Writing a Proper Essay on Cyber-Security in Banking Sector

The banking industry is very important for all people who deal with money. Banking systems throughout the globe regulate the monetary stability in a concrete country. Great unions regulate huge regions. Once a bank crashes, a country may live through a default, which means economic catastrophe. As the result, it involves other spheres and destabilizes normal life in general. One of the reasons that lead to problems is poor cybersecurity . This article concentrates on 6 good ways that help to improve cybersecurity in the banking sector.

Nowadays, cyber-attacks have increased many a time. This is a huge threat to every citizen of the Earth because privacy is violated. The threat becomes even more troublesome and dangerous when it involves cyber-attacks on banks. If you want to write an essay on the topic, but if seems too complicated for you, you can address professionals. Simply type write my essay for me by EssayHub in the search bar and find your essay helper!

Cybercriminals get directly into the pockets of citizens. This becomes possible due to multiple attacks of hackers on banks. The banking sector is of huge importance for the stability of people’s well-being. A hacker attack, which ruins the banking industry, leads to a dangerous destabilization of the economy of the country. Accordingly, it triggers lots of factors that affect other spheres of human activity. Such danger negatively affects business, education, culture, and so on. Attacks from hackers in the banking sector must be prevented and stopped. There are six measures, which can help to overcome this threatening situation.

1. The threat should be taken seriously.

Some banks strongly believe that they will never be robbed thanks to dependable safeguards and firewalls. They think that they are simply invisible. This makes them less cautious and actually irresponsible. They understand that their protective measures are weak when it’s too late. A solution is to fully realize all threats and accept the possibility of being attacked. Afterward, banks should implement new equipment to prevent dangers. No matter how good the equipment is, it should be constantly improved to stop new attempts, which become better each time.

2. Good analysis is required.

Banking protection systems compile data on various issues. This gives an opportunity to enhance every point to ensure safety, as well as other branches. One may simply say “Here is a problem and I have information about how to fix and improve it”. Unfortunately, tons of information isn’t analyzed properly. Regulators commonly don’t collect security data. As the result, there is no possibility to define the potential threats. It’s needed to change this function and gather all possible data. Thus, it will become much easier to foresee possible cyber assault.

3. All third-parties vendors must be verified.

They commonly give data on technology services. Nonetheless, the practice shows that they may open this data to other people, which sufficiently increases the risks. Other people may turn it to their advantage and steal money. Currently, this is a critical issue because there is no permission to verify third parties. The government should realize the risks and allow checking distributors of information in order to secure their own safety. Thus, the safety of banks will be enhanced as well.

4. Secure mobile operations.

Today, people actively use their cell phones for greater speed and comfort. It goes beyond all doubts that mobile banking is among them. Banks support this kind of access. People don’t have to stand in long queues while their turn comes. Banks thrive as well because they can make much more operations, which results in their prosperity at a great tempo. In the meanwhile, they don’t give enough heed to the security of mobile banking. It also requires modern equipment and advanced safeguards. Otherwise, clients become vulnerable to hacker attacks. Besides, banks are under a threat too.

5. Regulators should hire more IT specialists.

Currently, small and medium-sized banks aren’t protected properly. Commonly, they are considered to be units that are at low risk of attacks. IT specialists only make general analyses. This is a fatal mistake. Such banks are attacked on a constant basis. This inevitably leads to problems with bigger institutions. They become weaker. Banks should involve more experts to dig deeper into the slightest details.

6. The information on threats is supposed to be shared faster and with all the details.

People share information about potential hazards, but this process is way too slow and lacks details, which are crucial on such occasions. Once there appears suspicion, banks or clients don’t always have an immediate possibility to report the case. Sometimes, banks simply hide this data because they are afraid that their reputation will be shaken off. It’s much better to allow clients to share this vital information. This helps to prevent thousands of attacks annually.

The matter of banking security is important and it should be ensured in all possible ways and at any cost. There are at least six available variants. Unfortunately, some of them are disallowed. For example, banks hide or don’t compile data on cyber threats or the government doesn’t allow verifying third parties. Once these issues are solved, the danger of cyber-attacks will be significantly decreased”.

References:

- Anand, Priya. “6 ways the banking industry could improve on cybersecurity”. Marketwatch.com, https://www.marketwatch.com/story/6-ways-the-banking-industry-could-improve-on-cybersecurity-2015-07-02. 2015, 2 July.

- “How the Banking Industry is Fighting Cyber Crime”. Careersincybersecurity.com, https://careersincybersecurity.com/banking-industry-fighting-cyber-crime/. 2019

- Barnes, Samantha “HOW WILL BANKS ADDRESS GAPS IN CYBERSECURITY?” Internationalbanker.com, https://internationalbanker.com/technology/2017-will-banks-address-gaps-cybersecurity/. 2017, March 2.

For enquiries call:

+1-469-442-0620

Cybersecurity in Banking: Importance, Threats, Challenges

Home Blog Security Cybersecurity in Banking: Importance, Threats, Challenges

As we transition to a digital economy, cybersecurity in banking is becoming a serious concern. Utilizing methods and procedures created to safeguard the data is essential for a successful digital revolution. The effectiveness of cybersecurity in banks influences the safety of our Personally Identifiable Information (PII), whether it be an unintentional breach or a well-planned cyberattack.

The stakes are high in the banking and financial industry since substantial financial sums are at risk and the potential for significant economic upheaval if banks and other financial systems are compromised. With an exponential increase in financial cybersecurity, there is high demand for the profession of cybersecurity. Take a look at the best Security certifications .

What is Cybersecurity in Banking?

The arrangement of technologies, protocols, and methods referred to as "cybersecurity" is meant to guard against attacks, damage, malware, viruses, hacking, data theft, and unauthorized access to networks, devices, programs, and data.

Protecting the user's assets is the primary goal of cybersecurity in banking. As more people become cashless, additional acts or transactions go online. People conduct transactions using digital payment methods like debit and credit cards, which must be protected by cybersecurity.

.jpg&w=3840&q=75)

Current State of Cybersecurity in Banks

The market for IT security in banking has maintained its rapid growth in 2024. Since financial institutions are primary attack targets, investments in protection continue to scale. The market value reached $38.72 billion in 2021 , and projections see a compound growth rate of 22.4% and a value of $195.5 billion by 2029.

Between June 2018 and March 2022, Indian banks reported 248 successful data breaches by hackers and criminals; the government notified Parliament on Aug 2, 2022.

The Indian government has reported 11,60,000 cyber-attacks in 2022. It is estimated to be three times more than in 2019. India has been the target of serious cyberattacks, such as the phishing attempt that nearly resulted in a $171 million fraudulent transaction in 2016 against the Union Bank of India.

Another instance of a cyberattack involving online banking was Union Bank of India, resulting in a substantial loss. One of the officials fell for the phishing email and clicked on a dubious link, which allowed the malware to hack the system. The attackers entered the system using fake RBI IDs.

Banks have been mandated to strengthen their IT risk governance framework, which includes a mandate for their Chief Information Security Officer to play a proactive role in addition to the Board and the Board's IT committee playing a proactive role in ensuring compliance with the necessary standards.

Reasons Why Cybersecurity is Important in Banking

The banking industry has prioritized cybersecurity highly. Building credibility and trust is the cornerstone of banking, so it becomes much more essential. Here are five factors that demonstrate the significance of cybersecurity in the banking industry and why you should care:

- Everyone looks to be entirely cashless and using digital payment methods like debit and credit cards. In this case, ensuring that the required cybersecurity safeguards are in place to protect your privacy and data is critical.

- After data breaches, it could be difficult to trust financial institutions. That's a significant issue for banks. Data breaches caused by a shoddy cybersecurity solution may easily lead to their consumer base moving their business elsewhere.

- The majority of the time, when a bank's data is compromised, you lose time and money. Recovery from the same can be unpleasant and time-consuming. It would entail canceling cards, reviewing statements, and keeping a watchful lookout for issues.

- Inappropriate use of your private information might be very harmful. Your data is sensitive and could expose a lot of information that could be exploited against you, even if the cards are revoked and fraud is swiftly dealt with.

- Banks need to be more cautious than most other firms. That is the price for banks to retain the kind of valuable personal data they do. If the bank's information is not safeguarded against risks from cybercrime, it could be compromised.

.jpg&w=3840&q=75)

Top Cybersecurity Threats Faced by Banks

Cybercrimes have increased frequently over the past several years to the point where it is thought that they are one of the most significant hazards to the financial sector. Hackers have improved their technology and expertise, making it difficult for any banking sector to thwart the attack consistently. The following are some dangers to banks' cybersecurity:

1. Phishing Attacks

One of the most frequent problems with cybersecurity in the banking sector is phishing assaults. They can be used to enter a financial institution's network and conduct a more severe attack like APT, which can have a disastrous effect on those organizations ( Advanced Persistent Threat ). In an APT, a user who is not permitted can access the system and use it while going unnoticed for a long time. Significant financial, data and reputational losses may result from this. According to the survey , phishing assaults on financial institutions peaked in the first quarter of 2021.

