- Privacy Policy

Home » Sampling Methods – Types, Techniques and Examples

Sampling Methods – Types, Techniques and Examples

Table of Contents

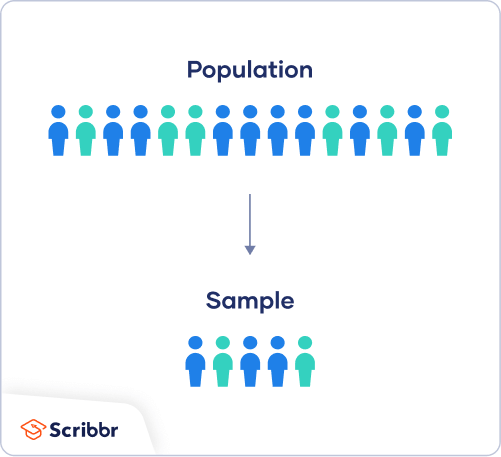

Sampling refers to the process of selecting a subset of data from a larger population or dataset in order to analyze or make inferences about the whole population.

In other words, sampling involves taking a representative sample of data from a larger group or dataset in order to gain insights or draw conclusions about the entire group.

Sampling Methods

Sampling methods refer to the techniques used to select a subset of individuals or units from a larger population for the purpose of conducting statistical analysis or research.

Sampling is an essential part of the Research because it allows researchers to draw conclusions about a population without having to collect data from every member of that population, which can be time-consuming, expensive, or even impossible.

Types of Sampling Methods

Sampling can be broadly categorized into two main categories:

Probability Sampling

This type of sampling is based on the principles of random selection, and it involves selecting samples in a way that every member of the population has an equal chance of being included in the sample.. Probability sampling is commonly used in scientific research and statistical analysis, as it provides a representative sample that can be generalized to the larger population.

Type of Probability Sampling :

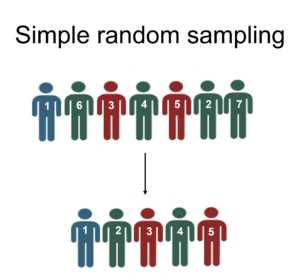

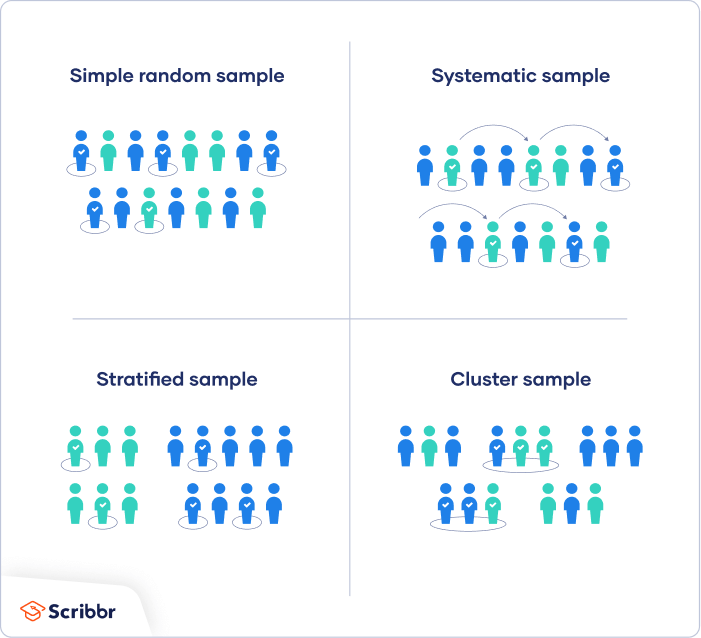

- Simple Random Sampling: In this method, every member of the population has an equal chance of being selected for the sample. This can be done using a random number generator or by drawing names out of a hat, for example.

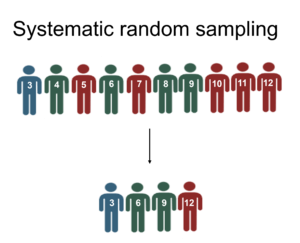

- Systematic Sampling: In this method, the population is first divided into a list or sequence, and then every nth member is selected for the sample. For example, if every 10th person is selected from a list of 100 people, the sample would include 10 people.

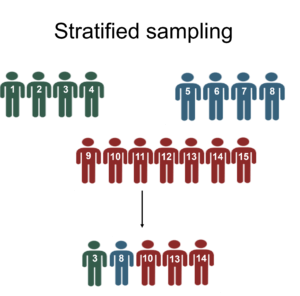

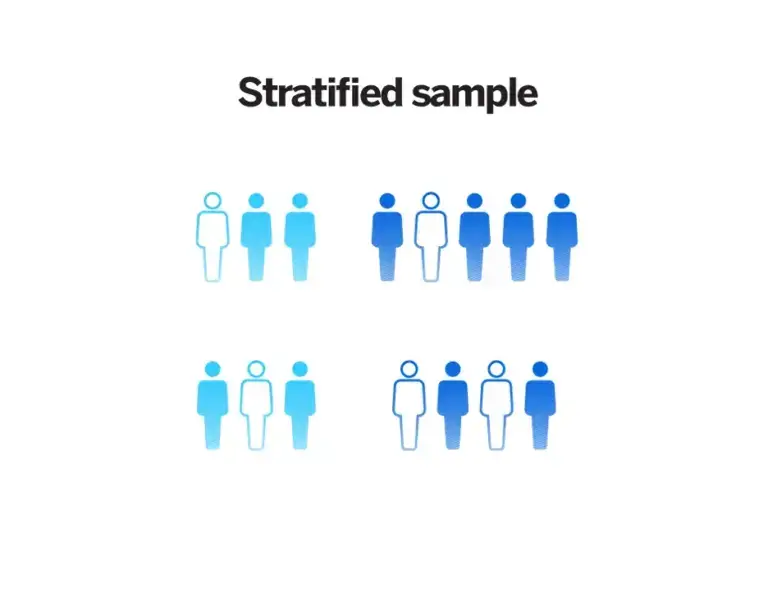

- Stratified Sampling: In this method, the population is divided into subgroups or strata based on certain characteristics, and then a random sample is taken from each stratum. This is often used to ensure that the sample is representative of the population as a whole.

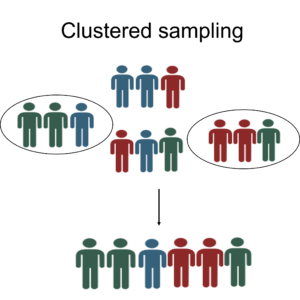

- Cluster Sampling: In this method, the population is divided into clusters or groups, and then a random sample of clusters is selected. Then, all members of the selected clusters are included in the sample.

- Multi-Stage Sampling : This method combines two or more sampling techniques. For example, a researcher may use stratified sampling to select clusters, and then use simple random sampling to select members within each cluster.

Non-probability Sampling

This type of sampling does not rely on random selection, and it involves selecting samples in a way that does not give every member of the population an equal chance of being included in the sample. Non-probability sampling is often used in qualitative research, where the aim is not to generalize findings to a larger population, but to gain an in-depth understanding of a particular phenomenon or group. Non-probability sampling methods can be quicker and more cost-effective than probability sampling methods, but they may also be subject to bias and may not be representative of the larger population.

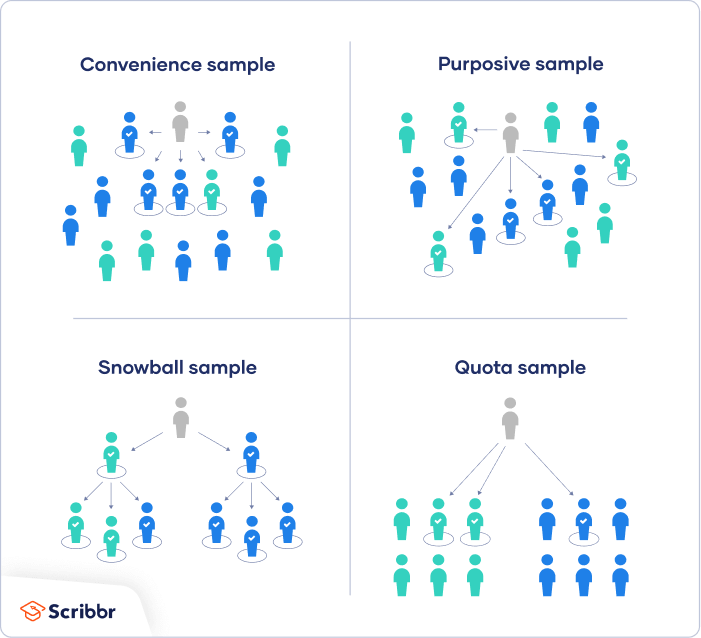

Types of Non-probability Sampling :

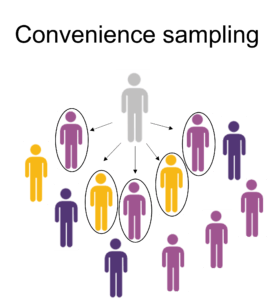

- Convenience Sampling: In this method, participants are chosen based on their availability or willingness to participate. This method is easy and convenient but may not be representative of the population.

