To read this content please select one of the options below:

Please note you do not have access to teaching notes, mutual funds marketing: a hybrid review and framework development.

International Journal of Bank Marketing

ISSN : 0265-2323

Article publication date: 25 August 2023

Issue publication date: 1 December 2023

This study examines current dynamics, consolidates current knowledge, elicits trends, identifies and analyzes primary research clusters, and offers future research directions for mutual fund marketing.

Design/methodology/approach

Using bibliographic information from the SCOPUS database, this study used sequential bibliometric (143 documents) and content analyses (37 documents). Bibliometric analysis aids descriptive analysis and science mapping, while content analysis facilitates identifying and analyzing research clusters and provides future research directions.

The study identifies publication trends, the most relevant authors, and journal articles and unveils the knowledge structures of the field. Analysis of bibliographic coupling reveals the following significant clusters: (1) socially responsible investing and investor preferences, (2) investor factors and traits and investment decisions; (3) external factors, mutual funds' performance and proxy information; (4) the role of disclosures and ratings in shaping investment choices, and (5) cognitive biases, information processing errors and investor behavior. Finally, it offers future research directions.

Research limitations/implications

Using different databases, bibliometric analysis tools, study periods or article screening criteria for the study might yield different results. However, this study's significant findings are robust to such alternatives.

Practical implications

This study summarizes primary clusters and identifies gaps in the current literature, which helps scholars, practitioners, regulators and policymakers understand the nuances of mutual funds marketing. Future studies may focus on the role of online and offline integration, using neuroscience for data m and contemporary investment behavior models.

Originality/value

This is the first study to apply a two-stage sequential hybrid review of articles published over the last decade in high-quality journals, enabling an analysis of the depth and breadth of mutual funds marketing research.

- Mutual fund

- Bibliometric analysis

- Content analysis

- Literature review

- Investor behavior

- Marketing communication

Thakker, N. , Kalro, H. , Joshipura, M. and Mishra, P. (2023), "Mutual funds marketing: a hybrid review and framework development", International Journal of Bank Marketing , Vol. 41 No. 7, pp. 1803-1828. https://doi.org/10.1108/IJBM-04-2023-0237

Emerald Publishing Limited

Copyright © 2023, Emerald Publishing Limited

Related articles

We’re listening — tell us what you think, something didn’t work….

Report bugs here

All feedback is valuable

Please share your general feedback

Join us on our journey

Platform update page.

Visit emeraldpublishing.com/platformupdate to discover the latest news and updates

Questions & More Information

Answers to the most commonly asked questions here

ORIGINAL RESEARCH article

Determinants of investment behavior in mutual funds: evidence from pakistan.

- 1 Lyallpur Business School, Government College University, Faisalabad, Pakistan

- 2 Department of Management Sciences, University of Gujrat, Gujrat, Pakistan

This paper aimed to provide empirical evidence on the behavior of the investor toward mutual funds by considering its relationship with risk perception (RP), return perception (Return P), investment criteria (IC), mutual fund awareness (MFA), and financial literacy (FL). Data were collected using a questionnaire from 500 mutual fund investors, from which 460 questionnaires were used for the analysis. In addition, the snowball sampling technique was used to collect data from different cities in Pakistan. The result showed that RP, Return P, and MFA are insignificant and negatively affect the behavior of mutual fund investors. Investment criteria have a negative and significant effect on the behavior of mutual fund investors. Financial literacy has a positive and insignificant effect on the behavior of mutual fund investors. The results provide better information and guidance to investors and policymakers on the factors that affect the behavior of mutual fund investors.

Introduction

A mutual fund is one of the professionally well-managed portfolios that typically pool funds for purchasing different shares from a variety of investors. Mutual funds utilize the wealth of small investors and families and make them available in the form of shares in business avenues, such as securities, bonds, and other financial instruments, to the economy. Mutual funds are very important for any market operation since risk control is also the most important issue, and it is important to analyze multiple variables that impact investors. In addition, the mutual fund makes it easier for small investors who do not have adequate knowledge, expertise, and low-risk tolerance to invest their savings in profitable portfolios by more skilled fund managers. To achieve a return for clients, these skillful technical managers target profitable and outperforming financial instruments.

In 1774, when the nation faced a massive downturn in its banking industry, the first mutual fund was launched in the Netherlands, followed by North America in 1924, and since 1980, the mutual fund has been a critical investment pool around the world. The mutual fund was first established in Pakistan in 1962 by the investment corporation. The Pakistan mutual funds association is described to be using mutual funds as a pooled investment system using a holistic approach ( Ahmed and Siddiqui, 2020 ). Mutual fund investing is a risky investment operation. This could be due to poor production of the asset class, change in design, and increases in high return costs. Sometimes the loss can also be related to the shift of the successful fund manager, which will allow you to generate a profit ( Kaveri and Bindu, 2017 ). Earlier research indicates that people with low-level financial literacy (FL) face personal financing issues such as savings, lending, investments, and pension plans. Hence, the judgment on investment means that particular transactions include risks and revenues, and a certain intensity of FL is needed to understand the risks and revenues involved with such purchases ( Assefa and Durga Rao, 2018 ).

The investment behavior of an individual may be studied under the theory of planned behavior as an extension of the theory of reasoned action. The theory of reasoned action if that purpose is the immediate falling of their behavior. It suggests that the behavior of an individual, which in turn is the responsibility of the attitude to an active and subjective norm, should be governed by his/her behavioral intention ( Kaur and Kaushik, 2016 ). This investing scheme is meant for those who want to invest in securities such as equity, stocks, instruments of the money market, and related assets. Mutual funds, especially in recent years, are an increasingly favored investment mode; this is apparent from the growing number of AMC funds. In 2018, the overall asset management companies (AMCs) stood at 20 with 248 funds under management with an average percentage shift of 40% for the year. The number of newly launched funds is another development that reflects the boom in the mutual fund market, with open funds facing rapid growth. According to the latest data released by the mutual fund association of Pakistan, the current amount of funds under administration as of December 2018 is Rs. 584 billion compared with Rs. 408 billion in 2014, reflecting a significant rise of 43% in 5 years. The tremendous number of mutual fund investors worldwide, especially in developed countries, indicates the option of investment. With the value of mutual funds and growth opportunities outlined above, mutual funds are becoming the center of focus, especially for researchers. Different authors conducted various facets of mutual funds, such as the effect of marketing with passively and actively managed funds, participation in foreign funds, and many more ( Ahmed and Siddiqui, 2020 ).

According to Kaur and Kaushik (2016) , perception has two dimensions: risk perception (RP) and return perception (Return P). First, perception is a method through which people look, evaluate, identify, and respond to all types of environmental information. Second, perception is a process through which a person tries to explain sensory data preeminently to help facilitate the participant to make a final verdict based on his intensity of experience and experience. The definition of “risks perception” applies to how investors perceive the risk of financial assets according to concern and experience. Risk perception implies an assumption that a risk arising is unbiased or incoherent or the degree, extent, and timing of its consequences retained by a person, group, or society is a significant success factor in facilitating good decision-making in risky situations. The fact that every investor has a tolerance to risk and RP complicates the study of financial risk. Therefore, a major factor that affects investment decisions is the RP of investors ( Sindhu and Kumar, 2014 ).

Investment criteria (IC) consist of defined parameters for evaluating the acquisition goal valued by financial and strategy purchasers. Sophisticated buyers typically have two criteria sets: the requirements that are revealed to brokers and investment bankers publicly so that they know how the user is looking to make appropriate contracts and the parameters for internal review that have been established to allow buyers to make quick decisions on whether the transaction should be pursued more closely. Geographical, investment size, or targeting business and industry are the most common publicly disclosed investment requirements. Several investors often disclose requirements regarding the type of investment, including management buyouts, distressed assets, and circumstances of succession. Investment criteria are generally defined as “another equity, which means that investments with the highest turnover rate on capital investment should be selected” ( Chenery, 1953 ).

Awareness programs, especially for institutional investors, are quite necessary to reduce the effect of interrogative or gambler mistakes ( Abbas et al., 2019 ). The research clarified the awareness of investors regarding mutual funds, the perceptions of investors, their priorities, and the level of satisfaction with mutual funds. This study aimed to know about this intensity of awareness for mutual funds and about investor preferences for mutual funds ( Sehdev and Ranjan, 2014 ). Financial literacy can also be described as integrating the knowledge of investors about, and their responsiveness to, financial risks, financial opportunities, informed decisions, information on where to support, and other successful steps to enhance the financial well-being of financial instruments and principles ( Abdeldayem, 2016 ).

The study aimed to (i) determine the choice of the investor on multiple forms of investment in Pakistan; (ii) find the effect of RP on investment behavior of investors toward the mutual fund in Pakistan; (iii) recognize the effects of the perception of return on the investment behavior of investors in Pakistan against mutual funds; (iv) identify the effects of mutual fund awareness (MFA) on the investment behavior of investors in Pakistan; (v) identify the influence of investment parameters on the investment behavior of investors in the mutual fund of Pakistan; and (vi) identify the effects of FL on the investment behavior of investors in the mutual fund of Pakistan.

