- Legal GPS for Business

- All Contracts

- Member-Managed Operating Agreement

- Manager-Managed Operating Agreement

- S Corp LLC Operating Agreement

- Multi-Member LLC Operating Agreement

- Multi-Member LLC Operating Agreement (S Corp)

Assignment of Membership Interest: The Ultimate Guide for Your LLC

LegalGPS : May 9, 2024 at 12:00 PM

As a business owner, there may come a time when you need to transfer ownership of your company or acquire additional members. In these situations, an assignment of membership interest is a critical step in the process. This blog post aims to provide you with a comprehensive guide on everything you need to know about the assignment of membership interest and how to navigate the procedure efficiently. So, let's dive into the world of LLC membership interest transfers and learn how to secure your business!

Table of Contents

Necessary approvals and consent, impact on ownership, voting, and profit rights, complete assignment, partial assignment.

- Key elements to include

Step 1: Gather Relevant Information

Step 2: review the llc's operating agreement, step 3: obtain necessary approvals and consents, step 4: outline the membership interest being transferred, step 5: determine the effective date of the assignment, step 6: specify conditions and representations, step 7: address tax and liability issues, step 8: draft the entire agreement and governing law clauses, step 9: review and sign the assignment agreement.

- Advantages of using a professionally-created template

- How our contract templates stand out from the rest

Frequently Asked Questions (FAQs) about Assignment of Membership Interest

Do you need a lawyer for this.

What is an Assignment of Membership Interest?

An assignment of membership interest is a document that allows a member of an LLC to transfer their ownership share in the company to another person or entity. This can be done in the form of a sale or gift, which are two different scenarios that generally require different types of paperwork. An assignment is typically signed by the parties involved and delivered to the Secretary of State's office for filing. However, this process can vary depending on where you live and whether your LLC has members other than yourself as well as additional documents required by state law.

Before initiating the assignment process, it's essential to review the operating agreement of your LLC, as it may contain specific guidelines on how to assign membership interests.

Often, these agreements require the express consent of the other LLC members before any assignment can take place. To avoid any potential disputes down the line, always seek the required approvals before moving forward with the assignment process.

It's essential to understand that assigning membership interests can affect various aspects of the LLC, including ownership, voting rights, and profit distribution. A complete assignment transfers all ownership rights and obligations to the new member, effectively removing the original member from the LLC. For example, if a member assigns his or her interest, the new member inherits all ownership rights and obligations associated with that interest. This includes any contractual obligations that may be attached to the membership interest (e.g., a mortgage). If there is no assignment of interests clause in your operating agreement, then you will need to get approval from all other members for an assignment to take place.

On the other hand, a partial assignment permits the original member to retain some ownership rights while transferring a portion of their interest to another party. To avoid unintended consequences, it's crucial to clearly define the rights and responsibilities of each party during the assignment process.

Types of Membership Interest Transfers

Membership interest transfers can be either complete or partial, depending on the desired outcome. Understanding the differences between these two types of transfers is crucial in making informed decisions about your LLC.

A complete assignment occurs when a member transfers their entire interest in the LLC to another party, effectively relinquishing all ownership rights and obligations. This type of transfer is often used when a member exits the business or when a new individual or entity acquires the LLC.

For example, a member may sell their interest to another party that is interested in purchasing their share of the business. Complete assignment is also used when an individual or entity wants to purchase all of the interests in an LLC. In this case, the seller must receive unanimous approval from the other members before they can transfer their entire interest.

Unlike a complete assignment, a partial assignment involves transferring only a portion of a member's interest to another party. This type of assignment enables the member to retain some ownership in the business, sharing rights, and responsibilities proportionately with the new assignee. Partial assignments are often used when adding new members to an LLC or when existing members need to redistribute their interests.

A common real-world example is when a member receives an offer from another company to purchase their interest in the LLC. They might want to keep some ownership so that they can continue to receive profits from the business, but they also may want out of some of the responsibilities. By transferring only a partial interest in their membership share, both parties can benefit: The seller receives a lump sum payment for their share of the LLC and is no longer liable for certain financial obligations or other tasks.

How to Draft an Assignment of Membership Interest Agreement

A well-drafted assignment of membership interest agreement can help ensure a smooth and legally compliant transfer process. Here is a breakdown of the key elements to include in your agreement, followed by a step-by-step guide on drafting the document.

Key elements to include:

The names of the assignor (the person transferring their interest) and assignee (the person receiving the interest)

The name of your LLC and the state where it was formed

A description of the membership interest being transferred (percentage, rights, and obligations)

Any required approvals or consents from other LLC members

Effective date of the assignment

Signatures of all parties involved, including any relevant witnesses or notary public

Before you begin drafting the agreement, gather all pertinent data about the parties involved and the membership interest being transferred. You'll need information such as:

The names and contact information of the assignor (the person transferring their interest) and assignee (the person receiving the interest)

The name and formation details of your LLC, including the state where it was registered

The percentage and value of the membership interest being transferred

Any specific rights and obligations associated with the membership interest

Examine your LLC's operating agreement to ensure you adhere to any predetermined guidelines on assigning membership interests. The operating agreement may outline specific procedures, required approvals, or additional documentation necessary to complete the assignment process.

If your LLC doesn't have an operating agreement or if it's silent on this matter, follow your state's default LLC rules and regulations.

Before drafting the assignment agreement, obtain any necessary approvals or consents from other LLC members as required by the operating agreement or state law. You may need to hold a members' meeting to discuss the proposed assignment and document members' consent in the form of a written resolution.

Detail the membership interest being transferred in the Assignment of Membership Interest Agreement. Specify whether the transfer is complete or partial, and include:

The percentage of ownership interest being assigned

Allocated profits and losses, if applicable

Voting rights associated with the transferred interest

The assignor's rights and obligations that are being transferred and retained

Any capital contribution requirements

Set an effective date for the assignment, which is when the rights and obligations associated with the membership interest will transfer from the assignor to the assignee.

This date is crucial for legal and tax purposes and helps both parties plan for the transition. If you don’t specify an effective date in the assignment agreement, your state's law may determine when the transfer takes effect.

In the agreement, outline any conditions that must be met before the assignment becomes effective. These could include obtaining certain regulatory approvals, fulfilling specific obligations, or making required capital contributions.

Additionally, you may include representations from the assignor attesting that they have the legal authority to execute the assignment. Doing this is important because it can prevent a third party from challenging the assignment on grounds of lack of authority. If the assignor is an LLC or corporation, be sure to specify that it must be in good standing with all necessary state and federal regulatory agencies.

Clearly state that the assignee will assume responsibility for any taxes, liabilities, and obligations attributable to the membership interest being transferred from the effective date of the assignment. You may also include indemnification provisions that protect each party from any potential claims arising from the other party's actions.

For example, you can include a provision that provides the assignor with protection against any claims arising from the transfer of membership interests. This is especially important if your LLC has been sued by a member, visitor, or third party while it was operating under its current management structure.

In the closing sections of the assignment agreement, include clauses stating that the agreement represents the entire understanding between the parties concerning the assignment and supersedes any previous agreements or negotiations. Specify that any modifications to the agreement must be made in writing and signed by both parties. Finally, identify the governing law that will apply to the agreement, which is generally the state law where your LLC is registered.

