- Recently Active

- Top Discussions

- Best Content

By Industry

- Investment Banking

- Private Equity

- Hedge Funds

- Real Estate

- Venture Capital

- Asset Management

- Equity Research

- Investing, Markets Forum

- Business School

- Fashion Advice

- Interview Questions

FP&A Interview Questions and Answers (30 Samples)

30 common FP&A technical, fit, behavioral, and logic questions to help you join the industry

Elliot currently works as a Private Equity Associate at Greenridge Investment Partners, a middle market fund based in Austin, TX. He was previously an Analyst in Piper Jaffray 's Leveraged Finance group, working across all industry verticals on LBOs , acquisition financings, refinancings, and recapitalizations. Prior to Piper Jaffray, he spent 2 years at Citi in the Leveraged Finance Credit Portfolio group focused on origination and ongoing credit monitoring of outstanding loans and was also a member of the Columbia recruiting committee for the Investment Banking Division for incoming summer and full-time analysts.

Elliot has a Bachelor of Arts in Business Management from Columbia University.

Prior to joining UBS as an Investment Banker, Himanshu worked as an Investment Associate for Exin Capital Partners Limited, participating in all aspects of the investment process, including identifying new investment opportunities, detailed due diligence, financial modeling & LBO valuation and presenting investment recommendations internally.

Himanshu holds an MBA in Finance from the Indian Institute of Management and a Bachelor of Engineering from Netaji Subhas Institute of Technology.

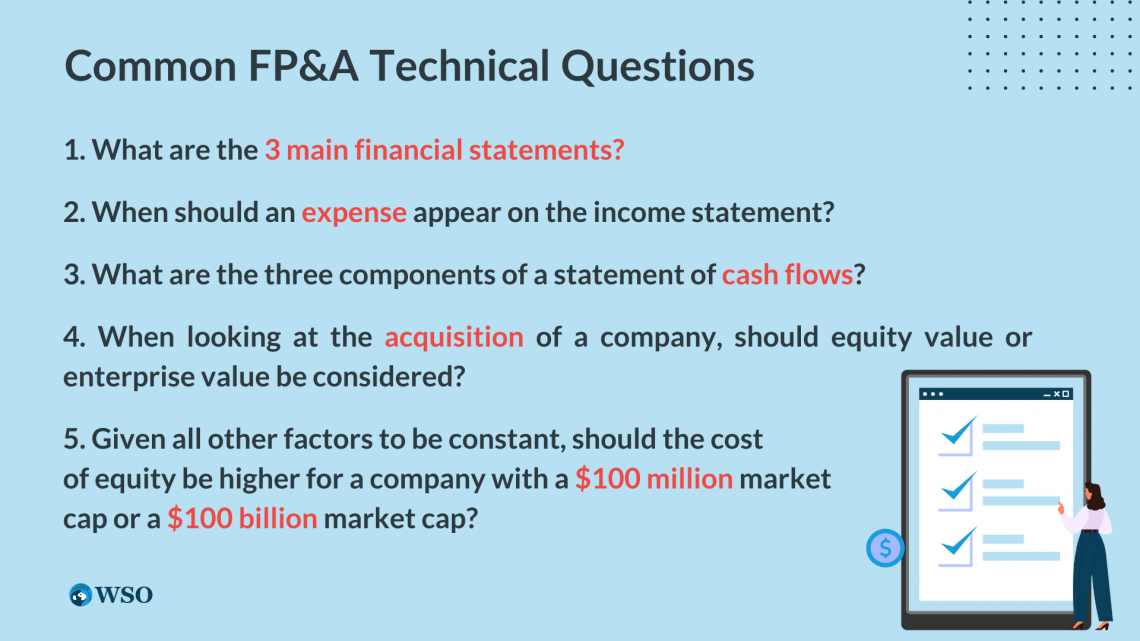

10 Common FP&A Technical Questions

- 10 Hard FP&A Technical Questions And Answers

5 Common FP&A Behavioral/Fit Questions

- 5 Firm-Specific Behavioural/ Fit Questions For FP&A Interviews

- WSO Interview Prep Guides & Additional Resources

Financial Planning & Analysis (FP&A) teams have established themselves as crucial to an organization’s long-term growth and success through budgeting, modeling, forecasting, and analyzing financial metrics utilized by management executives to make informed decisions.

The FP&A interview process is designed to identify capable candidates with strong attention to detail and critical thinking qualities. Given this, answering the technical and behavioral questions with confidence and consistency is key to converting an interview into an offer.

The following free WSO FP&A interview guide serves as a comprehensive resource designed to cover multiple aspects of the interview process, drastically improving your odds of receiving an FP&A offer at your dream F500 company.

This guide features 30 of the most common technical and behavioral questions, along with proven sample answers, that are asked by FP&A hiring professionals to candidates during the hiring process.

This resource further includes 15 firm-specific questions asked to candidates by professional FP&A hiring teams at F500 companies ( Morgan Stanley , Deloitte , etc.) and other world-renowned firms ( Houlihan Lokey , Vanguard Group , etc.), and there are sample answers to each question.

The Only Program You Need to Land in High Finance Careers

The most comprehensive curriculum and support network to break into high finance.

Technical questions are a critical component of almost every FP&A recruiting process. Generally, FP&A teams look for a solid understanding of basic concepts in finance and accounts, which you can consequently apply to technicals asked to you - as opposed to asking common questions easily memorized by candidates.

Therefore, naturally, your answers must demonstrate in-depth knowledge and expertise of the topic at hand.

The following section features 10 common FP&A interview questions , all of which have been provided sample answers. At the end of these 10 questions, we have provided you with 10 exclusive firm-specific technical questions to kickstart your mock interview training.

1. What are the 3 main financial statements?

- Revenues – Cost of Goods Sold – Expenses = Net Income

- Expenses include both cash and non-cash expenses and both operating and non- operating expenses .

- Net Income DOES NOT equal cash flow and should not be considered an accurate representation of a company’s ability to generate cash because the Income Statement includes non-cash expenses and does not reflect the cash impact of changes in Working Capital or Capital Expenditures.

- Assets = Liabilities + Shareholder ’s Equity

- Assets and Liabilities are often shown in order of “liquidity”, or the rate at which that asset or liability is expected to be realized in cash (ordered from most current/liquid to least current/liquid)

- SCF also shows capital expenditures (a non-operating cash outflow) as well as cash inflows from the sale of capital assets (for example, Plant, Property & Equipment) in the Cash Flow from Investing section

- SCF also contains the Cash Flow from Financing section, which shows the cash impact (inflow or outflow) of activity with a company’s investors (both debt and equity). This includes debt capital raised or repaid, equity capital raised or repurchased, or dividends paid.

- Beginning Cash + CF from Operations + CF from Investing + CF from Financing = Ending Cash

Sample Answer:

The three primary financial statements are the Income Statement, the Balance Sheet , and the Statement of Cash Flows.

The Income Statement shows a company’s revenues, costs, and expenses, which together yield net income.

The Balance Sheet shows a company’s assets, liabilities, and equity and represents the company’s financial health /position on one particular day in time.

The Cash Flow Statement starts with net income from the Income Statement; then, it shows adjustments for non-cash expenses, non-expense purchases such as capital expenditures, changes in working capital, or debt repayment and issuance to calculate the company’s ending cash balance.

2. When should an expense appear on the income statement?

Sample Answer:

In order to be presented on the income statement, the expense must be tax-deductible and must have been incurred during the period of the income statement.

Expenses that end up on the income statement are factors such as marketing expenses, employee salaries, etc.

3. What are the three components of a statement of cash flows?

The Statement of Cash Flows is one of the three financial reports that all public companies are required by the SEC to produce quarterly. Most non-public companies also prepare the Cash Flow (CF) Statements.

It comprises the three main components described below, showing all of the company’s sources and uses of cash. However, since companies tend to use accrual accounting, their net income may not (and most of the time does not) portray how much cash flows in or out due to non-cash expenses, investing activities, financing activities, changes in working capital, etc.

Because of this, even profitable ones may have trouble managing their cash flows, and non-profitable ones may be able to survive without raising outside capital.

Cash from operations: Cash generated or lost through normal operations, sales, and changes in working capital (more detail on working capital below).

Cash from investing: Cash generated or spent on investing activities; may include, for example, capital expenditures (use of cash) or asset sales (source of cash). This section will also show any investments in the financial markets and operating subsidiaries.

This section can explain a large negative cash flow during the reporting period, which isn’t necessarily bad if it is due to large capital expenditure in preparation for future growth.

Cash from financing: Cash raised to or paid for financing the business; may include proceeds from debt or equity issuance (source of cash) or cost of debt or equity repurchase (use of cash).

The three components of the Cash Flows Statement are Cash from Operations, Cash from Investing, and Cash from Financing.

4. When looking at the acquisition of a company, should equity value or enterprise value be considered?

Since the acquiring company must purchase both liabilities and equity to take over the business, the buyer will need to assess the company’s Enterprise Value , which includes both the debt and the equity.

