Top Rated in Impulse

- Sign Up Now

ClearView Research - Orlando

Welcome to ClearView Research- Orlando (formally About Orlando Market Research) - Central Florida's "Top Rated" qualitative market research facility. With over TEN years of top quality ratings, we have built our reputation by delivering excellence. Since 1997, giving clients the highest level of service has been our goal. In response, our clients have consistently rated ClearView Research-Orlando #1 in Central Florida.

* Recruiting is done in house with a trained and supervised staff. * Modern, flexible facility that offers two spacious focus group suites designed for comfort, efficiency and versatility. * Auditorium, classroom or traditional conference table seating. * Wireless internet/T1 High Speed connections- DVD Recording & Digital Audio - LCD Flat Panel Monitors. * Client lounges with computer and printer- Private Moderator work space * Attention to every detail of every project!

ClearView Research- Orlando is newly renovated adding two brand new spacious client lounges equipped with closed circuit viewing. We also have added a test kitchen with closed circuit viewing that offers the following:

- 2 full size refrigerators -  1 vertical freezer -  1 electric range -  5 microwaves -  2 large stainless steel islands with ample workspace

Doesnât your next project deserve the best?

View Nearby Hotels

Get Directions

View Floor Plans

ClearView Research Chicago ClearView Research  Orlando SIGN UP NOW REQUEST A QUOTE

ClearView Research Chicago

10600 W. Higgins Road Rosemont, IL 60018 847-827-9840

ClearView Research Orlando

5450 Lake Howell Road Winter Park, FL 32792 407-671-3344

© 2013 Clearview Research

Home | About | Services | Sign Up Now | Contact

for Informed Decisions.

Our Services

Request A Bid

Mars Research is dedicated to providing quality Market Research Services in a responsible and professional manner

With over 30 years of service, mars research is one of the most trusted data collection companies in south florida. we strive to offer a customized product – at mars research one size does not fit all ., our research process produces results, research objectives.

Identify and define marketing opportunities and problems.

DESIGN METHODOLOGY

Generate, refine + evaluate marketing actions.

DATA COLLECTION

Reliable samples screened by experienced recruiters.

ANALYZE & INTERPRET

Unbiased, secure + confidential research solutions.

REPORT FINDINGS

Actionable insights = educated decision-making.

At Mars Research we strive to offer a customized product.

Successful research techniques begin with understanding the specifications of our clients. our research provides reliable and concise data on consumers, professionals and businesses, as well as a full range of special target audiences. committed to identifying market opportunities, next steps and pitfalls that impact your marketing and business strategies, our team of experts offer reliable insights that drive valuable return on investment. mars research offers a range of services that span across all aspects of the research process., creativity leads to innovation, mars research offers a comprehensive range of services that encompass all aspects of the research process. through the systematic and objective identification, collection, analysis, dissemination and use of information we identify opportunities that may impact your marketing and business strategies based on reliable insights that drive valuable return on investment., we offer custom solutions for all of your qualitative and quantitative research needs including custom research design, data collection, recruitment, statistical analysis and reporting. mars research works closely with clients to plan each project, design the research, analyze the findings and present a report that draws concrete conclusions and makes actionable recommendations. mars analysis is designed to go beyond basic description and is used to bring new products to market, position advertising and measure its effectiveness, create new customer development strategies and build customer loyalty., mars listens: conducting qualitative research with the goal of understand customer’s attitudes and beliefs using in-depth interviews, focus groups and usability labs., mars explores: solutions for new innovations, product modifications, advertising and marketing campaigns and concept testing both onsite or in the field., mars explains: surveying consumers or businesses to compile demographic data on target markets, gauge customer satisfaction or investigate market segmentation., mars research #1 marketing research services, focus group facilities.

Our upscale Ft. Lauderdale Focus Group facility offers a large conference room, spacious client viewing, video steaming and a professional team of recruiters that can tackle any project

Sensory Research

Mars Research conducts sensory evaluation for a wide range of clients. Testing completed at our CLT Testing facility or respondents can be directly recruited to a client’s location.

Usability Studies

Online research.

Collecting data online via phones, tablets or computers is a fast and effective wat to capture consumer insights as well as immediate feedback following a user’s experience or transaction.

Multicultural Ethnic Studies

Companies must know their consumers are figure out the best way to reach them. Our Ethnic Research pinpoints certain groups based on their race, national origin or distinctive cultural patterns.

Analytics and Reporting

Top Marketing Research Companies in Florida

Below is a list of all Florida (FL) marketing research companies.

Search Results

More Filters

Loading filters...

Olson Research Group, Inc.

West Palm Beach/Boca Raton, FL

CSS/datatelligence, a division of CRG Global

Daytona Beach, FL

Big Village

Concepts in focus (aka rdteam-south).

Jacksonville, FL

Wise Market Insights

Crg global, inc., crg predictive intelligence, a division of crg global, inc., connected research & consulting, llc, test america online, a division of crg global, product insights, inc..

Orlando, FL

Herron Associates, Inc.

Tampa/St. Petersburg, FL

Research America - Market Research and Consumer Insights

Key lime interactive, sago orlando, opinions, ltd. – tampa, opinions, ltd. – miami, l&e research tampa, test america a division of crg global - tampa.

- Contact Us |

- Get a Quote

- Call Today for a FREE Consultation Toll-free: 1-877-225-7950

- About Us About Our Survey Company Company Experience Company Testimonials Executive Team Omnibus Surveys Data Security Job Opportunities

- Survey Hosting Survey Hosting Online Research Surveys Online Survey Services Market Research Software Survey Solutions Website Surveys

- Professional Services Survey Design Web Survey Administration Survey Reporting Mail Surveys Telephone Surveys Statistical Consulting Choice Based Conjoint Field Research Proxy Services

- Market Research Market Research Surveys Online Market Research Consumer Market Research B2B Market Research Technology Market Research Marketing Surveys International Market Research Market Research Firm

- Customer Surveys Customer Satisfaction Surveys Customer Feedback Surveys Customer Loyalty Surveys Online Customer Surveys Consumer Surveys Bank Customer Surveys Patient Satisfaction Surveys Alumni Surveys Student Teacher Evaluations

- Employee Surveys Job Satisfaction Surveys Online Employee Surveys Employee Engagement Surveys Employee Benefits Surveys Employee Survey Questions

Full-service customer survey and market research services

Welcome to our Mail, Phone and Online Survey Company

Amplitude Research® provides high-quality mail, telephone, and online survey research for consumer and b2b market research surveys, employee job satisfaction surveys, and all types of customer satisfaction, loyalty and feedback surveys. Our research services include questionnaire writing, survey programming, survey administration, data analysis, and report writing.

Amplitude Research delivers best practices in all aspects of the survey research process using the most effective online research techniques for consumer and b2b market research surveys , employee surveys , and customer surveys . Each study is assigned an experienced project manager who works directly with our client and provides personalized, quick response service and expert programming and survey administration .

Since 2002, our online survey company has provided online research for consumer, b2b, and technology market research surveys. We can target over 100 different demographic, recreational, and consumer or business data points including purchasing characteristics, business influencers and decision makers, small business owners, IT professionals, and financial advisors. Together with our sample partners, we are able to complete the most challenging studies involving difficult to reach sampling populations and balancing requirements. We guarantee sample delivery on all quoted projects. Our projects guarantee sample delivery. -->

Amplitude Research provides full-service customer satisfaction surveys including study design, questionnaire writing, data analysis, and management friendly report writing. Our surveys can help pinpoint areas of strength or weakness and assist in understanding the root cause of a particular problem. Our experienced team of survey researchers and statisticians is expert in all phases of customer research and how best to measure both satisfaction and loyalty.

Market Research Surveys • Customer Satisfaction Surveys • Employee Feedback Surveys Survey Design • Survey Administration • Online Survey Hosting • Market Research Consulting

- Market Research Surveys

- Customer Satisfaction Surveys

- Job Satisfaction Surveys

- Design, Administration and Reporting

View More

- Online Market Research

- Consumer Market Research

- B2B Market Research

- Technology Market Research

- Customer Loyalty Surveys

- Survey Hosting

- Mail Surveys

- Survey Design

Amplitude Research, Inc. - 2255 Glades Road, Suite 324A | Boca Raton, Florida (FL) USA | 33431-8571 Toll-Free: 1-877-225-7950 | Local: 561-948-2142 | Email: [email protected] © 2002-2024 Amplitude Research, Inc. All Rights Reserved.

- Trademarks/Copyright |

- Privacy Policy |

- Contract Vehicles |

Business growth

Marketing tips

How to conduct your own market research survey (with example)

After watching a few of those sketches, you can imagine why real-life focus groups tend to be pretty small. Even without any over-the-top personalities involved, it's easy for these groups to go off the rails.

So what happens when you want to collect market research at a larger scale? That's where the market research survey comes in. Market surveys allow you to get just as much valuable information as an in-person interview, without the burden of herding hundreds of rowdy Eagles fans through a product test.

