- school Campus Bookshelves

- menu_book Bookshelves

- perm_media Learning Objects

- login Login

- how_to_reg Request Instructor Account

- hub Instructor Commons

Margin Size

- Download Page (PDF)

- Download Full Book (PDF)

- Periodic Table

- Physics Constants

- Scientific Calculator

- Reference & Cite

- Tools expand_more

- Readability

selected template will load here

This action is not available.

9.6: Chapter 9 Formulas

- Last updated

- Save as PDF

- Page ID 27816

- Rachel Webb

- Portland State University

\( \newcommand{\vecs}[1]{\overset { \scriptstyle \rightharpoonup} {\mathbf{#1}} } \)

\( \newcommand{\vecd}[1]{\overset{-\!-\!\rightharpoonup}{\vphantom{a}\smash {#1}}} \)

\( \newcommand{\id}{\mathrm{id}}\) \( \newcommand{\Span}{\mathrm{span}}\)

( \newcommand{\kernel}{\mathrm{null}\,}\) \( \newcommand{\range}{\mathrm{range}\,}\)

\( \newcommand{\RealPart}{\mathrm{Re}}\) \( \newcommand{\ImaginaryPart}{\mathrm{Im}}\)

\( \newcommand{\Argument}{\mathrm{Arg}}\) \( \newcommand{\norm}[1]{\| #1 \|}\)

\( \newcommand{\inner}[2]{\langle #1, #2 \rangle}\)

\( \newcommand{\Span}{\mathrm{span}}\)

\( \newcommand{\id}{\mathrm{id}}\)

\( \newcommand{\kernel}{\mathrm{null}\,}\)

\( \newcommand{\range}{\mathrm{range}\,}\)

\( \newcommand{\RealPart}{\mathrm{Re}}\)

\( \newcommand{\ImaginaryPart}{\mathrm{Im}}\)

\( \newcommand{\Argument}{\mathrm{Arg}}\)

\( \newcommand{\norm}[1]{\| #1 \|}\)

\( \newcommand{\Span}{\mathrm{span}}\) \( \newcommand{\AA}{\unicode[.8,0]{x212B}}\)

\( \newcommand{\vectorA}[1]{\vec{#1}} % arrow\)

\( \newcommand{\vectorAt}[1]{\vec{\text{#1}}} % arrow\)

\( \newcommand{\vectorB}[1]{\overset { \scriptstyle \rightharpoonup} {\mathbf{#1}} } \)

\( \newcommand{\vectorC}[1]{\textbf{#1}} \)

\( \newcommand{\vectorD}[1]{\overrightarrow{#1}} \)

\( \newcommand{\vectorDt}[1]{\overrightarrow{\text{#1}}} \)

\( \newcommand{\vectE}[1]{\overset{-\!-\!\rightharpoonup}{\vphantom{a}\smash{\mathbf {#1}}}} \)

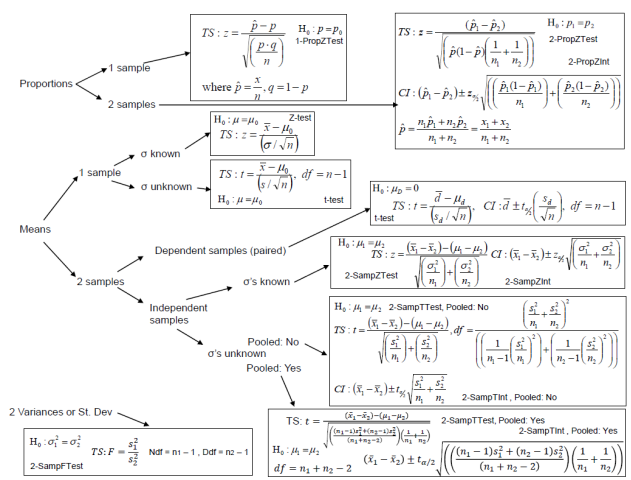

The following flow chart in Figure 9-18 can help you decide which formula to use. Start on the left, ask yourself is the question about proportions (%), means (averages), standard deviations or variances? Are there 1 or 2 samples? Was the population standard deviation given? Are the samples dependent or independent? Are you asked to test a claim? If yes then use the test statistic (TS) formula. Are you asked to find a confidence interval? If yes then use the confidence interval (CI) formula. In each box is the null hypothesis and the corresponding TI calculator shortcut key.

Figure 9-18

Download a .pdf version of the flowchart at: http://MostlyHarmlessStatistics.com .

The same steps are used in hypothesis testing for a one sample test. Use technology to find the p-value or critical value. A clue with many of these questions of whether the samples are dependent is the term “paired” is used, or the same person was being measured before and after some applied experiment or treatment. The p-value will always be a positive number between 0 and 1.

The same three methods to hypothesis testing, critical value method, p-value method and the confidence interval method are also used in this section. The p-value method is used more often than the other methods. The rejection rule for the three methods are:

- P-value method: reject H 0 when the p-value ≤ \(\alpha\).

- Critical value method: reject H 0 when the test statistic is in the critical tail(s).

- Confidence Interval method, reject H 0 when the hypothesized value (0) found in H 0 is outside the bounds of the confidence interval.

The most important step in any method you use is setting up your null and alternative hypotheses.

Like puzzles? Check out this daily anagram game: Raganam !

- Your Favourite Cheat Sheets

- Your Messages

- Your Badges

- Your Friends

- Your Comments

- View Profile

- Edit Profile

- Change Password

- New Cheat Sheet

- Live Cheat Sheets

- Draft Cheat Sheets

- Collaborations

- Cheat Sheet Downloads

- Download This Cheat Sheet (PDF)

- Rating: ( )

- Education >

- Statistics Cheat Sheets

Hypothesis testing cheatsheet Cheat Sheet by mmmmy

This is a cheat sheet that provides a basic introduction and summaries of different hypothesis testing in stats

steps of formulating a hypothesis

Errors in testing, chi-square test, one sample t-test, paired t-test statistics, independent two-sample t-test statistics, test of independence and homogeneity of variance, goodness of fit test, carrying out one-way anova test, how's your readability.

Cheatography is sponsored by Readable.com . Check out Readable to make your content and copy more engaging and support Cheatography!

Measure Your Readability Now!

Help Us Go Positive!

We offset our carbon usage with Ecologi. Click the link below to help us!

- Languages: English

- Published: 10th March, 2021

- Rated: 0 out of 5 stars based on 1 ratings

Favourited By

No comments yet. Add yours below!

Add a Comment

Please enter your name.

Please enter your email address

Please enter your Comment.

Related Cheat Sheets

Latest Cheat Sheet

Random Cheat Sheet

About Cheatography

Behind the scenes.

Recent Cheat Sheet Activity

Hypothesis Testing

Hypothesis testing is a tool for making statistical inferences about the population data. It is an analysis tool that tests assumptions and determines how likely something is within a given standard of accuracy. Hypothesis testing provides a way to verify whether the results of an experiment are valid.

A null hypothesis and an alternative hypothesis are set up before performing the hypothesis testing. This helps to arrive at a conclusion regarding the sample obtained from the population. In this article, we will learn more about hypothesis testing, its types, steps to perform the testing, and associated examples.

What is Hypothesis Testing in Statistics?

Hypothesis testing uses sample data from the population to draw useful conclusions regarding the population probability distribution . It tests an assumption made about the data using different types of hypothesis testing methodologies. The hypothesis testing results in either rejecting or not rejecting the null hypothesis.

Hypothesis Testing Definition

Hypothesis testing can be defined as a statistical tool that is used to identify if the results of an experiment are meaningful or not. It involves setting up a null hypothesis and an alternative hypothesis. These two hypotheses will always be mutually exclusive. This means that if the null hypothesis is true then the alternative hypothesis is false and vice versa. An example of hypothesis testing is setting up a test to check if a new medicine works on a disease in a more efficient manner.

Null Hypothesis

The null hypothesis is a concise mathematical statement that is used to indicate that there is no difference between two possibilities. In other words, there is no difference between certain characteristics of data. This hypothesis assumes that the outcomes of an experiment are based on chance alone. It is denoted as \(H_{0}\). Hypothesis testing is used to conclude if the null hypothesis can be rejected or not. Suppose an experiment is conducted to check if girls are shorter than boys at the age of 5. The null hypothesis will say that they are the same height.

Alternative Hypothesis

The alternative hypothesis is an alternative to the null hypothesis. It is used to show that the observations of an experiment are due to some real effect. It indicates that there is a statistical significance between two possible outcomes and can be denoted as \(H_{1}\) or \(H_{a}\). For the above-mentioned example, the alternative hypothesis would be that girls are shorter than boys at the age of 5.