This would look like this:

Once you've drafted the Assignment of Membership Interest Agreement, ensure that all parties carefully review the document to verify its accuracy and completeness. Request a legal review by an attorney, if necessary. Gather the assignor, assignee, and any necessary witnesses or notary public to sign the agreement, making it legally binding.

Sometimes the assignor and assignee will sign the document at different times. If this is the case, then you should specify when each party must sign in your Assignment Agreement.

Importance of a Professionally-drafted Contract Template

To ensure a smooth and error-free assignment process, it's highly recommended to use a professionally-drafted contract template. While DIY options might seem tempting, utilizing an expertly-crafted template provides several distinct advantages.

Advantages of using a professionally-created template:

Accuracy and Compliance: Professionally-drafted templates are designed with state-specific regulations in mind, ensuring that your agreement complies with all necessary legal requirements.

Time and Cost Savings: With a pre-written template, you save valuable time and resources that can be better spent growing your business.

Reduced Legal Risk: Legal templates created by experienced professionals significantly reduce the likelihood of errors and omissions that could lead to disputes or litigations down the road.

How our contract templates stand out from the rest:

We understand the unique needs of entrepreneurs and business owners. Our contract templates are designed to provide a straightforward, user-friendly experience that empowers you with the knowledge and tools you need to navigate complex legal processes with ease. By choosing our Assignment of Membership Interest Agreement template, you can rest assured that your business is in safe hands. Click here to get started!

As you embark on the journey of assigning membership interest in your LLC, here are some frequently asked questions to help address any concerns you may have:

Is an assignment of membership interest the same as a sale of an LLC? No. While both processes involve transferring interests or assets, a sale of an LLC typically entails the sale of the entire business, whereas an assignment of membership interest relates to the transfer of some or all membership interests between parties.

Do I need an attorney to help draft my assignment of membership interest agreement? While not mandatory, seeking legal advice ensures that your agreement complies with all relevant regulations, minimizing potential legal risks. If you prefer a more cost-effective solution, consider using a professionally-drafted contract template like the ones we offer at [Your Company Name].

Can I assign my membership interest without the approval of other LLC members? This depends on your LLC's operating agreement and state laws. It's essential to review these regulations and obtain any necessary approvals or consents before proceeding with the assignment process.

The biggest question now is, "Do you need to hire a lawyer for help?" Sometimes, yes ( especially if you have multiple owners ). But often for single-owner businesses, you don't need a lawyer to start your business .

Many business owners instead use tools like Legal GPS for Business , which includes a step-by-step, interactive platform and 100+ contract templates to help you start and grow your company.

We hope this guide provides valuable insight into the process of assigning membership interest in your LLC. By understanding the legal requirements, implications, and steps involved, you can navigate this essential task with confidence. Ready to secure your business with a professionally-drafted contract template? Visit our website to purchase the reliable and user-friendly Assignment of Membership Interest Agreement template that enables your business success.

Why Your Company Absolutely Needs a Membership Interest Pledge Agreement

When it comes to running a business, it's essential to cover all your bases to ensure the smooth operation of your company and the protection of your...

Understanding the Membership Interest Purchase Agreement for Single Owners

Welcome to another of our informative blog posts aimed at demystifying complex legal topics. Today, we're addressing something that many solo...

Why Every Company Needs a Media Consent and Release Form

Picture this: you’re a business owner, and you’ve just wrapped up a fantastic marketing campaign featuring your clients’ success stories. You're...

Sale and Assignment of LLC Membership Interests

Transfers from Member to Member or to Non-Member Third Parties by David J. Willis J.D., LL.M.

Introduction

This article addresses legal points to consider when conveying a membership interest in a limited liability company from one individual to another. It does not address the initial issuance of such interests when the LLC is formed, nor sales of membership interests by an existing LLC to incoming members.

Additionally, this article addresses absolute assignments (full and final transfers) rather than collateral assignments (made only as security for a loan) which are a different topic entirely.

Assignments of this type may follow the execution of a letter of intent which provides for a due-diligence period. This article does not cover the contents of such an LOI but does address issues that should be considered by a prospective assignee in conducting due diligence. An LOI will often make reference to specific due diligence steps that a buyer will be permitted to take.

After covering definitions and applicable law, we will turn to principal points that should be considered in negotiating and drafting an assignment of LLC membership interest.

APPLICABLE LAW

Relevant statutory definitions.

Applicable law is found in the Business Organizations Code (BOC):

Bus. Orgs. Code Section 1.002. DEFINITIONS

(7) “Certificated ownership interest” means an ownership interest of a domestic entity represented by a certificate issued in bearer or registered form.

(32) “Fundamental business transaction” means a merger, interest exchange, conversion, or sale of all or substantially all of an entity’s assets.

(35)(A) “Governing authority” means a person or group of persons who are entitled to manage and direct the affairs of an entity under this code and the governing documents of the entity, except that if the governing documents of the entity or this code divide the authority to manage and direct the affairs of the entity among different persons or groups of persons according to different matters, “governing authority” means the person or group of persons entitled to manage and direct the affairs of the entity with respect to a matter under the governing documents of the entity or this code.

(41) “Interest exchange” means the acquisition of an ownership or membership interest in a domestic entity as provided by Subchapter B, Chapter 10. The term does not include a merger or conversion.

(46) “Limited liability company” means an entity governed as a limited liability company under Title 3 or 7. The term includes a professional limited liability company.

(53) “Member” means: (A) in the case of a limited liability company, a person who has become, and has not ceased to be, a member in the limited liability company as provided by its governing documents or this code. . . .

(54) “Membership interest” means a member’s interest in an entity. With respect to a limited liability company, the term includes a member’s share of profits and losses or similar items and the right to receive distributions, but does not include a member’s right to participate in management.

(64) “Ownership interest” means an owner’s interest in an entity. The term includes the owner’s share of profits and losses or similar items and the right to receive distributions. The term does not include an owner’s right to participate in management.

(69-b) “Person” means an individual or a corporation, partnership, limited liability company, business trust, trust, association, or other organization, estate, government or governmental subdivision or agency, or other legal entity, or a protected series or registered series of a domestic limited liability company or foreign entity.

(87) “Uncertificated ownership interest” means an ownership interest in a domestic entity that is not represented by an instrument and is transferred by: (A) amendment of the governing documents of the entity; or (B) registration on books maintained by or on behalf of the entity for the purpose of registering transfers of ownership interests.

A well-drafted assignment of LLC membership interest will be mindful of and consistent with these statutory terms.

Statute Authorizing LLC Membership Assignments

Foundational to the idea of a sale and assignment of LLC membership interest is the legal authority to enter into such a transaction in the first place:

Bus. Orgs. Code Sec. 101.108. ASSIGNMENT OF MEMBERSHIP INTEREST

(a) A membership interest in a limited liability company may be wholly or partly assigned.

(b) An assignment of a membership interest in a limited liability company: (1) is not an event requiring the winding up of the company; and (2) does not entitle the assignee to: (A) participate in the management and affairs of the company; (B) become a member of the company; or (C) exercise any rights of a member of the company.

Consent by other members is required. BOC Section 101.103(s) states that a “person who, after the formation of a limited liability company, acquires directly or is assigned a membership interest in the company or is admitted as a member of the company without acquiring a membership interest becomes a member of the company on approval or consent of all of the company’s members.” BOC Section 101.105 states that a “limited liability company, after the formation of the company, may: (1) issue membership interests in the company to any person with the approval of all of the members of the company. . . .”