Table of contents:

What is a market research survey?

Why conduct market research, primary vs. secondary market research.

6 types of market research surveys

How to write and conduct a market research survey

Tips for running a market research survey.

Market research survey campaign example questions

Market research survey template

Use automation to put survey results into action

A market research survey is a questionnaire designed to collect key information about a company's target market and audience that will help guide business decisions about products and services, branding angles, and advertising campaigns.

Market surveys are what's known as "primary research"—that is, information that the researching company gathers firsthand. Secondary research consists of data that another organization gathered and published, which other researchers can then use for their own reports. Primary research is more expensive and time-intensive than secondary research, which is why you should only use market research surveys to obtain information that you can't get anywhere else.

A market research survey can collect information on your target customers':

Experiences

Preferences, desires, and needs

Values and motivations

The types of information that can usually be found in a secondary source, and therefore aren't good candidates for a market survey, include your target customers':

Demographic data

Consumer spending data

Household size

Lots of this secondary information can be found in a public database like those maintained by the Census Bureau and Bureau of Labor Statistics . There are also a few free market research tools that you can use to access more detailed data, like Think with Google , Data USA , and Statista . Or, if you're looking to learn about your existing customer base, you can also use a CRM to automatically record key information about your customers each time they make a purchase.

If you've exhausted your secondary research options and still have unanswered questions, it's time to start thinking about conducting a market research survey.

The first thing to figure out is what you're trying to learn, and from whom. Are you beta testing a new product or feature with existing users? Or are you looking to identify new customer personas for your marketers to target? There are a number of different ways to use a marketing research survey, and your choice will impact how you set up the questionnaire.

Here are some examples of how market research surveys can be used to fill a wide range of knowledge gaps for companies:

A B2B software company asks real users in its industry about Kanban board usage to help prioritize their project view change rollout.

A B2C software company asks its target demographic about their mobile browsing habits to help them find features to incorporate into their forthcoming mobile app.

A printing company asks its target demographic about fabric preferences to gauge interest in a premium material option for their apparel lines.

A wholesale food vendor surveys regional restaurant owners to find ideas for seasonal products to offer.

Market surveys are what's known as "primary research"—that is, information that the researching company gathers firsthand. Secondary research consists of data that another organization gathered and published, which other researchers can then use for their own reports.

Primary research is more expensive and time-intensive than secondary research, which is why you should only use market research surveys to obtain information that you can't get anywhere else.

Lots of this secondary information can be found in a public database like those maintained by the Census Bureau and Bureau of Labor Statistics . There are also a few free market research tools that you can use to access more detailed data, like Think with Google , Data USA , and Statista .

Or, if you're looking to learn about your existing customer base, you can also use a CRM to automatically record key information about your customers each time they make a purchase.

6 types of market research survey

Depending on your goal, you'll need different types of market research. Here are six types of market research surveys.

1. Buyer persona research

A buyer persona or customer profile is a simple sketch of the types of people that you should be targeting as potential customers.

A buyer persona research survey will help you learn more about things like demographics, household makeup, income and education levels, and lifestyle markers. The more you learn about your existing customers, the more specific you can get in targeting potential customers. You may find that there are more buyer personas within your user base than the ones that you've been targeting.

2. Sales funnel research

The sales funnel is the path that potential customers take to eventually become buyers. It starts with the target's awareness of your product, then moves through stages of increasing interest until they ultimately make a purchase.

With a sales funnel research survey, you can learn about potential customers' main drivers at different stages of the sales funnel. You can also get feedback on how effective different sales strategies are. Use this survey to find out:

How close potential buyers are to making a purchase

What tools and experiences have been most effective in moving prospective customers closer to conversion

What types of lead magnets are most attractive to your target audience

3. Customer loyalty research

Whenever you take a customer experience survey after you make a purchase, you'll usually see a few questions about whether you would recommend the company or a particular product to a friend. After you've identified your biggest brand advocates , you can look for persona patterns to determine what other customers are most likely to be similarly enthusiastic about your products. Use these surveys to learn:

The demographics of your most loyal customers

What tools are most effective in turning customers into advocates

What you can do to encourage more brand loyalty

4. Branding and marketing research

The Charmin focus group featured in that SNL sketch is an example of branding and marketing research, in which a company looks for feedback on a particular advertising angle to get a sense of whether it will be effective before the company spends money on running the ad at scale. Use this type of survey to find out:

Whether a new advertising angle will do well with existing customers

Whether a campaign will do well with a new customer segment you haven't targeted yet

What types of campaign angles do well with a particular demographic

5. New products or features research

Whereas the Charmin sketch features a marketing focus group, this one features new product research for a variety of new Hidden Valley Ranch flavors. Though you can't get hands-on feedback on new products when you're conducting a survey instead of an in-person meeting, you can survey your customers to find out:

What features they wish your product currently had

What other similar or related products they shop for

What they think of a particular product or feature idea

Running a survey before investing resources into developing a new offering will save you and the company a lot of time, money, and energy.

6. Competitor research

You can get a lot of information about your own customers and users via automatic data collection , but your competitors' customer base may not be made up of the same buyer personas that yours is. Survey your competitors' users to find out:

Your competitors ' customers' demographics, habits, and behaviors

Whether your competitors have found success with a buyer persona you're not targeting

Information about buyers for a product that's similar to one you're thinking about launching

Feedback on what features your competitors' customers wish their version of a product had

Once you've narrowed down your survey's objectives, you can move forward with designing and running your survey.

Step 1: Write your survey questions

A poorly worded survey, or a survey that uses the wrong question format, can render all of your data moot. If you write a question that results in most respondents answering "none of the above," you haven't learned much.

You'll find dozens of question types and even pre-written questions in most survey apps . Here are a few common question types that work well for market surveys.

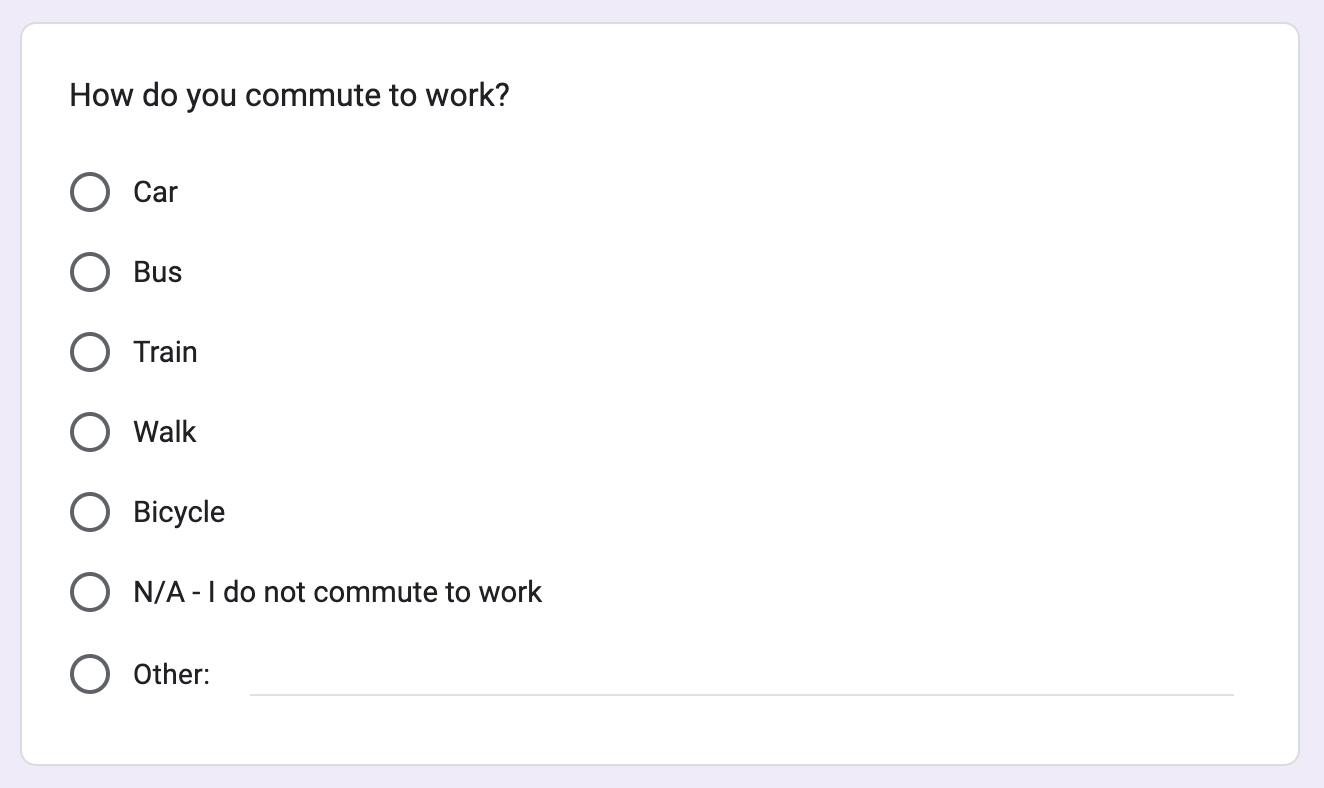

Categorical questions

Also known as a nominal question, this question type provides numbers and percentages for easy visualization, like "35% said ABC." It works great for bar graphs and pie charts, but you can't take averages or test correlations with nominal-level data.

