Simple Business Plan Template for Startups, Small Businesses & Entrepreneurs

Financial plan, what is a financial plan.

A business’ financial plan is the part of your business plan that details how your company will achieve its financial goals. It includes information on your company’s projected income, expenses, and cash flow in the form of a 5-Year Income Statement, Balance Sheet and Cash Flow Statement. The plan should also detail how much funding your company needs and the key uses of these funds.

The financial plan is an important part of the business plan, as it provides a framework for making financial decisions. It can be used to track progress and make adjustments as needed.

Why Your Financial Plan is Important

The financial section of your business plan details the financial implications of running your company. It is important for the following two reasons:

Making Informed Decisions

A financial plan provides a framework for making decisions about how to use your money. It can help you determine whether or not you can afford to make a major purchase, such as a new piece of equipment.

It can also help you decide how much money to reinvest in your business, and how much to save for paying taxes.

A financial plan is like a roadmap for your business. It can help you track your progress and make adjustments as needed. The plan can also help you identify potential problems before they arise.

For example, if your sales are below your projections, you may need to adjust your budget accordingly.

Your financial plan helps you understand how much outside funding is required, when your levels of cash might fall low, and what sales and other goals you need to hit to become financially viable.

Securing Funding

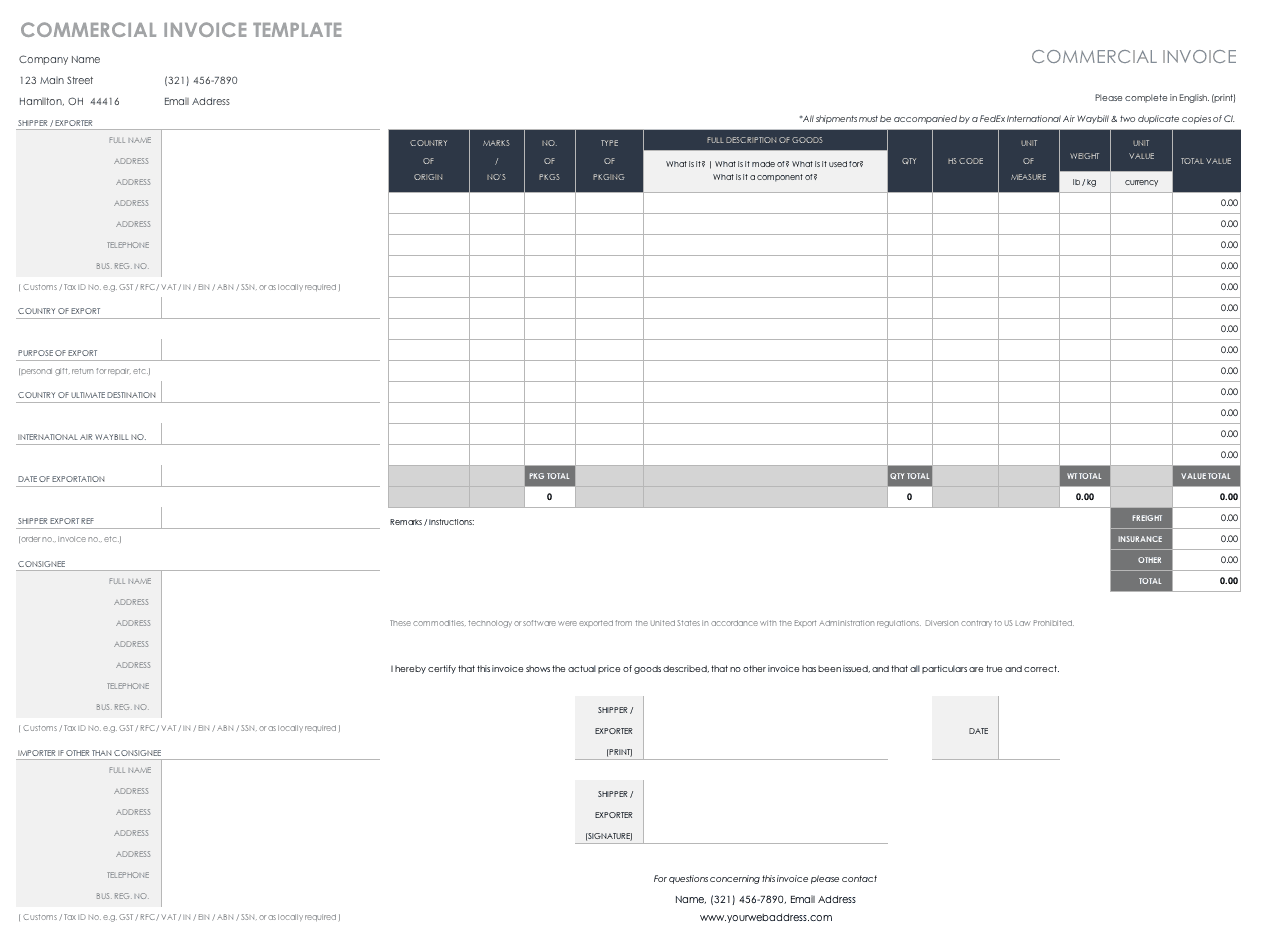

This section of your plan is absolutely critical if you are trying to secure funding. Your financial plan should include information on your revenue, expenses, and cash flow.

This information will help potential investors or lenders understand your business’s financial situation and decide whether or not to provide funding.

Include a detailed description of how you plan to use the funds you are requesting. For example, what are the key uses of the funds (e.g., purchasing equipment, paying staff, etc.) and what are the future timings of these financial outlays.

The financial information in your business plan should be realistic and accurate. Do not overstate your projected revenues or underestimate your expenses. This can lead to problems down the road.

Potential investors and lenders will be very interested in your future projections since it indicates whether you will be able to repay your loans and/or provide a nice return on investment (ROI) upon exit.

Financial Plan Template: 4 Components to Include in Your Financial Plan

The financial section of a business plan should have the following four sub-sections:

Revenue Model

Here you will detail how your company generates revenues. Oftentimes this is very straightforward, for instance, if you sell products. Other times, your answer might be more complex, such as if you’re selling subscriptions (particularly at different price/service levels) or if you are selling multiple products and services.

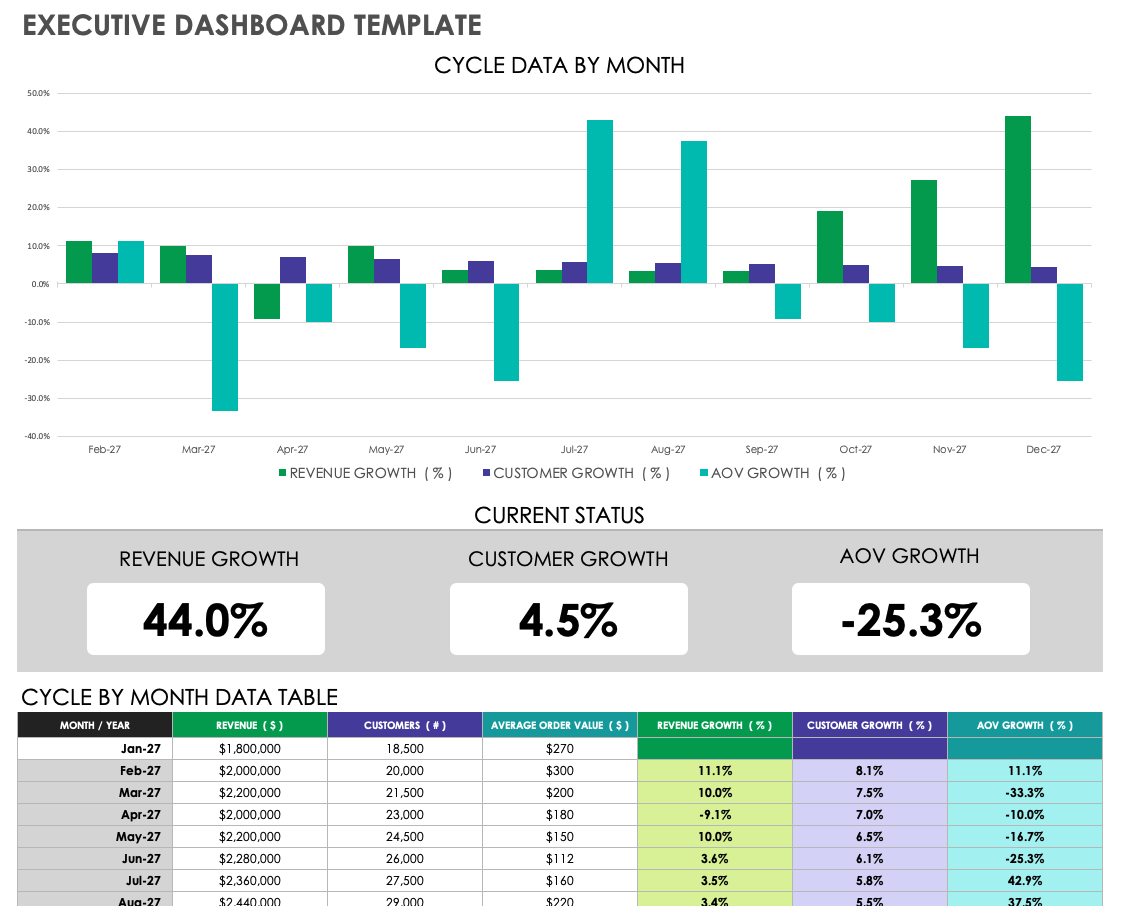

Financial Overview & Highlights

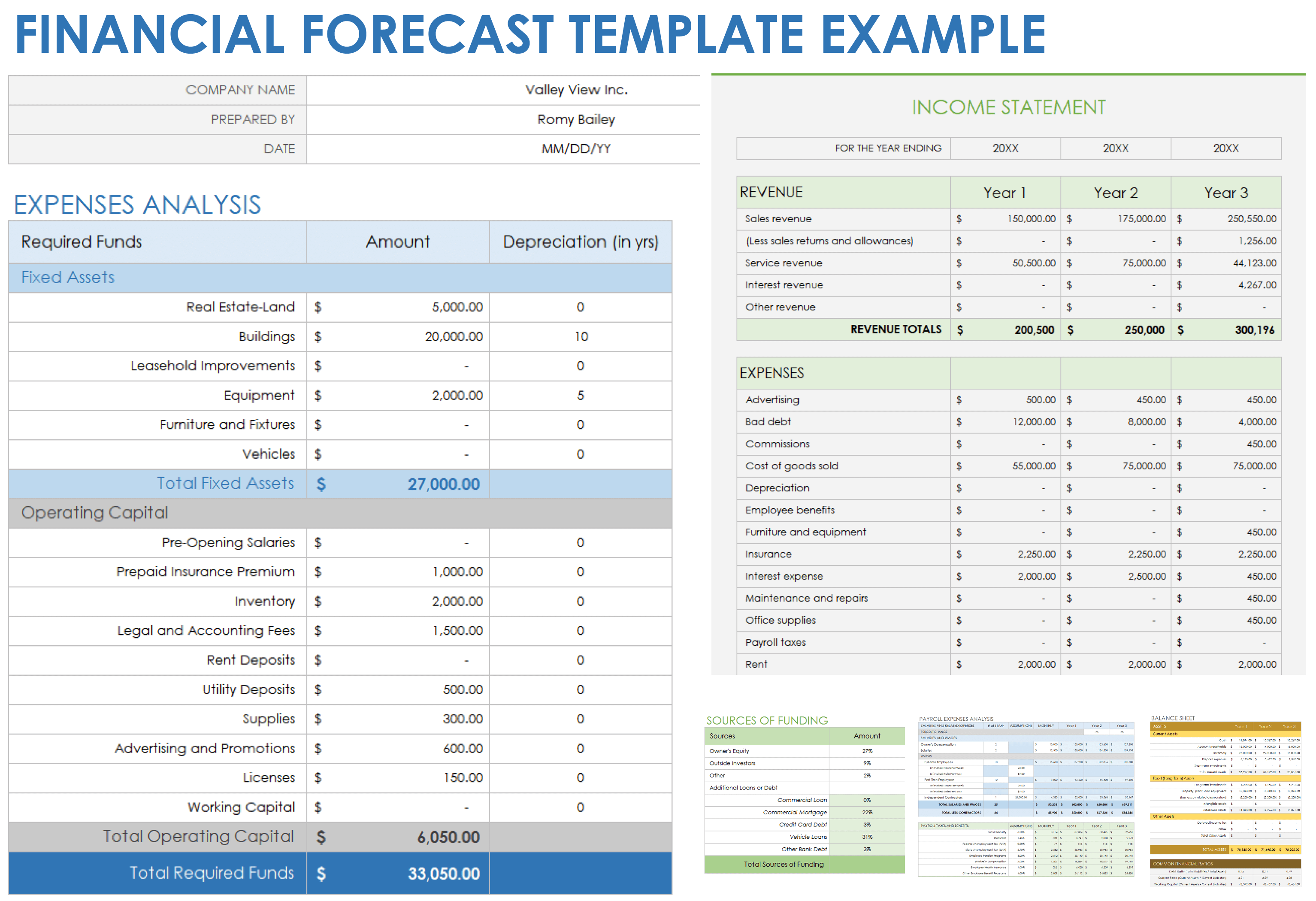

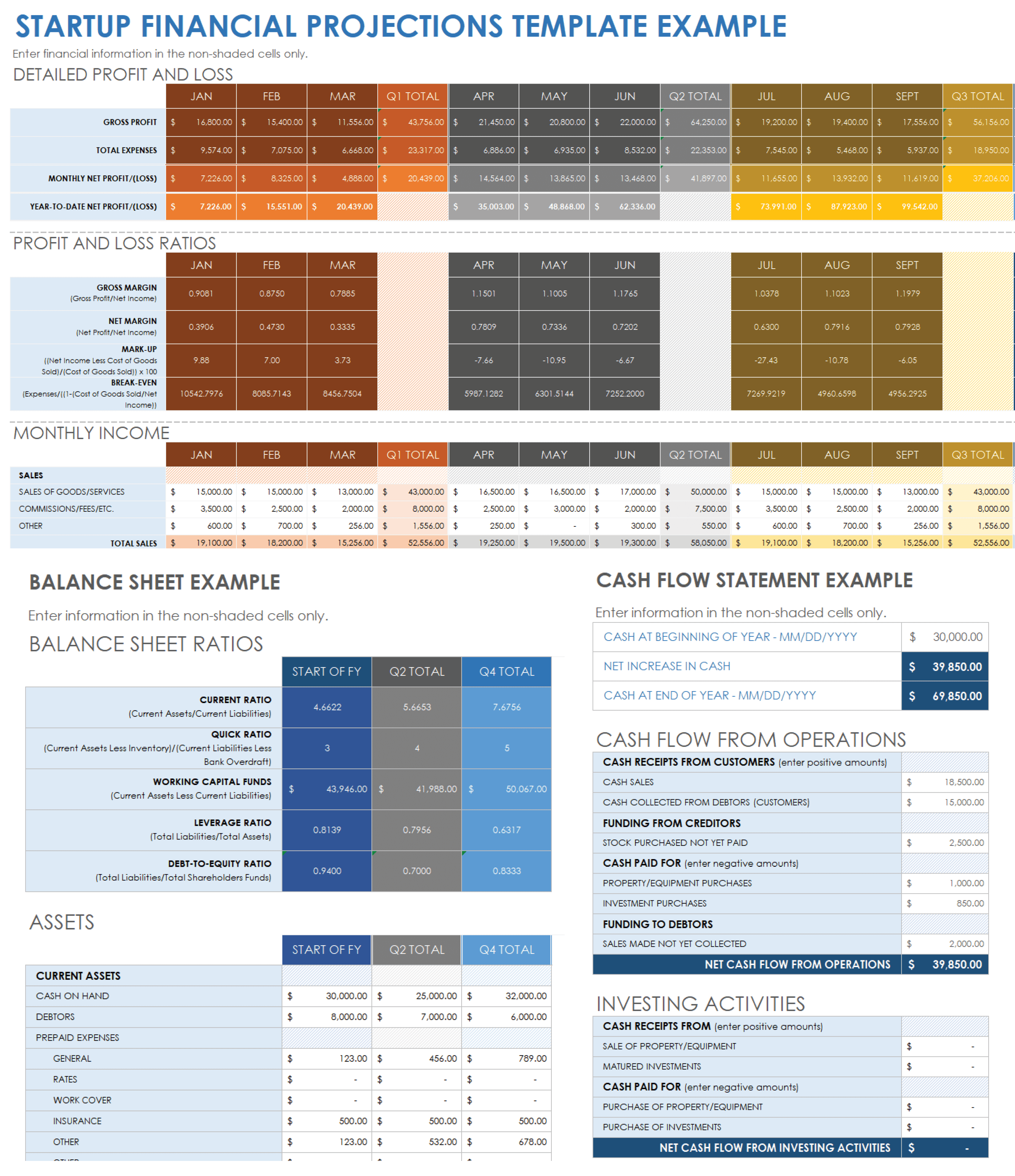

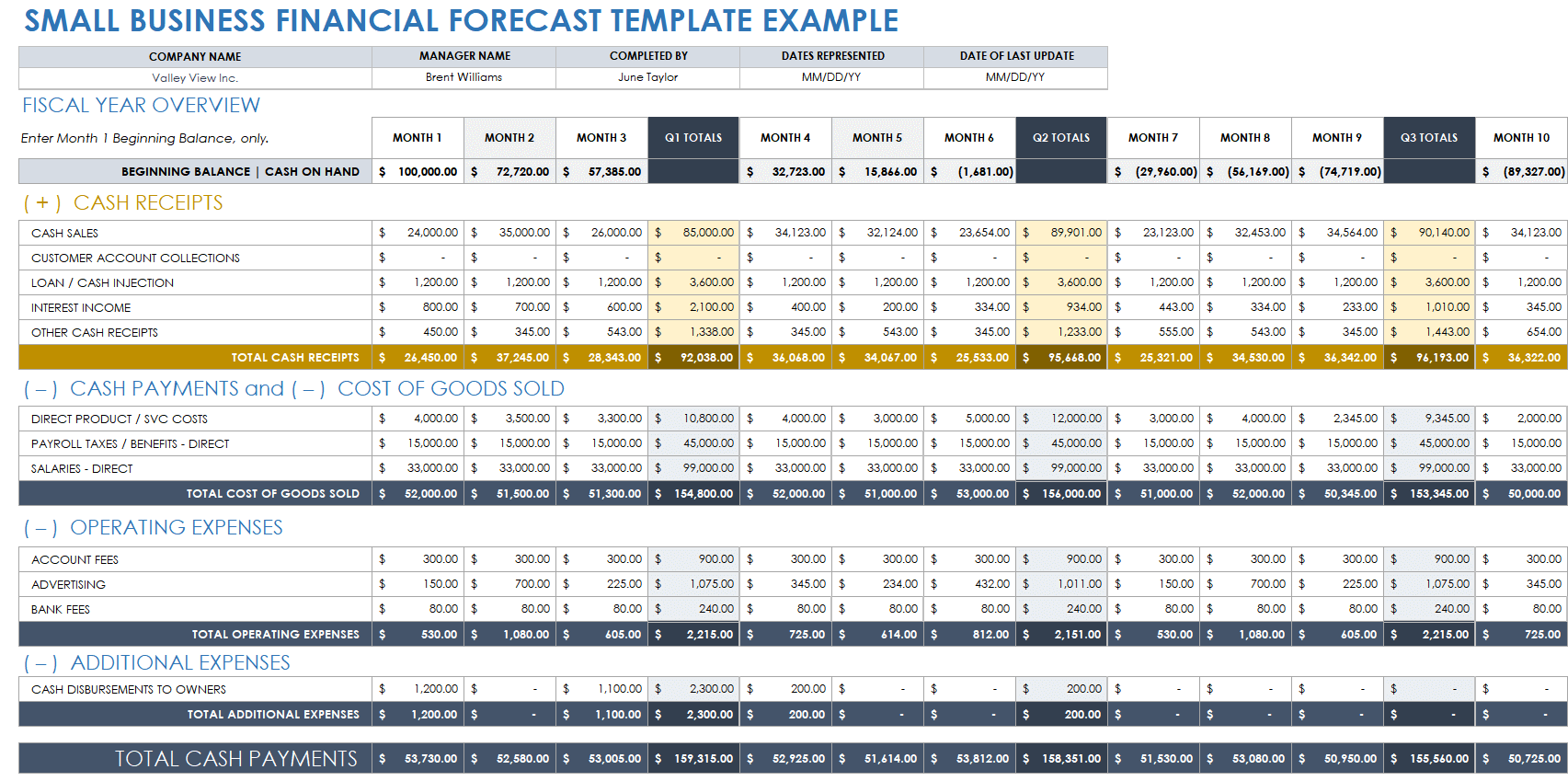

In developing your financial plan, you need to create full financial forecasts including the following financial statements.

