What is a Management Representation Letter?

Getting through financial audits can be frustrating for companies, especially when asked to provide management representation letters.

This article will clarify exactly what a management representation letter is, why auditors request them, what should be included, and provide examples to make the process smooth and compliant.

You'll learn the purpose of these letters, see template examples, understand international audit standards, and gain key takeaways to improve financial reporting at your organization.

Introduction to Management Representation Letters

A management representation letter is a formal document signed by a company's senior management that is provided to external auditors. It contains certain written representations that auditors require in order to complete an audit and form an opinion on the company's financial statements.

Defining the Management Representation Letter in Audit Context

The management representation letter serves an important role within the financial statement audit process. Auditors use it as audit evidence to support their assessment of whether the financial statements are free of material misstatement. Specifically, auditors request written confirmation from management regarding the accuracy and completeness of information provided during the audit. This includes representations related to:

- The financial statements and adequacy of disclosures

- Proper recording of transactions and account balances

- Internal controls over financial reporting

- Compliance with laws and regulations

By obtaining these written representations from management, auditors gain additional audit evidence to complete their testing and analysis. The management representation letter also outlines management's responsibilities under the audit engagement.

Essential Components of a Management Representation Letter

A standard management representation letter contains certain key statements that auditors rely upon. These include:

- Financial statement disclosures : Confirmation that management has provided the auditors with all relevant information and access needed to perform the audit.

- Recognition, measurement and disclosure : Assertion that the financial statements comply with the applicable financial reporting framework and standards.

- Non-compliance : Disclosure of any non-compliance with laws and regulations.

- Litigation and claims : Details of any actual, pending or threatened litigation and claims that could impact the financial statements.

The letter will also typically list areas of significant estimates and judgments made by management in preparing the financial statements. For example, allowances for doubtful accounts, asset impairment assessments, and assumptions used in valuation models.

By obtaining written representation on these matters, auditors gain evidence to issue their audit opinion. The management representation letter should be signed by the CEO and CFO or equivalent members of senior management.

Legal and Ethical Implications of Management Representations

Signing a management representation letter has legal and ethical implications. Management must ensure representations made to the auditors are accurate and made in good faith. Intentionally misrepresenting information or omitting relevant details could constitute fraud and result in legal liability.

Auditors also have a duty to assess the reasonableness of management representations and corroborate them with other audit evidence. Relying solely on management representations without further verification could call into question the quality of the audit.

Overall, the management representation letter facilitates open and transparent communication between management and auditors. It serves as a legally binding confirmation of management's fulfillment of its financial reporting responsibilities.

What is the main purpose of a management representation letter?

The main purpose of a management representation letter is to obtain written confirmation from management that they have fulfilled their responsibility for the fair presentation of the financial statements. This letter documents that management has provided the auditors with all relevant information and access needed to conduct the audit.

Some key purposes of the management representation letter include:

Confirming management's responsibility for the preparation and fair presentation of the financial statements in accordance with the applicable financial reporting framework (e.g. GAAP or IFRS).

Affirming that management has provided the auditors with all relevant information and access to records, documentation and personnel that is necessary for the audit.

Disclosing any instances of fraud involving management, employees with significant internal control roles, or those that cause a material misstatement of the financial statements.

Presenting details on matters that impact the financial statements - such as plans or intentions that may affect asset/liability carrying values, information about related parties, contingencies, subsequent events, etc.

Stating that all transactions have been recorded and are reflected in the financial statements. This helps confirm completeness and cut-off assertions.

So in summary, the management representation letter serves as important audit evidence that validates information provided by management to the auditors. It also formally documents management's responsibilities and representations concerning the financial statements.

What is the meaning of management representation?

Management representation refers to written confirmation provided by management of an entity to the auditors regarding the accuracy and completeness of financial statements and adequacy of internal controls.

The management representation letter is a key audit evidence prepared at the completion of the audit process. It contains management's assertions regarding:

- Fair presentation of financial statements

- Completeness of information provided to auditors

- Proper accounting policies used

- Reasonableness of significant estimates made

Essentially, through this letter, management takes responsibility for the fair presentation of the financial statements. They confirm to the auditors that they have fulfilled their financial reporting responsibilities.

The management representation letter covers all periods encompassed by the audit report and is dated the same date as the completion of audit fieldwork. It is addressed to the engagement partner and signed by those with appropriate responsibilities for the financial statements, usually the Chief Executive Officer and Chief Financial Officer.

By obtaining written representations from management, the auditors demonstrate they have obtained sufficient appropriate audit evidence to support their audit opinion. The representations serve as necessary supplementary corroboration of management's oral assertions made during the audit.

In summary, the management representation letter is a written statement from management provided to the auditors as part of the audit evidence. It confirms management's compliance with financial reporting responsibilities to enable auditors to form their audit opinion.

What is an example of a management representation letter?

We are providing this letter in connection with your audit of the cost representation statement of USAID resources managed by (Client Name) under Contract No. XXX “Project Name” for the period MM/DD/YY to MM/DD/YY.

We confirm, to the best of our knowledge and belief, the following representations made to you during your audit:

- We have made available to you all financial records and related data, including service auditor reports.

- There have been no communications from regulatory agencies concerning noncompliance with or deficiencies on financial reporting practices.

- We have no knowledge of any known or suspected fraudulent financial reporting or misappropriation of assets involving management or employees with significant roles in internal control.

- We have disclosed to you the results of our assessment of risk that the cost representation statement may be materially misstated as a result of fraud.

- There are no material transactions that have not been properly recorded in the accounting records.

- We believe the effects of any uncorrected financial statement misstatements aggregated by you are immaterial.

- We have disclosed all liabilities, both actual and contingent.

- There are no violations or possible violations of laws or regulations whose effects should be considered.

We confirm that the representations we have made to you during your audit are complete, truthful, and accurate.

Sincerely, [Signature] [Client Representative Name and Title]

What is the difference between management letter and management representation letter?

The key differences between a management letter and a management representation letter in an audit are:

Focus : The management letter focuses on identifying weaknesses and areas of improvement in the company's financial reporting process and internal controls. Management representation, on the other hand, focuses on providing evidence of management's understanding and support of the audit process.

Purpose : The purpose of a management letter is to communicate deficiencies in internal control and make suggestions for improvements. The purpose of a management representation letter is to confirm certain information that the auditors have requested from management.

Content : A management letter contains comments and recommendations from the auditor about issues encountered during the audit. A management representation letter contains specific statements by management regarding matters such as the fairness of financial statements.

Timing : A management letter is typically issued after the audit report while a management representation letter is obtained during the audit.

In summary, while both letters relate to the audit process, the management letter aims to provide suggestions for improvement while the management representation letter serves as audit evidence regarding management's assertions. The management representation letter supports the audit by confirming the accuracy of the financial statements.

sbb-itb-beb59a9

The purpose and importance of management representation letters.

Management representation letters serve several key purposes in the audit process. Most importantly, they provide additional audit evidence to support the auditor's opinion on the financial statements.

