- Skip to Nav

- Skip to Main

- Skip to Footer

COVID Rent Relief: Already Applied and Still Waiting? Here's What You (and Your Landlord) Can Do Now

Please try again

Leer en español

At the very last minute, California extended eviction protections for people who applied for the state's COVID-19 Rent Relief program by the deadline of March 31.

This means that if you're a tenant who applied for the program to receive help with your back rent — either in partnership with your landlord, or by yourself — the fact that you've applied will technically continue to protect you against eviction through June 30.

But more than half a million people have applied to the state’s emergency rent relief program — called Housing Is Key — since it launched in March 2021, and fewer than half of those applicants have received payments , according to the state’s own dashboard.

So if you're one of those who've applied and are still waiting on your money, what can you practically do during this time? And what can your landlord do while you're waiting for news on your application? Read on.

Does this extension of eviction protections mean there's a statewide eviction moratorium again?

No. California's statewide moratorium on evictions expired last fall, on Sept. 30, 2021.

But the state's COVID Rent Relief program has afforded its own kind of eviction protections, which started on Oct. 1, 2021. That's because, since that date, any landlord wanting to evict a tenant for failing to pay rent as a result of COVID hardship needs to first apply for rental relief before continuing with an eviction lawsuit. And renters affected by COVID hardship can prevent an eviction from moving forward if they show they've applied for the rent relief program as a defense in court.

These protections would have expired on March 31 , but now have been extended through June 30 by California's new legislation — although that's only for people who applied for the rent relief program by March 31.

Several cities and counties across the state had their own rent-related eviction moratoriums that stayed in place after the state moratorium expired. See if your Bay Area county still has an eviction moratorium.

I applied for rent relief before March 31. Am I guaranteed to get the money?

The state says that " all eligible applications received on or before March 31, 2022, for rent or utilities owed between April 1, 2020 through March 31, 2022, will be paid. "

But, although the Department of Housing and Community Development maintains that their goal is to turn applications around in 30 days, the average wait time is much longer — four months, on average , according to a recent report by the National Equity Atlas.

The state says as long as you've submitted your application by March 31, you'll still be able to access your application after that date "to check the status, respond to tasks, and provide additional information requested by your case manager."

If I applied by the deadline, is there any chance my landlord could still try to evict me?

When the law is working as it should, if you filled out an application and hit “submit” on or before March 31, you should be protected from eviction under this law. But, that doesn’t mean the law always works as it should.

Some tenant attorneys and advocates have reported clients who submitted an application that was still under review but received an eviction notice anyway. Usually, this is because the landlord either was not aware the tenant had applied or was falsely claiming their tenant hadn't filed all the required documentation for the application.

In late March, the state attorney general’s office sent warning letters to 91 law firms representing landlords across the state, reminding them that filing false declarations is against the law.

“Filing false averments in court violates multiple state laws,” wrote Deputy Attorney General Hunter Landerholm, “as does maintaining such a case after learning that the declaration used to initiate it is false.”

The letter encouraged those law firms to “review” the eviction cases on file to “ensure that they comply with the law.”

Evictions are still happening, said Madeline Howard, senior attorney at the Western Center on Law and Poverty, “because the protections are imperfect. And it's really hard to enforce them without an attorney.”

Typically, a lawyer can help a tenant combat these claims. So, if you applied for rent relief on or before March 31 and the application is still pending, but you’re getting an eviction notice, contact a lawyer. Find a legal aid office near you.

If your landlord is asking for proof that you've applied to the rent relief program, Howard advises that you download your application document on the Housing Is Key website, and send that to them, to “make it very clear that you have applied.”

A key thing to remember: For most tenants in California, starting April 1, landlords will still be able to take their tenants to court and start eviction proceedings over missed rent. That's because this new state legislation means a landlord can't evict you for not paying rent you owed before March 31 — but it doesn't protect you from eviction for not paying rent after that date.

My city lets me apply for rent relief after March 31. Could I be evicted while waiting for funds?

If you apply for rent relief, the funds will come either from the state or your own county, depending on where you live. You also can be eligible for both. When you applied through the state's COVID rent relief portal , you would have been directed to the right place to apply depending on your location, whether it's state assistance or local assistance.

The state's extension of eviction protections only applies to tenants who applied for rent relief on or before March 31. That means that if you live in a jurisdiction where your city or county is administering the rent relief program (and it’s not going through the state’s Housing Is Key program), and they allow you to submit an application for rent relief after April 1, you could still be evicted even if you’re waiting on rent relief from your city or county.

What if my landlord is threatening to evict me?

Howard said if you do get an eviction notice, "Please contact a legal aid office as soon as you can, because those cases move very, very quickly." Find a legal aid office near you.

Remember, since the official state eviction moratorium expired Sept. 30, 2021, renters affected by COVID hardship could prevent an eviction from moving forward if they presented their pending relief application as a defense in court — and this new extension of eviction protections means that'll now stay true through June 30.

"One of the problems with the statewide protections is they're very complicated and it's really hard for a tenant to use the state protections if they don't have an attorney," Howard said. "And most tenants who face eviction have to go to court without an attorney."

According to the ACLU, 10% of tenants have an attorney in court, compared with 90% of landlords .

Howard's colleague Lorraine López, senior attorney with the Western Center on Law and Poverty, recommends that you also look up community organizations and nonprofit legal services that assist tenants and access their information sheets, workshops and clinics to educate you about your rights in the event your landlord issues you with a legal notice. Find a legal aid office near you .

It's also critical that you don’t move out , said López. "We call this 'self-eviction,'" she explains, and said while "many tenants think that a notice is enough to evict them, in California a landlord needs to get a court order to remove you from your home."

So until a court has issued an order telling you to move? Don’t leave.

"In some cities and counties, a landlord can face not only criminal penalties if they forcibly remove you from your home without a court order, but also monetary penalties if the tenant files a lawsuit. The moment you leave, you lose many valuable protections and you may even end up with a judgment against you," said López.

If it's taking so long to process the claims, what happens if I'm still waiting by June 30?

If your application is still pending after this extension expires, yes: You could be evicted.

And it’s likely that many — tens of thousands of people — will find themselves in this category. Howard noted that an analysis of the rent relief program by the research group PolicyLink shows that at the current rate applications are being approved, some applicants will still be waiting for a decision at Thanksgiving .

That said, there are some things lawyers can do to help. If you find yourself in that situation — with a pending rent relief application and an eviction notice — you should contact a lawyer. Find a legal aid office near you .

Is there anything I can do to speed up my application?

"If you have an application in already and you're just waiting, I would suggest reaching out to HCD [the Housing and Community Development Department]," Howard said. She recommends calling the help line at (833) 430-2122.

If you’ve gotten a "pay or quit" eviction notice from your landlord, Howard recommends telling HCD you need them to expedite your application. The department operates off a prioritization list, and your application could be considered sooner if you’re in an emergency situation.

My county is rolling out its own eviction protections on April 1. Do they overrule the state's laws?

This is where things get really complicated.

If your local jurisdiction enacted eviction protections before Aug. 19, 2020, those protections are grandfathered in and will remain in place. This includes those passed in Alameda County, Oakland and the city of Los Angeles.

If your local jurisdiction enacted stronger local protections after that date, you are not grandfathered in. That means residents in San Francisco and Los Angeles County who would have been protected under new local regulations will no longer be protected.

If this strikes you as counterintuitive, you're not alone. Howard questions the "fundamental mismatch" in how California is effectively now "blocking these local protections that would have helped people for a time period that is not covered at all or addressed at all by the state law."

I missed the rent relief application deadline of March 31. Is there anything I can do?

It depends.

If you have not submitted an application to Housing Is Key, you will not be able to submit a new one after March 31.

If you’ve already submitted a Housing Is Key application, it’s possible the state may allow you to reapply for additional funds, including for prospective months.

If you live in a jurisdiction with its own rent relief program (like Sacramento, Oakland and Fresno), your local program may continue accepting applications beyond March 31.

That said, there may also be local resources that can help you with your rent. If you live in the Bay Area, call 311 to find out more.

What other financial assistance is available?

