Resume Worded | Proven Resume Examples

- Resume Examples

50+ Finance Resume Examples - Here's What Works In 2024

To break into finance, you need a strong resume that highlights your experience in the industry. if you need inspiration, look no further — we've provided a ton of downloadable resume samples that you can use as a starting point for your own finance resume..

Choose a category to browse Finance resumes

We've put together a number of free Finance resume templates that you can use. Choose a category depending on your field, or just scroll down to see all templates.

Bookkeeper Resumes

The bookkeeping field is wide open for those with a knack for numbers and a desire to help companies keep an accurate perspective of their finances. Learn how to make your bookkeeper resume stand out as we review four templates for bookkeepers from a variety of backgrounds and delve into key tips to keep in mind.

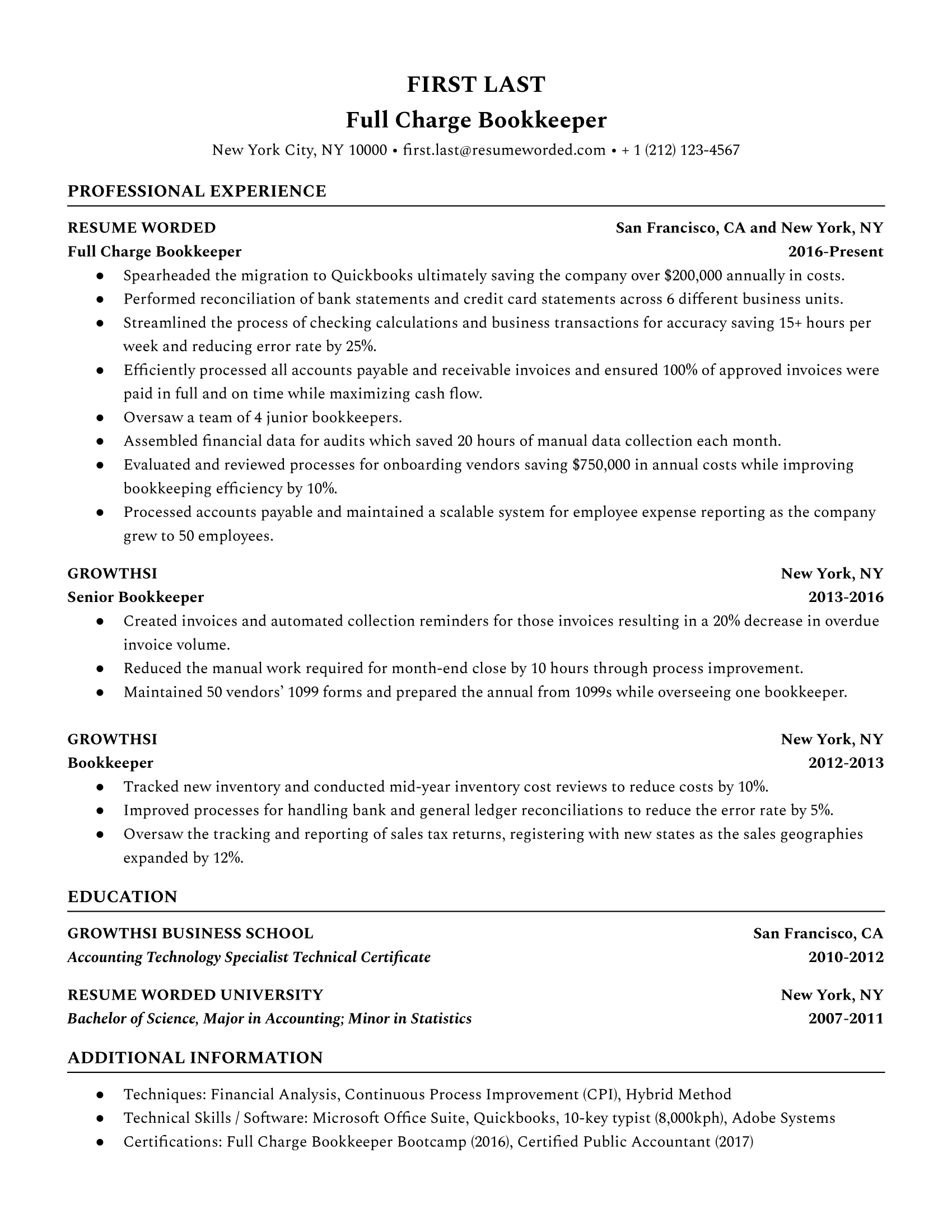

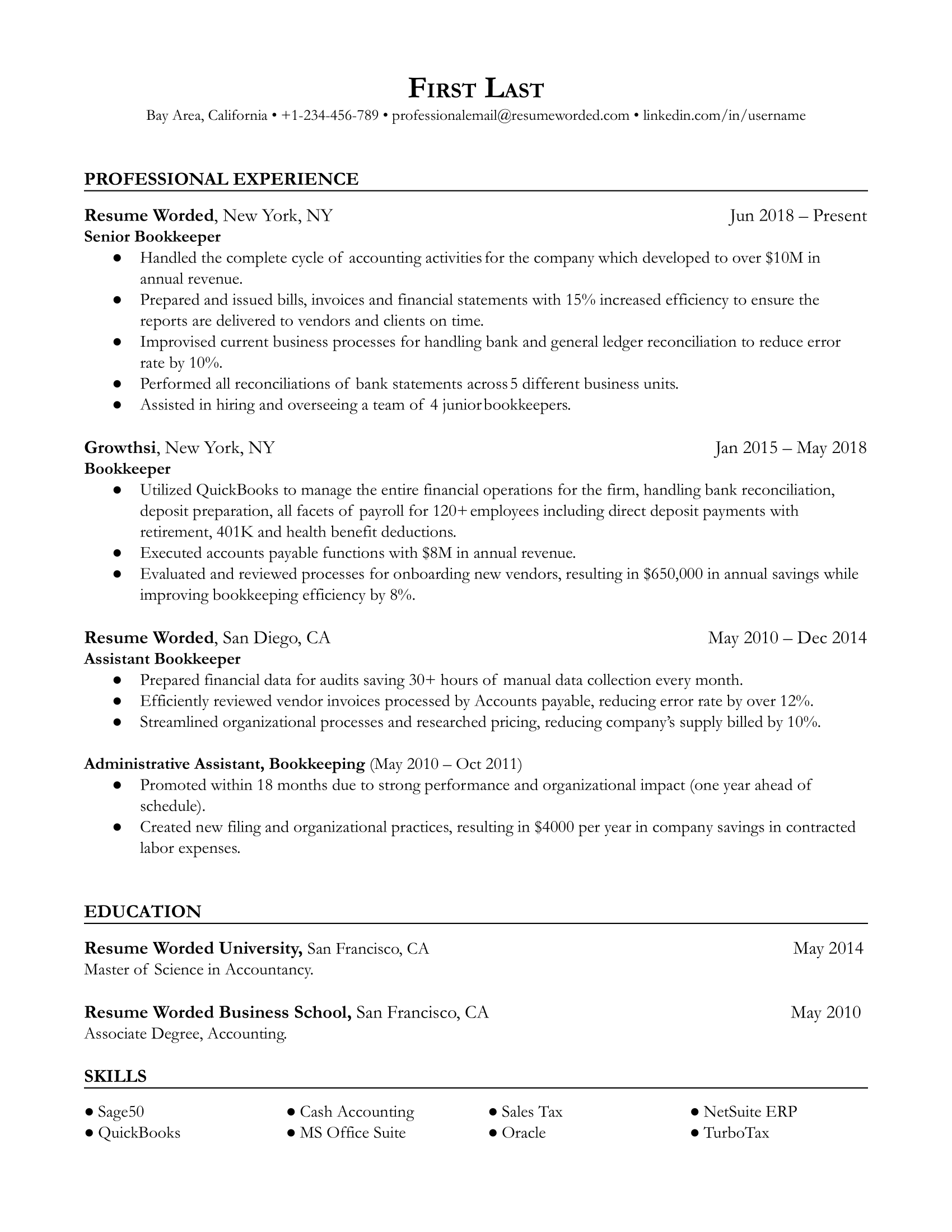

Full Charge Bookkeeper

Senior Bookkeeper

Entry Level Bookkeeper

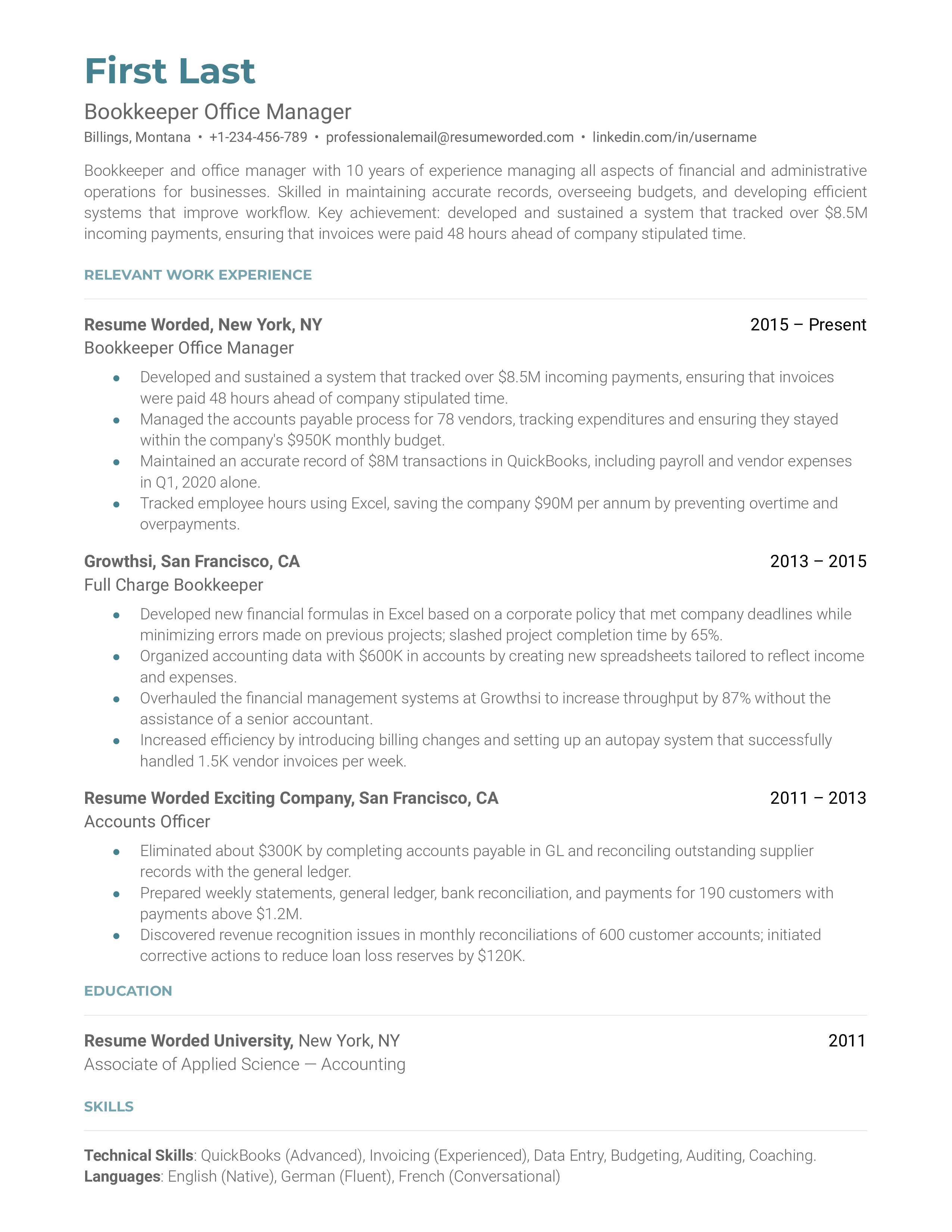

Bookkeeper Office Manager

Investment Banking Resumes

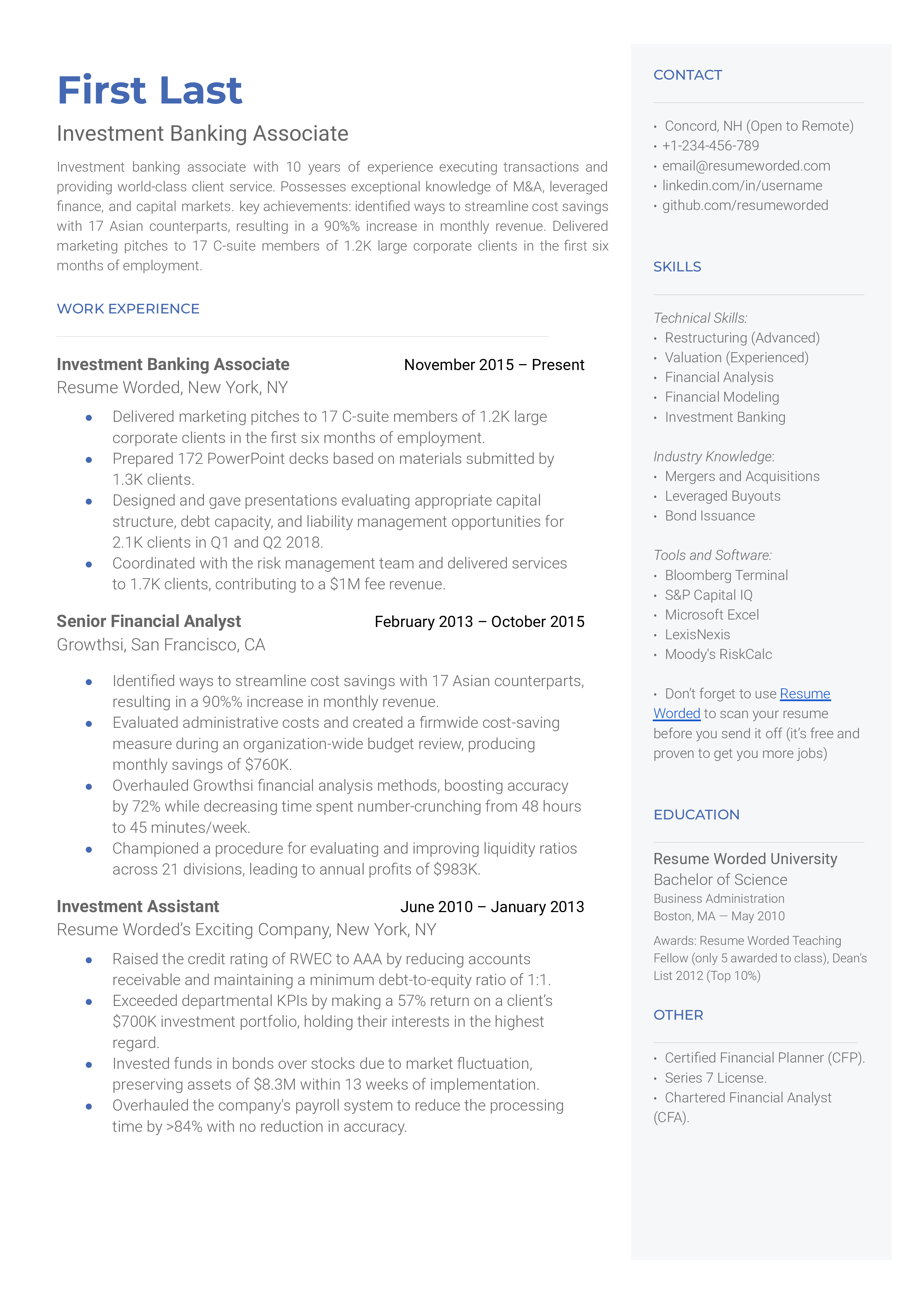

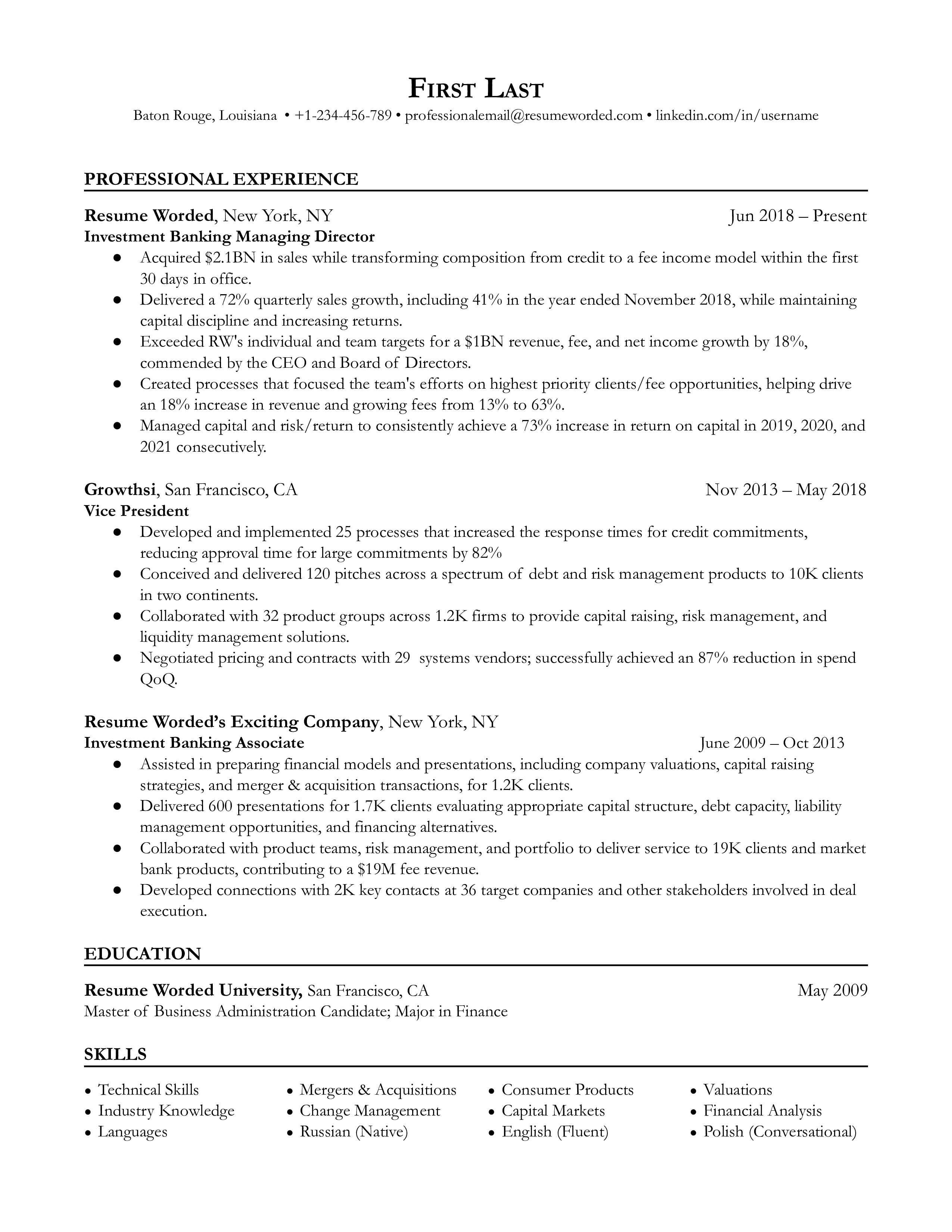

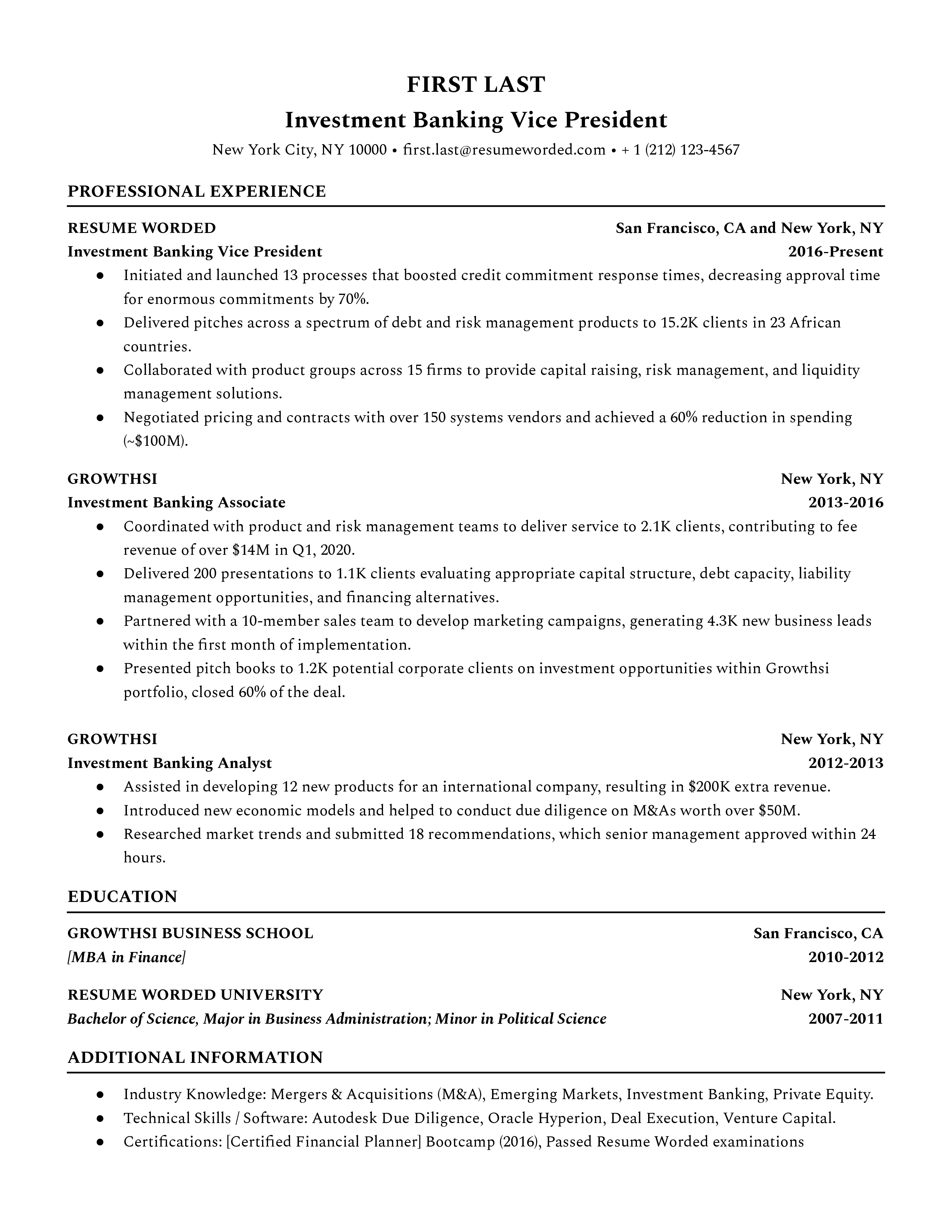

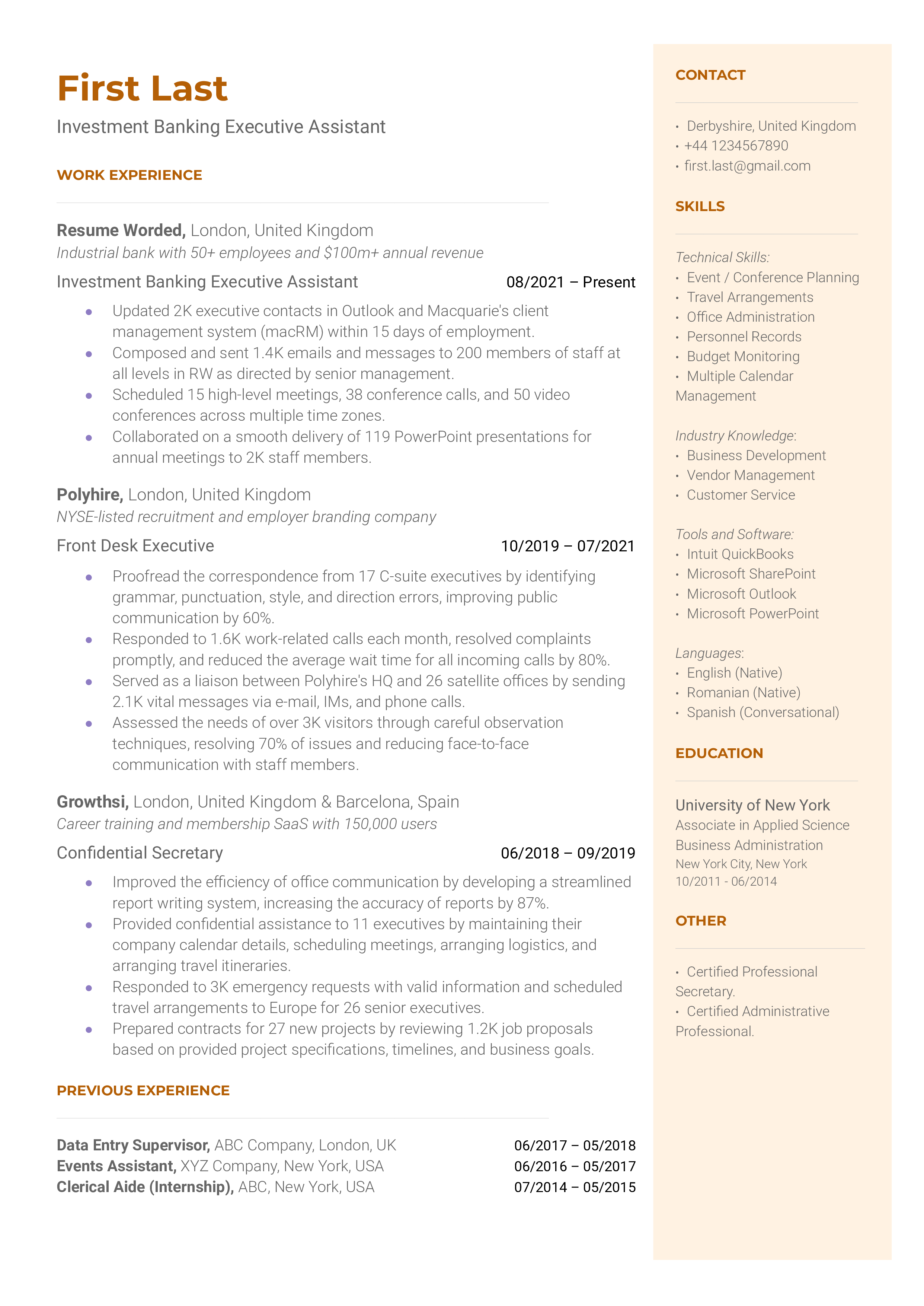

Investment banking can be a lucrative but also very demanding career where only the best of the best succeed. This guide has been created to help you create a resume that will stand out among the sea of impressive resumes recruiters see every day. We will define 5 investment banking positions, show you a strong resume sample for each, and give you pointers to help you elevate your resume and secure that interview.

Investment Banking Associate

Investment Banking Managing Director

Investment Banking Vice President

Investment Banking Executive Assistant

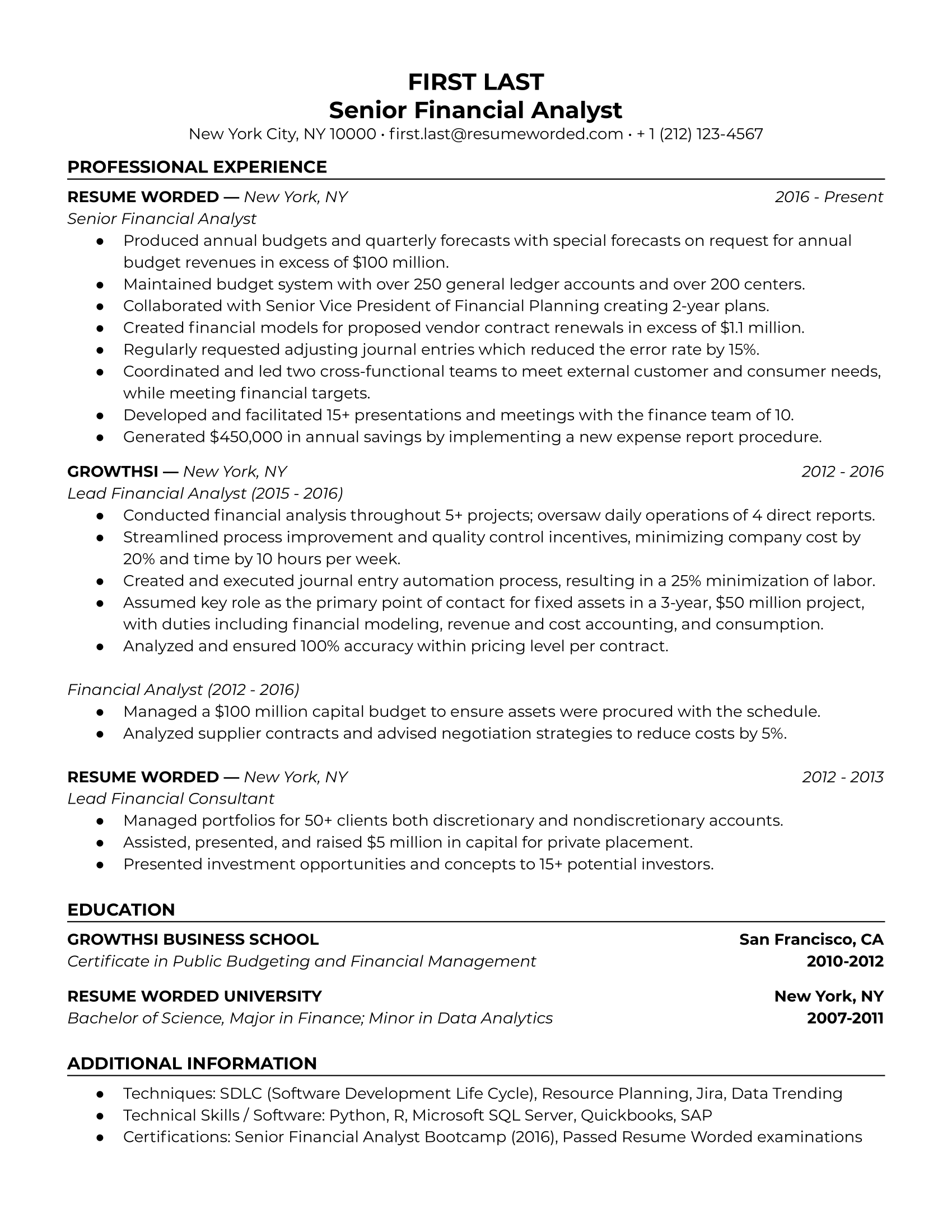

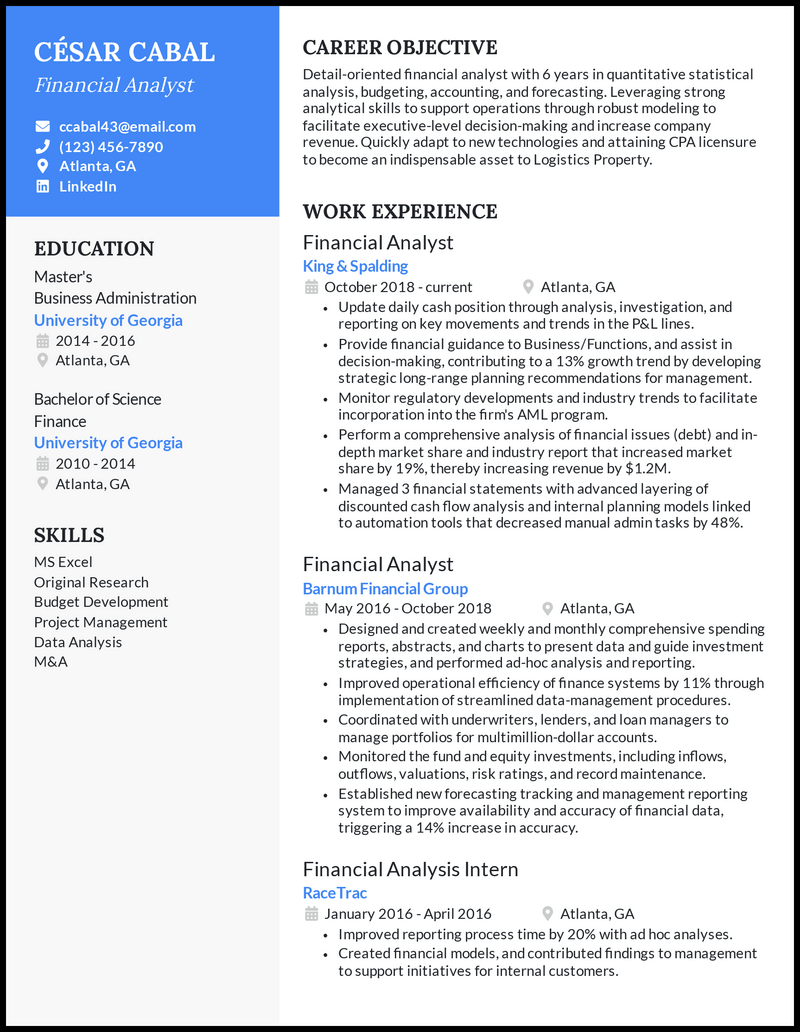

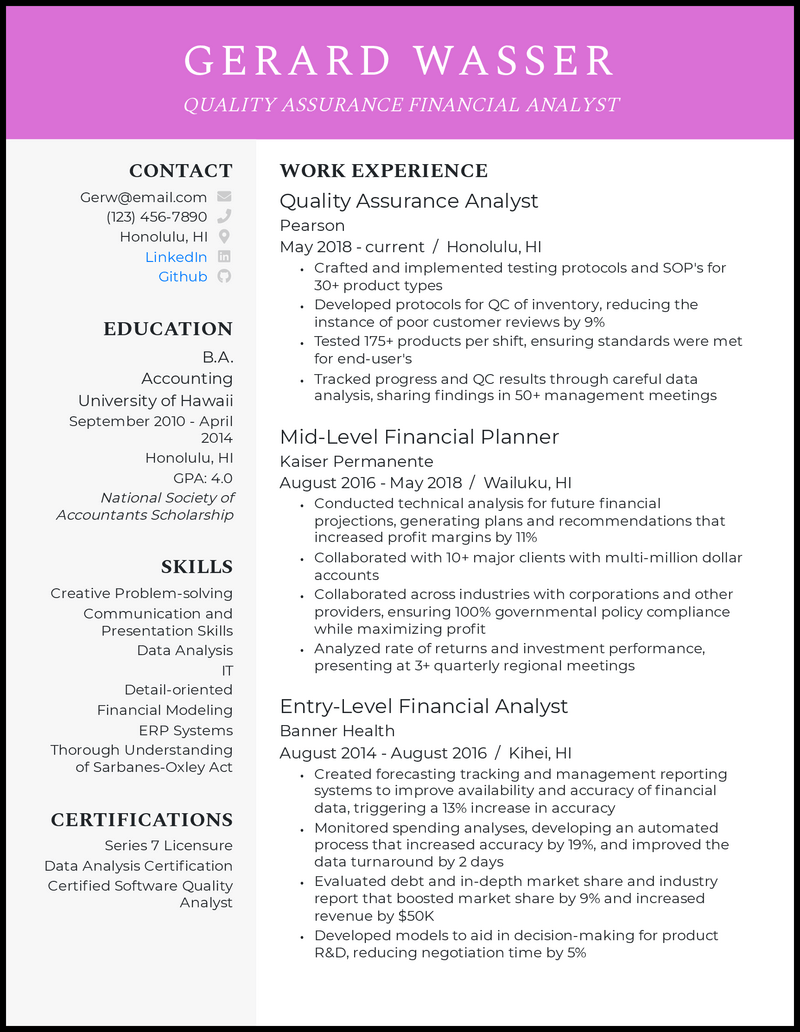

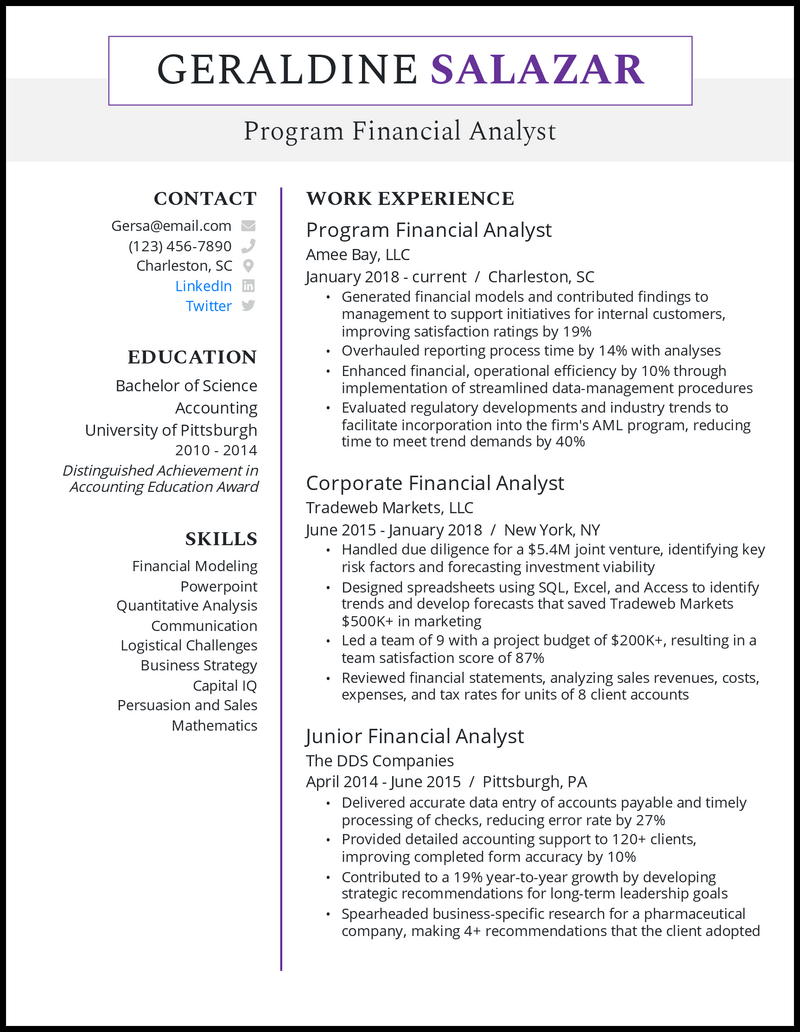

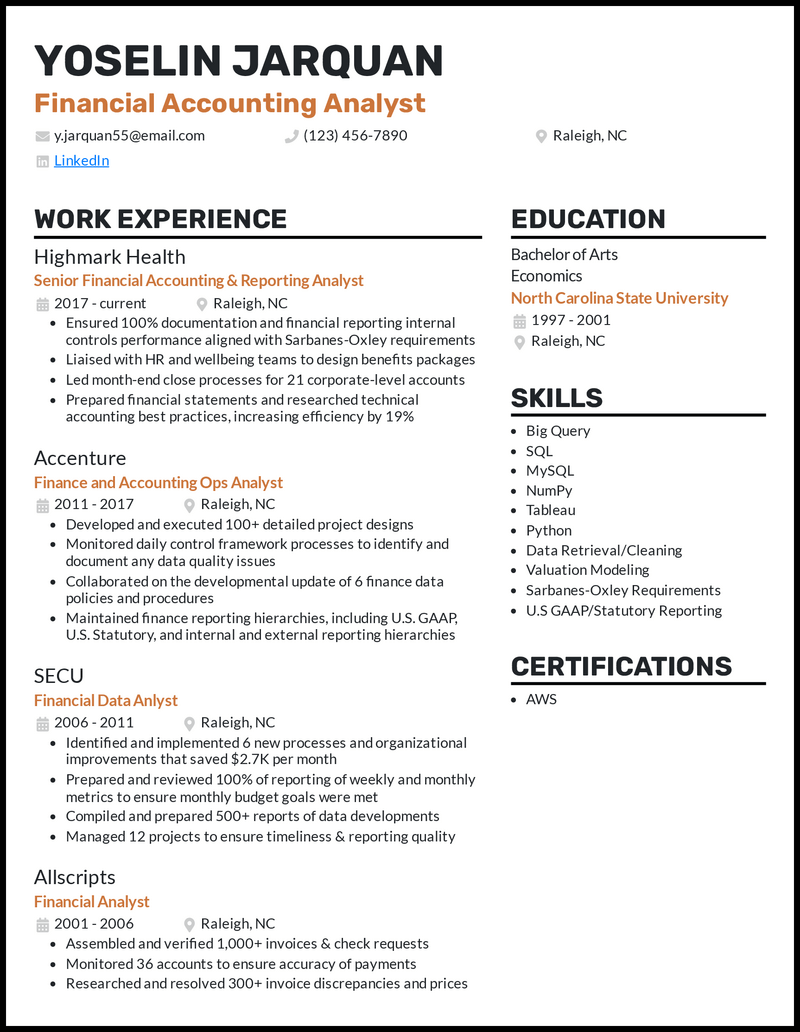

Financial Analyst Resumes

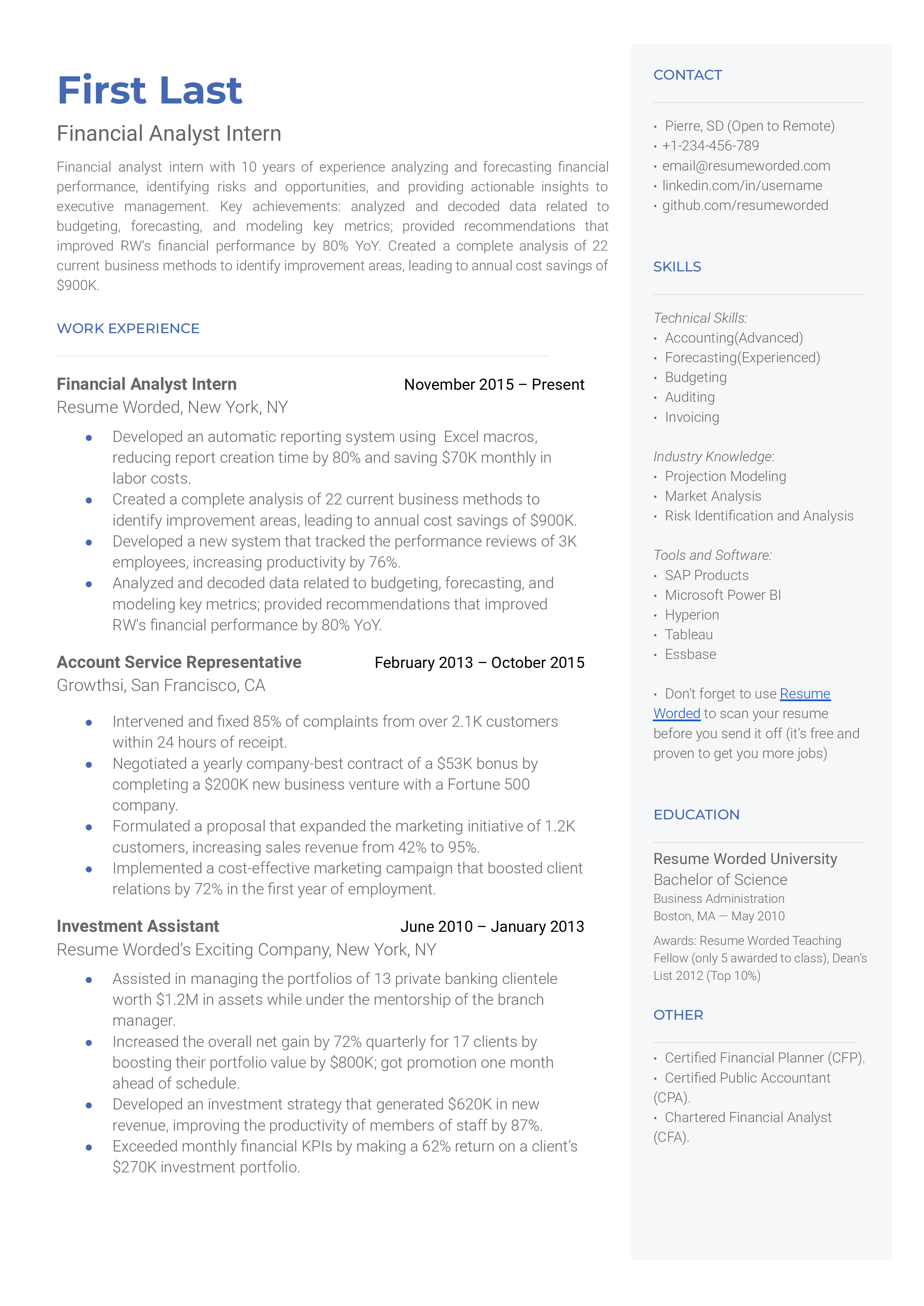

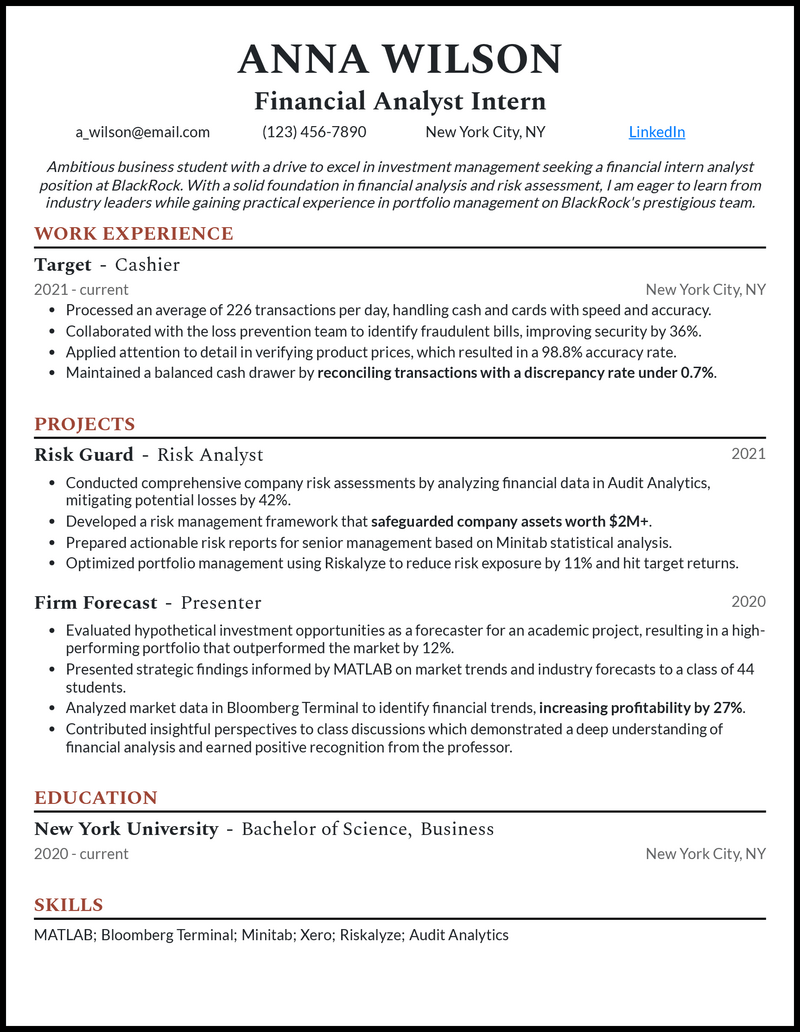

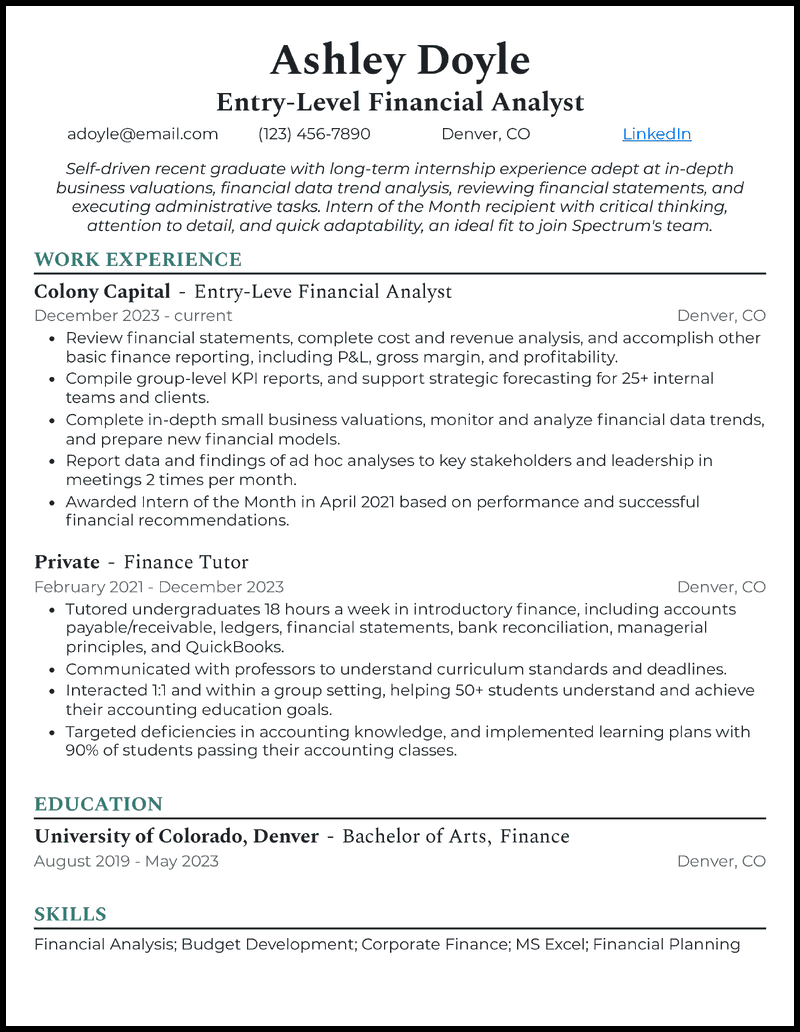

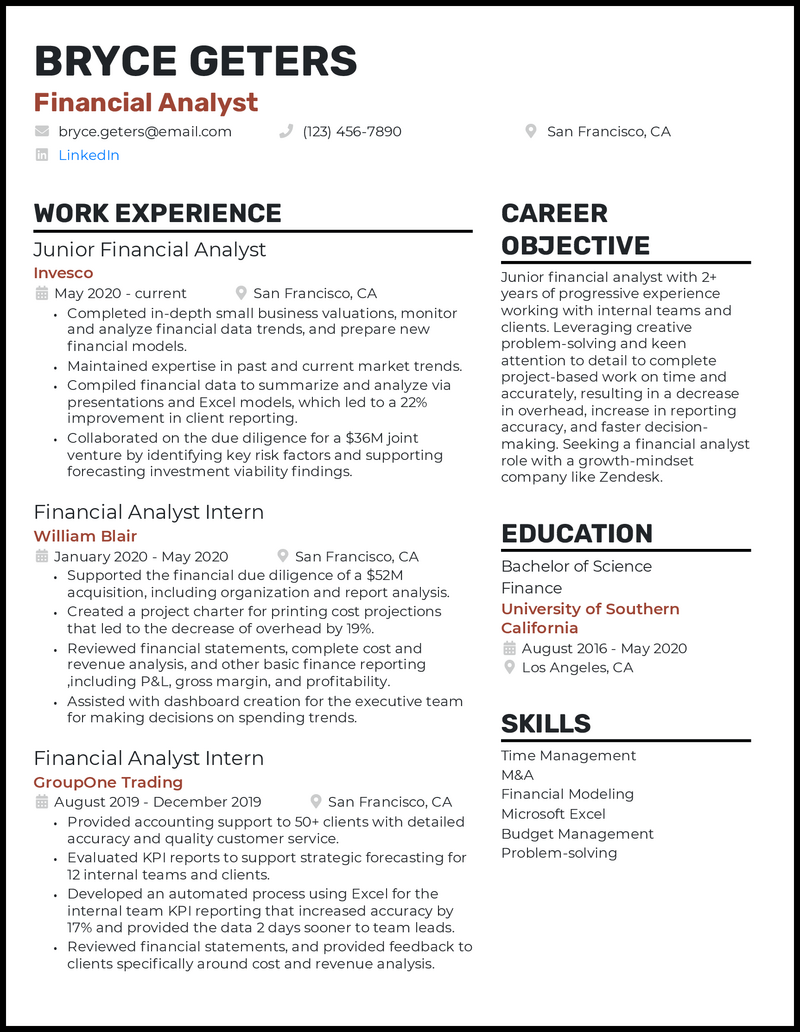

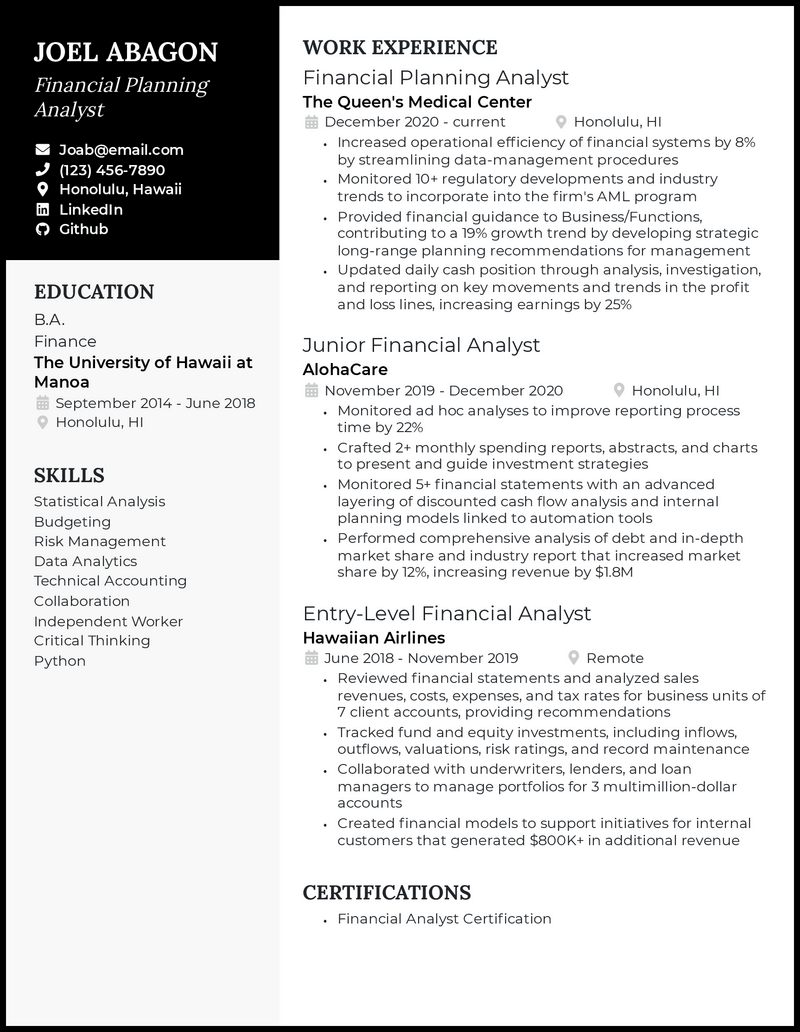

Great financial analysts can help companies thrive. We’ve got six sample resumes here to help you snag a job in 2023 (Google Docs and PDFs attached).

