- REALTOR® Store

- Fostering Consumer-Friendly Real Estate Marketplaces Local broker marketplaces ensure equity and transparency. Close

- Social Media

- Sales Tips & Techniques

- MLS & Online Listings

- Starting Your Career

- Being a Broker

- Being an Agent

- Condominiums

- Smart Growth

- Vacation, Resort, & 2nd Homes

- FHA Programs

- Home Inspections

- Arbitration & Dispute Resolution

- Fair Housing

- All Membership Benefits

- NAR REALTOR Benefits® Bringing you savings and unique offers on products and services just for REALTORS®. Close

- Directories Complete listing of state and local associations, MLSs, members, and more. Close

- Dues Information & Payment

- Become a Member As a member, you are the voice for NAR – it is your association and it exists to help you succeed. Close

- Logos and Trademark Rules Only members of NAR can call themselves a REALTOR®. Learn how to properly use the logo and terms. Close

- Your Membership Account Review your membership preferences and Code of Ethics training status. Close

- Highlights & News Get the latest top line research, news, and popular reports. Close

- Housing Statistics National, regional, and metro-market level housing statistics where data is available. Close

- Research Reports Research on a wide range of topics of interest to real estate practitioners. Close

- Presentation Slides Access recent presentations from NAR economists and researchers. Close

- State & Metro Area Data Affordability, economic, and buyer & seller profile data for areas in which you live and work. Close

- Commercial Research Analysis of commercial market sectors and commercial-focused issues and trends. Close

- Statistical News Release Schedule

- Advocacy Issues & News

- Federal Advocacy From its building located steps away from the U.S. Capitol, NAR advocates for you. Close

- REALTORS® Political Action Committee (RPAC) Promoting the election of pro-REALTOR® candidates across the United States. Close

- State & Local Advocacy Resources to foster and harness the grassroots strength of the REALTOR® Party. Close

- REALTOR® Party A powerful alliance working to protect and promote homeownership and property investment. Close

- Get Involved Now more than ever, it is critical for REALTORS® across America to come together and speak with one voice. Close

- All Education & Professional Development

- All NAR & Affiliate Courses Continuing education and specialty knowledge can help boost your salary and client base. Close

- Code of Ethics Training Fulfill your COE training requirement with free courses for new and existing members. Close

- Continuing Education (CE) Meet the continuing education (CE) requirement in state(s) where you hold a license. Close

- Designations & Certifications Acknowledging experience and expertise in various real estate specialties, awarded by NAR and its affiliates. Close

- Library & Archives Offering research services and thousands of print and digital resources. Close

- Commitment to Excellence (C2EX) Empowers REALTORS® to evaluate, enhance and showcase their highest levels of professionalism. Close

- NAR Academy at Columbia College Academic opportunities for certificates, associates, bachelor’s, and master’s degrees. Close

- Latest News

- NAR Newsroom Official news releases from NAR. Close

- REALTOR® Magazine Advancing best practices, bringing insight to trends, and providing timely decision-making tools. Close

- Blogs Commentary from NAR experts on technology, staging, placemaking, and real estate trends. Close

- Newsletters Stay informed on the most important real estate business news and business specialty updates. Close

- NAR NXT, The REALTOR® Experience

- REALTORS® Legislative Meetings

- AE Institute

- Leadership Week

- Sustainability Summit

- Mission, Vision, and Diversity & Inclusion

- Code of Ethics

- Leadership & Staff National, state & local leadership, staff directories, leadership opportunities, and more. Close

- Committee & Liaisons

- History Founded as the National Association of Real Estate Exchanges in 1908. Close

- Affiliated Organizations

- Strategic Plan NAR’s operating values, long-term goals, and DEI strategic plan. Close

- Governing Documents Code of Ethics, NAR's Constitution & Bylaws, and model bylaws for state & local associations. Close

- Awards & Grants Member recognition and special funding, including the REALTORS® Relief Foundation. Close

- NAR's Consumer Outreach

- Find a Member

- Browse All Directories

- Find an Office

- Find an Association

- NAR Group and Team Directory

- Committees and Directors

- Association Executive

- State & Local Volunteer Leader

- Buyer's Rep

- Senior Market

- Short Sales & Foreclosures

- Infographics

- First-Time Buyer

- Window to the Law

- Next Up: Commercial

- New AE Webinar & Video Series

- Drive With NAR

- Real Estate Today

- The Advocacy Scoop

- Center for REALTOR® Development

- Leading with Diversity

- Good Neighbor

- NAR HR Solutions

- Fostering Consumer-Friendly Real Estate Marketplaces Local broker marketplaces ensure equity and transparency.

- Marketing Social Media Sales Tips & Techniques MLS & Online Listings View More

- Being a Real Estate Professional Starting Your Career Being a Broker Being an Agent View More

- Residential Real Estate Condominiums Smart Growth Vacation, Resort, & 2nd Homes FHA Programs View More Home Inspections

- Legal Arbitration & Dispute Resolution Fair Housing Copyright View More

- Commercial Real Estate

- Right Tools, Right Now

- NAR REALTOR Benefits® Bringing you savings and unique offers on products and services just for REALTORS®.

- Directories Complete listing of state and local associations, MLSs, members, and more.

- Become a Member As a member, you are the voice for NAR – it is your association and it exists to help you succeed.

- Logos and Trademark Rules Only members of NAR can call themselves a REALTOR®. Learn how to properly use the logo and terms.

- Your Membership Account Review your membership preferences and Code of Ethics training status.

- Highlights & News Get the latest top line research, news, and popular reports.

- Housing Statistics National, regional, and metro-market level housing statistics where data is available.

- Research Reports Research on a wide range of topics of interest to real estate practitioners.

- Presentation Slides Access recent presentations from NAR economists and researchers.

- State & Metro Area Data Affordability, economic, and buyer & seller profile data for areas in which you live and work.

- Commercial Research Analysis of commercial market sectors and commercial-focused issues and trends.

- Federal Advocacy From its building located steps away from the U.S. Capitol, NAR advocates for you.

- REALTORS® Political Action Committee (RPAC) Promoting the election of pro-REALTOR® candidates across the United States.

- State & Local Advocacy Resources to foster and harness the grassroots strength of the REALTOR® Party.

- REALTOR® Party A powerful alliance working to protect and promote homeownership and property investment.

- Get Involved Now more than ever, it is critical for REALTORS® across America to come together and speak with one voice.

- All NAR & Affiliate Courses Continuing education and specialty knowledge can help boost your salary and client base.

- Code of Ethics Training Fulfill your COE training requirement with free courses for new and existing members.

- Continuing Education (CE) Meet the continuing education (CE) requirement in state(s) where you hold a license.

- Designations & Certifications Acknowledging experience and expertise in various real estate specialties, awarded by NAR and its affiliates.

- Library & Archives Offering research services and thousands of print and digital resources.

- Commitment to Excellence (C2EX) Empowers REALTORS® to evaluate, enhance and showcase their highest levels of professionalism.

- NAR Academy at Columbia College Academic opportunities for certificates, associates, bachelor’s, and master’s degrees.

- NAR Newsroom Official news releases from NAR.

- REALTOR® Magazine Advancing best practices, bringing insight to trends, and providing timely decision-making tools.

- Blogs Commentary from NAR experts on technology, staging, placemaking, and real estate trends.

- Newsletters Stay informed on the most important real estate business news and business specialty updates.

- Leadership & Staff National, state & local leadership, staff directories, leadership opportunities, and more.

- History Founded as the National Association of Real Estate Exchanges in 1908.

- Strategic Plan NAR’s operating values, long-term goals, and DEI strategic plan.

- Governing Documents Code of Ethics, NAR's Constitution & Bylaws, and model bylaws for state & local associations.

- Awards & Grants Member recognition and special funding, including the REALTORS® Relief Foundation.

- Top Directories Find a Member Browse All Directories Find an Office Find an Association NAR Group and Team Directory Committees and Directors

- By Role Broker Association Executive New Member Student Appraiser State & Local Volunteer Leader

- By Specialty Commercial Global Buyer's Rep Senior Market Short Sales & Foreclosures Land Green

- Multimedia Infographics Videos Quizzes

- Video Series First-Time Buyer Level Up Window to the Law Next Up: Commercial New AE Webinar & Video Series

- Podcasts Drive With NAR Real Estate Today The Advocacy Scoop Center for REALTOR® Development

- Programs Fair Housing Safety Leading with Diversity Good Neighbor NAR HR Solutions

- Writing a Business Plan

Writing a business plan may seem a daunting task as there are so many moving parts and concepts to address. Take it one step at a time and be sure to schedule regular review (quarterly, semi-annually, or annually) of your plan to be sure you on are track to meet your goals.

Why Write a Business Plan?

Making a business plan creates the foundation for your business. It provides an easy-to-understand framework and allows you to navigate the unexpected.

