- Go to our main website ⟶

Writing a Business Plan

Team sequoia.

When Brian, Joe and Nate founded Airbnb, they had an air mattress, entrepreneurial passion, and a vision for reinventing travel and hospitality, but no clear idea how to approach VCs or how to craft a pitch deck.

They came across Sequoia’s guide for how to write a business plan and the rest is history . They made a great deck.

But it wasn’t really the slides we liked—it was their ideas, the clarity of their thinking, and the scope of their ambition. We love partnering with founders hell-bent on bringing an idea to life that conventional wisdom deems impossible. And we love to partner early— when an idea is newly formed and has the maximal room to grow.

You can find our guide to pitching below (with a few refinements from years of use).

Company purpose Start here: define your company in a single declarative sentence. This is harder than it looks. It’s easy to get caught up listing features instead of communicating your mission.

Problem Describe the pain of your customer. How is this addressed today and what are the shortcomings to current solutions.

Solution Explain your eureka moment. Why is your value prop unique and compelling? Why will it endure? And where does it go from here?

Why now? The best companies almost always have a clear why now? Nature hates a vacuum—so why hasn’t your solution been built before now?

Market potential Identify your customer and your market. Some of the best companies invent their own markets.

Competition / alternatives Who are your direct and indirect competitors. Show that you have a plan to win.

Business model How do you intend to thrive?

Team Tell the story of your founders and key team members.

Financials If you have any, please include.

Vision If all goes well, what will you have built in five years?

- Capital Planning

Written by True Tamplin, BSc, CEPF®

Reviewed by subject matter experts.

Updated on July 12, 2023

Get Any Financial Question Answered

Table of contents, what is capital planning.

Capital planning is a critical process that businesses undertake to allocate financial resources to long-term investments and projects, such as acquiring new equipment, launching new products, or expanding operations.

The primary aim of capital planning is to ensure that a company's investments generate the highest possible return, contribute to its long-term growth and success, and minimize financial risks.

A well-designed capital plan can help a company identify the most beneficial investment opportunities, create a balanced portfolio of projects, and allocate resources strategically.

Effective capital planning is crucial for a business's long-term success and financial stability.

It allows organizations to make strategic decisions about where to invest resources to achieve their growth objectives, maximize shareholder value, and maintain a competitive edge in the marketplace.

By carefully evaluating potential investments, companies can ensure that they are putting their money into projects that align with their overall strategy and have the potential to deliver significant returns.

Furthermore, capital planning helps businesses minimize investment risks by identifying potential threats and developing strategies to mitigate them.

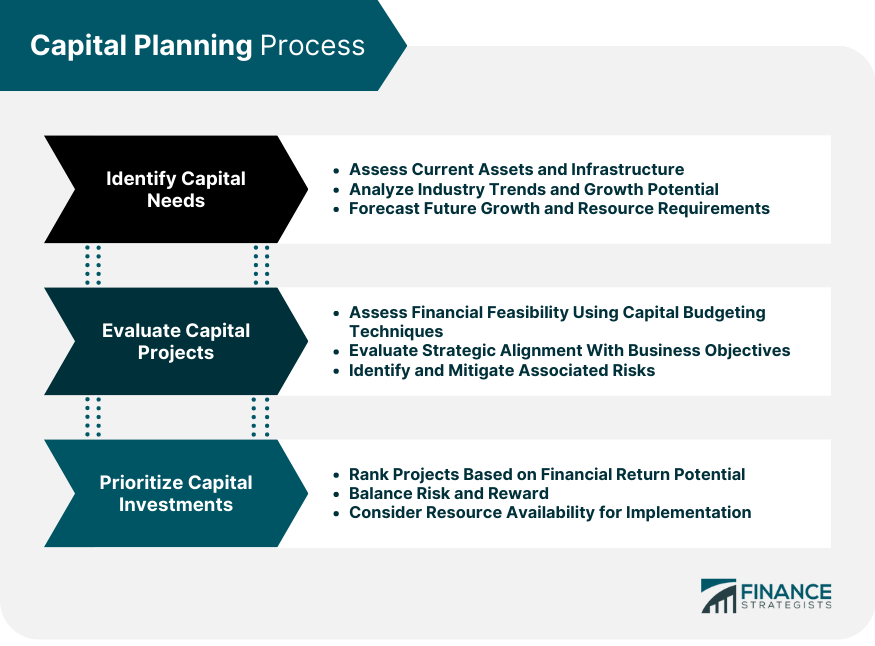

Capital Planning Process

Identifying capital needs.

This step involves assessing a company’s current assets , forecasting future growth, and analyzing industry trends.

It includes evaluating the organization's existing infrastructure, equipment, and technology to determine if they are adequate to meet its short and long-term objectives.

Additionally, companies should assess their growth potential by analyzing market trends, customer demand, and competition to identify areas where investment may be required.

Forecasting future growth is critical to identifying capital needs, as it provides valuable insights into the company's potential revenue streams and resource requirements.

Companies should utilize historical data, market research, and industry analysis to create accurate growth projections.

Understanding industry trends is essential for identifying opportunities for investment and potential challenges that may impact the organization's financial performance.

Evaluating Capital Projects

Evaluating a company’s potential capital projects is done to determine their financial feasibility, strategic alignment, and associated risks. Financial feasibility refers to the project's ability to generate a return on investment (ROI) that exceeds its cost of capital .

This can be assessed using various capital budgeting techniques , such as net present value (NPV) , internal rate of return (IRR) , and payback period.

Strategic alignment is essential in the evaluation process, as it ensures that the proposed project aligns with the company's overall business strategy and objectives.

This may involve analyzing the project's potential impact on market share , competitive positioning, and long-term growth potential.

Risk assessment is another critical aspect of project evaluation, as it involves identifying potential risks associated with the investment and developing strategies to mitigate them.

Prioritizing Capital Investments

This involves ranking projects according to their potential for financial return, considering factors such as projected cash flows, payback period, and NPV. Balancing risk and reward is also a critical aspect of prioritizing investments.

Companies should aim to create a balanced portfolio of projects that offers an optimal mix of potential returns and risk exposure.

Resource availability is another important factor to consider when prioritizing capital investments.

Companies must ensure they have the financial, human, and technological resources to support the successful implementation of their chosen projects. This may require reallocating resources from other business areas or seeking external financing to fund the investment.

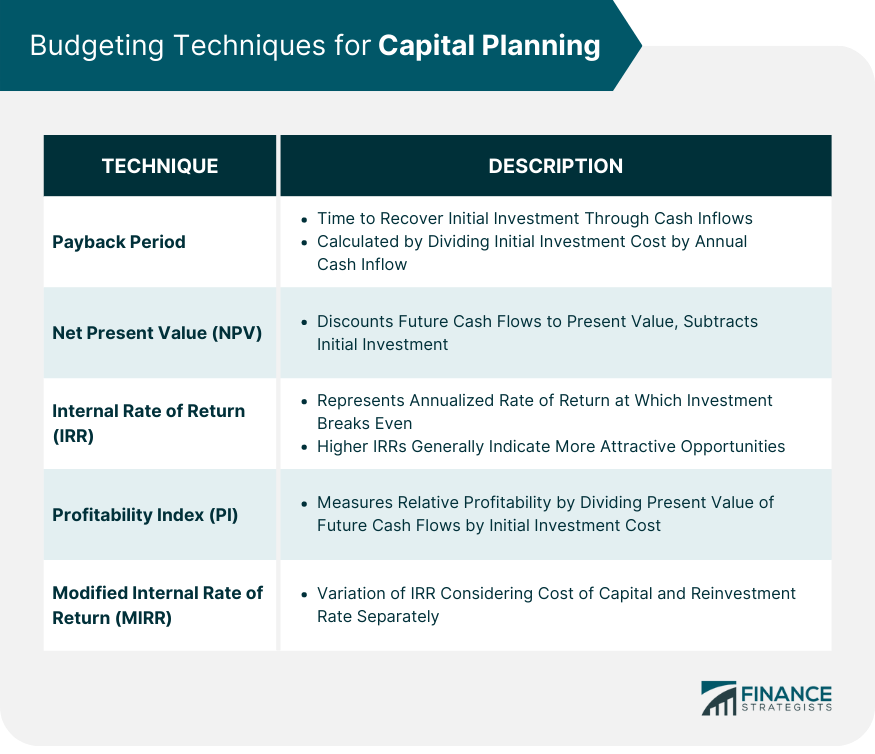

Budgeting Techniques for Capital Planning

Payback period.

