- Public Service That Makes a Difference ®

2020 • 20–20

Research department working papers, a fundamental connection: exchange rates and macroeconomic expectations.

An emerging perception in international economics is that exchange rates are disconnected contemporaneously from macroeconomic fundamentals and are instead more closely tied to financial variables, particularly asset prices. The authors argue that this notion is incorrect. They use novel econometric methods to show that, while quarterly exchange rate changes are tightly linked to movements in currency risk premia, new information revealed by announcements about macroeconomic indicators can explain much of the variation in these risk premia. They also show that this same macroeconomic news also explains most of the variation in exchange rate changes at a quarterly frequency and that this news has even greater explanatory power during economic downturns and periods of financial uncertainty.

- Nadine McCloud 1 ,

- Michael S. Delgado 2 &

- Man Jin 3

246 Accesses

Explore all metrics

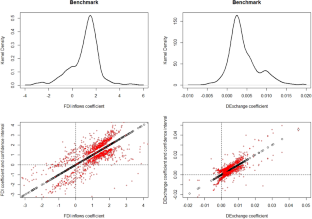

In theory, changes in a host country exchange rate can be a cause or consequence of changes in its level of foreign direct investment (FDI), and recent incidences suggest that government stability may have sizable implications for the interactions between FDI and the exchange rate. This paper uses a semiparametric system of simultaneous equations to empirically characterize the relationship between FDI and the exchange rate, with each country’s level of government stability serving as a moderator. The results suggest that across developed and developing economies the most prevalent type of symbiosis between FDI and the exchange rate is a positive effect of FDI on the exchange rate, but no effect of the exchange rate on FDI. This significant FDI effect is heterogeneous, with an interquartile range of 1.241. At the median, a 10% increase in FDI inflows relative to GDP causes approximately a 13.29% increase in the annual change in the exchange rate. Government stability acts as a moderator variable by strengthening the relationship between FDI and the exchange rate in some countries, but eliminates the relationship in other countries.

This is a preview of subscription content, log in via an institution to check access.

Access this article

Price includes VAT (Russian Federation)

Instant access to the full article PDF.

Rent this article via DeepDyve

Institutional subscriptions

Similar content being viewed by others

The impact of corruption on economic growth: a nonlinear evidence

Estimating the effects of Syrian civil war

Understanding economic openness: a review of existing measures

Based on World Bank data, between 2003 and 2013, Angola’s economy grew at an annual average of about 10.3% relative to all of Sub-Saharan Africa which grew by an average of approximately 5.7%.

See, e.g., Froot and Stein ( 1991 ), Broll and Wahl ( 1992 ), Blonigen ( 1997 ), Cushman ( 1985 ), Campa ( 1993 ), Aizenman ( 1992 ), Goldberg and Kolstad ( 1994 ), Campa and Goldberg ( 1995 ), Kiyota and Urata ( 2004 ), Russ ( 2007 ), Udomkerdmongkol et al. ( 2009 ), Yu and Walsh ( 2010 ), Alba et al. ( 2010 ).

Here, we avail ourselves of the symbiosis taxonomy in the biological literature to characterize the interactions between FDI inflows and changes in exchange rates.

Regarding the political economy determinants of FDI, see for example Schneider and Frey ( 1985 ), Hines ( 1995 ), Wei ( 2000 ), Harms and Ursprung ( 2002 ), Egger and Winner ( 2005 ), Egger and Winner ( 2006 ), Hakkala et al. ( 2008 ), Kolstad and Villanger ( 2008 ), Asiedu et al. ( 2009 ), Faeth ( 2009 ), Javorcik and Wei ( 2009 ), Aleksynska and Havrylchyk ( 2013 ), Sánchez-Martín et al. ( 2014 ), Akhtaruzzaman et al. ( 2017 ) and the references cited therein; and for exchange rates, see Bodea ( 2015 ), Beckmann et al. ( 2017 ), Beckmann and Czudaj ( 2017 ) and the references cited therein.

There is a broad literature studying the effect of capital inflows on productivity, that pays particularly close attention to relevant spillover effects. The hypothesis is that FDI often involves the transfer of knowledge from one country/firm to another (Keller 2004 ), and it facilitates gaining access to intangible productive “knowledge” assets from abroad such as new technologies, proprietary know-hows, more efficient and innovative marketing and management practices, established relational networks, or reputation, which can boost productivity of domestic firms. The effect is commonly referred to as the FDI spillover. Empirically, many studies find robust evidence that FDI has a positive effect on productivity for both immediate recipients, who benefit from direct learning of foreign knowledge, and other domestic firms in the region via technology/knowledge spillovers (Potterie and Lichtenberg 2001 ; Baldwin et al. 2005 ; Keller and Yeaple 2009 ; Malikov and Zhao 2021 ; Smarzynska Javorcik 2004 ).

For instance, Kosteletou and Liargovas ( 2000 ) empirically examine causality between the exchange rate and FDI for 12 EU countries using a simultaneous linear equation model where FDI and the exchange rate are jointly determined. They find that in large countries with freely floating currencies causality runs from the exchange rate to FDI, but that causality runs both ways in small countries with fixed or “quasi” fixed currencies. While we also focus on bidirectional links between the exchange rate and FDI, in contrast to Kosteletou and Liargovas ( 2000 ), we do not restrict our attention to either a limited sample of countries or to a linear regression setup.

There are also some work using bilateral exchange rate (Yuqing 2006 ) and effective exchange rate (Huong et al. 2020 ) to discuss the relationship between exchange rate and FDI in Asian countries.

There is a broader literature that looks at the link between trade openness and exchange rate volatility. For example, Calderón and Kubota ( 2018 ) find that higher trade openness leads to a more stable exchange rate, while Harms and Ursprung ( 2002 ) shows that monetary and supply shocks produce smaller exchange rate movements if an economy is more open to trade. Giovanni and Levchenko ( 2009 ) show that sectors more open to international trade are more volatile. A high GDP reflects larger production rates, an indication of greater demand for that country’s products. An increase in demand for a country’s goods and services often translates into increased demand for the country’s currency.

Note that this government stability index is available for 1984 and onwards, which inevitably fixes the beginning year of our dataset. Moreover, the current account data is not available after 2010. Therefore, our annual data series runs from 1984 to 2010.

Barro ( 1991 ) and Brunetti and Weder ( 1998 ) find empirical evidence that government instability is significantly related to cross-country differences in private investment.

Moreover, the Racine and Li ( 2004 ) kernels allow for interaction of unknown form between both fixed effects and variables that vary both across country and over time, so that our control of country- and year-specific effects is not restricted to additively separable effects.

