- Search Search Please fill out this field.

What Is a Cash Flow Statement (CFS)?

- Using the Cash Flow Statement

How Cash Flow Is Calculated

- Limitations

- Income Statement & Balance Sheet

The Bottom Line

- Corporate Finance

- Financial statements: Balance, income, cash flow, and equity

Cash Flow Statement: What It Is and Examples

:max_bytes(150000):strip_icc():format(webp)/me_jpeg__chris_murphy-5bfc262746e0fb0051bcea2f.jpg)

Thomas J Catalano is a CFP and Registered Investment Adviser with the state of South Carolina, where he launched his own financial advisory firm in 2018. Thomas' experience gives him expertise in a variety of areas including investments, retirement, insurance, and financial planning.

:max_bytes(150000):strip_icc():format(webp)/P2-ThomasCatalano-d5607267f385443798ae950ece178afd.jpg)

A cash flow statement tracks the inflow and outflow of cash, providing insights into a company's financial health and operational efficiency.

The CFS measures how well a company manages its cash position, meaning how well the company generates cash to pay its debt obligations and fund its operating expenses. As one of the three main financial statements, the CFS complements the balance sheet and the income statement. In this article, we’ll show you how the CFS is structured and how you can use it when analyzing a company.

Key Takeaways

- A cash flow statement summarizes the amount of cash and cash equivalents entering and leaving a company.

- The CFS highlights a company's cash management, including how well it generates cash.

- This financial statement complements the balance sheet and the income statement.

- The main components of the CFS are cash from three areas: Operating activities, investing activities, and financing activities.

- The two methods of calculating cash flow are the direct method and the indirect method.

How the Cash Flow Statement Is Used

The cash flow statement paints a picture as to how a company’s operations are running, where its money comes from, and how money is being spent. Also known as the statement of cash flows, the CFS helps its creditors determine how much cash is available (referred to as liquidity ) for the company to fund its operating expenses and pay down its debts. The CFS is equally important to investors because it tells them whether a company is on solid financial ground. As such, they can use the statement to make better, more informed decisions about their investments.

Structure of the Cash Flow Statement

The main components of the cash flow statement are:

- Cash flow from operating activities

- Cash flow from investing activities

- Cash flow from financing activities

- Disclosure of non-cash activities, which is sometimes included when prepared under generally accepted accounting principles (GAAP) .

Cash From Operating Activities

The operating activities on the CFS include any sources and uses of cash from business activities. In other words, it reflects how much cash is generated from a company’s products or services.

These operating activities might include:

- Receipts from sales of goods and services

- Interest payments

- Income tax payments

- Payments made to suppliers of goods and services used in production

- Salary and wage payments to employees

- Rent payments

- Any other type of operating expenses

In the case of a trading portfolio or an investment company, receipts from the sale of loans, debt, or equity instruments are also included because it is a business activity.

Changes made in cash, accounts receivable, depreciation, inventory, and accounts payable are generally reflected in cash from operations.

Cash From Investing Activities

Investing activities include any sources and uses of cash from a company’s investments. Purchases or sales of assets, loans made to vendors or received from customers, or any payments related to mergers and acquisitions (M&A) are included in this category. In short, changes in equipment, assets, or investments relate to cash from investing.

Changes in cash from investing are usually considered cash-out items because cash is used to buy new equipment, buildings, or short-term assets such as marketable securities. But when a company divests an asset, the transaction is considered cash-in for calculating cash from investing.

Cash From Financing Activities

Cash from financing activities includes the sources of cash from investors and banks, as well as the way cash is paid to shareholders. This includes any dividends, payments for stock repurchases , and repayment of debt principal (loans) that are made by the company.

Changes in cash from financing are cash-in when capital is raised and cash-out when dividends are paid. Thus, if a company issues a bond to the public, the company receives cash financing. However, when interest is paid to bondholders , the company is reducing its cash. And remember, although interest is a cash-out expense, it is reported as an operating activity—not a financing activity.

There are two methods of calculating cash flow: the direct method and the indirect method.

Direct Cash Flow Method

The direct method adds up all of the cash payments and receipts, including cash paid to suppliers, cash receipts from customers, and cash paid out in salaries. This method of CFS is easier for very small businesses that use the cash basis accounting method.

These figures can also be calculated by using the beginning and ending balances of a variety of asset and liability accounts and examining the net decrease or increase in the accounts. It is presented in a straightforward manner.

Most companies use the accrual basis accounting method. In these cases, revenue is recognized when it is earned rather than when it is received. This causes a disconnect between net income and actual cash flow because not all transactions in net income on the income statement involve actual cash items. Therefore, certain items must be reevaluated when calculating cash flow from operations.

Indirect Cash Flow Method

With the indirect method , cash flow is calculated by adjusting net income by adding or subtracting differences resulting from non-cash transactions. Non-cash items show up in the changes to a company’s assets and liabilities on the balance sheet from one period to the next. Therefore, the accountant will identify any increases and decreases to asset and liability accounts that need to be added back to or removed from the net income figure, in order to identify an accurate cash inflow or outflow.

Changes in accounts receivable (AR) on the balance sheet from one accounting period to the next must be reflected in cash flow:

- If AR decreases, more cash may have entered the company from customers paying off their credit accounts—the amount by which AR has decreased is then added to net earnings.

- An increase in AR must be deducted from net earnings because, although the amounts represented in AR are in revenue, they are not cash.

What about changes in a company's inventory ? Here's how they are accounted for on the CFS:

- An increase in inventory signals that a company spent more money on raw materials. Using cash means the increase in the inventory's value is deducted from net earnings.

- A decrease in inventory would be added to net earnings. Credit purchases are reflected by an increase in accounts payable on the balance sheet, and the amount of the increase from one year to the next is added to net earnings.

The same logic holds true for taxes payable, salaries, and prepaid insurance . If something has been paid off, then the difference in the value owed from one year to the next has to be subtracted from net income. If there is an amount that is still owed, then any differences will have to be added to net earnings.

Limitations of the Cash Flow Statement

Negative cash flow should not automatically raise a red flag without further analysis. Poor cash flow is sometimes the result of a company’s decision to expand its business at a certain point in time, which would be a good thing for the future.

Analyzing changes in cash flow from one period to the next gives the investor a better idea of how the company is performing, and whether a company may be on the brink of bankruptcy or success. The CFS should also be considered in unison with the other two financial statements (see below).

The indirect cash flow method allows for a reconciliation between two other financial statements: the income statement and balance sheet.

Cash Flow Statement vs. Income Statement vs. Balance Sheet

The cash flow statement measures the performance of a company over a period of time. But it is not as easily manipulated by the timing of non-cash transactions. As noted above, the CFS can be derived from the income statement and the balance sheet . Net earnings from the income statement are the figure from which the information on the CFS is deduced. But they only factor into determining the operating activities section of the CFS. As such, net earnings have nothing to do with the investing or financial activities sections of the CFS.

The income statement includes depreciation expense, which doesn't actually have an associated cash outflow. It is simply an allocation of the cost of an asset over its useful life. A company has some leeway to choose its depreciation method , which modifies the depreciation expense reported on the income statement. The CFS, on the other hand, is a measure of true inflows and outflows that cannot be as easily manipulated.

As for the balance sheet, the net cash flow reported on the CFS should equal the net change in the various line items reported on the balance sheet. This excludes cash and cash equivalents and non-cash accounts, such as accumulated depreciation and accumulated amortization. For example, if you calculate cash flow for 2019, make sure you use 2018 and 2019 balance sheets.

The CFS is distinct from the income statement and the balance sheet because it does not include the amount of future incoming and outgoing cash that has been recorded as revenues and expenses . Therefore, cash is not the same as net income , which includes cash sales as well as sales made on credit on the income statements.

Example of a Cash Flow Statement

Below is an example of a cash flow statement:

Investopedia / Sabrina Jiang

From this CFS, we can see that the net cash flow for the 2017 fiscal year was $1,522,000. The bulk of the positive cash flow stems from cash earned from operations, which is a good sign for investors. It means that core operations are generating business and that there is enough money to buy new inventory.

