Everything that you need to know to start your own business. From business ideas to researching the competition.

Practical and real-world advice on how to run your business — from managing employees to keeping the books

Our best expert advice on how to grow your business — from attracting new customers to keeping existing customers happy and having the capital to do it.

Entrepreneurs and industry leaders share their best advice on how to take your company to the next level.

- Business Ideas

- Human Resources

- Business Financing

- Growth Studio

- Ask the Board

Looking for your local chamber?

Interested in partnering with us?

Run » business financing, financing strategies for every stage of your business.

Bootstrapping, seed funding, equity crowdfunding, Series A: You may recognize these terms as different financing options, but how do you know which are available to your business venture?

The growth of a business can be categorized in roughly five stages; each stage brings new financing challenges and opportunities for investment. There are several ways to get financial support at various points of growth, and what’s right for one merchant might be unsustainable for another business owner. There are many paths to success for businesses; here are some of the most common, organized by each growth stage .

[Read more: Need to Raise Business Capital? Know These 5 Funding Rounds ]

Stage 1: Startup

In this phase, you’ve committed to making your idea a reality. Congratulations! This is where the hard work begins: Your business may exist, but as the owner, you’re responsible for finding customers , delivering a product or service and making enough money to survive.

At this stage, most business owners are bootstrapping their way to the next stage of growth. Bootstrapping means you are building the company using nothing but your personal savings and, hopefully, cash from your first sales. “More than 80% of startup operations are funded by the founders' personal finances; the median in start-up capital is about $10,000,” reports Investopedia .

In venture capitalist terms, this is also the “pre-seed” stage of financing. Merchants looking for pre-seed capital will draw from personal savings, friends and family members, and raise money through crowdfunding campaigns . Until you’ve verified that your business idea is something customers want, it’s generally not a good idea to take out a loan. Likewise, angel investors and venture capitalists will want to see some early business results before participating in a funding round.

Stage 2: Survival

A business that’s reached survival stage has verified that it has a workable business model. Your business idea is something that customers want and will continue to buy into. Now your challenge is to grow from simply existing to becoming a business with revenues, expenses, assets and employees.

Survival is also one of the hardest phases for new ventures. “It’s not uncommon for companies to grow broke at this stage. They don’t have enough money to cover the costs of building new products or hiring more people to provide more services,” writes American Express .

During the survival phase, your business will be in the seed phase of financing. In the venture capital world, the seed round is when business owners gather capital to get things up and running. Some venture capitalists and other investors may be interested in investing in your business at this stage, but there are a number of ways to get a quick injection of cash:

- Angel investors : An angel investor offers financial backing to small startups in exchange for ownership equity.

- Equity crowdfunding : Your business raises capital by selling securities, such as equity in the company and revenue shares.

- Grants: Apply for a grant from federal and state agencies, as well as some private companies.

- Micro-lenders : These very small loans, usually less than $50,000, are offered by individuals, not traditional lending institutions.

For most businesses in the stage, it’s too early to go for an SBA loan . The qualifications for an SBA loan include a certain number of years in business, a credit card score and at least $100,000 in annual revenue.

Bootstrapping means you are building the company using nothing but your personal savings and, hopefully, cash from your first sales.

Stage 3: Success

When your company can sustain itself profitably, it has reached the success stage. Ventures can stay at this stage indefinitely: Unless a natural disaster, economic downturn or other unforeseen catastrophe happens, this is the stage in which your business is stable and profitable.

Many entrepreneurs use financing in this phase to fuel even more growth. This might include launching a new product line, expanding to a new location or simply continuing to reach new customers and grow your profits. Investors will be seriously interested in your business’s track record of early success.

Financing options in this phase could include the following:

- Venture capital, Series A : A Series A investor wants to take your business revenue into the millions. According to Investopedia , the Series A round consists of anywhere between $2 million to $15 million in funding.

- SBA loan: It’s likely you’re ready for an SBA loan at this stage. Read more in our complete guide to SBA loans .

- Short-term business loans : If you just need extra cash for a big equipment purchase, for instance, consider a short-term small business loan that can increase your working capital.

- Bridge loans: Like a short-term business loan, a bridge loan can give you working capital while you’re waiting for more long-term funding to come. Read more in our guide to bridge loans .

[Read more: 3 Expert Strategies for Attracting Investors ]

Stage 4: Take-off

Once you’ve committed to expanding, the next phase is the “take-off” phase when many entrepreneurs choose between becoming a big business or selling their venture and starting anew. The best funding strategy at this stage is to work with a venture capitalist. They will be able to take you through Series B and Series C funding:

- Series B: This type of funding focuses on taking the business to the next level and meeting demand for your product or service. A Series B venture capitalist will ask for more market research and business development. Series B funding is typically between $7 million and $10 million.

- Series C: This funding is for businesses that are very successful and need more capital to continue scaling. Some businesses use their Series C funding to acquire or merge with a similar venture.

Outside of Series C, companies might also go through Series D and Series E financing rounds that accomplish similar goals.

Stage 5: Maturity

A mature company is no longer a small business. At this stage, your biggest challenge will be controlling your substantial finances. Some businesses at this stage choose to offer an initial public offering (IPO) . To go through that process, you will need roughly $100 million in revenue. Reaching this level of success takes years of hard work, a great idea and plenty of funding help along the way.

CO— aims to bring you inspiration from leading respected experts. However, before making any business decision, you should consult a professional who can advise you based on your individual situation.

Want to read more? Be sure to follow us on LinkedIn!

Applications are open for the CO—100! Now is your chance to join an exclusive group of outstanding small businesses. Share your story with us — apply today .

CO—is committed to helping you start, run and grow your small business. Learn more about the benefits of small business membership in the U.S. Chamber of Commerce, here .

Subscribe to our newsletter, Midnight Oil

Expert business advice, news, and trends, delivered weekly

By signing up you agree to the CO— Privacy Policy. You can opt out anytime.

More financing tips

How to use accounting software to generate accurate and timely financial reports, 20 funding options for black-owned businesses, what is alternative credit, and why does it matter for your smb.

By continuing on our website, you agree to our use of cookies for statistical and personalisation purposes. Know More

Welcome to CO—

Designed for business owners, CO— is a site that connects like minds and delivers actionable insights for next-level growth.

U.S. Chamber of Commerce 1615 H Street, NW Washington, DC 20062

Social links

Looking for local chamber, stay in touch.

Financial Strategy: Full Explanation with Examples

What is a Financial strategy?

A financial strategy refers to a business or individual’s approach to managing and using financial resources to achieve goals. It is an important part of the overall business strategy. It involves planning and decision-making related to investment, budgeting, fundraising, cost management, forecasting future financial scenarios, and managing financial risks.

The main objectives of a financial strategy are typically to increase shareholder value, secure the Company’s financial stability, and ensure the availability of funds for future growth or to deal with unpredicted situations.

Key components of a financial strategy might include:

- Investment strategy : Deciding what to invest in (equipment, personnel, research, development, etc.), when, and how much to invest. It can also refer to investment in financial assets, like stocks or bonds. Investment Strategy: Explained with Types and Examples

- Financing strategy : Determining how to raise the capital needed for investment, whether through equity (like selling company shares), debt (like loans or bonds), or internally generated cash flow. How to make a Financing strategy: Explained with a case study

- Risk management strategy : Identifying financial risks that the Company faces (like exchange rate risk, interest rate risk, or credit risk) and deciding how to mitigate them, typically through financial instruments like derivatives or operational changes. Risk Management Strategy in Finance: Explained with an Example

- Cash flow management strategy : Managing the Company’s cash flow to ensure there is always enough cash available to meet its immediate needs, like payroll or debt payments. Cash flow management Strategy: Full Explanation

- Capital structure strategy : Deciding what mix of equity and debt the company should have. This affects the risk and return of the Company and its valuation. Business Capital Structure

- Dividend policy : Determining how much of the Company’s earnings should be paid out to shareholders as dividends and how much should be retained for reinvestment in the Company. Dividend Policy: Meaning | Types | Factor Affecting | Examples

Remember, a well-designed financial strategy should align with the Company’s broader business goals and strategies, considering internal factors (like financial health, risk tolerance, and operational needs) and external factors (like market conditions, industry trends, and regulatory environment).

By the way, here is a course that will help you stand out in the world of strategy. The Strategic Thinking program for CxO by Cambridge Judge Business School maps your competitive advantage and teaches advanced techniques to formulate, evaluate, and execute winning strategies. Generate winning strategies and learn how to renew them in times of crisis for a competitive advantage.

How to make a financial strategy?

Creating a financial strategy is a multi-step process involving a deep understanding of the Company’s financial situation and business goals. Here are the steps to creating a financial strategy:

- Set clear goals : This is the first and perhaps the most crucial step. It involves identifying what the organization or individual wants to achieve financially. This could range from expanding the business, launching a new product, or improving financial stability. These goals should align with the broader business strategy.

- Understand your current financial situation : Analyze your current financial statements, including income statements, balance sheets, and cash flow statements. Assess your assets, liabilities, revenues, expenses, and cash flows to understand your financial standing.

- Forecast future scenarios : Based on historical data and expected market trends, project your future income, expenses, and cash flows. This can help you anticipate future financial needs and challenges.

