How does it work?

1. choose this template.

Start by clicking on "Fill out the template"

2. Complete the document

Answer a few questions and your document is created automatically.

3. Save - Print

Your document is ready! You will receive it in Word and PDF formats. You will be able to modify it.

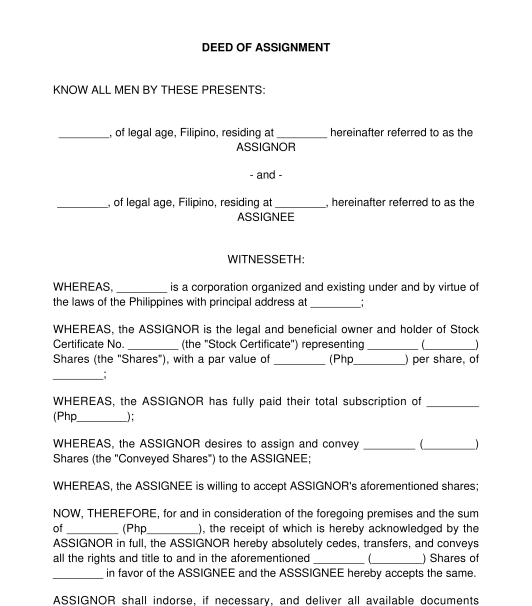

Deed of Assignment of Stock Subscription

Rating: 4.5 - 2 votes

A Deed of Assignment of Stock Subscription is a written document used to transfer shares of stock of a corporation from the registered owner (the "assignor") to another person (the "assignee"). It should specify the names of the parties , the date of the transfer , the number of the stock certificate that represents the shares to be transferred, and the number of shares that will be transferred.

Only shares that have been fully paid are transferable. This means that if the assignor has not yet paid the full amount of the subscription, then the shares under the subscription cannot be transferred .

In order to transfer the shares, the stock certificate should be endorsed by the owner or any person legally authorized to make the transfer. Indorsement means signing the back of the stock certificate.

Finally, the transfer of shares will only be valid between the parties until it is recorded in the books of the corporation.

How to use this document

This document can be used by the registered owner of shares of stock of a corporation to transfer the shares (or part of the shares) to another person. It assumes that the purchase price for the shares has been fully paid .

The user should complete the document by entering the information required in the document. Once it is completed, the assignor and the assignee should sign the document .

This Deed of Assignment also includes an Acknowledgment. An Acknowledgment is an act of a person before a notary public stating that the signature on a document was voluntarily affixed by him and he executed the document as his free and voluntary act . Acknowledging a document before a notary public turns the document into a public document . Public documents are generally self-authenticating, meaning no other evidence will be needed to prove the execution of the document.

The Documentary Stamp Tax ("DST") and other applicable taxes, such as the Capital Gains Tax , should also be paid to the Bureau of Internal Revenue ("BIR") by the assignor or the assignee. The DST is required to be paid for any issuance or transfer of shares. The BIR shall issue a Certificate Authorizing Registration ("CAR") once the DST and other taxes are paid.

The assignor or assignee can then present the document, together with the endorsed stock certificate and the CAR , to the Corporate Secretary so the transfer can be recorded in the books of the corporation .

Applicable law

The Revised Corporation Code and the general laws of contracts and obligations found in the Civil Code govern the transfer of shares. However, other laws, their rules and regulations, and SEC rules may affect the conduct and transactions of the Corporation such as but not limited to the 1987 Constitution of the Philippines , the Securities Regulation Code, the Foreign Investment Act, the Republic Act 8179, specifically the Foreign Investment Negative List, the Anti-Money Laundering Act, and the Anti-Dummy Law may affect the ownership requirements of a corporation, depending on the business of the corporation. Tax laws may also affect the transfer of the shares.

How to modify the template

You fill out a form. The document is created before your eyes as you respond to the questions.

At the end, you receive it in Word and PDF formats. You can modify it and reuse it.

Guides to help you

- What to do after Creating a Contract?

- When and how to Notarize a Document?

Other names for the document:

Deed of Assignment, Deed of Assignment of Shares, Deed of Assignment of Stock, Deed of Assignment of Shares of Stock, Deed of Transfer of Stock Subscription

Country: Philippines

General Business Documents - Other downloadable templates of legal documents

- Acknowledgement Receipt

- Minutes of the Meeting of the Stockholders

- Notice for Non-Renewal of Contract

- Loan Agreement

- Secretary's Certificate

- Minutes of the Meeting of the Board of Directors

- Monetary Demand Letter

- Notice of Meeting

- Letter of Consent of Nominee

- Business Name Change Letter

- Release, Waiver, and Quitclaim (One-Way)

- Notice of Dishonor for Bounced Check

- Withdrawal of Consent of Nominee

- Request to Alter Contract

- Subscription Agreement for Shares of Stock

- Breach of Contract Notice

- Affidavit of Closure of Business

- Debt Assignment and Assumption Agreement

- Notice of Death or Insolvency of a Partner

- Other downloadable templates of legal documents

Philippine Legal Forms

Deed of assignment of shares of stock sample.

Philippine Legal Forms Tags: Deed of Assignment , Deed of Assignment of Shares of Stock , Deed of Assignment Sample

Philippine Legal Resources

Philippine Legal Forms and Resources: Affidavit, Deed, Contract, Memorandum

Tuesday, July 14, 2020

Deed of assignment (shares of stock), popular posts.