Yes/No: The most basic survey question used in polls is the Yes/No question, which can be easily created using your survey app or by adding Yes/No options to a multiple-choice question.

Multiple choice: Use this type of question if you need more nuance than a Yes/No answer gives. You can add as many answers as you want, and your respondents can pick only one answer to the question.

Checkbox: Checkbox questions add the flexibility to select all the answers that apply. Add as many answers as you want, and respondents aren't limited to just one.

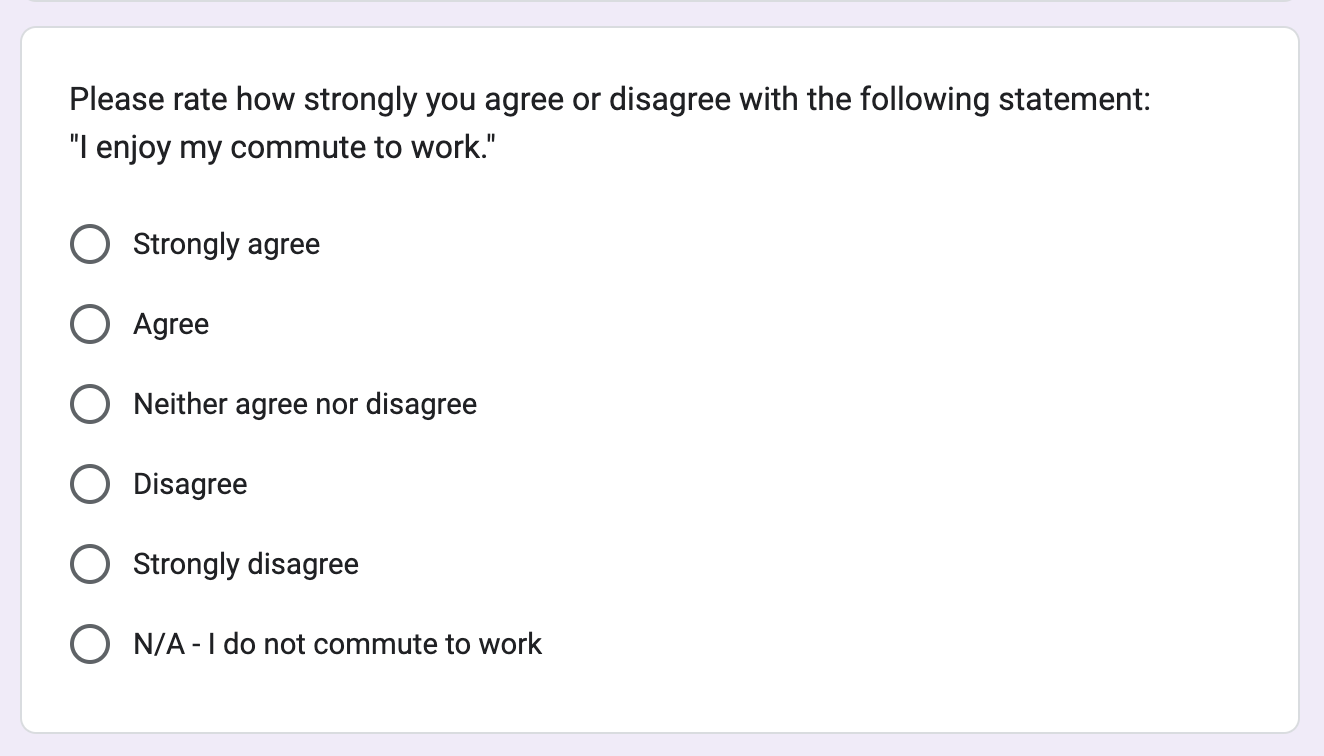

Ordinal questions

This type of question requires survey-takers to pick from options presented in a specific order, like "income of $0-$25K, $26K-$40K, $41K+." Like nominal questions, ordinal questions elicit responses that allow you to analyze counts and percentages, though you can't calculate averages or assess correlations with ordinal-level data.

Dropdown: Responses to ordinal questions can be presented as a dropdown, from which survey-takers can only make one selection. You could use this question type to gather demographic data, like the respondent's country or state of residence.

Ranking: This is a unique question type that allows respondents to arrange a list of answers in their preferred order, providing feedback on each option in the process.

Interval/ratio questions

For precise data and advanced analysis, use interval or ratio questions. These can help you calculate more advanced analytics, like averages, test correlations, and run regression models. Interval questions commonly use scales of 1-5 or 1-7, like "Strongly disagree" to "Strongly agree." Ratio questions have a true zero and often ask for numerical inputs (like "How many cups of coffee do you drink per day? ____").

Ranking scale: A ranking scale presents answer choices along an ordered value-based sequence, either using numbers, a like/love scale, a never/always scale, or some other ratio interval. It gives more insight into people's thoughts than a Yes/No question.

Matrix: Have a lot of interval questions to ask? You can put a number of questions in a list and use the same scale for all of them. It simplifies gathering data about a lot of similar items at once.

Example : How much do you like the following: oranges, apples, grapes? Hate/Dislike/Ok/Like/Love

Textbox: A textbox question is needed for collecting direct feedback or personal data like names. There will be a blank space where the respondent can enter their answer to your question on their own.

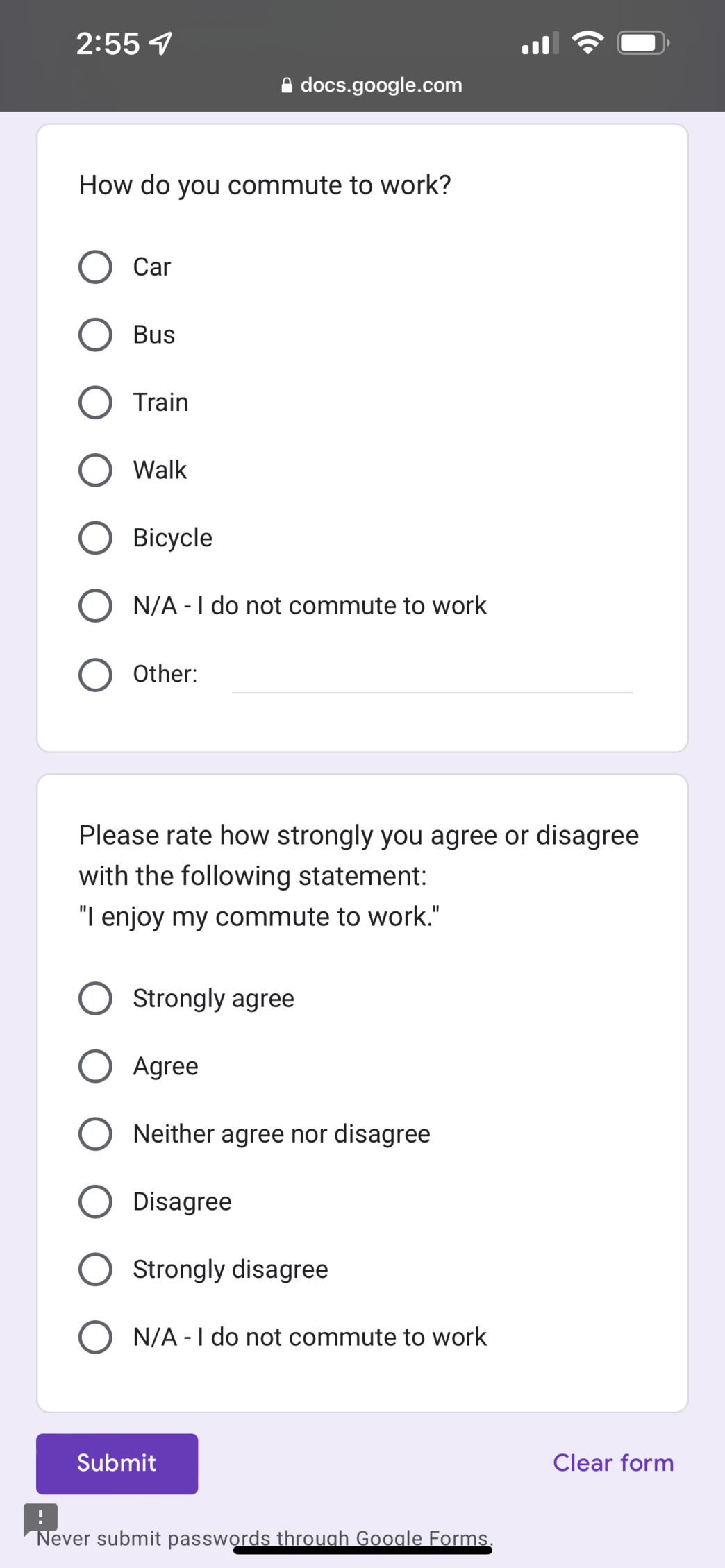

Step 2: Choose a survey platform

There are a lot of survey platforms to choose from, and they all offer different and unique features. Check out Zapier's list of the best online survey apps to help you decide.

