- Business Essentials

- Leadership & Management

- Credential of Leadership, Impact, and Management in Business (CLIMB)

- Entrepreneurship & Innovation

- Digital Transformation

- Finance & Accounting

- Business in Society

- For Organizations

- Support Portal

- Media Coverage

- Founding Donors

- Leadership Team

- Harvard Business School →

- HBS Online →

- Business Insights →

Business Insights

Harvard Business School Online's Business Insights Blog provides the career insights you need to achieve your goals and gain confidence in your business skills.

- Career Development

- Communication

- Decision-Making

- Earning Your MBA

- Negotiation

- News & Events

- Productivity

- Staff Spotlight

- Student Profiles

- Work-Life Balance

- AI Essentials for Business

- Alternative Investments

- Business Analytics

- Business Strategy

- Business and Climate Change

- Design Thinking and Innovation

- Digital Marketing Strategy

- Disruptive Strategy

- Economics for Managers

- Entrepreneurship Essentials

- Financial Accounting

- Global Business

- Launching Tech Ventures

- Leadership Principles

- Leadership, Ethics, and Corporate Accountability

- Leading Change and Organizational Renewal

- Leading with Finance

- Management Essentials

- Negotiation Mastery

- Organizational Leadership

- Power and Influence for Positive Impact

- Strategy Execution

- Sustainable Business Strategy

- Sustainable Investing

- Winning with Digital Platforms

How to Do a Cost-Benefit Analysis & Why It’s Important

- 05 Sep 2019

Are you unsure whether a particular decision is the best one for your business? Are you questioning whether a proposed project will be worth the effort and resources that will go into making it a success? Are you considering making a change to your business, marketing, or sales strategy, knowing that it might have repercussions throughout your organization?

The way that many businesses, organizations, and entrepreneurs answer these, and other, questions is through business analytics —specifically, by conducting a cost-benefit analysis.

Access your free e-book today.

What Is A Cost-Benefit Analysis?

A cost-benefit analysis is the process of comparing the projected or estimated costs and benefits (or opportunities) associated with a project decision to determine whether it makes sense from a business perspective.

Generally speaking, cost-benefit analysis involves tallying up all costs of a project or decision and subtracting that amount from the total projected benefits of the project or decision. (Sometimes, this value is represented as a ratio.)

If the projected benefits outweigh the costs, you could argue that the decision is a good one to make. If, on the other hand, the costs outweigh the benefits, then a company may want to rethink the decision or project.

There are enormous economic benefits to running these kinds of analyses before making significant organizational decisions. By doing analyses, you can parse out critical information, such as your organization’s value chain or a project’s ROI .

Cost-benefit analysis is a form of data-driven decision-making most often utilized in business, both at established companies and startups . The basic principles and framework can be applied to virtually any decision-making process, whether business-related or otherwise.

Related: 5 Business Analytics Skills for Professionals

Steps of a Cost-Benefit Analysis

1. establish a framework for your analysis.

For your analysis to be as accurate as possible, you must first establish the framework within which you’re conducting it. What, exactly, this framework looks like will depend on the specifics of your organization.

Identify the goals and objectives you’re trying to address with the proposal. What do you need to accomplish to consider the endeavor a success? This can help you identify and understand your costs and benefits, and will be critical in interpreting the results of your analysis.

Similarly, decide what metric you’ll be using to measure and compare the benefits and costs. To accurately compare the two, both your costs and benefits should be measured in the same “common currency.” This doesn’t need to be an actual currency, but it does frequently involve assigning a dollar amount to each potential cost and benefit.

2. Identify Your Costs and Benefits

Your next step is to sit down and compile two separate lists: One of all of the projected costs, and the other of the expected benefits of the proposed project or action.

When tallying costs, you’ll likely begin with direct costs , which include expenses directly related to the production or development of a product or service (or the implementation of a project or business decision). Labor costs, manufacturing costs, materials costs, and inventory costs are all examples of direct costs.

But it’s also important to go beyond the obvious. There are a few additional costs you must account for:

- Indirect costs: These are typically fixed expenses, such as utilities and rent, that contribute to the overhead of conducting business.

- Intangible costs: These are any current and future costs that are difficult to measure and quantify. Examples may include decreases in productivity levels while a new business process is rolled out, or reduced customer satisfaction after a change in customer service processes that leads to fewer repeat buys.

- Opportunity costs: This refers to lost benefits, or opportunities, that arise when a business pursues one product or strategy over another.

Once those individual costs are identified, it’s equally important to understand the possible benefits of the proposed decision or project. Some of those benefits include:

- Direct: Increased revenue and sales generated from a new product

- Indirect: Increased customer interest in your business or brand

- Intangible: Improved employee morale

- Competitive: Being a first-mover within an industry or vertical

3. Assign a Dollar Amount or Value to Each Cost and Benefit

Once you’ve compiled exhaustive lists of all costs and benefits, you must establish the appropriate monetary units by assigning a dollar amount to each one. If you don’t give all the costs and benefits a value, then it will be difficult to compare them accurately.

