- Search Menu

- Browse content in A - General Economics and Teaching

- Browse content in A1 - General Economics

- A10 - General

- A11 - Role of Economics; Role of Economists; Market for Economists

- A12 - Relation of Economics to Other Disciplines

- A13 - Relation of Economics to Social Values

- A14 - Sociology of Economics

- Browse content in A2 - Economic Education and Teaching of Economics

- A20 - General

- A29 - Other

- A3 - Collective Works

- Browse content in B - History of Economic Thought, Methodology, and Heterodox Approaches

- Browse content in B0 - General

- B00 - General

- Browse content in B1 - History of Economic Thought through 1925

- B10 - General

- B11 - Preclassical (Ancient, Medieval, Mercantilist, Physiocratic)

- B12 - Classical (includes Adam Smith)

- B13 - Neoclassical through 1925 (Austrian, Marshallian, Walrasian, Stockholm School)

- B14 - Socialist; Marxist

- B15 - Historical; Institutional; Evolutionary

- B16 - History of Economic Thought: Quantitative and Mathematical

- B17 - International Trade and Finance

- B19 - Other

- Browse content in B2 - History of Economic Thought since 1925

- B20 - General

- B21 - Microeconomics

- B22 - Macroeconomics

- B23 - Econometrics; Quantitative and Mathematical Studies

- B24 - Socialist; Marxist; Sraffian

- B25 - Historical; Institutional; Evolutionary; Austrian

- B26 - Financial Economics

- B27 - International Trade and Finance

- B29 - Other

- Browse content in B3 - History of Economic Thought: Individuals

- B30 - General

- B31 - Individuals

- Browse content in B4 - Economic Methodology

- B40 - General

- B41 - Economic Methodology

- B49 - Other

- Browse content in B5 - Current Heterodox Approaches

- B50 - General

- B51 - Socialist; Marxian; Sraffian

- B52 - Institutional; Evolutionary

- B53 - Austrian

- B54 - Feminist Economics

- B55 - Social Economics

- B59 - Other

- Browse content in C - Mathematical and Quantitative Methods

- Browse content in C0 - General

- C00 - General

- C02 - Mathematical Methods

- Browse content in C1 - Econometric and Statistical Methods and Methodology: General

- C10 - General

- C12 - Hypothesis Testing: General

- C13 - Estimation: General

- C14 - Semiparametric and Nonparametric Methods: General

- C18 - Methodological Issues: General

- C19 - Other

- Browse content in C2 - Single Equation Models; Single Variables

- C20 - General

- C21 - Cross-Sectional Models; Spatial Models; Treatment Effect Models; Quantile Regressions

- C22 - Time-Series Models; Dynamic Quantile Regressions; Dynamic Treatment Effect Models; Diffusion Processes

- C23 - Panel Data Models; Spatio-temporal Models

- C25 - Discrete Regression and Qualitative Choice Models; Discrete Regressors; Proportions; Probabilities

- Browse content in C3 - Multiple or Simultaneous Equation Models; Multiple Variables

- C30 - General

- C32 - Time-Series Models; Dynamic Quantile Regressions; Dynamic Treatment Effect Models; Diffusion Processes; State Space Models

- C34 - Truncated and Censored Models; Switching Regression Models

- C38 - Classification Methods; Cluster Analysis; Principal Components; Factor Models

- Browse content in C4 - Econometric and Statistical Methods: Special Topics

- C43 - Index Numbers and Aggregation

- C44 - Operations Research; Statistical Decision Theory

- Browse content in C5 - Econometric Modeling

- C50 - General

- Browse content in C6 - Mathematical Methods; Programming Models; Mathematical and Simulation Modeling

- C60 - General

- C61 - Optimization Techniques; Programming Models; Dynamic Analysis

- C62 - Existence and Stability Conditions of Equilibrium

- C63 - Computational Techniques; Simulation Modeling

- C65 - Miscellaneous Mathematical Tools

- C67 - Input-Output Models

- Browse content in C8 - Data Collection and Data Estimation Methodology; Computer Programs

- C82 - Methodology for Collecting, Estimating, and Organizing Macroeconomic Data; Data Access

- C89 - Other

- Browse content in C9 - Design of Experiments

- C90 - General

- C91 - Laboratory, Individual Behavior

- C92 - Laboratory, Group Behavior

- C93 - Field Experiments

- Browse content in D - Microeconomics

- Browse content in D0 - General

- D01 - Microeconomic Behavior: Underlying Principles

- D02 - Institutions: Design, Formation, Operations, and Impact

- D03 - Behavioral Microeconomics: Underlying Principles

- Browse content in D1 - Household Behavior and Family Economics

- D10 - General

- D11 - Consumer Economics: Theory

- D12 - Consumer Economics: Empirical Analysis

- D13 - Household Production and Intrahousehold Allocation

- D14 - Household Saving; Personal Finance

- Browse content in D2 - Production and Organizations

- D20 - General

- D21 - Firm Behavior: Theory

- D22 - Firm Behavior: Empirical Analysis

- D23 - Organizational Behavior; Transaction Costs; Property Rights

- D24 - Production; Cost; Capital; Capital, Total Factor, and Multifactor Productivity; Capacity

- D25 - Intertemporal Firm Choice: Investment, Capacity, and Financing

- Browse content in D3 - Distribution

- D30 - General

- D31 - Personal Income, Wealth, and Their Distributions

- D33 - Factor Income Distribution

- D39 - Other

- Browse content in D4 - Market Structure, Pricing, and Design

- D40 - General

- D41 - Perfect Competition

- D42 - Monopoly

- D43 - Oligopoly and Other Forms of Market Imperfection

- D46 - Value Theory

- Browse content in D5 - General Equilibrium and Disequilibrium

- D50 - General

- D51 - Exchange and Production Economies

- D57 - Input-Output Tables and Analysis

- D58 - Computable and Other Applied General Equilibrium Models

- Browse content in D6 - Welfare Economics

- D60 - General

- D61 - Allocative Efficiency; Cost-Benefit Analysis

- D62 - Externalities

- D63 - Equity, Justice, Inequality, and Other Normative Criteria and Measurement

- D64 - Altruism; Philanthropy

- D69 - Other

- Browse content in D7 - Analysis of Collective Decision-Making

- D71 - Social Choice; Clubs; Committees; Associations

- D72 - Political Processes: Rent-seeking, Lobbying, Elections, Legislatures, and Voting Behavior

- D73 - Bureaucracy; Administrative Processes in Public Organizations; Corruption

- D74 - Conflict; Conflict Resolution; Alliances; Revolutions

- Browse content in D8 - Information, Knowledge, and Uncertainty

- D80 - General

- D81 - Criteria for Decision-Making under Risk and Uncertainty

- D82 - Asymmetric and Private Information; Mechanism Design

- D83 - Search; Learning; Information and Knowledge; Communication; Belief; Unawareness

- D84 - Expectations; Speculations

- D85 - Network Formation and Analysis: Theory

- D86 - Economics of Contract: Theory

- D87 - Neuroeconomics

- Browse content in D9 - Micro-Based Behavioral Economics

- D91 - Role and Effects of Psychological, Emotional, Social, and Cognitive Factors on Decision Making

- Browse content in E - Macroeconomics and Monetary Economics

- Browse content in E0 - General

- E00 - General

- E01 - Measurement and Data on National Income and Product Accounts and Wealth; Environmental Accounts

- E02 - Institutions and the Macroeconomy

- Browse content in E1 - General Aggregative Models

- E10 - General

- E11 - Marxian; Sraffian; Kaleckian

- E12 - Keynes; Keynesian; Post-Keynesian

- E13 - Neoclassical

- E16 - Social Accounting Matrix

- E17 - Forecasting and Simulation: Models and Applications

- Browse content in E2 - Consumption, Saving, Production, Investment, Labor Markets, and Informal Economy

- E20 - General

- E21 - Consumption; Saving; Wealth

- E22 - Investment; Capital; Intangible Capital; Capacity

- E23 - Production

- E24 - Employment; Unemployment; Wages; Intergenerational Income Distribution; Aggregate Human Capital; Aggregate Labor Productivity

- E25 - Aggregate Factor Income Distribution

- E26 - Informal Economy; Underground Economy

- E27 - Forecasting and Simulation: Models and Applications

- Browse content in E3 - Prices, Business Fluctuations, and Cycles

- E30 - General

- E31 - Price Level; Inflation; Deflation

- E32 - Business Fluctuations; Cycles

- E37 - Forecasting and Simulation: Models and Applications

- Browse content in E4 - Money and Interest Rates

- E40 - General

- E41 - Demand for Money

- E42 - Monetary Systems; Standards; Regimes; Government and the Monetary System; Payment Systems

