Questionnaire Method In Research

Saul Mcleod, PhD

Editor-in-Chief for Simply Psychology

BSc (Hons) Psychology, MRes, PhD, University of Manchester

Saul Mcleod, PhD., is a qualified psychology teacher with over 18 years of experience in further and higher education. He has been published in peer-reviewed journals, including the Journal of Clinical Psychology.

Learn about our Editorial Process

Olivia Guy-Evans, MSc

Associate Editor for Simply Psychology

BSc (Hons) Psychology, MSc Psychology of Education

Olivia Guy-Evans is a writer and associate editor for Simply Psychology. She has previously worked in healthcare and educational sectors.

On This Page:

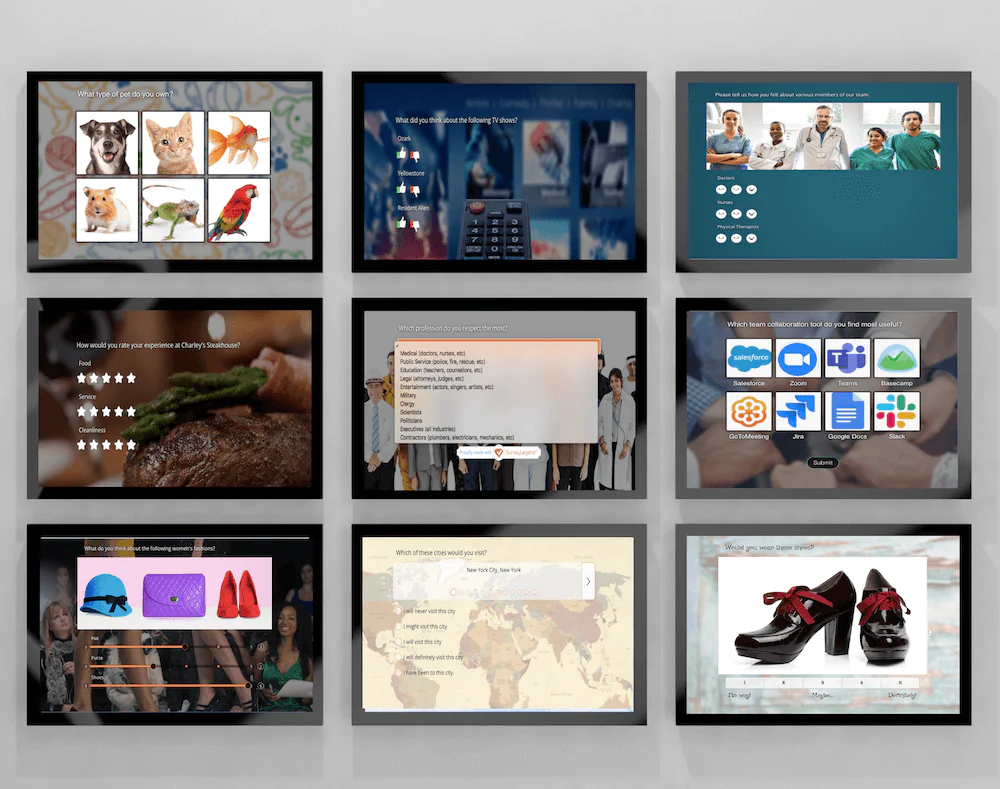

A questionnaire is a research instrument consisting of a series of questions for the purpose of gathering information from respondents. Questionnaires can be thought of as a kind of written interview . They can be carried out face to face, by telephone, computer, or post.

Questionnaires provide a relatively cheap, quick, and efficient way of obtaining large amounts of information from a large sample of people.

Data can be collected relatively quickly because the researcher would not need to be present when completing the questionnaires. This is useful for large populations when interviews would be impractical.

However, a problem with questionnaires is that respondents may lie due to social desirability. Most people want to present a positive image of themselves, and may lie or bend the truth to look good, e.g., pupils exaggerate revision duration.

Questionnaires can effectively measure relatively large subjects’ behavior, attitudes, preferences, opinions, and intentions more cheaply and quickly than other methods.

Often, a questionnaire uses both open and closed questions to collect data. This is beneficial as it means both quantitative and qualitative data can be obtained.

Closed Questions

A closed-ended question requires a specific, limited response, often “yes” or “no” or a choice that fit into pre-decided categories.

Data that can be placed into a category is called nominal data. The category can be restricted to as few as two options, i.e., dichotomous (e.g., “yes” or “no,” “male” or “female”), or include quite complex lists of alternatives from which the respondent can choose (e.g., polytomous).

Closed questions can also provide ordinal data (which can be ranked). This often involves using a continuous rating scale to measure the strength of attitudes or emotions.

For example, strongly agree / agree / neutral / disagree / strongly disagree / unable to answer.

Closed questions have been used to research type A personality (e.g., Friedman & Rosenman, 1974) and also to assess life events that may cause stress (Holmes & Rahe, 1967) and attachment (Fraley, Waller, & Brennan, 2000).

- They can be economical. This means they can provide large amounts of research data for relatively low costs. Therefore, a large sample size can be obtained, which should represent the population from which a researcher can then generalize.

- The respondent provides information that can be easily converted into quantitative data (e.g., count the number of “yes” or “no” answers), allowing statistical analysis of the responses.

- The questions are standardized. All respondents are asked exactly the same questions in the same order. This means a questionnaire can be replicated easily to check for reliability . Therefore, a second researcher can use the questionnaire to confirm consistent results.

Limitations

- They lack detail. Because the responses are fixed, there is less scope for respondents to supply answers that reflect their true feelings on a topic.

Open Questions

Open questions allow for expansive, varied answers without preset options or limitations.

Open questions allow people to express what they think in their own words. Open-ended questions enable the respondent to answer in as much detail as they like in their own words. For example: “can you tell me how happy you feel right now?”

Open questions will work better if you want to gather more in-depth answers from your respondents. These give no pre-set answer options and instead, allow the respondents to put down exactly what they like in their own words.

Open questions are often used for complex questions that cannot be answered in a few simple categories but require more detail and discussion.

Lawrence Kohlberg presented his participants with moral dilemmas. One of the most famous concerns a character called Heinz, who is faced with the choice between watching his wife die of cancer or stealing the only drug that could help her.

Participants were asked whether Heinz should steal the drug or not and, more importantly, for their reasons why upholding or breaking the law is right.

- Rich qualitative data is obtained as open questions allow respondents to elaborate on their answers. This means the research can determine why a person holds a certain attitude .

- Time-consuming to collect the data. It takes longer for the respondent to complete open questions. This is a problem as a smaller sample size may be obtained.

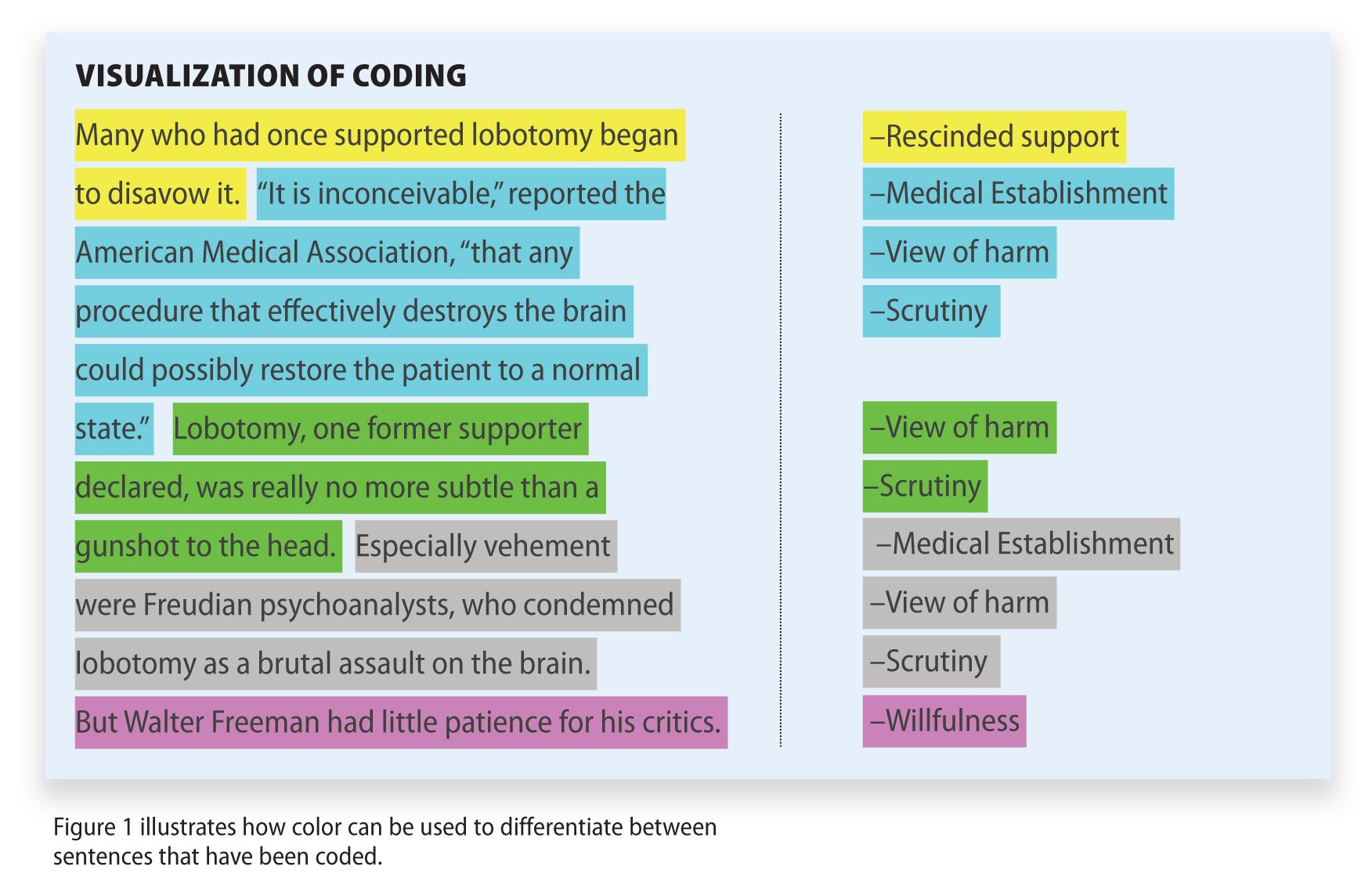

- Time-consuming to analyze the data. It takes longer for the researcher to analyze qualitative data as they have to read the answers and try to put them into categories by coding, which is often subjective and difficult. However, Smith (1992) has devoted an entire book to the issues of thematic content analysis that includes 14 different scoring systems for open-ended questions.

