- Great Depression Essays

The Great Depression Essay

The recession of the American economy led to the greatest depression that has never been experienced in the American economic history. The Great Depression, experienced between 1929 and 1932, was a period of extreme hardship in America as it forced Americans to experience an economic crisis which left many jobless and hopeless. It was the worst and longest difficult situation in the country’s economic history that threw many hardworking people into poverty. People lost their homes, farms as well as their businesses (Gunderson 4). The Great Depression led to economic stagnation and widespread unemployment and also the depression was experienced in virtually all in every major industrialized country (Hall and Ferguson 2). The impact of the Great Depression was devastating as many individuals lost their homes because they had no work and a steady income and as a result, most of them were forced to live in makeshift dwellings with poor condition and sanitation. Many children dropped out of school and married women were forced to carry a greater domestic burden. More so, the depression widened the gap between the rich and the poor (Freedman 14) because many poor individuals suffered the hardships during this period while the rich remained unaffected. This paper discusses the period of Great Depression and it covers the life during this time and how the city dwellers, farmers, children and minority groups were affected. The Great Depression started following the occurrence of the Wall Street crash and rapidly spread in different parts of the world; however, some have argued that it was triggered by mistakes in monetary policy and poor government policy (Evans 15). Different hardships and challenges were experience by individuals in different parts of the world with many people left with no work. More so, individuals especially farmers suffered from poverty and low profits, deflation and they had no opportunity for personal and economic growth. Notably, different people were affected differently, for instance, unemployment affected men and they were desperate for work while children were forced to leave school and search for something to do so as to earn money for their family. Farmers were greatly affected because this period led to decrease in price in the prices of their crops and livestock and they still worked hard to produce more so as to pay their debts, taxes and living expenses. The period before this economic crisis, farmers were already losing money due to industrialization in cities and so most of them were renting their land and machinery. When the depression started, prices on food produced by farmers deflated leaving them incapable of making profit and so they stopped selling their farm products and this in turn affected the city dwellers that were unable to produce their own food. Undoubtedly, after the stock market crash, many firms declined and many workers were forced out of their jobs because there were really no jobs. Moreover, many people had no money to purchase commodities and so the consumer demand for manufactured goods reduced significantly. Sadly, individuals had to learn to do without new clothing. The prices dropped significantly leaving farmers bankrupt and as a result most of them lost their farms. Some farmers were angry and desperate proposing that the government should intervene and ensure that farm families remain in their respective homes. But again, farmers were better off than city dwellers because they could produce much of their own food. Many farm families had large gardens with enough food crops and in some families, women made clothes from flour and feed sacks and generally, these farm families learned how to survive with what they have and little money.

Struggling with your HW?

Get your assignments done by real pros. Save your precious time and boost your marks with ease. Just fill in your HW requirements and you can count on us!

- Customer data protection

- 100% Plagiarism Free

Furthermore, the town and cities suffered too, for instance, as the factories were shutting down following the depression many industrial workers were left jobless. The life in the city was not easy as many individuals lived in overcrowded and unheated houses with poor sanitation. In addition, many firms closed and many individuals lost their jobs and had to deal with the reality of living in poverty. Town families were unable to produce their own food and so many city dwellers often went hungry during this period. During winter, they had hard times overcoming the cold because they had no money to buy coal to warm their houses. During the depression, the known role of women was homemaking because they had a difficult time finding jobs and so the only thing they were supposedly good at was preparing meals for their families and keeping their families together. Some women who managed to have jobs supported their families in overcoming this difficult time. Accordingly, many children were deprived their right to have access to quality education because many societies had to close down their schools due to lack of money. Some of them managed to be in schools but majority dropped out. More so, they suffered from malnutrition and those in rural areas were worse off because with the family’s low income, they were unable to purchase adequate nutritional food for all family members. Many children and even adults died from diseases and malnutrition (Gunderson 4). The minority groups in America especially the African American population who lived in rural areas working on the farms of white owners. Even though they lived in poverty, the Depression made the situation worse as their lived changed completely and remained extremely poor because the farmers they were working for had lost their land. All in all, many families struggled to leave on low incomes or no jobs with many children starving; lacked shelter and clothing as well as medical attention (Freedman 4).

In conclusion, the Great Depression was a tragic time in American history that left many people poor, unemployed or little pay, and children forced to work at a younger age. The Great Depression affected everyone from children to adults, farmers to city dwellers and so everyone’s lives changed drastically by the events experienced during this period. Many individuals were unemployed and remained desperate searching for better lives. In addition, children had no access to quality education as most of them left school and sadly they accompanied their mothers to look for work and search for a new life. However, some people particularly the employers and the wealthy were not affected during this period because they were protected from the depression with their position in the society.

Works Cited

Evans, Paul. “What Caused the Great Depression in the United States?” Managerial Finance 23.2 (1997): 15-24.

Used our essay samples for inspiration ?

For more help, tap into our pool of professional writers and get expert essay editing services!

Freedman, Russell. Children of the Great Depression. New York: Clarion Books, 2005. Print.

Gunderson, Cory G. The Great Depression. Edina, Minn: ABDO Pub, 2004. Internet resource.

Hall, Thomas E, and Ferguson J D. The Great Depression: An International Disaster of Perverse Economic Policies. Ann Arbor: University of Michigan Press, 1998. Internet resource.

Related Essays

Find Free Essays

We provide you with original essay samples, perfect formatting and styling

Request must contain at least 2 characters

Popular Topics

Samples by Essay Type

Cite this page

About our services

Topic Great Depression

Level High School

This sample is NOT ORIGINAL. Get 100% unique essay written under your req

- Only $11 per page

- Free revisions included

Studyfy uses cookies to deliver the best experience possible. Read more.

Studyfy uses secured cookies. Read more.

Home — Essay Samples — History — History of the United States — Great Depression

Essays on Great Depression

Great depression essay topic examples, argumentative essays.

Argumentative essays on the Great Depression require you to take a stance on a specific aspect of this historical event and provide evidence to support your viewpoint. Consider these topic examples:

- 1. Argue for the primary causes of the Great Depression, emphasizing the role of economic policies, banking practices, and global factors in triggering the crisis.

- 2. Debate the effectiveness of New Deal programs in alleviating the suffering of Americans during the Great Depression, discussing their long-term impact on the nation's economy and social fabric.

Example Introduction Paragraph for an Argumentative Great Depression Essay: The Great Depression remains a defining moment in American history, marked by economic turmoil and widespread suffering. In this argumentative essay, we will examine the primary causes of the Great Depression, focusing on economic policies, banking practices, and global factors that contributed to this devastating crisis.

Example Conclusion Paragraph for an Argumentative Great Depression Essay: In conclusion, the analysis of the Great Depression's causes underscores the complexity of this historical event. As we reflect on the lessons learned from this era, we are reminded of the importance of sound economic policies and vigilant oversight in preventing future economic crises.

Compare and Contrast Essays

Compare and contrast essays on the Great Depression involve analyzing the similarities and differences between various aspects of the era, such as its impact on different countries or the approaches taken to address the crisis. Consider these topics:

- 1. Compare and contrast the effects of the Great Depression on the United States and Germany, examining the economic, social, and political consequences in both nations.

- 2. Analyze and contrast the approaches taken by Franklin D. Roosevelt's New Deal and Adolf Hitler's economic policies in response to the Great Depression, exploring their divergent ideologies and outcomes.

Example Introduction Paragraph for a Compare and Contrast Great Depression Essay: The Great Depression had a global impact, affecting nations differently and prompting diverse responses. In this compare and contrast essay, we will explore the effects of the Great Depression on the United States and Germany, examining the economic, social, and political consequences in both countries.

Example Conclusion Paragraph for a Compare and Contrast Great Depression Essay: In conclusion, the comparison and contrast of the Great Depression's effects on the United States and Germany reveal the profound and lasting consequences of economic crises. As we study these different experiences, we gain insights into the resilience of nations facing adversity.

Descriptive Essays

Descriptive essays on the Great Depression allow you to provide detailed accounts and analysis of specific aspects, events, or individuals during this period. Here are some topic ideas:

- 1. Describe the everyday life of a typical American family during the Great Depression, detailing their struggles, coping mechanisms, and aspirations for a better future.

- 2. Paint a vivid picture of a significant event from the Great Depression era, such as the Dust Bowl or a famous protest, discussing its impact on society and the lessons learned.

Example Introduction Paragraph for a Descriptive Great Depression Essay: The Great Depression left an indelible mark on the lives of ordinary Americans, shaping their daily experiences and aspirations. In this descriptive essay, we will delve into the everyday life of a typical American family during this challenging period, exploring their struggles and hopes for a brighter future.

