A better way to drive your business

Managing the availability of supply to meet volatile demand has never been easy. Even before the unprecedented challenges created by the COVID-19 pandemic and the war in Ukraine, synchronizing supply and demand was a perennial struggle for most businesses. In a survey of 54 senior executives, only about one in four believed that the processes of their companies balanced cross-functional trade-offs effectively or facilitated decision making to help the P&L of the full business.

That’s not because of a lack of effort. Most companies have made strides to strengthen their planning capabilities in recent years. Many have replaced their processes for sales and operations planning (S&OP) with the more sophisticated approach of integrated business planning (IBP), which shows great promise, a conclusion based on an in-depth view of the processes used by many leading companies around the world (see sidebar “Understanding IBP”). Assessments of more than 170 companies, collected over five years, provide insights into the value created by IBP implementations that work well—and the reasons many IBP implementations don’t.

Understanding IBP

Integrated business planning is a powerful process that could become central to how a company runs its business. It is one generation beyond sales and operations planning. Three essential differentiators add up to a unique business-steering capability:

- Full business scope. Beyond balancing sales and operations planning, integrated business planning (IBP) synchronizes all of a company’s mid- and long-term plans, including the management of revenues, product pipelines and portfolios, strategic projects and capital investments, inventory policies and deployment, procurement strategies, and joint capacity plans with external partners. It does this in all relevant parts of the organization, from the site level through regions and business units and often up to a corporate-level plan for the full business.

- Risk management, alongside strategy and performance reviews. Best-practice IBP uses scenario planning to drive decisions. In every stage of the process, there are varying degrees of confidence about how the future will play out—how much revenue is reasonably certain as a result of consistent consumption patterns, how much additional demand might emerge if certain events happen, and how much unusual or extreme occurrences might affect that additional demand. These layers are assessed against business targets, and options for mitigating actions and potential gap closures are evaluated and chosen.

- Real-time financials. To ensure consistency between volume-based planning and financial projections (that is, value-based planning), IBP promotes strong links between operational and financial planning. This helps to eliminate surprises that may otherwise become apparent only in quarterly or year-end reviews.

An effective IBP process consists of five essential building blocks: a business-backed design; high-quality process management, including inputs and outputs; accountability and performance management; the effective use of data, analytics, and technology; and specialized organizational roles and capabilities (Exhibit 1). Our research finds that mature IBP processes can significantly improve coordination and reduce the number of surprises. Compared with companies that lack a well-functioning IBP process, the average mature IBP practitioner realizes one or two additional percentage points in EBIT. Service levels are five to 20 percentage points higher. Freight costs and capital intensity are 10 to 15 percent lower—and customer delivery penalties and missed sales are 40 to 50 percent lower. IBP technology and process discipline can also make planners 10 to 20 percent more productive.

When IBP processes are set up correctly, they help companies to make and execute plans and to monitor, simulate, and adapt their strategic assumptions and choices to succeed in their markets. However, leaders must treat IBP not just as a planning-process upgrade but also as a company-wide business initiative (see sidebar “IBP in action” for a best-in-class example).

IBP in action

One global manufacturer set up its integrated business planning (IBP) system as the sole way it ran its entire business, creating a standardized, integrated process for strategic, tactical, and operational planning. Although the company had previously had a sales and operations planning (S&OP) process, it had been owned and led solely by the supply chain function. Beyond S&OP, the sales function forecast demand in aggregate dollar value at the category level and over short time horizons. Finance did its own projections of the quarterly P&L, and data from day-by-day execution fed back into S&OP only at the start of a new monthly cycle.

The CEO endorsed a new way of running regional P&Ls and rolling up plans to the global level. The company designed its IBP process so that all regional general managers owned the regional IBP by sponsoring the integrated decision cycles (following a global design) and by ensuring functional ownership of the decision meetings. At the global level, the COO served as tiebreaker whenever decisions—such as procurement strategies for global commodities, investments in new facilities for global product launches, or the reconfiguration of a product’s supply chain—cut across regional interests.

To enable IBP to deliver its impact, the company conducted a structured process assessment to evaluate the maturity of all inputs into IBP. It then set out to redesign, in detail, its processes for planning demand and supply, inventory strategies, parametrization, and target setting, so that IBP would work with best-practice inputs. To encourage collaboration, leaders also started to redefine the performance management system so that it included clear accountability for not only the metrics that each function controlled but also shared metrics. Finally, digital dashboards were developed to track and monitor the realization of benefits for individual functions, regional leaders, and the global IBP team.

A critical component of the IBP rollout was creating a company-wide awareness of its benefits and the leaders’ expectations for the quality of managers’ contributions and decision-making discipline. To educate and show commitment from the CEO down, this information was rolled out in a campaign of town halls and media communications to all employees. The company also set up a formal capability-building program for the leaders and participants in the IBP decision cycle.

Rolled out in every region, the new training helps people learn how to run an effective IBP cycle, to recognize the signs of good process management, and to internalize decision authority, thresholds, and escalation paths. Within a few months, the new process, led by a confident and motivated leadership team, enabled closer company-wide collaboration during tumultuous market conditions. That offset price inflation for materials (which adversely affected peers) and maintained the company’s EBITDA performance.

Our research shows that these high-maturity IBP examples are in the minority. In practice, few companies use the IBP process to support effective decision making (Exhibit 2). For two-thirds of the organizations in our data set, IBP meetings are periodic business reviews rather than an integral part of the continuous cycle of decisions and adjustments needed to keep organizations aligned with their strategic and tactical goals. Some companies delegate IBP to junior staff. The frequency of meetings averages one a month. That can make these processes especially ineffective—lacking either the senior-level participation for making consequential strategic decisions or the frequency for timely operational reactions.

Finally, most companies struggle to turn their plans into effective actions: critical metrics and responsibilities are not aligned across functions, so it’s hard to steer the business in a collaborative way. Who is responsible for the accuracy of forecasts? What steps will be taken to improve it? How about adherence to the plan? Are functions incentivized to hold excess inventory? Less than 10 percent of all companies have a performance management system that encourages the right behavior across the organization.

By contrast, at the most effective organizations, IBP meetings are all about decisions and their impact on the P&L—an impact enabled by focused metrics and incentives for collaboration. Relevant inputs (data, insights, and decision scenarios) are diligently prepared and syndicated before meetings to help decision makers make the right choices quickly and effectively. These companies support IBP by managing their short-term planning decisions prescriptively, specifying thresholds to distinguish changes immediately integrated into existing plans from day-to-day noise. Within such boundaries, real-time daily decisions are made in accordance with the objectives of the entire business, not siloed frontline functions. This responsive execution is tightly linked with the IBP process, so that the fact base is always up-to-date for the next planning iteration.

A better plan for IBP

In our experience, integrated business planning can help a business succeed in a sustainable way if three conditions are met. First, the process must be designed for the P&L owner, not individual functions in the business. Second, processes are built for purpose, not from generic best-practice templates. Finally, the people involved in the process have the authority, skills, and confidence to make relevant, consequential decisions.

Design for the P&L owner

IBP gives leaders a systematic opportunity to unlock P&L performance by coordinating strategies and tactics across traditional business functions. This doesn’t mean that IBP won’t function as a business review process, but it is more effective when focused on decisions in the interest of the whole business. An IBP process designed to help P&L owners make effective decisions as they run the company creates requirements different from those of a process owned by individual functions, such as supply chain or manufacturing.

One fundamental requirement is senior-level participation from all stakeholder functions and business areas, so that decisions can be made in every meeting. The design of the IBP cycle, including preparatory work preceding decision-making meetings, should help leaders make general decisions or resolve minor issues outside of formal milestone meetings. It should also focus the attention of P&L leaders on the most important and pressing issues. These goals can be achieved with disciplined approaches to evaluating the impact of decisions and with financial thresholds that determine what is brought to the attention of the P&L leader.

The aggregated output of the IBP process would be a full, risk-evaluated business plan covering a midterm planning horizon. This plan then becomes the only accepted and executed plan across the organization. The objective isn’t a single hard number. It is an accepted, unified view of which new products will come online and when, and how they will affect the performance of the overall portfolio. The plan will also take into account the variabilities and uncertainties of the business: demand expectations, how the company will respond to supply constraints, and so on. Layered risks and opportunities and aligned actions across stakeholders indicate how to execute the plan.

Would you like to learn more about our Operations Practice ?