The CalFresh food program is California's version of the federal Supplemental Nutrition Assistance Program, or SNAP, which provides food benefits (also known as food stamps) to lower-income families. New CalFresh applicants can start their application online in English, Spanish or Chinese using the state’s official site, or by calling (877) 847-3663. You also can apply in person at your county’s designated CalFresh office.

The state says that if you receive assistance from its COVID-19 Rent Relief program, this won't disqualify you from any other state benefit assistance programs like CalFresh .

A version of this story was originally published on March 21, 2022. This story includes reporting from The Associated Press.

To learn more about how we use your information, please read our privacy policy.

- March 3, 2022: State of Waiting: California’s Rental Assistance Program One Month Before Expiration

State of Waiting: California’s Rental Assistance Program One Month Before Expiration

March 3, 2022 [updated march 7, 2022], our analysis of program data reveals that fewer than one in six applicants have received assistance thus far, while hundreds of thousands are still waiting, signaling the urgent need for policy fixes to deliver on the program’s promise and keep renters in their homes..

By Sarah Treuhaft, Alex Ramiller, Selena Tan, and Madeline Howard *

Already shouldering some of the worst housing affordability challenges in the nation, California’s low-income renters, predominantly people of color facing the additional burdens of systemic racism, were pummeled by the Covid-19 pandemic and its economic fallout. They disproportionately fell ill and lost family members to the disease, and many lost their jobs or suffered financially from reduced hours and incomes. School closures and a childcare shortage forced many working parents, especially women, to stay home and forego wages. And while California’s renters made tremendous sacrifices to keep current on rent — often incurring large debts to friends, family, and predatory lenders — many ended up falling behind. At the beginning of January 2022, 721,000 renter households in California owed their landlords an estimated $3.3 billion in back rent.

California’s Emergency Rental Assistance Program (ERAP) offers a pathway to clear rent debt that has accrued for low-income tenants impacted by the pandemic. After tremendous advocacy, Congress established a rental assistance program in December of 2020 — nine months into the pandemic — which has provided the state of California with $5.2 billion to operate emergency rental assistance programs. These resources are crucial to prevent evictions, displacement, and homelessness, and to ensure that smaller landlords can make their mortgage payments and stay in business.

These programs have been a lifeline for struggling renters who are able to access them, but they have been riddled with challenges . Many renters vulnerable to eviction have struggled to complete complex applications . Those who do make it through the application process may wait months for their application to be reviewed. And those whose applications are approved face another lag time before they are actually paid. At every stage of the process, the very people and families the program intends to serve and protect are living with the stress of potential eviction, enduring landlord harassment, and losing their homes.

While most of California’s eviction protections expired in October 2021, limited protections remain for eligible renters who apply for rental assistance. However, these protections are expiring on March 31. This means that the hundreds of thousands of families still waiting for assistance will be at imminent risk of eviction unless California policymakers extend these protections. At the same time, the California Department of Housing and Community Development just announced that the program is scheduled to close on March 31 , so renters who are eligible for relief but have not yet been able to apply to the program will have no option to do so.

This brief, produced by the National Equity Atlas in partnership with Housing NOW! and Western Center on Law & Poverty, examines the performance of California’s statewide rental assistance program since its launch. The state program covers about 63 percent of the state’s population; the other 37 percent of California residents live in the 25 cities and counties that opted to administer their own programs. Our analysis is based on a dataset tracking all rental assistance applications submitted by renters to the program through February 23, 2022, which we obtained through a Public Records Act request. It includes anonymized individual case data with applicant demographics (race/ethnicity, income, and language of application), zip code, amount of rent and utilities requested and paid, and landlord participation in the application. It also includes detailed case status categories including “Application Complete: Pending Payment,” which is assigned to households that have been approved for payment but have not actually received funds and are still waiting for assistance. [1] We used the 2015–2019 American Community Survey Public Use Microdata Sample to summarize rent burden, racial/ethnic demographics, and primary language, and Census Household Pulse Survey Data on rent debt to compare program applicants and beneficiaries to the likely population of renters in need of assistance.

Our key findings include the following:

- Only 16 percent of renters who have applied to the program have received assistance, either directly or through a payment to their landlord. Nearly half a million renters have submitted rental assistance requests but just 75,773 households have received their payments.

- The majority of applicants are still waiting for their applications to be reviewed. Fifty-nine percent of applicants (289,020 households) are still awaiting a decision on their applications. Among those whose applications have been initially approved, the typical wait time for a response was three months (a median of 104 days).

- Most renters whose applications have been approved are still waiting to be paid. As of February 23, 2022, 180,280 renter households have had their applications approved, but 104,507 of them (58 percent) have not yet received assistance. The median wait time between submitting an application and receiving payment is 135 days, indicating that it takes about a month for applicants to be paid even after approval.

- The speed with which rental assistance is being distributed is improving over time but remains painfully slow. Households that applied for aid in March 2021 typically waited 181 days to receive aid payments, and households that applied in October 2021 typically waited 119 days.

- Most renters who received assistance have requested additional support. Among renter households who have received rental assistance, 90 percent of them (69,336 households) have reapplied to the program for additional support.

- Renters whose primary language is not English appear to be underrepresented in the program. About half (51 percent) of California’s severely cost-burdened renter households speak a language other than English at home, yet 88 percent of rental assistance applicants indicated that their primary language was English.

- Long-term policy solutions, funding, and infrastructure are needed to support California's economically vulnerable renters. With 8,200 new applications submitted every week and 90 percent of rental assistance recipients requesting additional support, tenants’ ongoing need for financial relief due to pandemic-related economic hardship, and the number of indebted renters not yet reached by the program, the need for rental assistance will continue beyond March 31, 2022 (when the program is set to expire).

Our review of the program data reveals the need for urgent policy solutions to fulfill the promise of the state’s rental assistance program, eliminating pandemic-related rent debt for all low-income renters and ensuring that they can stay in their homes. For an equitable recovery, California policymakers need to extend statewide eviction protections without preempting local ones, streamline the application and approval processes and increase equitable access to relief funds, and institute a permanent program to support economically struggling renter households.

Nearly half a million renter households have submitted applications for rental assistance

Since March 15, 2021, when the state began accepting rental assistance applications, nearly half a million renter households (488,094) have applied for relief through the program. Applications peaked in September 2021 just before California’s eviction moratorium ended, with 115,000 renters submitting applications that month. Since January, about 8,200 new renters have submitted applications every week.

Most renters who have applied for assistance are still awaiting a response

Among the half million program applications, the majority — 59 percent, representing 289,020 renter households — are still under review. Four percent (18,794 households) have been explicitly denied assistance, while the remaining 36 percent (180,280 households) have been approved. But just 16 percent of applicants (75,773 households) have actually received assistance.

On average, program applicants wait an average of three months (a median of 104 days) after submitting their applications to receive initial approval. Many renters wait longer: nearly 20 percent of applicants waited more than 150 days to receive initial approval, and 4 percent of applicants waited more than 210 days. [2]

Among renters whose applications have been approved, the majority are waiting to be paid

While 36 percent of program applicants have been approved for relief, less than half of them have received any payment. This means that despite formal approval, 104,507 households are still awaiting assistance.

