Language selection

- Français fr

Assignment of a Purchase and Sale Agreement for a New House or Condominium Unit

From: Canada Revenue Agency

Effective May 7, 2022, all assignment sales in respect of newly constructed or substantially renovated residential housing are taxable for GST/HST purposes. This publication will be updated to reflect this legislative change. For more information about the legislative amendment, refer to GST/HST Notice 323, Proposed GST/HST Treatment of Assignment Sales .

GST/HST Info Sheet GI-120 July 2011

This info sheet explains how the GST/HST applies to the assignment of a purchase and sale agreement for the construction and sale of a new house.

The term "new house" used in this info sheet refers to a newly constructed or substantially renovated house or condominium unit. A house that has been substantially renovated is generally given the same treatment under the GST/HST as a newly constructed house. Extensive modifications must be made to a previously occupied house in order to meet the definition of a "substantial renovation" for GST/HST purposes. For a full explanation of the factors to consider in deciding if a substantial renovation has taken place, refer to GST/HST Technical Information Bulletin B-092, Substantial Renovations and the GST/HST New Housing Rebate .

In this publication, a house includes a single unit house, a semi detached house, a duplex, a rowhouse unit and a residential condominium unit (condo unit), but does not include a mobile home or floating home.

Where a person enters into a purchase and sale agreement with a builder for the construction and sale of a new house, the person may be entitled to assign their rights and obligations under the agreement to another person (an assignee). Generally, the result of the assignment is that the purchase and sale agreement is then between the builder and the assignee.

This publication addresses the situation where

- a purchaser (referred to as the first purchaser) enters into a purchase and sale agreement with a builder (Builder A) for the construction and sale of a new house, and

- the first purchaser subsequently assigns the agreement to an assignee (referred to as the assignee purchaser) before Builder A transfers possession or ownership of the house to the first purchaser and before any individual has occupied the house as a place of residence or lodging.

Generally, upon entering into an agreement for the construction and sale of a new house, the first purchaser is considered to have acquired an interest in the house. For GST/HST purposes, the assignment of the agreement to the assignee purchaser is normally considered to be a sale of the first purchaser's interest in the new house. The sale of an interest in a new house is generally taxable where the person selling the interest is a builder of the house.

For GST/HST purposes, the term "builder" is specifically defined and is not limited to a person who physically constructs a house. There are several instances in which an individual or other person is a builder for GST/HST purposes. For more information on persons who are included in the definition of "builder", refer to GST/HST Memorandum 19.2, Residential Real Property .

This info sheet addresses only whether a person is a builder as described in the following paragraph.

Primary purpose: selling the house or an interest in the house or leasing the house in certain circumstances

A builder includes a person who acquires an interest in a new house before it has been occupied by an individual as a place of residence or lodging for the primary purpose of selling the house or an interest in the house or leasing the house, other than to an individual who is acquiring the house otherwise than in the course of a business or adventure or concern in the nature of trade. When that person is an individual, the individual must acquire the interest in the course of a business or an adventure or concern in the nature of trade in order to be a builder described by this paragraph.

Even if a person is not a builder as described in the preceding paragraph, the person may be a builder based on one of the other definitions of the term as described in GST/HST Memorandum 19.2.

Assignment of a purchase and sale agreement by a person other than an individual

Where a person other than an individual (e.g., a corporation) is a builder as described in the section "Primary purpose: selling the house or an interest in the house or leasing the house in certain circumstances" and the person assigns a purchase and sale agreement for a new house, the person's sale of the interest in the house is subject to the GST/HST whether the sale takes place in the course of a business, an adventure or concern in the nature of trade, or otherwise.

Assignment of a purchase and sale agreement by an individual

If an individual enters into a purchase and sale agreement for one of the primary purposes described in the section "Primary purpose: selling the house or an interest in the house or leasing the house in certain circumstances", the sale of the interest in the house (or the house itself) is normally considered to be made in the course of an adventure or concern in the nature of trade or, depending on all of the surrounding circumstances, in the course of a business. If it is established that an individual is selling an interest in a new house in the course of a business or adventure or concern in the nature of trade, the individual is considered to have entered into the purchase and sale agreement for the primary purpose of selling the house or an interest in the house.

Whether the activity of acquiring an interest in a house, as a result of entering into a purchase and sale agreement, is done in the course of a business or an adventure or concern in the nature of trade is a question of fact. For more information on how to determine whether an activity is done in the course of a business or an adventure or concern in the nature of trade, refer to Appendix C of GST/HST Memorandum 19.5, Land and Associated Real Property .

Factors in determining the primary purpose

All of the relevant factors surrounding entering into a purchase and sale agreement should be considered in determining the primary purpose for a person's acquisition of an interest in a new house.

The following factors may indicate that, for GST/HST purposes, a person entered into a purchase and sale agreement for the primary purpose of selling an interest in the new house or the house itself. The factors are not listed in any particular order and there is no intent to weigh one more heavily than another.

- The person offers to sell their interest in the house or takes other actions to attract buyers before, or while, the house is under construction.

- The person finances the purchase of the house by a short-term mortgage, or an open mortgage that can be paid off without penalty, rather than by a long-term or closed mortgage.

- Financing of the house is beyond the person's means and that person is relying on the increased value and saleability of the house, or an interest in the house, in a rising housing market.

- The person is an individual and their stated intention to occupy the house as a place of residence is not supported by the circumstances of the case. For example, an individual has a family of four and enters into a purchase and sale agreement for a one-bedroom condo unit where they are not contemplating any changes in family circumstances.

- The person's pattern of activity is such that their occupancy of the house does not have the qualities or characteristics of being permanent. For example, the person purchases more than one house at or around the same time. This factor may be given extra weight where the person has previously entered into a purchase and sale agreement for purposes of selling the house or an interest in the house. There are no outward indicators to support a contrary primary intention (i.e., an intention contrary to an intention of resale). For example, an individual is selling a condo unit, one or more of the above factors are present, there are no physical actions or evidence that the individual's primary intention was to live in the condo unit, use it as a vacation home, or rent it to another individual for use as their place of residence, and no evidence that the sale of the condo unit was triggered by some unforeseen event.

In order for the acquisition of an interest in a new house to be for one of the primary purposes described in the section "Primary purpose: selling the house or an interest in the house or leasing the house in certain circumstances", the intention to sell the house or an interest in it, or to lease the house in the manner described in that section, must have existed at the time of acquiring the interest. Nonetheless, the intention at the time of acquisition may be demonstrated over a period of time.

If an individual acquired an interest in the house for the primary purpose of using it as a place of residence, the person is not considered to be a builder of the type described in this info sheet even if, at a later point in time, the person sells the house or an interest in the house. However, the person may still be a builder if the person meets one of the other definitions of that term as described in GST/HST Memorandum 19.2.

The following examples illustrate when a person may or may not be a builder of a new house.

Sarah, Francine, and Angela are roommates renting a three-bedroom house. They entered into a purchase and sale agreement with a builder in January 2010 for a one-bedroom condo unit in a new condominium complex that was to be built. The purchase price under the agreement was $300,000 and the closing date was July 31, 2013.

In March 2011, the fair market value of the new condo unit had increased by 50%. They entertained several offers for the sale of their interest in the condo unit before assigning it to James. No individual had occupied the condo unit as a place of residence or lodging when they sold their interest in the unit. They split the proceeds, which they each used as a down payment to buy their own homes.

As it would not be practical for the three individuals to live in the condo unit together, they considered several offers for their interest in the unit, and there are no indicators to support a contrary intention, Sarah, Francine and Angela are considered to have acquired their interest in the condo unit for the primary purpose of selling the unit or an interest in it. The sale is considered to be made in the course of a business or adventure or concern in the nature of trade. Accordingly, Sarah, Francine, and Angela are all builders of the condo unit for GST/HST purposes. As they are builders of the unit and the sale of their interest in the unit is not exempt, GST/HST applies to the sale of each of their interests.