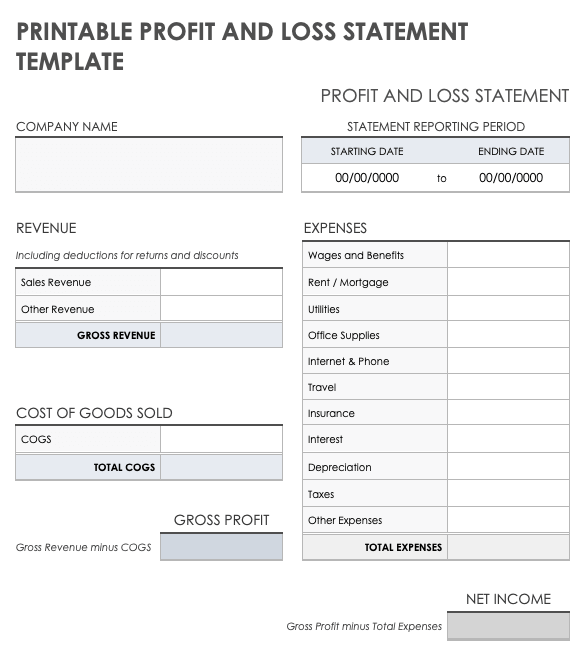

5-Year Income Statement / Profit and Loss Statement

An income statement, also known as a profit and loss statement (P&L), shows how much revenue your business has generated over a specific period of time, and how much of that revenue has turned into profits. The statement includes your company’s revenues and expenses for a given time period, such as a month, quarter, or year. It can also show your company’s net income, which is the amount of money your company has made after all expenses have been paid.

5-Year Balance Sheet

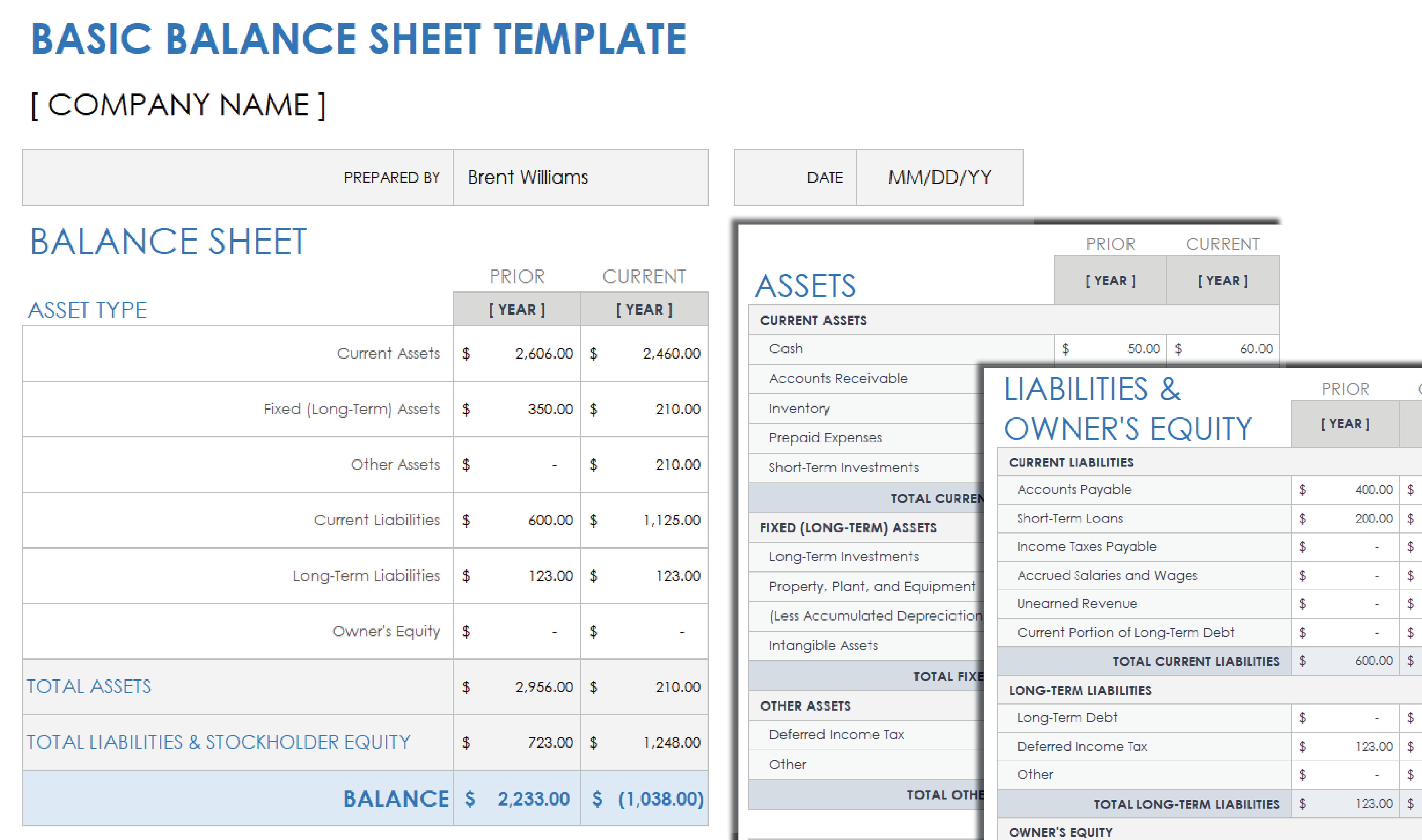

A balance sheet shows a company’s financial position at a specific point in time. The balance sheet lists a company’s assets (what it owns), its liabilities (what it owes), and its equity (the difference between its assets and its liabilities).

The balance sheet is important because it shows a company’s financial health at a specific point in time. A strong balance sheet indicates that a company has the resources it needs to grow and expand. A weak balance sheet, on the other hand, may indicate that a company is struggling to pay its bills and may be at risk of bankruptcy.

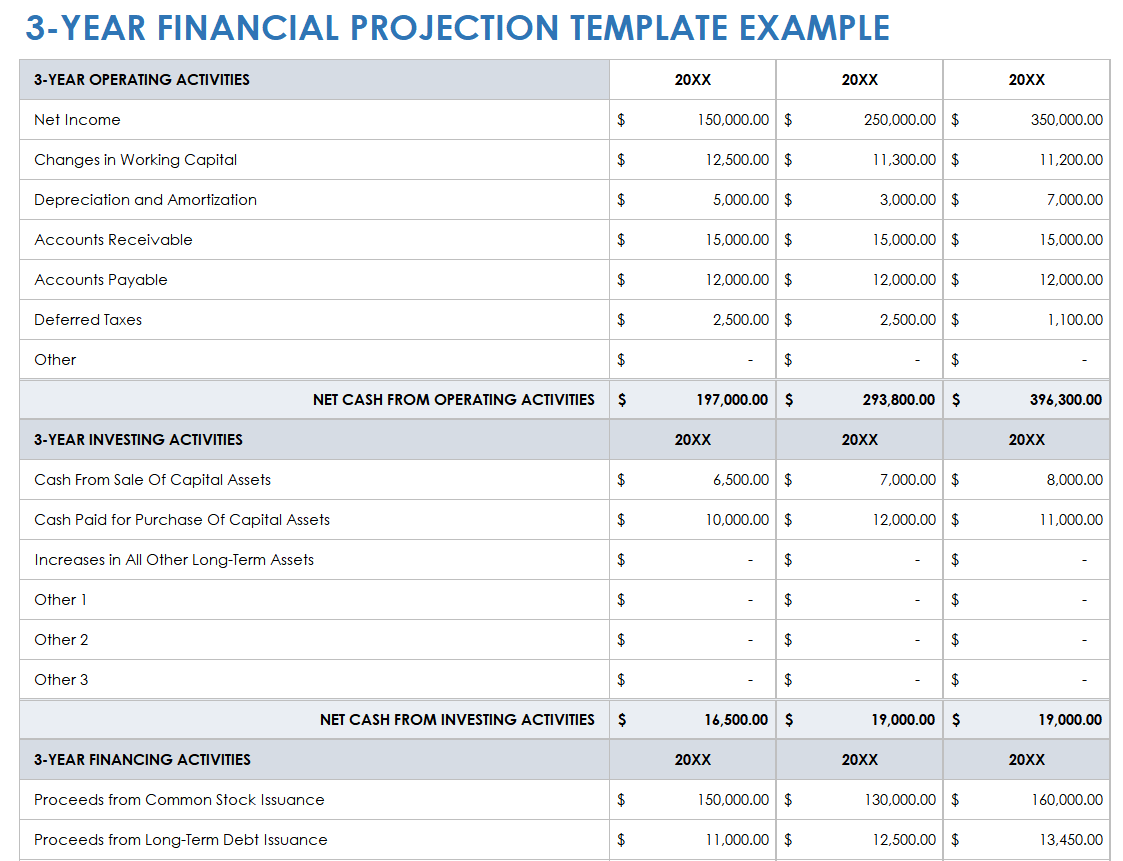

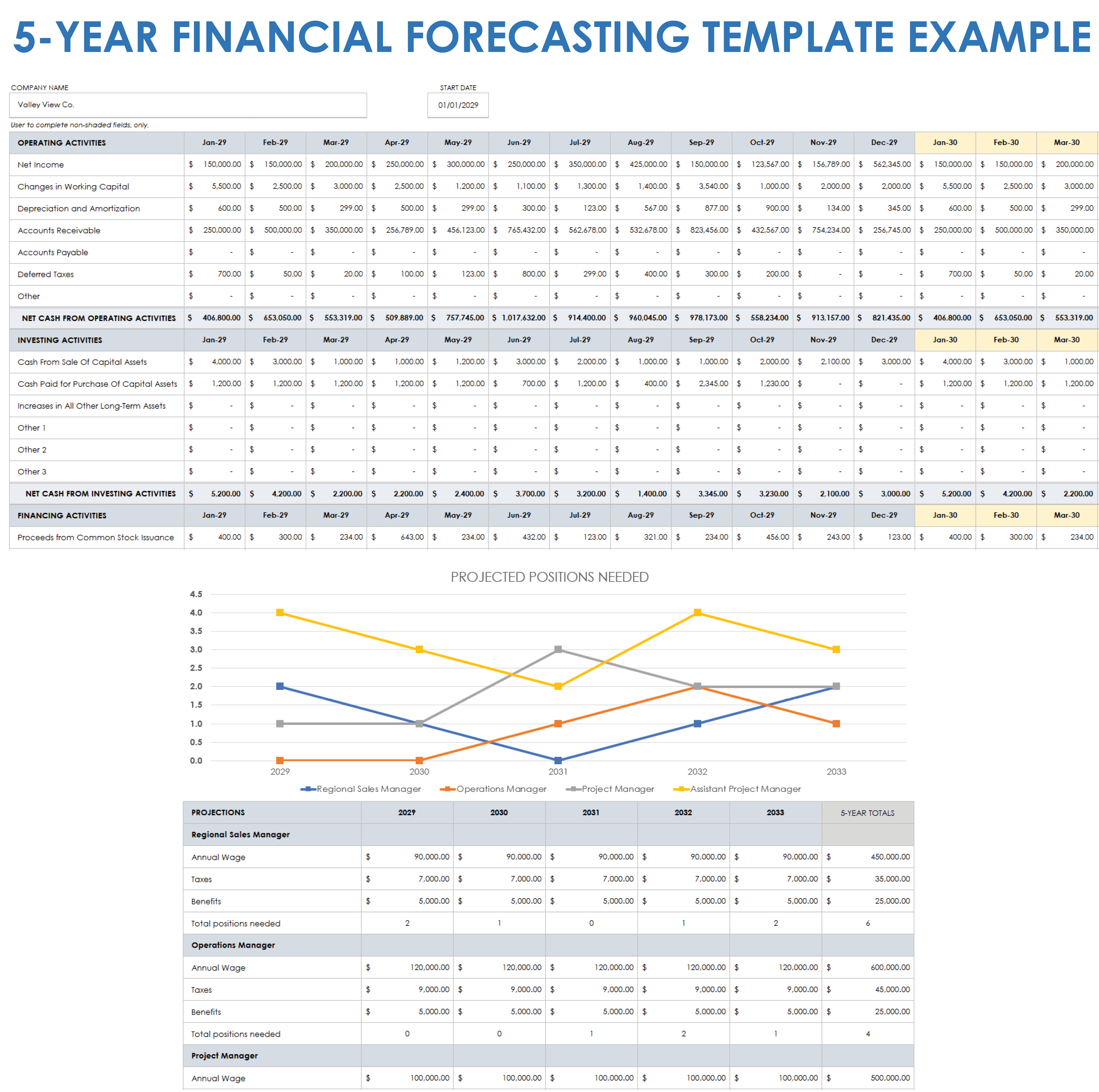

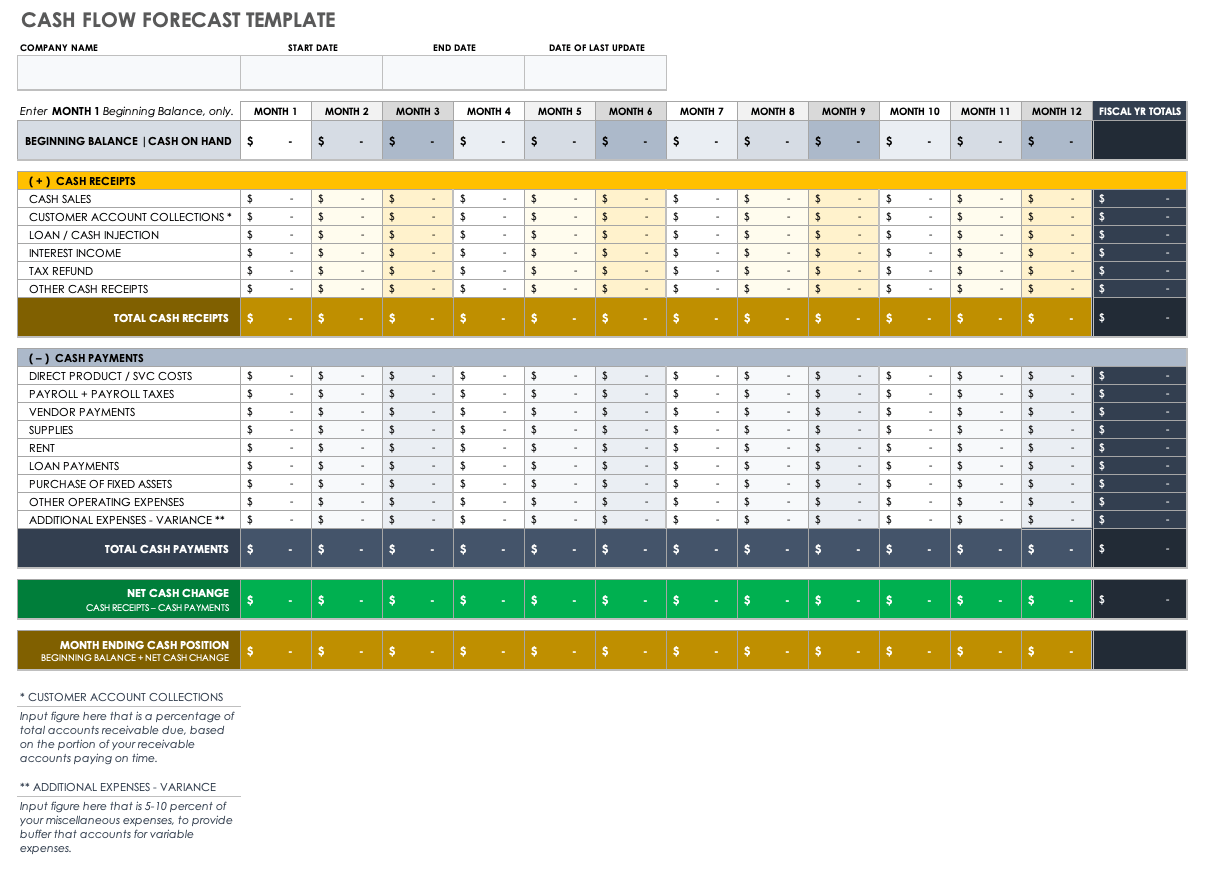

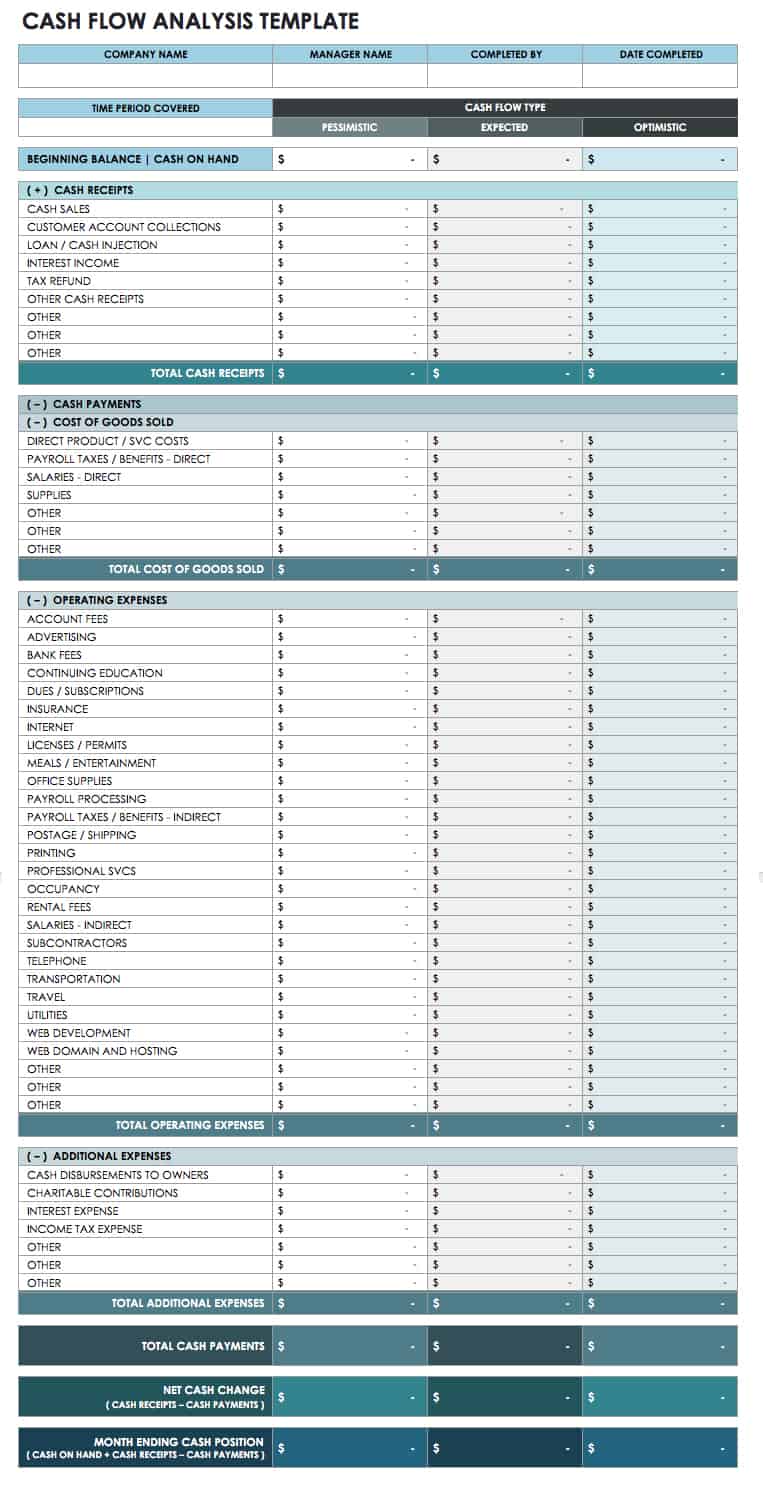

5-Year Cash Flow Statement

A cash flow statement shows how much cash a company has on hand, as well as how much cash it is generating (or losing) over a specific period of time. The statement includes both operating and non-operating activities, such as revenue from sales, expenses, investing activities, and financing activities.