The significance of this investigation is manifold. The research will cover several key factors of the investment behavior of mutual funds within the Pakistan mutual fund industry. First, it is imperative to appraise FL and its link with investment behavior; moreover, not much research was conducted in Pakistan to identify this relationship. The present review would provide a momentous contribution to behavioral finance through insights into the relationship between FL and investment behavior. This research aimed to identify the components that persuade the investment behavior of investors toward mutual funds. It also focused on the impact of awareness, FL, investment, and perception of investors on their investment behavior toward the mutual funds in Pakistan. As per our knowledge, no research has been conducted in Pakistan using the same variables used in this study.

This research includes new areas such as awareness of the behavior of mutual fund investors toward mutual funds, which has not been influenced in Pakistan, and no systematic study has been done on the behavior of investors in mutual funds. Therefore, this article would add to quality literature on behavioral finance, in particular on the behavior of investors against the mutual fund. The rest of the study is organized as follows. Section Literature Review presents the literature review. Section Methodology outlines the methodology of the study, detailed data source measures, and methodology deployed to test the various hypotheses. Section Results and Discussion provides empirical findings of the study. Finally, Section Conclusion presents the concluding remarks.

Literature Review

According to the base of this study, the research on the determinants of the behavior of the investor in mutual funds shows that evidence from Pakistan could be categorized into two parts: mutual funds and investors. These studies focus on mutual funds to examine the effect of different variables on the behavior of the investor in mutual funds. Also, they generally focus on variables like IC, RP, Return P, MFA, and FL. Examples of some studies related to those variables are given below.

The investment behavior of an individual may be studied under the theory of planned behavior as an extension of the theory of reasoned action. The purpose is to establish an immediate backdrop for the behavior. The theory suggests that the behavior of an individual, which is the attitude to an active and subjective norm, should be governed by his/her behavioral intention ( Kaur and Kaushik, 2016 ). The theory of planned behavior explains the relationship between perceived behavioral control and intentions as this study setting is based on perceived behavioral control and its positive association with intentions (MFA, IC, RP, Return P, and FL).

Prospect theory is a behavioral theory that explains how individuals choose between risky and uncertain options (e.g., percent likelihood of gains or losses). It shows that people consider predicted utility about a reference point (for example, current wealth) rather than absolute outcomes. Thus, according to prospect theory, people are loss-averse, which was established by framing uncertain options. Since people fear losses rather than equal gains, they are more likely to take risks to prevent a loss. This hypothesis corresponds to the following trend with risk due to biased weighting of probabilities (see certainty/possibility effects) and failure aversion ( Kahneman and Tversky, 1979 ; Kahneman et al., 2011 ).

The investing behavior of individual investors is very different from that of institutional investors. Individuals prefer to spend comparatively more in terms of non-tradable properties, such as real estate, hedge funds, or structured goods. The term institutional investor is commonly used to describe an entity, such as a mutual fund, a hedge fund, or a charitable organization, that invests on behalf of others. According to this report, investor behavior is one that an investor demonstrates in the quest for the acquisition, use, assessment, and disposal of products, resources, concepts, or experience to fulfill their needs and wishes. Environmental conditions largely impact the behavior of investors. While these variables are uncontrollable by the markets, they are quite significant in deciding the behavior of an investor. Investor actions, thus, suggest that investors modify their behaviors by purchasing and selling shares/commodities in different conditions ( Elankumaran and Ananth, 2013 ).

Cognitive capacity are features that let a person perceive even before their occurrence to take consolidated action in advance. The cognitive and decision-making processes are significantly connected. This study has also shown that rational thought always seeks to be influenced by cognitive capabilities. The intensity of motivation and possible motivation enhance the cognitive capacity to face a challenging situation ( Sarfraz et al., 2020a ). This study looks at the behavior of the investor to identify better investment paths. Investment strategy is a program intended to assist an individual in choosing the best investment portfolio to benefit them in meeting financial targets within a specific period. Particular investment forms give the lender, the business, and the community more advantages. This research explores the behavior of investors when considering multiple investment options ( Mane and Bhandari, 2014 ).

This study was performed to establish investor understanding of mutual funds, define the source of the information that affects the decision to buy, and define the factors that influence the choice of a particular fund. Among other factors, the study reveals that income schemes and open-ended strategies are more favored than growth schemes and close-ended schemes under the prevalent market conditions. Investors are pursuing security in order of priority for principal, liquidity, and capital growth. Magazines and newspapers are the first sources of information that investors can read about mutual funds/systems and is a major distinguishing factor in choosing mutual fund strategies on investor operation. The study also points out that investors see mutual funds as commodity goods and AMCs and that the consumer product distribution model should be adopted to catch the demand. Various papers and brief essays have been published in financial dailies, periodicals, and technical and academic journals since 1986, illustrating the fundamental definition of mutual funds and highlighting their relevance in the stock market environment. These papers and essays cover numerous elements such as mutual funds control, investor perceptions, investor security, and mutual growth pattern ( Bansal, 2014 ).

In the view of China, the intensity of the replacement of chief executive officers (CEOs) among poor state-owned companies is considerable. The tolerance of the government is also a strong source of bad performance. State-owned companies in China are allegedly managed extensively ( Sarfraz et al., 2020b ). There is a lack of research explicitly conducted to understand the investment behavior of mutual fund investors in Pakistan. Studies conducted on investment behavior in traditional finance have progressed far beyond the viewpoints of Markowitz, whereby investors (supposed to be the logical benefit maximizers) consider anticipated returns and risks on investment opportunities as the only deciding factors in their decision on investment ( Mishra and Kumar, 2016 ).

The effectiveness of a mutual fund relies on the level of awareness and confidence of investors—the pattern of investment changes with education, age, occupation, and gender. The ambition of this inquiry is to assess the intensity of awareness among investors. The research in Tezpur was conducted with a dataset of 99 individuals. The study initiates that investors have little awareness of mutual funds. The awareness of candidates with different educational backgrounds and ethnicity was also significantly different. A study has been done to determine the awareness of mutual funds of an investor to recognizing the sources of information affecting investor decisions and the elements affecting their choices. The study shows that income structures and open systems are needed in the prevailing market environment rather than development schemes and closed systems. Investors are pursuing the protection of principal, profitability, and appreciations in order of importance. The key information sources in the procurement of mutual funds are newspapers and journals. Investment schemes being informed by, and in the service of, an investor, is the main factor ( Chaudhary, 2016 ).

The study initiates that investment in mutual funds relates to investor behavior, which attracts investment in mutual funds. The opinions and perceptions of the investor were studied on several topics, including the variety of mutual fund schemes ( Trivedi et al., 2017 ). According to a research study, Chinese state-owned enterprises have financing challenges, except for state-owned firms, that can be funded through a commercial group. In this perspective, it may be stated that state-owned firms are more vulnerable than non-state-owned firms ( Sarfraz et al., 2020c ).

The study reveals the perception of risk and returns on the mutual funds of the investor. The inquiry examines the perception of an investor on mutual fund risk, returns from mutual funds, transparency, and disclosed practices compared with other financial avenues. The study also demonstrated that mutual funds are not considered a high-risk investment. Igt examined the behavior of investors against mutual funds. The study shows that RPs, current asset distribution, venture losses, investment blend, fund aging capital base, original fund efficiency, investment mixes, and portfolio diversification of an investor have been the main contributors to switching funds in the fund families. The research examined the significant aspects of mutual funds that affected investor perception and investigated the perception gaps between large and small investors based on factors investigated. Investment, return, and future have shown significant factors in the perception of investors of mutual funds ( Dhar et al., 2017 ).

This research is done on FL and its association with financial instruments and financial activity. It concludes that even though individuals are well aware of different financial instruments and have little impact on their financial behavior, they are of limited value in the case of FL. Various other researchers have indicated that psychological influences such as self-control, avoidance, and instant fulfillment are likely to be more associated with financial power than a lack of financial knowledge. Therefore, rather than teaching persons on the economic front, it is more important to understand these behavioral inclinations ( Gupta et al., 2018 ). The perception of risk, the perception of return, criteria of investment are some of the variables discussed in current research. By computing these variables, FL and awareness are used in this research. Until now, very limited evidence is available for research by using these two variables. According to our knowledge, there is no research conducted in Pakistan using these variables. As a result, current research analyses the link between the perception of return, the perception of risk, criteria of investment, awareness, and FL of investor behavior toward investment in mutual funds in Pakistan. It contained questions for RP and Return P, criteria of investment, MFA, and FL. Information about social demographics were obtained through direct questions about age, education, gender, level of savings, marital status, professional education, and income.

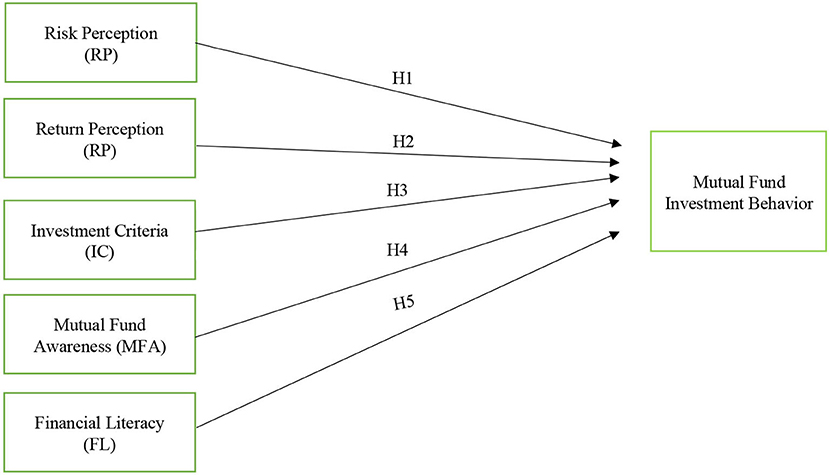

Following are the hypotheses of the study.

