Essay on Cashless India

Students are often asked to write an essay on Cashless India in their schools and colleges. And if you’re also looking for the same, we have created 100-word, 250-word, and 500-word essays on the topic.

Let’s take a look…

100 Words Essay on Cashless India

Introduction.

Cashless India refers to a scenario where the flow of cash within an economy is non-existent and all transactions are done digitally.

Benefits of Cashless India

A cashless India can reduce corruption and black money. It also makes transactions convenient and quick, saving time and effort.

However, it also poses challenges like the risk of cyber-crime, need for internet connectivity, and digital literacy.

Despite these challenges, with proper measures, a cashless India can lead to a transparent and efficient economy.

Also check:

- Paragraph on Cashless India

250 Words Essay on Cashless India

Introduction to cashless india.

India is rapidly advancing towards becoming a cashless society, a society where financial transactions are not conducted with money in the form of physical banknotes or coins, but rather through the transfer of digital information. This shift is fuelled by the rapid penetration of internet-based services and the proliferation of smartphones.

Driving Forces Behind Cashless India

The demonetization initiative of 2016 acted as a catalyst in the transition towards a cashless economy. The government’s push for digital payments, including the introduction of UPI, mobile wallets, and digital banking, has further accelerated this transition. The objective is to reduce dependency on cash, which is often associated with black money and corruption.

A cashless society offers numerous benefits. It promotes transparency, reduces the risk of money laundering and illegal activities, and enhances the ease of conducting financial transactions. It also aids in financial inclusion, enabling even the most remote and rural parts of the country to participate in the economy.

Challenges in the Path of Cashless India

However, the journey towards a cashless India is fraught with challenges. These include digital illiteracy, cybersecurity threats, and the lack of reliable internet connectivity in remote areas.

Despite these challenges, the vision of a cashless India is not unattainable. With the right policies, infrastructure, and awareness campaigns, India can successfully transition to a cashless economy. This shift would not only revolutionize the financial landscape but also contribute significantly to the country’s economic growth.

500 Words Essay on Cashless India

The concept of cashless india.

In a world where technology is rapidly advancing, the concept of a cashless society has become increasingly relevant. A cashless society is one where all financial transactions are conducted through digital means, eliminating the need for physical currency. India, being one of the fastest-growing economies, has been striving towards this goal, aiming to transform into a cashless society.

The Push Towards Cashless Transactions

The drive towards a cashless India gained momentum after the Indian government’s decision to demonetize high-value currency notes in November 2016. This move was aimed at curbing black money and promoting digital transactions. Following this, the government introduced various digital platforms like UPI (Unified Payments Interface), BHIM (Bharat Interface for Money), and digital wallets like Paytm, PhonePe, which have made online transactions seamless and efficient.

Benefits of a Cashless India

A cashless India offers numerous benefits. Firstly, it aids in curbing corruption and black money as all transactions are recorded, making it difficult for illegal transactions to go unnoticed. Secondly, it promotes financial inclusion by bringing the unbanked population into the formal banking system. Thirdly, it is convenient as it eliminates the need to carry cash, reducing the risk of theft or loss. Lastly, it can lead to significant cost savings in the long run, as the cost of printing, storing, and transporting physical currency can be avoided.

Despite the numerous advantages, the path to a cashless India is fraught with challenges. Firstly, digital literacy is a major concern. A significant portion of India’s population is still not comfortable with digital transactions due to lack of awareness and understanding. Secondly, in rural and remote areas, access to the internet and reliable electricity is still a major issue. Lastly, cybersecurity is a critical concern. With the increase in digital transactions, the risk of cyber frauds and data breaches has also increased, which can deter people from adopting digital payment methods.

The Future of Cashless India

The future of a cashless India looks promising, but it requires a multi-pronged approach. Increasing digital literacy, improving internet connectivity, and strengthening cybersecurity measures are crucial. Also, the government and financial institutions must work together to build trust among the public in digital transactions.

In conclusion, the transition to a cashless society in India is a journey filled with opportunities and challenges. While the potential benefits are enormous, the road to achieving it is complex. With strategic planning, effective implementation, and public participation, the dream of a cashless India can become a reality.

That’s it! I hope the essay helped you.

If you’re looking for more, here are essays on other interesting topics:

- Essay on National Flag of India

- Essay on Fit India

- Essay on India Gate

Apart from these, you can look at all the essays by clicking here .

Happy studying!

Leave a Reply Cancel reply

Your email address will not be published. Required fields are marked *

Save my name, email, and website in this browser for the next time I comment.

Talk to our experts

1800-120-456-456

- Cashless India Essay

An Introduction to Cashless India

A cashless India is the first step towards making the dream of digital India a reality. In this cashless India essay, we will be talking about the meaning of ‘cashless’, the different alternatives for our monetary system, and the disadvantages and advantages of a country going fully cashless and digital in its economy. The following cashless India essay in English is for students studying in class 5 and above. The language here has been kept simple for a better understanding of young students. This essay on the cashless economy in India would enable young students to write an essay on the cashless economy in India on their own.

As we know that cashless India is the new India and with the decision made by our honourable prime minister to demonetize money used previously, this concept of going cashless has become very popular. Although there are some disadvantages of going cashless, along with that there are more benefits as well. In this essay, you will know about everything that will help you to get better information about the concept of India going cashless.

Essay on Cashless India

On the evening of November 8, 2016, at 8 P.M., Narendra Modi, the Prime Minister of India announced the demonetization of 500 and 1000 rupees notes in India. That historic decision had many reasons. One of the reasons was laying the stepping stone towards the dream of a cashless India.

The traditional form of monetary transactions happens with the exchange of physical hard cash between people. Cashless India is going to make it almost redundant. This idea has got a huge amount of push due to the ongoing COVID-19 pandemic, given the concerns with the exchange of physical cash. There are a lot of advantages to going cashless. Remember that everything has a positive as well as a negative aspect. It is not that there won't be any disadvantages of going cashless but the thing is that you tend to find the ways by which you can prevent these disadvantages from harming you. All that you need to do is be more careful. As we all know, prevention is always better than cure.

First of all, let’s understand the meaning of a cashless economy. A cashless economy is one in which the liquid transactions through the system happen with the exchange of plastic currency or through digital currency. ATM debit and credit cards are plastic currency and online payments come under digital currency. The advent of blockchain technology has redefined the meaning of a cashless economy through bitcoins. A decentralized system of finance is defined by the concept of bitcoins, but we are not focusing on that in this particular essay on cashless India. We are more focused to discuss why India needs to go cashless and what are the benefits that will come with India taking on this new change. This essay provides you with information on the advantages and disadvantages of the digital payment system also. It is not that you are not going to face any problem in online transactions, you must have heard that a coin has two sides and just like that, this topic of cashless India also has both pros and cons. Let’s move on to the pros and cons of a digital payment system.

We can see the Three Main Advantages of Cashless India.

Reduction of Black Money

Black money is the money that is earned but not accounted for in taxes. That money is hidden by people from paying taxes. This black money is an illegal instrument in an economy that is capable of reducing a government down to bankruptcy. The cashless economy will ensure there’s no black money since unlike hard cash digital money cannot be hidden. At least there is no way yet that could make the hiding possible. Digital money enables governments to track all transactions in an economy that helps keep the income authentic and transparent. The technology behind the digital economy has to be well updated and sturdy though.

