Centre for Research on Energy and Clean Air

Share organization

Or copy link:

Add to list

You have no lists yet

Create your first list:

1 ? 's' : ''}`" >

If your institution is a member, please log into Policy Commons from a link provided by your institution. This typically involves logging in via a menu managed by your library.

Impact Data

Mentions by year, mentions by country.

United States of America

South Africa

United Kingdom

Publications

中 国⽓候转型: 2023展望.

30 Nov 2023

Health Benefits of Just Energy Transition and Coal Phase-out in Indonesia

18 Jul 2023

IESR - Manfaat Kesehatan dari Transisi Energi Berkeadilan dan Penghentian Bertahap

16 Jul 2023

The Inconsistent "Coal-Free Pledge" of Korea's National Pension Service - An...

21 Jun 2023

Resolving near-term power shortages in China from an economic perspective

13 Jun 2023

● 大気汚染物質の一つである微小粒子状物質(PM 2.5 )は、日本では毎年数千人、世界

15 May 2023

A ir quality implications of coal-ammonia co-firing

Opportunities and challenges of flexibility technologies, ambiguities versus ambition: a review of indonesia’s energy transition policy.

26 Mar 2023

Ambiguitas versus Ambisi: Tinjauan Kebijakan Transisi Energi Indonesia

Related topics.

Skip to Content

Centre for Environmental Rights – Advancing Environmental Rights in South Africa

Support Us Subscribe Search

Home / News / Deadly Air: Eskom is now world’s most polluting power company

Deadly Air: Eskom is now world’s most polluting power company

6 October 2021 at 11:45 am

New research from the Centre for Research on Energy and Clean Air (CREA) shows that Eskom is now the largest emitter of health-harming sulfur dioxide (SO 2 ) in the world. These findings stand in stark contrast to the World Health Organisation’s recently updated guidelines on ambient air quality and highlight the fact that unless Eskom complies with domestic air pollution laws or decommissions its older plants, South Africa is unlikely to attain safe air quality, particularly in the Mpumalanga Highveld.

The new expert research and recently strengthened WHO guidelines underscore the vast gulf that the soon-to-be-appointed expert panel on air quality standards in South Africa must try to bridge, if the country is to move from its comparatively weak national ambient air quality standards (NAAQS) and status as an air pollution hotspot, to a future in which millions of South Africans no longer have to breathe poisonous air.

Home of t he worst SO 2 emitting power company in the world

The new research [1] from CREA has found that Eskom emits more SO 2 than the entire power sector of the EU and US, or the US and China, combined. The expert analysis concludes that only India’s power sector accounts for more SO 2 emissions than Eskom.

The CREA report highlights that these emissions contribute to high levels of ambient air pollution and to air pollution-related deaths in South Africa estimated to be responsible for approximately 2,200 deaths annually according to another 2017 expert study. Most of these deaths are due to SO 2 emissions, which form fine particulate matter (PM 2.5 ) once released into the air.

“ Most other regions with large power sector air pollutant emissions have made rapid progress in reducing emissions, Eskom has been stuck in place, lobbying against even the most rudimentary requirements to curb its SO 2 pollution. As a result, the company has now become the worst SO 2 emitting power company in the world ,” explains Lauri Myllyvirta, Lead Analyst at CREA.

“Eskom’s sulfur dioxide emissions in 2019 exceeded those from the power sectors from each of the world’s three largest economies. Eskom’s emissions are shown for FY 2019–2020.”

The other global pandemic: air pollution

The CREA research on Eskom comes in the wake of the WHO tightening its health-based global air quality guidelines. These are recommended exposure limits to harmful air pollutants, including SO 2.

The WHO guidelines for the regulation of air pollutants were last updated 16 years ago in 2005. Since then air pollution has been recognised as the biggest environmental threat to human health, especially as it has been found that air pollutants threaten human health at lower concentrations than previously thought. Global air pollution now causes seven million deaths around the world each year, with over 90% of these deaths occurring in low and middle-income countries.

The new guidelines make recommendations for common air pollutants such as nitrogen dioxide, carbon monoxide and SO 2 . They also recommend that the average annual PM2.5 concentrations should be no higher than five micrograms per cubic metre, halving the old average annual limit of 10.

“ South Africa’s NAAQs are significantly weaker than even the old 2005 WHO guidelines. Despite setting this low bar, government’s own air quality rating map shows that a large portion of the Highveld and Limpopo still experience ‘poor’ air quality that exceeds the NAAQS, meaning that residents in these areas are exposed to dangerous levels of air pollution on a regular basis, with serious health implications” , says CER attorney Timothy Lloyd.

The Deadly Air case

The contrast between the WHO guidelines and the new research on Eskom goes to the heart of the landmark Deadly Air case in which groundWork and Vukani Environmental Justice Movement in Action, represented by CER, sued the government for its failure to reduce the toxic air pollution in the Mpumalanga Highveld in accordance with its own air quality management plan that seeks to protect residents’ right to a healthy environment.

“ The Deadly Air case was heard in the Pretoria High Court in May 2021 and while we still await the verdict, these related developments further support the urgent need for the effective implementation of air quality laws and plans in the Mpumalanga Highveld, to reduce health impacts and uphold constitutional rights. We welcome the establishment of the expert panel to review South Africa’s air quality standards, in a context that not only demands stricter health-based NAAQS, but also the unwavering enforcement of emission limits against big polluters such as Eskom as part of a just transition away from South Africa’s unsustainable coal-based economy ” Lloyd says.

[1] Eskom’s 15 coal power plants (44 GW) emitted 2,100 thousand tonnes (kt) of SO2 based on the company’s own monthly emissions reports.

Receive regular and timely news updates in your inbox.

Join our Mailing List

Latest News

Driving Change in Steel Making: The Role of AMSA Stakeholders and Civil Society

24 May 2024

LAC Statement on Minister Creecy’s decision to grant Sasol’s MES appeal

10 May 2024

Civil society organisations welcome imminent promulgation of the Climate Change Act: A crucial step towards a meaningful response to climate change

30 April 2024

Court orders Minister of Electricity to join the landmark #CancelCoal case as Fifth Respondent.

25 April 2024

A Gender Just Climate Transition: Report launch

22 April 2024

Mabola coalition in court again to safeguard Protected Area

16 April 2024

In the face of the climate emergency, the IRP2023 lacks climate commitment

27 March 2024

Can emitters be held liable for climate change loss and damages?

20 March 2024

Civil society approaches court to challenge go-ahead for Richard’s Bay gas-to-power plant

11 March 2024

Richards Bay Karpowership’s Environmental Authorisation Challenged in Appeal Process

23 November 2023

View Archive

- Climate modelling

- Extreme weather

- Health and Security

- Temperature

China energy

- Oil and gas

- Other technologies

- China Policy

- International policy

- Other national policy

- Rest of world policy

- UN climate talks

- Country profiles

- Guest posts

- Infographics

- Media analysis

- State of the climate

- Translations

- Daily Brief

- China Briefing

- Comments Policy

- Cookies Policy

- Global emissions

- Rest of world emissions

- UK emissions

- EU emissions

- Global South Climate Database

- Newsletters

- COP21 Paris

- COP22 Marrakech

- COP24 Katowice

- COP25 Madrid

- COP26 Glasgow

- COP27 Sharm el-Sheikh

- COP28 Dubai

- Privacy Policy

- Attribution

- Geoengineering

- Food and farming

- Nature policy

- Plants and forests

- Marine life

- Ocean acidification

- Ocean warming

- Sea level rise

- Human security

- Public health

- Public opinion

- Risk and adaptation

- Science communication

- Carbon budgets

- Climate sensitivity

- GHGs and aerosols

- Global temperature

- Negative emissions

- Rest of world temperature

- Tipping points

- UK temperature

- Thank you for subscribing

Social Channels

Search archive.

Receive a Daily or Weekly summary of the most important articles direct to your inbox, just enter your email below. By entering your email address you agree for your data to be handled in accordance with our Privacy Policy .

