Altice Europe N.V. Third Quarter 2020 Results 1

Group revenue +3.2% and Telecom revenue +2.7% Group EBITDA +5.1% €3.5 billion of available liquidity 2

AMSTERDAM--( BUSINESS WIRE )--Regulatory News:

Altice Europe N.V. (Euronext: ATC and ATCB) today announces financial and operating results for the quarter ended September 30, 2020.

Patrick Drahi, Altice Europe founder: “In line with the performance since the beginning of the year, the Group proved its resilience during the third quarter. In France, we have maintained growth in our core telecom business, supported by residential service revenue growth. The Altice Corporate Financing facility was repaid during the third quarter, following the issuance of €900 million equivalent of new 8.25-year Senior Secured Notes at Altice France. Including these transactions, the Group has repaid €1.4 billion of debt since April 2020. The Group’s diversified and simplified capital structure has no material maturities before 2025 and €3.5 billion of available liquidity. We maintain our FY 2020 guidance to grow revenue and EBITDA, and continue to focus on deleveraging the Group through growing revenue, EBITDA and cash flow.”

Altice Europe Q3 2020 Key Financial Highlights

- Group revenue grew by +3.2% YoY in Q3 2020.

- Telecom revenue excluding equipment and roaming grew by +4.4% YoY in Q3 2020.

- Residential service revenue excluding roaming grew by +1.9% YoY in Q3 2020.

- Telecom EBITDA grew by +0.7% YoY in Q3 2020 and Telecom EBITDA margin was 39.9%.

- Total accrued capital expenditure was €818 million in Q32020.

- Consequently, Operating Free Cash Flow amounted to €663 million in Q3 2020.

Altice Europe Q3 2020 Key Operational Highlights

- The residential fixed base grew by +21k net additions, with +113k fibre net additions and 50% of the total fixed subscriber base on fibre. The residential mobile postpaid base grew by +25k net additions.

- Altice France reported revenue growth of +4.0% YoY and EBITDA growth of +2.8% YoY in Q3 2020. Residential service revenue, excluding roaming out, grew by +3.2% YoY in Q3 2020.

- The residential fixed base grew by +17k net additions, with +50k fibre net additions. The residential mobile postpaid base grew by +27k net additions.

Capital Structure Key Highlights – including subsequent events

- Total consolidated Altice Europe net debt was €28.9 billion at the end of Q3 2020 (€28.5billion pro forma for the €375 million earn-out due in December 2021 related to the FastFiber partnership).

- On September 15, 2020, Altice Europe announced that it had issued €900 million (equivalent) 8.25-year Senior Secured Notes at Altice France S.A. (“Altice France”) following significant excess demand. The weighted average cost on a fully euro swapped basis is 4.125%. This consists of €500 million of 8.25-year Senior Secured Notes with a coupon of 4.125% and $475 million of 8.25-year Senior Secured Notes with a coupon of 5.125%. The proceeds from this transaction have been used to repay the then outstanding amount under the Altice France revolving credit facility of €150 million, and the remaining proceeds of €750 million have been used to repay the Altice Corporate Financing facility. The remainder of this facility has been repaid with cash on balance sheet at Altice International. Total annual interest savings pro forma for this transaction are €33 million, through a reduction of the average cost of debt.

- On September 11, 2020, Altice Europe and Next Private B.V. announced that a conditional agreement has been reached on a recommended public offer to be made by Next Private B.V., for all common shares A and all common shares B in the capital of Altice Europe, for €4.11 in cash per share (cum dividend). Altice Europe and Next Private continue to make good progress on the preparation for the offer and expect to be able to make a public announcement on the offer soon.

- On July 27, 2020, Altice Europe announced two agreements with Mediapro. Firstly, for the season 2020/21, Altice Europe will resell the UEFA rights to Mediapro in exchange for Altice Europe’s right to resell Mediapro’s TELEFOOT channel (including the main football matches for French Ligue 1 and Ligue 2). This will allow Mediapro to broadcast the UEFA Champions League and Europa League. Both the RMC Sport channel and Mediapro’s TELEFOOT channel will broadcast the two competitions from October 2020. SFR will offer all of the football to its customers with RMC Sport, TELEFOOT, Canal+ and BeIN SPORTS. Secondly, for the seasons 2021/22, 2022/23 and 2023/24, Altice Europe entered into a distribution agreement with Mediapro to resell the TELEFOOT channel (including the main football matches for French Ligue 1 and Ligue 2) with a revenue share mechanism. This is expected to generate additional revenues for the Altice France residential segment. With this agreement, Altice Europe maintains the commitment to improve Altice TV cash flow trends, approaching break-even, while SFR customers will continue to benefit from the best football offer in France.

- On July 22, 2020, Altice International repaid $385 million (€342 million equivalent) 7.625% 2025 notes. In addition to this, the Group has bought back €105 million of debt at Altice International in Q3 2020, or €244 million of debt at Altice International since April 2020. In combination with the Altice Corporate Financing (“ACF”) facility repayment, the Group has repaid €1.4 billion of debt since April 2020.

- On July 2, 2020, the transfer of approximately 9% of the share capital of Altice France S.A. from Altice Europe to Altice France Holding S.A. was completed, in-line with the previously stated objective as part of the January 2020 Altice France refinancing.