Trade-offs arising from risks and opportunities in realizing revenues, margins, or cost objectives are determined by the P&L owner at the level where those trade-offs arise—local for local, global for global. To make this possible, data visible in real time and support for decision making in meetings are essential. This approach works best in companies with strong data governance processes and tools, which increase confidence in the objectivity of the IBP process and support for implementing the resulting decisions. In addition, senior leaders can demonstrate their commitment to the value and the standards of IBP by participating in the process, sponsoring capability-building efforts for the teams that contribute inputs to the IBP, and owning decisions and outcomes.

Fit-for-purpose process design and frequency

To make IBP a value-adding capability, the business will probably need to redesign its planning processes from a clean sheet.

First, clean sheeting IBP means that it should be considered and designed from the decision maker’s perspective. What information does a P&L owner need to make a decision on a given topic? What possible scenarios should that leader consider, and what would be their monetary and nonmonetary impact? The IBP process can standardize this information—for example, by summarizing it in templates so that the responsible parties know, up front, which data, analytics, and impact information to provide.

Second, essential inputs into IBP determine its quality. These inputs include consistency in the way planners use data, methods, and systems to make accurate forecasts, manage constraints, simulate scenarios, and close the loop from planning to the production shopfloor by optimizing schedules, monitoring adherence, and using incentives to manufacture according to plan.

Determining the frequency of the IBP cycle, and its timely integration with tactical execution processes, would also be part of this redesign. Big items—such as capacity investments and divestments, new-product introductions, and line extensions—should be reviewed regularly. Monthly reviews are typical, but a quarterly cadence may also be appropriate in situations with less frequent changes. Weekly iterations then optimize the plan in response to confirmed orders, short-term capacity constraints, or other unpredictable events. The bidirectional link between planning and execution must be strong, and investments in technology may be required to better connect them, so that they use the same data repository and have continuous-feedback loops.

Authorize consequential decision making

Finally, every IBP process step needs autonomous decision making for the problems in its scope, as well as a clear path to escalate, if necessary. The design of the process must therefore include decision-type authority, decision thresholds, and escalation paths. Capability-building interventions should support teams to ensure disciplined and effective decision making—and that means enforcing participation discipline, as well. The failure of a few key stakeholders to prioritize participation can undermine the whole process.

Decision-making autonomy is also relevant for short-term planning and execution. Success in tactical execution depends on how early a problem is identified and how quickly and effectively it is resolved. A good execution framework includes, for example, a classification of possible events, along with resolution guidelines based on root cause methodology. It should also specify the thresholds, in scope and scale of impact, for operational decision making and the escalation path if those thresholds are met.

Transforming supply chains: Do you have the skills to accelerate your capabilities?

In addition to guidelines for decision making, the cross-functional team in charge of executing the plan needs autonomy to decide on a course of action for events outside the original plan, as well as the authority to see those actions implemented. Clear integration points between tactical execution and the IBP process protect the latter’s focus on midterm decision making and help tactical teams execute in response to immediate market needs.

An opportunity, but no ‘silver bullet’

With all the elements described above, IBP has a solid foundation to create value for a business. But IBP is no silver bullet. To achieve a top-performing supply chain combining timely and complete customer service with optimal cost and capital expenditures, companies also need mature planning and fulfillment processes using advanced systems and tools. That would include robust planning discipline and a collaboration culture covering all time horizons with appropriate processes while integrating commercial, planning, manufacturing, logistics, and sourcing organizations at all relevant levels.

As more companies implement advanced planning systems and nerve centers , the typical monthly IBP frequency might no longer be appropriate. Some companies may need to spend more time on short-term execution by increasing the frequency of planning and replanning. Others may be able to retain a quarterly IBP process, along with a robust autonomous-planning or exception engine. Already, advanced planning systems not only direct the valuable time of experts to the most critical demand and supply imbalances but also aggregate and disaggregate large volumes of data on the back end. These targeted reactions are part of a critical learning mechanism for the supply chain.

Over time, with root cause analyses and cross-functional collaboration on systemic fixes, the supply chain’s nerve center can get smarter at executing plans, separating noise from real issues, and proactively managing deviations. All this can eventually shorten IBP cycles, without the risk of overreacting to noise, and give P&L owners real-time transparency into how their decisions might affect performance.

P&L owners thinking about upgrading their S&OP or IBP processes can’t rely on textbook checklists. Instead, they can assume leadership of IBP and help their organizations turn strategies and plans into effective actions. To do so, they must sponsor IBP as a cross-functional driver of business decisions, fed by thoughtfully designed processes and aligned decision rights, as well as a performance management and capability-building system that encourages the right behavior and learning mechanisms across the organization. As integrated planning matures, supported by appropriate technology and maturing supply chain–management practices, it could shorten decision times and accelerate its impact on the business.

Elena Dumitrescu is a senior knowledge expert in McKinsey’s Toronto office, Matt Jochim is a partner in the London office, and Ali Sankur is a senior expert and associate partner in the Chicago office, where Ketan Shah is a partner.

Explore a career with us

Related articles.

To improve your supply chain, modernize your supply-chain IT

Supply-chain resilience: Is there a holy grail?

Search form

M-Prize Winner

This story is one of ten winning entries in the Long-Term Capitalism Challenge, the third and final leg of the Harvard Business Review / McKinsey M Prize for Management Innovation .

Story : Nike’s Gameplan for Growth that’s Good for All

Innovation is a cornerstone of the Nike brand. Our company was founded by two visionaries, Bill Bowerman and Phil Knight, who set out to reinvent athletic footwear. Over the past decade, our drive to design and produce better, faster, lighter products has evolved into an even more ambitious agenda – to embed long term sustainability into our business. This broader vision calls for new approaches to design, management, partnership and new tools and metrics to support integration and adoption throughout Nike. Many of Nike’s management innovations for sustainable growth started internally, with the Corporate Responsibility and Considered Design Teams. As internal efforts took hold, the focus expanded externally. Nike is now reinventing its supplier, industry and business relationships. It is leading industry efforts for systemic change and pursuing an agenda of truly disruptive innovation.

Nike Dare to Dream video: http://vimeo.com/11680452

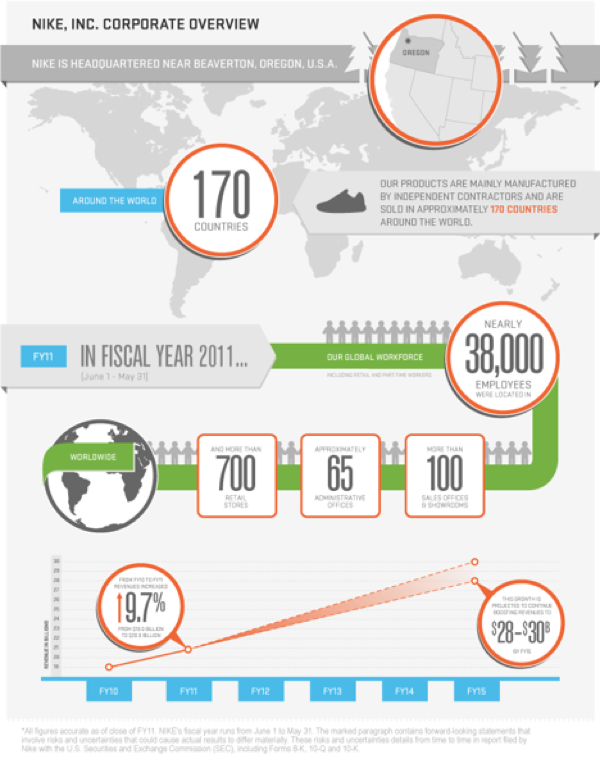

NIKE, Inc. based near Beaverton, Oregon, is the world's leading designer, marketer and distributor of authentic athletic footwear, apparel, equipment and accessories for a wide variety of sports and fitness activities. Wholly-owned NIKE subsidiaries include Cole Haan, which designs, markets and distributes luxury shoes, handbags, accessories and coats; Converse Inc., which designs, markets and distributes athletic footwear, apparel and accessories; Hurley International LLC, which designs, markets and distributes action sports and youth lifestyle footwear, apparel and accessories; and Umbro International Limited, which designs, distributes and licenses athletic and casual footwear, apparel and equipment, primarily for global football (soccer).

In 2011, NIKE Inc. earned $20.9 billion in revenues. NIKE Brand Footwear revenues in 2011 represented 55% of total NIKE, Inc revenues, followed by NIKE Brand apparel with 26%, and 5% for NIKE Brand equipment. Approximately 36% of NIKE, Inc. revenues were derived in North America, while the remainder are from across the globe.