Reinforcing the Auditor's Collection of Audit Evidences

Management representation letters reinforce the audit evidence the auditor has already obtained throughout the audit. As outlined in ISA 500 Audit Evidence, auditors must obtain sufficient appropriate evidence to support their opinion. The letter serves as written representation from management on important assertions related to the financial statements. This includes the completeness and accuracy of information provided to the auditor.

Management's Accountability for Financial Reporting

Additionally, the letter highlights management's responsibilities over financial reporting. Management, not the auditor, is responsible for the preparation and fair presentation of the financial statements. The representation letter formally documents that management has fulfilled these duties, a key assertion needed to issue an audit opinion.

Assurance on Contingent and Off-Balance-Sheet Liabilities

Auditors also rely on management's representations on significant estimates and disclosures. This includes assurance from management that the financial statements appropriately reflect contingent liabilities and off-balance-sheet liabilities in accordance with the applicable financial reporting framework.

In summary, representation letters serve as a final confirmation from management that they have fulfilled their financial reporting responsibilities. The letters provide key audit evidence and accountability to support the auditor's work in accordance with auditing standards.

Drafting a Management Representation Letter: Best Practices

A management representation letter is an important part of the audit process. It documents certain written representations made by management to the auditors regarding the company's financial statements.

Drafting an effective management representation letter requires following several best practices:

Management Representation Letter Template: A Starting Point

When creating a management representation letter, it's best to start with a template. This ensures all relevant topics are covered such as:

- Management's responsibility for the preparation and fair presentation of the financial statements

- Availability of all financial records and related data

- Completeness of information provided regarding transactions and events

- Disclosure of all liabilities, both actual and contingent

- Non-existence of any fraud or illegal acts

Tailor the template to the specific circumstances and transactions of the business. But the template establishes a solid foundation.

Who Should Sign the Management Representation Letter

Typically the management representation letter should be signed by:

- The CEO or Managing Director

- The CFO or Financial Controller

This demonstrates the company's overall governance has reviewed the representations and attests to their validity and completeness.

In some cases, representation from heads of divisions or departments may also be necessary regarding transactions or activities under their specific purview.

Customizing Representations to Reflect Unique Organizational Circumstances

While a template is useful, each management representation letter must be customized to reflect the distinct transactions and activities of the organization. Specifically call out areas the auditors have highlighted as potential risks or requiring further representations.

For example, if the company underwent a major acquisition, restructuring, or system implementation, representations would be needed to address the associated impacts and risks regarding financial reporting.

The management representation letter is not a mere formality. It serves as an indispensable record of the critical dialogue between management and auditors. Following these best practices helps craft letters that clearly communicate important representations.

Management Representation Letter Samples and Examples

Management representation letters are important documents in the financial audit process. They contain written confirmation from management about the accuracy and completeness of financial statements and disclosures. Reviewing examples can help companies understand what to include in their own letters.

Analyzing a Management Representation Letter Sample

Here is an excerpt from a sample management representation letter:

We acknowledge our responsibility for the fair presentation in the financial statements of financial position, results of operations, and cash flows in conformity with U.S. generally accepted accounting principles (GAAP). We have provided you with unrestricted access to persons within the Company...

This excerpt demonstrates several key elements:

- Acknowledgment of management's responsibility for financial statements conforming to GAAP

- Confirmation that auditors had full access to people and information

Other standard inclusions are statements around contingent liabilities, litigation matters, plans or intentions that may affect assets or liabilities, and confirmation that appropriate disclosures have been made.

Analyzing examples helps identify customary terms to include.

Management Representation Letter PDF: Accessibility and Format

Management representation letters are often provided to auditors as PDF files. This locked, uneditable format:

- Facilitates easy sharing of the definitive final version

- Allows clear version control with digital signatures

- Enables reliable long-term archival storage

PDF format removes ambiguity around which representation letter version was relied upon.

Real-World Examples: Complex Issues

Consider these excerpts from real-world representation letters:

"The restructuring provision of $20 million represents our best estimate of costs to complete the plant closure based on current plans..."

"We confirm that we have properly recorded and disclosed the acquisition of Company XYZ in the financial statements..."

These excerpts demonstrate how companies transparently address complex real situations like restructurings or major transactions in the representation letter.

Real examples provide assurance that the company has appropriately considered complex accounting matters.

Comparing Management Letters and Management Representation Letters

Management letters and management representation letters serve important but distinct purposes in the audit process.

Management Letter vs Management Representation Letter: Clarifying the Distinction

A management letter communicates deficiencies or recommendations for improvement identified by the auditor during the audit. These may relate to internal controls, processes, or compliance issues that could be made more effective.

In contrast, a management representation letter obtained near the end of an audit contains specific written representations from management about the accuracy and completeness of the financial statements and disclosures. Common representations confirm that:

- Financial statements are fairly presented

- Significant assumptions used by management are reasonable

- All relevant information has been provided to the auditor

- There are no undisclosed side agreements or contingencies

While management letters offer suggestions, representation letters confirm critical facts underlying the audit.

The Role of the Auditor in Relation to Management Representations

Auditors use both tools to fulfill their responsibilities:

Management letters reflect the auditor's duty to communicate control deficiencies to those charged with governance. This allows the entity to take timely remedial action.

Representation letters provide audit evidence as part of the auditor's risk assessment procedures under auditing standards. They represent a form of documentary evidence about management's intents, knowledge and accuracy of the financial statements.

If management were unwilling to sign the representation letter, the auditor would need to reconsider their audit opinion.

Impact on Audit Opinions and Auditor's Reports

The management letter has no direct bearing on the auditor's opinion, unless the issues it raises cast doubt on the fairness of the financial statements.

However, matters raised in the representation letter directly relate to the audit evidence obtained. If management refuses to sign the letter, the auditor would likely issue a qualified opinion or disclaimer of opinion on the financial statements due to the limitation on audit scope and evidence.

In summary, while management letters offer helpful recommendations, representation letters provide the auditor written confirmation of critical information pertinent to the audit itself. Both play key roles in the audit process.

International Standards on Auditing: ISA 580 Management Representations

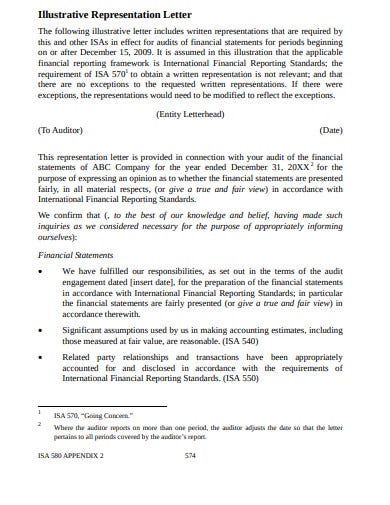

The International Standards on Auditing (ISA) provide a framework for conducting high quality external audits. ISA 580 specifically focuses on obtaining appropriate written representations from management to support the audit evidence gathered.