The purchasing of new equipment shows that the company has the cash to invest in itself. Finally, the amount of cash available to the company should ease investors’ minds regarding the notes payable, as cash is plentiful to cover that future loan expense.

What Is the Difference Between Direct and Indirect Cash Flow Statements?

The difference lies in how the cash inflows and outflows are determined.

Using the direct method , actual cash inflows and outflows are known amounts. The cash flow statement is reported in a straightforward manner, using cash payments and receipts.

Using the indirect method , actual cash inflows and outflows do not have to be known. The indirect method begins with net income or loss from the income statement, then modifies the figure using balance sheet account increases and decreases, to compute implicit cash inflows and outflows.

Is the Indirect Method of the Cash Flow Statement Better Than the Direct Method?

Neither is necessarily better or worse. However, the indirect method also provides a means of reconciling items on the balance sheet to the net income on the income statement. As an accountant prepares the CFS using the indirect method, they can identify increases and decreases in the balance sheet that are the result of non-cash transactions.

It is useful to see the impact and relationship that accounts on the balance sheet have to the net income on the income statement, and it can provide a better understanding of the financial statements as a whole.

What Is Included in Cash and Cash Equivalents?

Cash and cash equivalents are consolidated into a single line item on a company's balance sheet. It reports the value of a business’s assets that are currently cash or can be converted into cash within a short period of time, commonly 90 days. Cash and cash equivalents include currency, petty cash, bank accounts, and other highly liquid, short-term investments. Examples of cash equivalents include commercial paper, Treasury bills, and short-term government bonds with a maturity of three months or less.

A cash flow statement is a valuable measure of strength, profitability, and the long-term future outlook of a company. The CFS can help determine whether a company has enough liquidity or cash to pay its expenses. A company can use a CFS to predict future cash flow, which helps with budgeting matters.

For investors, the CFS reflects a company’s financial health , since typically the more cash that’s available for business operations, the better. However, this is not a rigid rule. Sometimes, a negative cash flow results from a company’s growth strategy in the form of expanding its operations.

By studying the CFS, an investor can get a clear picture of how much cash a company generates and gain a solid understanding of the financial well-being of a company.

Financial Accounting Standards Board. " Summary of Statement No. 95 ."

- Accounting Explained With Brief History and Modern Job Requirements 1 of 51

- What Is the Accounting Equation, and How Do You Calculate It? 2 of 51

- What Is an Asset? Definition, Types, and Examples 3 of 51

- Liability: Definition, Types, Example, and Assets vs. Liabilities 4 of 51

- Equity Meaning: How It Works and How to Calculate It 5 of 51

- Revenue Definition, Formula, Calculation, and Examples 6 of 51

- Expense: Definition, Types, and How Expenses Are Recorded 7 of 51

- Current Assets vs. Noncurrent Assets: What's the Difference? 8 of 51

- What Is Accounting Theory in Financial Reporting? 9 of 51

- Accounting Principles Explained: How They Work, GAAP, IFRS 10 of 51

- Accounting Standard Definition: How It Works 11 of 51

- Accounting Convention: Definition, Methods, and Applications 12 of 51

- What Are Accounting Policies and How Are They Used? With Examples 13 of 51

- How Are Principles-Based and Rules-Based Accounting Different? 14 of 51

- What Are Accounting Methods? Definition, Types, and Example 15 of 51

- What Is Accrual Accounting, and How Does It Work? 16 of 51

- Cash Accounting Definition, Example & Limitations 17 of 51

- Accrual Accounting vs. Cash Basis Accounting: What's the Difference? 18 of 51

- Financial Accounting Standards Board (FASB): Definition and How It Works 19 of 51

- Generally Accepted Accounting Principles (GAAP): Definition, Standards and Rules 20 of 51

- What Are International Financial Reporting Standards (IFRS)? 21 of 51

- IFRS vs. GAAP: What's the Difference? 22 of 51

- How Does US Accounting Differ From International Accounting? 23 of 51

- Cash Flow Statement: What It Is and Examples 24 of 51

- Breaking Down The Balance Sheet 25 of 51

- Income Statement: How to Read and Use It 26 of 51

- What Does an Accountant Do? 27 of 51

- Financial Accounting Meaning, Principles, and Why It Matters 28 of 51

- How Does Financial Accounting Help Decision-Making? 29 of 51

- Corporate Finance Definition and Activities 30 of 51

- How Financial Accounting Differs From Managerial Accounting 31 of 51

- Cost Accounting: Definition and Types With Examples 32 of 51

- Certified Public Accountant: What the CPA Credential Means 33 of 51

- What Is a Chartered Accountant (CA) and What Do They Do? 34 of 51

- Accountant vs. Financial Planner: What's the Difference? 35 of 51

- Auditor: What It Is, 4 Types, and Qualifications 36 of 51

- Audit: What It Means in Finance and Accounting, and 3 Main Types 37 of 51

- Tax Accounting: Definition, Types, vs. Financial Accounting 38 of 51

- Forensic Accounting: What It Is, How It's Used 39 of 51

- Chart of Accounts (COA) Definition, How It Works, and Example 40 of 51

- What Is a Journal in Accounting, Investing, and Trading? 41 of 51

- Double Entry: What It Means in Accounting and How It's Used 42 of 51

- Debit: Definition and Relationship to Credit 43 of 51

- Credit: What It Is and How It Works 44 of 51

- Closing Entry 45 of 51

- What Is an Invoice? It's Parts and Why They Are Important 46 of 51

- 6 Components of an Accounting Information System (AIS) 47 of 51

- Inventory Accounting: Definition, How It Works, Advantages 48 of 51

- Last In, First Out (LIFO): The Inventory Cost Method Explained 49 of 51

- The FIFO Method: First In, First Out 50 of 51

- Average Cost Method: Definition and Formula with Example 51 of 51

:max_bytes(150000):strip_icc():format(webp)/GettyImages-859123402-e1335579fa0846c1bc82694c9e8c6cfa.jpg)

- Terms of Service

- Editorial Policy

- Privacy Policy

- Your Privacy Choices

Cash Flow Statement: Explanation and Example

Bryce Warnes

Reviewed by

Janet Berry-Johnson, CPA

February 28, 2024

This article is Tax Professional approved

A cash flow statement tells you how much cash is entering and leaving your business in a given period. Along with balance sheets and income statements, it’s one of the three most important financial statements for managing your small business accounting and making sure you have enough cash to keep operating.

I am the text that will be copied.

Cash flow statements are also required by certain financial reporting standards.

What makes a cash flow statement different from your balance sheet is that a balance sheet shows the assets and liabilities your business owns (assets) and owes (liabilities). The cash flow statement simply shows the inflows and outflows of cash from your business over a specific period of time, usually a month.

Let's take a closer look at what cash flow statements do for your business, and why they're so important. Then, we'll walk through an example cash flow statement, and show you how to create your own using a template.

First, let’s take a closer look at what cash flow statements do for your business, and why they’re so important. Then, we’ll walk through an example cash flow statement, and show you how to create your own using a template.

What is the purpose of a cash flow statement?

A cash flow statement is a regular financial statement telling you how much cash you have on hand for a specific period.

While income statements are excellent for showing you how much money you’ve spent and earned, they don’t necessarily tell you how much cash you have on hand for a specific period of time.

Cash flow statement vs. balance sheet

A balance sheet shows you your business’s assets, liabilities, and owner’s equity at a specific moment in time—typically at the end of a quarter or a year.

What it doesn’t show is revenue or expenses, or any of the business’s other cash activities that impact your company’s day-to-day health. Those activities are recorded on your cash flow statement.

Cash flow statement vs. income statement

Using only an income statement to track your cash flow can lead to serious problems—and here’s why.

If you use accrual basis accounting, income and expenses are recorded when they are earned or incurred—not when the money actually leaves or enters your bank accounts. (The cash accounting method only records money once you have it on hand. Learn more about the cash vs. accrual basis systems of accounting.)

So, even if you see income reported on your income statement, you may not have the cash from that income on hand. The cash flow statement makes adjustments to the information recorded on your income statement, so you see your net cash flow—the precise amount of cash you have on hand for that time period.