- Identify investment needs and sources of capital : Based on your goals and forecasts, determine how much capital you will need and where you will invest it. Then, decide where this capital will come from, whether internal cash flows, debt, equity, or a combination.

- Manage financial risks : Identify the key financial risks you face, such as exchange rate risk, interest rate risk, or credit risk. Determine how you will mitigate these risks through financial instruments or operational changes.

- Create a budget : Based on the above steps, create a detailed budget that outlines your expected income and expenses. This will serve as a guide for your financial decision-making.

- Monitor and revise your strategy : Implement your strategy and monitor your financial performance regularly to ensure that you are on track to meet your goals. Adjust your strategy if your actual performance deviates from your plan or your business environment changes.

Creating a financial strategy is not a one-time task but an ongoing planning, implementation, and review process. It requires financial knowledge, strategic thinking, and careful management. It’s often beneficial to involve financial professionals in this process, either from within your organization or as external consultants.

By the way, to communicate our strategy effectively within the team, we all need a robust collaboration platform. Miro is the leading visual collaboration platform. Build anything together on Miro. It’s free and as easy to use as a whiteboard , but endlessly more powerful. Do use the Miro platform for strong communication within your team.

Examples of financial strategy

A financial strategy can take various forms depending on a business’s goals, needs, and circumstances. Here are some hypothetical examples:

- Tech Start-up’s Financial Strategy : A tech start-up might set a goal to develop and launch a new product within two years. To do so, it decides to invest heavily in research and development. Given the high upfront costs and uncertain short-term revenue, the Company might choose to fund these investments through venture capital. It plans to prioritize growth over profitability in the short term, expecting that this strategy will maximize its value in the long term. Financial Strategy of a Technology Startup

- Manufacturing Company’s Financial Strategy : A manufacturing company might set a goal to expand its operations by opening a new factory. It decides to fund this expansion partly through internal cash flows and partly through a bank loan. The Company plans to manage the risk of this new debt by maintaining a conservative cash flow management strategy, ensuring it always has enough cash to make its debt payments.

- Retail Business’s Financial Strategy : A retail business might aim to improve its financial stability by reducing its debt. It chooses to do this by cutting costs, increasing prices, and using excess cash flows to repay its loans early. It might also decide to hedge its interest rate risk by switching from variable-rate to fixed-rate debt.

- Individual’s Financial Strategy : A personal financial strategy might involve an individual setting a goal to retire comfortably at age 60. To achieve this, they might invest a portion of their income in a diversified portfolio of stocks and bonds. They also might decide to purchase life and health insurance to manage the risk of unexpected costs. As they get closer to retirement, they gradually plan to shift their investments from riskier stocks to safer bonds.

These strategies are tailored to the entity’s specific goals, resources, and risk tolerance. The specific tactics used in each strategy (like raising venture capital, taking on debt, hedging risks, or investing in stocks and bonds) can be used in different ways to support different strategies. It’s the combination of these tactics with clear goals that form a coherent financial strategy.

Case study on a financial strategy

Let’s consider a case study of Apple Inc.’s financial strategy:

Apple Inc. is well known for its strong financial strategy. A key aspect of Apple’s financial strategy has been its effective use of capital to generate shareholder value.

Capital Allocation : Apple’s cash flow from operating activities for the twelve months ending Sep ’22 was $24.977 bn. This reserve provides Apple with financial flexibility and security, allowing it to invest in research and development, acquisitions, and other strategic opportunities as they arise.

Shareholder Returns : Apple has consistently returned a significant portion of its profits to shareholders. Since initiating its capital return program in 2012, Apple has returned over $573 billion to shareholders through dividends and share repurchases . Share repurchases, in particular, have been a key part of Apple’s strategy. By repurchasing its own shares, Apple reduces the number of shares outstanding, which increases earnings per share and can lead to a higher stock price.

Investments and Acquisitions : While Apple is known for its conservative approach to acquisitions, the Company has used its strong balance sheet to make strategic purchases that support its product and service portfolio. This includes the acquisition of companies like LuxVue (for display technologies), Turi (for machine learning), and Anobit (for flash storage), among others.

Debt Financing : Apple has also strategically used debt despite its large cash reserves. The Company started issuing bonds in 2013 to help fund its capital return program, taking advantage of low-interest rates to borrow at a lower cost than repatriating overseas earnings would have incurred (prior to U.S. tax law changes in 2017). As of September 24, 2022, the Company had outstanding fixed-rate notes with varying maturities for an aggregate principal amount of $111.8 billion (collectively the “Notes”), with $11.1 billion payable within 12 months.

Risk Management : Apple manages financial risk through various methods, including using derivatives to hedge against foreign exchange risk and commodity price risk.

This case study illustrates how Apple’s financial strategy supports its business goals and creates shareholder value. The Company’s strategic use of capital — through a combination of capital returns, strategic investments, debt financing, and risk management — has played a key role in its financial success.

Related Posts

What is Margin Trading, and How Do You Trade On It?

Maximizing Your Entitlements: How to Use the Gratuity Calculator as a Private Sector Employee

Financial Strategy of a Technology Startup

Tax Loss Harvesting

Business Funding Strategies

Best Budgeting Strategy for Businesses

Cash Management Strategies

Working Capital Management Strategies

Type above and press Enter to search. Press Esc to cancel.