The payback period is a simple capital budgeting technique that calculates the amount of time it takes for an investment to recoup its initial cost through cash inflows.

It is calculated by dividing the initial investment cost by the annual cash inflow generated by the project.

The payback period is useful for comparing investment options with similar risk profiles , as it provides a straightforward measure of how quickly an investment will start generating positive returns.

However, the payback period must account for the time value of money or cash flows generated after the initial investment has been recouped, which may limit its usefulness in evaluating long-term projects.

Net Present Value

NPV is a more sophisticated capital budgeting technique that accounts for the time value of money by discounting future cash flows to their present value.

The NPV is calculated by subtracting the present value of cash outflows (initial investment) from the present value of cash inflows generated by the project over its life.

A positive NPV indicates that the project is expected to generate a return greater than the cost of capital, making it a potentially worthwhile investment.

In contrast, a negative NPV suggests that the project's returns are unlikely to cover its costs. NPV is widely used by businesses to compare investment opportunities and determine their financial viability.

Internal Rate of Return

The IRR calculates the discount rate at which the net present value of a project's cash flows becomes zero. In other words, the IRR represents the annualized rate of return at which the investment breaks even.

The IRR can be used to compare the profitability of different investment options, with higher IRRs generally indicating more attractive opportunities.

It is important to note that the IRR assumes that all future cash flows are reinvested at the same rate, which may only sometimes be the case in practice.

Profitability Index (PI)

The profitability index measures the relative profitability of an investment by dividing the present value of its future cash flows by the initial investment cost.

A PI greater than 1 indicates that the project is expected to generate a positive net present value. In contrast, a PI of less than 1 suggests that the investment may not be financially viable.

The PI is useful for comparing the relative profitability of different investment options, as it takes into account both the size of the investment and the potential returns.

Modified Internal Rate of Return (MIRR)

The modified internal rate of return (MIRR) is a variation of the IRR that addresses some of its limitations by considering the cost of capital and the reinvestment rate of cash flows separately.

The MIRR calculates the annualized rate of return at which the present value of a project's cash inflows, discounted at the reinvestment rate, equals the present value of its cash outflows, discounted at the cost of capital.

The MIRR provides a more realistic measure of a project's profitability, accounting for the actual reinvestment opportunities available to the company.

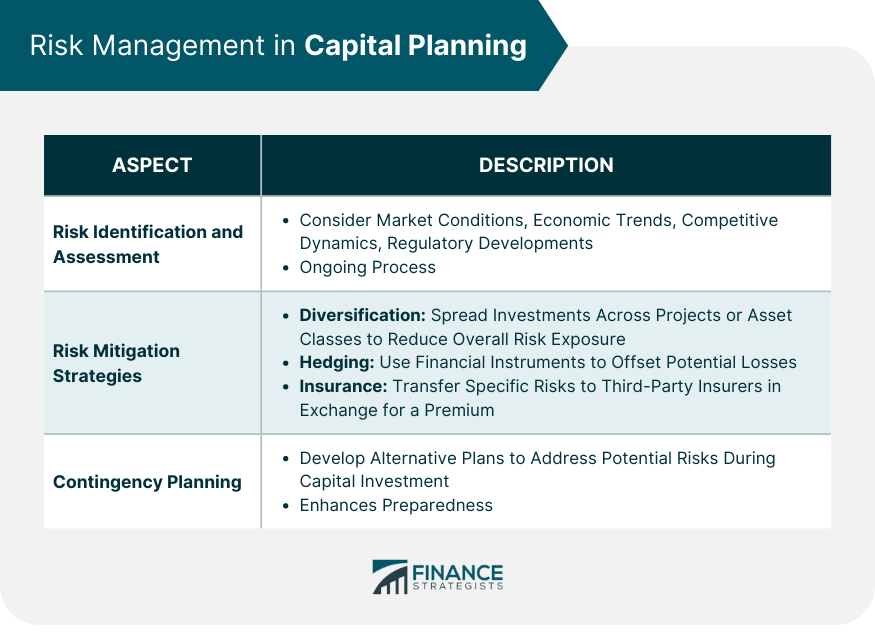

Risk Management in Capital Planning

Risk identification and assessment.

Risk management is a critical aspect of capital planning, as it helps businesses identify and assess potential risks associated with their investments.

This involves analyzing various factors, such as market conditions, economic trends, competitive dynamics, and regulatory developments, to determine the likelihood and potential impact of various risks on the company's financial performance.

Risk assessment should be an ongoing process, as new risks may emerge over time, or existing risks may change in magnitude or probability.

Risk Mitigation Strategies

Once risks have been identified and assessed, businesses should develop strategies to mitigate their potential impact on capital investments. This can involve a range of approaches, such as diversification, hedging , and insurance.

Diversification is spreading investments across a range of projects or asset classes to reduce the portfolio's overall risk exposure. Hedging involves using financial instruments, such as options or futures contracts , to offset potential losses from an investment.

Insurance can be used to transfer certain types of risk to a third party, such as property and casualty insurers or credit risk insurers, in exchange for a premium.

Contingency Planning

Contingency planning is an essential component of risk management. It involves developing alternative plans or strategies to address potential risks that may materialize during a capital investment.

This can include identifying backup suppliers or contractors, establishing alternative financing arrangements, or developing plans to scale back or modify the project if necessary.

Contingency planning helps businesses to be better prepared for unexpected events and to minimize the potential impact of risks on their capital investments.

Capital Planning Best Practices

Involving stakeholders.

One of the best practices in capital planning is involving all relevant stakeholders in the process. This includes the company's management and financial teams and employees, shareholders, customers, and suppliers.

By engaging stakeholders in the planning process, businesses can gain valuable insights, identify potential risks and opportunities, and build a shared understanding of the company's strategic objectives and investment priorities.

Aligning With Overall Business Strategy

Capital planning should be closely aligned with a company's overall business strategy, ensuring investments are directed toward projects supporting the organization's long-term goals and objectives.

To achieve this alignment, businesses should regularly review and update their strategic plans and ensure that capital planning is integral to their strategic decision-making process.

Regularly Reviewing and Updating the Plan

Capital planning is an ongoing process that requires regular review and updating to reflect changes in the company's financial position, market conditions, and strategic priorities.

By periodically revisiting their capital plan, businesses can ensure that their investment decisions remain aligned with their objectives, respond to new opportunities or risks, and adapt to changing circumstances.

Ensuring Transparency and Accountability

Transparency and accountability are essential for effective capital planning, as they help build trust among stakeholders and ensure that investment decisions are made in the company's best interests.