- Analysis: Clean energy was top driver of China’s economic growth in 2023

Lauri Myllyvirta

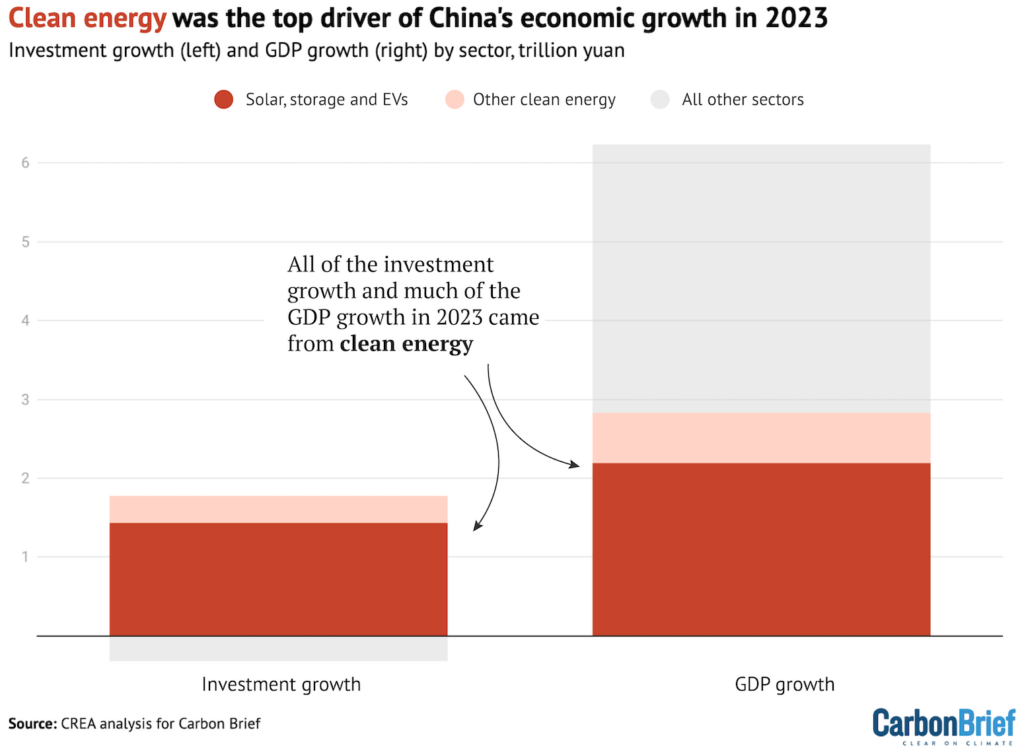

Clean energy contributed a record 11.4tn yuan ($1.6tn) to China’s economy in 2023, accounting for all of the growth in investment and a larger share of economic growth than any other sector.

The new sector-by-sector analysis for Carbon Brief, based on official figures, industry data and analyst reports, illustrates the huge surge in investment in Chinese clean energy last year – in particular, the so-called “ new three ” industries of solar power, electric vehicles (EVs) and batteries.

Solar power, along with manufacturing capacity for solar panels, EVs and batteries, were the main focus of China’s clean-energy investments in 2023, the analysis shows.

(For this analysis, we used a broad definition of “clean energy” sectors, including renewables, nuclear power, electricity grids, energy storage, EVs and railways. These are technologies and infrastructure needed to decarbonise China’s production and use of energy.)

Other key findings of the analysis include:

- Clean-energy investment rose 40% year-on-year to 6.3tn yuan ($890bn), with the growth accounting for all of the investment growth across the Chinese economy in 2023.

- China’s $890bn investment in clean-energy sectors is almost as large as total global investments in fossil fuel supply in 2023 – and similar to the GDP of Switzerland or Turkey .

- Including the value of production, clean-energy sectors contributed 11.4tn yuan ($1.6tn) to the Chinese economy in 2023, up 30% year-on-year.

- Clean-energy sectors, as a result, were the largest driver of China’ economic growth overall, accounting for 40% of the expansion of GDP in 2023.

- Without the growth from clean-energy sectors, China’s GDP would have missed the government’s growth target of “ around 5% ”, rising by only 3.0% instead of 5.2% .

The surge in clean-energy investment comes as China’s real-estate sector shrank for the second year in a row. This shift positions the clean-energy industry as a key part not only of China’s energy and climate efforts, but also of its broader economic and industrial policy.

However, the spectre of overcapacity means China’s clean-energy investment growth – and its investment-driven economic model, in general – cannot continue indefinitely.

The growing importance of these new industries gives China a significant economic stake in the global transition to clean-energy technologies.

Yet it also poses questions for overseas policymakers attempting to tie their own climate strategies to domestic industrial growth.

Clean energy drives China’s growth in 2023

Solar power, electric vehicles, energy efficiency, electricity storage and hydrogen, nuclear power, electricity grids, why clean energy took off in 2023, what clean-energy growth means for china – and the world.

China’s clean-energy investment boom means the sector accounted for all of the growth in investment across the country’s economy in 2023, with spending in other areas shrinking.

China invested an estimated 6.3tn yuan ($890bn) in clean-energy sectors in 2023, up from 4.6tn yuan in 2022, a 1.7tn yuan (40%) year-on-year increase. In total, clean energy made up 13% of the huge volume of investment in fixed assets in China in 2023, up from 9% a year earlier.

With Chinese investment growing by just 1.5tn yuan in 2023 overall, the analysis shows that clean energy accounted for all of the growth, while investment in sectors such as real estate shrank.

This is shown in the figure below, which also highlights the concentration of clean-energy investment in the so-called “new three” of solar, energy storage and EVs.

Clean energy was also the top contributor to China’s economic growth overall, contributing around 40% of the year-on-year increase in GDP across all sectors.

Including the value of goods and services, the clean-energy sector contributed an estimated 11.4tn yuan ($1.6tn) to China’s economy in 2023, an increase of 30% year-on-year.

This means clean energy accounted for 9.0% of China’s GDP in 2023, up from 7.2% in 2022.

Without the contribution of clean-energy sectors to China’s economic growth in 2023, the country would have seen its GDP rise by just 3.0%, instead of the 5.2% actually recorded.

This would have missed government growth targets at a time of increasing concerns over the nation’s economic prospects, amid the ongoing real-estate crisis and declining population .

The major role that clean energy played in boosting growth in 2023 means the industry is now a key part of China’s wider economic and industrial development.

This is likely to bolster China’s climate and energy policies – as well as its “ dual carbon ” targets for 2030 and 2060 – by enhancing the economic and political relevance of the sector.

Back to top

The ‘new three’ dominate clean-energy investment

This analysis is based on a combination of government releases, industry data and analyst reports, with the exact methodology varying sector-by-sector, as set out in the sections that follow.

The table below lists the estimated contributions of each sector to Chinese investment and GDP overall in 2023, as well as the year-on-year growth since 2022.

The analysis includes solar, EVs, energy efficiency, rail, energy storage, electricity grids, wind, nuclear and hydropower within the broad category of “clean-energy sectors”. All of these are technologies and infrastructure needed to decarbonise China’s energy supply and consumption.

The so-called “new three” of solar, storage and EVs are all prominent in the table – and all recorded strong growth.

Our analysis shows that investment in clean power generation and energy storage capacity reached 1.7tn yuan in 2023 (up 48% year-on-year), while investment in manufacturing capacity for solar, EVs and batteries reached 2.5tn yuan (+60%).

Investment in clean-energy infrastructure reached 1.4tn yuan (+9%, comprising grids, EV charging points and railways) and investment in energy efficiency was 600bn yuan (+15%).

Meanwhile, our analysis shows the value of production of goods and services in the clean-technology sectors reached 5.1tn yuan in 2023, increasing 26% year-on-year.

This includes the value of electricity generation, EV sales and solar exports, as well as the transport of passengers and goods via rail.