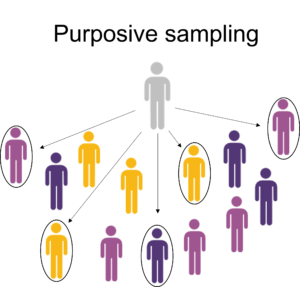

- Purposive Sampling: In this method, participants are selected based on specific criteria, such as their expertise or knowledge on a particular topic. This method is often used in qualitative research, but may not be representative of the population.

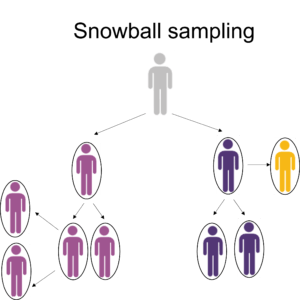

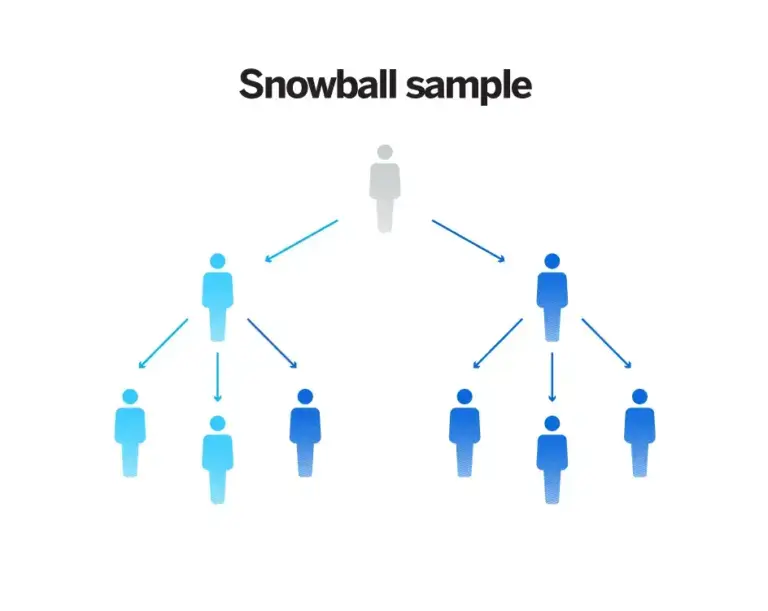

- Snowball Sampling: In this method, participants are recruited through referrals from other participants. This method is often used when the population is hard to reach, but may not be representative of the population.

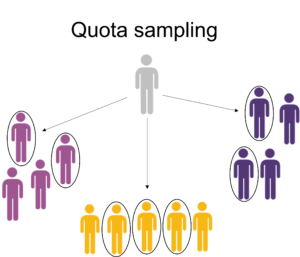

- Quota Sampling: In this method, a predetermined number of participants are selected based on specific criteria, such as age or gender. This method is often used in market research, but may not be representative of the population.

- Volunteer Sampling: In this method, participants volunteer to participate in the study. This method is often used in research where participants are motivated by personal interest or altruism, but may not be representative of the population.

Applications of Sampling Methods

Applications of Sampling Methods from different fields:

- Psychology : Sampling methods are used in psychology research to study various aspects of human behavior and mental processes. For example, researchers may use stratified sampling to select a sample of participants that is representative of the population based on factors such as age, gender, and ethnicity. Random sampling may also be used to select participants for experimental studies.

- Sociology : Sampling methods are commonly used in sociological research to study social phenomena and relationships between individuals and groups. For example, researchers may use cluster sampling to select a sample of neighborhoods to study the effects of economic inequality on health outcomes. Stratified sampling may also be used to select a sample of participants that is representative of the population based on factors such as income, education, and occupation.

- Social sciences: Sampling methods are commonly used in social sciences to study human behavior and attitudes. For example, researchers may use stratified sampling to select a sample of participants that is representative of the population based on factors such as age, gender, and income.

- Marketing : Sampling methods are used in marketing research to collect data on consumer preferences, behavior, and attitudes. For example, researchers may use random sampling to select a sample of consumers to participate in a survey about a new product.

- Healthcare : Sampling methods are used in healthcare research to study the prevalence of diseases and risk factors, and to evaluate interventions. For example, researchers may use cluster sampling to select a sample of health clinics to participate in a study of the effectiveness of a new treatment.

- Environmental science: Sampling methods are used in environmental science to collect data on environmental variables such as water quality, air pollution, and soil composition. For example, researchers may use systematic sampling to collect soil samples at regular intervals across a field.

- Education : Sampling methods are used in education research to study student learning and achievement. For example, researchers may use stratified sampling to select a sample of schools that is representative of the population based on factors such as demographics and academic performance.

Examples of Sampling Methods

Probability Sampling Methods Examples:

- Simple random sampling Example : A researcher randomly selects participants from the population using a random number generator or drawing names from a hat.

- Stratified random sampling Example : A researcher divides the population into subgroups (strata) based on a characteristic of interest (e.g. age or income) and then randomly selects participants from each subgroup.

- Systematic sampling Example : A researcher selects participants at regular intervals from a list of the population.

Non-probability Sampling Methods Examples:

- Convenience sampling Example: A researcher selects participants who are conveniently available, such as students in a particular class or visitors to a shopping mall.

- Purposive sampling Example : A researcher selects participants who meet specific criteria, such as individuals who have been diagnosed with a particular medical condition.

- Snowball sampling Example : A researcher selects participants who are referred to them by other participants, such as friends or acquaintances.

How to Conduct Sampling Methods

some general steps to conduct sampling methods:

- Define the population: Identify the population of interest and clearly define its boundaries.

- Choose the sampling method: Select an appropriate sampling method based on the research question, characteristics of the population, and available resources.

- Determine the sample size: Determine the desired sample size based on statistical considerations such as margin of error, confidence level, or power analysis.

- Create a sampling frame: Develop a list of all individuals or elements in the population from which the sample will be drawn. The sampling frame should be comprehensive, accurate, and up-to-date.

- Select the sample: Use the chosen sampling method to select the sample from the sampling frame. The sample should be selected randomly, or if using a non-random method, every effort should be made to minimize bias and ensure that the sample is representative of the population.

- Collect data: Once the sample has been selected, collect data from each member of the sample using appropriate research methods (e.g., surveys, interviews, observations).

- Analyze the data: Analyze the data collected from the sample to draw conclusions about the population of interest.

When to use Sampling Methods

Sampling methods are used in research when it is not feasible or practical to study the entire population of interest. Sampling allows researchers to study a smaller group of individuals, known as a sample, and use the findings from the sample to make inferences about the larger population.

Sampling methods are particularly useful when:

- The population of interest is too large to study in its entirety.

- The cost and time required to study the entire population are prohibitive.

- The population is geographically dispersed or difficult to access.

- The research question requires specialized or hard-to-find individuals.

- The data collected is quantitative and statistical analyses are used to draw conclusions.

Purpose of Sampling Methods

The main purpose of sampling methods in research is to obtain a representative sample of individuals or elements from a larger population of interest, in order to make inferences about the population as a whole. By studying a smaller group of individuals, known as a sample, researchers can gather information about the population that would be difficult or impossible to obtain from studying the entire population.