- E43 - Interest Rates: Determination, Term Structure, and Effects

- E44 - Financial Markets and the Macroeconomy

- E49 - Other

- Browse content in E5 - Monetary Policy, Central Banking, and the Supply of Money and Credit

- E50 - General

- E51 - Money Supply; Credit; Money Multipliers

- E52 - Monetary Policy

- E58 - Central Banks and Their Policies

- Browse content in E6 - Macroeconomic Policy, Macroeconomic Aspects of Public Finance, and General Outlook

- E60 - General

- E61 - Policy Objectives; Policy Designs and Consistency; Policy Coordination

- E62 - Fiscal Policy

- E63 - Comparative or Joint Analysis of Fiscal and Monetary Policy; Stabilization; Treasury Policy

- E64 - Incomes Policy; Price Policy

- E65 - Studies of Particular Policy Episodes

- Browse content in F - International Economics

- Browse content in F0 - General

- F00 - General

- F01 - Global Outlook

- F02 - International Economic Order and Integration

- Browse content in F1 - Trade

- F10 - General

- F11 - Neoclassical Models of Trade

- F12 - Models of Trade with Imperfect Competition and Scale Economies; Fragmentation

- F13 - Trade Policy; International Trade Organizations

- F14 - Empirical Studies of Trade

- F15 - Economic Integration

- F16 - Trade and Labor Market Interactions

- F17 - Trade Forecasting and Simulation

- F18 - Trade and Environment

- Browse content in F2 - International Factor Movements and International Business

- F20 - General

- F21 - International Investment; Long-Term Capital Movements

- F22 - International Migration

- F23 - Multinational Firms; International Business

- Browse content in F3 - International Finance

- F30 - General

- F31 - Foreign Exchange

- F32 - Current Account Adjustment; Short-Term Capital Movements

- F33 - International Monetary Arrangements and Institutions

- F34 - International Lending and Debt Problems

- F35 - Foreign Aid

- F36 - Financial Aspects of Economic Integration

- F37 - International Finance Forecasting and Simulation: Models and Applications

- F39 - Other

- Browse content in F4 - Macroeconomic Aspects of International Trade and Finance

- F40 - General

- F41 - Open Economy Macroeconomics

- F42 - International Policy Coordination and Transmission

- F43 - Economic Growth of Open Economies

- F44 - International Business Cycles

- F45 - Macroeconomic Issues of Monetary Unions

- F47 - Forecasting and Simulation: Models and Applications

- Browse content in F5 - International Relations, National Security, and International Political Economy

- F50 - General

- F51 - International Conflicts; Negotiations; Sanctions

- F53 - International Agreements and Observance; International Organizations

- F54 - Colonialism; Imperialism; Postcolonialism

- F55 - International Institutional Arrangements

- F59 - Other

- Browse content in F6 - Economic Impacts of Globalization

- F60 - General

- F61 - Microeconomic Impacts

- F62 - Macroeconomic Impacts

- F63 - Economic Development

- F64 - Environment

- F65 - Finance

- Browse content in G - Financial Economics

- Browse content in G0 - General

- G00 - General

- G01 - Financial Crises

- Browse content in G1 - General Financial Markets

- G10 - General

- G11 - Portfolio Choice; Investment Decisions

- G12 - Asset Pricing; Trading volume; Bond Interest Rates

- G13 - Contingent Pricing; Futures Pricing

- G14 - Information and Market Efficiency; Event Studies; Insider Trading

- G15 - International Financial Markets

- G18 - Government Policy and Regulation

- G19 - Other

- Browse content in G2 - Financial Institutions and Services

- G20 - General

- G21 - Banks; Depository Institutions; Micro Finance Institutions; Mortgages

- G22 - Insurance; Insurance Companies; Actuarial Studies

- G23 - Non-bank Financial Institutions; Financial Instruments; Institutional Investors

- G24 - Investment Banking; Venture Capital; Brokerage; Ratings and Ratings Agencies

- G28 - Government Policy and Regulation

- Browse content in G3 - Corporate Finance and Governance

- G30 - General

- G32 - Financing Policy; Financial Risk and Risk Management; Capital and Ownership Structure; Value of Firms; Goodwill

- G33 - Bankruptcy; Liquidation

- G34 - Mergers; Acquisitions; Restructuring; Corporate Governance

- G35 - Payout Policy

- G38 - Government Policy and Regulation

- Browse content in G5 - Household Finance

- G51 - Household Saving, Borrowing, Debt, and Wealth

- Browse content in H - Public Economics

- Browse content in H1 - Structure and Scope of Government

- H10 - General

- H11 - Structure, Scope, and Performance of Government

- H12 - Crisis Management

- Browse content in H2 - Taxation, Subsidies, and Revenue

- H20 - General

- H22 - Incidence

- H23 - Externalities; Redistributive Effects; Environmental Taxes and Subsidies

- H25 - Business Taxes and Subsidies

- H26 - Tax Evasion and Avoidance

- Browse content in H3 - Fiscal Policies and Behavior of Economic Agents

- Browse content in H4 - Publicly Provided Goods

- H40 - General

- H41 - Public Goods

- Browse content in H5 - National Government Expenditures and Related Policies

- H50 - General

- H53 - Government Expenditures and Welfare Programs

- H55 - Social Security and Public Pensions

- H56 - National Security and War

- Browse content in H6 - National Budget, Deficit, and Debt

- H60 - General

- H62 - Deficit; Surplus

- H63 - Debt; Debt Management; Sovereign Debt

- H68 - Forecasts of Budgets, Deficits, and Debt

- Browse content in H7 - State and Local Government; Intergovernmental Relations

- H70 - General

- H74 - State and Local Borrowing

- H77 - Intergovernmental Relations; Federalism; Secession

- Browse content in I - Health, Education, and Welfare

- Browse content in I0 - General

- I00 - General

- Browse content in I1 - Health

- I10 - General

- I12 - Health Behavior

- I14 - Health and Inequality

- I15 - Health and Economic Development

- Browse content in I2 - Education and Research Institutions

- I20 - General

- I21 - Analysis of Education

- I23 - Higher Education; Research Institutions

- I24 - Education and Inequality

- I26 - Returns to Education

- Browse content in I3 - Welfare, Well-Being, and Poverty

- I30 - General

- I31 - General Welfare

- I32 - Measurement and Analysis of Poverty

- I38 - Government Policy; Provision and Effects of Welfare Programs

- Browse content in J - Labor and Demographic Economics

- Browse content in J0 - General

- J00 - General

- J01 - Labor Economics: General

- J08 - Labor Economics Policies

- Browse content in J1 - Demographic Economics

- J10 - General

- J13 - Fertility; Family Planning; Child Care; Children; Youth

- J15 - Economics of Minorities, Races, Indigenous Peoples, and Immigrants; Non-labor Discrimination

- J16 - Economics of Gender; Non-labor Discrimination

- J18 - Public Policy

- Browse content in J2 - Demand and Supply of Labor

- J20 - General

- J21 - Labor Force and Employment, Size, and Structure

- J22 - Time Allocation and Labor Supply

- J23 - Labor Demand

- J24 - Human Capital; Skills; Occupational Choice; Labor Productivity

- J26 - Retirement; Retirement Policies

- J28 - Safety; Job Satisfaction; Related Public Policy

- J29 - Other

- Browse content in J3 - Wages, Compensation, and Labor Costs

- J30 - General

- J31 - Wage Level and Structure; Wage Differentials

- J32 - Nonwage Labor Costs and Benefits; Retirement Plans; Private Pensions

- J33 - Compensation Packages; Payment Methods

- J38 - Public Policy

- Browse content in J4 - Particular Labor Markets

- J40 - General

- J41 - Labor Contracts

- J42 - Monopsony; Segmented Labor Markets

- J44 - Professional Labor Markets; Occupational Licensing

- J45 - Public Sector Labor Markets

- J46 - Informal Labor Markets

- J48 - Public Policy

- J49 - Other

- Browse content in J5 - Labor-Management Relations, Trade Unions, and Collective Bargaining

- J50 - General

- J51 - Trade Unions: Objectives, Structure, and Effects

- J52 - Dispute Resolution: Strikes, Arbitration, and Mediation; Collective Bargaining

- J53 - Labor-Management Relations; Industrial Jurisprudence

- J54 - Producer Cooperatives; Labor Managed Firms; Employee Ownership

- J58 - Public Policy

- Browse content in J6 - Mobility, Unemployment, Vacancies, and Immigrant Workers

