inline-block;}@media (max-width: 480px){.css-1ixh9fn{display:block;margin-top:12px;}} .css-1uaoevr-heading-6{font-size:14px;line-height:24px;font-weight:500;-webkit-text-decoration:underline;text-decoration:underline;color:#F5F4F3;}.css-1uaoevr-heading-6:hover{color:#F5F4F3;} .css-ora5nu-heading-6{display:-webkit-box;display:-webkit-flex;display:-ms-flexbox;display:flex;-webkit-align-items:center;-webkit-box-align:center;-ms-flex-align:center;align-items:center;-webkit-box-pack:start;-ms-flex-pack:start;-webkit-justify-content:flex-start;justify-content:flex-start;color:#0D0E10;-webkit-transition:all 0.3s;transition:all 0.3s;position:relative;font-size:16px;line-height:28px;padding:0;font-size:14px;line-height:24px;font-weight:500;-webkit-text-decoration:underline;text-decoration:underline;color:#F5F4F3;}.css-ora5nu-heading-6:hover{border-bottom:0;color:#CD4848;}.css-ora5nu-heading-6:hover path{fill:#CD4848;}.css-ora5nu-heading-6:hover div{border-color:#CD4848;}.css-ora5nu-heading-6:hover div:before{border-left-color:#CD4848;}.css-ora5nu-heading-6:active{border-bottom:0;background-color:#EBE8E8;color:#0D0E10;}.css-ora5nu-heading-6:active path{fill:#0D0E10;}.css-ora5nu-heading-6:active div{border-color:#0D0E10;}.css-ora5nu-heading-6:active div:before{border-left-color:#0D0E10;}.css-ora5nu-heading-6:hover{color:#F5F4F3;} Get early access .css-1k6cidy{width:11px;height:11px;margin-left:8px;}.css-1k6cidy path{fill:currentColor;}

- Product overview

- All features

- App integrations

CAPABILITIES

- project icon Project management

- Project views

- Custom fields

- Status updates

- goal icon Goals and reporting

- Reporting dashboards

- workflow icon Workflows and automation

- portfolio icon Resource management

- Time tracking

- my-task icon Admin and security

- Admin console

- asana-intelligence icon Asana Intelligence

- list icon Personal

- premium icon Starter

- briefcase icon Advanced

- Goal management

- Organizational planning

- Campaign management

- Creative production

- Marketing strategic planning

- Request tracking

- Resource planning

- Project intake

- View all uses arrow-right icon

- Project plans

- Team goals & objectives

- Team continuity

- Meeting agenda

- View all templates arrow-right icon

- Work management resources Discover best practices, watch webinars, get insights

- What's new Learn about the latest and greatest from Asana

- Customer stories See how the world's best organizations drive work innovation with Asana

- Help Center Get lots of tips, tricks, and advice to get the most from Asana

- Asana Academy Sign up for interactive courses and webinars to learn Asana

- Developers Learn more about building apps on the Asana platform

- Community programs Connect with and learn from Asana customers around the world

- Events Find out about upcoming events near you

- Partners Learn more about our partner programs

- Support Need help? Contact the Asana support team

- Asana for nonprofits Get more information on our nonprofit discount program, and apply.

Featured Reads

- Project planning |

- How to create a competitive analysis (w ...

How to create a competitive analysis (with examples)

Competitive analysis involves identifying your direct and indirect competitors using research to reveal their strengths and weaknesses in relation to your own. In this guide, we’ll outline how to do a competitive analysis and explain how you can use this marketing strategy to improve your business.

Whether you’re running a business or playing in a football game, understanding your competition is crucial for success. While you may not be scoring touchdowns in the office, your goal is to score business deals with clients or win customers with your products. The method of preparation for athletes and business owners is similar—once you understand your strengths and weaknesses versus your competitors’, you can level up.

What is a competitive analysis?

Competitive analysis involves identifying your direct and indirect competitors using research to reveal their strengths and weaknesses in relation to your own.

![how to research competition for business plan [inline illustration] What is a competitive analysis (infographic)](https://assets.asana.biz/transform/c1a37dfd-53a8-44c4-b57b-10fc6a332ba1/inline-project-planning-competitive-analysis-example-1-2x?io=transform:fill,width:2560&format=webp)

Direct competitors market the same product to the same audience as you, while indirect competitors market the same product to a different audience. After identifying your competitors, you can use the information you gather to see where you stand in the market landscape.