With exception of the country and year indicators, we require the variables in \(Z_{it}\) to vary across both i and t , thus allowing our country and year indicators to absorb all country or time-varying factors that may lead to heterogeneity in the coefficient functions.

Our use of non-neutral fixed effects—in lieu of their neutral counterparts—circumvents the need to remove the fixed effects via some type of weighting or first difference transformation prior to estimation, to avoid biased and inconsistent estimates of, in particular, the marginal effects. Further, our use of generalized product kernels (Racine and Li 2004 ) allows us to avoid the incidental parameters problem associated with many parametric panel models that include dummy variables to account for unobserved effects.

We consider estimates of (A9) that use first stage estimates of A as our weighting matrix.

We use the Li et al. ( 2009 ) density equality test as a means to test whether the coefficient distributions estimated via the semiparametric simultaneous equations system are different from the coefficient distributions estimated by an equation-by-equation semiparametric estimator. The tests indicate that there are significant differences between the estimated coefficient distributions for both \(\Delta E\) and FDI across model specifications. We take this as support for our simultaneous equations structure.

Aisen A, Veiga FJ (2006) Does political instability lead to higher inflation? A panel data analysis. J Money Credit Bank 37(5):1379–1389

Article Google Scholar

Aizenman J (1992) Exchange rate flexibility, volatility, and domestic and foreign direct investment. IMF Staff Pap 39(4):890–922

Akhtaruzzaman M, Berg N, Hajzler C (2017) Expropriation risk and FDI in developing countries: does return of capital dominate return on capital? Eur J Polit Econ 49:84–107

Alba JD, Wang P, Park D (2010) The impact of exchange rate on FDI and the interdependence of FDI over time. Singap Econ Rev 55(04):733–747

Aleksynska M, Havrylchyk O (2013) FDI from the south: the role of institutional distance and natural resources. Eur J Polit Econ 29:38–53

Asiedu E (2006) Foreign direct investment in Africa: the role of natural resources, market size, government policy, institutions and political instability. World Econ 29(1):63–77

Asiedu E, Jin Y, Nandwa B (2009) Does foreign aid mitigate the adverse effect of expropriation risk on foreign direct investment? J Int Econ 78(2):268–275

Baldwin R, Braconier H, Forslid R (2005) Multinationals, endogenous growth, and technological spillovers: theory and evidence. Rev Int Econ 13(5):945–963

Barro RJ (1991) Economic growth in a cross section of countries. Q J Econ 106(2):407–443

Beckmann J, Czudaj R (2017) Exchange rate expectations and economic policy uncertainty. Eur J Polit Econ 47:148–162

Beckmann J, Ademmer E, Belke A, Schweickert R (2017) The political economy of the impossible trinity. Eur J Polit Econ 47:103–123

Blonigen BA (1997) Firm-specific assets and the link between exchange rate and foreign direct investment. Am Econ Rev 87(3):447–465

Google Scholar

Blonigen BA (2005) A review of the empirical literature on FDI determinants. Atl Econ J 33(4):383–403

Blonigen BA, Piger J (2014) Determinants of foreign direct investment. Can J Econ 47(3):775–812

Bodea C (2015) Fixed exchange rates with escape clauses: the political determinants of the European monetary system realignments. Eur J Polit Econ 39:25–40

Branson WH (1981) Macroeconomic determinants of real exchange rates. NBER working papers 0801, National Bureau of Economic Research, Inc

Branson W (1977) The specification of goods and factor markets in open-economy macroeconomic models. In: Jones RW, Kenen PB (eds) Handbook of International Economics, vol 2. North-Holland, Dordrecht

Broll U, Wahl JE (1992) International investments and exchange rate risk. Eur J Polit Econ 8(1):31–40

Bruce N, Purvis D (1984) The specification of goods and factor markets in open-economy macroeconomic models. In: Jones RW, Kenen PB (eds) Handbook of International Economics, vol 2. North-Holland, Dordrecht

Brunetti A, Weder B (1998) Investment and institutional uncertainty: a comparative study of different uncertainty measures. Rev World Econ 134(3):513–533

Busse M, Hefeker C (2007) Political risk, institutions and foreign direct investment. Eur J Polit Econ 23:397–415

Cai Z, Li Q (2008) Nonparametric estimation of varying coefficient dynamic panel data models. Econom Theor 24:1321–1342

Article MathSciNet Google Scholar

Calderón C, Kubota M (2018) Does higher openness cause more real exchange rate volatility? J Int Econ 110:176–204

Campa JM (1993) Entry by foreign firms in the United States under exchange rate uncertainty. Rev Econ Stat 75(4):614–22

Campa JM, Goldberg LS (1995) Investment in manufacturing, exchange rates and external exposure. J Int Econ 38(3–4):297–320

Chakrabarti A (2001) The determinants of foreign direct investments: sensitivity analyses of cross-country regressions. Kyklos 54(1):89–114

Corbo V (1985) Reforms and macroeconomic adjustments in Chile during 1974–1984. World Dev 13(8):893–916

Cosset J-C, Rianderie BD (1985) Political risk and foreign exchange rates: an efficient-market approach. J Int Bus Stud 16(3):21–55

Culem CG (1988) The locational determinants of direct investments among industrialized countries. Eur Econ Rev 32(4):885–904

Cushman DO (1985) Real exchange rate risk, expectations, and the level of direct investment. Rev Econ Stat 67(2):297–308

Cushman DO (1987) The effects of real wages and labor productivity on foreign direct investment. South Econ J 54(1):174–185

De Grauwe P, Danthine J, Katseli L, Thygesen N (1991) North-south in the EMS—convergence and divergence in inflation and real exchange rates, CEPS paper no. 50

Delgado MS, McCloud N, Kumbhakar SC (2014) A generalized empirical model of corruption, foreign direct investment, and growth. J Macroecon 42:298–316

Edwards S (1985) The behavior of interest rates and real exchange rates during a liberalization episode: the case of Chile 1973–83. NBER working papers 1702. National Bureau of Economic Research, Inc

Edwards S (1990) Capital flows, foreign direct investment, and debt-equity swaps in developing countries, number 3497. In: Capital flows, foreign direct investment, and debt-equity swaps in developing countries. National Bureau of Economic Research

Egger P, Winner H (2005) Evidence on corruption as an incentive for foreign direct investment. Eur J Polit Econ 21(4):932–952

Egger P, Winner H (2006) How corruption influences foreign direct investment: a panel data study. Econ Dev Cult Change 54(2):459–86

Faeth I (2009) Determinants of foreign direct investment—a tale of nine theoretical models. J Econ Surv 23(1):165–196

Fan J, Gijbels I (1996) Local Polynomial Modeling and Its Applications. Chapman and Hall, New York