Direct costs and benefits will be the easiest to assign a dollar amount to. Indirect and intangible costs and benefits, on the other hand, can be challenging to quantify. That does not mean you shouldn’t try, though; there are many software options and methodologies available for assigning these less-than-obvious values.

4. Tally the Total Value of Benefits and Costs and Compare

Once every cost and benefit has a dollar amount next to it, you can tally up each list and compare the two.

If total benefits outnumber total costs, then there is a business case for you to proceed with the project or decision. If total costs outnumber total benefits, then you may want to reconsider the proposal.

Beyond simply looking at how the total costs and benefits compare, you should also return to the framework established in step one. Does the analysis show you reaching the goals you’ve identified as markers for success, or does it show you falling short?

If the costs outweigh the benefits, ask yourself if there are alternatives to the proposal you haven’t considered. Additionally, you may be able to identify cost reductions that will allow you to reach your goals more affordably while still being effective.

Related: Finance vs. Accounting: What's the Difference?

Pros and Cons of Cost-Benefit Analysis

There are many positive reasons a business or organization might choose to leverage cost-benefit analysis as a part of their decision-making process. There are also several potential disadvantages and limitations that should be considered before relying entirely on a cost-benefit analysis.

Advantages of Cost-Benefit Analysis

A data-driven approach.

Cost-benefit analysis allows an individual or organization to evaluate a decision or potential project free of biases. As such, it offers an agnostic and evidence-based evaluation of your options, which can help your business become more data-driven and logical.

Makes Decisions Simpler

Business decisions are often complex by nature. By reducing a decision to costs versus benefits, the cost-benefit analysis can make this dilemma less complex.

Uncovers Hidden Costs and Benefits

Cost-benefit analysis forces you to outline every potential cost and benefit associated with a project, which can uncover less-than-obvious factors like indirect or intangible costs.

Limitations of Cost-Benefit Analysis

Difficult to predict all variables.

While cost-benefit analysis can help you outline the projected costs and benefits associated with a business decision, it’s challenging to predict all the factors that may impact the outcome. Changes in market demand, material costs, and the global business environment are unpredictable—especially in the long term.

Incorrect Data Can Skew Results

If you’re relying on incomplete or inaccurate data to finish your cost-benefit analysis, the results of the analysis will follow suit.

Better Suited to Short- and Mid-Length Projects

For projects or business decisions that involve longer timeframes, cost-benefit analysis has a greater potential of missing the mark for several reasons. For one, it’s typically more difficult to make accurate predictions the further into the future you go. It’s also possible that long-term forecasts won’t accurately account for variables such as inflation, which can impact the overall accuracy of the analysis.

Removes the Human Element

While a desire to make a profit drives most companies, there are other, non-monetary reasons an organization might decide to pursue a project or decision. In these cases, it can be difficult to reconcile moral or “human” perspectives with the business case.

In the end, cost-benefit analysis shouldn't be the only business analytics tool or strategy you use in determining how to move your organization into the future. Cost-benefit analysis isn’t the only type of economic analysis you can do to assess your business’s economic state, but a single option at your disposal.

Do you want to take your career to the next level? Download our free Guide to Advancing Your Career with Essential Business Skills to learn how enhancing your business knowledge can help you make an impact on your organization and be competitive in the job market.

This post was updated on July 12, 2022. It was originally published on September 5, 2019.

About the Author

An Expert Guide to Cost Benefit Analysis

By Joe Weller | December 8, 2016

- Share on Facebook

- Share on LinkedIn

Link copied

In business today, it’s essential to get the most out of every idea, option, and investment. To accomplish this, many organizations - from large enterprises to startups and small businesses - use cost benefit analyses to help make important decisions. Using a cost benefit analysis can help teams identify the highest and best return on an investment based on the cost, resources, and risk involved. In this article, we’ll walk you through the process of cost benefit analysis, and offer insight and tips from industry experts. They’ll shine a light on the risks and uncertainties you should be aware of as you work, and provide real-world examples to show cost benefit analysis in action.

Cost benefit analysis: What is it?

A cost benefit analysis (also known as a benefit cost analysis) is a process by which organizations can analyze decisions, systems or projects, or determine a value for intangibles. The model is built by identifying the benefits of an action as well as the associated costs, and subtracting the costs from benefits. When completed, a cost benefit analysis will yield concrete results that can be used to develop reasonable conclusions around the feasibility and/or advisability of a decision or situation. Why Use Cost Benefit Analysis? Organizations rely on cost benefit analysis to support decision making because it provides an agnostic, evidence-based view of the issue being evaluated—without the influences of opinion, politics, or bias. By providing an unclouded view of the consequences of a decision, cost benefit analysis is an invaluable tool in developing business strategy, evaluating a new hire, or making resource allocation or purchase decisions. Origins of Cost Benefit Analysis The earliest evidence of the use of cost benefit analysis in business is associated with a French engineer, Jules Dupuit, who was also a self-taught economist. In the mid-19th century, Dupuit used basic concepts of what later became known as cost benefit analysis in determining tolls for a bridge project on which he was working. Dupuit outlined the principles of his evaluation process in an article written in 1848, and the process was further refined and popularized in the late 1800s by British economist Alfred Marshall, author of the landmark text, Principles of Economics (1890).