Businesses should establish clear processes for evaluating and prioritizing capital projects, involve stakeholders in decision-making, and regularly report on the progress and outcomes of their investments.

Capital planning is an essential process that drives a company's long-term growth and financial success.

It involves identifying capital needs by assessing current assets and forecasting future growth, evaluating potential investments using capital budgeting techniques like NPV and IRR, and prioritizing projects based on expected returns , risks, and resource availability.

Effective capital planning also incorporates risk management strategies, such as risk identification, mitigation, and contingency planning, to minimize potential investment threats.

Adhering to best practices, such as involving stakeholders, aligning capital planning with overall business strategy, regularly reviewing and updating plans, and ensuring transparency and accountability, further enhances the effectiveness of capital planning.

By adopting a comprehensive and strategic approach to capital planning, businesses can maximize shareholder value and secure long-term success in a competitive market.

Capital Planning FAQs

What is capital planning.

Capital planning is the process of determining how an organization will allocate and invest its financial resources to fund long-term projects, acquisitions, or expansions.

Why is capital planning important?

Capital planning is essential because it helps organizations prioritize and make informed decisions about allocating funds to projects that will generate the most significant returns or strategic advantages.

How does capital planning support financial stability?

Capital planning helps organizations maintain financial stability by ensuring that sufficient funds are available for strategic investments, managing debt and equity ratios, and minimizing the risk of financial distress.

What role does risk assessment play in capital planning?

Risk assessment is a crucial component of capital planning as it helps identify potential risks associated with investment projects. By evaluating risks, organizations can make informed decisions, develop mitigation strategies, and allocate resources more effectively.

How often should capital planning be reviewed and updated?

Capital planning should be reviewed and updated regularly to account for changes in market conditions, business priorities, and financial goals. Typically, organizations conduct annual or periodic reviews to ensure the relevance and accuracy of their capital plans.

About the Author

True Tamplin, BSc, CEPF®

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide , a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University , where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon , Nasdaq and Forbes .

Related Topics

- Business Continuity Planning (BCP)

- Business Exit Strategies

- Business-to-Business (B2B)

- Business-to-Consumer (B2C)

- Change-In-Control Agreements

- Corporate Giving Programs

- Corporate Philanthropy

- Cross-Purchase Agreements

- Crowdfunding Platforms

- Employee Retention and Compensation Planning

- Employee Volunteer Programs (EVPs)

- Endorsement & Sponsorship Management

- Enterprise Resource Planning (ERP)

- Entity-Purchase Agreements

- Equity Crowdfunding

- Family Business Continuity

- Family Business Governance

- Family Business Transition Planning

- Family Limited Partnerships (FLPs) and Buy-Sell Agreements

- Human Resource Planning (HRP)

- Jumpstart Our Business Startups (JOBS) Act

- Request for Information (RFI)

- Request for Proposal (RFP)

- Revenue Sharing

- SEC Regulation D

- Sale of Business Contract

- Security Token Offerings (STOs)

- Shareholder Engagement and Proxy Voting

- Social Engagements

Ask a Financial Professional Any Question

Meet top certified financial advisors near you, find advisor near you, our recommended advisors.

Taylor Kovar, CFP®

WHY WE RECOMMEND:

Fee-Only Financial Advisor Show explanation

Certified financial planner™, 3x investopedia top 100 advisor, author of the 5 money personalities & keynote speaker.

IDEAL CLIENTS:

Business Owners, Executives & Medical Professionals

Strategic Planning, Alternative Investments, Stock Options & Wealth Preservation

Claudia Valladares

Bilingual in english / spanish, founder of wisedollarmom.com, quoted in gobanking rates, yahoo finance & forbes.

Retirees, Immigrants & Sudden Wealth / Inheritance

Retirement Planning, Personal finance, Goals-based Planning & Community Impact

We use cookies to ensure that we give you the best experience on our website. If you continue to use this site we will assume that you are happy with it.

Fact Checked

At Finance Strategists, we partner with financial experts to ensure the accuracy of our financial content.

Our team of reviewers are established professionals with decades of experience in areas of personal finance and hold many advanced degrees and certifications.

They regularly contribute to top tier financial publications, such as The Wall Street Journal, U.S. News & World Report, Reuters, Morning Star, Yahoo Finance, Bloomberg, Marketwatch, Investopedia, TheStreet.com, Motley Fool, CNBC, and many others.

This team of experts helps Finance Strategists maintain the highest level of accuracy and professionalism possible.

Why You Can Trust Finance Strategists

Finance Strategists is a leading financial education organization that connects people with financial professionals, priding itself on providing accurate and reliable financial information to millions of readers each year.

We follow strict ethical journalism practices, which includes presenting unbiased information and citing reliable, attributed resources.

Our goal is to deliver the most understandable and comprehensive explanations of financial topics using simple writing complemented by helpful graphics and animation videos.

Our writing and editorial staff are a team of experts holding advanced financial designations and have written for most major financial media publications. Our work has been directly cited by organizations including Entrepreneur, Business Insider, Investopedia, Forbes, CNBC, and many others.

Our mission is to empower readers with the most factual and reliable financial information possible to help them make informed decisions for their individual needs.

How It Works

Step 1 of 3, ask any financial question.

Ask a question about your financial situation providing as much detail as possible. Your information is kept secure and not shared unless you specify.

Step 2 of 3

Our team will connect you with a vetted, trusted professional.

Someone on our team will connect you with a financial professional in our network holding the correct designation and expertise.

Step 3 of 3

Get your questions answered and book a free call if necessary.

A financial professional will offer guidance based on the information provided and offer a no-obligation call to better understand your situation.

Where Should We Send Your Answer?

Just a Few More Details

We need just a bit more info from you to direct your question to the right person.

Tell Us More About Yourself

Is there any other context you can provide.

Pro tip: Professionals are more likely to answer questions when background and context is given. The more details you provide, the faster and more thorough reply you'll receive.

What is your age?

Are you married, do you own your home.

- Owned outright

- Owned with a mortgage

Do you have any children under 18?

- Yes, 3 or more

What is the approximate value of your cash savings and other investments?

- $50k - $250k

- $250k - $1m

Pro tip: A portfolio often becomes more complicated when it has more investable assets. Please answer this question to help us connect you with the right professional.

Would you prefer to work with a financial professional remotely or in-person?

- I would prefer remote (video call, etc.)

- I would prefer in-person

- I don't mind, either are fine

What's your zip code?

- I'm not in the U.S.

Submit to get your question answered.

A financial professional will be in touch to help you shortly.

Part 1: Tell Us More About Yourself

Do you own a business, which activity is most important to you during retirement.

- Giving back / charity

- Spending time with family and friends

- Pursuing hobbies

Part 2: Your Current Nest Egg

Part 3: confidence going into retirement, how comfortable are you with investing.

- Very comfortable

- Somewhat comfortable

- Not comfortable at all

How confident are you in your long term financial plan?

- Very confident

- Somewhat confident

- Not confident / I don't have a plan

What is your risk tolerance?

How much are you saving for retirement each month.

- None currently

- Minimal: $50 - $200

- Steady Saver: $200 - $500

- Serious Planner: $500 - $1,000

- Aggressive Saver: $1,000+

How much will you need each month during retirement?

- Bare Necessities: $1,500 - $2,500

- Moderate Comfort: $2,500 - $3,500

- Comfortable Lifestyle: $3,500 - $5,500

- Affluent Living: $5,500 - $8,000

- Luxury Lifestyle: $8,000+

Part 4: Getting Your Retirement Ready

What is your current financial priority.

