, , , , , , .

.

, , .

The Ultimate Guide to Writing a Nonprofit Business Plan

A business plan can be an invaluable tool for your nonprofit. Even a short business plan pushes you to do research, crystalize your purpose, and polish your messaging. This blog shares what it is and why you need it, ten steps to help you write one, and the dos and don’ts of creating a nonprofit business plan.

Nonprofit business plans are dead — or are they?

For many nonprofit organizations, business plans represent outdated and cumbersome documents that get created “just for the sake of it” or because donors demand it.

But these plans are vital to organizing your nonprofit and making your dreams a reality! Furthermore, without a nonprofit business plan, you’ll have a harder time obtaining loans and grants , attracting corporate donors, meeting qualified board members, and keeping your nonprofit on track.

Even excellent ideas can be totally useless if you cannot formulate, execute, and implement a strategic plan to make your idea work. In this article, we share exactly what your plan needs and provide a nonprofit business plan template to help you create one of your own.

What is a Nonprofit Business Plan?

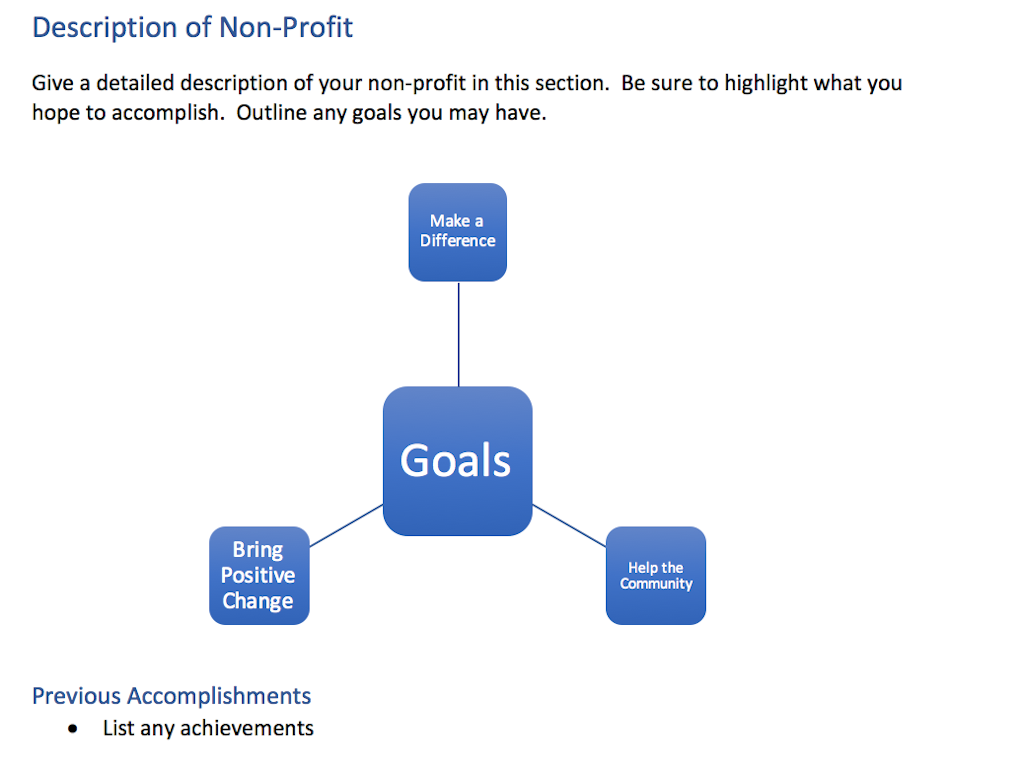

A nonprofit business plan describes your nonprofit as it currently is and sets up a roadmap for the next three to five years. It also lays out your goals and plans for meeting your goals. Your nonprofit business plan is a living document that should be updated frequently to reflect your evolving goals and circumstances.

A business plan is the foundation of your organization — the who, what, when, where, and how you’re going to make a positive impact.

The best nonprofit business plans aren’t unnecessarily long. They include only as much information as necessary. They may be as short as seven pages long, one for each of the essential sections you will read about below and see in our template, or up to 30 pages long if your organization grows.

Why do we need a Nonprofit Business Plan?

Regardless of whether your nonprofit is small and barely making it or if your nonprofit has been successfully running for years, you need a nonprofit business plan. Why?

When you create a nonprofit business plan, you are effectively creating a blueprint for how your nonprofit will be run, who will be responsible for what, and how you plan to achieve your goals.

Your nonprofit organization also needs a business plan if you plan to secure support of any kind, be it monetary, in-kind , or even just support from volunteers. You need a business plan to convey your nonprofit’s purpose and goals.

It sometimes also happens that the board, or the administration under which a nonprofit operates, requires a nonprofit business plan.

To sum it all up, write a nonprofit business plan to:

- Layout your goals and establish milestones.

- Better understand your beneficiaries, partners, and other stakeholders.

- Assess the feasibility of your nonprofit and document your fundraising/financing model.

- Attract investment and prove that you’re serious about your nonprofit.

- Attract a board and volunteers.

- Position your nonprofit and get clear about your message.

- Force you to research and uncover new opportunities.

- Iron out all the kinks in your plan and hold yourself accountable.

Before starting your nonprofit business plan, it is important to consider the following:

- Who is your audience? E.g. If you are interested in fundraising, donors will be your audience. If you are interested in partnerships, potential partners will be your audience.

- What do you want their response to be? Depending on your target audience, you should focus on the key message you want them to receive to get the response that you want.

10-Step Guide on Writing a Business Plan for Nonprofits

Note: Steps 1, 2, and 3 are in preparation for writing your nonprofit business plan.

Step 1: Data Collection

Before even getting started with the writing, collect financial, operating, and other relevant data. If your nonprofit is already in operation, this should at the very least include financial statements detailing operating expense reports and a spreadsheet that indicates funding sources.

If your nonprofit is new, compile materials related to any secured funding sources and operational funding projections, including anticipated costs.

Step 2: Heart of the Matter

You are a nonprofit after all! Your nonprofit business plan should start with an articulation of the core values and your mission statement . Outline your vision, your guiding philosophy, and any other principles that provide the purpose behind the work. This will help you to refine and communicate your nonprofit message clearly.

Your nonprofit mission statement can also help establish your milestones, the problems your organization seeks to solve, who your organization serves, and its future goals.

Check out these great mission statement examples for some inspiration. For help writing your statement, download our free Mission & Vision Statements Worksheet .

Step 3: Outline

Create an outline of your nonprofit business plan. Write out everything you want your plan to include (e.g. sections such as marketing, fundraising, human resources, and budgets).

An outline helps you focus your attention. It gives you a roadmap from the start, through the middle, and to the end. Outlining actually helps us write more quickly and more effectively.

An outline will help you understand what you need to tell your audience, whether it’s in the right order, and whether the right amount of emphasis is placed on each topic.

Pro tip: Use our Nonprofit Business Plan Outline to help with this step! More on that later.

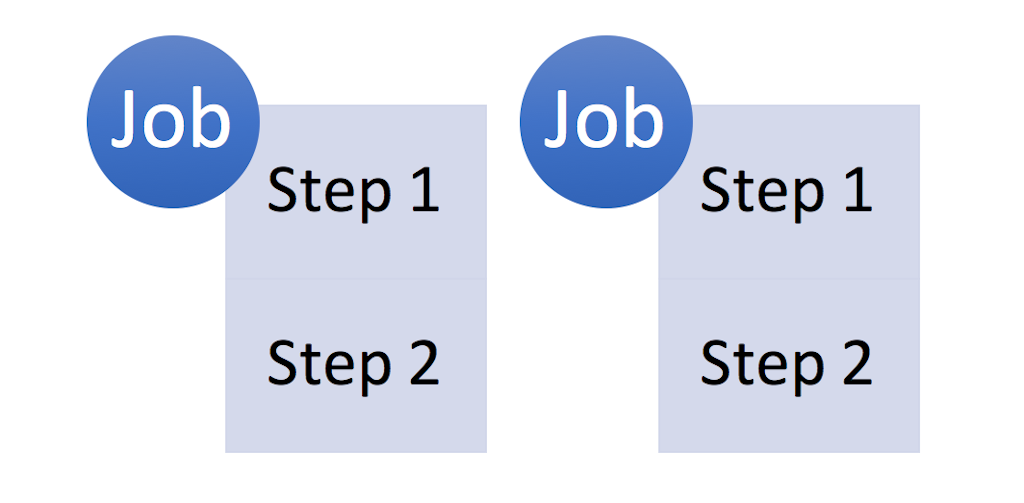

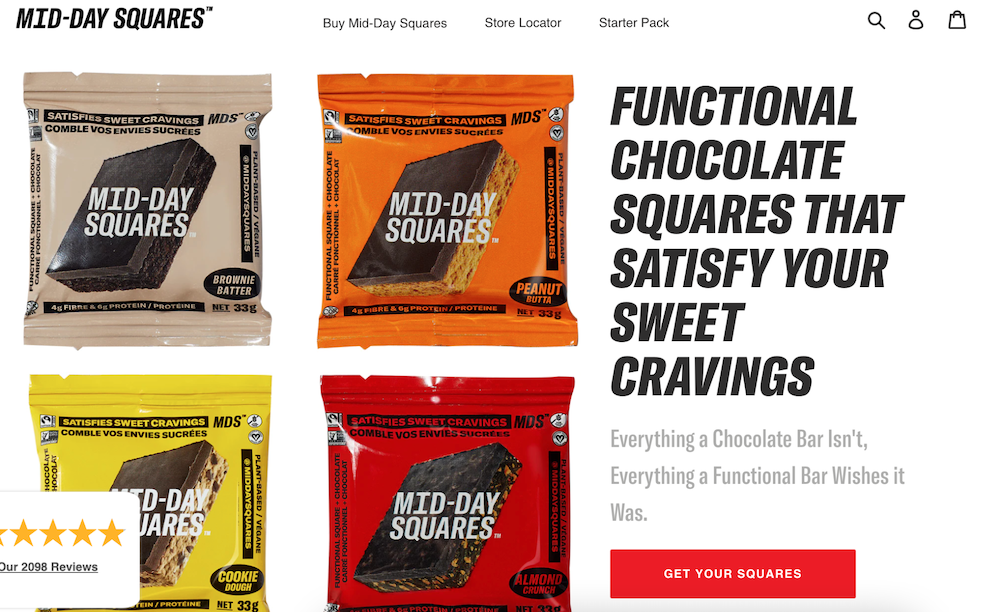

Step 4: Products, Programs, and Services

In this section, provide more information on exactly what your nonprofit organization does.

- What products, programs, or services do you provide?

- How does your nonprofit benefit the community?

- What need does your nonprofit meet and what are your plans for meeting that need?

E.g. The American Red Cross carries out its mission to prevent and relieve suffering with five key services: disaster relief, supporting America’s military families, lifesaving blood, health and safety services, and international service.

Don’t skimp out on program details, including the functions and beneficiaries. This is generally what most readers will care most about.

However, don’t overload the reader with technical jargon. Try to present some clear examples. Include photographs, brochures, and other promotional materials.