- J60 - General

- J61 - Geographic Labor Mobility; Immigrant Workers

- J62 - Job, Occupational, and Intergenerational Mobility

- J63 - Turnover; Vacancies; Layoffs

- J64 - Unemployment: Models, Duration, Incidence, and Job Search

- J65 - Unemployment Insurance; Severance Pay; Plant Closings

- J68 - Public Policy

- J69 - Other

- Browse content in J7 - Labor Discrimination

- J71 - Discrimination

- J78 - Public Policy

- Browse content in J8 - Labor Standards: National and International

- J80 - General

- J81 - Working Conditions

- J83 - Workers' Rights

- J88 - Public Policy

- Browse content in K - Law and Economics

- Browse content in K0 - General

- K00 - General

- Browse content in K1 - Basic Areas of Law

- K11 - Property Law

- K12 - Contract Law

- K13 - Tort Law and Product Liability; Forensic Economics

- Browse content in K2 - Regulation and Business Law

- K20 - General

- K21 - Antitrust Law

- K22 - Business and Securities Law

- K23 - Regulated Industries and Administrative Law

- K25 - Real Estate Law

- Browse content in K3 - Other Substantive Areas of Law

- K31 - Labor Law

- K39 - Other

- Browse content in K4 - Legal Procedure, the Legal System, and Illegal Behavior

- K40 - General

- K41 - Litigation Process

- K42 - Illegal Behavior and the Enforcement of Law

- Browse content in L - Industrial Organization

- Browse content in L0 - General

- L00 - General

- Browse content in L1 - Market Structure, Firm Strategy, and Market Performance

- L10 - General

- L11 - Production, Pricing, and Market Structure; Size Distribution of Firms

- L12 - Monopoly; Monopolization Strategies

- L13 - Oligopoly and Other Imperfect Markets

- L14 - Transactional Relationships; Contracts and Reputation; Networks

- L16 - Industrial Organization and Macroeconomics: Industrial Structure and Structural Change; Industrial Price Indices

- Browse content in L2 - Firm Objectives, Organization, and Behavior

- L20 - General

- L21 - Business Objectives of the Firm

- L22 - Firm Organization and Market Structure

- L23 - Organization of Production

- L24 - Contracting Out; Joint Ventures; Technology Licensing

- L25 - Firm Performance: Size, Diversification, and Scope

- L26 - Entrepreneurship

- L29 - Other

- Browse content in L3 - Nonprofit Organizations and Public Enterprise

- L30 - General

- L31 - Nonprofit Institutions; NGOs; Social Entrepreneurship

- L32 - Public Enterprises; Public-Private Enterprises

- L33 - Comparison of Public and Private Enterprises and Nonprofit Institutions; Privatization; Contracting Out

- L39 - Other

- Browse content in L4 - Antitrust Issues and Policies

- L40 - General

- L41 - Monopolization; Horizontal Anticompetitive Practices

- L44 - Antitrust Policy and Public Enterprises, Nonprofit Institutions, and Professional Organizations

- Browse content in L5 - Regulation and Industrial Policy

- L50 - General

- L52 - Industrial Policy; Sectoral Planning Methods

- Browse content in L6 - Industry Studies: Manufacturing

- L60 - General

- L61 - Metals and Metal Products; Cement; Glass; Ceramics

- L66 - Food; Beverages; Cosmetics; Tobacco; Wine and Spirits

- L67 - Other Consumer Nondurables: Clothing, Textiles, Shoes, and Leather Goods; Household Goods; Sports Equipment

- Browse content in L7 - Industry Studies: Primary Products and Construction

- L78 - Government Policy

- Browse content in L8 - Industry Studies: Services

- L80 - General

- L82 - Entertainment; Media

- Browse content in L9 - Industry Studies: Transportation and Utilities

- L97 - Utilities: General

- L98 - Government Policy

- Browse content in M - Business Administration and Business Economics; Marketing; Accounting; Personnel Economics

- Browse content in M0 - General

- M00 - General

- Browse content in M1 - Business Administration

- M10 - General

- M12 - Personnel Management; Executives; Executive Compensation

- M13 - New Firms; Startups

- M16 - International Business Administration

- Browse content in M2 - Business Economics

- M21 - Business Economics

- Browse content in M3 - Marketing and Advertising

- M37 - Advertising

- Browse content in M4 - Accounting and Auditing

- M41 - Accounting

- M49 - Other

- Browse content in M5 - Personnel Economics

- M51 - Firm Employment Decisions; Promotions

- M52 - Compensation and Compensation Methods and Their Effects

- M54 - Labor Management

- M55 - Labor Contracting Devices

- Browse content in N - Economic History

- Browse content in N0 - General

- N00 - General

- N01 - Development of the Discipline: Historiographical; Sources and Methods

- Browse content in N1 - Macroeconomics and Monetary Economics; Industrial Structure; Growth; Fluctuations

- N10 - General, International, or Comparative

- N11 - U.S.; Canada: Pre-1913

- N12 - U.S.; Canada: 1913-

- N13 - Europe: Pre-1913

- N14 - Europe: 1913-

- N15 - Asia including Middle East

- N17 - Africa; Oceania

- Browse content in N2 - Financial Markets and Institutions

- N20 - General, International, or Comparative

- N23 - Europe: Pre-1913

- N24 - Europe: 1913-

- N25 - Asia including Middle East

- N26 - Latin America; Caribbean

- Browse content in N3 - Labor and Consumers, Demography, Education, Health, Welfare, Income, Wealth, Religion, and Philanthropy

- N30 - General, International, or Comparative

- N32 - U.S.; Canada: 1913-

- N34 - Europe: 1913-

- Browse content in N4 - Government, War, Law, International Relations, and Regulation

- N43 - Europe: Pre-1913

- Browse content in N5 - Agriculture, Natural Resources, Environment, and Extractive Industries

- N50 - General, International, or Comparative

- N51 - U.S.; Canada: Pre-1913

- N52 - U.S.; Canada: 1913-

- N55 - Asia including Middle East

- N7 - Transport, Trade, Energy, Technology, and Other Services

- Browse content in N8 - Micro-Business History

- N80 - General, International, or Comparative

- Browse content in O - Economic Development, Innovation, Technological Change, and Growth

- Browse content in O1 - Economic Development

- O10 - General

- O11 - Macroeconomic Analyses of Economic Development

- O12 - Microeconomic Analyses of Economic Development

- O13 - Agriculture; Natural Resources; Energy; Environment; Other Primary Products

- O14 - Industrialization; Manufacturing and Service Industries; Choice of Technology

- O15 - Human Resources; Human Development; Income Distribution; Migration

- O16 - Financial Markets; Saving and Capital Investment; Corporate Finance and Governance

- O17 - Formal and Informal Sectors; Shadow Economy; Institutional Arrangements

- O18 - Urban, Rural, Regional, and Transportation Analysis; Housing; Infrastructure

- O19 - International Linkages to Development; Role of International Organizations

- Browse content in O2 - Development Planning and Policy

- O20 - General

- O23 - Fiscal and Monetary Policy in Development

- O24 - Trade Policy; Factor Movement Policy; Foreign Exchange Policy

- O25 - Industrial Policy

- Browse content in O3 - Innovation; Research and Development; Technological Change; Intellectual Property Rights

- O30 - General

- O31 - Innovation and Invention: Processes and Incentives

- O32 - Management of Technological Innovation and R&D

- O33 - Technological Change: Choices and Consequences; Diffusion Processes

- O34 - Intellectual Property and Intellectual Capital

- O35 - Social Innovation

- O38 - Government Policy

- O39 - Other

- Browse content in O4 - Economic Growth and Aggregate Productivity

- O40 - General

- O41 - One, Two, and Multisector Growth Models

- O43 - Institutions and Growth

- O44 - Environment and Growth

- O47 - Empirical Studies of Economic Growth; Aggregate Productivity; Cross-Country Output Convergence

- Browse content in O5 - Economywide Country Studies

- O50 - General

- O51 - U.S.; Canada

- O52 - Europe

- O53 - Asia including Middle East

- O54 - Latin America; Caribbean

- O55 - Africa

- Browse content in P - Economic Systems

- Browse content in P0 - General

- P00 - General

- Browse content in P1 - Capitalist Systems

- P10 - General

- P11 - Planning, Coordination, and Reform

- P12 - Capitalist Enterprises

- P13 - Cooperative Enterprises

- P14 - Property Rights

- P16 - Political Economy

- P17 - Performance and Prospects

- Browse content in P2 - Socialist Systems and Transitional Economies

- P20 - General

- P21 - Planning, Coordination, and Reform

- P25 - Urban, Rural, and Regional Economics

- Browse content in P3 - Socialist Institutions and Their Transitions

- P30 - General

- P31 - Socialist Enterprises and Their Transitions

- P32 - Collectives; Communes; Agriculture

- P35 - Public Economics

- P36 - Consumer Economics; Health; Education and Training; Welfare, Income, Wealth, and Poverty

