- Chemicals & Resources ›

Pulp & Paper

U.S. pulp and paper industry - statistics & facts

How much paper and pulp does the u.s. produce, paper products in the u.s., leading u.s. paper companies, key insights.

Detailed statistics

Share of global paper and paperboard production 2022, by region

Global pulp for paper production 2022, by country

Pulp and paper market size in the U.S. 2020-2021

Editor’s Picks Current statistics on this topic

Current statistics on this topic.

Production of paper and paperboard in the U.S. 1961-2022

Consumption of paper and paperboard in the U.S. 2000-2022

Paperboard and packaging paper production in the U.S. 1961-2022

Related topics

Recommended.

- Paper industry worldwide

- Paper packaging industry worldwide

- Global pulp industry

- Paper industry in Europe

- Forest products industry

- International Paper

- Kimberly-Clark

Recommended statistics

- Premium Statistic Share of global paper and paperboard production 2022, by region

- Basic Statistic Global pulp for paper production 2022, by country

- Premium Statistic Global production of paper and paperboard 2010-2022, by country

- Premium Statistic Pulp and paper market size in the U.S. 2020-2021

- Premium Statistic Selected figures in relation to the U.S. paper mill industry 2024

Distribution of paper and paperboard production worldwide in 2022, by region

Leading pulp for paper producing countries worldwide in 2022 (in million metric tons)

Global production of paper and paperboard 2010-2022, by country

Production volume of paper and paperboard in selected countries worldwide in 2010 and 2022 (in 1,000 metric tons)

Pulp and paper market size in the United States from 2020 to 2021 (in billion U.S. dollars)

Selected figures in relation to the U.S. paper mill industry 2024

Selected figures on the United States paper mill industry in January 2024

- Premium Statistic Imports and exports of wood pulp in the U.S. 1990-2022

- Premium Statistic Imports and exports of paper and paperboard in the U.S. 1990-2022

- Basic Statistic Paperboard and packaging paper export volume in the U.S. 2000-2022

- Basic Statistic Paperboard and packaging paper import volume in the U.S. 2000-2021

- Premium Statistic Paper and pulp products export volume in the U.S. 2022, by type

- Premium Statistic U.S. corrugated packaging shipments 1995-2026

Imports and exports of wood pulp in the U.S. 1990-2022

Import and export volume of wood pulp in the United States from 1990 to 2022 (in million metric tons)

Imports and exports of paper and paperboard in the U.S. 1990-2022

Import and export volume of paper and paperboard in the United States from 1990 to 2022 (in million metric tons)

Paperboard and packaging paper export volume in the U.S. 2000-2022

Export volume of packaging paper and paperboard in the United States from 2000 to 2022 (in million metric tons)

Paperboard and packaging paper import volume in the U.S. 2000-2021

Import volume of packaging paper and paperboard in the United States from 2000 to 2021 (in million metric tons)

Paper and pulp products export volume in the U.S. 2022, by type

Export volume of paper and pulp in the United States in 2022, by type (in 1,000 metric tons)

U.S. corrugated packaging shipments 1995-2026

Shipments of corrugated packaging in the United States from 1995 to 2026 (in billion square feet)

Production and consumption

- Premium Statistic Pulpwood production in the United States 2000-2022

- Premium Statistic Pulp for paper production in the United States 1961-2022

- Premium Statistic Wood pulp production in the United States 1961-2022

- Basic Statistic Production of paper and paperboard in the U.S. 1961-2022

- Basic Statistic Consumption of paper and paperboard in the U.S. 2000-2022

- Premium Statistic Consumption of paper and paperboard in the U.S 2022, by type

- Basic Statistic Distribution of U.S. recovered paper and paperboard utilization 2021, by type

Pulpwood production in the United States 2000-2022

Production of pulpwood in the United States from 2000 to 2022 (in million cubic meters)

Pulp for paper production in the United States 1961-2022

Production of pulp for paper in the United States from 1961 to 2022 (in million metric tons)

Wood pulp production in the United States 1961-2022

Production of wood pulp in the United States from 1961 to 2022 (in million metric tons)

Total production of paper and paperboard in the United States from 1961 to 2022 (in million metric tons)

Total consumption of paper and paperboard in the United States from 2000 to 2022 (in million metric tons)

Consumption of paper and paperboard in the U.S 2022, by type

Paper and paperboard consumption in the United States in 2022, by type (in million metric tons)

Distribution of U.S. recovered paper and paperboard utilization 2021, by type

Distribution of the utilization of recovered paper and paperboard in the United States in 2021, by type

- Premium Statistic Pulp production in the United States 2021, by type

- Premium Statistic Breakdown of paper and paperboard produced in the United States 2021, by type

- Basic Statistic Graphic papers production in the U.S. 1961-2022

- Basic Statistic Household and sanitary papers production in the U.S. 1961-2022

- Basic Statistic Paperboard and packaging paper production in the U.S. 1961-2022

- Premium Statistic Case materials production in the United States 2000-2022

Pulp production in the United States 2021, by type

Pulp production in the United States in 2021, by type (in million metric tons)

Breakdown of paper and paperboard produced in the United States 2021, by type

Distribution of paper and paperboard production in the United States in 2021, by type

Graphic papers production in the U.S. 1961-2022

Production of graphic papers in the United States from 1961 to 2022 (in million metric tons)

Household and sanitary papers production in the U.S. 1961-2022

Production of household and sanitary papers in the United States from 1961 to 2022 (in million metric tons)

Production of packaging paper and paperboard in the United States from 1961 to 2022 (in million metric tons)

Case materials production in the United States 2000-2022

Production of case materials in the United States from 2000 to 2022 (in million metric tons)

- Premium Statistic U.S. leading forestry and paper companies based on revenue 2022

- Premium Statistic International Paper's sales by major product 2010-2023

- Premium Statistic WestRock revenue 2020-2023, by segment

- Premium Statistic Market share of containerboard producers in North America 2021

- Premium Statistic Uncoated freesheet production shares in North America 2021, by company

- Premium Statistic Market share of tissue paper capacity in North America 2020, by manufacturer

U.S. leading forestry and paper companies based on revenue 2022

Revenue of selected leading paper companies in the United States in 2022 (in billion U.S. dollars)

International Paper's sales by major product 2010-2023

International Paper's worldwide paper sales from 2010 to 2023, by major product (in 1,000 short tons)

WestRock revenue 2020-2023, by segment

WestRock revenue from 2020 to 2023, by segment (in million U.S. dollars)

Market share of containerboard producers in North America 2021

Market share of North American containerboard producers in 2021

Uncoated freesheet production shares in North America 2021, by company

Distribution of the largest uncoated freesheet producers in North America as of September 2021

Market share of tissue paper capacity in North America 2020, by manufacturer

Market shares of tissue paper production capacity in North America in 2020, by manufacturer

Further reports Get the best reports to understand your industry

Get the best reports to understand your industry.

Mon - Fri, 9am - 6pm (EST)

Mon - Fri, 9am - 5pm (SGT)

Mon - Fri, 10:00am - 6:00pm (JST)

Mon - Fri, 9:30am - 5pm (GMT)

Pulp, paper, and packaging in the next decade: Transformational change

From what you read in the press and hear on the street, you might be excused for believing the paper and forest-products industry is disappearing fast in the wake of digitization. The year 2015 saw worldwide demand for graphic paper decline for the first time ever, and the fall in demand for these products in North America and Europe over the past five years has been more pronounced than even the most pessimistic forecasts.

But the paper and forest-products industry as a whole is growing, albeit at a slower pace than before, as other products are filling the gap left by the shrinking graphic-paper 1 The graphic-paper segment includes newsprint, printing, and writing papers. market (Exhibit 1). Packaging is growing all over the world, along with tissue papers, and pulp for hygiene products. Although a relatively small market as yet, pulp for textile applications is growing. And a broad search for new applications and uses for wood and its components is taking place in numerous labs and development centers. The paper and forest-products industry is not disappearing—far from it. But it is changing, morphing, and developing. We would argue that the industry is going through the most substantial transformation it has seen in many decades.

In this article, we outline the changes we see happening across the industry and identify the challenges CEOs and their leadership teams will need to manage over the next decade.

