Customer lifetime value: The customer compass

Traditional brand owners and retailers are increasingly encroaching into the e-commerce channel—and for good reason. After all, digital engagement with customers provides companies with valuable data on consumer behavior that allows them to optimize marketing and product development. In addition, by operating their own sales channel, providers retain control over user experience and brand image. Enter COVID-19, and suddenly the Internet is rapidly becoming the shopping channel of choice for more and more consumers, a trend that is likely to persist beyond the pandemic.

About the authors

This article was a collaborative effort by Max Ackermann , Karel Dörner , Fabian Frick, Marcus Keutel , and Philipp Kluge.

That said, the new e-commerce players also face a challenge: winning and retaining customers is an expensive affair. That is why it is crucial for success to invest primarily in those customers who are lucrative for the company in the long run. It is important to understand these customers intimately, to engage them with the right channels, and to tailor offers to their context and needs. This can only be achieved by drawing on customer-related metrics—of which customer lifetime value (CLV) is first among equals—and by interlinking them intelligently as the foundation for effective and efficient marketing.

“CLV is our core steering metric” Four questions for Emmanuel Thomassin, Chief Financial Officer of Delivery Hero

Just how important is clv for delivery hero.

Customer lifetime value is one of our core metrics. It’s a topic we’re driving intensively at all levels of the organization and we have set clear goals from which we can only deviate in exceptional cases. We use CLV to support our strategic and operational decisions, such as whether to enter a new market or whether to continue or end a marketing campaign.

So how do you go about that?

We have a standardized approach for all our markets. CLV monitoring is directly linked to our operational marketing systems and thus directly influences our investments. It is crucial to continuously adapt and improve the calculation of CLV and the corresponding operationalization in marketing. Initially, for example, we only calculated the cost of customer acquisition; meanwhile, we also know what it costs us to retain customers. Over time, we have learned an enormous amount, especially through monitoring in new markets and with the introduction of new business models.

Do you see a trend among your customers?

Perhaps the most important KPI-based analysis is breaking down customers into cohorts to fine-tune the targeting of marketing drives. Over the years, we have seen CLVs rising steadily across all our cohorts, even before Covid. Today, they are many times higher than the investments in customer acquisition and retention. This shows that our marketing measures, among them personalization, have a direct impact on the KPIs and thus on Delivery Hero’s success.

Do you still see untapped potential in the way you use CLV?

A major challenge is responding directly to improvements in the KPIs with measures designed for pinpoint accuracy, especially in marketing, and then evaluating these with precision. That’s something we are working on, aside from further refining our analytics and increasing their granularity to the level of geographical micro-cells.

Digitally aligned companies and start-ups have long been successfully applying and refining this approach (see sidebar, “‘CLV is our core steering metric,’ Four questions for Emmanuel Thomassin, Chief Financial Officer of Delivery Hero”). Many traditional manufacturers and retailers, on the other hand, still have some catching up to do. To make the most of the CLV approach and use it to manage their e-commerce business, they should adopt a long-term strategy and proceed systematically in three steps: collect data, determine true customer value, and target investments to the most valuable customers.

Collect data throughout the customer journey

To estimate the current and future value of customers and keeping privacy regulations in mind, companies need to collect relevant data points on as many customers and their behavior as possible over multiple years. This is because the corresponding analytical models are dependent on the availability of sufficient amounts of information to identify relevant patterns. The greater the volume of data available, the more meaningful and accurate the analyses. Three categories of data are required:

- Transaction data such as shopping timeline, product information, prices, method of payment, delivery, or returns are supplied by the e-commerce platform and the connected financial systems.

- Demographic data such as gender, age, occupation, and place of residence are condensed into customer profiles in order to better predict future shopping behavior and personalize marketing actions.

- Marketing data such as search behavior, response to campaigns, and external online data help to flesh out the respective customer profile and, in turn, deepen customer knowledge, including as regards preferences or purchasing behavior.

Despite ample data, it is often difficult to clearly identify customers throughout the entire customer journey. This is partly due to purchases made across different channels, for instance, in the company’s own online and offline stores or perhaps through third-party suppliers such as retail partners, which often do not require registration (with an e-mail address, etc.) for identification.

Successful providers solve this problem with an integrated customer database (customer data platform) that can recognize customers even when they do not sign in. For this purpose, profiles comprising as many attributes as possible are created for visitors to the various channels (based on browser data, among other things). Then, returning visitors (including to different channels) are identified by matching them against the full array of profiles compiled. Aside from linking different data sources and formats, the customer data platform also enables the integration of suitable external systems as well as customer segmentation according to behavior and demographic data. Key steps in this context include anchoring the system’s continuous improvement, but also data use by the organization’s departments from the outset.

Would you like to learn more about Leap , our business-building practice?

Determining the true value of customers.

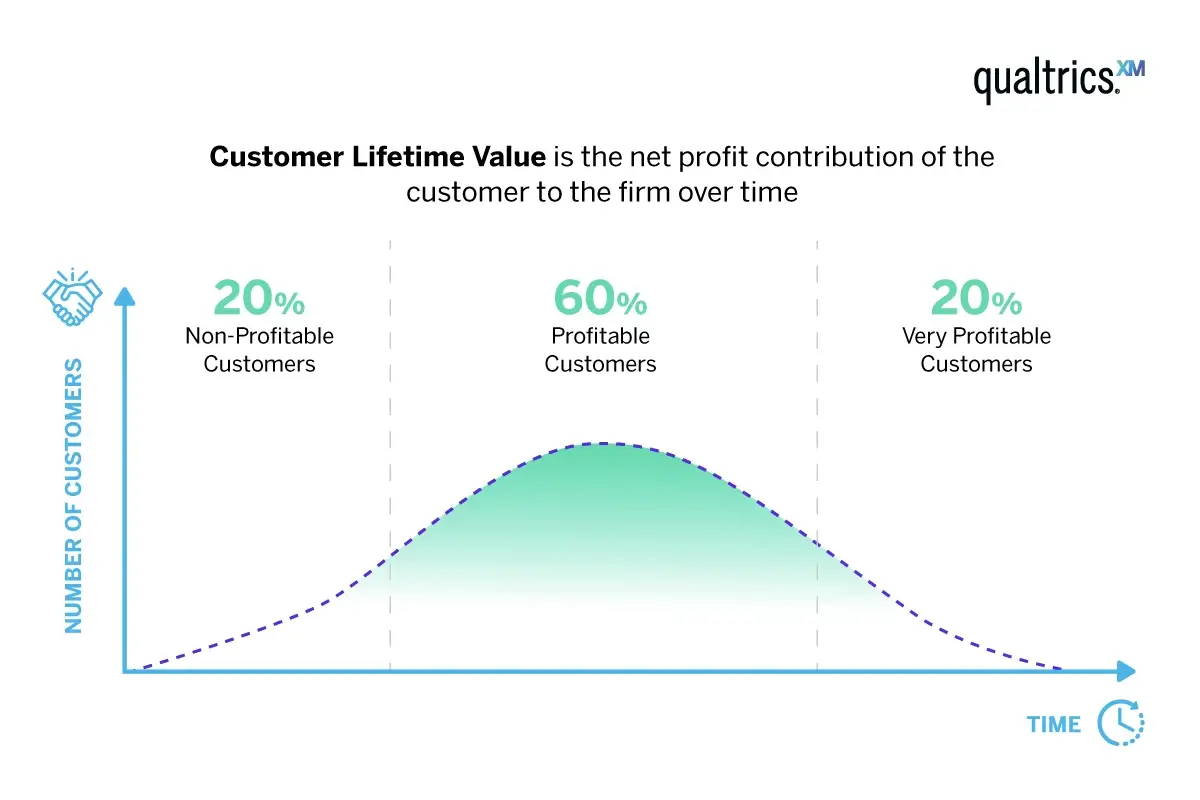

What happens to the data collected? Here, in the second step, is where customer lifetime value (CLV) comes into play. This is because it can be used to measure a customer’s value, in the long term, over their entire time as a customer of the company. This value is compared with the customer acquisition/ retention costs (CAC), i.e. the marketing investments made or planned that are necessary to acquire and retain the customer. Finally, both indicators are linked to derive recommendations for action with regard to strategic and operational decisions (Exhibit 1).

A distinction is made between three levels of complexity when modeling CLV and CAC:

The descriptive model calculates CLV using historical consumer data and identifies behavioral patterns of customer groups mostly through simple manual analysis. This comparatively simple method yields rapid results, but they are merely hypotheses and therefore of limited value; they can only serve as an initial indicator of CLV for potential decisions.

The predictive model uses historical data patterns to determine future CLV. Consequently, the results are more accurate and meaningful as the customer’s individual profile is factored into the equation along with their remaining time as a customer. Backed by this knowledge, CLV managers can make more effective decisions. However, this model requires more comprehensive advanced analytics capabilities, such as customer identification across multiple channels. For a 360-degree view, it is worth having complete historical customer data as well as regular updates of sales and cost data.