Senior Financial Analyst

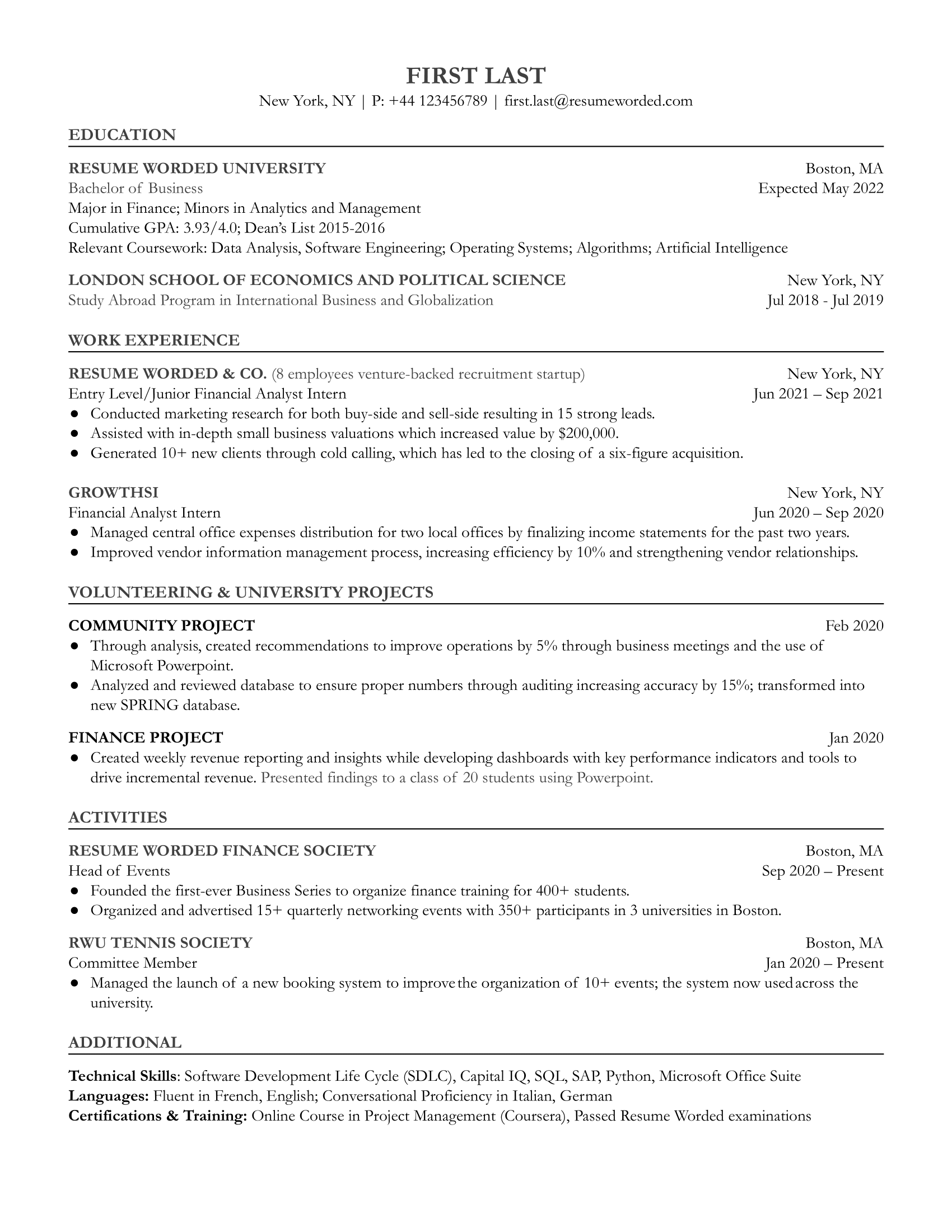

Entry Level/Junior Financial Analyst

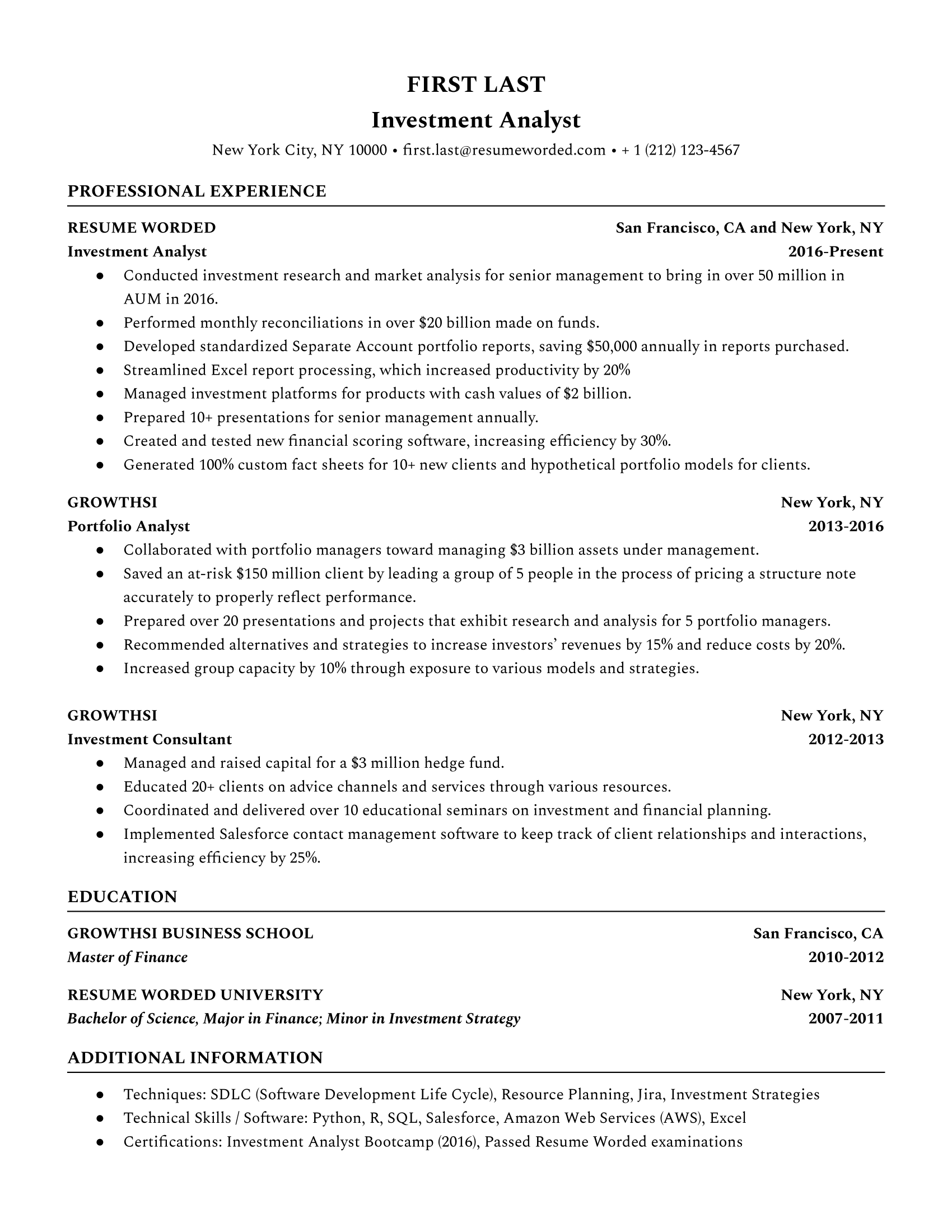

Investment Analyst

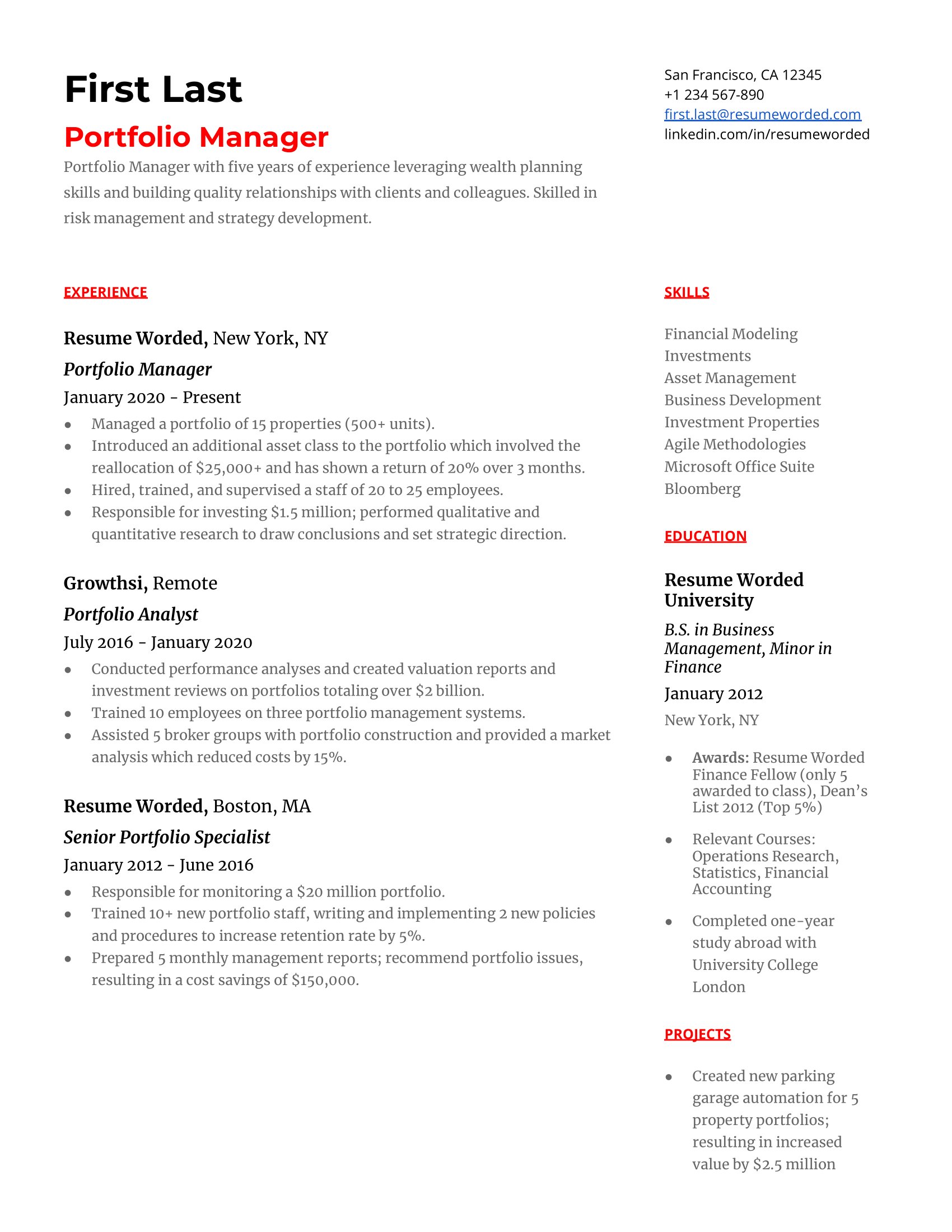

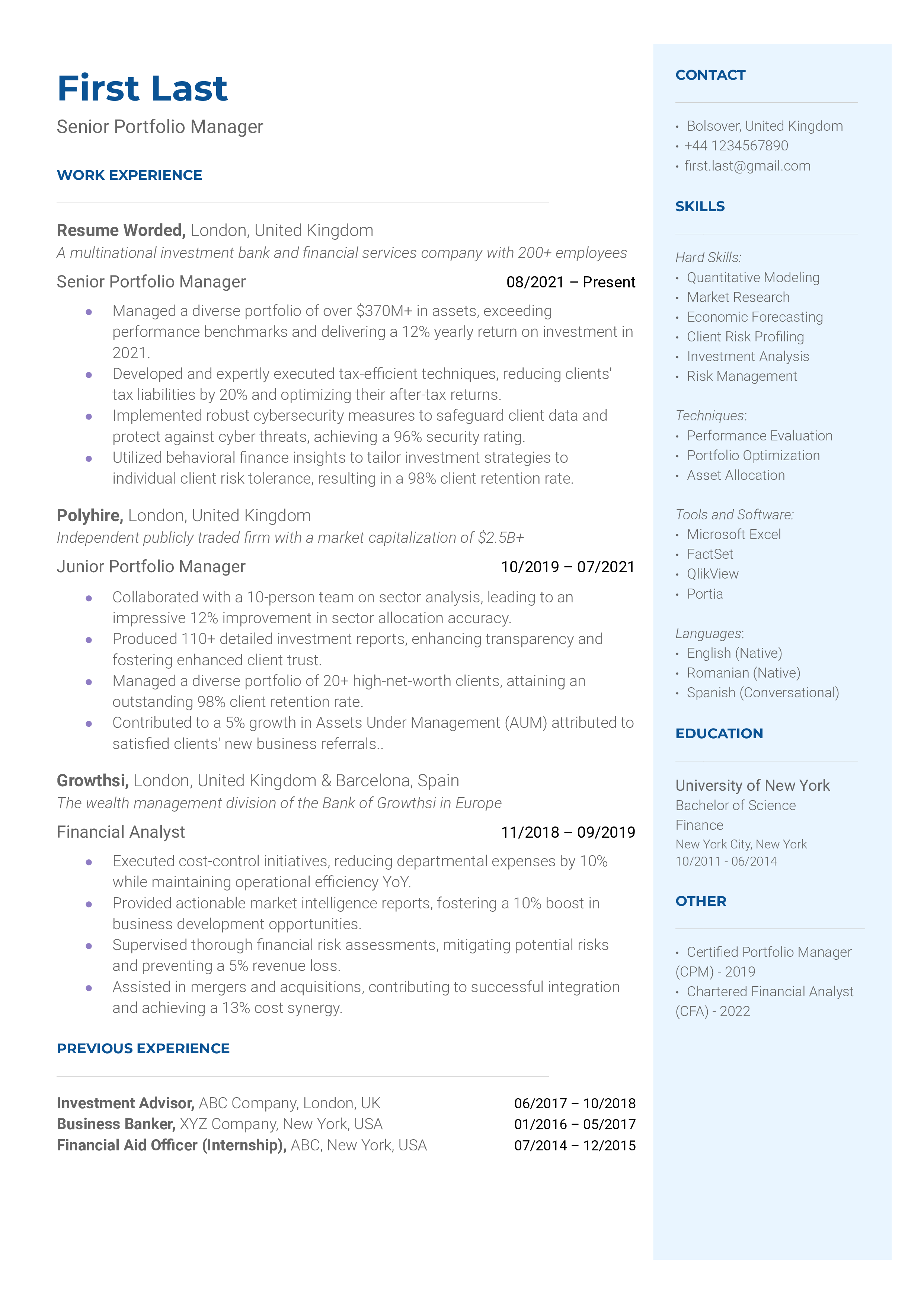

Portfolio Manager

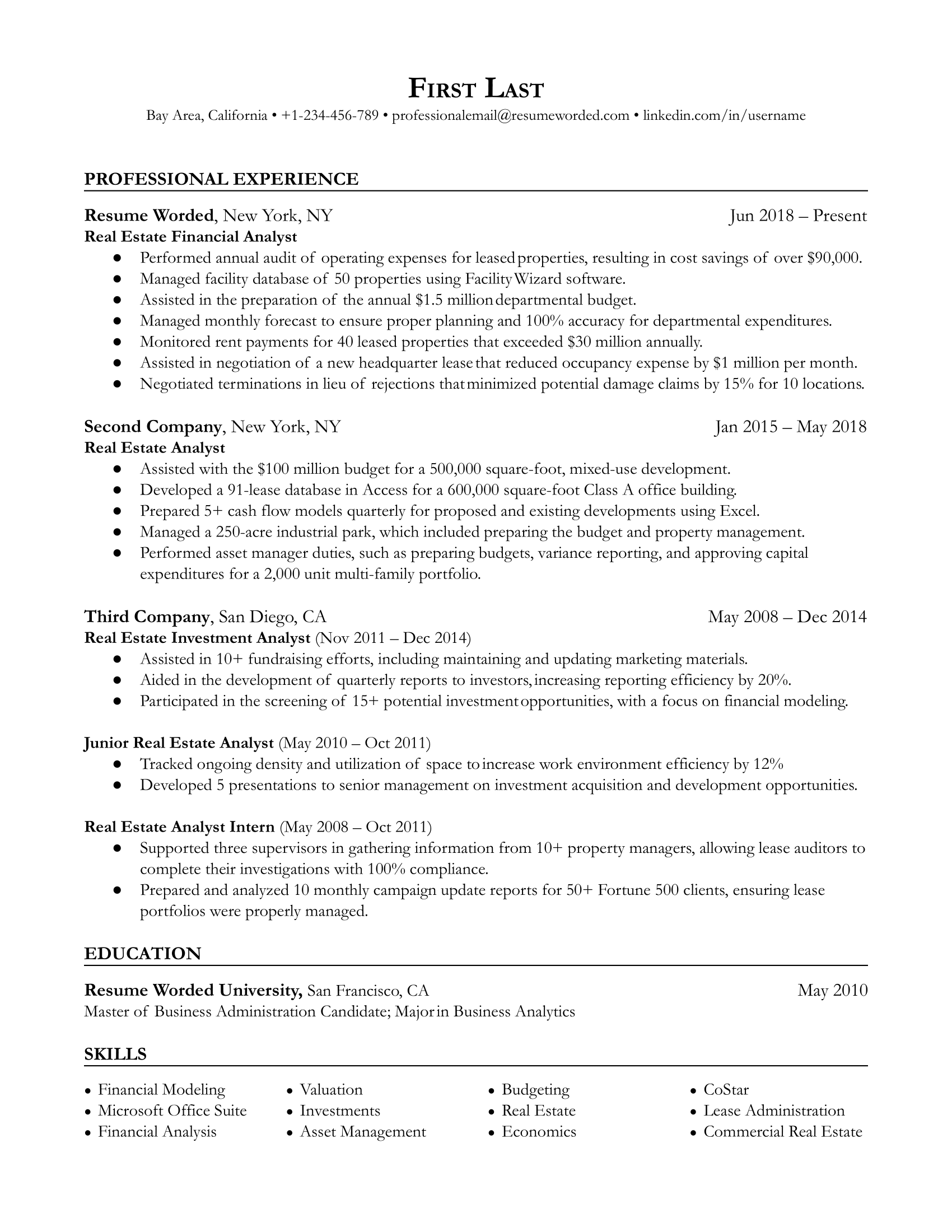

Real Estate Financial Analyst

Financial Analyst Intern

Senior Portfolio Manager

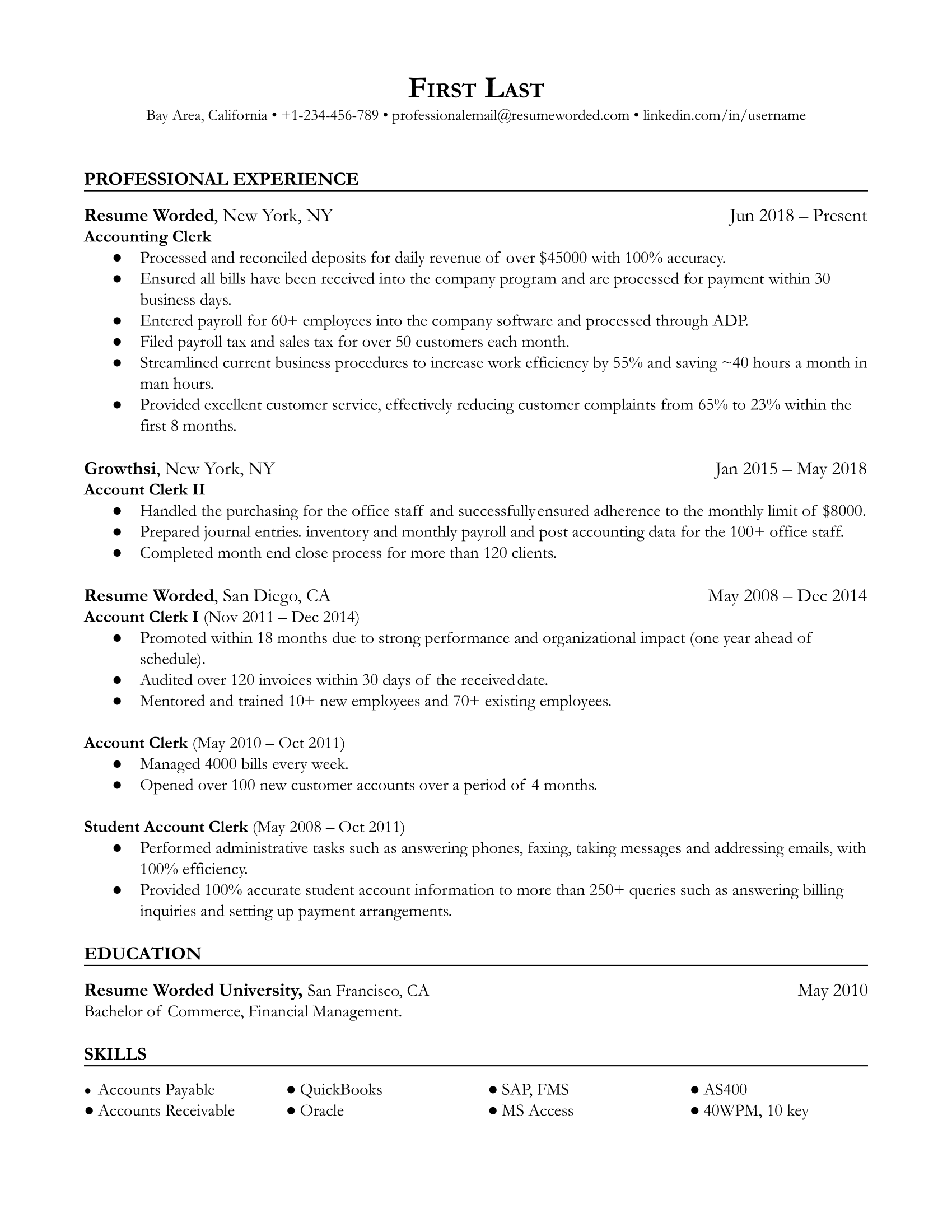

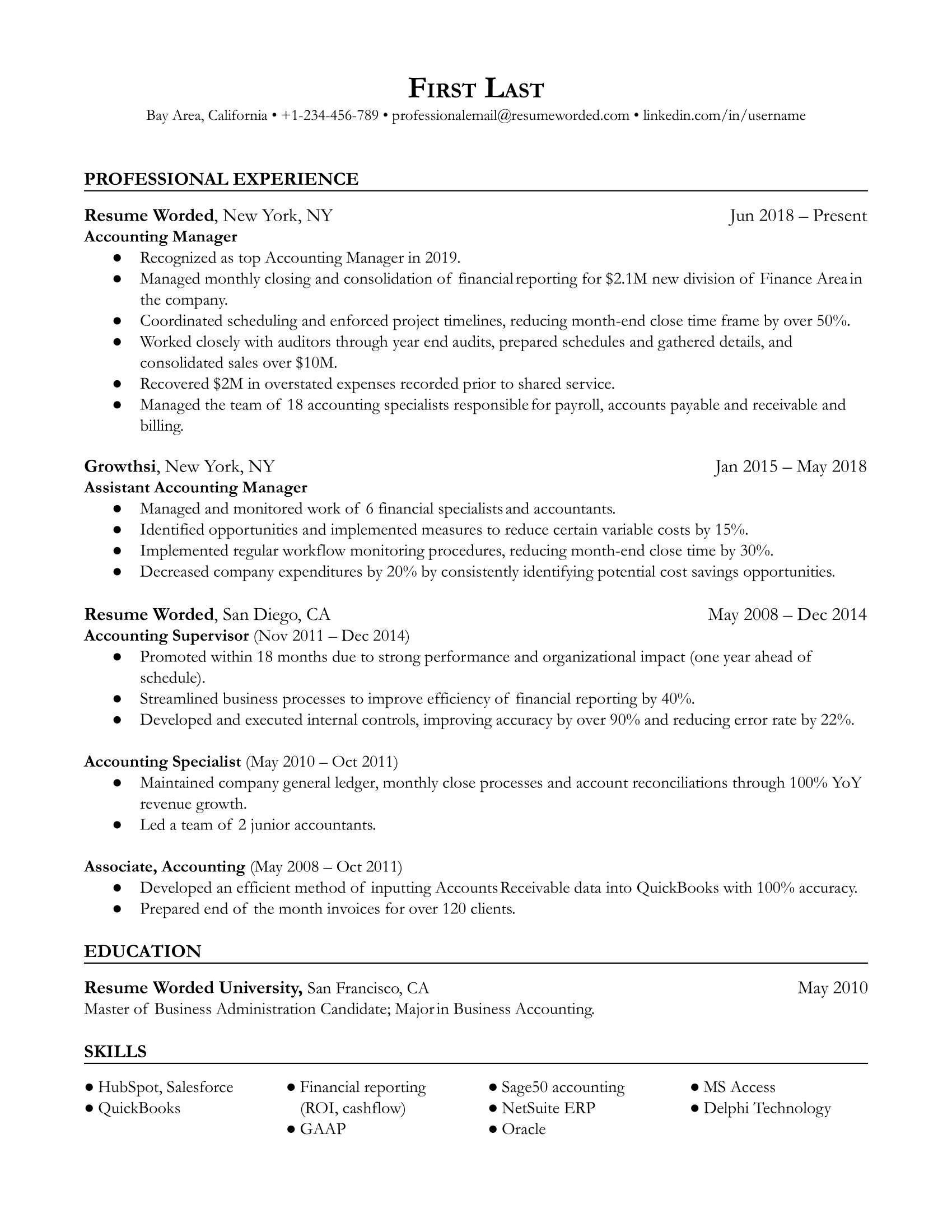

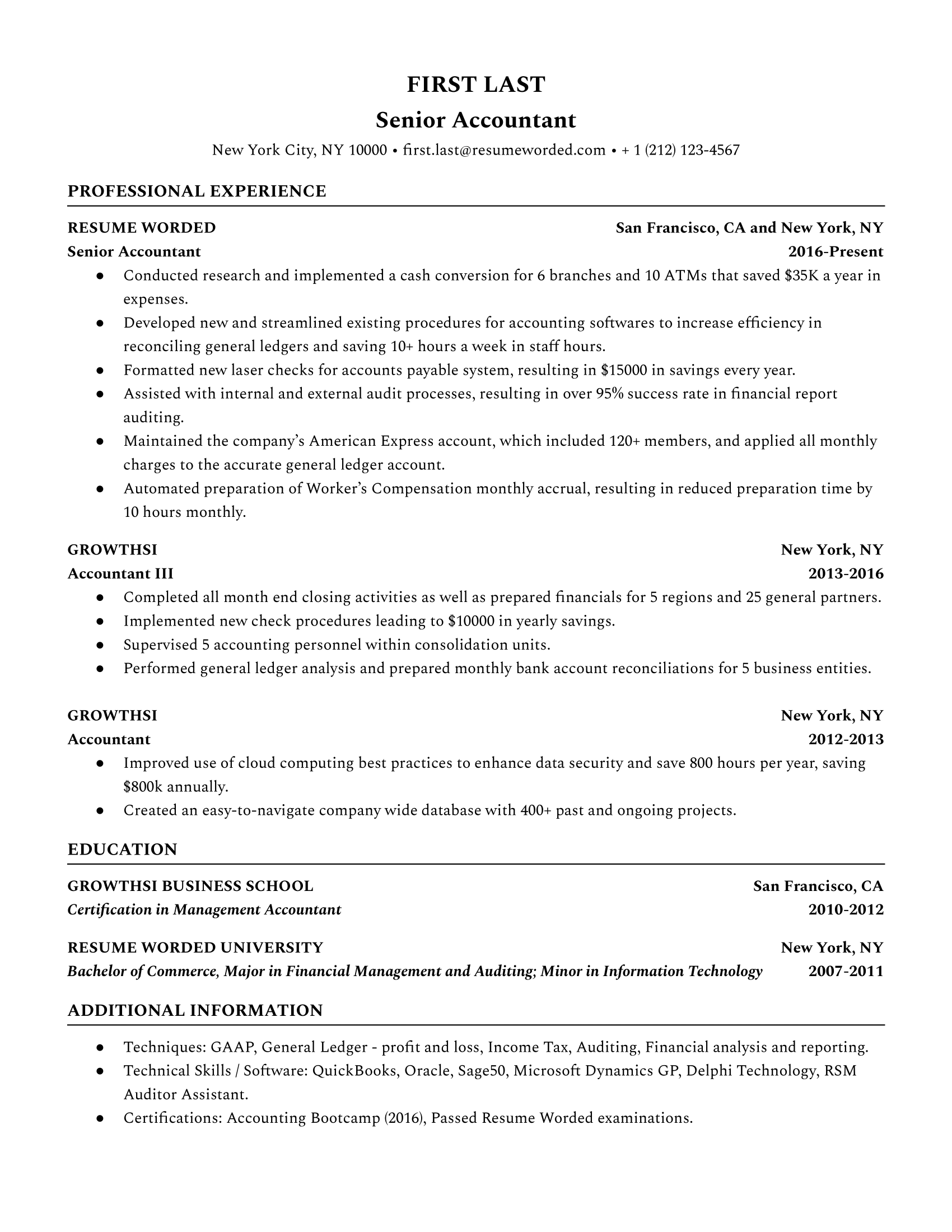

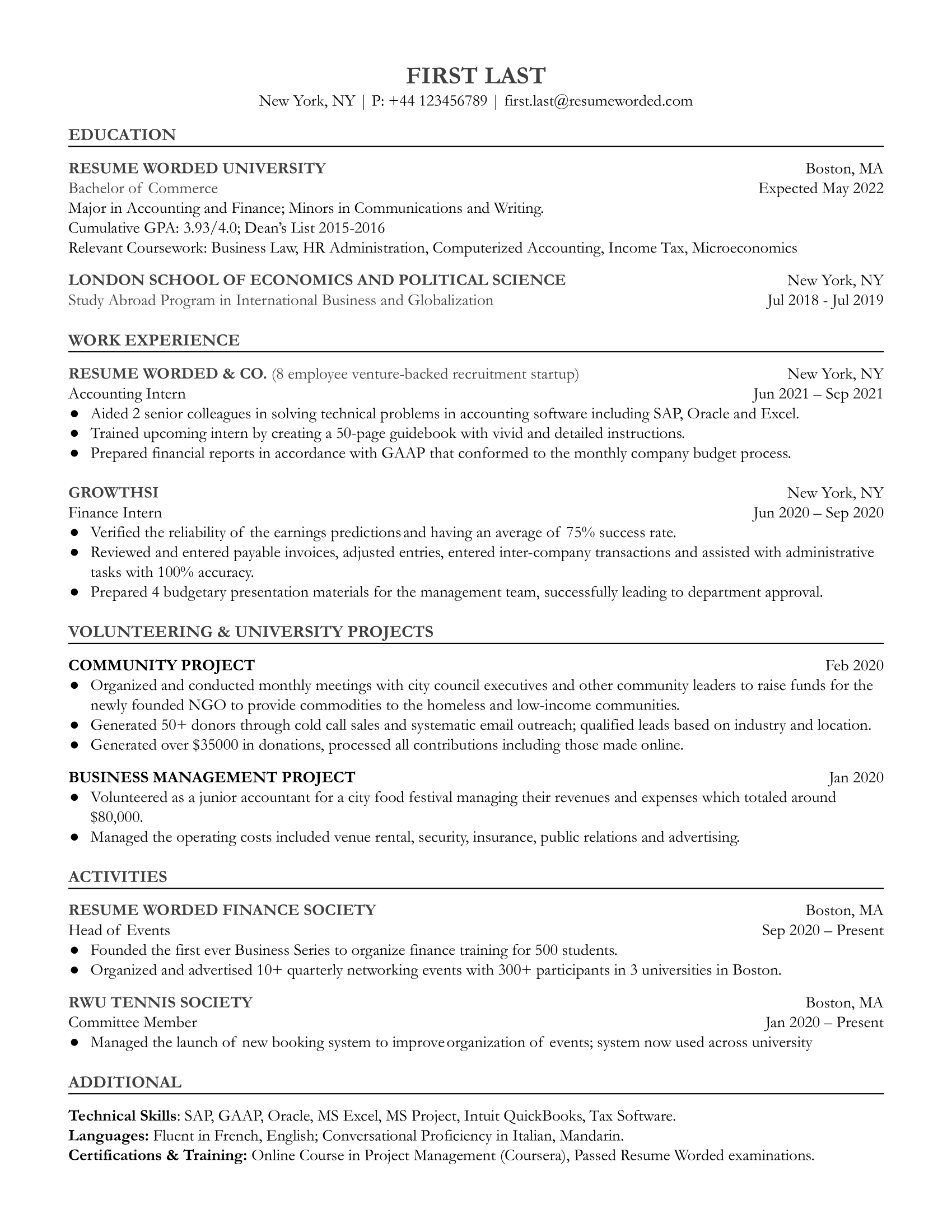

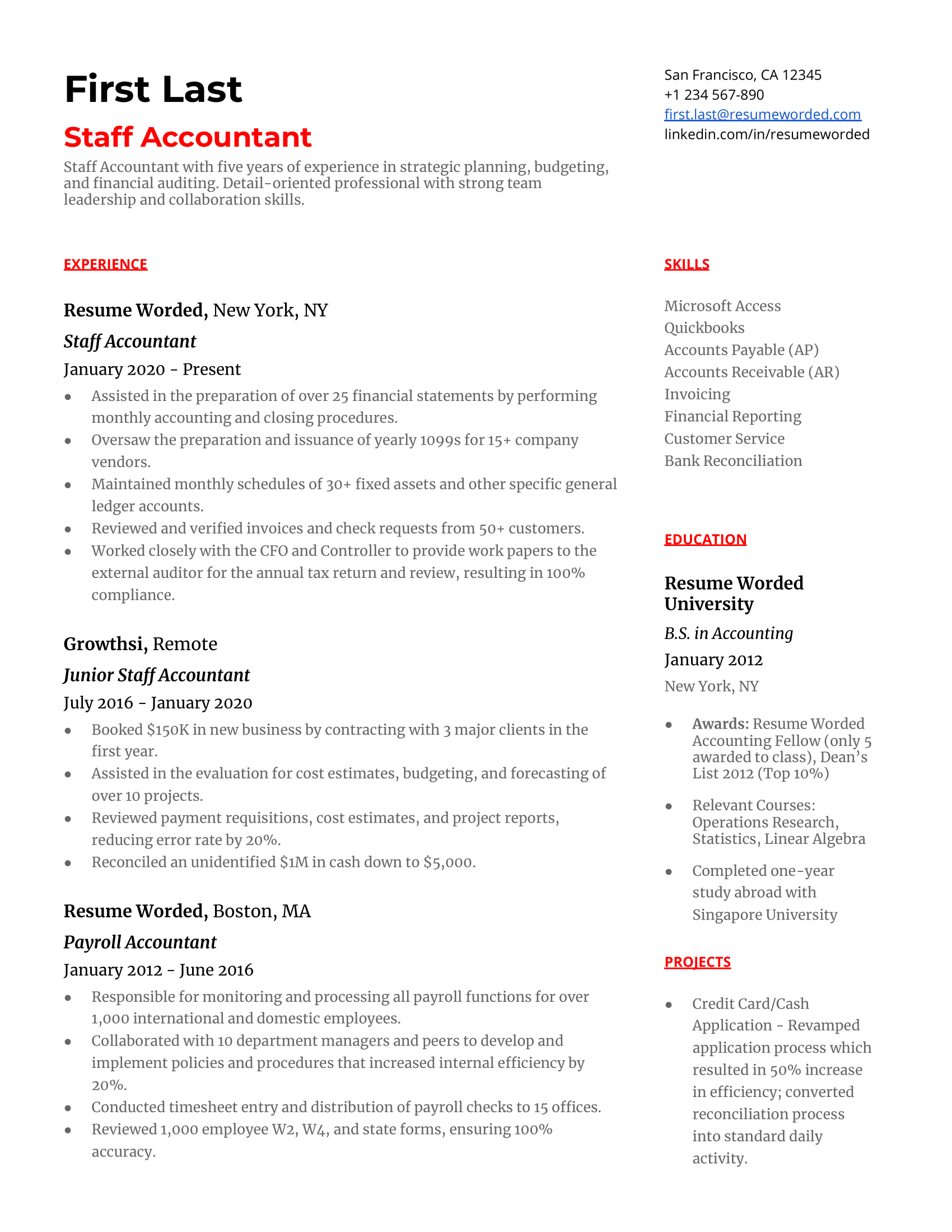

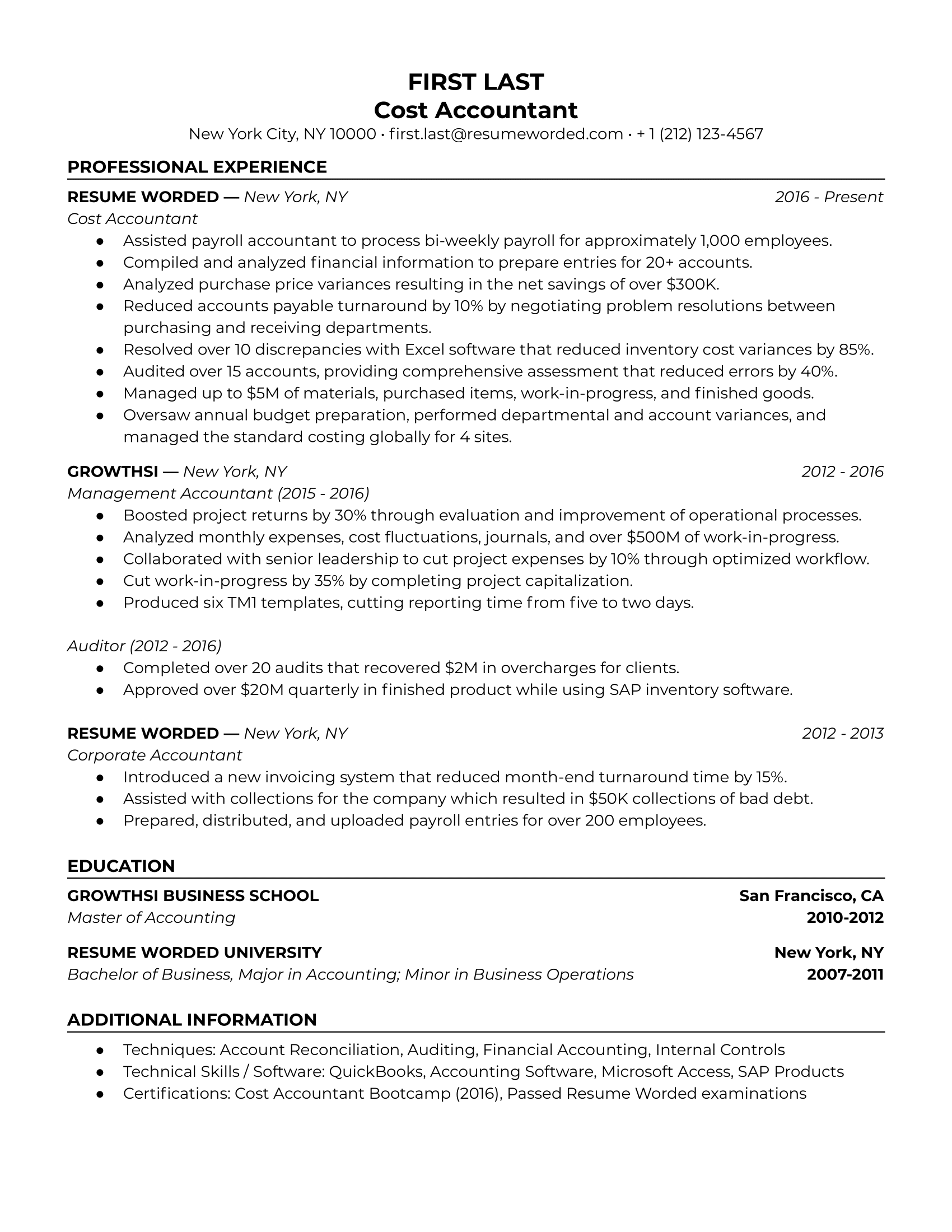

Accountant Resumes

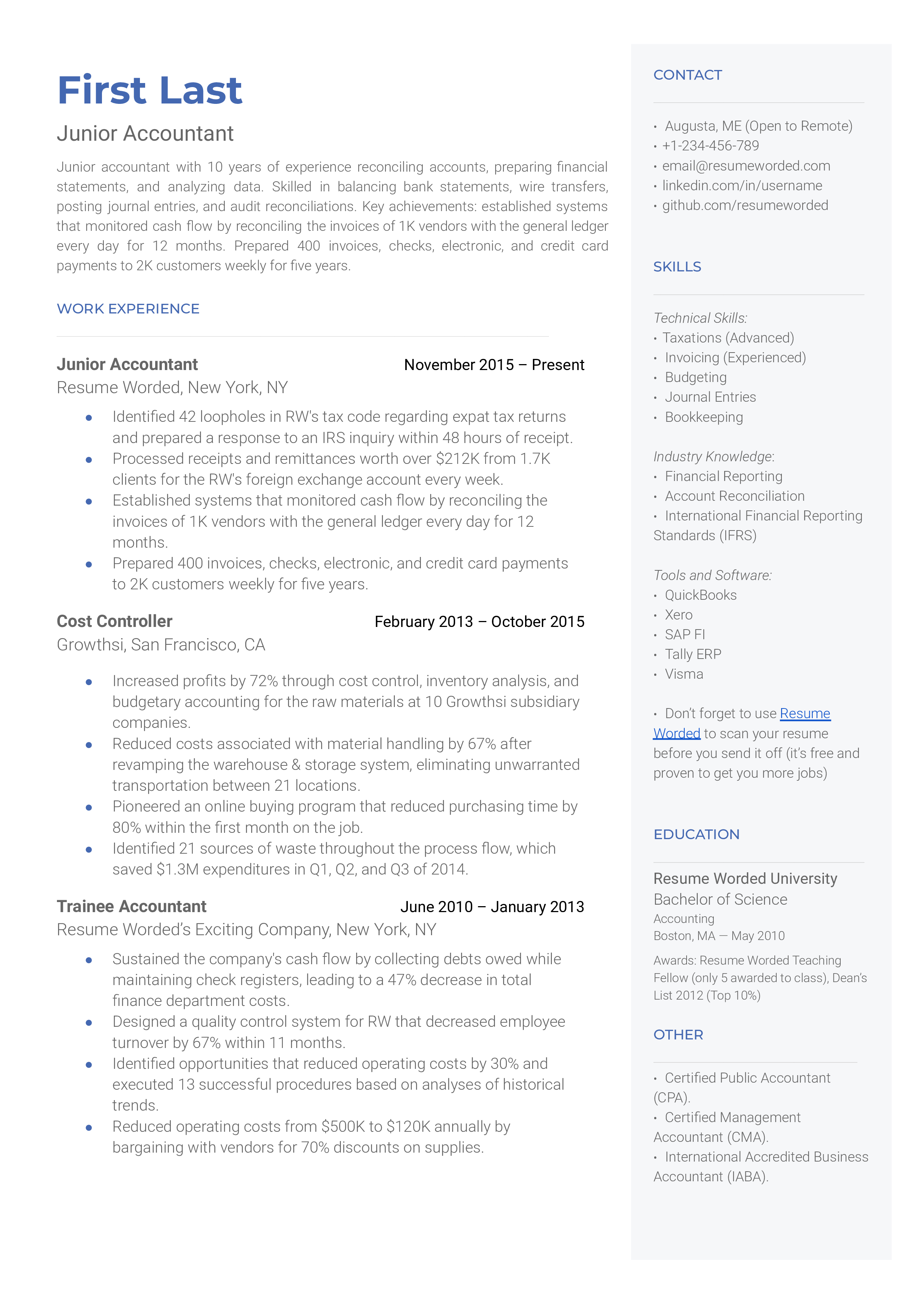

Accountants are key players in the daily operations of most businesses. We cover what you need to know to land an accounting job in 2023 (Google Docs and PDFs attached).