Quick Takeaways

- A good business plan not only creates a road map for your business, but helps you work through your goals and get them on paper

- Business plans come in many formats and contain many sections, but even the most basic should include a mission and vision statement, marketing plans, and a proposed management structure

- Business plans can help you get investors and new business partners

Source: Write Your Business Plan: United States Small Business Association

Writing a business plan is imperative to getting your business of the ground. While every plan is different – and most likely depends on the type and size of your business – there are some basic elements you don’t want to ignore.

Latest on this topic

NAR Library & Archives has already done the research for you. References (formerly Field Guides) offer links to articles, eBooks, websites, statistics, and more to provide a comprehensive overview of perspectives. EBSCO articles ( E ) are available only to NAR members and require the member's nar.realtor login.

Defining Your Mission & Vision

Writing a business plan begins by defining your business’s mission and vision statement. Though creating such a statement may seem like fluff, it is an important exercise. The mission and vision statement sets the foundation upon which to launch your business. It is difficult to move forward successfully without first defining your business and the ideals under which your business operates. A company description should be included as a part of the mission and vision statement. Some questions you should ask yourself include:

- What type of real estate do you sell?

- Where is your business located?

- Who founded your business?

- What sets your business apart from your competitors?

What is a Vision Statement ( Business News Daily , Jan. 16, 2024)

How to Write a Mission Statement ( The Balance , Jan. 2, 2020)

How to Write a Mission Statement ( Janel M. Radtke , 1998)

Using a SWOT Analysis to Structure Your Business Plan

Once you’ve created a mission and vision statement, the next step is to develop a SWOT analysis. SWOT stands for “Strengths, Weaknesses, Opportunities, and Threats.” It is difficult to set goals for your business without first enumerating your business’s strengths and weaknesses, and the strengths and weaknesses of your competitors. Evaluate by using the following questions:

- Do you offer superior customer service as compared with your competitors?

- Do you specialize in a niche market? What experiences do you have that set you apart from your competitors?

- What are your competitors’ strengths?

- Where do you see the market already saturated, and where are there opportunities for expansion and growth?

Strength, Weakness, Opportunity, and Threat (SWOT) ( Investopedia , Oct. 30, 2023)

How to Conduct a SWOT Analysis for Your Small Business ( SCORE , Apr. 28, 2022)

SWOT Analysis Toolbox ( University of Washington )

Setting Business Goals

Next, translate your mission and vision into tangible goals. For instance, if your mission statement is to make every client feel like your most important client, think about the following:

- How specifically will you implement this?

- Do you want to grow your business?

- Is this growth measured by gross revenue, profit, personnel, or physical office space?

- How much growth do you aim for annually?

- What specific targets will you strive to hit annually in the next few years?

Setting Business Goals & Objectives: 4 Considerations ( Harvard Business School , Oct. 31, 2023)

What are Business Goals? Definition, How To Set Business Goals and Examples ( Indeed , Jul. 31, 2023)

Establishing a Format

Most businesses either follow a traditional business plan format or a lean startup plan.

Traditional Business Plan

A traditional business plan is detailed and comprehensive. Writing this business plan takes more time. A traditional business plan typically contains the following elements:

- Executive Summary

- Company description

- Market analysis

- Organization and management

- Service or product line

- Marketing and sales

- Funding request

- Financial projections

Lean Startup Plan

A lean startup plan requires high-level focus but is easier to write, with an emphasis on key elements. A lean startup plan typically contains the following elements:

- Key partnerships

- Key activities

- Key resources

- Value proposition

- Customer relationships

- Customer segments

- Cost structure

- Revenue stream

Creating a Marketing Plan

You may wish to create a marketing plan as either a section of your business plan or as an addendum. The Marketing Mix concerns product , price , place and promotion .

- What is your product?

- How does your price distinguish you from your competitors—is it industry average, upper quartile, or lower quartile?

- How does your pricing strategy benefit your clients?

- How and where will you promote your services?

- What types of promotions will you advertise?

- Will you ask clients for referrals or use coupons?

- Which channels will you use to place your marketing message?

Your Guide to Creating a Small Business Marketing Plan ( Business.com , Feb. 2, 2024)

10 Questions You Need to Answer to Create a Powerful Marketing Plan ( The Balance , Jan. 16, 2020)

Developing a Marketing Plan ( Federal Deposit Insurance Corporation )

Forming a Team

Ensuring the cooperation of all colleagues, supervisors, and supervisees involved in your plan is another important element to consider. Some questions to consider are:

- Is your business plan’s success contingent upon the cooperation of your colleagues?

- If so, what specifically do you need them to do?

- How will you evaluate their participation?

- Are they on-board with the role you have assigned them?

- How will you get “buy in” from these individuals?

How to Build a Real Estate Team + 7 Critical Mistakes to Avoid ( The Close , May 17, 2023)

Don’t Start a Real Estate Team Without Asking Yourself These 8 Questions ( Homelight , Jan. 21, 2020)

Implementing a Business Plan and Reviewing Regularly

Implementation and follow-up are frequently overlooked aspects to the business plan, yet vital to the success of the plan. Set dates (annually, semi-annually, quarterly, or monthly) to review your business plans goals. Consider the following while reviewing:

- Are you on track?

- Are the goals reasonable to achieve, impossible, or too easy?

- How do you measure success—is it by revenue, profit, or number of transactions?

And lastly, think about overall goals.

- How do you plan to implement your business plan’s goals?

- When will you review and refine your business plan goals?

- What process will you use to review your goals?

- What types of quantitative and qualitative data will you collect and use to measure your success?

These items are only a few sections of a business plan. Depending on your business, you may want to include additional sections in your plan such as a:

- Cover letter stating the reasoning behind developing a business plan

- Non-disclosure statement

- Table of contents

How To Write a Business Proposal Letter (With Examples) ( Indeed , Jul. 18, 2023)

How To Implement Your Business Plan Objectives ( The Balance , Aug. 19, 2022)

The Bottom Line

Creating a business plan may seem daunting, but by understanding your business and market fully, you can create a plan that generates success (however you choose to define it).

Real Estate Business Plans – Samples, Instructional Guides, and Templates

9 Steps to Writing a Real Estate Business Plan + Templates ( The Close , Apr. 3, 2024)

How to Write a Real Estate Business Plan (+Free Template) ( Fit Small Business , Jun. 30, 2023)

The Ultimate Guide to Creating a Real Estate Business Plan + Free Template ( Placester )

Write Your Business Plan ( U.S. Small Business Administration )

General Business Plans – Samples, Instructional Guides, and Templates

Business Plan Template for a Startup Business ( SCORE , Apr. 23, 2024)

Guide to Creating a Business Plan with Template (Business News Daily, Mar. 28, 2024)

Nine Lessons These Entrepreneurs Wish They Knew Before Writing Their First Business Plans ( Forbes , Jul. 25, 2021)

How to Write a Business Plan 101 ( Entrepreneur , Feb. 22, 2021)

Books, eBooks & Other Resources

Ebooks & other resources.

The following eBooks and digital audiobooks are available to NAR members:

The Straightforward Business Plan (eBook)

Business Plan Checklist (eBook)

The SWOT Analysis (eBook)

The Business Plan Workbook (eBook)

Start-Up! A Beginner's Guide to Planning a 21st Century Business (eBook)

Complete Book of Business Plans (eBook)

How to Write a Business Plan (eBook)

The Easy Step by Step Guide to Writing a Business Plan and Making it Work (eBook)

Business Planning: 25 Keys to a Sound Business Plan (Audiobook)

Your First Business Plan, 5 th Edition (eBook)

Anatomy of a Business Plan (eBook)

Writing a Business Plan and Making it Work (Audiobook)

The Social Network Business Plan (eBook)

Books, Videos, Research Reports & More

As a member benefit, the following resources and more are available for loan through the NAR Library. Items will be mailed directly to you or made available for pickup at the REALTOR® Building in Chicago.

Writing an Effective Business Plan (Deloitte and Touche, 1999) HD 1375 D37w

Have an idea for a real estate topic? Send us your suggestions .

The inclusion of links on this page does not imply endorsement by the National Association of REALTORS®. NAR makes no representations about whether the content of any external sites which may be linked in this page complies with state or federal laws or regulations or with applicable NAR policies. These links are provided for your convenience only and you rely on them at your own risk.

Real Estate | How To

How to Write a Real Estate Business Plan (+ Free Template)

Published June 30, 2023

Published Jun 30, 2023

REVIEWED BY: Gina Baker

WRITTEN BY: Jealie Dacanay

This article is part of a larger series on How to Become a Real Estate Agent .