Example Conclusion Paragraph for a Descriptive Great Depression Essay: In conclusion, the descriptive exploration of a typical American family's life during the Great Depression reminds us of the resilience and determination of individuals in the face of adversity. As we reflect on their experiences, we are inspired by their unwavering spirit.

Persuasive Essays

Persuasive essays on the Great Depression involve advocating for specific actions, policies, or changes related to economic recovery, social welfare, or preventing future economic crises. Consider these persuasive topics:

- 1. Persuade your audience of the importance of implementing social safety net programs to prevent another Great Depression-like economic catastrophe, highlighting the potential benefits and challenges of such initiatives.

- 2. Advocate for increased financial literacy education in schools as a means to empower individuals with the knowledge and skills to make informed financial decisions, potentially preventing future economic crises.

Example Introduction Paragraph for a Persuasive Great Depression Essay: The lessons of the Great Depression continue to shape economic and social policies today. In this persuasive essay, I will make a compelling case for the implementation of social safety net programs aimed at preventing future economic catastrophes like the Great Depression, emphasizing the potential benefits and challenges of such initiatives.

Example Conclusion Paragraph for a Persuasive Great Depression Essay: In conclusion, the persuasive argument for social safety net programs underscores the importance of proactive measures to safeguard against economic crises. As we advocate for change, we contribute to a more resilient and equitable society.

Narrative Essays

Narrative essays on the Great Depression allow you to share personal stories, experiences, or observations related to this historical period, your family's history during the era, or the impact of the Great Depression on your community. Explore these narrative essay topics:

- 1. Narrate a family story or anecdote passed down through generations about how your family coped with the challenges of the Great Depression, highlighting the resilience and resourcefulness of your ancestors.

- 2. Share a personal narrative of how the Great Depression era shaped the values and principles of your community, discussing the lasting impact on your town or neighborhood.

Example Introduction Paragraph for a Narrative Great Depression Essay: The Great Depression was not just a historical event; it was a period that defined the experiences and values of countless individuals and communities. In this narrative essay, I will share a family story that has been passed down through generations, illustrating how my family coped with the challenges of this era and the lasting impact on our values.

Example Conclusion Paragraph for a Narrative Great Depression Essay: In conclusion, the narrative of my family's experience during the Great Depression serves as a reminder of the resilience and resourcefulness that emerged during this challenging period. As we reflect on our history, we find inspiration in the strength of those who came before us.

Social Issues in Cinderella Man

Grapes of wrath intercalary chapter summary, made-to-order essay as fast as you need it.

Each essay is customized to cater to your unique preferences

+ experts online

John Steinbeck and The Great Depression

The major causes and effects of the great depression in the united states, the great depression: hoover's and roosevelt's approaches, the start and end of the great depression in america, let us write you an essay from scratch.

- 450+ experts on 30 subjects ready to help

- Custom essay delivered in as few as 3 hours

New Deal Programs During The Great Depression

Impact and causes of the great depression, an analysis of the causes of the great depression, the great depression and its negative effects on the united states, get a personalized essay in under 3 hours.

Expert-written essays crafted with your exact needs in mind

The Great Depression in The USA

The great depression: america's biggest financial collapse in economic history, john steinbeck's involvement in the great depression and vietnam war, the great depression in the us: causes and solutions applied, impact of the great depression on women, the causes and effects of the great depression, the factors of the end of the great depression, relief, recovery and reform programs in the usa: the new deal, the culture of poverty in america during the great depression, the current american economic system: a direct result of the roaring twenties and the great depression, the objectives of franklin roosevelt's new deal program after the great depression, the great depression and the new deal, investigation of 1929 stock market crash, the factors that opened the door for the united states to deal with the great depression at the start of world war ii, the great depression in ottawa, migrant mother by dorothea lange – a picture worth a thousand words, analysis of the effects of the wall street crash of 1929, the great depression as the important factor in nazis empowerment in 1933, analysis of the wall street crash of 1929 as a cause of the great depression in america, depiction of poverty in eugenia collier’s marigolds and thomas hart benton’s cotton pickers.

1929 - c. 1939

Europe, United States

Franklin D. Roosevelt: As the President of the United States from 1933 to 1945, Roosevelt implemented the New Deal, a series of economic and social programs aimed at alleviating the effects of the Great Depression. John Steinbeck: An influential American author, Steinbeck wrote novels such as "The Grapes of Wrath" (1939), which depicted the plight of migrant workers during the Great Depression. His work shed light on the social and economic injustices faced by many Americans during that time. Dorothea Lange: A renowned documentary photographer, Lange captured powerful images of individuals and families affected by the Great Depression. Her iconic photograph "Migrant Mother" became a symbol of the hardships faced by ordinary Americans. Eleanor Roosevelt: The wife of President Franklin D. Roosevelt, Eleanor Roosevelt was a prominent advocate for social and economic reform. She played an active role in promoting the New Deal policies and was a strong voice for marginalized communities during the Great Depression.

The Great Depression, one of the most severe economic crises in history, occurred during the 1930s. It started in the United States with the stock market crash of 1929, often referred to as "Black Tuesday." This event led to a chain reaction of economic downturns worldwide, resulting in high unemployment rates, widespread poverty, and a significant decline in industrial production. The effects of the Great Depression were felt across various sectors, including agriculture, manufacturing, and banking.

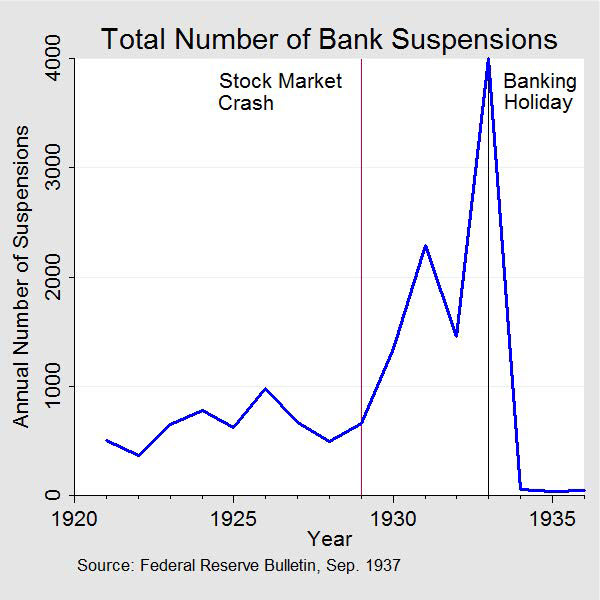

The Great Depression was preceded by a series of factors that set the stage for its occurrence. In the aftermath of World War I, the global economy experienced a period of instability and rapid growth known as the Roaring Twenties. However, beneath the surface of apparent prosperity, there were underlying vulnerabilities. One of the key factors contributing to the Great Depression was the rampant speculation in the stock market, fueled by easy credit and speculative investments. This speculative bubble eventually burst in October 1929, triggering the stock market crash and initiating a chain reaction of economic collapse. Additionally, international economic imbalances played a role in exacerbating the crisis. Protectionist trade policies, war reparations, and a decline in global trade contributed to a decline in industrial production and widespread unemployment. The collapse of the banking system further deepened the crisis, as bank failures wiped out people's savings and caused a severe liquidity crisis.

