- Search Search Please fill out this field.

What Is a Business Plan?

Understanding business plans, how to write a business plan, common elements of a business plan, how often should a business plan be updated, the bottom line, business plan: what it is, what's included, and how to write one.

Adam Hayes, Ph.D., CFA, is a financial writer with 15+ years Wall Street experience as a derivatives trader. Besides his extensive derivative trading expertise, Adam is an expert in economics and behavioral finance. Adam received his master's in economics from The New School for Social Research and his Ph.D. from the University of Wisconsin-Madison in sociology. He is a CFA charterholder as well as holding FINRA Series 7, 55 & 63 licenses. He currently researches and teaches economic sociology and the social studies of finance at the Hebrew University in Jerusalem.

:max_bytes(150000):strip_icc():format(webp)/adam_hayes-5bfc262a46e0fb005118b414.jpg)

A business plan is a document that details a company's goals and how it intends to achieve them. Business plans can be of benefit to both startups and well-established companies. For startups, a business plan can be essential for winning over potential lenders and investors. Established businesses can find one useful for staying on track and not losing sight of their goals. This article explains what an effective business plan needs to include and how to write one.

Key Takeaways

- A business plan is a document describing a company's business activities and how it plans to achieve its goals.

- Startup companies use business plans to get off the ground and attract outside investors.

- For established companies, a business plan can help keep the executive team focused on and working toward the company's short- and long-term objectives.

- There is no single format that a business plan must follow, but there are certain key elements that most companies will want to include.

Investopedia / Ryan Oakley

Any new business should have a business plan in place prior to beginning operations. In fact, banks and venture capital firms often want to see a business plan before they'll consider making a loan or providing capital to new businesses.

Even if a business isn't looking to raise additional money, a business plan can help it focus on its goals. A 2017 Harvard Business Review article reported that, "Entrepreneurs who write formal plans are 16% more likely to achieve viability than the otherwise identical nonplanning entrepreneurs."

Ideally, a business plan should be reviewed and updated periodically to reflect any goals that have been achieved or that may have changed. An established business that has decided to move in a new direction might create an entirely new business plan for itself.

There are numerous benefits to creating (and sticking to) a well-conceived business plan. These include being able to think through ideas before investing too much money in them and highlighting any potential obstacles to success. A company might also share its business plan with trusted outsiders to get their objective feedback. In addition, a business plan can help keep a company's executive team on the same page about strategic action items and priorities.

Business plans, even among competitors in the same industry, are rarely identical. However, they often have some of the same basic elements, as we describe below.

While it's a good idea to provide as much detail as necessary, it's also important that a business plan be concise enough to hold a reader's attention to the end.

While there are any number of templates that you can use to write a business plan, it's best to try to avoid producing a generic-looking one. Let your plan reflect the unique personality of your business.

Many business plans use some combination of the sections below, with varying levels of detail, depending on the company.

The length of a business plan can vary greatly from business to business. Regardless, it's best to fit the basic information into a 15- to 25-page document. Other crucial elements that take up a lot of space—such as applications for patents—can be referenced in the main document and attached as appendices.

These are some of the most common elements in many business plans:

- Executive summary: This section introduces the company and includes its mission statement along with relevant information about the company's leadership, employees, operations, and locations.

- Products and services: Here, the company should describe the products and services it offers or plans to introduce. That might include details on pricing, product lifespan, and unique benefits to the consumer. Other factors that could go into this section include production and manufacturing processes, any relevant patents the company may have, as well as proprietary technology . Information about research and development (R&D) can also be included here.

- Market analysis: A company needs to have a good handle on the current state of its industry and the existing competition. This section should explain where the company fits in, what types of customers it plans to target, and how easy or difficult it may be to take market share from incumbents.

- Marketing strategy: This section can describe how the company plans to attract and keep customers, including any anticipated advertising and marketing campaigns. It should also describe the distribution channel or channels it will use to get its products or services to consumers.

- Financial plans and projections: Established businesses can include financial statements, balance sheets, and other relevant financial information. New businesses can provide financial targets and estimates for the first few years. Your plan might also include any funding requests you're making.

The best business plans aren't generic ones created from easily accessed templates. A company should aim to entice readers with a plan that demonstrates its uniqueness and potential for success.

2 Types of Business Plans

Business plans can take many forms, but they are sometimes divided into two basic categories: traditional and lean startup. According to the U.S. Small Business Administration (SBA) , the traditional business plan is the more common of the two.

- Traditional business plans : These plans tend to be much longer than lean startup plans and contain considerably more detail. As a result they require more work on the part of the business, but they can also be more persuasive (and reassuring) to potential investors.

- Lean startup business plans : These use an abbreviated structure that highlights key elements. These business plans are short—as short as one page—and provide only the most basic detail. If a company wants to use this kind of plan, it should be prepared to provide more detail if an investor or a lender requests it.

Why Do Business Plans Fail?

A business plan is not a surefire recipe for success. The plan may have been unrealistic in its assumptions and projections to begin with. Markets and the overall economy might change in ways that couldn't have been foreseen. A competitor might introduce a revolutionary new product or service. All of this calls for building some flexibility into your plan, so you can pivot to a new course if needed.

How frequently a business plan needs to be revised will depend on the nature of the business. A well-established business might want to review its plan once a year and make changes if necessary. A new or fast-growing business in a fiercely competitive market might want to revise it more often, such as quarterly.

What Does a Lean Startup Business Plan Include?

The lean startup business plan is an option when a company prefers to give a quick explanation of its business. For example, a brand-new company may feel that it doesn't have a lot of information to provide yet.

Sections can include: a value proposition ; the company's major activities and advantages; resources such as staff, intellectual property, and capital; a list of partnerships; customer segments; and revenue sources.

A business plan can be useful to companies of all kinds. But as a company grows and the world around it changes, so too should its business plan. So don't think of your business plan as carved in granite but as a living document designed to evolve with your business.

Harvard Business Review. " Research: Writing a Business Plan Makes Your Startup More Likely to Succeed ."

U.S. Small Business Administration. " Write Your Business Plan ."

- How to Start a Business: A Comprehensive Guide and Essential Steps 1 of 25

- How to Do Market Research, Types, and Example 2 of 25

- Marketing Strategy: What It Is, How It Works, and How to Create One 3 of 25

- Marketing in Business: Strategies and Types Explained 4 of 25

- What Is a Marketing Plan? Types and How to Write One 5 of 25

- Business Development: Definition, Strategies, Steps & Skills 6 of 25

- Business Plan: What It Is, What's Included, and How to Write One 7 of 25

- Small Business Development Center (SBDC): Meaning, Types, Impact 8 of 25

- How to Write a Business Plan for a Loan 9 of 25

- Business Startup Costs: It’s in the Details 10 of 25

- Startup Capital Definition, Types, and Risks 11 of 25

- Bootstrapping Definition, Strategies, and Pros/Cons 12 of 25

- Crowdfunding: What It Is, How It Works, and Popular Websites 13 of 25

- Starting a Business with No Money: How to Begin 14 of 25

- A Comprehensive Guide to Establishing Business Credit 15 of 25

- Equity Financing: What It Is, How It Works, Pros and Cons 16 of 25

- Best Startup Business Loans for May 2024 17 of 25

- Sole Proprietorship: What It Is, Pros and Cons, and Differences From an LLC 18 of 25

- Partnership: Definition, How It Works, Taxation, and Types 19 of 25

- What Is an LLC? Limited Liability Company Structure and Benefits Defined 20 of 25

- Corporation: What It Is and How To Form One 21 of 25

- Starting a Small Business: Your Complete How-to Guide 22 of 25

- Starting an Online Business: A Step-by-Step Guide 23 of 25

- How to Start Your Own Bookkeeping Business: Essential Tips 24 of 25

- How to Start a Successful Dropshipping Business: A Comprehensive Guide 25 of 25

:max_bytes(150000):strip_icc():format(webp)/GettyImages-1456193345-2cc8ef3d583f42d8a80c8e631c0b0556.jpg)

- Terms of Service

- Editorial Policy

- Privacy Policy

- Your Privacy Choices

What is a Business Plan? Definition, Tips, and Templates

Published: June 07, 2023

In an era where more than 20% of small enterprises fail in their first year, having a clear, defined, and well-thought-out business plan is a crucial first step for setting up a business for long-term success.

