Revenue Recognition – Contract Assets & Contract Liabilities Illustrative Examples

Published on May 8, 2018 | Michael T. Kram, CPA

This article, and the related articles, provides a brief overview of the FASB Accounting Standards Codification – Topic 606, Revenue from Contracts with Customers (ASC 606) and omits requirements specific to public entities and many optional disclosures for non-public entities. ASC 606 and related guidance should be referred to for additional information and detail.

A contract with a customer creates legal rights and obligations. The rights and obligations under the contract may give rise to contract assets and contract liabilities.

Contract Assets

Commonly referred to as unbilled receivables or progress payments to be billed. A contract asset is an entity’s right to consideration in exchange for goods or services that the entity has transferred to a customer when that right is conditioned on something other than the passage of time (for example, the entity’s future performance). Receivables should be recorded separately from contract assets since only the passage of time is required before consideration is due. When goods or services have been transferred to a customer, but customer payment is contingent based on a future event, this amount is generally referred to as an unbilled receivable.

Contract Liabilities

Commonly referred to as deferred revenue or unearned revenue. A contract liability is an entity’s obligation to transfer goods or services to a customer for which the entity has received consideration from the customer (or the payment is due, see Example 2) but the transfer has not yet been completed.

Example 1 – Contract Liability Resulting from a Cancellable Contract with One Performance Obligation

On January 1, 2019, an entity enters into a cancellable contract with a customer. The contract requires the customer to advance $500 on February 1, 2019, and the entity promises to transfer a product to the customer on March 1, 2019. The following journal entries are made to account for the contract:

Entity receives $500 on February 1, 2019:

Entity transfers the product to the customer on March 1, 2019 (satisfying the performance obligation):

Example 2 – Contract Liability and Receivable Resulting from a Non-Cancellable Contract with One Performance Obligation

Assume the same facts in the previous example and additionally, the contract becomes non-cancellable on January 15, 2019. The following journal entries are made to account for the contract.

On January 15, 2019, the entity records a receivable as it has an unconditional right to consideration:

Example 3 – Contract Asset Resulting from a Contract with Multiple Performance Obligations

On January 1, 2019, an entity enters into a contract to transfer Product 1 and perform Service 1 to a customer for a total consideration of $750. The contract requires Product 1 to be delivered first, and that payment will not be made until Service 1 is performed. The entity has concluded that the delivery of Product 1 and the performance of Service 1 are separate performance obligations and has allocated $500 of the contract revenue to Product 1 and $250 to Service 1 based on analysis and historical data. The following journal entries are made to account for the contract.

Entity satisfies the performance obligation to transfer Product 1:

Entity satisfies the performance obligation to perform Service 1:

Example 4 – Contract Asset Resulting from a Contract with Multiple Performance Obligations That Spans Multiple Years

On January 1, 2019, an entity enters into a contract with a customer to transfer equipment and perform maintenance service for three years to a Customer. The contract requires the equipment to be delivered first for consideration of $6,000. Consideration for maintenance services amounts to $2,000 per year. Total contract price amounts to $12,000 and is invoiced annually on January 31, in the amount of $4,000 per year. The resulting allocation of the transaction price to each performance obligation on a stand-alone selling price basis results in 20 percent of the revenue ($2,400) allocated to the equipment and 80 percent of the revenue ($9,600) allocated to the maintenance. On January 1, 2019, the customer receives the equipment and pays the entity $4,000. The equipment and the maintenance services are distinct performance obligations, and the maintenance part of the contract was deemed to be a stand-ready obligation.

Depending on an entity’s existing accounting policies, either of the following alternatives are acceptable:

Alternative A

The following journal entries are made to account for the contract.

On January 1, 2019, control of the equipment is transferred to the customer and payment of $4,000 is received:

On January 31, 2019 (and each month thereafter), the entity would recognize revenue for maintenance services as follows:

On January 1, 2020, a payment of $4,000 is received:

Alternative B

The entity would allocate cash to the satisfied performance obligations (the equipment and the satisfied portion of the maintenance) while recording the remaining consideration due associated with the satisfied performance obligation as an unbilled receivable. Essentially not presenting a contract liability for maintenance paid for by the customer before performance.

On January 1, 2019, equipment is transferred to the customer and payment of $4,000 is received:

Note: The Contract Asset and Contract Liability are netted to $0 for reporting purposes.

On January 31, 2019 (and each month thereafter), the entity would record the following journal entry:

Contract assets and contract liabilities should be presented as current and noncurrent in a classified balance sheet, and determined at the contract level. Contract assets and liabilities for each performance obligation within a single contract should be reported on a net basis.

Liabilities recorded for product returns and volume rebates should not be netted with contract liabilities or assets, as they represent a separate expectation (i.e., expectation of cash payment as opposed to performance expectation).

Similarly, capitalized costs to obtain a contract should not be combined with contract assets. Capitalized incremental costs to obtain a contract should be presented as a single asset and classified as long-term unless the original amortization period is one year or less. Generally, the amortization of costs of obtaining a contract that are capitalized should be amortized and reported as expense within the selling, general and administrative section of the income statement.

