Using offsite construction for housing delivery in Scotland

This case study looks at four offsite housing projects in Scotland.

Scotland is currently facing a challenge in terms of providing sustainable, healthy, energy efficient and genuinely affordable housing across the country. It is generally accepted that a culture shift in methods of construction and delivery is required to address growing concerns in relation to labour and skills shortages in the construction industry, as well as a need to speed up delivery; control costs; and achieve high standards of design and innovation.

Offsite construction clearly has an important role to play in addressing these key issues in relation to housing delivery. Much has been researched and written about Offsite construction focussing predominantly on practical issues such as cost, deliverability, transportation and efficiency.

But what does an offsite house look like? What should you consider when aiming to deliver an offsite housing project? How does it feel to occupy an offsite house, and what examples are there across Scotland? This case study focusses on four offsite housing projects in Scotland as well as summarising the practicalities and challenges of delivering housing offsite in Scotland.

What this case study includes:

- learning about the processes and considerations in delivering four Offsite housing projects in Scottish urban, town, and rural island locations

- a technical overview of current offsite housing delivery in Scotland including insight into several offsite systems. These include panelised, Cross Laminated Timber, and volumetric

- lessons learned for each of the four projects covering issues such as the utilising offsite construction for affordable housing; delivering community led housing in a rural island location; delivering collective self-build in an urban location and micro housing to fit the rural vernacular

Case study: using offsite construction for housing delivery in Scotland

Download this case study to take away key learnings from the four projects found on this page.

This case study includes four housing development projects:

Heritage way, fraserburgh by gokay deveci, bath street collective custom build by john kinsley architects, ulva ferry housing by thorne wyness architects, skye mobile micro home by ann nisbet studio.

A development of 30 affordable houses on a brownfield site in Fraserburgh. The project is a housing exemplar for their low-energy consumption and approach to procurement.

A community self-build block of flats on a gap site in Portobello, Edinburgh utilising a Cross Laminated Timber structure. As 2018 winners of the Best Use of Timber Awards, Bath Street Collective’s approach allowed for minimal disruption to the local area and was installed in under two weeks from its arrival onsite.

Delivered by Mull and Iona Community trust these two-family homes provided energy efficient affordable family housing which in turn provided an ongoing role for the at-threat local school. Designed to Passivhaus standard, the method allowed for a more efficient construction process and drastically reduced the number of construction workers to be transported to the island.

This micro-home can be seen as a prototype for rural housing and seasonal accommodation, an alternative to the caravan. The ‘Black Park Model’ aims to create modest, locally produced and extremely energy efficient housing on cheaper rural land.

Header image credit: Ann Nisbet Studio

Explore more case studies

We have a variety of sustainability case studies available on our site. These project-specific case studies vary from residential to commercial to help you gain best practice examples of how you can design sustainable buildings.

Huntly Crescent, Raploch

Kilmun housing

Tigh-Na-Cladach

Related Expertise: Building Materials Industry , Infrastructure

The Offsite Revolution in Construction

May 08, 2019 By Romain de Laubier , Arne Burfeind , Sebastien Arnold , Sven Witthöft , and Marius Wunder

The construction industry is a paradox. The annual global growth rate is more than 3%, but the sector is in crisis: prices are soaring, jobs remain unfilled, and demand far outstrips supply. The crisis can be attributed to one broad shortcoming: unlike almost every other industry, construction has been reluctant to modernize and thereby boost its productivity. The car factory of 2019 looks nothing like the car factory of 1919, whereas the construction site has hardly changed during that time.

Of course, construction is not easily amenable to mass production, but it could certainly exploit modern industrial techniques more than it does. Offsite construction, or “prefabrication,” is the key: creating in a factory various parts of a building before assembling them on the building’s actual site. The parts can be either precast (concrete) or made from compound materials (such as sandwich panels). The offsite factory of today may produce flat-pack components (such as walls or beams), volumetric modules (bathroom pods or bedrooms), or even entire buildings. The practice of systematically constructing houses offsite goes back to the 20th century: builders in the US began selling “kit homes” in the early 1900s, for example, and European governments on both sides of the Iron Curtain turned to offsite construction after World War II to address housing shortages.

Despite its history, however, and despite the pressing need, offsite has remained a niche approach. That is changing at last. Offsite construction is now being adopted for projects as varied as high-end condos, hotels, and airport terminals. The disruptive potential is huge. Industry executives, as they weigh their options, need a clear understanding of the offsite phenomenon—why it is gaining in popularity, how companies are participating in it, and what it implies for the industry.

The Advantage of Offsite

Offsite construction alleviates several problems associated with traditional “onsite” methods. By moving a large proportion of the work from a messy, exposed open-air setting with limited working hours into a safe, controlled indoor factory setting with 24/7 production uptime potential, offsite construction offers five main benefits.

- Shorter Building Times and Lower Risk. Offsite construction is far less affected by the vagaries of the weather and by the heavy burden of onsite project management. It is also far less subject to the risks—legal and financial—inherent in complex collaborations with subcontractors. So offsite typically reduces building-completion times by more than a third and improves punctuality, with best-in-class builders approaching 100% for on-time delivery. That can be of great value to project owners; a hotel, for instance, can begin taking reservations earlier, and the risks of overspending and delays are reduced.

- Higher Quality. Thanks to standardization, a controlled environment, and in-factory quality checks, the defect rate can be halved; at best-in-class producers, the defect-free rate on new buildings is now above 95%.

- Lower Costs. The controlled, weatherproof workplace raises the productivity of individual employees, while also allowing economies of scale, optimized logistics, and lean manufacturing. The result is a saving of up to 10% on overall construction costs—savings that can be passed on to customers or reinvested in higher-quality finishes, for example.

- Improved Working Environment. Workers are protected from the weather and from many of the traditional dangers (such as working for long periods at great heights or underground), and their daily commute remains unchanged from project to project. Workplace accidents are halved, and recruiting becomes easier as the jobs are now more desirable.

- Reduced Environmental Impact. Construction waste and emissions can be halved, by virtue of production efficiencies and increased recycling.

These benefits merely mirror those of other industries as they modernized. With offsite construction now gathering pace, the industry is advancing into the 21st century.

Barriers to Adoption

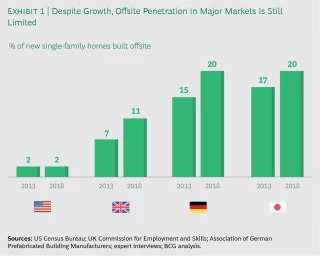

The global penetration of offsite construction is difficult to quantify. Analysts define offsite construction in different ways, according to the proportion of offsite content—50% versus 80%, say—and according to the techniques for measuring that offsite content. The data is most reliable for single-family homes, the segment that historically has been the main beneficiary of offsite construction. In some smaller markets, such as Sweden, more than 80% of new homes are now built offsite. But despite an upward trend, no major market yet exceeds 20% penetration; in the US, offsite barely registers at all. (See Exhibit 1.)

Despite its long history and its compelling value proposition, offsite is only now gaining traction. The reasons for the slow uptake are complex and vary from market to market. But four particular barriers apply very widely:

- An Image Problem. In continental Europe, people often associate offsite with low-quality, uniform, communist-style housing. In the UK, offsite evokes memories of the cheap “prefab bungalows” built to solve the postwar housing shortage. In the US, many people confuse offsite with low-income mobile homes, which are often termed “manufactured homes.” One notable exception to this tendency is Japan, where offsite-constructed houses are considered premium, high-quality products.