Business plans are a required tool for all entrepreneurs, business owners, business acquirers, and even business school students. But … what exactly is a business plan?

In this post, we'll explain what a business plan is, the reasons why you'd need one, identify different types of business plans, and what you should include in yours.

What is a business plan?

A business plan is a documented strategy for a business that highlights its goals and its plans for achieving them. It outlines a company's go-to-market plan, financial projections, market research, business purpose, and mission statement. Key staff who are responsible for achieving the goals may also be included in the business plan along with a timeline.

The business plan is an undeniably critical component to getting any company off the ground. It's key to securing financing, documenting your business model, outlining your financial projections, and turning that nugget of a business idea into a reality.

What is a business plan used for?

The purpose of a business plan is three-fold: It summarizes the organization’s strategy in order to execute it long term, secures financing from investors, and helps forecast future business demands.

Business Plan Template [ Download Now ]

Working on your business plan? Try using our Business Plan Template . Pre-filled with the sections a great business plan needs, the template will give aspiring entrepreneurs a feel for what a business plan is, what should be in it, and how it can be used to establish and grow a business from the ground up.

Purposes of a Business Plan

Chances are, someone drafting a business plan will be doing so for one or more of the following reasons:

1. Securing financing from investors.

Since its contents revolve around how businesses succeed, break even, and turn a profit, a business plan is used as a tool for sourcing capital. This document is an entrepreneur's way of showing potential investors or lenders how their capital will be put to work and how it will help the business thrive.

All banks, investors, and venture capital firms will want to see a business plan before handing over their money, and investors typically expect a 10% ROI or more from the capital they invest in a business.

Therefore, these investors need to know if — and when — they'll be making their money back (and then some). Additionally, they'll want to read about the process and strategy for how the business will reach those financial goals, which is where the context provided by sales, marketing, and operations plans come into play.

2. Documenting a company's strategy and goals.

A business plan should leave no stone unturned.

Business plans can span dozens or even hundreds of pages, affording their drafters the opportunity to explain what a business' goals are and how the business will achieve them.

To show potential investors that they've addressed every question and thought through every possible scenario, entrepreneurs should thoroughly explain their marketing, sales, and operations strategies — from acquiring a physical location for the business to explaining a tactical approach for marketing penetration.

These explanations should ultimately lead to a business' break-even point supported by a sales forecast and financial projections, with the business plan writer being able to speak to the why behind anything outlined in the plan.

.webp)

Free Business Plan Template

The essential document for starting a business -- custom built for your needs.

- Outline your idea.

- Pitch to investors.

- Secure funding.

- Get to work!

You're all set!

Click this link to access this resource at any time.

Free Business Plan [Template]

Fill out the form to access your free business plan., 3. legitimizing a business idea..

Everyone's got a great idea for a company — until they put pen to paper and realize that it's not exactly feasible.

A business plan is an aspiring entrepreneur's way to prove that a business idea is actually worth pursuing.

As entrepreneurs document their go-to-market process, capital needs, and expected return on investment, entrepreneurs likely come across a few hiccups that will make them second guess their strategies and metrics — and that's exactly what the business plan is for.

It ensures an entrepreneur's ducks are in a row before bringing their business idea to the world and reassures the readers that whoever wrote the plan is serious about the idea, having put hours into thinking of the business idea, fleshing out growth tactics, and calculating financial projections.

4. Getting an A in your business class.

Speaking from personal experience, there's a chance you're here to get business plan ideas for your Business 101 class project.

If that's the case, might we suggest checking out this post on How to Write a Business Plan — providing a section-by-section guide on creating your plan?

What does a business plan need to include?

- Business Plan Subtitle

- Executive Summary

- Company Description

- The Business Opportunity

- Competitive Analysis

- Target Market

- Marketing Plan

- Financial Summary

- Funding Requirements

1. Business Plan Subtitle

Every great business plan starts with a captivating title and subtitle. You’ll want to make it clear that the document is, in fact, a business plan, but the subtitle can help tell the story of your business in just a short sentence.

2. Executive Summary

Although this is the last part of the business plan that you’ll write, it’s the first section (and maybe the only section) that stakeholders will read. The executive summary of a business plan sets the stage for the rest of the document. It includes your company’s mission or vision statement, value proposition, and long-term goals.

3. Company Description

This brief part of your business plan will detail your business name, years in operation, key offerings, and positioning statement. You might even add core values or a short history of the company. The company description’s role in a business plan is to introduce your business to the reader in a compelling and concise way.

4. The Business Opportunity

The business opportunity should convince investors that your organization meets the needs of the market in a way that no other company can. This section explains the specific problem your business solves within the marketplace and how it solves them. It will include your value proposition as well as some high-level information about your target market.

5. Competitive Analysis

Just about every industry has more than one player in the market. Even if your business owns the majority of the market share in your industry or your business concept is the first of its kind, you still have competition. In the competitive analysis section, you’ll take an objective look at the industry landscape to determine where your business fits. A SWOT analysis is an organized way to format this section.

6. Target Market

Who are the core customers of your business and why? The target market portion of your business plan outlines this in detail. The target market should explain the demographics, psychographics, behavioristics, and geographics of the ideal customer.

7. Marketing Plan

Marketing is expansive, and it’ll be tempting to cover every type of marketing possible, but a brief overview of how you’ll market your unique value proposition to your target audience, followed by a tactical plan will suffice.

Think broadly and narrow down from there: Will you focus on a slow-and-steady play where you make an upfront investment in organic customer acquisition? Or will you generate lots of quick customers using a pay-to-play advertising strategy? This kind of information should guide the marketing plan section of your business plan.

8. Financial Summary

Money doesn’t grow on trees and even the most digital, sustainable businesses have expenses. Outlining a financial summary of where your business is currently and where you’d like it to be in the future will substantiate this section. Consider including any monetary information that will give potential investors a glimpse into the financial health of your business. Assets, liabilities, expenses, debt, investments, revenue, and more are all useful adds here.

So, you’ve outlined some great goals, the business opportunity is valid, and the industry is ready for what you have to offer. Who’s responsible for turning all this high-level talk into results? The "team" section of your business plan answers that question by providing an overview of the roles responsible for each goal. Don’t worry if you don’t have every team member on board yet, knowing what roles to hire for is helpful as you seek funding from investors.

10. Funding Requirements

Remember that one of the goals of a business plan is to secure funding from investors, so you’ll need to include funding requirements you’d like them to fulfill. The amount your business needs, for what reasons, and for how long will meet the requirement for this section.

Types of Business Plans

- Startup Business Plan

- Feasibility Business Plan

- Internal Business Plan

- Strategic Business Plan

- Business Acquisition Plan

- Business Repositioning Plan

- Expansion or Growth Business Plan

There’s no one size fits all business plan as there are several types of businesses in the market today. From startups with just one founder to historic household names that need to stay competitive, every type of business needs a business plan that’s tailored to its needs. Below are a few of the most common types of business plans.

For even more examples, check out these sample business plans to help you write your own .