H1 : Risk perception has a negative effect on mutual fund investment behavior.

H2 : Return perception has a negative effect on mutual fund investment behavior.

H3 : Investment criteria have a negative effect on mutual fund investment behavior.

H4 : Mutual fund awareness has a negative effect on mutual fund investment behavior.

H5 : Financial literacy has a positive effect on mutual fund investment behavior.

Methodology

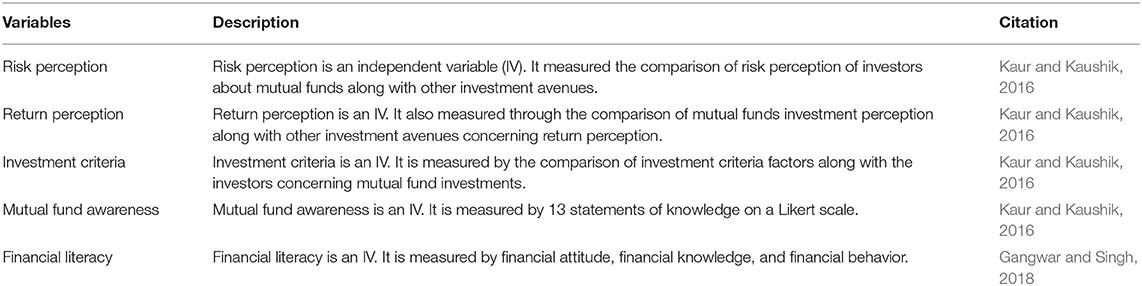

The study is quantitative, and the type of data is primary. The data were collected through questionnaires containing questions on RP and Return P, criteria of investment, awareness, and FL. Information about social demographics were obtained through direct questions about age, education, gender, level of savings, marital status, professional education, and income. Questionnaires were distributed through emails, social networking sites (Facebook, LinkedIn, etc.), and personal meetings. Out of the 500 distributed questionnaires, 460 responses were considered complete and up to the criteria. The sample included from a selected portion of a population for analysis is 460, and it is also known as the population part. In the research, we run binary logistic regression because the dependent variable is categorical. The explanatory variable in experiments is the one that is exploited; the dependent variable is the one that is examined. We also used Cronbach's alpha to check the reliability of the variables. In this study, the non-probability sampling technique was used to select a sample, that is, snowball sampling. The snowball sample was used to evaluate or analyze recruits from respondents, and it is used when potential participants are difficult to classify. It is called “snowball sampling” since (in theory) more “snow” is collected on the road before the ball is rolled up and is bigger. For example, basic random sampling, where the chances are the same for every respondent being chosen, was not effective. Instead, to select participants, the researchers used their judgment. Measurement of all variables used in the study is mentioned in Table 1 .

Table 1 . Measurement of variables.

The model formulated for regression analysis on basis of model Figure 1 is mentioned below

MFIB, mutual fund investment behavior; IC, investment criteria; MFA, mutual fund awareness; Return P, return perception; RP, risk perception; FL, financial literacy.

Figure 1 . Theoretical framework. The interpretation of Figure 1 is given in the section Methodology.

Investment behavior is described as how the systems are judged, predicted, analyzed, and checked by investors. Decision-making involves the psychology of investing, collecting, identifying, and interpreting knowledge, study, and analysis. Variables used in the study are categorical. Criteria or guidelines under which the planning authority allocates the cumulative sum of the investible funds of the community to different channels are referred to as IC. Perceptions of risk and return are beliefs about the possibility of effect or loss. It is a subjective assessment of the features of risk and the severity of risk taken by individuals. Financial literacy refers to the knowledge and understanding of how money is earned, invested, and saved and the skills and abilities used to make choices by financial resources. These options include how much money to make, save, and spend.

Results and Discussion

The demographic can be described in terms of analysis as a detailed group of people, organizations, institutions, and so on with shared themes of importance to the study. The shared features of the association distinguish them from others, organizations, objects, and so on. Individual investors have been included in the population from across Pakistan.

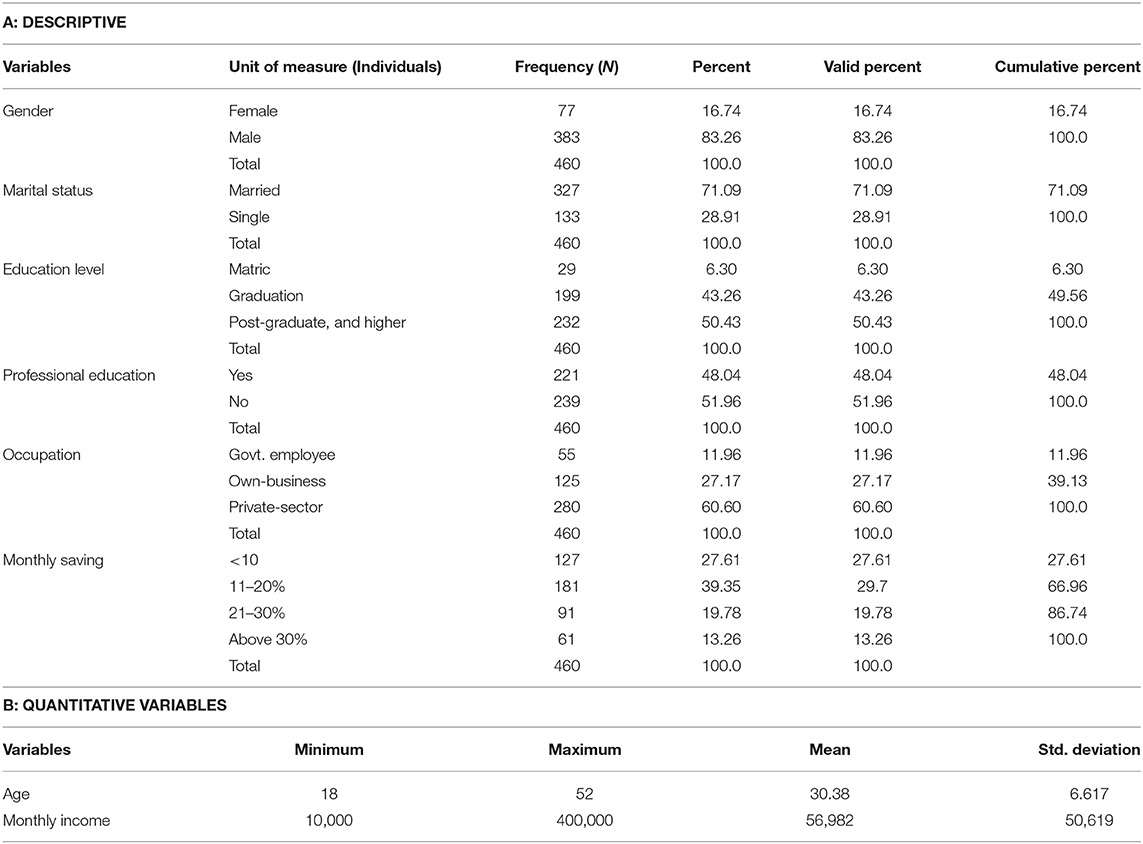

As shown Table 2 , this research represents 83.26% of participants as male, 16.74% of them as female. This research represents 71.09% of the respondents as married and 28.91% as single. Individuals who fill the questionnaires have different education levels: 6.30% of respondents were matric pass, 43.26% were graduates, and 50.43% were postgraduates or higher during the survey. This research presents 48.04% of respondents having a professional education and 51.96% having no professional education. It also presents 11.96% of respondents as working in a government sector, 27.17% as running their own business, and 60.60% as working in the private sector. Also, 27.61% of the respondents save <10%, 39.35% save 11–20%, 19.78% save 21–30%, and 13.26% save above 30%.

Table 2 . Demographic and socio-economic characteristics of respondents.

In this research, those individuals who responded were between 18 and 52 years. Those individuals who responds to our survey their income level ranges from 10000 to 400,000.