Changing industry structure

The structure of the industry landscape is changing. The changes are not dramatic individually, but the accumulation of changes over the long term has now reached a point where they are making a difference.

Consolidation has been a major factor in many segments of the industry. The big have become bigger in their chosen areas of focus. At the aggregate level, the world’s largest paper and forest-products companies have not grown much, if at all, and several of them have reduced in size. What they have done is focus their efforts on fewer segments. As a result, concentration levels in specific segments have generally, if not universally, increased (Exhibit 2). In some segments such as North American containerboard and coated fine paper, ownership concentration as defined by traditional approaches to drawing segment boundaries may be reaching levels where it would be difficult for companies to find further acquisition opportunities that could be approved by competition authorities.

A grouping of companies has emerged that is not identical to, but partly overlaps with, the group of largest companies, and is drawn from various geographies and market segments. Companies in this group have positioned themselves for further growth through high margins and low debt (Exhibit 3). Our analysis suggests the financial resources available to some members of this group for strategic capital expenditure could be five to ten times greater than other top players in the industry. This potentially represents a powerful force for change in the industry, and over the next few years it will be interesting to see how these companies choose to spend their resources. Some of these companies with large war chests and sizable annual cash flows deployable for strategic capex might even face a challenge to find opportunities on a scale that matches these resources.

Where there are leaders, there are also laggards. We believe the pronounced differences in performance among companies across the industry continues to pique the interest of investors and private-equity players in an industry that is already undergoing substantial restructuring and M&A.

Changing market segments

Whether companies are well positioned for further growth or still needing to earn the right to grow, they can expect demand to grow for paper and board products over the next decade. The graphic-paper market will continue to face declining demand worldwide, and our research has yet to find credible arguments for a specific floor for future demand. But this decline should be balanced by the increase in demand for packaging—industrial as well as consumer—and tissue products. All in all, demand for fiber-based products is set to increase globally, with some segments growing faster than others (Exhibit 4).

That picture is not without its uncertainties. One hazy spot in the demand skies might be concerns over how fast demand will grow in China. Expectations of growth from only a few years ago have proved a bit too optimistic, not only in graphic papers but also in tissue papers and packaging. And recently, as a result of turmoil in the market for recycled fiber, Chinese users of corrugated packaging have reduced their consumption, through weight reductions and use of reusable plastic boxes. Given China’s weight in the global paper and board market, even relatively modest changes can have significant impact.

How these demand trends will translate into industry profitability will of course be heavily influenced by the industry’s supply actions. Supply movements are notoriously difficult to forecast more than a few years out, but we believe the following observations are relevant to this discussion.

- Graphic papers, particularly newsprint and coated papers but also uncoated papers, will continue to face a severe decline in demand and significant pressure to restructure production capacity. We are likely to see continuing machine conversions into packaging and specialty papers, as well as more innovative structural moves that include innovations in distribution and the supply chain. Such structural changes are already having an impact and the profitability of graphic-paper companies has reemerged from several years in the doldrums. The turbulence in graphic papers has meanwhile spilled over to packaging and tissue segments, with capacity increases in segments that don’t really need it.

- Consumer packaging and tissue will be driven largely by demographic shifts and consumer trends such as the demand for convenience and sustainability. It will grow roughly on par with GDP. We expect innovation to be a critical success factor, particularly in light of recent concerns over plastic packaging waste, which could harbor both opportunities and challenges for fiber-based consumer packaging. But we are uncertain how far packaging players can drive innovation by themselves. Clearly, they can take the lead on materials development, but they may need to follow the lead of—and cooperate with—retailers and consumer-goods companies in areas such as formats, use, and technology. At the same time, the inflow of capacity from the graphic-paper segment will need to be managed.

- Transport and industrial packaging will also see opportunities for innovation and a certain amount of value-creating disruption in the intersection between sustainability requirements, e-commerce, and technology integration. We estimate that e-commerce will drive roughly half of the demand growth in transport packaging over the next several years. As packaging adapts to this particular channel, it will have to find new solutions to a variety of issues, such as how to handle last-mile deliveries, the sustainability choice between fiber-based and lightweight plastic packaging, and the potential merging of transport (secondary) and consumer (primary) packaging, to name but a few.

- Fiber has gone through some turbulent times in the past two years, largely to the delight of pulp producers and to the chagrin of users. Hardwood and softwood prices alike have seen steady increases since 2017, due to some slow start-up of capacity (hardwood pulp), limited capacity additions, and a certain measure of industry psychology. In the past two years, prices globally went through what we would term a “fly-up regime,” whereby prices are significantly and unusually higher than the cost of the marginal producer. Such situations, seen from time to time in many other basic-materials industries, are rarely long lived. Indeed, since the beginning of 2019, prices have come down—in China drastically so.

Would you like to learn more about our Paper & Forest Products Practice ?

But even with a readjustment of the market, the midterm prospects are likely to be in favor of the producers, with little new capacity until 2021–22 and some softwood capacity that is likely to be converted to other products, such as pulp for textile applications. For softwood particularly, challenges in expanding the forest supply are constraining new supply. Also, the fact that much of the industry’s softwood-production assets are aging and need complete renewal or substantial upgrades could further contribute to scarcity, especially since the scale of the investments required is a potential roadblock to them being made.

The lingering question is whether such supply-side challenges can trigger an accelerated development of applications that are less dependent on wood-fiber pulp.

Challenges for the next decade

In such an environment, what are the key challenges senior executives will need to address? What are the key battles they will have to fight? The paper and forest-products industry is often labelled a “traditional” industry. Yet given the confluence of technological changes, demographic changes, and resource concerns that we anticipate over the next decade, we believe the industry will have to embrace change that is, in character, as well as pace, vastly different from what we have seen before—and anything but traditional. This will pose significant challenges for CEOs regarding how they manage their companies.

We argue that there are three broad themes that paper and forest-products CEOs will have to address through 2020 and beyond:

- Managing short-to-medium-term “grade turbulence”

Finding the next level of cost optimization

- Finding value-creating growth roles for forest products in a fundamentally changing business landscape

Managing short-to-medium-term ‘grade turbulence’

The past couple of years have seen increased instability in forest-products segments. The negative impact of digital communications on graphic paper has led many companies to steer away from the segment and into higher-growth areas, either through conversion of machines or through redirection of investment funds. This is leading to a higher level of uncertainty and overcapacity in, for example, packaging grades. The instability has also been exacerbated by the capacity additions that primarily Asian producers have made despite the slowing demand growth in that region.

A case in point is virgin-fiber cartonboard. Several producers in Europe have converted machines away from graphic paper and into this segment, creating further oversupply in Europe and leading producers to redouble their efforts to sell to export markets. This is happening just as increasing capacity in Asia, and particularly in China, looks set to displace imports that have traditionally come into the region, mainly from Europe and North America. Some of the new Asian capacity could even find its way into export markets.

This development is likely to persist for several years until markets again find more of an equilibrium, and it poses challenging questions for companies. What, if any, safe havens exist for my products? How do I protect home-market volumes? How do I protect my export volumes? What is the appropriate pricing strategy to use in the different regions?

For CEOs looking to move into a new market segment, it will be equally important to make the right assessment of which segments to enter as they shift their footing. Where will I be the most competitive? How will my entry change market dynamics, and will this matter to me?

On the raw-materials (fiber) side, we have already described the past couple of years’ turbulence in virgin pulp. If that might seem to trend toward stabilization, the situation in recycled fibers is still very uncertain. As China, and gradually other Asian countries, have increasingly restricted the import of recovered fiber (as well as plastics and other recovered materials), the dynamics have shifted. While prices of old corrugated containers (OCC) and other papers for recycling have plummeted in North America and Europe, prices of domestic Chinese OCC have increased drastically, challenging both the price and availability of recycled-based corrugated board. In response, companies have set up capacity to produce recycled-fiber pulp to export to China, while the country is jacking up its import of containerboard for corrugated packaging, as well as virgin fiber for strengthening purposes.

This of course affects how companies, in any country, think about their fiber-supply strategies as well as their product focus.