Transparency

India has corruption inbred in its system starting from the ministerial level to the watchman level. And it exists due to the lack of transparency in our monetary system. In an economy that is as big as India, transparency is a huge issue. We have learned of scandals like the CWG or 2g scams or the Rafale Jet scams over the years, and these scams are a result of the lack of transparency in transactions. It’s a shame that a small cashless economy in India essay would never do justice to the topic since it will never be enough to write about all of the corruption scandals India has had since its independence. Corruptions of this scale could be brought down to a large extent if we could achieve that dream of a cashless economy throughout. And it's possible because the origin and endpoint of a transaction could easily be tracked in a cashless economy and that’s the biggest advantage.

There are Two Major Disadvantages of Cashless India.

Online Theft

With the improving technology every day, there’s a rampant increase in online cheating and fraud episodes. If the government is unable to achieve sturdy and not-possible-to-hack digital systems, in a country like India with a 135 crore population, it is completely impossible to make the economy cashless. People are still afraid of making big transactions online after watching the reports of online thefts on national news channels.

Infrastructure, or the Lack of it

Not just the government infrastructure, it requires infrastructure on an individual level too. A gadget or a smartphone, data connectivity, and electricity for charging the phones regularly are the basic requirements for making online transactions possible. These are privileges that exist mostly in urban India and most of rural India is still deprived of these privileges. The government should first fix this before even dreaming of making a cashless India possible.

The Government of India took the whole country by storm by announcing the demonetization on 8th November 2016. 500- and 1000-rupees notes were no longer legal tender. This move was aimed at getting rid of the black money in the economy that was largely used to fund criminals and terrorists and formed a parallel economy. The acute shortage of cash led to long queues outside ATMs and banks trying to withdraw cash or exchange notes. This was all to initiate the fruition of a dream of cashless India.

With the enormous amount of technological revolutions happening, it is close to impossible to find people without a smartphone in these times. Almost every citizen possesses a smartphone. The ease of transaction through interfaces like GooglePay or PhonePe or Paytm has never been more seamless than this. The Indian government has also introduced interfaces like UPI or Unified Payments Interface for hassle-free digital transactions that are fully cashless.

In recent years, we have been asked to be in very less contact with each other. This is because of the communicable diseases of Covid-19 that have seen an adverse effect throughout India. For this reason, online payments have recently been the most popular means of transaction. The money will directly get transferred to the account of the user from our account; all you need to do is just download the app that you can use for the transaction.

In the end, the demonetization step became crucial to start a cashless economy in the country. It has paved the way towards an economy in India that is defined by greater transparency and convenience and ease in monetary transactions.

FAQs on Cashless India Essay

1. Which Country is fully cashless?

There are a lot of benefits of going cashless and most of the benefits are discussed over here. Now the world is more focused on how to go cashless as they are well aware of the advantages that they will have after going cashless. This is the reason that most of the countries are seeking some changes and making constant efforts to make their country cashless. Going cashless will improve technologies and will also increase your economy. That is also one of the main reasons why this world is more focused on going cashless. Sweden could achieve a near cashless economy in the world.

2. Name the different Digital Currencies in the world?

Just as in terms of cash, we have rupees or dollars or pounds and so on. In the same way, it is not like only one kind of digital currency is used throughout the whole world. There are different kinds of currencies that the world uses for online transactions. Litecoin, Bitcoin, Ethereum are some of them that were found to be in existence as of 2020. You need to have good knowledge about these currencies and then you can easily transfer the money.

3. What are the apps that you can use to transfer money directly into another person's account in India?

In India going cashless is the new normal. People are using online money apps such as Google pay, Paytm, Payz app, PhonePe to make the transactions directly through their phone and bank account but when we talk about the currencies being used currently, Indians are more preferably using bitcoins as their online currency. India is now making efforts to go cashless and increase its economy.

4. How much is India cashless now?

In recent years, at the time of Corona, it was advised to people not to make contact with each other. It was at that time that the cashless India concept was created and the apps like Google Pay etc came into existence. The app was introduced in India before it came into use. In the covid time, most people used the cashless way of payment. The census has proved that 37% of India has not paid using cash since the Corona times.

5. Is it possible to have cashless India anytime sooner?

Given the regency usage and increased usage of the apps such as Google pay and Paytm and the increase in the number of vendors who have accepted this method of online payment, the more India can be cashless. The most difficult thing will be to make the people of India agree to use these online methods of payment and move toward increasing the other economy of India. India too can be cashless; it is just that we need to create awareness among people regarding this.

Essay on Cashless India | Pros & Cons | A Critical Analysis | 100, 150, 200, 300, 500 Words

A cashless economy is a way of doing business and buying things without using physical money. Present age is the digital age where cash is no longer king. It’s no surprise that India is moving towards becoming a cashless economy. The money is stored in cards or smartphones electronically. It’s like having a type of invisible money that you can use to buy things. Here are 5 amazing examples essay on cashless India .

Essay on Cashless India- 100 Words

India is moving towards a cashless future. We are changing the way we make payments. A cashless India means using digital methods for payments. We don’t use physical money in a cashless economy. It brings comfort and safety to transactions. With digital payments, we can shop online, pay bills, and transfer money more quickly. Cashless transactions reduce the risk of theft. They also make it easier to track expenses. It also helps people to learn more about money and how to use it responsibly. Everyone can participate in a digital economy. Using a cashless system in India makes it easier for us to handle our money. save time and contribute to a more efficient and progressive society.

Cashless India Essay- 150 Words

India is undergoing a revolution. Our country is swiftly progressing towards becoming a cashless society. This means we are shifting from using physical currency like notes and coins to electronic forms of payment. The main goal behind this change is to fight corruption and control the use of unaccounted money. To promote digital payments, the government has implemented various measures. Demonetization in 2016 was one such step. Along with the introduction of several schemes government also launched their digital payment apps like the BHIM app and Aadhaar Pay. The private sector has also played a significant role by introducing their own payment platforms such as Google Pay, PhonePe, Paytm etc. The transition to a cashless economy benefits not only the government but also individuals. Cashless transactions provide easy access to financial services and reduce the risk of theft. However, there are challenges to overcome, especially the lack of infrastructure in rural areas, which limits people’s access to these services. In conclusion, the shift towards a cashless India has both advantages and disadvantages. Embracing digital transactions instead of physical money can lead to a more transparent and efficient economy. It means we don’t have to rely on coins and notes as much.

- Essay on Beti Bachao Beti Padhao

- Powerful Essay on Animals in English

- Essay on Conservation of Plants and Animals

- Essay on How Animals Are Useful to Us

- 5 Amazing Essays on Pet Animals

Essay on Cashless India- 200 Words

Are you tired of carrying heavy wallets and losing cash now and then? Well, the solution is here – Cashless India! In recent years, the Indian government has been pushing for a digital economy to reduce corruption, increase transparency, and promote financial inclusion. The concept of going cashless might seem difficult at first, but once you understand its benefits, it can revolutionize the way we transact in our everyday lives. In the future, we want India to become a cashless country. It means we won’t need to carry money in our pockets. Instead, we can use special ways to pay for things using our phones or cards. These special ways are called digital payments. We can use mobile wallets, credit cards, or UPI to buy things without using coins or notes. It’s convenient, safe, and makes everything easier. We can pay for things with just a few taps on our phones. But there are some things we need to think about before making India completely cashless. Not everyone has access to digital technology or knows how to use it. Some people might feel uncomfortable using phones or computers for payments. We also need to be careful about cybersecurity. It means we also need to protect our online payments from hackers. These are important challenges we need to solve before we can have a cashless India for everyone.