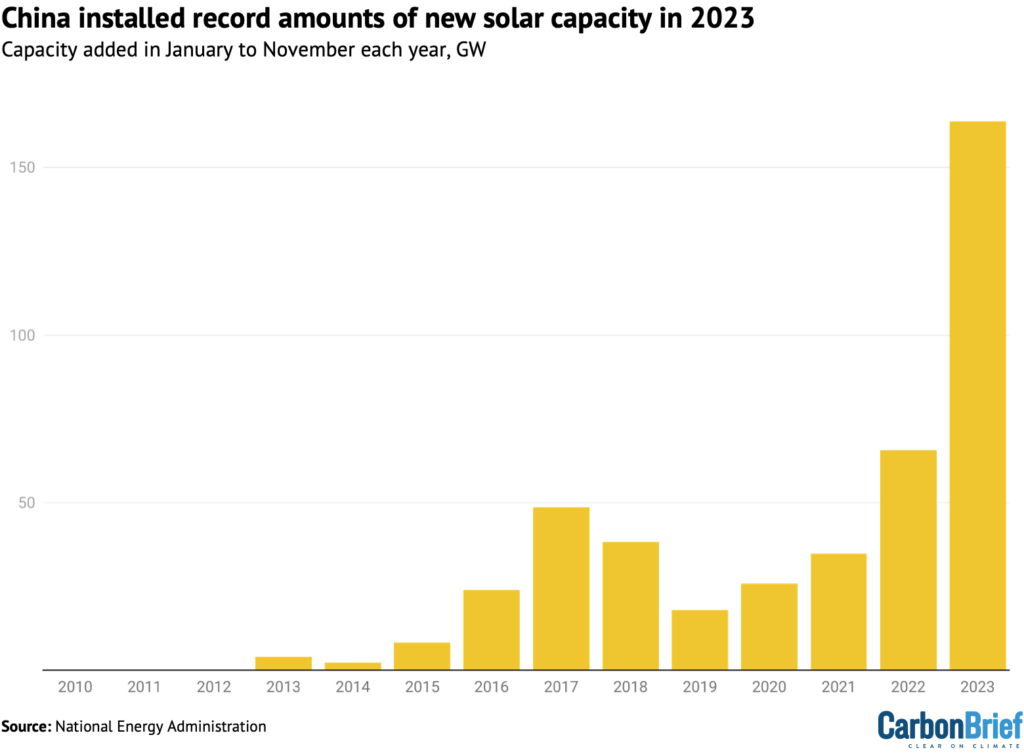

Solar was the largest contributor to growth in China’s clean-technology economy in 2023. It recorded growth worth a combined 1tn yuan of new investment, goods and services, as its value grew from 1.5tn yuan in 2022 to 2.5tn yuan in 2023, an increase of 63% year-on-year.

While China has dominated the manufacturing and installations of solar panels for years, the growth of the industry in 2023 was unprecedented.

On the installation side, two major central government initiatives drove increased volumes, namely the “ whole-county distributed solar ” and the “ clean energy base ” programmes.

In addition, in response to the slowdown in the real-estate sector, the central government introduced a new policy at the start of 2023, to encourage the development of solar power industries on unused and existing construction lands.

Meanwhile, during the annual legislative meetings in the spring of 2023, 15 provinces prioritised solar industry development in their government work agendas.

Detailed data on the growth in China’s solar installations in the first 11 months of the year is shown in the figure below. (An estimated 200GW was added across the country during 2023 as a whole, more than doubling from the record of 87GW set in 2022.)

At the same time, China’s solar manufacturing industry recorded even stronger growth in 2023. China added 340 gigawatts (GW) of polysilicon production capacity and 300GW of wafer, cell and module production capacity in 2023, according to the International Energy Agency (IEA).

China experienced a significant increase in solar product exports in 2023. It exported 56GW of solar wafers, 32GW of cells and 178GW of modules in the first 10 months of the year, up 90%, 72% and 34% year-on-year respectively, according to the China Photovoltaic Industry Association. However, due to falling costs, the export value of these solar products only increased by 3%.

Within the overall export growth there were notable increases in China’s solar exports to countries along the “belt and road”, to southeast Asian nations and to several African countries .

For this analysis, the value of investments in new solar manufacturing capacity was estimated from the average capital costs of each step in the supply chain, taken from a compilation of reported project costs. This gave a significantly lower cost level than reported in other literature.

The analysis assumes that local government investment in facilities and infrastructure, as well as direct subsidies, added 30% to the reported private investment.

Investment in solar power was estimated by multiplying the newly added capacity from Bloomberg New Energy Finance by the unit investment costs for rooftop and utility-scale systems from China Photovoltaic Industry Association.

The value of exported solar power equipment was based on China Photovoltaic Industry Association data for 2022 and reported export growth for 2023.

The value of solar power equipment produced for domestic installation was not included in our analysis, to avoid overlap with the already-estimated investment costs for domestic solar projects.

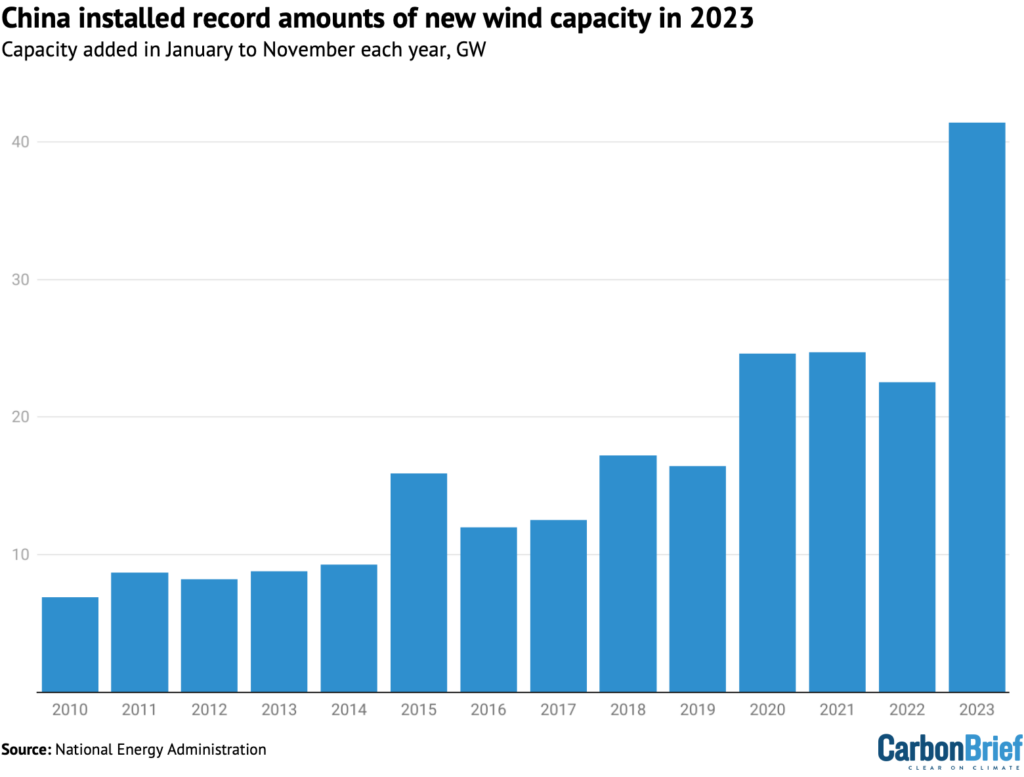

China installed 41GW of wind power capacity in the first 11 months of 2023, an increase of 84% year-on-year in new additions. Some 60GW of onshore wind alone was due to be added across 2023, according to China Galaxy Securities, based on trends in previous years.

In addition, offshore wind capacity increased by 6GW across the whole of 2023.

Wind capacity added in the first 11 months of each year is shown in the figure below.

By the end of 2023, the first batch of “clean-energy bases” were expected to have been connected to the grid, contributing to the growth of onshore wind power, particularly in regions such as Inner Mongolia and other northwestern provinces . The second and third batches of clean-energy bases are set to continue driving the growth in onshore wind installations.

The market is also being driven by the “ repowering ” of older windfarms, supported by central government policies promoting the model of replacing smaller, older turbines with larger ones.

The potential for distributed wind power is also being explored, with initiatives such as the “ villages wind utilisation action ” being planned for active implementation.

Progress on offshore wind power construction in 2023 got off to a slow start . This is a reflection of a shift from nearshore to deeper offshore projects and from single projects to larger bases.

Offshore wind projects are also facing complex approval processes, involving multiple regulatory aspects, leading to uncertainties and slower-than-expected installations.

However, these issues are being addressed and the fourth quarter of 2023 saw a rebound in offshore wind construction, with 2024 expected to be a significant year for project deliveries.

Since 2021 , new wind projects in China no longer receive subsidies from the central government.

Despite technological advancements reducing costs, increases in raw material prices have resulted in lower profit margins compared to the solar industry, leading to a smaller overall investment in wind power relative to solar power.