- Getting out of debt

- Growing my wealth

- Protecting my wealth

Do you already work with a financial advisor?

Which of these is most important for your financial advisor to have.

- Tax planning expertise

- Investment management expertise

- Estate planning expertise

- None of the above

Where should we send your answer?

Submit to get your retirement-readiness report., get in touch with, great the financial professional will get back to you soon., where should we send the downloadable file, great hit “submit” and an advisor will send you the guide shortly., create a free account and ask any financial question, learn at your own pace with our free courses.

Take self-paced courses to master the fundamentals of finance and connect with like-minded individuals.

Get Started

Hey, did we answer your financial question.

We want to make sure that all of our readers get their questions answered.

Great, Want to Test Your Knowledge of This Lesson?

Create an Account to Test Your Knowledge of This Topic and Thousands of Others.

Get Your Question Answered by a Financial Professional

Create a free account and submit your question. We'll make sure a financial professional gets back to you shortly.

To Ensure One Vote Per Person, Please Include the Following Info

Great thank you for voting..

How to Write a Business Plan: Step-by-Step Guide + Examples

Noah Parsons

24 min. read

Updated May 7, 2024

Writing a business plan doesn’t have to be complicated.

In this step-by-step guide, you’ll learn how to write a business plan that’s detailed enough to impress bankers and potential investors, while giving you the tools to start, run, and grow a successful business.

- The basics of business planning

If you’re reading this guide, then you already know why you need a business plan .

You understand that planning helps you:

- Raise money

- Grow strategically

- Keep your business on the right track

As you start to write your plan, it’s useful to zoom out and remember what a business plan is .

At its core, a business plan is an overview of the products and services you sell, and the customers that you sell to. It explains your business strategy: how you’re going to build and grow your business, what your marketing strategy is, and who your competitors are.

Most business plans also include financial forecasts for the future. These set sales goals, budget for expenses, and predict profits and cash flow.

A good business plan is much more than just a document that you write once and forget about. It’s also a guide that helps you outline and achieve your goals.

After completing your plan, you can use it as a management tool to track your progress toward your goals. Updating and adjusting your forecasts and budgets as you go is one of the most important steps you can take to run a healthier, smarter business.

We’ll dive into how to use your plan later in this article.

There are many different types of plans , but we’ll go over the most common type here, which includes everything you need for an investor-ready plan. However, if you’re just starting out and are looking for something simpler—I recommend starting with a one-page business plan . It’s faster and easier to create.

It’s also the perfect place to start if you’re just figuring out your idea, or need a simple strategic plan to use inside your business.

Dig deeper : How to write a one-page business plan

Brought to you by

Create a professional business plan

Using ai and step-by-step instructions.

Secure funding

Validate ideas

Build a strategy

- What to include in your business plan

Executive summary

The executive summary is an overview of your business and your plans. It comes first in your plan and is ideally just one to two pages. Most people write it last because it’s a summary of the complete business plan.

Ideally, the executive summary can act as a stand-alone document that covers the highlights of your detailed plan.

In fact, it’s common for investors to ask only for the executive summary when evaluating your business. If they like what they see in the executive summary, they’ll often follow up with a request for a complete plan, a pitch presentation , or more in-depth financial forecasts .

Your executive summary should include:

- A summary of the problem you are solving

- A description of your product or service

- An overview of your target market

- A brief description of your team

- A summary of your financials

- Your funding requirements (if you are raising money)

Dig Deeper: How to write an effective executive summary

Products and services description

This is where you describe exactly what you’re selling, and how it solves a problem for your target market. The best way to organize this part of your plan is to start by describing the problem that exists for your customers. After that, you can describe how you plan to solve that problem with your product or service.

This is usually called a problem and solution statement .

To truly showcase the value of your products and services, you need to craft a compelling narrative around your offerings. How will your product or service transform your customers’ lives or jobs? A strong narrative will draw in your readers.

This is also the part of the business plan to discuss any competitive advantages you may have, like specific intellectual property or patents that protect your product. If you have any initial sales, contracts, or other evidence that your product or service is likely to sell, include that information as well. It will show that your idea has traction , which can help convince readers that your plan has a high chance of success.

Market analysis

Your target market is a description of the type of people that you plan to sell to. You might even have multiple target markets, depending on your business.

A market analysis is the part of your plan where you bring together all of the information you know about your target market. Basically, it’s a thorough description of who your customers are and why they need what you’re selling. You’ll also include information about the growth of your market and your industry .

Try to be as specific as possible when you describe your market.

Include information such as age, income level, and location—these are what’s called “demographics.” If you can, also describe your market’s interests and habits as they relate to your business—these are “psychographics.”

Related: Target market examples

Essentially, you want to include any knowledge you have about your customers that is relevant to how your product or service is right for them. With a solid target market, it will be easier to create a sales and marketing plan that will reach your customers. That’s because you know who they are, what they like to do, and the best ways to reach them.

Next, provide any additional information you have about your market.

What is the size of your market ? Is the market growing or shrinking? Ideally, you’ll want to demonstrate that your market is growing over time, and also explain how your business is positioned to take advantage of any expected changes in your industry.

Dig Deeper: Learn how to write a market analysis

Competitive analysis

Part of defining your business opportunity is determining what your competitive advantage is. To do this effectively, you need to know as much about your competitors as your target customers.

Every business has some form of competition. If you don’t think you have competitors, then explore what alternatives there are in the market for your product or service.

For example: In the early years of cars, their main competition was horses. For social media, the early competition was reading books, watching TV, and talking on the phone.

A good competitive analysis fully lays out the competitive landscape and then explains how your business is different. Maybe your products are better made, or cheaper, or your customer service is superior. Maybe your competitive advantage is your location – a wide variety of factors can ultimately give you an advantage.

Dig Deeper: How to write a competitive analysis for your business plan

Marketing and sales plan

The marketing and sales plan covers how you will position your product or service in the market, the marketing channels and messaging you will use, and your sales tactics.

The best place to start with a marketing plan is with a positioning statement .

This explains how your business fits into the overall market, and how you will explain the advantages of your product or service to customers. You’ll use the information from your competitive analysis to help you with your positioning.

For example: You might position your company as the premium, most expensive but the highest quality option in the market. Or your positioning might focus on being locally owned and that shoppers support the local economy by buying your products.

Once you understand your positioning, you’ll bring this together with the information about your target market to create your marketing strategy .

This is how you plan to communicate your message to potential customers. Depending on who your customers are and how they purchase products like yours, you might use many different strategies, from social media advertising to creating a podcast. Your marketing plan is all about how your customers discover who you are and why they should consider your products and services.

While your marketing plan is about reaching your customers—your sales plan will describe the actual sales process once a customer has decided that they’re interested in what you have to offer.

If your business requires salespeople and a long sales process, describe that in this section. If your customers can “self-serve” and just make purchases quickly on your website, describe that process.

A good sales plan picks up where your marketing plan leaves off. The marketing plan brings customers in the door and the sales plan is how you close the deal.

Together, these specific plans paint a picture of how you will connect with your target audience, and how you will turn them into paying customers.

Dig deeper: What to include in your sales and marketing plan

Business operations

The operations section describes the necessary requirements for your business to run smoothly. It’s where you talk about how your business works and what day-to-day operations look like.

Depending on how your business is structured, your operations plan may include elements of the business like:

- Supply chain management

- Manufacturing processes

- Equipment and technology

- Distribution

Some businesses distribute their products and reach their customers through large retailers like Amazon.com, Walmart, Target, and grocery store chains.