- MOA on Sale of Lot

- Affidavit of Damage to Vehicle

- Contract of Lease of Commercial Building

- Affidavit of No Rental

- Deed of Assignment and Transfer of Rights

- Affidavit of Consented Land Use

- Deed of Absolute Sale of Business

- Demand to Vacate

- Affidavit of Loss of High School Diploma

- Download Free Legal Forms

Privacy Policy

This privacy policy tells you how we use personal information collected at this site. Please read this privacy policy before using the site or submitting any personal information. By using the site, you accept the practices described here. Collection of Information We collect personally identifiable information, like names, email addresses, etc., when voluntarily submitted by our visitors. The information you provide is used to fulfill your specific request, unless you give us permission to use it in another manner, for example, to add you to one of our mailing lists. Cookie/Tracking Technology Our site may use cookies and tracking technology which are useful for gathering information such as browser type and operating system, tracking the number of visitors to the site, and understanding how visitors use the Site. Personal information cannot be collected via cookies and other tracking technology, however, if you previously provided personally identifiable information, cookies may be tied to such information. Third parties such as our advertisers may also use cookies to collect information in the course of serving ads to you. Most web browsers automatically accept cookies, but you can usually modify your browser setting to decline cookies if you prefer. Distribution of Information We do not share your personally identifiable information to any third party for marketing purposes. However, we may share information with governmental agencies or other companies assisting us in fraud prevention or investigation. We may do so when: (1) permitted or required by law; or, (2) trying to protect against or prevent actual or potential fraud or unauthorized transactions; or, (3) investigating fraud which has already taken place. Commitment to Data Security Your personally identifiable information is kept secure. Only authorized staff of this site (who have agreed to keep information secure and confidential) have access to this information. All emails and newsletters from this site allow you to opt out of further mailings. Privacy Contact Information If you have any questions, concerns, or comments about our privacy policy you may contact us by email at [email protected]. We reserve the right to make changes to this policy. You are encouraged to review the privacy policy whenever you visit the site to make sure that you understand how any personal information you provide will be used.

Blog Archive

Featured post, minimum wage and rights of kasambahays (domestic workers in the philippines), affidavit, deed, acknowledgment & waiver, power of attorney, sale of personal property, corporation, real estate, donation & extrajudicial settlement, family law and annulment/nullity of marriage, credit and loan, other forms & pleadings, pageviews all time.

Transfer of stock shares

It must be noted that whether or not the shares of stock are evidenced by a stock certificate, the transfer must be recorded or registered in the books of the corporation to be valid against third parties and the corporation

Published in Daily Tribune on October 20, 2022 by: Mary Jasmin Zennaia M. Balasolla

- Share on Facebook

- Share on Twitter

- Share on Pinterest

- Share on LinkedIn

- Share on Reddit

- Share by Mail

Shares of stock in a corporation are classified as personal property. As a general rule, the owner of the stocks may dispose of them as he sees fit as an inherent attribute of his ownership thereof. However, because these are intangible personal properties, the manner of their transfer and conveyance is regulated by particular laws.

Section 63 of the Corporation Code specifies how a share of stock may be transferred. The provision on the transfer of shares of stock makes no restrictions as to whom they may be sold or transferred.

As the owner of personal property, a shareholder is free to dispose of it in favor of whomever he wishes, subject only to the general provisions of the law and the bylaws of the corporation to which it pertains.

SECTION 62. Certificate of Stock and Transfer of Shares. — The capital stock of corporations shall be divided into shares for which certificates signed by the president or vice president, countersigned by the secretary or assistant secretary, and sealed with the seal of the corporation shall be issued in accordance with the bylaws. Shares of stock so issued are personal property and may be transferred by delivery of the certificate or certificates endorsed by the owner, his attorney-in-fact, or any other person legally authorized to make the transfer. No transfer, however, shall be valid, except as between the parties, until the transfer is recorded in the books of the corporation showing the names of the parties to the transaction, the date of the transfer, the number of the certificate or certificates, and the number of shares transferred. The Commission may require corporations whose securities are traded in trading markets and which can reasonably demonstrate their capability to do so to issue their securities or shares of stocks in uncertificated or scripless form in accordance with the rules of the Commission.

No shares of stock against which the corporation holds any unpaid claim shall be transferable in the books of the corporation.

Under the above-mentioned provision, if the shares of stock are represented by a stock certificate, the following must be complied with for there to be a valid transfer of stocks:

(a) There must be the delivery of the stock certificates;

(b) The certificate must be endorsed by the owner or his attorney-in-fact or other persons legally authorized to make the transfer; and

(c) To be valid against third parties, the transfer must be recorded in the books of the corporation. (Teng v. Securities and Exchange Commission, G.R. No. 184332, (17 February 2016).

From the foregoing, it is the delivery of the certificate, coupled with the endorsement by the owner or his duly authorized representative that is the operative act of transfer of shares from the original owner to the transferee. The delivery contemplated herein pertains to the physical delivery of the certificate of shares by the transferor to the transferee and not delivery to the corporation. It is also worth mentioning that surrendering the original certificate of stock is necessary before the issuance of a new one so that the old certificate may be canceled.

On the other hand, if the shares of stock are not represented by a certificate, they may be transferred as follows:

1. By means of a deed of assignment; and

2. Such is duly recorded in the books of the corporation.

It must be noted that whether or not the shares of stock are evidenced by a stock certificate, the transfer must be recorded or registered in the books of the corporation to be valid against third parties and the corporation. There are several reasons why such registration is necessary: (1) to enable the transferee to exercise all the rights of a stockholder; (2) to inform the corporation of any change in share ownership so that it can ascertain the persons entitled to the rights and subject to the liabilities of a stockholder; and (3) to avoid fictitious or fraudulent transfers, among others.