Hypothesis Testing P Value

In hypothesis testing, the p value is used to indicate whether the results obtained after conducting a test are statistically significant or not. It also indicates the probability of making an error in rejecting or not rejecting the null hypothesis.This value is always a number between 0 and 1. The p value is compared to an alpha level, \(\alpha\) or significance level. The alpha level can be defined as the acceptable risk of incorrectly rejecting the null hypothesis. The alpha level is usually chosen between 1% to 5%.

Hypothesis Testing Critical region

All sets of values that lead to rejecting the null hypothesis lie in the critical region. Furthermore, the value that separates the critical region from the non-critical region is known as the critical value.

Hypothesis Testing Formula

Depending upon the type of data available and the size, different types of hypothesis testing are used to determine whether the null hypothesis can be rejected or not. The hypothesis testing formula for some important test statistics are given below:

- z = \(\frac{\overline{x}-\mu}{\frac{\sigma}{\sqrt{n}}}\). \(\overline{x}\) is the sample mean, \(\mu\) is the population mean, \(\sigma\) is the population standard deviation and n is the size of the sample.

- t = \(\frac{\overline{x}-\mu}{\frac{s}{\sqrt{n}}}\). s is the sample standard deviation.

- \(\chi ^{2} = \sum \frac{(O_{i}-E_{i})^{2}}{E_{i}}\). \(O_{i}\) is the observed value and \(E_{i}\) is the expected value.

We will learn more about these test statistics in the upcoming section.

Types of Hypothesis Testing

Selecting the correct test for performing hypothesis testing can be confusing. These tests are used to determine a test statistic on the basis of which the null hypothesis can either be rejected or not rejected. Some of the important tests used for hypothesis testing are given below.

Hypothesis Testing Z Test

A z test is a way of hypothesis testing that is used for a large sample size (n ≥ 30). It is used to determine whether there is a difference between the population mean and the sample mean when the population standard deviation is known. It can also be used to compare the mean of two samples. It is used to compute the z test statistic. The formulas are given as follows:

- One sample: z = \(\frac{\overline{x}-\mu}{\frac{\sigma}{\sqrt{n}}}\).

- Two samples: z = \(\frac{(\overline{x_{1}}-\overline{x_{2}})-(\mu_{1}-\mu_{2})}{\sqrt{\frac{\sigma_{1}^{2}}{n_{1}}+\frac{\sigma_{2}^{2}}{n_{2}}}}\).

Hypothesis Testing t Test

The t test is another method of hypothesis testing that is used for a small sample size (n < 30). It is also used to compare the sample mean and population mean. However, the population standard deviation is not known. Instead, the sample standard deviation is known. The mean of two samples can also be compared using the t test.

- One sample: t = \(\frac{\overline{x}-\mu}{\frac{s}{\sqrt{n}}}\).

- Two samples: t = \(\frac{(\overline{x_{1}}-\overline{x_{2}})-(\mu_{1}-\mu_{2})}{\sqrt{\frac{s_{1}^{2}}{n_{1}}+\frac{s_{2}^{2}}{n_{2}}}}\).

Hypothesis Testing Chi Square

The Chi square test is a hypothesis testing method that is used to check whether the variables in a population are independent or not. It is used when the test statistic is chi-squared distributed.

One Tailed Hypothesis Testing

One tailed hypothesis testing is done when the rejection region is only in one direction. It can also be known as directional hypothesis testing because the effects can be tested in one direction only. This type of testing is further classified into the right tailed test and left tailed test.

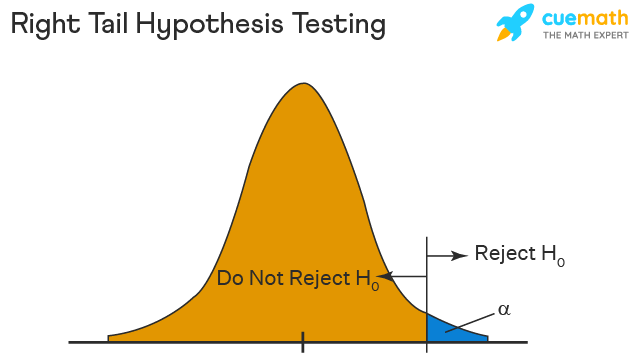

Right Tailed Hypothesis Testing

The right tail test is also known as the upper tail test. This test is used to check whether the population parameter is greater than some value. The null and alternative hypotheses for this test are given as follows:

\(H_{0}\): The population parameter is ≤ some value

\(H_{1}\): The population parameter is > some value.

If the test statistic has a greater value than the critical value then the null hypothesis is rejected

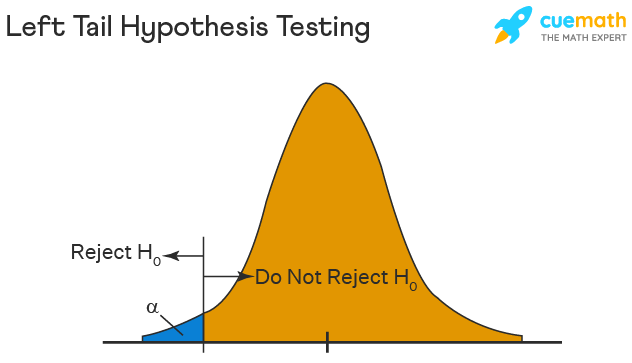

Left Tailed Hypothesis Testing

The left tail test is also known as the lower tail test. It is used to check whether the population parameter is less than some value. The hypotheses for this hypothesis testing can be written as follows:

\(H_{0}\): The population parameter is ≥ some value

\(H_{1}\): The population parameter is < some value.

The null hypothesis is rejected if the test statistic has a value lesser than the critical value.

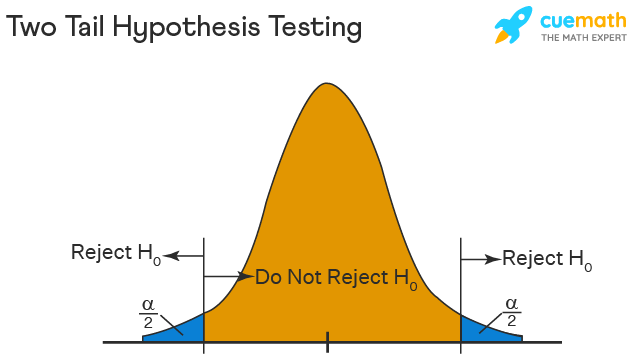

Two Tailed Hypothesis Testing

In this hypothesis testing method, the critical region lies on both sides of the sampling distribution. It is also known as a non - directional hypothesis testing method. The two-tailed test is used when it needs to be determined if the population parameter is assumed to be different than some value. The hypotheses can be set up as follows:

\(H_{0}\): the population parameter = some value

\(H_{1}\): the population parameter ≠ some value

The null hypothesis is rejected if the test statistic has a value that is not equal to the critical value.

Hypothesis Testing Steps

Hypothesis testing can be easily performed in five simple steps. The most important step is to correctly set up the hypotheses and identify the right method for hypothesis testing. The basic steps to perform hypothesis testing are as follows:

- Step 1: Set up the null hypothesis by correctly identifying whether it is the left-tailed, right-tailed, or two-tailed hypothesis testing.

- Step 2: Set up the alternative hypothesis.

- Step 3: Choose the correct significance level, \(\alpha\), and find the critical value.

- Step 4: Calculate the correct test statistic (z, t or \(\chi\)) and p-value.

- Step 5: Compare the test statistic with the critical value or compare the p-value with \(\alpha\) to arrive at a conclusion. In other words, decide if the null hypothesis is to be rejected or not.

Hypothesis Testing Example

The best way to solve a problem on hypothesis testing is by applying the 5 steps mentioned in the previous section. Suppose a researcher claims that the mean average weight of men is greater than 100kgs with a standard deviation of 15kgs. 30 men are chosen with an average weight of 112.5 Kgs. Using hypothesis testing, check if there is enough evidence to support the researcher's claim. The confidence interval is given as 95%.

Step 1: This is an example of a right-tailed test. Set up the null hypothesis as \(H_{0}\): \(\mu\) = 100.

Step 2: The alternative hypothesis is given by \(H_{1}\): \(\mu\) > 100.

Step 3: As this is a one-tailed test, \(\alpha\) = 100% - 95% = 5%. This can be used to determine the critical value.

1 - \(\alpha\) = 1 - 0.05 = 0.95

0.95 gives the required area under the curve. Now using a normal distribution table, the area 0.95 is at z = 1.645. A similar process can be followed for a t-test. The only additional requirement is to calculate the degrees of freedom given by n - 1.