Even though we see new ways of creating value in the forest-products industry, low cost is, and will remain, a critical factor for high financial performance. One of the characteristics shared by companies with high margins and high returns is that they have access to low-cost raw materials, primarily fiber. This will continue to be a high-priority area, albeit with some twists compared with today.

Beyond the price increases of the past couple of years, fresh fiber is facing other, more long-term, cost issues. It is unclear whether plantation land in the southern hemisphere (primarily for short-fiber wood) will continue to be available at current low prices. And as companies go to more remote areas to acquire inexpensive land, such as in Brazil, their infrastructure and logistics costs increase. Will higher productivity and yield allow the global industry to add ever more low-cost capacity, or are we going to see a gradual increase in raw-material costs? For long-fiber products, the difficulties to expand long-fiber pulp capacity will make such assets very valuable over the next several years. But at what point will development of the material properties of short-fiber pulps make them rival more expensive long-fiber pulps in a number of major applications?

Operating costs for paper and board production are another area where companies need to get a tighter grip. Despite the fact that this area receives continual focus from management, our experience suggests there is still significant potential for cost reduction by using conventional approaches to work smarter and reduce waste in the production chain. This is particularly the case in areas that are less the focus of management attention, such as converting.

Many companies need to go beyond the conventional approaches to a next level of cost optimization—and many are ready to take this step. Most if not all paper and forest-products companies have completed large fixed-cost reduction programs. But there are often broader systemic issues that companies still need to address to be able to build sustainable operating models. In addition, in some segments many companies fail to reduce fixed costs as quickly as capacity disappears. By radically rethinking the operating model, companies can significantly shift their fixed-cost structure. By doing so, they can set a very different starting point in terms of flexibility and agility for when market volumes go through their normal cyclical swings.

The paper and forest-products industry has much to gain from embracing digital manufacturing : according to our estimates, this could reduce the total cost base of a producer by as much as 15 percent. New applications such as forestry monitoring using drones or remote mill automation present tremendous opportunities for increased efficiency and cost reductions. This is also the case in areas where big data can be applied, for instance, to solve variability and throughput-related issues in each step of the integrated production flows (Exhibit 5). The industry is well placed to join the digital revolution, as paper and pulp producers typically start from a strong position when it comes to collected or collectable data.

At the customer-facing end, the opportunity for innovation is huge and has the potential to transform existing industries and create new ones, especially in packaging segments. Digital developments will also help disrupt previous B2B2C value chains, paving the way for direct B2C relationships between paper-product makers and end consumers, for example, in tissue products.

The digital world is unfamiliar territory to most paper industry CEOs. To avoid too much doodling with small uncoordinated efforts, it is necessary to undertake a thought-through program, preferably guided by digitally experienced people either on the top-management team or board.

Finding value-creating growth roles for forest products

For any paper-company CEO who looks out ten years, the really different challenges will not be around cost containment. Global trends are moving the industry into a new landscape, where the challenges and opportunities for finding value-creating growth roles for forest products are changing radically. For example, the industry’s historic linear value chains are giving way to more collaborative structures with players in and outside the industry. We believe examples will include new producer and distributor collaborations; pulp players collaborating more innovatively with non-integrated players; paper and packaging companies collaborating more intensively with retailers, consumer-goods companies, and technological experts; and new products such as bio-refinery products requiring novel go-to-market partnerships. Here are some interesting examples of how these and other trends could play out.

Staying relevant (and increasing relevancy) in a fast-changing packaging world. The packaging market is multifaceted and continuously morphing. Digital developments influence it both by stimulating demand for packaging used in e-commerce and by enabling the integration into packaging of sensors and other technology. E-commerce has highlighted new packaging topics such as improved product safety, the “un-boxing” experience, counterfeiting measures, optimization for last-mile delivery , and a growing interest—at least from the large e-commerce-based retailers—in the possibility of merging primary and secondary packaging. At the same time, the packaging industry has to deal with increasing pressures around cost, resource conservancy, and sustainability. That last topic has gained huge momentum in the past couple of years as concerns over plastic waste have added to the concern over CO 2 emissions from fossil-based packaging materials. Consumer-goods companies, retailers, packagers, and policy makers alike are now exploring a wide range of possible solutions for what tomorrow’s packaging will look like.

The opportunity for forest-products companies to develop a differentiated and distinct customer value proposition in this landscape has never been greater. Packaging-materials CEOs will have to address a number of choices and trade-offs as they seek the appropriate strategic posture. Should you be a pure upstream player or a packaging-solutions provider? Should you focus on fiber-based packaging only or providing multi-substrate solutions? Should you be at the forefront of technology integration and application development in packaging or focus on materials development?

To stay relevant, many companies in packaging are trying to move closer to the brand owner or end user. Only a few companies are positioned to successfully make this move, however, and even they should be cautious. We are already seeing brand owners and leading customers challenging the benefits of packaging companies coming with consumer-facing ideas such as complete packaging concepts. Some of these players would prefer packaging companies to focus instead on core competencies such as materials development or interfaces with other substrates such as plastics.

How the paper and forest-products industry thrives in the digital age

Finding the right path in next-generation bio-products. Wood is a biomaterial with exciting properties, from the log on down to fibers, micro- and nanofibers, and sugar molecules. A healthy niche industry making bio-products has existed for many years alongside large-volume pulp, paper, and board products. We are in the midst of an explosion of research activity to develop new bio-products, ranging from applications for nanofibers to composite materials and lignin-based carbon fiber. New processes are being designed to extract hemicellulose as feedstock for sugars and chemical production while still keeping the cellulose parts of the wood chip for pulp products.

We believe wood-based products will find new ways to enlarge their footprint in a more sustainable global economy. But the challenges are legion, particularly for finding cost-effective production methods that can withstand competition not only from oil-based materials but also from other biomaterials. Finding the right balance between developing the “new” and safeguarding the “old” will be a crucial undertaking for executives running companies with access to fresh fiber.

Finding growth in adjacent areas. Over the past decade or two we have seen the larger forest-products companies performing a focus adjustment. Most companies have moved from being fairly broad conglomerates present in various forest-products segments to focusing on a few core businesses. To find value-creating growth in the next two decades, we expect companies to start broadening their corporate portfolio again, but broadening it around the core businesses they have been working on, so as to create differentiated customer value propositions. Finding value-creating adjacencies to the core business will be a challenging exercise in creativity and business acumen for executive teams.

Finding new value-creating growth for forest products will also put the spotlight on a number of functional executive topics. We believe the following will be most important.

- Innovation: The forest-products industry has not been known for a fast-paced innovation agenda. By and large it hasn’t been necessary, as markets and demand characteristics have changed relatively slowly. In the future, however, innovation in products, processes, organizational setup, and business models will be imperative. For many companies, getting efficient innovation practices and organization up to speed will be an important challenge.

Talent management: The different skills required over the next ten to 15 years, dictated by developments such as new business models in an online world, increased need for innovation and commercialization of products, and digitalization’s impact on everything from manufacturing processes to the content of work will put particular onus on the talent pool of forest-products companies. Installing an executive team that is able to understand new demands across customer businesses, digital, bio-products that cater to completely different value chains, and cross-industry collaboration will be a major task for CEOs and boards.

One particular war-for-talent battle that can become a key differentiator is the content of work. Our research on the future of work highlights that already today, around 60 percent of all tasks, that is, not entire jobs or roles but their components, can be automated. And looking to the coming ten to 15 years, more than 30 percent of physical and manual skills risk becoming obsolete while technological skills will continue to grow very quickly. This will provide a critical and likely success-defining reskilling challenge for companies in the industry.

- Commercial excellence: Paper and forest-products companies will need to transform their commercial interface to stay relevant, particularly in packaging and downstream paper. They will need to put in place a more professionalized and skilled organization that focuses on value creation instead of focusing primarily on sales volumes.

We believe the paper and forest-products industry is moving into an interesting decade, one that will see nothing less than a transformation of large parts of the industry. There will be many barriers to overcome and metaphorical cliffs to fall off. But the companies that are able to navigate through successfully can look forward to an industry that has a new sense of purpose and an increasingly vital role to play.

This article was updated in August 2019; it was originally published in May 2017.