Most survey apps today look great on mobile, but be sure to preview your survey on your phone and computer, at least, to make sure it'll look good for all of your users.

If you have the budget, you can also purchase survey services from a larger research agency.

Step 3: Run a test survey

Before you run your full survey, conduct a smaller test on 5%-10% of your target respondent pool size. This will allow you to work out any confusing wording or questions that result in unhelpful responses without spending the full cost of the survey. Look out for:

Survey rejection from the platform for prohibited topics

Joke or nonsense textbox answers that indicate the respondent didn't answer the survey in earnest

Multiple choice questions with an outsized percentage of "none of the above" or "N/A" responses

Step 4: Launch your survey

If your test survey comes back looking good, you're ready to launch the full thing! Make sure that you leave ample time for the survey to run—you'd be surprised at how long it takes to get a few thousand respondents.

Even if you've run similar surveys in the past, leave more time than you need. Some surveys take longer than others for no clear reason, and you also want to build in time to conduct a comprehensive data analysis.

Step 5: Organize and interpret the data

Unless you're a trained data analyst, you should avoid crunching all but the simplest survey data by hand. Most survey platforms include some form of reporting dashboard that will handle things like population weighting for you, but you can also connect your survey platform to other apps that make it easy to keep track of your results and turn them into actionable insights.

You know the basics of how to conduct a market research survey, but here are some tips to enhance the quality of your data and the reliability of your findings.

Find the right audience: You could have meticulously crafted survey questions, but if you don't target the appropriate demographic or customer segment, it doesn't really matter. You need to collect responses from the people you're trying to understand. Targeted audiences you can send surveys to include your existing customers, current social media followers, newsletter subscribers, attendees at relevant industry events, and community members from online forums, discussion boards, or other online communities that cater to your target audience.

Take advantage of existing resources: No need to reinvent the wheel. You may be able to use common templates and online survey platforms like SurveyMonkey for both survey creation and distribution. You can also use AI tools to create better surveys. For example, generative AI tools like ChatGPT can help you generate questions, while analytical AI tools can scan survey responses to help sort, tag, and report on them. Some survey apps have AI built into them already too.

Focus questions on a desired data type: As you conceptualize your survey, consider whether a qualitative or quantitative approach will better suit your research goals. Qualitative methods are best for exploring in-depth insights and underlying motivations, while quantitative methods are better for obtaining statistical data and measurable trends. For an outcome like "optimize our ice cream shop's menu offerings," you may want to find out which flavors of ice cream are most popular with teens. This would require a quantitative approach, for which you would use categorical questions that can help you rank potential flavors numerically.

Establish a timeline: Set a realistic timeline for your survey, from creation to distribution to data collection and analysis. You'll want to balance having your survey out long enough to generate a significant amount of responses but not so long that it loses relevance. That length can vary widely based on factors like type of survey, number of questions, audience size, time sensitivity, question format, and question length.

Define a margin of error: Your margin of error shows how much the survey results might differ from the real opinions of the entire group being studied. Since you can't possibly survey every single person in your desired population, you'll have to settle on an acceptable percentage of error upfront, a percentage figure that varies by sample size, sample proportion, and confidence interval. According to University of Wisconsin-Madison's Pamela Hunter , 95% is the industry standard confidence level (though small sample sizes may get by with 90%). At the 95% level, for example, an acceptable margin of error for a survey of 500 respondents would be 3%. That means that if 80% of respondents give a positive response to a question, the data shows that between 77-83% respond positively 95 out of 100 times.

Market research survey campaign example

Let's say you own a market research company, and you want to use a survey to gain critical insights into your market. You prompt users to fill out your survey before they can access gated premium content.

Survey questions:

1. What size is your business?

<10 employees

11-50 employees

51-100 employees

101-200 employees

>200 employees

2. What industry type best describes your role?

3. On a scale of 1-4, how important would you say access to market data is?

1 - Not important

2 - Somewhat important

3 - Very important

4 - Critically important

4. On a scale of 1 (least important) to 5 (most important), rank how important these market data access factors are.

Accuracy of data

Attractive presentation of data

Cost of data access

Range of data presentation formats

Timeliness of data

5. True or false: your job relies on access to accurate, up-to-date market data.

Survey findings:

63% of respondents represent businesses with over 100 employees, while only 8% represent businesses with under 10.

71% of respondents work in sales, marketing, or operations.

80% of respondents consider access to market data to be either very important or critically important.

"Timeliness of data" (38%) and "Accuracy of data" (32%) were most commonly ranked as the most important market data access factor.

86% of respondents claimed that their jobs rely on accessing accurate, up-to-date market data.

Insights and recommendations: Independent analysis of the survey indicates that a large percentage of users work in the sales, marketing, or operations fields of large companies, and these customers value timeliness and accuracy most. These findings can help you position future report offerings more effectively by highlighting key benefits that are important to customers that fit into related customer profiles.

Market research survey example questions

Your individual questions will vary by your industry, market, and research goals, so don't expect a cut-and-paste survey to suit your needs. To help you get started, here are market research survey example questions to give you a sense of the format.

Yes/No: Have you purchased our product before?

Multiple choice: How many employees work at your company?

<10 / 10-20 / 21-50 / 51-100 / 101-250 / 250+

Checkbox: Which of the following features do you use in our app?

Push notifications / Dashboard / Profile customization / In-app chat

Dropdown: What's your household income?

$0-$10K / $11-$35K / $36-$60K / $61K+

Ranking: Which social media platforms do you use the most? Rank in order, from most to least.

Facebook / Instagram / Twitter / LinkedIn / Reddit

Ranking scale: On a scale of 1-5, how would you rate our customer service?

1 / 2 / 3 / 4 / 5

Textbox: How many apps are installed on your phone? Enter a number:

Market research survey question types

Good survey apps typically offer pre-designed templates as a starting point. But to give you a more visual sense of what these questions might look like, we've put together a document showcasing common market research survey question types.

You're going to get a lot of responses back from your survey—why dig through them all manually if you don't have to? Automate your survey to aggregate information for you, so it's that much easier to uncover findings.

Related reading:

Poll vs. survey: What is a survey and what are polls?

The best online survey apps

The best free form builders and survey tools

How to get people to take a survey

This article was originally published in June 2015 by Stephanie Briggs. The most recent update, with contributions from Cecilia Gillen, was in September 2023.

Get productivity tips delivered straight to your inbox

We’ll email you 1-3 times per week—and never share your information.

Amanda Pell

Amanda is a writer and content strategist who built her career writing on campaigns for brands like Nature Valley, Disney, and the NFL. When she's not knee-deep in research, you'll likely find her hiking with her dog or with her nose in a good book.

- Forms & surveys

Related articles

14 types of email marketing to experiment with

14 types of email marketing to experiment...

8 business anniversary marketing ideas and examples worth celebrating

8 business anniversary marketing ideas and...

A guide to verticalization: What it is, when to try it, and how to get started

A guide to verticalization: What it is, when...

12 Facebook ad copy examples to learn from

Improve your productivity automatically. Use Zapier to get your apps working together.

- Pollfish School

- Market Research

- Survey Guides

- Get started

Market Research Survey: The Complete Guide

This process involves gathering primary (self-conducted) and secondary (information already researched and made available) sources, to fully assess how a business will fare within a particular market and audience.

A market research survey is typically a source of primary information that businesses can use as part of their market research campaigns. It can also exist as a secondary source, in which case, its studies and results are published online or in a print publication.

This article will take a close look at the market research survey, so that you can use it to the optimum benefit for your business.

What Can you Achieve with Market Research?

A market research survey, as its name entails, is used for research purposes. Before we dive into all the aspects of this survey, it is apt to learn how you can use market research to your full advantage.

Market research is critical for a variety of purposes, including marketing , advertising , and branding campaigns.

Aside from providing data-based support for these macro purposes, market research gains you invaluable insight into particular markets. For example, you may consider running a research campaign for the retail market . Market research will help you gather all the relevant information pertaining to this specific market.

Aside from retail, you can conduct market research in a number of verticals, including ecommerce , technology, real estate and many others.

There are plenty of other applications for market research. Here are some of the ways to use market research to your advantage:

- Observe data to prepare for challenges in advance

- Gauge the demand for your product or service

- Learn key market trends and staples

- Discover how your competitors are winning or losing

- Uncover your target market’s desires, preferences, aversions and thoughts

The final point is remarkably crucial for market research and for generally keeping your business afloat. And so, we’ll now dig deep into the market research survey, as this tool is especially useful for this purpose.