Pascal and Chantal own a four-bedroom house where they live with their three children. This is the only home they have ever owned and lived in. They have never purchased any other real property.

In June 2009, they entered into a purchase and sale agreement with a builder for a 1-bedroom condo unit in a new high-rise condominium complex that was to be built. The purchase price under the agreement was $275,000 and the closing date was June 30, 2010. In May 2010, they sold their interest in the new condo unit for $400,000 before it had been occupied by any individual as a place of residence or lodging. They used the sale proceeds to build an addition to their current home.

Although Pascal and Chantal have no history of buying and selling real property, it would not be practical for their family of five to occupy the condo unit as their place of residence. Lacking evidence to support a contrary intention, their primary purpose in acquiring the interest in the condo unit is considered to be for the purpose of selling the condo unit or an interest in it in the course of a business or an adventure or concern in the nature of trade. Accordingly, they are builders of the new condo unit for GST/HST purposes. As the sale of their interest in the unit is not exempt, GST/HST applies to the sale of their interest.

Eric and Gina owned a 3-bedroom house where they lived with their 3 children. They entered into a purchase and sale agreement with a builder in October 2010 to purchase a new 4-bedroom house that was to be built. They intended to use the new house as their primary place of residence as it was located much closer to the children's school and to Eric and Gina's workplaces and had more space. The closing date is July 31, 2011.

Eric and Gina sold their current home in January 2011 and moved into a rented home they planned to live in until their new house was ready. However, in June 2011, Gina's mother became ill and moved in with them as she was no longer able to live on her own.

Eric and Gina decided that the new house would no longer be large enough and that they would now need a house with a granny suite. They sold their interest in the new 4-bedroom house so that they could buy a bigger home that would suit their changed needs.

Eric and Gina's sale of their original home and temporary move to a rented house during the construction of the new home and their choice to purchase a home located closer to school and work support that their intention in acquiring the interest in the new house was to use the house as their primary place of residence. Given this, and the fact that their only reason for selling the interest was due to a change in personal circumstance (i.e., the new house would no longer accommodate their family's needs), they are not considered to have acquired the interest in the house for the primary purpose of selling it. Accordingly, they are not builders of the new house for GST/HST purposes and the sale of their interest in the house is exempt.

Cindy entered into a purchase and sale agreement with a builder in November 2010 for a new house that was to be built. She intended to use the house as her primary place of residence. Her new home would be located within walking distance from her workplace and would be closer to her family than the apartment she is currently renting. The closing date for the purchase is September 30, 2011.

In July 2011, Cindy's employer announced that it was relocating to another city located three hours away. To keep her current job, Cindy had to move to that city. She sold her interest in the house to John.

Since Cindy had intended to use the house as her primary place of residence and her only reason for selling her interest in the house was due to work relocation, she did not acquire the interest in the house for the primary purpose of selling it. Therefore she is not a builder of the house for GST/HST purposes and the sale of her interest in the house is exempt.

Assignment fees

The consideration charged for the sale of an interest in a house generally includes amounts that a person paid to a builder (e.g., a deposit) and that the person wants to recover when assigning their interest in the house. The sale price for the interest may also include a profit, i.e., an amount over and above amounts the person had paid to the builder. If a person's sale of their interest to an assignee purchaser is taxable, the total amount payable for the sale of the interest is subject to GST/HST, including any amount the person paid as a deposit to the builder, whether or not such an amount is separately identified.

A first purchaser enters into a purchase and sale agreement for a new house with a builder (Builder A) and pays a deposit of $10,000 at that time. The first purchaser does not make any further payments to Builder A. The first purchaser subsequently assigns the agreement to an assignee purchaser for $15,000. If the sale of the interest in the house from the first purchaser to the assignee purchaser is subject to GST/HST, tax applies to the full $15,000. This is the case even if the assignment agreement identifies that the $10,000 is a recovery of the deposit that the first purchaser paid to Builder A.

The assignment of a purchase and sale agreement for a new house may be subject to the approval of the builder with whom the first purchaser originally entered into the agreement to construct and sell the new house. The agreement may list conditions related to the first purchaser's right to assign the agreement to an assignee purchaser and, in many cases, the builder charges a fee to the first purchaser for the assignment of the agreement to another person.

The fee charged by the builder in such circumstances is generally subject to the GST/HST.

Eligibility for a GST/HST new housing rebate and provincial new housing rebate (where applicable) where a purchase and sale agreement is assigned

The GST/HST new housing rebate, and where applicable, a provincial new housing rebate, may be available for a new house purchased from a builder and for owner-built new housing. Guide RC4028, GST/HST New Housing Rebate , sets out the eligibility criteria for both types of GST/HST new housing rebates and provincial new housing rebates.

If the first purchaser (the assignor) makes a taxable sale of an interest in a house, i.e., the first purchaser is a builder and assigns the purchase and sale agreement to an assignee purchaser, the first purchaser would not be eligible for either a GST/HST new housing rebate or provincial new housing rebate as they did not acquire the house for use as their primary place of residence. Even if the sale of the interest in the house by the first purchaser is not subject to GST/HST (i.e., in situations where the first purchaser is not a builder of the house), the first purchaser would generally not be eligible for either a GST/HST new housing rebate or a provincial new housing rebate as the conditions for claiming the rebates are not met (e.g., ownership of the house would not transfer to the first purchaser, but to the assignee purchaser).

The assignee purchaser, if an individual, may be eligible for a GST/HST new housing rebate, and where applicable a provincial new housing rebate, where the assignee purchaser receives an assignment of a purchase and sale agreement for a new house. The assignee purchaser would have to meet the eligibility conditions for the rebates as set out in Guide RC4028.

Where a purchase and sale agreement for a new house is assigned, there may be two builders of the house – the original builder (Builder A) and the first purchaser (the assignor). If that is the case, an assignee purchaser would generally have to pay the GST/HST to Builder A for the purchase of the new house and to the first purchaser for the purchase of the interest in the new house.

Claiming a GST/HST new housing rebate when there is more than one builder

In some cases, the builder of a new house pays or credits the amount of the GST/HST new housing rebate, and where applicable, a provincial new housing rebate, to the purchaser of the house. In this case, the builder credits the amount of the new housing rebates to the purchaser by reducing the total amount payable for the purchase of the house by the amount of the expected rebates.

Where this happens, the purchaser and the builder have to sign Form GST190, GST/HST New Housing Rebate Application for Houses Purchased from a Builder , and the builder has to send the form to the Canada Revenue Agency (CRA). As the purchaser receives the amount of the rebate from the builder, the builder may claim the amount as a credit against its net tax when it files its GST/HST return.

Only one new housing rebate application can be made for each new house. Therefore, an assignee purchaser cannot submit a rebate application through a builder (Builder A) for the tax paid to Builder A on the purchase of the house and submit a second rebate application through the first purchaser (the assignor), or directly to the CRA, for the tax paid to the first purchaser on the purchase of the interest in the house.

In such cases, the assignee purchaser may want to file their new housing rebate application directly with the CRA rather than through Builder A. In this way, the assignee purchaser can include in the new housing rebate application the tax paid to Builder A and the tax paid to the assignor in determining the amount of their GST/HST new housing rebate and, where applicable, a provincial new housing rebate.

This info sheet does not replace the law found in the Excise Tax Act (the Act) and its regulations. It is provided for your reference. As it may not completely address your particular operation, you may wish to refer to the Act or appropriate regulation, or contact any CRA GST/HST rulings office for additional information. A ruling should be requested for certainty in respect of any particular GST/HST matter. Pamphlet RC4405, GST/HST Rulings – Experts in GST/HST Legislation explains how to obtain a ruling and lists the GST/HST rulings offices. If you wish to make a technical enquiry on the GST/HST by telephone, please call 1-800-959-8287.