Stay current on your favorite topics

Peter Berg is a director of knowledge in McKinsey’s Stockholm office, where Oskar Lingqvist is a senior partner. Together they lead McKinsey’s global Paper & Forest Products Practice.

Explore a career with us

Related articles.

Winning with new models in packaging

Precision forestry: A revolution in the woods

Pulp and paper industry

Feb 25, 2012

2.15k likes | 6.78k Views

Pulp and paper industry. Case study Presentation by: Dalia Jankunaite. www.forestproducts.sca.com. Introduction. The pulp and paper industry converts wood or recycled fibre into pulp and primary forms of paper.

Share Presentation

- main wood component

- technical parameters

- providingspill containment

- brown stock washing efficiency

- lignin content

- small containers

Presentation Transcript

Pulp and paper industry Case study Presentation by: Dalia Jankunaite www.forestproducts.sca.com

Introduction • The pulp and paper industry converts wood or recycled fibre into pulp and primary forms of paper. • In the 1800s, there was a shift away from using cotton rags for paper production. Wood became the most important source of fiber. • First mechanical and then chemical methods have been developed to produce pulp from wood.

Pulp and paper mills • Pulp mills separate the fibres of wood or from other materials, such as rags, wastepaperor straw in order to create pulp. • Paper mills primarily are engaged in manufacturing paper from wood pulp and other fibre pulp, and may also manufacture converted paper products.

Production process The production process can be divided into 7 sub-processes: • raw materials processes; • wood-yard; • fibre line; • chemical recovery; • bleaching; • paper production; • products and recycling.

Simplified flow diagram of integrated mill

Pulping processes Pulping aims to separate cellulose fibers from the wood structure. Possible types of pulp production are: • Kraft (68%) • mechanical (22%) • semi-chemical (4%) • sulphite (4%) • dissolving (2%). www.handprint.com

Kraft Pulping Sulfate or Kraft pulping was invented in Germany in 1884 and remains the dominating technology today. Advantages: • higher pulp strength • wider variety of wood species may be used • more effective at removing impurities like resins. Disadvantage: • the pulp yield is low, less than 50%.

Environmental problems (1) Regulated wastes and emissions from the pulp and paper industry include liquid and solid wastes, air emissions, and wastewater. • Air emissions related with this process are: sulphur dioxide, nitrous oxides, particulate matter, methanol, polycyclic organic matter, hydrogen chloride, formaldehyde, chloroform, phenol and chlorinated phenolics, dioxins, furans and other chlorinated compounds.

Environmental problems (2) • Wastewater releases include chlorinated phenolics, dioxins, furans and other chlorinated compounds, phosphates and suspended sediments. • Paper mills also produce non-hazardous solid waste such as sludge derived from their pulping and bleaching operations.

Raw water use • Pulp mills are big water users. The total requirement of raw water has through cleaner production measures been reduced from about 200-300 m3 per ton of pulp in 1970 to well below 50 m3/ton, in some mills even below 10 m3/ton. • Consumption of fresh water can seriously harm habitats near mills, reduce water levels necessary for fish, and change water temperature, a critical environmental factor for fish.

Pollutants in effluents • The most common organic pollutants are suspended solids (SS): • lost cellulose fibre, • dissolved organic compounds such as dissolved lignin compounds, carbohydrates, starch and hemi-cellulose • Acidic compounds are predominantly natural resin acids. • Chlorinated organics (AOX)are found if elemental chlorine is used in the process.

Wastewater flowSCA Forest Products, Östrand pulp mill

Development of emissions of CODSCA Forest Products, Östrand pulp mill

Development of emissions of AOXSCA Forest Products, Östrand pulp mill

Solid wastes • Dirty wood chips or fibers as well as bark. • The broken, low-quality fibres are separated out to become waste sludge. • All the inks, dyes, coatings, pigments, staples and "stickies" (tape, plastic films, etc.) washed off the recycled fibres.

Organic wastes amount developmentSCA Forest Products, Östrand pulp mill

Energy use (1) • The pulp and paper industry uses 84% of the fuel energy consumed by the forest products industry as a whole. • It is one of the largest producers of greenhouse gas (GHG) emissions. • Over the past few years, the pulp and paper industry has considerably reduced its GHG emissions by introducing energy conservation projects and by increasing its use of biomass as an energy source.

Energy use (2) • A modern kraft pulp mill is essentially self-sufficient in energy. The only oil consumer is the causticing oven, which however can be replaced with bio-fuel. • A paper mill requires between 400 and 1000 kWh electricity/ton paper and 4 – 8 GJ heat/ton for drying in the paper machine. • In an integrated pulp and paper mill this energy is provided from the recovery boiler.

Cleaner production measuresRaw materials • Maintaining moisture contentof the raw materials constant all year around. • Keeping chemical inventory to a minimum and buying small containers of infrequently used materials. • Labelling storage area for hazardous substances. • Providingspill containment and collection systemsduring storage. • Genetically modifyingforest trees.

Genetically modified trees • Lignin is the main wood component that must be effectively removed from the pulp. • It has been possible to use genetic engineering to modify lignin content and/or composition in poplars. courses.washington.edu

Advantages of genetic modifications • Genetic modifications improved characteristics, allowing easier delignification, using smaller amount of chemicals, while yielding more high-quality pulp. • Owing to the genetic modification savings in energy and pollutant chemicals are achieved, thus leading to an environmentally more sustainable process.

Cleaner production measuresWood-yard (1) • Pulp mills integrated with lumbering facilities: acceptable lumber wood is removed during debarking; residual or waste wood from lumber processing is returned to the chipping process; in-house lumbering rejects can be a significant source of wood furnish. • Avoiding hydraulic debarking– saving energy and water consumption, reducing wastewater amount.

Cleaner production measuresWood-yard (2) • Reusing leachate water. • Co-production from bark: mulch, ground cover, charcoal. • Burning barkfrom debarking and small chips from chipping for energy production (depends on the moisture content).

Cleaner production measuresPulp production (1) • Increasing brown stock washing efficiency. Any remaining cooking liquor will increase the chemical consumption in subsequent stages. • Water reuse from evaporators. The evaporation plant is always one of the largest steam consumers in the mill. Condensate might be used instead of fresh water in the mill. • Repulping the rejects from screening rather than putting them into the landfill.

Cleaner production measuresPulp production (2) • Using pulp centrifugingto remove any remaining impurities. • Sludge utilization by means of land-spreading.This method of sludge disposal is an area of concern, as sludge constituents are not well identified. • Air emissions control devices. • Providing spill containment and collection system.

Cleaner production measuresChemicals recovery (1) • Using of new technologies (CHP, BLG, heat transfer, heat exchanger). • Improvements technical parameters of recovery boiler or furnace (geometrical shape etc.). • Using light gas strippers and gas collection systemswhich will remove hazardous and foul smelling pollution from the air and increase workplace safety.

Cleaner production measuresChemicals recovery (2) • Deaerator tanks ahead of the boilers to help reduce the intake of freshwater. • Air emissions control devices. • Providing spill containment and collection system.

Cleaner production measuresBleaching • Avoiding chlorine bleaching. • Continuing research on biotechnological bleaching and electrochemical bleaching. • Air emissions control devices. • Providing spill containment and collection systems.

Cleaner production measuresPaper production (1) • Cleaning the roll in the paper machines to avoid broken paper line. • Adjustment of edge cutterto reduce side trimming loss. • Use of soft water as a boiler feed water. • Recycling water evaporatedfrom drying process by condensing.

Cleaner production measuresPaper production (2) • Optimizing the thermal effects on waterused in the paper machine and stock preparation area. • Providingdisk save-allfor paper machine. • Repulping rejected paper in a closed loop manner.

Cleaner production measuresProducts processes and recycling • Increasing recycling rates. Recycling reduces energy consumption, decreases combustion and landfill emissions, and decreases the amount of carbon dioxide in the atmosphere. This process also saves money. • Possibility for easypackaging recycling. • Using “green” fuel for transportation.