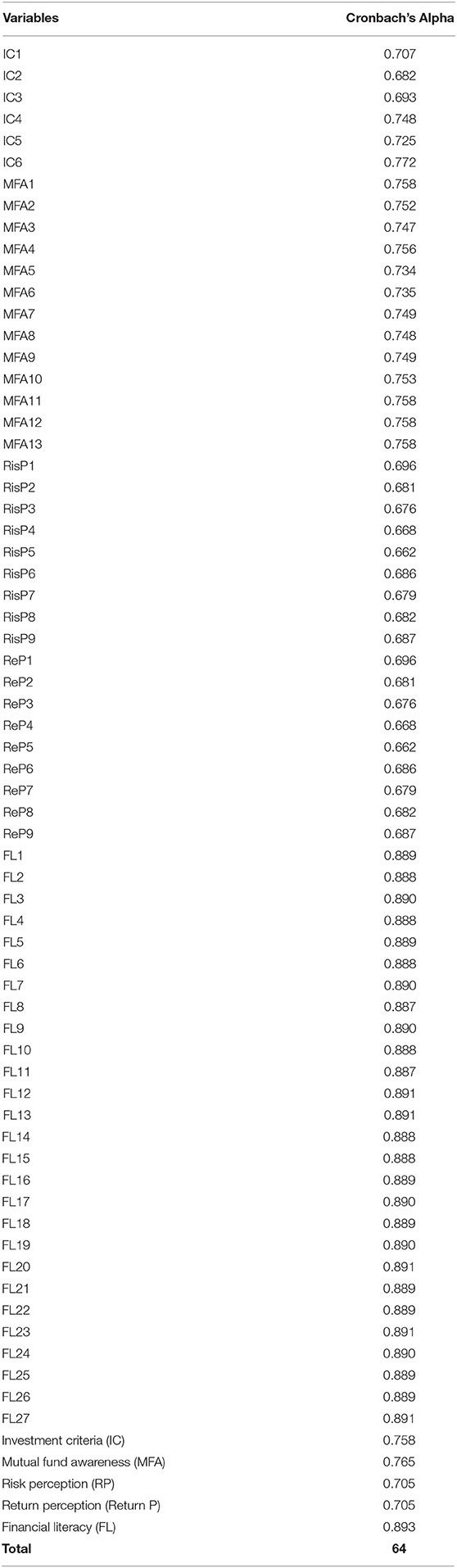

Using Cronbach's alpha, the reliability of the measurements was assessed. Cronbach's alpha helps calculate the reliability of distinct groups and is the most famous test of internal consistency (“reliability”). It is most widely found in a survey/questionnaire with several Likert questions that shape a measure and decides if the scale is accurate. It includes tests of how much variation occurred in the ratings of multiple factors attributed to casual or random errors. As a general rule and a simple measure of building reliability, a coefficient greater or equal to 0.5 is deemed acceptable ( Al-Tamimi, 2006 ). If you have inter-rater reliability issues.

The Cronbach's alpha ( Table 3 ) of the five divisions, specifically, IC, RP, Return P, MFA, and FL, were 0.758, 0.765, 0.705, 0.705, and 0.893, respectively. The Cronbach's alpha indicates that all these divisions are appropriate.

Table 3 . Reliability analysis.

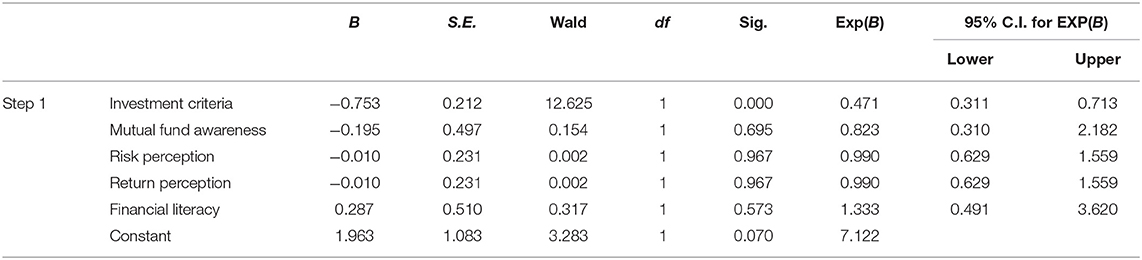

In this research, we run the binary logistic regression because the dependent variable is categorical. The explanatory variable in the experiments is the one used; the dependent variable is the one that is examined. As shown in Table 4 , IC insignificantly affect the behavior of the investor. According to Abbas et al. (2019) , IC positively affect the behavior of the investors. On the other hand, IC have a negative and significant relationship with the behavior of the investor under the coefficient of −0.735, a result consistent with Kaur and Kaushik (2016) , Abbas et al. (2019) , Smith and Albaum (2013) , and George and Mallery (2003) . According to Kaur and Kaushik (2016) , MFA has a positive effect on the behavior of investors. On the other hand, MFA has negative and insignificant relation with the behavior of the investor under a coefficient of −0.195, a result consistent with Chowdhury and Steve (2018) . According to Abbas et al. (2019) , RP and Return P negatively affect investor behavior. Risk perception and Return P both have a negative and insignificant association with investor behavior under the same coefficient of −0.010, a RP result consistent with Kaur and Kaushik (2016) and Abbas et al. (2019) and a Return P result consistent with Abbas et al. (2019) and Barlett et al. (2001) . According to Gangwar and Singh (2018) , FL has a positive and insignificant effect on the behavior of investors. Financial literacy has a positive and insignificant association with investor behavior with a coefficient of 0.287, a result consistent with results of Gangwar and Singh (2018) . Per our knowledge, no research has been conducted in Pakistan using the same variables we used in this study.

Table 4 . Variables in the equation.

This paper empirically investigated the determinants of the behavior of investors toward mutual funds in Pakistan. We established an important association between a mutual fund, the behavior of the investor, demographic characteristics of the respondents, and other variables used in the research. This research used a modified questionnaire that includes 64 items that fit into five divisions: IC, RP, Return P, MFA, and FL. Data were collected from 500 respondents, of which 460 questionnaires were used for the analysis. The logistic regression model was used to analyze the relationship between the variables. Cronbach's alpha was used to test the reliability of the data. Investment criteria is an important factor that affects the behavior of investors. If the investor has a high investment, then the association between IC and the behavior of the investor is positive and it should be negative when investment is low. In the study, the most important variable that affected the behavior of the investor is MFA. Awareness is one of the biggest reasons why investors invest in mutual funds. The behavior of investors depends on the awareness about mutual funds. If the investor has awareness about mutual funds, then there is a positive relationship between these two. If investors do have not much awareness of mutual funds, then the relationship is negative. The relationship between RP and investment behavior, whether positive or negative, depends on how investors perceive risk while investing. Return perception can affect the behavior of the investor in both negative and positive ways. It depends on how the investor perceives the return from investment. Financial literacy association with the behavior of the investor depends on the FL level of the investors. If the investor has a high level of FL, then the relationship is positive. If the investors have a low level of FL, then the association is negative. As per our knowledge, no research has been conducted in Pakistan using the same variables we used in this study.

Implications

The research has implications for mutual funds and regulatory authorities. This inquiry identifies an inadequacy of awareness of mutual funds as a reason for the failure of mutual funds among certain sectors of society. Therefore, the popular funds and regulators need to concentrate their efforts on women, elderly groups, and middle-income groups to increase their knowledge of mutual funds.

The policy implications of this research are numerous. First of all, for fund managers of AMCs, our findings are compelling and insightful because they give further indication of the stimulus of Islamic and traditional funds performing in Pakistan. Furthermore, these results are also valuable for investors and provide them with important information about the characteristics of funds that undoubtedly improve performance.

Limitations and Future Directions

It is suitable for investors who are aware of the professional competence of fund managers to join them to good return by moving to those funds. Investors should evaluate their portfolios on an ongoing basis and review their funds by modifying them as per position in the market to maximize returns.

The study was limited to 460 investors. The research has been conducted to analyze only some factors affecting the investment behavior of investors. The research is conducted only in a few cities. In this research sample, female existence is very low. This research enforced the technique of snowball sampling and may not be representative of the actual population. To educate investors, AMCs can organize seminars and training programs, among other activities, for investors, particularly in times of market fluctuations, economic recessions, market introduction of new products, etc. This will eliminate the uncertainty of the investor and create trust in the industry.

Data Availability Statement

The raw data supporting the conclusions of this article will be made available by the authors, without undue reservation.

Ethics Statement

Ethical review and approval was not required for the study on human participants in accordance with the local legislation and institutional requirements. Written informed consent for participation was not required for this study in accordance with the national legislation and the institutional requirements.

Author Contributions

RS designed the model and the computational framework and analyzed the data. MU carried out the implementation. MB performed the calculations. SS wrote the manuscript with input from all authors. FM conceived the study and was in charge of overall direction and planning, supervised the findings of this work. All authors contributed to the article and approved the submitted version.

Conflict of Interest

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a po tential conflict of interest.

Abbas, K. S., Usman, M., and Aftab, M. (2019). Public and private sector response to mutual funds in Pakistan using binary logistic regression. Rev. Cienc. Soc. Human. 4, 728–737.

Google Scholar

Abdeldayem, M. M. (2016). Is there a relationship between financial literacy and investment decisions in the kingdom of Bahrain? Manage. Admin. Sci. Rev. 5, 203–221.

Ahmed, S., and Siddiqui, D. A. (2020). Factors affecting fund flows in islamic and conventional mutual funds of Pakistan. SSRN Electron. J . doi: 10.2139/ssrn.3681179

CrossRef Full Text | Google Scholar

Al-Tamimi, H. A. H. (2006). Factors influencing individual investor behavior: an empirical study of the UAE financial markets. Bus. Rev. 5, 225–233.

Assefa, M., and Durga Rao, P. V. (2018). Financial literacy and investment behavior of salaried individuals: a case study of Wolaita Sodo Town. Int. J. Bus. Manage. Invent. 7, 43–50.

Bansal, S. (2014). Investor's perception regarding mutual funds and other investment tools. J. Int. Acad. Res. Multidiscipl. V2.

Barlett, J. E., Kotrlik, J. W., and Higgins, C. C. (2001). Organizational research: determining the appropriate sample size in survey research. Inform. Technol. Learn. Perform. J. 19, 43–50.