- 1 Write Your Mission Statement

- 2 Conduct a SWOT Analysis

- 3 Set Specific & Measurable Goals

- 4 Plan Your Marketing Strategies & Tactics

- 5 Create a Lead Generation & Nurturing Strategy

- 6 Calculate Your Income Goal

- 7 Set Times to Revisit Your Business Plan

- 8 Why Agents Need a Real Estate Business Plan

- 9 Real Estate Business Plan Examples & Templates

- 10 Bottom Line

- 11 Frequently Asked Questions (FAQs)

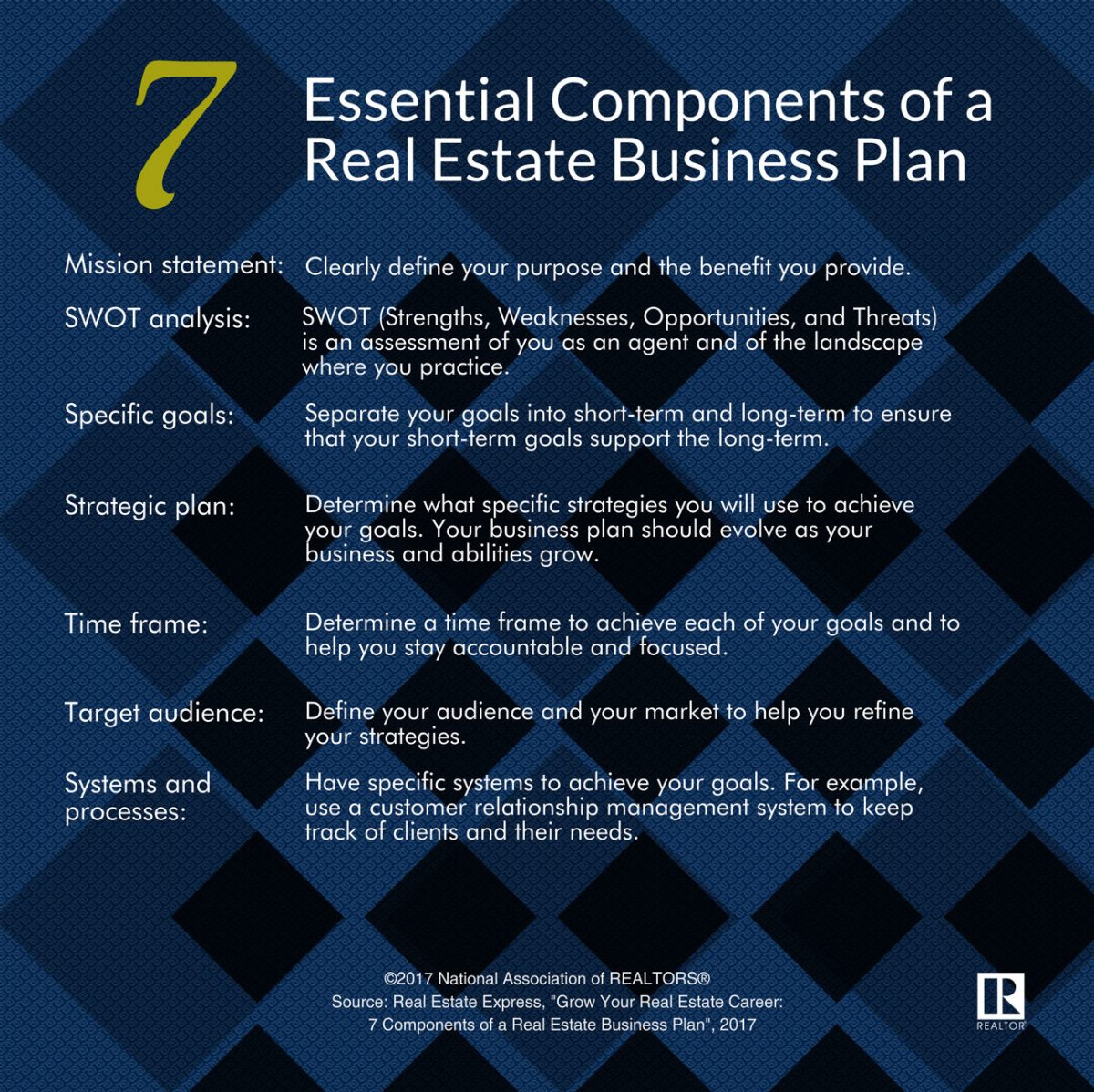

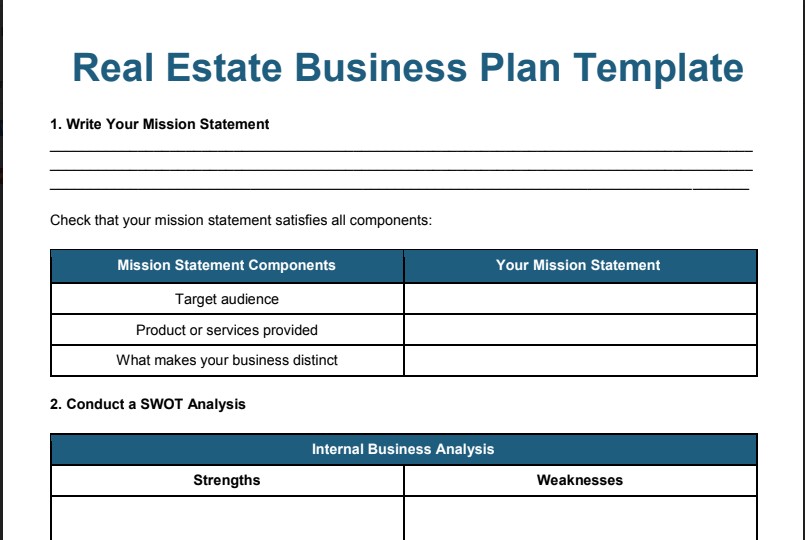

A real estate business plan lays the groundwork and provides direction on income targets, marketing tactics, goal setting, lead generation, and an overview of your industry’s competition. It describes your company’s mission statement in detail and assesses your SWOT (strengths, weaknesses, opportunities, and threats) as an organization. Business plans should include measurable goals and financial projections that you can review periodically throughout the year to ensure you meet your goals.

Continue reading to see real estate business plan examples and discover how to write a real estate business plan. Start by making your own by downloading and using the free real estate business plan template we’ve provided below.

FILE TO DOWNLOAD OR INTEGRATE

Real Estate Business Plan Template

Thank you for downloading!

💡Quick tip:

Market Leader provides a comprehensive paid inbound lead, automated marketing, and CRM solution to help agents acquire, engage, and nurture real estate leads.

Furthermore, Market Leader offers and guarantees you a number of exclusive seller and buyer leads in your target niche at a monthly rate.

1. Write Your Mission Statement

Every real estate agent’s business plan should begin with a mission statement, identifying your values and why your business exists. Your mission statement serves as the guide to achieving your ultimate business objective. When you create a solid clear mission statement, all other items identified in your realtor business plan should be aimed at fulfilling this statement.

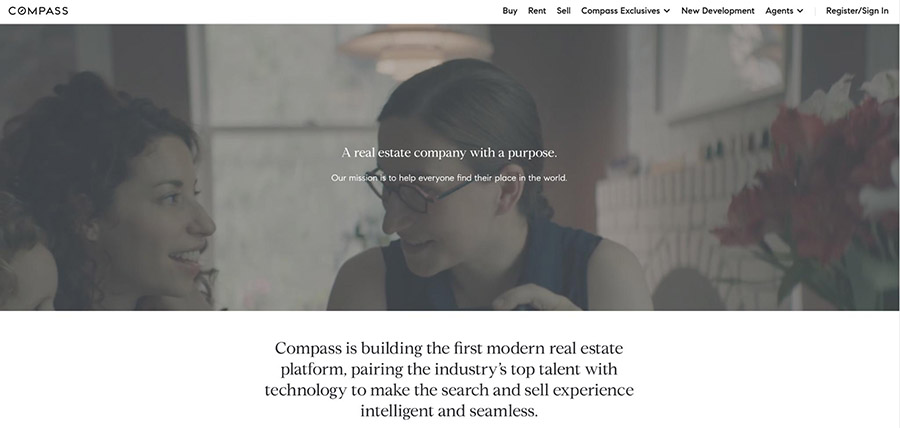

Compass’ mission statement: “Our mission is to help everyone find their place in the world.” (Source: Compass )

Your mission statement should identify your target audience, what product or service you provide, and what makes your business distinct. As seen in the example above, a powerful mission statement should be short and concise but sums up a business objective.

Let’s take Compass’ mission statement above as an example: “Our mission is to help everyone find their place in the world.” The statement identifies what the company offers, for what reasons, and who it benefits.

2. Conduct a SWOT Analysis

SWOT is an acronym that stands for a business’ strengths, weaknesses, opportunities, and threats. The primary objective of these four elements is to assess a business by evaluating internal and external factors that can drive decision-making and help you make more money . Conducting a SWOT analysis as you develop your business plan for real estate uncovers opportunities to differentiate yourself from the massive competition currently on the market.

Strengths & Weaknesses

Strengths and weaknesses are internal parts of your organization. Strengths identify what product or services you provide better than others, your access to resources, and items that benefit your customers. Weaknesses are items that need improvement, lack of resources, or what your competition does better. These are items within your control to change because you can convert a weakness into a strength.

See the example below if “Agent X” was doing their SWOT analysis:

Opportunities & Threats

External factors drive opportunities and threats and are areas you can take advantage of to benefit your business. Examples of opportunities can be shifts in the current marketplace, emerging trends you can capitalize on, features that competitors lack, or even changes with your competitors. Threats, on the other hand, are anything that can negatively impact your business. You don’t have control over changing the opportunities or threats, but you can develop a practice to anticipate and protect your business against the threats.