Recycling In Europe an average of 56% of used paper is recovered.The recycling process includes following stages: • Sorting • Dissolving • De – inking • Mixing • Papermaking process

Ideal paper mill (1) • From cleaner production point of view is a chlorine-free and zero-discharge one, with minimized quantity and toxicity of air pollution and solid wastes. • It is seen that closed loops represent the most effective approach to save both energy and resource consumption and at the same way to decrease all kind of wastes production.

Ideal paper mill (2) • Such an approach is developed in the form of paper recycling, different types of substances re-use during production processes, co-production and chemicals recovery. • Future research can develop more sustainable reuse options for kraft pulping solid wastes, as well as pulping methods that result in purified by-products that can serve as feedstock for other manufacturing processes.

- More by User

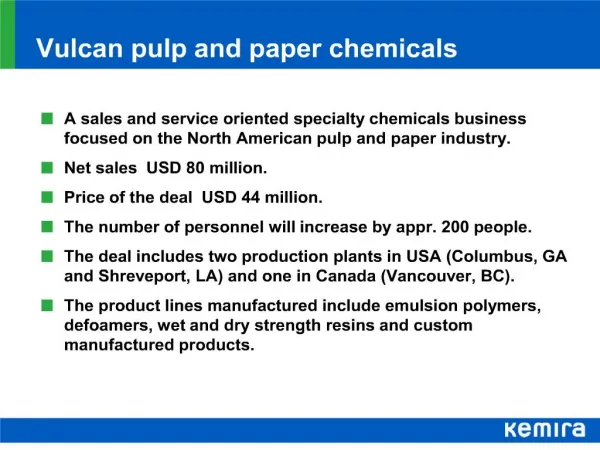

Vulcan pulp and paper chemicals

504 views • 10 slides

Pulp and Paper Products

Pulp and Paper Products. Topics. Industry Analysis Weyerhaeuser Analysis Economic Environment Recommendations Macro Impact. Objective. Present the relevance of the forest and paper products industry to the US economy.

1.6k views • 26 slides

NewPage Escanaba Pulp and Paper Mill

NewPage Escanaba Pulp and Paper Mill. General DescriptionLocated off shore of Lake MichiganLocated just north of the town of Escanaba, MI population ~13,000About 1,100 site workersProducts produced Coated freesheet from kraft pulp (77%), coated groundwood from refiner mechanical pulp (20%),

769 views • 19 slides

State of the North American Pulp & Paper Industry

State of the North American Pulp & Paper Industry. Into The Breach January 2009 ~ ’08 Q4 Preliminary Data Center for Paper Business and Industry Studies (CPBIS) ~ Dr. Jacquelyn McNutt . Overview. North American Forest Products Industry Review ~ The Industry Context Where Are We?

1.08k views • 79 slides

Global Dynamics of the Pulp and Paper Industry - 2013

Global Dynamics of the Pulp and Paper Industry - 2013. Richard B. Phillips, PhD North Carolina State University. [email protected]. Three Main Points. Growing imbalance between where paper and board are consumed and where wood fiber is grown

452 views • 25 slides

Indonesia’s Pulp & Paper Industry: Trends, Risks, Opportunities

Indonesia’s Pulp & Paper Industry: Trends, Risks, Opportunities. Christopher Barr Woods & Wayside International 21 October 2010. Indonesia’s pulp & paper sector. Rapid expansion since early-1990s 2010 BHKP capacity = 7.1 million Adt /yr 2009 BHKP production = 5.97 million tonnes

502 views • 14 slides

CENTURY PULP AND PAPER LALKUA, NAINITAL

CENTURY PULP AND PAPER LALKUA, NAINITAL ( A BK BIRLA GROUP OF COMPANY ) ISO –9001 – 2000 AND ISO -14001 CERTIFIED COM PANY. AN INTEGERATED PULP & PAPER UNIT 31320 TPA RAYON GRADE UNIT

1.43k views • 79 slides

Pulp Nonfiction Paper Choices and Sustainability in the Paper Industry *** Michael Peek

Pulp Nonfiction Paper Choices and Sustainability in the Paper Industry *** Michael Peek VP Sales Northeast. New Leaf Paper Experience. Sustainability is a core business value. Informs all aspects of the business: strategy, product design, marketing, operations, sales, etc.

396 views • 19 slides

WOOD 120 Pulp and Paper

WOOD 120 Pulp and Paper. Paper products. Raw material. Chemical pulp mill. http://w3.upm-kymmene.com/upm/internet/cms/upmmma.nsf/lupGraphics/Botnia_Fray%20Bentos%20mill_1.jpg/$file/Botnia_Fray%20Bentos%20mill_1.jpg. Chemical pulp mill.

1.65k views • 61 slides

Pulp and Paper

Pulp and Paper. Timber Committee forecasts by Mr. Kit Prins Expert presentation by Dr. Peter Ince , Research Forester, Forest Products Laboratory USDA Forest Service. Highlights of Forest Products Annual Market Review 2001-2002 (1-5).

534 views • 16 slides

Relevant to the Pulp and Paper Industry

Relevant to the Pulp and Paper Industry. Environmental Legilsation. Gladys Naylor Environmental Management Mondi South Africa. The Constitution. Section 24 of the Constitution sets out the environmental right as follows: 24. Environment (1) Everyone has the right:

906 views • 27 slides

Data Integration in Pulp and Paper Industry

Data Integration in Pulp and Paper Industry. Timo Syrjänen PELC 2006, 7th June 2006 World Forum Convention Centre, The Hague. Content. Key change forces in pulp and paper industry Data integration in one company Data integration in project and in mills

772 views • 35 slides

Visy Tumut Pulp and Paper Mill

Visy Tumut Pulp and Paper Mill. Presentation to SEATS 20 May 2010. Visy mill’s development history. Built to address Visy’s closed-loop recycling strategy Satisfies market need for plantation-based industrial paper Site selection criteria – people, wood, water

927 views • 15 slides

Hayward Gordon in the Pulp & Paper Industry

Hayward Gordon in the Pulp & Paper Industry. PRODUCTS. Hayward Gordon Pumps Hayward gordon Pumps & Systems Watson Marlow Bredel Pumps Liquiflo Pumps Waukesha Pumps Esco Pumps Hayward Strainers. Hayward Gordon Solids Handling Pumps. CHOPX CHOPPER PUMP. CHOPX CHOPPER PUMP.

352 views • 13 slides

Pulp & Paper:

Pulp & Paper:. A Sustainable Industry. Kevin C. Burk Environmental Engineer Clearwater Paper Corporation P.O. Box 727, McGehee, AR 71654 T 870.730.2561 F 870.730.2404 [email protected] www.clearwaterpaper.com. What is papermaking?.

752 views • 21 slides

Prepare chemical additives used in the pulp and paper industry

Prepare chemical additives used in the pulp and paper industry. P&P4EL Basics of chemical additives. P&P4EL SHE. P&P4EL Standard Operating Procedures. P&P4EL Maintenance. Prepare chemicals additives used in the pulp and paper industry. Topics. Modules. Notional Hours. 32 16 16 18

375 views • 16 slides

North American Pulp & Paper Industry

North American Pulp & Paper Industry. Impacts of High & Volatile Energy Costs on Energy Intensive Industries ~ Coping Strategies and Future Research Needs ~ ~ April 9-10 ~ 2008 ~ Morgantown, West Virginia Center for Paper Business and Industry Studies (CPBIS)

704 views • 48 slides

Global Paper pulp bleaching agent Industry 2015 Market Resea

A new research report on the international Paper pulp bleaching agent industry, with a key focus on the China market, has been recently added to the research report database. The report, titled “Global Paper pulp bleaching agent Industry 2015 Market Research Report”, is a detailed analysis of the key elements of the Paper pulp bleaching agent industry chain based on expert data gathered pertaining to report’s review period. A detailed forecast of the Paper pulp bleaching agent industry’s future state during the years 2020-2015 is formed based on historical data, prominent trends of the past, and development trends observed in the industry so far. The section of competitive analysis of the report presents a snapshot of the Paper pulp bleaching agent industry landscape in key countries and regions across the globe, with a keen focus on Chinese regions. Of the key Paper pulp bleaching agent international manufacturers, details such as product types manufactured, production capacities, production values, gross margins, product production global share, company contact information, product pictures, manufacturing processes, product cost structures, etc. are included. The report also studies the new projects in the Paper pulp bleaching agent marketplace, and presents SWOT analysis, investments feasibility and returns feasibility of these projects. A development trend analysis of the industry is meant to ease the process of formulating effective business strategies to sustain profitably in the industry, for both - the new entrants as well as established businesses. Distribution of production across the globe and China is separated according to regions, applications and technologies. Analysis of the international Paper pulp bleaching agent industry chain also covers details about supply and demand chain, marketing channels, equipment, proposals, and development trends. Browse Full Report with TOC @ http://www.marketresearchstore.com/report/global-paper-pulp-bleaching-agen