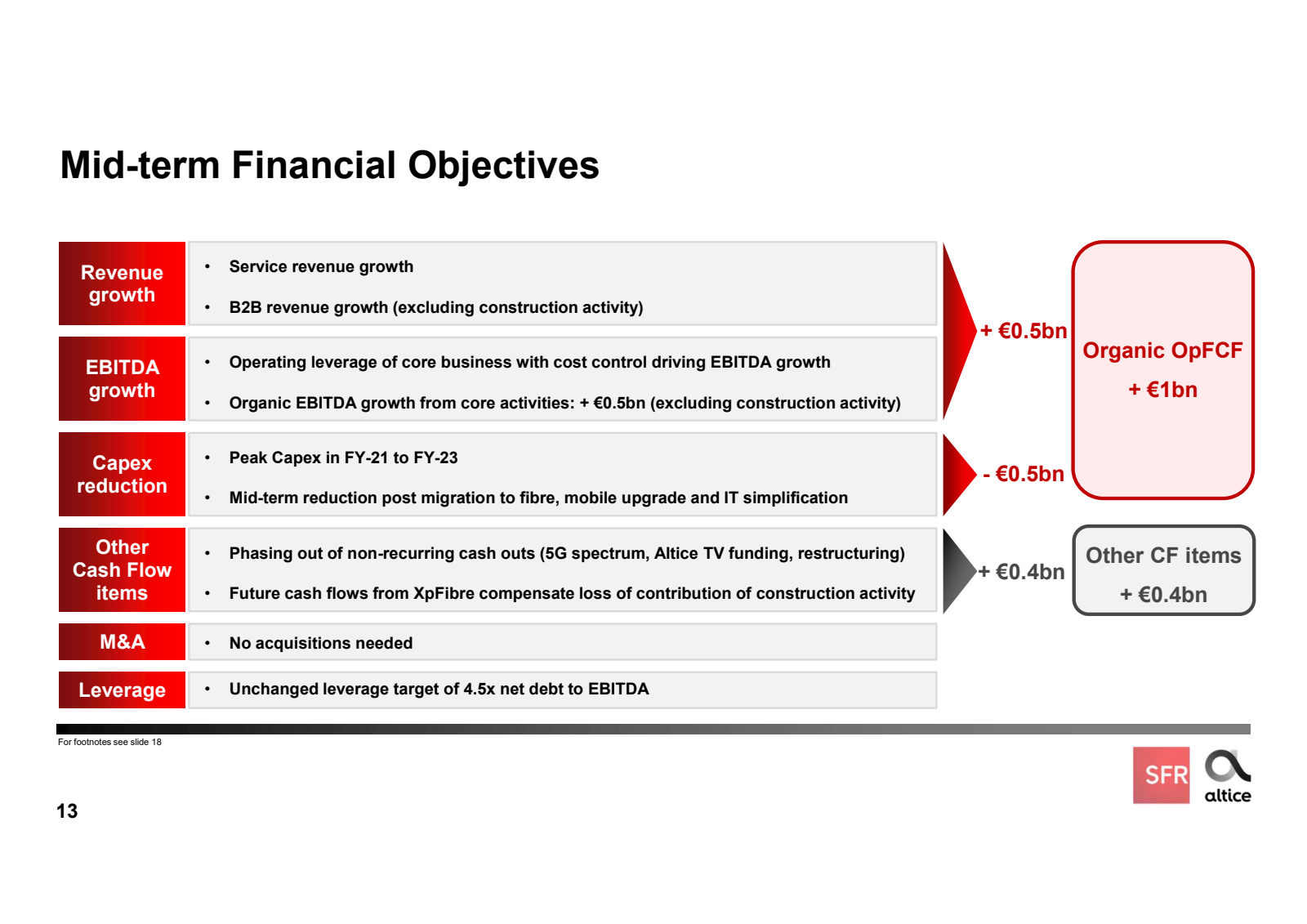

- Accelerate residential revenue growth in its key geographies;

- Grow Altice Europe revenue;

- Grow Altice Europe EBITDA.

- In the mid-term, the Group targets organic free cash flow 3 of more than €1 billion.

- Further delever the Group, target leverage of 4.0x to 4.5x net debt to EBITDA

- The Group continues to assess the potential impacts of the COVID-19 pandemic carefully, especially the impacts on roaming and advertising.

Conference call details

The company will host a conference call and webcast today, November 19, 2020 at 6:00pm CET (5:00pm GMT, 12:00pm EST).

Dial-in Access telephone numbers:

Participant Toll Free Dial-In Number: +1 (833) 968-2322

Participant International Dial-In Number: +1 (778) 560-2842

Conference ID: 7690887

A live webcast of the presentation will be available on the following website:

https://event.on24.com/wcc/r/2631118/05F1562E98E8A298F94071B9BF5EB615

The presentation for the conference call will be made available prior to the call on our investor relations website:

http://altice.net/investor-relations

About Altice Europe

Altice Europe (ATC & ATCB), listed on Euronext Amsterdam, is a convergent leader in telecoms, content, media, entertainment and advertising. Altice Europe delivers innovative, customer-centric products and solutions that connect and unlock the limitless potential of its over 30 million customers over fibre networks and mobile broadband. Altice Europe is also a provider of enterprise digital solutions to millions of business customers. Altice Europe innovates with technology, research and development and enables people to live out their passions by providing original content, high-quality and compelling TV shows, and international, national and local news channels. Altice Europe delivers live broadcast premium sports events and enables its customers to enjoy the most well-known media and entertainment.