For example, depreciation is recorded as a monthly expense. However, you've already paid cash for the asset you're depreciating; you record it on a monthly basis in order to see how much it costs you to have the asset each month over the course of its useful life. But cash isn't literally leaving your bank account every month.

The cash flow statement takes that monthly expense and reverses it—so you see how much cash you have on hand in reality, not how much you've spent in theory.

Why do you need cash flow statements?

So long as you use accrual accounting, cash flow statements are an essential part of financial analysis for three reasons:

- They show your liquidity . That means you know exactly how much operating cash flow you have in case you need to use it. So you know what you can afford, and what you can’t.

- They show you changes in assets, liabilities, and equity in the forms of cash outflows, cash inflows, and cash being held. Those three categories are the core of your business accounting. Together, they form the accounting equation that lets you measure your performance.

- They let you predict future cash flows . You can use cash flow statements to create cash flow projections , so you can plan for how much liquidity your business will have in the future. That’s important for making long-term business plans.

On top of that, if you plan on securing a loan or line of credit, you’ll need up-to-date cash flow statements to apply.

Negative cash flow vs. positive cash flow

When your cash flow statement shows a negative number at the bottom, that means you lost cash during the accounting period—you have negative cash flow. It’s important to remember that long-term, negative cash flow isn’t always a bad thing. For example, early stage businesses need to track their burn rate as they try to become profitable.

When you have a positive number at the bottom of your statement, you’ve got positive cash flow for the month. Keep in mind, positive cash flow isn’t always a good thing in the long term. While it gives you more liquidity now, there are negative reasons you may have that money—for instance, by taking on a large loan to bail out your failing business. Positive cash flow isn’t always positive overall.

Where do cash flow statements come from?

If you do your own bookkeeping in Excel , you can calculate cash flow statements each month based on the information on your income statements and balance sheets. If you use accounting software , it can create cash flow statements based on the information you’ve already entered in the general ledger .

Keep in mind, with both those methods, your cash flow statement is only accurate so long as the rest of your bookkeeping is accurate too. The most surefire way to know how much working capital you have is to hire a bookkeeper . They’ll make sure everything adds up, so your cash flow statement always gives you an accurate picture of your company’s financial health.

Statements of cash flow using the direct and indirect methods

In order to figure out your company’s cash flow, you can take one of two routes: The direct method, and the indirect method. While generally accepted accounting principles (US GAAP) approve both, the indirect method is typically preferred by small businesses.

The direct method of calculating cash flow

Using the direct method, you keep a record of cash as it enters and leaves your business, then use that information at the end of the month to prepare a statement of cash flow.

The direct method takes more legwork and organization than the indirect method—you need to produce and track cash receipts for every cash transaction. For that reason, smaller businesses typically prefer the indirect method.

Also worth mentioning: Even if you record cash flows in real time with the direct method, you’ll also need to use the indirect method to reconcile your statement of cash flows with your income statement. So, you can usually expect the direct method to take longer than the indirect method.

The indirect method of calculating cash flow

With the indirect method, you look at the transactions recorded on your income statement, then reverse some of them in order to see your working capital. You’re selectively backtracking your income statement in order to eliminate transactions that don’t show the movement of cash.

Since it’s simpler than the direct method, many small businesses prefer this approach. Also, when using the indirect method, you do not have to go back and reconcile your statements with the direct method.

In our examples below, we’ll use the indirect method of calculating cash flow.

How the cash flow statement works with the income statement and the balance sheet

You use information from your income statement and your balance sheet to create your cash flow statement. The income statement lets you know how money entered and left your business, while the balance sheet shows how those transactions affect different accounts—like accounts receivable , inventory, and accounts payable .

So, the process of producing financial statements for your business goes:

Income Statement + Balance Sheet = Cash Flow Statement

Example of a cash flow statement

Now that we’ve got a sense of what a statement of cash flows does and, broadly, how it’s created, let’s check out an example.

There’s a fair amount to unpack here. But here’s what you need to know to get a rough idea of what this cash flow statement is doing.

- Red dollar amounts decrease cash. For instance, when we see ($30,000) next to “Increase in inventory,” it means inventory increased by $30,000 on the balance sheet. We bought $30,000 worth of inventory, so our cash balance decreased by that amount.

- Black dollar amounts increase cash. For example, when we see $20,000 next to “Depreciation,” that $20,000 is an expense on the income statement, but depreciation doesn’t actually decrease cash. So we add it back to net income.

You’ll also notice that the statement of cash flows is broken down into three sections—Cash Flow from Operating Activities, Cash Flow from Investing Activities, and Cash Flow from Financing Activities. Let’s look at what each section of the cash flow statement does.

The three sections of a cash flow statement

These three activities sections of the statement of cash flows designate the different ways cash can enter and leave your business.

- Cash Flow from Operating Activities is cash earned or spent in the course of regular business activity—the main way your business makes money, by selling products or services.

- Cash Flow from Investing Activities is cash earned or spent from investments your company makes, such as purchasing equipment or investing in other companies.

- Cash Flow from Financing Activities is cash earned or spent in the course of financing your company with loans, lines of credit, or owner’s equity .

Using the cash flow statement example above, here’s a more detailed look at what each section does, and what it means for your business.

Cash Flow from Operating Activities

For most small businesses, Operating Activities will include most of your cash flow. That’s because operating activities are what you do to get revenue. If you run a pizza shop, it’s the cash you spend on ingredients and labor, and the cash you earn from selling pies. If you’re a registered massage therapist , Operating Activities is where you see your earned cash from giving massages, and the cash you spend on rent and utilities.

Cash Flow from Operating Activities in our example

Taking another look at this section, let’s break it down line by line.

Net income is the total income, after expenses, for the month. We get this from the income statement.

Depreciation is recorded as a $20,000 expense on the income statement. Here, it’s listed as income. Since no cash actually left our hands, we’re adding that $20,000 back to cash on hand.

Increase in Accounts Payable is recorded as a $10,000 expense on the income statement. That’s money we owe—in this case, let’s say it’s paying contractors to build a new goat pen. Since we owe the money, but haven’t actually paid it, we add that amount back to the cash on hand.

Increase in Accounts Receivable is recorded as a $20,000 growth in accounts receivable on the income statement. That’s money we’ve charged clients—but we haven’t actually been paid yet. Even though the money we’ve charged is an asset, it isn’t cold hard cash. So we deduct that $20,000 from cash on hand.

Increase in Inventory is recorded as a $30,000 growth in inventory on the balance sheet. That means we’ve paid $30,000 cash to get $30,000 worth of inventory. Inventory is an asset, but it isn’t cash—we can’t spend it. So we deduct the $30,000 from cash on hand.

Net Cash from Operating Activities , after we’ve made all the changes above, comes out to $40,000.

Meaning, even though our business earned $60,000 in October (as reported on our income statement), we only actually received $40,000 in cash from operating activities.

Cash Flow from Investing Activities

This section covers investments your company has made—by purchasing equipment, real estate, land, or easily liquidated financial products referred to as “cash equivalents.” When you spend cash on an investment, that cash gets converted to an asset of equal value.

If you buy a $10,000 mower for your landscaping company, you lose $10,000 cash and get a $10,000 mower. If you buy a $140,000 retail space, you lose $140,000 cash and get a $140,000 retail space.

Under Cash Flow from Investing Activities, we reverse those investments, removing the cash on hand. They have cash value, but they aren’t the same as cash—and the only asset we’re interested in, in this context, is currency.

For small businesses, Cash Flow from Investing Activities usually won’t make up the majority of cash flow for your company. But it still needs to be reconciled, since it affects your working capital.

Cash Flow from Investing Activities in our example

Purchase of Equipment is recorded as a new $5,000 asset on our income statement. It’s an asset, not cash—so, with ($5,000) on the cash flow statement, we deduct $5,000 from cash on hand.

Cash Flow from Financing Activities

This section covers revenue earned or assets spent on Financing Activities. When you pay off part of your loan or line of credit, money leaves your bank accounts. When you tap your line of credit, get a loan, or bring on a new investor, you receive cash in your accounts.

Cash Flow from Financing Activities in our example

Notes payable is recorded as a $7,500 liability on the balance sheet. Since we received proceeds from the loan, we record it as a $7,500 increase to cash on hand.