Read more: https://tribune.net.ph/2022/10/20/transfer-of-stock-shares/

Read more Daily Tribune stories at: https://tribune.net.ph/

Follow us on our social media Facebook: @tribunephl Youtube: TribuneNow Twitter: @tribunephl Instagram: @tribunephl TikTok: @dailytribuneofficial

Share this entry

Any questions email us.

Manila Office: Unit 203 Le Metropole Building 155 H.V. Dela Costa cor. Tordesillas Sts. Salcedo Village, 1227 Makati City, Philippines Tel. Nos. (02) 8817-9704 to 07 Email: [email protected] [email protected]

Bacolod Office:

Unit 2Q, Paseo Verde Complex Lacson St., Mandalagan 6100 Bacolod City, Philippines Tel. No. (034) 458-9941 Email: [email protected] [email protected]

Privacy Policy

Copyright © 2020 Aranas Cruz Araneta Parker & Faustino Law Offices. All rights reserved.

Legal & Tax Updates [Back to list]

Sec opinion 21-03: deed of trust and assignment over share of stock.

In SEC-OGC Opinion No. 21-03 dated February 18, 2021, the Securities and Exchange Commission ( “SEC” ) resolved the following issues:

- Whether a company with nominee shareholder can register in its Stock and Transfer Book ( “STB” ) and General Information Sheet ( “GIS” ) the changes in nominee shareholders pursuant to an existing Deed of Trust and Assignment without the need of an actual sale; and

- Whether there is a need to report to the SEC, through the company’s GIS, the said new nominee director.

Sysmex Philippines, Inc. ( “Sysmex” ) has five (5) nominee shareholders who also constitute the Board of Directors. One nominee shareholder/director is no longer connected with Sysmex; thus, the latter intends to appoint a new shareholder/director. However, Sysmex is in quandary on whether to execute a Deed of Trust and Assignment or Deed of Absolute Sale to effect such change.

Since the contemplated transfer of share/s to the new nominee shareholder is for purposes of qualifying the said nominee shareholder to be a member of the Board, and to complete the number of directors composing the same, the SEC cited its previous opinions where it held that:

“ For purposes of complying with the statutory minimum number of stockholders/directors, the owner may transfer one (1) qualifying share to each nominee stockholders for purposes of qualifying them to become members of the Board, without giving them the beneficial ownership of the shares. Said transfer would be more of a “trust” and not a transfer of “ownership,” hence, the beneficial interest in such shares will remain with the assignor while the assignee will hold only the legal title to the stock. In such case, the transferee should be described in the Deed of Assignment, corporate books and certificate of stock merely as a qualifying shareholder or nominee of the transferor. The fact that the stock standing on the corporate books is in the name of the person only as a qualifying shareholder or that the holder of the stock certificate is described merely as a nominee serves as a notice to the corporation and third parties that the holder thereof does not hold the share in his own right but holds it only as a nominee for the benefit of the real owner.” [emphasis supplied]

Thus, the SEC opined that Sysmex can validly report in its GIS changes in nominee shareholders pursuant to a validly executed Deed of Trust and Assignment.

With respect to the second issue, the SEC held that Section 25 of the Revised Corporation Code (“ RCC ”), which categorically mandates the submission of information relating to the election of directors, trustees and officers, is intended to timely apprise the SEC of any relevant changes in the submitted information on file with the latter as they arise. Section 25 of the RCC thus provides:

“Section 25. Within thirty (30) days after the election of the directors, trustees and officers of the corporation, the secretary , or any other officer of the corporation, shall submit to the Commission, the names, nationalities, shareholdings, and residence addresses of the directors, trustees, and officers elected. x x x” [Emphasis supplied]

The election or appointment of a new director is a circumstance of Sysmex’s governance structure that needs to be reported to the SEC through its GIS as it involves a material change in the Board’s composition.

- +63 917 194 0482

- [email protected]

How to transfer shares of stock in a corporation

When you own shares of stock, not traded thru stock exchange,in a company registered in the Philippines, this isconsidered part of your personal property. Not only are you entitled to stockholder benefits, you also have the right to transfer your shares.

You may decide to transfer them as a gift, sell them, or assign them to someone else. Here are the steps for transferring shares of stock in a corporation:

1. Gather the necessary documents

The first and foremost, the item you should have is a stock certificate , assuming your shares are fully paid. Your shares of stock must be covered by a certificate – this is proof of your stock ownership.

Another document that you may need is the Certificate Authorizing Registration (CAR) . The CAR is a certification required by the Bureau of International Revenue (BIR) for the stocks that are not traded on the Philippine Stock Exchange. This document allows the corporate secretary of the corporation to record your transfer of stocks in their books. The BIR may also need a proof of acquisition of the shares. This may be in the form of a subscription agreement, or prior deed of sale or deed of donation, or even a deed of partition, as the case maybe.

2. Get an endorsement of the share

Once you have the documents, you may now endorse your stock certificate. The endorsement can come from you as an owner of the shares.

3. Deliver the stock certificate with a Deed showing the proof of transfer

After you have your stock certificate endorsed, you may then transfer it. By delivering the stock certificate, ownership is now transferred to the person of your choice, whether they bought your shares of stock or received them from you as a gift.

Always make sure that your stock certificateis properly endorsedbefore you deliver it. Simplyhanding over the stock certificate is not a transfer of ownership. The transfer will not be valid because there is no proof without the endorsement and the recording of the transfer in the books of the corporation involved.