Financial Presentation

Altice Europe and its subsidiaries have operated for several years and have from time to time made significant equity investments in a number of cable and telecommunication businesses in various jurisdictions. Therefore, in order to facilitate an understanding of Altice Europe’s results of operations, we have presented and discussed the pro-forma consolidated financial information of Altice Europe – giving effect to each such significant acquisition and disposal as if such acquisitions and disposals had occurred by January 1, 2019. Therefore financials for Altice Europe for the quarters ended September 30, 2019 and September 30, 2020 exclude the press magazine Groupe L’Express (following disposal on July 30, 2019) and the newspaper Libération (following disposal on September 03, 2020).

This press release contains measures and ratios (the “Non-GAAP measures”), including Adjusted EBITDA, Capital Expenditure (“Capex”) and Operating Free Cash Flow, that are not required by, or presented in accordance with, IFRS or any other generally accepted accounting standards. We present Non-GAAP measures because we believe that they are of interest to the investors and similar measures are widely used by certain investors, securities analysts and other interested parties as supplemental measures of performance and liquidity. The Non-GAAP measures may not be comparable to similarly titled measures of other companies or have limitations as analytical tools and should not be considered in isolation or as a substitute for analysis of our, or any of our subsidiaries’, operating results as reported under IFRS or other generally accepted accounting standards. Non-GAAP measures such as Adjusted EBITDA are not measurements of our, or any of our subsidiaries’, performance or liquidity under IFRS or any other generally accepted accounting principles, including U.S. GAAP. In particular, you should not consider Adjusted EBITDA as an alternative to (a) operating profit or profit for the period (as determined in accordance with IFRS) as a measure of our, or any of our operating entities’, operating performance, (b) cash flows from operating, investing and financing activities as a measure of our, or any of our subsidiaries’, ability to meet its cash needs or (c) any other measures of performance under IFRS or other generally accepted accounting standards. In addition, these measures may also be defined and calculated differently than the corresponding or similar terms under the terms governing our existing debt.

Adjusted EBITDA is defined as operating income before depreciation and amortization, other expenses and income (capital gains, non-recurring litigation, restructuring costs) and share-based expenses and after operating lease expenses. This may not be comparable to similarly titled measures used by other entities. Further, this measure should not be considered as an alternative for operating income as the effects of depreciation, amortization and impairment excluded from this measure do ultimately affect the operating results, which is also presented within the annual consolidated financial statements in accordance with IAS 1 - Presentation of Financial Statements. All references to EBITDA in this press release are to Adjusted EBITDA, as defined in this paragraph.

Capital expenditure (Capex), while measured in accordance with IFRS principles is not a term that is defined in IFRS. However, Altice Europe’s management believe it is an important indicator for the Group as the profile varies greatly between activities:

- The fixed business has fixed Capex requirements that are mainly discretionary (network, platforms, general), and variable Capex requirements related to the connection of new customers and the purchase of Customer Premise Equipment (TV decoder, modem, etc.).

- Mobile Capex is mainly driven by investment in new mobile sites, upgrade to new mobile technology and licenses to operate; once engaged and operational, there are limited further Capex requirements.

- Other Capex: Mainly related to costs incurred in acquiring content rights.

Operating free cash flow (OpFCF) is defined as Adjusted EBITDA less Capex. This may not be comparable to similarly titled measures used by other entities. Further, this measure should not be considered as an alternative for operating cash flow as presented in the consolidated statement of cash flows in accordance with IAS 1 - Presentation of Financial Statements. It is simply a calculation of the two above mentioned non-GAAP measures.

Adjusted EBITDA and similar measures are used by different companies for differing purposes and are often calculated in ways that reflect the circumstances of those companies. You should exercise caution in comparing Adjusted EBITDA as reported by us to Adjusted EBITDA of other companies. Adjusted EBITDA as presented herein differs from the definition of “Consolidated Adjusted EBITDA” for purposes of any of the indebtedness of the Group. The financial information presented in this press release, including but not limited to the quarterly financial information, pro forma financial information as well as Adjusted EBITDA and OpFCF, is unaudited. In addition, the presentation of these measures is not intended to and does not comply with the reporting requirements of the U.S. Securities and Exchange Commission (the “SEC”) and will not be subject to review by the SEC; compliance with its requirements would require us to make changes to the presentation of this information.

Financial and Statistical Information and Comparisons

Financial and statistical information is for the quarter ended September 30, 2020, unless otherwise stated, and any year over year comparisons are for the quarter ended September 30, 2019.

Regulated Information

This press release contains inside information within the meaning of Article 7(1) of the EU Market Abuse Regulation.

Altice Europe Summary Financial Information

Notes to Summary Financial Information tables

- Segments are shown on a pro forma standalone reporting basis and Group figures are shown on a pro forma consolidated basis. Financials for Altice Europe exclude the press magazine Groupe L’Express (following disposal on July 30, 2019) and newspaper Libération (following disposal on September 03, 2020) from 1/1/19.

- Adjusted EBITDA is defined as operating income before depreciation and amortization, other expenses and income (capital gains, non-recurring litigation, restructuring costs) and share-based expenses and after operating lease expenses (straight-line recognition of the rent expense over the lease term as performed under IAS 17 Leases for operating leases).

- Teads gross revenue is presented before discounts (net revenue after discounts is recognised in the consolidated financial statements).

Altice Europe KPIs

Notes to KPIs tables

- Portugal fibre homes passed figures include homes where MEO has access through wholesale fibre operators (c.0.5 million in Q3 2020).

- Fibre unique customers represents the number of individual end users who have subscribed for one or more of our fibre / cable based services (including pay television, broadband or telephony), without regard to how many services to which the end user subscribed. It is calculated on a unique premise basis. Fibre customer base for France includes FTTH, FTTB and 4G Box customers and excludes white-label wholesale customers. For Israel, it refers to the total number of unique customer relationships, including both B2C and B2B.