ASC 340-40 provides that incremental costs to obtain a contract that are incurred as a result of obtaining a contract should be capitalized and amortized over the life of the contract (such costs may include sales commissions related to multiyear service contracts), if the entity expects to recover those costs. Costs to obtain a contract that are incurred regardless of whether a contract is obtained (such as travel or contract drafting legal expenses) should be expensed as incurred.

If you have questions on how the new revenue recognition will affect your entity, Selden Fox can help. For additional information please call us at 630.954.1400, or click here to contact us . We look forward to serving you soon.

About the Author

Michael T. Kram, CPA

Related services.

Audit & Assurance

Related industries.

Auto Dealers

Closely Held Businesses

Manufacturers

Interested in more insights, related insights.

Benefit Plan Audits – The 80/120 Rule

A New Credit Loss Model Creates Changes in Accounting and Disclosures for Most

Finding a Qualified Benefit Plan Auditor

The global body for professional accountants

- Search jobs

- Find an accountant

- Technical activities

- Help & support

Can't find your location/region listed? Please visit our global website instead

- Middle East

- Cayman Islands

- Trinidad & Tobago

- Virgin Islands (British)

- United Kingdom

- Czech Republic

- United Arab Emirates

- Saudi Arabia

- State of Palestine

- Syrian Arab Republic

- South Africa

- Africa (other)

- Hong Kong SAR of China

- New Zealand

- Our qualifications

- Getting started

- Your career

- Apply to become an ACCA student

- Why choose to study ACCA?

- ACCA accountancy qualifications

- Getting started with ACCA

- ACCA Learning

- Register your interest in ACCA

- Learn why you should hire ACCA members

- Why train your staff with ACCA?

- Recruit finance staff

- Train and develop finance talent

- Approved Employer programme

- Employer support

- Resources to help your organisation stay one step ahead

- Support for Approved Learning Partners

- Becoming an ACCA Approved Learning Partner

- Tutor support

- Computer-Based Exam (CBE) centres

- Content providers

- Registered Learning Partner

- Exemption accreditation

- University partnerships

- Find tuition

- Virtual classroom support for learning partners

- Find CPD resources

- Your membership

- Member networks

- AB magazine

- Sectors and industries

- Regulation and standards

- Advocacy and mentoring

- Council, elections and AGM

- Tuition and study options

- Study support resources

- Practical experience

- Our ethics modules

- Student Accountant

- Regulation and standards for students

- Your 2024 subscription

- Completing your EPSM

- Completing your PER

- Apply for membership

- Skills webinars

- Finding a great supervisor

- Choosing the right objectives for you

- Regularly recording your PER

- The next phase of your journey

- Your future once qualified

- Mentoring and networks

- Advance e-magazine

- Affiliate video support

- An introduction to professional insights

- Meet the team

- Global economics

- Professional accountants - the future

- Supporting the global profession

- Download the insights app

Can't find your location listed? Please visit our global website instead

IFRS 15 – Contract Assets and Contract Liabilities

- Study resources

- Financial Reporting (FR)

- Technical articles and topic explainers

- IFRS 15 – Contract Assets and Contract Liabilities

Application of IFRS® 15, Revenue from Contracts with Customers became mandatory for annual reporting periods beginning on or after 1 January 2018. For many entities, such as those in the retail trade, the introduction of IFRS 15 has had little effect on how revenue is accounted for. However, some industry sectors have felt a much greater impact. For example, the amount and timing of revenue for entities that deal primarily in contracts with multiple performance obligations (eg telecommunication companies) and those that deal with contracts that span multiple periods (eg construction companies) may be significantly different than in the past.

IFRS 15 is a complex standard and since its introduction, the FR examining team at ACCA has become aware of some confusion regarding the accounting treatment of certain elements of IFRS 15. In particular, how to account for contract assets and contract liabilities

What are contract assets and contract liabilities?

IFRS 15 includes the following definitions:

In simple terms, this means that a contract asset arises when an entity has done work for a customer that has been recognised as revenue to date but has not yet issued an invoice or received payment for that work. A contract liability arises when an entity has invoiced the customer or received payment from them but has not yet done the work and the invoices and/or payments exceed the revenue recognised to date.

Although IFRS 15 uses the terms ‘contract asset’ and ‘contract liability’, these might also be referred to using different terminology such as ‘accrued income’ and ‘deferred income’ respectively. Whatever terminology is used, entities must make sure that they are accounted for as being distinct from trade receivables which will arise when an invoice has been issued.

What is causing confusion?

ACCA are aware that some candidates and learning providers are still using the accounting requirements of IAS® 11, Construction Contracts rather than the requirements of IFRS 15 when calculating contract assets and contract liabilities. IAS 11 is one of the accounting standards that was superseded by the introduction of IFRS 15.

What is the correct accounting treatment under IFRS 15?

Calculating the contract asset or contract liability under IFRS 15 is very straight forward. It is simply:

For contracts where performance obligations are satisfied over a period of time, the stage of completion is required to calculate how much revenue should be recognised to date. However, there is no requirement to calculate the estimated profit/loss on the contract (except to the extent of determining whether the contract is onerous).

For the purposes of the FR exam, any costs incurred to fulfil a contract with a customer should be expensed to the statement of profit or loss as they are incurred. This simplification assumes that all costs incurred to date have been incurred in meeting performance obligations in the current year and that they do not relate to future performance obligations. Costs incurred in the current year but relating to future performance obligations would be recognised as a contract asset but are not examined in FR.

