- My presentations

Auth with social network:

Download presentation

We think you have liked this presentation. If you wish to download it, please recommend it to your friends in any social system. Share buttons are a little bit lower. Thank you!

Presentation is loading. Please wait.

4.8A - Quadratic Formula Applications

Published by Aksel Steensen Modified over 5 years ago

Similar presentations

Presentation on theme: "4.8A - Quadratic Formula Applications"— Presentation transcript:

Projectile Motion Review Game

The Quadratic Formula and the Discriminant.

Free Fall Chapter 2 Section 3. Free Fall Free Fall – An object in free fall falls at a constant acceleration towards the surface of a planet neglecting.

Free Fall Examples. Example 2-14 Falling from a tower (v 0 = 0) Note! Take y as positive DOWNWARD! v = at y = (½)at 2 a = g = 9.8 m/s 2.

Quadratic Word Problem Practice By: L. Keali’i Alicea

Free Fall Chapter 2 Section 3.

Chapter 9: Quadratic Equations and Functions

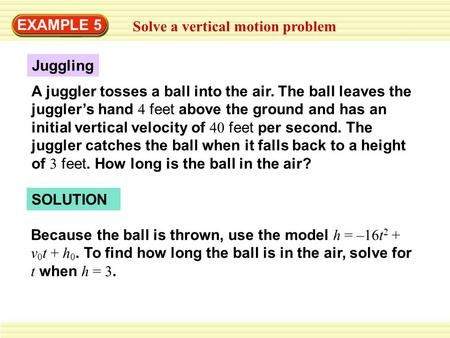

EXAMPLE 5 Solve a vertical motion problem Juggling

Solving Quadratic Equations

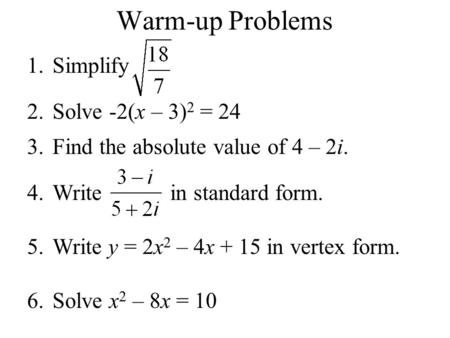

Warm-up Problems Simplify Solve -2(x – 3)2 = 24

Get out paper and something to write with!. On a sheet of paper answer the following questions…you may ask a neighbor. 1. What is gravity? 2. What is.

FURTHER GRAPHING OF QUADRATIC FUNCTIONS Section 11.6.

Graphs of Quadratic Functions Any quadratic function can be expressed in the form Where a, b, c are real numbers and the graph of any quadratic function.

Section 5 Chapter Copyright © 2012, 2008, 2004 Pearson Education, Inc. Objectives Formulas and Further Applications Solve formulas for variables.

Use Factoring to Solve Quadratic Word Problems ax^2 + bx + c.

Applications Day 1. Do Now 1) Find a quadratic equation to best model the data below using your graphing calculator. Use your equation to answer the question.

The Height Equation. h= ending height g = gravity constant (32 if feet, 9.8 if meters) v 0 = initial velocity h 0 = initial height t = time.

Chapter 4 Section 5.B Solving Quadratics by Finding Square Roots In this assignment, you will be able to... 1.Solve a quadratic equation. 2. Model a dropped.

Free Fall & Projectiles Chapter 3, sections 7-9 & Chapter 8, sections 1-4.

Quadratic word problems

About project

© 2024 SlidePlayer.com Inc. All rights reserved.

2.1 The Rectangular Coordinate Systems and Graphs

x -intercept is ( 4 , 0 ) ; ( 4 , 0 ) ; y- intercept is ( 0 , 3 ) . ( 0 , 3 ) .

125 = 5 5 125 = 5 5

( − 5 , 5 2 ) ( − 5 , 5 2 )

2.2 Linear Equations in One Variable

x = −5 x = −5

x = −3 x = −3

x = 10 3 x = 10 3

x = 1 x = 1

x = − 7 17 . x = − 7 17 . Excluded values are x = − 1 2 x = − 1 2 and x = − 1 3 . x = − 1 3 .

x = 1 3 x = 1 3

m = − 2 3 m = − 2 3

y = 4 x −3 y = 4 x −3

x + 3 y = 2 x + 3 y = 2

Horizontal line: y = 2 y = 2

Parallel lines: equations are written in slope-intercept form.

y = 5 x + 3 y = 5 x + 3

2.3 Models and Applications

C = 2.5 x + 3 , 650 C = 2.5 x + 3 , 650

L = 37 L = 37 cm, W = 18 W = 18 cm

2.4 Complex Numbers

−24 = 0 + 2 i 6 −24 = 0 + 2 i 6

( 3 −4 i ) − ( 2 + 5 i ) = 1 −9 i ( 3 −4 i ) − ( 2 + 5 i ) = 1 −9 i

5 2 − i 5 2 − i

18 + i 18 + i

−3 −4 i −3 −4 i

2.5 Quadratic Equations

( x − 6 ) ( x + 1 ) = 0 ; x = 6 , x = − 1 ( x − 6 ) ( x + 1 ) = 0 ; x = 6 , x = − 1

( x −7 ) ( x + 3 ) = 0 , ( x −7 ) ( x + 3 ) = 0 , x = 7 , x = 7 , x = −3. x = −3.

( x + 5 ) ( x −5 ) = 0 , ( x + 5 ) ( x −5 ) = 0 , x = −5 , x = −5 , x = 5. x = 5.

( 3 x + 2 ) ( 4 x + 1 ) = 0 , ( 3 x + 2 ) ( 4 x + 1 ) = 0 , x = − 2 3 , x = − 2 3 , x = − 1 4 x = − 1 4

x = 0 , x = −10 , x = −1 x = 0 , x = −10 , x = −1

x = 4 ± 5 x = 4 ± 5

x = 3 ± 22 x = 3 ± 22

x = − 2 3 , x = − 2 3 , x = 1 3 x = 1 3

2.6 Other Types of Equations

{ −1 } { −1 }

0 , 0 , 1 2 , 1 2 , − 1 2 − 1 2

1 ; 1 ; extraneous solution − 2 9 − 2 9

−2 ; −2 ; extraneous solution −1 −1

−1 , −1 , 3 2 3 2

−3 , 3 , − i , i −3 , 3 , − i , i

2 , 12 2 , 12

−1 , −1 , 0 0 is not a solution.

2.7 Linear Inequalities and Absolute Value Inequalities

[ −3 , 5 ] [ −3 , 5 ]

( − ∞ , −2 ) ∪ [ 3 , ∞ ) ( − ∞ , −2 ) ∪ [ 3 , ∞ )

x < 1 x < 1

x ≥ −5 x ≥ −5

( 2 , ∞ ) ( 2 , ∞ )

[ − 3 14 , ∞ ) [ − 3 14 , ∞ )

6 < x ≤ 9 or ( 6 , 9 ] 6 < x ≤ 9 or ( 6 , 9 ]

( − 1 8 , 1 2 ) ( − 1 8 , 1 2 )

| x −2 | ≤ 3 | x −2 | ≤ 3

k ≤ 1 k ≤ 1 or k ≥ 7 ; k ≥ 7 ; in interval notation, this would be ( − ∞ , 1 ] ∪ [ 7 , ∞ ) . ( − ∞ , 1 ] ∪ [ 7 , ∞ ) .

2.1 Section Exercises

Answers may vary. Yes. It is possible for a point to be on the x -axis or on the y -axis and therefore is considered to NOT be in one of the quadrants.

The y -intercept is the point where the graph crosses the y -axis.

The x- intercept is ( 2 , 0 ) ( 2 , 0 ) and the y -intercept is ( 0 , 6 ) . ( 0 , 6 ) .

The x- intercept is ( 2 , 0 ) ( 2 , 0 ) and the y -intercept is ( 0 , −3 ) . ( 0 , −3 ) .

The x- intercept is ( 3 , 0 ) ( 3 , 0 ) and the y -intercept is ( 0 , 9 8 ) . ( 0 , 9 8 ) .

y = 4 − 2 x y = 4 − 2 x

y = 5 − 2 x 3 y = 5 − 2 x 3

y = 2 x − 4 5 y = 2 x − 4 5

d = 74 d = 74

d = 36 = 6 d = 36 = 6

d ≈ 62.97 d ≈ 62.97

( 3 , − 3 2 ) ( 3 , − 3 2 )

( 2 , −1 ) ( 2 , −1 )

( 0 , 0 ) ( 0 , 0 )

y = 0 y = 0

not collinear

A: ( −3 , 2 ) , B: ( 1 , 3 ) , C: ( 4 , 0 ) A: ( −3 , 2 ) , B: ( 1 , 3 ) , C: ( 4 , 0 )

d = 8.246 d = 8.246

d = 5 d = 5

( −3 , 4 ) ( −3 , 4 )

x = 0 y = −2 x = 0 y = −2

x = 0.75 y = 0 x = 0.75 y = 0

x = − 1.667 y = 0 x = − 1.667 y = 0

15 − 11.2 = 3.8 mi 15 − 11.2 = 3.8 mi shorter

6 .0 42 6 .0 42

Midpoint of each diagonal is the same point ( 2 , –2 ) ( 2 , –2 ) . Note this is a characteristic of rectangles, but not other quadrilaterals.