These businesses should review how this part of their business works. The plan should discuss the logistics and costs of getting products onto store shelves and any potential hurdles the business may have to overcome.

If your business is much simpler than this, that’s OK. This section of your business plan can be either extremely short or more detailed, depending on the type of business you are building.

For businesses selling services, such as physical therapy or online software, you can use this section to describe the technology you’ll leverage, what goes into your service, and who you will partner with to deliver your services.

Dig Deeper: Learn how to write the operations chapter of your plan

Key milestones and metrics

Although it’s not required to complete your business plan, mapping out key business milestones and the metrics can be incredibly useful for measuring your success.

Good milestones clearly lay out the parameters of the task and set expectations for their execution. You’ll want to include:

- A description of each task

- The proposed due date

- Who is responsible for each task

If you have a budget, you can include projected costs to hit each milestone. You don’t need extensive project planning in this section—just list key milestones you want to hit and when you plan to hit them. This is your overall business roadmap.

Possible milestones might be:

- Website launch date

- Store or office opening date

- First significant sales

- Break even date

- Business licenses and approvals

You should also discuss the key numbers you will track to determine your success. Some common metrics worth tracking include:

- Conversion rates

- Customer acquisition costs

- Profit per customer

- Repeat purchases

It’s perfectly fine to start with just a few metrics and grow the number you are tracking over time. You also may find that some metrics simply aren’t relevant to your business and can narrow down what you’re tracking.

Dig Deeper: How to use milestones in your business plan

Organization and management team

Investors don’t just look for great ideas—they want to find great teams. Use this chapter to describe your current team and who you need to hire . You should also provide a quick overview of your location and history if you’re already up and running.

Briefly highlight the relevant experiences of each key team member in the company. It’s important to make the case for why yours is the right team to turn an idea into a reality.

Do they have the right industry experience and background? Have members of the team had entrepreneurial successes before?

If you still need to hire key team members, that’s OK. Just note those gaps in this section.

Your company overview should also include a summary of your company’s current business structure . The most common business structures include:

- Sole proprietor

- Partnership

Be sure to provide an overview of how the business is owned as well. Does each business partner own an equal portion of the business? How is ownership divided?

Potential lenders and investors will want to know the structure of the business before they will consider a loan or investment.

Dig Deeper: How to write about your company structure and team

Financial plan

Last, but certainly not least, is your financial plan chapter.

Entrepreneurs often find this section the most daunting. But, business financials for most startups are less complicated than you think, and a business degree is certainly not required to build a solid financial forecast.

A typical financial forecast in a business plan includes the following:

- Sales forecast : An estimate of the sales expected over a given period. You’ll break down your forecast into the key revenue streams that you expect to have.

- Expense budget : Your planned spending such as personnel costs , marketing expenses, and taxes.

- Profit & Loss : Brings together your sales and expenses and helps you calculate planned profits.

- Cash Flow : Shows how cash moves into and out of your business. It can predict how much cash you’ll have on hand at any given point in the future.

- Balance Sheet : A list of the assets, liabilities, and equity in your company. In short, it provides an overview of the financial health of your business.

A strong business plan will include a description of assumptions about the future, and potential risks that could impact the financial plan. Including those will be especially important if you’re writing a business plan to pursue a loan or other investment.

Dig Deeper: How to create financial forecasts and budgets

This is the place for additional data, charts, or other information that supports your plan.

Including an appendix can significantly enhance the credibility of your plan by showing readers that you’ve thoroughly considered the details of your business idea, and are backing your ideas up with solid data.

Just remember that the information in the appendix is meant to be supplementary. Your business plan should stand on its own, even if the reader skips this section.

Dig Deeper : What to include in your business plan appendix

Optional: Business plan cover page

Adding a business plan cover page can make your plan, and by extension your business, seem more professional in the eyes of potential investors, lenders, and partners. It serves as the introduction to your document and provides necessary contact information for stakeholders to reference.

Your cover page should be simple and include:

- Company logo

- Business name

- Value proposition (optional)

- Business plan title

- Completion and/or update date

- Address and contact information

- Confidentiality statement

Just remember, the cover page is optional. If you decide to include it, keep it very simple and only spend a short amount of time putting it together.

Dig Deeper: How to create a business plan cover page

How to use AI to help write your business plan

Generative AI tools such as ChatGPT can speed up the business plan writing process and help you think through concepts like market segmentation and competition. These tools are especially useful for taking ideas that you provide and converting them into polished text for your business plan.

The best way to use AI for your business plan is to leverage it as a collaborator , not a replacement for human creative thinking and ingenuity.

AI can come up with lots of ideas and act as a brainstorming partner. It’s up to you to filter through those ideas and figure out which ones are realistic enough to resonate with your customers.

There are pros and cons of using AI to help with your business plan . So, spend some time understanding how it can be most helpful before just outsourcing the job to AI.

Learn more: 10 AI prompts you need to write a business plan

- Writing tips and strategies

To help streamline the business plan writing process, here are a few tips and key questions to answer to make sure you get the most out of your plan and avoid common mistakes .

Determine why you are writing a business plan

Knowing why you are writing a business plan will determine your approach to your planning project.

For example: If you are writing a business plan for yourself, or just to use inside your own business , you can probably skip the section about your team and organizational structure.

If you’re raising money, you’ll want to spend more time explaining why you’re looking to raise the funds and exactly how you will use them.

Regardless of how you intend to use your business plan , think about why you are writing and what you’re trying to get out of the process before you begin.

Keep things concise

Probably the most important tip is to keep your business plan short and simple. There are no prizes for long business plans . The longer your plan is, the less likely people are to read it.

So focus on trimming things down to the essentials your readers need to know. Skip the extended, wordy descriptions and instead focus on creating a plan that is easy to read —using bullets and short sentences whenever possible.

Have someone review your business plan

Writing a business plan in a vacuum is never a good idea. Sometimes it’s helpful to zoom out and check if your plan makes sense to someone else. You also want to make sure that it’s easy to read and understand.

Don’t wait until your plan is “done” to get a second look. Start sharing your plan early, and find out from readers what questions your plan leaves unanswered. This early review cycle will help you spot shortcomings in your plan and address them quickly, rather than finding out about them right before you present your plan to a lender or investor.

If you need a more detailed review, you may want to explore hiring a professional plan writer to thoroughly examine it.

Use a free business plan template and business plan examples to get started

Knowing what information to include in a business plan is sometimes not quite enough. If you’re struggling to get started or need additional guidance, it may be worth using a business plan template.

There are plenty of great options available (we’ve rounded up our 8 favorites to streamline your search).

But, if you’re looking for a free downloadable business plan template , you can get one right now; download the template used by more than 1 million businesses.

Or, if you just want to see what a completed business plan looks like, check out our library of over 550 free business plan examples .

We even have a growing list of industry business planning guides with tips for what to focus on depending on your business type.

Common pitfalls and how to avoid them

It’s easy to make mistakes when you’re writing your business plan. Some entrepreneurs get sucked into the writing and research process, and don’t focus enough on actually getting their business started.

Here are a few common mistakes and how to avoid them:

Not talking to your customers : This is one of the most common mistakes. It’s easy to assume that your product or service is something that people want. Before you invest too much in your business and too much in the planning process, make sure you talk to your prospective customers and have a good understanding of their needs.

- Overly optimistic sales and profit forecasts: By nature, entrepreneurs are optimistic about the future. But it’s good to temper that optimism a little when you’re planning, and make sure your forecasts are grounded in reality.

- Spending too much time planning: Yes, planning is crucial. But you also need to get out and talk to customers, build prototypes of your product and figure out if there’s a market for your idea. Make sure to balance planning with building.