The opportunities and threats for “Agent X” would be:

When you complete your SWOT analysis, use it as a guide when creating strategies to meet your business objectives. To gain the most benefit from creating a SWOT analysis, make sure you are being realistic about your business and evaluating it in its present state. You don’t want to be unrealistic by listing strengths or opportunities that don’t exist yet, and you want to allocate time and money to the most impactful solution to your business issues.

If “Agent X” completed the above SWOT analysis, a few strategies they could derive would be:

- Incentivize agents to keep them at the brokerage for longer

- Implement a technology-based key machine to reduce lost keys and keep the team accountable

- Find a competitive advantage against competing brokerages and use that in marketing messages

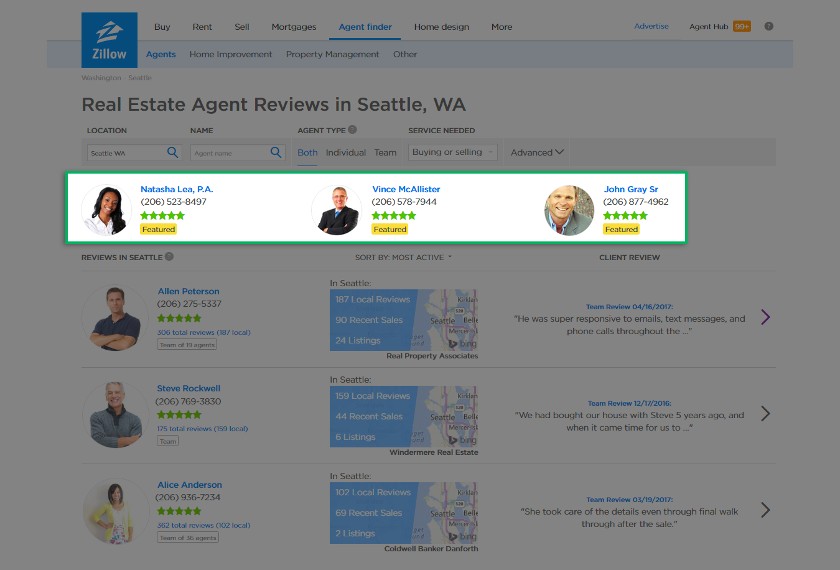

Zillow agent finder (Source: Zillow )

To help agents locate other brokerages operating in your preferred market, agents can use Zillow’s agent finder page as a research tool to see which agents or brokerages are operating in a specific area. You can find an agent by location, name, specialty, and language. Once you click on a Zillow profile , you can read their reviews, see their team members, contact and website information, and property listings. Take a deep dive into your competitor profiles and can use the information to implement strategies within your own business.

Visit Zillow

Read how our experts feel about this real estate lead generation company in our Zillow Premier Agent review .

3. Set Specific & Measurable Goals

You’re ready to set some business goals after clearly defining your mission statement and SWOT analysis. Goals can help set the tone to increase your performance and drive your business in the right direction. Your goals should have a definitive way to show progress, which can be a prime motivator to keep you on track to achieving them.

Each goal should follow a pattern to identify set criteria. This will ensure that your daily efforts are performed to meet business objectives within a set period. A way to do this is by using SMART goals:

Examples of SMART goals for agents or brokerages:

- Increase closed transactions by 20% to a total of 150 deals within the next year

- I will ask all closed clients for a referral and review within 30 days of closing the deal

Goals can be split into short-term and long-term goals. Short-term goal lengths vary between days and weeks but do not exceed six months. Short-term goals can also be worked on simultaneously with long-term goals. Long-term goals can take up to six months or more to complete and require careful planning and perseverance. A mix of short-term and long-term goals will help you maintain motivation.

All goals are equally important; however, success will stem from how you prioritize each one. Slowly add on additional goals as you have the capacity and feel comfortable with the current progress of your current set of goals. Without identifying your business goals, you’ll leave your results up to luck to attain your business objectives.

4. Plan Your Marketing Strategies & Tactics

Developing marketing strategies and tactics and implementing them help you identify and locate your current value proposition in the real estate industry, along with specific timelines for execution. In addition to determining your overall business objectives and goals, your marketing strategy and plan should include the following:

- Pinpoint general marketing goals

- Estimate projected marketing budget

- Know your geographic farm area data and identify your target niche audience

- Analyze market competition

- Identify your unique selling proposition

- Establish a timeline and set your plan in motion

- Track your progress and readjust as needed

While a marketing strategy identifies the overall marketing goals of your business, developing marketing tactics will help you achieve those individual goals. They can include referral business tactics, retention efforts, and ways to acquire new customers. For example, you can offer incentives to anyone who refers your business, or you can implement new email drip campaigns to help increase lead conversion rates.

These tactics should have set key performance indicators (KPIs) to help you evaluate your performance. For instance, a KPI you can set for your business could be that referral business should exceed 20% of your lead generation sources.

If you’re unsure how to put together your marketing plan, check out our article Real Estate Marketing Plan Template & Strategy Guide and download the free template to get started.

Postcard campaign example (Source: ProspectsPLUS! )

If direct mail is part of your promotion strategy, services like ProspectsPLUS! can help easily create and distribute mailers to a targeted area. It also has options for postcards , brochures, newsletters , flyers, and folders. You can also send mailers to prospective clients by geographic or demographic farm areas through its campaigns. Check out its templates and mailing options today.

Visit ProspectsPLUS!

Read how our experts feel about this real estate direct mail service in our ProspectsPLUS! review .

5. Create a Lead Generation & Nurturing Strategy

Having a successful lead generation strategy will help you maintain business growth. Lead generation can be performed organically and through paid advertisements to attract and convert prospective clients. In addition to generating leads, agents should have systems to manage, nurture, and re-engage with contacts to maximize opportunities.

Generating leads through a multipronged approach is the best way to maintain lead flow. Use organic strategies like hosting an open house, reaching out to your sphere of influence, and attending networking events. Employ paid generation strategies, such as purchasing leads from a lead generation company or setting up a website to funnel potential clients. Your marketing strategies will directly correlate with your lead generation strategies.

Every lead is an opportunity, even if they don’t immediately convert into a deal. Effectively nurturing leads can make sure no opportunity falls through the cracks. Agents can nurture leads by continuously engaging and developing relationships with prospective leads . It’s important to provide prospective clients with a constant flow of essential and relevant information, depending on where they are in the real estate buying or selling process.

Here are the top lead generation companies for real estate agents and brokers:

Engage more efficiently with buyer and seller leads using Market Leader’s new feature Network Boost. Network Boost has shown a 40% increase in agents successfully connecting with leads. Market Leader social media experts design highly targeted and optimized ads for your Instagram and Facebook. As visitors engage with your ads, they will be prompted to complete a form and funnel directly into your Market Leader client relationship manager (CRM). This will also trigger an automatic marketing campaign that nurtures your clients and lets you know they are ready to engage with you personally. Try Market Leader’s Network Boost today.

6. Calculate Your Income Goal

Your income goal is one of the most critical items to be included in your business plan. While this may be more difficult for new agents who are still learning the business, it’s still necessary to estimate the amount of money you will earn for the year. Work with an experienced agent or mentor to help you estimate your monetary goals. For professional agents, review your previous years to judge your income goals for the upcoming year.

To calculate your income goal and the amount of work you’ll need to complete to get to that goal, you’ll need to have some basic number estimates:

- Net income: The amount of money you will put in your pocket after commission splits with your real estate brokerage.

- Fee split with brokerage: This is the agreed-upon commission split you have with your brokerage for each completed transaction. For example, if you have a 70/30 split with your brokerage, you will collect 70% of the commission, and your brokerage will receive a 30% commission for each deal.

- Estimate of completed deals per year: You also want to estimate the number of deals you intend to complete yearly. Remember that some months will be busier than others, so make sure to account for holidays, weather, and your schedule.

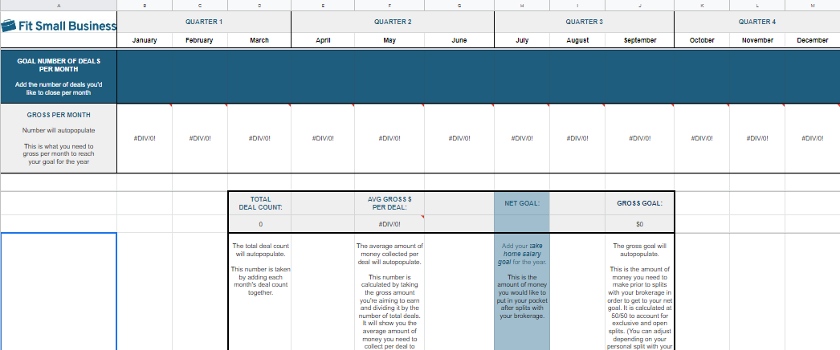

Real Estate Yearly Goal Calculator

By figuring out these numbers, you can give yourself a realistic number for your income goal. Compute the gross income commission (GCI) or amount of money you must make before the commission splits and the average profit per deal and month you’ll need to reach your goal.

