- Toll Free 1800 309 8859 / +91 80 25638240

Home Accounting What is Profitability Analysis? Definition and Importance

What is Profitability Analysis? Definition and Importance

Tally Solutions | Updated on: December 13, 2021

--> published date: | updated on: --> <--, what is profitability analysis, importance of profitability analysis, profitability ratio analysis, how tallyprime helps in simplified analysis of profit ratios.

When a company is incepted, one of the sole purposes of it is to make profits. Basically, to earn more than you spend is what every business owner wants for his company. Thus, to assess the growth of your business, careful study on profit is important, and that is pretty obvious. However, the nuances that secretly lie under various financial statements, will give you the real picture of your company’s profits.

Analysing of the profits which is basically the money remaining from the capital after subtracting all the overhead costs, will help you keep a track of your business’ performance. Profitability analysis allows companies to maximise their profit. Thus, resulting in maximising the opportunities that business can take advantage of, in order to continue growing in an extremely dynamic, competitive, and vibrant market. Profitability analysis helps businesses identify growth opportunities, fast/slow-moving stock items, market trends, etc, ultimately helping decision-makers see a more concrete picture of the company as a whole.

While profitability analysis gives business owners a 360° view of your company’s profits, different ratios that derive profitability ratios have different roles to play. Let’s take a look at the importance of these ratios:

Gross profit margin

It is a measure of the profit earned on sales which denotes the profit part of the total revenue earned, after deducting the costs of goods sold (COGS) . This report is extremely important as it covers the admin and office costs and also includes the dividends which are to be distributed to respective shareholders of the company. Higher the gross profit, the company will be more profitable. Gross profit margin is also used to assess the efficiency of cost management. So, if the ratio is low, the business owner can then identify these pain points and improve purchasing and production in terms of economy and effectiveness.

Net profit margin

It is the final ratio that validates the overall performance of a company. Any disturbances in other ratios will impact the net profit margin ultimately, thus this report is considered as one of the most important ratios. A low quick ratio would mean that sales have been low in a particular period, eventually impacting the net profit margin. This analysis will help investors to identify the cracks in the way they operate and take timely decisions to improve the company’s performance.

Returns on equity

Returns on equity is the percentage of the earnings, which shareholders get in return for the investments made towards the company. Higher the ROE, higher will be the dividends shareholders will receive. This triggers more investors for your company ultimately aiding in keeping your company afloat in the market.

Returns on capital employed (ROCE) and Return on assets (ROA)

These returns measure the efficiency of a company in utilising of its assets. By evaluating ROCE, the management can take decisions that’ll help them minimise the inefficiencies. Higher the ROCE, higher will be the efficiency in the production process of the company.

ROA is a measure of every penny of income earned on every penny of the asset owned by the company. Similar to ROCE, ROA also helps the management manage the utilisation of assets, diligently.

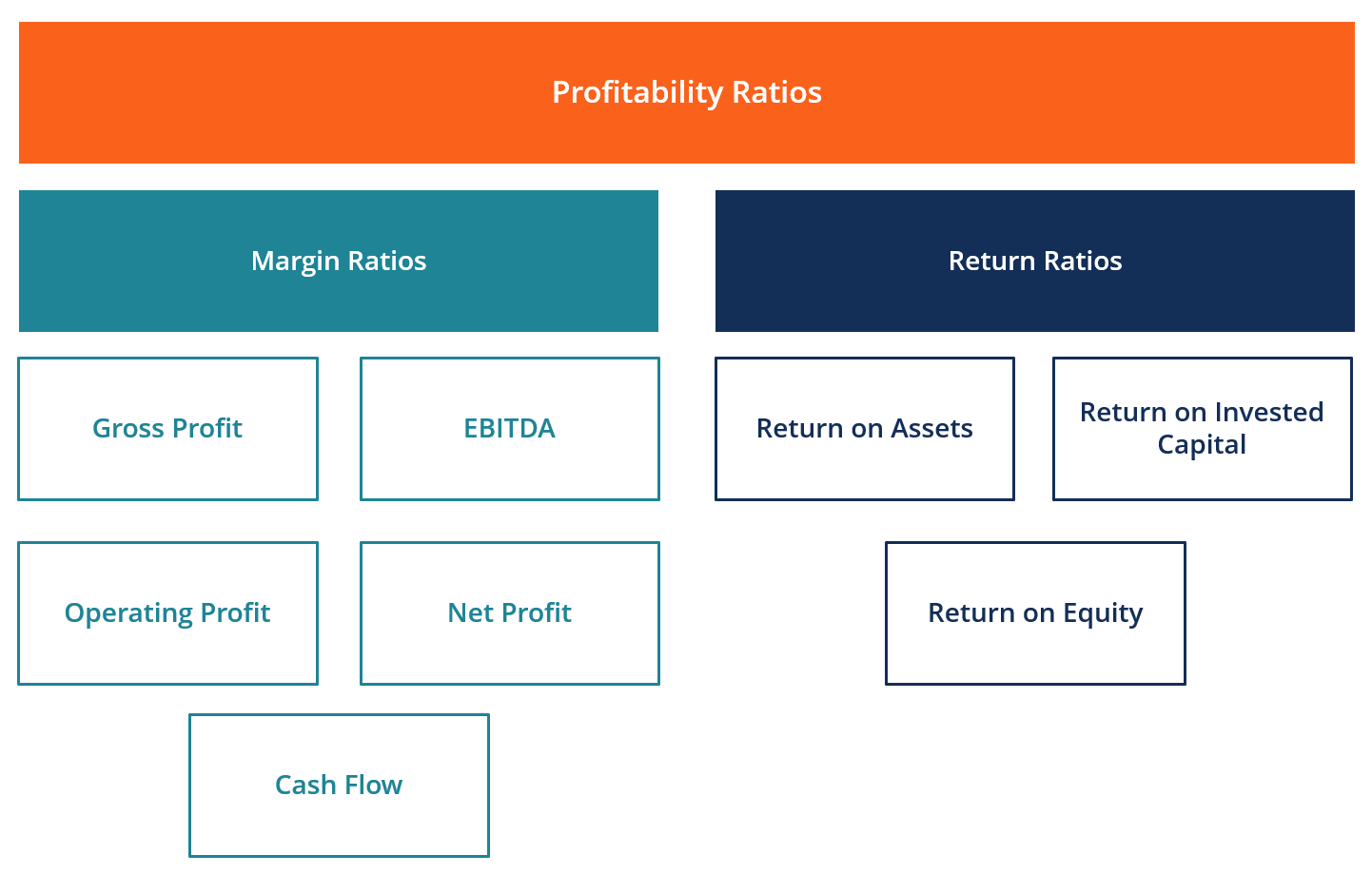

Analysts and investors use profitability ratios to measure and evaluate a company’s ability to generate income (profit) relative to revenue, balance sheet assets , operating costs, and shareholders’ equity during a specific period of time. They show how well a company utilises its assets to produce profit and value to shareholders.

A higher ratio establishes that the company is on the profitable side and is generating enough revenue, profit and cash flow . This ratio analysis comes in handy while doing a comparative analysis with your competitors in the market or even with previous periods, to understand the current financial position of your firm.

Let’s dive deeper into understanding what these categorisations mean:

Margin Ratios

To understand your company’s financial status during a specific period, it is imperative to understand your company’s ability to convert sales into profits. That is what margin ratio represents at various degrees of measurement. Some of the examples are gross profit margin, operating profit margin, net profit margin, cash flow margin, EBIT, EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization), NOPAT (Net Operating Profit After Tax), operating expense ratio, and overhead ratio.

Return Ratios

As the name suggests, return ratio us nothing but the company’s ability to generate returns to its shareholders. Examples include return on assets, return on equity, cash return on assets, return on debt, return on retained earnings, return on revenue, risk-adjusted return, return on invested capital, and return on capital employed.

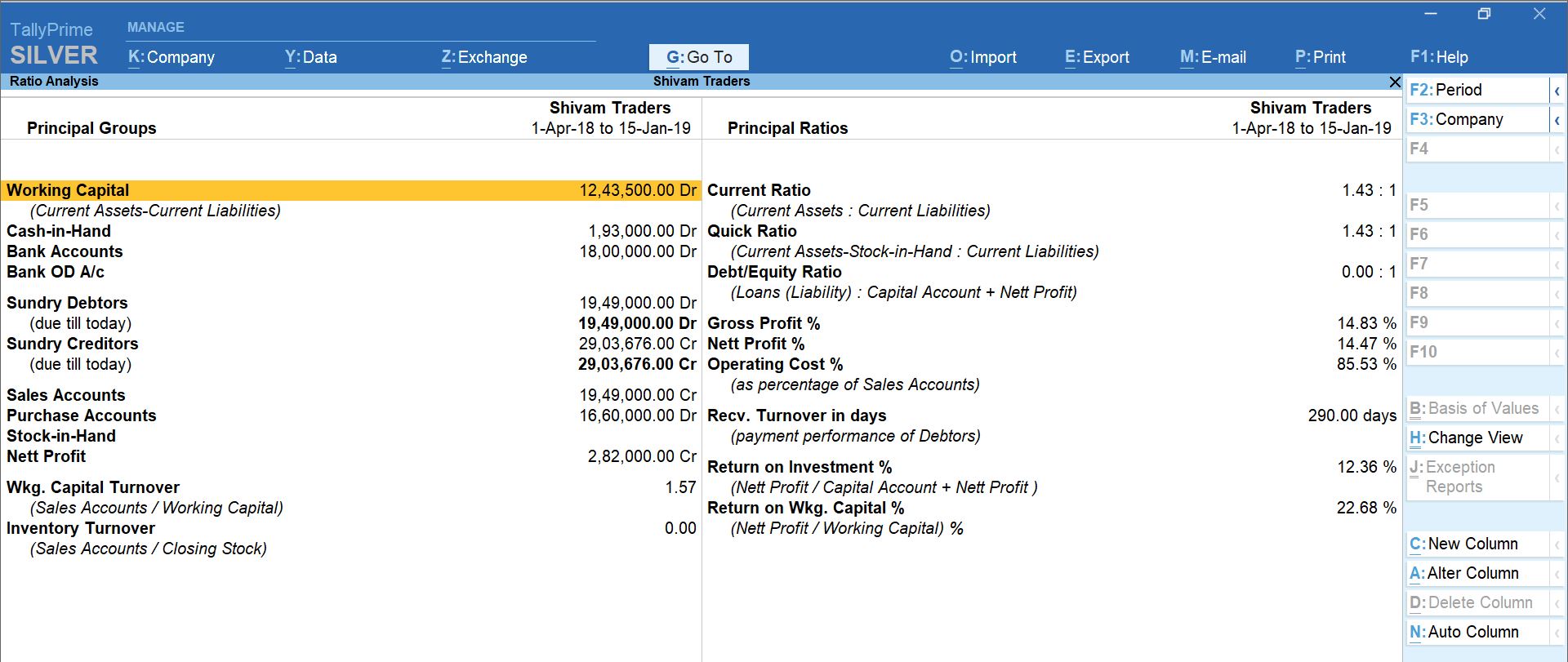

With easy navigation of reports in TallyPrime, you can get a holistic view as well as you can dive deeper to find out the minutest details of the profits earned. The ratio analysis report is primarily divided into two parts, principal groups and principal ratios. The principal groups are the key figures that give perspective to the ratios. Principal ratios relate two pieces of financial data to obtain a comparison that is meaningful. You can simply select 'Ratio Analysis' on Gateway of Tally and you can see your financial statements at a single shot for the selected period. From gross profit percentage to knowing your returns on investments, every single detail is easily accessible with the ratio analysis report.

You can even drill down to each of the ratios to understand their derivations and take decisions that will help improve your business efficiency.

Tally Solutions | Nov-13-2020

- Business Guides

- ERP Software

Latest Blogs

How to Easily Shift/Migrate Your Data to TallyPrime

Nuts & Bolts of Tally Filesystem: RangeTree

A Comprehensive Guide to UDYAM Payment Rules

UDYAM MSME Registration: Financial Boon for Small Businesses

Understanding UDYAM Registration: A Comprehensive Guide

MSME Payment Rule Changes from 1st April 2024: A Quick Guide

Accelerate your profitability & business growth with TallyPrime!

Thanks for Applying

We will be in touch with you shortly.

Profitability Analysis

- First Online: 05 August 2023

Cite this chapter

- Benedicto Kulwizira Lukanima 2

Part of the book series: Classroom Companion: Business ((CCB))

506 Accesses

Profitability is the most important performance measure used in business operations. Although it does not imply value, profit maximization signifies investment returns (interest and dividends paid to debtholders and shareholders) and growth potential (retained earnings). Therefore, investors and other users of financial statements tend to be more attentive to news about profitability than other financial metrics, thus making it the most important ratio in financial analysis. This chapter, therefore, takes a special interest and focuses on the key profitability ratios, aiming to demonstrate their implications in corporate valuation.

This is a preview of subscription content, log in via an institution to check access.

Access this chapter

- Available as PDF

- Read on any device

- Instant download

- Own it forever

- Available as EPUB and PDF

- Durable hardcover edition

- Dispatched in 3 to 5 business days

- Free shipping worldwide - see info

Tax calculation will be finalised at checkout

Purchases are for personal use only

Institutional subscriptions

Bibliography

Buffet, W. (1993). To the Shareholders of Berkshire Hathaway Inc., https://www.berkshirehathaway.com/letters/1992.html Accessed March 03, 2021.

Jiang, B. & Koller, T. (2006), A long-term look at ROIC , Available at McKinsey https://www.mckinsey.com.br/business-functions/strategy-and-corporate-finance/our-insights/a-long-term-look-at-roic Accessed February 01, 2006.

Kovar, J.F. (2020). M&A Adviser To Solution Providers: To Boost Valuation, Get To 50 Percent Recurring Revenue, Available at CRN https://www.crn.com/m-a-adviser-to-solution-providers-to-boost-valuation-get-to-50-percent-recurring-revenue Accessed March 03, 2020.

Scuttlebutt Investor (2016). A good metric is hard to find—return on capital, http://www.scuttlebuttinvestor.com/blog/2016/12/10/return-on-capital-and-other-diversions Accessed December 17, 2016.

Stern J. M, Stewart, B.G, Chew, D. H (1995), The EVA Financial Management System, Journal of Applied Corporate Finance , 8(2), 32.46. https://doi.org/10.1111/j.1745-6622.1995.tb00285.x

Trainer, D. (2019), Long-Term Trends Revealed by Analyzing ROIC By Sector, Available at Forbes, https://www.forbes.com/sites/greatspeculations/2019/06/19/long-term-trends-revealed-by-analyzing-roic-by-sector/?sh=7bfbe4b92e87 Accessed June 19, 2019.

Download references

Author information

Authors and affiliations.

Department of Finance and Accounting, Universidad del Norte, Barranquilla, Colombia

Benedicto Kulwizira Lukanima

You can also search for this author in PubMed Google Scholar

Corresponding author

Correspondence to Benedicto Kulwizira Lukanima .

1 Electronic Supplementary Material

Chapter slides—refer to the PowerPoint files for ► Chap. 7 (PPTX 1274 kb)

Excel workings and data—refer to the Excel sheets for ► Chap. 7 (XLSX 185 kb)

Rights and permissions

Reprints and permissions

Copyright information

© 2023 The Author(s), under exclusive license to Springer Nature Switzerland AG

About this chapter

Kulwizira Lukanima, B. (2023). Profitability Analysis. In: Corporate Valuation. Classroom Companion: Business. Springer, Cham. https://doi.org/10.1007/978-3-031-28267-6_7

Download citation

DOI : https://doi.org/10.1007/978-3-031-28267-6_7

Published : 05 August 2023

Publisher Name : Springer, Cham

Print ISBN : 978-3-031-28266-9

Online ISBN : 978-3-031-28267-6

eBook Packages : Economics and Finance Economics and Finance (R0)

Share this chapter

Anyone you share the following link with will be able to read this content:

Sorry, a shareable link is not currently available for this article.

Provided by the Springer Nature SharedIt content-sharing initiative

- Publish with us

Policies and ethics

- Find a journal

- Track your research

Profitability Analysis Essays

Case study: marriot inns ltd, popular essay topics.

- American Dream

- Artificial Intelligence

- Black Lives Matter

- Bullying Essay

- Career Goals Essay

- Causes of the Civil War

- Child Abusing

- Civil Rights Movement

- Community Service

- Cultural Identity

- Cyber Bullying

- Death Penalty

- Depression Essay

- Domestic Violence

- Freedom of Speech

- Global Warming

- Gun Control

- Human Trafficking

- I Believe Essay

- Immigration

- Importance of Education

- Israel and Palestine Conflict

- Leadership Essay

- Legalizing Marijuanas

- Mental Health

- National Honor Society

- Police Brutality

- Pollution Essay

- Racism Essay

- Romeo and Juliet

- Same Sex Marriages

- Social Media

- The Great Gatsby

- The Yellow Wallpaper

- Time Management

- To Kill a Mockingbird

- Violent Video Games

- What Makes You Unique

- Why I Want to Be a Nurse

- Send us an e-mail

- Search Search Please fill out this field.

What Is Financial Analysis?

Understanding financial analysis, corporate financial analysis, investment financial analysis, types of financial analysis, horizontal vs. vertical analysis.

- Example of Financial Analysis

- Financial Analysis FAQs

The Bottom Line

- Corporate Finance

- Financial statements: Balance, income, cash flow, and equity

Financial Analysis: Definition, Importance, Types, and Examples

:max_bytes(150000):strip_icc():format(webp)/david-kindness-cpa-headshot1-beab5f883dec4a11af658fd86cb9009c.jpg)

Financial analysis is the process of evaluating businesses, projects, budgets, and other finance-related transactions to determine their performance and suitability. Typically, financial analysis is used to analyze whether an entity is stable, solvent , liquid , or profitable enough to warrant a monetary investment.

Key Takeaways

- If conducted internally, financial analysis can help fund managers make future business decisions or review historical trends for past successes.

- If conducted externally, financial analysis can help investors choose the best possible investment opportunities.

- Fundamental analysis and technical analysis are the two main types of financial analysis.

- Fundamental analysis uses ratios and financial statement data to determine the intrinsic value of a security.

- Technical analysis assumes a security's value is already determined by its price, and it focuses instead on trends in value over time.

Investopedia / Nez Riaz

Financial analysis is used to evaluate economic trends, set financial policy, build long-term plans for business activity, and identify projects or companies for investment. This is done through the synthesis of financial numbers and data. A financial analyst will thoroughly examine a company's financial statements —the income statement , balance sheet , and cash flow statement . Financial analysis can be conducted in both corporate finance and investment finance settings.

One of the most common ways to analyze financial data is to calculate ratios from the data in the financial statements to compare against those of other companies or against the company's own historical performance.

For example, return on assets (ROA) is a common ratio used to determine how efficient a company is at using its assets and as a measure of profitability. This ratio could be calculated for several companies in the same industry and compared to one another as part of a larger analysis.

There is no single best financial analytic ratio or calculation. Most often, analysts use a combination of data to arrive at their conclusion.

In corporate finance, the analysis is conducted internally by the accounting department and shared with management in order to improve business decision making. This type of internal analysis may include ratios such as net present value (NPV) and internal rate of return (IRR) to find projects worth executing.

Many companies extend credit to their customers. As a result, the cash receipt from sales may be delayed for a period of time. For companies with large receivable balances, it is useful to track days sales outstanding (DSO), which helps the company identify the length of time it takes to turn a credit sale into cash. The average collection period is an important aspect of a company's overall cash conversion cycle .

A key area of corporate financial analysis involves extrapolating a company's past performance, such as net earnings or profit margin , into an estimate of the company's future performance. This type of historical trend analysis is beneficial to identify seasonal trends.

For example, retailers may see a drastic upswing in sales in the few months leading up to Christmas. This allows the business to forecast budgets and make decisions, such as necessary minimum inventory levels, based on past trends.

In investment finance, an analyst external to the company conducts an analysis for investment purposes. Analysts can either conduct a top-down or bottom-up investment approach. A top-down approach first looks for macroeconomic opportunities, such as high-performing sectors, and then drills down to find the best companies within that sector. From this point, they further analyze the stocks of specific companies to choose potentially successful ones as investments by looking last at a particular company's fundamentals .

A bottom-up approach, on the other hand, looks at a specific company and conducts a similar ratio analysis to the ones used in corporate financial analysis, looking at past performance and expected future performance as investment indicators. Bottom-up investing forces investors to consider microeconomic factors first and foremost. These factors include a company's overall financial health, analysis of financial statements, the products and services offered, supply and demand, and other individual indicators of corporate performance over time.

Financial analysis is only useful as a comparative tool. Calculating a single instance of data is usually worthless; comparing that data against prior periods, other general ledger accounts, or competitor financial information yields useful information.

There are two types of financial analysis: fundamental analysis and technical analysis .

Fundamental Analysis

Fundamental analysis uses ratios gathered from data within the financial statements, such as a company's earnings per share (EPS), in order to determine the business's value. Using ratio analysis in addition to a thorough review of economic and financial situations surrounding the company, the analyst is able to arrive at an intrinsic value for the security. The end goal is to arrive at a number that an investor can compare with a security's current price in order to see whether the security is undervalued or overvalued.

Technical Analysis

Technical analysis uses statistical trends gathered from trading activity, such as moving averages (MA). Essentially, technical analysis assumes that a security’s price already reflects all publicly available information and instead focuses on the statistical analysis of price movements . Technical analysis attempts to understand the market sentiment behind price trends by looking for patterns and trends rather than analyzing a security’s fundamental attributes.

When reviewing a company's financial statements, two common types of financial analysis are horizontal analysis and vertical analysis . Both use the same set of data, though each analytical approach is different.

Horizontal analysis entails selecting several years of comparable financial data. One year is selected as the baseline, often the oldest. Then, each account for each subsequent year is compared to this baseline, creating a percentage that easily identifies which accounts are growing (hopefully revenue) and which accounts are shrinking (hopefully expenses).

Vertical analysis entails choosing a specific line item benchmark, then seeing how every other component on a financial statement compares to that benchmark. Most often, net sales is used as the benchmark. A company would then compare cost of goods sold, gross profit, operating profit, or net income as a percentage to this benchmark. Companies can then track how the percent changes over time.

Examples of Financial Analysis

In the nine-month period ending Sept. 30, 2022, Amazon.com reported a net loss of $3 billion. This was a substantial decline from one year ago where the company reported net income of over $19 billion.

Financial analysis shows some interesting facets of the company's earnings per share (shown above. On one hand, the company's EPS through the first three quarters was -$0.29; compared to the prior year, Amazon earned $1.88 per share. This dramatic difference was not present looking only at the third quarter of 2022 compared to 2021. Though EPS did decline from one year to the next, the company's EPS for each third quarter was comparable ($0.31 per share vs. $0.28 per share).

Analysts can also use the information above to perform corporate financial analysis. For example, consider Amazon's operating profit margins below.

- 2022: $9,511 / $364,779 = 2.6%

- 2021: $21,419 / $332,410 = 6.4%

From Q3 2021 to Q3 2022, the company experienced a decline in operating margin, allowing for financial analysis to reveal that the company simply earns less operating income for every dollar of sales.

Why Is Financial Analysis Useful?

The financial analysis aims to analyze whether an entity is stable , liquid, solvent, or profitable enough to warrant a monetary investment. It is used to evaluate economic trends, set financial policies, build long-term plans for business activity, and identify projects or companies for investment.

How Is Financial Analysis Done?

Financial analysis can be conducted in both corporate finance and investment finance settings. A financial analyst will thoroughly examine a company's financial statements—the income statement, balance sheet, and cash flow statement.

One of the most common ways to analyze financial data is to calculate ratios from the data in the financial statements to compare against those of other companies or against the company's own historical performance. A key area of corporate financial analysis involves extrapolating a company's past performance, such as net earnings or profit margin, into an estimate of the company's future performance.

What Techniques Are Used in Conducting Financial Analysis?

Analysts can use vertical analysis to compare each component of a financial statement as a percentage of a baseline (such as each component as a percentage of total sales). Alternatively, analysts can perform horizontal analysis by comparing one baseline year's financial results to other years.

Many financial analysis techniques involve analyzing growth rates including regression analysis, year-over-year growth, top-down analysis such as market share percentage, or bottom-up analysis such as revenue driver analysis .

Last, financial analysis often entails the use of financial metrics and ratios. These techniques include quotients relating to the liquidity, solvency, profitability, or efficiency (turnover of resources) of a company.

What Is Fundamental Analysis?

Fundamental analysis uses ratios gathered from data within the financial statements, such as a company's earnings per share (EPS), in order to determine the business's value. Using ratio analysis in addition to a thorough review of economic and financial situations surrounding the company, the analyst is able to arrive at an intrinsic value for the security. The end goal is to arrive at a number that an investor can compare with a security's current price in order to see whether the security is undervalued or overvalued.

What Is Technical Analysis?

Technical analysis uses statistical trends gathered from market activity, such as moving averages (MA). Essentially, technical analysis assumes that a security’s price already reflects all publicly available information and instead focuses on the statistical analysis of price movements. Technical analysis attempts to understand the market sentiment behind price trends by looking for patterns and trends rather than analyzing a security’s fundamental attributes.

Financial analysis is a cornerstone of making smarter, more strategic decisions based on the underlying financial data of a company. Whether corporate, investment, or technical analysis, analysts use data to explore trends, understand growth, seek areas of risk, and support decision-making. Financial analysis may include investigating financial statement changes, calculating financial ratios, or exploring operating variances.

Amazon. " Amazon.com Announces Third Quarter Results ."

:max_bytes(150000):strip_icc():format(webp)/investing20-5bfc2b8f46e0fb00517be081.jpg)

- Terms of Service

- Editorial Policy

- Privacy Policy

- Your Privacy Choices

- Free Samples

- Premium Essays

- Editing Services Editing Proofreading Rewriting

- Extra Tools Essay Topic Generator Thesis Generator Citation Generator GPA Calculator Study Guides Donate Paper

- Essay Writing Help

- About Us About Us Testimonials FAQ

- Studentshare

- Profitability of a Company Analysis

Profitability of a Company Analysis - Essay Example

- Subject: Business

- Type: Essay

- Level: Undergraduate

- Pages: 2 (500 words)

- Downloads: 2

- Author: newtonrenner

Extract of sample "Profitability of a Company Analysis"

These factors also help the company to gain a competitive advantage in the market and to maintain its goodwill and credibility in the market.

It is the form of the corporate strategy adopted by the company to increase the profitability and market share of the firm by increasing its sales volume by expanding and diversifying its products and services as well as by opening new gates of profitability in new markets. It can occur at any level in a firm either at the single unit level in a business or a corporate level. At the business unit level, the firm would expand its operations into the new market by creating a new segment in the specific industry that the firm was already in. However, at the business level, the diversification of the firm includes the investing strategy. In this strategy, 3M would analyze the market situation to make sure either to invest in any promising business or to penetrate the market by creating a new segment for the expansion of the business and to gain a competitive edge over the other companies within the same industry.

As we know that vertical integration is the process of merging two businesses that involve different stages of production (Harrigan). If 3M would adopt this strategy of vertical integration with the other business excelling at different production levels; would enhance 3M’s capability and performance. As well as, it would help the company to control its costs, units of production, quality of the products, and delivery structure.

Strategic Alliance is the kind of approach used by organizations to form a corporate relationship between them. In this kind of relationship, a firm develops a strategic alliance with another firm to meet shared goals, needs, and objectives. Companies can strategically alliance with other companies for anything from benefiting with resources such as products to using the distribution channels, expertise, knowledge, machinery, and many more. Forming a strategic alliance with the other companies in the market would benefit 3M and its partner firms in fulfilling the goals, benefiting each other as well as it would help the companies to become more attractive to competition by the other firms.

In M&A strategy, the firms grow or expand in the same sector by acquiring or merging with the other firm to acquire, divide or merge with one or different operations within the firm. This strategy would benefit 3M to either merge or acquire with the other firm doing the same business in the industry. It would help the company to grow, expand its business processes or units, and to benefit from the knowledge, expertise, or production of the other company.

Divestment is the reverse of the investment. It is the corporate strategy in which the company fulfills its financial or social objectives or needs. Divestment would benefit 3M if the company wants to overcome its financial losses by divesting its particular subsidiary to remain focused on the core business of the firm.

Adopting all of the above discussed or any one of the strategies would help the company to grow its operations in the market. This would help the company to overcome its losses, and its weak areas and to remain ideally competitive in the market.

- Cited: 0 times

- Copy Citation Citation is copied Copy Citation Citation is copied Copy Citation Citation is copied

CHECK THESE SAMPLES OF Profitability of a Company Analysis

Profitability ratio analysis, customer relationship management: brand loyalty, ford motor company: a decade-long trend toward diminished profitability, profitability at hardhat limited: the relationships between revenues, profitability and liquidity analysis, profitability analysis j sainsbury plc, profitability ratios in financial ratio analysis, profitability ratios - ascential company.

- TERMS & CONDITIONS

- PRIVACY POLICY

- COOKIES POLICY

We use cookies to enhance our website for you. Proceed if you agree to this policy or learn more about it.

- Essay Database >

- Essay Examples >

- Essays Topics >

- Essay on Business

Profitability Analysis: Microsoft Inc Vs Apple Inc Essay Example

Type of paper: Essay

Topic: Business , Finance , Investment , Internet , Company , Wealth , Steve Jobs , Commerce

Words: 1000

Published: 03/30/2020

ORDER PAPER LIKE THIS

Profitability Analysis: Microsoft Inc

i) Profit Margins: Referring to the profit margin ratios of the company, we can infer that the fiscal year of 2013 was favorable for Apple Inc with 5.05% increase in profit margins of the company in comparison with the previous year of 2012. The company has improved its net profit margins after its fall in 2012. The improvement in the profit trend of the company seems sustainable as the increase in profit margins of the company was attributable to fall in operating expenses of the company. Although during 2013, the proportion of cost of revenue to the sales was increased from 24% to 26%, but Microsoft Inc was successful in reducing the proportion of operating expenses to sales from 46.70% to 40%. Furthermore, increased proportion of operating income from 30% to 34%, improved the bottom line profits of the company. By the end of the fiscal year of 2013, Microsoft Inc had recorded a 29% increase in its profit margins. ii) Return on Assets: Just as the profit margins, the company was successfully able to improve its Return on Asset Multiple. During the year, the ROA multiple of the company has improved by 1.35% after suffering significant decrease during 2012. Increase in ROA multiple of the company was attributed to increase in net profit margins of the company and increase in total assets figures. As already discussed in the previous section, the profit margins of the company increased by 28%, with 17.5% increase in total assets figures, it was able to increase its ROA multiple in a sustainable manner. iii) Return on Equity: After significant fall in 2012, the ROE multiple of the company, during 2013, has improved marginally from 25.58% to 27.69%. Although, the equity investors of the company might be relieved with this outcome but they would be still expecting a higher ROE. The increase in ROE multiple was achieved with 28% growth in the net income of the company and 19% increase in shareholder equity value i.e, net 9% growth to increase ROE.

Conclusion:

The analysis of profitability ratios of Microsoft Inc indicates that the financial position of the company has improved from its poor performance during 2011-2012. The Net profit margins, ROA and ROE multiple of the company has increased in a sustained manner primarily with growth in net income of the company. However, the investors of the company shall be expecting ROE levels of 2011.

Du-Pont Decomposition:

ROE: Net Profit Margin*Asset Turnover* Equity Multiplier ROE: (Net Profit/Sales)*(Sales/Assets)*(Assets/Shareholder Equity) Net Profit Margin: 0.28 Asset Turnover: 77849/142431*100= 0.5465 Equity Multiplier: 142431/78944*100= 1.8 Thus, as per Du-Pont Decomposition, ROE= .28*.5465*1.8= 27.54% So, our analysis indicates that major contributor to increased ROE multiple is equity multiplier while net margins have a very small portion in ROE of the company. This means that the things can get more risky in Microsoft Inc as the company seems to be over-leveraged now.

Profitability Analysis: Apple Inc

i) Net Profit Margin: Referring to the above analysis for Apple Inc, the company has reduced profit margins during 2013. During the year, the net margin of the company was recorded to be 21.67% which was 5% less than the previous year. Although the profit margins of the company improved during 2012, but with high cost of sales and decreased non-operating income of the company, the profit margins declined during 2013. While the proportion of cost of sales to revenue of the company increased from 56% to 62%, the share of non-operating income decreased from 36% to 29%. Thus, although the company was successfully able to maintain the proportion of operating expenses at 9%, but the above discussed factors forced the decline in net profit margins of the company. ii) Return on Assets: Just as the profit margins, the ROA multiple of the company has also declined during 2013 from 23.70% to 17.89%. The decline in ROA multiple of the company was attributed to increase in total assets by 17.56% which was further supported by decline in net margins and resulted in low ROA multiple.iii) Return on Equity (ROE): Investors of Apple Inc will not be satisfied with financial results of 2013 as the ROE of the company has decreased significantly during 2013 from 35.30% to 29.98%. Just as previously discussed profitability ratios, even ROE of the company was affected with declined net profit margin. Hence, 5% decline in profit margins and 4.5% increase in shareholder equity, together contributed in declining ROE of the company.

Our above analysis indicates that 2013 was not a good financial year for Apple Inc. All of its profitability ratios were in declining trend because of decreased net profit margins. As a result, both ROA and ROE multiple experienced decreasing trend indicating inefficiency of Apple Inc’s management to generate margins from the funds invested in the assets and for the investors of the company. ii) Du-Pont Analysis:

ROE: Net Profit Margin*Asset Turnover* Equity Multiplier

ROE: (Net Profit/Sales)*(Sales/Assets)*(Assets/Shareholder Equity) Net Profit Margin= 21.67% Asset Turnover= 170910/83451= 2.04 Equity Multiplier= 83451/123549= 0.67 So, ROE= .2167*2.04*.67= 29.61% Above Du-Pont analysis indicates that although the profitability margins of the company were on declining trend during 2013 but the ROE multiple of the company is sustainable with high net margins and high asset turnover contributing to the major portion to the ROE multiple.

Cite this page

Share with friends using:

Removal Request

Finished papers: 685

This paper is created by writer with

ID 272076317

If you want your paper to be:

Well-researched, fact-checked, and accurate

Original, fresh, based on current data

Eloquently written and immaculately formatted

275 words = 1 page double-spaced

Get your papers done by pros!

Other Pages

Fashion argumentative essays, personal statement on narrative a brief essay about my desire and motivation to become a physician assistant, personality essay example, free case study on revenue recognition, example of essay on minorities, term paper on operating system forensic tools, meridian plaza fire creative writing examples, research paper on the 2006 nobel prize laureate edmund phelps, creating a culture of evidence based practice research paper sample, health literacy essay, example of critical thinking on problem how companies can systematically create innovations that customers don, critique of an article critical thinking sample, essay on the actors and institutions involved, creative writing on history of gender inequality in the world, earliest art essay examples, marketing plan report, example of minimum wage versus living wage essay, example of global economy course work, exemplar essay on obscenity the limit to freedom of speech to write after, entrepreneurship paper essay examples, perfect model essay on current applications of expert systems, respiratory acidosis essay template for faster writing, anthropogenic and climate impact on the florida keys research papers example, economy and tourism an analysis term paper to use for practical writing help, marketing and the health care system research paper template for faster writing, free the role of the prophet in eastern and western religions essay top quality sample to follow, animal and society essay template for faster writing, nursing science essays examples, a three generation genogram essay examples, inspiring essay about goals of the advertisement, good what are the harmful effects of landfill to the environment essay example, two speeches comparison a top quality essay for your inspiration, free essay about own perspective, the japanese american internment as presented in american pastime exemplar essay to follow, meagher essays, peckham essays, luddism essays, avoider essays, phylo essays, schul essays, taejon essays, maggio essays, ofallon essays.

Password recovery email has been sent to [email protected]

Use your new password to log in

You are not register!

By clicking Register, you agree to our Terms of Service and that you have read our Privacy Policy .

Now you can download documents directly to your device!

Check your email! An email with your password has already been sent to you! Now you can download documents directly to your device.

or Use the QR code to Save this Paper to Your Phone

The sample is NOT original!

Short on a deadline?

Don't waste time. Get help with 11% off using code - GETWOWED

No, thanks! I'm fine with missing my deadline

Getting an Overview of the Core Terms in Margin Analysis

After completing this lesson, you will be able to:

- Get an Overview of the Core Terms in Margin Analysis

Overview of the Core Terms in Margin Analysis

https://learning.sap.com/learning-journeys/outline-cost-management-and-profitability-analysis-in-sap-s-4hana/outlining-profitability-analysis_b5b7efbb-55ea-4ff5-bc70-15d39d8a14eb

Introduction to Margin Analysis

The following video provides an overview of Margin Analysis.

Master Data

Master data in margin analysis include profitability characteristics and functional areas. Functional areas break down corporate expenditure into different functions, in line with the requirements of cost of sales accounting.

These functions can include:

- Production.

- Administration.

- Sales and Distribution.

- Research and Development.

For primary postings, the functional area is derived according to fixed rules and included in the journal entries. For secondary postings, the functional area and partner functional area are derived from the sender and receiver account assignments to reflect the flow of costs from sender to receiver.

Profitability Characteristics

Profitability characteristics represent the criteria used to analyze operating results and the sales and profit plan. Multiple profitability characteristics are combined to form profitability segments. The combination of characteristic values determines the profitability segment for which the gross margin structure can be displayed. A profitability segment corresponds to a market segment.

For example, the combination of the characteristic values North (Sales region), Electronics (Product group) and Wholesale (Customer group) determine a profitability segment for which the gross margin structure can be displayed.

True vs Attributed Account Assignments

Each activity relevant to Margin Analysis in the SAP system, such as billing, creates line items. G/L line items can carry true or attributed account assignments to profitability segments.

- Goods issue item or billing document item in a sell-from-stock scenario.

- Manual FI posting to profitability segment.

- Primary Costs or Revenue.

- Secondary Costs.

- Balance Sheet Accounts with a statistical cost element assigned.

The derivation of attributed profitability segments is based on the true account assignment object of the G/L line item. This object can be of the following types:

- Cost Center.

- Sales Order.

- Production Order (only for Engineer-to-Order process.)

- Maintenance Order.

- Service Document (service order or service contract.)

After the profitability characteristics are derived, the resulting data is mapped to the G/L line item according to specific mapping rules. An attributed profitability segment is derived to fulfill the requirement of filling as many characteristics in the item as possible to enable the maximum drilldown analysis capability.

Log in to track your progress & complete quizzes

Limited Time Deal Gets You Pro at Half-Price

Get The Market's Most Powerful Trading Tools — 50% Off Pro Memorial Day Sale

Exclusive News, Scanners, and Chat Power Pro Users to Win More

The Market's Most Powerful Trading Tools — 50% OFF Limited Time

- Get Benzinga Pro

- Data & APIs

- Our Services

- News Earnings Guidance Dividends M&A Buybacks Legal Interviews Management Offerings IPOs Insider Trades Biotech/FDA Politics Government Healthcare

- Markets Pre-Market After Hours Movers ETFs Forex Cannabis Commodities Binary Options Bonds Futures CME Group Global Economics Previews Small-Cap Real Estate Cryptocurrency Penny Stocks Digital Securities Volatility

- Ratings Analyst Color Downgrades Upgrades Initiations Price Target

- Ideas Trade Ideas Covey Trade Ideas Long Ideas Short Ideas Technicals From The Press Jim Cramer Rumors Best Stocks & ETFs Best Penny Stocks Best S&P 500 ETFs Best Swing Trade Stocks Best Blue Chip Stocks Best High-Volume Penny Stocks Best Small Cap ETFs Best Stocks to Day Trade Best REITs

- Money Investing Cryptocurrency Mortgage Insurance Yield Personal Finance Forex Startup Investing Real Estate Investing Credit Cards

- Cannabis Cannabis Conference News Earnings Interviews Deals Regulations Psychedelics

Boosting Cannabis Retail Growth With Data: LeafLink And CASA Unite To Deliver Profit-Driving Analytics

Zinger key points.

- LeafLink and CASA's partnership enables data-driven decisions to enhance operational efficiency and profitability for cannabis businesses.

- Complimentary Retail Data Analysis service, usually valued up to $5,000, now offered to enhance retailer margins.

LeafLink , a leader in cannabis wholesale, announced on Thursday that it was entering into a partnership with CASA , a retail data analysis service provider, to enhance profitability for cannabis retailers using sophisticated data analytics. This partnership promises quick integration and efficient onboarding with CASA’s “white glove” data services, designed to mesh seamlessly with retailers’ existing technology stacks.

Addressing Industry Challenges

Recent findings from Whitney Economics and the National Cannabis Industry Association cited by LeafLink indicate that 37% of cannabis businesses struggle to achieve profitability. The announced partnership addresses critical gaps in merchandise planning and data analysis expertise. Additionally, it tackles the lack of technological solutions that can deliver measurable ROI, making it a timely initiative in an industry seeking operational efficiency.

Join industry leaders and pioneering experts as we delve into the future of cannabis retail analytics at the upcoming Benzinga Cannabis Capital Conference in Chicago on Oct. 8-9. Get your tickets now before prices surge by following this link .

Expertise And Customized Service

Matt Hutchinson , chief product officer at LeafLink, praised the partnership. “CASA’s impact on retailers is unmatched, driving significant profit increases within the first 30-60 days for their customers. Their expertise in data analysis and merchandise planning complements our technology perfectly. It also addresses the needs of many stores that don't have the time, staff, or expertise to effectively embed analytics into their business planning.”

Complimentary Retail Data Analysis

As a benefit of this partnership, CASA is comping its "Retail Data Analysis" for dispensaries that engage with them, a service usually priced between $3,000 and $5,000. This analysis employs CASA’s proprietary reporting suite to scrutinize POS data, delivering actionable insights into profitability, margins and performance across various metrics including revenue, discount rates, sales velocity and inventory levels.

A Partnership Driven By Data

Taylor Stafford , CEO and founder of CASA, commented on the transformative potential of their tools: “Retailers want to harness their data to make decisions they know will drive higher profitability and better performance, CASA provides the tools, engineers, and analysts to make this a reality.”

"Partnering with LeafLink and leveraging their financial offerings enables CASA professionals to unlock additional retail profitability. The partnership is a natural fit, and we're excited to help operators be more efficient and increase their bottom line via data-driven decision-making," Stafford added.

Related News

- Unpacking 4/20’s Massive Impact On Cannabis Sales Through LeafLink’s Data

- LeafLink, New York Cannabis Retail Association Announce Partnership To Increase Efficiencies For Retailers

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.

The Benzinga Cannabis Capital Conference is coming to Florida

The Benzinga Cannabis Capital Conference is returning to Florida, in a new venue in Hollywood, on April 16 and 17, 2024. The two-day event at The Diplomat Beach Resort will be a chance for entrepreneurs, both large and small, to network, learn and grow. Renowned for its trendsetting abilities and influence on the future of cannabis, mark your calendars – this conference is the go-to event of the year for the cannabis world.

Get your tickets now on bzcannabis.com – Prices will increase very soon!

You are using an outdated browser. Upgrade your browser today or install Google Chrome Frame to better experience this site.

- IMF at a Glance

- Surveillance

- Capacity Development

- IMF Factsheets List

- IMF Members

- IMF Financial Statements

- IMF Senior Officials

- IMF in History

- Archives of the IMF

- Job Opportunities

- Climate Change

- Fiscal Policies

- Income Inequality

Flagship Publications

Other publications.

- World Economic Outlook

- Global Financial Stability Report

- Fiscal Monitor

- External Sector Report

- Staff Discussion Notes

- Working Papers

- IMF Research Perspectives

- Economic Review

- Global Housing Watch

- Commodity Prices

- Commodities Data Portal

- IMF Researchers

- Annual Research Conference

- Other IMF Events

IMF reports and publications by country

Regional offices.

- IMF Resident Representative Offices

- IMF Regional Reports

- IMF and Europe

- IMF Members' Quotas and Voting Power, and Board of Governors

- IMF Regional Office for Asia and the Pacific

- IMF Capacity Development Office in Thailand (CDOT)

- IMF Regional Office in Central America, Panama, and the Dominican Republic

- Eastern Caribbean Currency Union (ECCU)

- IMF Europe Office in Paris and Brussels

- IMF Office in the Pacific Islands

- How We Work

- IMF Training

- Digital Training Catalog

- Online Learning

- Our Partners

- Country Stories

- Technical Assistance Reports

- High-Level Summary Technical Assistance Reports

- Strategy and Policies

For Journalists

- Country Focus

- Chart of the Week

- Communiqués

- Mission Concluding Statements

- Press Releases

- Statements at Donor Meetings

- Transcripts

- Views & Commentaries

- Article IV Consultations

- Financial Sector Assessment Program (FSAP)

- Seminars, Conferences, & Other Events

- E-mail Notification

Press Center

The IMF Press Center is a password-protected site for working journalists.

- Login or Register

- Information of interest

- About the IMF

- Conferences

- Press briefings

- Special Features

- Middle East and Central Asia

- Economic Outlook

- Annual and spring meetings

- Most Recent

- Most Popular

- IMF Finances

- Additional Data Sources

- World Economic Outlook Databases

- Climate Change Indicators Dashboard

- IMF eLibrary-Data

- International Financial Statistics

- G20 Data Gaps Initiative

- Public Sector Debt Statistics Online Centralized Database

- Currency Composition of Official Foreign Exchange Reserves

- Financial Access Survey

- Government Finance Statistics

- Publications Advanced Search

- IMF eLibrary

- IMF Bookstore

- Publications Newsletter

- Essential Reading Guides

- Regional Economic Reports

- Country Reports

- Departmental Papers

- Policy Papers

- Selected Issues Papers

- All Staff Notes Series

- Analytical Notes

- Fintech Notes

- How-To Notes

- Staff Climate Notes

IMF Working Papers

Exploring the role of public expenditure in advancing female economic empowerment and gender equality.

Author/Editor:

Charla Britt ; Danielle Egerer

Publication Date:

May 24, 2024

Electronic Access:

Free Download . Use the free Adobe Acrobat Reader to view this PDF file

Disclaimer: IMF Working Papers describe research in progress by the author(s) and are published to elicit comments and to encourage debate. The views expressed in IMF Working Papers are those of the author(s) and do not necessarily represent the views of the IMF, its Executive Board, or IMF management.

This paper discusses connections between female economic empowerment and government spending. It is an abbreviated overview for non-gender-experts on how fiscal expenditure may support female economic empowerment as an interim step toward advancing gender equality. From this perspective, it offers a preliminary exploration of key factors and indicators associated with gender-differentiated impacts in each of five main categories of public spending (education, health, capital expenditure, government employment and compensation, and social protection and labor market programs). It examines and proposes indices within each category that can be used to identify and measure related gender gaps and suggests associations and connections between those indices, public spending, and other available proxy measurements with some benchmarking potential which is summarized at the end of each category in a Gender Lens Matrix for ease of reference. The paper draws on an extensive literature review and examination of publicly available datasets. It also highlights and discusses gaps in data which limit gender analysis. The purpose of the paper is to advance dialogue on the adoption of a gendered approach to government spending, by providing a gender lens that may assist country level assessments and discussions among IMF staff and member country authorites.

Working Paper No. 2024/108

9798400268892/1018-5941

WPIEA2024108

Please address any questions about this title to [email protected]

Profitability of homeowners insurance in Iowa

In 2020, insurers

paid out three times as

much as they took in

SOUTH DAKOTA

The owner of this home in Iowa, a state once considered low-risk, was dropped by his insurance company last year.

These houses and thousands more also lost their coverage as some insurance companies pulled out of Iowa altogether.

As climate change produces more extreme weather, insurers are losing money , even in states with low hurricane and wildfire danger.

Across the country, insurers are facing more bad years than good years . If this trend continues, it could destabilize the broader economy.

As Insurers Around the U.S. Bleed Cash From Climate Shocks, Homeowners Lose

Christopher Flavelle reported from Iowa and spoke with more than 40 insurance experts, officials and homeowners in a dozen states. Mira Rojanasakul analyzed insurance market data for carriers across the country. Photography by Jamie Kelter Davis.

At first glance, Dave Langston’s predicament seems similar to headaches facing homeowners in coastal states vulnerable to catastrophic hurricanes: As disasters have become more frequent and severe, his insurance company has been losing money. Then, it canceled his coverage and left the state.

But Mr. Langston lives in Iowa.

Relatively consistent weather once made Iowa a good bet for insurance companies. But now, as a warming planet makes events like hail and wind storms worse, insurers are fleeing.

Mr. Langston spent months trying to find another company to insure the townhouses, on a quiet cul-de-sac at the edge of Cedar Rapids, that belong to members of his homeowners association. Without coverage, “if we were to have damage that hit all 17 units, we’re looking at bankruptcy for all of us,” he said.

Dave and Linda Langston at their home in Cedar Rapids, Iowa.

A tornado in 2018 and a derecho in 2020 devastated Marshalltown, Iowa.

The insurance turmoil caused by climate change — which had been concentrated in Florida, California and Louisiana — is fast becoming a contagion, spreading to states like Iowa, Arkansas, Ohio, Utah and Washington. Even in the Northeast, where homeowners insurance was still generally profitable last year, the trends are worsening.

In 2023, insurers lost money on homeowners coverage in 18 states, more than a third of the country, according to a New York Times analysis of newly available financial data. That’s up from 12 states five years ago, and eight states in 2013. The result is that insurance companies are raising premiums by as much as 50 percent or more, cutting back on coverage or leaving entire states altogether. Nationally, over the last decade, insurers paid out more in claims than they received in premiums, according to the ratings firm Moody’s, and those losses are increasing.

The growing tumult is affecting people whose homes have never been damaged and who have dutifully paid their premiums, year after year. Cancellation notices have left them scrambling to find coverage to protect what is often their single biggest investment. As a last resort, many are ending up in high-risk insurance pools created by states that are backed by the public and offer less coverage than standard policies. By and large, state regulators lack strategies to restore stability to the market.

Where Insurers Are Losing Money

States where homeowners insurance was unprofitable .

Source: AM Best

States where homeowners

insurance was unprofitable .

“I believe we’re marching toward an uninsurable future” in many places, said Dave Jones, the former insurance commissioner of California and now director of the Climate Risk Initiative at the University of California Berkeley law school.

Insurers are still turning a profit from other lines of business, like commercial and life insurance policies. But many are dropping homeowners coverage because of losses.

Tracking the shifting insurance market is complicated by the fact it is not regulated by the federal government; attempts by the Treasury Department to simply gather data have been rebuffed by some state regulators . To understand what’s happening in the insurance industry, The New York Times interviewed more than 40 insurance executives, brokers, officials and homeowners in a dozen states, and also reviewed financial records from insurers in all 50 states going back more than a decade.

The Home Insurance Crunch: See What’s Happening in Your State

Climate change is making homeowners insurance less profitable. How has your state fared over the past decade?

By Christopher Flavelle and Mira Rojanasakul

Having Trouble With Your Homeowners Insurance? Tell Us.

Bills are soaring. Insurance companies are struggling. We want to hear how it’s affecting you.

The turmoil in insurance markets is a flashing red light for an American economy that is built on real property. Without insurance, banks won’t issue a mortgage; without a mortgage, most people can’t buy a home. With fewer buyers, real estate values are likely to decline, along with property tax revenues, leaving communities with less money for schools, police and other basic services.

And without sufficient insurance, people struggle to rebuild after disasters. Last year, storms, wildfires and other disasters pushed 2.5 million American adults out of their homes , according to census data, including at least 830,000 people who were displaced for six months or longer.

Severe Storms Increasingly Dominate Insured Losses in the U.S.

Changing weather patterns are making wind and hail storms more frequent and severe.

$100 billion

$80 billion

$60 billion

$40 billion

SEVERE STORM

Source: Aon

Note: “Other” hazards include drought, winter weather and earthquakes.

“Insurance is where many people are feeling the economic impacts of climate change first,” said Carolyn Kousky, associate vice president for economics and policy at the Environmental Defense Fund. “That is going to spill over into housing markets, mortgage markets, and local economies.”

Several factors are helping to drive the losses in homeowners insurance, including the rising cost of labor and materials to rebuild homes, outdated building codes, and the fact that Americans keep moving to areas that are at high risk of flooding or wildfire.

The industry has seen sustained losses before, including between 2008 and 2012. But experts say the past decade is different because of climate change. As the planet warms and storms and fires grow more intense, the cost of disasters is increasing faster than insurers can afford. A financial model designed for a mix of good and bad years threatens to unravel as more years become bad years.

“It’s becoming an untenable situation,” said Sridhar Manyem, senior director of industry research at AM Best, a company that rates the financial strength of insurers.

Highest-Cost Hazards by State Since 2000

In the Midwest, wind and hail storms have become more damaging.

Source: NOAA Billion-Dollar Weather and Climate Disasters

Note: Map reflects both insured and uninsured losses. “Other” category includes flooding, drought and winter storms.

Essentially, insurance companies make bets and set premiums based on damages they expect from historical weather patterns. But global warming has made weather unpredictable, leaving insurers unsure how to price policies.

“Climate change is real,” said Bill Montgomery, chief executive of Celina Insurance Group, one of the companies that has left Iowa in the past year. “We can’t raise rates fast enough or high enough.”

Secura Insurance used to sell homeowners coverage in Iowa and nine other states. On Feb. 1, the company began dropping all its homeowners outside its home state of Wisconsin. Next year, it plans to start dropping its customers there, too.

The decision was driven largely by increasingly erratic weather, said Kristin Heiges, a spokeswoman for Secura. “The volatility has been all over the place,” she said.

Homeowners are stunned.

“Instead of doing what they’re supposed to do, which is serve their customers, they are cutting them loose by the droves,” said Eldon Neighbor, an independent insurance agent in eastern Iowa, who lost his own home insurance last year when his carrier left the state. In Iowa, insurers faced $1.3 billion in losses last year, an enormous sum for a state with just three million residents and a fourfold increase from a decade earlier.

Those who can’t get insurance on the private market are flooding into state-mandated insurance pools of last resort, whose losses are ultimately borne by the public. Federal officials increasingly worry that states will eventually turn to Congress for assistance, putting all Americans on the hook.

Even the insurance companies are having trouble getting coverage. Reinsurance companies, global giants like Swiss Re, insure the insurers, sharing some of the risk of the policies they write. As disasters worsen, reinsurers have become more reluctant to underwrite insurance in parts of the United States. That’s made insurance companies even more conservative about where to do business.

Iowa demonstrates what happens when all these trends converge.

The state’s favorable insurance market began to unravel in 2020, said Tom O’Meara, chief executive officer of the group that represents the state’s independent insurance agents.

Clean-up efforts in Marshalltown days after a 2018 tornado.

Kelsey Kremer/The Des Moines Register, via Associated Press

Years after a spate of destructive weather, many homes in Marshalltown are still damaged.

That year, a derecho, a storm marked by intense winds, tore through the Midwest . It was followed by a string of disasters: wind storms, hail and tornadoes, making it hard for insurers to recover.

To gauge the level of financial distress hitting insurance companies in Iowa and elsewhere, The New York Times assembled data from AM Best, a company that rates the financial strength of insurers, showing “direct combined ratios,” a number that compares revenues to costs. AM Best calls it “a true measure” of insurers’ profitability.

In 2023, for every dollar insurers earned from homeowners policies in Iowa, they paid out $1.44 in losses and other costs. It was the fourth straight year of losses for Iowa’s home insurance market. Reinsurers started to back away.

“Insurance is based on optimism,” said Doug Ommen, Iowa’s insurance commissioner. “You can’t sustain a severe loss every year.”

Severe Storms Are Pushing Midwest Insurers Underwater

Once seen as a haven from climate shocks, the region has suffered growing insurance losses.

Since the start of last year, at least four companies have announced they would stop writing homeowners insurance in Iowa, including Secura, Celina and Pekin Insurance.

Some homeowners lost coverage while still recovering from disasters.

The home of Dr. Brandi Mace Storm and David Storm was damaged by hail last year.

Tim Kuehner’s home near Marshalltown was damaged in the 2020 derecho.

Hail damaged the roof of Dr. Brandi Mace Storm’s home near Des Moines last year. After months of haggling, her insurance company, Pekin, sent a check to cover the repairs. Before she could get the repairs done, Pekin dropped her, along with all of its 40,000 homeowners insurance customers in Iowa.

Trying to find a new company to insure a house with a damaged roof was a challenge, said Dr. Mace Storm, a dentist.

Severe weather combined with the rising costs of rebuilding is “making it unprofitable for us to successfully operate in that state,” said Susan Crisler, a spokeswoman for Pekin.

Others have been hit with sharp increases in their premiums. Tim Kuehner, a general contractor whose home just outside of Marshalltown was also damaged in the 2020 derecho, saw his annual premium jump to $9,189 this year from $6,453, a 42 percent increase.

In neighboring Minnesota, the home insurance industry has lost money in six of the last seven years, and those losses are growing. Insurers there are also pulling back, according to Tony J. Larson, senior vice president of personal lines coverage at Christensen Group Insurance, a brokerage.

Since last summer, 10 of the 25 insurers he works with that traditionally offer homeowners coverage, including Travelers and Nationwide, “have halted or made it near-impossible to place a new homeowners policy,” he said.

Trouble Throughout the Midwest

Profits from homeowners insurance have been shrinking. In most of the region, the industry was unprofitable last year.

A spokeswoman for Travelers, Chesleigh Fowler, said in a statement that the company continued to write and renew homeowners insurance in Minnesota, adding, “we monitor our risk exposure and make adjustments as needed to ensure we are operating responsibly.” Nationwide did not respond to requests for comment.

Other Midwestern states are facing similar pressure. Pekin says it has “paused” writing homeowners insurance in Illinois, Indiana, Ohio and Wisconsin, citing the increased frequency and severity of storms. Secura is dropping customers in Illinois, Indiana and Michigan.

The homeowners insurance market in each of those states has become unprofitable, according to AM Best data.

In the Southeast, climate change translates into stronger storms and hurricanes, which means more damage to homes and other properties.

In Arkansas, insurers spent $1.66 last year for every dollar they earned in home insurance premiums. In Kentucky, which was rocked by tornadoes and record rainfall in 2023, they spent $1.67 for every dollar they earned. And in Tennessee, where storms were severe enough in December for a presidential disaster declaration, insurers spent $1.25 last year for every dollar they collected in premiums.

The challenge facing the market “is probably unparalleled in recent decades,” said Kelley Erstine, president of the association that represents independent insurance agents in Arkansas.

High Winds and Floods Across the Southeast

Climate change has supercharged storms across the region.

A struggling homeowners insurance market “used to be a coastal problem,” Mr. Erstine said. “It’s now ubiquitous. It’s found in every corner of our country.”

Kevin Walters, a spokesman for the Tennessee Department of Commerce and Insurance, said the market remained sound, “despite some challenges.”

Insurance commissioners for Georgia, Kentucky and Mississippi, all states where insurance companies lost money on homeowners insurance last year, did not comment.

In the West, climate change has dried out wooded areas, making them increasingly susceptible to wildfires. In Arizona and Washington State, insurers’ annual losses for homeowners coverage have more than doubled over the past decade, before accounting for inflation. In Utah, losses more than tripled.

Wildfire Country

Americans have flocked to high-risk areas even as climate change is making fires more likely.

Matt Child, chief executive of Utah’s association of independent insurance agents, said insurers were increasingly reluctant to cover homes in what he called “alpine Utah,” like hillside towns and neighborhoods around Salt Lake City.