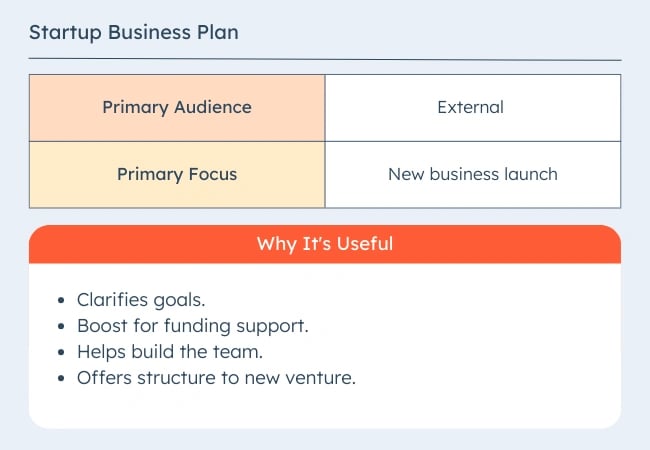

1. Startup Business Plan

As one of the most common types of business plans, a startup business plan is for new business ideas. This plan lays the foundation for the eventual success of a business.

The biggest challenge with the startup business plan is that it’s written completely from scratch. Startup business plans often reference existing industry data. They also explain unique business strategies and go-to-market plans.

Because startup business plans expand on an original idea, the contents will vary by the top priority goals.

For example, say a startup is looking for funding. If capital is a priority, this business plan might focus more on financial projections than marketing or company culture.

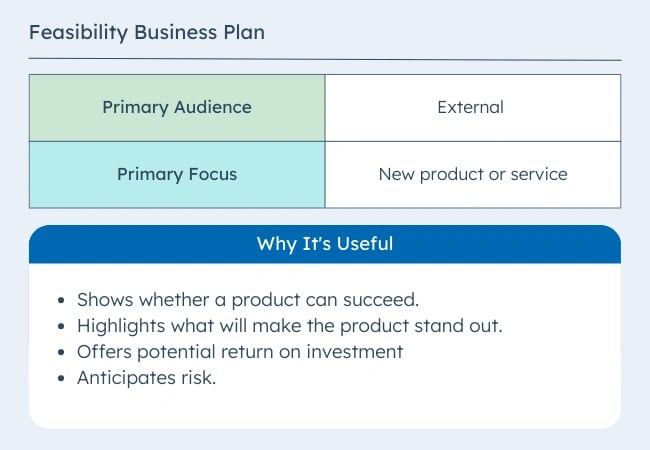

2. Feasibility Business Plan

This type of business plan focuses on a single essential aspect of the business — the product or service. It may be part of a startup business plan or a standalone plan for an existing organization. This comprehensive plan may include:

- A detailed product description

- Market analysis

- Technology needs

- Production needs

- Financial sources

- Production operations

According to CBInsights research, 35% of startups fail because of a lack of market need. Another 10% fail because of mistimed products.

Some businesses will complete a feasibility study to explore ideas and narrow product plans to the best choice. They conduct these studies before completing the feasibility business plan. Then the feasibility plan centers on that one product or service.

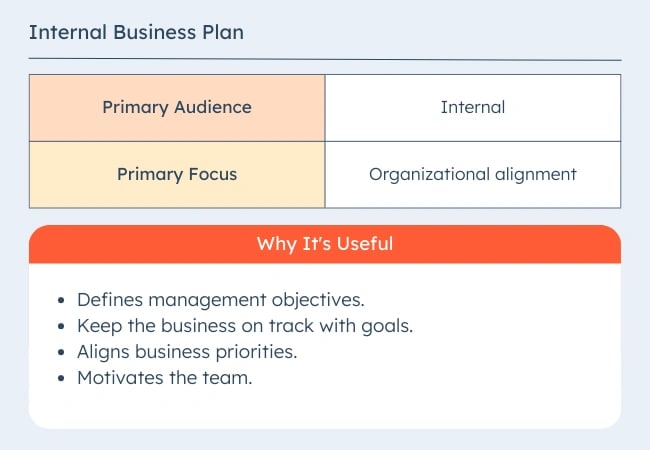

3. Internal Business Plan

Internal business plans help leaders communicate company goals, strategy, and performance. This helps the business align and work toward objectives more effectively.

Besides the typical elements in a startup business plan, an internal business plan may also include:

- Department-specific budgets

- Target demographic analysis

- Market size and share of voice analysis

- Action plans

- Sustainability plans

Most external-facing business plans focus on raising capital and support for a business. But an internal business plan helps keep the business mission consistent in the face of change.

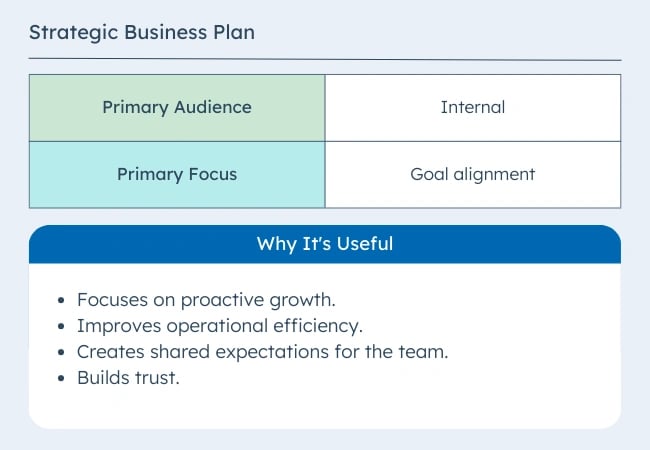

4. Strategic Business Plan

Strategic business plans focus on long-term objectives for your business. They usually cover the first three to five years of operations. This is different from the typical startup business plan which focuses on the first one to three years. The audience for this plan is also primarily internal stakeholders.

These types of business plans may include:

- Relevant data and analysis

- Assessments of company resources

- Vision and mission statements

It's important to remember that, while many businesses create a strategic plan before launching, some business owners just jump in. So, this business plan can add value by outlining how your business plans to reach specific goals. This type of planning can also help a business anticipate future challenges.

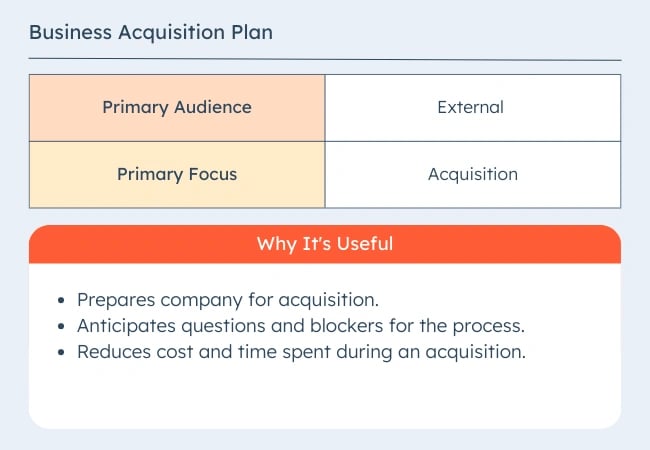

5. Business Acquisition Plan

Investors use business plans to acquire existing businesses, too — not just new businesses.

A business acquisition plan may include costs, schedules, or management requirements. This data will come from an acquisition strategy.

A business plan for an existing company will explain:

- How an acquisition will change its operating model

- What will stay the same under new ownership

- Why things will change or stay the same

- Acquisition planning documentation

- Timelines for acquisition

Additionally, the business plan should speak to the current state of the business and why it's up for sale.

For example, if someone is purchasing a failing business, the business plan should explain why the business is being purchased. It should also include:

- What the new owner will do to turn the business around

- Historic business metrics

- Sales projections after the acquisition

- Justification for those projections

6. Business Repositioning Plan

.webp?width=650&height=450&name=businessplan_6%20(1).webp)

When a business wants to avoid acquisition, reposition its brand, or try something new, CEOs or owners will develop a business repositioning plan.

This plan will:

- Acknowledge the current state of the company.

- State a vision for the future of the company.

- Explain why the business needs to reposition itself.

