- Skip to main content

- Skip to primary sidebar

- Skip to footer

- QuestionPro

- Solutions Industries Gaming Automotive Sports and events Education Government Travel & Hospitality Financial Services Healthcare Cannabis Technology Use Case NPS+ Communities Audience Contactless surveys Mobile LivePolls Member Experience GDPR Positive People Science 360 Feedback Surveys

- Resources Blog eBooks Survey Templates Case Studies Training Help center

Home Market Research

Qualitative Market Research : The Complete Guide

Content Index

What is Qualitative Market Research?

Qualitative market research methods and techniques, 4 types of qualitative market research testing methods, examples of qualitative market research.

- Ethical Considerations for Qualitative Market Research?

What are the Applications of Qualitative Market Research?

Advantages of qualitative market research, disadvantages of qualitative market research, online qualitative market research software- questionpro communities.

Qualitative market research is an open ended questions (conversational) based research method that heavily relies on the following market research methods : focus groups, in-depth interviews, and other innovative research methods. It is based on a small but highly validated sample size, usually consisting of 6 to 10 respondents .

The small size enables cost saving, while the “importance” of the samples and the lack of a defined questionnaire allows free and in-depth discussion and analysis of topics. Usually, the discussion is directed by the discretion of the interviewer or market researcher. You can use single ease questions . A single-ease question is a straightforward query that elicits a concise and uncomplicated response.

It is always better to have more heads than one. By canvassing a group of respondents for ideas and competence the quality of the data that is obtained is far more superior. This concept is known as crowdsourcing, derived from the two words “crowd” and “outsourcing”.

LEARN ABOUT: Perceived Value

Qualitative market research is most frequently used in political campaigning to understand voter perception of political candidates and their policies, interviewing business leaders and diving deeper into topics of interest, psychological profile studies and so on.

Qualitative market research is a relatively less expensive method to understand 2 critical factors in details – “what” the respondents think and feel about a certain topic and “why” they think and feel that way.

LEARN ABOUT: Market research industry

Why do we ask for an opinion? Any opinion for that matter? We ask because the person’s opinion matters to our decision making. None of the successful organizational decisions are made through mere guesses or speculations, but through real information gathered from real and valuable people.

Market research , in general, has played a critical role in inducing a thought process in present day’s organizational leaders where information and data dictate policies and decisions.

However, in market research design , not all information is just numbers and quantitative research . Some are just – conversational and qualitative!

LEARN ABOUT: Research Process Steps

Remember the super hit series Desperate Housewives? And do you remember the lovely housewives calling their friends over for a cup of tea or a couple of drinks to discuss the flashy new products they have bought?

It is not just a vague practice to flaunt these products but a thoughtful one because it matters what the friends think. Whether, they agree or disagree with the quality, brand and other features of those products. It matters what people think. Voila! Welcome to the world of qualitative market research.

Qualitative market research is all about understanding people’s beliefs and point of views and what they feel about the situation and what are the deciding factors that influence their behavior.

LEARN ABOUT: Marketing Insight

To conduct qualitative market research usually, one of these market research methods are used:

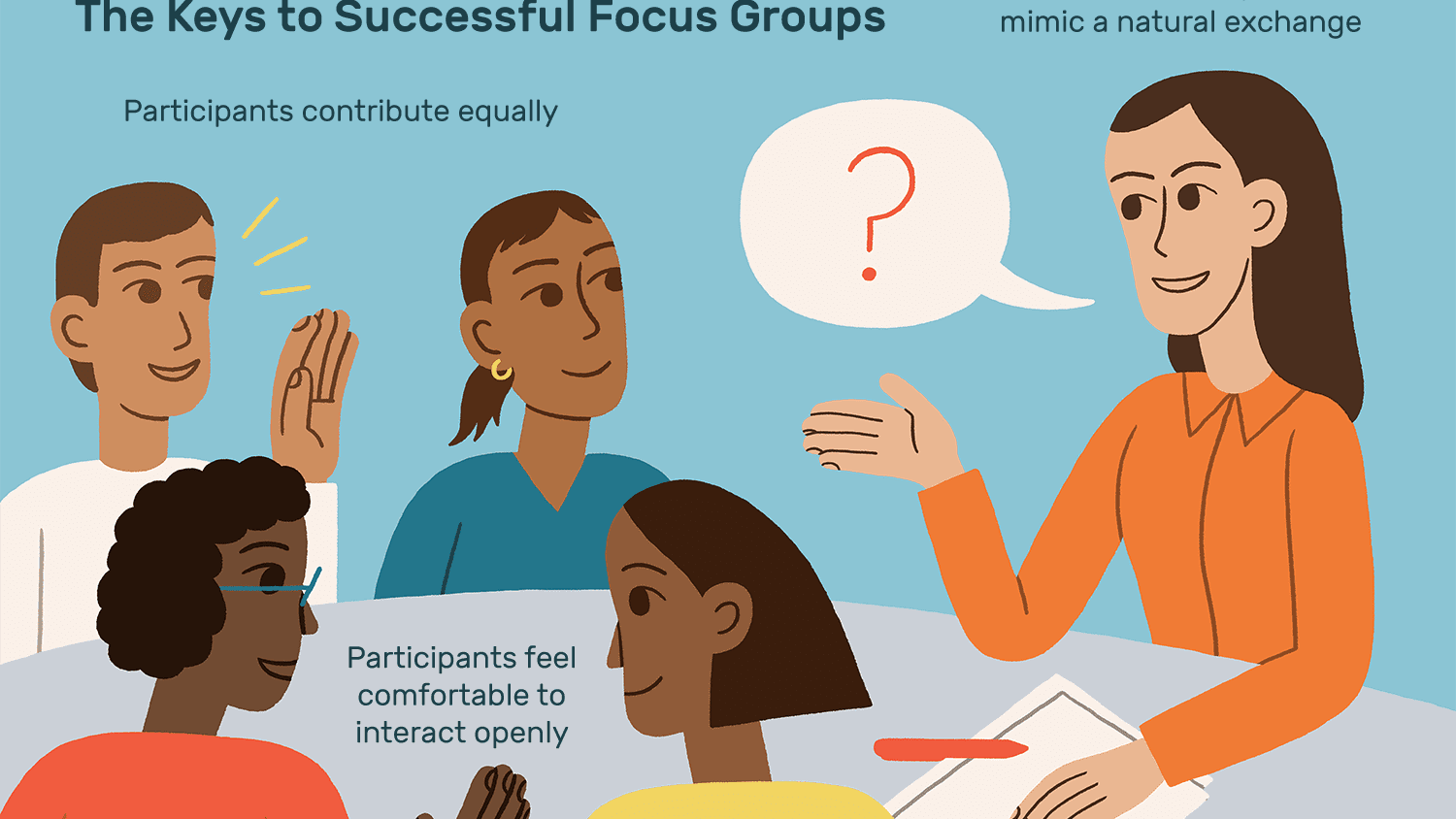

- Focus groups: As the name suggests, a group of people comprising usually of 6-10 members are brought together to discuss a particular product and its market strategies. Usually, experts in that particular field will comprise of the group. This group will have a moderator who will stimulate the discussion amongst the members to derive opinions. Since the focus groups are becoming a rare occurrence, platforms like Communities is on the rise.

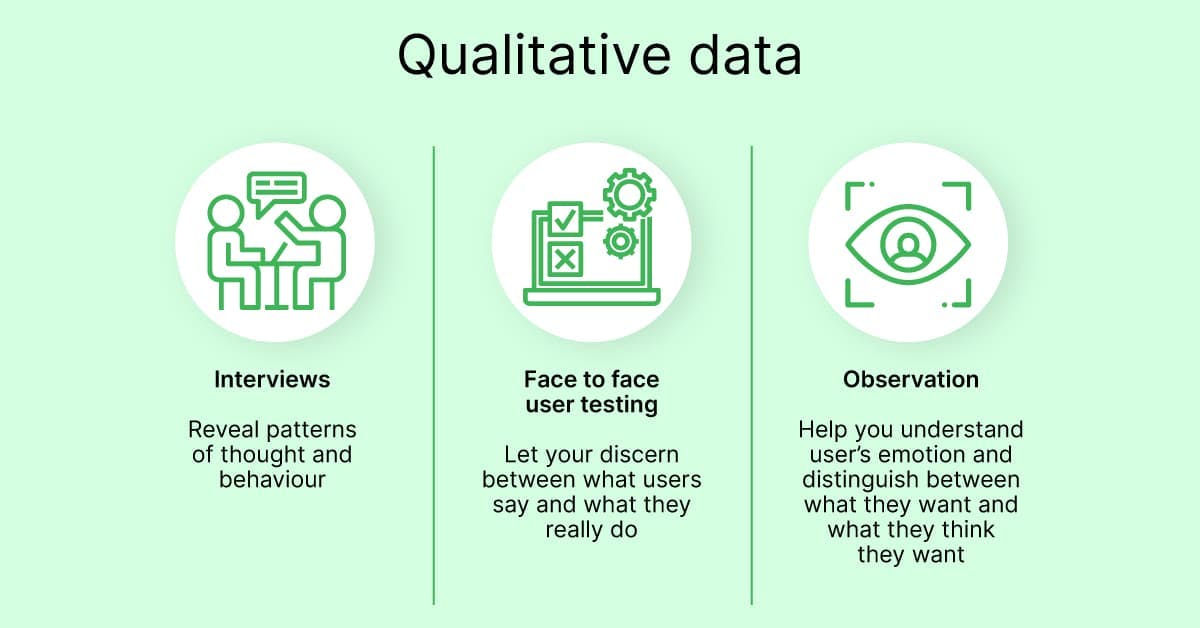

- In-depth Interviews: It is usually a one-on-one interview method conducted with a group of people, either face to face or over the telephone. This method is more conversational and asking open-ended questions helps gather better data.