After decades of phenomenal growth and becoming one of the world’s top brands (Interbrand 2010), Nike intentionally shifted its strategy to integrate sustainability as a vehicle for growth. We have come a long way, from our association with the discontent of globalization in the late1990s (and subsequently establishing one of the first corporate responsibility (CR) departments), to setting the bar in embedding sustainability into business practice. We no longer view sustainability as option. Rather it is a business imperative, an innovation opportunity and a potential competitive advantage. As CEO Mark Parker notes:

“The age of abundance is over. The definition of business performance is expanding. Innovation is being redefined. Expectations are being redefined. At Nike, we believe the world must innovate faster for growth that is good for all.”

Innovation is our core competency. Starting in 1964, Nike’s founders, Phil Knight and Bill Bowerman, looked for ways to improve upon the Onitsuka Tiger running shoes they were selling. They weren’t just distributors, they collaborated on design ideas. The legacy of innovation in search of better, lighter, faster product performance evolved and deepened over time. It drives every department, process and person in our company – from the product design process, through production, marketing and distribution. Phil and Bill had a vision that sparked and guided their innovation and approach. While the business has evolved and grown exponentially, that single-minded vision continues to feed innovative thinking, design and business practices today.

In addition, several significant events in the 1990’s and early 2000’s prompted a shift in Nike’s vision and approach: the labor crises related to sourcing and manufacturing practices; and scenario planning, which surfaced potential vulnerabilities across the business. The company also went through a reorganization to align more closely to consumers. Within this change, the company moved to embed sustianbility across the company with finance and product teams taking a greater role in the process alongside our VP of CR.

In the early 1990s, public reaction to labor practices in factories from which we sourced production triggered innovations in how we oversee and manage our supply chain. We took responsibility and developed stringent standards for our manufacturing partnerships - the Code of Conduct (CoC). While the CoC became a significant priority for us and our business partners, it was clear that there still was more to be done to oversee and manage our supply chain. We formed the CR committee of the Board. We disclosed our factory locations. We took measures to share information about our expectations and our progress against strict operational guidelines. These moves signaled our seriousness about the issue and our desire to move quickly and find solutions. The action with the greatest impact has been transparency. It has enabled us to better comprehend the problems and shape more approriate solutions..

We also recognized that corporate responsibility had to be a part of Nike’s business. We consolidated CR functions under the the newly created VP of CR position, led by Maria Eitel, which brought together our labor and environment strategies. By 2001, we established Nike’s Board of Directors’ CR Committee, set long-term environmental goals, and jointly published worker survey findings with the Global Alliance. These two important management shifts – the installment of an internal governance model and formalization of CR Reporting put us in the position to proactively manage our whole sustainability agenda. Nike was embarking on a journey to understand the true power of transparency, collaboration and governance.

In December 2004, Hannah Jones, became our second VP of CR reporting to Mark Parker, who was then co-president of the Nike brand. Mark Parker soon become CEO of NIKE, Inc. In assuming the CEO position, he brought a passion and commitment for sustainability. Concurrent with these management changes, we entered into an internal cultural shift, recognizing that we cannot solve these challenging issues alone. The commitment to transparent, operation-wide sustainability morphed into embedding sustainability as a future business driver for growth.

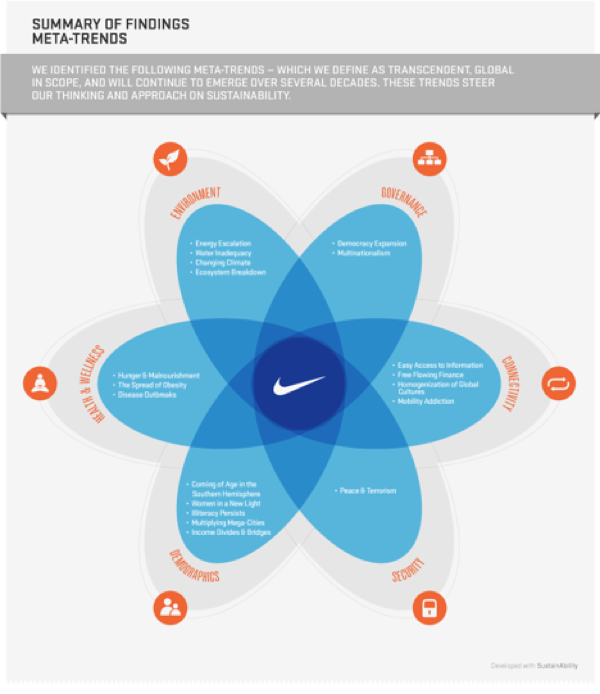

In 2007, Nike conducted (along with SustainAbility, a consulting firm) a scenario planning on global trends such as water, health, and energy, alongside increasing worldwide concern about climate change. This was not just about our sustainability strategy – it was part of our business strategy. We became acutely aware of our dependence on oil for materials and fossil fuel energy. We were vulnerable, as many companies are, to escalating oil prices and looming carbon restrictions from anti-climate change regulation. The waste production, use of materials and water by contract manufacturers also posed major risks. All of these issues were deemed significant and highlighted the areas of our value chain and our business that had the most potential for innovation. It eventually led us to our long-term vision to build a sustainable business and create value for Nike and our stakeholders by decoupling profitable growth from constrained resources.

The labor crises, the management shifts and the scenario planning exercise were all pivotal moments. Collectively, they triggered a commitment to drive sustainability into every aspect of Nike’s business. We have a new vision; we’ve redefined goals as in Nike terms, there is no finish line. It requires innovation in our design process, our production, our sourcing, our tools and metrics, and our whole team structure. Fortunately, innovation is in our cultural DNA and provides a strong foundation. Even so, embedding sustainability thinking in our strategy and then educating every person and evolving the process in the company is a challenge that takes time, continual reassessment, and unerring commitment. Early on, we missed some signals and now we have much stronger tools, teams and a culture that is structured to make progress against our bold sustainability goals. "It is clear to us that our long-term potential, and the long-term potential of virtually every other major company in the world, will be severely pressured by [these] external factors", Parker contends.

Innovation is at the very heart of our culture at Nike. One of the cornerstones of innovation is a willingness and desire to learn. And, while we have learned much from our past and others have learned much from our experience, we believe the next era in the evolution from an industrial economy toward a sustainable economy will teach greater lessons than learned before. This evolution requires us to innovate faster, more radically, more disruptively inside of Nike and throughout out our whole ecosystem. It is a top to bottom, bottom to top, inside out and outside in innovation.

In 2008, we produced a video for our design team. ‘Considered Design’ lays out a vision for the products we strive to produce. On screen, you see a close up of a runner’s shoes, pacing through puddles and mud. It evolves into a poetic series of athletes in action.

Considered Design video: http://www.youtube.com/watch?v=1WuyE_x8Vs8

The accompanying voiceover:

“This is not a shoe, it is an ethos, a shoe reborn as a tennis court, or basketball or … a better shoe…Why do [products] have a shelf life? What if ... there was a closed loop cycle? …A shoe can’t change the world, but an ethos can.”

The video was intended to inspire. It also set forth a mandate and a vision. How could Nike design products that have no shelf life? How can we reuse and reinvent products? How could we work towards a closed loop vision? This vision was the first important step in driving a new era of innovation.

Our CEO Mark Parker has a vision to embed sustainability as an ethos, as a a catalyst of innovation to deliver product and services that deliver superior athletic performance and lower enviromental impact and ultimately drive profitable and sustainable growth for the company “It’s not about a few people making sustainable products,” says Nike Considered GM, Lorrie Vogel. It’s about making sure that every person in the system adopts a different world view, sense of purpose and approach to their job.”

In order to embed sustainability and make it central to our ethos, we have made significant organizational changes, developed new tools and performance metrics, and redefined our relationship with suppliers and industry peers. We started with a focus on our own internal capabilities, knowledge and practices - our internal innovation phase. Over time, we have expanded our focus to include suppliers and industry peers - our external innovation phase.

Internal Innovation Phase – Corporate Responsibility and The Considered Group

In 2004, Nike’s various sustainability initiatives (including environmental responsibility) had not really worked their way into daily business decisions. CR was perceived as a risk management function not a valuable market opportunity. It was isolated from Nike’s business units as an add-on or layer to the business strategy and not as a core driver. The good news was that business unit managers spoke aspirationally about the potential of effective CR.