2.2 Section Exercises

It means they have the same slope.

The exponent of the x x variable is 1. It is called a first-degree equation.

If we insert either value into the equation, they make an expression in the equation undefined (zero in the denominator).

x = 2 x = 2

x = 2 7 x = 2 7

x = 6 x = 6

x = 3 x = 3

x = −14 x = −14

x ≠ −4 ; x ≠ −4 ; x = −3 x = −3

x ≠ 1 ; x ≠ 1 ; when we solve this we get x = 1 , x = 1 , which is excluded, therefore NO solution

x ≠ 0 ; x ≠ 0 ; x = − 5 2 x = − 5 2

y = − 4 5 x + 14 5 y = − 4 5 x + 14 5

y = − 3 4 x + 2 y = − 3 4 x + 2

y = 1 2 x + 5 2 y = 1 2 x + 5 2

y = −3 x − 5 y = −3 x − 5

y = 7 y = 7

y = −4 y = −4

8 x + 5 y = 7 8 x + 5 y = 7

Perpendicular

m = − 9 7 m = − 9 7

m = 3 2 m = 3 2

m 1 = − 1 3 , m 2 = 3 ; Perpendicular . m 1 = − 1 3 , m 2 = 3 ; Perpendicular .

y = 0.245 x − 45.662. y = 0.245 x − 45.662. Answers may vary. y min = −50 , y max = −40 y min = −50 , y max = −40

y = − 2.333 x + 6.667. y = − 2.333 x + 6.667. Answers may vary. y min = −10 , y max = 10 y min = −10 , y max = 10

y = − A B x + C B y = − A B x + C B

The slope for ( −1 , 1 ) to ( 0 , 4 ) is 3. The slope for ( −1 , 1 ) to ( 2 , 0 ) is − 1 3 . The slope for ( 2 , 0 ) to ( 3 , 3 ) is 3. The slope for ( 0 , 4 ) to ( 3 , 3 ) is − 1 3 . The slope for ( −1 , 1 ) to ( 0 , 4 ) is 3. The slope for ( −1 , 1 ) to ( 2 , 0 ) is − 1 3 . The slope for ( 2 , 0 ) to ( 3 , 3 ) is 3. The slope for ( 0 , 4 ) to ( 3 , 3 ) is − 1 3 .

Yes they are perpendicular.

2.3 Section Exercises

Answers may vary. Possible answers: We should define in words what our variable is representing. We should declare the variable. A heading.

2 , 000 − x 2 , 000 − x

v + 10 v + 10

Ann: 23 ; 23 ; Beth: 46 46

20 + 0.05 m 20 + 0.05 m

90 + 40 P 90 + 40 P

50 , 000 − x 50 , 000 − x

She traveled for 2 h at 20 mi/h, or 40 miles.

$5,000 at 8% and $15,000 at 12%

B = 100 + .05 x B = 100 + .05 x

R = 9 R = 9

r = 4 5 r = 4 5 or 0.8

W = P − 2 L 2 = 58 − 2 ( 15 ) 2 = 14 W = P − 2 L 2 = 58 − 2 ( 15 ) 2 = 14

f = p q p + q = 8 ( 13 ) 8 + 13 = 104 21 f = p q p + q = 8 ( 13 ) 8 + 13 = 104 21

m = − 5 4 m = − 5 4

h = 2 A b 1 + b 2 h = 2 A b 1 + b 2

length = 360 ft; width = 160 ft

A = 88 in . 2 A = 88 in . 2

h = V π r 2 h = V π r 2

r = V π h r = V π h

C = 12 π C = 12 π

2.4 Section Exercises

Add the real parts together and the imaginary parts together.

Possible answer: i i times i i equals -1, which is not imaginary.

−8 + 2 i −8 + 2 i

14 + 7 i 14 + 7 i

− 23 29 + 15 29 i − 23 29 + 15 29 i

8 − i 8 − i

−11 + 4 i −11 + 4 i

2 −5 i 2 −5 i

6 + 15 i 6 + 15 i

−16 + 32 i −16 + 32 i

−4 −7 i −4 −7 i

2 − 2 3 i 2 − 2 3 i

4 − 6 i 4 − 6 i

2 5 + 11 5 i 2 5 + 11 5 i

1 + i 3 1 + i 3

( 3 2 + 1 2 i ) 6 = −1 ( 3 2 + 1 2 i ) 6 = −1

5 −5 i 5 −5 i

9 2 − 9 2 i 9 2 − 9 2 i

2.5 Section Exercises

It is a second-degree equation (the highest variable exponent is 2).

We want to take advantage of the zero property of multiplication in the fact that if a ⋅ b = 0 a ⋅ b = 0 then it must follow that each factor separately offers a solution to the product being zero: a = 0 o r b = 0. a = 0 o r b = 0.

One, when no linear term is present (no x term), such as x 2 = 16. x 2 = 16. Two, when the equation is already in the form ( a x + b ) 2 = d . ( a x + b ) 2 = d .

x = 6 , x = 6 , x = 3 x = 3

x = − 5 2 , x = − 5 2 , x = − 1 3 x = − 1 3

x = 5 , x = 5 , x = −5 x = −5

x = − 3 2 , x = − 3 2 , x = 3 2 x = 3 2

x = −2 , 3 x = −2 , 3

x = 0 , x = 0 , x = − 3 7 x = − 3 7

x = −6 , x = −6 , x = 6 x = 6

x = 6 , x = 6 , x = −4 x = −4

x = 1 , x = 1 , x = −2 x = −2

x = −2 , x = −2 , x = 11 x = 11

z = 2 3 , z = 2 3 , z = − 1 2 z = − 1 2

x = 3 ± 17 4 x = 3 ± 17 4

One rational

Two real; rational

x = − 1 ± 17 2 x = − 1 ± 17 2

x = 5 ± 13 6 x = 5 ± 13 6

x = − 1 ± 17 8 x = − 1 ± 17 8

x ≈ 0.131 x ≈ 0.131 and x ≈ 2.535 x ≈ 2.535

x ≈ − 6.7 x ≈ − 6.7 and x ≈ 1.7 x ≈ 1.7

a x 2 + b x + c = 0 x 2 + b a x = − c a x 2 + b a x + b 2 4 a 2 = − c a + b 4 a 2 ( x + b 2 a ) 2 = b 2 − 4 a c 4 a 2 x + b 2 a = ± b 2 − 4 a c 4 a 2 x = − b ± b 2 − 4 a c 2 a a x 2 + b x + c = 0 x 2 + b a x = − c a x 2 + b a x + b 2 4 a 2 = − c a + b 4 a 2 ( x + b 2 a ) 2 = b 2 − 4 a c 4 a 2 x + b 2 a = ± b 2 − 4 a c 4 a 2 x = − b ± b 2 − 4 a c 2 a

x ( x + 10 ) = 119 ; x ( x + 10 ) = 119 ; 7 ft. and 17 ft.

maximum at x = 70 x = 70

The quadratic equation would be ( 100 x −0.5 x 2 ) − ( 60 x + 300 ) = 300. ( 100 x −0.5 x 2 ) − ( 60 x + 300 ) = 300. The two values of x x are 20 and 60.

2.6 Section Exercises

This is not a solution to the radical equation, it is a value obtained from squaring both sides and thus changing the signs of an equation which has caused it not to be a solution in the original equation.

He or she is probably trying to enter negative 9, but taking the square root of −9 −9 is not a real number. The negative sign is in front of this, so your friend should be taking the square root of 9, cubing it, and then putting the negative sign in front, resulting in −27. −27.

A rational exponent is a fraction: the denominator of the fraction is the root or index number and the numerator is the power to which it is raised.

x = 81 x = 81

x = 17 x = 17

x = 8 , x = 27 x = 8 , x = 27

x = −2 , 1 , −1 x = −2 , 1 , −1

y = 0 , 3 2 , − 3 2 y = 0 , 3 2 , − 3 2

m = 1 , −1 m = 1 , −1

x = 2 5 , ±3 i x = 2 5 , ±3 i

x = 32 x = 32

t = 44 3 t = 44 3

x = −2 x = −2

x = 4 , −4 3 x = 4 , −4 3

x = − 5 4 , 7 4 x = − 5 4 , 7 4

x = 3 , −2 x = 3 , −2

x = 1 , −1 , 3 , -3 x = 1 , −1 , 3 , -3

x = 2 , −2 x = 2 , −2

x = 1 , 5 x = 1 , 5

x ≥ 0 x ≥ 0

x = 4 , 6 , −6 , −8 x = 4 , 6 , −6 , −8

2.7 Section Exercises

When we divide both sides by a negative it changes the sign of both sides so the sense of the inequality sign changes.

( − ∞ , ∞ ) ( − ∞ , ∞ )

We start by finding the x -intercept, or where the function = 0. Once we have that point, which is ( 3 , 0 ) , ( 3 , 0 ) , we graph to the right the straight line graph y = x −3 , y = x −3 , and then when we draw it to the left we plot positive y values, taking the absolute value of them.

