- Cranfield School of Management

- MBA Programmes

- Full-time Master's Courses

- Part-time Master's Courses

- Master’s-level Apprenticeships

- Research Degrees

- Custom Programmes

- Open Executive Programmes

- Online Executive Programmes

- Online Stackable Programmes

- All Online Courses

- Application guide

- Funding opportunities

- All Online courses

- Executive Development

- Course Portfolio

- Consultancy

- Contextualised Courses

- Apprenticeships

- Business Simulations

- Capabilities and Thought Leadership

- Global reach

- Faculty Profiles

- Research Centres

- Research Clubs

- Research Projects

- Case Studies

- School of Management Library

- Careers and Employability Service

- Prospective students

- Links with industry

- The service

- Employer partners

- Alumni zone

- Welcome from the Dean

- Accreditations & Awards

- Life at Cranfield

- Thought Leadership

- Student and Faculty Blogs

- Tomorrow. Brighter.

- Transforming the way the world works

- Work at Cranfield

- Cranfield University

- Research Interests and Potential Doctoral Research Projects

Financial inclusion

Digital financial inclusion: the role of banking.

This is a very important area in banking, the relevance of which has accelerated by digital banking and the effects of the pandemic. Financial inclusion is central in improving the lives of individuals, businesses and communities and the role of banks in facilitating access to and usage of affordable banking services is instrumental to unlock the potential for growth among these communities and to meet important societal needs, namely the alleviation of poverty.

Supervisor: This project will be supervised by Professor Catarina Figueira , an expert in banking who advises a number of financial institutions and regularly engages with bankers, having also developed the first Mastership programme in retail and digital banking in the UK.

Application details: The PhD candidate should hold a minimum 2.1 class undergraduate degree in economics, finance or related discipline and have passed, or expect to have passed by autumn, a Master’s degree or equivalent research experience in a work setting. See Admission Requirements for English language requirements.

Deadline: Expressions of interest alongside a CV are invited via email to [email protected] .

Related academic

Professor Catarina Figueira

Professor of Applied Economics and Policy and Director of Education

- Understanding Poverty

- Financial Inclusion

The list of publications is automatically pulled from the World Bank’s library of externally available documents based on keywords relevant to the financial inclusion topic. These documents include formal publications, working papers, and informal series from departments around the Bank Group, as well as operational and publicly-disclosed projects documents. The list doesn’t represent all research on financial inclusion.

You have clicked on a link to a page that is not part of the beta version of the new worldbank.org. Before you leave, we’d love to get your feedback on your experience while you were here. Will you take two minutes to complete a brief survey that will help us to improve our website?

Feedback Survey

Thank you for agreeing to provide feedback on the new version of worldbank.org; your response will help us to improve our website.

Thank you for participating in this survey! Your feedback is very helpful to us as we work to improve the site functionality on worldbank.org.

An official website of the United States government

The .gov means it’s official. Federal government websites often end in .gov or .mil. Before sharing sensitive information, make sure you’re on a federal government site.

The site is secure. The https:// ensures that you are connecting to the official website and that any information you provide is encrypted and transmitted securely.

- Publications

- Account settings

Preview improvements coming to the PMC website in October 2024. Learn More or Try it out now .

- Advanced Search

- Journal List

- Front Public Health

Financial Inclusion and Its Impact on Health: Empirical Evidence From Asia

Wenling xiao.

1 School of Economics, Shandong Women's University, Jinan, China

2 Qingdao Municipal Center for Disease Control and Prevention, Qingdao, China

Associated Data

Publicly available datasets were analyzed in this study. This data can be found here: https://data.worldbank.org/ .

Asian countries have shown remarkable progress in financial inclusion and have become the world's fastest-growing regions. However, the financial inclusion-human health nexus has not received much attention. This study contributes to the empirical literature by examining the effect of financial inclusion on population health using panel data from Asian countries from 2007 to 2019. Population health is measured by death rate and life expectancy at birth. Our study finding shows that digital financial inclusion increases life expectancy but decreases the death rate in Asia. At the same time, financial inclusion positively impacts life expectancy and has a negative impact on the death rate in Asia. Finding also suggests that Internet users, GDP, and FDI have improved population health by increasing life expectancy and decreasing the death rate. The results suggest some essential policy implications.

Introduction

Financial inclusion provides affordable, accessible, and beneficial products and financial services to individuals and businesses responsibly and sustainably ( 1 , 2 ). Financial development denotes improvement in the size, stability, and efficiency of the financial system. While financial inclusion denotes those individuals and businesses are able to fulfill their requirements due to accessibility to affordable financial services and products ( 3 ). Recently, efforts to promote financial inclusion have enlarged. Financial inclusion is considered the fundamental tool that can be used to obtain social and economic development, especially in vulnerable societies ( 4 ). World Bank ( 1 ) declared financial inclusion as enabling most Sustainable Development Goals (SDGs). Access to finance simplifies daily activities and planning for long-term goals and emergencies for families and businesses.

United Nations Capital Development Fund (UNCDF) implies that financial account holders can access credit easily, enlarge and retain their businesses, invest in education and health, and handle financial shocks that enhance livelihoods' sustainability ( 5 ). Financial inclusion directly influences the health of people ( 6 ). Due to the occurrence of highly unpredictable diseases, financial inclusion can support individuals in bearing these treatment expenses through savings that lead to better health outcomes ( 7 , 8 ). Furthermore, financial inclusion helps people afford better quality health inputs, such as a nutritious diet, clean energy, and improved sanitation ( 9 ). Besides these, financial inclusion reduces mental stress by providing financial stability that could end up in good quality health outcomes ( 10 , 11 ). Various studies have explored the impact of financial inclusion on social and economic indicators ( 12 – 14 ), and very few studies have explored the impact of financial inclusion on human health ( 15 , 16 ). Literature discloses that high mortality is considered a measure representing the bad quality of human health, and enlarged life expectancy is a measure of good quality of human health.

As far as the theoretical aspect of financial inclusion is concerned, literature provides two theories regarding financial inclusion: the vulnerable group theory and the public goods theory of financial inclusion ( 17 ). The vulnerable group theory implies that financial inclusion should consider a vulnerable population of society, including the poor, younger, older, and women ( 6 ). In contrast, the public goods theory claims that financial inclusion should be accessible to the whole society and no one should be left excluded ( 18 ). However, the theory of capability implies that financial inclusion enlarges the freedom of people in making choices for essential necessities such as good quality healthcare, education, clean water, and sanitation facilities that improve the health outcomes of people ( 19 ).