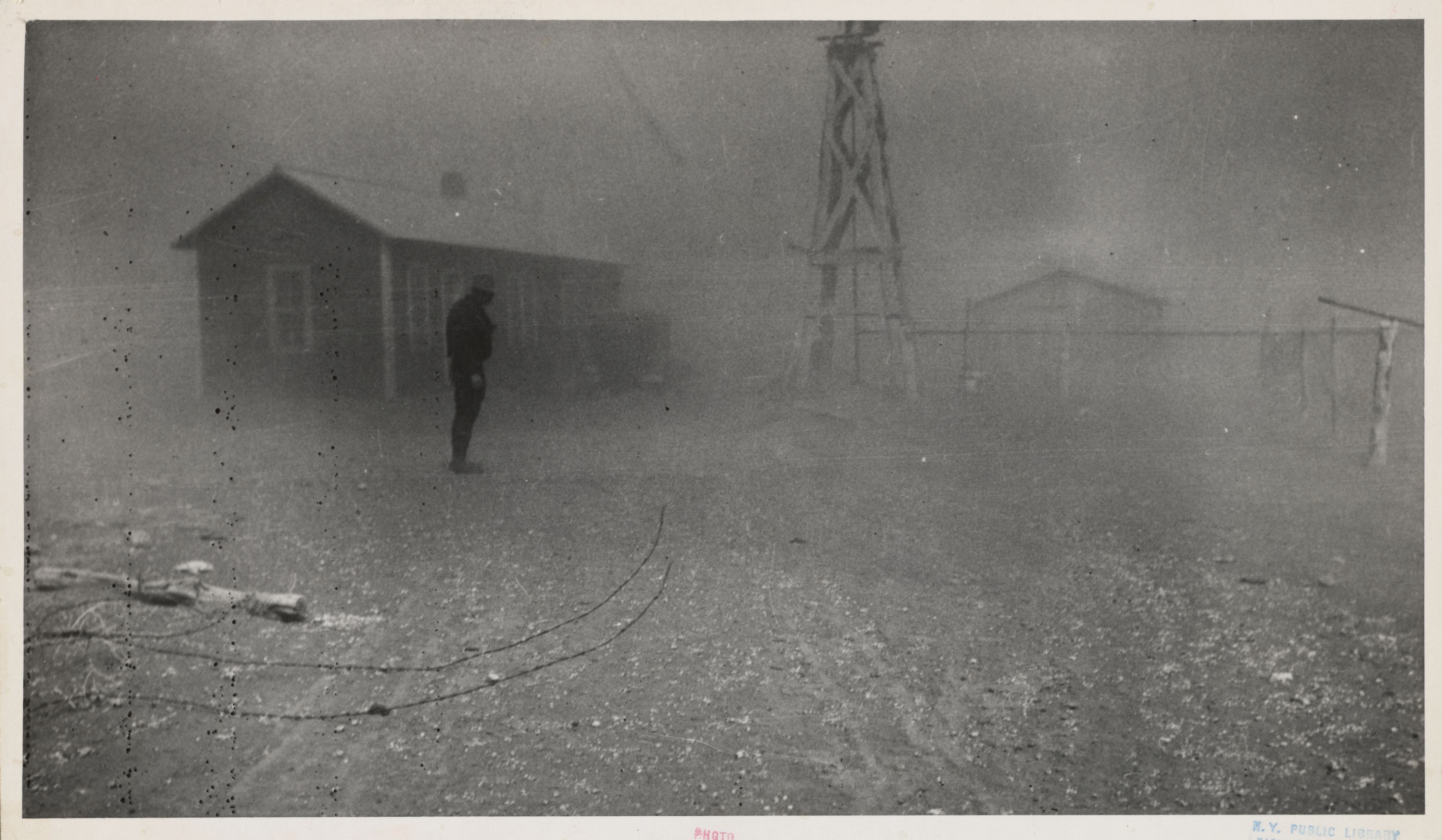

Stock Market Crash: On October 29, 1929, known as Black Tuesday, the stock market experienced a catastrophic crash, signaling the start of the Great Depression. This event led to a massive loss of wealth and investor confidence. Dust Bowl: In the early 1930s, severe drought and poor farming practices led to the Dust Bowl in the Great Plains region of the United States. Dust storms ravaged the land, causing agricultural devastation and mass migration of farmers to seek better opportunities elsewhere. New Deal: In response to the crisis, President Franklin D. Roosevelt implemented the New Deal, a series of programs and reforms aimed at providing relief, recovery, and reform. This included measures such as the creation of jobs, financial regulations, and social welfare initiatives.

Economic Collapse: The Great Depression plunged the global economy into a severe downturn. Industries faced widespread bankruptcies, trade declined, and unemployment soared. Poverty levels skyrocketed, leaving many families without basic necessities. Social Unrest: The economic hardship led to increased social unrest. Breadlines, shantytowns, and soup kitchens became common sights as people struggled to survive. Homelessness and hunger became prevalent, straining social structures. Global Impact: The Great Depression had a global reach, affecting countries around the world. International trade declined, leading to a sharp decline in exports and imports. This interconnectedness contributed to a worldwide economic slowdown. Political Shifts: The economic crisis paved the way for significant political shifts. Governments faced pressure to address the crisis, resulting in the rise of interventionist policies and increased government involvement in the economy. This gave birth to the concept of the welfare state. Cultural and Artistic Expression: The Great Depression influenced art, literature, and music, reflecting the hardships and struggles of the era. Artists and writers depicted the human suffering and the search for hope amid despair.

Literature: John Steinbeck's novel "The Grapes of Wrath" (1939) is a powerful depiction of the Great Depression's impact on migrant workers in the United States. It follows the Joad family as they face poverty, displacement, and exploitation while searching for a better life. The book explores themes of resilience, social injustice, and the human spirit in the face of adversity. Photography: The Farm Security Administration (FSA) hired photographers, including Dorothea Lange and Walker Evans, to document the effects of the Great Depression. Their iconic photographs, such as Lange's "Migrant Mother," captured the hardships faced by rural communities, evoking empathy and raising awareness about the human toll of the economic crisis. Films: Movies like "The Grapes of Wrath" (1940) and "It's a Wonderful Life" (1946) depicted the struggles and resilience of individuals and communities during the Great Depression. These films offered social commentary, showcased the impact of economic hardship, and explored themes of hope, perseverance, and the importance of human connections. Music: Artists like Woody Guthrie composed folk songs that reflected the experiences of those affected by the Great Depression. Guthrie's "This Land Is Your Land" and "Dust Bowl Blues" expressed the struggles of the working class and the desire for a more equitable society. Art: Painters such as Grant Wood and Thomas Hart Benton created works that captured the hardships and rural landscapes of the Great Depression. Wood's painting "American Gothic" became an iconic representation of the era, symbolizing the resilience and determination of the American people.

1. The Gross Domestic Product (GDP) of the United States dropped by approximately 30% during the Great Depression. 2. Between 1929 and 1932, over 9,000 banks in the United States failed, causing immense financial instability. 3. The poverty rate in the United States surged during the Great Depression. By 1933, around 15 million Americans, representing approximately 30% of the population at that time, were living below the poverty line.

The topic of the Great Depression holds significant importance as it marks a critical period in global history that profoundly impacted economies, societies, and individuals worldwide. Exploring this topic in an essay provides valuable insights into the causes, consequences, and responses to one of the most severe economic downturns in modern times. Understanding the Great Depression is essential to grasp the complexities of economic cycles, financial systems, and government policies. It allows us to reflect on the vulnerabilities of economies and the potential ramifications of economic crises. Moreover, studying the Great Depression enables us to analyze the various social, political, and cultural transformations that took place during that era, including the rise of social welfare programs, labor movements, and governmental interventions. By delving into this topic, we gain valuable lessons about resilience, adaptability, and the role of leadership during challenging times. Exploring the experiences of individuals and communities during the Great Depression also helps us empathize with their struggles and appreciate the importance of collective efforts to overcome adversity.

1. Bernanke, B. S. (1983). Nonmonetary effects of the financial crisis in the propagation of the Great Depression. The American Economic Review, 73(3), 257-276. 2. Eichengreen, B. (1992). Golden fetters: The gold standard and the Great Depression, 1919-1939. Oxford University Press. 3. McElvaine, R. S. (1993). The Great Depression: America, 1929-1941. Times Books. 4. Rothbard, M. N. (2000). America's Great Depression. Ludwig von Mises Institute. 5. Badger, A. J. (2014). The Great Depression as a revolution. The Journal of Interdisciplinary History, 44(2), 156-174. 6. Temin, P. (2010). The Great Depression: Lessons for macroeconomic policy today. MIT Press. 7. Kennedy, D. M. (1999). Freedom from fear: The American people in depression and war, 1929-1945. Oxford University Press. 8. Leuchtenburg, W. E. (2015). The FDR years: On Roosevelt and his legacy. Columbia University Press. 9. Roth, B. (2017). The causes and consequences of the Great Depression. OpenStax. 10. Galbraith, J. K. (1997). The Great Crash, 1929. Houghton Mifflin.

Relevant topics

- Industrial Revolution

- Civil Rights Movement

- Pearl Harbor

- Manifest Destiny

- Westward Expansion

- American Revolution

- Imperialism

- Frederick Douglass

By clicking “Check Writers’ Offers”, you agree to our terms of service and privacy policy . We’ll occasionally send you promo and account related email

No need to pay just yet!

We use cookies to personalyze your web-site experience. By continuing we’ll assume you board with our cookie policy .

- Instructions Followed To The Letter

- Deadlines Met At Every Stage

- Unique And Plagiarism Free

- History Classics

- Your Profile

- Find History on Facebook (Opens in a new window)

- Find History on Twitter (Opens in a new window)

- Find History on YouTube (Opens in a new window)

- Find History on Instagram (Opens in a new window)

- Find History on TikTok (Opens in a new window)

- This Day In History

- History Podcasts

- History Vault

Great Depression History

By: History.com Editors

Updated: October 20, 2023 | Original: October 29, 2009

The Great Depression was the worst economic crisis in modern history, lasting from 1929 until the beginning of World War II in 1939. The causes of the Great Depression included slowing consumer demand, mounting consumer debt, decreased industrial production and the rapid and reckless expansion of the U.S. stock market. When the stock market crashed in October 1929, it triggered a crisis in the international economy, which was linked via the gold standard. A rash of bank failures followed in 1930, and as the Dust Bowl increased the number of farm foreclosures, unemployment topped 20 percent by 1933. Presidents Herbert Hoover and Franklin D. Roosevelt tried to stimulate the economy with a range of incentives including Roosevelt’s New Deal programs, but ultimately it took the manufacturing production increases of World War II to end the Great Depression.