( − ∞ , 3 4 ] ( − ∞ , 3 4 ]

[ − 13 2 , ∞ ) [ − 13 2 , ∞ )

( − ∞ , 3 ) ( − ∞ , 3 )

( − ∞ , − 37 3 ] ( − ∞ , − 37 3 ]

All real numbers ( − ∞ , ∞ ) ( − ∞ , ∞ )

( − ∞ , − 10 3 ) ∪ ( 4 , ∞ ) ( − ∞ , − 10 3 ) ∪ ( 4 , ∞ )

( − ∞ , −4 ] ∪ [ 8 , + ∞ ) ( − ∞ , −4 ] ∪ [ 8 , + ∞ )

No solution

( −5 , 11 ) ( −5 , 11 )

[ 6 , 12 ] [ 6 , 12 ]

[ −10 , 12 ] [ −10 , 12 ]

x > − 6 and x > − 2 Take the intersection of two sets . x > − 2 , ( − 2 , + ∞ ) x > − 6 and x > − 2 Take the intersection of two sets . x > − 2 , ( − 2 , + ∞ )

x < − 3 or x ≥ 1 Take the union of the two sets . ( − ∞ , − 3 ) ∪ [ 1 , ∞ ) x < − 3 or x ≥ 1 Take the union of the two sets . ( − ∞ , − 3 ) ∪ [ 1 , ∞ )

( − ∞ , −1 ) ∪ ( 3 , ∞ ) ( − ∞ , −1 ) ∪ ( 3 , ∞ )

[ −11 , −3 ] [ −11 , −3 ]

It is never less than zero. No solution.

Where the blue line is above the orange line; point of intersection is x = − 3. x = − 3.

( − ∞ , −3 ) ( − ∞ , −3 )

Where the blue line is above the orange line; always. All real numbers.

( − ∞ , − ∞ ) ( − ∞ , − ∞ )

( −1 , 3 ) ( −1 , 3 )

( − ∞ , 4 ) ( − ∞ , 4 )

{ x | x < 6 } { x | x < 6 }

{ x | −3 ≤ x < 5 } { x | −3 ≤ x < 5 }

( −2 , 1 ] ( −2 , 1 ]

( − ∞ , 4 ] ( − ∞ , 4 ]

Where the blue is below the orange; always. All real numbers. ( − ∞ , + ∞ ) . ( − ∞ , + ∞ ) .

Where the blue is below the orange; ( 1 , 7 ) . ( 1 , 7 ) .

x = 2 , − 4 5 x = 2 , − 4 5

( −7 , 5 ] ( −7 , 5 ]

80 ≤ T ≤ 120 1 , 600 ≤ 20 T ≤ 2 , 400 80 ≤ T ≤ 120 1 , 600 ≤ 20 T ≤ 2 , 400

[ 1 , 600 , 2 , 400 ] [ 1 , 600 , 2 , 400 ]

Review Exercises

x -intercept: ( 3 , 0 ) ; ( 3 , 0 ) ; y -intercept: ( 0 , −4 ) ( 0 , −4 )

y = 5 3 x + 4 y = 5 3 x + 4

72 = 6 2 72 = 6 2

620.097 620.097

midpoint is ( 2 , 23 2 ) ( 2 , 23 2 )

x = 4 x = 4

x = 12 7 x = 12 7

y = 1 6 x + 4 3 y = 1 6 x + 4 3

y = 2 3 x + 6 y = 2 3 x + 6

females 17, males 56

x = − 3 4 ± i 47 4 x = − 3 4 ± i 47 4

horizontal component −2 ; −2 ; vertical component −1 −1

7 + 11 i 7 + 11 i

−16 − 30 i −16 − 30 i

−4 − i 10 −4 − i 10

x = 7 − 3 i x = 7 − 3 i

x = −1 , −5 x = −1 , −5

x = 0 , 9 7 x = 0 , 9 7

x = 10 , −2 x = 10 , −2

x = − 1 ± 5 4 x = − 1 ± 5 4

x = 2 5 , − 1 3 x = 2 5 , − 1 3

x = 5 ± 2 7 x = 5 ± 2 7

x = 0 , 256 x = 0 , 256

x = 0 , ± 2 x = 0 , ± 2

x = 11 2 , −17 2 x = 11 2 , −17 2

[ − 10 3 , 2 ] [ − 10 3 , 2 ]

( − 4 3 , 1 5 ) ( − 4 3 , 1 5 )

Where the blue is below the orange line; point of intersection is x = 3.5. x = 3.5.

( 3.5 , ∞ ) ( 3.5 , ∞ )

Practice Test

y = 3 2 x + 2 y = 3 2 x + 2

( 0 , −3 ) ( 0 , −3 ) ( 4 , 0 ) ( 4 , 0 )

( − ∞ , 9 ] ( − ∞ , 9 ]

x = −15 x = −15

x ≠ −4 , 2 ; x ≠ −4 , 2 ; x = − 5 2 , 1 x = − 5 2 , 1

x = 3 ± 3 2 x = 3 ± 3 2

( −4 , 1 ) ( −4 , 1 )

y = −5 9 x − 2 9 y = −5 9 x − 2 9

y = 5 2 x − 4 y = 5 2 x − 4

5 13 − 14 13 i 5 13 − 14 13 i

x = 2 , − 4 3 x = 2 , − 4 3

x = 1 2 ± 2 2 x = 1 2 ± 2 2

x = 1 2 , 2 , −2 x = 1 2 , 2 , −2

As an Amazon Associate we earn from qualifying purchases.

This book may not be used in the training of large language models or otherwise be ingested into large language models or generative AI offerings without OpenStax's permission.

Want to cite, share, or modify this book? This book uses the Creative Commons Attribution License and you must attribute OpenStax.

Access for free at https://openstax.org/books/college-algebra/pages/1-introduction-to-prerequisites

- Authors: Jay Abramson

- Publisher/website: OpenStax

- Book title: College Algebra

- Publication date: Feb 13, 2015

- Location: Houston, Texas

- Book URL: https://openstax.org/books/college-algebra/pages/1-introduction-to-prerequisites

- Section URL: https://openstax.org/books/college-algebra/pages/chapter-2

© Dec 8, 2021 OpenStax. Textbook content produced by OpenStax is licensed under a Creative Commons Attribution License . The OpenStax name, OpenStax logo, OpenStax book covers, OpenStax CNX name, and OpenStax CNX logo are not subject to the Creative Commons license and may not be reproduced without the prior and express written consent of Rice University.

FAC Number: 2024-04 Effective Date: 05/01/2024

Subpart 19.8 - Contracting with the Small Business Administration (The 8(a) Program)

19.800 general..

(a) Section 8(a) of the Small Business Act ( 15 U.S.C.637(a) ) established a program that authorizes the Small Business Administration (SBA) to enter into all types of contracts with other agencies and award subcontracts for performing those contracts to firms eligible for program participation. This program is the "8(a) Business Development Program," commonly referred to as the "8(a) program." A small business that is accepted into the 8(a) program is known as a "participant." SBA’s subcontractors are referred to as "8(a) contractors." As used in this subpart, an 8(a) contractor is an 8(a) participant that is currently performing on a Federal contract or order that was set aside for 8(a) participants.

(b) Contracts may be awarded to the SBA for performance by eligible 8(a) participants on either a sole source or competitive basis.

(c) Acting under the authority of the program, the SBA certifies to an agency that SBA is competent and responsible to perform a specific contract. The contracting officer has the discretion to award the contract to the SBA based upon mutually agreeable terms and conditions.

(d) The contracting officer shall comply with 19.203 before deciding to offer an acquisition to a small business concern under the 8(a) program. For acquisitions above the simplified acquisition threshold , the contracting officer shall consider 8(a) set-asides or sole source awards before considering small business set-asides.

(e) When SBA has delegated its 8(a) program contract execution authority to an agency, the contracting officer must refer to its agency supplement or other policy directives for appropriate guidance.

19.801 [Reserved]

19.802 determining eligibility for the 8(a) program..

Determining the eligibility of a small business to be a participant in the 8(a) program is the responsibility of the SBA. SBA’s regulations on eligibility requirements for participation in the 8(a) program are found at 13 CFR 124.101 through 124.112. SBA designates the concern as an 8(a) participant in the Dynamic Small Business Search (DSBS) at https://web.sba.gov/pro-net/search/dsp_dsbs.cfm . SBA's designation also appears in the System for Award Management (SAM ).

19.803 Selecting acquisitions for the 8(a) Program.

Through their cooperative efforts, the SBA and an agency match the agency's requirements with the capabilities of 8(a) participants to establish a basis for the agency to contract with the SBA under the program. Selection is initiated in one of three ways:

(a) The SBA advises the contracting activity of an 8(a) participant's capabilities through a search letter and requests the contracting activity to identify acquisitions to support the participant's business plans. In these instances, the SBA will provide at a minimum the following information in order to enable the contracting activity to match an acquisition to the participant's capabilities:

(1) Identification of the participant and its owners.

(2) Background information on the participant, including any and all information pertaining to the participant's technical ability and capacity to perform.

(3) The participant's present production capacity and related facilities.

(4) The extent to which contracting assistance is needed in the present and the future, described in terms that will enable the agency to relate the participant's plans to present and future agency requirements.

(5) If construction is involved, the request shall also include the following:

(i) A participant's capabilities in and qualifications for accomplishing various categories of construction work typically found in North American Industrial Category System subsector 236 ( construction of buildings), subsector 237 (heavy and civil engineering construction ), or subsector 238 (specialty trade contractors).