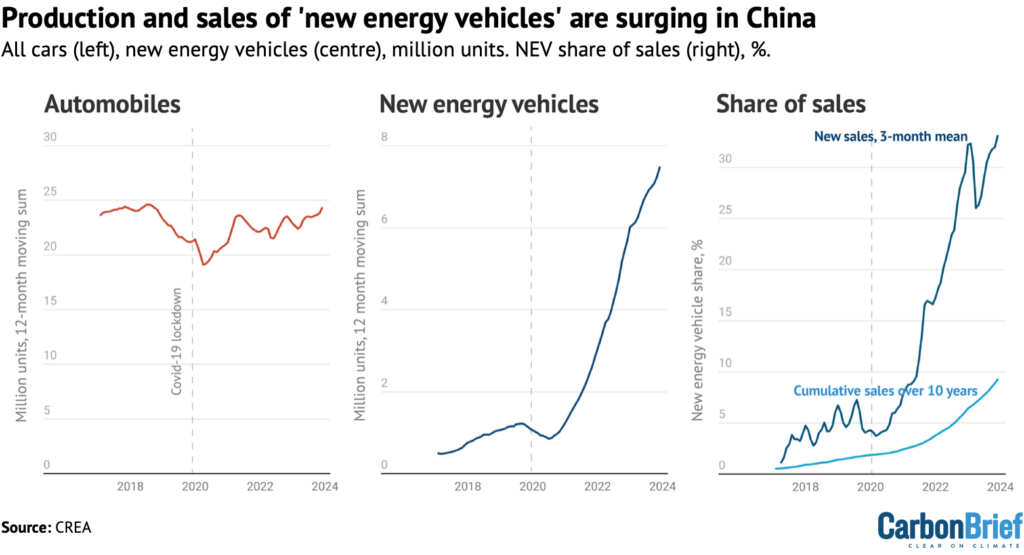

China’s production of electric vehicles grew 36% year-on-year in 2023 to reach 9.6m units , a notable 32% of all vehicles produced in the country.

The vast majority of EVs produced in China are sold domestically, with sales growing strongly despite the phase-out of purchase subsidies announced in 2020 and completed at the end of 2022.

The national purchase subsidy for EVs was a central government finance instrument that had been fostering the EV market for 13 years. Its demise highlights a gradual shift from policy-driven to market-driven demand, making growth more likely to be sustained.

Sales of EVs made in China reached 9.5m units in 2023, a 38% year-on-year increase. Of this total, 8.3m were sold domestically, accounting for one-third of Chinese vehicle sales overall, while 1.2m EVs were exported, a 78% year-on-year increase.

The growth of “new energy vehicle” (NEV, mainly EVs) production and sales is shown in the figure below, which also shows their rising share of all vehicles sold.

China’s EV market is highly competitive, with at least 94 brands offering more than 300 models. Domestic brands account for 81% of the EV market, with BYD, Wuling, Chery, Changan and GAC among the top players.

Sustaining this growth has required major investment in manufacturing capacity.

This analysis estimates investments in EV manufacturing capacity based on a study by China International Association for Promotion of Science and Technology (CIAPST), which put investment in EV manufacturing at 0.7tn yuan in 2021.

The analysis assumes that EVs accounted for all of the growth in investment in vehicle manufacturing capacity reported by China’s national bureau of statistics (NBS) in 2022 and 2023, while investment in conventional vehicles was stable

This implies that investment in EV manufacturing reached CNY 1.2tn yuan in 2023. This is likely to be conservative, because production volumes for combustion engine vehicles are falling, implying a corresponding fall in investment.

This analysis accounts for the expansion of battery manufacturing capacity separately – alongside electricity storage – even though it is being driven by the growth in EV production.

The analysis estimates the value of EV production, including both domestic sales and exports, based on vehicle production volumes from NBS and the reported average EV price.

These EV prices include the value of batteries produced for EVs, so the value of battery production is not included separately.

Meanwhile, EV charging infrastructure is expanding rapidly, enabling the growth of the EV market. In 2022, more than 80% of the downtown areas of “first-tier” cities – megacities such as Beijing, Shanghai and Guangzhou – had installed charging stations, while 65% of the highway service zones nationwide provided charging points.

More than 3m new charging points were put into service during 2023, including 0.93m public and 2.45m private chargers. The accumulated total by November 2023 reached 8.6m charging points.

This analysis puts investment in EV charging infrastructure at 0.1tn yuan in 2023, based on an estimated average cost of 30,000 yuan per charging point.

China’s energy intensity reduction targets have put pressure on industries to reduce their energy use per unit of output, spurring investment in more efficient processes.

For this analysis, the size of the market for energy service companies is used as a proxy for investment in energy efficiency in industries and buildings. This market grew to an estimated 0.6tn yuan in 2023, up from 0.5tn yuan in 2022, based on the revenue growth of the top 10 listed energy service companies ranked by market capitalization, for the first two or three quarters of 2023.

Over the past two decades, China’s energy service sector has experienced rapid expansion, growing from 1.8bn yuan in 2003 to 607bn yuan in 2021. Investment in the industrial service sector has been a key driver, accounting for about 60% of the total investment.

However, 2022 saw a significant downturn in the industrial energy service output, influenced by poor industrial growth , even though the building service sector continued expanding.

This analysis puts China’s investment in building energy efficiency at 80bn yuan per year. The country’s 14th five-year plan for energy savings in buildings and development of “green buildings” targets 80m square metres per year of renovated and newly built green buildings.

Compared with the almost 1,000m square metres of building space completed annually, this is a small percentage, and accordingly, the estimated value of total investments is modest.

China is rapidly scaling up electricity storage capacity. This has the potential to significantly reduce China’s reliance on coal- and gas-fired power plants to meet peaks in electricity demand and to facilitate the integration of larger amounts of variable wind and solar power into the grid.

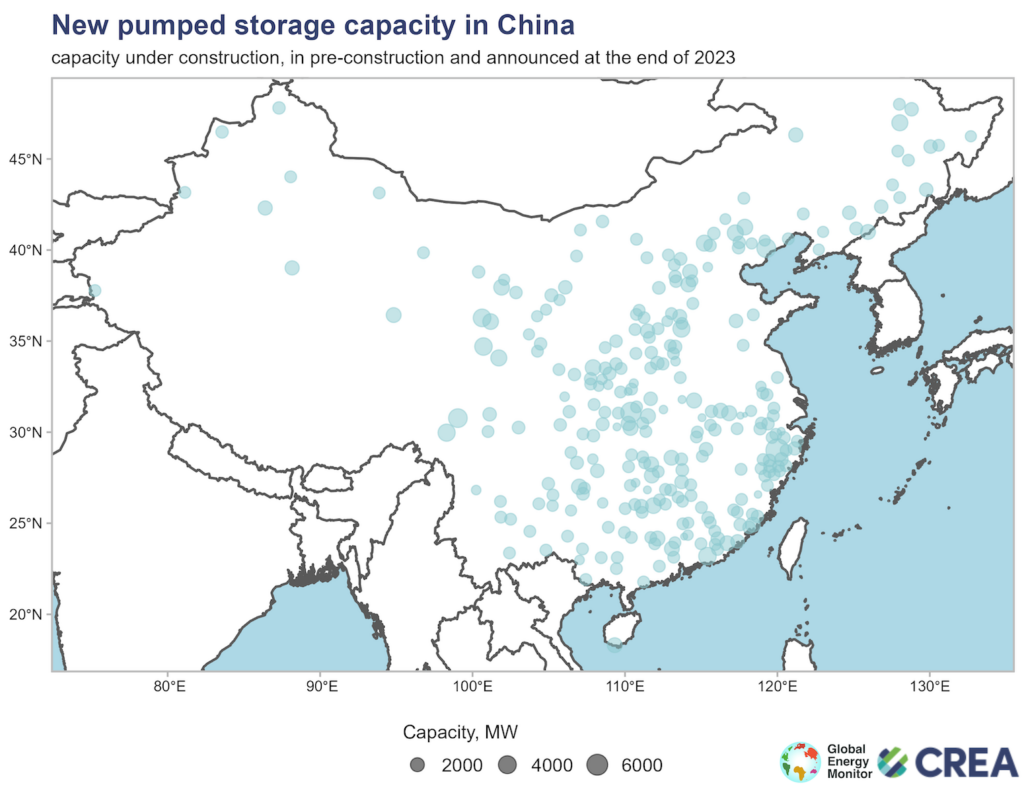

The construction of pumped hydro storage capacity increased dramatically in the last year, with capacity under construction reaching 167GW, up from 120GW a year earlier.

This growth is illustrated in the figure below, which shows pumped hydro capacity under construction or in earlier stages of development at the end of 2023.

Data from Global Energy Monitor identifies another 250GW in pre-construction stages, indicating that there is potential for the current surge in capacity to continue.

For this analysis, estimated annual investments in pumped storage are assumed to be proportional to the capacity under construction, while the reported construction cost of 6 yuan per watt is spread over three years. This implies that investment in 2023 amounted to 0.3tn yuan.