Defining a Market Research Survey

This tool is the most commonly used market research method — and for good reason. A market research survey allows you to gather data on your target market. Moreover, it allows businesses to do so by accessing any insights they need, as long as they form corresponding questions to their investigation.

Surveys have a far-reaching history, as they date back to ancient civilizations such as Greece and Rome. There was a surge in survey use in 1930s America, in which the government sought to understand the economic and social state of the nation.

Surveys have taken up a variety of forms, including analog forms, such as paper and mail-in formats .

Telephone surveys were the medium of choice for survey research during the 1960s-90s. But, as technological advancements would have it, those have declined in usefulness as well.

In the present day, surveys are conducted online, particularly through the use of designated software platforms. This type of software has paved the way for easy access to primary research.

Businesses can use online survey software and tools and to carry out all their survey research (save for creating the screener and questions). Many such tools available both allow you to build surveys along with deploying them.

To reiterate, market research surveys are powerful tools, in that they empower businesses to ask any question they choose to better understand their market and consumer base. They also can offer key insights into competitors.

The Components of a Market Research Survey

This tool contains two major components: the screener and the questionnaire . These form the bulk of the insights your primary research will gather.

There are also two auxiliary components to incorporate to make your survey research successful. These include the call-out (introduction) and the thank you message (conclusion).

Unlike the essential components, the need to use these will vary based on your survey deployment method and campaign. For example, an emailed survey won’t require a call-out, as the email itself serves this purpose.

A web or mobile survey, on the other hand, will need a call-out to get the attention of your respondents.

Here is a break-down of each component, beginning with the essential elements:

- These conditions often deal with demographics, which is incredibly important, as you would need to first and foremost, survey your target market. The screener will ensure it is only your target market that takes part in the survey.

- The screener is often comprised of 2-3 questions.

- The questionnaire should ask all the necessary questions you need for a particular campaign or sub-campaign. Or, if used in a preliminary stage of your market research, they can deal with questions particularly designed to segment your target market.

- If respondents are contacted via email, the call-out is in the email’s body, inviting participants to take it, listing why it’s important, its length and what it’s used for.

- If the survey exists within a website (either as a banner, or button), the call-out is the clickable element itself (the button/banner to the survey). It too should explain the survey to respondents.

- If the survey is on a website/app, the call-out has to be visible and attractive enough for users to notice it and click on it.

- The survey often routes users to another page with a thank you message.

- It’s important, as it lets participants know that their survey has in fact been submitted.

How to Create a Market Research Survey

Here are a few steps to take into consideration when starting on a market research survey project.

Step 1: Find a topic your business needs to learn more about.

This is particularly important if it is a topic that has little to no secondary sources. In this case, opting for a survey is the best way to learn more about it firsthand, from the people who matter most: your target market. Pay attention to any problems your business may experience, as surveys should help resolve them.

Step 2: Consider the topic in regards to your target market

When you’ve narrowed down a problem or two, think about your target market. Do you know who constitutes it? If yes, tailor your survey topic into a subtopic that they’ll be most likely to respond to. For example, if your target market is middle-aged men who watch sports, consider whether your problem/topic will be relevant to them.

If you don’t know your target market, you should conduct some secondary research about it first, then perform market segmentation (surveys can help on this front too).

Step 3: Find the larger application of the survey campaign

Now that you’ve settled on a topic/problem and decided on whether it’s fitting for your target market, consider what the parent campaign of the survey would be. Let’s hypothetically say your topic is related to a product. Would a survey on that topic benefit a branding campaign like finding your next slogan? Would it be better suited to settle on a theme for an advertising campaign?

Once you find the most appropriate application or macro campaign to house the survey, your market research will be organized and your survey will be better set up for success.

Step 4: Calculate your margin of error

A margin of error , in simple terms, is a measurement of how effective your survey will be. Expressed as a percentage, it measures the difference between survey results and the population value.

You need to measure this unit, as surveys represent a large group of people, but are made up of a much smaller group. Therefore, the larger the margin of error, the less accurate the opinions of the survey represent an entire population.

Step 5: Create your survey(s)

Now that you’ve calculated the margin of error, start creating your campaign. Decide on how many surveys you would need, in regard to your margin of error and your market research needs.

Start with a broader topic and get more specific in each question. Or, create multiple surveys focused on different but closely related subtopics to your main topic.

Send out your surveys through a trusted survey platform.

Questions to Ask for Various Campaigns

The steps laid out above are part of a simple procedure in developing a market research survey. However, there is much more to these steps, especially that of creating the survey.

Namely, you would need the correct set of questions, as they are the lifeblood of a survey. With so many different survey research campaigns and purposes, brainstorming questions can seem almost counterintuitive.

To avoid information overload and any confusion that creating a survey may incite, review the below question examples. They are organized per campaign type, so you can discern which questions are most suitable for which corresponding research purpose.

Questions for Branding

Branding campaigns include efforts that build the identity of your business; this includes gathering data-backed ideas on logos, imagery, messaging and core themes surrounding your brand. You can use these when embarking on a new campaign, revamping an existing one or when you’re looking to change your brand’s reputation and style.

- Which of these brands do you know?

- What do you like most/least about this brand?

- Which idea is more important? (Use an idea behind setting up your brand’s image/style)

- Which images do you find the most inspiring? (To compare images you’ll use in your marketing/ definitive to your brand)

- What do you like about [brand]? (Can be open-ended)

Questions for Advertising

Using market research for advertising will help you obtain ideas for new advertising campaigns, testing already established campaign ideas and predicting the success of new ones.

- How would you rate the motivating power of this ad?

- Which of the following ads resonate the most with you?

- Do you remember this ad? (Name and image/video of a popular ad within your industry)

- How do you feel after watching this ad?

- What kind of use do you think this product/service produces?

Questions for Comparing Yourself with Competitors

Studying your competitors is often associated with secondary research, but you can gain intelligence on this topic through your own survey research. The great thing about surveys is that you don’t have to focus on one competitor when managing these surveys.

- How often do you use this product/service?

- Which brand do you use for this product/service? (Include one open-ended answer).

- Which of the following products (same kind, different brand) do you find the most useful?

- What about [competitor product] would you like to see change?

- Which brand has improved your life? (Include one open-ended question).

Questions for Market Segmentation

This application is possibly the most challenging, as it involves understanding who your target market already is, then further segmenting it. We understand coming to terms with your target market first, before narrowing it any further down.

Here is how to segment your target market; you’ll notice that the questions are much more granular than the typical questions associated with each topic. (Ex: demographics typically ask for race, age, gender, income, etc).

- Demographic segmentation: Which of the following groups do you identify with most closely? (It can involve anything from music, to shopping habits, to lifestyle choices)

- Geographic segmentation: Which of the following areas do you typically spend time in to make physical purchases?

- Psychographic segmentation: How do you feel about retailers who test their products on animals?

- Behavioral segmentation: How often do you buy this kind of product?

- Sentimental segmentation: How do the following [practices, images, actions] make you feel?

Securing the Most Benefits Out of Your Market Research Survey

As we can deduce from this guide, the market research survey is a critical tool for market research . There is so much to discover about your industry, competitors and chiefly, your customers. But before making any hasty decisions, it is vital to peruse all your research documents, not just the primary research ones, such as surveys.

When you combine primary and secondary research sources, you’re setting up any business move for greater success.

That’s because market research involves studying more than one source. It may appear daunting, but with the right tools, you can design better products, innovate on existing products, appeal to a wider audience and gain more revenue from your marketing efforts.

Thus, pair your market research survey with other research means for a lucrative market research campaign. Knowledge truly is power.

Frequently asked questions

What is a market research survey.

A market research survey is a survey used for conducting primary market research and is the most commonly used market research method. Market research surveys help you understand your target market, gathering data necessary to make informed decisions on content creation, product development, and more.

What are the components of a market research survey?

There are 4 major components in a market research survey. First, we have the callout to get digital visitors to participate in a survey. Next is the screener which determines who is eligible to take the survey based on their demographics information and answers to screening questions. Then, there is the questionnaire—-- this is the heart of the survey, containing a set of open-ended or closed-ended questions. Lastly, there’s the callout. This introduces the survey to respondents. Next, there’s the thank you message. This acts as the conclusion to the survey.

How can you create a market research survey?

Creating a market research survey starts with identifying the topics your business needs to learn more about. Next, you consider topics within the context of your target market and find the larger application of the survey campaign. Calculate your margin of error and then create your survey using online software.

What types of questions should you ask on your market research survey?

You can ask branding related questions to gather information on how your identity of your business is perceived. You can also ask questions that spark ideas for new advertising campaigns. To supplement your secondary research on competitors, ask questions about your business’s place in the industry. Questions can also be used for market segmentation. These are questions on demographic, geographic, psychographic, behavioral and sentimental topics.