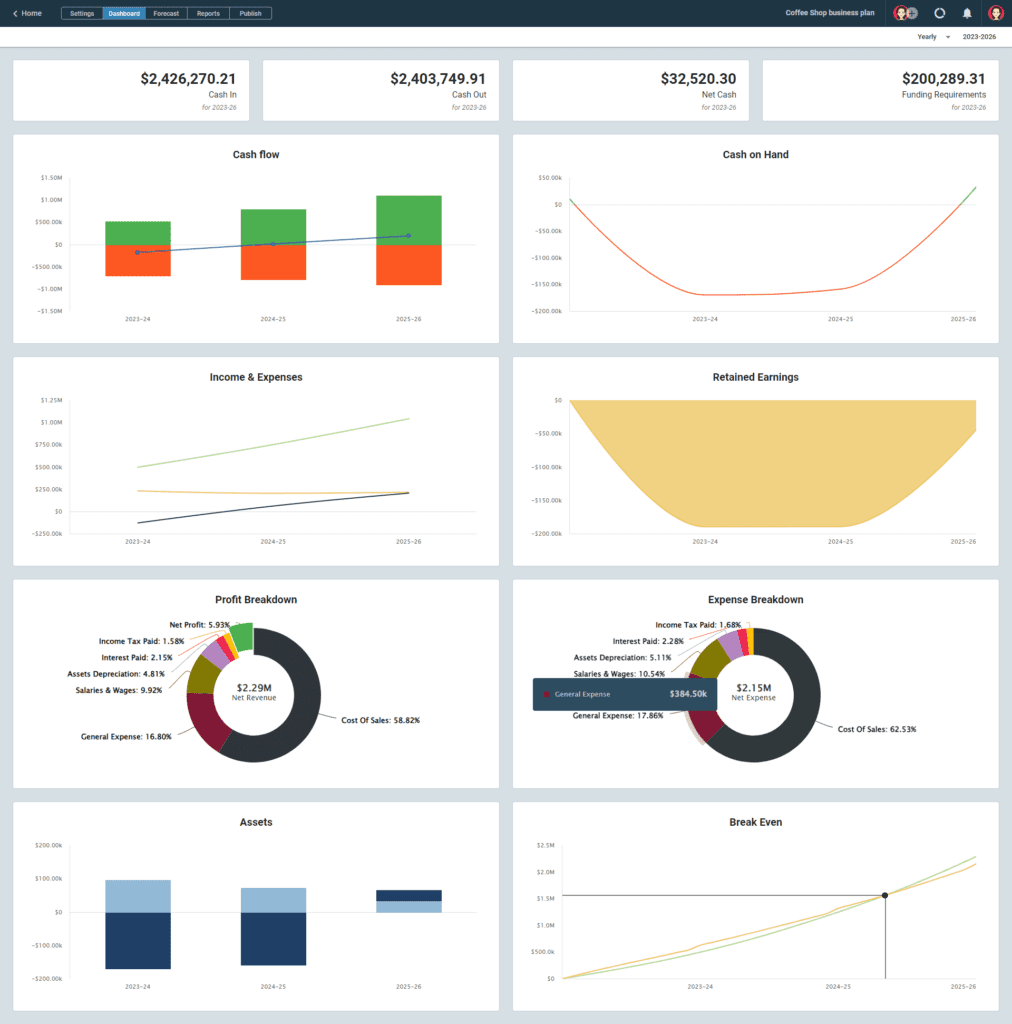

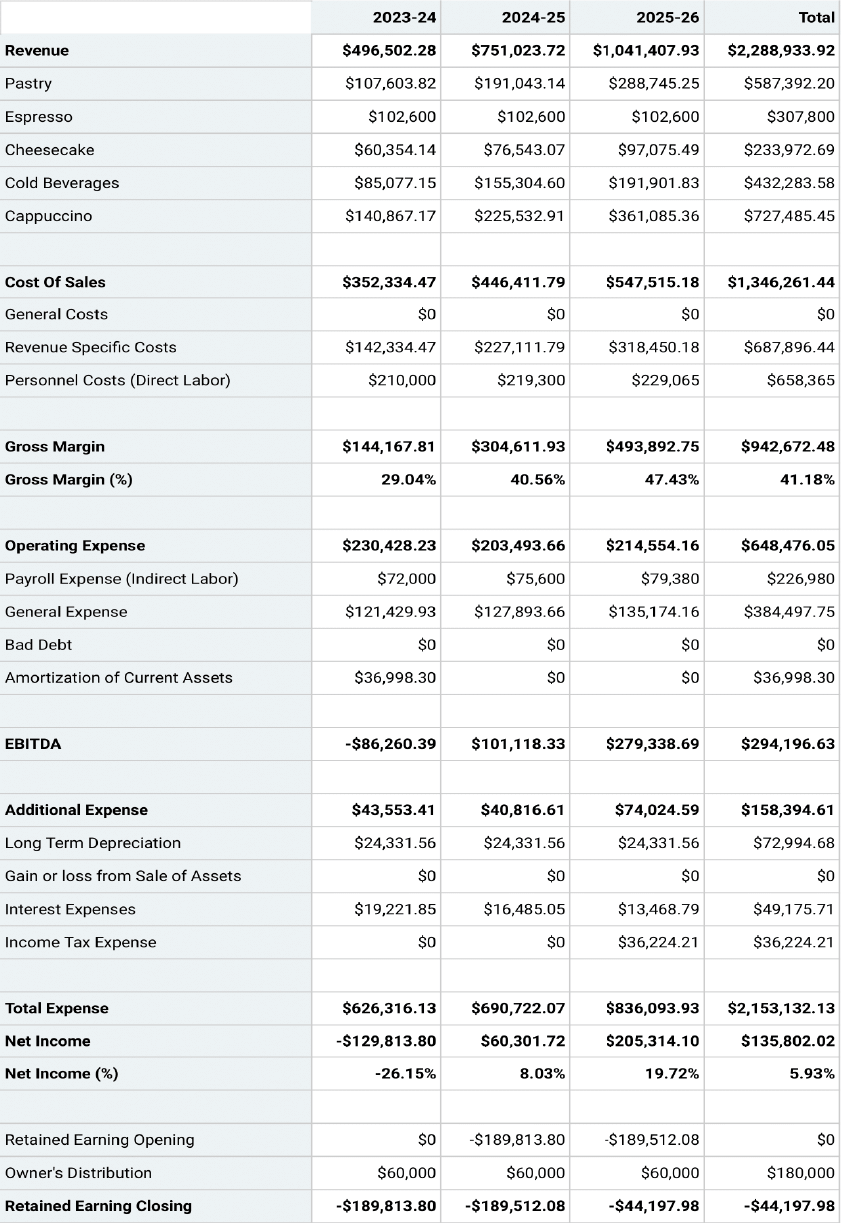

How to Write a Small Business Financial Plan

Noah Parsons

4 min. read

Updated April 22, 2024

Creating a financial plan is often the most intimidating part of writing a business plan.

It’s also one of the most vital. Businesses with well-structured and accurate financial statements are more prepared to pitch to investors, receive funding, and achieve long-term success.

Thankfully, you don’t need an accounting degree to successfully create your budget and forecasts.

Here is everything you need to include in your financial plan, along with optional performance metrics, funding specifics, mistakes to avoid , and free templates.

- Key components of a financial plan

A sound financial plan is made up of six key components that help you easily track and forecast your business financials. They include your:

Sales forecast

What do you expect to sell in a given period? Segment and organize your sales projections with a personalized sales forecast based on your business type.

Subscription sales forecast

While not too different from traditional sales forecasts—there are a few specific terms and calculations you’ll need to know when forecasting sales for a subscription-based business.

Expense budget

Create, review, and revise your expense budget to keep your business on track and more easily predict future expenses.

How to forecast personnel costs

How much do your current, and future, employees’ pay, taxes, and benefits cost your business? Find out by forecasting your personnel costs.

Profit and loss forecast

Track how you make money and how much you spend by listing all of your revenue streams and expenses in your profit and loss statement.

Cash flow forecast

Manage and create projections for the inflow and outflow of cash by building a cash flow statement and forecast.

Balance sheet

Need a snapshot of your business’s financial position? Keep an eye on your assets, liabilities, and equity within the balance sheet.

What to include if you plan to pursue funding

Do you plan to pursue any form of funding or financing? If the answer is yes, then there are a few additional pieces of information that you’ll need to include as part of your financial plan.

Highlight any risks and assumptions

Every entrepreneur takes risks with the biggest being assumptions and guesses about the future. Just be sure to track and address these unknowns in your plan early on.

Plan your exit strategy

Investors will want to know your long-term plans as a business owner. While you don’t need to have all the details, it’s worth taking the time to think through how you eventually plan to leave your business.

- Financial ratios and metrics

With your financial statements and forecasts in place, you have all the numbers needed to calculate insightful financial ratios.

While including these metrics in your plan is entirely optional, having them easily accessible can be valuable for tracking your performance and overall financial situation.

Key financial terms you should know

It’s not hard. Anybody who can run a business can understand these key financial terms. And every business owner and entrepreneur should know them.

Common business ratios

Unsure of which business ratios you should be using? Check out this list of key financial ratios that bankers, financial analysts, and investors will want to see.

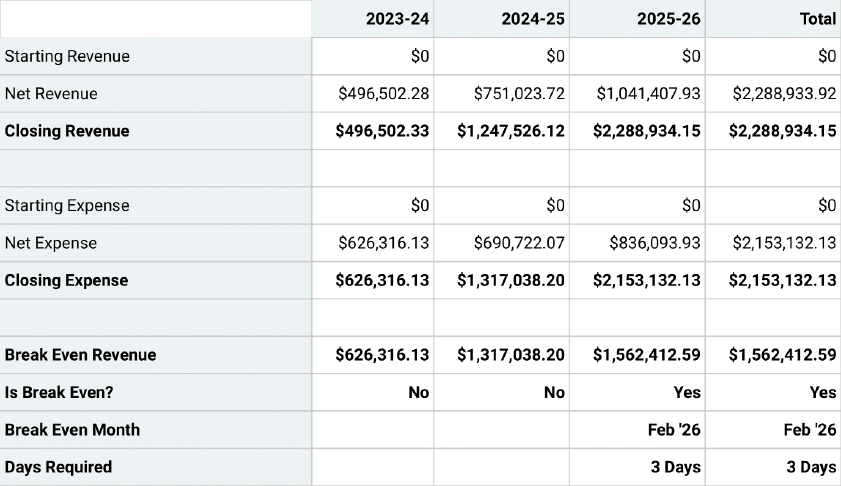

Break-even analysis

Do you want to know when you’ll become profitable? Find out how much you need to sell to offset your production costs by conducting a break-even analysis.

How to calculate ROI

How much could a business decision be worth? Evaluate the efficiency or profitability by calculating the potential return on investment (ROI).

- How to improve your financial plan

Your financial statements are the core part of your business plan that you’ll revisit most often. Instead of worrying about getting it perfect the first time, check out the following resources to learn how to improve your projections over time.

Common mistakes with business forecasts

I was glad to be asked about common mistakes with startup financial projections. I read about 100 business plans per year, and I have this list of mistakes.

How to improve your financial projections

Learn how to improve your business financial projections by following these five basic guidelines.

Brought to you by

Create a professional business plan

Using ai and step-by-step instructions.

Secure funding

Validate ideas

Build a strategy

- Financial plan templates and tools

Download and use these free financial templates and calculators to easily create your own financial plan.

Sales forecast template

Download a free detailed sales forecast spreadsheet, with built-in formulas, to easily estimate your first full year of monthly sales.

Download Template

Accurate and easy financial forecasting

Get a full financial picture of your business with LivePlan's simple financial management tools.

Get Started

Noah is the COO at Palo Alto Software, makers of the online business plan app LivePlan. He started his career at Yahoo! and then helped start the user review site Epinions.com. From there he started a software distribution business in the UK before coming to Palo Alto Software to run the marketing and product teams.

Table of Contents

- What to include for funding

Related Articles

10 Min. Read

How to Write the Company Overview for a Business Plan

24 Min. Read

The 10 AI Prompts You Need to Write a Business Plan

3 Min. Read

What to Include in Your Business Plan Appendix

How to Write a Competitive Analysis for Your Business Plan

The Bplans Newsletter

The Bplans Weekly

Subscribe now for weekly advice and free downloadable resources to help start and grow your business.

We care about your privacy. See our privacy policy .

The quickest way to turn a business idea into a business plan

Fill-in-the-blanks and automatic financials make it easy.

No thanks, I prefer writing 40-page documents.