Costs falling under the scope of another standard (eg plant and equipment purchased and used for the purposes of a contract – IAS 16) may be examined and should be accounted for under the relevant standard (ie capitalise and depreciate the asset used for the purposes of a contract – the depreciation charge being an allowable costs of contract).

How are ACCA dealing with any confusion?

The calculation of the contract asset under IFRS 15 outlined above is the technically correct one and the FR examining team will only accept this approach.

Written by a member of the FR examining team

Related Links

- Student Accountant hub page

Advertisement

- ACCA Careers

- ACCA Career Navigator

- ACCA Learning Community

Useful links

- Make a payment

- ACCA-X online courses

- ACCA Rulebook

- Work for us

Most popular

- Professional insights

- ACCA Qualification

- Member events and CPD

- Supporting Ukraine

- Past exam papers

Connect with us

Planned system updates.

- Accessibility

- Legal policies

- Data protection & cookies

- Advertising

Presentation of Contract Assets and Contract Liabilities in ASC 606

Analysis and examples of contract assets and liabilities under ASC 606, including balance sheet presentation and implementation effects

An important component of Accounting Standards Codification (ASC) 606 is guidance on the proper presentation of balance sheet items generated when an entity or its customer performs in a revenue-related contract. An entity performs by transferring goods or providing services to a customer, and a customer performs by paying consideration to an entity. When one of the two parties satisfies its obligation, the performance is reflected in the entity’s financial statements as a contract asset or contract liability.

Terminology: The terms “contract asset” and “contract liability” were created by ASC 606, but they describe well-known concepts. For example, a contract asset may also be referred to as progress payments to be billed, unbilled receivables, or unbilled revenue. A contract liability may be called deferred revenue, unearned revenue, or refund liability. The change in terminology simply reflects ASC 606’s revenue model, in which reclassification from a contract asset to a receivable is contingent on fulfilling performance obligations— not on invoicing a client. Nevertheless, entities are not required to use the terms “contract asset” and “contract liability” for presentation purposes (ASC 606-10-45-5), and many entities continue to use more familiar terms such as “deferred revenue” on the face of their financial statements (see Apple, Inc.’s 2019 balance sheet ).

Recognition of Contract Assets and Liabilities

While similar to prior guidance for construction- and production-type contracts, the concept behind contract assets and contract liabilities contains some differences. Furthermore, under ASC 606, contract assets and contract liabilities may be recognized for all contract types.

A contract asset is an entity’s right to payment for goods and services already transferred to a customer if that right to payment is conditional on something other than the passage of time. For example, an entity will recognize a contract asset when it has fulfilled a contract obligation but must perform other obligations before being entitled to payment. In contrast, a receivable represents a right to payment that is unconditional , except for the passage of time. Because a receivable is not a contract asset, receivables must be presented separately from contract assets on the balance sheet (ASC 606-10-45-3).

A contract liability is an entity’s obligation to transfer goods or services to a customer (1) when the customer prepays consideration or (2) when the customer’s consideration is due for goods and services that the entity will yet provide (ASC 606-10-45-2)—whichever happens earlier.

Generally, contract assets and contract liabilities are based on past performance. Whether to record a contract asset or a contract liability depends on which party acted first. For example, when a customer prepays, the receiving entity records a contract liability—an obligation that must be fulfilled to “earn” the prepaid consideration. Once the entity performs by transferring goods or services to the customer, the entity can recognize revenue and adjust the liability downward. On the other hand, an entity could perform first by transferring goods or services to the customer, recognizing a contract asset and revenue for their work although they are not yet legally entitled to payment. Once the entity is legally entitled to payment, the entity can record a receivable and remove the contract asset from their books.

A possible exception to the past performance rule is a non-cancellable contract in which an entity records a contract liability before payment is received. For example, suppose an entity enters into a contract to deliver goods to a customer. The contract is non-cancellable, and the entity and customer agree upon a payment schedule. Assume the date for a customer’s prepayment arrives, but the customer fails to pay on time. The entity recognizes a receivable because non-cancellable contract payments are treated as guaranteed. In this situation, recognition of the receivable is based on the contract’s payment schedule rather than the timing of revenue recognition. In conjunction with the receivable, the entity will also recognize a contract liability to deliver goods. This liability will be reversed, and revenue will be recognized once the entity fulfills the performance obligation by delivering goods to the customer.

It should be noted, however, that there is a general resistance to “grossing up” the balance sheet in this manner. If a payment is due but has not been received, a company will likely consider other factors before recognizing a receivable (e.g., concerns about the relationship with the customer, enforceability of the arrangement, and collectability of the enforcement).

Receivables and contract assets are both subject to credit loss testing in accordance with ASC 326-20-35 (Financial Instruments—Credit Losses). When there is a difference between a receivable linked to a contract liability and the associated revenue later recognized, the refundable amount is treated as a credit loss (ASC 606-10-45-4). Credit losses on receivables or contract assets that originate from contracts with customers should be presented separately from other credit losses.

