- Class 6 Maths

- Class 6 Science

- Class 6 Social Science

- Class 6 English

- Class 7 Maths

- Class 7 Science

- Class 7 Social Science

- Class 7 English

- Class 8 Maths

- Class 8 Science

- Class 8 Social Science

- Class 8 English

- Class 9 Maths

- Class 9 Science

- Class 9 Social Science

- Class 9 English

- Class 10 Maths

- Class 10 Science

- Class 10 Social Science

- Class 10 English

- Class 11 Maths

- Class 11 Computer Science (Python)

- Class 11 English

- Class 12 Maths

- Class 12 English

- Class 12 Economics

- Class 12 Accountancy

- Class 12 Physics

- Class 12 Chemistry

- Class 12 Biology

- Class 12 Computer Science (Python)

- Class 12 Physical Education

- GST and Accounting Course

- Excel Course

- Tally Course

- Finance and CMA Data Course

- Payroll Course

Interesting

- Learn English

- Learn Excel

- Learn Tally

- Learn GST (Goods and Services Tax)

- Learn Accounting and Finance

- GST Tax Invoice Format

- Accounts Tax Practical

- Tally Ledger List

- GSTR 2A - JSON to Excel

Are you in school ? Do you love Teachoo?

We would love to talk to you! Please fill this form so that we can contact you

Case Based Questions (MCQ)

- Ex 5.4 (Optional)

Question 1 - Case Based Questions (MCQ) - Chapter 5 Class 10 Arithmetic Progressions

Last updated at April 16, 2024 by Teachoo

India is competitive manufacturing location due to the low cost of manpower and strong technical and engineering capabilities contributing to higher quality production runs. The production of TV sets in a factory increases uniformly by a fixed number every year. It produced 16000 sets in 6th year and 22600 in 9th year.

Based on the above information, answer the following questions: googletag.cmd.push(function() { googletag.display('div-gpt-ad-1669298377854-0'); }); (adsbygoogle = window.adsbygoogle || []).push({});, find the production during first year., (adsbygoogle = window.adsbygoogle || []).push({});, find the production during 8 th year., find the production during first 3 years., in which year, the production is rs 29,200., find the difference of the production during 7th year and 4th year..

Question India is competitive manufacturing location due to the low cost of manpower and strong technical and engineering capabilities contributing to higher quality production runs. The production of TV sets in a factory increases uniformly by a fixed number every year. It produced 16000 sets in 6th year and 22600 in 9th year. Based on the above information, answer the following questions:Question 1 Find the production during first year. Rs 5000 Question 2 Find the production during 8th year. Production during 8th year is (a + 7d) = 5000 + 2(2200) = 20400 Question 3 Find the production during first 3 years.Question 4 In which year, the production is Rs 29,200.N = 12 Question 5 Find the difference of the production during 7th year and 4th year.Difference = 18200 – 11600 = 6600

Davneet Singh

Davneet Singh has done his B.Tech from Indian Institute of Technology, Kanpur. He has been teaching from the past 14 years. He provides courses for Maths, Science, Social Science, Physics, Chemistry, Computer Science at Teachoo.

Hi, it looks like you're using AdBlock :(

Please login to view more pages. it's free :), solve all your doubts with teachoo black.

- News Releases

India’s Opportunity to Become a Global Manufacturing Hub

• A new study by the World Economic Forum presents five ways India can realize its manufacturing potential and build a thriving manufacturing sector • According to the report, India can play a significant role in reshaping supply chains and could contribute more than $500 billion in annual economic impact to the global economy by 2030 • India’s domestic demand, demographics and government programmes encouraging manufacturing put it in a unique position • Read the full report here

Geneva, Switzerland, 2 August 2021 – Beyond the unprecedented health impact, the COVID‑19 pandemic has been catastrophic for the global economy and businesses and is disrupting manufacturing and Global Value Chains (GVCs), disturbing different stages of the production in different locations around the world. Furthermore, the pandemic has accelerated the already ongoing fundamental shifts in GVCs, driven by the aggregation of three megatrends: emerging technologies; the environmental sustainability imperative; and the reconfiguration of globalization.

In this fast-evolving context, as global companies adapt their manufacturing and supply chain strategies to build resilience, India has a unique opportunity to become a global manufacturing hub. It has three primary assets to capitalize on this unique opportunity: the potential for significant domestic demand, the Indian Government’s drive to encourage manufacturing, and with a distinct demographic edge, including considerable proportion of young workforce.

These factors will position India well for a larger role in GVCs. A thriving manufacturing sector will also generate additional benefits and help India deliver on the imperatives to create economic opportunities for nearly 100 million people likely to enter its workforce in the coming decade, to distribute wealth more equitably and to contain its burgeoning trade deficit.

The World Economic Forum’s new White Paper entitled Shifting Global Value Chains: The India Opportunity , produced in collaboration with Kearney, found India’s role in reshaping GVCs and its potential to contribute more than $500 billion in annual economic impact to the global economy by 2030. The White Paper presents five possible paths forward for India to realize its manufacturing potential.

The insights presented in the White Paper reflect the perspectives of leaders from multiple industries in the region. The five possible solutions include:

· Coordinated action between the government and the private sector to help create globally competitive manufacturing companies

· Shifting focus from cost advantage to building capabilities through workforce skilling, innovation, quality, and sustainability

· Accelerating integration in global value chains by reducing trade barriers and enabling competitive global market access for Indian manufacturers

· Focusing on reducing the cost of compliance and establishing manufacturing capacities faster

· Focusing infrastructure development on cost savings, speed, and flexibility

“For India to become a global manufacturing hub, business and government leaders need to work together to understand ongoing disruptions and opportunities, and develop new strategies and approaches aimed at generating greater economic and social value”, said Francisco Betti , Head of Shaping the Future of Advanced Manufacturing and Production, World Economic Forum.

“A thriving manufacturing sector could potentially be the most critical building block for India’s economic growth and prosperity in the coming decade. The ongoing post-COVID rebalancing of Global Value Chains offers India’s government and business leaders a unique opportunity to transform and accelerate the trajectory of manufacturing sector”, said Viswanathan Rajendran , Partner, Kearney.

This White Paper aims to serve as an initial framework for deliberation and action in the manufacturing ecosystem. The World Economic Forum, in collaboration with Kearney, will continue to develop this agenda by working closely with the manufacturing community in India to generate new insights, help inform discussions and strategy decisions, facilitate new partnerships, and provide a platform for exchanges with the global community.

Notes to editors

Learn about the World Economic Forum’s impact: https://www.weforum.org/our-impact

View the best Forum Flickr photos at http://wef.ch/pix

Become a fan of the Forum on Facebook at http://wef.ch/facebook

Follow the Forum on Twitter at http://wef.ch/twitter

Read the Forum blog at http://wef.ch/agenda

View upcoming Forum events at http://wef.ch/events

Subscribe to Forum news releases at http://wef.ch/news

Fulfilling the promise of India’s manufacturing sector

India’s manufacturers have a golden chance to emerge from the shadow of the country’s services sector and seize more of the global market. McKinsey analysis finds that rising demand in India, together with the multinationals’ desire to diversify their production to include low-cost plants in countries other than China, could together help India’s manufacturing sector to grow sixfold by 2025, to $1 trillion, while creating up to 90 million domestic jobs.

Four imperatives for India’s government

India’s central and state governments must eliminate four barriers that slow down the efforts of the country’s manufacturers to improve their capital and labor productivity.

1. Product market and ownership barriers. More than half of India’s employees in the organized sector (regulated by labor laws for hiring and firing) still work in government-owned institutions—for example, in the base-metals, petroleum, and power generation industries. Product market barriers and government ownership tend to lower productivity and distort markets significantly.

Yet receding levels of government ownership have dramatically improved the productivity of labor and capital in other parts of the economy. India’s automotive sector, for example, was among the first to be liberalized, in the early 1990s, and the entry of multinational and domestic players sparked a competitive transformation. Subsequently, between 1995 and 2005 the automotive sector’s GDP per manufacturing employee grew by a factor of 15. Today, India produces nearly three million small cars a year, of which about one-quarter are exported. To be sure, India’s government might well deem some sectors (aerospace and defense, for example) as strategic and limit the extent of foreign participation. Yet for a majority of sectors, greater private and multinational participation in India can help unlock productivity structurally.

2. Land market barriers. Distortions in the land market (including high stamp duties and cumbersome regulations) are a huge barrier to productivity improvements in India. In the steel industry alone, we estimate that more than $60 billion of committed capital currently awaits environmental or land clearances. Much of this planned investment has already been delayed by three to five years.

Challenges to aggregating land in India also make it tough for suppliers and manufacturers to raise their overall productivity by locating facilities closely together and thus reaping network effects enabled by streamlined supply chains, the sharing of infrastructure, and mutual learning opportunities.

3. Labor barriers. Stringent labor laws make it difficult for Indian companies to restructure and thus to increase their productivity and expand output. Firing underperforming workers is difficult in India, and this ongoing problem translates into high levels of unproductive labor at many companies there. India’s government should consider liberalizing its labor laws by encouraging reskilling programs that could help workers become more productive and prepare them for new jobs. Encouragingly, India’s National Skill Development Corporation (NSDC) is experimenting with ways to use public–private partnerships to strengthen vocational training. Coupled with sensible labor laws, such moves could quickly begin to make a difference.

4. Infrastructure. Urgent attention is needed to create more railways, roads, ports, and power-generating capacity across India. Poor infrastructure saps industrial productivity and leaves the country at a huge disadvantage compared with others. Bad road conditions, for example, limit trucks carrying cargo in India to an average distance of only about 250–300 kilometers a day, compared with the developed world’s average of 500 kilometers. Similarly, turnaround times for ships loading and unloading in India’s ports can be up to four days, compared with only 10 to 12 hours in Hong Kong.