5. Given all other factors to be constant, should the cost of equity be higher for a company with a $100 million market cap or a $100 billion market cap?

Typically, a smaller company is expected to produce greater returns than a large company, meaning the smaller company is riskier and would have a higher cost of equity .

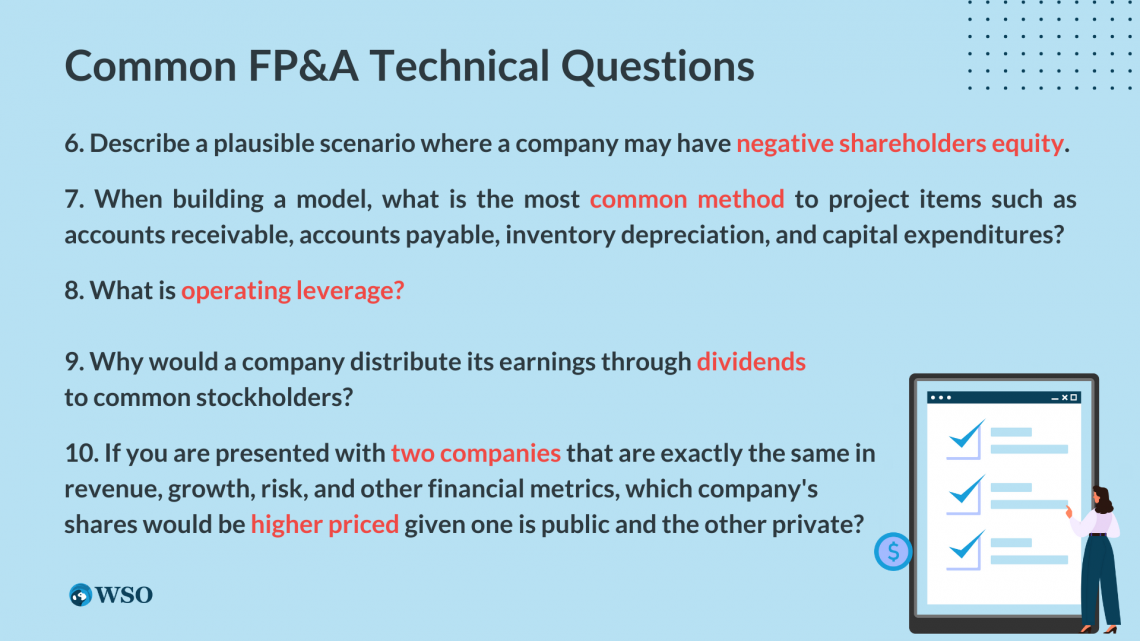

6. Describe a plausible scenario where a company may have negative shareholders equity.

If a company has had negative net income for a long time, it would have a negative retained earnings balance, which would lead to negative shareholders equity . A leveraged buy-out could have the same effect, and so would a large dividend payment to the owners of the business.

Sample Follow-up Question: If a company with a highly levered capital structure was attempting to execute a large dividend recap (which may or may not create a negative shareholders equity balance), what might a debt holder do to enforce any protections he/she has as a debt investor?

Sample follow-up Answer:

Suppose a company has a highly levered capital structure. In that case, the legal documents governing the debt financing will generally limit the amount of total leverage (or indebtedness) that the company could raise. These limits are called negative covenants and will also be so specific as to clarify how much debt could be incurred that is senior to the existing debt in the capital structure and how much could be junior debt in the capital structure.

7. When building a model, what is the most common method to project items such as accounts receivable, accounts payable, inventory depreciation, and capital expenditures?

- Accounts receivable is usually projected as a percentage of revenues or using a ratio like Days Sales Outstanding .

- Accounts payable is generally projected as a percentage of the cost of goods sold or using a ratio like Days Payable Outstanding .

- Inventory is typically projected as a percentage of the cost of goods sold or using a ratio like Inventory Days.

- Depreciation can be calculated very simply using a percentage of the prior years’ PP&E or can be calculated at the individual asset level using different schedules, useful lives, etc.

- Capex is normally projected as a percentage of revenues, or from company guidance, you will have a relatively good idea of what CAPEX requirements are going forward.

8. What is operating leverage?

- Operating leverage is the percentage of costs that are fixed versus variable.

- A company whose costs are mostly fixed has a high level of operating leverage.

- Suppose a company has a high level of operating leverage. In that case, it means that much of any increase in revenue will fall straight to the bottom line in the form of profit because the incremental cost of producing another unit is so low.

- For example, a swim club is a business that operates with a high level of operating leverage. Once the club is built and opened, its costs are relatively fixed. With the same number of staff, same size pool, same locker rooms, same maintenance expense, the club could go from 500 members to 510 members with little additional cost. Nearly 100% of the membership fees collected from the 10 new members boost the bottom line.

Operating leverage is the relationship between a company’s fixed and variable costs . A company with relatively higher fixed costs as compared to variable costs has a higher level of operating leverage.

While a company with a high degree of operating leverage will have a higher earnings growth potential than a company with a largely variable cost structure , certain financial institutions will prefer to lend to businesses with a variable cost structure to help mitigate their downside risk – the financial institution is comforted by the fact that the company they are lending to still has the ability to cut back on some of their expenses should they see an economic downturn approaching or other signs of a decrease in financial performance .

Equity investors benefit the most from earnings growth potential and, as such, will prefer to invest in companies with a higher degree of operating leverage.

9. Why would a company distribute its earnings through dividends to common stockholders?

The distribution of a dividend signals that a company is healthy and profitable, thus attracting more investors, potentially driving up the company’s stock price.

10. If you are presented with two companies that are exactly the same in revenue, growth, risk, and other financial metrics, which company’s shares would be higher priced given one is public and the other private?

The public company most likely will be priced higher due to the liquidity premium one would pay to be able to buy and sell the shares quickly and easily in the public capital markets.

Another reason the public shares should be priced higher would be the transparency required for the firm to be listed on a public exchange. For example, publicly traded companies are required to file audited financial statements , allowing investors to view them.

The public company is likely to be priced higher for several reasons. The main reason is the liquidity premium investors will pay for the ability to trade their stock quickly and easily on the public exchanges. A second reason is a sort of “transparency premium” that derives from the public company’s requirement to make their audited financial documents public.

10 Hard FP&A Technical Questions And Answers

Understanding the critical underlying concepts of the 10 technical problems covered above will undoubtedly result in a competitive edge over the applicant pool. However, to further capitalize upon this and achieve technical expertise, we believe it’s critical to tailor your preparation to the company you are applying for.

The following section features 10 exclusive questions asked to candidates by professional FP&A hiring teams at F500 companies (Morgan Stanley, Deloitte, etc.) and other world-renowned firms (Houlihan Lokey, Vanguard Group, etc.)

The following questions have been taken from WSO’s Company Database , which is sourced from the detailed experiences of more than 30,000 people with FP&A interviews.

Morgan Stanley FP&A Technical Questions:

- This question is used to gauge your general interest in the financial markets . You probably will not be expected to know the number to the penny, but knowing the levels of the three major exchanges/indices, as well as whether they were up or down and why will show your interviewer that you keep track of what is going on in the world of finance.

- You should know how the market moved (up or down) the previous day and why it moved. You can find this information by watching CNBC , reading the WSJ, or using Google.

- Yesterday the XXXX closed at XXXX, up/down XXX from the open. I also noticed that it was up XXX from the day before due to …

- It would also be a good demonstration of market interest to know the overall valuation levels of the three major indices. The P/E ratios for the overall Dow, S&P 500, and Nasdaq are publicly available on major financial news publications.

Sample Answer: Quantitative Easing is the name given to government policy to increase the money supply by injecting liquidity into the economy . This is done by repurchasing government assets from the market.

The reason behind using this policy is that it will increase the capital within the financial sector and, therefore, increase the amount that banks lend to consumers and small businesses to promote economic growth . However, this policy is usually only done when interest rates are already extremely low, and there are no other measures that can be taken to stimulate economic activity.

To see the complete definition, check out WSO’s Financial Dictionary Quantitative Easing page .

Nordstrom Corporate Technical:

Sample Answer: I would determine who to go after by running down the corporate structure . Then, in the event that the parent company went bankrupt, I would consult with our counsel to see what legal action we could take.

Houlihan Lokey Technical Questions:

Sample Answer: The reason you project FCF for the DCF is that FCF is the amount of actual cash that could hypothetically be paid out to debt holders and equity holders from a company’s earnings.

Sample Answer: If you have a company with very unpredictable cash flows, then attempting to project those flows and create a DCF model would not be practical or accurate. Instead, you will most likely want to use a multiples or precedent transactions analysis in this situation.

Beta represents a given investment’s relative volatility or risk concerning the market.

- β < 1 means less volatile than the market (lower risk, lower reward).

- β > 1 means more volatile than the market (higher risk, higher reward).

- A beta of 1.2 means that an investment theoretically will be 20% more volatile than the market. If the market goes up 10%, that investment should increase by 12%.