Accounting Clerk

Accounting Manager

Senior Accountant / Accounting Executive

Entry Level Accountant

Staff Accountant

Cost Accountant

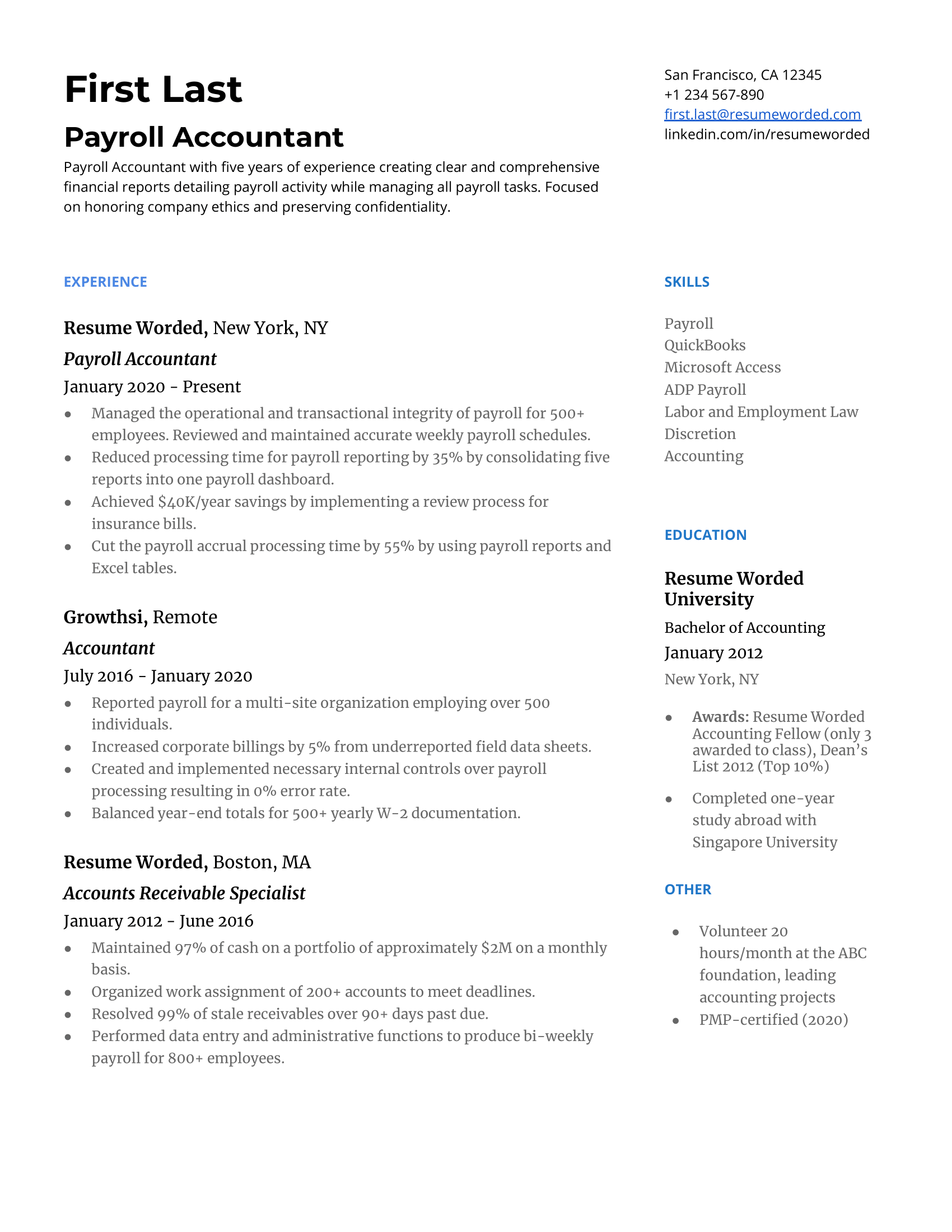

Payroll Accountant

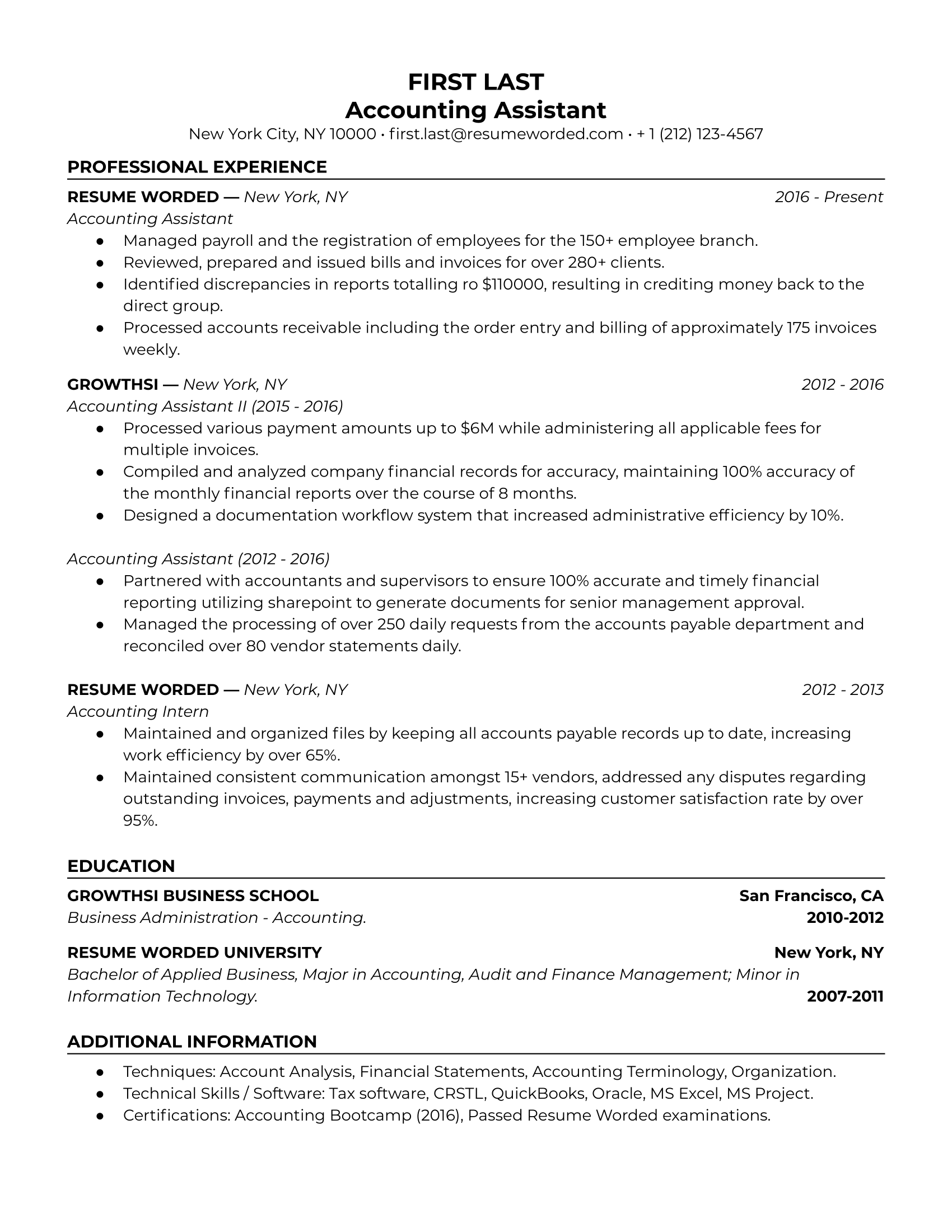

Accounting Assistant

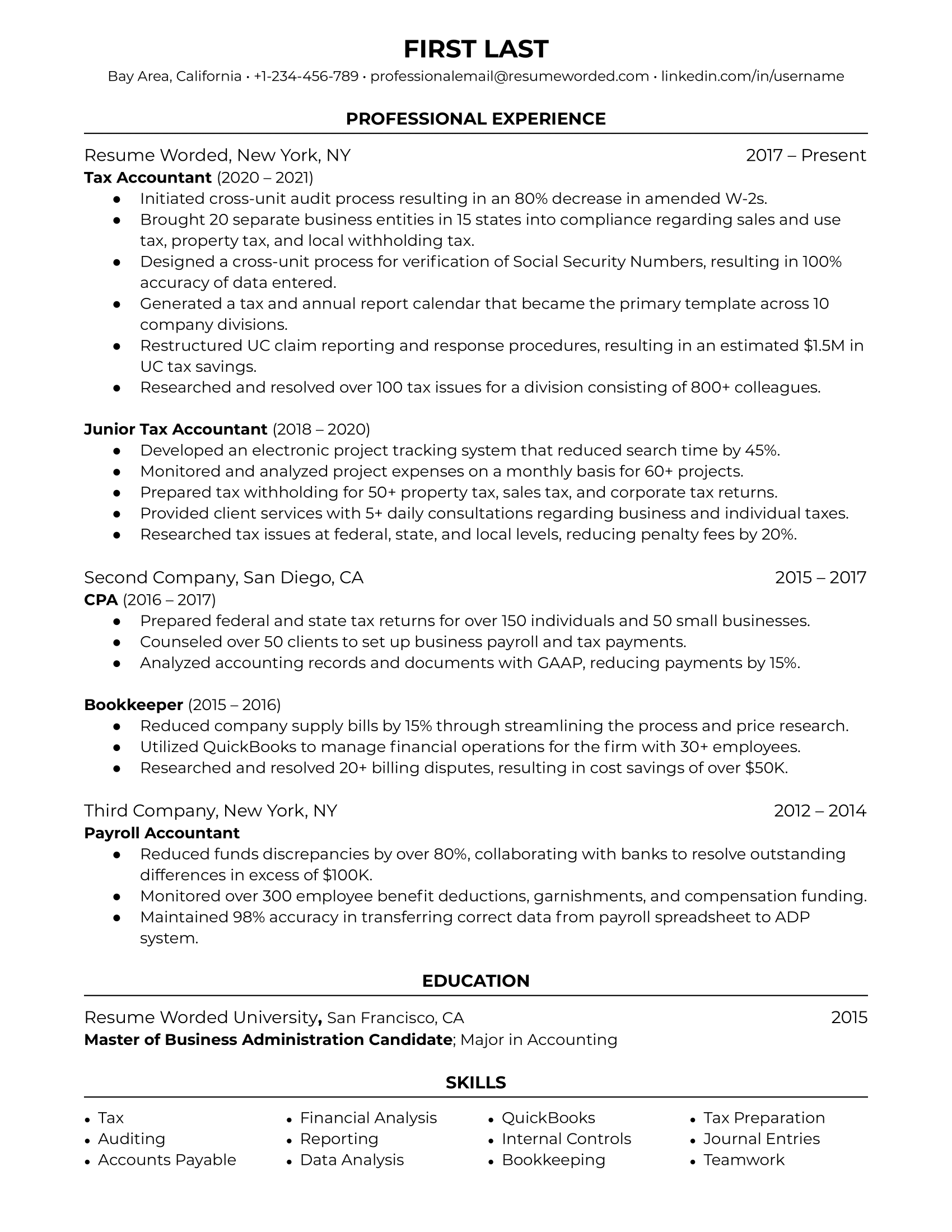

Tax Accountant

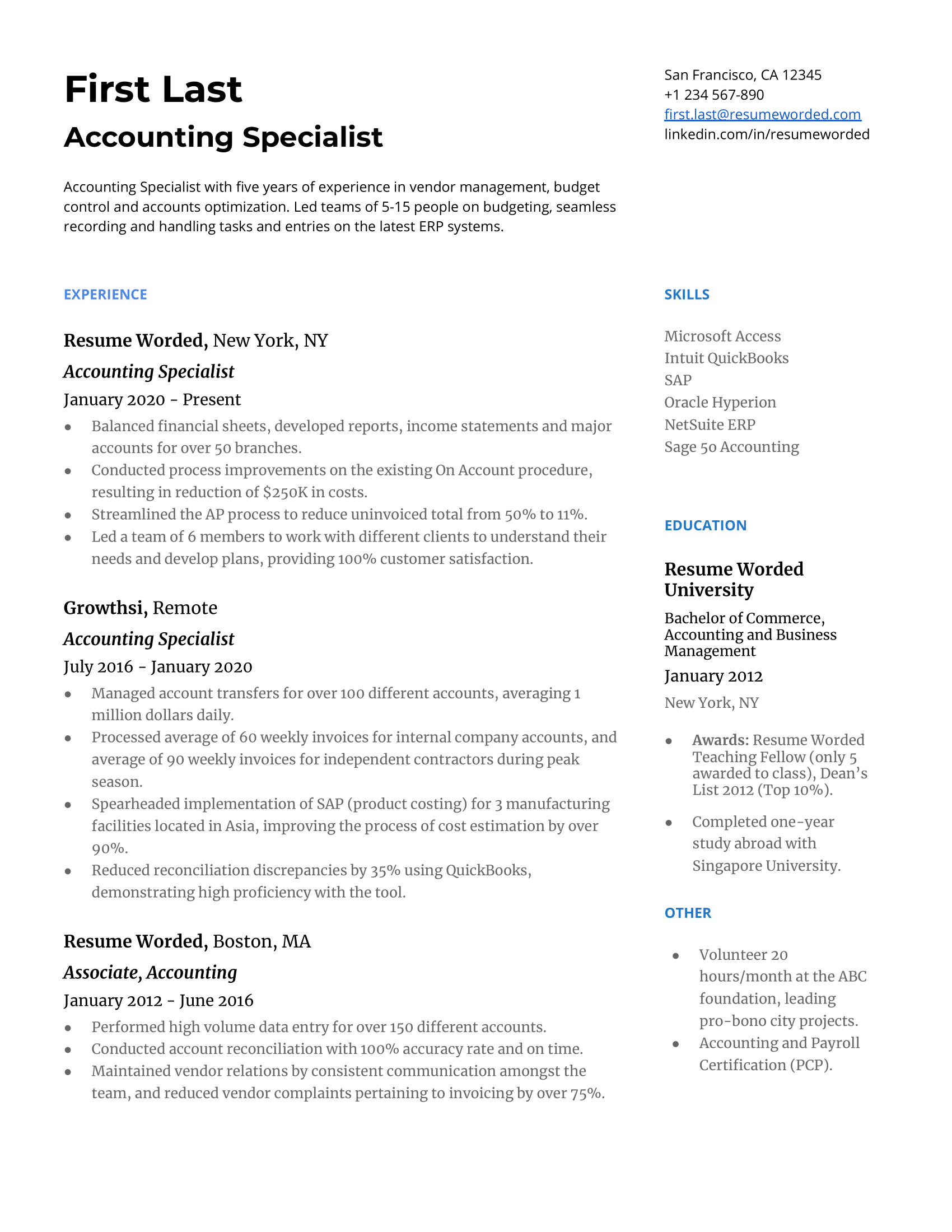

Accounting Specialist

Junior Accountant

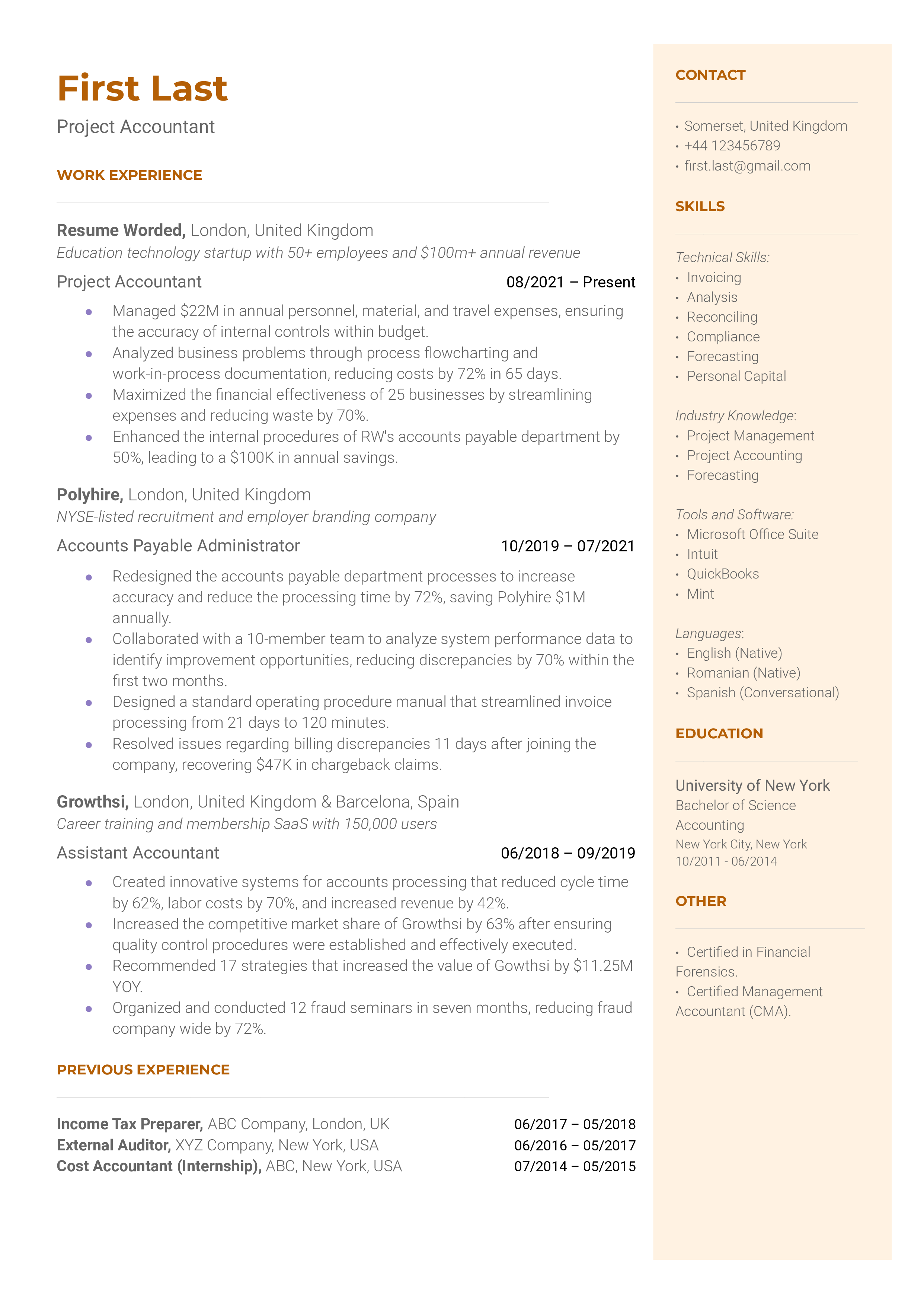

Project Accountant

Public Accountant

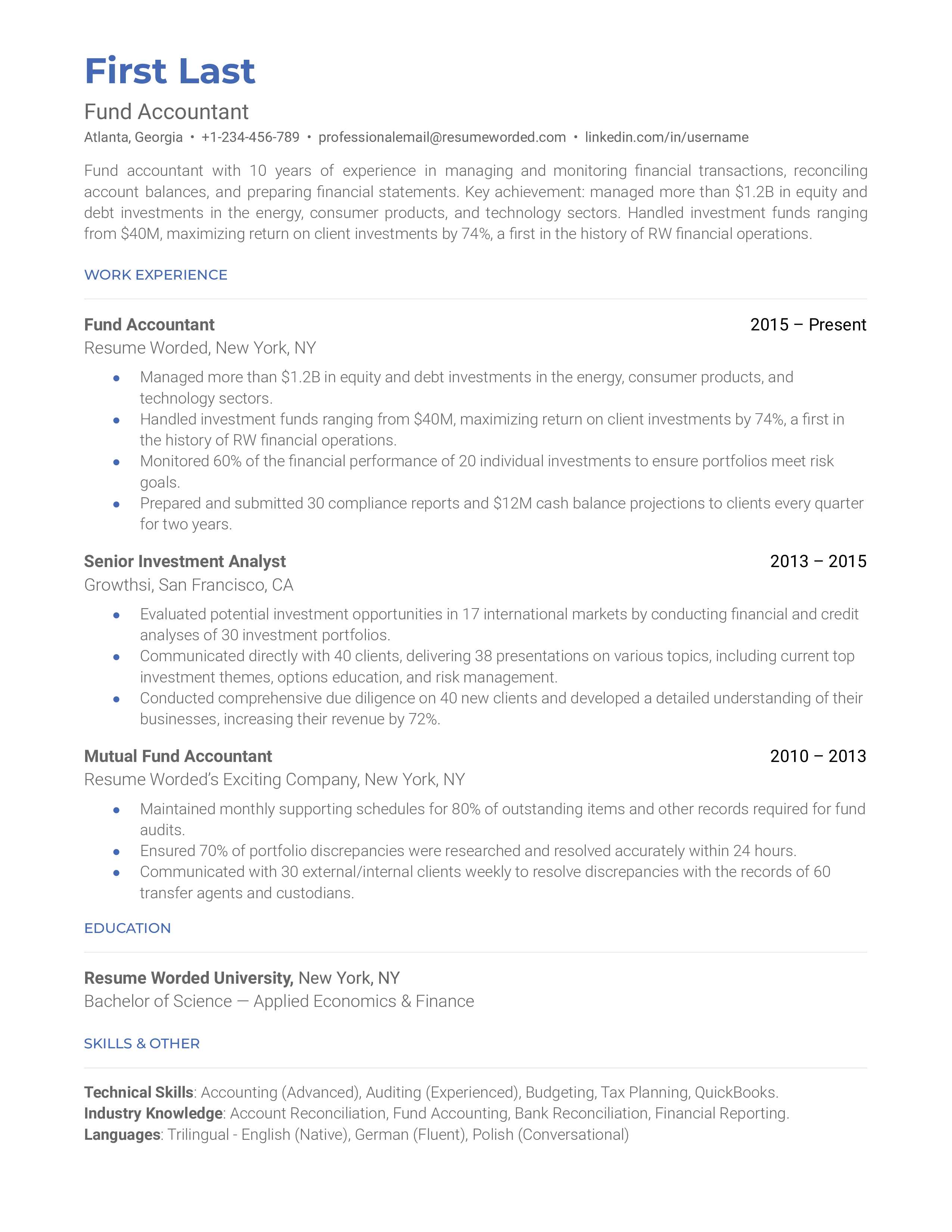

Fund Accountant

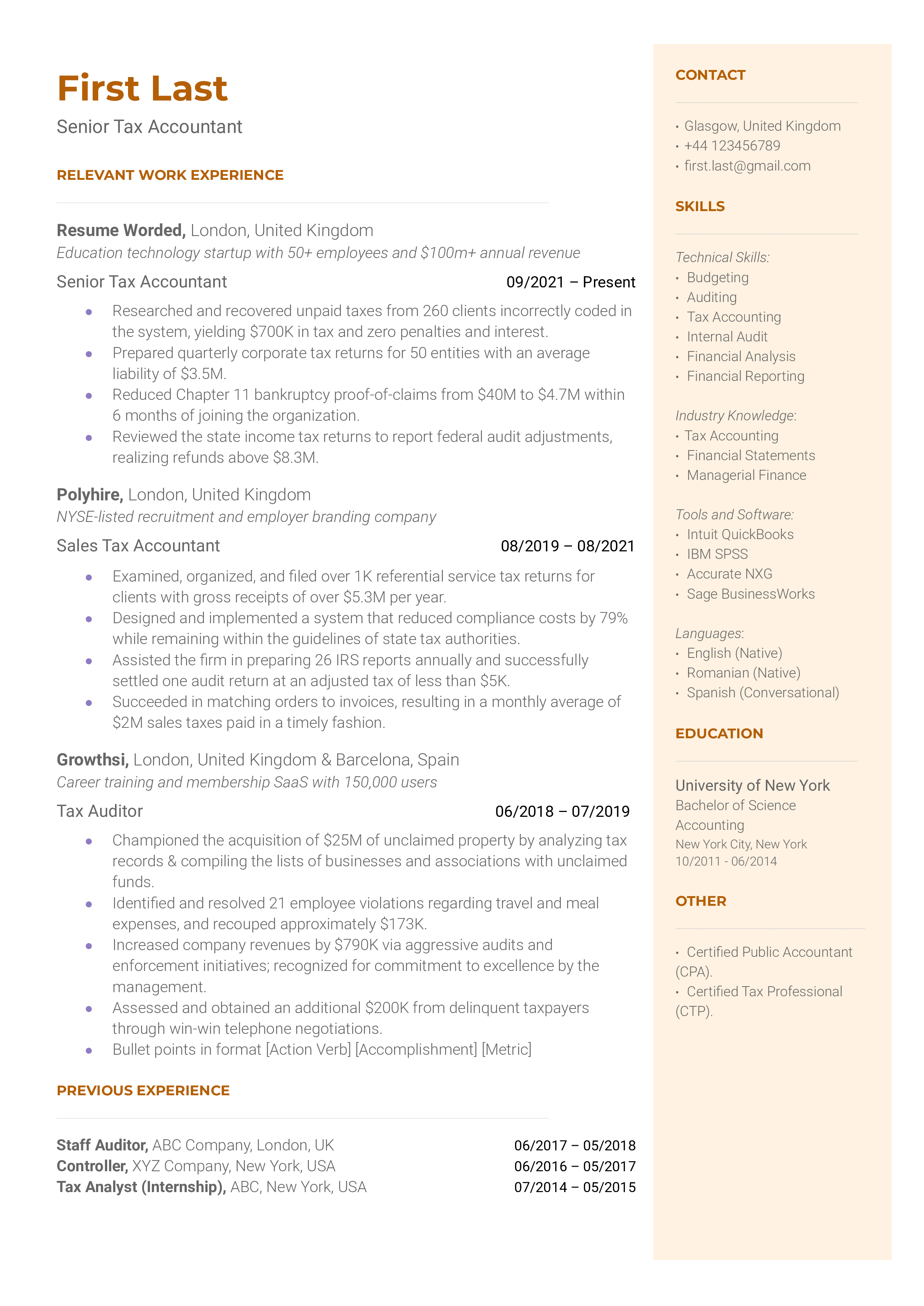

Senior Tax Accountant

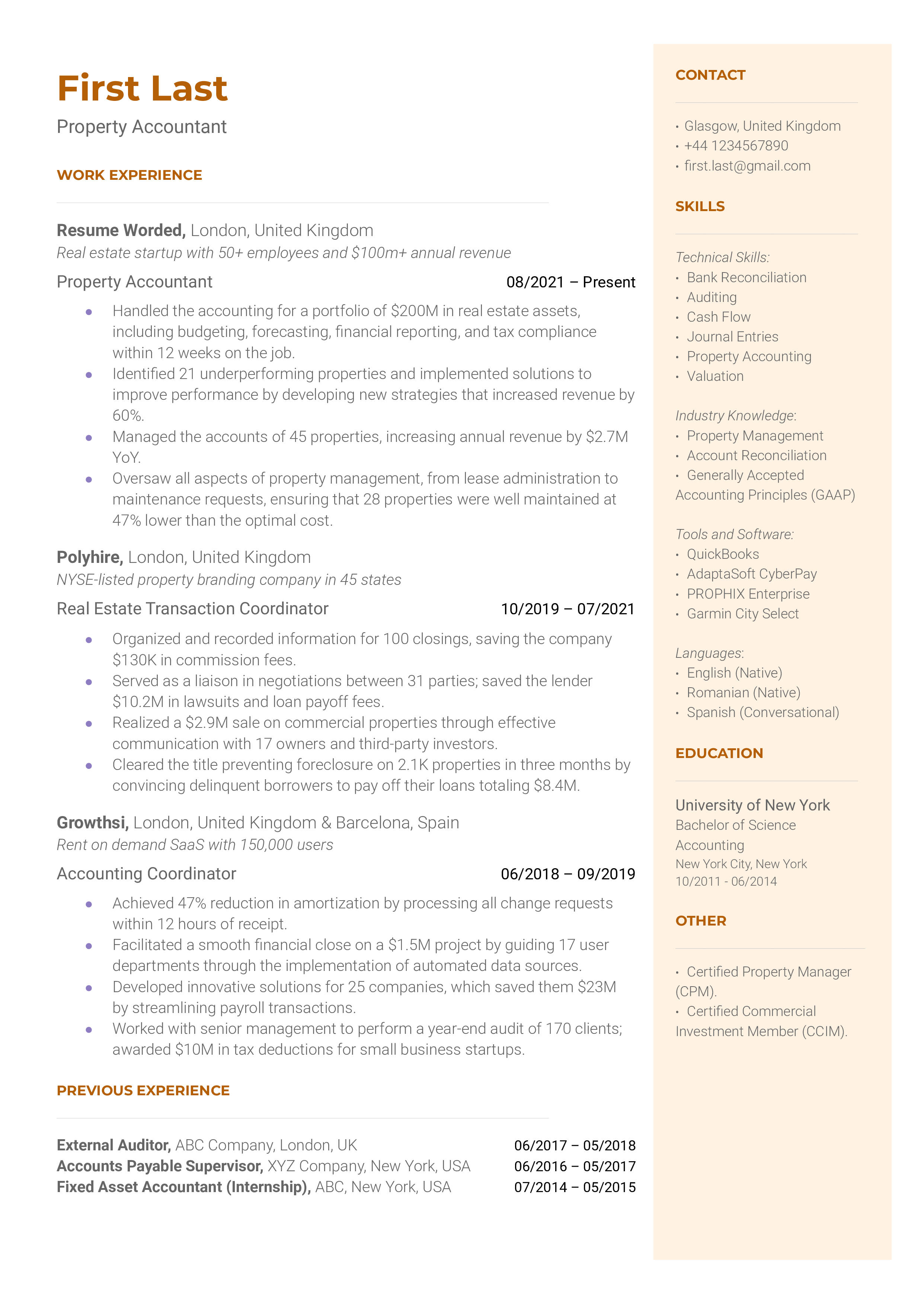

Property Accountant

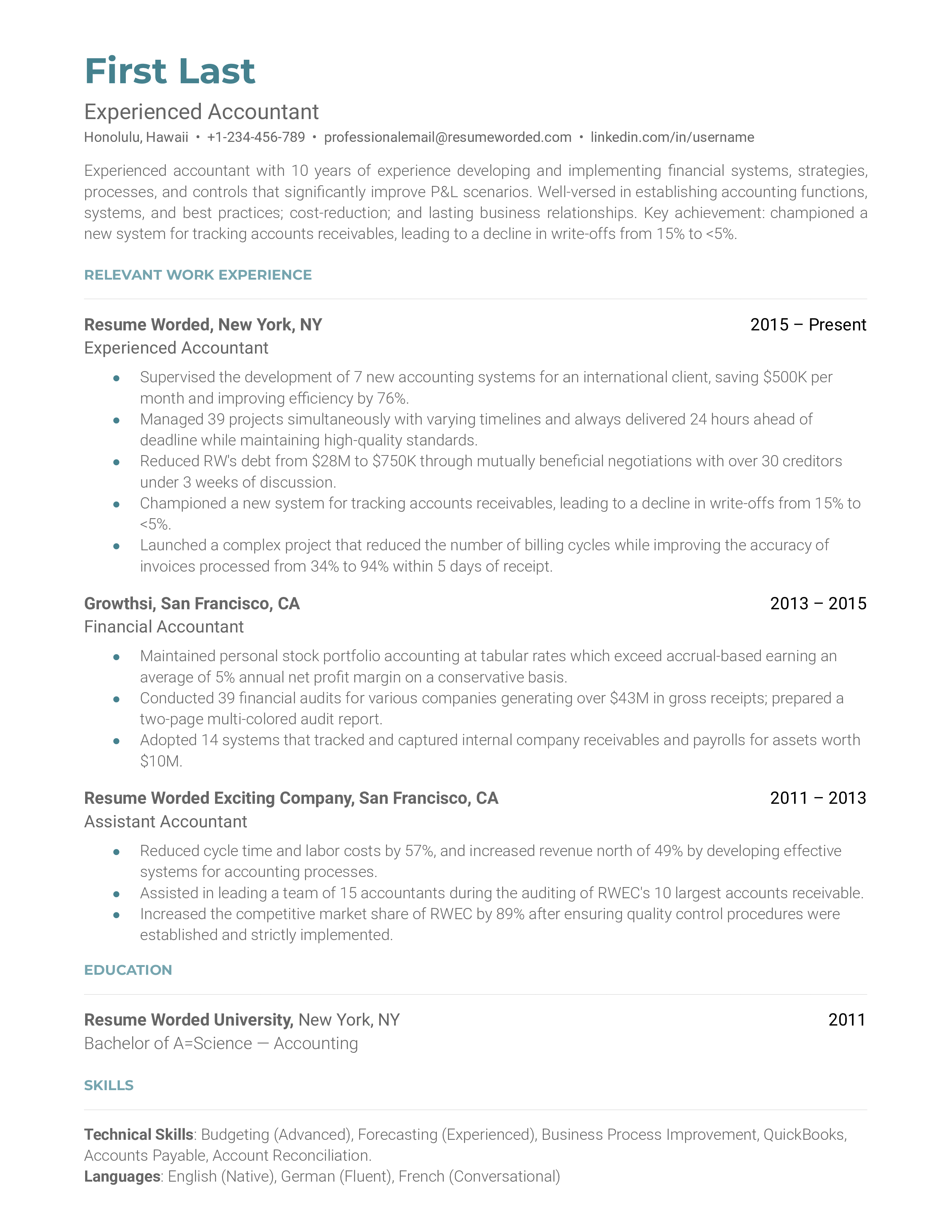

Experienced Accountant

Construction Accountant

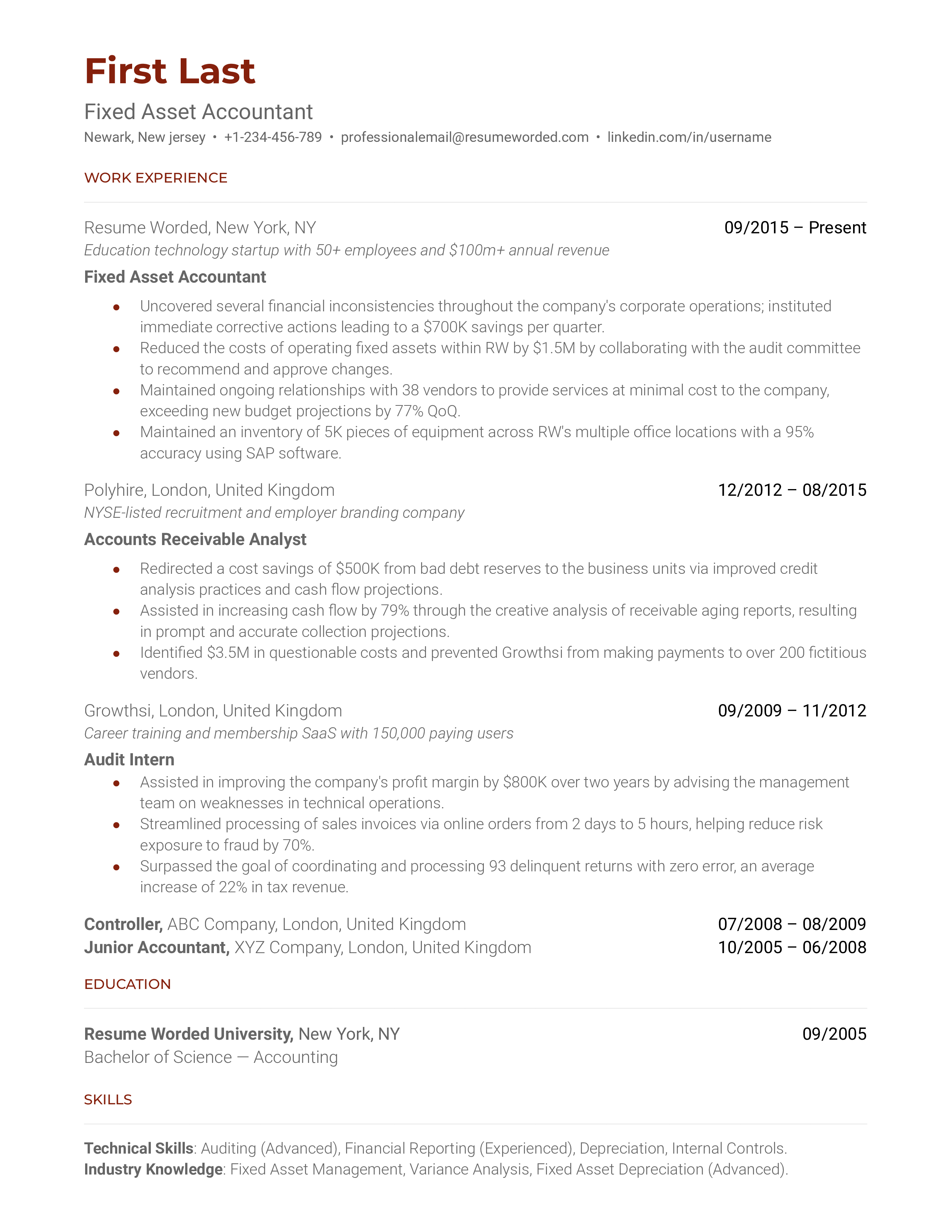

Fixed Asset Accountant

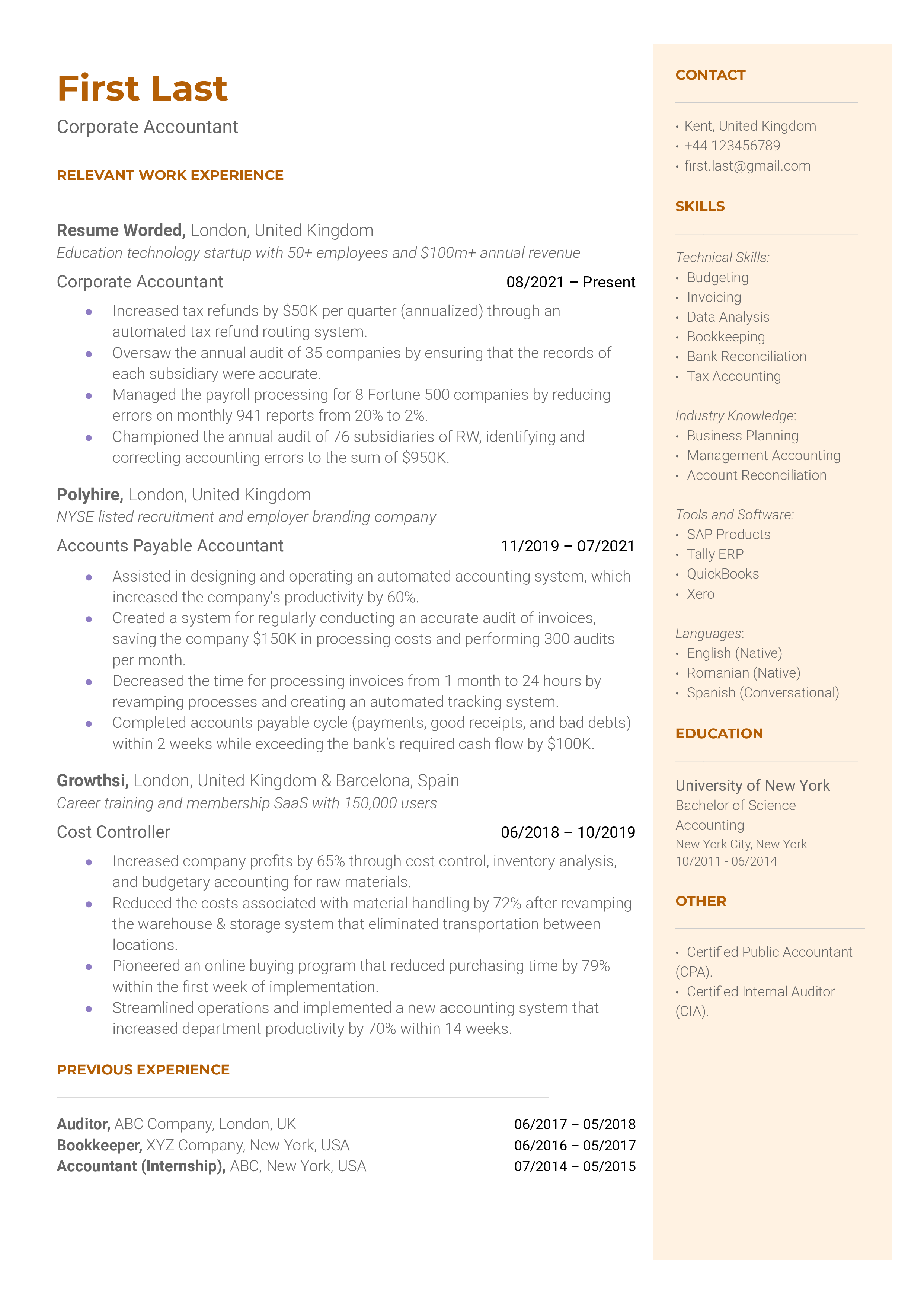

Corporate Accountant

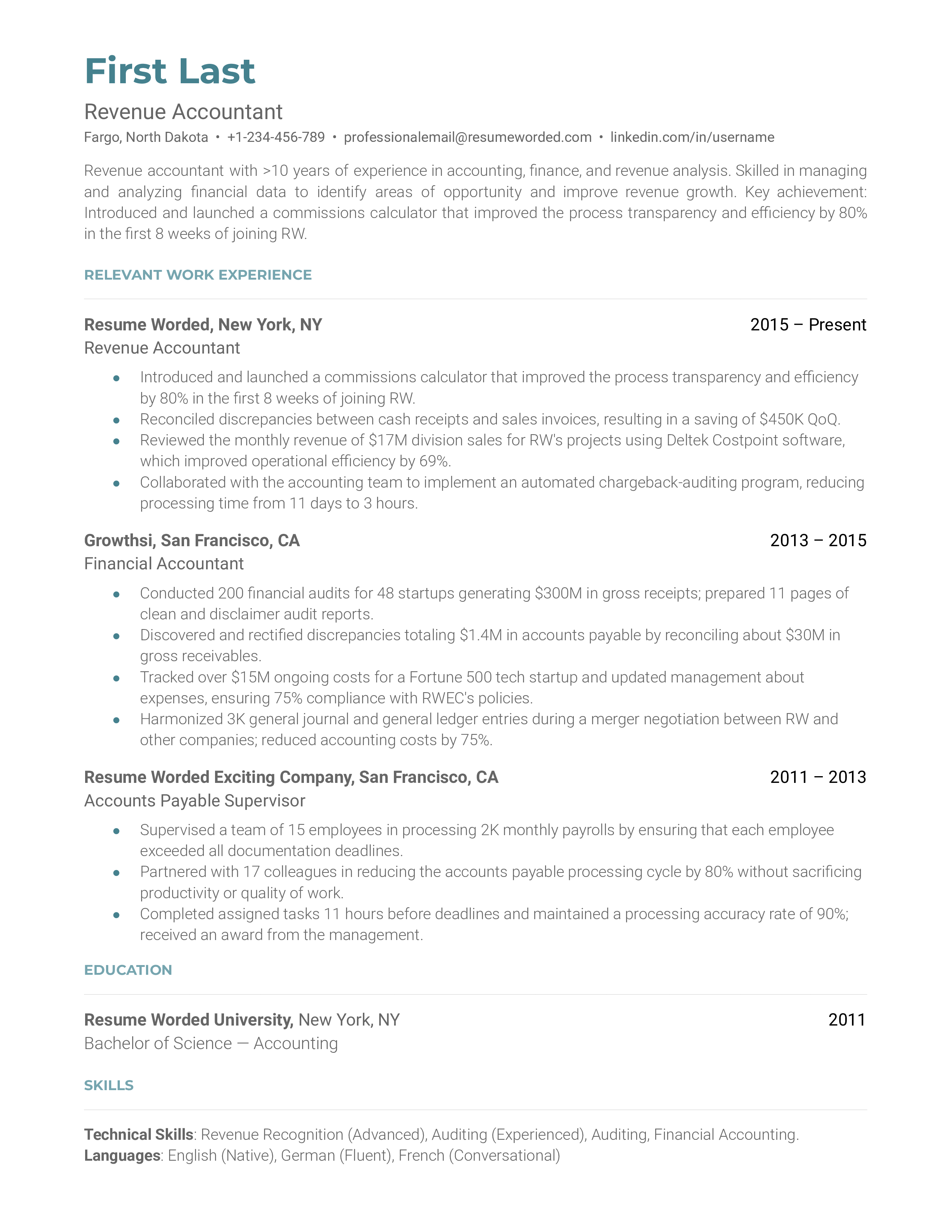

Revenue Accountant

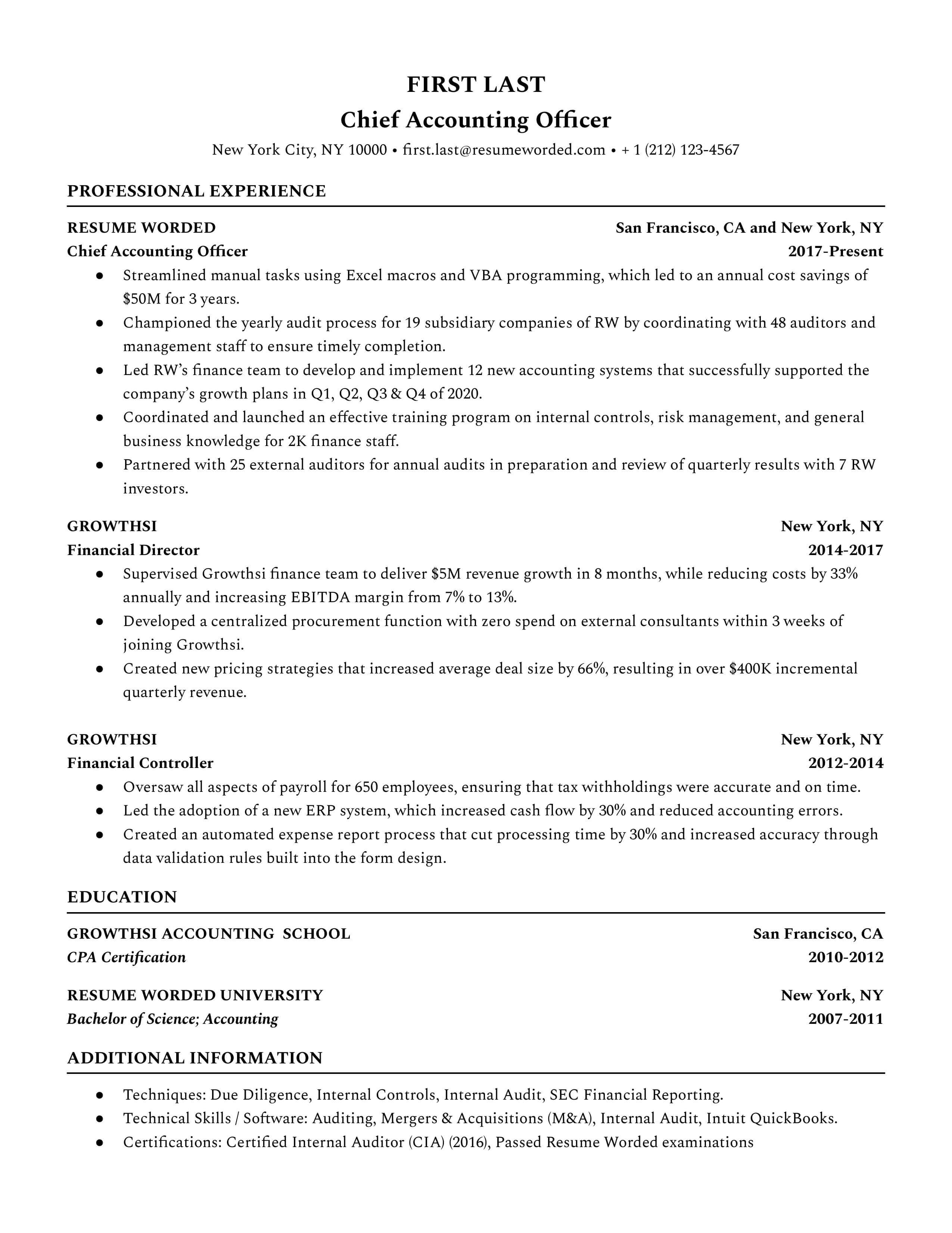

Chief Accounting Officer

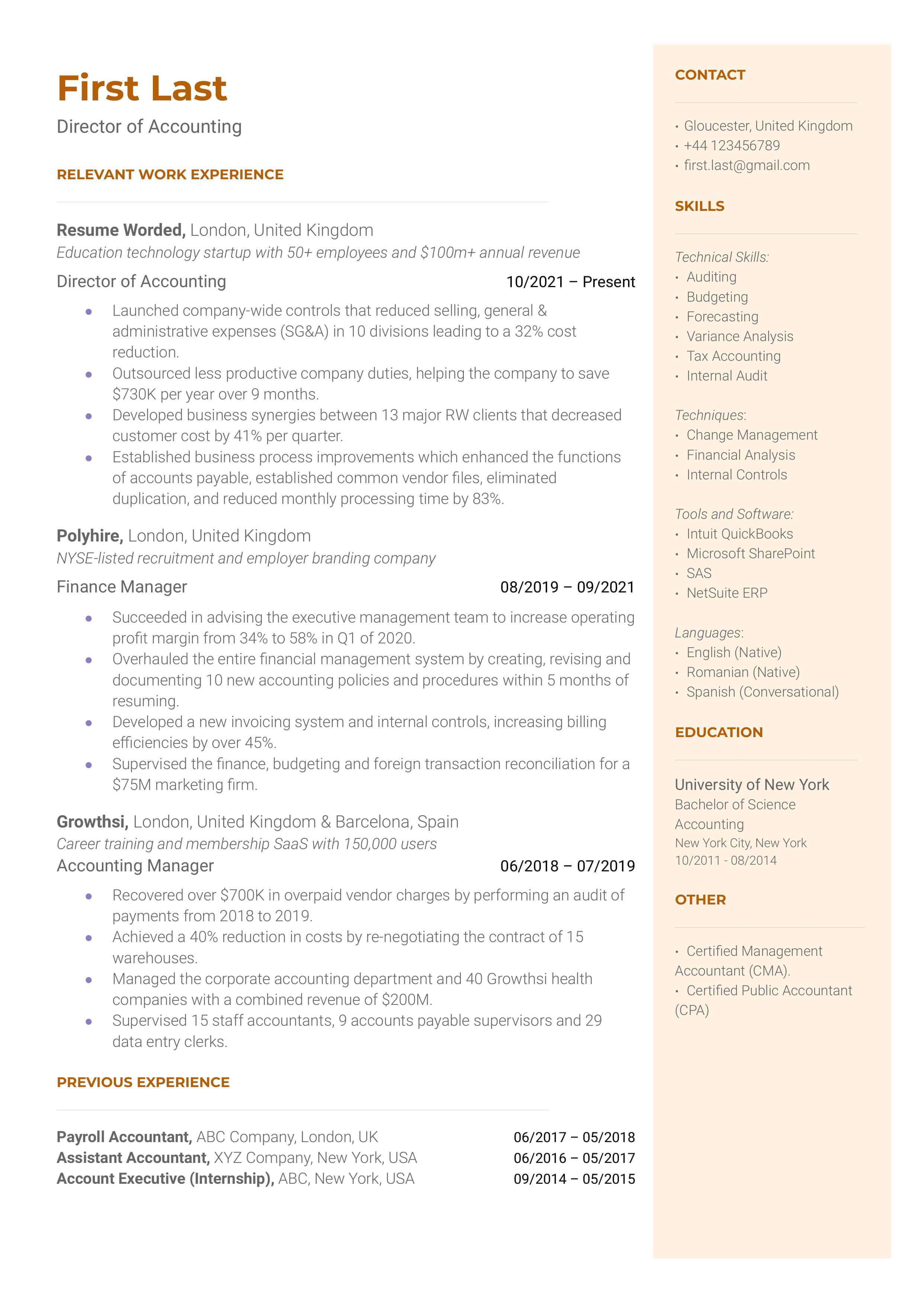

Director of Accounting

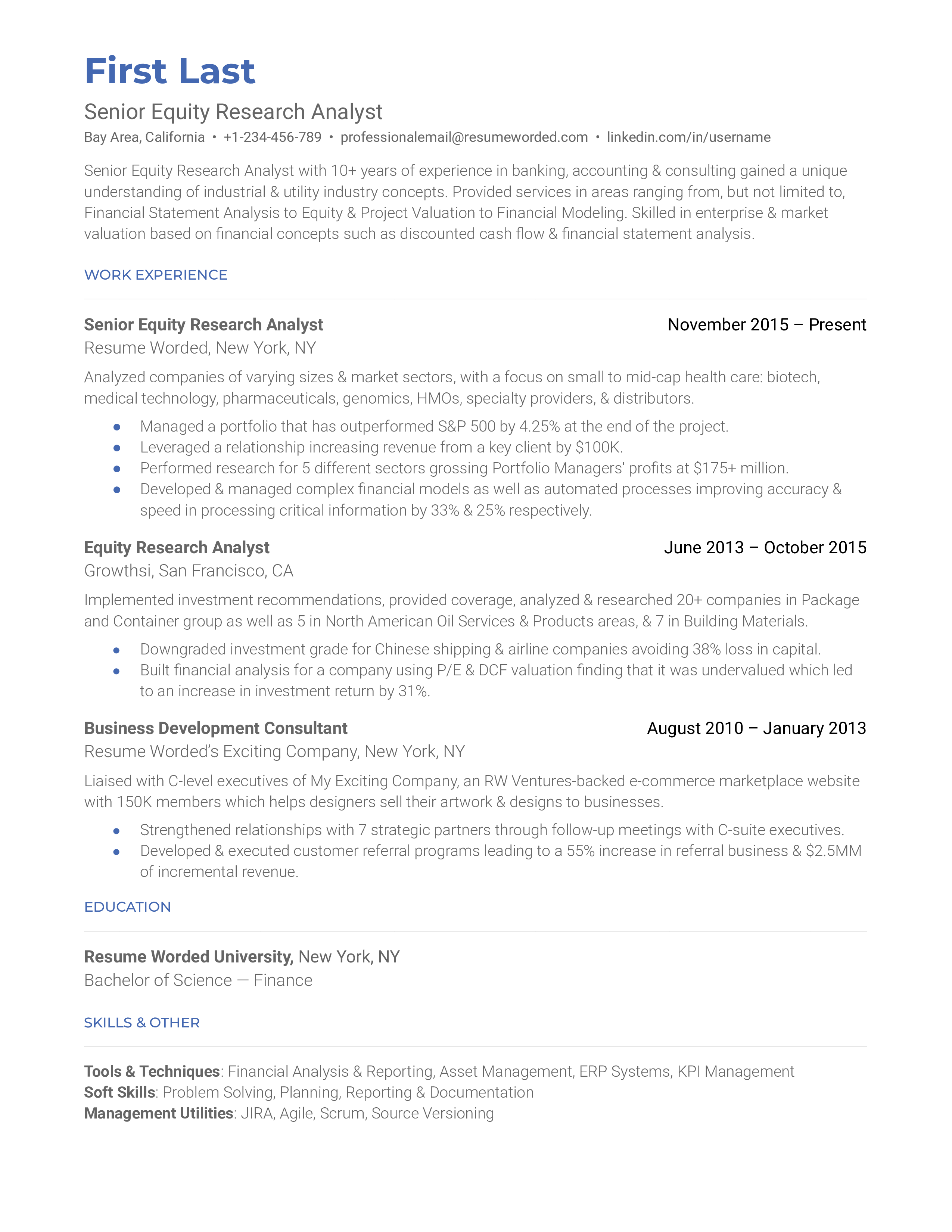

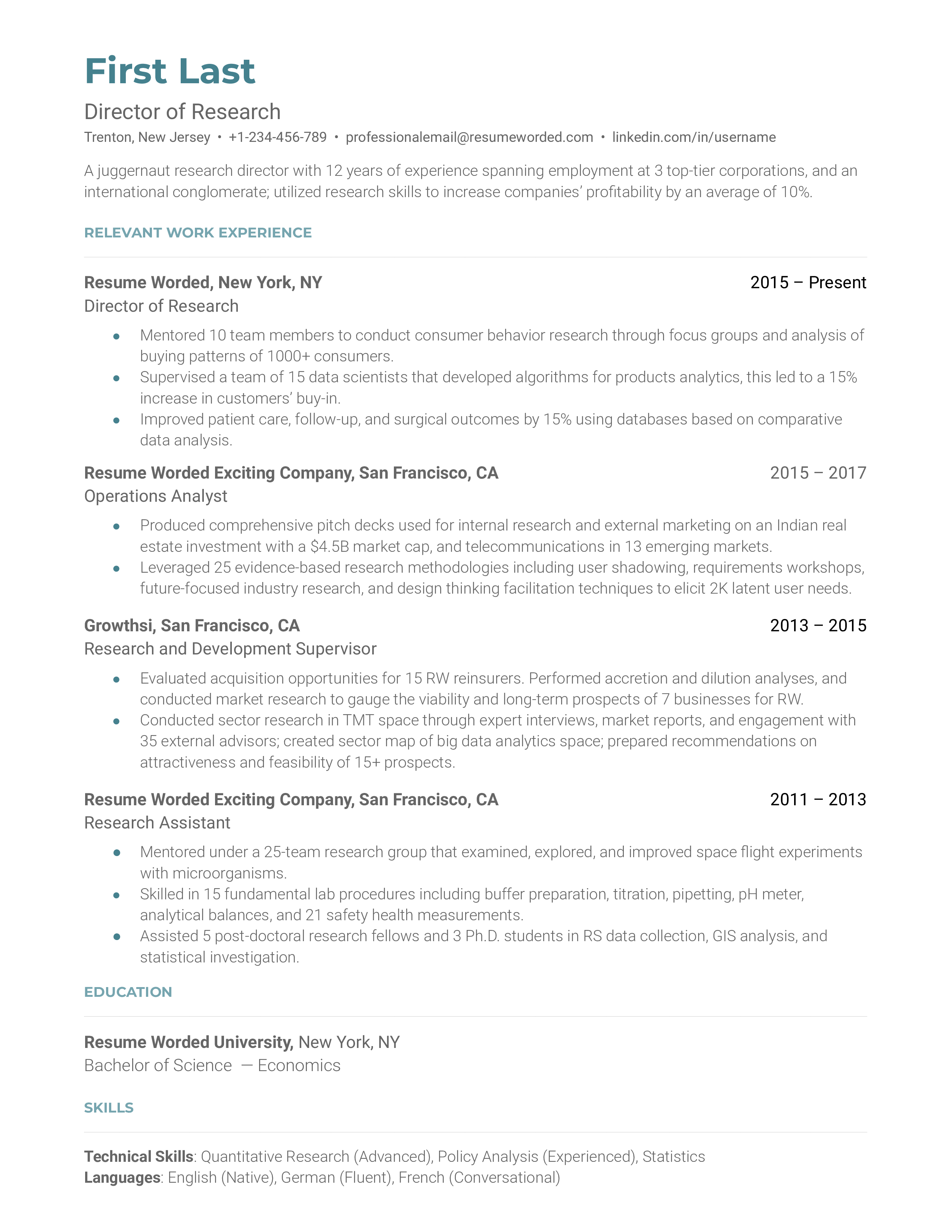

Equity Research Resumes

Equity researcher analysts are the advisers of the securities industry. They make sure decision-makers have the best information to make the best decisions. This guide will show you how to craft a resume that will impress recruiters.

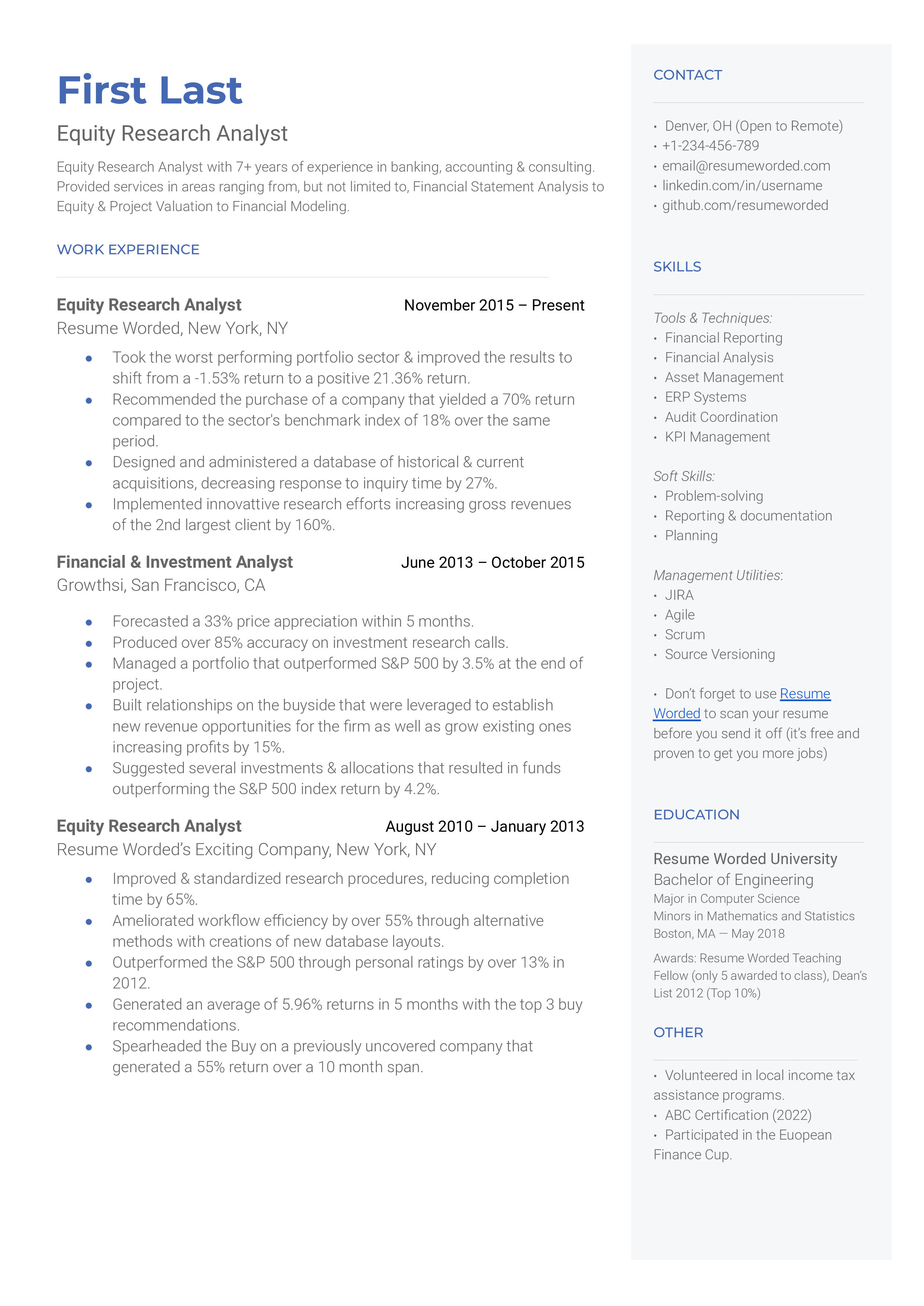

Equity Research Analyst

Equity Research Senior Analyst

Director of Research

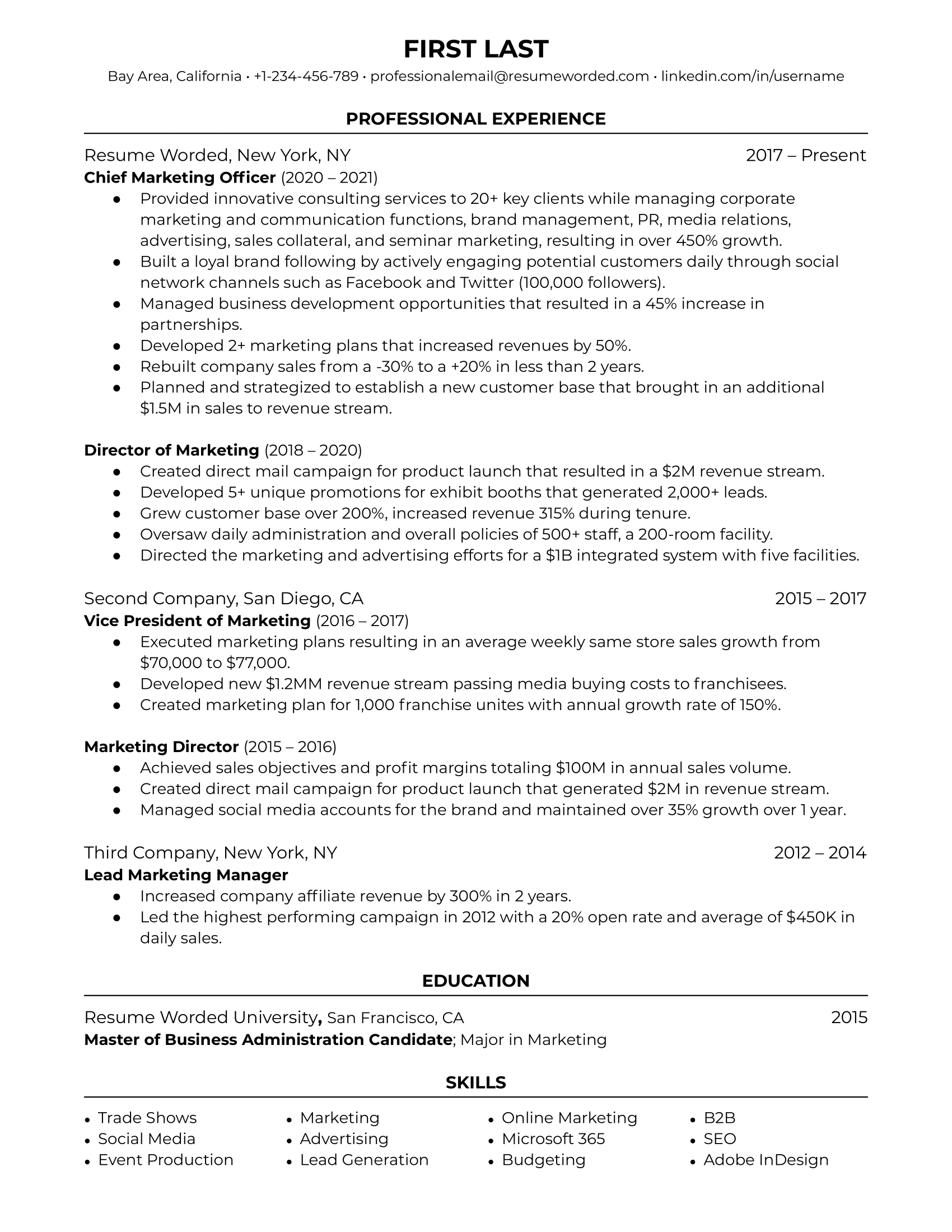

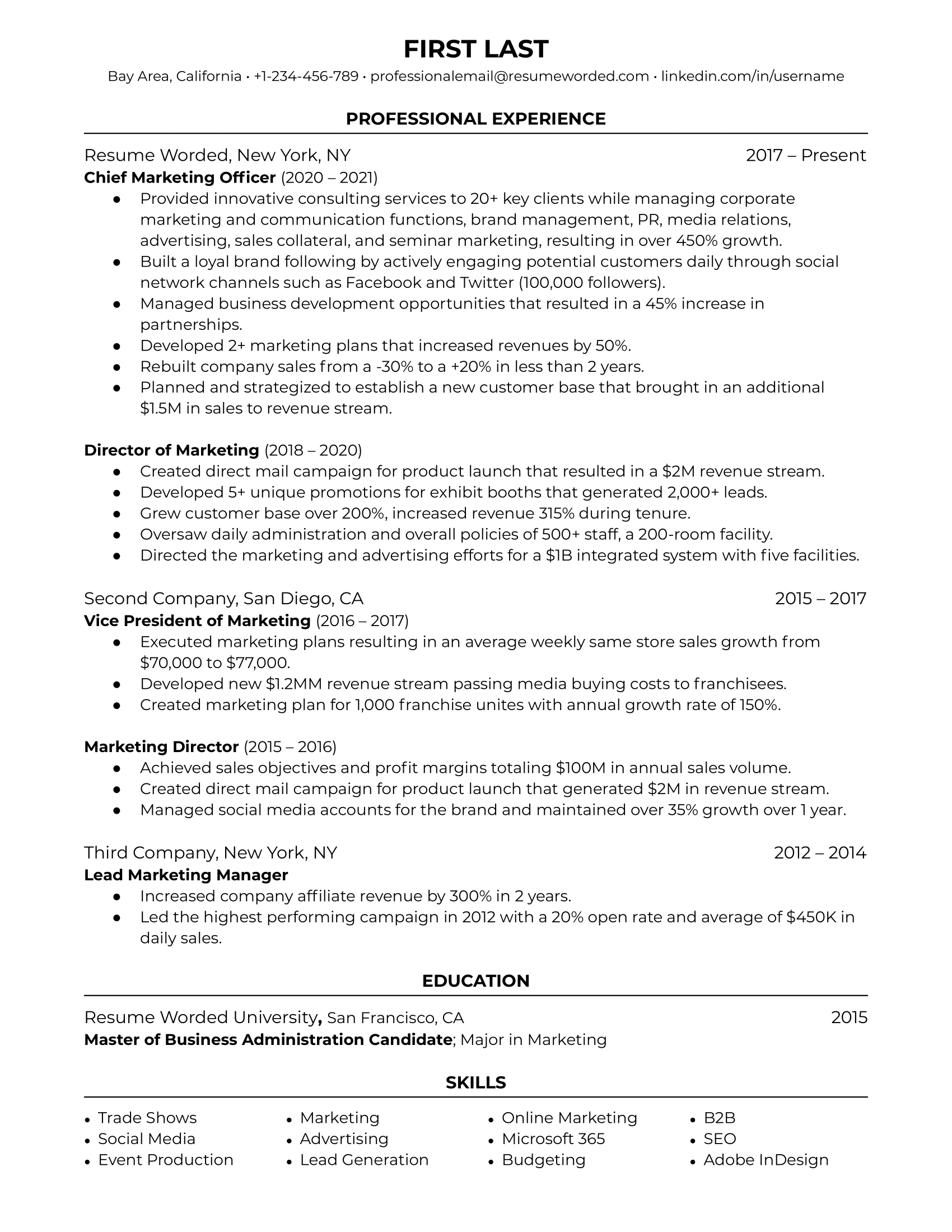

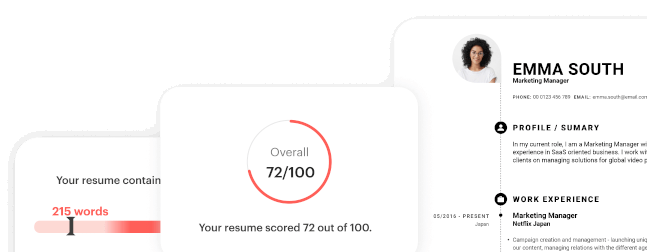

C-Level and Executive Resumes

No company can run smoothly without top C-level executives. If you’re applying for one of these demanding roles, you’ll need a resume that speaks for itself — and we can help. In this guide, you’ll find resume examples for any C-suite role as well as key industry-specific tips and insights.

Chief Marketing Officer (CMO) - 1

Chief Marketing Officer (CMO) - 2

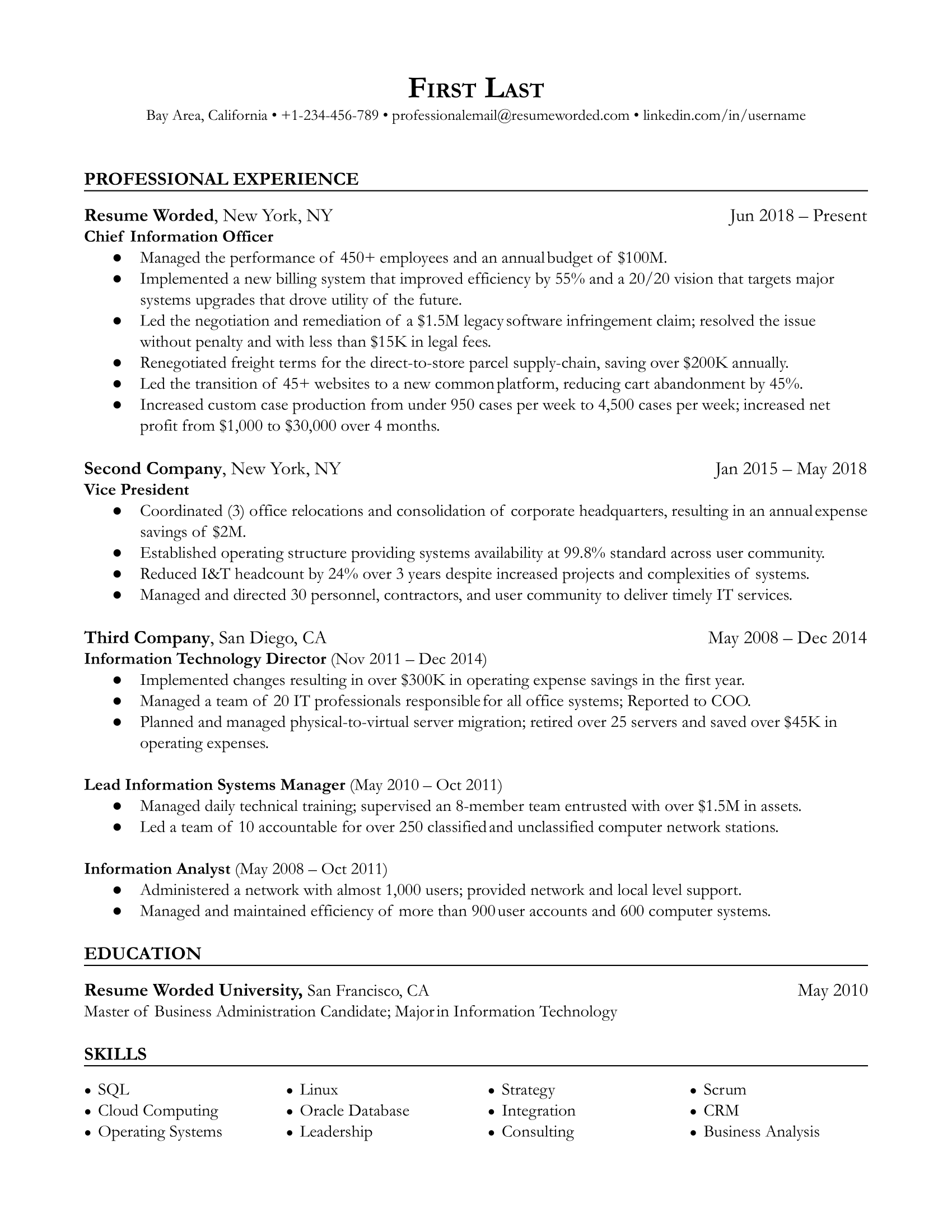

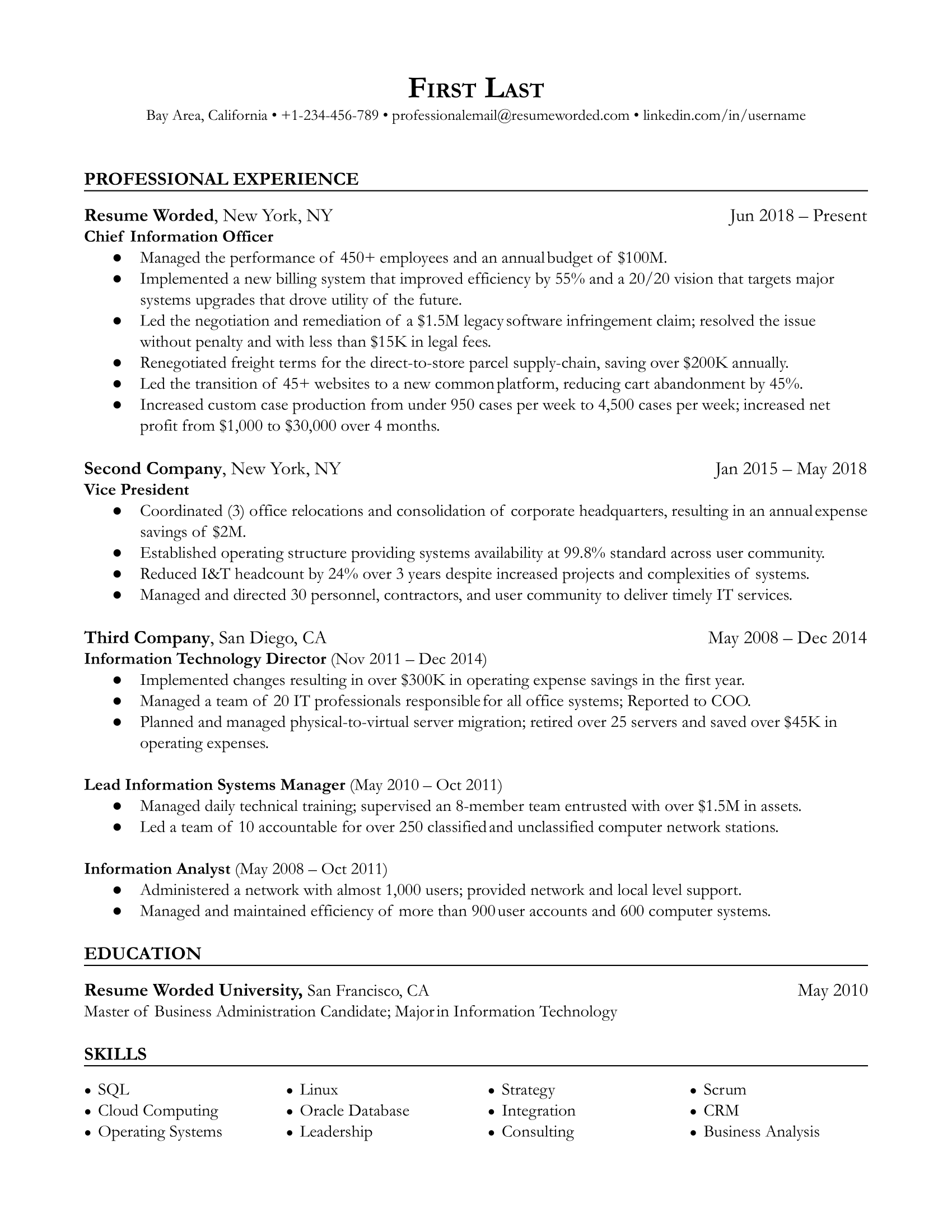

Chief Information Officer (CIO) - 1

Chief Information Officer (CIO) - 2

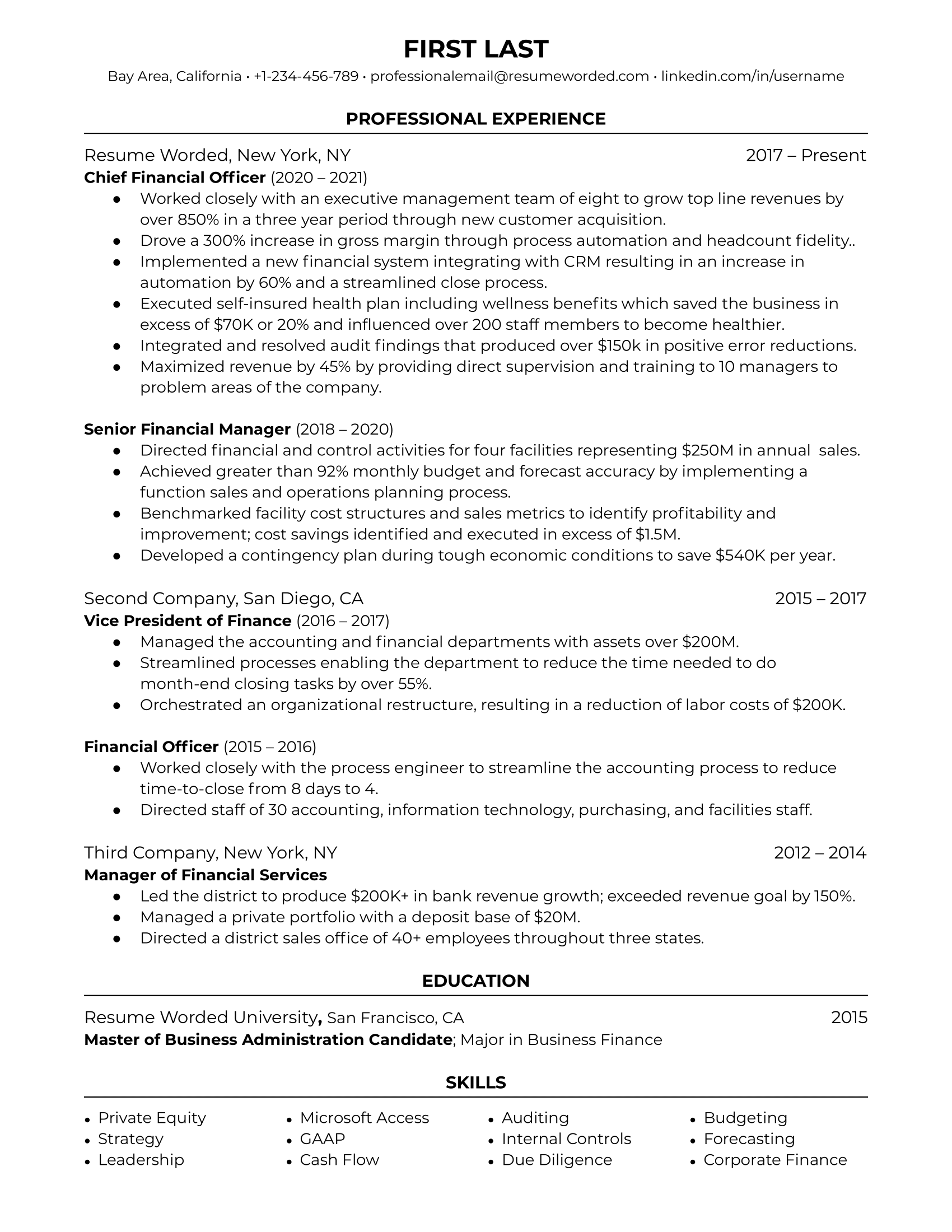

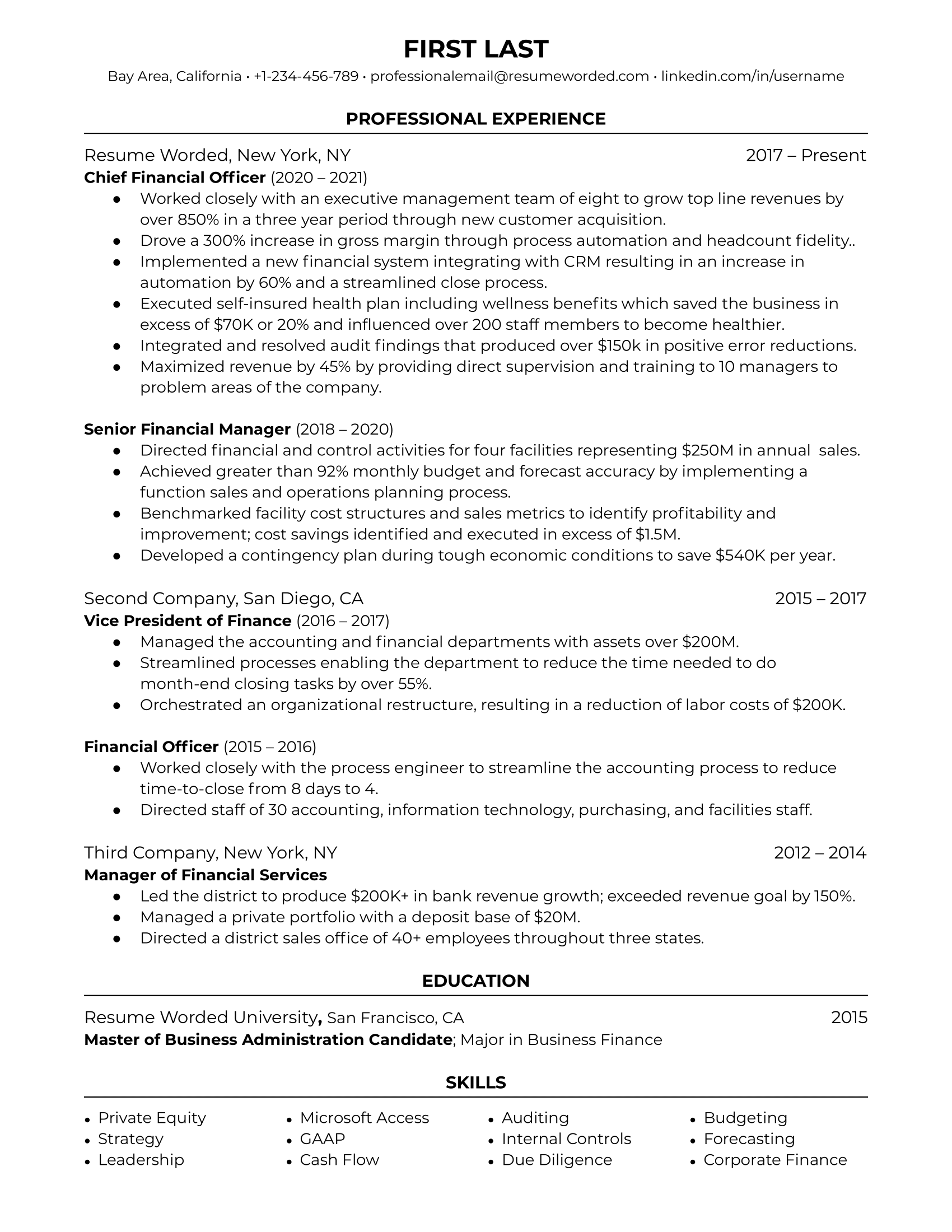

Chief Financial Officer (CFO) - 1

Chief Financial Officer (CFO) - 2

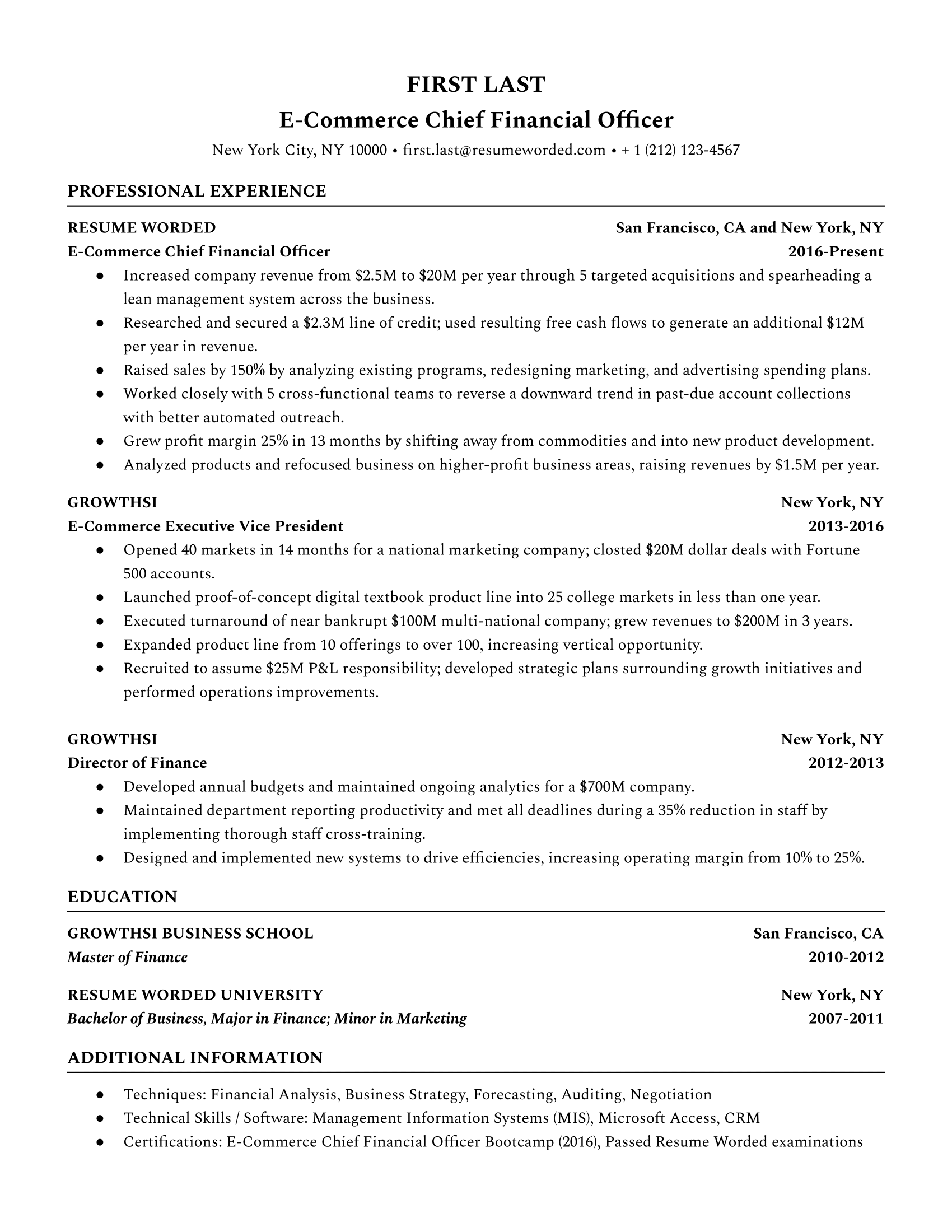

E-Commerce Chief Financial Officer

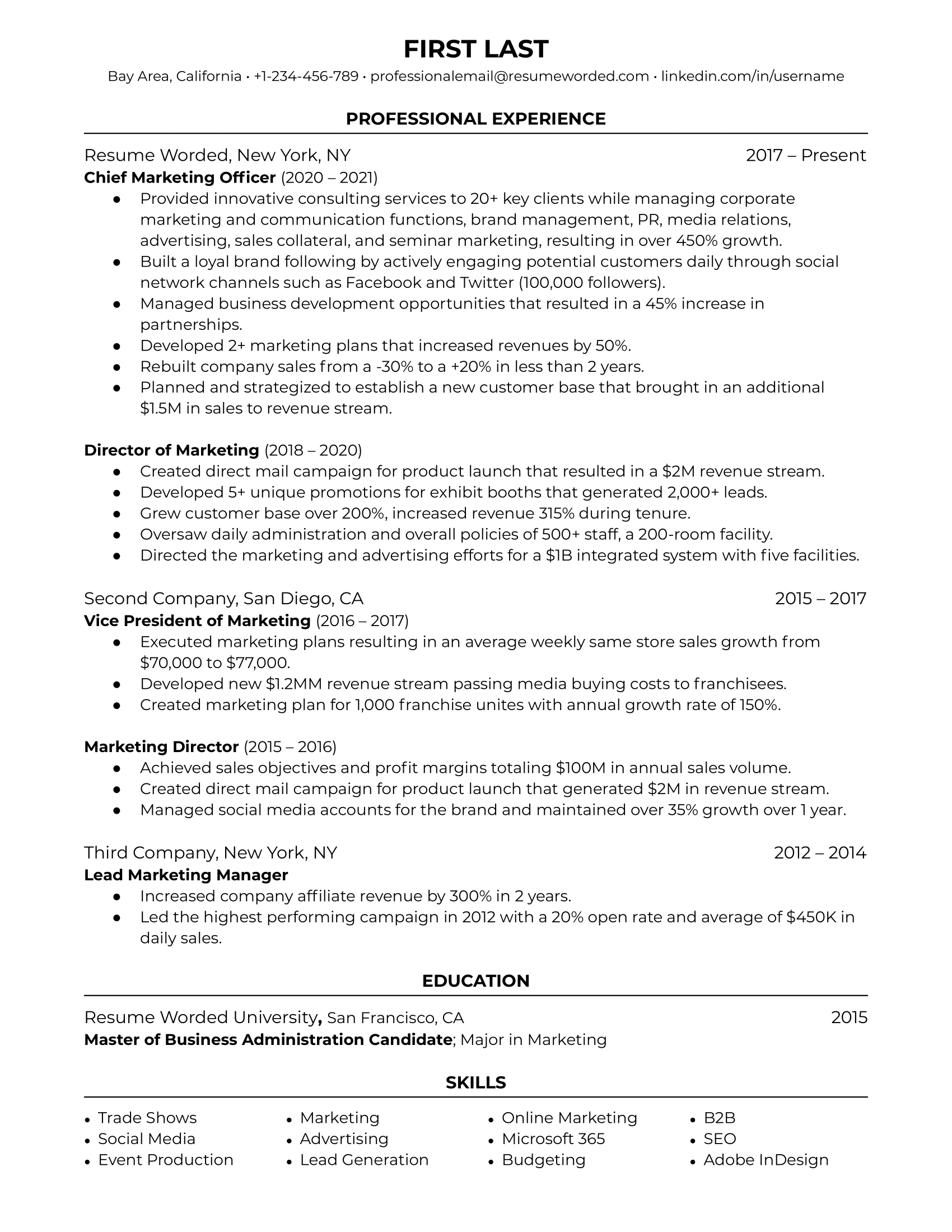

Chief Marketing Officer (CMO)

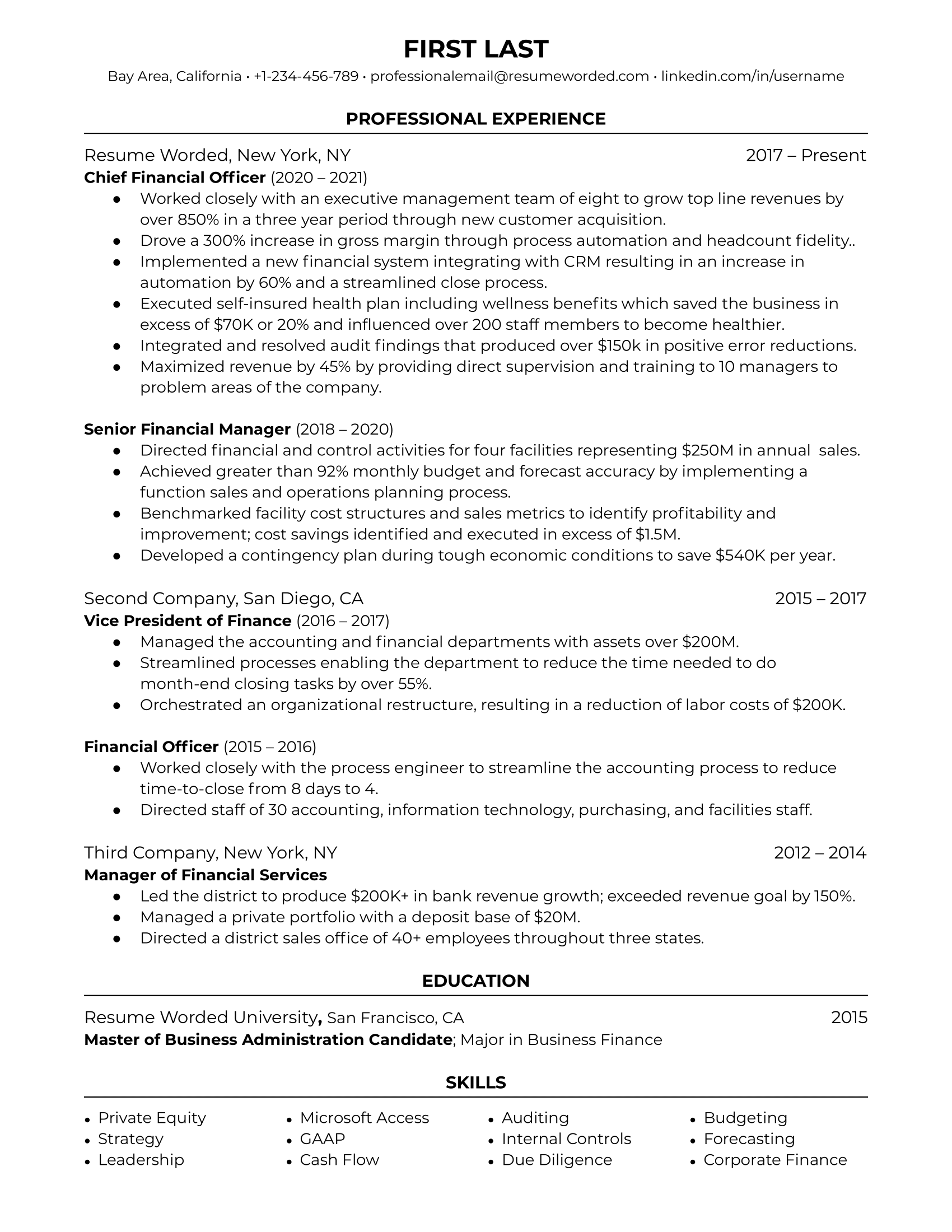

Chief Financial Officer (CFO)

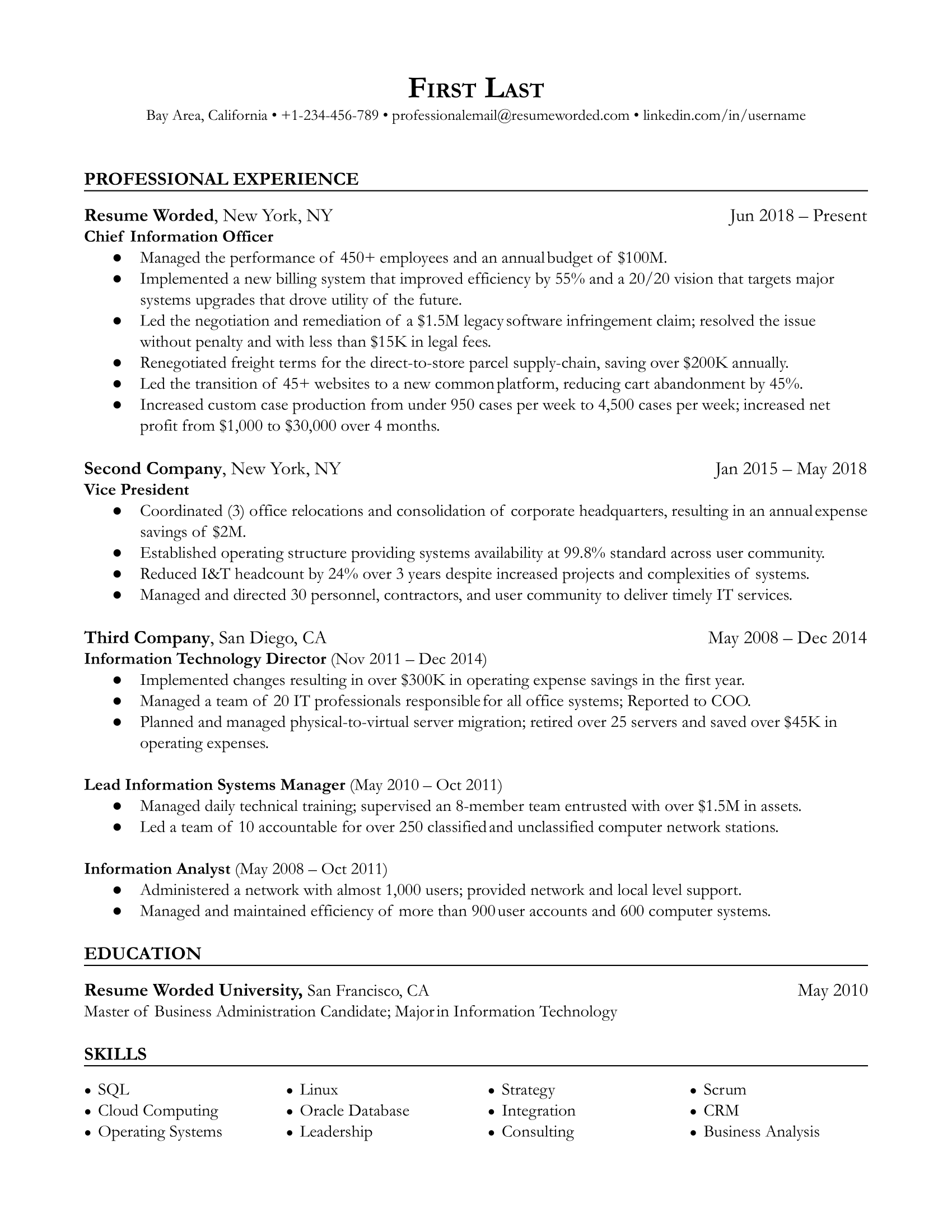

Chief Information Officer (CIO)

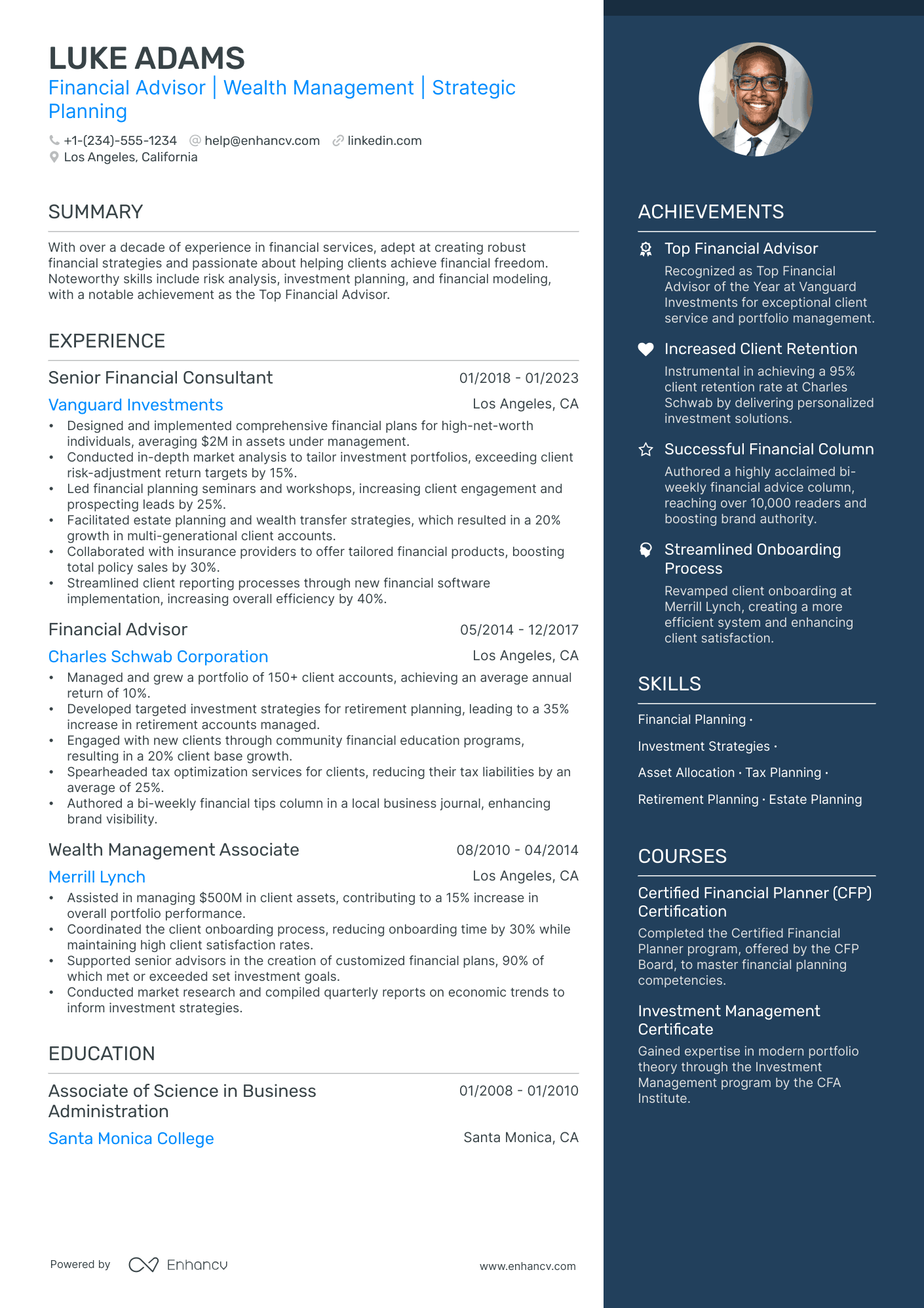

Financial Advisor Resumes

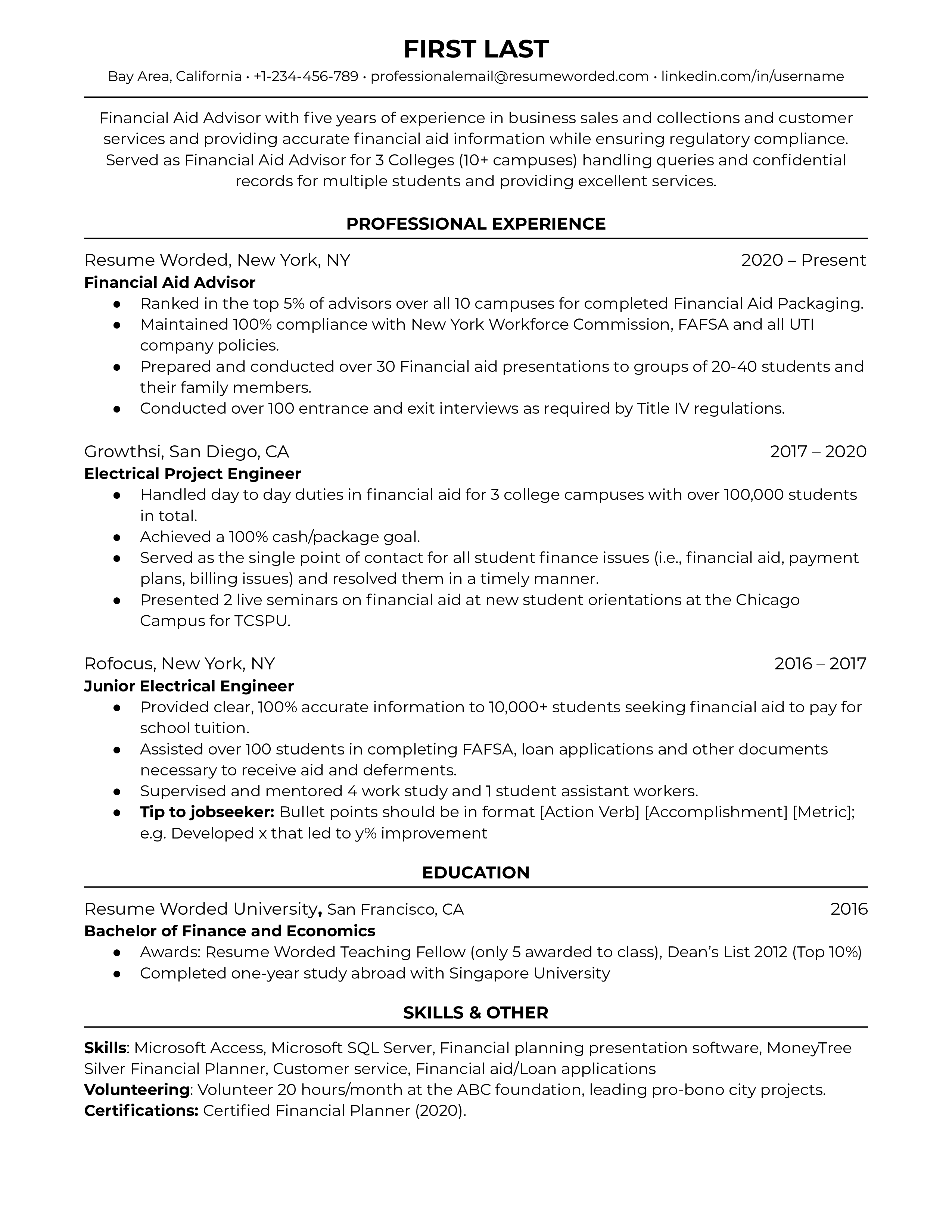

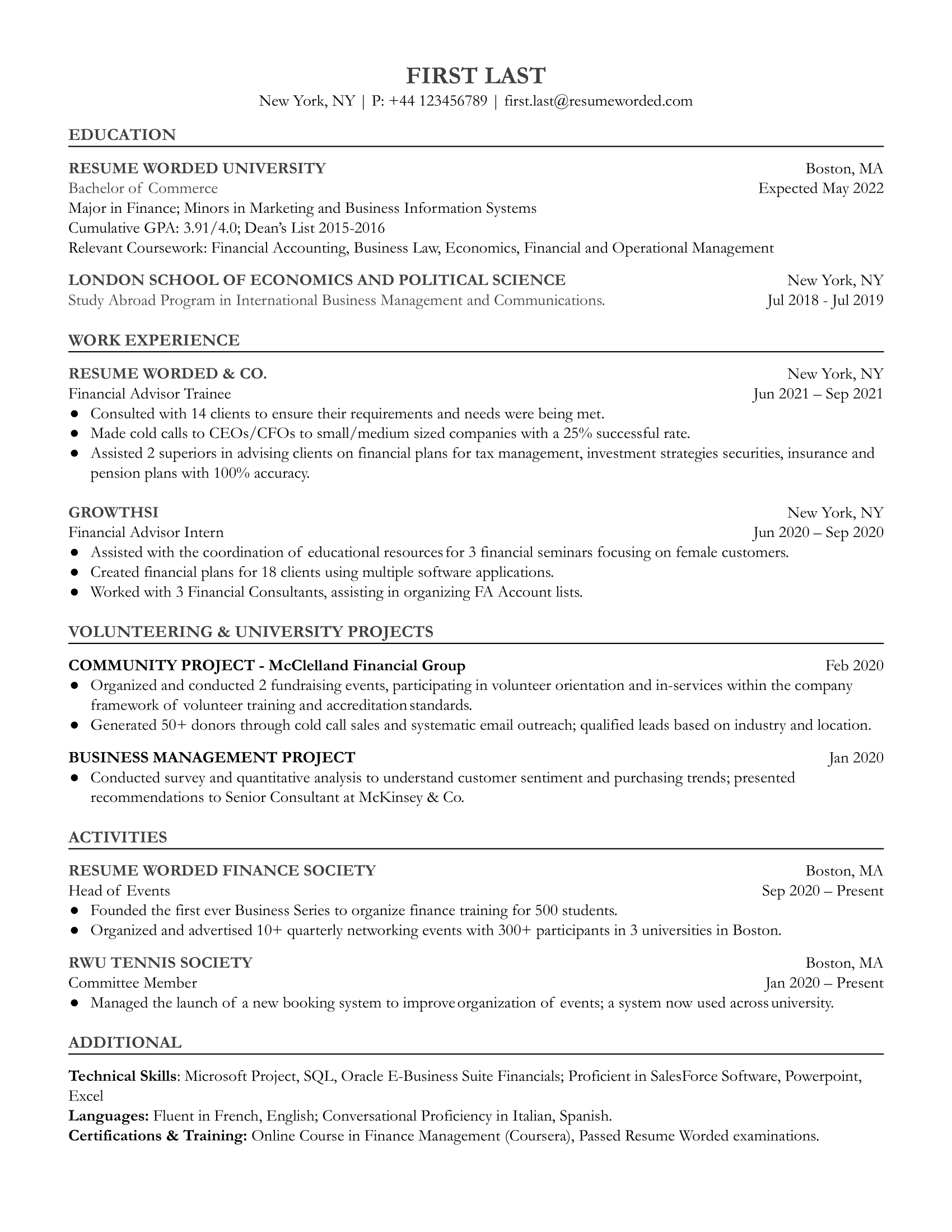

The financial advisor career path can be both stable and rewarding, especially if you have an affinity for numbers and data entry. This guide discusses three financial advisor resume templates and provides tips on writing your resume, along with highlighting strong action verbs and skills to include.