As long as the empirical aspect of the nexus between financial inclusion and health is concerned, Claessens and Feijen ( 20 ) found that credit to the private sector is positively linked with human health. In the case of South Africa, Sarma & Pais ( 21 ) found a strong association between financial development and life expectancy. Their study measures financial development by domestic credit as a percent of GDP, M3 as a percent of GDP, and domestic credit to the private sector as a percent of GDP ( 22 ). In the case of OECD economies, Gunakar ( 23 ) found that financial development enhances health outcomes by increasing the extent of life expectancy and reducing the rate of infant mortality. Financial development in this study is measured by liquid liabilities as a percent of GDP, credit to the private sector as a percent of GDP, and market capitalization as a percent of GDP ( 24 ). In the case of African economies, Chireshe ( 25 ) found that financial development increases life expectancy and reduces the child mortality rate. Gyasi et al. ( 15 ) explored the impact of financial inclusion on adult health in the case of Ghana. It is reported that financial inclusion is positively related to the health outcomes of adults ( 26 ). However, despite much effort, we cannot find any study exploring the impact of financial inclusion on human health in the case of Asian economies ( 27 ). This study provides us answer to the following question: Does financial inclusion lead to better health outcomes? To our knowledge, this is the first study of its kind that determines the nexus between financial inclusion and health outcomes ( 18 ).

Given this lacuna of existing literature, our study investigates the impact of financial inclusion on public health in the case of selected Asian economies. The sample of the study is selected based on data availability ( 28 ). Our study will make contributions to the existing literature in the following manners. Firstly, to the best of the authors' knowledge, this study is the first one exploring the nexus between financial inclusion and public health in the case of the Asian region. Secondly, the study will use 2 SLS and GMM approaches to explore this nexus from 2007 to 2019 ( 29 ). Thirdly, this is the first-ever study in the Asian region covering proxy health measures such as life expectancy and death rate. Lastly, most previous studies measure financial development through domestic credit to the private sector as a percent of GDP ( 26 ). However, our study measures financial inclusion using two proxy measures, namely ATMs and debit cards. This study tries to deal with the endogeneity issues and perform sensitivity analysis to check the robustness of the outcomes. The findings of the study will support policymakers in designing such policies that ease the involvement of individuals in financial activities to protect their health outcomes.

Model and Methods

In recent years, financial inclusion has been supposed as a dynamic tool for attaining human development in advanced and developing countries ( 30 ). Financial inclusion also improves macroeconomic stability and inclusive economic growth ( 2 ). Our study is based on the vulnerable group theory ( 17 ). Theoretical developments have argued that financial inclusion improves human development. As such, we employ the following economic model that follows ( 31 ):

where is the population health ( Health it ) that depend on financial inclusion ( FI ), internet users (Internet), health expenditure (HE), GDP growth (GDP), and foreign direct investment (FDI). Where λ i refers to unobserved individual-country and ε it is the error term. However, i (t) represents the country (year), and the remaining η s are coefficients of the concerned explanatory variables. Financial inclusion can significantly improve human health outcomes. Thus, we expect an estimate of d to be positive. Following the research work of Immurana et al. ( 32 ), the control variables included in the health model include internet users, health expenditure, GDP growth, and FDI. The remaining explanatory variables have a favorable impact on population health; thus, estimates of η 2 , η 3 , η 4 , and η 5 are expected to be positive. We estimate model ( 1 ) using the two-stage least squares (2 SLS) technique. This method is best suited because it can easily address the problem of endogeneity. The main sources of endogeneity are measurement errors, omitted variable bias, and reverse causality. These issues arise for different reasons; however, they can overcome the problem using instrumental variables. For estimation, this study employs the 2 SLS estimators to estimate the baseline outcomes. In our model, financial inclusion is a potential endogenous variable. The augmented panel model is:

while Health it −1 is the first lag of health outcomes in equation ( 2 ), which is a dynamic term in the panel model. We estimate model ( 2 ) using the Blundell & Bond ( 33 ) system GMM technique. The system GMM approach has been used in many previous empirical health-related studies ( 32 ). Following Immurana et al. ( 31 , 34 ), we use the dynamic panel-data model ( 2 ). This econometric specification is widely used in the empirical finance literature to examine the nexus between financial inclusion and human development. This approach is suitable as the number of countries ( N = 18) is more than the number of years ( T = 13), as in our study. Few diagnostics tests, such as the serial correlation test and the Sargan test statistic—are also used to demonstrate the validity of estimates.

Table 1 displays the details of descriptive statistics of variables, definitions and symbols of variables, and sources of data series. The list of selected Asian countries is reported in Table 2 . Asian Health in this study is measured by two indicators such as life expectancy and death rate. Two indicators also measure financial inclusion: ATMs per 1,000 adults and debit cards (% age 15+). Previous studies have used the same variables for financial inclusion ( 2 , 35 ). The role of internet use, health expenditures, foreign direct investment, and GDP growth have been added as control variables. Internet use is measured as internet users in the percentage of the population. Health expenditures are measured as a percentage of GDP. GDP growth is taken in annual percentage. Net inflows determine FDI as a percent of GDP. The data for financial inclusion indicators have been taken from IMF, while the data for the remaining variables have been collected from the World Bank. Table 2 shows that the mean (standard deviation) for life expectancy is 72.4 (44.7), the death rate is 6.57 (1.95), ATMs is 53.0 (39.4), a debit card is 30.7 (24.0), the internet user is 36.7 (27.4), health expenditure is 4.33 (1.38), GDP growth is 5.38 (2.85), and FDI is 4.46 (3.99). While Table 3 shows that the correlation matrix and findings is free from multicollinearity problem.

Descriptive statistics and definitions.

List of countries.

Matrix of correlations.