- P37 - Legal Institutions; Illegal Behavior

- Browse content in P4 - Other Economic Systems

- P40 - General

- P41 - Planning, Coordination, and Reform

- P46 - Consumer Economics; Health; Education and Training; Welfare, Income, Wealth, and Poverty

- P48 - Political Economy; Legal Institutions; Property Rights; Natural Resources; Energy; Environment; Regional Studies

- Browse content in P5 - Comparative Economic Systems

- P50 - General

- P51 - Comparative Analysis of Economic Systems

- P52 - Comparative Studies of Particular Economies

- Browse content in Q - Agricultural and Natural Resource Economics; Environmental and Ecological Economics

- Browse content in Q0 - General

- Q00 - General

- Q01 - Sustainable Development

- Browse content in Q1 - Agriculture

- Q15 - Land Ownership and Tenure; Land Reform; Land Use; Irrigation; Agriculture and Environment

- Q18 - Agricultural Policy; Food Policy

- Browse content in Q3 - Nonrenewable Resources and Conservation

- Q30 - General

- Browse content in Q4 - Energy

- Q41 - Demand and Supply; Prices

- Q42 - Alternative Energy Sources

- Q48 - Government Policy

- Browse content in Q5 - Environmental Economics

- Q50 - General

- Q54 - Climate; Natural Disasters; Global Warming

- Q56 - Environment and Development; Environment and Trade; Sustainability; Environmental Accounts and Accounting; Environmental Equity; Population Growth

- Q57 - Ecological Economics: Ecosystem Services; Biodiversity Conservation; Bioeconomics; Industrial Ecology

- Browse content in R - Urban, Rural, Regional, Real Estate, and Transportation Economics

- Browse content in R0 - General

- R00 - General

- Browse content in R1 - General Regional Economics

- R10 - General

- R11 - Regional Economic Activity: Growth, Development, Environmental Issues, and Changes

- R12 - Size and Spatial Distributions of Regional Economic Activity

- R15 - Econometric and Input-Output Models; Other Models

- Browse content in R2 - Household Analysis

- R20 - General

- Browse content in R3 - Real Estate Markets, Spatial Production Analysis, and Firm Location

- R30 - General

- R31 - Housing Supply and Markets

- R4 - Transportation Economics

- Browse content in R5 - Regional Government Analysis

- R51 - Finance in Urban and Rural Economies

- R58 - Regional Development Planning and Policy

- Browse content in Y - Miscellaneous Categories

- Browse content in Y1 - Data: Tables and Charts

- Y10 - Data: Tables and Charts

- Browse content in Y3 - Book Reviews (unclassified)

- Y30 - Book Reviews (unclassified)

- Browse content in Y8 - Related Disciplines

- Y80 - Related Disciplines

- Browse content in Z - Other Special Topics

- Browse content in Z0 - General

- Z00 - General

- Browse content in Z1 - Cultural Economics; Economic Sociology; Economic Anthropology

- Z10 - General

- Z11 - Economics of the Arts and Literature

- Z12 - Religion

- Z13 - Economic Sociology; Economic Anthropology; Social and Economic Stratification

- Z18 - Public Policy

- Browse content in Z2 - Sports Economics

- Z29 - Other

- Advance articles

- Editor's Choice

- Author Guidelines

- Submission Site

- Open Access

- About Cambridge Journal of Economics

- About the Cambridge Political Economy Society

- Editorial Board

- Advertising and Corporate Services

- Self-Archiving Policy

- Dispatch Dates

- Terms and Conditions

- Journals on Oxford Academic

- Books on Oxford Academic

Article Contents

1. introduction, 2. the united nature of heterodox economics, 3. the divided practice of heterodox economists, 4. conclusion, acknowledgements, bibliography, the nature of heterodox economics revisited.

- Article contents

- Figures & tables

- Supplementary Data

Yannick Slade-Caffarel, The nature of heterodox economics revisited, Cambridge Journal of Economics , Volume 43, Issue 3, May 2019, Pages 527–539, https://doi.org/10.1093/cje/bey043

- Permissions Icon Permissions

This paper revisits the conception of heterodox economics advanced by Tony Lawson in 2006 and critically assesses its reception. I consider the bearing of later contributions—most importantly, his 2013 paper ‘What is this “school” called neoclassical economics’—in which Lawson further develops his analysis of heterodox economics. The goal is to provide additional clarity to the discussion.

Amongst the contributions that Tony Lawson has made to the study of economics, there is a thesis that could be characterised as central to it all: the problem with mainstream economics is that its defining characteristic—an ‘insistence on mathematical modelling’—presupposes a vision of social reality that is inconsistent with how social reality really is ( Lawson, 2006 , p. 465). 1 This thesis is underpinned by a conception of social ontology that Lawson has elaborated and defended over the past 20 years, an outline of how he understands social reality really to be. 2

Lawson argues that social scientists should seek out methods of analysis that are appropriate for studying the social realm. By this, he means that the methods employed by a researcher studying the social realm should be relevant to what we know, or hold as our most explanatorily successful account, of the nature of social reality. Lawson argues that mainstream economics, by insisting on the use of mathematical modelling to study the social realm, does not do this.

His justification of this assessment, and his solution to the problem, come by way of providing a detailed description of the nature and broad contours of social reality. This account of social reality serves as a starting point, and a benchmark, from and against which we can build, and make normative claims with regards to, methods for studying social phenomena. In other words, by providing an explanatorily powerful account of the nature of social reality, Lawson hopes to contribute to the possibility that social scientists may choose and develop increasingly appropriate methods for studying the social realm.

Within the discipline of economics, those towards which Lawson’s arguments primarily are directed are heterodox economists and students. Lawson considers the mainstream of economics to be, quite frankly, a lost cause. So, heterodox economists and students are, he believes, the best and seemingly only hope if economics is to improve its explanatory relevance. However, the prevailing belief amongst heterodox economists is that there is no real identifiable coherence to the disparate collection of schools of thought housed under the banner of heterodoxy other than perhaps their common opposition to the mainstream 3 :

Current heterodox economics would consist, therefore, of all the schools of thought and approaches that differ from [...] the mainstream [...]. [...] For many scholars with whom I tend to concur, the current period seems to be one of these cases in which there are no significant ideas common to all heterodox approaches or schools of thought. ( Dequech, 2007 , p. 298)

And some have even gone so far as to suggest that not even this opposition to the mainstream is a source of real commonality:

[W]ithin the self-identified community of self-identified heterodox economists there is little agreement as to whether members are pluralist, or what their attitude is to the mainstream. Indeed, there is little agreement on any core concepts or principles. […] Based on this study, heterodox economics appears a complex web of interacting individuals and as a group is a fuzzy set. ( Mearman, 2011 , p. 480)

All this, if true, does not provide a strong basis for building coherent, positive, reform. In contrast, Lawson (2006) presents a view that there is indeed a larger coherence to heterodox economics. The nature of heterodox economics, he argues, is a shared commitment to a social ontology of the type that he has elaborated and defended. This is an assessment that, although influential, has, since it was proposed, by no means replaced the prevailing view. It has even been suggested that this fact is enough to argue for the inadequacy of Lawson’s thesis ( Hodgson, 2017 ).

Clearly a consensus, or lack of one, says nothing per se about accuracy. In my view, an important reason for the lack of uptake has been the mistaken interpretation that Lawson’s thesis implies that heterodox economists never, and ought never to, use mathematical models, whilst it is an empirical fact that many economists who consider themselves heterodox clearly do. It is perhaps understandable that this has been a common interpretation of Lawson’s position. Lawson’s 2006 assessment is made in an uncharacteristically positive fashion and expressed in a rather broad manner, which I will detail below.

However, this perceived problem also follows a pattern of misunderstanding with regard to Lawson’s views on the use of mathematical modelling. Lawson is regularly accused of upholding an anti-mathematics stance. And it is often claimed that his critique of mainstream economics implies that there should be no mathematical modelling by economists whatsoever. But this, as I will take the time to show below, is simply not the case. Rather, Lawson’s argument is one that is about understanding the contexts in which the use of mathematical modelling is appropriate.

When misrepresentations are left unchallenged, they may start to be taken as fact. It is, therefore, important to provide clarification. As I will show, Lawson’s assessment of heterodox economics does not imply that if an economist uses mathematical modelling then they are necessarily mainstream. Whilst this can perhaps be read into Lawson (2006) , later papers do give a fuller picture of his conception of heterodox economics. Specifically, Lawson (2013) observes that many heterodox economists do indeed use mathematical modelling, a method that is largely inconsistent with the conception of social ontology he defends, whilst arguing that, for reasons I will elaborate below, such economists are still committed to that ontological conception.