(ii) The participant’s capacity in each construction category in terms of estimated dollar value ( e.g. , electrical, up to $100,000).

(b) The SBA identifies a specific requirement for one or more 8(a) participant(s) and sends a requirements letter to the agency's Office of Small and Disadvantaged Business Utilization , or for the Department of Defense, Office of Small Business Programs, requesting the contracting office offer the acquisition to the 8(a) program. In these instances, in addition to the information in paragraph (a) of this section, the SBA will provide-

(1) A clear identification of the acquisition sought; e.g. , project name or number;

(2) A statement as to how the required equipment and real property will be provided in order to ensure that the participant will be fully capable of satisfying the agency's requirements;

(3) If construction , information as to the bonding capability of the participant(s); and

(4) Either-

(i) If a sole source request-

(A) The reasons why the participant is considered suitable for this particular acquisition ; e.g. , previous contracts for the same or similar supply or service; and

(B) A statement that the participant is eligible in terms of its small business size status relative to the assigned NAICS code, business support levels, and business activity targets; or

(ii) If competitive, a statement that at least two 8(a) participants are considered capable of satisfying the agency's requirements and a statement that the participants are also eligible in terms of their small business size status relative to the assigned NAICS code, business support levels, and business activity targets. If requested by the contracting office , SBA will identify at least two such participants and provide information concerning the participants’ capabilities.

(c) Agencies may also review other proposed acquisitions for the purpose of identifying requirements which may be offered to the SBA. Where agencies independently, or through the self marketing efforts of an 8(a) participant, identify a requirement for the 8(a) program, they may offer on behalf of a specific 8(a) participant, for the 8(a) program in general, or for 8(a) competition.

19.804 Evaluation, offering, and acceptance.

19.804-1 agency evaluation..

In determining the extent to which a requirement should be offered in support of the 8(a) program, the agency should evaluate-

(a) Current and future plans to acquire the specific items or work that 8(a) participants are seeking to provide, identified in terms of-

(1) Estimated quantities of the supplies or services required or the estimated number of construction projects planned;

(2) Length of contract, including option periods (see 19.812 (d)); and

(3) Performance or delivery requirements, including–

(i) Required monthly production rates, when applicable; and

(ii) For construction , the geographical location where work is to be performed;

(b) The impact of any delay in delivery;

(c) Whether the items or work have previously been acquired using small business set-asides, and the date the items or work were acquired;

(d) Problems encountered in previous acquisitions of the items or work from the 8(a) participants or other contractors; and

(e) Any other pertinent information about known 8(a) participants, the items, or the work. This includes any information concerning the participants' products or capabilities. When necessary, the contracting agency shall make an independent review of the factors in 19.803 (a) and other aspects of the participants' capabilities which would ensure the satisfactory performance of the requirement being considered for commitment to the 8(a) program.

19.804-2 Agency offering.

(a) After completing its evaluation, the contracting office shall notify the SBA of the extent of its plans to place 8(a) contracts with the SBA for specific quantities of items or work, including 8(a) contracts that are reserved in accordance with 19.503. The notification, referred to as an offering letter, shall identify the time frames within which resulting 8(a) awards must be completed in order for the agency to meet its responsibilities. The offering letter shall also contain the following information applicable to each prospective contract:

(1) A description of the work to be performed or items to be delivered, and a copy of the statement of work, if available.

(2) The estimated period of performance.

(3) The NAICS code that applies to the principal nature of the acquisition .

(4) The anticipated dollar value of the requirement, including options , if any.

(5) Any special restrictions or geographical limitations on the requirement (for construction , include the location of the work to be performed).

(6) Any special capabilities or disciplines needed for contract performance.

(7) The type of contract anticipated.

(8) The acquisition history, if any, of the requirement, including the names and addresses of any small business contractors that have performed this requirement during the previous 24 months.

(9) A statement that prior to the offering no solicitation for the specific acquisition has been issued as a small business, HUBZone , service-disabled veteran-owned small business set-aside, or a set-aside under the Women-Owned Small Business (WOSB) Program, and that no other public communication (such as a notice through the Governmentwide point of entry (GPE )) has been made showing the contracting agency’s clear intention to set-aside the acquisition for small business, HUBZone small business, service-disabled veteran-owned small business concerns , or a set-aside under the WOSB Program.

(10) Identification of any particular 8(a) participant designated for consideration, including a brief justification, such as-

(i) The 8(a) participant, through its own efforts, marketed the requirement and caused it to be reserved for the 8(a) program; or

(ii) The acquisition is a follow-on or renewal contract and the nominated 8(a) participant is the incumbent.

(11) Bonding requirements, if applicable.

(12) Identification of all 8(a) participants which have expressed an interest in being considered for the acquisition .

(13) Identification of all SBA field offices that have asked for the acquisition for the 8(a) program.

(14) A request, if appropriate, that a requirement with an estimated contract value under the applicable competitive threshold be awarded as an 8(a) competitive contract (see 19.805-1 (d)).

(15) A request, if appropriate, that a requirement with a contract value over the applicable competitive threshold be awarded as a sole source contract (see 19.805-1 (b)).

(16) Any other pertinent and reasonably available data.

(1) An agency offering a construction requirement for which no specific offeror is nominated should submit it to the SBA District Office for the geographical area where the work is to be performed.

(2) An agency offering a construction requirement on behalf of a specific offeror should submit it to the SBA District Office servicing that concern .

(3) Sole source requirements, other than construction , should be forwarded directly to the district office that services the nominated 8(a) participant. If the contracting officer is not nominating a specific 8(a) participant, the offering letter should be forwarded to the district office servicing the geographical area in which the contracting office is located.

(c) All requirements for 8(a) competition, other than construction , should be forwarded to the district office servicing the geographical area in which the contracting office is located. All requirements for 8(a) construction competition should be forwarded to the district office servicing the geographical area in which all or the major portion of the construction is to be performed. All requirements, including construction , must be synopsized through the GPE. For construction , the synopsis must include the geographical area of the competition set forth in the SBA’s acceptance letter.

19.804-3 SBA acceptance.

(a) Upon receipt of the contracting office 's offering letter, SBA will determine whether to accept the requirement for the 8(a) program. SBA’s decision whether to accept the requirement will be transmitted to the contracting office in writing within 10 working days of receipt of the offer if the contract is likely to exceed the simplified acquisition threshold and within two working days of receipt if the contract is at or below the simplified acquisition threshold . The contracting office may grant an extension of these time periods, if requested by SBA.

(1) For acquisitions exceeding the simplified acquisition threshold , if SBA does not respond to an offering letter within ten working days, the contracting office may seek SBA’s acceptance through the Associate Administrator for Business Development. The contracting office may assume that SBA has accepted the requirement into the 8(a) program if it does not receive a reply from the Associate Administrator for Business Development within five calendar days of receipt of the contracting office 's request.

(2) For acquisitions not exceeding the simplified acquisition threshold , when the contracting office makes an offer to the 8(a) program on behalf of a specific 8(a) participant and does not receive a reply to its offering letter within two working days, the contracting office may assume the offer is accepted and proceed with award of an 8(a) contract.

(b) As part of the acceptance process, SBA will review the appropriateness of the NAICS code designation assigned to the requirement by the contracting officer .

(1) SBA will not challenge the NAICS code assigned to the requirement by the contracting officer if it is reasonable, even though other NAICS codes may also be reasonable.

(2) If SBA and the contracting officer are unable to agree on a NAICS code designation for the requirement, SBA may refuse to accept the requirement for the 8(a) program, appeal the contracting officer 's determination to the head of the agency pursuant to 19.810 , or appeal the NAICS code designation to the SBA Office of Hearings and Appeals under subpart C of 13 CFR part 134 .

(c) Sole source 8(a) awards . If an appropriate match exists, SBA will advise the contracting officer whether it will participate in contract negotiations or whether SBA will authorize the contracting officer to negotiate directly with the identified 8(a) participant. Where SBA has delegated its contract execution functions to a contracting agency, SBA will also identify that delegation in its acceptance letter. For a joint venture, SBA will determine eligibility as part of its acceptance of a sole-source requirement and will approve the joint venture agreement prior to award in accordance with 13 CFR 124.513(e) .

(1) Sole source award where the contracting officer nominates a specific 8(a) participant. SBA will determine whether an appropriate match exists where the contracting officer identifies a particular participant for a sole source award.

(i) Once SBA determines that a procurement is suitable to be accepted as an 8(a) sole source contract, SBA will normally accept it on behalf of the 8(a) participant recommended by the contracting officer , provided that the 8(a) participant complies with the requirements of 13 CFR 124.503(c)(1) .

(ii) If an appropriate match does not exist, SBA will notify the 8(a) participant and the contracting officer , and may then nominate an alternate 8(a) participant.

(2) Sole source award where the contracting officer does not nominate a specific 8(a) participant. When a contracting officer does not nominate an 8(a) participant for performance of a sole source 8(a) contract, SBA will select an 8(a) participant for possible award from among two or more eligible and qualified 8(a) participants. The selection will be based upon relevant factors, including business development needs, compliance with competitive business mix requirements (if applicable), financial condition, management ability, technical capability, and whether award will promote the equitable distribution of 8(a) contracts. (For construction requirements see 13 CFR 124.503(d)(1) ).