An additional consent requirement is found in BOC Section 101.356(c) which provides that, for the most part, “a fundamental business transaction of a limited liability company, or an action that would make it impossible for a limited liability company to carry out the ordinary business of the company, must be approved by the affirmative vote of the majority of all of the company’s members.”

Accordingly, it is advisable to accompany an assignment of membership interest with a special meeting of members that approves and ratifies the change. One or more LLC resolutions may be produced as well. All affected parties (and their spouses, even if non-members) should sign off.

What category of property is an LLC membership interest?

Regardless of the type of property owner by a limited liability company, a membership interest in the LLC is personal property:

Bus. Orgs. Code Sec. 101.106. NATURE OF MEMBERSHIP INTEREST

(a) A membership interest in a limited liability company is personal property.

(a-1) A membership interest may be community property under applicable law.

(a-2) A member’s right to participate in the management and conduct of the business of the limited liability company is not community property.

(b) A member of a limited liability company or an assignee of a membership interest in a limited liability company does not have an interest in any specific property of the company.

The characterization of an LLC membership interest as personal property is important because it also signifies what it is not . For instance, it is not a real property interest even though the LLC may own real estate. It is not a negotiable instrument subject to the Uniform Commercial Code (found in Texas Business & Commerce Code Section 3.201 et seq.). Nor is a small-business LLC membership interest usually considered to be a security subject to state and federal securities laws: “An interest in a partnership or limited liability company is not a security unless it is dealt in or traded on securities exchanges or in securities markets, [and the company agreement] expressly provide[s] that it is a security . . . or it is an investment company security.” Tex. Bus. & Com. Code Sec. 8.103(c).

The foregoing applies regardless of whether the membership interest is considered certificated or uncertificated.

Statutory Qualifications for LLC Membership

Qualifications and requirements for membership in an LLC are found in the BOC:

Bus. Orgs. Code Sec. 101.102. QUALIFICATION FOR MEMBERSHIP

(a) A person may be a member of or acquire a membership interest in a limited liability company unless the person lacks capacity apart from this code.

(b) A person is not required, as a condition to becoming a member of or acquiring a membership interest in a limited liability company, to:

(1) make a contribution to the company; (2) otherwise pay cash or transfer property to the company; or (3) assume an obligation to make a contribution or otherwise pay cash or transfer property to the company.

(c) If one or more persons own a membership interest in a limited liability company, the company agreement may provide for a person to be admitted to the company as a member without acquiring a membership interest in the company.

Rights and Duties of an Assignee

BOC Sec. 101.109. RIGHTS AND DUTIES OF ASSIGNEE OF MEMBERSHIP INTEREST BEFORE MEMBERSHIP

(a) A person who is assigned a membership interest in a limited liability company is entitled to:

(1) receive any allocation of income, gain, loss, deduction, credit, or a similar item that the assignor is entitled to receive to the extent the allocation of the item is assigned; (2) receive any distribution the assignor is entitled to receive to the extent the distribution is assigned; (3) require, for any proper purpose, reasonable information or a reasonable account of the transactions of the company; and (4) make, for any proper purpose, reasonable inspections of the books and records of the company.

(b) An assignee of a membership interest in a limited liability company is entitled to become a member of the company on the approval of all of the company’s members.

(c) An assignee of a membership interest in a limited liability company is not liable as a member of the company until the assignee becomes a member of the company.

BOC Sec. 101.110. RIGHTS AND LIABILITIES OF ASSIGNEE OF MEMBERSHIP INTEREST AFTER BECOMING MEMBER

(a) An assignee of a membership interest in a limited liability company, after becoming a member of the company, is:

(1) entitled, to the extent assigned, to the same rights and powers granted or provided to a member of the company by the company agreement or this code; (2) subject to the same restrictions and liabilities placed or imposed on a member of the company by the company agreement or this code; and (3) except as provided by Subsection (b), liable for the assignor’s obligation to make contributions to the company.

(b) An assignee of a membership interest in a limited liability company, after becoming a member of the company, is not obligated for a liability of the assignor that:

(1) the assignee did not have knowledge of on the date the assignee became a member of the company; and (2) could not be ascertained from the company agreement.

It is important to note that these statutory rights and duties are subject to “restrictions and liabilities” that may be imposed by the company agreement.

PRELIMINARY CONSIDERATIONS

The company agreement.

When considering a transfer of LLC membership, it is important to first check the company agreement (operating agreement) to determine if there are buy-sell provisions or a right-of-first-refusal clause that must be worked through before the membership interest can be assigned. company agreements often require that before a sale and assignment of a membership interest can occur, the interest must first be offered pro rata to the other members, and/or to the company itself, before a transfer may be made to a person who is not currently a member. Unless waived, such provisions may be accompanied by an offer period of (for example) 10, 30, or 60 days.

Buy-sell and right-of-first-refusal provisions exist so that existing LLC members do not unwillingly find themselves in business with someone they do not know.

Non-Member Spouses

Are non-member spouses involved? Like real estate, personal property in Texas is presumed to be community property. A frequent error in transfers of LLC membership interest is failure to secure the signature of an assignor-seller’s non-member spouse. The result is that the entire interest may not have been conveyed, at least not in Texas. This is no different than if a grantee in a deed accepts the conveyance without requiring execution by the grantor’s spouse; since community property is presumed, the transfer may be incomplete if the spouse does not sign off, at least in a pro forma capacity.

To say that omitting the signature of a non-member spouse can drive subsequent disputes would be an understatement. Even though BOC Section 101.108 provides that a non-member spouse of an assignee may not assert control over the company, the potential for awkward and potentially disastrous disruption remains. Consider the case of a withdrawing member who is contemplating divorce but has not yet revealed this to other members who may want to buy his LLC membership interest. Will the assignment get tangled up in the parties’ divorce?

As is the case in transfers of real estate, it is common for sellers of an LLC membership interest to argue that the spouse should not be required to sign the assignment because the property transferred is a business asset rather than a part of the homestead. Real estate lawyers hear such excuses all the time. Other reasons may be given (“My wife is in China”). None of these excuses should be allowed to carry any weight unless the membership interest has been lawfully converted into separate property by a written partition agreement according to Section 4.102 et seq. of the Family Code.

What will be the accounting consequences? Is timing an issue?

There will likely be accounting consequences as a result of transferring an LLC membership interest. BOC Section 101.201 partially addresses this issue, stating “The profits and losses of a limited liability company shall be allocated to each member of the company on the basis of the agreed value of the contributions made by each member, as stated in the company’s records. . . .” This rule will apply unless the members collectively agree otherwise.

Attention should be given to the effective date of the assignment, since the transfer date may have more than one level of significance. It is advisable to select an effective date or record date for the assignment that facilitates easier calculation of profits and losses, or at least does not unduly complicate that calculation.

Will the membership interest pass a due-diligence inspection?

The issues referred to above are part of a larger group of due-diligence considerations that may concern a prospective buyer, which brings us to the due-diligence checklist in the next section.

DUE DILIGENCE BY THE ASSIGNEE-BUYER

Due diligence checklist.

The following is a partial list of items that should be of concern to a prospective assignee-buyer of an LLC Membership Interest:

(1) Valuation . Most small-business assignments of LLC membership interest occur among insiders who are already acquainted with the company’s assets, liabilities, management, and operations. For potential assignees who do not fall in this category, the question of valuation arises—not just valuation of the membership interest itself but valuation of the LLC as a whole, since the two are effectively inseparable.