- Innovative research methods: In this method, the researcher can click photographs of the person who is answering the questions or can even record their videos. Observing these photographs or videos later would tell the researcher about their responses/reactions to various situations.

- Observations or “Shop-alongs”: Qualitative Observations or shop-alongs are now becoming an increasingly used research method in qualitative market research. This method allows the researcher to observe from afar and actually see how a consumer reacts to an actual product and purchase experience. This mitigates the scope to be dishonest with feedback or even forget about the shopping experience at a later stage.

LEARN ABOUT: Qualitative Interview

- Lifestyle Immersion: A newer method of conducting qualitative market research is attending a social or family event that user/s are at and collecting feedback. This helps with the getting feedback from users when they are in a comfortable environment. This is a great way to collect candid feedback in a comfortable environment.

- Online Focus Groups: With the ease of access to social media, online focus groups are becoming easier to manage. It is easy to recruit people to a focus group based study and even manage data collection and analytics.

- Ethnography: Ethnographic research is the process of being in an end user environment and seeing the user indulge with a product in a real-life example. This qualitative research method is best positioned to help create immediate and impactful product tweaks.

- Projective Techniques: Projective techniques are conducted by trained moderators who uncover hidden thoughts of the respondents. The questions or questioning methods are of an indirect nature and the moderator then deduces and uncovers underlying feelings that aren’t explicitly mentioned.

- Online Forums: Online forums is now becoming an increasingly preferred way of conducting qualitative market research. Members in a panel are brought onto a common platform to discuss a certain topic and the moderator ensures the discussion is driven in the direction of the outcome required. The moderator probes, asks the right questions and coerces to ensure a thorough discussion is conducted.

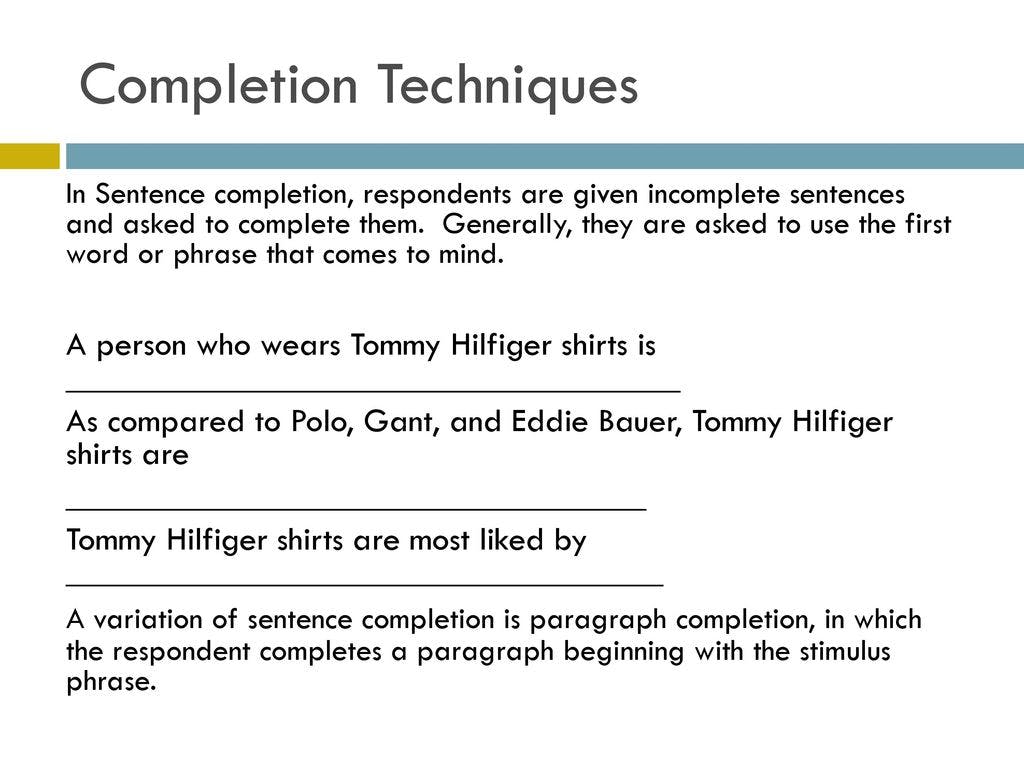

- Online Sentence Completion and Word Association: One of the easier but exhaustive nature of completing qualitative market research is to get respondents to match words that may be related to a product or even complete sentences online and this provides a deeper insight into the thoughts of the user.

Learn more about qualitative research methods

Here are the steps involved in conducting qualitative market research:

- Planning & Determining research objectives: Each research study needs to have a desired outcome at the outset so that the resources behind planning and executing are not wasted and it helps towards business agility.

- Deciding the method to conduct the research: Qualitative market research can be conducted in many ways. Depending on the nature of the study, target audience demographics , geographical location, a product that is being surveyed etc., would the survey method be utilized.

- Getting the right personnel for the job: Conducting a qualitative market research study requires moderators that know how to elicit and track responses from potential respondents.

- Purposive Sampling : In this method, the sample is created with a purpose in mind. The contours of the demographics are planned well in advance and users that fit this criterion are onboard for the market research survey.

- Quota Sampling: Quota sampling is the process of selecting samples from a given quota and the selected users are said to be a representative of the larger population. This can be a random sampling or put some qualifying criteria in.

- Snowball Sampling: Snowball sampling model is based on a reference model. Users that match criteria are asked to refer users that they are personally aware of that match the criteria.

- Survey design: The survey has to be designed in a way to elicit maximum value so that the responses received build towards robust and actionable feedback.

- Data collection: The data collection can be done via online or offline methods. It is imperative to collect the data in such a way that sense could be made of it and it could be used to analyze and report.

- Data Analysis: Data means nothing if it is not analyzed. Data that has been analyzed can give actionable insights for a product or brand to build on and this is imperative for a qualitative marketing research survey.

- Reporting: Once data has been collected and analyzed, it has to be reported in an easy to consume format to the relevant stakeholders as a milestone in the market research process.

LEARN ABOUT: Steps in Qualitative Research

There are 4 distinct types of qualitative market research testing methods that can be conducted. They are:

- Direct Exploration: This qualitative market research method is a no holds barred feedback method for a potential idea or product. This method is conducted where the users are told about the idea where no physical product is provided and all possible feedback is collected. This feedback is then collected and explored to form the basis of the new product.

- Monadic Testing: This method evaluates feedback by providing users with one single idea, concept, feature or product and asks for feedback. In this method, despite there being multiple concepts available, other designs are not shown. This method is important to elicit individual piece of feedback about a desired feature or concept.

- Sequential Monadic Testing: This testing method is similar to monadic testing because each concept, product or feature is shown one time. The only difference is that an alternate design to each concept is shown at the same time and feedback is collected on both from a user. This testing method is also called paired testing or paired nomadic testing.

- Discrete Choice Testing: Discrete choice testing is like paired nomadic testing but the only difference is that all choices are provided at once, not sequentially and the users are asked to pick one feature over another and then explain their choice.

LEARN ABOUT: User Experience Research

Successful businesses tend to use qualitative market research to keep pace with the ongoing market trend analysis , to make better-informed decisions and to achieve business excellence.

Whether your business is a start-up or a well-established entity, qualitative market research is a powerful method to identify your target audience and understand how they will respond to your product.

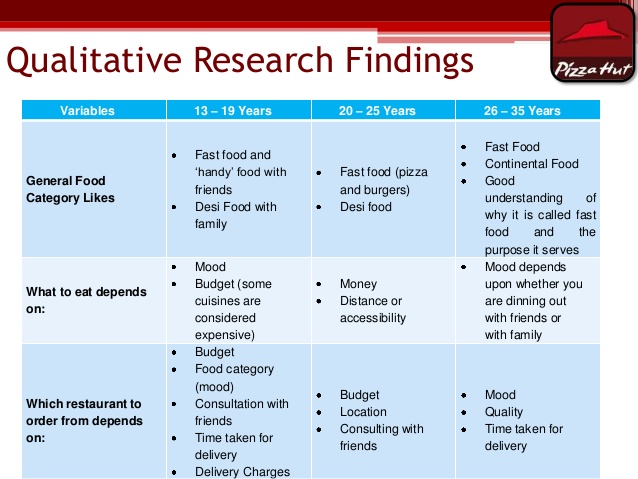

Before we dig deeper here are some of the real-time examples of qualitative market research case studies:

- AP, Norc and QuestionPro partner on geolocation exit polling app

- Washington State Ferry

Some examples of business expansion where qualitative market research plays a critical role by crowdsourcing concrete ideas for optimized decision-making :

- Branding : Many companies fail to understand how consumers perceive their brand or what is the brand positioning in comparison to their competitors. The research is typically done by conducting interviews with customers or organizing focus groups to collect feedback on marketing content and collaterals. In this way, the surveyor can explore different topics in-depth and get feedback from the respondents. Using this market research method, brands can gather information that can help them upscale and reposition their brand better in the market. LEARN ABOUT: Brand health

- Understanding the Consumer Behaviour: Sometimes, organizations/ companies/ entrepreneurs need more information about their consumer in order to place their product in a better manner. To do so they might need information about their gender, age, marital status etc. Qualitative market research helps them gather such information. For understanding the consumer behavior conducting in-depth interviews is the best option, as these interviews are conducted on one to one basis a decent amount of information can be collected.