Reference in this publication is made to supplies that are subject to the GST or the HST. The HST applies in the participating provinces at the following rates: 13% in Ontario, New Brunswick and Newfoundland and Labrador, 15% in Nova Scotia, and 12% in British Columbia. The GST applies in the rest of Canada at the rate of 5%. If you are uncertain as to whether a supply is made in a participating province, you may refer to GST/HST Technical Information Bulletin B-103, Harmonized Sales Tax – Place of Supply Rules for Determining Whether a Supply is Made in a Province .

If you are located in Quebec and wish to make a technical enquiry or request a ruling related to the GST/HST, please contact Revenu Québec at 1-800-567-4692. You may also visit the Revenu Québec Web site to obtain general information.

All technical publications related to GST/HST are available on the CRA Web site at www.cra.gc.ca/gsthsttech .

Page details

- Video Presentation

- Our Lawyers

- Our Services

- Video Testimonials – Real Estate

- Video Testimonials – Immigration

- Client Testimonials

- Appointment

HST on Assignments

- Sign-up to our newsletter?

An assignment is a sales transaction that is carried out between the owner (assignor) and the buyer (assignee). The original owner sells the property to the buyer before the original buyer closes on the property. In short, the buyer sells the property to gain any interest or profit on the house by selling the property before they close on the property.

HST on Assignment Sale

The assignor pays the HST on the assignment sale along with the original price. The assignment agreement is prepared, clearly stating the profit on a transaction. It is advisable to hire a Real Estate lawyer to prepare the agreement with all the necessary information.

Important Changes in the HST on Assignment Sales

In the 2022 Federal Budget, two important changes were introduced in the HST on assignments. The changes that will govern the New Home Contract are as follows:

HST on Assignments is Applicable on all New Home Contracts

The government announced that all Assignment agreements for New Homes entered in on or after May 7 th, 2022 are now subject to HST. In the past, the HST on assignments was decided based on the intention of the original buyer, who often paid no HST on assignments. In short, the government has now removed all exemptions, and every New Home Assignment is subject to HST now.

The intention of the original owner is no longer taken into consideration, and all New Home Assignments are now deemed to be a taxable supply to HST.

Deposits are Exempt from HST under Conditions

The government has removed another confusion that often clouded the judgment of whether or not HST is to be paid on the deposit. To exempt the deposit from HST, the Assignment Agreement must include that part of the assignment price is the reimbursement of the deposit paid by the original buyer under the purchase agreement. In short, the writing must clearly state that the assignment price already includes the deposit, so the HST can be exempt.

As stated in the HST Info Sheet GI-120, the HST is only charged to the extent the assignment price exceeds the deposits paid by the assignor in the New Home Contract. The HST does not apply to the original deposit paid by the assignor. However, the above condition must be met. The HST is only payable on any other amount paid to Assignor over and above the deposit.

Nanda & Associate Lawyers Professional Corporation assists Canadian residents and businesses with their HST needs. Get in touch with us today for more details.

Fill In the form below, We will get in touch with you as soon as possible.

Demo Description

This will close in 0 seconds

- 1759 Avenue Road Toronto - M5M-3Y8

- Contact Us By Dialing 416-250-6400

- Working Hours Mon - Sat 8:00 to 18:00

Assignment Sales and HST

An assignment sale is a type of real estate transaction that occurs when a buyer of a pre- construction home or condo decides to sell their rights to purchase the property to another buyer before the construction of the building is complete. This type of sale transfers the purchase agreement from the original buyer to the new buyer (known as the “assignee”)

As of May 2022, the government introduced a new rule requiring HST (Harmonized Sales Tax) to be paid on all assignment sales of single-unit residential or condo properties that are newly constructed or renovated. This means that the assignee must pay HST on the difference between the original purchase price and the resale price.

For example, if a pre-construction home was originally purchased for $500,000 and then sold as an assignment sale for $600,000, the assignee must pay $13,000 in HST (calculated as 13% of $100,000, which is the difference between the original purchase price and the resale price).

It is the responsibility of the lawyers involved in the transaction to make sure that the HST portion is remitted correctly, taking into account various factors such as the date of the assignment and the completion date of the building.

Despite the introduction of HST, an assignment sale still continues to have many benefits, such as being a more convenient way for original buyers to sell their rights to the property without having to go through hurdles of selling a fully completed property.

- Privacy Policy

- Website Terms

- Cookies Policy

- Payment Terms

- Why work with us

All Website Contents and Advertising Contents are The Exclusive Property of Cactus Law

- All Listings

- Places with Parking

- All of Ontario

- Assignments

- Only at Condo Culture

Top Neighbourhoods

- Innovation District, Kitchener

- Bauer District, Kitchener

- City Centre District, Kitchener

- Midtown, Kitchener

- Belmont District, Kitchener

- Uptown, Waterloo

- How We Help You Invest

- Highest Appreciation Properties

- Cash Flow vs ROI

- Buying vs. Renting

- How We Help Buyers

- Renting vs. Buying - A Case Study

- Buying An Assignment

- Pet-Friendly Buildings

- How We Help Tenants

- How We Help Landlords

- Ontario's Standardized Lease

Selling With Condo Culture

- How We Help Sellers

- Condo Sellers Guide

- About Condo Assignment Selling

- Selling Assignments and HST

- Selling a Condo with a Tenant

Your Property

- What's Your Property Worth?

- All Buildings

New Developments

Top buildings.

- Caroline Street Private Residences

- Midtown Lofts

- Bauer Lofts

Top Communities

- Station Park, Kitchener

- Garment District, Kitchener

- Kaufman Lofts, Kitchener

- Blackstone, Waterloo

- Seagram Lofts, Waterloo

- DUO at Station Park

Buying in a New Development

- 5 Things to Know when Buying Pre-Construction

- Pre-Construction vs. Resale Investing

How HST Applies to Selling Assignments As of May 7th 2022

By Condo Culture

There have been plenty of conversations amongst the real estate community and assignment sellers regarding the Federal government announcing that they will be making HST payable on profits made by either end-user buyers or investors, effective May 7th, 2022.

Here’s What Has Changed

This additional charge has always been in place with HST on profits being the responsibility of the Seller. There were specific workarounds in place which won’t apply anymore. This regulation already applied to investors, so nothing changes with this particular type of purchaser. The government essentially wants to tighten up on end-users purchasing a pre-construction unit and subsequently assigning. So moving forward, regardless if the intention was to move into your unit as an end-user, any profit from any assignment sale will now be subject to HST .

Savings - Have a Professional Team On Your Side

Even if you’re an end-user buyer and need to sell your unit for whatever reason as an assignment sale, you can deduct certain expenses from your profit to reduce the amount of HST you pay. The commission of your REALTOR®, lawyer and accountant fees, other assignment-related costs, upgrades to the property, and additional ones are potentially eligible. It’s certainly possible to save between 15% to 20% on what you need to pay for HST based on leveraging applicable deductions.

We highly recommend having an experienced REALTOR®, accountant, and lawyer representing you who all have experience with assignment transactions. Your team can help you navigate through the process from start to finish and beyond, so there are no surprises along the way and to ensure you feel comfortable knowing that you didn’t pay more in HST than you need to in order to maximize your ROI.

Condo Culture has a vast amount of expertise handling all types of assignment transactions and we are all over new regulations as they morph and change over time, so be sure to reach out for any of your assignment selling or buying needs. Assignments can offer unique value given their off-market nature with less buyer competition. They are a great option to review as you explore all possible Condo purchase possibilities.

A Simple Assignment Selling Example

When selling an assignment unit, you pay HST on the deposits made on the purchase, plus the 13% on the home’s increase in value once the deal is complete.

Let’s look at an example - if you originally bought a condo for $450K and ultimately sold it as an assignment listing for $650K, then you will need to pay an additional 13% HST on the increase of $200K minus any deductions as outlined above.