Step 4: Calculate the z test statistic. This is because the sample size is 30. Furthermore, the sample and population means are known along with the standard deviation.

z = \(\frac{\overline{x}-\mu}{\frac{\sigma}{\sqrt{n}}}\).

\(\mu\) = 100, \(\overline{x}\) = 112.5, n = 30, \(\sigma\) = 15

z = \(\frac{112.5-100}{\frac{15}{\sqrt{30}}}\) = 4.56

Step 5: Conclusion. As 4.56 > 1.645 thus, the null hypothesis can be rejected.

Hypothesis Testing and Confidence Intervals

Confidence intervals form an important part of hypothesis testing. This is because the alpha level can be determined from a given confidence interval. Suppose a confidence interval is given as 95%. Subtract the confidence interval from 100%. This gives 100 - 95 = 5% or 0.05. This is the alpha value of a one-tailed hypothesis testing. To obtain the alpha value for a two-tailed hypothesis testing, divide this value by 2. This gives 0.05 / 2 = 0.025.

Related Articles:

- Probability and Statistics

- Data Handling

Important Notes on Hypothesis Testing

- Hypothesis testing is a technique that is used to verify whether the results of an experiment are statistically significant.

- It involves the setting up of a null hypothesis and an alternate hypothesis.

- There are three types of tests that can be conducted under hypothesis testing - z test, t test, and chi square test.

- Hypothesis testing can be classified as right tail, left tail, and two tail tests.

Examples on Hypothesis Testing

- Example 1: The average weight of a dumbbell in a gym is 90lbs. However, a physical trainer believes that the average weight might be higher. A random sample of 5 dumbbells with an average weight of 110lbs and a standard deviation of 18lbs. Using hypothesis testing check if the physical trainer's claim can be supported for a 95% confidence level. Solution: As the sample size is lesser than 30, the t-test is used. \(H_{0}\): \(\mu\) = 90, \(H_{1}\): \(\mu\) > 90 \(\overline{x}\) = 110, \(\mu\) = 90, n = 5, s = 18. \(\alpha\) = 0.05 Using the t-distribution table, the critical value is 2.132 t = \(\frac{\overline{x}-\mu}{\frac{s}{\sqrt{n}}}\) t = 2.484 As 2.484 > 2.132, the null hypothesis is rejected. Answer: The average weight of the dumbbells may be greater than 90lbs

- Example 2: The average score on a test is 80 with a standard deviation of 10. With a new teaching curriculum introduced it is believed that this score will change. On random testing, the score of 38 students, the mean was found to be 88. With a 0.05 significance level, is there any evidence to support this claim? Solution: This is an example of two-tail hypothesis testing. The z test will be used. \(H_{0}\): \(\mu\) = 80, \(H_{1}\): \(\mu\) ≠ 80 \(\overline{x}\) = 88, \(\mu\) = 80, n = 36, \(\sigma\) = 10. \(\alpha\) = 0.05 / 2 = 0.025 The critical value using the normal distribution table is 1.96 z = \(\frac{\overline{x}-\mu}{\frac{\sigma}{\sqrt{n}}}\) z = \(\frac{88-80}{\frac{10}{\sqrt{36}}}\) = 4.8 As 4.8 > 1.96, the null hypothesis is rejected. Answer: There is a difference in the scores after the new curriculum was introduced.

- Example 3: The average score of a class is 90. However, a teacher believes that the average score might be lower. The scores of 6 students were randomly measured. The mean was 82 with a standard deviation of 18. With a 0.05 significance level use hypothesis testing to check if this claim is true. Solution: The t test will be used. \(H_{0}\): \(\mu\) = 90, \(H_{1}\): \(\mu\) < 90 \(\overline{x}\) = 110, \(\mu\) = 90, n = 6, s = 18 The critical value from the t table is -2.015 t = \(\frac{\overline{x}-\mu}{\frac{s}{\sqrt{n}}}\) t = \(\frac{82-90}{\frac{18}{\sqrt{6}}}\) t = -1.088 As -1.088 > -2.015, we fail to reject the null hypothesis. Answer: There is not enough evidence to support the claim.

go to slide go to slide go to slide

Book a Free Trial Class

FAQs on Hypothesis Testing

What is hypothesis testing.

Hypothesis testing in statistics is a tool that is used to make inferences about the population data. It is also used to check if the results of an experiment are valid.

What is the z Test in Hypothesis Testing?

The z test in hypothesis testing is used to find the z test statistic for normally distributed data . The z test is used when the standard deviation of the population is known and the sample size is greater than or equal to 30.

What is the t Test in Hypothesis Testing?

The t test in hypothesis testing is used when the data follows a student t distribution . It is used when the sample size is less than 30 and standard deviation of the population is not known.

What is the formula for z test in Hypothesis Testing?

The formula for a one sample z test in hypothesis testing is z = \(\frac{\overline{x}-\mu}{\frac{\sigma}{\sqrt{n}}}\) and for two samples is z = \(\frac{(\overline{x_{1}}-\overline{x_{2}})-(\mu_{1}-\mu_{2})}{\sqrt{\frac{\sigma_{1}^{2}}{n_{1}}+\frac{\sigma_{2}^{2}}{n_{2}}}}\).

What is the p Value in Hypothesis Testing?

The p value helps to determine if the test results are statistically significant or not. In hypothesis testing, the null hypothesis can either be rejected or not rejected based on the comparison between the p value and the alpha level.

What is One Tail Hypothesis Testing?

When the rejection region is only on one side of the distribution curve then it is known as one tail hypothesis testing. The right tail test and the left tail test are two types of directional hypothesis testing.

What is the Alpha Level in Two Tail Hypothesis Testing?

To get the alpha level in a two tail hypothesis testing divide \(\alpha\) by 2. This is done as there are two rejection regions in the curve.

Formula Review

11.1 facts about the chi-square distribution.

χ 2 = ( Z 1 ) 2 + ( Z 2 ) 2 + . . . ( Z df ) 2 chi-square distribution random variable

μ χ 2 = df chi-square distribution population mean

σ χ 2 = 2 ( d f ) σ χ 2 = 2 ( d f ) chi-square distribution population standard deviation

11.2 Goodness-of-Fit Test

∑ k ( O − E ) 2 E ∑ k ( O − E ) 2 E goodness-of-fit test statistic where O : observed values E : expected values k : number of different data cells or categories

df = k − 1 degrees of freedom

11.3 Test of Independence

- The number of degrees of freedom is equal to (number of columns–1)(number of rows–1).

- The test statistic is Σ ( i ⋅ j ) ( O – E ) 2 E Σ ( i ⋅ j ) ( O – E ) 2 E where O = observed values, E = expected values, i = the number of rows in the table, and j = the number of columns in the table.

- If the null hypothesis is true, the expected number E = (row total)(column total) total surveyed E = (row total)(column total) total surveyed .

11.4 Test for Homogeneity

∑ i ⋅ j ( O − E ) 2 E ∑ i ⋅ j ( O − E ) 2 E Homogeneity test statistic where O = observed values E = expected values i = number of rows in data contingency table j = number of columns in data contingency table

df = ( i −1)( j −1) degrees of freedom

11.6 Test of a Single Variance

χ 2 = χ 2 = ( n − 1 ) ⋅ s 2 σ 2 ( n − 1 ) ⋅ s 2 σ 2 Test of a single variance statistic where n : sample size s : sample standard deviation σ : population standard deviation

df = n – 1 degrees of freedom

- Use the test to determine variation.

- The degrees of freedom is the number of samples – 1.

- The test statistic is ( n – 1 ) ⋅ s 2 σ 2 ( n – 1 ) ⋅ s 2 σ 2 , where n = the total number of data, s 2 = sample variance, and σ 2 = population variance.

- The test may be left-, right-, or two-tailed.

As an Amazon Associate we earn from qualifying purchases.

This book may not be used in the training of large language models or otherwise be ingested into large language models or generative AI offerings without OpenStax's permission.

Want to cite, share, or modify this book? This book uses the Creative Commons Attribution License and you must attribute Texas Education Agency (TEA). The original material is available at: https://www.texasgateway.org/book/tea-statistics . Changes were made to the original material, including updates to art, structure, and other content updates.