- Not suitable for less educated respondents as open questions require superior writing skills and a better ability to express one’s feelings verbally.

Questionnaire Design

With some questionnaires suffering from a response rate as low as 5%, a questionnaire must be well designed.

There are several important factors in questionnaire design.

Pilot Study

Question order.

Questions should progress logically from the least sensitive to the most sensitive, from the factual and behavioral to the cognitive, and from the more general to the more specific.

The researcher should ensure that previous questions do not influence the answer to a question.

Question order effects

- Question order effects occur when responses to an earlier question affect responses to a later question in a survey. They can arise at different stages of the survey response process – interpretation, information retrieval, judgment/estimation, and reporting.

- Types of question order effects include: unconditional (subsequent answers affected by prior question topic), conditional (subsequent answers depend on the response to the prior question), and associational (correlation between two questions changes based on order).

- Question order effects have been found across different survey topics like social and political attitudes, health and safety studies, vignette research, etc. Effects may be moderated by respondent factors like age, education level, knowledge and attitudes about the topic.

- To minimize question order effects, recommendations include avoiding judgmental dependencies, separating potentially reactive questions, randomizing questions, following good survey design principles, considering respondent characteristics, and intentionally examining question context and order.

Terminology

- There should be a minimum of technical jargon. Questions should be simple, to the point, and easy to understand. The language of a questionnaire should be appropriate to the vocabulary of the group of people being studied.

- Use statements that are interpreted in the same way by members of different subpopulations of the population of interest.

- For example, the researcher must change the language of questions to match the social background of the respondent’s age / educational level / social class/ethnicity, etc.

Presentation

Ethical issues.

- The researcher must ensure that the information provided by the respondent is kept confidential, e.g., name, address, etc.

- This means questionnaires are good for researching sensitive topics as respondents will be more honest when they cannot be identified.

- Keeping the questionnaire confidential should also reduce the likelihood of psychological harm, such as embarrassment.

- Participants must provide informed consent before completing the questionnaire and must be aware that they have the right to withdraw their information at any time during the survey/ study.

Problems with Postal Questionnaires

At first sight, the postal questionnaire seems to offer the opportunity to get around the problem of interview bias by reducing the personal involvement of the researcher. Its other practical advantages are that it is cheaper than face-to-face interviews and can quickly contact many respondents scattered over a wide area.

However, these advantages must be weighed against the practical problems of conducting research by post. A lack of involvement by the researcher means there is little control over the information-gathering process.

The data might not be valid (i.e., truthful) as we can never be sure that the questionnaire was completed by the person to whom it was addressed.

That, of course, assumes there is a reply in the first place, and one of the most intractable problems of mailed questionnaires is a low response rate. This diminishes the reliability of the data

Also, postal questionnaires may not represent the population they are studying. This may be because:

- Some questionnaires may be lost in the post, reducing the sample size.

- The questionnaire may be completed by someone not a member of the research population.

- Those with strong views on the questionnaire’s subject are more likely to complete it than those without interest.

Benefits of a Pilot Study

A pilot study is a practice / small-scale study conducted before the main study.

It allows the researcher to try out the study with a few participants so that adjustments can be made before the main study, saving time and money.

It is important to conduct a questionnaire pilot study for the following reasons:

- Check that respondents understand the terminology used in the questionnaire.

- Check that emotive questions are not used, as they make people defensive and could invalidate their answers.

- Check that leading questions have not been used as they could bias the respondent’s answer.

- Ensure the questionnaire can be completed in an appropriate time frame (i.e., it’s not too long).

Frequently Asked Questions

How do psychological researchers analyze the data collected from questionnaires.

Psychological researchers analyze questionnaire data by looking for patterns and trends in people’s responses. They use numbers and charts to summarize the information.

They calculate things like averages and percentages to see what most people think or feel. They also compare different groups to see if there are any differences between them.

By doing these analyses, researchers can understand how people think, feel, and behave. This helps them make conclusions and learn more about how our minds work.

Are questionnaires effective in gathering accurate data?

Yes, questionnaires can be effective in gathering accurate data. When designed well, with clear and understandable questions, they allow individuals to express their thoughts, opinions, and experiences.

However, the accuracy of the data depends on factors such as the honesty and accuracy of respondents’ answers, their understanding of the questions, and their willingness to provide accurate information. Researchers strive to create reliable and valid questionnaires to minimize biases and errors.

It’s important to remember that while questionnaires can provide valuable insights, they are just one tool among many used in psychological research.

Can questionnaires be used with diverse populations and cultural contexts?

Yes, questionnaires can be used with diverse populations and cultural contexts. Researchers take special care to ensure that questionnaires are culturally sensitive and appropriate for different groups.

This means adapting the language, examples, and concepts to match the cultural context. By doing so, questionnaires can capture the unique perspectives and experiences of individuals from various backgrounds.

This helps researchers gain a more comprehensive understanding of human behavior and ensures that everyone’s voice is heard and represented in psychological research.

Are questionnaires the only method used in psychological research?

No, questionnaires are not the only method used in psychological research. Psychologists use a variety of research methods, including interviews, observations , experiments , and psychological tests.

Each method has its strengths and limitations, and researchers choose the most appropriate method based on their research question and goals.

Questionnaires are valuable for gathering self-report data, but other methods allow researchers to directly observe behavior, study interactions, or manipulate variables to test hypotheses.

By using multiple methods, psychologists can gain a more comprehensive understanding of human behavior and mental processes.

What is a semantic differential scale?

The semantic differential scale is a questionnaire format used to gather data on individuals’ attitudes or perceptions. It’s commonly incorporated into larger surveys or questionnaires to assess subjective qualities or feelings about a specific topic, product, or concept by quantifying them on a scale between two bipolar adjectives.

It presents respondents with a pair of opposite adjectives (e.g., “happy” vs. “sad”) and asks them to mark their position on a scale between them, capturing the intensity of their feelings about a particular subject.

It quantifies subjective qualities, turning them into data that can be statistically analyzed.

Ayidiya, S. A., & McClendon, M. J. (1990). Response effects in mail surveys. Public Opinion Quarterly, 54 (2), 229–247. https://doi.org/10.1086/269200

Fraley, R. C., Waller, N. G., & Brennan, K. A. (2000). An item-response theory analysis of self-report measures of adult attachment. Journal of Personality and Social Psychology, 78, 350-365.

Friedman, M., & Rosenman, R. H. (1974). Type A behavior and your heart . New York: Knopf.

Gold, R. S., & Barclay, A. (2006). Order of question presentation and correlation between judgments of comparative and own risk. Psychological Reports, 99 (3), 794–798. https://doi.org/10.2466/PR0.99.3.794-798

Holmes, T. H., & Rahe, R. H. (1967). The social readjustment rating scale. Journal of psychosomatic research, 11(2) , 213-218.

Schwarz, N., & Hippler, H.-J. (1995). Subsequent questions may influence answers to preceding questions in mail surveys. Public Opinion Quarterly, 59 (1), 93–97. https://doi.org/10.1086/269460

Smith, C. P. (Ed.). (1992). Motivation and personality: Handbook of thematic content analysis . Cambridge University Press.

Further Information

- Questionnaire design and scale development

- Questionnaire Appraisal Form

Related Articles

Research Methodology

Qualitative Data Coding

What Is a Focus Group?

Cross-Cultural Research Methodology In Psychology

What Is Internal Validity In Research?

Research Methodology , Statistics

What Is Face Validity In Research? Importance & How To Measure

Criterion Validity: Definition & Examples

Questionnaires

Questionnaires can be classified as both, quantitative and qualitative method depending on the nature of questions. Specifically, answers obtained through closed-ended questions (also called restricted questions) with multiple choice answer options are analyzed using quantitative methods. Research findings in this case can be illustrated using tabulations, pie-charts, bar-charts and percentages.

Answers obtained to open-ended questionnaire questions (also known as unrestricted questions), on the other hand, are analyzed using qualitative methods. Primary data collected using open-ended questionnaires involve discussions and critical analyses without use of numbers and calculations.

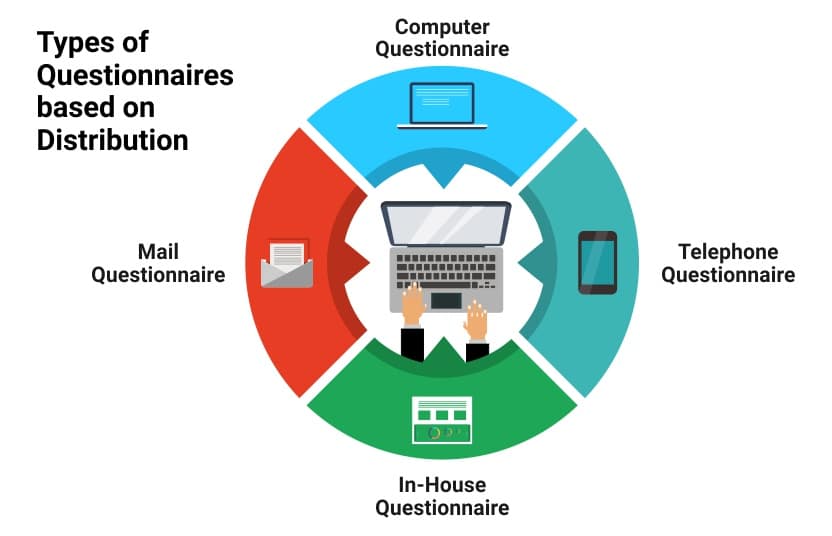

There are following types of questionnaires:

Computer questionnaire . Respondents are asked to answer the questionnaire which is sent by mail. The advantages of the computer questionnaires include their inexpensive price, time-efficiency, and respondents do not feel pressured, therefore can answer when they have time, giving more accurate answers. However, the main shortcoming of the mail questionnaires is that sometimes respondents do not bother answering them and they can just ignore the questionnaire.

Telephone questionnaire . Researcher may choose to call potential respondents with the aim of getting them to answer the questionnaire. The advantage of the telephone questionnaire is that, it can be completed during the short amount of time. The main disadvantage of the phone questionnaire is that it is expensive most of the time. Moreover, most people do not feel comfortable to answer many questions asked through the phone and it is difficult to get sample group to answer questionnaire over the phone.

In-house survey . This type of questionnaire involves the researcher visiting respondents in their houses or workplaces. The advantage of in-house survey is that more focus towards the questions can be gained from respondents. However, in-house surveys also have a range of disadvantages which include being time consuming, more expensive and respondents may not wish to have the researcher in their houses or workplaces for various reasons.

Mail Questionnaire . This sort of questionnaires involve the researcher to send the questionnaire list to respondents through post, often attaching pre-paid envelope. Mail questionnaires have an advantage of providing more accurate answer, because respondents can answer the questionnaire in their spare time. The disadvantages associated with mail questionnaires include them being expensive, time consuming and sometimes they end up in the bin put by respondents.

Questionnaires can include the following types of questions:

Open question questionnaires . Open questions differ from other types of questions used in questionnaires in a way that open questions may produce unexpected results, which can make the research more original and valuable. However, it is difficult to analyze the results of the findings when the data is obtained through the questionnaire with open questions.

Multiple choice question s. Respondents are offered a set of answers they have to choose from. The downsize of questionnaire with multiple choice questions is that, if there are too many answers to choose from, it makes the questionnaire, confusing and boring, and discourages the respondent to answer the questionnaire.

Dichotomous Questions . Thes type of questions gives two options to respondents – yes or no, to choose from. It is the easiest form of questionnaire for the respondent in terms of responding it.

Scaling Questions . Also referred to as ranking questions, they present an option for respondents to rank the available answers to questions on the scale of given range of values (for example from 1 to 10).

For a standard 15,000-20,000 word business dissertation including 25-40 questions in questionnaires will usually suffice. Questions need be formulated in an unambiguous and straightforward manner and they should be presented in a logical order.

Questionnaires as primary data collection method offer the following advantages:

- Uniformity: all respondents are asked exactly the same questions

- Cost-effectiveness

- Possibility to collect the primary data in shorter period of time

- Minimum or no bias from the researcher during the data collection process

- Usually enough time for respondents to think before answering questions, as opposed to interviews

- Possibility to reach respondents in distant areas through online questionnaire

At the same time, the use of questionnaires as primary data collection method is associated with the following shortcomings:

- Random answer choices by respondents without properly reading the question.

- In closed-ended questionnaires no possibility for respondents to express their additional thoughts about the matter due to the absence of a relevant question.

- Collecting incomplete or inaccurate information because respondents may not be able to understand questions correctly.

- High rate of non-response

Survey Monkey represents one of the most popular online platforms for facilitating data collection through questionnaires. Substantial benefits offered by Survey Monkey include its ease to use, presentation of questions in many different formats and advanced data analysis capabilities.

Survey Monkey as a popular platform for primary data collection

There are other alternatives to Survey Monkey you might want to consider to use as a platform for your survey. These include but not limited to Jotform, Google Forms, Lime Survey, Crowd Signal, Survey Gizmo, Zoho Survey and many others.

My e-book, The Ultimate Guide to Writing a Dissertation in Business Studies: a step by step approach contains a detailed, yet simple explanation of quantitative methods. The e-book explains all stages of the research process starting from the selection of the research area to writing personal reflection. Important elements of dissertations such as research philosophy, research approach, research design, methods of data collection and data analysis are explained in simple words.

John Dudovskiy

Market Research

Your ultimate guide to questionnaires and how to design a good one

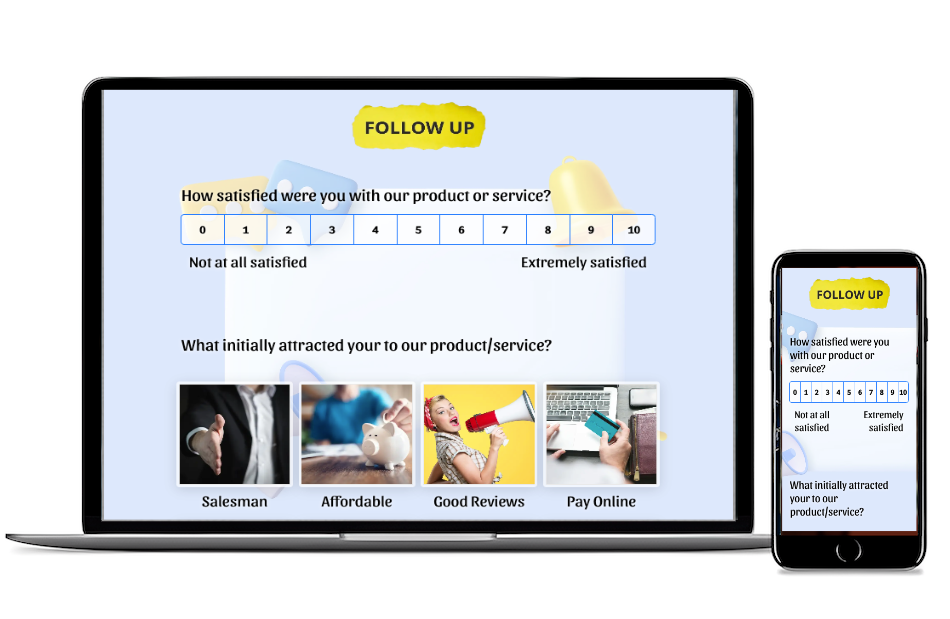

The written questionnaire is the heart and soul of any survey research project. Whether you conduct your survey using an online questionnaire, in person, by email or over the phone, the way you design your questionnaire plays a critical role in shaping the quality of the data and insights that you’ll get from your target audience. Keep reading to get actionable tips.

What is a questionnaire?

A questionnaire is a research tool consisting of a set of questions or other ‘prompts’ to collect data from a set of respondents.

When used in most research, a questionnaire will consist of a number of types of questions (primarily open-ended and closed) in order to gain both quantitative data that can be analyzed to draw conclusions, and qualitative data to provide longer, more specific explanations.

A research questionnaire is often mistaken for a survey - and many people use the term questionnaire and survey, interchangeably.

But that’s incorrect.

Which is what we talk about next.

Get started with our free survey maker with 50+ templates

Survey vs. questionnaire – what’s the difference?

Before we go too much further, let’s consider the differences between surveys and questionnaires.

These two terms are often used interchangeably, but there is an important difference between them.

Survey definition

A survey is the process of collecting data from a set of respondents and using it to gather insights.

Survey research can be conducted using a questionnaire, but won’t always involve one.

Questionnaire definition

A questionnaire is the list of questions you circulate to your target audience.

In other words, the survey is the task you’re carrying out, and the questionnaire is the instrument you’re using to do it.

By itself, a questionnaire doesn’t achieve much.

It’s when you put it into action as part of a survey that you start to get results.

Advantages vs disadvantages of using a questionnaire

While a questionnaire is a popular method to gather data for market research or other studies, there are a few disadvantages to using this method (although there are plenty of advantages to using a questionnaire too).

Let’s have a look at some of the advantages and disadvantages of using a questionnaire for collecting data.

Advantages of using a questionnaire

1. questionnaires are relatively cheap.

Depending on the complexity of your study, using a questionnaire can be cost effective compared to other methods.

You simply need to write your survey questionnaire, and send it out and then process the responses.

You can set up an online questionnaire relatively easily, or simply carry out market research on the street if that’s the best method.

2. You can get and analyze results quickly

Again depending on the size of your survey you can get results back from a questionnaire quickly, often within 24 hours of putting the questionnaire live.

It also means you can start to analyze responses quickly too.

3. They’re easily scalable

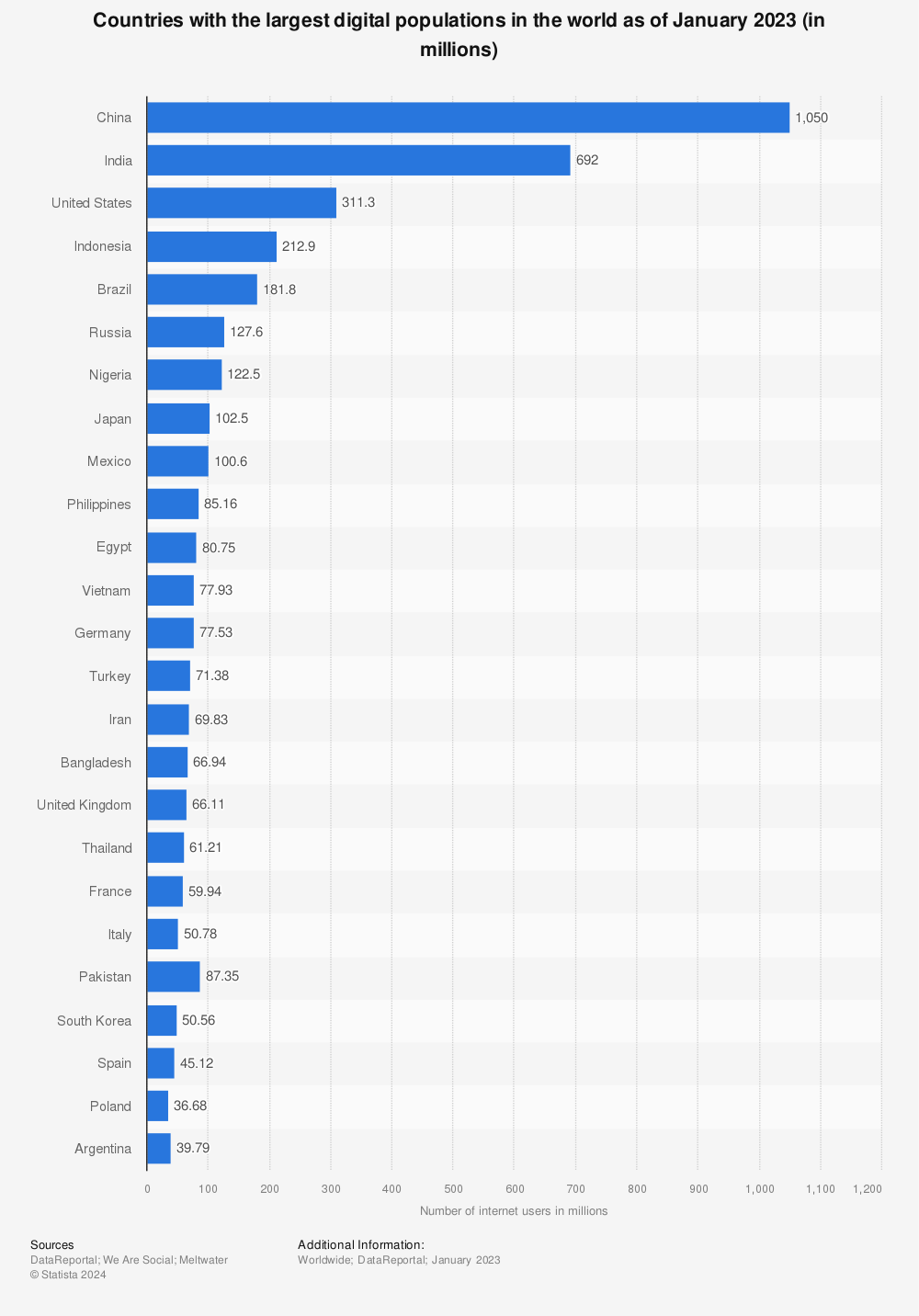

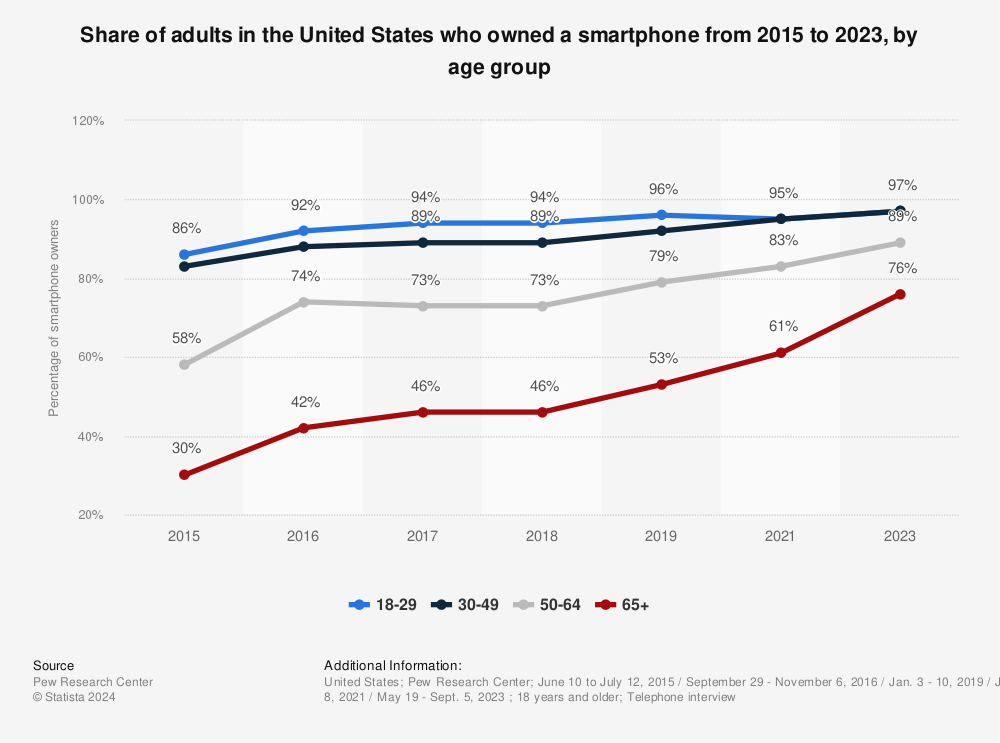

You can easily send an online questionnaire to anyone in the world and with the right software you can quickly identify your target audience and your questionnaire to them.

4. Questionnaires are easy to analyze

If your questionnaire design has been done properly, it’s quick and easy to analyze results from questionnaires once responses start to come back.

This is particularly useful with large scale market research projects.

Because all respondents are answering the same questions, it’s simple to identify trends.

5. You can use the results to make accurate decisions

As a research instrument, a questionnaire is ideal for commercial research because the data you get back is from your target audience (or ideal customers) and the information you get back on their thoughts, preferences or behaviors allows you to make business decisions.

6. A questionnaire can cover any topic

One of the biggest advantages of using questionnaires when conducting research is (because you can adapt them using different types and styles of open ended questions and closed ended questions) they can be used to gather data on almost any topic.

There are many types of questionnaires you can design to gather both quantitative data and qualitative data - so they’re a useful tool for all kinds of data analysis.

Disadvantages of using a questionnaire

1. respondents could lie.

This is by far the biggest risk with a questionnaire, especially when dealing with sensitive topics.

Rather than give their actual opinion, a respondent might feel pressured to give the answer they deem more socially acceptable, which doesn’t give you accurate results.

2. Respondents might not answer every question

There are all kinds of reasons respondents might not answer every question, from questionnaire length, they might not understand what’s being asked, or they simply might not want to answer it.

If you get questionnaires back without complete responses it could negatively affect your research data and provide an inaccurate picture.

3. They might interpret what’s being asked incorrectly

This is a particular problem when running a survey across geographical boundaries and often comes down to the design of the survey questionnaire.

If your questions aren’t written in a very clear way, the respondent might misunderstand what’s being asked and provide an answer that doesn’t reflect what they actually think.

Again this can negatively affect your research data.

4. You could introduce bias

The whole point of producing a questionnaire is to gather accurate data from which decisions can be made or conclusions drawn.

But the data collected can be heavily impacted if the researchers accidentally introduce bias into the questions.

This can be easily done if the researcher is trying to prove a certain hypothesis with their questionnaire, and unwittingly write questions that push people towards giving a certain answer.

In these cases respondents’ answers won’t accurately reflect what is really happening and stop you gathering more accurate data.

5. Respondents could get survey fatigue

One issue you can run into when sending out a questionnaire, particularly if you send them out regularly to the same survey sample, is that your respondents could start to suffer from survey fatigue.

In these circumstances, rather than thinking about the response options in the questionnaire and providing accurate answers, respondents could start to just tick boxes to get through the questionnaire quickly.

Again, this won’t give you an accurate data set.

Questionnaire design: How to do it

It’s essential to carefully craft a questionnaire to reduce survey error and optimize your data . The best way to think about the questionnaire is with the end result in mind.

How do you do that?

Start with questions, like:

- What is my research purpose ?

- What data do I need?

- How am I going to analyze that data?

- What questions are needed to best suit these variables?

Once you have a clear idea of the purpose of your survey, you’ll be in a better position to create an effective questionnaire.

Here are a few steps to help you get into the right mindset.

1. Keep the respondent front and center

A survey is the process of collecting information from people, so it needs to be designed around human beings first and foremost.

In his post about survey design theory, David Vannette, PhD, from the Qualtrics Methodology Lab explains the correlation between the way a survey is designed and the quality of data that is extracted.

“To begin designing an effective survey, take a step back and try to understand what goes on in your respondents’ heads when they are taking your survey.

This step is critical to making sure that your questionnaire makes it as likely as possible that the response process follows that expected path.”

From writing the questions to designing the survey flow, the respondent’s point of view should always be front and center in your mind during a questionnaire design.

2. How to write survey questions

Your questionnaire should only be as long as it needs to be, and every question needs to deliver value.

That means your questions must each have an individual purpose and produce the best possible data for that purpose, all while supporting the overall goal of the survey.

A question must also must be phrased in a way that is easy for all your respondents to understand, and does not produce false results.

To do this, remember the following principles:

Get into the respondent's head

The process for a respondent answering a survey question looks like this:

- The respondent reads the question and determines what information they need to answer it.

- They search their memory for that information.

- They make judgments about that information.

- They translate that judgment into one of the answer options you’ve provided. This is the process of taking the data they have and matching that information with the question that’s asked.

When wording questions, make sure the question means the same thing to all respondents. Words should have one meaning, few syllables, and the sentences should have few words.

Only use the words needed to ask your question and not a word more .

Note that it’s important that the respondent understands the intent behind your question.

If they don’t, they may answer a different question and the data can be skewed.

Some contextual help text, either in the introduction to the questionnaire or before the question itself, can help make sure the respondent understands your goals and the scope of your research.

Use mutually exclusive responses

Be sure to make your response categories mutually exclusive.

Consider the question:

What is your age?

Respondents that are 31 years old have two options, as do respondents that are 40 and 55. As a result, it is impossible to predict which category they will choose.

This can distort results and frustrate respondents. It can be easily avoided by making responses mutually exclusive.

The following question is much better:

This question is clear and will give us better results.

Ask specific questions

Nonspecific questions can confuse respondents and influence results.

Do you like orange juice?

- Like very much

- Neither like nor dislike

- Dislike very much

This question is very unclear. Is it asking about taste, texture, price, or the nutritional content? Different respondents will read this question differently.

A specific question will get more specific answers that are actionable.

How much do you like the current price of orange juice?

This question is more specific and will get better results.

If you need to collect responses about more than one aspect of a subject, you can include multiple questions on it. (Do you like the taste of orange juice? Do you like the nutritional content of orange juice? etc.)

Use a variety of question types

If all of your questionnaire, survey or poll questions are structured the same way (e.g. yes/no or multiple choice) the respondents are likely to become bored and tune out. That could mean they pay less attention to how they’re answering or even give up altogether.

Instead, mix up the question types to keep the experience interesting and varied. It’s a good idea to include questions that yield both qualitative and quantitative data.

For example, an open-ended questionnaire item such as “describe your attitude to life” will provide qualitative data – a form of information that’s rich, unstructured and unpredictable. The respondent will tell you in their own words what they think and feel.

A quantitative / close-ended questionnaire item, such as “Which word describes your attitude to life? a) practical b) philosophical” gives you a much more structured answer, but the answers will be less rich and detailed.

Open-ended questions take more thought and effort to answer, so use them sparingly. They also require a different kind of treatment once your survey is in the analysis stage.

3. Pre-test your questionnaire

Always pre-test a questionnaire before sending it out to respondents. This will help catch any errors you might have missed. You could ask a colleague, friend, or an expert to take the survey and give feedback. If possible, ask a few cognitive questions like, “how did you get to that response?” and “what were you thinking about when you answered that question?” Figure out what was easy for the responder and where there is potential for confusion. You can then re-word where necessary to make the experience as frictionless as possible.

If your resources allow, you could also consider using a focus group to test out your survey. Having multiple respondents road-test the questionnaire will give you a better understanding of its strengths and weaknesses. Match the focus group to your target respondents as closely as possible, for example in terms of age, background, gender, and level of education.

Note: Don't forget to make your survey as accessible as possible for increased response rates.

Questionnaire examples and templates

There are free questionnaire templates and example questions available for all kinds of surveys and market research, many of them online. But they’re not all created equal and you should use critical judgement when selecting one. After all, the questionnaire examples may be free but the time and energy you’ll spend carrying out a survey are not.

If you’re using online questionnaire templates as the basis for your own, make sure it has been developed by professionals and is specific to the type of research you’re doing to ensure higher completion rates. As we’ve explored here, using the wrong kinds of questions can result in skewed or messy data, and could even prompt respondents to abandon the questionnaire without finishing or give thoughtless answers.

You’ll find a full library of downloadable survey templates in the Qualtrics Marketplace , covering many different types of research from employee engagement to post-event feedback . All are fully customizable and have been developed by Qualtrics experts.

Qualtrics // Experience Management

Qualtrics is the technology platform that organizations use to collect, manage, and act on experience data, also called X-data™. The Qualtrics XM Platform™ is a system of action, used by teams, departments, and entire organizations to manage the four core experiences of business—customer, product, employee, and brand—on one platform.

Over 12,000 enterprises worldwide, including more than 75 percent of the Fortune 100 and 99 of the top 100 U.S. business schools, rely on Qualtrics to consistently build products that people love, create more loyal customers, develop a phenomenal employee culture, and build iconic brands.

Related Articles

June 27, 2023

The fresh insights people: Scaling research at Woolworths Group

June 20, 2023

Bank less, delight more: How Bankwest built an engine room for customer obsession

June 16, 2023

How Qualtrics Helps Three Local Governments Drive Better Outcomes Through Data Insights

April 1, 2023

Academic Experience

Great survey questions: How to write them & avoid common mistakes

March 21, 2023

Sample size calculator

March 9, 2023

Experience Management

X4 2023: See the XM innovations unveiled for customer research, marketing, and insights teams

February 22, 2023

Achieving better insights and better product delivery through in-house research

December 6, 2022

Improved Topic Sentiment Analysis using Discourse Segmentation

Stay up to date with the latest xm thought leadership, tips and news., request demo.

Ready to learn more about Qualtrics?

- Skip to main content

- Skip to primary sidebar

- Skip to footer

- QuestionPro

- Solutions Industries Gaming Automotive Sports and events Education Government Travel & Hospitality Financial Services Healthcare Cannabis Technology Use Case NPS+ Communities Audience Contactless surveys Mobile LivePolls Member Experience GDPR Positive People Science 360 Feedback Surveys

- Resources Blog eBooks Survey Templates Case Studies Training Help center

Home Market Research

Questionnaire: The ultimate guide, advantages & examples

What is a Questionnaire?

A questionnaire is a research instrument that consists of a set of questions or other types of prompts that aims to collect information from a respondent. A research questionnaire is typically a mix of close-ended questions and open-ended questions .

Open-ended, long-form questions offer the respondent the ability to elaborate on their thoughts. Research questionnaires were developed in 1838 by the Statistical Society of London.

LEARN ABOUT: Candidate Experience Survey

The data collected from a data collection questionnaire can be both qualitative as well as quantitative in nature. A questionnaire may or may not be delivered in the form of a survey , but a survey always consists of a questionnaire.

LEARN ABOUT: Testimonial Questions

Advantages of a good questionnaire design

- With a survey questionnaire, you can gather a lot of data in less time.

- There is less chance of any bias(like selection bias ) creeping if you have a standard set of questions to be used for your target audience. You can apply logic to questions based on the respondents’ answers, but the questionnaire will remain standard for a group of respondents that fall in the same segment.

- Surveying online survey software is quick and cost-effective. It offers you a rich set of features to design, distribute, and analyze the response data.

- It can be customized to reflect your brand voice. Thus, it can be used to reinforce your brand image.

- The responses can be compared with the historical data and understand the shift in respondents’ choices and experiences.

- Respondents can answer the questionnaire without revealing their identity. Also, many survey software complies with significant data security and privacy regulations.

LEARN ABOUT: Structured Questionnaire

Characteristics of a good questionnaire

Your survey design depends on the type of information you need to collect from respondents. Qualitative questionnaires are used when there is a need to collect exploratory information to help prove or disprove a hypothesis. Quantitative questionnaires are used to validate or test a previously generated hypothesis. However, most questionnaires follow some essential characteristics:

- Uniformity: Questionnaires are very useful to collect demographic information, personal opinions, facts, or attitudes from respondents. One of the most significant attributes of a research form is uniform design and standardization. Every respondent sees the same questions. This helps in data collection and statistical analysis of this data. For example, the retail store evaluation questionnaire template contains questions for evaluating retail store experiences. Questions relate to purchase value, range of options for product selections, and quality of merchandise. These questions are uniform for all customers.

LEARN ABOUT: Research Process Steps

- Exploratory: It should be exploratory to collect qualitative data. There is no restriction on questions that can be in your questionnaire. For example, you use a data collection questionnaire and send it to the female of the household to understand her spending and saving habits relative to the household income. Open-ended questions give you more insight and allow the respondents to explain their practices. A very structured question list could limit the data collection.

LEARN ABOUT: Best Data Collection Tools

- Question Sequence: It typically follows a structured flow of questions to increase the number of responses. This sequence of questions is screening questions , warm-up questions, transition questions, skip questions, challenging questions, and classification questions. For example, our motivation and buying experience questionnaire template covers initial demographic questions and then asks for time spent in sections of the store and the rationale behind purchases.

Types & Definitions

As we explored before, questionnaires can be either structured or free-flowing. Let’s take a closer look at what that entails for your surveys.

- Structured Questionnaires: Structured questionnaires collect quantitative data . The questionnaire is planned and designed to gather precise information. It also initiates a formal inquiry, supplements data, checks previously accumulated data, and helps validate any prior hypothesis.

- Unstructured Questionnaires: Unstructured questionnaires collect qualitative data . They use a basic structure and some branching questions but nothing that limits the responses of a respondent. The questions are more open-ended to collect specific data from participants.

Types of questions in a questionnaire

You can use multiple question types in a questionnaire. Using various question types can help increase responses to your research questionnaire as they tend to keep participants more engaged. The best customer satisfaction survey templates are the most commonly used for better insights and decision-making.

Some of the widely used types of questions are:

- Open-Ended Questions: Open-ended questions help collect qualitative data in a questionnaire where the respondent can answer in a free form with little to no restrictions.

- Dichotomous Questions: The dichotomous question is generally a “yes/no” close-ended question . This question is usually used in case of the need for necessary validation. It is the most natural form of a questionnaire.

- Multiple-Choice Questions: Multiple-choice questions are a close-ended question type in which a respondent has to select one (single-select multiple-choice question) or many (multi-select multiple choice question) responses from a given list of options. The multiple-choice question consists of an incomplete stem (question), right answer or answers, incorrect answers, close alternatives, and distractors. Of course, not all multiple-choice questions have all of the answer types. For example, you probably won’t have the wrong or right answers if you’re looking for customer opinion.

- Scaling Questions: These questions are based on the principles of the four measurement scales – nominal, ordinal, interval, and ratio . A few of the question types that utilize these scales’ fundamental properties are rank order questions , Likert scale questions , semantic differential scale questions , and Stapel scale questions .

LEARN ABOUT: System Usability Scale

- Pictorial Questions: This question type is easy to use and encourages respondents to answer. It works similarly to a multiple-choice question. Respondents are asked a question, and the answer choices are images. This helps respondents choose an answer quickly without over-thinking their answers, giving you more accurate data.

Types of Questionnaires

Questionnaires can be administered or distributed in the following forms:

- Online Questionnaire : In this type, respondents are sent the questionnaire via email or other online mediums. This method is generally cost-effective and time-efficient. Respondents can also answer at leisure. Without the pressure to respond immediately, responses may be more accurate. The disadvantage, however, is that respondents can easily ignore these questionnaires. Read more about online surveys .

- Telephone Questionnaire: A researcher makes a phone call to a respondent to collect responses directly. Responses are quick once you have a respondent on the phone. However, a lot of times, the respondents hesitate to give out much information over the phone. It is also an expensive way of conducting research. You’re usually not able to collect as many responses as other types of questionnaires, so your sample may not represent the broader population.

- In-House Questionnaire: This type is used by a researcher who visits the respondent’s home or workplace. The advantage of this method is that the respondent is in a comfortable and natural environment, and in-depth data can be collected. The disadvantage, though, is that it is expensive and slow to conduct.

LEARN ABOUT: Survey Sample Sizes

- Mail Questionnaire: These are starting to be obsolete but are still being used in some market research studies. This method involves a researcher sending a physical data collection questionnaire request to a respondent that can be filled in and sent back. The advantage of this method is that respondents can complete this on their own time to answer truthfully and entirely. The disadvantage is that this method is expensive and time-consuming. There is also a high risk of not collecting enough responses to make actionable insights from the data.

How to design a Questionnaire

Questionnaire design is a multistep process that requires attention to detail at every step.

Researchers are always hoping that the responses received for a survey questionnaire yield useable data. If the questionnaire is too complicated, there is a fair chance that the respondent might get confused and will drop out or answer inaccurately.

LEARN ABOUT: Easy Test Maker

As a survey creator , you may want to pre-test the survey by administering it to a focus group during development. You can try out a few different questionnaire designs to determine which resonates best with your target audience. Pre-testing is a good practice as the survey creator can comprehend the initial stages if there are any changes required in the survey .

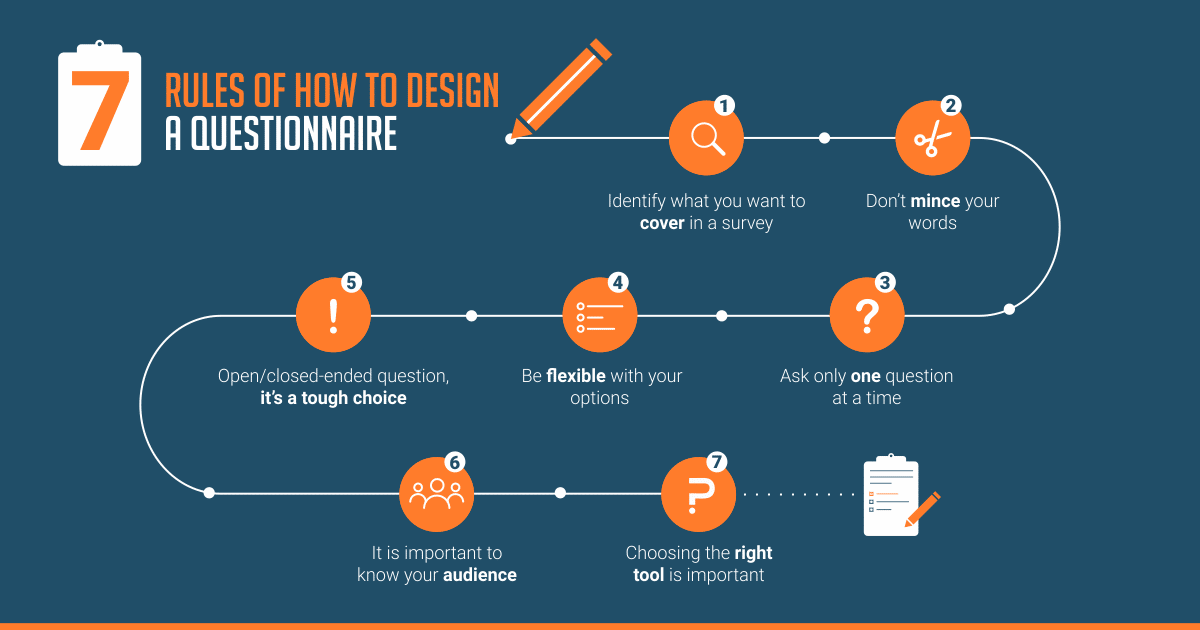

Steps Involved in Questionnaire Design

1. identify the scope of your research:.

Think about what your questionnaire is going to include before you start designing the look of it. The clarity of the topic is of utmost importance as this is the primary step in creating the questionnaire. Once you are clear on the purpose of the questionnaire, you can begin the design process.

LEARN ABOUT: Social Communication Questionnaire

2. Keep it simple:

The words or phrases you use while writing the questionnaire must be easy to understand. If the questions are unclear, the respondents may simply choose any answer and skew the data you collect.

3. Ask only one question at a time:

At times, a researcher may be tempted to add two similar questions. This might seem like an excellent way to consolidate answers to related issues, but it can confuse your respondents or lead to inaccurate data. If any of your questions contain the word “and,” take another look. This question likely has two parts, which can affect the quality of your data.

4. Be flexible with your options:

While designing, the survey creator needs to be flexible in terms of “option choice” for the respondents. Sometimes the respondents may not necessarily want to choose from the answer options provided by the survey creator. An “other” option often helps keep respondents engaged in the survey.

5. The open-ended or closed-ended question is a tough choice:

The survey creator might end up in a situation where they need to make distinct choices between open or close-ended questions. The question type should be carefully chosen as it defines the tone and importance of asking the question in the first place.

If the questionnaire requires the respondents to elaborate on their thoughts, an open-ended q u estion is the best choice. If the surveyor wants a specific response, then close-ended questions should be their primary choice. The key to asking closed-ended questions is to generate data that is easy to analyze and spot trends.

6. It is essential to know your audience:

A researcher should know their target audience. For example, if the target audience speaks mostly Spanish, sending the questionnaire in any other language would lower the response rate and accuracy of data. Something that may seem clear to you may be confusing to your respondents. Use simple language and terminology that your respondents will understand, and avoid technical jargon and industry-specific language that might confuse your respondents.

For efficient market research, researchers need a representative sample collected using one of the many sampling techniques , such as a sample questionnaire. It is imperative to plan and define these target respondents based on the demographics required.

7. Choosing the right tool is essential:

QuestionPro is a simple yet advanced survey software platform that the surveyors can use to create a questionnaire or choose from the already existing 300+ questionnaire templates.

Always save personal questions for last. Sensitive questions may cause respondents to drop off before completing. If these questions are at the end, the respondent has had time to become more comfortable with the interview and are more likely to answer personal or demographic questions.

Differences between a Questionnaire and a Survey

Read more: Difference between a survey and a questionnaire

Questionnaire Examples

The best way to understand how questionnaires work is to see the types of questionnaires available. Some examples of a questionnaire are:

USE THIS FREE TEMPLATE

The above survey questions are typically easy to use, understand, and execute. Additionally, the standardized answers of a survey questionnaire instead of a person-to-person conversation make it easier to compile useable data.

The most significant limitation of a data collection questionnaire is that respondents need to read all of the questions and respond to them. For example, you send an invitation through email asking respondents to complete the questions on social media. If a target respondent doesn’t have the right social media profiles, they can’t answer your questions.

Learn More: 350+ Free Survey Examples and Templates

MORE LIKE THIS

Cannabis Industry Business Intelligence: Impact on Research

May 28, 2024

Top 10 Dynata Alternatives & Competitors

May 27, 2024

What Are My Employees Really Thinking? The Power of Open-ended Survey Analysis

May 24, 2024

I Am Disconnected – Tuesday CX Thoughts

May 21, 2024

Other categories

- Academic Research

- Artificial Intelligence

- Assessments

- Brand Awareness

- Case Studies

- Communities

- Consumer Insights

- Customer effort score

- Customer Engagement

- Customer Experience

- Customer Loyalty

- Customer Research

- Customer Satisfaction

- Employee Benefits

- Employee Engagement

- Employee Retention

- Friday Five

- General Data Protection Regulation

- Insights Hub

- Life@QuestionPro

- Market Research

- Mobile diaries

- Mobile Surveys

- New Features

- Online Communities

- Question Types

- Questionnaire

- QuestionPro Products

- Release Notes

- Research Tools and Apps

- Revenue at Risk

- Survey Templates

- Training Tips

- Uncategorized

- Video Learning Series

- What’s Coming Up

- Workforce Intelligence

Surveys & Questionnaires

Surveys involve asking a series of questions to participants. They can be administered online, in person, or remotely (e.g. by post/mail). The data collected can be analysed quantitatively or qualitatively (or both). Researchers might carry out statistical surveys to make statistical inferences about the population being studied. Such inferences depend strongly on the survey questions used (Solomon, 2001) meaning that getting the wording right is crucial. For this reason, many test out surveys in pilot studies with smaller populations and use the results to refine their survey instrument.

Sampling for surveys can range between self-selection (e.g. where a link is shared with members of a target population in the hope they and others contribute data and share the survey) through to the use of specialised statistical techniques (“probability sampling”) that analyse results from a carefully selected sample to draw statistical conclusions about the wider population. Survey methodologies therefore cover a range of considerations including sampling, research instrument design, improving response rates, ensuring quality in data, and methods of analysis (Groves et al., 2011).

One common question format is to collect quantitative data alongside qualitative questions. This allows a more detailed description or justification for the answer given to be provided. Collecting ordinal data (e.g. ranking of preferences through a Likert scale) can be a way to make qualitative data more amenable to quantitative analysis. But there is no one superior approach: the crucial thing is that the survey questions and their phrasing aligns with the research question(s) correctly.

Surveys are widely used in education science and in the social sciences more generally. Surveys are highly efficient (both in terms of time and money) compared with other methods, and can be administered remotely. They can provide a series of data points on a subject which can be compared across the sample group(s). This provides a considerable degree of flexibility when it comes to analysing data as several variables may be tested at once. Surveys also work well when used alongside other methods, perhaps to provide a baseline of data (such as demographics) for the first step in a research study. They are also commonly used in evaluations of teaching & learning (i.e. after an intervention to assess the impact). However, there are some noteworthy disadvantages to using surveys. Respondents may not feel encouraged to provide accurate answers, or may not feel comfortable providing answers that present themselves in a unfavourable manner (particularly if the survey is not anonymous). “Closed” questions may have a lower validity rate than other question types as they might be interpreted differently. Data errors due to question non-responses may exist creating bias. Survey answer options should be selected carefully because they may be interpreted differently by respondents (Vehovar & Katja Lozar, 2008).

Surveys & Questionnaires: GO-GN Insights

Marjon Baas collected quantitative data through a questionnaire among teachers within an OER Community of Practice to explore the effect of the activities undertaken to encourage the use of the community on teachers’ behaviour in relation to OER.

“I used several theoretical models (Clements and Pawlowski, 2012; Cox and Trotter, 2017; Armellini and Nie, 2013) to conceptualise different aspects (that relate to) OER adoption. This enabled me as a researcher to design my specific research instruments.”

Judith Pete had a deliberate selection of twelve Sub-Saharan African universities across Kenya, Ghana and South Africa with randomly sampled students and lecturers to develop a representative view of OER. Separate questionnaires were used for students (n=2249) and lecturers (n=106).

“We used surveys to collect data across three continents. Online survey tools were very helpful in online data collection and, where that was not possible, local coordinators used physical copies of the survey and later entered the information into the database. This approach was cost-effective, versatile and quick and easy to implement. We were able to reach a wide range of respondents in a short time. Sometimes we wondered, though, whether all those who responded had enough time to fully process and understand the questions that they were being asked. We had to allocate a significant amount of time to curating the data afterwards.”

Samia Almousa adopted Unified Theory of Acceptance and Use of Technology (UTAUT) survey questionnaire, along with additional constructs (relating to information quality and culture) as a lens through which her research data is analysed.

“In my research, I have employed a Sequential Explanatory Mixed Methods Design (online questionnaires and semi-structured interviews) to examine the academics’ perceptions of OERs integration into their teaching practices, as well as to explore the motivations that encourage them to use and reuse OERs, and share their teaching materials in the public domain. The online questionnaire was an efficient and fast way to reach a large number of academics. I used the online survey platform, which does not require entering data or coding as data is input by the participants and answers are saved automatically (Sills & Song, 2002). Using questionnaires as a data collection tool has some drawbacks. In my study, the questionnaire I developed was long, which made some participants choose their answers randomly. In addition, I have received many responses from academics in other universities although the questionnaire was sent to the sample university. Since I expected this to happen, I required the participants to write the name of their university in the personal information section of the questionnaire, then excluded the responses from outside the research sample. My advice for any researcher attempting to use questionnaires as a data collection tool is to ensure that their questionnaire is as short and clear as possible to help the researcher in analysing the findings and the participants in answering all questions accurately. Additionally, personal questions should be as few as possible to protect the identity and privacy of the participants, and to obtain the ethical approval quickly.”

Olawale Kazeeem Iyikolakan adopted a descriptive survey of the correlational type. The author research design examines the relationship among the key research variables (technological self-efficacy, perception, and use of open educational resources) and to identify the most significant factors that influence academic performance of LIS undergraduates without a causal connection.

“The descriptive research design is used as a gathering of information about prevailing conditions or situations for the purpose of description and interpretation (Aggarwal, 2008). My research design examines the relationship among the key research variables (technological self-efficacy, perception, and use of open educational resources) to identify the most significant factors that influence academic performance of Library & Information Science undergraduates without a causal connection. Ponto (2015) describes that descriptive survey research is a useful and legitimate approach to research that has clear benefits in helping to describe and explore variables and constructs of interest by using quantitative research strategies (e.g., using a survey with numerically rated items. “The reason for the choice of descriptive survey research instead of ex-post-facto quasi-experimental design is that this type of research design is used to capture people’s perceptions, views, use, about a current issue, current state of play or movements such as perception and use of OER. This research design comes with several merits as it enables the researcher to obtain the needed primary data directly from the respondents. Other advantages include: (1) Using this method, the researcher has no control over the variable; (2) the researcher can only report what has happened or what is happening. One of the demerits of this type of research design is that research results may reflect a certain level of bias due to the absence of statistical tests.”

Useful references for Surveys & Questionnaires: Aggarwal (2008); Fowler (2014); Groves et al., 2011); Lefever, Dal & Matthíasdóttir (2007); Ponto (2015); Sills & Song (2002); Solomon (2001); Vehovar & Manfreda (2008); Vehovar, Manfreda, & Berzelak (2018)

Research Methods Handbook Copyright © 2020 by Rob Farrow; Francisco Iniesto; Martin Weller; and Rebecca Pitt is licensed under a Creative Commons Attribution 4.0 International License , except where otherwise noted.

Share This Book

Live revision! Join us for our free exam revision livestreams Watch now →

Reference Library

Collections

- See what's new

- All Resources

- Student Resources

- Assessment Resources

- Teaching Resources

- CPD Courses

- Livestreams

Study notes, videos, interactive activities and more!

Sociology news, insights and enrichment

Currated collections of free resources

Browse resources by topic

- All Sociology Resources

Resource Selections

Currated lists of resources

Study Notes

Research Methods: Questionnaires

Last updated 15 Jun 2020

- Share on Facebook

- Share on Twitter

- Share by Email

A questionnaire, or social survey, is a popular research method that consists of a list of questions.

If administered directly by the researcher to the subject in person then this is the same as a structured interview ; however, questionnaires can also be completed independently (self-completion questionnaires) and therefore administered in bulk, through the post or electronically for example. The method can use closed or open questions or indeed a mixture of the two, depending on what sort of data is desired and how the researcher intends to analyse it.

Reliability and Validity of Questionnaires

In the context of research, the reliability of a method refers to the extent to which, were the same study to be repeated, it would produce the same results. For this to be the case, samples need to be representative, questions or processes need to be uniform and data would generally need to be quantitative. Researchers need to be confident that if they repeat the same research and the result is different that what they are studying has genuinely changed and not just that their original method was not sufficiently reliable. If you take the example of opinion polls on people's voting preferences: if the support for parties changes by several points, the researchers (and their "customers") need to be confident that this is because people are really changing their minds about how they intend to vote; that it is not simply that the research method is unreliable and therefore changes between polls are likely and unpredictable. If that were the case it would render their data useless.

Questionnaires are generally considered to be high in reliability . This is because it is possible to ask a uniform set of questions. Any problems in the design of the survey can be ironed out after a pilot study . The more closed questions used, the more reliable the research.

Valid research reveals a true picture. Data that is high in validity tends to be qualitative and is often described as "rich". It seeks to provide the researcher with verstehen - a deep, true understanding of their research object. The validity of data produced by questionnaires can be undermined by the use of closed questions which limit respondents' answers.

In a questionnaire (or structured interview ) it is possible to ask open questions or closed questions. Closed questions are those with a limited number of possible responses, often "yes" or "no". Closed questions help to make data easier to analyse and more reliable. This is because closed questions produce quantitative data. However, restricting responses can impact validity. To try to overcome this, sociologists often broaden possible responses to closed questions, by, for example, ranking possible responses or indicating the degree of agreement with a statement. The latter is known as the Likert Scale, and is a way of quantifying qualitative data for ease of analysis. It is also possible to mix closed questions with an open "other (please specify)" option.

Open questions do not limit the possible answers that the responder can give, producing qualitative data which is generally considered to be higher in validity. This is because it can be detailed and the respondent can give their own views, rather than be limited by the assumptions of the researcher. However, such data can be very difficult to analyse. There is also the danger that options are simply limited during analysis rather than design (ie. the researcher puts the wide range of responses into a smaller number of categories in order to analyse them). This depends on the researcher's interpretation of the respondent's response which could be affected by subjectivity or the researcher's values.

Because questionnaires are usually used to produce quantitative data, they are generally thought to be more reliable than valid. However, they do have the advantage of being able to produce a mixture of reliable and valid data, known as triangulation .

- Questionnaire

- Closed Questions

- Open Question

- Primary Data

- Response Rate

You might also like

The british census.

18th February 2020

Quantitative Research Methods (Online Lesson)

Online Lessons

Methods in Context: Researching Cultural Factors (Online Lesson)

A new model of social class findings from the bbc’s great british class survey experiment, overview of ‘university’s not for me – i’m a nike person' by archer et al, research methods - interviews.

Topic Videos

Are You Ready for the Release of the 2021 Census Data?

19th September 2022

Broken Britain? Measuring social attitudes in contemporary society

5th October 2022

Our subjects

- › Criminology

- › Economics

- › Geography

- › Health & Social Care

- › Psychology

- › Sociology

- › Teaching & learning resources

- › Student revision workshops

- › Online student courses

- › CPD for teachers

- › Livestreams

- › Teaching jobs

Boston House, 214 High Street, Boston Spa, West Yorkshire, LS23 6AD Tel: 01937 848885

- › Contact us

- › Terms of use

- › Privacy & cookies

© 2002-2024 Tutor2u Limited. Company Reg no: 04489574. VAT reg no 816865400.

18 Different Types of Survey Methods + Pros & Cons

There are many reasons why surveys are important. Surveys help researchers find solutions, create discussions, and make decisions. They can also get to the bottom of the really important stuff, like, coffee or tea? Dogs or cats? Elvis or The Beatles? When it comes to finding the answers to these questions, there are 18 different types of survey methods to use.