While your full financial projections will go in your Appendix, highlights of your financial projections will go in the Financial Plan section.

These highlights include your Total Revenue, Direct Expenses, Gross Profit, Other Expenses, EBITDA (Earnings Before Interest, Taxes, Depreciation and Amortization), and Net Income projections. Also include key assumptions used in creating these future projections such as revenue and cost growth rates.

Funding Requirements/Use of Funds

In this section, you will detail how much outside funding you require, if any, and the core uses of these funds.

For example, detail how much of the funding you need for:

- Product Development

- Product Manufacturing

- Rent or Office/Building Build-Out

Exit Strategy

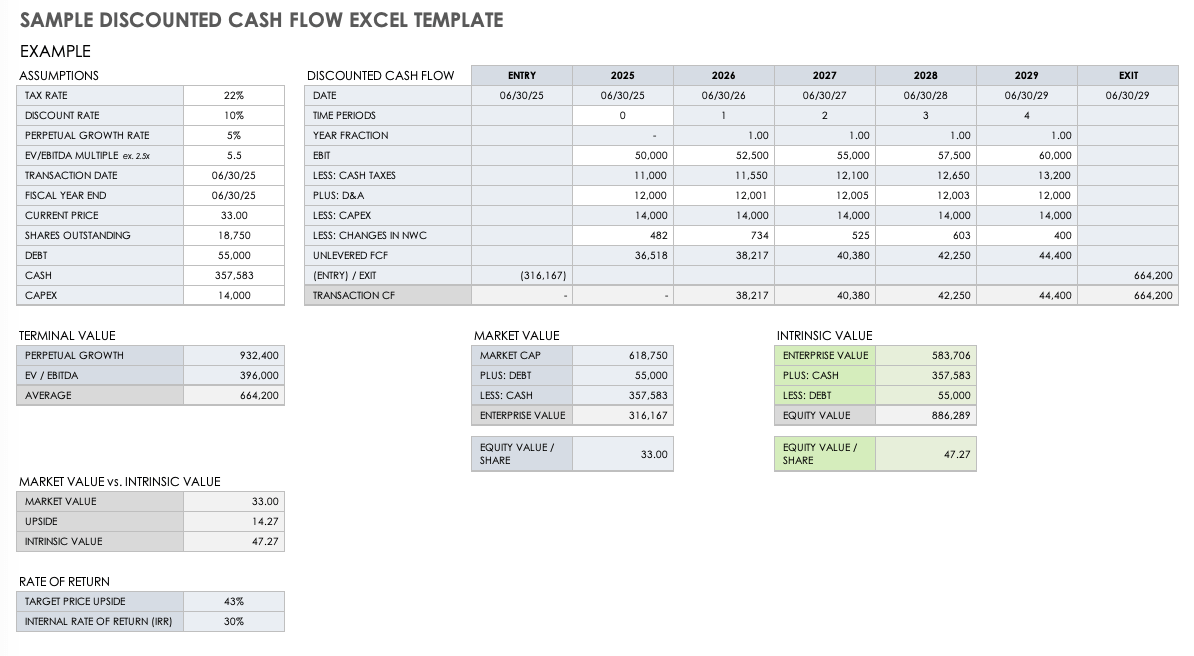

If you are seeking equity capital, you need to explain your “exit strategy” here or how investors will “cash out” from their investment.

To add credibility to your exit strategy, conduct market research. Specifically, find other companies in your market who have exited in the past few years. Mention how they exited and the amounts of the exit (e.g., XYZ Corp. bought ABC Corp. for $Y).

Business Plan Financial Plan FAQs

What is a financial plan template.

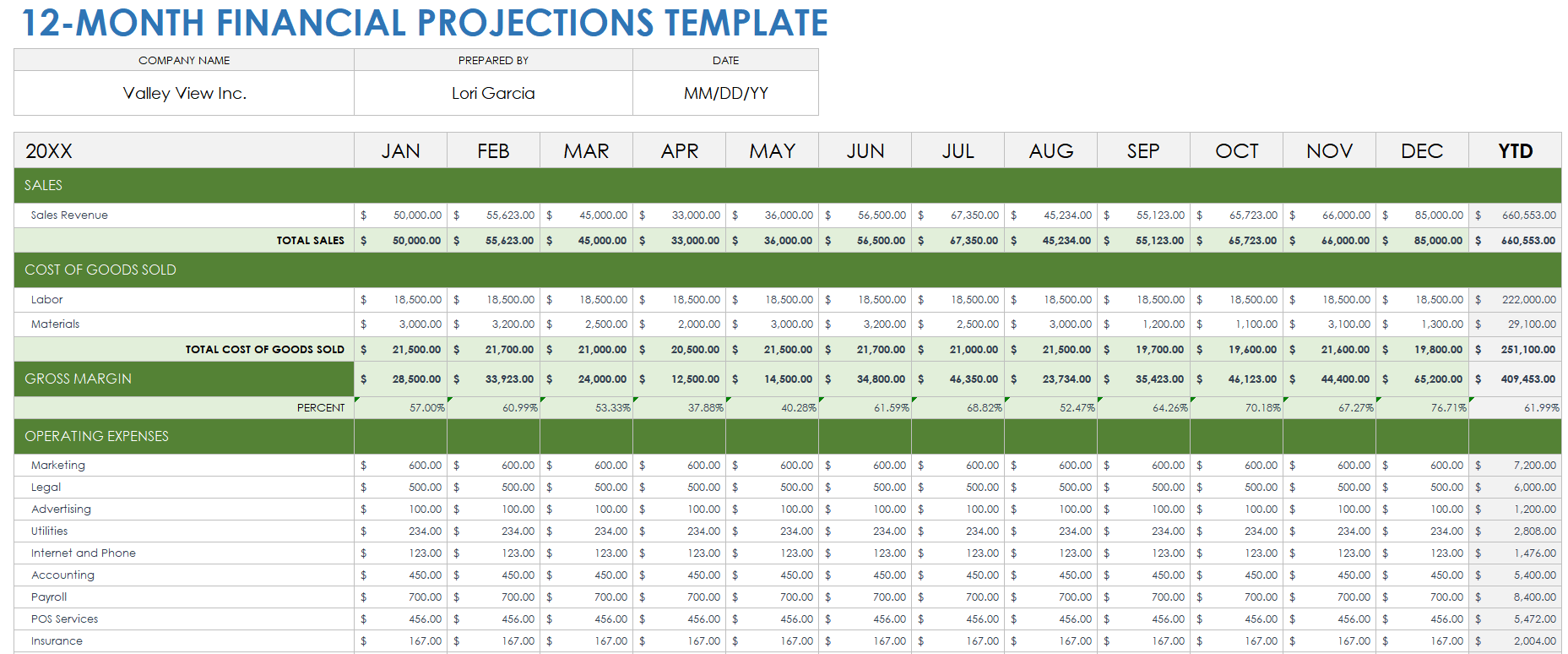

A financial plan template is a pre-formatted spreadsheet that you can use to create your own financial plan. The financial plan template includes formulas that will automatically calculate your revenue, expenses, and cash flow projections.

How Can I Download a Financial Plan Template?

Download Growthink’s Ultimate Business Plan Template which includes a complete financial plan template and more to help you write a solid business plan in hours.

How Do You Make Realistic Assumptions in Your Business Plan?

When forecasting your company’s future, you need to make realistic assumptions. Conduct market research and speak with industry experts to get a better idea of the key trends affecting your business and realistic growth rates.

You should also use historical data to help inform your projections. For example, if you are launching a new product, use past sales data to estimate how many units you might sell in Year 1, Year 2, etc.

Learn more about how to make the appropriate financial assumptions for your business plan.

How Do You Make the Proper Financial Projections for Your Business Plan?

Your business plan’s financial projections should be based on your business model and your market research. The goal is to make as realistic and achievable projections as possible.

To create a good financial projection, you need to understand your revenue model and your target market. Once you have this information, you can develop assumptions around revenue growth, cost of goods sold, margins, expenses, and other key metrics.

Once you have your assumptions set, you can plug them into a financial model to generate your projections.

Learn more about how to make the proper financial projections for your business plan.

What Financials Should Be Included in a Business Plan?

There are a few key financials that should be included in a traditional business plan format. These include the Income Statement, Balance Sheet, and Cash Flow Statement.

Income Statements, also called Profit and Loss Statements, will show your company’s expected income and expense projections over a specific period of time (usually 1 year, 3 years, or 5 years). Balance Sheets will show your company’s assets, liabilities, and equity at a specific point in time. Cash Flow Statements will show how much cash your company has generated and used over a specific period of time.

Growthink's Ultimate Business Plan Template includes a complete financial plan template to easily create these financial statements and more so you can write a great business plan in hours.

BUSINESS PLAN TEMPLATE OUTLINE

- Business Plan Template Home

- 1. Executive Summary

- 2. Company Overview

- 3. Industry Analysis

- 4. Customer Analysis

- 5. Competitive Analysis

- 6. Marketing Plan

- 7. Operations Plan

- 8. Management Team

- 9. Financial Plan

- 10. Appendix

- Business Plan Summary

Other Helpful Business Planning Articles & Templates

How to Write a Business Plan: Step-by-Step Guide + Examples

Noah Parsons

24 min. read

Updated May 7, 2024

Writing a business plan doesn’t have to be complicated.

In this step-by-step guide, you’ll learn how to write a business plan that’s detailed enough to impress bankers and potential investors, while giving you the tools to start, run, and grow a successful business.

- The basics of business planning

If you’re reading this guide, then you already know why you need a business plan .

You understand that planning helps you:

- Raise money

- Grow strategically

- Keep your business on the right track

As you start to write your plan, it’s useful to zoom out and remember what a business plan is .

At its core, a business plan is an overview of the products and services you sell, and the customers that you sell to. It explains your business strategy: how you’re going to build and grow your business, what your marketing strategy is, and who your competitors are.

Most business plans also include financial forecasts for the future. These set sales goals, budget for expenses, and predict profits and cash flow.

A good business plan is much more than just a document that you write once and forget about. It’s also a guide that helps you outline and achieve your goals.

After completing your plan, you can use it as a management tool to track your progress toward your goals. Updating and adjusting your forecasts and budgets as you go is one of the most important steps you can take to run a healthier, smarter business.

We’ll dive into how to use your plan later in this article.

There are many different types of plans , but we’ll go over the most common type here, which includes everything you need for an investor-ready plan. However, if you’re just starting out and are looking for something simpler—I recommend starting with a one-page business plan . It’s faster and easier to create.

It’s also the perfect place to start if you’re just figuring out your idea, or need a simple strategic plan to use inside your business.

Dig deeper : How to write a one-page business plan

Brought to you by

Create a professional business plan

Using ai and step-by-step instructions.

Secure funding

Validate ideas

Build a strategy

- What to include in your business plan

Executive summary

The executive summary is an overview of your business and your plans. It comes first in your plan and is ideally just one to two pages. Most people write it last because it’s a summary of the complete business plan.

Ideally, the executive summary can act as a stand-alone document that covers the highlights of your detailed plan.

In fact, it’s common for investors to ask only for the executive summary when evaluating your business. If they like what they see in the executive summary, they’ll often follow up with a request for a complete plan, a pitch presentation , or more in-depth financial forecasts .

Your executive summary should include:

- A summary of the problem you are solving

- A description of your product or service

- An overview of your target market

- A brief description of your team

- A summary of your financials

- Your funding requirements (if you are raising money)

Dig Deeper: How to write an effective executive summary

Products and services description

This is where you describe exactly what you’re selling, and how it solves a problem for your target market. The best way to organize this part of your plan is to start by describing the problem that exists for your customers. After that, you can describe how you plan to solve that problem with your product or service.

This is usually called a problem and solution statement .

To truly showcase the value of your products and services, you need to craft a compelling narrative around your offerings. How will your product or service transform your customers’ lives or jobs? A strong narrative will draw in your readers.

This is also the part of the business plan to discuss any competitive advantages you may have, like specific intellectual property or patents that protect your product. If you have any initial sales, contracts, or other evidence that your product or service is likely to sell, include that information as well. It will show that your idea has traction , which can help convince readers that your plan has a high chance of success.

Market analysis

Your target market is a description of the type of people that you plan to sell to. You might even have multiple target markets, depending on your business.

A market analysis is the part of your plan where you bring together all of the information you know about your target market. Basically, it’s a thorough description of who your customers are and why they need what you’re selling. You’ll also include information about the growth of your market and your industry .

Try to be as specific as possible when you describe your market.

Include information such as age, income level, and location—these are what’s called “demographics.” If you can, also describe your market’s interests and habits as they relate to your business—these are “psychographics.”

Related: Target market examples

Essentially, you want to include any knowledge you have about your customers that is relevant to how your product or service is right for them. With a solid target market, it will be easier to create a sales and marketing plan that will reach your customers. That’s because you know who they are, what they like to do, and the best ways to reach them.

Next, provide any additional information you have about your market.

What is the size of your market ? Is the market growing or shrinking? Ideally, you’ll want to demonstrate that your market is growing over time, and also explain how your business is positioned to take advantage of any expected changes in your industry.

Dig Deeper: Learn how to write a market analysis

Competitive analysis

Part of defining your business opportunity is determining what your competitive advantage is. To do this effectively, you need to know as much about your competitors as your target customers.

Every business has some form of competition. If you don’t think you have competitors, then explore what alternatives there are in the market for your product or service.

For example: In the early years of cars, their main competition was horses. For social media, the early competition was reading books, watching TV, and talking on the phone.

A good competitive analysis fully lays out the competitive landscape and then explains how your business is different. Maybe your products are better made, or cheaper, or your customer service is superior. Maybe your competitive advantage is your location – a wide variety of factors can ultimately give you an advantage.

Dig Deeper: How to write a competitive analysis for your business plan

Marketing and sales plan

The marketing and sales plan covers how you will position your product or service in the market, the marketing channels and messaging you will use, and your sales tactics.

The best place to start with a marketing plan is with a positioning statement .

This explains how your business fits into the overall market, and how you will explain the advantages of your product or service to customers. You’ll use the information from your competitive analysis to help you with your positioning.

For example: You might position your company as the premium, most expensive but the highest quality option in the market. Or your positioning might focus on being locally owned and that shoppers support the local economy by buying your products.

Once you understand your positioning, you’ll bring this together with the information about your target market to create your marketing strategy .

This is how you plan to communicate your message to potential customers. Depending on who your customers are and how they purchase products like yours, you might use many different strategies, from social media advertising to creating a podcast. Your marketing plan is all about how your customers discover who you are and why they should consider your products and services.

While your marketing plan is about reaching your customers—your sales plan will describe the actual sales process once a customer has decided that they’re interested in what you have to offer.

If your business requires salespeople and a long sales process, describe that in this section. If your customers can “self-serve” and just make purchases quickly on your website, describe that process.

A good sales plan picks up where your marketing plan leaves off. The marketing plan brings customers in the door and the sales plan is how you close the deal.

Together, these specific plans paint a picture of how you will connect with your target audience, and how you will turn them into paying customers.

Dig deeper: What to include in your sales and marketing plan

Business operations

The operations section describes the necessary requirements for your business to run smoothly. It’s where you talk about how your business works and what day-to-day operations look like.

Depending on how your business is structured, your operations plan may include elements of the business like:

- Supply chain management

- Manufacturing processes

- Equipment and technology

- Distribution

Some businesses distribute their products and reach their customers through large retailers like Amazon.com, Walmart, Target, and grocery store chains.

These businesses should review how this part of their business works. The plan should discuss the logistics and costs of getting products onto store shelves and any potential hurdles the business may have to overcome.

If your business is much simpler than this, that’s OK. This section of your business plan can be either extremely short or more detailed, depending on the type of business you are building.

For businesses selling services, such as physical therapy or online software, you can use this section to describe the technology you’ll leverage, what goes into your service, and who you will partner with to deliver your services.