Financial Aid Advisor

Entry Level Financial Advisor

Procurement Resumes

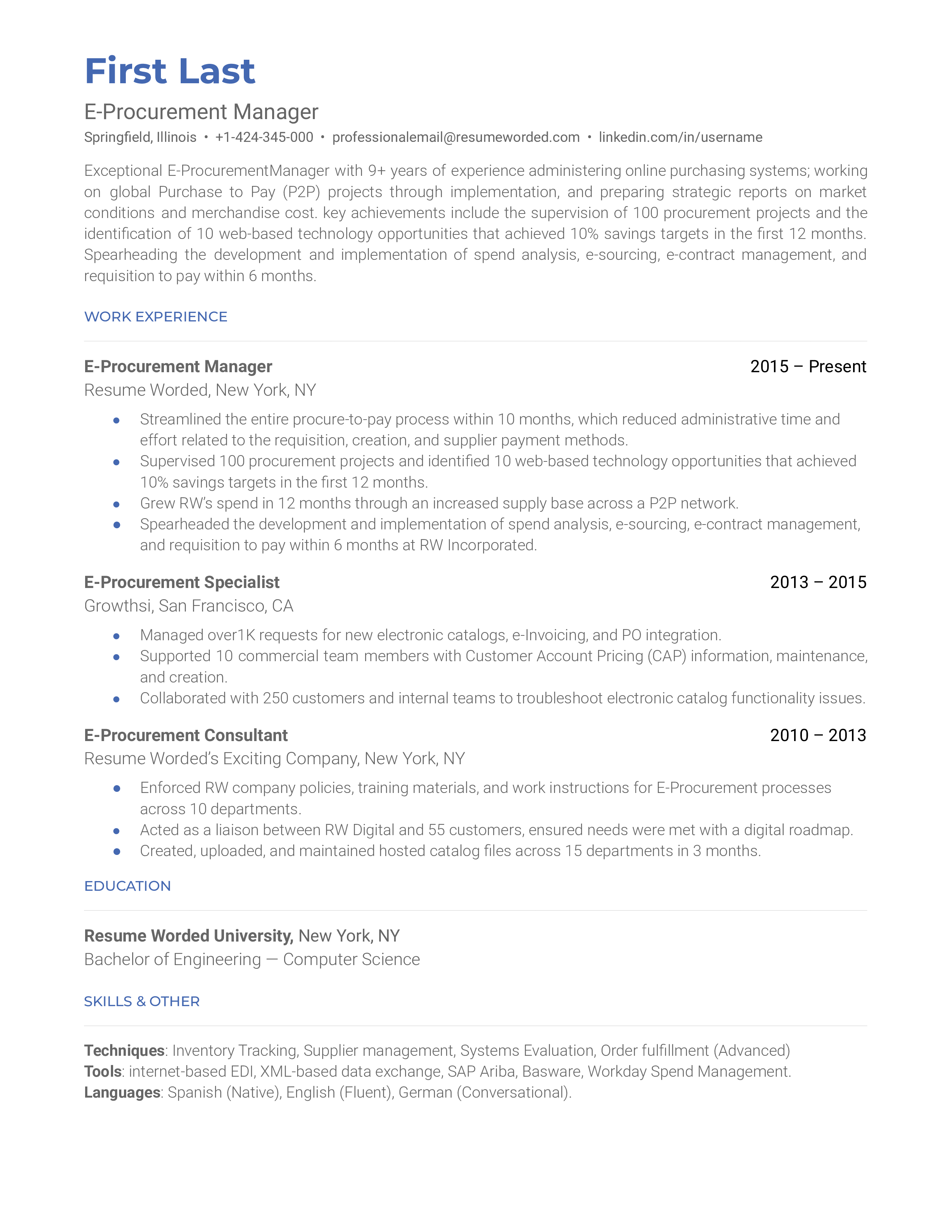

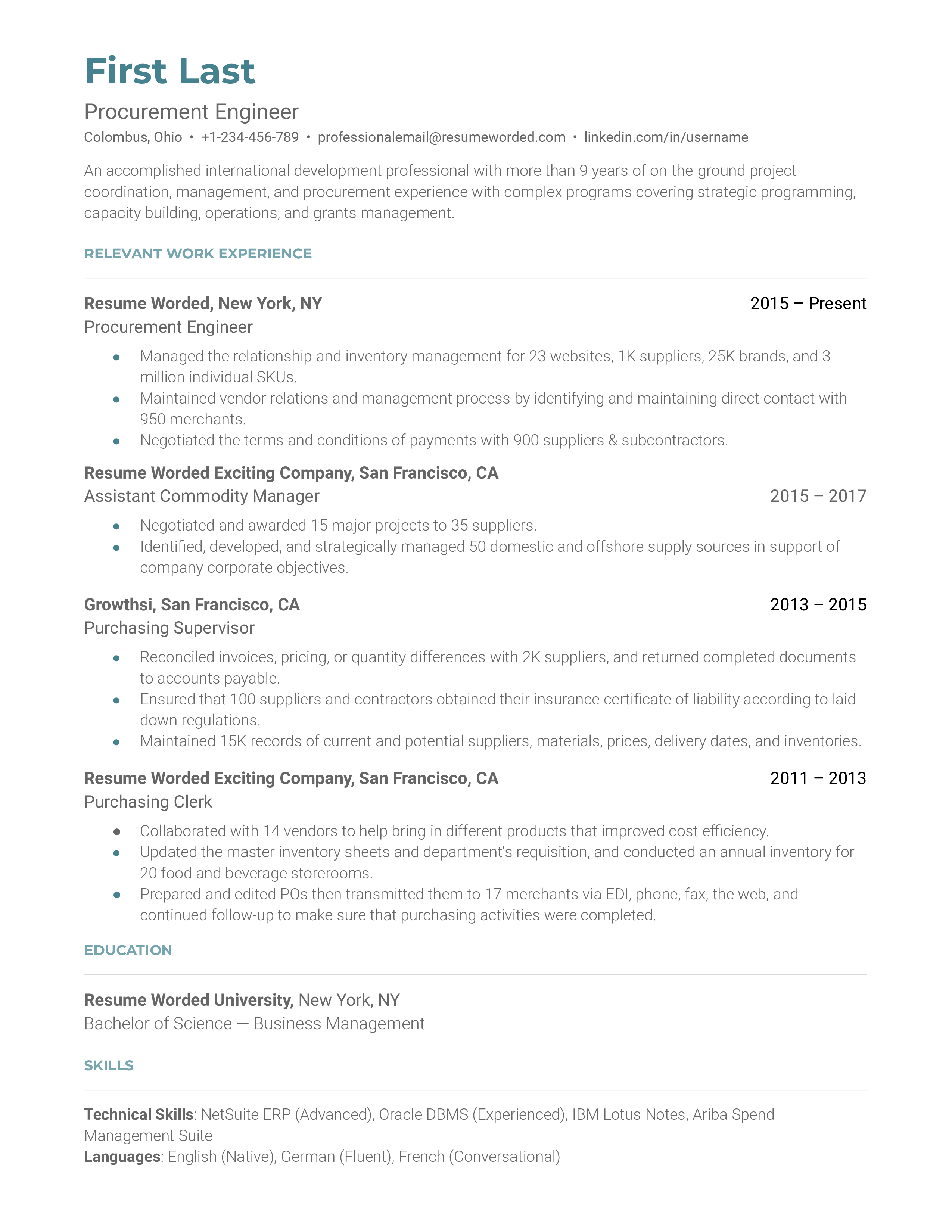

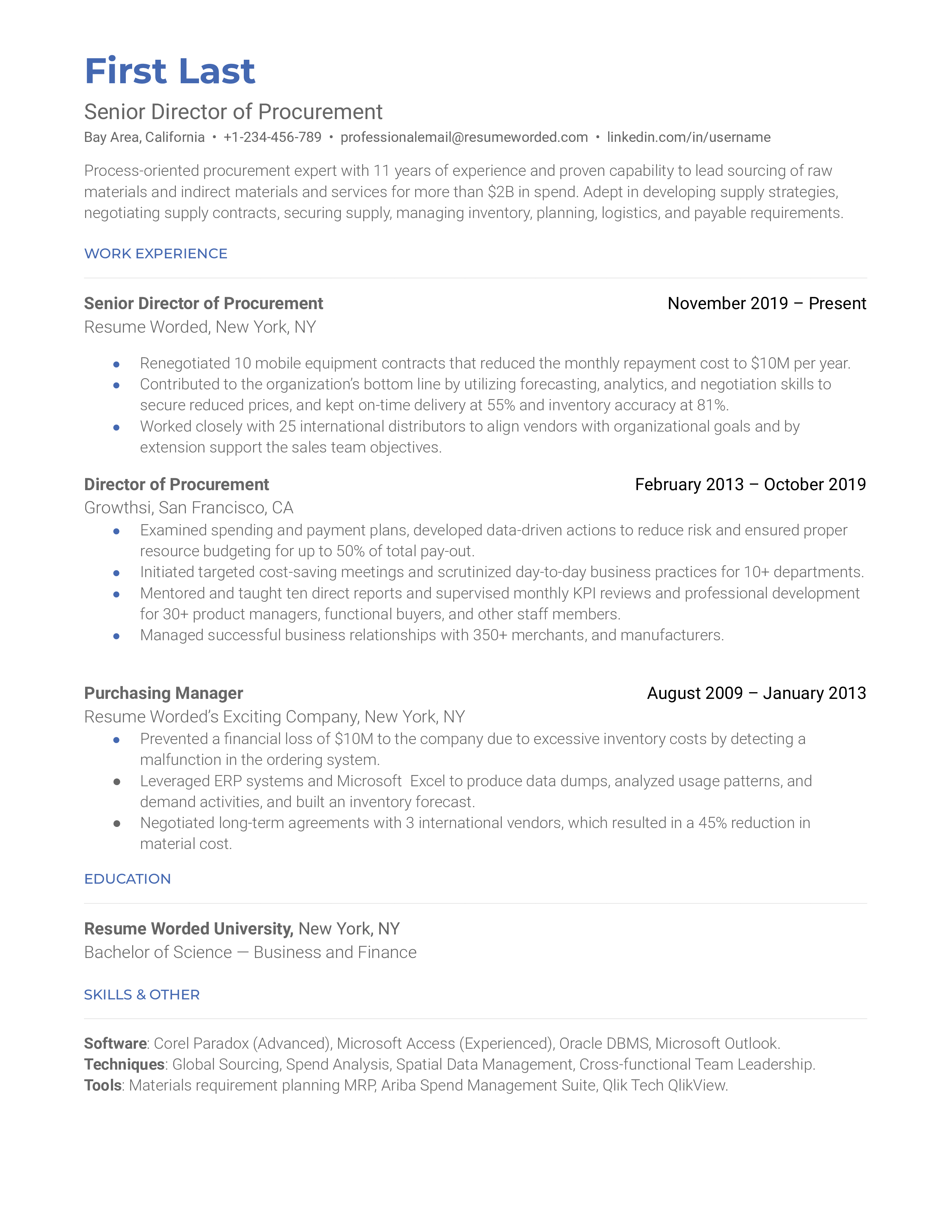

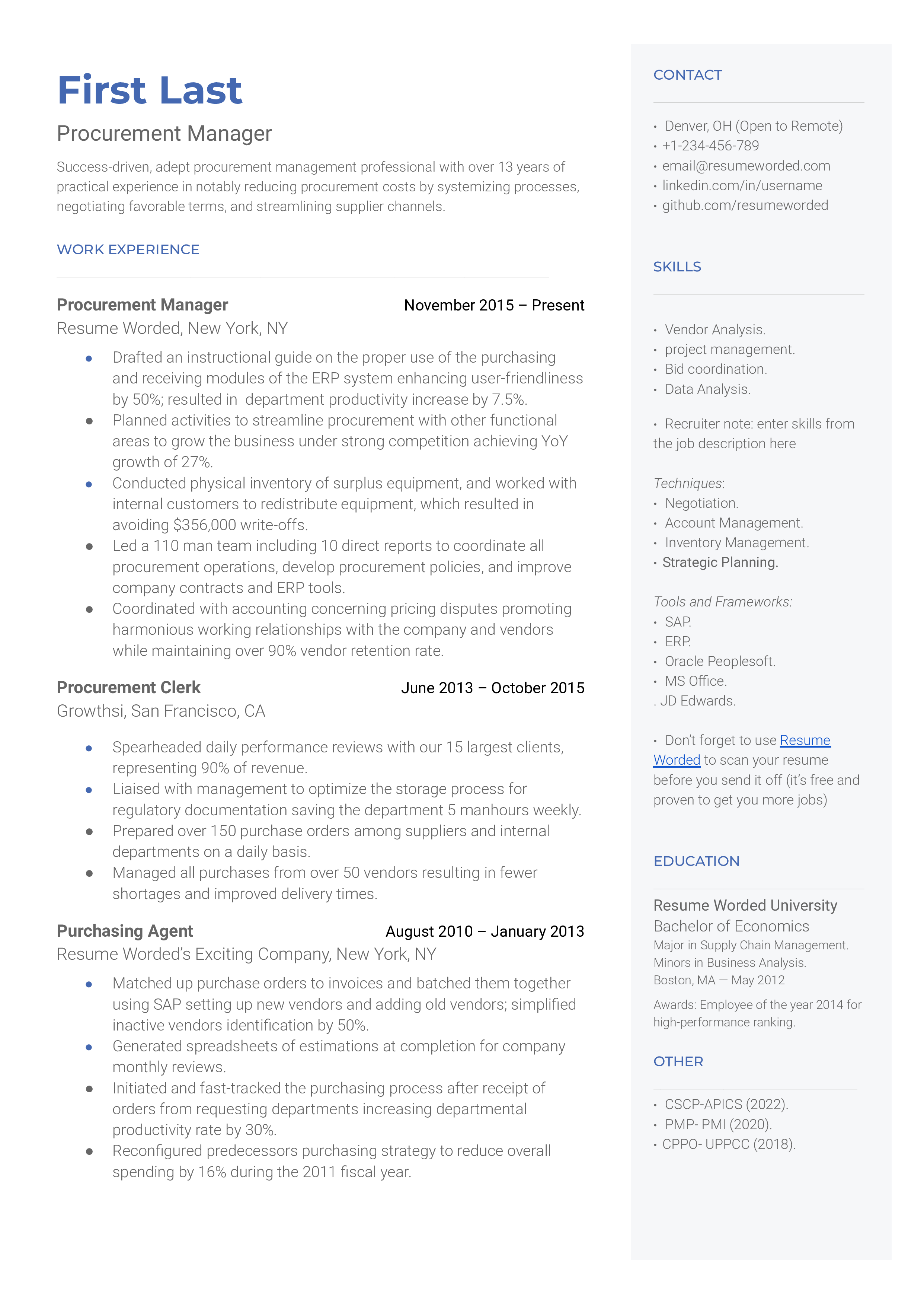

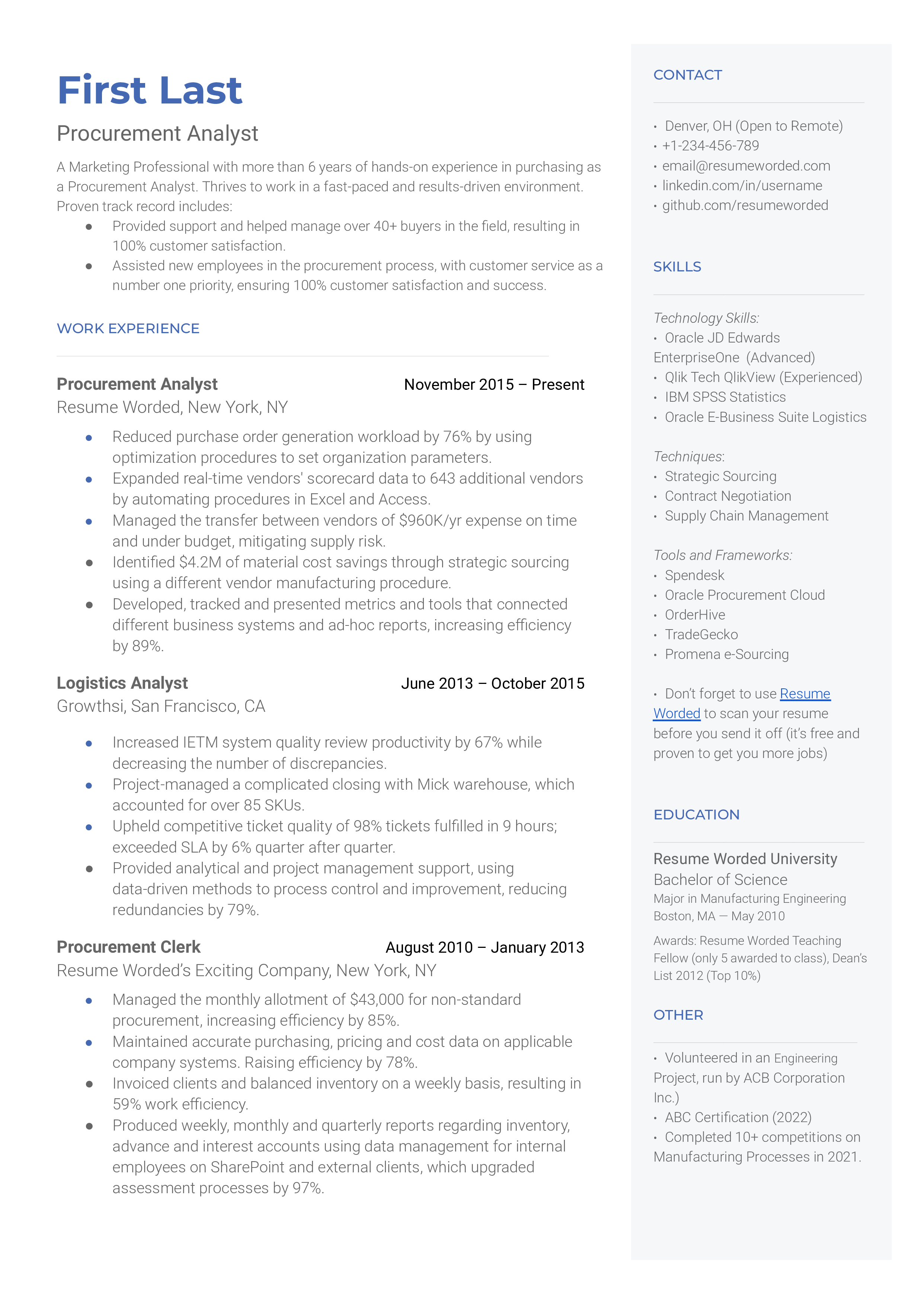

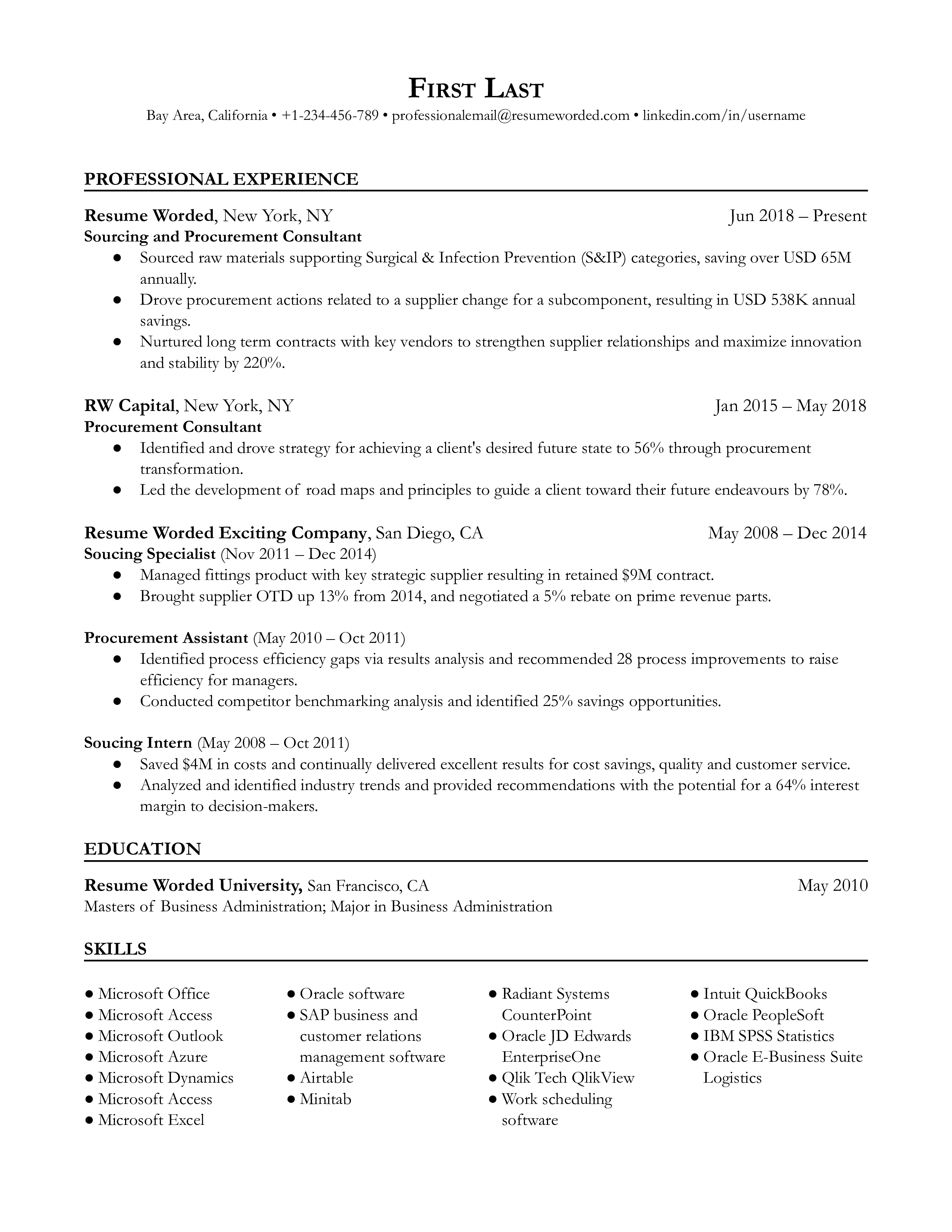

Procurement professionals are vital in an organization and need a balance of skills to thrive. They must be great communicators and negotiators and also sticklers for the budget. This guide will show you how to highlight the skills and qualifications in your resume that recruiters will most certainly be looking for.

E-Procurement Manager

Procurement Engineer

Senior Director of Procurement

Procurement Manager

Procurement Specialist

Procurement Analyst

Sourcing and Procurement Consultant

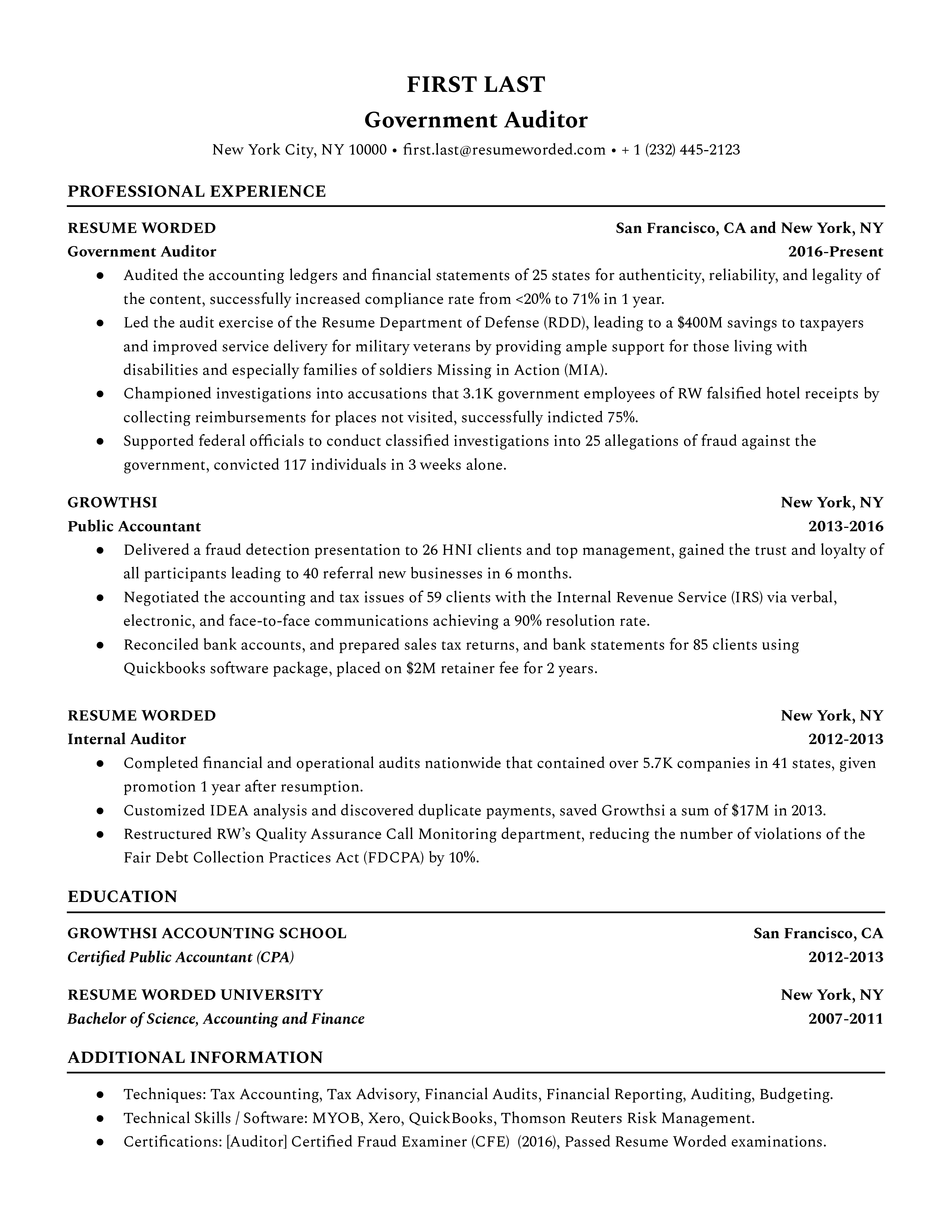

Auditor Resumes

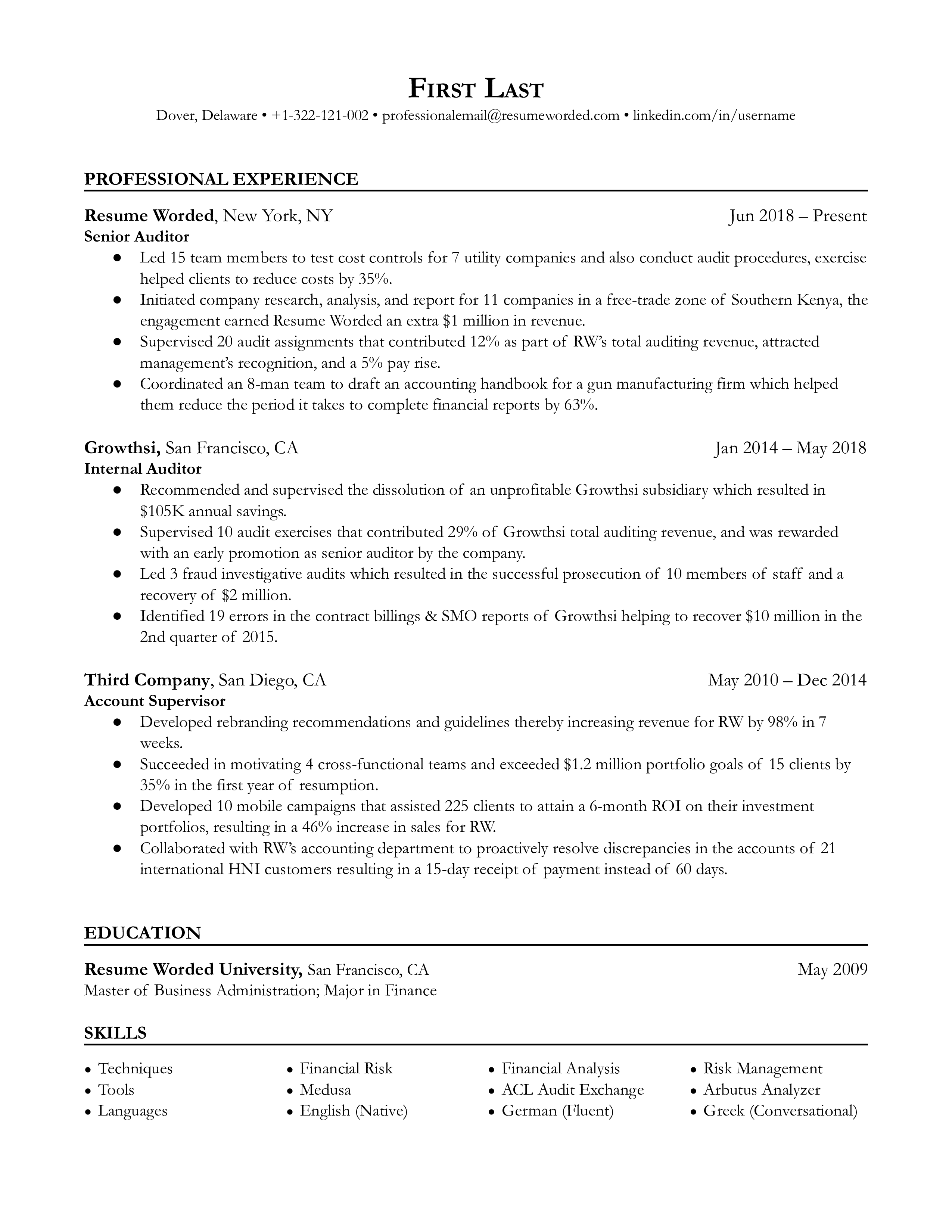

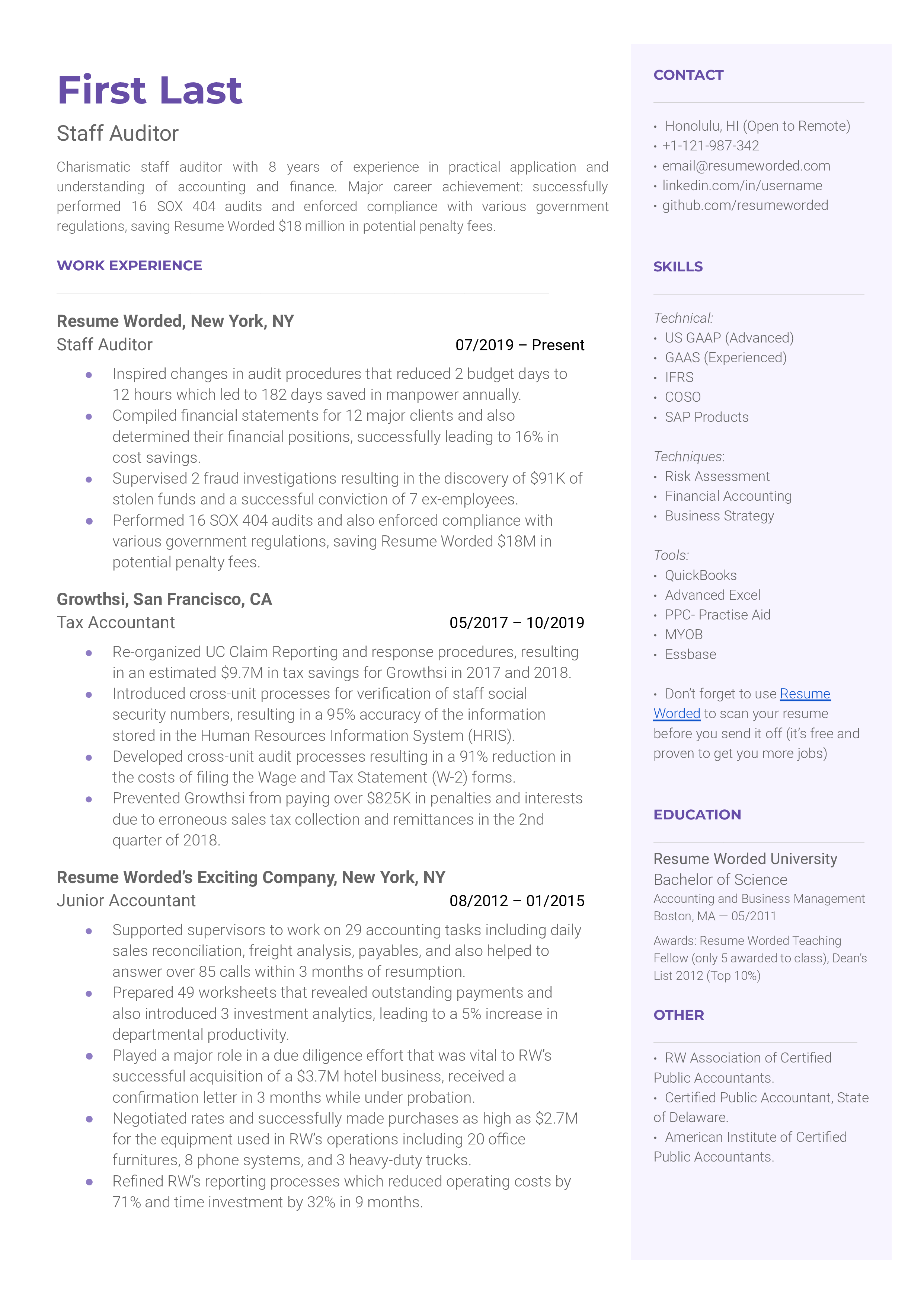

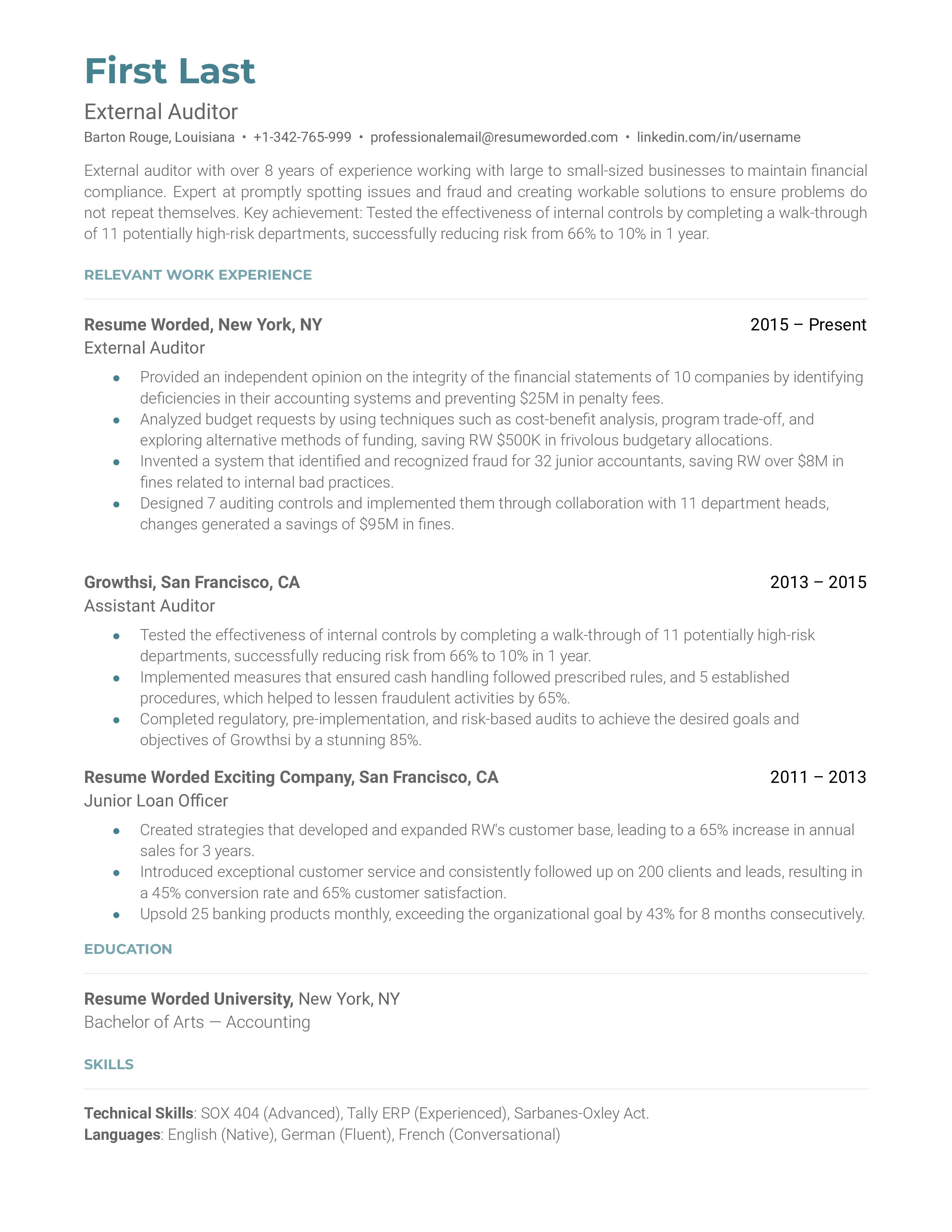

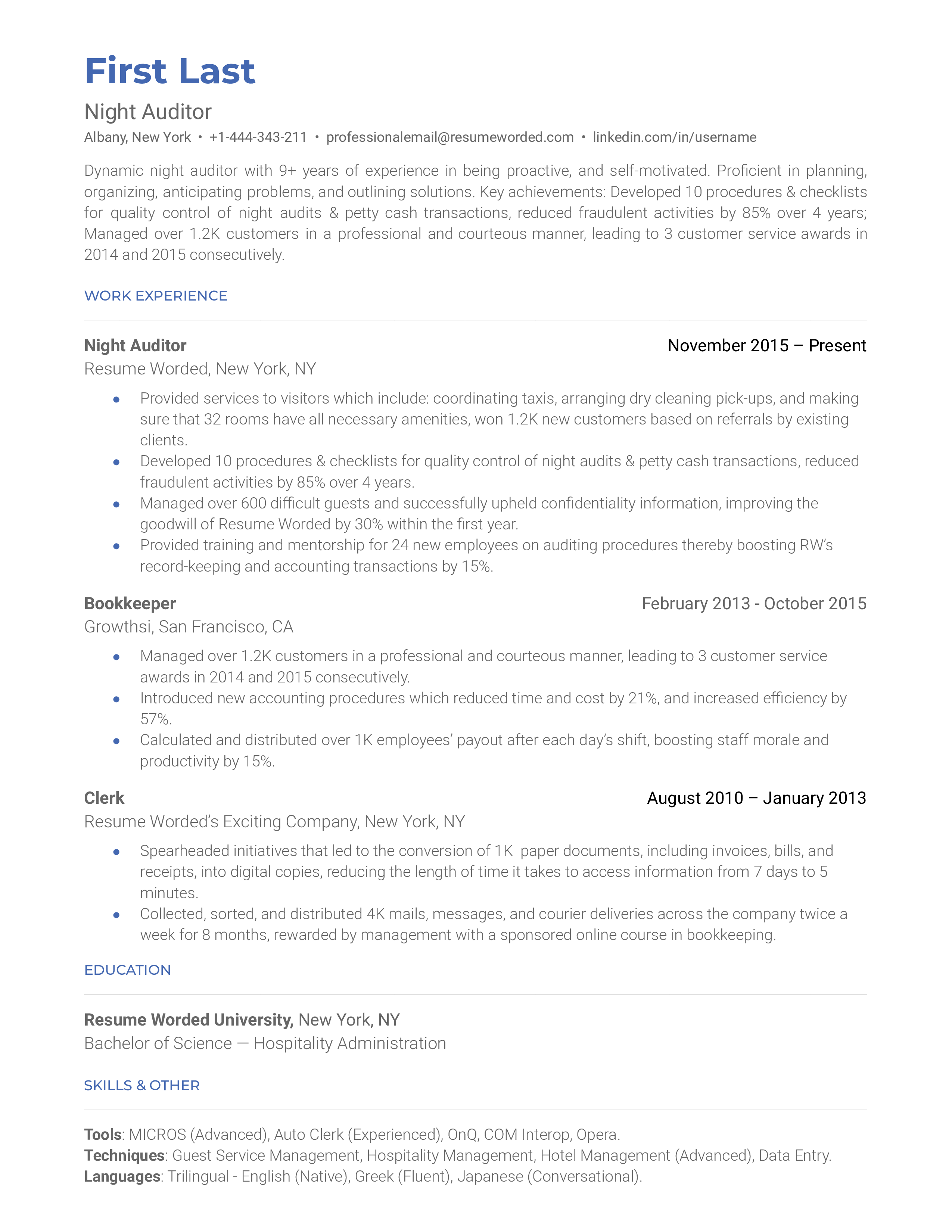

While getting audited can sound like a terrifying ordeal, auditors’ work is actually vital for the health and long-term success of a company. Auditors will help a company cross their ts and dot their I’s when it comes to their financial documents. They ensure that everything is done correctly and that everything adds up. This guide will highlight auditor titles, give strong resume samples of each, and provide suggestions on how you can craft your own successful auditor resume. Let’s get started.

Senior Auditor

Staff Auditor

External Auditor

Night Auditor

Government Auditor

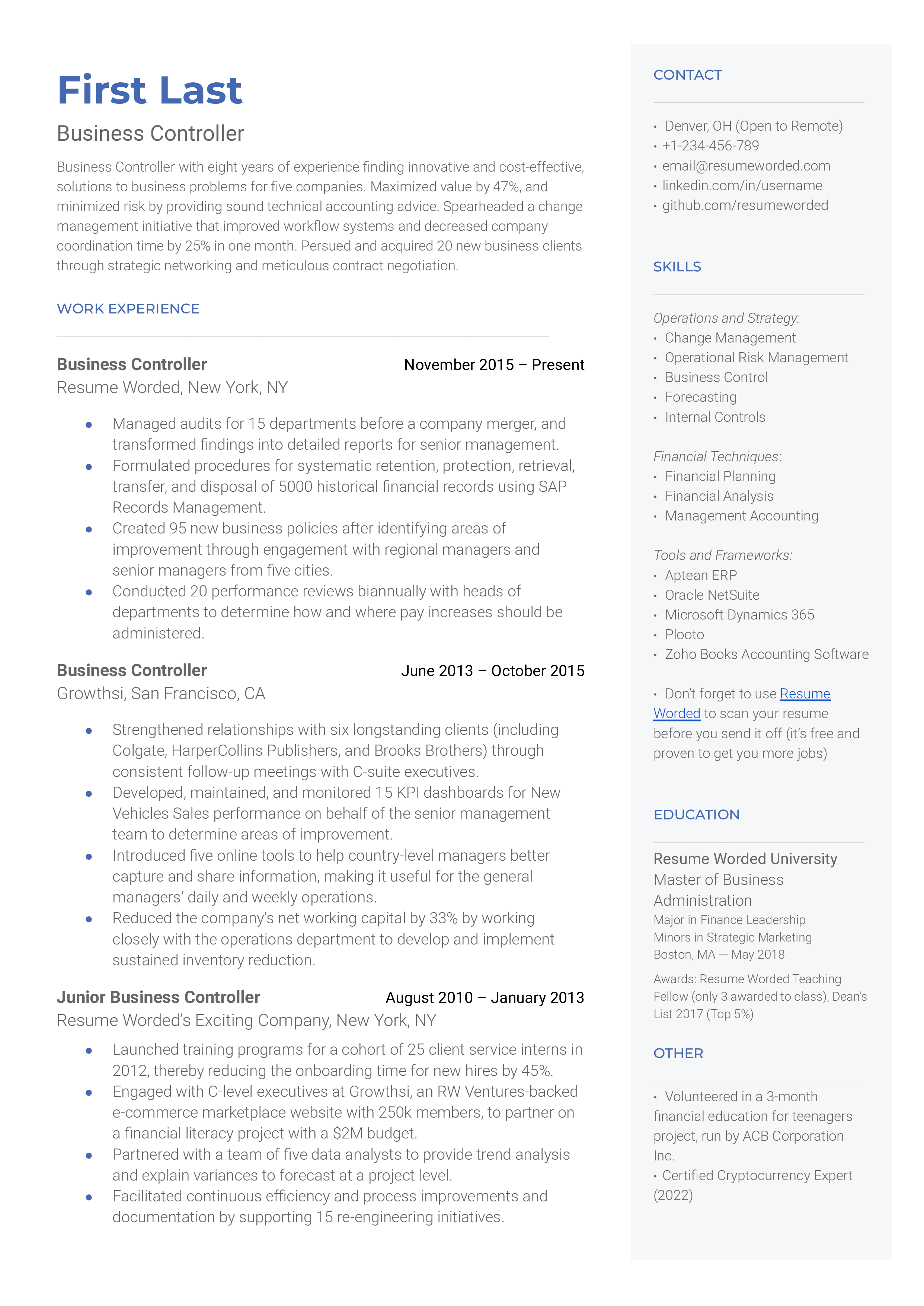

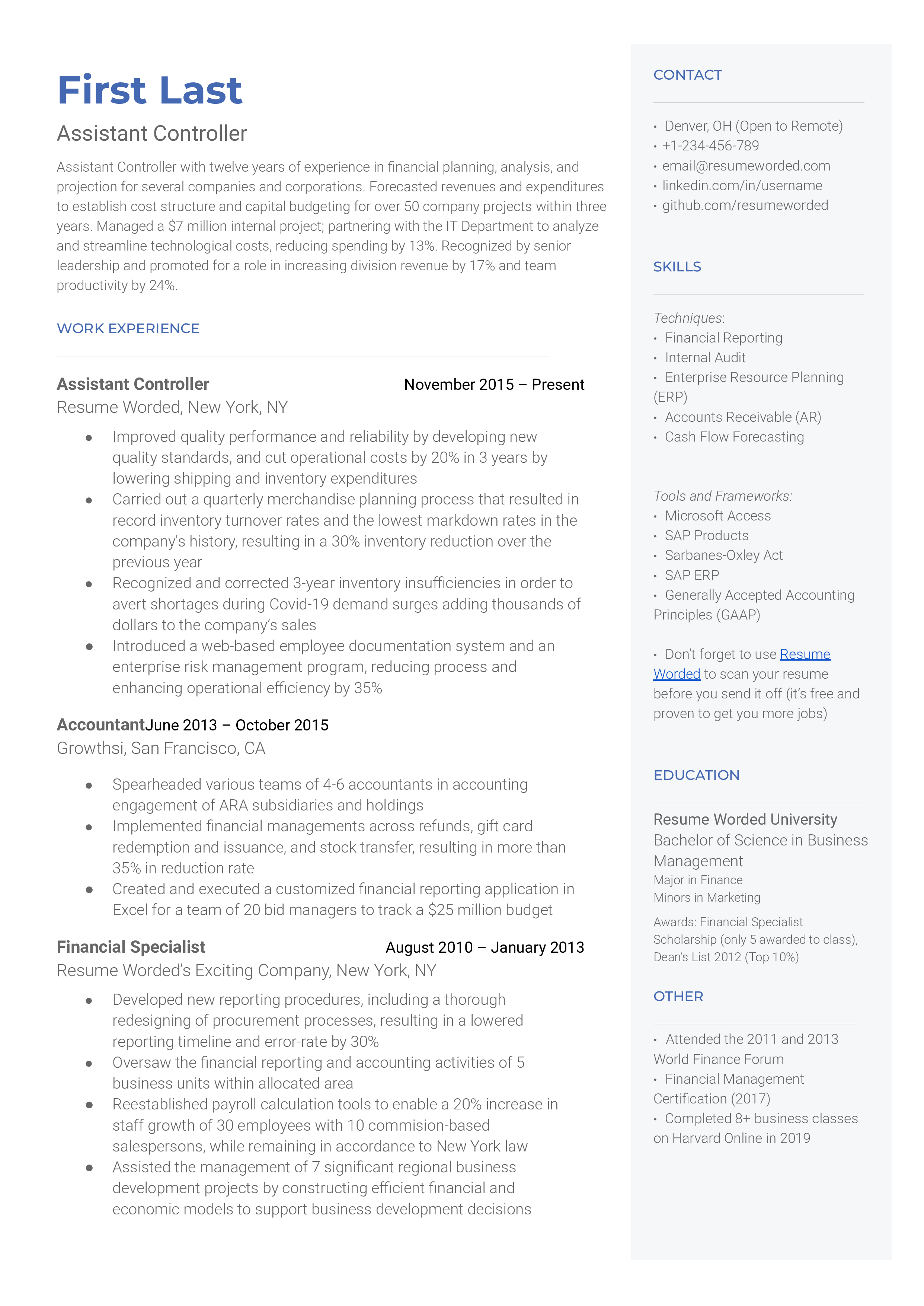

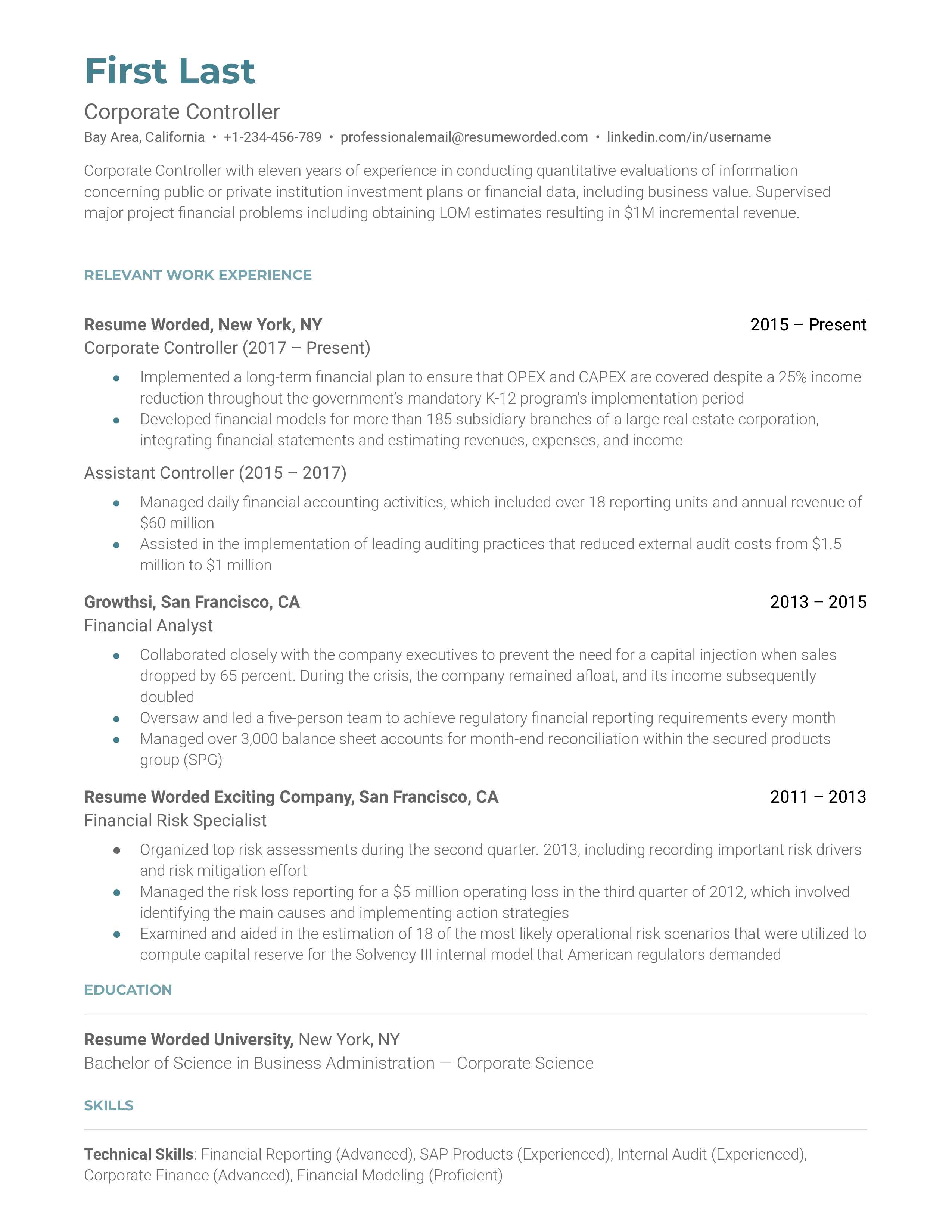

Financial Controller Resumes

Financial controllers are sometimes called company historians and are responsible for a company’s financial functions and records. This is a high-ranking position and requires high qualifications, extensive experience, and a high level of trust. This guide will specify the requirements and expectations for specific financial controller positions and give you some tips and resume samples to help you create a stellar financial controller resume.

Business Controller

Assistant Controller

Corporate Controller

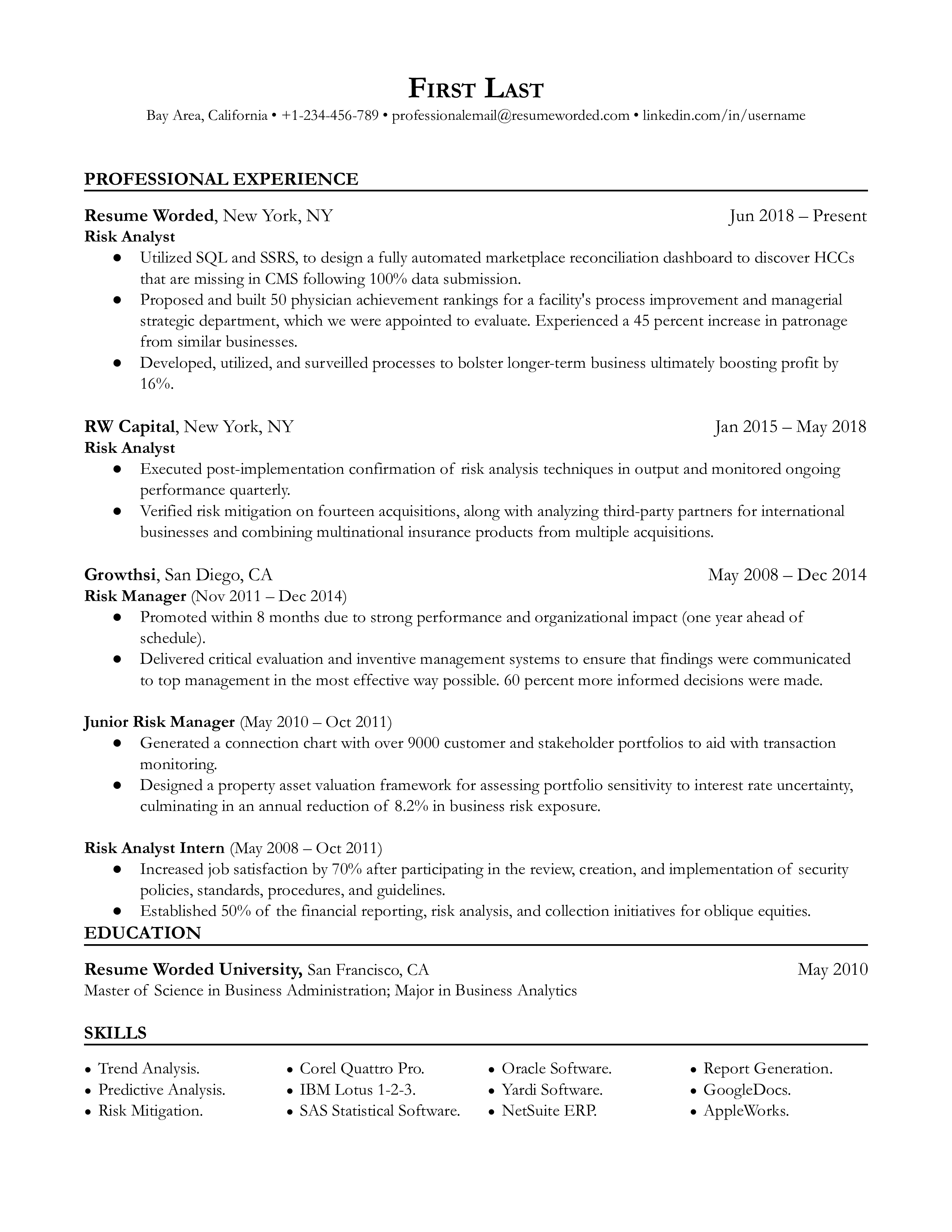

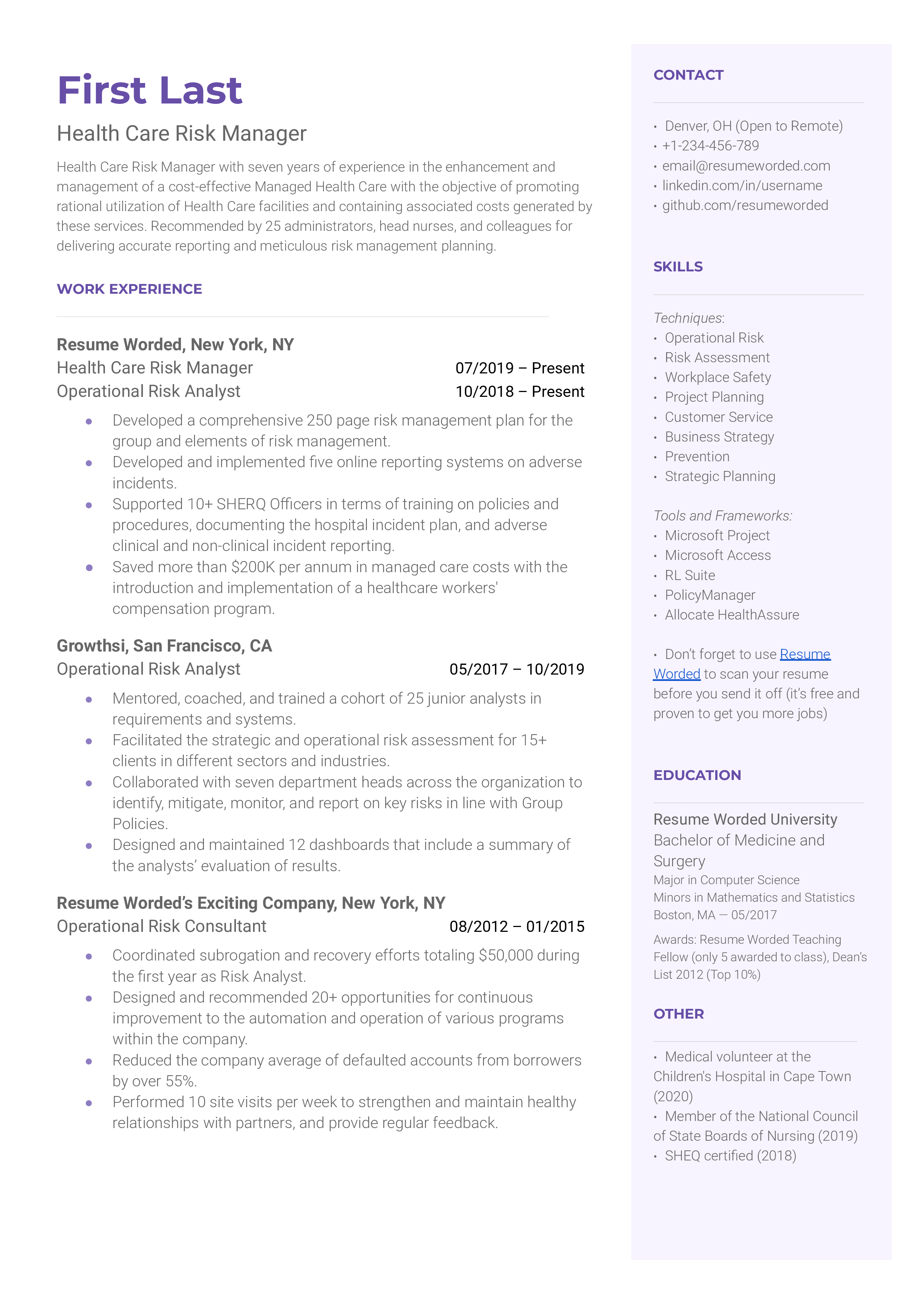

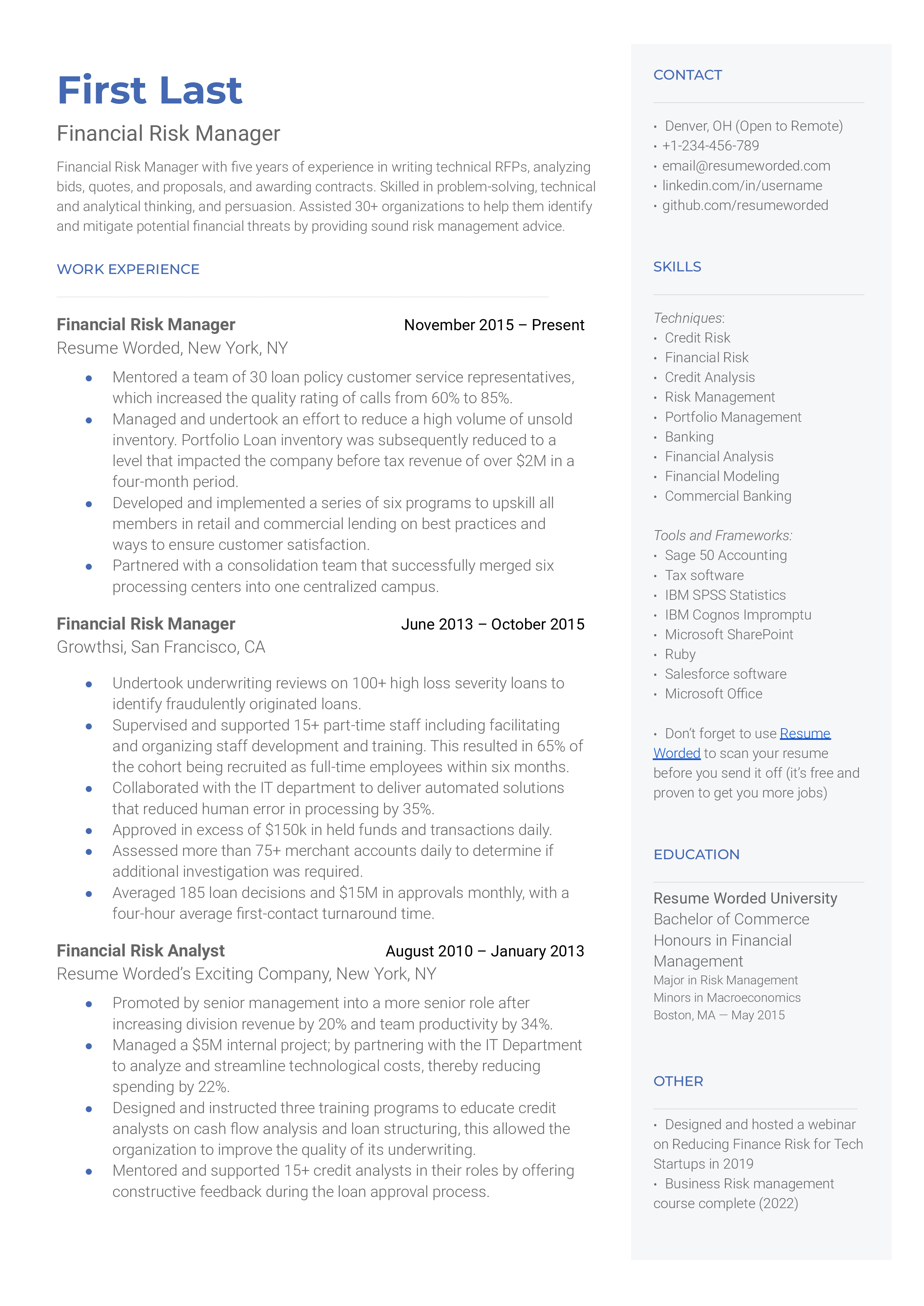

Risk Management Resumes

Risk managers are the bodyguards of a company. It is their job to investigate, identify and analyze potential risks to a company and offer solutions to safeguard against any negative outcomes. Like bodyguards, they must be perceptive, resourceful, and trustworthy. In this guide, we will show you 4 resume samples for 4 risk management positions, and give you some tips to help you create an effective resume of your own.