Our team set the conceptual metric of return on investment squared or “ROI 2 ” as CR’s new strategic compass, emphasizing that business decisions included both financial and corporate responsibility returns – people, planet and profit. If CR delivered ROI 2 , it was helping the business succeed and improve its social and environmental footprint. We took a strategic approach to CR that emphasized value creation, collaboration with business units and proactive strategic planning.

“We wanted to show how we could help them deliver returns on investment to our shareholders. The end goal for us had to be that businesses institutionalize CR into the DNA of the company so that CR is a living, breathing approach to how one does business. By organizing CR around ROI 2 , we hoped it would evolve from being seen as a cost to being an intrinsic part of a healthy business model, complete with profitability and sustainable growth.

ROI 2 is Nike’s measure of creating an exponential return from integrating corporate responsibility into our business. Take waste, for example. In FY05-06 we carefully documented and measured the amount of waste generated across our entire supply chain. In one year, the cost of waste across footwear alone was estimated at $844 million. Everyone is involved in initiatives to reduce our waste across the supply chain: from designers to chief financial officer to business partners. Less waste is better for margins and better for the environment. By using design to reduce our waste, we’re tapping one of our greatest resources - innovation – and fueling other insights and successes. This provided the backdrop to our evolution and to the targets we set over the course of the next five years.

“Under our CEO’s guidance and influence, the team began exploring where best to start integrating this strategy into Nike’s ecosystem. We focused on our product creation process and honed in on product design as a key intervention point. Due to its position at the beginning of the supply chain, the design function offered great opportunity to design out environmental issues. We wanted to help Nike “design the future...as opposed to retrofit the past.” According to one of my colleagues the choice to work with designers was natural: “The designer’s job is to design the future. It’s natural that they would be huge champions of sustainability and they thrive on daunting, new problems. Also, because design is situated at the beginning of the supply chain, the design function is an opportune intervention point.”

In late 2005, the Considered Design ethos was formally embedded within our business strategy, with a focus on high-performing, aesthetically pleasing greener products. The Considered Group is a think tank, tool box, internal consultancy, competitive catalyst, and an antenna to the outside world. It serves as the hub of the Considered design ethos – consider the choices, consider the impacts. Their mandate is to provide inspiration, education, and the tools to drive sustainability best practices deep into Nike’s product creation units and processes. The team’s objectives include helping Nike assess the entire product lifecycle.

The whole structure of Considered Design is thoughtfully designed to cultivate innovation. Instead of commanding and controlling how the business units implement sustainability, the team places responsibility for sustainability in the hands of designers. The team is a centralized hub with reach into key Nike functions. The hub’s spokes are product creation units, to which Considered disseminates knowledge, tools, and support. The team has both environmental and product creation expertise and collaborates closely with the related product engines. Considered’s GM, Lorrie Vogel, explained the organizing philosophy: “If you don’t know how to translate environmental knowledge into products and processes, you’ll always be outside of the product creation engine.”

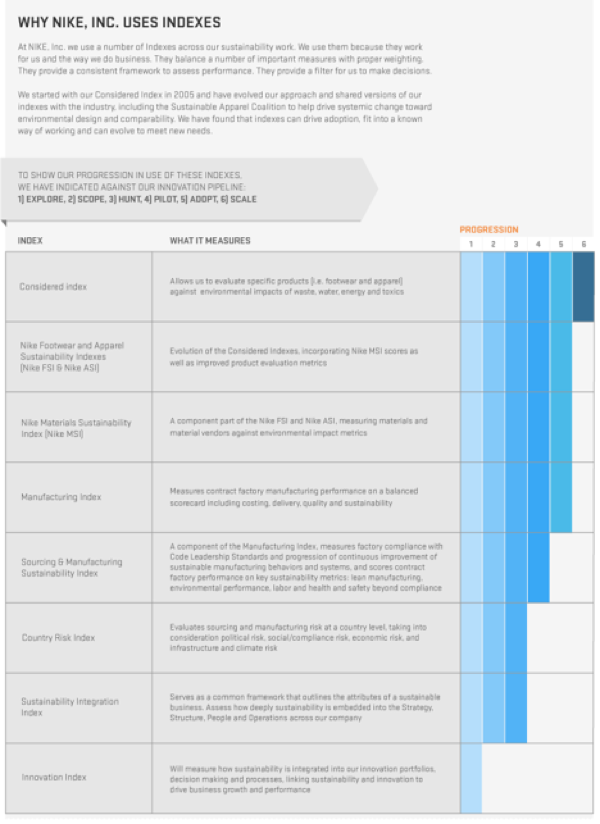

The Considered team was surprised by how difficult it was to create usable metrics for the product teams. They developed a holistic, predictive way to score products at different intervals throughout the development process. After 18 months of extensive work on developing the right metrics for the tools, the Considered Index was introduced in September 2007.

The Index provided predictive metrics that would work uniformly across Nike’s varied footwear line. It evaluated a product’s bill of materials (BOM), a roster of all materials specifications for a shoe’s components, using Nike’s Materials Assessment Tool, an abbreviated life cycle analysis for raw materials. The Index scored environmentally preferred materials (EPMs) on multiple criteria including toxic hazard, energy and water usage, recycled content, recyclability, and other supply chain responsibility issues.

As a learning and motivation tool for Nike’s product teams, the Index included a “Change Agent” category. Teams could win points for up to three new significant footprint-reducing product or process ideas. Lesser awards were also given to teams that adopted other teams’ recent innovations.

The Index was carefully calibrated to reward only those products that performed above Nike’s historical averages, with Bronze representing baseline sustainability and Silver and Gold both qualifying as “Considered”; the distinction was purely internal. The Considered team planned to toughen the Index’s scoring over time.

As one manager noted, “The intention is that we just keep raising the bar. As we do, business units will have to improve.”

The Considered team trained product teams how to use the Index. It built a network of Considered “super-users” who served as internal category experts on Considered questions and provided feedback to the Considered team. Through super-users, Considered would provide updates on noteworthy examples of inspirational implementation and innovation.

The Index ran on an intranet calculator. Product teams could self-score their products in a minute by entering their product’s BOM number and clicking checkboxes for design and process options. While teams scored their product at the end of the development process to receive an official Considered rating, many product teams used the Index at interim product gates. The very fact that the information and scoring was public was motivating. It cultivated peer competition and energized the pace of adoption and innovation.

From the beginning, the team had visible CEO level support. As Vogel explained, “CEO Mark Parker believes that sustainability is the future of Nike. He also wanted to see the scores up on the wall so that we could really track and learn from the process.”

Since Nike began setting targets years ago, we have learned the greatest opportunity to drive change is in the areas where we have the most impact. Materials create Nike’s greatest environmental impact. Nike also controls the design and became the area of focus to roll out the Considered Design ethos in 2009. This same methodology and rigor has been applied to design sustainability into the way we source and manufacture our products.

Nike’s effort to drive further innovation throughout the company and integrate sustainability into the very core of our efforts is multifaceted. We have scripted a new vision. We changed the organizational structure and introduced a whole new department. We provided training and leveraged technology. And, we encouraged healthy competition and celebrated successes.

Even the best strategy comes to nothing without the commitment, people and processes to make it happen. Continuing to integrate sustainability into our business, rather than layering it on top of how NIKE, Inc. and our brands currently operate, will increase and accelerate progress, drive scale and the proliferation of sustainable innovation, and enable broad employee engagement.

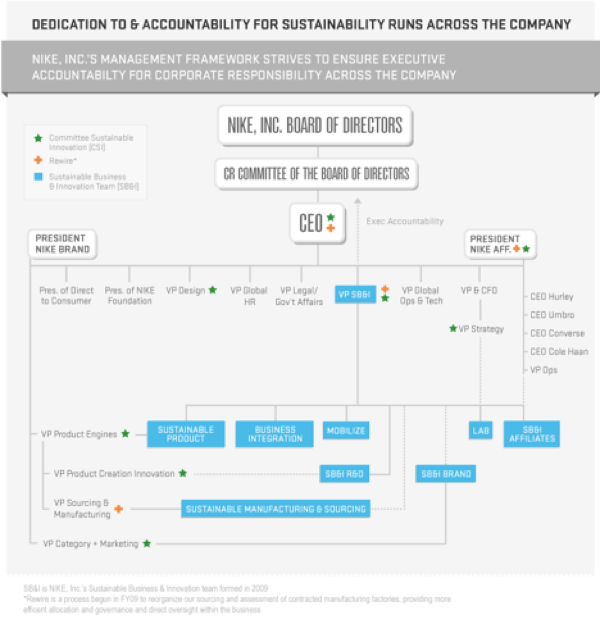

At Nike, dedication to and accountability for sustainability begins at the top. In 2001, we formed a Corporate Responsibility (CR) Committee as part of our Board of Directors committee structure. The CR Committee has oversight of environmental impact and sustainability issues, labor practices and corporate responsibility issues in major business decisions.