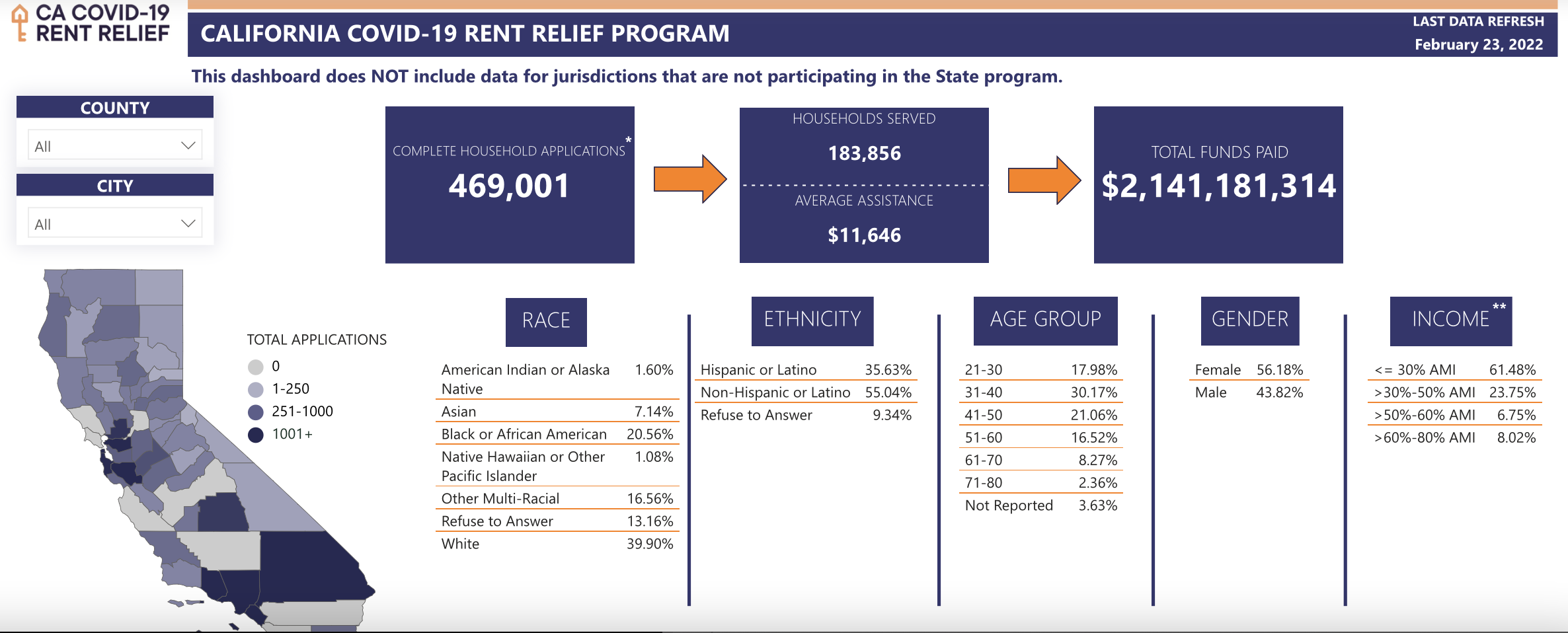

This reality of long delays in relief delivery to renters whose applications have been approved contrasts with the snapshot of program performance provided on the public Housing Is Key data dashboard, which stated that 183,856 households have been “served” as of February 23, 2022 . [3]

Source: California Covid-19 Rent Relief Program dashboard, February 23, 2022 Although we currently do not have data on the number of days between application approval and receipt of payment, we can examine the number of days between application submission and payment. For renters who have received assistance and have not requested additional support, the median time between submission and payment is 135 days. About 39 percent of recipients have waited more than 150 days to get paid. This implies that the typical renter waits three months just to receive an initial decision on their application, and then another month or more to actually receive aid.

The pace of delivering rental assistance has improved marginally over time. Whereas households that applied for aid in March 2021 waited an average of 181 days to receive aid payments, that figure declined to 119 days by October 2021. The program was delivering assistance most quickly in June and July, before the surge in applications in the fall.

The vast majority of tenants who received rental assistance have requested additional support

About 90 percent of renter households who have actually received funds from the state program (69,336 households) have reapplied to the program for additional funds. Given that applicants who are awaiting review or payment have similar income levels as those who’ve received payment, and most of them are extremely low income, we would expect that these applicants will also require additional assistance after their initial payment.

Renters whose primary language is not English appear to be underrepresented in the applicant pool

Since the launch of California’s rental assistance program, low-income renters who’ve suffered job and income losses due to the pandemic have faced numerous challenges accessing relief. These include technological and language barriers, lack of access for tenants with disabilities, difficulty supplying the necessary documentation of income losses, difficulty communicating with landlords or obtaining documentation from them, and fear of landlord harassment/retaliation and deportation or other immigration-related consequences.

To assess whether California’s rental assistance program is reaching renters with the greatest needs, we compared the racial/ethnic composition of applicants with that of severely cost-burdened renters (those who pay more than 50 percent of their household income for rent and utilities), a population that represents renters at risk of having pandemic-related rent debt. To approximate the statewide program's service area, we excluded from the severely rent-burdened reference group 11 counties and five additional cities that are within areas operating local rental assistance programs. (We also exclude the city of Signal Hill, because it is entirely contained within the Long Beach census geography.)

This analysis reveals that the demographics are similar across both groups, indicating that the statewide program appears to be representative of the renters hardest-hit by the pandemic rent debt crisis. One exception could be Asian and Pacific Islander renters, who might be underrepresented in the applicant pool.

Renters whose primary language is not English, particularly Spanish-speaking renters and Chinese-speaking renters, also appear to be underrepresented in the applicant pool. Among California renters who are extremely cost-burdened, 51 percent speak a language other than English at home, yet 88 percent of program applicants indicated that their primary language is English on the application form. A significant share of the state’s severely cost-burdened renters speak Spanish at home (32 percent), yet only 10 percent of applications were submitted by people who indicated that Spanish is their primary language.

Renters whose primary language is not English, particularly Spanish-speaking renters and Chinese-speaking renters, appear to be underrepresented in the applicant pool. Among California renters who are extremely cost-burdened, 51 percent speak a language other than English at home, yet 88 percent of program applicants indicated that their primary language is English on the application form. A significant share of the state’s extremely cost-burdened renters speak Spanish at home (32 percent), yet only 10 percent of applications were submitted by people who indicated that Spanish is their primary language.

The demographics of program recipients reflect the demographics of the applicant pool

The federal emergency rental assistance program is targeted to low-income renters experiencing negative financial impacts due to the pandemic, and thus is means-tested: applicants need to have incomes below 80 percent of the area median income in order to qualify for assistance. In addition, the state program has prioritized serving tenants who indicate that they are imminently facing eviction, either on their application or via email correspondence. [4] Our analysis shows that the incomes of program applicants and recipients reflect the program’s targeting: well more than half of renters who apply to and are served by the program are extremely low income.

Examining the racial/ethnic composition of applicants compared with those who are approved for and receive payment, we see that the demographics are similar and the program itself appears to be serving applicants equitably by race/ethnicity.

California needs permanent policy solutions, funding, and infrastructure to support economically vulnerable renters

California’s statewide rental assistance program was initially allocated $3.07 billion by the federal government and received an additional $62 million in January when the Treasury began reallocating funds. Approximately $900 million in aid has been delivered to struggling renters and landlords, and another $1.15 billion is in the process of being delivered to applicants whose payments are pending. An additional $4.97 billion has been requested by households with applications still under initial review. That adds up to just over $7 billion in total requests to date, with 8,200 new requests coming in every week and 90 percent of aid recipients requesting additional support. The need continues to grow as we approach the end of the program on March 31.

Recognizing the critical demand for additional funding to ensure all eligible renters who apply in time can receive assistance, California’s legislature passed a bill this month that allocates General Fund resources to state and local rental assistance programs.

This budget allocation fills an urgent need, especially given that many locally administered programs have already exhausted their funds. But it will not be sufficient to protect and stabilize all vulnerable households still reeling from the economic impacts of the pandemic. The program’s expiration date of March 31, 2022 is an artificial and arbitrary endpoint, as the need for rent relief is ongoing and still extensive, and many eligible renters have not yet applied. Despite the desire to return to normal, many renters continue to face Covid-related economic hardships. Recognizing the pandemic is not over, the state of New York and Los Angeles County have extended eviction protections through the end of 2022, and California should follow suit.

Urgent policy fixes are needed to realize the promise of California’s rental assistance program

When California’s eviction protections expire on March 31, 2022, tenants eligible for assistance who are still waiting to receive payment can face eviction in court — and many will. With application processing times lasting four months and beyond, tens of thousands of tenants are likely to still be waiting when these protections expire. If the legislature does not extend eviction protections, many Covid-impacted renters may lose their homes because of the application backlog, exposing families and communities to the cascading harms of housing precarity and homelessness. Even with temporary protections in place, every day of delay leaves families more vulnerable to eviction and unable to make financial plans.