- Outline a process for how the company will adjust.

Companies planning for a business reposition often do so — proactively or retroactively — due to a shift in market trends and customer needs.

For example, shoe brand AllBirds plans to refocus its brand on core customers and shift its go-to-market strategy. These decisions are a reaction to lackluster sales following product changes and other missteps.

7. Expansion or Growth Business Plan

When your business is ready to expand, a growth business plan creates a useful structure for reaching specific targets.

For example, a successful business expanding into another location can use a growth business plan. This is because it may also mean the business needs to focus on a new target market or generate more capital.

This type of plan usually covers the next year or two of growth. It often references current sales, revenue, and successes. It may also include:

- SWOT analysis

- Growth opportunity studies

- Financial goals and plans

- Marketing plans

- Capability planning

These types of business plans will vary by business, but they can help businesses quickly rally around new priorities to drive growth.

Getting Started With Your Business Plan

At the end of the day, a business plan is simply an explanation of a business idea and why it will be successful. The more detail and thought you put into it, the more successful your plan — and the business it outlines — will be.

When writing your business plan, you’ll benefit from extensive research, feedback from your team or board of directors, and a solid template to organize your thoughts. If you need one of these, download HubSpot's Free Business Plan Template below to get started.

Editor's note: This post was originally published in August 2020 and has been updated for comprehensiveness.

Don't forget to share this post!

Related articles.

24 of My Favorite Sample Business Plans & Examples For Your Inspiration

![discuss the basic structure of business plans How to Write a Powerful Executive Summary [+4 Top Examples]](https://blog.hubspot.com/hubfs/executive-summary-example_5.webp)

How to Write a Powerful Executive Summary [+4 Top Examples]

Maximizing Your Social Media Strategy: The Top Aggregator Tools to Use

The Content Aggregator Guide for 2023

![discuss the basic structure of business plans 7 Gantt Chart Examples You'll Want to Copy [+ 5 Steps to Make One]](https://blog.hubspot.com/hubfs/gantt-chart-example.jpg)

7 Gantt Chart Examples You'll Want to Copy [+ 5 Steps to Make One]

![discuss the basic structure of business plans The 8 Best Free Flowchart Templates [+ Examples]](https://blog.hubspot.com/hubfs/flowchart%20templates.jpg)

The 8 Best Free Flowchart Templates [+ Examples]

16 Best Screen Recorders to Use for Collaboration

The 25 Best Google Chrome Extensions for SEO

Professional Invoice Design: 28 Samples & Templates to Inspire You

Customers’ Top HubSpot Integrations to Streamline Your Business in 2022

2 Essential Templates For Starting Your Business

Marketing software that helps you drive revenue, save time and resources, and measure and optimize your investments — all on one easy-to-use platform

🎉 Celebrate Small Business Month:

25% Off Annual Plans! SAVE NOW

0 results have been found for “”

Return to blog home

What Is a Business Plan? Definition and Planning Essentials Explained

Posted february 21, 2022 by kody wirth.

What is a business plan? It’s the roadmap for your business. The outline of your goals, objectives, and the steps you’ll take to get there. It describes the structure of your organization, how it operates, as well as the financial expectations and actual performance.

A business plan can help you explore ideas, successfully start a business, manage operations, and pursue growth. In short, a business plan is a lot of different things. It’s more than just a stack of paper and can be one of your most effective tools as a business owner.

Let’s explore the basics of business planning, the structure of a traditional plan, your planning options, and how you can use your plan to succeed.

What is a business plan?

A business plan is a document that explains how your business operates. It summarizes your business structure, objectives, milestones, and financial performance. Again, it’s a guide that helps you, and anyone else, better understand how your business will succeed.

Why do you need a business plan?

The primary purpose of a business plan is to help you understand the direction of your business and the steps it will take to get there. Having a solid business plan can help you grow up to 30% faster and according to our own 2021 Small Business research working on a business plan increases confidence regarding business health—even in the midst of a crisis.

These benefits are directly connected to how writing a business plan makes you more informed and better prepares you for entrepreneurship. It helps you reduce risk and avoid pursuing potentially poor ideas. You’ll also be able to more easily uncover your business’s potential. By regularly returning to your plan you can understand what parts of your strategy are working and those that are not.

That just scratches the surface for why having a plan is valuable. Check out our full write-up for fifteen more reasons why you need a business plan .

What can you do with your plan?

So what can you do with a business plan once you’ve created it? It can be all too easy to write a plan and just let it be. Here are just a few ways you can leverage your plan to benefit your business.

Test an idea

Writing a plan isn’t just for those that are ready to start a business. It’s just as valuable for those that have an idea and want to determine if it’s actually possible or not. By writing a plan to explore the validity of an idea, you are working through the process of understanding what it would take to be successful.

The market and competitive research alone can tell you a lot about your idea. Is the marketplace too crowded? Is the solution you have in mind not really needed? Add in the exploration of milestones, potential expenses, and the sales needed to attain profitability and you can paint a pretty clear picture of the potential of your business.

Document your strategy and goals

For those starting or managing a business understanding where you’re going and how you’re going to get there are vital. Writing your plan helps you do that. It ensures that you are considering all aspects of your business, know what milestones you need to hit, and can effectively make adjustments if that doesn’t happen.

With a plan in place, you’ll have an idea of where you want your business to go as well as how you’ve performed in the past. This alone better prepares you to take on challenges, review what you’ve done before, and make the right adjustments.

Pursue funding

Even if you do not intend to pursue funding right away, having a business plan will prepare you for it. It will ensure that you have all of the information necessary to submit a loan application and pitch to investors. So, rather than scrambling to gather documentation and write a cohesive plan once it’s relevant, you can instead keep your plan up-to-date and attempt to attain funding. Just add a use of funds report to your financial plan and you’ll be ready to go.

The benefits of having a plan don’t stop there. You can then use your business plan to help you manage the funding you receive. You’ll not only be able to easily track and forecast how you’ll use your funds but easily report on how it’s been used.

Better manage your business

A solid business plan isn’t meant to be something you do once and forget about. Instead, it should be a useful tool that you can regularly use to analyze performance, make strategic decisions, and anticipate future scenarios. It’s a document that you should regularly update and adjust as you go to better fit the actual state of your business.

Doing so makes it easier to understand what’s working and what’s not. It helps you understand if you’re truly reaching your goals or if you need to make further adjustments. Having your plan in place makes that process quicker, more informative, and leaves you with far more time to actually spend running your business.

What should your business plan include?

The content and structure of your business plan should include anything that will help you use it effectively. That being said, there are some key elements that you should cover and that investors will expect to see.

Executive summary

The executive summary is a simple overview of your business and your overall plan. It should serve as a standalone document that provides enough detail for anyone—including yourself, team members, or investors—to fully understand your business strategy. Make sure to cover the problem you’re solving, a description of your product or service, your target market, organizational structure, a financial summary, and any necessary funding requirements.

This will be the first part of your plan but it’s easiest to write it after you’ve created your full plan.

Products & Services

When describing your products or services, you need to start by outlining the problem you’re solving and why what you offer is valuable. This is where you’ll also address current competition in the market and any competitive advantages your products or services bring to the table. Lastly, be sure to outline the steps or milestones that you’ll need to hit to successfully launch your business. If you’ve already hit some initial milestones, like taking pre-orders or early funding, be sure to include it here to further prove the validity of your business.

Market analysis

A market analysis is a qualitative and quantitative assessment of the current market you’re entering or competing in. It helps you understand the overall state and potential of the industry, who your ideal customers are, the positioning of your competition, and how you intend to position your own business. This helps you better explore the long-term trends of the market, what challenges to expect, and how you will need to initially introduce and even price your products or services.

Check out our full guide for how to conduct a market analysis in just four easy steps .

Marketing & sales

Here you detail how you intend to reach your target market. This includes your sales activities, general pricing plan, and the beginnings of your marketing strategy. If you have any branding elements, sample marketing campaigns, or messaging available—this is the place to add it.

Additionally, it may be wise to include a SWOT analysis that demonstrates your business or specific product/service position. This will showcase how you intend to leverage sales and marketing channels to deal with competitive threats and take advantage of any opportunities.

Check out our full write-up to learn how to create a cohesive marketing strategy for your business.

Organization & management

This section addresses the legal structure of your business, your current team, and any gaps that need to be filled. Depending on your business type and longevity, you’ll also need to include your location, ownership information, and business history. Basically, add any information that helps explain your organizational structure and how you operate. This section is particularly important for pitching to investors but should be included even if attempted funding is not in your immediate future.

Financial projections

Possibly the most important piece of your plan, your financials section is vital for showcasing the viability of your business. It also helps you establish a baseline to measure against and makes it easier to make ongoing strategic decisions as your business grows. This may seem complex on the surface, but it can be far easier than you think.

Focus on building solid forecasts, keep your categories simple, and lean on assumptions. You can always return to this section to add more details and refine your financial statements as you operate.

Here are the statements you should include in your financial plan:

- Sales and revenue projections

- Profit and loss statement

- Cash flow statement

- Balance sheet

The appendix is where you add additional detail, documentation, or extended notes that support the other sections of your plan. Don’t worry about adding this section at first and only add documentation that you think will be beneficial for anyone reading your plan.

Types of business plans explained

While all business plans cover similar categories, the style and function fully depend on how you intend to use your plan. So, to get the most out of your plan, it’s best to find a format that suits your needs. Here are a few common business plan types worth considering.

Traditional business plan

The tried-and-true traditional business plan is a formal document meant to be used for external purposes. Typically this is the type of plan you’ll need when applying for funding or pitching to investors. It can also be used when training or hiring employees, working with vendors, or any other situation where the full details of your business must be understood by another individual.

This type of business plan follows the outline above and can be anywhere from 10-50 pages depending on the amount of detail included, the complexity of your business, and what you include in your appendix. We recommend only starting with this business plan format if you plan to immediately pursue funding and already have a solid handle on your business information.

Business model canvas

The business model canvas is a one-page template designed to demystify the business planning process. It removes the need for a traditional, copy-heavy business plan, in favor of a single-page outline that can help you and outside parties better explore your business idea.

The structure ditches a linear structure in favor of a cell-based template. It encourages you to build connections between every element of your business. It’s faster to write out and update, and much easier for you, your team, and anyone else to visualize your business operations. This is really best for those exploring their business idea for the first time, but keep in mind that it can be difficult to actually validate your idea this way as well as adapt it into a full plan.

One-page business plan

The true middle ground between the business model canvas and a traditional business plan is the one-page business plan. This format is a simplified version of the traditional plan that focuses on the core aspects of your business. It basically serves as a beefed-up pitch document and can be finished as quickly as the business model canvas.

By starting with a one-page plan, you give yourself a minimal document to build from. You’ll typically stick with bullet points and single sentences making it much easier to elaborate or expand sections into a longer-form business plan. This plan type is useful for those exploring ideas, needing to validate their business model, or who need an internal plan to help them run and manage their business.

Now, the option that we here at LivePlan recommend is the Lean Plan . This is less of a specific document type and more of a methodology. It takes the simplicity and styling of the one-page business plan and turns it into a process for you to continuously plan, test, review, refine, and take action based on performance.

It holds all of the benefits of the single-page plan, including the potential to complete it in as little as 27-minutes . However, it’s even easier to convert into a full plan thanks to how heavily it’s tied to your financials. The overall goal of Lean Planning isn’t to just produce documents that you use once and shelve. Instead, the Lean Planning process helps you build a healthier company that thrives in times of growth and stable through times of crisis.

It’s faster, keeps your plan concise, and ensures that your plan is always up-to-date.

Try the LivePlan Method for Lean Business Planning

Now that you know the basics of business planning, it’s time to get started. Again we recommend leveraging a Lean Plan for a faster, easier, and far more useful planning process.

To get familiar with the Lean Plan format, you can download our free Lean Plan template . However, if you want to elevate your ability to create and use your lean plan even further, you may want to explore LivePlan.

It features step-by-step guidance that ensures you cover everything necessary while reducing the time spent on formatting and presenting. You’ll also gain access to financial forecasting tools that propel you through the process. Finally, it will transform your plan into a management tool that will help you easily compare your forecasts to your actual results.

Check out how LivePlan streamlines Lean Planning by downloading our Kickstart Your Business ebook .

Like this post? Share with a friend!

Posted in Business Plan Writing

Join over 1 million entrepreneurs who found success with liveplan, like this content sign up to receive more.

Subscribe for tips and guidance to help you grow a better, smarter business.

You're all set!

Exciting business insights and growth strategies will be coming your way each month.

We care about your privacy. See our privacy policy .

11.4 The Business Plan

Learning objectives.

By the end of this section, you will be able to:

- Describe the different purposes of a business plan

- Describe and develop the components of a brief business plan

- Describe and develop the components of a full business plan

Unlike the brief or lean formats introduced so far, the business plan is a formal document used for the long-range planning of a company’s operation. It typically includes background information, financial information, and a summary of the business. Investors nearly always request a formal business plan because it is an integral part of their evaluation of whether to invest in a company. Although nothing in business is permanent, a business plan typically has components that are more “set in stone” than a business model canvas , which is more commonly used as a first step in the planning process and throughout the early stages of a nascent business. A business plan is likely to describe the business and industry, market strategies, sales potential, and competitive analysis, as well as the company’s long-term goals and objectives. An in-depth formal business plan would follow at later stages after various iterations to business model canvases. The business plan usually projects financial data over a three-year period and is typically required by banks or other investors to secure funding. The business plan is a roadmap for the company to follow over multiple years.

Some entrepreneurs prefer to use the canvas process instead of the business plan, whereas others use a shorter version of the business plan, submitting it to investors after several iterations. There are also entrepreneurs who use the business plan earlier in the entrepreneurial process, either preceding or concurrently with a canvas. For instance, Chris Guillebeau has a one-page business plan template in his book The $100 Startup . 48 His version is basically an extension of a napkin sketch without the detail of a full business plan. As you progress, you can also consider a brief business plan (about two pages)—if you want to support a rapid business launch—and/or a standard business plan.

As with many aspects of entrepreneurship, there are no clear hard and fast rules to achieving entrepreneurial success. You may encounter different people who want different things (canvas, summary, full business plan), and you also have flexibility in following whatever tool works best for you. Like the canvas, the various versions of the business plan are tools that will aid you in your entrepreneurial endeavor.

Business Plan Overview

Most business plans have several distinct sections ( Figure 11.16 ). The business plan can range from a few pages to twenty-five pages or more, depending on the purpose and the intended audience. For our discussion, we’ll describe a brief business plan and a standard business plan. If you are able to successfully design a business model canvas, then you will have the structure for developing a clear business plan that you can submit for financial consideration.

Both types of business plans aim at providing a picture and roadmap to follow from conception to creation. If you opt for the brief business plan, you will focus primarily on articulating a big-picture overview of your business concept.

The full business plan is aimed at executing the vision concept, dealing with the proverbial devil in the details. Developing a full business plan will assist those of you who need a more detailed and structured roadmap, or those of you with little to no background in business. The business planning process includes the business model, a feasibility analysis, and a full business plan, which we will discuss later in this section. Next, we explore how a business plan can meet several different needs.

Purposes of a Business Plan

A business plan can serve many different purposes—some internal, others external. As we discussed previously, you can use a business plan as an internal early planning device, an extension of a napkin sketch, and as a follow-up to one of the canvas tools. A business plan can be an organizational roadmap , that is, an internal planning tool and working plan that you can apply to your business in order to reach your desired goals over the course of several years. The business plan should be written by the owners of the venture, since it forces a firsthand examination of the business operations and allows them to focus on areas that need improvement.