Risk Analyst

Health Care Risk Manager

Financial Risk Manager

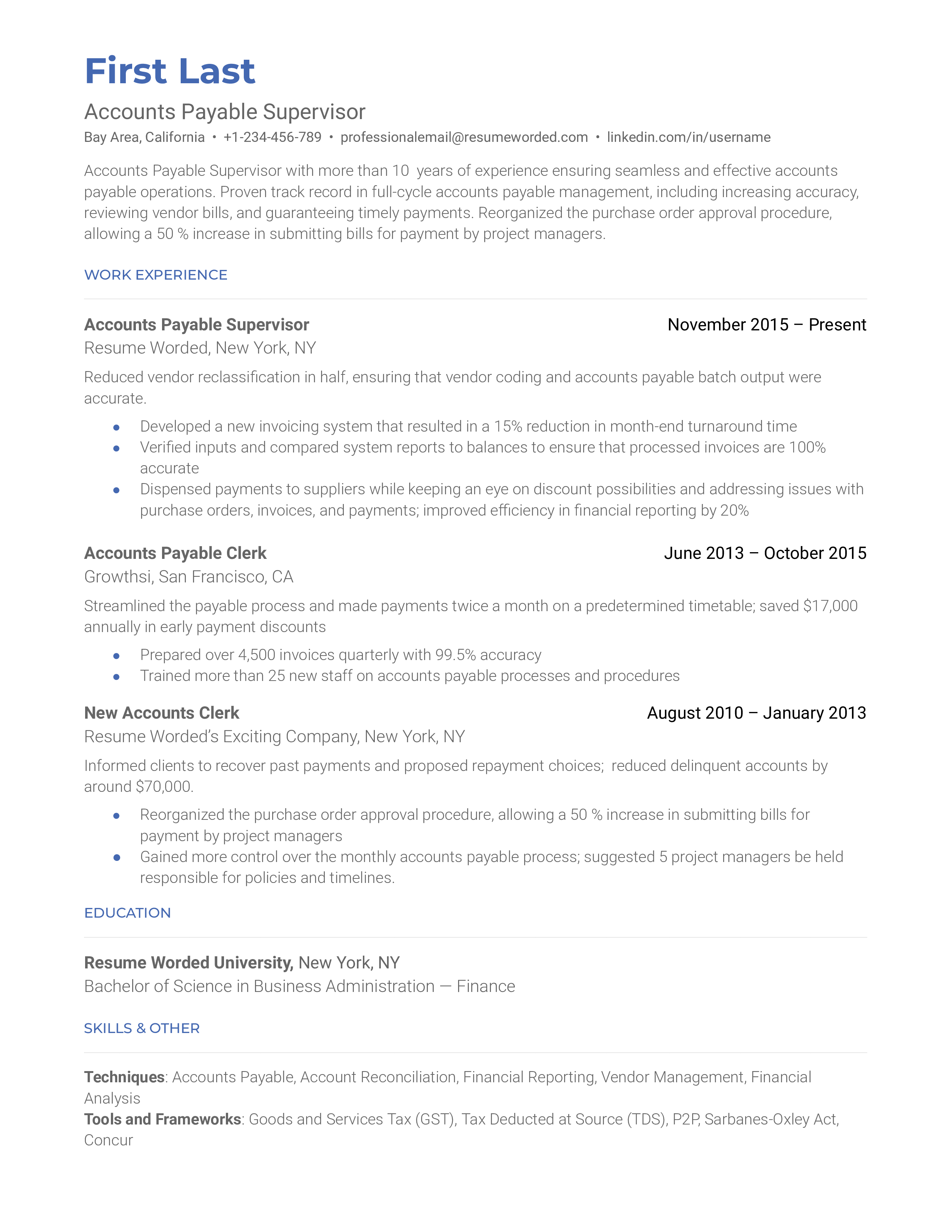

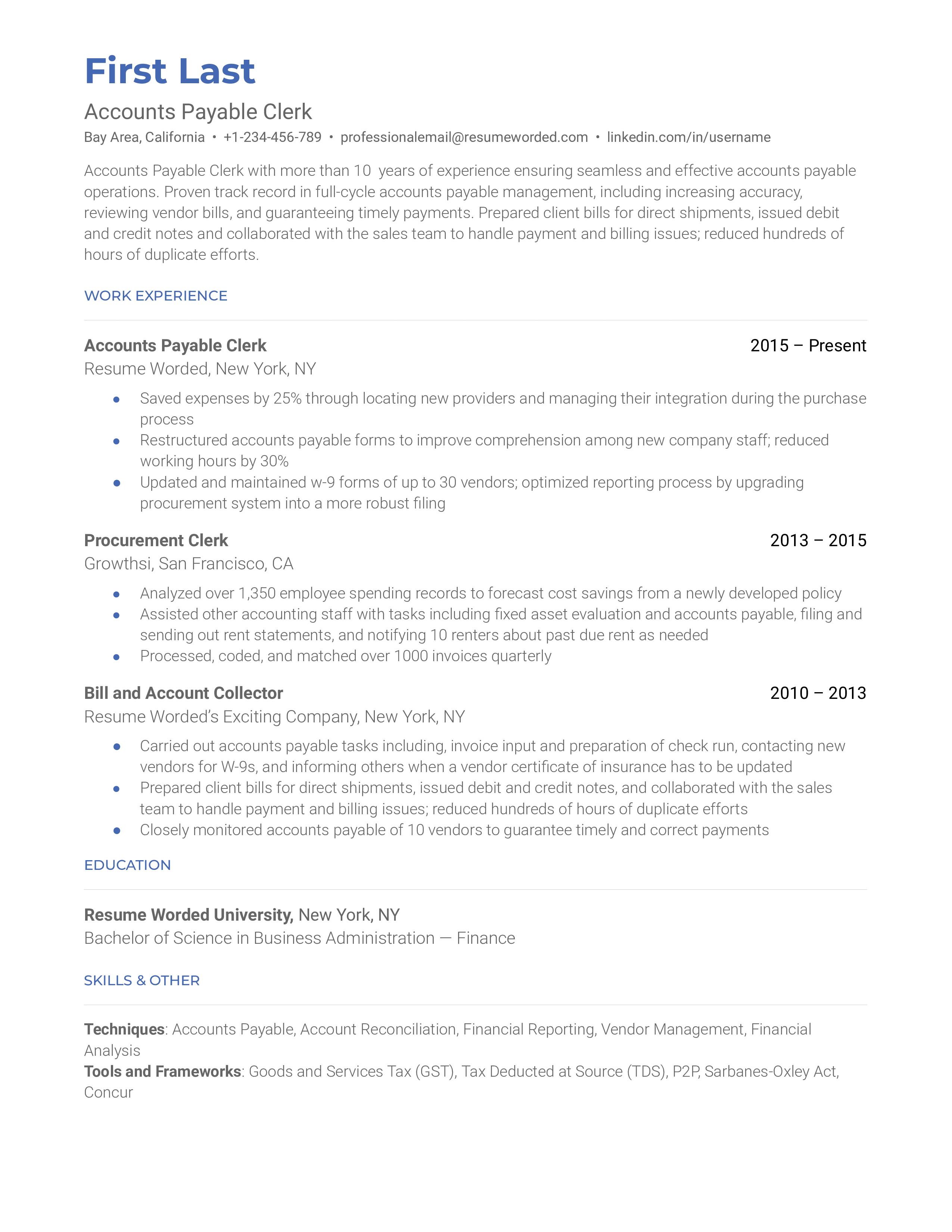

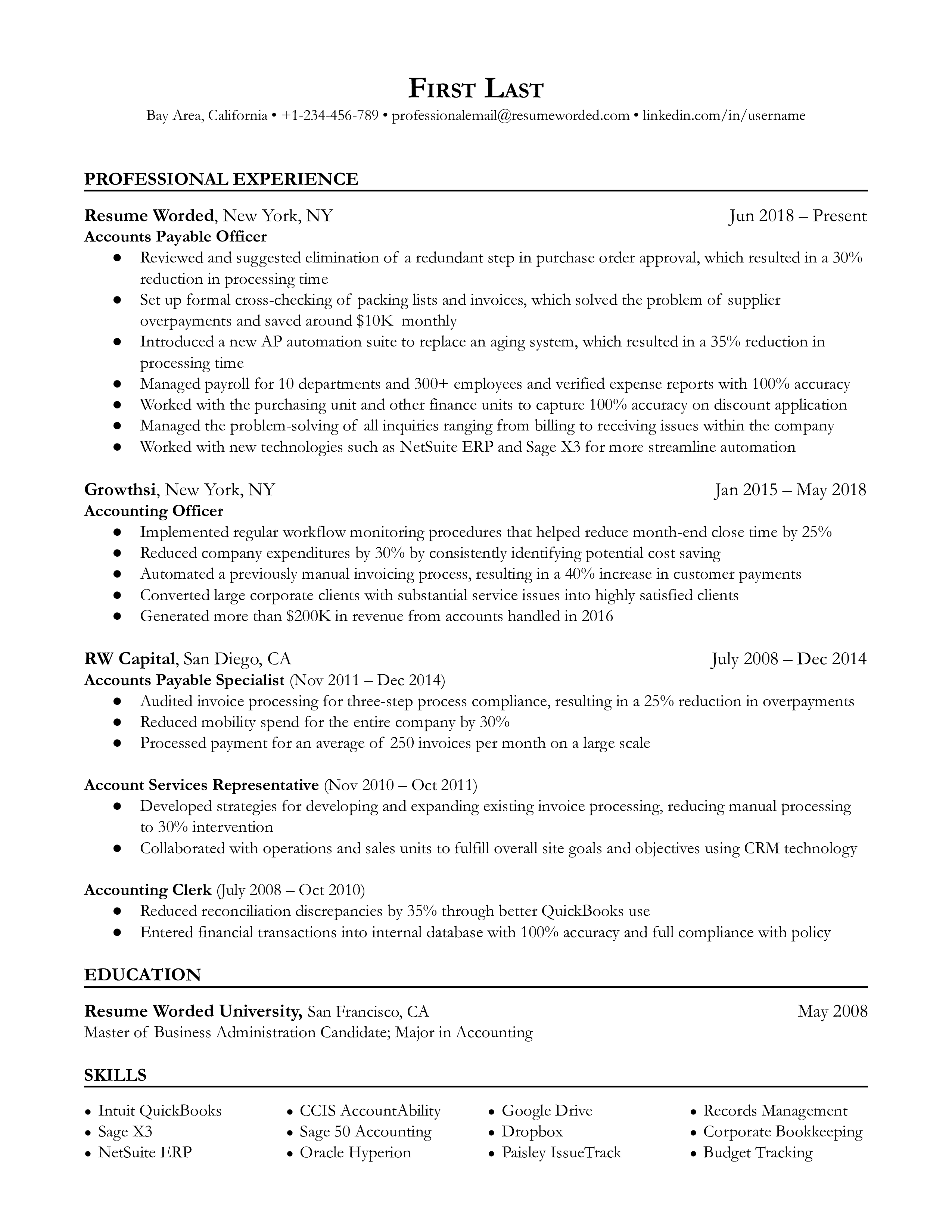

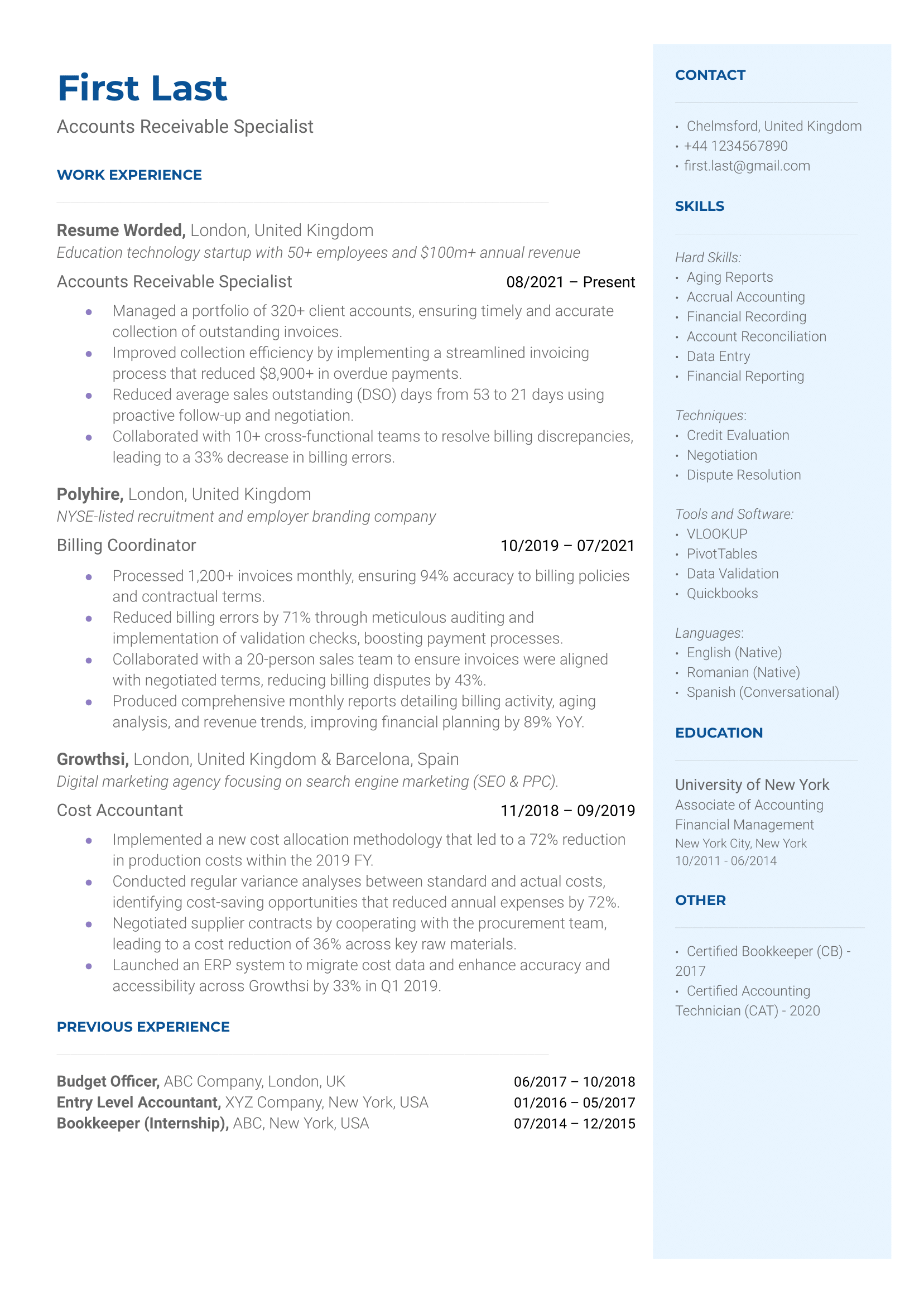

Accounts Payable Resumes

Every business has monetary transactions. They may better understand their development and improve their operations by keeping track of these transactions. To do so, they need an account-payable team! Within this guide, we created downloadable resume templates to show what a successful accounts payable resume can look like. Our tips add a professional touch to resumes, so ensure to use them!

Accounts Payable Supervisor

Accounts Payable Clerk

Accounts Payable Officer

Accounts Receivable

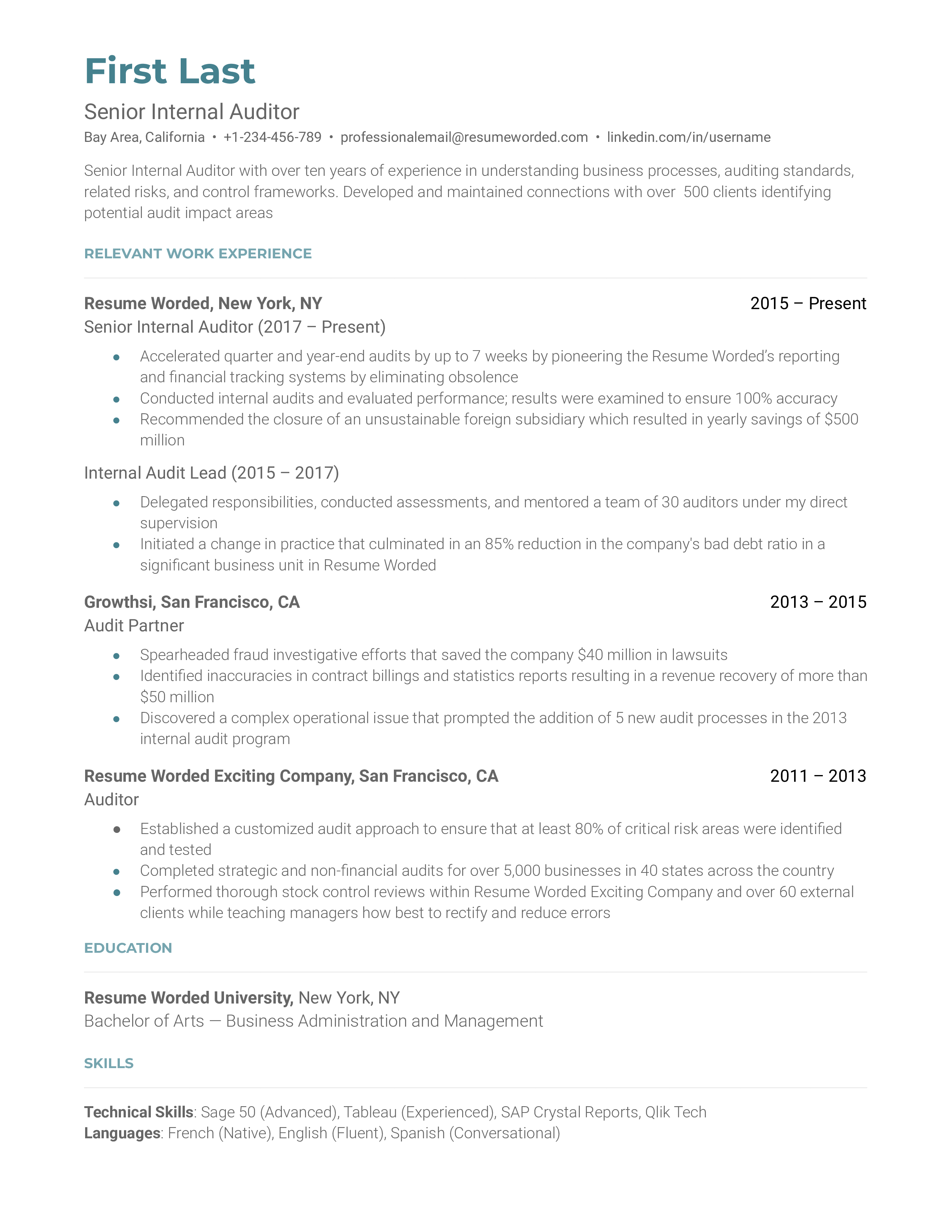

Internal Audit Resumes

Internal auditors enhance the company’s productivity by restructuring operations. Yet, one of their most important roles is to make sure the company follows legal compliance. Most organizations are visited by an external auditor once in a while. If they identify issues in the internal controls, the company may face serious legal issues. That’s why the internal auditor’s responsibility is to prevent problems in the internal controls. The demand for auditors is expected to increase by up to seven percent. That’s why building a persuasive and efficient internal audit resume is crucial. This guide will help you do just that. We’ll share some resume examples and give you tips to help you develop your internal audit resume.

Senior Internal Auditor

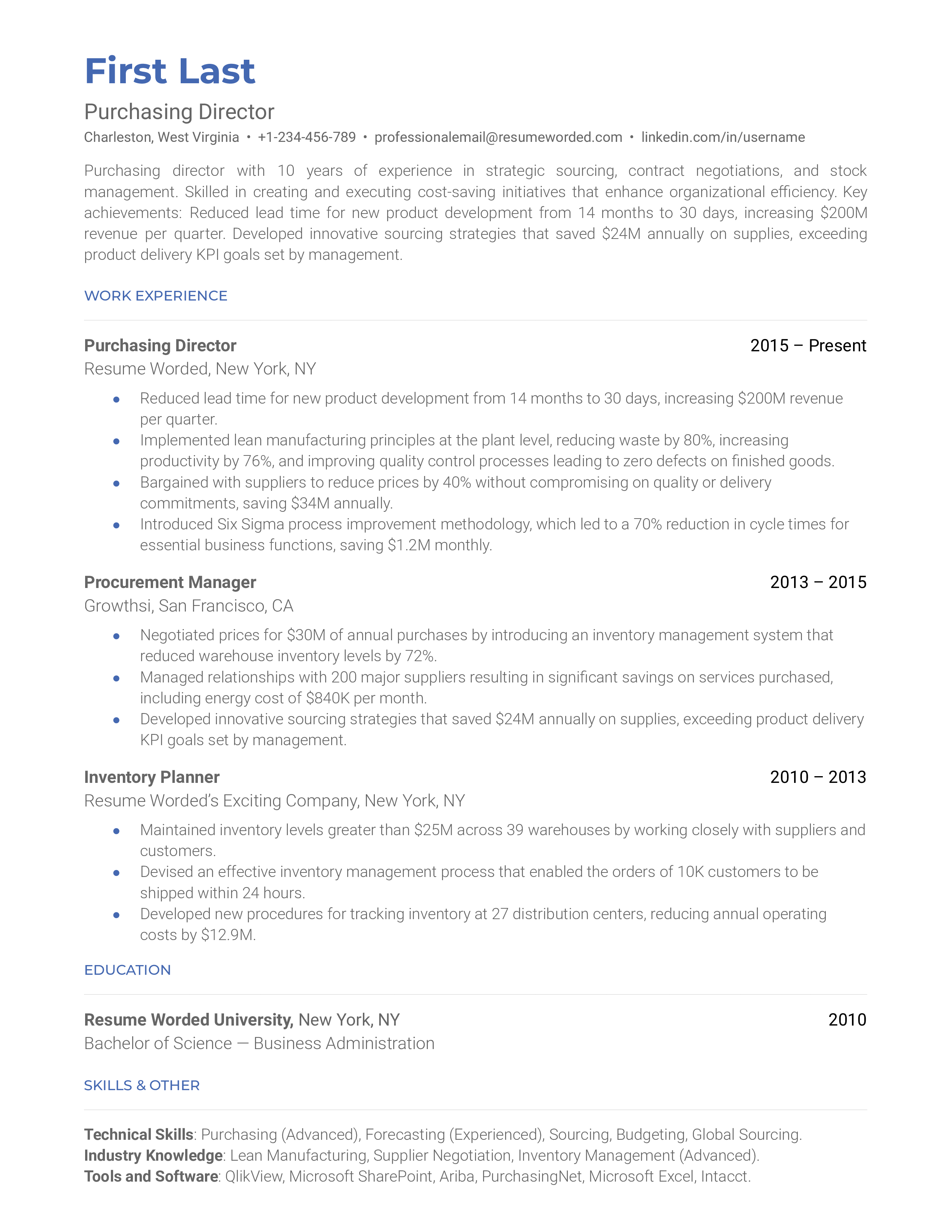

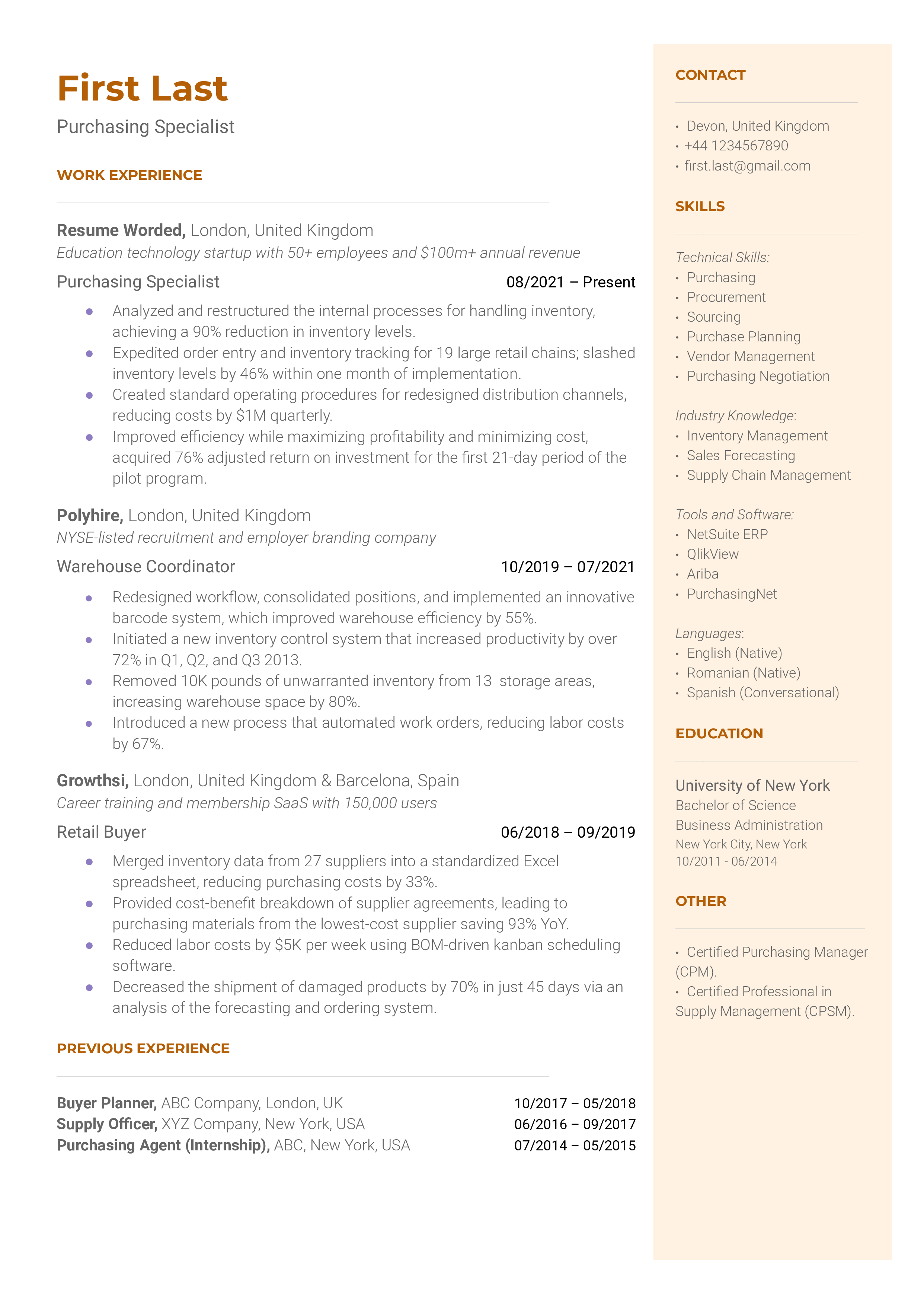

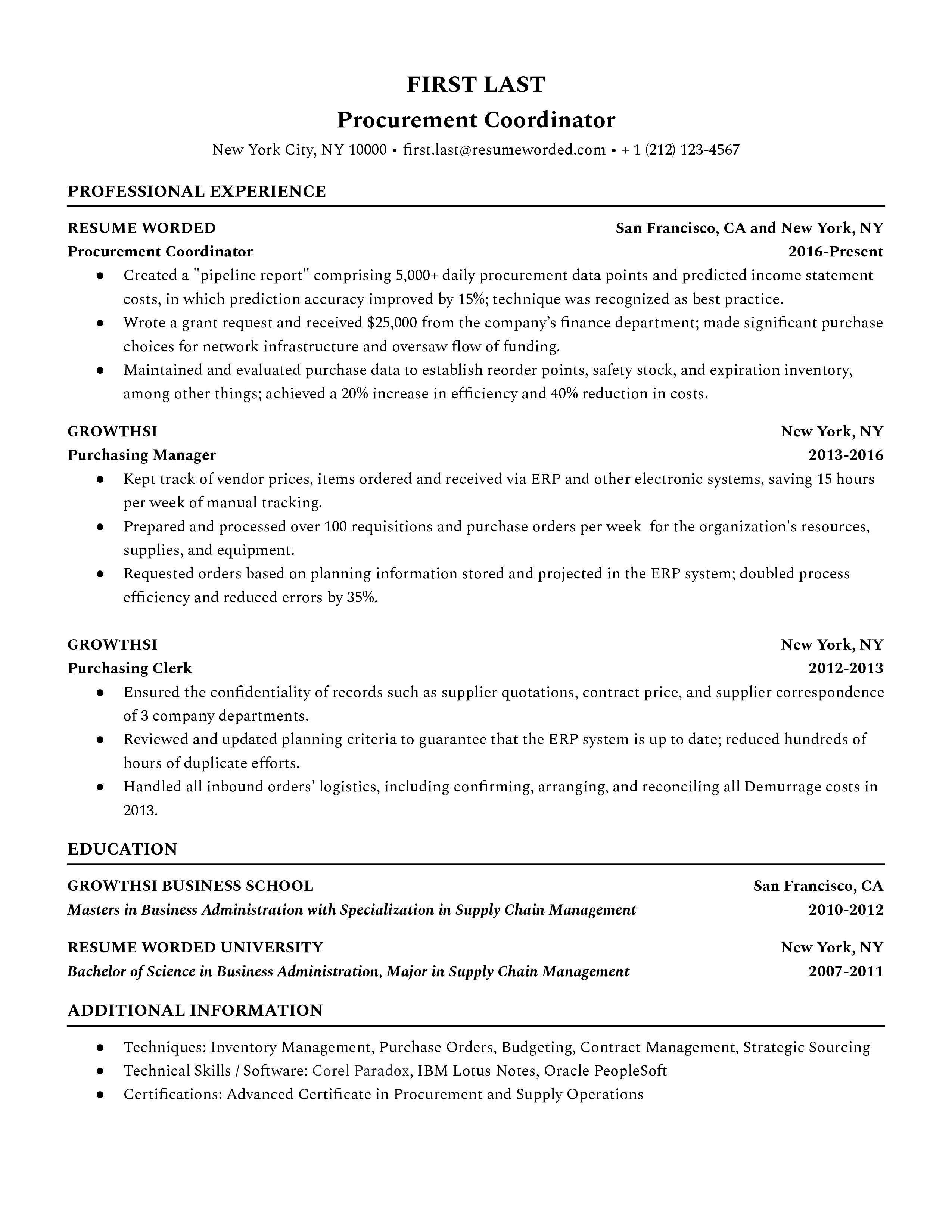

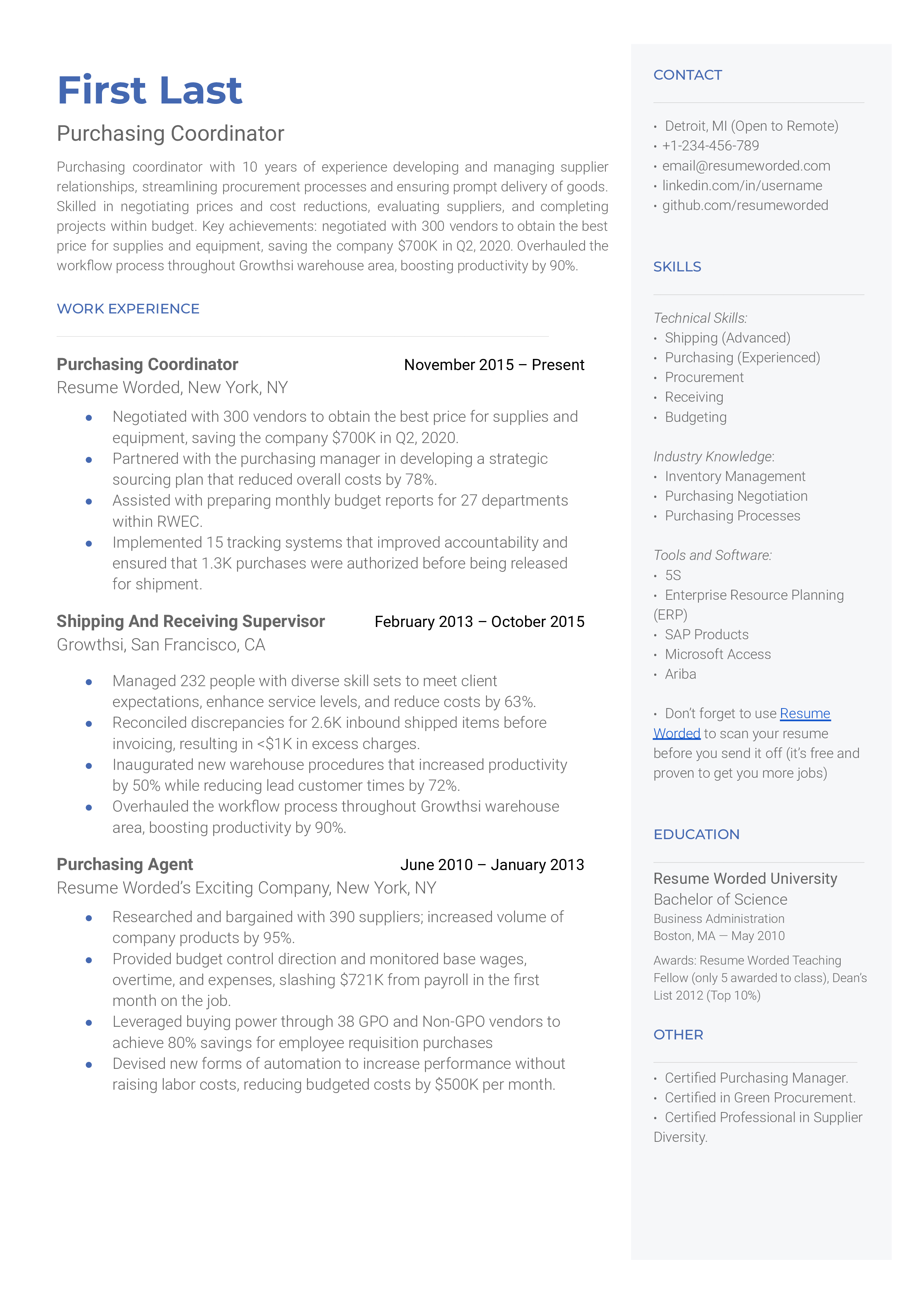

Purchasing Manager Resumes

Purchasing managers are the head of the purchasing team. They buy goods and materials that the company needs for reselling or developing new products. This is a senior-level job that requires a combination of education and industry experience. They must guide purchasing agents in the process of negotiating with suppliers. According to the Bureau of Labor Statistics, there are over 45,800 purchasing manager job openings every year. If you are interested in getting this role and you have the experience required, we’ve got you covered. This guide will help you create your own purchasing manager resume.

Purchasing Director

Purchasing Specialist

Strategic Sourcing Director

Procurement Coordinator

Purchasing Coordinator

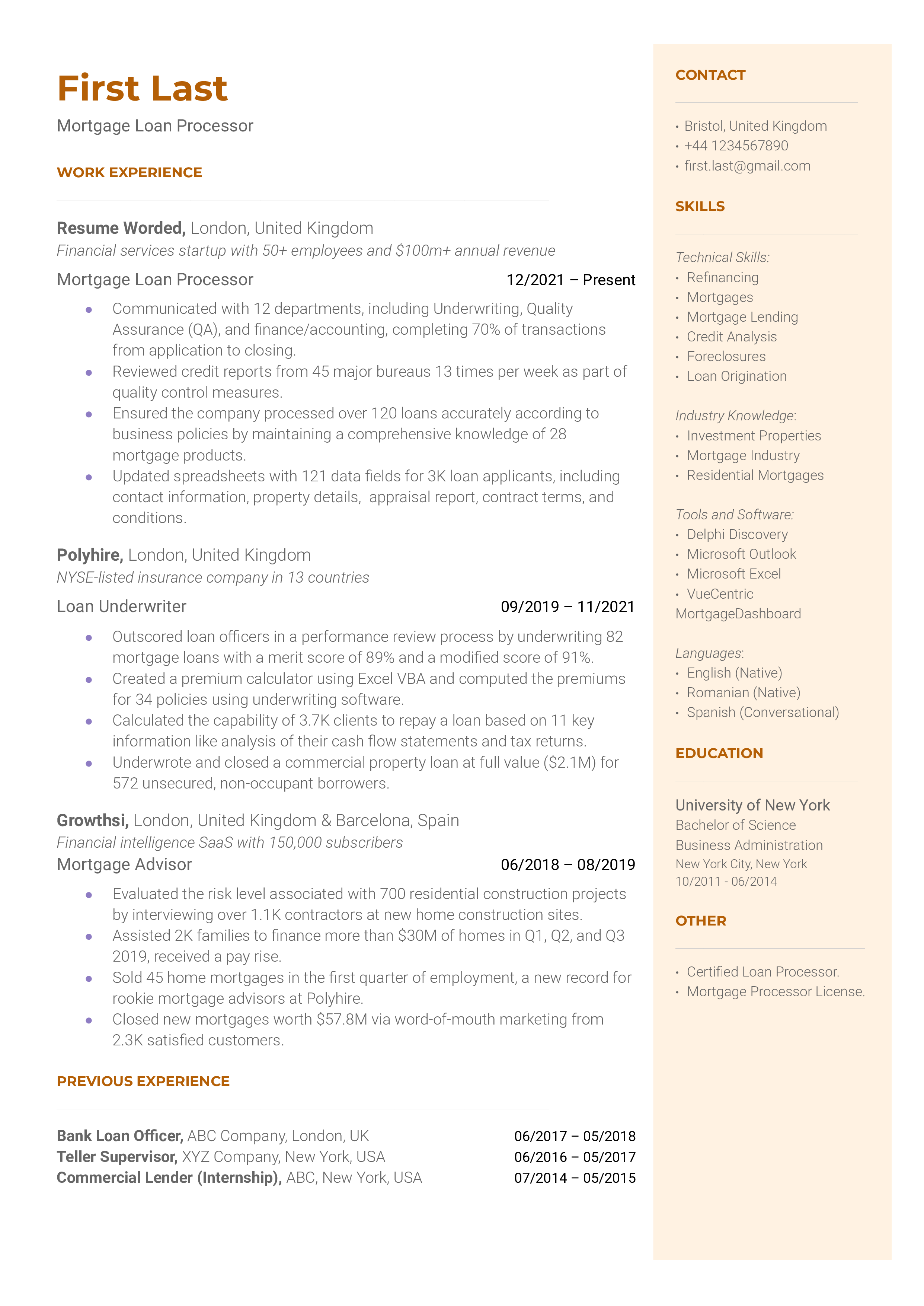

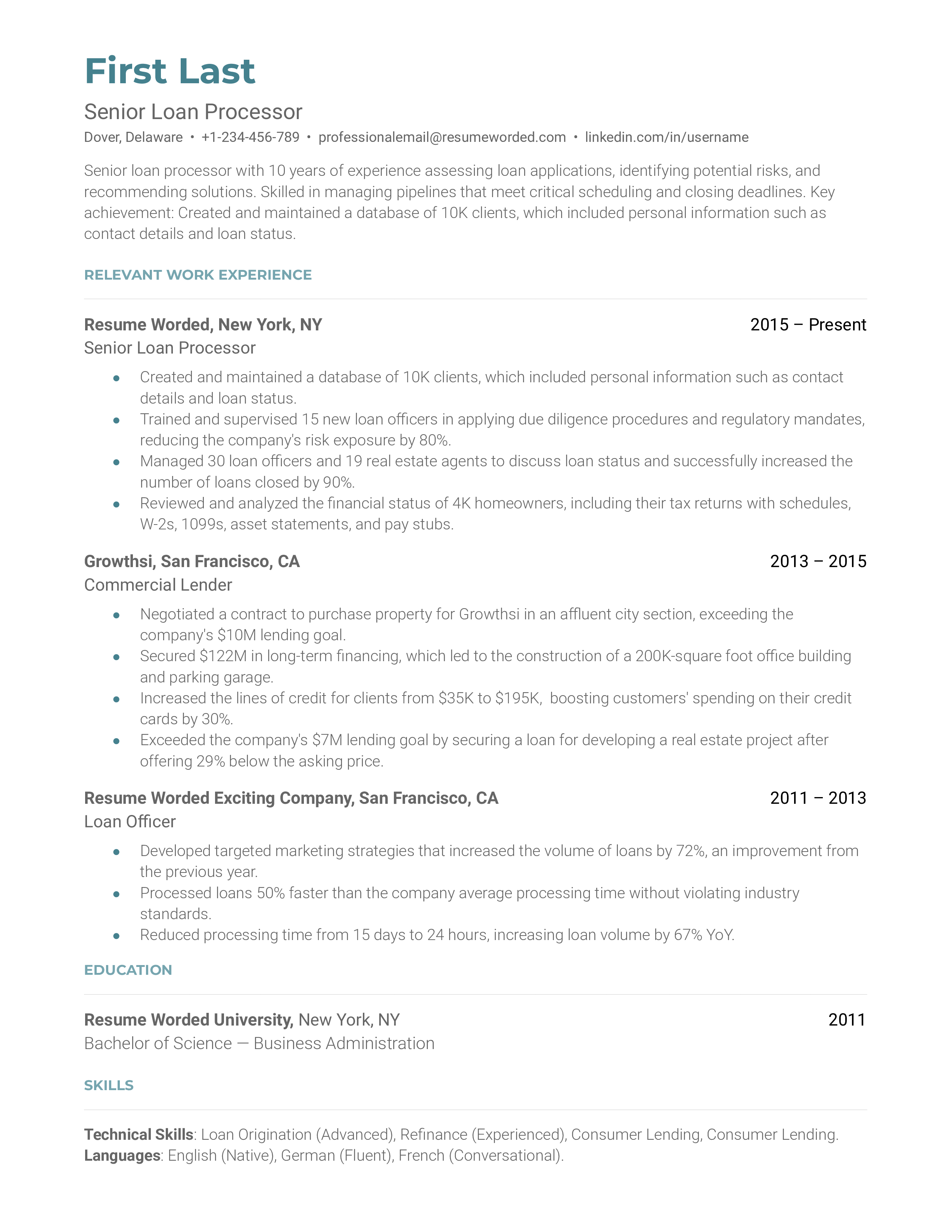

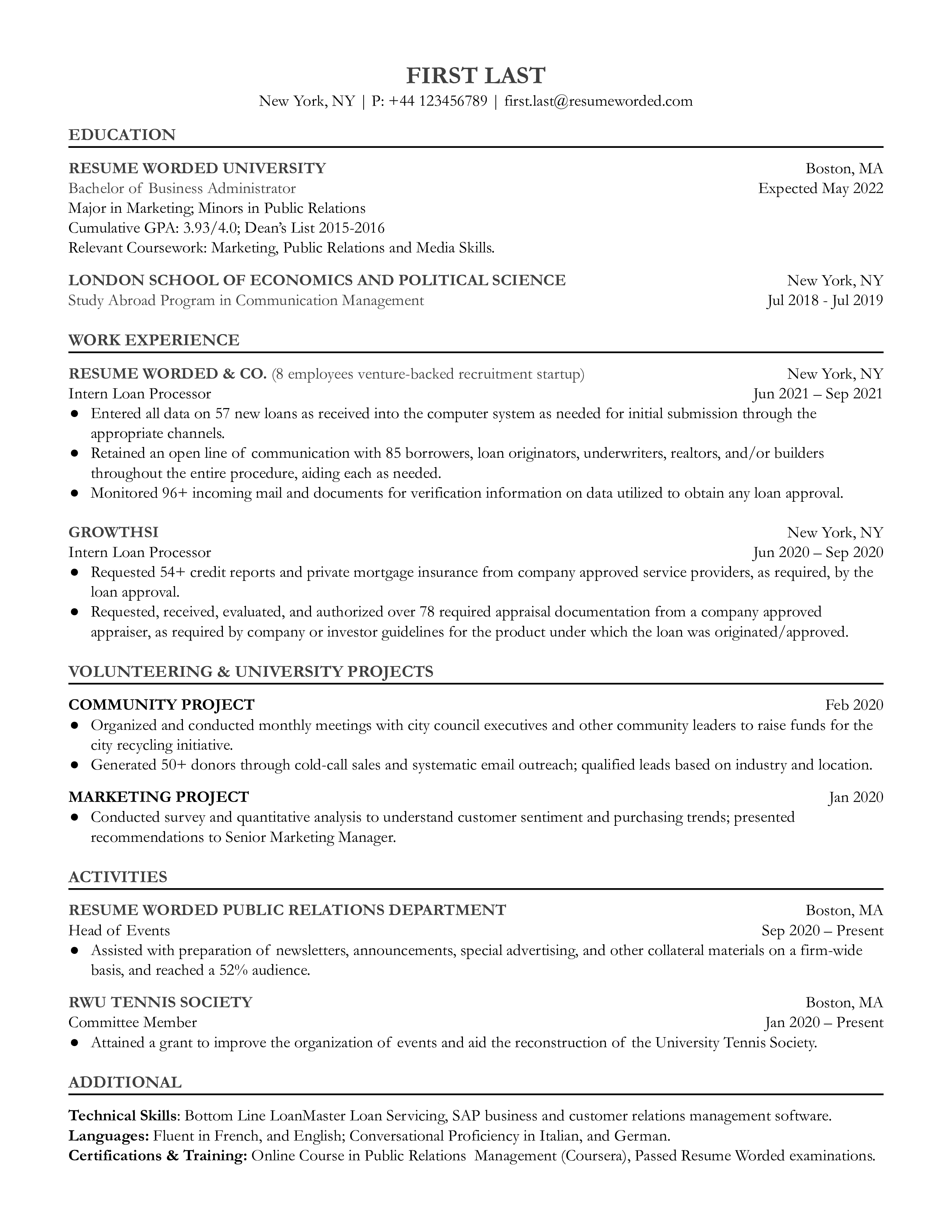

Loan Processor Resumes

Loans are an important financial tool that most adults will use in their lifetimes. Loan processors are a vital part of the loan approval process. This guide will identify 4 loan processor positions, provide resume templates for each, and give tips on upgrading your resume and getting that dream loan processor job.

Mortgage Loan Processor

Senior Loan Processor

Entry-Level Loan Processor

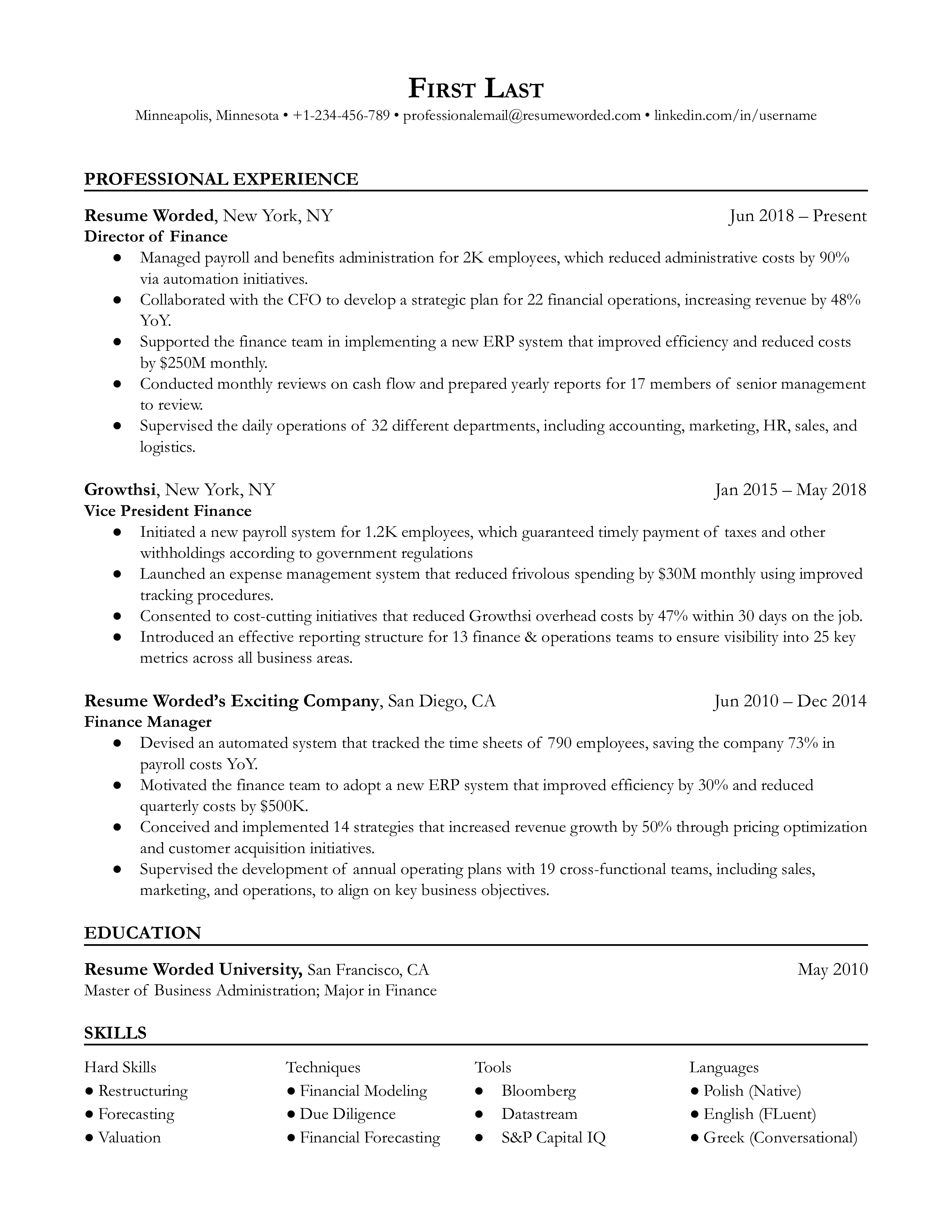

Finance Director Resumes

A company’s financial health is the most important thing for its survival. It is the finance director's job to know the financial health of a company at all times and to create policies and strategies to keep it healthy and thriving. This guide will help you formulate your winning finance director resume to secure your dream job.