Sampling methods allow researchers to:

- Study a smaller, more manageable group of individuals, which is typically less time-consuming and less expensive than studying the entire population.

- Reduce the potential for data collection errors and improve the accuracy of the results by minimizing sampling bias.

- Make inferences about the larger population with a certain degree of confidence, using statistical analyses of the data collected from the sample.

- Improve the generalizability and external validity of the findings by ensuring that the sample is representative of the population of interest.

Characteristics of Sampling Methods

Here are some characteristics of sampling methods:

- Randomness : Probability sampling methods are based on random selection, meaning that every member of the population has an equal chance of being selected. This helps to minimize bias and ensure that the sample is representative of the population.

- Representativeness : The goal of sampling is to obtain a sample that is representative of the larger population of interest. This means that the sample should reflect the characteristics of the population in terms of key demographic, behavioral, or other relevant variables.

- Size : The size of the sample should be large enough to provide sufficient statistical power for the research question at hand. The sample size should also be appropriate for the chosen sampling method and the level of precision desired.

- Efficiency : Sampling methods should be efficient in terms of time, cost, and resources required. The method chosen should be feasible given the available resources and time constraints.

- Bias : Sampling methods should aim to minimize bias and ensure that the sample is representative of the population of interest. Bias can be introduced through non-random selection or non-response, and can affect the validity and generalizability of the findings.

- Precision : Sampling methods should be precise in terms of providing estimates of the population parameters of interest. Precision is influenced by sample size, sampling method, and level of variability in the population.

- Validity : The validity of the sampling method is important for ensuring that the results obtained from the sample are accurate and can be generalized to the population of interest. Validity can be affected by sampling method, sample size, and the representativeness of the sample.

Advantages of Sampling Methods

Sampling methods have several advantages, including:

- Cost-Effective : Sampling methods are often much cheaper and less time-consuming than studying an entire population. By studying only a small subset of the population, researchers can gather valuable data without incurring the costs associated with studying the entire population.

- Convenience : Sampling methods are often more convenient than studying an entire population. For example, if a researcher wants to study the eating habits of people in a city, it would be very difficult and time-consuming to study every single person in the city. By using sampling methods, the researcher can obtain data from a smaller subset of people, making the study more feasible.

- Accuracy: When done correctly, sampling methods can be very accurate. By using appropriate sampling techniques, researchers can obtain a sample that is representative of the entire population. This allows them to make accurate generalizations about the population as a whole based on the data collected from the sample.

- Time-Saving: Sampling methods can save a lot of time compared to studying the entire population. By studying a smaller sample, researchers can collect data much more quickly than they could if they studied every single person in the population.

- Less Bias : Sampling methods can reduce bias in a study. If a researcher were to study the entire population, it would be very difficult to eliminate all sources of bias. However, by using appropriate sampling techniques, researchers can reduce bias and obtain a sample that is more representative of the entire population.

Limitations of Sampling Methods

- Sampling Error : Sampling error is the difference between the sample statistic and the population parameter. It is the result of selecting a sample rather than the entire population. The larger the sample, the lower the sampling error. However, no matter how large the sample size, there will always be some degree of sampling error.

- Selection Bias: Selection bias occurs when the sample is not representative of the population. This can happen if the sample is not selected randomly or if some groups are underrepresented in the sample. Selection bias can lead to inaccurate conclusions about the population.

- Non-response Bias : Non-response bias occurs when some members of the sample do not respond to the survey or study. This can result in a biased sample if the non-respondents differ from the respondents in important ways.

- Time and Cost : While sampling can be cost-effective, it can still be expensive and time-consuming to select a sample that is representative of the population. Depending on the sampling method used, it may take a long time to obtain a sample that is large enough and representative enough to be useful.

- Limited Information : Sampling can only provide information about the variables that are measured. It may not provide information about other variables that are relevant to the research question but were not measured.

- Generalization : The extent to which the findings from a sample can be generalized to the population depends on the representativeness of the sample. If the sample is not representative of the population, it may not be possible to generalize the findings to the population as a whole.

About the author

Muhammad Hassan

Researcher, Academic Writer, Web developer

You may also like

Probability Sampling – Methods, Types and...

Quota Sampling – Types, Methods and Examples

Simple Random Sampling – Types, Method and...