Results and Discussion

Table 4 reports the results of 2 SLS and GMM estimates for life expectancy models. It is found that ATMs and life expectancy are significantly and positively associated in both 2 SLS and GMM models. It reveals that a 1 percent upsurge in the number of ATMs improves life expectancy by 0.134 percent in the 2 SLS model and 0.051 percent in the GMM model. The findings further reveal that debit card and life expectancy are also significantly and positively associated in both 2 SLS and GMM models. It implies that a 1 percent upsurge in the number of credit cards improves life expectancy by 0.091 percent in the 2 SLS model and 0.024 percent in the GMM model. Hence, it is confirmed that both financial inclusion indicators contribute significantly to enhancing population health in selected 18 Asian economies. This finding is supported by Immurana ( 32 ), who noted that financial inclusion enhances health in Africa. This finding infers that digital financial inclusion easy financial services, enabling people to acquire health-related goods and services. This means that financial services boost human health. This finding is also backed by Ofosu-Mensah Ababio et al. ( 34 ), who reported that financial inclusion is an effective tool for achieving socio-economic development by reducing poverty and income inequality. The findings validate the study of Churchill et al. ( 36 ) that shows that financial inclusion has a strong poverty-reducing effect, improving population health. Another possible reason is that financial inclusion improves human health via income channels. Financial inclusion prompts the human development process in Asian economies. Findings infer that a well-performing digital financial system is an important factor in human development.

Financial inclusion and life expectancy (2 SLS & GMM).

The impact of internet use on life expectancy is found to be significant and positive on life expectancy in all four models, displaying that the use of the internet tends to improve human health in the sample of selected Asian economies. This result is in line with Majeed & Khan ( 37 ), who found that internet development improves population health by increasing financial and health literacy, spreading health information, and health care services. This finding is also supported by Mushtaq & Bruneau ( 38 ), who noted that the composite impact of internet development and financial inclusion is an important factor for human development. The findings display that the nexus between health expenditures and life expectancy is significantly positive only in one model, confirming that current health expenditures are capable to improve health outcomes in Asian economies. The GDP and life expectancy association is found significantly positive in both GMM models, showing that an upsurge in GDP improves public health in Asian economies. Ordinarily, economic progress is found to improve human health by increasing positive externalities. For instance, Woodward et al. ( 39 ) found economic development to boost human health. The impact of FDI on life expectancy is found to be significantly positive in all four models confirming that FDI plays a prominent role in improving people's health in Asian economies. Thus, it is confirmed that financial inclusion, internet use, GDP, and FDI are significant indicators of human health in the case of Asian economies. Both GMM models are correctly specified, as confirmed by a statistically insignificant coefficient estimate of the Sargan test.

Table 5 reports the results of 2 SLS and GMM estimates for death rate models. It is reported that ATMs and death rates are significantly and negatively associated in both 2 SLS and GMM models. It implies that a 1 percent upsurge in ATMs users reduces the death rate by 0.008 percent in the 2 SLS model and 0.007 percent in the GMM model. The findings display that debit card and death rate are associated significantly and negatively in the GMM model only, while the association is found statistically insignificant in the case of the 2 SLS model. It displays that a 1 percent rise in the number of credit cards reduces the death rate by 0.002 percent in the GMM model. Thus, the findings of both 2 SLS and GMM models confirmed that both determinants of financial inclusion, ATMs and credit card, play a significant role in improving population health in Asian economies. The nexus between internet use and the death rate is found significant and negative in the case of two models, revealing that internet use plays a prominent role in improving human health in selected Asian economies. The nexus between health expenditures and the death rate is found significant and negative in all four models, displaying that current health expenditures play a fundamental role in improving population health in Asian economies. The nexus between GDP and death rate is significantly negative in the case of both GMM models, displaying that increase in GDP significantly improves public health in selected Asian economies. The association between FDI and death rate is significantly negative in the case of three models, inferring that FDI plays a key role in the improvement of population health in the case of Asian economies. Similar to the life expectancy model, financial inclusion, internet use, GDP, and FDI are significant determinants of human health in the sample of selected 18 Asian economies. The statistically insignificant coefficient estimate of the Sargan test confirms that both GMM models are correctly specified.

Financial inclusion and death rate (2 SLS & GMM).

Conclusion and Implications

In this study, an effort is made to explore the nexus between financial inclusion and population health in the case of selected Asian economies over the time span of 1995–2020. Financial inclusion is measured through ATMs and debit cards in this study, while health is measured through death rate and life expectancy. For estimation purposes, the 2 SLS and GMM methods have been used. The obtained results are as follows. Both ATMs and credit cards positively affect population health, revealing that financial inclusion enhances population health in Asian economies. Other control variables such as GDP, current health expenditures, FDI, and internet use positively influence human health as described in most cases.

Thus, the study put forward some important policy implications for policymakers, stakeholders, and governments of Asian economies. It is suggested that the enlargement of financial inclusion should be the responsibility of governments, stakeholders, potential customers, service providers, financial supervisors, financial regulators, and development agencies. The promotion of financial inclusion should be embarked by the whole banking sector to further improves human health. New savings or deposit methods through branchless avenues and technological methods must be encouraged to support customers in accessing and depositing money. The governments should start initiatives that provide financial education and training to individuals about using branchless and digital avenues. Another suggestion is that there should be strong collaborations and linkages among financial service providers, financial regulations, and governments. The restrictions on inflows of FDI should be relaxed. Governments should establish strong regulatory and law enforcement organizations. Remote and backward areas should be modernized by establishing improved physical infrastructures such as telecommunication, electricity, and paved roads that provide mental peace to people, thus improving their health and livelihood. The stakeholders and governments should struggle to guarantee financial inclusion services to individuals from both supply and demand sides to enhance the health and wellbeing of people in Asian economies.

Besides these implications, the study also faces some limitations that must be considered in future studies. For instance, the study has used only two indicators to measure human health; however, there are several other health indicators that must be considered in future research, such as mental health, other chronic diseases, and maternal health. Our study is limited to the Asian region and adopts a linear method of estimation to explore the nexus between financial inclusion and human health. However, future studies can adopt non-linear methods of estimation to get more interesting results. Furthermore, future studies can also replicate these analyses for other regions and economies.

Data Availability Statement

Author contributions.

WX: conceptualization, software, data curation, and writing—original draft preparation. RT: methodology and writing—reviewing and editing. WX and RT: visualization and investigation. Both authors contributed to the article and approved the submitted version.