The operative model goes one step further: it automatically predicts CLVs using machine learning and makes initial recommendations for decisions, amplifying the CLV effect. In addition, predictive accuracy and decision making improve with each update. For the operational teams, this means that rather than elaborating decision recommendations, their primary job is to review and continuously monitor them. Yet, creating such models is a much more complex endeavor that can take months, if not years.

For all three models, continuous updating data and calculations is indispensable. For example, CLV must be adjusted after each customer purchase, but the CAC value must also be increased if, for instance, a marketing campaign is launched for a specific customer group. This is essential so that the data and the associated analytics results can be used for future campaigns.

Targeted investment in high-value customers

The last and most important step is to evaluate the CLV and CAC computations in such a way that the company can derive strategic and operational recommendations for action and decisions from them. It is essential to consistently measure the impact of the respective decisions, for example, the increase in CLV as a result of certain marketing measures.

With regard to the depth of evaluation, a distinction can be made between three levels. At the first level, only the average of all customers is considered, although this can already be very helpful when making decisions about expansion into new markets, channels or brands, for example. As a rule of thumb, expansion is advisable as soon as the estimated CLV exceeds the CAC by a multiple—even if profitability has not yet been reached. In practice, mature digital business models should display CLV-to-CAC ratios ranging between at least 2:1 and up to 8:1 or more. At this level, CLV can also be used as a metric to measure and improve the performance of organizational units such as country branches, or to gain a more customer-focused perspective on the business (rather than a purely sales- and profit-centric view).

The next analytical level focuses on cohorts of customers clustered on the basis of their CLV and CAC values in order to improve operational decisions in particular. Demographic data, such as gender, age, place of residence, but also behavioral data such as purchase frequency, brand loyalty, and returns are typically taken into account.

These data sets help marketing and sales teams identify indicators of high CLV and low CAC respectively, and tailor marketing campaigns to individual cohorts. Exhibit 2 illustrates an example of such a cohort analysis: in addition to the distribution of customers among the various CLV levels, it shows the characteristics of less lucrative and particularly valuable customers, as well as the recommended actions that can be derived from them.

Finally, at the third level with maximum analytical depth, the model targets individual customers. However, this only makes sense if the company is operating advanced, automated marketing platforms. Otherwise, individual marketing efforts would be prohibitively expensive and the cost of acquiring and retaining customers would skyrocket.

In a nutshell, CLV offers both established and new players in the e-commerce space the opportunity to better understand, target, and serve their customers in order to engage them in an effective and efficient manner, and create value for them. However, the operationalization of CLV and CAC can also set in motion entirely new developments. For example, successful e-commerce companies are moving to build a network of physical stores to operate in tandem with their online business. Take, for instance, Mr. Spex, Europe’s largest online eyewear retailer, which is opening more and more stores in German cities to attract new customers and create an omnichannel experience. A response to the rising cost of customer acquisition and retention in the online channel in recent years, this trend capitalizes on the fact that it is often cheaper and more efficient to strike the desired CLV-to-CAC ratio in conjunction with offline channels.

Max Ackermann is an associate partner in McKinsey’s Berlin office; Karel Dörner is a senior partner in the Munich office, where Dr. Philipp Kluge is an associate partner; Marcus Keutel is a partner in the Cologne Office; and Fabian Frick is a project manager in the Frankfurt office.

Explore a career with us

Related articles.

Five traps to avoid: The long game of DTC and e-commerce

How tech will revolutionize retail

How Telkomsel transformed to reach digital-first consumers

What Is Customer Lifetime Value (CLV)

Updated: Mar 21, 2023, 9:10am

Table of Contents

What is customer lifetime value (clv), reasons to know your clv, how to calculate customer lifetime value in 4 steps, 3 examples of clv, how to improve your customer lifetime value, common mistakes around clv, bottom line, frequently asked questions (faqs).

The estimated value of each customer can play an integral role when making business decisions, such as whether to invest more in customer acquisition or retention. That said, customer lifetime value (CLV) is a metric used to determine the amount of money customers spend on your business throughout an average business relationship. In this article, we’ll teach you everything you need to know about this metric, why it matters and how you can calculate it.

Customer lifetime value (CLV) is a business metric used to determine the amount of money customers will spend on your products or service over time.

For example, if someone is loyal to an auto brand whose vehicles average at $30,000 and the customer buys three cars from them in their lifetime, their CLV is $90,000. Whereas, someone who visits their local coffee chain five days a week and spends $4 on a coffee, will have a CLV of $10,400 over the course of 10 years.

Understanding CLV is crucial for businesses because it helps determine how much money to invest in acquiring and retaining customers.

Let’s take a look at several reasons why CLV matters.

1. Determine customer acquisition cost

How much should you invest in hiring a new customer? When you can determine the amount a customer will spend on your business, you can gauge the amount of money to spend on marketing campaigns.

For example, when you find out a customer spends an average of $1,000 on your business over time—you might have the budget to spend more on advertising and targeting campaigns. Not only that, but you have room to invest more money to personalize your email marketing strategy or content strategy.

Alternatively, if the estimated CLV is $1,000, you would only invest this much in convincing a customer to stay. Otherwise, you wouldn’t profit from the relationship.

2. Improve profitability consistently over time

Optimizing CLV helps you focus on ensuring consistent profitability over time. If you only invest in acquisition and closing new deals, it won’t be easy to remain profitable during slow seasons. In contrast, a high CLV means you can rely on enough people to return to your store throughout the year.

With higher revenue, you can confidently invest in growing your business—for instance, making your products and services available for international customers, investing more money in your content strategy and producing new products.

3. More accurate forecasting

Customer lifetime value (CLV) can help you make better production, workforce and inventory decisions. It helps pinpoint the types of clients you have, the best-selling products you buy and the factors that drive customer loyalty. Otherwise, you may spend more on producing products with insufficient demand.

4. Improve overall business strategy

Understanding CLV helps you determine the most effective strategy for your business growth. If your CLV is low, you may need to invest more in loyalty programs and initiatives to boost customer retention. In contrast, a high CLV means you may need to look into the best-selling products and campaigns driving growth to keep the momentum going. Over time, this strategy will help you create more cost-effective strategies around customer acquisition, marketing and sales.

5. Better understand loyal customers

Customer lifetime value helps you understand the most loyal brand advocates. How often do they shop from your business? What items are they more likely to purchase? Answering these questions can help you brainstorm ways to engage with your most loyal customers.

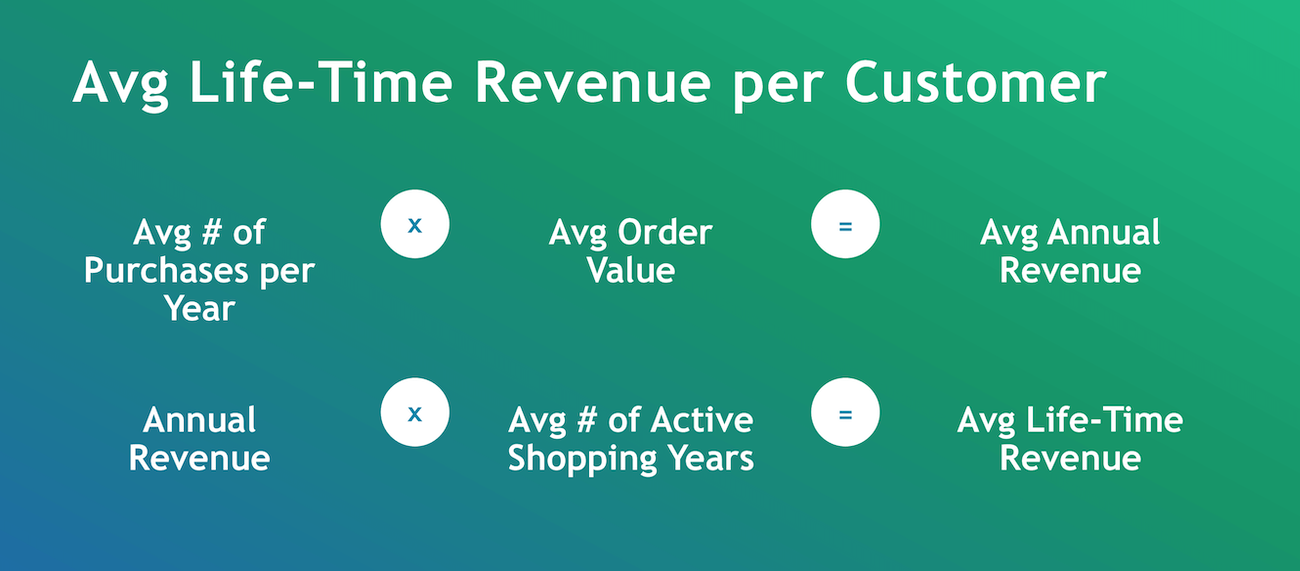

There are four essential steps to calculate CLV.

1. Determine the average order value

Determine the average amount customers spend on your business. To get this information, check out your e-commerce analytics tool or get an estimate based on customer transactions in the last few months.

2. Identify frequency of transactions

Next, identify how often customers come to your store. How many times do they come back, given a specific period? Do they return weekly, monthly or annually?