Convenience Sampling – Method, Types and Examples

Purposive Sampling – Methods, Types and Examples

Systematic Sampling – Types, Method and Examples

Search Markets

- Report Store

- Airport Systems Research

- Aviation Research

- CNS Systems Research

- Components Research

- Defence Platforms & Systems Research

- Defense Platforms & Systems Research

- Electronic Warfare Research

- Homeland Security Research

- Maintenance, Repair, and Overhaul (MRO) Research

- Marine/Others Research

- Security Research

- Simulation & Training Research

- Space Research

- Unmanned Systems Research

- Agricultural Biologicals Research

- Agrochemicals & Fertilizers Research

- Animal Feed & Feed Additives Research

- Farm Equipment & Irrigations Research

- Feed & Animal Nutrition Research

- Life Sciences Research

- Precision Agriculture Research

- Seeds & Others Research

- Testing & Services Research

- Automotive Components Research

- Automotive Logistics Research

- Automotive Technology & Services Research

- Autonomous Vehicles Research

- Bikes And Motorcycles Research

- ICE, Electric, Hybrid, Autonomous Vehicles Research

- Off Road Vehicles, LCV, HCV Research

- Power Generation, Transmission & Distribution Research

- Railway Research

- Sensor And Control Research

- Telematics & Infotainment Research

- Testing, Inspection & Certification Research

- Tires & Wheels Research

- Banking Research

- FinTech Research

- Insurance Research

- Payments Research

- Accounting Services Research

- Architectural and Engineering Services Research

- Commercial Cleaning Services Research

- Corporate Training & Development Research

- Environmental Services Research

- Health and Safety Services Research

- Human Resources Services Research

- Information Technology Services Research

- Management Consulting Research

- Overhead, Consumables and Accessories Research

- Professional Services Research

- Real Estate Services Research

- Security Services Research

- Supply Chain Management Services Research

- Adhesives & Sealants Research

- Advanced Materials Research

- Basic Chemicals Research

- Disinfectants & Preservatives Research

- Inorganic Chemicals Research

- Metals & Alloys Research

- Nano Technology Research

- Organic Chemicals Research

- Packaging Research

- Petrochemicals Research

- Pharmaceutical Research

- Plastics, Polymers & Resins Research

- Polymers & Plastics Research

- Renewable Chemicals Research

- Specialty Chemicals Research

- Water Treatment Chemicals Research

- `Building Construction Research

- Construction Equipment & Machinery Research

- Construction Materials Research

- Engineering Services Research

- Green Construction Research

- Infrastructure Construction Research

- Machinery & Equipment Research

- Safety & Security Equipment Research

- Smart Infrastructure Research

- Specialty Construction Research

- Beauty & Personal Care Research

- Clothing, Footwear & Accessories Research

- Consumer Electronic Devices Research

- Consumer F&B Research

- Electronic & Electrical Research

- Electronics & Appliances Research

- Food & Beverage Research

- Food Packaging Research

- Homecare & Decor Research

- Luxury & Designer Research

- Sports & Leisure Research

- Sustainable Consumer Goods Research

- E-Learning & Online Education Research

- Higher Education Research

- K-12 Education Research

- Augmented/Virtual Reality Research

- Battery & Wireless Charging Research

- Camera, Display & Lighting Research

- Chipset And Processors Research

- Communication & Connectivity Technology Research

- Data Center & Networking Research

- Display Technology Research

- Drones & Robotics Research

- Electronics System & Components Research

- Energy Storage Research

- Industrial Automation Research

- Information System & Analytics Research

- Internet of Things & M2M Research

- Materials & Components Research

- Nanotechnology Research

- Next Generation Technologies Research

- Power & Energy Research

- Security, Access Control And Robotics Research

- Semiconductor Materials & Components Research

- Silicon, Wafer & Fabrication Research

- Wearable Technology Research

- Batteries Research

- Drilling, Intervention & Completion Research

- Industrial Motors, Pumps & Control Devices Research

- Offshore Oil & Gas Research

- Renewable Energy Research

- Smart Grid Research

- Alternative Food Sources Research

- Cold Chain Logistics Research

- Flavors, Colors & Fragrances Research

- Food Additives & Ingredients Research

- Food & Beverage Additives Research

- Food & Beverage Ingredients Research

- Food & Beverage Logistics Research

- Food & Beverage Logistics, Cold Chain & Packaging Research

- Food & Beverage Processing and Technology Research

- Food Processing Equipment & Technology Research

- Food Safety & Processing Research

- Food Safety & Standards Research

- Nutraceuticals & Dietary Supplements Research

- Nutraceuticals & Functional Foods Research

- Plant Based Alternatives/Ingredients Research

- Processed & Frozen Foods Research

- Proteins, Vitamins and Minerals Research

- Software & Services Research

- Analytics Research

- Application Software Research

- Artificial Intelligence (AI) Research

- Cloud Computing Research

- Communication Services Research

- Cyber Security Research

- Digital Media Research

- Digitalization & IoT Research

- E-commerce Research

- Endpoint Security Research

- Healthcare IT Research

- Healthcare Services Research

- Maintenance and Repair Services Research

- Materials Research

- Medical Devices Research

- Mobility & Telecom Research

- Network Security Research

- Public Safety Research

- Building Construction Research

- Chemicals & Pharmaceuticals Research

- Consumer Goods Research

- Electronics & Semiconductor Research

- Environmental Management Research

- Environmental & Safety Research

- Heavy Industry Research

- Recycling Research

- Recycling & Waste Management Research

- Safety Equipment Research

- Textiles & Apparel Research

- Valves & Actuators Research

- Metallic Minerals Research

- Metals Research Analysis

- Mining Equipment & Technology Research

- Mining Services Research

- Non-Metallic Minerals Research

- Biotechnology Research

- Cell Biology Research

- Medical Device Research

- Apparel & Footwear Research

- Brick And Mortar Research

- E-Commerce Research

- Home & Furniture Research

- Specialty Retail Research

Seeding the Insights Harvest: Understanding Sampling Techniques in Market Research

In the expansive landscape of market research, sampling techniques serve as the compass, guiding researchers through the complex task of understanding diverse populations. The choice of a sampling method is pivotal, as it directly influences the representativeness and reliability of research findings.

This exploration delves into the significance of sampling techniques in market research , examining various methodologies, their strengths, limitations, and the strategic considerations that shape the selection process.

Significance of Sampling Techniques in Market Research

- Representation of Diversity: Sampling techniques are fundamental to achieving a representative sample. A well-designed sample mirrors the diversity of the target population, ensuring that research findings can be generalized confidently.

- Resource Optimization: Effective sampling allows for the optimization of resources. Rather than attempting to survey an entire population, which can be impractical and costly, researchers can strategically select a subset that encapsulates the characteristics of the larger group.

- Statistical Inference: Sampling techniques underpin statistical inference. By concluding a carefully selected sample, researchers can make informed inferences about the broader population, providing valuable insights for decision-making.

- Efficient Data Collection: Sampling facilitates efficient data collection. Researchers can gather insights from a population subset, streamlining the research process and enabling focused analysis without the overwhelming challenge of studying the entire population.

Common Sampling Techniques in Market Research

- Random Sampling: Methodology: Every member of the population has an equal chance of being selected. Application: Random sampling is ideal when the population is homogeneous, and each member is equally likely to represent the entire group. Strengths: Ensures representativeness and minimizes bias. Limitations: This may be impractical for large or dispersed populations.

- Stratified Sampling: Methodology: Divide the population into subgroups (strata) based on certain characteristics, then randomly sample from each stratum. Application: Useful when the population is heterogeneous, researchers want to ensure representation from different subgroups. Strengths: Guarantees representation from all strata, leading to more accurate insights. Limitations: Requires knowledge of the population’s characteristics to create meaningful strata.

- Systematic Sampling: Methodology: Select every kth element from a list after randomly choosing a starting point. Application: Useful when the population is ordered, and researchers want a systematic representation. Strengths: Simplicity and efficiency in selecting a representative sample. Limitations: Susceptible to periodic patterns that may exist in the population list.

- Cluster Sampling: Methodology: Divides the population into clusters, randomly selects clusters, and then includes all members within the chosen clusters. Application: Suitable when the population is naturally grouped, and it is impractical to sample individuals independently. Strengths: Cost-effective and logistically efficient. Limitations: It may introduce intra-cluster homogeneity and inter-cluster heterogeneity.

- Convenience Sampling: Methodology: Involves selecting participants based on ease of access or availability Application: Common in exploratory research or when resources are limited. Strengths: Quick and cost-effective. Limitations: Prone to selection bias, as the sample may not represent the broader population.

Advantages of Effective Sampling Techniques in Market Research

- Increased Generalizability: Effective sampling techniques enhance the generalizability of research findings. Researchers can confidently extrapolate insights to the broader population by selecting a representative sample.

- Resource Optimization: Well-chosen sampling methods optimize resource utilization. Researchers can achieve meaningful results with a manageable sample size, avoiding the impracticality of studying an entire population.

- Minimized Bias: Rigorous sampling techniques minimize bias. Through randomization or careful stratification, researchers reduce the risk of selecting a sample that does not accurately reflect the population.

- Statistical Rigor: Statistical analyses rely on the foundations laid by effective sampling techniques. Researchers can confidently apply statistical tests and inferential methods when the sample is representative and well-designed.

- Efficient Data Collection: Well-structured sampling leads to efficient data collection. Researchers can focus on a population subset, streamlining the research process and making the most available resources.

Potential Pitfalls and Challenges in Sampling Techniques

- Sampling Bias: Sampling bias occurs when the chosen sample is not representative of the population. This can lead to inaccurate conclusions and compromise the external validity of the study.

- Undercoverage: Undercoverage happens when certain population segments are systematically excluded from the sampling process. It can result in a skewed representation and limit the generalizability of findings.

- Nonresponse Bias: Nonresponse bias occurs when individuals selected for the sample do not participate in the study. If nonrespondents differ systematically from respondents, the sample may not accurately reflect the population.

- Sampling Frame Issues: A sampling frame is the list from which the sample is drawn, and issues with the frame can impact the validity of the sample. Inaccurate or outdated sampling frames may introduce biases.

- Logistical Challenges: Certain sampling methods, such as random or stratified sampling, can pose logistical challenges, especially with large or dispersed populations. These challenges may affect the feasibility and cost-effectiveness of the study.

Best Practices for Effective Sampling in Market Research

- Clearly Defined Objectives: Define the research objectives before selecting a sampling method. The choice of sampling technique should align with the study’s goals, ensuring relevance and accuracy.

- Understand Population Characteristics: Gain a thorough understanding of the population characteristics. This knowledge is essential for choosing appropriate sampling methods, especially in stratified sampling or when creating clusters.

- Randomization: Embrace randomization to minimize bias. Random sampling or random assignment within strata enhances the representativeness of the sample.

- Consider Logistics and Resources: Consider logistical constraints and available resources. The chosen sampling method should be practical and feasible within the limitations of time, budget, and access.

- Pilot Testing: Conduct pilot testing to assess the effectiveness of the sampling method. Piloting helps identify potential issues, refine procedures, and ensure the reliability of the selected sampling technique.

Strategic Considerations in Sampling Techniques

- Population Homogeneity vs. Heterogeneity: The level of heterogeneity within the population influences the choice of sampling method. Homogeneous populations may benefit from simpler methods, while heterogeneous populations may require more sophisticated techniques like stratified sampling.

- Research Objectives and Study Design: The objectives of the research and the overall study design play a crucial role in selecting the appropriate sampling method. Exploratory studies may tolerate convenience sampling, while rigorous scientific investigations may demand more stringent methods.

- Resource Allocation: The allocation of resources, both in terms of time and budget, affects the choice of sampling method. Cluster sampling might be more cost-effective in certain situations, while random sampling may be justifiable when resources allow.

- Logistical Feasibility: The logistical feasibility of implementing a sampling method is a practical consideration. Alternative techniques should be explored if certain methods are impractical due to geographical constraints or resource limitations.

- Ethical Considerations: Ethical considerations, such as ensuring informed consent and respecting participant autonomy, should guide the choice of sampling methods. Ethical practices contribute to the credibility and integrity of the research.