Understanding ISA 580 and Its Relevance to Management Representation Letters

ISA 580 outlines the auditor's responsibilities for obtaining written representations from management to confirm certain matters or to support other audit evidence. Some key points:

- Requires auditors to obtain written representations from management that they have fulfilled their financial reporting responsibilities

- Covers areas like recognition, measurement, presentation, and disclosure of information as per the financial reporting framework

- Helps auditors obtain confirmation on matters material to the financial statements, like the completeness of information provided

- Allows for detection of material misstatements due to fraud

By adhering to ISA 580, auditors can ensure management representation letters align with the necessary audit evidence requirements.

Compliance with International Standards on Auditing

It is critical that management representation letters comply with ISA guidelines, including:

- Obtaining representations from appropriate individuals : Those with overall responsibility for financial reporting, such as the CEO and CFO

- Written format : Printed on the organization's letterhead and signed by hand

- Date : No earlier than the date of the audit report

- Wording : Clear acknowledgement of responsibilities, accuracy of information provided, etc.

Strict compliance ensures the representations constitute valid and appropriate audit evidence as per ISA 500.

Case Studies: Adherence to ISA 580 in Practice

Company A - Drafted a management representation letter that was vague, unsigned, and outdated. By not adhering to ISA 580, they had to invest additional time and resources to obtain proper representations.

Company B - Carefully followed ISA 580 requirements. The CFO and CEO signed off on a letter confirming completeness of information and awareness of responsibilities. This aligned smoothly with the audit process.

As exemplified, non-compliance ultimately wastes time and resources. Whereas alignment with ISA 580 standards helps streamline external audits.

Conclusion and Key Takeaways

Management representation letters are important, standard audit evidence that reduce risk. They signify management's representations concerning the financial statements and accountability for internal controls, fraud, and information provided to auditors.

Summarizing the Role of Management Representation Letters in Audits

Management representation letters summarize key information and representations from management to auditors. They serve several key functions:

- Confirm management's responsibility for the preparation and fair presentation of the financial statements

- Disclose any issues or deficiencies in internal controls

- Affirm that all relevant information has been provided to auditors

- Highlight any fraud, illegal acts, or noncompliance with laws and regulations

By obtaining these written representations, auditors reduce engagement risk and confirm their understanding of management's views and positions.

Final Thoughts on Best Practices and Compliance

It is critical that management representation letters adhere to regulations and professional standards. Key best practices include:

- Ensuring the letter is dated as of the date of the auditor's report

- Having the letter signed by those with appropriate responsibilities and authority

- Disclosing all relevant issues completely and accurately

- Following the guidelines and requirements outlined in ISA 580 and other applicable standards

Diligent compliance promotes accuracy, transparency, and accountability.

Encouraging Diligence and Transparency in Financial Reporting

At their core, management representation letters aim to foster diligent, truthful, and transparent financial reporting. By eliciting key written representations from management, auditors promote an environment of responsibility, compliance, and ethical practice. This ultimately supports the accuracy and reliability of financial statements for all stakeholders.

Related posts

- What is Transfer Pricing?

- Related Party Disclosures in Financial Statements

- Statutory Audit vs Internal Audit

- Financial Statement Presentation: Structure and Requirements

Beyond Salary: Crafting a Compelling Job Offer Letter (Step-by-Step Guide)

Actuary Salary: Deciphering the Pay in Actuarial Science

How to Implement Advanced Tracking in Xero: Refining Financial Tracking

We've received your job requirements, and our team is working hard to find the perfect candidate for you. If you have more job openings available, feel free to submit another job description, and we'll be happy to assist you.

- Submit a New Job Description

Unlock the Talent Your Business Deserves

Hire Accounting and Finance Professionals from South America.

- Start Interviewing For Free

Management Representation Letter: Format, Content, Signature

Home » Bookkeeping » Management Representation Letter: Format, Content, Signature

As of 2019, the FASB requires publicly traded companies to prepare financial statements following the Generally Accepted Accounting Principles (GAAP). Auditors are required by professional standards to report, in writing, internal control matters that they believe should be brought to the attention of those charged with governance (the board). Generally, if your auditor is going to put an internal control matter in a letter, they have assessed that the matter was the result of a deficiency in internal controls. This is an important part of that audit that the profession does not take lightly.

One common example of a deficiency in internal control that’s severe enough to be considered a material weakness or significant deficiency is when an organization lacks the knowledge and training to prepare its own financial statements, including footnote disclosures. The “SAS 115” letter is usually issued when any significant deficiencies or material weaknesses would have been discussed with management during the audit, but are not required to be communicated in written form. In performing an audit of your Plan’s internal controls and plan financials, your auditors are required to obtain an understanding of the Plan’s operations and internal controls.

A management representation letter is a form letter written by a company’s external auditors, which is signed by senior company management. The letter attests to the accuracy of the financial statements that the company has submitted to the auditors for their analysis. The CEO and the most senior accounting person (such as the CFO) are usually required to sign the letter. The letter is signed following the completion of audit fieldwork, and before the financial statements are issued along with the auditor’s opinion. External auditors follow a set of standards different from that of the company or organization hiring them to do the work.

In doing so, they may become aware of matters related to your Plan’s internal control that may be considered deficiencies, significant deficiencies, or material weaknesses. Audits performed by outside parties can be extremely helpful in removing any bias in reviewing the state of a company’s financials. Financial audits seek to identify if there are any material misstatements in the financial statements. An unqualified, or clean, auditor’s opinion provides financial statement users with confidence that the financials are both accurate and complete. External audits, therefore, allow stakeholders to make better, more informed decisions related to the company being audited.

The representation should reaffirm your client’s understanding of all significant terms in the engagement letter. A relevant assertion is a financial statement assertion that has a reasonable possibility of containing a misstatement or misstatements that would cause the financial statements to be materially misstated.

The purpose of an internal audit is to ensure compliance with laws and regulations and to help maintain accurate and timely financial reporting and data collection. It also provides a benefit to management by identifying flaws in internal control or financial reporting prior to its review by external auditors.

Depending on materiality and other qualitative factors, the auditors will consider the deficiency to be an “other” matter, significant deficiency, or material weakness. The auditor has discretion on which category the deficiency falls into, but are otherwise required to use the standard wording and definitions in the letter.

It serves to document management’s representations during the audit, reducing misunderstandings of management’s responsibilities for the financial statements. The definition of good internal controls is that they allow errors and other misstatements to be prevented or detected and corrected by (the nonprofit’s) employees in the normal course of performing their duties.

Material weaknesses or significant deficiencies may exist that were not identified during the audit, and auditors are required to disclose this in their written communication. The auditor’s report contains the auditor’s opinion on whether a company’s financial statements comply with accounting standards. The results of the internal audit are used to make managerial changes and improvements to internal controls.

What is a management representation letter?

A management representation letter is a form letter written by a company’s external auditors, which is signed by senior company management. The letter attests to the accuracy of the financial statements that the company has submitted to the auditors for their analysis.