This study was supported by High-level Talent Introduction Research Project of Shandong Women's University (Grant No. 2021RCYJ03) and Cultivation Fund for High-level Scientific Research Projects of Shandong Women's University (Grant No. 2021GSPSJ05).

Conflict of Interest

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Publisher's Note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

Digital Inclusion and Financial Inclusion: Evidence from Peer-to-Peer Lending

- Original Paper

- Published: 18 May 2024

Cite this article

- Xiaoran Jia ORCID: orcid.org/0000-0002-4523-4316 1 &

- Kiridaran Kanagaretnam 2

We explore whether digital inclusion, a public policy designed to provide high-speed internet infrastructure for historically digitally excluded populations, is associated with the social and ethical challenge of financial inclusion. Using evidence from a sizable P2P lender in the U.S., we document that digital inclusion is positively associated with P2P lending penetration and that this relation is more pronounced in counties with limited commercial bank loan penetration and higher minority populations. Our new evidence from cross-sectional tests suggests that digital inclusion plays a key role in financial inclusion, particularly in regions with more vulnerable and/or underserved populations. In consequence tests, we document that high-risk borrowing is less likely to be denied in counties with higher digital inclusion and that digital inclusion is positively associated with P2P lending efficiency in the form of more repeated borrowing, decreased funding time, and improved funding fulfillment. In addition, we show that the availability of alternative information, a plausible channel through which digital inclusion is related to financial inclusion, is positively associated with efficiency in P2P lending. Our findings indicate that digital inclusion can empower financial service providers and other stakeholders to collaboratively fulfill their ethical and social responsibilities to meet the financial needs of historically marginalized groups.

This is a preview of subscription content, log in via an institution to check access.

Access this article

Price includes VAT (Russian Federation)

Instant access to the full article PDF.

Rent this article via DeepDyve

Institutional subscriptions

Data availability

All data are publically available.

For example, according to the 2021 World Bank Global Financial Inclusion database, the global average percentage of adults with an account increased from 51% in 2011 to 76% in 2021 (Demirgüç-Kunt et al., 2022 ).

Babalola et al. ( 2022 ) provide commentaries from the editors of the Journal of Business Ethics on the future of business ethics, containing topics such as leadership, psychology, finance, and accounting. Our paper borrows from ideas and insights that span the commentary section provided by Guedhami, Liang, and Shailer.

Such practices include, for example, the redlining with the National Housing Act in 1934 that excluded Black populations from mortgage lending and the Affordable Care Act failing to expand to states with more Black Americans (Florant et al. 2020 ).

According to a 2022 report from the Joint Economic Committee (JEC), 50 million American consumers do not have a valid credit bureau score, or are ‘credit invisible,’ of which most are minorities or low-income individuals.

For example, small business entrepreneurs often need such loans as an important source of leverage to start or expand their small businesses.

A 2022 JEC report suggests that there are two groups of U.S. consumers with no valid credit scores. The first group are those without a credit record in any of the nationwide credit reporting agencies; the second group are those who are considered “unscorable” by the nationwide credit reporting agencies. In particular, these people are disproportionately minorities or low-income individuals.

A 2020 market research report shows that LendingClub and Prosper are the two largest P2P lenders in the U.S. ( https://mangosoft.tech/blog/top-5-peer-to-peer-lending-companies-2020-full-market-research ).

The high-speed and basic internet connections data are from FCC Form 477, and the households’ high-speed internet subscriptions data are from the U.S. Census Bureau.

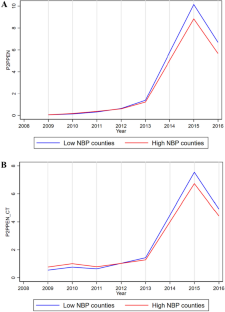

We choose 2013 as the cutoff year for the following reasons: Although the NBP funding deployment was in 2010, the exact years it takes for a county to materialize the digital inclusion effect can vary. Our trend analysis illustrated in Fig. 1 suggests that most counties started to exhibit tangible divergence in P2P penetration after 3 years of NBP deployment. Indeed, FCC ( 2010 ) argues that internet infrastructure investments typically require a multi-year horizon to manifest tangible effects, stemming from the complexities associated with implementation, integration, and user adaptation.

For example, in November 2021, U.S. President Joe Biden signed the Infrastructure Investment and Jobs Act (IIJA) into law and provided $65 billion for broadband: https://broadbandusa.ntia.doc.gov/resources/federal/federal-funding .

This study also corroborates the regulators’ initiatives to utilize big data in the traditional financial institutions. For example, Jelena McWilliams, the former Chairman of Federal Deposit Insurance Corporation (FDIC), stressed that FDIC is “actively engaged with” financial institutions to provide “affordable access to financial services and products” for the “most vulnerable populations.” Source: https://www.fdic.gov/news/events/banking-on-data/index.html .

A more illustrative version of the Prosper credit rating system is shown in Table 1 , Panel A and Panel B.

Source: https://www.fcc.gov/general/broadband-deployment-data-fcc-form-477 .

Source: https://www.fcc.gov/form-477-census-tract-data-internet-access-services .

Released by the FCC on March 17, 2020, the NBP aims to provide universal high-speed internet access, bridging the digital divide. Source: https://www.fcc.gov/general/national-broadband-plan . In addition, the data related to the county-level NBP deployment can be downloaded at: https://transition.fcc.gov/national-broadband-plan/broadband-availability-gap-data.zip .

Prosper claims that the “custom risk model” uses historical Prosper data and is built on the Prosper borrower population, i.e., the model inputs all historical Prosper loan records and makes predictive analysis.

Considering that starting from 2020, Prosper added a new product—home equity line of credit—we also use a cutoff sample period up to the end of 2019. We find consistent results on all tests.

Call Report is short for Consolidated Reports of Condition and Income. All national banks, state member banks, insured state nonmember banks, and savings associations are required to submit Call Report data to bank regulators.

While not tabulated, we document similar empirical results with a winsorization at the top and bottom 2% levels, considering the prevalence of outliers of the P2P penetration measures.

Using Column (1) as an example, the impact of a one standard deviation increase in DI on P2PPEN is computed as 0.9953 (the coefficient of DI ) × 1.1357 (the sample standard deviation of DI ) ÷ 4.6092 (the sample mean of P2PPEN ) × 100% = 24.52%.