3. Measure customer retention

Figure out how long an average customer remains loyal to your business. Some industries, including restaurants and retail, tend to have a lower CLV because customers tend to go to establishments that offer a better deal. Meanwhile, industries such as technology and travel have a higher CLV because customers seek updated product features and personalized holiday experiences.

4. Calculate CLV

Once you have all this information, calculate CLV with this formula:

CLV = average order value × number of transactions × average length of the customer relationship (in years)

Using this information, we can assume a father that regularly purchases smartphones for his family might be worth:

$1,000 (per smartphone) × 2 (smartphones per year) × 10 (years) = $20,000

The CLV is $20,000.

CLV varies based on the nature of the product or service. Let’s examine various industries to show how CLV could affect your bottom line.

1. Grocery Shop

Grocery stores inspire loyalty among residents within the vicinity. Let’s say a shopper frequents a grocery in New York every week. He spends around $100 per visit. He returned every week, 52 weeks a year, for an average of three years.

$100 (purchase per visit) × 52 (visits per year) × 3 (years) = $15,600 (CLV)

2. SaaS Service

A UX designer uses a cloud-based subscription service to conceptualize mobile apps. He spends $70 per month for 10 years on the software. In this example, the SaaS product is a necessary job-related expense, so the subscription lasted a long time.

$70 (subscription fee per month) × 12 (payments per year) × 10 (years) = $8,400 (CLV)

3. Interior Design

The interior design agency has higher average order values. For example, a homeowner spends $100,000 to renovate their home. Because they liked the initial experience, they became a patron of the interior design firm and renovated their property every 10 years within 20 years.

$100,000 (per renovation) × 0.1 (annual purchase) × 20 (years) = $200,000 (CLV)

These examples show CLV varies across industries. While day-to-day products such as coffee are bought more frequently, you need to get customers to purchase often to get a high CLV. In contrast, some products such as houses, automobiles or interior design agencies have a lower purchase frequency. But due to the nature of the product or service, they rack up thousands of dollars with only a few transactions.

Improving your CLV can enhance your business’s profitability over time. To that end, here are a few ways to improve customer loyalty and retention.

1. Create a loyalty and rewards program

A growing body of research proves rewards programs effectively drive loyalty and retention. Gamify the experience by offering discounts and perks every time customers complete a milestone (e.g., making their first order and spending a specific amount).

For example, Victoria’s Secret Pink Nation loyalty program lets customers receive members-only perks such as exclusive content, early access to sales, mental health tips and playlists.

2. Increase average order value

Making customers spend more in your store can boost CLV. Offer free shipping or freebies for customers who reach a specific order amount, such as $50 or $100. Alternatively, you can bundle related products and sell them at a discounted price.

For SaaS businesses, you can give temporary upgrades such as seven-day or 14-day trials. Not only does this allow your customers to see the advanced features they’re missing out on, but it may also persuade them to upgrade and make the transition.

3. Launch post-purchase email campaigns

Offer next-order coupons or discounts to encourage customers to shop again. A good tip is to place them on order confirmation emails because they have a high open rate of around 65%, which is nearly four times higher than an average email. Another way is to deliver post-purchase emails seeking reviews to encourage customers to shop again.

4. Place product recommendations

Product recommendations matter. A study found 92.4% of consumers are influenced by reviews when purchasing. Nearly 90% of consumers believe in product reviews as much as advice from family and friends.

Having product recommendations lets customers evaluate whether or not a product is worth buying. So, recommendations are another way to get customers to buy more, which increases customer lifetime value.

Amazon’s algorithm selects product recommendations based on users’ past purchases and browsing behavior. Using this information, it can make suggestions such as “similar items viewed” or “frequently bought together” by consumers with the same interests or preferences. That’s why 35% of Amazon.com’s revenue comes from its recommendation engine. Judging by the numbers, recommendations are crucial to increasing CLV.

5. Create personalized experiences

Businesses that want to retain customers should focus on increasing their value and relevance. That’s why creating personalized experiences relevant to shoppers’ interests is essential. A survey of 1,000 U.S. adults by Epsilon and GBH Insights found that 80% of respondents want personalization from retailers. Likewise, McKinsey predicts shopping will feel incredibly personalized by 2030.

Moving forward, businesses must be able to segment customers based on their demographics, interests and purchasing behaviors. This could mean tailoring content recommendations based on browsing behavior.

6. Offer quality customer service

Good customer service is essential to encourage customers to be long-time patrons. It only takes one bad experience to prompt a customer to switch to your competitors. A Qualtrics study found 80% of customers have changed brands because of a poor customer experience.

A good tip is to increase communication channels for customer support. Ideally, it would help if you looked into the channels your consumers use the most and created touchpoints there. A study found companies with solid omnichannel customer engagement retain 89% of their buyers.

7. Create unified customer experiences

Thanks to the evolution of technology, most consumers adopt a hybrid approach when purchasing. They may discover a product on Facebook, visit the brand’s website and go to an in-store outlet to examine the physical product—and this won’t stop soon.

While brands can create different touchpoints, ensuring these experiences are streamlined is essential. For example, Timberland lets people stand in front of augmented reality mirrors to envision how apparel fits before going to the fitting room. Similarly, IKEA’s app allows shoppers to browse products online and use their smartphone’s camera to see how it looks in a room.

8. Make returns easy (and ideally, free)

Sometimes customers aren’t delighted with the product—and that’s perfectly okay. Just make it easy for customers to return products and services. A fast and easy return process will encourage customers to return to your online store and give it a try again.

9. Create actionable surveys

Understand your customers by creating actionable surveys. This information will help you understand customers’ level of satisfaction with your products or services. Not only that, but it will help you determine the most effective strategies to drive higher CLV while growing your customer base.

For example, Sephora collected consumer data and found that 70% of customers that visited its website within 24 hours before visiting the store spent 13% more than other customers.

After realizing the importance of online customer journeys, it launched online campaigns that improved in-store engagement. The results? It found a higher return on ad spend (ROAS) by 3.9 times and a threefold increase in conversion rates.

CLV isn’t a magical metric that will solve all your problems. If used wisely, businesses can fall prey to costly pitfalls. Remember these mistakes when examining your CLV.

No Segmentation

Sure, it’s excellent to increase CLV for your entire customer base—but it’s not an effective strategy. Marketing to everyone will lead you to invest more resources in low CLV customers.

Examine cohorts with a high CLV—which could be your top 20% spenders. Ideally, it would be best if you focused on increasing CLV among valuable customers who are likely to spend more on your products and services based on data. Identify, understand and engage with them to understand their preferences, lifestyle, attitudes and behaviors.

Wrong Segmentation

You can also identify CLV within a customer cohort or segment. A segment is a group of customers with similar characteristics, attitudes and behavior. Proper segmentation provides an overview of consumer behavior and what makes them distinct.

Creating campaigns that target specific segments is more effective due to personalization. However, incorrect segmentation may lead to a waste of precious company resources.

Targeting an Unrealistic CLV

Some customers will abandon your product or service no matter how hard you try. Only some people will pay thousands of dollars to transact with your business over time. There’s also no point in investing hundreds of dollars on low-value prospects.

As with any business objective, you have to be realistic. Think of ways to appeal to your target demographic but do not expect everyone to end up with a high CLV.

Failure To Be Flexible

Turning your small business into an empire is ideal—but things aren’t always smooth sailing. Sometimes recessions or inflation could decrease your CLV. Or, you may have to increase the prices of your products and services based on production costs and uncontrollable market forces. Be flexible when unpredictable situations arise and don’t be afraid to change your CLV based on these trends.

Customer lifetime value (CLV) can help determine how much customers will spend on your business in the long term. It helps inform customer loyalty, acquisition, marketing and sales decisions.

Improving CLV can be done through various tactics such as creating a loyalty and rewards program, creating personalized experiences and offering quality customer service. Staying aware of common pitfalls when aiming for high CLV can also help prevent errors that could make your company waste valuable resources.

What is the customer lifetime value formula?

To calculate customer lifetime value, multiply the average order value (AOV) by the number of transactions and the average length that a customer remains loyal to your business. You can get this information from an e-commerce analytics tool or by analyzing financial transactions.

What is customer lifetime value and why is it important?

Customer lifetime value is a business metric used to determine the amount of money a customer will spend throughout the business relationship. It helps businesses determine customer acquisition costs, improve forecasting and increase profits over time. It also serves as a guide for decisions about their overall business strategy.

Is higher or lower CLV better?

A higher CLV indicates customers spend more money on your product or service throughout the business relationship. When customers spend more and purchase frequently, your business is more successful and profitable.

Which industries have the highest customer lifetime value?

The industries with the highest customer lifetime value are architecture firms for $1,129,000, followed by business operations consulting firms for $385,800 and healthcare consulting firms priced at $328,600. These firms generate high amounts of revenue for hourly fees, consultation fees, material costs and projects.

- Best CRM Software

- Best CRM for Small Business

- Best Open Source CRM

- Best CRM For Real Estate

- Best Marketing CRM

- Best Social Media Management Software

- Best Simple CRM

- Best Customer Data Platform

- Best Mortgage CRM

- Salesforce Review

- Zoho Review

- Monday.com Review

- HubSpot CRM Review

- Pipedrive Review

- Zendesk Sell Review

- Bitrix24 Review

- Zoho Desk Review

- Benefits of CRM

- What is CRM Integration?