On January 1, 20X9, McGregor Aerospace Corporation enters into a cancellable contract to deliver a rocket guidance system to its customer SD Researchers on March 31, 20X9. The contract requires SD to pay consideration of $100,000 in advance on January 31, 20X9. However, SD pays the consideration on February 28, 20X9 (instead of January 31). McGregor transfers the rocket guidance system on March 31, 20X9. The following journal entries illustrate how McGregor accounts for the contract, excluding contract costs:

Assume the same facts as above, except that the contract is non-cancellable. The following journal entries illustrate how McGregor Aerospace accounts for the contract:

On January 1, 20X7 Partially Hydrogenated Suppliers Company (PHS) enters into a contract to deliver (1) a mixing machine and (2) an industrial deep fryer to its customer Wholesome Healthy Baking Company (WHB) for $5,000. The contract requires the mixing machine to be delivered first and states that the $5,000 payment is only due after PHS has transferred both the mixing machine and the industrial deep fryer to WHB. PHS identifies the promises to deliver the mixing machine and the deep fryer as two unique performance obligations. Using relative standalone selling prices , PHS allocates $2,000 to the performance obligation to deliver the mixing machine and $3,000 to its obligation to deliver the deep fryer. PHS recognizes revenue for each respective performance obligation when control of the product transfers to the customer. On February 1, 20X7, PHS delivers the mixing machine. It delivers the deep fryer on March 1, 20X7. PHS makes the following journal entries:

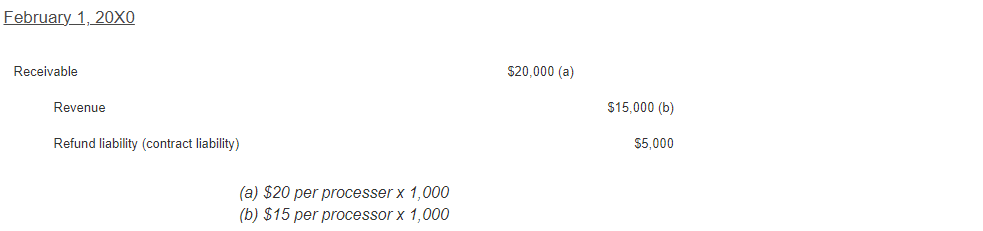

On January 1, 20X0, McCoy Technology enters into a contract with Carmichael Systems to deliver computer processors for $20 per unit. If Carmichael purchases more than 100,000 products in one calendar year, the agreement states that the price per unit will be retrospectively reduced to $15 through a rebate. According to the contract, consideration is due when control of the products transfers to the customer. As such, McCoy has an unconditional right to consideration for $20 per processor until 100,000 units ship, at which point the retrospective price reduction will apply. Assume that while determining transaction price McCoy concludes that Carmichael will ultimately meet the threshold for the price reduction. Therefore, the estimated transaction price is $15 per unit instead of $20. On February 1, 20X0, Carmichael is shipped its first 1,000 processors. McCoy will make the following entry:

McCoy recognizes a receivable assuming the full price because at this point, it has an unconditional right to receive that amount. The refund of $5 per processor is what McCoy expects to provide Carmichael in a volume-based rebate (see our article on Volume-Based Rebates ). The refund liability is a contract liability because it is conditional upon additional purchases by Carmichael (606-10-32-10). McCoy recognizes revenue only for the amount it expects to receive after the price reduction. McCoy will address the refund liability’s impact on the receivable as an expense at a later point.

A comment letter response submitted by Ebix, Inc., a technology company, illustrates its adherence to ASC 606-10-45-3 guidelines in managing contract assets: “The Company [Ebix, Inc.] records a contract asset when revenue recognized on a contract exceeds the billings. The contract asset is transferred to receivables when the entitlement to payment becomes unconditional. These contract assets are primarily related to project based revenue where we recognize revenue using the input method calculated using expected hours to complete the project measured against the actual hours completed to date. Beginning with our Form 10-Q to be filed for the quarter ended September 30, 2019 we will reclassify our unbilled receivable to contract assets to be in line with the ASC 606 terminology.” Ultimately, this SEC comment letter emphasizes the process of transferring contract assets to receivables if the unconditional requirement is met, as outlined by ASC 606-10-45-3.

Common Contract Asset and Liability Presentation Questions

Issue 1: multiple performance obligations.

Some entities have questioned whether a single contract could have both a contract asset and a contract liability. For example, assume an entity has two performance obligations to fulfill in a contract. It has fulfilled the first and recognized a contract asset. Then the customer prepays for the unfulfilled second obligation, creating a contract liability. What is the proper treatment at this point?

ASC 606-10-45-1 states that an entity presents the contract as either a contract asset or a contract liability, net. Therefore, the Financial Accounting Standards Board (FASB) concluded that the remaining obligations should be presented on a net basis, either as a contract asset or a contract liability.

Some have argued that an entity should present contract assets and contract liabilities at the performance obligation level, meaning that both could be presented for a single contract. However, the guidance specifically outlines that contracts are presented on a net basis. Entities should also remember that receivables are presented separately from contract assets or contract liabilities and should not be included in a contract’s net asset or liability position.

Issue 2: Presentation of Two or More Contracts That Have Been Combined Under Step 1

When an entity and a customer enter into two or more contracts at or near the same time, the contracts are combined, and the entity accounts for them as a single contract. In these situations, should an entity determine a contract asset or contract liability (a) for each contract separately or (b) for one combined contract?