- Inflexibility and Uniform Design. In the past, to keep costs down, offsite-construction companies adhered to a policy of standardization. This cookie-cutter approach tended to conflict with building-site constraints and with the individual owner’s preference for some degree of customization.

- Regulation and Local Building Codes. Traditional construction is widely subject to tight labor rules regulating who can do what onsite, for instance, or specifying the minimum number of workers for a particular task. Such rules contravene the offsite labor model, which is based on small teams of broadly trained workers. Other rules, including health and safety regulations, planning codes, and mortgage or insurance requirements, have similarly hampered the development of offsite construction. To make matters worse, the rules are often local, and thus difficult to change, so no easy scaling of solutions has been possible.

- Risk Aversion. The construction sector is historically risk-averse, for good reasons. Construction is expensive when done right and potentially ruinous when done wrong, as recent high-profile cases such as Berlin’s new airport can attest. On the supply side, construction is a project-based and cyclical business, with constant cost pressures and low margins, and hence an aversion to heavy capital expenditure and to R&D. (Contractors, in particular, are certainly unaccustomed to investing hundreds of millions or even billions of dollars in factories.) Builders and clients alike have therefore been wary of experimenting with new methods and technologies. (See Shaping the Future of Construction: A Breakthrough in Mindset and Technology , a World Economic Forum report, prepared in collaboration with BCG, May 2016, pp. 13-15.)

In combination, these barriers had the effect of forcing offsite construction into a vicious cycle. The barriers kept demand for offsite weak; the weak demand discouraged investment into offsite, so the supply remained very limited; and in light of the limited supply, there was little impetus to break down the barriers that kept demand low. Fortunately, this cycle is at last starting to collapse.

Breaking Down the Barriers

Three new factors have come into play that are now bringing offsite construction to an inflection point.

The first factor is the long-running skills shortage. The construction workforce in wealthy countries has been declining rapidly as current workers retire, since traditional construction jobs hold little appeal for younger workers today (see Shaping the Future of Construction: A Breakthrough in Mindset and Technology , pp. 15 and 36). The old solution—importing workers from abroad—is becoming less viable, as the importing countries are tightening their immigration policies and the exporting countries are generating more attractive jobs for their own workers. Offsite construction is an obvious remedy—appealing to local construction workers while increasing overall productivity in the sector.

The second factor is the surging use of digital technology. This development is helping to erode the barriers to offsite, in particular the barrier related to inflexibility. Thanks to digital tools, such as building information modeling (BIM), it is becoming easier to integrate offsite components into conventional builds and to create more sophisticated and flexible systems of offsite components. (See “ The Transformative Power of Building Information Modeling ,” BCG Perspectives, March 2016.) Moreover, advances in digital production methods, such as robotics and 3D printing, should one day be able to turn the ideal of “mass customization” into a reality. (See “ Will 3D Printing Remodel the Construction Industry? ,” BCG article, January 2018.)

Thanks to digital tools, it is becoming easier to integrate offsite components into conventional builds and to create more sophisticated systems of offsite components.

Copy Shareable Link

The third factor is government support. Governments around the world are now backing offsite construction far more vigorously than before. Faced with serious housing shortages and chronically tight budgets, governments in Australia, Singapore, and the UK are making offsite construction a strategic priority and are favoring offsite in procurement. Others will doubtless follow their lead, and in doing so will create stable demand, help to standardize designs, shape new regulations, and publicize the benefits of offsite. Private companies will then have the incentive to get seriously involved as well.

To be sure, some challenges remain. Offsite construction can ease the labor shortage, but it requires new skill sets and training programs, and these are still under-developed. BIM will help to integrate offsite into the planning and building process, but not while incompatible standards persist and not until adoption rates increase. Robotics and 3D printing need considerably more investment and R&D before they can realize their full potential. And most governments still need to assign offsite a higher status; in the US, for instance, only a few city- and state-level authorities have formulated a comprehensive policy on offsite construction.

Nevertheless, the momentum is unstoppable. Companies that emphasize the opportunities rather than the challenges, and quickly consolidate their base of talent and technology, will enjoy a competitive advantage. That is something that smart investors recognize. Venture capital is pouring in, and two startups, Katerra and Revolution Precrafted, have already attained “unicorn status,” with valuations exceeding $1 billion each. Private equity funds run by Bain Capital, PIMCO, and others have invested hundreds of millions in offsite companies such as Consolis and Polcom Modular. The veteran UK contractor Laing O’Rourke is hurriedly building yet another offsite manufacturing plant. Even Google has invested $300 million in offsite construction to produce homes for its employees. All the signs are that this wave of investment will grow even stronger.

The Markets and the Prospects

Although the trend for offsite construction is undeniably upward, the pace of its development is difficult to determine. The landscape could change dramatically if an individual participant makes the right bold move—an offsite construction company acquiring a large traditional contractor, for example, or a major building materials company opting for a switch to offsite. The detailed changes are impossible to predict, but there are some rough guidelines for gauging how offsite will evolve in any particular market.

First, offsite in general will likely grow fastest in regions that emphasize new buildings rather than renovations and that have key market shapers, such as a major developer or active government support. The UK and Japan, for instance, fulfill both of these conditions and have fast-growing offsite ecosystems accordingly. In contrast, Germany skews toward renovations, and the US lacks any major national offsite champion, whether private or public. Growth of offsite in these markets is therefore likely to be more subdued or localized.

Offsite will likely grow fastest in regions that emphasize new buildings rather than renovations and that have key market shapers, such as a major developer or government support.

Second, within any region, adoption will be highest in construction segments that feature one or more of the following factors:

- A high degree of complexity, with multiple and/or sophisticated components that would benefit greatly from the time savings derived from offsite methods

- A high degree of repetitiveness, either within or between projects, facilitating standardization and economies of scale

- Strict requirements regarding quality, cost, or onsite logistics

(See Exhibit 2 for a schematic representation of these factors.)

The segment that is currently the main application for offsite construction is that of residential buildings, and it will likely continue to be so. Houses are not unduly complex, but they are characterized by a high degree of repetitiveness. And they often are subject to strict requirements, in the form of buyers’ expectations concerning quality and price. So most of the major offsite-construction companies have a strong housing presence, or even an explicit preference.

In nonresidential segments, the prospects are more varied. Hospitals, hotels, schools, and prisons, for example, are in general prime candidates for offsite construction. They are highly standardized, follow strict requirements in regard to safety or branding, and are time-constrained and labor-intensive when it comes to furnishing and outfitting. For other types of building, offsite can sometimes be the optimal approach on account of project-specific factors: for example, for the Leadenhall Building, a towering office block in the City of London, more than 80% of the components were built offsite, in order to meet the double challenge of a tight construction site and a tight delivery timeline.

Finally, hard infrastructure is likely to remain less receptive to offsite construction. Of course, small standardized components, such as sewage pipes or railroad sleepers, are frequently precast offsite. But major components—of a bridge, for instance—are often large and awkward to transport from an offsite location, so it might be more cost-effective to construct them onsite. Once again, however, project-specific factors will sometimes favor offsite construction: the Geneva airport is resorting to offsite methods for its new intercontinental terminal, which has to fit into a site barely 20 meters wide. Such specialized offsite projects will likely increase in frequency, especially since infrastructure is the most international branch of construction, with many contractors operating across borders.