Step 5: Marketing Plan

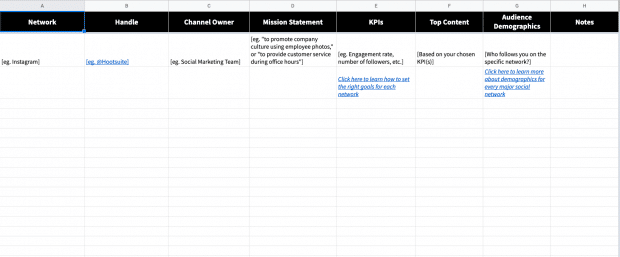

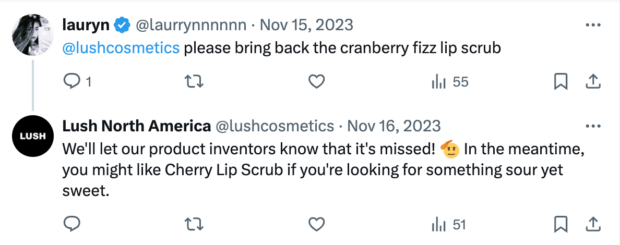

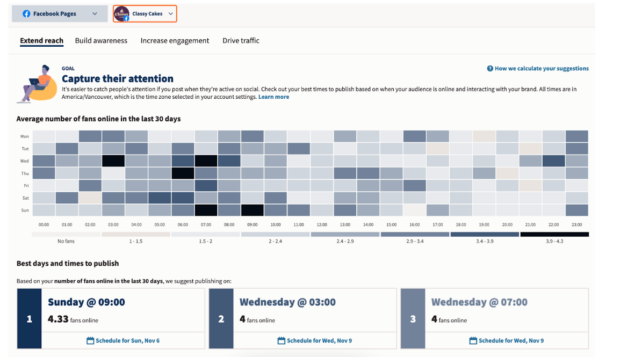

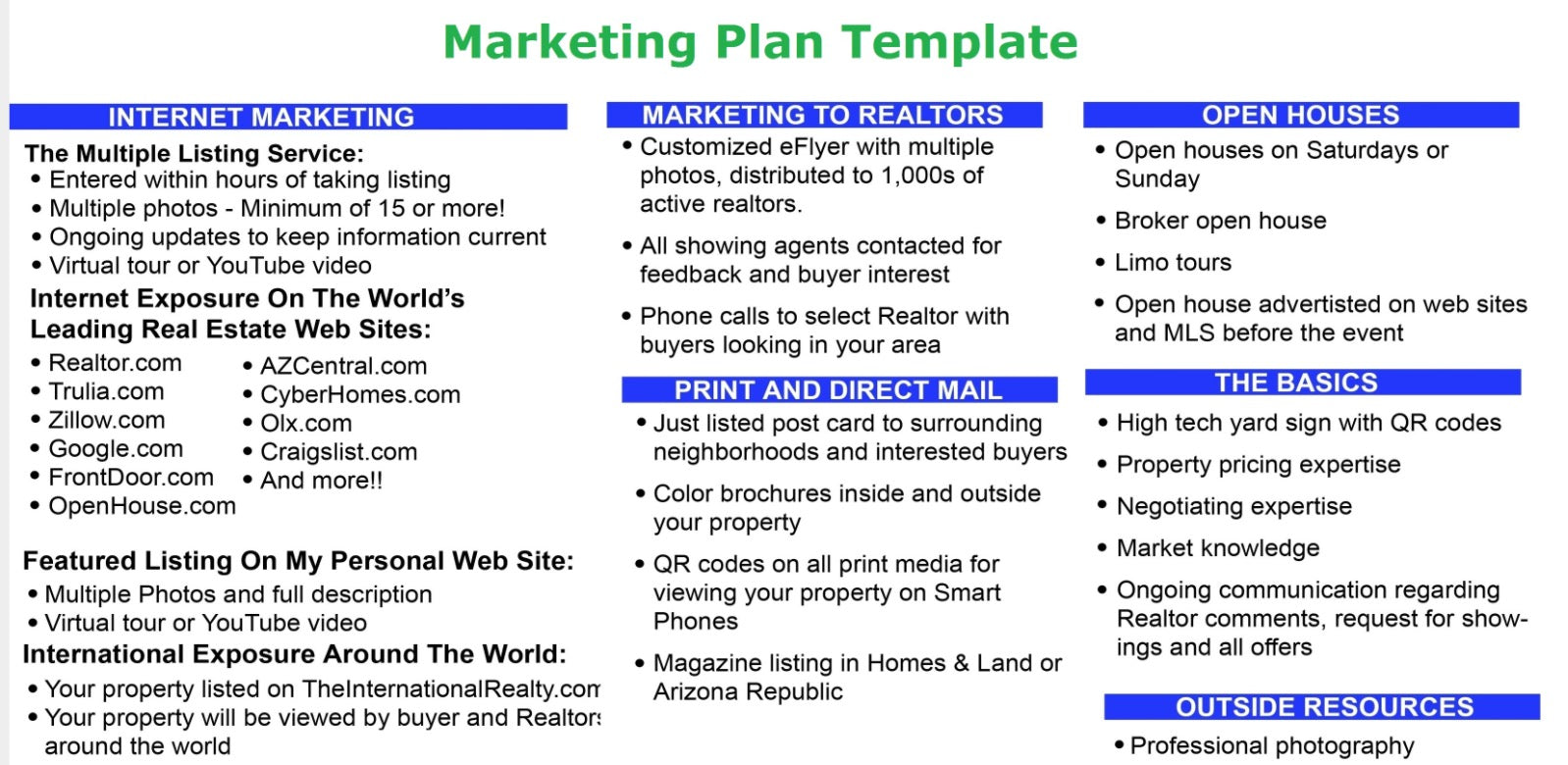

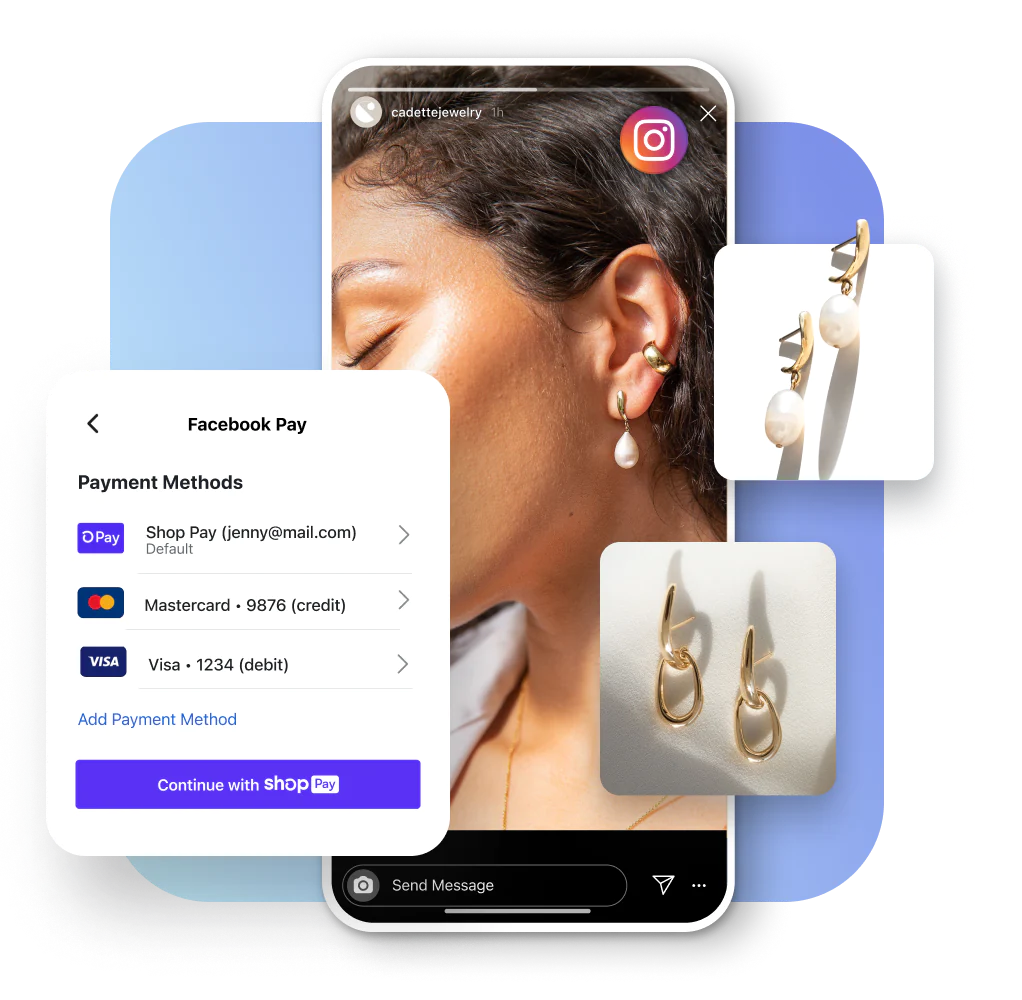

A marketing plan is essential for a nonprofit to reach its goals. If your nonprofit is already in operation, describe in detail all current marketing activities: any outreach activities, campaigns, and other initiatives. Be specific about outcomes, activities, and costs.

If your nonprofit is new, outline projections based on specific data you gathered about your market.

This will frequently be your most detailed section because it spells out precisely how you intend to carry out your business plan.

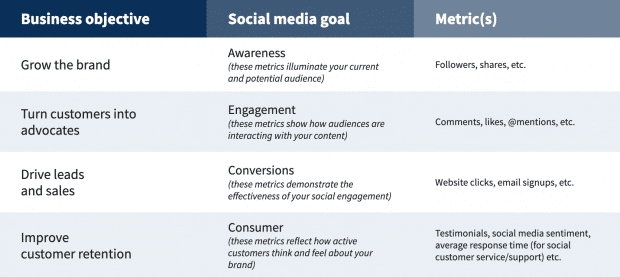

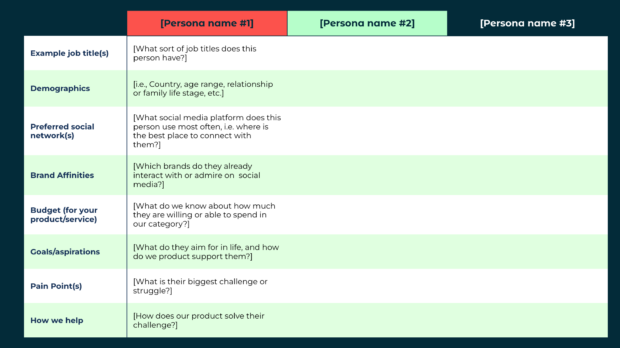

- Describe your market. This includes your target audience, competitors, beneficiaries, donors, and potential partners.

- Include any market analyses and tests you’ve done.

- Outline your plan for reaching your beneficiaries.

- Outline your marketing activities, highlighting specific outcomes.

Step 6: Operational Plan

An operational plan describes how your nonprofit plans to deliver activities. In the operational plan, it is important to explain how you plan to maintain your operations and how you will evaluate the impact of your programs.

The operational plan should give an overview of the day-to-day operations of your organization such as the people and organizations you work with (e.g. partners and suppliers), any legal requirements that your organization needs to meet (e.g. if you distribute food, you’ll need appropriate licenses and certifications), any insurance you have or will need, etc.