Current Exclusive Assignment Opportunities

We have a bunch of fantastic assignment buying options available right now, including these two beauties.

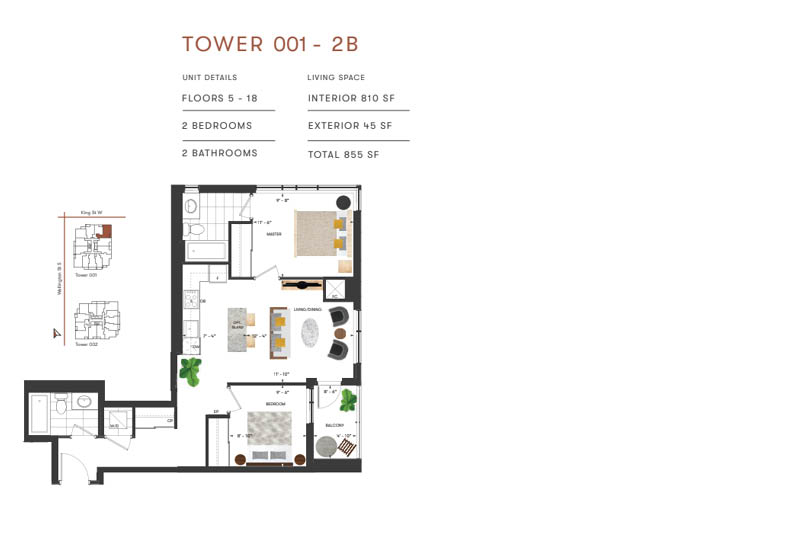

Unit 1012 at Station Park in Tower 1

Highlights:

🛌 2 bedrooms 🛀 2 bathrooms 🚘 1 parking spot 🔐 1 locker ⏹ 810 sq.ft. + a 45 sq.ft balcony ⬆ $18.5K in upgrades on the kitchen and bathroom. Corner unit facing King Street with stunning city views. Expected occupancy: Fall 2022 List price: $699,900

Analysis: This spectacular two-bedroom condo is in a highly sought-after corner unit looking out onto King Street. It’s well priced at $864/sq.ft. and that includes almost $20K in gorgeous upgrades along with a premium lighting package addition, plus a parking spot, as well.

Unit 512 at Station Park in Tower 2

🛌 1 bedroom 🛀 1 bathroom ⏹ 625 sq.ft. + a 60 sq.ft balcony ⬆Entertainment package upgrade included. Corner unit facing both King and Wellington Street with nice 5th-floor views. Expected occupancy: Early 2023 List price: $510,000

Analysis: This wonderful corner unit has a solid price per square foot at $816 including an entertainment package that has been added. It has a generous amount of space for a 1 bedroom unit and a good-sized balcony to lounge, dine, and entertain

We have helped hundreds of clients navigate the unique assignment selling and buying process, and would love to leverage our deep experience to help you succeed with your future transactions. In addition to our Assignment expertise, we are also experts in Condo Resale and Pre-Construction transactions - we are a full spectrum condo brokerage that’s at your service!

To learn more about our assignment selling and buying approach and unique expertise, be sure to read this informative article and connect with us if you have any questions or got any type of condo business to take care of.

Share This Post

We're growing. Join our firm. Learn more about Careers at Schwarz Law.

- Firm Profile

- Testimonials

- Environmental Actions

- Jayson Brian Schwarz

- Konrad Grzymski

- Robin Hammond

- Patrick Squire (Associate Counsel)

- Corinne Lobe (Patent Counsel)

- Corporate and Commercial Business Law

- Commercial Real Estate, Financing & Land Development

- Wills and Estate Law

- Articles & News

- Associate Firms

- Affiliated Firms

HST on Assignments

By: Jayson Schwarz LLM and Hamza Ahmad JD

Many clients think that doing an assignment of a home purchase agreement is a simple transaction, but the reality is far different. It is an extremely complex transaction and if not handled properly can result in the loss of a lot of money. This article describes two issues relating to HST that assignors (seller) and assignees (buyer) should consider when entering pre-construction freehold and condominium assignments.

HST on Assignment Fees

HST is payable on an assignment sale of an Agreement of Purchase and Sale (“APS”). Remember when you do an assignment you are not selling the house or property you are selling your APS. The issue is what you pay the HST on, who pays it and how much that will be. Generally the HST will be in addition to the price and paid for by the buyer.

Your assignment agreement must be clear to show what the profit is on the transaction, as it should only be the profit that is subject to HST.

The standard realtor’s form of an assignment agreement does not include sections on crucial issues regarding HST. It is important you get a lawyer to help carefully draft the assignment agreement to reduce the risk of future issues with CRA. In a resale home situation HST is payable on the profit only provided the assignment agreement is properly drafted.

As an interesting aside, most people would reasonably conclude that getting back your deposit is not subject to HST, but CRA takes the position it is, even after CRA lost in Court and the Court said there is no HST on deposit returns!!!!!!

HST New Housing Rebate

Adjustments on closing can surprise homebuyers new to pre-construction properties and assignments only add to the potential shock. The builder will want to collect the HST on closing of the original purchase where there has been an assignment sale and the buyer will need to get the HST back later.

Newly built properties are subject to HST but some or all the HST payable can be recovered immediately on closing through the HST New Housing Rebate (the “Rebate”). The Rebate has specific rules that may affect a purchaser whom’s circumstances change over time; the Rebate is provided if only the purchaser or an immediate family member resides at the property and if the builder accepts that this is correct and there has been no assignment outside that group.

In pre-construction condominium assignments with occupancy closings, an assignee must confirm whether the unit has ever been occupied. If a unit has been occupied then the assignee may not be eligible for the Rebate.

The moral of the story is that you really should retain an experienced lawyer to help you through these issues whether buying or selling. Realators are great but it is your lawyer who if hired to do so that will take the time to review everything properly and make sure you are protected and that there are no open questions.

Perhaps the most difficult part of writing these articles relates not the actual writing, but thinking of a topic to address. So help us!!! Mail, deliver or fax letters to the magazine or to us, use the web site ( www.schwarzlaw.ca ), email ( [email protected] ) and give us your questions, concerns, critiques and quandaries. We will try to deal with them in print or electronic form.

Also seen on NextHome.ca

Everything you need to know about Preconstruction Assignment Sales

Have you sold pre-construction homes before closing on assignments?

Have you wondered about what are the tax implications on selling pre-construction homes before closing?

We often advise our clients to not to sell their pre-construction homes before closing if possible. It can trigger a series of tax implications – HST and income tax implications.

Before the announcement of Budget 2022, CRA had adopted the policies that HST would be applicable on not just the assignment fees, but also the deposit.

This could be a huge tax cost that most investors weren’t aware of.

Now, let’s use an example to explain .

Say you agree to purchase a pre-construction home for $700,000. You sign the agreement of purchase and sale and pay a deposit of $100,000 to the builder.

The new home is expected to be completed a few years later.

You decided to sell the property on assignment before it’s ready for closing for an additional $50,000.

Scenario 1: When you signed the agreement of purchase and sale, you intended to move into the property and use it as your primary residence.

Life circumstances change. You now decided to sell the property before closing. You sold it on assignment before May 6, 2022 .

HST: As your intention was to move into the property as your primary residence, you had no HST liability obligation.

Again, intention is subjective. If you’re questioned in court, you would have to provide evidence to prove your own intention.

Most clients thought that the CRA would have to prove that they were wrong. The truth however is that the taxpayers are the one who have the responsibility to prove to CRA their own filing position.

Make sure your have documentation proving your initial intention.

Income Tax: Assuming you have strong documentation proving that you did intend to purchase this pre-construction home as your primary residence, the $50,000 assignment fees could be reported as capital gain.