A control objective provides a specific target against which to evaluate the effectiveness of controls. Management representation is a letter issued by a client to the auditor in writing as part of audit evidences. The representations letter must cover all periods encompassed by the audit report, and must be dated the same date of audit work completion.

These types of auditors are used when an organization doesn’t have the in-house resources to audit certain parts of their own operations. The assertion of completeness is an assertion that the financial statements are thorough and include every item that should be included in the statement for a given accounting period. The assertion of completeness also states that a company’s entire inventory, even inventory that may be temporarily in the possession of a third party, is included in the total inventory figure appearing on a financial statement. The compilation standards do not require practitioners to obtain a management representation letter, but this does not mean that it’s not a prudent thing to do. Obtaining a representation letter helps to ensure your client understands the services that you have provided, the limitations on the work you have completed, and that they are ultimately responsible for their financial statements.

The biggest difference between an internal and external audit is the concept of independence of the external auditor. When audits are performed by third parties, the resulting auditor’s opinion expressed on items being audited (a company’s financials, internal controls, or a system) can be candid and honest without it affecting daily work relationships within the company. Auditors evaluate each internal control deficiency noted during the audit to determine whether the deficiency, or a combination of deficiencies, is severe enough to be considered a material weakness or significant deficiency. In assessing the deficiency, auditors consider the magnitude of potential misstatements of your financial statements as well as the likelihood that internal controls would not prevent or detect and correct the misstatements.

Representation to Management

- In an audit of financial statements, professional standards require that auditors obtain an understanding of internal controls to the extent necessary to plan the audit.

- written confirmation from management to the auditor about the fairness of various financial statement elements.

- Auditors use this understanding of internal controls to assess the risk of material misstatement of the financial statements and to design appropriate audit procedures to minimize that risk.

The idea behind a management representation letter is to take away some of the legal burdens of delivering wrong financial statements from the auditor to the company. A material weakness is a deficiency, or combination of deficiencies, in internal control, such that there is a reasonable possibility that a material misstatement of the entity’s financial statements will not be prevented, or detected and corrected on a timely basis. Internal auditors are employed by the company or organization for whom they are performing an audit, and the resulting audit report is given directly to management and the board of directors. Consultant auditors, while not employed internally, use the standards of the company they are auditing as opposed to a separate set of standards.

If the auditors detect an unexpected material misstatement during your audit, it could indicate that your internal controls are not functioning properly. Conversely, lack of an actual misstatement doesn’t necessarily mean that your internal controls are working.

The determination of whether an assertion is a relevant assertion is based on inherent risk, without regard to the effect of controls. Financial statements and related disclosures refers to a company’s financial statements and notes to the financial statements as presented in accordance with generally accepted accounting principles (“GAAP”). References to financial statements and related disclosures do not extend to the preparation of management’s discussion and analysis or other similar financial information presented outside a company’s GAAP-basis financial statements and notes.

External audits can include a review of both financial statements and a company’s internal controls. When a company’s financial statements are audited, the principal element an auditor reviews is the reliability of the financial statement assertions. In the United States, the Financial Accounting Standards Board (FASB) establishes the accounting standards that companies must follow when preparing their financial statements.

In an audit of financial statements, professional standards require that auditors obtain an understanding of internal controls to the extent necessary to plan the audit. Auditors use this understanding of internal controls to assess the risk of material misstatement of the financial statements and to design appropriate audit procedures to minimize that risk. written confirmation from management to the auditor about the fairness of various financial statement elements. The purpose of the letter is to emphasize that the financial statements are management’s representations, and thus management has the primary responsibility for their accuracy.

Expert Social Media Tips to Help Your Small Business Succeed

This letter is useful for setting the expectations of both parties to the arrangement. Almost all companies receive a yearly audit of their financial statements, such as the income statement, balance sheet, and cash flow statement. Lenders often require the results of an external audit annually as part of their debt covenants. For some companies, audits are a legal requirement due to the compelling incentives to intentionally misstate financial information in an attempt to commit fraud.

Management representation letter

As long as there’s a reasonable possibility for material misstatement of account balances or financial statement disclosures, your internal controls are considered to be deficient. An auditor typically will not issue an opinion on a company’s financial statements without first receiving a signed management representation letter. An audit engagement is an arrangement that an auditor has with a client to perform an audit of the client’s accounting records and financial statements. The term usually applies to the contractual arrangement between the two parties, rather than the full set of auditing tasks that the auditor will perform. To create an engagement, the two parties meet to discuss the services needed by the client.

As a result of the Sarbanes-Oxley Act (SOX) of 2002, publicly traded companies must also receive an evaluation of the effectiveness of their internal controls. As noted above, an internal control letter is usually the result of a deficiency in internal controls discovered during the audit, most commonly from a material audit adjustment. The letter includes required language regarding the severity of the deficiency.

Real Business Owners,

The parties then agree on the services to be provided, along with a price and the period during which the audit will be conducted. This information is stated in an engagement letter, which is prepared by the auditor and sent to the client. If the client agrees with the terms of the letter, a person authorized to do so signs the letter and returns a copy to the auditor. By doing so, the parties indicate that an audit engagement has been initiated.

Also, the letter provides supplementary audit evidence of an internal nature by giving formal management replies to auditor questions regarding matters that did not come to the auditor’s attention in performing audit procedures. Some auditors request written representations of all financial statement items. All auditors require representations regarding receivables, inventories, plant and equipment, liabilities, and subsequent events. The letter is required at the completion of the audit fieldwork and prior to issuance of the financial statements with the auditor’s opinion.

Auditors spend a lot of time assessing how material audit adjustments and immaterial adjustments that have the potential to be material will be communicated in the internal control letter. The Representation Letter is issued with the draft audit and is required by auditing standards to finalize the audit. The Representation Letter is a letter from the Association to our firm confirming responsibilities of the board and management for the financial statements, as well as confirming information provided to us during the audit. The President or Treasurer and Management need to sign the Representation Letter and return it back to our office within 60 days from the date the draft audit was issued. Representation Letters received after the 60-day mark may result in additional auditing procedures in order to finalize the audit and comply with auditing standards at an additional expense to the Association.

03 Apr What are Management Representation Letters?

In the world of assurance engagements, a management representation letter is a formal document that represents management’s agreement with the financial statements that are being audited or reviewed. This letter is a critical part of the assurance engagement process and is required by the auditor or reviewer as evidence that management acknowledges and accepts responsibility for the financial statements.

A management representation letter is typically issued by senior management, such as the CEO or CFO, and is addressed to the CPA firm performing the audit or review. It contains a series of statements that confirm certain facts and assurances about the company’s financial information, including the completeness and accuracy of financial records, disclosures of relevant information, and adherence to accounting principles.

The letter serves several purposes, including:

- Confirming the accuracy of financial information : The management representation letter is used to confirm that the financial statements are accurate and complete. This helps provide assurance to stakeholders that the financial statements are reliable.

- Demonstrating management’s responsibility : By signing the letter, management acknowledges its responsibility for the accuracy and completeness of the financial statements. This helps to provide accountability and transparency to stakeholders.