- Creating a CRM Strategy

- CRM Analytics Guide

- Customer Journey Map

- 10 CRM Best Practices

- CRM Data Types

- Customer Onboarding

- Customer Segmentation

- CRM Implementation

- What Is Churn Rate?

Next Up In Business

- Best CRM Software For Small Business

- The Best Live Chat Software

- Pipedrive Pricing Plans Guide

- Salesforce Pricing: Everything You Need To Know

- Freshsales Review

- Netsuite Review: Features, Pricing & More

15 Ways to Advertise Your Business in 2024

What Is a Proxy Server?

How To Get A Business License In North Dakota (2024)

How To Write An Effective Business Proposal

Best New Hampshire Registered Agent Services Of 2024

Employer Staffing Solutions Group Review 2024: Features, Pricing & More

Monique Danao is a highly experienced journalist, editor, and copywriter with an extensive background in B2B SaaS technology. Her work has been published in Forbes Advisor, Decential, Canva, 99Designs, Social Media Today and the South China Morning Post. She has also pursued a Master of Design Research at York University in Toronto, Canada.

Home — Essay Samples — Business — Customer — Customer Lifetime Value

Customer Lifetime Value

- Categories: Customer Customer Relationship Management Customer Service

About this sample

Words: 810 |

Published: Dec 5, 2018

Words: 810 | Pages: 2 | 5 min read

Cite this Essay

Let us write you an essay from scratch

- 450+ experts on 30 subjects ready to help

- Custom essay delivered in as few as 3 hours

Get high-quality help

Verified writer

- Expert in: Business

+ 120 experts online

By clicking “Check Writers’ Offers”, you agree to our terms of service and privacy policy . We’ll occasionally send you promo and account related email

No need to pay just yet!

Related Essays

2 pages / 1101 words

2 pages / 739 words

2 pages / 1021 words

5 pages / 2417 words

Remember! This is just a sample.

You can get your custom paper by one of our expert writers.

121 writers online

Still can’t find what you need?

Browse our vast selection of original essay samples, each expertly formatted and styled

Consumer Choice and Freedom: Discuss the importance of consumer choice and freedom, and argue that Buy Nothing Day restricts individuals' ability to make choices about their purchases and lifestyle. Economic [...]

Identifying Customer Pain Points: A definitive achievement or disappointment of an item is hovering around clients. Except if you have not pinpointed the torment purposes of your clients, the possibility of new item [...]

It is very important for banks to focus on what their customer need and how their interactions with different organisations ae impacting their expectations from the bank. In today’s scenario very high standards are being set by [...]

Just a mere decade ago, the majority of advertisers viewed the internet as unchartered territory - a gold mine with unimaginable potential just waiting to be mobilized and deployed. The influx of awareness has caused a major [...]

ISO 9001 is an internationally recognized standard that specifies the requirement for establishing, implementing and maintaining the requirements for quality management systems in an organization. It helps businesses and [...]

The use of Customer Relationship Management (CRM) in banking has gained importance with the aggressive strategies for customer acquisition and retention being employed by banks in today’s competitive milieu. This has resulted in [...]

Related Topics

By clicking “Send”, you agree to our Terms of service and Privacy statement . We will occasionally send you account related emails.

Where do you want us to send this sample?

By clicking “Continue”, you agree to our terms of service and privacy policy.

Be careful. This essay is not unique

This essay was donated by a student and is likely to have been used and submitted before

Download this Sample

Free samples may contain mistakes and not unique parts

Sorry, we could not paraphrase this essay. Our professional writers can rewrite it and get you a unique paper.

Please check your inbox.

We can write you a custom essay that will follow your exact instructions and meet the deadlines. Let's fix your grades together!

Get Your Personalized Essay in 3 Hours or Less!

We use cookies to personalyze your web-site experience. By continuing we’ll assume you board with our cookie policy .

- Instructions Followed To The Letter

- Deadlines Met At Every Stage

- Unique And Plagiarism Free

Customer Lifetime Value: The Significance of Repeat Business

- First Online: 04 May 2019

Cite this chapter

- David W. Stewart 3

Part of the book series: Palgrave Studies in Marketing, Organizations and Society ((PSMOS))

1578 Accesses

2 Citations

Loyal customers, those customers who return to purchase again and again, are critical to the long-term financial success of the firm. This chapter explores the role of customer loyalty and repeat purchasing on the financial performance of the firm. The chapter develops the concept of lifetime value of a customer as a conceptual framework for linking marketing actions to cash flow and for evaluating the value of individual customers and the return on marketing actions and expenditures designed to create and maintain loyalty among customers.

This is a preview of subscription content, log in via an institution to check access.

Access this chapter

- Available as PDF

- Read on any device

- Instant download

- Own it forever

- Available as EPUB and PDF

- Compact, lightweight edition

- Dispatched in 3 to 5 business days

- Free shipping worldwide - see info

- Durable hardcover edition

Tax calculation will be finalised at checkout

Purchases are for personal use only

Institutional subscriptions

Bejou, D., Keiningham, T. L., & Aksoy, L. (2016). Customer Lifetime Value: Reshaping the Way We Manage to Maximize Profits . New York: Routledge.

Google Scholar

Blokdyk, G. (2017). Activity-Based Costing ABC . Scotts Valley: CreateSpace Independent Publishing Platform.

Buttle, F., & Maklan, S. (2016). Customer Relationship Management (3rd ed.). New York: Taylor and Francis/Routledge.

Foster, T. (2017). Why Your Sales Leader Needs to Understand CAC and CLTV . Sales Benchmark Index (SBI). https://salesbenchmarkindex.com/insights/why-your-sales-leader-needs-to-understand-cac-and-cltv/

Grunberg, J. (2016, September 14). A Forbes Insight Study: Linking Customer Retention with Profitable Growth. Forbes . https://www.sailthru.com/marketing-blog/a-forbes-insights-study-linking-customer-retention-with-profitable-growth/

Kumar, V. (2008). Customer Lifetime Value: The Path to Profitability . Boston: Now Publishers.

Lawrence, A. (2012, November 1). Five Customer Retention Tips for Entrepreneurs. Forbes . https://www.forbes.com/sites/alexlawrence/2012/11/01/five-customer-retention-tips-for-entrepreneurs/#56751e735e8d

Reichheld, F. E. (1994). Loyalty and the Renaissance of Marketing. Marketing Management, 2 (4), 10–21.

Reynolds, R. (2012, July). To Sell More, Focus on Existing Customers. Harvard Business Review . https://hbr.org/2012/07/to-sell-more-focus-on-existing

Download references

Author information

Authors and affiliations.

College of Business Administration, Loyola Marymount University, Los Angeles, CA, USA

David W. Stewart

You can also search for this author in PubMed Google Scholar

Corresponding author

Correspondence to David W. Stewart .

Rights and permissions

Reprints and permissions

Copyright information

© 2019 The Author(s)

About this chapter

Stewart, D.W. (2019). Customer Lifetime Value: The Significance of Repeat Business. In: Financial Dimensions of Marketing Decisions. Palgrave Studies in Marketing, Organizations and Society. Palgrave Macmillan, Cham. https://doi.org/10.1007/978-3-030-15565-0_8

Download citation

DOI : https://doi.org/10.1007/978-3-030-15565-0_8

Published : 04 May 2019

Publisher Name : Palgrave Macmillan, Cham

Print ISBN : 978-3-030-15564-3

Online ISBN : 978-3-030-15565-0

eBook Packages : Business and Management Business and Management (R0)

Share this chapter

Anyone you share the following link with will be able to read this content:

Sorry, a shareable link is not currently available for this article.

Provided by the Springer Nature SharedIt content-sharing initiative

- Publish with us

Policies and ethics

- Find a journal

- Track your research

Root out friction in every digital experience, super-charge conversion rates, and optimize digital self-service

Uncover insights from any interaction, deliver AI-powered agent coaching, and reduce cost to serve

Increase revenue and loyalty with real-time insights and recommendations delivered to teams on the ground

Know how your people feel and empower managers to improve employee engagement, productivity, and retention

Take action in the moments that matter most along the employee journey and drive bottom line growth

Whatever they’re are saying, wherever they’re saying it, know exactly what’s going on with your people

Get faster, richer insights with qual and quant tools that make powerful market research available to everyone

Run concept tests, pricing studies, prototyping + more with fast, powerful studies designed by UX research experts

Track your brand performance 24/7 and act quickly to respond to opportunities and challenges in your market

Explore the platform powering Experience Management

- Free Account

- For Digital

- For Customer Care

- For Human Resources

- For Researchers

- Financial Services

- All Industries

Popular Use Cases

- Customer Experience

- Employee Experience

- Employee Exit Interviews

- Net Promoter Score

- Voice of Customer

- Customer Success Hub

- Product Documentation

- Training & Certification

- XM Institute

- Popular Resources

- Customer Stories

- Market Research

- Artificial Intelligence

- Partnerships

- Marketplace

The annual gathering of the experience leaders at the world’s iconic brands building breakthrough business results, live in Sydney.