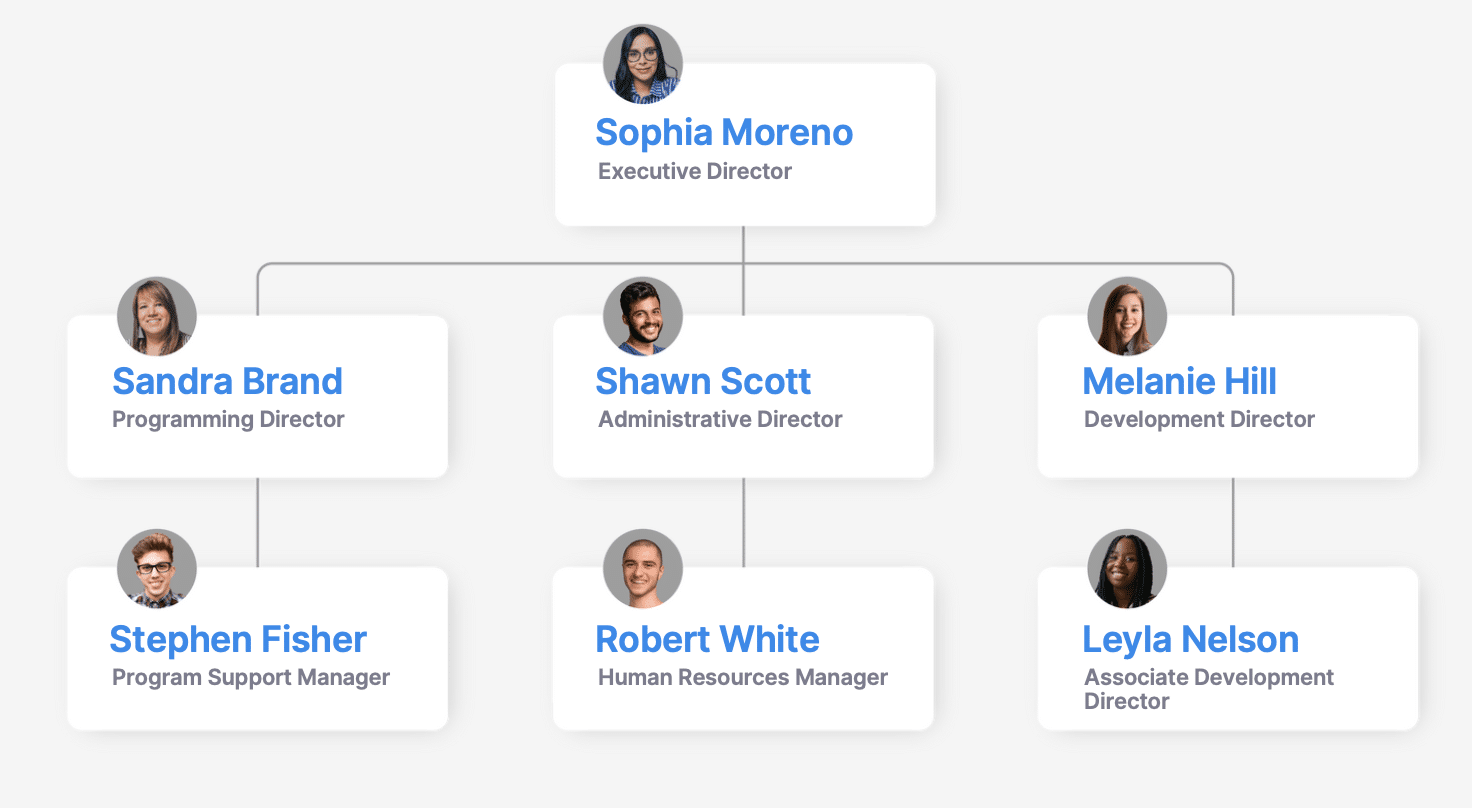

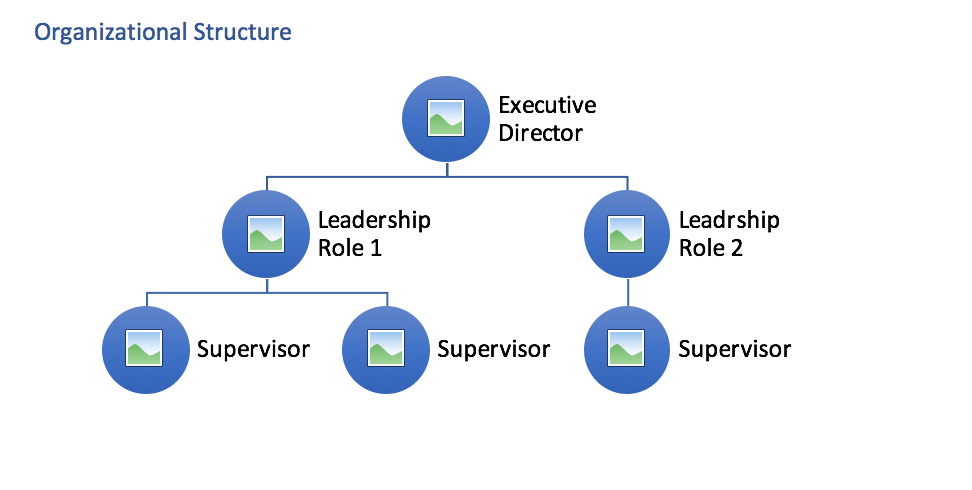

In the operational plan, also include a section on the people or your team. Describe the people who are crucial to your organization and any staff changes you plan as part of your business plan.

Pro tip: If you have an organizational chart, you can include it in the appendix to help illustrate how your organization operates. Learn more about the six types of nonprofit organizational charts and see them in action in this free e-book .

Step 7: Impact Plan

For a nonprofit, an impact plan is as important as a financial plan. A nonprofit seeks to create social change and a social return on investment, not just a financial return on investment.

Your impact plan should be precise about how your nonprofit will achieve this step. It should include details on what change you’re seeking to make, how you’re going to make it, and how you’re going to measure it.

This section turns your purpose and motivation into concrete accomplishments your nonprofit wants to make and sets specific goals and objectives.

These define the real bottom line of your nonprofit, so they’re the key to unlocking support. Funders want to know for whom, in what way, and exactly how you’ll measure your impact.

Answer these in the impact plan section of your business plan:

- What goals are most meaningful to the people you serve or the cause you’re fighting for?

- How can you best achieve those goals through a series of specific objectives?

E.g. “Finding jobs for an additional 200 unemployed people in the coming year.”

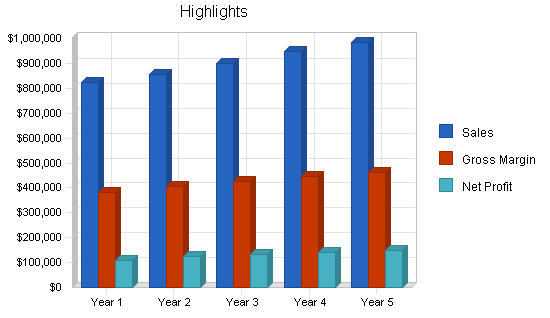

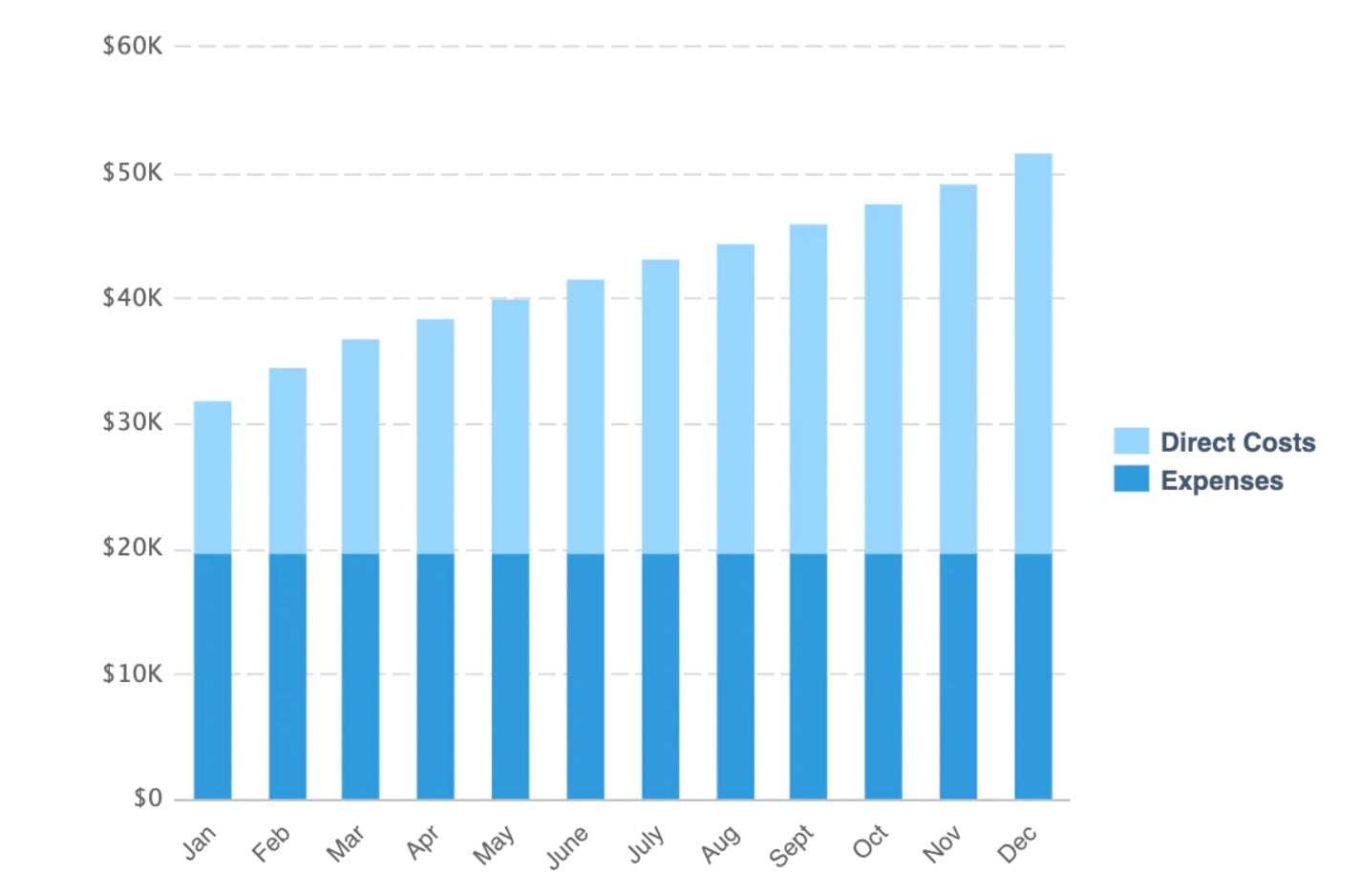

Step 8: Financial Plan

This is one of the most important parts of your nonprofit business plan. Creating a financial plan will allow you to make sure that your nonprofit has its basic financial needs covered.

Every nonprofit needs a certain level of funding to stay operational, so it’s essential to make sure your organization will meet at least that threshold.

To craft your financial plan:

- Outline your nonprofit’s current and projected financial status.

- Include an income statement, balance sheet , cash flow statement, and financial projections.

- List any grants you’ve received, significant contributions, and in-kind support.

- Include your fundraising plan .

- Identify gaps in your funding, and how you will manage them.

- Plan for what will be done with a potential surplus.

- Include startup costs, if necessary.

If your nonprofit is already operational, use established accounting records to complete this section of the business plan.

Knowing the financial details of your organization is incredibly important in a world where the public demands transparency about where their donations are going.

Pro tip : Leverage startup accelerators dedicated to nonprofits that can help you with funding, sponsorship, networking, and much more.

Step 9: Executive Summary

Normally written last but placed first in your business plan, your nonprofit executive summary provides an introduction to your entire business plan. The first page should describe your non-profit’s mission and purpose, summarize your market analysis that proves an identifiable need, and explain how your non-profit will meet that need.

The Executive Summary is where you sell your nonprofit and its ideas. Here you need to describe your organization clearly and concisely.

Make sure to customize your executive summary depending on your audience (i.e. your executive summary page will look different if your main goal is to win a grant or hire a board member).