Construction of new battery manufacturing capacity was another major driver of investments, estimated at 0.3tn. This is based on the added capacity reported by the China Automotive Power Battery Industry Innovation Alliance and estimated average investment costs per unit of production capacity, taken from a compilation of publicly reported project costs.

Investment in electrolysers for “green” hydrogen production almost doubled year-on-year in 2023, reaching approximately 90bn yuan, based on estimates for the first half of the year from SWS Research. Analyst reports and compilations of projects published in news media put far larger numbers on China’s investments in green hydrogen, but these generally include the spending on electricity generation, which in this analysis is accounted for separately.

Investment in “new energy storage technologies” – a classification dominated by batteries – more than doubled in 2023, reaching 75bn yuan. This estimate is based on newly added capacity in 2023 reported by China Energy Storage Alliance and average investment costs calculated from National Energy Administration data .

China’s ministry of transportation reported that investment in railway construction increased 7% in January–November 2023, implying investment of 0.8tn for the full year. This includes major investments in both passenger and freight transport. Investment in roads fell slightly, while investment in railways overall grew by 22%.

The share of freight volumes transported by rail in China has increased from 7.8% in 2017 to 9.2% in 2021, thanks to the rapid development of the railway network.

In 2022, some 155,000km of rail lines were in operation , of which 42,000km were high-speed. This is up from 146,000km of which 38,000km were high-speed in 2020.

The value of passenger and freight transportation on China’s railways increased by 39% year-on-year in 2023, reaching nearly 1tn yuan.

In 2023, 10 nuclear power units were approved in China, exceeding the anticipated rate of 6-8 units per year set by the China Nuclear Energy Association in 2020 for the second year in a row.

There are 77 nuclear power units that are currently operating or under construction in China, the second-largest total in the world. The total yearly investment in 2023 was estimated for this analysis at 87bn yuan, an increase of 45% year-on-year, based on data for January–November from the National Energy Administration.

The highest numbers of nuclear projects are located in coastal provinces with large concentrations of heavy industry, such as Guangdong, Fujian and Zhejiang, as the development of inland nuclear power projects remains stalled .

These provinces get around 20% of their electricity from nuclear power and continue to expand the technology as part of their efforts to cut emissions from their power sectors.

China’s power-sector development plans include a major increase in inter-provincial electricity transmission capacity and numerous long-distance transmission lines from west to east.

State Grid, the government-owned operator that runs the majority of the country’s electricity transmission network, has a target to raise inter-provincial power transmission capacity to 300GW by 2025 and 370GW by 2030, from 230GW in 2021. These plans play a major role in enabling the development of clean energy bases in western China.

China Electricity Council reported investments in electricity transmission at 0.5tn yuan in 2023, up 8% on year – just ahead of the level targeted by State Grid.

The clean-energy investment boom in 2023 is the outcome of a major pivot in China’s macroeconomic strategy . As this analysis shows, investment flowed from real estate into manufacturing – primarily in the clean-energy sector.

Total investment in the manufacturing industry increased by 9% year-on-year in 2023, while investment in the power and heat sectors climbed 23%. These increases were entirely due to growth in investment in clean energy, with investment in other areas falling. Therefore, China’s pivot into manufacturing was, in reality, a pivot to cleantech manufacturing.

The reason for this pivot was the contraction in the real-estate sector, where investment fell by 10% year-on-year in 2022 and another 9% in 2023. While this drop was in line with the government’s aim to address financial risks and excess leverage in the sector, it left a major hole in aggregate investment demand and in the revenue of China’s local governments.

Local governments were under pressure to attract investment, meaning that they offered generous subsidies and helped arrange financing.

The central government, for its part, eased private-sector access to financial markets and bank loans during the Covid-19 pandemic, facilitating the growth of the clean-energy sector.

Unlike the state-owned firms dominating traditional industries, the low-carbon sector, largely composed of private companies, gained access to previously constrained credit.

The significance of this economic shift is reflected not only in the figures revealed by this analysis but also in the language being used by Chinese media.

The three largest of clean-energy sectors by value, namely solar, storage and EVs, are being referred to as the “new three”, in contrast to the “old three” – clothing, home appliances and furniture.

This pivot was only possible because China’s clean-energy policies and wider industrial policy had built the foundation and scaled up these sectors so that they were primed for rapid growth.

The post-Covid credit “push” for clean energy growth also coincided with a demand “pull”, driven by falling costs and the increased competitiveness of low-carbon technologies against fossil fuels due to technological advancements.

Moreover, the announcement in 2020 of the 2060 carbon neutrality target had raised expectations and provided the political signal for the scale-up.

Clean technology has been an important part of China’s energy policy, industrial strategy and climate change efforts for a long time. Last year marked the first time that the sector also became a key economic driver for the country. This has important implications.

China’s reliance on the clean-technology sectors to drive growth and achieve key economic targets boosts their economic and political importance. It could also support an accelerated energy transition.

The massive investment in clean technology manufacturing capacity and exports last year means that China has a major stake in the success of clean energy in the rest of the world and in building up export markets.

For example, China’s lead climate negotiator Su Wei recently highlighted that the goal of tripling renewable energy capacity globally, agreed in the COP28 UN climate summit in December, is a major benefit to China’s new energy industry. This will likely also mean that China’s efforts to finance and develop clean energy projects overseas will intensify.

Globally, China’s unprecedented clean-energy manufacturing boom has pushed down prices, with the cost of solar panels falling 42% year-on-year – a dramatic drop even compared to the historical average of around 17% per year, while battery prices fell by an even steeper 50%.

This, in turn, has encouraged much faster take-up of clean-energy technologies.

Projections of solar power deployment, in particular, have been upended. The IEA’s latest World Energy Outlook introduced an additional global energy scenario just to look at the implications, projecting that if global deployment of solar power and grid-connected batteries follows the expansion of manufacturing capacity, then global power-sector coal use and carbon dioxide emissions could be a sizable 15% lower than in the base case by 2030. Most of the additional deployment of solar in the IEA’s revised projections is in China.

Even with the increased deployment, however, there is a limit to how much solar power, batteries and other clean technology can be absorbed, as the manufacturing expansion has already saturated most of the global market.

This means that the expansion will run into overcapacity, if maintained. On the other hand, in order to keep driving growth in investment, clean-technology manufacturing would need to not only absorb as much capital as it did in 2023, but keep increasing investment year after year.

The clean-technology investment boom has provided a new lease of life to China’s investment-led economic model. There are new clean-energy technologies where there is scope for expansion, such as electrolysers .

Eventually, however, entirely new sectors will have to be found for investment – or China’s economic model will have to be transformed once there is nowhere left for investment to flow.

The manufacturing boom also cements China’s dominant position in clean-energy supply chains. Other countries therefore face a choice of whether they want to benefit from the low-cost supply of solar panels, batteries, EVs and other clean-energy technology from China.

The alternative is diversifying their supply and paying the cost of building new supply chains, in the form of subsidies and import tariffs required to enable domestic producers or producers in third countries to compete against Chinese suppliers. Such efforts would further increase supply and push down global prices even further.

Analysis: Monthly drop hints that China’s CO2 emissions may have peaked in 2023

Interview: China’s renewables ‘pave the way to rapidly reduce coal reliance’

Guest post: Solar plus batteries ‘cheaper than new coal’ for meeting China’s rising demand

Analysis: Record drop in China’s CO2 emissions needed to meet 2025 target

Expert analysis direct to your inbox.

Get a round-up of all the important articles and papers selected by Carbon Brief by email. Find out more about our newsletters here .

share this!

February 12, 2020

Air pollution costs $2.9 trillion a year: NGO

by Marlowe Hood

The global cost of air pollution caused by fossil fuels is $8 billion a day, or roughly 3.3 percent of the entire world's economic output, an environmental research group said on Wednesday.

The report from the Centre for Research on Energy and Clean Air (CREA) and Greenpeace Southeast Asia is the first to assess the global cost of air pollution specifically from burning oil, gas and coal.