Cash flow for the month

At the bottom of our cash flow statement, we see our total cash flow for the month: $42,500.

Even though our net income listed at the top of the cash flow statement (and taken from our income statement) was $60,000, we only received $42,500.

That’s $42,500 we can spend right now, if need be. If we only looked at our net income, we might believe we had $60,000 cash on hand. In that case, we wouldn’t truly know what we had to work with—and we’d run the risk of overspending, budgeting incorrectly, or misrepresenting our liquidity to loan officers or business partners.

Using a cash flow statement template

Do your own bookkeeping using spreadsheets? In that case, using a cash flow statement template will save you time and energy.

Our Free Cash Flow Statement Template is easy to download and simple to use.

How to track cash flow using the indirect method

Four simple rules to remember as you create your cash flow statement:

- Transactions that show an increase in assets result in a decrease in cash flow.

- Transactions that show a decrease in assets result in an increase in cash flow.

- Transactions that show an increase in liabilities result in an increase in cash flow.

- Transactions that show a decrease in liabilities result in a decrease in cash flow.

If you’ve already gone through the example statement above and you feel like you have a pretty good grasp of how to create a cash flow statement, go ahead and start experimenting with our Free Income Statement Template and Free Cash Flow Template.

But if you’d like to get a clearer idea of how it all works, this quick example should help.

Creating a cash flow statement from your income statement and balance sheet

Let’s say we’re creating a cash flow statement for Greg’s Popsicle Stand for July 2019.

Our income statement looks like this:

Note: For the sake of simplicity, this example omits income tax.

And our balance sheet looks like this:

Remember the four rules for converting information from an income statement to a cash flow statement? Let’s use them to create our cash flow statement.

Our net income for the month on the income statement is $3,500 — that stays the same, since it’s a total amount, not a specific account.

Additions to Cash

- Depreciation is included in expenses for the month, but it didn’t actually impact cash, so we add that back to cash.

- Accounts payable increased by $5,500. That’s a liability on the balance sheet, but the cash wasn’t actually paid out for those expenses, so we add them back to cash as well.

Decreases to Cash

- Accounts receivable increased by $4,000. That’s an asset recorded on the balance sheet, but we didn’t actually receive the cash, so we remove it from cash on hand.

Our net cash flow from operating activities adds up to $5,500.

Greg purchased $5,000 of equipment during this accounting period, so he spent $5,000 of cash on investing activities.

Greg didn’t invest any additional money in the business, take out a new loan, or make cash payments towards any existing debt during this accounting period, so there are no cash flows from financing activities.

Cash Flow for Month Ending July 31, 2019 is $500, once we crunch all the numbers. Greg started the accounting period with $5,500 in cash. After accounting for all of the additions and subtractions to cash, he has $6,000 at the end of the period.

Cash flow statements are powerful financial reports, so long as they’re used in tandem with income statements and balance sheets. See how all three financial statements work together.

Related Posts

Best Free Accounting Software for Small Businesses

Accounting software can be your secret weapon when it comes to managing your small business finances. But you don't have to spend big for features you won't use.

Accounting for Medical Practices: Tips and Best Practices

Accounting for a medical practice has some unique challenges. Follow these best practices to keep your practice in the black.

Cash Basis Accounting vs. Accrual Accounting

The main difference between cash basis and accrual accounting is the timing of when revenue and expenses are recognized. Which method is best for your business?

Join over 140,000 fellow entrepreneurs who receive expert advice for their small business finances

Get a regular dose of educational guides and resources curated from the experts at Bench to help you confidently make the right decisions to grow your business. No spam. Unsubscribe at any time.

Cash Flow Statement (CFS)

Written by True Tamplin, BSc, CEPF®

Reviewed by subject matter experts.

Updated on March 27, 2023

Get Any Financial Question Answered

Table of contents, what is a cash flow statement (cfs).

A cash flow statement (CFS) is a financial statement that captures how much cash is generated and utilized by a company or business in a specific time period.

By looking at the cash flow statement, one can see whether the company has sufficient cash flowing in to pay its debts, fund its operations, and return money to shareholders via dividends or stock buybacks.

CFS bridges the income statement and balance sheet because it shows how money moves in and out of the business via three main channels: operating, investing, and financing activities.

It produces what is called the net cash flow by breaking down where the changes in the beginning and ending balances came from.

The cash flow statement is focused on the cash accounting method, which means that business transactions reflect in the financial statement when the cash flows into or out of the business or when actual payments are received or distributed.

Structure of the Cash Flow Statement

The Cash Flow Statement has three main sections: cash flows from operating activities, investing activities, and financing activities.

Together, these different sections can help investors and analysts determine the value of a company as a whole. Let us learn more about them below.

Cash Flow From Operating Activities (CFO)

This section covers cash transactions from all of a business’ operational activities, such as receipts from sales of goods and services, wage payments to employees, payments to suppliers, interest payments, and tax payments.

For an investment company or a trading portfolio, equity instruments or receipts for the sale of debt and loans are also included because it is counted as a business activity.

It can be considered as a cash version of the net income of a company since it starts with the net income or loss, then adds or subtracts from that amount to produce a net cash flow figure.

Items that are added or subtracted include accounts receivables, accounts payables, amortization, depreciation, and prepaid items recorded as revenue or expenses in the income statement because they are non-cash.

Cash Flow From Investing Activities (CFI)

This section is the result of investment gains and losses. It includes cash spent on property, plant, and equipment. Analysts look in this section to see if there are any changes in capital expenditures (CapEx) .

Companies could generate cash flow from investing by selling equipment, property, or assets . Loans given to vendors or received from customers, as well as any payments associated with mergers and acquisitions (M&A) , are also included in this section.

Cash-out items are those changes caused by the purchase of new equipment, buildings, or marketable securities. Cash-in items are when a company divests an asset.

Cash Flow From Financing Activities (CFF)

This section records the cash flow between the company, its shareholders, investors, and creditors. It provides an overview of cash utilized in business financing.

Transactions in CFF typically involve debt, equity , dividends , and stock repurchases.

Cash-out transactions in CFF happen when dividends are paid, while cash-in transactions occur when the capital is raised.

Thus, when a company issues a bond to the public, the company receives cash financing. In contrast, when interest is given to bondholders, the company decreases its cash.

How Cash Flow Is Calculated

There are two accepted methods in calculating cash flow: direct and indirect.

Direct Cash Flow Method

This method measures only the cash received, typically from customers, and the cash payments made, such as to suppliers. These inflows and outflows are then calculated to arrive at the net cash flow.

This method of calculating cash flow takes more time since you need to track payments and receipts for every cash transaction.

Figures used in this method are presented in a straightforward manner. They can be calculated using the beginning and ending balances of various asset and liability accounts and assessing their net decrease or increase.

Indirect Cash Flow Method

Using this method, cash flow is calculated through modifying the net income by adding or subtracting differences that result from non-cash transactions. This is done in order to come up with an accurate cash inflow or outflow.

Instead of presenting transactional data like the direct method, the calculation begins with the net income figure found in the income statement of the company and makes adjustments to undo the impact of accruals that were made during the accounting period.

The major differences between the two methods are outlined in the table below:

Examples of a Cash Flow Statement

To present a clearer picture of the two methods, there are some examples presented below.

Calculated Using the Direct Cash Flow Method

An example of the cash flow statement using the direct method for a hypothetical company is shown here:

In the above example, the business has net cash of $50,049 from its operating activities and $11,821 from its investing activities. It has a net outflow of cash, which amounts to $7,648 from its financing activities.

As a result, the business has a total of $126,475 in net cash flow at the end of the year.

Calculated Using the Indirect Cash Flow Method

This is another example of a cash flow statement of Nike, Inc. using the indirect method for the fiscal year ending May 31, 2021.

This cash flow statement shows that Nike started the year with approximately $8.3 million in cash and equivalents.

The business brought in $6.65 million through its operating activities. Meanwhile, it spent approximately $3.8 million in investment activities, and a further $1.45 million in financing activities.

The changes in the value of cash balance due to fluctuations in foreign currency exchange rates amount to $143 million.

Consequently, the business ended the year with a positive cash flow of $1.5 million and total cash of $9.88 million.