- Beta is a measure of the volatility of an investment compared with the market as a whole. The market has a beta of 1, while investments that are more volatile than the market have a beta greater than 1, and those that are less volatile have a beta less than 1.

Nordea Bank Technical Question:

Sample Answer: If interest rates fall, bonds prices will rise, so you should buy bonds.

Deloitte Technicals:

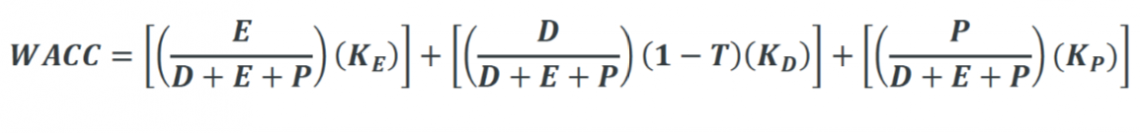

Sample Answer: WACC is the acronym for Weighted Average Cost of Capital . It reflects the overall cost for a company to raise new capital, which represents the riskiness of investment in the company (the higher the risk, the higher the cost of capital). It is commonly used as the discount rate in a discounted cash flow analysis to calculate the present value of a company’s cash flows and terminal value .

The formula below helps you calculate the WACC of a company if you are put on the spot and asked to calculate it as part of your technical interview:

Where E = Market value of equity D = Book value of debt P = Value of preferred stock KE= Cost of equity ( Calculate using CAPM ) KD = Cost of debt (Current yield of debt) KP = Cost of preferred stock (Interested rate on preferred stock) T = Corporate tax rate

Keeping your technical overview at a high level in an interview is vital. Start with a high-level overview and be ready to provide more detail upon request.

- Project out cash flows for 5 - 10 years depending on the stability of the company

- Discount these cash flows to account for the time value of money

- Determine the terminal value of the company - assuming that the company does not stop operating after the projection window

- Discount the terminal value to account for the time value of money

- Sum the discounted values to find an enterprise value

- Subtract the present value of debt (this is generally the market value of debt) and then divide by diluted shares outstanding to find an intrinsic share price

Common questions that follow this are:

Why do you multiply by (1-tax rate)?

You do this because interest expense (the cost of debt ) is tax-deductible, so you need to account for the benefit provided by this "debt tax shield."

What is the cost of equity ?

The cost of equity is usually calculated using the Capital Asset Pricing Model ( CAPM ).

CAPM = Risk-free rate + Beta * (Expected market return - Risk-free rate)

What is the exit multiple method for determining the terminal value?

Find an industry average multiple and multiply it by final year revenue (if using EV/Revenue) or final year EBITDA (if using EV/EBITDA).

The Vanguard Group FP&A Question:

- You can base your answer on the implied probability for future fed funds interest rates, which is what the market is pricing in. You can find this from the CME searching CME FedWatch. World interest rate monitors are available from a variety of places as well.

- There’s no lack of other interest rate commentary out there as well. Focus on primary resources like Fed Statements, studying the Treasury Curve, and economic indicators .

Sample Answer 1:

I believe we’re in a lower for longer interest rate environment, and I think the Fed will remain cautious with any hikes until global economic conditions improve. However, the Fed Funds are currently implying a 53% chance for a rate hike by December, and I believe we’ll get the next rate hike in December or early next year.

Sample Answer 2:

I have a hard time believing that the Fed would pull out the rug on the market with quick interest rate hikes while other global central banks are still cutting their rates amidst sluggish global growth.

Behavioral questions, also commonly referred to as “fit” questions, are designed to determine your attitude, work ethic, and personality in relation to the firm you are applying to. The FP&A interviewing team, on the other side, looks for an alignment between your values and that of their company.

FP&A teams typically take fit extremely seriously because you must collaborate over long hours and under tight deadlines, and therefore strong chemistry between team members is ideal.

This section walks you through 5 of the most common types of fit questions and suggests approaches for answering them. The proposed approaches and sample answers are meant to be illustrative. But, always remember, you need to adapt your answers to be true to yourself and your own words.

"Coming from someone in FP&A, I would highlight your ability to model and, in specific terms, how modeling can improve their processes. Fit is a big part of FP&A because you’re going to work on a lean team and deal with all the chaotic moments together. You have to be on the same page. FP&A isn’t rocket science - you just need to be down to earth and show your willingness to be a team player!"

The following extract has been edited and was taken from WSO User @deadpool7’s comment on the “ How To Prep For FP&A Interviews ” post on WSO Forums .

1. How do you see yourself contributing to our firm in both the short-term and long term?

The short-term goal should just be to accomplish everything you are given quickly and correctly while learning as much as possible during your first few years. Longer-term goals can be things such as: learning to lead and manage a team, bringing in new business, etc.

2. What serves as your biggest motivation?

Some factors you can list are:

- Outperforming expectations

- Hitting deadlines,

- Earning respect from your peers

- Maximizing efficiency

Rather than just saying what motivates you, have a story prepared that shows you are motivated by whatever you answer.

Sample Answer: My biggest motivation is earning the respect of my peers and boss. For example, in my job last summer, I was the sole intern responsible for building a model for a client. My boss, Mike, gave me the specifications and told me when he needed them. I wanted to make a positive impression, so I worked almost around the clock, including time at home, to build it in only three days. This allowed me time to sit down and go through it with Mike before it was needed and still get it edited well before the deadline. Mike respected me for getting it done early, and earning that kind of respect is what keeps me going.

3. Describe your ideal work environment.

The most important thing about your work environment, especially in an industry like finance where you spend so many hours together, is the people you work with.

Talk about the fact that you want to be in an environment with others who are all as dedicated, driven, and hard-working as you are, where everyone can rely on one another to get tasks done efficiently.

Say you excel in an environment with excellent communication and teamwork, one that will allow you to grow professionally and intellectually, where you are evaluated and rewarded based on your performance.

In my mind, at least in finance, the most essential aspect of the working environment is the people you are working with. When working side-by-side for countless hours per week, for years, if you do not enjoy the company of your colleagues, the environment will be challenging. My ideal workplace is one where everyone communicates well, works hard, and trusts each other to get the job done right and on time—and then the team is evaluated and rewarded based on performance.

4. Can you explain a concept to me that you learned in one of your classes in 60 seconds?

While this may seem a bit daunting, as long as you have thought about it at least a little bit in advance of your interview, you should be able to come up with a pretty good response.

Typically the interviewer is looking for something quantitative, likely from finance, accounting, engineering, class, etc. However, if you are explaining something from engineering or biochemistry, make sure it’s in plain English, and you aren’t throwing around acronyms that the average person wouldn’t understand. If you can explain something that maybe the interviewer doesn’t already know, in layman’s terms, that may be more engaging. But, if you are more comfortable explaining a financial or accounting topic, that’s fine too.

Let’s take the theory of the time value of money. This theory says basically that a dollar in hand today is worth more than a dollar in hand in the future. The reasoning behind this, in its simplest form, is twofold. First, due to inflation, today’s dollar is worth more than a dollar in X years because it can buy more goods. Second, if you have a dollar today, you can invest that dollar, which will appreciate in value.

5. Why do you wish to go into finance rather than entering another industry or starting your own business?

Talk about the learning experience FP&A will provide.

Acknowledge that the idea of starting your own business someday sounds exciting, but at this point, you don’t even know what it takes for a business to succeed; working in finance will teach you the skills and give you the experience to help make that happen.

Starting a business is difficult, especially with no track record.

My school was focused on entrepreneurship, which is definitely something that appeals to me. However, I concentrated on finance because I knew I wanted to get experience before ever trying to start something on my own. I knew that getting into finance would give me exposure to many different businesses and how they really work, allowing me to have a solid foundation for anything that I would want to do, whether staying in finance, going back to school, or starting a new venture. I know that this is the best step to building my career coming out of college.

5 Firm-Specific Behavioural/ Fit Questions for FP&A Interviews

Knowing the culture of each FP&A team before walking into an interview is key to clicking with the interviewer and walking out with an offer. The following section features 5 exclusive questions that interviewers ask in the world’s biggest firms during interviews. It aims to help you jumpstart your training for the respective firms and tier FP&A you are interviewing for.

WSO’s company database

The following questions have been taken from WSO’s company database, which contains detailed interviews experiences of more than 30,000 people.

WSO Company Database

Gain Access to Exclusive Data on Compensation, Interviews, and Employee Reviews.

Morgan Stanley FP&A Behavioral Assessment:

1. You have a finance background and have some HNWIs you can prospect, but there are 10,000 other people exactly like you. So why should you be the one to get this job?

"You're absolutely right. However, I believe my unique background working as a buy-side analyst with my good presentation skills with clients allows me to build credibility faster with HNWIs versus someone from a less technical background. People can smell a sales pitch , but I actually have the portfolio management skills to back it up."

2. How do you react to rejection?

I take it as an opportunity to overcome an objection, and if that fails, I learn from it. I look at rejection as a necessary consequence of speaking with a diverse group of people. It's not a personal reflection on me, assuming I did a good job highlighting my portfolio management services to the prospect. Rejection doesn't discourage me because I know I have something of value to offer, which motivates me to continue speaking with prospects until I find a good fit for my services.