Dig Deeper: Learn how to write the operations chapter of your plan

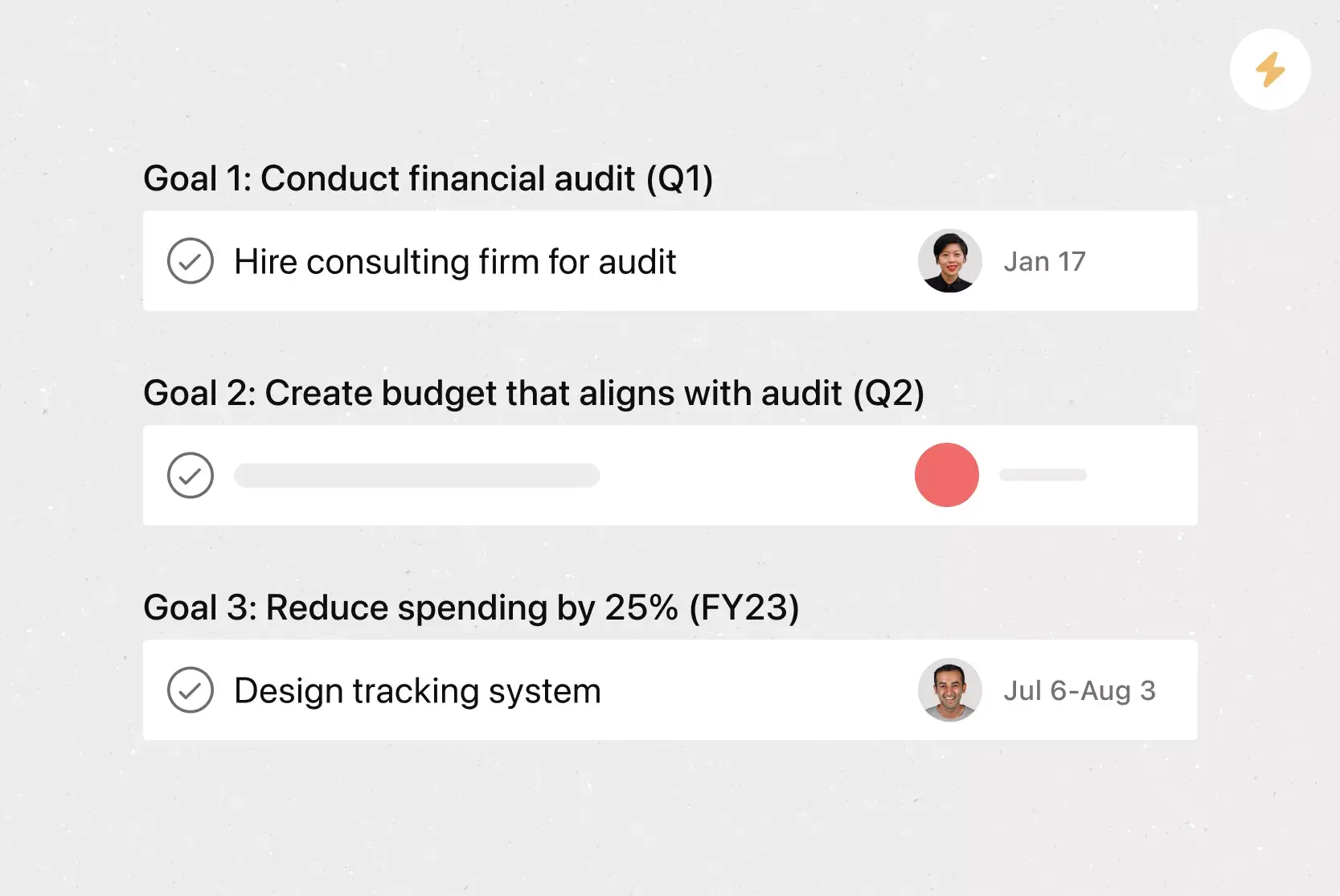

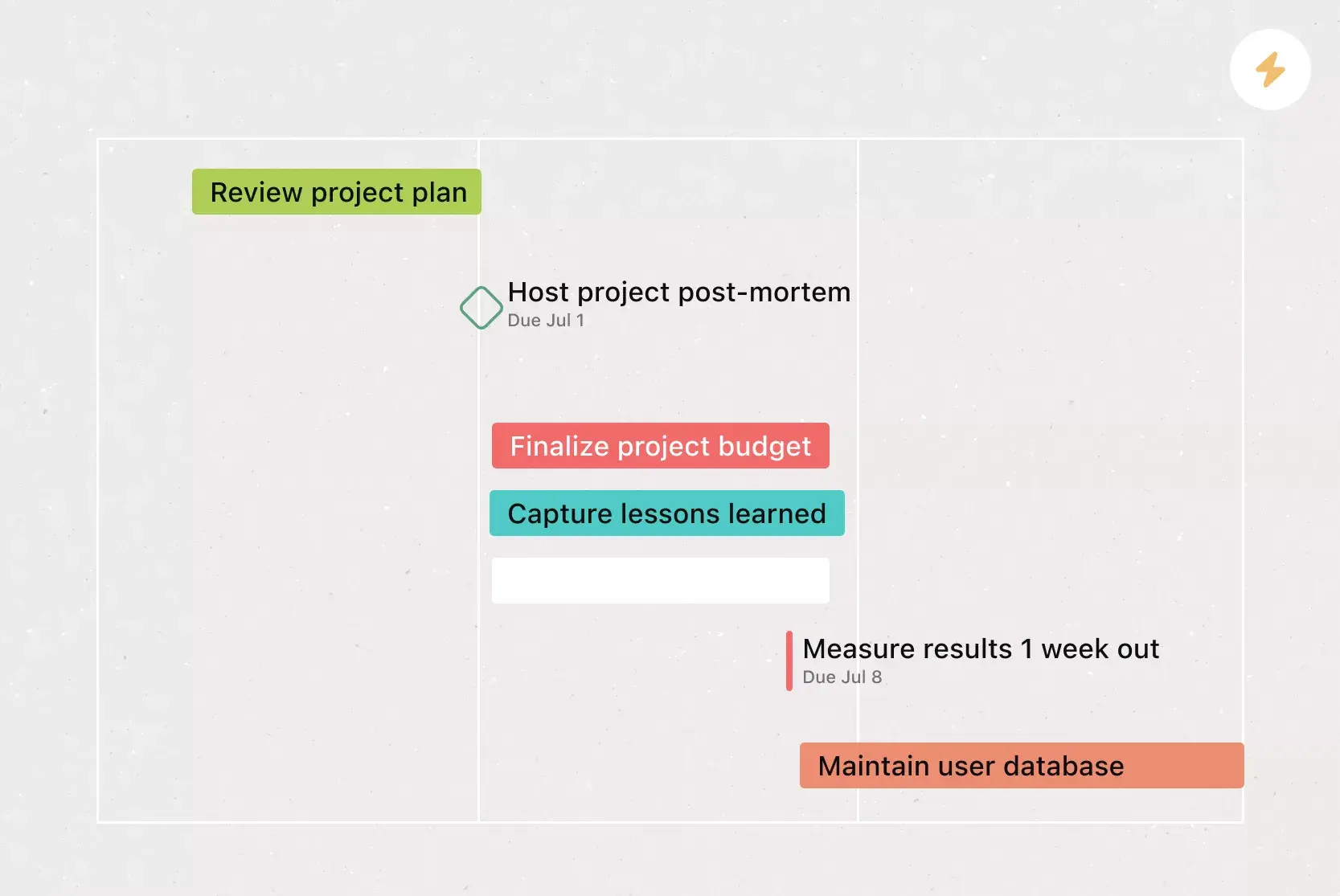

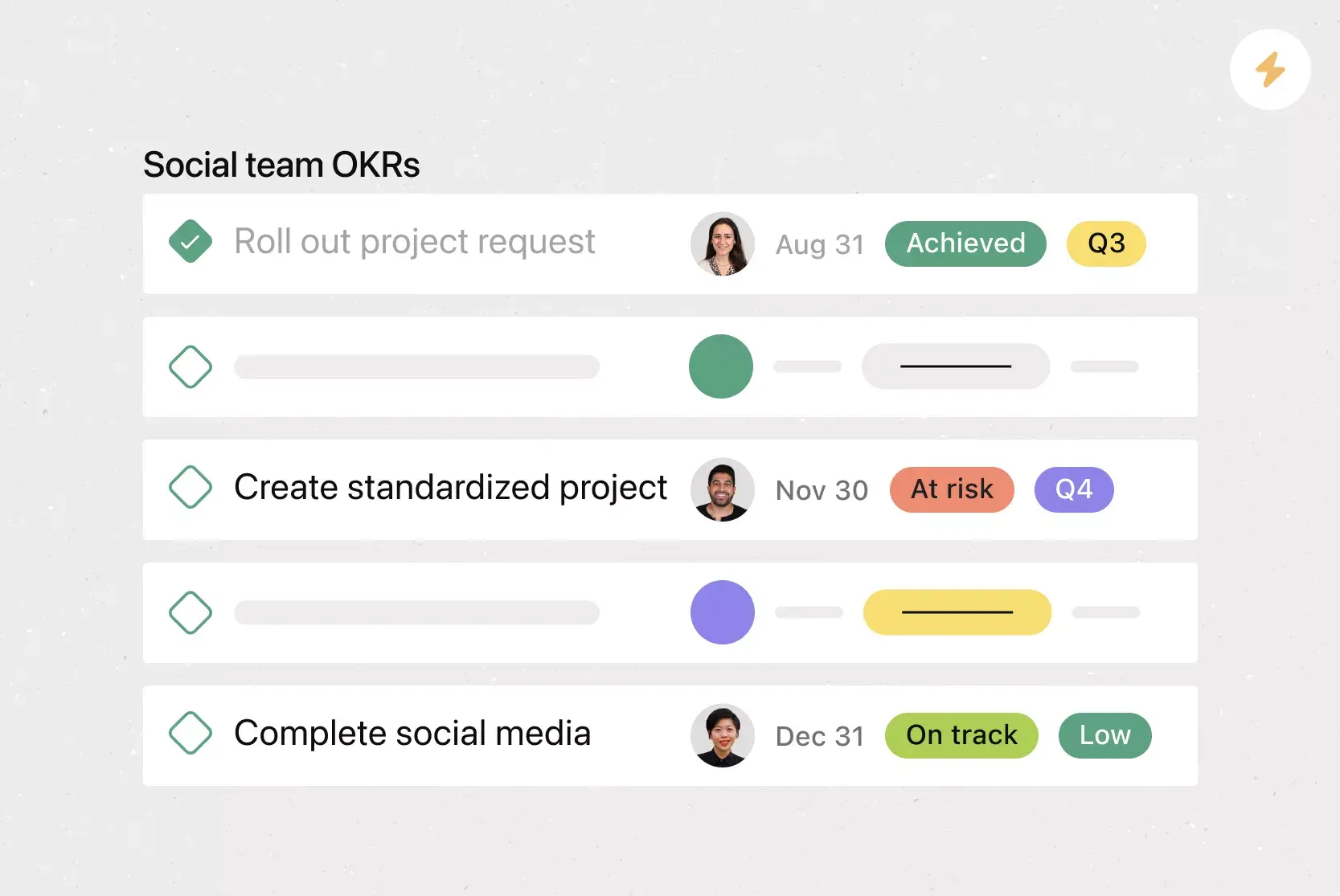

Key milestones and metrics

Although it’s not required to complete your business plan, mapping out key business milestones and the metrics can be incredibly useful for measuring your success.

Good milestones clearly lay out the parameters of the task and set expectations for their execution. You’ll want to include:

- A description of each task

- The proposed due date

- Who is responsible for each task

If you have a budget, you can include projected costs to hit each milestone. You don’t need extensive project planning in this section—just list key milestones you want to hit and when you plan to hit them. This is your overall business roadmap.

Possible milestones might be:

- Website launch date

- Store or office opening date

- First significant sales

- Break even date

- Business licenses and approvals

You should also discuss the key numbers you will track to determine your success. Some common metrics worth tracking include:

- Conversion rates

- Customer acquisition costs

- Profit per customer

- Repeat purchases

It’s perfectly fine to start with just a few metrics and grow the number you are tracking over time. You also may find that some metrics simply aren’t relevant to your business and can narrow down what you’re tracking.

Dig Deeper: How to use milestones in your business plan

Organization and management team

Investors don’t just look for great ideas—they want to find great teams. Use this chapter to describe your current team and who you need to hire . You should also provide a quick overview of your location and history if you’re already up and running.

Briefly highlight the relevant experiences of each key team member in the company. It’s important to make the case for why yours is the right team to turn an idea into a reality.

Do they have the right industry experience and background? Have members of the team had entrepreneurial successes before?

If you still need to hire key team members, that’s OK. Just note those gaps in this section.

Your company overview should also include a summary of your company’s current business structure . The most common business structures include:

- Sole proprietor

- Partnership

Be sure to provide an overview of how the business is owned as well. Does each business partner own an equal portion of the business? How is ownership divided?

Potential lenders and investors will want to know the structure of the business before they will consider a loan or investment.

Dig Deeper: How to write about your company structure and team

Financial plan

Last, but certainly not least, is your financial plan chapter.

Entrepreneurs often find this section the most daunting. But, business financials for most startups are less complicated than you think, and a business degree is certainly not required to build a solid financial forecast.

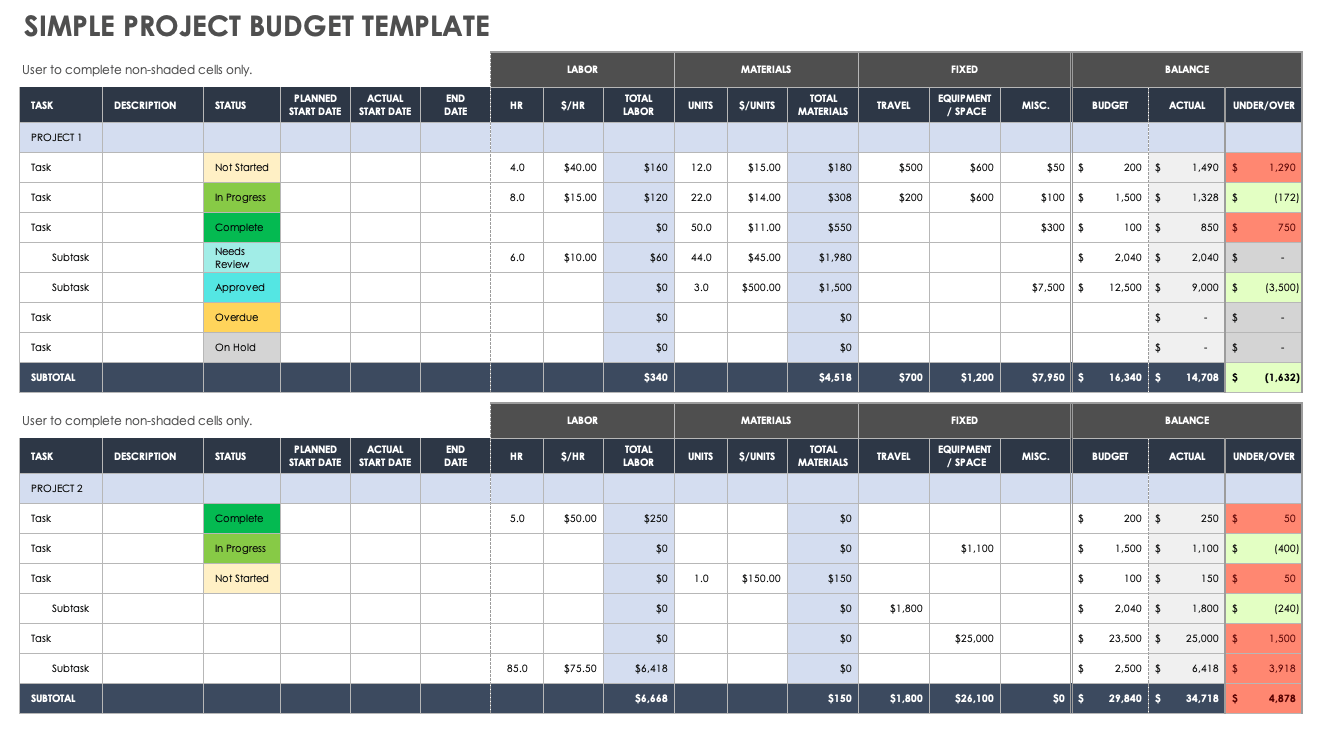

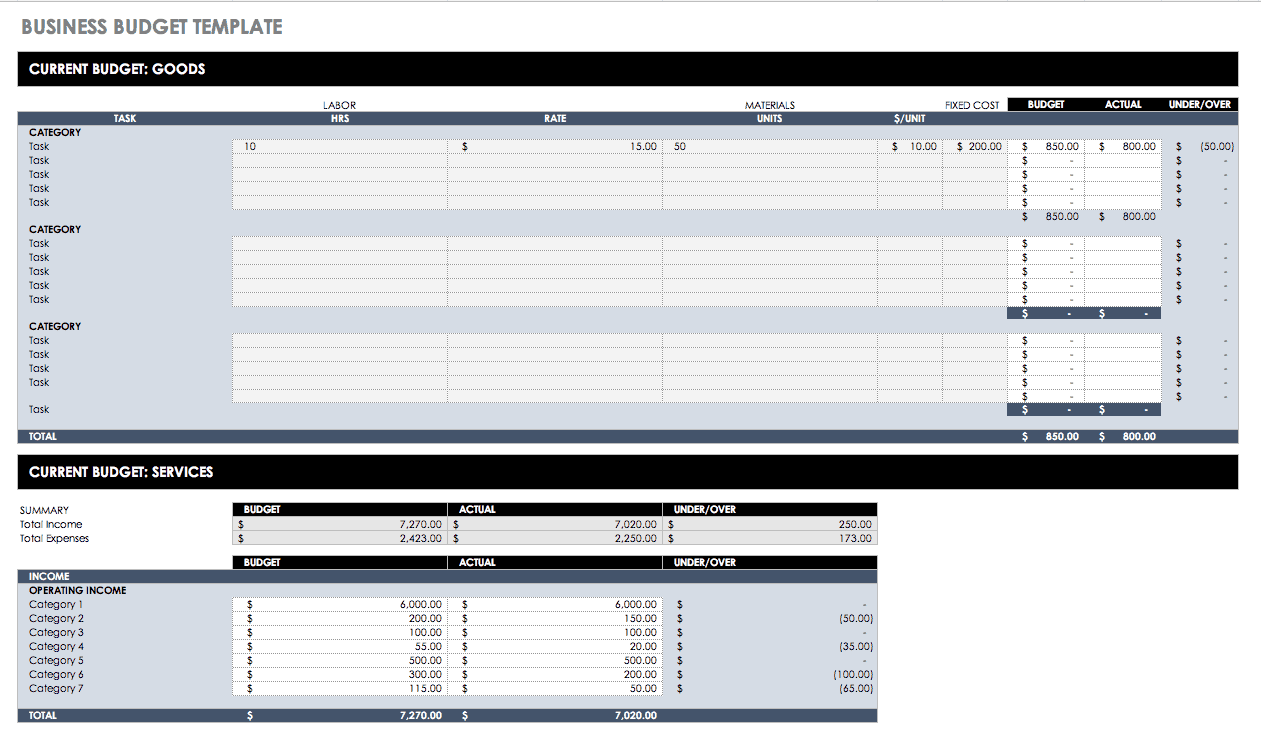

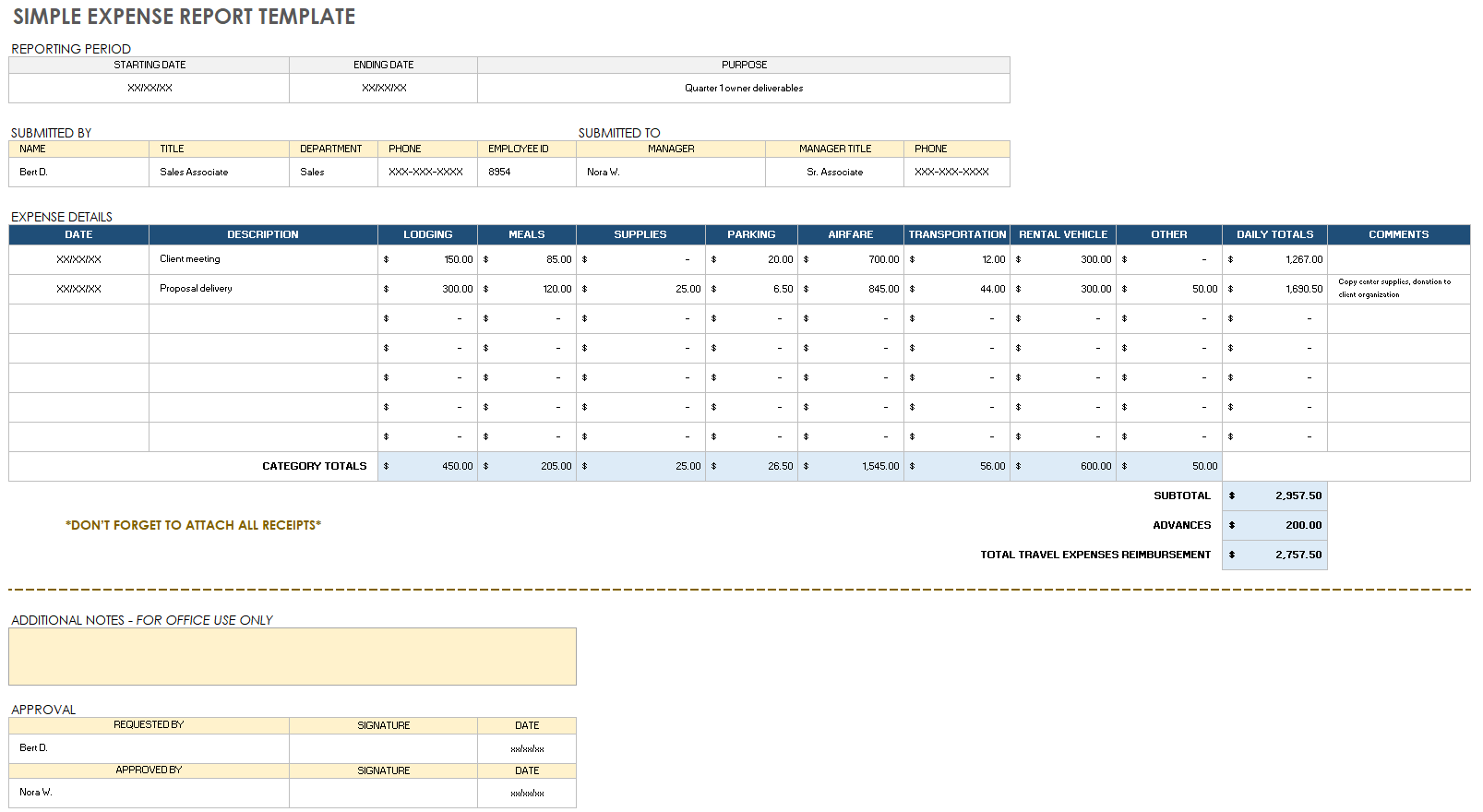

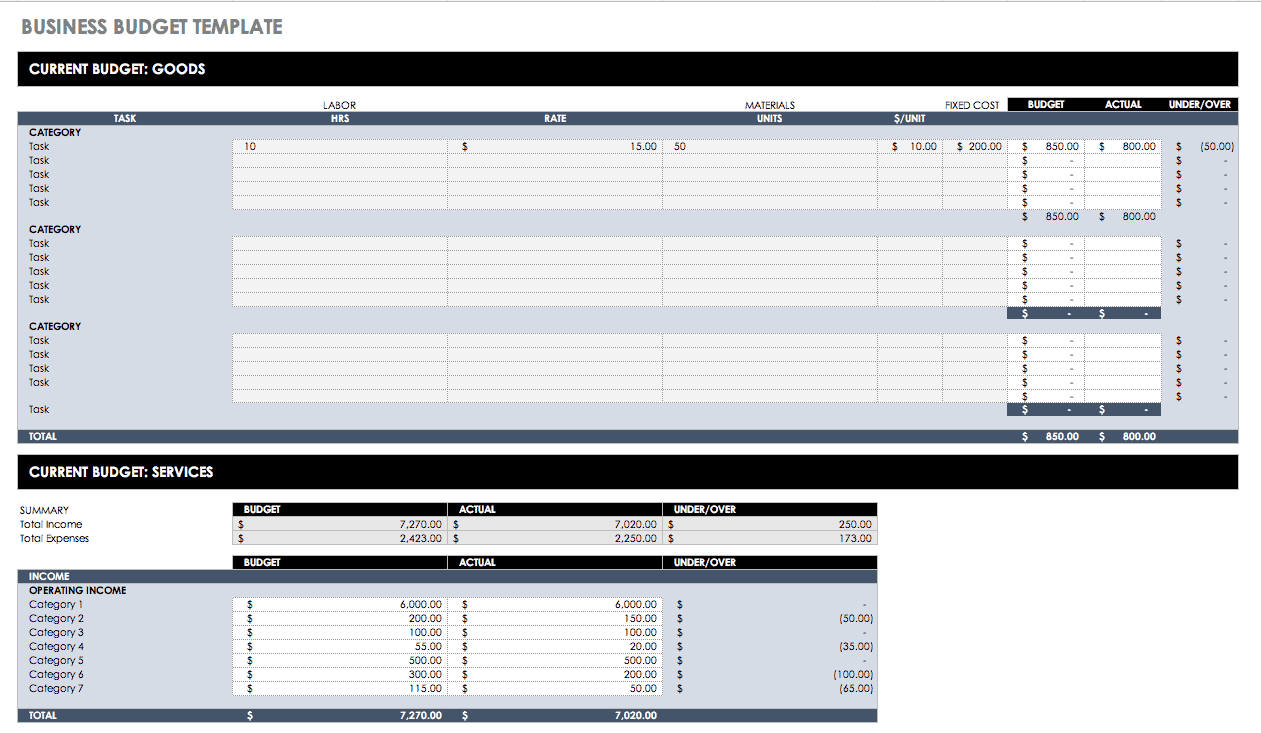

A typical financial forecast in a business plan includes the following:

- Sales forecast : An estimate of the sales expected over a given period. You’ll break down your forecast into the key revenue streams that you expect to have.