What Caused the Great Depression?

Throughout the 1920s, the U.S. economy expanded rapidly, and the nation’s total wealth more than doubled between 1920 and 1929, a period dubbed “ the Roaring Twenties .”

The stock market, centered at the New York Stock Exchange on Wall Street in New York City , was the scene of reckless speculation, where everyone from millionaire tycoons to cooks and janitors poured their savings into stocks. As a result, the stock market underwent rapid expansion, reaching its peak in August 1929.

By then, production had already declined and unemployment had risen, leaving stock prices much higher than their actual value. Additionally, wages at that time were low, consumer debt was proliferating, the agricultural sector of the economy was struggling due to drought and falling food prices and banks had an excess of large loans that could not be liquidated.

The American economy entered a mild recession during the summer of 1929, as consumer spending slowed and unsold goods began to pile up, which in turn slowed factory production. Nonetheless, stock prices continued to rise, and by the fall of that year had reached stratospheric levels that could not be justified by expected future earnings.

Stock Market Crash of 1929

On October 24, 1929, as nervous investors began selling overpriced shares en masse, the stock market crash that some had feared happened at last. A record 12.9 million shares were traded that day, known as “Black Thursday.”

Five days later, on October 29, or “Black Tuesday,” some 16 million shares were traded after another wave of panic swept Wall Street. Millions of shares ended up worthless, and those investors who had bought stocks “on margin” (with borrowed money) were wiped out completely.

As consumer confidence vanished in the wake of the stock market crash, the downturn in spending and investment led factories and other businesses to slow down production and begin firing their workers. For those who were lucky enough to remain employed, wages fell and buying power decreased.

Many Americans forced to buy on credit fell into debt, and the number of foreclosures and repossessions climbed steadily. The global adherence to the gold standard , which joined countries around the world in fixed currency exchange, helped spread economic woes from the United States throughout the world, especially in Europe.

Bank Runs and the Hoover Administration

Despite assurances from President Herbert Hoover and other leaders that the crisis would run its course, matters continued to get worse over the next three years. By 1930, 4 million Americans looking for work could not find it; that number had risen to 6 million in 1931.

Meanwhile, the country’s industrial production had dropped by half. Bread lines, soup kitchens and rising numbers of homeless people became more and more common in America’s towns and cities. Farmers couldn’t afford to harvest their crops and were forced to leave them rotting in the fields while people elsewhere starved. In 1930, severe droughts in the Southern Plains brought high winds and dust from Texas to Nebraska, killing people, livestock and crops. The “ Dust Bowl ” inspired a mass migration of people from farmland to cities in search of work.

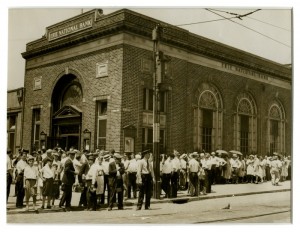

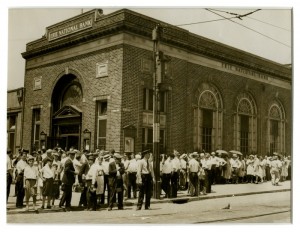

In the fall of 1930, the first of four waves of banking panics began, as large numbers of investors lost confidence in the solvency of their banks and demanded deposits in cash, forcing banks to liquidate loans in order to supplement their insufficient cash reserves on hand.

Bank runs swept the United States again in the spring and fall of 1931 and the fall of 1932, and by early 1933 thousands of banks had closed their doors.

In the face of this dire situation, Hoover’s administration tried supporting failing banks and other institutions with government loans; the idea was that the banks in turn would loan to businesses, which would be able to hire back their employees.

FDR and the Great Depression

Hoover, a Republican who had formerly served as U.S. secretary of commerce, believed that government should not directly intervene in the economy and that it did not have the responsibility to create jobs or provide economic relief for its citizens.

In 1932, however, with the country mired in the depths of the Great Depression and some 15 million people unemployed, Democrat Franklin D. Roosevelt won an overwhelming victory in the presidential election.

By Inauguration Day (March 4, 1933), every U.S. state had ordered all remaining banks to close at the end of the fourth wave of banking panics, and the U.S. Treasury didn’t have enough cash to pay all government workers. Nonetheless, FDR (as he was known) projected a calm energy and optimism, famously declaring "the only thing we have to fear is fear itself.”

Roosevelt took immediate action to address the country’s economic woes, first announcing a four-day “bank holiday” during which all banks would close so that Congress could pass reform legislation and reopen those banks determined to be sound. He also began addressing the public directly over the radio in a series of talks, and these so-called “ fireside chats ” went a long way toward restoring public confidence.

During Roosevelt’s first 100 days in office, his administration passed legislation that aimed to stabilize industrial and agricultural production, create jobs and stimulate recovery.

In addition, Roosevelt sought to reform the financial system, creating the Federal Deposit Insurance Corporation ( FDIC ) to protect depositors’ accounts and the Securities and Exchange Commission (SEC) to regulate the stock market and prevent abuses of the kind that led to the 1929 crash.

The New Deal: A Road to Recovery

Among the programs and institutions of the New Deal that aided in recovery from the Great Depression was the Tennessee Valley Authority (TVA) , which built dams and hydroelectric projects to control flooding and provide electric power to the impoverished Tennessee Valley region, and the Works Progress Administration (WPA) , a permanent jobs program that employed 8.5 million people from 1935 to 1943.

When the Great Depression began, the United States was the only industrialized country in the world without some form of unemployment insurance or social security. In 1935, Congress passed the Social Security Act , which for the first time provided Americans with unemployment, disability and pensions for old age.

After showing early signs of recovery beginning in the spring of 1933, the economy continued to improve throughout the next three years, during which real GDP (adjusted for inflation) grew at an average rate of 9 percent per year.

A sharp recession hit in 1937, caused in part by the Federal Reserve’s decision to increase its requirements for money in reserve. Though the economy began improving again in 1938, this second severe contraction reversed many of the gains in production and employment and prolonged the effects of the Great Depression through the end of the decade.

Depression-era hardships fueled the rise of extremist political movements in various European countries, most notably that of Adolf Hitler’s Nazi regime in Germany. German aggression led war to break out in Europe in 1939, and the WPA turned its attention to strengthening the military infrastructure of the United States, even as the country maintained its neutrality.

African Americans in the Great Depression

One-fifth of all Americans receiving federal relief during the Great Depression were Black, most in the rural South. But farm and domestic work, two major sectors in which Black workers were employed, were not included in the 1935 Social Security Act, meaning there was no safety net in times of uncertainty. Rather than fire domestic help, private employers could simply pay them less without legal repercussions. And those relief programs for which African Americans were eligible on paper were rife with discrimination in practice since all relief programs were administered locally.

Despite these obstacles, Roosevelt’s “Black Cabinet,” led by Mary McLeod Bethune , ensured nearly every New Deal agency had a Black advisor. The number of African Americans working in government tripled .

Women in the Great Depression

There was one group of Americans who actually gained jobs during the Great Depression: Women. From 1930 to 1940, the number of employed women in the United States rose 24 percent from 10.5 million to 13 million Though they’d been steadily entering the workforce for decades, the financial pressures of the Great Depression drove women to seek employment in ever greater numbers as male breadwinners lost their jobs. The 22 percent decline in marriage rates between 1929 and 1939 also created an increase in single women in search of employment.

Women during the Great Depression had a strong advocate in First Lady Eleanor Roosevelt , who lobbied her husband for more women in office—like Secretary of Labor Frances Perkins , the first woman to ever hold a cabinet position.

Jobs available to women paid less but were more stable during the banking crisis: nursing, teaching and domestic work. They were supplanted by an increase in secretarial roles in FDR’s rapidly-expanding government. But there was a catch: over 25 percent of the National Recovery Administration’s wage codes set lower wages for women, and jobs created under the WPA confined women to fields like sewing and nursing that paid less than roles reserved for men.

Married women faced an additional hurdle: By 1940, 26 states had placed restrictions known as marriage bars on their employment, as working wives were perceived as taking away jobs from able-bodied men—even if, in practice, they were occupying jobs men would not want and doing them for far less pay.