Recently, India’s Ministry of Commerce & Industries called for the development of National Investment and Manufacturing Zones (NIMZs). 1 1. For more, see the government’s recently announced National Manufacturing Policy (NMP), available at www.india.gov.in. The encouragement of such industrial clusters is a positive development, since they are a proven way of catalyzing the efforts of the public and private sectors to address infrastructure challenges. In the Indian state of Jharkhand, for instance, a cluster in the city of Jamshedpur attracted dozens of industrial companies that teamed up to improve the local infrastructure. The benefits extend beyond better roads, power, and water supply: companies in Jamshedpur actively collaborate to improve workers’ skills and have even, in some cases, developed shared pools of workers. The learning benefits for companies are substantial, too, as industrial clusters help spark the kinds of supplier ecosystems that help innovation thrive.

Capturing this opportunity will require India’s manufacturers to improve their productivity dramatically—in some cases, by up to five times current levels. 1 1. To improve total factor productivity three to five times, a manufacturer would have to improve its labor productivity by a factor of 2.0 to 3.0 and its capital productivity by a factor of 1.5 to 2.0. The country’s central and state governments can help by dismantling barriers in markets for land, labor, infrastructure, and some products (see sidebar, “Four imperatives for India’s government”). But the lion’s share of the improvement must come from India’s manufacturers themselves.

Recognizing this, a few leading ones are upgrading their competitiveness by bolstering their operations to improve the productivity of labor and capital, while launching targeted programs to train the plant operators, managers, maintenance engineers, and other professionals the country needs to reach its manufacturing potential. A closer look at the experiences of these companies offers lessons for other Indian manufacturers and for global product makers considering opportunities in India.

Made in India?

India’s manufacturers have long performed below their potential. Although the country’s manufacturing exports are growing (particularly in skill-intensive sectors such as auto components, engineered goods, generic pharmaceuticals, and small cars) its manufacturing sector generates just 16 percent of India’s GDP—much less than the 55 percent from services. 2 2. In fact, India exports goods worth 17 percent of GDP but also imports manufactured goods worth nearly 16 percent of GDP, so the net contribution of the manufacturing sector’s exports to overall GDP is negligible. By contrast, China’s manufacturing sector contributes 47 percent of China’s GDP, and its contribution to net exports is large. Services account for 44 percent of China’s GDP. Moreover, a majority of India’s largest manufacturers don’t return their cost of capital (Exhibit 1), a factor that dampens investment in the sector and makes it less attractive than its counterparts in competing economies, such as China and Thailand. Indeed, China’s manufacturers captured nearly 45 percent of the global growth in manufacturing exports from low-cost countries between 2001 and 2010, whereas India accounted for a paltry 5 percent.

More than half of India’s manufacturing companies do not return their cost of capital.

Nonetheless, India’s rapidly expanding economy, which has grown by 7 percent a year over the past decade, gives the country’s manufacturers a huge opportunity to reverse the tide. History shows that as incomes rise, the demand for consumer goods skyrockets. And many of India’s consumption sectors—including food and beverages, textiles and apparel, and electrical equipment and machinery—have reached this inflection point. In fact, our research suggests that these sectors will grow from 12 to 20 percent annually over the next 15 years (Exhibit 2).

Many sectors in India will experience strong domestic market growth driven by increased consumption.

To be sure, global economic growth is poised to create opportunities for low-cost manufacturers everywhere: by 2015 the market for manufactured goods from low-cost countries will more than double, to nearly $8 trillion a year. China will probably capture much of the growth. Still, we estimate that up to $5 trillion a year will be up for grabs as global companies seek to diversify production and sources of supply beyond China, both to address rising factor costs there and to chase domestic demand in other countries.

India has a massive workforce, an emerging supply base, and access to natural resources needed in production—notably, iron ore and aluminum for engineered goods, cotton for textiles, and coal for power generation. The country could become a viable manufacturing alternative to China in industries ranging from apparel to auto components and might even dominate some skill-intensive manufacturing sectors (Exhibit 3).

India could be competitive in a number of industries.

If India’s manufacturing sector realized its full potential, it could generate 25 to 30 percent of GDP by 2025, thus propelling the country into the manufacturing big leagues, along with China, Germany, Japan, and the United States. Along the way, we estimate that India could create 60 million to 90 million new manufacturing jobs and become an attractive investment destination for its own entrepreneurs and multinational companies.

India’s product makers must embrace global best practices in operations—while tailoring them to India’s unique environment—to improve the efficiency and effectiveness of the country’s manufacturing investments dramatically. A look at how some Indian companies are making inroads in these areas suggests a path that others can follow.

Bolster operations

India’s legacy of industrial protectionism has left many of the country’s manufacturers uncompetitive. To seize the opportunities now available to them, they must dramatically increase the productivity of their labor and capital. The rewards could be significant: a McKinsey benchmarking study of 75 Indian manufacturers found that for an average company, the potential productivity improvements represented about seven percentage points in additional returns on sales.

Improve labor productivity

Indian manufacturers lag behind their global peers in production planning, supply chain management, quality, and maintenance—areas that contribute to their lower productivity (Exhibit 4). Consequently, workers in India’s manufacturing sector are almost four and five times less productive, on average, than their counterparts in Thailand and China, respectively.

Indian manufacturers lag behind their global peers in key operational areas.

Nonetheless, some Indian companies are making strides. Tata Steel, for instance, improved its output per worker by a factor of eight between 1998 and 2011, largely by adapting its operational and management practices to India’s unique conditions. The company dramatically improved the output of its blast furnaces, for example, by learning to adjust them continually to account for the large variations in the ash content of Indian coal from shipment to shipment. In this way, the steelmaker can burn coal with a high ash content more efficiently than would otherwise be possible.

The company has also made significant organizational changes to support the new ways of working. To make employees more accountable, for example, Tata Steel reduced the number of managerial layers to 5, from 13. It also began investing heavily in building analytical and interpersonal skills among frontline managers and staff to ensure access to scarce competencies. Today, the company’s Shavak Nanavati Technical Institute trains more than 2,000 employees a year in both “hard” skills as well as “soft” ones, such as conflict resolution. Together, these moves strengthened the company’s focus on continuous improvement—Tata Steel won the coveted Deming Prize in 2008 for advances in process excellence and quality improvements—and helped it become one of the world’s lowest-cost steel producers.

Improve capital productivity

India’s manufacturers must also improve the productivity of their capital, 3 3. In this article, we define capital productivity as operating profit divided by total assets. in some cases by 50 percent or more. While such improvements are challenging, they are possible if companies set bold targets and adopt an “owner–entrepreneur” mind-set when tackling large capital projects or making other big investments.

For example, a global mining and metals company that was setting up aluminum smelter operations in India set a capital cost target 50 percent lower than the industry’s global average. The company then empowered its project teams to reach the goal—for example, by giving them greater freedom to make decisions about capital specifications and which low-cost equipment suppliers to use. (A technical and commercial audit team of senior managers ensured that the new approach didn’t compromise the quality of capital equipment or backfire in the form of graft.)

Moreover, the company did not give the contract out on an EPC 4 4. Engineer, procure, construct: a common contracting arrangement, under which the contractor is responsible for all aspects of engineering, procurement, and construction, including the management of subcontractors. basis. Instead, it brought together a mix of Chinese and European companies to finalize the design and to supply the equipment needed, and the integration and commissioning work was done in-house, thus saving much of the margin that would otherwise have been given away. Together, these moves helped the company to launch its Indian smelter operations at a capital cost 50 percent below industry averages (and 20 percent less than other players in the same market spent).

Many Indian companies are also assessing the technical design of their capital equipment to make trade-offs between capital expenditures and life cycle expectations for reliability—essentially “Indianizing” the specifications. Tata Power, for example, has lowered its capital expenditures in a drive to identify relatively inexpensive designs and specifications for big projects. During the planning stages of a new 4,000-megawatt facility, for instance, the company brought together customers, suppliers, and Tata engineers to make a number of Indianized design decisions. These included using cheaper welded tubes instead of seamless ones in feedwater heaters and redesigning the layout of the turbine-generator building to make it more compact. Together, such trade-offs saved the company more than $100 million in capital outlays while preserving the plant’s core capabilities and meeting standards for safety and reliability.

Meanwhile, some Indian companies are working to raise the productivity of their existing assets—for example, by focusing on the reliability of equipment. In our experience, throughput improvements from 40 to 100 percent 5 5. In our assessment, the potential improvement ranges from 20 to 40 percent for continuous-process industries (such as steel), 30 to 60 percent for discrete manufacturing (automotive, mining), and 50 to 100 percent for batch-process-based industries (such as pharmaceuticals). are possible when Indian companies apply traditional lean-management techniques to keep machines running longer and to reduce time wasted during retooling and production line changeovers. Tata Steel, for instance, focused on standardized tasks throughout its mills and trained workers to uncover the root causes of equipment problems. One of the company’s melting shops we studied raised its production dramatically over two years by standardizing jobs and empowering its operations and maintenance employees to identify potential problems of key machines that had previously been prone to creating production bottlenecks.

Targeted skill development

India’s manufacturers could learn a lot from the IT sector’s experience in promoting the large-scale development of skills. India’s IT services and business-process-outsourcing sectors together hire nearly a million new recruits a year and bring them up to speed in just months. A key factor in this success was the early recognition among Indian IT companies, back in the 1990s, that the number of engineering graduates in computer sciences wouldn’t meet the needs of the country’s burgeoning IT sector. In response, Infosys, Wipro, and other companies began hiring graduates from all engineering disciplines and using in-house curricula and faculties to build skills among new hires. That approach ultimately led to the formation of a successful network of independent, privately owned computer-training institutes, such as Aptech and NIIT.

India’s manufacturers should follow a similar path by establishing in-house training centers to promote vital manufacturing roles, including those of fitters, machinists, maintenance engineers, and welders. Some Indian companies are already taking matters into their own hands. For example, to impart vocational skills, India’s largest automaker, Maruti Suzuki, has adopted six technical institutes across the country, some in regions with little manufacturing presence. By using the company’s own managers as faculty for some classes, Maruti Suzuki inculcates trainees with a strong feel for its culture as well. The automaker is now expanding its training programs to include employees of key suppliers.