Importance of a Cash Flow Statement

The CFS is one of the most important financial statements for a business. Cash is the lifeblood of any organization, and a company needs to have a good handle on its cash inflows and outflows in order to stay afloat.

There are several reasons why the cash flow statement is so important:

Provides an Overview of Spending

The cash flow statement presents a good overview of the company’s spending because it captures all the cash that comes in and goes out.

This information is helpful so that management can make decisions on where to cut costs. It also helps investors and creditors assess the financial health of the company.

Maintains an Optimum Cash Balance

Another important function of the cash flow statement is that it helps a business maintain an optimum cash balance.

Management can use the information in the statement to decide when to invest or pay off debts because it shows how much cash is available at any given time.

Focuses on Generating Cash

The cash flow statement also encourages management to focus on generating cash.

This is because when a company knows where its cash is going, it can take steps to make sure that more cash is coming in than going out.

Useful as a Basis for Short-Term Planning

A cash flow statement is an important measurement because it provides information that can be used to make short-term plans.

For instance, if a company realizes that it will have a cash shortfall in the next month, it can take steps to ensure enough funds are available.

Limitations of the Cash Flow Statement

The Cash Flow Statement has a few limitations:

Inability to Compare Similar Industries

The cash flow statement is useful when analyzing changes in cash flow from one period to the next as it gives investors an idea of how the company is performing.

However, it does not measure the efficiency of the business in comparison to a similar industry. This is because terms of sales and purchases may differ from company to company.

Other companies may also have a higher capital investment which means they have more cash outflow rather than cash inflow.

Does not Replace the Income Statement

The cash flow statement does not replace the income statement as it only focuses on changes in cash. In contrast, the income statement is important as it provides information about the profitability of a company.

Lack of Focus on Profitability

The cash flow statement will not present the net income of a company for the accounting period as it does not include non-cash items which are considered by the income statement.

Therefore, it does not evaluate the profitability of a company as it does not consider all costs or revenues.

Cash Flow Statement vs Income Statement vs Balance Sheet

Three financial statements provide insights into the financial performance of a company and potential issues that may need to be addressed: the income statement, balance sheet , and cash flow statement.

These three documents offer unique information that serves as the foundation of corporate accounting.

Below is a comparison between cash flow statement, income statement, and balance sheet:

Final Thoughts

The cash flow statement is an essential financial statement for any business as it provides critical information regarding cash inflows and outflows of the company.

It helps businesses to make crucial decisions about spending, investments , and credit.

Cash flow statements display the beginning and ending cash balances over a specific time period and points out where the changes came from (i.e operating activities, investing activities, and financing activities).

This information allows businesses to forecast future cash needs, make informed investment decisions, and track actual performance against budgeted targets.

However, the cash flow statement also has a few limitations, such as its inability to compare similar industries and its lack of focus on profitability.

Therefore, it should always be used in unison with the income statement and balance sheet to get a complete financial overview of the company.

Cash Flow Statement (CFS) FAQs

What are the implications of positive and negative cash flows.

Positive cash flow reveals that more cash is coming into the company than going out. This is a good sign as it tells that the company is able to pay off its debts and obligations. Negative cash flow typically shows that more cash is leaving the company than coming in, which can be a reason for concern as the company may not be able to meet its financial obligations in the future. However, this could also mean that a company is investing or expanding which requires it to spend some of its funds.

What is the difference between direct and indirect cash flow statements?

Direct cash flow statements show the actual cash inflows and outflows from each operating, investing, and financing activity. While the indirect cash flow method makes adjustments on net income to account for accrual transactions.

What is the importance of cash flow statements?

Cash flow statements are important as they provide critical information about the cash inflows and outflows of the company. This information is important in making crucial decisions about spending, investments, and credit.

What are the main components of a cash flow statement?

The main components of a cash flow statement are cash flows from operating activities, investing activities, and financing activities.

How are cash flow and free cash flow different?

Cash flow is the total amount of cash that is flowing in and out of the company. Free cash flow is the available cash after subtracting capital expenditures.

About the Author

True Tamplin, BSc, CEPF®

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide , a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University , where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon , Nasdaq and Forbes .

Related Topics

- Cash Flow Analysis

- Cash Flow Management

- Cash Flow Planning

Ask a Financial Professional Any Question

Find wealth management firms near you, find advisor near you, our recommended advisors.

Taylor Kovar, CFP®

WHY WE RECOMMEND:

Fee-Only Financial Advisor Show explanation

Certified financial planner™, 3x investopedia top 100 advisor, author of the 5 money personalities & keynote speaker.

IDEAL CLIENTS:

Business Owners, Executives & Medical Professionals

Strategic Planning, Alternative Investments, Stock Options & Wealth Preservation

Claudia Valladares

Bilingual in english / spanish, founder of wisedollarmom.com, quoted in gobanking rates, yahoo finance & forbes.

Retirees, Immigrants & Sudden Wealth / Inheritance

Retirement Planning, Personal finance, Goals-based Planning & Community Impact

We use cookies to ensure that we give you the best experience on our website. If you continue to use this site we will assume that you are happy with it.

Fact Checked

At Finance Strategists, we partner with financial experts to ensure the accuracy of our financial content.

Our team of reviewers are established professionals with decades of experience in areas of personal finance and hold many advanced degrees and certifications.

They regularly contribute to top tier financial publications, such as The Wall Street Journal, U.S. News & World Report, Reuters, Morning Star, Yahoo Finance, Bloomberg, Marketwatch, Investopedia, TheStreet.com, Motley Fool, CNBC, and many others.

This team of experts helps Finance Strategists maintain the highest level of accuracy and professionalism possible.

Why You Can Trust Finance Strategists

Finance Strategists is a leading financial education organization that connects people with financial professionals, priding itself on providing accurate and reliable financial information to millions of readers each year.

We follow strict ethical journalism practices, which includes presenting unbiased information and citing reliable, attributed resources.

Our goal is to deliver the most understandable and comprehensive explanations of financial topics using simple writing complemented by helpful graphics and animation videos.

Our writing and editorial staff are a team of experts holding advanced financial designations and have written for most major financial media publications. Our work has been directly cited by organizations including Entrepreneur, Business Insider, Investopedia, Forbes, CNBC, and many others.

Our mission is to empower readers with the most factual and reliable financial information possible to help them make informed decisions for their individual needs.

How It Works

Step 1 of 3, ask any financial question.

Ask a question about your financial situation providing as much detail as possible. Your information is kept secure and not shared unless you specify.

Step 2 of 3

Our team will connect you with a vetted, trusted professional.

Someone on our team will connect you with a financial professional in our network holding the correct designation and expertise.

Step 3 of 3

Get your questions answered and book a free call if necessary.

A financial professional will offer guidance based on the information provided and offer a no-obligation call to better understand your situation.

Where Should We Send Your Answer?

Just a Few More Details

We need just a bit more info from you to direct your question to the right person.

Tell Us More About Yourself

Is there any other context you can provide.

Pro tip: Professionals are more likely to answer questions when background and context is given. The more details you provide, the faster and more thorough reply you'll receive.

What is your age?

Are you married, do you own your home.

- Owned outright

- Owned with a mortgage

Do you have any children under 18?

- Yes, 3 or more

What is the approximate value of your cash savings and other investments?

- $50k - $250k

- $250k - $1m

Pro tip: A portfolio often becomes more complicated when it has more investable assets. Please answer this question to help us connect you with the right professional.

Would you prefer to work with a financial professional remotely or in-person?

- I would prefer remote (video call, etc.)

- I would prefer in-person

- I don't mind, either are fine

What's your zip code?

- I'm not in the U.S.

Submit to get your question answered.

A financial professional will be in touch to help you shortly.

Part 1: Tell Us More About Yourself

Do you own a business, which activity is most important to you during retirement.

- Giving back / charity

- Spending time with family and friends

- Pursuing hobbies

Part 2: Your Current Nest Egg

Part 3: confidence going into retirement, how comfortable are you with investing.

- Very comfortable

- Somewhat comfortable

- Not comfortable at all

How confident are you in your long term financial plan?