Discover the world’s #1 plan building software

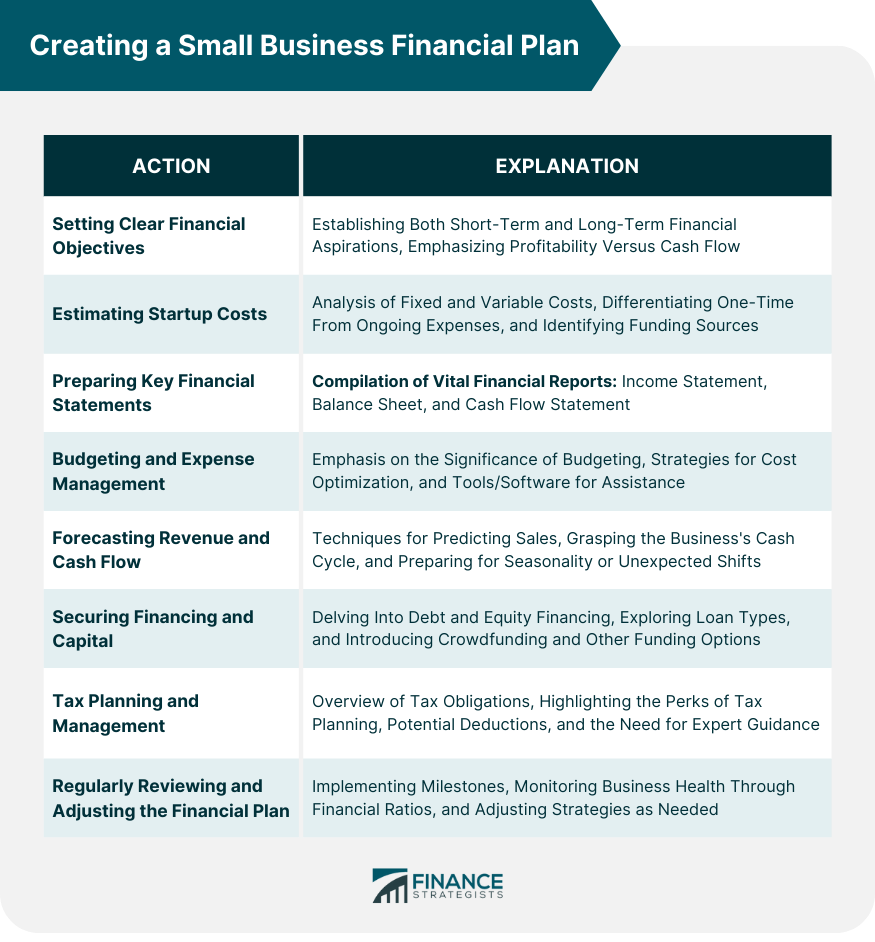

- Creating a Small Business Financial Plan

Written by True Tamplin, BSc, CEPF®

Reviewed by subject matter experts.

Updated on September 02, 2023

Get Any Financial Question Answered

Table of contents, financial plan overview.

A financial plan is a comprehensive document that charts a business's monetary objectives and the strategies to achieve them. It encapsulates everything from budgeting and forecasting to investments and resource allocation.

For small businesses, a solid financial plan provides direction, helping them navigate economic challenges, capitalize on opportunities, and ensure sustainable growth.

The strength of a financial plan lies in its ability to offer a clear roadmap for businesses.

Especially for small businesses that may not have a vast reserve of resources, prioritizing financial goals and understanding where every dollar goes can be the difference between growth and stagnation.

It lends clarity, ensures informed decision-making, and sets the stage for profitability and success.

Understanding the Basics of Financial Planning for Small Businesses

Role of financial planning in business success.

Financial planning is the backbone of any successful business endeavor. It serves as a compass, guiding businesses toward profitability, stability, and growth.

With proper financial planning, businesses can anticipate potential cash shortfalls, make informed investment decisions, and ensure they have the capital needed to seize new opportunities.

For small businesses, in particular, tight financial planning can mean the difference between thriving and shuttering. Given the limited resources, it's vital to maximize every dollar and anticipate financial challenges.

Through diligent planning, small businesses can position themselves competitively, adapt to market changes, and drive consistent growth.

Core Components of a Financial Plan for Small Businesses

Every financial plan comprises several core components that, together, provide a holistic view of a business's financial health and direction. These include setting clear objectives, estimating costs , preparing financial statements , and considering sources of financing.

Each component plays a pivotal role in ensuring a thorough and actionable financial strategy .

For small businesses, these components often need a more granular approach. Given the scale of operations, even minor financial missteps can have significant repercussions.

As such, it's essential to tailor each component, ensuring they address specific challenges and opportunities that small businesses face, from initial startup costs to revenue forecasting and budgetary constraints.

Setting Clear Small Business Financial Objectives

Identifying business's short-term and long-term financial goals.

Every business venture starts with a vision. Translating this vision into actionable financial goals is the essence of effective planning.

Short-term goals could range from securing initial funding and achieving a set monthly revenue to covering startup costs. These targets, usually spanning a year or less, set the immediate direction for the business.

On the other hand, long-term financial goals delve into the broader horizon. They might encompass aspirations like expanding to new locations, diversifying product lines, or achieving a specific market share within a decade.

By segmenting goals into short-term and long-term, businesses can craft a step-by-step strategy, making the larger vision more attainable and manageable.

Understanding the Difference Between Profitability and Cash Flow

Profitability and cash flow, while closely linked, are distinct concepts in the financial realm. Profitability pertains to the ability of a business to generate a surplus after deducting all expenses.

It's a metric of success and indicates the viability of a business model . Simply put, it answers whether a business is making more than it spends.

In contrast, cash flow represents the inflow and outflow of cash within a business. A company might be profitable on paper yet struggle with cash flow if, for instance, clients delay payments or unexpected expenses arise.

For small businesses, maintaining positive cash flow is paramount. It ensures that they can cover operational costs, pay employees, and reinvest in growth, even if they're awaiting payments or navigating financial hiccups.

Estimating Small Business Startup Costs (for New Businesses)

Fixed vs variable costs.

When embarking on a new business venture, understanding costs is paramount. Fixed costs remain consistent regardless of production levels. They include expenses like rent, salaries, and insurance . These are predictable outlays that don't fluctuate with business performance.

Variable costs , conversely, change in direct proportion to production or business activity. Think of costs associated with materials for manufacturing or commission for sales .

For a startup, delineating between fixed and variable costs aids in crafting a more dynamic budget, allowing for adaptability as the business scales and evolves.

One-Time Expenditures vs Ongoing Expenses

Startups often grapple with numerous upfront costs. From purchasing equipment and setting up a workspace to initial marketing campaigns, these one-time expenditures lay the foundation for business operations.

They differ from ongoing expenses like utility bills, raw materials, or employee wages that recur monthly or annually.

For a small business owner, distinguishing between these costs is critical. One-time expenditures often demand a larger chunk of initial capital, while ongoing expenses shape the monthly and annual budget.

By categorizing them separately, businesses can strategize funding needs more effectively, ensuring they're equipped to meet both immediate and recurrent financial obligations.

Funding Sources for Small Businesses

Personal savings.

This is often the most straightforward way to fund a startup. Entrepreneurs tap into their personal savings accounts to jumpstart their business.

While this method has the benefit of not incurring debt or diluting company ownership, it intertwines the individual's personal financial security with the business's fate.

The entrepreneur must be prepared for potential losses, and there's the evident psychological strain of putting one's hard-earned money on the line.

Loans can be sourced from various institutions, from traditional banks to credit unions . They offer a substantial sum of money that can be paid back over time, usually with interest .

The main advantage of taking a loan is that the entrepreneur retains full ownership and control of the business.

However, there's the obligation of monthly repayments, which can strain a business's cash flow, especially in its early days. Additionally, securing a loan often requires collateral and a sound credit history.

Investors, including angel investors and venture capitalists , offer capital in exchange for equity or a stake in the company.

Angel investors are typically high-net-worth individuals who provide funding in the initial stages, while venture capitalists come in when there's proven business potential, often injecting larger sums. The advantage is substantial funding without the immediate pressure of repayments.

However, in exchange for their investment, they often seek a say in business decisions, which might mean compromising on some aspects of the original business vision.

Grants are essentially 'free money' often provided by government programs, non-profit organizations, or corporations to promote innovation and support businesses in specific sectors.

The primary advantage of grants is that they don't need to be repaid, nor do they dilute company ownership. However, they can be highly competitive and might come with stipulations on how the funds should be used.

Moreover, the application process can be lengthy and requires showcasing the business's potential or alignment with the specific goals or missions of the granting institution.

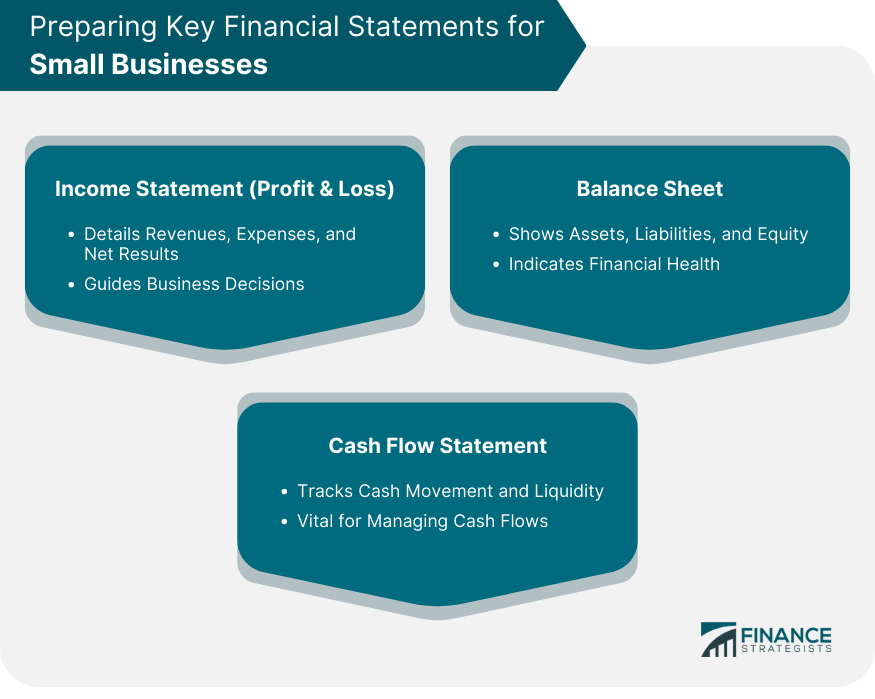

Preparing Key Financial Statements for Small Businesses

Income statement (profit & loss).