Create your first survey, form, or poll now!

18 Different Types of Survey Methods

Different surveys serve different purposes, which is why there are a number of them to choose from. “What are the types of surveys I should use,” you ask? Here’s a look at the 18 types of survey methods researchers use today.

1. Interviews

Also known as in-person surveys or household surveys, this used to be one of the most popular types of survey to conduct. Researchers like them because they involve getting face-to-face with individuals. Of course, this method of surveying may seem antiquated when today we have online surveying at our fingertips. However, interviews still serve a purpose.

Researchers conduct interviews when they want to discuss something personal with people. For example, they may have questions that may require extensive probing to uncover the truth. Sure, some interviewees may be more comfortable answering questions confidentially behind a keyboard. However, a skilled interviewer is able to put them at ease and get genuine responses. They can often go deeper than you may be able to using other surveying methods.

Often, in-person interviews are recorded on camera. This way, an expert can review them afterward. They do this to determine if the answers given may be false based on an interviewee’s change in tone. A change in facial expressions and body movements may also be a signal they pick up on.

2. Intercept Surveys

While interviews tend to choose respondents and have controls in place, intercept surveys (or “man on the spot”) surveys are conducted at certain locations or events. This involves having an interviewer, or multiple interviewers, scoping out an area and asking people, generally at random, for their thoughts or viewpoints on a particular topic.

3. Focus Groups

These types of surveys are conducted in person as well. However, focus groups involve a number of people rather than just one individual. The group is generally small but demographically diverse and led by a moderator. The focus group may be sampling new products, or to have a discussion around a particular topic, often a hot-button one.

The purpose of a focus group survey is often to gauge people’s reaction to a product in a group setting or to get people talking, interacting—and yes, arguing—with the moderator taking notes on the group’s behavior and attitudes. This is often the most expensive survey method as a trained moderator must be paid. In addition, locations must be secured, often in various cities, and participants must be heavily incentivized to show up. Gift cards in the $75-100 range for each survey participant are the norm.

4. Panel Sampling

Recruiting survey-takers from a panel maintained by a research company is a surefire way to get respondents. Why? Because people have specifically signed up to take them. The benefit of these types of surveys for research, of course, is there you can be assured responses. In addition, you can filter respondents by a variety of criteria to be sure you’re speaking with your target audience.

The downside is data quality. These individuals get survey offers frequently. So, they may rush through them to get their inventive and move on to the next one. In addition, if you’re constantly tapping into the same people from the same panel, are you truly getting a representative sample?

5. Telephone Surveys

Most telephone survey research types are conducted through random digit dialing (RDD). RDD can reach both listed and unlisted numbers, improving sampling accuracy. Surveys are conducted by interviewers through computer-assisted telephone interviewing (CATI) software. CATI displays the questionnaire to the interviewer with a rotation of questions.

Telephone surveys started in the 1940s. In fact, in a recent blog , we recount how the predictions for the 1948 presidential election were completely wrong because of sampling bias in telephone surveys. Rising in popularity in the late 50s and early 60s when the telephone became common in most American households, telephone surveys are no longer a very popular method of conducting a survey. Why? Because many people refuse to take telephone surveys or simply are not answering calls from a number they don’t recognize.

6. Post-Call Surveys

If a telephone survey is going to be conducted, today it is usually a post-call survey. This is often accomplished through IVR, or interactive voice response. IVR means there is no interviewer involved. Instead, customers record answers to pre-recorded questions using numbers on their touch-tone keypads. If a question is open-ended, the interviewee can respond by speaking and the system records the answer. IVR surveys are often deployed to measure how a customer feels about a service they just received. For example, after calling your bank, you may be asked to stay on the line to answer a series of questions about your experience.

Most post-call surveys are either NPS surveys or customer satisfaction (CSAT) surveys. The former asks the customer “How likely are you to recommend our organization to a f riend or family based on your most recent interaction?” while the CSAT survey asks customers “How satisfied are you with the results of your most recent interaction?”. NPS survey results reflect how the customer feels about the brand, while CSAT surveys a re all about individual agent and contact center performance.

7. SMS Text Surveys

Many people rarely using their phone to talk anymore, and ignore calls from unknown numbers. This has given rise to the SMS (Short Messaging Service) text survey. SMS surveys are delivered via text to people who have opted in to receive notifications from the sender. This means that there is usually some level of engagement, improving response rates. The one downside is that questions typically need to be short, and answers are generally 1-2 words or simply numbers (this is why many NPS surveys, gauging customer satisfaction, are often conducted via SMS text). Be careful not to send too many text surveys, as a person can opt-out just as easily, usually by texting STOP.

8. Mail-in Surveys / Postal Surveys

These are delivered right to respondents’ doorsteps! Mail surveys were frequently used before the advent of the internet when respondents were spread out geographically and budgets were modest. After all, mail-in surveys didn’t require much cost other than the postage.

So are mail-in surveys going the way of the dinosaur? Not necessarily. They are still occasionally more valuable compared to different methods of surveying. Because they are going to a specific name and home address, they often feel more personalized. This personalization can prompt the recipient to complete the survey.

They’re also good for surveys of significant length. Most people have short attention spans, and won’t spend more than a few minutes on the phone or filling out an online survey. At least, not without an incentive! However, with a mail-in survey, the person can complete it at their leisure. They can fill out some of it, set it aside, and then come back to it later. This gives mail-in surveys a relatively high response rate.

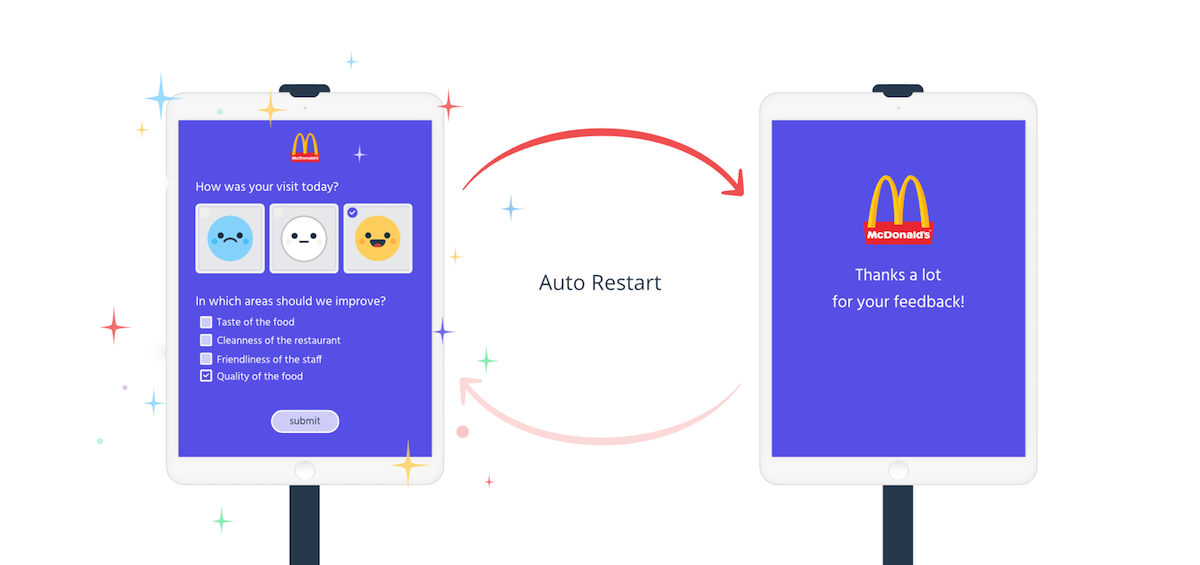

9. Kiosk Surveys

These surveys happen on a computer screen at a physical location. You’ve probably seen them popping up in stores, hotel lobbies, hospitals, and office spaces. These days, they’re just about anywhere a researcher or marketer wants to collect data from customers or passers-by. Kiosk surveys provide immediate feedback following a purchase or an interaction. They collect responses while the experience is still fresh in the respondent’s mind. This makes their judgment more trustworthy. Below is an example of a SurveyLegend kiosk survey at McDonald’s. The kiosk survey collects information, thanks the respondent for their feedback, and then resets for the next customer. Read how to create your own kiosk survey here .

10. Email Surveys

Email surveys are one of the most effective surveying methods as they are delivered directly to your audience via their online account. They can be used by anyone for just about anything, and are easily customized for a particular audience. Another good thing about email surveys is you can easily see who did or did not open the survey and make improvements to it for a future send to increase response rates. You can also A/B test subject lines, imagery, and so on to see which is more effective. SurveyLegend offers dozens of different types of online survey questions, which we explore in our blog 12 Different Types of Survey Questions and When to Use Them (with Examples) .

11. Pop-up Surveys

A pop-up survey is a feedback form that pops up on a website or app. Although the main window a person is reading on their screen remains visible, it is temporarily disabled until a user interacts with the pop-up, either agreeing to leave feedback or closing out of it. The survey itself is typically about the company whose site or app the user is currently visiting (as opposed to an intercept survey, which is an invitation to take a survey hosted on a different site).

A pop-up survey attempts to grab website visitors’ attention in a variety of ways, popping up in the middle of the screen, moving in from the side, or covering the entire screen. While they can be intrusive, they also have many benefits. Read about the benefits of pop-up surveys here .

12. Embedded Surveys

The opposite of pop-up surveys, these surveys live directly on your website or another website of your choice. Because the survey cannot be X’ed out of like a pop-up, it takes up valuable real estate on your site, or could be expensive to implement on someone else’s site. In addition, although the embedded survey is there at all times, it may not get the amount of attention a pop-up does since it’s not “in the respondent’s face.”

13. Social Media Surveys