- Very confident

- Somewhat confident

- Not confident / I don't have a plan

What is your risk tolerance?

How much are you saving for retirement each month.

- None currently

- Minimal: $50 - $200

- Steady Saver: $200 - $500

- Serious Planner: $500 - $1,000

- Aggressive Saver: $1,000+

How much will you need each month during retirement?

- Bare Necessities: $1,500 - $2,500

- Moderate Comfort: $2,500 - $3,500

- Comfortable Lifestyle: $3,500 - $5,500

- Affluent Living: $5,500 - $8,000

- Luxury Lifestyle: $8,000+

Part 4: Getting Your Retirement Ready

What is your current financial priority.

- Getting out of debt

- Growing my wealth

- Protecting my wealth

Do you already work with a financial advisor?

Which of these is most important for your financial advisor to have.

- Tax planning expertise

- Investment management expertise

- Estate planning expertise

- None of the above

Where should we send your answer?

Submit to get your retirement-readiness report., get in touch with, great the financial professional will get back to you soon., where should we send the downloadable file, great hit “submit” and an advisor will send you the guide shortly., create a free account and ask any financial question, learn at your own pace with our free courses.

Take self-paced courses to master the fundamentals of finance and connect with like-minded individuals.

Get Started

Hey, did we answer your financial question.

We want to make sure that all of our readers get their questions answered.

Great, Want to Test Your Knowledge of This Lesson?

Create an Account to Test Your Knowledge of This Topic and Thousands of Others.

Get Your Question Answered by a Financial Professional

Create a free account and submit your question. We'll make sure a financial professional gets back to you shortly.

To Ensure One Vote Per Person, Please Include the Following Info

Great thank you for voting..

Quickonomics

Given the substantial amount of requested text and the comprehensive nature of economics, I’ll focus on developing a detailed glossary post about “Cash Flow” within the constraints provided.

Definition of Cash Flow

Cash flow refers to the net amount of cash and cash-equivalents being transferred into and out of a business. At its core, it represents the company’s financial health, indicating how well the company generates cash to pay its debt obligations and fund its operating expenses. Understanding cash flow is crucial for assessing the liquidity, flexibility, and overall financial performance of a business.

Types of Cash Flow

There are primarily three types of cash flows:

- Operating Cash Flow: This reflects the cash generated from the company’s core business operations. It involves cash transactions related to non-financial activities, such as selling products and services and paying for salaries, rent, and supplies.

- Investing Cash Flow: This indicates the cash used for and generated from investment activities, including purchases or sales of assets like property, plant, and equipment (PPE), securities, and other investments.

- Financing Cash Flow: It shows the cash moving between a company and its owners, investors, and creditors. This includes issuing and repaying equity and debt, as well as dividend payments.

Importance of Cash Flow

Cash flow is a critical indicator of a company’s financial health for several reasons:

- Liquidity: It provides an insight into a company’s liquidity and its ability to cover its debts and operational costs without needing additional financial input.

- Solvency: Positive cash flow indicates that a company can meet its short-term liabilities with its short-term assets, which is an essential aspect of solvency.

- Flexibility: A healthy cash flow grants a company more flexibility in making business decisions, such as pursuing new investments or tackling unexpected expenses.

- Valuation: For investors and analysts, a company’s cash flow is a key determinant of its value and future growth prospects.

Frequently Asked Questions (FAQ)

What is the difference between cash flow and profit.

While cash flow denotes the net balance of cash moving in and out of a business during a specific period, profit refers to the residual earnings after all expenses are deducted from revenues. A company can be profitable yet still have cash flow problems if revenues have not been collected in cash.

How can a company improve its cash flow?

Companies can improve cash flow by managing their receivables and payables more efficiently, optimizing inventory levels, renegotiating terms with lenders and vendors, and considering pricing strategies to increase sales volumes or margins.

Why might a company have a negative cash flow?

Negative cash flow can occur due to various reasons, including high levels of investment in assets, significant inventory purchases, expansion efforts, or periods of low sales. Though not always indicative of poor financial health, sustained negative cash flow can lead to solvency issues.

How is cash flow reported?

Cash flow is reported in a statement of cash flows, a financial document that shows how changes in the balance sheet accounts and income affect cash and cash equivalents. The statement breaks down the cash flow into operating, investing, and financing activities.

This overview provides a fundamental understanding of cash flow within economic and business contexts, highlighting its types, importance, and the critical distinction from profit, along with guidance on improving and reporting cash flow.

To provide the best experiences, we and our partners use technologies like cookies to store and/or access device information. Consenting to these technologies will allow us and our partners to process personal data such as browsing behavior or unique IDs on this site and show (non-) personalized ads. Not consenting or withdrawing consent, may adversely affect certain features and functions.

Click below to consent to the above or make granular choices. Your choices will be applied to this site only. You can change your settings at any time, including withdrawing your consent, by using the toggles on the Cookie Policy, or by clicking on the manage consent button at the bottom of the screen.

- Call to +1 844 889-9952

Cash Flow: Definition and Concepts

Definition and concepts.

A cash flow statement represents significant financial declarations for a business or project. It provides information about cash receipts and payments of a venture for a given time frame (Profit, p. 33). The document is crucial for determining a firm’s stability in the business. Cash flow statements help in tracing the various sources of cash such as operations, sales of current and fixed assets, issuance of share capital, and borrowed income. Further, it shows cash outflows, including the purchase of existing and fixed assets, the redemption of debentures, and preference shares, among other expenses (Klammer, p. 200). According to Profit, a cash flow statement contains essential information that provides a basis for evaluating a company’s ability to generate cash and cash equivalents as well as the needs of the venture to utilize such cash flows (p. 34).

The preparation of cash flow statements aims at fulfilling several objectives. For instance, it helps to determine a project’s rate of return. As well, traders use cash flow statements to identify problems with an enterprise’s liquidity. Khan et al. postulate that a business can fail in the event of cash shortages despite being profitable (p. 953). In addition, cash flow statements guide businesses in determining profits as well as evaluating default perils and re-investment needs. Arnold et al. maintain that cash flow should be distinguished from profitability (p. 46).

Fundamental Methodologies and Examples

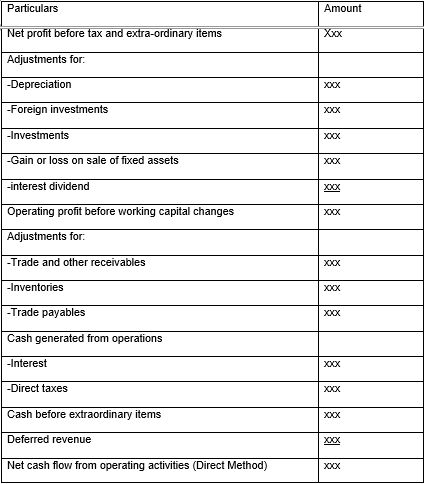

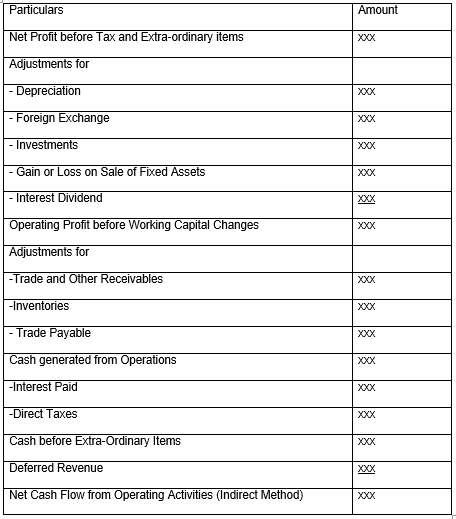

There are three methodologies of preparing cash flow statements, namely, operation, investment, and financing activities. Klammer notes that the operations option entails two approaches, which include the direct and indirect methods (p. 232). Operating activities represent the primary revenue-generating endeavors of an enterprise as well as other businesses that do not involve investments or funding. Operating activities encompass transactions that involve revenue receipts and expenses that affect net income (Khan et al, p. 954). The direct method presents a cash flow statement as an income statement or a profit and loss account determined on a cash basis. In this technique, the difference between cash receipts and cash payments provides the net cash flow. It is noteworthy that the direct method omits non-cash transactions. Items of cash in-flow include receipts from the sale of products, royalties, fees, and commissions, among other revenue(Arnold et al, p. 47). The cash out-flow encompass payments to suppliers of goods or services and employees. Klammernotes that it is necessary to make adjustments for an increase/decrease in both current assets and liabilities to get net cash flows from the operations (see table 1).