Step 10: Appendix

Include extra documents in the section that are pertinent to your nonprofit: organizational chart , current fiscal year budget, a list of the board of directors, your IRS status letter, balance sheets, and so forth.

The appendix contains helpful additional information that might not be suitable for the format of your business plan (i.e. it might unnecessarily make it less readable or more lengthy).

Do’s and Dont’s of Nonprofit Business Plans – Tips

- Write clearly, using simple and easy-to-understand language.

- Get to the point, support it with facts, and then move on.

- Include relevant graphs and program descriptions.

- Include an executive summary.

- Provide sufficient financial information.

- Customize your business plan to different audiences.

- Stay authentic and show enthusiasm.

- Make the business plan too long.

- Use too much technical jargon.

- Overload the plan with text.

- Rush the process of writing, but don’t drag it either.

- Gush about the cause without providing a clear understanding of how you will help the cause through your activities.

- Keep your formatting consistent.

- Use standard 1-inch margins.

- Use a reasonable font size for the body.

- For print, use a serif font like Times New Roman or Courier. For digital, use sans serifs like Verdana or Arial.

- Start a new page before each section.

- Don’t allow your plan to print and leave a single line on an otherwise blank page.

- Have several people read over the plan before it is printed to make sure it’s free of errors.

Nonprofit Business Plan Template

To help you get started we’ve created a nonprofit business plan outline. This business plan outline will work as a framework regardless of your nonprofit’s area of focus. With it, you’ll have a better idea of how to lay out your nonprofit business plan and what to include. We have also provided several questions and examples to help you create a detailed nonprofit business plan.

Download Your Free Outline

At Donorbox, we strive to make your nonprofit experience as productive as possible, whether through our donation software or through our advice and guides on the Nonprofit Blog . Find more free, downloadable resources in our Library .

Many nonprofits start with passion and enthusiasm but without a proper business plan. It’s a common misconception that just because an organization is labeled a “nonprofit,” it does not need to operate in any way like a business.

However, a nonprofit is a type of business, and many of the same rules that apply to a for-profit company also apply to a nonprofit organization.

As outlined above, your nonprofit business plan is a combination of your marketing plan , strategic plan, operational plan, impact plan, and financial plan. Remember, you don’t have to work from scratch. Be sure to use the nonprofit business plan outline we’ve provided to help create one of your own.

It’s important to note that your nonprofit should not be set in stone—it can and should change and evolve. It’s a living organism. While your vision, values, and mission will likely remain the same, your nonprofit business plan may need to be revised from time to time. Keep your audience in mind and adjust your plan as needed.

Finally, don’t let your plan gather dust on a shelf! Print it out, put up posters on your office walls, and read from it during your team meetings. Use all the research, data, and ideas you’ve gathered and put them into action!

If you want more help with nonprofit management tips and fundraising resources, visit our Nonprofit Blog . We also have dedicated articles for starting a nonprofit in different states in the U.S., including Texas , Minnesota , Oregon , Arizona , Illinois , and more.

Learn about our all-in-one online fundraising tool, Donorbox, and its simple-to-use features on the website here .

Raviraj heads the sales and marketing team at Donorbox. His growth-hacking abilities have helped Donorbox boost fundraising efforts for thousands of nonprofit organizations.

Join the fundraising movement!

Subscribe to our e-newsletter to receive the latest blogs, news, and more in your inbox.

Raise More & Grow Your Nonprofit.

The complete guide to writing a nonprofit business plan.

August 14, 2019

Leadership & Management

July 7, 2022

TABLE OF CONTENTS

Statistics from the National Center for Charitable Statistics (NCCS) show that there are over 1.5 million nonprofit organizations currently operating in the U.S. alone. Many of these organizations are hard at work helping people in need and addressing the great issues of our time. However, doing good work doesn’t necessarily translate into long-term success and financial stability. Other information has shown that around 12% of non-profits don’t make it past the 5-year mark, and this number expands to 17% at the 10-year mark.

12% of non-profits don’t make it past the 5-year mark and 17% at the 10-year mark

There are a variety of challenges behind these sobering statistics. In many cases, a nonprofit can be sunk before it starts due to a lack of a strong nonprofit business plan. Below is a complete guide to understanding why a nonprofit needs a business plan in place, and how to construct one, piece by piece.

The purpose of a nonprofit business plan

A business plan for a nonprofit is similar to that of a for-profit business plan, in that you want it to serve as a clear, complete roadmap for your organization. When your plan is complete, questions such as "what goals are we trying to accomplish?" or "what is the true purpose of our organization?" should be clear and simple to answer.

Your nonprofit business plan should provide answers to the following questions:

1. What activities do you plan to pursue in order to meet the organization’s high level goals?

2. What's your plan on getting revenue to fund these activities?

3. What are your operating costs and specifically how do these break down?

Note that there’s a difference between a business plan and a strategic plan, though there may be some overlap. A strategic plan is more conceptual, with different ideas you have in place to try and meet the organization’s greater vision (such as fighting homelessness or raising climate change awareness). A business plan serves as an action plan because it provides, in as much detail as possible, the specifics on how you’re going to execute your strategy.

More Reading

- What is the Difference Between a Business Plan and a Strategic Plan?

- Business Planning for Nonprofits

Creating a nonprofit business plan

With this in mind, it’s important to discuss the individual sections of a nonprofit business plan. Having a proper plan in a recognizable format is essential for a variety of reasons. On your business’s end, it makes sure that as many issues or questions you may encounter are addressed up front. For outside entities, such as potential volunteers or donors, it shows that their time and energy will be managed well and put to good use. So, how do you go from conceptual to concrete?

Step 1: Write a mission statement

Having a mission statement is essential for any company, but even more so for nonprofits. Your markers of success are not just how the organization performs financially, but the impact it makes for your cause.

One of the easiest ways to do this is by creating a mission statement. A strong mission statement clarifies why your organization exists and determines the direction of activities.

At the head of their ethics page , NPR has a mission statement that clearly and concisely explains why they exist. From this you learn:

- The key point of their mission: creating a more informed public that understands new ideas and cultures

- Their mechanism of executing that vision: providing and reporting news/info that meets top journalistic standards

- Other essential details: their partnership with their membership statement

You should aim for the same level of clarity and brevity in your own mission statement.

The goal of a mission statement isn’t just about being able to showcase things externally, but also giving your internal team something to realign them if they get off track.

For example, if you're considering a new program or services, you can always check the idea against the mission statement. Does it align with your higher level goal and what your organization is ultimately trying to achieve? A mission statement is a compass to guide your team and keep the organization aligned and focused.

Step 2: Collect the data

You can’t prepare for the future without some data from the past and present. This can range from financial data if you’re already in operation to secured funding if you’re getting ready to start.

Data related to operations and finances (such as revenue, expenses, taxes, etc.) is crucial for budgeting and organizational decisions.

You'll also want to collect data about your target donor. Who are they in terms of their income, demographics, location, etc. and what is the best way to reach them? Every business needs to market, and answering these demographic questions are crucial to targeting the right audience in a marketing campaign. You'll also need data about marketing costs collected from your fundraising, marketing, and CRM software and tools. This data can be extremely important for demonstrating the effectiveness of a given fundraising campaign or the organization as a whole.

Then there is data that nonprofits collect from third-party sources as to how to effectively address their cause, such as shared data from other nonprofits and data from governments.

By properly collecting and interpreting the above data, you can build your nonprofit to not only make an impact, but also ensure the organization is financially sustainable.

Step 3: Create an outline

Before you begin writing your plan, it’s important to have an outline of the sections of your plan. Just like an academic essay, it’s easier to make sure all the points are addressed by taking inventory of high level topics first. If you create an outline and find you don’t have all the materials you need to fill it, you may need to go back to the data collection stage.

Writing an outline gives you something simple to read that can easily be circulated to your team for input. Maybe some of your partners will want to emphasize an area that you missed or an area that needs more substance.

Having an outline makes it easier for you to create an organized, well-flowing piece. Each section needs to be clear on its own, but you also don’t want to be overly repetitive.

As a side-note, one area where a lot of business novices stall in terms of getting their plans off the ground is not knowing what format to choose or start with. The good news is there are a lot of resources available online for you to draw templates for from your plan, or just inspire one of your own.

Using a business plan template

You may want to use a template as a starting point for your business plan. The major benefit here is that a lot of the outlining work that we mentioned is already done for you. However, you may not want to follow the template word for word. A nonprofit business plan may require additional sections or parts that aren’t included in a conventional business plan template.

The best way to go about this is to try and focus less on copying the template, and more about copying the spirit of the template. For example, if you see a template that you like, you can keep the outline, but you may want to change the color scheme and font to better reflect your brand. And of course, all your text should be unique.

When it comes to adding a new section to a business plan template, for the most part, you can use your judgment. We will get into specific sections in a bit, but generally, you just want to pair your new section with the existing section that makes the most sense. For example, if your non-profit has retail sales as a part of a financial plan, you can include that along with the products, services and programs section.

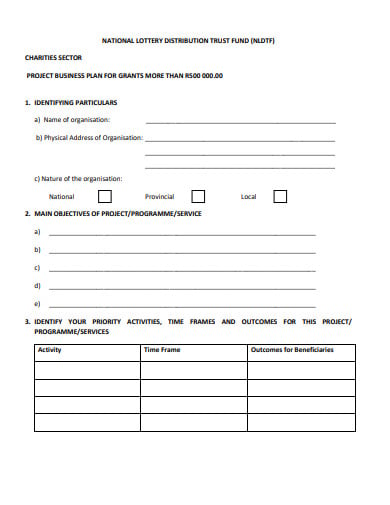

- Free Nonprofit Sample Business Plans - Bplans

- Non-Profit Business Plan Template - Growthink

- Sample Nonprofit Business Plans - Bridgespan

- Nonprofit Business Plan Template - Slidebean

- 23+ Non Profit Business Plan Templates - Template.net

Nonprofit business plan sections

The exact content is going to vary based on the size, purpose, and nature of your nonprofit. However, there are certain sections that every business plan will need to have for investors, donors, and lenders to take you seriously. Generally, your outline will be built around the following main sections:

1. Executive summary

Many people write this last, even though it comes first in a business plan. This is because the executive summary is designed to be a general summary of the business plan as a whole. Naturally, it may be easier to write this after the rest of the business plan has been completed.

After reading your executive summary a person should ideally have a general idea of what the entire plan covers. Sometimes, a person may be interested in learning about your non-profit, but doesn’t have time to read a 20+ page document. In this case, the executive summary could be the difference between whether or not you land a major donor.

As a start, you want to cover the basic need your nonprofit services, why that need exists, and the way you plan to address that need. The goal here is to tell the story as clearly and and concisely as possible. If the person is sold and wants more details, they can read through the rest of your business plan.

2. Products/Services/Programs

This is the space where you can clarify exactly what your non-profit does. Think of it as explaining the way your nonprofit addresses that base need you laid out earlier. This can vary a lot based on what type of non-profit you’re running.

This page gives us some insight into the mechanisms Bucks County Historical Society uses to further their mission, which is “to educate and engage its many audiences in appreciating the past and to help people find stories and meanings relevant to their lives—both today and in the future.”

They accomplish this goal through putting together both permanent exhibits as well as regular events at their primary museum. However, in a non-profit business plan, you need to go further.

It’s important here not only to clearly explain who benefits from your services, but also the specific details how those services are provided. For example, saying you “help inner-city school children” isn’t specific enough. Are you providing education or material support? Your non-profit business plan readers need as much detail as possible using simple and clear language.