In FY06, we created a management framework to ensure executive accountability for corporate responsibility across the company. The Vice President for Sustainable Business & Innovation (SB&I) reports directly to President and CEO Mark Parker, and co-manages dedicated teams with business and functional executives to develop and review policies with Board oversight, approve investments and evaluate and refine our approach and direction.

The SB&I team acts as a catalyst for sustainability companywide. Made up of about 130 people, the team leads sustainability strategy development; provides content expertise and consulting to teams companywide; collaborates with sustainability specialists in other parts of the organization; drives sustainability integration; leads engagement with stakeholders; works to mitigate risk and facilitate compliance; and reports on our progress to scale the impact of sustainable innovation beyond Nike.

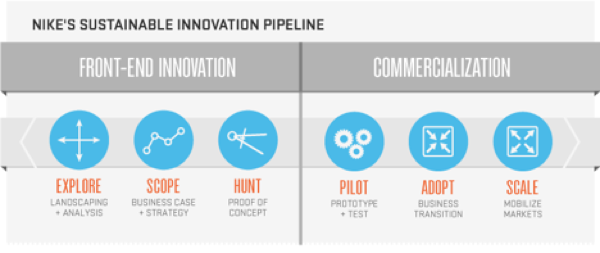

Our new executive-level Committee for Sustainable Innovation also steers our efforts specific to innovation. In 2011, we launched an executive-level Committee for Sustainable Innovation. This group is chaired by our CEO and oversees our innovation pipeline and portfolio. It helps to fully capitalize on opportunities by accelerating adoption and bringing these activities to scale.

Ultimately, the greatest measure of our success can be found in the finer detail of Nike’s culture. The very vocabulary of Nike designers has changed. We now hear team members say ‘ that’s an inconsiderate design’ in commenting on a product that does not meet the new criteria.

External Innovation Phase – Materials Sustainability Index, GreenXchange, Sustainable Apparel Coalition

As Nike advanced through a company-wide adoption of the Considered ethos, it became clear that for true, holistic change, we needed to focus beyond our own internal operations. To drive adoption and scale at an industry level, to ultimately change the marketplace for the better, Nike recognized the potential benefit in sharing knowledge, information and tools with suppliers, peers and other stakeholders.

Four key initiatives show what we are doing to cultivate innovation outside the business: the Nike Material Sustainability Index (MSI), the GreenXchange, the Sustainable Apparel Coalition, and the DyeCoo waterless dying strategic partnership.

Nike Material Sustainability Index (MSI)

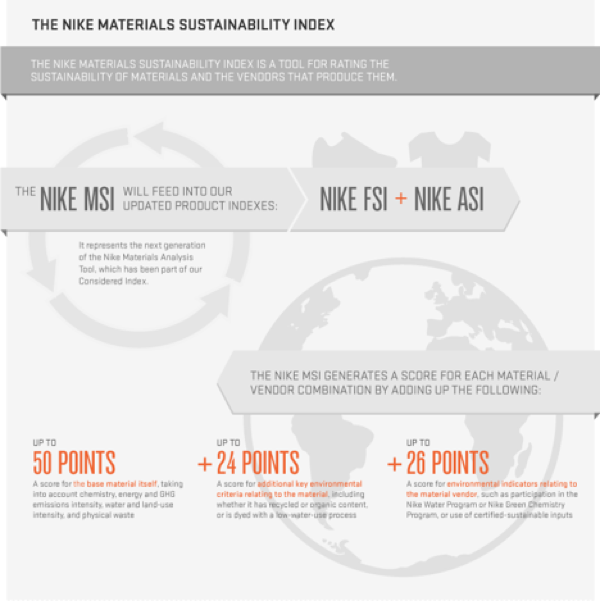

The materials in just our NIKE Brand footwear and apparel products come from 900 different material vendors (i.e., supplier companies). We do not source directly with these vendors; they are independent companies that sell materials to our contract finished-goods manufacturers based on our design specifications. To drive sustainability improvements in materials, we focus on the part of the value chain over which we have the most control: product design.

Decisions made in the product design phase determine the majority of a product’s environmental impacts. Nike teams design products with very detailed material specifications, and by providing those teams with the information they need to choose better materials from better vendors, we can improve the sustainability of our products.

We are now working to take the Considered Indexes to the next level. We have been on a multi-year journey to refine the footwear and apparel Considered Indexes based on feedback from product creation teams. In addition, we have significantly upgraded the materials rating tool embedded in the Indexes and are calling the new tool the Nike Materials Sustainability Index (Nike MSI). The Nike MSI is embedded in the Indexes that our designers and developers use to assess potential products, and it plays a pivotal role in product design.

One major improvement in the Nike MSI is that it rates material vendors in addition to materials themselves, providing strong incentives for the vendors to become more environmentally sustainable. We score material vendors on criteria such as whether they are complying with the Restricted Substance List (RSL) testing requirements and the Nike Water Program requirements; if they take part in materials certification processes, such as the Global Recycle Standard; and whether they have ISO 14001 certification or operate out of certified “green” buildings. Rating higher on these types of criteria will increase a vendor’s overall Nike MSI score.

The Nike MSI does more than rate our material vendors, however. It also scores materials according to (among other things) the chemicals required to make or process them. These scores enable our Nike product-creation teams to make more sustainable, less-toxic choices during product design. It also assigns sustainability scores to materials based on multiple criteria, including how much water is required to produce them and the water stewardship of vendors that process them. The Nike MSI creates a strong incentive for material vendors to enroll in the Nike Water Program and reduce their water-related impacts by recycling process water or implementing innovative low- or no-water coloring processes – as these activities help to increase their MSI scores. Water-efficient materials from water-efficient vendors receive more points on the MSI, and, therefore, stand a better chance of being selected by our product creation teams than other similar materials.

Materials are a substantial cost, so identifying long-term access to affordable materials that meet our environmental standards is key to our ongoing success and our ability to decouple materials from scarce resources.

GreenXchange

Over the past ten years of working on sustainability, we have come to understand the value of collaboration and shared knowledge. Without it, companies replicate efforts, reinvent wheels and often only make incremental progress.

Nike worked with the collaboration nonprofit, Creative Commons which also believe in the power of open innovation. Nike and Creative Commons share a vision of creating a digital platform that promotes the creation, sharing and adoption of technologies that can potentially solve important global or industry-wide challenges.

GreenXchange, a web-based marketplace we founded with several other companies, was born in conversation leading up to the World Economic Forum in Davos in 2009, and launched in 2010. By using a set of standardized, free, legal tools, patent owners can make portions of their intellectual property portfolio available under a set of terms between the current choices of "all rights reserved" and "no rights reserved." With GreenXchange patent licensing tools, patent owners open up a wide swath of technologies for research, development and innovative commercial uses. Patent users receive the rights they need to innovate, and patent owners receive credit for their works - as well as the option to receive annual licensing payments.

GreenXchange builds on a culture to create common spaces for innovative reuse, as well as standardization efforts for biological materials and scientific data. It also bridges some key gaps in the way that green technologies are developed and utilized.

Many active R&D companies create green technologies that are not core to their business: they may represent good practices shareable across a large set of companies - sometimes even including competitors - but lack the business infrastructure to make those patents available for wider use.

GreenXchange was our first foray into open innovation with other businesses, set up to allow organizations to collaborate and share intellectual property. We have gained significant insights from this collaboration which continue to inform our strategy to bring sustainability innovations to scale. The very concept of GreenXchange is a management innovation. Instead of taking a proprietary, short term approach to developing and controlling important information and sources, we have done the opposite. Nike continues to urge its peers to collaborate, and is leading the way through its own commitments.

Sustainable Apparel Coalition

Complementing our work to improve factory conditions, Nike is exploring ways to evaluate and communicate the environmental and social performance of individual products. We are doing this in cooperation with the Sustainable Apparel Coalition (SAC), a group of which we were founding partners.

The SAC is an industry-wide group of leading apparel and footwear brands, retailers, manufacturers, NGOs, academic experts and the U.S. Environmental Protection Agency, working to reduce the environmental and social impacts of apparel and footwear products around the world.