- Expense budget : Your planned spending such as personnel costs , marketing expenses, and taxes.

- Profit & Loss : Brings together your sales and expenses and helps you calculate planned profits.

- Cash Flow : Shows how cash moves into and out of your business. It can predict how much cash you’ll have on hand at any given point in the future.

- Balance Sheet : A list of the assets, liabilities, and equity in your company. In short, it provides an overview of the financial health of your business.

A strong business plan will include a description of assumptions about the future, and potential risks that could impact the financial plan. Including those will be especially important if you’re writing a business plan to pursue a loan or other investment.

Dig Deeper: How to create financial forecasts and budgets

This is the place for additional data, charts, or other information that supports your plan.

Including an appendix can significantly enhance the credibility of your plan by showing readers that you’ve thoroughly considered the details of your business idea, and are backing your ideas up with solid data.

Just remember that the information in the appendix is meant to be supplementary. Your business plan should stand on its own, even if the reader skips this section.

Dig Deeper : What to include in your business plan appendix

Optional: Business plan cover page

Adding a business plan cover page can make your plan, and by extension your business, seem more professional in the eyes of potential investors, lenders, and partners. It serves as the introduction to your document and provides necessary contact information for stakeholders to reference.

Your cover page should be simple and include:

- Company logo

- Business name

- Value proposition (optional)

- Business plan title

- Completion and/or update date

- Address and contact information

- Confidentiality statement

Just remember, the cover page is optional. If you decide to include it, keep it very simple and only spend a short amount of time putting it together.

Dig Deeper: How to create a business plan cover page

How to use AI to help write your business plan

Generative AI tools such as ChatGPT can speed up the business plan writing process and help you think through concepts like market segmentation and competition. These tools are especially useful for taking ideas that you provide and converting them into polished text for your business plan.

The best way to use AI for your business plan is to leverage it as a collaborator , not a replacement for human creative thinking and ingenuity.

AI can come up with lots of ideas and act as a brainstorming partner. It’s up to you to filter through those ideas and figure out which ones are realistic enough to resonate with your customers.

There are pros and cons of using AI to help with your business plan . So, spend some time understanding how it can be most helpful before just outsourcing the job to AI.

Learn more: 10 AI prompts you need to write a business plan

- Writing tips and strategies

To help streamline the business plan writing process, here are a few tips and key questions to answer to make sure you get the most out of your plan and avoid common mistakes .

Determine why you are writing a business plan

Knowing why you are writing a business plan will determine your approach to your planning project.

For example: If you are writing a business plan for yourself, or just to use inside your own business , you can probably skip the section about your team and organizational structure.

If you’re raising money, you’ll want to spend more time explaining why you’re looking to raise the funds and exactly how you will use them.

Regardless of how you intend to use your business plan , think about why you are writing and what you’re trying to get out of the process before you begin.

Keep things concise

Probably the most important tip is to keep your business plan short and simple. There are no prizes for long business plans . The longer your plan is, the less likely people are to read it.

So focus on trimming things down to the essentials your readers need to know. Skip the extended, wordy descriptions and instead focus on creating a plan that is easy to read —using bullets and short sentences whenever possible.

Have someone review your business plan

Writing a business plan in a vacuum is never a good idea. Sometimes it’s helpful to zoom out and check if your plan makes sense to someone else. You also want to make sure that it’s easy to read and understand.

Don’t wait until your plan is “done” to get a second look. Start sharing your plan early, and find out from readers what questions your plan leaves unanswered. This early review cycle will help you spot shortcomings in your plan and address them quickly, rather than finding out about them right before you present your plan to a lender or investor.

If you need a more detailed review, you may want to explore hiring a professional plan writer to thoroughly examine it.

Use a free business plan template and business plan examples to get started

Knowing what information to include in a business plan is sometimes not quite enough. If you’re struggling to get started or need additional guidance, it may be worth using a business plan template.

There are plenty of great options available (we’ve rounded up our 8 favorites to streamline your search).

But, if you’re looking for a free downloadable business plan template , you can get one right now; download the template used by more than 1 million businesses.

Or, if you just want to see what a completed business plan looks like, check out our library of over 550 free business plan examples .

We even have a growing list of industry business planning guides with tips for what to focus on depending on your business type.

Common pitfalls and how to avoid them

It’s easy to make mistakes when you’re writing your business plan. Some entrepreneurs get sucked into the writing and research process, and don’t focus enough on actually getting their business started.

Here are a few common mistakes and how to avoid them:

Not talking to your customers : This is one of the most common mistakes. It’s easy to assume that your product or service is something that people want. Before you invest too much in your business and too much in the planning process, make sure you talk to your prospective customers and have a good understanding of their needs.

- Overly optimistic sales and profit forecasts: By nature, entrepreneurs are optimistic about the future. But it’s good to temper that optimism a little when you’re planning, and make sure your forecasts are grounded in reality.

- Spending too much time planning: Yes, planning is crucial. But you also need to get out and talk to customers, build prototypes of your product and figure out if there’s a market for your idea. Make sure to balance planning with building.

- Not revising the plan: Planning is useful, but nothing ever goes exactly as planned. As you learn more about what’s working and what’s not—revise your plan, your budgets, and your revenue forecast. Doing so will provide a more realistic picture of where your business is going, and what your financial needs will be moving forward.

- Not using the plan to manage your business: A good business plan is a management tool. Don’t just write it and put it on the shelf to collect dust – use it to track your progress and help you reach your goals.

- Presenting your business plan

The planning process forces you to think through every aspect of your business and answer questions that you may not have thought of. That’s the real benefit of writing a business plan – the knowledge you gain about your business that you may not have been able to discover otherwise.

With all of this knowledge, you’re well prepared to convert your business plan into a pitch presentation to present your ideas.

A pitch presentation is a summary of your plan, just hitting the highlights and key points. It’s the best way to present your business plan to investors and team members.

Dig Deeper: Learn what key slides should be included in your pitch deck

Use your business plan to manage your business

One of the biggest benefits of planning is that it gives you a tool to manage your business better. With a revenue forecast, expense budget, and projected cash flow, you know your targets and where you are headed.

And yet, nothing ever goes exactly as planned – it’s the nature of business.

That’s where using your plan as a management tool comes in. The key to leveraging it for your business is to review it periodically and compare your forecasts and projections to your actual results.

Start by setting up a regular time to review the plan – a monthly review is a good starting point. During this review, answer questions like:

- Did you meet your sales goals?

- Is spending following your budget?

- Has anything gone differently than what you expected?

Now that you see whether you’re meeting your goals or are off track, you can make adjustments and set new targets.

Maybe you’re exceeding your sales goals and should set new, more aggressive goals. In that case, maybe you should also explore more spending or hiring more employees.

Or maybe expenses are rising faster than you projected. If that’s the case, you would need to look at where you can cut costs.

A plan, and a method for comparing your plan to your actual results , is the tool you need to steer your business toward success.

Learn More: How to run a regular plan review

Free business plan templates and examples

Kickstart your business plan writing with one of our free business plan templates or recommended tools.

Free business plan template

Download a free SBA-approved business plan template built for small businesses and startups.

Download Template

One-page plan template

Download a free one-page plan template to write a useful business plan in as little as 30-minutes.

Sample business plan library

Explore over 500 real-world business plan examples from a wide variety of industries.

View Sample Plans

How to write a business plan FAQ

What is a business plan?

A document that describes your business , the products and services you sell, and the customers that you sell to. It explains your business strategy, how you’re going to build and grow your business, what your marketing strategy is, and who your competitors are.

What are the benefits of a business plan?

A business plan helps you understand where you want to go with your business and what it will take to get there. It reduces your overall risk, helps you uncover your business’s potential, attracts investors, and identifies areas for growth.

Having a business plan ultimately makes you more confident as a business owner and more likely to succeed for a longer period of time.

What are the 7 steps of a business plan?

The seven steps to writing a business plan include:

- Write a brief executive summary

- Describe your products and services.

- Conduct market research and compile data into a cohesive market analysis.

- Describe your marketing and sales strategy.

- Outline your organizational structure and management team.

- Develop financial projections for sales, revenue, and cash flow.

- Add any additional documents to your appendix.

What are the 5 most common business plan mistakes?

There are plenty of mistakes that can be made when writing a business plan. However, these are the 5 most common that you should do your best to avoid:

- 1. Not taking the planning process seriously.

- Having unrealistic financial projections or incomplete financial information.

- Inconsistent information or simple mistakes.

- Failing to establish a sound business model.

- Not having a defined purpose for your business plan.

What questions should be answered in a business plan?

Writing a business plan is all about asking yourself questions about your business and being able to answer them through the planning process. You’ll likely be asking dozens and dozens of questions for each section of your plan.

However, these are the key questions you should ask and answer with your business plan:

- How will your business make money?

- Is there a need for your product or service?

- Who are your customers?

- How are you different from the competition?

- How will you reach your customers?

- How will you measure success?

How long should a business plan be?

The length of your business plan fully depends on what you intend to do with it. From the SBA and traditional lender point of view, a business plan needs to be whatever length necessary to fully explain your business. This means that you prove the viability of your business, show that you understand the market, and have a detailed strategy in place.

If you intend to use your business plan for internal management purposes, you don’t necessarily need a full 25-50 page business plan. Instead, you can start with a one-page plan to get all of the necessary information in place.

What are the different types of business plans?

While all business plans cover similar categories, the style and function fully depend on how you intend to use your plan. Here are a few common business plan types worth considering.

Traditional business plan: The tried-and-true traditional business plan is a formal document meant to be used when applying for funding or pitching to investors. This type of business plan follows the outline above and can be anywhere from 10-50 pages depending on the amount of detail included, the complexity of your business, and what you include in your appendix.

Business model canvas: The business model canvas is a one-page template designed to demystify the business planning process. It removes the need for a traditional, copy-heavy business plan, in favor of a single-page outline that can help you and outside parties better explore your business idea.

One-page business plan: This format is a simplified version of the traditional plan that focuses on the core aspects of your business. You’ll typically stick with bullet points and single sentences. It’s most useful for those exploring ideas, needing to validate their business model, or who need an internal plan to help them run and manage their business.

Lean Plan: The Lean Plan is less of a specific document type and more of a methodology. It takes the simplicity and styling of the one-page business plan and turns it into a process for you to continuously plan, test, review, refine, and take action based on performance. It’s faster, keeps your plan concise, and ensures that your plan is always up-to-date.

What’s the difference between a business plan and a strategic plan?

A business plan covers the “who” and “what” of your business. It explains what your business is doing right now and how it functions. The strategic plan explores long-term goals and explains “how” the business will get there. It encourages you to look more intently toward the future and how you will achieve your vision.

However, when approached correctly, your business plan can actually function as a strategic plan as well. If kept lean, you can define your business, outline strategic steps, and track ongoing operations all with a single plan.

See why 1.2 million entrepreneurs have written their business plans with LivePlan

Noah is the COO at Palo Alto Software, makers of the online business plan app LivePlan. He started his career at Yahoo! and then helped start the user review site Epinions.com. From there he started a software distribution business in the UK before coming to Palo Alto Software to run the marketing and product teams.

.png?format=auto)

Table of Contents

- Use AI to help write your plan

- Common planning mistakes

- Manage with your business plan

- Templates and examples

Related Articles

3 Min. Read

What to Include in Your Business Plan Appendix

1 Min. Read

How to Calculate Return on Investment (ROI)

5 Min. Read

How To Write a Business Plan for a Life Coaching Business + Free Example

7 Min. Read

How to Write a Bakery Business Plan + Sample

The Bplans Newsletter

The Bplans Weekly

Subscribe now for weekly advice and free downloadable resources to help start and grow your business.

We care about your privacy. See our privacy policy .

The quickest way to turn a business idea into a business plan

Fill-in-the-blanks and automatic financials make it easy.

No thanks, I prefer writing 40-page documents.

Discover the world’s #1 plan building software

Filter by Keywords

10 Free Business Plan Templates in Word, Excel, & ClickUp

Praburam Srinivasan

Growth Marketing Manager

February 13, 2024

Turning your vision into a clear and coherent business plan can be confusing and tough.

Hours of brainstorming and facing an intimidating blank page can raise more questions than answers. Are you covering everything? What should go where? How do you keep each section thorough but brief?

If these questions have kept you up at night and slowed your progress, know you’re not alone. That’s why we’ve put together the top 10 business plan templates in Word, Excel, and ClickUp—to provide answers, clarity, and a structured framework to work with. This way, you’re sure to capture all the relevant information without wasting time.

And the best part? Business planning becomes a little less “ugh!” and a lot more “aha!” 🤩

What is a Business Plan Template?

What makes a good business plan template, 1. clickup business plan template, 2. clickup sales plan template, 3. clickup business development action plan template, 4. clickup business roadmap template, 5. clickup business continuity plan template, 6. clickup lean business plan template, 7. clickup small business action plan template, 8. clickup strategic business roadmap template , 9. microsoft word business plan template by microsoft, 10. excel business plan template by vertex42.

A business plan template is a structured framework for entrepreneurs and business executives who want to create business plans. It comes with pre-arranged sections and headings that cover key elements like the executive summary , business overview, target customers, unique value proposition, marketing plans, and financial statements.

A good business plan template helps with thorough planning, clear documentation, and practical implementation. Here’s what to look for:

- Comprehensive structure: A good template comes with all the relevant sections to outline a business strategy, such as executive summary, market research and analysis, and financial projections

- Clarity and guidance: A good template is easy to follow. It has brief instructions or prompts for each section, guiding you to think deeply about your business and ensuring you don’t skip important details

- Clean design: Aesthetics matter. Choose a template that’s not just functional but also professionally designed. This ensures your plan is presentable to stakeholders, partners, and potential investors

- Flexibility : Your template should easily accommodate changes without hassle, like adding or removing sections, changing content and style, and rearranging parts 🛠️

While a template provides the structure, it’s the information you feed it that brings it to life. These pointers will help you pick a template that aligns with your business needs and clearly showcases your vision.

10 Business Plan Templates to Use in 2024

Preparing for business success in 2024 (and beyond) requires a comprehensive and organized business plan. We’ve handpicked the best templates to help you guide your team, attract investors, and secure funding. Let’s check them out.

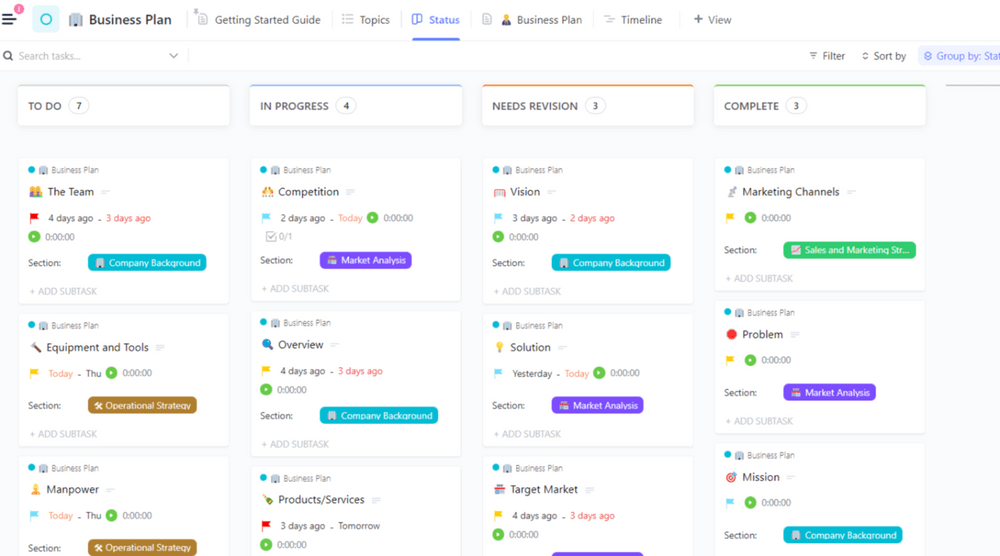

If you’re looking to replace a traditional business plan document, then ClickUp’s Business Plan Template is for you!