Sampling techniques are the cornerstone of market research, providing the scaffolding for insightful conclusions. Carefully selecting a sampling method is not merely a technical exercise but a strategic decision that shapes the entire research endeavor.

By understanding the nuances of different sampling techniques, acknowledging their strengths and limitations, and aligning choices with research objectives, businesses can navigate the intricacies of diverse populations, ensuring that the insights gained are meaningful and representative of the dynamic landscapes they seek to understand.

About Verified Market Research

Verified Market Research is a global market research and consulting firm that has been delivering exhaustive market research studies and business intelligence for its clients since its establishment.

We focus on pushing our clients to achieve their business goals – with the fuel of in-depth business insights, including the latest market trends, customer behavior, and competitive analysis. Our transparent approach and high-rated market research reports have offered us a credible position in the eyes of most Fortune 500 companies.

Since our inception, we have formed fruitful and long-lasting relationships with each one of the clients whom we have serviced so far. It explains our performance when it comes to market research. We use client requirements and desired outcomes as our quality assurance measures to offer a precise and concise report on each market aspect.

Related Articles

Decoding the consumer mind: understanding consumer insights and behavior, navigating the research labyrinth: best practices for unlocking actionable insights, gauging the customer pulse: unveiling the power of market research through surveys, crafting the compass: effective survey design in market research, market assessment: unveiling opportunities and challenges through research, deciphering the desire: market demand in market research, shaping a better future: market research as the compass for public policy, navigating the future: the essence of market forecast in market research, looking into insights on customer satisfaction through market research, navigating the competitive seas: a comprehensive guide to understanding the competitive landscape.

View More Articles

Live revision! Join us for our free exam revision livestreams Watch now →

Reference Library

Collections

- See what's new

- All Resources

- Student Resources

- Assessment Resources

- Teaching Resources

- CPD Courses

- Livestreams

Study notes, videos, interactive activities and more!

Business news, insights and enrichment

Currated collections of free resources

Browse resources by topic

- All Business Resources

Resource Selections

Currated lists of resources

Study Notes

Marketing Research - Sampling

Last updated 22 Mar 2021

- Share on Facebook

- Share on Twitter

- Share by Email

What is sampling? In market research, sampling means getting opinions from a number of people, chosen from a specific group, in order to find out about the whole group. Let's look at sampling in more detail and discuss the most popular types of sampling used in market research.

It would be expensive and time-consuming to collect data from the whole population of a market. Therefore, market researchers make extensive of sampling from which, through careful design and analysis, marketers can draw information about their chosen market.

Sample Design

Sample design covers:

- Method of selection

- Sample structure

- Plans for analysing and interpreting the results.

Sample designs can vary from simple to complex. They depend on the type of information required and the way the sample is selected.

Sample design affects the size of the sample and the way in which analysis is carried out; in simple terms the more precision the market researcher requires, the more complex the design and larger the sample size will be.

The sample design may make use of the characteristics of the overall market population, but it does not have to be proportionally representative . It may be necessary to draw a larger sample than would be expected from some parts of the population: for example, to select more from a minority grouping to ensure that sufficient data is obtained for analysis on such groups.

Many sample designs are built around the concept of random selection . This permits justifiable inference from the sample to the population, at quantified levels of precision. Random selection also helps guard against sample bias in a way that selecting by judgement or convenience cannot.

Defining the Population

The first step in good sample design is to ensure that the specification of the target population is as clear and complete as possible. This is to ensure that all elements within the population are represented.

The target population is sampled using a sampling frame .

Often, the units in the population can be identified by existing information such as pay-rolls, company lists, government registers etc.

A sampling frame could also be geographical. For example, postcodes have become a well-used means of selecting a sample.

Sample Size

For any sample design, deciding upon the appropriate sample size will depend on several key factors:

- No estimate taken from a sample is expected to be exact: assumptions about the overall population based on the results of a sample will have an attached margin of error

- To lower the margin of error usually requires a larger sample size: the amount of variability in the population, ie the range of values or opinions, will also affect accuracy and therefore size of the sample

- The confidence level is the likelihood that the results obtained from the sample lie within a required precision: the higher the confidence level, the more certain you wish to be that the results are not atypical. Statisticians often use a 95% confidence level to provide strong conclusions

- Population size does not normally affect sample size: in fact the larger the population size, the lower the proportion of that population needs to be sampled to be representative. It's only when the proposed sample size is more than 5% of the population that the population size becomes part of the formulae to calculate the sample size

Types of Sampling

There are many different types of sampling methods, here's a summary of the most common:

Cluster sampling

Units in the population can often be found in certain geographic groups or "clusters" for example, primary school children in Derbyshire.

A random sample of clusters is taken, then all units within the cluster are examined.

- Quick and easy

- Doesn't need complete population information

- Good for face-to-face surveys

Disadvantages

- Expensive if the clusters are large

- Greater risk of sampling error

Convenience sampling

Uses those who are willing to volunteer and easiest to involve in the study.

- Subjects are readily available

- Large amounts of information can be gathered quickly

- The sample is not representative of the entire population, so results can't speak for them - inferences are limited. future data

- Prone to volunteer bias

Judgement sampling

A deliberate choice of a sample - the opposite of random

- Good for providing illustrative examples or case studies

- Very prone to bias

- Samples often small

- Cannot extrapolate from sample

Quota sampling

The aim is to obtain a sample that is "representative" of the overall population.

The population is divided ("stratified") by the most important variables such as income, age and location. The required quota sample is then drawn from each stratum.

- Quick and easy way of obtaining a sample

- Not random, so some risk of bias

- Need to understand the population to be able to identify the basis of stratification

Simply random sampling

This makes sure that every member of the population has an equal chance of selection.

- Simple to design and interpret

- Can calculate both estimate of the population and sampling error

- Need a complete and accurate population listing

- May not be practical if the sample requires lots of small visits over the country

Systematic sampling

After randomly selecting a starting point from the population between 1 and * n , every nth unit is selected.

* n equals the population size divided by the sample size.

- Easier to extract the sample than via simple random

- Ensures sample is spread across the population

- Can be costly and time-consuming if the sample is not conveniently located

- Secondary research

- Quantitative research

- Qualitative research

- Marketing research

You might also like

Leadership: Tough Decisions to Turn Starbucks Around

29th January 2012

What happened to McDonalds?

5th March 2015

Marketing Planning (Overview)

Are you the next lord sugar.

9th November 2015

Hotels and Market Research case study.

27th January 2016

The Importance of Relational Capitalism

The prisoner’s solution – podcast and question sheet.

22nd January 2017

Guerrilla marketing by Burger King

2nd February 2019

Our subjects

- › Criminology

- › Economics

- › Geography

- › Health & Social Care

- › Psychology

- › Sociology

- › Teaching & learning resources

- › Student revision workshops

- › Online student courses

- › CPD for teachers

- › Livestreams

- › Teaching jobs

Boston House, 214 High Street, Boston Spa, West Yorkshire, LS23 6AD Tel: 01937 848885

- › Contact us

- › Terms of use

- › Privacy & cookies

© 2002-2024 Tutor2u Limited. Company Reg no: 04489574. VAT reg no 816865400.

- Sign Up Now

- -- Navigate To -- CR Dashboard Connect for Researchers Connect for Participants

- Log In Log Out Log In

- Recent Press

- Papers Citing Connect

- Connect for Participants

- Connect for Researchers

- Connect AI Training

- Managed Research

- Prime Panels

- MTurk Toolkit

- Health & Medicine

- Conferences

- Knowledge Base

- The Online Researcher’s Guide To Sampling

How to Build a Sampling Process for Marketing Research

Quick Navigation:

When is it necessary to use sampling for market research, defining your target population, questions to ask when building a sampling strategy, how easy is it to reach your target audience, how much money do you have available for your project, how quickly do you need the data, what kind of information are you seeking from participants, calculating and justifying required sample size, selecting a method for sourcing participants.

By Cheskie Rosenzweig, MS, Aaron Moss, PhD, & Leib Litman, PhD

Online Researcher’s Sampling Guide, Part 3: How to Build a Sampling Process for Marketing Research

Most businesses can’t survive without conducting some research. What is our market share? Are our customers happy? Who is likely to buy this product? Questions like these are what lead businesses around the world to spend tens of billions of dollars per year on market research.