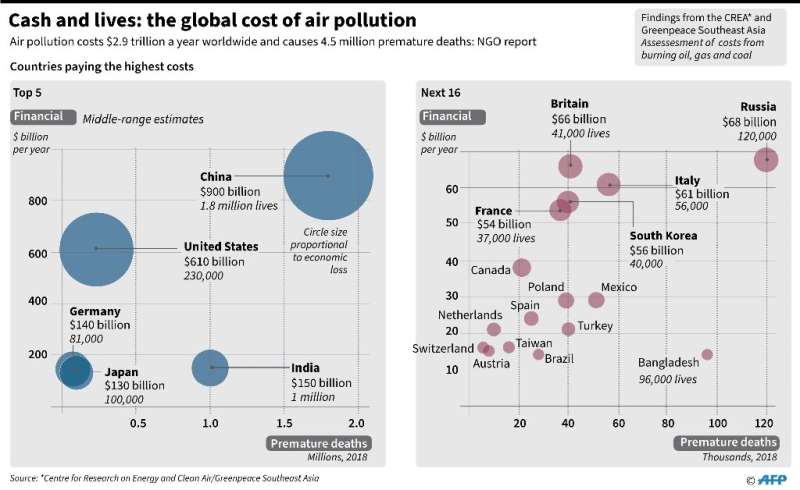

"We found that the China Mainland, the United States and India bear the highest costs from fossil fuel air pollution worldwide, an estimated $900 billion, $600 billion and $150 billion per year, respectively," the report said.

Particles thrown off by fossil fuel usage account for 4.5 million premature deaths each year around the globe, including 1.8 million in China and a million in India, the researchers found.

The new figure is in line with World Health Organization (WHO) estimates of 4.2 million deaths each year linked to ground-level air pollution, mostly from heart disease, stroke, lung cancer and acute respiratory infections in children.

Living in the New Delhi area of India is like smoking 10 cigarettes a day, earlier research has shown.

"Air pollution from fossil fuels is a threat to our health and our economies that takes millions of lives and costs us trillions of dollars," said Minwoo Son, clean air campaigner at Greenpeace East Asia.

The global cost for 2018 was $2.9 trillion, the report estimated.

"But this is a problem that we know how to solve: by transitioning to renewable energy sources, phasing out diesel and petrol cars, and building public transport."

The 44-page report breaks down the global burden of fossil fuel-driven air pollution—measured in economic costs and premature deaths—by type of pollutant and by country.

Each year the global economy takes a $350 billion hit from nitrogen dioxide (NO2)—a byproduct of fossil fuel combustion in vehicles and power plants—and a further $380 billion hit from ozone, according to middle-ground estimates.

Deep into the lungs

By far the most costly pollutant is microscopic fine particulate matter (PM 2.5), which accounts for more than two trillion dollars per year in damages, measured in health impacts, missed work days and years lost to premature death.

The global breakdown for premature deaths each year was 500,000 for NO2, one million for ozone, and three million for PM 2.5.

Some 40,000 children die every year before their fifth birthday due to PM 2.5, which also leads to two million preterm births annually and twice as many cases of asthma.

PM 2.5 particles penetrate deep into the lungs and enter the bloodstream, causing cardiovascular respiratory problems. In 2013, the WHO classified it as a cancer-causing agent.

Middle-range estimates of the number of premature deaths stemming from fossil fuel pollution include 398,000 for the European Union, 230,000 for the United States, 96,000 for Bangladesh, and 44,000 for Indonesia.

Among countries taking the biggest economic hit each year are China ($900 billion), the United States ($610 bn), India ($150 bn), Germany ($140 bn), Japan ($130 bn), Russia ($68 bn) and Britain ($66 bn).

Globally, air pollution accounts for 29 percent of all deaths and disease from lung cancer, 17 percent from acute lower respiratory infection, and a quarter from stroke and heart disease, according to the WHO.

Air pollution is a focal point of social discontent in some parts of the world, leading some experts to speculate that it could drive a more rapid drawdown of fossil fuel use.

"Are we approaching a tipping point where it will no longer be acceptable to shorten the lives of people with fossil fuel pollution?" Johan Rockstrom, head of the Potsdam Institute for Climate Impact Research, told AFP.

The new report used global datasets for surface-level concentrations of the three main pollutants analysed, and then calculated health and cost impacts for 2018.

Estimates of PM 2.5 and NO2 concentrations were based on Earth observation instruments on two NASA satellites that monitor aerosols in the atmosphere.

Deaths, years of life lost and years lived with disability due to PM 2.5 exposure are drawn from the Global Burden of Disease, published in 2018 by PNAS.

Explore further

Feedback to editors

Trout in mine-polluted rivers are genetically 'isolated,' new study shows

9 hours ago

Novel mobile air monitoring technology yields greater insight into post-disaster pollution levels

10 hours ago

New genomic tools for three modern cotton varieties could guide future breeding efforts

11 hours ago

Accelerated approach leads to discovery of a new catalytic promoter on par with decades of study

Controlling ion transport for a blue energy future: Research highlights the potential of nanopore membranes

Tsunami sands help scientists assess Cascadia earthquake models

12 hours ago

Tracing the evolution of ferns' surprisingly sweet defense strategy

Novel method for mass production of recombinant proteins uses mono-sodium glutamate

13 hours ago

The missing puzzle piece: A striking new snake species from the Arabian Peninsula

Microscopic defects in ice influence how massive glaciers flow, study shows

Relevant physicsforums posts, iceland warming up again - quakes swarming.

May 29, 2024

Mount Ibu, Indonesia erupts

Adirondack mountains and earthquakes.

May 23, 2024

The Secrets of Prof. Verschure's Rosetta Stones

Mt. vesuvius 1944 eruption light show -- static electricity.

May 22, 2024

Can a glass of water be filled to its edge?

May 21, 2024

More from Earth Sciences

Related Stories

India leads world in pollution linked deaths: study

Dec 18, 2019

Rapid global shift to renewable energies can save millions of lives

Apr 1, 2019

European urbanites breathing highly polluted air: report

Nov 19, 2014

New obstacles ahead in China's pollution fight: report

Jan 16, 2020

Nearly 50% of transport pollution deaths linked to diesel: study

Feb 27, 2019

Countries with the highest pollution deaths, mortality rates

Oct 20, 2017

Recommended for you

Historic iceberg surges offer insights on modern climate change

14 hours ago

Study suggests faster decomposition rates in waterways could exacerbate greenhouse gas emissions, threaten biodiversity

Model simulates urban flood risk with an eye to equity

15 hours ago

A local bright spot among melting glaciers: 2,000 km of Antarctic ice-covered coastline has been stable for 85 years

17 hours ago

Rapid urbanization in Africa transforms local food systems and threatens biodiversity, says study

Let us know if there is a problem with our content.

Use this form if you have come across a typo, inaccuracy or would like to send an edit request for the content on this page. For general inquiries, please use our contact form . For general feedback, use the public comments section below (please adhere to guidelines ).

Please select the most appropriate category to facilitate processing of your request

Thank you for taking time to provide your feedback to the editors.

Your feedback is important to us. However, we do not guarantee individual replies due to the high volume of messages.

E-mail the story

Your email address is used only to let the recipient know who sent the email. Neither your address nor the recipient's address will be used for any other purpose. The information you enter will appear in your e-mail message and is not retained by Phys.org in any form.

Newsletter sign up

Get weekly and/or daily updates delivered to your inbox. You can unsubscribe at any time and we'll never share your details to third parties.

More information Privacy policy

Donate and enjoy an ad-free experience

We keep our content available to everyone. Consider supporting Science X's mission by getting a premium account.

E-mail newsletter

- Oil Futures

- Energy-General

- Heating Oil

- Natural Gas

- Company News

- Geopolitics

- Nuclear Power

- Solar Energy

- Hydroelectric

- Renewable Energy

- Geothermal Energy

- Tidal Energy

- Global Warming

- Breaking News

- Premium Articles

- Latest Discussions

- Energy General

- Oil Stocks & Prices

- Other Energy Topics

- OPEC Blends

- Canadian Blends

- U.S. Blends

- 55 mins Russia’s Largest Oil Company Reports Doubling in Q1 Net Profit

- 2 hours Oil Prices Set for a Weekly Decline as Futures Market Swings Into Contango

- 14 hours Saudi Aramco Announces Secondary Public Offering of 1.545 Billion Shares

- 15 hours Sources Warn of Potential OPEC+ ‘Plot Twist’ on Sunday

- 16 hours Spanish Gas Lobby Calls for Urgent Support Amid Renewables Boom

- 17 hours Germany to Ditch Controversial Tax on Gas Transit in 2025

- 18 hours Strong Indian Purchases Push Asia’s Crude Imports to One-Year High

- 19 hours Chevron Close to Signing Natural Gas Exploration Deal With Algeria

- 20 hours EU Finalizes Decision to Quit Energy Treaty Over Climate Issues

- 21 hours Saudi Aramco Set to Announce Secondary Share Sale

- 23 hours Global Renewable Energy Progress Slowing Down on Policy Uncertainties

- 1 day Rapid Battery Storage Growth Will Help California Avoid Blackouts This Summer