Scenarios Utilizing Cost Benefit Analysis

As mentioned previously, cost benefit analysis is the foundation of the decision-making process across a wide variety of disciplines. In business, government, finance, and even the nonprofit world, cost benefit analysis offers unique and valuable insight when:

- Developing benchmarks for comparing projects

- Deciding whether to pursue a proposed project

- Evaluating new hires

- Weighing investment opportunities

- Measuring social benefits

- Appraising the desirability of suggested policies

- Assessing change initiatives

- Quantifying effects on stakeholders and participants

How to Do a Cost Benefit Analysis

While there is no “standard” format for performing a cost benefit analysis, there are certain core elements that will be present across almost all analyses. Use the structure that works best for your situation or industry, or try one of the resources and tools listed at the end of this article. We’ll go through the five basic steps to performing a cost benefit analysis in the sections below, but first, here’s a high-level of overview:

- Establish a framework to outline the parameters of the analysis

- Identify costs and benefits so they can be categorized by type, and intent

- Calculate costs and benefits across the assumed life of a project or initiative

- Compare cost and benefits using aggregate information

- Analyze results and make an informed, final recommendation

As with any process, it’s important to work through all the steps thoroughly and not give in to the temptation to cut corners or base assumptions on opinion or “best guesses.” According to a paper from Dr. Josiah Kaplan, former Research Associate at the University of Oxford, it’s important to ensure that your analysis is as comprehensive as possible: “The best cost-benefit analyses take a broad view of costs and benefits, including indirect and longer-term effects, reflecting the interests of all stakeholders who will be affected by the program.”

How to Establish a Framework

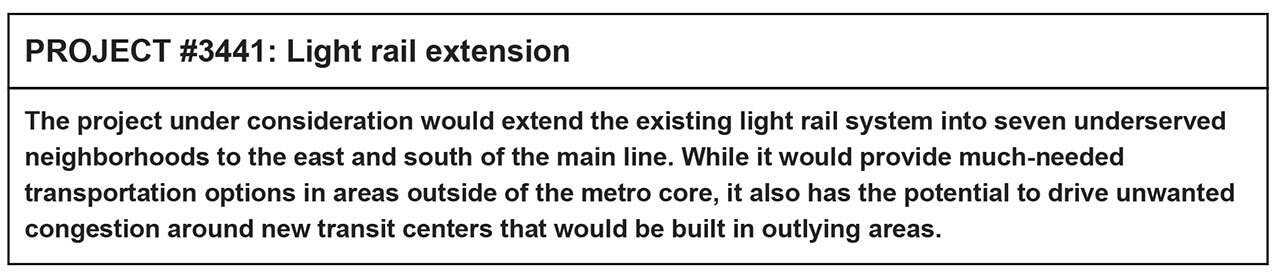

In establishing the framework of your cost benefit analysis, first outline the proposed program or policy change in detail. Look carefully at how you position what exactly is being evaluated in relationship to the problem being solved. For example, the analysis associated with the question, “should we add a new professor to our staff?” will be much more straightforward than a broader programmatic question, such as, “how should we resolve the gaps in our educational offering?” Example:

Once your program or policy change is clearly outlined, you’ll need to build out a situational overview to examine the existing state of affairs including background, current performance, any opportunities it has brought to the table, and its projected performance in the future. Also make sure to factor in an objective look at any risks involved in maintaining the status quo moving forward. Now decide on how you will approach cost benefits. Which cost benefits should be included in your analysis? Include the basics, but also do a bit of thinking outside the box to come up with any unforeseen costs that could impact the initiative in both the short and long term. In some cases geography could play a role in determining feasibility of a project or initiative. If geographically dispersed stakeholders or groups will be affected by the decision being analyzed, make sure to build that into the framework upfront, to avoid surprises down the road. Conversely, if the scope of the project or initiative may scale beyond the intended geographic parameters, that should be taken into consideration as well.

Identify and Categorize Costs and Benefits

Now that your framework is in place, it’s time to sort your costs and benefits into buckets by type. The primary categories that costs and benefits fall into are direct/indirect , tangible/intangible , and real :

- Direct costs are often associated with production of a cost object (product, service, customer, project, or activity)

- Indirect costs are usually fixed in nature, and may come from overhead of a department or cost center

- Tangible costs are easy to measure and quantify, and are usually related to an identifiable source or asset, like payroll, rent, and purchasing tools

- Intangible cost s are difficult to identify and measure, like shifts in customer satisfaction, and productivity levels

- Real costs are expenses associated with producing an offering, such as labor costs and raw materials

Now that you’ve developed the categories into which you’ll sort your costs and benefits, it’s time to start crunching numbers.

How to Calculate Costs and Benefits

With the framework and categories in place, you can start outlining overall costs and benefits. As mentioned earlier, it’s important to take both the short and long term into consideration, so ensure that you make your projections based on the life of the program or initiative, and look at how both costs and benefits will evolve over time.

TIP: People often make the mistake of monetizing incorrectly when projecting costs and benefits, and therefore end up with flawed results. When factoring in future costs and benefits, always be sure to adjust the figures and convert them into present value.