Refer to the business venture throughout the document. Generally speaking, a business plan should not be written in the first person.

A major external purpose for the business plan is as an investment tool that outlines financial projections, becoming a document designed to attract investors. In many instances, a business plan can complement a formal investor’s pitch. In this context, the business plan is a presentation plan, intended for an outside audience that may or may not be familiar with your industry, your business, and your competitors.

You can also use your business plan as a contingency plan by outlining some “what-if” scenarios and exploring how you might respond if these scenarios unfold. Pretty Young Professional launched in November 2010 as an online resource to guide an emerging generation of female leaders. The site focused on recent female college graduates and current students searching for professional roles and those in their first professional roles. It was founded by four friends who were coworkers at the global consultancy firm McKinsey. But after positions and equity were decided among them, fundamental differences of opinion about the direction of the business emerged between two factions, according to the cofounder and former CEO Kathryn Minshew . “I think, naively, we assumed that if we kicked the can down the road on some of those things, we’d be able to sort them out,” Minshew said. Minshew went on to found a different professional site, The Muse , and took much of the editorial team of Pretty Young Professional with her. 49 Whereas greater planning potentially could have prevented the early demise of Pretty Young Professional, a change in planning led to overnight success for Joshua Esnard and The Cut Buddy team. Esnard invented and patented the plastic hair template that he was selling online out of his Fort Lauderdale garage while working a full-time job at Broward College and running a side business. Esnard had hundreds of boxes of Cut Buddies sitting in his home when he changed his marketing plan to enlist companies specializing in making videos go viral. It worked so well that a promotional video for the product garnered 8 million views in hours. The Cut Buddy sold over 4,000 products in a few hours when Esnard only had hundreds remaining. Demand greatly exceeded his supply, so Esnard had to scramble to increase manufacturing and offered customers two-for-one deals to make up for delays. This led to selling 55,000 units, generating $700,000 in sales in 2017. 50 After appearing on Shark Tank and landing a deal with Daymond John that gave the “shark” a 20-percent equity stake in return for $300,000, The Cut Buddy has added new distribution channels to include retail sales along with online commerce. Changing one aspect of a business plan—the marketing plan—yielded success for The Cut Buddy.

Link to Learning

Watch this video of Cut Buddy’s founder, Joshua Esnard, telling his company’s story to learn more.

If you opt for the brief business plan, you will focus primarily on articulating a big-picture overview of your business concept. This version is used to interest potential investors, employees, and other stakeholders, and will include a financial summary “box,” but it must have a disclaimer, and the founder/entrepreneur may need to have the people who receive it sign a nondisclosure agreement (NDA) . The full business plan is aimed at executing the vision concept, providing supporting details, and would be required by financial institutions and others as they formally become stakeholders in the venture. Both are aimed at providing a picture and roadmap to go from conception to creation.

Types of Business Plans

The brief business plan is similar to an extended executive summary from the full business plan. This concise document provides a broad overview of your entrepreneurial concept, your team members, how and why you will execute on your plans, and why you are the ones to do so. You can think of a brief business plan as a scene setter or—since we began this chapter with a film reference—as a trailer to the full movie. The brief business plan is the commercial equivalent to a trailer for Field of Dreams , whereas the full plan is the full-length movie equivalent.

Brief Business Plan or Executive Summary

As the name implies, the brief business plan or executive summary summarizes key elements of the entire business plan, such as the business concept, financial features, and current business position. The executive summary version of the business plan is your opportunity to broadly articulate the overall concept and vision of the company for yourself, for prospective investors, and for current and future employees.

A typical executive summary is generally no longer than a page, but because the brief business plan is essentially an extended executive summary, the executive summary section is vital. This is the “ask” to an investor. You should begin by clearly stating what you are asking for in the summary.

In the business concept phase, you’ll describe the business, its product, and its markets. Describe the customer segment it serves and why your company will hold a competitive advantage. This section may align roughly with the customer segments and value-proposition segments of a canvas.

Next, highlight the important financial features, including sales, profits, cash flows, and return on investment. Like the financial portion of a feasibility analysis, the financial analysis component of a business plan may typically include items like a twelve-month profit and loss projection, a three- or four-year profit and loss projection, a cash-flow projection, a projected balance sheet, and a breakeven calculation. You can explore a feasibility study and financial projections in more depth in the formal business plan. Here, you want to focus on the big picture of your numbers and what they mean.

The current business position section can furnish relevant information about you and your team members and the company at large. This is your opportunity to tell the story of how you formed the company, to describe its legal status (form of operation), and to list the principal players. In one part of the extended executive summary, you can cover your reasons for starting the business: Here is an opportunity to clearly define the needs you think you can meet and perhaps get into the pains and gains of customers. You also can provide a summary of the overall strategic direction in which you intend to take the company. Describe the company’s mission, vision, goals and objectives, overall business model, and value proposition.

Rice University’s Student Business Plan Competition, one of the largest and overall best-regarded graduate school business-plan competitions (see Telling Your Entrepreneurial Story and Pitching the Idea ), requires an executive summary of up to five pages to apply. 51 , 52 Its suggested sections are shown in Table 11.2 .

Are You Ready?

Create a brief business plan.

Fill out a canvas of your choosing for a well-known startup: Uber, Netflix, Dropbox, Etsy, Airbnb, Bird/Lime, Warby Parker, or any of the companies featured throughout this chapter or one of your choice. Then create a brief business plan for that business. See if you can find a version of the company’s actual executive summary, business plan, or canvas. Compare and contrast your vision with what the company has articulated.

- These companies are well established but is there a component of what you charted that you would advise the company to change to ensure future viability?

- Map out a contingency plan for a “what-if” scenario if one key aspect of the company or the environment it operates in were drastically is altered?

Full Business Plan

Even full business plans can vary in length, scale, and scope. Rice University sets a ten-page cap on business plans submitted for the full competition. The IndUS Entrepreneurs , one of the largest global networks of entrepreneurs, also holds business plan competitions for students through its Tie Young Entrepreneurs program. In contrast, business plans submitted for that competition can usually be up to twenty-five pages. These are just two examples. Some components may differ slightly; common elements are typically found in a formal business plan outline. The next section will provide sample components of a full business plan for a fictional business.

Executive Summary

The executive summary should provide an overview of your business with key points and issues. Because the summary is intended to summarize the entire document, it is most helpful to write this section last, even though it comes first in sequence. The writing in this section should be especially concise. Readers should be able to understand your needs and capabilities at first glance. The section should tell the reader what you want and your “ask” should be explicitly stated in the summary.

Describe your business, its product or service, and the intended customers. Explain what will be sold, who it will be sold to, and what competitive advantages the business has. Table 11.3 shows a sample executive summary for the fictional company La Vida Lola.

Business Description

This section describes the industry, your product, and the business and success factors. It should provide a current outlook as well as future trends and developments. You also should address your company’s mission, vision, goals, and objectives. Summarize your overall strategic direction, your reasons for starting the business, a description of your products and services, your business model, and your company’s value proposition. Consider including the Standard Industrial Classification/North American Industry Classification System (SIC/NAICS) code to specify the industry and insure correct identification. The industry extends beyond where the business is located and operates, and should include national and global dynamics. Table 11.4 shows a sample business description for La Vida Lola.

Industry Analysis and Market Strategies

Here you should define your market in terms of size, structure, growth prospects, trends, and sales potential. You’ll want to include your TAM and forecast the SAM . (Both these terms are discussed in Conducting a Feasibility Analysis .) This is a place to address market segmentation strategies by geography, customer attributes, or product orientation. Describe your positioning relative to your competitors’ in terms of pricing, distribution, promotion plan, and sales potential. Table 11.5 shows an example industry analysis and market strategy for La Vida Lola.