- Providing evidence for auditors and reviewer s: The management representation letter provides evidence to the CPA firm that management has taken responsibility for the financial statements, which helps to support the audit opinion or review conclusion.

- Reducing the risk of misstatements : The letter helps to reduce the risk of misstatements by requiring management to review the financial statements and provide assurance that they are accurate and complete.

Overall, the management representation letter is a critical part of the assurance engagement process, as it helps to provide assurance that the financial statements are accurate and complete, and that management takes responsibility for them. Without this letter, CPA firms would not have the necessary evidence to support their opinions and conclusions, which could lead to a lack of confidence in the financial statements and potential legal and financial consequences for the company. In fact, CPA firms are not permitted to complete their engagement and issue an audit or review engagement report until management provides a signed management representation letter.

If you require an audit or review and would like to speak to someone about these processes, please contact us to set up a free consultation.

Jennifer Scott

Cpa, cga – senior manager.

Jennifer Scott, a Senior Manager at Clearline brings a wealth of expertise in Private Enterprise and Assurance, holding designations as a CPA and CGA. Jennifer’s focus at Clearline includes conducting reviews, compilations, and providing tax services tailored to owner-manager businesses and partnerships, with a keen interest in industries such as professionals, manufacturing, real estate, and services. Her commitment to exceptional client service is evident through her proactive approach to staying updated on evolving accounting standards and tax legislation, thereby making her clients’ lives easier Jennifer’s educational background includes a Bachelor of Commerce from UBC with a major in Accounting, followed by over 15 years of experience in public practice, specializing in private enterprise. She appreciates the supportive environment at Clearline and enjoys various activities outside of work, including travelling, cheering on her children in sports like soccer, baseball, and volleyball, indulging in long walks with her dog while listening to podcasts, spending quality time with loved ones, and exploring her passion for baking through experimenting with new recipes.

Charmaine Pirrie

Cpa, ca(sa) – senior manager.

Charmaine Pirrie, a Senior Manager at Clearline is a CPA and CA (SA) with a background in audit and review engagements. With experience from Grant Thornton and D&Co, she brings expertise in private company audits and values Clearline’s supportive environment and technical resources. Charmaine also finds fulfillment in delving into her clients’ businesses to provide tailored services, ensuring meticulous audit and review procedures. Outside of work, she enjoys spending time with family, going for walks, and swimming.

Deepeka Dhillon

Cpa – manager.

Deepeka Dhillon, a Manager at Clearline, holds a CPA designation with a focus in Private Enterprise and Tax. Her primary responsibilities include compliance, corporate restructuring, and, estate and succession planning. Deepeka’s passion lies in continuous learning, enabling her to provide tailored solutions to clients’ unique needs. With a CPA designation and completion of the CPA in-depth tax program, she brings a strong educational background to her role at Clearline. Deepeka values the countless opportunities at Clearline to expand her knowledge in the complex world of tax. Outside work, she enjoys spending time with her beloved Jack Russell Terrier, Opie.

Raj Momrath

Cpa, ca, senior tax manager.

Raj Momrath, a Senior Tax Manager at Clearline, is a CPA, CA specializing in Canadian Tax. With a focus on Canadian tax planning, corporate reorganizations, estate planning, and providing business advice, Raj caters to a diverse clientele, including small owner-manager companies, high-net-worth individuals and large privately held multinational firms. His passion lies in helping Canadian owner-manager businesses and their shareholders minimize their overall tax obligations while navigating disputes with the Canada Revenue Agency and ensuring compliance with the complex Canadian tax system. Raj’s professional journey includes prior experience in PwC’s tax group, where he obtained his Chartered Accountant designation and then some time at some mid-sized firms. Raj completed the CPA Canada InDepth Tax course in 2017 strengthening his knowledge of Canadian tax. At Clearline, Raj appreciates working alongside knowledgeable colleagues and enjoys spending quality time with his wife and two sons and attending and volunteering with their sports activities. In his leisure time, Raj indulges in barbequing, golfing, and spending time outdoors, finding relaxation and enjoyment in these pursuits.

Julia Wallis

Julia Wallis, a Senior Manager at Clearline, holds designations as a CPA, CGA, and also holds a BA. Working within the Private Enterprise Group, her primary focus revolves around assisting entrepreneurs in understanding their personal and business finances while ensuring compliance with tax reporting requirements. Julia finds fulfillment in learning about her clients’ businesses and providing financial insights to enhance their management effectiveness while optimizing tax strategies. With a diverse career spanning various companies and public practice roles, including as a controller, Julia’s progression has equipped her with invaluable skills and insights into different business operations. She chose Clearline for its respected partners and staff, aligned philosophy on client service, and flexibility to balance demanding tax filing periods with leisure time for travel and personal interests such as gardening, wine exploration, reading, and relaxation.

Annelie Vistica

Cpa, ca – principal.

Annelie Vistica, a Principal at Clearline, is a CPA and CA with a strong background in private enterprise and assurance. With a Bachelor of Accountancy from the University of Stellenbosch in South Africa and extensive experience in tax, Annelie brings expertise in business setup, growth planning, and estate transitioning. She is passionate about engaging with clients to support them through various business stages, from inception to succession planning. Annelie values the supportive environment at Clearline, where she appreciates colleagues’ assistance in tax and assurance. Outside work, she enjoys spending time with her family and dog, exploring nature, visiting family in the Okanagan, and travelling the world.

Bilal Kathrada

Cpa, ca, principal.

Bilal, a Principal at Clearline Chartered Professional Accountants, primarily focuses on income tax and succession planning for Canadian owner-managed businesses in various industries. Bilal received his Bachelor of Commerce degree from the University of Victoria and obtained his CA designation in 2005.

Prior to Clearline, he worked in the tax group of a large international accounting firm in Vancouver and a mid-sized accounting firm located in the Fraser Valley.

Outside of the office, he enjoys spending time with his wife and three children. He enjoys outdoor activities such as golf and spending time with his family and friends.

Danny Sandhu

Cpa, manager.

Bio coming soon.

Shehzel Saif

Cpa, tax manager.

As Clearline’s Tax Manager, Shehzel focuses on tax planning, corporate reorganizations and succession and estate planning. She’s passionate about continuous learning and staying up to date on tax legislation changes and helping clients with succession. In addition to her CPA designation, Shehzel also has a Bachelor of Business Administration and has completed the CPA In-Depth Taxation Program. Outside of work, she enjoys spending time with family and friends, traveling and trying out new recipes.

Ameeta Randhawa

As Clearline’s HR Manager, Ameeta supports our firm’s greatest resource—our staff. With a Bachelor of Business Administration in Human Resources and over 7 years of HR experience in various industries, she ensures all employees have a positive experience at Clearline. Ameeta’s focuses include recruitment, performance management, employee relations, program and policy development, and employee engagement. Outside of work, she enjoys traveling and spending time with friends and family.