- 1 day China Allows More Wind and Solar Waste to Maintain Growth

- 1 day Hungary Teams Up with Belarus for New Nuclear Reactor

- 1 day API Reports Significant Draw in Crude Oil Inventories

- 2 days Double Eagle Poised for Massive Permian Asset Sale

- 2 days Libyan Oil Minister Cleared of Smuggling, Mismanagement Allegations

- 2 days Iran to Launch $4.6 Billion Worth of Oil Projects

- 2 days Norway Holds Firm on Oil Drilling Ban in Protected Region

- 2 days Germany Repurposes Underground Gas Storage for Green Hydrogen

- 2 days Signs of Weakening Oil Demand in China Multiply

- 2 days ConocoPhillips to Buy Marathon Oil in $22.5-Billion All-Stock Deal

- 2 days ConocoPhillips in Talks to Buy Marathon Oil in All-Stock Deal

- 2 days Shadow Fleet Derails Shipping Industry’s Efforts to Cut Emissions

- 2 days Former Pioneer CEO Hits Back at FTC Over OPEC Collusion Allegations

- 2 days Oil Prices Rise as OPEC+ Meeting Draws Near

- 3 days Oil and Gas Investments in Norway Set for Record-High in 2024

- 3 days India's Largest Refinery Inks Russian Oil Deal

- 3 days Gasoline Prices Surge as Summer Driving Season Heats Up

- 3 days Hess Shareholders Head for Crucial Vote on Acquisition Proposal by Chevron

- 3 days TotalEnergies and VERBUND Explore Green Hydrogen Production in Tunisia

- 3 days UK Wind Farm to Pay $42 Million for Breaching Market Rules

- 3 days Saudi Arabia Begins New Bond Sale to Plug Budget Deficit

- 3 days Canada Could Lose $55 Billion in Oil Investment if Emissions Cap Is Implemented

- 3 days Saudi Aramco Shares Tick Higher on Stock Sale News

- 3 days New Petrobras CEO Promises Higher Shareholder Returns

- 3 days Oil Prices Climb on Stronger-Than-Expected Fuel Demand in the U.S.

- 4 days Memorial Day Jet Fuel Demand Outshines Gasoline

- 4 days Russia Seals Nuclear Power and Gas Deal with Uzbekistan

- 4 days OPEC Remains Optimistic About Global Oil Demand

- 3 minutes e-car sales collapse

- 6 minutes America Is Exceptional in Its Political Divide

- 11 minutes Perovskites, a ‘dirt cheap’ alternative to silicon, just got a lot more efficient

- 2 hours GREEN NEW DEAL = BLIZZARD OF LIES

- 10 hours Bad news for e-cars keeps coming

- 19 hours How Far Have We Really Gotten With Alternative Energy

- 14 days What fool thought this was a good idea...

- 2 days The U.S. Is Determined to Revolutionize Its Microchip Industry

- 12 days A question...

Breaking News:

Russia’s Largest Oil Company Reports Doubling in Q1 Net Profit

China Threatens 25% Car Tariff Against US, EU Moves

Beijing is still mulling its…

Oil Prices Remain Under Pressure Despite Rising Gasoline Demand

Oil prices are under pressure…

- Latest Energy News

Julianne Geiger

Julianne Geiger is a veteran editor, writer and researcher for Oilprice.com, and a member of the Creative Professionals Networking Group.

Related News

- Chevron Close to Signing Natural Gas Exploration Deal With Algeria

- Strong Indian Purchases Push Asia’s Crude Imports to One-Year High

- EU Finalizes Decision to Quit Energy Treaty Over Climate Issues

- Saudi Aramco Set to Announce Secondary Share Sale

- Global Renewable Energy Progress Slowing Down on Policy Uncertainties

Europe Imports Russian Oil Products via Turkey, Skirting Sanctions

Since the implementation of the EU/G7 petroleum products ban on February 5, 2023, until the end of February 2024, the EU has sourced 5.16 million tonnes of oil products valued at EUR 3.1 billion from the Turkish ports of Ceyhan, Marmara Ere?lisi, and Mersin. These ports, lacking refining capabilities, imported 86% of their oil products from Russia during this period, turning Turkey into a significant re-export hub.

Turkey's imports of Russian oil have surged nearly fivefold over the past decade. By 2023, Turkey became the largest global buyer of Russian oil products, importing 18% of Russia's total exports. This reliance has grown from 52% in 2022 to 72% in 2023, indicating a deepening dependency on Russian refined products like diesel, gasoil, and jet fuel.

Investigations by CREA and CSD suggest that European entities may have been importing Russian oil products that are either mixed or re-exported from Turkish storage terminals. An example cited is the Toros Ceyhan oil terminal, which received 26,923 tonnes of gasoil from Novorossiysk in May 2023 and subsequently shipped a similar volume to Greece's MOH Corinth refinery. This trade exploits legal loopholes, allowing blended Russian oil products to enter the EU.

The rerouting of Russian oil through Turkey has not only circumvented sanctions but also generated significant tax revenues for Russia, estimated at EUR 5.4 billion, supporting its war efforts in Ukraine. To address this, CREA and CSD recommend tightening EU legislation, enforcing strict rules of origin, and investigating shipments to prevent further sanctions evasion.

By Julianne Geiger for Oilprice.com

More Top Reads From Oilprice.com:

- Oil Prices Climb on a U.S. Inventory Draw and Inflation Optimism

- Memorial Day Travel Expected to Near Record High

- The IEA Has Cut Its Oil Demand Growth Forecast for 2024

Join the discussion | Back to homepage

Previous Post

Saudi Aramco Signs MOUs with U.S. Firms to Advance Lower-Carbon Solutions

WTI Challenges $80 Again on Strong Economic Data

Related posts

Sources Warn of Potential OPEC+ ‘Plot Twist’ on Sunday

Spanish Gas Lobby Calls for Urgent Support Amid Renewables Boom

Germany to Ditch Controversial Tax on Gas Transit in 2025

Leave a comment

Most popular.

U.S. Power and NatGas Prices Plummet to Below Zero

Ukrainian Drones Hit Major Rosneft Refinery in Russia

First Niger Oil Bound for China Blocked in West Africa Border Row

Suriname Oil Discoveries Hit 2.4 Billion Barrels

U.S. Crude Oil Inventories See Surprise Draw

ADVERTISEMENT

Most Commented

Taxing Fossil Fuel Giants Could Generate $900 Billion

Why the IEA is Wrong About Peak Oil Demand

Profits Over ESG as Supermajors Pivot Back to Their Core Business

Large Crude Inventory Build Rocks Oil Prices

- More About Us

- Advertise with us

- Editorial Staff

- Terms & Conditions

- Privacy Policy

© OilPrice.com Google+ -->

The materials provided on this Web site are for informational and educational purposes only and are not intended to provide tax, legal, or investment advice.

Nothing contained on the Web site shall be considered a recommendation, solicitation, or offer to buy or sell a security to any person in any jurisdiction.

Merchant of Record: A Media Solutions trading as Oilprice.com

Petras Katinas

April 2024 — Monthly analysis of Russian fossil fuel exports and sanctions

Create an account

Create a free IEA account to download our reports or subcribe to a paid service.

Strategies for Affordable and Fair Clean Energy Transitions

World Energy Outlook Special Report

About this report

Issues of affordability and fairness have moved towards the centre of debates about clean energy transitions in many countries. The global energy crisis revealed the vulnerabilities and risks inherent to today’s fossil fuel-based energy system, while bringing the benefits of transitions – such as greater energy security, improved air quality, reduced emissions and less exposure to volatile fuel prices – into sharper relief. But even as clean energy technologies become increasingly cost-competitive, they still require a step-change in investment to overcome the inertia that favours incumbent fuels and technologies.

As living costs have increased around the world, important questions have emerged about how to pay for clean energy transitions, as well as how the costs and benefits will be shared. Low-income households, in particular, risk being locked out of transitions if they cannot afford the upfront costs.

The IEA’s new special report, Strategies for Affordable and Fair Clean Energy Transitions , explores these challenges and how they might be addressed. Its first-of-its-kind analysis provides a comprehensive evidence base for this discussion and a pragmatic look at policy approaches that can safeguard affordability and fairness as transitions advance.

Online table of contents

1.0 executive summary.