Competitive Analysis

The competitive analysis is a statement of the business strategy as it relates to the competition. You want to be able to identify who are your major competitors and assess what are their market shares, markets served, strategies employed, and expected response to entry? You likely want to conduct a classic SWOT analysis (Strengths Weaknesses Opportunities Threats) and complete a competitive-strength grid or competitive matrix. Outline your company’s competitive strengths relative to those of the competition in regard to product, distribution, pricing, promotion, and advertising. What are your company’s competitive advantages and their likely impacts on its success? The key is to construct it properly for the relevant features/benefits (by weight, according to customers) and how the startup compares to incumbents. The competitive matrix should show clearly how and why the startup has a clear (if not currently measurable) competitive advantage. Some common features in the example include price, benefits, quality, type of features, locations, and distribution/sales. Sample templates are shown in Figure 11.17 and Figure 11.18 . A competitive analysis helps you create a marketing strategy that will identify assets or skills that your competitors are lacking so you can plan to fill those gaps, giving you a distinct competitive advantage. When creating a competitor analysis, it is important to focus on the key features and elements that matter to customers, rather than focusing too heavily on the entrepreneur’s idea and desires.

Operations and Management Plan

In this section, outline how you will manage your company. Describe its organizational structure. Here you can address the form of ownership and, if warranted, include an organizational chart/structure. Highlight the backgrounds, experiences, qualifications, areas of expertise, and roles of members of the management team. This is also the place to mention any other stakeholders, such as a board of directors or advisory board(s), and their relevant relationship to the founder, experience and value to help make the venture successful, and professional service firms providing management support, such as accounting services and legal counsel.

Table 11.6 shows a sample operations and management plan for La Vida Lola.

Marketing Plan

Here you should outline and describe an effective overall marketing strategy for your venture, providing details regarding pricing, promotion, advertising, distribution, media usage, public relations, and a digital presence. Fully describe your sales management plan and the composition of your sales force, along with a comprehensive and detailed budget for the marketing plan. Table 11.7 shows a sample marketing plan for La Vida Lola.

Financial Plan

A financial plan seeks to forecast revenue and expenses; project a financial narrative; and estimate project costs, valuations, and cash flow projections. This section should present an accurate, realistic, and achievable financial plan for your venture (see Entrepreneurial Finance and Accounting for detailed discussions about conducting these projections). Include sales forecasts and income projections, pro forma financial statements ( Building the Entrepreneurial Dream Team , a breakeven analysis, and a capital budget. Identify your possible sources of financing (discussed in Conducting a Feasibility Analysis ). Figure 11.19 shows a template of cash-flow needs for La Vida Lola.

Entrepreneur In Action

Laughing man coffee.

Hugh Jackman ( Figure 11.20 ) may best be known for portraying a comic-book superhero who used his mutant abilities to protect the world from villains. But the Wolverine actor is also working to make the planet a better place for real, not through adamantium claws but through social entrepreneurship.

A love of java jolted Jackman into action in 2009, when he traveled to Ethiopia with a Christian humanitarian group to shoot a documentary about the impact of fair-trade certification on coffee growers there. He decided to launch a business and follow in the footsteps of the late Paul Newman, another famous actor turned philanthropist via food ventures.

Jackman launched Laughing Man Coffee two years later; he sold the line to Keurig in 2015. One Laughing Man Coffee café in New York continues to operate independently, investing its proceeds into charitable programs that support better housing, health, and educational initiatives within fair-trade farming communities. 55 Although the New York location is the only café, the coffee brand is still distributed, with Keurig donating an undisclosed portion of Laughing Man proceeds to those causes (whereas Jackman donates all his profits). The company initially donated its profits to World Vision, the Christian humanitarian group Jackman accompanied in 2009. In 2017, it created the Laughing Man Foundation to be more active with its money management and distribution.

- You be the entrepreneur. If you were Jackman, would you have sold the company to Keurig? Why or why not?

- Would you have started the Laughing Man Foundation?

- What else can Jackman do to aid fair-trade practices for coffee growers?

What Can You Do?

Textbooks for change.

Founded in 2014, Textbooks for Change uses a cross-compensation model, in which one customer segment pays for a product or service, and the profit from that revenue is used to provide the same product or service to another, underserved segment. Textbooks for Change partners with student organizations to collect used college textbooks, some of which are re-sold while others are donated to students in need at underserved universities across the globe. The organization has reused or recycled 250,000 textbooks, providing 220,000 students with access through seven campus partners in East Africa. This B-corp social enterprise tackles a problem and offers a solution that is directly relevant to college students like yourself. Have you observed a problem on your college campus or other campuses that is not being served properly? Could it result in a social enterprise?

Work It Out

Franchisee set out.

A franchisee of East Coast Wings, a chain with dozens of restaurants in the United States, has decided to part ways with the chain. The new store will feature the same basic sports-bar-and-restaurant concept and serve the same basic foods: chicken wings, burgers, sandwiches, and the like. The new restaurant can’t rely on the same distributors and suppliers. A new business plan is needed.

- What steps should the new restaurant take to create a new business plan?

- Should it attempt to serve the same customers? Why or why not?

This New York Times video, “An Unlikely Business Plan,” describes entrepreneurial resurgence in Detroit, Michigan.

- 48 Chris Guillebeau. The $100 Startup: Reinvent the Way You Make a Living, Do What You Love, and Create a New Future . New York: Crown Business/Random House, 2012.

- 49 Jonathan Chan. “What These 4 Startup Case Studies Can Teach You about Failure.” Foundr.com . July 12, 2015. https://foundr.com/4-startup-case-studies-failure/

- 50 Amy Feldman. “Inventor of the Cut Buddy Paid YouTubers to Spark Sales. He Wasn’t Ready for a Video to Go Viral.” Forbes. February 15, 2017. https://www.forbes.com/sites/forbestreptalks/2017/02/15/inventor-of-the-cut-buddy-paid-youtubers-to-spark-sales-he-wasnt-ready-for-a-video-to-go-viral/#3eb540ce798a

- 51 Jennifer Post. “National Business Plan Competitions for Entrepreneurs.” Business News Daily . August 30, 2018. https://www.businessnewsdaily.com/6902-business-plan-competitions-entrepreneurs.html

- 52 “Rice Business Plan Competition, Eligibility Criteria and How to Apply.” Rice Business Plan Competition . March 2020. https://rbpc.rice.edu/sites/g/files/bxs806/f/2020%20RBPC%20Eligibility%20Criteria%20and%20How%20to%20Apply_23Oct19.pdf

- 53 “Rice Business Plan Competition, Eligibility Criteria and How to Apply.” Rice Business Plan Competition. March 2020. https://rbpc.rice.edu/sites/g/files/bxs806/f/2020%20RBPC%20Eligibility%20Criteria%20and%20How%20to%20Apply_23Oct19.pdf; Based on 2019 RBPC Competition Rules and Format April 4–6, 2019. https://rbpc.rice.edu/sites/g/files/bxs806/f/2019-RBPC-Competition-Rules%20-Format.pdf

- 54 Foodstart. http://foodstart.com

- 55 “Hugh Jackman Journey to Starting a Social Enterprise Coffee Company.” Giving Compass. April 8, 2018. https://givingcompass.org/article/hugh-jackman-journey-to-starting-a-social-enterprise-coffee-company/

As an Amazon Associate we earn from qualifying purchases.

This book may not be used in the training of large language models or otherwise be ingested into large language models or generative AI offerings without OpenStax's permission.

Want to cite, share, or modify this book? This book uses the Creative Commons Attribution License and you must attribute OpenStax.