For a more detailed breakdown of your yearly goal, download and use our yearly goal calculator. Input your information into the highlighted yellow boxes, and the spreadsheet will automatically calculate the GCI, total deal count, and gross income you’ll have to earn each month to reach your goal. Adjust the average gross commission per deal and brokerage split as necessary.

FitSmallBusiness Year Goal Calculator

For additional information on real estate agent salaries, review our article Real Estate Agent Salary: How Much Do Real Estate Agents Make?

7. Set Times to Revisit Your Business Plan

Business plans are only effective if you use them. A business plan is a roadmap for your business, and you’ll need to revisit it often to ensure you’re staying on track. It should be a constant resource to guide you through meeting your goals and business objectives, but it’s not necessarily set in stone if you need to make any changes.

Agents should revisit their business plans monthly to measure progress and make any changes to stay the course. If you find that you’re missing the times set for your goals, then you should continue to revisit your business plan regularly. Changing the business plan itself should occur annually once you can have a complete picture of your yearly performance. Evaluating the business plan can help you discover new strategies and ensure you have the appropriate resources for the upcoming year.

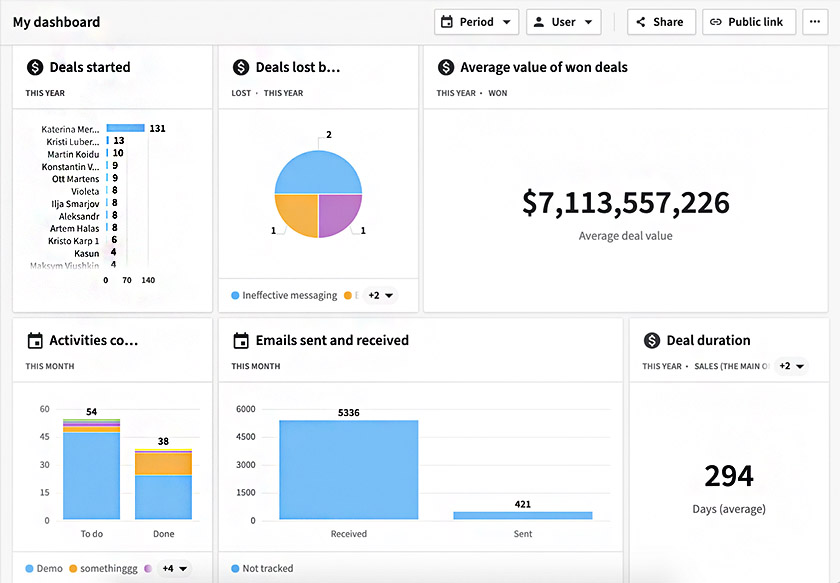

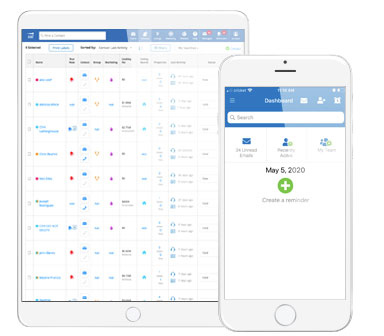

Overall status of sales activities in the dashboard (Source: Pipedrive )

Sales software like Pipedrive can help you track your overall business performance when revisiting your business plan. It presents company sales data in easy-to-visualize dashboards that track your business performance and contains forecasting tools to project future revenue. It can maintain company and team goals with progress tracking to keep goals top of mind.

Visit Pipedrive

Read how our experts feel about this real estate customer relationship manager (CRM) system in our Pipedrive review .

Why Agents Need a Real Estate Business Plan

A real estate business plan keeps you up to date on market developments and one step ahead of your competitors. It also enables you to test lead-generating tactics and create new marketing campaigns while keeping track of results over time. A solid business plan for a real estate agent presents the following:

- Where you are at the moment

- Where you would like to be

- How you’re going to get there

- How to evaluate and measure your performance

- When and when to correct the course

Real Estate Business Plan Examples & Templates

Real estate agents and brokerages don’t have to build their business plans from scratch, as many resources provide different examples. Business plan templates can also have different objectives. Some are used to secure financing or help you focus on lead generation, while others are single-page plans meant to get you started.

Here are five real estate business plan examples you can use to create yours:

Lead Generation & Income Plan

Market Leader business plan example (Source: Market Leader )

This business plan is from Market Leader, a third-party lead generation platform. It specializes in lead generation, marketing, and converting leads into customers with an attractive IDX (Internet Data Exchange) website and robust automation tools. Agents can also participate in purchasing leads through their lead products to receive a guaranteed number of leads per month.

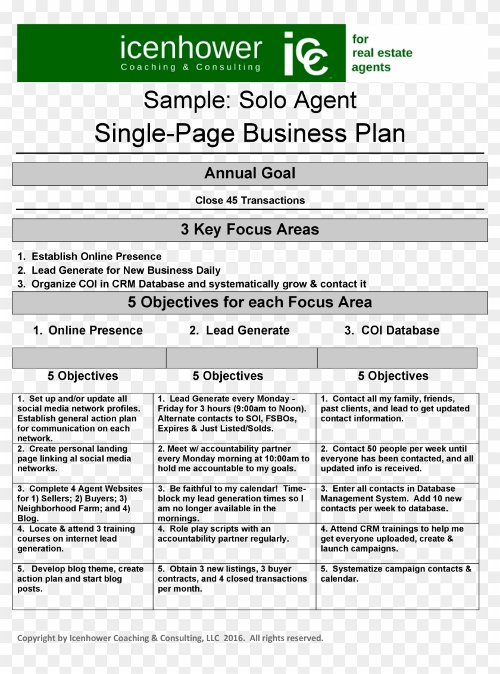

A Single-page Business Plan

Business plan for real estate (Source: PngFind )

Agents who are new to writing a business plan can start small. Business plans do not have to be multipage to be effective. This single-page business plan helps identify a single goal followed by three areas to focus on and five objectives for each focus area. As real estate agents begin to feel comfortable with goal setting and completion, they can continue to add to this single-page business plan with duplicate pages, identifying additional goals.

Business Plan for Real Estate Brokers

Real estate broker business plan (Source: AgentEDU )

This robust real estate broker business plan is designed to address organization and management goals. It contains pages identifying personnel information like title, job description, and salary. The business plan also encourages the broker to identify operational goals for future personnel changes. It’s best suited for a broker with a larger team to help drive operational change.

Business Plan With Detailed Financials

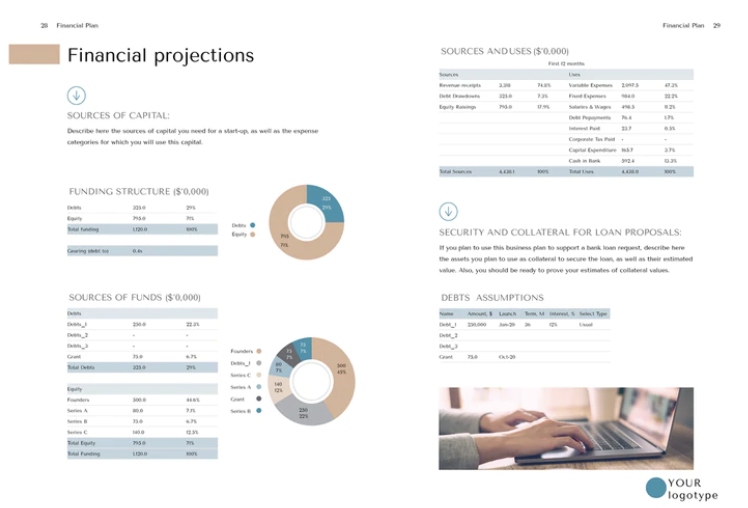

Example of real estate agent business plan template (Source: FinModelsLab )

This multipage business plan contains eye-catching graphics and detailed company financial information for real estate agents and brokers seeking funding from outside investors. One of the last sections of the business plan is a financial planning section geared toward showing how viable your business is through your provided income statements, cash flow, and balance sheet reports.

Real Estate Developers’ Business Plan

Realtor business plan template sample (Source: Upmetrics )

Upmetrics’ real estate business plan templates are easy to edit and share and contain professional cover pages to help agents convert their business ideas into actionable goals. The business plans from Upmetrics are geared toward agents looking to transition into real estate development. This plan includes vital sections important for a developer to analyze, such as building location, demand for housing, and pricing.

Real estate CRM (Source: Market Leader )

Market Leader’s business plan is centered around driving more business through lead generation. It helps agents understand their lead sources, average sales price, and how much commission was earned in a given year. It also allows agents to set income and transactional goals for the following year.

Visit Market Leader

Bottom Line

Whether you are a new real estate agent or looking to grow your brokerage, writing a real estate business plan template will help you define the steps needed to build a successful business . It serves as a guided roadmap to help you achieve your business goals, identify areas of improvement, and provide guidance in all aspects of your business, from marketing, operations, and finance to your products and services. Business plans can help determine if your business is viable and worth the financial investment.