Although training programs make good business sense, they are also increasingly necessary to get local populations to accept the establishment of a manufacturing footprint in India. Tata Motors’ partnership with the Gujarat state government to improve the skills of local workers, for example, helped the company to ameliorate concerns about the displacement of residents by the construction of a Tata Nano car factory, while giving the company access to new workers. Today, nearly 1,000 people who live within a 10-kilometer radius of this Sanand factory make Nanos. Similarly, Tata Steel has agreed with the Orissa state government to train and improve the skills of workers living near a planned steel plant in Kalinganagar. The company has pledged to give local villagers jobs in the project’s execution and operations.

Frontline workers aren’t the only ones whose skills need upgrading; India’s manufacturers must also improve those of managers. Consider the experience of the cement maker Holcim, where executives set—and achieved—such goals as significantly improving the reliability and energy efficiency of the production process, as well as other important operating metrics at the company’s Indian subsidiaries.

At the heart of this initiative is an academy the company set up in its Indian plant to help future leaders bolster their skills through a “field and forum” approach that intersperses class work with hands-on fieldwork in the form of operational-improvement projects. Similarly, Holcim trains its managers to focus performance dialogues with frontline employees on the importance of identifying the root causes of problems and of finding potential solutions through cross-functional teams. The company uses operational “war rooms” in its Indian plants to serve as a clearinghouse for the best ideas and to uncover the best contributions. In parallel, Holcim created an ambitious leadership program to support the personal development of up-and-coming manufacturing leaders.

The combination of rocketing domestic demand and the multinationals’ desire to diversify their manufacturing footprint offers Indian product makers a once-in-a-generation opportunity to emerge from the shadow of the country’s services sector. By improving their productivity and bolstering operations, they could become an engine of economic prosperity for the whole country.

Rajat Dhawan is a director in McKinsey’s Delhi office, of which Gautam Swaroop is an alumnus; Adil Zainulbhai is a director in the Mumbai office.

Explore a career with us

Related articles.

How multinationals can win in India

Is your emerging-market strategy local enough?

Can India lead the mobile-Internet revolution?

- 中文 (Chinese)

Trending Topics

- Look Forward: Multidimensional Transition

- Look Forward: Supply Chain 2024

- AI in Banking: AI Will Be An Incremental Game Changer

- The Return of Energy Security

- The AI Governance Challenge

- India's Future: The Quest for High and Stable Growth

Offerings by Division

- S&P Global Market Intelligence

- S&P Global Ratings

- S&P Global Commodity Insights

- S&P Dow Jones Indices

- S&P Global Mobility

- S&P Global Sustainable1

S&P Global Offerings

Featured Topics

Featured Products

- Market Intelligence

- Commodity Insights

- Sustainable1

S&P Capital IQ Pro

Platts Connect

S&P Global ESG Scores

AutoCreditInsight

SPICE: The Index Source for ESG Data

- S&P Global Home

- Explore S&P Global

- Data & Analytics

- Research & Insights

Ratings & Benchmarks

- Technology Solutions

- See all S&P Global Products & Solutions

Find a Rating

Market Insights

- Special Reports

Sustainability

Capital Markets

Global Trade

Energy & Commodities

Technology & Innovation

Geopolitical Risk

Artificial Intelligence

Featured S&P Global Events

Webinar Replays

About S&P Global

- Corporate Responsibility

Diversity, Equity, & Inclusion

- Investor Relations

- Research and insights

- / Research & Insights /

- / Look Forward / 'Make In India' Manufacturing Push Hinges on Logistics Investments

- Look Forward

'Make In India' Manufacturing Push Hinges on Logistics Investments

A strong logistics framework will be key to transforming India from a services-dominated economy into a manufacturing-dominant one.

Published: August 3, 2023

By Rahul Kapoor and Chris Rogers

India has an immense opportunity to increase its share of global manufacturing exports, and the government is seeking to raise manufacturing to 25% of GDP from 17.7% by 2025.

Developing a strong logistics framework will be key to transforming India from a services-dominated economy to a manufacturing-dominant one, particularly enhancements in intermodal connectivity and heavy investments in ports and shipping capacity.

Accelerated investments should aid India's ambition; a boom in Indian mobile phone production provides a template for future policies in other sectors.

India stands on the cusp of a massive opportunity to increase its share of global manufacturing exports. Corporate manufacturing giants are looking for alternative production and sourcing destinations to accelerate supply chain diversification. India should benefit from these positive tailwinds, aided by significant milestones already achieved in its domestic and export logistics framework as well as by projects now underway. The telecom sector provides a case study for the delivery of the Modi administration’s “Make in India, Make for the World” policies. Global smartphone manufacturers are setting up shop in India after years of patient government intervention via targeted trade policies focused on phones and components.

Successive Indian governments have emphasized policies promoting domestic manufacturing to reduce India’s import dependence and to increase its share of global exports. The current administration’s focus on “Make in India, Make for the World” encourages investments in manufacturing, especially through Production-Linked Incentive (PLI) schemes. First introduced in 2020 for electronics makers, PLIs provide incentives to domestic and foreign companies that invest in Indian manufacturing and meet predetermined output targets.

India’s policy landscape is often disparate , spanning multiple states with independent reform agendas. Approaching reform at a national level through platforms like PLIs can allow the central government to circumvent state-level differences. Effective uptake of these schemes will be crucial as India seeks to increase manufacturing to 25% of GDP by the year ending March 2025 . It was 17.7% last fiscal year, according to S&P Global Market Intelligence.

Policies in complementary sectors — especially logistics — will be key to meeting the government’s goal of transforming India from a services-dominated economy into a manufacturing-dominant one. Sophisticated logistics could give India a competitive advantage over other countries vying for inbound investment.

Accelerated Investments Should Aid India’s Global Manufacturing Ambitions

India’s ability to compete internationally against other manufacturing exporters will be enhanced by its two-pronged approach to logistics. This is focused on improving intermodal connectivity and on heavy investment in ports and shipping capacity.

Capital-intensive infrastructure projects would also be supported by the government’s strong digitalization efforts. Existing frameworks such as the National Logistics Policy (NLP) could help to build a technology-enabled, integrated, cost-effective and dependable logistics ecosystem.

Digital and infrastructure initiatives have already helped India to rise six spots since 2018 in the World Bank’s Logistics Performance Index (LPI), to rank 38th out of 139 countries in 2023. The country has significantly improved its score in four of the six LPI indicators (infrastructure, international shipments, logistics quality and competence, and timeliness), which bodes well for the future.

A key variable affecting India’s manufacturing potential is cost competitiveness in logistics. Costs are about 14% to 18% of GDP, according to the country’s full-year 2022–23 Economic Survey. The government aims to lower these costs to below 10% to be more in line with major Asian exporters.

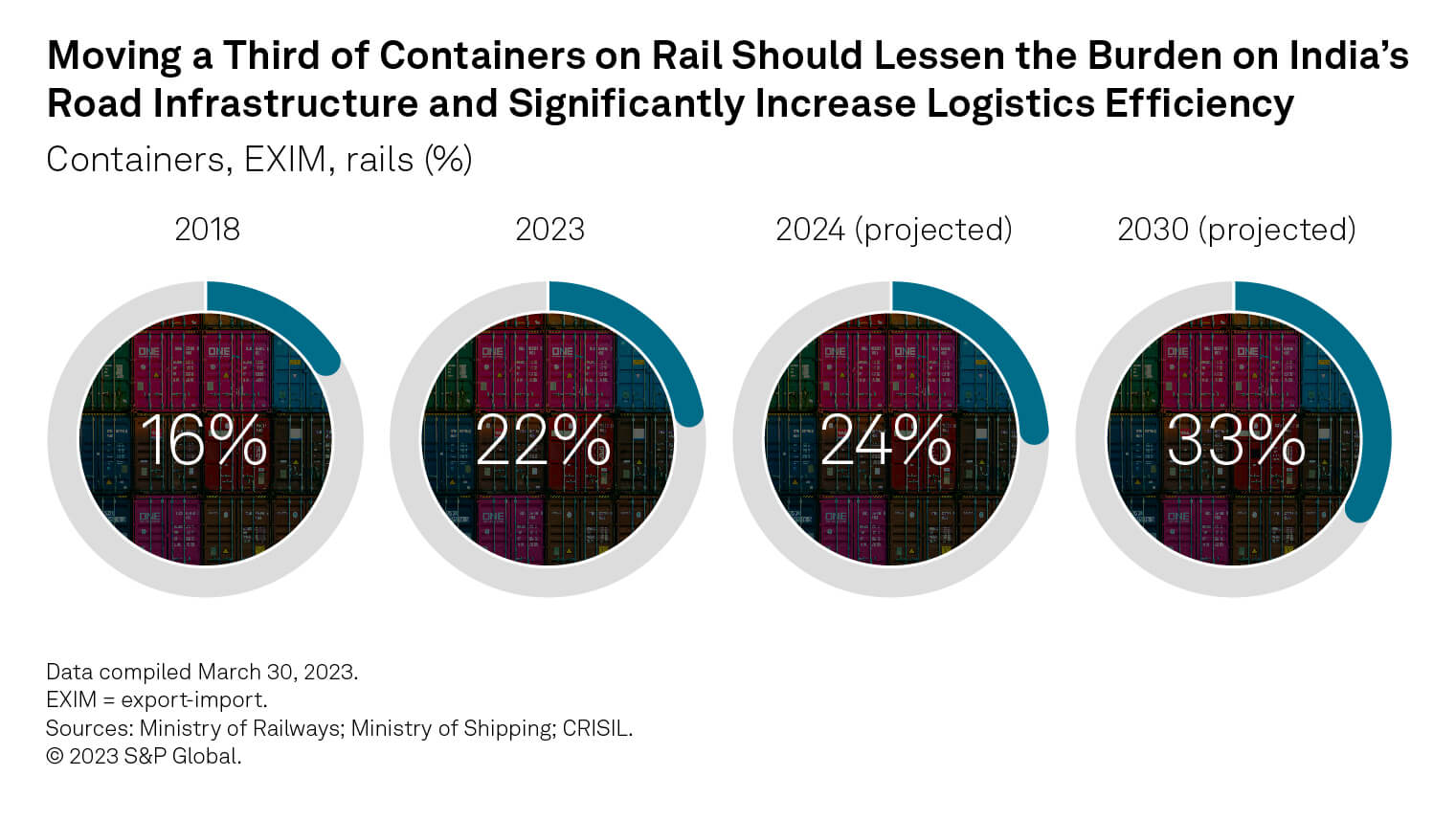

Improving road and rail connectivity will help to cut logistics costs. There is already a noticeable acceleration in national highway building, with the government expecting construction to reach 33 km/day in fiscal year 2024, almost double the 17 km/day achieved in fiscal year 2016. The share of containers being shipped by rail is also rising: It is forecast to hit 23.5% in fiscal year 2024 and 33% in fiscal year 2030, according to the government.