As proof of transfer, you will need to execute a Deed of Sale, or Donation or a similar transfer document, transferring the shares to your vendee or donee or heirs.

4. Record the transfer in the books

After delivering your endorsed stock certificate, finalize your transfer by having it recorded in the Stock and Transfer Book of the said corporation. According to Section 63 of the Corporation Code, it is important to have the transfer recorded in their books or else it willbe considered invalid. Make sure that the bookkeeper documents the following:

- Names of the parties involved with the transfer

- Date of the transfer

- Number of certificate/s

- Number of shares transferred

Having the transfer recorded in the books updates the corporation on who its current shareholders are. It also lets the corporation know who they can call for stockholder meetings and officer elections.

Learn more about owning and transferring shares of stock in the Philippines

For more information, get in touch with Duran & Duran-Schulze Law at [email protected] or (+632) 478 5826.

Leave a Reply Cancel reply

Your email address will not be published. Required fields are marked *

Consult Now

Let us help you manage your legal and regulatory needs so you and your staff can focus your attention on where it matters most – your core business.

- Unit 1210 Highstreet South Corporate Plaza Tower 2, 26th St., Bonifacio Global City, Taguig City, 1634

- (02) 8478 5826

Deed of Assignment: Everything You Need to Know

A deed of assignment refers to a legal document that records the transfer of ownership of a real estate property from one party to another. 3 min read updated on January 01, 2024

Updated October 8,2020:

A deed of assignment refers to a legal document that records the transfer of ownership of a real estate property from one party to another. It states that a specific piece of property will belong to the assignee and no longer belong to the assignor starting from a specified date. In order to be valid, a deed of assignment must contain certain types of information and meet a number of requirements.

What Is an Assignment?

An assignment is similar to an outright transfer, but it is slightly different. It takes place when one of two parties who have entered into a contract decides to transfer all of his or her rights and obligations to a third party and completely remove himself or herself from the contract.

Also called the assignee, the third party effectively replaces the former contracting party and consequently assumes all of his or her rights and obligations. Unless it is stated in the original contract, both parties to the initial contract are typically required to express approval of an assignment before it can occur. When you sell a piece of property, you are making an assignment of it to the buyer through the paperwork you sign at closing.

What Is a Deed of Assignment?

A deed of assignment refers to a legal document that facilitates the legal transfer of ownership of real estate property. It is an important document that must be securely stored at all times, especially in the case of real estate.

In general, this document can be described as a document that is drafted and signed to promise or guarantee the transfer of ownership of a real estate property on a specified date. In other words, it serves as the evidence of the transfer of ownership of the property, with the stipulation that there is a certain timeframe in which actual ownership will begin.

The deed of assignment is the main document between the seller and buyer that proves ownership in favor of the seller. The party who is transferring his or her rights to the property is known as the “assignor,” while the party who is receiving the rights is called the “assignee.”

A deed of assignment is required in many different situations, the most common of which is the transfer of ownership of a property. For example, a developer of a new house has to sign a deed of assignment with a buyer, stating that the house will belong to him or her on a certain date. Nevertheless, the buyer may want to sell the house to someone else in the future, which will also require the signing of a deed of assignment.

This document is necessary because it serves as a temporary title deed in the event that the actual title deed for the house has not been issued. For every piece of property that will be sold before the issuance of a title deed, a deed of assignment will be required.

Requirements for a Deed of Assignment

In order to be legally enforceable, an absolute sale deed must provide a clear description of the property being transferred, such as its address or other information that distinguishes it from other properties. In addition, it must clearly identify the buyer and seller and state the date when the transfer will become legally effective, the purchase price, and other relevant information.

In today's real estate transactions, contracting parties usually use an ancillary real estate sale contract in an attempt to cram all the required information into a deed. Nonetheless, the information found in the contract must be referenced by the deed.

Information to Include in a Deed of Assignment

- Names of parties to the agreement

- Addresses of the parties and how they are binding on the parties' successors, friends, and other people who represent them in any capacity

- History of the property being transferred, from the time it was first acquired to the time it is about to be sold

- Agreed price of the property

- Size and description of the property

- Promises or covenants the parties will undertake to execute the deed

- Signatures of the parties

- Section for the Governors Consent or Commissioner of Oaths to sign and verify the agreement

If you need help understanding, drafting, or signing a deed of assignment, you can post your legal need on UpCounsel's marketplace. UpCounsel accepts only the top 5 percent of lawyers to its site. Lawyers on UpCounsel come from law schools such as Harvard Law and Yale Law and average 14 years of legal experience, including work with or on behalf of companies like Google, Menlo Ventures, and Airbnb.

Hire the top business lawyers and save up to 60% on legal fees

Content Approved by UpCounsel

- Define a Deed

- Contract for Deed California

- Contract for Deed in Texas

- Assignment Law

- Deed Contract Agreement

- Assignment Of Contracts

- Legal Assignment

- Deed vs Agreement

- Assignment Legal Definition

- Contract for a Deed

Create your Deed of Trust and Assignment (for shares of stock) in minutes.

Step-by-step assistance.

Click the "Begin Here" button at the top of this page to start creating your document. Answer questions and download your customized document once finished.

Look for the following icons as you answer the Q&A to know more about the question and our suggested answer.

What is this?

Click this icon for information about the question.

Suggested Answer

Click this icon to know what is the recommended answer based on similar documents.

Things you need to know about Deed of Trust and Assignment (for shares of stock).

1. what is a deed of trust and assignment.