- English/AU & NZ

- Español/Europa

- Español/América Latina

- Português Brasileiro

- REQUEST DEMO

- Experience Management

- Customer Churn

- Customer Lifetime Value

See how XM for Customer Frontlines works

What is customer lifetime value (clv) and how can you increase it.

15 min read Customer lifetime value (CLV) is one of the key stats to track as part of a customer experience program. Customer lifetime value is a measurement of how valuable a customer is to your company, not just on a purchase-by-purchase basis but across entire customer relationships. Learn how to calculate customer lifetime value and increase your customer ROI with our guide.

What is customer lifetime value (CLV)?

Customer lifetime value is the total worth to a business of a customer over the whole period of their relationship with the brand. Rather than looking at the value of individual transactions, this value takes into account all potential transactions to be made during a customer relationship timespan and calculates the specific revenue from that customer.

There are two ways of looking at customer lifetime value: historic customer lifetime value (how much each existing customer has already spent with your brand) and predictive customer lifetime value (how much customers could spend with your brand). Both measurements of customer lifetime value are useful for tracking business success.

Free eBook: The Ultimate Guide to Improving Customer Loyalty

Historic customer lifetime value

If you’ve bought a $40 Christmas tree from the same grower for the last 10 years, for example, your customer lifetime value has been $400 – pretty straightforward. This is an example of historic customer lifetime value – a measure that works by looking back at past events. It’s helpful to understand what an existing customer has brought to your brand and for building profiles of ideal customers, but it’s not as useful for predicting future revenue when considered alone.

Predictive customer lifetime value

You can also calculate predictive customer lifetime value . This is an algorithmic process that takes historical data and uses it to make a smart prediction of how long a customer relationship is likely to last and what its value will be. It can take into account customer acquisition costs, average purchase frequency rate, business overheads and more to give you a more realistic customer lifetime value prediction. It can be a more complex way to calculate customer lifetime value, but it can help you to see when you need to invest in your customer loyalty.

How is customer lifetime value different from other customer metrics?

Customer lifetime value is distinct from the Net Promoter Score (NPS) that measures customer loyalty , and CSAT that measures customer satisfaction because it is tangibly linked to revenue rather than a somewhat intangible promise of loyalty and satisfaction.

It’s a confirmed understanding of how much loyal customers bring to your business financially, or in the case of predictive customer lifetime value, how much they are likely to bring based on past data.

Knowing existing customers’ lifetime values helps businesses to develop targeted strategies to acquire new customers and retain existing ones while maintaining profit margins. Read on to understand why customer lifetime value is a key metric to track, and how to calculate and improve on it.

Why is customer lifetime value important to your business?

It helps you save money.

Customer lifetime value is an important metric to track, as it costs less to keep existing, loyal customers than it does to acquire new ones. Recent research has found that even in sectors with potentially easier customer acquisition, such as e-commerce, t here’s been a 222% increase in costs for new customers over the last eight years.

Focusing on increasing the current customer lifetime value of your existing customers is a great way to drive growth. Rather than relying on new customers (and spending lots to get them), you can figure out what keeps your customer base loyal and replicate your actions for increased value with existing customers.

It helps you spot and stop attrition

Customer lifetime value is a great metric to use to spot early signs of attrition and combat them. Let’s say you notice that customer lifetime value is dropping, and pinpoint that customers are neglecting to sign up for a continuation of an ongoing subscription of your product or service. You might decide to launch or improve a loyalty program to tempt customers back, or provide better customer support or marketing efforts around renewal times to help encourage customers to sign up again. This will help to increase customer lifetime value and business revenue again.

It helps you find your best customers and replicate them

Your best customers will have a higher customer lifetime value, and through careful analysis you’ll be able to understand the commonalities between these individuals. What drives them to buy into your brand again and again? Is it a common need, a particular income bracket, a specific geographical location? You can define a whole customer segment based on these higher value existing customers alone.

Image Source: Relently

Once you’ve analyzsed the drivers for high customer lifetime value and created a buyer persona specifically for this type of customer, you can seek out new customers using this information. Once you’ve got them on board, you have your predictive customer lifetime value to rely on for future revenue.

How much are your existing customers costing you?

Customer lifetime value goes hand in hand with another important metric – CAC (customer acquisition cost). That’s the money you invest in attracting a new customer, including advertising, marketing, special offers and so on. Customer lifetime value only really makes sense if you also take the customer acquisition cost into account.

For example, if the customer lifetime value of an average coffee shop customer is $1,000 and the customer acquisition cost is more than $1,000 (using advertising, marketing, offers, etc.) the coffee chain could be losing money unless it pares back its customer acquisition costs.

Another factor in the equation is Cost to Serve. This is part of the cost of doing business, and it involves everything you do to get the product or service into the customer’s hands and doing what they need it to do. For example, logistics, overheads in your physical location, contact centre costs and so on.

Breaking this down by customer can help you understand these costs on a granular level, and dig into details like whether your customers with a higher customer lifetime value cost the same as the low ones, and whether some customers are more expensive than others. If the cost of serving existing customers becomes too high, you may be making a loss despite their seemingly high customer lifetime value.

Cost to serve may vary across the customer lifetime, unlike customer acquisition which is a one-off expense. To use a paid TV subscription as an example, your cost to serve might be higher in the first year of a contract but gradually drop off the longer the customer stays with you. Thus, if your renewal rates drop, your average cost to serve is likely to rise and cause a drop in profitability.

Understanding these numbers over time and being able to track them side by side is the only way to get a true understanding not only of what’s driving customer spend and loyalty but also what it’s delivering back to the business’s bottom line.

Start your customer experience journey with Qualtrics today

How do you calculate customer lifetime value (CLV)?

There are a couple of factors that go into how you calculate customer lifetime value – we’ve laid them out below.

A simple customer lifetime value formula

The simplest formula for measuring customer lifetime value is:

Customer revenue per year * Duration of the relationship in years – Total costs of acquiring and serving the customer = customer lifetime value

This formula is suitable for situations where the figures are likely to remain relatively flat year-on-year.

There are other useful formulas that can help you to calculate customer lifetime value. Read our helpful guide to calculating customer lifetime value to understand what these formulas are and how to apply them.

Other important factors for your customer lifetime value calculation

As you can imagine, in bigger companies with more complex products and business models, customer lifetime value gets more complicated to calculate.

Some companies don’t attempt to measure customer lifetime value, citing the challenges of segregated teams, inadequate systems, and untargeted marketing.

When data from all areas of an organisation is integrated, however, it becomes easier to calculate customer lifetime value more accurately.

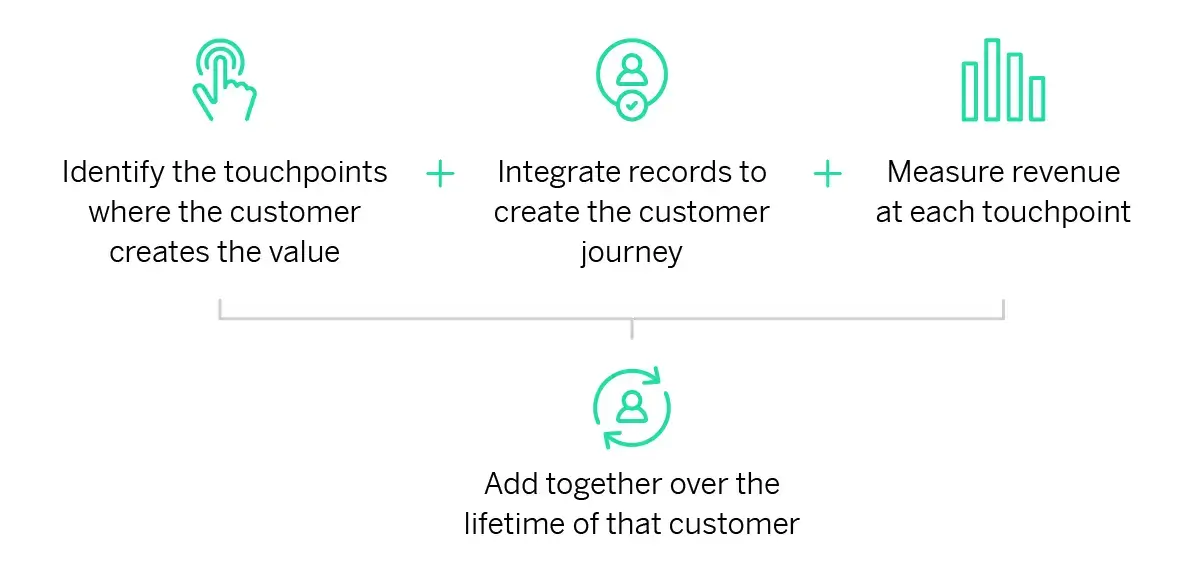

Customer lifetime value can be measured in the following way:

- Identify the touchpoints where the customer creates the value

- Integrate records to create the customer journey

- Measure revenue at each touchpoint

- Add together over the lifetime of that customer

How to improve customer lifetime value (CLV)

Customer lifetime value is all about forming a lasting positive connection with your customers. So it naturally follows that the way to boost your customer lifetime value figures is to nurture those customer relationships. Here are a few ways of doing that.