Great Depression Ends and World War II Begins

With Roosevelt’s decision to support Britain and France in the struggle against Germany and the other Axis Powers, defense manufacturing geared up, producing more and more private-sector jobs.

The Japanese attack on Pearl Harbor in December 1941 led to America’s entry into World War II, and the nation’s factories went back into full production mode.

This expanding industrial production, as well as widespread conscription beginning in 1942, reduced the unemployment rate to below its pre-Depression level. The Great Depression had ended at last, and the United States turned its attention to the global conflict of World War II.

Photo Galleries

HISTORY Vault

Stream thousands of hours of acclaimed series, probing documentaries and captivating specials commercial-free in HISTORY Vault

Sign up for Inside History

Get HISTORY’s most fascinating stories delivered to your inbox three times a week.

By submitting your information, you agree to receive emails from HISTORY and A+E Networks. You can opt out at any time. You must be 16 years or older and a resident of the United States.

More details : Privacy Notice | Terms of Use | Contact Us

Essays on the Great Depression

- Ben S. Bernanke

50% off with code FIFTY

Before you purchase audiobooks and ebooks

Please note that audiobooks and ebooks purchased from this site must be accessed on the Princeton University Press app. After you make your purchase, you will receive an email with instructions on how to download the app. Learn more about audio and ebooks .

Support your local independent bookstore.

- United States

- United Kingdom

Economics & Finance

From the Nobel Prize–winning economist and former chair of the U.S. Federal Reserve, a landmark book that provides vital lessons for understanding financial crises and their sometimes-catastrophic economic effects

- Download Cover

As chair of the U.S. Federal Reserve during the Global Financial Crisis, Ben Bernanke helped avert a greater financial disaster than the Great Depression. And he did so by drawing directly on what he had learned from years of studying the causes of the economic catastrophe of the 1930s—work for which he was later awarded the Nobel Prize. This influential work is collected in Essays on the Great Depression , an important account of the origins of the Depression and the economic lessons it teaches.

"Bernanke certainly knows the importance of well-functioning markets. In Essays on the Great Depression he wrote persuasively that runs on the banks and extensive defaults on loans reduced the efficiency of the financial sector, prevented it from doing its normal job in allocating resources, and contributed to the Depression severity. The Depression-era problems he studied are mirrored by similar issues today, and they need urgent attention."—Robert J. Shiller, New York Times

"Bernanke probably knows more about the Depression of the 1930s, about specific events and economic interpretations, than any other living person."—Michael Barone, U.S. News & World Report

"Tempting as it is to focus on President Herbert Hoover and the 1929 U.S. market crash, Bernanke explores conditions across dozens of countries—assessing where banking crises erupted, how deeply economic activity plummeted and which central banks made the right calls."—Carlos Lozada, Washington Post

"Having devoted much of his career to studying the causes of the Great Depression, Bernanke was the academic expert on how to prevent financial crises from spinning out of control and threatening the general economy. One line from his Essays on the Great Depression sounds especially prescient today: 'To the extent that bank panics interfere with normal flows of credit, they may affect the performance of the real economy.'"—Roger Lowenstein, New York Times Magazine

"Fortunately, before he became entangled in these restrictions [Bernanke] did edit and help write a book, Essays on the Great Depression . . . . Bernanke's motive was that understanding the depression would provide important clues to what can go wrong with capitalist market systems."—Samuel Brittan, Financial Times

"The financial crisis has made Federal Reserve Chairman Ben Bernanke's book Essays on the Great Depression a hot seller. . . . Bernanke, a former Princeton University economist, is considered the pre-eminent living scholar of the Great Depression. He is practicing today what he preached in his book: Flood the system with money to avoid a depression."—Dennis Cauchon, USA Today

"When Ben Bernanke arrived at the Federal Reserve in February 2006 as the new chairman of the central bank, he had a copy of his 2001 book, Inflation Targeting: Lessons from the International Experience , tucked under his arm. Not literally, of course. He was hoping to convince his colleagues on the Federal Open Market Committee of the value of an explicit inflation target. Little did he know that less than two years later he'd be shelving Inflation Targeting and turning to Essays on the Great Depression , another of his books, for guidance. In his book of essays, Bernanke calls the Great Depression the 'Holy Grail of macroeconomics.' He writes that 'the experience of the 1930s continues to influence macroeconomists' beliefs, policy recommendations, and research agendas.'"—Caroline Baum, Bloomberg.com

"With some observers saying that the ongoing financial crisis could be the worst since the Great Depression, the greatest living expert on that period is getting the chance to apply its economic lessons. . . . In Essays on the Great Depression . . . [Bernanke] notes that understanding that period is the 'holy grail of macroeconomics.'"—Spencer Jakab, Dow Jones Newswires

"Bernanke is the master of applied microeconomics. Not only is he technically proficient but his ability to place his results in a larger macroeconomic context is unparalleled."—Mark Toma, Financial History Review

"This influential body of work is a significant contribution to our understanding the depth and persistence of the Great Depression. . . . This book will become a standard reference in the field of business cycle research."—Randall Kroszner, University of Chicago

"Bernanke's work has had a powerful impact on the economics profession, alerting macroeconomists to the advantages of historical analysis, and a number of important figures (James Hamilton, Steve Cecchetti, for example), inspired by his work, have followed him into the field. The nine essays form a remarkably coherent whole."—Barry Eichengreen, University of California, Berkeley, and author of Globalizing Capital: A History of the International Monetary System

"Collecting these essays together will provide a single source for students to find Bernanke's substantial contributions. . . . His papers demonstrate conclusively that the international view of the great depression has impressive explanatory power."—Peter Temin, Massachusetts Institute of Technology

Stay connected for new books and special offers. Subscribe to receive a welcome discount for your next order.

50% off sitewide with code FIFTY | May 7 – 31 | Some exclusions apply. See our FAQ .

- ebook & Audiobook Cart

Cause and Effects of The Great Depression

Introduction.

The great Depression took place in America during the 1920s and its effects were unprecedented as it caused poverty and suffering upon the society.

Many believe that that the depression was caused by the U.S. stock-market crash that took place in 1929. Nonetheless, there is no consensus on its cause as other factors are also acceptable. The economic devastation of the 1920s led to the Great Depression and brought a tragedy for the whole society.

Causes of The Depression

Many causes have been put forward to explain the causes of the great Depression over which the economists have disagreed. However, one thing that cannot be disputed is that the Depression had major impacts upon the country and the lives of people.

Crash of stock market

The crash of the stock market in 1929 ushered in the Great Depression. The capital in America was represented by stocks. There were easy-money policies that caused the stocks prices to go very high and this led to a big speculation that made people invest all their money in the stock market.

Eventually, the price of the stocks went down sharply and people started selling their stocks in panic. The number of stocks available for sale was higher that the number of people willing to buy and eventually the market crashed (Great Depression, 2008).

Uneven distribution of prosperity

The 1920s saw the American economy rise but the prosperity was unevenly distributed and the farmers as well as the untrained laborers were largely excluded. It therefore led to the nation having a greater production capacity and could not match in consuming the products.

Moreover, the policies of the Republican administration in regards to war-debts and tariff had led to a decline in market for the American goods (Great Depression, 2008).

Effects of The Depression

The effects of the Great Depression were felt both at home and abroad. No one escaped its reeling effects. For example, countries in Europe were affected greatly as their economies were hit hard. In Germany, the economic blow led to social dislocation that is alleged to have played a major role bringing Adolf Hitler to power (Great Depression, 2008).

Unemployment

When the Great Depression set in many people lost their jobs. The unemployment levels rose as many factories closed and up to about 16 million people had lost their jobs between 1932 and 1933 (Great Depression, 2008). The Great Depression compares to the economic recession that took place in 2007 in American and its effects felt on a global scale.

For instance, the following words by president Obama show the similarities “Even though economists may say the recession officially ended last year, obviously for the millions of people who are still out of work… it’s still very real for them” (Hill, 2010).

Massive poverty

Consequently, job losses and loss of money in the stock market the people fell into massive levels of poverty. The people did not have a source of income and suffered a great deal. The country’s economy suffered too” The gross national product declined from the 1929 figure of $103,828,000,000 to $55,760,000,000 in 1933” (Great Depression, 2008, par. 2).

The suffering led economic hardships as well as physical, emotional, emotional and cognitive sufferings to the people because the Depression was a big tragedy hence they exhibited signs that people going through other crises exhibit (Barr, 2005).

The Great Depression led to untold suffering to millions of Americans as well as the devastation of the country’s economy. The effects extended to other countries as well due to international trade just as it happened during the recent economic down turn. No country is in isolation and its activities affect other countries too even if they do not have a hand in causing the problems.