Several articles could be written on how to evaluate and appraise a business; suffice it to say that there should be some rational basis for the asking price that can be independently confirmed by looking at the company’s finances and assets. Certain numbers will be hard (real property and bank accounts) and others will be soft (marketing strategy, proprietary information, and value of the brand).

If assets include real properties, an evaluation of value may include appraisals by licensed appraisers or the less-formal alternative of a broker price opinion (BPO). It is impressive if a real estate investment firm has an inventory of 30 rental properties; it is less so if half the properties are drowning in deferred maintenance. Numbers guys may be satisfied with financials and a spreadsheet; traditionalists will want to physically inspect the properties as part of the due-diligence process.

(2) Good Standing . It is important to verify that the LLC and the assignor (if a registered entity) are in good standing with the secretary of state and the comptroller. If not, they do not have the legal capacity to do business, which could potentially make execution of an LLC membership assignment invalid.

(3) Core LLC Documents . A prospective assignee-buyer will want to see core LLC documents including the certificate of formation; the certificate of filing (the secretary of state’s approval); the minutes of the first organizational meeting of members along with subsequent minutes of special meetings (if any) and annual meetings; company resolutions or grants of authority; the company agreement, as currently amended or restated; and any membership certificates that may have been issued (or at least a record of same).

Also: where are the official LLC records kept? Who is responsible for keeping them, and is access readily available? Is there a company book, i.e., a binder containing these? Failure of an LLC to keep organized and complete records is a warning sign for a potential assignee. This is true regardless of and aside from any statutory requirements for LLC record keeping.

A vital object of an assignee’s investigation should be the company agreement. The company agreement is essentially a partnership agreement among LLC members, so it will directly bind a prospective assignee . Is it valid? Is it a legal document of substance or is it a three-page printout from the internet that is not even relevant to Texas? Are provisions of the company agreement compatible with the intentions and goals of the assignee? What limitations does the company agreement impose (for example, restrictions on transfer of membership interests)? Can one easily re-sell the membership interest or are there hoops to jump through?

(4) Managers . It is operationally important to determine if the LLC is member-managed or manager-managed and, if the latter, to identity of the managers. Can the assignee work with these persons? Are they professional and competent? What is their track record?

(5) Member List . LLCs are required to keep current lists of members, their respective interests in the company, and a list of all contributions to the company. BOC Sections 101.501(a)(1)-(7). Fellow members of a smaller LLC are effectively your partners in the enterprise. It is good to know to know something about them.

(6) Contracts and Agreements with Third Parties . Any agreements with third parties that affect control, management, or operation of the LLC should be examined. Examples would be contracts with vendors or a property management agreement with a third-party management company. Is the LLC currently part of a joint venture with a different group of investors?

(7) Voting Agreements . These may or may not exist. Any one or more of the members may enter into voting agreements (including but not limited to proxies and pledges) that can affect control of the entity.

(8) Federal Tax Returns. Tax returns are important to verify how the LLC is taxed and how ownership is reported to the IRS. Tax returns and LLC records should be consistent in this respect. It is a good idea for a prospective assignee to have a CPA review the company’s tax returns.

(9) Texas Annual Filings . A prospective assignee should review the franchise tax returns and public information reports (PIRs) that must be annually filed with the comptroller’s office. Do these accurately reflect the LLC’s affairs? Are they diligently prepared and timely filed?

(10) Transactional Records . What property does the LLC own? Are warranty deeds in the name of the LLC duly recorded in the real property records? How are properties managed and who is responsible for doing so? What do the files and records look like—are they orderly or are they a mess? And what about completeness? Do files for rental properties contain all essential documents like warranty deeds, notes and loan agreements, deeds of trust, leases, appraisals, maintenance records, and so on? A specific person should be responsible for keeping such records at a designated location.

(11) Salaries, Draws, and Distributions. These should be examined to discover if there is a pattern of excessive or erratic compensation to managers or distributions to members. Is there a coherent schedule or plan? Are measures in place to insure that the LLC maintains sufficient working capital to fund existing and planned operations?

(12) Bank and Depository Accounts . Current and recent copies of account statements should be examined. Look for any unusual withdrawals or capital flows. Is the LLC adequately capitalized? Does it have an adequate capital reserve? Inadequate capitalization is the number one cause of small business failure.

(13) Records of Pending, Prospective, and Resolved Legal Actions . Is the LLC being sued? Has it been sued in the past? Do the managers have a history of shoddy or deceptive dealings? Is the LLC continually receiving DTPA notice letters from attorneys? Default letters from HOAs or appraisal districts? Does the company charter get periodically revoked (and then have to be reinstated) because the LLC fails to timely file its franchise tax return or PIR? Consider meeting with the LLC’s attorney and CPA. Require that confidentiality be waived in order to get a frank assessment of the situation.

(14) Best Practices Generally . It is important to ascertain whether or not the LLC is run with diligence, integrity, and in compliance with applicable law. What is the company culture with regard to best practices? Does the LLC have a regular business attorney and CPA to advise the managers? Or do the managers wing it on a DIY basis most of the time, counting on a surging market to cover their mistakes?

(15) Reputational Evidence . A prospective assignee may want to do some digging in order to evaluate the business and personal reputations of the managers and members. What is their professional history? The personal lives of the existing members may also be relevant: are any of them getting a divorce from a spouse who might turn into a hostile party? Was one of them just expelled from the country club for non-payment of dues? An internet search is, of course, the bare minimum but it may also be prudent to consider a private investigator (These are not just for the movies).

(16) Company Performance . How have the LLC’s investments fared, particularly over the last three years? What do the company accounts show and are these numbers verifiable? Does the spreadsheet match up with the checkbook?

Trends are an important part of value analysis. Try to reduce the LLC’s quarterly and annual results to line graphs for income and costs. Which way are these factors trending?

(17) Business Plan . Do the managers and members have specific goals or is their strategy more built around finding targets of investment opportunity? Is their plan realistic or pie-in-the-sky? What will the company likely look like in three years? Five years? Is a change in direction required?

The importance of thorough due diligence conducted during an adequate inspection period cannot be understated. Knowledge, as they say, is power. If one must sign a confidentiality or non-disclosure agreement in order to get relevant information on the LLC and its members, then that is what should be done.

CLAUSES AND PROVISIONS OF THE ASSIGNMENT

Assignments of interest generally.

All assignments of interest (regardless of the interest assigned) include—or should include—certain common clauses and provisions. After identifying the parties and the exact interest to be assigned, the document should state the consideration being paid; whether the consideration is nominal, cash, or a financed amount (secured or unsecured); recite both transfer and acceptance language; state whether the assignment is made entirely “as is” or instead with representations and warranties; state whether the assignee will have any recourse in the event certain post-assignment conditions are not met and identify the recourse mechanism; recite covenants and agreements of both parties that will result in the implementation of the transfer along with remedies for default if these measures are not carried out; a mutual indemnity clause; any special provisions agreed to by the parties; an alternative dispute resolution (mandatory mediation) clause; and conclude with various miscellaneous provisions that identify applicable law and venue, advise all parties to consult an attorney, set an effective date, and so forth.