3. Marketing

For a non-profit to succeed, it needs to have a steady stream of both donors and volunteers. Marketing plays a key role here as it does in a conventional business. This section should outline who your target audience is, and what you’ve already done/plan on doing to reach this audience. How you explain this is going to vary based on what stage your non-profit is in. We’ll split this section to make it more clear.

Nonprofits not in operation

Obviously, it’s difficult to market an idea effectively if you’re not in operation, but you still need to have a marketing plan in place. People who want to support your non-profit need to understand your marketing plan to attract donors. You need to profile all the data you have about your target market and outline how you plan to reach this audience.

Nonprofits already in operation

Marketing plans differ greatly for nonprofits already in operation. If your nonprofit is off the ground, you want to include data about your target market as well, along with other key details. Describe all your current marketing efforts, from events to general outreach, to conventional types of marketing like advertisements and email plans. Specific details are important. By the end of this, the reader should know:

- What type of marketing methods your organization prefers

- Why you’ve chosen these methods

- The track record of success using these methods

- What the costs and ROI of a marketing campaign

4. Operations

This is designed to serve as the “how” of your Products/Services/Programs section.

For example, if your goal is to provide school supplies for inner-city schoolchildren, you’ll need to explain how you will procure the supplies and distribute them to kids in need. Again, detail is essential. A reader should be able to understand not only how your non-profit operates on a daily basis, but also how it executes any task in the rest of the plan.

If your marketing plan says that you hold community events monthly to drum up interest. Who is in charge of the event? How are they run? How much do they cost? What personnel or volunteers are needed for each event? Where are the venues?

This is also a good place to cover additional certifications or insurance that your non-profit needs in order to execute these operations, and your current progress towards obtaining them.

Your operations section should also have a space dedicated to your team. The reason for this is, just like any other business plan, is that the strength of an organization lies in the people running it.

For example, let’s look at this profile from The Nature Conservancy . The main points of the biography are to showcase Chief Development Officer Jim Asp’s work history as it is relevant to his job. You’ll want to do something similar in your business plan’s team section.

Equally important is making sure that you cover any staff changes that you plan to implement in the near future in your business plan. The reason for this is that investors/partners may not want to sign on assuming that one leadership team is in place, only for it to change when the business reaches a certain stage.

The sections we’ve been talking about would also be in a traditional for profit business plan. We start to deviate a bit at this point. The impact section is designed to outline the social change you plan to make with your organization, and how your choices factor into those goals.

Remember the thoughts that go into that mission statement we mentioned before? This is your chance to show how you plan to address that mission with your actions, and how you plan to track your progress.

Let’s revisit the idea of helping inner-city school children by providing school supplies. What exactly is the metric you’re going to use to determine your success? For-profit businesses can have their finances as their primary KPI, but it’s not that easy for non-profits. Let’s say that your mission is to provide 1,000 schoolchildren in an underserved school district supplies for their classes. Your impact plan could cover two metrics:

- How many supplies are distributed

- Secondary impact (improved grades, classwork completed, etc).

The primary goal of this section is to transform that vision into concrete, measurable goals and objectives. A great acronym to help you create these are S.M.A.R.T. goals which stands for: specific, measurable, attainable, relevant, and timely.

Vitamin Angels does a good job of showing how their action supports the mission. Their goal of providing vitamins to mothers and children in developing countries has a concrete impact when we look at the numbers of how many children they service as well as how many countries they deliver to. As a non-profit business plan, it’s a good idea to include statistics like these to show exactly how close you are to your planned goals.

6. Finances

Every non-profit needs funding to operate, and this all-important section details exactly how you plan to cover these financial needs. Your business plan can be strong in every other section, but if your financial planning is flimsy, it’s going to prove difficult to gather believers to your cause.

It's important to paint a complete, positive picture of your fundraising plans and ambitions. Generally, this entails the following parts:

- Current financial status, such as current assets, cash on hand, liabilities

- Projections based off of your existing financial data and forms

- Key financial documents, such as a balance sheet, income statements, and cash flow sheet

- Any grants or major contributions received

- Your plan for fundraising (this may overlap with your marketing section which is okay)

- Potential issues and hurdles to your funding plan

- Your plans to address those issues

- How you'll utilize surplus donations

- Startup costs (if your non-profit is not established yet)

In general, if you see something else that isn’t accounted for here, it’s better to be safe than sorry, and put the relevant information in. It’s better to have too much information than too little when it comes to finances, especially since there is usually a clear preference for transparent business culture.

- How to Make a Five-Year Budget Plan for a Nonprofit

- Financial Transparency - National Council of Nonprofits

7. Appendix

Generally, this serves as a space to attach additional documents and elements that you may find useful for your business plan. This can include things like supplementary charts or a list of your board of directors.

This is also a good place to put text or technical information that you think may be relevant to your business plan, but might be long-winded or difficult to read. A lot of the flow and structure concerns you have for a plan don’t really apply with an appendix.

In summary, while a non-profit may have very different goals than your average business, the ways that they reach those goals do have a lot of similarities with for-profit businesses. The best way to ensure your success is to have a clear, concrete vision and path to different milestones along the way. A solid, in-depth business plan also gives you something to refer back to when you are struggling and not sure where to turn.

Alongside your business plan, you also want to use tools and resources that promote efficiency at all levels. For example, every non-profit needs a consistent stream of donations to survive, so consider using a program like GiveForms that creates simple, accessible forms for your donors to easily make donations. Accounting and budgeting for these in your plans can pay dividends later on.

Share this Article

Related articles, start fundraising today.

- Insights & Analysis

- Nonprofit Jobs

Business Planning for Nonprofits

Business planning is a way of systematically answering questions such as, “What problem(s) are we trying to solve?” or “What are we trying to achieve?” and also, “Who will get us there, by when, and how much money and other resources will it take?”

The business planning process takes into account the nonprofit’s mission and vision, the role of the board, and external environmental factors, such as the climate for fundraising.

Ideally, the business planning process also critically examines basic assumptions about the nonprofit’s operating environment. What if the sources of income that exist today change in the future? Is the nonprofit too reliant on one foundation for revenue? What happens if there’s an economic downturn?

A business plan can help the nonprofit and its board be prepared for future risks. What is the likelihood that the planned activities will continue as usual, and that revenue will continue at current levels – and what is Plan B if they don't?

Narrative of a business plan

You can think of a business plan as a narrative or story explaining how the nonprofit will operate given its activities, its sources of revenue, its expenses, and the inevitable changes in its internal and external environments over time. Ideally, your plan will tell the story in a way that will make sense to someone not intimately familiar with the nonprofit’s operations.

According to Propel Nonprofits , business plans usually should have four components that identify revenue sources/mix; operations costs; program costs; and capital structure.

A business plan outlines the expected income sources to support the charitable nonprofit's activities. What types of revenue will the nonprofit rely on to keep its engine running – how much will be earned, how much from government grants or contracts, how much will be contributed? Within each of those broad categories, how much diversification exists, and should they be further diversified? Are there certain factors that need to be in place in order for today’s income streams to continue flowing?

The plan should address the everyday costs needed to operate the organization, as well as costs of specific programs and activities.

The plan may include details about the need for the organization's services (a needs assessment), the likelihood that certain funding will be available (a feasibility study), or changes to the organization's technology or staffing that will be needed in the future.

Another aspect of a business plan could be a "competitive analysis" describing what other entities may be providing similar services in the nonprofit's service and mission areas. What are their sources of revenue and staffing structures? How do their services and capacities differ from those of your nonprofit?

Finally, the business plan should name important assumptions, such as the organization's reserve policies. Do your nonprofit’s policies require it to have at least six months of operating cash on hand? Do you have different types of cash reserves that require different levels of board approval to release?

The idea is to identify the known, and take into consideration the unknown, realities of the nonprofit's operations, and propose how the nonprofit will continue to be financially healthy. If the underlying assumptions or current conditions change, then having a plan can be useful to help identify adjustments that must be made to respond to changes in the nonprofit's operating environment.

Basic format of a business plan

The format may vary depending on the audience. A business plan prepared for a bank to support a loan application may be different than a business plan that board members use as the basis for budgeting. Here is a typical outline of the format for a business plan:

- Table of contents

- Executive summary - Name the problem the nonprofit is trying to solve: its mission, and how it accomplishes its mission.

- People: overview of the nonprofit’s board, staffing, and volunteer structure and who makes what happen

- Market opportunities/competitive analysis

- Programs and services: overview of implementation

- Contingencies: what could change?

- Financial health: what is the current status, and what are the sources of revenue to operate programs and advance the mission over time?

- Assumptions and proposed changes: What needs to be in place for this nonprofit to continue on sound financial footing?

More About Business Planning

Budgeting for Nonprofits

Strategic Planning

Contact your state association of nonprofits for support and resources related to business planning, strategic planning, and other fundamentals of nonprofit leadership.

Additional Resources

- Components of transforming nonprofit business models (Propel Nonprofits)

- The matrix map: a powerful tool for nonprofit sustainability (Nonprofit Quarterly)

- The Nonprofit Business Plan: A Leader's Guide to Creating a Successful Business Model (David La Piana, Heather Gowdy, Lester Olmstead-Rose, and Brent Copen, Turner Publishing)

- Nonprofit Earned Income: Critical Business Model Considerations for Nonprofits (Nonprofit Financial Commons)

- Nonprofit Sustainability: Making Strategic Decisions for Financial Viability (Jan Masaoka, Steve Zimmerman, and Jeanne Bell)

Disclaimer: Information on this website is provided for informational purposes only and is neither intended to be nor should be construed as legal, accounting, tax, investment, or financial advice. Please consult a professional (attorney, accountant, tax advisor) for the latest and most accurate information. The National Council of Nonprofits makes no representations or warranties as to the accuracy or timeliness of the information contained herein.

- Apply for a Discount

- Sign Up for Free

How to write a nonprofit business plan: A comprehensive guide

Steps to write a nonprofit business plan.

- Start with research

- Define your mission and vision

- Outline your programs and services

- Determine your organizational structure

- Conduct a market analysis

- Craft your marketing strategy

- Develop financial projections

- Write and refine

Business plans aren’t only for startups and corporations; they’re equally crucial for nonprofit organizations. A well-drafted nonprofit business plan not only provides direction but also attracts donors and other stakeholders. In this article, we’ll delve into the hows and whys of writing a nonprofit business plan and walk you through the process step by step.

The purpose and importance of a nonprofit business plan

A business plan is like a roadmap. It charts the course, setting clear goals and detailing the strategies needed to reach your destination (e.g., business goals). Given the unique challenges nonprofits face — competing for funding, demonstrating impact, and managing resources efficiently — a business plan is indispensable for staying on track.

What is a nonprofit business plan?

A nonprofit business plan is a document that outlines an organization’s operational and financial objectives, and details the strategies and resources (both human and capital) required to achieve those objectives. It serves as an internal guide for the organization’s leadership and a tool for communicating with external stakeholders.

Why do nonprofits need a business plan?

At its core, a nonprofit organization thrives on clarity of purpose, and a business plan offers just that. It establishes a clear mission and vision, serving as a guiding light for every strategic decision and action.

Beyond this foundational benefit, a business plan fosters operational efficiency. Meticulously outlining processes and delineating roles and responsibilities ensures a streamlined workflow, preventing any overlaps or omissions that could hamper the organization’s effectiveness.

In a competitive landscape where nonprofits vie for funding, a well-articulated business plan attests to the organization’s seriousness, structure, and transparency. Donors and sponsors are more inclined to invest when they see a clear roadmap detailing how an organization will use their contributions.

Last, a business plan serves as a robust framework for performance evaluation. Setting benchmarks and expectations drives the organization toward its goals and creates a culture of accountability — ensuring that every stakeholder is aligned and contributing to the collective mission.