It therefore follows that countries must take precautions to prevent an event like the Great Depression by learning its causes as well as its effects in order to minimize future damage or suffering in case of a similar tragedy.

Reference List

Barr, J.G. (2005). Predicting and Managing Crisis Behavior.

Great Depression. (2008). Retrieved from EBSCOhost database.

Hill, P. (2010). Recession over a year, but recovery not felt . The Washington Times . P1, 1. Web.

- Chicago (A-D)

- Chicago (N-B)

IvyPanda. (2018, May 23). Cause and Effects of The Great Depression. https://ivypanda.com/essays/cause-and-effects-of-the-great-depression/

"Cause and Effects of The Great Depression." IvyPanda , 23 May 2018, ivypanda.com/essays/cause-and-effects-of-the-great-depression/.

IvyPanda . (2018) 'Cause and Effects of The Great Depression'. 23 May.

IvyPanda . 2018. "Cause and Effects of The Great Depression." May 23, 2018. https://ivypanda.com/essays/cause-and-effects-of-the-great-depression/.

1. IvyPanda . "Cause and Effects of The Great Depression." May 23, 2018. https://ivypanda.com/essays/cause-and-effects-of-the-great-depression/.

Bibliography

IvyPanda . "Cause and Effects of The Great Depression." May 23, 2018. https://ivypanda.com/essays/cause-and-effects-of-the-great-depression/.

- The Great Depression Crisis

- Great Depression in the United States

- Economic Depression in USA

- Salem Witch Trials Causes

- Market Revolution

- United States Arm Control

- Valley Archive Collections

- A Closer Look at the History of the Colonial America

48e. Social and Cultural Effects of the Depression

No nation could emerge from the cauldron of national crisis without profound social and cultural changes. While many undesirable vices associated with hopelessness were on the rise, many family units were also strengthened through the crisis. Mass migrations reshaped the American mosaic. While many businesses perished during the Great Depression, others actually emerged stronger. And new forms of expression flourished in the culture of despair.

The Great Depression brought a rapid rise in the crime rate as many unemployed workers resorted to petty theft to put food on the table. Suicide rates rose, as did reported cases of malnutrition. Prostitution was on the rise as desperate women sought ways to pay the bills. Health care in general was not a priority for many Americans, as visiting the doctor was reserved for only the direst of circumstances. Alcoholism increased with Americans seeking outlets for escape, compounded by the repeal of prohibition in 1933. Cigar smoking became too expensive, so many Americans switched to cheaper cigarettes.

Higher education remained out of reach for most Americans as the nation's universities saw their student bodies shrink during the first half of the decade. High school attendance increased among males, however. Because the prospects of a young male getting a job were so incredibly dim, many decided to stay in school longer. However, public spending on education declined sharply, causing many schools to open understaffed or close due to lack of funds.

Demographic trends also changed sharply. Marriages were delayed as many males waited until they could provide for a family before proposing to a prospective spouse. Divorce rates dropped steadily in the 1930s. Rates of abandonment increased as many husbands chose the "poor man's divorce" option — they just ran away from their marriages. Birth rates fell sharply, especially during the lowest points of the Depression. More and more Americans learned about birth control to avoid the added expenses of unexpected children.

Mass migrations continued throughout the 1930s. Rural New England and upstate New York lost many citizens seeking opportunity elsewhere. The Great Plains lost population to states such as California and Arizona. The Dust Bowl sent thousands of "Okies" and "Arkies" looking to make a better life. Many of the migrants were adolescents seeking opportunity away from a family that had younger mouths to feed. Over 600,000 people were caught hitching rides on trains during the Great Depression. Many times offenders went unpunished.

Classic films like Frankenstein , It Happened One Night , and Gone with the Wind debuted during the Great Depression. Radio flourished as those who owned a radio set before the crash could listen for free. President Roosevelt made wide use of radio technology with his periodic "fireside chats" to keep the public informed. Dorothea Lange depicted the sadness of Depression farm life with her stirring photographs.

Report broken link

If you like our content, please share it on social media!

Copyright ©2008-2022 ushistory.org , owned by the Independence Hall Association in Philadelphia, founded 1942.

THE TEXT ON THIS PAGE IS NOT PUBLIC DOMAIN AND HAS NOT BEEN SHARED VIA A CC LICENCE. UNAUTHORIZED REPUBLICATION IS A COPYRIGHT VIOLATION Content Usage Permissions

Banking Panics of 1930-31

November 1930–august 1931.

John Poole, president of the Federal American National Bank in Washington, D.C., stands on a narrow ledge outside the building and declares to the crowd that the institution was sound, February 5, 1931.

In the fall of 1930, the economy appeared poised for recovery. The previous three contractions, in 1920, 1923, and 1926, had lasted an average of fifteen months. 1 The downturn that began in the summer of 1929 had lasted for fifteen months. A rapid and robust recovery was anticipated. In November 1930, however, a series of crises among commercial banks turned what had been a typical recession into the beginning of the Great Depression .

When the crises began, over 8,000 commercial banks belonged to the Federal Reserve System, but nearly 16,000 did not. Those nonmember banks operated in an environment similar to that which existed before the Federal Reserve was established in 1914. That environment harbored the causes of banking crises.

One cause was the practice of counting checks in the process of collection as part of banks’ cash reserves. These ‘floating’ checks were counted in the reserves of two banks, the one in which the check was deposited and the one on which the check was drawn. 2 In reality, however, the cash resided in only one bank. Bankers at the time referred to the reserves composed of float as fictitious reserves. The quantity of fictitious reserves rose throughout the 1920s and peaked just before the financial crisis in 1930. This meant that the banking system as a whole had fewer cash (or real) reserves available in emergencies (Richardson 2007).

Another problem was the inability to mobilize bank reserves in times of crisis. Nonmember banks kept a portion of their reserves as cash in their vaults and the bulk of their reserves as deposits in correspondent banks in designated cities. Many, but not all, of the ultimate correspondents belonged to the Federal Reserve System. This reserve pyramid limited country banks’ access to reserves during times of crisis. 3 When a bank needed cash, because its customers were panicking and withdrawing funds en masse, the bank had to turn to its correspondent, which might be faced with requests from many banks simultaneously or might be beset by depositor runs itself. The correspondent bank also might not have the funds on hand because its reserves consisted of checks in the mail, rather than cash in its vault. If so, the correspondent would, in turn, have to request reserves from another correspondent bank. That bank, in turn, might not have reserves available or might not respond to the request. 4

These problems turned the collapse of Caldwell and Company into a painful financial event. Caldwell was a rapidly expanding conglomerate and the largest financial holding company in the South. It provided its clients with an array of services – banking, brokerage, insurance – through an expanding chain controlled by its parent corporation headquartered in Nashville, Tennessee. The parent got into trouble when its leaders invested too heavily in securities markets and lost substantial sums when stock prices declined. In order to cover their own losses, the leaders drained cash from the corporations that they controlled.

On November 7, one of Caldwell’s principal subsidiaries, the Bank of Tennessee (Nashville) closed its doors. On November 12 and 17, Caldwell affiliates in Knoxville, Tennessee, and Louisville, Kentucky, also failed. The failures of these institutions triggered a correspondent cascade that forced scores of commercial banks to suspend operations. In communities where these banks closed, depositors panicked and withdrew funds en masse from other banks. Panic spread from town to town. Within a few weeks, hundreds of banks suspended operations. About one-third of these organizations reopened within a few months, but the majority were liquidated (Richardson 2007).

Panic began to subside in early December. But on December 11, the fourth-largest bank in New York City, Bank of United States, ceased operations. The bank had been negotiating to merge with another institution. The New York Fed had helped with the search for a merger partner. When negotiations broke down, depositors rushed to withdraw funds, and New York’s superintendent of banking closed the institution. This event, like the collapse of Caldwell, generated newspaper headlines throughout the United States, stoking fears of financial panics and currency shortages like the panic of 1907 and inducing jittery depositors to withdraw funds from other banks.

The Federal Reserve’s reaction to this crisis varied across districts. The crisis began in the Sixth District, headquartered in Atlanta. The leaders of the Federal Reserve Bank of Atlanta believed that their responsibility as a lender of last resort extended to the broader banking system. The Atlanta Fed expedited discount lending to member banks, encouraged member banks to extend loans to their nonmember respondents, and rushed funds to cities and towns beset by banking panics. 5

The crisis also hit the Eighth District, headquartered in St. Louis. The leaders of the Federal Reserve Bank of St. Louis had a narrower view of their responsibilities and refused to rediscount loans for the purpose of accommodating nonmember banks. During the crisis, the St. Louis Fed limited discount lending and refused to assist nonmember institutions.