In a Deed of Trust and Assignment, the signor (the trustee) confirms that he/she is holding certain shares of stock in a corporation only in trust for the benefit of another person (the trustor).

The signor also appoints the Corporate Secretary of the corporation that issued the shares of stock as his/her attorney-in-fact to sell, assign and transfer the shares of stock in favor of the trustor or any person designated by the trustor.

2. What information do you need to create the Deed of Trust and Assignment?

To create your Deed of Trust and Assignment, you’ll need the following minimum information:

- The name and details (i.e. nationality and address) of the trustee

- The name of the trustor

- The number of shares held in trust

- The corporation which issued the shares of stock

3. How much is the document?

The document costs PhP 350 for a one-time purchase.

You can also avail of Premium subscription at PhP 1,000 and get (a) unlimited use of our growing library of documents, from affidavits to contracts; and (b) unlimited use of our “ Ask an Attorney ” service which lets you consult an expert lawyer anytime for any legal concern you have.

Document Name

Cancel Save

9 Eymard Drive, New Manila Quezon City Owned and operated by JCArteche’s Online Documentation & Referral Services

Back to Top

- Terms of Service

- Privacy Policy

- Create Documents

- Ask An Attorney

- How It Works

- Customer Support

Deed of Assignment of Stock Subscription

About the template.

Rating: 4.5 - 2 votes

How does it work?

1. choose this template.

Start by clicking on "Fill out the template"

2. Complete the document

Answer a few questions and your document is created automatically.

3. Save - Print

Your document is ready! You will receive it in Word and PDF formats. You will be able to modify it.

A Deed of Assignment of Stock Subscription is a written document used to transfer shares of stock of a corporation from the registered owner (the "assignor") to another person (the "assignee"). It should specify the names of the parties , the date of the transfer , the number of the stock certificate that represents the shares to be transferred, and the number of shares that will be transferred.

Only shares that have been fully paid are transferable. This means that if the assignor has not yet paid the full amount of the subscription, then the shares under the subscription cannot be transferred .

In order to transfer the shares, the stock certificate should be indorsed by the owner or any person legally authorized to make the transfer. Indorsement means signing the back of the stock certificate.

Finally, the transfer of shares will only be valid between the parties until it is recorded in the books of the corporation.

How to use this document

This document can be used by the registered owner of shares of stock of a corporation to transfer the shares (or part of the shares) to another person. It assumes that the purchase price for the shares has been fully paid .

The user should complete the document by entering the information required in the document. Once it is completed, the assignor and the assignee should sign the document .

This Deed of Assignment also includes an Acknowledgment. An Acknowledgment is an act of a person before a notary public stating that the signature on a document was voluntarily affixed by him and he executed the document as his free and voluntary act . Acknowledging a document before a notary public turns document into a public document . Public documents are generally self-authenticating, meaning no other evidence will be needed to prove the execution of the document.

The Documentary Stamp Tax ("DST") and other applicable taxes, such as the Capital Gains Tax , should also be paid to the Bureau of Internal Revenue ("BIR") by the assignor or the assignee. The DST is required to be paid for any issuance or transfer of shares. The BIR shall issue a Certificate Authorizing Registration ("CAR") once the DST and other taxes are paid.

The assignor or assignee can then present the document, together with the indorsed stock certificate and the CAR , to the Corporate Secretary so the transfer can be recorded in the books of the corporation .

Applicable law

The Revised Corporation Code and the general laws of contracts and obligations found in the Civil Code govern transfer of shares. However, other laws, their rules and regulations, and SEC rules may affect the conduct and transactions of the Corporation such as but not limited to the 1987 Constitution of the Philippines , the Securities Regulation Code, the Foreign Investment Act, the Republic Act 8179, specifically the Foreign Investment Negative List, the Anti-Money Laundering Act, and the Anti-Dummy Law may affect the ownership requirements of a corporation, depending on the business of the corporation. Tax laws may also affect the transfer of the shares.

How to modify the template

You fill out a form. The document is created before your eyes as you respond to the questions.

At the end, you receive it in Word and PDF formats. You can modify it and reuse it.

Guides to help you

- What to do after Creating a Contract?

- When and how to Notarize a Document?

Other names for the document: Deed of Assignment, Deed of Assignment of Shares, Deed of Assignment of Stock, Deed of Assignment of Shares of Stock, Deed of Transfer of Stock Subscription

Country: Philippines

General Business Documents - Other downloadable templates of legal documents

- Acknowledgement Receipt

- Minutes of the Meeting of the Stockholders

- Notice for Non-Renewal of Contract

- Loan Agreement

- Secretary's Certificate

- Minutes of the Meeting of the Board of Directors

- Monetary Demand Letter

- Notice of Meeting

- Letter of Consent of Nominee

- Business Name Change Letter

- Release, Waiver, and Quitclaim (One-Way)

- Notice of Dishonor for Bounced Check

- Withdrawal of Consent of Nominee

- Request to Alter Contract

- Subscription Agreement for Shares of Stock

- Breach of Contract Notice

- Affidavit of Closure of Business

- Debt Assignment and Assumption Agreement

- Notice of Death or Insolvency of a Partner

Deed of Assignment and Transfer of Rights [Parts and Template]

A Deed of Assignment and Transfer of Rights is a legal document used when a person or a company who originally was a party to a contract (also known as the assignor or transferor) transfers his or its rights under the contract to another party (the assignee or transferee).

Accordingly, when the Deed of Assignment and Transfer of Rights has been drafted on the basis that in the original contract there is no prohibition to or restriction on assignment, and hence signed by both parties, it can be consequently assigned without the other contracting party’s consent.