I will proceed by first outlining the manner in which Lawson (2006) arrives at his thesis regarding heterodox economics. I will then demonstrate how arguments made in Lawson (2013) clarify his views on the use of mathematical modelling by heterodox economists. Finally, I will show that Lawson’s assessment allows for heterodox economists who use mathematical modelling, whilst also identifying why this is, in most cases, inappropriate. Indeed, this is the strength of Lawson’s thesis.

Due to mistaken interpretation, I believe that the importance of this contribution has not been fully appreciated. Therefore, it warrants revisiting. When properly understood, Lawson’s conception of the nature of heterodox economics is powerful as it is able to coherently capture the current variety of approaches categorised as heterodox, explain why a distinction between the heterodoxy and the mainstream is still justified, whilst also providing a clear avenue towards improving the general explanatory success of contributions made by heterodox economists.

[H]eterodox economics is, in the first instance, an orientation in ontology ( Lawson, 2006 , p.498)

The assessment at which Lawson (2006) arrives is that what unites heterodox economics is a common, if implicit, commitment to a conception of social reality such as that which he defends:

[S]omething like the alternative ontology described [...] systematises the implicit preconceptions of the various heterodox traditions, and ultimately explains their enduring opposition to the mainstream. ( Lawson, 2006 , p. 497)

How does he get there? Lawson sets out to counter the aforementioned idea that heterodox economics is only united, if at all, by its enduring opposition to mainstream economics:

[W]e appear to reach an apparently widely shared assessment of heterodox economics only in terms of what it is not, or rather in terms of that to which it stands opposed; the one widely recognised and accepted feature of all the heterodox traditions is a rejection of the modern mainstream project. ( Lawson, 2006 , p. 485)

Lawson, however, quickly points out that this shared assessment does not say much more than a dictionary definition of the term heterodox:

According to the Shorter Oxford English Dictionary , for example, the qualification heterodox just means ‘[n]ot in accordance with established doctrines or opinions, or those generally recognised as orthodox’. ( Lawson, 2006 , p. 486)

Lawson’s aim is to take our understanding further, towards deeper factors that, he argues, underpin this opposition. Importantly, Lawson observes that this opposition is approved by heterodox economists, continually, and across the board:

[T]he phenomenon to explain is not just that a heterodox opposition exists, but that it is, as noted, relatively widespread, firm, often highly vocal and enduring. ( Lawson, 2006 , p. 492)

As such, he reasons that there must be something common to all mainstream contributions to account for all the features towards which the heterodoxy aim their opposition:

[A]n explicit rejection of orthodoxy in any sphere is presumably undertaken for certain reasons. And a sustained opposition, such as we find in modern economics, leads us to expect that the reasons for resistance are deep ones. Further, in addition to explicitly formalised grounds for an opposition to any orthodoxy, there are often other less-than-clearly-unrecognised presuppositions. I think this is so with heterodox economics [...]. ( Lawson, 2006 , p. 486)

Therefore, the question becomes: is there anything common to all mainstream contributions? Lawson answers that there is indeed a unifying characteristic to mainstream economics:

I believe there is a feature of modern mainstream economics that is essential to it. And it is an aspect so taken for granted that it goes largely unquestioned. This is just the formalistic-deductive framework that mainstream economists everywhere adopt, and indeed insist upon. […] The truth is that modern mainstream economics is just the reliance on certain forms of mathematical (deductivist) method. ( Lawson, 2006 , pp. 488–89)

Heterodox economics has shown itself to be, and is, more or less by definition, the collection of approaches that are opposed to mainstream economics. Consequently, on the surface, Lawson argues, it stands to reason that it is towards this methodological dogma that heterodox economics is collectively opposed:

If [heterodox economics] […] is first and foremost a rejection of modern mainstream economics […] then heterodox economics, in the first instance, is just a rejection of [the insistence that forms of mathematical-deductive method should everywhere be utilised]. Notice that this does not amount to a rejection of all mathematical-deductive modelling. But it is a rejection of the insistence that we all always and everywhere use it. In other words, heterodox economics, in the first instance, is a rejection of a very specific form of methodological reductionism. It is a rejection of the view that formalistic methods are everywhere and always appropriate. ( Lawson, 2006 , p. 492)

Lawson (2006 , p. 494), then argues that ‘any presumption of the universal relevance of mathematical-modelling methods […] ultimately presupposes the ubiquity of strict event regularities’. That is, a closed system of isolated atoms, where the term ‘atom’ means factors or:

[I]tems which exercise their own separate, independent and invariable (and so predictable) effects (relative to, or as a function of, initial conditions). ( Lawson, 2006 , p. 494)

Therefore, underlying all mainstream economics are ontological presuppositions that the world is characterised by strict or probabilistic event regularities, which are guaranteed only if human beings and any other agents are formulated in terms of isolated atoms. His critique of mainstream economics is, in the simplest terms, that this ontology does not generally seem to be how social reality really is:

[A] world of isolated atoms [...] may actually be rather rare in the social realm. I draw this conclusion on the basis of an (a posteriori derived) theory of social ontology, a conception of the nature of the material of social reality [...]. ( Lawson, 2006 , p. 495)

It is, however, important to clarify what Lawson means exactly by his opposition to the ‘insistence’ on mathematical modelling and the fact that ‘this does not amount to a rejection of all mathematical deductive modelling’. Lawson takes great care regularly to reiterate that his ‘argument is not at all an anti-mathematics one; and it never has been’ ( Lawson, 2004 ). What then is Lawson’s position exactly? The answer begins with the fact that mathematical modelling, like all methods, has ontological presuppositions:

[A]ll methods have ontological presuppositions or preconditions, that is conditions under which their usage is appropriate. To use any research method is immediately to presuppose a worldview of sorts. [...] [M]ethods of mathematical-deductivist modelling, like all methods, do have ontological presuppositions. ( Lawson, 2003 , p. 12)

Therefore, Lawson argues, as with any method, the use of mathematical modelling is appropriate only in certain contexts:

I recognise that all tools, including mathematical ones, are limited in their scope of application […] and that the relevance of mathematics in any specific application depends on the context-specific merits of the case. ( Lawson, 2009d , p. 190)

Methods of mathematical modelling, Lawson argues, are appropriate only when their ontological presuppositions are consistent with the nature of the stuff being studied: phenomena generated in closed systems of isolated atoms, where a closed system is the term Lawson uses for any situation in which an event regularity occurs. And, as Lawson argues, this is the case for all mathematical modelling of the sort pursued by economists regardless of how apparently complex the model might be:

Consider complexity theory […]. Its implicit ontology is still one of closed systems of isolated atoms. […] [T]he path mapped out in any simulation will be irreversible. But there is no history, no time and no real process. There is merely a one-way relationship. If we consider the functional relationship y = x 2 , then we find that for any given value of x we can determine a unique value of y , but we cannot take the reverse path, a given value of y does not lead us “back” to a unique x . Complexity economics, as it stands, is merely a complex version of such a functional relationship. […] [T]he ontology is clearly still one of isolated atoms. ( Lawson, 2009c , p. 104)

Therefore, for Lawson, the only context in which it is appropriate to use such mathematical modelling—of any level of complexity—is in the analysis of closed systems of isolated atoms, and, as Lawson observes, this seems to be a rare occurrence in the social realm. However, that is not to say that Lawson rules out the possibility of local closures occurring, nor does he wish to preclude an ontologically aware experimentation with the use of mathematical modelling:

To date, formalistic methods that presuppose an atomistic ontology have met with very little success, and from the perspective of the ontological framework I defend, this is none too surprising. But even if the ontology I defend is roughly right, there may yet be pockets of social reality that provide the appropriate conditions for successes with formalistic modelling […]. ( Lawson, 2009c , p. 121) [O]ntological argument (even if correct – and like everything else it is fallible) cannot establish that localised closures may not occur here and there. So not only do I not criticise explorative endeavour, I do not rule out the idea that the use of standard econometric methods may occasionally prove useful either […]. ( Lawson, 2009b , p. 312)

It is clear, then, that Lawson is not against mathematical modelling. Rather, he is against any dogmatic insistence on it, and he is for restricting its use to contexts where it is appropriate: closed systems of isolated atoms. That said, Lawson does consider that any sustained successful use of mathematical modelling to study the social world is unlikely, and he acknowledges that were this to occur it would likely require some substantial revisions to his social ontology:

To put the matter bluntly (the pun may be useful), it is like attempting to cut the grass with a hammer or a piece of paper. The latter objects have their uses, but mowing the lawn is not one of them. Methods of applied mathematics of the sort economists wield have their uses, but illuminating social reality is not one of them, or at best, is so only in exceptional circumstances. I hope that it is clear that this explanation, whether correct or not, reflects a stance that is not anti-mathematics but anti a mismatch of tool and object – and so, given the circumstances, anti the abuse of mathematics. ( Lawson, 2017b , p. 27)

This assessment rests upon his arguments about the nature of the social realm. So how does Lawson suppose social reality to exist? Lawson broadly upholds that social reality is in some sense brought into existence by, and depends on, human beings. It emerges from, and is reproduced and transformed by, our interactions. Social structures are the transformed and/or reproduced results of socio-historically specific social relations between human beings. And concurrently these social structures have a power of conditioning over the actions of human beings who, in turn, transform and reproduce them. It is a never-ending dynamic back and forth. According to this conception of social ontology, any occurrence of strict or probabilistic event regularities would, if present at all, be very limited; social reality is fundamentally open ( Lawson, 2006 , 2012 , 2015a ).