For example, FCC ( 2010 ) argues that internet infrastructure investments typically require a multi-year horizon to manifest tangible effects, stemming from the complexities associated with implementation, integration, and user adaptation.

A February 2013 report by the FCC also showed that the nationwide average subscribed speed by consumers by the end of third quarter of 2012 was 15.6 Mbps, representing an average annualized speed increase of about 20%. Source: https://www.fcc.gov/reports-research/reports/measuring-broadband-america/measuring-broadband-america-february-2013 .

The survey data are at the state level, which is available from NTIA: https://www.ntia.doc.gov/data/digital-nation-data-explorer#sel=socialNetworkUser&disp=map .

Agarwal, V., Mullally, K. A., Tang, Y., & Yang, B. (2015). Mandatory portfolio disclosure, stock liquidity, and mutual fund performance. The Journal of Finance, 70 (6), 2733–2776.

Article Google Scholar

Aiyar, A., & Venugopal, S. (2020). Addressing the ethical challenge of market inclusion in base-of-the-pyramid markets: A macromarketing approach. Journal of Business Ethics, 164 , 243–260.

Ambrose, B. W., Conklin, J. N., & Lopez, L. A. (2021). Does borrower and broker race affect the cost of mortgage credit? The Review of Financial Studies, 34 (2), 790–826.

Arellano, M., & Bond, S. (1991). Some tests of specification for panel data: Monte Carlo evidence and an application to employment equations. The Review of Economic Studies, 58 (2), 277–297.

Babalola, M. T., Bal, M., Cho, C. H., Garcia-Lorenzo, L., Guedhami, O., Liang, H., Shailer, G., & van Gils, S. (2022). Bringing excitement to empirical business ethics research: Thoughts on the future of business ethics. Journal of Business Ethics, 180 (3), 903–916.

Balyuk, T., Berger, A. N., & Hackney, J. (2020). What is fueling FinTech lending? The role of banking market structure. SSRN Electronic Journal . https://doi.org/10.2139/ssrn.3633907

Bartlett, R., Morse, A., Stanton, R., & Wallace, N. (2022). Consumer-lending discrimination in the FinTech era. Journal of Financial Economics, 143 (1), 30–56.

Bayer, P., Ferreira, F., & Ross, S. L. (2018). What drives racial and ethnic differences in high-cost mortgages? The role of high-risk lenders. The Review of Financial Studies, 31 (1), 175–205.

Beck, T., Demirgüç-Kunt, A., & Levine, R. (2007). Finance, inequality and the poor. Journal of Economic Growth, 12 (1), 27–49.

Berg, T., Burg, V., Gombović, A., & Puri, M. (2020). On the rise of FinTechs: Credit scoring using digital footprints. The Review of Financial Studies, 33 (7), 2845–2897.

Black, H., Schweitzer, R. L., & Mandell, L. (1978). Discrimination in mortgage lending. The American Economic Review, 68 (2), 186–191.

Google Scholar

Blundell, R., & Bond, S. (1998). Initial conditions and moment restrictions in dynamic panel data models. Journal of Econometrics, 87 (1), 115–143.

Bruhn, M., & Love, I. (2014). The real impact of improved access to finance: Evidence from Mexico—Impact of access to finance on poverty. The Journal of Finance, 69 (3), 1347–1376.

Buchak, G., Matvos, G., Piskorski, T., & Seru, A. (2018). FinTech, regulatory arbitrage, and the rise of shadow banks. Journal of Financial Economics, 130 (3), 453–483.

Butler, A. W., Mayer, E. J., & Weston, J. P. (2022). Racial disparities in the auto loan market. The Review of Financial Studies, 36 (1), 1–41.

Carr, J. H., & Megbolugbe, I. F. (1993). The Federal Reserve bank of Boston study on mortgage lending revisited. Journal of Housing Research, 4 (2), 277–313.

Corrado, G., & Corrado, L. (2015). The geography of financial inclusion across Europe during the global crisis. Journal of Economic Geography, 15 (5), 1055–1083.

De Roure, C., Pelizzon, L., & Thakor, A. (2022). P2P Lenders versus banks: Cream skimming or bottom fishing? The Review of Corporate Finance Studies, 11 (2), 213–262.

Demirgüç-Kunt, A., Klapper, L., & Singer, D. (2017). Financial inclusion and inclusive growth: A review of recent empirical evidence. World Bank Policy Research Working Paper 8040.

Demirgüç-Kunt, A., Klapper, L., Singer, D., & Ansar, S. (2022). The Global Findex Database 2021: Financial inclusion, digital payments, and resilience in the age of COVID-19 . World Bank Publications.

Book Google Scholar

Dittmar, A., Mahrt-Smith, J., & Servaes, H. (2003). International corporate governance and corporate cash holdings. Journal of Financial and Quantitative Analysis, 38 (1), 111–133.

Fairlie, R., Robb, A., & Robinson, D. T. (2021). Black and white: Access to capital among minority-owned start-ups. Management Science, 68 (4), 2377–3174.

Federal Communications Commission (FCC). (2010). Connecting America: The National Broadband Plan. Available from: https://transition.fcc.gov/national-broadband-plan/national-broadband-plan.pdf

Federal Deposit Insurance Corporation (FDIC). 2022. Despite COVID-19 pandemic, record 96% of U.S. households were banked in 2021 . FDIC: PR-75-2022.

Fernández-Olit, B., Martín Martín, J. M., & Porras González, E. (2019). Systematized literature review on financial inclusion and exclusion in developed countries. International Journal of Bank Marketing, 38 (3), 600–626.

Florant, A., Julien, JP., Stewart III, S., Wright, J., & Yancy, N. (2020). The case for accelerating financial inclusion in black communities . McKinsey & Company

Frost, J., Gambacorta, L., Huang, Y., Shin, H. S., & Zbinden, P. (2019). BigTech and the changing structure of financial intermediation. Economic Policy, 34 (100), 761–799.

Fuster, A., Goldsmith-Pinkham, P., Ramadorai, T., & Walther, A. (2022). Predictably unequal? The effects of machine learning on credit markets. The Journal of Finance, 77 (1), 5–47.