How can you get the most benefits out of your market research survey?

You can get the most out of your market research survey by using the correct online survey platform-- one with specific audience targeting for real consumers, radius targeting and quality screening questions-- you’ll get relevant answers from the right audience.

Do you want to distribute your survey? Pollfish offers you access to millions of targeted consumers to get survey responses from $0.95 per complete. Launch your survey today.

Privacy Preference Center

Privacy preferences.

Top 17 market research companies in the United States (US)

5. pollfish, 6. ascendant consulting firm, 8. ready to launch research, 9. antedote, 10. b2b international, 13. nielsen, 15. forrester research services, 16. momentive, 17. veridata insights.

Your company can’t navigate the constantly changing marketplace without understanding business landscapes, consumer needs, or buying habits. Market analysis is key to how you find and capitalize on market trends before your competitors do. You can start by outlining research goals and needs. But let’s be real, making data-driven decisions is a whole lot easier with top market research firms by your side.

The right market research agencies, platforms and companies do more than just surveys to offer actionable insights so you can make smarter decisions for business growth. They make consumer research easy with strategic zero-party data collection, comprehensive data analysis, and intelligent insights.

If you’re tired of searching through market research companies in the United States, this article leads you straight to the best ones out there.

Here’s a quick rundown of the top US market research companies:

Looking to dive deep into the minds of your target audience? Sign up for a demo to see how Attest makes it effortless to gain consumer insights from 125 million consumers across the globe.

Attest is one of the top market research companies in the US. This consumer research platform lets you collect data from 125 million diverse respondents in 59 countries. You can use Attest to do market research for branding , consumer profiling, market analysis, and much more!

Every Attest customer has access to expert research advice from their in-house Customer Research Team. Whether you’re new to research and need some guidance, or a research pro looking for a second pair of eyes on your market research project, Attest’s Customer Research Team is here for you.

Besides speedy surveys and quick responses, this platform features an intuitive results dashboard that turns data into mesmerizing stories. You can also send surveys on a recurring basis to spot changes in responses or compare data from two groups. Plus, expert advice is only a click away when you aren’t sure about choosing market research tools or reaching market research goals.

Attest has been really instrumental in driving home the reality of the consumer need, and surfacing that it is much harder to get a younger demographic to engage with pensions. Georgie Burks , Head of Brand Marketing, Penfold

Trustpilot relied on the Attest market analysis solution to research consumer attitudes among marketers and engage them in eight key markets. Here’s what they think about the value Attest brings.

We were thinking about how businesses could look within their reviews and understand what was important to their consumers, but we didn’t actually know what the most important things consumers cared about were. So we decided the best way to find out was just to ask consumers themselves. Gillian Harris , Global Marketing Program Manager, Trustpilot

Location: London

Founded: 2015

Pricing: Pricing on request

Best for:

- Market analysis: unlocks new market opportunities

- Brand tracking: measures brand health and performance

- Creative testing: validates the creative impact of ad campaigns

- Consumer profiling: dives deep into existing and future customers

- New product development: tests product ideas or marketing messages with your target market

Get reliable consumer insights fast with Attest

With Attest you get high-speed insights, so you can make informed decisions when they matter. And you get designated research advice from the experts in the Customer Research Team—they’re with you at every step of your research journey!

Bixa is a market research studio specializing in mobile youth research and custom UX research services. Their qualitative and qualitative research offerings are best for those trying to validate new markets, gather product feedback, or understand the target audience better.

They make marketing research a breeze by completing the entire cycle of participant recruitment to report delivery in three to four weeks. Besides conducting customer surveys, user testing, and mobile ethnography, Bixa also offers market research consulting for companies looking to jumpstart their product and marketing research.

Location: Alexandria, Virginia

Founded: 2012

Pricing: Available on request

- In-depth interviews

- Product research

- Hyper-profitable targeting

- Customer surveys

- Usability testing

- Website and app review

- Team coaching

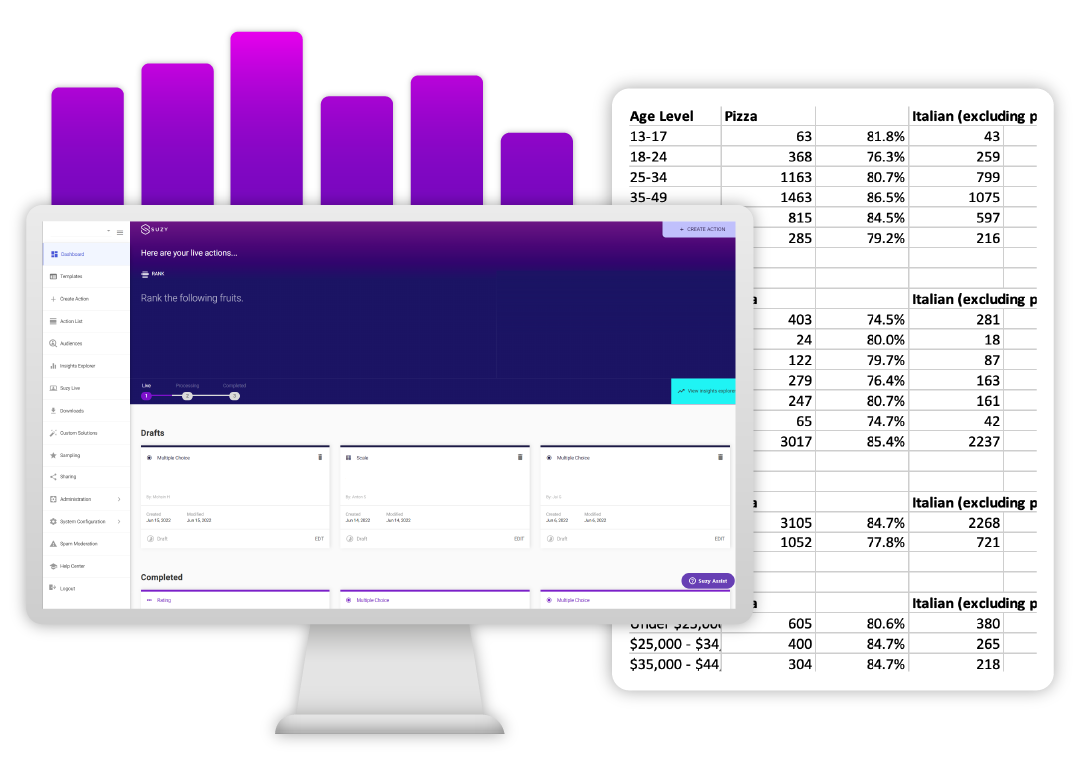

Suzy is a leading qualitative market research software with iterative research capabilities. Its end-to-end consumer insights platform offers qualitative insights into complex research questions. The best part is that you can get real-time data from Suzy’s proprietary audience of one million consumers. On the other hand, Attest offers a larger audience in more countries, making it ideal for those with market research campaigns spanning the globe. In addition, Attest provides designated advice from experienced researchers for all customers.

Suzy offers qualitative research solutions such as product development, advertising, shopper and behavioral insights, and tracking and measurement. Industries ranging from finance to media use Suzy to improve business performance through qualitative studies.

Location: New York

Founded: 2017

- Concept testing

- Competitive analysis

- Consumer profiling

- Positioning strategy

- Shopper and category insights

- Tracking research services

- UX design research

Remesh is one of the top market research firms in New York City. They offer artificial intelligence-driven research solutions to companies looking to streamline qualitative and quantitative insight discovery. This marketing research firm makes it easy for companies or governments to speak to thousands of customers or citizens at the same time. Then it analyzes interactions and opinions to offer key insights.

Market researchers use Remesh to get actionable feedback on product ideas, messaging, and packaging from online focus groups. You can also use their online surveys to improve employee listening and boost corporate reputation.

Founded: 2013

- Packaging testing

- Civic engagement

- Consumer insights

- Collective intelligence

- Employee engagement

- Shelf placement testing

- Product issue identification

- Employee experience and engagement

Pollfish is a modern survey research platform that uses artificial intelligence to help you create surveys in seconds. This DIY market research company helps you gain real-time insights from over 250 million consumers worldwide. The platform also comes loaded with cutting-edge technology capabilities for dynamic sampling and random device engagement.

Attest is a great alternative to Pollfish for conducting primary market research. Attest’s platform detects bad-quality responses that contain non-relevant, incomplete, and conflicting answers. Additionally, Attest is much easier to use and provides advice from experienced researchers.

Pricing: Starts at $95

- Brand awareness

- Brand perceptions

- Advertising testing

- Logo testing

- Brand diagnostics

- Product concept testing

Ascendant Consulting Firm is one of the best in the marketing research industry. They specialize in competitive intelligence, consumer insights, and market feasibility services. With 95+ years of collective experience in market research analysis, they help you make data-driven business decisions for business expansion, market entry, and assessments.