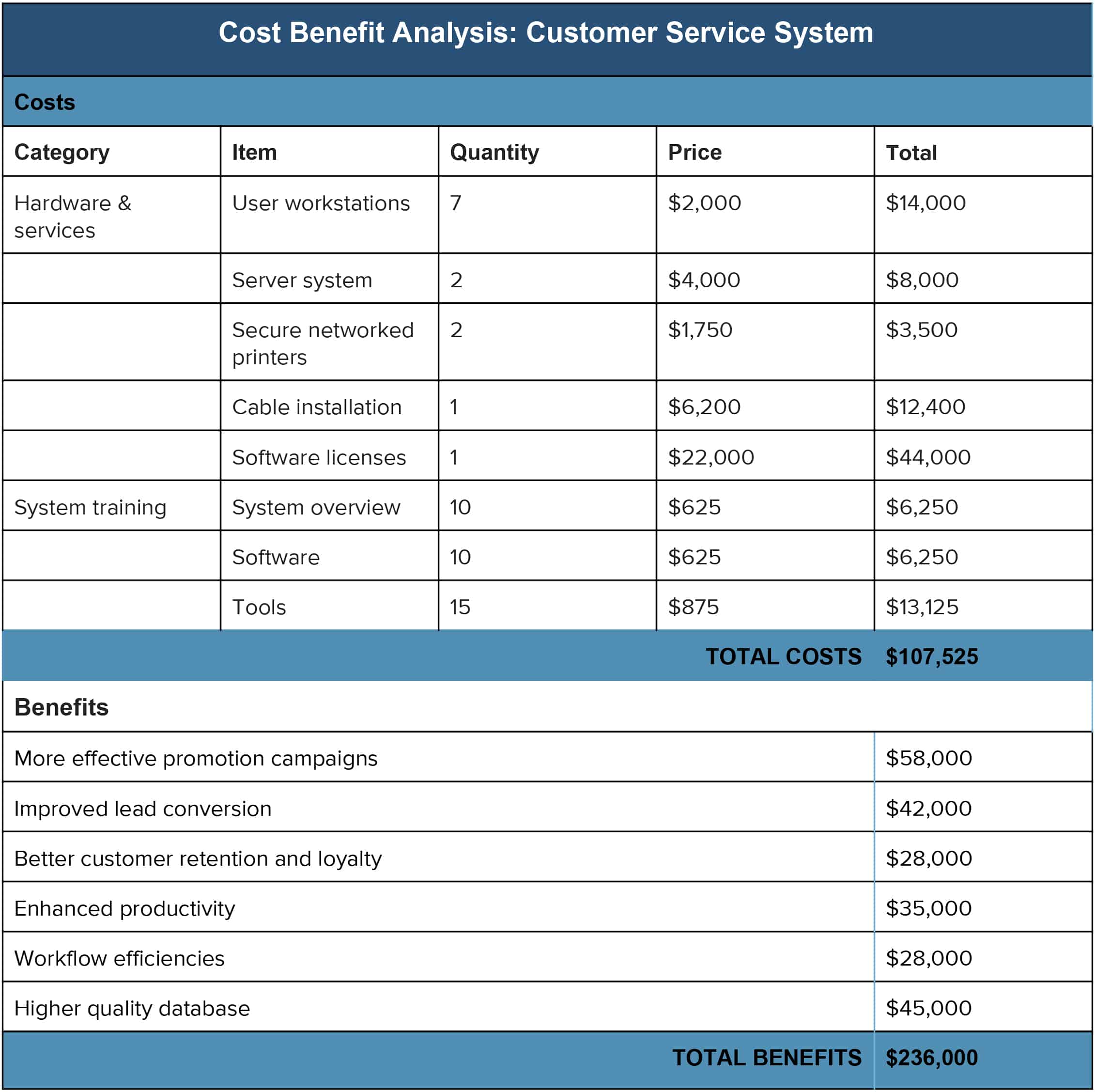

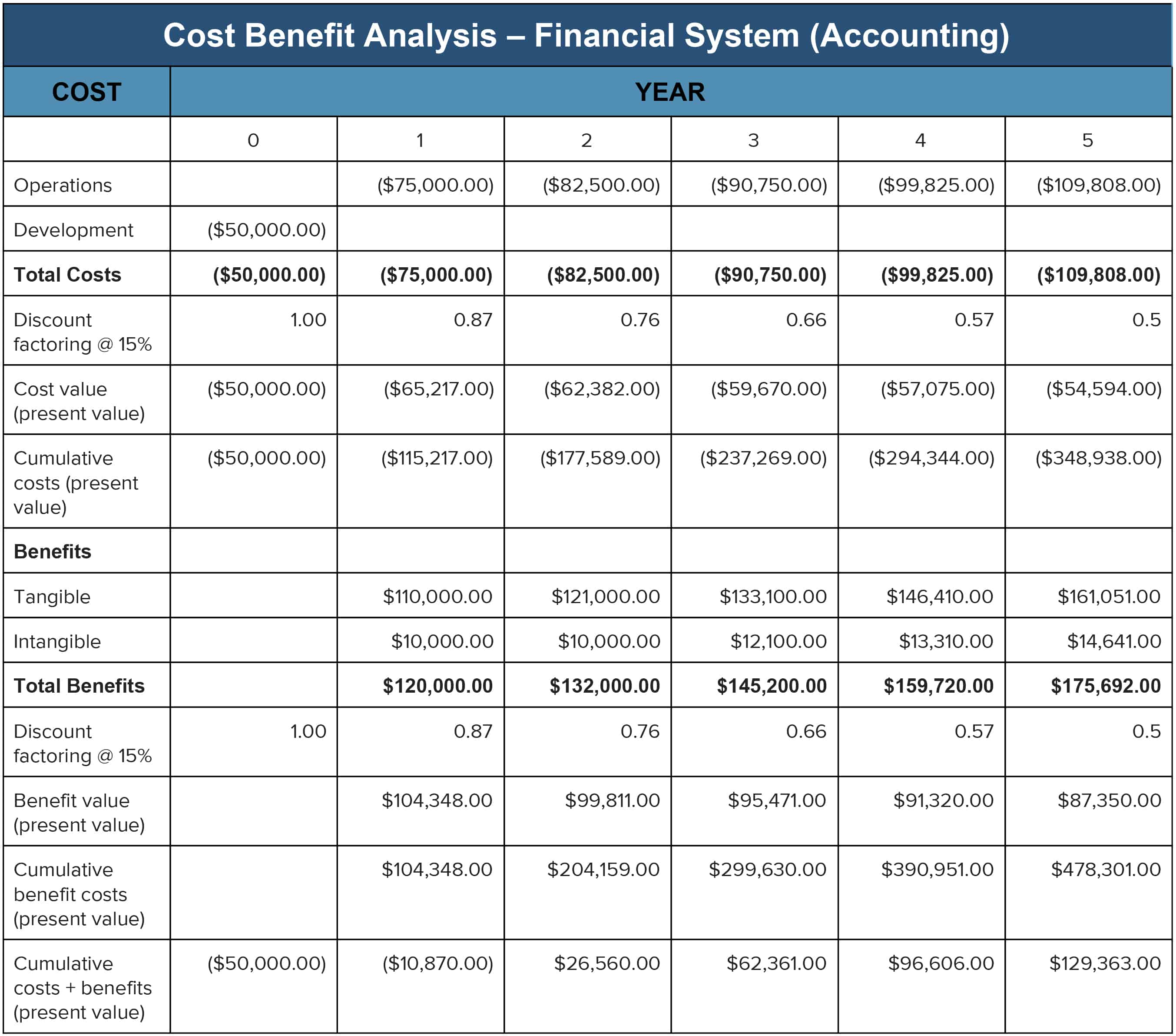

Compare Aggregate Costs and Benefits

Here we’ll determine net present values by subtracting costs from benefits, and project the timeframe required for benefits to repay costs, also known as return on investment (ROI). Example:

The process doesn’t end there. In certain situations, it’s important to address any serious concerns that could impact feasibility from a legal or social justice standpoint. In cases like these, it can be helpful to incorporate a “with/without” comparison to identify areas of potential concern. With/Without Comparison The impact of an initiative can be brought into sharp focus through a basic “with/without” comparison. In other words, this is where we look at what the impact would be—on organizations, stakeholders, or users—both with, and without, this initiative. Thayer Watkins, who taught a course on cost benefit analysis during his 30-year career as a professor in the San Jose State University Department of Economics, offers this example of a “with/without” comparison: “The impact of a project is the difference between what the situation in the study area would be with and without the project. So that when a project is being evaluated the analysis must estimate not only what the situation would be with the project but also what it would be without the project. For example, in determining the impact of a fixed guideway rapid