Business Models and Participants

No specific business model or company has yet emerged as the winner in offsite construction. But current participants can be classified into two broad groups: end-to-end providers and ecosystem coordinators.

The first group, end-to-end providers, consists of asset-heavy, vertically integrated generalists, which participate all along the value chain. Companies of this type have their own design and engineering departments; they manufacture and preassemble most components in their own factories; and they actively manage the final onsite assembly. They believe that having a seamless, integrated manufacturing system is crucial for producing top-quality results, and they are willing to invest capital to secure it. This model is currently the most common one. Among the leading examples are Katerra in the US, Laing O’Rourke in the UK, and Daiwa House and Sekisui House in Japan.

The second group of companies, ecosystem coordinators, consists of asset-light overseers. Having developed an offsite-construction system, they then coordinate an ecosystem of specialized partners to deal with individual aspects of it. They may, for example, limit their own direct role to that of overall design and customer-relationship management, while relying on partners to make the various components to their specifications. They favor flexibility in manufacturing over sophisticated machinery. For instance, Bryden Wood and Skanska, two leading ecosystem coordinators, have developed the “flying factory” concept: they find an underused building, such as a barn, close to the construction site, and convert it into a temporary, low-tech plant to assemble components supplied by third-party partners. The ecosystem coordinator model is fairly new, but many new entrants might be attracted to it because of its asset-light nature.

The two business models are distinct in theory, but companies do not stay neatly within the confines of one or the other. End-to-end providers, such as Sekisui House, readily revert to independent suppliers for some components. Conversely, the ecosystem coordinator Bryden Woods initially operated its own factory for testing and learning purposes. Moreover, both types of companies rely on specialized third parties for key technologies. (See “The Surrounding Community of Technology Companies.”) Still, most offsite companies have very clear strategies regarding which parts of the value chain they want to own and where they want to invest.

THE SURROUNDING COMMUNITY OF TECHNOLOGY COMPANIES

A rich and growing community of technology companies plays an indispensable auxiliary role in offsite construction. The two types of company that arguably make the greatest contribution are those providing software and those involved in robotics.

Software. Software developers offer vital support in fields such as design and engineering (Tekla and Aditazz are prominent examples) and project management (GenieBelt and Sablono, for instance). Some areas are still maturing, notably software that can really integrate some of the links in the value chain, especially design and production; at the moment, it still takes considerable manual intervention to translate a design intent into production instructions. The experience of other industries—as in the case of printed circuit boards—suggests that the solution will not be easy to find but will have a dramatic effect once it is found.

Robotics. Most robots currently used in offsite construction are generic ones, performing basic manufacturing or assembling tasks. The potential here is two-fold— refining the performance of these generic robots, and developing construction-specific robots.

First, the generic robots could be optimized for construction-specific tasks. Consider the task of assembling a building frame, for example: today it is still a nontrivial task for robots because they are not situationally aware, and without the right instructions they often crash into parts of the frame that have already been built. Given that the designs keep changing, the programming needed to resolve this issue is particularly complex. But it should eventually be possible to do such programming at scale, and promising work is under way at research labs such as the Swiss National Centre of Competence in Research for Digital Fabrication at ETH Zurich.

Second, construction-specific robots should soon become more common and more versatile—able to work with awkward materials such as concrete and to cope with many current challenges, such as the weight of very large components and the proximity of human workers. Developers can derive much encouragement from the successful adaptation of related technologies: 3D printing, notably, is now being exploited very productively to build complex components for construction projects. (See “ Will 3D Printing Remodel the Construction Industry? ,” BCG article, January 2018.)

It is too early to tell which of the two models will predominate, if either. They might well continue to coexist on roughly equal terms. Would-be entrants should consider which model best suits their strengths and risk tolerance. An end-to-end provider will boast a proprietary and differentiated offering, but faces the worry of having underutilized factories whenever business takes a downturn. An ecosystem coordinator has a different worry: how to retain ownership of its system, given that its IP necessarily has to be shared among multiple third parties.

It is too early to tell which of the two models will predominate, if either. They might well continue to coexist on roughly equal terms.

As well as pondering the business models, companies need to consider three strategic questions:

- How much standardization should we aim for in regard to design and manufacturing?

- How much automation and robotics should we use in manufacturing and in onsite assembly?

- Where and when should we use fully preassembled volumetric components versus flat-pack units?

The answers here will depend on local market circumstances and on the relevant segment. This variability has two important implications. First, companies should question any received wisdom or success formulas derived from other companies. For instance, the common mantra that “volumetric is just transporting air” is certainly not applicable when the project is a fully outfitted hotel or hospital. Second, companies should allow themselves some flexibility or else accept the inevitable tradeoffs. For example, if a company commits to a volumetric-only system—in pursuit of an overall cost advantage, perhaps—it should do so in the clear knowledge that some projects would then be beyond its reach, for logistical reasons.

In seeking the optimal responses to the three strategic questions, companies need to conduct a thorough analysis of their target market and an honest assessment of their strengths. And even then, they should be prepared to adjust their responses nimbly, in keeping with the rapid changes taking place in the market.

Offsite is going to be highly disruptive to construction as a whole, and existing companies are at risk of losing considerable value.

Strategic implications.

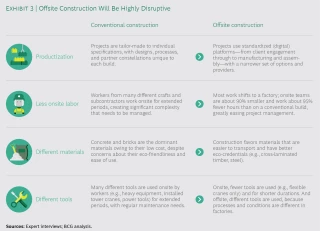

Offsite construction clearly has an upside potential that traditional companies cannot ignore. But there are other reasons for companies to participate in the offsite market. Offsite is going to be highly disruptive to construction as a whole, and existing companies are at risk of losing a significant amount of value. Specifically, offsite construction will mean more productization, less onsite labor, different materials, and different tools. ( Productization refers here to the adoption of standardized, factory-made components, such as walls or even rooms, to replace the traditional process of constructing each individual component onsite.) See Exhibit 3 for some of the details.

These transformative developments will affect all companies along the value chain, to a greater or lesser degree. Here is the likely scenario:

General contractors will feel the impact most intensely. Their service offering will become commoditized. The pool of value that they can access will shrink as construction sites diminish in size and complexity; their current labor model, equipment, and subcontractor/supplier relationships will become redundant; and they will come under greater pressure than ever to reduce costs and delivery times. Global competition will sharpen: Poland’s Polcom Modular, for instance, is able to deliver offsite-built hotels around the world. The best survival strategy for contractors is to expand their offsite capabilities, in the way that Laing O’Rourke and Skanska did (using the end-to-end-provider and ecosystem coordinator models, respectively). Contractors are well-positioned to make this switch because they oversee the entire value chain—but they need to act quickly.

Producers of light-side building materials will see their business volume and margin premium decline drastically. As construction gets more productized, they will have to become offsite-compatible if they hope to win any contracts. Their current individual brands, customer relationships, systems, and distribution networks will lose their distinctive value in a productized market. At the extreme, they could even lose their status as original equipment manufacturers (OEMs) and instead become suppliers to OEMs, and have to submit tenders to them to produce specified components. If they are to remain specification makers rather than specification takers, they need to work proactively at shaping new offsite ecosystems, in partnership with other companies that have complementary expertise.