Chaudhary, N. (2016). A study on the awareness level of investors about mutual fund investment. SSRN Electr. J . doi: 10.2139/ssrn.2868325

Chenery, H. B. (1953). The application of investment criteria. Q. J. Econ. 67, 76–96. doi: 10.2307/1884149

Chowdhury, E., and Steve, D. R. (2018). Impact of attitude and awareness of investors on their investment behavior - a study on Bangladesh stock market. Bangl. Account. 50. 81–89.

Dhar, S., Salema, S. M. K., and Saha, A. (2017). Factors affecting individual investor behavior: empirical evidence from mutual fund investors in Dhaka city. Manage. Dev. 31, 79–101.

Elankumaran, A., and Ananth, A. A. (2013). Impacting factors on individual investors' behaviour towards commodity market in India. Res. J. Soc. Sci. Manage. 2, 147–153.

Gangwar, R., and Singh, R. (2018). Analyzing Factors Affecting Financial Literacy and its Impact on Investment Behavior Among Adults in India . Munich personal RePEc Archive, MPRA Paper No. 89452, 1–24. doi: 10.2139/ssrn.3266655

George, D., and Mallery, P. (2003). SPSS for Windows Step by Step: A Simple Guide and Reference 11.0 Update . Boston, MA: Allyn and Bacon.

Gupta, K., Gupta, S. K., and Pathania, K. S. (2018). Analysis of financial awareness and factors affecting selection and purpose of investment options in Himachal Pradesh. IMPACT Int J Res Human Arts Liter. 6, 93–108.

Kahneman, D., Lovallo, D., and Sibony, O. (2011). Before you make that big decision. Harv. Bus. Rev. 89, 50–60.

Kahneman, D., and Tversky, A. (1979). On the interpretation of intuitive probability: a reply to Jonathan Cohen. Cognition 7, 409–411. doi: 10.1016/0010-0277(79)90024-6

Kaur, I., and Kaushik, K. P. (2016). Determinants of investment behavior of investors towards mutual funds. J. Ind. Bus. Res. 8, 19–42. doi: 10.1108/JIBR-04-2015-0051

Kaveri, M., and Bindu, B. (2017). Impact of investors' perception and attitude towards investment decision in mutual funds at Velachery, Chennai. Int. J. Res. Arts Sci. 3, 4–9. doi: 10.9756/IJRAS.10489

Mane, S., and Bhandari, R. (2014). A study of investor's awareness and selection of different financial investment avenues for the investor in Pune City. Int. Res. J. Bus. Manage. 6, 45–51.

Mishra, S. K., and Kumar, M. (2016). “A comprehensive model of information search and processing behavior of mutual fund investors,” in Financial Literacy and the Limits of Financial Decision-Making (Cham: Palgrave Macmillan), 26–56. doi: 10.1007/978-3-319-30886-9_3

Sarfraz, M., He, B., and Shah, S. (2020a). Elucidating the effectiveness of cognitive CEO on corporate environmental performance: the mediating role of corporate innovation. Environ. Sci. Pollut. Res. 27, 45938–45948. doi: 10.1007/s11356-020-10496-7

PubMed Abstract | CrossRef Full Text | Google Scholar

Sarfraz, M., Shah, S., Fareed, Z., and Shahzad, F. (2020b). Demonstrating the interconnection of hierarchical order disturbances in CEO succession with corporate social responsibility and environmental sustainability. Corp. Soc. Respons. Environ. Manage. 27, 2956–2971. doi: 10.1002/csr.2014

Sarfraz, M., Shah, S., Ivascu, L., and Qureshi, M. (2020c). Explicating the impact of hierarchical CEO succession on small-medium enterprises' performance and cash holdings. Int. J. Fin. Econ . 2020, 1–15. doi: 10.1002/ijfe.2289

Sehdev, R., and Ranjan, P. (2014). A study on Investor's perception towards mutual fund investment. Sch. J. Econ. Bus. Manage. 1, 105–115.

Sindhu, K. P., and Kumar, S. R. (2014). Influence of risk perception of investors on investment decisions: an empirical analysis. J. Fin. Bank Manage. 2, 15–25.

Smith, S. M., and Albaum, G. S. (2013). Fundamentals of Marketing Research . Thousands Oaks, CA: SAGE.

Trivedi, R., Swain, K. P, and Dash, P. (2017). A study of investor's perception towards mutual fund decision: an indian perspective. Int. J. Econ. Res . 14, 209–219.

Keywords: mutual fund investors behavior, investment criteria, mutual fund awareness, risk perception, return perception, financial literacy

Citation: Saleem S, Mahmood F, Usman M, Bashir M and Shabbir R (2021) Determinants of Investment Behavior in Mutual Funds: Evidence From Pakistan. Front. Psychol. 12:666007. doi: 10.3389/fpsyg.2021.666007

Received: 02 March 2021; Accepted: 09 June 2021; Published: 12 July 2021.

Reviewed by:

Copyright © 2021 Saleem, Mahmood, Usman, Bashir and Shabbir. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY) . The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Faiq Mahmood, drfaiqmahmood@gcuf.edu.pk

Disclaimer: All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article or claim that may be made by its manufacturer is not guaranteed or endorsed by the publisher.

Using Machine Learning to Predict Mutual Fund Performance

I n Machine-Learning the Skill of Mutual Fund Managers (NBER Working Paper 29723) Ron Kaniel , Zihan Lin , Markus Pelger , and Stijn Van Nieuwerburgh use a neural network to predict mutual fund performance. They estimate relationships among a large set of fund attributes to identify the US mutual funds with the best relative performance. They apply their model to predict the best-performing decile of funds each month and to compute portfolio weights for different funds that will produce the maximum return within the top decile.

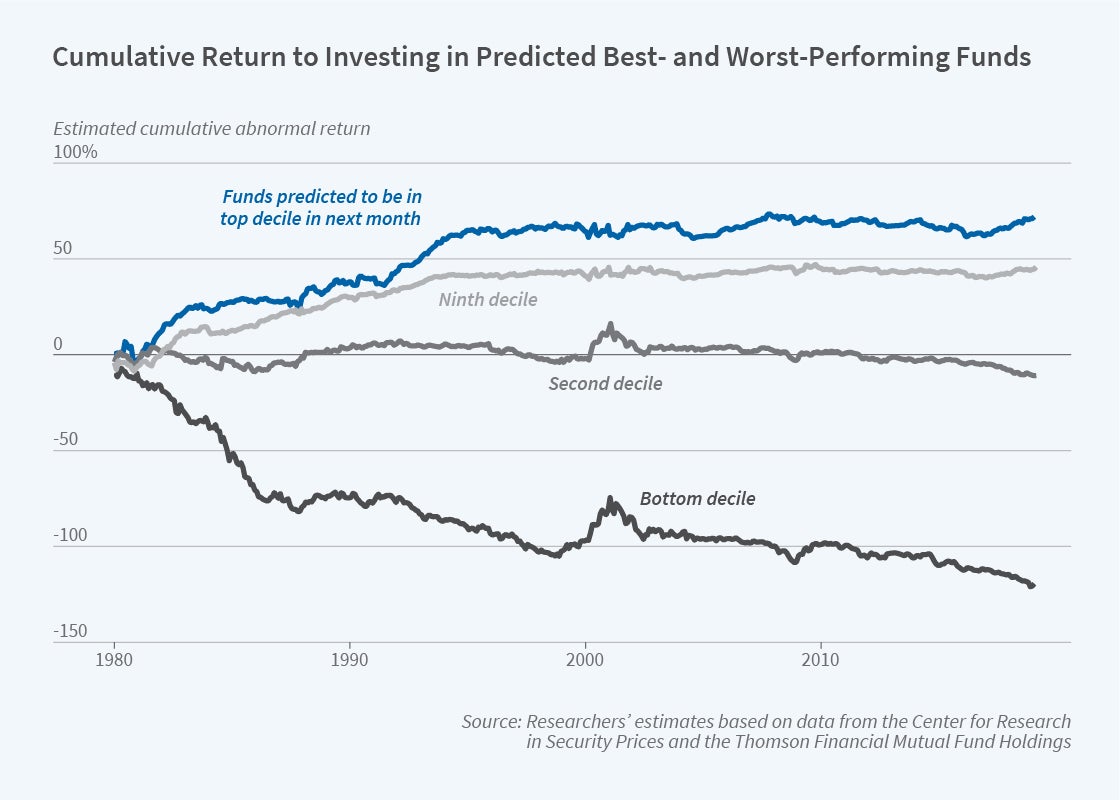

Investing according to the model’s predictions generated a cumulative abnormal return of 72 percent over the 1980 to 2019 period. The decile of mutual funds that was predicted to exhibit the worst returns each month produced a cumulative abnormal return of −119 percent over the same period. The difference between the returns in the best and the worst deciles, 191 percent, was both economically large and statistically significant.

A model that includes interaction effects between investor sentiment, fund flows, and fund momentum has substantial power to predict the best- and worst-performing funds.

The average mutual fund in the sample of 3,275 funds was almost 14 years old, had $1.15 billion in assets, and charged a monthly expense ratio of about 0.1 percent. Abnormal returns were those earned in excess of what an investor would expect given a fund’s level of risk. Such returns were estimated by subtracting the monthly Treasury-bill yield from a fund’s monthly performance before fees, minus the estimated compensation for systematic risk factor exposure. Ten to 20 percent of funds in the sample generated positive abnormal returns after fees were subtracted, with most gains accruing from avoiding the worst-performing funds. The average abnormal return was −0.03 percent per month.