Some local governments, including Alameda County, Los Angeles County, Fresno, San Francisco, and Stockton have passed their own eviction protections for tenants who could not pay rent because of the economic impacts of Covid-19. Extending statewide eviction protections while allowing local governments the flexibility to meet the needs of their communities is the most effective way to stabilize vulnerable renters and keep them in their homes while assistance is distributed.

The pandemic has deepened the harms of structural racism on communities of color , who have suffered disproportionate deaths, job losses, and housing instability. Continuing to conduct outreach to underrepresented communities of color is imperative to ensure that rental assistance dollars do not further exacerbate the racialized harms of the Covid-19 pandemic.

For California’s rental assistance program to be effective, California’s policymakers need to:

Protect people from eviction by extending the state’s current eviction protections;

Ensure local jurisdictions can enact and strengthen eviction protections;

Streamline the screening and payment process for rental assistance;

Promote equity by increasing outreach to underrepresented renters; and

Fund the rental assistance program to ensure low-income tenants receive ongoing support.

* Madeline Howard is is a senior attorney at Western Center on Law & Poverty.

Correction (March 7, 2022): The March 3, 2022 version of this report included a data error relating to the racial/ethnic composition of severely rent-burdened households in California due to incorrect weighting of the sample data. This incorrect data suggested that Latinx households were underrepresented in the statewide rental assistance program. We have corrected the data and we no longer find any underrepresentation of Latinx households, so we have updated the analysis of the data to reflect this (positive) new finding.

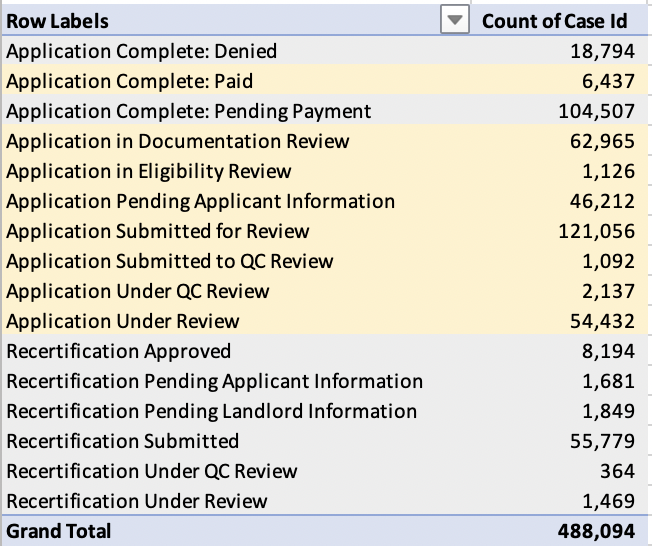

[1] The table below, provided directly from the Department of Housing and Community Development in response to a Public Records Act request, shows the number of cases across the 16 case status categories provided in the dataset. “Approved” applications in this analysis include all applications in the categories "Application Complete: Paid," “Application Complete: Pending Payment," and all Recertification categories. “Application Complete: Pending Payment” means the application is approved for payment and a request for payment has been made, but the applicant has not actually received funds. “Recertification” means that applicants have received payment and have requested additional assistance. Applications that are categorized as “Application Complete: Paid” and those that fall under any of the recertification categories represent tenants that have actually received assistance.

Detailed case categories

[2] This median wait time is for renters who have received initial approval but have not yet been paid.

[3] The slight discrepancy of the number served on the public dashboard and the total paid renter households reported here is due to the timing of the database pull and continual program activity.

[4] This is based on two sources of information: 1) a positive response to the question, “Has your landlord issued a Notice to Pay, an Eviction Notice, filed an Unlawful Detainer against you due to unpaid rent, or indicated they will be seeking to evict you?” on the rental assistance application; and 2) applicants who send information about a pending eviction to the [email protected] email box including documentation from the landlord or legal documents related to an unlawful detainer (the final stage of the eviction process).

Statewide Emergency Rental Assistance Program (ERAP)

Hagale clic aquí para leer esta página web en español.

To learn more about the status of the Statewide Emergency Rental Assistance Program please review Public Counsel FAQ in your preferred language https://publiccounsel.org/ca-rent-relief /

Tenants Together partners including Public Counsel , SAJE , Policy Link , Western Center on Law & Poverty , ACCE , Legal Aid Foundation of Los Angles , and Covington & Burling LLP were successful cuing the CA Dept of Housing Community & Development operation of the Housing Is Key COVID-19 Emergency Rental Assistance Program

What eviction protections still exist if I have rent debt due to COVID?

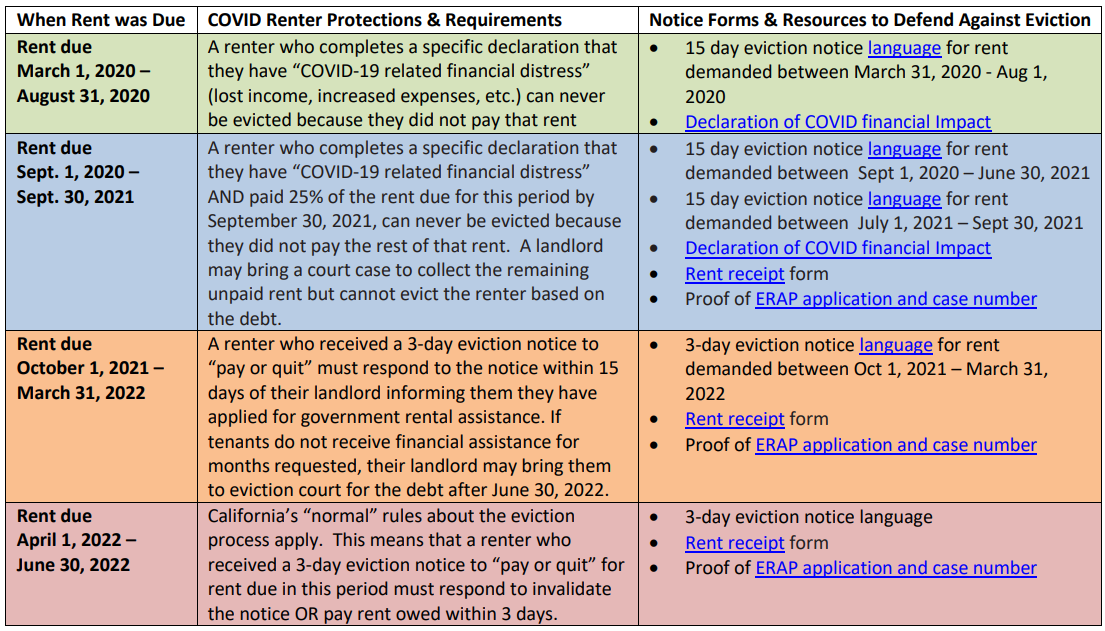

- The statewide eviction protections for COVID rent payment ended September 30, 2021 (see visual below).

- Tenants who were actively applying to ERAP during October 1, 2021 – March 31, 2022, and received a 3 day “pay or quit” notice from their landlord must have responded within 15 days of receiving the eviction notice with proof of their ERAP application and case number.

- California normal rules about the eviction process applied. This means that a renter who received a 3-day eviction notice to “pay or quit” for rent due is in this period must respond to invalidate the notice OR pay rent owed within 3 days.

- There are very few local jurisdictions that have remaining COVID eviction moratorium. Please review LegalFAQ.org to see if you are eligible for local COVID eviction protections.

How will I be informed about the status of my ERAP application?

- Email address

- Mailing address

- Any 3rd party or other person the tenant listed in their application who helped them apply

- Housing Is Key Call Center: 833-430-2122

- Local Partner Network: 833-687-0967

Which tenants are covered by this ERAP settlment?

- Any tenant who applied to ERAP on or before March 31, 2022 AND still has a pending application or was denied on or after June 7, 2022 .