In the wooded areas north and east of Phoenix that are prone to wildfires, like Flagstaff, it’s becoming increasingly difficult to find homeowners insurance, according to Matthew Baker, a risk adviser with Strong Tower, an insurance agency in Gilbert, Ariz. “Pretty much none of the carriers will write there,” Mr. Baker said.

The threat of wildfires is also causing insurers to back away from areas around Seattle and other parts of Washington, where Mr. Baker also works.

States regulate insurance markets, with the power to approve or reject rate increases, the extent of coverage and protections for consumers.

Some are trying to make it easier for insurers to earn more profits, or shift more cost onto homeowners. Louisiana and Washington have sped up the process for insurance companies to raise their premiums. Arkansas recently allowed insurers to impose higher deductibles on people whose homes are damaged by hail or wind.

Amy Bach, executive director of United Policyholders, a consumer advocacy group, said state officials must make sure that rate increases reflect actual losses and not projections. “We want to make sure regulators are continuing to base their regulatory actions on data, and not just perception,” she said.

In Colorado, where insurers have lost money in eight of the past 11 years, officials are setting up a high-risk pool in case private insurers start dropping large numbers of customers. Similar plans exist in 35 states and are designed for people who can’t find private insurance. Losses are typically covered by a surcharge added to everyone’s insurance bill.

So many homeowners have flooded into Florida’s state-backed high-risk pool that it is now the state’s largest insurer, with rates that are too low to reflect the risk it faces in the event of a major hurricane.

A home in Central City, Iowa. Insurers faced $1.3 billion in losses in the state last year.

Last month, Dave Langston signed a new insurance policy for the houses in his homeowners group. Finding that policy took three months and four insurance agents.

Other states are focusing on better protecting homes from severe weather.

California is requiring that insurers give discounts to homeowners who install fire-resistant roofs or make other changes to reduce their risk, with the idea that insurers will have to pay out less money as a result. Minnesota has likewise required insurers to offer discounts to people who make their homes more resilient against storms; Kentucky and Georgia recently passed similar legislation.

But most states lack a comprehensive plan to restore the market.

Mr. Ommen, the Iowa state insurance commissioner, said he was waiting to see if the problem persisted. “This has been a challenging year,” he said. “We’ll look at it next year and make an evaluation.”

The industry is likely to rebound by changing its practices: not just raising rates, but also narrowing coverage and exiting certain markets, said Tim Zawacki, principal research analyst for insurance at S&P Global Market Intelligence.

But what’s good for insurers isn’t necessarily good for consumers.

On Apr. 29, Dave Langston signed a new insurance policy for the 17 properties in his homeowners association. Finding that policy took three months and four insurance agents; he signed it two days before his previous coverage expired.

The total premium amount for those homes jumped 43 percent, to $26,500. But that wasn’t the most painful part. Under the old insurance, the maximum deductible for wind or hail damage was $25,000 for all 17 homes. It is now $120,000.

If a major storm were to hit Mr. Langston’s quiet cul-de-sac now, “the high expense would wipe out all the money we have in the association,” he said, “and then levy thousands of dollars on everybody to make the difference.”

“We just didn’t have any choice,” Mr. Langston said. “Pretty soon, it will be happening to everybody else.”

A correction was made on May 14, 2024: An earlier version of this article stated incorrectly the number of states where Secura Insurance has sold homeowner coverage. It used to write home policies in 10 states, not 13, and has never sold them in Pennsylvania.

Editors: Lyndsey Layton and Douglas Alteen

Additional visual editing: Claire O'Neill and Matt McCann

Methodology

Insurance profitability charts show the direct combined ratios in the homeowners sector, which are calculated by dividing costs from payouts and other expenses by revenue from premiums. Combined ratios data was provided by AM Best, based on regulatory filings from insurance companies. The 2023 figures reflect 98 percent of companies reporting.

Direct combined ratios do not include reinsurance payments. Insurers that run an operating loss can still make money by investing their revenue.

Direct combined ratios usually present unprofitable years as having a ratio greater than 100, and profitable years as having a ratio of less than 100. To make the data easier to interpret, the charts in this article use an inverted Y axis, so that unprofitable years appear as negative values, and profitable years as positive values.

Insured loss data from insurance broker Aon include losses from both private and public insurance entities.

Billion-dollar disaster data from the National Oceanic and Atmospheric Administration reflect both insured and uninsured losses. The direct losses include physical damage to residential, commercial and government buildings, material assets within a building, vehicles, public and private infrastructure, time costs for businesses, and agricultural assets. The estimates capture around 80 percent of the total U.S. losses from weather and climate hazards, according to NOAA’s analysis.

- Share full article

Advertisement

IMAGES

VIDEO

COMMENTS

Analyzing component ratios of operating profitability is important because they evolve differently over time, and they drive free cash flow. Thus, profitability analysis. helps in forecasting free cash flow, estimating value, and predicting stock returns. (e.g., Nissim and Penman 2001, Binz et al. 2022). 6.

Key innovations relate to the separation and analysis of activities other than operating and financing, and, most importantly, to the decomposition of operating profitability. Three drivers of operating profitability are analyzed: profit margin, asset turnover, and a funding ratio that measures the proportion of operating assets funded by capital.

This study describes a comprehensive profitability analysis that introduces several novel ratios and decompositions. Key innovations relate to the separation and analysis of activities other than operating and financing, and, most importantly, to the decomposition of operating profitability. Three drivers of operating profitability are analyzed: profit margin, asset turnover, and a funding ...

Profitability ratio analysis. Analysts and investors use profitability ratios to measure and evaluate a company's ability to generate income (profit) relative to revenue, balance sheet assets, operating costs, and shareholders' equity during a specific period of time. They show how well a company utilises its assets to produce profit and ...

Here's how to complete a profitability analysis step-by-step, including the most commonly used profitability ratios: 1. Gather financial statements. To calculate the appropriate metrics for your profitability analysis, you'll need the profit-and-loss (P&L) statement and balance sheet for your own company and those of a competitor for the same ...

This study examines the profitability analysis of the selected private bank such as Axis bank, ICICI bank, and South Indian Bank. The data analysed through various profitability r atios. This ...

Profitability analysis, therefore, focuses on measuring the performance of the following key aspects: sales and cost of goods sold, management and control of expenses, and financial resource efficiency. It should be noted, however, that the profit maximization goal does not mean value maximization (refer to Chap. 2 ).

What are the main types of profitability analysis and how can they assist businesses with managing their operations?

Profitability ratios are used to measure and evaluate the ability of a company to generate income (profit) relative to revenue, balance sheet assets, operating costs, and shareholders' equity during a specific period of time. ... financial analysis, modeling and more. Start with a free account to explore 20+ always-free courses and hundreds of ...

Profitability Analysis Essays. Case Study: Marriot Inns Ltd. Financial information refers to the data and documentation that convey a company's financial activities and performance. It contains various financial statements, reports, and calculations that shed light on the company's financial health (Atrill and McLaney, 2018; Yström, 2019 ...

Here are some key methods to consider: 1. SWOT Analysis: Conduct a comprehensive assessment of your business's strengths, weaknesses, opportunities, and threats. This analysis will provide insights into your competitive advantage, internal challenges, market potential, and potential risks. 2.

Evaluation of profitability analysis. Making profit is the major goal of all business entity. Without profitability the business entity will not survive in the long term. Measuring the profitability of Woolworths is helpful for an ethical investor who wants to achieve the best return on investment. Chart 1: Growth rates of.

The results of the regression analysis show that EBITDA profitability will increase by about 3.7 · 10-7% for each 1 000 GJ energy consumed. View Show abstract

Financial analysis is the process of evaluating businesses, projects, budgets and other finance-related entities to determine their performance and suitability. Typically, financial analysis is ...

The essay "Profitability of a Company Analysis" focuses on the critical analysis of the major issues in the profitability of a company. It is heavily influenced by various business factors such as diversification, vertical integration, strategic alliances, M&A integrations, and divestment…

Essay Cost Volume Profit Analysis . Cost volume profit (CVP) analysis and costing for the 21st century has evolved into a very complex and difficult paradigm. Even the most gifted accountants find that grasping the entire concept of accounting for a corporation can be very mind-boggling and difficult. Yet, understanding such a fundamental ...

Abstract: The main purpose of a business unit is to make profit. The profitability analysis is done to throw light on the current operating performance and efficiency of business firms. It should be duly noted that net income figure alone is not very helpful in determining the efficiency and performance of the business firm unless it is related ...

Profitability Analysis: Microsoft Inc. i) Profit Margins: Referring to the profit margin ratios of the company, we can infer that the fiscal year of 2013 was favorable for Apple Inc with 5.05% increase in profit margins of the company in comparison with the previous year of 2012.