- Mobile subscribers are equal to the net number of lines or SIM cards that have been activated on the Group’s mobile networks and excludes M2M.

Altice Europe Financial and Operational Review by Segment

For the quarter ended September 30, 2020 compared to the quarter ended September 30, 2019

France (Altice France including SFR)

Altice France reported residential service revenue growth in Q3 2020, supported by a sustained focus on operations and significant and ongoing investment in proprietary infrastructure.

At the end of Q3 2020, Altice France had 18.8 million homes passed (FTTH/FTTB), an increase of more than 1.3 million homes passed compared to Q2 2020. SFR had 6,481 fibre municipalities at the end of Q3 2020 (vs. 5,515 in Q2 2020 and 4,918 in Q1 2020).

Altice France continues to invest in its 4G network, with 47,822 4G systems activated (1,646 new units in Q3 2020). The current 4G coverage of the SFR Mobile network reaches 99% of the national population (32,532 municipalities). Altice France continues to deploy 4G and new radio sites in white areas. 4G+ is offered in the top 32 French cities, and 2,600 municipalities.

Altice France's media business DTT channels achieved new historical records in Q3 2020, with 6.7% of national audience share. Altice France has consolidated its position as the third largest private broadcasting group in France. Additionally, an agreement on the restructuring plan announced on May 19, 2020 has been signed with unions on September 15, 2020 and approved by the administration. The plan opened on October 8, 2020 and will end on December 23, 2020.

On August 20, 2020, SFR successfully launched TELEFOOT as well as the associated offers. SFR offers subscribers a significant array of sport content, including all major French football (Ligue 1, Ligue 2) and European football (UEFA Champions League, UEFA Europa League, English Premier League, Spanish and Italian championships).

On October 1, 2020, SFR announced it had obtained 80 MHz as part of the allocation of 5G frequencies in the 3.4-3.8 Ghz band. Following the auction for the allocation of the remaining spectrum in the 3.4-3.8 GHz band, SFR obtained 3 additional 10MHz blocks, bringing its total spectrum in this band to 80MHz. The price for SFR for these 80Mhz frequencies will total €728 million (€350 million to be paid over a 15-year period in equal amounts, and €378 million paid over 4 years also in equal amounts). The first payment of c. €118 million is expected to take place in Q4 2020. SFR will be able to offer an optimal 5G experience to its customers. SFR has recently carried out several demonstrations of the potential of 5G, with tests under real conditions in Toulouse, Nantes and Velizy (Paris).

- Total revenue increased by +4.0% YoY in Q3 2020 to €2,745 million. This increase was supported by residential and business services revenue growth, offsetting media revenue declines.

- Residential service revenue in Q3 2020, excluding roaming, grew by +3.2% YoY as a result of subscriber base growth and improved ARPU trends. This segment was still affected by the COVID-19 pandemic related impacts as roaming revenue remained depressed year over year.

- Fibre net additions reached +113k in Q3 2020 (vs. +100k in Q2 2020 and +59k in Q3 2019) due to increasing fibre appetite and DSL to fibre conversions.

- The mobile residential postpaid customer base increased by +25k net additions in Q3 2020 (vs. +99k in Q2 2020 and +234k in Q2 2019).

- Business service revenue grew by +9.2% YoY in Q3 2020. In Q3 2020, 270k FTTH homes were constructed by SFR FTTH (vs. 268k in Q2 2020 and 192k in Q1 2020).

- Media revenue declined by -7.6% YoY in Q3 2020, mainly driven by the slowdown of the global advertising market because of the COVID-19 pandemic. The Group has seen a recovery in Q3 2020.

- Total EBITDA in Q3 2020 of €1,084 million grew by +2.8% YoY and, Telecom EBITDA grew by +0.7% YoY.

- Total Capex amounted to €608 million in Q3 2020, an increase of 14.9% YoY, following lower Capex YoY in H1 2020.

Portugal (MEO)

MEO delivered a solid performance in Q3 2020, with a return to revenue and EBITDA growth. Customer subscriber base growth was sustained and the converged proportion of the customer base continued to grow. MEO maintained low levels of churn.

In Q3 2020, FastFiber increased the coverage of its FTTH fibre network by 51 thousand new homes passed, reaching a total coverage of 4.84 million homes passed (including shared network). In addition, FastFiber connected close to 12 thousand additional kilometers of dark fibre network in Q3 2020.

Sustained mobile network investment in both 4G and 4G+ has resulted in penetration of 99.5% and 87.9%, respectively, at the end of Q3 2020. Altice Portugal had 5.4 million FTTH homes passed in total at the end of Q3 2020.

On November 5, 2020, ANACOM announced that it is estimated that the 5G auction will start on November 21, 2020, and the allocation of rights of use for frequencies is scheduled for Q1 2021.

- Total revenue grew +0.9% YoY in Q3 2020 to €541 million.

- Total residential service revenue grew by +1.9% YoY in Q3 2020, or +2.6% excluding roaming out, which remained depressed year over year. Overall, trends improved in Q3 2020, helped by the progressive reopening of the economy, recovery equipment revenues and premium sport content revenues compared to the second quarter, as well as underlying customer base growth.

- Fibre customer net additions in Q3 2020 were +42k (vs. +29k in Q2 2020 and +38k in Q3 2019), with 65% of the total customer base taking fibre. Convergence of the customer base continues to grow (+1.6pp YoY), resulting in more valuable customers with higher lifetime value (convergent customers have less than half of non-convergent customers churn rate).