- Only for statewide ERAP – does not apply to local rental assistance programs run by a city or county

- Does NOT re-open the ERAP program to new applications

How do I appeal denied or partial approval status on my ERAP application that I received since June 7, 2022?

- Appeals process is now EXTENDED! Tenants have 30 days to appeal, or if not the denial notice will be considered final

- Portal will automatically open an appeals process on ERAP applications that retroactively received a partial denial, who were denied for “partial approval notice”

- Email: [email protected]

- Phone: 833-430-2122

- Directly through the portal

Help build power for renters' rights:

U.S. Department of the Treasury

Looking for rental assistance.

Renters and landlords can find out what emergency rental assistance covers, how it works, and who’s eligible on the interagency housing portal hosted by the Consumer Financial Protection Bureau (CFPB).

The Department of the Treasury (Treasury) is providing these frequently asked questions (FAQs) as guidance regarding the requirements of the Emergency Rental Assistance program (ERA1) established by section 501 of Division N of the Consolidated Appropriations Act, 2021, Pub. L. No. 116-260 (Dec. 27, 2020) and the Emergency Rental Assistance program (ERA2) established by section 3201 of the American Rescue Plan Act of 2021, Pub. L. No. 117-2 (March 11, 2021).

These FAQs apply to both ERA1 and ERA2, except where differences are specifically noted. References in these FAQs to “the ERA” apply to both ERA1 and ERA2. These FAQs will be supplemented by additional guidance. Grantees must establish policies and procedures to govern the implementation of their ERA programs consistent with the statutes and these FAQs. To the extent that these FAQs do not provide specific guidance on a particular issue, a grantee should establish its own policy or procedure that is consistent with the statutes and follow it consistently. Additions and changes to FAQs are tracked in a change log .

1. Who is eligible to receive assistance under the Act and how should a grantee document the eligibility of a household?

A grantee may only use the funds provided in the ERA to provide financial assistance and housing stability services to eligible households. To be eligible, a household must be obligated to pay rent on a residential dwelling and the grantee must determine that:

- one or more individuals within the household has qualified for unemployment benefits or experienced a reduction in household income, incurred significant costs, or experienced other financial hardship due, directly or indirectly, to the COVID-19 outbreak;

- one or more individuals within the household can demonstrate a risk of experiencing homelessness or housing instability; and

- the household has a household income at or below 80 percent of area median income.

- one or more individuals within the household has qualified for unemployment benefits or experienced a reduction in household income, incurred significant costs, or experienced other financial hardship during or due, directly or indirectly, to the coronavirus pandemic;

- the household is a low-income family (as such term is defined in section 3(b) of the United States Housing Act of 1937 (42 U.S.C. 1437a(b)). 2

While there are some differences in eligibility between ERA1 and ERA2, the eligibility requirements are very similar, and Treasury is seeking to implement ERA2 consistently with ERA1, to the extent possible, to reduce administrative burdens for grantees.

The FAQs below describe the documentation requirements for each of these conditions of eligibility. These requirements provide for various means of documentation so that grantees may extend this emergency assistance to vulnerable populations without imposing undue documentation burdens. As described below, given the challenges presented by the COVID-19 pandemic, grantees may be flexible as to the particular form of documentation they require, including by permitting photocopies or digital photographs of documents, e-mails, or attestations from employers, landlords, caseworkers, or others with knowledge of the household’s circumstances. Treasury strongly encourages grantees to avoid establishing documentation requirements that are likely to be barriers to participation for eligible households, including those with irregular incomes such as those operating small businesses or gig workers whose income is reported on Internal Revenue Service Form 1099. However, grantees must require all applications for assistance to include an attestation from the applicant that all information included is correct and complete.

When documenting eligibility for households to receive housing stability services without any financial assistance, special considerations apply. The ERA1 statute specifies these services may be provided only to “eligible households,” meaning the household must meet all ERA1 eligibility requirements. When housing stability services represent the only ERA1 assistance a household will receive (i.e., no payments using ERA1 funds will be made either to the household, to the landlord, or to a utility provider), grantees are encouraged to rely on a household’s self-attestations for purposes of confirming eligibility. If all eligibility requirements are expressly addressed by the household’s self-attestation, the grantee is not required to collect additional income documentation, past due notices, or other eligibility-verification documents as described above or below. Further, the ERA2 statute does not restrict the provision of housing stability services to “eligible households.” As a result, grantees are not required to document a household’s eligibility if the grantee provides the household with no assistance other than housing stability services paid with ERA2 funds. However, for both ERA1 and ERA2, a grantee must collect any demographic or other information from the household needed to fulfill the grantee’s reporting obligations.

In all cases, grantees must document their policies and procedures for determining a household’s eligibility to include policies and procedures for determining the prioritization of households in compliance with the statute and maintain records of their determinations. Grantees must also have controls in place to ensure compliance with their policies and procedures and prevent fraud. Grantees must specify in their policies and procedures under what circumstances they will accept written attestations from the applicant without further documentation to determine any aspect of eligibility or the amount of assistance, and in such cases, grantees must have in place reasonable validation or fraud-prevention procedures to prevent abuse.

2 As of the date of these FAQs, the definition of “low-income families” in 42 U.S.C. 1437a(b) is “those families whose incomes do not exceed 80 per centum of the median income for the area, as determined by the Secretary [of Housing and Urban Development] with adjustments for smaller and larger families, except that the Secretary may establish income ceilings higher or lower than 80 per centum of the median for the area on the basis of the Secretary’s findings that such variations are necessary because of prevailing levels of construction costs or unusually high or low family incomes.”

Updated on July 6, 2022

Updated on May 7, 2021

2. How should applicants document that a member of the household has qualified for unemployment benefits, experienced a reduction in income, incurred significant costs, or experienced other financial hardship during or due to the COVID-19 outbreak?

A grantee must document that one or more members of the applicant’s household either (i) qualified for unemployment benefits; or (ii) (a) for ERA1, experienced a reduction in household income, incurred significant costs, or experienced other financial hardship due, directly or indirectly, to the COVID-19 outbreak or (b) for ERA2, experienced a reduction in household income, incurred significant costs, or experienced other financial hardship during or due, directly or indirectly, to the coronavirus pandemic. 3 If the grantee is relying on clause (i) for this determination, or if the grantee is relying on clause (ii) in ERA2, the grantee is permitted to rely on either a written attestation signed by the applicant or other relevant documentation regarding the household member’s qualification for unemployment benefits. If the grantee is relying on clause (ii) for this determination in ERA1, the statute requires the grantee to obtain a written attestation signed by the applicant that one or more members of the household meets this condition.

While grantees relying on clause (ii) in ERA1 must show financial hardship “due, directly or indirectly, to” COVID-19, grantees in ERA2 are also permitted to rely on financial hardship “during” the pandemic. It may be difficult for some grantees to establish whether a financial hardship experienced during the pandemic is due to the COVID-19 outbreak. Therefore, Treasury strongly encourages grantees to rely on the self-certification of applicants with regard to whether their financial hardship meets these statutory eligibility requirements. Further, because the standard in ERA2 is broader than the standard in ERA1, any applicant that self-certifies that it meets the standard in ERA1 should be considered to meet the standard for purposes of ERA2.

3 Treasury is interpreting the two different statutory terms (“the COVID-19 outbreak” and “the coronavirus pandemic”) as having the same meaning.

3. How should a grantee determine that an individual within a household is at risk of experiencing homelessness or housing instability?

The statutes establishing ERA1 and ERA2 both require that one or more individuals within the household can demonstrate a risk of experiencing homelessness or housing instability. Such a demonstration may include (i) a past due utility or rent notice or eviction notice, (ii) unsafe or unhealthy living conditions (which may include overcrowding), or (iii) any other evidence of risk, as determined by the grantee. Grantees may establish alternative criteria for determining whether a household satisfies this requirement, and should adopt policies and procedures addressing how they will determine the presence of unsafe or unhealthy living conditions and what evidence of risk to accept in order to support their determination that a household satisfies this requirement. A grantee may rely on an applicant’s self-certification identifying the applicable risk factor or factors, without further documentation, if other documentation is not immediately available.

