A How-To Guide for Creating a Business Budget

Amanda Smith

Reviewed by

September 23, 2022

This article is Tax Professional approved

Most business owners know how important a business budget is when it comes to managing expenses and planning for the future—but in a challenging economic environment like the one we’ve been experiencing, your business budget takes on even greater significance.

With inflation running rampant and the possibility of a recession looming, business owners need to be able to forecast their cash flow, manage their expenses, and plan for the future. Creating a detailed business budget is the first step.

Whether you want to revamp your budgeting method, or you’ve never created a business budget before, this guide will walk you through the process.

I am the text that will be copied.

What is a business budget?

A budget is a detailed plan that outlines where you’ll spend your money monthly or annually.

You give every dollar a “job,” based on what you think is the best use of your business funds, and then go back and compare your plan with reality to see how you did.

A budget will help you:

- Forecast what money you expect to earn

- Plan where to spend that revenue

- See the difference between your plan and reality

What makes a good budget?

The best budgets are simple and flexible. If circumstances change (as they do), your budget can flex to give you a clear picture of where you stand at all times.

Every good budget should include seven components:

1. Your estimated revenue

This is the amount you expect to make from the sale of goods or services. It’s all of the cash you bring in the door, regardless of what you spent to get there. This is the first line on your budget. It can be based on last year’s numbers or (if you’re a startup ), based on industry averages.

2. Your fixed costs

These are all your regular, consistent costs that don’t change according to how much you make—things like rent, insurance, utilities, bank fees, accounting and legal services, and equipment leasing.

Further reading: Fixed Costs (Everything You Need to Know)

3. Your variable costs

These change according to production or sales volume and are closely related to “ costs of goods sold ,” i.e., anything related to the production or purchase of the product your business sells. Variable costs might include raw materials, inventory, production costs, packaging, or shipping. Other variable costs can include sales commission, credit card fees, and travel. A clear budget plan outlines what you expect to spend on all these costs.

The cost of salaries can fall under both fixed and variable costs. For example, your core in-house team is usually associated with fixed costs, while production or manufacturing teams—anything related to the production of goods—are treated as variable costs. Make sure you file your different salary costs in the correct area of your budget.

Further reading: Variable Costs (A Simple Guide)

4. Your one-off costs

One-off costs fall outside the usual work your business does. These are startup costs like moving offices, equipment, furniture, and software, as well as other costs related to launch and research.

5. Your cash flow

Cash flow is all money traveling into and out of a business. You have positive cash flow if there is more money coming into your business over a set period of time than going out. This is most easily calculated by subtracting the amount of money available at the beginning of a set period of time and at the end.

Since cash flow is the oxygen of every business, make sure you monitor this weekly, or at least monthly. You could be raking it in and still not have enough money on hand to pay your suppliers.

6. Your profit

Profit is what you take home after deducting your expenses from your revenue. Growing profits mean a growing business. Here you’ll plan out how much profit you plan to make based on your projected revenue, expenses, and cost of goods sold. If the difference between revenue and expenses (aka “ profit margins ”) aren’t where you’d like them to be, you need to rethink your cost of goods sold and consider raising prices .

Or, if you think you can’t squeeze any more profit margin out of your business, consider boosting the Advertising and Promotions line in your budget to increase total sales.

7. A budget calculator

A budget calculator can help you see exactly where you stand when it comes to your business budget planning. It might sound obvious, but getting all the numbers in your budget in one easy-to-read summary is really helpful.

In your spreadsheet, create a summary page with a row for each of the budget categories above. This is the framework of your basic budget. Then, next to each category, list the total amount you’ve budgeted. Finally, create another column to the right—when the time period ends, use it to record the actual amounts spent in each category. This gives you a snapshot of your budget that’s easy to find without diving into layers of crowded spreadsheets.

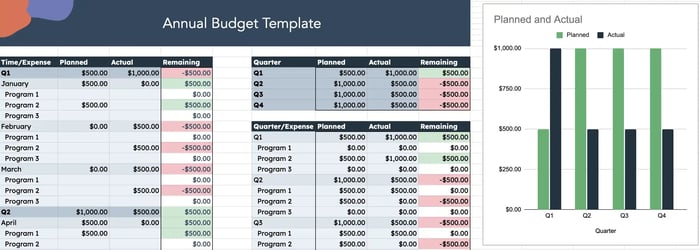

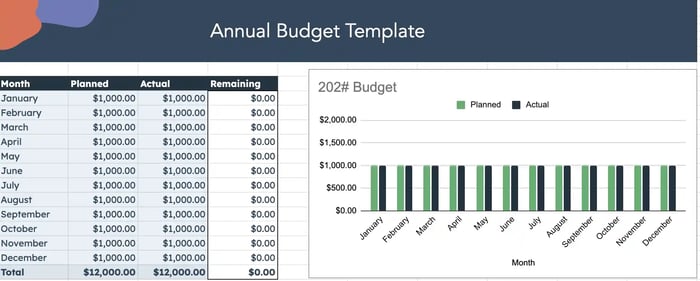

See the sample below.

Pro tip: link the totals on the summary page to the original sums in your other budget tabs . That way when you update any figures, your budget summary gets updated at the same time. The result: your very own budget calculator.

You can also check out this simple Startup Cost Calculator from CardConnect. It lays out some of the most common expenses that you might not have considered. From there, you can customize a rough budget for your own industry.

Small business budgets for different types of company

While every good budget has the same framework, you’ll need to think about the unique budgeting quirks of your industry and business type.

Seasonal businesses

If your business has a busy season and a slow season, budgeting is doubly important.

Because your business isn’t consistent each month, a budget gives you a good view of past and present data to predict future cash flow . Forecasting in this way helps you spot annual trends, see how much money you need to get you through the slow months, and look for opportunities to cut costs to offset the low season. You can use your slow season to plan for the next year, negotiate with vendors, and build customer loyalty through engagement.

Don’t assume the same thing will happen every year, though. Just like any budget, forecasting is a process that evolves. So start with what you know, and if you don’t know something—like what kind of unexpected costs might pop up next quarter— just give it your best guess . Better to set aside money for an emergency that doesn’t happen than to be blindsided.

Ecommerce businesses

The main budgeting factor for ecommerce is shipping. Shipping costs (and potential import duties) can have a huge impact.

Do you have space in your budget to cover shipping to customers? If not, do you have an alternative strategy that’s in line with your budget—like flat rate shipping or real-time shipping quotes for customers? Packaging can affect shipping rates, so factor that into your cost of goods sold too. While you’re at it, consider any international warehousing costs and duties.

You’ll also want to create the best online shopping experience for your customers, so make sure you include a good web hosting service, web design, product photography, advertising, blogging, and social media in your budget.

Inventory businesses

If you need to stock up on inventory to meet demand, factor this into your cost of goods sold. Use the previous year’s sales or industry benchmarks to take a best guess at the amount of inventory you need. A little upfront research will help ensure you’re getting the best prices from your vendors and shipping the right amount to satisfy need, mitigate shipping costs, and fit within your budget.

The volume of inventory might affect your pricing. For example, if you order more stock, your cost per unit will be lower, but your overall spend will be higher. Make sure this is factored into your budget and pricing, and that the volume ordered isn’t greater than actual product demand.

You may also need to include the cost of storage solutions or disposal of leftover stock.

Custom order businesses

When creating custom ordered goods, factor in labor time and cost of operations and materials. These vary from order to order, so make an average estimate.

Budgeting is tricky for startups—you rarely have an existing model to use. Do your due diligence by researching industry benchmarks for salaries, rent, and marketing costs. Ask your network what you can expect to pay for professional fees, benefits, and equipment. Set aside a portion of your budget for advisors—accountants, lawyers, that kind of thing. A few thousand dollars upfront could save you thousands more in legal fees and inefficiencies later on.

This is just scratching the surface, and there’s plenty more to consider when creating a budget for a startup. This business startup budget guide from The Balance is a great start.

Service businesses

If you don’t have a physical product, focus on projected sales, revenue, salaries, and consultant costs. Figures in these industries—whether accounting, legal services, creative, or insurance—can vary greatly, which means budgets need flexibility. These figures are reliant on the number of people required to provide the service, the cost of their time, and fluctuating customer demand.

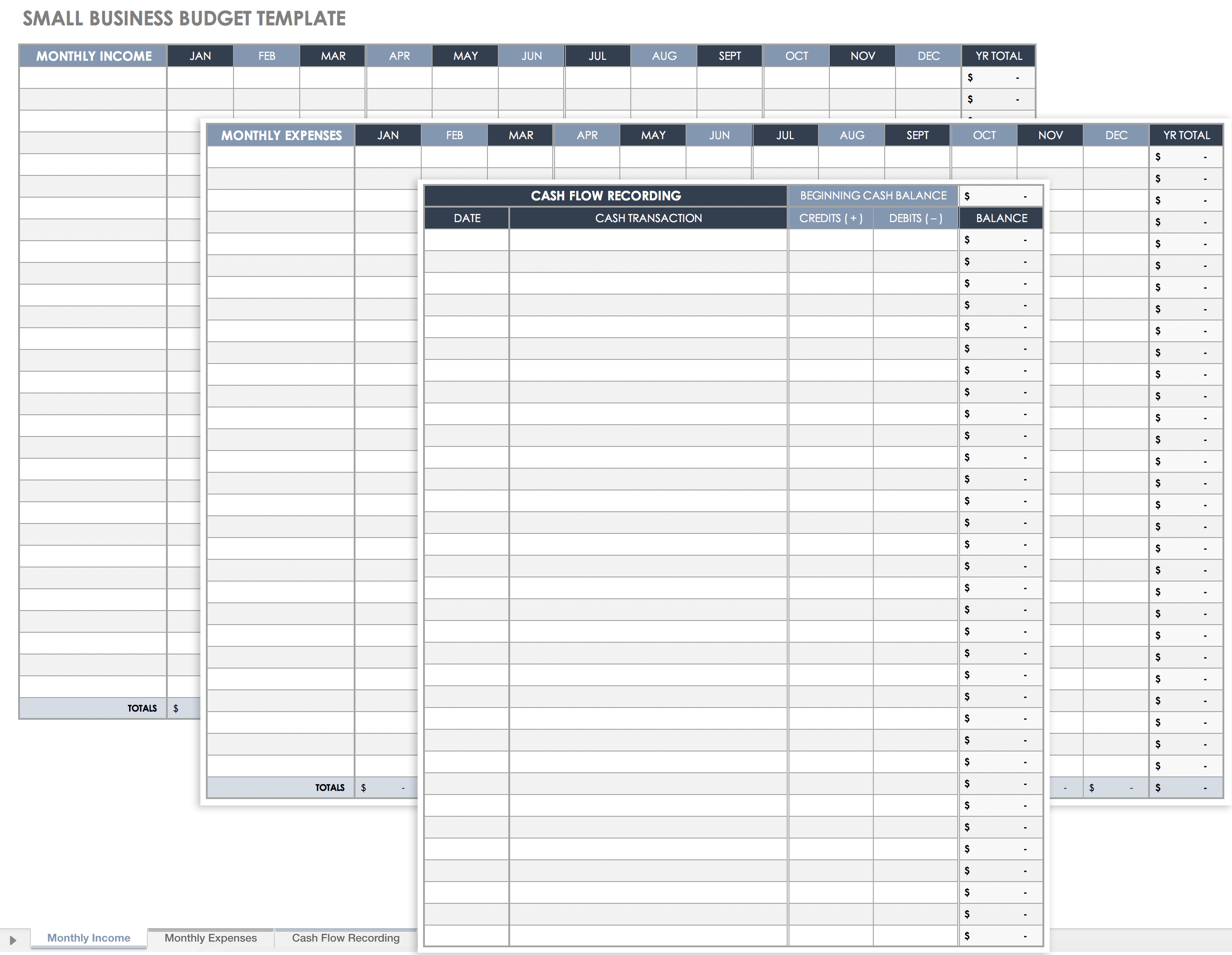

Small business budgeting templates

A business budget template can be as simple as a table or as complex as a multi-page spreadsheet. Just make sure you’re creating something that you’ll actually use.

Create your budget yearly—a 12-month budget is standard fare—with quarterly or monthly updates and check-ins to ensure you’re on track.

Here are some of our favorite templates for you to plug into and get rolling.

- The Balance has a clear table template that lists every budget item, the budgeted amount, the actual amount, and the difference between the two. Use this one if you’re looking to keep it simple.

- Capterra has both monthly and annual breakdowns in their Excel download. It’s straightforward, thorough, and fairly foolproof.

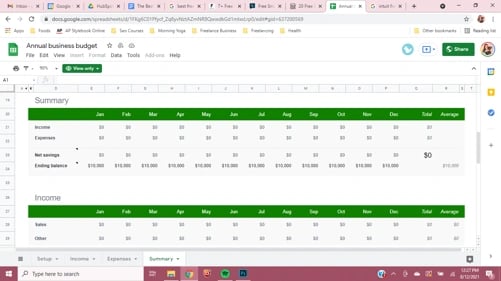

- Google Sheets has plenty of budget templates hiding right under your nose. They’re easy to use, and they translate your figures into clear tables and charts on a concise, visual summary page.

- Smartsheet has multiple resources for small businesses, including 12-month budget spreadsheets, department budget templates, projection templates, project-by-project templates, and startup templates. These templates are ideal if you’re looking for a little more detail.

- Scott’s Marketplace is a blog for small businesses. Their budget template comes with step-by-step instructions that make it dead simple for anyone.

- Vertex42 focuses on Excel spreadsheets and offers templates for both product-based and service-based businesses, as well as a business startup costs template for anyone launching a new business.

Budgeting + bookkeeping = a match made in heaven

Making a budget is kind of like dreaming: it’s mostly pretend. But when you can start pulling on accurate historical financials to plan the upcoming year, and when you can check your budget against real numbers, that’s when budgets start to become useful.

The only way to get accurate financial data is through consistent bookkeeping.

Don’t have a regular bookkeeping process down pat? Check out our free guide, Bookkeeping Basics for Entrepreneurs . We’ll walk you through everything you need to know to get going yourself, for free.

If you need a bit more help, get in touch with us. Bookkeeping isn’t for everyone, especially when you’re also trying to stay on top of a growing business—but at Bench, bookkeeping is what we do best.

Related Posts

.png)

What Is Equity, and How Do You Calculate It?

How much of your business do you actually own? If you understand equity, you can answer that question.

The Basics of Small Business Accounting: A How-to

New to business? Learn the fundamentals of small business accounting, and set your financials up for success.

Quicken Alternatives: Your Top Six Options

Looking for a Quicken replacement? Here are your top six options.

Join over 140,000 fellow entrepreneurs who receive expert advice for their small business finances

Get a regular dose of educational guides and resources curated from the experts at Bench to help you confidently make the right decisions to grow your business. No spam. Unsubscribe at any time.

Accounting | How To

How To Create a Small Business Budget [+Free Template]

Published June 20, 2023

Published Jun 20, 2023

REVIEWED BY: Tim Yoder, Ph.D., CPA

WRITTEN BY: Eric Gerard Ruiz, CPA

This article is part of a larger series on Bookkeeping .

- 1. Create a Budget Process

- 2. Determine Key Assumptions in Budgeting

- 3. Create the Sales Budget

- 4. Create the Inventory and Purchases Budget

- 5. Create the COGS Budget

- 6. Create the Sales & Administrative Budget

- 7. Create the Capital Budget

- 8. Create the Cash Budget

- 9. Assemble Proforma Financial Statements

Common Problems in Budgeting

Bottom line.