transit system such as the Bay Area Rapid Transit (BART) in the San Francisco Bay Area the number of rides that would have been taken on an expansion of the bus system should be deducted from the rides provided by BART and likewise the additional costs of such an expanded bus system would be deducted from the costs of BART. In other words, the alternative to the project must be explicitly specified and considered in the evaluation of the project.” TIP: Never confuse with/without with a before-and-after comparison.

3 Steps for Analyzing the Results and Make a Recommendation

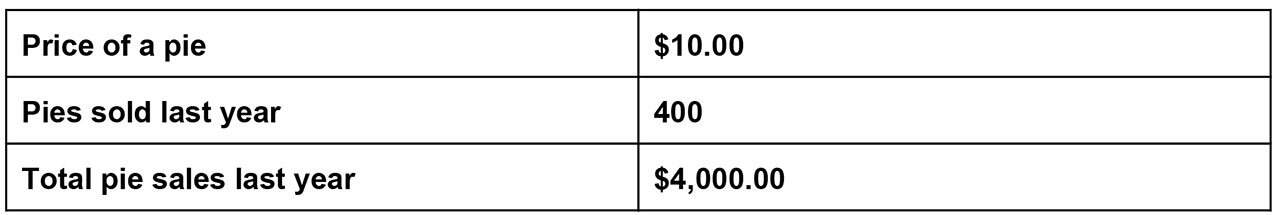

In the home stretch of the cost benefit analysis, you’ll be looking at the results of your work and forming the basis to make your decision. 1. Perform Sensitivity Analysis Dr. Kaplan recommends performing a sensitivity analysis (also known as a “what-if”) to predict outcomes and check accuracy in the face of a collection of variables. “Information on costs, benefits, and risks is rarely known with certainty, especially when one looks to the future,” Dr. Kaplan says. “This makes it essential that sensitivity analysis is carried out, testing the robustness of the CBA result to changes in some of the key numbers.” EXAMPLE of Sensitivity Analysis In trying to understand how customer traffic impacts sales in Bob’s Pie Shop, in which sales are a function of both price and volume of transactions, let’s look at some sales figures:

Bob has determined that a 10% increase in store traffic will boost his pie sales by 5%. This allows Bob to build the following sensitivity analysis, based upon his sales of 400 pies last year, that demonstrates that his pie sales are significantly impacted by fluctuations or growth in store traffic:

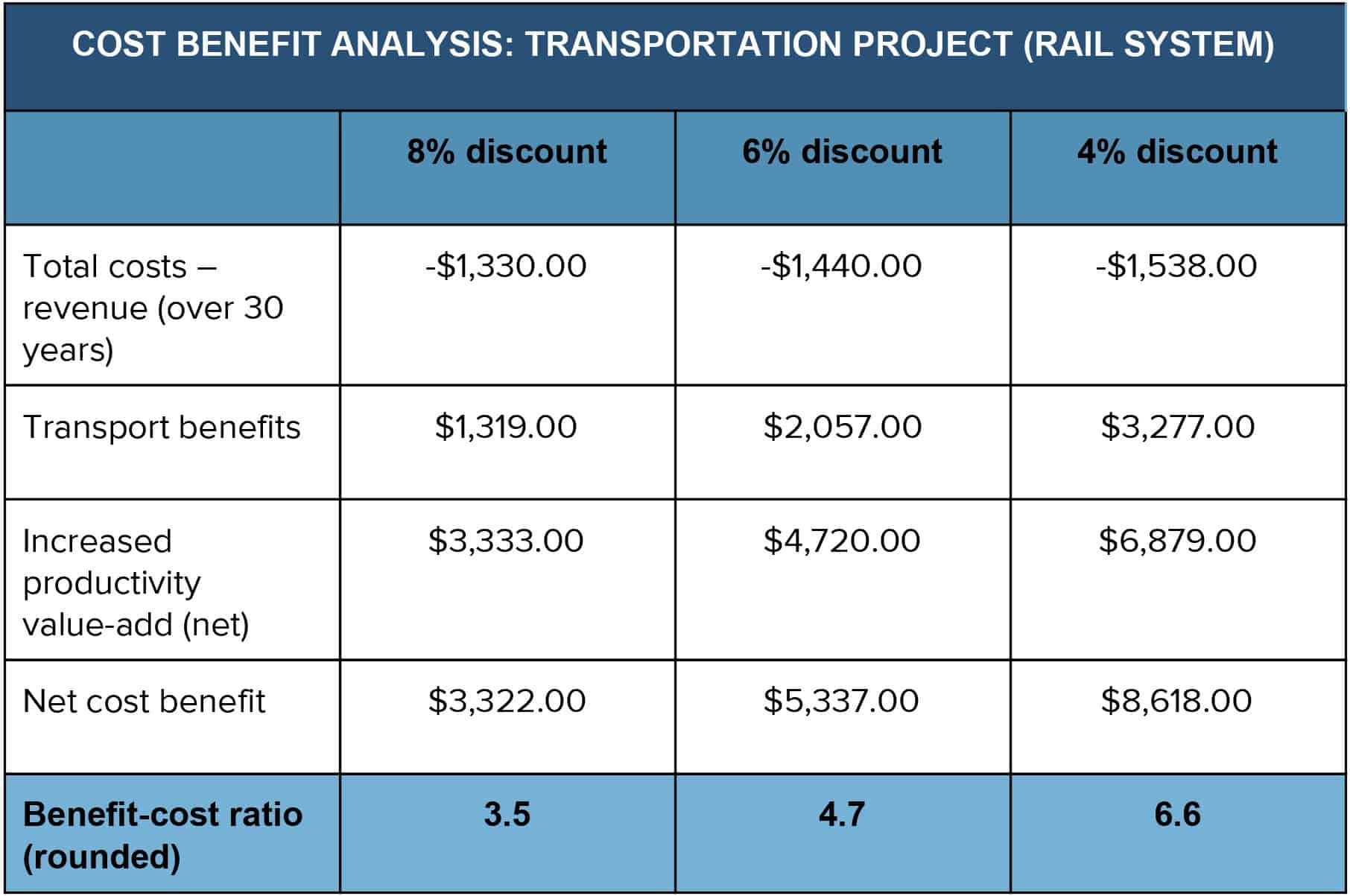

2. Consider Discount Rates When evaluating your findings, it’s important to take discount rates into consideration when determining project feasibility.

- Social discount rates – Used to determine the value to funds spent on government projects (education, transportation, etc.)