Updated on August 25, 2021

4. The statutes establishing ERA1 and ERA2 limit eligibility to households based on certain income criteria. How is household income defined for purposes of the ERA? How will income be documented and verified?

Definition of Income : With respect to each household applying for assistance, grantees may choose between using the Department of Housing and Urban Development’s (HUD) definition of “annual income” in 24 CFR 5.609 and using adjusted gross income as defined for purposes of reporting under Internal Revenue Service Form 1040 series for individual federal annual income tax purposes.

Definition of Area Median Income : For purposes of ERA1, the area median income for a household is the same as the income limits for families published by the Department of Housing and Urban Development (HUD) in accordance with 42 U.S.C. 1437a(b)(2), available under the heading for “Access Individual Income Limits Areas” . When determining area median income with respect to Tribal members, Tribal governments and TDHEs may rely on the methodology authorized by HUD for the Indian Housing Block Grant Program as it pertains to households residing in an Indian area comprising multiple counties (see HUD Office of Native American Programs, Program Guidance No. 2021-01, June 22, 2021).

Methods for Income Determination : The statute establishing ERA1 provides that grantees may determine income eligibility based on either (i) the household’s total income for calendar year 2020, or (ii) sufficient confirmation of the household’s monthly income at the time of application, as determined by the Secretary of the Treasury (Secretary).

If a grantee in ERA1 uses a household’s monthly income to determine eligibility, the grantee should review the monthly income information provided at the time of application and extrapolate over a 12-month period to determine whether household income exceeds 80 percent of area median income. For example, if the applicant provides income information for two months, the grantee should multiply it by six to determine the annual amount. If a household qualifies based on monthly income, the grantee must redetermine the household income eligibility every three months for the duration of assistance.

For ERA2, if a grantee uses the same income determination methodology that it used in ERA1, it is presumed to be in compliance with relevant program requirements; if a grantee chooses to use a different methodology for ERA2 than it used for ERA1, the methodology should be reasonable and consistent with all applicable ERA2 requirements. In addition, if a household is a single family that the grantee determined met the income requirement for eligibility under ERA1, the grantee may consider the household to be eligible under ERA2, unless the grantee becomes aware of any reason the household does not meet the requirements for ERA2. Finally, if multiple families from the same household receive funding under an ERA2 program, the grantee should ensure that there is no duplication of the assistance provided.

Documentation of Income Determination : Grantees in ERA1 and ERA2 must have a reasonable basis under the circumstances for determining income. A grantee may support its determination with both a written attestation from the applicant as to household income and also documentation available to the applicant, such as paystubs, W-2s or other wage statements, tax filings, bank statements demonstrating regular income, or an attestation from an employer. In appropriate cases, grantees may rely on an attestation from a caseworker or other professional with knowledge of a household’s circumstances to certify that an applicant’s household income qualifies for assistance.

Alternatively, a grantee may rely on a written attestation without further documentation of household income from the applicant under three approaches:

- Self-attestation Alone – Provided that a grantee’s policies and procedures permitted the use of self-attestation alone to establish income as of May 11, 2023, the grantee may rely on a self-attestation of household income without further verification if the applicant confirms in their application or other document that they are unable to provide documentation of their income. If a written attestation without further verification is relied on to document the majority of the applicant’s income, the grantee must reassess the household’s income every three months, by obtaining appropriate documentation or a new self-attestation. Income attestations should specify the monthly or annual income claimed by the household to ensure that the household meets the applicable ERA requirements and to enable appropriate reporting. Under this approach, grantees are encouraged to incorporate self-attestation to demonstrate income eligibility into their application form. Similarly, grantees may rely on self-attestations to demonstrate applicants’ financial hardship and risk of homelessness or housing instability as described above in FAQs 2 and 3 above. Thus, grantees may allow for self-attestation for income eligibility as specified above and are encouraged to allow self-attestation to demonstrate applicants’ financial hardship and risk of homelessness or housing instability as described above in FAQs 2 and 3 .

- Categorical Eligibility – If an applicant’s household income has been verified to be at or below 80 percent of the area median income (for ERA1) or if an applicant’s household has been verified as a low-income family as defined in section 3(b) of the United States Housing Act of 1937 (42 U.S.C. 1437a(b)) (for ERA2) in connection with another local, state, or federal government assistance program, grantees are permitted to rely on a determination letter from the government agency that verified the applicant’s household income or status as a low-income family, provided that the determination for such program was made on or after January 1, 2020.

- Fact-specific proxy – A grantee may rely on a written attestation from the applicant as to household income if the grantee also uses any reasonable fact-specific proxy for household income, such as reliance on data regarding average incomes in the household’s geographic area.

Grantees also have discretion to provide waivers or exceptions to this documentation requirement to accommodate disabilities, extenuating circumstances related to the pandemic, or a lack of technological access. In these cases, the grantee is still responsible for making the required determination regarding the applicant’s household income and documenting that determination. Treasury encourages grantees to partner with state unemployment departments or entities that administer federal benefits with income requirements to assist with the verification process, consistent with applicable law.

Updated on May 10, 2023

5. ERA funds may be used for rent and rental arrears. How should a grantee document where an applicant resides and the amount of rent or rental arrears owed?

Grantees must obtain, if available, a current lease, signed by the applicant and the landlord or sublessor, that identifies the unit where the applicant resides and establishes the rental payment amount. If a household does not have a signed lease, documentation of residence may include evidence of paying utilities for the residential unit, an attestation by a landlord who can be identified as the verified owner or management agent of the unit, or other reasonable documentation as determined by the grantee. In the absence of a signed lease, evidence of the amount of a rental payment may include bank statements, check stubs, or other documentation that reasonably establishes a pattern of paying rent, a written attestation by a landlord who can be verified as the legitimate owner or management agent of the unit, or other reasonable documentation as defined by the grantee in its policies and procedures.

Written Attestation : If an applicant is able to provide satisfactory evidence of residence but is unable to present adequate documentation of the amount of the rental obligation, grantees may accept a written attestation from the applicant to support the payment of assistance up to a monthly maximum of 100 percent of the greater of the Fair Market Rent or the Small Area Fair Market Rent for the area in which the applicant resides, as most recently determined by HUD and made available at https://www.huduser.gov/portal/datasets/fmr.html . In this case, the applicant must also attest that the household has not received, and does not anticipate receiving, another source of public or private subsidy or assistance for the rental costs that are the subject of the attestation. This limited payment is intended to provide the most vulnerable households the opportunity to gather additional documentation of the amount of the rental obligation or to negotiate with landlords in order to avoid eviction. The assistance described in this paragraph may only be provided for three months at a time, and a grantee must obtain evidence of rent owed consistent with the above after three months in order to provide further assistance to such a household; Treasury expects that in most cases the household would be able to provide documentation of the amount of the rental obligation in any applications for further assistance.

6. ERA funds may be used for “utilities and home energy costs” and “utilities and home energy costs arrears.” How are those terms defined and how should those costs be documented?

Utilities and home energy costs are separately stated charges related to the occupancy of rental property. Accordingly, utilities and home energy costs include separately stated electricity, gas, water and sewer, trash removal, and energy costs, such as fuel oil. Payments to public utilities are permitted.

All payments for utilities and home energy costs should be supported by a bill, invoice, or evidence of payment to the provider of the utility or home energy service.

Utilities and home energy costs that are covered by the landlord will be treated as rent.

7. The statutes establishing ERA1 and ERA2 allow the funds to be used for certain "other expenses," as defined by the Secretary. What are some examples of these "other expenses"?

Under the statute establishing ERA1, funds used for “other expenses” must be related to housing and “incurred due, directly or indirectly, to the novel coronavirus disease (COVID-19) outbreak.” In contrast, the statute establishing ERA2 requires that “other expenses” be “related to housing” but does not require that they be incurred due to the COVID-19 outbreak.