Bank of America FP&A Fit Questions:

3. How would you tell clients that they lost a large part of their investments in a market correction? Would you tell them upfront or wait until the whole process was over?

When this question is asked - they want to see you have good ethics and integrity.

I would inform the client upfront, explain the situation to them, and explain the preventive measures I would undertake to minimize the risk of such an instance occurring again. I don’t believe in covering up our mistakes, and I believe integrity is key to establishing a long-lasting relationship with clients.

4. What is your biggest weakness?

Seeing how common this question is (even outside of the finance industry), we have a dedicated page for this question to support you in answering it ideally during the interview. The “Good Responses To Biggest Weakness Questions” page can be found here .

5. “Tell me about a time that…”

There are countless variations of this question, from “Tell me about a time you acted with integrity” to “Tell me about when you had difficulty dealing with coworkers”. It is key to have a well-rehearsed response for each and a general guideline to follow.

Ideally, you can develop 6-8 stories that cover the 30-40 basic questions, with only slight modifications. DON’T wing it. For every potential question, map out the story using the SOAR framework.

Describe the Situation (10-15 seconds), Obstacle (10-15s), Action (60-75s), and Result (15-30s).

Stories for these questions should be 1.5 - 2 minutes long and focus only on what’s important.

WSO Interview Prep Guides & Additional Resources

Over recent years, breaking into a lucrative finance career has tremendously increased in difficulty with an extremely high number of qualified applicants applying for a limited number of positions. Given this, professionals and students alike should capitalize upon every resource available to them to ensure success in their job search.

WSO offers premium 1:1 services , such as the WSO Resume Review and WSO Mentor Service , that will match you with an elite professional in your target industry for one-on-one help to drastically increase your odds of landing your dream FP&A job. With a successful track record of delivering results to over 2,300 clients over the last 10 years , you can rest assured our premium service will deliver results.

Check out WSO Resume Review and WSO Mentor Service by clicking on the buttons below.

Additionally, finetune your preparation and training towards your dream FP&A position. From our comprehensive Investment Banking Interview Prep Course , which features 7,548 questions across 469 investment banks , to our WSO Elite Modeling Package covering Excel, 3 Statements , LBO , M&A, Valuation + DCF Modeling , we’ve got you covered for every career path of finance!

Check out our complete collection of courses offered by clicking the button below.

Additional WSO resources:

The following additional resources are recommended by WSO for taking a look at.

- For Those Of You In FP&A, What Are Your Hours?

- How Engaging Is FP&A Really?

Additional interview resources

To learn more about interviews and the questions asked, please check out the additional interview resources below:

- Investment Banking Interview Questions and Answers

- Private Equity Interview Questions and Answers

- Hedge Funds Interview Questions and Answers

- Finance Interview Questions and Answers

- Accounting Interview Questions and Answers

Get instant access to lessons taught by experienced private equity pros and bulge bracket investment bankers including financial statement modeling, DCF, M&A, LBO, Comps and Excel Modeling.

or Want to Sign up with your social account?

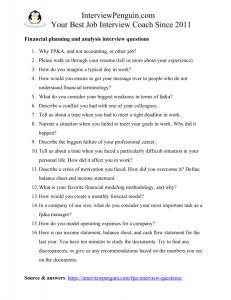

- InterviewPenguin.com – Your best job interview coach since 2011

Financial Planning and Analysis Interview Questions: Get a job of an FP&A Analyst or Manager

You’ve earned your degree in Accounting or Mathematics, but you find recording transactions rather boring . Numbers interest you, but you want to see behind them . You want to find the reason why company made that much, or that little money, in a given time period.

Finding interesting stories while reading financial data , and providing managers with the information they need, in order to take both strategical and operational decisions, is definitely more interesting than just recording transactions and preparing balance sheets (that’s what accountants do).

FP&A jobs are a great choice, and each bigger corporation runs an entire FP&A department . Let’s have a look at some questions they may ask you in an interview, and what you should say to get the job .

Table of Contents

Why FP&A, and not accounting, or other job?

They want to see whether you understand the difference between the two , and if you know why you actually applied.

You can say that you are rather creative, and prefer to dig deep into the numbers. Discovering the things happening behind the scenes (or behind the numbers) is more motivating for you than simply recording the financial transactions.

If you apply in a big corporation and had an accounting job before, you can also say that you prefer to try both approaches , and that after working as an accountant you’d like to try FP&A. Then you will be ready to progress to a position of a controller, or finance manager.

Please tell us more about yourself.

They do not specify what you should talk about—the choice is yours. And while some interview coaches say you should stay strictly work-related in your answer, I do not agree with their advice . You should simply focus on your strengths , while trying to make a g ood initial connection with the people in the room. What does it mean?

Your strengths depend on your situation in an interview. If you’ve been working as a financial analyst for four years already , or had your own accounting business before applying for this job, or if you have a degree from some Ivy League university, it makes sense to talk about such things—your education and experience is your greatest strength. But if the only position you had before was a part time role with KFC , or some side-hustle you did online, while focusing on your education, it doesn’t really make sense to talk about your working experience at length.

In such a case, you should focus on who you are, your goals and ambitions , and perhaps your abilities and personal traits , strengths that make from you a good applicant for the job in FP&A.

What’s more, it is always a good idea to share something from your personal life with the interviewers—whether you have a family, one or two hobbies you enjoy to do in your free time, and so on, just to show them that you have a life outside of work , and to demonstrate that you want to talk in an open and genuine manner in your interview…

How do you imagine a typical day in work in financial planning and analysis team?

The most important thing is to have a realistic idea of your day in work. Just like any other analyst or manager, you’ll spend a lot of time in meetings, answering emails, and doing other semi-productive tasks, many of them boring.

But you’ll spend also a significant amount of time working with profit-loss statement and cash-flow. Checking individual transactions, talking to employees responsible for them, and trying to identify any deviations, abnormalities, and trends , you’ll eventually come up with forecasts and recommendations for the company management.

Obviously the exact scope of your duties will differ from one company to another, and it also depends on your exact role within the FP&A team. If they run an entire department, you may respond just for a small part, for example analyzing certain types of transactions.

If you are the only fp&a employee, however, you’ll respond for everything I mentioned. And you will easily spend 60 hours in work each week . Or more…

How would you ensure to get your message over to people who do not understand financial terminology?

Ensure the interviewers that you do not mind stepping out of your comfort zone, explaining difficult things in a simple way. Say that you always try to adjust your language to the specialization, intelligence, and communication skills of your audience.

Using demonstration, PowerPoint presentations, and case studies and practical examples , you try to make the things simple to understand. Because you know that your work is useless, unless the others understand you…

What do you consider your biggest weakness in terms of fp&a?

You have several options for a good answer. First one is saying that you aren’t aware of any particular weakness that will restrain you from achieving great results in your work. That’s exactly the reason why you opted for financial planning and analysis, and not for some other occupation.

Second is picking something that is somehow important, but isn’t central for the job. For example, say that you are slow with MS Excel or SAP, that you lack efficiency when working with the software. Elaborate on your answer, saying that you are aware of your weakness, and hope that practice makes perfect , and that you will improve your efficiency with the software, once you start the job.

Another option is saying that you simply do not know. Surely, there are some things you can improve on, but you have to do the job first for a few weeks , to be able to tell exactly what your weaknesses are–and then you will improve on them…

Other questions you may face in an FP&A interview

* Behavioral (or situational) questions examine your attitude to various work-related situations. You will certainly get at least some of them in each interview in a big corporation . Most of the questions in the list below belong to this group…

- Describe a conflict you had with one of your colleagues.

- Tell me about an obstacle you overcame.

- Describe a situation when you used logic to solve a problem.

- Tell us about a time when you had to meet a tight deadline.

- Have you ever worked on a project that was a failure?

- Describe a crisis of motivation you faced. How did you overcome it?

- Give an example of a time you showed initiative at work.

- In your opinion, what are the current trends in FP&A?

- What are the most common challenges we face in FP&A right now?

- What was the best financial forecast and the worst financial forecast you have made in your career?

Special tip : If you aren’t sure how you’d answer the questions , or experience anxiety, but really want to succeed in your interview, have a look at a new eBook I wrote for you, the FP&A Interview Guide . Several sample answers to all 25 most common FP&A interview questions will help you streamline your preparation for this important meeting, make a great impression on the hiring managers, and eventually secure a new FP&A Analyst or Manager employment contract. You will find some excellent sample answers directly on the product page , so it makes sense to check it out even if you do not plan to purchase anything…

Technical questions in an fp&a interview

Whether you will deal with any technical questions, and the level of their difficulty, depends on several factors. The most important one is the specialization of your interviewer.

If it’s an HR Generalist, or HR manager, or a recruiter from some general agency, they won’t ask you any technical questions. Or just a few simple questions. They won’t ask you, since they do not have the capacity to assess the accuracy of your answers to technical questions .