Scenario 2: When you signed the agreement of purchase and sale, you intended to move into the property and use it as your primary residence.

Life circumstances change. You now decided to sell the property before closing. You sold it on assignment after May 6, 2022 .

Budget 2022 changed the rule. For all assignment sales happened after May 6, 2022, regardless of your intention, you’re required to pay HST on the assignment sales.

HST implication:

This means that the $50,000 collected is no longer all yours. This $50,000 collected, if you don’t charge HST on top, is inclusive of HST.

You must remit the HST to CRA on sale on assignment. In this case, it would have been $5.8K.

Presumably, you would also be able to claim Input Tax Credit, which is the HST you paid on services that you used to allow you to sell the property. This includes the HST you paid on your legal cost and HST you paid on brokerage fees.

The net amount can be remitted to CRA.

Income Tax Implication:

Budget 2022 also made some rule changes when it comes down to sale of property. The sale of a property within one year of ownership is considered on income account, meaning 100% of the profit you make is taxable, with some exceptions allowed, effective Jan 1, 2023.

When you apply this new rule to this scenario, it is unknown as to whether an assignment sale is considered a flipped property. It’s difficult to say whether this rule is applicable to assignment sale at this point.

Regardless, you still would need to keep proper and relevant documentation supporting your intention that you were trying to move into the property as your primary residence. With proper documentation, you could still report the net income from assignment sale on capital account, meaning only 50% of the profit you make is taxable.

In our example, assuming client didn’t incur other cost of selling, the client would be reporting $44K of capital gain, 50% of which would be taxable.

Scenario 3: When you signed the agreement of purchase and sale, you intended to rent out your property.

Interest rate changed. You now decided to sell the property before closing. You sold it on assignment before May 6, 2022 .

Your intent was never to move into the property as your primary residence or have any of your family members moving in, as a result HST is applicable on assignment sale.

Assignment fees are subject to HST. $50,000 assignment fees you collected are subjected to HST.

CRA also adopted the position that the deposits $100K are also subject to HST as well. Ouch!

You thought you made $50,000 – but after considering the HST on assignment fees $5.8K and HST on deposits $11.5K, you really only net $33K.

This calculation hasn’t considered the brokerage fees as well as the lawyer fees yet. Yikes!

Income Tax implication:

The net amount profit of $33K (assuming there’s no brokerage fees or lawyer fees, if you have, the net profit is lower) would likely have to be reported as income, 100% of it is taxable.

If you own the property in your personal name, the entire amount is added to your job income or whatever income you have in your personal name. You’re taxed at the respective marginal tax rates, which can be as high as 53.5% in Ontario.

Triple Yikes!

If you own the property in the corporation, the profit is taxed as regular business income, most likely at 12.2% for qualified small businesses.

Scenario 4: When you signed the agreement of purchase and sale, you intended to rent out your property.

Interest rate changed. You now decided to sell the property before closing. You sold it on assignment AFTER May 12, 2022 .

The Government also recognized that charging HST on deposits were not right. Budget 2022 specified that HST would no longer be charged on deposits .

Assignment fees are subject to HST but deposits are not subject to HST anymore to avoid double taxation.

Assignment fees are reported as income 100% taxable.

So continuing with the same example, HST is applicable on the $50,000 assignment fees, meaning that you would incur HST liability of $5.8K as calculated above.

Again, you could offset the HST liability with the HST you pay on realtor commission as well as lawyer fees on closing.

The net amount would have to be paid to CRA.

The net profit of $44K (assuming there’s no brokerage fees or lawyer fees, if you have, the net profit is lower) would likely have to be reported as income, 100% of it is taxable.

Similar to Scenario 3, if you own the property in your personal name, the entire amount is added to your job income or whatever income you have in your personal name. You’re taxed at the respective marginal tax rates, which can be as high as 53.5% in Ontario.

Now that we’ve gone through the assignment sales tax implication in details – Are you still planning to sell your properties on assignment?

Let us know below.

Lastly, our team has been working tirelessly to prepare for the upcoming Wealth Hacker Conference on preparing everyone for the upcoming recession. We have experts such as Dalia sharing her insights on how to protect your portfolio and grow from this recession. If you are lost, join us at the upcoming Wealth Hacker Conference.

Visit WealthHacker.ca now to get your tickets.

Until next time, happy Canadian Real Estate Investing.

Cherry Chan, CPA, CA

Your Real Estate Accountant

Related Posts

How to Maneuver Through the Tax Hike in the Federal Budget

The Unfair 2024 Federal Budget

LP/GP Unraveled: Tax Efficiency and T5013 Clarifications for Investors

Your T1 Tax Roadmap: 8 Key Tips for a Smooth Journey

Hit enter to search or ESC to close

New Tax Rules for Real Estate Assignments and Flipping

Written by Sukhman Sandhu

Blog | real estate law, june 6, 2022.

To combat the sharp rise in real estate prices, the Canadian government has proposed new GST/HST rules in relation to Assignments (effective May 7, 2022) and Income Tax rules in relation to flipping real estate in general (effective January 1, 2023).

GST/HST to Apply for all Assignment Sales

As of May 7, 2022, where an individual sells an assignment of a new build or substantially renovated residential property, the transaction will be subject to HST, regardless of original intentions, as per the Canadian Excise Tax Act (“ETA”). Every individual assignor of residential real estate will now have to collect GST/HST on their assignment profit and remit it to the CRA.

Previously, if the original intention of entering the pre-construction Agreement of Purchase and Sale (APS) was for personal use, GST/HST did not apply to the assignment agreement. GST/HST previously only applied if the original intention was to sell for profit or flip the property. Effective May 7, 2022, whatever your intention, GST/HST will apply on the assignment profit.

Accompanied with some good news, the new rules do clarify that HST is no longer charged on recovered deposits. Prior to May 7, 2022, despite the court ruling against the CRA in a previous case dealing with this issue, the CRA continued to represent to tax payers that if the assignment is subject to GST/HST, the amount provided from the assignee (new buyer) to the assignor (original buyer) which reimburses the assignor for the assignor’s deposit to the builder is also subject to GST/HST. This created double taxation as the deposit that the assignor paid to the seller/builder is already subject to GST/HST.

For illustration purposes, envision Carrol purchased a new construction residential property for $1,200,000 and paid the builder’s lawyer a deposit of $200,000. Subsequently, Carrol entered into an assignment agreement for the assignment sale price of $1,500,000. Carrol in this situation is known as the ‘assignor’ and the individual who purchased from her is known as the ‘assignee’. The assignee must pay $500,000 to Carrol ($300,000 for the difference between assignment sale price of $1,500,000 and original purchase price of $1,200,000 + $200,000 to reimburse the assignor for assignor’s previous deposit to builder/builder’s lawyer) and $1,000,000 to the builder to complete the purchase (not including any closing/miscellaneous fees).

Prior to May 7, 2022, if Carrol’s original intention was to purchase for personal use, she would not be responsible to pay any HST/GST in relation to the assignment sale.

Prior to May 7, 2022, If Carrol’s original intention was not for personal use (i.e. investment property), then she would be liable to pay GST/HST on $500,000 (both the profit and deposit) which at the rate of 13% would have equaled $65,000. It is important to note that Carrol, on advise of her accountant, could have only paid GST/HST on $300,000 (avoiding any tax on deposit) by only remitting $39,000 and citing previous case ruling against double taxation on recovered deposit to the CRA.

As of May 7, 2022, regardless of Carrol’s original intention, she is liable to pay GST/HST on $300,000 which at the rate of 13% would equal $39,000.

Business Income instead of Capital Gains for Residential Property Flipping

Effective January 1, 2023, a new residential property flipping rule will classify the appreciation amount of all residential properties that are owned for less than 12 months to be business income under the Canadian Income Tax Act (“ITA”). This new legislation change will be subject to limited “life events” exceptions, such as the growth of a household, separation, a disability or illness, an employment change, insolvency, or an involuntary disposition.