- Not revising the plan: Planning is useful, but nothing ever goes exactly as planned. As you learn more about what’s working and what’s not—revise your plan, your budgets, and your revenue forecast. Doing so will provide a more realistic picture of where your business is going, and what your financial needs will be moving forward.

- Not using the plan to manage your business: A good business plan is a management tool. Don’t just write it and put it on the shelf to collect dust – use it to track your progress and help you reach your goals.

- Presenting your business plan

The planning process forces you to think through every aspect of your business and answer questions that you may not have thought of. That’s the real benefit of writing a business plan – the knowledge you gain about your business that you may not have been able to discover otherwise.

With all of this knowledge, you’re well prepared to convert your business plan into a pitch presentation to present your ideas.

A pitch presentation is a summary of your plan, just hitting the highlights and key points. It’s the best way to present your business plan to investors and team members.

Dig Deeper: Learn what key slides should be included in your pitch deck

Use your business plan to manage your business

One of the biggest benefits of planning is that it gives you a tool to manage your business better. With a revenue forecast, expense budget, and projected cash flow, you know your targets and where you are headed.

And yet, nothing ever goes exactly as planned – it’s the nature of business.

That’s where using your plan as a management tool comes in. The key to leveraging it for your business is to review it periodically and compare your forecasts and projections to your actual results.

Start by setting up a regular time to review the plan – a monthly review is a good starting point. During this review, answer questions like:

- Did you meet your sales goals?

- Is spending following your budget?

- Has anything gone differently than what you expected?

Now that you see whether you’re meeting your goals or are off track, you can make adjustments and set new targets.

Maybe you’re exceeding your sales goals and should set new, more aggressive goals. In that case, maybe you should also explore more spending or hiring more employees.

Or maybe expenses are rising faster than you projected. If that’s the case, you would need to look at where you can cut costs.

A plan, and a method for comparing your plan to your actual results , is the tool you need to steer your business toward success.

Learn More: How to run a regular plan review

Free business plan templates and examples

Kickstart your business plan writing with one of our free business plan templates or recommended tools.

Free business plan template

Download a free SBA-approved business plan template built for small businesses and startups.

Download Template

One-page plan template

Download a free one-page plan template to write a useful business plan in as little as 30-minutes.

Sample business plan library

Explore over 500 real-world business plan examples from a wide variety of industries.

View Sample Plans

How to write a business plan FAQ

What is a business plan?

A document that describes your business , the products and services you sell, and the customers that you sell to. It explains your business strategy, how you’re going to build and grow your business, what your marketing strategy is, and who your competitors are.

What are the benefits of a business plan?

A business plan helps you understand where you want to go with your business and what it will take to get there. It reduces your overall risk, helps you uncover your business’s potential, attracts investors, and identifies areas for growth.

Having a business plan ultimately makes you more confident as a business owner and more likely to succeed for a longer period of time.

What are the 7 steps of a business plan?

The seven steps to writing a business plan include:

- Write a brief executive summary

- Describe your products and services.

- Conduct market research and compile data into a cohesive market analysis.

- Describe your marketing and sales strategy.

- Outline your organizational structure and management team.

- Develop financial projections for sales, revenue, and cash flow.

- Add any additional documents to your appendix.

What are the 5 most common business plan mistakes?

There are plenty of mistakes that can be made when writing a business plan. However, these are the 5 most common that you should do your best to avoid:

- 1. Not taking the planning process seriously.

- Having unrealistic financial projections or incomplete financial information.

- Inconsistent information or simple mistakes.

- Failing to establish a sound business model.

- Not having a defined purpose for your business plan.

What questions should be answered in a business plan?

Writing a business plan is all about asking yourself questions about your business and being able to answer them through the planning process. You’ll likely be asking dozens and dozens of questions for each section of your plan.

However, these are the key questions you should ask and answer with your business plan:

- How will your business make money?

- Is there a need for your product or service?

- Who are your customers?

- How are you different from the competition?

- How will you reach your customers?

- How will you measure success?

How long should a business plan be?

The length of your business plan fully depends on what you intend to do with it. From the SBA and traditional lender point of view, a business plan needs to be whatever length necessary to fully explain your business. This means that you prove the viability of your business, show that you understand the market, and have a detailed strategy in place.

If you intend to use your business plan for internal management purposes, you don’t necessarily need a full 25-50 page business plan. Instead, you can start with a one-page plan to get all of the necessary information in place.

What are the different types of business plans?

While all business plans cover similar categories, the style and function fully depend on how you intend to use your plan. Here are a few common business plan types worth considering.

Traditional business plan: The tried-and-true traditional business plan is a formal document meant to be used when applying for funding or pitching to investors. This type of business plan follows the outline above and can be anywhere from 10-50 pages depending on the amount of detail included, the complexity of your business, and what you include in your appendix.

Business model canvas: The business model canvas is a one-page template designed to demystify the business planning process. It removes the need for a traditional, copy-heavy business plan, in favor of a single-page outline that can help you and outside parties better explore your business idea.

One-page business plan: This format is a simplified version of the traditional plan that focuses on the core aspects of your business. You’ll typically stick with bullet points and single sentences. It’s most useful for those exploring ideas, needing to validate their business model, or who need an internal plan to help them run and manage their business.

Lean Plan: The Lean Plan is less of a specific document type and more of a methodology. It takes the simplicity and styling of the one-page business plan and turns it into a process for you to continuously plan, test, review, refine, and take action based on performance. It’s faster, keeps your plan concise, and ensures that your plan is always up-to-date.

What’s the difference between a business plan and a strategic plan?

A business plan covers the “who” and “what” of your business. It explains what your business is doing right now and how it functions. The strategic plan explores long-term goals and explains “how” the business will get there. It encourages you to look more intently toward the future and how you will achieve your vision.

However, when approached correctly, your business plan can actually function as a strategic plan as well. If kept lean, you can define your business, outline strategic steps, and track ongoing operations all with a single plan.

Noah is the COO at Palo Alto Software, makers of the online business plan app LivePlan. He started his career at Yahoo! and then helped start the user review site Epinions.com. From there he started a software distribution business in the UK before coming to Palo Alto Software to run the marketing and product teams.

Table of Contents

- Use AI to help write your plan

- Common planning mistakes

- Manage with your business plan

- Templates and examples

Related Articles

1 Min. Read

How to Calculate Return on Investment (ROI)

5 Min. Read

How To Write a Business Plan for a Life Coaching Business + Free Example

3 Min. Read

What to Include in Your Business Plan Appendix

7 Min. Read

How to Write a Bakery Business Plan + Sample

The Bplans Newsletter

The Bplans Weekly

Subscribe now for weekly advice and free downloadable resources to help start and grow your business.

We care about your privacy. See our privacy policy .

The quickest way to turn a business idea into a business plan

Fill-in-the-blanks and automatic financials make it easy.

No thanks, I prefer writing 40-page documents.

Discover the world’s #1 plan building software

- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

You’re our first priority. Every time.

We believe everyone should be able to make financial decisions with confidence. And while our site doesn’t feature every company or financial product available on the market, we’re proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward — and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about (and where those products appear on the site), but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services. Here is a list of our partners .

How to Write a Business Plan, Step by Step

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money .

What is a business plan?

1. write an executive summary, 2. describe your company, 3. state your business goals, 4. describe your products and services, 5. do your market research, 6. outline your marketing and sales plan, 7. perform a business financial analysis, 8. make financial projections, 9. summarize how your company operates, 10. add any additional information to an appendix, business plan tips and resources.