- Postpaid residential mobile subscriber net additions in Q3 2020 were +32k (vs. +17k in Q2 2020 and +41k in Q3 2019), supported by MEO’s ongoing network investments and steady performance and successful convergent strategy. Mobile service revenue was impacted by lower roaming out revenue, in addition to lower out of bundle revenue streams.

- Business services revenue grew +0.3% YoY in Q3 2020, despite the impacts of the COVID-19 pandemic.

- Total EBITDA grew +0.5% YoY to €217 million.

- Total Capex amounted to €120 million in Q3 2020 (€99 million in Q3 2019). The expansion of fibre coverage continued, with 51k FTTH homes constructed for Fastfiber in Q3 2020.

Israel (HOT)

HOT achieved robust commercial results in Q3 2020, growing the fixed customer base with +8k net additions in Q3 2020 in the fixed residential customer base, resulting in growth for the seventh successive quarter. In addition, the postpaid mobile residential subscriber base grew by +2k net additions in Q3 2020.

The 5G spectrum auction has been concluded in Q3 2020 and HOT has been awarded a license to operate the new network. HOT is offering customers data packages on their cellphones of up to 1,000 gigabytes (1 terabyte). It has deployed the network at 250 sites and is expected to expand the network significantly through the network sharing agreement.

On September 15, 2020, HOT announced that it has taken a minority stake in IBC Israel Broadband (IBC). HOT will become an equal partner in the IBC Partnership (that holds 70% of IBC's share capital), together with Cellcom and Israel Infrastructure Fund (IIF) and HOT will hold indirectly 23.3% of IBC's share capital, through an investment in the company substantially equal to the investment made by each of Cellcom and IIF. There is an agreement between IBC and HOT, under which HOT undertakes to purchase an indefeasible right, or IRU, to use IBC's fibre-optic network. There is also a service agreement between IBC and HOT, under which IBC undertakes to purchase certain services from HOT. The completion of the transaction is subject to regulatory change and required approvals, including regulatory and third-party approvals.

- Residential service revenue declined by -0.5% YoY in Q3 2020 on a CC basis and decreased by -2.5% on a reported basis, as a result of the effects of the second wave of COVID 19 and the continuing fierce competition in both fixed and mobile market.

- Business services revenue grew by +7.1% YoY in Q3 2020 on a CC basis mainly due to equipment sales and despite the decommissioning of iDEN technology by the end of Q4 2019. Excluding iDEN, business services revenue grew +12.2% YoY in Q3 2020 on a CC basis.

- EBITDA decreased by -10.7% YoY on a CC basis and -12.9% on a reported basis in Q3 2020, to €81 million. EBITDA margin decreased by 4.6 bpts YoY on a CC basis (from 37.9% in Q3 2019 to 33.3% in Q3 2020) mainly as a result of higher low-margin equipment sales in Q3 2020 YoY and a decline in high margin mobile roaming revenue, as a result of the wider COVID-19 pandemic, as well as a seasonality effect on certain operating expense items, mainly marketing costs.

- Total Capex was €66 million in Q3 2020, an increase of +8.4% YoY on a CC basis and +6.5% on a reported basis.

In 2019, increasing household consumption and public expenditure in Israel fueled a significant upturn in the Israeli Shekel. Despite the macroeconomic circumstances in Q3 2020, the Israeli Shekel has remained robust in the first half of 2020, though depreciated slightly in Q3 2020, contributing to a decrease in revenue and EBITDA growth in reported currency in Q3 2020.

Dominican Republic (Altice Dominicana)

Altice Dominicana has seen a commercial slowdown due to the COVID-19 pandemic, which impacted revenue and EBITDA trends in the first half of 2020. In Q3 2020, commercial activity regained momentum, mobile and fixed subscriber base trends were robust and Altice Dominicana returned to growth on a local currency basis.

Key factors that improved in Q3 2020 included the progressive de-escalation of measures, increased internet demand due to the starting of the new school year and a recovery in reconnection and late payment charges.

- Residential service revenue excluding roaming increased +4.1% YoY in Q3 2020 on a CC basis. Retail revenues in Q3 2020 were positively impacted by customer base increase and installation and reconnection fees post COVID-19 pandemic de-escalation. Mobile service revenues regained commercial momentum thanks to recovery of customers topping up.

- The total fixed residential subscriber base declined by -1k in Q3 2020 (vs. +2k in Q2 2020 and flat in Q3 2019), while the subscriber base is still growing +2.7% YoY.

- The total residential mobile subscriber base decreased by -42k net additions in Q3 2020 (vs. +11k in Q2 2020 and -153k in Q3 2019) mainly driven by mobile prepaid. Residential mobile postpaid net losses were -7k in Q3 2020 (vs. -10k in Q2 2020 and +12k in Q3 2019). Postpaid mobile net additions slowed as gross adds decreased, due to the slow development of commercial channels and due to a decrease of migrations from prepaid to postpaid.

- Business services revenue declined by -3% YoY in Q3 2020 on a CC basis, mainly driven by lower levels of visitor roaming.

- Total EBITDA declined by -1.1% YoY on a CC basis in Q3 2020, or -18.2% YoY on a reported basis to €58 million. The EBITDA margin decreased slightly YoY to 48.4% on a reported basis.

- Total Capex was €20 million in Q3 2020, a significant decrease YoY due to less fixed Capex.

The COVID-19 pandemic led to a fall in economic activity and pressures on the Dominican Republic given its dependence on tourism and remittances. This has led to further deterioration of the Dominican Peso in Q3 2020, contributing to the decrease of revenue and EBITDA in reported currency.