Essay on Cashless India | 300 Words

Imagine a world where you don’t need to carry physical money. That’s what a cashless India is all about. It means using digital methods like mobile wallets, online banking, and cards to pay for things. It’s like having a virtual wallet. This makes shopping online super easy. No more long queues or worrying about having exact change. It’s convenient and saves time. One of the coolest things about a cashless India is the safety it offers. When you use digital payments, you don’t have to carry a lot of cash, which means there’s less risk getting it stolen. Plus, every transaction leaves a digital trail, making it easier to keep track of your expenses. You can see where your money goes and plan your budget better. It’s like having your own money superhero! Going cashless could also help to boost the economy by making it more efficient. For example, businesses would no longer need to handle large amounts of cash, which can be costly and time-consuming. Similarly, consumers would be able to make payments more quickly and easily using their mobile phones or other devices. However, there are also challenges that need addressing before we can realize this vision fully. For instance, rural areas still lack internet connectivity and digital literacy; cybercrime is also on rise; privacy concerns remain unresolved. And not all small vendors accept online payments yet. In short, achieving a truly cashless India requires sustained efforts from all stakeholders – citizens, banks, regulators – to overcome these hurdles. Cashless India also promotes financial addition. It means that everyone, no matter where they live or how much money they have, can participate in the digital economy. Even people who don’t have bank accounts can use mobile wallets to pay for things. This opens up opportunities for everyone to be a part of India’s progress. It’s like giving wings to dreams and empowering people to chase their goals. In conclusion, a cashless India brings convenience, safety, and financial stability. It’s a digital revolution that benefits everyone.

Essay on Cashless India | 500 Words

India has been moving towards a cashless economy for some time now, and it’s exciting to see all the changes that come with it. From digital payment apps to contactless payments, there are plenty of options available for those who want to embrace this new way of living. But what does a cashless India really look like? Let’s explore the benefits and challenges of making the transition from cash-based transactions to digital ones. However, this is changing. The Indian government is promoting the use of plastic money and digital payments, in a move to make India a cashless society. The transition to a cashless economy will not be easy, but it is necessary in order to realize the full potential of the Indian economy.

Meaning of Cashless India?

Cashless India refers to a digital payment ecosystem where financial transactions are conducted without the use of physical cash. This means that money is transferred electronically through various modes of online payments. These payments can be through debit/credit cards, mobile wallets, UPI (Unified Payments Interface), and other digital platforms. This would reduce the role of cash in the economy and make it easier for the government to track spending and collect taxes. There are many advantages to moving towards a cashless society. it would help to reduce crime, as criminals would no longer be able to get away with stealing physical money. Cashless transactions are often faster and more convenient than paying with cash.

Advantages of Cashless India

The transition towards a cashless society in India presents both advantages and drawbacks. Advantages include increased convenience as digital transactions are faster, easier to make, and more secure than traditional cash payments. Additionally, it can help curb corruption by reducing the prevalence of black money and illegal activities. Let’s see in detail- Convenience and Accessibility- Cashless transactions offer convenience and accessibility to individuals across the country. With digital payment methods, people can make transactions anytime and anywhere, without the need to carry physical cash. This ease of use is particularly beneficial in situations where immediate payments are required or when physical currency is not readily available. Enhanced Security- Cashless transactions provide a higher level of security compared to traditional cash transactions. When using digital payment methods, there is no risk of loss due to theft or misplacement of physical currency. Additionally, measures such as encryption, biometric authentication, and two-factor authentication help protect users’ financial information and minimize the chances of fraud. Transparency and Accountability- Moving towards a cashless economy promotes transparency and accountability in financial transactions. Digital payment systems generate electronic records of every transaction, making it easier to track and monitor financial activities. This can help in combating corruption, money laundering, and other illicit activities, as well as facilitate better tax compliance. Financial Inclusion- One of the significant benefits of a cashless India is the potential to increase financial inclusion. By providing access to digital payment systems, even to those without a traditional bank account, more individuals can participate in the formal financial ecosystem. This empowers people to save, borrow, and engage in economic activities, fostering economic growth and reducing income inequality. Cost Efficiency for both Public and Government- Adopting digital payment methods can lead to cost savings for both individuals and the government. Cash transactions involve the printing, transportation, and storage of physical currency, which incurs expenses. On the other hand, digital payments significantly reduce or eliminate these costs, making transactions more efficient and cost-effective in the long run.

Disadvantages of Cashless India

On the other hand, one of the major concerns with going cashless is accessibility for low-income families who may not have access or knowledge about digital payment methods. It also poses a risk for individuals who are digitally illiterate or those living in remote areas without proper internet connectivity. Dependency on Technology- A cashless society relies heavily on technology and digital infrastructure. Any disruption in connectivity, power outages, or technical glitches can hinder transactions, leaving people without the means to make payments. Cybersecurity and Data Privacy Risks- Cashless transactions involve the exchange of sensitive personal and financial information. This data is susceptible to cyberattacks, hacking, or data breaches, which can lead to identity theft or financial loss. Safeguarding cybersecurity and ensuring robust data privacy measures are essential to mitigate these risks in a cashless society. Limited Acceptance and Interoperability- Despite the growth of digital payment options, there are instances where cash is still the preferred mode of transaction. Small businesses, street vendors, and rural establishments may not have the necessary infrastructure or acceptance mechanisms for digital payments. Limited acceptance and interoperability can create inconvenience and limit the usability of digital payment systems. Technological Disruption and Skill Gap: Transitioning to a cashless economy requires a significant shift in behavior and mindset. It may disrupt traditional businesses and livelihoods that heavily rely on cash transactions. Moreover, it can create a skill gap among sections of the population who may not be familiar with or resistant to adopting digital payment methods, hindering their participation in the economy.

How to Go Cashless in India

Going cashless in India may seem challenging for some, but it’s actually quite easy. Here are a few tips to help you make the transition:

1.Get familiar with digital payment apps: There are several popular digital payment apps in India such as Paytm, Google Pay, PhonePe and more. Download one or two of them and get comfortable with how they work. 2.Link your bank account: Once you have downloaded a digital payment app of your choice, link your bank account with the app so that you can easily transfer money from your bank to the app. 3.Use UPI (Unified Payment Interface): UPI is an instant real-time payment system developed by National Payments Corporation of India facilitating inter-bank transactions. It allows users to instantly send and receive money using a virtual ID linked to their bank account. 4.Educate yourself about online payments: Before making any online purchase, ensure that the website is secure and has SSL encryption enabled to protect your personal details.

What are the Different Payment Methods in India?

India is a country that has embraced digital payment methods over the past few years, and there are several options available to consumers. Firstly, there are mobile wallets like Paytm, PhonePe, and Google Pay which allow users to store money digitally on their smartphones and make payments at participating merchants. These wallets also offer cashback rewards for certain transactions. Secondly, debit and credit cards are widely accepted in India with most businesses having enabled card machines for payment processing. This method of payment is secure as it requires authentication through a PIN or signature. Thirdly, Unified Payments Interface (UPI) allows users to transfer funds between bank accounts instantly using just an email address or mobile number. This system eliminates the need for bank account details making it easier to send money even without knowing the recipient’s account number or IFSC code.

Net Banking is another popular option where customers can log into their banks’ online portals from anywhere in the world and conduct transactions such as paying bills or transferring funds. India offers a diverse range of payment options that cater to different needs of consumers while promoting financial inclusion by allowing more people access to formal financial systems.

Challenges in Transforming India into Cashless Economy

Despite the government’s push to make India a cashless economy. There are still many challenges that need to be addressed.