A business plan outlines your business’s financial goals and explains how you’ll achieve them over the next three to five years. Here’s a step-by-step guide to writing a business plan that will offer a strong, detailed road map for your business.

ZenBusiness

A business plan is a document that explains what your business does, how it makes money and who its customers are. Internally, writing a business plan should help you clarify your vision and organize your operations. Externally, you can share it with potential lenders and investors to show them you’re on the right track.

Business plans are living documents; it’s OK for them to change over time. Startups may update their business plans often as they figure out who their customers are and what products and services fit them best. Mature companies might only revisit their business plan every few years. Regardless of your business’s age, brush up this document before you apply for a business loan .

» Need help writing? Learn about the best business plan software .

This is your elevator pitch. It should include a mission statement, a brief description of the products or services your business offers and a broad summary of your financial growth plans.

Though the executive summary is the first thing your investors will read, it can be easier to write it last. That way, you can highlight information you’ve identified while writing other sections that go into more detail.

» MORE: How to write an executive summary in 6 steps

Next up is your company description. This should contain basic information like:

Your business’s registered name.

Address of your business location .

Names of key people in the business. Make sure to highlight unique skills or technical expertise among members of your team.

Your company description should also define your business structure — such as a sole proprietorship, partnership or corporation — and include the percent ownership that each owner has and the extent of each owner’s involvement in the company.

Lastly, write a little about the history of your company and the nature of your business now. This prepares the reader to learn about your goals in the next section.

» MORE: How to write a company overview for a business plan

The third part of a business plan is an objective statement. This section spells out what you’d like to accomplish, both in the near term and over the coming years.

If you’re looking for a business loan or outside investment, you can use this section to explain how the financing will help your business grow and how you plan to achieve those growth targets. The key is to provide a clear explanation of the opportunity your business presents to the lender.

For example, if your business is launching a second product line, you might explain how the loan will help your company launch that new product and how much you think sales will increase over the next three years as a result.

» MORE: How to write a successful business plan for a loan

In this section, go into detail about the products or services you offer or plan to offer.

You should include the following:

An explanation of how your product or service works.

The pricing model for your product or service.

The typical customers you serve.

Your supply chain and order fulfillment strategy.

You can also discuss current or pending trademarks and patents associated with your product or service.

Lenders and investors will want to know what sets your product apart from your competition. In your market analysis section , explain who your competitors are. Discuss what they do well, and point out what you can do better. If you’re serving a different or underserved market, explain that.

Here, you can address how you plan to persuade customers to buy your products or services, or how you will develop customer loyalty that will lead to repeat business.

Include details about your sales and distribution strategies, including the costs involved in selling each product .

» MORE: R e a d our complete guide to small business marketing

If you’re a startup, you may not have much information on your business financials yet. However, if you’re an existing business, you’ll want to include income or profit-and-loss statements, a balance sheet that lists your assets and debts, and a cash flow statement that shows how cash comes into and goes out of the company.

Accounting software may be able to generate these reports for you. It may also help you calculate metrics such as:

Net profit margin: the percentage of revenue you keep as net income.

Current ratio: the measurement of your liquidity and ability to repay debts.

Accounts receivable turnover ratio: a measurement of how frequently you collect on receivables per year.

This is a great place to include charts and graphs that make it easy for those reading your plan to understand the financial health of your business.

This is a critical part of your business plan if you’re seeking financing or investors. It outlines how your business will generate enough profit to repay the loan or how you will earn a decent return for investors.

Here, you’ll provide your business’s monthly or quarterly sales, expenses and profit estimates over at least a three-year period — with the future numbers assuming you’ve obtained a new loan.

Accuracy is key, so carefully analyze your past financial statements before giving projections. Your goals may be aggressive, but they should also be realistic.

NerdWallet’s picks for setting up your business finances:

The best business checking accounts .

The best business credit cards .

The best accounting software .

Before the end of your business plan, summarize how your business is structured and outline each team’s responsibilities. This will help your readers understand who performs each of the functions you’ve described above — making and selling your products or services — and how much each of those functions cost.

If any of your employees have exceptional skills, you may want to include their resumes to help explain the competitive advantage they give you.

Finally, attach any supporting information or additional materials that you couldn’t fit in elsewhere. That might include:

Licenses and permits.

Equipment leases.

Bank statements.

Details of your personal and business credit history, if you’re seeking financing.

If the appendix is long, you may want to consider adding a table of contents at the beginning of this section.

How much do you need?

with Fundera by NerdWallet

We’ll start with a brief questionnaire to better understand the unique needs of your business.

Once we uncover your personalized matches, our team will consult you on the process moving forward.

Here are some tips to write a detailed, convincing business plan:

Avoid over-optimism: If you’re applying for a business bank loan or professional investment, someone will be reading your business plan closely. Providing unreasonable sales estimates can hurt your chances of approval.

Proofread: Spelling, punctuation and grammatical errors can jump off the page and turn off lenders and prospective investors. If writing and editing aren't your strong suit, you may want to hire a professional business plan writer, copy editor or proofreader.

Use free resources: SCORE is a nonprofit association that offers a large network of volunteer business mentors and experts who can help you write or edit your business plan. The U.S. Small Business Administration’s Small Business Development Centers , which provide free business consulting and help with business plan development, can also be a resource.

On a similar note...

Find small-business financing

Compare multiple lenders that fit your business

How to Write a Business Plan for Raising Venture Capital

Written by Dave Lavinsky

Are you looking for VC funding or funding from other potential investors?

You need a good business idea – and an excellent business plan.

Business planning and raising capital go hand-in-hand. A venture capital business plan is required for attracting a venture capital firm. And the desire to raise capital (whether from an individual “angel” investor or a venture capitalist) is often the key motivator in the business planning process.

Download the Ultimate VC Business Plan Template here

Writing an Investor-Ready Business Plan

Executive summary.

Goal of the executive summary: Stimulate and motivate the investor to learn more.

- Hook them on the first page. Most investors are inundated with business plans. Your first page must make them want to keep reading.

- Keep it simple. After reading the first page, investors often do not understand the business. If your business is truly complex, you can dive into the details later on.

- Be brief. The executive summary should be 2 to 4 pages in length.

Company Analysis

Goal of the company analysis section: Educate the investor about your company’s history and explain why your team is perfect to execute on the business opportunity.

- Give some history. Provide the background on the company, including date of formation, office location, legal structure, and stage of development.

- Show off your track record. Detail prior accomplishments, including funding rounds, product launches, milestones reached, and partnerships secured, among others.

- Why you? Demonstrate your team’s unique unfair competitive advantage, whether it is technology, stellar management team, or key partnerships.

Industry Analysis

Goal of the industry analysis section: Prove that there is a real market for your product or service.

- Demonstrate the need – rather than the desire – for your product. Ideally, people are willing to pay money to satisfy this need.

- Cite credible sources when describing the size and growth of your market.

- Use independent research. If possible, source research through an independent research firm to enhance your credibility. For general market sizes and trends, we suggest citing at least two independent research firms.

- Focus on the “relevant” market size. For example, if you sell a portable biofeedback stress relief device, your relevant market is not the entire health care market. In determining the relevant market size, focus on the products or services that you will directly compete against.

- It’s not just a research report – each fact, figure, and projection should support your company’s prospects for success.

- Don’t ignore negative trends. Be sure to explain how your company would overcome potential negative trends. Such analysis will relieve investor concerns and enhance the venture capital business plan’s credibility.

- Be prepared for due diligence. It’s critical that the data you present is verifiable since any serious investor will conduct extensive due diligence.