Read online

2.0 Exploring affordable energy transitions

3.0 investment and energy bills, 4.0 policies promoting affordability, 5.0 price shocks and affordability, cite report.

IEA (2024), Strategies for Affordable and Fair Clean Energy Transitions , IEA, Paris https://www.iea.org/reports/strategies-for-affordable-and-fair-clean-energy-transitions, Licence: CC BY 4.0

Share this report

- Share on Twitter Twitter

- Share on Facebook Facebook

- Share on LinkedIn LinkedIn

- Share on Email Email

- Share on Print Print

Subscription successful

Thank you for subscribing. You can unsubscribe at any time by clicking the link at the bottom of any IEA newsletter.

IMAGES

VIDEO

COMMENTS

Welcome to the Centre for Research on Energy and Clean Air (CREA). We are an independent research organisation focused on revealing the trends, causes, and health impacts, as well as the solutions to air pollution.. Health-harming pollutants from burning fossil fuels are responsible for at least 3 million air pollution deaths per year. However, rapid advances in modern, clean energy ...

Welcome to the Centre for Research on Energy and Clean Air (CREA). We are an independent research organisation focused on revealing the trends, causes, and health impacts, as well as the solutions to air pollution. We use scientific data, research and evidence to support the efforts of governments, companies and campaigning organisations ...

The Centre for Research on Energy and Clean Air (CREA) is a nonprofit think tank researching energy and air pollution. CREA was founded in Helsinki in 2019 with the goal of tracking the impacts of air pollution by providing data-backed research products. References This page ...

China's Climate Transition Outlook 2023: Expert Survey and Interviews. As part of the Centre for Research on Energy and Clean Air's (CREA) annual China Climate Transition Outlook report to measure insiders' views on whether …. 21 November 2023.

Estimating the daily impact of biomass burning on air quality using air trajectory modeling and machine learning. Power generation. Access daily-updated power generation data for European countries, China, India, US and more. ... Centre for Research on Energy and Clean Air (CREA), 2024 ...

We do this by providing research, modeling and data analysis on air pollution to support and enable the work of partners based on strategic priorities. Types of data we produce include: air quality and health impact assessments. assessment on energy trends, electricity sector growth and Industrial output. analysis of trends in air quality and ...

Isaac Levi, Europe-Russia Policy & Energy Analysis Team Lead. Petras Katinas, Energy Analyst. Vaibhav Raghunandan, EU Russia Analyst & Research Writer. South Asia. Sunil Dahiya, Analyst. Manoj Kumar N., Researcher. Southeast Asia. ... Centre for Research on Energy and Clean Air (CREA), 2024 ...

China's deployment of clean energy generation in 2023 has reached the scale projected in 1.5-degree scenarios. Maintaining annual additions of clean electricity production capacity at the 2023 level or increasing them further will enable China to peak and decline its CO2 emissions in the coming years. But to successfully achieve a peaking and ...

The Centre for Research on Energy and Clean Air (CREA) is identifying fossil fuel exports from Russia and effective economic and financial countermeasures against Russia to help end the Russian military's unprovoked and unjustified attack against the sovereign nation of Ukraine, which CREA absolutely condemns as a violation of the fundamental ...

5. Centre for Research on Energy and Clean Air (CREA) 4,211 followers. 1w. 🎙️🇮🇳 PODCAST: India's 2024 Election and the Role of Renewable Energy Listen in on #EnergyInsights as CREA's ...

China energy and emissions trends: March 2024 snapshot. 18 March 2024. 1 2 3 … 13 Next. Centre for Research on Energy and Clean Air (CREA), 2024 ...

This report from the Centre for Research on Energy and Clean Air (CREA) and the Global Energy Monitor (GEM) takes a closer look at China's permitting of new coal power plants in 2022, the possible implications for China's climate commitments, and provides policy recommendations.

The Centre for Research on Energy and Clean Air's dataset of pipeline and seaborne trade of Russian fossil fuels sheds light on their trade. Russia's earnings from #FossilFuel exports in the first 6 months of the war have outstripped the estimated total cost of the invasion. €158 billion 🆚 €100 billion The EU imported 54% of this.

A 2023 peak in China's CO2 emissions is possible if the buildout of clean energy sources is kept at the record levels seen last year. ... Categories Air pollution, Blog, China Tags air pollution, china, co2, emissions. Weekly snapshot ‑ Russian fossil fuels 13 to 19 May 2024. Centre for Research on Energy and Clean Air (CREA), 2024 ...

Speaking in April, Sunil Dahiya from the Centre for Research on Energy and Clean Air told BBC News: "The current crisis has shown us that clear skies and breathable air can be achieved very fast ...

The Centre for Research on Energy and Clean Air (CREA) is identifying fossil fuel exports from Russia and effective economic and financial countermeasures against Russia to help end the Russian military's unprovoked and unjustified attack against the sovereign nation of Ukraine, which CREA absolutely condemns as a violation of the fundamental ...

Centre for Research on Energy and Clean Air (CREA) is an independent research organisation focused on revealing the trends, causes, and health impacts, as well as the solutions to air pollution. We use scientific data, research and evidence to support the efforts of governments, companies and campaigning organizations worldwide in their efforts ...

By Lauri Myllyvirta, lead analyst at Centre for Research on Energy and Clean Air (CREA) covering air quality and energy trends in China. China's carbon dioxide (CO2) emissions are set to fall in 2024 and could be facing structural decline, due to record growth in the installation of new low-carbon energy sources.

6 October 2021 at 11:45 am. New research from the Centre for Research on Energy and Clean Air (CREA) shows that Eskom is now the largest emitter of health-harming sulfur dioxide (SO2) in the world. These findings stand in stark contrast to the World Health Organisation's recently updated guidelines on ambient air quality and highlight the ...

Lauri Myllyvirta, analyst at Centre for Research on Energy and Clean Air covering air quality and energy trends in China. As China emerges from one of the most serious epidemics of the century - even as much of the rest of the world remains in a coronavirus crisis - the country's energy demand and emissions are beginning to return to normal.

See all Research from Centre for Research on Energy and Clean Air (CREA) > The sunny side of Asia. November 10, 2022. Norman Waite, Centre for Research on Energy and Clean Air (CREA), EMBER... Report . Join our newsletter. Keep up to date with all the latest from IEEFA ...

The risks are expected to become more certain if ammonia blended generators are bid in the clean hydrogen power generation bidding market to be held this year. The government should scrap the plan to use ammonia in coal-fired power plants and move forward with efforts to end coal-fired power generation by 2030 as soon as possible.

Lauri Myllyvirta, lead analyst at Centre for Research on Energy and Clean Air (CREA) covering air quality and energy trends in China. Qi Qin, China analyst at CREA. China's carbon dioxide (CO2) emissions grew 4% in the first quarter of 2023, reaching a record high for the first three months of the year.

It also damages our economies and the environment. For the first time, Greenpeace Southeast Asia and the Centre for Research on Energy and Clean Air (CREA) have quantified the global cost of air pollution from fossil fuels, finding that it has reached an estimated US$8 billion per day, or roughly 3.3% of the world's GDP.

"New three" refers to solar, EVs and storage. Source: Centre for Research on Energy and Clean Air (CREA) analysis for Carbon Brief. Chart by Carbon Brief. Including the value of goods and services, the clean-energy sector contributed an estimated 11.4tn yuan ($1.6tn) to China's economy in 2023, an increase of 30% year-on-year.

Lauri Myllyvirta is the co-founder and lead analyst of the Centre for Research on Energy and Clean Air, an independent research organization headquartered in Finland with staff across Europe and Asia. He has worked for the past decade as an energy analyst covering climate, energy and air pollution issues across Asia, and was based in Beijing in ...

The report from the Centre for Research on Energy and Clean Air (CREA) and Greenpeace Southeast Asia is the first to assess the global cost of air pollution specifically from burning oil, gas and ...

By Julianne Geiger - May 17, 2024, 2:30 PM CDT. A recent report by the Centre for Research on Energy and Clean Air (CREA) and the Center for the Study of Democracy (CSD) reveals that the European ...

28 May 2024 20 May 2024. Centre for Research on Energy and Clean Air (CREA), 2024

Issues of affordability and fairness have moved towards the centre of debates about clean energy transitions in many countries. The global energy crisis revealed the vulnerabilities and risks inherent to today's fossil fuel-based energy system, while bringing the benefits of transitions - such as greater energy security, improved air quality, reduced emissions and less exposure to volatile ...