As already noted, Lawson proposes that it is something like this social ontology that unites heterodox economics:

My claim is that something like the alternative ontology described above [...] systematises the implicit preconceptions of the various heterodox traditions, and ultimately explains their enduring opposition to the mainstream. […] [T]he post-Keynesian emphasis on fundamental uncertainty is easily explained if openness is a presupposition, just like the institutionalist emphasis on evolutionary method and on technology as a dynamic force […] are explained if it is presupposed that the social system is a process, and the feminist emphasis on caring and interdependence presupposes an ontology of internal relationality, amongst other things. The dominant emphases of the separate heterodox traditions, in other words, are just manifestations of categories of social reality that conflict with the assumption that social life is everywhere composed of isolated atoms; as I say, they are categories best explained by an implicit attachment to something like the social ontology outlined above. ( Lawson, 2006 , p. 497) [M]odern heterodoxy is […] first and foremost an orientation in ontology. It is to be distinguished from the mainstream by its willingness to approach theory and method in a manner informed by the available insights into the nature of social reality. ( Lawson, 2006 , p. 502)

Lawson argues that if the social ontology presupposed by mainstream economics is one of a ubiquity of closed systems couched in terms of human beings interpreted as isolated atoms, then any sustained heterodox opposition to the mainstream is likely grounded in something like the conception of social ontology that he defends, whether this is fully appreciated and explicitly acknowledged, or not. Lawson argues that heterodox economists reveal an at least implicit commitment to the ontology defended because the main categories he observes are used in heterodox research all require the world to exist in a manner similar to how he has described it.

One of the strengths of Lawson’s assessment here is that whilst it focusses on what unites heterodox economics, it also serves to clarify what is distinctive about the various heterodox traditions, that is, they focus on different aspects of this shared underlying conception of social ontology. And finally, Lawson argues that it is due to a shared belief that the world exists in a fashion similar to how he has described it that heterodox economists are generally more open to studying the world in a variety of ways that attempt to take into account the open reality of social existence. This, accordingly, explains why most heterodox economists express support for a greater pluralism of method.

Lawson’s motivation for writing the 2006 article appears to have been to counteract the still popular idea that there is no real unity amongst the different approaches that are collected under the banner of heterodox economics. Lawson was convinced that there is something fundamentally different between mainstream and heterodox economics. In 2006, he wished to explain the situation as he found it: despite ostensibly large differences, it was possible to discuss the variety of philosophical and methodological issues that plague economics with those economists that call themselves heterodox. With those who identified as mainstream, these discussions had been all but impossible.

Lawson (2006) represents an attempt to provide an ontological explanation for this phenomenon. In this, Lawson seeks to differentiate heterodox economics as clearly as possible from mainstream economics. And, as I will now discuss, the strength of the contribution comes from achieving this whilst managing to encompass the full range of approaches that make up heterodox economics. Moreover, the understanding of heterodoxy provided does not impede critique and, if anything, is useful in pinpointing precisely the problems that have held heterodox economics back from achieving greater explanatory success.

Several years after the publication of the paper outlining his thesis on the nature of heterodox economics, Lawson took up a project in which he systematically focussed on contributions that revealed an inconsistency or tension between the methods employed and the conception of social ontology to which the contributors otherwise seemingly subscribed. A paper in which he presents some of the assessments derived from this research, entitled ‘What is this “school” called neoclassical economics’, proposes that the term ‘neoclassical’, as it was intended by the economist Thorstein Veblen, who coined it, refers precisely to this type of inconsistency. In it, Lawson observes that many heterodox economists do, indeed, make use of mathematical modelling in their research:

[A] good deal of sustained heterodox research is couched in conceptual frameworks consistent with the sort of causal-processual ontological conception just described. All too often, however, this goes hand in hand with a lack of realisation that methods of mathematical modelling require formulations that are in severe tension with this ontology. This lack of realisation both underpins a misapprehension of the source of the unrealistic nature of many competing claims, as well as the recourse of many heterodox economists to using mathematical modelling methods in seeking to advance insights obtained by other means. ( Lawson, 2013 , p. 957)

As I will show, although this does not undermine his earlier assessment, it does provide an important development by clearly acknowledging that there is a problem posed by the fact that, within the heterodoxy, many contributors make significant use of mathematical modelling. Lawson does, of course, consider this sustained use of mathematical modelling to be a problem—a ‘lack of realisation’, as he terms it. As such, an aim in his 2013 paper is to differentiate explicitly between those heterodox contributions where methods are consistent with the more sustainable social ontology that he has described and defended and those where they are not.

In the later paper, Lawson proposes that the term ‘neoclassical’, in its Veblenian sense, is perhaps appropriately used to refer to heterodox economists who employ mathematical modelling:

I am suggesting that Veblen introduces the term “neoclassical” to distinguish a line of thinking that is ultimately characterised by possessing a degree of ontological awareness whilst persevering with a methodology inconsistent with this awareness; it is a line of thinking identified precisely by this ontological/methodological tension or inconsistency. ( Lawson, 2013 , p. 971)

Using this distinction, Lawson identifies three different categories of economists, specifically, mainstream economists along with two strands of heterodox economists. The latter, I believe, might be best labelled consistent heterodox economists and inconsistent heterodox economists. Indeed, Lawson also refers in later contributions to the consistent heterodoxy:

Not all heterodox economists adopt methods consistent with ontological presuppositions they appear (at least in a general way) to support. Some do – the consistent heterodoxy. Others do not, in particular those that focus heavily on mathematical modelling. So, coherence is not complete. ( Lawson, 2018c )

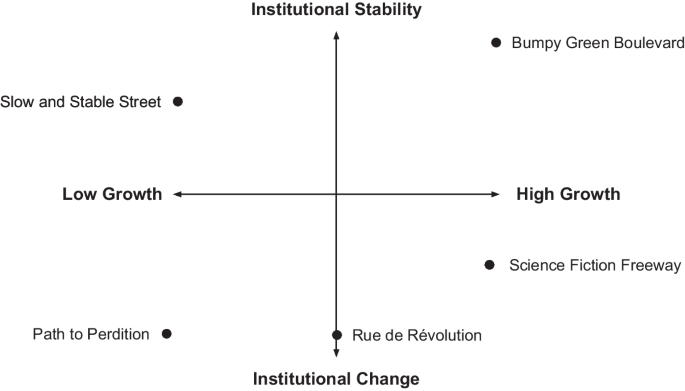

The inconsistent heterodox category then matches Lawson’s Veblenian notion of neoclassical, and was provisionally referred to as such by Lawson (2013) before he concludes by suggesting we might ultimately drop the term. These distinctions are expressed as follows, with category (1) referring to mainstream economists, category (2) referring to consistent heterodox economists, and category (3) referring to inconsistent heterodox economists:

(1) […] a group dominated in modern times by those that accept mathematical deductivism as an orientation to science for us all, and [...] effectively regard any stance that questions this approach, whatever the basis, as inevitably misguided. (2) those who are aware that social reality is of a causal-processual nature as elaborated above, who prioritise the goal of being realistic, and who fashion methods in the light of this ontological understanding and thereby recognise the limited scope for any […] science […] that relies on methods of mathematical deductive modelling. (3) those who are aware (at some level) that social reality is of a causal-processual nature as elaborated above, who prioritise the goal of being realistic, and yet who fail themselves fully to recognise or to accept the limited scope for any […] approach […] that makes significant use of methods of mathematical deductive modelling. ( Lawson, 2013 , p. 979)

The question of the group of economists referred to in category (3) has been the subject of some dispute. 4 So, let me explain why I consider that, for Lawson, category (3) refers only to confused, inconsistent, heterodox economists, as I have suggested above, rather than some group of potentially enlightened mainstream economists.