327 views • 5 slides

Pulp & Paper Industry Mailing Leads

There is a reason why we have so many loyal clients. The Pulp and Paper Products Manufacturing Industry Lists is quite specific and that means you will need an email list just as specific. This is why we offer specialized and fully customizable databases. www.globalb2bcontacts.com [email protected] https://globalb2bcontacts.com/sub-industry-email-database.html

175 views • 7 slides

PULP AND PAPER PRODUCTS EMAIL LIST

Our Pulp & Paper Products Email List reaches the administrative, technical and operating personnel in the industry and technical members of the Pulp and Paper Association including students & retired members. You can use our custom mailing lists for mailing, emailing and telemarketing campaigns to meet your business needs. [email protected] http://www.globalb2bcontacts.com Contact number: - 1-816-286-4114.

73 views • 6 slides

![paper industry presentation Centripetal Screen Basket Pulping Equipment [Paper & Pulp Industry]](https://cdn4.slideserve.com/8421711/centripetal-basket-dt.jpg)

Centripetal Screen Basket Pulping Equipment [Paper & Pulp Industry]

Centripetal Screen Basket Pulping Equipment [Paper & Pulp Industry] Large, open screening surface High sticky removal efficiency Less energy consumption High stability by welded profile bars Suitable for all centripetal screening machines High screening efficiency Trouble-free operation Modular design Low energy consumption Low maintenance costs

45 views • 4 slides

Products for the Pulp & Paper Industry

Products for the Pulp & Paper Industry. Our HISTORY. & counting. In operation since 1982, Constant America has forged a solid reputation as a service-oriented company offering innovative chemicals and unparalleled expertise. Our COMPANY.

381 views • 29 slides

- My presentations

Auth with social network:

Download presentation

We think you have liked this presentation. If you wish to download it, please recommend it to your friends in any social system. Share buttons are a little bit lower. Thank you!

Presentation is loading. Please wait.

To view this video please enable JavaScript, and consider upgrading to a web browser that supports HTML5 video

Global Dynamics of the Pulp and Paper Industry

Published by Poppy Hawkins Modified over 8 years ago

Similar presentations

Presentation on theme: "Global Dynamics of the Pulp and Paper Industry"— Presentation transcript:

Outlook for Book Publishing Papers John Maine, VP World Graphic Paper BMI Management Conference April,

Papir- og fiberinstituttet AS Paper and Fibre Research Institute Paper and Fibre Research Institute (PFI) Biomass-Conversion: Energy production.

CANFOR CORPORATION University of Victoria Student Research CFA Institute Research Challenge 2012.

Making the Transition to the Secondary Materials Economy Scott Mouw NC Division of Pollution Prevention and Environmental Assistance.

Transforming the forest products industry through innovation Opportunities for the Future Forest Products Industry Ron Brown President and Executive Director.

CQVB Jan 13, 2009 Bioproducts from Dissolving Pulp Manufacturing January 13, 2009 Michael Paice.

NE Minnesota Pulp and Paper Industry: A decade of change

Presentation to: Tembec Marketing Group January 24, 2006 Montreal, Quebec, Canada Global Trends in Market Pulp Brian McClay Brian McClay & Associates Inc.

TAML TM Oxidant Activators: Green Bleaching Agents for Paper Manufacturing A Green Chemistry Module.

How Cost Competitive is Wood Pulp Production in South China? Christopher Barr and Christian Cossalter Center for International Forestry Research (CIFOR)

Outlook for Australia’s forestry and forest products industry

Graphs Showing Forecasts made for 70th Timber Committee meeting (supplement) UNECE/FAO Forestry and Timber Section Geneva, Switzerland October 2012.

Carton Recycling Markets Victor Storelli Storelli Recycling Carton Council Markets and Materials Brokerage.

Peter Ince U.S. Forest Service Forest Products Laboratory Madison, WI.

Available for download here:

Forest Industry Trends and Outlook Second Butler/Cunningham Conference on Agriculture and the Environment Presented By: Ken Muehlenfeld November 3, 2003.

Jaime Malaga, Ph.D. Center for North American Studies Texas Tech University - Department of Agricultural & Applied Economics Recent Trends in U.S. Cotton.

Paper Task Force White Paper No. 10A Environmental Comparison: Manufacturing Technologies for Virgin and Recycled-Content Printing and Writing Paper Prepared.

North American Containerboard Outlook

About project

© 2024 SlidePlayer.com Inc. All rights reserved.

- Operational Intelligence

- Presentations

PI System and BI, Essential Tools for Productivity in the Paper Industry

Presentation: pi system and bi, essential tools for productivity in the paper industry, presentation, 2018 - pi world - san francisco - forest & paper products.

Industrial Insight and International Paper have been using PI AF, PI Event Frames, PI Vision, PI OLEDB Enterprise, and the PI BI Integrator for Analytics to investigate numerous issues plaguing several mills. We have also combined these tools with both Tableau and Power BI to understand problems in ways we never have before. Some of the issues we have looked at: 1. Paper Machine runnability 2. Paper Machine centerlining 3. Batch Digester performance and steam usage 4. Sheet break re-thread performance on a paper machine Some other issues to address would be: 1. How to get people on board with the designs 2. Challenges in rolling out new tools (how do you let everyone know they are there, how to use them, etc.) 3. Real-time vs. post-process analytics and the nuances of each

Jim Gavigan is President and Founder of Industrial Insight, Inc, which focuses on helping companies leverage data to increase profitability. Jim has a background in control engineering and in sales, including a 2 year stint with OSIsoft as an account manager. Jim has been developing technical solutions around the PI System for Fortune 500 companies for the last 2 1/2 years and is always looking to push the envelope on what can be done.

Rick Smith is a Chemical Engineer with 34 years of paper industry experience. His career has always been focused around process control, process data and mill information systems. His focus has long been to get the data to the decision makers to improve product quality and company profitability. Rick has worked with the PI system since the ‘90’s and spend a lot of time in the past five years educating new hires on methods for retrieving process data to solve day-to-day problems.

- All Resource

PPT Templates

Single slides.

- Pitch Deck 209 templates

- Animation 326 templates

- Vertical Report 316 templates

- Business 803 templates

- Finance 56 templates

- Construction 45 templates

- IT/Commerce 171 templates

- Medical 64 templates

- Education 45 templates

- Lifestyle 394 templates

- Pitch Decks 138 templates

- Business 541 templates

- Finance 20 templates

- Construction 75 templates

- IT/Commerce 73 templates

- Medical 27 templates

- Lifestyle 578 templates

- Pitch Decks 140 templates

- Business 469 templates

- Finance 19 templates

- Construction 64 templates

- IT/Commerce 72 templates

- Medical 29 templates

- Education 39 templates

- Lifestyle 490 templates

- Cover 266 templates

- Agenda 97 templates

- Overview 216 templates

- CEO 28 templates

- Our Team 142 templates

- Organization 48 templates

- History 38 templates

- Vision, Mission 109 templates

- Problem, Solution 193 templates

- Opportunity 154 templates

- Business Model 158 templates

- Product, Services 299 templates

- Technology 65 templates

- Market 155 templates

- Prices 56 templates

- Customers 55 templates

- Competitor 113 templates

- Business Process 151 templates

- Analysis 222 templates

- Strategy 120 templates

- Marketing, Sales 61 templates

- Profit, Loss 69 templates

- Financials 247 templates

- Timeline 122 templates

- Proposal 40 templates

- Contact Us 272 templates

- Break Slides 16 templates

- List 361 templates

- Process 351 templates

- Cycle 177 templates

- Hierarchy 98 templates

- Relationship 152 templates

- Matrix 86 templates

- Pyramid 67 templates

- Tables 145 templates

- Map 96 templates

- Puzzles 163 templates

- Graph 217 templates

- Infographics 436 templates

- SWOT 111 templates

- Icon 418 templates

- Theme Slides 138 templates

- Mockup 42 templates

- Column 315 templates

- Line 199 templates

- Pie 139 templates

- Bar 179 templates

- Area 130 templates

- X Y,Scatter 16 templates

- Stock 59 templates

- Surface 3 templates

- Doughnut 256 templates

- Bubble 65 templates

- Radar 83 templates

- Free PPT Templates 2,101 templates

- Free Keynote 2,017 templates

- Free Google Slides 2,098 templates

- Free Theme Slides 35 templates

- Free Diagram 126 templates

- Free Chart 49 templates

- New Updates

Slide Members Premium Membership Benefits

If you sign up for our premium membership, you can enjoy the better contents all year round.