This one-page business plan template, designed in ClickUp Docs , is neatly broken down into the following sections:

- Company description : Overview, mission, vision, and team

- Market analysis : Problem, solution, target market, competition, and competitive advantage

- Sales and marketing strategy : Products/services and marketing channels

- Operational plan : Location and facilities, equipment and tools, manpower, and financial forecasts

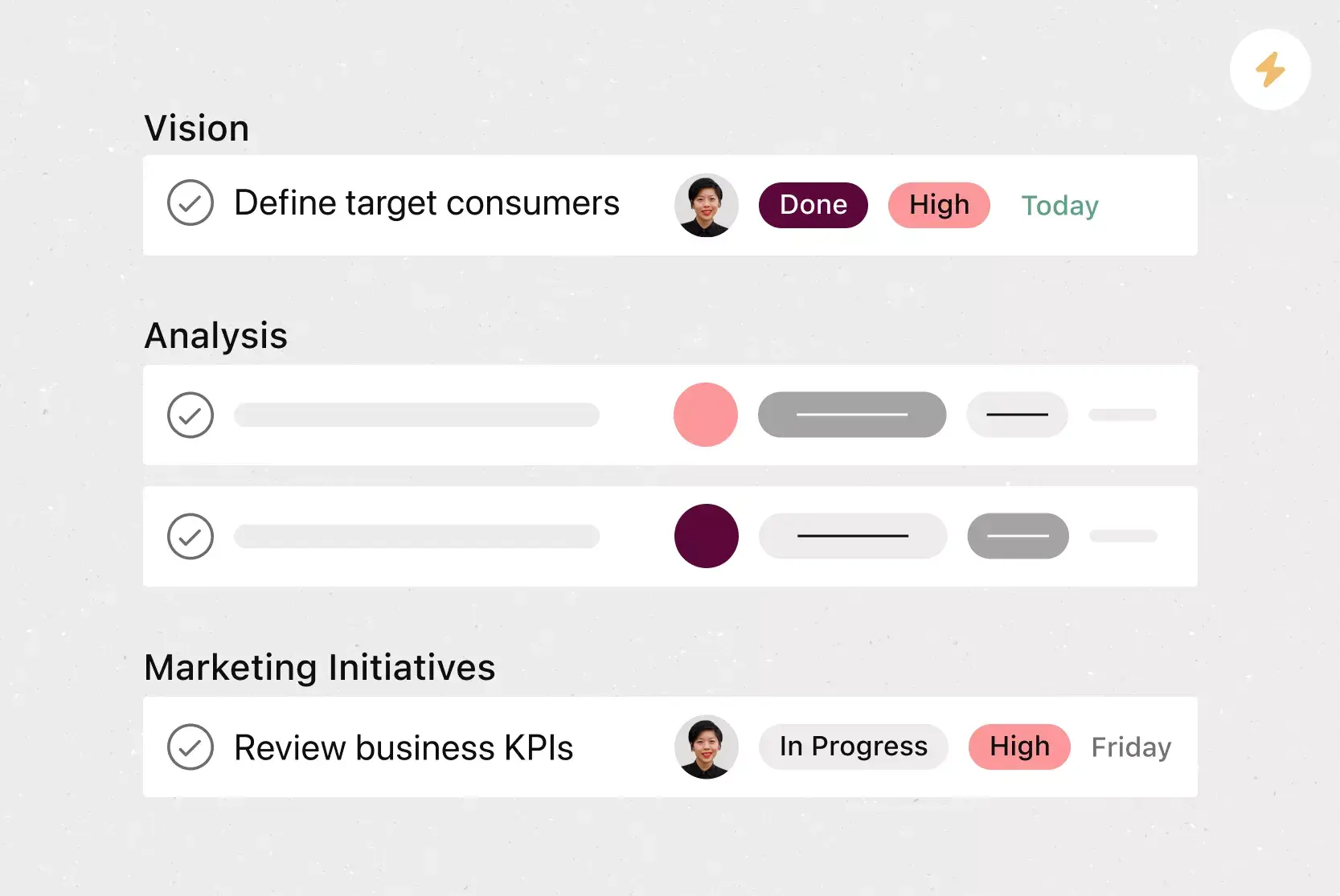

- Milestones and metrics: Targets and KPIs

Customize the template with your company logo and contact details, and easily navigate to different sections using the collapsible table of contents. The mini prompts under each section guide you on what to include—with suggestions on how to present the data (e.g., bullet lists, pictures, charts, and tables).

You can share the document with anyone via URL and collaborate in real time. And when the business plan is ready, you have the option to print it or export it to PDF, HTML, or Markdown.

But that’s not all. This template is equipped with basic and enterprise project management features to streamline the business plan creation process . The Topics List view has a list of all the different sections and subsections of the template and allows you to assign it to a team member, set a due date, and attach relevant documents and references.

Switch from List to Board view to track and update task statuses according to the following: To Do, In Progress, Needs Revision, and Complete.

This template is a comprehensive toolkit for documenting the different sections of your business plan and streamlining the creation process to ensure it’s completed on time. 🗓️

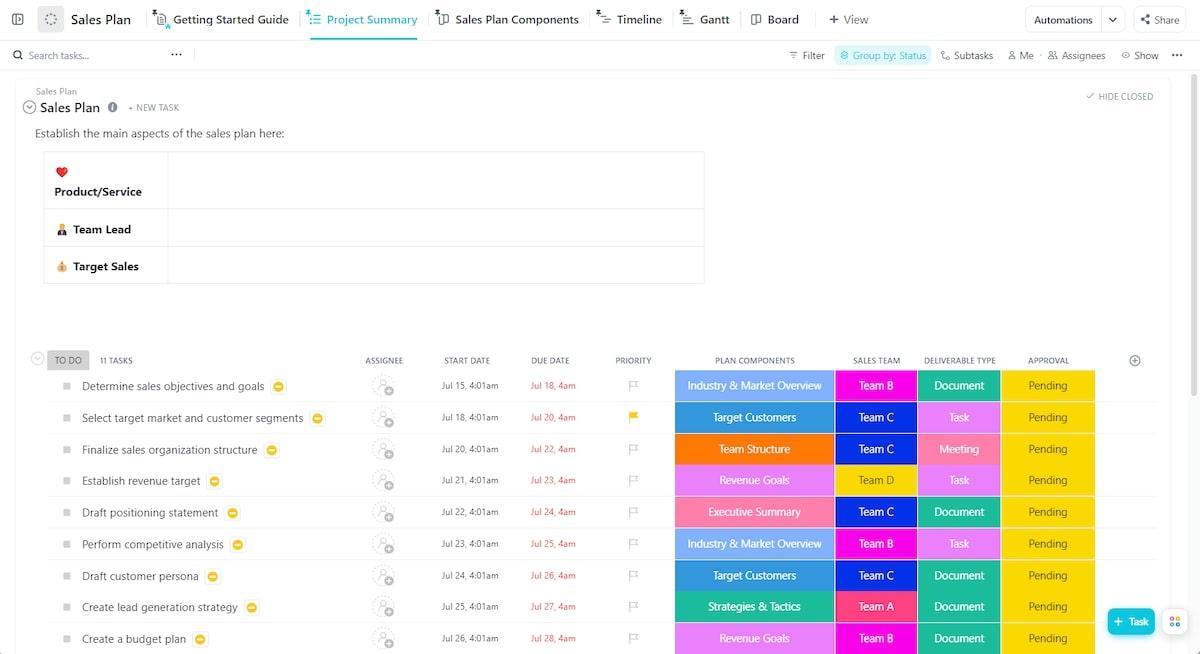

If you’re looking for a tool to kickstart or update your sales plan, ClickUp’s Sales Plan Template has got you covered. This sales plan template features a project summary list with tasks to help you craft a comprehensive and effective sales strategy. Some of these tasks include:

- Determine sales objectives and goals

- Draft positioning statement

- Perform competitive analysis

- Draft ideal customer persona

- Create a lead generation strategy

Assign each task to a specific individual or team, set priority levels , and add due dates. Specify what section of the sales plan each task belongs to (e.g., executive summary, revenue goals, team structure, etc.), deliverable type (such as document, task, or meeting), and approval state (like pending, needs revisions, and approved).

And in ClickUp style, you can switch to multiple views: List for a list of all tasks, Board for visual task management, Timeline for an overview of task durations, and Gantt to get a view of task dependencies.

This simple business plan template is perfect for any type of business looking to create a winning sales strategy while clarifying team roles and keeping tasks organized. ✨

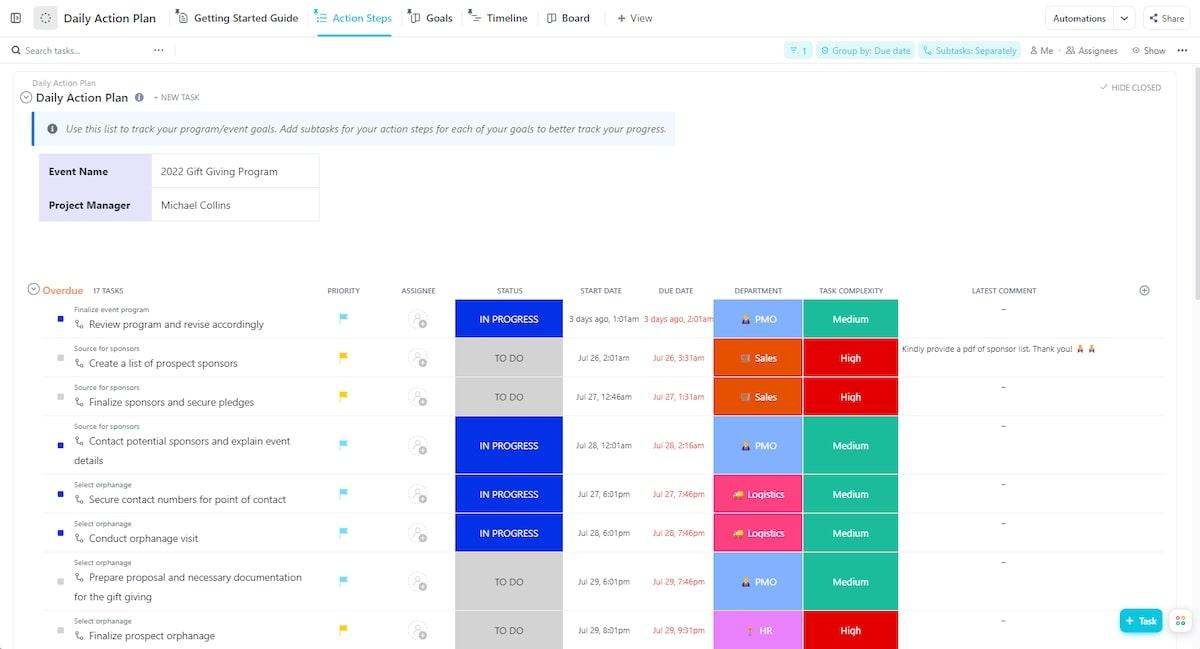

Thinking about scaling your business’s reach and operations but unsure where or how to start? It can be overwhelming, no doubt—you need a clear vision, measurable goals, and an actionable plan that every member of your team can rally behind.

Thankfully, ClickUp’s Business Development Action Plan Template is designed to use automations to simplify this process so every step toward your business growth is clear, trackable, and actionable.

Start by assessing your current situation and deciding on your main growth goal. Are you aiming to increase revenue, tap into new markets, or introduce new products or services? With ClickUp Whiteboards or Docs, brainstorm and collaborate with your team on this decision.

Set and track your short- and long-term growth goals with ClickUp’s Goals , break them down into smaller targets, and assign these targets to team members, complete with due dates. Add these targets to a new ClickUp Dashboard to track real-time progress and celebrate small wins. 🎉

Whether you’re a startup or small business owner looking to hit your next major milestone or an established business exploring new avenues, this template keeps your team aligned, engaged, and informed every step of the way.

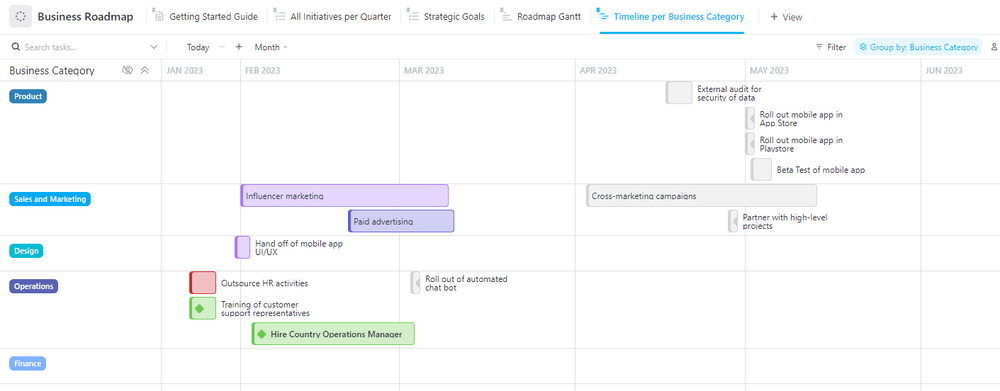

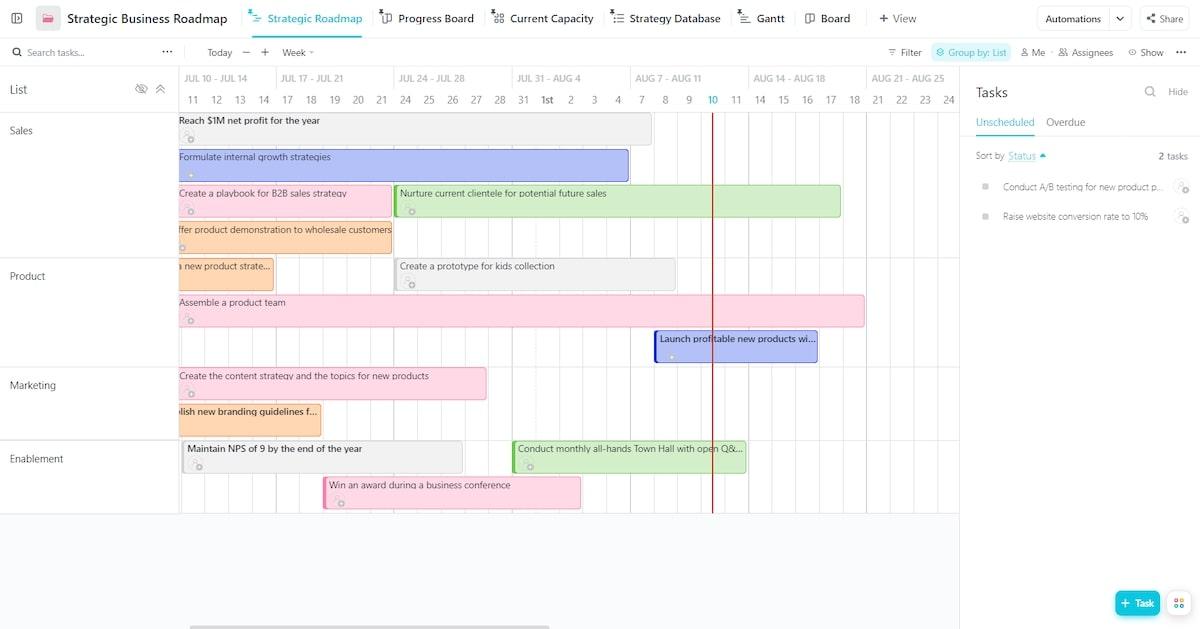

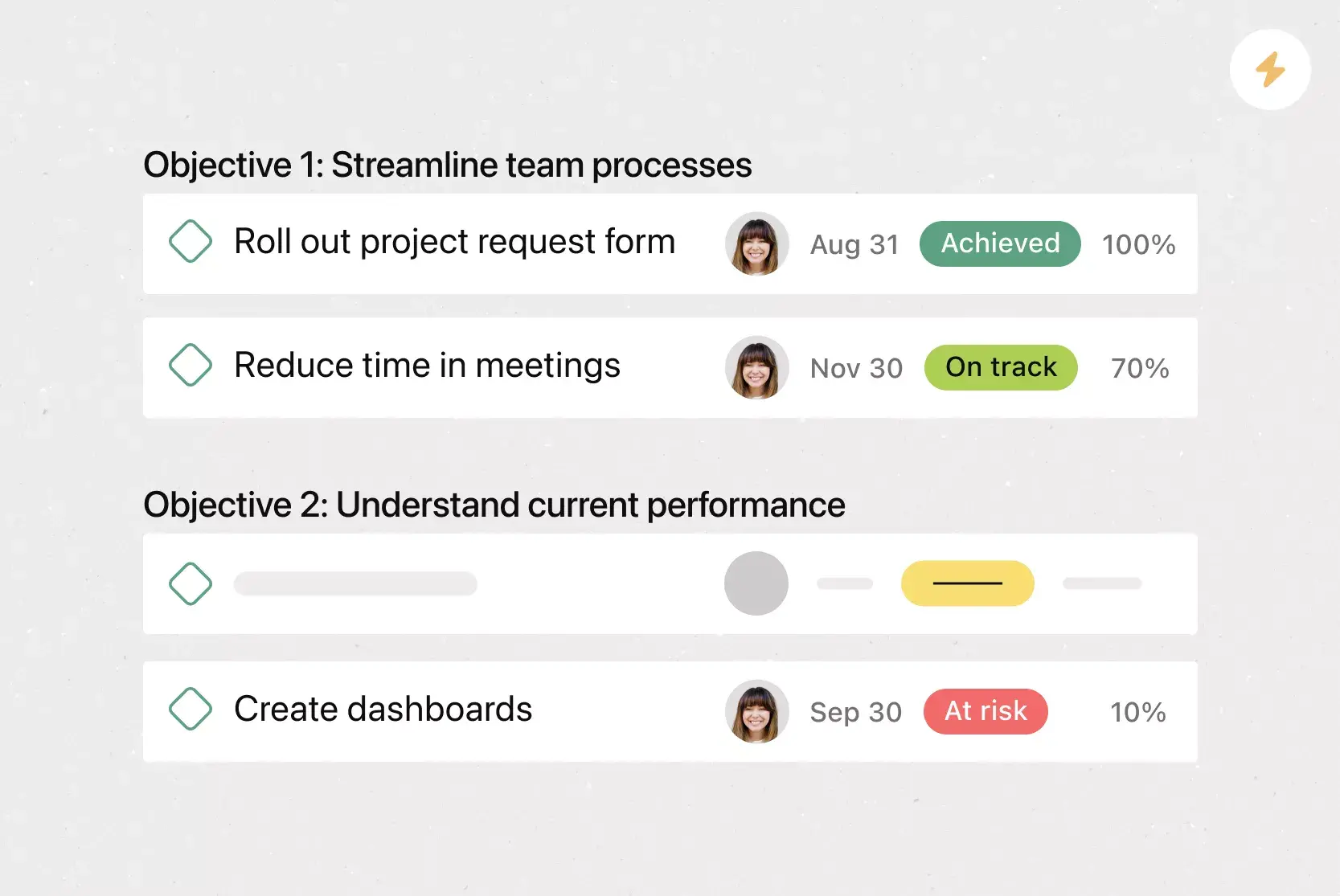

ClickUp’s Business Roadmap Template is your go-to for mapping out major strategies and initiatives in areas like revenue growth, brand awareness, community engagement, and customer satisfaction.

Use the List view to populate tasks under each initiative. With Custom Fields, you can capture which business category (e.g., Product, Operations, Sales & Marketing, etc.) tasks fall under and which quarter they’re slated for. You can also link to relevant documents and resources and evaluate tasks by effort and impact to ensure the most critical tasks get the attention they deserve. 👀

Depending on your focus, this template provides different views to show just what you need. For example, the All Initiatives per Quarter view lets you focus on what’s ahead by seeing tasks that need completion within a specific quarter. This ensures timely execution and helps in aligning resources effectively for the short term.

This template is ideal for business executives and management teams who need to coordinate multiple short- and long-term initiatives and business strategies.

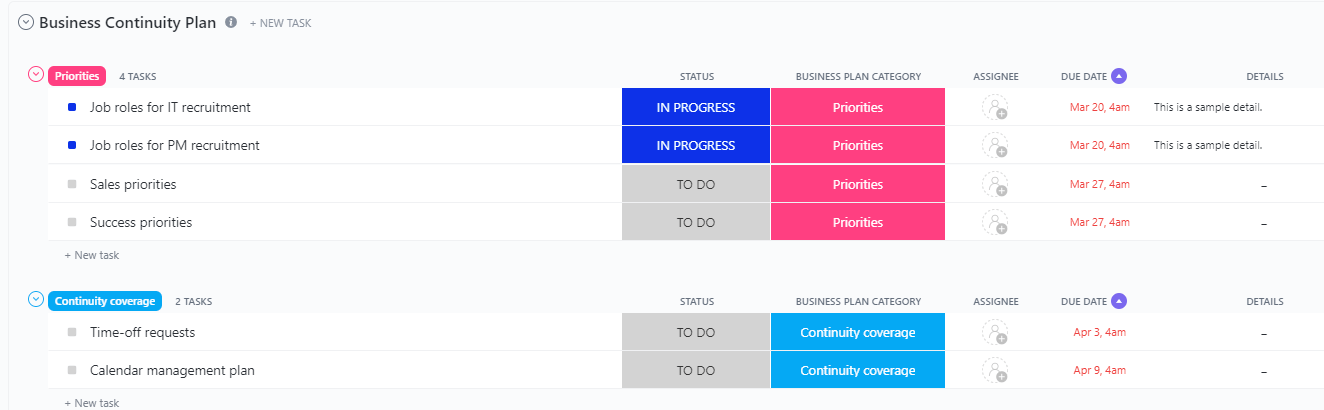

In business, unexpected threats to operations can arise at any moment. Whether it’s economic turbulence, a global health crisis, or supply chain interruptions, every company needs to be ready. ClickUp’s Business Continuity Plan Template lets you prepare proactively for these unforeseen challenges.