The purpose of contract combination is to identify a single unit of account (ASU 2014-09 BC72). The Boards’ intention to use a combined contract as the unit of account logically implies that the position of a contract asset or liability should be determined in aggregate. Therefore, the best way to present the rights and obligations of a combined contract is on a net basis (BC317).

Issue 3: Offsetting Other Balance Sheet Items Against the Contract Asset or Liability

An entity will have both a receivable and a contract liability on its balance sheet if the entity has recognized a receivable for completed performance obligations and has collected on previously billed receivables in advance of performance. ASC 606 requires that “an entity shall present any unconditional rights to consideration separately as a receivable.” Therefore, entities should not offset other balance sheet items, including receivables, against the contract asset or liability.

Issue 4: Netting the Sum of Contract Assets and Contract Liabilities

ASC 606 does not explicitly state whether an entity should present its total contract assets and total contract liabilities as separate line items or on a net basis. Considering the principles in ASC 210-20 and the guidance stating that an entity must disclose the balances of each balance sheet item separately, an entity should not combine total contract assets with total contract liabilities to present a net position; rather, both balances should be presented separately. However, this does not preclude an entity from netting on a customer-by-customer basis when a right to setoff exists in accordance with ASC 210-20.

In a comment letter CarGurus, Inc., an online automotive platform, demonstrates how ASC 210 can be applied in determining if a company has the ability and right to offset gross trade accounts receivable. “The Company acknowledges the Staff’s comment and respectfully advises the Staff that the Company leverages a third-party payment processor (the “Processor”) to collect fees from dealers for its wholesale and product offerings. Pursuant to the terms of the arrangement between the Company and the Processor, the Processor pays the Company in advance of cash collections from certain end customers. At any point in time, the Company could have amounts due from the Processor for funds the Processor has collected from end customers but for which has not yet been remitted to the Company, as well as amounts paid by the Processor to the Company in advance of collecting payments from the end customer(s). The Company has concluded that pursuant to ASC 210-20-45-1 it has the right and the ability to offset gross trade accounts receivable with these payments received in advance from the Processor. Therefore, on the Company’s balance sheet the Company can either have a net receivable balance due from the Processor, which is included within accounts receivable, or can have a net liability which is recorded in accrued expenses if the advance payments exceed the receivable position from the Processor as of the balance sheet date. On December 31, 2021, the Company was in a net liability position of $28,075 because advance payments from the Processor of $46,822 exceeded receivables collected by the Processor but not yet paid to the Company of $18,747. Furthermore, please refer to what the Company believes is enhanced disclosure under “Concentration of Credit Risk” on pages 7-8 in the Q2 2022 Form 10-Q.”

Implementation Effects

Implementation of the guidance in ASC 606 regarding contract assets and liabilities will likely impact a company in three key ways. Implementation will require increased collaboration between departments, and companies may see changes in the audit and on the face of the balance sheet. For example, the IT department may need to modify systems to collect more or different types of data that will accompany financial statements in the disclosure section. Project managers may need to develop new measures for determining contract performance to support the timing of revenue recognition. In the audit, there will be more focus on management’s estimates and on internal controls, and auditors may spend more time reviewing disclosures and internal memos containing policy changes. In addition, some of the labels on the balance sheet may change from terms like “unbilled receivables” and “deferred revenue” to “contract assets” and “contract liabilities.” The balances of some accounts may also change ( DHG ).

ASC 606 introduces the terms “contract assets” and “contract liabilities,” though an entity may use different terms in its financial statements. A contract liability is recognized when a customer prepays consideration or owes prepayment to an entity according to the terms of a contract. A contract asset is recognized when an entity has satisfied a performance obligation but cannot recognize a receivable until other obligations are satisfied. While a contract asset represents a right to payment that is conditional on further performance, a receivable represents an unconditional right to payment. Both contract assets and receivables are tested for credit loss. For presentation purposes, contract assets and contract liabilities should be netted at the contract level and presented separately from each other in aggregate. Receivables should be presented separately from contract assets and contract liabilities.

Resources Consulted

- ASC 606-10-45-1 to 45-3, 55-284 to 55-294.

- ASU 2014-09: “Revenue from Contracts with Customers.” BC 341-347.

- EY, Financial Reporting Developments: “ Revenue from Contracts with Customers .” January 2020. Section 10.1.

- KPMG, Issues in Depth: “ Revenue from Contracts with Customers .” May 2016. Section 11.

- PwC, “ Revenue from contracts with customers .” August 2019. Section 12.

- DHG, Views: “ Revenue Recognition: It’s Not Just About Revenue .” October 2016.