Producers of heavy-side building materials will suffer as demand shifts to other materials in certain segments. The product at greatest risk is probably cement, which is too heavy for widespread offsite use. To respond, firms can shift toward more offsite-appropriate materials, drawing on specialized know-how: the Austrian startup Cree, for instance, has developed a new wood-concrete hybrid material. Alternatively, firms can expand into offsite-related services, such as 3D printing of formwork, which enables mass-customization of precast concrete. (See “How Building Materials Manufacturers Can Integrate Down the Value Chain.”)

HOW BUILDING MATERIALS MANUFACTURERS CAN INTEGRATE DOWN THE VALUE CHAIN

Traditionally, within the construction sector, building materials companies aspiring to vertical integration would look upstream. Cement companies would acquire the limestone quarries; asphalt producers strove to control aggregates production and bitumen logistics.

When downstream moves did occur, they would occur typically in a limited scenario: a cement company, for instance, leveraging its market power to gain control of the ready-mix and precast market in specific regions. One scenario that would not commonly occur was that of a cement or asphalt company acquiring a large construction contractor (although the reverse scenario might readily occur). It was as if the building materials industry regarded the construction business itself as a no-go area, one that suffered from three serious drawbacks: lower margins, higher risks, and an unfamiliar business model.

More specifically, the construction industry has always been under higher price pressure than building materials manufacturing has been; construction projects are subject to so many contingencies, and cash flow is difficult to manage; and a project-based business requires very different skill sets and thinking from those used in a manufacturing business. No wonder that building materials companies have shown little interest in moving into construction proper.

As the offsite construction trend gains strength, however, this traditional perception is sure to change. Building materials companies have various options for their move downstream: acquiring an established contractor, for example, or partnering with one, or creating an end-to-end offering of their own. A two-step approach seems to be gaining favor: first getting involved in the manufacturing of components and later moving into the market for actual construction services.

Equipment manufacturers will struggle as demand for conventional equipment plummets. Their primary strategy must be to shift their emphasis away from the building site and into the factory setting. That would probably involve acquisitions or partnerships, since the new type of equipment will likely be closer to industrial-automation solutions than standalone tools. A secondary strategy is to develop new types of onsite equipment, better suited to the stringent timelines and less-specialized onsite workers that will soon be the norm; and/or to develop new service models optimized for shorter and more flexible equipment usage during onsite assembly.

Architects and engineers will have to adjust their business model as construction becomes more productized. They will need to adapt their approach to customers and gain deeper expertise in the actual manufacturing process. Meanwhile, the design process itself will change, making greater use of standardized components and even automated design. To cope with that change, architecture firms are well-placed to become ecosystem coordinators, devising systems that allow customized designs based on standard components. At the very least, they should be able to integrate offsite components into their designs, and be competent in offsite-related skills such as DfMA (design for manufacturing and assembly).

Developers and real estate investors should generally benefit from the offsite revolution—specifically from the shorter delivery times, lower costs, and higher quality—without having to make major changes to their existing business model. This does not mean they can just stay still, however. Demand for best-in-class offsite manufacturers far exceeds supply; in fact, some of the leading manufacturers have long waiting lists. So developers should seek partnerships right away, to ensure that they have access to the best offsite manufacturers and to maximize their attractiveness to clients, buyers, and investors.

Time for Action

The offsite construction market remains a white space. There are still more questions than answers; more clarity on the broad trends than on the specifics; more promising newcomers than proven incumbents; more freedom to experiment than hard-and-fast rules. For some stakeholders, this unsettled picture might represent a counsel of caution. Better to wait and see, they would argue, when so many uncertainties remain and the offsite revolution has faltered so many times before.

Our view is that waiting on the sidelines is a greater risk than stepping onto the playing field. The value proposition of offsite construction is strengthening every day, and so are the factors fueling its growth—labor shortages, suitable technology, government backing. Hence the numerous sophisticated investors, not just from the industry itself but also from venture capital, private equity, and technology firms. They will have a head start over the bystanders—and perhaps an unassailable lead when offsite reaches scale.

Venturing into offsite does not yet mean “betting the firm.” With the obvious exception of startups, most of today’s offsite-active companies began their involvement with just a small side project and increased their commitment only when it looked safe to do so. Companies should think of offsite involvement as another tool in the toolbox rather than as a new start. Time is running out, though, and the companies that hesitate could be gambling with their future in a far riskier way than the bold companies are.

Managing Director & Senior Partner; Asia-Pacific Chair, BCG X

Managing Director & Senior Partner

ABOUT BOSTON CONSULTING GROUP

Boston Consulting Group partners with leaders in business and society to tackle their most important challenges and capture their greatest opportunities. BCG was the pioneer in business strategy when it was founded in 1963. Today, we work closely with clients to embrace a transformational approach aimed at benefiting all stakeholders—empowering organizations to grow, build sustainable competitive advantage, and drive positive societal impact.

Our diverse, global teams bring deep industry and functional expertise and a range of perspectives that question the status quo and spark change. BCG delivers solutions through leading-edge management consulting, technology and design, and corporate and digital ventures. We work in a uniquely collaborative model across the firm and throughout all levels of the client organization, fueled by the goal of helping our clients thrive and enabling them to make the world a better place.

© Boston Consulting Group 2024. All rights reserved.

For information or permission to reprint, please contact BCG at [email protected] . To find the latest BCG content and register to receive e-alerts on this topic or others, please visit bcg.com . Follow Boston Consulting Group on Facebook and X (formerly Twitter) .

Subscribe to our Industrial Goods E-Alert.

Whilst the Transformation Plan stops, the Construction Sector Accord is to continue in a different form. This website is under review and will be updated soon.

- About Beacon case studies

- How-to guide: The Living Pā case study

- How-to guide: Offsite manufacturing case study

- How-to Guide: Te Wānanga o Raukawa

- How-to guide: Naylor Love - Diverting construction waste

- How-to guide: Scafit - people centric approach

- How to guide: MJH Engineering case study

- How-to Guide: Supplier diversity contracting for broader outcomes

- How-to Guide: Relationship based contracting for complex projects

- How-To Guide: Kāinga Ora Case Study

- How-to guide: QOROX case study

- How-to Guide: Auckland District Health Board case study

- How-to Guide: New Plymouth District Council

- How-To Guide: KiwiRail Case Study

- How-To Guide: Canam Case Study

- Case Study: Tidy Slabs – creating an organisation of leaders

- Beacon Project: Watercare – partnering for carbon reduction

- How-to Guide: Fonterra Case Study

- How-to Guide: City Rail Link Case Study

- How-to Guide: Piritahi case study

Case study: Offsite manufacturing delivers multi-storey timber frame apartments

This case study showcases how a multi-storey timber frame apartment complex across three six-storey buildings containing 216 modules is being constructed with offsite manufacturing.

On this page

After seeing a market demand for suppliers who could deliver quality housing at pace and scale, Property Partners decided to investigate offsite-manufacturing. They started researching offsite manufacturing methods around the world, and ultimately decided that the Swedish model was the best approach for them to bring to the New Zealand market.

While the use of offsite manufacturing techniques is becoming increasingly popular around New Zealand for small-scale builds, Property Partners wanted to use timber volumetric modular construction, a form of offsite manufacturing in which buildings are put together by connecting a series of pre-built modules and stacking them vertically to build apartments. This offsite manufacturing method is common in Sweden and globally.