Access for free at https://openstax.org/books/statistics/pages/1-introduction

- Authors: Barbara Illowsky, Susan Dean

- Publisher/website: OpenStax

- Book title: Statistics

- Publication date: Mar 27, 2020

- Location: Houston, Texas

- Book URL: https://openstax.org/books/statistics/pages/1-introduction

- Section URL: https://openstax.org/books/statistics/pages/11-formula-review

© Jan 23, 2024 Texas Education Agency (TEA). The OpenStax name, OpenStax logo, OpenStax book covers, OpenStax CNX name, and OpenStax CNX logo are not subject to the Creative Commons license and may not be reproduced without the prior and express written consent of Rice University.

- Previous Article

This CD engagement covered two distinct areas to help the National Bank of Georgia (NBG) deliver on its price stability mandate, it: 1) provided a forward-looking analysis of the NBG’s balance sheet to assess its policy solvency and to help institutionalize such a process, and 2) outlined a strategy to develop hedging instruments in interest rate and foreign exchange (FX) markets to support monetary policy transmission. With virtually no interest-bearing liabilities, the NBG balance sheet is robust. Under the adverse shock, it improves on account of FX revaluation gains. Higher inflation also helps, since the need for a higher policy rate generates larger domestic interest income. Institutionalizing this analysis allows for early warning of the need to reduce dividend payments (or for re-capitalization) thereby supporting operational independence. Georgia has made good progress on many of the enabling conditions for developing hedging markets, but several structural factors provide challenges. A supportive regulatory environment is in place, market infrastructure is robust, and there is a range of instruments available to serve as the underlying instrument for derivatives. However, there is a lack of heterogeneity of financial risk profile and appetite amongst participants. Recommendations include setting up a standardized FX forward trading platform, pushing for upgrades of banks’ treasury management systems, supporting the targeted education and training efforts of the Georgian Financial Markets Treasuries Association, revising the current FX forward index to be more informative by publishing outright transacted rates; and publishing Overnight Indexed Swap benchmarks.

- Executive Summary

This report addresses two distinct issues to help the National Bank of Georgia (NBG) deliver on its price stability mandate . Firstly, it provides a forward-looking analysis of the NBG’s balance sheet to assess its policy solvency and to help institutionalize such a process. Separately, it outlines a strategy to develop hedging instruments in interest rate and foreign exchange (FX) markets to support monetary policy transmission.

A central bank can be considered “policy solvent” if, over time, it has realized earnings that are greater than its monetary policy and operating costs . While central banks do not face a liquidity constraint, they must be policy solvent to meet their monetary policy objective. Central banks can operate with a negative equity, but to do so effectively requires strong institutional arrangements, underlying profitability, and sufficient fiscal buffers. To assess the risks to policy solvency, the central bank balance sheet is stressed-tested under different macroeconomic scenarios.

The Central Bank Balance Sheet (CBBS) model forecasts balance sheet items based on scenarios of macroeconomic variables . Projections for real GDP, inflation, and the exchange rate are aligned with assumptions from area departments. The model incorporates accounting rules and equations derived from macroeconomics or finance. The model generates total equity decomposed into realized earnings and the revaluation account. Satellite models are developed for forecasting several key balance sheet items (e.g., currency in circulation) given the macroeconomic scenarios.

The Georgian economy has performed well recently despite the COVID-19 pandemic and Russia’s war in Ukraine . Two macro-scenarios are analyzed. In the base scenario, assuming continued strong tourism and FX inflows, GDP growth is expected to be robust and accompanied by mild inflation. In the adverse scenario, unexpected increase in commodity prices, slowdown in trading partners, and decrease in foreign exchange (FX) inflows lead to a temporary negative macroeconomic shock with an assumed recovery after 2025.

The NBG balance sheet is robust because it has virtually no interest-bearing liabilities . It has positive net foreign assets and positive net claims on the government. It also has claims on banks signifying the liquidity shortage that banks must meet by borrowing (i.e., through open market operations) from the NBG. Under the adverse shock, the NBG’s balance sheet improves on account of revaluation gains arising from the greater expected depreciation of USD/GEL. Higher inflation also helps, since the need for a higher policy rate generates larger domestic interest income via open market operations and investments in GEL government bonds.

Institutionalizing CBBS modeling will allow for early warning of the need to reduce dividend payments (or for re-capitalization) thereby supporting operational independence . This process requires dedicated NBG staff to run the model on a regular basis. It is also recommended that macroeconomic inputs to the central bank balance sheet model are consistent with the internal macroeconomic projections used for policy making.

There is good potential to develop hedging markets, but several structural factors provide challenges . The financial system is bank-centric and highly concentrated with two banks accounting for around 80 percent of banking sector assets. The spot FX market is liquid, but activity in FX forwards and swap markets is very low. Interest rate derivatives are also rarely traded. The floating exchange rate should incentivize FX hedging, but the high level of dollarization remains a major constraint on financial market development.

Markets targeted first for development should be those associated with the most relevant risks for the potential users, and where there are relatively fewer preconditions . FX risks are prominent given the openness of the economy. Hence, development of the FX forward market is a priority, given that it can deepen the spot market. Georgia’s forward market activity is below international comparisons, highlighting room for development. Developing interest rate derivatives is also important, given the lack of term instruments. This is, however, more challenging, although there is potential in the overnight indexed swap (OIS) market.

Georgia has made good progress on many of the enabling conditions for derivatives markets to develop . First, a coherent and supportive regulatory environment is in place. Second, the market infrastructure is robust, although market participants’ treasury and risk management systems need improvement. Third, a range of financial instruments is available to serve as the underlying instrument for derivatives. However, a significant structural impediment is the lack of heterogeneity of financial risk profile and appetite amongst participants.

In the short and medium-term, authorities should focus their development efforts in seven key areas : (i) set up a standardized FX forward trading platform on BMatch (the platform currently used for spot FX transactions) to provide NFCs additional access to liquidity; (ii) push for swift implementation of a joint treasury management system; (iii) assess the impact of the NBG FX intervention strategy on the incentives for hedging FX risks; (iv) continue to support the targeted education and training efforts of the Georgian Financial Markets Treasuries Association (GFMTA); (v) review the possible barriers for the Pension Agency (PA) to participate in the derivatives market; (vi) consider revising the current FX forward index to be more informative by publishing outright transacted rates; and (vii) publish OIS benchmarks.

Key Recommendations

- I. Introduction

1. The Georgian economy has performed well recently with a staff-level agreement reached for the second review under the Stand-by Arrangement (approved June 2022) . The economy grew by 7.2 percent year-on-year in the first quarter of 2023, with medium-term growth expected to be around 5 percent. There have been limited spillovers from the war in Ukraine, while relatedly, tourism has been buoyant, and there has been a surge in migrant and financial inflows. Headline inflation, after peaking at 13.9 percent in December 2021, has fallen to 1.5 percent (annual to May 2023), just below the NBG’s 3 percent target. Core inflation was higher at 3.9 percent but fell below target by the end of 2023.

2. The NBG has implemented an inflation-targeting regime since 2009 . This regime ushered in lower inflation; however, inflation volatility has remained high, reflecting challenges faced by the authorities. One such challenge is dollarization (about 50 percent for deposits and 44 percent for loans), which, although on a steady downtrend trend, remains a material factor undermining the efficacy of monetary policy. The NBG introduced a de-dollarization program in 2016, which included the banning of foreign currency lending for small loans and implementing liquidity coverage ratios with preferential treatment for GEL-denominated liabilities.

3. The NBG recognizes the importance of “policy solvency” to deliver on its price stability mandate . While central banks do not face a liquidity constraint and can, in some circumstances, operate with negative equity, to be effective, they must be policy solvent . 2 This condition requires the central bank to have realized earnings (i.e., operating profits) on average over time; revaluation gains should not be considered. 3 Other necessary conditions are strong institutional arrangements and a sound fiscal position. To assess the risks to policy solvency, central bank balance sheets can be stressed under different macro-scenarios. While central banks must not deviate from policy settings that keep inflation at target levels, an institutionalized approach to forecasting its balance sheet may provide early warning of the need to scale back dividend payments (or for recapitalization), thereby supporting its independence.

4. To further improve the efficacy of monetary policy, the NBG seeks to deepen its financial markets . Financial markets are the conduit through which central bank signals are transmitted to the real economy. Shallow or undeveloped markets inhibit transmission, and in Georgia, compound the challenges arising from dollarization. While the overnight unsecured market is sufficiently liquid, allowing for a representative benchmark rate, the repo market is very shallow. The secondary government bond market is illiquid amid buy-and-hold strategies pursued by domestic entities and in the absence of non-resident investors. The spot FX market is continuously liquid while there is little activity in the FX forward and swap markets.