Teads achieved a return to revenue 4 growth during Q3 2020, as many global advertisers resumed their adverts spend in Q3 2020.

- Total revenue for Teads increased by +12.7% YoY in Q3 2020 to €128 million (+15.3% on a CC basis).

- Many advertisers shifted a larger share of their spend into performance advertising across the marketplace. Teads benefitted from this trend through the Teads Performance offering which represented a growing share of Teads revenue. Certain global advertisers also accelerated spend with Teads as a result of their boycott of the social media platforms. We expect these advertisers to maintain their increased levels of spend with Teads.

- Increased adoption of Teads' self-serve ad platform and continued efforts on cost-reduction drove accelerated EBITDA growth in the quarter. Teads reported an EBITDA of €41 million in Q3 2020.

- Altice TV revenue was €70 million in Q3 2020, notably benefitting from the sale of UEFA semi-finals and finals to TF1 and the launch of TELEFOOT in August 2020.

- EBITDA was €7 million in Q3 2020.

- The Group is in discussion with UEFA to be compensated following the suspension of the competition between March and August 2020.

Shares outstanding

As at September 30, 2020, Altice Europe had 1,194,011,147 5 common shares outstanding and 1,855,664 preference shares B outstanding.

Altice Europe Consolidated Net Debt as of September 30, 2020 , breakdown by credit silo 6

- Group weighted average debt maturity of 6.0 years;

- Reduced WACD from 5.0% at year-end 2019 to 4.5%;

- 89% fixed interest rate;

- No major maturities until 2025;

- Available liquidity of €3.5 billion 7 .

- Total consolidated Altice Europe net debt was €28.9 billion (€28.5 billion pro forma for the €375 million earn-out due in December 2021, from the sale of 49.99% of FastFiber) at the end of Q3 2020.

Altice Europe Pro Forma Net Leverage Reconciliation as of September 30, 2020

Altice Europe Non-GAAP Reconciliation to unaudited GAAP measures as of September 30, 2020 year to date 9

FORWARD-LOOKING STATEMENTS

Certain statements in this press release constitute forward-looking statements. These forward-looking statements include, but are not limited to, all statements other than statements of historical facts contained in this press release, including, without limitation, those regarding our intentions, beliefs or current expectations concerning, among other things: our future financial conditions and performance, results of operations and liquidity; our strategy, plans, objectives, prospects, growth, goals and targets; and future developments in the markets in which we participate or are seeking to participate. These forward-looking statements can be identified by the use of forward-looking terminology, including the terms “believe”, “could”, “estimate”, “expect”, “forecast”, “intend”, “may”, “plan”, “project” or “will” or, in each case, their negative, or other variations or comparable terminology. Where, in any forward-looking statement, we express an expectation or belief as to future results or events, such expectation or belief is expressed in good faith and believed to have a reasonable basis, but there can be no assurance that the expectation or belief will be achieved or accomplished. To the extent that statements in this press release are not recitations of historical fact, such statements constitute forward-looking statements, which, by definition, involve risks and uncertainties that could cause actual results to differ materially from those expressed or implied by such statements including risks referred to in our annual and quarterly reports.

1 Financials exclude press magazine Groupe L’Express (following disposal on July 30, 2019) and daily newspaper Libération (following disposal on September 03, 2020) from 1/1/19 2 €3.5 billion liquidity includes €2.1 billion of undrawn revolvers and €1.3 billion of cash. The €1.3 billion of cash is including the €375 million earn-out to be received in December 2021 (not including the €375 million earn-out to be received in December 2026) and excludes funding of the Covage acquisition expected in Q4 2020 and any associated construction-related EBITDA 3 Excluding spectrum and significant litigations paid and received 4 Teads gross revenue is presented before discounts (net revenue after discounts is recognised in the financial statements) 5 As at September 30, 2020, Altice Europe had 1,071,179,150 common shares A (including 72,103,159 treasury shares) and 194,935,156 common shares B outstanding 6 Group net debt is pro forma for the €375 million earn-out in December 2021 from the sale of 49.99% of FastFiber. Group net debt includes €21 million of cash at Altice Europe and other subsidiaries outside debt silos 7 €3.5 billion liquidity includes €2.1 billion of undrawn revolvers and €1.3 billion of cash. The €1.3 billion of cash is including the €375 million earn-out to be received in December 2021 (not including the €375 million earn-out to be received in December 2026) and excludes funding of the Covage acquisition expected in Q4 2020 and any associated construction-related EBITDA 8 The €1.3 billion of cash is including the €375 million earn-out to be received in December 2021 (not including the €375 million earn-out to be received in December 2026) and excludes funding of the Covage acquisition expected in Q4 2020 and any associated construction-related EBITDA 9 The difference in consolidated revenue as reported for Altice Europe in the Non-GAAP Reconciliation to GAAP measures as of September 30, 2020 year to date and the Pro Forma Financial Information for Altice Europe as disclosed in this press release is mainly due to Teads gross revenue which is presented before discounts in this press release (net revenue after discounts is recognised in the financial statements). In addition, financials for Altice Europe exclude press magazine Groupe L’Express (following disposal on July 30, 2019) and daily newspaper Libération (following disposal on September 03, 2020) from 1/1/19

Altice Europe

Head of Investor Relations Altice Europe Sam Wood: +41 79 538 66 82 / [email protected]

Head of Communications Altice Europe Arthur Dreyfuss: +41 79 946 4931 / [email protected]