19.804-4 Repetitive acquisitions.

In order for repetitive acquisitions to be awarded through the 8(a) program, there must be separate offers and acceptances. This allows the SBA to determine-

(a) Whether the requirement should be a competitive 8(a) award;

(b) A nominated 8(a) participant's eligibility, and whether or not it is the same 8(a) participant that performed the previous contract;

(c) The effect that contract award would have on the equitable distribution of 8(a) contracts; and

(d) Whether the requirement should continue under the 8(a) program.

19.804-5 Basic ordering agreements and blanket purchase agreements.

(a) The contracting office shall submit an offering letter for, and SBA must accept, each order under a basic ordering agreement (BOA) or a blanket purchase agreement (BPA) issued under part 13 (see 13.303), in addition to the agency offering and SBA accepting the BOA or BPA itself.

(b) SBA will not accept for award on a sole-source basis any order that would cause the total dollar amount of orders issued under a specific BOA or BPA to exceed the competitive threshold amount in 19.805-1 .

(c) Once an 8(a) participant's program term expires, the participant otherwise exits the 8(a) program, or becomes other than small for the NAICS code assigned under the BOA or the BPA, SBA will not accept new orders under the BOA or BPA for the participant.

19.804-6 Indefinite delivery contracts.

(a) Separate offers and acceptances are not required for individual orders under multiple-award contracts (including the Federal Supply Schedules managed by GSA, multi-agency contracts or Governmentwide acquisition contracts, or indefinite-delivery, indefinite-quantity (IDIQ) contracts) that have been set aside for exclusive competition among 8(a) contractors, and the individual order is to be competed among all 8(a) contract holders. SBA's acceptance of the original contract is valid for the term of the contract. Offers and acceptances are required for individual orders under multiple-award contracts that have not been set aside for exclusive competition among 8(a) contractors.

(b) The contracting officer may issue an order on a sole source basis when—

(1) The multiple-award contract was set aside for exclusive competition among 8(a) participants;

(2) The order has an estimated value less than or equal to the dollar thresholds set forth at 19.805-1 (a)(2); and

(3) The offering and acceptance procedures at 19.804-2 and 19.804-3 are followed.

(c) The contracting officer may issue an order directly to one 8(a) contractor in accordance with 19.504 (c)(1)(ii) when—

(1) The multiple-award contract was reserved for 8(a) participants;

(2) The order has an estimated value less than or equal to $7 million for acquisitions assigned manufacturing NAICS codes and $4.5 million for all other acquisitions ; and

(d) An 8(a) contractor may continue to accept new orders under the contract, even if it exits the 8(a) program, or becomes other than small for the NAICS code(s) assigned to the contract.

(e) Agencies may continue to take credit toward their prime contracting small disadvantaged business or small business goals for orders awarded to 8(a) contractors, even after the contractor's 8(a) program term expires, the contractor otherwise exits the 8(a) program, or the contractor becomes other than small for the NAICS code(s) assigned under the 8(a) contract. However, if an 8(a) contractor rerepresents that it is other than small for the NAICS code(s) assigned under the contract in accordance with 19.301-2 or, where ownership or control of the 8(a) contractor has changed and SBA has granted a waiver to allow the contractor to continue performance (see 13 CFR 124.515 ), the agency may not credit any subsequent orders awarded to the contractor towards its small disadvantaged business or small business goals.

19.805 Competitive 8(a).

19.805-1 general..

(a) Except as provided in paragraph (b) of this section, an acquisition offered to the SBA under the 8(a) program shall be awarded on the basis of competition limited to eligible 8(a) participants when-

(1) There is a reasonable expectation that at least two eligible and responsible 8(a) participants will submit offers and that award can be made at a fair market price ; and

(2) The anticipated total value of the contract, including options , will exceed $7 million for acquisitions assigned manufacturing North American Industry Classification System (NAICS) codes and $4.5 million for all other acquisitions .

(b) Where an acquisition exceeds the competitive threshold (see paragraph (a)(2) of this section), the SBA may accept the requirement for a sole source 8(a) award if-

(1) There is not a reasonable expectation that at least two eligible and responsible 8(a) participants will submit offers at a fair market price ; or

(2) SBA accepts the requirement on behalf of a concern owned by an Indian tribe or an Alaska Native Corporation.

(c) A proposed 8(a) requirement with an estimated value exceeding the applicable competitive threshold amount shall not be divided into several requirements for lesser amounts in order to use 8(a) sole source procedures for award to a single firm.

(d) The SBA Associate Administrator for Business Development may approve a contracting office 's request for a competitive 8(a) award below the competitive thresholds. Such requests will be approved only on a limited basis and will be primarily granted where technical competitions are appropriate or where a large number of responsible 8(a) participants are available for competition. In determining whether a request to compete below the threshold will be approved, the SBA Associate Administrator for Business Development will, in part, consider the extent to which the contracting activity is supporting the 8(a) program on a noncompetitive basis. The agency may include recommendations for competition below the threshold in the offering letter or by separate correspondence to the SBA Associate Administrator for Business Development.

19.805-2 Procedures.

(a) Offers shall be solicited from those sources identified in accordance with 19.804-3 .

(b) The SBA will determine the eligibility of the apparent successful offeror . Eligibility is based on section 8(a) program criteria (see 13 CFR 124.501(g) and 19.816 (c)).

(1) In either negotiated or sealed bid competitive 8(a) acquisitions SBA will determine the eligibility of the apparent successful offeror and advise the contracting office within 5 working days after receipt of the contracting office 's request for an eligibility determination.

(i) If SBA determines that the apparent successful offeror is ineligible , the contracting office will then send to SBA the identity of the next highest evaluated offeror for an eligibility determination. The process is repeated until SBA determines that an identified offeror is eligible for award.

(ii) If the contracting officer believes that the apparent successful offeror (or the offeror SBA has determined eligible for award) is not responsible to perform the contract, the contracting officer must refer the matter to SBA for Certificate of Competency consideration under subpart 19.6 .

(2) For a two-step design-build procurement , an 8(a) participant must be eligible for award under the 8(a) program on the initial date for receipt of phase one offers specified in the solicitation (see 13 CFR 124.507(d)(3) .

(3) In any case in which an 8(a) participant is determined to be ineligible , SBA will notify the 8(a) participant of that determination.

(c) Any party with information questioning the eligibility of an 8(a) participant to continue participation in the 8(a) program or for the purposes of a specific 8(a) award may submit such information to the SBA in accordance with 13 CFR 124.112(c) .

(1) SBA does not certify joint ventures, as entities, into the 8(a) program.

(2) A contracting officer may consider a joint venture for contract award. SBA does not approve joint ventures for competitive awards (but see 13 CFR 124.501(g) for SBA's determination of participant eligibility).

19.806 Pricing the 8(a) contract.

(a) The contracting officer shall price the 8(a) contract in accordance with subpart 15.4 . If required by subpart 15.4 , the SBA shall obtain certified cost or pricing data from the 8(a) contractor. If the SBA requests audit assistance to determine the proposed price to be fair and reasonable in a sole source acquisition , the contracting activity shall furnish it to the extent it is available.

(b) An 8(a) contract, sole source or competitive, may not be awarded if the price of the contract results in a cost to the contracting agency which exceeds a fair market price .

(c) If requested by the SBA, the contracting officer shall make available the data used to estimate the fair market price within 10 working days.

(d) The negotiated contract price and the estimated fair market price are subject to the concurrence of the SBA. In the event of a disagreement between the contracting officer and the SBA, the SBA may appeal in accordance with 19.810 .

19.807 Estimating fair market price.

(a) The contracting officer shall estimate the fair market price of the work to be performed by the 8(a) contractor.

(b) In estimating the fair market price for an acquisition other than those covered in paragraph (c) of this section, the contracting officer shall use cost or price analysis and consider commercial prices for similar products and services, available in-house cost estimates, data (including certified cost or pricing data ) submitted by the SBA or the 8(a) contractor, and data obtained from any other Government agency.

(c) In estimating a fair market price for a repeat purchase, the contracting officer shall consider recent award prices for the same items or work if there is comparability in quantities, conditions, terms, and performance times. The estimated price should be adjusted to reflect differences in specifications, plans, transportation costs, packaging and packing costs, and other circumstances. Price indices may be used as guides to determine the changes in labor and material costs. Comparison of commercial prices for similar items may also be used.

19.808 Contract negotiation.

19.808-1 sole source..

(a) The SBA may not accept for negotiation a sole-source 8(a) contract that exceeds $25 million unless the requesting agency has completed a justification in accordance with the requirements of 6.303 .

(b) The SBA is responsible for initiating negotiations with the agency within the time established by the agency. If the SBA does not initiate negotiations within the agreed time and the agency cannot allow additional time, the agency may , after notifying the SBA, proceed with the acquisition from other sources.

(c) The SBA should participate, whenever practicable, in negotiating the contracting terms. When mutually agreeable, the SBA may authorize the contracting officer to negotiate directly with the 8(a) participant. Whether or not direct negotiations take place, the SBA is responsible for approving the resulting contract before award.

(d) An 8(a) participant must represent that it is a small business in accordance with the size standard corresponding to the NAICS code assigned to the contract.

(e) A concern must be a current participant in the 8(a) program at the time of an 8(a) sole-source award.