Lawson’s assessment of mainstream economics is that it is the approach that insists on the universal application of mathematical-deductivist method—the description of category (1). Lawson’s assessment of heterodox economics is that it covers all those approaches that at least implicitly accept a social ontology similar to that which he describes and defends, which covers categories (2) and (3). For category (2), Lawson formulates this commitment as being ‘aware that social reality is of a causal-processual nature’. For category (3), he states it as being, ‘aware (at some level) that social reality is of a causal-processual nature’ ( Lawson, 2013 , p. 979). Both of these formulations fit Lawson’s assessment of heterodox economics, but not of mainstream economics, which Lawson argues is entirely unaware of, or unconcerned about, such matters.

Indeed, in the end, Lawson decides that he does not in fact believe that it is appropriate to denote any school of thought by an inconsistency. And he suggests that we give up the term neoclassical:

[R]ather than distinguish/identify a group on the grounds of a fundamental inconsistency in (ontological) theory and (methodological) practice, the term neoclassical economics should be dropped from the literature. ( Lawson, 2013 , p. 980)

Without the term ‘neoclassical’, what remains is the important assessment that heterodox economics, distinguished as all those approaches that accept, at least implicitly, a social ontology similar to that defended by Lawson, is divided between those who make significant use of mathematical modelling and those who use methods that are consistent with the social ontology Lawson defends. Heterodox economics, according to Lawson, exists in two groups: consistent heterodox economists and inconsistent heterodox economists.

The development made in Lawson (2013) to the assessment of heterodox economics in Lawson (2006) is to clearly acknowledge that there is a serious problem posed by the fact that some, and perhaps many, heterodox researchers now make significant use of mathematical modelling, which was left mostly unsaid in 2006. Perhaps then, due to not making this explicit, and to the various misinterpretations that persist regarding Lawson’s views with regards to mathematics, it has been widely thought that economists who use mathematical modelling cannot, according to Lawson’s thesis, be heterodox at all. This, however, for Lawson, is not the case.

Lawson believes that there is a ‘coherent core’ of heterodox economists who employ methods that are consistent with the social ontology they implicitly advance. However, Lawson also acknowledges that many also use mathematical modelling, a method that presupposes a social ontology that is in severe tension with it ( Lawson, 2013 , p. 979). Therefore, I repeat, Lawson proposes that heterodox economists in fact exist in two groups, those who use methods consistent with the social ontology they are committed to, and those who do not. But all are heterodox economists.

Lawson’s hope is that by making the kind of social ontology presupposed by mathematical modelling clear, heterodox economists will increasingly review the legitimacy of the modelling approach. However, Lawson still considers those who make such a methodological mistake to be heterodox economists. For they still, he argues, are committed to the social ontology he defends and always reveal it in some way in their analyses or pronouncements:

[T]he more sustainable causal ontology of openness, process, significant internal relationality and so on is nevertheless regularly, if often only implicitly, recognised, most especially by heterodox practitioners. Or at least this alternative social ontology is often acknowledged in some manner within heterodox pronouncements and more general forms of reasoning. ( Lawson, 2013 , pp. 956–57)

Heterodox economists, so identified, then employ a diversity of methods, including mathematical modelling, which is consistent with the current reality of this diverse grouping. Indeed, pluralism is a crucial but often unacknowledged element of Lawson’s assessment of heterodox economics, and one that further clarifies his position with regard to mathematics:

[M]ost heterodox economists seemingly embrace the idea of pluralism. The need for pluralism, however, applies not just at the level of substantive theorising and policy formulation, but also at the level of method, with informed choices necessitating philosophical reflection and analysis. As I have often repeated, there is no need to exclude methods of mathematical modelling from the tool box; but there are many other methods and approaches that can be fruitfully (and with greater reason) included. A reliance upon any warrants explanation. ( Lawson, 2017b , p. 40)

However, the fact that some, and perhaps many, economists in this grouping make sustained usage of methods of mathematical modelling is not, for Lawson, desirable. In recent years, Lawson has been increasingly frustrated by the continued use of mathematical modelling by heterodox economists, as well as by movements towards its increased usage. 5 An argument made by such heterodox economists is that the problem identified by Lawson lies not with mathematical modelling per se but with the sort of mathematical methods used. They argue that poor mathematical modelling has been the problem and that better, more complex, models will be able to capture the reality of human existence.

Lawson clearly regards that methodological argument to be mistaken. For, as stated above, he finds that even complex mathematical models presuppose a closed system. However, he maintains that the social reality that such researchers reveal themselves to implicitly accept is at least quite similar to that which he defends. Their concern with being realistic, for one, speaks volumes. Therefore, these researchers should, he believes, still be distinguished from the mainstream.

This is the strength of Lawson’s assessment. It is powerful as it is able to encompass the wide variety of approaches that make up heterodox economics whilst also clearly identifying which of those economists are making inappropriate methodological choices. It is a conception that reflects the pluralist reality of heterodox economics and also provides a clear way forward towards improving the explanatory relevance of the discipline. Therefore, Lawson, in his most recent contributions, considers that those who ought to be engaged with most directly, in an attempt to improve the discipline, are heterodox economists that persistently use methods inconsistent with the social ontology in which they otherwise appear to believe.

Lawson’s view is that heterodox economists are best differentiated from the mainstream on the basis of an at least implicit acceptance of a social ontology such as he describes. However, he observes that often, this commitment does not translate to the use of methods that presuppose a consistent world view. Lawson’s assessment should not be mistaken as evidence that he believes all is well in heterodox economics. Indeed, Lawson’s picture of heterodox economics is multifaceted. Although he still considers many who use mathematical models to be heterodox economists, he does not consider them to be contributing to the improvement of economics.

‘[A]ll methods have ontological presuppositions’ and these are inescapable ( Lawson, 2003 , p. 12). So, if ontology is unavoidable, it is better to be explicit and knowingly coherent than implicit and likely not. Regardless of what some heterodox economists might otherwise believe, the sustained use of mathematical modelling presupposes closed systems of isolated atoms and is therefore largely inappropriate for studying social reality. For Lawson, the way forward is for heterodox economists to devise methods that are appropriate to their subject matter. Lawson’s conception of heterodox economics, when properly understood, is powerful as it at once accommodates the variety of approaches that are generally classified as heterodox, identifies what he considers to be their major problem and points to a way forward.

What practical implications follow from this? First, let me indicate what does not. It should now be clear that Lawson does not argue for excluding mathematical models. Rather, as with all other methods, they should only be applied in conditions in which their use is appropriate, though admittedly Lawson does, as an empirical matter, assess the occurrence of the latter to be relatively rare. His stance is not anti-mathematical method but anti- mismatch of method and context of application. Second, although Lawson has argued that methods such as contrast explanation fit with the conception of social ontology defended, he does not suggest that it should always be employed. Like all methods, its use must be justified ( Lawson, 2009a ; Morgan and Patomäki, 2017 ). Furthermore, Lawson does not regard the conception of social ontology defended as infallible for ‘all knowledge is fallible and historically transient’ ( Lawson, 1997 , p. 246). Indeed, he has devoted much research to other contributions, drawing contrasts and exploring their relative explanatory power. He finds the account he defends to be superior so far. But that is all ( Fullbrook, 2009 ; Lawson, 2012 , 2016b , 2016c , 2016d , 2016e , 2018a , 2018b ; Searle, 2016 , 2017 ). What Lawson does argue for regarding practice is an explicit, systematic and sustained ontological awareness, which he believes can only improve the methodological choices of heterodox economists.

That said, no heterodox economist can ignore the institutional constraints that impede such ontologically aware methodological pluralism. There is immense pressure to publish and many journals only accept papers with mathematical modelling. However, whilst it is recognised that survival often requires compromise, Lawson argues that many forms of compromise do more harm than good. He is particularly critical of attempts to present mathematical models that have different or radical assumptions or conclusions as somehow a step forward, or even defining of heterodoxy:

Many [economists] even distinguish themselves as heterodox not by reducing their emphasis on mathematical modelling, but according to the sorts of policy conclusions (for example anti-austerity) they profess to support with their modelling. In so doing, of course, they are most of the time simply reproducing the typical mistakes made by most other modellers; their results, if left-leaning, or ‘alternative’, are mostly just as irrelevant because of the manner in which they are produced. ( Lawson, 2017b , p. 33)

Faced with a situation in which the large-scale transformation of academic economics seems very unlikely, Lawson has instead advocated committing available resources to forming highly protected sub-communities, which he calls ‘eudaimonic bubbles’, in which participants can act authentically. He believes this strategy would benefit in all walks of life in which there is a need to escape dominant forces regarded as harmful ( Lawson, 2017a ). In the case of heterodox economics, Lawson simply advocates that ontological awareness is key and that any increase in such reflection will be positive. However, he is under no illusion that a large-scale transformation of modern economics is imminent. Until it is, he argues that, practically, the best way forward is for heterodox economists to create bubbles in which ontological and methodological debate can flourish.

I would like to thank this journal’s editors and anonymous referees for their very helpful comments in developing this paper.