For both ERA1 and ERA2, other expenses related to housing include relocation expenses (including prospective relocation expenses), such as rental security deposits, and rental fees, which may include application or screening fees. It can also include reasonable accrued late fees (if not included in rental or utility arrears), and Internet service provided to the rental unit. Internet service provided to a residence is related to housing and is in many cases a vital service that allows renters to engage in distance learning, telework, and telemedicine and obtain government services. However, given that coverage of Internet would reduce the amount of funds available for rental assistance, grantees should adopt policies that govern in what circumstances that they will determine that covering this cost would be appropriate. In addition, rent or rental bonds, where a tenant posts a bond with a court as a condition to obtaining a hearing, reopening an eviction action, appealing an order of eviction, reinstating a lease, or otherwise avoiding an eviction order, may also be considered an eligible expense.

All payments for housing-related expenses must be supported by documentary evidence such as a bill, invoice, or evidence of payment to the provider of the service. If a housing-related expense is included in a bundle or an invoice that is not itemized (for example, internet services bundled together with telephone and cable television services) and obtaining an itemized invoice would be unduly burdensome, grantees may establish and apply reasonable procedures for determining the portion of the expense that is appropriate to be covered by ERA. As discussed in FAQ 26 , under certain circumstances, the cost of a hotel stay may also be covered as an “other expense.”

Updated on March 16, 2021

8. Must a beneficiary of the rental assistance program have rental arrears?

No. The statutes establishing ERA1 and ERA2 permit the enrollment of households for only prospective benefits. For ERA1, if an applicant has rental arrears, the grantee may not make commitments for prospective rent payments unless it has also provided assistance to reduce the rental arrears; this requirement does not apply to ERA2.

9. May a grantee provide assistance for arrears that have accrued before the date of enactment of the statute?

Yes, but not for arrears accrued before March 13, 2020, the date of the emergency declaration pursuant to section 501(b) of the Robert T. Stafford Disaster Relief and Emergency Assistance Act, 42 U.S.C. 5191(b).

10. Is there a limit on how many months of financial assistance a tenant can receive?

Yes. In ERA1, an eligible household may receive up to twelve (12) months of assistance (plus an additional three (3) months if necessary to ensure housing stability for the household, subject to the availability of funds). The aggregate amount of financial assistance an eligible household may receive under ERA2, when combined with financial assistance under ERA1, must not exceed 18 months.

In ERA1, financial assistance for prospective rent payments is limited to three months based on any application by or on behalf of the household, except that the household may receive assistance for prospective rent payments for additional months (i) subject to the availability of remaining funds currently allocated to the grantee, and (ii) based on a subsequent application for additional assistance. In no case may an eligible household receive more than 18 months of assistance under ERA1 and ERA2, combined.

11. Must a grantee pay for all of a household’s rental or utility arrears?

No. The full payment of arrears is allowed up to the limits established by the statutes, as described in FAQ 10 . A grantee may structure a program to provide less than full coverage of arrears. Grantees are encouraged to consider whether payments of less than the full amount of arrears may result in a significant disincentive for landlord participation in the ERA program. Moreover, consistent with FAQ 32 , grantees should consider methods for avoiding evictions for nonpayment or utility cutoffs in cases where arrearages are paid only in part.

12. What outreach should be made by a grantee to a landlord or utility provider before determining that the landlord or utility provider will not accept direct payment from the grantee?

Treasury expects that in general, rental and utility assistance can be provided most effectively and efficiently when the landlord or utility provider participates in the program. However, in cases where a landlord or utility provider does not participate in the program, the only way to achieve the statutory purpose is to provide assistance directly to the eligible household.

In ERA1, grantees must make reasonable efforts to obtain the cooperation of landlords and utility providers to accept payments from the ERA program. Outreach will be considered complete if (i) a request for participation is sent in writing, by mail, to the landlord or utility provider, and the addressee does not respond to the request within seven calendar days after mailing; (ii) the grantee has made at least three attempts by phone, text, or e-mail over a five calendar-day period to request the landlord or utility provider’s participation; or (iii) a landlord confirms in writing that the landlord does not wish to participate. The final outreach attempt or notice to the landlord must be documented. The cost of contacting landlords would be an eligible administrative cost.

ERA2 does not require grantees to seek the cooperation of the landlord or utility provider before providing assistance directly to the tenant. However, if an ERA2 grantee chooses to seek the cooperation of landlords or utility providers before providing assistance directly to tenants, Treasury strongly encourages the grantee to apply the same ERA1 requirements as described above.

13. Is there a requirement that the eligible household have been in its current rental home when the public health emergency with respect to COVID-19 was declared?

No. There is no requirement regarding the length of tenure in the current unit.

14. What data should a grantee collect regarding households to which it provides rental assistance in order to comply with Treasury’s reporting and recordkeeping requirements?

Treasury provided interim guidance to ERA1 grantees regarding reporting requirements covering the period January through May 2021. The interim guidance required grantees to report limited data elements for the first quarter of 2021, as well as monthly for April to August. A grantee’s failure to submit required reports to Treasury on a timely basis may constitute a violation of the ERA award terms.

Treasury has provided grantees with additional guidance regarding quarterly reporting requirements. Grantees are required to submit reports in accordance with the additional guidance beginning with the first quarter of 2021 for ERA1 and the second quarter of 2021 for ERA2, with the first reports under the additional guidance being due in October 2021.

ERA1 grantees will be required to submit monthly reports from September to December 2021, which will be consistent with monthly reports that were previously required for April to August.

Treasury’s Office of Inspector General may require the collection of additional information in order to fulfill its oversight and monitoring requirements. 6 Grantees under ERA1 must comply with the requirement in section 501(g)(4) of Division N of the Consolidated Appropriations Act, 2021, to establish data privacy and security requirements for information they collect; grantees under ERA2 are also encouraged to comply with those requirements. 7

The assistance listing number assigned to the ERA is 21.023.

6 Note that this FAQ is not intended to address all reporting requirements that will apply to the ERA but rather to note for grantees information that they should anticipate needing to collect from households with respect to the provision of rental assistance.

7 Specifically, the statute establishing ERA1 requires grantees to establish data privacy and security requirements for certain information regarding applicants that (i) include appropriate measures to ensure that the privacy of the individuals and households is protected; (ii) provide that the information, including any personally identifiable information, is collected and used only for the purpose of submitting reports to Treasury; and (iii) provide confidentiality protections for data collected about any individuals who are survivors of intimate partner violence, sexual assault, or stalking.

Updated on June 24, 2021

15. The statute establishing ERA1 requires that payments not be duplicative of any other federally funded rental assistance provided to an eligible household. Are tenants of federally subsidized housing, e.g., Low Income Housing Credit, Public Housing, or Indian Housing Block Grant-assisted properties, eligible for the ERA?

An eligible household that occupies a federally subsidized residential or mixed-use property or receives federal rental assistance may receive assistance in the ERA, provided that ERA1 funds are not applied to costs that have been or will be reimbursed under any other federal assistance. Grantees are required to comply with Title VI of the Civil Rights Act (which prohibits discrimination on the ground of race, color, or national origin in programs or activities receiving federal financial assistance) and Section 504 of the Rehabilitation Act of 1973 (which prohibits discrimination because of disability in programs or activities receiving federal financial assistance), and should evaluate whether their policies and practices regarding assistance to households that occupy federally subsidized residential or mixed-use properties or receive federal rental assistance comply with Title VI and Section 504. In addition, grantees are required to comply with the Fair Housing Act, which prohibits discrimination in housing because of race, color, national origin, sex (including gender identity and sexual orientation), religion, disability, and having, expecting, adopting, or fostering a child under the age of 18. With respect to ERA2, grantees must not refuse to provide assistance to households on the basis that they occupy such properties or receive such assistance, due to the disproportionate effect such a refusal could have on populations intended to receive assistance under the ERA and the potential for such a practice to violate applicable law, including Title VI, Section 504, and the Fair Housing Act.

If an eligible household participates in a HUD-assisted rental program or lives in certain federally assisted properties (e.g., using a Housing Choice Voucher, Public Housing, or Project-Based Rental Assistance) and the tenant rent is adjusted according to changes in income, the renter household may receive ERA1 assistance for the tenant-owed portion of rent or utilities that is not subsidized. Grantees are encouraged to confirm that the participant has already reported any income loss or financial hardship to the Public Housing Authority or property manager and completed an interim re-examination before assistance is provided.