The term "Trojan" is used to designate several dangerous tactics hackers use to cheat their way into secure data. Until it is installed on a computer, a Banker Trojan looks like trustworthy software. However, it is a malicious computer application created to access private data processed or kept by online banking systems. This kind of computer program has a backdoor that enables access to a computer from the outside.

Around the globe, there were roughly 54,000 installation packages for mobile banking trojans in the first quarter of 2022. There has been an increase of more than 53% compared to last year's quarter. After declining for the first three quarters of 2021, the number of trojan packages targeting mobile banking increased in the fourth quarter.

3. Ransomware

A cyber threat known as ransomware encrypts important data and prevents owners from accessing it until they pay a high cost or ransom. Since 90% of banking institutions have faced ransomware in the past year, it poses a severe threat to them.

In addition to posing a threat to financial cybersecurity, ransomware also affects cryptocurrency. Due to their decentralized structure, cryptocurrencies allow fraudsters to break into trading systems and steal money.

4. Spoofing

Hackers use a clone site in this type of cyberattack. By posing as a financial website, they;

- Design a layout that resembles the original one in both appearance and functionality.

- Establish a domain with a modest modification in spelling or domain extension.

The user can access this duplicate website via a third-party messaging service, such as text or email. Hackers can access a user's login information when the person is not paying attention. Seamless multi-factor authentication can solve a lot of these issues.

The Reserve Bank of India (RBI) reported bank frauds of 604 billion Indian rupees in 2022. From more than 1.3 trillion rupees in 2021, this was a decline.

Applications of Cybersecurity in Banking

Cybersecurity threats are constantly evolving, and the banking sector must take action to protect itself. Hackers adapt when new defenses threaten more recent attacks by developing tools and strategies to compromise security. The financial cybersecurity system is only as strong as its weakest link. It is critical to have a selection of cybersecurity tools and approaches available to protect your data and systems. Here are a few crucial cybersecurity tools:

1. Network Security Surveillance

Network monitoring is known as continuously scanning a network for signs of dangerous or intrusive behavior. It is frequently utilized with other security solutions like firewalls, antivirus software, and IDS ( Intrusion Detection System ). The software allows for either manual or automatic network security monitoring .

2. Software Security

Application security safeguards applications that are essential to business operations. It has features like an application allowing listing and code signing and could help you synchronize your security policies with file-sharing permissions and multi-factor authentication. The use of AI in cybersecurity will inevitably improve software security.

3. Risk Management

Financial cybersecurity includes risk management, data integrity, security awareness training, and risk analysis . Essential elements of risk management include risk evaluation and the prevention of harm from those risks. Data security also addresses the security of sensitive information.

4. Protecting Critical Systems

Wide-area network connections help avoid attacks on massive systems. It upholds the rigid safety standards set by the industry for users to follow when taking cybersecurity steps to protect their devices. It continuously monitors all programs and performs security checks on users, servers, and the network.

How to Make Banking Institutions Cyber Secure?

Security ratings are a great approach to indicate that you're concerned about the organization's cybersecurity. Still, you must also demonstrate that you're following industry and regulatory best practices for IT security and making long-term decisions based on that knowledge. A cybersecurity framework may be beneficial. You can go for Ethical Hacking training to enhance your knowledge further.

Top Cybersecurity Framework for Banks

A cybersecurity framework provides a common language and set of standards for security leaders across countries and industries to understand their security postures and those of their vendors. With a framework, it becomes easier to define the processes and procedures your organization must take to assess, monitor, and mitigate cybersecurity risk.

Let us take a look at some common financial cybersecurity frameworks:

1. NIST Cybersecurity Framework

The former president's executive order, Improving Critical Infrastructure Cybersecurity, asked for increased cooperation between the public and private sectors for recognizing, analyzing, and managing cyber risk. In response, the NIST Cybersecurity Framework was created. NIST has emerged as the gold standard for evaluating cybersecurity maturity, detecting security weaknesses, and adhering to cybersecurity legislation even when compliance is optional. To achieve NIST compliance , organizations can follow the guidelines outlined in the NIST Cybersecurity Framework and undergo rigorous assessments to ensure they meet the necessary standards.

2. The Bank of England's CBEST Vulnerability Testing Framework

CBEST vulnerability testing methodology was developed by the UK Financial Authorities in collaboration with CREST (the Council for Registered Ethical Security Testers) and Digital Shadows. It is an intelligence-led testing framework. CBEST's official debut took place on June 10, 2013.

CBEST leverages intelligence from reputable commercial and government sources to find possible attackers for a specific financial institution. Then, it imitates these potential attackers' methods to see how successfully they can breach the institution's Defenses. This enables a company to identify the weak points in its system and create and implement corrective action plans.

3. Cybersecurity and Privacy Framework for Privately Held Information Systems (the CIPHER Framework)

Computer systems that organizations, both public and private, control and that hold personal data gathered from their clients are referred to as PHISs (Privately Held Information Systems).

CIPHER framework addresses electronic systems, digital information kinds, and methods for data sharing, processing, and upkeep (not paper documents).

The CIPHER methodological framework's primary goal is to suggest procedures and best practices for protecting privately held information systems online (PHIS). The following are the main features of CIPHER methodological framework:

- Technology independence (versatility) refers to the ability to be used by any organization functioning in any field, even as existing technologies deteriorate or are replaced by newer ones.

- PHIS owners, developers, and citizens are the three primary users who focus on this user-centric approach.

- Practicality - outlines possible precautions and controls to improve or verify whether the organization is safeguarding data from online dangers.

- It is simple to use and doesn't require specialized knowledge from businesses or individuals.

Challenges in Implementing Cybersecurity in Banking

Some contributing elements have presented a significant challenge to digital cybersecurity in banking. The following are some of these:

- Lack of Knowledge: The general public's understanding of cybersecurity has been relatively low, and few businesses have significantly invested in raising that awareness.

- Budgets That are Too Small and Poor Management: Due to the low priority given to cybersecurity, it frequently receives short budgetary shrift. Cybersecurity continues to receive little attention from top management, and programs that assist it are accorded low priority. They might have underestimated how serious these risks are, which is why.

- Identities and Access are Poorly Managed: The core component of cybersecurity has always been identity and access management, especially now when hackers are in control and might access a business network with just one compromised login. Although there has been a little progress in this area, much work still needs to be done.

- Increase in Ransomware: Recent computer attacks have brought our attention to the growing threat of ransomware. Cybercriminals are beginning to employ various techniques to avoid being identified by endpoint protection code that concentrates on executable files.

- Smartphones and Apps: The majority of banking organizations now conduct business primarily through mobile devices. Every day the base grows, making it the best option for exploiters. Due to increased mobile phone transactions, mobile phones have become a desirable target for hackers.

- Social Media: Hackers have increased their exploitation as a result of social media adoption. Customers that are less knowledgeable expose their data to the public, which the attackers abuse.

Cybersecurity in the Banking Sector as a Career: Outlook

Compared to many other occupations, the cybersecurity field offers more job stability. For instance, the BLS predicts a 33% increase in employment for information security experts between 2020 and 2030. Information security in banking has also exponentially increased, and there is a high job demand for protecting against cyber threats to the banking industry. The following skills are required for cybersecurity in the banking industry:

1. Problem Solving Skills

In your day-to-day work as a cybersecurity specialist, problem-solving will be crucial. People working in the field must come up with innovative solutions to tackle and solve difficult information security concerns in a range of current and new technologies as well as digital surroundings.

2. Technical Skills

As the name suggests, cybersecurity focuses on technology. You will probably be assigned with duties including diagnosing, maintaining, and updating information security systems, putting in place continuous network monitoring, and offering real-time security solutions. To carry out a cybersecurity professional's daily duties, one must be digitally competent.

3. Communication Skills

Since you'll be collaborating closely with people in various departments and jobs as a cybersecurity professional, it's crucial that you can clearly express your discoveries, worries, and solutions to others. Speaking clearly and concisely about cybersecurity strategy and policy is crucial, as is being able to explain technical concepts to people with varying degrees of technical knowledge.

Looking to boost your ITIL knowledge? Join our unique online ITIL Foundation course ! Gain valuable insights and skills to excel in the IT industry. Enroll now and enhance your career prospects. Don't miss out!

Every organization is concerned about cyber security. It is crucial for banks to have the proper cyber security solutions and procedures in place, especially for institutions that store a lot of personal data and transaction lists. Banking cyber security is an issue that cannot be bargained with. Hackers are more likely to target the banking sector as digitalization advances.

KnowledgeHut is a platform that provides hundreds of courses in Data Science, Machine Learning, DevOps, Cybersecurity, Full Stack Development, and People and Process Certifications. With KnowledgeHut top Cybersecurity certifications , you can increase your knowledge about cybersecurity in the banking industry and get the proper training.