In this article, I’ll try to dissect a sample Deed of Assignment and Transfer of Rights of a St. Peter Life Plan and provide descriptions of its fundamental elements or parts. As drafting a deed requires abundant caution, presence of mind, and knowledge of property and other allied laws, I highly advise that you seek help from experts and experienced in legal transactions.

Parts of a Deed of Assignment and Transfer of Rights

[1] Title of Deed . As implied above, deeds come in different forms and types. Check if the document and the first section displays the title – Deed of Assignment and Transfer of Rights. Conventionally, the first paragraph runs:

KNOW ALL MEN BY THESE PRESENTS:

This deed, made and entered made and entered into this 13 rd day of January 2018 at the City of Manila, by and between:

[2] Parties Involved . A Deed of Assignment and Transfer of Rights must contain accurate information about the identities of the assigning and assigned parties. Other information such as age legality, citizenship, and postal address must be included, just as seen below:

Juan De la Cruz, Filipino citizen, of legal age, married to Josefina De la Cruz, and with residence and postal address at 123 Kasiglahan Street, Karangalan Village, Dela Paz, Pasig City, Philippines, hereinafter referred to as the “ASSIGNOR/TRANSFEROR”

Sebastian Maliksi, Filipino citizen, of legal age, single, and with residence and postal address at 456 Kasimanwa Street, Karangalan Village, Dela Paz, Pasig City, Philippines, hereinafter referred to as the “ASSIGNEE/TRANSFEREE”

[3] Contract Details . A Deed of Assignment and Transfer of Rights must contain a detailed description of the contract, hence in the context here – St. Peter Traditional Life Plan (St. Anne) contract and the Life Plan Agreement (LPA) Number:

WHEREAS, the ASSIGNOR/TRANSFEROR is the owner of life / memorial plan contract which is identified as St. Peter Traditional Life Plan (St. Anne), with Life Plan Agreement No. 123456;

[4] Contract Assignment and Transfer Agreement . As one of the most important and critical parts, this specifies the terms and conditions of the agreement. See sample below:

WHEREAS, for and in consideration of the value of the plan and out of accommodation and assistance for the ASSIGNEE/TRANSFEREE, the ASSIGNOR/TRANSFEROR is assigning and transferring all his/her rights and interests over the Life Plan mentioned in the immediately preceding paragraph to the ASSIGNEE/TRANSFEREE;

NOW, therefore for and in consideration of forgoing premises, the parties hereto have agreed on the following terms and conditions, to wit;

THE ASSIGNOR/TRANSFEROR, hereby waives all his / her rights and interests in the subject life plan in favor of the ASSIGNEE/TRANSFEREE. It is understood that when the Life Plan is assigned / availed of, then all obligations of St. Peter Life Plan, Inc. are fulfilled and discharged.

As a consequence of this assignment / transfer of rights, the ASSIGNEE/TRANSFEREE hereby assumes all the obligations and accountabilities of the ASSIGNOR/TRANSFEROR to St. Peter Life Plan, Inc. in connection with the life plan contract which it issued to the latter.

The ASSIGNEE/TRANSFEREE obligates and / or undertakes to comply with and abide by the requirements which St. Peter Life Plan Inc. may impose in connection with the purchase, possession, and use of the said Life Plan particularly the requirement that it should be fully paid before the memorial service could be availed of pursuant to the Life Plan.

[5] Execution . Once the Deed of Assignment and Transfer of Rights is drafted, the parties involved shall execute it by affixing their signatures. Other than the assigning and assigned parties, witnesses should also sign all the pages of the document. In addition, the deed shall be acknowledged and notarized by a legal practitioner.

IN WITNESS WHEREOF the parties have hereunto set their hands on the date and place first above written.

[ Assignor/Transferor] [Assignee/Transferee]

SIGNED IN THE PRESENCE OF:

[Witness] [Witness]

Disclaimer: Although much effort has been exerted in the creation of this article, the author disclaims any legal expertise and does not guarantee the accuracy and legitimacy of any or all of the information. Hence, it is advised that you consult with professionals such as insurance brokers and lawyers before engaging in legal transactions.

Related Articles

Special Power of Attorney [Parts and Template]

What is Special Power of Attorney? A Special Power of Attorney, as one of the two categories of a power of attorney (the other being [Read more…]

Sample Application Letter for Teachers

Sample Application Letter for Teachers. Writing business letters has always been a challenging task. In fact, even professionals struggle dealing with appropriate expressions and tones. [Read more…]

Sample NTE (Excessive Tardiness) Response Letter

A Notice to Explain (or NTE) is a show cause letter or a corporate internal communication sent by an employer, usually represented by the Human [Read more…]

Be the first to comment

Share your thoughts cancel reply.

Your email address will not be published.

© 2024 signedMARCO. All rights reserved. About • Contact • Privacy • Subscribe

- Tucupita Marcano Under Investigation For Betting On Baseball

- Jose Urquidy May Require Season-Ending Surgery

- Mariners To Sign Víctor Robles

- Orioles To Promote Connor Norby

- Twins Option Edouard Julien; Royce Lewis Expected To Return Tuesday

- Tigers To Option Spencer Torkelson To Triple-A

- Hoops Rumors

- Pro Football Rumors

- Pro Hockey Rumors

MLB Trade Rumors

A’s Designate Aaron Brooks For Assignment

By Nick Deeds | June 2, 2024 at 9:03am CDT

The A’s announced this morning that they’ve activated right-hander Luis Medina from the 60-day injured list. To make room for Medina on both the club’s active and 40-man rosters, right-hander Aaron Brooks was designated for assignment.