Fuster, A., Plosser, M., Schnabl, P., & Vickery, J. (2019). The role of technology in mortgage lending. The Review of Financial Studies, 32 (5), 1854–1899.

Gant, J., Turner-Lee, N., Li, Y., & Miller, J. (2010). National minority broadband adoption: Comparative trends in adoption, acceptance and use . Joint Center for Political and Economic Studies.

Ghent, A. C., Hernández-Murillo, R., & Owyang, M. T. (2014). Differences in subprime loan pricing across races and neighborhoods. Regional Science and Urban Economics, 48 , 199–215.

Han, R., & Melecky, M. (2013). Financial inclusion for financial stability . Policy Research Working Papers. The World Bank.

Hannig, A., & Jansen, S. (2010). Financial inclusion and financial stability: Current policy issues. SSRN Electronic Journal . https://doi.org/10.2139/ssrn.1729122

Hau, H., Huang, Y., Shan, H., & Sheng, Z. (2019). How FinTech enters China’s credit market. AEA Papers and Proceedings, 109 , 60–64.

Hill, R. P., & Martin, K. D. (2014). Broadening the paradigm of marketing as exchange: A public policy and marketing perspective. Journal of Public Policy & Marketing, 33 (1), 17–33.

Hodula, M. (2022). Does Fintech credit substitute for traditional credit? Evidence from 78 countries. Finance Research Letters, 46 , 102469.

Howell, S., Kuchler, T., Snitkof, D., Stroebel, J., & Wong, J. (2021). Automation and racial disparities in small business lending: Evidence from the paycheck protection program . National Bureau of Economic Research.

Jagtiani, J., & Lemieux, C. (2017). Fintech lending: Financial inclusion, risk pricing, and alternative information. SSRN Electronic Journal . https://doi.org/10.2139/ssrn.3096098

Kempson, E., & Whyley, C. (1999). Kept out or opted out? Understanding and combating financial exclusion . The Policy Press.

Kent, A. H., & Ricketts, L. R. (2022). Racial and ethnic household wealth trends and wealth inequality . Federal Reserve Bank of St. Louis.

Khan, H. R. (2012). Financial inclusion and financial stability: Are they two sides of the same coin? Address by Shri HR Khan, Deputy Governor of the Reserve Bank of India, at BANCON, 1–12.

Khan, U., & Ozel, N. B. (2016). Real activity forecasts using loan portfolio information. Journal of Accounting Research, 54 (3), 895–937.

Kim, J. H. (2016). A study on the effect of financial inclusion on the relationship between income inequality and economic growth. Emerging Markets Finance and Trade, 52 (2), 498–512.

Ladd, H. F. (1998). Evidence on discrimination in mortgage lending. Journal of Economic Perspectives, 12 (2), 41–62.

Lapukeni, A. F. (2015). Financial inclusion and the impact of ICT: An overview. American Journal of Economics, 5 (5), 495–500.

Leyshon, A., & Thrift, N. (1995). Geographies of financial exclusion: Financial abandonment in Britain and the United States. Transactions of the Institute of British Geographers, 20 (3), 312.

Maskara, P. K., Kuvvet, E., & Chen, G. (2021). The role of P2P platforms in enhancing financial inclusion in the United States: An analysis of peer-to-peer lending across the rural–urban divide. Financial Management, 50 (3), 747–774.

Munnell, A. H., Tootell, G. M. B., Browne, L. E., & McEneaney, J. (1996). Mortgage lending in Boston: Interpreting HMDA data. The American Economic Review, 86 (1), 25–53.

Omar, M. A., & Inaba, K. (2020). Does financial inclusion reduce poverty and income inequality in developing countries? A panel data analysis. Journal of Economic Structures, 9 (1), 37.

Ozili, P. K. (2018). Impact of digital finance on financial inclusion and stability. Borsa Istanbul Review, 18 (4), 329–340.

Park, C. Y., & Mercado, R. (2015). Financial inclusion, poverty, and income inequality in developing Asia. Asian Development Bank Economics Working Paper Series , p. 426.

Philippon, T. (2016). The FinTech opportunity . National Bureau of Economic Research.

Philippon, T. (2019). On Fintech and financial inclusion . National Bureau of Economic Research.

Reid, C. K., Bocian, D., Li, W., & Quercia, R. G. (2017). Revisiting the subprime crisis: The dual mortgage market and mortgage defaults by race and ethnicity. Journal of Urban Affairs, 39 (4), 469–487.

Reisdorf, B., & Rhinesmith, C. (2020). Digital inclusion as a core component of social inclusion. Social Inclusion, 8 (2), 132–137.

Rhinesmith, C. (2016). Digital inclusion and meaningful broadband adoption initiatives . Benton Foundation.

Sanders, C. K., & Scanlon, E. (2021). The digital divide is a human rights issue: Advancing social inclusion through social work advocacy. Journal of Human Rights and Social Work, 6 , 130–143.

Schafer, R., & Ladd, H. F. (1981). Discrimination in mortgage loans . MIT Press.

Shultz, C. J., Deshpandé, R., Cornwell, T. B., Ekici, A., Kothandaraman, P., Peterson, M., Shapiro, S., Talukdar, D., & Veeck, A. (2012). Marketing and public policy: Transformative research in developing markets. Journal of Public Policy & Marketing, 31 (2), 178–184.

Stock, J., & Yogo, M. (2005). Testing for weak instruments in linear IV regression. Identification and inference for econometric models: Essays in honor of Thomas Rothenberg (pp. 80–108). Cambridge: Cambridge University Press.

Chapter Google Scholar

Tang, H. (2019). Peer-to-peer lenders versus banks: Substitutes or complements? The Review of Financial Studies, 32 (5), 1900–1938.

Villasenor, J. D., West, D. M., & Lewis, R. J. (2015) The 2015 Brookings Financial and Digital Inclusion Project Report . Washington, D.C: The Brookings Institution.

Viswanathan, M., Sridharan, S., Ritchie, R., Venugopal, S., & Jung, K. (2012). Marketing interactions in subsistence marketplaces: A bottom-up approach to designing public policy. Journal of Public Policy & Marketing, 31 (2), 159–177.