After seeing the benefits of volumetric modular construction methods in their own work, Property Partners decided to invest in a manufacturing plant in Wiri, Auckland and launch a subsidiary, Evergreen Modular, to focus entirely on volumetric modular construction. The investment into the manufacturing plant has allowed Evergreen Modular to deliver several large-scale offsite manufactured projects across New Zealand, including in Wellington, Hawkes Bay and Auckland.

This includes 108 apartments in Richardson Road, Owairaka, Auckland. The Richardson Road project consists of three six-storey apartment buildings containing 216 modules. Upon completion, the project will be constructed completely with timber volumetric modules, which is a first in New Zealand and a significant step forward for timber volumetric modular construction at this height.

Video Transcript

Scene 1- opening

Drone footage zoning in on Richardson Road construction site.

Text on screen: Offsite manufacturing delivers 108 multi-storey timber frame apartments in Richardson Road, Auckland.

Drone shots of the Evergreen modular construction in progress, the unique scaffold structure, the people on site, people in the factory, the lifting process, and factory construction in progress.

Switching between 5 speakers

Dan McNelis: It's really rare to be involved in something truly innovative. And what we're doing at Evergreen Modular is real innovation in New Zealand.

Jurgens: It's part of the evolution of construction. The way we've built 50 years ago. The way we build now and the way we're gonna build in 50 years, it's all different.

Steve Mikkelsen: Evergreen Modular is the first company of its kind in New Zealand. We build timber volumetric modules up to eight levels, enabling more sustainable and healthy construction at scale. Now there's a pivot point in the way that we deliver apartments and houses, and that's through offsite manufacturing.

Dan McNelis: When we started talking about the potential for offsite manufacturing and, and modular construction in New Zealand, we really had, um, a bit of synergy there that it was something we were both really passionate about. Modular construction offers as many opportunities really as traditional construction does. We are just maximizing that in the efficiency of how we put those buildings together.

Jurgens: So we on the corner of Richardson and Hendon Avenue today, um, so it's a six level modular building, which has never been attempted in New Zealand. These modules are all built indoors in our factory. Um, they're not susceptible to weather as what we are here on site. So with the roof it can, we can push it as we need it. Um, we can, you know, open it up in the mornings, install modules, um, close it up in the afternoon. Obviously the weather this last couple of months in Auckland was really bad, so it was a really good idea by our site team, um, um, to install the roof and also our contractors that's involved in the roof. So it just gives us that flexibility to also install modules if the weather isn't too great on the day.

Matt Heal: We've been working with Steve and the team at Evergreen Modular for some years, and speed of delivery is really important so that we can deliver some housing outcomes quickly. Um, it's all timber framed, which is excellent 'cause it totally aligns with our sustainability objectives. Um, and we really like the quality that you get from a factory produced product.

Brian Berg: It's a bit of a snapshot about what's happening in the New Zealand residential construction sector as a whole. You know, we're building new kinds of typologies, these six to eight story apartment buildings. This mid-rise construction, that's a new typology for New Zealand. It's also, you know, new to build it out of timber as well.

Dan McNelis: It's locally grown. We all know it. We all understand it. And instinctively we're drawn to these natural environments. What we're creating is healthy human spaces. Embodied carbon is a huge issue in construction in New Zealand. It's often not talked about as, as much as operational carbon about building performance over the lifespan of the building. The volumetric timber boxes that we use from Evergreen at the scale of a project like Richardson Road is about 20% of the weight of an equivalent concrete building.

Brian Berg: For our sector. We need to be looking at what's the impact across the whole life cycle. And, you know, thinking about both the, the short term which is upfront and body carbon, but then the longer term as well, which is the energy, the health, and the wellbeing, um, of the people who move into these homes.

Steve Mikkelsen: Compared to a concrete building, we're achieving 103% less embodied carbon. And over a 90 year life cycle, we're achieving 49% less over concrete construction. We're currently achieving cost savings over traditional construction. However, this will increase with further product development and scale.

Dan McNelis: The construction industry is traditionally very slow to innovate. Um, compared to manufacturing, compared to other large scale industries, we're probably the laggard in terms of picking up new technologies, new materials, and bringing them into the mainstream. As an architect, we've had to really re-skill ourselves in what's called design for manufacturing assembly or D F M A. You have to start with the end result. You have to start with the manufacturing process and how these buildings can be put together. So we have the opportunity to test what's actually achievable on an assembly line in the factory and get that as efficient, uh, and as high quality as possible before that's then taken out to site and put together in a finished building.

Steve Mikkelsen: When we look offshore, like for example in Sweden, 85% of all of their homes are built in factories and they've been doing this well since the sixties. We can produce much larger numbers within a much faster timeframe and a lot more precision construction. Currently, the factory has a capacity on a single shift to produce 120 apartments per year. The new factory, however, has the ability to produce in excess of 4,000 modules per year, which is the equivalent of about 2000 apartments. This could go over a number of different sectors such as aged care, retirement, social housing, affordable housing, student accommodation, et cetera. This is very exciting to finally see something that we can actually grab a hold of and, and increase the scale and pace of the housing supply through innovation.

Dan McNelis: I genuinely believe this is the future of construction and would like to see this type of construction adopted on a mass scale. There's no reason we shouldn't be building new cities in engineered timber and in volumetric modular buildings.

Scene 3 – End of video

Drone footage of the area around Richardson Road site looking out towards Auckland city in the background.

End of video

In 2017, one of Property Partners’ key clients asked its suppliers to find new solutions that would increase the scale, pace and quality of housing supply to address New Zealand’s housing crisis. This happened around the same time as the publication of the Auckland Unitary Plan, which provided a long-term strategy for Auckland’s growth and allowed for significantly more intensification across the region. As a result, Property Partners started putting serious consideration into setting up an off-site manufacturing facility for volumetric modular apartment construction in New Zealand.

Volumetric modular construction is a type of offsite manufacturing in which buildings are put together by connecting a series of pre-built modules.

Property Partners (external link) - propertypartners.co.nz

Property Partners began researching offsite manufacturing methods and techniques used around the world, including China, the United States and Sweden, and did a study tour to learn from some of the world’s best prefabricated house manufacturers. Of all the offsite manufacturing markets, Sweden stood out as a world leader, and there were also lessons to be learned from Sweden’s own housing crises. In 2018, the team travelled to Sweden to learn more about offsite manufacturing. They built connections and relationships with key people from one of the world’s leading manufacturers of machinery and systems for offsite manufacturing, who they still collaborate with to this day.

Property Partners wanted to test whether the concepts and techniques they learned about in Sweden could work in New Zealand. In collaboration with design consultants and the offsite manufacturing processing team at Auckland Council, they produced a code-compliant design using volumetric modular construction techniques. The design was modelled on a three-storey walk-up apartment that used conventional construction methods.

Auckland Council – Modular components and buildings (external link) - aucklandcouncil.govt.nz

In 2020, Property Partners used a volumetric modular construction approach for one of the buildings on a Kāinga Ora project. Despite being the last building on the project site to start, it was the first to finish. The completed building sat there for nine months waiting for the rest of the project to catch up. Because the building was empty, the biggest challenge was keeping the external stair wells clear of nesting birds.

Kāinga Ora project (external link) - kaingaora.govt.nz

The success of this project gave Property Partners the confidence to invest in a volumetric modular manufacturing plant in Wiri, Auckland, and use this type of construction for multi-level apartments. Property Partners decided to launch a subsidiary, Evergreen Modular, that would manage its Wiri manufacturing plant and focus solely on delivering volumetric modular construction projects.