- Measuring the reach of marketing activities: Many businesses go an extra mile to do a better job in promoting their brands. Here is where their marketing activities come into play. Market research can provide organizations with information about their marketing effectiveness by gathering first-hand information on how consumers look at their marketing message. This helps organizations maximize their marketing budget.

- Identifying new business opportunities: Market research helps organizations explore new opportunities leading to business expansion. By gathering data through market research through focus groups, organizations can pin a location, understand business dynamics, know their key competitors etc., to grow their business in the right direction.

- Getting insights on products: If a company comes up with a new product or looking to improve a current one, it is always better to take a market research in order to understand how acceptable is the product amongst the consumers. When a product comes to the market people have an opinion about its shape, size, utility, color, features etc. Qualitative market research through in-depth interviews will help gather systematic data that can be later used to modify or make the existing product better.

LEARN ABOUT: Market Evaluation

Employee Experience: Definition

Research ethics are as important as important as the ethics in any other research field. It is important to safeguard the participants’ interest. Like there is training and formal processes for researchers in other fields like in healthcare and medical research, market research is also governed by similar policies.

Due to the nature of qualitative market research, it is very important to have informed consent from a participant to be a part of the research study. This means that they are aware of basic information like:

- Nature of the research

- Expected time of completion

- If there are any sociological or physical risks or benefits

- Will a monetary or remuneration in other form be present

- Confidentiality protection

- How will the name and other personal details be used

- Any legal repercussions

Since this is a relatively less expensive and a more flexible method of market research there are a few applications of this market research methodology:

- It helps to understand the needs of the customers and their behavioral research pattern.

- What consumers think and perceive your product as.

- To understand the efficiency of your business planning and also to know if the strategies and planning that you put in place are working or not.

- What sort of marketing messages has a strong impact on the consumers and what just fall on deaf ears?

- Whether or not there is a demand for your product or services in the market?

LEARN ABOUT: Test Market Demand

Ultimately, qualitative market research is all about asking people to elaborate on their opinion to get a better insight into their behavioral pattern. It’s about understanding “Why” even before “What”.

LEARN ABOUT: Behavioral Targeting

- It helps you gather detailed information: One of the major advantages of this market research method is that it helps you collect details information instead of just focusing on the metrics of data. It helps you understand the subtleties of the information obtained thus enabling in-depth analysis .

- It’s adaptive in nature: This market research can adapt to the quality of information that is collected. If the available data seems not to be providing any results, the researcher can immediately seek to collect data in a new direction. This offers more flexibility to collect data.

- It operates within structures that are fluid: The data collected through this research method is based on observation and experiences, therefore, an experienced researcher can follow up with additional open ended questions if needed to extract more information from the respondents.

- Helps communicate brand proposition accurately: Through this market research method, the consumers can communicate with the brand effectively and vice versa. Any product terminology, product jargons etc are effectively communicated as this research method gives a chance to the brand and the consumer to express their needs and values freely, thus minimizing any miscommunication.

- It helps reduce customer churn : Consumer behaviors can change overnight, leaving a brand to wonder what went wrong. By conducting qualitative market research, brands have a chance to understand what consumers want and if they are fulfilling their needs or not, thereby reducing customer churn . Thus the brand-consumer relationship is maintained.

LEARN ABOUT: Market research vs marketing research

- It is time-consuming: Qualitative market research can take days, weeks, months and in some cases even years to complete. This isn’t good to get quick actionable insights. In some cases, the premise with which the survey began may be non-existent due to market evolution.

- It is expensive: Due to the time taken to complete, qualitative market research is extremely expensive. They are also expensive to conduct and create actionable insights because the data is humungous and people with certain research skill sets are required to manage the research process.

- It is subjective: What one user may think could be very different from another. Due to this, there is no standardization of responses. This also means that the lines between true and false blur out to the point that each response is to be considered at face value.

- No result verification: Data collected cannot be verified because in most cases in a qualitative market research, the data is based on personal perceptions. Hence for analysis, each opinion is considered as it is valid.

- Halo effect: Due to the highly subjective nature of the research, the preconceived notion of the moderator or the person conducting the analysis skews the reporting of the research. It is human tendency to gravitate towards what’s known and it is very tough to get rid of this research bias .

LEARN ABOUT: Self-Selection Bias

With the increasing competition in the business world, the extensive need for business research has also increased. QuestionPro Communities is a qualitative research platform that is interactive, where existing customers can submit their feedback and also stay well informed about the market research activities, helps researchers undertake studies to maximize sales and profits. Through the communities platform, researchers can carry out research to effectively target and understand their customers, understand what is the market trend, prevent future research problems and thereby reduce customer churn .

This qualitative research platform helps in developing businesses to know their competitors and help identify the latest trends in the market. To carry out a well-directed research, businesses need a software platform that can help researchers understand the mindset of the consumers, interpret their thoughts and collect meaningful qualitative data .

QuestionPro Communities is the World’s leading platform for conducting analytics powered qualitative method . This online qualitative market research software helps researchers save their time, using niche technology like text analysis , where computers are used to extract worthwhile information from human language in an efficient manner, increase flexibility and improve the validity of qualitative research questions . This online platform help researchers reduce manual and clerical work.

QuestionPro Communities Qualitative Market Research Tools Includes:

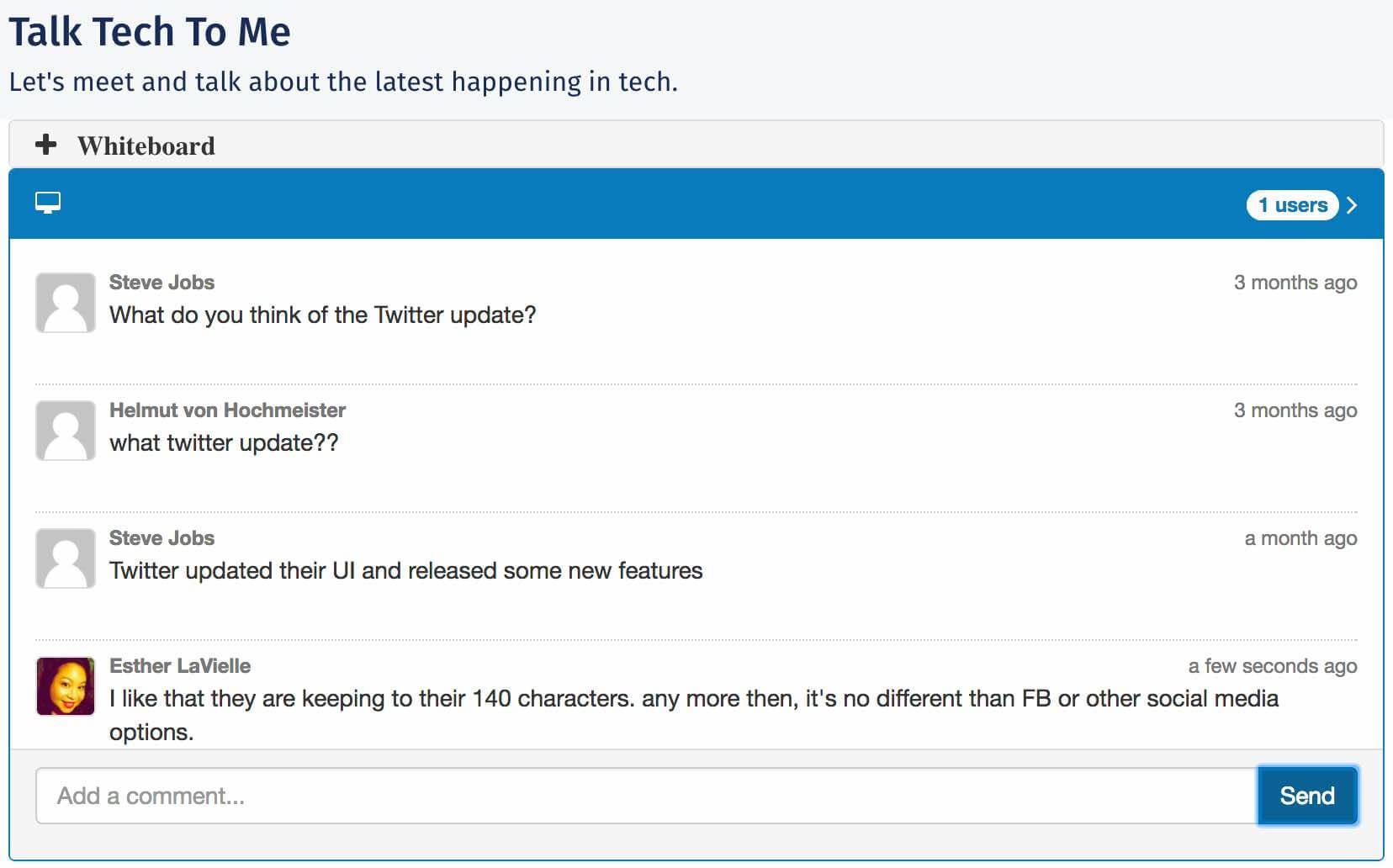

Discussions

The online qualitative research software and tool, Discussions, allows a researcher to invite respondents to a community discussion session and moderate the focus group online. This can also be done live at a specific time that is convenient to the researcher and offer the users the flexibility to post responses when they login to their community. Invitations can be sent out well in advance to a specific target group the researcher would like to gather feedback from.