II. Stress Testing the NBG Balance Sheet

- A. Policy Solvency

5. A central bank is assessed to be policy solvent if its debt is on a sustainable path, which is a condition that requires positive realized earnings on average, over time . The absolute level of equity is less important as there are some examples of central banks having operated effectively with negative equity. All these cases involved strong institutional frameworks, central banks with underlying (i.e., realized) profitability, and governments with strong fiscal positions. The dynamics of the realized earnings are important since revaluation gains cannot be relied upon to meet the operational costs, since they may not be sustainable and could be reversed. Similarly, dividends should not be paid from the revaluation gains, as to do so would monetize the gains, possibly undermining policy effectiveness.

6. If the central bank is not policy solvent, there are two possible outcomes ( Figure 1 ) . If the government has the fiscal space to recapitalize the central bank, then it should do so. Alternatively, if the government does not have the fiscal space, then the outcomes are limited to either financial repression (e.g., capital controls, negative real interest rates) or a loss of control over financial conditions (e.g., the exchange rate) and consequently over inflation.

Assessing Policy Solvency

Citation: Technical Assistance Reports 2024, 038; 10.5089/9798400275616.019.A001

- Download Figure

- Download figure as PowerPoint slide

B. Central Bank Balance Sheet Model

7. The Central Bank Balance Sheet (CBBS) model forecasts balance sheet items from

the initial balance sheet using scenarios of macroeconomic variables ( Figure 2 ) on a five-year horizon . Projections of real GDP, inflation, and the exchange rate are centered on area department assumptions while the policy rate is based on a Taylor rule. 4 The model incorporates accounting rules and equations derived from macroeconomics and finance. All material items on the balance sheet are modeled, deriving a path for total equity that is split between retained earnings and the revaluation account. The items can be classified into three groups:

Exogenous or policy-determined items. These include net purchases of foreign currency and investments in domestic government bonds. These items are not estimated but derived from policy decisions (e.g., regarding the target level of net international reserves).

Autonomous items determined by macroeconomic variables that do not explicitly depend on other items on the balance sheet (i.e., currency in circulation). These items are outside the direct and immediate control of the central bank and therefore not directly related to monetary policy operations but can influence the amount of liquidity in the banking system. Therefore, they need to be forecasted using the satellite models.

Endogenously determined items. Excess reserves are the key endogenously determined item as they are determined by changes in currency in circulation (CiC) and required reserves on the liability side and net purchases of USD and investment in government bonds on the asset side. Excess reserves also reflect interest expenses and operating cost.

The Balance Sheet Model

- Core Model Equations

8. The equations in the core model follow the accounting identities as follows :

Equity : The total equity can be obtained in two ways, which together provide for a consistency check.

(1) Equity t = Total Assets t — Total Liabilities t

(2) Equity t = Equity t-1 + Realized earnings t + Reval Account t

A clearing item : Depending upon the operational framework, either open market operations (OMO) or excess reserves are a clearing item which captures changes in the assets and liabilities that impact realized earnings ( Box 1 ). Revaluation gains or losses in items are not captured as they go directly against the revaluation account. 5 Where excess reserves are low and constant, the changes in the balance sheet (that impact realized earnings) will be reflected in changes in the OMO. This is given by: (i) net USD purchases for NFR AFXInt t ; (ii) net increases in government bond investments AGovBond t ; (iii) changes in currency in circulation Δ CiC t ; (iv) changes in the required reserves A RR t ; and (v) interest income IRIncome t and operating costs Op t . In the case of NBG, the refinancing loan (i.e., OMO) is the main monetary policy tool, which earns interest at the policy rate ( Box 1 ).

OMO t = OMO t-1 + [- ΔFXInt t – ΔGovBond t + Δ CiC t + Δ RR t + IRIncome t – Op t ]

Foreign reserve accumulation : The dynamics for gross foreign reserve accumulation is driven by three terms: 6 (i) foreign currency interest income; (ii) FX revaluation gains or losses; and (iii) net USD purchases for NFR accumulation. 7 Note that the equation below is shown in the simplest case. For example, when there is net inflow to USD required reserves from financial institutions, there is an additional term AFXRes t to account for the equivalent change in gross foreign reserves. Our benchmark assumption is conservative with no such an inflow, but the model is flexible to allow such reserves to increase, depending on the macroeconomic environment. 8 In the equation below, FXRes t is the foreign reserves at time t. FIRIncome t is the foreign interest income. Revaluation t FXRes is the revaluation gain due to the change in exchange rates. Δ FXInt t is the net amount of the purchase of foreign currencies, which is primarily USD.

National Bank of Georgia: Monetary Operations

The NBG implements an inflation-targeting framework with the short-term interbank interest rate as the operational target. The NBG aligns this market interest rate with its monetary policy rate , which it announces to signal the stance of monetary policy. The 15 licensed commercial banks are the monetary policy counterparts. There is a structural liquidity deficit, which routinely requires banks to borrow from the NBG to meet their payment obligations. The main monetary instrument is the weekly refinancing loan (seven-day maturity), which is calibrated using forecasts of liquidity deficit. These loans are offered through multiple-price auctions and are fully collateralized.

Standing facilities contain short-term interest rate volatility. The interest rate on overnight loans is 75 basis points above the monetary policy rate, and 175 basis points below for overnight deposits (this corridor is symmetric after allowing for the tax treatment on the deposit facility). Reserve requirements are imposed on banks’ domestic currency deposits of one year and less. The maintenance period is 14-days, with full reserve averaging. The current ratio is 5 percent, and the reserves are remunerated at the monetary policy rate. Requirements are applied on foreign currency deposits of two years and less. The ratio is set between 10 and 20 percent for deposits of 1 year and less, and between 10 and 15 percent for deposits between one and two years. In both cases, the ratio depends on the deposit dollarization rate of the respective bank. The maintenance period is also 14 days, averaging is not permitted, and remuneration is set at zero.

One-month refinancing loans are used occasionally to manage the structural deficit and are offered on the same basis as the seven-day instrument. Three-month certificates of deposit may also be issued but there has been no recent increase in issuance (the stock of certificates is at a low level to encourage market activity in that part of the yield curve).

- Key Satellite Models

9. Satellite models are developed for three items that have material impacts on equity dynamics . Unlike the core model equations described above, assumptions are based on specific macroeconomic circumstances. What follows are parsimonious but still sufficiently flexible models for the key balance sheet items. These satellite models can be replaced with simpler models or more sophisticated models depending upon the purpose of the CBBS model users.

- CiC dynamics: CiC is assumed to linearly increase with nominal GDP and depends on the policy rate. 9 The economic intuition is that a larger economy requires more CiC for transactional purposes, and households hold less cash if interest rates are higher (i.e., opportunity cost). The policy rate serves as the proxy for the deposit rate. The interest-sensitivity parameter is calibrated using the historical data. CIC t = η CIC NGDP t ⋅ ( i 0 i t ) γ CiC

- Required reserves in GEL: Required reserves are assumed to increase with nominal GDP. This is because required reserves increase as total bank deposits grow (given a constant ratio on the reserve requirement), and total deposits increase with nominal GDP. Interest paid on required reserves is calculated at the policy rate. ResReq t = η Req NGDP t + i req,t-1 ResReq t − 1

- Required reserves in foreign currency: Required reserves in foreign currency are also assumed to move linearly with nominal GDP. The intuition is the same as for GEL while accounting for the fact that no remuneration is paid on foreign currency required reserves. In the default setting, the parameter n.usDReq is set equal to zero by assuming that U.S. dollars in the banking system are stable even if nominal GDP changes over time. USD − ResReq t = η USDReq ( NGDP t − NGDP t − 1 ) + FX t FX t − 1 USD − ResReq t − 1

C. Application to the National Bank of Georgia

- Financial Relations Between the NBG and the Government

10. The equity of NBG comprises charter (authorized) capital (GEL 15 million), the general reserve fund, and the revaluation reserve . The NBG Law, which governs the institutional arrangements, establishes how profits should be transferred internally to the different components of equity, and externally to the State budget of Georgia. These transfers are overseen by the Council, which is the only statutory body entitled to make decisions on the distribution of annual net profits.

11. The NBG’s annual net operating profit (i.e., realized earnings) is transferred to the reserve fund, while unrealized net gains are transferred to the revaluation reserve . The NBG Law stipulates that transfers of annual net profits should be used to fill the reserve fund until the reserve fund reaches 15 percent of reserve money. The remaining portion of annual net profit should then be transferred to the State budget of Georgia within six months after the end of the financial year. It is important to note that the NBG Law allows the NBG Board to transfer annual net profits to the government before the reserve fund is filled to the threshold of 15 percent of reserve money.