Ffrench-Davis R (1983) The monetarist experiment in Chile: a critical survey. World Dev 11(11):905–926

Fielding D, Shortland AK (2005) How does political violence affect confidence in a local currency? Evidence from Egypt. J Int Dev 17(7):841–866

Froot K, Stein J (1991) Exchange rates and foreign direct investment: an imperfect capital markets approach. Q J Econ 106(4):1191–1217

Giavazzi F, Spaventa L (1990) The “new" EMS. Quaderni-working paper DSE

Giovanni J, Levchenko AA (2009) Trade openness and volatility. Rev Econ Stat 91(3):558–585

Goldberg LS, Kolstad CD (1994) Foreign direct investment, exchange rate variability and demand uncertainty. NBER working papers 4815, National Bureau of Economic Research, Inc

Goldberg LS, Kolstad CD (1995) Foreign direct investment, exchange rate variability and demand uncertainty. Int Econ Rev 36(4):855–873

Hacche G (1983) The determinants of exchange rate movements. OECD Economics Department Working Papers 7, OECD Publishing

Hakkala KN, Norbäck P, Svaleryd H (2008) Asymmetric effects of corruption on FDI: evidence from Swedish multinational firms. Rev Econ Stat 90(4):627–642

Hall P, Li Q, Racine JS (2007) Nonparametric estimation of regression functions in the presence of irrelevant regressors. Rev Econ Stat 89(6):784–789

Harberger A (1985) Observations on the Chilean economy 1973–83. Econ Dev Cult Change 33(3):451–462

Harms P, Ursprung HW (2002) Do civil and political repression really boost foreign direct investments? Econ Inq 40(4):651–663

Hau H (2002) Real exchange rate volatility and economic openness: theory and evidence. J Money Credit Bank 34(3):611–630

Hines JR (1995) Forbidden payment: foreign bribery and American business after 1977. NBER working papers 5266. National Bureau of Economic Research

Huong TTX, Nguyen M-LT, Lien NTK (2020) An empirical study of the real effective exchange rate and foreign direct investment in Vietnam. Invest Manag Financ Innov 17(4):1

IMF (2005) Angola: 2004 Article IV Consultation: Staff Report; Staff Statement; Public Information Notice on the Executive Board Discussion; and Statement by the Executive Director for Angola, IMF Staff Country Reports, International Monetary Fund

Javorcik B, Wei S (2009) Corruption and cross-border investment in emerging markets: firm-level evidence. J Int Money Financ 28(4):605–624

Keller W (2004) International technology diffusion. J Econ Lit 42(3):752–782

Keller W, Yeaple SR (2009) Multinational enterprises, international trade, and productivity growth: firm-level evidence from the United States. Rev Econ Stat 91(4):821–831

Kiyota K, Urata S (2004) Exchange rate, exchange rate volatility and foreign direct investment. World Econ 27(10):1501–1536

Klein MW, Rosengren E (1994) The real exchange rate and foreign direct investment in the United States: relative wealth vs. relative wage effects. J Int Econ 36(3–4):373–389

Kogut B, Chang SJ (1996) Platform investments and volatile exchange rates: direct investment in the US by Japanese electronic companies. Rev Econ Stat 78(2):221–231

Kolstad I, Villanger E (2008) Determinants of foreign direct investment in services. Eur J Polit Econ 24(2):518–533

Kosteletou N, Liargovas P (2000) Foreign direct investment and real exchange rate interlinkages. Open Econ Rev 11:135–148

Kravis IB, Lipsey RE (1982) The location of overseas production and production for export by us multinational firms. J Int Econ 12(3–4):201–223

Li Q, Racine JS (2004) Cross-validated local linear nonparametric regression. Stat Sin 14:485–512

MathSciNet Google Scholar

Li Q, Racine JS (2007) Nonparametric Econometrics: Theory and Practice. Princeton University Press, Princeton

Li Q, Racine JS (2010) Smooth varying coefficient estimation and inference for qualitative and quantitative data. Econom Theor 26:1607–1637

Article MathSciNet CAS Google Scholar

Li Q, Maasoumi E, Racine JS (2009) A nonparametric test for equality of distributions with mixed categorical and continuous data. J Econom 148(2):186–200

Lunn J (1980) Determinants of us direct investment in the EEC: further evidence. Eur Econ Rev 13(1):93–101

Malikov E, Zhao S (2021) On the estimation of cross-firm productivity spillovers with an application to FDI. Rev Econ Stat 1–46

McCloud N, Delgado M, Kumbhakar S (2018) Foreign direct investment and growth symbiosis: a semiparametric system of simultaneous equations analysis. J Econom Methods 7(1):1–31

Mussa M (1986) Nominal exchange rate regimes and the behavior of real exchange rates: evidence and implications. In: Carnegie-Rochester conference series on public policy, vol 25. Elsevier, pp 117–214

Nigh D (1985) The effect of political events on United States direct foreign investment: a pooled time-series cross-sectional analysis. J Int Bus Stud 16:1–17

Pearce DK (1983) Alternative views of exchange-rate determination. Econ Rev 68:16–30

Potterie BvPdl, Lichtenberg F (2001) Does foreign direct investment transfer technology across borders? Rev Econ Stat 83(3):490–497

Racine JS, Li Q (2004) Nonparametric estimation of regression functions with both categorical and continuous data. J Econom 119(1):99–130

Russ KN (2007) The endogeneity of the exchange rate as a determinant of FDI: a model of entry and multinational firms. J Int Econ 71(2):344–372

Sánchez-Martín ME, de Arce R, Escribano G (2014) Do changes in the rules of the game affect FDI flows in Latin America? A look at the macroeconomic, institutional and regional integration determinants of FDI. Eur J Polit Econ 34:279–299

Schmitz A, Bieri J (1972) EEC tariffs and US direct investment. Eur Econ Rev 3(3):259–270

Schneider FG, Frey BS (1985) Economic and political determinants of foreign direct investment. World Dev 13(2):161–175

Smarzynska Javorcik B (2004) Does foreign direct investment increase the productivity of domestic firms? In search of spillovers through backward linkages. Am Econ Rev 94(3):605–627

Sung H, Lapan HE (2000) Strategic foreign direct investment and exchange-rate uncertainty. Int Econ Rev 41(2):411–423

Tsai P-L (1994) Determinants of foreign direct investment and its impact on economic growth. J Econ Dev 19(1):137–163

Udomkerdmongkol M, Morrissey O, Gorg H (2009) Exchange rates and outward foreign direct investment: US FDI in emerging economies. Rev Dev Econ 13(4):754–764

UNCTAD (2007) Transnational corporations, extractive industries and development. World investment report 9789211127188. New York and Geneva, United Nations

Wei S-J (2000) How taxing is corruption on international investors? Rev Econ Stat 82(1):1–11

Article ADS Google Scholar

Wheeler D, Mody A (1992) International investment location decisions: the case of U.S. firms. J Int Econ 33(1–2):57–76

World Bank (2012) World Development Indicators [CD-ROM], Washington, DC

Yuqing X (2006) Why is china so attractive for FDI? the role of exchange rates. China Econ Rev 17(2):198–209

Yu J, Walsh JP (2010) Determinants of foreign direct investment. IMF working papers 10/187, International Monetary Fund

Download references

Author information

Authors and affiliations.