Ports Need Investment to Boost India’s Cargo Capacity and Throughput

Increasing India’s manufacturing exports in a cost-competitive and efficient manner will require improvements in logistics. The country has geographical advantages including a long coastline of more than 7,500 km and proximity to shipping traffic transiting the Indian Ocean.

Looking Forward

India lags Japan, South Korea and mainland China in export infrastructure and efficiency, particularly in terms of port capacity. To narrow this infrastructure gap and to become the global manufacturing destination of choice, India will need massive upgrades covering areas such as rail, ports and freight corridors.

India needs to reduce its reliance on transshipments via hubs such as Singapore and Hong Kong to help manufacturers avoid potentially lengthy transit times. This means adding efficient high-capacity ports that can handle the largest container ships or incentivizing operators to introduce direct services to major markets. It will also entail strengthening links with global container carriers and freight forwarders.

India has an opportunity to increase its share of global container shipments and bulk commodities, even if North Asia will likely continue to be the driver of global container volumes, according to S&P Global’s Global Trade Analytics suite. Accelerating port infrastructure development will be key to achieving this goal.

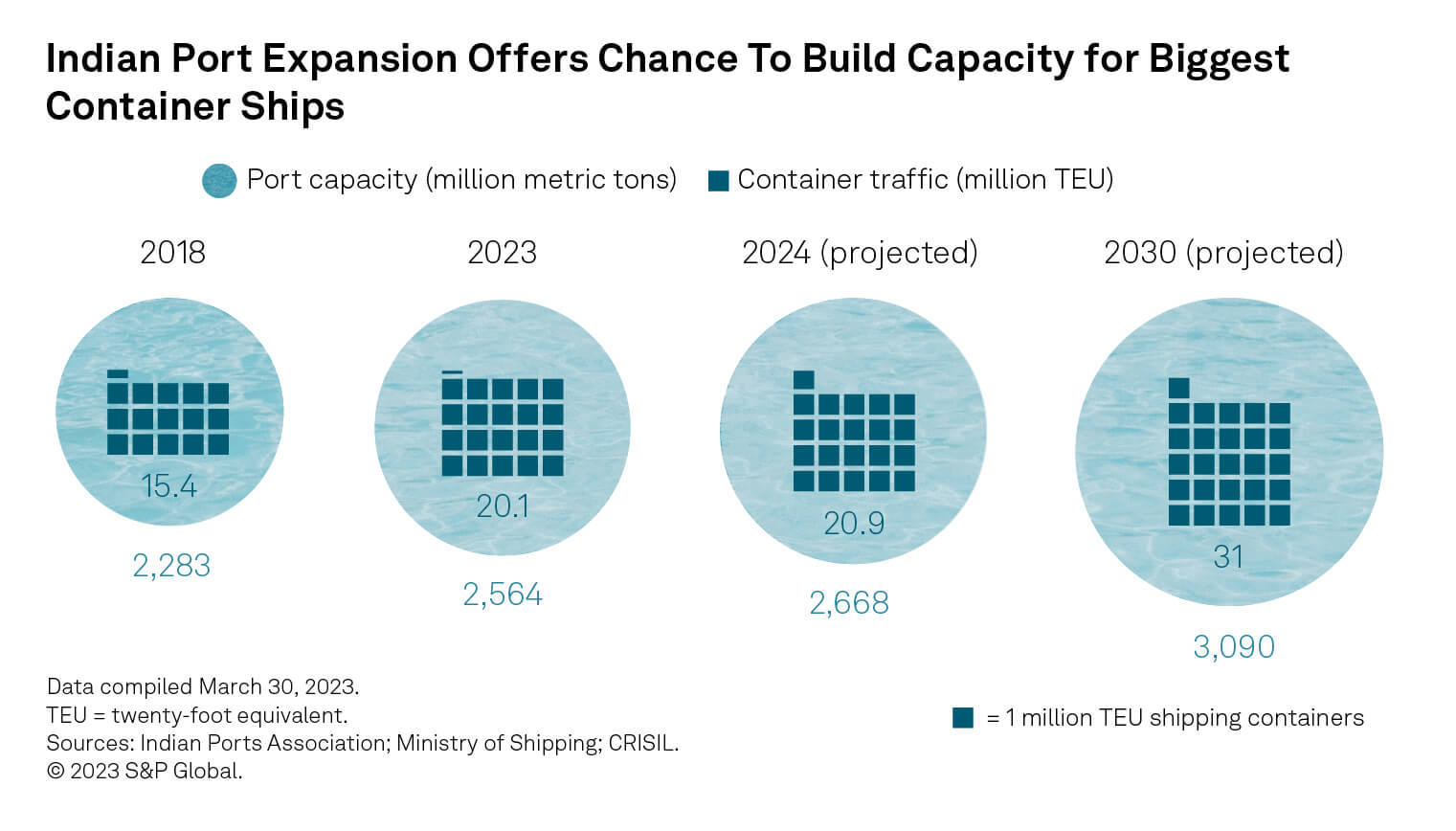

Port capacity and container throughput have experienced robust growth in India over the last five years. Looking forward, capacity will have a compound annual growth rate of 2.7% in 2023–30, with container traffic achieving 6.5%, based on estimates from CRISIL, an S&P Global company. This is growth from a low base, and a key question is how India facilitates significantly more port investments and higher growth rates in support of its bid to become an export powerhouse.

Successfully emerging as a global manufacturing hub is central to achieving India’s domestic growth target and geopolitical ambitions. The path to achieving this goes via the government’s ability to design and build a world-class logistics system, encompassing domestic road and rail networks, as well as international shipping services.

Smartphones Show Potential for Electronics Manufacturing

Getting the logistics framework right should facilitate growth in sectors earmarked for exports, especially high-strategic areas like electronics that require tightly integrated supply chains. Electronics makers also generally rely on airfreight, which means the sector is less affected by India’s existing seaport constraints.

India’s policy interventions in the smartphone sector illustrate its ambitions for manufacturing as a conduit to service the domestic market as well as its geopolitical aims. Smartphones are among the most sophisticated manufactured products, and their ubiquity makes them a logical target for any country looking to extend its economic development. The arrival of Apple contractors as major players in Indian mobile phone production shines a light on the nation’s success so far and on its opportunities for future growth.

Evolution in India’s Domestic Market

Reshoring of telecom manufacturing is a competitive field, with India facing significant competition as multinationals look to expand their operations. However, India’s large domestic market gives it an advantage, especially over Southeast Asian countries.

A revolution in India’s telecom services has helped to make the country one of the world’s most digitalized economies. India’s next target is to ensure the availability of low-cost mobile phones.

Sales of telecom products in India are projected to reach $18.3 billion — or 1.3% of the global total — in 2027, according to forecasts by S&P Global Market Intelligence. The market is expected to grow 7.3% annually through 2027, outpacing the global average of 6.2%. India’s large mobile phone sales make it worthwhile setting up local supply chains serving both domestic and export markets. Major manufacturers that already operate in India include Samsung Electronics and Xiaomi, as well as contract producers for Apple including Wistron and Pegatron.

The “Make in India” strategy includes a variety of import restrictions on phones and parts, which offers support to local manufacturers. Domestically produced, low-cost phones may also help bring informal, unregistered businesses into the mainstream economy.