The team at Ascendant is also adept at advanced quantitative analytics suitable for financial and strategic marketing analyses. Other key capabilities include full service market research, survey design, and secondary data research.

Location: Miami

Founded: 2010

- White label research

- Product market research

- Market opportunity evaluation

- Survey reporting and analysis

- Employee experience and satisfaction research

- Consumer attitude, usage, and trends research

Isurus offers bespoke market research services to B2B and technology companies. This market research company leverages multiple statistical analysis tools to help you gain a 360° understanding of markets and decision-makers. Moreover, they also make it effortless for you to evaluate competitors for competitive advantage or validate market opportunities.

Business software, manufacturing, and financial services companies rely on Isurus to keep a pulse on what customers want and find the right pricing strategies. The team at Isurus can also help you with brand tracking and creative performance testing. They specialize in quantitative, qualitative, international, and secondary research.

Location: Burlington

Founded: 2000

- Persona analysis

- Competitor profiling

- Pricing strategy research

- Brand perception research

- Market segmentation research

- Customer satisfaction analysis

- Market assessment and planning

- Brand audit, tracking, and management

Ready to Launch Research is a California-based market research agency that serves a wide variety of industries with qualitative, quantitative, and digital research strategies. Whether you want to quantify consumer behavior or get qualitative consumer journey insights, they have the expertise to handle all your needs.

They leverage the following research methods to get you the insights you need.

- Creative testing

- Online discussions

- Home use test (HUT)

- Focus group moderation

Ready to Launch Research serves many dynamic industries ranging from pet to education to consumer electronics. Once you reach out to them with research requirements, they’ll get in touch to know more details and design the research process.

Location: Los Angeles

Founded: 2014

- Ethnography

- Focus group discussions

- Advertising research

- Online communities research services

Antedote is an innovation consultancy that delivers strategic market research insights by combining data science, in-depth research, and next-generation digital tools. What makes them different is their ability to use different qualitative and quantitative research tools instead of relying on a one-size-fits-all approach.

The team at Antedote helps you uncover insights in various areas such as user research, cultural research, and scenario planning. You can also partner with them for creating innovation roadmaps or concept development and visualization. Antedote’s plug-and-play approach means you have an agile and collaborative team that makes problem-solving easy with guidelines and blueprints.

Location: San Francisco

- Brand positioning

- Concept crafting

- Demand space segmentation

- Internal engagement programs

- Price and proposition optimization

- Product and portfolio development

- Workshop design and facilitation

B2B International by Merkle is one the largest market research agencies in London , with several locations in the United States. This market research company serves B2B companies looking to gather business insights and intelligence. They can help you with customer loyalty testing, pricing effectiveness, and market size analysis.

B2B International also specializes in delivering research services for go-to-market strategy, customer journey mapping, and voice-of-customer surveys. Their experience of working across different industries ranging from chemicals to media to logistics makes them uniquely qualified for B2B market research.

Location: London (with offices in Boston, Chicago and New York)

Founded: 1998

- Market sizing research

- Customer journey research

- Thought leadership research

- Product and proposition research

- Customer research and segmentation

Ipsos is one of the top market research companies trusted by top brands and companies across the Americas, Africa, the Middle East and Europe. Besides market strategy and innovation services, Ipsos also offers marketing management analytics, brand health tracking, and advisory services.

With tailored market research solutions for every need, Ipsos helps you optimize brand positioning, discover shopper journeys, and understand consumers. The team can also help you with product testing, package research, and creative idea assessment. Other services include brand health tracking, employee engagement research, and channel performance optimization.

Location: Paris (with locations in New York)

Founded: 1975

- Mystery shopping

- Brand health research

- User experience study

- Innovation and forecasting

- Social intelligence analysis

- Creative development and assessment

Dynata is a first-party data platform that helps you gather and analyze business intelligence for efficient decision-making. Their platform streamlines the entire research workflow so you can focus more on insights. Dynata lets you ask questions to their proprietary 67 million consumers and visualize those responses effortlessly.

The Dynata insights platform lets you build surveys for concept testing, creative testing, and ad-hoc market research. Other research services include market segmentation, brand health monitoring, campaign measurement, and voice of the customer surveys. With real-time dashboards and research reports, Dynata makes it easy for you to gain useful data insights.

Location: Plano, Texas

Founded: 1940

- Survey authoring

- Digital ethnography

- Online research panel

- Online qualitative research

- Data analytics and reporting

- Brand performance tracking

Nielsen is a global data, analytics, and audience measurement company that offers bespoke research solutions to help you discover audience intelligence across channels and platforms. This market research company divides its services into four core categories:

- Media planning

- Content metadata

- Marketing optimization

- Audience measurement

Audience measurement is all about using quantitative and qualitative research to discover shifting habits of audiences. Media planning, on the other hand, offers a comprehensive understanding of competitive intelligence, audience segmentation, and scenario planning. Marketing optimization research services help you analyze and boost campaign performance. Finally, content metadata improves customer experience with easy audio and video content discovery.

Founded: 1923

- Scenario planning

- Competitive intelligence

- Audience segmentation

- Cross-platform audience measurement

- Marketing campaign performance analysis

Westat is a 100% employee-owned market research company that delivers superior quantitative and qualitative research services in transportation, health, social policy, and education. They specialize in survey research, statistical sciences, and providing technical assistance.

Westat’s expertise in integrated data collection strategies helps them create focus groups, run web surveys, and create questionnaires for finding the right data. Plus, they use a research-driven communications framework to engage audiences effortlessly. They also use machine learning and artificial intelligence-assisted interviewing systems to solve your research challenges.

Location: Rockville

Founded: 1963

- Custom research

- Clinical trials

- Survey and analytical needs

- Biomedical science research

- Behavioral health and health policy research

Forrester Research Services is the market research wing of the global research and advisory firm Forrester. Their customer-obsessed approach helps companies turn their strategic research needs into reality. They currently offer market research services to companies in technology, sales, B2B marketing, product, B2C marketing, customer experience, and digital business space.

Forrester offers research services in the following domains:

- Sales operations optimization

- Marketing strategy formulation

- Competitive market intelligence

- Product lifecycle process research

- Corporate communications strategy

- Integrated campaign strategy planning

- Business change management strategy

- Customer insights collection and analysis

- Customer acquisition and retention research

- Route-to-market configuration and optimization

- Account-based marketing and demand generation research

Location: Cambridge

Founded: 1983

- Public sector research

- Sales and product management

- Customer experience analysis

- Digital business transformation

- B2B and B2C marketing research

Momentive is an artificial intelligence-powered market research platform that helps you gather on-demand customer and market feedback for actionable insights. This market research company is known for its agile experience management solution that lets you better understand markets, competitors, or even internal teams.

Their purpose-built market insights solutions offer you actionable insights from consumer panels. You can also decode buyer attitudes, understand consumer segments, and monitor buyer preferences. Mometive’s AI solutions also make it easy for you to conduct customer experience research, track product experience, and transform employee engagement.

Location: San Mateo

Founded: 1999

- Market sizing

- Idea screening

- Industry tracking

- Shopper insights

- Customer effort score

- Mobile app experience

- Customer segmentation

- Post-purchase experience

- Product and price optimization

- Custom market research services

- Employee engagement and retention

Veridata Insights is another top-rated market research company with recruitment capabilities to serve 100+ countries. Whether you want to analyze complex data with quantitative methodologies or need qualitative insights, they can help you with it all.

The team at Veridata Insights strives to deliver stress-free, budget-friendly, and timely research services that keep you ahead of the competition. Apart from their proprietary technology and global reach, they’re known for data quality and panel strength. They can also help you gather business intelligence with data processing and easy-to-understand dashboards.

Location: Dallas

Founded: 2019

- Consumer research

- Online data collection

- Survey programming

- B2B audience research

- Dashboards and analytics

Break into your US target market with Attest

Choosing the right agency isn’t easy, especially with so many players in the market research industry. Businesses often struggle with finding one that delivers accurate and valuable insights while simplifying their findings. Plus, the biggest challenge is targeting the right audience that matters to your business.

Attest solves all these problems by letting you handpick the target audience you want to reach. You can use filters and quotas to filter the most appropriate audience from 125 million people in 59 countries. Moreover, the platform empowers you to run surveys that bring in results in days instead of weeks. With hybrid research and a three-layer data quality check, you’ll never have any nonsense answers. And you also get to interact with the data, thanks to the interactive dashboard.

Ready to transform your business with easy-to-access consumer insights? Sign up for a dem o to see how Attest can be your ally in conducting market research effortlessly.

Make decisions based on reliable consumer insighs

Insights with Attest are triple-checked for data quality, so you know that you’re making smart decisions based on data you can trust.

Nikos Nikolaidis

Senior Customer Research Manager

Nikos joined Attest in 2019, with a strong background in psychology and market research. As part of Customer Research Team, Nikos focuses on helping brands uncover insights to achieve their objectives and open new opportunities for growth.