Invest in customer experience

Customer experience is made up of every instance of connection between a customer and a brand , including store visits, contact centre queries, purchases, product use and even their exposure to advertising and social media. Improving the experience is a business-wide endeavour that’s often addressed using a customer experience management program . This is a process of monitoring, listening and making changes that add up to a lasting improvement in how customers feel and their tendency to be loyal over the long-term.

Ensure your onboarding process is seamless

Customer experience starts the moment a potential customer encounters your brand, but often companies can forget that customers need care after the purchase. Make sure your onboarding process is optimised for your customers’ needs, and it’s as simple and easy as possible for minimal customer effort . Personalisation and communicating the extra value you provide to your customers should be a priority. You should also remember that how you treat your customers during the onboarding process is how they expect to be treated ongoing, so make sure your customer experience reflects this.

Start a loyalty program

A loyalty program incentivises repeat business by offering discounts or benefits in return. A loyalty program might take the form of a loyalty card or app, or a points system that customers accrue when they make a purchase. Although it’s not a silver bullet for customer retention , a loyalty program can yield great results when it’s planned and executed well.

Recognise and reward your best customers

With your customer experience management program up and running, you’ll already have some ideas about which customers are likely to have the best customer lifetime value. You can nurture your relationships with these individuals or groups using targeted marketing and special offers that recognise their loyalty. This could include free expedited shipping, top-tier benefits in your loyalty program, or access to exclusive or pre-release products and services.

Provide omnichannel support

Your customers will have a variety of preferences for how they engage with you, so your support channels need to reflect this. Do your research to find out which channels your particular customer base prefers, rather than just offering what you think they’ll want to use. Get customer feedback on self-service options and frontline interactions to provide a great customer experience with omnichannel support.

Remember the power of social media

Social media is increasingly important not only for customer communication, but for customers to gather information on your brand and public image. If customers feel as though your social media responses to a query or issue aren’t fast enough, thorough enough, or empathetic, this will affect the opinion the customer has of your brand moving forward. Make sure you factor in social media – mentions, and responses into your customer experience strategy.

Close the loop with unhappy customers

Closed-loop feedback is a powerful way to reduce unwanted churn and turn dissatisfied customers into newly loyal ones. In this model, businesses proactively reach out to detractors o r complainants and intervene before issues can escalate and lead to a breakdown of the customer relationship. In many cases, this targeted effort and active listening on the part of the business actually makes the relationship stronger than it was originally. It’s a valuable extension of your customer experience management program.

Making customer experience a vital driver of customer lifetime value

Ultimately, you don’t need to get bogged down in complex calculations – you just need to be mindful of the value that a customer provides over their lifetime relationship with you. By understanding the customer experience and measuring feedback at all key touchpoints, you can start to improve on the key drivers of customer lifetime value.

At Qualtrics, we believe that customer experience is a vital reason why customers return to a brand again and again. By focusing on customer experience, you’re able to easily increase customer lifetime value – we’ve found that customers who rate an experience 5/5 stars are more than twice as likely to buy again, and 80% of satisfied consumers will spend more.

Make accurate predictions for future revenue based on a holistic view of your customers’ relationship with your brand. See customer acquisition costs and more data alongside the results of customer satisfaction surveys and more on one integrated dashboard.

Related resources

Customer Churn & Retention

Churn Reduction 15 min read

Customer acquisition 21 min read, customer retention strategies 13 min read, calculate clv 13 min read, customer retention 21 min read, customer loyalty programs 12 min read, customer loyalty 18 min read, request demo.

Ready to learn more about Qualtrics?

- Deutschland

- Asia, Australia & New Zealand

- Europe, Middle East & Africa

- United States & Canada

- Latinoamérica

Important lessons for embracing customer lifetime value

When businesses and marketers think about customers, the focus is often on immediate transactions: what people are buying now and how. Marketing strategies, then, involve valuing these customers only over the short term.

However, when it comes to driving profitable growth in the long term, customer lifetime value (CLV) is a metric that can no longer be ignored. CLV, which measures the total value a business receives from a single customer over their entire relationship, is an ideal way to acquire, develop, and retain the most valuable customers for business growth.

Companies can benefit from having a clearer understanding of how to invest in long-term customer relationships instead of optimizing volumes of short-term transactions.

However, the simplicity of CLV — a single metric that quantifies the future value of each customer — can mask the challenges of implementing it.

Here are five tips for companies as they start their journey to adopting CLV in their own businesses.

1. Look as far ahead as possible

Despite the well-established history of CLV models, shifting from short-term to long-term thinking, especially with a predictive metric, involves the perception of risk. What if the model is wrong? What if my customers behave differently from any other business? The discount factor — finding future cash flow values — in the CLV model includes some level of risk and uncertainty. To help moderate these risks, companies will often truncate their calculation of CLV to fit their existing short-term mindset of six- or 12-month projections. Avoid this temptation. Narrowing your understanding of the future could deprive your business of valuable opportunities and, just as importantly, valuable customers who may purchase infrequently but spend high amounts when they do so. If your business is stuck, consider running CLV models with both short- and long-term time horizons, focusing on the actual differences between the two. How much value would be given up? What customers or behaviors would be missed in the shorter period? Can your marketing efforts be tailored to acquire the long-haulers while still meeting internal pressures for quicker returns?

2. Don’t drill down too deeply for data

The combination of machine learning and unimaginable amounts of data have led to some companies constructing incredibly detailed behavioral profiles of their best customers: “They exist in this specific market, and they engage with us on this type of device from 3-4 p.m. on Wednesdays.” While impressive, that level of precision may be counterproductive because there are only so many similar customers who may exhibit the same behavior. To borrow from a fishing metaphor, you’ll be more productive with a net than a spear. Keep the size of your prospective audiences in mind as you’re trying to classify user behavior. Start simply by looking broadly for customers who are more valuable than those you are acquiring today, then start to drill down — but not too far.

3. Use the right approach at the right time

While several types of statistical models, such as negative binomial distribution models, have emerged as favorites for their precision and long-term stability, they require customer observations over multiple periods of time before a prediction can be made. This can make bid optimization for digital ads difficult for platforms that often require a success metric every few days.

Successful advertisers have embraced machine learning as an interim measure for more immediate — although less granular — predictions while reverting to traditional techniques as soon as the customer relationship allows. Be careful to avoid a false sense of confidence, though. It’s necessary to alternate between machine learning and traditional stochastic models, which are random variable models.

Benefits and challenges of different CLV models

4. always look for new types of customers.

The primary source of data for CLV models is your company’s data, but it will be biased because it’s based on the types of customers you’ve tried to acquire in the past. If your marketing actions were oriented toward immediate purchasers, those likely to engage in longer-term relationships may not represent a substantial portion of your dataset. As such, a portion of your marketing budget should always be put aside for exploration — finding and engaging with new types of customers who may be a more substantial source of long-term growth than your current. Put another way, you may not have found your best customers yet. Keep searching.

Put aside a portion of your marketing budget to find and engage with new types of customers for long-term growth.

5. Find ways to appeal to other stakeholders

Adopting CLV can be disruptive: shifting budgets, a delayed understanding of performance, and the gut reaction of judging previous short-term investments in a more critical light. Try to avoid making any large-scale changes at first. Focus on education instead. Help others understand the metric and how it could apply to their business. Be transparent about what will benefit from experimentation, and be open to how they see it impacting their own processes. It may be a slower, more deliberative process, but it improves the likelihood of the approach taking hold.

In the end, perhaps the most important lesson is simply to find ways to integrate CLV into your business rather than shaping your business to accommodate CLV. Be mindful of the guidelines and best practices , but avoid following any metric to such a dogmatic extent that it undermines all the optimizations and processes your business has developed to this point. You were successful because of them, so don’t forget them. Evolve them together instead.

Others are viewing

Marketers who view this are also viewing

Destination unknown: Travelers are prone to change their minds and this can benefit brands

3 ways you can work smarter, not harder, and drive results with ai in marketing, scoring with gamers: new findings on html5 players that’ll grow gaming revenues, marketing playbook for 2024: digital marketing strategies to navigate changes ahead, getting customers to make confident purchase decisions on every screen and format with video marketing, for the win: how non-gaming publishers can boost engagement and revenue with html5 games, peter fader, others are viewing looking for something else, complete login.

To explore this content and receive communications from Google, please sign in with an existing Google account.

You're visiting our Asia, Australia & New Zealand website.

Based on your location, we recommend you check out this version of the page instead:

What is customer lifetime value (CLV), and how it can help you forecast revenue?

When businesses want to maximize their revenue from customers, they rely on a metric known as customer lifetime value (CLV). This metrics helps helps companies learn how to best keep customers they have and increase profitability. Below, we’ll go into the benefits of CLV, how to calculate it, and how to improve it.

What is customer lifetime value?

CLV measures the complete revenue a business can predict from a customer during their entire relationship. It offers businesses a comprehensive view of a customer’s value by encompassing all purchases, subscriptions, and interactions over time.