If you apply for an entry level job in a big corporation , you typically won’t face any technical questions either. Such corporations have excellent training programs . You will learn the technical stuff before starting the job.

They care more about your general intelligence, communication skills, motivation, and attitude to work. These are tested with a different set of questions (personal and behavioral).

Interview with an expert

However, if a senior analyst, accountant, or financial manager leads your interview, or if you apply for a lone FP&A vacancy in a corporation, you may get some technical questions .

Once again, their difficulty depends on the knowledge and experience of your interviewers , as well as on your future role in the company (and the level of independence you’ll have in the job). We analyze most of them in the eBook , here is a short selection:

- What is your favorite financial modeling methodology, and why?

- What profitability models have you used for forecasting a project?

- Are you familiar with developing business casing and ad-hoc analysis?

- How do you model operating expenses for a company?

- Here is our income statement, balance sheet, and cash flow statement for the last year. You have ten minutes to study the documents. Try to find any discrepancies, or give us any recommendations based on the numbers you see on the documents.

Special Tip : You can also download the full list of questions in a one page long .PDF , print it, and practice your interview answers anytime later:

Conclusion and next steps

Interview for a job of FP&A Analyst, or of FP&A Manager, belongs to difficult job interviews . It goes about a popular job field, and you will typically compete with many other people for the position.

What is more, interviewers will test you with a set of personal , behavioral , and sometimes also technical questions . Short case studies are nothing uncommon, especially if we talk about job interviews in big corporations.

Try to prepare for the questions. Success in this interview is not a question of luck. Unless you prepare well, you cannot expect to outclass the other job candidates and get the job… And if you’d like to get some professional help, consider checking out my eBook, FP&A Interview Guide . Thank you, I wish you best of luck!

Matthew Chulaw, Your personal interview coach

May also help you :

- Financial Controller Interview – Overseeing an entire accounting department of any middle sized or big corporation is not a small task, and you will have to pass a tough one to get this job.

- How to handle interview nerves – Feeling anxious? Learn how to get rid of your interview stress.

- Recent Posts

© InterviewPenguin.com

Privacy Policy

The Tesla Financial Analyst Interview Guide

Walk through the Tesla financial analyst interview process and learn how I landed a job with Tesla’s FP&A Business Operations team.

Introduction

In this article, Michael (former FP&A and Business Operations Analyst at Tesla), will walk you through the steps he took to land a full-time analyst role at Tesla. This guide will cover the various stages of the interview process alongside general notes, tips, and sample interview questions and answers.

#1 Passing the Resume Screen

Tesla received 3 million job applications in all of 2021. This may sound a bit daunting, but there are several different things that you can do to squeeze past this first obstacle.

Clean Up Your Resume

First, you need to clean up your resume and tailor all of your experiences to best fit the financial analyst role or whichever role you are applying for.

Tesla is an innovative, technology-driven company that likes seeing people use data to make logical business decisions. Keep this in mind when tuning up the bullets in your resume.

When writing the experience section of your resume, you should make sure to start each bullet with an action verb. This will help cut down the excess “fluff” in your resume and make it easier for recruiters to understand your previous tasks and experiences.

Sample Action Verbs:

- More Action Verbs

In addition to using action verbs, you should quantify your resume as much as possible so that you clearly state how you added value to your previous companies. For example, you can change “Reduced product line wait time” to “Reduced product line wait time by 3 seconds resulting in a 15% increase in production efficiency.”

For more details and tips, check out our other article on how to write the perfect resume .

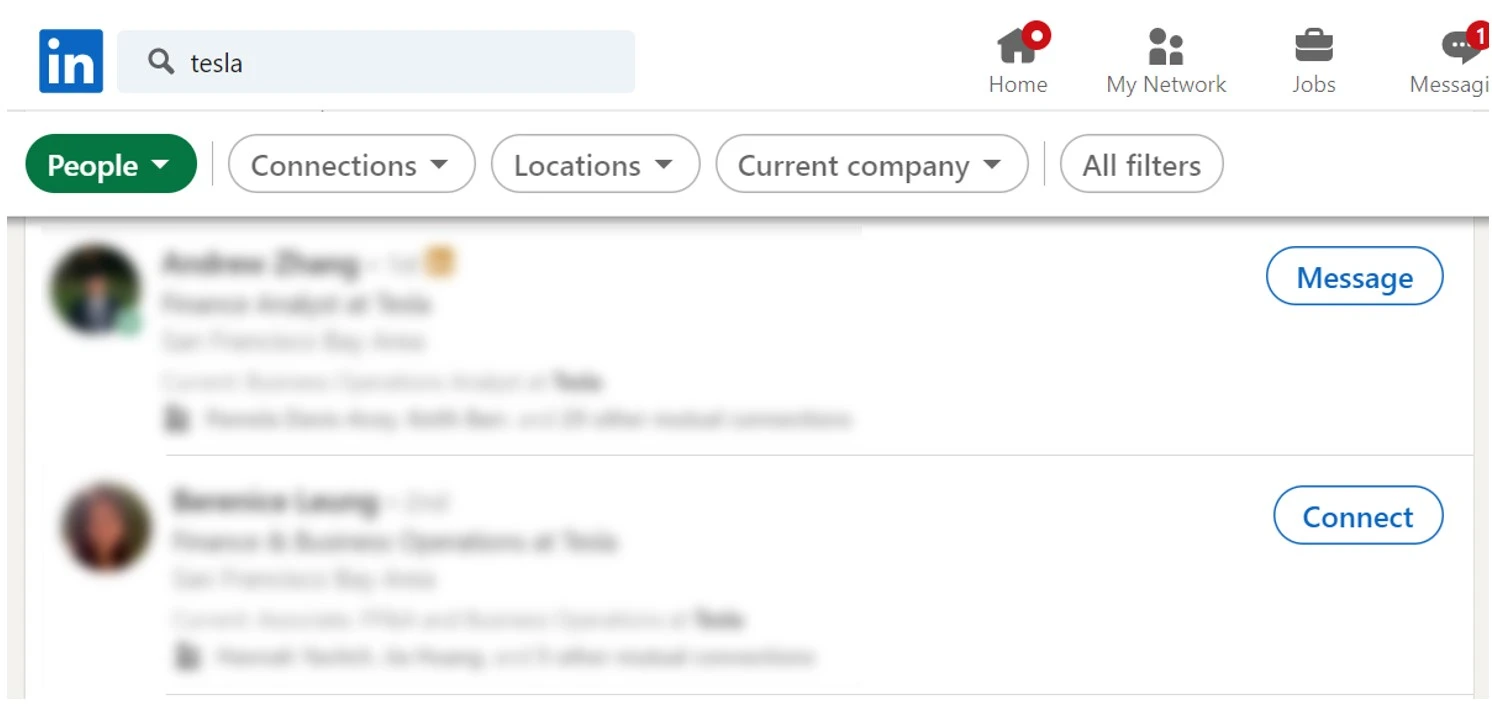

Try to Obtain an Employee Referral

With thousands of applications flowing into Tesla each day, an employee referral would certainly help bring your resume to the top of the stack.

Now if you don’t have any existing friends or connections that work at Tesla, you can try to use LinkedIn and cold emails to contact an existing employee to ask for a quick phone call.

When scrolling through your LinkedIn network, try to look for your school alumni and ideally people who work on the finance team or the team that you are applying to. The goal is to hop on a phone call with your connection so that you can learn more about the working roles at Tesla and demonstrate a genuine interest in the company.

For those looking to better their chances of a referral, we recommend you check out our article on Networking Cold Email Templates.

#2 Phone Screen

If you make it past the resume screen, then congratulations, you’ve made it past the largest cutting stage of the application process.

Following the resume screen, you’ll likely have to hop on a call with one recruiter and one or two finance managers. These calls are quite straightforward and very behavioral-focused. Although they seem quite simple, it will be important to give off a good impression and to make your interviewers believe that you will be a good fit on one of their teams.

Preparation Tip: Read Up on Tesla News

- Spend an hour reading online articles on Tesla. Finance-oriented publications like CNBC , The Financial Times , and Bloomberg are great places to start.

- Watch YouTube videos on recent company stories. Tesla has its own channel and Rob Maurer also runs a very informative YouTube channel called the Tesla Daily .

- Read Tesla’s 10-K annual report. Every public company is required to post a publicly available 10-K company report . I’d recommend taking a look at the section on “Risk Factors” and “Management Opportunities, Challenges, and Risks.” (These sections are perfect for coming up with interesting follow-up questions that you can ask your interviewer).

Sample Questions & Answers

The following should give you an idea of the types of questions that you may be asked in these phone screen interviews.

Q: Why do you want to work for Tesla?

Sample Answer:

“Tesla seems to be a very dynamic and innovative company. With this in mind, I figured that this type of work exposure, particularly at the junior level, would be extremely rewarding as I would be forced to learn many things in a rapid environment. Although this may seem daunting for some, I’ve always been the type to throw myself into challenging situations to force myself to figure things out. Tesla has made tremendous progress since its first factory opening in Fremont, California and I’d simply love to take part in its massive global mission.”