Arestis , P . 1990 . Post-Keynesianism: a new approach to economics , Review of Social Economy , vol. XLVIII , no. 3 , 222 – 46

Google Scholar

Blaug , M . 1996 . Economic Theory in Retrospect , Cambridge , Cambridge University Press

Google Preview

Colander , D. , Holt , R. and Rosser , B . 2004 . The changing face of mainstream economics , Review of Political Economy , vol. 16 , no. 4 , 485 – 99

Dequech , D . 2007 . Neoclassical, mainstream, orthodox, and heterodox economics , Journal of Post Keynesian Economics , vol. 30 , no. 2 , 279 – 302

Dow , S. C . 1992 . Post Keynesian school , pp. 176 – 207 in Mair , D. and Miller A . (eds), A Modern Guide to Economic Thought: An Introduction to Comparative Schools of Thought in Economics , Aldershot , Edward Elgar

Dow , S. C . 2011 . Heterodox economics: history and prospects , Cambridge Journal of Economics , vol. 35 , no. 6 , 1151 – 65

Fullbrook , E . (ed.) 2009 . Ontology and economics: Tony Lawson and his critics . New York , Routledge

Hodgson , G. M . 1989 . Post-Keynesian and institutionalism: the missing link , pp. 94 – 123 in Phelby J . (eds), New Directions in Post-Keynesian Economics , Aldershot , Edward Elgar

Hodgson , G. M . 2006 . Characterizing institutional and heterodox economics—a reply to Tony Lawson , Evolutionary and Institutional Economics Review , vol. 2 , no. 2 , 213 – 23

Hodgson , G. M . 2017 . The pathology of heterodox economics and the limits to pluralism , in Cambridge Realist Workshop , Cambridge , Clare College , 13 November 2017

Keen , S . 2011 . Debunking Economics: The Naked Emperor Dethroned? , London , Zed Book

Keen , S . 2017 . Can We Avoid Another Financial Crisis? , Malden , Polity

Lavoie , M . 1992 . Towards a new research programme for post-Keynesianism and new-Ricardianism , Review of Political Economy , vol. 4 , no. 1 , 37 – 78

Lawson , T . 1995 . A realist perspective on contemporary ‘Economic Theory’ , Journal of Economic Issues , vol. 29 , no. 1 , 1 – 32

Lawson , T . 1996 . Developments in economics as realist social theory , Review of Social Economy , vol. 54 , no. 4 , 405 – 22

Lawson , T . 1997 . Economics and Reality , London; New York , Routledge

Lawson , T . 1999 . What has realism got to do with it ?, Economics and Philosophy , vol. 15 , no. 2 , 269 – 82

Lawson , T . 2003 . Reorienting Economics , London; New York , Routledge

Lawson , T . 2004 . Reorienting economics: on heterodox economics, themata and the use of mathematics in economics , Journal of economic methodology , vol. 11 , no. 3 , 329 – 40

Lawson , T . 2006 . The nature of heterodox economics , Cambridge Journal of Economics , vol. 30 , no. 4 , 483 – 505

Lawson , T . 2009a . Applied economics, contrast explanation and asymmetric information , Cambridge Journal of Economics , vol. 33 , no. 3 , 405 – 19

Lawson , T . 2009b . Feminism, realism and essentialism: reply to van Staveren , pp. 311 – 24 in Fullbrook E . (ed.), Ontology and Economics: Tony Lawson and His Critics , New York , Routledge

Lawson , T . 2009c . Heterodox economics and pluralism: reply to Davis , pp. 93 – 129 in Fullbrook E . (ed.), Ontology and Economics: Tony Lawson and His Critics , New York , Routledge

Lawson , T . 2009d . On the nature and roles of formalism in economics: reply to Hodgson , pp. 189 – 231 in Fullbrook E . (ed.), Ontology and Economics: Tony Lawson and His Critics , New York , Routledge

Lawson , T . 2012 . Ontology and the study of social reality: emergence, organisation, community, power, social relations, corporations, artefacts and money , Cambridge Journal of Economics , vol. 36 , no. 2 , 345 – 85

Lawson , T . 2013 . What is this ‘school’ called neoclassical economics , Cambridge Journal of Economics , vol. 37 , no. 5 , 947 – 83

Lawson , T . 2015a . A conception of social ontology , pp. 19 – 52 in Pratten S . (ed.), Social Ontology and Modern Economics , London , Routledge

Lawson , T . 2015b . Essays on the Nature and State of Modern Economics , Abingdon; New York , Routledge, Taylor & Francis Group

Lawson , T . 2016a . Collective practices and norms , pp. 249 – 79 in Archer M. S . (ed.), Morphogenesis and the Crisis of Normativity , Switzerland , Springer

Lawson , T . 2016b . Comparing conceptions of social ontology: emergent social entities and/or institutional facts ?, Journal for the Theory of Social Behaviour , vol. 46 , no. 4 , 359 – 99

Lawson , T . 2016c . Ontology and social relations: reply to Doug Porpora and to Colin Wight , Journal for the Theory of Social Behaviour , vol. 46 , no. 4 , 438 – 49

Lawson , T . 2016d . Social positioning and the nature of money , Cambridge Journal of Economics , vol. 40 , no. 4 , 961 – 96

Lawson , T . 2016e . Some critical issues in social ontology: reply to John Searle , Journal for the Theory of Social Behaviour , vol. 46 , no. 4 , 426 – 37

Lawson , T . 2017a . Eudaimonic bubbles, social change and the NHS , pp. 239 – 61 in Archer M. S . (ed.), Morphogenesis and Human Flourishing , Switzerland , Springer

Lawson , T . 2017b . What is wrong with modern economics, and why does it stay wrong ?, Journal of Australian Political Economy , no. 80 , 26 – 42

Lawson , T . 2018a . The constitution and nature of money , Cambridge Journal of Economics , vol. 42 , no. 3 , 851 – 73

Lawson , T . 2018b . Debt as money , Cambridge Journal of Economics , vol. 42 , no. 4 , 1165 – 81

Lawson , T . 2018c . ‘ What Is Neoclassical Economics ?’ Lecture Notes, 15/02/2018, Economics Tripos Part IIA Paper 8, Issues in Social Ontology: University of Cambridge

Mearman , A . 2011 . Who do heterodox economists think they are ?, The American Journal of Economics and Sociology , vol. 70 , no. 2 , 480

Morgan , J . 2015 . What Is Neoclassical Economics?: Debating the Origins, Meaning and Significance , London , Routledge

Morgan , J. and H. Patomäki . 2017 . Contrast explanation in economics: its context, meaning, and potential , Cambridge Journal of Economics , vol. 41 , no. 5 , 1391 – 418

Pratten , S . 2015 . Social Ontology and Modern Economics , London; New York , Routledge, Taylor & Francis Group

Rutherford , M . 2000 . Understanding institutional economics: 1918–1929 , Journal of the History of Economic Thought , vol. 22 , no. 3 , 277 – 308

Rutherford , M . 2011 . The Institutionalist Movement in American Economics, 1918–1947: Science and Social Control , Cambridge , Cambridge University Press

Sawyer , M. C . 1988 . Post-Keynesian Economics , Aldershot , E. Elgar

Searle , J. R . 2016 . The limits of emergence: reply to Tony Lawson , Journal for the Theory of Social Behaviour , vol. 46 , no. 6 , 400 – 12

Searle , J. R . 2017 . Money: ontology and deception , Cambridge Journal of Economics , vol. 41 , no. 5 , 1453 – 70

Williamson , O . 1998 . Transaction cost economics: how it works; where it is headed , Quarterly Review of the Royal Netherlands Economic Association , vol. 146 , no. 1 , 23 – 58

For a detailed elaboration of this argument, see Lawson (1995 , 1996 , 1997 , 1999 , 2003 ).

For recent formulations of this conception of social ontology, see Lawson (2012 , 2015a , 2015b , 2016a , 2016b , 2016e ). For wider contributions to this description and a history of the Cambridge Social Ontology Group, see Pratten (2015) .

For a variety of examples of arguments that lean towards this point of view with regards to both heterodox economics and constituent schools of thought such as post-Keynesian economics and institutional economics, see Sawyer (1988) , Hodgson (1989 , 2006 ), Arestis (1990) , Dow (1992 , 2011 ), Lavoie (1992) , Colander et al . (2004) , Rutherford (2000 , 2011 ), Blaug (1996) , Williamson (1998) , Dequech (2007) and Mearman (2011) .

For more on Lawson’s conception of neoclassical economics, and on those of others, see Morgan (2015) .

For more, see Keen (2011 , 2017 ).

Email alerts

Citing articles via.

- Contact Cambridge Political Economy Society

- Recommend to your Library