India’s Viability as Export Hub

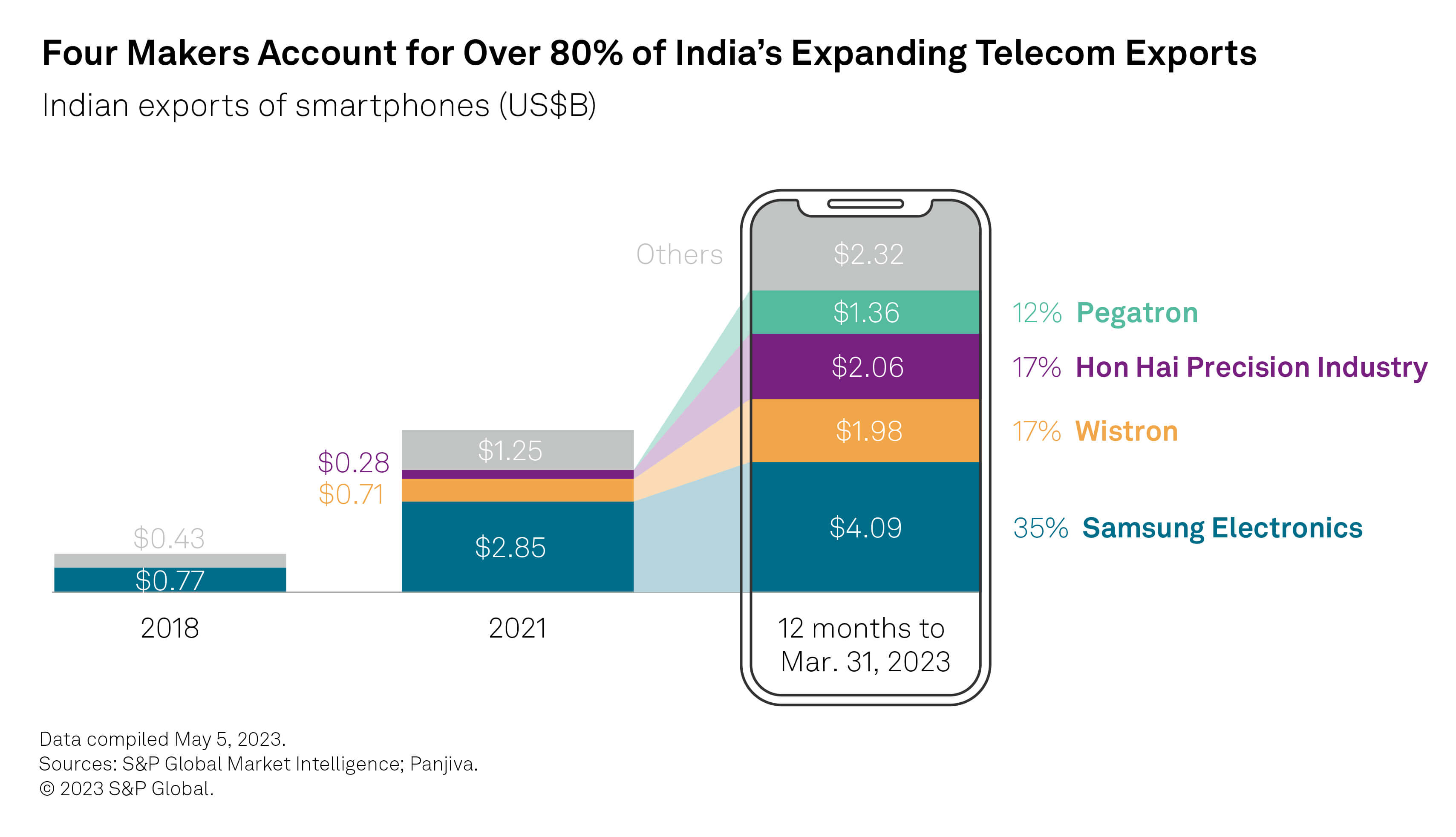

India’s export industry for telecom equipment, including smartphones, is rapidly expanding. Exports reached $11.8 billion in the 12 months to March 31, 2023, data from S&P Global Market Intelligence and Panjiva shows. Samsung Electronics led with 35% of exports, followed by contract manufacturers Wistron and Foxconn (Hon Hai Precision Industry) with 17% each.

To ensure sustainable growth in telecom, public and private sector coordination will be needed to transition beyond only assembling smartphones. This work can always be relocated to lower-cost locations, whereas fully integrated operations are stickier. Such operations would also make India pivotal to the global telecom equipment supply chain.

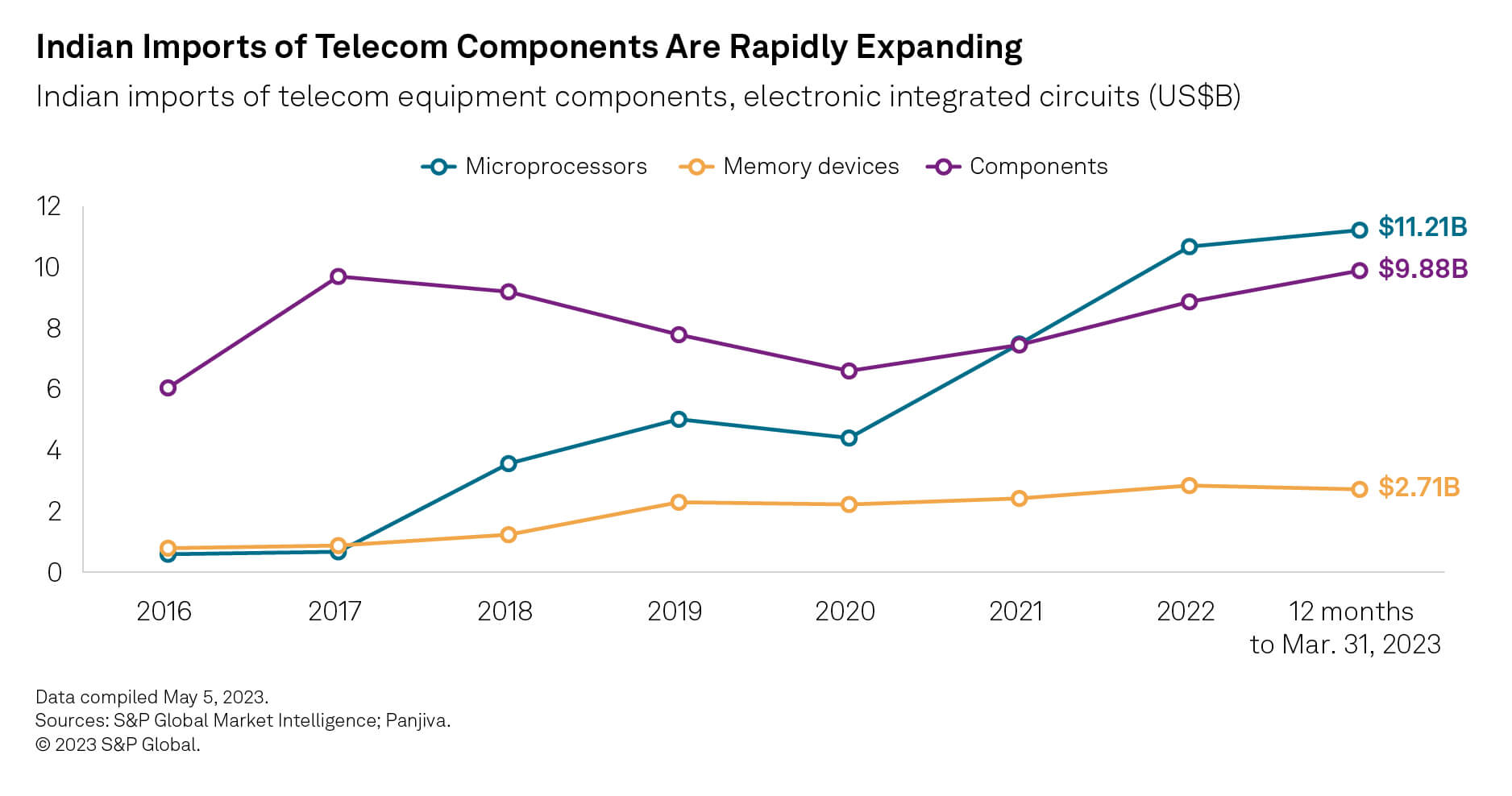

Replicating the full supply chain back to semiconductors is not necessary. For instance, mainland China and Vietnam both import processors and other chips. India’s imports of semiconductors and other parts for telecom and computing devices have tracked steadily upward. Panjiva data shows imports of telecom equipment and computer chips reached $27.4 billion in the 12 months to March 31, 2023, after 12% of compound annual growth since 2017.

India has significant opportunities for manufacturing expansion across a range of sectors. Success so far in smartphone supply chains provides a template for future development potential — in terms of both scale and the complex hurdles to be overcome.

Right place, right time: Supply chain outlook for third quarter 2023 Before the battery and magnet: IRA and mineral supply chains

Next Article: Future Farming: Agriculture’s Role in a More Sustainable India

This article was authored by a cross-section of representatives from S&P Global and in certain circumstances external guest authors. The views expressed are those of the authors and do not necessarily reflect the views or positions of any entities they represent and are not necessarily reflected in the products and services those entities offer. This research is a publication of S&P Global and does not comment on current or future credit ratings or credit rating methodologies.

- X LinkedIn Facebook Email WhatsApp

Content Type

- Our Purpose

- Our History

- News Releases

- Quarterly Earnings

- SEC Filings & Reports

- Customer Care & Sales

- Support by Division

- Report an Ethics Concern

- Office Locations

- Our Organization

- IOSCO ESG Rating & Data Product Statements

- Terms of Use

- Cookie Notice

- Privacy Policy

- Client Privacy Portal

- Do Not Sell or Share My Personal Information

© 2024 S&P Global

Related Expertise: Manufacturing , International Business , Operations

India’s Manufacturing Cost Competitiveness: Holding Steady

August 19, 2014 By Arun Bruce

If any Indian industrial sector were well positioned to benefit from the nation’s growing low-cost advantage, cotton fabrics and garments would seem a likely candidate. India is the world’s second-leading exporter of raw cotton and has an immense, growing workforce. What’s more, the cost of Indian labor has remained virtually flat over the past decade when adjusted for productivity gains. That should give India a big advantage in apparel, a sector for which labor accounts for nearly 30 percent of the total cost. By contrast, labor costs in China’s coastal provinces have nearly tripled.

Cost Competitiveness: A Country Guide

- An Interactive View

- Australia: Losing Ground

- United Kingdom: A Rising Regional Star

- India: Holding Steady

- Mexico: A Rising Global Star

Yet India accounts for only 3 percent of the global apparel trade—and there has been no big rush to build cotton textile or apparel plants in India. Instead, much of the country’s raw cotton and yarn is still shipped to China, where it is woven into fabrics and converted into apparel at factories that are primarily located in China, Bangladesh, Cambodia, and Vietnam.

The reasons illustrate the challenges that economies such as India must still overcome before they can fully translate their low-cost advantages into a surge of manufacturing investment and exports across a broad range of industries. In terms of direct manufacturing costs, the new BCG Global Manufacturing Cost-Competitiveness Index shows that India has held steady from 2004 to 2014 relative to the U.S. Within Asia, India has the potential to become a rising regional star. Strong productivity growth and a depreciating currency have offset the increase in average manufacturing wages. Electricity and natural-gas costs have risen less than in most other major Asian export economies since 2004.