Evergreen Modular (external link) - evergreenmodular.co.nz

Note: Property Partners is a group of companies that work together to deliver a range of property development services for a variety of corporate and government clients. Evergreen Modular is one of four subsidiary companies within Property Partners, alongside Oxygen Architecture, Habitat Living and Build Partners.

Property Partners has been developing its volumetric modular construction approach over the course of several years. They made a prototype design model based on an existing three-storey walk-up apartment as it allowed them to do an ‘apples-to-apples’ comparison with conventional site-based methods. Due to the seismic conditions being different in New Zealand to those in Sweden, Property Partners’ architectural subsidiary, Oxygen Architects, went through a number of additional design and installation challenges. These issues were worked through with the architectural and build teams, who made the necessary adjustments.

Property Partners used the learnings from the design model and applied them to another project. The apartment building they manufactured offsite had the same architectural design as the conventionally built apartment buildings they were also working on as part of the project. They leased an empty warehouse to manufacture the volumetric modules. Although the process was very manual (since they did not yet have any manufacturing machinery), Property Partners used similar techniques to the ones they had learnt about in Sweden. Once completed, the modules were loaded onto trucks and taken out to site. The modules were then craned into place, which only took one and a half days. Property Partners then completed the ancillary work, such as landscaping, access stairs and services.

Evergreen Modular animation (external link) - linkedin.com

After seeing the benefits of volumetric modular construction first-hand, Evergreen Modular invested in an offsite manufacturing plant. Setting up their Wiri manufacturing plant was challenging as the industrial lease market was tight, the company still needed to do due diligence and there was a lot of work to complete to get the site operational. The production line had to be designed from scratch and equipment had to be imported from Europe to ensure the production line was set up properly. The inventory system, quality assurance system and inspection testing systems also had to be set up. Evergreen Modular then had to find and train 60 staff in the midst of the Covid-19 pandemic, all while setting up and developing its offsite manufacturing processes and systems. It took a lot of effort to get everything up and running, consulting with their Swedish partners for tips and tricks along the way.

Since launching its Wiri manufacturing plant, Evergreen Modular has focused on a few key things to increase efficiency and create cost reductions that can be passed onto clients:

- Building capacity: Evergreen Modular is currently working at increasing capacity without overinvesting in the factory. They have taken things slowly, focusing on getting the basics right, such as implementing and refining their processes, products, software and systems, as well as training and developing their staff. Once they are confident that they have built a strong foundation and are in a position to scale up, the company is planning to bring in more automation and invest in a large-scale purpose-designed facility.

- Improving products and processes: Refining the product and how that product flows through their production line, and connects to the building site, is crucial. Evergreen Modular has worked to improve their design for manufacture and assembly (DfMA) processes and how they standardise various structural components.

- Implementing software and systems: Evergreen Modular has focused on implementing the right software and systems that will enable them to scale up when the time is right. For example, the manufacturing software has the capability to produce a simple A3 printed shop drawing, which the floor team can use to make walls, floors and ceiling elements. The same datafile can direct a chain of automated robot cells simultaneously working together that can produce the same elements whilst maintaining precision tolerances. Future-proofing their software now will give Evergreen Modular the ability to scale up quickly when they are ready to do so.

- Research and Development (R&D): Through their R&D department, Evergreen Modular continually makes small improvements over time. The R&D working group includes team members from Evergreen Modular, Property Partners, Oxygen Architecture and Build Partners (another Property Partners subsidiary), as well as a specialist team of consultants and engineers. The group meets monthly to review lessons learnt and come up with better ways to design, manufacture and deliver modular construction. There are project reviews at various stages throughout each project to capture learnings, and those learnings are subsequently used in other projects. Evergreen Modular have regular meetings with their Swedish mentors and continue to bounce ideas off them to keep learning and improving.

The Wiri manufacturing plant has enabled Evergreen Modular to deliver several large-scale projects, including 108 apartments in Richardson Road, Owairaka, Auckland. Evergreen Modular is using cutting-edge offsite manufacturing fabrication that was modelled in a fully detailed building information modelling (BIM) environment, as well as a DfMA methodology. The Richardson Road project consists of three six-storey apartment buildings which will be constructed primarily using timber volumetric modules. The project is the tallest timber-framed building in New Zealand to have used offsite manufactured timber volumetric modules. The project also included a number of unique aspects, such as a seven-storey high scaffolding with a slidable roof for all weather construction.

Richardson Road (external link) - propertypartners.co.nz

Outcomes and benefits

Less on-site construction time and reduced overall construction costs.

Using timber volumetric modular construction techniques, Property Partners and Evergreen Modular have been able to reduce the overall time on site by 40 percent compared to a traditional build. This has inevitably resulted in overall construction cost reductions for their clients. The time savings of offsite manufacturing are significant, but so are the cost savings.

Better community interactions

Less construction time on site has resulted in less impacts on the surrounding local communities that Evergreen Modular builds in. Since a large part of the works are completed in the factory, the project does not take over the street with noise, dust and tradies’ cars lining the roads for months on end.

Improved quality control

By building in a controlled environment, Evergreen Modular can be very confident about the quality of their products. The manufacturing process is repetitive, and Evergreen Modular has an experienced team who have gotten very good at what they do which has resulted in a limited margin of error. Evergreen Modular has developed standard operating processes and procedures for all parts of the factory and the production line is constantly being optimized for quality and efficiency. The controlled indoor environment means that materials are protected from the outdoors, which ensures that the quality of materials is retained.

Carbon reduction and environmental sustainability

Possibly the most impactful and long-lasting benefit of timber volumetric modular construction is its low carbon output. Evergreen Modular completed a lifecycle embodied carbon assessment for the Richardson Road project and the results were eye opening 1 . The volumetric modules used New Zealand-sourced sustainable timber, which resulted in 103 percent less embodied carbon than an equivalent concrete apartment building. This type of timber-based volumetric modular construction also achieves a reduction of 49 percent in carbon over a 90-year lifecycle 2 when compared to an equivalent concrete apartment building.

Overall, offsite manufacturing is more environmentally sustainable as the process requires only the amount of building materials that are actually needed. This means products aren’t wasted unnecessarily. Evergreen Modular uses a New Zealand-sourced and carbon-positive timber in their construction. When compared to cross-laminated timber or other mass timber structures, an engineered timber frame means that they can achieve the same square meterage using a fraction of the raw materials, making every tree they use go further. This approach reduces the weight of the overall building, which means lighter foundations. This has the added benefit of being able to build on a variety of ground conditions.

Better health and safety

Evergreen Modular has found that offsite manufacturing has better health and safety outcomes for their staff. Since they work in a controlled factory environment, the workplace is very structured. There are not the usual risks you would find in a typical outdoor construction site. Everybody works at ground level on stations that they know, which also creates manufacturing efficiency gains.

Evergreen Modular also found other wellbeing benefits of offsite manufacturing. The offsite manufacturing approach requires a strong team environment where all workers are helping and learning from each other. To be able to work in an offsite manufacturing environment, the team at Evergreen Modular makes sure that all their employees are properly trained and well-supported. They have built a tight knit team who are used to working with one another.