Department of Economics, University of the West Indies at Mona, Kingston 7, Jamaica

Nadine McCloud

Department of Agricultural Economics, Purdue University, West Lafayette, IN, USA

Michael S. Delgado

Department of Economics, Oakland University, Rochester, MI, 48306, USA

You can also search for this author in PubMed Google Scholar

Corresponding author

Correspondence to Michael S. Delgado .

Ethics declarations

Conflict of interest.

Dr. Nadine McCloud declares that she has no conflict of interest. Dr. Michael S. Delgado declares that he has no conflict of interest. Dr. Man Jin declares that she has no conflict of interest.

Ethical approval

This article does not contain any studies with human participants or animals performed by any of the authors.

Additional information

Publisher's note.

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Bryan Black and Rosan Reynolds-Salmon provided research assistance. We are grateful to participants at the 26th Silvaplana Workshop in Political Economy 2017 for comments. A previous draft of this paper was titled “A mutualism analysis of capital inflows and exchange rates: Does government stability matter?”.

Supplementary Information

Below is the link to the electronic supplementary material.

Supplementary file 1 (pdf 814 KB)

Rights and permissions.

Springer Nature or its licensor (e.g. a society or other partner) holds exclusive rights to this article under a publishing agreement with the author(s) or other rightsholder(s); author self-archiving of the accepted manuscript version of this article is solely governed by the terms of such publishing agreement and applicable law.

Reprints and permissions

About this article

McCloud, N., Delgado, M.S. & Jin, M. Foreign capital inflows, exchange rates, and government stability. Empir Econ 66 , 945–977 (2024). https://doi.org/10.1007/s00181-023-02490-y

Download citation

Received : 11 July 2022

Accepted : 08 August 2023

Published : 18 November 2023

Issue Date : March 2024

DOI : https://doi.org/10.1007/s00181-023-02490-y

Share this article

Anyone you share the following link with will be able to read this content:

Sorry, a shareable link is not currently available for this article.

Provided by the Springer Nature SharedIt content-sharing initiative

- Foreign direct investment

- Exchange rate

- Government stability

- Parameter heterogeneity

- Semiparametric system of equations model

JEL Classification

- Find a journal

- Publish with us

- Track your research

Research on exchange rates and monetary policy: an overview

This paper reviews research carried out on exchange rates and monetary policy by central banks that participated at the Autumn Meeting of Central Bank Economists on "Exchange rates and monetary policy", which the BIS hosted on 28-29 October 2004. The first part of the paper focuses on the approaches that central banks have found most useful in modelling exchange rate behaviour. We describe efforts to explain exchange rate behaviour ex post and to forecast its future evolution ex ante. We then summarise central banks' recent research on the linkage between exchange rates and inflation, output, profits and the current account. We highlight the main models and methodologies, the main empirical results and the key challenges ahead. The second part of the paper is devoted to research that examines the actual experience that countries have had in incorporating the exchange rate into their monetary policy decisions, and the main lessons learned.

JEL Classification Numbers: E5, F3, F4

Keywords: Monetary Policy, International Finance, Macroeconomic Aspects of International Trade and Finance

- Share this page

- Sign up to receive email alerts

- Translations

- Legal information

- Terms and conditions

- Copyright and permissions

- Privacy notice

- Cookies notice

- Email scam warning

Exchange Rate Exposure

In this paper we examine the relationship between exchange rate movements and firm value. We estimate the exchange rate exposure of publicly listed firms in a sample of eight (non-US) industrialized and emerging markets, and find that a significant percentage of these firms are indeed exposed. These results differ substantially from most previous studies in the literature that find little evidence of exposure. In robustness checks we find that: (i) the choice of exchange rate matters, and using the trade-weighted exchange rate is likely to understate the extent of exposure, (ii) conditioning on the value-weighted vs. the equally-weighted market index has little effect on estimated exposure, while conditioning on the international index does change the estimate of exposure, (iii) the extent of exposure is not a result of a spurious correlation between random variables with high variances, (iv) exposure increases with the return horizon, (v) within a country and within an industry, exposure coefficients are roughly evenly split between positive and negative values, (vi) averaging across the (absolute value of the) significant exposure coefficients in our sample of countries, we find an exposure coefficient of about 0.5, (vii) the extent of exposure is not sensitive to the sample period, but the set of firms that is exposed does vary over time, and (viii) the sign of the exposure coefficients changes across subperiods for about half of the firms of our sample. We find that exposure is not systematically related to firm size, industry affiliation, multinational status, foreign sales, international assets or industry-level trade.

- Acknowledgements and Disclosures

MARC RIS BibTeΧ

Download Citation Data

Published Versions

More from nber.

In addition to working papers , the NBER disseminates affiliates’ latest findings through a range of free periodicals — the NBER Reporter , the NBER Digest , the Bulletin on Retirement and Disability , the Bulletin on Health , and the Bulletin on Entrepreneurship — as well as online conference reports , video lectures , and interviews .

Get two weeks of complimentary access to a wealth of news, analysis and data across. Corporate email accounts required.

- News & Insights

- Data Solutions

- Events & Awards

TONA futures offer ‘greater precision’ for policy-led strategies – paper

- Published 20 May 2024

- Last Updated 20 May 2024 11:52

- Derivatives

The emergence of exchange traded Japanese risk-free rate contracts has provided market participants with the ability to more precisely hedge possible rates hikes in the future, research published by Japan Exchange Group (JPX) has shown

Existing Subscriber?

If you are an existing subscriber please sign in to read this article in full.

Sign up for a free trial

Take a complimentary trial to the FOW Marketing Intelligence Platform and gain access to a wealth of news, analysis and data across the Asset Management, Securities Finance, Custody, Fund Services and Derivatives markets.

Contact the author

Use the form below to contact the author of this article with any feedback, amendments, or general comments.