Key components of a nonprofit business plan

Like a blueprint, a business plan has several elements that are indispensable to its structure. But depending on your organization’s goals and purpose, there may be elements unique to you. Let’s consider the pillar elements of every plan:

- The executive summary provides an overview of the organization, including its mission, vision, goals, and achievements to date.

- An organization description details the history, structure, and values of the organization.

- A market analysis provides a detailed examination of the community or population the nonprofit serves as well as a description of their needs and the ways the organization meets them.

- The organizational structure outlines the roles and responsibilities of team members, the board of directors, and other key personnel.

- The services and programs section provides details on the services the organization provides or the programs it runs.

- The marketing plan explains how the organization will raise awareness about its work. It includes strategies for donor engagement, fundraising events, and promotional campaigns.

- The financial projections section provides an estimate of the organization’s financial outlook for the next three to five years. It includes expected income, expenses, and milestones to reach financial sustainability.

A step-by-step guide to writing a nonprofit business plan

Creating a nonprofit business plan can seem daunting, but it can be rewarding if you take the right approach. Follow this step-by-step guide to help you navigate the process:

- Start with research. Understand the needs of your target community. This knowledge forms the foundation of your business plan.

- Define your mission and vision. Clearly state what your organization aims to achieve and the change it wants to bring about.

- Outline your programs and services. Detail how you plan to achieve your mission. Break down your offerings, explaining the impact and benefit of each.

- Determine your organizational structure. Establish the hierarchy, roles, and responsibilities to help in operations and decision-making processes.

- Conduct a market analysis. Identify key trends in the nonprofit sector and analyze your competitors. Determine what sets you apart.

- Craft your marketing strategy. Consider how you’ll communicate your mission and raise funds. You might include events, online campaigns, and collaborations.

- Develop financial projections. While predicting donations is challenging, try to provide a realistic financial outlook. Base projections on past data, if available, or make educated guesses using your market analysis.

- Write and refine. Draft the business plan, integrating all the components. Use clear, concise language. Once your draft is complete, review and refine it for clarity and coherence. It’s a good idea to have another professional review it too, as they may see things that you’ve missed.

Tips and best practices

- Stay realistic. While optimism is great, your projections and plans should be grounded in reality.

- Engage stakeholders. Consult team members, board members, and even potential donors when drafting the plan.

- Regularly review and update. A business plan isn’t a static document. As your organization evolves, make sure your business plan does too.

- Use visuals. Graphs, charts, and infographics can make your plan more engaging and easier to understand.

How Jotform can help you create a nonprofit business plan

Crafting a nonprofit business plan requires meticulous organization and seamless data collection. As you dive into the process, Jotform can help you create customized forms that streamline various aspects of your planning.

Whether you’re gathering initial research and feedback, managing donor information, registering volunteers, or even tracking impact metrics, Jotform ensures that every piece of data is organized and accessible.

Jotform’s intuitive interface and templates make it easy to design forms tailored to your nonprofit’s specific needs. Use Jotform’s business plan templates to give yourself a head start. From soliciting feedback on a new program idea to managing donor relationships to reporting on the tangible impact of your efforts, Jotform simplifies the process. You can even use the business proposal template to collect grantor signatures.

Nonprofit organizations are eligible for a 50-percent discount on paid Jotform plans.

Photo by Monstera Production

Thank you for helping improve the Jotform Blog. 🎉

RECOMMENDED ARTICLES

How to Start A Nonprofit Organization

How to start an online petition

6 of the best credit card processing solutions for nonprofits

5 discount software tools for nonprofit organizations

How a Seattle Website Used Jotform to Raise $20,000 for Local Schools and Nonprofits

How to start a scholarship fund

15 best WordPress plug-ins for nonprofits

5 ways Jotform can facilitate your giving campaigns

Learn How MidTown Uses Jotform Nonprofit Forms

The essentials of Google Pay for nonprofits

How to get people to donate money to you

How to organize a potluck

Announcing a New Book on Maximizing Donations

DonorPerfect vs eTapestry: Comparing nonprofit CRM systems

The 14 best nonprofit CRM solutions for 2024

DonorPerfect vs Raiser's Edge

How to conduct prospect research for nonprofits

How First Tee Greater Detroit uses Jotform to empower youth through golf

Scaling up your operations: Unlocking growth with tech

The United States of Charity The Generosity Index: Ranking the Most Charitable Places in the U.S.

Aplos vs QuickBooks: Navigating financial software choices

5 Ways Jotform Can Help Your Nonprofit

How to organize a 5K run

How to Create a Winning Donation Form

Little Green Light vs Salesforce

How to use Jotform Tables to facilitate giving

Donor management: Nonprofit tips for retaining donors

How a Nonprofit Museum Uses Jotform

How to write a powerful nonprofit mission statement

Raiser’s Edge vs Salesforce: Which is best?

How does a nonprofit fill out a W-9 form?

Use Jotform for Nonprofit Management

Get a Nonprofit Discount With These Companies

Webinar: Maximum Impact: 5 ways to automate year-end giving

How to set up Venmo for nonprofit organizations

10 of the best nonprofit event management software apps

Avoid making these costly donation form mistakes

Marketing automation for nonprofits

Top 7 online donation tools to raise more money

Webinar: How to prepare for giving season with Jotform + Square

How to collect donations with Carrd

6 tips to get your donation form in front of donors during COVID-19

Best way to collect donations online: Jotform

The best WordPress donation plug-ins

9 table templates to help with your nonprofit

Reviewing WildApricot’s pricing: Which plan is best for you?

Top donation management software solutions

How to set up a relief fund

How to set up a GivingTuesday donation system using Jotform

Best 5 nonprofit websites of 2024

How to improve nonprofit grant management

How to accept nonprofit stock donations

WildApricot vs MemberPlanet: A detailed comparison

How to write a grant proposal for a nonprofit

Reasons to Use Jotform as a PayPal Donate Button Alternative

4 effective ways to boost your nonprofit’s finances

How to set up an emergency rental assistance program in your community

How to find a Form 990 for a nonprofit

Year-end giving campaign ideas

The Importance of a Great Donate Button

Top 25 nonprofit survey questions

Top 5 membership management software solutions

How a Nonprofit Supports Documentary Filmmaking with the Help of Jotform

The 10 best Blackbaud alternatives for nonprofits in 2024

10+ marketing strategies and tools every nonprofit needs

Send Comment :

How to Write a Non-Profit Business Plan

Sylvia Okoye

Last updated on January 29, 2024 5 mins read

So you’re starting a non-profit business but haven’t sat down to craft a business plan?

Many entrepreneurs venture into non-profit with a truckload of impactful ideas they intend to achieve. Along the way these ideas begin to wither away due to poor planning and execution.

To manage and grow a non-profit business, you must outline your strategies, goals and objectives. A clear, non-profit business plan is the first of many steps to getting this done.

Table of Contents

What is a Non-Profit Business Plan?

A non-profit business plan is a strategic document outlining the mission, objectives, operational structure and financial projection of an organization.

It serves as a blueprint for achieving the organization’s goals, guiding the decision-making processes, and showcasing its viability to stakeholders, donors, and grant-making entities.

Whether launching a new non-profit business or seeking to strengthen an existing one, having a comprehensive plan is fundamental to your success.

Why Write a Non-Profit Plan?

A non-profit business plan differs from a for-profit business plan in that a for-profit business plan also clarifies how a business will grow in the market and in revenue.

Beyond securing funding, a well-written non-profit business plan offers several benefits:

- Clarity and Focus – The plan is a roadmap for movement and aligning everyone to the business’s missions and goals.

- Strategic Decision-Making – It helps you make informed decisions about resource allocation, program development, and fundraising strategies.

- Improved Communication – It serves as a communication tool, showcasing your organization’s credibility and professionalism to potential donors, partners and volunteers.

- Impactful Measurement – It establishes benchmarks for measuring your impact and demonstrating the effectiveness of your programs.

- Organizational Growth – It lays the foundation for sustainable growth and expansion, enabling you to reach more people and make a greater impact.

Crafting Your Non-Profit Business Plan

Every non-profit business plan has specified components attached to it that describe your business and what you do. Below are some components:

Executive Summary

The executive summary is a concise overview of your organization. It usually appears first in the business plan, however, it’s often the last thing you write because it encapsulates the essence of the entire document.

A good summary should include in brief the mission of your business, its key objectives, target audience and a summary of your financial projections. It needs to be well-structured such that it is easily comprehensible to anyone who reads it. Writing a poor summary negatively affects your business and its reputation around sponsors.

Mission, Vision, and Values

Whether you are a human service, educational, environmental or religious non-profit organization, you should have a clear mission and vision. Let us know why you do what you do and how you intend to positively impact the world.

Define the mission statement that encapsulates your organization’s purpose, followed by a clear vision outlining the future you aim to create. Incorporate the core values that guide your actions and decisions, reflecting the principles on which your non-profit stands.

For example, the Epileptic Foundation a Humanitarian non-profit organization for epileptic people clearly defines their mission statements, visions and core values.

Your mission and vision statements should be boldly and clearly articulated to represent your business and cause.

Organizational Structure and Management

Sponsors, donors and benefactors are more likely to give to nonprofits with organizational structure than those without. This is because a hierarchical structure shows that the business wants to be a business.

Keep this structure as detailed as possible. Include board members, key personnel, and their role in the company. Highlight their qualifications and experiences, emphasizing their relevance to the organization’s mission.

Programs and Services

Every non-profit is created for a cause. This is the same as services or the product of a for-profit business. Let your donors know what you offer by reading your business plan.

In a clear concise manner, describe the programs and services your non-profit offers. Explain how these initiatives align with your mission, their anticipated impact, and how they address the needs of your target beneficiaries or community.

Target Audience and Market Analysis

Identify and analyze your target audience or beneficiaries. Conduct market research to understand the needs, demographics and challenges of your intended community or beneficiaries. Clearly articulate how your programs meet those needs.

Marketing and Fundraising Strategies

As you know your non-profit is solely based on donations and contributions to a cause. This step is crucial to writing a spectacular non-profit business plan. You need to state clearly your marketing and fundraising strategies. These tips need to answer some of the questions like?

- What are your marketing strategies?

- How to create and promote awareness about your non-profit organization?

- How to reach your potential donors, volunteers and stakeholders?

- What social media channels do you use to communicate with your target audience and benefactors?

- What fundraising initiatives and events have you designed to generate revenue for the organization?

- What are the eligibility criteria for potential donors and partners?

Financial Projections and Budget

Show your initial capital, how much you were worth, how much you are worth now and your future financial projection. Distill the reports to a fifth-grade level, such that anyone who picks it up knows the state of things.

Include your income statements, balance sheets, and cash flow statements. Present a clear budget that outlines anticipated expenses and revenue sources, demonstrating fiscal responsibility and sustainability.

Evaluation and Measurement Metrics

Define key performance indicators and metrics to evaluate the success of your programs and initiatives. Establish a framework for regular assessment and adjustment to ensure you’re effectively meeting your goals.

Risk Management and Contingency Plans

Identify potential risks and challenges that could impact your organization’s operations. Develop contingency plans to mitigate these risks, ensuring the continuity of your programs and services.

Tips for Writing a Compelling Non-Profit Business Plan

- Focus on your impact – Clearly articulate the positive change your non-profit is making and the lives you are touching. Use compelling stories and data to showcase your impact.

- Keep it concise and comprehensible – Aim for a clear and concise writing style, avoid jargon and technical terms. Your business plan should be easy for anyone to understand regardless of their background.