Lack of Infrastructure – One of the biggest challenges is the lack of infrastructure and access to banking services in rural areas. According to a report by the RBI, only about 35% of households in rural areas have access to formal banking services. This means that a large majority of the population is still reliant on cash transactions. Low Rate of Financial Literacy- Another challenge is the low rate of financial literacy in the country. A study by the National Financial Inclusion Strategy found that only 53% of adults in India are financially literate. This means that many people do not understand how to use digital payment methods or are unaware of the benefits of going cashless. Concerns about Security and Privacy- There are also concerns about security and privacy when it comes to digital payments. With so much personal and financial data being stored online, there is a risk of it being hacked or leaked. There have been several high-profile cases of data breaches in recent years, which has made people wary of using digital payment methods.

Despite these challenges, the government is still working towards its goal of making India a cashless economy. It has launched several initiatives to promote digital payments and is working on improving infrastructure and access to banking services in rural areas. With time and more awareness, it is hoped that India will successfully make the transition to a cashless society.

The shift towards a cashless economy is an exciting prospect for India. While it is true that there are some downsides to going cashless, such as concerns about cybersecurity and privacy, these can be addressed by implementing appropriate regulations and security measures. The benefits of a cashless society far outweigh the drawbacks. Cashless transactions make life easier for everyone involved: merchants, consumers, and government agencies alike. They also help to reduce corruption and promote financial inclusion. There are many different payment methods available in India today, from mobile wallets to UPI transfers. Choosing the right method for your needs will depend on factors like convenience, security features offered etc. As more people embrace digital payments in India we hope that this trend will continue to grow until one day soon we can truly say that our country has become fully cashless!

1.Can India really become a cashless economy? Ans : It is possible for India to become a cashless economy, but it will take time and effort. People would need to use digital methods like mobile payments, online banking, and cards instead of physical cash. What are the effects of a cashless scheme in India, on the Indian economy? A cashless scheme can have positive effects on the Indian economy. It can make transactions faster and more efficient. It can also help reduce corruption and the use of counterfeit money. However, it may also create challenges for people who are not familiar

2. What is the effect of demonetization on cashless transactions in India? Ans : Demonetization, which happened in 2016, aimed to reduce the circulation of certain currency notes. It led to a push for digital payments and increased awareness about cashless transactions in India. Many people started using digital payment methods after demonetization.

3. What would be the effect on banking sectors, if India goes cashless? Ans : If India becomes a cashless economy, the banking sector would play a crucial role. Banks would need to provide secure and convenient digital payment services. It could lead to an increase in online banking and mobile payment usage, benefiting the banking sector in the long run.

4. Why did India choose only the cashless economy? Ans : India didn’t choose to go completely cashless, but it aims to promote digital payments as a convenient and secure alternative to cash. The government wants to reduce the use of black money, improve financial transparency, and promote financial inclusion by making digital payment methods accessible to all.

Related Posts

Essay on Cashless India

Cashless India is a scheme which is focusing on bringing a great change in the economy of the country. It involves no longer the provision of exchange of currency notes and coins. The transactions made should be totally online.

Short and Long Essays on Cashless India

These essays written under various words limit will help you to know all aspects of the cashless India scheme.

Essay 1 (250 Words) – What is the Concept of Cashless India

Introduction

The cashless India mission is aimed at reducing the dependency of people on cash exchange for buying, paying bills, or for several other works. The payment has to be made by using mobile applications, internet banking, debit or credit cards, etc.

Concept of Cashless India

This mission was enhanced by the announcement of the demonetization of 500 and 1000 currency notes on 8 November 2016, at sharp 8 pm. The blocking of the cash economy and no availability of getting money exchanged from banks had left no option for the people. The only way left was to make online transactions. This was the main reason for the demonetization that a cashless scheme must be initiated.

Making India a cashless economy is not a very easy task. It is because the majority of people reside in villages. They are not properly equipped with technological aids. Many of the people are even not educated which is a great problem for making India Cashless. It requires a lot of effort and facilitations done to make this scheme successful.

It is a very easy and time-saving process to make payments online. The payments can be made anywhere and at any place. This saves our time as well as energy too. There is no need of carrying cash wherever we go. There must be a mobile with a bank account attached and proper internet services to complete the online transaction.

The motive of making India a cashless nation is a great effort of the government. There must be more focus on creating proper facilities and educating people. Without reaching these objectives the aim of making India cashless can never be achieved.

Essay 2 (400 Words) – Cashless Transactions as Boon during COVID-19 Pandemic

The word ‘cashless India’ explains about making our country free of cash transactions. The initiative is directed towards the digitalization of India. The system of going cashless is about reducing the exchange of money physically and making online transactions and payments.

Scenario Before and After Digitalization

Earlier we have to visit different stores to pay bills and continue the hindered services. It also happened that sometimes due to deadlines of several bill payments like electricity and water bills, a person has to stand in queue for hours. This was the wastage of time and energy. The banks were almost crowded by people on all the working days for different purposes. Due to the excessive workload, we have to visit the bank, again and again, to get our problems resolved.

The digitalization concept has provided us with different options to pay bills and complete transactions online. We can complete the payments by sitting at home and the offices themselves. There is no wastage of time and energy. It simply requires a little knowledge and a smartphone with internet connectivity to complete the transaction. BHIM, Amazon Pay, PhonePe, Google Pay, Paytm are some of the examples of applications for the online transaction. The transactions can also be completed by entering credit card or debit card details.

Cashless Transactions as Boon during COVID-19 Pandemic

The concept of making online transactions was greatly favored by people during the pandemic. The world is still suffering because of the Pandemic Covid-19. The disease is easily transferable by touch and close contact. Therefore it is necessary to maintain a distance and avoid contact. The transmission can also be possible by the exchange of notes and coins as it is touched by several people.

The best way to avoid contact and transmission during this critical situation is mandatory to make use of online transaction methods. It will be a safe measure and time-saving method. The person can complete the transaction from home only. It is not needed to step out of the house also. These facilities enable us to protect ourselves from getting infected and also help us to follow the guidelines to remain safe.

Challenges in Transforming India into Cashless Economy

There are a lot of problems which is a hindrance in making our nation cashless. There must be proper arrangements made to achieve this initiative. The rural areas are lacking proper connectivity. There is a need to invest in making proper Infrastructures and facilities.

Secondly, illiterate people are not able to understand the concept and procedure of online transactions. There must be an arrangement made for training and educating people about this concept. Poverty and illiteracy are still prevailing in our country to a large extent. These are the major challenges in the way of making India a cashless nation.

A number of people have shown their interest in making online transactions. The online applications provide several awards and cash backs on the transactions which are made. Online transactions are convenient and provide greater transparency. Any change requires a start-up first and the same is observed.

Essay 3 (600 Words) – How Cashless Economy will Benefit India

As the fastest developing nation, the emergence of newer technologies and schemes in India will lead our country towards growth and development.

Technological Advancements Leading Towards Digitalization

The concept of enabling cashless transactions comes under the Digitalization of India. Digitalization is only possible with the advent of newer devices and technology. Going cashless is totally based on technological advancements which are carried out on in the whole world. There is a total involvement of ideas and innovations to make transactions easy and simple in online mode. The use of smartphones makes our work easier. Transactions can be completed in seconds. The advancing technology is ensuring the reliability of the consumers to go for cashless options and making our nation to move towards digitalization.

Initiative taken by our Prime Minister

The cashless India programme, launched by PM Narendra Modi, for making our country a digital nation was initiated by the government on 1st July 2015. The main objective of this plan was to ensure the different services of the government must reach the people digitally. It could be made possible only by improving the online Infrastructure, connectivity of the Internet, and by linking all the areas especially rural areas.