(f) An 8(a) participant owned by an Alaska Native Corporation, Indian Tribe, Native Hawaiian Organization, or Community Development Corporation may not receive an 8(a) sole-source award that is a follow-on contract to an 8(a) contract, if the predecessor contract was performed by another 8(a) participant (or former 8(a) participant) owned by the same Alaska Native Corporation, Indian Tribe, Native Hawaiian Organization, or Community Development Corporation (See 13 CFR 124.109 through 124.111).

19.808-2 Competitive.

In competitive 8(a) acquisitions , including follow-on 8(a) acquisitions , subject to part 15, the contracting officer conducts negotiations directly with the competing 8(a) participants. Conducting competitive negotiations among eligible 8(a) participants prior to SBA's formal acceptance of the acquisition for the 8(a) program may be grounds for the SBA's not accepting the acquisition for the 8(a) program.

19.809 Preaward considerations.

19.809-1 preaward survey..

The contracting officer should request a preaward survey of the 8(a) participant whenever considered useful. If the results of the preaward survey or other information available to the contracting officer raise substantial doubt as to the participant's ability to perform, the contracting officer shall refer the matter to SBA for Certificate of Competency consideration under subpart 19.6 .

19.809-2 Limitations on subcontracting and nonmanufacturer rule.

(a) Limitations on subcontracting. To be awarded a contract or order under the 8(a) program, the 8(a) participant is required to perform—

(1) For services (except construction ), at least 50 percent of the cost incurred for personnel with its own employees;

(2) For supplies or products (other than a procurement from a nonmanufacturer of such supplies or products ), at least 50 percent of the cost of manufacturing the supplies or products (not including the cost of materials);

(3) For general construction , at least 15 percent of the cost with its own employees (not including the cost of materials); and

(4) For construction by special trade contractors, at least 25 percent of the cost with its own employees (not including the cost of materials).

(b) Compliance period. An 8(a) contractor is required to comply with the limitations on subcontracting—

(1) For a contract under the 8(a) program, either by the end of the base term and then by the end of each subsequent option period or by the end of the performance period for each order issued under the contract, at the contracting officer 's discretion; and

(2) For an order competed exclusively among contractors who are 8(a) participants or for an order issued directly to one 8(a) contractor in accordance with 19.504 (c)(1)(ii), by the end of the performance period for the order.

(c) Waiver. The applicable SBA District Director may waive the provisions in paragraph (b)(1) requiring a participant to comply with the limitations on subcontracting for each period of performance or for each order. Instead, the SBA District Director may permit the participant to subcontract in excess of the limitations on subcontracting where the SBA District Director makes a written determination that larger amounts of subcontracting are essential during certain stages of performance.

(1) The 8(a) participant is required to provide the SBA District Director written assurance that the participant will ultimately comply with the requirements of this section prior to contract completion. The contracting officer shall review the written assurance and inform the 8(a) participant of their concurrence or nonconcurrence. The 8(a) participant can only submit the written assurance to the SBA District Director upon concurrence by the contracting officer .

(2) The contracting officer does not have the authority to waive the provisions of this section requiring an 8(a) participant to comply with the limitations on subcontracting for each period of performance or order, even if the agency has a Partnership Agreement with SBA.

(3) Where the 8(a) participant does not ultimately comply with the limitations on subcontracting by the end of the contract, SBA will not grant future waivers for the 8(a) participant.

(d) Nonmanufacturer rule. See 19.505 (c) for application of the nonmanufacturer rule, inclusive of waivers and exceptions to the nonmanufacturer rule.

19.810 SBA appeals.

(a) The SBA Administrator may submit the following matters for determination to the agency head if the SBA and the contracting officer fail to agree on them:

(1) The decision not to make a particular acquisition available for award under the 8(a) Program.

(2) A contracting officer ’s decision to reject a specific 8(a) participant for award of an 8(a) contract after SBA’s acceptance of the requirement for the 8(a) program.

(3) The terms and conditions of a proposed 8(a) contract, including the contracting officer ’s NAICS code designation and estimate of the fair market price .

(4) A contracting officer 's decision that an acquisition previously procured under the 8(a) program is a new requirement not subject to the release requirements at 13 CFR 124.504(d)(1) (see 19.815 (a) and (d)(1)).

(1) Notification by SBA of an intent to appeal to the agency head -

(i) Must be received by the contracting officer within 5 working days after SBA is formally notified of the contracting officer 's decision; and

(ii) Must be provided to the contracting agency Director for the Office of Smalland Disadvantaged Business Utilization or, for the Department of Defense, the Director of the Office of Small Business Programs.

(2) SBA must send the written appeal to the agency head within 15 working days of SBA’s notification of intent to appeal or the appeal may be considered withdrawn. Pending issuance of a decision by the agency head , the contracting officer shall suspend action on the acquisition . The contracting officer need not suspend action on the acquisition if the contracting officer makes a written determination that urgent and compelling circumstances that significantly affect the interests of the United States will not permit waiting for a decision.

(c) If the SBA appeal is denied, the decision of the agency head shall specify the reasons for the denial, including the reasons why the selected participant was determined incapable of performance, if appropriate. The decision shall be made a part of the contract file.

19.811 Preparing the contracts.

19.811-1 sole source..

(a) The contract to be awarded by the agency to the SBA shall be prepared in accordance with agency procedures and in the same detail as would be required in a contract with a business concern . The contracting officer shall use the Standard Form 26 as the award form, except for construction contracts, in which case the Standard Form 1442 shall be used as required in 36.701 (a).

(b) The contracting officer shall prepare the contract that the SBA will award to the 8(a) participant in accordance with agency procedures, as if awarding the contract directly to the 8(a) participant, except for the following:

(1) The award form shall cite 41 U.S.C. 3304(a)(5) or 10 U.S.C. 3204(a)(5) (as appropriate) as the authority for use of other than full and open competition .

(2) Appropriate clauses shall be included, as necessary, to reflect that the contract is between the SBA and the 8(a) contractor.

(3) The following items shall be inserted by the SBA:

(i) The SBA contract number.

(ii) The effective date.

(iii) The typed name of the SBA’s contracting officer .

(iv) The signature of the SBA’s contracting officer .

(v) The date signed.

(4) The SBA will obtain the signature of the 8(a) contractor prior to signing and returning the prime contract to the contracting officer for signature . The SBA will make every effort to obtain signatures and return the contract, and any subsequent bilateral modification, to the contracting officer within a maximum of 10 working days.

(c) Except in procurements where the SBA will make advance payments to its 8(a) contractor, the agency contracting officer may , as an alternative to the procedures in paragraphs (a) and (b) of this subsection, use a single contract document for both the prime contract between the agency and the SBA and its 8(a) contractor. The single contract document shall contain the information in paragraphs (b) (1), (2), and (3) of this subsection. Appropriate blocks on the Standard Form (SF) 26 or 1442 will be asterisked and a continuation sheet appended as a tripartite agreement which includes the following:

(1) Agency acquisition office, prime contract number, name of agency contracting officer and lines for signature , date signed, and effective date.

(2) The SBA office, the SBA contract number, name of the SBA contracting officer , and lines for signature and date signed.

(3) Name and lines for the 8(a) subcontractor’s signature and date signed.

(d) For acquisitions not exceeding the simplified acquisition threshold , the contracting officer may use the alternative procedures in paragraph (c) of this subsection with the appropriate simplified acquisition forms.

19.811-2 Competitive.

(a) The contract will be prepared in accordance with 14.408-1 (d), except that appropriate blocks on the Standard Form 26 or 1442 will be asterisked and a continuation sheet appended as a tripartite agreement which includes the following:

(1) The agency contracting activity , prime contract number, name of agency contracting officer , and lines for signature , date signed, and effective date.

(2) The SBA office, the SBA subcontract number, name of the SBA contracting officer and lines for signature and date signed.

(b) The process for obtaining signatures shall be as specified in 19.811-1 (b)(4).

19.811-3 Contract clauses.

(a) The contracting officer shall insert the clause at 52.219-11 , Special 8(a) Contract Conditions, in contracts between the SBA and the agency when the acquisition is accomplished using the procedures of 19.811-1 (a) and (b).

(b) The contracting officer shall insert the clause at 52.219-12 , Special 8(a) Subcontract Conditions, in contracts between the SBA and its 8(a) contractor when the acquisition is accomplished using the procedures of 19.811-1 (a) and (b).

(c) The contracting officer shall insert the clause at 52.219-17 , Section 8(a) Award, in competitive solicitations and contracts when the acquisition is accomplished using the procedures of 19.805 and in sole source awards which utilize the alternative procedure in 19.811-1 (c).

(d) The contracting officer shall insert the clause at 52.219-18 , Notification of Competition Limited to Eligible 8(a) Participants, in competitive solicitations and contracts when the acquisition is accomplished using the procedures of 19.805 . Use the clause at 52.219-18 with its Alternate I when competition is to be limited to 8(a) participants within one or more specific SBA districts pursuant to 19.804-2 .

(e) For contracts or orders resulting from this subpart, see 19.507 (e) for use of 52.219-14 , Limitations on Subcontracting, and 19.507 (h) for use of 52.219-33 , Nonmanufacturer Rule.