The researchers conclude that little can be learned about a fund’s performance from the characteristics of the stocks it holds. Their alternative approach began with 59 fund characteristics and studied how they were associated with subsequent fund returns. The machine learning model they apply to these data uncovered substantial interaction effects between investor sentiment and both fund flow and fund momentum. A fund’s momentum is its mean abnormal return in the preceding 12 months, excluding the most recent month. Flow is the change in total net assets in a month. Abnormal returns were nearly identical when the fund characteristics in the model were pared down to these three attributes.

Periods of above-average investor sentiment drove the strong association between fund momentum, flow, and the next month’s abnormal performance. When combined with fund characteristics, the state of the macroeconomy, proxied by the Chicago Fed National Activity Index (CFNAI), predicted the best and worst performers as well as investor sentiment. Though models that use sentiment and the CFNAI put 78 percent of the same funds in the bottom decile and 74 percent of the same funds in the top decile, the model with sentiment did a better job of predicting funds’ actual abnormal returns. Investor sentiment was also better at predicting the relative returns within the top and bottom deciles. Prediction-weighted portfolios created from the top decile of funds earned a cumulative abnormal return of 72 percent. Investing in equally weighted portfolios returned just 48 percent.

The results are consistent with investors successfully detecting skilled managers and reallocating their investments toward them. They are also consistent with funds and fund families successfully using marketing to attract investors. Fund inflows create buying pressure for the stocks held, raising their prices and lifting fund returns. That demand pressure increases prices further, generating momentum in fund returns. The fact that flows and fund momentum have a much stronger association with fund performance in high-sentiment periods lends further credence to this marketing-driven channel. However, changes in inflows were gradual and small enough, the researchers found, to take several months before the fund ran into zero marginal abnormal returns. Skill, therefore, leaves a trail in the form of fund return momentum, and investors can exploit this to earn higher returns.

— Linda Gorman

Researchers

Working groups, conferences.

NBER periodicals and newsletters may be reproduced freely with appropriate attribution.

More from NBER

In addition to working papers , the NBER disseminates affiliates’ latest findings through a range of free periodicals — the NBER Reporter , the NBER Digest , the Bulletin on Retirement and Disability , the Bulletin on Health , and the Bulletin on Entrepreneurship — as well as online conference reports , video lectures , and interviews .

© 2023 National Bureau of Economic Research. Periodical content may be reproduced freely with appropriate attribution.

- Privacy Policy

Home » Research Methodology – Types, Examples and writing Guide

Research Methodology – Types, Examples and writing Guide

Table of Contents

Research Methodology

Definition:

Research Methodology refers to the systematic and scientific approach used to conduct research, investigate problems, and gather data and information for a specific purpose. It involves the techniques and procedures used to identify, collect , analyze , and interpret data to answer research questions or solve research problems . Moreover, They are philosophical and theoretical frameworks that guide the research process.

Structure of Research Methodology

Research methodology formats can vary depending on the specific requirements of the research project, but the following is a basic example of a structure for a research methodology section:

I. Introduction

- Provide an overview of the research problem and the need for a research methodology section

- Outline the main research questions and objectives

II. Research Design

- Explain the research design chosen and why it is appropriate for the research question(s) and objectives

- Discuss any alternative research designs considered and why they were not chosen

- Describe the research setting and participants (if applicable)

III. Data Collection Methods

- Describe the methods used to collect data (e.g., surveys, interviews, observations)

- Explain how the data collection methods were chosen and why they are appropriate for the research question(s) and objectives

- Detail any procedures or instruments used for data collection

IV. Data Analysis Methods

- Describe the methods used to analyze the data (e.g., statistical analysis, content analysis )

- Explain how the data analysis methods were chosen and why they are appropriate for the research question(s) and objectives

- Detail any procedures or software used for data analysis

V. Ethical Considerations

- Discuss any ethical issues that may arise from the research and how they were addressed

- Explain how informed consent was obtained (if applicable)

- Detail any measures taken to ensure confidentiality and anonymity

VI. Limitations

- Identify any potential limitations of the research methodology and how they may impact the results and conclusions

VII. Conclusion

- Summarize the key aspects of the research methodology section

- Explain how the research methodology addresses the research question(s) and objectives

Research Methodology Types

Types of Research Methodology are as follows:

Quantitative Research Methodology

This is a research methodology that involves the collection and analysis of numerical data using statistical methods. This type of research is often used to study cause-and-effect relationships and to make predictions.

Qualitative Research Methodology

This is a research methodology that involves the collection and analysis of non-numerical data such as words, images, and observations. This type of research is often used to explore complex phenomena, to gain an in-depth understanding of a particular topic, and to generate hypotheses.

Mixed-Methods Research Methodology

This is a research methodology that combines elements of both quantitative and qualitative research. This approach can be particularly useful for studies that aim to explore complex phenomena and to provide a more comprehensive understanding of a particular topic.

Case Study Research Methodology

This is a research methodology that involves in-depth examination of a single case or a small number of cases. Case studies are often used in psychology, sociology, and anthropology to gain a detailed understanding of a particular individual or group.

Action Research Methodology

This is a research methodology that involves a collaborative process between researchers and practitioners to identify and solve real-world problems. Action research is often used in education, healthcare, and social work.

Experimental Research Methodology

This is a research methodology that involves the manipulation of one or more independent variables to observe their effects on a dependent variable. Experimental research is often used to study cause-and-effect relationships and to make predictions.

Survey Research Methodology

This is a research methodology that involves the collection of data from a sample of individuals using questionnaires or interviews. Survey research is often used to study attitudes, opinions, and behaviors.

Grounded Theory Research Methodology

This is a research methodology that involves the development of theories based on the data collected during the research process. Grounded theory is often used in sociology and anthropology to generate theories about social phenomena.

Research Methodology Example

An Example of Research Methodology could be the following:

Research Methodology for Investigating the Effectiveness of Cognitive Behavioral Therapy in Reducing Symptoms of Depression in Adults

Introduction:

The aim of this research is to investigate the effectiveness of cognitive-behavioral therapy (CBT) in reducing symptoms of depression in adults. To achieve this objective, a randomized controlled trial (RCT) will be conducted using a mixed-methods approach.

Research Design:

The study will follow a pre-test and post-test design with two groups: an experimental group receiving CBT and a control group receiving no intervention. The study will also include a qualitative component, in which semi-structured interviews will be conducted with a subset of participants to explore their experiences of receiving CBT.

Participants:

Participants will be recruited from community mental health clinics in the local area. The sample will consist of 100 adults aged 18-65 years old who meet the diagnostic criteria for major depressive disorder. Participants will be randomly assigned to either the experimental group or the control group.

Intervention :

The experimental group will receive 12 weekly sessions of CBT, each lasting 60 minutes. The intervention will be delivered by licensed mental health professionals who have been trained in CBT. The control group will receive no intervention during the study period.

Data Collection:

Quantitative data will be collected through the use of standardized measures such as the Beck Depression Inventory-II (BDI-II) and the Generalized Anxiety Disorder-7 (GAD-7). Data will be collected at baseline, immediately after the intervention, and at a 3-month follow-up. Qualitative data will be collected through semi-structured interviews with a subset of participants from the experimental group. The interviews will be conducted at the end of the intervention period, and will explore participants’ experiences of receiving CBT.

Data Analysis:

Quantitative data will be analyzed using descriptive statistics, t-tests, and mixed-model analyses of variance (ANOVA) to assess the effectiveness of the intervention. Qualitative data will be analyzed using thematic analysis to identify common themes and patterns in participants’ experiences of receiving CBT.

Ethical Considerations:

This study will comply with ethical guidelines for research involving human subjects. Participants will provide informed consent before participating in the study, and their privacy and confidentiality will be protected throughout the study. Any adverse events or reactions will be reported and managed appropriately.

Data Management:

All data collected will be kept confidential and stored securely using password-protected databases. Identifying information will be removed from qualitative data transcripts to ensure participants’ anonymity.

Limitations:

One potential limitation of this study is that it only focuses on one type of psychotherapy, CBT, and may not generalize to other types of therapy or interventions. Another limitation is that the study will only include participants from community mental health clinics, which may not be representative of the general population.

Conclusion:

This research aims to investigate the effectiveness of CBT in reducing symptoms of depression in adults. By using a randomized controlled trial and a mixed-methods approach, the study will provide valuable insights into the mechanisms underlying the relationship between CBT and depression. The results of this study will have important implications for the development of effective treatments for depression in clinical settings.

How to Write Research Methodology

Writing a research methodology involves explaining the methods and techniques you used to conduct research, collect data, and analyze results. It’s an essential section of any research paper or thesis, as it helps readers understand the validity and reliability of your findings. Here are the steps to write a research methodology:

- Start by explaining your research question: Begin the methodology section by restating your research question and explaining why it’s important. This helps readers understand the purpose of your research and the rationale behind your methods.

- Describe your research design: Explain the overall approach you used to conduct research. This could be a qualitative or quantitative research design, experimental or non-experimental, case study or survey, etc. Discuss the advantages and limitations of the chosen design.

- Discuss your sample: Describe the participants or subjects you included in your study. Include details such as their demographics, sampling method, sample size, and any exclusion criteria used.