- Unlimited Download

- Premium Templates

- Animation Slides

- 24/7 Support

- Vertical Report , Business

Pulp and Paper Industry Startup PPT Templates

- Product ID : SM-18676

- Subject : Pulp and Paper Industry

- Quantity : 25 slides

- Ratio : Letter

- Format : MS Powerpoint

- Colors : green black

- Languages : EN

- Used Font : Bebas Neue, Calibri

- License : Personal and commercial use

- Rating : Premium

Slide Description

- All elements are editable

- Highly editable presentation template.

- Easy color change

- Shapes and text are 100% editable

- Free font used

Membership Pricing

Premium member of Slide Members can have unlimited access to the 19,000+ advanced slide templates.

Basic (1 Day)

5 Downloads per Day

Basic (7 Days)

$ 10.99 /mo

All contents in Slide Members are available for commercial and personal use.

The contents that other members downloaded with this content

Pulp & Paper Industry Action plan PPT

Easy to change colors Possible to change shape and color properties Changable into PDF, JPG, and PNG formats Modern and clean design Drag & drop friendly

Forestry Business PowerPoint Backgrounds

Easy to edit and customize Highly editable presentation template. 100% vector (fully editable maps, infographic, icons) Professional business presentation Drag & drop friendly

Construction Design PowerPoint Backgrounds

Easy customization Highly editable presentation template. Premium & modern multipurpose Created by professionals Suitable for creative projects Creatively crafted slides

Stop Ocean Plastic Pollution PowerPoint Theme

100% vector objects & icons Professional and unique slides Beautiful presentation decks and templates Professionally designed infographic templates Creatively crafted slides All elements are editable

Pulp and Paper Industry Google Slides Template Diagrams Design

Shapes and text are 100% editable Free font used All elements are editable Highly editable presentation template. Easy color change

Virtual Reality Interactive PPT

Quick and easy to customize Easy to change colors Shapes and text are 100% editable Easy to customize without graphic design skills Changable into PDF, JPG, and PNG formats

virtual Reality Simple Templates Design

100% fully editable PowerPoint slides Easy to customize without graphic design skills Professional and unique slides Beautiful presentation decks and templates Creatively crafted slides

Forestry Business template keynote

Trend Keynote template Very easy to customize Easily editable content Data charts

Free Slides

Slide Members

All Rights Reserved 2024 © Copyright Slide Members

Information

- Privacy Policy

- Terms & Conditions

Recent Slides

- 26+ Latest weekly update Powerpoint Templates & Google slides

- 19+ Recently Powerpoint Templates & Google slides Update

- 9+ New Powerpoint Templates & Google Slides Update

- Customer Favourites

Paper Industry

Powerpoint Templates

Icon Bundle

Kpi Dashboard

Professional

Business Plans

Swot Analysis

Gantt Chart

Business Proposal

Marketing Plan

Project Management

Business Case

Business Model

Cyber Security

Business PPT

Digital Marketing

Digital Transformation

Human Resources

Product Management

Artificial Intelligence

Company Profile

Acknowledgement PPT

PPT Presentation

Reports Brochures

One Page Pitch

Interview PPT

All Categories

- You're currently reading page 1

Stages // require(['jquery'], function ($) { $(document).ready(function () { //removes paginator if items are less than selected items per page var paginator = $("#limiter :selected").text(); var itemsPerPage = parseInt(paginator); var itemsCount = $(".products.list.items.product-items.sli_container").children().length; if (itemsCount ? ’Stages’ here means the number of divisions or graphic elements in the slide. For example, if you want a 4 piece puzzle slide, you can search for the word ‘puzzles’ and then select 4 ‘Stages’ here. We have categorized all our content according to the number of ‘Stages’ to make it easier for you to refine the results.

Category // require(['jquery'], function ($) { $(document).ready(function () { //removes paginator if items are less than selected items per page var paginator = $("#limiter :selected").text(); var itemsperpage = parseint(paginator); var itemscount = $(".products.list.items.product-items.sli_container").children().length; if (itemscount.

- Anatomy (1)

- Block Chain (3)

- Brochures Layout (2)

- Business Plan Word (139)

- Business Plans (8)

- Preferences

Pulp and Paper - PowerPoint PPT Presentation

Pulp and Paper

Pulp and paper pulp and paper industry presentation team gold standard presenters: vernon scott: introduction industry analysis demand factors tim leaumont: intl ... – powerpoint ppt presentation.

- Team Gold Standard

- Vernon Scott

- Introduction

- Industry Analysis

- Demand Factors

- Tim Leaumont

- The word paper comes from the ancient Egyptian writing material called papyrus, which was woven from papyrus plants. Papyrus was produced as early as 3000 BC in Egypt, and in ancient Greece and Rome.

- Paper was invented in Ancient China by Ts'ai Lun in AD 105

- Global pulp and paper industry dominated by United States, Canada, Sweden, Finland and East Asian countries (such as Japan)

- Australasia and Latin America also have significant pulp and paper industries

- Russia and China expected to be key in the industry's growth over the next few years for both demand and supply

- 2005 is 3-4 Below 1999 Peak

- Growth rate projected at 2-3

- Capacity has stabilized

- Demand is still below potential, rising slowly

- Long-term problem with overcapacity

- 10 annual growth rate

- 6 growth rate in other developing countries

- 50 of world growth

- Majority to be domestically produced

- Future projections remain strong

- Increased domestic production in China will limit growth of exports to China

- If domestic Chinese production increases faster than internal demand, China could become net exporter of low cost pulp paper products

- Nature of Business is Subject to Environmentalist Attack

- Emit chemicals into water supplies

- Air pollution

- High energy consumption

- High Water consumption

- Large amount of solid waste

- Deforestation

- International Trade Issues

- Capacity in other regions of the world exceeded demand looking to the U.S. to sell at low prices

- Government subsidized expansion in other countries China

- Free access to foreign markets difficult

- International Paper established in 1898 with merger of 20 US paper mills

- In 1960s, IP began producing paper products internationally, diversified into land development, oil and gas, other non-paper products

- Diversification into disposable diapers and tissue in 1970s led to overcapacity and debt

- The 1980s and 1990s saw more acquisitions in U.S. and Europe

- IP and Union Camp are in the process of merging, will have

- 22 of US market for writing paper, computer printing, photocopying

- 14 market share for container and linerboard

- Core products

- Forest Products

- 24.1 billion in sales in 2005

- 2nd largest private land owner in US

- Global operations across Europe, Asia, and Latin America

- Total sales continue to drop but core sales are flat

- Must control cost or diversify product line for future growth

- Eliminate holdings outside of key platform businesses over 4 years

- Use proceeds (8-10 Billion) for

- Debt repayment

- Return value to shareholders

- Selective Reinvestment in growth markets

- Notes Brazil, China, Russia, and Europe

- Industry analysts project IP will have negative earnings growth for the Q1/Q2 of 06, low single digit growth for full year

- Performing at 60 of industry average in 06

- Expected rebound next year above industry and SP averages

- Five year earnings growth projections for IP are only 92 of industry average, 57 of SP average