Director of Finance

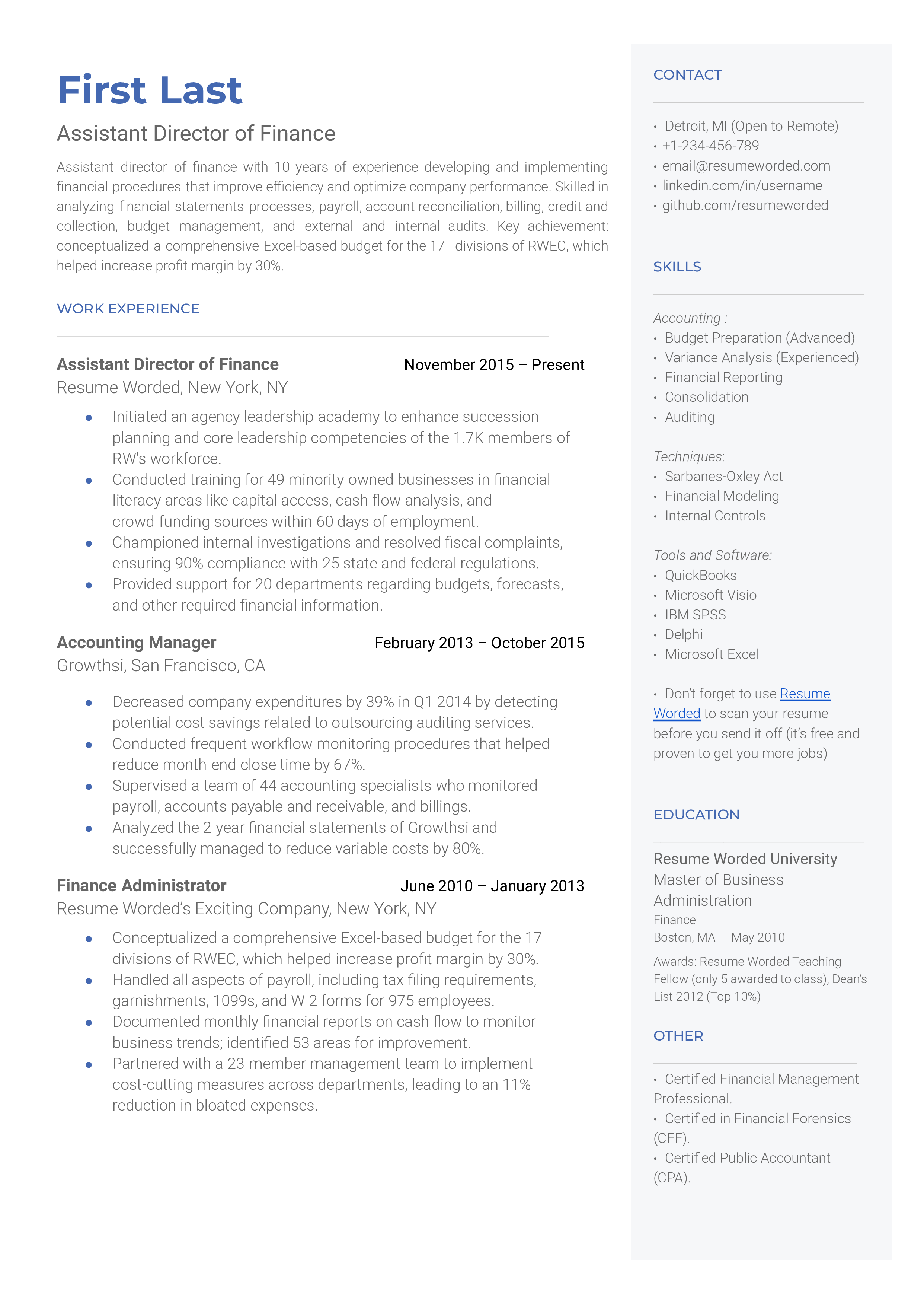

Assistant Director of Finance

Credit Analyst Resumes

A credit analyst works in banks to determine lenders’ reliability, reduce risks, and increase revenue for the organization. This is an excellent career if you are passionate about finances, statistics, and economics. Credit analysis is also a highly in-demand profession these days. According to the Bureau of Labor Statistics (BLS), financial analysts’ demand is expected to increase by up to nine percent, which is higher than most occupations’ job outlook. If you have a background in finances and the required skills to break into credit analysis, this guide is for you. We’ll help you create an industry-relevant resume for your credit analyst career. We’ll share insightful tips and three resume templates

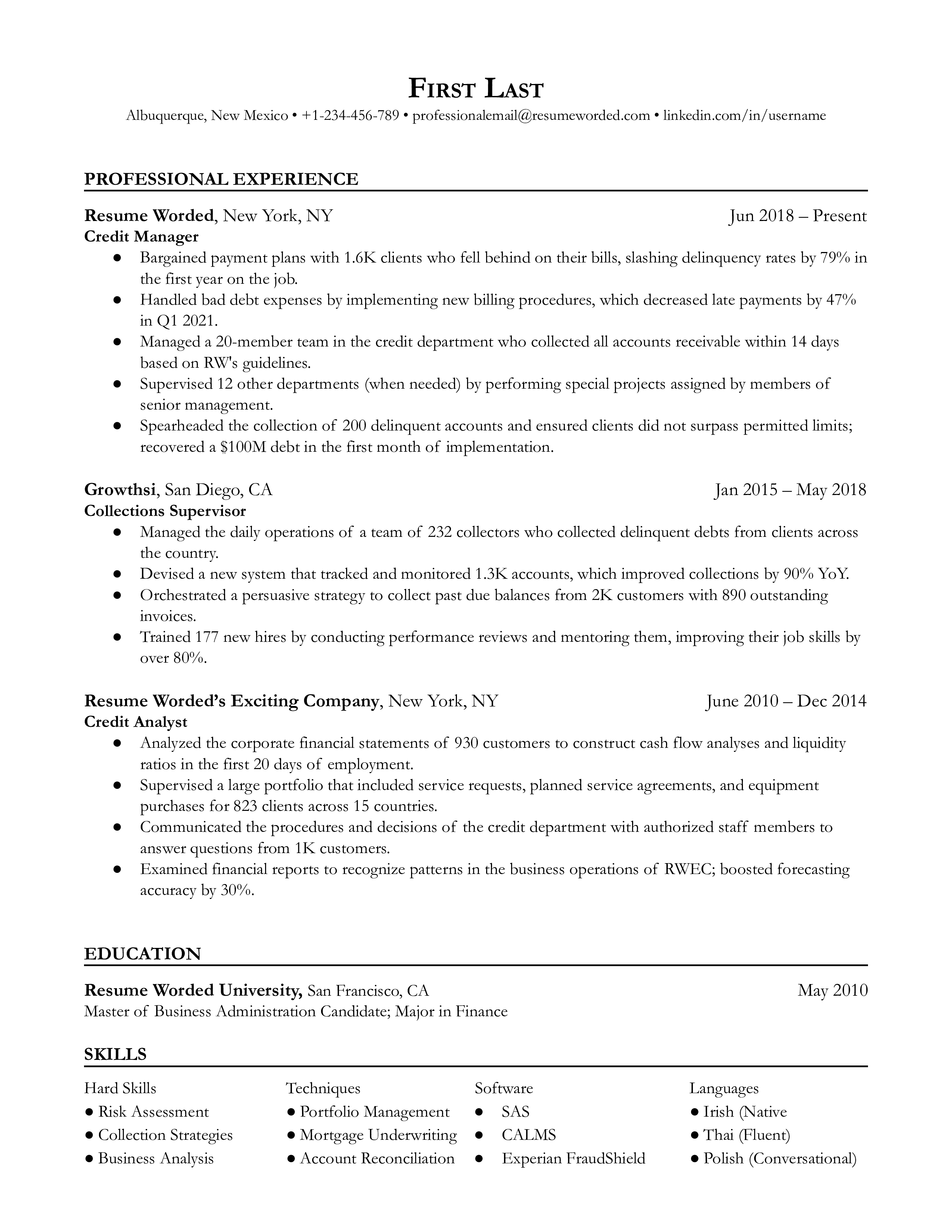

Credit Manager

Commercial Credit Analyst

Collections Specialist Resumes

Collection specialists may get a bad rap, but they play an important role in assisting companies to recover money owed to them. This guide will show you how to create a winning collection specialist resume.

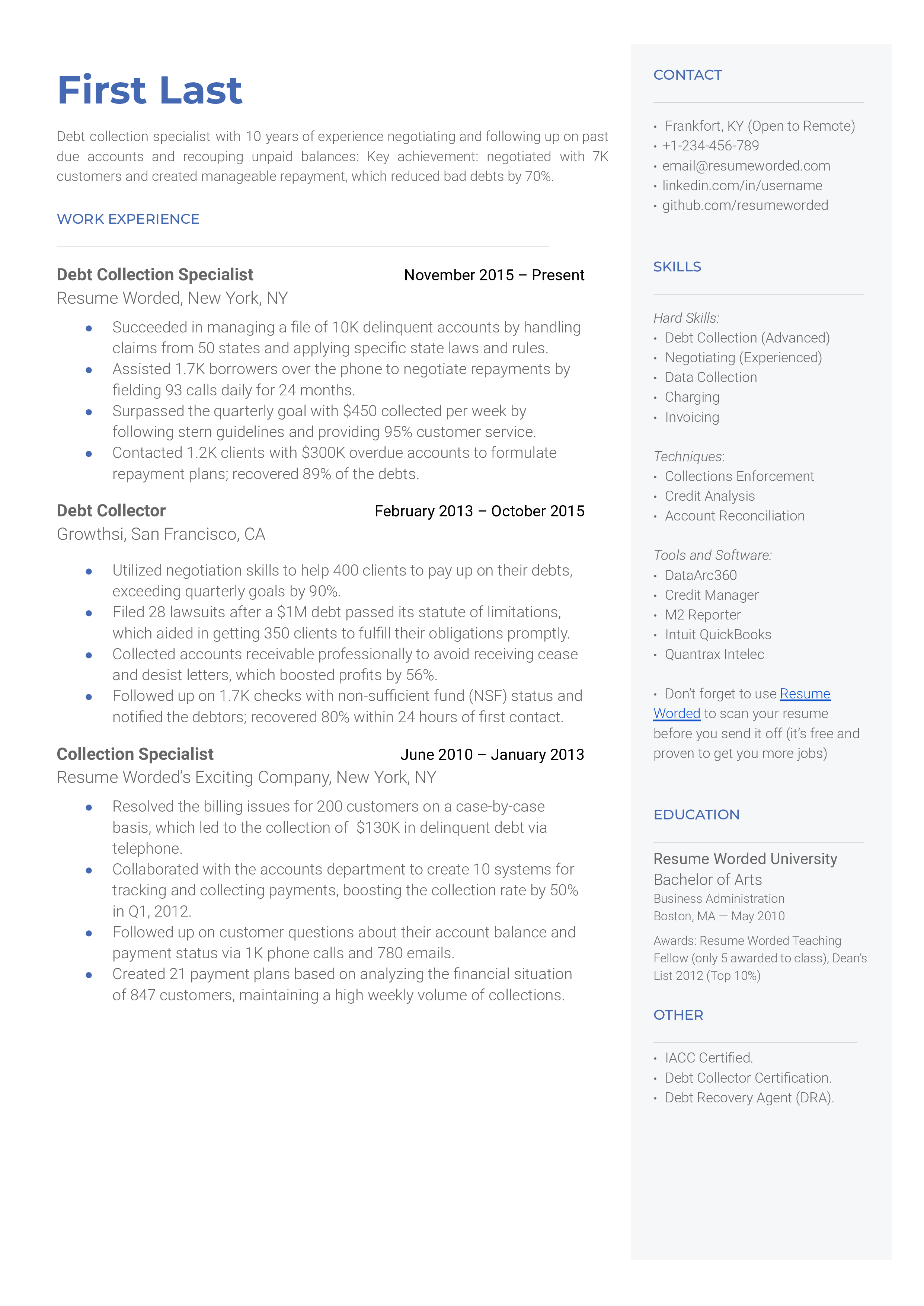

Debt Collection Specialist

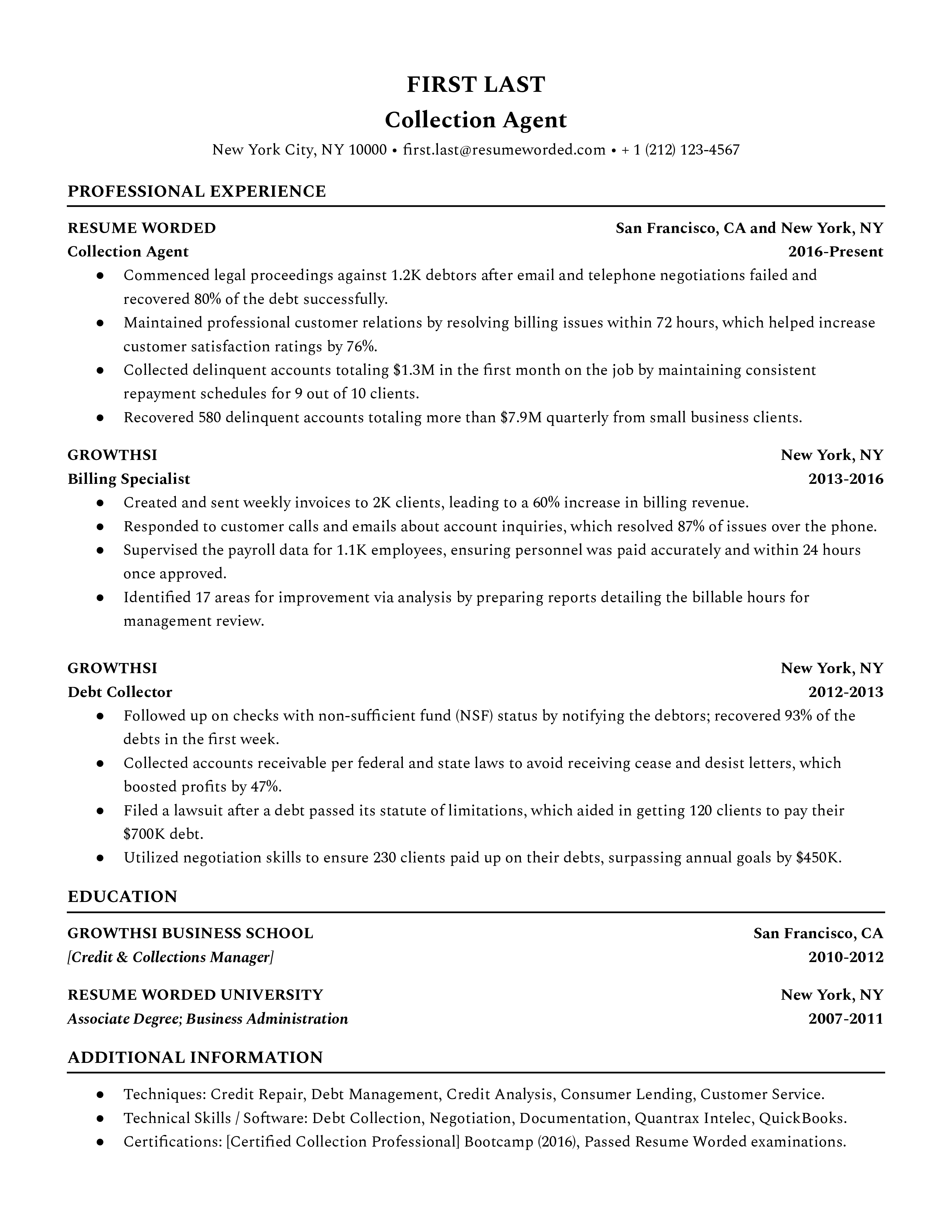

Collection Agent

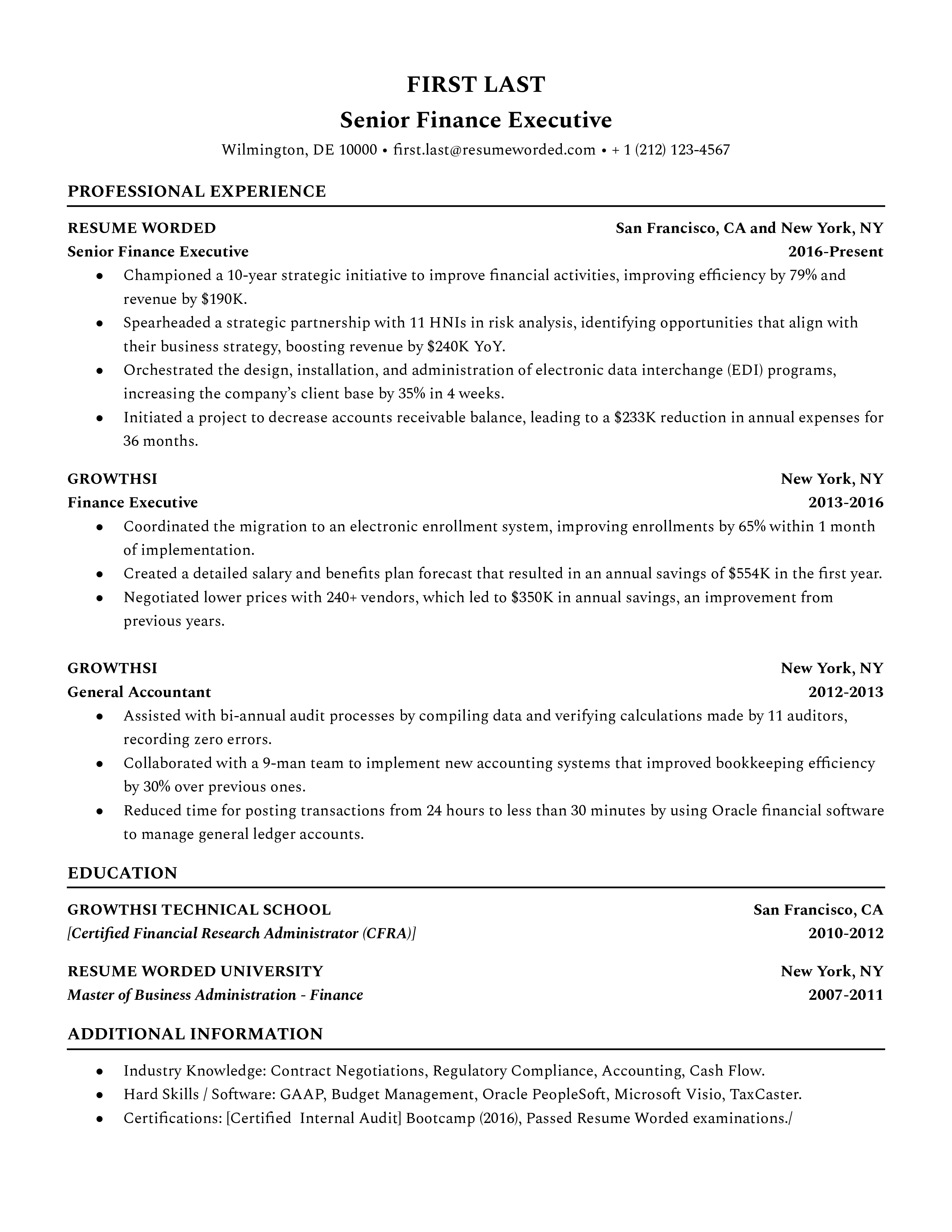

Finance Executive Resumes

Finance executives are at the head of the finance department and keep companies functioning. This resume guide has been developed to help you craft a winning finance executive resume that will get you to the top of the pile with recruiters.

Senior Finance Executive

Junior Finance Executive

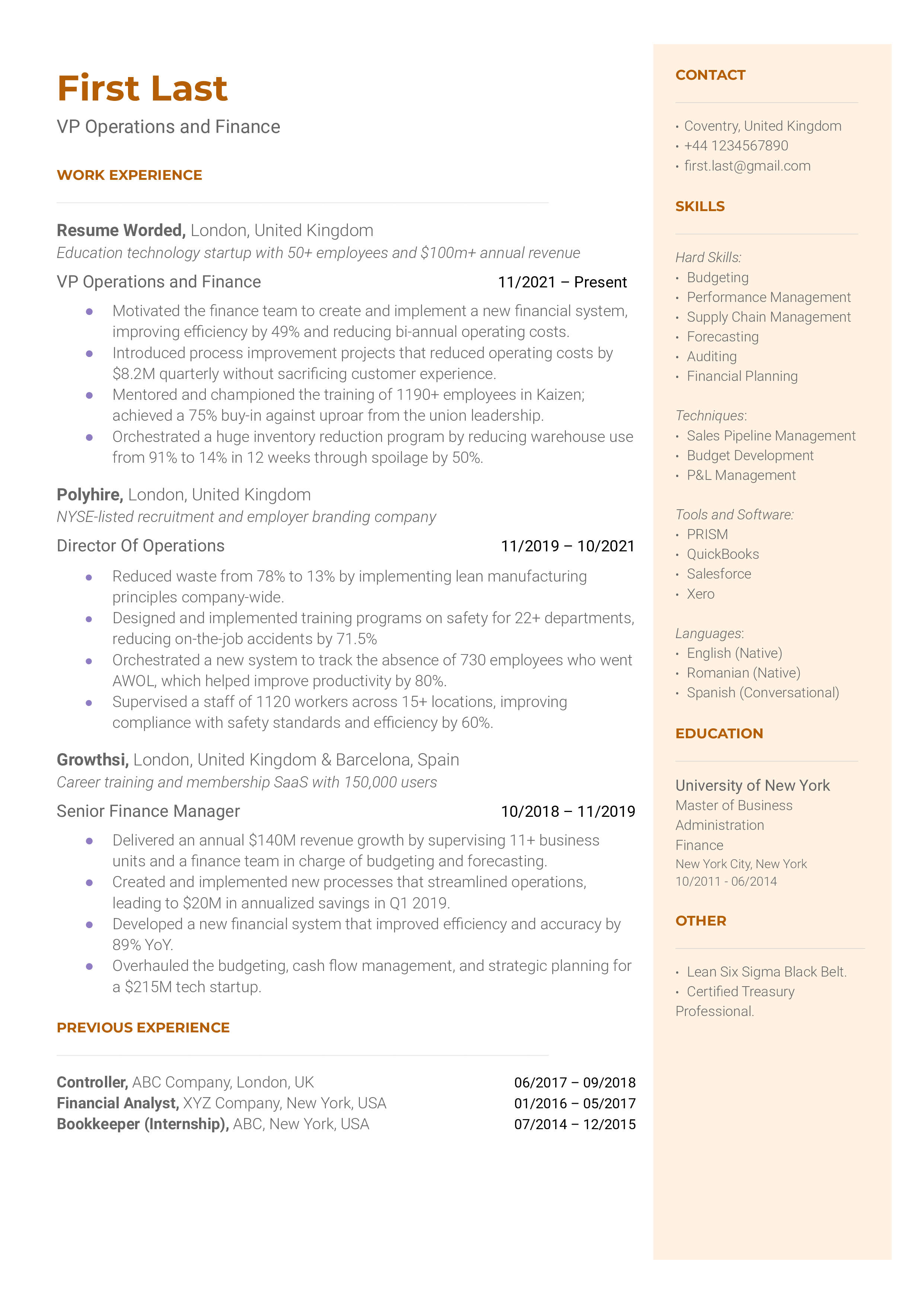

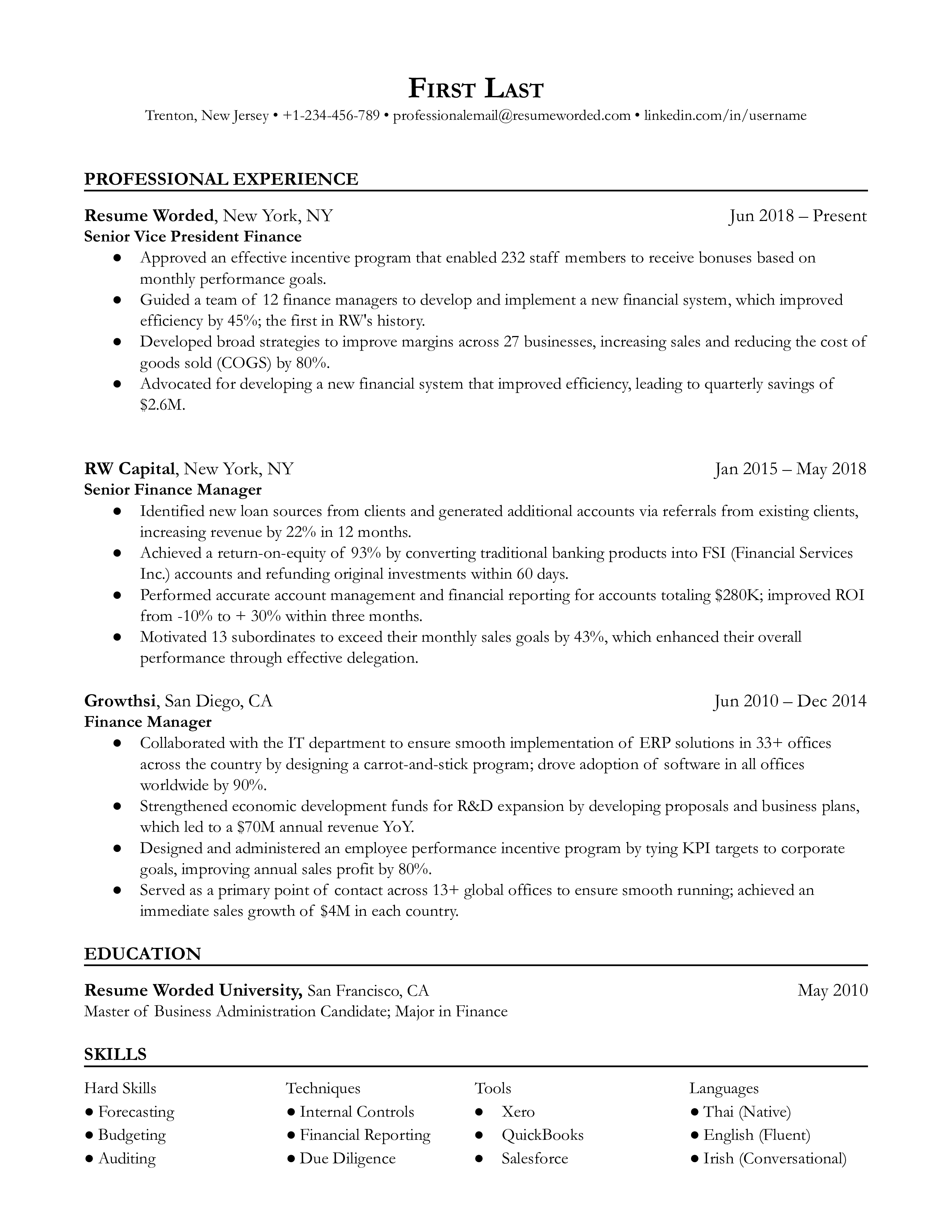

VP of Finance Resumes

With the world and economy recovering from Covid and bracing for a period of recession, a good vice president of finance who can work to maintain a company’s financial health is what all companies want. This resume guide which has been curated by top recruiters in the finance industry will show you what recruiters look for and give you specific tips to elevate your resume and secure yourself a job.

VP Operations and Finance

Senior Vice President Finance

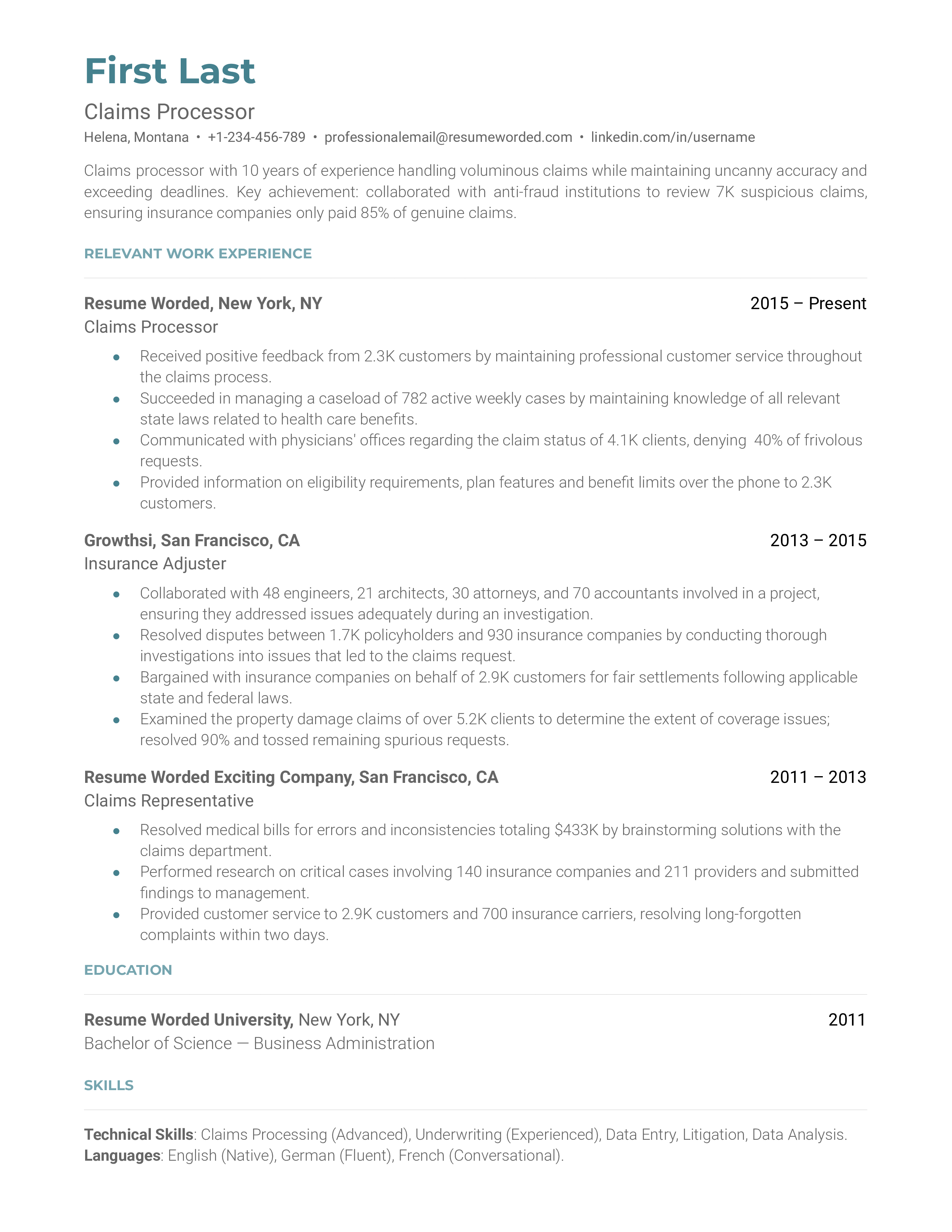

Claims Adjuster Resumes

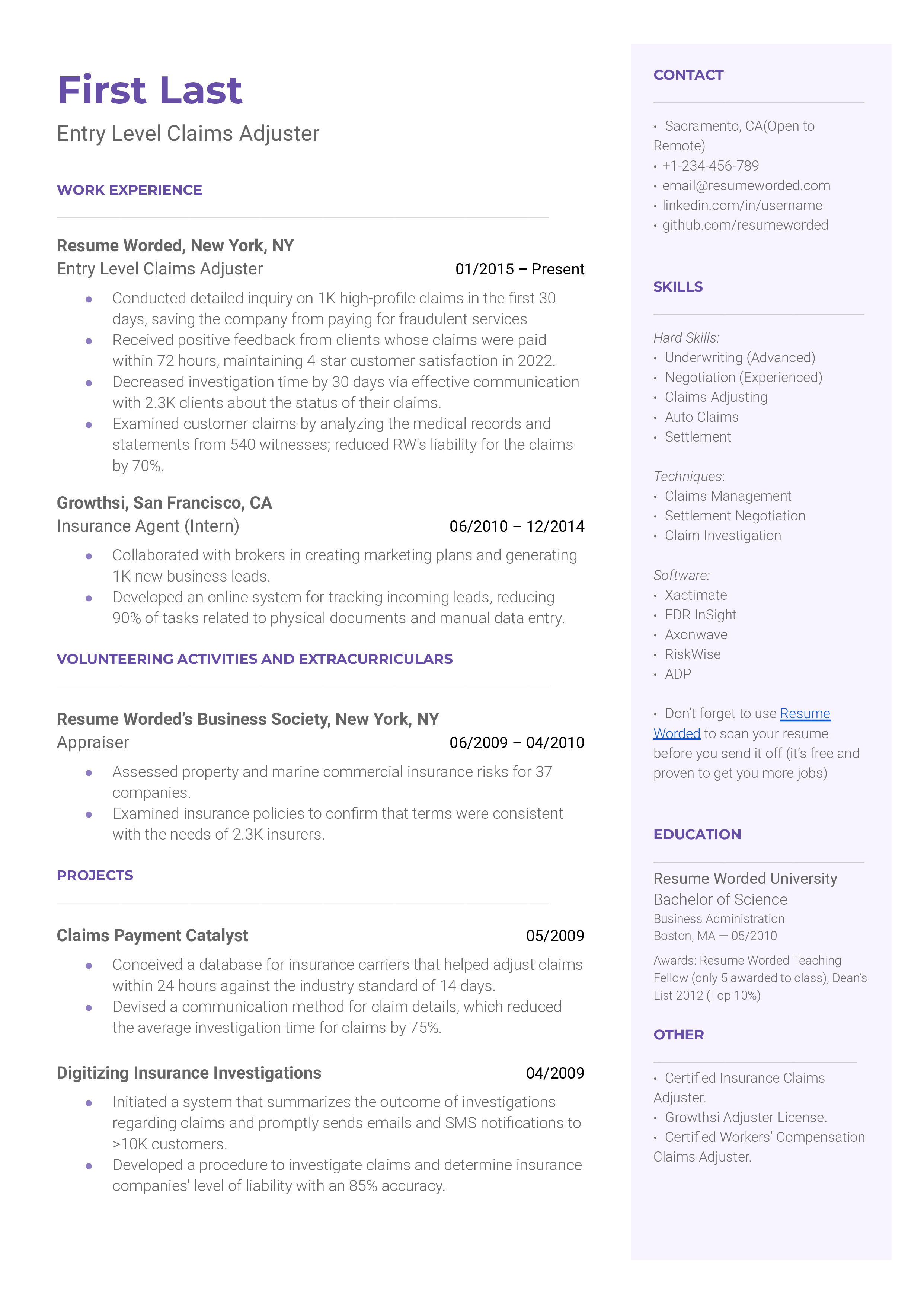

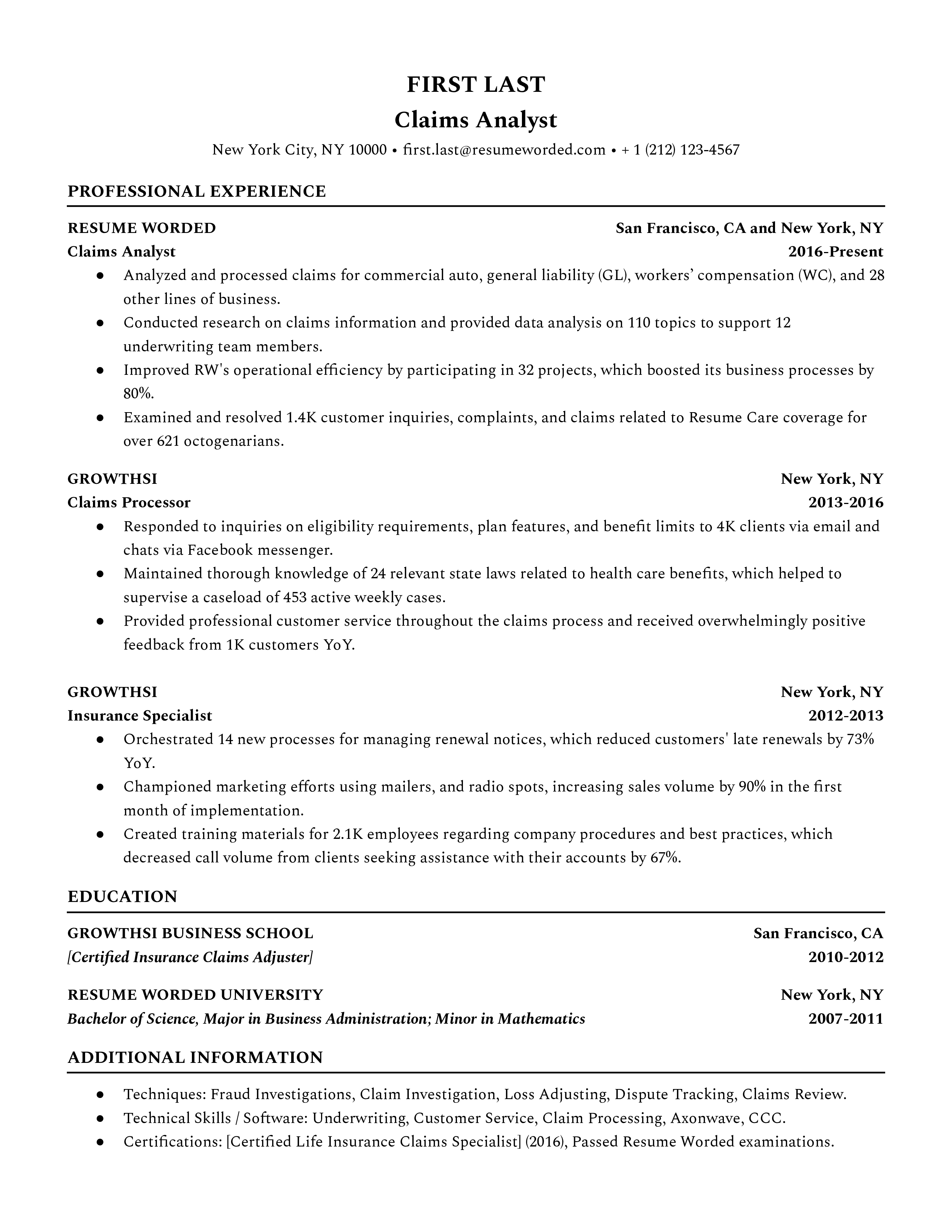

Insurance is big business, and insurance companies go to great lengths to ensure that their insurance policies do not get taken advantage of by opportunists. Claim adjusters are part of the team that investigates claims to make sure insurance companies settle claims that are fair and warranted. This guide will help professionals create a successful resume in this field. Included are resume samples and useful recruiter tips.

Claims Processor

Entry Level Claims Adjuster

Claims Analyst

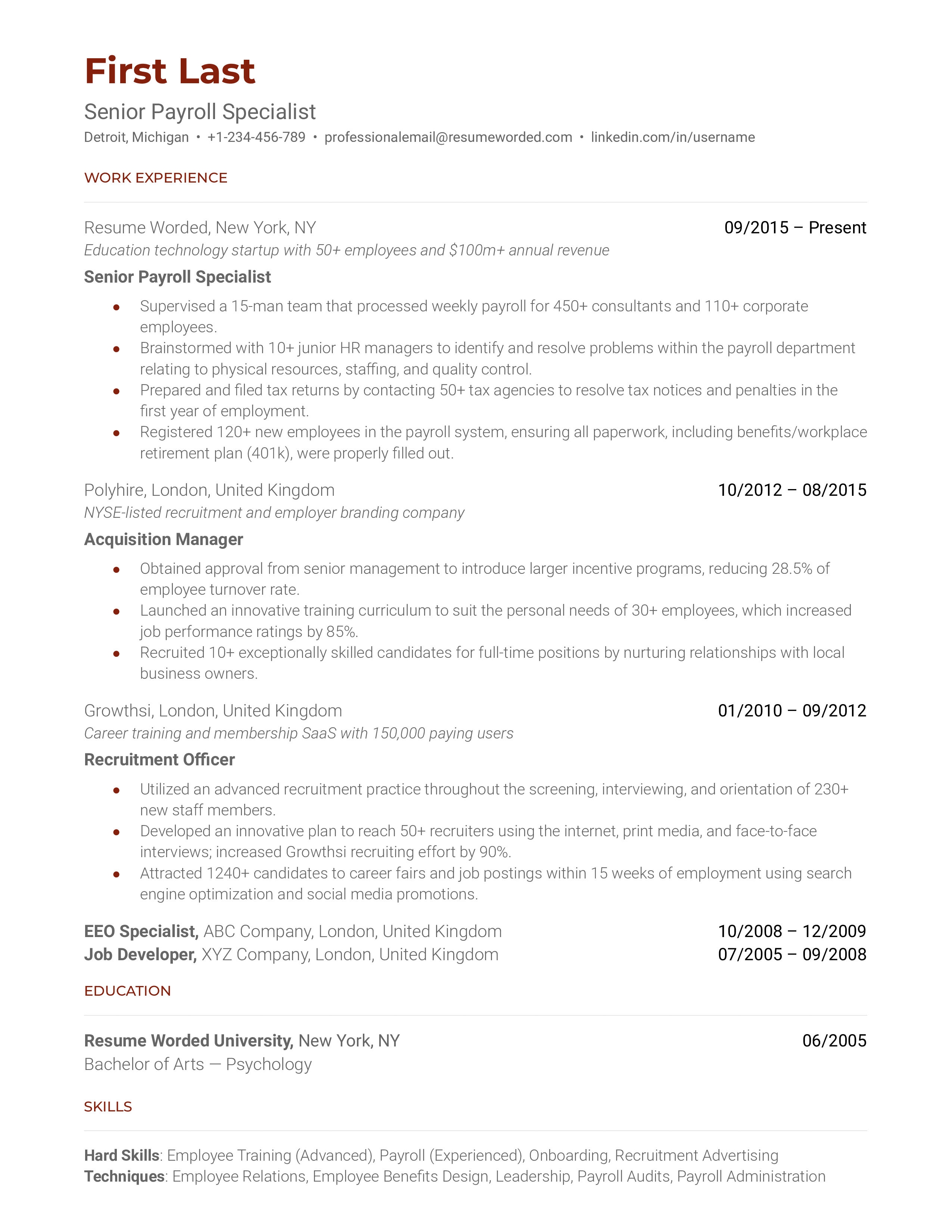

Payroll Specialist Resumes

A payroll specialist manages payment operations from start to finish. This includes calculating costs from personnel, deducting taxes, issuing payments, and reporting to upper management. This is an essential role in the accounting and HR departments. If you’re a payroll specialist trying to improve your resume, you’re in the right place. In this guide, we’ll share relevant tips that can help you demonstrate your value in the industry. Also, don’t forget to check our downloadable resume templates for payroll specialists.

Senior Payroll Specialist

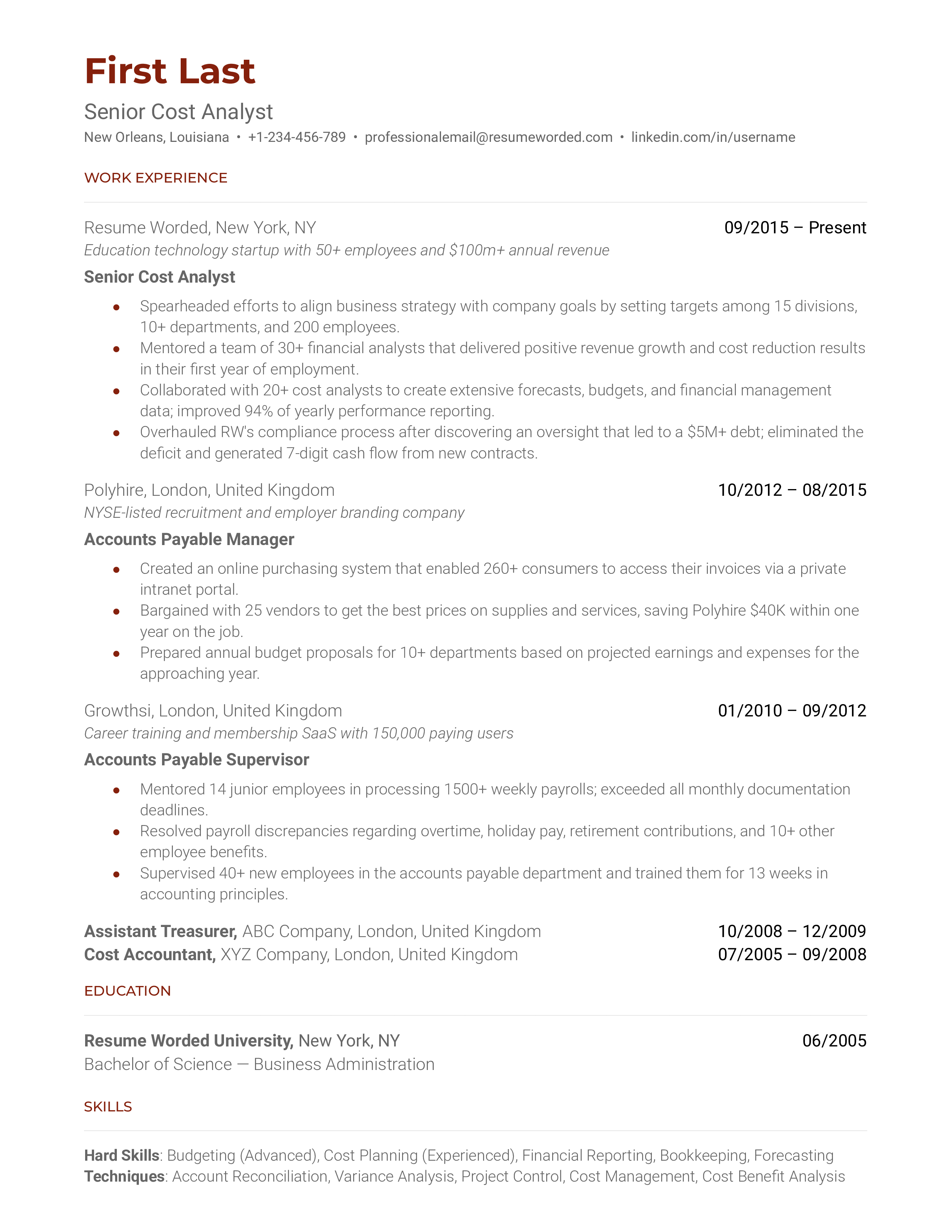

Cost Analyst Resumes

A cost analyst helps businesses make more informed decisions on their spending and budgetary plans. They are responsible for auditing a company’s expenses to identify financial issues that could affect production efficiency. If you’d like to start your job hunt as a cost analyst, we’ll help you out. This cost analyst resume guide will give you some handy tips to improve your performance and two downloadable templates.

Senior Cost Analyst

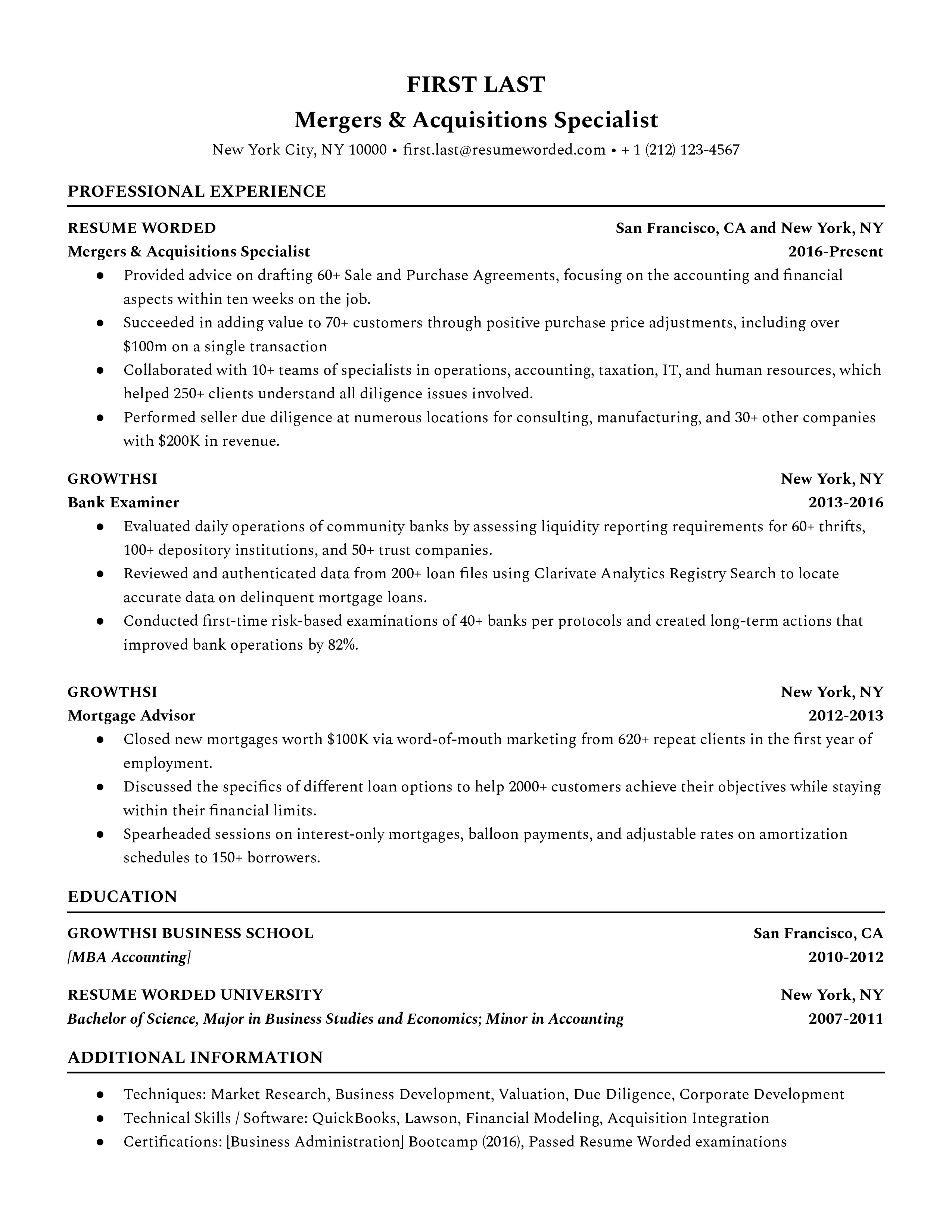

M&A Resumes

Mergers and acquisitions specialists carry out the necessary operations to coordinate a merger or company acquisition. They are responsible for analyzing risks, determining the benefits of that transaction, and negotiating with both parties. To become an M&A specialist or analyst you should have a background in accounting or finances. If you are an M&A specialist in the job hunt, this guide is for you. We’ll help you craft the best resume for your industry.

Mergers & Acquisitions Specialist

Action Verbs For Finance Resumes

- Restructured

- Implemented

How to use these action verbs?

A strong finance-based resume should show past successes in finance-related jobs, internships, or education. Always use clear resume action verbs to discuss them. You may want to showcase your industry prowess with finance-specific verbs like “modelled”, “analyzed”, or “audited”.

Finance Resume Guide

- Bookkeeper Resume Templates

- Investment Banking Resume Templates

- Financial Analyst Resume Templates

- Accountant Resume Templates

- Equity Research Resume Templates

- C-Level and Executive Resume Templates

- Financial Advisor Resume Templates

- Procurement Resume Templates

- Auditor Resume Templates

- Financial Controller Resume Templates

- Risk Management Resume Templates

- Accounts Payable Resume Templates

- Internal Audit Resume Templates

- Purchasing Manager Resume Templates

- Loan Processor Resume Templates

- Finance Director Resume Templates

- Credit Analyst Resume Templates

- Collections Specialist Resume Templates

- Finance Executive Resume Templates

- VP of Finance Resume Templates

- Claims Adjuster Resume Templates

- Payroll Specialist Resume Templates

- Cost Analyst Resume Templates

- M&A Resume Templates

- Finance Action Verbs

- All Resume Examples

Download this template for free

Download this ats-compatible resume template in word or google docs format. edit it directly in google docs., access samples from top resumes, get inspired by real resume samples that helped candidates get into top companies., get a free resume review, get actionable steps to revamp your resume and land more interviews using our free ai-powered tool..

- Have an account? Sign in

E-mail Please enter a valid email address This email address hasn't been signed up yet, or it has already been signed up with Facebook or Google login.

Password Show Your password needs to be between 6 and 50 characters long, and must contain at least 1 letter and 1 number. It looks like your password is incorrect.

Remember me

Forgot your password?

Sign up to get access to Resume Worded's Career Coaching platform in less than 2 minutes

Name Please enter your name correctly

E-mail Remember to use a real email address that you have access to. You will need to confirm your email address before you get access to our features, so please enter it correctly. Please enter a valid email address, or another email address to sign up. We unfortunately can't accept that email domain right now. This email address has already been taken, or you've already signed up via Google or Facebook login. We currently are experiencing a very high server load so Email signup is currently disabled for the next 24 hours. Please sign up with Google or Facebook to continue! We apologize for the inconvenience!

Password Show Your password needs to be between 6 and 50 characters long, and must contain at least 1 letter and 1 number.

Receive resume templates, real resume samples, and updates monthly via email

By continuing, you agree to our Terms and Conditions and Privacy Policy .

Lost your password? Please enter the email address you used when you signed up. We'll send you a link to create a new password.

E-mail This email address either hasn't been signed up yet, or you signed up with Facebook or Google. This email address doesn't look valid.

Back to log-in

Thank you for the checklist! I realized I was making so many mistakes on my resume that I've now fixed. I'm much more confident in my resume now.

- Finance Resume Examples

A strong resume is your greatest asset. Create your own with our finance resume examples , writing tips, and professional Resume Builder .

Our Recommended Template

Finance manager, popular templates in the finance space, paraprofessional, personal banker, financial analyst.

Table of Contents

- Finance Resume Examples by Job Title

Create a Finance Resume in 5 Simple Steps

Get expert writing recommendations for your finance resume, 6 do’s and don’ts for writing a finance resume, beat the ats with these finance resume skills, finance resumes for every professional level, recommended finance cover letter.

Resume Success Stories

Statistics and Facts About Finance Jobs

Finance resume.