IFRScommunity.com

IFRS Forums and IFRS Knowledge Base

Contract Assets and Contract Liabilities (IFRS 15)

Last updated: 15 January 2024

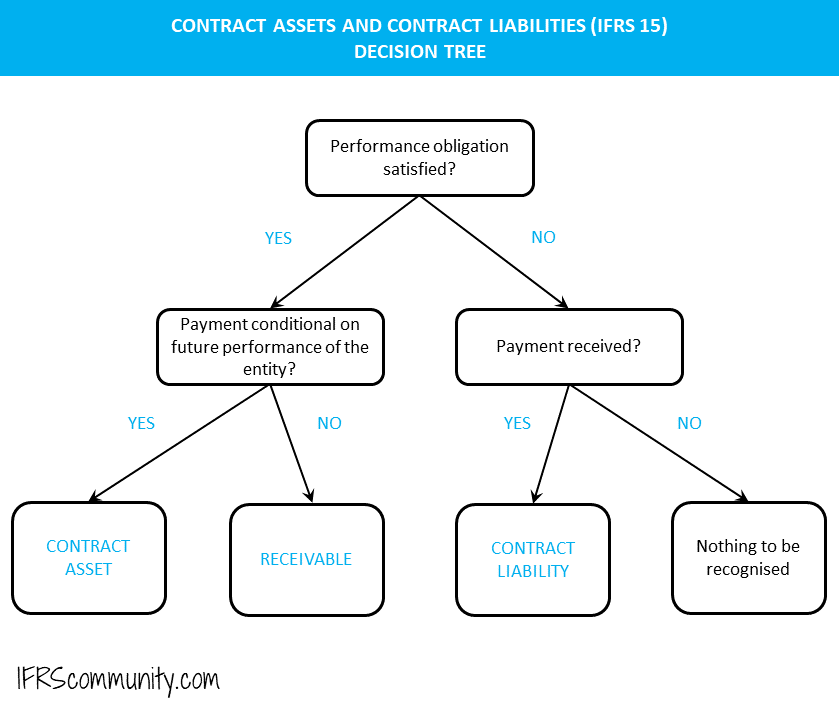

Contract asset

A contract asset is recognised when a performance obligation is satisfied, meaning the work is complete and revenue has been recognised, but the payment remains conditional on the entity’s future performance. This often implies that the entity can only invoice the customer after satisfying additional performance obligations within the same contract.

Contract assets differ from trade receivables due to the nature of the entity’s right to payment. In the case of trade receivables, the entity holds an unconditional right to receive payment, meaning only the passage of time is needed before payment is due (IFRS 15.105, 107-108). On the other hand, contract assets not only bear the credit risk but other risks as well, usually performance risk. The decision tree below illustrates this and an example follows.

Are you tired of the constant stream of IFRS updates? I know it's tough! That's why I created Reporting Period – a once-a-month summary for professional accountants. It consolidates all essential IFRS developments and Big 4 insights into one readable email. I personally curate every issue to ensure it's packed with the most relevant information, delivered straight to your inbox. It's free, with no spam, and if it turns out not to be right for you, you can unsubscribe with just one click.

Example: Contract asset and trade receivable in a telecommunications company

Let’s consider a telecommunications company that signs a contract with a customer. The customer purchases a smartphone for $100, payable within 30 days of contract signing, and a 24-month voice plan at $30 per month. Thus, the total transaction price in the contract is $820 ($100 + $30 x 24 months). The company regards the smartphone and voice plan as separate performance obligations. It allocates $340 to the smartphone and the remaining $480 to the voice plan. When the contract is signed and the smartphone is delivered, the company recognises these entries:

In this case, $340 of revenue is recognised when the smartphone is delivered to the customer. This amount reflects the transaction price allocated to this performance obligation, which may not match the price stated in the contract. However, only $100 is unconditionally due (to be paid within 30 days). The remaining $240 is contingent on the company’s future provision of the voice plan. If the company ceased to provide telecommunications services, the customer would not owe this amount. As such, $240 is recognised as a contract asset.

When the company issues an invoice for $30 for the first month of the voice plan, the following entries are recognised:

While the customer sees $30 on the invoice for the voice plan, from the company’s perspective, $10 is a partial repayment of the contract asset linked to the smartphone, with only $20 relating to the voice plan. This process is repeated monthly until the contract asset is fully converted to receivables and paid by the customer.

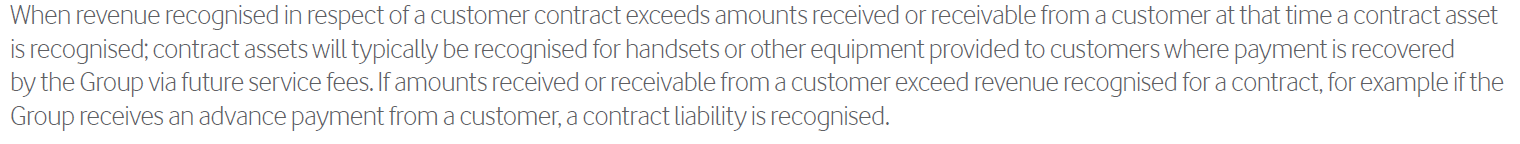

See also this real-life example from IFRS financial statements of Vodafone Group Plc:

Accrued and unbilled revenue

Is accrued or unbilled revenue considered a contract asset? Not necessarily. Just because an invoice has not yet been issued does not automatically classify the asset as a contract asset. If:

- Performance obligation has been satisfied and the related revenue recognised, and

- Payment isn’t conditional on satisfying other performance obligations in the contract, but

- Invoice hasn’t been issued by the reporting date (perhaps the precise amount isn’t yet known, or the accounts receivable accountant was late),

then the asset corresponding to the recognised revenue is classified as a receivable, not a contract asset (IFRS 15.105, BC323-326).