The template organizes tasks into three main categories:

- Priorities: Tasks that need immediate attention

- Continuity coverage: Tasks that must continue despite challenges

- Guiding principles: Resources and protocols to ensure smooth operations

The Board view makes it easy to visualize all the tasks under each of these categories. And the Priorities List sorts tasks by those that are overdue, the upcoming ones, and then the ones due later.

In times of uncertainty, being prepared is your best strategy. This template helps your business not just survive but thrive in challenging situations, keeping your customers, employees, and investors satisfied. 🤝

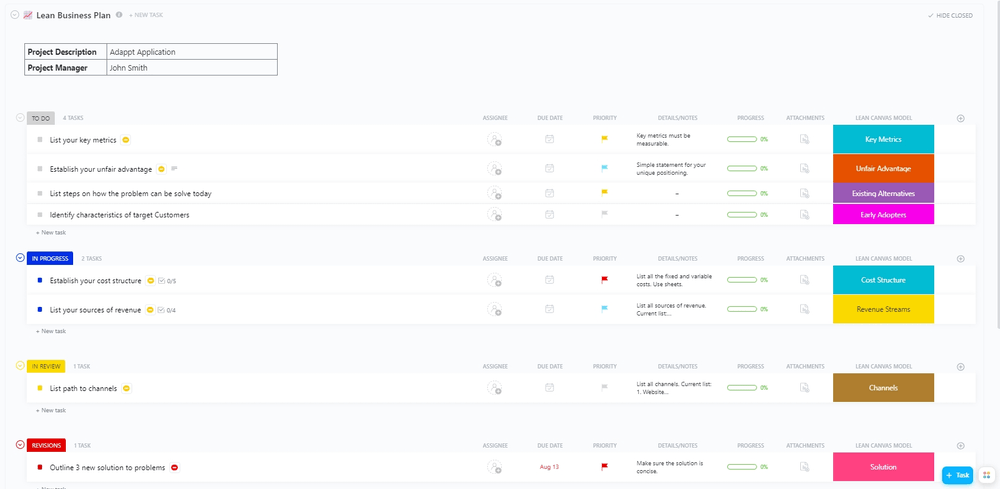

Looking to execute your business plan the “lean” way? Use ClickUp’s Lean Business Plan Template . It’s designed to help you optimize resource usage and cut unnecessary steps—giving you better results with less effort.

In the Plan Summary List view, list all the tasks that need to get done. Add specific details like who’s doing each task, when it’s due, and which part of the Business Model Canvas (BMC) it falls under. The By Priority view sorts this list based on priorities like Urgent, High, Normal, and Low. This makes it easy to spot the most important tasks and tackle them first.

Additionally, the Board view gives you an overview of task progression from start to finish. And the BMC view rearranges these tasks based on the various BMC components.

Each task can further be broken down into subtasks and multiple checklists to ensure all related action items are executed. ✔️

This template is an invaluable resource for startups and large enterprises looking to maximize process efficiencies and results in a streamlined and cost-effective way.

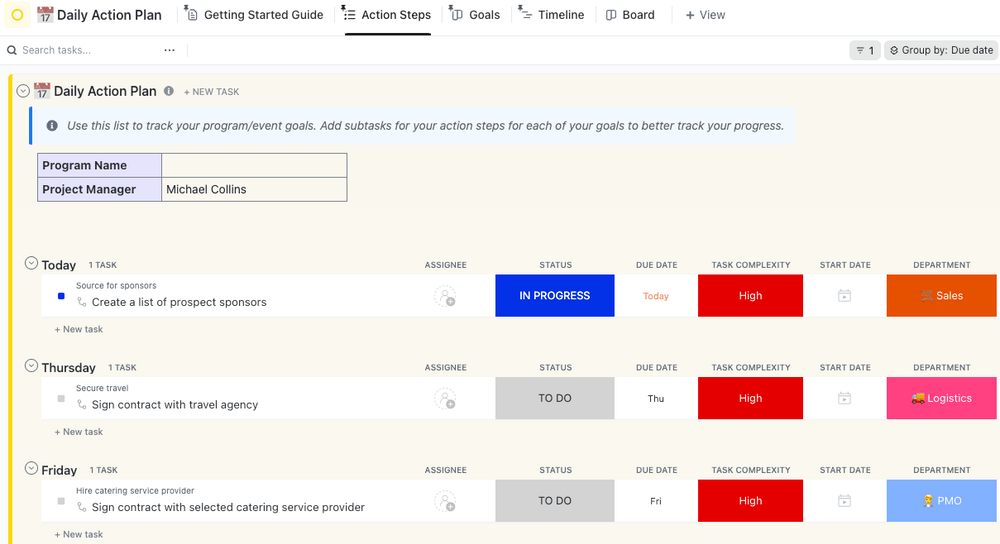

The Small Business Action Plan Template by ClickUp is tailor-made for small businesses looking to transform their business ideas and goals into actionable steps and, eventually, into reality.

It provides a simple and organized framework for creating, assigning, prioritizing, and tracking tasks. And in effect, it ensures that goals are not just set but achieved. Through the native dashboard and goal-setting features, you can monitor task progress and how they move you closer to achieving your goals.

Thanks to ClickUp’s robust communication features like chat, comments, and @mentions, it’s easy to get every team member on the same page and quickly address questions or concerns.

Use this action plan template to hit your business goals by streamlining your internal processes and aligning team efforts.

For larger businesses and scaling enterprises, getting different departments to work together toward a big goal can be challenging. The ClickUp Strategic Business Roadmap Template makes it easier by giving you a clear plan to follow.

This template is packaged in a folder and split into different lists for each department in your business, like Sales, Product, Marketing, and Enablement. This way, every team can focus on their tasks while collectively contributing to the bigger goal.

There are multiple viewing options available for team members. These include:

- Progress Board: Visualize tasks that are on track, those at risk, and those behind

- Gantt view: Get an overview of project timelines and dependencies

- Team view: See what each team member is working on so you can balance workloads for maximum productivity

While this template may feel overwhelming at first, the getting started guide offers a step-by-step breakdown to help you navigate it with ease. And like all ClickUp templates, you can easily customize it to suit your business needs and preferences.

Microsoft’s 20-page traditional business plan template simplifies the process of drafting comprehensive business plans. It’s made up of different sections, including:

- Executive summary : Highlights, objectives, mission statement, and keys to success

- Description of business: Company ownership and legal structure, hours of operation, products and services, suppliers, financial plans, etc.

- Marketing: Market analysis, market segmentation, competition, and pricing

- Appendix: Start-up expenses, cash flow statements, income statements, sales forecast, milestones, break-even analysis, etc.

The table of contents makes it easy to move to different sections of the document. And the text placeholders under each section provide clarity on the specific details required—making the process easier for users who may not be familiar with certain business terminology.

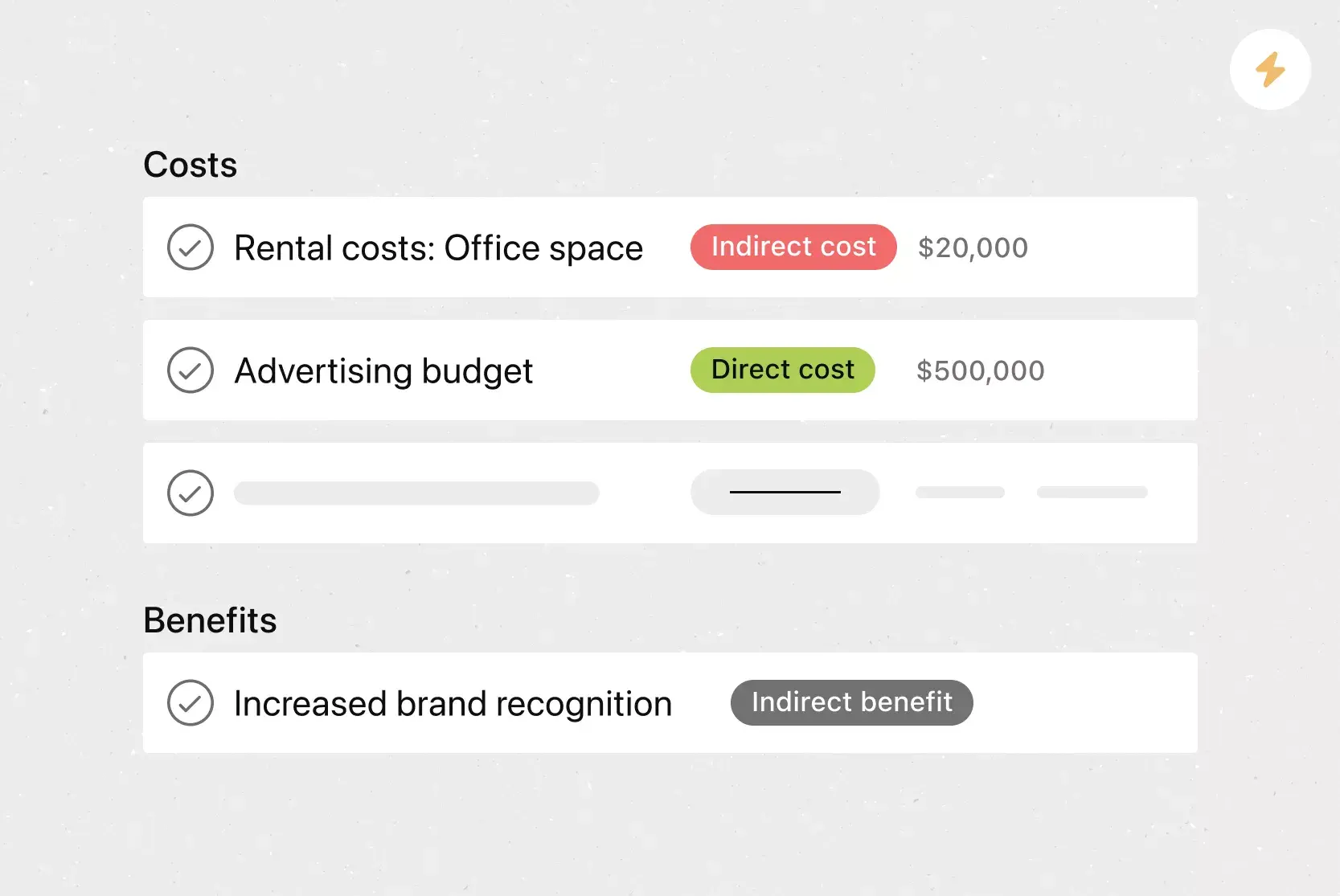

No business template roundup is complete without an Excel template. This business plan template lets you work on your business financials in Excel. It comes with customizable tables, formulas, and charts to help you look at the following areas:

- Highlight charts

- Market analysis

- Start-up assets and expenses

- Sales forecasts

- Profit and loss

- Balance sheet

- Cash flow projections

- Break-even analysis

This Excel template is especially useful when you want to create a clear and visual financial section for your business plan document—an essential element for attracting investors and lenders. However, there might be a steep learning curve to using this template if you’re not familiar with business financial planning and using Excel.

Try a Free Business Plan Template in ClickUp

Launching and running a successful business requires a well-thought-out and carefully crafted business plan. However, the business planning process doesn’t have to be complicated, boring, or take up too much time. Use any of the above 10 free business plan formats to simplify and speed up the process.

ClickUp templates go beyond offering a solid foundation to build your business plans. They come with extensive project management features to turn your vision into reality. And that’s not all— ClickUp’s template library offers over 1,000 additional templates to help manage various aspects of your business, from decision-making to product development to resource management .

Sign up for ClickUp’s Free Forever Plan today to fast-track your business’s growth! 🏆

Questions? Comments? Visit our Help Center for support.

Receive the latest WriteClick Newsletter updates.

Thanks for subscribing to our blog!

Please enter a valid email

- Free training & 24-hour support

- Serious about security & privacy

- 99.99% uptime the last 12 months

Professor Excel

Let's excel in Excel

Business Plan: How to Create Great Financial Plans in Excel

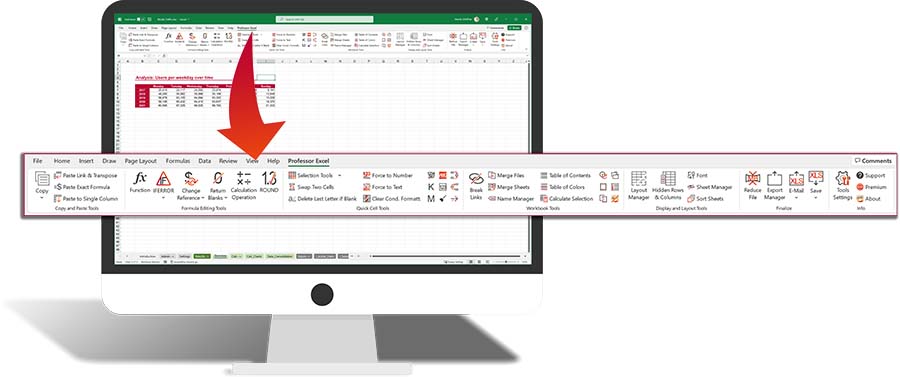

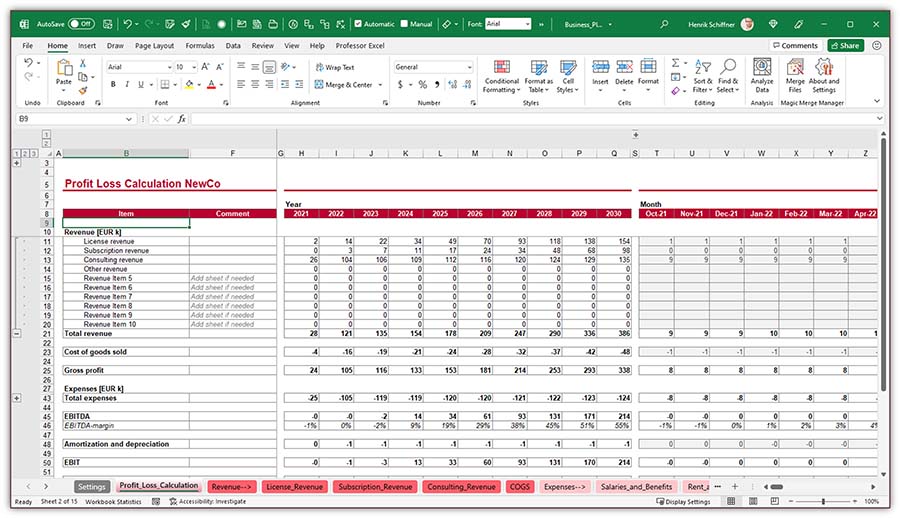

I guess, you are about to write a business plan and that is why you have come to this page. Very good – because in this article I am going to write down my experience with business plans and what I have learned creating them with Microsoft Excel. As I will point out again further down, I will only concentrate on the financial part of business plans. Specifically, how to set it up in Excel. Of course, you can also download an Excel template .

Parts of business plans

As you reached this page I suppose you already have a rough idea of what a business plan is. So, we will skip this part here.

A business plan is a formal written document containing the goals of a business, the methods for attaining those goals, and the time-frame for the achievement of the goals.” https://en.wikipedia.org/wiki/Business_plan

But one comment concerning the scope of this article: The formal business plan has usually many different parts, in which you describe the business idea and product, the market, competition, legal construct and so on. But typically, investors are most interested in the financial part. They want to know first, what they can get out of it. Of course, the other parts are also very important, but the financial topics usually put everything described in the other sections into numbers.

I’m not going further into the details of all the other parts than then financial section here. Specifically, we will dive into the basics of the financial part and how to model it in Excel.

Please scroll down to download the business plan template. We are going to explore all the following advice with this template.

How to create a business plan in Excel

Advice 1: be clear about the purpose and the recipient of the business plan.

Before you start opening Excel, make sure that you are 100% clear of the purpose this business plan. Is the business plan just for you? Or do you create it for someone else, for example an investor or bank? Although the next steps might still be the same, the focus might be different. For example: Maybe you have a very good understanding of the major assumptions because you have been working in this field for some time. But for someone external you still need to validate them. Of course, in both cases the assumptions should be realistic and goals should be achievable. But maybe for your own peace of mind you would choose more pessimistic assumptions if the plan was only for you.

Advice 2: Go top-down in terms of line items

Now, let’s start in Excel. But how do we start?

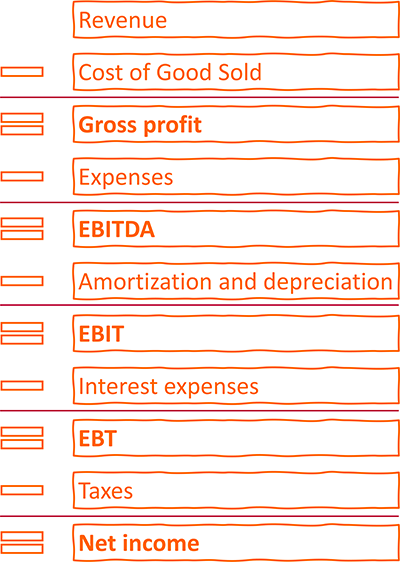

My approach is to go top-down. I usually use a basic P&L (“Profit- and loss” calculation) structure to start with, having some placeholders for revenue and costs.

Specifically, I go through the following parts (also shown on the right-hand side).

Let’s assume that you develop and sell Excel add-ins: 50 EUR per license – once-off. You would now start with assumptions of how many you can sell per month and the price. This is your first revenue item. At this point in time, I would leave it like this. We can later drill further down as much as we need (for example modeling discounts, the connection between marketing spending and number of units sold, price changes, etc.).

If we have multiple products, we calculate them in a similar manner.

Cost of goods sold

Cost of goods sold – or COGS – refers to the direct costs of producing the goods sold. Depending on the complexity you could also summarize cost of sales here or keep it separately.

Often, the COGS are directly linked to the number of units produced so you could refer to the numbers already calculated for the revenues.

In our example from above, we don’t have any direct costs for producing the Excel add-ins because we develop them ourselves and our salary will be regarded under “Salaries and Benefits”.

All other expenses

The structure of the expenses highly depends on your business. I usually start with these:

- Salaries and Benefits

- Rent and Overhead

- Marketing and Advertising

- Other expenses

Again, these items might look completely different for you. Example: if you travel a lot for your business, you might plan travel costs separately.

Subtracting costs from the revenue leads to the EBITDA (earnings before interest, taxes, depreciation, and amortization). This is one of the important financial performance indicators.

Amortization and depreciation

If you buy any assets for your business (for example machines, computers, even cars), you usually plan to use them over a certain period. When you first buy them, let’s say for 1,000 USD, you basically just exchange money for assets in the same amount. The problem: The assets will decrease in value the longer you use them. Within the cost items above, you don’t regard the acquisition value. So, how to regard them in your business plan?

You only regard the annual decrease of value. If you plan to use your 1,000 USD item for 5 years, you could (plainly speaking), each year regard 200 USD as depreciation.

Please note: If you later plan your cash, you have to make sure that you fully regard the initial sales price and not the depreciation.

The key difference between amortization and depreciation is that amortization is used for intangible assets, while depreciation is used for tangible assets. https://www.fool.com/knowledge-center/whats-the-difference-between-amortization-deprecia.aspx

Subtracting the amortization and depreciation from the EBITDA leads to the second key performance indicator, the EBIT (earnings before interest and tax).

Interest and taxes

Eventually, you have to prognose your interest costs (for example what you have to pay for bank loans) and your taxes, which is typically just a percentage of the EBT (the earning before taxes).

Advice 3: Think about the business drivers carefully

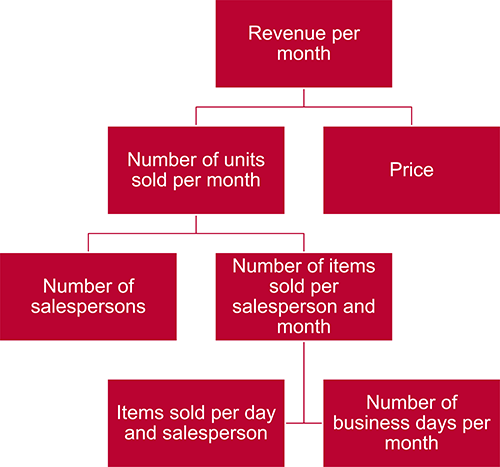

Good business plans are driver based.