Regardless of whether you have a significant market research budget or one with very limited resources, it is of paramount importance for your business that your funds are spent efficiently and effectively. How do you do that? The first step might be recognizing when you do and do not need to gather your own data.

Not all market research requires a team of people to go out and gather data. Sometimes, your business has internal data, or you can use data other people have collected (known as secondary data) to answer your research questions. Internal data can help companies understand consumer behavior, and secondary data might help a company understand the market or its competitors.

But there are some questions no amount of internal or secondary data can answer. How do customers feel about our brand compared to others? How can we improve our product or service? Finding answers to questions like these requires talking to your customers or potential customers, and that means sampling people for the purpose of primary research.

As an example, imagine we lead the research team at a young company based in Minneapolis, Minnesota. Our company, aptly named SunVac, developed a new vacuum that runs on solar energy and never needs to be plugged in. As you might guess, we are excited that our hard work has come to fruition. We did it! We created an environmentally friendly vacuum with no more pesky wires to get tangled!

The problem we have now is that we aren’t sure how much our vacuum is worth on the open market. Although we have some secondary data on how much people will pay for wireless vacuums, we decide our product is sufficiently different from other models that we need to gather data to determine pricing sensitivity and the best way to market our product. The first step is determining who we need to sample.

Before embarking on any research project, it’s important to spend time clearly defining your objectives. Defining what you want to learn will guide your decisions about which source of data is best, how you should sample, and who you should sample.

Consider our company, SunVac. Our research team knows that we should conduct some studies investigating how much people will pay for our product and what kind of messages will convince people to buy it. From here, we need to define a target population for our studies, and while doing so, it is a good time to think about potential sources of sampling bias.

Is it important that our study represent certain demographic groups or people from various regions of the country? Should we make sure men and women are equally represented in the study? Does how much money people make influence whether they will buy our vacuum? Thinking about potential sources of bias can help us clarify who to sample.

Based on intuition and some secondary data, the research team at SunVac has a sense of who may have an interest in our product, who buy the product at different price points, and who respond to different marketing campaigns.

We decide we should sample people who may be in the market for a vacuum cleaner. We also decide it is important to collect data from people in various regions of the country to account for regional differences in environmental attitudes. If we limited our sampling to people in Minneapolis, we might end up with biased results, because Minneapolis is a city ranked cleanest in the U.S. and 6 th -most eco-friendly in the world , meaning people in Minneapolis may value our product more than potential customers elsewhere. Finally, we consider data we have seen that married people vacuum more than single adults. We decide we should sample more married people than singles. So, our target sample is adults from various regions of the US who may be interested in buying a vacuum. Let us next consider where we could collect our sample.

Once you identify a target population, you need to form a plan to reach them and to gather your data. There are several related issues to consider.

Some people are harder to find as research participants than others. CEOs and managers are less plentiful than entry-level employees. There are fewer older adults online than younger adults. When forming a sampling plan, it is important to consider how hard it is to reach your target audience.

The amount of money budgeted for your project will affect your decisions about how to reach your target audience. For example, gathering a nationally representative sample based on probability sampling is often quite expensive. If it isn’t essential that your project be based on probability sampling, many researchers find it more affordable to collect a controlled sample that uses quotas to match to the U.S. census.

The amount of money you have budgeted for your project can also affect other considerations, such as where to find participants. Some online platforms allow researchers to do more of the work in data collection, which lowers overall costs. Other online platforms manage data collection for researchers, which adds to overall costs. How much money you have will influence the decisions you make.

How quickly you need your data will affect not only the total cost of your study, but also your decisions of how to sample. If you need the data quickly, then it doesn’t make sense to adopt a slow strategy like voluntary sampling or face-to-face interviewing.

When researchers need data quickly, they often turn to online sampling sources. The internet makes it possible to run faster and more affordable studies than many other methods of data collection.

The information you’re asking participants to provide may influence how and where you decide to gather data. Specifically, if you are looking for participants to engage in an hour-long task, during which they rate several products and provide detailed responses about each one, then you will probably get the best results from a crowdsourcing platform like Mechanical Turk. Crowdsourcing platforms allow you to control participant compensation, and by paying participants adequately for their time, it is possible to get data from crowdsourcing sites that participants from most online panels would never take the time to provide.

On the other hand, if you are gathering simple survey responses from participants, then there are many platforms that are suited to the type of data you seek to collect.

How might the questions above affect the research decisions we make at SunVac?

First, we know it’s relatively easy to reach our target audience. Any sizeable online panel should have access to adults from around the U.S. and allow us to target married couples.

Second, as a small company, we don’t have a massive budget for research. Because a random sample isn’t necessary for our research questions, we will gather a non-random sample and aim to control for potential sources of bias. For example, we will use quotas in our data collection to ensure we gather data from people of various ethnic and age groups.

Third, we want the data quickly. We know our competitors are close to developing a similar product, and we want to make sure our product hits the market first. As a result, we want to conduct our project within the next two weeks, meaning we should choose a sampling method and source that yield quick data.

Finally, our study asks participants to answer some questions about our product and to tell us which features of different marketing messages are most persuasive. Because our study isn’t too long or too demanding, we can consider a wide range of online panels with which to run our study.

To summarize, we know that most online panels will allow us to sample the people we are interested in, but we need our data quickly and we have a tight budget to stick to. The ideal platform for our project may be something like CloudResearch’s Prime Panels, or if we want to do some of the work ourselves, we might run the study on Mechanical Turk using CloudResearch’s MTurk Toolkit.

Now that we’ve built a sampling plan, we have to decide how many people to sample.

How many people you recruit into your study depends on your goals, the type of study you’re conducting, and how you plan to use your data.

If you’re conducting a survey, as our company, SunVac, is, then you need to consider a few factors when determining sample size. First, how large is the population you’re studying? As the size of the population you seek to understand grows, so does the number of people you need to sample. Our population for the SunVac project is quite large, encompassing nearly all adults in the U.S.

Second, how much inaccuracy are you willing to accept in the results? While your initial reaction may be “none,” it’s important to keep in mind that all sampling entails some margin of error. The question you have to answer is how important it is for your project to minimize the margin of error while balancing the increased costs of gathering a larger sample.

At SunVac, someone on our team has a background in statistical methods. She informs us it would be wise to run a conjoint analysis project asking people to rate the attractiveness of a series of descriptions of vacuum cleaners at different price points and with different features. She explains to us that it will take some time to design the survey itself, but she estimates that for appropriate statistical power to analyze the results among the different market segments we are interested in (region, relationship status, age groups), we will need data from 2,000 potential customers.

Now, you’re ready to find participants. The problem is that there is an overwhelming number of online options to choose from.

Depending on who you want to sample and what you want them to do within your study, online panels and crowdsourcing platforms both offer options for obtaining the sample you are interested in.

Online panels offer access to tens of millions of participants worldwide. When using online panels, researchers can easily target participants based on demographic characteristics, geographic location, psychographics and more. At SunVac, we could easily run our study using an online panel.

In addition to online panels, crowdsourcing platforms like Amazon’s Mechanical Turk are increasingly popular among market researchers. Crowdsourcing platforms give researchers more control over how their study is setup, how communication with participants takes place, and how much participants are compensated. Each of these features can be used to elicit more participant engagement than is typical in online panels.

If we decide at SunVac to conduct our study with an online panel, we will need the ability to collect high-quality data from a diverse sample of 2,000 adults, with a quota for a particular number of men and women who come from different age groups and regions of the country, and are either married or single. This means we will need a platform that allows us to selectively recruit 2,000 vacuum cleaner users for a 15—20 minute survey, and we want to make sure we collect good data from participants who are paying attention.

Ideally, what might happen next for SunVac, and hopefully to you, our reader, is that, in the process of researching how to find the best sample for your needs, you come to this website, read this page, and realize that CloudResearch has what you need. At CloudResearch, we have the ability to connect researchers with samples for nearly any project. In addition, we can provide advice for your data collection or gather the sample for you . Our solutions are tailored to your needs.

Why wait? Reach out today and see how we can help you achieve your research goals. Collect participants via Prime Panels or our MTurk Toolkit by signing up for a CloudResearch account , or ask for our assistance in designing your survey or sampling approach or for help with data collection or analysis today.