Frequently Asked Questions (FAQs)

The goal of cybersecurity in the banking sector is to protect consumer assets. The bank should also take action to thwart the hackers. The number of financial-related acts is growing as more individuals work.

Through fraudulent transactions, cyberattacks can result in significant financial losses for the customer and the banks. Attackers who steal sensitive data from a banking institution may sell it. Data that has been stolen is later misused.

Antivirus software is typically used on bank computers, firewalls, fraud detection, and website encryption, which encrypts data so that only the intended receiver can read it. Your financial institution likely implements these security precautions if you bank online.

Vitesh Sharma

Vitesh Sharma, a distinguished Cyber Security expert with a wealth of experience exceeding 6 years in the Telecom & Networking Industry. Armed with a CCIE and CISA certification, Vitesh possesses expertise in MPLS, Wi-Fi Planning & Designing, High Availability, QoS, IPv6, and IP KPIs. With a robust background in evaluating and optimizing MPLS security for telecom giants, Vitesh has been instrumental in driving large service provider engagements, emphasizing planning, designing, assessment, and optimization. His experience spans prestigious organizations like Barclays, Protiviti, EY, PwC India, Tata Consultancy Services, and more. With a unique blend of technical prowess and management acumen, Vitesh remains at the forefront of ensuring secure and efficient networking solutions, solidifying his position as a notable figure in the cybersecurity landscape.

Avail your free 1:1 mentorship session.

Something went wrong

Upcoming Cyber Security Batches & Dates

- Leading in the Post-COVID World

- Leadership Development

- Top C-Suite Interviews

- Women in Leadership

- Career and Learning

- Corporate Governance

- Culture & Lifestyle

- Legal Services

- Future Series

- Accelerator Series

- Emerging Ideas

- Design Thinking

- Business Model

- Latest News

- Digital Transformation

- Artificial Intelligence

- Blockchain & Crypto

- Big Data & Analytics

- Computer & Software

- Internet of Things

- Business Mobility & E-Commerce

- Industry 4.0 & Manufacturing

- Product and Service Reviews

- Home Improvement

- Strategic Spotlight

- People Management

- Remote Work

- Organisational Change

- Crisis Management

- Global Business

- Luxury Strategy

- Personal Finance

- Social Media

- Business Process

- Transportation & Business Fleet

- Succession Planning

- Climate Change & Green Business

- Social Impact

- Health & Wellness

- Top Executive Education with Best ROI

- Interviews with Directors and Faculties

- Executive Education Calendar

- Programme Highlights

- Success Stories

- Industry Insights

- Programme Directory

- Executive Education Q&As

- The Hamilton Mann Conversation: Digital For Good

- Fernanda Arreola – Inclusive Innovation: Rendering Change Accessible

- Simon L. Dolan – A Future Shaper

- Hervé LEGENVRE – EIPM Research on Technology and Collaboration

- Mapping the Future of Business with Jacques Bughin

- Adrian Furnham – On Your Head

- Kamil Mizgier On Navigating Risk Frontiers

- Delivering Innovation – Accenture Research

- The Better Boards Podcast Series

- Best Partners for Business Growth

- David De Cremer on Management

- Success through the Lorange Network

- A Special Report on AI and Humans by AiTH, NUS Business School

- Surdak on Technology

- Female Leadership In Our Time

- Europe’s recovery is possible. This is how…

- Editors’ Pick

- Business Events Calendar

- Events Partnership

- Travel & Leisure

- Our Mission

- Top Executive Education

- Advertising

- Guidelines for Authors

- Past Covers

- Privacy Policy

- Terms and Conditions

- IoT & Cyber Security

Cybersecurity in Banking Industry: Importance, Challenges, and Use-Cases

Cybersecurity is not a recent term in the financial industry. Banking institutions have been using it to protect their systems, data, and transactions to avoid fraud and identity thefts.

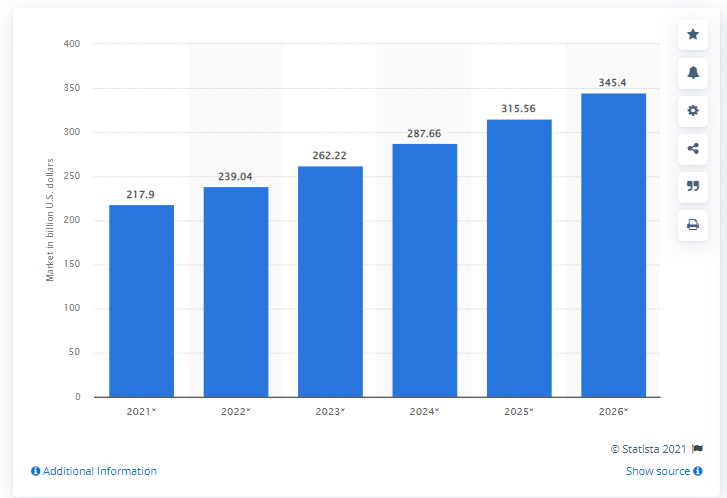

According to Statista, by 2026 , the global cybersecurity market size is forecast to grow to 345.4 billion U.S. dollars . Similarly, India crossed over 500 million dollars in 2020 , which would rise to 800 million dollars by 2022 .

This means that Cybersecurity in the banking industry is a relatively not new concept, but it will increase exponentially in the future.

However, Did you ever think about it? :

- Why is it so important?

- What are the challenges of Cybersecurity in the banking industry?

- And what are the use-cases of it?

Not yet? Don’t worry; you will learn about them in this article. Let’s first start with the importance of Cybersecurity in the banking industry.

Cybersecurity in Banking Industry: Importance

1. Prevent Financial Losses

The banking industry holds the data of millions of people, and this data can help hackers in many ways. For example, if someone hacks your bank account using your ID info, they can steal all your money in seconds, not to mention that it is almost impossible to recover stolen money.

In such cases, banks are left with three options:

- They can compensate money

- Freeze the account in which fraud has occurred

- Close down the entire branch where fraud has happened.

But banks do not prefer two out of all these three options. Compensating money can be costly, and freezing accounts may result in a loss of customers.

With the help of Cybersecurity in the banking industry, banks can minimize these losses and protect their accounts from fraud. Technology like biometric authentication and Artificial Intelligence (AI) can help credit institutions save money.

Furthermore, it will protect customers’ accounts and increase customers’ trust in the banking industry.

2. Protect Customer Data

The banking industry is expanding daily, and with that expansion comes a great deal of responsibility. Financial authorities now need to prioritize the security of their customers’ data and transactions since it can be used for multiple purposes:

• Phishing : This technique uses fake emails like official emails, but they contain links to malware. Hackers use this technique to steal customers’ sensitive data like passwords, credit card numbers, etc.

• Identity Theft: This refers to changing a person’s personal information without their consent and then using it for harmful purposes.

• Denial Of Service (DOS): A DOS attack works by sending traffic from unrelated sources towards a server on which an organization’s website is hosted. It causes the server to overload and shut down, resulting in the organization losing its site temporarily.

• Pharming: This technique is used by fraudsters to redirect users from an authentic website to a fake website. Hackers use it to steal the information required for online transactions. Therefore, this technique puts customers’ data at risk and financial security.

Moreover, all these techniques share one thing: They use sensitive personal information for personal and financial gains. In addition to this, if hackers get access to these techniques, they can misuse them for other purposes as well. That is why Cybersecurity in the banking industry is so important.

Some big organizations have already started using it. For example, Citigroup has introduced biometric authentication for all its US customers.

3. Preserve Bank’s Reputation

Banks must follow strict regulations, so it takes them quite some time to adopt new technology. However, with the increased number of cyberattacks, they are now more open to Cybersecurity.

The increase in cyberattacks has also hurt the reputation of banks. According to a study by Kaspersky Lab, out of 1000 consumers surveyed in the UK, Germany, India, and USA, 94% of consumers said they would switch banks if their data got into the wrong hands.

The study also revealed that 60% of consumers take their time when choosing a bank because they are afraid of becoming a victim of a cyberattack.