Q: Where do you see yourself in 5 years?

“It’s hard to answer that question specifically as 5 years is quite a long time. What I can say is that I would like to spend the first few years of my analyst career learning the little details and all the ins and outs of the business. Then, after building up my fundamentals and overall experience, I would like to transition into a role that would allow me to make thoughtful and impactful business decisions.”

Q: What do you like to do outside of work and school?

“I really enjoy going fishing when I have some free time over the weekend. Although it seems like fishing is a relatively relaxed activity, I actually really enjoy the strategic side of a fishing operation. Whether it's looking a weather and wave height reports or researching specific species and testing different baits and fishing equipment, I actually really enjoy the process of testing out different theories to find what works best for me.”

#3 Excel Case Study Interview

If you make it past the phone screen stage, you’ll likely move on to an Excel case study interview. To prepare for this Excel case study test, I recommend you make sure you are comfortable with basic Excel skills and finance fundamentals.

Excel: In my case study, I ended up using simple formulas like SUMIFS and VLOOKUPS and I didn’t have to use pivot tables or macros. That said it certainly wouldn’t hurt to learn pivot tables and other Excel functions as they’ll likely switch up the case studies every now and then.

Finance: The Excel case study (at least when interviewing for the financial analyst role) is very much finance oriented. At a minimum, make sure you understand the ins and outs of an income statement so that you can comfortably solve for gross and net profit margins, EBITDA, etc.

General Tip: They will likely ask you for your insights or recommendations given the figures and data available. If certain figures or assumptions seem a bit high, perhaps you could recommend the analyst to speak with the manufacturing team or distribution team for more details on mandatory vs optional expenses (this makes it seem like you are familiar with real work scenarios).

If you’re interested in learning more about how you can best prepare for your interviews, consider checking out our Excel for Business & Finance Course and our Complete Finance & Valuation Course . These two courses should help you comfortably tackle finance interviews at the most competitive corporations and investment banks!

#4 Final Round: 4-5 Back-to-Back 30-Minute Interviews

If you make it past the Excel case study test, you’ll likely have an opportunity to take part in a final round interview consisting of 4-5 back-to-back 30-minute interviews with members from various finance teams.

These interviews will consist of mostly technical and brain teaser questions. With this in mind, you should expect to open up Excel during the interview to share your screen and walk through mini case studies and teaser problems.

General Tip: Once you find a reasonable solution, don’t just stop at the numerical answer. The interviewer wants to see how you can connect the data to actionable business ideas. You’ll usually want to make some surface-level assumptions to arrive at a figure, then tell your interviewer the types of follow-up questions you would ask if you had more time to work on this in a real business setting.

You should also expect a couple of behavioral questions at the end of the interview alongside an opportunity to ask the interviewer general questions.

The following should give you an idea of the types of problem-solving questions that you might be asked in the final round of interviews.

Q: Tell me 3 different methods that you could use to price a Tesla car entering a new market?

- You can use a competitive pricing model. Simply put, you can look up the prices of competing cars in the new market and price the Tesla car within a certain range of its competitors (maybe plus or minus 5%). It will also be interesting to factor in any potential tax benefits that some countries give to electric vehicle consumers as that could give Teslas a big pricing edge over traditional combustion engine vehicles.

- You can use a cost-based pricing model. In this method, you can add up all the costs required to manufacture and distribute a vehicle. Then you can apply a percentage premium to that cost basis to arrive at the consumer-facing price. Perhaps you could use some industry-standard or comparable markup figure to determine the percentage premium to use.

- You could create a model based on customer income. In this method, you could start by looking at all of the existing markets, and create a ratio using the Tesla prices in those markets relative to the median family income in that area. Once you have that ratio, you can apply it to your new market by finding the median family income in the new area.

Q: Identify the bottleneck of the car manufacturing line given XYZ data

This question will likely require you to use simple math to figure out which stage in the production line is taking up the most time. Once you figure out the bottleneck, the interviewer might ask you a follow-up question modifying the figures of the original scenario.

For example, your interviewer might say: “If you were presented with the opportunity to invest $X amount of dollars to cut down the bottleneck time by 25%, would you proceed with the project?”

To approach this problem, you would likely have to calculate how much more product you would be able to produce and the dollar value of that additional product. From there, you could calculate the payback period or essentially how long it would take for the additional profits to cover the cost of the initial investment.

#5 Job Offer!

If you make it past the final round of interviews, congratulations, you’ll likely receive an email and a call from the HR team.

If you don’t get the job offer, don’t worry and keep your chin up. It’s already quite an accomplishment to make it to the final round of interviewers. Even if you don’t end up at Tesla, you can still apply to many other great companies like Apple, Amazon, Visa, and more.

If you're fishing around for a new job, consider signing up for our weekly newsletter for more career news and interesting job opportunities that we find at fortune 500 companies across the globe.

Additional Resources

If you’re looking to better prepare your technical skills for any competitive business or finance interviews, consider checking out our courses using the get started button below!

Other Articles You Might Find Useful

- Interview With a Tesla Financial Analyst

- Goldman Sachs Interview Process

- Investment Banking Target Schools

- Accounting Internships

- Goldman Sachs Interview Questions

Building a cash flow statement from scratch using a company income statement and balance sheet is one of the most fundamental finance exercises commonly used to test interns and full-time professionals at elite level finance firms.

Test hyperlink

Dolor enim eu tortor urna sed duis nulla. Aliquam vestibulum, nulla odio nisl vitae. In aliquet pellentesque aenean hac vestibulum turpis mi bibendum diam. Tempor integer aliquam in vitae malesuada fringilla.

Elit nisi in eleifend sed nisi. Pulvinar at orci, proin imperdiet commodo consectetur convallis risus. Sed condimentum enim dignissim adipiscing faucibus consequat, urna. Viverra purus et erat auctor aliquam. Risus, volutpat vulputate posuere purus sit congue convallis aliquet. Arcu id augue ut feugiat donec porttitor neque. Mauris, neque ultricies eu vestibulum, bibendum quam lorem id. Dolor lacus, eget nunc lectus in tellus, pharetra, porttitor.

- Test Bullet List 1

- Test Bullet List 2

- Test Bullet List 3

"Ipsum sit mattis nulla quam nulla. Gravida id gravida ac enim mauris id. Non pellentesque congue eget consectetur turpis. Sapien, dictum molestie sem tempor. Diam elit, orci, tincidunt aenean tempus."

Tristique odio senectus nam posuere ornare leo metus, ultricies. Blandit duis ultricies vulputate morbi feugiat cras placerat elit. Aliquam tellus lorem sed ac. Montes, sed mattis pellentesque suscipit accumsan. Cursus viverra aenean magna risus elementum faucibus molestie pellentesque. Arcu ultricies sed mauris vestibulum.

Morbi sed imperdiet in ipsum, adipiscing elit dui lectus. Tellus id scelerisque est ultricies ultricies. Duis est sit sed leo nisl, blandit elit sagittis. Quisque tristique consequat quam sed. Nisl at scelerisque amet nulla purus habitasse.

Nunc sed faucibus bibendum feugiat sed interdum. Ipsum egestas condimentum mi massa. In tincidunt pharetra consectetur sed duis facilisis metus. Etiam egestas in nec sed et. Quis lobortis at sit dictum eget nibh tortor commodo cursus.

Odio felis sagittis, morbi feugiat tortor vitae feugiat fusce aliquet. Nam elementum urna nisi aliquet erat dolor enim. Ornare id morbi eget ipsum. Aliquam senectus neque ut id eget consectetur dictum. Donec posuere pharetra odio consequat scelerisque et, nunc tortor. Nulla adipiscing erat a erat. Condimentum lorem posuere gravida enim posuere cursus diam.

Ready to Level Up Your Career?

Learn the practical skills used at Fortune 500 companies across the globe.

FP&A Analyst Interview Questions

The most important interview questions for FP&A Analysts, and how to answer them

Getting Started as a FP&A Analyst

- What is a FP&A Analyst

- How to Become

- Certifications

- Tools & Software

- LinkedIn Guide

- Interview Questions

- Work-Life Balance

- Professional Goals

- Resume Examples

- Cover Letter Examples

Interviewing as a FP&A Analyst

Types of questions to expect in a fp&a analyst interview, behavioral questions, technical and financial modeling questions, case study and scenario-based questions, business acumen and market awareness questions, preparing for a fp&a analyst interview, how to do interview prep as an fp&a analyst.

- Understand the Company's Financial Landscape: Research the company's financial statements, annual reports, and any available analyst reports. This will help you understand their revenue streams, cost structures, and financial health, enabling you to discuss their financial strategies knowledgeably.

- Brush Up on Financial Modeling and Analysis: Be prepared to demonstrate your proficiency in Excel, financial modeling, and data analysis. You might be asked to solve a case study or perform an impromptu analysis, so practicing these skills is crucial.

- Review Key FP&A Concepts and Metrics: Ensure you're familiar with key financial concepts such as variance analysis, budgeting, forecasting, and key performance indicators (KPIs) relevant to the industry.