An Income Statement , often termed as the Profit & Loss statement , showcases a business's financial performance over a specific time frame. It details revenues , expenses, and ultimately, profits or losses.

By analyzing this statement, business owners can pinpoint revenue drivers, identify exorbitant costs, and understand the net result of their operations.

For small businesses, this document is instrumental in making informed decisions. For instance, if a certain product line is consistently unprofitable, it might be prudent to discontinue it. Conversely, if another segment is thriving, it might warrant further investment.

The Income Statement, thus, serves as a financial mirror, reflecting the outcomes of business strategies and decisions.

Balance Sheet

The Balance Sheet offers a snapshot of a company's assets , liabilities , and equity at a specific point in time.

Assets include everything the business owns, from physical items like equipment to intangible assets like patents .

Liabilities, on the other hand, encompass what the company owes, be it bank loans or unpaid bills.

Equity represents the owner's stake in the business, calculated as assets minus liabilities.

This statement is crucial for small businesses as it offers insights into their financial health. A robust asset base, minimal liabilities, and growing equity signify a thriving enterprise.

In contrast, mounting liabilities or dwindling assets could be red flags, signaling the need for intervention and strategy recalibration.

Cash Flow Statement

While the Income Statement reveals profitability, the Cash Flow Statement tracks the actual movement of money.

It categorizes cash flows into operating (day-to-day business), investing (buying/selling assets), and financing (loans or equity transactions) activities. This statement unveils the liquidity of a business, indicating whether it has sufficient cash to meet immediate obligations.

For small businesses, maintaining positive cash flow is often more vital than showcasing profitability.

After all, a business might be profitable on paper yet struggle if clients delay payments or unforeseen expenses emerge.

By regularly reviewing the Cash Flow Statement, small business owners can anticipate cash crunches and strategize accordingly, ensuring seamless operations irrespective of revenue cycles.

Small Business Budgeting and Expense Management

Importance of budgeting for a small business.

Budgeting is the financial blueprint for any business, detailing anticipated revenues and expenses for a forthcoming period. It's a proactive approach, enabling businesses to allocate resources efficiently, plan for investments, and prepare for potential financial challenges.

For small businesses, a meticulous budget is often the linchpin of stability, ensuring they operate within their means and avoid financial pitfalls.

Having a well-defined budget also fosters discipline. It curtails frivolous spending, emphasizes cost-efficiency, and sets clear financial boundaries.

For small businesses, where every dollar counts, a stringent budget is the gateway to financial prudence, ensuring that funds are utilized judiciously, fostering growth, and minimizing wastage.

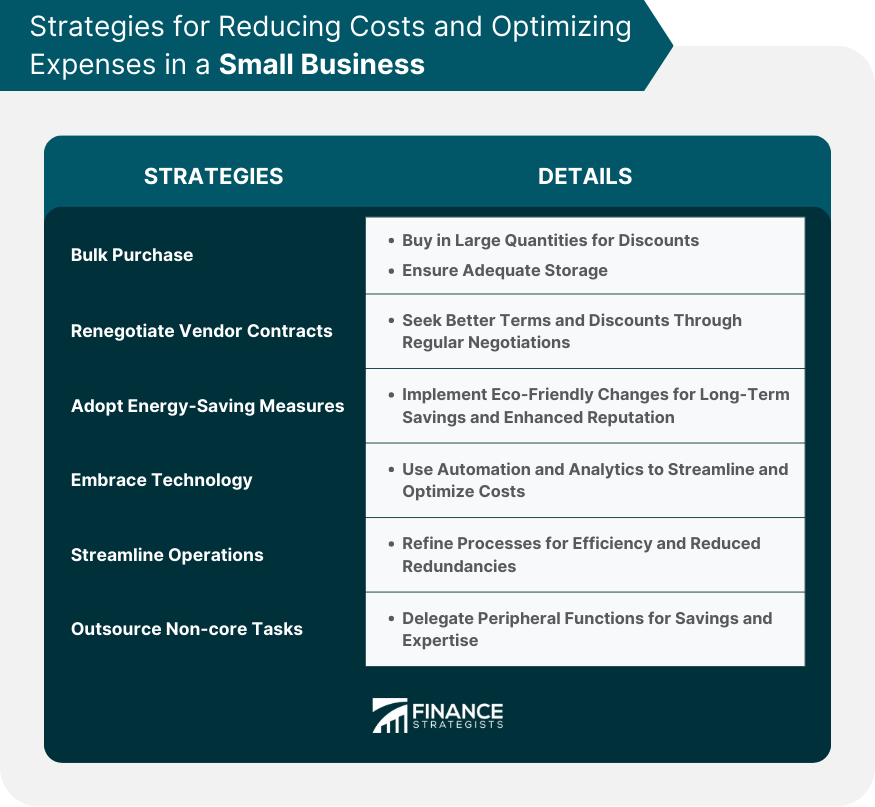

Strategies for Reducing Costs and Optimizing Expenses

Bulk purchasing.

When businesses buy supplies in large quantities, they often benefit from discounts due to economies of scale . This can significantly reduce per-unit costs.

However, while bulk purchasing leads to immediate savings, businesses must ensure they have adequate storage and that the products won't expire or become obsolete before they're used.

Renegotiating Vendor Contracts

Regularly reviewing and renegotiating contracts with suppliers or service providers can lead to better terms and lower costs. This might involve exploring volume discounts, longer payment terms, or even bartering services.

Building strong relationships with vendors often paves the way for such negotiations.

Adopting Energy-Saving Measures

Simple changes, like switching to LED lighting or investing in energy-efficient appliances, can lead to long-term savings in utility bills. Moreover, energy conservation not only reduces costs but also minimizes the environmental footprint, which can enhance the business's reputation.

Embracing Technology

Modern software and technology can streamline business processes. Automation tools can handle repetitive tasks, reducing labor costs.

Meanwhile, data analytics tools can provide insights into customer preferences and behavior, ensuring that marketing budgets are used effectively and target the right audience.

Streamlining Operations

Regularly reviewing and refining business processes can eliminate redundancies and improve efficiency. This might mean merging roles, cutting down on unnecessary meetings, or simplifying supply chains. A leaner operation often translates to reduced expenses.

Outsourcing Non-core Tasks

Instead of maintaining an in-house team for every function, businesses can outsource tasks that aren't central to their operations.

For instance, functions like accounting , IT support, or digital marketing can be outsourced to specialized agencies, often leading to cost savings and access to expert skills.

Cultivating a Culture of Frugality

Encouraging employees to adopt a cost-conscious mindset can lead to collective savings. This can be fostered through incentives, regular training, or even simple practices like recycling and reusing office supplies.

When everyone in the organization is attuned to the importance of cost savings, the cumulative effect can be substantial.

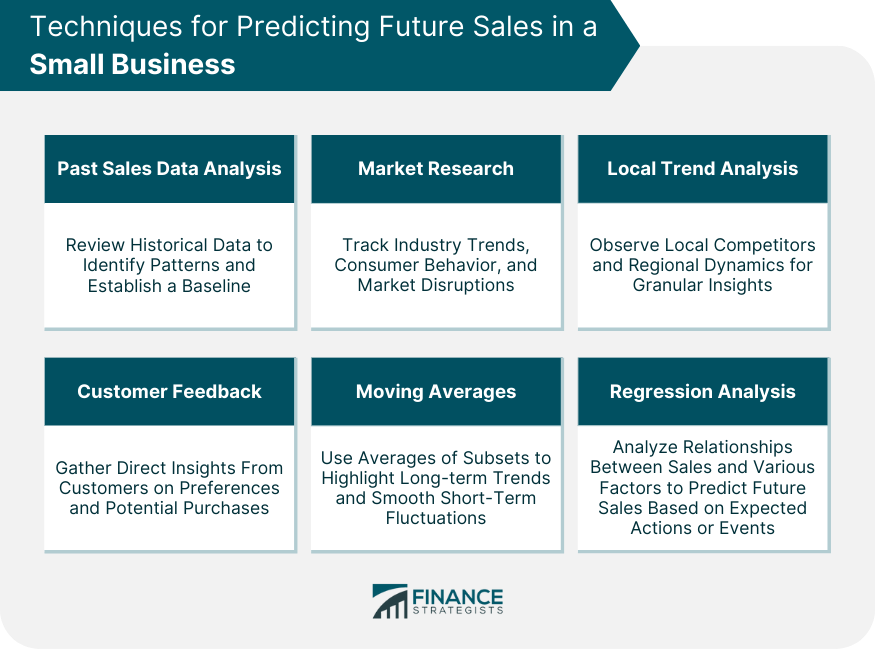

Forecasting Small Business Revenue and Cash Flow

Techniques for predicting future sales in a small business, past sales data analysis.