Making India a cashless nation is a great step towards enabling Digitalization. The mission of making India cashless was initiated by our Prime Minister. The announcement of the demonetization of 500 and 1000 notes on 8 November 2016 by Prime Minister Narendra Modi was a better initiative for boosting the cashless transactions in our country. As there was a shortage of money in banks and ATMs, people have to stand for hours in the queue for exchanging money. The best option was choosing online transaction methods.

Advantages and Disadvantages of Cashless India

Advantages:

- Check on Black Money – The cashless transactions are made online. There are details available of whatever transactions are made. The government can easily monitor all the transactions if the concept of going cashless is made prominent. This will impose a check on the flow of black money.

- Reduce Overcrowding in Banks – The crowds at banks will be reduced to a large extent if the transactions are carried online. The bank work will increase but crowds of people will be decreased.

- Eco-Friendly Technology – The cashless transactions will reduce the charges of printing and maintenance of the currency notes and coins. This is a great step towards efficient usage of paper, thus ensuring eco-friendly technology.

- Reduced cases of Robbery – The fear of theft and robbery prevails in our minds when we carry cash with us. The cashless transactions help in reducing this fear as there are no chances of theft. This will also reduce the work of the police as there will be a reduction in theft and robbery cases.

- Saves our Money, Time, and Energy – The cashless transactions reduce the unnecessary pain of traveling and paying bills. This can be done from any place but the connectivity should be there. The accounting works of the different bigger organization also gets easier and reduced.

Disadvantages:

- The Danger of Cybercrimes – The cases of cybercrime are also increasing day by day. This is possible only when we enter our details for cashless transactions and hackers easily get the information regarding the same. There are many people who have been the victims of these crimes.

- People of Rural Areas and Illiterate People will have to Suffer – The people who are illiterate cannot understand and make transactions until and unless they are educated and trained for the same. In rural areas, there is the problem of connectivity which is a great hindrance for Digital India’s mission to be fulfilled.

Cashless India is initiated for the betterment of our Country. It will help in developing the connectivity in all the parts of India. The transformation of a nation into cashless needs immense effort to provide all the facilities like good infrastructure, internet connectivity, educating and training to people, etc. It is a great step towards the development of our nation.

Related Posts

Essay on tiger, essay on books, essay on good manners, essay on time is money, essay on fashion, essay on generation gap, essay on unemployment, essay on necessity is the mother of invention, essay on natural resources.

Essay On Cashless India

Table of Contents

Short Essay On Cashless India

Cashless India is a term that refers to the Indian government’s initiative to move the country towards a digital economy. The idea behind this initiative is to reduce the dependence on cash transactions and promote the use of digital payment methods, such as credit cards, debit cards, mobile wallets, and UPI.

One of the main advantages of a cashless economy is increased financial inclusion. Digital payment methods make it easier for people to access financial services, even those who do not have a bank account. This can help to reduce poverty, as people are able to participate in the economy and access credit. Furthermore, digital payments also increase transparency and reduce the opportunity for corruption, as transactions are recorded electronically and can be easily audited.

Another advantage of a cashless economy is increased efficiency. Digital payments are faster and more convenient than cash transactions, and they can also save time and reduce costs. For example, digital payments can be made 24/7, without the need to visit a bank or an ATM. Additionally, digital payments also reduce the need for handling and transporting physical cash, which can be costly and time-consuming.

However, there are also some challenges to the implementation of a cashless economy. One of the main challenges is the lack of infrastructure and technology, particularly in rural areas. In order to fully embrace a cashless economy, it is necessary to invest in the infrastructure and technology needed to support digital payments. Additionally, there are also concerns about security and privacy, as digital payments rely on the protection of sensitive financial information.

In conclusion, cashless India is a bold and ambitious initiative that has the potential to transform the country’s economy. While there are challenges to overcome, the advantages of a cashless economy, such as increased financial inclusion, efficiency, and transparency, make it an exciting and promising future. By working together, the government, businesses, and citizens of India can help to create a digital economy that benefits everyone.

Long Essay On Cashless India

The digital revolution is transforming India into a cashless economy. This shift towards cashless transactions has already had a major impact on our daily lives, and it’s only going to continue in the future. In this article, we will explore the advantages of a cashless India and discuss some of the challenges that may arise along with it.

Introduction to Cashless India

In India, “Cashless” refers to the electronic mode of payment. The Reserve Bank of India (RBI) has been promoting the use of cashless mode of payment for some time now. There are multiple ways to make a cashless transaction in India.

One can use credit/debit cards, prepaid cards, mobile wallets, internet banking, etc. for making payments without using cash. The government has also launched a few initiatives to promote cashless transactions in the country. For example, the Unified Payment Interface (UPI) and BharatQR are two such initiatives.

The main advantage of going cashless is that it saves time and is more convenient than using cash. Moreover, it is also safe and secure as there is no risk of losing money. In a country like India where a large population is still unbanked, going cashless can help in inclusive growth.

The RBI has set up a task force to promote digital payments in the country. It has also advised banks to provide basic banking services at all their branches so that people can open bank accounts and start using them for digital payments. The government is also working on creating awareness about digital payments among the people.

Benefits of Cashless India

There are many benefits of cashless India. The most obvious benefit is that it will reduce corruption. With all transactions being done electronically, there will be no need for physical currency notes which can be easily manipulated. This will also lead to more transparency and accountability as all transactions will be traceable.

Another big benefit is that it will help in curbing black money. As people move towards digital payments, there will be less need to use cash which is often used to hoarded undeclared income. This will also make it difficult to launder money as all transactions will be recorded.

Cashless India will also boost the economy by increasing efficiency and reducing transaction costs. It has been estimated that digitizing payments can save the economy up to $22 billion annually. Further, it will promote financial inclusion as more people will have access to banking and financial services.

Lastly, going cashless will also be helpful in emergency situations like natural disasters when ATMs may not be working and physical currency notes may get destroyed.

Challenges Faced by the Indian Government towards Cashless India

The Indian government has been pushing for a cashless economy for some time now. However, there are several challenges that it faces in this regard.

One of the biggest challenges is the lack of infrastructure. There are not enough point-of-sale (POS) terminals and ATMs in the country to cater to the needs of all citizens. This means that many people still have to rely on cash transactions.

Another challenge is awareness. Many people are simply not aware of the benefits of going cashless. The government will need to do more to educate people on this front if it wants them to make the switch.

Finally, there is the issue of security. With digital payments, there is always the risk of fraud and hacking. The government will need to put in place robust security measures to ensure that people feel safe using these technologies.

Ways and Means for Achieving a Completely Cashless Economy

There are a number of ways and means for achieving a completely cashless economy. One way is to encourage the use of debit and credit cards for all transactions, both online and offline. Another way is to promote the use of mobile wallets and other digital payment methods. The government can also create awareness about the benefits of going cashless and provide incentives for using digital payments.

Card payments can be made more convenient by providing discounts or cashback on card transactions. Mobile wallets can be made more user-friendly by providing features like one-click payment, QR code scanning, etc. Digital payment platforms can be made more secure by implementing two-factor authentication or biometric authentication. The government can also launch campaigns to educate people about the benefits of going cashless and how to use various digital payment methods.

Impact of Digital Payments on the Indian Economy

Digital payments have had a profound impact on the Indian economy. They have transformed the way businesses operate, leading to increased efficiency and productivity. In addition, digital payments have made it easier for people to access banking services and make financial transactions.

Digital payments have also helped to boost the growth of the e-commerce sector in India. Online businesses have been able to reach a wider audience through digital platforms such as mobile wallets and online payment portals. This has resulted in increased sales and revenues for these businesses.