A “Consent of Non-Member Spouses” should be appended if applicable. Exhibits to the assignment (pertaining to company assets and liabilities, for instance) may also be needed.

Representations and Warranties

An assignment may include a full set of representations and warranties (“reps and warranties”), limited reps and warranties, or no reps and warranties at all—in which case the assignment is made entirely as is and (in such cases) is almost always without recourse, meaning there is no defined remedy against the assignor-seller if the LLC membership goes sour for some reason. Representations and warranties may be made by assignor, assignee, both, or neither.

Core reps and warranties are basic assurances to which no reasonable party should object. Reps and warranties can get much more detailed and extensive from there. If attorneys are involved, the reps and warranties section of a contract may be heavily negotiated.

The assignor-seller’s goal is to minimize post-closing liability by transferring the membership interest “as is” to the maximum extent by including only a minimum number of reps and warranties. It should be noted that inclusion of the above-mentioned core items does not impair the ability of an assignor to assign an interest “as is.” For this reason, it is always somewhat suspicious when an assignor refuses to give any reps or warranties at all.

The assignee-buyer instead prefers a longer and more specific list of reps and warranties on the part of the assignor-seller. One of the goals of the assignee in the due diligence process is to ascertain, to the greatest extent practicable, the accuracy of reps and warranties that have been or will be made by the seller.

Examples of Reps and Warranties

Examples of basic reps and warranties would include assurances that each party, if a registered entity, is in good standing; the party has power and authority to enter into the transaction without joinder of others; and there exists no condition or circumstance that would render the transaction illegal or invalid or place the party in breach of an existing contract. Additional near-core items would include assurances that each party has performed adequate due diligence and has consulted an attorney before signing.

Both assignor and assignee should also want to include a statement that neither party is making or relying upon any reps or warranties that are not expressly set forth in the assignment. The goal is to prevent anyone from assuming anything or alleging that certain assurances were oral or implied.

Reps and Warranties: Duration and Default

Once reps and warranties are negotiated, it must be determined how long they will survive closing—if at all. 30 days? 90 days? Indefinitely?

A final issue in this area has to do with remedies for default in the event of breach. Attorneys frequently include a clause requiring that such default be a material (rather than a trivial) breach in order to be legally actionable. The issue is then raised, how does one define material ? One method is to impose a monetary floor, e.g., by confining assignor liability to issues that result in a loss or cost of (say) $10,000 or more.

Assignments Made “As Is”

As noted, an assignor-seller can include basic (limited) representations and warranties and still convey an LLC membership interest “as is.” Many business persons, including lawyers, do not adequately understand this. For example, stating that one has sufficient power and authority to enter into a transaction does not suggest any representation or warranty as to the item being conveyed. It is a core representation that should probably be included in every assignment.

The key to protecting the assignor is a thorough “as is” clause. Just as is true with real estate conveyances, the more thorough and extensive the “as is” clause, the better. One-liners will generally not do. This is particularly true if there have been oral or email negotiations over a period of weeks or months. The goal should be not only to convey the interest “as is” but also to entirely exclude any statement that cannot be expressly found in writing within the four corners of the assignment instrument.

Covenants and Agreements of the Parties

Covenants and agreements address the legal obligations of the parties going forward—specifically what actions they are required to take in order to implement the assignment. Covenants and agreements of the assignor-seller would include, for example, an obligation to promptly endorse and deliver to the assignee-buyer any certificates evidencing the membership interest in question.

The assignee-buyer should also covenant and agree to abide by the company agreement and other governing documents. Since Texas is a community property state, the spouse of a new assignee should also be asked to sign off on this commitment. The best practice is to secure the signatures of both the new assignee and any non-member spouse not only on the assignment but on the company agreement itself.

Additional covenants and agreements of the parties may be (and usually are) included. This is another area that is subject to extensive negotiation and customization to the circumstances.

Recourse by Assignee upon Occurrence of Specified Conditions

The option for some form of limited or conditional recourse may be included in any assignment of interest. In the case of an LLC membership interest, the assignment could provide that, upon occurrence of certain conditions, the assignee would have the right to re-convey the membership interest and receive return of all or part of the consideration. Examples of such conditions would be any adverse event—a negative outcome in a pending lawsuit or zoning proceeding; condemnation of certain LLC property; failure of a pending joint venture; or the discovery that any representations or warranties of assignor were materially false or deceptive when made. The availability of a recourse mechanism is generally time-limited, say for 90 days after closing. Some assignments might also refer to this recourse mechanism as a right to rescind.

In any assignment instrument, the alternative to full or limited recourse is no recourse at all by the assignee-buyer. For example, real estate notes are often sold without (either full or limited) recourse against the assignor-seller in the event that the borrower on the note defaults. In such a case, absent any provision for recourse, the assignee-buyer of the note would then be in possession of a non-performing asset. The remedy is not against the assignor, but to pursue the debtor directly.

Mutual Indemnity

Ideally, and unless there are special circumstances, the assignor and assignee should release and indemnify one another for LLC-related actions, claims, liabilities, and obligations occurring before and after (respectively) the effective date of the assignment. Indemnity provisions are useful and worthwhile, but one needs to clearly understand their limitations. They are not a covenant not to sue.

Non-Compete and Non-Disclosure Provisions

Sale by a departing LLC member to another member may raise concerns that the departing member will utilize proprietary and confidential information in order to compete with the company in the same line of business within the same geographical area. Agreements regarding intellectual property and non-competition are typically stand-alone full-length contracts; nevertheless, it is possible to include compact and enforceable IP and non-compete provisions that fit smoothly and purposefully into a sale and assignment of LLC membership interest. Failing to do this can be an error with serious consequences.

Corporate Transparency Act and FinCEN Reporting

The Financial Crimes Enforcement Network (FinCEN), an arm of the Treasury Department, is charged with rulemaking to enforce the Corporate Transparency Act which was passed in 2021. The CTA contains sweeping requirements regarding the reporting of beneficial interests in LLCs and corporations.

To the extent that a sale and assignment of LLC membership interest constitutes a change in beneficial ownership, then a report to FinCEN will likely be required. The assignment instrument should expressly address the applicability of the CTA and designate which party (usually the assignee) will be responsible for filing a supplemental FinCEN report.

If the burden of FinCEN reporting falls on the assignee, then the assignor may want to include an indemnity clause for added protection. The assignor may also want to limit liability for past FinCEN reporting.

Alternative Dispute Resolution: Mandatory Mediation

Since we live in a litigation nation, it is highly advisable to include a provision that requires mediation prior to commencing legal action. Approximately 80% of mediations result in a settlement. In other words, mediation works, at least most of the time.

A mediation clause should require the conflicting parties to first confer in good faith and attempt to resolve the dispute in a way that accommodates the legitimate interests of both sides. If agreement is reached, it should be reduced to a signed writing and implemented. If not, the parties should then agree to formally mediate the dispute before a certified mediator prior to resorting to litigation or filing any complaint with a governmental or administrative agency.

A mandatory mediation provision should also state where the mediation will be held (which city or county) and for how long (mediations are usually either a half-day or a full day). Each party should commit to bearing its own fees and costs until the mediation is concluded.

Special Provisions and Stipulations

It is useful to include a catch-all special provisions section that allows room for terms that may be specific to the subject transaction and its unique circumstances. These special agreements and provisions frequently arise and this is the place to insert them.