Historical sales data is a foundational element in any forecasting effort. By reviewing previous sales figures, businesses can identify patterns, understand seasonal fluctuations, and recognize the effects of past initiatives.

This information offers a baseline upon which to build future projections, accounting for known recurring variables in the business cycle .

Market Research

Understanding the larger market dynamics is crucial for accurate forecasting. This involves tracking industry trends, monitoring shifts in consumer behavior, and being aware of potential market disruptions.

For instance, a sudden technological advancement can change consumer preferences or regulatory changes might impact an industry.

Local Trend Analysis

For small businesses, localized insights can be especially impactful. Observing local competitors, understanding regional consumer preferences, or noting shifts in the local economy can offer precise data points.

These granular details, when integrated into a larger forecasting model, can enhance prediction accuracy.

Customer Feedback

Direct feedback from customers is an invaluable source of insights. Surveys, focus groups, or even informal chats can reveal customer sentiments, preferences, and potential future purchasing behavior.

For instance, if a majority of loyal customers express interest in a new product or service, it can be indicative of future sales potential.

Moving Averages

This technique involves analyzing a series of data points (like monthly sales) by creating averages from different subsets of the full data set.

For yearly forecasting, a 12-month moving average can be used to smooth out short-term fluctuations and highlight longer-term trends or cycles.

Regression Analysis

Regression analysis is a statistical tool used to identify relationships between variables. In sales forecasting, it can help understand how different factors (like marketing spend, seasonal variations, or competitor actions) relate to sales figures.

Once these relationships are understood, businesses can predict future sales based on planned actions or expected external events.

Understanding the Cash Cycle of Business

The cash cycle encompasses the time it takes for a business to convert resource investments, often in the form of inventory, back into cash.

This involves the processes of purchasing inventory, selling it, and subsequently collecting payment. A shorter cycle implies quicker cash turnarounds, which are vital for liquidity.

For small businesses, a firm grasp of the cash cycle can aid in managing cash flow more effectively.

By identifying bottlenecks or delays, businesses can strategize to expedite processes. This might involve renegotiating payment terms with suppliers, offering discounts for prompt customer payments, or optimizing inventory levels to prevent overstocking.

Ultimately, understanding and optimizing the cash cycle ensures that a business remains liquid and agile.

Preparing for Seasonality and Unexpected Changes

Seasonality affects many businesses, from the ice cream vendor witnessing summer surges to the retailer bracing for holiday shopping frenzies.

By analyzing historical data and market trends, businesses can prepare for these cyclical shifts, ensuring they stock up, staff appropriately, and market effectively.

Small businesses, often operating on tighter margins , need to be especially vigilant. Beyond seasonality, they must also brace for unexpected changes – a local construction project obstructing store access, a sudden competitor emergence, or unforeseen regulatory changes.

Building a financial buffer, diversifying product or service lines, and maintaining flexible operational strategies can equip small businesses to weather these unforeseen challenges with resilience.

Securing Small Business Financing and Capital

Role of debt and equity financing.

When businesses seek external funding, they often grapple with the debt vs. equity conundrum. Debt financing involves borrowing money, typically via loans. While it doesn't dilute ownership, it necessitates regular interest payments, potentially impacting cash flow.

Equity financing, on the other hand, entails selling a stake in the business to investors. It might not demand regular repayments, but it dilutes ownership and might influence business decisions.

Small businesses must weigh these options carefully. While loans offer a structured repayment plan and retained control, they might strain finances if the business hits a rough patch.

Equity financing, although relinquishing some control, might bring aboard strategic partners, offering expertise and networks in addition to funds.

The optimal choice hinges on the business's financial health, growth aspirations, and the founder's comfort with sharing control.

Choosing Between Different Types of Loans

A staple in the lending arena, term loans offer businesses a fixed amount of capital that is paid back over a specified period with interest. They're often used for significant one-time expenses, such as purchasing machinery, real estate , or even business expansion.

With predictable monthly payments, businesses can plan their budgets accordingly. However, they might require collateral and a robust credit history for approval.

Lines of Credit

Unlike term loans that provide funds in a lump sum, a line of credit grants businesses access to a pool of funds up to a certain limit.

Businesses can draw from this line as needed, only paying interest on the amount they use. This makes it a versatile tool, especially for managing cash flow fluctuations or unexpected expenses. It serves as a financial safety net, ready for use whenever required.

As the name suggests, microloans are smaller loans designed to cater to businesses that might not need substantial amounts of capital. They're particularly beneficial for startups, businesses with limited credit histories, or those in need of a quick, small financial boost.

Since they are of a smaller denomination, the approval process might be more lenient than traditional loans.

Peer-To-Peer Lending

A contemporary twist to the traditional lending model, peer-to-peer (P2P) platforms connect borrowers directly with individual lenders or investor groups.

This direct model often translates to quicker approvals and competitive interest rates as the overheads of traditional banking structures are removed. With technology at its core, P2P lending can offer a more user-friendly, streamlined process.

However, creditworthiness still plays a pivotal role in determining interest rates and loan amounts.

Crowdfunding and Alternative Financing Options

In an increasingly digital age, crowdfunding platforms like Kickstarter or Indiegogo have emerged as viable financing avenues.

These platforms enable businesses to raise small amounts from a large number of people, often in exchange for product discounts, early access, or other perks. This not only secures funds but also validates the business idea and fosters a community of supporters.

Other alternatives include invoice financing, where businesses get an advance on pending invoices, or merchant cash advances tailored for businesses with significant credit card sales.

Each financing mode offers unique advantages and constraints. Small businesses must meticulously evaluate their financial landscape, growth trajectories, and risk appetite to harness the most suitable option.

Small Business Tax Planning and Management

Basic tax obligations for small businesses.

Navigating the maze of taxation can be daunting, especially for small businesses. Yet, understanding and fulfilling tax obligations is crucial.

Depending on the business structure—whether sole proprietorship , partnership , LLC , or corporation—different tax rules apply. For instance, while corporations are taxed on their earnings, sole proprietors report business income and expenses on their personal tax returns.

In addition to income taxes, small businesses may also be responsible for employment taxes if they have employees. This covers Social Security , Medicare , federal unemployment, and sometimes state-specific taxes.

There might also be sales taxes, property taxes, or special state-specific levies to consider.

Consistently maintaining accurate financial records, being aware of filing deadlines, and setting aside funds for tax obligations are essential practices to avoid penalties and ensure compliance.

Advantages of Tax Planning and Potential Deductions

Tax planning is the strategic approach to minimizing tax liability through the best use of available allowances, deductions, exclusions, and breaks.

For small businesses, effective tax planning can lead to significant savings.

This might involve strategies like deferring income to a later tax year, choosing the optimal time to purchase equipment, or taking advantage of specific credits available to businesses in certain sectors or regions.

Several potential deductions can reduce taxable income for small businesses. These include expenses like rent, utilities, business travel, employee wages, and even certain meals.

By keeping abreast of tax law changes and actively seeking out eligible deductions, small businesses can optimize their financial landscape, ensuring they're not paying more in taxes than necessary.

Importance of Hiring a Tax Professional or Accountant

While it's feasible for small business owners to manage their taxes, the intricate nuances of tax laws make it beneficial to consult professionals.

An experienced accountant or tax consultant can not only ensure compliance but can proactively recommend strategies to reduce tax liability.

They can guide businesses on issues like whether to classify someone as an employee or a contractor, how to structure the business for optimal taxation, or when to make certain capital investments.

Beyond just annual tax filing, these professionals offer year-round counsel, helping businesses maintain clean financial records, stay updated on tax law changes, and plan for future financial moves.

The investment in professional advice often pays dividends , saving businesses from costly mistakes, penalties, or missed financial opportunities.

Regularly Reviewing and Adjusting the Small Business Financial Plan

Setting checkpoints and milestones.

Like any strategic blueprint, a financial plan isn't static. It serves as a guiding framework but should be flexible enough to adapt to evolving business realities.

Setting regular checkpoints— quarterly , half-yearly, or annually—can help businesses assess whether they're on track to meet their financial objectives.

Milestones, such as reaching a specific sales target, launching a new product, or expanding into a new market, offer tangible markers of progress. Celebrating these victories can bolster morale, while any shortfalls can serve as lessons, prompting strategy tweaks. F

or small businesses, where agility is an asset, regularly revisiting the financial plan ensures that the business remains aligned with its overarching financial goals while being responsive to the dynamic marketplace.

Using Financial Ratios to Monitor Business Health

Financial ratios offer a distilled snapshot of a business's health. Ratios like the current ratio ( current assets divided by current liabilities ) can shed light on liquidity, indicating whether a business can meet short-term obligations.

The debt-to-equity ratio , contrasting borrowed funds with owner's equity, offers insights into the business's leverage and potential financial risk.

Profit margin , depicting profitability relative to sales, can highlight operational efficiency. By consistently monitoring these and other pertinent ratios, small businesses can glean actionable insights, understanding their financial strengths and areas needing attention.

In a realm where early intervention can stave off major financial setbacks, these ratios serve as vital diagnostic tools, guiding informed decision-making.