Outcomes differed between the districts. After the crisis, in the Sixth District, the economic contraction slowed and recovery began. In the Eighth District, hundreds of banks failed. Lending declined. Business faltered and unemployment rose (Richardson and Troost 2009; Jalil 2014; Ziebarth 2013).

The banking crisis that began with the collapse of Caldwell subsided in early 1931. A new crisis erupted in June 1931, this time in the city of Chicago. Once again, depositor runs beset networks of nonmember banks, some of which had invested in assets that had declined in value. In Chicago, the problem particularly involved real estate.

These regional banking crises harmed the national economy in several ways. The crises disrupted the process of credit creation, increasing the prices that firms paid for working capital and preventing some firms from acquiring credit at any price (Bernanke 1983). This process was particularly pronounced in regions, like the Eighth Federal Reserve District, where large numbers of banks failed, and the information that those banks possessed about who in their community was a good and a bad credit risk disappeared.

The crises also generated deflation because they convinced bankers to accumulate reserves and the public to hoard cash (Friedman and Schwartz 1964). Hoarding reduced the proportion of the monetary base deposited in banks. Accumulating reserves reduced the proportion of deposits that banks loaned out. Together, hoarding and accumulating reduced the supply of money, particularly the amount of money in checking accounts, which at the time were the principal means of payment for goods and services. As the stock of money declined, the prices of goods necessarily followed.

Deflation harmed the economy in many ways. Deflation forced banks, firms, and debtors into bankruptcy; distorted economic decision-making; reduced consumption; and increased unemployment. The gold standard transmitted deflation to other industrial nations, which contributed to financial crises in those countries, and reflected back onto the United States, exacerbating a deflationary feedback loop.

The deflation ended with the Bank Holiday of 1933 and the Roosevelt administration’s recovery programs. These programs included the suspension of the gold standard and the reflation of prices, discussed in essays on Roosevelt’s Gold Program and the Gold Reserve Act of 1934 , as well as the reform of financial regulation, creation of deposit insurance, and recapitalization of commercial banks, discussed in essays on the Emergency Banking Act , Banking Act of 1933 , and Banking Act of 1935 .

- 1 The contraction of 1920 lasted nineteen months. 1923 lasted fourteen months. 1926 lasted thirteen months. These business cycle dates come from the National Bureau of Economic Research .

- 2 Checks in the process of collection could appear on the balance sheet of multiple banks if the checks passed through one (or more) correspondents as they wound their way through the clearing process.

- 3 A country bank was the official designation for a bank that operated outside of a reserve or central reserve city.

- 4 It is worth noting that at the time, the flaws of the dual banking system were widely recognized. Both of the flaws discussed in this essay were identified by the National Monetary Commission and addressed in the Federal Reserve Act. The act, however, only attempted to solve these problems for the banks that voluntarily joined the Federal Reserve System.

- 5 A respondent was a bank that deposited its reserve and transaction balances in a correspondent bank.

Bibliography

Bernanke, Ben. “Nonmonetary Effects of the Financial Crisis in the Propagation of the Great Depression.” American Economic Review 73, no. 3 (June 1983): 257-276.

Calomiris, Charles W., and Joseph R. Mason. "Fundamentals, Panics, and Bank Distress During the Depression." American Economic Review 93, no. 5(2003): 1615-1647.

Chandler, Lester V. America’s Greatest Depression , 1929-1941. New York: Harper and Row, 1970.

Friedman, Milton and Anna Schwartz. The Great Contraction, 1929-1933 . Princeton: Princeton University Press, 1964.

Jalil, Andrew. “Monetary Intervention Really Did Mitigate Banking Panics During the Great Depression: Evidence Along the Atlanta Federal Reserve District Border.” Forthcoming in the Journal of Economic History , 2014.

Kemmerer, Edwin Walter. The A B C of the Federal Reserve System: Why the Federal Reserve System Was Called into Being, the Main Features of its Organization, and How it Works . Princeton: Princeton University Press, 1918.

McFerrin, James B. Caldwell and Company . Chapel Hill: University of North Carolina Press, 1939.

Richardson, Gary. “The Check is in the Mail: Correspondent Clearing and the Collapse of the Banking System, 1930 to 1933.” Journal of Economic History 67, no. 3 (September 2007): 643-671.

Richardson, Gary. “Categories and Causes of Bank Distress during the Great Depression, 1929—1933: The Illiquidity versus Insolvency Debate Revisited.” Explorations in Economic History 44, no. 4 (October 2007): 586-607.

Richardson, Gary and William Troost. “Monetary Intervention Mitigated Banking Panics During the Great Depression: Quasi-Experimental Evidence from the Federal Reserve District Border, 1929 to 1933.” Journal of Political Economy 117, no. 6 (December 2009): 1031-1073.

Richardson, Gary and Patrick Van Horn. “Intensified Regulatory Scrutiny and Bank Distress in New York City during the Great Depression.” Journal of Economic History 69, no. 2 (June 2009).

Temin, Peter. Did Monetary Forces Cause the Great Depression? New York: W. W. Norton, 1976.

White, Eugene. “A Reinterpretation of the Banking Crisis of 1930.” Journal of Economic History 44, no. 1 (March 1984): 119-138.

Wicker, Elmus. “A Reconsideration of the Causes of the Banking Panic of 1930.” Journal of Economic History 40, no. 3 (September 1980): 571-583.

Ziebarth, Nicolas L. “Identifying the Effects of Bank Failures from a Natural Experiment in Mississippi during the Great Depression.” American Economic Journal: Macroeconomics 5, no. 1 (2013): 81-101.

Written as of November 22, 2013. See disclaimer .

Related Essays

- Banking Panics of 1931-33

- The Great Depression

- Bank Holiday of 1933

- Banking Acts of 1932

Federal Reserve History

Great Depression

By Roger D. Simon | Reader-Nominated Topic

The Great Depression, which lasted from 1929 to 1941, was characterized in both the Philadelphia region and the nation by a severe contraction in all levels of economic activity, massive unemployment, widespread bank failures, and sharp price deflation. Many people lost their life savings and their homes. Untold thousands went hungry; some starved. It led to powerful labor unions, a change in political alignments, and a new conception of the role of government.

The Depression began in Philadelphia even before the stock market crash. In April 1929 city-wide unemployment stood at 10 percent; 30 percent of the jobless had been idle for six months or longer. The textile industry, the city’s largest manufacturing sector, suffered competition from plants elsewhere in the region, particularly Reading, as well as in the South. Although the garment industry did well, seasonal layoffs and low wages characterized both the textile and apparel sectors. Production of knit goods, radios, and motor vehicle parts helped to bolster employment, but as soon as the national economy began to falter, Americans cut back on the purchase of manufactured goods.

From the end of 1929 to the spring of 1933 the national and local economy spiraled downward. The decline was staggering; regional manufacturing output plummeted 45 percent, while factory payrolls fell by 60 percent; retail sales sank by 40 percent. Construction went into free fall, dropping 84 percent. Unemployment rose inexorably. By April 1930, 135,000 Philadelphians were jobless with another 46,000 working only part time. A year later, the number of unemployed approached 250,000, more than a quarter of the workforce. The slide continued until March 1933; by then, only 40 percent of the workforce was employed full time, the rest worked only part time or not at all. Although the entire region was hard hit, the city suffered the worst. In 1930 Philadelphia’s unemployment rate was twice that of Chester and Montgomery counties. Manufacturing workers had higher rates of unemployment than did those in white collar and service occupations. The foreign born and African Americans, because they were concentrated in manufacturing and low skilled jobs, and because of outright discrimination, sustained particularly high levels of joblessness.

The sinking economy jeopardized an overextended banking sector. As property owners defaulted on mortgages, banks found themselves in trouble. Between 1929 and 1933 more than half of the commercial banks and building and loan associations in Philadelphia failed. Nor were bank failures and foreclosures limited to the cities. In Camden County, banks closed in every single municipality. Since there was no federal deposit insurance before 1933, thousands of people lost their savings. The largest bank failure was that of Bankers Trust Company , which had 100,000 depositors.

Republican Machine Dominated

Government in Philadelphia, as well as most of the region, was firmly in the hands of the Republican Party. An entrenched and corrupt Republican machine completely dominated the city. Party officials and wealthy local elites shared the conservative ideology of President Herbert Hoover and his animus against government intervention and publicly-funded charity. It was this doctrinaire laissez-faire outlook that informed the city’s response to the Depression and to calls for public relief under mayors Harry Mackey (1928-32) and his successor, J. Hampton Moore (1932-36).