How customer lifetime value can support your business goals

Focusing on CLV provides businesses with several advantages:

- Allows businesses to recognize customers with high value, which allows them to prioritize keeping them through targeted marketing efforts

- Businesses can customize their offerings to cater to customer demands, which results in increased customer retention rates

- Minimizes customer acquisition expenses and maximizes the value derived from current customers

- “Companies can use CLV to help predict future revenue,” Yasin Arafat, Founder and CEO of DOPPCALL, advises. It enhances business planning and forecasting by providing a more accurate understanding of long-term revenue streams.

CLV provides the best advantage to businesses that rely on loyal, returning customers. Examples include:

- Subscription services

- Financial services

- Self-care, such as salons and spas

How to calculate customer lifetime value

Depending on the business model, there are multiple formulas available to calculate lifetime value. Below, we’ll discuss two of the most popular options.

If you have a stable customer pattern, the simplified CLV formula can work well for you:

Simplified CLV formula:

CLV = Average Purchase Value × Average Purchase Frequency × Customer Lifespan

For example: Consider a streaming platform with an average purchase value of $10, with a customer lifespan of three years, and an average purchase frequency of 12 times per year.

CLV = $10 x 12 x 3 = $360

A churn-based CLV formula offers a little more nuance based on how likely a customer is to leave:

Churn-based CLV formula

CLV= (Average Purchase Value x Average Purchase Frequency) ÷ Churn Rate

To calculate the churn rate , use the following formula:

Churn rate calculation

Churn rate percentage = (number of customers lost during the time period ÷ total number of customers at the start of the time period) x 100

For example: A gym membership costs $30 per month at a frequency of 12 times per year. Your gym has a 20% annual churn rate.

CLV = (30 x 1200) ÷ 0.20 = $1800

How to track & increase customer lifetime value

By tracking customer lifetime value, businesses can make better decisions based on real data. To increase customer lifetime value, use these strategies:

- Engage customers regularly through promos, newsletters, and social media. Hannah Parvaz, founder of Aperture, increases CLV by building effective onboarding flows. During lockdown, Parvaz started a daily newsletter written from her perspective that led to a 40% increase in conversion. Use a customer relationship management (CRM) platform to stay in touch with past customers.

- Reward customers for their loyalty. This includes cash back programs, punch cards, or tiered loyalty rewards that gamify the loyalty process.

- Work to keep customers by offering an excellent customer experience and issue resolution.

- Offer upsells and cross-sells to increase how often a customer makes a purchase.

The takeaway

Knowing the customer lifetime value and working to increase it can help with growth and profitability of a business. To increase this metric, a business should focus on what it takes to keep a customer coming back through personalized marketing efforts, loyalty programs, and making customer satisfaction a priority.

EDITORIAL DISCLOSURE : The advice, opinions, or rankings contained in this article are solely those of the Fortune Recommends ™ editorial team. This content has not been reviewed or endorsed by any of our affiliate partners or other third parties.

Guide to CRM software

What is churn rate the key metric to customer retention, what is a sales pipeline, and how can it boost your bottom line, 8 benefits of using a crm for your business, what is crm the ultimate guide to customer relationship management.

The Benefits of Customer Lifetime Value: Why It Matters

- By Totango Team

- June 27th, 2019

What do America’s longest running companies all have in common? They focus on the big picture: customer lifetime value.

If you want your business to last, you need to prioritize customer lifetime value, too. To succeed in today’s customer-centered economy, you can’t simply focus on attracting new customers. After all, there are plenty of competitors to choose from, and customer expectations are higher than ever. Instead, view each customer in terms of their lifetime value, meaning the total amount they may spend long-term if you retain them.

For companies willing to evolve, the benefits of customer lifetime value are many. By cultivating customers who have a high lifetime value, you can ensure stable revenue for years to come. But first, you have to know how to retain them.

The Benefits of Customer Lifetime Value

When you emphasize customer lifetime value, you can cultivate a base of loyal customers to ensure steady returns on a regular basis. This strategy will secure your market presence for decades to come.

Cultivating customer lifetime value:

- Is Cost-Effective: Convincing a new customer to make a purchase is an expensive process. It costs advertising dollars and requires sales people and sometimes even the collaboration of several different teams. By simply keeping the customers you already have, you avoid paying these expenses a second time.

- Fosters Brand Loyalty: Customers with high customer lifetime value have proven their loyalty, and loyal customers are likely to spread good word-of-mouth about your brand and evangelize online. This provides unsolicited testimonials, which potential customers see as highly credible, and improves your brand reputation.

- Saves Time: Knowing each customer’s customer lifetime value helps you identify where your customer success team’s efforts are most likely to pay off and who would benefit from an upsell. High customer lifetime value clients already have a track record of bringing in strong revenue, so go straight to this group when looking for growth areas.

- Predicts Churn: Customers with high lifetime value are less likely to churn. They have a track record of success with your product and aren’t likely to leave unless something changes dramatically.

Of course, the higher your customers’ lifetime value is, the more your company will profit. So, the more work you put into raising customer lifetime value, the more revenue you’re likely to bring in.

How to Reap the Benefits of Customer Lifetime Value

If your business is looking to focus on customer lifetime value, you’re in luck. There are many best practices that will help you foster positive customer lifetime value , including:

Increase Your Number of Repeat Customers

Move away from just thinking about single-purchase customers so you can encourage customers to continue using your product. The goal is to cultivate more repeat customers until they make up the majority of your sales. You can start simple, with the goal of getting one-time customers to come back for a second transaction. Some ways of doing this include contacting the customer to remind them of the value your product offered them. Depending on the product or industry, you could make follow-up phone calls. You can also ask for feedback. Whatever you do, remember that winning a customer back for a second purchase means starting a relationship with them. As time goes on, you’ll form a lasting bond with the customer.

Next, focus on getting repeat customers to increase their order frequency rather than trying to raise the amount spent per order. This gets customers in the habit of buying and using your product. From this point on, focus on raising customer loyalty. You can do this by implementing customer loyalty programs or connecting with customers through feedback surveys, special offers, or other rewards. As the number of loyal customers increases, you can expect more revenue that doesn’t come at the expense of your advertising budget.

Optimize Onboarding

Onboarding begins as soon as the transaction is complete and lasts until your customer learns how to use all your product’s features. If customers don’t fully adopt your product and gain value from it during onboarding, they run a high risk of churning —higher than any other stage.

Be sure to communicate the value your product offers from the very start. Provide how-to videos and tutorials. Monitor your product use and if you see a reduction in the frequency of use, alert your customer success team so they can offer help.

Provide Value Constantly

Continue to provide value, even when the customer moves into the adoption and renewal stages. Engage customers through tactics such as by releasing new features or periodically sending automated communications. These messages can provide information such as how much money your product has saved the client, information about their resolved support tickets, or how the customer is progressing toward certain goals. Never stop proving your product’s worth to your customer and you’ll eliminate one of the greatest causes of churn .

Retain Customers for Life Using Customer Success Software

Customers have plenty of choices in today’s customer-centered economy, and if your company prioritizes the pursuit of short-term revenue, customers will be more likely to churn. Instead, ensure stable revenue from loyal customers by cultivating the benefits of customer lifetime value.

But cultivating customer lifetime value doesn’t happen overnight; rather, it requires a dedication to enhancing the customer lifecycle long-term. If your business is having trouble engaging customers in meaningful ways, try using customer success software . It can give you the functionality you need to measure, respond to, and improve every stage of the customer journey. America’s oldest companies have lasted this long because they’ve built loyal customer bases by adapting to meet changing customer demand over the years. Give your success team the functionality it needs to provide deeper customer engagements and your business can last a lifetime, too.

When you need functionality that can help you build customer lifetime value, try Totango . Our comprehensive customer success software helps you retain customers and increase loyalty at every point along the customer journey. Request a demo or explore Spark to learn more.

- Posted on: June 27th, 2019

How to Calculate Customer Lifetime Value says:

[…] lifetime value is the total amount a customer will spend if you retain them. To accurately evaluate the net benefit over time, you need to factor in the cost of acquiring the […]

Customer Retention Optimization Strategies to Keep Customers Long-Term says:

[…] are your enterprise’s life’s blood. When you get a new customer, work to retain them and grow customer lifetime value. While the sales team will always be looking for new customers, retaining a current customer is far […]

Get the latest in customer success best practices

Ready to get started.

The Importance of Customer Life-time Value

What is customer lifetime value (cltv).

Customer lifetime value measures how much customers are worth for the duration of their relationship with your business.

Why does CLTV Matter?

There are several reasons that customer life-time value matters.

First, understanding lifetime value helps you determine how much your business can afford to spend to acquire new customers and to retain existing customers.

Second, customer life-time value tends to vary by customer segment. Understanding which segments are most and least profitable helps you identify which types of customers to nurture and, in some cases, which customers to “fire.”

Third, analyzing the different parts that make up customer lifetime value will help you identify which levers are most important in improving customer profitability. For example, if you find a significant drop-off between a customer making a first purchase and a second purchase, you might focus on increasing the number of customers who make a second purchase.

The bottom line is that understanding your customers’ lifetime value is a critical underpinning of growing and maintaining a healthy and profitable business.

How do I calculate customer life-time value (CLTV)?

Let’s start with the basic equation.

You will need to determine a period of time you are going to use as your customers’ lifetime. That means how long your customer will remain an active customer. For this exercise, let’s assume a lifetime of three years. An analysis of your business’ customer cohorts will get you a more precise answer, but for now, let’s use three years as an example. Here is what you will need to know:

If you want to understand your gross margin per customer, you’d adjust the formula this way.

Now we need to look at the cost of acquisition.

Why do I need to look at the cost of customer acquisition?

For most businesses, the cost of acquiring a customer is a significant expense. Rarely do businesses generate enough revenue and margin in the first purchase to recover the cost of acquiring the customer. Backing out the cost of acquisition gives your business a much more accurate view of your overall profitability.

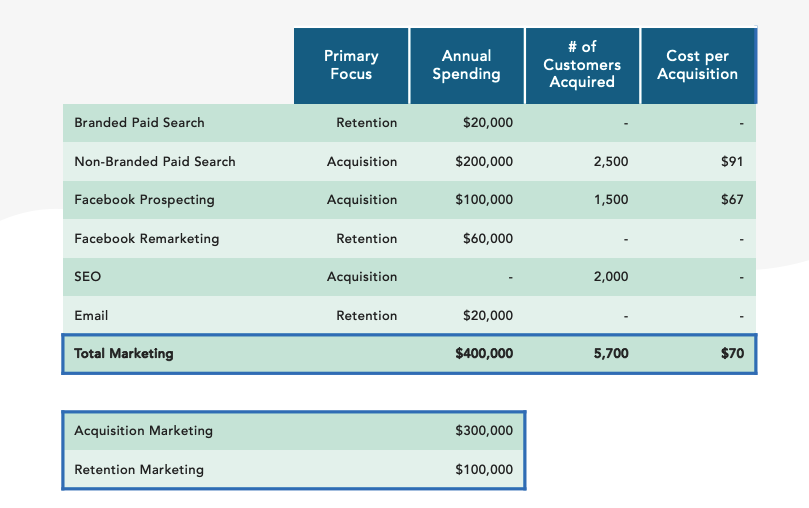

I don’t have a fancy analytics team; how do I calculate the cost of customer acquisition?

The most straightforward way to estimate customer acquisition cost is to assign a role to each marketing channel. In other words, a marketing channel is labeled as either acquisition or retention. The costs associated with that marketing channel are then applied to either acquisition or retention. We have an example below for you to follow. The numbers we are using are annual, but you can use quarterly or monthly numbers if your business has a lot of seasonality or prefer a greater precision level.

In this case, the blended cost of acquisition is $70 per customer. The business is spending $300,000 a year on acquisition and $100,000 a year on retention marketing.

Let’s wrap up the customer lifetime value for this business.

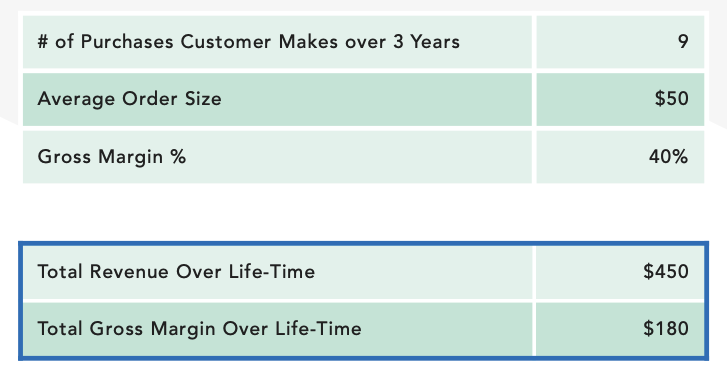

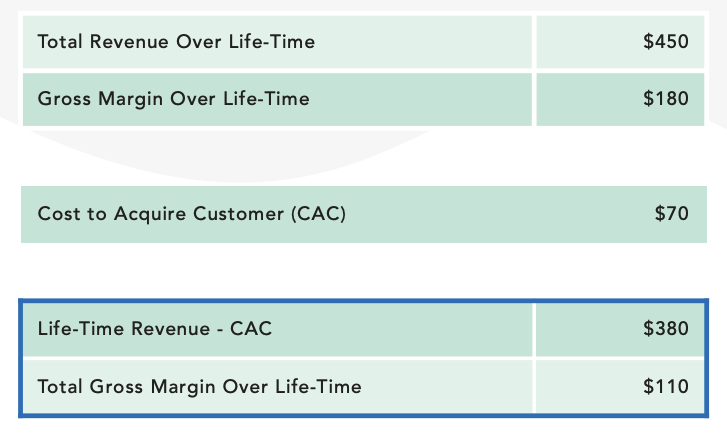

Assume a scenario where customers make 9 purchases over a 3-year period, each one averaging $50. That means the customer generates $450 over the lifetime. With a 40% margin, that is equivalent to $180 in gross margin.

To calculate the life-time revenue and margin, you would do the following:

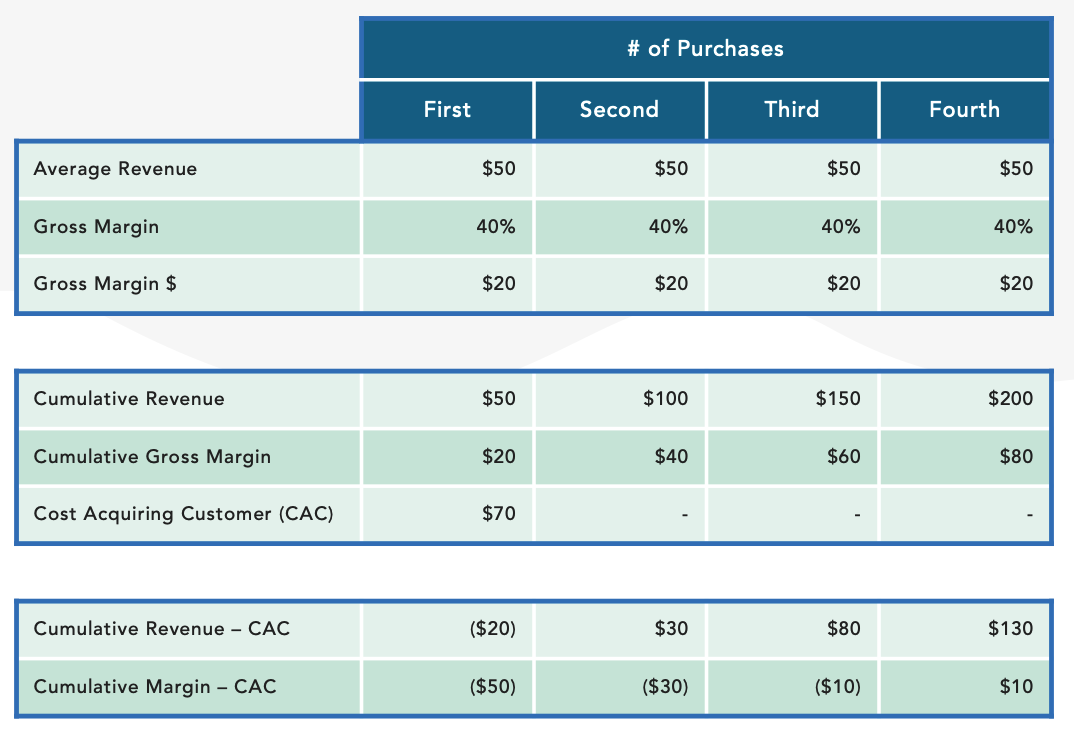

The average lifetime revenue after CAC is $380, and the margin is $110. It’s important to note that this business does not break-even on acquisition until the fourth purchase. This is what makes customer segmentation and customer nurture programs so important. That is not to say that every business will break-even only on the fourth purchase, but most businesses do NOT break-even on the first purchase, and it’s important to understand when they do so that you can maximize your business’ productivity.

An example of the cumulative revenue and margin for the first four purchases is below:

Customer Lifetime Value and Additional Services Essay

Additional services, customer lifetime value.

High-end stores such as Bloomingdales or Taylor & Lord often aim at turning the process of purchasing a piece of clothing into an exciting and delightful experience for their customers. To ensure client satisfaction, such stores add luxury services that go beyond selling traditional items. These may include:

- Personal styling;

- Same-day deliveries;

- Gift consultation and wrapping;

- Style trial — home delivery of a number of clothing pieces that a customer has chosen him- or herself or that were handpicked by an in-house stylist;

- Serving drinks such as champagne.

Personal styling may be one of the most common services offered at stores. Recently, it even left the realm of elite clothes and tapped into the mass market. Such popularity is easily explainable: customers find joy and pleasure in receiving special treatment and feeling that they matter. When a customer enters a store, he or she might have two issues: first, they are unsure as to what they would like to buy, and second, they are not familiar with what the store has to offer. A personal stylist considers a customer’s requests and makes up outfits out of the items available in stock.