- Tailor your plan to your Audience – Adapt your language and content to resonate with specific audiences such as potential donors, grantmakers, or volunteers.

- Be realistic and Data-Driven – Base your plans on realistic assumptions and support your claims with data and research.

- Get Feedback and Revise – Share your draft plan with key stakeholders and incorporate their feedback to refine and improve it.

Remember your non-profit business plan is a living document. It should be regularly reviewed and updated to reflect changes in your organization, the needs of your community and the funding landscape.

By following these tips and resources, you can create a compelling non-profit business plan that will guide your organization towards a sustainable and impactful future.

The world will continue to need difference makers in the form of non-profit organizations. If you’d do the work, you might as well do it with a business plan.

Leave a Reply Cancel reply

Your email address will not be published. Required fields are marked *

Save my name, email, and website in this browser for the next time I comment.

Share this article

With the rise of online ordering and delivery, social media marketing, and growing interest in health and wellness, there are

Should you use a Google Chrome extension? Chrome is the most widely used browser in the world. Business owners and

Do you want to rank higher on the Google search result page? Or looking for ways to boost Shopify SEO

How To Write A Business Plan For A Nonprofit Organization

Dodd Caldwell

July 21, 2020.

Writing a business plan for a new nonprofit is essential, and this guide will show you exactly what to include and how to put it together. Without a business plan, it’s easy to lose direction, harder to recruit quality personnel, and nearly impossible to successfully apply for funding.

Your business plan, once complete, should not only help you achieve those goals, but also provide you with a clear pathway to success. It should frequently be referenced during key decision-making times to stay on track and to make sure your not for profit organization always adheres to its stated vision. This guide will help you to create a business plan that fulfills all those roles.

Your Basic Nonprofit Business Plan Template

The best business plans aren’t unnecessarily long, but do include as much information as necessary. They may be as short as seven pages long, one for each of these essential sections, or up to 30 pages long as your organization grows and becomes more complicated.

Don’t worry if your business plan seems too short. Here, brevity is a virtue. If your plan has these seven sections and all the details mentioned here, you should be well on your way to meeting your nonprofit goals.

1. Title Page

This is the easiest part but should not be overlooked. This is like the title page of a resume. You should make sure your nonprofit’s name about is 2-3 inches from the top of the page. Below it, you need to have the following details:

- Business Plan – Just under your Nonprofit’s Name should be the words “business plan” to show exactly what the document is.

- The Date Your Plan was Finalized – You can write it any way you want, from September 2017 to 09/2017.

- Contact Information – Name, Address, Email and Phone Number all go below.

2. Executive Summary

You can draft this up first, but it should be the last thing you work on. This is the most important part of your business plan. Here you must summarize, on one page, every critical aspect of your nonprofit. This summary will determine if someone, be it an investor or potential staff member, will continue reading.

The Executive Summary is where you sell your organization and its ideas. Here you need to describe your organization.

- What makes your organization stand out?

- What is your ultimate vision?

- Which problems are you solving?

Then talk about how you are achieving those goals.

- What accomplishments have you made?

- What are your next steps?

- How financially stable are you?

And, if you are applying for funding there are some things you need to think about.

- Why do you need funding?

- What are good sources for funding?

- How will you seek funding from those sources?

- What will you do to try and turn the funding into recurrent funding?

- What grants are available?

- What work is involved in obtaining grants?

- What work is involved in maintaining the grants?

You should be able to answer all these questions in your executive summary.

3. Nonprofit Description – Details of Previous Accomplishments

If your nonprofit organization has a significant list of achievements and needs a dedicated space for them, this is the place to do it. At its best, this section will demonstrate how past goals were met on-time. It can also show real examples of how funding challenges were met or goals were exceeded. This should go directly after your Executive Summary.

4. Product, Service, and Program Details

As a nonprofit, you more than likely won’t be producing a product. (If you do, the complexities regarding your tax status and whether it is or is not eligible should be discussed with a qualified accountant or attorney.) As such, you should focus on what services you offer and how you plan to offer them. This section should be able to answer the following questions:

- How do your programs and services make a positive change?

- How can the effects of your accomplishments be measured?

- Is there a chance of achieving this goal?

5. Management Team Summary

This is where you introduce the key players in your organization. List names, credentials, and relevant experience. You can go on to talk about their role in your nonprofit, too.

Then, if you have space, you can discuss any gaps you may have and your plans to fill them. For example, if you have a growing volunteer community and require a dedicated staff member, say that you are looking for one and what their qualifications should be.

6. Marketing Strategy

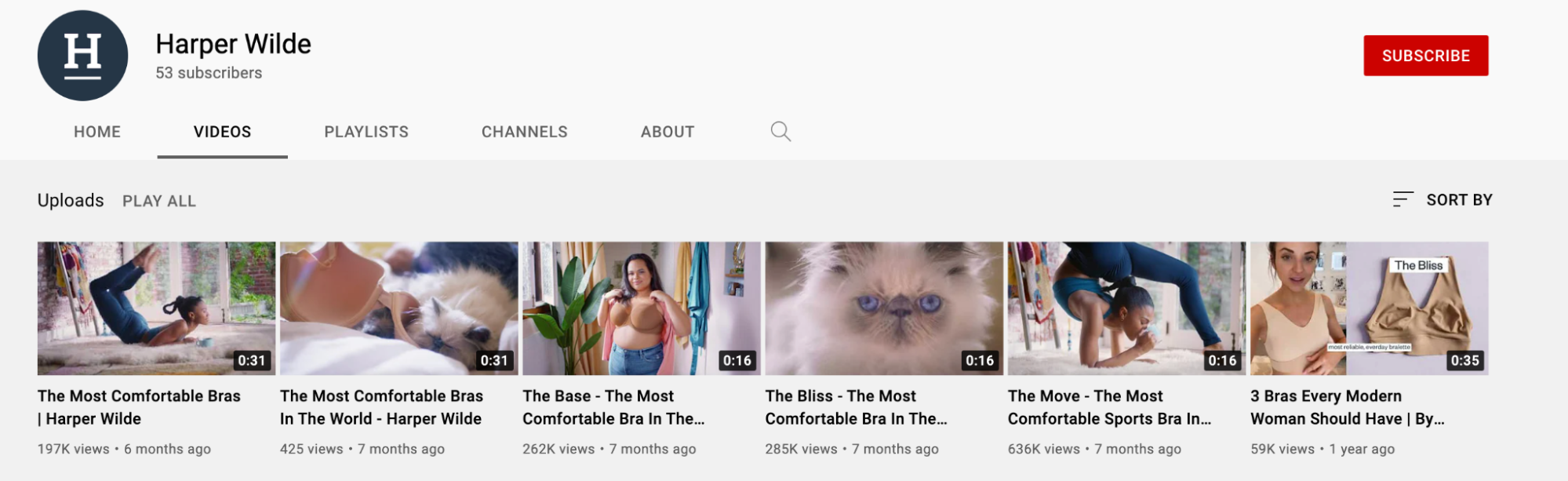

This section is where you detail how you plan to raise awareness for your cause.

- Do you already have local traction?

- Do you have a plan for acquiring media attention?

- Is someone on your team a master of social media marketing tactics?

- Do you plan on doing community outreach?

- What is your impact potential and how do you plan to reach it?

Your marketing section should include examples of past campaigns and their effectiveness, if possible, and as space allows.

7. Capitalization and Finances

Here you need to list where your finances stand today as well as a 3-to-5 year projection. As you will update your business plan at least every two years, these number should stay relatively current. Make sure to keep your projections realistic and in-line with current or reasonably expected growth. This section is a prime space for charts, graphs, and other visual material.

Once you have provided all the basics, talk about what you plan to do if there is a surplus from any activity. What will you do if individual financial goals fall short? What fund-raising methods will you use? How will you seek out or process donations?

8. Appendix – Supporting Documents

This is the place to put any miscellaneous supporting documents like financial statements, endorsements or agreements. As a brand, new nonprofit, you might not have much to put here, and that’s okay.

Remember, you only need to include what is most relevant, and you can leave out anything you may have covered in another section.

Don’t cram this section with unnecessary documents – a maximum of 5 pages is more than enough.

Additional Sections

In the above section, you learned about the eight essential components of your business plan. Now you can add any of the additional sections below. Though not necessary, they may be useful to attempt if you’re still trying to nail down all aspects of your organization.

As your nonprofit grows, or if it’s already been active for some years, these sections may be essential to providing readers with a comprehensive look at your organization.

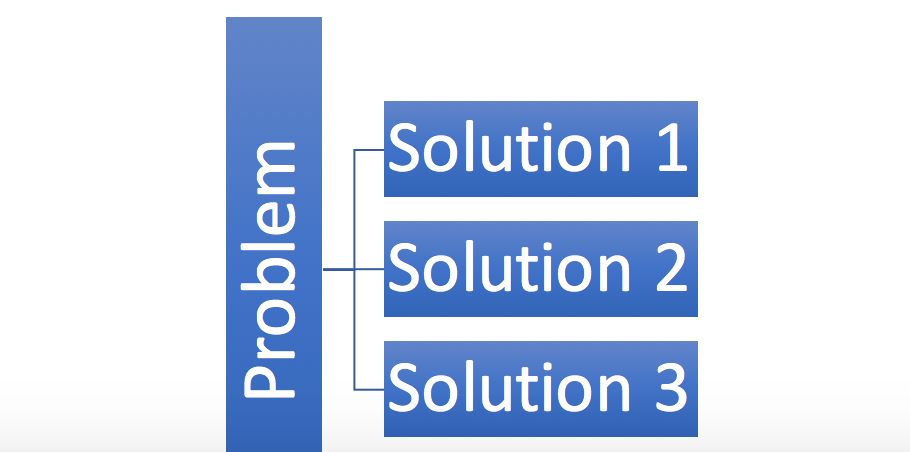

Problem Statement

Sometimes called “Market Research” or a “Needs Analysis,” this is where you put what you have learned about other nonprofits in this area.

- Is anyone else trying to solve this same problem?

- Does your organization do a better job or have a different angle?

- Is your goal open-ended or do you have a defined objective that you can finish?

- Will that goal evolve?

If you have any strategies or research to your credit or benefit that have not been mentioned elsewhere that will be an essential part of your nonprofit, include them in this section of your business plan.

Organizational Structure and Personnel Plan

This section would go after your “Management Team” or “Key Roles” summary. Here you will go into further detail about what positions you need to fill and how you plan to go about doing that.

You may also include examples of staffing schedules. This is also the place to go in-depth about how you will handle volunteers and which tasks you should reserve for them. Effective volunteer management is a valuable skill for any nonprofit.

Operational Plan

Depending on which other sections you have chosen to include, your operational plan should show a brief outline of your current typical operating procedures as well as any changes you intend to make as your organization grows.

If the information you would put here is repeated in any other section, leave this section out.

Putting it All Together

Before you finalize your business plan, here are five things to keep in mind.

The Title Page goes first, followed by the Executive Statement. The Appendix always goes last. Everything else goes in between, in order of most relevant to least, however you feel that applies to your nonprofit.

You may use visuals in your business plan to underline important points. Financial charts and visual projections are always appreciated. Images of your successes may be, too.

Not only will they make it easier for others to skim over your plan (and many people will do that before deciding to read it in-depth) but it helps break up the monotony of plain text. However, don’t let them stretch your document beyond recommended levels.

Keep it simple. A business plan that includes all the necessary information is more impressive than one with fancy formatting. There are, however, a few things to keep in mind.

- Keep your formatting consistent.

- Use standard 1-inch margins.

- Use a reasonable font size for the body, such as 12 point.