Continue Reading: The Online Researcher’s Guide to Sampling

Part 4: Pros and Cons of Different Sampling Methods

Part 1: What Is the Purpose of Sampling in Research?

Part 2: How to Reduce Sampling Bias in Research

Related articles, what is data quality and why is it important.

If you were a researcher studying human behavior 30 years ago, your options for identifying participants for your studies were limited. If you worked at a university, you might be...

How to Identify and Handle Invalid Responses to Online Surveys

As a researcher, you are aware that planning studies, designing materials and collecting data each take a lot of work. So when you get your hands on a new dataset,...

SUBSCRIBE TO RECEIVE UPDATES

2024 grant application form, personal and institutional information.

- Full Name * First Last

- Position/Title *

- Affiliated Academic Institution or Research Organization *

Detailed Research Proposal Questions

- Project Title *

- Research Category * - Antisemitism Islamophobia Both

- Objectives *

- Methodology (including who the targeted participants are) *

- Expected Outcomes *

- Significance of the Study *

Budget and Grant Tier Request

- Requested Grant Tier * - $200 $500 $1000 Applicants requesting larger grants may still be eligible for smaller awards if the full amount requested is not granted.

- Budget Justification *

Research Timeline

- Projected Start Date * MM slash DD slash YYYY Preference will be given to projects that can commence soon, preferably before September 2024.

- Estimated Completion Date * MM slash DD slash YYYY Preference will be given to projects that aim to complete within a year.

- Project Timeline *

- Email This field is for validation purposes and should be left unchanged.

- Name * First Name Last Name

- I would like to request a demo of the Sentry platform

- Name * First name Last name

- Comments This field is for validation purposes and should be left unchanged.

- Name * First Last

- Phone This field is for validation purposes and should be left unchanged.

- Name * First and Last

- Please select the best time to discuss your project goals/details to claim your free Sentry pilot for the next 60 days or to receive 10% off your first Managed Research study with Sentry.

- Name This field is for validation purposes and should be left unchanged.

- Email * Enter Email Confirm Email

- Organization

- Job Title *

Educational resources and simple solutions for your research journey

What are Sampling Methods? Techniques, Types, and Examples

Every type of research includes samples from which inferences are drawn. The sample could be biological specimens or a subset of a specific group or population selected for analysis. The goal is often to conclude the entire population based on the characteristics observed in the sample. Now, the question comes to mind: how does one collect the samples? Answer: Using sampling methods. Various sampling strategies are available to researchers to define and collect samples that will form the basis of their research study.

In a study focusing on individuals experiencing anxiety, gathering data from the entire population is practically impossible due to the widespread prevalence of anxiety. Consequently, a sample is carefully selected—a subset of individuals meant to represent (or not in some cases accurately) the demographics of those experiencing anxiety. The study’s outcomes hinge significantly on the chosen sample, emphasizing the critical importance of a thoughtful and precise selection process. The conclusions drawn about the broader population rely heavily on the selected sample’s characteristics and diversity.

Table of Contents

What is sampling?

Sampling involves the strategic selection of individuals or a subset from a population, aiming to derive statistical inferences and predict the characteristics of the entire population. It offers a pragmatic and practical approach to examining the features of the whole population, which would otherwise be difficult to achieve because studying the total population is expensive, time-consuming, and often impossible. Market researchers use various sampling methods to collect samples from a large population to acquire relevant insights. The best sampling strategy for research is determined by criteria such as the purpose of the study, available resources (time and money), and research hypothesis.

For example, if a pet food manufacturer wants to investigate the positive impact of a new cat food on feline growth, studying all the cats in the country is impractical. In such cases, employing an appropriate sampling technique from the extensive dataset allows the researcher to focus on a manageable subset. This enables the researcher to study the growth-promoting effects of the new pet food. This article will delve into the standard sampling methods and explore the situations in which each is most appropriately applied.

What are sampling methods or sampling techniques?

Sampling methods or sampling techniques in research are statistical methods for selecting a sample representative of the whole population to study the population’s characteristics. Sampling methods serve as invaluable tools for researchers, enabling the collection of meaningful data and facilitating analysis to identify distinctive features of the people. Different sampling strategies can be used based on the characteristics of the population, the study purpose, and the available resources. Now that we understand why sampling methods are essential in research, we review the various sample methods in the following sections.

Types of sampling methods

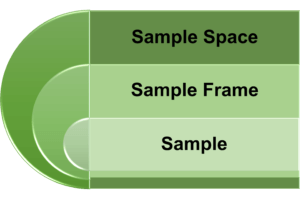

Before we go into the specifics of each sampling method, it’s vital to understand terms like sample, sample frame, and sample space. In probability theory, the sample space comprises all possible outcomes of a random experiment, while the sample frame is the list or source guiding sample selection in statistical research. The sample represents the group of individuals participating in the study, forming the basis for the research findings. Selecting the correct sample is critical to ensuring the validity and reliability of any research; the sample should be representative of the population.

There are two most common sampling methods:

- Probability sampling: A sampling method in which each unit or element in the population has an equal chance of being selected in the final sample. This is called random sampling, emphasizing the random and non-zero probability nature of selecting samples. Such a sampling technique ensures a more representative and unbiased sample, enabling robust inferences about the entire population.

- Non-probability sampling: Another sampling method is non-probability sampling, which involves collecting data conveniently through a non-random selection based on predefined criteria. This offers a straightforward way to gather data, although the resulting sample may or may not accurately represent the entire population.

Irrespective of the research method you opt for, it is essential to explicitly state the chosen sampling technique in the methodology section of your research article. Now, we will explore the different characteristics of both sampling methods, along with various subtypes falling under these categories.

What is probability sampling?

The probability sampling method is based on the probability theory, which means that the sample selection criteria involve some random selection. The probability sampling method provides an equal opportunity for all elements or units within the entire sample space to be chosen. While it can be labor-intensive and expensive, the advantage lies in its ability to offer a more accurate representation of the population, thereby enhancing confidence in the inferences drawn in the research.

Types of probability sampling

Various probability sampling methods exist, such as simple random sampling, systematic sampling, stratified sampling, and clustered sampling. Here, we provide detailed discussions and illustrative examples for each of these sampling methods:

- Simple random sampling: In simple random sampling, each individual has an equal probability of being chosen, and each selection is independent of the others. Because the choice is entirely based on chance, this is also known as the method of chance selection. In the simple random sampling method, the sample frame comprises the entire population.

For example, A fitness sports brand is launching a new protein drink and aims to select 20 individuals from a 200-person fitness center to try it. Employing a simple random sampling approach, each of the 200 people is assigned a unique identifier. Of these, 20 individuals are then chosen by generating random numbers between 1 and 200, either manually or through a computer program. Matching these numbers with the individuals creates a randomly selected group of 20 people. This method minimizes sampling bias and ensures a representative subset of the entire population under study.

- Systematic sampling: The systematic sampling approach involves selecting units or elements at regular intervals from an ordered list of the population. Because the starting point of this sampling method is chosen at random, it is more convenient than essential random sampling. For a better understanding, consider the following example.

For example, considering the previous model, individuals at the fitness facility are arranged alphabetically. The manufacturer then initiates the process by randomly selecting a starting point from the first ten positions, let’s say 8. Starting from the 8th position, every tenth person on the list is then chosen (e.g., 8, 18, 28, 38, and so forth) until a sample of 20 individuals is obtained.

- Stratified sampling: Stratified sampling divides the population into subgroups (strata), and random samples are drawn from each stratum in proportion to its size in the population. Stratified sampling provides improved representation because each subgroup that differs in significant ways is included in the final sample.

For example, Expanding on the previous simple random sampling example, suppose the manufacturer aims for a more comprehensive representation of genders in a sample of 200 people, consisting of 90 males, 80 females, and 30 others. The manufacturer categorizes the population into three gender strata (Male, Female, and Others). Within each group, random sampling is employed to select nine males, eight females, and three individuals from the others category, resulting in a well-rounded and representative sample of 200 individuals.