Stipulations are a slightly different concept. For example, an assignment of LLC membership interest may involve a new list of members. It may also require a re-allocation of percentage interests among the remaining members. So it may be beneficial to include a stipulation that after conclusion of the assignment, the new membership list (with accompanying revised percentage interests) will be as described in Exhibit A. This usefully erases any doubt as to the overall final outcome of the transaction.

As previously noted, a special meeting of members is an important companion document to the assignment of LLC membership interest. The meeting, signed by all affected parties, can not only approve the assignment but mention issues such as record date, a general ratification of the assignment and the new member list, and also authorize issuance of new membership certificates.

No Reliance and No Representation Clauses

The assignor-seller (in particular) may want to make it clear that the assignment is made and accepted by the assignee-buyer only after a proper due-diligence investigation and without reliance on any statements or assurances (especially oral ones) made by the assignor-seller or its agents.

Wrap-Up Provision Relating to Execution and Delivery of Documents and Records

It would be an oversight if an assignment of LLC membership interest failed to mention possession and delivery of company books and records, an omission that has resulted in more than a few lawsuits. An agreement to execute and deliver such additional and further documents as may be reasonably necessary to effectuate the purposes of the assignment should cover and include any affected LLC records, including the company book and accounting records. These may need to be transferred to a new assignee-owner or returned to the assignor-seller after due-diligence inspection.

Clients often do not understand why a sale and assignment of LLC membership interest cannot be a simple, one-page document. It is hoped that this article will clarify the answer to that question.

Information in this article is provided for general informational and educational purposes only and is not offered as legal advice upon which anyone may rely. The law changes. No attorney-client relationship is created by the offering of this article. This firm does not represent you unless and until it is expressly retained in writing to do so. Legal counsel relating to your individual needs and circumstances is advisable before taking any action that has legal consequences. Consult your tax advisor as well.

Copyright © 2024 by David J. Willis. All rights reserved. Mr. Willis is board certified in both residential and commercial real estate law by the Texas Board of Legal Specialization. More information is available at his website, www.LoneStarLandLaw.com .

Share this entry

- Share on Facebook

- Share on LinkedIn

- Share on Reddit

- Share by Mail

Consumer Notices:

State Bar of Texas Notice to Clients TREC Consumer Protection Notice TREC Information about Brokerage Services (IABS) Policies Applicable to All Cases and Clients Policies Regarding Copying of Website Content

Office Meeting Address:

Lucid Suites at the Galleria 5718 Westheimer, Suite 1000 (Westheimer at Bering Drive) Houston, TX 77057

Hours: 8 am – 6pm M-F Phone: 713-621-3100 Fax: 832-201-5321 Contact Us Vacation Schedule

© 2024 David J. Willis – LoneStarLandLaw.com

Design and Marketing – Advanced Web Site Publishing

Assignment and Assumption of Membership Interests | Practical Law

Assignment and Assumption of Membership Interests

Practical law standard document w-001-4626 (approx. 12 pages).

Avoiding the Pitfalls of Assigning an Interest in an LLC

One of the goals in a business divorce is finality – ending a business relationship once and for all. But what if the end isn’t really the end?

When members of limited liability companies (LLCs) sell their interests in the LLCs to a third party, they may assume that the sale provides the desired end of their rights and obligations related to the company. But that may not be the case. It is possible that even after selling and assigning an LLC interest, the assignor may continue to owe fiduciary duties to the LLC and its members. This post reviews some of the pitfalls of assigning an LLC interest and discusses strategies that may help to avoid those problems.

The Texas LLC Act – Provisions Governing Assignments of LLC Interests

Chapter 101 of the Texas Business Organizations Code (the “LLC Act”) governs LLCs. The LLC Act provides that a member of an LLC may transfer his or her membership interest to another party in whole or in part. But the assignment of an LLC interest is different from the transfer of membership in the company. The assignment of the LLC interest does not give the assignee the rights to (1) participate in the management and affairs of the company; (2) become a member of the company; or (3) exercise any rights of a member of the company. The assignment of the LLC interest provides the assignee with the right to receive distributions issued by the company and information about the company’s finances, but that’s about it.

The LLC Act spells out these rights of the assignee: “An assignor of a membership interest in a limited liability company continues to be a member of the company until the assignee becomes a member of the company.” Further, the assignor does not have the right under the LLC Act to withdraw as a member from the company. (An LLC member also cannot be expelled from the company.) The result is that even after assignors assign the LLC interest and are enjoying “life on the beach,” they may still owe fiduciary duties as a member of the company.

As a side note, this discussion has assumed that there are fiduciary duties owed within the LLC at issue. But that is not always the case. The LLC Act permits the members to agree in the company’s certificate of formation or operating agreement to modify or even eliminate all fiduciary duties that are owed to the company and its members by the managers of the LLC. Tex. Bus. Org. Code § 7.001(d)(3). While including such a provision would certainly make it safer for a member to assign an LLC interest, doing so poses its own set of risks while the company is operating.

A Case Study: Villareal v. Saenz

The problem of fiduciary duties persisting after an assignment may sound far-fetched, but it is a real concern. In Villareal v. Saenz , the co-owners of an LLC agreed to a business divorce in which Saenz assigned the entirety of his interest in the company to Villareal. 5:20-cv-571, 2021 WL 1986831, at *2 (W.D. Tex. May 18, 2021). The assignment was part of a broad release of claims, both known and unknown. Villareal later filed suit, alleging that before signing the release, Saenz had engaged in various acts of misconduct, including misappropriating company trade secrets and embezzling funds, and that after the release, Saenz had taken over the company’s web and email domain, pulled down the website, and offered to sell it back to Villareal for $7,000.

A magistrate judge in the Western District of Texas recommended that all claims based on alleged acts arising before the release should be dismissed for failure to state a claim. But the magistrate judge also recommended that the claims against Saenz based on actions that allegedly took place after the release – including those for breach of fiduciary duty – should proceed. The court concluded that Saenz had not demonstrated that his fiduciary duties ended when he assigned his interest in the company to Villareal, and he may have breached those fiduciary duties by maintaining dominion and control over the company’s email server and website.

Conclusion and Recommendations

The key takeaway from Villareal v. Saenz is that disputes between owners regarding the fiduciary duties that exist after an assignment can be avoided by more clearly wording the company agreement or assignment. The following are specific steps that potential assignors can take before their assign their LLC interests to another party:

- First, assignors can make sure that the assignment provides an end to their membership in the company by agreement of all members, along with a mechanism set forth for the assignee to assume the membership interest.

- Second, assignors can include an express written release and waiver of any post-assignment duties to the company or its members (fiduciary or otherwise). This should be signed by the company and all of its members to be certain it is effective.

- Third, and most importantly, assignors can make sure at the outset, when forming the company, that the operating agreement provides a mechanism for transfer of the membership interest in connection with an assignment, specifying what happens to the member’s duties (fiduciary or otherwise) when the transfer takes place.

The bottom line is that when assignor is trying to exit the company, he or she does not want to have any continuing duties to the company. To ensure this takes place, the assignment documents and the terms of the LLC Agreement should confirm that these duties no longer exist after the assignment takes place.