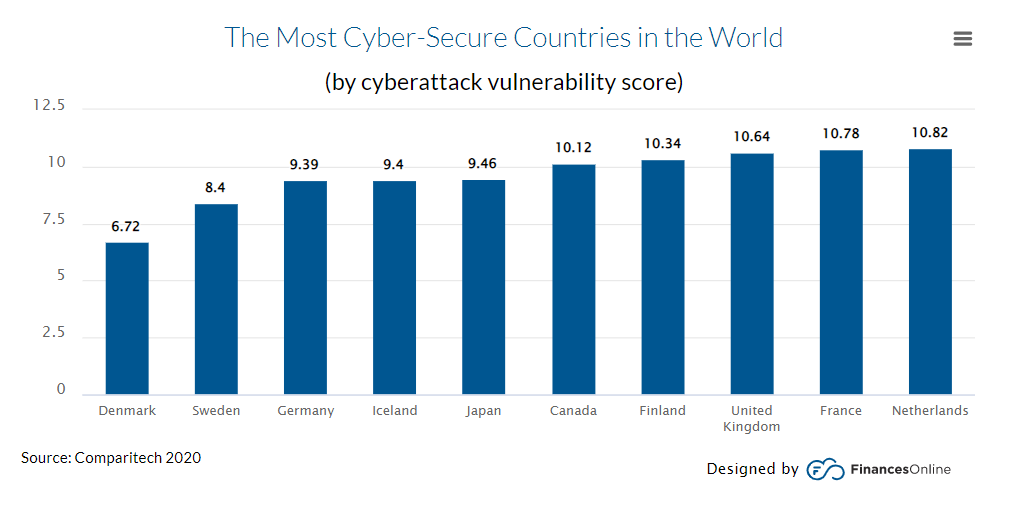

Therefore, banks need to restore their reputation by introducing new technology like AI, data encryption, etc., for better security. Furthermore, according to Comparitech’s 2020 report, the most cyber-safe countries in the world are Denmark (6.72), Sweden (8.40), Germany (9.39), Ireland (9.40), and Japan (9.46) based on cyberattack vulnerability scores.

4. Avoid Penalties For FDIC Non-Compliance

The next most considerable importance of Cybersecurity in the banking industry is avoiding penalties from FDIC. If a bank does not follow the Federal Deposit Insurance Corporation (FDIC) regulations, it can impose hefty fines and even shut down that particular bank.

Some of the fines that FDIC imposes on banks for non-compliance are:

• Up to $1 million per violation.

• In severe cases, a year in prison may be imposed.

• Forced ratification of contracts violations in some cases.

And many others.

So, imagine what would happen if a bank’s security was compromised due to a hack? That is why banks should implement security measures to prevent such a situation. FinTech companies can provide cybersecurity solutions using blockchain technology to help banks improve their security standards.

Besides, some financial institutions hire blockchain developers to help them use this technology for their purposes. Accordingly, here are some examples of how blockchain can be used in financial institutions to improve cybersecurity:

- Using blockchain, financial institutions can store sensitive information about their clients in a decentralized database. It will help them stay compliant with regulations and avoid hefty fines imposed by FDIC.

- Banks can also use blockchain to share information about the customer without compromising their identity and security. It can be beneficial to prevent fraud and money laundering cases in the future.

- By integrating blockchain technology into their systems, banks can create a scalable and efficient system that will prevent security breaches like:

- Phishing attacks to access customers’ sensitive information.

- Man in the middle (MITM) attacks.

- DDoS Attack.

- Some experts say that as blockchain is decentralized, it is more secure than conventional databases because it is nearly impossible to hack. The encryption technology used in blockchain also makes it more secure than conventional systems.

- Blockchain protects sensitive information by splitting it into pieces and storing it on different nodes, decentralizing the whole system. This way, hackers will not find or misuse any information even if they manage to access a single block.

5. Digitization Of Services

Another importance of cyber security in banking is the digitization of services. As we know, more and more people prefer online bank account management to the old brick-and-mortar institutions. They can do everything from their computers or mobile phones that they could do at a physical branch.

For example:

• Direct deposit means customers don’t have to wait days to get their paychecks.

• Purchasing shares of a company is now as easy as buying vegetables at the local supermarket.

• Transferring money to another country has never been easier because all you need is an internet connection and bank account number or routing number.

As digitalization becomes more popular, banks spend vast chunks of their revenue upgrading their systems. But, these huge costs are not being returned to banks because people have already mastered the art of managing their bank accounts online.

This is why there’s a massive need for cyber security in the banking industry because, without it, all that investment will go down the drain.

So, you can see how critical cybersecurity is to banks and other financial institutions. It is now time to count down the banking industry’s challenges.

Cybersecurity in Banking Industry: Challenges

1. balancing security and convenience.

Although cybersecurity is essential to banks, they also need to provide convenience to their customers. If a bank’s security measures are too strict, many people may switch their accounts to a bank with less stringent regulations.

On the other hand, if the security provided by a bank is not convenient, then there will be huge costs because of the extra security measures. More money will need to be spent on additional personnel, software, and hardware for the bank’s security system.

Therefore, banks must come up with the right balance of convenience and security to survive in the long run.

2. Effectively Managing The Risk Of Breaches

Another challenge faced by banks is to manage the risk of breaches effectively. They may have the most secure system in place, but hackers can still find ways to compromise these systems.

That is why banks must test their system regularly for vulnerabilities. They also need to continuously update their security systems with the latest technologies available to remain one step ahead of hackers.

3. Financial Impact Of Breaches

Not only does cybersecurity affect customers, but it also has a direct impact on the bank’s bottom line. When hackers successfully breach a bank’s system and gain access to sensitive information, there’s no telling what they’ll do with it.

This can be terrifying because it could result in lawsuits against the bank or even government regulations that change its operation. These changes will affect a bank’s profit margins because additional costs will be deducted from their revenue.

4. Constant Evolution Of Threats And Vulnerabilities

Another cybersecurity challenge faced by banks is the constant evolution of threats and vulnerabilities. Hackers are constantly updating their techniques to get around new security measures.

Therefore, banks may need to continuously update their cyber security protocols to stay ahead of hackers every step of the way. Also, it requires a lot of time and money because banks need to hire more personnel, spend vast amounts on software, and buy new hardware for their security systems.

5. Efficient Protection Against Advanced Threats

In addition to the constant evolution of threats and vulnerabilities, banks also need to focus on efficient protection against advanced threats. Furthermore, hackers are becoming more sophisticated by the day, which means that a bank’s security system will struggle to keep up.

This is especially problematic because the more time hackers have to unleash their attack, the higher the chances of successfully breaching a bank’s system. This means that banks need to invest in new technologies for defense against these advanced threats to ensure cyber security.

These were some of the cybersecurity challenges faced by banks. If you are interested in learning about use cases for Cybersecurity in Banking, you can keep reading this blog.

5 Use Cases for Cybersecurity in Banking

1. fraud monitoring and prevention.

When customers use their bank accounts, they must provide personal information for verification purposes. Hackers can abuse this information by transferring money to their accounts or creating unauthorized transactions.

Banks will need to incorporate more advanced technologies like machine learning algorithms to prevent fraud. These tools can learn how customers use their bank accounts and detect “suspicious” transactions.

2. Identify Compromised Devices

These days, many credit card fraud cases can be traced back to hacked personal computers or mobile phones. Hackers will seek out any device with access to a person’s bank account and then try to hijack it to run their transactions.

Since this can be difficult to detect, banks will need “threat intelligence” tools that will allow them to keep track of any suspicious behavior on the account holder’s end.

3. Payment Security

Sending bank customers bogus emails that look to come from their banks is one of the most prevalent ways hackers obtain information. These emails will ask the bank customers to verify their information by clicking on a link or providing their security credentials.

This way, hackers can gain access to a person’s bank account because they now have all the personal and financial information they need. Banks will need “phishing protection tools” to keep track of these fraudulent emails to protect their customers.

4. Data Retrieval

Before a bank customer can withdraw or transfer money, they must provide the proper data such as account numbers and PINs. Banks must always be on guard for stolen credentials because these can give hackers direct access to the targeted person’s bank account.

Banks can protect their customers by requiring additional security measures before money can be withdrawn or transferred. For example, they can ask for verification codes sent through text messages generated every time a transaction is made.

5. Data Protection Tools

One of the most fundamental reasons we need to focus on cyber security is that hackers can use stolen customer credentials to access sensitive company data. If a hacker manages to infiltrate a bank’s system, they can steal any information in the server, including personal and financial data.

This is very dangerous because it can lead to identity theft or fraud—Banks must-have tools in place that will keep hackers out of their data storage.

As you can see, banks will need top-of-the-line technology to protect their customers and company data from hackers. If they don’t focus on cyber security, they can expect significant losses in the future due to stolen records or leaked customer information.

This article should have given you some examples or use cases for cybersecurity in banking. Why is it important to banks and other financial institutions? What challenges will banks face when they incorporate cybersecurity into their business model?

Although, if you are searching for banking software development companies in India that can help you with your banking needs or any other financial software development? Feel free to contact PixelCrayons; we will provide you with the best cost-effective solution per your requirement.

RELATED ARTICLES MORE FROM AUTHOR

Emerging Technology Trends in Real Estate: Transforming the Market in 2024

What is AES Encryption and How Does It Work?

5 Unknown Risks of AI Personal Assistants

How AI Liberates the Transition to a Skill-Based Organisation

Navigating the World of Hidden Apps on Android: A Deep Dive into Privacy and Security

Privacy Matters: How to Maintain Anonymity and Security When Using Escort Sites

Leave a reply cancel reply.

Save my name, email, and website in this browser for the next time I comment.

Free Online Event for Digital Publishing and News Media Professionals!

Ai & big data expo north america, responsible business europe 2024 (london, june 11-12), international hrd summit 2024, curious2024 – future insight™ conference, global ev & mobility technology forum, 2024 world battery & energy storage industry expo (wbe), reuters events: sustainable transport 2024 (3-4 september, amsterdam), leading people and teams, online mba – stephen m. ross school of business, meet our mba alumni – university of bath, v-entrepreneurs talk 2024: the ritchie story, 2024 learning impact conference, meet us in london – university of st.gallen (hsg), mba experience event – ghent campus – vlerick business school, hr day 2024 – vlerick business school, featured articles.

Unlocking the Power of AI Leadership: A Dialogue with Professor David De Cremer

How Top-Performing Firms Needed to Reorganise Seven Times for Digital

How to Put Curiosity to Work in Your Organisation

Leading the Gen AI Revolution: Building Workers’ Trust to Reinvent Work in Europe

Aligning Organisational Ecosystems to be Fit for Purpose

Generative AI Update for 2024

Longevity for Sustainability: Adding Value That Lasts

Magnetic Loyalty: Crafting Effective Loyalty Programmes that Attract and Retain Customers

A New Business Leadership Paradigm to Understand Signals and Timing: When to ENTER a Business and When to EXIT

Future series.

What Does EVhype Teach Us, and How Can We Consider the Lessons in AI’s Development?

Embracing AI: The Next Frontier in Elderly Housing

The Dawn of the Value Economy Era

Models to Scale ESG Metrics and Data

Strategy & management.

How To Build a Strong Brand Identity for Your SaaS MVP

Bluemina: A Leading Force in Citizenship and Residency Solutions Launching a Virtual Office for Clients Anytime Anywhere!

How to Build a Highly Successful Email Marketing Funnel for Conversions

German Stock Index Hits Record

Gender Pay Disparities Persist Among Independent Contractors

Upcoming events, privacy overview.

Cybersecurity hazards and financial system vulnerability: a synthesis of literature

- Original Article

- Published: 18 August 2020

- Volume 22 , pages 239–309, ( 2020 )

Cite this article

- Md. Hamid Uddin ORCID: orcid.org/0000-0003-3025-0206 1 , 2 ,

- Md. Hakim Ali 2 &

- Mohammad Kabir Hassan 3

2683 Accesses

25 Citations

1 Altmetric

Explore all metrics

In this paper, we provide a systematic review of the growing body of literature exploring the issues related to pervasive effects of cybersecurity risk on the financial system. As the cybersecurity risk has appeared as a significant threat to the financial sector, researchers and analysts are trying to understand this problem from different perspectives. There are plenty of documents providing conceptual discussions, technical analysis, and survey results, but empirical studies based on real data are yet limited. Besides, the international and national regulatory bodies suggest guidelines to help banks and financial institutions managing cyber risk exposure. In this paper, we synthesize relevant articles and policy documents on cybersecurity risk, focusing on the dimensions detrimental to the banking system’s vulnerability. Finally, we propose five new research avenues for consideration that may enhance our knowledge of cybersecurity risk and help practitioners develop a better cyber risk management framework.

This is a preview of subscription content, log in via an institution to check access.

Access this article

Price includes VAT (Russian Federation)

Instant access to the full article PDF.

Rent this article via DeepDyve

Institutional subscriptions

Similar content being viewed by others

Cybersecurity disclosure in the banking industry: a comparative study

A Survey of Cybersecurity Risk Management Frameworks

Cyber risk and cybersecurity: a systematic review of data availability

The systems should be designed to ensure a high degree of security and operational reliability. Also, the system should be strong enough to predict the likelihood of future cyber events and take auto protective measures in anticipation of a cyber breach.

It is because cybersecurity risk cannot be mitigated by mere application of upgraded hardware or software as no technology is perfect, and perpetrators can always break the system. Therefore, cybersecurity is now a boardroom issue. It means the corporate managers of financial institutions need to consider the amount of investment in cyber technology more rationally. Otherwise, it might adversely affect the financial performance and stability of banks.

The operational efficiency declines because of unavoidable cybersecurity hazards that often require the users to apply more complex passwords or two-stage authentication. Since complex passwords and multi-stage authorization processes are difficult to memorize, the chances of access denial to genuine users increase that has an implication of time and cost for the users.

The asymmetry of cyber knowledge (between criminals and innocent users) allows criminals to exploit the innocent users to breach the system, suggesting a positive association between faster and widespread use of cyber technology and security risk exposure (Willison and Warkentin 2013 ; Longstaff et al. 2020 ).

Bouveret ( 2018 ) proposed a broader framework of cyber risk assessment that captures the different dimension of cybersecurity hazards such as (i) security threat level, (ii) system vulnerability status, and (iii) financial consequences of a security breach.

The expert report suggests that the DDoS attack can be prevented by increasing bandwidth, creating redundancy in cyber infrastructure, configuring hardware, and deploying anti-DDoS hardware and software, using the DDoS protection appliance, move to a cloud-based DNS provider (Rubens 2018 ).

Without technological support, hybrid securities cannot be developed.

For example, General Data Protection Regulation 2016 (for EU), the UK Data Protection Act 2018, the Personal Data Protection Act 2010 of Malaysia.

Abraham, S., and P.J. Shrives. 2014. Improving the relevance of risk factor disclosure in corporate annual reports. The British accounting review 46 (1): 91–107.

Google Scholar

ACSS. 2016. Australia’s cyber security strategy. Commonwealth of Australia, Department of the Prime Minister and Cabinet. https://cybersecuritystrategy.homeaffairs.gov.au/ .

Ahmad, N., and P. Schreyer. 2016. Measuring GDP in a digitalised economy . Paris: OECD Publishing. https://doi.org/10.1787/18152031 .

Book Google Scholar

AIG. 2016. December. Is cyber risk systemic? New York: American International Group. https://www.aig.com/content/dam/aig/america-canada/us/documents/business/cyber/aig-cyber-risk-systemic-final.pdf .

Akhawe, D., A. Barth, P.E. Lam, J. Mitchell, and D. Song. 2010. Towards a formal foundation of web security. In 2010 23rd IEEE computer security foundations symposium , 290–304. IEEE.

Akhisar, İ., K.B. Tunay, and N. Tunay. 2015. The effects of innovations on bank performance: The case of electronic banking services. Procedia—Social and Behavioral Sciences 195: 369–375.

Aldasoro, I., L. Gambacorta, P. Giudici, and T. Leach. 2020a. Operational and cyber risks in the financial sector. BIS Working Paper No. 840 . Basel, Switzerland: Bank for International Settlements.

Aldasoro, I., L. Gambacorta, P. Giudici, and T. Leach. 2020b. The drivers of cyber risk. BIS Working Paper No. 865 . Basel, Switzerland: Bank for International Settlements.

Alex Johnson. 2018, May 9. Equifax breaks down just how bad last year’s data breach was. NBC News. https://www.nbcnews.com/news/us-news/equifax-breaks-down-just-how-bad-last-year-s-data-n872496 .

Allen, F., and D. Gale. 2004. Competition and financial stability. Journal of Money, Credit and Banking 36 (3): 453–480.

Almansi, A.A. 2018. Financial sector’s cybersecurity: Regulations and supervision . Washington, United States of America: World Bank Group.

Almansi, A.A., Y.C. Lee, and J. Lincoln. 2017. Financial sector’s cybersecurity: A regulatory digest. World Bank . Washington: Financial Sector Advisory Center.

Ames, M., T. Schuermann, and H.S. Scott. 2015. Bank capital for operational risk: A tale of fragility and instability. Journal of Risk Management in Financial Institutions 8 (3): 227–243.

Antonescua, M., and R. Birău. 2015. Financial and non-financial implications of cybercrimes in emerging countries. Procedia Economics and Finance 32: 618–621.

Arner, D.W., J. Barberis, and R.P. Buckley. 2016. FinTech, RegTech, and the reconceptualization of financial regulation. Northwestern Journal of International Law & Business 37 (3).

Aseef, N., P. Davis, M. Mittal, K. Sedky, and A. Tolba. 2005. Cyber-criminal activity and analysis . Washington Education: White paper.

Ashford, W. 2019, July 31. Financial services top cyber attack target. Computer Weekly . https://www.computerweekly.com .

Aziz, A.S., M.A. Salama, A.E. Hassanien, and S.E.O. Hanaf. 2012. Artificial immune system inspired intrusion detection system using genetic algorithm. Informatica 36: 347–357.

Banker, R.D., R.J. Kauffman, and R.C. Morey. 1990. Measuring gains in operational efficiency from information technology: A study of the Positran deployment at Hardee’s Inc. Journal of Management Information Systems 7 (2): 29–54.

Barrett, M., E. Davidson, J. Prabhu, and S.L. Vargo. 2015. Service innovation in the digital age: Key contributions and future directions. MIS quarterly 39 (1): 135–154.

Barthelemy, J. 2001. The hidden costs of IT outsourcing: Lessons from 50 IT-outsourcing efforts show that unforeseen costs can undercut anticipated benefits. Understanding the issues can lead to better outsourcing decisions. MIT Sloan Management Review 42 (3): 60–72.

BDO. 2017. Cyber security in banking industry . India: BDO.

Beccalli, E. 2007. Does IT investment improve bank performance? Evidence from Europe. Journal of Banking & Finance 31 (7): 2205–2230.

Beitollahi, H., and G. Deconinck. 2012. Analyzing well-known countermeasures against distributed denial of service attacks. Computer Communications 35 (11): 1312–1332.

Benaroch, M., A. Chernobai, and J. Goldstein. 2012. An internal control perspective on the market value consequences of IT operational risk events. International Journal of Accounting Information Systems 13: 357–381.

Berger, A.N., and R.D. Young. 1997. Problem loans and cost efficiency in commercial banks. Journal of Banking & Finance 21 (6): 849–870.

Berkman, H., J. Jona, G. Lee, and N. Soderstrom. 2018. Cybersecurity awareness and market valuations. Journal of Accounting and Public Policy 37 (6): 508–526.

Bernik, I. 2014. Cybercrime: The cost of investments into protection. Journal of Criminal Justice and Security 16 (2): 105–116.

Biener, C., M. Eling, and J.H. Wirfs. 2015. Insurability of cyber risk: An empirical analysis. The Geneva Papers on Risk and Insurance-Issues and Practice 40 (1): 131–158.

BIS. 2004. Consolidated KYC risk management. Basel Committee on Banking Supervision. https://www.bis.org/publ/bcbs110.pdf .

BIS. 2013. The road to a more resilient banking sector. BIS. https://www.bis.org/publ/arpdf/ar2013e.htm .

BIS. 2016, June. Bank for international settlements. www.bis.org . https://www.bis.org/cpmi/publ/d146.pdf .

Boer, M., and J. Vazquez. 2017. Cyber security & financial stability: How cyber-attacks could materially impact the global financial system . Washington: The Institute of International Finance.

Böhme, R. 2010. Security Metrics and Security Investment Models. In Advances in information and computer security , ed. I. Echizen, N. Kunihiro, and R. Sasaki, 10–24. Berlin: Springer.

Böhme, R. 2012, February. Security audits revisited. in International conference on financial cryptography and data security , 129–147. Berlin: Springer.

Boin, A., and A. McConnell. 2007. Preparing for critical infrastructure breakdowns: The limits of crisis management and the need for resilience. Journal of Contingencies and Crisis Management 15 (1): 50–59.

Bouveret, A. 2018. Cyber risk for the financial sector: A framework for quantitative assessment. IMF Working Paper No. WP/18/143 . International Monetary Fund.

Bouveret, A. 2019a. Cyber risk for the financial services sector. Journal of Financial Transformation 49.

Bouveret, A. 2019b. Estimation of losses due to cyber risk for financial institutions. Journal of Operational Risk , Forthcoming.

Brechbuhl, H., R. Bruce, S. Dynes, and M.E. Johnson. 2010. Protecting critical information infrastructure: Developing cybersecurity policy. Information Technology for Development 16 (1): 83–91.

Brown, C.S. 2015. Investigating and prosecuting cyber crime: Forensic dependencies and barriers to justice. International Journal of Cyber Criminology 9 (01): 55–119. https://doi.org/10.5281/zenodo.22387 .

Article Google Scholar

Burden, K., and C. Palmer. 2003. Internet crime: Cyber crime—A new breed of criminal? Computer Law & Security Review 19 (3): 222–227.

Cabinet Decision. 2015. Cybersecurity strategy. The Government of Japan. https://www.nisc.go.jp/eng/pdf/cs-strategy-en.pdf .

Carey, M., and R.M. Stulz. 2008. The risks of financial institutions. Journal of Contingencies and Crisis Management 16 (1): 65–66. https://doi.org/10.1111/j.1468-5973.2008.00532_2.x .

CarlColwill, 2009. Human factors in information security: The insider threat—Who can you trust these days? Information Security Technical Report 14 (4): 186–196.

Caron, F. 2015. Cyber risk management in financial market infrastructures: Elements for a holistic and risk - based approach to cyber security. Belgium: National Bank of Belgium. https://lirias.kuleuven.be/1834699?limo=0 .

Carter, W.A., and D.E. Zheng. 2015. The evolution of cybersecurity requirements for the U.S. financial industry . USA: Center for Strategic and International Studies.

Caruana, J. 2009, February. Lessons of the financial crisis for future regulation of financial institutions and markets and for liquidity management . Washington, DC: IMF.

Casu, B., A. Ferrari, C. Girardone, and J.O. Wilson. 2016. Integration, productivity and technological spillovers: Evidence for eurozone banking industries. European Journal of Operational Research 255 (3): 971–983.

Cavusoglu, H., S. Raghunathan, and W. Yue. 2008. Decision-theoretic and game-theoretic approaches to IT security investment. Journal of Management Information Systems 25 (2): 281–304.

Cebula, J.J., and L.R. Young. 2010. A taxonomy of operational cyber. Carnegie-Mellon Univ Pittsburgh PA Software Engineering Inst.

Cetorelli, N., B. Hirtle, D. Morgan, S. Peristiani, and A.J. Santos. 2007. Trends in financial market concentration and their implications for market stability. Federal Reserve Bank of New York Policy Review 33–51.

Chauhan, Y., and S.B. Kumar. 2018. Do investors value the nonfinancial disclosure in emerging markets? Emerging Markets Review 37: 32–46.

Cherdantseva, Y., P. Burnap, A. Blyth, P. Eden, K. Jones, H. Soulsby, and K. Stoddart. 2016. A review of cyber security risk assessment methods for SCADA systems. Computers & Security 56: 1–27.

Choo, K.-K.R. 2011. The cyber threat landscape: Challenges and future research directions. Computers & Security 33 (8): 719–731.

Choo, K.-K.R., R.G. Smith, and R. McCusker. 2007. Future directions in technology-enabled crime: 2007–09 . Canberra: Australian Institute of Criminology.

Chowdhury, A. 2003. Information technology and productivity payoff in the banking industry: Evidence from the emerging markets. Journal of International Development 15 (6): 693–708.

Clare Sullivan, E.B. 2017. “In the public interest”: The privacy implications of international business-to-business sharing of cyber-threat intelligence. Computer Law & Security Review 33: 14–29.

Committee on Payments and Market Infrastructures. 2016. Guidance on cyber resilience for financial market infrastructures. Bank for International Settlements. https://www.bis.org/cpmi/publ/d146.pdf .

Crisanto, J.C., and J. Prenio. 2017, August. Regulatory approaches to enhance banks’ cyber - security frameworks. Bank for International Settlements. https://www.bis.org/fsi/publ/insights2.pdf .

Das, S., A. Mukhopadhyay, and M. Anand. 2012. Stock market response to information security breach: A study using firm and attack characteristics. Journal of Information Privacy and Security 8 (4): 27–55.

Deloitte. 2014. Transforming cybersecurity in the Financial Services Industry. Deloitte. https://www2.deloitte.com/content/dam/Deloitte/za/Documents/risk/ZA_Transforming_Cybersecurity_05122014.pdf .

Demirgüç-Kunt, A., L. Klapper, D. Singer, S. Ansar, and J. Hess. 2018. The global findex database 2017: Measuring financial inclusion and the Fintech revolution. The World Bank.

Derek Young, J.L. 2016. A framework for incorporating insurance in critical infrastructure cyber risk strategies. International Journal of Critical Infrastructure Protection 14: 43–57.

Diamond, D.W., and P.H. Dybvig. 1983. Bank runs, deposit insurance, and liquidity. Journal of Political Economy 91 (3): 401–419.

Diamond, D.W., and P.H. Dybvig. 1986. Banking theory, deposit insurance, and bank regulation. The Journal of Business 59 (1): 55–68.

Donge, Z., F. Luo, and G. Liang. 2018. Blockchain: A secure, decentralized, trusted cyber infrastructure solution for future energy systems. Journal of Modern Power Systems and Clean Energy 1–10.

Duffie, D., and J. Younger. 2019. Cyber runs. Hutchins Center Working Paper #51 . Washington, DC: The Hutchins Center on Fiscal & Monetary Policy, Brookings Institution.

Dufwenberg, M., and M.A. Dufwenberg. 2018. Lies in disguise—A theoretical analysis of cheating. Journal of Economic Theory 175: 248–264.

Duncan, N.B. 1995. Capturing flexibility of information technology infrastructure: A study of resource characteristics and their measure. Journal of Management Information Systems 12 (2): 37–57.

Duran, R.E., & P. Griffin. 2019. Smart contracts: Will Fintech be the catalyst for the next global financial crisis? Journal of Financial Regulation and Compliance (in press)

Dutta, A., and K. McCrohan. 2002. Management’s role in information security in a cyber economy. California Management Review . https://doi.org/10.2307/41166154 .

Eling, M., and M. Lehmann. 2018. The impact of digitalization on the insurance value chain and the insurability of risks. The Geneva Papers on Risk and Insurance-Issues and Practice 43 (3): 359–396.

Eling, M., and J. Wirfs. 2019. What are the actual costs of cyber risk events? European Journal of Operational Research 272 (3): 1109–1119.

Embrechts, P., H. Furrer, and R. Kauffman. 2003. Quantifying regulatory capital for operational risk. Derivatives Use, Trading and Regulation 9 (3): 217–233.

EU. 2018, May. The Directive on security of network and information systems (NIS Directive). https://ec.europa.eu/digital-single-market/en/network-and-information-security-nis-directive .

Euromoney. 2017, August 1. Technology investments drive up banks’ costs. Euromoney Magazine . London.

Fed. 2017, September. Federal reserve policy on payment system risk. Washington: Federal Reserve System.

Federal Office for Information Security. 2017. The state of IT security in Germany 2017. FOIS.

Fitch. 2017, April. Cybersecurity an increasing focus for financial institutions. https://www.fitchratings.com/site/pr/1022468 .

Francis, L., and V.R. Prevosto. 2010. Data and disaster: The role of data in the financial crisis. In casualty actuarial society e-forum, 62. New York: Springer.

Garg, A., J. Curtis, and H. Halper. 2003. The financial impact of IT security breaches: What do investors think? Information Systems Security 12 (1): 22–33.

Gatzlaff, K.M., and K.A. McCullough. 2010. The effect of data breaches on shareholder wealth. Risk Management and Insurance Review 13 (1): 61–83.

Gelenbe, E., and G. Loukas. 2007. A self-aware approach to denial of service defence. Computer Networks 51: 1299–1314.

Germano, J.H. 2014. Cybersecurity partnerships: A new era of public-private collaboration . New York: New York University School of Law.

Geyres, S., and M. Orozco. 2016. Think banking cybersecurity is just a technology issue? Think again. Accenture strategy. https://www.accenture.com/t20160419t004021__w__/us-en/_acnmedia/pdf-13/accenture-strategy-cybersecurity-in-banking.pdf .

Gladstone, R. 2016, March 15. Bangladesh Bank chief resigns after cyber theft of $81 million. The New York Times .

Glaessner, T., T. Kellermann, and V. McNevin. 2002. Electronic security: Risk mitigation in financial transactions — Public policy issues. The World Bank.

Goel, S., and H.A. Shawky. 2009. Estimating the market impact of security breach announcements on firm values. Information & Management 46 (7): 404–410.

Goldman, D. 2012, September 28. Major banks hit with biggest cyberattacks in history. CNN Business . Altanta.

Gommans, L., J. Vollbrecht, B.G.-D. Bruijn, and C.D. Laat. 2015. The service provider group framework a framework for arranging trust and power to facilitate authorization of network services. Future Generation Computer Systems 45: 176–192.

Goodman, S.E., and R. Ramer. 2007. Identify and mitigate the risks of global IT outsourcing. Journal of Global Information Technology Management 10 (4): 1–6.

Gopalakrishnan, R., and M. Mogato. 2016, May 19. Bangladesh Bank official’s computer was hacked to carry out $81 million heist: Diplomat. Reuters: Business News . Thomson Reuters.

Gordon, L.A., and M.P. Loeb. 2002a. The economics of information security investment. ACM Transactions on Information and Systems Security 5 (4): 438–457.

Gordon, L.A., and M.P. Loeb. 2002b. Return on information security investments, myths vs realities. Strategic Finance 84 (5): 26–31.

Gordon, L.A., M.P. Loeb, W. Lucyshyn, and T. Sohail. 2006. The impact of the Sarbanes-Oxley Act on the corporate disclosures of information security activities. Journal of Accounting and Public Policy 25 (5): 503–530.

Gracie, A. 2015. Cyber resilience: A financial stability perspective. Cyber defence and network security conference. London. https://www.bankofengland.co.uk/speech/2015/cyber-resilience-a-financial-stability-perspective .

Granåsen, M., and D. Andersson. 2016. Measuring team effectiveness in cyber-defense exercises: A cross-disciplinary case study. Cognition, Technology & Work 18 (1): 121–143.

Gupta, U.G., and A. Gupta. 2007. Outsourcing the is function: Is it necessary for your organization? Information Systems Management 9 (3): 44–47.

Gutu, L.M. 2014. The impact of Internet technology on the Romanian banks performance. In Proceedings of international academic conferences (No. 0702397). International Institute of Social and Economic Sciences.

Hall, C., R.J. Anderson, R. Clayton, E. Ouzounis, and P. Trimintzios. 2013. Resilience of the internet interconnection ecosystem. Economics of Information Security and Privacy III: 119–148.

Heeks, R. 2002. Information systems and developing countries: Failure, success, and local improvisations. The Information Society 18: 101–112.

Hemphill, T.A., and P. Longstreet. 2016. Financial data breaches in the U.S. retail economy: Restoring. Technology in Society 44: 30–38.

Herath, T., and H.R. Rao. 2009. Encouraging information security behaviors in organizations: Role of penalties, pressures and perceived effectiveness. Decision Support System 47 (02): 154–165.

HKMA. 2016. Enhanced competency framework on cybersecurity. Hong Kong: Hong Kong Monetary Authority. https://www.hkma.gov.hk/media/eng/doc/key-information/guidelines-and-circular/2016/20161219e1.pdf .

Ho, S.J., and S.K. Mallick. 2010. The impact of information technology on the banking industry. Journal of the Operational Research Society 61 (2): 211–221.

Holt, T.J., and E. Lampke. 2010. Exploring stolen data markets online: Products and market forces. Criminal Justice Studies 23 (1): 33–50.

Hon, W.K., and C. Millard. 2018. Banking in the cloud: Part 1—Banks’ use of cloud services. Computer Law & Security Review 34: 4–24.

Horne, R. 2014. The cyber threat to banking. PWC. https://www.bba.org.uk/wp-content/uploads/2014/06/BBAJ2110_Cyber_report_May_2014_WEB.pdf .

Hovav, A., and J. D’Arcy. 2004. The impact of virus attack announcements on the market value of firms. Information Systems Security 13 (3): 32–40.

Hsu, A.W.-H., H. Pourjalali, and Y.-J. Song. 2018. Fair value disclosures and crash risk. Journal of Contemporary Accounting & Economics 14 (3): 358–372.

Humayun, M., N. J. Mahmood Niazi, M. Alshayeb, and S. Mahmood. 2020. Cyber security threats and vulnerabilities: A systematic mapping study. Arabian Journal for Science and Engineering 1–19.

Hyytinen, A., and T. Takalo. 2002. Enhancing bank transparency: A re-assessment. Review of Finance 6 (3): 429–445.

IDSA. 2012. India’s cyber security challenge. New Delhi: Institute for Defence Studies and Analyses. https://idsa.in/system/files/book/book_indiacybersecurity.pdf .

IOSC. 2016. Cyber security in securities markets — An international perspective. International Organization of Securities Commissions. https://www.iosco.org/library/pubdocs/pdf/IOSCOPD528.pdf .

Ismail, N. 2018. The financial impact of data breaches is just the beginning . www.information-age.com . https://www.information-age.com/data-breaches-financial-impact-123470254/ .

ITU. 2012a. Cyberwellness profile hong kong. Hong Kong: ITU. https://www.itu.int/dms_pub/itu-d/opb/str/D-STR-SECU-2015-PDF-E.pdf .

ITU. 2012b. Cyberwellness profile poland. Poland: ITU. https://www.itu.int/en/ITU-D/Cybersecurity/Documents/Country_Profiles/Poland.pdf .

ITU. 2013. Cyberwellness profile Hungary. Hungary: ITU. https://www.itu.int/en/ITU-D/Cybersecurity/Documents/Country_Profiles/Hungary.pdf .

ITU Slovakia. 2012. Cyberwellness profile slovakia. ITU. https://www.itu.int/en/ITU-D/Cybersecurity/Documents/Country_Profiles/Slovakia.pdf .

Javaid, M.A. 2013. Cyber security: Challenges ahead. Available SSRN 2339594 . http://nexusacademicpublishers.com/uploads/portals/Cyber_Security_Challenged_Ahead.pdf .

Jayawardhena, C., and P. Foley. 2000. Changes in the banking sector—The case of Internet banking in the UK. Internet Research 10 (1): 19–31.

Johnson, K.N. 2015. Managing cyber risk. Georgia Law Review 50 (2): 548–592.

Jordan, J.S., J. Peek, and E.S. Rosengren. 2000. The market reaction to the disclosure of supervisory actions: Implications for bank transparency. Journal of Financial Intermediation 9 (3): 298–319.

Juma’h, A.H., and Y. Alnsour. 2020. The effect of data breaches on company performance. International Journal of Accounting & Information Management 28 (2): 275–301.

Kamiya, S., KangJun-Koo, K. Jungmin, A. Milidonis, and R. M. Stulz. 2020. Risk management, firm reputation, and the impact of successful cyberattacks on target firms. Journal of Financial Economics

Kark, K., A. Shaikh, and C. Brown. 2017, November 28. Technology budgets: From value preservation to value creation. Deloitte Insight. London.

Kauffman, R.J., J. Liu, and D. Ma. 2015. Technology investment decision-making under uncertainty. Information Technology and Management 16 (2): 153–172.

Kayworth, T., and D. Whitten. 2012. Effective information security requires a balance of social and technology factors. MIS Quarterly Executive 9(3).

Kesswani, N., and S. Kumar. 2015. Maintaining cyber security: Implications, cost and returns. Proceedings of the 2015 ACM SIGMIS Conference on Computers and People Research. New York: Association for Computer Machinery, 161–164.

Khoury, S., and E. Rolland. 2006. Conceptual model for explaining the IT investment paradox in the banking sector. International Journal of Technology, Policy and Management 6 (3): 309–326.

King, R.G., and R. Levine. 1993. Finance, entrepreneurship, and growth. Journal of Monetary Economics 3 (32): 513–542.

Ko, M., and C. Dorantes. 2006. The impact of information security breaches on financial performance of the breached firms: An empirical investigation. Journal of Information Technology Management 17 (2): 13–22.

Koette, M., and T. Poghosyan. 2009. The identification of technology regimes in banking: Implications for the market power-fragility nexus. Journal of Banking & Finance 33 (8): 1413–1422.

Kopp, E., L. Kaffenberger, and C. Wilson. 2017. Cyber risk, market failures, and financial stability, working paper. International Monetary Fund (WP/17/185).

Kox, H. L. 2013. Cybersecurity in the perspective of Internet traffic growth. Working paper. CPB Netherlands Bureau for Economic Policy Analysis. https://mpra.ub.uni-muenchen.de/47994/ .

Kröger, W. 2008. Critical infrastructures at risk: A need for a new conceptual approach and extended analytical tools. Reliability Engineering & System Safety 93 (12): 1781–1787.

Kunreuther, H., and G. Heal. 2003. Interdependent security. Journal of Risk and Uncertainty 26 (2–3): 231–249.

Kwast, M.L., and J.T. Rose. 1982. Pricing, operating efficiency, and profitability among large commercial banks. Journal of Banking & Finance 6 (2): 233–254.

Lagazio, M., N. Sherif, and A.M. Cushman. 2014. A multi-level approach to understanding the impact of cyber crime on the financial sector. Computers & Security 45: 58–74.

Lages, L.F. 2016. VCW-value creation wheel: Innovation, technology, business, and society. Journal of Business Research 69: 4849–4855.

Langton, J. 2018, June 4. Data breaches credit negative for BMO and CIBC: Moody’s . www.investmentexecutive.com : https://www.investmentexecutive.com/news/industry-news/data-breaches-credit-negative-for-bmo-and-cibc-moodys/ .

Lee, D., and S. Mithas. 2014. IT investments, alignment and firm performance: Evidence from an emerging economy. ICIS Conference Proceedings. Association for Information Systems. https://aisel.aisnet.org/icis2014/proceedings/ISStrategy/29/ .

Lever, K.E., and K. Kifayat. 2020. Identifying and mitigating security risks for secure and robust NGI networks. Sustainable Cities and Society 59: 102098.

Levine, R.G. 1993. Finance and growth: Schumpeter might be right. The Quarterly Journal of Economics 108 (3): 717–737.

Lewis, J.A. 2002. Assessing the risks of cyber terrorism, cyber war and other cyber threats . Washington, DC: Center for Strategic & International Studies.

Lewis, J., and S. Baker. 2013. The economic impact of cybercrime and cyber espionage. McAfee.

Li, H., W.G. No, and T. Wang. 2018. SEC’s cybersecurity disclosure guidance and disclosed cybersecurity risk factors. International Journal of Accounting Information Systems 30: 40–55.

Linsley, P.M., and P.J. Shrives. 2005. Transparency and the disclosure of risk information in the banking sector. Journal of Financial Regulation and Compliance 13 (3): 205–214.

Longstaff, T., C. Chittister, R. Pethia, and Y. Haimes. 2020. Are we forgetting the risks of information technology. Computer 33 (12): 43–51.

Low, P. 2017. Insuring against cyber-attacks. Computer Fraud & Security 2017: 18–20.

Macaulay, T. 2018. Critical infrastructure: Understanding its component parts, vulnerabilities, operating risks, and interdependencies , 1st ed. Boca Raton: Taylor and Francis Group.

Mandeville, T. 1998. An information economics perspective on innovation. International Journal of Social Economics 25 (2/3/4): 357–364.

Mayahi, A., and I. Humaid. 2016. Development of a comprehensive information security system for UAE e-Government. PhD thesis, Prifysgol Bangor University

McConnell, Patrick, and Keith Blacker. 2013. Systemic operational risk: Does it exist and if so, how do we regulate it? The Journal of Operational Risk 8 (1): 59–99.

McGraw, G. 2013. Cyber war is inevitable (unless we build security in). Journal of Strategic Studies 36 (1): 109–119. https://doi.org/10.1080/01402390.2012.742013 .

MCI. 2017. Public consultation paper on the draft cybersecurity bill. The Ministry of Communications and Information (MCI) and the Cyber Security Agency of Singapore. https://www.csa.gov.sg/~/media/csa/cybersecurity_bill/consult_document.pdf .

Ministry of Digital Affairs. 2017. National framework of cybersecurity policy of Republic of Poland for 2017-22 . Warsaw: Government of Poland.

Mohammed, A.-M., B. Idris, G. Saridakis, and V. Benson. 2020. Chapter 8—Information and communication technologies: A curse or blessing for SMEs? . New York: Academic Press.

Moore, T. 2010. The economics of cybersecurity: Principles and policy options. International Journal of Critical Infrastructure Protection 3 (3–4): 103–117.

Moore, T., S. Dynes, and F. Chang. 2015. Identifying how firms manage cybersecurity investment . Dallas: Southern Methodist University.

Morton, M., J. Werner, P. Kintis, K. Snow, M. Antonakakis, M. Polychronakis, and F. Monrose. 2018. Security risks in asynchronous web servers: When performance optimizations amplify the impact of data-oriented attacks. IEEE European Symposium on Security and Privacy , pp. 167–182.

Moumen, N., H.B. Othman, and K. Hussainey. 2015. The value relevance of risk disclosure in annual reports: Evidence from MENA emerging markets. Research in International Business and Finance 34: 177–204.

Mugarura, N., and E. Ssali. 2020. Intricacies of anti-money laundering and cyber-crimes regulation in a fluid global system. Journal of Money Laundering Control .

Mukhopadhyay, A., D.S. Samir Chatterjee, A. Mahanti, and A.S. Sadhukhan. 2013. Cyber-risk decision models: To insure IT or not? Decision Support Systems 56: 11–26.

NCG. 2016. 4 important cybersecurity focus areas for banks. Portland: Northcross Group. http://www.northcrossgroup.com .

NCSB. 2014. National cybersecurity strategy. Dhaka: ICT Ministry. https://sherloc.unodc.org/cld/lessons-learned/bgd/the_national_cybersecurity_strategy_of_bangladesh.html ?.

NCSC. 2018. The cyber threat to UK business. UK: The National Cyber Security Centre. https://www.ncsc.gov.uk/home .

Ngonzi, T.T. 2016. Theorizing ICT-based social innovation on development in the context of developing countries of Africa . Captown: University of Cape Town.

Ni, J., X. Lin, and X. Shen. 2019. Towards edge-assisted internet of things: From security and efficiency perspectives. IEEE Network 33 (2): 50–57.

OECD. 2015. Digital security risk management for economic and social prosperity: OECD recommendation and companion document . Paris: OECD Publishing.

OFR. 2017. Cybersecurity and financial stability: Risks and resilience. Office of Financial Research. https://www.financialresearch.gov/viewpoint-papers/files/OFRvp_17-01_Cybersecurity.pdf .

Page, J., M. Kaur, and E. Waters. 2017. Directors’ liability survey: Cyber attacks and data loss—A growing concern. Journal of Data Protection & Privacy 1 (2): 173–182.

Park, I., J. Lee, H.R. Rao, and S.J. Upadhyaya. 2006. Part 2: Emerging issues for secure knowledge management-results of a Delphi study. IEEE Transactions on Systems, Man, and Cybernetics-Part A: Systems and Humans 36 (3): 421–428.

Patterson, D., A. Brown, P. Broadwell, G. Candea, and J.C. Mike Chen. 2002. Recovery oriented computing (ROC): Motivation, definition, techniques, and case studies. UC Berkeley Computer Science.

Paul, J.A., and X. Wang. 2019. Socially optimal IT investment for cybersecurity. Decision Support Systems 122: 113069.

Pavlou, P.A., H. Liang, and Y. Xue. 2007. Understanding and mitigating uncertainty in online exchange relationships: A PrincipalAgent perspective. MIS Quarterly, 105–136.