The Depression took a devastating toll on the people. With increasing despair, men pounded the pavement in search of any work at all. After exhausting personal savings, the unemployed ran up debts to local store owners, and skipped rent, mortgage, utility, and tax payments. Thousands went hungry. Some turned to begging, petty theft, and scavenging for discarded or spoiled food. Further aggravating conditions, banks foreclosed on delinquent homeowners. Between 1929 and1933, in Philadelphia alone, over 90,000 families lost their homes. Evicted families, when they could, moved in with relatives, whole families cramming into one or two rooms. Some squatted in abandoned houses under appalling conditions. Makeshift homeless encampments sprang up, derisively named Hoovervilles after the president, with the largest in Philadelphia along the east bank of the Schuylkill River near the Museum of Art . Pride and self-esteem melted away.

At first, private charities tried to alleviate the suffering. Soup kitchens and bread lines quickly appeared in churches, missions, empty stores, settlement houses, and fire stations–over eighty in Philadelphia alone. The food was free, but the humiliation of standing in line, advertising one’s need, was a high price to pay. By the fall of 1930, the magnitude of the crisis overwhelmed the efforts of the private charities. Philadelphia had discontinued direct assistance to the needy in 1879. In late 1930 Mayor Harry Mackey appointed a Committee on Unemployment led by prominent banker Horatio Gates Lloyd that coordinated a massive city-wide volunteer relief program which drew national attention. Over the next two years it provided vouchers for food and fuel, hot breakfasts to school children, a homeless shelter for 3,000 men, and organized used clothing drives and work relief projects. The city and state contributed several large grants, but most of the money came from private donations. In June 1932, while aiding 57,000 families, the Gates committee ran out of funds and shut down entirely, laying bare the failure of a voluntary solution. In September, Pennsylvania stepped in and funded a system of countywide relief boards, but during that desperate summer of 1932 there was very little help for anyone. Elsewhere in the region, Wilmington and Camden County made similar efforts. Wilmington was particularly eager to avoid street begging and soup kitchens that might tarnish the city’s image.

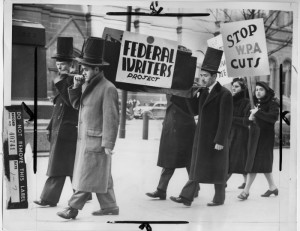

From the outset, labor activists called for government action to alleviate suffering. Communists, a small but highly committed group, tried to galvanize the unemployed to action, particularly among the textile workers in the Kensington-Richmond areas. The demands were hardly radical: public works jobs, adequate relief grants, and a halt to evictions. In February 1930, a small group rallied at Philadelphia City Hall which police broke up, sending dozens to the hospital. A second rally at City Hall a week later drew twice the crowd, but remained peaceful. In March, after a strikebreaker killed a worker during a bitter strike against Aberle hosiery mill, the victim’s funeral drew thousands and became the largest protest against conditions yet seen. Over the next two years, labor leaders organized workers in Kensington-Richmond and other neighborhoods hard hit by the Depression. Communist involvement allowed the mayor and newspapers to dismiss the protestors as “reds”; in reality, the Communists attracted few adherents.

Battle of Reyburn Plaza

Meanwhile, increasingly militant workers, particularly in Philadelphia, took aggressive steps to help themselves. In June 1932 over 1,000 textile workers founded the Northeast Unemployed Citizens League which resisted evictions and distributed food to its members while calling for unemployment insurance and old age pensions. In response, a frightened Mayor Moore established a police department “red squad.” In August, 1932, when 1,500 “hunger marchers” rallied for jobs at City Hall, Moore sent the police to disperse the crowd in what came to be known as the “Battle of Reyburn Plaza.” After badly beating the organizer they arrested him for inciting a riot. Although such demonstrations struck panic into the hearts of many elites, the growing ranks of the destitute evidenced little militancy. They were too fatalistic or simply too ashamed to actively clamor for help.

Mayor Moore seemed oblivious to the human crisis. In January 1932, after a drive through hard-hit South Philadelphia , he famously concluded, “No one is starving in Philadelphia,” although people clearly were. In 1935, opposing slum clearance and public housing, he asserted: “this city is too proud to have slums,” despite the abysmal conditions in which many lived. Under his tenure the city contributed nothing to relief of the needy. However, the decline in property values meant a sharp drop in city revenue, and Moore was determined to maintain the city’s credit without raising tax rates. He slashed the city’s payroll, and avoided default, but Philadelphia’s financial situation remained grave throughout the decade, providing an excuse to do little for the impoverished.

The calamity of the Depression and the failure of the Hoover administration to provide either relief or to halt the decline resulted in the beginning of a long-term political realignment in Philadelphia and Camden. At first, the shift affected national more than local elections. In Philadelphia in the 1920s the Democratic Party was so weak and ineffectual that the Republicans were secretly paying the rent on their headquarters. In 1931 and 1932 contractors John B. Kelly and Matthew McCloskey, real estate developer and banker Alfred M. Greenfield, and newspaper publisher David Stern led the effort to build a new Democratic coalition around blue-collar workers, particularly eastern and southern European immigrants and African Americans. In November 1933, because of the popularity of Roosevelt’s New Deal, and possibly because the US Justice department sent federal marshals to monitor the voting, Philadelphia Democrats carried two key city-wide races, electing the city treasurer and S. Davis Wilson as controller. The following year Democrats captured three congressional seats in Philadelphia. George Brunner pursued a similar strategy in Camden and gained several seats on the city commission in 1935.

In 1935, the Democrats in Philadelphia had a chance to capture the mayor’s office for the first time in fifty years. Both Kelly and Wilson sought the Democratic nomination, but when Kelly got the nod, Wilson switched parties and narrowly won as a Republican, although fraudulent vote counting possibly made the difference. Wilson did promise to cooperate with the New Deal. In 1936, Roosevelt carried the city by over 200,000 votes, and Democrats won all seven congressional seats. Roosevelt also swept the other regional cities. In national politics, the shift to the Democratic Party was complete. Never again would a Republican presidential candidate carry Philadelphia, and rarely would the GOP even win a congressional race there. However, while a Democrat was elected to Philadelphia City Council for first time in sixteen years, that was the peak of Democrats’ local prospects in the decade. The Republican machine staggered on until 1951.

Relief and Recovery

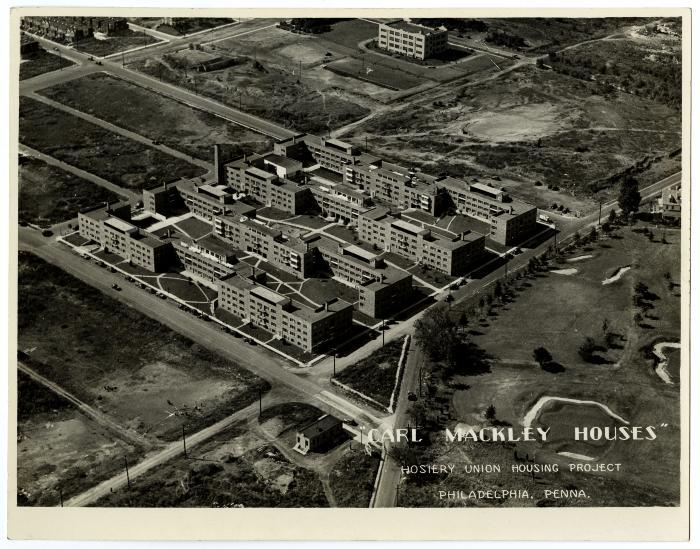

The New Deal, launched by President Franklin D. Roosevelt beginning in March 1933, established programs for relief and economic recovery. Federal aid for the most needy, administered through local agencies, began to flow almost immediately. At its peak, in April 1935, the Philadelphia County Relief Board provided aid to 105,000 families, spending a million dollars a month. In December 1936 the Board still aided 14 percent of the population. By comparison, in the Pennsylvania suburban counties, between 5 and 8 percent were getting aid. In addition, work relief and public works programs employed thousands. The Public Works Administration (PWA) funded projects around the region, notably the innovative Carl Mackley housing project in Philadelphia, the high-speed commuter rail line to Camden, and new high schools in Camden County and Wilmington.

The work relief programs, which required local government contributions, were more contentious. The Civil Works Administration (CWA), which operated in the winter of 1933-34, was followed in 1935 by the Works Progress Administration (WPA). In Philadelphia Mayor Moore and City Council, demonstrating intense Republican antipathy to any federal interference and to Roosevelt’s New Deal especially, opposed cooperating with CWA until the newspapers and businesses exerted pressure on the city to participate. CWA then put 25,000 local people to work. In 1935, Moore, this time with stronger support from the Republican establishment, refused any funds for WPA projects. Consequently, 12,000 city residents worked for WPA on projects in the suburbs. Philadelphia did not participate in WPA until the new mayor, S. Wilson Davis, took office in January 1936; at its peak, later that year, WPA employed 48,000 in the city. In Camden officials were eager for WPA projects.