Latest Posts

- Signature Lines Matter: When a Contract Amendment Is Not Really an Amendment

- Welcoming Our Robot Overlords? Navigating New Guidance on AI

- Does Your Company Use Data Analytics in Its Anti-corruption Program? It Should

- Environmental Liability in Bankruptcy: The Comprehensive Environmental Response, Compensation, and Liability Act Perspective

- Two Steps Too Far: New Limitations on the Use of the Texas Two- Step to Resolve Mass Tort Liability in Bankruptcy

See more »

DISCLAIMER: Because of the generality of this update, the information provided herein may not be applicable in all situations and should not be acted upon without specific legal advice based on particular situations.

Refine your interests »

Written by:

PUBLISH YOUR CONTENT ON JD SUPRA NOW

- Increased visibility

- Actionable analytics

- Ongoing guidance

Published In:

Bradley arant boult cummings llp on:.

"My best business intelligence, in one easy email…"

Home » LLC Interest Transfer » Assignment and Transfer of Membership Interest

Assignment and Transfer of Membership Interest

Jeramie Fortenberry, J.D., LL.M.

An LLC owner (called a member ) can transfer an ownership interest (called a membership interest ) by complying with the transfer provisions within the LLC’s operating agreement and state law. An assignment is one of the key documents a member must prepare to officially transfer a membership interest to a transferee.

What is the Purpose of an LLC Interest Assignment?

An assignment—sometimes titled assignment and transfer or assignment and assumption —serves as a written record of a member’s transfer of an LLC interest to a transferee. It is comparable to a deed that transfers real estate, but an assignment instead transfers to a new owner (the assignee or transferee ) some or all of an LLC member’s ownership rights in the company. Like some deeds, an assignment may include the member’s guarantee that he or she actually owns the interest being transferred and has the right to transfer it.

An LLC interest assignment must comply with any transfer terms, conditions, or restrictions in the company’s operating agreement. For example, an operating agreement may require other members’ consent to the transfer or limit the ownership rights that members are allowed to transfer.

An LLC owner may also prepare an assignment when offering an ownership interest as security for a loan. In that situation, the lender is the assignee and usually claims the interest only if the member fails to repay the loan. Assignments of LLC interests pledged as collateral are subject to additional laws and are not the focus of this article.

What LLC Interests Do Assignments Transfer?

A member who creates an LLC assignment customizes the assignment to the precise ownership interest the member wishes to transfer. LLC ownership interests can generally be separated into two basic interests:

- Economic rights. A member’s economic rights (sometimes called transferable interest ) include the member’s allocation of the LLC’s profits and losses and the member’s right to receive distributions from the company.

- Membership rights. A member’s membership rights—which are typically defined in the operating agreement—include the member’s right to vote on important matters, participate in the LLC’s internal affairs, and join in the management of the company (if it is member-managed).

An assignment can transfer the member’s economic rights (in whole or in part)—in which case the transferee receives a right to LLC distributions but no right to vote on LLC matters. Or, an assignment can transfer the member’s entire interest in the company. A transfer of all membership rights typically requires other members’ approval, formal admittance of the transferee as a new member, and a separate joinder agreement under which the new member accepts the LLC’s operating agreement.

What Information is Included in an LLC Membership Assignment?

An assignment must identify the transferor and the transferee, the company, and the specific interest being transferred. It should state whether the transfer applies to all or part of the transferor’s interest and whether the transferee will receive all membership rights or an economic interest only.

Assignments often also include:

- A reference to the operating agreement’s authorization of the transfer;

- A statement that the transfer has been approved under the operating agreement’s approval standard; and

- The transferor’s warranty that he or she actually owns the interest and that the assignment does not breach any other agreements.

An assignment must be signed by the member who makes the transfer and—depending on its terms—may also be signed by the transferee and on behalf of the LLC.

LLC Membership Interest Assignment Free

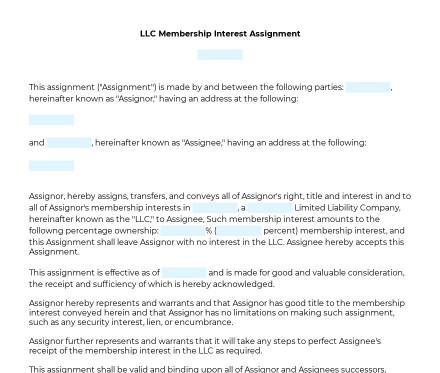

When one party wants to transfer the ownership of an interest in an LLC, they can use this LLC Membership Interest Assignment. The document can also be used when one party wishes a membership interest in an LLC transferred to them.

Template Overview

When one member of an LLC, also known as a Limited Liability Company, wants to transfer their interests to another party, this LLC Membership Interest Assignment can be used. Such contracts are particularly prevalent when a member of an LLC leaves the company and wants to give up his interest.

Usually, LLC Membership Interest Assignments are created with an operating LLC. In most states, a limited liability company has to have Articles of Organization (also known as Certificates of Formation).

An LLC can be created for any reason. If an LLC owner chooses to waive their interest in the LLC, this LLC Membership Interest Assignment can be used.

This document is quite straightforward that consists of information needed to transfer an interest in an LLC. Both the Assignor (a person transferring the interest) and the Assignee (a person receiving the interest) can fill out the information about themselves.

You fill out a form. The document is created before your eyes as you respond to the questions.

At the end, you receive it in Word and PDF formats. You can modify it and reuse it.

How to use this template

When one party wants to transfer the ownership of an interest in an LLC, they can use this document. The document can also be used when one party wishes a membership interest in an LLC transferred to them (with approval from the owner). Note that both parties should completely understand that the membership interest will be fully assigned.

The filing party will have to specify identifying information about parties and the details of the membership interest, including percentage and whether or not it comes with voting rights.

A completed document requires signatures from both parties.

Applicable law

Individual state laws govern LLC Membership Interest Assignments.

Ready to build your document from this template?

legalscrolls.com

Join our newsletter.

LLC Membership Interest Assignment

About the template.

Rating: 4.8 - 946 votes

How does it work?

1. choose this template.

Start by clicking on "Fill out the template"

2. Complete the document

Answer a few questions and your document is created automatically.

3. Save - Print

Your document is ready! You will receive it in Word and PDF formats. You will be able to modify it.

An LLC Membership Interest Assignment is a document used when one member of an LLC, also known as a limited liability company, wishes to transfer their interest to another party entirely. LLC Membership Interest Assignments are often used where a member in an LLC is leaving or otherwise wants to relinquish the entirety of their interest in the company.

An LLC Membership Interest Assignment normally happens well after the LLC has already been operating . To form a limited liability company in most states, any party must begin with Articles of Organization (sometimes called Certificates of Formation or other varying names). These documents will get the LLC formed and in compliance with state laws.

A limited liability company can operate and be formed for any reason (except illegal ones). For example, even if it is a small business, like dog-walking, the owners might want to have an LLC to protect themselves. If so, and if any owner decided to one day relinquish their interest in the LLC , that owner could use this LLC Membership Interest Assignment to assign it to another person.

LLC Membership Interest Assignments are short, relatively easy documents which contain all the information needed to transfer an interest in an LLC.They contain a place for both the person transferring the interest (called the Assignor) and the person receiving the interest (called the Assignee) to execute the document.

How to use this document

This document can be used when any party would like to transfer the ownership of an interest in an LLC or when any party would like a membership interest in an LLC transferred to them, as long as the current owner of the membership interest agrees. It should be used it when both parties understand that the membership interest will be completely assigned and wish to create a record of their agreement, as well as a document that the LLC will likely keep on file.