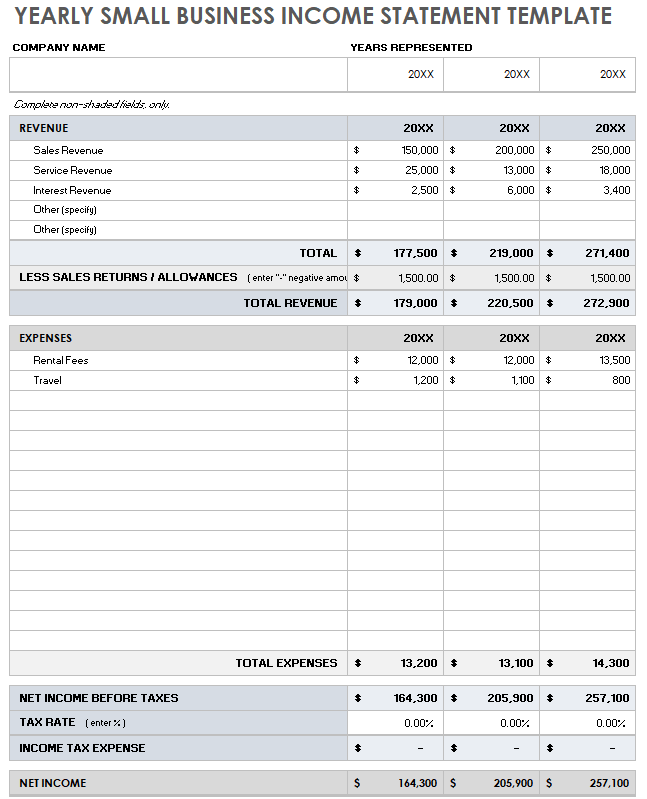

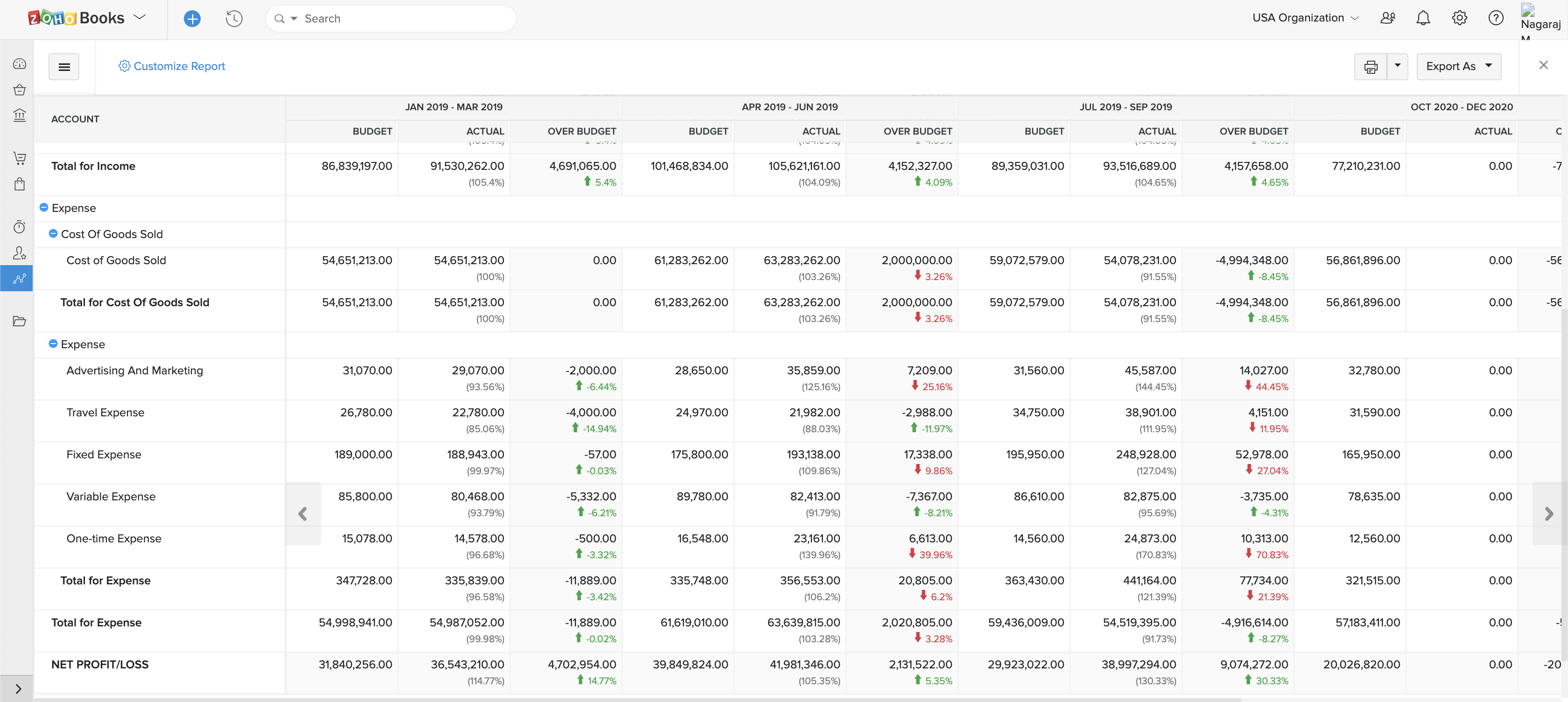

Creating a business budget is an important step in planning. A small business budget starts with creating the budgeting process, the operating budgets, such as sales, inventory and purchases, cost of goods sold (COGS), and sales and administrative, and ends with the financial budgets, such as cash, capital, and proforma financial statements.

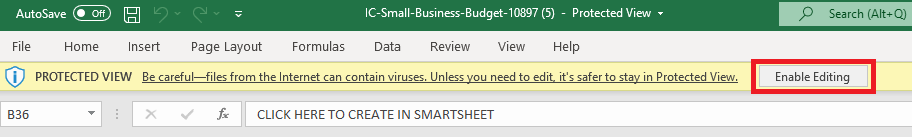

To help you get started, we’ve provided a very simplified version of a budget spreadsheet to illustrate how information from each area of your business is combined to form an annual budget. We’ll discuss how to use this spreadsheet throughout our article.

FILE TO DOWNLOAD OR INTEGRATE

FILE TO DOWNLOAD

Thank you for downloading!

Budgeting is an important subset of managerial accounting. Read our small business guide to managerial accounting and learn how managerial accounting concepts can be applied in a small business setup.

Step 1: Create a Budget Process

The budget process shows how the different departments of the business create a budget. Without a process, budgeting would be chaotic, and it would result in inefficiencies. In the budget process, you need to consider the following:

- Budget period: When are budgets created, reviewed, implemented, and evaluated against actual performance?

- Budgeting method: How are budgets created? Is it created from scratch (zero-based budgeting)? Is it based on actual results with adjustments (incremental budgeting)?

- Budget involvement: Who creates the budgets?

- Budget committee: Who oversees and approves the budgets?

- Budget manual: What are the guidelines for creating budgets?

Budget Period

The first thing to consider in the budget process is the budget period. How long should budgets be prepared? When will it be implemented? The budget period can be any time before the next business year begins. Hence, you can create next year’s budget three months prior to the end of the current year.

The crucial periods for budget planning are as follows:

- Budget preparation : The time at which managers and heads create a budget for their department.

- Budget review and approval : The time at which top management will review and approve all lower-level budgets.

- Budget implementation : The time at which all concerned parties will act upon planned activities stated in the budget. This phase runs until the effectiveness of the budget lasts.

- Budget accountability : The time at which top management will assess if the business is meeting its budgetary goals. This phase runs intermittently during the year, such as monthly, quarterly, or semiannually, especially during performance evaluation and review.

As a small business, you need not be particular about the phases. You can modify the phases depending on small business needs.

Budgeting Method

There are four different types of budgeting methods, but for small businesses, we picked only two, as they are the most appropriate for the setup:

- Zero-based budgeting : This is a budgeting technique that starts from scratch. It doesn’t use information from past budgets. Instead, departments and managers need to justify every dollar in the budget without referring to past performance or past budgeting practices.

- Incremental budgeting : This is a budgeting technique that uses actual figures from the past years and adjusts with a certain percentage. For example, if actual sales last year is $20,000, the incremental budgeted sales could be 10 percent more or $22,000.

Budget Involvement

Small businesses must consider what kind of involvement is needed during the budgeting process, given that budgets can be used to measure the performance of departments and managers. There are two kinds of budget involvement—for small businesses, authoritative budgeting is suitable if the small business owner is heavily involved in daily operations. Alternatively, participatory budgeting applies if the owner delegates decision-making to managers.

1. Authoritative budgeting

Also known as top-down budgeting, this budget involvement strategy only includes top management in the budgeting process, where operating personnel and lower-level employees have little to no say in the budget. It takes less time to create since there are fewer employees involved.

However, some operating personnel and lower-level employees may disagree with top management’s estimates in the budget. At the least, this strategy creates discord between top management and operating personnel due to conflicting views. But if prepared appropriately, authoritative budgeting reflects the business’ vision, mission, and goals better.

2. Participatory budgeting

This is also called bottom-up budgeting, and this budget involvement strategy includes operating personnel and lower-level employees in creating a budget. It is a budget co-created by everyone involved or affected by the budget being created.

It enhances the relationship between top management and operating personnel since everyone has a say in the budget. However, this strategy can take time since more employees are involved in the budgeting process. Also, some lower-level managers can use this opportunity to insert some budgetary slack so that they look good during performance.

Budget Committee

The budget committee is responsible for compiling all lower-level budgets and assembling them into one package called the master budget and reviewing and approving budgets from different departments. For small businesses, the composition of the budget committee can be the small business owners, chief executive officer (CEO), treasurer, budget coordinator, and chief accountant.

The role of the budget coordinator is to reach out to lower-level managers and communicate the wishes of the budget committee. If you’re a family-grown small business, family members, including the small business accountant or finance officer, can be committee members.

Budget Manual

The first order of business of the budget committee is to create a budget manual, which outlines the budgeting process. Lower-level managers and department heads will use the budget manual when creating lower-level budgets. The budget committee may also set specific budget formats and deadlines.

A budget manual standardizes the budgeting process—it ensures fairness and comparability among departments and managers. With this manual in place, you can prevent the instance of inserting unfamiliar line items in the budget or using different sources in forecasting budgeted figures.

The budget manual should include the following:

- Statements of budgetary purpose

- Budgetary activities, such as budget preparation, budget hearing and evaluation, budget approval, budget execution, and budget accountability

- Schedule of budgetary activities and deadlines

- Sample budgets

- Key assumptions used in budgeting

You can create a budget easily using QuickBooks Online. Its budgeting functions create budgets per account in the chart of accounts. Read our QuickBooks Online review for detailed information on our recommendation.

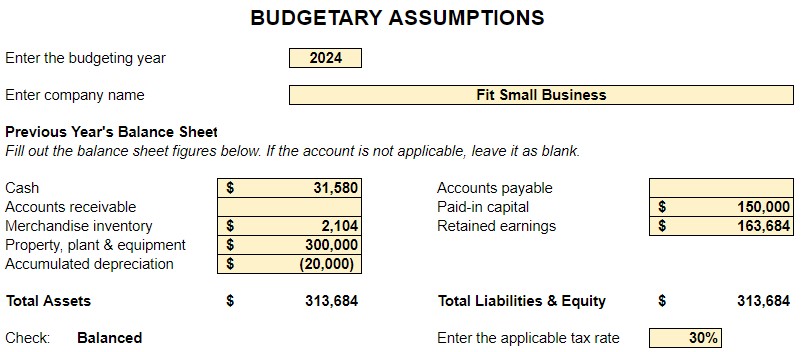

Step 2: Determine Key Assumptions in Budgeting

After performing the groundwork for budgeting, the next step is determining the key assumptions. These assumptions make it easy to prepare budgets since not all information is readily available until it happens. These assumptions are not arbitrary because they must be based on past experience and good business practices.

Examples of assumptions are:

- Sales forecast

- Selling price per unit

- Cost per unit

- Estimated discounts given to customers

- Estimated sales returns

- Desired ending inventory per month or quarter

- Number of raw materials used to produce one good unit

- Number of labor hours needed to produce one good unit

- Number of overhead hours (if any) needed to produce one good unit

- Inventory cost flow method used, such as first-in, first-out (FIFO), last-in, first-out (LIFO), or average cost

- Cash collection patterns

- Cash payments patterns

- Cash retention policies

Input your assumptions in the second tab of our downloadable spreadsheet. When done, all of the reports will automatically populate. It’s the quality of your assumptions that will determine if your budget is realistic. As you improve your budgeting process, you’ll come up with additional assumptions to include in the process.

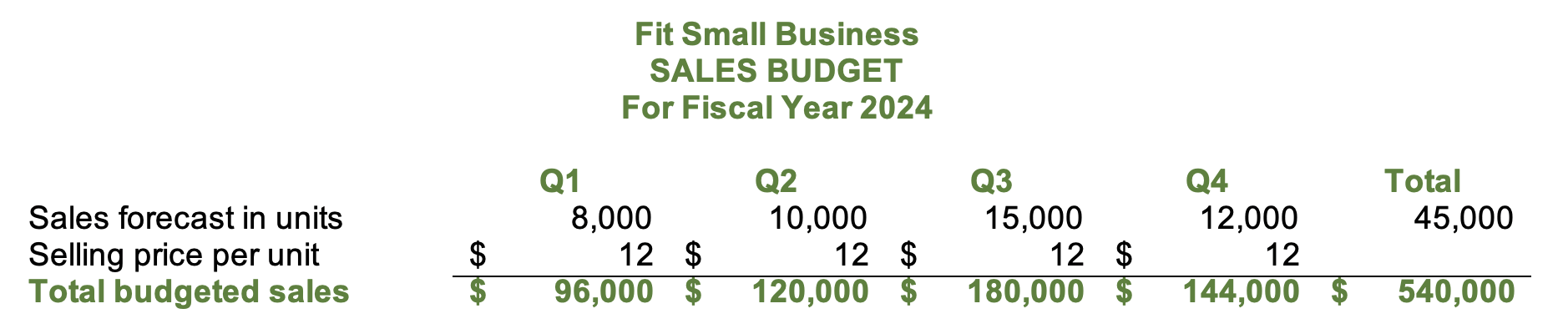

Step 3: Create the Sales Budget

The sales budget is the first budget that should be prepared because almost all budgets will depend on the information in it. It is the responsibility of the sales department to forecast and create the sales budget of the company, and it is crucial that the department forecast sales reasonably using the appropriate forecasting method. Our article about sales forecasting discusses the method of sales forecasting and shows how CRM software can help.

Below is an example of the sales budget taken from our small business master budget template.

Sales budget

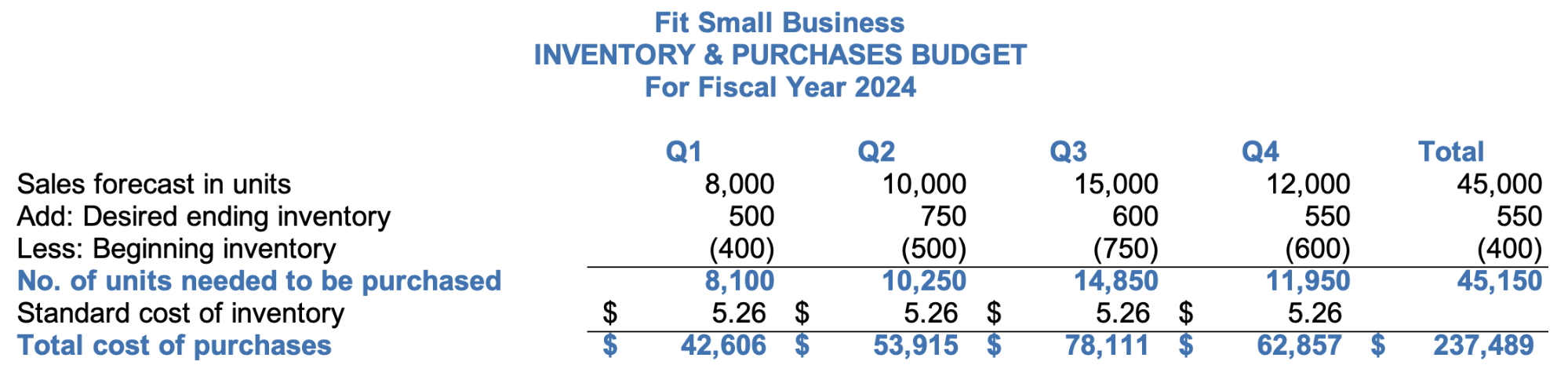

Step 4: Create the Inventory & Purchases Budget

There are two ways to call this budget: merchandising companies can call it inventory and purchases budget while manufacturing companies can call it production budget. However, the information shown in this budget remains the same. The inventory or production budget shows the number of units needed to meet the sales demand.