Sign in to your Futures & Options World account

By logging into this site, you agree to our Privacy Policy

Previous website user? Before you first log in you will need to reset your password in the “Forgotten your password?” form below. For assistance contact [email protected]

A link has been emailed to you - check your inbox.

Forgotten your password?

Submit your email address below to receive instructions on how to reset your password.

Related Articles

23 May 2024 People

Eurex discusses progress in 'home of the Euro-yield curve' initiative

Matthias Graulich, executive Board Member, Eurex Clearing, said the EMIR 3.0...

23 May 2024 Trading

HKEX to boost fixed income, FX with new advisory panel

Hong Kong Exchanges and Clearing said on Thursday it has created a FIC (fixed...

ANALYSIS: FX options market nears tipping point - Eurex

Growth in listed foreign exchange markets has encouraged more buyside firms to...

- MyU : For Students, Faculty, and Staff

News Roundup Spring 2024

CEGE Spring Graduation Celebration and Order of the Engineer

Forty-seven graduates of the undergraduate and grad student programs (pictured above) in the Department of Civil, Environmental, and Geo- Engineering took part in the Order of the Engineer on graduation day. Distinguished Speakers at this departmental event included Katrina Kessler (MS EnvE 2021), Commissioner of the Minnesota Pollution Control Agency, and student Brian Balquist. Following this event, students participated in the college-wide Commencement Ceremony at 3M Arena at Mariucci.

UNIVERSITY & DEPARTMENT

The University of Minnesota’s Crookston, Duluth, and Rochester campuses have been awarded the Carnegie Elective Classification for Community Engagement, joining the Twin Cities (2006, 2015) and Morris campuses (2015), and making the U of M the country’s first and only university system at which every individual campus has received this selective designation. Only 368 from nearly 4,000 qualifying U.S. universities and colleges have been granted this designation.

CEGE contributed strongly to the College of Science and Engineering’s efforts toward sustainability research. CEGE researchers are bringing in over $35 million in funded research to study carbon mineralization, nature and urban areas, circularity of water resources, and global snowfall patterns. This news was highlighted in the Fall 2023 issue of Inventing Tomorrow (pages 10-11). https://issuu.com/inventingtomorrow/docs/fall_2023_inventing_tomorrow-web

CEGE’s new program for a one-year master’s degree in structural engineering is now accepting applicants for Fall 2024. We owe a big thanks to DAN MURPHY and LAURA AMUNDSON for their volunteer work to help curate the program with Professor JIA-LIANG LE and EBRAHIM SHEMSHADIAN, the program director. Potential students and companies interested in hosting a summer intern can contact Ebrahim Shemshadian ( [email protected] ).

BERNIE BULLERT , CEGE benefactor and MN Water Research Fund founder, was profiled on the website of the University of Minnesota Foundation (UMF). There you can read more about his mission to share clean water technologies with smaller communities in Minnesota. Many have joined Bullert in this mission. MWRF Recognizes their Generous 2024 Partners. Gold Partners: Bernie Bullert, Hawkins, Inc., Minnesota Department of Health, Minnesota Pollution Control Agency, and SL-serco. Silver Partners: ISG, Karl and Pam Streed, Kasco, Kelly Lange-Haider and Mark Haider, ME Simpson, Naeem Qureshi, Dr. Paul H. Boening, TKDA, and Waterous. Bronze Partners: Bruce R. Bullert; Brenda Lenz, Ph.D., APRN FNP-C, CNE; CDM Smith; Central States Water Environment Association (CSWEA MN); Heidi and Steve Hamilton; Jim “Bulldog” Sadler; Lisa and Del Cerney; Magney Construction; Sambatek; Shannon and John Wolkerstorfer; Stantec; and Tenon Systems.

After retiring from Baker-Tilly, NICK DRAGISICH (BCE 1977) has taken on a new role: City Council member in Lake Elmo, Minnesota. After earning his BCE from the University of Minnesota, Dragisich earned a master’s degree in business administration from the University of St. Thomas. Dragisich retired in May from his position as managing director at Baker Tilly, where he had previously served as firm director. Prior to that, he served as assistant city manager in Spokane, Washington, was the city administrator and city engineer in Virginia, Minnesota, and was mayor of Chisholm, Minnesota—all adding up to more than 40 years of experience in local government. Dragisich was selected by a unanimous vote. His current term expires in December 2024.

PAUL F. GNIRK (Ph.D. 1966) passed away January 29, 2024, at the age of 86. A memorial service was held Saturday, February 24, at the South Dakota School of Mines and Technology (SDSM&T), where he started and ended his teaching career, though he had many other positions, professional and voluntary. In 2018 Paul was inducted into the SDSM&T Hardrocker Hall of Fame, and in 2022, he was inducted into the South Dakota Hall of Fame, joining his mother Adeline S. Gnirk, who had been inducted in 1987 for her work authoring nine books on the history of south central South Dakota.

ROGER M. HILL (BCE 1957) passed away on January 13, 2024, at the age of 90. His daughter, Kelly Robinson, wrote to CEGE that Roger was “a dedicated Gopher fan until the end, and we enjoyed many football games together in recent years. Thank you for everything.”

KAUSER JAHAN (Ph.D. 1993, advised by Walter Maier), PE, is now a civil and environmental engineering professor and department head at Henry M. Rowan College of Engineering. Jahan was awarded a 3-year (2022- 2025), $500,000 grant from the U.S. Department of Environmental Protection Agency (USEPA). The grant supports her project, “WaterWorks: Developing the New Generation of Workforce for Water/Wastewater Utilities,” for the development of educational tools that will expose and prepare today’s students for careers in water and wastewater utilities.

SAURA JOST (BCE 2010, advised by Timothy LaPara) was elected to the St. Paul City Council for Ward 3. She is part of the historic group of women that make up the nation’s first all-female city council in a large city.

The 2024 ASCE Western Great Lakes Student Symposium combines several competitions for students involved in ASCE. CEGE sent a large contingent of competitors to Chicago. Each of the competition groups won awards: Ethics Paper 1st place Hans Lagerquist; Sustainable Solutions team 1st place overall in (qualifying them for the National competition in Utah in June); GeoWall 2nd place overall; Men’s Sprint for Concrete Canoe with rowers Sakthi Sundaram Saravanan and Owen McDonald 2nd place; Product Prototype for Concrete Canoe 2nd place; Steel Bridge (200 lb bridge weight) 2nd place in lightness; Scavenger Hunt 3rd place; and Aesthetics and Structural Efficiency for Steel Bridge 4th place.

Students competing on the Minnesota Environmental Engineers, Scientists, and Enthusiasts (MEESE) team earned second place in the Conference on the Environment undergraduate student design competition in November 2023. Erin Surdo is the MEESE Faculty Adviser. Pictured are NIKO DESHPANDE, ANNA RETTLER, and SYDNEY OLSON.