Frequently Asked Questions (FAQs)

What is a real estate business plan.

A real estate business plan is a document that presents an outline of your organizational goals. A business plan lays out future company goals and structured procedures to achieve them. Business plans commonly contain plans for one to five years at a time, though they can differ from investor to investor.

A real estate business plan will put you in a position to succeed while also assisting you in avoiding potential pitfalls. It serves as a guide to follow when things go as expected and when they diverge from the initial plan of action. Also, a real estate business plan will ensure that investors know the steps they need to take to succeed.

How do I jump-start my real estate business?

It is important to note that starting a real estate business is not a simple task. Before launching a firm in any field, entrepreneurs should spend numerous hours researching and developing a solid business plan. As you start your real estate business, use the following tips as guidance:

- Think about your professional goals

- Conduct extensive research

- Organize your finances

- Create a business plan

- Establish an LLC

- Make a marketing plan

- Create a website

- Start campaigns

- Keep track of leads

- Develop a network of connections

How can I grow my real estate business?

You can use multiple strategies and ways to grow your real estate business. They include:

- Assess your current situation

- Invest in your professional growth

- Establish strategic alliances

- Take advantage of omnichannel marketing

- Start blogging

- Create consistent social media profiles and campaigns

- Improve your website

- Consider working with a marketing company

- Optimize your signs and direct mail

About the Author

Find Jealie On LinkedIn

Jealie Dacanay

Jealie is a staff writer expert focusing on real estate education, lead generation, marketing, and investing. She has always seen writing as an opportunity to apply her knowledge and express her ideas. Over the years and through her internship at a real estate developer in the Philippines, Camella, she developed and discovered essential skills for producing high-quality online content.

By downloading, you’ll automatically subscribe to our weekly newsletter.

Join Fit Small Business

Sign up to receive more well-researched small business articles and topics in your inbox, personalized for you. Select the newsletters you’re interested in below.

We use essential cookies to make Venngage work. By clicking “Accept All Cookies”, you agree to the storing of cookies on your device to enhance site navigation, analyze site usage, and assist in our marketing efforts.

Manage Cookies

Cookies and similar technologies collect certain information about how you’re using our website. Some of them are essential, and without them you wouldn’t be able to use Venngage. But others are optional, and you get to choose whether we use them or not.

Strictly Necessary Cookies

These cookies are always on, as they’re essential for making Venngage work, and making it safe. Without these cookies, services you’ve asked for can’t be provided.

Show cookie providers

- Google Login

Functionality Cookies

These cookies help us provide enhanced functionality and personalisation, and remember your settings. They may be set by us or by third party providers.

Performance Cookies

These cookies help us analyze how many people are using Venngage, where they come from and how they're using it. If you opt out of these cookies, we can’t get feedback to make Venngage better for you and all our users.

- Google Analytics

Targeting Cookies

These cookies are set by our advertising partners to track your activity and show you relevant Venngage ads on other sites as you browse the internet.

- Google Tag Manager

- Infographics

- Daily Infographics

- Popular Templates

- Accessibility

- Graphic Design

- Graphs and Charts

- Data Visualization

- Human Resources

- Beginner Guides

Blog Business 5 Real Estate Business Plan Examples & How to Create One?

5 Real Estate Business Plan Examples & How to Create One?

Written by: Danesh Ramuthi Nov 28, 2023

Crafting a business plan is essential for any business and the real estate sector is no exception. In real estate, a comprehensive business plan serves as a roadmap, delineating a clear path towards business growth.

It guides owners, agents and brokers through various critical aspects such as identifying target markets, devising effective marketing strategies, planning finances and managing client relationships.

For real estate businesses, a well-written plan is crucial in attracting potential investors, showcasing the company’s mission statement, business model and long-term income goals.

So, how can you write one?

Leveraging tools like Venngage Business Plan Make r with their Business Plan Templates to create your own real estate business plan can be transformative.

They offer a lot of real estate business plan examples and templates, streamlining the process of crafting a comprehensive plan.

Click to jump ahead:

- 5 real estate business plan examples

How to write a real estate business plan?

- Wrapping Up

5 Real estate business plan examples

As I have said before, a well-crafted business plan is a key to success. Whether you’re a seasoned agent or just starting out, examples of effective real estate business plans can offer invaluable insights.

These examples showcase a range of strategies and approaches tailored to various aspects of the real estate market. They serve as guides to structuring a plan that addresses key components like market analysis, marketing strategies, financial planning and client management, ensuring a solid foundation for any real estate venture.

Real estate business plan example

There are various elements in a real estate business plan that must be integrated. Incorporating these elements into a real estate business plan ensures a comprehensive approach to launching and growing a successful real estate business.

What are they?

- Executive summary: The executive summary is a concise overview of the real estate business plan. It highlights the mission statement, outlines the business goals and provides a snapshot of the overall strategy.

- Company overview: An overview on the history and structure of the real estate business. It includes the company’s mission and vision statements, information about the founding team and the legal structure of the business.

- Service: Here, the business plan details the specific services offered by the real estate agency. This could range from residential property sales and leasing to commercial real estate services. The section should clearly articulate how these services meet the needs of the target client and how they stand out from competitors.

- Strategies: A very crucial part of the plan outlines the strategies for achieving business goals. It covers marketing strategies to generate leads, pricing strategies for services, and tactics for effective client relationship management. Strategies for navigating market shifts, identifying key market trends and leveraging online resources for property listings and real estate listing presentations to help with lead generation are also included.

- Financial plan: The financial plan is a comprehensive section detailing the financial projections of the business. It includes income statements, cash flow statements, break-even analysis and financial goals. Besides, a financial plan section also outlines how resources will be allocated to different areas of the business and the approach to managing the financial aspects of the real estate market, such as average sales price and housing market trends.

Read Also: 7 Best Business Plan Software for 2023

Real estate investment business plan example

A real estate investment business plan is a comprehensive blueprint that outlines the goals and strategies of a real estate investment venture. It serves as a roadmap, ensuring that all facets of real estate investment are meticulously considered.

Creating a business plan for real estate investment is a critical step for any investor, regardless of their experience level Typically, these plans span one to five years, offering a detailed strategy for future company objectives and the steps required to achieve them.

Key components:

- Executive summary: Snapshot of the business, outlining its mission statement, target market, and core strategies. It should be compelling enough to attract potential investors and partners.

- Market analysis: A thorough analysis of the real estate market, including current trends, average sales prices and potential market shifts.

- Financial projections: Detailed financial plans, including income statements, cash flow analysis, and break-even analysis.

- Strategy & implementation: Outlines how the business plans to achieve its goals. This includes marketing efforts to generate leads, pricing strategies and client relationship management techniques.

- Legal structure & resource allocation: Details the legal structure of the business and how resources will be allocated across various operations, including property acquisitions, renovations and management.

Real estate agent business plan example

A real estate agent business plan is a strategic document that outlines the operations and goals of a real estate agent or agency. It is a crucial tool for communicating with potential lenders, partners or shareholders about the nature of the business and its potential for profitability.

A well-crafted real estate agent business plan will include

- Where you are today: A clear understanding of your current position in the market, including strengths, weaknesses and market standing.

- Where you aim to be: Sets specific, measurable goals for future growth, whether it’s expanding the client base, entering new markets or increasing sales.

- How can you get there: Outlines the strategies and action plans to achieve these goals, including marketing campaigns, client acquisition strategies and business development initiatives.

- Measuring your performance: Defines the key performance indicators (KPIs) and metrics to assess progress towards the set goals, such as sales figures, client satisfaction rates and market share.

- Course correction: Establishes a process for regular review and adjustment of the plan, ensuring flexibility to adapt to market changes, shifts in client needs and other external factors.

For real estate agents, a comprehensive business plan is not just a roadmap to success; it is a dynamic tool that keeps them accountable and adaptable to market changes.

Realtor business plan example

A realtor business plan is a comprehensive document that outlines the strategic direction and goals of a real estate business. It’s an essential tool for realtors looking to either launch or expand their business in the competitive real estate market. The plan typically includes details about the company’s mission, objectives, target market and strategies for achieving its goals.

Benefits of a realtor business plan and applications:

- For launching or expanding businesses: The plan helps real estate agents to structure their approach to entering new markets or growing in existing ones, providing a clear path to follow.

- Securing loans and investments: A well-drafted business plan is crucial for securing financing for real estate projects, such as purchasing new properties or renovating existing ones.

- Guideline for goal achievement: The plan serves as a guideline to stay on track with sales and profitability goals, allowing realtors to make informed decisions and adjust strategies as needed.

- Valuable for real estate investors: Investors can use the template to evaluate potential real estate businesses and properties for purchase, ensuring they align with their investment goals.

- Improving business performance: By filling out a realtor business plan template , realtors can gain insights into the strengths and weaknesses of their business, using this information to enhance profitability and operational efficiency.

A realtor business plan is more than just a document; it’s a roadmap for success in the real estate industry.