Related articles

How to conduct a market trend analysis (and stay 3 steps ahead of the competition), market analysis, how to market a new product: 11 must-follow methods for 2023, new product development, a tasteful guide to food product development, food & beverage, subscribe to our newsletter.

Fill in your email and we’ll drop fresh insights and events info into your inbox each week.

* I agree to receive communications from Attest. Privacy Policy .

You're now subscribed to our mailing list to receive exciting news, reports, and other updates!

Find the right market research agencies, suppliers, platforms, and facilities by exploring the services and solutions that best match your needs

list of top MR Specialties

Browse all specialties

Browse Companies and Platforms

by Specialty

by Location

Browse Focus Group Facilities

Manage your listing

Follow a step-by-step guide with online chat support to create or manage your listing.

About Greenbook Directory

IIEX Conferences

Discover the future of insights at the Insight Innovation Exchange (IIEX) event closest to you

IIEX Virtual Events

Explore important trends, best practices, and innovative use cases without leaving your desk

Insights Tech Showcase

See the latest research tech in action during curated interactive demos from top vendors

Stay updated on what’s new in insights and learn about solutions to the challenges you face

Greenbook Future list

An esteemed awards program that supports and encourages the voices of emerging leaders in the insight community.

Insight Innovation Competition

Submit your innovation that could impact the insights and market research industry for the better.

Find your next position in the world's largest database of market research and data analytics jobs.

For Suppliers

Directory: Renew your listing

Directory: Create a listing

Event sponsorship

Get Recommended Program

Digital Ads

Content marketing

Ads in Reports

Podcasts sponsorship

Run your Webinar

Host a Tech Showcase

Future List Partnership

All services

Dana Stanley

Greenbook’s Chief Revenue Officer

Top Marketing Research Firms in Tampa St Petersburg (FL)

Featured marketing research firms in tampa st petersburg (fl).

in Tampa St Petersburg (FL)

Service or Speciality

Alcoholic Beverages

Attitude & Usage Research

Banking - Retail

Central Location

Conjoint Analysis / Trade-off/Choice Modeling

Consultation

Consumer Durables

Consumer Services

Consumer Trends

Controlled Store Tests

Customer Satisfaction

Data Processing

Data Tabulation

Doctors / Physicians

Employee Experience & Satisfaction

Ethnography / Observational Research

Executive / Professional Search

Executives / Professionals

Exit Interviews

Eye Tracking

Field Services

Focus Group Facility

Focus Group Recruiting

Foods / Nutrition

Fragrance Industry

Full Service

General - Healthcare

Home Use Tests

Household Products/Services

Hybrid / Mixed Methodology

Legal / Lawyers

Mall Intercept

Market Opportunity Evaluation

Market Segmentation

Mobile Ethnography

Mobile Surveys

Mock Juries

Nurses / Nurse Practitioners

One-on-One / In-depth Interviews (IDIs)

Online - Quantitative

Online Focus Group Platforms & Software

Online Panels

Personal Care Items

Pet Owners / Foods / Supplies

Pre-Recruiting

Product Market Research

Product Purchasing / Sample Pick-up

Product Testing

Product Usability Testing

Qualitative Research

Quantitative Research

Questionnaire / Survey Design

Questionnaire Coding

Recruiting Research

Retail Industry

Secondary Research / Desk Research

Segmentation

Sensory Research

Shopper Insights

Survey Reporting and Analysis

Taste Test Facility

Taste Tests / Sensory Tests

Telecommunications

Test/Commercial Kitchen

Cleveland (OH)

Miami-Fort Lauderdale (FL)

Orlando (FL)

Tampa-St. Petersburg (FL)

United States of America

Vendor type

Data Collection

Support Services

Business Designation

Minority-Owned Business

SBE Certified

Women-Owned Business

Clear filters ( 0 )

Compare Tampa St Petersburg (FL)

Miami, Florida

Save to my lists

Featured expert

Ascendant Consulting Firm (Branch)

The Ascendant Consulting Firm provides premium consumer insight, competitive intelligence and market viability/feasibility analysis.

Why choose Ascendant Consulting Firm (Branch)

Virtual Meeting

Case Study Presentation

Recommendations Provided

Presentation Preparation

White Label Research Svc

Learn more about Ascendant Consulting Firm (Branch)

Ormond Beach, Florida

SOCIAL LINKS

CRG Global - Test America (Branch)

CRG Global specalizes in full service market research including CLTs, HUTs, focus groups, mobile research, eye tracking, facial coding, and more.

Why choose CRG Global - Test America (Branch)

40 + yrs in the Industry

Executional Expertise

Global Data Collection

Purpose-built Facilities

Extensive Panel 440K+

Learn more about CRG Global - Test America (Branch)

Tampa, Florida

L&E Research - Tampa

National recruiting + Top Rated Facilities in Raleigh, Charlotte, Tampa, Cincinnati, Columbus, Denver and New York since 1984.

Why choose L&E Research - Tampa

99% Client Recommended

In-Person or Online

Nationwide Recruiting

Advanced Technology

Industry Leading Service

Learn more about L&E Research - Tampa

Chagrin Falls, Ohio

Opinions (Branch)

Opinions, Ltd. specializes in mall intercepts, pre-recruits and on-site interviewing. 20+ owned & operated facilities/studios nationwide USA.

Why choose Opinions (Branch)

Product & Package Testing

CLT Facilities & In-Store

Qual Integration

Owned & Operated Centers

À la carte Services

Learn more about Opinions (Branch)

Tarpon Springs, Florida

Blue Sky Research Group LLC

Tampa, FL company to manage your local and national product procurement requests. Available staff for interviewing and other in-store assignments.

Learn more about Blue Sky Research Group LLC

Sign Up for Updates

We will send you a greatest letters one per week for your happy

I agree to receive emails with insights-related content from Greenbook. I understand that I can manage my email preferences or unsubscribe at any time and that Greenbook protects my privacy under the General Data Protection Regulation.*

Your guide for all things market research and consumer insights

Create a New Listing

Manage My Listing

Find Companies

Find Focus Group Facilities

Tech Showcases

GRIT Report

Expert Channels

Get in touch

Marketing Services

Future List

Publish With Us

Privacy policy

Cookie policy

Terms of use

Copyright © 2024 New York AMA Communication Services, Inc. All rights reserved. 234 5th Avenue, 2nd Floor, New York, NY 10001 | Phone: (212) 849-2752

- SCAM WARNING

- Request A Quote

- Join Our Survey Database!

- Print Location List

- Demographics

- Covid-19 Update

- Home Welcome

- About C&C Who We Are

- Services What We Do

- Locations Our 33 Offices

- Careers Join Our Team

- Contact Get In Touch

Miami/fort Lauderdale - Broward Mall 8000 W. Broward Blvd #1124, Plantation, FL 33388

- Miami/Fort Lauderdale

Sorry, Photos Unavailable

Looks like IMGUR might be having issues.

View this gallery on Imgur

Broward Mall Office

954-473-2294 954-473-2296 [email protected]

Broward Mall in Plantation, FL has 96 stores which include the following anchors: Dillards, Jcpenney, Regal Cinemas, Macy's. - Mall Website

Demographics Accommodations Directions

Facility features, population breakdown.

- Caucasian - 54%

- Hispanic - 20%

Note: Less than 4% is not labeled on the chart.

Pre-recruiting Zip Code(s)

33004, 33008, 33009, 33019, 33020, 33021, 33022, 33023, 33024, 33025, 33026, 33027, 33028, 33055, 33056, 33060, 33061, 33063, 33065, 33066, 33068, 33069, 33071, 33075, 33077, 33081, 33082, 33083, 33084, 33093, 33097, 33301, 33302, 33303, 33304, 33305, 33306, 33307, 33308, 33309, 33310, 33311, 33312, 33313, 33314, 33315, 33316, 33317, 33318, 33319, 33320, 33321, 33322, 33323, 33324, 33325, 33326, 33327, 33328, 33329, 33330, 33331, 33332, 33334, 33335, 33336, 33337, 33338, 33339, 33340, 33345, 33346, 33348, 33349, 33351, 33355, 33359, 33388, 33394

Hotel Recommendation(s)

- Riverside Hotel,(866) 573-4235

- Embassy Suites,(866) 538-1314

Closest Airport(s)

Get directions to broward mall.

Directions:

Root out friction in every digital experience, super-charge conversion rates, and optimize digital self-service

Uncover insights from any interaction, deliver AI-powered agent coaching, and reduce cost to serve

Increase revenue and loyalty with real-time insights and recommendations delivered to teams on the ground

Know how your people feel and empower managers to improve employee engagement, productivity, and retention

Take action in the moments that matter most along the employee journey and drive bottom line growth

Whatever they’re are saying, wherever they’re saying it, know exactly what’s going on with your people

Get faster, richer insights with qual and quant tools that make powerful market research available to everyone