19.812 Contract administration.

(a) The contracting officer shall assign contract administration functions, as required, based on the location of the 8(a) contractor (see Federal Directory of Contract Administration Services Components (available via the Internet at https://piee.eb.mil/pcm/xhtml/unauth/index.xhtml )).

(b) The agency shall distribute copies of the contract(s) in accordance with part 4 . All contracts and modifications, if any, shall be distributed to both the SBA and the 8(a) contractor in accordance with the timeframes set forth in 4.201 .

(c) To the extent consistent with the contracting activity ’s capability and resources, 8(a) contractors furnishing requirements shall be afforded production and technical assistance, including, when appropriate, identification of causes of deficiencies in their products and suggested corrective action to make such products acceptable.

(d) For 8(a) contracts exceeding 5 years including options , the contracting officer shall verify in DSBS or SAM that the concern is an SBA-certified 8(a) participant no more than 120 days prior to the end of the fifth year of the contract. If the concern is not an SBA-certified 8(a) participant, the contracting officer shall not exercise the option (see 13 CFR 124.521(e)(2) ).

(e) An 8(a) contract, whether in the base or an option year, must be terminated for convenience if the 8(a) contractor to which it was awarded transfers ownership or control of the firm or if the contract is transferred or novated for any reason to another firm, unless the Administrator of the SBA waives the requirement for contract termination (13 CFR 124.515). The Administrator may waive the termination requirement only if certain conditions exist. Moreover, a waiver of the requirement for termination is permitted only if the 8(a) contractor's request for waiver is made to the SBA prior to the actual relinquishment of ownership or control, except in the case of death or incapacity where the waiver must be submitted within 60 calendar days after such an occurrence. The clauses in the contract entitled "Special 8(a) Contract Conditions" and "Special 8(a) Subcontract Conditions" require the SBA and the 8(a) subcontractor to notify the contracting officer when ownership of the firm is being transferred. When the contracting officer receives information that an 8(a) contractor is planning to transfer ownership or control to another firm, the contracting officer shall take action immediately to preserve the option of waiving the termination requirement. The contracting officer shall determine the timing of the proposed transfer and its effect on contract performance and mission support. If the contracting officer determines that the SBA does not intend to waive the termination requirement, and termination of the contract would severely impair attainment of the agency's program objectives or mission, the contracting officer shall immediately notify the SBA in writing that the agency is requesting a waiver. Within 15 business days thereafter, or such longer period as agreed to by the agency and the SBA, the agency head must either confirm or withdraw the request for waiver. Unless a waiver is approved by the SBA, the contracting officer must terminate the contract for convenience upon receipt of a written request by the SBA. This requirement for a convenience termination does not affect the Government's right to terminate for default if the cause for termination of an 8(a) contract is other than the transfer of ownership or control.

19.813 Protesting an 8(a) participant's eligibility or size status.

(a) The eligibility of an 8(a) participant for a sole source or competitive 8(a) requirement may not be challenged by another 8(a) participant or any other party, either to SBA or any administrative forum as part of a bid or other contract protest (see 13 CFR 124.517 ).

(b) The size status of an 8(a) participant nominated for an 8(a) sole source contract may not be protested by another 8(a) participant or any other party.

(c) The size status of the apparent successful offeror for competitive 8(a) awards may be protested. The filing of a size status protest is limited to-

(1) Any offeror whom the contracting officer has not eliminated for reasons unrelated to size;

(2) The contracting officer ; or

(3) The SBA District Director in either the district office serving the geographical area in which the contracting activity is located or the district office that services the apparent successful offeror , or the Associate Administrator for Business Development.

(d) Protests of competitive 8(a) awards shall follow the procedures at 19.302 . For additional information, refer to 13 CFR 121.1001 .

19.814 Requesting a formal size determination (8(a) sole source requirements).

(a) If the size status of an 8(a) participant nominated for award of an 8(a) sole source contract is called into question, a request for a formal size determination may be submitted to SBA pursuant to 13 CFR 121.1001(b)(2)(ii) by-

(1) The 8(a) participant nominated for award of the particular sole source contract;

(2) The contracting officer who has been delegated SBA’s 8(a) contract execution functions, where applicable, or the SBA program official with authority to execute the 8(a) contract;

(3) The SBA District Director in the district office that services the 8(a) participant or the Associate Administrator for Business Development; or

(4) The SBA Inspector General.

(b) SBA’s Government Contracting Area Director will issue a formal size determination within 15 business days, if possible, after SBA receives the request for a formal size determination.

(c) An appeal of an SBA size determination shall follow the procedures at 19.302 .

19.815 Release and notification requirements for non-8(a) procurement.

(a) Once a requirement has been accepted by SBA into the 8(a) program, any follow-on requirements (see definition at 13 CFR 124.3 ) shall remain in the 8(a) program unless—

(1) SBA agrees to release the requirement from the 8(a) program for a follow-on, non-8(a) procurement in accordance with 13 CFR 124.504(d) (see paragraph (b) of this section); or

(2) There is a mandatory source (see 8.002 or 8.003 ; also see paragraph (f) of this section).

(b) To obtain release of a requirement for a follow-on, non-8(a) procurement , (other than a mandatory source listed at 8.002 or 8.003 ), the contracting officer shall make a written request to, and receive concurrence from, the SBA Associate Administrator for Business Development.

(1) The written request to the SBA Associate Administrator for Business Development shall indicate

(i) Whether the agency has achieved its small disadvantaged business goal;

(ii) Whether the agency has achieved its HUBZone , SDVOSB, WOSB, or small business goal(s); and

(iii) Whether the requirement is critical to the business development of the 8(a) contractor that is currently performing the requirement.

(2) Generally, a requirement that was previously accepted into the 8(a) program will only be released for procurements outside the 8(a) program when the contracting activity agency agrees to set aside the requirement under the small business, HUBZone , SDVOSB, or WOSB programs.

(3) The requirement that a follow-on procurement must be released from the 8(a) program in order for it to be fulfilled outside the 8(a) program does not apply to task or delivery orders offered to and accepted into the 8(a) program, where the basic contract was not accepted into the 8(a) program.

(1) When a contracting officer decides that a requirement previously procured under the 8(a) program is a new requirement and not a follow-on requirement to an 8(a) contract(s), the contracting officer shall coordinate with and submit a written notice to the SBA District Office servicing the 8(a) incumbent firm and to the SBA procurement center representative (or, if a procurement center representative is not assigned, see 19.402 (a)) indicating that the agency intends to procure the requirement outside the 8(a) program (see 19.810 (a)(4)).

(2) The written notice shall include a copy of the acquisition plan, if available; the performance work statement (PWS ), statement of work (SOW), or statement of objectives (SOO ) for the new contract requirement; and the values of the existing 8(a) contract(s) and the new contract requirement.

(1) When a contracting officer decides to procure a follow-on requirement to an 8(a) contract using an existing, limited competition contracting vehicle that is not available to all 8(a) participants, and the current or previous 8(a) contract was available to all 8(a) participants, the contracting officer shall coordinate with and submit a written notice to the SBA District Office servicing the 8(a) incumbent firm and to the SBA procurement center representative (or, if a procurement center representative is not assigned, see 19.402 (a)) indicating the intent to do so.

(2) The written notice shall include a copy of the acquisition plan, if available; the PWS, SOW, or SOO for the new contract requirement; and the values of both contracts.

(1) When a mandatory source will be used for a follow-on requirement to an 8(a) contract, the contracting officer should submit a written notice to the SBA Associate Administrator for Business Development of the intent to do so at least 30 days prior to the end of the contract or order in accordance with 13 CFR 124.504(d)(4)(ii) .

(2) The written notice should include a written determination that a mandatory source will be used to fulfill the requirement.

19.816 Exiting the 8(a) program.

(a) Except as provided in paragraph (c) of this section, when a contractor exits the 8(a) program, it is no longer eligible to receive new 8(a) contracts. However, the contractor remains under contractual obligation to complete existing contracts, and any priced options that may be exercised.

(b) If an 8(a) contractor is suspended from the program (see 13 CFR 124.305 ), it may not receive any new 8(a) contracts unless the head of the contracting agency makes a determination that it is in the best interest of the Government to issue the award and SBA adopts that determination.

(c) A contractor that has completed its term of participation in the 8(a) program may be awarded a competitive 8(a) contract if it was an 8(a) participant eligible for award of the contract on the initial date specified for receipt of offers contained in the solicitation , and if the contractor continues to meet all other applicable eligibility criteria (see 13 CFR 124.507(d) ).

(d) SBA's regulations on exiting the 8(a) program are found at 13 CFR 124.301 through 124.305, and 13 CFR 124.507(d) .

Definitions

FAC Changes

Style Formatter

- Data Initiatives

- Regulations

- Smart Matrix

- Regulations Search

- Acquisition Regulation Comparator (ARC)

- Large Agencies

- Small Agencies

- CAOC History

- CAOC Charter

- Civilian Agency Acquisition Council (CAAC)

- Federal Acquisition Regulatory Council

- Interagency Suspension and Debarment Committee (ISDC)

ACQUISITION.GOV

An official website of the General Services Administration

CAAC Consultation to Issue a Class Deviation From the Federal Acquisition Regulation (FAR) Regarding the Small Business Administration (SBA) Memorandum, “Impact of Recent Court Decision (Ultima Servs. Corp. v. Dep’t of Ag. (E.D. Tenn.)) on the use of the 8(a) Program”

United States Department of the Treasury

Assignment: Weather Changes and Predictions 4.8A Assignment

Created by Katelyn R (Cool Organism) on 03/2/2023

4 activities: 4 games

Activity 1: Question Game. Estimated duration: 15 min

Newton Pool

The game consists of hand-crafted levels where the player controls a white ball. The goal of each level is to get the white ball to the end of the level in as few moves as possible, while racking up points by bumping golden balls into obstacles on the way! The game does not have any instructional math content, it simply has math review questions spread throughout.