What to include in a competitive analysis

The purpose of this type of analysis is to get a competitive advantage in the market and improve your business strategy. Without a competitive analysis, it’s difficult to know what others are doing to win clients or customers in your target market. A competitive analysis report may include:

A description of your company’s target market

Details about your product or service versus the competitors’

Current and projected market share, sales, and revenues

Pricing comparison

Marketing and social media strategy analysis

Differences in customer ratings

You’ll compare each detail of your product or service versus the competition to assess strategy efficacy. By comparing success metrics across companies, you can make data-driven decisions.

How to do a competitive analysis

Follow these five steps to create your competitive analysis report and get a broad view of where you fit in the market. This process can help you analyze a handful of competitors at one time and better approach your target customers.

1. Create a competitor overview

In step one, select between five and 10 competitors to compare against your company. The competitors you choose should have similar product or service offerings and a similar business model to you. You should also choose a mix of both direct and indirect competitors so you can see how new markets might affect your company. Choosing both startup and seasoned competitors will further diversify your analysis.

Tip: To find competitors in your industry, use Google or Amazon to search for your product or service. The top results that emerge are likely your competitors. If you’re a startup or you serve a niche market, you may need to dive deeper into the rankings to find your direct competitors.

2. Conduct market research

Once you know the competitors you want to analyze, you’ll begin in-depth market research. This will be a mixture of primary and secondary research. Primary research comes directly from customers or the product itself, while secondary research is information that’s already compiled. Then, keep track of the data you collect in a user research template .

Primary market research may include:

Purchasing competitors’ products or services

Interviewing customers

Conducting online surveys of customers

Holding in-person focus groups

Secondary market research may include:

Examining competitors’ websites

Assessing the current economic situation

Identifying technological developments

Reading company records

Tip: Search engine analysis tools like Ahrefs and SEMrush can help you examine competitors’ websites and obtain crucial SEO information such as the keywords they’re targeting, the number of backlinks they have, and the overall health of their website.

3. Compare product features

The next step in your analysis involves a comparison of your product to your competitors’ products. This comparison should break down the products feature by feature. While every product has its own unique features, most products will likely include:

Service offered

Age of audience served

Number of features

Style and design

Ease of use

Type and number of warranties

Customer support offered

Product quality

Tip: If your features table gets too long, abbreviate this step by listing the features you believe are of most importance to your analysis. Important features may include cost, product benefits, and ease of use.

4. Compare product marketing

The next step in your analysis will look similar to the one before, except you’ll compare the marketing efforts of your competitors instead of the product features. Unlike the product features matrix you created, you’ll need to go deeper to unveil each company’s marketing plan .

Areas you’ll want to analyze include:

Social media

Website copy

Press releases

Product copy

As you analyze the above, ask questions to dig deeper into each company’s marketing strategies. The questions you should ask will vary by industry, but may include:

What story are they trying to tell?

What value do they bring to their customers?

What’s their company mission?

What’s their brand voice?

Tip: You can identify your competitors’ target demographic in this step by referencing their customer base, either from their website or from testimonials. This information can help you build customer personas. When you can picture who your competitor actively targets, you can better understand their marketing tactics.

5. Use a SWOT analysis

Competitive intelligence will make up a significant part of your competitor analysis framework, but once you’ve gathered your information, you can turn the focus back to your company. A SWOT analysis helps you identify your company’s strengths and weaknesses. It also helps turn weaknesses into opportunities and assess threats you face based on your competition.

During a SWOT analysis, ask yourself:

What do we do well?

What could we improve?

Are there market gaps in our services?

What new market trends are on the horizon?

Tip: Your research from the previous steps in the competitive analysis will help you answer these questions and fill in your SWOT analysis. You can visually present your findings in a SWOT matrix, which is a four-box chart divided by category.

6. Identify your place in the market landscape

The last step in your competitive analysis is to understand where you stand in the market landscape. To do this, you’ll create a graph with an X and Y axis. The two axes should represent the most important factors for being competitive in your market.

For example, the X-axis may represent customer satisfaction, while the Y-axis may represent presence in the market. You’ll then plot each competitor on the graph according to their (x,y) coordinates. You’ll also plot your company on this chart, which will give you an idea of where you stand in relation to your competitors.

This graph is included for informational purposes and does not represent Asana’s market landscape or any specific industry’s market landscape.

![how to research competition for business plan [inline illustration] Identify your place in the market landscape (infographic)](https://assets.asana.biz/transform/fb2a8437-bb5e-4f0c-b5d0-91d67116bebe/inline-project-planning-competitive-analysis-example-2-2x?io=transform:fill,width:2560&format=webp)

Tip: In this example, you’ll see three companies that have a greater market presence and greater customer satisfaction than yours, while two companies have a similar market presence but higher customer satisfaction. This data should jumpstart the problem-solving process because you now know which competitors are the biggest threats and you can see where you fall short.