Brooks, 34, signed with the A’s on a minor league deal over the winter and was called up last month to help fill out the club’s rotation mix amid a number of injuries to key veterans such as Alex Wood , Ross Stripling , and Paul Blackburn . He ultimately made four starts for the A’s, pitching to a 5.82 ERA with a 5.59 FIP in 21 2/3 innings of work with a strikeout rate of just 10% against a 6% walk rate. With potential long-term pieces like JP Sears and Mitch Spence currently filling out the rest of the club’s rotation mix, Brooks’s mediocre performance wasn’t enough to justify a rotation spot for the righty now that Medina is healthy enough to take the mound.

Going forward, the A’s will have one week to either trade Brooks or attempt to pass the veteran righty through waivers. Should he clear waivers, the veteran would have the opportunity to reject an outright assignment in favor of free agency should he wish to do so. Despite his lackluster results this year, it’s feasible that a club in need of starting pitching depth could have interest in the righty. After all, he’s a veteran of six major league seasons who has compiled 56 appearances and 32 starts in the majors during that time as a back-end starter and long reliever who enjoyed some success overseas while pitching in the Korea Baseball Organization from 2020-21.

Brooks’s spot both on the 40-man roster and in the starting rotation will be taken by Medina, who the A’s acquired alongside Sears and Ken Waldichuk in the Frankie Montas trade at the 2022 trade deadline. The 25-year-old made his big league debut with the A’s last year and struggled to a 5.42 ERA in 23 appearances, 17 of which were starts. Medina’s difficulties at the big league level were primarily attributable to his unsightly 11.5% walk rate, which clocked in less than ten points below his 21.4% strikeout rate.

Despite those ugly peripheral marks, Medina’s 96.1 mph average velocity on his fastball offers plenty of reason for excitement about his abilities if he figure out his command, and his performance improved as the 2023 season continued with a 4.22 ERA and 4.04 FIP in his final 70 1/3 innings of work last year. Medina’s tantalizing upside made him a strong candidate for the fifth starter role in Oakland entering the season until he found himself sidelined by a grade 2 MCL sprain in early March. Medina has been shelved ever since, but now is healthy enough for the A’s to once again offer him the opportunity to join their rotation alongside Sears, Spence, Joey Estes , and Hogan Harris .

10 Comments

Trade closer Miller before his warranty expires(or he’s injured)and his value plummets.

Agreed, what’s the point of having a “star” closer if he’s gonna burn his arm before the A’s are competitive..if ever.

Hopefully they don’t go for high quantity and medium quality in prospects this time. Who am I kidding?

David Forst will put a smile on some other team’s face. You can put your money on that.

I’m not optimistic on the return for whoever the A’s trade at this point. They just seem to get low upside guys for the most part who get to play because the roster is weak.

A a RON just has a hard time getting MLB hitters out . I don’t even know how Kotsay let him give up more runs in yesterday’s game . A’s had the lead and it was blown out . They did win their game but…. He would probably make a good pitching coach because he knows the struggles.

People talking off topic on this post about Mason Miller “ The Reaper “ well I’m for trading him to the Orioles for Colby Mayo. , and I’ll let the A’s figure out the rest of the package . The A’s have never won without a competent Third baseman . Sal Bando , Wayne Gross , Carney Lansford , Eric Chavez , Josh Donaldson , and Matt Chapman .

Funky. Cold.

That’s what you get after they throw you to the wolves… yeah the win had nothing to do with brooks but he was not so terrible in his other starts. Lots of teams need PCL veterans tho

He had a few good years for the Saints in the early 00s

Saw this coming when Brooks joined the org

Leave a Reply Cancel reply

Please login to leave a reply.

Log in Register

- Feeds by Team

- Commenting Policy

- Privacy Policy

MLB Trade Rumors is not affiliated with Major League Baseball, MLB or MLB.com

Username or Email Address

Remember Me

IMAGES

VIDEO

COMMENTS

Size 2 to 3 pages. 4.5 - 2 votes. Fill out the template. A Deed of Assignment of Stock Subscription is a written document used to transfer shares of stock of a corporation from the registered owner (the "assignor") to another person (the "assignee"). It should specify the names of the parties, the date of the transfer, the number of the stock ...

Account No. 111-222-333. Type of Shares: Common Shares. Number of Shares: 1000. Par Value: 1 peso/share. The ASSIGNEE hereby accepts the assignment. IN WITNESS WHEREOF, the parties have signed this deed on 7 July 2014 at Pasay City, Philippines. MARIA S. SANTOS MARIO C. CRUZ. ASSIGNOR ASSIGNEE. SIGNED IN THE PRESENCE OF:

Deed of Assignment (Shares of Stock) DEED OF ASSIGNMENT OF SHARES OF STOCK. KNOW ALL MEN BY THESE PRESENTS: This Deed of Assignment, made and executed this (Date) at ( Place), by and between: (NAME OF ASSIGNOR), of legal age, Filipino, single/married, and resident of (Place of Residence), and hereinafter referred to as the "ASSIGNOR"; - in ...

This document is a deed of assignment transferring ownership of 29,975 shares of stock from an assignor to an assignee. The assignor currently owns the shares in a corporation and is willing to transfer ownership to the assignee, who accepts the assignment. The assignment transfers ownership of the shares absolutely and irrevocably from the assignor to the assignee free of any liens or ...