Access for free at https://openstax.org/books/entrepreneurship/pages/1-introduction

- Authors: Michael Laverty, Chris Littel

- Publisher/website: OpenStax

- Book title: Entrepreneurship

- Publication date: Jan 16, 2020

- Location: Houston, Texas

- Book URL: https://openstax.org/books/entrepreneurship/pages/1-introduction

- Section URL: https://openstax.org/books/entrepreneurship/pages/11-4-the-business-plan

© Jan 4, 2024 OpenStax. Textbook content produced by OpenStax is licensed under a Creative Commons Attribution License . The OpenStax name, OpenStax logo, OpenStax book covers, OpenStax CNX name, and OpenStax CNX logo are not subject to the Creative Commons license and may not be reproduced without the prior and express written consent of Rice University.

- Sources of Business Finance

- Small Business Loans

- Small Business Grants

- Crowdfunding Sites

- How to Get a Business Loan

- Small Business Insurance Providers

- Best Factoring Companies

- Types of Bank Accounts

- Best Banks for Small Business

- Best Business Bank Accounts

- Open a Business Bank Account

- Bank Accounts for Small Businesses

- Free Business Checking Accounts

- Best Business Credit Cards

- Get a Business Credit Card

- Business Credit Cards for Bad Credit

- Build Business Credit Fast

- Business Loan Eligibility Criteria

- Small-Business Bookkeeping Basics

- How to Set Financial Goals

- Business Loan Calculators

- How to Calculate ROI

- Calculate Net Income

- Calculate Working Capital

- Calculate Operating Income

- Calculate Net Present Value (NPV)

- Calculate Payroll Tax

12 Key Elements of a Business Plan (Top Components Explained)

Starting and running a successful business requires proper planning and execution of effective business tactics and strategies .

You need to prepare many essential business documents when starting a business for maximum success; the business plan is one such document.

When creating a business, you want to achieve business objectives and financial goals like productivity, profitability, and business growth. You need an effective business plan to help you get to your desired business destination.

Even if you are already running a business, the proper understanding and review of the key elements of a business plan help you navigate potential crises and obstacles.

This article will teach you why the business document is at the core of any successful business and its key elements you can not avoid.

Let’s get started.

Why Are Business Plans Important?

Business plans are practical steps or guidelines that usually outline what companies need to do to reach their goals. They are essential documents for any business wanting to grow and thrive in a highly-competitive business environment .

1. Proves Your Business Viability

A business plan gives companies an idea of how viable they are and what actions they need to take to grow and reach their financial targets. With a well-written and clearly defined business plan, your business is better positioned to meet its goals.

2. Guides You Throughout the Business Cycle

A business plan is not just important at the start of a business. As a business owner, you must draw up a business plan to remain relevant throughout the business cycle .

During the starting phase of your business, a business plan helps bring your ideas into reality. A solid business plan can secure funding from lenders and investors.

After successfully setting up your business, the next phase is management. Your business plan still has a role to play in this phase, as it assists in communicating your business vision to employees and external partners.

Essentially, your business plan needs to be flexible enough to adapt to changes in the needs of your business.

3. Helps You Make Better Business Decisions

As a business owner, you are involved in an endless decision-making cycle. Your business plan helps you find answers to your most crucial business decisions.

A robust business plan helps you settle your major business components before you launch your product, such as your marketing and sales strategy and competitive advantage.

4. Eliminates Big Mistakes

Many small businesses fail within their first five years for several reasons: lack of financing, stiff competition, low market need, inadequate teams, and inefficient pricing strategy.

Creating an effective plan helps you eliminate these big mistakes that lead to businesses' decline. Every business plan element is crucial for helping you avoid potential mistakes before they happen.

5. Secures Financing and Attracts Top Talents

Having an effective plan increases your chances of securing business loans. One of the essential requirements many lenders ask for to grant your loan request is your business plan.

A business plan helps investors feel confident that your business can attract a significant return on investments ( ROI ).

You can attract and retain top-quality talents with a clear business plan. It inspires your employees and keeps them aligned to achieve your strategic business goals.

Key Elements of Business Plan

Starting and running a successful business requires well-laid actions and supporting documents that better position a company to achieve its business goals and maximize success.

A business plan is a written document with relevant information detailing business objectives and how it intends to achieve its goals.

With an effective business plan, investors, lenders, and potential partners understand your organizational structure and goals, usually around profitability, productivity, and growth.

Every successful business plan is made up of key components that help solidify the efficacy of the business plan in delivering on what it was created to do.

Here are some of the components of an effective business plan.

1. Executive Summary

One of the key elements of a business plan is the executive summary. Write the executive summary as part of the concluding topics in the business plan. Creating an executive summary with all the facts and information available is easier.

In the overall business plan document, the executive summary should be at the forefront of the business plan. It helps set the tone for readers on what to expect from the business plan.

A well-written executive summary includes all vital information about the organization's operations, making it easy for a reader to understand.

The key points that need to be acted upon are highlighted in the executive summary. They should be well spelled out to make decisions easy for the management team.

A good and compelling executive summary points out a company's mission statement and a brief description of its products and services.

An executive summary summarizes a business's expected value proposition to distinct customer segments. It highlights the other key elements to be discussed during the rest of the business plan.

Including your prior experiences as an entrepreneur is a good idea in drawing up an executive summary for your business. A brief but detailed explanation of why you decided to start the business in the first place is essential.

Adding your company's mission statement in your executive summary cannot be overemphasized. It creates a culture that defines how employees and all individuals associated with your company abide when carrying out its related processes and operations.

Your executive summary should be brief and detailed to catch readers' attention and encourage them to learn more about your company.

Components of an Executive Summary

Here are some of the information that makes up an executive summary:

- The name and location of your company

- Products and services offered by your company

- Mission and vision statements

- Success factors of your business plan

2. Business Description

Your business description needs to be exciting and captivating as it is the formal introduction a reader gets about your company.

What your company aims to provide, its products and services, goals and objectives, target audience , and potential customers it plans to serve need to be highlighted in your business description.

A company description helps point out notable qualities that make your company stand out from other businesses in the industry. It details its unique strengths and the competitive advantages that give it an edge to succeed over its direct and indirect competitors.

Spell out how your business aims to deliver on the particular needs and wants of identified customers in your company description, as well as the particular industry and target market of the particular focus of the company.

Include trends and significant competitors within your particular industry in your company description. Your business description should contain what sets your company apart from other businesses and provides it with the needed competitive advantage.

In essence, if there is any area in your business plan where you need to brag about your business, your company description provides that unique opportunity as readers look to get a high-level overview.

Components of a Business Description

Your business description needs to contain these categories of information.

- Business location

- The legal structure of your business

- Summary of your business’s short and long-term goals

3. Market Analysis

The market analysis section should be solely based on analytical research as it details trends particular to the market you want to penetrate.

Graphs, spreadsheets, and histograms are handy data and statistical tools you need to utilize in your market analysis. They make it easy to understand the relationship between your current ideas and the future goals you have for the business.

All details about the target customers you plan to sell products or services should be in the market analysis section. It helps readers with a helpful overview of the market.

In your market analysis, you provide the needed data and statistics about industry and market share, the identified strengths in your company description, and compare them against other businesses in the same industry.

The market analysis section aims to define your target audience and estimate how your product or service would fare with these identified audiences.

Market analysis helps visualize a target market by researching and identifying the primary target audience of your company and detailing steps and plans based on your audience location.

Obtaining this information through market research is essential as it helps shape how your business achieves its short-term and long-term goals.

Market Analysis Factors

Here are some of the factors to be included in your market analysis.

- The geographical location of your target market

- Needs of your target market and how your products and services can meet those needs

- Demographics of your target audience

Components of the Market Analysis Section

Here is some of the information to be included in your market analysis.

- Industry description and statistics

- Demographics and profile of target customers

- Marketing data for your products and services

- Detailed evaluation of your competitors

4. Marketing Plan