The SAC believes a common approach for measuring and evaluating sustainability performance is essential for driving a “race to the top” in the apparel supply chain. Apparel retailers and brands can compare the performance of products and upstream supply-chain partners, and those partners will have a single standard for measuring and reporting performance to their downstream customers. Eventually, this approach can provide a foundation for reporting to consumers on the environmental and social footprint of the products they purchase.

Through multi-stakeholder engagement, the Coalition seeks to lead the industry toward a shared vision of sustainability built upon a common approach for measuring and evaluating apparel and footwear product sustainability performance that will spotlight priorities for action and opportunities for technological innovation.

The Sustainable Apparel Coalition’s vision and purpose are based on a set of shared beliefs:

- The environmental and social challenges around the global apparel supply system affect the entire industry.

- These challenges reflect systemic issues which no individual company can solve on their own.

- Pre-competitive collaboration can accelerate improvement in environmental and social performance for the industry as a whole and reduce cost for individual companies.

- This collaboration enables individual companies to focus more resources on product and process innovation.

- Credible, practical, and universal standards and tools for defining and measuring environmental and social performance support the individual interests of all stakeholders.

DyeCoo waterless dying strategic partnership

Nike recently entered into a strategic partnership with DyeCoo Textile Systems B.V., a Netherlands-based company that has developed and built the first commercially available waterless textile dyeing machines. By using recycled carbon dioxide, DyeCoo’s technology eliminates the use of water in the textile dyeing process. With no water consumption or auxiliary chemical use, a reduction in energy use, elimination of drying and improving the process, the technology can enhance the quality of the dyed fabric and potentially revolutionize textile manufacturing. Our VP of Merchandising and Product, Eric Sprunk further explains, "Waterless dyeing is a significant step in our journey to serve both the athlete and the planet, and this partnership reinforces Nike’s long-term strategy and deep commitment to innovation and sustainability. We believe this technology has the potential to revolutionize textile manufacturing, and we want to collaborate with progressive dye houses, textile manufacturers and consumer apparel brands to scale this technology and push it throughout the industry."

In earlier years, we were about innovating solely to deliver optimal performance to our athletes, and strong financial returns to our stakeholders. We also had to react to risks and constraints in our ecosystem. Organizationally, the initial charge resided with the Vice President of the Corporate Responsibility Group. Over time, we made further changes to support, iterate and integrate the leadership vision thoughout the company. It meant an evolution in our approach. Now, our long-term vision is to deliver growth that is good for all – our athletes, our consumers, our investors, our suppliers, our partners, and the world in which we operate. We are using sustainability to redefine business performance and look to show the industry how we can embed sustainability into our approaches to product and manufacturing, and solve challenges in business and sustainability for the world. To enable adoption, our innovation strategy focuses on utilizing better processes, making better choices and bringing those choices to scale. We develop certain tools, such as the Considered Index, to drive our internal integration. We set targets that align to and support our strategy and have expanded our focus to our supply chain and industry peers. We work to optimize and improve our impact, and, at the same time, we innovate with a focus on changing the future.

1964 Blue Ribbon Sports founded by runners and revolutionaries - Bill Bowerman and Phil Knight -as a distrbutor for the Onitsuka Tiger footwear brand (now ACIS)

1971 Swoosh logo designed for $35. The Nike swoosh the spirit of the winged goddess who inspired the most courageous and chivalrous warriors at the dawn of civilization

Year-end revenues reach $1million.

1972 BRS founds Nike

late 1970s Nike establishes headquarters in Beaverton, Oregon, expansion internationally.

1985 Sock Racer championed Bowerman’s minimalist values with a breathable four-way-stretch upper, instead of layers of fabric, reducing weight and using less materials.

1988 Launch of ‘Just Do It” campaign and the reputation for unique and inspiring ads.

Revenues exceed $1.2 billion

1990 Niketown stores launched; Labor practices questions

1992 Nike’s first Code of Conduct published to guide practices in contract factories

1993 Nike launched its Reuse-A-Shoe program, allowing consumers to drop off any brand of worn out athletic shoes. Nike grinded the shoes and used the recycled material and manufacturing scrap in new sports surfaces. Since its launch, Nike has recycled more than 25 million pairs of athletic shoes.

1995 Nike began the journey of phasing out volatile organic compounds (VOCs) or petroleum-derived solvents (PDS) from its footwear production, reducing the use of VOCs 90% in just over five years to 2001. Nike also started to manufacture its shoeboxes with 100% recycled cardboard.

1997 Nike committed to fully phasing out SF6, a global warming gas used in Air-Sole cushioning units. In 2006, Nike completed the phase out of all F-gases in Nike-branded footwear. Nike began to blend organic cotton into a range of t-shirts.

2000 Nike Woven started the conversation about using less adhesives and less waste while maintaining comfort, performance and breathability. The Standoff Singlet worn in Sydney was the first time Nike used 75% recycled polyester in a performance product.

2001 CR Committee of Board established. Nike also established its first comprehensive list of restricted substances (RSL) to guide suppliers in the production of safe and legally compliant product. The RSLs were based on the most stringent worldwide legislation and also included substances that Nike had voluntarily decided to restrict.

2004 Hannah Jones assumes role as VP, Corporate Responsibility.

That year, Nike also developed an environmentally preferred rubber that contained 96% fewer toxins by weight than the original formulations. Also, Nike’s first retail introduction of apparel, the Men’s Fitness recycled polyester track suit, was made from 100% recycled polyester in a range of men’s fitness jackets and pants.

2005 Considered Design was formed as an ethos of the company to create products that address environmental impact by reducing waste, increasing the use of environmentally preferred materials and eliminating toxics. Nike introduced the Considered Boot, using a single shoelace woven between the leather parts of the upper, minimizing adhesives and allowing for easier disassembly.

2006 Mark Parker becomes CEO

2007 Considered Index introduced. Also, the Nike Long Ball Slip-On was a unique performance-based shoe constructed without the use of solvents to hold it together.

2008 Nike launched the AIR JORDAN XX3, incorporating sustainability without sacrificing performance. That same year, the Air Pegasus 25, one of Nike’s most iconic running shoes, was designed to maximize efficiency.

2010 GreenXchange launched and some of the world’s leading football (soccer) players wore the most environmentally friendly and technologically advanced jerseys on the pitch.

Also, Nike’s EADT software application enabled designers to make the most sustainable choices right at the start of the product creation process, in real time. The tool was created based on Nike’s internal Considered Index, tested and utilized since 2006, and released to the industry to support transparency and collaboration.

2011 Sustainable Apparel Coalition launched. Also, using a new fabric that’s both thick and soft, the women’s Nike Legend Pant was made from recycled polyester, material made from recycled plastic water bottles. The Nike Legacy GS Boardshort brought performance and innovation to the next level for the competitive surfer, while also lowering environmental impact.

2012 Implementation of Nike Materials Sustainability Index began. And, NIKE, Inc. announced a strategic partnership with DyeCoo Textile Systems B.V., developer and builder of the first commercially available waterless textile dyeing machine. The technology eliminates the use of water in the textile dyeing process.

Challenges and Fixes

Nike has faced a number of challeges in its efforts to integrate sustainability within product design and innovate a redefined future but it has led to us iterating, innovating and finding new ways to operate more efficiently, effectively and creatively:

Uneven adoption of the Index and new vision.

Even though corporate leadership held all categories accountable for achieving Considered targets, there was considerable variation in how quickly different groups have integrated the Considered Index and how well they operationalized the tool. Some businesses have faced greater challenges. Some businesses had a more entrenched resistance. Since then, Nike has integrated sustainability principles into its innovation processes, governance and portfolios to generate innovation that delivers products and services that combine performance, innovation and sustainability. Additionally, Nike has set a vision for what changes are needed in innovation, with its people and culture and in the way it works in two areas– in product and in manufacturing – that build on past achievements and on processes established to drive change.

Perfromance risks in the adoption of new materials.

There were a number of performance and aesthetic risks that Nike footwear faced in using EPMs such as synthetic leather. There was a potential performance risk, for example, that using recycled content could degrade physical properties like material durability, threatening Nike’s strict quality standards. One of the product creation directors in footwear described that with some EPM synthetic leather alternatives, the options weren’t very attractive: “Leathers look boardy and dry, and the textiles aren’t very interesting.” Today, rising input costs mean the need for innovation and technology has never been greater. Through innovative design, science, technology and process changes, our long term vision is to progressively design out waste, eliminate hazardous chemicals and non-renewable energy consumption. Innovation also allows us to design in new materials and new approaches to products.