- For print, use a serif font like Times New Roman or Courier. For digital, use sans serifs like Verdana or Arial. The font does make a difference.

- Do start a new page before each section.

- Don’t allow your plan to print and leave a single line on an otherwise blank page. Find a way to fit it in appropriately.

Edit your work or ask someone to do it for you, maybe another board member. Writing your business plan should be fun, but it does have a purpose. Check each page and make sure every line supports whatever section you happen to be explaining.

Cut anything that is unnecessary. If you still feel like you need help, consider finding a mentor. You could approach a local nonprofit owner or contact a reputable organization like SCORE.

You should be able to write a business plan that is, excluding the Appendix, no more than 15 to 20 pages long. Being thorough is admirable, but the people who ask for your business plan may not read past your executive summary and if they do they expect to find only the information they need to support their decision, no more.

Planning for the Future

Your business plan must evolve with your nonprofit. At a minimum, it should be revised every two years. Changes should reflect staffing updates, new accomplishments, revised policies or goals, and updates financial data, etc. Keeping your business plan up-to-date can help remind you and the board of what your nonprofit stands for as well as ease the burden of making rushed corrections if a significant change has occurred and you must apply for financing.

Plan to Write a Lot of Thank You Notes

As a nonprofit, paying attention to your donors is critical to your success. It is much easier to get recurring donations than it is to find new donors. Further, given your nonprofit status, you must provide receipts for gifts of $250 or more.

Personalized notes, whether digital or hand-written, are valued by your community so make sure you collect enough information to make those thank-yous personal and include the right receipts. If you can do that, your nonprofit has a much better chance of growing from a handful of supporters to a thriving community.

RelatedPosts

Using Squarespace Websites And MoonClerk Together

September 26, 2023

Moonclerk recurring payments vs. squarespace recurring payments.

7 Ways To Create A Thriving Referral Program

- Sample Business Plans

- Nonprofit & Community

Charity Business Plan

Starting a charity business is a huge responsibility. To make a positive impact in society, you will need to build your charity business strong, for which you will need a detailed business plan.

Need help writing a business plan for your charity business? You’re at the right place. Our charity business plan template will help you get started.

Free Business Plan Template

Download our free business plan template now and pave the way to success. Let’s turn your vision into an actionable strategy!

- Fill in the blanks – Outline

- Financial Tables

How to Write A Charity Business Plan?

Writing a charity business plan is a crucial step toward the success of your business. Here are the key steps to consider when writing a business plan:

1. Executive Summary

An executive summary is the first section planned to offer an overview of the entire business plan. However, it is written after the entire business plan is ready and summarizes each section of your plan.

Here are a few key components to include in your executive summary:

Introduce your Business:

Start your executive summary by briefly introducing your business to your readers.

Market Opportunity:

Highlight the charity programs you offer your clients. The USPs and differentiators you offer are always a plus.

Marketing & Sales Strategies:

Financial highlights:, call to action:.

Ensure your executive summary is clear, concise, easy to understand, and jargon-free.

Say goodbye to boring templates

Build your business plan faster and easier with AI

Plans starting from $7/month

2. Business Overview

The business overview section of your business plan offers detailed information about your company. The details you add will depend on how important they are to your business. Yet, business name, location, business history, and future goals are some of the foundational elements you must consider adding to this section:

Business Description:

Describe your business in this section by providing all the basic information:

Describe what kind of charity company you run and the name of it. You may specialize in one of the following charity businesses:

- Humanitarian charities

- Public charity

- Private charity

- Health charities

- Educational charities

- Environmental charities

- Animal welfare charities

- Describe the legal structure of your charity company, whether it is a sole proprietorship, LLC, partnership, or others.

- Explain where your business is located and why you selected the place.

Mission Statement:

Business history:.

If you’re an established charity service provider, briefly describe your business history, like—when it was founded, how it evolved over time, etc.

Future Goals

This section should provide a thorough understanding of your business, its history, and its future plans. Keep this section engaging, precise, and to the point.

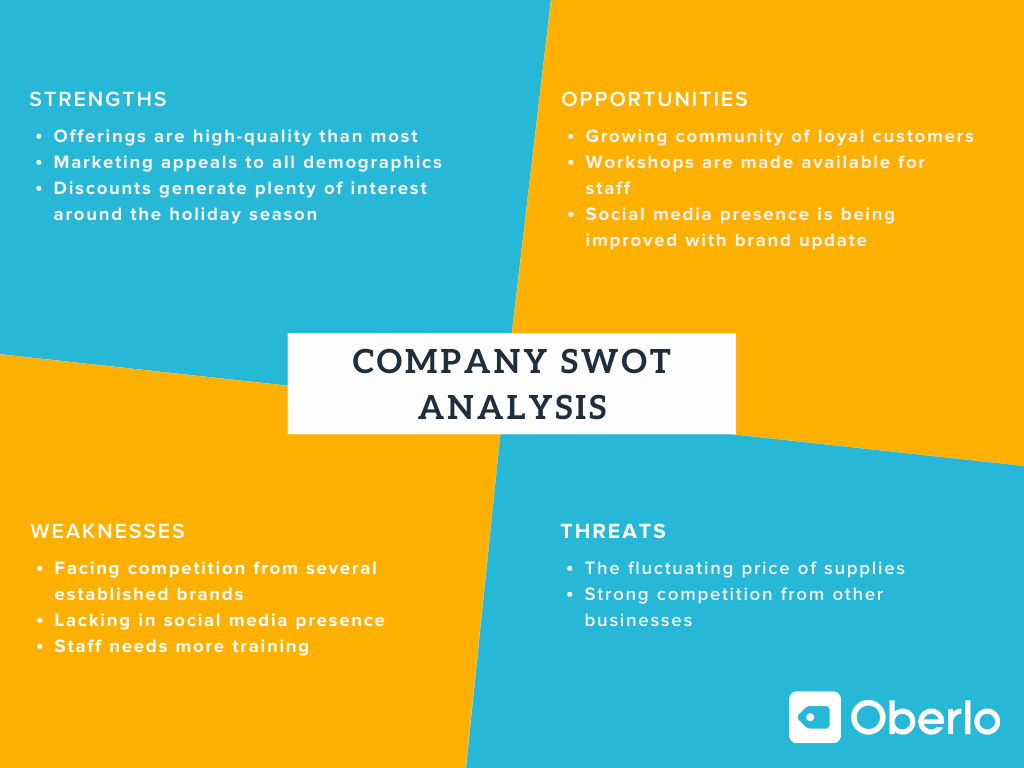

3. Market Analysis

The market analysis section of your business plan should offer a thorough understanding of the industry with the target market, competitors, and growth opportunities. You should include the following components in this section.

Target market:

Start this section by describing your target market. Define your ideal customer and explain what types of services they prefer. Creating a buyer persona will help you easily define your target market to your readers.

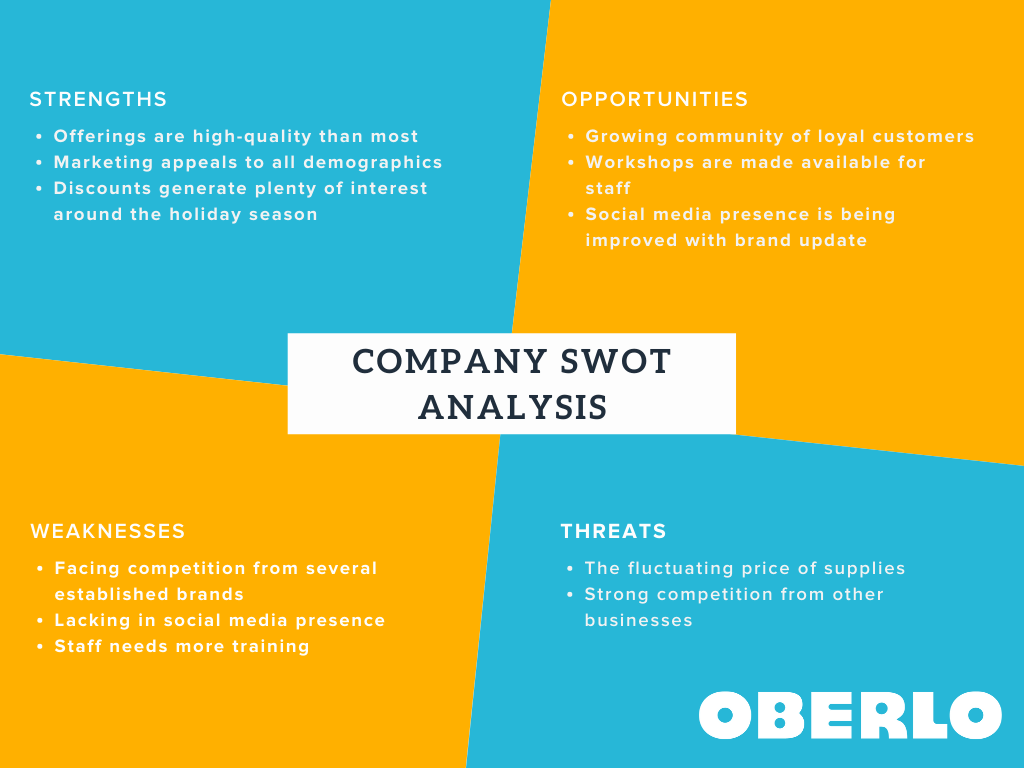

Conduct SWOT analysis:

Competitive analysis:, market trends:.

Analyze emerging trends in the industry, such as technology disruptions, changes in customer behavior or preferences, etc. Explain how your business will cope with all the trends.

Regulatory Environment:

Here are a few tips for writing the market analysis section of your charity business plan:

- Conduct market research, industry reports, and surveys to gather data.

- Provide specific and detailed information whenever possible.

- Illustrate your points with charts and graphs.

- Write your business plan keeping your target audience in mind.

4. Products of Your Bicycle Shop

The product and services section should describe the specific services and products that will be offered to customers. To write this section should include the following:

Describe your programs:

Mention the charity programs your business will offer. This list may include:

- Direct assistance

- Education and training

- Healthcare & medical services

- Social services

- Advocacy and awareness

Describe the objectives behind programs:

Supportive services:.

In short, this section of your charity plan must be informative, precise, and client-focused. By providing a clear and compelling description of your offerings, you can help potential investors and readers understand the value of your business.

5. Sales And Marketing Strategies

Writing the sales and marketing strategies section means a list of strategies you will use to attract and retain your clients. Here are some key elements to include in your sales & marketing plan:

Unique Selling Proposition (USP):

Define your business’s USPs depending on the market you serve, the equipment you use, and the unique services you provide. Identifying USPs will help you plan your marketing strategies.

Marketing Mix:

Marketing channels:, fundraising strategies:.

Describe the fundraising strategies you plan on implementing to generate revenue for your nonprofit. Your nonprofit may generate income from grants, major gifts, individual giving, charity events, online fundraising, corporate sponsorship, etc.

Donor Retention:

Overall, this section of your charity business plan should focus on customer acquisition and retention.

Have a specific, realistic, and data-driven approach while planning sales and marketing strategies for your charity business, and be prepared to adapt or make strategic changes in your strategies based on feedback and results.

6. Operations Plan

The operations plan section of your business plan should outline the processes and procedures involved in your business operations, such as staffing requirements and operational processes. Here are a few components to add to your operations plan:

Staffing & Training:

Operational process:, equipment & software:.

Include the list of equipment and software required for charity, such as office equipment, software & IT infrastructure, communication & presentation tools, fundraising equipment, vehicles & transportation, etc.

Adding these components to your operations plan will help you lay out your business operations, which will eventually help you manage your business effectively.

7. Management Team