But factors other than direct costs undermine India’s competitiveness by adding risk and hidden costs. Bottlenecks at India’s seaports add days to shipping times. It typically takes six months to a year to clear all the regulatory hurdles needed to build a new factory in India. Labor laws that make it difficult and expensive for companies to manage their workforces during slow times discourage companies from building large-scale, cost-efficient factories. And while the government keeps electricity rates low for end consumers, in reality many manufacturers must pay much more for power than in other Asian economies. Because there is a perennial shortage of power capacity in the country, many factories must operate expensive diesel-powered generators on their own.

There is some cause for optimism. Container terminals and expressways are being built and expanded in India, and the growing use of power exchanges is bringing down electricity prices in some industrial areas. In addition, the country is developing special economic zones that offer speedier regulatory approvals and help in managing human resources. The Indian government has also been working harder to promote India as a global manufacturing base.

But fundamental reforms in labor, energy, and investment regulations are required before India can fully capitalize on its low-cost advantage. If the new government can accomplish such reforms, India is in a powerful position to emerge as Asia’s next star in manufacturing.

ABOUT BOSTON CONSULTING GROUP

Boston Consulting Group partners with leaders in business and society to tackle their most important challenges and capture their greatest opportunities. BCG was the pioneer in business strategy when it was founded in 1963. Today, we work closely with clients to embrace a transformational approach aimed at benefiting all stakeholders—empowering organizations to grow, build sustainable competitive advantage, and drive positive societal impact.

Our diverse, global teams bring deep industry and functional expertise and a range of perspectives that question the status quo and spark change. BCG delivers solutions through leading-edge management consulting, technology and design, and corporate and digital ventures. We work in a uniquely collaborative model across the firm and throughout all levels of the client organization, fueled by the goal of helping our clients thrive and enabling them to make the world a better place.

© Boston Consulting Group 2024. All rights reserved.

For information or permission to reprint, please contact BCG at [email protected] . To find the latest BCG content and register to receive e-alerts on this topic or others, please visit bcg.com . Follow Boston Consulting Group on Facebook and X (formerly Twitter) .

- Screen Reader

- Skip to main content

- Text Size A

- Language: English

Case Studies

- EXIM Procedure

Media & Events

- Image Gallery

- Media Coverage

Other Links

- GI of India

- Experience India

- Indian Trend Fair 2022

India Organic Biofach 2022

Gulfood dubai 2023, manufacturing, indian manufacturing industry analysis, india is the third most sought-after manufacturing destination in the world and has the potential to export goods worth us$ 1 trillion by 2030., advantage india, robust demand.

* Manufacturing exports have registered highest ever annual exports of US$ 447.46 billion with 6.03% growth during FY23 surpassing the previous year (FY22) record exports of US$ 422 billion.

* By 2030, Indian middle class is expected to have the second-largest share in global consumption at 17%.

Increasing Investment

* Propelled by growth in priority sectors and driven by favourable megatrends, India’s manufacturing sector has opened itself into new geographies and segments.

* Building on the competitive advantage of a skilled workforce and lower cost of labour, the manufacturing sector is also witnessing an increased inflow of capex and heightened M&A activity, leading to a surge in manufacturing output and resultant increased contribution to exports.

Policy Support

* The Production Linked Incentive (PLI) scheme has been notified for Large Scale Electronics Manufacturing in India. The scheme aims to attract large investments in the mobile phone manufacturing and specified electronic components, including Assembly, Testing, Marking and Packaging (ATMP) units.

* Initiatives like Make in India, Digital India and Startup India have given the much-needed thrust to the Electronics System Design and Manufacturing (ESDM) sector in India.

Competitive Advantage

* The positive developments in the manufacturing sector, driven by production capacity expansion, government policy support, heightened M&A activity, and PE/VC-led investment, are creating a robust pipeline for the country’s sustained economic growth in the years to come.

Manufacturing Industry Report

The Indian manufacturing industry generated 16-17% of India’s GDP pre-pandemic and is projected to be one of the fastest growing sectors. The machine tool industry was literally the nuts and bolts of the manufacturing industry in India. Today, technology has stimulated innovation with digital transformation a key aspect in gaining an edge in this highly competitive market.

Manufacturing is emerging as an integral pillar in the country’s economic growth, thanks to the performance of key sectors like automotive, engineering, chemicals, pharmaceuticals, and consumer durables.

Technology has today encouraged creativity, with digital transformation being a critical element in gaining an advantage in this increasingly competitive industry. The Indian manufacturing sector is steadily moving toward more automated and process-driven manufacturing, which is projected to improve efficiency and enhance productivity.

India has the capacity to export goods worth US$ 1 trillion by 2030 and is on the road to becoming a major global manufacturing hub.

With 17% of the nation’s GDP and over 27.3 million workers, the manufacturing sector plays a significant role in the Indian economy. Through the implementation of different programmes and policies, the Indian government hopes to have 25% of the economy’s output come from manufacturing by 2025.

India now has the physical and digital infrastructure to raise the share of the manufacturing sector in the economy and make a realistic bid to be an important player in global supply chains.

Manufacturing exports have registered highest ever annual exports of US$ 447.46 billion with 6.03% growth during FY23 surpassing the previous year (FY22) record exports of US$ 422 billion. By 2030, Indian middle class is expected to have the second-largest share in global consumption at 17%.

Propelled by growth in priority sectors and driven by favourable megatrends, India’s manufacturing sector has opened itself into new geographies and segments. Significant initiatives have been introduced under Aatmanirbhar Bharat and Make in India programmes to enhance India’s manufacturing capabilities and exports across the industries. Sector specific Production Linked incentives (PLI) have been introduced in the aftermath of the pandemic to incentivize domestic and foreign investments and to develop global champions in the manufacturing industry.

Building on the competitive advantage of a skilled workforce and lower cost of labour, the manufacturing sector is also witnessing an increased inflow of capex and heightened M&A activity, leading to a surge in manufacturing output and resultant increased contribution to exports. The positive developments in the manufacturing sector, driven by production capacity expansion, government policy support, heightened M&A activity, and PE/VC-led investment, are creating a robust pipeline for the country’s sustained economic growth in the years to come.

The Index of Industrial Production (IIP) from April-October 2023 stood at 143.5.

At the aggregate level, capacity utilisation (CU) for the manufacturing sector recovered to 68.3% in Q2:2021-22 after waning of the second wave of COVID-19 pandemic in the country, which had caused plummeting of CU to 60.0% in the previous quarter.

In Q2 FY24, the survey, which covered 380 manufacturers that account for about Rs. 4.8 trillion (US$ 58 billion) in sales, showed a robust 74% capacity utilization and improved future investment outlook during Q2.

India’s manufacturing exports have traditionally grown between 5% and 10% pre–Covid-19 years, but exports have seen tremendous growth over the last two years, with a compound annual growth rate (CAGR) of 15%. India reached US$ 418 billion of manufacturing exports in fiscal year 2022 (FY22).

Chemicals, pharmaceuticals, electronics, automotive, industrial machinery, and textiles (among others) are expected to propel manufacturing exports to reach US$ 1 trillion by FY28.

Mobile phone production has increased fivefold in the past five years, and India is on track to emerge as a global exporting hub of mobile phones, which creates robust demand for integrated circuits and semiconductors. This will get a boost with the focus moving from assembly to developing expertise in end-to-end hardware component manufacturing.

India is planning to offer incentives of up to Rs. 18,000 crore (US$ 2.2 billion) to spur local manufacturing in six new sectors including chemicals, shipping containers, and inputs for vaccines.

The fourth industrial revolution, Industry 4.0 is poised to happen on a global scale, taking the automation of manufacturing processes to a new level by linking the cyber & physical, incorporating AI and enabling customized and flexible mass production technologies.

Six new technology innovation platforms launched to enhance indigenous manufacturing. The platforms have been developed with the aim of facilitating globally competitive manufacturing in India.

These six platforms will work towards urging industries (including Original Equipment Manufacturers (OEMs), Tier 1, Tier 2 & Tier 3 companies and raw material manufacturers), start-ups, domain experts/professionals, R&D institutions, and academia (college and universities) to come up with technology solutions, suggestions and opinions on matters related to manufacturing technologies.

India has potential to become a global manufacturing hub and by 2030, it can add more than US$ 500 billion annually to the global economy.¬

India’s gross value added (GVA) at current prices was estimated at US$ 626.5 billion as per the quarterly estimates of the first quarter of FY22.

The manufacturing GVA at current prices was estimated at US$ 110.48 billion in the first quarter of FY24.

The manufacturing sector has seen some major developments, investments and support from the Government in the recent past.

- The combined index of eight core industries stood at 154.1 for April-September 2023 against 143.0 for April-September 2022.

- The cumulative index of eight core industries increased by 7.8% during April-September 2023-24 over the corresponding period of the previous year.

- In FY23, the Manufacturing Purchasing Managers’ Index (PMI) in India stood at 55.6.

- India's manufacturing sector activity continued to expand in November 2023, with the S&P Global Purchasing Managers' Index (PMI) reaching 56.

- In FY23, the export of the top 6 major commodities (Engineering goods, Petroleum products, Gems and Jewellery, Organic and Inorganic chemicals, and Drugs and Pharmaceuticals) stood at US$ 295.21 billion.

- The Employees' Provident Fund Organisation (EPFO) added 1,720,615 in September 2023.

- During the financial year 2022-23, around 1.39 crore net members were added by EPFO with an increase of 13.22% compared to the previous financial year 2021-22 wherein EPFO had added approximately 1.22 crore net members.

According to Department for Promotion of Industry and Internal Trade (DPIIT), India received a total foreign direct investment (FDI) inflow of US$ 46.03 billion in FY23.

In the Union Budget 2022-23, Ministry of Defence has been allocated Rs. 525,166 crore (US$ 67.66 billion). The government allocated Rs. 2,403 crore (US$ 315 million) for Promotion of Electronics and IT Hardware Manufacturing.

The PLI for semiconductor manufacturing is set at Rs. 760 billion (US$ 9.71 billion), with the goal of making India one of the world's major producers of this crucial component.