CPA, CA, Senior Manager

Michael is a Senior Manager in Private Enterprise, carrying out reviews, compilations, and tax services for small- to medium-sized businesses. With a Bachelor of Commerce specializing in finance and a Diploma in Accounting, backed by over a decade of accounting experience, Michael is a trusted advisor who helps clients’ businesses succeed. Outside of the office, Michael enjoys spending time with family, trying out different restaurants in the city, and building and collecting mechanical keyboards.

CPA, CGA, Manager

Victor K. Yoshida

Victor was born and raised in Vancouver and obtained his Bachelor of Commerce from the University of British Columbia. He articled with Deloitte & Touche and received his CA designation in 1984. Victor was accepted to the firm’s tax group and went on to complete the Canadian Institute of Chartered Accountants In-Depth Tax course.

Victor specializes in Canadian income tax issues for professional and owner-managed businesses. He has extensive experience with business succession, estate planning, wealth preservation issues, corporate reorganizations, as well as mergers and acquisitions.

Victor was a member of the education committee of the Institute of Chartered Accountants of British Columbia and has held executive positions with various amateur sport organizations.

In his free time, Victor enjoys training for marathons, travelling, and spending time with his family.

Clarity, strategy and confidence straight to your inbox.

Sign up for Clearline news and insights

Illustrative Management Representation Letter: SOC 2® Type 1

AICPA MEMBER

AT-C section 205, Assertion-Based Examinations, requires the service auditor to request written representations from the responsible party in a SOC 2 engagement. These representation should be in the form of a letter addressed to the service auditor. The following illustrative management representation letter includes the representations required by AT-C section 205 as well as additional representations specific to a SOC 2 Type 1 examination and should be used for engagements with reports dated on or after June 15, 2022. This

Download the Illustrative Management Rep Letter: SOC 2® Type 1

File name: illustrative-mgmt-rep-letter-for-soc-2-type-1.pdf

Reserved for AICPA® & CIMA® Members

Already a member of the aicpa or cima, log in with your account, not a member of the aicpa or cima, mentioned in this article, related content.

This site is brought to you by the Association of International Certified Professional Accountants, the global voice of the accounting and finance profession, founded by the American Institute of CPAs and The Chartered Institute of Management Accountants.

CA Do Not Sell or Share My Personal Information

All Formats

Table of Contents

11+ management representation letter templates in doc | pdf, 1. management representation letters template, 2. illustrative management representation letter template, 3. management representation letter template in pdf, 4. sample management representation letter template, 5. management representation letter format, 6. management representation letter for profit entities template, 7. general management representation letter template, 8. basic management representation letter template, 9. attestation management representation letter template, 10. draft management representation letter template, 11. management report & representation letter, 12. management representation letter template in doc, who approves a management representation letter, what is the purpose of writing a management representation letter, a better understanding on management representation letter:, what are the concerns that are highlighted in a management representation letter, what are the clauses in a management representation letter, the necessities or the importance of a management representation letter:, audit templates.

A management representation letter is a structure letter composed by an organization’s outer reviewers, which is marked by a senior organization the board. The letter verifies the precision of the financial reports that the organization has submitted to the examiners for their investigation. For samples of different letters, check out our collection of more representation letter templates on our official website template.net that you can use. You may also see more different types of representation letters in Word from our official website template.net.

- Generally, the letter expresses that the entirety of the data submitted is precise and that all material data has been uncovered to the reviewers. The evaluators utilize this letter as a feature of their review proof. View a wider selection of Creative Letter Templates right here.

- The letter likewise moves some fault to the board, on the off chance that things being what they are, a few components of the examined fiscal summaries don’t reasonably speak to the money related outcomes, monetary position, or incomes of the business.

- Consequently, the explanations that the reviewer remembers for the letter are very expansive extending, enveloping each conceivable zone in which the board’s failings could prompt the issuance of off base or deceiving budget summaries. Looking for more insights? Dive into our blog post about representative cover letter templates.

- The executives are answerable for the best possible introduction of the budget summaries as per the pertinent bookkeeping system. Find more Letter Format Templates by visiting this link.

- Every single money related record have been made accessible to the examiners

- All governing body minutes are finished

- The board has made accessible all letters from administrative organizations concerning monetary revealing resistance

- There are no unrecorded exchanges

- The net impact of every uncorrected misquote is insignificant

- The supervisory crew recognizes its duty regarding the arrangement of budgetary controls. You can also find a wider variety of management representation letters in Pdf format on our official website at template.net.

- All related gathering exchanges have been revealed; Explore a variety of Professional Letter Templates here.

- Every unforeseen risk have been revealed;

- All unasserted cases or evaluations have been revealed;

- The organization has revealed all liens and different encumbrances on its advantages;

- Every material exchange have been appropriately recorded;

- The board is liable for frameworks intended to distinguish and forestall extortion;

- The board has no information on misrepresentation inside the organization;

- The budget reports comply with the relevant bookkeeping system.

- Evaluators regularly don’t enable the administration to roll out any improvements to the substance of this letter before marking it, since this would successfully lessen the risk of the executives. Check out more Personal Letter Templates available here.

- An inspector regularly won’t give a supposition on an organization’s fiscal summaries without first getting a marked administration portrayal letter.

- An administration portrayal letter is a particular letter composed by an organization’s outer reviewers and afterward marked by the senior organization the executives. The date of the archive can’t be later than the date at which the review wraps up. The letter confirms that the data gave is precise and revealed to the examiners.

- On the off chance that for reasons unknown it’s discovered that a few components of the evaluated budget summaries are not exact then evaluators should lead further examinations. As you can envision, to state there’s a ton of strain to hit the nail on the head the first run-through is putting it mildly. You can also discover a greater variety of management representation letters in Pages on our official website, template.net.

- All dangers, vulnerabilities, liens, encumbrances, unrecorded and recorded exchanges, legitimate infringement, unexpected liabilities, and unasserted cases or evaluations have been sufficiently recorded and uncovered.

- Every money related record has been made accessible to the evaluators. You may also see more on Business Letter templates here.

- All board and investor meeting minutes have been made accessible to the examiner.

- The executives are liable for frameworks intended to recognize and forestall extortion and have no information on misrepresentation inside the organization.

- The executives don’t expect to have changes that will affect the estimation of organization resources or liabilities.

- The board is answerable for the correct introduction of the fiscal reports by the relevant bookkeeping structure and the group recognizes its duty regarding the arrangement of money related controls.

- The board has made accessible all letters from administrative offices concerning money related detailing rebelliousness. For the best experience, explore a wider range of management representation letters in Google Docs directly from our official website, template.net.

More in Audit Templates

Contract management report template, printable crm template, achievement report hr template, technical report template, report cover template, employee report template, digital marketing agency link building strategy report template, digital marketing agency a/b testing results report template, digital marketing agency client progress review report template, digital marketing agency monthly blog and content calendar report template.