Prior to January 1, 2023, investment properties (i.e. rentals) sold within or after 12 months of ownership are subject to capital gains tax which is 50% of business income tax and principal residence properties (owner-occupied) sold within or after 12 months of ownership are entirely exempt from tax.

Growing commentators believe that this proposed Residential Property Flipping Rule may also result in assignment sales treated as business income as opposed to capital gains. This would result in the assignor not only paying GST/HST on the portion of their assignment profit but also adding 100% of the assignment profit amount (minus remitted GST/HST) onto their annual personal income amount. We look forward to receiving further clarification in the near future.

If you are buying or selling investment properties, or have questions or concerns about residential or commercial real estate law in general, contact us at Sukh Law .

Sukh Law publishes articles for information purposes only and is not intended to constitute legal advice.

Related Resources…

Understanding the New Home HST Rebate in Ontario

Apr 30, 2024

When navigating the complexities of purchasing a new home in Ontario, understanding the nuances of the New Home HST...

Navigating Residency Requirements for Provincial and Canadian Corporations

Apr 25, 2024

Understanding the intricacies of corporate residency requirements is essential for any entrepreneur or investor...

Post-Closing Issues in Real Estate Transactions

Apr 18, 2024

Understanding the complexities of real estate transactions doesn't end at closing. In fact, issues that arise...

- Mon-Fri 9:00 - 17:00

- [email protected]

- 647-300-8391

Assignment Sale in Ontario: Definition & How It Works

An assignment sale is a unique transaction in the real estate market where the property’s original buyer (assignor) transfers their rights and obligations under a purchase contract to a new buyer (assignee) before the property’s completion. Particularly common in pre-construction projects in Ontario, this type of sale offers flexibility for investors and those whose circumstances may have changed. This article explores the definition, legal framework, and process of assignment sales in Ontario, providing essential insights for buyers and sellers engaged in these transactions.

What is an Assignment Sale?

What do the terms assignor and assignee mean, who pays hst on assignment sale, is builder’s consent required for assignment sale, how we can help.

An assignment sale is a transaction in the real estate market where the original purchaser of a property, known as the assignor, transfers their rights and obligations under a purchase agreement to another party, called the assignee, before the completion of the property. This type of sale is usually associated with pre-construction homes or condos that are yet to be built or are under construction at the time of the sale. The assignee takes over the rights and obligations of the original buyer, including any remaining payments to the developer and all other terms originally agreed upon in the contract.

The primary benefit of an assignment sale is its flexibility. It provides an exit strategy for buyers willing to complete the purchase. It offers potential for profit or entry into a property that might otherwise have been unavailable on the open market. For the assignor, it can be a way to liquidate their investment without waiting for the property to be completed. It can be particularly advantageous if their financial situation changes or market conditions favour such a move. Meanwhile, assignees can purchase a new property without waiting for a new phase of development to be launched, potentially benefiting from price appreciation since the original sale.

The assignor is the person or entity that originally purchased a property and holds the rights and responsibilities under the initial purchase agreement. This individual or entity may have entered into a contract to buy a property before its construction but decided to transfer this agreement to another party before the property was completed.

The assignee is the person or entity who accepts the transfer of the property purchase agreement from the assignor. By assuming the assignor’s agreement, the assignee agrees to fulfill the original contract’s terms, including any payments to the developer and adherence to any conditions specified in the agreement.

When a property is sold through assignment, the assignor is responsible for paying the Harmonized Sales Tax (HST) on the sale price, which includes the original price and any profit made on the transaction. To ensure clarity and avoid any legal issues, it is recommended that a Real Estate lawyer prepare the assignment agreement with all necessary information.

The builder’s consent is usually a requirement for assignment sales. The builder’s contract will specify if it is allowed and under what conditions. This clause is necessary because it lets the builder maintain control over who is becoming a part of the development and ensures that the assignee has the financial capability to complete the purchase.

Acquiring the builder’s consent can come with additional fees, and approval procedures can vary depending on the developer. Some builders may charge a flat fee, a percentage of the sale price, or a combination of both to grant permission for the contract assignment. Additionally, the builder may have specific requirements that must be met before approving the assignment, such as the construction status or payment of a certain percentage of the original purchase price. It is advisable to review the terms of the original agreement carefully and prepare for any financial or procedural requirements that obtaining such consent might entail.

It is often possible to obtain a builder’s consent to assign an agreement, even if such consent was not included in the original contract. Many builders will waive the clause prohibiting assignment from the agreement, provided that certain criteria and forms are followed and any required fees are paid. The builder’s sales office can determine if consent is possible and under what conditions. Different builders have varying processes for property assignment.

Assignment sales involve complex legal and financial considerations requiring thorough understanding and careful handling. Potential participants in assignment sales should consult with real estate professionals and legal advisors to navigate the process effectively and ensure compliance with all relevant legal requirements.

Insight Law Professional Corporation is a real estate law firm located in Toronto. If you need more information on real estate transactions, contact us today and learn how a real estate lawyer can help you.

The information provided above is of a general nature and should not be considered legal advice. Every transaction or circumstance is unique, and obtaining specific legal advice is necessary to address your particular requirements. Therefore, if you have any legal questions, it is recommended that you consult with a lawyer.

About The Author

Demet Altunbulakli

Related posts.

Real Estate Lawyer: Role, How Does It Work, When To Contact

Real Estate Closing Costs: Definition & How It Works

Insight Law Professional Corporation is a Law Firm situated in the heart of Midtown Toronto. We specialize in Real Estate Law, Business and Commercial Law, Wills & Estates, as well as offering Notary Public & Commissioner of Oaths services.

Contact Info

- 160 Eglinton Avenue E Suite 300 Toronto, ON M4P 3B5

- 647-255-5437 (Fax)

- Media Coverage

Practice Areas

- Real Estate Law

- Business Law

- Wills & Estates

- Notary Public

Insight Law Professional Corporation © 2023

Terms and Conditions

Privacy Policy

Thank you for your message

The New Proposed HST Treatment On Pre-Construction Assignment Of Sales

Assignment Sale

What is an assignment sale in ontario.

If you have purchased pre construction properties in Ontario, chances are you have come across the term “assignment sale”. So what exactly is an assignment sale?

An assignment sale is when the original purchaser of a pre-construction property assigns their original purchase agreement to another party before taking ownership of the unit. The new purchaser then takes on all the obligations of the original contract and completes the transaction with the builder.

Assignment sales are prevalent in new construction condo buildings. This is because many purchasers who buy pre-construction condos do so with the intention of flipping the unit for a profit before taking possession.

The Importance of an Assignment Clause in Pre Construction Condo Purchase

A purchase and agreement of a new construction property may include an assignment clause. This assignment clause gives the purchaser the right to assign their contract to another party, subject to the approval of the developer. An assignment fee and their lawyer’s legal fees are typically charged by the builder.

If you are planning to assign your pre-construction purchase, it is essential to have a real estate lawyer review the contract beforehand to make sure the important assignment agreement clause is included and that you understand all the terms and conditions. Assignment sales can be complex transactions with many different stakeholders involved.

Does Land Transfer Taxes Apply in Assignment Sales?

If you are the seller of the assignment, then you are not required to pay a land transfer tax. However, if you are the buyer of an assignment sale, you will be required to pay a land transfer tax on the assignment purchase price. Be sure to factor in these additional closing costs when considering an assignment sale.

HST on Profit

On April 7, 2022, the Government of Canada unveiled Budget 2022: A Plan to Grow Our Economy and Make Life More Affordable. As a result, GST will be added to all assignment sales of newly constructed properties as part of the government’s effort to curb housing speculation. These tax implications are important to take into consideration when contemplating an assignment sale.