The adoption of digital payments has also had a positive impact on employment in India. With more businesses moving towards digital platforms, there is a need for skilled workers who can manage these technologies. This has created new job opportunities for people with the right skillset.

Overall, digital payments have had a positive impact on the Indian economy. They have led to increased efficiency and productivity, as well as boosted growth in sectors such as e-commerce.

To conclude, cashless India is a revolutionary step by the government and it is sure to bring about immense changes in our lives. It will not only make life easier for us but also help reduce corruption and black money. India has great potential when it comes to digital payments and this move will definitely help in its growth. The government needs to ensure that all citizens have access to banking services so that they can benefit from this shift towards a cashless economy. With conscious efforts from every section of society, we can make this dream of a Cashless India come true!

Manisha Dubey Jha is a skilled educational content writer with 5 years of experience. Specializing in essays and paragraphs, she’s dedicated to crafting engaging and informative content that enriches learning experiences.

Related Posts

Essay on importance of yoga, essay on cow, climate change essay, essay on slaver, leave a comment cancel reply.

Your email address will not be published. Required fields are marked *

Save my name, email, and website in this browser for the next time I comment.

- _English Q&A

- _English MCQ

- __Prose MCQ

- __Story MCQ

- __Compulsory Books

- _Class 10th Books (Odisha Board)

- _Class 9th Books (Odisha Board)

- _Class 8th Books (Odisha Board)

- Extra Knowledge

- Web Stories

Essay on Cashless India in English by The CHSE Student

cashless india essay.

It's a very good initiative under Digital India Scheme that we started transactions digitally, I mean without physical cash. It is very difficult for people to carry cash in larger amounts. We have been noticing the news of robbery or thefts in the newspapers regarding these cases. The new emerging technology namely cashless India has made transactions easy for the people. We need not carry cash amounts but the same can be given by card payment or via online applications.

Every time while paying bills, sending or receiving money, payments on the shop we can use this technology. This reduces the time and effort of people in India. There are many more things that you need to know about the topic. It has been given in form of a long essay that may be an aid to school, college, and university students.

Short Essay and Long Essay on Cashless India in English

Short and long essays on Cashless India in different word limits are given below for students of classes 1, 2, 3, 4, 5, 6, 7, 8, 9, 10, 11 and 12. In this essay, the language is kept simple so that every student can understand these essays properly.

10 Lines Essay on Cashless India (in 100 – 120 Words)

1) The government launched the “Cashless India” scheme to make India a cashless economy.

2) A cashless economy promotes online transactions instead of cash transactions.

3) As part of Digital India launched on 1 July 2015, a cashless India is envisioned.

4) This scheme will also help in controlling corruption.

5) The growing cases of robbery and theft will also be reduced due to this scheme.

6) Cashless transactions are fast and more secure than cash transactions.

7) This scheme aims to carry out all the financial activities digitally without involving physical cash.

8) Cashless transactions can be done through UPI (Unified Payment Interface), online banking, micro ATMs, etc.

9) However, online transactions are prone to cybercrimes.

10) This scheme is a disadvantage for poor and illiterate people.

Advantages and Disadvantages of Cashless India (in 250 words) - Essay 1

A cashless economy means curbing cash transactions and carrying out online transactions. The scheme cashless India had been launched by the government of India to make India a cashless economy in the world. Here we will be discussing the advantages and disadvantages of going cashless.

Advantages of cashless transaction:

Fast and convenient transactions.

The transactions can be easily done by using smartphones through Paytm, Google pay, UPI, etc. The process is very fast and easy to do.

No theft risks

When we opt for cashless transactions we will not have to carry cash with us. This will reduce the chances of theft.

Environment-friendly

Cashless transactions will help in reducing the charges of printing currency notes and coins. It promotes the efficient use of paper and hence an eco-friendly initiative.

Exciting discounts

We avail of good cashback and offers whenever we do debit/credit card or online transactions.

Reduce corruption

In cashless transactions; there will be transparency as the transactions can easily be traced. Therefore it will help in reducing the bribery and flow of black money in India.

Disadvantages of cashless transaction:

Risk of online crimes.

The risk of online fraud and cheating is a threat in doing online transactions. People fear doing online transactions as many have been the victim of these online frauds. The government needs to impose a high-security check in the system to foster safe digital transactions otherwise the dream of making India a cashless nation can never come into reality.

Poverty and illiteracy

Many people in India are illiterate and are living in poverty. People in rural areas do not know how to use smartphones. It is difficult to make this mission successful without eliminating these problems.

Meaning of Cashless India and Digital Payment Methods (in 500 words) - Essay 2

Introduction.

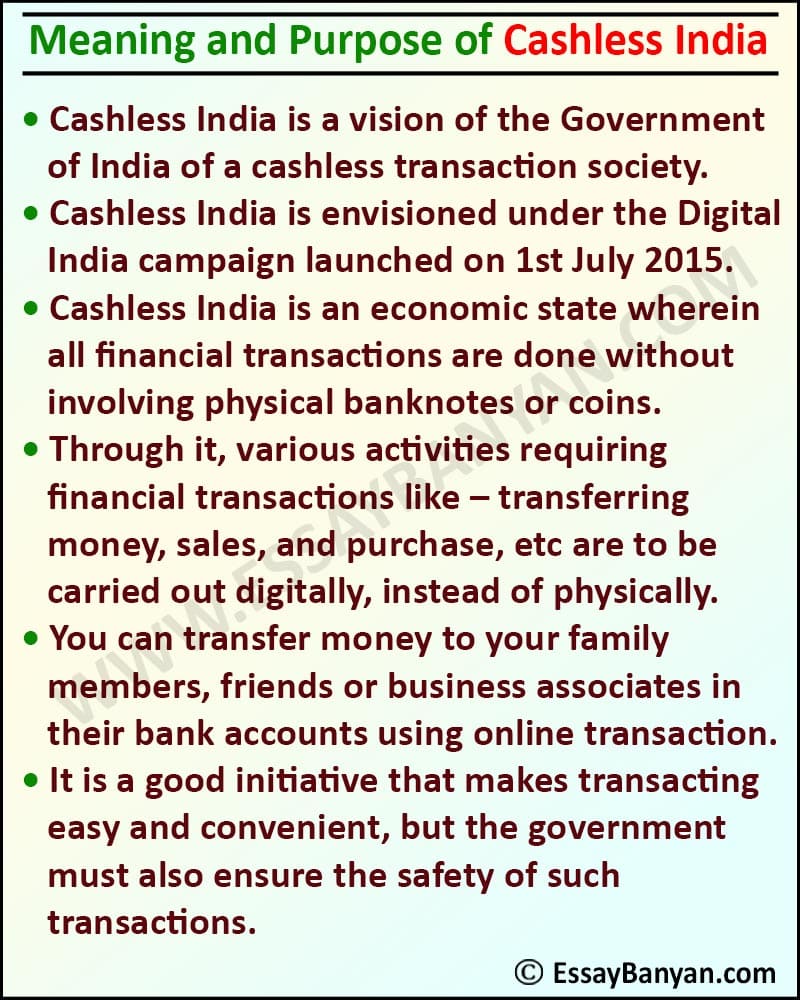

Cashless India is a vision of the Government of India of a cashless transaction society. Cashless India is envisioned under the Digital India campaign launched on 1st July 2015.

Meaning of Cashless India

Cashless India would be an economic state wherein all financial transactions are done without involving physical banknotes or coins. That is, various activities requiring financial transactions like – transferring money, sales, and purchase, etc are to be carried out digitally, instead of physically.