In case you are looking for respondents to share their ideas and allow others to analyze and offer a feedback and vote on the existing submissions, then this is a great tool to manage and present your results to the key stakeholders.

In this online community, you can submit topics, cast your vote in the existing posts and add comments or feedback instantly.

QuestionPro Communities is the only panel management and discussion platform that offers a seamless mobile communities experience. When it comes to engagement, how you reach respondents matter! Go mobile and take Discussions, Topics, and Idea Board anywhere your respondents go.

Feel free to explore our latest blog discussing practical examples of qualitative data in education – a valuable resource to deepen your insights into student experiences and learning dynamics. Why not give it a read and discover fresh perspectives for enhancing educational practices?

Learn about the other market research method: Quantitative Market Research

MORE LIKE THIS

Why Multilingual 360 Feedback Surveys Provide Better Insights

Jun 3, 2024

Raked Weighting: A Key Tool for Accurate Survey Results

May 31, 2024

Top 8 Data Trends to Understand the Future of Data

May 30, 2024

Top 12 Interactive Presentation Software to Engage Your User

May 29, 2024

Other categories

- Academic Research

- Artificial Intelligence

- Assessments

- Brand Awareness

- Case Studies

- Communities

- Consumer Insights

- Customer effort score

- Customer Engagement

- Customer Experience

- Customer Loyalty

- Customer Research

- Customer Satisfaction

- Employee Benefits

- Employee Engagement

- Employee Retention

- Friday Five

- General Data Protection Regulation

- Insights Hub

- Life@QuestionPro

- Market Research

- Mobile diaries

- Mobile Surveys

- New Features

- Online Communities

- Question Types

- Questionnaire

- QuestionPro Products

- Release Notes

- Research Tools and Apps

- Revenue at Risk

- Survey Templates

- Training Tips

- Uncategorized

- Video Learning Series

- What’s Coming Up

- Workforce Intelligence

Qualitative research in marketing: definition, methods and examples

Apr 7th, 2022

What is qualitative research?

Qualitative research methods, how to design qualitative research , qualitative research examples.

- Share this article

Qualitative research allows businesses to determine customers’ needs, generate ideas on improving the product or expanding the product line, clarify the marketing mix and understand how the product would fit into customers’ lifestyles. The research will be useful for businesses of any size and type. For example, entrepreneurs can use qualitative research to gain insight into customers’ feelings, values, and impressions of the product or service. With qualitative research, you can understand the reasons and motives of customers’ reactions and use this information to create marketing and sales strategies .

The research can also help you design products and services that meet the requirements of your target audience. For instance, imagine you are a restaurant owner and want to introduce a new menu; you can conduct qualitative research and invite local residents to give you feedback on the food, service, and pricing. This approach will increase your chances of success.

Qualitative research studies the motives that determine consumer behavior by employing observation methods and unstructured questioning techniques, such as individual in-depth interviews and group discussions. The approach involves the collection and analysis of primary and secondary non-numerical data. The goal of qualitative research is to understand the underlying reasons for making purchasing decisions and learn about customers’ values and beliefs.

Qualitative research asks open-ended questions beginning with the words “what”, “how”, and “why” to get feedback concerning a new product or service before the launch or development phase. This method reveals customers’ perceptions of the brand, buyers’ needs, advantages, and drawbacks of the product or service. Furthermore, it helps evaluate promotional materials and predict how the product or service can influence the lives of your customers.

This research method emerged in the early 1940s when American sociologist Paul Lazarsfeld introduced focus group interviews to study the impact of propaganda during World War II. In the late 1940s, American psychologist and marketing expert Ernest Dichter developed a new type of consumer research called motivational research. Dichter used Freudian psychoanalytic concepts to understand the motives of consumer behavior. He conducted in-depth interviews to learn more about customers’ needs and attitudes towards certain products.

In the 1960s, marketing academic John Howard began studying consumer behavior from the perspective of social sciences, including psychology, anthropology, and economics. At the same time, market researchers focused on the emotions, feelings, and attitudinal elements of consumption. As a result, in-depth interviews, video-recorded focus groups, and computer-assisted telephone interviews became prevalent qualitative research techniques.

With the advent of the Internet and mobile devices, qualitative research has undergone numerous changes. Today the Internet allows researchers to conduct surveys on a much larger scale. The marketers can use hyper-segmentation and hyper-personalization to launch targeted advertising campaigns, utilize market research analysis software and gather customer opinions using social media analysis. Let us take a detailed look at the basic methods of qualitative research.

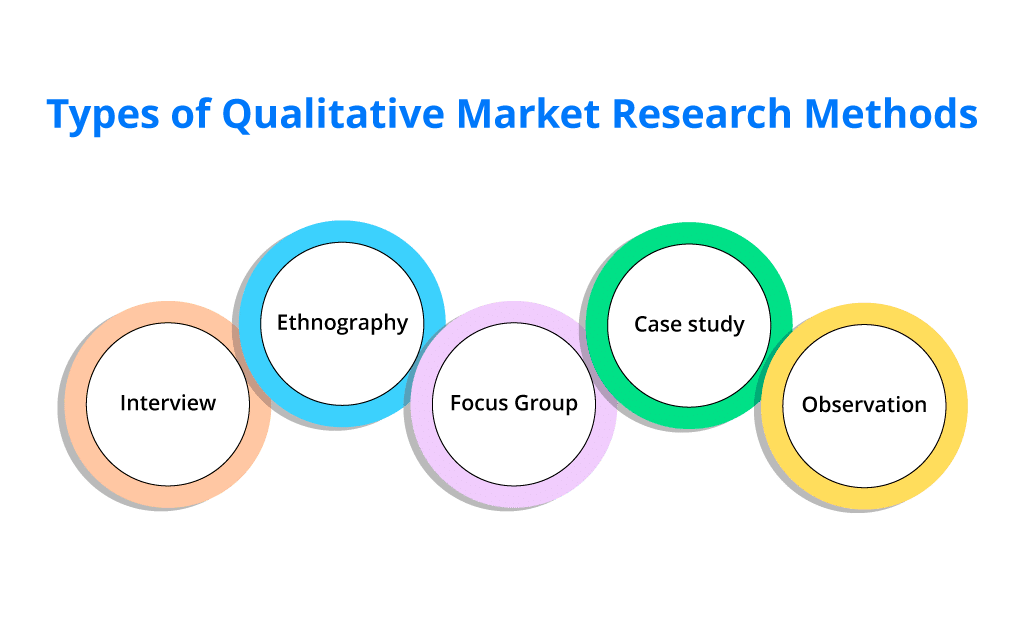

The most common qualitative research methods include focus groups, individual interviews, observations, in-home videos, lifestyle immersion, ethnographic research, online sentence completion, and word association. We will consider each of them in more detail below.

Focus groups

Focus groups are discussions dedicated to a specific product and its marketing strategies . The groups typically consist of 6-10 people and a moderator who encourages them to express their opinions and feelings about the product. Usually, focus groups are held in-person to study consumers’ verbal and non-verbal reactions to the product or advertising campaign.

This method has several applications, including testing marketing programs, evaluating the overall concept for a product, examining the copy and images of the advertisements, and analyzing the new types of product packaging. Nowadays, in-person focus groups are losing popularity, while online discussions via video conferencing tools are attracting a lot of attention from researchers.

Social media analysis

Social media and mobile devices give brands more opportunities to gather and analyze information. Customers now interact directly with brands on social media platforms where they spend their free time. Content analysis of Facebook posts, comments, tweets, YouTube videos , and Instagram photos allows brands to track consumers’ activities, locations, and commonly used words.

You can ask for users’ feedback , encourage them to fill out a brief survey, or engage with customers to inform them of your marketing plans and the development of new products. Furthermore, the qualitative research participants can provide additional contextual information like photos and videos, which gives a better understanding of their thoughts and attitudes.

Individual interviews

An individual interview is usually conducted in person, over the phone, or via video conferencing platforms. The interviewer asks the existing customer a number of questions to determine his motivation to buy a particular product. One-to-one interviews are held as a free-flowing conversation and include open-ended questions. The interviews can be flexible, semi-structured, and unstructured. You can ask about the customer’s frustrations concerning the product, motivations and reasons for purchase, and the sources of information from which they learned about the product.

Observations

Observations allow researchers to see how the customers react to the products in the store and analyze their shopping behavior and purchase experience. This method is more effective than written surveys as it provides better insight into consumer reactions. For example, the researchers can observe how customers stop outside the store, what attracts them to the shop window and which way they walk once they enter the store. In addition, observations help determine problems related to product placement on store shelves, clutter, or products that are out of stock. You can also collect customer feedback to improve some aspects of the shopping process, like packaging design.

In-home videos

In-home videos allow researchers to watch how customers engage with the product in the comfort of their own homes. Using this method, you can monitor user behavior in a natural and relaxed environment. Thus, you can have a better picture of the ways people use your product. The customers can keep video diaries or film the videos with detailed comments concerning your product. You can store the qualitative content in one place and create an insight hub to analyze and reuse the collected information in the future.

Lifestyle immersion

Lifestyle immersion is another method that allows obtaining customer feedback in a comfortable environment. Immersion refers to the researcher’s profound personal involvement in a customer’s life. For instance, the researcher visits an event, such as a party or family gathering, and observes the user’s reactions and behaviors in a familiar setting. Watching how users speak to their family and friends is an increasingly effective technique that allows learning more about their needs, challenges, and motives.