The CEGE CLASS OF 2023 raised money to help reduce the financial barrier for fellow students taking the Fundamentals of Engineering exam, a cost of $175 per test taker. As a result of this gift, they were able to make the exam more affordable for 15 current CEGE seniors. CEGE students who take the FE exam pass the first time at a rate well above national averages, demonstrating that CEGE does a great job of teaching engineering fundamentals. In 2023, 46 of 50 students passed the challenging exam on the first try.

This winter break, four CEGE students joined 10 other students from the College of Science and Engineering for the global seminar, Design for Life: Water in Tanzania. The students visited numerous sites in Tanzania, collected water source samples, designed rural water systems, and went on safari. Read the trip blog: http://globalblogs.cse.umn.edu/search/label/Tanzania%202024

Undergraduate Honor Student MALIK KHADAR (advised by Dr. Paul Capel) received honorable mention for the Computing Research Association (CRA) Outstanding Undergraduate Research Award for undergraduate students who show outstanding research potential in an area of computing research.

GRADUATE STUDENTS

AKASH BHAT (advised by William Arnold) presented his Ph.D. defense on Friday, October 27, 2023. Bhat’s thesis is “Photolysis of fluorochemicals: Tracking fluorine, use of UV-LEDs, and computational insights.” Bhat’s work investigating the degradation of fluorinated compounds will assist in the future design of fluorinated chemicals such that persistent and/or toxic byproducts are not formed in the environment.

ETHAN BOTMEN (advised by Bill Arnold) completed his Master of Science Final Exam February 28, 2024. His research topic was Degradation of Fluorinated Compounds by Nucleophilic Attack of Organo-fluorine Functional Groups.

XIATING CHEN , Ph.D. Candidate in Water Resources Engineering at the Saint Anthony Falls Laboratory is the recipient of the 2023 Nels Nelson Memorial Fellowship Award. Chen (advised by Xue Feng) is researching eco-hydrological functions of urban trees and other green infrastructure at both the local and watershed scale, through combined field observations and modeling approaches.

ALICE PRATES BISSO DAMBROZ has been a Visiting Student Researcher at the University of Minnesota since last August, on a Doctoral Dissertation Research Award from Fulbright. Her CEGE advisor is Dr. Paul Capel. Dambroz is a fourth year Ph.D. student in Soil Science at Universidade Federal de Santa Maria in Brazil, where she studies with her adviser Jean Minella. Her research focuses on the hydrological monitoring of a small agricultural watershed in Southern Brazil, which is located on a transition area between volcanic and sedimentary rocks. Its topography, shallow soils, and land use make it prone to runoff and erosion processes.

Yielding to people in crosswalks should be a very pedestrian topic. Yet graduate student researchers TIANYI LI, JOSHUA KLAVINS, TE XU, NIAZ MAHMUD ZAFRI (Dept.of Urban and Regional Planning at Bangladesh University of Engineering and Technology), and Professor Raphael Stern found that drivers often do not yield to pedestrians, but they are influenced by the markings around a crosswalk. Their work was picked up by the Minnesota Reformer.

TIANYI LI (Ph.D. student advised by Raphael Stern) also won the Dwight David Eisenhower Transportation (DDET) Fellowship for the third time! Li (center) and Stern (right) are pictured at the Federal Highway Administration with Latoya Jones, the program manager for the DDET Fellowship.

The Three Minute Thesis Contest and the Minnesota Nice trophy has become an annual tradition in CEGE. 2023’s winner was EHSANUR RAHMAN , a Ph.D. student advised by Boya Xiong.

GUANJU (WILLIAM) WEI , a Ph.D. student advised by Judy Yang, is the recipient of the 2023 Heinz G. Stefan Fellowship. He presented his research entitled Microfluidic Investigation of the Biofilm Growth under Dynamic Fluid Environments and received his award at the St. Anthony Falls Research Laboratory April 9. The results of Wei's research can be used in industrial, medical, and scientific fields to control biofilm growth.

BILL ARNOLD stars in an award-winning video about prairie potholes. The Prairie Potholes Project film was made with the University of Delaware and highlights Arnold’s NSF research. The official winners of the 2024 Environmental Communications Awards Competition Grand Prize are Jon Cox and Ben Hemmings who produced and directed the film. Graduate student Marcia Pacheco (CFANS/LAAS) and Bill Arnold are the on-screen stars.

Four faculty from CEGE join the Center for Transportation Studies Faculty and Research Scholars for FY24–25: SEONGJIN CHOI, KETSON ROBERTO MAXIMIANO DOS SANTOS, PEDRAM MORTAZAVI, and BENJAMIN WORSFOLD . CTS Scholars are drawn from diverse fields including engineering, planning, computer science, environmental studies, and public policy.

XUE FENG is coauthor on an article in Nature Reviews Earth and Environment . The authors evaluate global plant responses to changing rainfall regimes that are now characterized by fewer and larger rainfall events. A news release written at Univ. of Maryland can be found here: https://webhost.essic. umd.edu/april-showers-bring-mayflowers- but-with-drizzles-or-downpours/ A long-running series of U of M research projects aimed at improving stormwater quality are beginning to see practical application by stormwater specialists from the Twin Cities metro area and beyond. JOHN GULLIVER has been studying best practices for stormwater management for about 16 years. Lately, he has focused specifically on mitigating phosphorous contamination. His research was highlighted by the Center for Transportation Studies.

JIAQI LI, BILL ARNOLD, and RAYMOND HOZALSKI published a paper on N-nitrosodimethylamine (NDMA) precursors in Minnesota rivers. “Animal Feedlots and Domestic Wastewater Discharges are Likely Sources of N-Nitrosodimethylamine (NDMA) Precursors in Midwestern Watersheds,” Environmental Science and Technology (January 2024) doi: 10.1021/acs. est.3c09251

ALIREZA KHANI contributed to MnDOT research on Optimizing Charging Infrastructure for Electric Trucks. Electric options for medium- and heavy-duty electric trucks (e-trucks) are still largely in development. These trucks account for a substantial percentage of transportation greenhouse gas emissions. They have greater power needs and different charging needs than personal EVs. Proactively planning for e-truck charging stations will support MnDOT in helping to achieve the state’s greenhouse gas reduction goals. This research was featured in the webinar “Electrification of the Freight System in Minnesota,” hosted by the University of Minnesota’s Center for Transportation Studies. A recording of the event is now available online.

MICHAEL LEVIN has developed a unique course for CEGE students on Air Transportation Systems. It is the only class at UMN studying air transportation systems from an infrastructure design and management perspective. Spring 2024 saw the third offering of this course, which is offered for juniors, seniors, and graduate students.