Competitive analysis example

Imagine you work at a marketing startup that provides SEO for dentists, which is a niche industry and only has a few competitors. You decide to conduct a market analysis for your business. To do so, you would:

Step 1: Use Google to compile a list of your competitors.

Steps 2, 3, and 4: Use your competitors’ websites, as well as SEO analysis tools like Ahrefs, to deep-dive into the service offerings and marketing strategies of each company.

Step 5: Focusing back on your own company, you conduct a SWOT analysis to assess your own strategic goals and get a visual of your strengths and weaknesses.

Step 6: Finally, you create a graph of the market landscape and conclude that there are two companies beating your company in customer satisfaction and market presence.

After compiling this information into a table like the one below, you consider a unique strategy. To beat out your competitors, you can use localization. Instead of marketing to dentists nationwide like your competitors are doing, you decide to focus your marketing strategy on one region, state, or city. Once you’ve become the known SEO company for dentists in that city, you’ll branch out.

![how to research competition for business plan [inline illustration] Competitive analysis framework (example)](https://assets.asana.biz/transform/56c32354-f525-4610-9250-f878ea0b9f26/inline-project-planning-competitive-analysis-example-3-2x?io=transform:fill,width:2560&format=webp)

You won’t know what conclusions you can draw from your competitive analysis until you do the work and see the results. Whether you decide on a new pricing strategy, a way to level up your marketing, or a revamp of your product, understanding your competition can provide significant insight.

Drawbacks of competitive analysis

There are some drawbacks to competitive analysis you should consider before moving forward with your report. While these drawbacks are minor, understanding them can make you an even better manager or business owner.

Don’t forget to take action

You don’t just want to gather the information from your competitive analysis—you also want to take action on that information. The data itself will only show you where you fit into the market landscape. The key to competitive analysis is using it to problem solve and improve your company’s strategic plan .

Be wary of confirmation bias

Confirmation bias means interpreting information based on the beliefs you already hold. This is bad because it can cause you to hold on to false beliefs. To avoid bias, you should rely on all the data available to back up your decisions. In the example above, the business owner may believe they’re the best in the SEO dental market at social media. Because of this belief, when they do market research for social media, they may only collect enough information to confirm their own bias—even if their competitors are statistically better at social media. However, if they were to rely on all the data available, they could eliminate this bias.

Update your analysis regularly

A competitive analysis report represents a snapshot of the market landscape as it currently stands. This report can help you gain enough information to make changes to your company, but you shouldn’t refer to the document again unless you update the information regularly. Market trends are always changing, and although it’s tedious to update your report, doing so will ensure you get accurate insight into your competitors at all times.

Boost your marketing strategy with competitive analysis

Learning your competitors’ strengths and weaknesses will make you a better marketer. If you don’t know the competition you’re up against, you can’t beat them. Using competitive analysis can boost your marketing strategy and allow you to capture your target audience faster.

Competitive analysis must lead to action, which means following up on your findings with clear business goals and a strong business plan. Once you do your competitive analysis, you can use the templates below to put your plan into action.

Related resources

How to use a feasibility study in project management

How to track utilization rate and drive team profitability

How to accomplish big things with long-term goals

Smooth product launches are simpler than you think

- Starting a Business

- Growing a Business

- Small Business Guide

- Business News

- Science & Technology

- Money & Finance

- For Subscribers

- Write for Entrepreneur

- Entrepreneur Store

- United States

- Asia Pacific

- Middle East

- South Africa

Copyright © 2024 Entrepreneur Media, LLC All rights reserved. Entrepreneur® and its related marks are registered trademarks of Entrepreneur Media LLC

- Write Your Business Plan | Part 1 Overview Video

- The Basics of Writing a Business Plan

- How to Use Your Business Plan Most Effectively

- 12 Reasons You Need a Business Plan

- The Main Objectives of a Business Plan

- What to Include and Not Include in a Successful Business Plan

- The Top 4 Types of Business Plans

- A Step-by-Step Guide to Presenting Your Business Plan in 10 Slides

- 6 Tips for Making a Winning Business Presentation

- 3 Key Things You Need to Know About Financing Your Business

- 12 Ways to Set Realistic Business Goals and Objectives

- How to Perfectly Pitch Your Business Plan in 10 Minutes

- Write Your Business Plan | Part 2 Overview Video

- How to Fund Your Business Through Friends and Family Loans and Crowdsourcing

- How to Fund Your Business Using Banks and Credit Unions

- How to Fund Your Business With an SBA Loan

- How to Fund Your Business With Bonds and Indirect Funding Sources

- How to Fund Your Business With Venture Capital

- How to Fund Your Business With Angel Investors

- How to Use Your Business Plan to Track Performance

- How to Make Your Business Plan Attractive to Prospective Partners

- Is This Idea Going to Work? How to Assess the Potential of Your Business.

- When to Update Your Business Plan

- Write Your Business Plan | Part 3 Overview Video

- How to Write the Management Team Section to Your Business Plan

- How to Create a Strategic Hiring Plan

- How to Write a Business Plan Executive Summary That Sells Your Idea

- How to Build a Team of Outside Experts for Your Business

- Use This Worksheet to Write a Product Description That Sells

- What Is Your Unique Selling Proposition? Use This Worksheet to Find Your Greatest Strength.

- How to Raise Money With Your Business Plan

- Customers and Investors Don't Want Products. They Want Solutions.

- 5 Essential Elements of Your Industry Trends Plan

- How to Identify and Research Your Competition

- Who Is Your Ideal Customer? 4 Questions to Ask Yourself.

- How to Identify Market Trends in Your Business Plan

- How to Define Your Product and Set Your Prices

- How to Determine the Barriers to Entry for Your Business

- How to Get Customers in Your Store and Drive Traffic to Your Website

- How to Effectively Promote Your Business to Customers and Investors

- What Equipment and Facilities to Include in Your Business Plan

- How to Write an Income Statement for Your Business Plan

- How to Make a Balance Sheet

- How to Make a Cash Flow Statement

- How to Use Financial Ratios to Understand the Health of Your Business

- How to Write an Operations Plan for Retail and Sales Businesses

- How to Make Realistic Financial Forecasts

- How to Write an Operations Plan for Manufacturers

- What Technology Needs to Include In Your Business Plan

- How to List Personnel and Materials in Your Business Plan

- The Role of Franchising

- The Best Ways to Follow Up on a Buisiness Plan

- The Best Books, Sites, Trade Associations and Resources to Get Your Business Funded and Running

- How to Hire the Right Business Plan Consultant

- Business Plan Lingo and Resources All Entrepreneurs Should Know

- How to Write a Letter of Introduction

- What To Put on the Cover Page of a Business Plan

- How to Format Your Business Plan

- 6 Steps to Getting Your Business Plan In Front of Investors

How to Identify and Research Your Competition Emphasizing your competitive advantage is an essential part of any business plan.

By Eric Butow Oct 27, 2023

Key Takeaways

- Why competitive analysis matters

- Questions to ask about your industry

- How to find similar companies

Opinions expressed by Entrepreneur contributors are their own.

This is part 2 / 8 of Write Your Business Plan: Section 4: Marketing Your Business Plan series.

Successful entrepreneurs are renowned for intuitively feeling a market's pulse, project trends before anyone else detects them, and identifying needs that even customers are unaware of. After you are famous, perhaps you can claim a similar psychic connection to the market. But for now, you'll need to reinforce your claims to market insight by presenting solid research in your plan.

Market research aims to understand the reasons consumers will buy your product. It studies consumer behavior, specifically how cultural, societal, and personal factors influence that behavior. For instance, market research aiming to understand consumers who buy in-line skates might study the cultural importance of fitness, the societal acceptability of marketing directed toward children and teens, and the effect of personal influences such as age, occupation, and lifestyle in directing a skate purchase.

Related: 4 Effective Ways To Accomplish This Missing Step That Most Entrepreneurs Overlook

Market research is often split into two varieties: primary and secondary. Primary research studies customers directly, whereas secondary research studies information others have gathered about customers. Primary research might be telephone interviews or online polls with randomly selected target group members. You can also study your own sales records to gather primary research. Secondary research might come from reports on other organizations' websites or blogs about the industry.

Conducting market research provides answers to those unknown elements. It will greatly reduce risk as you start your business. It will help you understand your competitive position and the strengths and weaknesses of your competitors. And it will improve your marketing and sales process."

Related: You Need Consumer Insights To Ensure The Success Of Your Business. Here Are Five Ways To Find Them.

Questions to Ask About Your Industry

To start preparing your industry analysis and outlook, dig up the following facts about your field:

- What is your total industry-wide sales volume? In dollars? In units?