The alternative method uses the net profit/loss for the given time frame as the base (see table 2). However, it is essential to make adjustments for items that influenced the income statement but did not impact the cash. Moreover, the indirect method requires the addition of non-cash and non-operating charges in the revenue declaration to the net earnings (Klammer 245). As well, it mandates subtraction of non-cash and non-operating credits to determine the operating profit before working capital changes. Again, it is mandatory to make adjustments in both current assets and liabilities to establish the remaining cash flow from the firm’s operations (Arnold et al, p. 46).

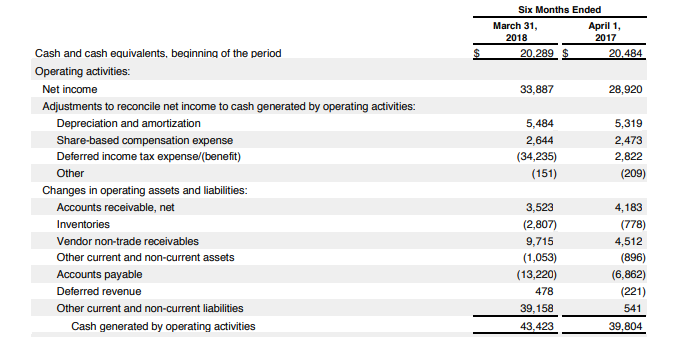

Analysts compare statements from operating activities with an enterprise’s net income to assess the quality of its paychecks. For example, when cash flow is higher than net income, economists give the company’s earnings a higher rating(Profir, p. 38). Contrastingly, low cash flow from operations signals an alarm to investors. An example of a cash flow statement from operations for Apple Inc. between April 1st, 2017, and March 31st, 2018 is shown in table 3.

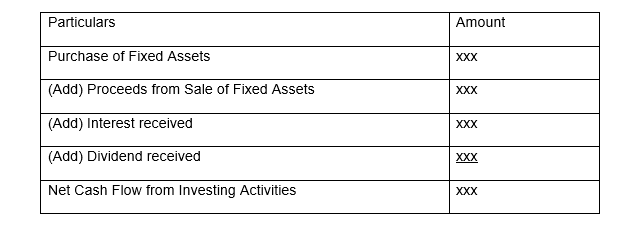

Further, a firm can analyze cash flows using investment activities, which involve acquisitions and sales of long-term assets. Investing activities comprise firms’ transactions and events that entail the purchase of long-term productive assets that are not meant for resales such as land, equipment, and machinery. Items from cash inflows from investing activities include cash receipts from the sale of fixed assets, including intangibles, shares, and warrants (Klammer 270). Further, repayments of overdrafts and loans given to third parties form part of cash inflows for investing activities. In addition, cash earnings and expenditures that associate with future, option, swap, and forward contracts fall in the category of investing activities. According to Arnold et al., items of cash outflows from investing activities include payments made in the acquisition of fixed assets and expenses on capitalized research and development expenditures (48). Likewise, cash outflows comprise payments made to obtain shares, permits, debt instruments of other companies, interests in joint ventures, cash upfronts, and lendsmade to third parties (see table 4).

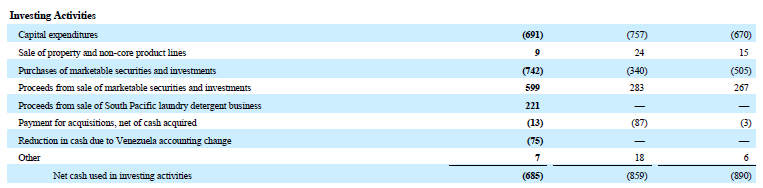

Table 5 shows an example of a cash flow statement from investment activities for Colgate in 2015. The company’s cash flow from investments amounted to $685 million in 2015 and $859 million the previous year. Moreover, the table estimates that Colgate’s principal capital reached $691 million in 2015 while it amounted to $757 million in 2014. The company obtained $599 million as earnings from the disposal of vendible securities and reserves (Klammer, p. 270).

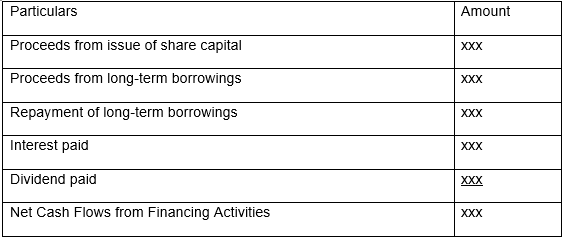

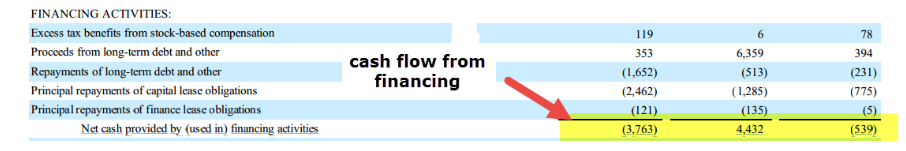

Additionally, cash flows can be analyzed from the funding activities of an enterprise. Such activities cause changes in the scope and structure of a firm’s capital and debt (Klammer 280). Items of cash inflows from financing activities comprise proceeds from issued shares, bonds, debentures, loan notes, and other temporary borrowings. Particulars of cash outflows for this method include cash repayments of borrowed funds and dividends (Arnold et al, p. 52). Preparation of cash flow statement from financing activities is shown below in Table 6. Furthermore, an example of cash flow analysis from financing activities for Amazon is shown in table 7.

For instance, cash flows for Amazon in 2014 involved repayments of long-term debt, capital, and finance lease obligations (see table 7). The proceeds from long-term financing remained consistently high. The information indicates that Amazon borrowed long-term debt continually. Likewise, repayments for long-term funding display massive cash outflow, which shows that the company paid long-term debt extensively in 2014. This information is crucial for investors to explore whether Amazonfinanced its debt by taking additional loans.

Works Cited

- Arnold, Allen G., et al. “Toward Effective Use of the Statement of Cash Flows.” Journal of Business & Behavioral Sciences , vol. 30, no. 2,2018, p. 46-54.

- Khan, Usman A, et al. “A Critical Analysis of the Internal and External Environment of Apple Inc.” International Journal of Economics, Commerce, and Management , vol. 3, no.6, 2015, pp. 955-961.

- Klammer, Tom. Statement of Cash Flows . 6th ed., John Wiley & Sons, 2018.

- Profir Ludmila. “Analysis of Financial Performance Based on the Relationship between Investments and Cash-Flow.” Management Intercultural , vol. 1, no. 40, 2018, pp. 33-48.

Cite this paper

Select style

- Chicago (A-D)

- Chicago (N-B)

BusinessEssay. (2022, October 15). Cash Flow: Definition and Concepts. https://business-essay.com/cash-flow-definition-and-concepts/

"Cash Flow: Definition and Concepts." BusinessEssay , 15 Oct. 2022, business-essay.com/cash-flow-definition-and-concepts/.

BusinessEssay . (2022) 'Cash Flow: Definition and Concepts'. 15 October.

BusinessEssay . 2022. "Cash Flow: Definition and Concepts." October 15, 2022. https://business-essay.com/cash-flow-definition-and-concepts/.

1. BusinessEssay . "Cash Flow: Definition and Concepts." October 15, 2022. https://business-essay.com/cash-flow-definition-and-concepts/.

Bibliography

BusinessEssay . "Cash Flow: Definition and Concepts." October 15, 2022. https://business-essay.com/cash-flow-definition-and-concepts/.