Wu, Y., & Zhang, T. (2021). Can credit ratings predict defaults in peer-to-peer online lending? Evidence from a Chinese platform. Finance Research Letters, 40 , 101724.

Yu, L., & Zhang, X. (2021). Can small sample dataset be used for efficient internet loan credit risk assessment? Evidence from online peer to peer lending. Finance Research Letters, 38 , 101521.

Zhong, W., & Jiang, T. (2021). Can internet finance alleviate the exclusiveness of traditional finance? Evidence from Chinese P2P lending markets. Finance Research Letters, 40 , 101731.

Download references

Acknowledgements

We gratefully acknowledge helpful comments from Hao Liang (the Section Editor) and two anonymous reviewers. Jia and Kanagaretnam thank the CPA Ontario and Schulich School of Business Joint Centre in Digital Accounting Information for its financial support. Kanagaretnam thanks the Social Sciences and Humanities Research Council of Canada (SSHRC) for its financial support.

Author information

Authors and affiliations.

Lazaridis School of Business and Economics, Wilfrid Laurier University, Waterloo, ON, Canada

Xiaoran Jia

Schulich School of Business, York University, Toronto, ON, Canada

Kiridaran Kanagaretnam

You can also search for this author in PubMed Google Scholar

Corresponding author

Correspondence to Xiaoran Jia .

Ethics declarations

Conflict of interest.

We hereby state that we do not have any conflicts of interest with the subjects and/or data we use for this research.

Research Involving Human and/or Animal Participants

Our research does not involve human participants or animals.

Informed Consent

No informed consent is applicable in our research, we use all public data.

Additional information

Publisher's note.

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendix A: Variable Definitions

Rights and permissions.

Springer Nature or its licensor (e.g. a society or other partner) holds exclusive rights to this article under a publishing agreement with the author(s) or other rightsholder(s); author self-archiving of the accepted manuscript version of this article is solely governed by the terms of such publishing agreement and applicable law.

Reprints and permissions

About this article

Jia, X., Kanagaretnam, K. Digital Inclusion and Financial Inclusion: Evidence from Peer-to-Peer Lending. J Bus Ethics (2024). https://doi.org/10.1007/s10551-024-05689-w

Download citation

Received : 06 March 2023

Accepted : 07 April 2024

Published : 18 May 2024

DOI : https://doi.org/10.1007/s10551-024-05689-w

Share this article

Anyone you share the following link with will be able to read this content:

Sorry, a shareable link is not currently available for this article.

Provided by the Springer Nature SharedIt content-sharing initiative

- Digital inclusion

- Financial inclusion

- Public policy

- Social responsibilities

- Peer-to-peer lending

- Alternative information

JEL Classification

- Find a journal

- Publish with us

- Track your research

M&T Bank x CSVC Case Competition Sees Graduate Students Promote Financial Inclusion Solutions

How can local banks increase their role in community development, broaden financial inclusion and empower individuals to utilize banking resources? Just ask graduate students at the University of Maryland’s Robert H. Smith School of Business.

On April 12, eight teams comprised of students from the Smith School’s business master's and MBA programs presented their solutions toward addressing those grand challenges during the M&T Bank x CSVC Case Competition (Center for Social Value Creation) .

David Perez, MBA ’25, Tanvi Murumkar, MS in Business Analytics ’24, Andrew Trepicchio, MBA ’25, and Stephen Alexander, MBA ’24, earned first-place honors at the social impact case competition, which tasked teams with assessing the U.S. financial landscape and exploring various methods enabling M&T Bank to enhance banking engagement among members of low and middle-income households.

Harshil Patel, MS in Information Systems ’24, was a member of the second-place team that presented an approach leveraging AI-powered tools to refine risk assessments, meet Community Reinvestment Act (CRA) requirements, provide alternative data for credit evaluations and take advantage of M&T Bank’s partnerships with governmental bodies, non-profits, CDFIs, and NGOs.

To Patel, the experience was “enriching” as it satisfied his avid interest in participating in case competitions. It was especially fulfilling for him due to the opportunity to work and interact with M&T Bank senior managers and executives.

“Networking with them provided invaluable insights and connections, further fueling our passion for innovation in banking. I’m excited to continue championing innovation and social impact in the banking sector,” said Patel.

This year’s competition was organized by CSVC’s Keola Evans and held in partnership with M&T Bank. Nicole Coomber , assistant dean of experiential learning and clinical professor of management and organization, and lecturer Roy Thomason represented the Smith School faculty on the judges' panel. They were joined by M&T Bank’s Syreeta Smith, assistant vice president and branch manager; Aursland D. Seymour, assistant vice president and branch manager; Keron Samaroo, senior relationship banker; Lynnett Berger, vice president, CIMA, PMP; and Derek Tokaz.

- Nicole M. Coomber

- Roy Thomason

- Business Masters

- Full-Time MBA

- Center for Social Value Creation

Media Contact

Greg Muraski Media Relations Manager 301-405-5283 301-892-0973 Mobile [email protected]

About the University of Maryland's Robert H. Smith School of Business

The Robert H. Smith School of Business is an internationally recognized leader in management education and research. One of 12 colleges and schools at the University of Maryland, College Park, the Smith School offers undergraduate, full-time and flex MBA, executive MBA, online MBA, business master’s, PhD and executive education programs, as well as outreach services to the corporate community. The school offers its degree, custom and certification programs in learning locations in North America and Asia.

- My Shodhganga

- Receive email updates

- Edit Profile

Shodhganga : a reservoir of Indian theses @ INFLIBNET

- Shodhganga@INFLIBNET

- University of Hyderabad

- School of Management Studies

Items in Shodhganga are licensed under Creative Commons Licence Attribution-NonCommercial-ShareAlike 4.0 International (CC BY-NC-SA 4.0).

IMAGES

VIDEO

COMMENTS

1 INTRODUCTION. Financial inclusion has risen to the top of the development agenda (Ardic, Heimann, & Mylenko, 2011).According to the World Bank's 2017 Global Findex, 1.7 billion adults worldwide have no access to formal financial services (Demirgüç-Kunt, Klapper, Singer, Ansar, & Hess, 2018).Advocates of financial inclusion argue that improving access to finance is central to achieving ...

Financial Inclusion is considered to be a critical indicator for development and well-being of the society around the globe. Providing inclusive financial services, that is, financial services affordable for all, has become a basic priority in many countries including India. G-20 Nations have emphasized on financial inclusion as a facilitator ...

Digital financial inclusion: the role of banking. This is a very important area in banking, the relevance of which has accelerated by digital banking and the effects of the pandemic. ... Application details: The PhD candidate should hold a minimum 2.1 class undergraduate degree in economics, finance or related discipline and have passed, or ...

Financial inclusion also benefits society more broadly. Shifting payments from cash into accounts allows for more efficient and more transparent payments from governments or 1 See Klapper, et al. (2016) for a review of how financial inclusion can help achieve the Sustainable Development Goals (SDG's).

But much remains to be done to achieve meaningful financial inclusion. The recent evidence and spate of programming evaluations from India (Burgess and Pande Citation 2005; Field et al. Citation 2016; Schaner Citation 2016) make it easy to think that there have been significant and expansive strides towards financial inclusion of low-income populations on the sub-continent.

and request I had throughout my PhD. Their guidance, support and encouragement helped me to complete this dissertation. I would also like to thank the ESRC for funding this investigation ... Promoting financial inclusion, commonly defined as the use of formal financial services, has become a relevant topic for both academics and policy makers ...

We provide PhD Scholarships that are designed to support the research of the AXA Chair in Global Finance - Professor Victor Murinde, in the School of Finance and Management, at SOAS University of London. ... Her research has an emphasis on understanding the impact of financial literacy on strengthening Financial Inclusion (FI) in low-income ...

Rethinking Financial Inclusion uses EPoD's Smart Policy Design and Implementation framework, a structured approach for evidence-driven innovation, to inform the design of financial products in a world where technology and client demands are changing rapidly. Based on a keen understanding of both the client and the broader environment ...

The consistent gender gap in financial inclusion over time is postulated by World Bank Findex data despite an increase in the overall financial inclusion level around the globe. ... Binoti Patro ([email protected]) after obtaining her PhD from IIT (ISM) Dhanbad, she joined NIT Rourkela as an ad hoc faculty and taught various core and elective ...

Research. The list of publications is automatically pulled from the World Bank's library of externally available documents based on keywords relevant to the financial inclusion topic. These documents include formal publications, working papers, and informal series from departments around the Bank Group, as well as operational and publicly ...

This PhD thesis contributes to our understanding about financial development, focusing on three main topics: (1) the link between financial deepening and financial stability; (2) the determinants of financial inclusion; and (3) the effect of financial inclusion on improving economic welfare, which have received less attention in the literature.

financial inclusion, social inclusion, and multidimensional poverty reduction using, as target population, the poor in Ghana who earn and spend less than $1.90 a day. It is established in the literature that poverty is multidimensional in nature and that a large proportion of poor population suffer exclusion from many essential services including

4. Conclusions and Discussion. The aim of this research is to analyse the evolution of the concept of financial inclusion during the period 1986-2020, through a bibliometric analysis of 1731 research articles recorded in the Scopus database, this being the first available bibliometric analysis on Financial Inclusion.

From lower Q 0.25 to higher Q 0.50 quantile, the magnitude of financial inclusion is reported increasing and become highly significant at 1% level. The influence of financial inclusion reports that a one percent increase in financial inclusion increases energy productivity by 0.054 in Q 0.25, 0.138 in Q 0.50, and 0.98 percent in Q 0.75 ...

Abstract. This article presents several theories of financial inclusion. Financial inclusion is defined as the availability of, and the ease of access to, basic formal financial services to all ...

rapid pace of financial inclusion will bring vast amounts of income and tax revenues into the global economy that is important to understand as it creates different opportunities and challenges for developing and advanced countries that they will need to prepare for.

The main purpose of this study is to scrutinize the effect of financial inclusion on financial sustainability, financial efficiency, gross domestic product, and human development in the context of G20 nations. This study has employed annual data of 15 developed and emerging economies during the period from 2004 to 2017. The current study has utilized a single index for financial inclusion ...

At the same time, financial inclusion positively impacts life expectancy and has a negative impact on the death rate in Asia. Finding also suggests that Internet users, GDP, and FDI have improved population health by increasing life expectancy and decreasing the death rate. The results suggest some essential policy implications.

The results using the fixed effects estimation show that financial inclusion has an alleviating effect on poverty in low- and lower middle-income countries. The absolute reduction in the poverty headcount ratio of 5,50 USD per day is greater than the one at 1,90 USD per day.

Financial inclusion is an important aspect of financial growth since it helps financial sectors and institutions grow. Financial inclusion is a notion that has been around since the early 2000s, when research identified financial exclusion as a key source of poverty (Chibba, Citation 2009 ; Liu et al., Citation 2021 ; Schumacher et al ...

Financial inclusion refers to the provision of various types of financial services, such as deposit or transaction accounts, access to credit, and mobile payment, to the historically excluded populations (e.g., Demirgüç-Kunt et al., 2017; Fernández-Olit et al., 2019).Although financial inclusion has improved evidently during the past decade worldwide, Footnote 1 salient gaps in access to ...

University of Maryland's Smith School of Business students are pioneering advancements in the banking sector, focusing on community development and financial inclusion. In the M&T Bank x CSVC Case Competition, teams presented scholarly solutions, utilizing technology and partnerships for enhanced banking engagement.

Reviewing editor: Robert Read, University of Lancaster, Lancaster, UK. Abstract: This paper investigated the threshold effect of financial inclusion on poverty reduction in sub-Saharan Africa (SSA). Using an annual dataset spanning 2010 to 2017, the Hansen's estimation and Differenced generalized method of moments (GMM) methods were used to ...

Welcome to White Rose eTheses Online - White Rose eTheses Online

Governments, banks, and financial institutions focus on providing financial services for unserved and underserved populations. The traditional form of financial services spread was uneven across the territories and rural areas were ignored due to unprofitable. Hence, technology would help to overcome some of the barriers to financial inclusion.

Background. Globally, 1.4 billion adults do not have an account with a formal financial institution, such as a bank, microfinance institution, post office, or mobile financial service provider, and are thus financially excluded [Citation 1].Although national data on financial inclusion disaggregated by disability remain scarce, available data show that the proportion of people with disability ...