For example, if you are out for making a purchase of groceries for home, you should be able to do it without a single penny in your pocket. This kind of transaction mandates two essential requirements – firstly you must have a debit card, credit card, or any web application that certifies your bank account and authenticates transactions on your behalf. Secondly, the seller, in this case, the grocery shop owner must be in the possession of a Point of Sale (POS) device to carry out the transaction. At the end of the transaction, your bank account will be debited and the account of the shopkeeper will be credited without an exchange of any physical currency.

Likewise, there could be several examples of cashless India, like transferring money to your family members, friends, or business associates, without even physically depositing the money in their bank accounts.

Digital Payment Methods

The following digital payment methods are used under the Cashless India campaign –

1. Banking Cards

Different kinds of banking cards are debit cards, credit cards, travel cards, cash cards, etc. The cards offer discounts and additional facilities, for digital transactions. Also, the transaction is secured by two-way authentications, involving secure PIN and OTP (One Time Password).

2. Unstructured Supplementary Service Data (USSD)

This service allows financial transactions to be carried out without an internet connection and through the basic phone. ‘*99#’ could be dialed from the phone to avail services like interbank fund transfer, mini statement, balance inquiry, etc. This service empowers the rural population or the elders, who usually use basic keypad phones and are not comfortable using smartphones.

3. Unified Payment Interface (UPI)

Unified Payment Interface is an application that allows managing multiple bank accounts through a single platform. You only have to download the UPI App on your smartphone and provide the account and bank details you want to link. The services offered are many, including a balance inquiry, money transfer, transaction history, etc.

4. Mobile Wallet

Mobile Wallet allows you to carry money digitally on your mobile. The mobile wallet application could be linked to credit or debit cards and can be used for online transfer of money. The mobile wallet allows you to carry out financial transactions without requiring physical debit or credit card.

5. Point of Sale (POS) Device

A point of sale device is a small cordless device available at merchant establishments to carry out financial transactions. Customers are required to swipe their credit/debit cards and authenticate the transaction by entering a PIN in the device, which then completes the transaction and prints a receipt.

6. Micro ATMs

Micro ATM is a small device given to business correspondents or small shop owners to carry out instant transactions on behalf of their customers. The device is connected to several banks across the country and allows instant deposits and withdrawal of money. The business correspondents act as a bank in this case.

Cashless India is the government’s initiative for a cashless society wherein financial transactions, howsoever, small or large are carried out digitally. It is a good initiative that makes transacting easy and convenient, but the government must also ensure the safety of such transactions.

Essay on Cashless India

FAQs: Frequently Asked Questions on Cashless India

Q.1 Which is the first cashless village of India?

Ans. Dhasai, a village in Thane district Murbad taluka in Maharashtra, is known to be the first cashless village in India.

Q.2 Which country uses the least cash?

Ans. Sweden has reduced its cash transaction to 2% and thereby moving towards a cashless nation in the world.

Q.3 How much of GDP is invested by India in printing cash?

Ans. India invests 1.7% of its GDP in printing the cash.

Q.4 How is going cashless helpful?

Ans. It will be helpful in reducing crime and fraud and save money wasted on printing and circulating cash.

Q.5 Did Demonetization give a pace to Cashless India?

Ans. Yes, demonetization fostered online transactions as there was a scarcity of cash thereby giving a pace to cashless India.

Post a Comment

Contact form.

Home — Essay Samples — Economics — Banking — Cashless India: Overview of the Mission

Cashless India: Overview of The Mission

- Categories: Banking Indian Economy

About this sample

Words: 702 |

Published: Feb 12, 2019

Words: 702 | Pages: 2 | 4 min read

Cite this Essay

Let us write you an essay from scratch

- 450+ experts on 30 subjects ready to help

- Custom essay delivered in as few as 3 hours

Get high-quality help

Dr. Heisenberg

Verified writer

- Expert in: Economics

+ 120 experts online

By clicking “Check Writers’ Offers”, you agree to our terms of service and privacy policy . We’ll occasionally send you promo and account related email

No need to pay just yet!

Related Essays

2 pages / 944 words

2 pages / 1060 words

5 pages / 2444 words

5 pages / 2973 words

Remember! This is just a sample.

You can get your custom paper by one of our expert writers.

121 writers online

Still can’t find what you need?

Browse our vast selection of original essay samples, each expertly formatted and styled

Related Essays on Banking

Throughout history, wars have been fought for a variety of reasons. From territorial disputes to ideological conflicts, the motivations for war are complex, multifaceted, and often contentious. However, there is a growing body [...]

The World Bank is dedicated to reducing global poverty and promoting shared prosperity in developing nations. As someone who was raised in a lower middle-class family in India, I have personally witnessed various [...]

Agrawal, A., & Singh, R. K. (2017). Management information system: Conceptual foundations, structure and development. IGI Global.Banomyong, R., & Supatn, N. (2016). Supply chain management in the digital age: Challenges, [...]

Lucy Edwards, a former Bank of New York vice president, and her husband Peter Berlin was accused to the biggest cases of money laundering. The couple was admitted to the United states District in Manhattan after about 18 months [...]

An internship is on-the-job training for many professional jobs, similar to an apprenticeship, more often taken up by college and university students during his undergraduate or master degree in their free time to supplement [...]

The Fair and Accurate Credit Transactions Act ("FACTA") is an amendment to the Fair Credit Reporting Act ("FCRA") that was added in 2003 protect people from the threats of identity theft. FACTA created guidelines that determine [...]

Related Topics

By clicking “Send”, you agree to our Terms of service and Privacy statement . We will occasionally send you account related emails.

Where do you want us to send this sample?

By clicking “Continue”, you agree to our terms of service and privacy policy.

Be careful. This essay is not unique

This essay was donated by a student and is likely to have been used and submitted before

Download this Sample

Free samples may contain mistakes and not unique parts

Sorry, we could not paraphrase this essay. Our professional writers can rewrite it and get you a unique paper.

Please check your inbox.

We can write you a custom essay that will follow your exact instructions and meet the deadlines. Let's fix your grades together!

Get Your Personalized Essay in 3 Hours or Less!

We use cookies to personalyze your web-site experience. By continuing we’ll assume you board with our cookie policy .

- Instructions Followed To The Letter

- Deadlines Met At Every Stage

- Unique And Plagiarism Free

Essay on Cashless India

Cashless India is a mission launched by the Government of India led by Prime Minister Narendra Modi to reduce dependency of Indian economy on cash and to bring hoards of stashed black money lying unused into the banking system. The country embarked upon this transition to a cashless economy when the government took the revolutionary step of demonetization of old currency notes of Rs 500 and Rs 1000 on November 08, 2016. This move was targeted at the fake currency circulating in Indian market and the black money that somehow escaped the radar of tax authorities.

Post demonetization acute shortage of currency in Banks and long queues outside ATMs, gradually turned people towards digital transactions, one of the prime requirements under cashless India. If the government succeeds in providing secure and fast digital payment methods to the consumers and merchant establishments across the nation, then the dream of India becoming a completely cashless economy will materialize.

Long and Short Cashless India Essay in English

We are here providing a variety of long and short essay on Cashless India to empower the students with ready material available online in different word length – in 100, 150, 200, 250, 300 and 400 words.

These Cashless India Essay written in a simple language will help the students choose any one as per their requirements.

After going through these essays you will understand the concept of cashless India and its benefits on the economy.

You can use the essays in your school/college competitions for writing essays, debates or giving speech.