12. The recapitalization procedure is well-defined in the NBG Law . If the capital of the NBG falls below the authorized capital (GEL 15 million), the Ministry of Finance shall, within five months after the year-end, unconditionally issue circulating government bonds to the NBG under terms and conditions similar to those of other government securities to replenish authorized capital to the minimum level.

- The NBG Balance Sheet

13. The NBG balance sheet is strong, with few interest-bearing liabilities ( Table 2 ) . Total equity (March 2023) was GEL 2.3 billion (3.3 percent of GDP). On the asset side, all assets are income generating; 75 percent are foreign assets, and the remaining are domestic assets (government bonds and OMO). The OMO on the asset side highlights that the Georgian banking system faces liquidity shortages and must borrow from the NBG each day to meet its obligations. On the liability side, interest costs accrue to the Fund’s Extended Funding Facility (EFF) and SDR allocations, which are 15 percent of the total liabilities. Five percent of the total liabilities incur cost at domestic interest rates, all of which relate to GEL required reserves. The balance of the liabilities is non-interest bearing, with foreign currency required reserves and CiC accounting for 33 percent and 32 percent of the total liabilities, respectively. An aggregation of the balance sheet ( Table 3 ) facilitates the detailed analysis.

NBG Balance Sheet—March 31, 2023

NBG Aggregated Balance Sheet—March 31, 2023

- Stress Testing the Balance Sheet

Base Scenario

14. Supported by continued strong tourism, transit trades through Georgia, and FX inflows, real GDP is forecasted to grow 5.2 percent in 2023 . Each of these three key macro variables shows stable paths ( Figure 3 ). The USD/GEL exchange rate is relatively stable at around 2.7. Inflation is forecasted to increase marginally, from 2.6 percent to 3 percent, which is the long-term target inflation level.

15. Under this scenario, the balance sheet, after dividend payments consistent with the NBG law, strengthens considerably . Equity increases from GEL 2.3 billion (3.3 percent of GDP) to GEL 5.7 billion (5.5 percent of GDP) in 2027Q4. The main driver is the realized earnings, which come from both the GEL interest income on refinancing loans, the investment in the government bonds, and foreign interest income on the international reserves.

Macro-assumptions: Base Scenario

Transfer to Ministry of Finance

Base Scenario Projections

Adverse Scenario

16. The adverse scenario incorporates an increase in commodity prices, a slowdown in trading partners’ GDP, and a decrease in FX inflows . 10 GDP is lower in 2023H2 and 2024 but recovers after 2024. All three key macro variables are shocked temporarily but then stabilize ( Figure 6 ). Real GDP growth drops to 0.4 percent but then recovers to 5.1 percent. The USD/GEL falls to 2.95 in 2024 and stabilizes at that level after the shock. Inflation increases from 2.6 percent to 4.3 percent before falling back to the 3 percent target.

Macro-assumptions: Adverse Scenario

17. Equity increases from GEL 2.3 billion to 6.3 billion in 2027Q4 ( Figure 7 ) . It also increases as a percentage of GDP, from 3.3 to 6.2 percent. This is an improvement relative to the base scenario, which highlights the resilience of the balance sheet. The main driver of the increase is the larger currency depreciation, which provides a bigger FX revaluation gain.

Capital Surges: Exchange Rate and Dollarization Impacts

18. The NBG’s balance sheet is stressed with a dollarization shock . An econometric model links the dollarization ratio with macroeconomic variables and estimates the model based on historical data. The scenario is motivated by the events from January 2021 to December 2022, when the USD/GEL appreciated by approximately 19 percent. In 2022, this was driven predominantly by Russians migrating to Georgia at the commencement of Russia’s war in Ukraine, causing significant capital inflows. This analysis assumes this appreciation to be completely reversed over a two-year period starting in January 2024 because of an emerging dollarization trend through intensified private FC borrowing and, hence, debt-servicing. Satellite models are estimated to calibrate the impact of this latter depreciation shock on inflation and the domestic policy rate.

Adverse Scenario Projections

19. A satellite model for dollarization was estimated to assess the impact of exchange rate depreciation on dollarization . From this model, a 25 percent appreciation in the exchange rate (as seen from 2021 to 2022) causes dollarization to increase by approximately seven percentage points. The impact is delayed, however, which is consistent with the actual dollarization trend seen during 2021 to 2022. This observed delay results in pent-up demand for foreign currency loans, causing dollarization to eventually start to increase in January 2024. Specifically, it is assumed that dollarization increases by an estimated seven percent over the period January 2024 to December 2025. Dollarization is then assumed to stabilize over 2026 to 2027, returning to its long-term trend of marginal quarterly reductions.

Capital Surge Scenario: Macro-variables and Dollarization

20. The combination of greater exchange rate depreciation and higher inflation increases the level of equity ( Figure 8 ) . The equity in 2027Q4 is 7.9 percent of GDP, and higher than under the base case. The results indicate that the NBG’s balance sheet becomes stronger when dollarization increases.

Capital Surge Scenario: Projections

III. Developing Hedging Markets

- A. Financial Market Context

21. The financial system is bank-centric and highly concentrated . Banks account for 96 percent of the financial sector with two banks having around 80 percent of total banking assets. Non-bank Financial Intermediaries (NBFIs) are largely absent, although the recently established Pension Agency ( Box 2 ) is a welcome initiative that incentivizes savings and will contribute to deeper financial markets. It currently has GEL 3.4 billion under management (around 5 percent of GDP). Foreign banks are absent, which has also held back financial market development.

The Pension Agency of Georgia

The Pension Agency (PA), established in 2018, handles the mandatory defined contribution component of Georgia’s pension scheme. The PA is regulated and supervised by the NBG and has a two-tiered governance structure which separates the oversight of pension administration (Supervisory Board) and that of investment management (Investment Board). The latter consists of independent members and selects the chief investment officer.

The PA is the largest NBFI in Georgia with GEL 3.4 billion under management, and it is expected to grow steadily as it receives a combined 6 percent of contributions of eligible contributors’ salaries. Beginning in 2023Q3, following a five-year transition period, during which inflows were directed to the PA’s low-risk portfolio, funds will also be invested in medium- and high-risk portfolios.

The increasing diversification entails a growing allocation to foreign assets. Currently, foreign currency denominated assets are capped at 20 percent, but that portion is expected to increase as the target weight of such assets in the medium and high-risk portfolios is 20–40 percent and 40–60 percent, respectively. As part of this asset allocation shift, the PA will likely convert a significant amount of GEL in the coming months and is anticipated to create a steady but moderate supply of GEL in the FX market in the long run.

Exposure limit constraints and IT-system challenges currently prevent the PA from engaging in derivative transactions. The Investment Policy prohibits the use of options, futures, forwards, and other derivatives, except for portfolio hedging purposes. In addition, the PA, like many banks in Georgia, lacks the IT-system capacity to easily process derivatives transactions and is looking at treasury management options.

Once the infrastructure is in place and the riskier portfolios are built up, the PA could potentially become a regular user of financial derivatives within its mandate. In the case of its domestic fixed income assets, short-term or variable rate instruments can be hedged using OIS swaps to help align the interest rate risk of the assets with that of the liabilities. Exchange rate risk associated with foreign assets can be mitigated by selling foreign currency forward.

22. Dollarization remains a major constraint to further development of financial markets . The NBG successfully embarked on a de-dollarization program in 2016 which included the banning of foreign currency lending for small loans and liquidity coverage ratios with higher requirements for foreign currency liabilities. Still, although on a downward trend, dollarization remains material at 56 percent for deposits and 45 percent for loans ( Figure 10 ).

Hedging Markets in Georgia

23. The NBG has implemented an inflation-targeting regime with a floating exchange rate . The USD/GEL depreciated by about 5 percent annually between April 2017 and March 2022, amid moderate volatility of 8–10 percent. Over the last three months, this volatility has decreased, falling below the levels observed in many other countries: 9.6 percent in advanced economies and 8.2 percent in emerging markets ( Figure 10 ). Capital inflows from Russian immigrants since the start of the war have caused the USD/GEL to appreciate by about 20 percent, while daily volatility has fallen to 4 percent from 8–10 percent previously. The stability of the exchange rate has been supported by the NBG’s regular FX interventions to meet several objectives, including accumulating foreign reserves, meeting government obligations, and countering excessive volatility.