On the other hand, if the shares of stock are not represented by a certificate, they may be transferred as follows: 1. By means of a deed of assignment; and. 2. Such is duly recorded in the books of the corporation. It must be noted that whether or not the shares of stock are evidenced by a stock certificate, the transfer must be recorded or ...

SEC Opinion 21-03: Deed of Trust and Assignment over Share of Stock. In SEC-OGC Opinion No. 21-03 dated February 18, 2021, the Securities and Exchange Commission ("SEC") resolved the following issues:Whether a company with nominee shareholder can register in its Stock and Transfer Book ("STB") and General Information Sheet ("GIS") the changes in nominee shareholders pursuant to an ...

Co. Ltd. TO HOLD the same to the assignee. absolutely, subject nevertheless to the conditions on which the assignor held the same up to date. AND the assignee hereby agrees to take the said Equity Shares subject to such conditions. IN WITNESS WHEREOF the assignor and the assignee do hereto affix their respective signatures on the day, month and ...

2. Get an endorsement of the share. Once you have the documents, you may now endorse your stock certificate. The endorsement can come from you as an owner of the shares. 3. Deliver the stock certificate with a Deed showing the proof of transfer. After you have your stock certificate endorsed, you may then transfer it.

Deed of Assignment of Shares - Free download as Word Doc (.doc), PDF File (.pdf), Text File (.txt) or read online for free. The document is a Deed of Assignment of Shares whereby an Assignor transfers and conveys 500 shares of common stock in a corporation to an Assignee for 500 Philippine pesos. The Assignor authorizes the corporate secretary to transfer the shares to the Assignee in the ...

Notarized Deed of Assignment reflecting the transfer of shares to the new stockholder. ii. Certificate Authorizing Registration (CAR) issued by the BIR representing the transfer of shares ... the resolution of the stockholders representing at least 2/3 of the outstanding capital stock approving the issuance of shares in exchange for a property ...

This document is a Deed of Assignment transferring ownership of shares of stock from an Assignor to an Assignee. It specifies that the Assignor desires to assign a certain number of shares they hold in a corporation to the Assignee. The Assignee accepts the shares and the Assignor agrees to be responsible for any costs or taxes from the transfer. It is signed by both parties and includes ...

A deed of assignment refers to a legal document that records the transfer of ownership of a real estate property from one party to another. It states that a specific piece of property will belong to the assignee and no longer belong to the assignor starting from a specified date. In order to be valid, a deed of assignment must contain certain ...

would be more of a "trust" and not a transfer of "ownership", hence, the beneficial interest in such shares will remain with the assignor while the assignee will hold only the legal title to the stock. In such case, the transferee should be described in the Deed of Assignment, corporate books and certificate of

3. Deed of Assignment e. Shares of Stock 1. Detailed schedule of the shares of stock showing the name of stockholder, stock certificate number, number of shares and the basis of transfer value whether market or book value certified by the treasurer 2. Audited financial statements of the investee co mpany as of the last fiscal year

DEED OF SALE OF SHARES OF STOCK KNOW ALL MEN BY THESE PRESENTS: I, _____, of legal age, Filipino, single/married, and resident of ... The Corporate Secretary is hereby requested to record this sale in the Stock and Transfer Book of the Corporation. IN WITNESS WHEREOF, I have hereunto set my hand this _____ ...

4 min. In the realm of intellectual property, a Deed of Assignment is a formal legal document used to transfer all rights, title, and interest in intellectual property from the assignor (original owner) to the assignee (new owner). This is crucial for the correct transfer of patents, copyrights, trademarks, and other IP rights.

Deed of Assignment - Template - Free download as Word Doc (.doc), PDF File (.pdf), Text File (.txt) or read online for free. The document assigns shares of stock in Mobile Exchange Services Inc. from an Assignor to an Assignee, transferring all rights, title, interests and obligations of the Assignor's shares to the Assignee for a specified monetary amount.

Create your Deed of Trust and Assignment (for shares of stock) in minutes. Begin Here. Step-by-step Assistance. ... Corporate Secretary of the corporation that issued the shares of stock as his/her attorney-in-fact to sell, assign and transfer the shares of stock in favor of the trustor or any person designated by the trustor. 2.

A Deed of Assignment of Stock Subscription is a written document used to transfer shares of stock of a corporation from the registered owner (the "assignor") to another person (the "assignee"). It should specify the names of the parties, the date of the transfer, the number of the stock certificate that represents the shares to be transferred, and the number of shares that will be transferred.

A Deed of Assignment and Transfer of Rights is a legal document used when a person or a company who originally was a party to a contract (also known as the assignor or transferor) transfers his or its rights under the contract to another party (the assignee or transferee). Accordingly, when the Deed of Assignment and Transfer of Rights has been ...

Deed of Transfer of Shares - Free download as Word Doc (.doc / .docx), PDF File (.pdf), Text File (.txt) or read online for free. Miguel Angelo C. Ocampo assigned and transferred 100 common shares of stock he owned in ABC Inc. to Krizzia Camille R. Gojar for 1,000 Philippine pesos. The assignment was signed on February 14th in Makati City and witnessed by Charisse Castillo and Crystal Diona ...

By Nick Deeds | June 2, 2024 at 9:03am CDT. The A's announced this morning that they've activated right-hander Luis Medina from the 60-day injured list. To make room for Medina on both the ...

This document assigns shares of stock from an individual to another individual. It states the name of the corporation whose shares are being assigned, the number of shares being assigned, and that the assignment is being done for valuable consideration and in an absolute and irrevocable manner. The assignor and assignee sign the document, along with two witnesses. A notary public then ...