- 3+ Audit Debrief Templates in PDF | MS Word

- 11+ Audit Confirmation Templates in MS Word | Excel | PDF

- 11+ Audit Corrective Action Plan Templates in MS Word | Excel | PDF

- 10+ Free Audit Findings Report Templates in PDF | MS Word

- 11+ Asset Management Audit Templates in PDF | MS Word

- 6+ 401 K Audit Templates in PDF | MS Word

- 5+ Antibiotic Prescribing Audit Templates in PDF | Excel

- 6+ Audit Findings Letter Templates in PDF | MS Word

- 10+ Audit Exception Report Templates in PDF | MS Word

- 15+ Audit Confirmation Letter Templates in MS Word | PDF

- 10+ Audit Engagement Checklist Templates in PDF | MS Word

- 11+ Audit Committee Report Templates in PDF | MS Word

- 11+ Audit Executive Summary Templates in PDF | MS Word

- 10+ Audit Engagement Letter Templates in PDF | MS Word

- 10+ Audit Committee Meeting Agenda Templates in PDF | MS Word

File Formats

Word templates, google docs templates, excel templates, powerpoint templates, google sheets templates, google slides templates, pdf templates, publisher templates, psd templates, indesign templates, illustrator templates, pages templates, keynote templates, numbers templates, outlook templates.

14+ Management Representation Letter Format, What is It, Examples

- Letter Format

- January 24, 2024

- Business Letters , Contract Letters , Legal Letters

Management Representation Letter Format : A management representation letter format is a formal document used by auditors to obtain written confirmation from management about certain financial and non-financial matters . The Business letter is an important part of the audit process as it helps auditors gain a better understanding of the client’s business operations, accounting policies, and financial reporting practices .

- Business Inauguration Invitation Letter

- Business Proposal Acceptance Letter Format

- Business Invitation Letter Format

- Business Agreement Letter Format

- Business Contract Letter Format

Management Representation Letter Format

Content in this article

The management representation letter format is typically including the following components:

- Opening Paragraph: The Legal letter begins with a formal greeting and an explanation of the purpose of the letter. It may also include the date of the audit and the reporting period.

- Responsibilities of Management: This section outlines the responsibilities of management in relation to the financial statements and the audit process. It confirms that management is responsible for the preparation and presentation of the financial statements in accordance with accounting principles, maintaining adequate internal controls, and providing the auditor with access to all relevant information.

- Representations: This is the main body of the letter, where management makes specific representations about various financial and non-financial matters. These may include statements about the completeness and accuracy of financial statements, compliance with laws and regulations, the absence of fraud, and the adequacy of internal controls.

- Closing Paragraph: The Contract letter concludes with a statement confirming that management has disclosed all relevant information to the auditor and that the representations made in the letter are true and accurate.

It is important to note that the management representation letter Format is a legal document and should be drafted with care. Management should review the letter carefully before signing it, as they are legally responsible for the accuracy of the information provided.

In addition to providing auditors with important information about the client’s business, the management representation letter can also serve as a valuable communication tool between management and the auditor . It can help to identify potential issues early in the audit process and facilitate a smoother and more efficient audit.

Management Representation Letter Format – Sample Format

Below is a Sample Format of Management Representation Letter Format:

[Your Company Letterhead]

[External Auditor’s Name]

[External Auditor’s Firm]

[Address Line 1]

[Address Line 2]

[City, State, ZIP Code]

Dear [External Auditor’s Name],

Re: Management Representation Letter

We appreciate the opportunity to work with your firm in connection with the audit of the financial statements of [Your Company Name] for the fiscal year ended [Date]. In connection with your audit, we are providing you with this representation letter.

We, the management of [Your Company Name], confirm the following representations:

- The financial statements have been prepared in conformity with the generally accepted accounting principles (GAAP) and present fairly the financial position, results of operations, and cash flows of the company.

- Management is responsible for establishing and maintaining effective internal control over financial reporting, and there have been no significant changes in the internal control over financial reporting that could have a material effect on the company’s ability to record, process, summarize, and report financial data.

- To the best of our knowledge, there has been no fraud or illegal acts that have materially affected or are reasonably likely to materially affect the financial statements.

- Except as disclosed in the financial statements or in the notes thereto, there are no pending or threatened legal actions, claims, or assessments that could have a material effect on the financial statements.

- All significant information and documentation related to the company’s operations and financial transactions have been made available to your firm.

- We have disclosed all significant events occurring after the balance sheet date that would require adjustment to, or disclosure in, the financial statements.

This representation letter is provided to you in connection with your audit of the financial statements of [Your Company Name] and should be read in conjunction with the auditor’s report. We acknowledge our responsibility for the design and implementation of internal controls to prevent and detect fraud, as well as the preparation of financial statements.

Please let us know if you need any further information or clarification. We appreciate your professional services and look forward to a successful audit.

[Your Name]

[Your Title]

[Your Company Name]

[Your Contact Information]

This is a general template for a management representation letter. Specific content may vary based on the company’s circumstances and the requirements of the external auditor. It is advisable to consult with legal and accounting professionals when preparing such letters.

Email Ideas about Management Representation Letter Format

Here’s an Email Ideas for Management Representation Letter Format:

Subject: Request for Management Representation Letter

Dear [Manager’s Name],

I am writing to request your assistance in providing a management representation letter format to complete our audit process. As you are aware, the management representation letter is a crucial document that provides written confirmation from management on the accuracy and completeness of financial statements and related disclosures.

The representation letter helps our auditors to obtain evidence in support of the financial statements and to obtain assurance that management has fulfilled its responsibilities. It also serves as a tool for our auditors to document the representations made by management during the course of the audit.

We would appreciate it if you could provide the management representation letter as soon as possible, but no later than [date]. We understand that the process of preparing this letter can take some time and we are available to discuss any questions or concerns you may have.

Please let us know if you need any further information or assistance in preparing the letter. We appreciate your cooperation and look forward to completing the audit process.

Thank you for your attention to this matter.

Management Representation Letter Format to Auditor

This letter, presented to auditors, formalizes the company’s commitments, affirming the accuracy of financial data, adherence to accounting standards, and cooperation with auditors to ensure a transparent and accurate audit process.

We appreciate the opportunity to collaborate with your firm for the audit of the financial statements of [Your Company Name] for the fiscal year ended [Date]. In connection with the audit, we are pleased to provide you with the following representations:

- The management of [Your Company Name] is responsible for the preparation and fair presentation of the financial statements in conformity with the generally accepted accounting principles (GAAP).

Should you require any further information or clarification, please do not hesitate to contact us. We appreciate your professional services and look forward to a successful audit.

This letter is a general format for a management representation letter to an auditor. Specific content may vary based on the company’s circumstances and the requirements of the external auditor. Always consult with legal and accounting professionals when preparing such letters.

Management Representation Letter Format to Bank

This Management Representation Letter Format serves to affirm the accuracy of financial information, adherence to credit terms, and compliance with agreements, fostering transparency in the company’s dealings with the bank.

[Bank Name]

[Bank Address Line 1]

[Bank Address Line 2]

Dear [Bank Manager’s Name],

Re: Management Representation Letter for Banking Purposes

We hereby provide this Management Representation Letter in connection with our banking relationship with [Bank Name]. This letter is to confirm certain representations to assist the bank in its assessment of our financial standing and creditworthiness.