- Challenges for International Paper

- Lack of significant growth prospects in existing lines of business

- Markets for IP products are flat or slow-growth, with much lower projections compared to GDP growth forecast

- Threat of lower-cost competition from emerging market countries (China)

- Higher prices for raw materials and energy put downward pressure on earnings

- International Paper must

- Continue to reduce costs and debt

- Pursue new markets, specifically Bio-mass fuel

- Bio-mass fuel will

- Reduce International Paper energy costs

- Bio-mass fuel opens up substantial growth opportunities over time

- Leverages existing company expertise

- IP has recently taken aggressive steps to become lower cost producer

- Will see better returns as lower cost facilities allow higher margins

- Company has low-cost positions in U.S., Eastern Europe and Brazil, needs to continue drive to lower costs

- Bio-Mass Fuel

- Biomass has surpassed hydro-electric power as largest domestic source of renewable energy

- Provides over 3 of U.S. total energy consumption

- Biomass-derived ethanol and biodiesel provide the only renewable alternative liquid fuel for transportation

- With oil prices staying higher than 50 per barrel, bio-mass fuel represents substantial long-term growth opportunity

- Recommendation begin ramping up substantial RD efforts

- 2001-2005 economy saw mild recession, then modest recovery that gained strength in last two years

- The FED moved to lower Interest rates as the economy slowed, and is now raising rates again as the recovery builds momentum

- Unemployment rate showed steady declines in late 90s, followed by modest increase in recession, still higher than 2000 levels

- Inflation rose pre-recession, dropped in 2001-2002, now on the rise again

- Growth from 1995-2000, mild recession in 2001, recovery 2002-2005

- Residential construction stronger in post-recession period

- Structures spending has not recovered to level of 1990s

- Federal purchases dropped in 1995-2000, big increases since 2001

- Only 5 of 10 categories declined in 2001 recession

- Drive towards lower cost production - needs significant investment relocation away from North American base of Intl. Paper highlights importance of cash from divestiture program

- Increasing capacity in China will limit growth potential

- China may become new low cost competitor as domestic production capacity increases

- Companies will continue to try to remove packaging costs from products to increase margins lower growth for packaging

- Companies will continue to reduce paper consumption by driving higher use of electronic documents and paperless workflow systems lower growth for printing paper

- Intl. Paper must pursue new business opportunities with long-term prospects for high revenue and high profit growth Bio-mass fuels

- Recent trend of solid economic growth in key markets has not produced strong growth in Intl. Paper or industry group core products

- Soft demand high fuel costs high cost of raw materials high debt higher interest rates difficult for Intl. Paper and competitors to add more fuel efficient production capacity

- Strong growth in developing markets is offset by rapid increase in production capacity in these same markets Export growth from North America has been flat or in decline - limited export potential

PowerShow.com is a leading presentation sharing website. It has millions of presentations already uploaded and available with 1,000s more being uploaded by its users every day. Whatever your area of interest, here you’ll be able to find and view presentations you’ll love and possibly download. And, best of all, it is completely free and easy to use.

You might even have a presentation you’d like to share with others. If so, just upload it to PowerShow.com. We’ll convert it to an HTML5 slideshow that includes all the media types you’ve already added: audio, video, music, pictures, animations and transition effects. Then you can share it with your target audience as well as PowerShow.com’s millions of monthly visitors. And, again, it’s all free.

About the Developers

PowerShow.com is brought to you by CrystalGraphics , the award-winning developer and market-leading publisher of rich-media enhancement products for presentations. Our product offerings include millions of PowerPoint templates, diagrams, animated 3D characters and more.

IMAGES

VIDEO

COMMENTS

Market size of paper and pulp industry worldwide in 2021, with an estimated figure for 2022 and a forecast for 2029 (in billion U.S. dollars) Trade 5

1. 2. What is paper: It is the material manufactured in thin sheets from the pulp of wood or other fibrous substances, used for writing, drawing, or printing on, or as wrapping material. Fridayday, November 29, 2013 (Paper industry) 2. 4. Paper is formed by pulp. Pulp: A mixture of cellulose material, such as wood, paper, and rags, ground up ...

In 2021, the U.S. pulp and paper market was valued at almost 60 billion U.S. dollars, which accounted for almost 20 percent of the global paper and pulp industry market size . Show more. Published ...

2. Introduction The pulp and paper industry converts wood or recycled fibre into pulp and primary forms of paper. In the 1800s, there was a shift away from using cotton rags for paper production. Wood became the most important source of fiber. First mechanical and then chemical methods have been developed to produce pulp from wood.2.

introduction the paper industry plays a very prominent role in the world economy. the pulp and paper industry converts wood or recycled fibre into pulp and primary forms of paper. in the 1800s, there was a shift away from using cotton rags for paper production. but later wood became the most important source of fiber. first mechanical and then ...

Pulp, paper, and packaging in the next decade: Transformational change. From what you read in the press and hear on the street, you might be excused for believing the paper and forest-products industry is disappearing fast in the wake of digitization. The year 2015 saw worldwide demand for graphic paper decline for the first time ever, and the ...

The pulp and paper sector currently plays important part in the world's economy. In this paper, we present a review of pulping technologies to convert logs or wood chips and non-woody materials ...

Presentation on theme: "Pulp and Paper Industry"— Presentation transcript: 1 Pulp and Paper Industry. 2 Pulp Making Process. 3 Pulp making process Wood is mostly composed of cellulose fibres which gives tensile (stretching) strength and lignin matrix provides compressive strength. Tensile (stretching) strength Compressive strength.

Free PPT Template - Wood Working industry. paper industry PPT Templates FREE for commercial and personal use! Download over 6,300+ complete free templates in high resolution. Startups & Business Executives.

Pulp and Paper Industry - Free download as Powerpoint Presentation (.ppt / .pptx), PDF File (.pdf), Text File (.txt) or view presentation slides online. The pulp and paper industry converts wood or recycled fibre into pulp and primary forms of paper. First mechanical and then chemical methods have been developed to produce pulp from wood. Paper mills primarily are engaged in manufacturing ...

Pulp & Paper Industry|Business|Templates|Action plan PPT. brown,grey. 16:9. Powerpoint. With the theme of the paper industry, it was designed using calm beige and brown colors along with various paper, puff, paper and factory images. It's a template with a variety of layouts and neatly laid out images and text. Modern and clean design Drag & drop friendly Easy to change colors Possible to ...

Pulp and paper industry Case study Presentation by: Dalia Jankunaite www.forestproducts.sca.com. Introduction • The pulp and paper industry converts wood or recycled fibre into pulp and primary forms of paper. • In the 1800s, there was a shift away from using cotton rags for paper production. Wood became the most important source of fiber.

1 Global Dynamics of the Pulp and Paper Industry - 2013 Box made in China largely from waste paper recovered in the United States and exported to China A roll of toilet paper produced in China from softwood pulp produced in Canada at a mill owned by a Chinese company. A piece of premium ink jet paper produced in the United States from eucalyptus pulp imported from Brazil.

PRESENTATION 2018 - PI World - San Francisco - Forest & Paper Products ... Rick Smith is a Chemical Engineer with 34 years of paper industry experience. His career has always been focused around process control, process data and mill information systems. His focus has long been to get the data to the decision makers to improve product quality ...

Below you'll see thumbnail sized previews of the title slides of a few of our 32 best pulp paper industry templates for PowerPoint and Google Slides. The text you'll see in in those slides is just example text. The pulp paper industry-related image or video you'll see in the background of each title slide is designed to help you set the ...

The abrasion of the grinding wheel against the wood physically separates the wood fibers. The grinding process usually is auto- matic and continuous. The groundwood pulp is then screened, bleached or brightened, treated, and pre- pared for the paper machine (figure 2-2). Figure 2-2-Stone Groundwood Pulp Mill Flow.

4. Global paper industry: Production The pulp and paper industry is a large and growing portion of the world's economy World production of paper and paperboard is around 390 million tonnes and is expected to reach 490 million tones by 2020. The pulp and paper industry is faced with mounting environmental, political, and economic pressures to reduce the volume and toxicity of its industrial ...