This vision has been built on years of assessing trends and materiality for Nike and the changes that are impacting our business, our value chain, our consumers and the world. In 2007, we undertook an assessment with SustainAbility some meta trends that have only become more relevant as we’ve shaped and defined our strategy. These meta trends highlight the areas of our value chain and our business that have the most potential for innovation. We use these filters in our work, our assessment of opportunity and the way we approach reporting.

Added complexity.

In most cases, Considered made the design process more complex. While designers liked to iteratively find the right design, Considered required thinking about pattern efficiency much earlier in the process. It required more planning, often took longer, and it was often harder to find designs that both looked “cool” and were efficient. “On most product decisions, it’s not lower in cost, better in performance, and more sustainable,” explained one category product director. “If it was that easy, that’d be great! So usually on every component of a shoe, there are tough decisions to be made.” A designer within the Cleated category noted, “We try to make designs look cool first, then run it by other filters like cost and Considered. We design in response to a lot of constraints, like price and performance requirements, and goals like cool looks and feel. More constraints makes the process harder and, maybe, slower.” Different from then, sustainable innovation is now increasingly at the core of the business. To hedge against the complexity, we needed to focus on identifying disruptive solutions in order to manage environmental impact and business risk. So, what does this mean in terms of the sustainability of our products? The truth is, it’s a challenge to figure out how to measure that. Rather than working toward a certain percentage of, say, recycled content in a finished product, we have worked to improve our base materials, and we are now creating systems that allow us to better assess the impacts of the resulting products. That said, we do already have some ways to measure our success. For example, over the past five years we have achieved a 19 percent reduction in waste related to the production of footwear uppers. Considered Design contributed to that gain, along with manufacturing process optimization and other best practices. That’s the same as not producing 15 million pairs of shoe uppers over that time period. Our use of Environmentally Preferred Materials (EPMs) – ones that have lower environmental impacts throughout their lifecycles in terms of chemistry, water, energy use and waste – provides another strong indicator of our progress. We also learned that addressing symptoms doesn’t embed change so it focuses in on the earliest stages of the product life cycle.

Given the extremely fast pace of product development in response to consumer trends and ongoing organizational change efforts, product creation employees didn’t have a lot of time for implementing Considered. We now recognize that integration is an imperative to address process changes so we redefined reporting structures, design and sourcing processes and created materials to help us better achieve superior products with lower environmental impact.

Higher Costs

The potential additional costs for developing greener footwear was another challenge facing Considered. Alongside the increasing cost of petroleum, adding EPMs made Considered design potentially even more expensive. Large product category teams had some success negotiating price reductions based on volume, but smaller categories struggled to overcome margin pressures. Because Nike is a growth copany, sustainability, today, becomes increasingly important to our growth strategy. As we have learned over the years, sustainability is not just a strategy for growth, but a competitive advantage.

Supply Chain Partners

Some contract manufacturers have been highly responsive to category requests for help implementing Considered, but others, either because of their size, prior capital investments in less-efficient machinery, management focus, or lack of technical capacity, were not able to nimbly and successfully execute the Considered design requirements.

Because we now know that early intervention is key, educating factories on why a stable, competitive, well compensated workforce makes good business sense. Nike focuses on training, incentivizing and holding contract manufacturers accountable to its Nike standards and continues to raise the bar with each iteration of the Indexes. Nike’s new rating system, the Manufacturing Index, looks comprehensively at a contract manufacturer’s total performance and includes a deeper look at how a factory approaches sustainability. This Index elevates labor and environmental performance alongside traditional supply chain measures of quality, cost and on-time delivery.

Considered faced several challenges with consumers. For one, many consumers were skeptical that a running shoe made from EPMs would in fact perform as well as a shoe that was not. For example, one focus group initially was very receptive to a Considered running shoe, but after being told it was unusually “green” started viewing it as a lower performance product. Today, Nike is meeting consumer demands through performance, innovation and sustainability which drive superior product. The Flyknit technology is a good example of where performance meets sustainability. Nike Flyknit, which uses precisely engineered yarn and fabric variations to create a featherweight, formfitting and virtually seamless upper. It’s a new way to knit the multiple pieces of a shoe upper out of what is essentially a single thread. It’s great for the athlete because it is lighter and offers a more custom fit. It’s good for the planet because it drastically reduces waste from the upper production process. And shareholders stand to benefit from the reduced cost of production and potential for increased margins over time as the the innovation grows to full scale. It’s a nascent technology that holds tremendous opportunity.

Nike FlyKnit video: http://nikeinc.com/news/nike-flyknit

Nike had not yet figured how to market performance, aesthetics and sustainability in one complete package. There was internal debate as to whether Considered should become its own brand within Nike, or simply a new dimension of the Nike brand. Ultimately, Nike decided that there would be no compromise to performance, no 'green' line of products and that sustainability should not be a constraint but an innovation challenge for designers.

We know where we’ve been, and we know where we want to go. And we know that there is substantial work ahead. We continue to set the bar higher for ourselves and our business. We have evaluated our business model and our impacts across our value chain, have assessed the coming scenarios and challenges, taken account of our progress against past performance, and worked across our business to set targets embedded deeply into the way we operate.

Many of the sustainability issues we seek to solve are still undergoing innovation. Others are firmly in place and moving forward with needed changes.

We deliver on our vision in two ways:

- Make today better by taking account of our impacts, driving efficiency and optimization

- Design the future by unleashing innovation, embedding sustainability into our approaches to product and manufacturing, and solving challenges in business and sustainability for the world

Accelerated innovation. Our sustainability vision both inspired and drove us to reinvent our creative process. It accelerated and strengthened innovation as a core competency.

Abillity to attract the best talent. Our success in pioneering sustainability in a holistic way, and to continue to deliver “the cool factor” and superior performance means we can attract the very best designers, engineers, strategists and marketers.

Brand value and goodwill. After our CR challenges in the late 90s we have not only worked hard to regain the trust and respect of customers and industry peers, we have set forth a strategy to lead. We are proud to be a respected brand, design company, innovator and among those recognized as a leader in sustainability.

Reduced costs of sustainable sourcing. By sharing best practices and providing open access to our tools and sourcing information, we are driving industry peers to adopt similar processes, materieals and metrics. This means we have the volumes to drive down the costs of what has been a more sustainable, but more costly source.

Lead with a vision. Every person in the organization must understand and embrace a very specific idea of what the future beholds. Provide a specific example that illustrates the vision and engenders passion and a sense of purpose. As Lorrie Vogel says of the Considered Change video: “ We created a concrete vision of what we wanted to be and we got that in front of every person in the company.”

Secure Executive level support. To fully integrate changes throughout an organzation, it must be very apparent that the initiative has CEO level support – not just through words, and verbal endorsements, but through the actions and interactions that CEO has inside and outside the company.

Set clear targets and metrics to measure success and track progress. Even if the initial measures are imperfect, its important to start to have some means of tracking progress and reinforce the learning. “If you don’t measure it, it doesn’t happen,” says Lorrie Vogel.

Provide the tools to facilitate the adoption process Very few individuals and organzations take to change easily. It’s human to be comfortable with what is known and to resist change that challenges the status quo. It is critical to provide the education, training and toolsets to engage people more easily and affect change. We embedded our training and tools within the existing system, leveraging existing processes as much as possible. We provide our product creation teams with extensive training in how to use the Considered Indexes and on the importance of focusing on the sustainability of materials. The teams are given scoring targets for each season of products they design. In the current version of the Considered Indexes, materials make up 35 percent of the score for footwear and 60 percent of the score for apparel, so it’s clear to the design teams that focusing on materials is an effective way to meet their goals. While the Considered Indexes have been used primarily by the NIKE Brand, our Affiliate brands have also begun introducing and using them to evaluate their product designs and have committed to adopt the indexes by the end of FY15. For example, Hurley International scored selected apparel designs in FY11. The designers and team members did not need to learn a new system in order to get the information they needed.

Celebrate and reward success. The creation of incentives is another critical aspect of driving change. It is very important to incentive the right behaviors to make sure we achieve the change we want to see. Nike assigned innovation points to drive competition, and managed these through a living index, a forum that was pubic and enabled team members to gauge their success. It also fed a healthy competition between teams and efforts.

Collaborate with others. Engage outisde experts to help formulate a vision and maintain an objective peer review. As Lorrie Vogel shares: “We engaged Natural Step to help develop our ‘North Star’.