- Today's news

- Reviews and deals

- Climate change

- 2024 election

- Fall allergies

- Health news

- Mental health

- Sexual health

- Family health

- So mini ways

- Unapologetically

- Buying guides

Entertainment

- How to Watch

- My Portfolio

- Latest News

- Stock Market

- Premium News

- Biden Economy

- EV Deep Dive

- Stocks: Most Actives

- Stocks: Gainers

- Stocks: Losers

- Trending Tickers

- World Indices

- US Treasury Bonds

- Top Mutual Funds

- Highest Open Interest

- Highest Implied Volatility

- Stock Comparison

- Advanced Charts

- Currency Converter

- Basic Materials

- Communication Services

- Consumer Cyclical

- Consumer Defensive

- Financial Services

- Industrials

- Real Estate

- Mutual Funds

- Credit cards

- Balance Transfer Cards

- Cash-back Cards

- Rewards Cards

- Travel Cards

- Personal Loans

- Student Loans

- Car Insurance

- Morning Brief

- Market Domination

- Market Domination Overtime

- Opening Bid

- Stocks in Translation

- Lead This Way

- Good Buy or Goodbye?

- Fantasy football

- Pro Pick 'Em

- College Pick 'Em

- Fantasy baseball

- Fantasy hockey

- Fantasy basketball

- Download the app

- Daily fantasy

- Scores and schedules

- GameChannel

- World Baseball Classic

- Premier League

- CONCACAF League

- Champions League

- Motorsports

- Horse racing

- Newsletters

New on Yahoo

- Privacy Dashboard

Yahoo Finance

Altice moves more units out of reach, spooking creditors.

(Bloomberg) -- Debt tied to Altice fell on Wednesday after the company spooked investors with disclosures saying that it freed certain units from debt covenants, according to people with knowledge of the matter.

Most Read from Bloomberg

Slovak Premier Fighting for Life After Assassination Attempt

China Considers Government Buying of Unsold Homes to Save Property Market

US Inflation Ebbs for First Time in Six Months in Relief for Fed

How One of the World's Oldest Hedge Funds Went Bankrupt

Flood of China Used Cooking Oil Spurs Call to Hike US Levies

Altice France’s euro-denominated term loans due August 2028 dropped 2 cents on the euro and are indicated at about 72 cents, according to Stonex data. The company’s bonds due October 2029 also fell around 1 cent to 65.6 cents, according to data compiled by Bloomberg. Altice International’s bonds due January 2028 slumped 2.5 cents to about 59.9 cents.

The struggling telecommunications group posted filings in an investor portal saying it had designated a series of subsidiaries as “unrestricted,” said the people, who asked not to be identified because the disclosures were private.

Those moves are often the first step to raising new money in deals that hurt creditors by weakening their claims on collateral, or selling assets without giving the proceeds to creditors

Traders and investors were left scrambling to figure out what assets — if any — were held by the new unrestricted units, the people added. The subsidiaries include AlticeXPM, Altice Participations and Altice Luxco III S.a.r.l., the people said.

A representative for Altice declined to comment.

Altice France, which controls French mobile operator SFR and is part of billionaire Patrick Drahi’s telecom empire, shocked markets earlier this year when management told investors they would need to participate in “discounted transactions” to help the company cut its debt. The company previously designated its Altice Media unit as an unrestricted asset, ensuring that proceeds from its sale can be used for other ends than paying down debt.

Altice International owns telecommunications operators in Portugal, Israel and Dominican Republic.

Filings to the Luxembourg registry show that Altice Luxco 3 Sarl was created on April 15.

--With assistance from Libby Cherry and Benoit Berthelot.

(Updates with Altice International bonds prices in third paragraph and description in eighth.)

Most Read from Bloomberg Businessweek

How the ‘Harvard of Trading’ Ruined Thousands of Young People’s Lives

Kids Hooked on Video Games Prompt a Flurry of Lawsuits

The DNA Test Delusion

US East Coast Ports Are Spending Billions to Profit From Asia’s Shifting Exports

Silicon Valley Is Searching for Its Piece of the AI Action

©2024 Bloomberg L.P.

First-quarter profit improves at Altice Europe's French unit, driving shares up

- Medium Text

- Altice France Q1 adjusted EBITDA up 2 pct

- Preliminary results issued in regulatory filing

- Shares reverse earlier losses

Sign up here.

Reporting by Mathieu Rosemain and Gwenaelle Barzic; Editing by Sudip Kar-Gupta and Sarah White

Our Standards: The Thomson Reuters Trust Principles. New Tab , opens new tab

Business Chevron

Nestle India shareholders vote against increase in royalty to Swiss parent

Shareholders in Nestle India have rejected a company proposal to increase royalty payments to its Swiss parent Nestle , the company said late on Friday.

We've detected unusual activity from your computer network

To continue, please click the box below to let us know you're not a robot.

Why did this happen?

Please make sure your browser supports JavaScript and cookies and that you are not blocking them from loading. For more information you can review our Terms of Service and Cookie Policy .

For inquiries related to this message please contact our support team and provide the reference ID below.

Altice France

Covenant Analysis: Exploring Altice France’s Liability Management Options: Debt Push-Down, Priming / Subordination Threats Could Be Used to Coerce Creditors Into a Deal

Share this article :, to read the full story.

Or sign in here

Interested in a Reorg subscription for your business?

Sign up for reorg on the record.

Weekly highlights from our global intel and expert analysis

Thank you for signing up for Reorg on the Record!

Financial Results

- Email Alerts

- Company Profile

- RSS News Feed

Altice France Holding S.A Investor Relations Material

- Altice France Holding S.A

Latest events

Latest reports from Altice France Holding S.A

Key slides for altice france holding s.a.