Electronics, vehicle, and solar panel production account for around 80% of total manufacturing expenditure, with semiconductors/electronics value chain accounting for 50% of total expenditure in February 2022.

As per the survey conducted by the Federation of Indian Chambers of Commerce and Industry (FICCI), capacity utilisation in India’s manufacturing sector stood at 72.0% in the second quarter of FY22, indicating significant recovery in the sector.

In September 2021, Prime Minister Mr. Narendra Modi approved the production-linked incentive (PLI) scheme in the textiles sector—for man-made fibre (MMF) apparel, MMF fabrics and 10 segments/products of technical textiles—at an estimated outlay of Rs. 10,683 crore (US$ 1.45 billion).

The 'Operation Green' scheme of the Ministry of the Food Processing Industry, which was limited to onions, potatoes and tomatoes, has been expanded to 22 perishable products to encourage exports from the agricultural sector. This will facilitate infrastructure projects for horticulture products.

To propagate Make in India, in July 2021, the Defence Ministry issued a tender of Rs. 50,000 crore (US$ 6.7 billion) for building six conventional submarines under Project-75 India.

Production-linked incentive (PLI) was launched to establish global manufacturing champions across 13 sectors with an allocation of ~Rs. 1.97 lakh crore (US$ 27.02 billion) over the next five years (starting FY22).

India's display panel market is estimated to grow from ~US$ 7 billion in 2021 to US$ 15 billion in 2025.

The future outlook of the manufacturing sector looks on track with pandemic easing out.

The manufacturing sector of India has the potential to reach US$ 1 trillion by 2025. The implementation of the Goods and Services Tax (GST) will make India a common market with a GDP of US$ 3.4 trillion along with a population of 1.48 billion people, which will be a big draw for investors. With impetus on developing industrial corridors and smart cities, the Government aims to ensure holistic development of the nation.

Related News

Export-Import Bank of India predicts India's merchandise exports to reach US$ 116.7 billion, driven by strong economic fundamentals and sectoral activity.

India's manufacturing displayed growth, with PMI hitting 58.8 in April, marking the sector's second-strongest expansion since 2021, driven by robust demand.

Business activity in April surged to its highest level in almost 14 years, as reflected in a composite index of 62.2, affirming India's rapid economic growth.

Manufacturing witnesses a surge in demand for female apprentices, aiming for a 40% female workforce by year-end, aligning with vocational training reforms.

India delivers BrahMos missiles to the Philippines, strengthening regional security amid escalating tensions in the South China Sea, marking strategic cooperation in a US$ 375 million deal.

Manufacturing Clusters

- Maharashtra

- Andhra Pradesh

- Uttar Pradesh

Industry Contacts

- Electronics Industries Association of India (ELCINA)

- Telecom Equipment Manufacturers Association (TEMA)

- Indian Chemical Council

- Alkali Manufacturers Association of India

- Indian Specialty Chemical Manufacturers' Association

PREFERRED MANUFACTURING DESTINATION

India ranks third in most-suitable locations for global manufacturing.

IBEF Campaigns

APEDA India Pavilion Gulfood February 20th-26th, 2022 | World Trade Centre,...

Ibef Organic Indian Pavilion BIOFACH2022 July 26th-29th, 2022 | Nuremberg, ...

Financial Resurgence: A Comprehensive Exploration of the Recent Boom in Mutual Fund Investments in India

Mutual funds play an indispensable role in capital markets, serving as a gateway for individuals and institutions to access a diverse range of securit...

Transforming India's Logistics Sector: Challenges and Opportunities

The logistics industry plays a vital role in the dynamic economic landscape of India by enabling the efficient movement of goods and services througho...

Promoting Indigenous Start-ups: Case Study of Investor Interest in Small-town Start-ups

As urban markets become saturated, investors are turning their gaze towards the untapped potential of small-town innovation, driven by a desire to fos...

Promoting Diversity: Women's Entrepreneurship and Economic Empowerment in India

Women empowerment is a transformative force that goes beyond mere gender pa...

Start-up Ecosystem: Fostering Innovation and Entrepreneurship in India's Tech Industry

In recent years, India has rapidly risen as a global powerhouse within the ...

Infrastructure Development: Indian Railways’ Plan for Enhanced Passenger Experience

In India's big web of transportation, Indian Railways is like an import...

Not a member

- Bihar Board

- RBSE 12th Result 2024

SRM University

- RBSE 10th Result 2024

- Maharashtra HSC Result

- MBSE Result 2024

- TBSE Result 2024

- CBSE Board Result 2024

- Shiv Khera Special

- Education News

- Web Stories

- Current Affairs

- नए भारत का नया उत्तर प्रदेश

- School & Boards

- College Admission

- Govt Jobs Alert & Prep

- GK & Aptitude

- CBSE Class 10 Study Material

CBSE Class 10 Maths Case Study Questions for Maths Chapter 5 - Arithmetic Progression (Published by CBSE)

Case study questions on cbse class 10 maths chapter 5 - arithmetic progression are provided here. these questions are published by cbse to help students prepare for their maths exam..

CBSE Class 10 Case Study Questions for Maths Chapter 5 - Arithmetic Progression are available here with answers. All the questions have been published by the CBSE board. Students must practice all these questions to prepare themselves for attempting the case study based questions with absolute correctness and obtain a high score in their Maths Exam 2021-22.

Case Study Questions for Class 10 Maths Chapter 5 - Arithmetic Progression

CASE STUDY 1:

India is competitive manufacturing location due to the low cost of manpower and strong technical and engineering capabilities contributing to higher quality production runs. The production of TV sets in a factory increases uniformly by a fixed number every year. It produced 16000 sets in 6th year and 22600 in 9th year.

Based on the above information, answer the following questions:

1. Find the production during first year.

2. Find the production during 8th year.

3. Find the production during first 3 years.

4. In which year, the production is Rs 29,200.

5. Find the difference of the production during 7th year and 4th year.

2. Production during 8th year is (a+7d) = 5000 + 2(2200) = 20400

3. Production during first 3 year = 5000 + 7200 + 9400 = 21600

4. N = 12 5.

Difference = 18200 - 11600 = 6600

CASE STUDY 2:

Your friend Veer wants to participate in a 200m race. He can currently run that distance in 51 seconds and with each day of practice it takes him 2 seconds less. He wants to do in 31 seconds.

1. Which of the following terms are in AP for the given situation

a) 51,53,55….

b) 51, 49, 47….

c) -51, -53, -55….

d) 51, 55, 59…

Answer: b) 51, 49, 47….

2. What is the minimum number of days he needs to practice till his goal is achieved

Answer: c) 11

3. Which of the following term is not in the AP of the above given situation

Answer: b) 30

4. If nth term of an AP is given by an = 2n + 3 then common difference of an AP is

Answer: a) 2

5. The value of x, for which 2x, x+ 10, 3x + 2 are three consecutive terms of an AP

Answer: a) 6

CASE STUDY 3:

Your elder brother wants to buy a car and plans to take loan from a bank for his car. He repays his total loan of Rs 1,18,000 by paying every month starting with the first instalment of Rs 1000. If he increases the instalment by Rs 100 every month , answer the following:

1. The amount paid by him in 30th installment is

Answer: a) 3900

2. The amount paid by him in the 30 installments is

Answer: b) 73500

3. What amount does he still have to pay offer 30th installment?

Answer: c) 44500

4. If total installments are 40 then amount paid in the last installment?

Answer: a) 4900

5. The ratio of the 1st installment to the last installment is

Answer: b) 10:49

Also Check:

CBSE Case Study Questions for Class 10 Maths - All Chapters

Tips to Solve Case Study Based Questions Accurately

Get here latest School , CBSE and Govt Jobs notification in English and Hindi for Sarkari Naukari and Sarkari Result . Download the Jagran Josh Sarkari Naukri App . Check Board Result 2024 for Class 10 and Class 12 like CBSE Board Result , UP Board Result , Bihar Board Result , MP Board Result , Rajasthan Board Result and Other States Boards.

- Rajasthan Board 12th Result 2024

- rajeduboard.rajasthan.gov.in Result 2024

- Rajasthan Board Class 12th Result 2024

- 12th Result 2024 Rajasthan Board

- GBSHSE SSC Result 2024

- SSC Result 2024 Goa

- CDS 2 Notification 2024

- results.gbshsegoa.net Result 2024

- CBSE 10th Result 2024

- CBSE Study Material

- CBSE Class 10

Latest Education News

RBSE Rajasthan Board 12th Result 2024: न हों निराश राजस्थान बोर्ड के नतीजों में होंगे सब पास, जानें कैसे देखें अपने मार्क्स

[LIVE] RBSE 12th Result 2024: Check Rajasthan Board Class 12 Arts, Commerce and Science Results Today at rajeduboard.rajasthan.gov.in, Jagran Josh with Roll Number

RBSE 12th Result 2024 LIVE: राजस्थान बोर्ड 12वीं Science, Commerce, Arts और वरिष्ठ उपाध्याय रिजल्ट rajeduboard.rajasthan.gov.in पर जल्द, रोल नंबर से करें चेक

12th Result 2024 Rajasthan Board: BSER Ajmer Board Class 12 Arts, Commerce and Science Results at rajeduboard.rajasthan.gov.in

[रिजल्ट लिंक] JAC 8th Result 2024: आठवीं के नतीजे जल्द, jac.jharkhand.gov.in पर Result Link से डाउनलोड करें Marksheet

Bihar STET Expected Cut Off 2024: Category-Wise Cut Off Marks Here

RBSE 12th Science, Commerce and Arts Result 2024 with Jagran Josh, Get Your Rajasthan Board Class 12 Results in Easy Steps

Rajasthan Board 12th Result 2024: ऐसे चेक करें 12वीं साइंस, आर्ट्स, कॉमर्स और वरिष्ठ उपाध्याय रिजल्ट Digilocker, Umang App, IVRS और SMS के जरिये

rajeduboard.rajasthan.gov.in Result 2024: यहां मिलेगा राजस्थान 12वीं का आर्ट्स, साइंस, और कॉमर्स रिजल्ट डाउनलोड करने की वेबसाइट का लिंक