Ethnographic research

Ethnography is a type of research that originates from 20th-century anthropology and involves observing people in a natural environment rather than a lab. Namely, the researchers watch how respondents cope with their daily tasks, such as grocery shopping or preparing dinner. This helps see what people actually do instead of what they claim to do.

Ethnography applies a variety of approaches, including direct observation, video recordings, diary studies, and photography. Researchers can observe the user’s behavior at home, at the workplace, or with their family or friends. Passive observation as a method of ethnographic research implies following and watching users without interacting with them or interfering with their actions. Active observation, in contrast, entails working or cooperating with consumers, asking them questions about a product or service, and joining their team or group.

Online sentence completion and word association

Sentence completion is a projective technique used in qualitative research to allow customers to express their opinions and feelings. According to this method, the respondents receive the survey with unfinished sentences. They should complete sentences that describe the product or find the words that would be appropriate in the context of the sentence. With this method, the researcher can put qualitative data in a structured form.

Word association is a similar technique that helps researchers gather information about brand awareness , images, and associations related to a specific product or brand. The respondents are given the trigger words and instructed to write the first word, association, or image that comes to mind. In contrast to the interviews and focus groups, sentence completion and word association techniques can reach more people when conducted online. Moreover, it takes less time to analyze the results and understand users’ perceptions.

Once you have learned about the most widely used qualitative research methods, it is time to plan the research process step by step.

The success of your research outcomes greatly depends on adequate planning and appropriate strategy. Here we will list some general guidelines on how to conduct qualitative research.

Determine research objectives

The first step to designing or running qualitative market research is understanding the goals you want to achieve with your study. In particular, the research objectives might include discovering the existing or potential product or brand positioning , understanding perceptions about the company or product, investigating how people react to advertising campaigns, packaging or design, evaluating website usability, and identifying strengths and weaknesses in the product. The absence of clear objectives would create challenges for the researcher as qualitative research involves open-ended questions and in-depth replies that are difficult to interpret and analyze directly.

Choose the methodology to conduct the research

Determine the most suitable method to perform market research taking into account demographics, geographical location of your target audience, lifestyle behaviors, and the product that is being examined. Market researchers usually collaborate with professional recruiters who find and screen the participants. A significant part of the researcher’s work is to develop a list of topics for discussion in small groups. You need to involve moderators who would spend from 90 to 120 minutes with the group asking questions, observing their reactions, and analyzing behavior.

Investigate various data collection methods

Once you have chosen the observation method, you need to involve a moderator to examine the participants’ behavior and take notes. This approach usually requires a video camera or a one-way mirror. You can also combine qualitative and quantitative research to collect numerical data and analyze metrics together with customers’ replies and observation results.

When running focus groups, you can either organize one discussion with eight to ten participants or a series of online meetings which will last three-four days. Respondents will answer the questions from the moderator or react to prerecorded videos.

When you conduct one-on-one interviews, you need to speak with the respondents on the phone or organize a personal meeting. This method will be suitable if you want customers to try the product and share their impressions.

Analyze the collected data

Researchers will typically need a few days to a few weeks to collect the information. Then researchers will examine the data to provide responses to your questions. The next step is qualitative coding or the technique of categorizing the findings to identify themes and patterns. The specialists might also include the statistics to explain what the data is indicating. Besides, the report might contain a narrative analysis of underlying messages and phrasings.

Study the report and recommendations

The final step is to review the report provided by the researchers. It can be a written document or video recording. The paper, based on MECE principles , will help you group the patterns and similarities and sort them according to demographics and other customer characteristics. The document will contain specific recommendations, so you can draw conclusions and start making improvements to your product marketing strategy .

In the next section of this article, we will review how famous brands have put qualitative research methods into practice.

Qualitative market research helps brands strengthen their reputation and credibility, segment customers , identify market trends, increase awareness, rebrand products , and get feedback from the consumers on their preferences. Let us discover how McDonald’s, Starbucks, and LEGO use data to confront tough competition.

When conducting market research, McDonald’s asks the customers several critical questions regarding best-performing products, the most appropriate pricing , the effective advertisements, and the most attended restaurants. Finding answers to these questions allows for analyzing whether the company managed to expand its customer base.

Furthermore, McDonald’s collects customer feedback to improve the products. In particular, many customers were disappointed with the lack of healthy and organic options on the menu. As a result, the company added apple slices and other healthy items to the menu and launched an advertising campaign to show that chicken nuggets and burgers were made of real meat.

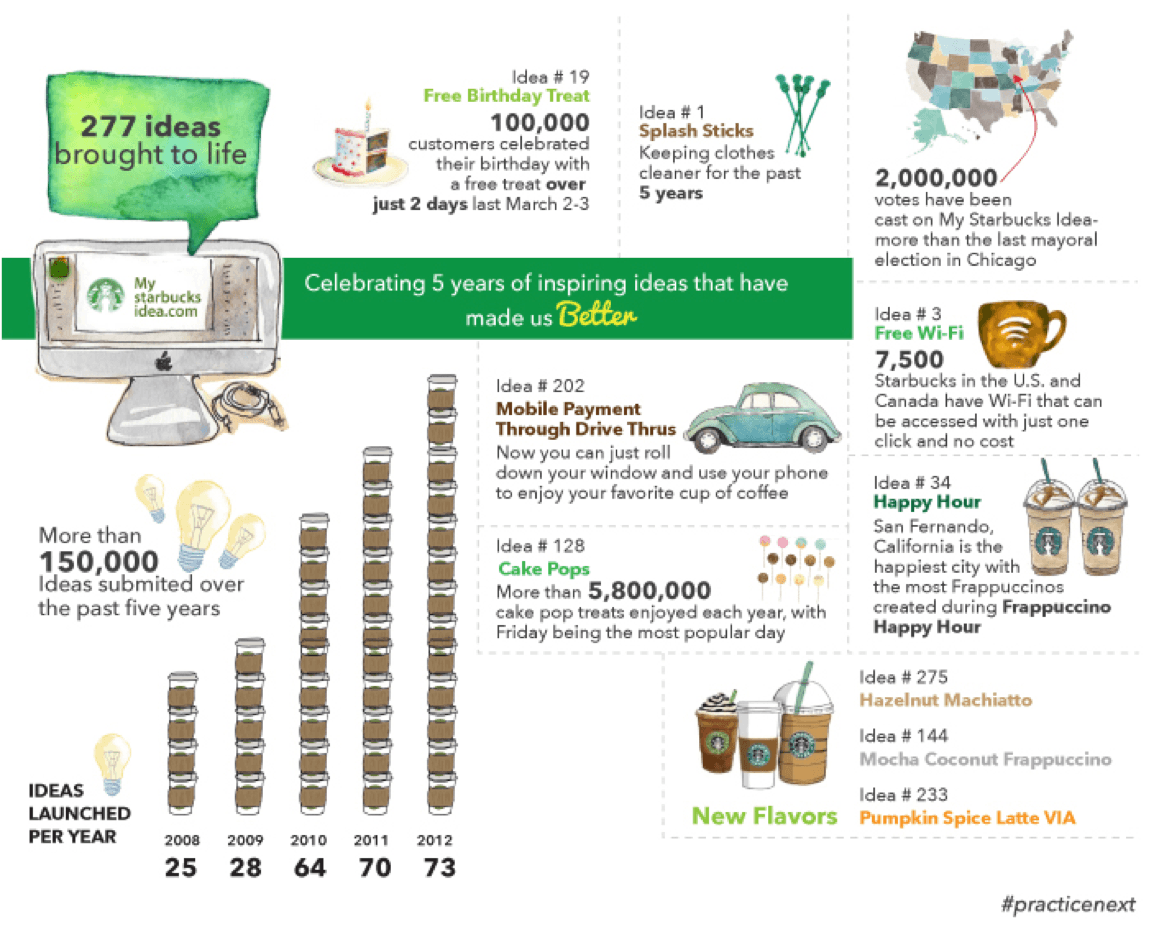

Starbucks encourages customers to share feedback on the official site and contribute ideas via Twitter . The company monitors social media, tracks cultural trends, and offers customers to test the products in the stores. From 2008 to 2018, Starbucks used the My Starbucks Idea platform to collect ideas and continuously improve its products. The company implemented over 275 consumer ideas, including recommendations about new products and methods to improve corporate responsibility.

Some years before, LEGO was considered to be primarily a boy-oriented company. Then LEGO decided to promote inclusivity and create toys targeted at all genders. The company conducted research involving 3,500 girls and their parents to examine children’s behavior while playing with toys. Later LEGO used the collected data to determine the size of the figures and create bright packaging for the new toy line called “Friends” which was designed specifically for girls.

Companies would not create new offers, improve their existing products, satisfy the needs of their customers, or solve the most difficult challenges without market research. Qualitative research will help you obtain a clear understanding of your target customers, recognize the emotional connections to your brand, identify potential obstacles to purchase and features that are missing in your offer, and as a result, develop an outstanding product.

- Marketing Strategy & Branding

- Content Marketing & SEO

- Product Focused Marketing

- Digital Experience Design

- Marketing Automation

- Video Production

© 2023 Awware

Qualitative Market Research Methods + Examples

Qualitative market research is one of the most effective ways to understand consumer sentiment . If you really want to know how people feel about a product or business; and the ‘why’ behind it, qualitative research will tell you what you need to know.