Writing a real estate business plan is a comprehensive process that involves several key steps. Here’s a detailed guide to help you craft an effective business plan :

- Tell your story : Start with a self-evaluation. Define who you are as a real estate agent, why you are in this business and what you do. Develop your mission statement, vision statement and an executive summary.

- Analyze your target real estate market : Focus on local market trends rather than national or state-wide levels. Examine general trends, market opportunities, saturations, and local competition. This step requires thorough research into the real estate market you plan to operate in.

- Identify your target client : After understanding your market, identify the niche you aim to serve and the type of clients you want to target. Create a client persona that reflects their specific needs and concerns.

- Conduct a SWOT analysis : Analyze your business’s Strengths, Weaknesses, Opportunities and Threats. This should reflect a combination of personal attributes and external market conditions.

- Establish your SMART goals : Set specific, measurable, attainable, realistic and timely goals. These goals could be financial, expansion-related or based on other business metrics.

- Create your financial plan : Account for all operating expenses, including marketing and lead generation costs. Calculate the number of transactions needed to meet your financial goals. Remember to separate personal and business finances.

- Revisit your business plan to monitor & evaluate : Treat your business plan as a living document. Plan periodic reviews (quarterly, semi-annually or annually) to check if your strategies are advancing you toward your goals.

- Defining your mission & vision : Include a clear mission and vision statement. Describe your business type, location, founding principles and what sets you apart from competitors.

- Creating a marketing plan : Develop a marketing plan that addresses the product, price, place and promotion of your services. Determine your pricing strategy, promotional methods and marketing channels.

- Forming a team : Ensure the cooperation of colleagues, supervisors and supervisees involved in your plan. Clarify their roles and how their participation will be evaluated.

Related: 15+ Business Plan Examples to Win Your Next Round of Funding

Wrapping up

The journey to a successful real estate venture is intricately linked to the quality and depth of your business plan. From understanding the nuances of the real estate market to setting strategic goals, a well-crafted business plan acts as the backbone of any thriving real estate business. Whether you’re developing a general real estate business plan, focusing on investment, working as an agent, or operating as a realtor, each plan type serves its unique purpose and addresses specific aspects of the real estate world.

The examples and insights provided in this article serve as a guide to help you navigate the complexities of the real estate industry. Remember, a real estate business plan is not a static document but a dynamic blueprint that evolves with your business and the ever-changing market trends.

Crafting a strategic real estate business plan is a crucial step towards achieving your business goals. So, start shaping your vision today with Venngage.

Explore venngage business plan maker & our business plan templates and begin your journey to a successful real estate business now!

Discover popular designs

Infographic maker

Brochure maker

White paper online

Newsletter creator

Flyer maker

Timeline maker

Letterhead maker

Mind map maker

Ebook maker

How to Plan, Start, & Grow a Real Estate Business: 27 Essential Tips

Published: February 21, 2024

Starting a real estate business isn’t for the faint of heart, but there’s hope for 2024. It’s expected that housing prices will soften in certain parts of the country , and despite what we’re hearing, experts are not predicting a housing market crash .

If the real estate world is calling you, don’t be put off. Here’s a down-to-earth look at how to start your own real estate business, plus advice for avoiding mistakes that hijack momentum as you grow.

In this article:

It’s Never Too Late to Start Your Business

How to start a real estate business, how to start in real estate, how to grow your real estate business, common professional pitfalls (and how to avoid them).

For many new real estate agents , real estate is their second, third, or even fourth career.

Whether you’re a solo agent or new to a team, if you have dreams of outperforming the average real estate agent salar y ($44,507 per year), you need to start thinking like a business owner — and that means planning.

.png)

Free Real Estate Planning Template

Use this free template to plan the marketing, sales, and growth for your real estate business.

- Company Overview

- Territory Overview

- Market Penetration Strategy

You're all set!

Click this link to access this resource at any time.

- Craft your ideal personal plan.

- Write a real estate business plan.

- Build a consistent marketing plan.

- Get a website.

- Prospect consistently.

- Nurture leads.

- Have good time management.

1. Get a CRM.

Barry Jenkins is the broker-owner of the #2 Better Homes and Gardens Real Estate Team in the United States. He’s also a guy who hates inefficiency. “I, to a fault, like to make things easy. The reason my business is so successful is that it was built on the core principle of leverage.”

In order to bring that principle to life, Barry uses his CRM as a true lead conversion machine . A CRM is a Customer Relationship Management system that helps you organize your contacts and come up with actionable insights. With it, you can walk leads through relevant nurture campaigns based on lead source or automate the entire transaction process.

.webp?width=540&height=442&name=Crm-free-hero-asset-fall-24@2x%20(1).webp)

Get HubSpot's Free CRM for Your Real Estate Business

This is incredibly useful in real estate because the home buying process is so long with many different steps, multiplied across many agents and even more leads and customers.

Using a CRM to achieve boss-level organization is how Barry and his team sold 240 homes in a year. And it’s not all about the front end, either. Barry also uses his CRM to send automated onboarding drips to new team members and keep the business admin completely streamlined so that nothing important ever falls through the cracks.

2. Craft your ideal personal plan.

Before you set the right financial goals for your business, you need clear financial goals for your life.

Commissions are great, but — let's face it — we all came into this business wanting something bigger and better than what we had.

Consider the following questions:

- What time do you want to start work?

- What time do you want to finish?

- How do you want to feel each day?

- How much money do you want to make?

Top tip for defining your personal plan: Think about the real why. Running a successful real estate business is more about the impact on our lives or our families' lives and less about earning cash. Get to the real motivator behind work.

3. Write a real estate business plan.

Start writing your real estate business plan, paying special attention to the things that set you apart from other businesses in your area. Give it some real thought. This is where your personal and business identities can really come together to make profit-driving magic.

Start with these questions:

- How does selling real estate make a meaningful difference for you, your prospects, and even the world?

- What are the values and principles that drive your real estate business?

- How are those different from the real estate business next door?

- What are the three to five things you are going to own completely in the business?

- Who will take care of the rest?

Even if you’re just looking to take administrative work off your plate by hiring your first virtual assistant, it's critical to create that big-picture vision to keep your team inspired and avoid repeating unproductive patterns.

Top tip for writing your business plan: While creating that big-picture plan, make sure you also pay attention to the details. Writing your plan is an opportunity for you to explore ideas and see what’s feasible.

Featured Resource: Free Business Plan Template

Be the agent who’s always there, and you’ll automatically beat the herd.

8. Have good time management.

If you’re like most of us, a big part of the dream is to have more time and energy for the things that really light you up.

But most agents who set out to build a real estate business haven’t built that into the plan. They end up with a revolving door of team members and have to outwork the business problem du jour. But it doesn’t have to be that way.

For experts in automation, a motivating factor is saving time. By eliminating manual work through automation, you can free up time to focus on the activities that actually drive revenue.

The ability to do marketing automation further underscores your need for a CRM, which ends up acting as the engine that supports your efforts.

Top tip for introducing automation: Start with low-risk tasks that you don’t want to handle.

.webp)

Don't forget to share this post!

Related articles.

![real estate business plan overview 20 Impressive Examples of Realtor Bios That Win Clients [Template & Examples]](https://blog.hubspot.com/hubfs/realtor-bio_14.webp)

20 Impressive Examples of Realtor Bios That Win Clients [Template & Examples]

25 Real Estate Marketing Ideas to Bring in Qualified Buyers

45 Real Estate Stats Agents Should Know in 2024

The Ultimate Guide to Real Estate

The 8 Best Real Estate Designations for Prestige and Expertise

The 18 Best Real Estate Apps Every Agent Needs

The 15 Best Real Estate Websites for Selling a Home in 2020

A Beginner's Guide to Running a Comparative Market Analysis

70 Motivational, Relatable, & Funny Real Estate Quotes Every Agent Should Read

How the Procuring Cause Works in Real Estate

Powerful and easy-to-use sales software that drives productivity, enables customer connection, and supports growing sales orgs

Ultimate Guide: 11 Points to Writing a Real Estate Business Plan

Failing to plan is planning to fail. Your business plan is the GPS for success. Instead of wandering, push towards your goals and objectives with clear direction. Developing a real estate business plan is critical to forming a healthy and sustainable business.

A real estate business plan is an important step for any real estate agent looking to build a successful career in the industry. While there is no one-size-fits-all approach, there are certain key elements that should be included in any plan. First and foremost, it is essential to set clear goals and objectives.

A study of 2,877 business owners found that companies are twice as likely to secure loans and funding if they have a business plan and 75% more likely to grow. Another study showed that 64% of companies who created a plan increased their businesses, compared to 43% of companies that hadn't yet finished a plan.

Your own business plan is an essential tool for any business, small or large. Real estate agents use business plans to map their marketing strategies, target their advertising, and track their progress. A business plan helps agents set goals and stay on track throughout the year. It is also a valuable reference point when meeting with clients and potential investors.

While there are many different ways to create a real estate business plan, certain elements should be included in every scenario. These elements include an overview of the business, the company's goals and objectives, a marketing strategy, and a financial analysis. By having these key components, companies can ensure that their real estate business plan is comprehensive and will help them achieve their desired results.