As of May 7, 2022, under the Excise Tax Act, every individual assignor of residential real estate would have to collect GST/HST on their assignment profit and remit it to the CRA. For example, if you originally purchased a pre-construction condo for $500,000 and assigned it for $700,000, you would be required to remit GST/HST ($23,008.96) on the profit to the CRA. For greater understanding, it is important that you consult a tax specialist.

Factors to Consider When Purchasing on Assignment

It is important to have a lawyer review the contract to ensure that the important clauses are included and that you understand all the terms and conditions before considering an assignment sale.

There are a number of closing costs associated with purchasing a pre-construction condo unit. These costs can include but are not limited to development levies, meter installation fees, real estate lawyer fees, and land transfer taxes. As part of the assignment agreement, these will all need to be paid by the new purchaser.

An assignment deal can be a great way to get into the real estate market. However, it is important to do your homework and understand all cost involves. If you have any questions, be sure to speak with a real estate lawyer.

Right to Lease During Occupancy

An interim occupancy period occurs when a purchaser takes possession of their new condo unit before the building has been officially registered. In return, the purchaser will pay the builder monthly occupancy fees which include the property tax, maintenance fees, and interest on the outstanding balance owed to the builder. These occupancy fees are payable until the project is registered and the title has been transferred to the purchaser.

If you are planning to purchase a pre-construction condo unit with the intention of renting it out, it is important to ensure that the contract includes a clause that allows for interim occupancy with the right to lease. This is typically only allowed with the permission of the developer and would be at their discretion. If you are planning on leasing the unit, it is important to make sure that you will be able to do so before signing a purchase and sale contract.

What are the Legal fees for an Assignment Sale?

If you are planning on selling your condo unit before taking occupancy, it is important to factor in the real estate lawyer fees associated with an assignment sale. These fees can range from $1000 plus disbursements and are typically paid by the seller. As an assignment is not a typical sales transaction, it is important to ensure that you have both a real estate lawyer and a real estate agent who is experienced in handling these types of transactions.

Previous post

Post a comment cancel reply.

Save my name, email, and website in this browser for the next time I comment.

Our Expertise

- Refinance / Mortgage

- Pre-Construction & Assignments

Service Areas

- Mississauga

Head Office

- 223-6200 Dixie Rd

- Mississauga, ON, L5T2E1

- Tel:1855.711.7555

- Fax: 289.275.1740

- E-mail: [email protected]

© 2022 TheClosing.ca. All Rights Reserved

- All communications with your lawyer & law clerk via phone and/or email

- One in-person or virtual signing appointment

- Review of the Agreement of Purchase & Sale

- Communication with the realtor’s office for commission payments

- Preparation of all legal closing documentation

- Discharge of one mortgage (If Applicable)

- All internal disbursements such as photocopies, faxes, couriers etc.

- A stress-free closing day!

As with every law firm, disbursements are extra. In real estate transactions, these fees differ and depend on the type of transaction. These can include fees for title search, title insurance, deed registration, certified cheques and so forth.

Nothing is due until the closing day itself. Disbursements and the lawyer fees are drawn from the closing proceeds (if selling) or from the down-payment cheque (if buying). Contact us for any questions or a detailed quote.

AGREEMENT TO TERMS These Terms and Conditions constitute a legally binding agreement made between you, whether personally or on behalf of an entity (“you”) and [business entity name] (“we,” “us” or “our”), concerning your access to and use of the [website name.com] website as well as any other media form, media channel, mobile website or mobile application related, linked, or otherwise connected thereto (collectively, the “Site”). You agree that by accessing the Site, you have read, understood, and agree to be bound by all of these Terms and Conditions. If you do not agree with all of these Terms and Conditions, then you are expressly prohibited from using the Site and you must discontinue use immediately. Supplemental terms and conditions or documents that may be posted on the Site from time to time are hereby expressly incorporated herein by reference. We reserve the right, in our sole discretion, to make changes or modifications to these Terms and Conditions at any time and for any reason. We will alert you about any changes by updating the “Last updated” date of these Terms and Conditions, and you waive any right to receive specific notice of each such change. It is your responsibility to periodically review these Terms and Conditions to stay informed of updates. You will be subject to, and will be deemed to have been made aware of and to have accepted, the changes in any revised Terms and Conditions by your continued use of the Site after the date such revised Terms and Conditions are posted. INTELLECTUAL PROPERTY RIGHTS Unless otherwise indicated, the Site is our proprietary property and all source code, databases, functionality, software, website designs, audio, video, text, photographs, and graphics on the Site (collectively, the “Content”) and the trademarks, service marks, and logos contained therein (the “Marks”) are owned or controlled by us or licensed to us, and are protected by copyright and trademark laws and various other intellectual property rights and unfair competition laws of the United States, foreign jurisdictions, and international conventions. The Content and the Marks are provided on the Site “AS IS” for your information and personal use only. Except as expressly provided in these Terms and Conditions, no part of the Site and no Content or Marks may be copied, reproduced, aggregated, republished, uploaded, posted, publicly displayed, encoded, translated, transmitted, distributed, sold, licensed, or otherwise exploited for any commercial purpose whatsoever, without our express prior written permission.

Preparing for the tidal wave of Canadian tax changes

2024 Canadian ESG Reporting Insights

Findings from the 2024 Global Digital Trust Insights

PwC Canada's Federal budget analysis

Canada’s Draft Sustainability Disclosure Standards

27th Annual Global CEO Survey—Canadian insights

2023 Canadian holiday outlook

Embracing the future of capital markets

Five opportunities facing Canadian government and public-sector organizations

How can Canadian family business founders and owners create the right outcomes

Managed Services

Nicolas Marcoux, CEO of PwC Canada, recognized for his commitment to the advancement of women in business

PwC Canada drives adoption of Generative AI with firmwide implementation of Copilot for Microsoft 365

Our purpose, vision and values

Apply today! Now hiring students and new graduates

We’re empowering women to thrive in tech

Why join our assurance practice?

Loading Results

No Match Found

Tax Insights: GST/HST issues relating to the assignment of agreements to purchase newly constructed condominiums

February 01, 2021

Issue 2021-03

The combination of rising home prices and the financial stress and uncertainty created by the COVID-19 pandemic is resulting in more condominium purchasers reconsidering their acquisition. While some buyers always planned to assign their agreements of purchase and sale (APS) to a third party, many other buyers that originally intended to lease or reside in their condominium units are also assigning their APS. There are a number of reasons for this, one of which is a reduction in the demand for rental condominiums in many Canadian cities. As discussed in a recent Tax Court of Canada decision, Chen Sun v. The Queen, 2020 TCC 112, there are many Goods and Services Tax/Harmonized Sales Tax (GST/HST) issues to consider when an APS is assigned to a third party, including whether:

- GST/HST is payable by the assignee on the assignment fee and the amount attributable to the deposit that was paid by the assignor to the builder of the property

- the assignee is eligible to claim the GST/HST new housing rebate

- the new housing rebate can be assigned to the builder and credited against the purchase price

Is the assignment of an APS a taxable supply

The assignment of an APS will constitute a taxable supply, unless it qualifies for an exemption. This is because “real property” is defined to include an interest in real property, and the making of a supply of real property (other than an exempt supply) is deemed to be made in the course of a “commercial activity.” The sale of an interest in a residential complex by a person that is not a “builder” is generally exempt; however, the sale of an interest in a new home or condominium is generally subject to GST/HST when the assignor is a “builder.”

A “builder” is defined in a manner which can potentially include someone that is merely entering into an APS with a builder. For example, subject to a specific exclusion that only applies to individuals, someone that acquires an interest in a home before it is occupied (or a condominium before it is registered) can be a builder if their primary purpose was to either:

- sell the home to any person

- lease the home to someone other than an individual for their personal use

Individuals are excluded from being a builder if they did not acquire their interest in the course of a business or an adventure or concern in the nature of trade, which is determined by considering the following factors:

- nature of the property sold

- length of period of ownership

- frequency or number of other similar transactions by the taxpayer

- work expended on or in connection with the property realized

- circumstances that were responsible for the sale of the property

- taxpayer’s motive or intention

To the extent that the assignor is a “builder,” GST/HST will be payable on the value of consideration that is paid by the assignee and the assignor will be required to collect GST/HST unless the assignee is registered for GST/HST.