Latest articles

Explore Burberry's journey from a small outfitter to a global luxury fashion icon under Daniel Lee's creative vision.

The life, work, and legacy of Nike’s legendary founder Phil Knight and his path to the top of athletic footwear and apparel.

Discover how Palantir Technologies, a leader in data analytics since 2003, shapes global events and keeps growing rapidly into various domains.

IMAGES

VIDEO

COMMENTS

Altice France - Results & presentations - 20.03.2024 SFR (Altice France) - Q4 & FY 2023 Results Presentation ... Télécharger - PDF 429.46 Ko. Altice France - Press Releases & Notices - 15.03.2024 Altice France has entered into an exclusivity agreement to sell Altice Media (BFM, RMC) to the CMA CGM Group ... SFR (Altice France) Q4 & FY 2023 ...

Altice France Q1 2021 Results Presentation. 20.05.2021 Altice France Holding Restricted Group Q1 2021 Results . ... Invitation for Debt Investors - 24.02.2021 - 1:30pm CET. 03.02.2021 Altice France has entered into an exclusivity agreement to sell its interest in Hivory to Cellnex - 03.02.2021 - 5:45pm CET -

Altice Europe N.V.: Q3 2020 and Historical Pro Forma Financial Information - 19.11.2020 - 5:35pm CET. Download - XLSX 1.54 MB. 1.

Altice France announces launch of offering of €900 million (equivalent) senior secured notes due 2028 Download - PDF 127.28 KB. ... Altice SA IPO investor presentation Download - PDF 881.57 KB. Results and presentations - 13.11.2013 Altice VII Third quarter 2013 report

Altice France Holding Restricted Group Q2 2021 Results Call - Invitation for Debt Investors. Download - PDF 113.64 KB. Altice France - Financial documentation - 05.07.2021.

Altice France Full Year and Q4 2020 Results Call - Invitation for Debt Investors - 24.02.2021 - 1:30pm CET. 03.02.2021.

A call for existing and prospective debt investors of the Altice France Holding Restricted Group will be held today, Thursday, November 18, 2021 at 2:00pm CET (1:00pm GMT, 08:00am EST), to discuss its Q3 ... Financial Presentation Altice France Holding S.A. holds 100% less one share of Altice France S.A., and Altice Luxembourg S.A. ...

A call for existing and prospective debt investors of the Altice France Holding Restricted Group will be held today, Wednesday, July 28, 2021 at 2:00pm CEST (1:00pm BST, 08:00am EDT), to discuss its Q2 ... Financial Presentation Altice France Holding S.A. holds 100% less one share of Altice France S.A., and Altice Luxembourg S.A. ...

The Altice Corporate Financing facility was repaid during the third quarter, following the issuance of €900 million equivalent of new 8.25-year Senior Secured Notes at Altice France.

Read more about Altice International Non-Deal Road Show Presentation; Altice International - Q2 2023 Results Presentation. Submitted by Xia on Mon, 08/07/2023 ... Existing and prospective Altice France and Altice International debt investors may refer to the separate Altice France and Altice International webpages. Close.

Altice France, which controls French mobile operator SFR and is part of billionaire Patrick Drahi's telecom empire, shocked markets earlier this year when management told investors they would ...

Altice's Portuguese unit generated 509 million euros of revenue in the first quarter, up 0.4 percent from a year earlier, according to Altice Luxembourg's filing. Its adjusted EBITDA grew 1.4 ...

1:50. Debt tied to Altice fell on Wednesday after the company spooked investors with disclosures saying that it freed certain units from debt covenants, according to people with knowledge of the ...

A deal could value XpFibre, which is owned by Drahi's Altice France, at around €6 billion to €7 billion including debt, the people said. XpFibre had about €2.5 billion of net debt as of 2023, according to a September investor presentation. Bloomberg News previously reported that KKR and Macquarie Group Ltd. were shortlisted in the bidding.

Q3'23 Presentation Nov. 22, 2023 investor call transcript Nov. 2023 Altice International Capacity Analysis June 2023 Altice France SSNs 2029 Core Analysis (issued 6 Oct., 2021) Will Altice France cut its debt by €4 billion by the August deadline management set in 2023?

Altice France - Q1 2020 Consolidated Financial Statements. Friday, May 22, 2020 - 10:49. Download - PDF 0.2 MB.

Investor Relations 2024 Annual Meeting of Stockholders Jun 12, 2024 9:00 am EDT. ... multiscreen advertising solutions to local, regional and national businesses and advertising clients. Altice USA also offers hyper-local, national, international and business news through its News 12, and i24NEWS networks. ... Presentation. PDF . Trended ...

The stir created by French telecommunications and media company Altice France SA's fourth-quarter 2023 earnings call is yet to die down. The trigger was management's notification that it had revised its deleveraging target, now aiming to delever below 4x, which would require participation of investors in discounted debt repurchase or exchange transactions. Investors are still digesting the ...

Fiscal Year Ended Dec 31, 2023. Earnings Release. HTML PDF

Altice International - FY 2023 Non-Financial Performance Statement. Tuesday, May 14, 2024 - 10:31. Download - PDF 4.9 MB.

Access Altice France Holding S.A (undefined) Investor Relations material, such as Live Earnings Calls, Transcripts, Slides, Reports, and Estimates using Quartr ... Altice France Holding S.A Investor Relations Material. Companies. Altice France Holding S.A. Latest events. Q3 2023. Altice France Holding S.A. Q3 2023. 22 Nov, 2023. Q2 2023.