Project diversity

People often assume that timber volumetric modular construction will all look the same, but this is not the case. The high-quality chassis that Evergreen Modular creates can be used across a large number of applications, whether it’s apartments, retirement villages, hotels, or student accommodation. By working closely with their architectural team, Evergreen Modular is able to customise the exterior and interiors of a project as much as specified. The internal fittings can be as cost-efficient or high-spec as desired by the client.

1. The lifecycle embodied carbon assessment was an independent study conducted by the Kāinga Ora Carbon Neutral Housing team to current New Zealand best practice for whole building lifecycle embodied carbon assessments. The study was conducted in partnership with the Evergreen Modular who supplied the building material quantities from their offsite manufacturing fabrication process, and the project design and documentation. 2. Carbon LCA calculated using LCAQuick v3.4

Lessons learned

Learning is an ongoing journey.

Evergreen Modular treats its current manufacturing facility as a learning factory, a place for them to test, improve and refine their processes, products, software and systems. While this is most obvious through their R&D programme, learnings are captured through all aspects of their work. They use their learnings to improve what they are doing in their other projects, both current and future, and have enabled the business to scale up quickly as required. Lessons from their design model helped inform their first offsite manufactured project, and the subsequent lessons from that helped inform their more recent projects, such as Richardson Road.

Valuing your mentor’s advice

Building connections and relationships in Sweden played a huge part in developing the Evergreen Modular offsite manufacturing approach. Those relationships are still going strong, and the New Zealand team frequently touches base with their Swedish mentors to test ideas. When the Accord asked Evergreen Modular what they would have done differently next time, they said they could have followed the advice of their Swedish contacts more closely. New Zealand firms sometimes tend to think that things are a bit different down here, and Evergreen Modular couldn’t help but put its own spin on things using the Kiwi ‘No. 8 wire’ mentality. Taking learnings from the Swedish and adding in the New Zealand context has been an ongoing R&D process. While it has taken a while to work through the best methods, testing and trialing different approaches has taught them great lessons and has allowed Evergreen Modular to make better decisions going forward.

Building differently requires a different mindset

Going down the timber volumetric modular construction route has inevitably attracted people who are open to change and want to see innovation in the construction industry. Making buildings in a factory requires a DfMA mindset, and traditional building work only happens on site once the modules have been set in place. Those switching over from traditional building methods and techniques into offsite manufacturing are likely going to need to break some old habits and change how they think about the overall building and construction process.

Taking your time

Evergreen Modular has been careful about building capacity over time. They noticed that other companies often put too much focus on the automation and technology but not enough time and effort on the processes and systems. They have made a conscious decision to take things a bit more slowly, building and refining their products, processes, software and systems while focusing on training and growing their people. Their slow and steady approach is evident in how they started their offsite manufacturing journey, by creating a design model and then an initial project before investing in a manufacturing plant. At this point in time, Evergreen Modular is planning and preparing for the next step to scale up.

Check out the How-to guide

Crown copyright © 2024

https://www.constructionaccord.nz/good-practice/beacon-projects/case-study-offsite-manufacturing-delivers-multi-storey-timber-frame-apartments Please note: This content will change over time and can go out of date.

An official website of the United States government

Here's how you know

Official websites use .gov A .gov website belongs to an official government organization in the United States.

Secure .gov websites use HTTPS A lock ( Lock Locked padlock ) or https:// means you’ve safely connected to the .gov website. Share sensitive information only on official, secure websites.

Offsite Construction for Housing: Research Roadmap

Report Acceptance Date: June 2022 (94 pages)

Posted Date: January 24, 2023

Offsite construction of housing, which includes manufactured housing, modular homes, and prefabricated structural components, offers potential for production efficiencies, improved quality, and lower costs. Key knowledge gaps and research needs to be addressed to overcome the barriers and challenges of offsite construction and fulfill its potential. A literature review and industry consultation informed development of this research roadmap and recommended research priorities for the Department of Housing and Urban Development and broader public-private collaborations to advance offsite construction for housing. Research priorities are identified for six topical areas: Regulatory Framework; Standards and System Performance; Capital, Finance, and Insurance; Project Delivery and Contracts; Labor and Workforce Training and Management; and Business Models and Economic Performance.

- Planning & Construction

- Building Control

- Construction Technology News

- Construction Software News

- Health & Safety

- HR & Skills

- Stakeholders

- Publications

- Our Audience

- Prestige Contributors

- Testimonials

- BIM Software Providers

- Structural Warranty Providers

- Planning & Construction News

Case study: The changing face of offsite construction

Raymond Millar, Construction Director at the McAvoy Group and Buildoffsite member, looks at the design and offsite construction of a new state-of-the-art academy in Slough and how it was delivered weeks ahead of programme

Lynch Hill Enterprise Academy is a £20m education campus and one of the largest-ever modular schools to be built in the UK. It demonstrates a number of innovations that contributed to its early completion – an unprecedented 17 weeks ahead of programme, giving this new free school the benefit of even earlier occupation.

Lynch Hill is a 1,140-place academy built offsite by principal contractor the McAvoy Group for the Learning Alliance Academy Trust. In recognition of its success, the project has already been shortlisted for five industry awards.

Funded by the Education & Skills Funding Agency (ESFA) , this three-storey, 8,750m2 building is an exemplar offsite education project which has a design inspired by the world-leading Harvard Business School.

Pre-construction challenges

The design for Lynch Hill was initially developed for another site and then had to be adapted for a second and final brownfield site . The build programme had to accommodate extensive demolition works, asbestos removal, restricted access and the school’s first intake of pupils, who were located in temporary buildings also on the site.

Advertisement

Construction had to be phased to allow early handover of the sports hall and changing facilities for use by the school.

Design criteria

The design brief set out a number of important criteria, all to be met within the ESFA’s available budget:

- Facilitate the exchange of knowledge with business and encourage a sense of enterprise among students, thereby helping to bridge the skills gap for local companies.

- Create an environment for collaborative learning and mentoring, and provide good visibility as part of the school’s anti-bullying strategy.

- Excellent acoustic performance.

- Community access to the sports facilities.

A design to encourage collaborative learning

The school is designed around four large multi-functional central spaces that help to maximise natural light and encourage collaborative learning. The use of inspirational messages and bold colours throughout reflects the academy’s ethos of enterprise, aspiration and achievement.

The building features an impressive full-height glazed entrance, a striking timber colonnade and a palette of materials that includes render and timber-effect rainscreen cladding to harmonise the scheme in its semi-rural location.

Outstanding educational facilities

Offsite construction was used for the curriculum wing. Facilities include science laboratories, an ICT suite, SEN hub, studios for music, drama and art, areas for informal learning, sixth form study and social space, kitchen and café. An enterprise exchange runs through the core of the building on two levels to facilitate collaboration with local businesses.

Externally there is a landscaped area and social space, which form a large arrival plaza at the front of the school. This creates a sense of place and identity for the academy and encourages informal gatherings with its planting and seating.

Technical advancements in offsite construction

Lynch Hill demonstrates a number of technical advancements in offsite construction. Larger, 15.6m-long modules and a new lifting system were specially engineered by McAvoy for the project, which reduced time, transport and installation costs and further improved construction efficiency. Some of the steel-framed modules were pre-clad offsite in the factory to further reduce time on site.

The use of a McAvoy offsite solution removed the need for storage of large volumes of building materials on the site, helping to address the issue of restricted access.

Around 65% of the building’s construction was completed offsite. A total of146 modules were installed with doors, windows, ironmongery, internal walls, plumbing, electrics and joinery already in place. This approach reduced the build programme to just 53 weeks.