- Hurdle rates – The minimum return on investment required by investors or stakeholders

- Annual effective discount rates – Based on a percentage of the end-of-year balance, the amount of interest paid or earned

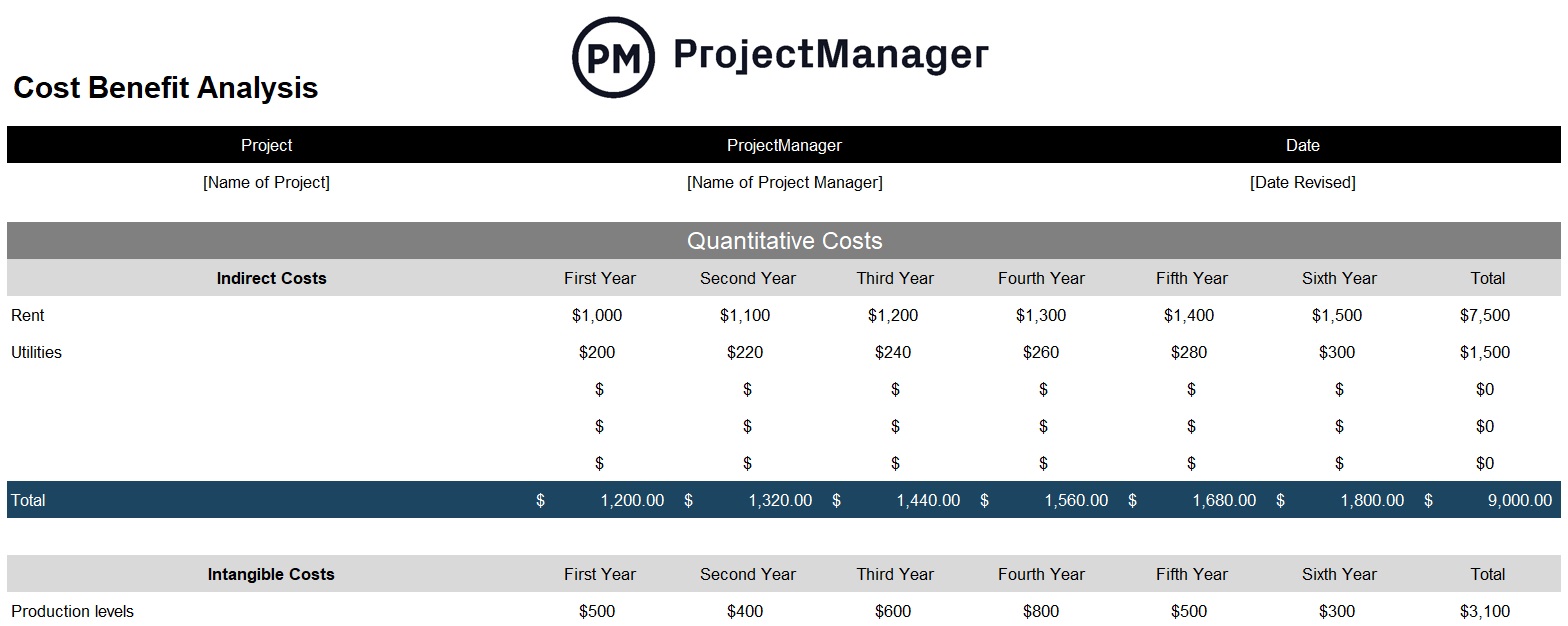

Here is a template where you can make your Cost Benefit Analysis

Download Simple Cost Benefit Analysis Template

Microsoft Excel | Smartsheet

3. Use Discount Rates to Determine Course of Action After determining the appropriate discount rate, look at the change in results as you both increase and decrease the rate:

- Positive - If both increasing and decreasing the rate yields a positive result, the policy or initiative is financially viable.

- Negative - If both increasing and decreasing the rate yields a negative result, revisit your calculations based upon adjusting to a zero-balance point, and evaluate using the new findings.

Based upon these results, you will now be able to make a clear recommendation, grounded in realistic data projections.

The Risks and Uncertainties of Cost Benefit Analysis

Despite its usefulness, cost benefit analysis has several associated risks and uncertainties that are important to note. These risks and uncertainties can result from human agendas, inaccuracies around data utilized, and the use of heuristics to reach conclusions. Know the Risks Much of the risk involved with cost benefit analysis can be correlated to the human elements involved. Stakeholders or interested parties may try to influence results by over- or understating costs. In some cases, supporters of a project may insert a personal or organizational bias into the analysis. On the data side, there can be a tendency to rely too much on data compiled from previous projects. This may inadvertently yield results that don’t directly apply to the situation being considered. Since data leveraged from an earlier analysis may not directly apply to the circumstances at hand, this may yield results that are not consistent with the requirements of the situation being considered. Using heuristics to assess the dollar value of intangibles may provide quick, “ballpark-type” information, but it can also result in errors that produce an inaccurate picture of costs that can invalidate findings. In addressing risk, it’s sometimes helpful to utilize probability theory to identify and examine key patterns that can influence the outcome. Uncertainties There are several “wild-card” issues that can influence the results of any cost benefit analysis, and while they won’t apply in every situation, it’s important to keep them in mind as you work:

- Accuracy affects value – Inaccurate cost and benefit information can diminish findings around value.