The Canada Revenue Agency (CRA) considers an amount paid by an assignee on account of the assignor’s deposit to be part of the consideration paid for the assignment of an APS, and is therefore subject to GST/HST if the assignor is a builder. Accordingly, unless the assignment is restructured to result in the builder refunding the deposit to the assignor and receiving a replacement deposit from the assignee, the assignee may pay double tax on the deposit. It is also important to note that the Tax Court of Canada’s decision in Casa Blanca Homes Ltd. v. The Queen, 2013 TCC 338 contradicts the CRA’s view. In Casa Blanca Homes Ltd., the Tax Court of Canada held that the amount paid to the assignor relating to the deposit constituted an exempt supply of a financial service and would therefore not be subject to GST/HST.

Can the assignee claim the GST/HST new housing rebate

The assignment of an APS may also impact the assignee’s eligibility to claim the new housing rebate, as evidenced by the Tax Court of Canada’s recent decision in Chen Sun. The federal new housing rebate is equal to 36% of the federal component of GST/HST paid, up to a maximum of $6,300 (for homes valued at $350,000), with the rebate being gradually reduced and phased out when the value of the home reaches $450,000. For properties in Ontario, the provincial new housing rebate is equal to 75% of the provincial component of GST/HST paid, up to a maximum of $24,000 (for homes valued at $400,000 or higher).

For a purchaser to be eligible for the new housing rebate, the following conditions must be met:

- the purchaser must be an individual that is acquiring the home from a builder, as opposed to an assignor who may not be a builder

- at the time the individual becomes liable or assumes liability, they must acquire the home as their primary place of residence or that of a relation

- ownership of the property must be transferred to the individual after construction is substantially completed

- the first person to occupy the home must be the individual or a relation

- all persons named on the APS must meet the aforementioned conditions

When the purchaser qualifies for the new housing rebate, the builder is generally entitled to pay or credit the rebate amount to the purchaser pursuant to subsection 254(4) of the Excise Tax Act.

In situations where a third party is acquiring ownership of a home or condominium and they receive title directly from the builder, it does not necessarily mean that the APS has been assigned to the third party and that the builder has sold the condominium to the assignee. As argued by the Crown in Chen Sun, if the builder has not accepted the assignment, then the assignee may not be the person that is acquiring the condominium from the builder. Fortunately, in Chen Sun, the court ultimately held that the APS was in fact assigned on the basis that the builder, by its conduct, accepted the assignment and therefore the builder did sell the condominium directly to the assignee. Accordingly, the assignee was eligible to claim the new housing rebate (and the builder was entitled to credit the assignee with the rebate) because the assignee acquired the condominium from the builder and the other conditions to claim the rebate were satisfied.

How should builders deal with assignments

As the builder and purchaser are jointly and severally liable for housing rebates that have been claimed in error, it is important for builders to make sure that purchasers qualify for the rebate before they pay or credit the purchaser with the rebate. The CRA heavily scrutinizes rebate claims and, to the extent each and every condition to claim the rebate is not satisfied, the CRA will deny the rebate claim. In situations where an APS has been assigned, builders should consider whether:

- they should credit the assignee with the housing rebate or advise the assignee to file the rebate claim directly with the CRA

- it is easier to “tear” up the original APS and enter into a new APS with the assignee

- the assignment has been clearly documented so that there is no dispute that the assignee has become the purchaser under the APS, which may not be the case when only the title is transferred to the assignee at the assignor’s direction

The takeaway

All parties to a transaction in which an APS is being assigned and a housing rebate is being claimed should consider the GST/HST implications of the assignment. Failure to structure these assignments in an appropriate manner can significantly increase GST/HST costs for the respective parties, including:

- builders being assessed penalties for erroneously crediting the housing rebate to assignees

- assignors being assessed penalties for failing to collect tax on the assignments

- assignees paying GST/HST on the replacement deposits

PwC can help structure these assignments in a tax-efficient manner.

Download a PDF

Related services

Real estate

Subscribe to tax publications

Brent Murray

Partner, PwC Law LLP

Tel: +1 416 947 8960

Wayne Mandel

Director, PwC Canada

Tel: + 1 905 738 2914

Fred Cassano

Partner, National Real Estate Tax Leader, PwC Canada

Tel: +1 905 418 3469

Ken Griffin

Partner, PwC Canada

Tel: +1 416 815 5211

Dean Landry

National Tax Leader, PwC Canada

Tel: +1 416 815 5090

© 2018 - 2024 PwC. All rights reserved. PwC refers to the PwC network and/or one or more of its member firms, each of which is a separate legal entity. Please see www.pwc.com/structure for further details.

- Cookies info

- Terms & Conditions

- Site Provider

- Accessibility

- Property Listings

- Top Schools

- Mississauga Condo Profiles

- Builder New Condos

- Square One Condos For Sale

New Assignment Rule 2022

New Assignment Rule 2022 – Buyer to Pay HST on Profit

New assignment rule 2022 – 13% hst in ontario, assignment sales entered into after may 7, 2022 are now subject to hst on the profit portion of the final price..

Pre-construction assignment sales are now subject to 13% HST in Ontario . This has to be paid only on the first buyer’s profit when the contract is sold to a second purchaser.

The HST is not charged on the total price of the property but only on the profit portion. It has to be paid by the second purchaser.

What is an Assignment Sale?

Assignment sale is when a buyer wishes to sell or offload his or her builder’s new condo at pre-construction stage to another interested buyer.

So there are three parties involved in an assignment sale: the builder, the first buyer and the second buyer. The first buyer has an “Agreement of Purchase and Sale” with the builder. The first buyer sells his “Agreement of Purchase and Sale” to the second buyer.

In a pre-construction assignment sale, since the property is not yet built, it is merely a transaction of “the interest in the Agreement of Purchase and Sale” of that property. The second buyer is not buying the property, he or she is buying the Agreement of Purchase and Sale of that property. This is known as an assignment sale.

Most of the builders of new condos permit assignment sales, often free of cost, or at a predetermined cost.

Get some tips and read more about the pros and cons of assignment sales.

What do the terms Assignor and Assignee mean?

Assignor (or the first buyer) is a person who is the original purchaser of a pre-construction home or condo directly from the builder. When the assignor sells the pre-construction unit to another purchaser before closing, that purchaser is known as an assignee.

An example of an Assignment Transaction

In simple terms, if an assignor bought a pre-construction home or condo for $500,000 and sells it as an assignment sale to an assignee for $600,000, then the assignee has to pay 13% HST on $100,000 to the government. It is the job of the lawyers to ensure that the HST portion is remitted to the government.

Why have these changes been introduced?

These measures have been introduced by our government to get more money into their coffers as they see a lot of speculation going on in the real estate market with people making handsome profits in recent years. It is aimed at curbing the rampant speculation and to slow down the feisty real estate market.

This rule intends to tax the assignee, just like any other buyer who purchases any goods and services from the market and pays 13% tax in Ontario.

As for the assignor, he or she will have to pay tax on the total income or the profit he or she makes from the transaction.

Note: This blog post and the contents herein DO NOT serve as legal or financial advice. Kindly consult with your professional accountant and lawyer before making any decision regarding sale or purchase of an assignment home or condo, and payment of taxes arising out of it.

Looking to Buy or Sell Assignment Home or Condo? Contact Team Kalia!

Your Name (required)

Your Email (required)

Phone (required)

Are you in the market to? (required)

Buy Sell Invest Evaluate Property Other

Additional comments and information