Teacher Ratings (699) 4.0 stars.

Student Ratings (235053) 4.0 stars.

Activity 2: Question Game. Estimated duration: 14 min

Floating Spheres: Weather Prediction (Elem)

You will answer rounds of questions about weather and how it is predicted. When you answer questions correctly, you will be taken into outer space, where you control your sphere and try to capture other spheres. Your sphere starts out small but grows larger as you collide with other spheres. You will continually be tested as you progress and increase the size of your sphere.

Teacher Ratings (40) 3.8 stars.

Student Ratings (8758) 3.9 stars.

Activity 3: Instructional Game. Estimated duration: 15 min

Weather Road

Show off your weather forecasting skills as you travel around the country on a hilarious road trip!

Teacher Ratings (14) 4.3 stars.

Student Ratings (8834) 3.8 stars.

Activity 4: Instructional Game. Estimated duration: 15 min

Squeaky's New Weather Balloon

Join Squeaky as he steers his new weather balloon through fierce storms and turbulent skies while learning about weather instruments, forecasting, and clouds!

Teacher Ratings (30) 4.3 stars.

Student Ratings (19126) 4.2 stars.

An official website of the United States Government

- Kreyòl ayisyen

- Search Toggle search Search Include Historical Content - Any - No Include Historical Content - Any - No Search

- Menu Toggle menu

- INFORMATION FOR…

- Individuals

- Business & Self Employed

- Charities and Nonprofits

- International Taxpayers

- Federal State and Local Governments

- Indian Tribal Governments

- Tax Exempt Bonds

- FILING FOR INDIVIDUALS

- How to File

- When to File

- Where to File

- Update Your Information

- Get Your Tax Record

- Apply for an Employer ID Number (EIN)

- Check Your Amended Return Status

- Get an Identity Protection PIN (IP PIN)

- File Your Taxes for Free

- Bank Account (Direct Pay)

- Payment Plan (Installment Agreement)

- Electronic Federal Tax Payment System (EFTPS)

- Your Online Account

- Tax Withholding Estimator

- Estimated Taxes

- Where's My Refund

- What to Expect

- Direct Deposit

- Reduced Refunds

- Amend Return

Credits & Deductions

- INFORMATION FOR...

- Businesses & Self-Employed

- Earned Income Credit (EITC)

- Child Tax Credit

- Clean Energy and Vehicle Credits

- Standard Deduction

- Retirement Plans

Forms & Instructions

- POPULAR FORMS & INSTRUCTIONS

- Form 1040 Instructions

- Form 4506-T

- POPULAR FOR TAX PROS

- Form 1040-X

- Circular 230

Future Developments

Indian tribal governments/enterprises..

Forms SS-4 and SS-4(sp) absorb Form SS-4PR.

Pub. 51 and Pub. 80 rolled into Pub. 15, plus new Pub. 15(sp).

Purpose of Form

Apply for an EIN online.

Keep Form SS-4 information current.

File only one Form SS-4.

EIN applied for, but not received.

How To Apply for an EIN

Apply by telephone—option available to international applicants only.

Apply by fax.

Apply by mail.

How To Get Tax Help, Forms, and Publications

Related forms and publications, individuals., estate of a decedent., partnerships., corporations., plan administrators..

Line 2. Trade name of business.

Line 3. Executor, administrator, trustee, “care of” name.

Lines 4a–4b. Mailing address.

Lines 5a–5b. Street address.

Line 6. County and state where principal business is located.

Responsible party defined.

Lines 8a–8c. Limited liability company (LLC) information.

Sole proprietor.

Corporation., personal service corporation., other nonprofit organization., plan administrator., state/local government., federal government., indian tribal government/enterprise., disregarded entities., started new business., hired employees., banking purpose., changed type of organization., purchased going business., created a trust., created a pension plan..

Line 11. Date business started or acquired.

Personal service corporations.

Line 13. Highest number of employees expected in the next 12 months.

Line 14. Do you want to file Form 944?

Withholding agent.

Construction., real estate., rental & leasing., manufacturing., transportation & warehousing., finance & insurance., health care & social assistance., accommodation & food services., wholesale-agent/broker., wholesale-other..

Third-Party Designee.

Privacy Act and Paperwork Reduction Act Notice.

Instructions for form ss-4 (12/2023), application for employer identification number (ein).

Section references are to the Internal Revenue Code unless otherwise noted.

Revised: 12/2023

General Instructions

Use these instructions to complete Form SS-4, Application for Employer Identification Number (EIN). Also, see Do I Need an EIN? on page 2 of Form SS-4.

For the latest information related to Form SS-4 and its instructions, such as legislation enacted after they were published, go to IRS.gov/FormSS4 .

Form SS-4, line 14, now reflects the ceiling for wages paid by employers in U.S. territories electing to file Form 944. This information has been available in the instructions for Line 14 .

We added guidance to Line 1 and Line 9a , later, for Indian tribal governments, and for certain tribal enterprises that are not recognized as separate entities for federal tax purposes, under Regulations section 301.7701-1(a)(3).

Form SS-4PR, Solicitud de Número de Identificación Patronal, will no longer be available after 2023. Instead, if you are an employer in Puerto Rico, you will file Form SS-4. If you prefer your form and instructions in Spanish, you can file new Form SS-4 (sp), Solicitud de Número de Identificación del Empleador (EIN).

Pub. 51, Agricultural Employer’s Tax Guide, and Pub. 80, Federal Tax Guide for Employers in the U.S. Virgin Islands, Guam, American Samoa, and the Commonwealth of the Northern Mariana Islands, will no longer be available after 2023. Instead, information specific to agricultural employers and employers in the U.S. territories will be included in Pub. 15, Employer’s Tax Guide, beginning with the Pub. 15 for use in 2024. Beginning in 2024, there will be a new Pub. 15 (sp) that is a Spanish-language version of Pub. 15.

Use Form SS-4 to apply for an EIN. An EIN is a 9-digit number (for example, 12-3456789) assigned to sole proprietors, corporations, partnerships, estates, trusts, and other entities for tax filing and reporting purposes. The information you provide on this form will establish your business tax account.

For applicants in the U.S. or U.S. territories, you can apply for and receive an EIN free of charge on IRS.gov. See How To Apply for an EIN , later.

Use Form 8822-B to report changes to your responsible party, address or location. Changes in responsible parties must be reported to the IRS within 60 days.

Generally, a sole proprietor should file only one Form SS-4 and needs only one EIN, regardless of the number of businesses operated as a sole proprietorship or trade names under which a business operates. However, if a sole proprietorship incorporates or enters into a partnership, a new EIN is required. Also, each corporation in an affiliated group must have its own EIN.

If you don’t have an EIN by the time a return is due, write “Applied For” and the date you applied in the space shown for the number. Don’t show your SSN as an EIN on returns. If you don’t have an EIN by the time a tax deposit is due, send your payment to the Internal Revenue Service Center for your filing area as shown in the instructions for the form that you are filing. Make your check or money order payable to the “United States Treasury” and show your name (as shown on Form SS-4), address, type of tax, period covered, and date you applied for an EIN.

You can apply for an EIN online (only for applicants in the U.S. or U.S. territories), by telephone (only for applicants outside of the U.S. or U.S. territories), by fax, or by mail, depending on how soon you need to use the EIN. Use only one method for each entity so you don’t receive more than one EIN for an entity.

If you have a legal residence, principal place of business, or principal office or agency in the U.S. or U.S. territories, you can receive an EIN online and use it immediately to file a return or make a payment. Go to the IRS website at IRS.gov/EIN .

The principal officer, general partner, grantor, owner, trustor, etc., must have a valid taxpayer identification number (SSN, EIN, or ITIN) in order to use the online application. Taxpayers who apply online have an option to view, print, and save their EIN assignment notice at the end of the session. Authorized third-party designees, see Line 18 , later.

If you have NO legal residence, principal place of business, or principal office or agency in the U.S. or U.S. territories, you may call 267-941-1099 (not a toll-free number), 6:00 a.m. to 11:00 p.m. (Eastern time), Monday through Friday, to obtain an EIN.

The person making the call must be authorized to receive the EIN and answer questions concerning Form SS-4. Complete the Third Party Designee section only if you want to authorize the named individual to receive the entity’s EIN and answer questions about the completion of Form SS-4. The designee’s authority terminates at the time the EIN is assigned and released to the designee. You must complete the signature area for the authorization to be valid.

It will be helpful to complete Form SS-4 before contacting the IRS. An IRS representative will use the information from Form SS-4 to establish your account and assign you an EIN. Write the number you're given on the upper right corner of the form and sign and date it. Keep this copy for your records.

If requested by an IRS representative, mail or fax the signed Form SS-4 (including any third-party designee authorization) within 24 hours to the IRS address provided by the IRS representative.