This guide covers qualitative market research methods, including the different tools and techniques, their benefits, and examples of qualitative research in action.

What is qualitative market research?

Qualitative market research uncovers key insights into how people feel about a product or brand. It’s more of a touchy-feely type of market research than quantitative research , often performed with a small, handpicked group of respondents.

There are many different ways to conduct qualitative research. These include focus groups, interviews, ethnographic, observational research, and even biometrics. Although it takes time to conduct and analyze results, it’s one of the most popular types of market research .

Qualitative market research methods

Market research surveys are the most widely used qualitative market research method. Perhaps that’s down to their ease of use, availability, or the low cost of getting them out, in, and analyzed. But let’s be honest; all types of market research have pros and cons, which is exactly why picking the right technique is key.

Focus groups

What it is: Focus groups can be done in person or online. Participants are selected from within a target market or audience. Typically, people answer questions about the how, what, and why of a specific topic. While focus group formats vary, participant numbers should always be limited to ensure each person has the chance to contribute.

Best for: This type of qualitative market research is beneficial for testing new concepts or products in a market. It’s also good for getting feedback on existing products and things like usability, functionality, and ease of use.

Good to know: Online focus groups are becoming increasingly popular. As no interaction is required between participants, running them online allows responses to be collected in minutes without impacting data quality. It also reduces costs and means more people can attend due to fewer travel or time constraints.

What it is: Interviews are a tried-and-trusted qualitative research method that can be done in person or over the phone. It’s a highly personal approach that takes a conversational format between just two or three people. Researchers ask pre-set questions designed to collect intel and insights for further analysis. Interview formats vary depending on the research questions .

Best for Granular feedback from people within a target market or a target persona. Researchers obtain details about a person’s intentions, beliefs, motivations, and preferences.

Helpful Scroll to the qualitative market research examples section and view a copy of our template for customer interviews at Similarweb.

Read more: 83 Qualitative Research Questions & Examples

What it is: Most people have used or consumed case study content in the past without necessarily realizing it’s a type of qualitative research. It analyzes contextual factors relevant to a specific problem or outcome in detail. Case study research can be carried out by marketing professionals or researchers and typically follows a structured approach, exploring a problem, the solution, and its impact.

Case studies can take anything from one month upwards to a year to develop and often involve using other types of qualitative market research, such as focus groups or interviews, to inform key content.

Best for: They’re more commonly used as a marketing tool to showcase a solution or service’s impact within a target market or use case. But, new product or service developments are two other popular applications.

What it is: One of the lesser-known methods of qualitative market research is biometrics. There’s an article about this on Bloomberg , showcasing how Expedia uses biometrics in its market research stack. The format for their project takes the trusty focus group scenario, adding a modern twist.

In this example, research participants were asked to attach a set of skin response sensors to their hands. But there could also be eye-tracking, emotional analysis, heat mapping, or facial sensors being used to track responses in tandem. Individuals were tasked with surfing the web; a researcher requested they do specific tasks or carry out a search in a self-directing manner. Responses are recorded, analyzed, and translated into meaningful insights.

Depending on the tech being used, the direction, and the goal of the research, this type of qualitative market research can show:

- How people surf the web or use a site

- The way people react in a specific situation

- How they respond to content, CTAs, layouts, promotions, tasks, or experiences

- Insights into what drives people to take action on a site

Best for: Larger digital-first companies with a budget to suit; those who want to perform UX testing to improve the content, customer journey, experience, or layout of a website.

Insightful The adoption of biometric technology in market research was at an all-time high in 2020. With the technology becoming more widely available, the adoption cost will likely fall, making it more accessible to a larger pool of organizations.

Ethnography

What it is: Enthnograprhic market research (EMR) is one of the costliest types of qualitative research. An experienced ethnographic researcher is needed to design and conduct the study. It analyzes people in their own environment, be it at home, an office, or another location of interest.

Research can take place over a few hours, months, or even years. It’s typically used during the early-stage development of a user-centric design project. But it can also be useful in identifying or analyzing issues arising once a product or service has gone to market.

Best for: It’s widely adopted within useability, service design, and user-focused fields. Getting under the skin of a design problem helps develop a deeper understanding of issues a product should solve. Outcomes help to build improvements or new features in products or services.

Grounded theory

What it is: Researchers use various qualitative market research methods, such as surveys or interviews, and combine them with other types of secondary market research to inform outcomes. Typically, participant groups are between 20-60, making it a larger sample size than focus groups. Responses are collated, and a series of specialist coding techniques are used to formulate a theory that explains behavioral patterns.

Best for: Organizations can better understand a target audience by using research to generate a theory. The findings provide explanations that can inform design decisions or spark new innovation through features or improvements to products or services. A typical use case could be when particularly heavy use of a product occurs or frustrations arise with usability – grounded theory is then used to explore the reasoning behind these behaviors.

Observational

What it is: Contrary to belief, this type of qualitative market research can occur remotely or on-site. A researcher will observe people via camera or being physically present in a shopping mall, store, or other location. Systematic data are collated using subjective methods that monitor how people react in a natural setting. Researchers usually remain out of sight to ensure they go undetected by the people they observe.

Best for: Low-budget market research projects. Suited to those with a physical store or who seek to examine consumer behavior in a public setting. Researchers can see how people react to products or how they navigate around a store. It can also provide insights into shopping behavior, and record the purchase experience.

Useful to know: Observational research provides more effective feedback than market research surveys. This is because instinctive reactions are more reflective of real-world behaviors.

Online Forums

What it is: A web message board or online forum is quick and easy to set up. Most people know how they work, and users’ names can be anonymized. This makes it a safe space to conduct group research and gain consensus or garner opinions on things like creative concepts, promotions, new features, or other topics of interest. The researcher moderates it to ensure discussions remain focused and the right questions are asked to thoroughly explore a topic.

Organizations typically invite between 10-30 participants, and forums are open for anything between 1-5 days. The researcher initiates various threads and may later divide people into subgroups once initial responses are given.

Here’s an example.

If a group of male participants indicates they dislike a specific content on the forum. The moderator would create a subgroup on the fly, with the intent of probing into the viewpoints of that group in more detail.

Best for: Discussing sensitive research topics that people may feel uncomfortable sharing in a group or interview. Getting feedback from people from a broad area and diverse backgrounds is easy. And a more cost-effective way to run focus groups with similar aims and outcomes.

What it is: For a survey to be considered a type of qualitative market research, questions should remain open and closed-ended. Surveys are typically sent digitally but can also be done in person or via direct mail. Feedback can be anonymous or with user details exposed. Surveys are a type of primary research and should be tailored to the research goals and the audience. Segmentation is a great way to uncover more about a select group of people that make up a target persona or market.

Best for: A low-cost way to question a large group of people and gain insights into how they feel about a topic or product. It can be used to flesh out usability issues, explore the viability of new features, or better understand a target audience in almost any sector. Surveys can also be used to explore UX or employee experience in greater detail.

Read more: 18 Ways Businesses Can Use Market Research Surveys

Diary or journal logging

What it is: When you think about it, almost all qualitative research methods aim to help you understand the experiences, lives, and motivations of people. What better way is there to connect with how people think and feel than a journal? Yes, it’s pretty much exactly what it claims to be; a simple note-taking exercise that records regular input, insights, feelings, and thoughts over a period of time.

A survey or focus group captures sentiment at a single point in time. Whereas journal logging gives way to more frequent input without any pressures of time to consider. It’s also more reliable data, as there’s no requirement for people to think about and recall data, as input occurs at the moment. Popular formats include digital diaries, paper journals, and voice journals.

Key parameters are set out from the start. And offer prompts so people know what to record, how often they need to make an entry, the time of day (if relevant), how much they should write, and the purpose or goal of the research.

Best for: Measuring change or impact over time. They’re also a great tool to establish things like:

- Usage scenarios

- Motivations

- Changes in perception

- Behavioral shifts

- Customer journeys

Start building your story with Similarweb today

Benefits of qualitative market research.

- Flexible – It can be adjusted according to the situation. For example, if the questions being asked aren’t yielding useful information, the researcher can change direction with open questions and adapt as needed.

- Clear and open communication – Forums like these can help a brand and its customers communicate effectively. The voice of the customer is paramount, and participants are encouraged to express their values and needs freely.

- Provides detailed information – One of the biggest draws of qualitative research is the level of detail given by respondents. Data collected can be vital in helping organizations gain an in-depth understanding of consumer pain points and perspectives.

- Improve retention – Qualitative research gets under the hood, helping an organization know how consumers think or feel about a business or its products. The intel can shape future offerings or improve service elements, thus boosting loyalty.

Qualitative market research examples

Whether you’ve carried out qualitative research in the past or not, it’s never a bad idea to look at what others are doing. Who knows, it could inspire your research project or give you an example of qualitative research in action to use as a base.

Here are three qualitative market research examples in action!

Example 1: This Voice of Customer questionnaire is an example of qualitative research we use here at Similarweb.

Example 2: A market research survey used in retail. It’s sent out with a digital copy of a store receipt and aims to explore how people feel about their in-store experience.

Example 3: A case study report published by Forrester Consulting. It highlights the ROI of Similarweb following a period of use and a forward-looking estimation.

A smarter way to get Similar results in less time

While different in nature, qualitative and quantitative research go hand in hand. In short, qualitative can explain what quantitative research shows. While qualitative research costs vary, it takes time to plan, conduct, and analyze. Not everybody has the luxury of time or the resources to carry out their own qualitative market research. And with how fast markets and consumer behaviors shift, it’s not always the optimal solution.