Impairment of contract assets

Contract assets are subject to the impairment requirements of IFRS 9. These requirements relate to the measurement, presentation, and disclosure concerning impairment (IFRS 15.107). In particular, entities are mandated to account for expected credit losses on their contract assets.

Please refer to the accompanying discussion regarding whether contract assets are considered financial assets.

Contract liability

A contract liability refers to an entity’s obligation to deliver goods or services and is recognised when a customer’s payment is due, or already received, prior to the fulfilment of a related performance obligation (IFRS 15.106). This type of liability is commonly recognised when a customer places an order and pays in advance. This is illustrated in the following example:

Example: Contract liability and trade receivable

Suppose Entity A enters into a contract with a customer to manufacture and deliver 100 products for a total consideration of $1m. According to the contract, the customer is to be charged upfront for 30% of the contract’s total value, with this payment due within 30 days from the contract signing date. Entity A recognises the following entries:

An invoice for 30% of the contract’s total value is issued to the customer:

The customer settles the invoice:

The products are dispatched to the customer, an invoice for the remaining amount is issued, and revenue recognised:

As the rights and obligations in a contract with a customer are interdependent, contract assets and liabilities are presented on a net basis at a contract level (IFRS 15.BC317).

More about IFRS 15

See other pages relating to IFRS 15:

© 2018-2024 Marek Muc

The information provided on this website is for general information and educational purposes only and should not be used as a substitute for professional advice. Use at your own risk. Excerpts from IFRS Standards come from the Official Journal of the European Union (© European Union, https://eur-lex.europa.eu). You can access full versions of IFRS Standards at shop.ifrs.org. IFRScommunity.com is an independent website and it is not affiliated with, endorsed by, or in any other way associated with the IFRS Foundation. For official information concerning IFRS Standards, visit IFRS.org.

Questions or comments? Join our Forums

Applying IFRS: Presentation and disclosure requirements of IFRS 15

Ey global crs.

- Link copied

This updated publication summarizes the presentation and disclosure requirements of IFRS 15 both at transition and on an ongoing basis.

Our updated publication summarizes the presentation and disclosure requirements of IFRS 15 Revenue from Contracts with Customers on an ongoing basis. It illustrates possible formats for disclosing information required by IFRS 15 using real-life examples.

Show resources

Download this ifrs resource.

Connect with us

Our locations

Legal and privacy

EY refers to the global organization, and may refer to one or more, of the member firms of Ernst & Young Global Limited, each of which is a separate legal entity. Ernst & Young Global Limited, a UK company limited by guarantee, does not provide services to clients.

EY | Assurance | Consulting | Strategy and Transactions | Tax

EY is a global leader in assurance, consulting, strategy and transactions, and tax services. The insights and quality services we deliver help build trust and confidence in the capital markets and in economies the world over. We develop outstanding leaders who team to deliver on our promises to all of our stakeholders. In so doing, we play a critical role in building a better working world for our people, for our clients and for our communities.

EY refers to the global organization, and may refer to one or more, of the member firms of Ernst & Young Global Limited, each of which is a separate legal entity. Ernst & Young Global Limited, a UK company limited by guarantee, does not provide services to clients. For more information about our organization, please visit ey.com.

© EYGM Limited. All Rights Reserved.

EYG/OC/FEA no.

This material has been prepared for general informational purposes only and is not intended to be relied upon as accounting, tax, or other professional advice. Please refer to your advisors for specific advice.

Welcome to EY.com

In addition to cookies that are strictly necessary to operate this website, we use the following types of cookies to improve your experience and our services: Functional cookies to enhance your experience (e.g. remember settings), and Performance cookies to measure the website's performance and improve your experience . , and Marketing/Targeting cookies , which are set by third parties, allow us to execute marketing campaigns, manage our relationship with you, build a profile of your interests and provide you with content or service offerings in accordance with your preferences.

We have detected that Do Not Track/Global Privacy Control is enabled in your browser; as a result, Marketing/Targeting cookies , which are set by third parties that allow us to execute marketing campaigns, manage our relationship with you, build a profile of your interests and provide you with content or service offerings in accordance with your preferences are automatically disabled.

You may withdraw your consent to cookies at any time once you have entered the website through a link in the privacy policy, which you can find at the bottom of each page on the website.

Review our cookie policy for more information.

Customize cookies

I decline optional cookies

IMAGES

VIDEO

COMMENTS

33.3 Presenting contract-related assets and liabilities. The revenue standard provides guidance on presentation of assets and liabilities generated from contracts with customers. ASC 606-10-45-1. When either party to a contract has performed, an entity shall present the contract in the statement of financial position as a contract asset or a ...

The purpose of this article is to provide an overview regarding the accounting for and presentation of contract assets and contract liabilities. ... and omits requirements specific to public entities and many optional disclosures for non-public entities. ASC 606 and related guidance should be referred to for additional information and detail ...

3. Presentation within the primary financial statements 7 3.1 Revenue from contracts with customers 7 3.2 Contract balances 10 3.3 Assets recognised from the costs to obtain or fulfil a contract 15 3.4 Assets and liabilities arising from rights of return 17 3.5 Significant financing components 18 4.