Business drivers are the key inputs and activities that drive the operational and financial results of a business. Common examples of business drivers are salespeople, number of stores, website traffic, number and price of products sold, units of production, etc. https://corporatefinanceinstitute.com/resources/knowledge/modeling/business-drivers/

Let me explain with an example: You want to plan the revenues. You have two different options:

- Revenue per month is split into number of units sold times price per unit.

- Number of units sold is further split into number of salespersons and number of items sold per salesperson and month, and so on.

- Or you could just write a number and every following year you assume a growth in percentage (e.g. +2% per year).

Let’s finish this section with some final comments:

- Choose drivers that are measurable. You will most probably later on compare the drivers to reality and therefore make sure that they are not impossible to measure.

- Figure out, which driver has most impact. You should focus on those first. Driver with no or very limited impact can be skipped initially.

- Are drivers depending on each other? If yes, it should be modeled accordingly.

Advice 4: Choose the smallest period from the beginning in your business plan

So far, we have been focusing on the line items, for example costs, revenue, or drivers. Now, let’s talk about the time frame.

The question is: Should you plan on annual, monthly or any other basis? Or a mix?

I have seen many business plans doing it something like this:

- Plan on monthly basis for the first 24 to 36 months.

- Switch to annual planning for the years 3/4 to 5.

Most business plans are not going beyond 5 years planning period.

My recommendation: Plan on monthly basis for the full period. There will be a point in time when you need to break it down into months. And it is always easier to sum up 12 months for annual values than to drill down from years to months.

Do you want to boost your productivity in Excel ?

Get the Professor Excel ribbon!

Add more than 120 great features to Excel!

Advice 5: Keep a unified, professional business plan structure

This advice should count for most Excel models: Try to keep the same structure throughout the whole Excel file.

- Structure of worksheets: Make sure that most worksheets are set up with the same structure. For example, start with a headline in cell B2, years starting in column H, content in row 10.

- Layout / format of cells: Make sure you use a consistent formatting. For example, Excel provides cell styles – use them. For more recommendations about professional formatting, please refer to this article .

- Universal settings and assumptions should be consolidated on one sheet (for example tax rates, start date, company name).

Advice 6: Document business plan assumptions well

I can not say this often enough: Document your assumptions! Not only the values or variables, also your thoughts behind them. Why have you chosen this value? What is it based on? What is it used for?

Advice 7: Gross vs. net values

This question I am asked quite frequently: Should you use gross or net values? That means, include tax in revenues and costs?

Typically, you only work with net values, excluding VAT. For Germany with a tax rate of 19%, for example, if you invoice 119 EUR to a customer, you would only regard 100 EUR. Also, for costs, you would only regard net values.

Then, in your business plan, you start with revenue minus costs and eventually reach the EBT (earning before tax, please scroll up to see the P&L). From this, you calculate your company tax.

Advice 8: Think ahead

Some more things you should keep in mind when creating your business plan.

- Business plans are “living documents”. Keep in mind that at some point in the future you have to update it or extend it.

- Validate your assumptions: After some time, you will come back to your plan having real life figures. Now, it’s time to compare and – if necessary – adjust the plan.

- a valuation (“Discounted Cash Flow model”),

- liquidity planning,

- bank loan simulations,

- financial dashboards,

- budget planning,

- maybe even the first real official P&L (at least when it comes to the line items of your business plan)

- and much more…

Download business plan template

So, after reading all this description and advice, it’s time to start. Probably many things I have written above sounds like common sense, right? But I can assure you: Doing it and regarding as much advice as possible is not necessarily simple.

That’s why I have decided to create a template. I have pre-filled it with an imaginary example.

I know, there are countless Excel business plan templates around. So, why should you use this one?

- This template is very flexible: I have always included place holders so that you can add much more items if needed.

- In terms of the time frame, I have created monthly columns for up to ten years. Typically, you need less. Then just hide the extra columns.

- Also, I have created a consistent structure throughout the model.

- No fancy Excel functions and formulas, mainly just plain links.

Please feel free to take a look at it. If you like it, just use it. If not, please feel free to create your individual business plan – you now know how to do it!

Download link: Click here to start the download .

Image by koon boh Goh from Pixabay

Image by mohamed Hassan from Pixabay

Image by Memed_Nurrohmad from Pixabay

Henrik Schiffner is a freelance business consultant and software developer. He lives and works in Hamburg, Germany. Besides being an Excel enthusiast he loves photography and sports.

Leave a comment Cancel reply

Your email address will not be published. Required fields are marked *

Save my name, email, and website in this browser for the next time I comment.

Privacy Overview

- Product overview

- All features

- App integrations

CAPABILITIES

- project icon Project management

- Project views

- Custom fields

- Status updates

- goal icon Goals and reporting

- Reporting dashboards

- workflow icon Workflows and automation

- portfolio icon Resource management

- Time tracking

- my-task icon Admin and security

- Admin console

- asana-intelligence icon Asana Intelligence

- list icon Personal

- premium icon Starter

- briefcase icon Advanced

- Goal management

- Organizational planning

- Campaign management

- Creative production

- Marketing strategic planning

- Request tracking

- Resource planning

- Project intake

- View all uses arrow-right icon

- Project plans

- Team goals & objectives

- Team continuity

- Meeting agenda

- View all templates arrow-right icon

- Work management resources Discover best practices, watch webinars, get insights

- What's new Learn about the latest and greatest from Asana

- Customer stories See how the world's best organizations drive work innovation with Asana

- Help Center Get lots of tips, tricks, and advice to get the most from Asana

- Asana Academy Sign up for interactive courses and webinars to learn Asana

- Developers Learn more about building apps on the Asana platform

- Community programs Connect with and learn from Asana customers around the world

- Events Find out about upcoming events near you

- Partners Learn more about our partner programs

- Support Need help? Contact the Asana support team

- Asana for nonprofits Get more information on our nonprofit discount program, and apply.

Featured Reads

- Strategic planning |

- Business plan

Business plan template

If you’re looking for a way to start your business off on the right foot, a business plan template can help you establish the foundation for your strategy. Get started in a few clicks with Asana’s free business plan template.

Sign up to use this template.

- A library of 70+ templates

- Hundreds of app integrations

- AI features to get more done—faster

You’re pumped—you just thought of the greatest business idea ever. You want to get started, but you don’t have a plan laid out. You need a loan to get your idea off the ground, and the bank wants to see an in-depth business plan. We’re here to help.

What is a business plan template?

A business plan template is a framework that helps you solidify your ideas in an organized format. Our free business plan template walks you through how to create a new business from scratch, or re-imagine your existing business in a new market.

What components are included in a business plan template?

Our business plan template covers what an organization wants to achieve within three to five years. By using our template, you’ll have a place to capture all of the major information you need in order to complete your business plan. That includes:

Company description : Information like your executive summary , your company’s mission statement and vision, and your founder’s bio.

Product and services: A high-level overview of what your company provides, including core products or services. This may also include how your product is developed, any potential screenshots or prototypes of your product, and pricing plans.

Marketing plan: How you plan to bring your product into market at a high level. You can add information like a SWOT analysis , target market research, and brand positioning in this section.

Financial plan: Important financial information such as balance sheets, a break-even analysis, and your cash flow projections.

Management and organization information: Information on your company’s founders, executive team, and the board of directors.

How to use our free business plan template

Using Asana’s free business plan template is simple. Start by creating a new project with our free template. From there, add relevant information for your specific business plan in the sections provided in our template. If there’s more information you want to include in your business plan, you’re free to add sections, custom fields, or additional tasks to make this template fit your needs.

Integrated features

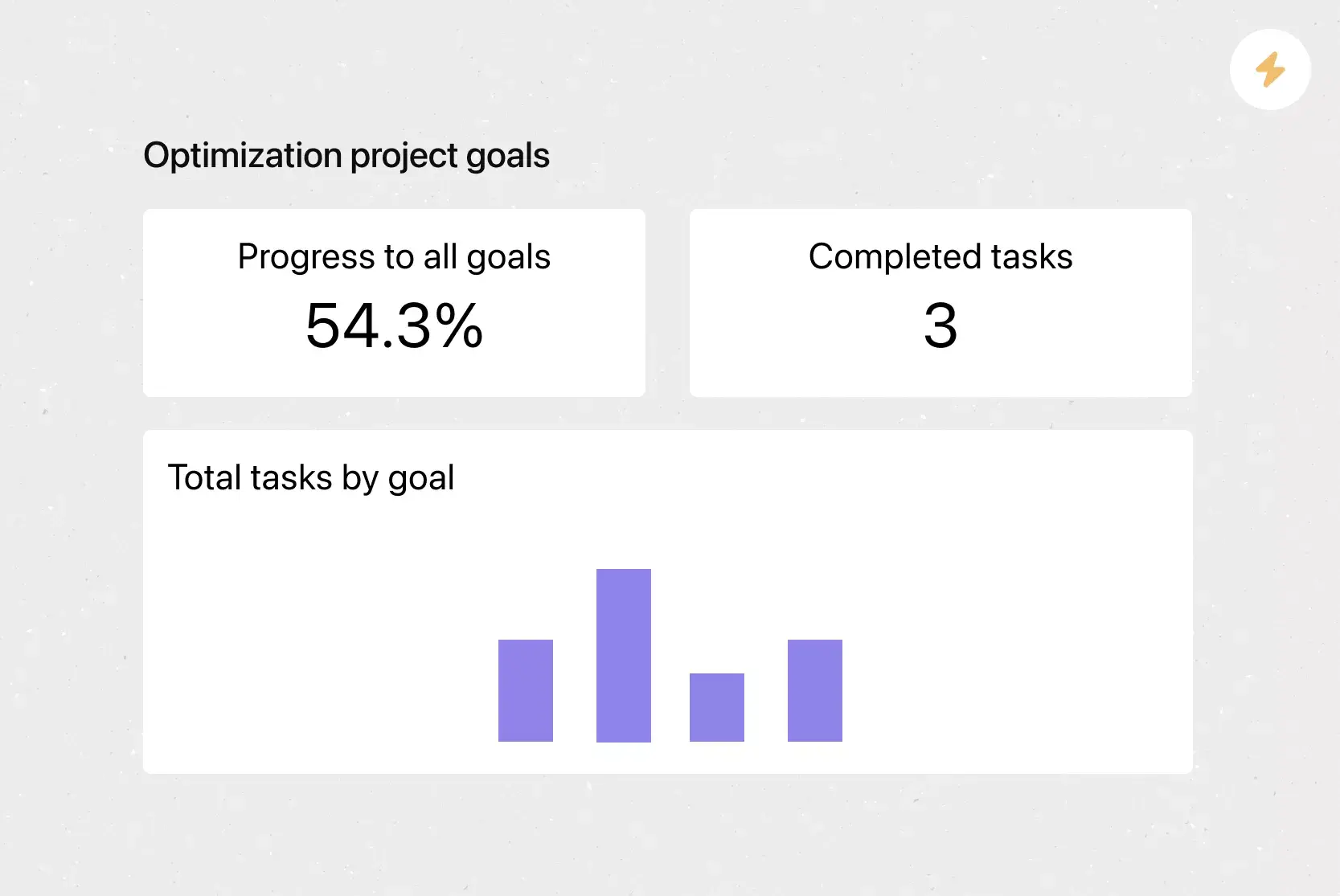

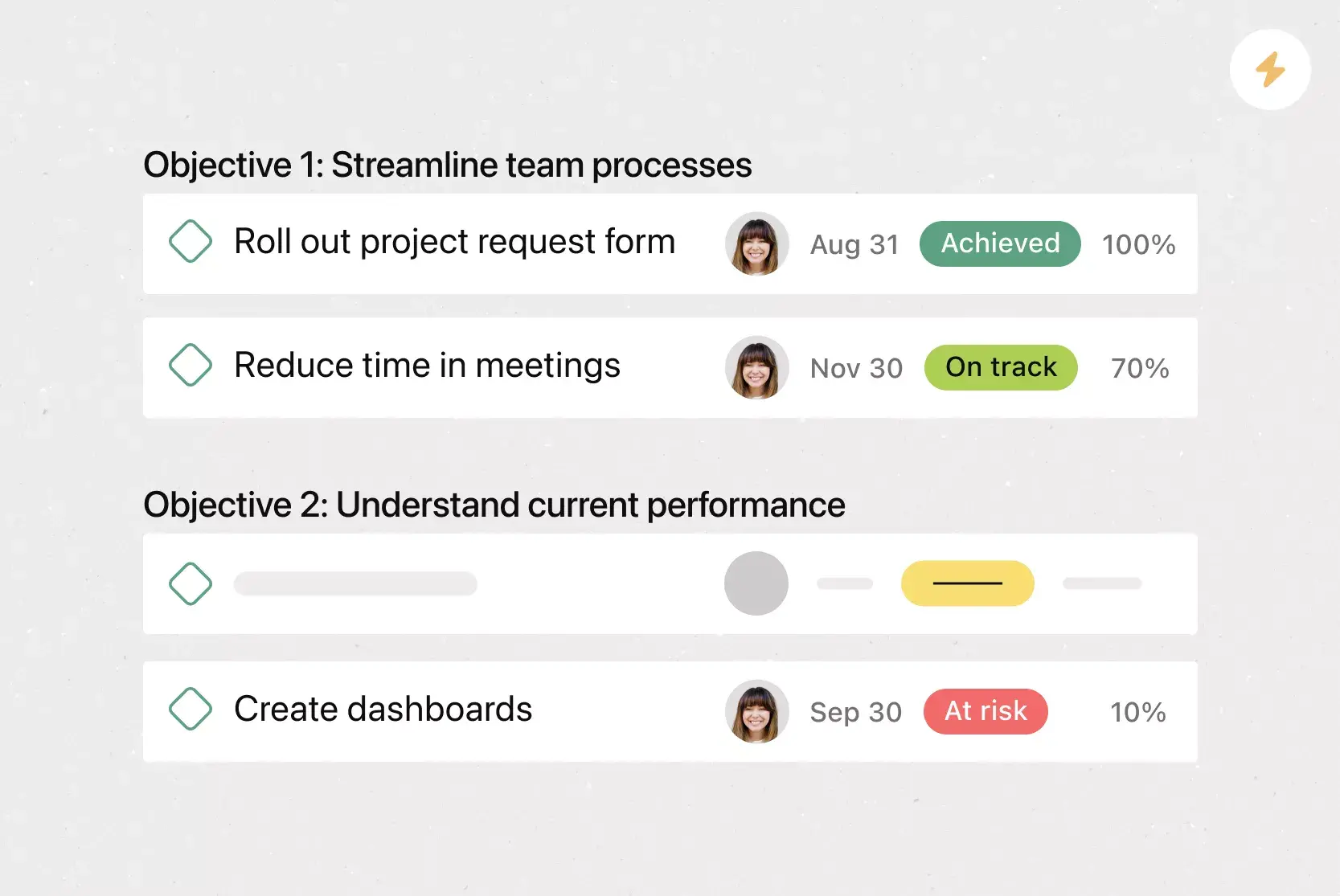

Goals . Goals in Asana directly connect to the work you’re doing to hit them, making it easy for team members to see what they’re working towards. More often than not, our goals live separate from the work that goes into achieving them. By connecting your team and company goals to the work that supports them, team members have real-time insight and clarity into how their work directly contributes to your team—and company—success. As a result, team members can make better decisions. If necessary, they can identify the projects that support the company’s strategy and prioritize work that delivers measurable results.

Reporting . Reporting in Asana translates project data into visual charts and digestible graphs. By reporting on work where work lives, you can reduce duplicative work and cut down on unnecessary app switching. And, because all of your team’s work is already in Asana, you can pull data from any project or team to get an accurate picture of what’s happening in one place.

Milestones . Milestones represent important project checkpoints. By setting milestones throughout your project, you can let your team members and project stakeholders know how you’re pacing towards your goal. Use milestones as a chance to celebrate the little wins on the path towards the big project goal.

Project Overview . Project Overview is your one-stop-shop for all important project context. Give your team a bird’s-eye view of the what, why, and how of your project work. Add a project description to set the tone for how you’ll work together in Asana. Then, share any important resources and context—like meeting details, communication channels, and project briefs—in one place.

Recommended apps

Microsoft Teams . With the Microsoft Teams + Asana integration, you can search for and share the information you need without leaving Teams. Easily connect your Teams conversations to actionable items in Asana. Plus, create, assign, and view tasks during a Teams Meeting without needing to switch to your browser.

Slack . Turn ideas, work requests, and action items from Slack into trackable tasks and comments in Asana. Go from quick questions and action items to tasks with assignees and due dates. Easily capture work so requests and to-dos don’t get lost in Slack.

Google Workplace . Attach files directly to tasks in Asana with the Google Workplace file chooser, which is built into the Asana task pane. Easily attach any My Drive file with just a few clicks.

Gmail . With the Asana for Gmail integration, you can create Asana tasks directly from your Gmail inbox. Any tasks you create from Gmail will automatically include the context from your email, so you never miss a beat. Need to refer to an Asana task while composing an email? Instead of opening Asana, use the Asana for Gmail add-on to simply search for that task directly from your Gmail inbox.

How do I create a business plan template? .css-i4fobf{-webkit-transition:-webkit-transform 200ms ease-in-out;transition:transform 200ms ease-in-out;-webkit-transform:rotateZ(0);-moz-transform:rotateZ(0);-ms-transform:rotateZ(0);transform:rotateZ(0);}

Instead of taking the time to create a business plan from scratch, start the process off with Asana’s free template.To further customize your template, add evergreen information about your specific business, such as your business model, company name, address, mission statement, value proposition, or target audience. Adding these details to your template lets you avoid documenting this information from scratch every time you create a new business plan.

What components should I include in a business plan template?

Business plan templates typically contain five main sections: a company description, products and services, a marketing plan, basic management and organization information, and your current financial plan.

How long should my business plan be?

Short answer—as long as you need it to be. The long answer is that your business plan should have the answers to specific questions on how your business is run, from the perspective of an investor. The goal of a business plan is to highlight your business strategy for the next three to five years. This means any important operational, financial, and strategic information should be included.

Related templates

Action plan template

Taking action has never been easier. Learn how to create a reusable action plan template in Asana to take the guesswork out of strategic planning.

Marketing strategy

A marketing strategy template is a useful tool that helps your marketing team achieve their goals. Learn how to create your marketing strategy with Asana.

PEST analysis

A PEST analysis template helps compile info on the external environment affecting your business. Learn how to prevent risk with a PEST analysis template.

Objectives and key results (OKR) template

Learn how to create an OKR template in Asana so you can standardize the goal-setting process for everyone.

Cost benefit analysis template

Digital cost benefit analysis templates are a useful framework to see if a new project or idea is viable. Learn how to create your own in a few simple steps, with Asana.

Nonprofit business plan template

Success doesn’t just happen—it’s planned. Stay focused on your most crucial work with a custom nonprofit business plan template.

Contingency plan

Using a contingency plan template will help you create well-developed strategies to help you protect your business from potential risk. Learn how Asana can help.

Requirements traceability matrix

A requirements traceability matrix template is a tool to help organize project requirements in a concise manner. Learn how to create one for your team.

Creating a digital punch list template can help streamline the final bits of a project for your team. Here’s how to create one.

Go-to-market strategy template

Simplify your GTM strategy with a go-to-market strategy template that aligns teams and keeps work on track. Learn how in Asana.

Project closure template

Endings are important. Create a project closure template to help your team tie up loose ends and finish their projects with confidence.

Project reporting

Stay on top of your project’s performance. Keep everyone on the same page about what’s been completed and where your project is headed.

![business plan financial spreadsheets [Templates] Product Roadmap (Card image)](https://assets.asana.biz/transform/2728edf4-eb35-4dd5-8d03-25ba8cbe5864/TG23-web-thumbnail-028-scrumban-feature-static-2x?io=transform:fill,width:2560&format=webp)

Product roadmap

What if you could create, share, and update your product roadmap in one place? Everyone could see you’re tackling the right priorities. Start planning your product roadmap with this template.

Program roadmap

Create a program roadmap template and know the exact structure of each program, how they operate, and their future plans—company-wide.