It is in the spirit of transparency and collaboration that we share our journey and hope that the the definition of business performance is expanding. We will constantly need to deliver innovations that evolve our approach at Nike and share our lessons with the industry to affect the positive change. We hope the world innovates faster than expectations. We cannot achieve our bold goals for sustainability simply by delivering incremental improvements. Sustainability will be the catalyst in transforming business economies and markets, and we will continue to evolve our business to ensure we are able to grow profitably, and to lead.

Nike 2011 Sustainable Business Performance Summary: www.nikeresponsibility.com

MIT Case Study: Nike Considered: Getting Traction on Sustainability by Rebecca Henderson, Richard M. Locke, Christopher Lyddy, Cate Reavis : https://mitsloan.mit.edu/MSTIR/sustainability/NikeConsidered/Documents/08.077.Nike%20Considered.Getting%20Traction%20on%20Sustainability.Locke.Henderson.pdf

FY10-11 Sustainable Business Performance Summary: www.nikeresponsibility.com

Nike Dare to Dream video: http://vimeo.com/11680452

Nike Considered Design history, ethos with Bowerman, how we work: http://www.nike.com/nikeos/p/gamechangers/en_US/considered

Nike Better World: http://www.nikebetterworld.com/

Nike Better World Innovation Timeline: http://nikeinc.com/system/assets/8684/NBW_Innovation_Timeline_SU12_v3_original.pdf?1332281984

Considered Design video

http://www.youtube.com/watch?v=1WuyE_x8Vs8

Nike FlyKnit video: http://nikeinc.com/news/nike-flyknit

FY10-11 Sustainable Business Performance Summary – www.nikeresponsibility.com

Nike Dare to Dream video

http://vimeo.com/11680452

Nike Considered Design history, ethos with Bowerman, how we work

http://www.nike.com/nikeos/p/gamechangers/en_US/considered

Nike Better World

http://www.nikebetterworld.com/

Nike Better World Innovation Timeline

http://nikeinc.com/system/assets/8684/NBW_Innovation_Timeline_SU12_v3_original.pdf?1332281984

You need to register in order to submit a comment.

- Join the MIX now

Move the World

Welcome to nike careers, we use the power of sport to move the world.

At NIKE, Inc., we see a world where everybody is an athlete—united in the joy of movement. Driven by our passion for sport and our instinct for innovation, we aim to elevate human potential. Whether our job is designing the ultimate sneaker or coding a revolutionary app, we’re united by the same mission: to bring inspiration and innovation to every athlete in the world. That means you. Because, as Bill Bowerman—Nike’s co-founder and legendary coach—once said, “If you have a body, you are an athlete.” Every day, we are demanding a better future for ourselves, our athletes, and our communities. We believe that diversity fosters creativity and accelerates innovation. We believe in protecting a planet where all athletes can thrive. And we believe every kid, everywhere, should have access to sport.

NIKE, Inc. is a family of brands

At NIKE, Inc., we believe in pursuing greatness everywhere: on the field, on the court, on the beach and on the street. That’s why our family of brands include Jordan and Converse. We may not look or act the same, but we all share the same drive for greatness. That is the backbone of the Nike family.

Tour our World

Nike locations.

Oregon is home to Nike, but our story goes far beyond Beaverton. From Amsterdam to Shanghai to Buenos Aires, we have locations around the world to inspire athletes* everywhere to reach their potential. *If you have a body, you are an athlete

- North America

- Greater China

Corporate Offices

Retail stores, countries served, win as a team.

Entre otras razones, esto podría deberse a que la empresa ya no acepta solicitudes, no está contratando activamente o está evaluando solicitudes. Utiliza nuestro buscador para acceder a nuevos empleos

Trabajos por profesión en México:

- Auxiliar Administrativo

- Ayudante General

- auxiliar contable

- Almacenista

- Auxiliar de Almacén

- asesor de ventas

- Ejecutivo De Ventas

- Chofer Repartidor

- Auxiliar de Limpieza

- Recepcionista

- Auxiliar de Recursos Humanos

- Recepcionista / Auxiliar Administrativo

- Asistente Administrativo

- Guardia De Seguridad

- Vendedor de piso

- Técnico En Mantenimiento

- Gerente De Sucursal

- Personal De Limpieza

- Auxiliar De Mantenimiento

- Atención A Clientes

- Auxiliar De Compras

- Averigua Tu Score para Esta Posición y Adapta Tu

- inspector de calidad

- Promotor De Ventas

- Montacarguista

- Chofer De Reparto

- Representante De Ventas

- Asesor Comercial

- Auxiliar De Almacen

- Vendedor De Mostrador

- Auxiliar De Cocina

- Chofer Almacenista

- Generalista De Recursos Humanos

Trabajos por ubicación en México:

- San Miguel Xico

- Guadalajara

- Ciudad de México

- Monterrey City

- Delegación Tláhuac

- Heróica Puebla de Zaragoza

- Delegación Iztapalapa

- Naucalpan de Juárez

- Tlanepantla de baz

- Ciudad Apodaca

- Delegación Miguel Hidalgo

- Tlaquepaque

- Toluca de Lerdo

- Santiago de Querétaro

- Santa Catarina

- Gustavo A. Madero

- Azcapotzalco

- Aguascalientes

- Delegación Tlalpan

- San Luis Potosí

COMMENTS

Senior Director Integrated Business Planning, Global at Nike Portland, Oregon, United States. 684 followers ... Senior Director Integrated Business Planning, Global at Nike.

Director, Global Integrated Business Planning Portland, Oregon, United States. 264 followers ... Director, Global Integrated Business Planning Nike Jul 2022 - Present ...

Director of Global Integrated Business Planning Nike Sep 2017 - Present 6 years 8 months. Beaverton, Or ... NA Merch Financial Planning Director at Nike Portland, Oregon Metropolitan Area ...

Supply Chain Strategy And Portfolio Director, North America. ROLES: Operations (Logistics) LEVEL: Director Nike. Nov 2014 — Oct 2016 ∙︎ 1 year 11 months

Get the details of Pamm Chambers's business profile including email address, phone number, work history and more. ... Global Director, Integrated Business Planning at Nike ... Pamm Chambers Email & Phone number. Engage via Email. p***@nike.com. Engage via Phone (503) ***-**** Engage via Mobile (***) ***-**** Reveal Information. Pamm Chambers ...

Integrated Business Planning Director. 2023 - actualidad 1 año. Guadalajara, Jalisco, Mexico. Leading integrated business planning ecosystem ensuring operational plans are aligned and serve a healthy marketplace. Driving alignment, decisions and actions that result in achievement of business results and delivery of enterprise strategies.

Strategic Planning teams keep Nike moving in the right direction by leading the strategic business planning process and spearheading transformational projects across Nike businesses and geographies. Embedded in teams across the company, strategy professionals explore complex business issues; conduct consumer, competitive and market analyses ...

Duncan works at Nike as APLA Director of Integrated Business Planning. Duncan is based out of Portland, Oregon Metropolitan Area and works in the Retail industry. View Duncan Cremer's email address (d*****@nike***.com) and phone number.

NIKE GLOBAL TRADING B.V. SINGAPORE BRANCH By continuing to browse our site you agree to our use of cookies. Close. A Singapore Government Agency Website ... Integrated Business Planning Director MCF-2021-0174941. MAPLETREE BUSINESS CITY, 10-31/32 30 PASIR PANJANG ROAD 117440. Full Time. Senior Management. 8 years exp.

View Sophia Battle's email address (s*****@nike***.com) and phone number. Sophia works at Nike as EMEA Integrated Business Planning Director. Sophia is based out of The Randstad, Netherlands and works in the Retail industry.

Sr. Director - Integrated Business Planning, APLA Beaverton, Oregon, United States. 594 followers ... Operations & Strategy Leader at Nike | Planning, Supply Chain, Omnichannel

View Sheree McCabe's email address (s*****@nike***.com) and phone number. Sheree works at Nike as Integrated Business Planning Director, SEA&I. Sheree is based out of Singapore and works in the Retail industry.

One global manufacturer set up its integrated business planning (IBP) system as the sole way it ran its entire business, creating a standardized, integrated process for strategic, tactical, and operational planning. Although the company had previously had a sales and operations planning (S&OP) process, it had been owned and led solely by the supply chain function.

In 2011, NIKE Inc. earned $20.9 billion in revenues. NIKE Brand Footwear revenues in 2011 represented 55% of total NIKE, Inc revenues, followed by NIKE Brand apparel with 26%, and 5% for NIKE Brand equipment. Approximately 36% of NIKE, Inc. revenues were derived in North America, while the remainder are from across the globe.