Cashless India Essay 1 (100 words)

It was on 8 November 2016 that the Government of India took the whole country by storm by announcing that the currency notes of Rs 500 and Rs 1,000 were no longer legal tender. The government move aimed at curtailing the menace of black or counterfeit money which is largely used to fund criminals and terrorists as part of a parallel economy. The acute shortage of money in the wake of this decision led to long queues of people outside ATMs or banks seeking to exchange their notes or withdrawing cash.

But eventually, the move has turned out to be a push towards cashless India that is bound to pave the way for a cashless economy, marked by greater transparency, ease and convenience in monetary transactions.

Cashless India Essay 2 (150 words)

The Union government’s demonetization initiative and the subsequent drive towards developing a cashless India have invited its share of both bricks and bouquets. There have been widespread protests organised by the opposition parties across the country against the cash crunch in the wake of ban on old currency notes of Rs 500 and Rs 1000.

However, the initial difficulties have subsided now and the people are beginning to realize the safe and convenient modes of digital payment. Moreover, to encourage the people to further go for cashless modes, the Narendra Modi Government has provided a slew of incentives and measures.

The latest World Bank report has mentioned that the demonetization will not have any long-term adverse effect on the health of Indian Economy. Rather it will prove beneficial with growth of the Indian economy rising to 7.6% in fiscal year 2018. Liquidity expansion in the banking system post-demonetization has helped the banks to lower lending rates, which in turn is bound to lift economic activity.

Cashless India Essay 3 (200 words)

The Union government headed by Prime Minister Narendra Modi has been moving towards realizing his vision for a cashless India, ever since the demonetization of the old currency notes of Rs 500 and Rs 1000, which was announced by it on November 8, 2016. It was really a bold move considering the fact that in India people are more reliant on cash than in other countries of the world. Suddenly, there was severe shortage of cash in the wake of this decision and people had to encounter great difficulties in buying things they wanted with little cash available in banks and ATMs they would throng in unending queues day and night.

Conclusion: However, the benefits of this move have now started trickling in with more and more people switching to digital modes of receiving and making payment. India is gradually transitioning from a cash-centric to cashless economy. Digital transactions are traceable, therefore easily taxable, leaving no room for the circulation of black money. The whole country is undergoing the process of modernisation in money transactions, with e-payment services gaining unprecedented momentum. A large number of businesses, even street vendors, are now accepting electronic payments, prompting the people to learn to transact the cashless way at a faster pace than ever before.

Cashless India Essay 4 (250 words)

Cashless India is a term coined recently after the Union government went ahead with its plans to demonetize currency notes of Rs 500 and Rs 1000. Initially, it led to severe criticism as people faced great difficulties in exchanging the old currency notes or withdrawing cash from their accounts.

According to the critics of the government, adequate arrangements should have been made in advance to support the people in dealing with cash crunch in the wake of this move towards cashless India. Also, adequate security measures are required to guard online transactions against fraud which is very common in India. They critics further argue that due to unavailability of required cash flow in the market, many people died and lost their jobs, painting a scary picture of India becoming cashless post-demonetization.

However, after the demonetization of the currency notes of Rs 500 and Rs 1,000, the country has witnessed a surge in cashless transactions through the digital mode, be it through credit/debit cards, mobile phone applications, Unified Payments Interface (UPI), BHIM (Bharat Interface for Money) app under Aadhaar Enabled Payment System (AEPS) or e-wallets etc.

Conclusion: True, there are difficulties in implementing the idea of cashless economy in a vast country like India where a large number of people are living under misery and poverty, yet a beginning had to be made someday. Today, there is a sea change in the mindset of people with regard to digital means of monetary dealings which are safe, easy, convenient and transparent. There is no place for black money or counterfeit currency in cashless India.

Cashless India Essay 5 (300 words)

Cashless India is a recently introduced phenomenon targeted to bring a sea change in the country’s economy by the Indian government, transforming the cash-based economy into cashless through digital means.

However, still there are various challenges to be addressed if we want to make India cashless in true sense. India is a vast country and the convenience of making transactions through the online mode is not available across the country. In small cities and villages, the people are mostly suffering due to acute cash crunch situation. To make India cashless in true sense, investment is required to be made in enhancing the facility required on a mass scale for cashless transactions across the country.

Handling the flow of cash with digital technology has a range of advantages. Cashless transactions have made people keep all their cash into the bank and hence liquidity in the banking system has increased. Also, it has stopped the flow of black money, up to some extent. Now the banks and financial institutions have more money to lend to the people to support the growth of Indian economy. The other most important advantage is that this situation will make people pay their taxes in a transparent manner; hence the government will have more money to run various schemes meant for the welfare of the public.

Conclusion: Post-demonetisation, the people have finally started believing in the power of the plastic money in the form of credit card/debit card, and other channels of electronic payment. Online banking has gained prominence due to unavailability of enough cash in the market. Moreover, E-commerce modes of making payments have also become popular, as most of the people have now started making payments of even Rs 50 through the digital modes. All these developments are considered to be good for the healthy growth of the economy.

Cashless India Essay 6 (400)

Introduction

Cashless India is a move that has assumed significance in the backdrop of demonetisation of high value currency by the NDA government at the Centre. On November 8, 2016, Prime Minister Narendra Modi announced demonetisation of currency notes of Rs 500 and Rs 1000 and took the people by surprise. People standing in spiralling queues at ATMs and banks’ counters to exchange their old currency notes or withdraw cash became a familiar scene across the country.

However, the new cashless revolution ignited by this move has gradually started changing the mindset of people, who were earlier mostly dependent of currency notes only for doing transactions.

Benefits of cashless India

- Cashless transaction does away with any hassle to carry cash.

- It is in keeping with the worldwide trend. People need not carry any cash in various countries around the world as most of the transactions there are done electronically.

- In digital transactions, you can view history of your expenses at one go which helps you to manage your budget easily.

- Since cashless transactions are traceable, they invite payment of taxes, wherever applicable, thus ruling out use of black money.

- As tax collections become easy through the cashless mode, it accelerates the pace of economic development, making it easier for the government to spend on education, health care, employment generation, infrastructure and the overall welfare of the people.

- Increased tax collections lead to reduction and simplification of the tax structure.

- Transfer of monetary benefits to the poor and the needy through bank transfer rules out their exploitation by the unscrupulous middle men.

- Cashless transactions deal a body blow to counterfeit currency or distribution of black money through Hawala channels. It also cuts the supply of unaccounted money used in funding of criminal and terrorist activities.

- It saves the government substantial costs in printing and circulation of currency notes.

- Increased liquidity of money with the banks makes them lower their interest rates puts the huge amounts of cash deposited with them to some productive use.

Conclusion: A part of Digital India programme, the concept of cashless economy in India is centred around the vision of transforming the country into a society, which is digitally enabled and empowered by several modes of cashless transactions. Consequently, digital modes like credit/debit cards, mobile wallets, banks pre-paid cards, UPI, AEPS, USSD, Internet banking etc have gained in currency, leading to cashless India in near future.

Related Information:

Paragraph on Digital India

Essay on Digital India

Essay on Make in India

Digital India Scheme

Related Posts

Money essay, music essay, importance of education essay, education essay, newspaper essay, my hobby essay.

Write an Essay on Cashless Economy for upsc & All Competitive Exams | English Essay Writing

Essay on cashless economy.

Introduction The transition to a cashless economy in India has been a topic of much discussion and debate. From the government's demonetization efforts to the rise of digital payment platforms, the country is gradually moving towards a cashless society. A cashless economy refers to a system where transactions are conducted electronically, without the use of physical cash.