RBSE Result 2024: आज 12:15pm पर जारी होगा राजस्थान बोर्ड 12वीं का रिजल्ट, rajresults.nic.in पर मिलेगा Result Link

JAC 8th Result 2024 Link: झारखंड बोर्ड 8वीं का रिजल्ट jacresults.com पर, Roll Number से डाउनलोड करें मार्कशीट

[Official] Rajasthan Board 12th Result 2024 Today at 12:15pm: Check RBSE Class 12 Science, Arts and Commerce Results Link Online

rajeduboard.rajasthan.gov.in Result 2024: Official LINKS and Digilocker App to Check Rajasthan Board Class 12 Results Online

Bihar STET Exam Analysis 2024: Check Paper Review, Difficulty Level, Good Attempts

Top 20 Question of the Day for School Assembly with Answers (May 20, 2024)

12th Result 2024 RBSE:आरबीएससी 12वीं रिजल्ट यहाँ से करें डायरेक्ट डाउनलोड, और देखें अपने अंक

Rajasthan Praveshika Result 2023, RBSE Results, rajresults.nic.in

RBSE Vrishth Upadhyay Result 2024: राजस्थान वरिष्ठ उपाध्याय रिजल्ट Link at Jagran Josh, rajeduboard.rajasthan.gov.in, rajresults.nic.in

RBSE Result 2024: राजस्थान बोर्ड रिजल्ट Link at Jagran Josh, rajeduboard.rajasthan.gov.in, rajresults.nic.in

RBSE 12th Result 2024: राजस्थान 12वीं रिजल्ट Link at Jagran Josh, rajeduboard.rajasthan.gov.in, rajresults.nic.in

- Sectoral Studies on Competitiveness of Indian Manufacturing

Home » Research Programme » Sectoral Studies on Competitiveness of Indian Manufacturing

Research Programme

- Industrial Structure, Performance, and Policies

- Corporate Governance and Industrial Financing

- Leveraging MSMEs and Start-ups for Industrial Transformation

- Globalization, FDI, and Trade

- Technology, Innovation, and Industry 4.0

- Green Industrialization Strategy

- Employment and Labour Markets

- Spatial Dimensions of Industrial Development and Industrial Infrastructure

To catch up with the potential of manufacturing sector, the Government of India launched the Make in India programme in 2014-15. It was reinforced by the Aatmanirbhar Bharat Abhiyaan in 2020 to expedite economic recovery in the aftermath of the COVID pandemic. As a part of these initiatives, the production-linked incentive (PLI) scheme was launched in 2020 in two phases, covering 13 manufacturing sectors. This scheme aims to make Indian manufacturers globally competitive, attracting investments in cutting-edge technology areas, creating economies of scale, enhancing exports, reducing import dependence, and making India an integral part of the global supply chain. This work programme aims to analyze the challenges Indian enterprises in select manufacturing sectors are facing with respect to enhancing their domestic value addition and international competitiveness, including a review of PLI scheme where applicable, and make policy recommendations.

Fostering Medical Devices Industry of India: Issues, Challenges and the Way Forward

ISID has been awarded a major research project focusing on the challenges faced in the development of the Medical Device Industry of India, by the Indian Council of Social Science Research (ICSSR) in March 2023. The medical device sector is highly critical for prevention. Yet over 70% of the medical device demand of the country are met through import. However, in recent past, India has taken several measures to promote medical device industry and promote competitiveness in the global market. This study aims to examine the structural characteristics of the Indian medical devices sector and the effectiveness of recent policy initiatives, especially the Modified-Special Incentive Scheme 2012 that provides capital subsidy, Medical Device Parks 2019, Production Linked Initiative scheme 2020 and National Medical Device Policy (draft) 2022, in improving the domestic manufacturing ecosystem. Lastly, it will examine the India’s comparative advantage in the sector.

Research Team : Dr Shailender Kumar Hooda

Collaboration : ICSSR

Status : [Ongoing], project launched in March 2023; time frame: March 2025.

Make in India: An Assessment of the Impact of the Programme on Six Manufacturing Sectors

The Make in India programme was launched in 2014 with the objective of increasing the share of the manufacturing sector in the GDP by facilitating investment, both domestic and foreign, into the industrial sector; fostering innovation; building best-in-class infrastructure; developing industrial clusters; and making India a hub of manufacturing, design, and innovation while giving due emphasis to decarbonisation for a sustainable socio-economic development. As part of this programme, the Government of India has taken various measures to encourage manufacturing and investment such as the Production-Linked Incentive (PLI) schemes, improving ease of doing business, reduction in corporate tax, FDI reforms, quality control measures, development of industrial clusters, local content requirements and public procurement orders. This study aims to analyse the impact of the Make in India programme in six manufacturing sectors, i.e., pharmaceuticals, textiles and garments, steel, solar PV modules, fertilizers, and toys. It will make specific recommendations in each of the six sectors with a view to enhance the impact of the Make in India programme on the manufacturing sector of India. The project team consists of.

Research Team : Dr Reji K Joseph, Dr Anjali Tandon, Dr Beena Saraswathy, Dr Ramaa Arun Kumar, DrSangeeta Ghosh and Dr Seenaiah Kale

Status : [Ongoing], project launched in September 2023; time frame: March 2024.

Automobile Industry: Technology, Changing Product Lines and Policy Initiatives

The automobile industry in India is one of the sectors that experienced impressive growth in the post-liberalization period. A protected sector controlled by quantitative restrictions and high import tariffs during the import substitution regime was gradually opened to foreign players through liberalization policies. Huge pent-up domestic demand due to the growth of the middle-class segment and demographic change contributed to the expansion of the production capacity of the automobile industry in India. Besides the original equipment manufacturers, the auto component sector grew through policies of phased manufacturing and later by way of producing for MNCs operating in the domestic market and abroad. This sector entails deep backward and forward linkages extended to domestic and foreign value chains, attracts FDI, and faces global competition both in terms of scale effects and innovation. This study aims to delineate the different factors that contribute to the competitiveness of this sector in the context of domestic and global market and the way automotive manufacturers are coping with the challenges of growing market and emerging technologies. It also reviews the prospects for the PLI scheme for the auto sector. The output of the project has been reported in ISID Working Paper #255.

Research Team : Dr Satyaki Roy

Status : [Ongoing]; started in 2022-23; time frame: 12 months.

Fostering India’s Industrial Transformation: The India Industrial Development Report (IIDR) 2024

The IIDR is the first in a new series of biennial flagship reports launched by ISID, to mark the India@75. It draws upon in-house analytical work, wide-ranging consultations with noted experts, and policy discussions to build a compelling narrative on criticality, opportunities, challenges, and policy reforms needed for industrial transformation of India at the current juncture of its development trajectory as it seeks to emerge as a developed nation by 2047. Besides being one of the biggest economies in the world, India should also be a global leader in inclusive and sustainable development. While drawing lessons from the experiences of the successful industrializers of the West and the East in terms of strategic interventions deployed, it is also cognizant of local specificities and initial conditions besides the changed external context that has turned less benign with recent trends of protectionism, stalled multilateral trade negotiations and the global slow down following the COVID pandemic. In support of the Make-in-India and Aatmanirbhar Bharat programmes, the Report identifies the opportunities of creating decent job opportunities for India’s youthful workforce through empowering MSMEs, providing an enabling framework to budding entrepreneurs and start-ups, improving the quality of FDI inflows, and unleashing the large national champions to emerge as competitive players on the global markets through leveraging technology, including the Industry 4.0. It also offers analysis and thoughts on green industrialization to enable India to contribute to global sustainability targets. It will be backed by extensive policy advocacy through high-level policy dialogues, popular columns, and social media.

Research Team : Prof Nagesh Kumar and the entire faculty.

Status : [Ongoing], project launched in 2022-23; time frame: to be completed by March 2024

Indian Steel Industry: Challenges for Enhancing Value Addition and Competitiveness

Steel plays a key role in the economic progress of nations. Availability of good quality steel at affordable prices is crucial for the sustenance of various other sub-sectors such as infrastructure, construction, automobiles, machinery, and domestic appliances which makes it the backbone of industrial development. Currently, India is the second-largest crude steel producer in the world. However, the presence of India in this market is meagre when compared with the share of China, the leading supplier which controls more than half of the global production. Nevertheless, India is gradually growing its share of world exports, while decreasing its reliance on imports. However, there is a significant demand-supply imbalance for value-added steel products such as specialty steel, for which the country forgoes a significant amount of foreign exchange. In this context, PLI scheme has been announced for selected specialty steel products. The present study aims to comprehensively cover the opportunities and challenges faced by the sector such as low demand, performance of private and public sector firms in the sector, MSMEs in the sector, trade competitiveness of various sub-components, deregulation and pricing, and use of artificial intelligence in various segments of operation.

Research Team: Dr Beena Saraswathy

Status: [Ongoing]; started in 2022-23; time frame: one year

Chemical Fertiliser Industry: Challenges for Reducing Import Dependence

Demand for food is enormously growing due to (a) increasing population and (b) decreasing per capita arable land (globally including India), therefore it is imperative to boost agricultural productivity. It is evident from the history of India that a significant role was played by fertilizers in enhancing India’s food production during the 1960s, termed as Green Revolution. Since then the government has made efforts to optimize fertilizer production to improve agricultural productivity. Given the huge gap between demand for and supply of fertilizer in India, the Government of India is trying to reduce import dependency. Currently 80 percent self-sufficiency has been achieved in the production capacity of urea (nitrogenous fertilizer-N), but in the area of phosphatic and potassic fertilizers (P and K) India is heavily dependent on imports. Therefore, this study will investigate the issues of fertilizer production and its import dependency and assess them from a policy angle to strengthen the industry.

Research Team: Dr K Seenaiah

Status: [Ongoing]; started in 2022-23; time frame: nine months.

Electrical Equipment Sector: Technology Gaps, Technology Transfer, and Import Dependence