- Describe your data collection methods : Explain how you collected data from your participants. This could include surveys, interviews, observations, questionnaires, or experiments. Include details on how you obtained informed consent, how you administered the tools, and how you minimized the risk of bias.

- Explain your data analysis techniques: Describe the methods you used to analyze the data you collected. This could include statistical analysis, content analysis, thematic analysis, or discourse analysis. Explain how you dealt with missing data, outliers, and any other issues that arose during the analysis.

- Discuss the validity and reliability of your research : Explain how you ensured the validity and reliability of your study. This could include measures such as triangulation, member checking, peer review, or inter-coder reliability.

- Acknowledge any limitations of your research: Discuss any limitations of your study, including any potential threats to validity or generalizability. This helps readers understand the scope of your findings and how they might apply to other contexts.

- Provide a summary: End the methodology section by summarizing the methods and techniques you used to conduct your research. This provides a clear overview of your research methodology and helps readers understand the process you followed to arrive at your findings.

When to Write Research Methodology

Research methodology is typically written after the research proposal has been approved and before the actual research is conducted. It should be written prior to data collection and analysis, as it provides a clear roadmap for the research project.

The research methodology is an important section of any research paper or thesis, as it describes the methods and procedures that will be used to conduct the research. It should include details about the research design, data collection methods, data analysis techniques, and any ethical considerations.

The methodology should be written in a clear and concise manner, and it should be based on established research practices and standards. It is important to provide enough detail so that the reader can understand how the research was conducted and evaluate the validity of the results.

Applications of Research Methodology

Here are some of the applications of research methodology:

- To identify the research problem: Research methodology is used to identify the research problem, which is the first step in conducting any research.

- To design the research: Research methodology helps in designing the research by selecting the appropriate research method, research design, and sampling technique.

- To collect data: Research methodology provides a systematic approach to collect data from primary and secondary sources.

- To analyze data: Research methodology helps in analyzing the collected data using various statistical and non-statistical techniques.

- To test hypotheses: Research methodology provides a framework for testing hypotheses and drawing conclusions based on the analysis of data.

- To generalize findings: Research methodology helps in generalizing the findings of the research to the target population.

- To develop theories : Research methodology is used to develop new theories and modify existing theories based on the findings of the research.

- To evaluate programs and policies : Research methodology is used to evaluate the effectiveness of programs and policies by collecting data and analyzing it.

- To improve decision-making: Research methodology helps in making informed decisions by providing reliable and valid data.

Purpose of Research Methodology

Research methodology serves several important purposes, including:

- To guide the research process: Research methodology provides a systematic framework for conducting research. It helps researchers to plan their research, define their research questions, and select appropriate methods and techniques for collecting and analyzing data.

- To ensure research quality: Research methodology helps researchers to ensure that their research is rigorous, reliable, and valid. It provides guidelines for minimizing bias and error in data collection and analysis, and for ensuring that research findings are accurate and trustworthy.

- To replicate research: Research methodology provides a clear and detailed account of the research process, making it possible for other researchers to replicate the study and verify its findings.

- To advance knowledge: Research methodology enables researchers to generate new knowledge and to contribute to the body of knowledge in their field. It provides a means for testing hypotheses, exploring new ideas, and discovering new insights.

- To inform decision-making: Research methodology provides evidence-based information that can inform policy and decision-making in a variety of fields, including medicine, public health, education, and business.

Advantages of Research Methodology

Research methodology has several advantages that make it a valuable tool for conducting research in various fields. Here are some of the key advantages of research methodology:

- Systematic and structured approach : Research methodology provides a systematic and structured approach to conducting research, which ensures that the research is conducted in a rigorous and comprehensive manner.

- Objectivity : Research methodology aims to ensure objectivity in the research process, which means that the research findings are based on evidence and not influenced by personal bias or subjective opinions.

- Replicability : Research methodology ensures that research can be replicated by other researchers, which is essential for validating research findings and ensuring their accuracy.

- Reliability : Research methodology aims to ensure that the research findings are reliable, which means that they are consistent and can be depended upon.

- Validity : Research methodology ensures that the research findings are valid, which means that they accurately reflect the research question or hypothesis being tested.

- Efficiency : Research methodology provides a structured and efficient way of conducting research, which helps to save time and resources.

- Flexibility : Research methodology allows researchers to choose the most appropriate research methods and techniques based on the research question, data availability, and other relevant factors.

- Scope for innovation: Research methodology provides scope for innovation and creativity in designing research studies and developing new research techniques.

Research Methodology Vs Research Methods

About the author.

Muhammad Hassan

Researcher, Academic Writer, Web developer

You may also like

How to Cite Research Paper – All Formats and...

Data Collection – Methods Types and Examples

Delimitations in Research – Types, Examples and...

Research Paper Format – Types, Examples and...

Research Process – Steps, Examples and Tips

Research Design – Types, Methods and Examples

Investor Behavior Towards Mutual Fund

- First Online: 29 September 2022

Cite this chapter

- Devamrita Biswas 5

Part of the book series: Studies in Autonomic, Data-driven and Industrial Computing ((SADIC))

305 Accesses

1 Altmetric

This study explores how mutual fund advisors help in planning the unmet needs of the clients and suggesting them different investment options. It helps to ‘demonstrate and analyze’ the ‘Selection Behaviour’ of customers towards ‘Mutual Funds’ and depicts the risk associated with those. Financial Planning along with all the aspects of Risk Management by means of ‘Life Insurance’, ‘Health Insurance’, ‘Emergency Planning’ is discussed. Further, the discussion moved into details for ‘Mutual Funds’, its mechanism of working, types, ‘Risk-Reward’ parameters and Ratios, Systematic Investment Plan, ‘Rupee-Averaging’, ‘Compounding effect’, Accounting and Taxation part. Client Interaction part is thoroughly highlighted where common investor biases are depicted. Later, mechanisms to overcome those biases by means of ‘Systematic allocation of assets’ and ‘Risk-Profiling’ have been highlighted.

This is a preview of subscription content, log in via an institution to check access.

Access this chapter

- Available as EPUB and PDF

- Read on any device

- Instant download

- Own it forever

- Compact, lightweight edition

- Dispatched in 3 to 5 business days

- Free shipping worldwide - see info

- Durable hardcover edition

Tax calculation will be finalised at checkout

Purchases are for personal use only

Institutional subscriptions

Similar content being viewed by others

Mutual Funds and Risk Management

Competing Logics in the Islamic Funds Industry: A Market Logic Versus a Religious Logic

Socially Responsible Investment (SRI): From Niche to Mainstream

Jiang G, Xu D, Yao T (2009) The information content of idiosyncratic volatility. J Financ Quant Anal 44(1):1–28. https://doi.org/10.1017/S0022109009090073

Article Google Scholar

Doukas JA et al (2006) Divergence of opinion and equity returns. J Financ Quant Anal 41(3):573–606. JSTOR

Google Scholar

Baltussen G, Van Bekkum S, Van der Grient B (2018) Unknown unknowns: uncertainty about risk and stock returns. J Financ Quant Anal 53(4):1615–1651. https://doi.org/10.1017/S0022109018000480

Bali T, Murray S (2013) Does risk-neutral skewness predict the cross-section of equity option portfolio returns? J Financ Quant Anal 48(4):1145–1171. https://doi.org/10.1017/S0022109013000410

Margarida A (2019) How biased is the behavior of the individual investor in warrants? Res Int Bus Financ 47(C):139–149

Huang D, Schlag C, Shaliastovich I, Thimme J (2019) Volatility-of-volatility risk. J Financ Quant Anal 54(6):2423–2452. https://doi.org/10.1017/S0022109018001436

https://www.icraonline.com/mfanalytics.html ; https://www.valueresearchonline.com

Download references

Author information

Authors and affiliations.

Project Manager, BFSI SEAL US-SE 1.6—Group 6, Tata Consultancy Services, Kolkata, India

Devamrita Biswas

You can also search for this author in PubMed Google Scholar

Corresponding author

Correspondence to Devamrita Biswas .

Editor information

Editors and affiliations.

Tata Consultancy Services Ltd, Pune, Maharashtra, India

Neha Sharma

Mandar Bhatavdekar

Rights and permissions

Reprints and permissions

Copyright information

© 2022 The Author(s), under exclusive license to Springer Nature Singapore Pte Ltd.

About this chapter

Biswas, D. (2022). Investor Behavior Towards Mutual Fund. In: Sharma, N., Bhatavdekar, M. (eds) World of Business with Data and Analytics. Studies in Autonomic, Data-driven and Industrial Computing. Springer, Singapore. https://doi.org/10.1007/978-981-19-5689-8_7

Download citation

DOI : https://doi.org/10.1007/978-981-19-5689-8_7

Published : 29 September 2022

Publisher Name : Springer, Singapore

Print ISBN : 978-981-19-5688-1

Online ISBN : 978-981-19-5689-8

eBook Packages : Computer Science Computer Science (R0)

Share this chapter

Anyone you share the following link with will be able to read this content:

Sorry, a shareable link is not currently available for this article.

Provided by the Springer Nature SharedIt content-sharing initiative

- Publish with us

Policies and ethics

- Find a journal

- Track your research

A .gov website belongs to an official government organization in the United States.

A lock ( ) or https:// means you've safely connected to the .gov website. Share sensitive information only on official, secure websites.