Paragraphs 105-107 [606-10-45-1 through 45-3] state that: 1. 105 When either party to a contract has performed, an entity shall present the contract in the statement of financial position as a contract asset or a contract liability, depending on the relationship between the entity's performance and the customer's payment.

IFRS 15 includes the following definitions: Contract asset. An entity's right to consideration in exchange for goods or services that the entity has transferred to a customer when that right is conditioned on something other than the passage of time (for example, the entity's future performance). Contract liability.

A contract liability is an entity's obligation to transfer goods or services to a customer (1) when the customer prepays consideration or (2) when the customer's consideration is due for goods and services that the entity will yet provide (ASC 606-10-45-2)—whichever happens earlier. Generally, contract assets and contract liabilities are ...

Paragraphs 105-107 [606-10-45-1 through 45-3] state that: 1. 105 When either party to a contract has performed, an entity shall present the contract in the statement of financial position as a contract asset or a contract liability, depending on the relationship between the entity's performance and the customer's payment.

then the asset corresponding to the recognised revenue is classified as a receivable, not a contract asset (IFRS 15.105, BC323-326). Impairment of contract assets. Contract assets are subject to the impairment requirements of IFRS 9. These requirements relate to the measurement, presentation, and disclosure concerning impairment (IFRS 15.107).

Since the issuance of ASC 606,3 questions have arisen related to both the recognition and measurement of contract assets and contract liabilities in a business combination. Specifically, stakeholders have questioned whether entities should apply the concept of a performance obligation in determining whether a contract liability should be recognized as part of an acquisition.

Presentation in financial statements. Contracts with customers will be presented in an entity's statement of financial position as a contract liability, a contract asset, or a receivable, depending on the relationship between the entity's performance and the customer's payment. [IFRS 15:105]

This updated publication summarizes the presentation and disclosure requirements of IFRS 15 both at transition and on an ongoing basis. Our updated publication summarizes the presentation and disclosure requirements of IFRS 15 Revenue from Contracts with Customers on an ongoing basis. It illustrates possible formats for disclosing information ...

Topic 606: Classification & Presentation of Retainage & Contract Assets & Liabilities. that the contract's terms and provisions have been evalu-ated appropriately and the retained amount isn't contingent upon anything except the passage of time. This evidence of a thorough analysis and potentially a legal opinion may be necessary to support ...

accounting standards update 2021-08—business combinations (topic 805): accounting for contract assets and contract liabilities from contracts with customers

IFRS 15 replaces IAS 11, IAS 18, IFRIC 13, IFRIC 15, IFRIC 18 and SIC-31. IFRS 15 provides a comprehensive framework for recognising revenue from contracts with customers. In September 2015 the Board issued Effective Date of IFRS 15 which deferred the mandatory effective date of IFRS 15 to 1 January 2018.

FASB ASC 606 provides specific presentation requirements for contract assets and contract liabilities. An entity will need to consider the level of detail necessary to satisfy the disclosure objective and how much emphasis to place on each of the various requirements.

ASU 2021-08 does not affect the accounting for other assets or liabilities that may arise from revenue contracts with customers in accordance with FASB ASC 606, such as refund liabilities, or in a business combination, such as customer-related intangible assets and contract-based intangible assets. For example, if acquired revenue contracts are ...

Contract assets, receivables and contract liabilities should be presented separately on the statement of financial position or in the footnotes. Entities should look to other accounting standards (for example, balance sheet offsetting guidance in ASC 210-20) to assess if it is appropriate to net contract assets and contract liabilities

IFRS 15 Revenue from Contracts with Customers (IFRS 15 or the standard) provides accounting requirements for all revenue arising from contracts with customers. It affects all entities that enter into contracts to provide goods or services to their customers, unless the contracts are in the scope of other IFRSs, such as the leases standard.

Notice to Constituents General Principles Presentation Assets Liabilities Equity Revenue Expenses Broad Transactions Industry Master Glossary Accounting Standards Updates Proposed Accounting Standards Updates Maintenance Updates Other Exposure Documents Pre-Codification ... Memo No. 7 Presentation of a Contract as a Contract Asset or a Contract ...

FASB ASC 606-10-50-11 is clear that private companies need to disclose BOTH opening AND closing balances of receivables, contract assets, and contract liabilities, if not otherwise separately presented or disclosed. 2nd Year Trap. The disclosure requirement for opening accounts receivable balance in FASB ASC 606-10-50-11 is often satisfied in ...

In this presentation, we will dive into the world of contract assets and liabilities as defined by the International Financial Reporting Standards (IFRS) 15. By the end of this presentation, you'll have a comprehensive understanding of the recognition criteria, measurement, and presentation requirements of these critical elements.

12. The requirements for the presentation on the statement of financial position and the unit of account for contracts to which the PAA applies are the same as in the general model. Therefore, the PAA applies to a group of contracts and offsetting of groups of contracts to which the PAA applies is prohibited.

Currently, ASC 805 and IFRS 3 state that the assets acquired and liabilities assumed in a business combination generally should be recognized and measured at fair value on the acquisition date. ASU No. 2021-08, Business Combinations (Topic 805): Accounting for Contract Assets and Contract Liabilities from Contracts with Customers, creates a difference between US GAAP and IFRS, as under US GAAP ...