- Prepare for Behavioral Questions: Reflect on your past experiences and be ready to discuss how you've contributed to financial decision-making processes, handled budget discrepancies, or improved financial reporting in your previous roles.

- Understand the Role of Technology: FP&A roles increasingly rely on technology. Familiarize yourself with common FP&A software and tools, and be ready to discuss how you've used technology to improve financial processes.

- Develop Insightful Questions: Prepare thoughtful questions that demonstrate your interest in the company's financial strategies and your role in shaping them. This could include questions about the company's growth plans, investment strategies, or challenges in financial planning.

- Practice with Mock Interviews: Conduct mock interviews with a mentor or professional in the field to get feedback on your responses and to refine your communication skills, especially when explaining complex financial concepts.

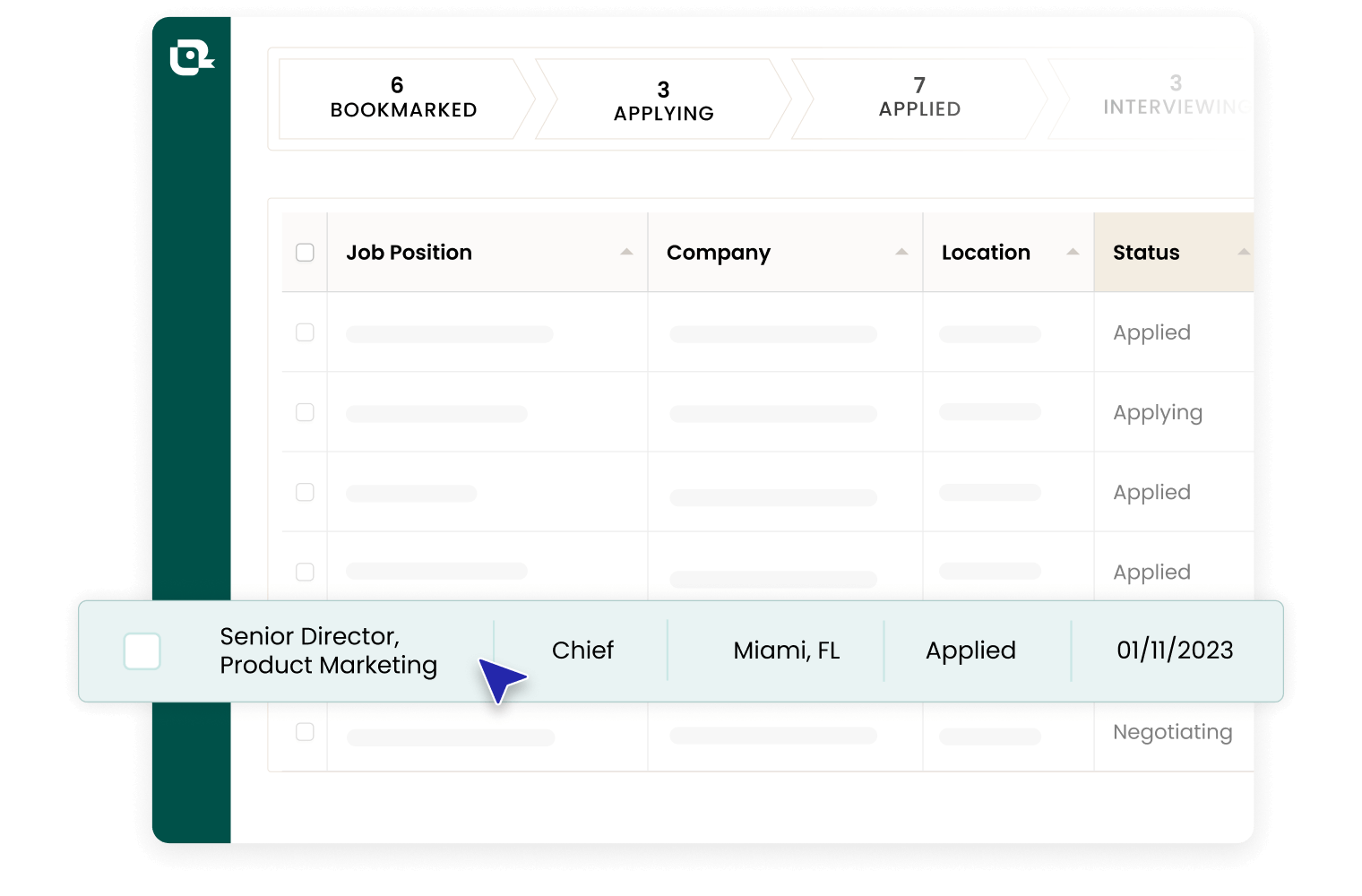

Stay Organized with Interview Tracking

FP&A Analyst Interview Questions and Answers

"how do you forecast revenue and expenses for a company", how to answer it, example answer, "can you describe a time when you identified a significant variance in the budget and how you addressed it", "how do you evaluate the financial health of a company", "explain how you would approach a cost-benefit analysis for a proposed project.", "how do you handle tight deadlines and pressure during the monthly close process", "what experience do you have with financial reporting and analysis software", "how do you ensure the accuracy of your financial models and forecasts", "can you discuss a time when you had to present complex financial information to non-financial stakeholders", which questions should you ask in a fp&a analyst interview, good questions to ask the interviewer, "can you describe the financial planning and analysis processes in place and how the fp&a team contributes to strategic decision-making", "what are the key challenges the fp&a team is currently facing, and how do you foresee an fp&a analyst helping to address these challenges", "how does the company approach professional development for fp&a analysts, and what opportunities are there for growth and advancement", "could you provide an example of a recent strategic initiative the fp&a team was involved in and the outcome of that initiative", what does a good fp&a analyst candidate look like, financial expertise, strategic thinking, data analysis & interpretation, business acumen, communication & collaboration, adaptability & continuous learning, interview faqs for fp&a analysts, what is the most common interview question for fp&a analysts, what's the best way to discuss past failures or challenges in a fp&a analyst interview, how can i effectively showcase problem-solving skills in a fp&a analyst interview.

FP&A Analyst Job Title Guide

Related Interview Guides

Driving financial strategies, analyzing market trends for business profitability

Driving financial health and growth, steering company's fiscal decisions and strategies

Navigating financial landscapes, optimizing costs and enhancing company's fiscal health

Steering financial success with strategic oversight, ensuring fiscal integrity and growth

Driving financial strategy and performance, steering company growth with fiscal acumen

Driving financial strategy and growth, ensuring fiscal health and sustainability

Start Your FP&A Analyst Career with Teal

How Cube works

Sync data, gain insights, and analyze business performance right in Excel, Google Sheets, or the Cube platform.

Built with world-class security and controls from day one.

Cube meets you where you work—your spreadsheets. Get started quickly with a fast implementation and short time to value.

Developer Center

Cube's API empowers teams to connect and transform their data seamlessly.

Integrations

Connect and map data from your tech stack, including your ERP, CRM, HRIS, business intelligence, and more.

Break free from clunky financial analysis tools. Say hello to a flexible, scalable FP&A solution.

See Cube in action

Centralized Data Management

Automatically structure your data so it aligns with how you do business and ensure it fits with your existing models.

Reporting & Analytics

Easily collaborate with stakeholders, build reports and dashboards with greater flexibility, and keep everyone on the same page.

Planning & Modeling

Accelerate your planning cycle time and budgeting process to be prepared for what's next.

.png)

Creating a high-impact finance function

Get secrets from 7 leading finance experts.

Download the ebook

Business Services

Real Estate

Financial Services

Manufacturing

Learn how Veryable unwound a complex spreadsheet stack

Essential reading for forward-thinking FP&A leaders.

Customer Stories

Discover how finance teams across all industries streamline their FP&A with Cube.

Featured Customers

BlueWind Medical reduced company spend by over $100k with Cube

Edge Fitness Clubs cuts reporting time by 50% & saves $300,000 annually

Join our exclusive, free Slack community for strategic finance professionals like you.

Join the community

Content Library

Discover books, articles, webinars, and more to grow your finance career and skills.

Find the Excel, Google Sheets, and Google Slide templates you need here.

Discover expert tips and best practices to up-level your FP&A and finance function.

Need your finance and FP&A fix? Sign up for our bi-weekly newsletter from former serial CFO turned CEO of Cube, Christina Ross.

Help Center

Make the most of Cube or dig into the weeds on platform best practices.

The future of strategic finance

Get the definitive guide for forward-thinking FP&A leaders

Get the guide

We're on a mission to help every company hit their numbers. Learn more about our values, culture, and the Cube team.

Grow your career at Cube. Check out open roles and be part of the team driving the future of FP&A.

Got questions or feedback for Cube? Reach out and let's chat.

In the news

Curious what we're up to? Check out the latest announcements, news, and stories here.

A newsletter for finance—by finance

Sign up for our bi-weekly newsletter from 3x serial CFO turned CEO of Cube, Christina Ross.