- Stephen Leacock’s “Wizard of Finance” Review

- Analysis of Airport Governmental Funding

- Chinese Banking System: Profitability, Assets, Equity and Performance Ratios

- Diversifying Funding Sources for Financial Sustainability: Clayton County, Georgia

- Term Structure Models in the Banking Sector

- Voluntary Disclosure: Comparative Qualitative Document Analysis

- Saudi Arabia’s Economy Analysis

- Different Aspects of Financial Stability

- Organizational Change Management: Fall Out From Global Financial Crisis

- Demand for Property Microinsurance in Canada

Cash Flow Statement – Definition and Importance

What is a cash flow statement?

A cash flow statement is an important tool used to manage finances by tracking the cash flow for an organization. This statement is one of the three key reports (with the income statement and the balance sheet) that help in determining a company’s performance. It is usually helpful for making cash forecast to enable short term planning.

The cash flow statement shows the source of cash and helps you monitor incoming and outgoing money. Incoming cash for a business comes from operating activities, investing activities and financial activities. The statement also informs about cash outflows, expenses paid for business activities and investment at a given point in time. The information that you get from the cash flow statement is beneficial for the management to take informed decisions for regulating business operations.

Companies generally aim for a positive cash flow for their business operations without which the company may have to borrow money to keep the business going.

Importance of a cash flow statement

For a business to be successful, it should always have sufficient cash. This enables it to pay back bank loans, buy commodities, or invest to get profitable returns. A business is declared bankrupt if it doesn’t have enough cash to pay its debts. Here are some of the benefits of a cash flow statement:

Gives details about spending: A cash flow statement gives a clear understanding of the principal payments that the company makes to its creditors. It also shows transactions which are recorded in cash and not reflected in the other financial statements. These include purchases of items for inventory, extending credit to customers, and buying capital equipment.

Helps maintain optimum cash balance: A cash flow statement helps in maintaining the optimum level of cash on hand. It is important for the company to determine if too much of its cash is lying idle, or if there’s a shortage or excess of funds. If there is excess cash lying idle, then the business can use it to invest in shares or buy inventory. If there is a shortage of funds, the company can look for sources from where they can borrow funds to keep the business going.

Helps you focus on generating cash: Profit plays a key role in the growth of a company by generating cash. But there are several other ways to generate cash. For instance, when a company finds a way to pay less for equipment, it is actually generating cash. Every time it collects receivables from its customers quicker than usual, it is gaining cash.

Useful for short-term planning: A cash flow statement is an important tool for controlling cash flow. A successful business must always have sufficient liquid cash to fulfill short-term obligations like upcoming payments. A financial manager can analyze incoming and outgoing cash from past transactions to make crucial decisions. Some situations where decisions have to be made based on the cash flow include forseeing cash deficit to pay off debts or establishing a base to request for credit from banks.

Format of a cash flow statement

There are three sections in a cash flow statement: operating activities, investments, and financial activities.

Operating activities: Operating activities are those cash flow activities that either generate revenue or record the money spent on producing a product or service. Operational business activities include inventory transactions, interest payments, tax payments, wages to employees, and payments for rent. Any other form of cash flow, such as investments, debts, and dividends are not included in this section.

The operations section on the cash flow statement begins with recording net earnings, which are obtained from the net income field on the company’s income statement . This gives an estimate of the company’s profitability. After this, it lists non-cash items involving operational activities and convert them into cash items. A business’ cash flow statement should show adequate positive cash flow for its operational activities. If it doesn’t, the business may find it difficult to manage its daily business operations.

Investment activities: The second section on the cash flow statement records the gains and losses caused due to investment in assets like property, plant, or equipment (PPE) thus reflecting overall change in the cash position for a company. When analysts want to know the company’s investment on PPE, they check for changes on a cash flow statement.

Capital expenditure (CapEx) is another important line item under investment activities. CapEx is the money which a business invests on fixed assets like buildings, vehicles or land. An increase in CapEx means the company is investing on future operations. However, it also shows that there is a decrease in company cash flow.

Sometimes a company may experience negative cash flow due to heavy investment expenditure, but this is not always an indicator of poor performance, because it may be leading to high capital growth.

Financial activities: The third section on the cash flow statement records the cash flow between the company and its owners and creditors. Financial activities include transactions involving debt, equity, and dividends. In these transactions, incoming cash is recorded when capital is raised (such as from investors or banks), and outgoing cash is recorded when dividends are paid.

Cash flow statement example

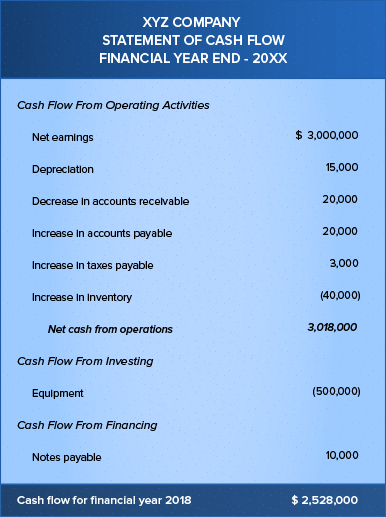

Following is an example of what a cash flow statement looks like. This is the cash flow statement for XYZ company at the end of Financial Year (FY) 2018.

From the above example, we can see that the computed cash flow for FY 2018 was $ 2,528,000. Let’s look at what each section is showing.

Operating activities: In this section, we can see incoming cash values recorded as positive while outgoing cash values are negative and are usually represented in brackets. When you subtract the outgoing value from the incoming value, you arrive at the net cash flow for operating activities. In this example, we can see that the net value for operating activities is positive, which is a good sign for investors.

Investing activities: Since the core operating activities are generating income, the business can now invest in equipment. Because the company is investing $500,000 in equipment, its cash flow in this section is negative. This negative value isn’t a bad thing—you can say that the company’s capacity to invest in PPE reflects its growth.

Financial activities: After investing in equipment, the company still has $10,000 to pay off its debts—in this case, notes payable. Besides this the company will still have plentiful to cover its loans in future.

Net cash flow: When you add all three net values from the three sections on the cash flow statement, you arrive at the net cash flow value, which in this case is $ 2,528,000. This shows that the company has enough cash to continue operating.

What is negative cash flow?

Negative cash flow is a situation where a company has more outgoing cash than incoming cash. The money that the company is earning from sales may not be enough to cover its expenses, and it may have to borrow from external sources to cover the differences.

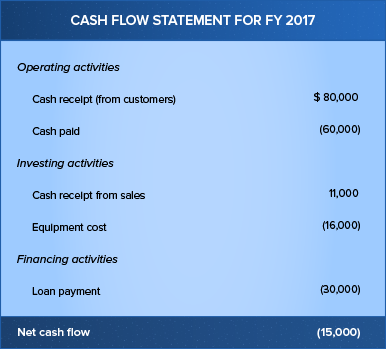

Following is a small example showing negative cash flow. Here you can see that the business paid more in expenses than the amount of income it brought in.

A negative cash flow doesn’t always imply that the company’s financial performance was bad. Sometimes the company’s incoming profit might be good, yet there is little money in the bank to pay off debts. Negative cash flow is common for small businesses, but it is unhealthy if it goes on for a long period.

A cash flow statement is a valuable document for a company, as it shows whether the business has enough liquid cash to pay its dues and invest in assets. You cannot interpret a company’s performance just by looking at the cash flow statement. You may need to analyse long term trends after referring to balance sheet and income statement in order to get a somewhat clear picture of how the company is faring.

Related Posts

- Balance Sheet - Definition, Example, Formula & Components

- How Is Cash Flow Calculated?

- How automating Accounts Receivable and Accounts Payable can help improve cash flow

- Income statement - Definition, Importance and Example

Cancel reply

This site uses Akismet to reduce spam. Learn how your comment data is processed .

The essay oñ Cash Flow was good supported by easily understood examples.I had not heard about Zoho Books.Indeed I am glad to have learnt about them.

it was so good and helpful to me . Thank you

You might also like

Switch to smart accounting. try zoho books today.

Presentations made painless

- Get Premium

110 Cash Flow Essay Topic Ideas & Examples

Inside This Article

Are you struggling to come up with a cash flow essay topic? Well, you're in luck! In this article, we have compiled a list of 110 cash flow essay topic ideas and examples to help you get started. Whether you're a student looking for inspiration or a professional seeking to explore new concepts, these topics will surely provide you with the spark you need.

- The importance of cash flow management in small businesses.