Research Professor SOFIA (SONIA) MOGILEVSKAYA has been developing international connections. She visited the University of Seville, Spain, November 13–26, 2023, where she taught a short course titled “Fundamentals of Homogenization in Composites.” She also met with the graduate students to discuss collaborative research with Prof. Vladislav Mantic, from the Group of Continuum Mechanics and Structural Analysis at the University of Seville. Her visit was a part of planned activities within the DIAGONAL Consortium funded by the European Commission. CEGE UMN is a partner organization within DIAGONAL, represented by CEGE professors Mogilevskaya and Joseph Labuz. Mantic will visit CEGE summer 2024 to follow up on research developments and discuss plans for future collaboration and organization of short-term exchange visits for the graduate students from each institution.

DAVID NEWCOMB passed away in March. He was a professor in CEGE from 1989–99 in the area of pavement engineering. Newcomb led the research program on asphalt materials characterization. He was the technical director of Mn/ROAD pavement research facility, and he started an enduring collaboration with MnDOT that continues today. In 2000, he moved from Minnesota to become vice-president for Research and Technology at the National Asphalt Pavement Association. Later he moved to his native Texas, where he was appointed to the division head of Materials and Pavement at the Texas A&M Transportation Institute, a position from which he recently retired. He will be greatly missed.

PAIGE NOVAK won Minnesota ASCE’s 2023 Distinguished Engineer of the Year Award for her contributions to society through her engineering achievements and professional experiences.

The National Science Foundation (NSF) announced ten inaugural (NSF) Regional Innovation Engines awards, with a potential $1.6 billion investment nationally over the next decade. Great Lakes ReNEW is led by the Chicago-based water innovation hub, Current, and includes a team from the University of Minnesota, including PAIGE NOVAK. Current will receive $15 mil for the first two years, and up to $160 million over ten years to develop and grow a water-focused innovation engine in the Great Lakes region. The project’s ambitious plan is to create a decarbonized circular “blue economy” to leverage the region’s extraordinary water resources to transform the upper Midwest—Illinois, Indiana, Michigan, Minnesota, Ohio, and Wisconsin. Brewing one pint of beer generates seven pints of wastewater, on average. So what can you do with that wastewater? PAIGE NOVAK and her team are exploring the possibilities of capturing pollutants in wastewater and using bacteria to transform them into energy.

BOYA XIONG has been selected as a recipient of the 2024 40 Under 40 Recognition Program by the American Academy of Environmental Engineers and Scientists. The award was presented at the 2024 AAEES Awards Ceremony, April 11, 2024, at the historic Howard University in Washington, D.C.

JUDY Q. YANG received a McKnight Land-Grant Professorship Award. This two-year award recognizes promising assistant professors and is intended to advance the careers of individuals who have the potential to make significant contributions to their departments and their scholarly fields.

Professor Emeritus CHARLES FAIRHURST , his son CHARLES EDWARD FAIRHURST , and his daughter MARGARET FAIRHURST DURENBERGER were on campus recently to present Department Head Paige Novak with a check for $25,000 for the Charles Fairhurst Fellowship in Earth Resources Engineering in support of graduate students studying geomechanics. The life of Charles Fairhurst through a discussion with his children is featured on the Engineering and Technology History Wiki at https://ethw.org/Oral-History:Charles_Fairhurst#00:00:14_INTRODUCTION

Related news releases

- Matthew J. Huber Student Award

- Catherine French, NAE

- Climate Change for Engineers

- Focused on the Road Ahead

- Randal Barnes receives Horace T Morace Award

- Future undergraduate students

- Future transfer students

- Future graduate students

- Future international students

- Diversity and Inclusion Opportunities

- Learn abroad

- Living Learning Communities

- Mentor programs

- Programs for women

- Student groups

- Visit, Apply & Next Steps

- Information for current students

- Departments and majors overview

- Departments

- Undergraduate majors

- Graduate programs

- Integrated Degree Programs

- Additional degree-granting programs

- Online learning

- Academic Advising overview

- Academic Advising FAQ

- Academic Advising Blog

- Appointments and drop-ins

- Academic support

- Commencement

- Four-year plans

- Honors advising

- Policies, procedures, and forms

- Career Services overview

- Resumes and cover letters

- Jobs and internships

- Interviews and job offers

- CSE Career Fair

- Major and career exploration

- Graduate school

- Collegiate Life overview

- Scholarships

- Diversity & Inclusivity Alliance

- Anderson Student Innovation Labs

- Information for alumni

- Get engaged with CSE

- Upcoming events

- CSE Alumni Society Board

- Alumni volunteer interest form

- Golden Medallion Society Reunion

- 50-Year Reunion

- Alumni honors and awards

- Outstanding Achievement

- Alumni Service

- Distinguished Leadership

- Honorary Doctorate Degrees

- Nobel Laureates

- Alumni resources

- Alumni career resources

- Alumni news outlets

- CSE branded clothing

- International alumni resources

- Inventing Tomorrow magazine

- Update your info

- CSE giving overview

- Why give to CSE?

- College priorities

- Give online now

- External relations

- Giving priorities

- CSE Dean's Club

- Donor stories

- Impact of giving

- Ways to give to CSE

- Matching gifts

- CSE directories

- Invest in your company and the future

- Recruit our students

- Connect with researchers

- K-12 initiatives

- Diversity initiatives

- Research news

- Give to CSE

- CSE priorities

- Corporate relations

- Information for faculty and staff

- Administrative offices overview

- Office of the Dean

- Academic affairs

- Finance and Operations

- Communications

- Human resources

- Undergraduate programs and student services

- CSE Committees

- CSE policies overview

- Academic policies

- Faculty hiring and tenure policies

- Finance policies and information

- Graduate education policies

- Human resources policies

- Research policies

- Research overview

- Research centers and facilities

- Research proposal submission process

- Research safety

- Award-winning CSE faculty

- National academies

- University awards

- Honorary professorships

- Collegiate awards

- Other CSE honors and awards

- Staff awards

- Performance Management Process

- Work. With Flexibility in CSE

- K-12 outreach overview

- Summer camps

- Outreach events

- Enrichment programs

- Field trips and tours

- CSE K-12 Virtual Classroom Resources

- Educator development

- Sponsor an event

IMAGES

VIDEO

COMMENTS

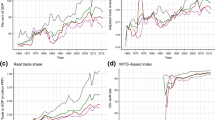

To do so, this study uses Rodrik's (Citation 2008) paper, "The real exchange rate and economic growth," as a benchmark to carry out a panel data analysis of the impact of currency undervaluation on economic growth. The data includes 93 countries over the period of 1990-2018. ... an increasing number of researchers in these fields of ...

IMF Working Papers. describe research in progress by the author(s) and are published to elicit comments and to encourage debate. ... (FXI) is effective in stabilizing the nominal exchange rate in the short run, its impacts on the real exchange rate are less significant: Limitations on nominal exchange rate

The authors may be contacted at [email protected], [email protected], and [email protected]. The Policy Research Working Paper Series disseminates the findings of work in progress to encourage the exchange of ideas about development issues. An objective of the series is to get the findings out quickly, even if the presentations are ...

Of the various exchange rate change components (related to changes in expectations about currency risk premia, short-term policy rates, and inflation), the currency risk premium component is the most volatile, exhibiting about the same degree of volatility as the nominal exchange rate change itself. ... . 2020. "A Fundamental Connection ...

1 INTRODUCTION. The currency market is the largest and most liquid financial market in the world (Balcilar, Gupta, Kyei, & Wohar, 2016; FOREX, 2020).The exchange rate is one of the most important prices in open economies due to its relationship with companies, investors and policymakers, this through the determination of investments, risk management and economic decisions of governments ...

Abstract This paper surveys the theoretical and empirical literature on the effects of the real exchange rate (RER) on international trade, economic development and growth. ... The mechanisms through which the RER influences long-run growth and structural change remains a promising area of research and the relevance of individual channels in ...

Rethinking Exchange Rate Regimes Ethan Ilzetzki, Carmen M. Reinhart, and Kenneth S. Rogoff NBER Working Paper No. 29347 October 2021 JEL No. E5,F3,F4,N2 ABSTRACT This paper employs an updated algorithm and database for classifying exchange rate and anchor currency choice, to explore the evolution of the global exchange rate system, including ...

Working Paper 32436. DOI 10.3386/w32436. Issue Date May 2024. Financial markets play two roles with implications for the exchange rate: they accommodate risk sharing and act as a source of shocks. In prevailing theories, these roles are seen as mutually exclusive and individually face challenges in explaining exchange rate dynamics.

What Drives the Exchange Rate? Oleg Itskhoki & Dmitry Mukhin. Working Paper 32008. DOI 10.3386/w32008. Issue Date December 2023. We use a general open-economy wedge-accounting framework to characterize the set of shocks that can account for major exchange rate puzzles. Focusing on a near-autarky behavior of the economy, we show analytically ...

Exchange-Rate Swings and Foreign Currency Intervention Prepared by Andrew Filardo, Gaston Gelos, and Thomas McGregor1. July 2022. IMF Working Papers describe research in progress by the author(s) and are published to elicit comments and to encourage debate. The views expressed in IMF Working Papers are those of the author(s) and do not ...

The research in this domain also sheds light on the specific challenges faced by LDCs in the face of exchange rate fluctuations, underlining the global and varied implications of exchange rate volatility. The research outputs on exchange rate volatility and international trade span a wide range of academic journals, demonstrating the ...

The paper has reported results from an empirical comparison of different deep learning frameworks for exchange rate prediction. We have found further support for previous findings that exchange rates are highly non-stationary (Kayacan et al. 2010). Even training in a rolling window setting cannot always ensure that training and trading set ...

1.0 Introduction. Theories of how exchange rates are determined have changed since the transition from the fixed rate system to the. floating rate system. Traditional theories that mainly ad ...

In summary, in their paper, Mehtiyev et al. (2021) investigated the impacts of exchange rates on international trade in the European Union (EU) using correlation analysis for the period 2008-2020.

1. An exchange rate is the relative price of two monies. Exactly what is being exchanged. has of course varied with the assets that were used as money at a ny point in time. In ancient. times and ...

In theory, changes in a host country exchange rate can be a cause or consequence of changes in its level of foreign direct investment (FDI), and recent incidences suggest that government stability may have sizable implications for the interactions between FDI and the exchange rate. This paper uses a semiparametric system of simultaneous equations to empirically characterize the relationship ...

This paper surveys a wide body of economic literature on the relationship between exchange rates and trade. Specifically, two main issues are investigated: the impact of exchange rate volatility and of currency misalignments on international trade flows. On average, exchange rate volatility has a negative (even if not large) impact on trade.

The exchange rate is a key macroeconomic factor that affects international trade and the real economy of each country. The development of international trade creates conditions where volatility comes with the exchange rate. The purpose of this paper is to examine the effect of real effective exchange rate volatility on economic growth in the Central and Eastern European countries.

This paper reviews research carried out on exchange rates and monetary policy by central banks that participated at the Autumn Meeting of Central Bank Economists on "Exchange rates and monetary policy", which the BIS hosted on 28-29 October 2004. The first part of the paper focuses on the approaches that central banks have found most useful in ...

Working Paper 12163. DOI 10.3386/w12163. Issue Date April 2006. This paper deals with the relationship between inflation targeting and exchange rates. I address three specific issues: first, I analyze the effectiveness of nominal exchange rates as shock absorbers in countries with inflation targeting. This issue is closely related to the ...

The power of monetary policy to affect interest rates and exchange rates depends on the downward slope of the demand function. This column uses the Chinese experiment with parallel currencies to study the impact of sudden increases in money supply. The authors find causal evidence that increases in money supply lead to currency depreciations, and use this to quantify the interest elasticity of ...

External Shocks, Policies, and Tail-Shifts in Real Exchange Rates. Nicolás E. Magud. Published in IMF Working Papers 1 June 2023. Economics. View via Publisher.

PDF | On Jan 1, 2017, Sheetal Maurya published Factors affecting Exchange Rate and its Impact on Economy of India | Find, read and cite all the research you need on ResearchGate

Exchange Rate Exposure. Kathryn M.E. Dominguez & Linda L. Tesar. Working Paper 8453. DOI 10.3386/w8453. Issue Date September 2001. In this paper we examine the relationship between exchange rate movements and firm value. We estimate the exchange rate exposure of publicly listed firms in a sample of eight (non-US) industrialized and emerging ...

The emergence of exchange traded Japanese risk-free rate contracts has provided market participants with the ability to more precisely hedge possible rates hikes in the future, research published by Japan Exchange Group (JPX) has shown ... "The explanation can be found in how market participants shifted their expectations," the paper said ...

CEGE Spring Graduation Celebration and Order of the EngineerForty-seven graduates of the undergraduate and grad student programs (pictured above) in the Department of Civil, Environmental, and Geo- Engineering took part in the Order of the Engineer on graduation day. Distinguished Speakers at this departmental event included Katrina Kessler (MS EnvE 2021), Commissioner of the Minnesota ...