- Accounts Officer Resume

- Aml Investigator Resume

- Anti Money Laundering Analyst Resume

- Asset Management Analyst Resume

- Asset Protection Specialist Resume

- Assistant Auditor Resume

- Assistant Bank Manager Resume

- Assistant Manager Resume

- Associate Auditor Resume

- Automotive Finance Manager Resume

- Bank Officer Resume

- Banking Assistant Resume

- Banking Consultant Resume

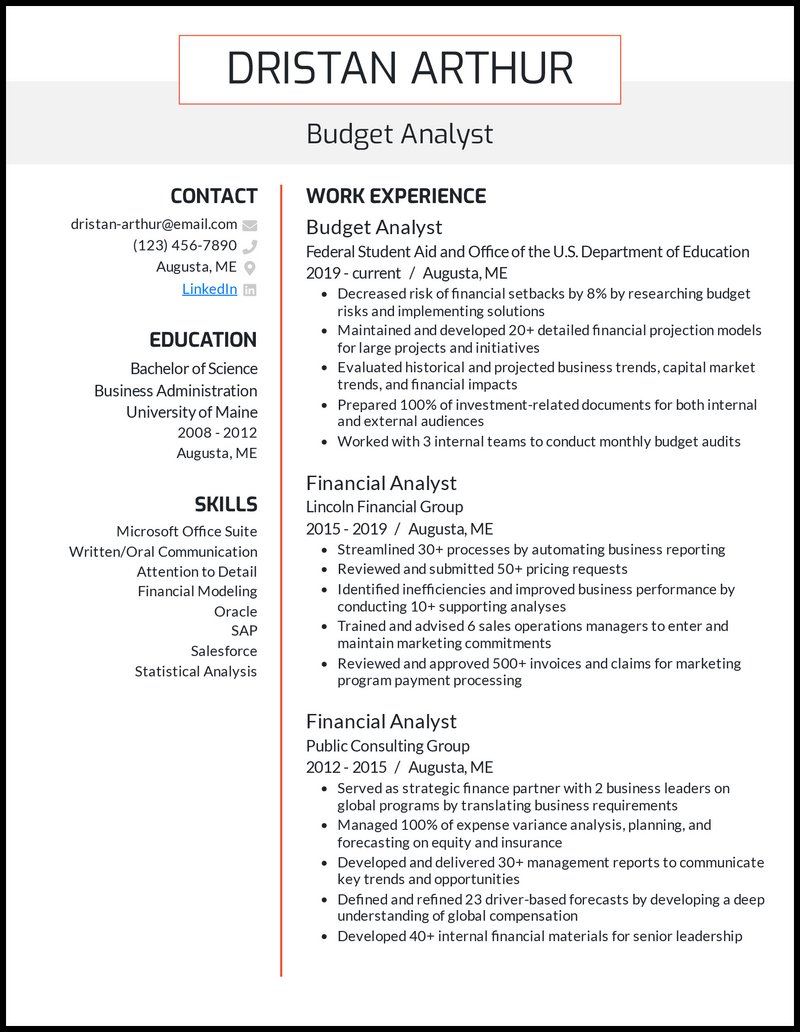

- Budget Analyst Resume

- Budget Assistant Resume

- Budget Officer Resume

- Capital Project Manager Resume

- Certified Fraud Examiner Resume

- Commercial Credit Analyst Resume

- Commodity Trader Resume

- Corporate Financial Analyst Resume

- Cost Controller Resume

- Credit Analyst Resume

- Credit Card Processor Resume

- Credit Controller Resume

- Credit Manager Resume

- Credit Risk Analyst Resume

- Dealership Manager Resume

- Debt Recovery Officer Resume

- Derivatives Analyst Resume

- Energy Trader Resume

- Equity Research Analyst Resume

- Erp Business Analyst Resume

- External Auditor Resume

- Administrator Resume

- Director Resume

- Officer Resume

- Advisor Assistant Resume

- Financial Aid Counselor Resume

- Financial Aid Officer Resume

- Assistant Resume

- Controller Resume

- Coordinator Resume

- Project Analyst Resume

- Foreign Exchange Trader Resume

- Fund Manager Resume

- Fx Trader Resume

- Income Tax Preparer Resume

- Loss Mitigation Specialist Resume

- Money Market Trader Resume

- Mortgage Assistant Resume

- Personal Advisor Resume

- Ship Broker Resume

- Staff Analyst Resume

- Stock Broker Resume

- Stock Market Trader Resume

- Tax Advisor Resume

- Tax Assistant Resume

- Tax Auditor Resume

- Tax Consultant Resume

- Tax Manager Resume

- Tax Preparer Resume

- Tax Specialist Resume

- Trade Specialist Resume

- Trading Assistant Resume

- Treasury Manager Resume

- Venture Capital Analyst Resume

- Wealth Management Advisor Resume

Finance Cover Letter

- Account Officer Cover Letter

- Account Representative Cover Letter

- Administrative Assistant Cover Letter

- Advisor Cover Letter

- Aid Advisor Cover Letter

- Aid Counselor Cover Letter

- Aid Officer Cover Letter

- Aml Investigator Cover Letter

- Analyst Cover Letter

- Assistant Cover Letter

- Assistant Controller Cover Letter

- Board Member Cover Letter

- Branch Manager Cover Letter

- Budget Analyst Cover Letter

- Chief Financial Officer Cover Letter

- Consultant Cover Letter

- Economic Development Officer Cover Letter

- Economist Cover Letter

- Equity Research Associate Cover Letter

- International Trade Expert Cover Letter

- Junior Financial Analyst Cover Letter

- Junior Trader Cover Letter

- Manager Cover Letter

- Officer Cover Letter

- Portfolio Manager Cover Letter

- Revenue Analyst Cover Letter

- Senior Financial Analyst Cover Letter

- Service Representative Cover Letter

- Specialist Cover Letter

- Treasurer Cover Letter

- Treasury Manager Cover Letter

- Branch Manager CV

- Financial Analyst CV

In many ways, your resume is your capital when applying for a job in finance. A well-written resume created using LiveCareer’s Resume Builder will ensure that your resume includes the industry keywords necessary to show your value to a potential employer.

Our team of certified resume writers offers pre-written text suggestions for your finance industry, chosen specifically for the job title you seek. Here are some examples our builder might make for your finance resume:

- Applied mathematical abilities on daily basis to calculate and check figures in all areas of accounting systems

- Returned phone calls and emails to clients within a 24-hour period for speedy and effective resolutions to issues

- Prepared wide array of returns such as corporate, fiduciary, gift, individual and private foundation returns

- Maintained account accuracy by reviewing and reconciling checks monthly

- Managed all areas of accounting, including accounts payable and receivable, general ledger management

- Assisted with month-end closing processes and verified journal entries

- Do include a strong professional summary. Your professional summary helps a hiring manager determine whether the rest of your resume is worth a closer look. Mention your experience with banking and financial institutions if you have it, or emphasize your business or finance degrees. Add in soft skills, such as being detail-oriented, as these skills are sought-after by employers.

- Do focus your resume on relevant positions. Instead of mentioning every position you have held since your first job, only list those that are directly related to the finance industry. A year of experience as a bank teller is more relevant than two years working as a carpenter. However, if past roles helped you learn transferable skills relevant to finance, such as customer service skills, include them.

- Do remember to use finance-related keywords. Many hiring managers are relying on ATS software to help weed out unqualified applicants from the pool. Resumes with finance-specific terms are more likely to pass. For instance, stating “extensive knowledge of tax codes” is more useful than “team player.”

- Don’t use an outdated resume. The financial industry is constantly changing, with new software and new laws and regulations requiring workflow adjustments all the time. If your resume is outdated, it may inadvertently imply that you cannot keep pace with such changes. Update your resume each year and customize your resume for each role.

- Don’t overload your resume with industry jargon. Even though you are applying for a position within the financial sector, don’t pack your resume with finance terms. Use critical keywords but remember that the recruiter reading your resume may not be familiar with industry jargon.

- Don’t include references. Including references on your resume is no longer a best practice, according to most job-search experts. References will be requested at a later stage of the hiring process. Instead, use the space on your resume to list more details about your finance-related experience.

Today’s hiring managers use applicant tracking systems (ATS) to narrow applicants down to just the most viable candidates. An ATS uses keywords input by the hiring manager to review and score resumes. It also rejects resumes that do not contain the right words and phrases. Although smaller financial businesses may not rely on ATS software, larger companies such as major banks and investment firms most likely do.

When writing a resume, it is important for job seekers to take into consideration what they can do to overcome this added challenge. LiveCareer’s Resume Builder can help by suggesting job-specific skills and phrases for your finance resume. Here are some examples of what our builder might recommend:

- Financial planning expertise

- Comprehensive knowledge of taxation

- Investor regulatory compliance standards

- Treasury management

- Quarterly budget reports

- Strong mathematical skills

- Proficiency in debt liquidation plan

- Finance ethics

- Client relationship management

- Quickbooks and Oracle

Entry-level Finance Resume Example: Finance Intern

Having little to no experience in finance can make it a challenge for a job seeker to write a finance resume. Without a strong work history, this job seeker uses a functional resume format to focus on his relevant internships and the skills he will bring to the position. By listing his knowledge of financial analysis and problem-solving, the job seeker lets hiring managers know that he has the potential to succeed in an entry-level position.

Mid-career Finance Resume Example: Income Tax Preparer

A job seeker with several years of finance experience should use a combination resume format to emphasize both work history and skills in equal measure. Although this job seeker has only held a few positions, outlining the responsibilities for each job helps hiring managers understand what she can bring to the role at hand. Presenting her skills up front also helps show her aptitude for the requirements of the role.

Executive-level Finance Resume Example: Chief Revenue Officer

An executive-level job seeker with years of finance-related work is smart to use the chronological resume format to emphasize their lengthy experience in the industry. This finance resume example effectively shows how the job seeker has progressed from an entry-level job to an executive role. In this format, the job seeker only included a few skills. However, he chose the ones most frequently used in the role he seeks.

CREATE MY RESUME

Most common occupations in finance

- Financial manager 715,157 people in the workforce

- Tellers 313,033

- Insurance sales agents 482,242

- Personal financial advisors 301,636

- Insurance claims and policy processing clerks 327,038

Source: DataUSA

Gender demographics in the finance field

3.99 million

3.01 million

*As seen in :

- English (UK)

You control your data

We and our partners use cookies to provide you with our services and, depending on your settings, gather analytics and marketing data. Find more information on our Cookie Policy . Tap "Settings” to set preferences. To accept all cookies, click “Accept”.

Cookie settings

Click on the types of cookies below to learn more about them and customize your experience on our Site. You may freely give, refuse or withdraw your consent. Keep in mind that disabling cookies may affect your experience on the Site. For more information, please visit our Cookies Policy and Privacy Policy .

Choose type of cookies to accept

These cookies allow us to analyze our performance to offer you a better experience of creating resumes and cover letters. Analytics related cookies used on our Site are not used by Us for the purpose of identifying who you are or to send you targeted advertising. For example, we may use cookies/tracking technologies for analytics related purposes to determine the number of visitors to our Site, identify how visitors move around the Site and, in particular, which pages they visit. This allows us to improve our Site and our services.

These cookies give you access to a customized experience of our products. Personalization cookies are also used to deliver content, including ads, relevant to your interests on our Site and third-party sites based on how you interact with our advertisements or content as well as track the content you access (including video viewing). We may also collect password information from you when you log in, as well as computer and/or connection information. During some visits, we may use software tools to measure and collect session information, including page response times, download errors, time spent on certain pages and page interaction information.

These cookies are placed by third-party companies to deliver targeted content based on relevant topics that are of interest to you. And allow you to better interact with social media platforms such as Facebook.

These cookies are essential for the Site's performance and for you to be able to use its features. For example, essential cookies include: cookies dropped to provide the service, maintain your account, provide builder access, payment pages, create IDs for your documents and store your consents.

To see a detailed list of cookies, click here .

This site uses cookies to ensure you get the best experience on our website. To learn more visit our Privacy Policy

- Resume Examples

- Finance Resume Examples & Writing Guide for 2024

Finance Resume Examples & Writing Guide for 2024

Our customers have been hired by:

There will be finance as long as there is money, so you can sleep soundly, right? Wrong.

Finance workers must be as dynamic and complex as the markets they deal with. Faced with that prospect, financial institutions only want to hire the best. So how do you show you’re a luxury employee without sounding like an overinflated hedge fund? Write a finance resume that would make Peter Lynch proud.

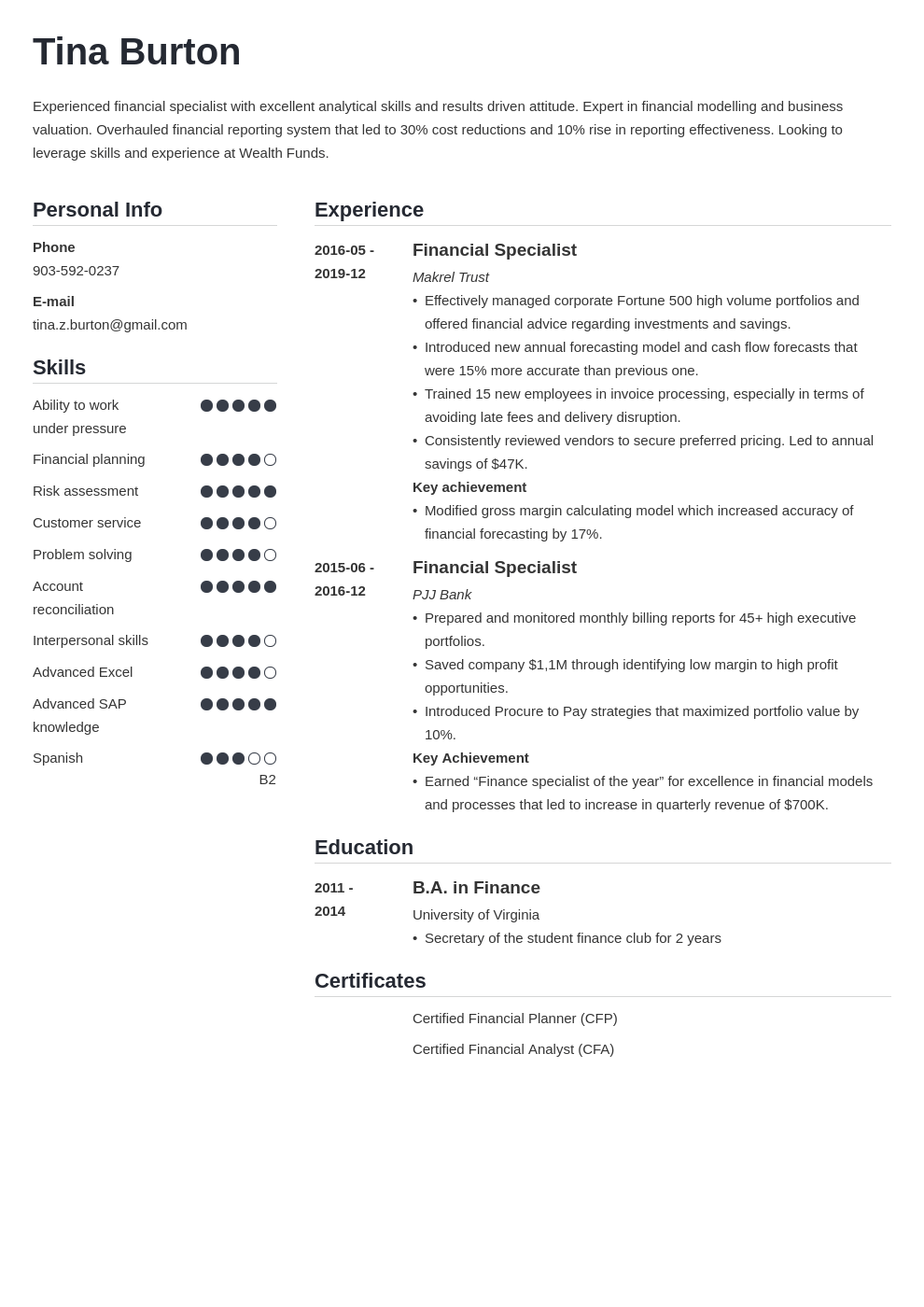

Want to save time and have your resume ready in 5 minutes? Try our resume builder. It’s fast and easy to use. Plus, you’ll get ready-made content to add with one click. See 20+ resume templates and create your resume here .

Create your resume now

Sample resume made with our builder— See more resume examples here .

About Zety’s Editorial Process

This article has been reviewed by our editorial team to make sure it follows Zety's editorial guidelines . We’re committed to sharing our expertise and giving you trustworthy career advice tailored to your needs. High-quality content is what brings over 40 million readers to our site every year. But we don't stop there. Our team conducts original research to understand the job market better, and we pride ourselves on being quoted by top universities and prime media outlets from around the world.

- https://www.bls.gov/iag/tgs/iag50.htm

- https://www2.deloitte.com/us/en/insights/industry/financial-services/financial-services-industry-outlooks/banking-industry-outlook.html

Don't miss out on exclusive stories that will supercharge your career!

Get a weekly dose of inspiration delivered to your inbox

Similar articles

Best Resume Outline Examples to Get a Job in 2024

How to make a resume outline. Learn a basic format that is simple and proven to help you create a successful resume template. See examples and read more!

![resume samples for finance professionals Traditional Resume Template [5+ Classic Resume Examples]](https://cdn-images.zety.com/pages/traditional_resume_2.jpg?fit=crop&h=250&dpr=2)

Traditional Resume Template [5+ Classic Resume Examples]

Not sure what kind of resume will boost your chances of landing an interview? Go for a traditional resume template. It’s much more than timelessly elegant.

What Makes a Good Resume? 11 Things Your Resume Needs

Ever wondered what makes a good resume good? We found the 11 things your resume needs to be the very best.

- Resume Examples

Finance Resume Example—Template and Writing Guide

Build your resume with the same level of diligence you have for financial reports. Learn the good ways of writing a finance resume and which practices you should avoid.

Think of your resume as if it was an Excel spreadsheet. You don't want it to be a mess. Each word you put on your finance resume is potentially worth thousands of dollars. So land your dream job, and don't lose that cash flow!

Learn to write a killer resume for finance that will make you soar in projected value.

In this guide, you’ll find:

- A finance resume sample that gets jobs.

- How to ace your finance job description on a resume.

- How to write a resume for finance that gets the interview.

- Expert tips and examples to boost your chances of landing a finance job.

Save hours of work and get a job-winning resume like this. Try our resume builder with 20+ resume templates and create your resume now.

Create your resume now

What users say about ResumeLab:

I had an interview yesterday and the first thing they said on the phone was: “Wow! I love your resume.” Patrick I love the variety of templates. Good job guys, keep up the good work! Dylan My previous resume was really weak and I used to spend hours adjusting it in Word. Now, I can introduce any changes within minutes. Absolutely wonderful! George

Looking for different finance resume guides? Check out our other articles:

- Accounting Manager Resume

- Accounting Resume

- Bank Teller Resume

- Business Analyst Resume

- Data Analyst Resume

- Entry-Level Business Analyst Resume

- Entry-Level Financial Analyst Resume

- Financial Advisor Resume

- Financial Analyst Resume

- Senior Accountant Resume

- Tax Account Resume

Finance Resume Template

Christopher Elias

Senior Financial Specialist

734-529-6285

linkedin.com/in/chriselias1

Highly professional senior financial specialist with 7+ years of experience in the field. Managed projects and portfolios with budgets of up to $200M+. Performed detailed financial analysis for over 80 companies throughout my career. Saved in aggregate tens of billions of dollars for my clients. Seeking to use proven skills to enhance profitability at Daybreak LLC.

Pacific Bay Financial Corporation, San Francisco, CA

June 2020–Present

- Created and implemented a financial planning method that saved my client over $220M in direct costs annually.

- Trained a new team of financial specialists, reducing the company's turnover rate by 50%.

- Incorporated a new expense management procedure that generated $8M monthly savings across all the company departments.

- Generated financial reports for the State of California.

- Managed a significant company's tax filings, clearing 71% of outstanding tax liabilities.

Financial Specialist

Philip Benson Financial Services, San Francisco, CA

October 2016–May 2020

- Streamlined client databases, which led to a 6% increase in process efficiency.

- Performed analysis on new projects, which generated upwards of $40M in revenue.

- Created detailed budgeting plans, lowering costs of production by 15%.

- Co-managed a $150M company portfolio, which grew 32% in value in a year.

Junior Financial Specialist

GROW Finance, Irvine, CA

February 2015–September 2016

- Managed the company's database system of 100+ clients.

- Performed financial analysis for clients, increasing the client company's performance by up to 12%.

- Conducted and presented detailed cash flow analysis.

Master of Finance

UC Irvine, Merage School of Business, CA

September 2013–July 2015

- Was a member of the University Finance Club.

- Took extracurricular Data Analytics courses.

- Had a 3.8 GPA score.

Courses and Certificates

- Certification in Finance & Quantitative Modeling for Analysts, University of Pennsylvania, 2019

- Financial Reporting Certificate, University of Illinois, 2016

- Certified Financial Planner, Certified Financial Planner Board of Standards, 2015

- Microsoft Excel

- Data Analysis

- Mathematical Skills

- Communication Skills

- Database Management

- Time Management and Organization

- Financial Statement Analysis Techniques

- Business Valuation

Some finance specialists provide financial advice and risk assessment, while others serve as business model analysts. Some directly interact with their clients’ portfolios, developing profitable trading strategies. And your finance resume aims to show that expertise in the vast field of finances.

So let's show the recruiters a finance resume they won't ignore:

1. Choose the Best Finance Resume Format

Choosing the wrong resume format is like applying the wrong financial analysis method. Yes, you will get a result. But a bad one . Don't let that happen. Make your resume format readable with a few steps:

- Use the reverse-chronological format for the resume . This way, you show your most impressive stuff first. And recruiters will quickly find what they’ve been looking for.

- Choose a readable resume font and size. For example, Calibri 10–12pt.

- Set your resume margins to 1-inch. Have large, readable titles, and leave some white space not to clutter the page.

- Put relevant info in the header of your resume . Name, phone number, email address, and your LinkedIn page.

- Make room for relevant resume sections : resume summary/objective, work experience, skills, and education.

- Include some resume extras to make yourself stand out. Certifications and publications are very beneficial to have. If you have relevant hobbies, include them, especially if you don't have extensive experience in finance.

- Save your resume in a PDF format when you’re done, unless the job offer says otherwise.

2. Write an Eye-Catching Finance Resume Objective or Summary

So, how do you immediately catch the recruiter's attention? With a resume summary that shows your value! Your employers must see you know your yields and liquidities.

To create one, use:

- One adjective (professional, reliable, analytical)

- Job title (Financial Specialist)

- Years of experience (6+, 7+)

- How you'll help (enhance profitability at Daybreak LLC)

- Most significant achievements (Saved in aggregate tens of billions of dollars, Managed projects and portfolios with budgets of up to $200M+)

These finance resume examples show you exactly why:

Finance Resume Summary—Sample

The difference is clear-cut!

That first financial specialist is for sure the one worth investing in. His highlighted stats-backed achievements leave little room for doubt.

But what if you're starting out in finance? Don't worry ! Even if you don't have years of experience, you still have your skills and achievements. So use them in your resume objective .

Entry-Level Finance Resume Objective—Sample

The first candidate is clearly more dedicated. Not only do they show some skills right off the bat, but they also prove their commitment by running a blog. They have a great deal to offer.

Remember that finance summary/objective is kind of like a book abstract. It’s easier to write it after you’re finished with the rest of your resume. So fill this section last, once you’re done with other resume sections.

3. Add the Best Finance Job Description

The Business & Finance field is full of different specialties. And with its median annual wage in May 2021 being over $75,000, you want to maximize your chances of landing that next job in finance.

Increase your Return-on-Resume with these guidelines:

- Read and analyze the job offer.

- List out the relevant skills and duties from it.

- Find a couple you can prove represent your own skills.

- Write detailed resume bullets that clearly show your abilities.

These financial specialist resume examples show you how:

Finance Resume Sample—Job Description

San Francisco, CA, Pacific Bay Financial Corporation

- Implemented a cost-saving financial planning method.

- Trained a new team of financial specialists.

- Applied company-wide expense management procedures.

- Worked with the State of California.

- Managed company's tax filings.

Candidate #1 is a surefire investment.

Not only do they show skills wanted by the employer, but they also supplement the resume with professional achievements . And employers love that. But what if you don't have much resume work experience ?

Don't worry! You can also make your internships or junior positions into a compelling sales pitch. Just use this junior finance position as an example:

Entry-Level Finance Resume Job Description

See? You may not have much professional experience that can be backed with impressive million-dollar numbers. But you still show what you did. And that you did it well.

Now that you know how to write your finance job description let's move on to the next step.

4. Pick the Best Finance Resume Skills

Just so we're on the same page, don't copy-paste skill lists from the internet. But these lists can help you pick some of the best skills for a resume .

So use this list for reference and inspiration, not blind copying:

Finance Resume Skills

- Microsoft Access

- Mathematics

- Business Knowledge

- Critical Thinking

- Computer Skills

- Data Visualization

- Financial Law

- Leadership Skills

- Time Management

- Financial Analysis

- Financial Reporting

- Trend Analysis

- Systems Integration

- Financial Planning

- Revenue Projections

- Liquidity Analysis

- Portfolio Management

- Project Management

But remember to choose only the most critical skills. Keep the length of your resume in mind. You want to have a two-page resume at most.

If you're proficient in using industry-standard software, include it as a skill, just like you add Excel or Access to your list.

The ResumeLab builder is more than looks. Get specific content to boost your chances of getting the job. Add job descriptions, bullet points, and skills. Easy. Improve your resume in our resume builder now .

CREATE YOUR RESUME NOW

Nail it all with a splash of color, choose a clean font, and highlight your skills in just a few clicks. You're the perfect candidate, and we'll prove it. Use our resume builder now .

5. Turn Your Education Section Into a Reason to Hire You

Your financial education matters. Graduating from a business university is, in many cases, necessary to land a job in finance. But you can make the resume education section stand out even more!

Here's how:

Finance Resume Education—Example

And that's how you show you didn't just attend the university. You've been finance-oriented from the start! And you're serious about it.

Remember that listing relevant courses and academic achievements is not necessary for senior positions, but it helps when you're inexperienced.

6. Finish Your Finance Resume With Valuable Extra Sections

This is where you add that extra spin to your finance resume by creating a well-diversified portfolio of other achievements. You may be wondering what to include in a resume extra section?

This part is for all the miscellaneous sections of your finance resume. You can spice up your resume by showcasing won awards, received certifications, publications, volunteer work, language proficiency , and memberships. A sprinkle of these bonus personal achievements can make your finance resume stand out from the crowd.

Additional Sections on a Finance Resume—Example

Certifications

Publications

- "Do Investors Value Sustainability?" Wall Street Journal, May 2018

- "The Old Ways of Conducting Business Are Dead" The Economist, January 2021

Additional Activities

- Member, CFA Institute

- Advisory Board Member, AAFM

- Frequently attend financial conferences

- Published an article featured in Forbes magazine

That first example is definitely in the green.

Sometimes you may want to use different certification placements on your resume , especially if you have some key certificates to show. If that happens, either showcase something else in the end, or omit this section.

To significantly increase your chances of landing a job interview, don't forget to attach a finance cover letter. Even though most employers don't read them, many won't acknowledge your financial resume without it.

Double your impact with a matching resume and cover letter combo. Use our cover letter generator and make your application documents pop out.

CREATE YOUR COVER LETTER NOW

Want to try a different look? There's 21 more. A single click will give your document a total makeover. Pick a cover letter template here .

For a finance resume that gets noticed:

- Use the finance resume template up top. Your rate of interviews will be sky-high.

- Focus on the job description section. Show your employer you're made for the job.

- Pick the right finance skills. Check what your employer wants, and show them what you have.

- Write a finance cover letter. Talk about your most outstanding achievements to make the hiring manager want you instantly.

Got questions on how to write an excellent resume for finance jobs? Not sure how to show finance on a resume? Leave a comment. We'll be happy to reply.

About ResumeLab’s Editorial Process

At ResumeLab, quality is at the crux of our values, supporting our commitment to delivering top-notch career resources. The editorial team of career experts carefully reviews every article in accordance with editorial guidelines , ensuring the high quality and reliability of our content. We actively conduct original research, shedding light on the job market's intricacies and earning recognition from numerous influential news outlets . Our dedication to delivering expert career advice attracts millions of readers to our blog each year.

Mariusz is a career expert with a background in quality control & economics. With work experience in FinTech and a passion for self-development, Mariusz brings a unique perspective to his role. He’s dedicated to providing the most effective advice on resume and cover letter writing techniques to help his readers secure the jobs of their dreams.

Was it interesting? Here are similar articles

Career Change Resume Examples for 2024 (+Templates & Tips)

You're about to change your career. Learn how to write a career change resume that will get you the dream job.

Tom Gerencer, CPRW

Career Writer at ResumeLab

56 Resume Writing Tips and Tricks for 2024

You can stop searching—this is the ultimate collection of best resume tips that can help you succeed in 2024. These resume writing tips will help to impress hiring managers.

Roma Kończak, CPRW

Career Expert

20+ Simple Resume Templates: Basic Templates For Any Job

Like white shirts and blue jeans, simple resume templates never go out of style. Check out our timeless collection of basic resume templates and make a resume you’ll be proud of.

- Career Blog

Finance Resume: Top Examples and Tips for 2024

The finance industry is constantly evolving, so it’s essential to have a strong and effective resume to catch the attention of employers. A finance resume is used to highlight your skills and experience in the field, demonstrating your value and competence to potential employers. A strong finance resume is critical to landing a job in finance, but what does it take to create one?

In this article, we will explore some of the top examples and tips for crafting a successful finance resume. We’ll cover everything from the basics of resume writing to specific strategies for presenting your finance experience in a compelling way. Whether you’re new to the field or a seasoned professional, you’ll find valuable tips and advice to help you create a finance resume that stands out from the crowd.

The Importance of Having a Strong Finance Resume

Your finance resume is the first impression you make on potential employers. A strong and effective resume can help you stand out from other applicants and secure a job interview. A well-crafted finance resume also demonstrates that you have the skills and experience necessary to succeed in the field, giving employers confidence in your ability to perform the job.

A finance resume is critical for anyone looking to work in finance, but it’s especially important for those applying to competitive positions. In a field where every candidate is highly skilled and qualified, a strong resume can make all the difference in securing a position.

Overview of the Article

In this article, we’ll examine some of the best practices for creating a finance resume that highlights your experience and skills in the field. We’ll start with the basics of resume writing and formatting, including tips for selecting the right format for your experience level and the position you’re applying for.

Next, we’ll delve into strategies for presenting your finance experience in a clear and compelling way. This will include tips for highlighting your key accomplishments and quantifying your achievements to demonstrate your value to potential employers.

We’ll also explore some of the top examples of finance resumes, including samples and templates for different experience levels and positions. You’ll be able to see firsthand what works and what doesn’t when it comes to crafting an effective finance resume.

Finally, we’ll wrap up with some additional tips and best practices for creating a winning finance resume. We’ll cover everything from customizing your resume for each job application to common mistakes to avoid when writing and formatting your resume.

No matter where you are in your finance career, this article is designed to help you create a resume that will get you noticed by potential employers. So, let’s get started!

Understanding the Finance Industry

When it comes to the finance industry, there are a variety of sectors that make up this field. Each sector has its own unique role, but they all work together to manage financial assets and create value for businesses and individuals.

Overview of the Different Finance Sectors

Investment Banking: Investment bankers help companies raise capital by underwriting and issuing securities (stocks and bonds).

Commercial Banking: This sector includes retail banking and lending services for individuals and businesses.

Asset Management: This sector manages investment portfolios for institutions and high net worth individuals.

Hedge Funds: Hedge funds are alternative investment managers that aim to generate high returns through complex investment strategies.

Private Equity: This sector is focused on investing in private companies, buying them, and selling them for a profit.

Insurance: Insurance companies provide protection against financial loss due to unexpected events such as accidents, illnesses, or natural disasters.

Key Skills and Qualifications for a Finance Professional

To be successful in the finance industry, there are several key skills and qualifications that are necessary.

Analytical Skills: A finance professional needs to be able to analyze and interpret financial data to make informed decisions.

Strong communication skills: A finance professional must be able to communicate complex financial concepts to both clients and colleagues in a clear and concise manner.

Attention to detail: The finance industry requires a high level of accuracy and attention to detail.

Knowledge of financial regulations: Financial professionals must be knowledgeable about financial regulations, such as the Sarbanes-Oxley Act, and how they impact their work.

Strong academic background: A degree in business, finance, accounting or a related field is typically required for a career in finance.

Professional certifications: Many finance professionals hold professional certifications, such as the Certified Financial Analyst (CFA) or the Certified Public Accountant (CPA) designation, which demonstrate their expertise in their field.

The finance industry is a diverse sector that requires a variety of skills and qualifications. Graduates with a strong academic background and professional certifications, as well as a passion for finance, will find numerous career opportunities in this dynamic field.

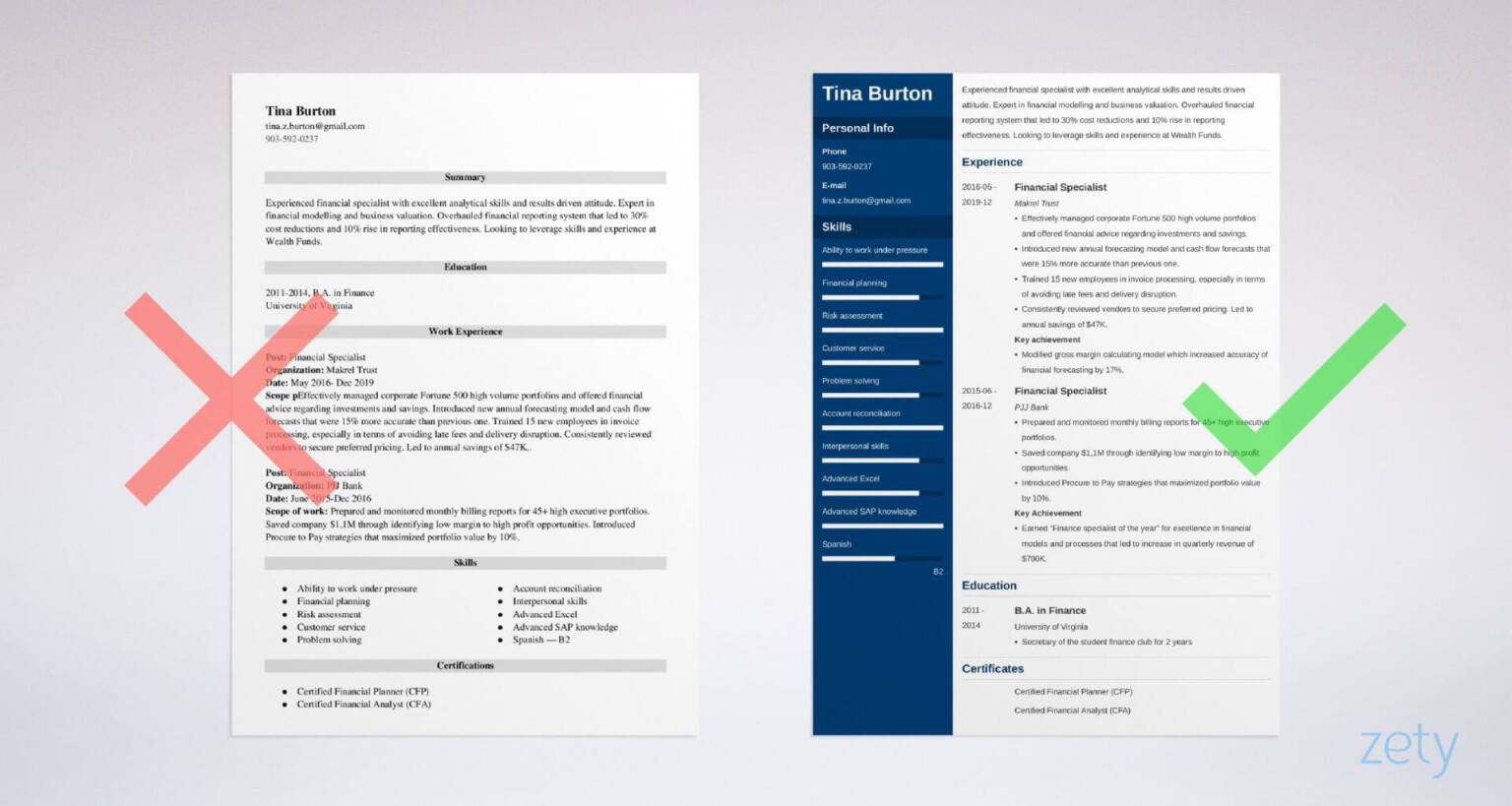

Common Finance Resume Mistakes

When it comes to writing a finance resume, there are plenty of common mistakes that candidates tend to make. These mistakes can be detrimental to your chances of landing your dream job in the finance industry. Therefore, it is essential to avoid them. Here are some common finance resume mistakes that you should know about and tips to help you avoid them.

Analysis of Common Mistakes in Finance Resumes

- Grammatical and spelling errors

One of the most common mistakes in finance resumes is simple grammatical and spelling errors. These errors are easy to make, but they can severely impact your chances of getting hired. This is because the finance industry requires attention to detail and accuracy.

- Lack of quantifiable achievements

Your finance resume should include quantifiable achievements that showcase your skills and abilities. However, many candidates fail to include these achievements, instead opting for a list of responsibilities. This mistake can leave the hiring manager wondering why they should hire you.

- Generic resume objectives

Your resume objective should be tailored to the specific role you are applying for. Generic objectives such as “To obtain a challenging position in finance” do not grab the hiring manager’s attention.

- Long blocks of text

A resume filled with long blocks of text can be overwhelming and off-putting to a hiring manager. Use bullet points and white space to break up your resume, making it easier to read.

Tips on Avoiding These Common Errors

- Proofread your resume

Before sending out your finance resume, proofread it, and have someone else proofread it as well. This ensures that there are no grammar or spelling errors that could hurt your chances of being hired.

- Include quantifiable achievements

To showcase your skills and abilities, include quantifiable achievements in your resume. Use numbers to back up your achievements, such as “increased sales by 20% in six months.”

- Tailor your resume objective

Write a tailored objective that speaks to the specific role you are applying for. Research the company and job position, then write an objective that aligns with the company’s goals and needs.

- Use bullet points and white space

Use bullet points and white space to make your finance resume more readable. This helps the hiring manager focus on the most important information and prevents your resume from appearing too cluttered.

By avoiding these common finance resume mistakes and following the tips outlined above, you can increase your chances of landing your dream job in the finance industry.

Tailoring Your Finance Resume for Specific Roles

One of the most important aspects of a successful finance resume is tailoring it to specific job roles. This means customizing your resume to align with the specific skills, experiences, and qualifications that a potential employer is looking for. Here are some tips on how to customize your finance resume for different roles:

1. Read the Job Description Carefully

Before you start customizing your resume, you need to understand the job requirements of the role you are applying for. Read the job description carefully and make a list of the required skills, experiences, and qualifications.

2. Identify and Highlight Key Skills and Experiences

Once you have a clear understanding of the job requirements, you should identify the key skills and experiences that you possess that match those requirements. These can include technical skills like financial analysis, data analysis, and budget forecasting, as well as soft skills like communication, teamwork, and problem-solving.

3. Customize Your Resume Summary and Objective

Your resume summary and objective are the first things that hiring managers will read, so they should be customized to the specific job role. Use keywords and phrases from the job description to highlight your relevant skills and experiences.

4. Rearrange Your Resume Sections

Tailoring your finance resume for a specific role may require rearranging your resume sections. For example, if a job requires a lot of financial analysis, you may want to move your financial analysis experience to the top of your professional experience section.

5. Focus on Achievements, Not Just Duties

When customizing your finance resume, it’s important to focus on your achievements, not just your duties. Use specific examples of how you have contributed to the success of previous projects or organizations.

By following these tips, you can customize your finance resume to showcase your skills and experiences in a way that aligns with the specific requirements of the job role you are applying for.

Formatting Your Finance Resume

Your finance resume is your ticket to landing your dream job in the finance industry. And one of the most critical aspects of your resume is its formatting. A well-structured finance resume sets the tone for your potential employer and gives them an insight into your qualifications, experience, and attention to detail.

Importance of Proper Formatting

Recruiters and hiring managers review dozens of resumes every day, and they might not have the time to go through each detail of your resume. Therefore, it’s crucial to make it visually appealing and easy to read. Proper formatting allows you to showcase your credentials in a clear and concise way, making it easier for recruiters to scan through your resume effortlessly.

Your finance resume’s proper formatting can be the difference between getting an interview call and getting your resume tossed aside. The goal is not only to get your resume noticed but also to make it stand out impressively in the eyes of your prospective employer.

Tips on Choosing an Appropriate Design and Layout

There’s no one-size-fits-all design or layout for resumes. However, there are some design elements and layouts that are more suitable for finance resumes. Here are some tips on choosing an appropriate design and layout:

1. Go For Simplicity and Clarity

The ideal finance resume should be simple, clear, and easy to read. Avoid cluttering your resume with unnecessary information, and use a font size that’s at least 10pt for easy readability.

2. Use Bullet Points

Bullet points help break down your experience and accomplishments, making your resume easier to skim through. Use clear and concise bullet points to highlight your achievements and skills.

3. Keep It Consistent

Maintain consistency throughout your resume. Use the same font type, size, and color scheme for headings and subheadings. Avoid underlining or italicizing text, as it can be distracting.

4. Highlight Your Achievements

Don’t just list your job responsibilities; show how you added value to the company. Highlight any relevant achievements or numbers-based results such as cost savings or revenue increases.

5. Use Keywords

Recruiters often use Applicant Tracking Systems (ATS) to scan resumes. To ensure your resume passes through the ATS, incorporate relevant keywords from the job description.

6. Utilize White Space

White space, also known as negative space, is the area between text and graphics. Use white space to create visual balance in your resume, making it easy on the eyes.

Proper formatting is critical to creating a compelling finance resume. Use these tips to choose an appropriate design and layout that showcases your experience and qualifications in the best possible way. A well-formatted resume increases your chances of getting your foot in the door and landing your dream job in the finance industry.

Essential Elements of a Finance Resume

When it comes to crafting a finance resume that stands out from the rest, there are several key components that should not be overlooked. Whether you are just starting out in the industry or have years of experience under your belt, incorporating these essential elements will help showcase your skills and experience to potential employers.

Key components of a finance resume

Summary Statement: A clear and concise summary statement at the top of your resume can grab a recruiter’s attention and provide a brief overview of your experience, skills, and career goals. Keep it focused on what you can offer the organization, rather than what you want.

Education & Certification: Detail your educational background and any relevant certifications. Highlighting any additional training or advanced degrees in your field can help set you apart from other candidates.

Professional Experience: Highlighting your professional experience with a comprehensive list of past positions shows recruiters that you have the experience needed to excel in the role. Be sure to use specific examples of accomplishments and achievements from each position, quantifying results where possible.

Core Competencies: A list of core competencies (such as financial analysis, forecasting, and budgeting) can help showcase your specific skills and areas of expertise.

Technical Skills: With many finance jobs requiring advanced technical skills, it’s important to list any relevant software, programs, and tools you are proficient in, such as Excel, QuickBooks, or SAP.

Tips on how to showcase your skills and experience

Use Metrics: Incorporate hard numbers and data to quantify your accomplishments and contributions in previous finance roles. For example, instead of saying “increased revenue,” provide the specific percentage increase.

Tailor Your Resume: Customize your resume to match the job description and requirements. Highlight your experience and skills that align with what the employer is seeking.

Be Clear and Concise: Recruiters often have hundreds of resumes to review, so it’s important to be clear and concise in your resume. Avoid using jargon or industry-specific terms that may not be familiar to everyone.

Proofread and Edit: A resume with spelling and grammar errors can quickly land in the “no” pile. Make sure to proofread and edit your resume thoroughly before submitting it.

Be Honest: It’s tempting to oversell your accomplishments, but it’s important to be honest and transparent in your resume. Focus on your real achievements and experience, and be ready to provide examples and evidence if asked during the interview process.

Incorporating these key components and tips into your finance resume can help you stand out from the competition and showcase your skills and experience to potential employers.

Finance Resume Examples

If you’re looking to break into the finance industry, your resume must stand out from the competition. Here are top finance resume examples for different roles that can inspire you to create a strong resume and land your dream job:

1. Financial Analyst Resume Example

This financial analyst resume example successfully showcases the candidate’s skills and experience. The resume is easy to read and includes relevant information such as key accomplishments, professional experience, and education. The applicant also uses strong action verbs to communicate their achievements effectively.

Results-oriented financial analyst with a strong background in financial analysis, forecasting, and reporting. Proven ability to analyze complex financial data, identify trends, and provide strategic insights. Excellent problem-solving skills and attention to detail.

Financial Analyst | ABC Corporation | Anytown, USA

- Conducted financial analysis, including variance analysis and trend forecasting.

- Prepared detailed financial reports for senior management.

- Collaborated with cross-functional teams to develop and implement cost-saving initiatives.

- Assisted in budget planning and monitoring.

Junior Financial Analyst | XYZ Company | Anytown, USA

- Assisted senior analysts in conducting financial research and analysis.

- Prepared financial models and projections.

- Monitored market trends and provided recommendations for investment opportunities.

- Assisted in the preparation of financial presentations.

Bachelor of Science in Finance | University of Anytown | Anytown, USA

2. Finance Manager Resume Example

This finance manager resume example effectively presents the candidate’s experience and achievements in the field of finance. The resume highlights their leadership skills and experience with budget management, financial analysis, and risk management. It’s important to note that this resume also includes quantifiable metrics, which helps the hiring manager understand the candidate’s impact on previous employers.

Seasoned finance manager with a track record of success in driving financial growth and managing complex financial operations. Skilled in financial analysis, budgeting, risk management, and team leadership. Strong ability to develop and implement financial strategies aligned with organizational goals.

Finance Manager | ABC Corporation | Anytown, USA

- Oversaw financial planning, budgeting, and forecasting processes.

- Conducted financial analysis and provided strategic recommendations.

- Managed risk through the implementation of financial controls.

- Led a team of finance professionals, providing mentorship and guidance.

Senior Financial Analyst | XYZ Company | Anytown, USA

- Led financial analysis and modeling efforts to support decision-making.

- Prepared financial reports and presentations for executive management.

- Streamlined financial processes and improved efficiency.

- Collaborated with cross-functional teams on special projects.

Master of Business Administration (MBA) | Anytown University | Anytown, USA

3. Investment Banker Resume Example

This investment banker resume example demonstrates the applicant’s expertise in financial analysis, valuation, and deal origination. The resume also highlights their ability to work well in teams through experience in project management and communication skills. In addition, the candidate’s educational background is impressive, showcasing their commitment to educational development.

Experienced investment banker with expertise in financial analysis, deal origination, and project management. Strong understanding of capital markets and investment strategies. Skilled in financial modeling, valuation, and due diligence. Excellent communication and presentation skills.

Investment Banker | ABC Investment Bank | Anytown, USA

- Conducted financial analysis and due diligence for potential investment opportunities.

- Developed financial models and performed valuation analysis.

- Assisted in deal structuring and negotiations.

- Collaborated with cross-functional teams to ensure successful deal execution.

Analyst | XYZ Investment Firm | Anytown, USA

- Conducted market research and analyzed investment trends.

- Assisted in the preparation of investment proposals and pitch books.

- Collaborated with senior bankers on client presentations.

- Assisted in the execution of various transactions.

What makes these resumes effective?

The finance industry is highly competitive, and a strong resume needs to catch the recruiter’s attention and stand out from the rest. Here are a few elements of these finance resume examples that you can incorporate into your resume:

Clear and concise language: Use bullet points to break down your experience and achievements. This makes it easier for recruiters to skim and understand.

Quantifiable results: Do not just list your duties, but also share the outcome of your work with specific numbers, such as increased revenue or decreased costs. This helps demonstrate your value as an employee.

Tailored content: Customize your resume to fit the specific job description you’re applying for to show the recruiter that you have the required skills for the role.

Professional experience: Highlight your relevant professional experience, including internships or part-time jobs. This helps demonstrate your dedication to the field and develop skills that can be utilized in the position.

By incorporating these elements in your finance resume, you can create a strong presentation of your skills and experience to help you stand out from other candidates.

Writing Your Finance Resume Summary

A well-written summary statement can be the key to getting your finance resume noticed by hiring managers. Here are some tips for creating a compelling summary:

How to create a compelling summary statement

- Start with a strong opening sentence that highlights your most relevant skills and experience.

- Keep it concise – aim for no more than 2-3 sentences.

- Focus on your measurable achievements, such as cost savings, revenue growth, or successful projects.

- Use active verbs and specific numbers to quantify your accomplishments.

- Show your passion for finance and your desire to make a positive impact in the industry.

Tips on tailoring your summary to the job posting

To make your finance resume stand out, it’s important to tailor your summary statement to each job posting. Here are some tips:

- Review the job description and make note of the skills and experience the employer is looking for.

- Use keywords from the job posting in your summary statement to show that you meet their requirements.

- Highlight specific achievements or experiences that match the job description.

- Keep it relevant – only include information that directly relates to the job you’re applying for.

A well-written summary statement can be the difference between getting your finance resume noticed and getting lost in the shuffle. By following these tips, you can create a powerful summary that showcases your skills, experience, and passion for finance.

Listing Your Finance Experience

When it comes to describing your professional experience in finance, there are a few tips to keep in mind. First, be specific and focus on the accomplishments you achieved in each role. This will help to demonstrate your skills and expertise to potential employers.

To further enhance your resume, try to quantify your achievements using specific metrics. For example, if you reduced operating costs for a company, provide exact figures or percentages. Numbers help to add credibility to your accomplishments and show that you have a results-driven mindset.

When it comes to quantifying your achievements, remember to focus on both the qualitative and quantitative aspects. This may include an increase in revenue, a decrease in expenses, or other measurable outcomes that demonstrate your impact.

Your finance resume should showcase your professional experience and highlight the value you can bring to a company. By following these tips and emphasizing your accomplishments, you can increase your chances of landing your dream job in finance.

Highlighting Your Finance Skills

As a finance professional, your resume is a critical marketing tool that can either make or break your job search. When crafting a finance resume, it is vital to highlight your finance skills to demonstrate your suitability for the role. This section provides guidance on identifying the most important finance skills and tips on showcasing them in your resume.

Identifying the most important finance skills

Finance is a multifaceted profession that requires numerous skills for optimal performance. However, not all of these skills are equally important when crafting a finance resume. To identify which finance skills to highlight, scrutinize the job description carefully, and identify the essential skills required for the role. In general, the following finance skills are highly valued across the industry:

- Financial analysis

- Budgeting and forecast

- Financial modeling

- Risk management

- Financial reporting

- Strategic planning

- Tax planning and compliance

- Cost accounting

- Corporate finance

- Financial software and systems

Tips on showcasing these skills in your resume

Once you have identified the most important finance skills required for the role, you need to showcase your proficiency in these areas in your resume. The following tips can help you highlight your finance skills effectively:

Use relevant keywords: Incorporating specific finance-related keywords from the job description can help ensure that your resume makes it through the Applicant Tracking System (ATS) and on to the hiring manager. These keywords include technical finance skills, industry-specific jargon, company-specific terminology, and certifications.

Quantify your achievements: Use numbers, percentages, or dollar figures to quantify your finance skills’ impact on the company’s bottom line. For example, mention how your financial modeling skills saved the company a certain amount of money, or how your strategic planning skills increased revenue by a certain percentage.

Provide examples of your work: Including specific examples of your accomplishments in your resume can provide concrete evidence of your finance skills’ value. For instance, mention a financial analysis project, a complex budgeting project, or a successful tax planning project you executed.

Highlight your certifications: If you have any relevant finance certifications, mention them prominently in your resume. These certifications demonstrate your competence in specific finance skills and can give you a competitive edge over other candidates.

By highlighting your finance skills effectively in your resume, you can increase your chances of standing out in the highly competitive finance job market. Use the tips above to showcase your finance skills in the most effective way possible.

Education and Certifications

When it comes to pursuing a career in finance, education and certifications can boost your chances of landing the job and advancing in the industry. In fact, they are often considered as key factors for success in this field.

Here are some tips on how to effectively list your qualifications in your finance resume:

1. Start with the most recent qualification

Begin by listing your most recent degree or certification and work your way backwards. This will showcase your most relevant education and certifications at the top of your resume.

2. Highlight the relevant qualifications

Make sure to only include qualifications that are relevant to the position you are applying for. For example, if you are applying for a financial analyst job, it would be best to showcase a degree in finance or a relevant certification such as the Chartered Financial Analyst (CFA).

3. Use action verbs

Use strong action verbs to describe your qualifications. Rather than simply listing your degree or certification, you can add impact by using descriptive verbs that illustrate your strengths. Some examples include ‘Mastered’, ‘Excelled’, ‘Attained’ etc.

4. Include relevant coursework

This is especially important for recent graduates who may not have much professional experience. Including relevant coursework can demonstrate that you have obtained the necessary knowledge and skills for the role.

5. Keep it concise

Your education and certification section of your resume should be concise and easy to read. If you have multiple degrees or certifications, consider grouping them together under one heading such as “Education and Certifications” to avoid cluttering your resume.

Education and certifications are critical components of a finance resume. By following these tips, you can effectively showcase your qualifications and stand out as a strong candidate for the job.

Related Articles

- Rise to the Top: 20 Successful Recruiter Resume Examples

- Secrets to Success in Federal Job Interviews: The Top 6 Tips

- 10 Pharmacist Resume Examples That Secured Jobs in 2023

- Application Support Engineer: Key Responsibilities & Skills

- Crafting a Salary Increase Letter: Examples & Best Practices

Rate this article

0 / 5. Reviews: 0

More from ResumeHead

Build my resume

- Build a better resume in minutes

- Resume examples

- 2,000+ examples that work in 2024

- Resume templates

- Free templates for all levels

- Cover letters

- Cover letter generator

- It's like magic, we promise

- Cover letter examples

- Free downloads in Word & Docs

11 Real Financial Analyst Resume Examples That Worked in 2024

Financial Analyst

Best for senior and mid-level candidates

There’s plenty of room in our elegant resume template to add your professional experience while impressing recruiters with a sleek design.

Resume Builder

Like this template? Customize this resume and make it your own with the help of our Al-powered suggestions, accent colors, and modern fonts.

- Financial Analyst Resume

- Financial Analyst Resumes by Experience

- Financial Analyst Resumes by Role