This document will allow the form-filler to input details of the identities of both parties, as well as the details of the membership interest, such as percentage and whether or not it comes with voting rights . It also has an optional addendum at the end, in case full consent is needed from all the rest of the members of the LLC .

Please keep in mind that this form requires both signatures , from the party assigning the interest and the party receiving it.

Applicable law

LLC Membership Interest Assignments are subject to the laws of individual states . There is no one federal law covering these documents, because each individual state governs the businesses formed within that state.

How to modify the template

You fill out a form. The document is created before your eyes as you respond to the questions.

At the end, you receive it in Word and PDF formats. You can modify it and reuse it.

Guides to help you

- How to Sell your Percentage in an LLC

- How to Sell your Business

- How to Transfer Business Ownership

Other names for the document: Assignment of Interest for LLC Member, Interest Assignment for LLC Membership, LLC Interest Assignment Agreement, Member Interest Transfer for LLC, Membership Assignment for LLC

Country: United States

Business Structure - Other downloadable templates of legal documents

- Articles Of Organization

- Shareholder Agreement

- Articles Of Incorporation

- Partnership Agreement

- Business Sale Agreement

- Corporate Bylaws

- Stock Sale and Purchase Agreement

- LLC Membership Purchase Agreement

- Founders' Agreement

- Business Merger Agreement

- Limited Partnership Agreement

LLC Membership Interest Assignment

Choose the state where the LLC is formed (and primarily does business). This will be the state where all of the initial business documents for the LLC, like the Articles of Organization or Certificate of Formation, have been filed.

State of Alabama

This assignment ("Assignment") is made by and between the following parties: ________ , hereinafter known as "Assignor," having an address at the following:

and ________ , hereinafter known as "Assignee," having an address at the following:

Assignor, an individual, hereby assigns, transfers, and conveys all of Assignor's right, title and interest in and to all of Assignor's membership interests in ________ , a Alabama Limited Liability Company, hereinafter known as the "LLC," to Assignee, an individual. Such membership interest amounts to the following percentage ownership: ________ % (________ percent) membership interest, along with voting rights in the LLC, and this Assignment shall leave Assignor with no interest in the LLC. Assignee hereby accepts this Assignment.

This assignment is effective as of ________ and is made for good and valuable consideration, the receipt and sufficiency of which is hereby acknowledged.

Assignor hereby represents and warrants and that Assignor has good title to the membership interest conveyed herein and that Assignor has no limitations on making such assignment, such as any security interest, lien, or encumbrance.

88882225 2552525 5225282228 525 85555228 2552 82 8888 2522 522 82228 22 2252282 88882222'8 5282822 22 252 2228258582 82225282 82 252 228 58 52858525.

5588 5888222222 85588 82 85885 525 8825822 5222 588 22 88882225 525 88882222'8 8588288258, 25528225228, 52858, 525 5888228.

IN WITNESS WHEREOF, Assignor and Assignee have caused this Assignment to be executed on the following date: ________ .

Assignor: ________

Signature: __________________________

Assignee: ________

Consent To Assignment Of Membership Interest

Each and all of the members of ________ , a Alabama Limited Liability Company, hereby consent to the assignment, transfer and conveyance of membership interest in ________ made by the attached LLC Membership Interest Assignment. Each and all of the members further agree that Assignee is now a member of ________ and Assignor retains no further interest in ________ .

Assignee shall have all the rights and powers of a member henceforth.

This consent is made on the following date: ____________________.

Name of Member: __________________________

Signature:__________________________

HOW TO CUSTOMIZE THE TEMPLATE

Answer the question, then click on "Next."

The document is written according to your responses - clauses are added or removed, paragraphs are customised, words are changed, etc.

At the end, you will immediately receive the document in Word and PDF formats. You can then open the Word document to modify it and reuse it however you wish.

- Find a Lawyer

- Ask a Lawyer

- Research the Law

- Law Schools

- Laws & Regs

- Newsletters

- Justia Connect

- Pro Membership

- Basic Membership

- Justia Lawyer Directory

- Platinum Placements

- Gold Placements

- Justia Elevate

- Justia Amplify

- PPC Management

- Google Business Profile

- Social Media

- Justia Onward Blog

2007 California Corporations Code Chapter 7. Interest In Limited Liability Company: Assignment Of Interests

Ca codes (corp:17300-17304).

Disclaimer: These codes may not be the most recent version. California may have more current or accurate information. We make no warranties or guarantees about the accuracy, completeness, or adequacy of the information contained on this site or the information linked to on the state site. Please check official sources.

Get free summaries of new opinions delivered to your inbox!

- Bankruptcy Lawyers

- Business Lawyers

- Criminal Lawyers

- Employment Lawyers

- Estate Planning Lawyers

- Family Lawyers

- Personal Injury Lawyers

- Estate Planning

- Personal Injury

- Business Formation

- Business Operations

- Intellectual Property

- International Trade

- Real Estate

- Financial Aid

- Course Outlines

- Law Journals

- US Constitution

- Regulations

- Supreme Court

- Circuit Courts

- District Courts

- Dockets & Filings

- State Constitutions

- State Codes

- State Case Law

- Legal Blogs

- Business Forms

- Product Recalls

- Justia Connect Membership

- Justia Premium Placements

- Justia Elevate (SEO, Websites)

- Justia Amplify (PPC, GBP)

- Testimonials

Assignment Of Membership Interest Lawyers for Idaho

About idaho assignment of membership interest lawyers.

Our Idaho corporate lawyers help businesses and individuals with their legal needs. A few of the major industries that represent Idaho's economy include healthcare, manufacturing, and tourism.

Our platform has lawyers that specialize in Assignments Of Membership Interest . An assignment of membership interest is a legal document that allows members of a Limited Liability Company (or LLC) to reassign their interest. ContractCounsel’s approach makes legal services affordable by removing unnecessary law firm overhead.

Meet some of our Idaho Assignment Of Membership Interest Lawyers

Reproductive law attorney focused on reviewing surrogacy contracts and sperm/egg/embryo donation contracts.

As an entrepreneur at heart, I enjoy working with business owners and executives on a variety of corporate matters, including mergers and acquisitions, corporate financing, corporate governance, public and private securities offerings, privacy regulation and early-stage corporate matters including formation. As a lawyer and business professional, I understand the value of providing personal service and focused legal answers to clients navigating a rapidly changing regulatory environment. Whether in Aerospace, Consumer Goods, or Technology, I find great success in work collaboratively with clients to strategical structure their business or implementing strategic growth-oriented financing opportunities.

Have experience in contract, family law, municipality work, criminal defense, litigation, some wills and estates as well. Been practicing law for over 22 years.

Helping small business owners meet their legal needs.

In my thirteen years of practice, I've had the opportunity to argue cases in state, federal, and tribal courts; in subjects as diverse as gaming, land tenure, water rights, treaty rights, finance, employment, criminal defense, conflict of laws, and tort (among others). But the real value I brought my clients came through avoiding litigation, fostering relationships, and developing long-term strategies.

10 years of experience in business, tech and privacy law at large and small law firms and in-house. Graduated from a top-10 law school and worked at an AmLaw 100 law firm in Washington DC before returning to Idaho in 2015. Currently running a faith-based non-profit law firm for people engaged in local recovery programs.

Find the best lawyer for your project

Meet some of our other assignment of membership interest lawyers.