Feature spotlight: Audience Analysis

Similarweb’s audience behavior research tool shows you where people in your target market spend their time online. Uncovering critical, unbiased insights at pace.

- Audience metrics show you demographics , geographics , audience loyalty , and interests.

- Competitive insights allow you to see any rivals’ reach and unpack their successes.

- Visualize your target market like never before – layered with insights that show where and how they spend time online.

- Segment your audience to see industry-specific consumer interests.

- Discover untapped audiences to acquire and grow your share of market.

As a single source of truth, Similarweb Research Intelligence lets you get the measure of the digital world that matters to you most. At a glance, you can see what’s happening in any market, and drill down into any rival or audience group to spot trends, analyze changes, and inform key decisions; fast. As far as market research tools go, it’s the only platform that brings together feedback from mobile web, desktop, and mobile apps in a single place. Giving you a complete and comprehensive picture of your digital landscape.

Wrapping Up…

Compared to quantitative research, the qualitative approach can take more time and cost more money. But, there are distinct benefits that make it hard to dismiss. While statistical research can show you the ‘what,’ ‘who,’ and ‘when’, qualitative research complements this and helps uncover the ‘why’ and ‘how’ – giving you the complete picture.

From the high-hitting budget owners to the SMBs who need to research a market or audience, qualitative research is a vital tool that’ll help you uncover insights and focus on growth.

Digital intelligence platforms like Similarweb can give you a framework to outline a story that can be filled in with qualitative research later down the line.

What’s the difference between quantitative and qualitative research methods? Qualitative market research is a type of primary research method that explores how people think and feel about a topic. Quantitative research is statistics-based and analyses numerical data.

What are the different types of qualitative market research? The most popular types of qualitative market research include Focus groups, interviews, ethnography, case studies, grounded theory, observational, online forums, open-ended surveys, biometrics, narrative, thematic analysis, diary or journal logging, thematic analysis, and phenomenological study.

How is qualitative research used in marketing? Qualitative market research serves as a tool that helps marketing teams identify consumer needs, refine product messaging, generate ideas for campaigns, discover new channels, and develop targeted campaigns that resonate with target audiences.

What Types of Questions are Asked in Qualitative Market Research? Qualitative market research often focuses on open-ended questions that allow respondents to provide detailed answers about their attitudes, opinions, and experiences. Examples of questions include: What factors influence your decision to purchase a particular product or service? How do you use a product or service? What do you like or dislike about a product or service?

What are the Limitations of Qualitative Market Research? Qualitative market research can be subjective and may be limited by the number of participants and the amount of time available for research. Additionally, qualitative research does not provide quantitative data , which can be useful for measuring and comparing consumer behavior.

Related Posts

What is Quantitative Data? Your Guide to Data-Driven Success

Demand Forecasting 101: How to Predict Future Demand For Your Products

US Financial Outlook: Top Trends to Watch in 2024

Top Economic Trends in Australia to Watch in 2024

What Is Data Management and Why Is It Important?

What is a Niche Market? And How to Find the Right One

Wondering what similarweb can do for your business.

Give it a try or talk to our insights team — don’t worry, it’s free!

- Pollfish School

- Market Research

- Survey Guides

- Get started

The Complete Guide to Qualitative Market Research

So what exactly is qualitative research? At a glance, this type of research method seeks to gather in-depth data about a phenomenon without focusing on numerical data or on quantities.

But there is much more to this kind of study method. Learn holistically about qualitative market research with this complete guide.

What Defines & Makes Up Qualitative Research?

Qualitative research is centered around experiences, ideas and opinions. As such, it does not focus on statistical or quantitative outcomes. Instead, it seeks out an in-depth understanding of an issue, occurrence or phenomenon.

Thus, this research method zeroes in on the “what” and more importantly, the “why” of a research subject. (Unlike quantitative research, which focuses on the “how much”).

Here are some of the applications of qualitative research:

Understanding an issue in greater depth

Finding the reason behind an occurrence (whether it’s desirable or undesirable)

Uncovering trends in target market opinions

Forming educated solutions to address customer/studied subject concerns

Discovering the causes of certain actions

Qualitative research generally relies on a smaller sample size in order to get a deep read of happenings, causes and motivations. This kind of research method functions through the usage of open-ended and exploratory questions.

Understanding the “why” behind an issue is then used to make decisions on how to resolve the issue or how to improve on an existing productive situation.

Qualitative data must occur in natural environments. This denotes a kind of environment in which participants discuss their opinions at length and at ease, which researchers use to gain deeper knowledge and form inferences around a topic.

Prior to the internet, this kind of research was conducted in-person, but with the advent of the internet and innovations in market research, qualitative data has been collected online. The digital space can also serve as a natural environment.

The Five Main Types of Qualitative Research

Just as with quantitative research, there is not a single approach to conducting qualitative research. On the contrary, there are five main varieties of performing qualitative research. Aside from their methodology, these sub-categories also seek different types of answers and conclusions.

1. Narrative Research

This research is used to form a cohesive story, or narrative, by way of consolidating several events from a small group of people. It involves running in-depth interviews and reading up on documents featuring similar actions as a means of theme-searching.

The point of this is to discover how one narrative is shaped by larger contextual influences. Interviews should be conducted for weeks to months and sometimes even for years. The narrative that the researcher uncovers does not have to be presented in sequential order.

Instead, it should be projected as one with defined themes that attempt to reconcile inconsistent stories. This method can highlight the research study’s ongoing challenges and hardships, which can be used to make any improvements.

2. Ethnographic Research

The most common qualitative research method, ethnography relies on entrenching oneself in various participant environments to extract challenges, goals, themes and cultures.

As the name suggests, it involves taking an ethnographic approach to research, meaning that researchers would experience an environment themselves to draw research. Using this firsthand observation, the researcher would not need to then rely on interviews or surveys.

This approach may seem to be far-fetched where market research is concerned, but it is doable. For example, you’d like to see the effectiveness or frustration that customers face when using your product. Since you can’t follow them home, you can request videos that show them using it. Many big brands have call-outs on their websites (ex: on product pages) for their customers to send in videos of their interactions with the products.

3. Phenomenological Research

This qualitative method entails researchers having to probe a phenomenon or event by bringing lived experiences to light and then interpreting them. In order to achieve this, researchers use several methods in combination.

These include conducting surveys, interviews and utilizing secondary research such as available documents and videos on the studied phenomenon. Additionally, as in ethnographic research, phenomenological research involves visiting places to collect research.

These will help you understand how your participants view your subject of examination. In turn, you will gain insight into the participants’ motivations.

In this research type, you would conduct between 5 and 25 surveys or interviews, then peruse them for themes. Once again, you would scrutinize experiences and sentiment over numerical data.

4. Grounded Theory Research

In contrast to phenomenological research, which seeks to fully form the core of an issue, grounded theory attempts to find explanations (the why) behind an issue. To achieve this, researchers use interviews, surveys and secondary research to form a theory around the issue/occurrence.

The sample of this study tends to be on the larger side, at 20-60 participants. Data extracted from this type of research is interpreted to determine the reasoning behind, for example, heavy usage of or frustration with a product. These types of studies help a business innovate an existing product by getting into the weeds of how it’s used.

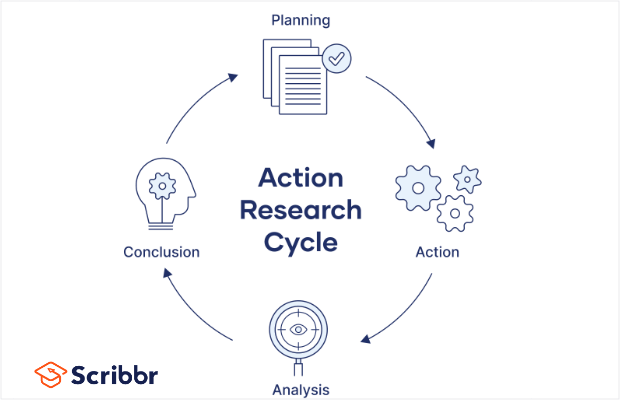

5. Action Research

This type of research involves researchers and participants working collaboratively to bring theory to practice. Also called participatory research, collaborative inquiry, emancipatory research and action learning, this method entails the act of “learning by doing.”

This means a group of researchers come together to find and address a problem, resolve it and then study the success of their endeavors. If they underperformed or their outcomes don’t satisfy their expectations, they would then reattempt the process.

In action research , a researcher spends a considerable amount of time on collecting, analyzing, and presenting data in an ongoing, periodic process. This involves researchers coming up with their own surveys and interviews around a subject matter, then presenting their findings to one another to draw conclusions and solutions.

They would put into practice the means to improve a situation and continue measuring their success throughout the process.

Examples of Questions for Qualitative Research

When working within the capacity of any of the above research types, it’s crucial to ask the right questions. Here you’ll find the questions you can use when conducting each of the five types of qualitative research.

Bear in mind that some of these questions will appear to be similar in nature; some are even interchangeable. That is normal, as researchers may search for the same answers, but apply a different approach in their research method.

In any case, all of the below features questions that fit within the larger qualitative research framework.