Subscribe now

FP&A interview questions: a cheat sheet for landing the next FP&A role

Professional development.

Updated: October 31, 2023 |

Billy is an expert in the FP&A space. Before joining Cube at the seed stage, Billy found success as a tax advisor at companies like Grant Thornton LLP and Gemini.com. He holds a BA and MA in Accounting from William & Mary and splits his time between NYC and New England.

If you’re looking to break into FP&A, there’s never been a better time.

If you want to get in the door with a corporate finance department, you’ll need to prepare for a wide range of interview questions. These questions allow hiring managers to learn about your background and skills, but also about your creative reasoning and interpersonal skills.

While we can’t cover everything an interviewer might ask, we’ve compiled a list of common questions you’ll encounter at an FP&A interview.

In this article, you’ll learn:

- The qualities that make up a great FP&A candidate

- Interview questions for interns, analysts, and managers

- Technical questions to consider in advance

Ready to flex your interview muscles? Read on.

Billy Russell

FP&A Strategist, Cube Software

Get out of the data entry weeds and into the strategy.

Sign up for The Finance Fix

Sign up for our bi-weekly newsletter from serial CFO and CEO of Cube, Christina Ross.

What qualities do hiring managers look for in FP&A candidates?

While you're expected to know the basics of financial planning , financial modeling, and other ways to determine a company's financial health, the best candidates have a suite of soft skills in addition to their technical knowledge.

Let's take a look at some of them.

Finance skills

A foundational understanding of finance and accounting practices is the cornerstone of a career in finance. While specializations such as advanced Excel and FP&A software skills can be learned on the job , a strong grasp of the basics is required.

Be ready to address questions about your finance skills and look for opportunities to discuss your analytical process.

Cross-functional skills

Many FP&A candidates come from different backgrounds in the professional world. Some are looking for a new challenge, while others are attracted to the numbers and processes behind operational success in their former departments.

Managers often seek cross-functional skills in well-rounded candidates who can understand business challenges from multiple perspectives.

Creative thinking and curiosity

Curiosity is a defining characteristic of a high-quality FP&A candidate. Much of planning and analysis requires complex problem-solving skills. The best problem solvers are both naturally curious people and outside-the-box thinkers.

Hiring managers look for candidates with creative thinking skills—those who always need to know “why.” Curiosity is a valuable asset to an organization.

Interpersonal “soft” skills

Finance professionals don’t hide behind their spreadsheets. In the modern Finance organization, analysts and managers must be skilled communicators. They must be able to communicate ideas, collaborate with other leaders on solutions, educate decision-makers, and gain consensus on a course of action.

Showcase your interpersonal and leadership skills during the interview, and look for opportunities to weave examples into your interview answers.

Sample questions for every type of FP&A interview

Prepare to answer a range of questions during your interview. Depending on the hiring manager, they may ask a series of questions to determine your analytical skills, technical knowledge, creative thinking, and team mindset. Here are some examples of questions and the rationale behind them.

FP&A intern interview questions

If you want to know how to break into FP&A with an internship or an entry-level position, the secret is to find ways to demonstrate the skills necessary for the role. While you may have little or no FP&A experience, find ways to demonstrate your analytical, presentation, and communication skills in applicable ways.

How will your educational background aid you in this internship?

Be prepared to discuss your current coursework. This is especially important if you are looking for strategic finance internships from outside of a finance or accounting curriculum. Give examples of how analytics and critical thinking integrate into your coursework.

Why pursue an FP&A internship versus accounting or another discipline?

Are you interested in business or accounting but exploring planning and analysis as part of your major? Be specific about why an FP&A job interests you. Share examples of your interest in planning and analysis, as well as showcase any cross-applicable skills.

How strong are your Microsoft Excel skills?

Strong skills are a huge benefit when working within a Finance organization. Although many FP&A software tools exist, many professionals still prefer to work within spreadsheets for much of their analysis. Having advanced chops in Excel is a valuable skill.

Tell me about X

You're expected to know the basics of what financial analysts do and the types of financial statements you'll encounter on the job. Be prepared to talk about core concepts like:

- Creating a simple financial model

- The three financial statements (Income statement, Balance sheet, and Cash Flow Statement )

- Capital assets

- Capital expenditures

- Fixed and variable costs

- Operating expenses

- Assessing a company's current financial position

- Financial planning

- The qualities of a good Excel model

- What about accounts payable?

- What are accounts receivable?

- What is non-cash working capital?

It's always a good idea to come prepared with an analysis of the company's market share based on the data available to you. For example, even though you don't have access to that company's historical data or last year's revenue, you can talk in hypotheticals.

FP&A analyst questions

At the analyst level, you're expected to be proficient at creating a financial model from a budget and manipulating financial data .

You should be able to talk about how models interact with each other. For example, many models forecast operating expenses. Can you interpret that model and explain its effect on a company's cash flow?

You're expected to have a solid understanding of the three financial statements: the income statement, the balance sheet, and the cash flow statement.

Likewise, you're expected to understand the core essentials of financial planning.

What do you consider your biggest weakness in terms of FP&A?

Most candidates are happy to showcase their strengths during the interview, so this question creates opportunities to see how they talk about their less-developed skills and areas of expertise. This question also allows an interviewer to see where skill gaps might appear and what enrichment opportunities might be helpful to the successful candidate.

Remember that because FP&A degree programs are few and far between, most FP&A training is on the job. So this is a good time to talk about the circumstances of your current or previous positions and what you never got to work on. If you were never able to model operating expenses or create a forecast model because your team was highly segmented in terms of responsibility, you should talk about how you'd like to learn those skills in this new position.

If you're applying to work at a company with a new type of revenue model or offer, there's a lot to talk about here. If your previous company was SaaS but your new company has warehouses of products they sell, you'll encounter new questions that you previously never had to answer, like "how does inventory write-down affect cash flows?"

Tell me about a time you disagreed with a boss or other superior.

Complex financial modeling may present opposing viewpoints about how to move forward through a challenge. As an analyst, part of the candidate's job will be communicating and educating on their analyses.

The best candidate will have the analytical skills to produce accurate analysis, confidently propose solutions, educate on the facts of the situation, and act as a strategic partner up and down the organization.

It's important to have a well-thought-out answer to this question. Spend some time before your interview thinking about how you'd approach this if asked.

Have you ever worked on a project that failed? How did you handle it?

It’s often said we learn more from our failures than our successes. This question allows the interviewer a window into your thought process when things don’t go as planned.

how the process you used to arrive at your conclusions, any circumstances affecting the outcome, and what you took away from the experience.

What do you think is the most desirable quality of an FP&A analyst?

There are many answers to this question, and whichever you pick will reveal something about your perception of the FP&A role. Analytical ability is an essential prerequisite for analysts, but creative thinking and problem-solving are also valuable. Presentation skills are another vital aspect, allowing you to communicate your results and recommendations clearly and effectively.

Project management skills, leadership, and communication skills are other avenues to consider in answering. Your answer to this question will give your interviewer a window into your potential skill fit and culture fit with the company.

What should you do if you find issues with a model or forecast?

This could be a question about technical skills or soft skills, and answering both aspects will provide valuable insight into your work style. Ask for specifics about the issues and use any detail the interviewer provides in forming your answer.

FP&A manager questions

At this level, you should not only understand how to model revenues and assess future business needs, but you should also be able to assess both internal and external challenges facing a business.

Likewise, at the manager level, you should expect to lead a finance team . You should also have opinions on the overall strategic direction for FP&A—your FP&A philosophy, as it were.

What are the most common challenges FP&A departments currently face?

This question provides a broader context for your finance knowledge within the wider world. It shows that you spend time researching the economic and global impacts on businesses and demonstrates that you possess an interest in the subject beyond the technical functions of the job.

How do you communicate with stakeholders that have limited finance knowledge?

Finance professionals in a modern business environment must be educators. Translating detailed information into a usable format for many different audiences is an important skill. Many finance professionals invest time and resources in expanding their communication skills along with their analytical skills for this reason. Demonstrate to your interviewer that you can communicate effectively across the organization and to internal and external audiences.

Can you tell me about the biggest challenges we face as a company currently?

Like the question about general FP&A challenges, this question is a chance to demonstrate your deep understanding of the finance function. In this case, you’ll also demonstrate that you’ve done your homework about the company and its financials. This question serves as a check against your interest in the role, as well as your communication and analysis skills.

Be sure to talk about both internal and external challenges in this answer. Not only should you do your best to evaluate future business, but you should also talk about the company's market share and its trajectory for growth.

Being able to create hypotheses without access to historical data and draw conclusions about external challenges based on what you can observe in the market shows you're a smart candidate. It'll take you far in the interview process.

How would you describe your management style?

Finance managers must be able to guide and support their analysis team throughout their careers, providing guidance, mentorship, and leadership. Discussing your management style in specific allows the interviewer to visualize how you will fit within the larger organization. It also demonstrates your ability to navigate interpersonal relationships, provide balanced leadership, and work as part of a team.

How do you engage employees in the process?