Harvard Business Review (HBR) stated that the chances of success rose by 12% for those that spent no longer than three months on their plan . With any longer proving futile. So, how do you write a business plan for your real estate business without getting bogged down in the details? In this post, we'll look at actionable steps agents and brokers can take to outline, execute and measure the performance of a business plan.

As a real estate agent, you know that the housing market can be unpredictable. You need to be prepared for the ups and downs of the market, and one way to do that is to have a business plan. Your business plan will help you set goals and track your progress. It will also force you to think about the costs of running your business and how you will generate leads. There are many online resources that can help you write a business plan, but the most important thing is to get started. By taking the time to write a plan, you will ensure that your business is ready for whatever the housing market throws your way.

What is a real estate business plan?

A business plan is a written document that captures the future of your business. It details what you plan and how you plan to do it.

Real estate business plans are essential for two reasons. First, they provide a road map for agents to follow as they work to build their businesses. Second, they force agents to think through all the crucial aspects of their business, such as their marketing efforts, target market, and financial goals.

By taking the time to write a Real Estate Business Plan, agents can ensure that they are taking all the necessary steps to build a successful business.

A Real Estate Business Plan is an essential tool for any business, whether you are just starting or have been in business for years. There are many benefits to creating a Real Estate Business Plan, including:

- Having a Real Estate Business Plan forces you to take a step back and assess your business as a whole. It allows you to see where your business stands, and identify any areas that need improvement.

- A Real Estate Business Plan provides a roadmap for your business. It can help you to set goals and track your progress over time.

- A Real Estate Business Plan can help secure your business funding. If you seek investment from Venture Capitalists or Banks, they will often require a copy of your business plan before considering your request.

- A Real Estate Business Plan can help you to attract and retain top talent. If you are looking to hire employees or contractors, having a well-crafted business plan can be a significant selling point.

- A Real Estate Business Plan can be a valuable tool for managing day-to-day operations. A clear and concise plan can help you better decide where to allocate resources and how to utilize your team's time and talents best.

- A Real Estate Business Plan can help you to measure and track your marketing efforts. By setting specific goals and objectives, you can more effectively gauge the success of your marketing campaigns and make necessary adjustments along the way.

- A Real Estate Business Plan can serve as a valuable sales tool. A professional business plan can give you a significant competitive advantage if you are looking to sell properties or convert leads into clients.

- A Real Estate Business Plan helps to keep you organized and on track. Trying to run a successful real estate business without a plan is like trying to drive from New York to Los Angeles without a map - chances are, you'll get lost along the way!

Having a Real Estate Business Plan gives you credibility in the eyes of others. If you are working with other professionals such as lenders, appraisers, or title companies, having a well-developed business plan shows that you are serious about your business and increases the likelihood that they will want to work with you in the future.

Last but not least, creating a Real Estate Business Plan is empowering! Taking the time to develop a comprehensive plan shows that you believe in yourself and your business and sets the foundation for long-term success.

Precisely, it conveys your business goals, the strategies and tactics you'll use to achieve them, potential problems you may run into along the way and how to overcome them, roles and responsibilities, SWOT analysis, and measurement strategies.

What should a real estate business plan include?

Real estate business plans are different from traditional business plans.

Real estate agents need to focus on their target market, their uniqueness, and how they will succeed against the competition. Real estate business plans should also include an analysis of the current market conditions and the potential for growth in the future. In addition, real estate agents should outline their marketing strategy and have a budget for advertising and promotions. By taking the time to create a comprehensive business plan, real estate agents can increase their chances of success in this competitive industry.

Real estate business plans vary in length and complexity, but all should include the following elements:

- An overview of the real estate market

- A description of the agent's target market

- A marketing plan

- A financial plan

- A discussion of the agent's competitive advantages

Real estate business plans provide a roadmap for agents to achieve their goals. They should include specific strategies for generating leads, marketing properties, and closing deals. The business plan should also outline the agent's budget and target income. Additionally, the real estate business plan should set forth a schedule for prospecting, listing appointments, and open houses. By following a real estate business plan, agents can increase their chances of success in real estate.

How do you assemble a real estate business plan?

A business plan is essential for any real estate business, whether you're just starting out or have been in the industry for years. It provides a roadmap for your business, laying out your goals and strategies for achieving them. But how do you go about assembling a business plan?

First, you'll need to identify your target market. Who are you trying to reach with your real estate business? Once you know your target market, you can start developing your marketing strategy. What methods will you use to get potential clients? How will you differentiate yourself from other real estate businesses in your area?

Next, you'll need to put together a financial plan. What are your revenue sources? How much money do you expect to bring in each month? What are your expenses? How much do you need to save for a rainy day? A clear financial picture will help you make sound decisions for your business.

Lastly, don't forget to include a personal development plan. What skills do you need to improve to succeed in the real estate business? What classes or training programs can you take to close more deals and earn more commissions? A well-rounded business plan will help ensure your real estate business is booming.

Writing a Real Estate Business Plan in 11 Easy Steps

1. write a detailed business description.

There's a story and context behind your business, and the business description is where that should shine. Write a brief overview of your Real Estate business. Include your business goals and how you plan on achieving them. Then create a description of your company, including its history, structure, and other relevant information.

The mission statement is part of the business description — which helps keep the rest on the track. Many mission statements follow a familiar format, like:

"To be the best, full-service Real Estate company in the Triangle and to enhance our quality of life through active community involvement.".

In a microstudy of 200 mission statements, it was found that mission statements most often talk about the company's dedication to customers (85%), shareholders (37%), employees (21%), and society (3%).

As well as a defined mission statement, make sure to include:

- When you were founded

- Where you are located

- Who the leaders are

- Special advantages/partnerships

- Market opportunities

- Legal structure

A very brief real estate business description example is:

"Norris & Company Real Estate is Vero Beach's premier upscale real estate firm. They specialize in luxury waterfront homes and condominiums, particularly in Vero Beach and Indian River County, FL."

2. Market Analysis

Research the Real Estate market in your area and identify any trends or opportunities. Include this information in your business plan.

Real estate agents must constantly be aware of the market conditions in their area to serve their clients best. Agents can provide expert guidance and advice by understanding the trends and opportunities.

When writing your Real Estate business plan, including a comprehensive analysis of the market conditions in your area. It will help you better understand your client's needs and identify potential opportunities.

Your market analysis should include:

- An overview of the Real Estate market in your area

- Identification of any trends or opportunities

- An explanation of how you will address these trends or options in your business plan

By including this information in your Real Estate business plan, you will be able to show potential clients that you are knowledgeable and prepared to help them navigate the Real Estate market.

3. Perform a SWOT Analysis

A SWOT analysis is a technique used to identify and define several key characteristics that will impact your business: Strengths, Weaknesses, Opportunities, and Threats.

Think of it this way:

Strengths and Weaknesses are internal. Threats and Opportunities are external.

An analysis can be as simple as making lists of items under each category.

For example, a strength could be a solid and experienced sales team, while a weakness might be that your business is expensive to run because you haven't nurtured supplier relations.

It could be as simple as filling four sheets of paper with descriptions of the strengths, weaknesses, opportunities, and threats — collaboratively or alone. To make the answers clearer and the exercise more manageable, you can use questions like:

- What do our competitors do better than us? Threat .

- What's our unique selling point? Strength .

- Why have customers churned in the past? Weakness .

- Which markets are underserved in your territory? Opportunities .

4. List Your #1 SMART Goal

It's great to be ambitious, but focusing on one goal makes it easier to stay motivated, track progress, and see the measurable effect of achieving it. Even better if that goal is a SMART Specific, Measurable, Attainable, Realistic, and Timed – goal.

Examples of SMART goals you might set for your growing real estate business are:

- Build a new real estate website in the next three months

- Hire and onboard three new SDRs in the next six months

- Increase monthly leads by 50% by next year

- Sell ten houses in the Dallas metro area in the next 30 days.

Pick one at a time and focus on it! Sticking to an achievable goal with a time limit makes it more likely to come to fruition. And, even just writing it down makes you 42% more likely to attain it.

5. Identify Your Market Niche

Before setting out your facts and figures, it's essential to spotlight your target market and how you'll serve this niche. It helps you decide what's realistic and feasible to achieve in your business plan.

Determining your market niche is a fancier way of saying: Who are your services best suited to? While honing in on a narrow target seems a little exclusionary, niche marketing can save you time, effort, and money on marketing.

One tool to help you define your market is a buyer persona. A persona is a fictional typification of your ideal customer, with information that enables you to steer your sales and marketing in the right direction.

It's essential to assess your niche and ensure it is consistent with the market in your area.

For example, if you've decided to focus on first-time buyers, do some research to look at relevant stats and figures:

- What percentage of sales in your market were to first-time buyers in the last 12–14 months?

- What was the average sales price to first-time buyers?

Also, assess how competitive this market is:

- Are you the only agent catering to the young first-timer?

- Are you competing with well-known heavy hitters?

A competitive SEO audit can be a helpful starting point in finding your competitors in the online space, where almost all leads will turn at some point in the buying process.

6. Implementation Plan