Inventory budget

The image above shows the sample inventory budget in our free template. One of our assumptions is that the business intends to keep 5% of next quarter’s sales forecast as current quarter’s ending inventory. In Q1, desired ending inventory is 500 units, which is 5% of 10,000 units of Q2’s sales forecast.

After determining the number of units needed, multiply them to the standard cost of inventory to get the total cost of inventory. The standard inventory cost is also the budgeted cost of inventory. Since some inventory prices fluctuate, setting standard costs makes it easy for us to budget.

When adding values in the total column, do not sum up the values in the beginning and desired ending inventory rows. Instead, the total beginning inventory in the total column should be the Q1 beginning inventory, while the total ending inventory should be the Q4 ending inventory.

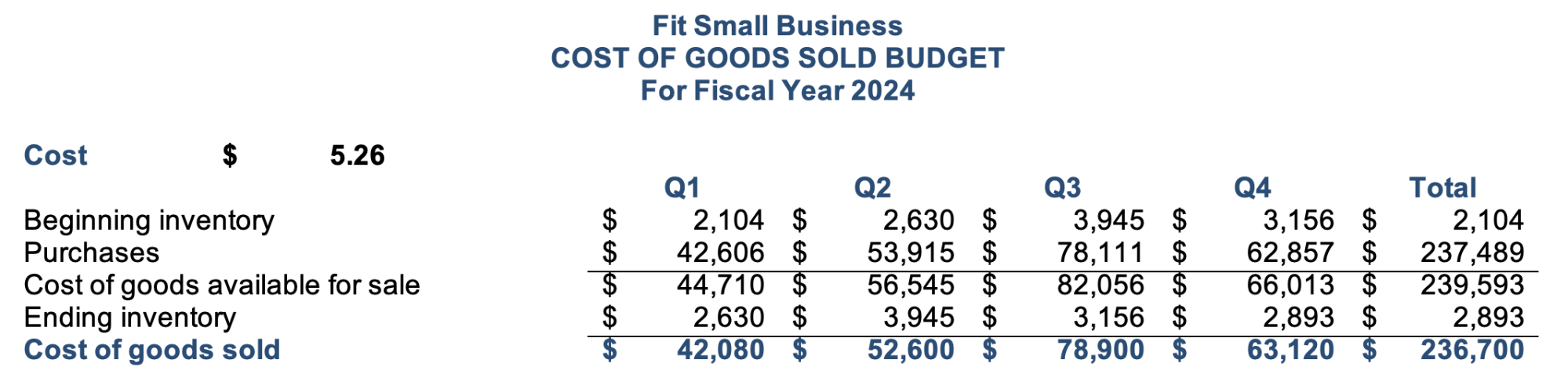

Step 5: Create the COGS Budget

The next logical step after budgeting inventory and purchases is to determine the COGS. Through the COGS budget, we can estimate the level of COGS per quarter. This budget is necessary for preparing the proforma income statement.

Below is the COGS budget from our small business budget template:

COGS budget

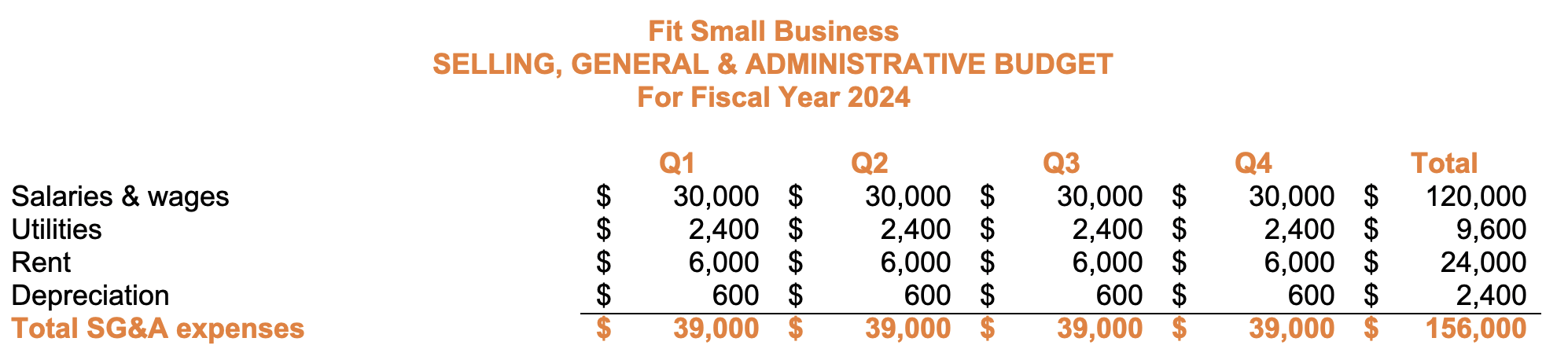

Step 6: Create the Sales & Administrative Budget

The sales and administrative (S&A) budget presents the budgeted costs for sales expenses, office expenses, and administrative expenses. This is necessary for budgeting the salaries of employees and other fixed expenses. The image below shows the sales and administrative budget from our template:

S&A budget

Most expenses in this budget are fixed costs. That’s why the amounts are the same for every quarter. Manufacturing companies may also call this budget a “fixed overhead budget.”

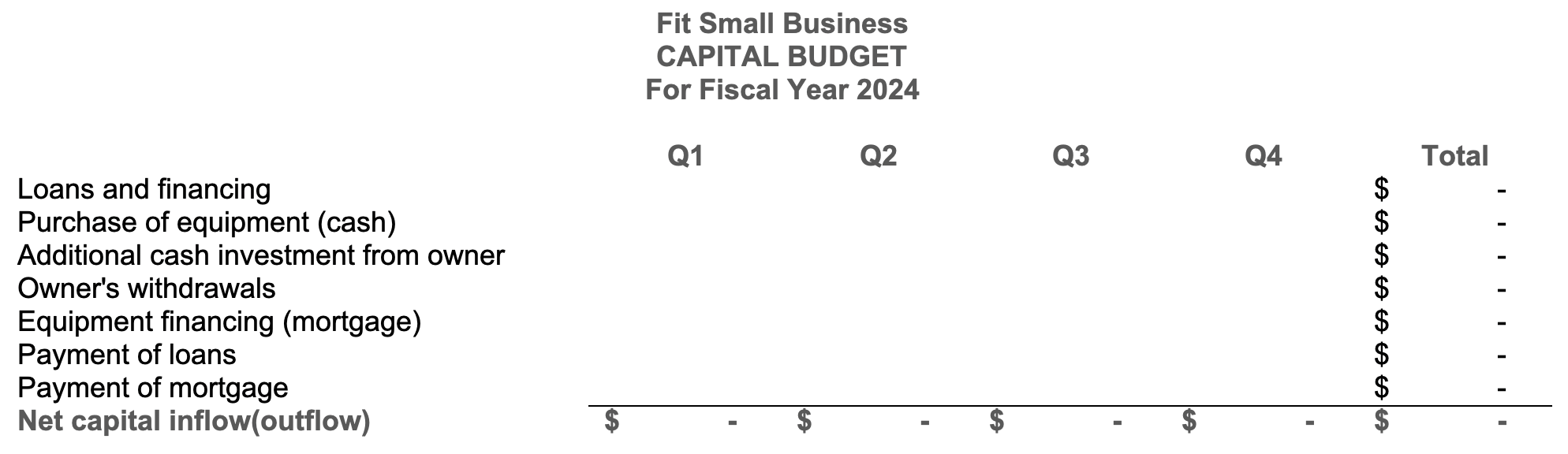

Step 7: Create the Capital Budget

A capital budget shows all the planned capital expenditures during the year. In our capital budget example below, there are no figures because the sample company didn’t plan any capital decisions for 2024. However, we’ve included common capital decisions for you to fill out when you use our template. For instance, a bank loan is a capital inflow while the purchase of equipment is a capital outflow.

Capital budget

The capital budget in our downloadable spreadsheet does not auto-populate from the assumptions tab. Instead, enter your budgeted loans and purchases directly in the report.

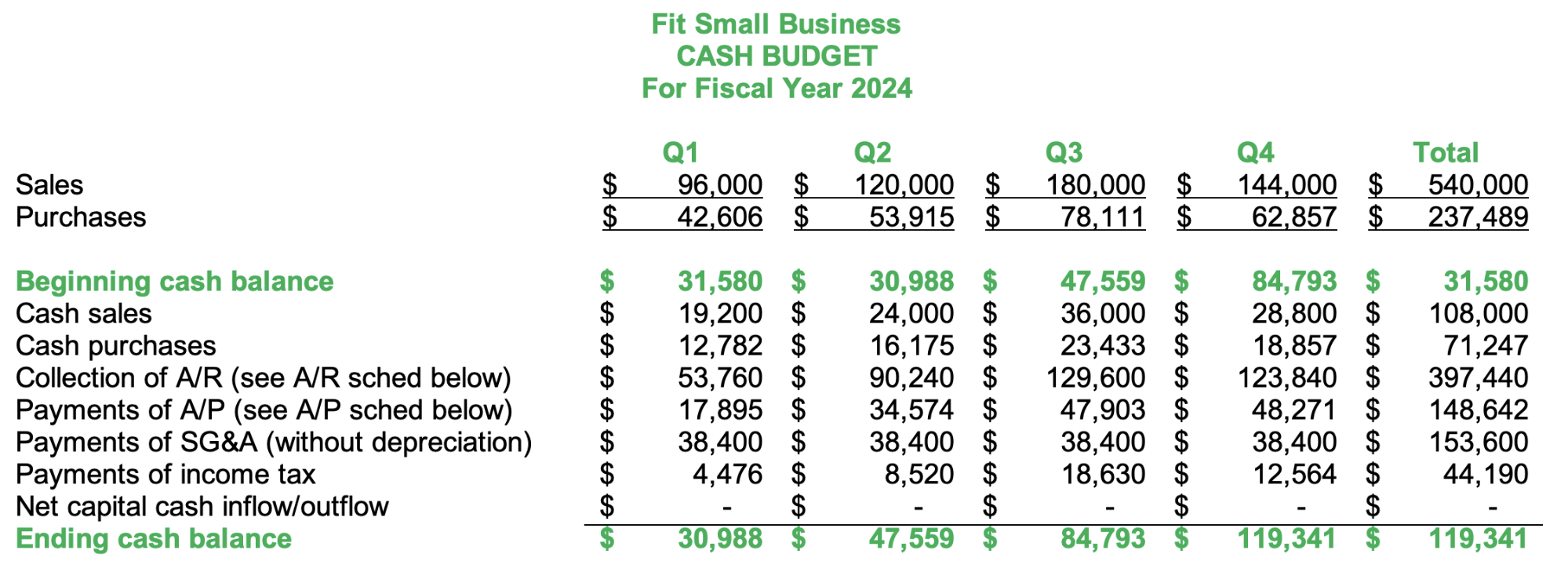

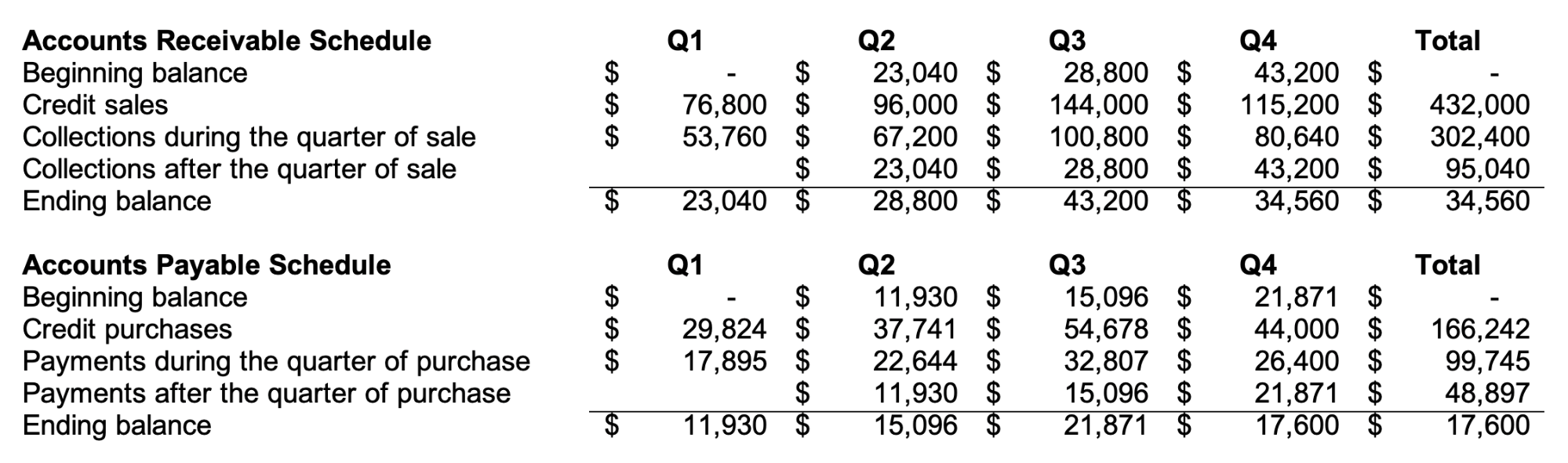

Step 8: Create the Cash Budget

The last budget that you need to prepare is the cash budget, which shows all the cash inflows and outflows from all budgets. Almost all budgets above affect cash flow. For example, the sales budget can show all cash inflows from cash sales and subsequent cash collections from credit sales.

Cash budget

Accounts Receivable & Accounts Payable Schedule

Collections from accounts receivables (A/R) and payments of accounts payable (A/P) are integral parts of the cash budget. Creating the A/R and A/P schedules helps in computing the ending balance of A/R and A/P and the amount of cash collections and payments per quarter. Below are the supporting A/R and A/P schedules for our cash budget above:

A/R and A/P schedules

Step 9: Assemble the Proforma Financial Statements Based on Budgeted Figures

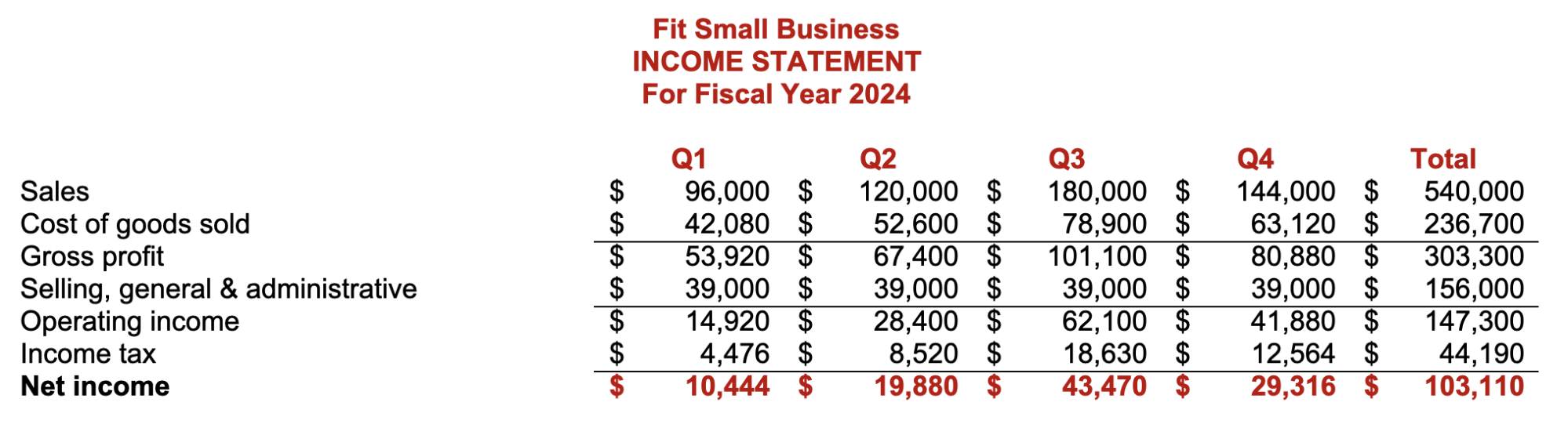

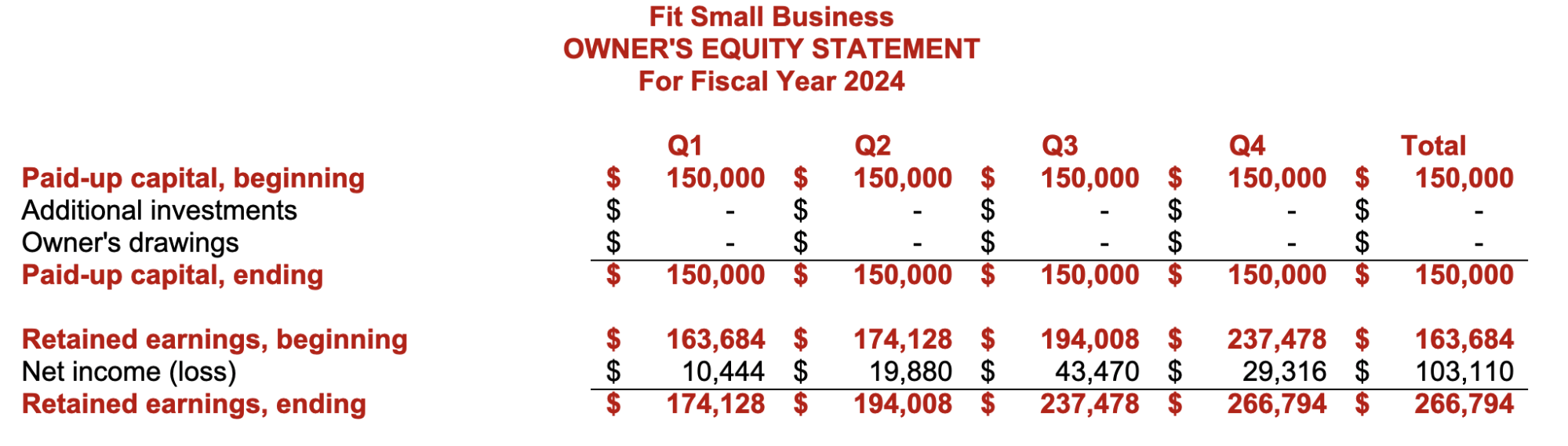

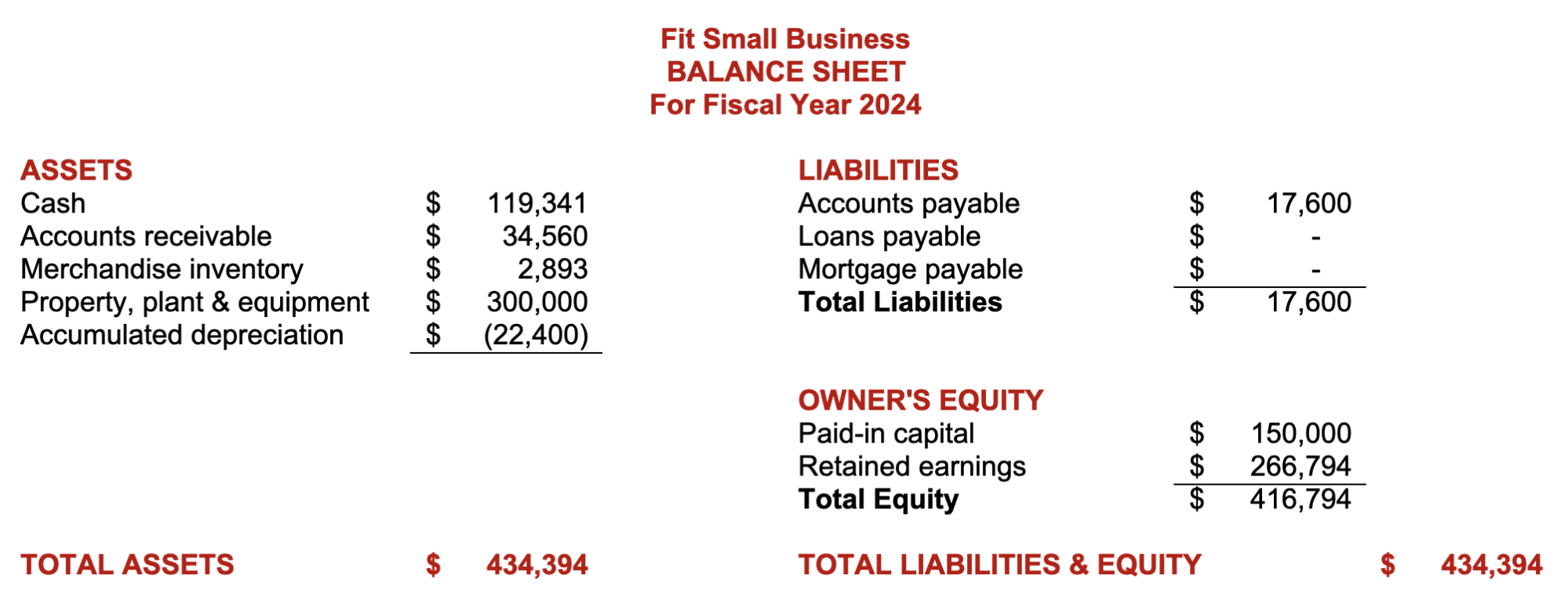

The ultimate result of the budgeting process is the proforma financial statements, which are the budgeted or projected results of planned activities. If the budget goes as planned, the actual financial statements should be near the proforma financial statements. Below are the proforma income statement and balance sheet in our small business budget template.

Proforma Income Statement

Proforma Owner’s Equity Statement

Proforma Balance Sheet

Budgeting helps businesses plan on future events and meet company goals. However, it is likely that you will experience difficulties and problems during the budgeting process. The four problems we’ll discuss are budgetary slack, goal incongruence, budget myopia, and standard setting.

Budgetary slack and goal incongruence occur when managers are not aligned with the business’s overall goals and objectives, while budget myopia happens when the business forgets to consider the impact of short-term decisions in the long run. Lastly, standard setting often poses a problem when standards are too high or ideal. Let’s discuss each of them in greater detail below.

Budgetary Slack

Sometimes, managers and heads can use budgets to preempt results to their favor. This unethical practice is called budgetary slack or budget padding. Budget slacks occur when managers underestimate revenue goals and overestimate expense goals and when the business follows the participatory budget involvement strategy.

When time for evaluation arrives, budget slacks will make the manager’s performance as exemplary. Managers tend to include budgetary slacks when top management is too strict and punitive whenever budgets aren’t met.

For example, the sales manager underestimates the sales forecast at $50,000 for the first quarter, knowing that they can achieve actual sales of $70,000. This example shows how budgetary slack can affect performance evaluation and create a false reflection of the company’s ability to generate revenue.

Goal Incongruence

Budgets are goals. When goals of management and employees don’t meet, the budget will not reflect the results that’s best for the business as a whole. Preventing goal incongruence enhances the quality of the budget. The goal of employees should be aligned with the business’s goals, and top management should provide opportunities for employees to pursue their career growth within the business.

Improper communication of business goals and ineffective leadership are the common causes of goal incongruence. As a small business owner or manager, you should show employees that you are committed to them with respect to their professional goals and that you expect them to align themselves with the business’s overall goals.

Budget Myopia

Budget myopia occurs when budgeting focuses only on short-term goals without considering how these goals will affect the company in the future. Managers become “myopic” in budgeting when they see budgets as measures for performance—they forget that the main objective of budgeting is to plan, organize, and manage the firm’s resources. As a result, budget realignments occur because there is a failure to plan future events.

Standard Setting

Another hurdle in budgeting is setting standards, which are tools for planning and controlling. If used inappropriately, they can cause problems in the budgeting process. It is important that you have to set your standards at a practical level.

Practical standards allow room for error or inefficiencies. It gives employees a chance to learn and improve their outputs without affecting performance. Unwise managers often impose ideal standards or standards that require optimum performance and perfection.

As a result, imposing ideal standards results in employee burnout, decreased productivity, and negative employee morale. Discouraged employees might also result in dysfunctional behavior that might be detrimental to the company.

Frequently Asked Questions (FAQs)

Why is budgeting important.

Budgets help in planning and managing business resources. Since plans and goals require an outflow of resources, budgets help the business determine the right amount of resources needed to achieve the goal.

Who should have an active participation in the budgeting process for small businesses?

The small business owner should have an active role in helping managers and supervisors craft their budgets. As the owner, you should guide your employees to align their goals with the business’ overall goals.

With our small business budget guide and template, you can create a small business master budget. We hope that the template will help you understand why budgeting is crucial to the planning, organizing, and controlling business operations.

About the Author

Find Eric Gerard On LinkedIn

Eric Gerard Ruiz, CPA

Eric is an accounting and bookkeeping expert for Fit Small Business. He has a CPA license in the Philippines and a BS in Accountancy graduate at Silliman University. Since joining FSB, Eric has used his expertise and authority in curating and writing content about small business accounting and bookkeeping, accounting software, financial accounting and reporting, managerial accounting, and financial management.

Join Fit Small Business

Sign up to receive more well-researched small business articles and topics in your inbox, personalized for you. Select the newsletters you’re interested in below.

How to Write a Business Plan: Step-by-Step Guide + Examples

Noah Parsons

24 min. read

Updated May 7, 2024

Writing a business plan doesn’t have to be complicated.

In this step-by-step guide, you’ll learn how to write a business plan that’s detailed enough to impress bankers and potential investors, while giving you the tools to start, run, and grow a successful business.

- The basics of business planning

If you’re reading this guide, then you already know why you need a business plan .

You understand that planning helps you:

- Raise money

- Grow strategically

- Keep your business on the right track

As you start to write your plan, it’s useful to zoom out and remember what a business plan is .

At its core, a business plan is an overview of the products and services you sell, and the customers that you sell to. It explains your business strategy: how you’re going to build and grow your business, what your marketing strategy is, and who your competitors are.

Most business plans also include financial forecasts for the future. These set sales goals, budget for expenses, and predict profits and cash flow.

A good business plan is much more than just a document that you write once and forget about. It’s also a guide that helps you outline and achieve your goals.

After completing your plan, you can use it as a management tool to track your progress toward your goals. Updating and adjusting your forecasts and budgets as you go is one of the most important steps you can take to run a healthier, smarter business.

We’ll dive into how to use your plan later in this article.

There are many different types of plans , but we’ll go over the most common type here, which includes everything you need for an investor-ready plan. However, if you’re just starting out and are looking for something simpler—I recommend starting with a one-page business plan . It’s faster and easier to create.

It’s also the perfect place to start if you’re just figuring out your idea, or need a simple strategic plan to use inside your business.

Dig deeper : How to write a one-page business plan

Brought to you by

Create a professional business plan

Using ai and step-by-step instructions.

Secure funding

Validate ideas

Build a strategy

- What to include in your business plan

Executive summary

The executive summary is an overview of your business and your plans. It comes first in your plan and is ideally just one to two pages. Most people write it last because it’s a summary of the complete business plan.

Ideally, the executive summary can act as a stand-alone document that covers the highlights of your detailed plan.

In fact, it’s common for investors to ask only for the executive summary when evaluating your business. If they like what they see in the executive summary, they’ll often follow up with a request for a complete plan, a pitch presentation , or more in-depth financial forecasts .

Your executive summary should include:

- A summary of the problem you are solving

- A description of your product or service

- An overview of your target market

- A brief description of your team

- A summary of your financials

- Your funding requirements (if you are raising money)

Dig Deeper: How to write an effective executive summary

Products and services description

This is where you describe exactly what you’re selling, and how it solves a problem for your target market. The best way to organize this part of your plan is to start by describing the problem that exists for your customers. After that, you can describe how you plan to solve that problem with your product or service.

This is usually called a problem and solution statement .

To truly showcase the value of your products and services, you need to craft a compelling narrative around your offerings. How will your product or service transform your customers’ lives or jobs? A strong narrative will draw in your readers.

This is also the part of the business plan to discuss any competitive advantages you may have, like specific intellectual property or patents that protect your product. If you have any initial sales, contracts, or other evidence that your product or service is likely to sell, include that information as well. It will show that your idea has traction , which can help convince readers that your plan has a high chance of success.

Market analysis

Your target market is a description of the type of people that you plan to sell to. You might even have multiple target markets, depending on your business.

A market analysis is the part of your plan where you bring together all of the information you know about your target market. Basically, it’s a thorough description of who your customers are and why they need what you’re selling. You’ll also include information about the growth of your market and your industry .

Try to be as specific as possible when you describe your market.

Include information such as age, income level, and location—these are what’s called “demographics.” If you can, also describe your market’s interests and habits as they relate to your business—these are “psychographics.”

Related: Target market examples

Essentially, you want to include any knowledge you have about your customers that is relevant to how your product or service is right for them. With a solid target market, it will be easier to create a sales and marketing plan that will reach your customers. That’s because you know who they are, what they like to do, and the best ways to reach them.

Next, provide any additional information you have about your market.

What is the size of your market ? Is the market growing or shrinking? Ideally, you’ll want to demonstrate that your market is growing over time, and also explain how your business is positioned to take advantage of any expected changes in your industry.

Dig Deeper: Learn how to write a market analysis

Competitive analysis

Part of defining your business opportunity is determining what your competitive advantage is. To do this effectively, you need to know as much about your competitors as your target customers.

Every business has some form of competition. If you don’t think you have competitors, then explore what alternatives there are in the market for your product or service.

For example: In the early years of cars, their main competition was horses. For social media, the early competition was reading books, watching TV, and talking on the phone.

A good competitive analysis fully lays out the competitive landscape and then explains how your business is different. Maybe your products are better made, or cheaper, or your customer service is superior. Maybe your competitive advantage is your location – a wide variety of factors can ultimately give you an advantage.

Dig Deeper: How to write a competitive analysis for your business plan

Marketing and sales plan

The marketing and sales plan covers how you will position your product or service in the market, the marketing channels and messaging you will use, and your sales tactics.

The best place to start with a marketing plan is with a positioning statement .

This explains how your business fits into the overall market, and how you will explain the advantages of your product or service to customers. You’ll use the information from your competitive analysis to help you with your positioning.

For example: You might position your company as the premium, most expensive but the highest quality option in the market. Or your positioning might focus on being locally owned and that shoppers support the local economy by buying your products.

Once you understand your positioning, you’ll bring this together with the information about your target market to create your marketing strategy .

This is how you plan to communicate your message to potential customers. Depending on who your customers are and how they purchase products like yours, you might use many different strategies, from social media advertising to creating a podcast. Your marketing plan is all about how your customers discover who you are and why they should consider your products and services.

While your marketing plan is about reaching your customers—your sales plan will describe the actual sales process once a customer has decided that they’re interested in what you have to offer.

If your business requires salespeople and a long sales process, describe that in this section. If your customers can “self-serve” and just make purchases quickly on your website, describe that process.

A good sales plan picks up where your marketing plan leaves off. The marketing plan brings customers in the door and the sales plan is how you close the deal.

Together, these specific plans paint a picture of how you will connect with your target audience, and how you will turn them into paying customers.

Dig deeper: What to include in your sales and marketing plan

Business operations

The operations section describes the necessary requirements for your business to run smoothly. It’s where you talk about how your business works and what day-to-day operations look like.

Depending on how your business is structured, your operations plan may include elements of the business like:

- Supply chain management

- Manufacturing processes

- Equipment and technology

- Distribution

Some businesses distribute their products and reach their customers through large retailers like Amazon.com, Walmart, Target, and grocery store chains.

These businesses should review how this part of their business works. The plan should discuss the logistics and costs of getting products onto store shelves and any potential hurdles the business may have to overcome.

If your business is much simpler than this, that’s OK. This section of your business plan can be either extremely short or more detailed, depending on the type of business you are building.

For businesses selling services, such as physical therapy or online software, you can use this section to describe the technology you’ll leverage, what goes into your service, and who you will partner with to deliver your services.

Dig Deeper: Learn how to write the operations chapter of your plan

Key milestones and metrics

Although it’s not required to complete your business plan, mapping out key business milestones and the metrics can be incredibly useful for measuring your success.

Good milestones clearly lay out the parameters of the task and set expectations for their execution. You’ll want to include:

- A description of each task

- The proposed due date

- Who is responsible for each task

If you have a budget, you can include projected costs to hit each milestone. You don’t need extensive project planning in this section—just list key milestones you want to hit and when you plan to hit them. This is your overall business roadmap.

Possible milestones might be:

- Website launch date

- Store or office opening date

- First significant sales

- Break even date

- Business licenses and approvals

You should also discuss the key numbers you will track to determine your success. Some common metrics worth tracking include:

- Conversion rates

- Customer acquisition costs

- Profit per customer

- Repeat purchases

It’s perfectly fine to start with just a few metrics and grow the number you are tracking over time. You also may find that some metrics simply aren’t relevant to your business and can narrow down what you’re tracking.

Dig Deeper: How to use milestones in your business plan

Organization and management team

Investors don’t just look for great ideas—they want to find great teams. Use this chapter to describe your current team and who you need to hire . You should also provide a quick overview of your location and history if you’re already up and running.

Briefly highlight the relevant experiences of each key team member in the company. It’s important to make the case for why yours is the right team to turn an idea into a reality.

Do they have the right industry experience and background? Have members of the team had entrepreneurial successes before?

If you still need to hire key team members, that’s OK. Just note those gaps in this section.

Your company overview should also include a summary of your company’s current business structure . The most common business structures include:

- Sole proprietor

- Partnership

Be sure to provide an overview of how the business is owned as well. Does each business partner own an equal portion of the business? How is ownership divided?

Potential lenders and investors will want to know the structure of the business before they will consider a loan or investment.

Dig Deeper: How to write about your company structure and team

Financial plan

Last, but certainly not least, is your financial plan chapter.

Entrepreneurs often find this section the most daunting. But, business financials for most startups are less complicated than you think, and a business degree is certainly not required to build a solid financial forecast.

A typical financial forecast in a business plan includes the following:

- Sales forecast : An estimate of the sales expected over a given period. You’ll break down your forecast into the key revenue streams that you expect to have.

- Expense budget : Your planned spending such as personnel costs , marketing expenses, and taxes.

- Profit & Loss : Brings together your sales and expenses and helps you calculate planned profits.

- Cash Flow : Shows how cash moves into and out of your business. It can predict how much cash you’ll have on hand at any given point in the future.

- Balance Sheet : A list of the assets, liabilities, and equity in your company. In short, it provides an overview of the financial health of your business.

A strong business plan will include a description of assumptions about the future, and potential risks that could impact the financial plan. Including those will be especially important if you’re writing a business plan to pursue a loan or other investment.

Dig Deeper: How to create financial forecasts and budgets

This is the place for additional data, charts, or other information that supports your plan.

Including an appendix can significantly enhance the credibility of your plan by showing readers that you’ve thoroughly considered the details of your business idea, and are backing your ideas up with solid data.

Just remember that the information in the appendix is meant to be supplementary. Your business plan should stand on its own, even if the reader skips this section.

Dig Deeper : What to include in your business plan appendix

Optional: Business plan cover page

Adding a business plan cover page can make your plan, and by extension your business, seem more professional in the eyes of potential investors, lenders, and partners. It serves as the introduction to your document and provides necessary contact information for stakeholders to reference.

Your cover page should be simple and include:

- Company logo

- Business name

- Value proposition (optional)

- Business plan title

- Completion and/or update date

- Address and contact information

- Confidentiality statement

Just remember, the cover page is optional. If you decide to include it, keep it very simple and only spend a short amount of time putting it together.

Dig Deeper: How to create a business plan cover page

How to use AI to help write your business plan

Generative AI tools such as ChatGPT can speed up the business plan writing process and help you think through concepts like market segmentation and competition. These tools are especially useful for taking ideas that you provide and converting them into polished text for your business plan.

The best way to use AI for your business plan is to leverage it as a collaborator , not a replacement for human creative thinking and ingenuity.

AI can come up with lots of ideas and act as a brainstorming partner. It’s up to you to filter through those ideas and figure out which ones are realistic enough to resonate with your customers.

There are pros and cons of using AI to help with your business plan . So, spend some time understanding how it can be most helpful before just outsourcing the job to AI.

Learn more: 10 AI prompts you need to write a business plan

- Writing tips and strategies

To help streamline the business plan writing process, here are a few tips and key questions to answer to make sure you get the most out of your plan and avoid common mistakes .

Determine why you are writing a business plan

Knowing why you are writing a business plan will determine your approach to your planning project.

For example: If you are writing a business plan for yourself, or just to use inside your own business , you can probably skip the section about your team and organizational structure.

If you’re raising money, you’ll want to spend more time explaining why you’re looking to raise the funds and exactly how you will use them.

Regardless of how you intend to use your business plan , think about why you are writing and what you’re trying to get out of the process before you begin.

Keep things concise

Probably the most important tip is to keep your business plan short and simple. There are no prizes for long business plans . The longer your plan is, the less likely people are to read it.

So focus on trimming things down to the essentials your readers need to know. Skip the extended, wordy descriptions and instead focus on creating a plan that is easy to read —using bullets and short sentences whenever possible.

Have someone review your business plan

Writing a business plan in a vacuum is never a good idea. Sometimes it’s helpful to zoom out and check if your plan makes sense to someone else. You also want to make sure that it’s easy to read and understand.

Don’t wait until your plan is “done” to get a second look. Start sharing your plan early, and find out from readers what questions your plan leaves unanswered. This early review cycle will help you spot shortcomings in your plan and address them quickly, rather than finding out about them right before you present your plan to a lender or investor.

If you need a more detailed review, you may want to explore hiring a professional plan writer to thoroughly examine it.

Use a free business plan template and business plan examples to get started

Knowing what information to include in a business plan is sometimes not quite enough. If you’re struggling to get started or need additional guidance, it may be worth using a business plan template.

There are plenty of great options available (we’ve rounded up our 8 favorites to streamline your search).

But, if you’re looking for a free downloadable business plan template , you can get one right now; download the template used by more than 1 million businesses.

Or, if you just want to see what a completed business plan looks like, check out our library of over 550 free business plan examples .

We even have a growing list of industry business planning guides with tips for what to focus on depending on your business type.

Common pitfalls and how to avoid them

It’s easy to make mistakes when you’re writing your business plan. Some entrepreneurs get sucked into the writing and research process, and don’t focus enough on actually getting their business started.

Here are a few common mistakes and how to avoid them:

Not talking to your customers : This is one of the most common mistakes. It’s easy to assume that your product or service is something that people want. Before you invest too much in your business and too much in the planning process, make sure you talk to your prospective customers and have a good understanding of their needs.

- Overly optimistic sales and profit forecasts: By nature, entrepreneurs are optimistic about the future. But it’s good to temper that optimism a little when you’re planning, and make sure your forecasts are grounded in reality.

- Spending too much time planning: Yes, planning is crucial. But you also need to get out and talk to customers, build prototypes of your product and figure out if there’s a market for your idea. Make sure to balance planning with building.

- Not revising the plan: Planning is useful, but nothing ever goes exactly as planned. As you learn more about what’s working and what’s not—revise your plan, your budgets, and your revenue forecast. Doing so will provide a more realistic picture of where your business is going, and what your financial needs will be moving forward.

- Not using the plan to manage your business: A good business plan is a management tool. Don’t just write it and put it on the shelf to collect dust – use it to track your progress and help you reach your goals.

- Presenting your business plan

The planning process forces you to think through every aspect of your business and answer questions that you may not have thought of. That’s the real benefit of writing a business plan – the knowledge you gain about your business that you may not have been able to discover otherwise.

With all of this knowledge, you’re well prepared to convert your business plan into a pitch presentation to present your ideas.

A pitch presentation is a summary of your plan, just hitting the highlights and key points. It’s the best way to present your business plan to investors and team members.

Dig Deeper: Learn what key slides should be included in your pitch deck

Use your business plan to manage your business

One of the biggest benefits of planning is that it gives you a tool to manage your business better. With a revenue forecast, expense budget, and projected cash flow, you know your targets and where you are headed.

And yet, nothing ever goes exactly as planned – it’s the nature of business.

That’s where using your plan as a management tool comes in. The key to leveraging it for your business is to review it periodically and compare your forecasts and projections to your actual results.

Start by setting up a regular time to review the plan – a monthly review is a good starting point. During this review, answer questions like:

- Did you meet your sales goals?

- Is spending following your budget?

- Has anything gone differently than what you expected?

Now that you see whether you’re meeting your goals or are off track, you can make adjustments and set new targets.

Maybe you’re exceeding your sales goals and should set new, more aggressive goals. In that case, maybe you should also explore more spending or hiring more employees.

Or maybe expenses are rising faster than you projected. If that’s the case, you would need to look at where you can cut costs.

A plan, and a method for comparing your plan to your actual results , is the tool you need to steer your business toward success.

Learn More: How to run a regular plan review

Free business plan templates and examples

Kickstart your business plan writing with one of our free business plan templates or recommended tools.

Free business plan template

Download a free SBA-approved business plan template built for small businesses and startups.

Download Template

One-page plan template

Download a free one-page plan template to write a useful business plan in as little as 30-minutes.

Sample business plan library

Explore over 500 real-world business plan examples from a wide variety of industries.

View Sample Plans

How to write a business plan FAQ

What is a business plan?

A document that describes your business , the products and services you sell, and the customers that you sell to. It explains your business strategy, how you’re going to build and grow your business, what your marketing strategy is, and who your competitors are.

What are the benefits of a business plan?

A business plan helps you understand where you want to go with your business and what it will take to get there. It reduces your overall risk, helps you uncover your business’s potential, attracts investors, and identifies areas for growth.

Having a business plan ultimately makes you more confident as a business owner and more likely to succeed for a longer period of time.

What are the 7 steps of a business plan?

The seven steps to writing a business plan include:

- Write a brief executive summary

- Describe your products and services.

- Conduct market research and compile data into a cohesive market analysis.

- Describe your marketing and sales strategy.

- Outline your organizational structure and management team.

- Develop financial projections for sales, revenue, and cash flow.

- Add any additional documents to your appendix.

What are the 5 most common business plan mistakes?

There are plenty of mistakes that can be made when writing a business plan. However, these are the 5 most common that you should do your best to avoid:

- 1. Not taking the planning process seriously.

- Having unrealistic financial projections or incomplete financial information.

- Inconsistent information or simple mistakes.

- Failing to establish a sound business model.

- Not having a defined purpose for your business plan.

What questions should be answered in a business plan?

Writing a business plan is all about asking yourself questions about your business and being able to answer them through the planning process. You’ll likely be asking dozens and dozens of questions for each section of your plan.

However, these are the key questions you should ask and answer with your business plan:

- How will your business make money?

- Is there a need for your product or service?

- Who are your customers?

- How are you different from the competition?

- How will you reach your customers?

- How will you measure success?

How long should a business plan be?

The length of your business plan fully depends on what you intend to do with it. From the SBA and traditional lender point of view, a business plan needs to be whatever length necessary to fully explain your business. This means that you prove the viability of your business, show that you understand the market, and have a detailed strategy in place.

If you intend to use your business plan for internal management purposes, you don’t necessarily need a full 25-50 page business plan. Instead, you can start with a one-page plan to get all of the necessary information in place.

What are the different types of business plans?

While all business plans cover similar categories, the style and function fully depend on how you intend to use your plan. Here are a few common business plan types worth considering.

Traditional business plan: The tried-and-true traditional business plan is a formal document meant to be used when applying for funding or pitching to investors. This type of business plan follows the outline above and can be anywhere from 10-50 pages depending on the amount of detail included, the complexity of your business, and what you include in your appendix.

Business model canvas: The business model canvas is a one-page template designed to demystify the business planning process. It removes the need for a traditional, copy-heavy business plan, in favor of a single-page outline that can help you and outside parties better explore your business idea.

One-page business plan: This format is a simplified version of the traditional plan that focuses on the core aspects of your business. You’ll typically stick with bullet points and single sentences. It’s most useful for those exploring ideas, needing to validate their business model, or who need an internal plan to help them run and manage their business.

Lean Plan: The Lean Plan is less of a specific document type and more of a methodology. It takes the simplicity and styling of the one-page business plan and turns it into a process for you to continuously plan, test, review, refine, and take action based on performance. It’s faster, keeps your plan concise, and ensures that your plan is always up-to-date.

What’s the difference between a business plan and a strategic plan?

A business plan covers the “who” and “what” of your business. It explains what your business is doing right now and how it functions. The strategic plan explores long-term goals and explains “how” the business will get there. It encourages you to look more intently toward the future and how you will achieve your vision.

However, when approached correctly, your business plan can actually function as a strategic plan as well. If kept lean, you can define your business, outline strategic steps, and track ongoing operations all with a single plan.

Noah is the COO at Palo Alto Software, makers of the online business plan app LivePlan. He started his career at Yahoo! and then helped start the user review site Epinions.com. From there he started a software distribution business in the UK before coming to Palo Alto Software to run the marketing and product teams.

Table of Contents

- Use AI to help write your plan

- Common planning mistakes

- Manage with your business plan

- Templates and examples

Related Articles

3 Min. Read

What to Include in Your Business Plan Appendix

1 Min. Read

How to Calculate Return on Investment (ROI)

7 Min. Read

How to Write a Bakery Business Plan + Sample

5 Min. Read

How To Write a Business Plan for a Life Coaching Business + Free Example

The Bplans Newsletter

The Bplans Weekly

Subscribe now for weekly advice and free downloadable resources to help start and grow your business.

We care about your privacy. See our privacy policy .

The quickest way to turn a business idea into a business plan

Fill-in-the-blanks and automatic financials make it easy.

No thanks, I prefer writing 40-page documents.

Discover the world’s #1 plan building software

The Best Free Business Budget Templates

Published: October 12, 2023

Business budgets are a source of truth for your income and expenses. That includes all the money you spend — from A/B testing your marketing campaigns to your monthly office rent.

While organizing the numbers may sound difficult, using a business budget template makes the process simple. Plus, there are thousands of business budget templates for you to choose from.

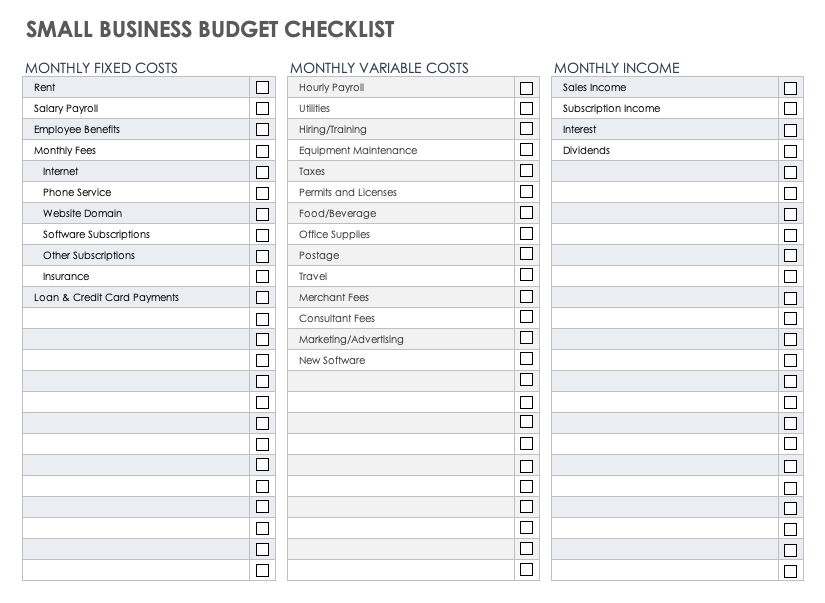

We’ll share seven budget templates that can help organize your finances. But first, you’ll learn about different types of business budgets and how to create one.

What is a Business Budget?

A business budget is a spending plan that estimates the revenue and expenses of a business for a period of time, typically monthly, quarterly, or yearly.

The business budget follows a set template, which you can fill in with estimated revenues, plus any recurring or expected business expenses.

For example, say your business is planning a website redesign. You'd need to break down the costs by category: software, content and design, testing, and more.

Having a clear breakdown will help you estimate how much each category will cost and compare it with the actual costs.

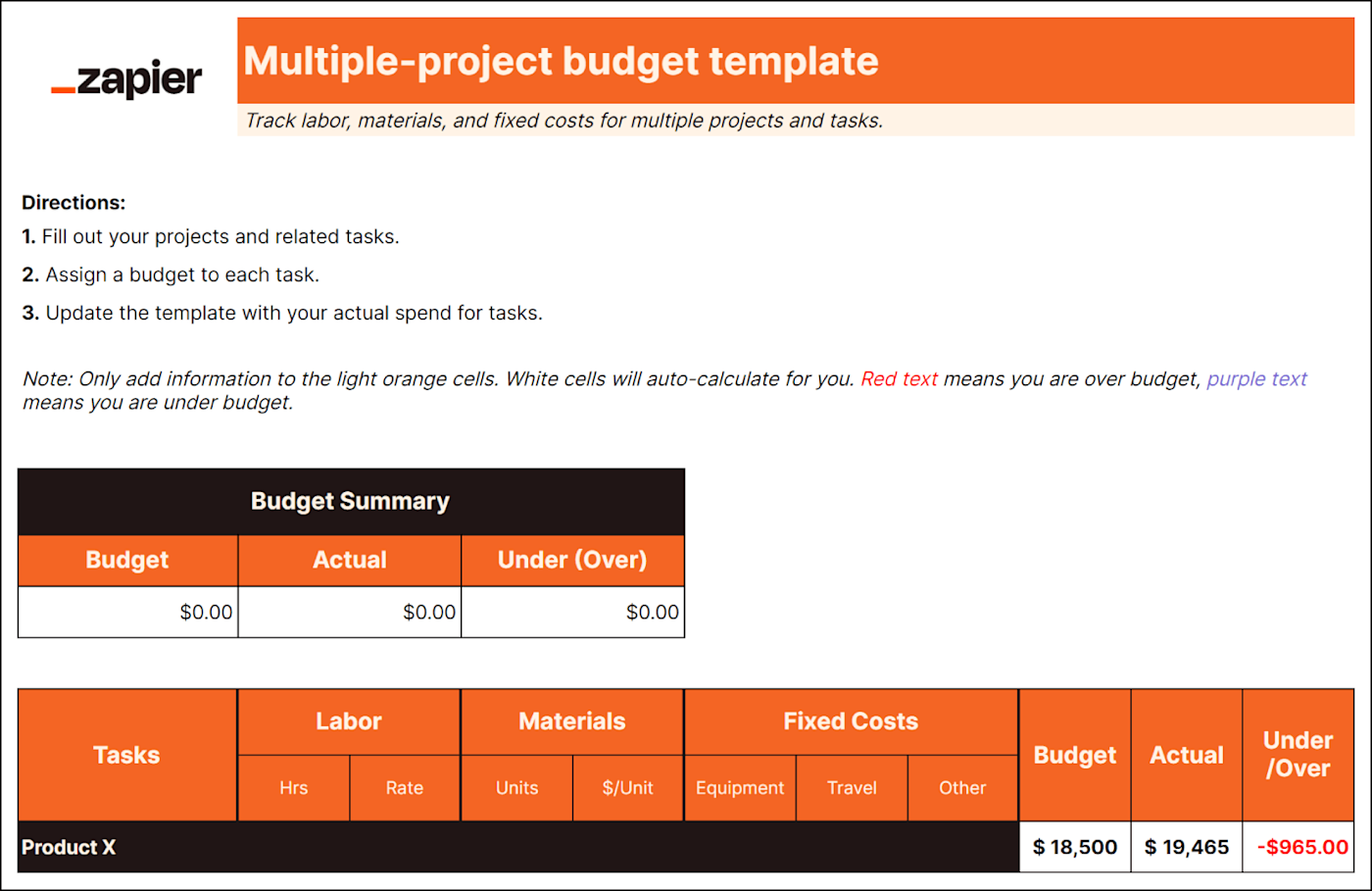

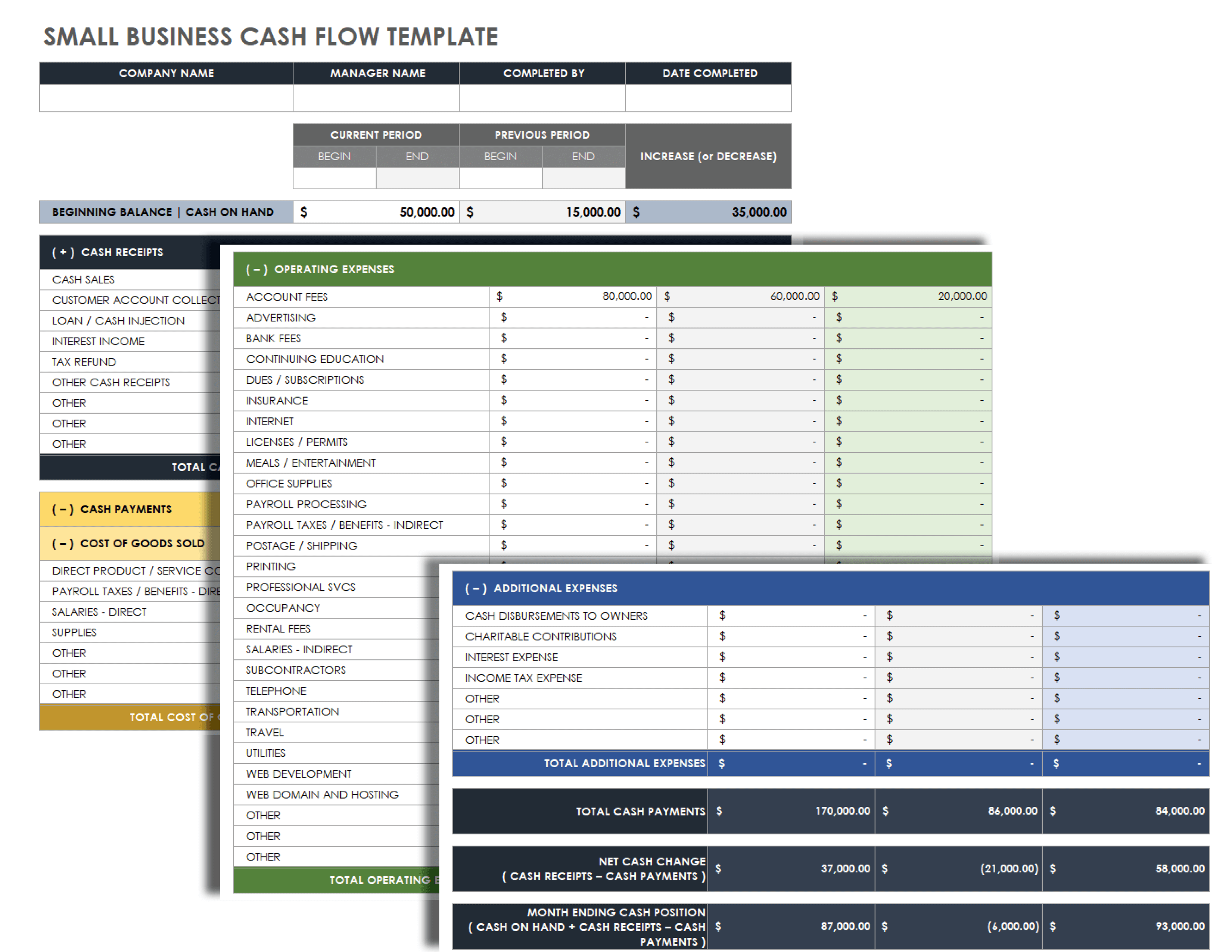

Image Source

Types of Budgets for a Business

Master budget, operating budget, cash budget, static budget, departmental budget, capital budget, labor budget, project budget.

Business budgets aren’t one size fits all. In fact, there are many different types of budgets that serve various purposes. Let’s dive into some commonly used budgets:

Think of a master budget as the superhero of budgets — it brings together all the individual budgets from different parts of your company into one big, consolidated plan. It covers everything from sales and production to marketing and finances.

It includes details like projected revenues, expenses, and profitability for each department or business unit. It also considers important financial aspects like cash flow, capital expenditures, and even creates a budgeted balance sheet to show the organization's financial position.

The master budget acts as a guide for decision-making, helps with strategic planning, and gives a clear picture of the overall financial health and performance of your company. It's like the master plan that ties everything together and helps the organization move in the right direction.

Your operating budget helps your company figure out how much money it expects to make and spend during a specific period, usually a year. It not only predicts the revenue your business will bring in, but also outlines expenses it will need to cover, like salaries, rent, bills, and other operational costs.

By comparing your actual expenses and revenue to the budgeted amounts, your company can see how it's performing and make adjustments if needed. It helps keep things in check, allowing your business to make wise financial decisions and stay on track with its goals.

.png)

Free Business Budget Templates

Manage your business, personal, and program spend on an annual, quarterly, and monthly basis.

- Personal Budget Template

- Annual Budget Template

- Program Budget Template

You're all set!

Click this link to access this resource at any time.

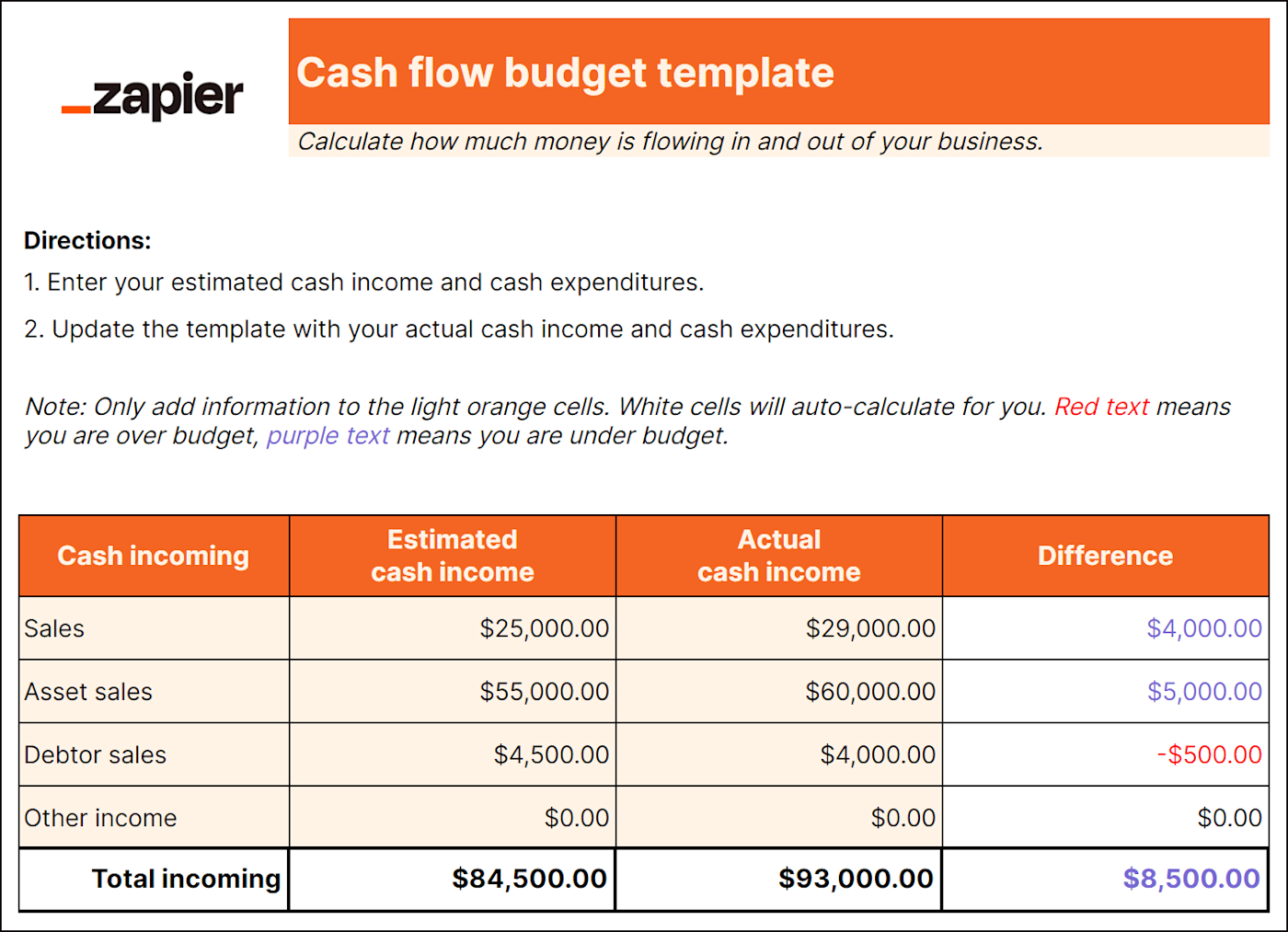

A cash budget estimates the cash inflows and outflows of your business over a specific period, typically a month, quarter, or year. It provides a detailed projection of cash sources and uses, including revenue, expenses, and financing activities.

The cash budget helps you effectively manage your cash flow, plan for cash shortages or surpluses, evaluate the need for external financing, and make informed decisions about resource allocation.

By utilizing a cash budget, your business can ensure it has enough cash on hand to meet its financial obligations, navigate fluctuations, and seize growth opportunities.

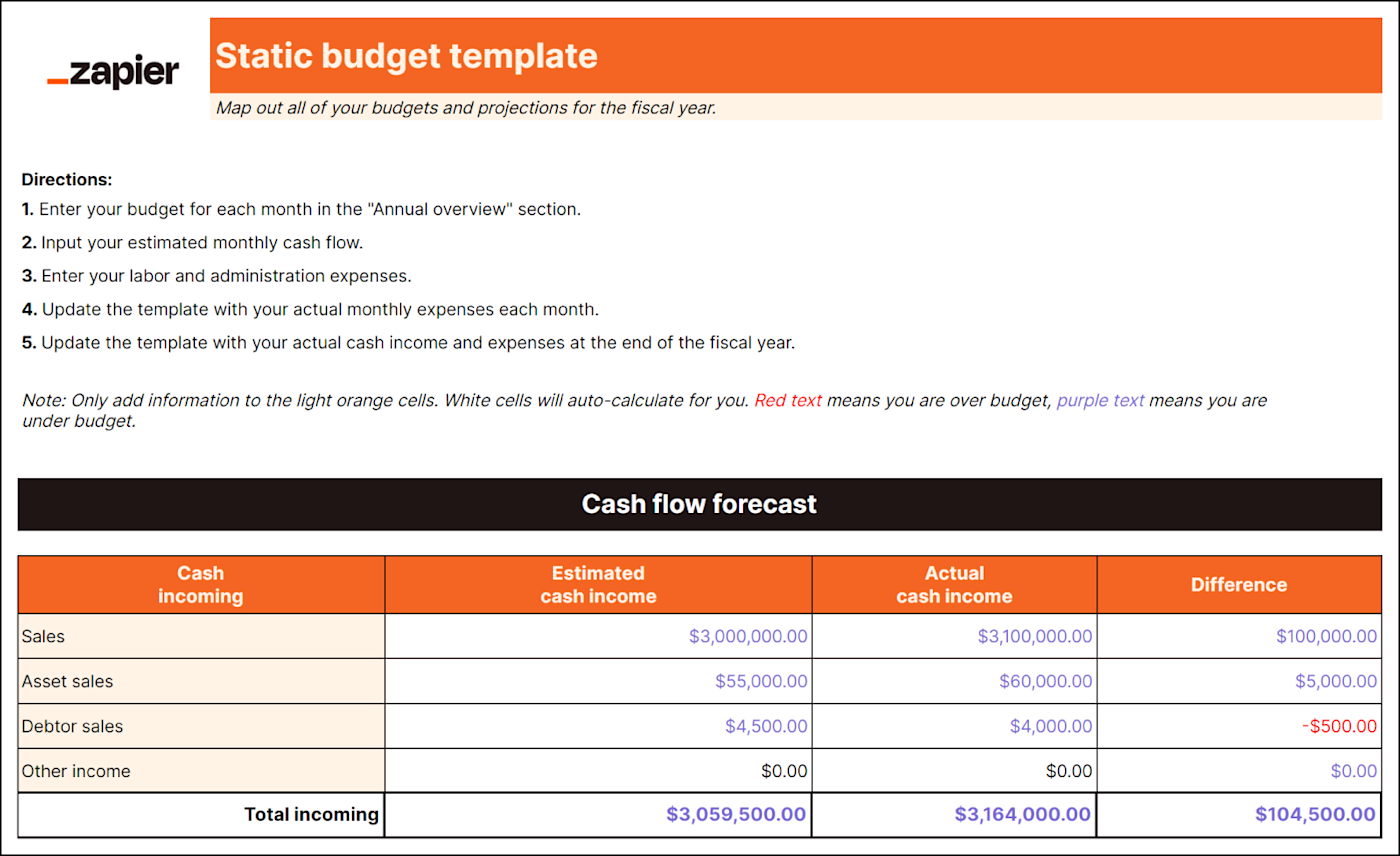

A static budget is a financial plan that remains unchanged, regardless of actual sales or production volumes.

It’s typically created at the beginning of a budget period and doesn’t account for any fluctuations or changes in business conditions. It also assumes that all variables, such as sales, expenses, and production levels, will remain the same throughout the budget period.

While a static budget provides a baseline for comparison, it may not be realistic for businesses with fluctuating sales volumes or variable expenses.

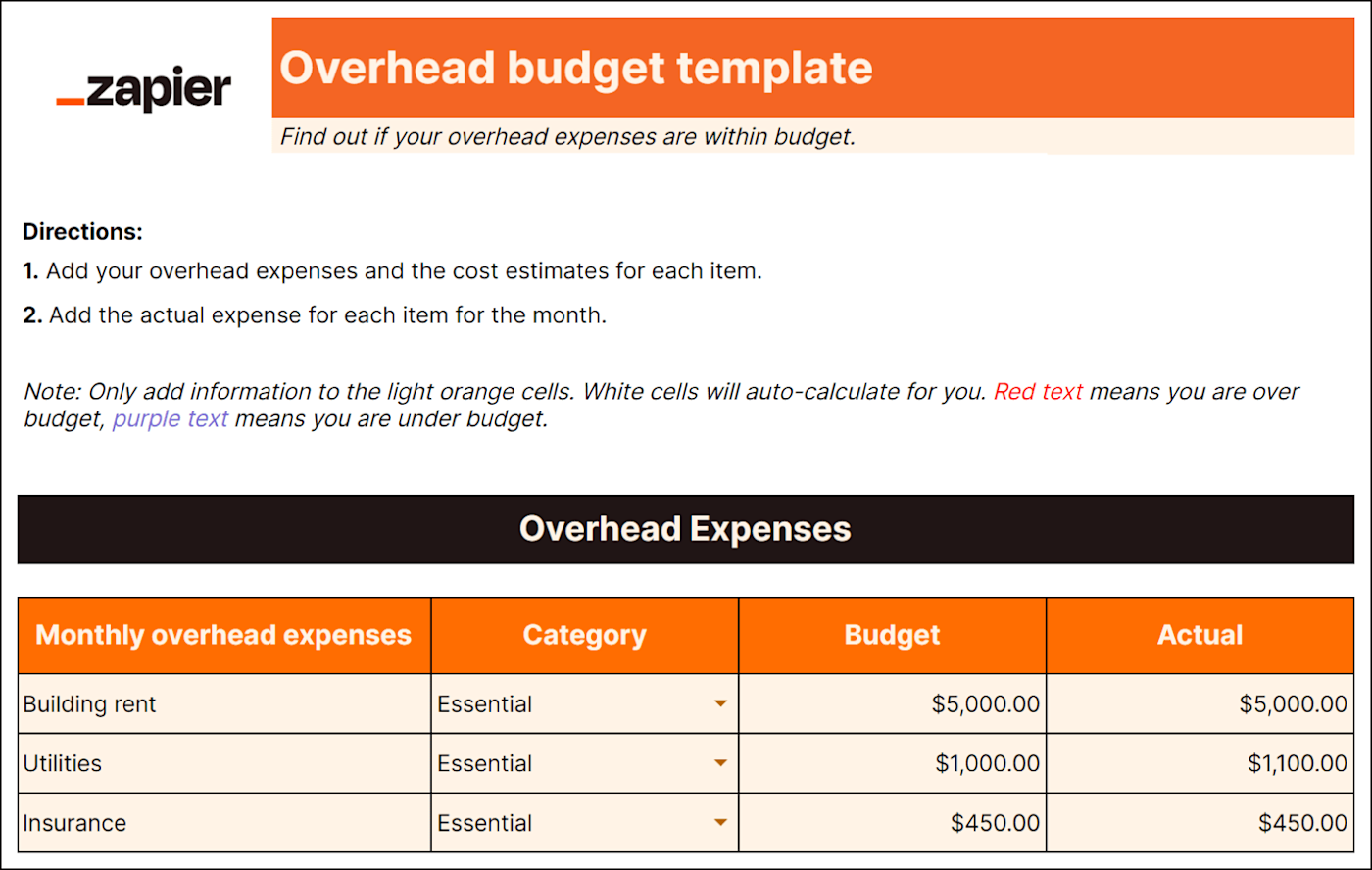

A departmental budget focuses on the financial aspects of a specific department within your company, such as sales, marketing or human resources.

When creating a departmental budget, you may look at revenue sources like departmental sales, grants, and other sources of income. On the expense side, you consider costs such as salaries, supplies, equipment, and any other expenses unique to that department.

The goal of a departmental budget is to help the department manage its finances wisely. It acts as a guide for making decisions and allocating resources effectively. By comparing the actual numbers to the budgeted amounts, department heads can see if they're on track or if adjustments need to be made.

A capital budget is all about planning for big investments in the long term. It focuses on deciding where to spend money on things like upgrading equipment, maintaining facilities, developing new products, and hiring new employees.

The budget looks at the costs of buying new stuff, upgrading existing things, and even considers depreciation, which is when something loses value over time. It also considers the return on investment, like how much money these investments might bring in or how they could save costs in the future.

The budget also looks at different ways to finance these investments, whether it's through loans, leases, or other options. It's all about making smart decisions for the future, evaluating cash flow, and choosing investments that will help the company grow and succeed.

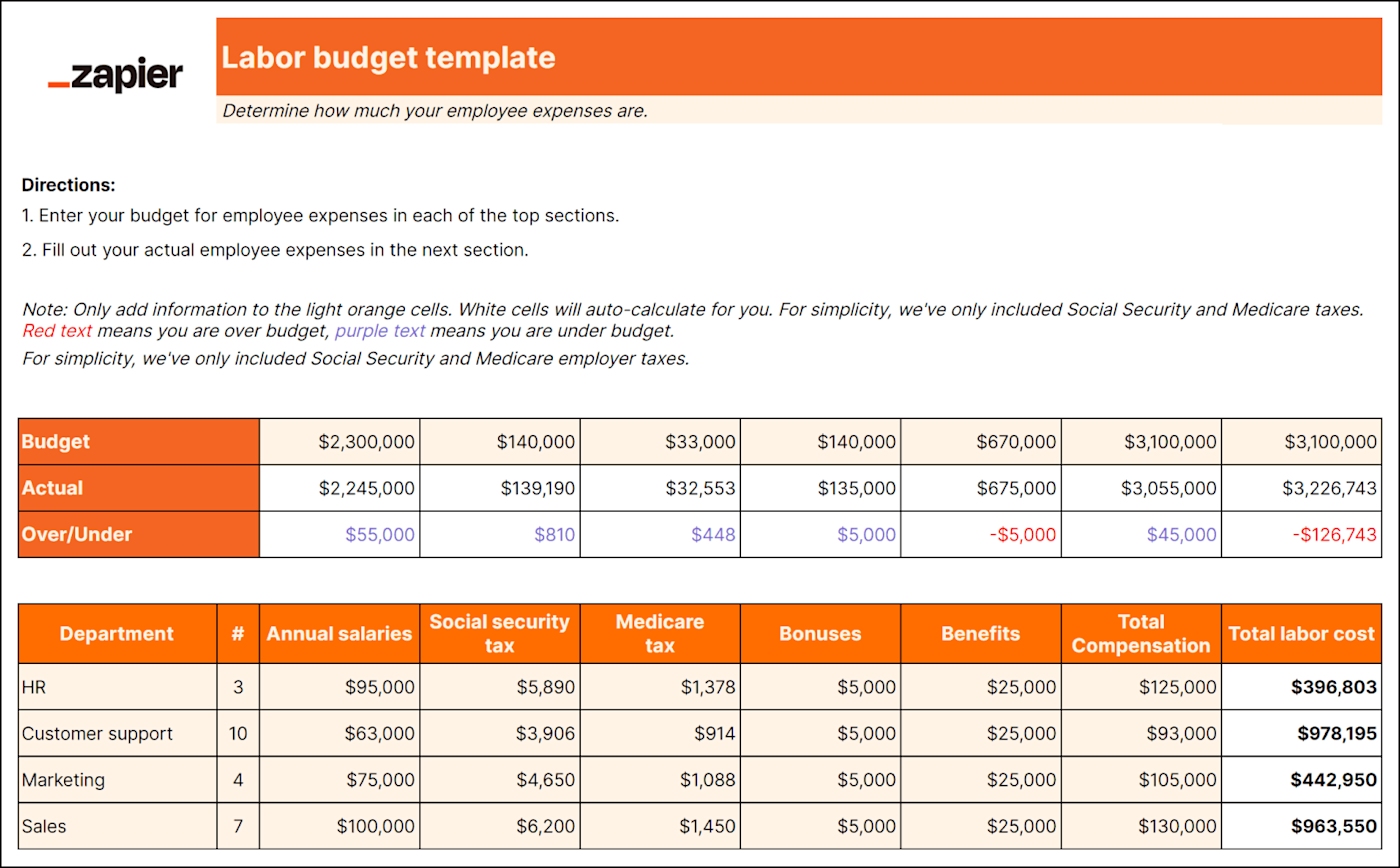

A labor budget helps you plan and manage the costs related to your employees. It involves figuring out how much your business will spend on wages, salaries, benefits, and other labor-related expenses.

To create a labor budget, you'll need to consider factors like how much work needs to be done, how many folks you'll need to get it done, and how much it'll all cost. This can help your business forecast and control labor-related expenses and ensure adequate staffing levels.

By having a labor budget in place, your business can monitor and analyze your labor costs to make informed decisions and optimize your resources effectively.

A project budget is the financial plan for a specific project.

Let's say you have an exciting new project you want to tackle. A project budget helps you figure out how much money you'll need and how it will be allocated. It covers everything from personnel to equipment and materials — basically, anything you'll need to make the project happen.

By creating a project budget, you can make sure the project is doable from a financial standpoint. It helps you keep track of how much you planned to spend versus how much you actually spend as you go along. That way, you have a clear idea of whether you're staying on track or if there are any financial challenges that need attention.

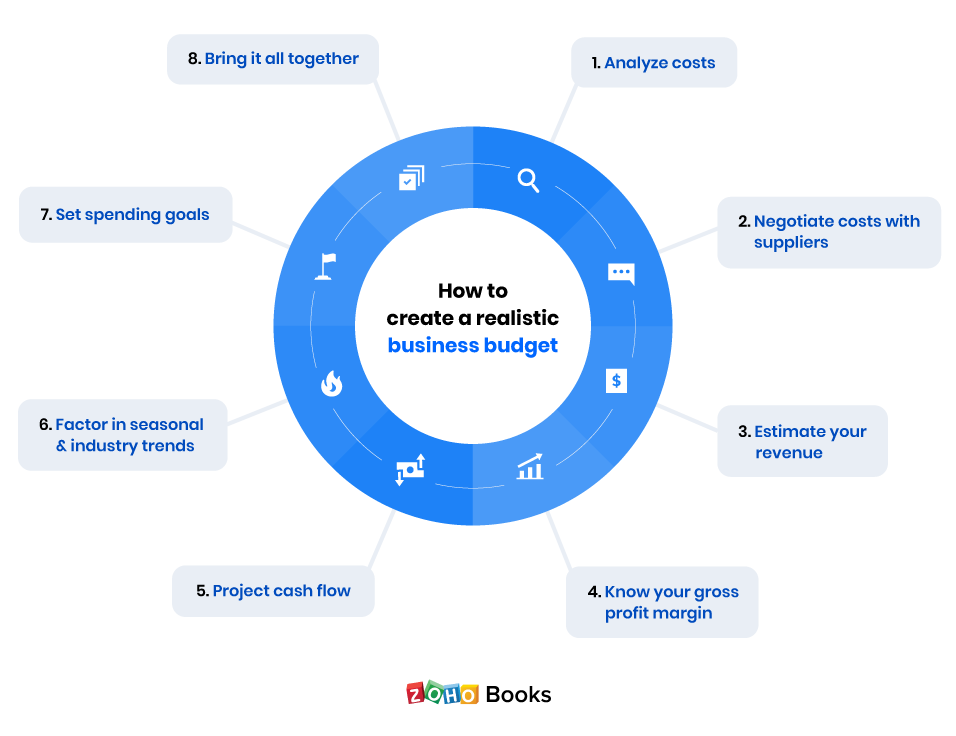

How to Create a Business Budget

While creating a business budget can be straightforward, the process may be more complex for larger companies with multiple revenue streams and expenses.

No matter the size of your business, here are the basic steps to creating a business budget.

1. Gather financial data.

Before you create a business budget, it’s important to gather insights from your past financial data. By looking at things like income statements, expense reports, and sales data, you can spot trends, learn from past experiences, and see where you can make improvements.

Going through your financial history helps you paint a true picture of your income and expenses. So, when you start creating your budget, you can set achievable targets and make sure your estimates match what's actually been happening in your business.

2. Find a template, or make a spreadsheet.

There are many free or paid budget templates online. You can start with an already existing budget template. We list a few helpful templates below.

You may also opt to make a spreadsheet with custom rows and columns based on your business.

3. Fill in revenues.

Once you have your template, start by listing all the sources of your business’ income. With a budget, you’re planning for the future, so you’ll also need to forecast revenue streams based on previous months or years. For a new small business budget, you’ll rely on your market research to estimate early revenue for your company.

When you estimate your revenue , you're essentially figuring out how much money you have to work with. This helps you decide where to allocate your resources and which expenses you can fund.

4. Subtract fixed costs for the time period.

Fixed costs are the recurring costs you have during each month, quarter, or year. Examples include insurance, rent for office space, website hosting, and internet.

The key thing to remember about fixed costs is that they stay relatively stable, regardless of changes in business activity. Even if your sales decrease or production slows down, these costs remain the same.

However, it's important to note that fixed costs can still change over the long term, such as when renegotiating lease agreements or adjusting employee salaries.

5. Consider variable costs.

Variable costs will change from time to time. Unlike fixed costs, variable costs increase or decrease as the level of production or sales changes.

Examples include raw materials needed to manufacture your products, packaging and shipping costs, utility bills, advertising costs, office supplies, and new software or technology.

You may always need to pay some variable costs, like utility bills. However, you can shift how much you spend toward other expenses, like advertising costs, when you have a lower-than-average estimated income.

6. Set aside time for business budget planning.

Unexpected expenses might come up, or you might want to save to expand your business. Either way, review your budget after including all expenses, fixed costs, and variable costs. Once completed, you can determine how much money you can save. It’s wise to create multiple savings accounts. One should be used for emergencies. The other holds money that can be spent on the business to drive growth.

Fill out the form to get the free templates.

How to manage a business budget.

There are a few key components to managing a healthy business budget.

Budget Preparation

The process all starts with properly preparing and planning the budget at the beginning of each month, quarter, or year. You can also create multiple budgets, some short-term and some long-term. During this stage, you will also set spending limits and create a system to regularly monitor the budget.

Budget Monitoring

In larger businesses, you might delegate budget tracking to multiple supervisors. But even if you’re a one-person show, keep a close eye on your budget. That means setting a time in your schedule each day or week to review the budget and track actual income and expenses. Be sure to compare the actual numbers to the estimates.

Budget Forecasting

With regular budget tracking, you always know how your business is doing. Check in regularly to determine how you are doing in terms of revenue and where you have losses. Find where you can minimize expenses and how you can move more money into savings.

Why is a Budget Important for a Business?

A budget is crucial for businesses. Without one, you could easily be drowning in expenses or unexpected costs.

The business budget helps with several operations. You can use a business budget to keep track of your finances, save money to help you grow the business or pay bonuses in the future, and prepare for unexpected expenses or emergencies.

You can also review your budget to determine when to take the next leap for your business. For example, you might be dreaming of a larger office building or the latest software, but you want to make sure you have a healthy net revenue before you make the purchase.

Best Free Business Budget Templates

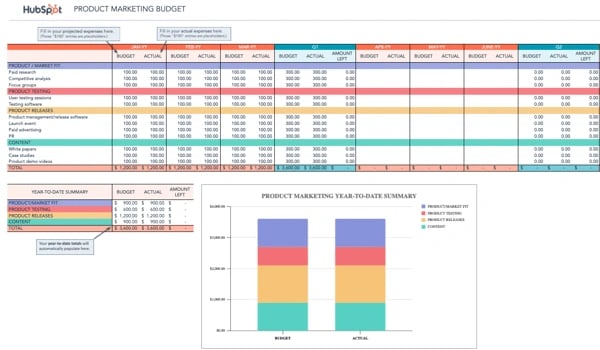

1. marketing budget template.

Knowing how to manage a marketing budget can be a challenge, but with helpful free templates like this marketing budget template bundle , you can track everything from advertising expenses to events and more.

This free bundle includes eight different templates, so you can create multiple budgets to help you determine how much money to put toward marketing, plus the return on your investment.

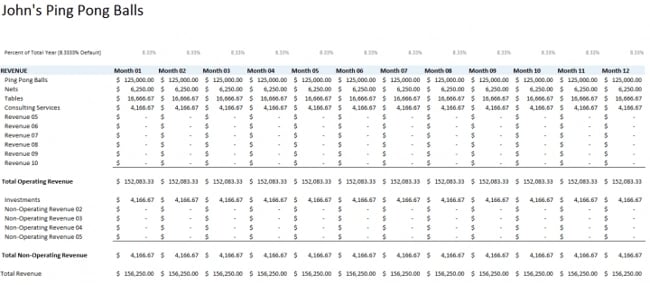

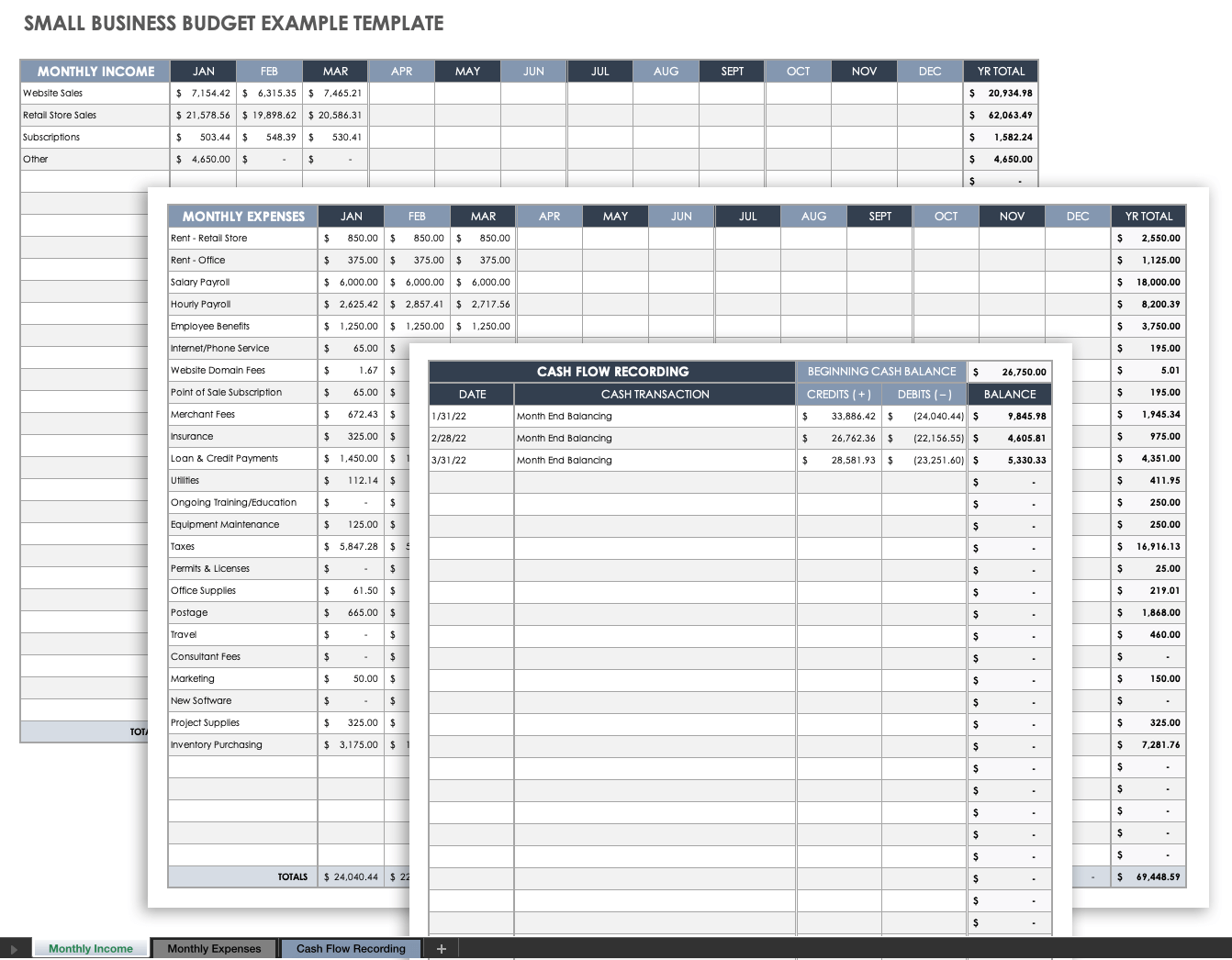

2. Small Business Budget Template

For small businesses, it can be hard to find the time to draw up a budget, but it’s crucial to help keep the business in good health.

Capterra offers a budget template specifically for small businesses. Plus, this template works with Excel. Start by inputting projections for the year. Then, the spreadsheet will project the month-to-month budget. You can input your actual revenue and expenses to compare, making profits and losses easy to spot.

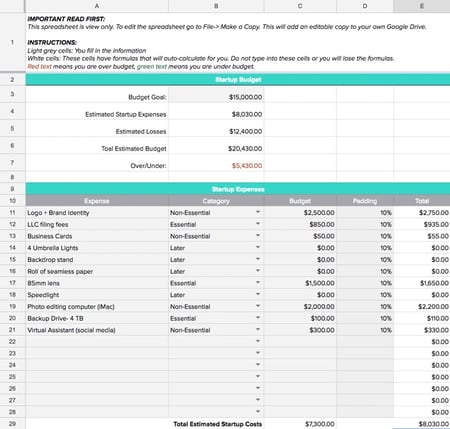

3. Startup Budget Template

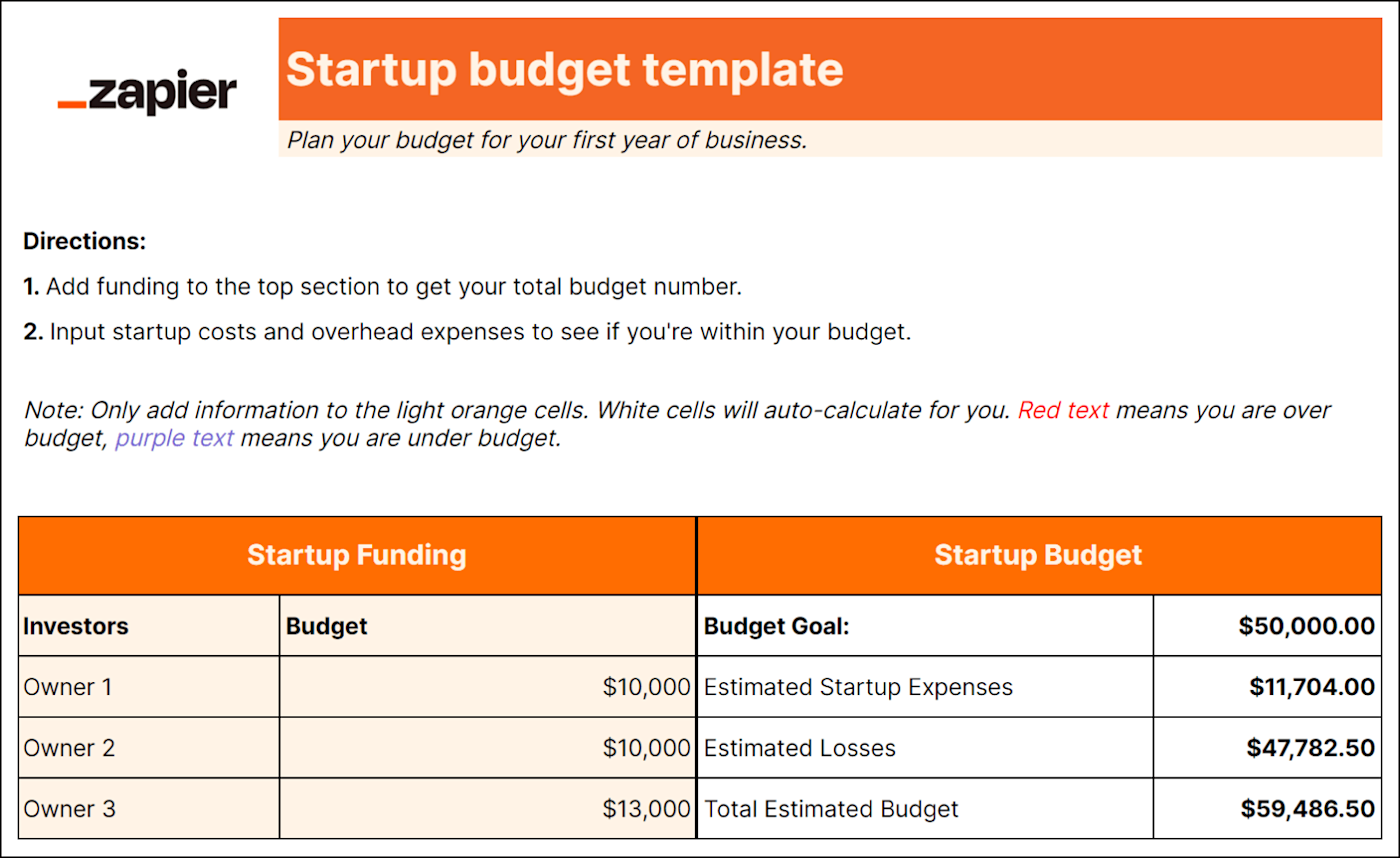

What if you don’t have any previous numbers to rely on to create profit and expense estimates? If you are a startup, this Gusto budget template will help you draw up a budget before your business is officially in the market. This will help you track all the expenses you need to get your business up and running, estimate your first revenues, and determine where to pinch pennies.

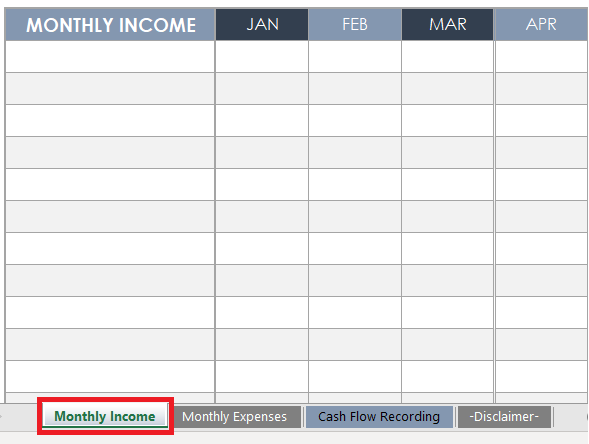

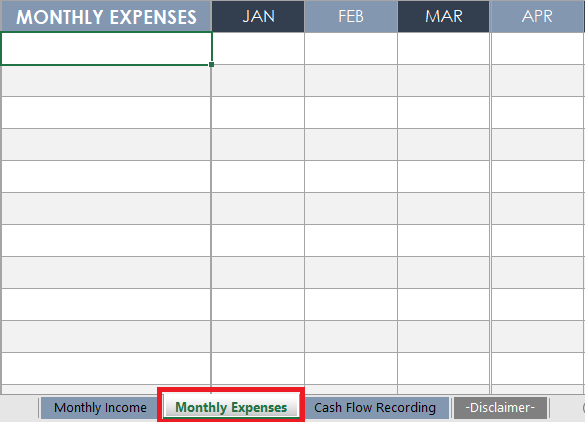

4. Free Business Budget Template

You might be familiar with Intuit. Many companies, big and small, rely on Intuit’s services like Quickbooks and TurboTax. Even if you don’t use the company’s paid financial services, you can take advantage of Intuit’s free budget template , which works in Google Sheets or Excel.

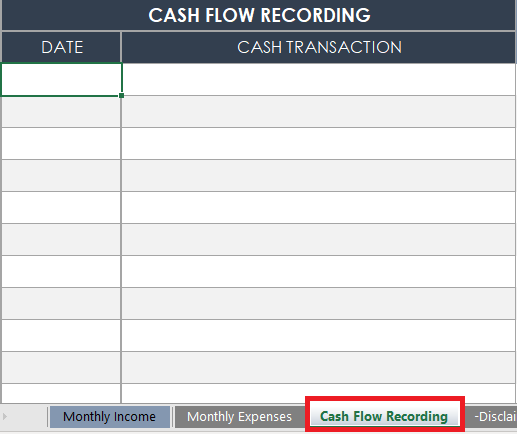

It features multiple spreadsheet tabs and simple instructions. You enter your revenue in one specific tab and expenses in another. You can also add additional tabs as needed. Then, like magic, the spreadsheet uses the data in the income and expense tabs to summarize the information. This template can even determine net savings and the ending balance.

5. Department Budget Sheet

A mid- to large-size company will have multiple departments, all with different budgetary needs. These budgets will all be consolidated into a massive, company-wide budget sheet. Having a specific template for each department can help teams keep track of spending and plan for growth.

This free template from Template.net works in either document or spreadsheet formats. This budget template can help different departments keep track of their income and spending.

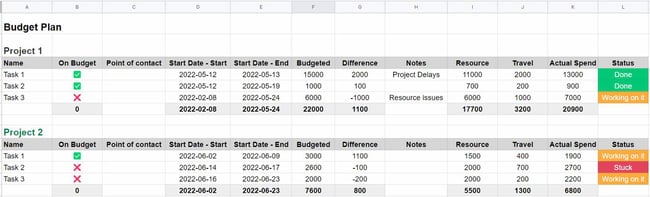

6. Project Budget Template

Every new project comes with expenses. This free budget template from Monday will help your team estimate costs before undertaking a project. You can easily spot if you're going over budget midway through a project so you can adjust.

This template is especially useful for small companies that are reporting budgets to clients and for in-house teams getting buy-in for complex projects.

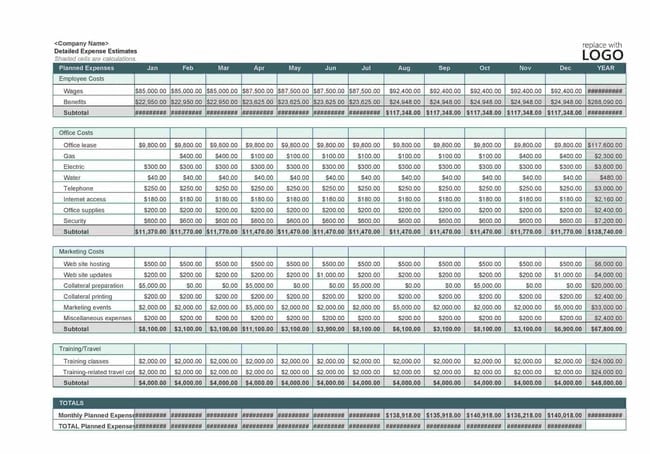

7. Company Budget Template

Want to keep track of every penny? Use this template from TemplateLab to draw up a detailed budget. The list of expenses includes fixed costs, employee costs, and variable costs. This business template can be especially useful for small businesses that want to keep track of expenses in one, comprehensive document.

Create a Business Budget to Help Your Company Grow

Making your first business budget can be daunting, especially if you have several revenue streams and expenses. Using a budget template can make getting started easy. And, once you get it set up, these templates are simple to replicate.

With little planning and regular monitoring, you can plan for the future of your business.

Editor's note: This post was originally published in September 2021 and has been updated for comprehensiveness.

Don't forget to share this post!

Related articles.