Learn more about asking insightful market research questions . Here are a few examples of the questions within the five categories:

1. How do people who witnessed domestic violence understand its effects in their own relationships?

Variable: Views of domestic violence on one’s own relationships

Demographic: People in relationships, who’ve witnessed domestic violence

Qualitative Research Type : Narrative

2. What are the lived experiences of working-class Americans between the ages of 20 and 40?

Variable: Experiences and views of a working-class background

Demographic: Working-class Americans ages 20-40

3. How do Asian Americans experience reaching out to address mental health concerns?

Variable: The experiences in seeking out care for mental health

Demographic: Asian Americans seeking help for mental health

Qualitative Research Type: Ethnographic

4. What do you enjoy about this product or service?

Variable: The positive experiences of using a particular product/service

Demographic: The target market of a product or service

5. How have people who have experienced poverty changed their shopping habits when they entered the middle (or higher) class?

Variable: The changes or stagnation in shopping habits

Demographic: those who experienced poverty, but climbed the social ladder

Qualitative Research Type : Phenomenological

6. What was it like when you had a negative online shopping experience?

Variable: unpleasant shopping experiences

Demographic: a group that is most likely to shop at a particular online store

7. What influences managers in private sectors to seek further professional advancement?

Variable: Motivation for seniority

Demographic: Managers in the private sector

Qualitative Research Type: Grounded Theory

8. How do women in third world countries set up financial independence?

Variable: Efforts at reaching financial independence

Demographic: Women in third-world countries

9. What impact does collaborative working have on the UX optimization efforts of a telecommunications company?

Variable: effects of collaboration on the UX of a telecommunications company

Demographic: workers in the telecommunications space

Qualitative Research Type: Action Research

10. What strategies can marketing managers use to improve the reach of millennial customers?

Variable: Strategies to improve millennial reach and their outcomes

Demographic: Marketing managers

When to Use the Research and How to Analyze It

The qualitative research method has specific use cases. You ought to consider which is best for your particular business, which includes your strategy, your marketing and other facets.

The core of qualitative research is to understand a phenomenon (a problem, an inadequacy, and a slew of other occurrences) including its causes, its motivations, its goals and its solutions. Researchers do this by observing smaller portions of a population.

Researchers should use this form of research whenever you need to get the gist of a particular occurrence or event. It is particularly useful for studying how your target market experiences certain situations and how it feels about them.

There are several more specific ways that elucidate why this research style is valuable if not completely necessary. Here are some of the most crucial ways this method of research is vital:

Helps brands see the emotional connections customers have with them

Allows brands to find gaps in customer experience (CX) and user experience (UX)

Enables brands to create experiences that are more tailored to their target market

Helps businesses understand how they can improve on their product, service or CX

Finds experiences that customers had that highlight sensitive topics/language for them

Shows businesses how customers compare them to their competitors

Identifies possible solutions and innovations based on customer attitudes and experiences

To analyze qualitative research, you should first identify your subject of study and decide on the type of research you need to conduct based on the five types of research that fall under the qualitative category.

Then, brainstorm several questions that you can use to form the base of your studies. During the process make sure to jot down (either digitally or otherwise) your observations. For example, record interviews and store surveys in an organized database.

Make sure you ask open-ended questions in surveys, interviews, focus groups, et al. Aggregate secondary research such as government database documents, articles in your niche, images, videos and more.

Search for patterns or similarities within your findings. When you group them together and organize them by demographics, you can start drawing conclusions and proposing solutions.

The Benefits and Drawbacks of Qualitative Research

Qualitative research can be extraordinarily beneficial. But as with other aspects of research and beyond, it too comes with a set of drawbacks. As a business owner, marketer or market researcher, you should know both the pros and cons. Here are some notable ones:

More intimate understanding of context and causation: besides understanding “what” in a granular way, you also learn the “why” and “how” of a particular situation.

Understanding key experiences: Open-ended questions lead to unique answers, exposing things numerical-based surveys can’t answer.

A foundation of deep insights: The design of the study is made to understand how customers relate to particular occurrences, events, ideas and products.

Context-driven: Finding insights on motivation and past behaviors allows researchers to understand what their target market needs and what it tries to avoid.

No need to find and create the correct measuring units: Open-ended questions don’t require a scale, a number range or any other measuring tools — one less thing to worry about.

Smaller sample size: Smaller sample sizes allow researchers to study responses more thoroughly to form more accurate hypotheses and conclusions.

Inspirational : The responses received can also help researchers form new studies.

Flexible and detail-oriented : Since questions aren’t based on scales and other units, you can ask more creative and in-depth questions. Questions focus on details and subtleties for robust insights.

Relies on researcher experience: It relies on the researchers’ experience; not all are familiar with industry topics.

Not statistically representative: Only collects perspective-based research; does not provide statistical representation. Only comparisons, not measurements can be executed.

Difficult to make copies of data. Individual perspectives make it hard to replicate findings, making it it more difficult to form conclusions.

More likely to have researcher bias: Both conscious or subconscious of the researcher can affect the data. The conclusions they draw can thus be influenced by their bias. (This can be avoided by using controls in data collection.

The Final Word

Market research is a wide-spanning undertaking. It has a wide swath of aspects, practices and applications. As such, researchers should know its main categories and qualitative research is one such category of significance.

As opposed to quantitative research, which has four methods, qualitative research has five — not all of which will be of use to your particular market research needs. In any case, this type of research involves imbuing as much context and particularities around a phenomenon as possible.

As such, researchers should create questions more specific to the aforementioned examples of this article. That is because those are more encompassing, generalized questions that researchers can attempt to answer after conducting all of their research and parsing of the findings.

But prior to that, researchers should ask several related questions around a particular topic and tailor those questions as best as possible to the target audience.

Frequently asked questions

What is qualitative research.

Qualitative research is a type of research that is conducted to gain deep or unexpected insights rather than focusing on numeral or quantitative data.

Why is qualitative research conducted?

Qualitative research is conducted to find the “why” of the research subject, rather than the “what’ of that subject. For example, qualitative research might be conducted to understand an issue more deeply, to understand why something is happening, or to learn how to address a target market’s concerns.

What is narrative research?

Narrative research is a type of research that is used to create an in-depth story about a phenomenon or event. It is conducted by interviewing a small group of people who were directly involved in the event.

How is ethnographic research conducted?

When conducting ethnographic research, the researchers use firsthand observations of an environment to more deeply understand the goals, challenges, or opinions of the target audience.

What is action research?

Action research is a type of qualitative research in which researchers and participants collaborate to better understand a phenomenon. Together the group works to find and solve the problem by gathering information on an ongoing and evolving basis.

Do you want to distribute your survey? Pollfish offers you access to millions of targeted consumers to get survey responses from $0.95 per complete. Launch your survey today.

Privacy Preference Center

Privacy preferences.

How To Create a Mailchimp Popup To Grow Your Email List

Campaign Types

Floating Bars

The Ultimate OptinMonster Guide for Publishers

Case Study: Paint Your Life

- Get OptinMonster

Join 1,213,437+ using OptinMonster to get more subscribers and customers.

See all Features

7 Types of Qualitative Research + 6 Types of Qualitative Methods of Research

Last updated on

Jennifer Butler Keeton

Friend's Email Address

Your Email Address

Do you want to learn about the types of qualitative research and some examples of methodologies?

Qualitative studies are vital to the market research process. They provide an understanding of the reasons and motivations behind consumer decisions. You can use this information to improve your marketing and increase sales.

What does that mean for your business?

If you have a product that isn’t selling as well as you expected, qualitative research can help you understand why. Or, if you’re launching a new marketing campaign, qualitative studies can help you create ads that will entice your target audience.

If you’re new to this kind of market research, you’re in the right place.

In this guide, you’ll learn the basics of qualitative market research. We’ll also share how your business can use qualitative data to better appeal to your customers.

What is Qualitative Research?

Why use qualitative research, 7 types of qualitative research, 6 types of qualitative methods of research.

- Ideas for Analyzing Qualitative Data

Qualitative research is any research that provides subjective, non-numerical information. It focuses on people: their experiences, beliefs, and behaviors. It’s generally conducted using observation or unstructured questioning.

Qualitative research is used across many fields and industries, including sales, marketing, health care, education, and social sciences.

Qualitative vs. Quantitative Research

You likely hear the term “qualitative” used in contrast with “quantitative.”

Quantitative research generates specific numerical data. Its goal is to quantify and generalize the results of a study through numbers, percentages, and statistics. Quantitative research seeks to answer the what , where , when, and who of decision-making.

Qualitative market research, on the other hand, provides insights into the deeper motives behind consumer purchases. Qualitative research answers the why and how .

Why should your business use qualitative research as opposed to quantitative research?

Well, first of all, you should not use qualitative market research instead of quantitative. The 2 are complementary to each other.

Qualitative research on its own is not conclusive. However, you can use it to:

- Explain quantitative research results.

- Conduct market research when traditional surveys are unavailable. For instance, when your topic involves sensitive or complex questions.

- Conduct market research when more structured research is not possible.

Let’s look at an example of combining quantitative and qualitative research.

For instance, we’ll say that your business wants to conduct research to improve your website.

Quantitative research would give you information such as:

- The number of website visitors

- The length of time users stay on each page

- The number of leads generated from each email signup form

- More quantitative data, such as online shopping statistics and conversion rates

This information is all important data about user behavior. But it doesn’t give you the why behind this behavior.

Qualitative research fills in the rest of the picture with information such as:

- Which parts of your website users find difficult to use

- Whether users find your lightbox popups to be intrusive

- Which special offers and coupon codes shoppers find exciting

- More subjective information about how users view the style, relevance, and usability of your site

A complete website study should include both quantitative and qualitative research. Then, you can improve your website based both on hard numbers and users’ experiences and opinions.