Customer Analysis

Goal of customer analysis section: Convey the needs of your potential customers and show how your company’s products and services satisfy those needs.

- Define your customers precisely. For example, it’s not adequate to say your company is targeting small businesses since there are several million of these.

- Detail their demographics. How many customers fit the definition? Where are these customers located? What is their average income?

- Identify the needs of these customers. Use data to demonstrate past actions (X% have purchased a similar product), future projections (X% said they would purchase the product), and/or implications (X% use a product/service which your product enhances).

- Explain what drives their decisions. For example, is price more important than quality?

- Detail the decision-making process. For example, will the customer seek multiple bids? Will the customer consult others in their organization before making a decision?

Finish Your Investor Business Plan in 1 Day!

Don’t you wish there was a faster, easier way to finish your business plan?

And know it’s in the exact format that venture capitalists want?

With Growthink’s Ultimate Business Plan Template , you can finish your plan in just 8 hours or less!

Competitive Analysis

Goal of the competitive analysis section: Define the competition and demonstrate your competitive advantage.

- List competitors. Many companies make the mistake of conveying that they have few or no real competitors. From an investor’s standpoint, a competitor is something that fulfills the same need as your product. If you claim you have no competitors, you are seriously undermining the credibility of your business plans.

- Include direct and indirect competitors. Direct competitors serve the same target market with similar products. Indirect competitors serve the same target market with different products or different target markets with similar products.

- List public companies (when relevant, of course). A public company implies that the market size is big. This gives the assurance that if management executes well, the company has substantial profit and liquidity potential.

- Don’t just list competitors. Carefully describe their strengths and weaknesses, as well as the key drivers of competitive differentiation in the marketplace. And when describing competitors’ weaknesses, be sure to use objective information (e.g. market research).

- Demonstrate barriers to entry. In describing the competitive landscape, show how your business model creates competitive advantages, and – more importantly – defensible barriers to entry.

Marketing Plan

Goal of the marketing plan: Describe how your company will penetrate the market, deliver products/services, and retain customers.

- Products. Detail all current and future products and services – but focus primarily on the short-to-intermediate time horizon.

- Promotions. Explain exactly which marketing/advertising strategies will be used and why.

- Price. Be sure to provide a clear rationale for your pricing strategy.

- Place. Explain exactly how your products and services will be delivered to your customers.

- Detail your customer retention plan. Explain how you will retain your customers, whether through customer relationship management (CRM) applications, building network externalities, introducing ongoing value-added services, or other means.

- Define your partnerships. From an investor’s perspective, what partnership you have with whom is not nearly as important as the specific terms of the partnership. Be sure to document the specifics of the partnerships (e.g. how it will work, the financial terms, the types of customer leads expected from each partner, etc.).

Operations Plan

Goal of the operations plan: Present the action plan for executing your company’s vision.

- Concept vs. reality. The operations plan transforms business plans from concept into reality. Investors do not invest in concepts; they invest in reality. And the operations plan proves that the management team can execute your concept better than anybody else.

- Everyday processes. Detail the short-term processes and systems that provide your customers with your products and services.

- Business milestones. Lay out the significant long-term business milestones for the company, and prove that the team will execute on the long-term vision. A great way to present the milestones is to organize them into a chart with key milestones on the left side and target dates on the right side.

- Be consistent. Make sure that the milestone projections are consistent with the rest of the venture capital business plan – particularly the financial plan.

- Be aggressive but credible. Presenting a plan in which the company grows too quickly will show the naiveté of the team while presenting too conservative a growth plan will often fail to excite an early stage investor (who typically looks for a 10X return on her investment).

Financial Plan

Goal of the financial plan: Explain how your business will generate returns for your investors.

- Detail all revenue streams. Be sure to include all revenue streams. Depending on the type of business, these may include sales of products/services, referral revenues, advertising sales, licensing/royalty fees, and/or data sales.

- Be consistent with your Pro-forma statements. Pro-forma statements are projected financial statements. It is critical that these projections reflect the other sections of your newly formed business plan.

- Validate your assumptions and projections. The financial plan must detail your key assumptions, and it is critical that these assumptions are feasible. Be sure to use competitive research to validate your projections and assumptions versus the reality in your marketplace. Assessing and basing financial projections on those of similar firms will greatly validate the realism and maturity of the financial projections.

- Detail the uses of funds. Understandably, investors want to know what, specifically, you plan to do with their money. Uses of funds could include expenses involved with marketing, staffing, technology development, office space, among other uses.

- Provide a clear exit strategy. All investors are motivated by a clear picture of your exit strategy, or the timing and method through which they can “cash in” on their investment. Be sure to provide comparable examples of firms that have successfully exited. The most common exits are IPOs or acquisitions. And while the exact method is not always crucial, the investor wants to see this planning in order to better understand the management team’s motivation and commitment to building long-term value.

Above all, the business plan is a marketing document that helps to sell the investor on the business opportunity, the team, the strategy, and the potential for significant return on investment.

How to raise venture capital is a difficult and time-intensive challenge. There is no easy shortcut or silver bullet. However, you can greatly improve your chances of raising venture capital by writing a business plan that speaks directly to the investor’s perspective. A VC business plan template will significantly help in cutting down the time it takes to complete your plan.

Finish Your VC Business Plan in 1 Day!

Raising venture capital faqs, what is the purpose of a business plan for raising venture capital.

The purpose of writing a business plan for raising venture capital is to convince investors that the proposed new or existing company has a good chance of being successful and can earn them a favorable return on investment (ROI).

A VC Business Plan Template will help you in creating an investor ready plan quickly and easily.

What Does VC Funding Entail?

VC funding is a type of financial transaction in which the venture capital firm invests in startup companies or early-stage companies. The firm invests its own capital (which it receives from other entities that invest in the VC firm) in these nascent companies with the goal of rapidly expanding them. Generally, early-stage companies use bootstrapping, self-funding, bank loans, and/or angel investment before raising their first round of venture capital. Companies might receive several rounds of VC funding.

What is a Typical Amount of Capital to Raise?

Typically, the first round (Series A) of venture capital amounts to $2-10 million. To raise that amount from VCs at the very start of your company is often very difficult. Rather, you should consider approaching angel investors and banks to provide initial financing to get you to the point at which venture capitalists are interested in providing funding. Gaining customer traction is generally the point in which VCs are ready to provide Series A financing. VCs will provide Series B funding, Series C funding, etc. to help continue to fund a company’s growth if the company seems poised for success. These funding rounds are usually much larger than Series A rounds.

How Long Does It Take For Investors To Decide If My Business Is Worth Investing In?

It varies from investor to investor, but prepare yourself to wait up to three months before receiving a check from a VC. The process typically includes sending the VC a teaser email to get their interest, following up with a business plan, giving a pitch presentation, and negotiating the terms of the funding round.

How Do I Find Venture Capitalists?

There are many venture capital firms and virtually all of them have websites and are thus fairly easy to find. There are also directories of them available on the internet. You may also be able to find VCs through personal introductions or by attending industry events.

Look for VCs that have funded companies in your industry/sector, at your stage of development and in your geographical area.

What Capital Raising Options are Available For a Business?

There are four broad options for raising money or venture capital when you run a business. These include venture capital firms, angel investors, loans and venture debt, or bootstrapping.

Venture Capitalists

A Venture Capitalist is an investor that provides equity financing for companies that have already achieved some traction but lack the financial resources to scale up their operations. Their investment objective is typically to grow the company so it can be sold or go public at a later date so the VC can exit or cash in on their success.

Angel Investors