24. The spot USD/GEL market is moderately liquid and appears competitive . The interbank segment is organized as a central limit orderbook (Bloomberg BMatch) where brokered customer flows are also executed. BMatch is accessible to 14 banks and their clients. Credit risk limits are applied automatically pre-trade. BMatch is granted or revoked by the NBG in its capacity as the FX market regulator. Daily average interbank volume, including brokered trades, is about $12 million, one-third of which involves the NBG. The NBG also transacts with MoF Treasury for the benefit of state-owned enterprises at its official exchange rate. 11 The dealer-to-customer segment is large (more than $100 million per day), most of which are offsetting customer flows matched internally within banks. Spot market competition is reportedly strong, with smaller banks being able to attract demand beyond the customers with which they have their major banking relationship. A significant portion of non-bank participation is reportedly related to Microfinance Institutions (MFIs), further strengthening competition ( Box 3 ). As a result, bid-ask spreads in the interbank segment can be as low as 20 bps, while they remain close to 80 bps in dealer-to-customer activity.

25. Activity in FX forwards and swap markets is very low ( Figure 10 ) . Interbank forward activity is largely non-existent as the risks arising from the relatively small volume of customer transactions are managed internally, or via the spot market. Non-financial corporate (NFC) demand for forwards is limited to FX sales by a handful of exporters. Importers are reluctant to use forwards to hedge as they can pass on the effect of a potential lari depreciation to their domestic clients. FX bureaus and other financial institutions buy FX forward in small amounts. In the FX swap market, most trades are cross-border with large international names borrowing GEL. Onshore, smaller banks and MFIs that cannot lend their FX deposits due to size limits place their FX liquidity in FX swaps with the larger banks.

26. The money market is sufficiently liquid in the overnight unsecured segment . This segment has relatively high volume (GEL 150–200 million daily) with the NBG successfully managing rates close to its announced policy rate. This enables the NBG to produce a reliable and representative overnight benchmark interest rate, the Tbilisi Interbank Offered Rate (TIBR). Commercial bank certificates of deposit and term lari deposits are also available. Repo market activity is light as market participants manage their liquidity within unsecured limits, while there is no demand from the NBFI sector for cash or security driven repos.

Microfinance Institutions’ Role in the Georgian FX Market

Microfinance institutions (MFIs) play an important role in the Georgian FX market, particularly through cash currency conversions and transfers. In recent years, as tourism has grown and with an increase in Russian immigrants, the inflow of U.S. dollars (USD) into Georgia has intensified.

Consequently, MFIs have emerged as significant intermediaries in distributing USD to the financial sector. This dynamic primarily unfolds through FX swaps with larger banks, which arise as MFIs lack alternative USD investment options due to regulatory restrictions on their lending activities. Specifically, their typical lending size falls below the minimum regulatory threshold of GEL 100,000 for FX lending, making it difficult for them to place USD loans. MFIs also extend their reach into the FX market through partnerships with recognized international money transfer service providers. Their competitive edge is further sharpened by their operational flexibility: MFIs remain open on weekends, allowing them to serve customer needs outside traditional banking hours.

Recent regulatory developments have provided MFIs with the opportunity to become microbanks. This transition could provide MFIs with access to the central bank’s accounts and liquidity facilities, further boosting their position in the Georgian financial sector. However, this benefit comes at the cost of intensified supervision, which might discourage some market players.

Despite their critical role in FX operations, MFIs face challenges from larger banking institutions that view them as competitors. For instance, larger banks often impose high fees for wire transfers, which raises barriers for MFIs looking to expand into the FX business for larger corporates—a crucial part of the banks’ business model.

To mitigate these challenges, MFIs resort to cash transactions, often conducting simultaneous withdrawals and deposits in both local and foreign currencies for their clients’ accounts. This process, although practical, isn’t a complete solution to the structural barriers imposed by the larger banks.

Recently, the central bank introduced a cap on local currency settlement fees, which is expected to somewhat lower these entry barriers. However, banks can still impose substantial fees on the FX transfer leg, which is not part of the real-time gross settlement (RTGS) system.

Further regulatory action could foster competition and contribute to the smooth functioning of the FX market. The incorporation of FX into the RTGS and the introduction of caps on FX settlement fees would be significant steps in this direction. By easing restrictions and fostering fair competition, these measures could enhance the vital role MFIs play in Georgia’s FX market.

27. Government bonds are currently issued up to seven years, but the secondary market is illiquid . 12 The lack of heterogeneity in the investor base renders the secondary market largely inactive despite a primary dealer arrangement that incorporates market-making commitments. Domestic participants (mainly banks and, going forward, the pension fund) pursue buy-and-hold strategies while there are very few non-resident investors. With little secondary market activity and the absence of longer-term bonds (90 percent of the outstanding government bonds are shorter than five years, and only 0.3 percent of the portfolio is longer than seven years), price discovery is problematic. Consequently, market participants resort to theoretical values when estimating the yield curve, while the NBG relies on primary market auction prices. The absence of a solid foundation for pricing the underlying (i.e., cash) market, undermines the development of the longer-term interest rate derivatives market.

28. Short-term interest rate derivatives are rarely traded . Four market participants regularly provide indicative OIS quotes for short tenors. A handful of OIS have been traded by the biggest banks with non-resident counterparties (e.g., the European Bank for Reconstruction and Development) but there have been none transacted between two domestic parties. Although banks have systems to manage foreign exchange risks, including those arising from customer trades, the same is not true for interest rate risks. Any trades currently conducted are processed and accounted for manually. There is therefore a need to modernize banks’ treasury management systems. This shortcoming is recognized by the banking industry and the NBG, and a comprehensive project is underway to make improvements. 13

29. The surveys of banks and NFCs provided some relevant findings . While NFCs view exchange risk as the most important risk, most never hedge with FX forwards because they find it too costly, while others can generate natural hedges (e.g., through FX liability management). Banks’ use of FX forwards is also limited since they rarely need it for managing their FX positions. Their common view is that corporate demand for FX forwards is held back by the lack of awareness about exchange rate risks.

- B. Which Hedging Markets?

30. The first markets to target for development are those associated with the most relevant risks for the potential users, and those with the most favorable conditions . In an open economy with a floating exchange rate, FX risks will likely dominate. According to the Bank for International Settlements’ triennial FX and derivatives surveys (2022), in emerging markets, the turnover of FX derivatives was twice that of interest rate derivatives. 14 Another consideration is that derivatives with relatively fewer preconditions should be prioritized. More complex derivatives, which rely on deeper markets and possibly on other derivatives, should wait. In the case of FX derivatives, this implies that a forward market be developed before an options market. And for interest rate derivatives, a focus on the local currency OIS market should precede that of the cross-currency swap market.

31. The FX forward market is important as it can strengthen spot market liquidity . Global shocks to domestic currencies, which typically spill over to the domestic market because of purchases and sales by non-residents, can be offset by domestic actors hedging their opposing exposures through FX forwards. Such hedging activity could lead to lower exchange rate volatility than in the case without it.

OIS Mechanics

Interest rate swaps are agreements to exchange floating and fixed interest rates. In an overnight indexed swap (OIS), the floating leg of the swap is linked to an overnight reference interest rate (e.g., euro short-term rate, secured overnight financing rate, and sterling overnight index average), which is subject to daily changes. This a key difference from longer-term interest rate swaps where the reference rates are modified less frequently (e.g., quarterly).

OIS transactions have limited impact on credit risk and liquidity. No cash is transferred at the inception of an OIS trade, and the parties only exchange the difference between fixed and floating interest rates upon maturity. Counterparties only need to take credit risk into account to the extent of the net present value of future interest payments, which puts little burden on the banks’ counterparty limits.

The cash flow of the OIS transaction upon maturity is computed as the difference of the cash value of the two legs using the following formula:

where n is the tenor of the OIS in days, r i o / n is the overnight reference interest rate on day I , and r fix is the interest rate on the fixed leg of the swap.

At inception, the fixed rate can be established using the above formula by setting a series of expected overnight rates over the swap’s tenor, aiming to achieve a cash value of zero. Subsequently, a spread can be added or subtracted from this rate to reflect the compensation for market making.

Assuming strong monetary transmission, and a well-functioning OIS market, policy rate expectations can be derived from the fixed rate of the OIS. This could be a useful source of information for the central bank when formulating its policy decisions or the associated communication strategy.

The introduction of overnight risk-free rates (RFRs) and the phasing out of quote-based term benchmarks have created a structural shift in interest rate derivatives markets globally. The phasing out of LIBOR and the shift to compounded overnight RFRs removed the fixing risk associated with interest rate benchmarks, making forward rate agreements (FRAs) obsolete. As a result, interest rate swaps referencing the LIBOR have been replaced with OIS, which is linked to overnight RFRs. The latest BIS data corroborates this shift as it indicates a sharp decline of FRA trading and an increase in OIS trading in 2022 in jurisdictions where these transitions have taken place.