Pivoting Strategies Based on Financial Performance

In the ever-evolving world of business, flexibility is paramount. If financial reviews indicate that certain strategies aren't yielding anticipated results, it might be time to pivot.

This could involve tweaking product offerings, revising pricing strategies, targeting a different customer segment, or even overhauling the business model.

For small businesses, the ability to pivot can be a lifeline. It allows them to respond swiftly to market changes, customer feedback, or internal challenges.

A robust financial plan, while offering direction, should also be pliable, accommodating shifts in strategy based on real-world performance. After all, in the business arena, adaptability often spells the difference between stagnation and growth.

Bottom Line

Financial foresight is integral for the stability and growth of small businesses. Effective revenue and cash flow forecasting, anchored by historical sales data and enhanced by market research, local trends, and customer feedback, ensures businesses are prepared for future demands.

With the unpredictability of the business environment, understanding the cash cycle and preparing for unforeseen challenges is essential.

As businesses contemplate external financing, the decision between debt and equity and the myriad of loan types, should be made judiciously, keeping in mind the business's health, growth aspirations, and risk appetite.

Furthermore, diligent tax planning, with professional guidance, can lead to significant financial benefits. Regular reviews using financial ratios allow businesses to gauge their performance, adapt strategies, and pivot when necessary.

Ultimately, the agility to adapt, guided by a well-structured financial plan, is pivotal for businesses to thrive in a dynamic marketplace.

Creating a Small Business Financial Plan FAQs

What is the importance of a financial plan for small businesses.

A financial plan offers a structured roadmap, guiding businesses in making informed decisions, ensuring growth, and navigating financial challenges.

How do forecasting revenue and understanding cash cycles aid in financial planning?

Forecasting provides insights into expected income, aiding in budget allocation, while understanding cash cycles ensures effective liquidity management.

What are the core components of a financial plan for small businesses?

Core components include setting objectives, estimating startup costs, preparing financial statements, budgeting, forecasting, securing financing, and tax management.

Why is tax planning vital for small businesses?

Tax planning ensures compliance, optimizes tax liabilities through available deductions, and helps businesses save money and avoid penalties.

How often should a small business review its financial plan?

Regular reviews, ideally quarterly or half-yearly, ensure alignment with business goals and allow for strategy adjustments based on real-world performance.

About the Author

True Tamplin, BSc, CEPF®

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide , a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University , where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon , Nasdaq and Forbes .

Related Topics

- Average Cost of a Certified Financial Planner

- Benefits of Having a Financial Planner

- Cash Flow Management

- Cash Flow-Based Financial Planning

- Charitable Financial Planning

- Components of a Good Financial Plan

- Debt Reduction Strategies

- Divorce Financial Planning

- Education Planning

- Fee-Only Financial Planning

- Financial Contingency Planning

- Financial Planner for Retirement

- Financial Planning Career Pathway

- Financial Planning Pyramid

- Financial Planning Tips

- Financial Planning Trends

- Financial Planning and Analysis

- Financial Planning for Allied Health Professionals

- Financial Planning for Married Couples

- Financial Planning for Military Families

- Financial Planning for Retirement

- Financial Planning for Startups

- Financial Planning vs Budgeting

- Financial Tips for Young Adults

- How to Build a 5-Year Financial Plan

- Limitations of Financial Planning

- Military Spouse Financial Planning

- The Function of a Financial Planner

- When Do You Need a Financial Planner?

Ask a Financial Professional Any Question

Meet top certified financial advisors near you, find advisor near you, our recommended advisors.

Taylor Kovar, CFP®

WHY WE RECOMMEND:

Fee-Only Financial Advisor Show explanation

Certified financial planner™, 3x investopedia top 100 advisor, author of the 5 money personalities & keynote speaker.

IDEAL CLIENTS:

Business Owners, Executives & Medical Professionals

Strategic Planning, Alternative Investments, Stock Options & Wealth Preservation

Claudia Valladares

Bilingual in english / spanish, founder of wisedollarmom.com, quoted in gobanking rates, yahoo finance & forbes.

Retirees, Immigrants & Sudden Wealth / Inheritance

Retirement Planning, Personal finance, Goals-based Planning & Community Impact

We use cookies to ensure that we give you the best experience on our website. If you continue to use this site we will assume that you are happy with it.

Fact Checked

At Finance Strategists, we partner with financial experts to ensure the accuracy of our financial content.

Our team of reviewers are established professionals with decades of experience in areas of personal finance and hold many advanced degrees and certifications.

They regularly contribute to top tier financial publications, such as The Wall Street Journal, U.S. News & World Report, Reuters, Morning Star, Yahoo Finance, Bloomberg, Marketwatch, Investopedia, TheStreet.com, Motley Fool, CNBC, and many others.

This team of experts helps Finance Strategists maintain the highest level of accuracy and professionalism possible.

Why You Can Trust Finance Strategists

Finance Strategists is a leading financial education organization that connects people with financial professionals, priding itself on providing accurate and reliable financial information to millions of readers each year.

We follow strict ethical journalism practices, which includes presenting unbiased information and citing reliable, attributed resources.

Our goal is to deliver the most understandable and comprehensive explanations of financial topics using simple writing complemented by helpful graphics and animation videos.

Our writing and editorial staff are a team of experts holding advanced financial designations and have written for most major financial media publications. Our work has been directly cited by organizations including Entrepreneur, Business Insider, Investopedia, Forbes, CNBC, and many others.

Our mission is to empower readers with the most factual and reliable financial information possible to help them make informed decisions for their individual needs.

How It Works

Step 1 of 3, ask any financial question.

Ask a question about your financial situation providing as much detail as possible. Your information is kept secure and not shared unless you specify.

Step 2 of 3

Our team will connect you with a vetted, trusted professional.

Someone on our team will connect you with a financial professional in our network holding the correct designation and expertise.

Step 3 of 3

Get your questions answered and book a free call if necessary.

A financial professional will offer guidance based on the information provided and offer a no-obligation call to better understand your situation.

Where Should We Send Your Answer?

Just a Few More Details

We need just a bit more info from you to direct your question to the right person.

Tell Us More About Yourself

Is there any other context you can provide.

Pro tip: Professionals are more likely to answer questions when background and context is given. The more details you provide, the faster and more thorough reply you'll receive.

What is your age?

Are you married, do you own your home.

- Owned outright

- Owned with a mortgage

Do you have any children under 18?

- Yes, 3 or more

What is the approximate value of your cash savings and other investments?

- $50k - $250k

- $250k - $1m

Pro tip: A portfolio often becomes more complicated when it has more investable assets. Please answer this question to help us connect you with the right professional.

Would you prefer to work with a financial professional remotely or in-person?

- I would prefer remote (video call, etc.)

- I would prefer in-person

- I don't mind, either are fine

What's your zip code?

- I'm not in the U.S.

Submit to get your question answered.

A financial professional will be in touch to help you shortly.

Part 1: Tell Us More About Yourself

Do you own a business, which activity is most important to you during retirement.

- Giving back / charity

- Spending time with family and friends

- Pursuing hobbies

Part 2: Your Current Nest Egg

Part 3: confidence going into retirement, how comfortable are you with investing.

- Very comfortable

- Somewhat comfortable

- Not comfortable at all

How confident are you in your long term financial plan?

- Very confident

- Somewhat confident

- Not confident / I don't have a plan

What is your risk tolerance?

How much are you saving for retirement each month.

- None currently

- Minimal: $50 - $200

- Steady Saver: $200 - $500

- Serious Planner: $500 - $1,000

- Aggressive Saver: $1,000+

How much will you need each month during retirement?

- Bare Necessities: $1,500 - $2,500

- Moderate Comfort: $2,500 - $3,500

- Comfortable Lifestyle: $3,500 - $5,500

- Affluent Living: $5,500 - $8,000

- Luxury Lifestyle: $8,000+

Part 4: Getting Your Retirement Ready

What is your current financial priority.

- Getting out of debt

- Growing my wealth

- Protecting my wealth

Do you already work with a financial advisor?

Which of these is most important for your financial advisor to have.

- Tax planning expertise

- Investment management expertise

- Estate planning expertise

- None of the above

Where should we send your answer?

Submit to get your retirement-readiness report., get in touch with, great the financial professional will get back to you soon., where should we send the downloadable file, great hit “submit” and an advisor will send you the guide shortly., create a free account and ask any financial question, learn at your own pace with our free courses.

Take self-paced courses to master the fundamentals of finance and connect with like-minded individuals.

Get Started

Hey, did we answer your financial question.

We want to make sure that all of our readers get their questions answered.

Great, Want to Test Your Knowledge of This Lesson?

Create an Account to Test Your Knowledge of This Topic and Thousands of Others.

Get Your Question Answered by a Financial Professional

Create a free account and submit your question. We'll make sure a financial professional gets back to you shortly.

To Ensure One Vote Per Person, Please Include the Following Info

Great thank you for voting..

How to make a business plan

Table of Contents

How to make a good business plan: step-by-step guide.

A business plan is a strategic roadmap used to navigate the challenging journey of entrepreneurship. It's the foundation upon which you build a successful business.

A well-crafted business plan can help you define your vision, clarify your goals, and identify potential problems before they arise.

But where do you start? How do you create a business plan that sets you up for success?