- We confirm that the financial statements provided to the bank are prepared in accordance with generally accepted accounting principles (GAAP) and present fairly our financial position as of [Date].

- All information provided regarding our credit facilities, loans, and guarantees is accurate, complete, and reflective of our current financial obligations to the best of our knowledge.

- We confirm that we are in compliance with all terms and conditions outlined in our loan agreements, credit facilities, and any other financial arrangements with the bank.

- We have disclosed any material changes in our financial condition, business operations, or other relevant matters that may impact our ability to meet our financial obligations to the bank.

- There are no pending or threatened legal proceedings, disputes, or litigation that could materially affect our ability to fulfill our financial commitments to the bank.

- The undersigned individuals have the authority to provide these representations on behalf of the company, and all necessary corporate approvals have been obtained.

This Management Representation Letter is provided solely for the purpose of supporting our banking relationship with [Bank Name]. We acknowledge our responsibility to promptly inform the bank of any material changes that may affect the accuracy of these representations.

If you require any additional information or documentation, please do not hesitate to contact us. We appreciate your continued support and understanding.

This Management Representation Letter to the bank is a formal document confirming key financial and operational details. Customize it as needed based on your specific banking relationship and requirements.

Management Representation Letter Format – Template

Here’s a Template of Management Representation Letter Format:

[Company Letterhead]

[External Auditor Name] [External Auditor Address] [External Auditor City, State ZIP Code]

Dear [External Auditor Name],

We are pleased to provide you with this management representation letter in connection with the audit of our financial statements for the year ended [Date]. As management of [Company Name], we acknowledge our responsibility for the preparation and presentation of the financial statements in accordance with generally accepted accounting principles.

We confirm that we have provided you with all relevant information necessary for the audit and that we have disclosed all known or suspected fraud, illegal acts, or non-compliance with laws and regulations that may have a material effect on the financial statements.

We represent that the financial statements are complete and accurate, and that they fairly present, in all material respects, the financial position of [Company Name] as of [Date], and the results of its operations and cash flows for the year then ended.

We also confirm that the representations made in this letter are true and accurate as of the date of this letter.

[Your Name] [Your Title] [Your Company Name]

Management Representation Letter for External Audit

This letter reinforces the company’s commitment to transparency, providing essential assurances to external auditors regarding the accuracy of financial information and cooperation throughout the audit, crucial for ensuring the integrity of the audit process.

[Audit Firm Name]

[Audit Firm Address]

Re: Management Representation for the External Audit of [Company Name]

We, the undersigned management of [Your Company Name], hereby provide this letter to confirm certain representations in connection with the external audit of our financial statements for the fiscal year ending [Date].

- We confirm that the financial statements, including the balance sheet, income statement, and cash flow statement, present a true and fair view of the financial position of [Your Company Name] as of [Date].

- The financial statements have been prepared in accordance with generally accepted accounting principles (GAAP) [or International Financial Reporting Standards (IFRS)].

- We have established and maintained effective internal controls to provide reasonable assurance regarding the reliability of financial reporting and the preparation of financial statements in accordance with applicable accounting standards.

- All significant information and disclosures related to our operations, financial position, and business transactions that may affect the understanding and interpretation of the financial statements have been disclosed to the best of our knowledge.

- All assets and liabilities, including contingent liabilities, have been properly recorded and disclosed in the financial statements.

- We have disclosed to you all known and potential legal claims, disputes, and litigations that may have a material impact on the financial statements.

- We acknowledge our responsibility to provide you and your team with complete access to all information and documents requested during the audit process.

- We confirm that there have been no changes in accounting policies or practices that materially affect the financial statements without appropriate disclosure.

This letter is provided solely for the purpose of supporting the external audit of our financial statements. We understand the importance of your audit in providing assurance to our stakeholders, and we commit to providing all necessary cooperation throughout the audit process.

If you require any additional information or clarification, please do not hesitate to contact us.

This Management Representation Letter for an external audit assures the auditor of the accuracy and completeness of financial statements, compliance with accounting standards, and cooperation during the audit process. Customize it as per your specific company and audit requirements.

Management Representation Letter to Investors

This letter serves as a transparent communication tool, instilling confidence among investors by affirming the company’s commitment to sound financial practices, compliance, and overall business stability.

[Investor’s Name]

[Investor’s Company/Organization]

[Investor’s Address]

Dear [Investor’s Name],

Re: Management Representation Letter to Investors

We, the undersigned management of [Your Company Name], are pleased to provide this letter to investors to affirm certain key aspects of our operations and financial position. This representation is made as of [Date] in connection with your investment in our company.

- We confirm that the financial statements provided to investors accurately represent the financial position of [Your Company Name] as of [Date]. The statements have been prepared in accordance with generally accepted accounting principles (GAAP) [or International Financial Reporting Standards (IFRS)].

- The management assures investors that the operational performance of the company is in line with the disclosed business plans and strategies. Any material changes have been duly communicated.

- We confirm that the company is in compliance with all applicable laws and regulations relevant to its operations. Any deviations have been appropriately addressed or disclosed.

- All material contracts and agreements that may impact the company’s financial position have been accurately disclosed to investors. There have been no material breaches of these contracts.

- The management has disclosed all known risk factors that may materially affect the company’s financial position or future prospects. We are committed to proactive risk management.

- Funds invested by our esteemed investors have been utilized in accordance with the stated purposes and business plans as communicated during the investment process.

- Any forward-looking statements made by the management are based on reasonable assumptions. However, actual results may vary, and the company is not obligated to update these statements.

- The management is dedicated to maintaining open lines of communication with investors. Any significant developments or changes in the company’s status will be promptly communicated.

This letter is intended to provide additional assurance and transparency to our valued investors. We appreciate your trust in [Your Company Name] and remain committed to creating value and fostering a mutually beneficial partnership.

If you have any questions or require further clarification, please do not hesitate to contact us.

This Management Representation Letter to Investors affirms key aspects of the company’s financial position, operational performance, and commitment to transparency, providing reassurance to investors about their investment in the company. Customize it as per your specific company and investor relations.

Management Representation Letter to Regulators

This letter serves as a formal commitment from the company’s management to regulatory bodies, ensuring transparency, accountability, and adherence to regulatory requirements, thereby fostering trust and regulatory compliance.

[Regulatory Authority Name]

Subject: Management Representation Letter

Dear [Regulatory Authority Name],

Re: Management Representation for Compliance with [Applicable Laws/Regulations]

We, the undersigned management of [Your Company Name], hereby provide this letter to confirm our commitment to compliance with all applicable laws, regulations, and industry standards under the jurisdiction of [Regulatory Authority Name].

- We affirm that our company operates in full compliance with all relevant laws and regulations governing our industry and business operations.

- The financial statements of [Your Company Name], including the balance sheet, income statement, and cash flow statement, have been prepared in accordance with applicable accounting standards, providing a true and fair view of the company’s financial position.