The build programme was around six months less compared to site-based construction for a school of this scale.

The client perspective

Phil Clarke, ESFA Project Manager, said: “The main driver for offsite for this project was speed – and to see a building of this scale constructed so quickly was amazing. The McAvoy construction team was fantastic and demonstrated a high level of skill and flexibility.

“The combination of steel-framed construction and the offsite solution works really well and is seamless. You would never know this was a modular build. This is an outstanding secondary school scheme.”

Gillian Coffey, Executive Head Teacher at Lynch Hill, said: “This new academy has been developed to address a severe shortfall in school places in Slough. The facilities are terrific and the children are enjoying a fantastic new learning environment and the benefits of cutting-edge design. The building works very well to optimise the space, to provide excellent acoustic performance and high levels of natural light, and to futureproof the needs of the children.

“The speed of offsite construction was the biggest benefit of the approach on this project. To build a school of this scale over two floors and using a state-of-the-art design within a year is amazing.”

Digitising construction

BIM was valuable for the Lynch Hill project, allowing design plans to be reviewed for clash detection of services with the modular structure. This helped to ensure seamless construction and removed the need for additional site works.

BIM allows processes to be streamlined to help deliver better decision making at the earliest possible stages in the life of a project. The increased use of BIM will deliver shorter design periods, giving schools and LEAs the benefit of reduced risk and even earlier occupation. It also allows all of the necessary technical data for the building assets to be embedded into models.

Since the inception of Lynch Hill, McAvoy now offers virtual reality , which is particularly valuable for education schemes to enhance stakeholder collaboration. Teaching staff can now be ‘put into’ a virtual building and have the opportunity to ‘walk around’ the building at the earliest design stage to feel and experience its functionality and assess usability.

The industry view

Commenting on the project, Ian Pannell, a Director of Buildoffsite , said: “This project takes the use of offsite for secondary schools to a completely new level for speed, quality and design.

“Time and cost overruns on both public and private sector building projects are still unacceptably high. By contrast and as McAvoy successfully demonstrates with Lynch Hill, offsite construction can significantly reduce risk with much greater assurance of delivery on time and on budget.

“It is also fantastic to see the synergy between offsite solutions and the latest digital technologies. Harnessing BIM allows processes to be streamlined even further, to help facilitate better decision making among schools and local authorities. The enhanced stakeholder engagement at the earliest possible stages of a project will result in truly outstanding buildings.”

Raymond Millar

Construction Director

The McAvoy Group

Tel: +44 (0)845 076 0100

www.mcavoygroup.com

RELATED ARTICLES MORE FROM AUTHOR

Collaborative nature of archicad model brings city campus to life, leveraging bim for enhanced risk assessment and insurability in civil infrastructure and large-scale property, reshaping the future of uk housebuilding: introducing m-dock, tophat managing director to move on after just four years in post, children in crisis: confronting the stark reality of england’s housing emergency, administration notice filed by go modular technologies uk, ireland: a centre of excellence for modern methods of construction in europe, industry statistics showcase successful offsite construction projects, bouygues uk boosts efficiency, visibility and risk management with payment applications, what’s wrong with uk construction, digital construction today: get the global view on bim, digital twins, ai, iot and much more, designing homes with mmc for the future homes standard, leave a reply cancel reply.

Save my name, email, and website in this browser for the next time I comment.

Featured MMC News

The modular building institute: the voice of commercial modular construction.

News. Analysis. Opinion.

The Planning, Building & Construction Today website is the place to come for compelling and informative features, news and products for a diverse audience serving a wide construction sector.

- Terms & Conditions

- Privacy Policy

- GDPR Information

- GDPR Privacy Policy

© Adjacent Digital Politics Ltd

Study at Cambridge

About the university, research at cambridge.

- Undergraduate courses

- Events and open days

- Fees and finance

- Postgraduate courses

- How to apply

- Postgraduate events

- Fees and funding

- International students

- Continuing education

- Executive and professional education

- Courses in education

- How the University and Colleges work

- Term dates and calendars

- Visiting the University

- Annual reports

- Equality and diversity

- A global university

- Public engagement

- Give to Cambridge

- For Cambridge students

- For our researchers

- Business and enterprise

- Colleges & departments

- Email & phone search

- Museums & collections

- Laing O'Rourke Centre for Construction Engineering and Technology

- About overview

- Management Board

- Education and Skills overview

- Construction Engineering Masters Programme overview

- About the Programme

- Why Participate?

- Course Dates and Fees

- Entry requirements and how to apply

- FAQs and Q&A sessions overview

- Q&A session booking form

- CEM prospectus

- Research and Innovation overview

- Digital Engineering, Data and Computer Vision overview

- CIT Laboratory

- Performance & Productivity

- Procurement

- Sustainability overview

- Decarbonising construction

- Underground Construction

- Wellbeing in Construction Forum

- Policy and Thought leadership overview

- Papers and Industry Reports

- Impact Case Studies

- Dissertation Research overview

- Centre's Reports

- People overview

- Core Academic Team

- Academic Visitors and Secondees

- Academic Staff Affiliated

- Research and Computer Associates

- PhD Students

- Professional Staff

- Previous Members

Methodology for quantifying the benefits of offsite construction

- Policy and Thought leadership

- Education and Skills

- Research and Innovation

CIRIA and the Laing O’Rourke Centre for Construction Engineering and Technology , University of Cambridge, have launched a new guidance framework to unlock evidence-based assessments of offsite construction and data driven decision-making for the industry. The guide urges the construction industry to unify project performance monitoring by applying a consistent methodology.

Offsite construction offers the potential to deliver a variety of benefits including better quality construction, improved health and safety, a faster construction programme as well as predictability of cost and time on a project. Despite this, uptake of offsite construction is slow and there is limited objective, evidence-based research to validate these suggested benefits.

The CIRIA guide C792 , launched on 16 March, proposes a methodology for evaluating project performance with the intention of identifying how construction approach influences project outcomes and whether offsite construction delivers the expected benefits.

This guide is the result of a year-long research project by CIRIA and the Laing O’Rourke Centre for Construction Engineering and Technology, University of Cambridge. The research team were advised by a project steering group (PSG) comprising 27 organisations from across the construction industry to ensure the relevance of the proposed methodology for industry.

The resulting publication describes the process of identifying and measuring relevant metrics that may be influenced by offsite construction and then applies the proposed methodology to a set of case study projects to evaluate how construction approach influences project performance.

The data and analysis highlight the challenges that can be expected when assessing the performance of construction projects and developing robust benchmarks for comparison. The report speaks directly to these challenges by proposing a framework which would enable the industry to:

- Keep consistent records across projects and companies.

- Assess the value and benefits achieved on projects.

- Establish a database on project performance.

- Facilitate wider collaboration.

Identifying relevant metrics for measurement

The first step of this project sought to identify the expected benefits of offsite construction and how to measure them. Apart from the upfront construction impacts, it was important to include broad impacts beyond just capital cost, addressing environmental and societal factors such as local disruption and workforce quality of life. The guide identified metrics to quantify the project’s impact on each factor, and defined the boundaries of assessment to ensure metrics can be consistently measured across different projects or organisations.

These metrics, together with the guidance for measuring them, form a methodology that project stakeholders can use to assess the value and benefits achieved on projects and determine if offsite construction delivered the expected benefits.