What is a notice of assignment?

An assignment takes place when one party is holding a right to property, claims, bills, lease, etc., of another party and wishes to pass it along (or sell it) to a third party. As complicated as that sounds, it really isn’t. Strangely enough, many assignments can be made under the law without immediately informing, or obtaining the permission, of the personal obligated to perform under the contract. An example of this is when your mortgage is sold to another mortgage company. The original mortgage company may not inform you for several weeks, and they certainly aren’t going to ask your permission to make the sale.

If a person obligated to perform has received notice of the assignment and still insists on paying the initial assignor, the person will still be obligated to pay the new assignee according to the agreement. If the obligated party has not yet been informed of the assignment and pays the original note holder (assignor), the assignor is obligated to turn those funds over to the new assignee. But, what are the remedies if this doesn’t take place? Actually, the new assignee may find themselves in a difficult position if the assignor simply takes off with their funds or payment. They are limited to taking action against the person they bought the note from (assignor) and cannot hold the obligator liable. Therefore, it is important to remember that if any note or obligation is assigned to another party, each party should be well aware of their responsibilities in the transaction and uphold them according to the laws of their state. Assignment forms should be well thought out and written in a manner which prevents the failure of one party against another.

Related posts:

- Does your Agreement Require an Assignment Legal Form?

- Why Every Landlord and Tenant Needs a Lease Agreement

- Why you need a Power of Attorney and How to Assign One

Related Posts

- Seven Slip-and-Fall Accidents FAQs That You Should Know

- What is a mutual non-disclosure agreement?

- Can I use a form to change my name?

- When do I need a mechanic’s lien?

Leave a Reply Cancel reply

Your email address will not be published. Required fields are marked *

CAPTCHA Code *

- Skip to primary navigation

- Skip to main content

- Skip to primary sidebar

- Skip to footer

Legal Templates

Home Business Assignment Agreement

Assignment Agreement Template

Use our assignment agreement to transfer contractual obligations.

Updated February 1, 2024 Reviewed by Brooke Davis

An assignment agreement is a legal document that transfers rights, responsibilities, and benefits from one party (the “assignor”) to another (the “assignee”). You can use it to reassign debt, real estate, intellectual property, leases, insurance policies, and government contracts.

What Is an Assignment Agreement?

What to include in an assignment agreement, how to assign a contract, how to write an assignment agreement, assignment agreement sample.

Partnership Interest

An assignment agreement effectively transfers the rights and obligations of a person or entity under an initial contract to another. The original party is the assignor, and the assignee takes on the contract’s duties and benefits.

It’s often a requirement to let the other party in the original deal know the contract is being transferred. It’s essential to create this form thoughtfully, as a poorly written assignment agreement may leave the assignor obligated to certain aspects of the deal.

The most common use of an assignment agreement occurs when the assignor no longer can or wants to continue with a contract. Instead of leaving the initial party or breaking the agreement, the assignor can transfer the contract to another individual or entity.

For example, imagine a small residential trash collection service plans to close its operations. Before it closes, the business brokers a deal to send its accounts to a curbside pickup company providing similar services. After notifying account holders, the latter company continues the service while receiving payment.

Create a thorough assignment agreement by including the following information:

- Effective Date: The document must indicate when the transfer of rights and obligations occurs.

- Parties: Include the full name and address of the assignor, assignee, and obligor (if required).

- Assignment: Provide details that identify the original contract being assigned.

- Third-Party Approval: If the initial contract requires the approval of the obligor, note the date the approval was received.

- Signatures: Both parties must sign and date the printed assignment contract template once completed. If a notary is required, wait until you are in the presence of the official and present identification before signing. Failure to do so may result in having to redo the assignment contract.

Review the Contract Terms

Carefully review the terms of the existing contract. Some contracts may have specific provisions regarding assignment. Check for any restrictions or requirements related to assigning the contract.

Check for Anti-Assignment Clauses

Some contracts include anti-assignment clauses that prohibit or restrict the ability to assign the contract without the consent of the other party. If there’s such a clause, you may need the consent of the original parties to proceed.

Determine Assignability

Ensure that the contract is assignable. Some contracts, especially those involving personal services or unique skills, may not be assignable without the other party’s agreement.

Get Consent from the Other Party (if Required)

If the contract includes an anti-assignment clause or requires consent for assignment, seek written consent from the other party. This can often be done through a formal amendment to the contract.

Prepare an Assignment Agreement

Draft an assignment agreement that clearly outlines the transfer of rights and obligations from the assignor (the party assigning the contract) to the assignee (the party receiving the assignment). Include details such as the names of the parties, the effective date of the assignment, and the specific rights and obligations being transferred.

Include Original Contract Information

Attach a copy of the original contract or reference its key terms in the assignment agreement. This helps in clearly identifying the contract being assigned.

Execution of the Assignment Agreement

Both the assignor and assignee should sign the assignment agreement. Signatures should be notarized if required by the contract or local laws.

Notice to the Other Party

Provide notice of the assignment to the non-assigning party. This can be done formally through a letter or as specified in the contract.

File the Assignment

File the assignment agreement with the appropriate parties or entities as required. This may include filing with the original contracting party or relevant government authorities.

Communicate with Third Parties

Inform any relevant third parties, such as suppliers, customers, or service providers, about the assignment to ensure a smooth transition.

Keep Copies for Records

Keep copies of the assignment agreement, original contract, and any related communications for your records.

Here’s a list of steps on how to write an assignment agreement:

Step 1 – List the Assignor’s and Assignee’s Details

List all of the pertinent information regarding the parties involved in the transfer. This information includes their full names, addresses, phone numbers, and other relevant contact information.

This step clarifies who’s transferring the initial contract and who will take on its responsibilities.

Step 2 – Provide Original Contract Information

Describing and identifying the contract that is effectively being reassigned is essential. This step avoids any confusion after the transfer has been completed.

Step 3 – State the Consideration

Provide accurate information regarding the amount the assignee pays to assume the contract. This figure should include taxes and any relevant peripheral expenses. If the assignee will pay the consideration over a period, indicate the method and installments.

Step 4 – Provide Any Terms and Conditions

The terms and conditions of any agreement are crucial to a smooth transaction. You must cover issues such as dispute resolution, governing law, obligor approval, and any relevant clauses.

Step 5 – Obtain Signatures

Both parties must sign the agreement to ensure it is legally binding and that they have read and understood the contract. If a notary is required, wait to sign off in their presence.

Related Documents

- Purchase Agreement : Outlines the terms and conditions of an item sale.

- Business Contract : An agreement in which each party agrees to an exchange, typically involving money, goods, or services.

- Lease/Rental Agreement : A lease agreement is a written document that officially recognizes a legally binding relationship between two parties -- a landlord and a tenant.

- Legal Resources

- Partner With Us

- Terms of Use

- Privacy Policy

- Do Not Sell My Personal Information

The document above is a sample. Please note that the language you see here may change depending on your answers to the document questionnaire.

Thank you for downloading!

How would you rate your free template?

Click on a star to rate

Factoring , Newsletters

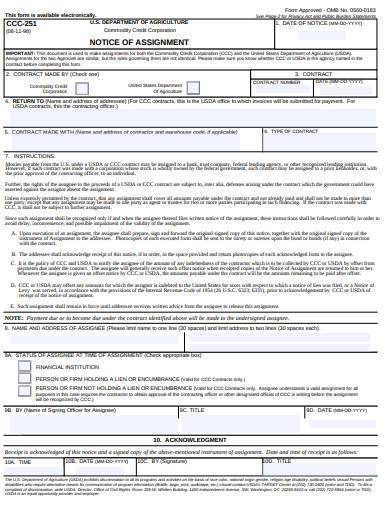

THE NOTICE OF ASSIGNMENT: A REFRESHER COURSE

Allen J. Heffner Nov 20, 2023

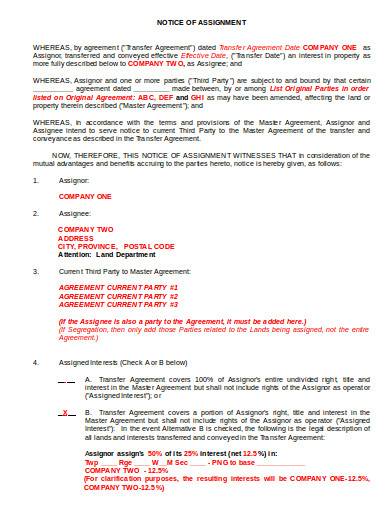

The Notice of Assignment is probably the single most important document for a Factor. Understanding what needs to be included in the Notice of Assignment, how to send it, and who to send it to can mean the difference between getting paid and not. Despite the fact that every Factor is (or should be) familiar with legal requirements relating to Notices of Assignment, we still find that many of our factoring clients who end up in litigation make basic mistakes relating to their Notices of Assignment. The article focuses on what information needs to be included in the Notice, who the Notice should be sent to, and how the Notice should be delivered.

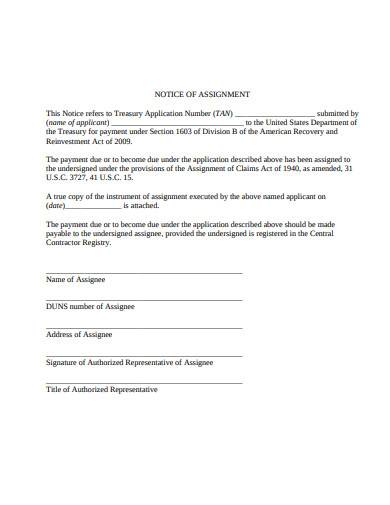

What needs to be included in the Notice of Assignment?

To be effective, there is certain information that must be included in the Notice of Assignment. The Uniform Commercial Code (“UCC”) requires that the notice must:

- Notify the Account Debtor that the amount due or to become due has been assigned;

- Notify the Account Debtor that payment is to be made to the Factor;

- Reasonably identify the rights assigned; and

- Be signed by the Factor or its client.

The Notice of Assignment should also include a remittance address so the Account Debtor is informed how and in what manner the Factor should be paid.

Additionally, while not explicitly required under the current version of the UCC, Factors should include language in their Notice of Assignment that: (i) the Client has assigned all of its present and future accounts receivable to Factor; (ii) the Factor holds a first priority security interest in all of the client’s accounts receivable; and (iii) all payments owing to the client must be paid to the Factor.

Who should the Notice of Assignment be sent to?

Notices of Assignment should not be sent directly to individuals with an Account Debtor. Sending the Notice to a specific individual may lead to issues relating to the authority of that individual to receive documents on behalf of the Account Debtor. Moreover, Factors that direct Notices of Assignment directly to individuals open themselves up to arguments that the Notices of Assignment was not properly delivered. For instance, our clients that have sent Notices of Assignment to individuals have ended up in situations where the individual to whom the Notice of Assignment was addressed no longer worked with the Account Debtor or the individual was located at a different office and the Notice of Assignment was not sent to the proper location. To be safe and to avoid unnecessary issues, Factors should send the Notice of Assignment to the Account Debtor’s accounts payable department.

Additionally, some states have specialized definitions for what constitutes “notice” on behalf of a company. If there is any question as to where a Notice of Assignment should be sent, Factors should check with their attorney to determine where these should be sent.

How should the Notice of Assignment be delivered?

The crucial issue for the enforceability of a Notice of Assignment is proof of receipt by the Account Debtor, not proof of delivery. Therefore, it is good business practice to send the Notice of Assignment either certified mail or other method that provides for proof of delivery.

Many of our clients have asked about whether it is proper to deliver the Notice of Assignment via e-mail asking the Account Debtor to confirm receipt or with “read receipts” turned on. Some Factors prefer this method because it is more cost efficient.

While sending Notices of Assignment via e-mail is enforceable, we would not recommend it as a general business practice. Sending the Notice in this manner requires delivering the Notice to a specific individual, which we have discussed above can be problematic. Sometimes officers and directors of companies have assistants or other personnel manage their e-mail accounts, raising the possibility that the individual to whom the Notice was sent, never saw the e-mail, even though the e-mail was “read.”

Last, there is no requirement that the Notice be signed by the Account Debtor and returned to the Factor. Often, we see our client’s Notice include a “confirmation of receipt” line for the Account Debtor to sign and return. Sometimes, the Factor will have proof of delivery to the Account Debtor but the Notice was not signed and returned by the Account Debtor. This adds unnecessary ambiguity as to whether the Notice was actually received by the Account Debtor. Therefore, we instruct our clients not to include such requests for proof of receipt.

Who should send the Notice of Assignment?

Some of our clients that have had bad experiences with Account Debtors after delivering a Notice of Assignment have chosen to have their Client be the one to deliver the Notice of Assignment. There is no legal requirement as to whether the Factor or the Client is the correct party to deliver the Notice of Assignment. However, we recommend the Factor be the one to deliver the Notice of Assignment. This way, the Factor is in complete control of the contents of the Notice of Assignment, how it is delivered, and receives confirmation of its delivery. We have been in situations in which the Factor allowed the Client to deliver the Notice of Assignment, but the Client did not deliver the Notice of Assignment in accordance with the law, leading to avoidable litigation.

Should a Factor respond to an Account Debtors questions regarding a Notice of Assignment?

Absolutely, yes. If requested by an Account Debtor, pursuant to the UCC, a Factor must furnish reasonable proof of the assignment for the Notice of Assignment to be valid. Too often we see situations in which requests are made or questions are posed by Account Debtors that the Factor ignores, thinking that because the Account Debtor received the Notice of Assignment, nothing else needs to be done. The Factor should respond to the Account Debtor and provide reasonable proof of the assignment. These communications can also provide invaluable insight as to the relationship between the client and the Account Debtor, how and when payments will be made, and can provide the Account Debtor a sense of trust with the Factor.

A Notice of Assignment is crucial for Factors because it provides legal protection, establishes priority of interest, prevents confusion, facilitates legal recourse, and enables effective communication with Account Debtors. Without this notice, Factors may encounter difficulties in asserting their rights and collecting payments from Account Debtors, potentially jeopardizing the financial transaction.

Bruce Loren and Allen Heffner of the Loren & Kean Law Firm are based in Palm Beach Gardens and Fort Lauderdale. For over 25 years, Mr. Loren has focused his practice on construction law and factoring law. Mr. Loren has achieved the title of “Certified in Construction Law” by the Florida Bar. The Firm represents factoring companies in a wide range of industries, including construction, regarding all aspects of litigation and dispute resolution. Mr. Loren and Mr. Heffner can be reached at [email protected] or [email protected] or 561-615-5701

Bruce E. Loren · Michael I. Kean · Allen J. Heffner · Kyle W. Ohlenschlaeger · Frank Sardinha, III · Lucia E. DeFilippo

Newsletters & Media

Testimonials

Press Releases Privacy Policy Terms of Use

© 2022 All Rights Reserved

Assignment of Contract

Jump to section, what is an assignment of contract.

An assignment of contract is a legal term that describes the process that occurs when the original party (assignor) transfers their rights and obligations under their contract to a third party (assignee). When an assignment of contract happens, the original party is relieved of their contractual duties, and their role is replaced by the approved incoming party.

How Does Assignment of Contract Work?

An assignment of contract is simpler than you might think.

The process starts with an existing contract party who wishes to transfer their contractual obligations to a new party.

When this occurs, the existing contract party must first confirm that an assignment of contract is permissible under the legally binding agreement . Some contracts prohibit assignments of contract altogether, and some require the other parties of the agreement to agree to the transfer. However, the general rule is that contracts are freely assignable unless there is an explicit provision that says otherwise.

In other cases, some contracts allow an assignment of contract without any formal notification to other contract parties. If this is the case, once the existing contract party decides to reassign his duties, he must create a “Letter of Assignment ” to notify any other contract signers of the change.

The Letter of Assignment must include details about who is to take over the contractual obligations of the exiting party and when the transfer will take place. If the assignment is valid, the assignor is not required to obtain the consent or signature of the other parties to the original contract for the valid assignment to take place.

Check out this article to learn more about how assigning a contract works.

Contract Assignment Examples

Contract assignments are great tools for contract parties to use when they wish to transfer their commitments to a third party. Here are some examples of contract assignments to help you better understand them:

Anna signs a contract with a local trash company that entitles her to have her trash picked up twice a week. A year later, the trash company transferred her contract to a new trash service provider. This contract assignment effectively makes Anna’s contract now with the new service provider.

Hasina enters a contract with a national phone company for cell phone service. The company goes into bankruptcy and needs to close its doors but decides to transfer all current contracts to another provider who agrees to honor the same rates and level of service. The contract assignment is completed, and Hasina now has a contract with the new phone company as a result.

Here is an article where you can find out more about contract assignments.

Assignment of Contract in Real Estate

Assignment of contract is also used in real estate to make money without going the well-known routes of buying and flipping houses. When real estate LLC investors use an assignment of contract, they can make money off properties without ever actually buying them by instead opting to transfer real estate contracts .

This process is called real estate wholesaling.

Real Estate Wholesaling

Real estate wholesaling consists of locating deals on houses that you don’t plan to buy but instead plan to enter a contract to reassign the house to another buyer and pocket the profit.

The process is simple: real estate wholesalers negotiate purchase contracts with sellers. Then, they present these contracts to buyers who pay them an assignment fee for transferring the contract.

This process works because a real estate purchase agreement does not come with the obligation to buy a property. Instead, it sets forth certain purchasing parameters that must be fulfilled by the buyer of the property. In a nutshell, whoever signs the purchase contract has the right to buy the property, but those rights can usually be transferred by means of an assignment of contract.

This means that as long as the buyer who’s involved in the assignment of contract agrees with the purchasing terms, they can legally take over the contract.

But how do real estate wholesalers find these properties?

It is easier than you might think. Here are a few examples of ways that wholesalers find cheap houses to turn a profit on:

- Direct mailers

- Place newspaper ads

- Make posts in online forums

- Social media posts

The key to finding the perfect home for an assignment of contract is to locate sellers that are looking to get rid of their properties quickly. This might be a family who is looking to relocate for a job opportunity or someone who needs to make repairs on a home but can’t afford it. Either way, the quicker the wholesaler can close the deal, the better.

Once a property is located, wholesalers immediately go to work getting the details ironed out about how the sale will work. Transparency is key when it comes to wholesaling. This means that when a wholesaler intends to use an assignment of contract to transfer the rights to another person, they are always upfront about during the preliminary phases of the sale.

In addition to this practice just being good business, it makes sure the process goes as smoothly as possible later down the line. Wholesalers are clear in their intent and make sure buyers know that the contract could be transferred to another buyer before the closing date arrives.

After their offer is accepted and warranties are determined, wholesalers move to complete a title search . Title searches ensure that sellers have the right to enter into a purchase agreement on the property. They do this by searching for any outstanding tax payments, liens , or other roadblocks that could prevent the sale from going through.

Wholesalers also often work with experienced real estate lawyers who ensure that all of the legal paperwork is forthcoming and will stand up in court. Lawyers can also assist in the contract negotiation process if needed but often don’t come in until the final stages.

If the title search comes back clear and the real estate lawyer gives the green light, the wholesaler will immediately move to locate an entity to transfer the rights to buy.

One of the most attractive advantages of real estate wholesaling is that very little money is needed to get started. The process of finding a seller, negotiating a price, and performing a title search is an extremely cheap process that almost anyone can do.

On the other hand, it is not always a positive experience. It can be hard for wholesalers to find sellers who will agree to sell their homes for less than the market value. Even when they do, there is always a chance that the transferred buyer will back out of the sale, which leaves wholesalers obligated to either purchase the property themselves or scramble to find a new person to complete an assignment of contract with.

Learn more about assignment of contract in real estate by checking out this article .

Who Handles Assignment of Contract?

The best person to handle an assignment of contract is an attorney. Since these are detailed legal documents that deal with thousands of dollars, it is never a bad idea to have a professional on your side. If you need help with an assignment of contract or signing a business contract , post a project on ContractsCounsel. There, you can connect with attorneys who know everything there is to know about assignment of contract amendment and can walk you through the whole process.

ContractsCounsel is not a law firm, and this post should not be considered and does not contain legal advice. To ensure the information and advice in this post are correct, sufficient, and appropriate for your situation, please consult a licensed attorney. Also, using or accessing ContractsCounsel's site does not create an attorney-client relationship between you and ContractsCounsel.

Meet some of our Lawyers

I am a lawyer with over 10 years of experience drafting and negotiating complex capital agreements, service agreements, SaaS agreements, waivers and warranties.

John Arthur-Mensah is a highly skilled attorney with extensive expertise in drafting contracts, information law, international law, insurance defense, and complex civil litigation. Throughout his career, he has demonstrated a keen eye for detail and a strong ability to craft well-structured, comprehensive legal agreements. John's track record includes successfully managing the entire contract drafting process, from initial negotiation to final execution. His proficiency in legal research and documentation enables him to ensure that contracts comply with applicable laws and regulations. With a strategic approach and persuasive communication skills, John excels in negotiating contract terms and providing valuable counsel on contractual matters. Admitted to the Maryland Bar and the United States District Court in Maryland, he is well-equipped to handle a diverse range of legal challenges, making him a valuable asset in contract drafting and beyond.

Construction lawyer practicing in Southern California since 1988. Have extensive experience in construction contracts and forms drafting, negotiating. I also serve as counsel for large material suppliers and have extensive experience in commercial transactions, drafting and negotiation of commercial documents including dealerships, NDAs, etc.

Business attorney with over 15 years of experience serving companies big and small with contracting including business, real estate and employment.

At Whalen Legal Group, PC, we strive to ensure that our clients are provided with the highest quality legal representation. Our team is committed to providing you with personalized and effective legal advice. We specialize in Business Law, Estate Planning and Trust, and Real Estate Law and have years of experience in these fields.Our goal is to provide our clients with the best possible service and to ensure that their legal matters are handled with compassion, integrity, and transparency. We understand that every situation is different and we take the time to listen and understand each and every one of our clients’ needs.

I represent business owners throughout California with their business, IP and employment law matters.

I attended the University of Illinois- College of Law on a full merit scholarship. While in law school, I was a 711 Attorney at the Lake County State's Attorney's Office, specializing in traffic and misdemeanor cases. After graduation, I served as in-house counsel for one of the largest insurance companies in the world, managing thousands of cases from initial intake to trial. Upon leaving this position, I accepted a role as Legal Counsel to the Illinois Senate Minority Leader. There, I advised Senators on legislative matters, labor and employment law, and complex constitutional questions. After leaving public service, I accepted a role at a mid-size Chicago-based law firm, where I practice insurance defense and litigation. In addition to this, I also serve as outside general counsel to a food brokerage business, where I handle all of their labor and employment matters.

Find the best lawyer for your project

Quick, user friendly and one of the better ways I've come across to get ahold of lawyers willing to take new clients.

Need help with a Contract Agreement?

Post Your Project

Get Free Bids to Compare

Hire Your Lawyer

CONTRACT LAWYERS BY TOP CITIES

- Austin Contracts Lawyers

- Boston Contracts Lawyers

- Chicago Contracts Lawyers

- Dallas Contracts Lawyers

- Denver Contracts Lawyers

- Houston Contracts Lawyers

- Los Angeles Contracts Lawyers

- New York Contracts Lawyers

- Phoenix Contracts Lawyers

- San Diego Contracts Lawyers

- Tampa Contracts Lawyers

ASSIGNMENT OF CONTRACT LAWYERS BY CITY

- Austin Assignment Of Contract Lawyers

- Boston Assignment Of Contract Lawyers

- Chicago Assignment Of Contract Lawyers

- Dallas Assignment Of Contract Lawyers

- Denver Assignment Of Contract Lawyers

- Houston Assignment Of Contract Lawyers

- Los Angeles Assignment Of Contract Lawyers

- New York Assignment Of Contract Lawyers

- Phoenix Assignment Of Contract Lawyers

- San Diego Assignment Of Contract Lawyers

- Tampa Assignment Of Contract Lawyers

Contracts Counsel was incredibly helpful and easy to use. I submitted a project for a lawyer's help within a day I had received over 6 proposals from qualified lawyers. I submitted a bid that works best for my business and we went forward with the project.

I never knew how difficult it was to obtain representation or a lawyer, and ContractsCounsel was EXACTLY the type of service I was hoping for when I was in a pinch. Working with their service was efficient, effective and made me feel in control. Thank you so much and should I ever need attorney services down the road, I'll certainly be a repeat customer.

I got 5 bids within 24h of posting my project. I choose the person who provided the most detailed and relevant intro letter, highlighting their experience relevant to my project. I am very satisfied with the outcome and quality of the two agreements that were produced, they actually far exceed my expectations.

How It Works

Want to speak to someone.

Get in touch below and we will schedule a time to connect!

Find lawyers and attorneys by city

Notice of Assignment | Practical Law

Notice of Assignment

Practical law canada standard document 3-599-7067 (approx. 8 pages).

How does it work?

1. choose this template.

Start by clicking on "Fill out the template"

2. Complete the document

Answer a few questions and your document is created automatically.

3. Save - Print

Your document is ready! You will receive it in Word and PDF formats. You will be able to modify it.

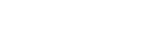

Contract Assignment Agreement

Rating: 4.8 - 105 votes

This Contract Assignment Agreement document is used to transfer rights and responsibilities under an original contract from one Party, known as the Assignor, to another, known as the Assignee. The Assignor who was a Party to the original contract can use this document to assign their rights under the original contract to the Assignee, as well as delegating their duties under the original contract to that Assignee. For example, a nanny who as contracted with a family to watch their children but is no longer able to due to a move could assign their rights and responsibilities under the original service contract to a new childcare provider.

How to use this document

Prior to using this document, the original contract is consulted to be sure that an assignment is not prohibited and that any necessary permissions from the other Party to the original contract, known as the Obligor, have been obtained. Once this has been done, the document can be used. The Agreement contains important information such as the identities of all parties to the Agreement, the expiration date (if any) of the original contract, whether the original contract requires the Obligor's consent before assigning rights and, if so, the form of consent that the Assignor obtained and when, and which state's laws will govern the interpretation of the Agreement.

If the Agreement involves the transfer of land from one Party to another , the document will include information about where the property is located, as well as space for the document to be recorded in the county's official records, and a notary page customized for the land's location so that the document can be notarized.

Once the document has been completed, it is signed, dated, and copies are given to all concerned parties , including the Assignor, the Assignee, and the Obligor. If the Agreement concerns the transfer of land, the Agreement is then notarized and taken to be recorded so that there is an official record that the property was transferred.

Applicable law

The assignment of contracts that involve the provision of services is governed by common law in the " Second Restatement of Contracts " (the "Restatement"). The Restatement is a non-binding authority in all of U.S common law in the area of contracts and commercial transactions. Though the Restatement is non-binding, it is frequently cited by courts in explaining their reasoning in interpreting contractual disputes.

The assignment of contracts for sale of goods is governed by the Uniform Commercial Code (the "UCC") in § 2-209 Modification, Rescission and Waiver .

How to modify the template

You fill out a form. The document is created before your eyes as you respond to the questions.

At the end, you receive it in Word and PDF formats. You can modify it and reuse it.

Other names for the document:

Assignment Agreement, Assignment of Contract Agreement, Contract Assignment, Assignment of Contract Contract, Contract Transfer Agreement

Country: United States

General Business Documents - Other downloadable templates of legal documents

- Amendment to Agreement

- Loan Agreement

- Loan Agreement Modification

- Release of Loan Agreement

- Non-Compete Agreement

- Partnership Dissolution Agreement

- Notice of Withdrawal from Partnership

- Power Of Attorney

- Debt Acknowledgment Form

- Meeting Minutes

- Request to Alter Contract

- Release Agreement

- Guaranty Agreement

- Joint Venture Agreement

- Debt Settlement Agreement

- Breach of Contract Notice

- Corporate Proxy

- Mutual Rescission and Release Agreement

- Notice for Non-Renewal of Contract

- Meeting Notice

- Other downloadable templates of legal documents

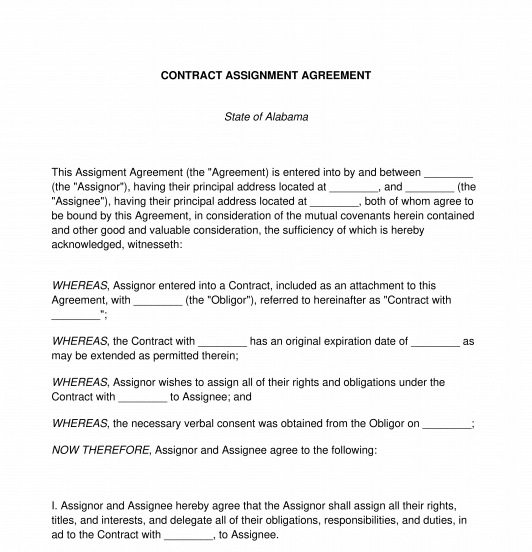

Notice of Assignment

This notice of assignment letter can be used by a party to a commercial contract to provide notice to the other party of its assignment of its rights or performance under the contract to a third party. This template includes practical guidance, drafting notes, and alternate and optional clauses. Counsel should review the underlying agreement. This template presumes that consent is not required for assignment and that the entire agreement is being assigned. The underlying agreement should also provide confirmation of the proper individual or department to whom the notice is sent. For a full listing of related assignment content, see Assignment in Commercial Transactions Resource Kit. For a full listing of related contract clauses, see General Commercial Contract Clause Resource Kit. For more information regarding the assignability of commercial contracts, see Commercial Contracts Assignment. If consent to an assignment is required, see Request for Consent to Assignment.

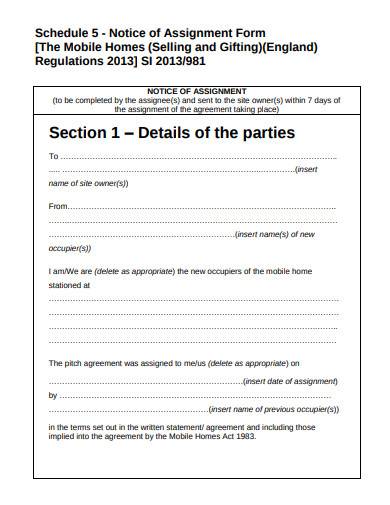

Assignments: why you need to serve a notice of assignment

It's the day of completion; security is taken, assignments are completed and funds move. Everyone breathes a sigh of relief. At this point, no-one wants to create unnecessary paperwork - not even the lawyers! Notices of assignment are, in some circumstances, optional. However, in other transactions they could be crucial to a lender's enforcement strategy. In the article below, we have given you the facts you need to consider when deciding whether or not you need to serve notice of assignment.

What issues are there with serving notice of assignment?

Assignments are useful tools for adding flexibility to banking transactions. They enable the transfer of one party's rights under a contract to a new party (for example, the right to receive an income stream or a debt) and allow security to be taken over intangible assets which might be unsuitable targets for a fixed charge. A lender's security net will often include assignments over contracts (such as insurance or material contracts), intellectual property rights, investments or receivables.

An assignment can be a legal assignment or an equitable assignment. If a legal assignment is required, the assignment must comply with a set of formalities set out in s136 of the Law of Property Act 1925, which include the requirement to give notice to the contract counterparty.

The main difference between legal and equitable assignments (other than the formalities required to create them) is that with a legal assignment, the assignee can usually bring an action against the contract counterparty in its own name following assignment. However, with an equitable assignment, the assignee will usually be required to join in proceedings with the assignor (unless the assignee has been granted specific powers to circumvent that). That may be problematic if the assignor is no longer available or interested in participating.

Why should we serve a notice of assignment?

The legal status of the assignment may affect the credit scoring that can be given to a particular class of assets. It may also affect a lender's ability to effect part of its exit strategy if that strategy requires the lender to be able to deal directly with the contract counterparty.

The case of General Nutrition Investment Company (GNIC) v Holland and Barrett International Ltd and another (H&B) provides an example of an equitable assignee being unable to deal directly with a contract counterparty as a result of a failure to provide a notice of assignment.

The case concerned the assignment of a trade mark licence to GNIC . The other party to the licence agreement was H&B. H&B had not received notice of the assignment. GNIC tried to terminate the licence agreement for breach by serving a notice of termination. H&B disputed the termination. By this point in time the original licensor had been dissolved and so was unable to assist.

At a hearing of preliminary issues, the High Court held that the notices of termination served by GNIC , as an equitable assignee, were invalid, because no notice of the assignment had been given to the licensee. Although only a High Court decision, this follows a Court of Appeal decision in the Warner Bros Records Inc v Rollgreen Ltd case, which was decided in the context of the attempt to exercise an option.

In both cases, an equitable assignee attempted to exercise a contractual right that would change the contractual relationship between the parties (i.e. by terminating the contractual relationship or exercising an option to extend the term of a licence). The judge in GNIC felt that "in each case, the counterparty (the recipient of the relevant notice) is entitled to see that the potential change in his contractual position is brought about by a person who is entitled, and whom he can see to be entitled, to bring about that change".

In a security context, this could hamper the ability of a lender to maximise the value of the secured assets but yet is a constraint that, in most transactions, could be easily avoided.

Why not serve notice?

Sometimes it's just not necessary or desirable. For example:

- If security is being taken over a large number of low value receivables or contracts, the time and cost involved in giving notice may be disproportionate to the additional value gained by obtaining a legal rather than an equitable assignment.

- If enforcement action were required, the equitable assignee typically has the option to join in the assignor to any proceedings (if it could not be waived by the court) and provision could be made in the assignment deed for the assignor to assist in such situations. Powers of attorney are also typically granted so that a lender can bring an action in the assignor's name.

- Enforcement is often not considered to be a significant issue given that the vast majority of assignees will never need to bring claims against the contract counterparty.

Care should however, be taken in all circumstances where the underlying contract contains a ban on assignment, as the contract counterparty would not have to recognise an assignment that is made in contravention of that ban. Furthermore, that contravention in itself may trigger termination and/or other rights in the assigned contract, that could affect the value of any underlying security.

What about acknowledgements of notices?

A simple acknowledgement of service of notice is simply evidence of the notice having been received. However, these documents often contain commitments or assurances by the contract counterparty which increase their value to the assignee.

Best practice for serving notice of assignment

Each transaction is different and the weighting given to each element of the security package will depend upon the nature of the debt and the borrower's business. The service of a notice of assignment may be a necessity or an optional extra. In each case, the question of whether to serve notice is best considered with your advisers at the start of a transaction to allow time for the lender's priorities to be highlighted to the borrowers and captured within the documents.

For further advice on serving notice of assignment please contact Kirsty Barnes or Catherine Phillips from our Banking & Finance team.

- [email protected]

- T: +44 (0)370 733 0605

- Download vCard for Catherine Phillips

Related Insights & Resources

Gowling WLG updates

Sign up to receive our updates on the latest legal trends and developments that matter most to you.

This site uses cookies to deliver and enhance the quality of its services and to analyze traffic.

Notice of Assignment Template

Document description.

This notice of assignment template has 1 pages and is a MS Word file type listed under our legal agreements documents.

Sample of our notice of assignment template:

OBJECT: NOTICE OF ASSIGNMENT Dear [CONTACT NAME], You are hereby notified that on [DATE] we have assigned and transferred to [SPECIFY] the following [SPECIFY] existing between us: [DESCRIBE] Please direct any further correspondence (or payments, if applicable) to them at the following address: [ADDRESS] Please contact us should you have any questions. Thank you for your cooperation. [YOUR NAME] [YOUR TITLE] [YOUR PHONE NUMBER] [[email protected]] [YOUR COMPANY NAME] [YOUR COMPLETE ADDRESS] Tel: [YOUR PHONE NU

Related documents

3,000+ templates & tools to help you start, run & grow your business, all the templates you need to plan, start, organize, manage, finance & grow your business, in one place., templates and tools to manage every aspect of your business., 8 business management modules, in 1 place., document types included.

Want to save money on fuel? Click here .

Learn how to set up your business for success this year on our blog .

+1 (410) 204 2084

What Is A Notice Of Assignment In The Trucking Industry?

To understand a notice of assignment, trucking company owners first have to be familiar with factoring—and to understand factoring, we’ll have to discuss the nuances of cash flow in the shipping industry.

Basically, the challenge for fleet owners (and owner-operators) is that their customers take forever to pay their invoices. You deliver a load and issue the invoice. The shipper may take 30 or 45 or 60 days—or more—to pay that invoice. Meanwhile, you’ve got fuel costs, payroll, insurance payments, and the thousand other financial obligations that keep your trucks on the road. You need that invoice paid now .

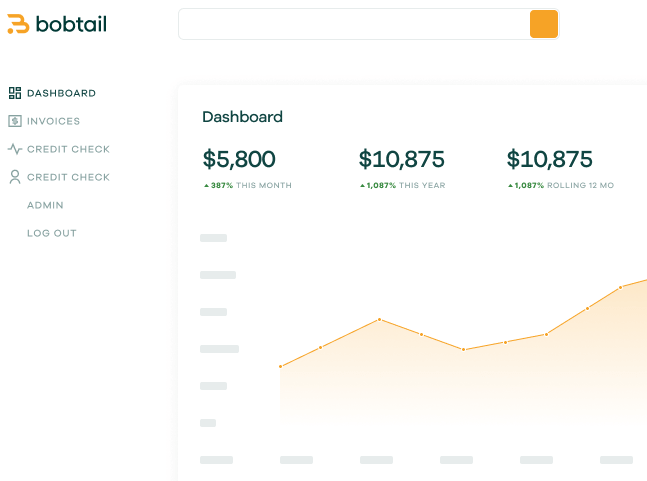

Factoring is the industry’s solution for quick payments to carriers. A factoring company steps in and pays your invoice today. Then that company collects from your customer, the shipper or broker who hired you to haul a given load. For their service, the factoring company keeps a low percentage of the total invoice value. (With Bobtail, the factoring fee ranges from 1.99% to 2.99%, depending on the volume of invoices you factor.)

Note that factoring is not a loan; the factoring company buys your invoices, so there’s no compounding interest or credit impact. Factoring beats loans as a cash-flow solution, hands down.

Struggling with slow payments from shippers and brokers? Keep cash flowing the simple way with Bobtail factoring.

With these preliminaries out of the way, we’re ready to answer the question that brought you here: What exactly is a notice of assignment in trucking?

Defining The Notice Of Assignment In Trucking

Factoring requires shippers and brokers to make changes in their billing systems. You’re no longer the collector on a factored invoice; the factoring company is. Accounts payable departments are busy places, and it’s easy for a shipper’s finance team to get confused when you do the work but another company collects the payment (after that company pays you, of course).

A notice of assignment clears up the billing relationship in a factoring agreement. A notice of assignment is a contractual document, supplied to both the carrier and the customer, that tells the customer to pay the factoring company, not the carrier.

The notice of assignment is an essential piece of paperwork, one of the documents you’ll have to keep on file as you establish a factoring relationship. You’ll have to sign the notice of assignment, and so will your customer. In short, this is a contractual agreement that carries legal consequences, and clarifies who exactly the shipper should pay for a delivered load.

Why is a notice of assignment important?

Consider the case of a trucking company that shifts to factoring after months or years of collecting directly from a shipper. That carrier’s payment details are already set up in the shipper’s accounting systems. Due to accidents or willful fraud, it’d be easy for the carrier to collect on an invoice twice—once from the factoring company and again from the customer.

In that scenario, the factoring company loses money, or at least becomes embroiled in a flurry of paperwork and legal challenges. So the notice of assignment is designed to protect the factoring company. But this document provides benefits for you, the carrier, and your customers, too.

How A Notice Of Assignment Benefits Shippers And Carriers

Who needs more paperwork? While it may seem like just another legal document, notices of assignment are actually helpful for all three parties involved in a factoring payment deal: the factoring company, sure, but also the carrier and the customer.

For shippers , the notice of assignment is a strong incentive to update payment details in their accounting systems. It delineates the nature of the financial agreement. It provides visibility and clarity that avoids conflict down the line. Most importantly, factoring companies require shippers to sign a notice of assignment—and factoring benefits customers, too. It keeps them from having to renegotiate payment terms, and gives them the full 30 or 60 days to pay, which allows them to optimize their own cash utilization.

Carriers also benefit from the clarity that comes with a notice of assignment. This document allows you to rest assured that the customer won’t accidentally pay you for a factored invoice, so you don’t have to spend all day trying to get the money into the right hands—or face collection threats of your own.

The binding agreement contained within a notice of assignment protects you from legal problems. It’s simply smart business to make sure everyone knows exactly who should get paid, and for what. Notices of assignment accomplish this goal—and, with Bobtail, the paperwork is simpler than you might think.

Simplifying Notices Of Assignment

Traditional factoring companies aren’t the most efficient financial operators in the world. They make you sign restrictive contracts. They might even tell you who you can work with, and who you can’t. They stack hidden fees on everything from set-up to ACH transfers to terminating the deal. And they make you fill out reams of paperwork before depositing a cent.

Bobtail is different every step of the way. We started this company to eliminate the inefficiencies in the factoring process, and that includes personalized assistance with handling notices of assignment.

When you sign up with Bobtail—a quick, online process involving a single application form—you’ll get a personal account manager who’s always ready to answer questions and solve problems. They’ll issue your notice of assignment and make sure your customers understand the document and why it’s necessary.

All you have to do is carry on carrying loads.

When you decide to factor an invoice, the process is even simpler. Just deliver the load, upload the invoice, attach a rate confirmation and a bill of lading, and get paid. It’s all done through Bobtail’s online system, so you can handle financing from the rig. We also provide a user-friendly digital dashboard that makes it easy to track every invoice at every step of the financing process. There’s simply no easier way to factor an invoice.

At Bobtail, we believe that you know what’s best for your business. That’s why we don’t make you sign a long-term contract; this is no-contract factoring. You pick which accounts to factor and which to collect from directly, and we don’t have volume requirements or exclusive financing deals.

We also don’t charge hidden fees. You just pay a flat factoring fee so there’s no confusion on exactly how much cash will hit your bank account—or when. Invoices are filled the same day you submit them, or the next day if the invoice arrives after 11 a.m. Eastern time.

Don’t be intimidated by a notice of assignment in trucking—or any other documents related to your factoring service. With Bobtail, our devoted customer service team makes sure everything runs smoothly, and we’re there to help every step of the way. Or, as one Trustpilot review puts it:

“They always answer the phone! The staff is very helpful and cordial. The three things I love are: Payments are on time, the website is easy to use, and great customer service!”

(Read more customer reviews on Trustpilot.)

Ready to improve cash flow without the headaches? Sign up to learn more today.

If you have questions about account set-up, notices of assignment, or anything else related to factoring, contact the Bobtail sales team at (410) 204-2084, or email us at [email protected].

Caroline Asiala is the Digital Marketing Manager at Bobtail. With a background rooted in advocating for migrant rights, Caroline leverages her expertise in content creation to support small trucking businesses, many of which are immigrant-owned and operated, with the information they need to make their businesses thrive.

Download our mobile app

- Business Templates

- Sample Notice

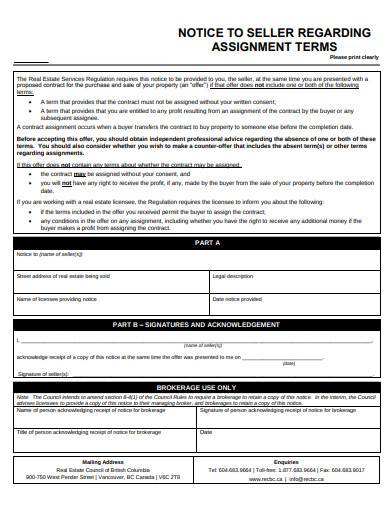

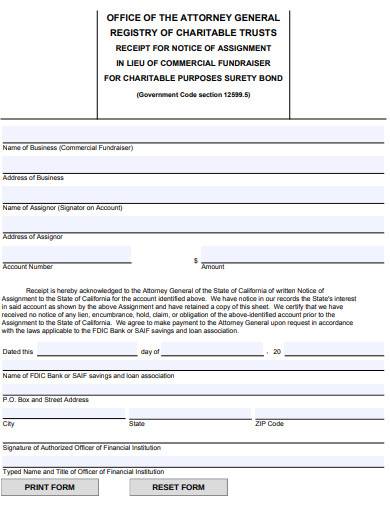

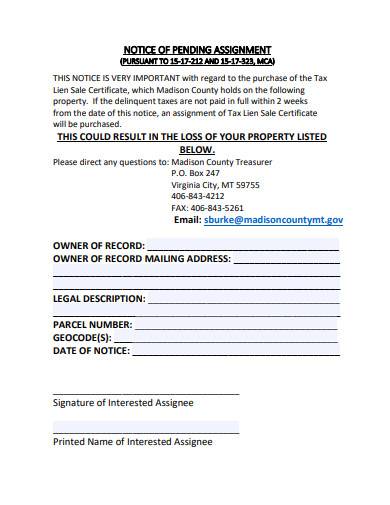

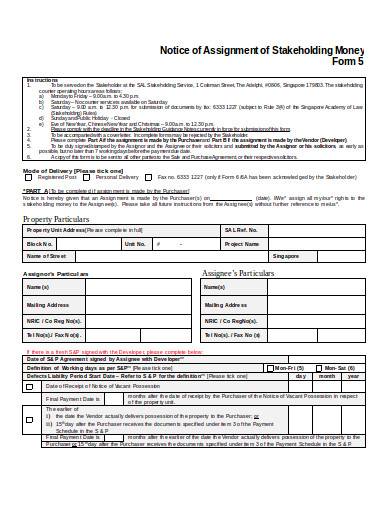

FREE 11+ Notice of Assignment Samples in PDF | MS Word

There are many ways of promoting awareness of something, and one of that is giving notice. Notices are used to make all sorts of announcements. The public is notified of new processes, operating schedules, and other changes through a public notice. At work, you’re required to give notice before going on leave or before resigning from your post by filling out an employee notice form . In business, it is essential to give notice if you granted someone the authority to do specific tasks on your behalf. That notice is called a notice of assignment, and that’s what we’re about to discuss below.

Notice Of Assignment

What is a notice of assignment, assignment vs. delegation: what should you use, 11+ notice of assignment samples, 1. notice of assignment sample, 2. basic notice of assignment template, 3. notice of assignment of real estate purchase contract, 4. standard notice of assignment sample, 5. notice to seller regarding assignment template, 6. notice of assignment in pdf, 7. notice of assignment form sample, how a notice of assignment works, step #1: contract review, step #2: transfer of rights, step #3: sending of official notification, step #4: execution of the assignment, 8. notice of assignment and discharge by performance, 9. receipt for notice of assignment template, 10. notice of pending assignment template, 11. notice of assignment of stakeholding money form in doc, 12. notice of assignment in doc.

A business partnership is common in different business industries. Most companies partner with another company to cover certain functions for them. So they assign their rights to another company that specializes in the specific task they want to be done. The company here is basically transferring rights to another company so that they can perform the assigned tasks. In legal terms, this process is called an assignment. A Notice of Assignment is provided after the Notice of Assignment Contract is signed. A Notice of Assignment is similar to a sale notice or a meeting notice whose purpose is to let a group of people know about something they are interested in or are involved in.

Some companies partner with factoring companies to succeed in their accounts receivable financing. The Notice of Assignment is an essential part of the partnership. It is also used as a notice of assignment of debt. Through this notice, debtors are notified that a new company has acquired or purchased their debt. It also serves as a payment notice informing the debtor of the new company who will be collecting their payment and other payment details.

The terms assignment and delegation may seem so similar that a lot of people use them interchangeably. It may be forgivable to let it be, but it’s just so wrong, especially when what is being referred to are legal terms. One thing that is common between assignment and delegation is the act or process of transferring. What they want to transfer is the main factor that makes them different.

In the assignment process, the assignor transfers their rights to another person. An assignment is specific and the rights assigned to an assignee is limited to what they’ve been tasked to do. Common examples are Assignment of Lease and Deed of Assignment . After the assignment is made, a Notice of Assignment is provided to notify the involved individuals. When delegating, you’re not transferring any rights but you are distributing your obligations to a different party. That just sounds like an easy way to rid yourself of your obligations. Well, as a consequence, the party delegating the obligation is held liable for anything that will happen, good or bad. Before deciding to assign or delegate, make sure that it’s allowed in your contract. Now that you know of their differences, you should be able to decide whether to assign or delegate.

You may browse through and download the samples provided below, and use them as reference or study materials.

Size: 415.1 KB

Size: 74.5 KB

Size: 8.0 KB

Size: 4.4 KB

Size: 145.3 KB

Size: 64.0 KB

Size: 123.4 KB

Understanding legal terms and processes can be complicated, especially if it’s your first encounter with such legal terms and processes. Unlike a notice memo that is simple and easy to understand, a Notice of Assignment is entirely on a different level. Here’s a simplified explanation that will help you understand how a Notice of Assignment works.

There are clauses in a contract that may prohibit you from assigning rights to another party. Reviewing your contract with another company or entity is like taking extra steps to ensure that you’ll not get yourself into a contract breach.

Two parties are involved in the transfer of rights. The assignor is the party transferring the rights, and the assignee is the party receiving the rights. This is a legal transaction, so a legal document such as a contract is signed by both parties to prove that they both agree on the terms and conditions of the transaction.

Those who are involved or affected by the transfer is notified of the changes through a Notice of Assignment. The notice lets the entities involved know that the assignee will be doing specific transactions, like collecting and receiving payments. Sending out the Notice of Assignment is an essential step if the transaction is related to building a partnership.

After the notices have been sent out, the assignment shall be carried out by the assignee as agreed in the contract. The assignee only has rights to do things that were specifically assigned to them.

Size: 247.7 KB

Size: 769.0 KB

Size: 354.7 KB

Size: 28.9 KB

Size: 10.6 KB

Companies and other entities can transfer their rights to process a specific transaction to another party through an assignment. The transafer is announced through a Notice of Assignment that is sent to both the companies involved and their customers.

Related Posts

10+ separation notice samples & templates, 13+ two weeks notice samples & templates, 6+ sample disagreement letter, formal resignation letter, 14+ student schedule samples, 14+ job resignation letter templates, 27+ contract termination letter examples & templates, 6+ sample air force letter of recommendation, 6+ audit quotations, 9+ sample resignation letter, 9+ literary essay example, 8+ letter of resignation example, 8+ how to make a company profile sample, 8+ sample class schedule, 12+ sample reference sheet templates, 16+ sample endorsement letter samples, 8+ sample employee notice form, 8+ sample resignation letters 2 week notice, 9+ separation notice templates.

Get A Free Consultation 866.834.7338

- Equipment Financing

- Ultimate Invoice Factoring Guide

- Recommended Load Boards

- Partner with Integrity

- Get Started

- Application to Become a New Client

- Why Integrity Factoring

- Employment Opportunities

What is a Notice of Assignment?

- What is a Notice of…

A factoring contract can contain many parts, but few are as important as the Notice of Assignment.

What are the parts of a notice of assignment.

A notice of assignment contains a few standard parts. First, it informs your customers that you are factoring your invoices and that your factoring company has been assigned as the payee for your accounts receivables. Next, a notice of assignment provides your customer with an updated remittance address for all current and future payments to be sent to. Third, it contains explicit instructions that all payments should be made to the factoring company’s remittance address only, and that no other payments should be made to any other address without explicit permission from the factoring company. It also contains verbiage that states that payments made in conflict to this notice of assignment will not be considered to have discharged a customer’s obligation for payment to the factoring company. Lastly, the factoring client signs the notice of assignment to prove it is valid.

Why do my customers need to know that I’m factoring?

The right to receive payments for amounts owed is one of the main protections a factoring company has in the factoring process. It is an essential part of almost every factoring program. In order to assure that payments are directed appropriately, a factoring company must contact a customer to verify that the notice of assignment has been accepted and the remittance address has been updated.

Why does my factoring company receive payments for invoices that weren’t factored?

A notice of assignment gives your factoring company the right to collect for ALL payments owed to you by your customer. Some factoring companies require that you factor every invoice for your customers, making this a non-issue. However, if you are working with a factoring company that allows you to pick and choose which invoices to factor for a customer, your factoring company will also receive payments for those unfactored invoices.

This happens for two reasons. First, allowing multiple remittance addresses for a payee exponentially increases the chance of a misdirected payment being made. Second, asking the customer to shoulder the additional workload of keeping track of which payments should be made to which remittance address would make invoice factoring unattractive for many customers, and thus limit the number of companies willing to work with a business that was factoring. All factoring companies have policies to efficiently deal with unfactored payments when they arrive.

What happens if I receive a payment that should have been sent to my factoring company?

Most factoring companies understand that accidents happen, and mistakes will be made. If an error in payment occurs in good faith, factoring companies have processes in place to deal with the issue. Firstly, it is important that a factoring client does not deposit the payment into their account, but rather they should immediately notify their factoring company of the errant payment and send it immediately to their factoring company. If a factoring client fails to do so, or attempts to hide the payment from their factoring company, then that client will be responsible for a misdirected payment, which often carries heavy penalties in the factoring contract.

(216) 292-5660

216.930.1983

Learn About Notice of Assignment for Invoice Factoring

In a factoring relationship, you agree to assign your selected receivables to the factoring company. By advancing your cash against your invoices, the factor has purchased the right to collect amounts due from your customers. The Notice of Assignment is a critical part of your factoring paperwork as it reflects the change in invoice ownership.

What is a Notice of Assignment?

The Notice of Assignment is a simple letter the factoring company sends to your customers whose invoices you are factoring. In writing, the notice informs your customers that the accounts receivable is assigned, and future payments should be made payable to the factoring company. The notice will also include a remittance address so your customer can change their payment information.

The Notice of Assignment legally explains to your customers that any payments they make to you instead of the factor will not satisfy their obligation. The factoring company may hold your customers liable for misdirected amounts. This may occur if your customers choose to ignore the notice or fail to update payment information.

Many factors will require your customers to sign and return a copy of the notice to acknowledge receipt. This is not always required, though. Instead, the Notice of Assignment may include language that considers your customer’s continued use of your services to constitute an agreement to the notice. In addition, the factor may only revoke a Notice of Assignment if they send a signed and notarized release notification to your customers. They will do so if you choose not to factor that account any longer or you end your factoring relationship. In either case, the account must have no outstanding balance.

What Programs Don’t Use a Notice of Assignment?

Financing programs that do not use a notice of assignment include non-notification factoring and sales ledger financing.

Non-notification factoring is similar to regular factoring, but with a few key differences. Instead of sending a conventional Notice of Assignment to customers, the factoring company informs them of a new payment address using the company’s regular letterhead. This allows the customer to still send payments to the new address without being aware that it belongs to the factor. To qualify for non-notification factoring, companies typically need to have monthly revenues of at least $300,000, a track record of over a year, reliable financial reports, and no serious financial difficulties.

Sales ledger financing operates like a line of credit based on outstanding receivables. Companies can access up to 90% of their outstanding receivables at any given time without the need to submit a factoring schedule of accounts for each transaction. Although the finance company still handles payments, the customer does not receive a Notice of Assignment. Instead, they receive a letter indicating a change in the payment address. Sales ledger financing offers greater flexibility compared to non-notification factoring, with daily rates allowing for better cost control. The qualification requirements for sales ledger financing usually include monthly revenues of at least $300,000, a track record of 1-2 years, reliable financial reports, good receivables management systems, and no serious financial difficulties.

Get Started Now

Secure the funds you need today. Complete the form or call.

Why do Factoring Companies Notify Your Customers?

The Notice of Assignment is a vital form of protection for a factoring company. It protects the factor in case the business owner (the factor’s client) receives the payment instead of the factoring company.

In a best-case scenario, the notice serves to inform every party in a factoring transaction of their rights and responsibilities. It also gives your customer the appropriate address to make account payments, allowing your factoring relationship to continue smoothly.

In a worst-case scenario, a factor can recover unpaid amounts from your customer should they continuously pay over notice or not pay at all. A Notice of Assignment is evidence in any legal proceeding — from a demand letter for payment to a full-fledged lawsuit — that asserts the factor’s standing and rights to payment.

What Will Your Customers Think?

Customers may have concerns or questions when they receive a letter regarding the use of invoice factoring. It’s understandable that they may be unsure or unfamiliar with this financing tool. As a business owner, it’s important to address these concerns and communicate with your customers effectively.

First and foremost, it’s essential to acknowledge that invoice factoring is a common practice utilized by many small and midsize companies to finance their operations and facilitate growth. Chances are, your customers are already aware of this financing method and how it works.

When discussing invoice factoring with your customers, emphasize the benefits it provides to them. By using factoring, you can offer them extended payment terms, such as 30- to 60-day terms, while still ensuring excellent service. This enables your customers to utilize their available cash resources more effectively. Without factoring, providing extended payment terms might be challenging, especially for businesses experiencing growth.

It’s crucial to assure your customers that little is changing in terms of the services and support your company provides. Reassure them that they will still have the same level of communication and engagement with you and your employees as before. Highlight that despite factoring being implemented, your commitment to their satisfaction remains unchanged.

Address the misconception that factoring indicates financial trouble within your company. Remind your customers that factoring is a versatile tool used to achieve various goals and objectives, just like other forms of financing such as loans or lines of credit. Factoring simply serves to smooth out your cash flow and support your business’s overall financial stability and growth.

Overall, open communication with your customers is key. Provide them with transparency and reassurance, explaining the benefits of factoring and emphasizing that it is a common and established financing practice. By effectively addressing their concerns, you can foster trust and maintain strong relationships with your valued customers.

Why a Notice of Assignment Matters To You

You will receive a copy of the Notice of Assignment that the factor sends to your customers. While the notice is to inform your customers, it also has an important implication for you as well.

As your factoring agreement explains, payments your company receives from your customers over notice are payable to the factoring company. Even in the smoothest transition, you may receive payments sent before receipt of the notice or released before your customers’ updated their payment system. There will likely be a provision explaining the procedure for sending misdirected payments to the factor in these cases. Misdirected payments are usually sent by overnight check or via bank transfer.

However, you may be responsible for additional penalties and fees if your customers continue to pay over notice, and you deposit those payments into your account. In addition, you may end up owing more, depending on fee structure, due to the extra time it takes for the factor to receive payment. Some factors include a misdirected payment fee in the factoring agreement that you will have to pay if you fail to return misdirected payments to the factor. Therefore, fees may be higher if you are responsible for the misdirection.

As with any legal document, be sure to be fully aware of the language used within the Notice of Assignment. Be mindful of your customers’ responsiveness to the notice. Take action immediately if you realize that any of your customers are not sending their payments on time. This transparency solidifies your factoring relationship, builds trust with your factor, and protects your interests.

What if the Payment is for an Invoice I Didn’t Factor?

When you assign your customers’ receivables to your factoring company, you agree to direct all payments to the factor, even for invoices that you did not factor. This eliminates complications for all parties and ensures that the factoring company receives every payment they should. Without an all-inclusive assignment, your customers would receive a notification every single time you factor an invoice. They would have to retain two addresses on file, increasing the likelihood of misdirected payments.

Your factoring company will have a straightforward procedure in place to address non-factored payments. This may include applying those payments to open invoices and sending you the difference or the total amount in a regularly scheduled reserve release. Stay prepared by asking your factor about their policies surrounding non-factored payments.

Factor Finders can help you find the right factoring company for your invoice factoring needs. Contact us to learn more about our factoring services for every industry and to get started today.

Don’t want to talk on the phone?

Get a free quote by filling out our online form .

Connect With Us

(216) 865-4922

Newsletter Sign-Up

Need fresh ideas on how to grow your small business? We've got you covered!

Quick Links

© 2024 Factor Finders, LLC All Rights Reserved.

Privacy Overview

Secure the funds you need today.

1.915-859-8900 Get a Free Quote

WE ARE CELEBRATING 25 YEARS OF EXCELLENCE! 🎉 JOIN US IN CELEBRATING THIS MILESTONE YEAR.

Factoring Notice of Assignment (NOA): Everything You Need to Know

A factoring notice of assignment (NOA) is usually required when you factor your invoices. Rest assured, NOAs are quite common in business and aren’t a cause for concern. However, it helps to understand what they are and how they work so that you can explain them to your customers as needed.

Assignment of Debt Explained

Companies transfer debt, along with all associated rights and obligations, to third parties all the time. One example of this occurs with collection companies. In these cases, the business, also referred to as the creditor, sells its uncollectable balances or assigns specific debts to the collection company. The collection company is then authorized to collect those specific balances on behalf of the creditor.

Assignment of debt may also come into play when businesses outsource their receivables and leverage certain types of funding, among other situations.

What Does Notice of Assignment Mean?

The customer, also referred to as the debtor, must be informed when a creditor assigns their debt to a third party. The document used in this process is referred to as a notice of assignment of debt.

What is a Notice of Assignment in Factoring?

When you leverage invoice factoring , you’re selling an unpaid B2B invoice to a factoring company at a discount. In exchange, you receive up to 98 percent of the invoice’s value right away and get the remaining sum minus a small factoring fee when your client pays. This means you’re not waiting 30, 60, or more days for payment. This cash flow acceleration helps businesses bridge cash flow gaps caused by slow-paying customers, seasonality, rapid growth, and more. Plus, the cash can be used for anything the business needs. This unique process means businesses can receive immediate funding without creating debt like other funding sources.

A notice of assignment is required in factoring because you’re assigning debt to a third party – the factoring company – and the customers involved need to know.

The Role of Notice of Assignment for Cash Flow

Invoice factoring stands out as a solution for businesses seeking to improve their cash flow. When a company decides to use invoice factoring, it enters into a factoring relationship, where accounts receivable and financial rights are handled differently than usual. This process involves the NOA, a pivotal document in factoring transactions. Essentially, NOA is a simple letter informing customers that the payment terms have changed and future payments should be made payable to the factoring company.

This notification ensures that there are no misdirected payments, which is a critical aspect when managing accounts payable and securing immediate cash. By using factoring, businesses can access working capital, which reduces the strain of slow-paying customers. It’s important for factoring clients to understand how factoring companies notify your customers and the implications of this process. The factoring contract typically outlines these details, ensuring that every party in a factoring transaction is aware of their responsibilities, especially regarding remittance addresses and payment information.

Factoring services offer an alternative to traditional lines of credit, providing businesses with high advances at low rates. This method is beneficial for companies that demand longer payment terms from their clients. By transferring the right to collect payments to the factoring company, the business can focus on its core operations while the finance company handles the receivables. Understanding the benefits of factoring and effectively communicating them to your customers may improve the factoring process and maintain healthy customer relationships, even when introducing new financial arrangements like invoice factoring.

The Importance of a Notice of Assignment in Factoring

Notice of Assignment in invoice factoring keeps your customers in the loop so they know who is collecting and why. It also lets them know where to send their payments. This streamlines the process and helps ensure there’s no confusion about where payments need to go.

Elements of a Factoring NOA Document

Each factoring company words its NOA a bit differently, but NOAs usually include:

- A statement that indicates the factoring company is now managing the invoice or invoices.

- A notice that payments should be made to the factoring company.

- Details on how payments can be made, including addresses, bank details, or payment portal information.

- What will occur if payments are sent to the business instead of the third party.

- A signature from someone at your business to show your customer that the NOA is authentic and a signature space for your customer to sign indicating that they’ve read and understand the document.

How Do Factoring Companies Notify Your Customers

A factoring notice of assignment is usually sent to customers by U.S. mail, though sometimes factoring companies use other delivery services or even digitize the NOA.

What Will Your Clients Think of You Factoring Your Invoices?

Sometimes, businesses that are new to invoice factoring have concerns about how customers will react to factoring or receiving an NOA. However, it’s usually not a cause for concern.

Although your factoring company isn’t an outsourcing company, it behaves quite similarly when collecting invoices. Nearly 40 percent of small businesses outsource at least one business process, Clutch reports. That means a significant portion of your customers already have some experience engaging with third parties. Furthermore, invoice factoring is growing in leaps and bounds and is expected to grow by eight percent in the coming years, per Grandview Research . Many of your customers already have experience with factoring or will very soon. Because most businesses have some exposure to factoring or will in the near future, it’s generally seen as an ordinary business practice – nothing more, nothing less.

However, even if factoring is entirely new to your customers, how they respond to your decision is often determined by how you present it. For instance, it accelerates payments without putting pressure on your customers to pay faster. It has benefits for them, too, and can help improve the relationship. This alone can actually help some businesses win bids or attract new customers. Explaining it to them this way can help soothe any concerns if customers come to you with questions.

How to Ensure Your Customer Relationships Are Protected