This article will explore the step-by-step process of creating a comprehensive business plan.

What is a business plan?

A business plan is a formal document that outlines a business's objectives, strategies, and operational procedures. It typically includes the following information about a company:

Products or services

Target market

Competitors

Marketing and sales strategies

Financial plan

Management team

A business plan serves as a roadmap for a company's success and provides a blueprint for its growth and development. It helps entrepreneurs and business owners organize their ideas, evaluate the feasibility, and identify potential challenges and opportunities.

As well as serving as a guide for business owners, a business plan can attract investors and secure funding. It demonstrates the company's understanding of the market, its ability to generate revenue and profits, and its strategy for managing risks and achieving success.

Business plan vs. business model canvas

A business plan may seem similar to a business model canvas, but each document serves a different purpose.

A business model canvas is a high-level overview that helps entrepreneurs and business owners quickly test and iterate their ideas. It is often a one-page document that briefly outlines the following:

Key partnerships

Key activities

Key propositions

Customer relationships

Customer segments

Key resources

Cost structure

Revenue streams

On the other hand, a Business Plan Template provides a more in-depth analysis of a company's strategy and operations. It is typically a lengthy document and requires significant time and effort to develop.

A business model shouldn’t replace a business plan, and vice versa. Business owners should lay the foundations and visually capture the most important information with a Business Model Canvas Template . Because this is a fast and efficient way to communicate a business idea, a business model canvas is a good starting point before developing a more comprehensive business plan.

A business plan can aim to secure funding from investors or lenders, while a business model canvas communicates a business idea to potential customers or partners.

Why is a business plan important?

A business plan is crucial for any entrepreneur or business owner wanting to increase their chances of success.

Here are some of the many benefits of having a thorough business plan.

Helps to define the business goals and objectives

A business plan encourages you to think critically about your goals and objectives. Doing so lets you clearly understand what you want to achieve and how you plan to get there.

A well-defined set of goals, objectives, and key results also provides a sense of direction and purpose, which helps keep business owners focused and motivated.

Guides decision-making

A business plan requires you to consider different scenarios and potential problems that may arise in your business. This awareness allows you to devise strategies to deal with these issues and avoid pitfalls.

With a clear plan, entrepreneurs can make informed decisions aligning with their overall business goals and objectives. This helps reduce the risk of making costly mistakes and ensures they make decisions with long-term success in mind.

Attracts investors and secures funding

Investors and lenders often require a business plan before considering investing in your business. A document that outlines the company's goals, objectives, and financial forecasts can help instill confidence in potential investors and lenders.

A well-written business plan demonstrates that you have thoroughly thought through your business idea and have a solid plan for success.

Identifies potential challenges and risks

A business plan requires entrepreneurs to consider potential challenges and risks that could impact their business. For example:

Is there enough demand for my product or service?

Will I have enough capital to start my business?

Is the market oversaturated with too many competitors?

What will happen if my marketing strategy is ineffective?

By identifying these potential challenges, entrepreneurs can develop strategies to mitigate risks and overcome challenges. This can reduce the likelihood of costly mistakes and ensure the business is well-positioned to take on any challenges.

Provides a basis for measuring success

A business plan serves as a framework for measuring success by providing clear goals and financial projections . Entrepreneurs can regularly refer to the original business plan as a benchmark to measure progress. By comparing the current business position to initial forecasts, business owners can answer questions such as:

Are we where we want to be at this point?

Did we achieve our goals?

If not, why not, and what do we need to do?

After assessing whether the business is meeting its objectives or falling short, business owners can adjust their strategies as needed.

How to make a business plan step by step

The steps below will guide you through the process of creating a business plan and what key components you need to include.

1. Create an executive summary

Start with a brief overview of your entire plan. The executive summary should cover your business plan's main points and key takeaways.

Keep your executive summary concise and clear with the Executive Summary Template . The simple design helps readers understand the crux of your business plan without reading the entire document.

2. Write your company description

Provide a detailed explanation of your company. Include information on what your company does, the mission statement, and your vision for the future.

Provide additional background information on the history of your company, the founders, and any notable achievements or milestones.

3. Conduct a market analysis

Conduct an in-depth analysis of your industry, competitors, and target market. This is best done with a SWOT analysis to identify your strengths, weaknesses, opportunities, and threats. Next, identify your target market's needs, demographics, and behaviors.

Use the Competitive Analysis Template to brainstorm answers to simple questions like:

What does the current market look like?

Who are your competitors?

What are they offering?

What will give you a competitive advantage?

Who is your target market?

What are they looking for and why?

How will your product or service satisfy a need?

These questions should give you valuable insights into the current market and where your business stands.

4. Describe your products and services

Provide detailed information about your products and services. This includes pricing information, product features, and any unique selling points.

Use the Product/Market Fit Template to explain how your products meet the needs of your target market. Describe what sets them apart from the competition.

5. Design a marketing and sales strategy

Outline how you plan to promote and sell your products. Your marketing strategy and sales strategy should include information about your:

Pricing strategy

Advertising and promotional tactics

Sales channels

The Go to Market Strategy Template is a great way to visually map how you plan to launch your product or service in a new or existing market.

6. Determine budget and financial projections

Document detailed information on your business’ finances. Describe the current financial position of the company and how you expect the finances to play out.

Some details to include in this section are:

Startup costs

Revenue projections

Profit and loss statement

Funding you have received or plan to receive

Strategy for raising funds

7. Set the organization and management structure

Define how your company is structured and who will be responsible for each aspect of the business. Use the Business Organizational Chart Template to visually map the company’s teams, roles, and hierarchy.

As well as the organization and management structure, discuss the legal structure of your business. Clarify whether your business is a corporation, partnership, sole proprietorship, or LLC.

8. Make an action plan

At this point in your business plan, you’ve described what you’re aiming for. But how are you going to get there? The Action Plan Template describes the following steps to move your business plan forward. Outline the next steps you plan to take to bring your business plan to fruition.

Types of business plans

Several types of business plans cater to different purposes and stages of a company's lifecycle. Here are some of the most common types of business plans.

Startup business plan

A startup business plan is typically an entrepreneur's first business plan. This document helps entrepreneurs articulate their business idea when starting a new business.

Not sure how to make a business plan for a startup? It’s pretty similar to a regular business plan, except the primary purpose of a startup business plan is to convince investors to provide funding for the business. A startup business plan also outlines the potential target market, product/service offering, marketing plan, and financial projections.

Strategic business plan

A strategic business plan is a long-term plan that outlines a company's overall strategy, objectives, and tactics. This type of strategic plan focuses on the big picture and helps business owners set goals and priorities and measure progress.

The primary purpose of a strategic business plan is to provide direction and guidance to the company's management team and stakeholders. The plan typically covers a period of three to five years.

Operational business plan

An operational business plan is a detailed document that outlines the day-to-day operations of a business. It focuses on the specific activities and processes required to run the business, such as:

Organizational structure

Staffing plan

Production plan

Quality control

Inventory management

Supply chain

The primary purpose of an operational business plan is to ensure that the business runs efficiently and effectively. It helps business owners manage their resources, track their performance, and identify areas for improvement.

Growth-business plan

A growth-business plan is a strategic plan that outlines how a company plans to expand its business. It helps business owners identify new market opportunities and increase revenue and profitability. The primary purpose of a growth-business plan is to provide a roadmap for the company's expansion and growth.

The 3 Horizons of Growth Template is a great tool to identify new areas of growth. This framework categorizes growth opportunities into three categories: Horizon 1 (core business), Horizon 2 (emerging business), and Horizon 3 (potential business).

One-page business plan

A one-page business plan is a condensed version of a full business plan that focuses on the most critical aspects of a business. It’s a great tool for entrepreneurs who want to quickly communicate their business idea to potential investors, partners, or employees.

A one-page business plan typically includes sections such as business concept, value proposition, revenue streams, and cost structure.

Best practices for how to make a good business plan

Here are some additional tips for creating a business plan:

Use a template

A template can help you organize your thoughts and effectively communicate your business ideas and strategies. Starting with a template can also save you time and effort when formatting your plan.

Miro’s extensive library of customizable templates includes all the necessary sections for a comprehensive business plan. With our templates, you can confidently present your business plans to stakeholders and investors.

Be practical

Avoid overestimating revenue projections or underestimating expenses. Your business plan should be grounded in practical realities like your budget, resources, and capabilities.

Be specific

Provide as much detail as possible in your business plan. A specific plan is easier to execute because it provides clear guidance on what needs to be done and how. Without specific details, your plan may be too broad or vague, making it difficult to know where to start or how to measure success.

Be thorough with your research

Conduct thorough research to fully understand the market, your competitors, and your target audience . By conducting thorough research, you can identify potential risks and challenges your business may face and develop strategies to mitigate them.

Get input from others

It can be easy to become overly focused on your vision and ideas, leading to tunnel vision and a lack of objectivity. By seeking input from others, you can identify potential opportunities you may have overlooked.

Review and revise regularly

A business plan is a living document. You should update it regularly to reflect market, industry, and business changes. Set aside time for regular reviews and revisions to ensure your plan remains relevant and effective.

Create a winning business plan to chart your path to success

Starting or growing a business can be challenging, but it doesn't have to be. Whether you're a seasoned entrepreneur or just starting, a well-written business plan can make or break your business’ success.