The abolition of the LIBOR also necessitated adjustments in the FX derivatives markets. Cross-currency interest rate swaps’ conventions had to be modified to link the payments to RFRs instead of LIBOR rates. A well-functioning domestic OIS market would help align local market conventions with international ones and provide a forward-looking reference interest rate.

32. The importance of exchange rate risk is associated with the openness of the economy . From a sample of 46 countries ( Figure 10 ), there is a positive correlation between the volume of a country’s international trade and domestic NFCs FX forward trading. This relationship is non-linear, suggesting that other factors associated with the countries’ size might also be at play. The relationship between NFCs forward volumes and spot activity ( Figure 10 ) indicates stability around the relative size of the FX spot and forward markets.

33. Georgia is below international comparisons of forward market activity, indicating there is room for development . Georgia is on par with other countries when the forward turnover is compared to the country’s international trade volume (adjusted for size). It is, however, an outlier with its relatively small forward volumes by NFCs when compared with spot volumes. Some other Eastern European countries show similar patterns, albeit to a lesser magnitude.

34. Developing interest rate derivatives is more challenging . Intuitively, this makes sense as importers and exporters naturally generate significant financial exposures in their business operations. In contrast, interest rate risk typically involves more concentrated exposures in shorter maturities and is less dynamic. Moreover, price volatility in exchange rates higher than that for interest rates. 15 With this very likely smaller market, the initial focus should be on short-term OIS tenors (up to 12 months). Participants would most likely seek to insure against adverse monetary policy actions, which potentially could hurt cashflow and jeopardize a business. Ultimately, as more participants enter the market with different risk profiles, longer-dated interest rate risk hedging products would follow.

C. Enabling Conditions for Market Development

35. There are four building blocks of derivatives markets’ development , described in detail below. The situation in Georgia is assessed against these:

An enabling regulatory environment that ensures legal certainty of the derivative contracts, covering aspects like covering of close-out netting, regulation of eligible collateral, hedge accounting, and margin requirements.

A robust market infrastructure , encompassing payment and settlement systems, trading platforms, market data providers, trade repositories, and the treasury and risk management systems of market participants.

A diverse range of financial instruments , available to serve as the source of the underlying product for derivatives (e.g., overnight interbank money market reference rates 16 for the OIS and FX spot markets for FX forwards) as well as a potential tool for market participants to hedge their derivative positions if needed (i.e., assets with fixed or floating rate coupons for OIS).

A broad user base with heterogenous risk profiles , possessing incentives and sufficient knowledge to manage financial risks.

36. The Georgian authorities have implemented an array of legal and regulatory reforms to support development of the derivatives market ( Table 4 ) . These include introducing in Georgian legislation comprehensive definitions of the main types of derivatives. These follow International Swaps and Derivatives Association and International Capital Market Association guidelines, ensuring enforceability of derivatives contracts, perfecting netting, and close-out netting, and clarifying the rights of re-use of different types of financial collateral. An important prudential element of these reforms is that at least one counterparty in a derivative transaction must be a supervised financial institution. Authorities have chosen not to prescribe binding margin requirements. Instead, financial intermediaries may set initial and variation margins based on their internal risk management processes.

37. Appropriate treatment of hedge accounting is still to be addressed . Hedge accounting under International Financial Reporting Standards aligns the accounting treatment of financial instruments with the risk management activities of an organization to minimize volatility in profit or loss statement. In Georgia, there is no distinction between derivatives used for hedging or speculative purposes, and all unrealized mark-to-market gains on derivatives are taxed. This treatment undermines incentives for the use of derivatives since taxes may be incurred where no actual profit has accrued.

Status of Derivatives Markets’ Regulation 17

- Infrastructure

38. Financial market infrastructures have been implemented to support market activity ( Table 2 ) . These include a real-time gross settlement system and securities settlement system to facilitate delivery-versus-payment transfers of funds and securities between counterparties. Bloomberg is widely used as the standard data provider and trading platform (BMatch). The NBG requires granular reporting from participants for effective monitoring of financial market risks, including those arising from derivatives transactions. There is, however, no central counterparty (CCP) for clearing of derivatives trades in Georgia and one could not currently be justified given that derivatives volumes are expected to remain low in the medium term. When considering establishing a CCP, the NBG should undertake a full cost/benefit analysis of the business case. 18

39. Banks have recognized deficiencies in their treasury management systems regarding, specifically in the management of interest rate risks . While these shortcomings are not currently perceived to be important, due to the prominence of short-term and variable rate products (deposits and lending), addressing them is essential for market development. Accordingly, the NBG has facilitated a project in which six banks are collaborating to finance a new treasury system. This system would include functionality for managing interest rate risk, including that arising from derivatives transactions. 19

Status of Market Infrastructure

40. A lack of heterogeneity of financial risk profiles and appetite amongst participants is the biggest constraint to market development ( Table 6 ) . Financial markets facilitate the transfer of financial risks between participants, but to function, markets require participants that gain from such trades. Currently, these “gains from trade” are severely limited due to the bank-centered and highly concentrated nature of the financial sector. With hedging markets, participants must first be able to assess the extent and probability of potential losses arising from their financial exposure. Then they should be able to price that risk to make an informed decision on engaging in a hedging transaction; if the price of hedging is assessed as too high, they will not engage in the transaction. Important in this pricing is the extent to which there is another participant willing to take the other side—either because they have an opposite exposure, or they are willing to assume the risk in expectation of profiting from a favorable move in the price (i.e., an open or speculative trade). The greater the number of participants with dynamic, heterogenous risk profiles and appetites, the more liquid market activity will become.

41. The mission’s survey confirmed that there is limited awareness of hedging instruments among potential users . Corporates cited the lack of need, inadequate price transparency, and the relatively high cost as the main reasons for not using derivatives for hedging. Banks were of the view that corporate demand for FX forwards is held back by the lack of awareness about the exchange rate risk and the limited knowledge of the available hedging instruments.

42. The NBG has significantly contributed to the training and education of market participants in collaboration with the GFMTA . Established as Georgia’s equivalent of an FX committee, essential for the effective adoption of the Global FX Code, the GFMTA has served as a consultative body for participants in the broader financial market beyond FX. In addition, one of its core activities has been organizing training courses offered by the International Capital Market Association for domestic market participants. In fact, the NBG set the attainment of relevant professional certificates by banks’ treasury staff as the precondition for participating in the domestic interbank FX market. This requirement has strengthened the incentives for banks to participate in these training programs.

43. The small size of the Georgian economy limits non-resident banks’ active participation in the local financial markets . In the past, several large international banks operated subsidiaries with various business models in Georgia, but the small size of the domestic market prevented the scale required for them to leverage on their competitive advantages, particularly in relation to the retail sector. The greatest value these banks could add would be in the case of export-oriented domestic subsidiaries of large multinational companies. This structural feature of the economy is difficult to overcome.

Status of User Base

- Underlying and Supporting Products

44. The FX spot and the unsecured overnight interbank money markets are liquid, facilitating representative and reliable reference rates for derivatives . The FX spot market is functioning well, allowing the NBG to produce its daily official reference rate in a representative and robust manner. Similarly, trading volume in the unsecured overnight interbank money market is sufficient for setting the TIBR rate. Those reference rates are based on comprehensive frameworks that safeguard their credibility.

45. Alternative assets that can be used to hedge derivative positions are partially available . As for FX derivatives, the spot market is deep and liquid enough so that market participants with exposures from derivative instruments can effectively adjust their positions. Regarding the development of the OIS market, it is helpful that its underlying benchmark, the TIBR rate, is broadly used as a reference rate for a wide range of financial instruments, including floating rate bonds and bank loans.

46. The absence of a liquid market for financial instruments paying at a fixed rate hinders demand for OIS . Of the two sides of the market, participants who would pay fixed interest rates (e.g., fixed rate borrowers) in exchange for receiving floating rates include banks. On the other hand, fixed rate receivers are largely absent, or if present, seem inactive (e.g., insurance companies and pension funds). The reliable reference rate (i.e., the TIBR) is present. Of the potential hedging instruments, there are no net issuances of government bonds over the last three years, and secondary market activity is subdued.

47. Domestic funding markets are accessible for potential derivative users . FX forward users can access GEL funding locally. Currently, abundant U.S. dollar funding is available, as 45 percent of the deposits in Georgia are in dollars. The availability of funding markets is not essential for the development of the OIS market since OIS transactions do not impact liquidity (see Box 4 ).

Status of Underlying Products

D. Medium-term Development Strategy