Treasury encourages grantees to enter into partnerships with owners of federally subsidized housing to implement methods of meeting the statutory requirement to prioritize assistance to households with income that does not exceed 50 percent of the area median income for the household, or where one or more individuals within the household are unemployed as of the date of the application for assistance and have not been employed for the 90-day period preceding such date.

Pursuant to section 501(k)(3)(B) of Division N of the Consolidated Appropriations Act, 2021, and 2 CFR 200.403, when providing ERA1 assistance, the grantee must review the household’s income and sources of assistance to confirm that the ERA1 assistance does not duplicate any other assistance, including federal, state, or local assistance provided for the same costs.

Grantees may rely on an attestation from the applicant regarding non-duplication with other government assistance in providing assistance to a household. Grantees with overlapping or contiguous jurisdictions are particularly encouraged to coordinate and participate in joint administrative solutions to meet this requirement. The requirement described in this paragraph does not apply to ERA2; however, to maximize program efficacy, Treasury encourages grantees to minimize the provision of duplicative assistance.

16. In ERA1, may a Tribe or Tribally Designated Housing Entity (TDHE) provide assistance to Tribal members living outside Tribal lands?

Yes. Tribal members living outside Tribal lands may receive ERA1 funds from their Tribe or TDHE, provided they are not already receiving ERA assistance from another Tribe or TDHE, state, or local government.

17. In ERA1, may a Tribe or TDHE provide assistance to non-Tribal members living on Tribal lands?

Yes. A Tribe or TDHE may provide ERA1 funds to non-Tribal members living on Tribal lands, provided these individuals are not already receiving ERA assistance from another Tribe or TDHE, state, or local government.

18. May a grantee provide assistance to households for which the grantee is the landlord?

Yes. A grantee may provide assistance to households for which the grantee is the landlord, provided that the grantee complies with the all provisions of the statute establishing ERA1 or ERA2, as applicable, the award terms, and applicable ERA guidance issued by Treasury, and that no preferences (beyond the prioritization described in FAQ 22 ) are given to households that reside in the grantee’s own properties.

19. May a grantee provide assistance to a renter household with respect to utility or energy costs without also covering rent?

Yes. A grantee is not required to provide assistance with respect to rent in order to provide assistance with respect to utility or energy costs. For ERA1, the limitations in section 501(c)(2)(B) of Division N of the Consolidated Appropriations Act, 2021, limiting assistance for prospective rent payments do not apply to the provision of utilities or home energy costs.

20. May a grantee provide ERA assistance to homeowners to cover their mortgage, utility, or energy costs?

No. ERA assistance may be provided only to eligible households, which is defined by statute to include only households that are obligated to pay rent on a residential dwelling. However, homeowners may be eligible for assistance under programs using funds under the Homeowner Assistance Fund, which was established by Treasury under the American Rescue Plan Act of 2021.

21. May grantees administer ERA programs by using contractors, subrecipients, or intergovernmental cooperation agreements?

Yes. Grantees may use ERA payments to make subawards to other entities, including non-profit organizations and local governments, to administer ERA programs on behalf of the grantees. The subrecipient monitoring and management requirements set forth in 2 CFR 200.331-200.333 will apply to such entities. Grantees may also enter into contracts using ERA payments for goods or services to implement ERA programs. Grantees must comply with the procurement standards set forth in 2 CFR 200.317-200.327 in entering into such contracts. Grantees are encouraged to achieve administrative efficiency and fiduciary responsibility by collaborating with other grantees in joint administrative solutions to deploying ERA resources.

22. ERA requires a prioritization of assistance for households with incomes less than 50 percent of area median income or households with one or more individuals that have not been employed for the 90-day period preceding the date of application. How should grantees prioritize assistance?

Grantees should establish a preference system for assistance that prioritizes assistance to households with incomes less than 50 percent area median income 8 and to households with one or more members that have been unemployed for at least 90 days. Grantees should document the preference system they plan to use and should inform all applicants about available preferences.

Treasury will require grantees to report to Treasury on the methods they have established to implement this prioritization of assistance and to publicly post a description of their prioritization methods, including on their program web page if one exists, by July 15, 2021.

8 For the definition of area median income, see FAQ 4 .

23. ERA1 and ERA2 both allow for up to 10 percent of the funds received by a grantee to be used for certain housing stability services. What are some examples of these services?

ERA1 and ERA2 have different requirements for housing stability services.

Under ERA1, these funds may be used to provide eligible households with case management and other services related to the COVID-19 outbreak, as defined by the Secretary, intended to help keep households stably housed.

Under ERA2, these services do not have to be related to the COVID-19 outbreak and the ERA2 statute does not restrict the provision of housing stability services to “eligible households.

For purposes of ERA1 and ERA2, housing stability services include those that enable households to maintain or obtain housing. Such services may include, among other things, eviction prevention and eviction diversion programs; mediation between landlords and tenants; housing counseling; fair housing counseling; housing navigators or promotoras that help households access ERA programs or find housing; case management related to housing stability; housing-related services for survivors of domestic abuse or human trafficking; legal services or attorney’s fees related to eviction proceedings and maintaining housing stability; and specialized services for individuals with disabilities or seniors that support their ability to access or maintain housing. Grantees using ERA funds for housing stability services must maintain records regarding such services and the amount of funds provided to them.

24. Are grantees required to remit interest earned on ERA payments made by Treasury?

No. ERA payments made by Treasury to states, territories, and the District of Columbia are not subject to the requirement of the Cash Management Improvement Act and Treasury’s implementing regulations at 31 CFR part 205 to remit interest to Treasury. ERA payments made by Treasury to local governments, Tribes, and TDHEs are not subject to the requirement of 2 CFR 200.305(b)(8)-(9) to maintain balances in an interest-bearing account and remit payments to Treasury.

25. When may Treasury recoup ERA funds from a grantee?

Treasury may recoup ERA funds from a grantee if the grantee does not comply with the applicable limitations on the use of those funds.

26. May rental assistance be provided to temporarily displaced households living in hotels or motels?

Yes. The cost of a hotel or motel room occupied by an eligible household may be covered using ERA assistance within the category of certain “other expenses related to housing” (as described in FAQ 7 ) provided that:

- the household has been temporarily or permanently displaced from its primary residence or does not have a permanent residence elsewhere;

- the total months of assistance provided to the household do not exceed the applicable time limit described in FAQ 10 ; and

- documentation of the hotel or motel stay is provided and the other applicable requirements provided in the statute and these FAQs are met.

The cost of the hotel or motel stay would not include expenses incidental to the charge for the room.

Grantees covering the cost of such stays must develop policies and procedures detailing under what circumstances they would provide assistance to cover such stays. In doing so, grantees should consider the cost effectiveness of offering assistance for this purpose as compared to other uses. If a household is eligible for an existing program with narrower eligibility criteria that can provide similar assistance for hotel or motel stays, such as the HUD Emergency Solutions Grant program or FEMA Public Assistance, grantees should utilize such programs prior to providing similar assistance under the ERA program.

27. May a renter subject to a "rent-to-own" agreement with a landlord be eligible for ERA assistance?

A grantee may provide financial assistance to households that are renting their residence under a “rent-to-own” agreement, under which the renter has the option (or obligation) to purchase the property at the end of the lease term, provided that a member of his or her household:

- is not a signor or co-signor to the mortgage on the property;

- does not hold the deed or title to the property; and

- has not exercised the option to purchase.

Homeowners may be eligible for assistance under programs using funds under the Homeowner Assistance Fund, which was established by Treasury under the American Rescue Plan Act of 2021.

28. Under what circumstances may households living in manufactured housing (mobile homes) receive assistance?

Rental payments for either the manufactured home or the parcel of land the manufactured home occupies are eligible for financial assistance under ERA programs. Households renting manufactured housing or the parcel of land the manufactured home occupies may also receive assistance for utilities and other expenses related to housing, as detailed in FAQ 7 above. This principle also applies to mooring fees for water-based dwellings (houseboats).

29. What are the applicable limitations on administrative expenses?