- About Heart Disease

- Risk Factors

- Heart Disease Facts

- Healthy People 2030

- Heart Disease Communications Toolkit

- Publication

- Community-Clinical Linkages Health Equity Guide

Emergency Medical Services (EMS) Home Rule State Law Fact Sheet

- American Heart Month Toolkits

- Healthy Eating Communications Kit

- About Stroke

- About High Blood Pressure

- About Cholesterol

- This fact sheet was created to describe the influence of local government autonomy on emergency medical services and its relation to cardiovascular disease outcomes in medically underserved communities.

- The fact sheet describes the types of state laws analyzed by public health attorneys between January 2021 and January 2022.

- The fact sheet begins to clarify the influence that local government autonomy and property tax laws have on EMS and health outcomes.

Introduction

The Division for Heart Disease and Stroke Prevention created the Home Rule-Emergency Medical Services (HR-EMS) Project to assess the influence of local government autonomy on emergency medical services and its relation to cardiovascular disease outcomes in medically underserved communities.

As part of the project, this state law fact sheet discusses the collection of laws related to local government autonomy to establish and fund local EMS for five US states: Alabama, California, Georgia, Massachusetts, and Ohio.

This fact sheet walks through the types of state laws analyzed by public health attorneys between January 2021 and January 2022.

The laws in this study address local government EMS funding mechanisms related to local property taxes, special districts, mutual aid contracts, issuance of government bonds, and user/service fees.

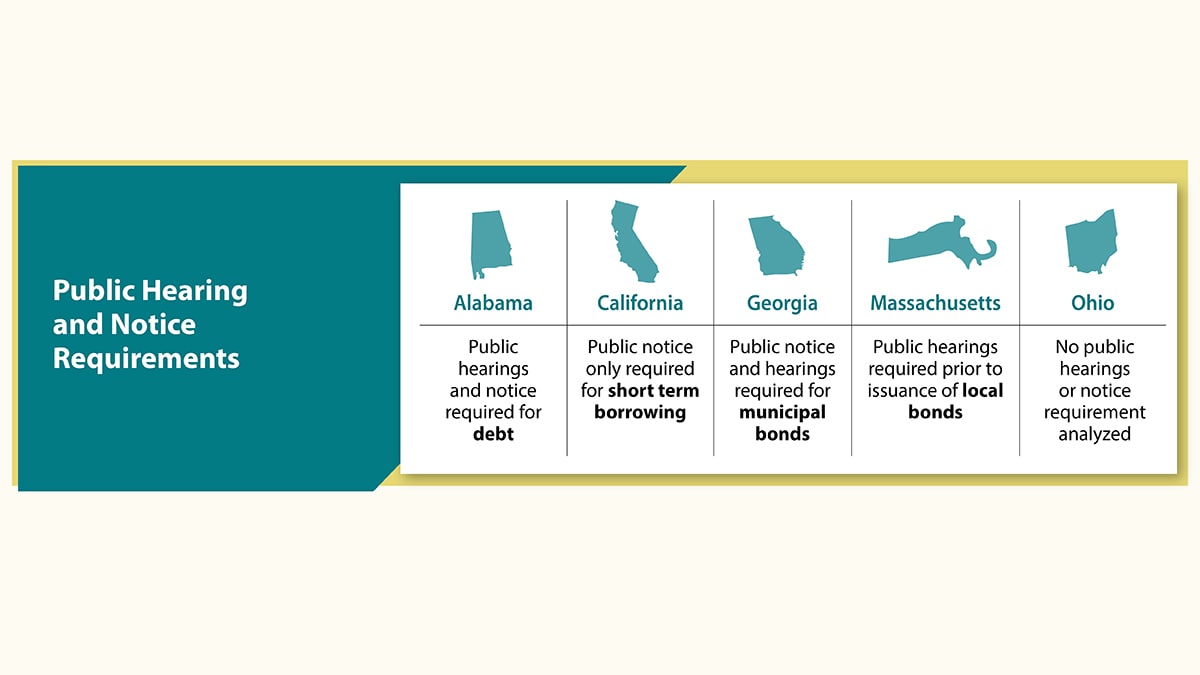

Bureaucratic requirements, such as voting, public hearing, and public notice requirements, are also analyzed and discussed.

Research that examines the relationship between a community's socioeconomic status and EMS resources is lacking. Further research can help examine EMS funding and its correlation to cardiovascular disease outcomes in disproportionately affected communities.

This fact sheet begins to clarify the influence that local government autonomy and property tax laws have on EMS and health outcomes.

The policy surveillance information presented here may help policy makers, public health practitioners, researchers, and others understand existing structures, facilitators, and challenges that local governments face in providing and funding life-saving emergency medical services. This information can guide improvements and advance health equity.

Snapshots of the laws discussed in this fact sheet

Below are snapshots of the laws discussed in this fact sheet and outlined in more detail in Table 1: Summary of Laws Pertaining to Local Government Autonomy and Local EMS Funding Mechanisms, in Effect as of January 31, 2022 .

EMS background

In the United States, emergency medical services are not considered essential services. 1 They are provided and funded mainly by local governments, which leads to a wide variation in the cost and quality of services.

Nationwide, the cost of ambulance transport for ground ambulance providers varies substantially. Although recent estimates are limited, as of 2012, the median cost per transport was $429, but depending on the geographic area, this cost could be as low as $224 or as high as $2,204 (for both Medicare and non-Medicare transports). 2

Communities with lower average household incomes have a higher incidence of severe, life-threatening illnesses and rely more heavily on EMS (prehospital) care. 3 However, one recent nationwide study found that areas with higher median household incomes have shorter EMS response times and a higher percentage of White residents. 3

These differences in quality may also be due to system structure. 3 In addition to variations in cost, there are also differences in the level of service to rural areas across the United States. Rural counties have a higher percentage of elderly residents and residents with limitations in activities due to chronic conditions, as well as a lower median income than their urban counterparts. These factors make them among the groups that most need hospital services. 4 A 2018 study found that the 43% of rural hospitals that closed between 2005 and 2017 were more than 15 miles from the next closest hospital, resulting in substantially longer transport times. 5

Finally, female patients and patients in minority populations are disproportionately affected by delays and other shortcomings in emergency medical care. 6 For example, a nationwide EMS study reported that a lower percentage of women with chest pain received recommended treatments during emergency care. 6

In the United States, EMS care is funded mainly at the local level. Some states have adopted a more centralized EMS infrastructure, while others allow local jurisdictions to retain greater authority to develop, fund, and implement their EMS systems. These differences among states may be explained in part by the extent to which states constitutionally or legislatively grant local jurisdictions the power to enact their own laws to address issues of local concern, a concept known as local autonomy. 7

Such powers allow counties and cities to adopt their own public health laws around the provision and funding of emergency medical care.

Common sources of local government revenue include taxes (primarily property and sales taxes), user fees/fines, and bonds. Special districts are also frequently used to help fund these services.

Data collection and methods

Between January 2021 and January 2022, four public health attorneys and three legal interns (collectively referred to as the project team) collected and analyzed state statutes in effect as of January 31, 2022. They gathered relevant laws in Alabama, California, Georgia, Massachusetts, and Ohio from Westlaw Edge (Thomson Reuters in Eagan, Minnesota) and official state legislation websites.

States were selected based on:

- Geographic diversity (at least one state from each of the following Census regions: Northeast, South, Midwest, West).

- Diversity in urban/rural breakdown in each state (based on the 2018 CityLab's Congressional Density Index). 8

- Availability of public information about state and local EMS funding.

- Amount of local government revenue generated from property taxes (based on 2017 US Census Bureau revenue data and the state property tax database by Lincoln Institute of Land Policy). 9

Before collecting data and coding laws, the project team conducted a literature review and consulted experts in the legal field to help them develop coding protocols. The protocols outline exclusion and inclusion criteria, coding instructions, and coding questions.

For each state, two project team members independently collected and coded the laws using the coding protocols. The two team members subsequently met to discuss and reconcile discrepancies in codes and analyses of state law.

The project team coded state laws related to local autonomy and funding of local EMS. This study does not include analysis of:

- Case law (law based on judicial decisions).

- Special districts that do not pertain to EMS or fire services.

- Laws pertaining to property, such as laws governing eminent domain, blighted property, or tax penalties.

Local governments' authority to regulate local EMS agencies

Laws from each state were analyzed to assess the level of authorized local government autonomy to establish and fund local EMS agencies. Four of the five states grant statewide local government autonomy (i.e., all local governments in the state can enact ordinances to regulate local EMS).

Table 2a lists laws related to statewide local government autonomy in effect as of January 31, 2022. Although Alabama does not allow statewide local government autonomy, selected local governments are granted autonomy through constitutional amendments (e.g., ALA. CONST. amend. 783, § 5.01 (West, Westlaw through 2021 amendments)).

Taxes and government bonds as funding mechanisms for local EMS

In all five states, special taxes are allowed and require an election in the community in order to be imposed. Special taxes are those levied when the county or special district's board of directors finds that the current revenue is insufficient to cover the expenses of the local EMS agency.

Bonds are another method that local governments may use to supply the needs of local EMS agencies. The ability to incur debt for local EMS purposes is authorized throughout the five states. The type of bonds analyzed varied by state (see Table 1 for type of local bonds analyzed; see Table 2b for a compiled list of laws).

State government restrictions on local tax levies and government bonds