- Clustered sampling: In this sampling method, the population is divided into clusters, and then a random sample of clusters is included in the final sample. Clustered sampling, distinct from stratified sampling, involves subgroups (clusters) that exhibit characteristics similar to the whole sample. In the case of small clusters, all members can be included in the final sample, whereas for larger clusters, individuals within each cluster may be sampled using the sampling above methods. This approach is referred to as multistage sampling. This sampling method is well-suited for large and widely distributed populations; however, there is a potential risk of sample error because ensuring that the sampled clusters truly represent the entire population can be challenging.

For example, Researchers conducting a nationwide health study can select specific geographic clusters, like cities or regions, instead of trying to survey the entire population individually. Within each chosen cluster, they sample individuals, providing a representative subset without the logistical challenges of attempting a nationwide survey.

Use s of probability sampling

Probability sampling methods find widespread use across diverse research disciplines because of their ability to yield representative and unbiased samples. The advantages of employing probability sampling include the following:

- Representativeness

Probability sampling assures that every element in the population has a non-zero chance of being included in the sample, ensuring representativeness of the entire population and decreasing research bias to minimal to non-existent levels. The researcher can acquire higher-quality data via probability sampling, increasing confidence in the conclusions.

- Statistical inference

Statistical methods, like confidence intervals and hypothesis testing, depend on probability sampling to generalize findings from a sample to the broader population. Probability sampling methods ensure unbiased representation, allowing inferences about the population based on the characteristics of the sample.

- Precision and reliability

The use of probability sampling improves the precision and reliability of study results. Because the probability of selecting any single element/individual is known, the chance variations that may occur in non-probability sampling methods are reduced, resulting in more dependable and precise estimations.

- Generalizability

Probability sampling enables the researcher to generalize study findings to the entire population from which they were derived. The results produced through probability sampling methods are more likely to be applicable to the larger population, laying the foundation for making broad predictions or recommendations.

- Minimization of Selection Bias

By ensuring that each member of the population has an equal chance of being selected in the sample, probability sampling lowers the possibility of selection bias. This reduces the impact of systematic errors that may occur in non-probability sampling methods, where data may be skewed toward a specific demographic due to inadequate representation of each segment of the population.

What is non-probability sampling?

Non-probability sampling methods involve selecting individuals based on non-random criteria, often relying on the researcher’s judgment or predefined criteria. While it is easier and more economical, it tends to introduce sampling bias, resulting in weaker inferences compared to probability sampling techniques in research.

Types of Non-probability Sampling

Non-probability sampling methods are further classified as convenience sampling, consecutive sampling, quota sampling, purposive or judgmental sampling, and snowball sampling. Let’s explore these types of sampling methods in detail.

- Convenience sampling: In convenience sampling, individuals are recruited directly from the population based on the accessibility and proximity to the researcher. It is a simple, inexpensive, and practical method of sample selection, yet convenience sampling suffers from both sampling and selection bias due to a lack of appropriate population representation.

For example, imagine you’re a researcher investigating smartphone usage patterns in your city. The most convenient way to select participants is by approaching people in a shopping mall on a weekday afternoon. However, this convenience sampling method may not be an accurate representation of the city’s overall smartphone usage patterns as the sample is limited to individuals present at the mall during weekdays, excluding those who visit on other days or never visit the mall.

- Consecutive sampling: Participants in consecutive sampling (or sequential sampling) are chosen based on their availability and desire to participate in the study as they become available. This strategy entails sequentially recruiting individuals who fulfill the researcher’s requirements.

For example, In researching the prevalence of stroke in a hospital, instead of randomly selecting patients from the entire population, the researcher can opt to include all eligible patients admitted over three months. Participants are then consecutively recruited upon admission during that timeframe, forming the study sample.

- Quota sampling: The selection of individuals in quota sampling is based on non-random selection criteria in which only participants with certain traits or proportions that are representative of the population are included. Quota sampling involves setting predetermined quotas for specific subgroups based on key demographics or other relevant characteristics. This sampling method employs dividing the population into mutually exclusive subgroups and then selecting sample units until the set quota is reached.

For example, In a survey on a college campus to assess student interest in a new policy, the researcher should establish quotas aligned with the distribution of student majors, ensuring representation from various academic disciplines. If the campus has 20% biology majors, 30% engineering majors, 20% business majors, and 30% liberal arts majors, participants should be recruited to mirror these proportions.

- Purposive or judgmental sampling: In purposive sampling, the researcher leverages expertise to select a sample relevant to the study’s specific questions. This sampling method is commonly applied in qualitative research, mainly when aiming to understand a particular phenomenon, and is suitable for smaller population sizes.

For example, imagine a researcher who wants to study public policy issues for a focus group. The researcher might purposely select participants with expertise in economics, law, and public administration to take advantage of their knowledge and ensure a depth of understanding.

- Snowball sampling: This sampling method is used when accessing the population is challenging. It involves collecting the sample through a chain-referral process, where each recruited candidate aids in finding others. These candidates share common traits, representing the targeted population. This method is often used in qualitative research, particularly when studying phenomena related to stigmatized or hidden populations.

For example, In a study focusing on understanding the experiences and challenges of individuals in hidden or stigmatized communities (e.g., LGBTQ+ individuals in specific cultural contexts), the snowball sampling technique can be employed. The researcher initiates contact with one community member, who then assists in identifying additional candidates until the desired sample size is achieved.

Uses of non-probability sampling

Non-probability sampling approaches are employed in qualitative or exploratory research where the goal is to investigate underlying population traits rather than generalizability. Non-probability sampling methods are also helpful for the following purposes:

- Generating a hypothesis

In the initial stages of exploratory research, non-probability methods such as purposive or convenience allow researchers to quickly gather information and generate hypothesis that helps build a future research plan.

- Qualitative research

Qualitative research is usually focused on understanding the depth and complexity of human experiences, behaviors, and perspectives. Non-probability methods like purposive or snowball sampling are commonly used to select participants with specific traits that are relevant to the research question.

- Convenience and pragmatism

Non-probability sampling methods are valuable when resource and time are limited or when preliminary data is required to test the pilot study. For example, conducting a survey at a local shopping mall to gather opinions on a consumer product due to the ease of access to potential participants.

Probability vs Non-probability Sampling Methods

Frequently asked questions .

- What is multistage sampling ? Multistage sampling is a form of probability sampling approach that involves the progressive selection of samples in stages, going from larger clusters to a small number of participants, making it suited for large-scale research with enormous population lists.

- What are the methods of probability sampling? Probability sampling methods are simple random sampling, stratified random sampling, systematic sampling, cluster sampling, and multistage sampling.

- How to decide which type of sampling method to use? Choose a sampling method based on the goals, population, and resources. Probability for statistics and non-probability for efficiency or qualitative insights can be considered . Also, consider the population characteristics, size, and alignment with study objectives.

- What are the methods of non-probability sampling? Non-probability sampling methods are convenience sampling, consecutive sampling, purposive sampling, snowball sampling, and quota sampling.

- Why are sampling methods used in research? Sampling methods in research are employed to efficiently gather representative data from a subset of a larger population, enabling valid conclusions and generalizations while minimizing costs and time.

R Discovery is a literature search and research reading platform that accelerates your research discovery journey by keeping you updated on the latest, most relevant scholarly content. With 250M+ research articles sourced from trusted aggregators like CrossRef, Unpaywall, PubMed, PubMed Central, Open Alex and top publishing houses like Springer Nature, JAMA, IOP, Taylor & Francis, NEJM, BMJ, Karger, SAGE, Emerald Publishing and more, R Discovery puts a world of research at your fingertips.

Try R Discovery Prime FREE for 1 week or upgrade at just US$72 a year to access premium features that let you listen to research on the go, read in your language, collaborate with peers, auto sync with reference managers, and much more. Choose a simpler, smarter way to find and read research – Download the app and start your free 7-day trial today !

Related Posts

What is Confidence Interval and How to Calculate it (with Examples)

What is Stratified Sampling? Definition, Types, and Examples

An overview of sampling methods

Last updated

27 February 2023

Reviewed by

Cathy Heath

When researching perceptions or attributes of a product, service, or people, you have two options:

Survey every person in your chosen group (the target market, or population), collate your responses, and reach your conclusions.

Select a smaller group from within your target market and use their answers to represent everyone. This option is sampling .

Sampling saves you time and money. When you use the sampling method, the whole population being studied is called the sampling frame .

The sample you choose should represent your target market, or the sampling frame, well enough to do one of the following: