Financing | Templates

How To Write an SBA Business Plan [+Free Template]

Published June 13, 2023

Published Jun 13, 2023

REVIEWED BY: Tricia Jones

WRITTEN BY: Andrew Wan

This article is part of a larger series on Business Financing .

- 1. Write the Company Description

- 2. Identify Organization & Management

- 3. Specify the Market Analysis

- 4. Write Descriptions of the Products or Services

- 5. Indicate the Marketing & Sales Strategy

- 6. List Financial Data & Projections

- 7. Write the Financing Request

- 8. Fill In the Appendix & Supplemental Information

- 9. Complete the Executive Summary

- Additional Resources

Bottom Line

FILE TO DOWNLOAD OR INTEGRATE

SBA Business Plan Template Download

Thank you for downloading!

If you’re applying for a loan from the Small Business Administration (SBA), there’s a good chance that you’ll need a business plan to get approved. An SBA business plan provides a summary of the various aspects of your business, and we will guide you through the process of creating it, from writing your company description and marketing and sales strategies to completing financial data and projections and your executive summary.

Although there is no standard format, and to help you ensure nothing is overlooked, you can use our SBA business plan template above to ensure you cover the most important areas of your company. A well-prepared business plan can improve your chances of getting an SBA loan.

Step 1: Write the Company Description

This section should contain information about the purpose of your business. It should include a description of the problem or challenge your product or service aims to solve and what types of individuals or organizations will benefit.

A strong company description should also address the following questions:

- Why does your company exist?

- What problems does your business aim to address?

- What prompted you to start your business?

- What organizations or individuals will benefit from your company’s product or service?

- What makes your company different from others?

- What competitive advantages does your business offer?

- What would a successful product launch look like?

- Does your company have strategic partnerships with other vendors?

Step 2: Identify Organization & Management

Details about the legal and tax structure of your business should be included in this section. It can also be helpful to include an organizational chart of your company. You can include information about each team member’s background and experience and how it is relevant to your company:

- Highlight what business structure you have selected and why. Examples commonly include a sole proprietorship, limited liability company (LLC), partnership, S corporation (S-corp), and C corporation (C-corp)

- Include an organizational chart showing which team members are responsible for the various aspects of your company

- You can include resumes for members of your leadership team highlighting their experience and background

Step 3: Specify the Market Analysis

The market analysis section of your SBA business plan should look at who your competitors will be. Look at what they are doing well, what their weaknesses are, and how your company compares.

The SBA’s market analysis page contains information on how you can approach this. Questions you should also consider addressing should include:

- Who are the major competitors in the market?

- What are competitors doing well and are there areas for improvement?

- How does your company compare to the top competitors?

- How has the product or service evolved over time?

- Are there any trends for supply and demand throughout the year?

- What can your company do to stand apart from the top competitors?

Step 4: Write Descriptions of the Products or Services

In this section, you should detail the product or service offered by your business. You should explain what it does, how it helps your customers, and its expected lifecycle. You can also include things like any expected research and development costs, intellectual property concerns such as patents, what the lifecycle of your product looks like, and what is needed to manufacture or assemble it.

Here are some things to consider as you are working on this section:

- Description of what your product or service does

- How your product or service works

- How your customers will benefit from your product or service

- Illustration of the typical lifecycle

- Any patents or intellectual property you or your competitors have

- Pricing structure

- Plans for research and development

- Discuss plans for handling intellectual property, copyright, and patent filings

Step 5: Indicate the Marketing & Sales Strategy

Details of your marketing and sales strategy will be highly dependent on your business. It’s also something that may evolve and change over time in response to things like the overall economic environment, release of competitor’s products or services, and changes in pricing.

With that being said, here is a list of some items that should be addressed:

- Who is your target audience?

- How will you attract customers?

- How and where will sales be made?

- If applicable, what will the sales process look like?

- Where will you market and advertise your product or service?

- How does your marketing strategy compare to other companies in the industry?

- How much should you spend on marketing?

- What is the expected return on investment for marketing?

- Do you have any data showing the effect of marketing?

Step 6: List Financial Data & Projections

If your business has been running, you should include information about its finances. This should include all streams of revenue and expenses. Data for financial projections should also be included, along with a description of the methodology you used to reach those conclusions.

If available, you should be prepared to provide the following financial documents for at least the last three years to five years:

- Personal and business tax returns

- Balance sheets

- Profit and loss (P&L) statements

- Cash flow statements

- Hard and soft collateral owned by your business

- Business bank statements for the last six to 12 months

Financial projections should include enough data to offer some confidence that your business is viable and will succeed. It’s recommended that you provide monthly projections looking forward at least three years, with annual projections for years four and five.

- Projections for revenue and methodology used in arriving at these figures

- Expected shifts in revenue or expenses as a result of seasonality or other factors affecting supply and demand

- Expected expenses from loan payments, rent, lease payments, marketing and advertising fees, employee salaries, benefits, legal fees, warranty expenses, and more

You can use our SBA loan calculator to help you estimate monthly payments for the funding you’re currently looking for and projections for any additional loans you may need. Monthly payments can fluctuate depending on the terms of your loan. If you’re looking for accurate estimates, you can read our article on SBA loan rates .

Step 7: Write the Financing Request

This section is where you should specify how much funding you need, why you need it, what you’ll use it for, and the impact you expect it will have on your business. It’s also a good idea to indicate when you expect to use the funds over the course of the next three to five years.

Here is a checklist of some important items you should cover:

- How much funding you need and why

- When you will use the funds over the next three to five years

- What you will use the funds for

- The expected impact this will have on your business and how it will help reach your business goals

- The anticipation of any recurring needs for additional funding

- Your strategy for how you expect to pay off the loan

- Any future financial plans for your business

Step 8: Fill In the Appendix & Supplemental Information

This last section of your SBA business plan should include any additional information that may be helpful for lenders. This can include more detailed explanations or clarifications of data from other sections of your business plan.

Here are some examples of documents you can include:

- Business licenses

- Certifications or permits

- Letters of reference

- Photos of products

- Resumes of business owners

- Contractual agreements and other legal documents

Step 9: Complete the Executive Summary

The executive summary, which is the first section in a business plan, should be no more than one to two pages and provide a high-level overview of the items listed below. Since each section above is already detailed, a brief description of those sections will be sufficient:

- Your company’s mission statement

- The background and experience of your leadership team

- The product or service and what purpose it serves

- Your target market for the product or service

- Competitive analysis of other products and services

- Your competitive advantage or why your company will succeed

- Marketing and sales strategy

- Financial projections and funding needs

Depending on the type of SBA loan you’re applying for, certain areas of your business plan may be weighed more heavily than others. You can learn about the SBA loan options you can choose from in our guide on the different types of SBA loans .

Additional Resources for Writing an SBA Business Plan

If you’re looking for additional resources to help you write a business plan, you can consider the options below. Since a business plan is just one of many documents you’ll need, you can also read our guide on how to get an SBA loan if you need help with other areas of the loan process:

- SBA: SBA’s business guide contains information on how you can start a small business. It includes steps on creating a business plan, funding your company, and launching a business.

- SCORE: Through SCORE, you can request to be paired with a mentor and get business-related education. Educational courses come in several formats, including webinars, live events, and online courses.

- Small Business Development Center (SBDC): SBDCs provide training and counseling to small business owners. This can help with various aspects of your company such as getting access to working capital, business planning, financial management, and more. You can use the SBA’s tool to find your closest SBDC .

Having a strong SBA business plan can improve your chances of getting approved for an SBA loan. If you’re unsure where to start, you can use our guide and template to cover the most important aspects of your business. You can also see our tips on how to get a small business loan . To get even more ideas on creating a strong business plan, you can also utilize resources through organizations such as SCORE and the SBA itself.

About the Author

Find Andrew On LinkedIn

Andrew Wan is a staff writer at Fit Small Business, specializing in Small Business Finance. He has over a decade of experience in mortgage lending, having held roles as a loan officer, processor, and underwriter. He is experienced with various types of mortgage loans, including Federal Housing Administration government mortgages as a Direct Endorsement (DE) underwriter. Andrew received an M.B.A. from the University of California at Irvine, a Master of Studies in Law from the University of Southern California, and holds a California real estate broker license.

Join Fit Small Business

Sign up to receive more well-researched small business articles and topics in your inbox, personalized for you. Select the newsletters you’re interested in below.

SBA Business Plan Template: Full Guide [2023]

- January 12, 2023

- Small Businesses

In 2020, SBA’s flagship 7(a) loan program approved more than 42,000 loans totalling $22 billion . Yet, SBA loans are notoriously difficult to obtain for small businesses: less than 15% of SBA loan applications were granted by big banks. If you’re applying for a SBA loan , you will need a solid business plan template for your loan application.

In this article we go through, step-by-step, all the different sections you need in your business plan to build a complete, clear and solid business plan lenders will approve. Read on!

Why do you need a business plan for your SBA loan application?

Other than your basic eligibility requirements, the primary element that lenders would review is your business plan. Having a good business plan determines if your business is a lucrative opportunity for SBA lenders.

Also, a solid business plan makes it easier to get your loans approved because banks would be confident that your business would be successful and you would be able to repay your loan.

However, business plans tend to differ depending on the nature and status of your business. If you’re running an independent business or launching a startup for example, your business plan will be reviewed more thoroughly.

1. Executive summary

The executive summary is the most important page of your SBA business plan template . We can’t make this clearer. This is the first section that the lenders will have a look at.

Before we go into specifics, keep in mind the executive summary actually is a summary. Keep it brief: your executive summary should never be more than 2 pages maximum .

Your executive summary should consists of 5 parts:

- The “mission statement “: what problem(s) is your business solving?

- Product and service : what is it that you sell? to whom? where?

- People : who are the founders / management? What about their experience? How many people / teams do you employ?

- Key financials and projections : what are your key metrics and financials today (revenues, customers, etc.)? What do you expect these to be in 3/5 years from now?

- Funding ask : what (how much) are you asking as part of this loan? Where will you spend it? For what?

2. Company description

The company description is where we go into more details about your business, and which problem(s) it actually solves.

You should explain here clearly:

What is the problem at stake?

You should list here the 2/3 friction points you aim to tackle.

Remember: even if your business isn’t necessarily innovative, your business is potentially solving a problem, as obvious as it may be, for many people out there. The more obvious the problem is, the more people it affects, the better

What is your solution?

Your business is commercialising a product and/or a service which solves the problem mentioned above. Here, you should explain 2 things: how your product / service works, and what benefits it brings to your customers.

Ideally, you should compare the pain points explained earlier (the problem) to the benefits your solution brings to your customers. That way, it is crystal clear to lenders and investors your solution really adds value to potential customers .

When explaining your business’ solution, you should explain clearly who is your customer persona . In other words, who are your customers (or who do you think they will be)? Which gender, age range, social background, interests, etc?

Where are you going?

The third section of the company description should explain what your strategy is in the short to long term. Are you expecting to launch new products? To expand regionally, internationally? Etc.

3. Market plan and analysis

The market plan and analysis section tell investors and lenders that you have extensively studied the market and reveal your competitive plan.

Your market plan and analysis section should include the following:

Industry overview and outlook

Here you need to clearly identify 2 very important metrics:

- Market size : how big is your market?

- Market growth: how fast does your market grow?

If you are operating in a niche market, chances are that you will face some challenges: the information might not be publicly available. In any case, you should be able to make a high-level estimation of your market. Read our article on market sizing and how to estimate TAM, SAM and SOM for your startup .

When looking for these metrics, you have multiple sources of information: public reports, specialised press, etc. Even public companies publish press releases and annual reports including some of their proprietary market estimates so be sure to look there too.

Competitive landscape

Here we must answer 2 key questions:

How fragmented is your market?

Are there 3 big players sharing 90% market share or thousands of small players? Here, refer to public market reports and your own understanding of the competitive landscape .

A few questions you could ask yourself, among others:

- Who are your competitors?

- Are they local, regional, national or global?

- Are there any product alternatives to your product?

- What about their IP / technological advantage?

Where do you position yourself vs. competition?

Is your solution a game changer other competitors don’t have (yet)? Do you have competitors with similar products/services?

Ideally, you would create a small table with, for each type of competitors and their main characteristics.

For instance, do they all a global presence? Do they cover all the products you offer? What is their relative price positioning (expensive vs. accessible)?

4. Organization and management

The amount of details you need to include here varies depending on the size of your company.

No matter how many leadership roles there are, an organizational chart effectively shows lenders and investors how the management system is structured.

If you plan on running your business alone indefinitely, you can write a short paragraph explaining your qualifications and previous professional experiences.

The first thing you should include in this section is a list of each management position. This list includes who will fill the role and the qualifications of these people. These people are the heart of your company, and their skills and experience are vital in ensuring your company’s success.

Next, provide any additional information about how the management team will contribute to the business’s success. Be sure to give as many details as possible since lenders need to be comfortable and confident that you have a good team running your business.

Lastly, include information about the Board of Directors (and/or any other advisors to your business).

5. Service or product line

The level of detail and the content of this section changes depending on the type of business you have. A number of questions you need to answer are shown below (but not limited to):

- Are you selling products or services (or both)?

- How many products do you sell?

- What are they?

- What is their pricing?

- How do they work?

- Are your products protected by any kind of intellectual property (copyright, patent, etc.)?

- If you do not manufacture all of your product(s): who are they suppliers? Where do they fit in the value chain ? etc.

Expert-built financial model templates for tech startups

6. Marketing and sales

Your SBA business plan template should include a marketing and sales plan where you describe your strategy for acquiring potential clients.

Here, you should give details about your marketing plan. A few questions you should answer are:

- How you plan to build and support your sales strategy ?

- What channel(s) are you using (online vs. offline)?

- How it makes sense for your target audience (the customer persona mentioned above)?

What about your metrics?

Sales and marketing goals and KPIs are also provided in this section. Don’t forget to include a detailed report about budgets for both sales and marketing.

Include metrics such as conversion rate, customer acquisition cost (CAC) , the efficiency of your sales team, etc.

It’s ok if you don’t know them already (if you are about to launch you new venture for example), yet you should have at least targets for them. How many website visitors do you expect to generate next year? What is your target conversion rate? Etc.

This particular report would be of great interest to lenders since they will glimpse how you handle your budget. Indeed, if you expect to spend in average $100 Customer Acquisition Cost, lenders will tie the number into your financial projections later on (more on that below).

Proving lenders you are able to link your financial projections with your actual business metrics (customers, sales volume, etc.) is a big plus . Indeed, that way you will show lenders you understand very clearly your business and how it ties into your financials (more on that in our article on why you should build a solid financial projections ).

7. Funding request

The funding request is the section of your SBA business plan template where you communicate to your investors how much you need.

This report also includes how you plan on repaying your loan. It’s also essential to explain how you plan to spend the funding you’ll receive for your business.

Will you spend the loan in working capital , in equipment, in inventory, salaries or marketing costs? The more specific you are, the better.

If you haven’t done so, we really recommend you read our article on how to determine how much you should raise for you business . While raising too little creates obvious problems, raising too much isn’t necessarily better.

On top of the amount, a good practice is to include a pie chart of where you will spend that money over a given period (your runway). Will you spend the bulk of it in product development to build your MVP? Or will you use a large portion in sales & marketing to commercialise your product and find product-market fit?

Our financial model templates include a cash burn dashboard where you can easily assess how much you should raise, and where you will spend your money. We also included charts ready to be included in your pitch deck. See how to use our cash burn dashboard here .

The funding request usually includes an overview of the business. You also have to outline how much funding you need for the next five years. The standard timeframe for repaying your loan is usually ten years, so lenders expect to see some success in your business by that time. Mention a detailed explanation of how the funds will be used and strategic financial plans for the future here. Include financial information for current operations if applicable.

8. Financial projections

The financial projections section of your SBA business plan is one of the most important one.

Why? Lenders will have a thorough review of your expected financials over the next 3 to 5 years and judge whether your financial projections:

Are realistic (and use verifiable assumptions)

We are all by nature optimistic, especially when we are running businesses. It’s good to be optimistic, yet it is another one to be unrealistic.

Also, when presenting your financial projections, make sure to make it clear what are your assumptions. The more sources you can find to back up your forecasts, the better.

If you need help building realistic projections for your business, we have lots of free content. Make sure to check out our guides below:

- The 5 Mistakes To Avoid For Your Startup Financial Plan

- How To Build Realistic Revenue Projections For Your Startup?

Allow you to repay the SBA loan in the future

It’s great if you have built rock-solid and realistic financial projections for your business plan. Yet, if your plan doesn’t allow you to meet your debt obligations (the SBA loan and any other debt your business might have), lenders will not grant you any loan.

When assessing whether your financial plan allows you to repay the debt, you should check if the positive cash flows your business generates are enough to cover your debt repayment (and interests).

What financials should you include?

In short, you should present 3 different set of financials:

- Profit-and-loss

- Balance sheet

- Cash flow statement

If you don’t know them already, these are the financial statements every business need to prepare at least annually (with the help of an accountant). For more information on what they are and how to prepare them, read our articles below:

- 4 Key Financial Statements For Your Startup Business Plan

- SBA Loan Application: 6 Steps To Build Solid Financial Projections

9. Appendix

This section is the best place to add supporting documents like charts, graphs, and data.

For example, a complete list of documents like licenses, contracts, maps, etc. makes you more attractive to lenders as it gives them more content to review. If you do so, make sure to reference the documents in appendix and link them to pages in earlier sections. Avoid using the appendix as a dump section: it should be well organised and structured (else no one will bother looking at it).

Privacy Overview

Developing an SBA Loan Business Plan

Embarking on the journey to secure a Small Business Administration (SBA) loan can be a transformative step for any entrepreneur. Crafting a well-thought-out business plan is not just a requirement for most SBA loans but also a fundamental blueprint that steers your business toward success.

In this comprehensive guide, we will walk you through the essential steps of creating an effective SBA loan business plan. We’ll provide a business plan roadmap, share example templates, and offer insights to help with writing a business plan that not only meets stringent SBA criteria but also lays a robust foundation for your business’s future.

The Importance of a Business Plan for SBA Loans

Before diving into the mechanics of writing a business plan, it’s crucial to understand its significance. A business plan is a detailed document that outlines your business’s core objectives, strategies, market, financial forecasts, and operational structure. For SBA loans , this plan acts as a demonstration of your commitment and your business’s viability. It reassures lenders that you have a clear pathway to profitability and a strategy for repaying the loan.

Step-by-Step Guide on How to Write A Business Plan for A Loan

Executive Summary: Your Business at a Glance

Start with an executive summary that encapsulates the essence of your business in a concise manner. This section should include your business name, location, the nature of your business, your mission statement, and a brief description of your products or services. Highlight key financial information and what you intend to do with the SBA loan. The goal is to excite and engage the reader about your business prospects.

Company Description: Who You Are and What You Plan to Achieve

The company description provides more detail about your business. Discuss the problems that your business solves, your target market, and what sets your business apart from competitors (your unique selling proposition). This section should also outline your business’s legal structure, history, and the nature of your industry.

Market Analysis: Demonstrating Your Competitive Advantage

A thorough market analysis validates the demand for your product or service. It involves detailing your target market demographics, size, location, and economic attributes. Assess your competitors—what they do well and how you can do it better or differently. This part of your SBA business plan should convincingly show why your business will be able to succeed where others might not.

Organization and Management: Your Business’s Backbone

This section should outline your business’s organizational structure. Include bios and professional backgrounds of your management team, their roles, and how their experience will contribute to the success of your business. If available, include an organizational chart that explains the hierarchy and relationship between management roles.

Service or Product Line: What You’re Selling

Describe what you are selling or the service you are providing. Detail the benefits of your products or services to the consumer. If applicable, discuss the product life cycle, intellectual property status, and any research and development activities that could influence your business.

Marketing and Sales Strategy: How You Will Attract and Retain Customers

Explain your approach to attracting and retaining customers. This should include detailed strategies for promotion, advertising, sales methodologies, and customer engagement. Highlight how these strategies will be adapted to your target market’s preferences and behaviors.

Funding Request: Specify What You Need

If the purpose of your business plan is to secure funding, specify the amount you are requesting, how you plan to use the funds, and the type of SBA loan you are seeking. Detail your funding request by years, and discuss future financial strategies.

Financial Projections: Showcasing Your Financial Savvy

Follow a detailed financial projections to back up your funding request. This section should include forecasted income statements, balance sheets, cash flow statements, and capital expenditure budgets for the next three to five years. Utilize an SBA financial projections template to ensure that all the required elements are thoroughly and accurately presented.

Appendix: Supporting Documents

Include any additional information that can help establish the credibility of your business plan for sba loan, such as market studies, legal agreements, product pictures, marketing materials, and more.

How to Improve Your Chances of Being Approved for an SBA Loan

Securing an SBA loan can be competitive, but there are several strategies to enhance your approval odds:

- Strong Business Plan: Emphasize your thorough market research, realistic financial projections, and a clear explanation of how the loan will contribute to your business goals.

- Credit History: Ensure your business and personal credit histories are in good standing. Resolve any discrepancies before applying.

- Equity Investment: Show your commitment by investing personal equity into the business, which proves to lenders that you have skin in the game.

- Sufficient Collateral: Offer assets to secure the loan, reducing the risk for the lender.

- Preparation and Professionalism: Be well-prepared when meeting with lenders. Have all necessary documents organized and ready to present.

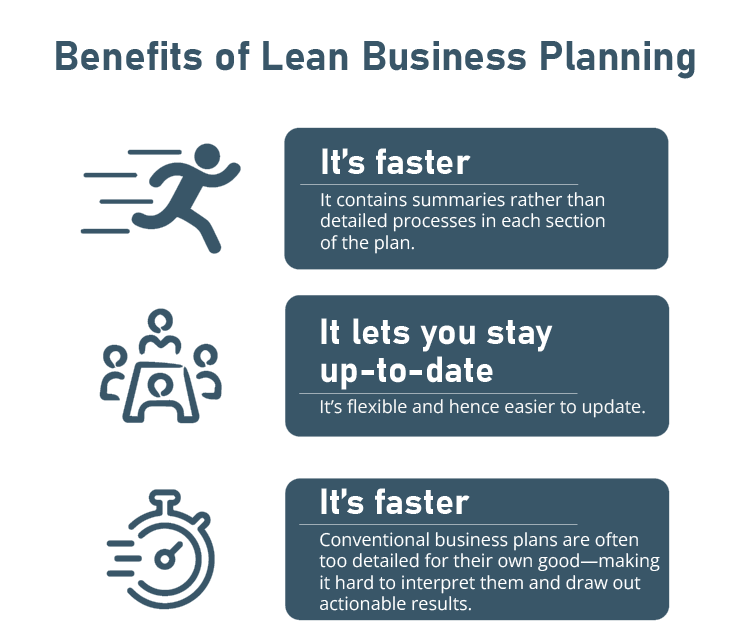

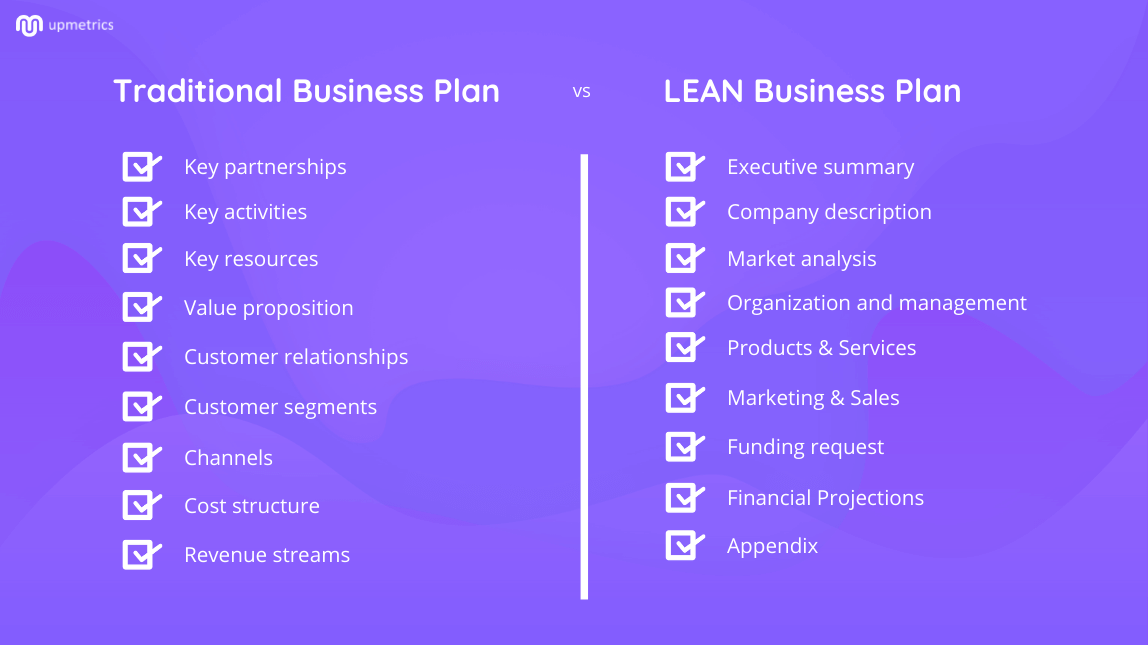

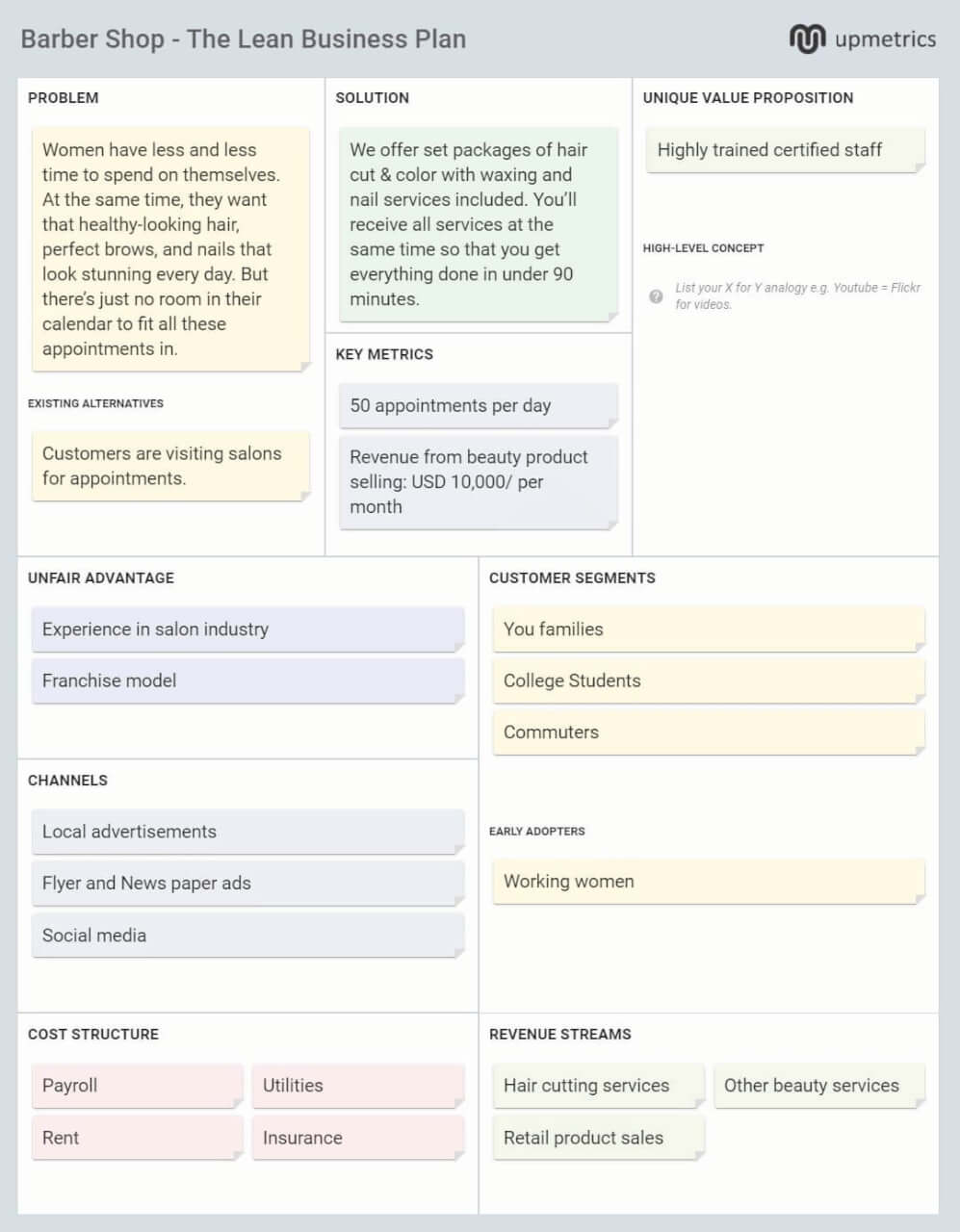

Should I Write a Traditional or Lean Business Plan?

When preparing a business plan for an SBA loan, one crucial decision you’ll face is whether to opt for a traditional business plan or a lean startup plan. Both formats have their merits and can be effective, depending on your business type, industry, and specific needs. Below, we explore both types of plans and provide a comparison to help you decide which is most suitable for your SBA loan application.

Traditional Business Plan

A traditional business plan is comprehensive, detailed, and extensively outlines every aspect of the business. It is particularly beneficial for businesses that require significant funding, are entering a highly competitive market, or have complex operational structures. This type of plan typically includes a thorough market analysis, detailed financial projections, and an exhaustive description of the business’s operational and management structures.

Lean Business Plan

An SBA lean business plan is a modern, streamlined version of the business plan, which focuses on summarizing the key elements of the business using concise bullet points and brief explanations. It is ideal for business es that can describe their value proposition, infrastructure, customers, and finances succinctly. This format is often preferred by entrepreneurs who need to adapt quickly to changes and iterate on their business model.

Comparison Table: Traditional vs. Lean Business Plan

Deciding Which Plan to Use

Choosing between a traditional and a lean business plan for your SBA loan application depends on the specific requirements of your lender, the complexity of your business, and your industry’s demands. If your business operates in a traditional sector or you’re seeking funding from conventional sources, a traditional business plan might be more appropriate. However, if you are in a fast-paced industry or require the flexibility to pivot, a lean business plan could be more advantageous.

Consider your business’s needs, your industry standards, and your lender’s expectations when deciding which type of business plan to create. Both types of plans have their place in the business world, and choosing the right one can significantly impact the effectiveness of your loan application.

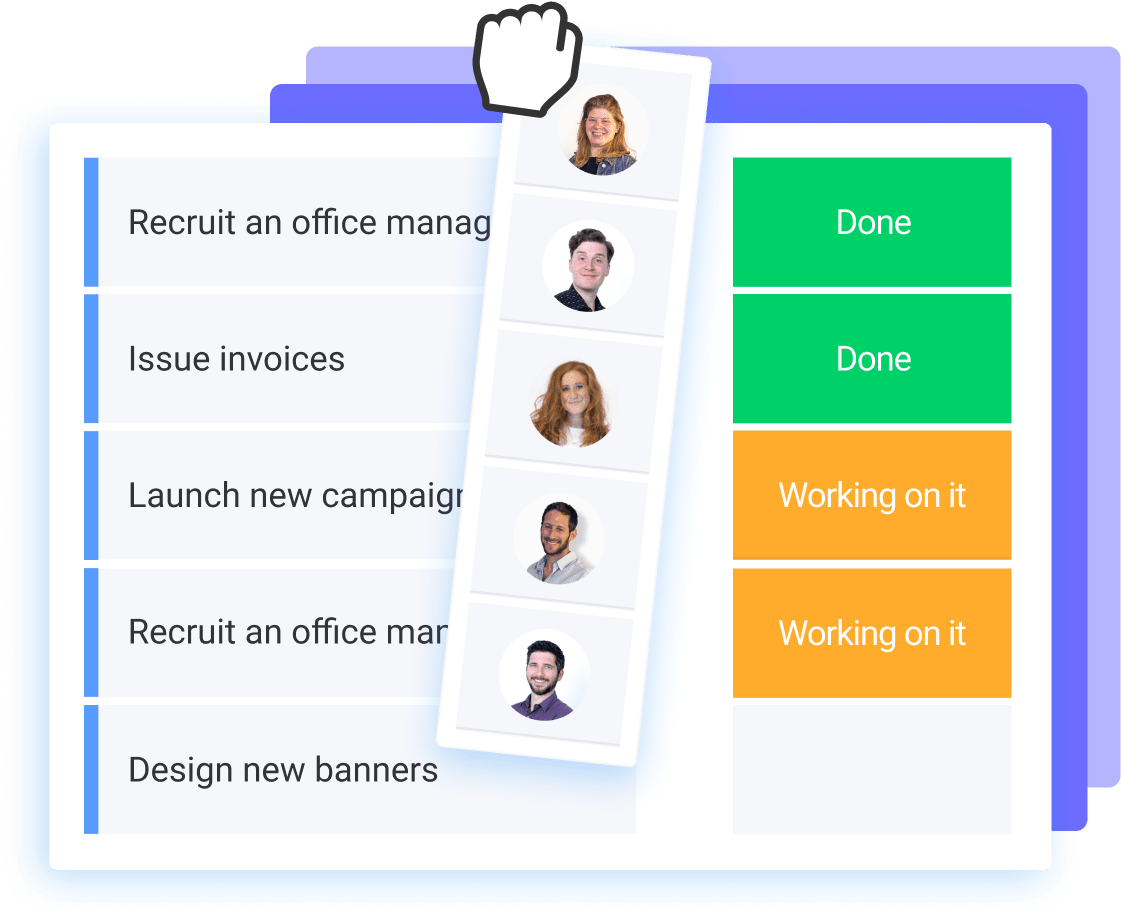

Example Templates and Tool

Creating a business plan can be streamlined using specialized templates and tools designed to guide you through the process efficiently and effectively. Utilizing an SBA business plan outline and understanding how to write a business plan for SBA loan are crucial steps in ensuring that your plan adheres to industry standards and meets the expectations of lenders and investors. Here’s a closer look at how these tools can assist you and where you can find them.

Online Templates and Resources

SCORE Business Plan Template

SCORE, a nonprofit association dedicated to helping small businesses get off the ground, offers a variety of free SBA business plan templates that are ideal for startups and established businesses alike. These templates cover various business planning elements and are easily adaptable to your specific needs, making them a perfect choice if you are looking for a business plan template for a small business.

Whether you need help with your financial projections, marketing strategy, or overall business description, SCORE provides detailed guidance and examples, effectively serving as an SBA business plan guide for small business owners.

You will find a free SBA business plan template that includes:

- A standard business plan outline that can be used for an SBA loan application.

- Financial projection worksheets designed to help you create comprehensive financial statements.

- Marketing plan templates that focus on identifying target markets and strategies.

U.S. Small Business Administration Business Plan Tools

The U.S. Small Business Administration itself is another excellent resource for potential loan applicants. The SBA offers a business plan tool that provides a step-by-step guide on how to create a business plan for a loan directly on their website. This interactive tool allows you to save your work and come back to it at your convenience, making the planning process flexible and adaptable to your schedule.

The SBA business plan tool is particularly useful for:

- Structuring your business plan according to SBA standards.

- Ensuring all required sections are comprehensive and well-detailed.

- Providing tips and prompts that help you think critically about each segment of your business.

Software Tools

Apart from a free SBA template, there are several software tools available that can help in drafting a detailed business plan. Software like LivePlan and Bizplan not only offer templates but also provide interactive, step-by-step guidance through the planning process. These tools come with features like financial calculators, chart generators, and performance trackers, which can be invaluable for maintaining accurate records and projections.

Key features of such software include:

- Step-by-step guidance through each section of the business plan.

- Financial tools that automatically generate profit and loss statements, cash flow statements, and more based on your data.

- Collaboration features that allow team members to contribute and edit various parts of the business plan in real time.

Customized Consultant Services

While templates and software can provide a solid starting point, customized consultant services can also be instrumental, especially for unique business models or complex financial needs. Business consultants, particularly SBA business plan writers, are experts in tailoring business plans to meet the specific requirements of banks and SBA lenders. These professionals can offer valuable insights and feedback that elevate the quality of your business plan.

In summary, leveraging these templates and tools can dramatically enhance your ability to create a compelling and thorough business plan for your SBA loan application. By combining these resources with a clear understanding of your business goals and financial strategies, you will significantly increase your chances of success with lenders.

Developing a detailed business plan for your SBA loan application is a crucial and rewarding task. This process not only enhances your application’s attractiveness to lenders but also clarifies your strategic direction, enabling you to envision a more defined path to business success. By taking this step, you set a solid groundwork that can support sustainable growth and operational effectiveness.

Maximize Your SBA Loan Potential with BSBCON’s Strategic Assistance

Crafting a comprehensive business plan is just the beginning. To refine your strategy and significantly boost your chances of securing a loan, expert guidance is invaluable.

At BSBCON , we are dedicated to assisting enterprises like yours in managing the complexities of SBA loan applications. We specialize in optimizing SBA business plans and simplifying the application process to equip you with the tools necessary for success. Reach out to us today to discover how we can help you meet your business objectives and secure the funding you need.

By adhering to the guidelines in this guide and leveraging the appropriate resources, you are laying a robust foundation for success in your business ventures and your pursuit of an SBA loan . Let us help you turn your business aspirations into achievements with precision and confidence.

How can we help you?

Get in touch with us or visit our office

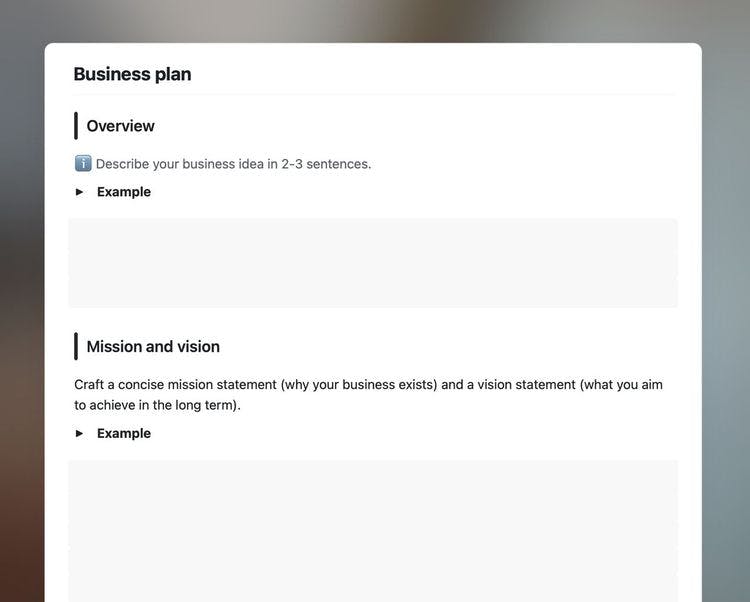

Lean business plan

Discover the lean business plan template, perfect for entrepreneurs and small businesses. Simplify planning with key sections on strategy, market analysis, and financials.

Share this Template

Streamline your business strategy: The essential lean business plan template

Dive into strategic planning with our lean business plan template, designed specifically for entrepreneurs, startups, and small business owners looking for a streamlined approach to business planning. This template strips away the complexities, helping you focus on the core elements necessary to articulate your business vision, strategy, and action plan efficiently.

What's inside this lean business plan template?

- Company name & mission : Begin with the basics, establishing your business identity and mission to guide all your strategic decisions.

- Our offer : Clearly articulate what your business offers, highlighting your unique value proposition to stand out in the market.

- Problem statement : Define the problem you're solving, ensuring your business targets real needs for a solid market fit.

- Solution : Summarize your solution in one sentence, showcasing how you uniquely address the problem.

- Target market : Identify and describe your primary audience segments, tailoring your approach to meet their specific needs.

- Key competitors : Offer insights into your competition, helping you position your business effectively in the marketplace.

- Sales and marketing strategy : Outline how you'll reach and convert your target audience, detailing sales channels and marketing tactics.

- Financial projections : Present a snapshot of your financial outlook, including key expenses, revenue streams, and growth trends.

- Management team and partners : Highlight the people behind the business and their roles, underscoring your team's expertise and capabilities.

- Action plan : Set clear milestones and deadlines, assigning responsibilities to ensure progress towards your business goals.

Key benefits of using this lean business plan template

- Focused strategy : Concentrate on what truly matters to get your business off the ground or to the next level with a clear, concise plan.

- Efficient planning : Save time and resources with this streamlined business plan tempalate that covers the essentials without the fluff.

- Clear direction : Eliminate ambiguity in your business strategy, making it easier for your team and partners to align with your vision.

- Competitive insight : Understand your market and competition better, enabling you to position your business more strategically.

- Financial clarity : Gain insights into your financial health and projections, aiding in better decision-making and investor communications.

- Action-oriented : Move from planning to doing with a structured action plan that keeps your team focused and accountable.

Get started

Elevate your business strategy without the complexity. Our lean business plan template is your first step towards a more focused, effective, and successful business journey. Start shaping your strategy today, driving your business forward with clarity and purpose.

And, for a more comprehensive approach to business planning try our business plan template.

FAQ About the Lean business plan Template

Trusted by millions, including teams at

Discover More Templates

Take impactful to a whole new level

Always with you

Easy to use

Works your way

Powerful Features

Get in or get out

Offline first

Beautiful sharing

You’re not alone

We’re here to help

8 Business Plan Templates You Can Get for Free

8 min. read

Updated April 10, 2024

A business plan template can be an excellent tool to simplify the creation of your business plan.

The pre-set structure helps you organize ideas, covers all critical business information, and saves you time and effort on formatting.

The only issue? There are SO many free business plan templates out there.

So, which ones are actually worth using?

To help remove the guesswork, I’ve rounded up some of the best business plan templates you can access right now.

These are listed in no particular order, and each has its benefits and drawbacks.

What to look for in a business plan template

Not all business plan templates are created equal. As you weigh your options and decide which template(s) you’ll use, be sure to review them with the following criteria in mind:

- Easy to edit: A template should save you time. That won’t be the case if you have to fuss around figuring out how to edit the document, or even worse, it doesn’t allow you to edit at all.

- Contains the right sections: A good template should cover all essential sections of a business plan , including the executive summary, product/service description, market/competitive analysis, marketing and sales plan, operations, milestones, and financial projections.

- Provides guidance: You should be able to trust that the information in a template is accurate. That means the organization or person who created the template is highly credible, known for producing useful resources, and ideally has some entrepreneurial experience.

- Software compatibility: Lastly, you want any template to be compatible with the software platforms you use. More than likely, this means it’s available in Microsoft Word, Google Docs, or PDF format at a minimum.

1. Bplans — A plan with expert guidance

Since you’re already on Bplans, I have to first mention the templates that we have available.

Our traditional and one-page templates were created by entrepreneurs and business owners with over 80 years of collective planning experience. We revisit and update them annually to ensure they are approachable, thorough, and aligned with our team’s evolving best practices.

The templates, available in Word, PDF, or Google Doc formats, include in-depth guidance on what to include in each section, expert tips, and links to additional resources.

Plus, we have over 550 real-world sample business plans you can use for guidance when filling out your template.

Download: Traditional lender-ready business plan template or a simple one-page plan template .

Brought to you by

Create a professional business plan

Using ai and step-by-step instructions.

Secure funding

Validate ideas

Build a strategy

2. SBA — Introduction to business plans

The U.S. Small Business Administration (SBA) offers two different business plan templates along with a short planning guide.

While not incredibly in-depth, it’s enough to help you understand how traditional and lean plans are structured and what information needs to be covered. The templates themselves are more like examples, providing you with a finished product to reference as you write your plan.

The key benefit of using these templates is that they were created by the SBA. While they may provide less guidance, you can be assured that the information and structure meet their expectations.

Explore: The SBA’s planning guide and free templates

3. SCORE — Planning workbook

SCORE’s template is more like a workbook. It includes exercises after each section to help you get your ideas down and turn them into a structured plan.

The market research worksheets are especially useful. They provide a clear framework for identifying your target market and analyzing competitors from multiple angles. Plus, they give you an easy way to document all the information you’re collecting.

You will likely have to remove the exercises in this template to make it investor-ready. But it can be worth it if you’re struggling to get past a blank page and want a more interactive planning method.

Download: SCORE’s business plan template

4. PandaDoc — A template with fillable forms

PandaDoc’s library offers a variety of industry-specific business plan templates that feature a modern design flair and concise instructions.

These templates are designed for sharing. They include fillable fields and sections for non-disclosure agreements, which may be necessary when sending a plan to investors.

But the real benefit is their compatibility with PandaDoc’s platform. Yes, they are free, but if you’re a PandaDoc subscriber, you’ll have far more customization options.

Out of all their templates, the standard business plan template is the most in-depth. The rest, while still useful, go a bit lighter on guidance in favor of tailoring the plan to a specific industry.

Explore: PandaDoc’s business plan template library

5. Canva — Pitch with your plan

Canva is a great option for building a visually stunning business plan that can be used as a pitch tool. It offers a diverse array of templates built by their in-house team and the larger creative community, meaning the number of options constantly grows.

You will need to verify that the information in the template you choose matches the standard structure of a traditional business plan.

You should do this with any template, but it’s especially important with any tool that accepts community submissions. While they are likely reviewed and approved, there may still be errors.

Remember, you can only edit these templates within Canva. Luckily, you only need a free subscription, and you may just miss out on some of the visual assets being used.

To get the most value, it may be best to create a more traditional planning document and transfer that information into Canva.

Explore: Canva’s business plan gallery

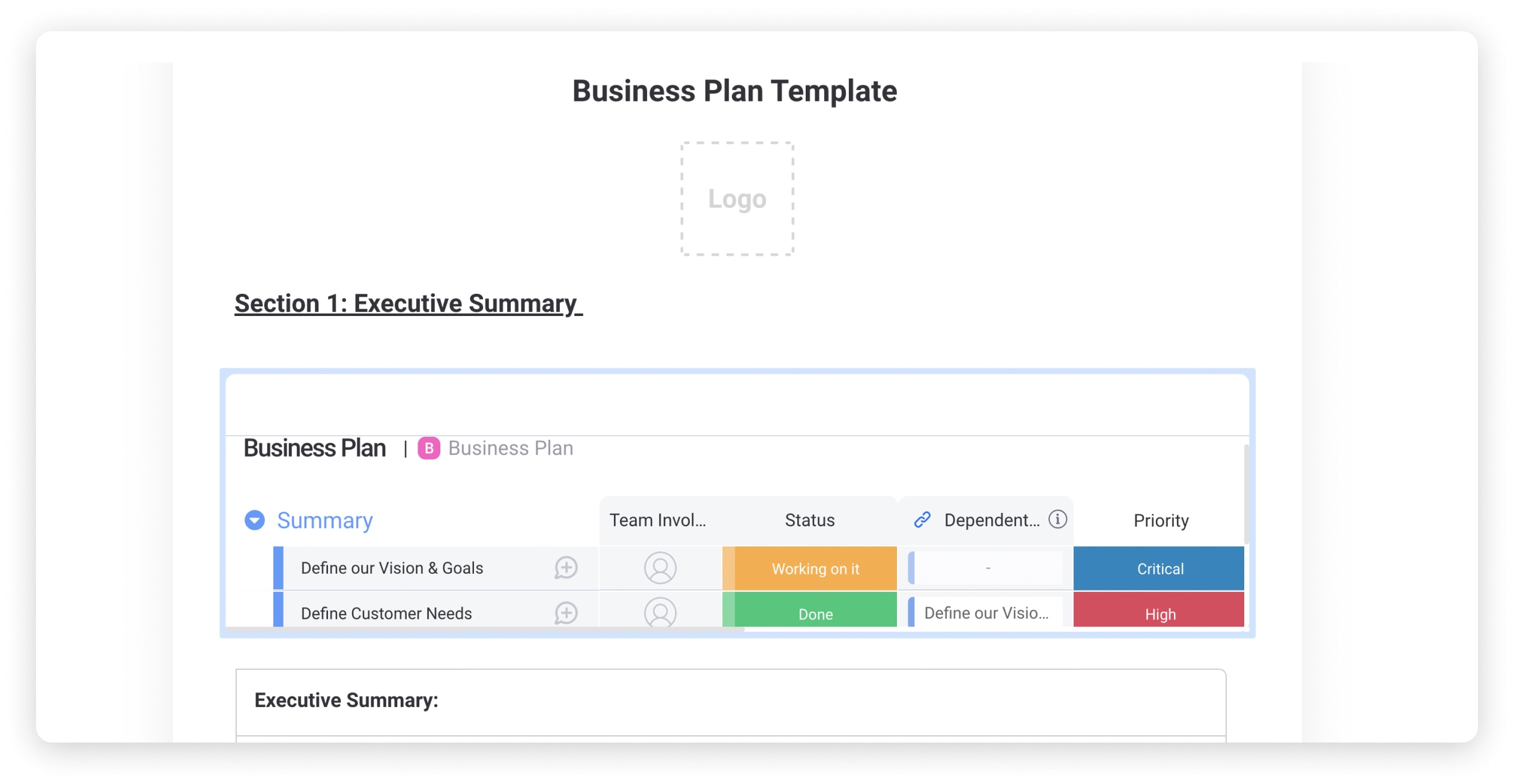

6. ClickUp — The collaborative template

Out of all the project management tools that offer free business plan templates, ClickUp’s is the most approachable.

Rather than throwing you into all the features and expecting you to figure it out—ClickUp provides a thorough startup guide with resource links, images, and videos explaining how to write a plan using the tool.

There’s also a completed sample plan (structured like an expanded one-page plan) for you to reference and see how the more traditional document can connect to the product management features. You can set goals, target dates, leave comments, and even assign tasks to someone else on your team.

These features are limited to the ClickUp platform and will not be useful for everyone. They will likely get in the way of writing a plan you can easily share with lenders or investors.

But this is a great option if you’re looking for a template that makes internal collaboration more fluid and keeps all your information in one place.

Sign Up: Get a free trial of ClickUp and explore their template library

7. Smartsheet — A wide variety of templates

I’m including Smartsheet’s library of templates on this list because of the sheer number of options they provide.

They have a simple business plan template, a one-page plan, a fill-in-the-blank template, a plan outline, a plan grading rubric, and even an Excel-built project plan. All are perfectly usable and vary in visual style, depth of instructions, and the available format.

Honestly, the only drawback (which is also the core benefit) is that the amount of templates can be overwhelming. If you’re already uncertain which plan option is right for you, the lengthy list they provide may not provide much clarity.

At the same time, it can be a great resource if you want a one-stop shop to view multiple plan types.

Explore: Smartsheet’s business plan template library

8. ReferralRock affiliate marketing business plan

I’m adding ReferralRock’s template to this list due to its specificity.

It’s not your standard business plan template. The plan is tailored with specific sections and guidance around launching an affiliate marketing business.

Most of the template is dedicated to defining how to choose affiliates, set commissions, create legal agreements, and track performance.

So, if you plan on starting an affiliate marketing business or program, this template will provide more specific guidance. Just know that you will likely need to reference additional resources when writing the non-industry sections of your plan.

Download: ReferralRock affiliate marketing business plan template

Does it matter what business plan template you use?

The short answer is no. As long as the structure is correct, it saves you time, and it helps you write your business plan , then any template will work.

What it ultimately comes down to, is what sort of value you hope to get from the template.

- Do you need more guidance?

- A simple way to structure your plan?

- An option that works with a specific tool?

- A way to make your plan more visually interesting?

Hopefully, this list has helped you hone in on an option that meets one (or several) of these needs. Still, it may be worth downloading a few of these templates to determine the right fit.

And really, what matters most is that you spend time writing a business plan . It will help you avoid early mistakes, determine if you have a viable business, and fully consider what it will take to get up and running.

If you need additional guidance, check out our library of planning resources . We cover everything from plan formats , to how to write a business plan, and even how to use it as a management tool .

If you don’t want to waste time researching other templates, you can download our one-page or traditional business plan template and jump right into the planning process.

Kody Wirth is a content writer and SEO specialist for Palo Alto Software—the creator's of Bplans and LivePlan. He has 3+ years experience covering small business topics and runs a part-time content writing service in his spare time.

Table of Contents

- Qualities of a good template

- ReferralRock

- Does the template matter?

Related Articles

5 Min. Read

Business Plan Vs Strategic Plan Vs Operational Plan—Differences Explained

2 Min. Read

How Long Should a Business Plan Be?

10 Min. Read

When Should You Write a Business Plan?

12 Min. Read

Do You Need a Business Plan? Scientific Research Says Yes

The Bplans Newsletter

The Bplans Weekly

Subscribe now for weekly advice and free downloadable resources to help start and grow your business.

We care about your privacy. See our privacy policy .

The quickest way to turn a business idea into a business plan

Fill-in-the-blanks and automatic financials make it easy.

No thanks, I prefer writing 40-page documents.

Discover the world’s #1 plan building software

A Guide to Creating a Lean Business Plan (2022)

Don’t have the time to develop a formal business plan for your startup? Here’s how to create a lean business plan to put things into motion.

Vivienne Chen

Vivienne is a Product Marketer at Bubble. She is a storyteller and is passionate about meaningful ways technology can help foster social solidarity.

More posts by Vivienne Chen.

The dramatic increase of small businesses in the United States during the last five years prompted the business community to rekindle the concept of Lean Business Plans. While having all these start-ups is laudable, 45% of them fail after five years.

The key to having a successful business, small or large, is having the right idea at the right time and crafting a viable business plan to fill that market niche . However, many entrepreneurs don't write business plans because they recoil at writing a voluminous traditional or formal business plan that spans 30 pages and has multi-year income statements and layers of operational complexity.

A lean business plan is the perfect solution for that problem.

Traditional Business Plan vs. Lean Business Plan

Traditional business plans tend to be written for start-ups that have multi-million-dollar revenue objectives and require large amounts of seed funding for a large staff and large office spaces that keep the enterprise running until it turns a profit. Investors want to know how their money will get spent, the potential market share, and the founders' experience. Hence, the 30-page masterwork loaded with numbers, graphs, and charts takes three months to create.

A lean business plan, however, is more effective for a small- to medium-sized business (SMB) because it concentrates on the key elements of the company. You’ll give a traditional plan a big haircut by writing a lean plan that outlines your business idea, what market problem you’re solving, how you’ll solve it, how much money you need, and when you’ll break even.

Why Lean Business Plan Methodology Is Gaining in Popularity

The Small Business Association (SBA) encourages entrepreneurs to develop a lean business plan first , even when contemplating writing a traditional plan later. This approach helps lean startups organize their concepts without getting bogged down with unwieldy traditional plans that often discourage writing a plan in the first place.

Start-ups commonly fail for six reasons . However, entrepreneurs today have access to a greater variety of resources than ever. Web-based apps, digital libraries, government agencies like the SBA, and mobile solutions provide a robust ecosystem for new companies.

These invaluable support systems often mitigate the need to write traditional plans for SMB start-ups because vast data stores are but a click away that can help entrepreneurs and potential investors validate any business model.

Benefits of a Lean Business Plan

Lean Business Plans continue to grow in popularity for these important reasons:

- Accessibility: Lean plans are relatively easy to conceive, formulate, and understand. Anyone with basic business sense can discern the unique value proposition (UVP) and unique selling proposition (USP) without being a former CEO.

- Speed: A lean business plan only takes two to four days to write and requires only three to five pages to complete. Compared to a traditional plan, this lean approach moves at light speed.

- Flexibility: A lean plan allows you to organize the business concept and summarize the UVP and USP in short, easy-to-digest thoughts, which can be modified when new information or investor inputs are presented. And it can be upgraded to a traditional plan later if needed.

The Major Components of a Lean Business Plan

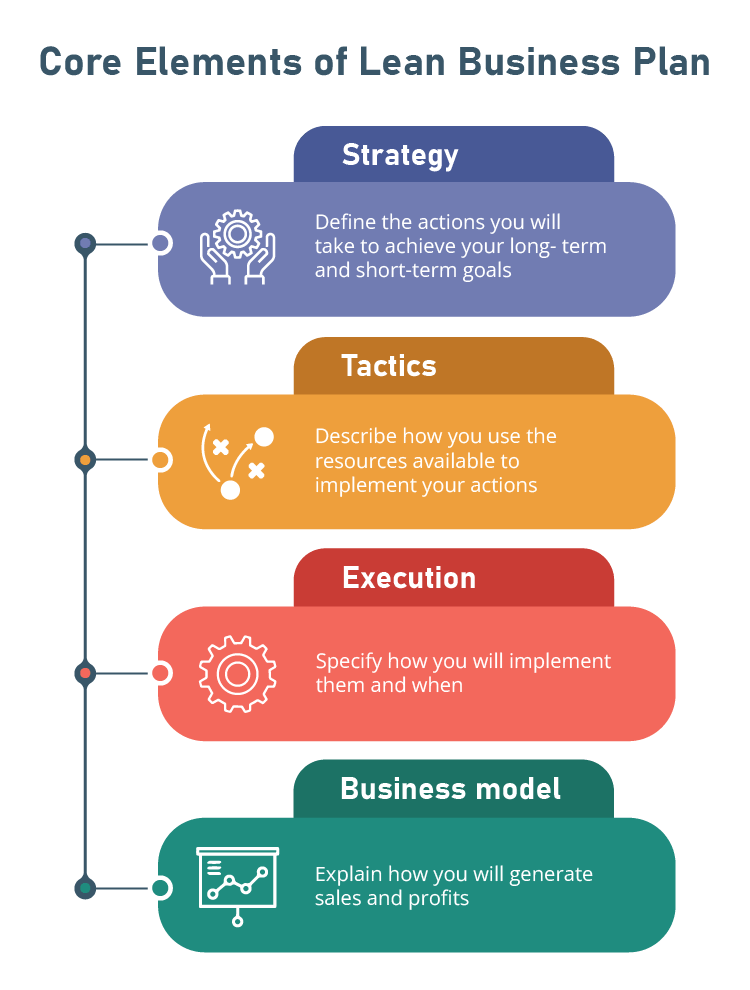

Since you’re writing a lean business plan, you’ll be pleased to learn that such plans still have all the key elements of a traditional plan (again, making it a great foundation to build on later as you grow your business).

- Business Model : There’s no way around this essential requirement. Everyone, especially you, must understand the business model you’re starting to make a profit (e.g., retail, manufacturing, fee-for-service, etc.).

- Strategy: This describes how your company will solve a problem or addresses a market need and how it differs from competitors (aka the differentiator).

- Tactics: Outlines the operational steps needed to manage marketing, sales, and business objectives.

- Schedule: Explains when your business starts operations, where it’s located, when it expects to break even, and when it’s profitable.

- Income/Expense Statement: Summarizes revenues, sales, and expense projections for one year.

What to Include in a Lean Business Plan

The value of “lean” means describing these elements in a few short and clear sentences; write only one paragraph per subject.

- Overview: Describes your company’s mission

- Problem: Shows what problem you’ll solve or market need

- Solution: Outlines how you solve the problem

- Target Market: Defines your customers and the market

- Competition: Identifies competitors and what differentiates your company

- Marketing: Explains how you’ll reach customers

- Sales Channels/POS : Outlines where you’ll meet customer needs

- Revenue: Shows how you’ll make money

- Expenses: Summarizes start-up costs and ongoing expenses

- Milestones/Growth: Projects timelines for attaining business goals

- Partners/Resources: Indicates your business connections and other professional assets

- Talent/Roles: Identifies the team, relevant experience, and type of expertise you still need

How to Write a Lean Business Plan

Since you now understand the requisite elements of a good lean business plan, these links provide excellent resources and apps to help you write a lean business plan document.

- Hoshin Planning Process : Outlines a step-by-step thought process needed to develop a lean business plan.

- SBA Guide to Lean Business Plans : Shows how to write a lean business plan.

- What It Costs to Start a Business in 2022 : The Bubble community offers excellent tips on what it costs to start a business.

- Emerald Insight : Provides insights on what kind of business plan to use.

- Startly : A one-stop service that provides enhanced time and expense solutions.

Important Next Steps

- Add an MVP Summary. A start-up that plans to sell a new version of an existing product should consider adding a Minimum Viable Product (MVP) summary. The MVP protocol is an important testing and engineering process that ensures a prototype gets the proper development and testing prior to release.

The MVP methodology plays well with the lean business philosophy because it enhances the development of existing products rather than starting from square one.

- Get Funding. Once you have a solid lean business plan, you'll be in an excellent position to look for funding. The Bubble community can show you how to get seed funding .

- Getting Started. There is no time like the present to start building your dream. This is your Call to Action (CTA): wake up, get up, and start-up. Today.

How a No-Code Solution Like Bubble Can Help

Bubble’s numerous no-code platform solutions are invaluable tools that help entrepreneurs start new businesses. In addition to saving considerable time and money during the development phase, the Bubble community offers a wealth of know-how and support tools that guide entrepreneurs during the daunting start-up process.

These support structures complement the lean business plan approach because Bubble eliminates many infrastructure costs and operational hurdles a new company must overcome.

About Bubble

Bubble is a leader in the no-code movement. Bubble offers a powerful point-and-click web editor and cloud hosting platform that allows users to build fully customizable web applications and workflows, ranging from simple prototypes to complex marketplaces, SaaS products, and more.

Millions of users are building and launching businesses on Bubble — many have gone on to participate in top accelerator programs, such as Y Combinator, and even raised $365M in venture funding. Bubble is more than just a product. We are a strong community of builders and entrepreneurs who are united by the belief that everyone should be able to create technology.

Start building with a free account

Build the next big thing with Bubble

- How to build

- Responsive design

- Version control

- Feature index

- Integrations

- Marketplace

- Partnerships

- Brand guidelines

Lean Business Plan Template & How-To Guide

Written by Dave Lavinsky

Historically, business owners have devoted months to constructing a detailed plan to establish strategy, executive, and financial numbers for their business. Although a strategic plan is often created, these entrepreneurs often miss a big piece: gathering feedback from potential customers.

Without collecting data and insight from target customers, the detailed business plan becomes a document of assumptions and guesses rather than a proven success blueprint.

Download our Ultimate Business Plan Template here

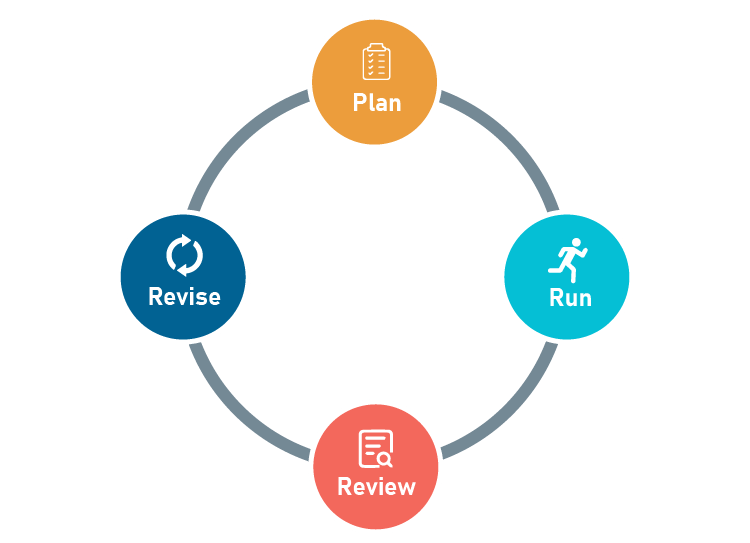

Lean business planning allows you to more quickly and accurately develop your business plan based on actual customer feedback and interactions.

On this page:

Key benefits of lean startup business planning, can you use a lean plan to raise funding, key elements of a lean business plan.

- Lean Planning Process

- Putting The Lean Plan Into Action

Review Your Results & Revise Your Plan

Lean business plan faqs, other helpful business plan articles & templates.

The lean startup business model is supported by a one-page business plan that does not require extensive financial forecasting or long-term market research and development plans. While the traditional business plan details every aspect of your company’s operations, the lean business plan focuses on key factors that present immediate opportunities for new companies to gain a competitive advantage over their competitors. This approach allows you to maintain company focus on your core mission and avoid adding unnecessary information that can weigh down your final document.

The lean startup movement has encouraged entrepreneurs to shorten their plans down from hundreds of pages to a one-page business plan or less – essentially eliminating the need for small businesses to create traditional plans at all. Rather than spending time creating lengthy reports, owners can simply list their core values, mission statement, market analysis, marketing strategies, and projected financial statements – all on one page.

Some companies even document their entire value proposition on a single sheet of paper which serves as both the foundation for further market research and development to improve its product or service offering. By having this type of information readily available to share with investors or clients, your company will appear more professional and prepared without taking up too much time creating unnecessary documentation.

Developing a lean business plan is a critical step in launching or growing your business. However, it’s important to note that if you’re seeking VC funding , bank funding, or angel investors , a traditional business plan is required. Such a plan includes additional research, strategy, and financial forecasts to give investors and lenders the information they need to determine whether they will receive an adequate ROI (return on investment) if they provide funding to you.

Below are nine key elements of a lean business plan example:

Business overview

Describe what the business does.

Value propositions

Detail the value your business brings to the market and the industry.

Key partnerships

List the key partners, including suppliers, manufacturers, distributors, vendors, or software firms, with whom your business will work.

Key activities

List the key activities your business will perform to gain a competitive advantage, grow market share, and fuel profits.

Key resources

List the resources that your business has at its disposal to create maximum value. This could include human capital (your own experience or that of your core team), intellectual property, patents, funding, etc.

Customer relationships

Describe how your customers will interact with your business. Will you have personal or automated channels of communication available? Chart out the end-to-end customer experience journey and how you intend on building customer relationships.

Customer segments and channels

Specify your target audience, what requirements of theirs you cater to, how you reach out to them, and, most importantly, the steps you are taking to generate a customer experience that will result in long-term loyalty.

Cost structure

Define your key costs and variable costs, and how they represent a competitive advantage if applicable. A lean startup business plan (versus a lean business plan for an existing company), needs to also include key startup costs you anticipate in launching your company.

Revenue streams

Describe how your business generates money. What are your revenue streams or sources, for example, selling advertising space on your app or publication, membership fees, direct sales, etc? List all your revenue sources in this section, starting with the source that delivers the largest revenue.

Download Your Free Lean Business Plan Template

Lean Business Planning Process

To create your lean business plan, follow these 4 steps:

Create the Plan

Your lean business plan will start with you, your business idea, and one sheet of paper. Yes, one sheet is all you will need.

Business Strategy

You will first begin by explaining your business strategy. This is simply a summary of what you are planning to do, who your customers are, and who your competitors are.

Identify the problem you are trying to solve along with your solution and potential alternative solutions. Then, describe your target customers. Focus on defining and describing the audience you expect to serve, who they are, where they live, etc. Lastly, explain who your competitors are. Describe what they’re doing and how they’re doing it.

Easy enough, that is all you need for your plan. With lean business planning, you simply create a business strategy that focuses on the essence and function of your business: what you’re doing and who it’s for.

Course of Action

The next piece of your lean business plan is laying out an outline of your course of action. This section will illustrate how you’re going to make your strategy happen. Here, you will focus on sales, marketing, your team members, and any potential key partners or future relationships in the business world.

Sales Strategy

It is important to first begin creating your course of action by establishing just what your sales strategy is. Will you be selling in a physical store or online? Or both? Consider whether or not your product will be sold in stores owned by other companies, and who these companies would be.

Marketing Strategy

Next up is creating your marketing strategy. Think about how you will effectively and attractively reach your potential customers. Here, consider the following:

- Target market

- Online presence

- Advertising

- Public relations

- Special promotions

Team Members

The success of your course of action will be dependent on the team members who execute it. If you need to build a team, think about who the key people are that you will need to hire. What are their qualifications and characteristics? If you already have an existing business, highlight the key members that help run your company and accomplish strategy and success.

Partners and Business Resources

Begin to think of the other businesses that you might want to work with. Most likely there are other companies that you will have to work with to make your strategy work. Brainstorm all key resources, business partners, distributors, and key suppliers that you will need to have relationships with.

After constructing your Course of Action, it’s time to create your schedule. Since lean business planning is centered around efficiency, designing an organized schedule is key.

For startups:

If you’re starting a new business, you should begin with getting to know your customers. For you to grow a viable business, you must understand your customers’ views, wants, and needs. Your goal here will be to ensure that you’ve developed a strategic, organized strategy. A startup’s schedule will often include sending out surveys, interviewing customers, and researching locations.

For established businesses:

For most businesses that have been around, your schedule should be focused on achieving the business goals you have identified. Your schedule should have specific actions with names, dates, and even times. The schedule you create should hold your business and its employees accountable for their work and progress.

The final part of scheduling is to make time to regularly review your Lean Business Plan. As your business progresses, so will your Lean Business Plan. Setting a regular review time is critical to get your business moving in the right direction and your team members on board.

Forecast and Budget

Even if you have the best business idea in the world, if the numbers aren’t there, it won’t work out. The final section of your Lean Business Plan should depict a business model that forecasts and budgets for the future.

Here, all you have to do is create basic bottom-up sales forecasts and a basic budget for expenses. Do not try to sugarcoat here, these numbers should be as practical as possible. With this, you will be able to identify just what will and won’t work for your business.

By taking on this pragmatic sense, you may begin to feel like your business will not be able to succeed unless you are flooding with customers or getting daily news coverage. You may need to alter your business model here and adjust your pricing and expenses to ensure that you can turn a profit. Also, keep in mind any funding options for large-scale marketing and PR campaigns. Keep a realistic view, but also be sure to acknowledge offers that may be available to help you out.

Putting The Lean Business Plan Into Action

After you have completed your lean business plan, it’s time to put it into action. Your main goal here should be to get a deeper understanding of your customers. Is your product solving their problem? Are they willing to pay for it? Do they want something else?

Reaching out to your customers early on will help you get a grasp on their wants and needs to make the necessary alterations to your Lean Business Plan for ultimate success. It will also provide you with some insight as to what products you may want to produce in the future.

As earlier mentioned, your lean plan should be reviewed regularly to discern just what is working and what isn’t. Compare your results with your lean plan. Are sales growing according to plan? Does the plan need to be changed?

For startups who have little to no metrics to track, review your customer interviews, surveys, or any other information that you have gathered about the industry. Here, you can begin to continually refine your plan and strategy if necessary.

If you are an established business, review your recent results with those from the past. Take note of your key metrics as well as foot traffic in stores, website visits, and any other critical units of measure for your business success.

After analyzing your results, it’s time to revise your plan. Remember that your Lean Business Plan is a process rather than a finalized document, and it is made for continuous improvements. Don’t be afraid to make any necessary changes to aid in your business’s success.

Lean business planning might just be the key to your company’s ultimate success. This simple method of business planning has helped many startups and existing businesses advance and flourish such as Google, Facebook, YouTube, and Amazon. By focusing on reviewing, revising, and business management, lean planning allows you to test out different strategies to find the best one to create a successful business.

How to Finish Your Business Plan in 1 Day!

Don’t you wish there was a faster, easier way to finish your business plan?

With Growthink’s Ultimate Business Plan Template you can finish your plan in just 8 hours or less!

What is a lean business plan?

A lean business plan is a compact, single-page document typically for internal use. Lean planning is a short-term business plan strategy for making small changes and measuring the results to improve the efficiency of the business. This compares to the formal business plan which is typically very detailed, includes 10 key components , and can be up to 15-25 pages in length.

What is the purpose of a lean business plan?

The lean business plan is primarily for internal use, so it doesn’t have to be a fancy document. The purpose of this plan is for you to document the changes you’ve made to your business so that you can analyze their effectiveness in improving business operations, marketing, and/or sales over a short period.

How long is a lean business plan?

The lean business plan is typically a one-page document to describe your business strategy including your goals, targeted audience, your business model, and how your sales and marketing strategies work to support your business goals.

How do you create a lean business plan?

Refer to our article on ‘ Lean Business Plan: How-To Guide & Template ’ for the 4 steps in creating a lean business plan or a lean startup business plan template . You can also download our free lean plan template to help you get started.

Lean Business Plan Template

What is a Lean Business Plan?

A Lean Business Plan is a streamlined, highly measurable approach to achieving your business goals. It helps teams of any size and industry to create a comprehensive strategy with clear focus areas, objectives, and measurable targets (KPIs). By taking small steps, measuring results, and making frequent course corrections, teams can optimize their business performance and ensure they are taking the best steps to reach their goals.

What's included in this Lean Business Plan template?

- 3 focus areas

- 6 objectives

Each focus area has its own objectives, projects, and KPIs to ensure that the strategy is comprehensive and effective.

Who is the Lean Business Plan template for?

The Lean Business Plan Template is designed for teams of any size and industry looking to take small steps, consistent tracking, and frequent course corrections for optimize the business. It is an effective and efficient way to organize, track, and optimize the performance of any business.

1. Define clear examples of your focus areas

A focus area is a broad category that is related to your business. Examples of focus areas could include optimizing cash flow, increasing customer satisfaction, or improving productivity.

2. Think about the objectives that could fall under that focus area

Objectives are the specific tasks you need to complete in order to reach your overall focus area goal. When defining objectives, be sure to be as specific as possible and think about measurable targets (KPIs) that will help you track your progress. Examples of some objectives for the focus area of Optimize Cash Flow could be: Increase Cash Flow, and Increase Revenue.

3. Set measurable targets (KPIs) to tackle the objective

KPIs (key performance indicators) are measurable targets that you set to help track your progress. KPIs can be financial, operational, or customer-related goals that give you insight into the performance of your business. An example of a KPI for the focus area of Optimize Cash Flow could be: Decrease avg payment time from 30 days to 15 days.

4. Implement related projects to achieve the KPIs

Projects (or actions) are specific initiatives that need to be completed in order to reach your objectives. Think about the resources, time, and budget required to complete each action and how it will help you reach your goals. An example of a project related to Optimize Cash Flow could be: Launch Payment Process.

5. Utilize Cascade Strategy Execution Platform to see faster results from your strategy

The Cascade Strategy Execution Platform is a comprehensive tool that helps teams to track progress, and make frequent course corrections to reach their goals faster. With user-friendly dashboards, and easy-to-track metrics, Cascade helps teams to easily track, measure, and optimize their business performance.

- 400+ Sample Business Plans

- WHY UPMETRICS?