- Don’t rely on intuition – Always research benefits and costs thoroughly to gather concrete data—regardless of your level of expertise with the subject at hand.

- Cash is unpredictable – Revenue and cash flow are moving targets, experiencing peaks and valleys, and translating them into meaningful data for analysis can be challenging.

- Income influences decisions – Income level can drive a customer’s ability or willingness to make purchases.

- Money isn’t everything – Some benefits cannot be directly reflected in dollar amounts.

- Value is subjective – The value of intangibles can always be subject to interpretation.

- Don’t automatically double up – When measuring a project in multiple ways, be mindful that doubling benefits or costs can results in inconsistent results.

Controversial Aspects When thinking about the most controversial aspects of cost benefit analysis, all paths seem to lead to intangibles. Concepts and things that are difficult to quantify, such as human life, brand equity, the environment, and customer loyalty can be difficult to map directly to costs or value. With respect to intangibles, Dr. Kaplan suggests that using the cost benefit analysis process to drive more critical thinking around all aspects of value—perceived and concrete—can be beneficial outcomes. “[Cost benefit analysis] assumes that a monetary value can be placed on all the costs and benefits of a program, including tangible and intangible returns. ...As such, a major advantage of cost-benefit analysis lies in forcing people to explicitly and systematically consider the various factors which should influence strategic choice,” he says.

Cost Benefit Analysis in the Real World

Extending Transport Options in Seattle

Originally built for the 1962 World’s Fair, the Seattle monorail runs between the Seattle Center and the city’s downtown area. Several times over the past 50+ years, the city has considered extending monorail service to key areas in order to provide more transport options for residents. The following is an excerpt from a cost benefit analysis performed by DJM Consulting and ECONorthwest on behalf of the Elevated Transportation Company to assess an expansion project. Costs The estimated costs for constructing and operating the monorail are $1.68 billion (in 2002 dollars). This includes a total capital cost of $1.26 billion and a total discounted stream of operating costs of $420 million (at approximately $29 million a year), using the same discount rate (7.95%). Operating costs were discounted over a span of 22 years, from 2008 through 2029. Benefits

Benefit type Benefit value (millions, 2002$) Value of travel time savings $77.1 Parking savings 28.7 Reduced auto operating/ownership costs 11.2 Reliability 7.7 Road capacity for drivers 4.6 Reduction in bus-related accidents 3.7 Reduction in auto-related accidents 2.6 2020 Benefits $135.6

Benefits accrue for 23 years from 2007 through 2029. A discount rate of 7.95% was used to estimate the total benefits, in 2002 dollars. The net benefits were evaluated to be $2,067,263,000. Analysis

- Net present value B-C = $390,164,000

- Benefit-cost ratio B/C = 1.23

- Nominal rate of return = 7.95%

Sensitivity Analysis A team of outside engineers and contractors determined that there is a 60% chance the monorail project would come in at or under budget and a 90% chance the project will come in under 1.15 times the budget. The travel demand forecasters included a 10% range around their estimate of future monorail ridership. For the case where the costs are low and the benefits are high, a 9.9% return is expected. For the case where the costs are higher than expected and the benefits are lower, a 5.2% return is expected. Read the full analysis here . Solid Waste Reduction in California California's Department of Resources Recycling and Recovery’s mission is to help state residents achieve the highest waste reduction, recycling and reuse goals in the U.S. The following is an excerpt from a cost benefit analysis performed in 1997 to compare the costs of Cardiovascular Group’s (CVG) solid waste reduction program to its economic benefits. Costs According to the Environmental Manager, one employee spends eight hours per day on recycling duties. This employee is paid an average of $5.50 per hour. The Environmental Manager spends an estimated 5% of his time ($100,000/per year compensation) directing the solid waste reduction program. Utilizing this cost data, the calculations below demonstrate that CVG spent an estimated $16,440 in 1997 on its solid waste reduction program: (1 Employee) X ($5.50/hr.) X (8 hrs./day) X (260 work days/year) = $11,440 per year + 5%(100,000) = $16,440 per year Benefits 1995 Disposal cost reductions (1989 Baseline disposal costs – 1995 disposal costs) = $99,190 - $26,800 = $72,390 1996 Disposal cost reductions (1989 Baseline disposal costs – 1996 disposal costs) = $99,190 - $33,850 = $65,340 Average Annual Disposal Cost Reduction (DCR) (1995 DCR + 1996 DCR)/ 2 = ($72,390 + $65,340)/2 = $68,865 Analysis

- Nominal Rate of Return = 7.95%

From these data, it is clear that CVG has benefited economically from its solid waste reduction programs. Average annual costs amounted to $16,440 per year, while benefits equaled $1,308,865 per year. Therefore, net savings from CVG’s solid waste reduction program amounted to $1,292,425 per year.

Discover a Better Way to Manage Your Finance Operations

Befähigen Sie Ihr Team, über sich selbst hinauszuwachsen – mit einer flexiblen Plattform, die auf seine Bedürfnisse zugeschnitten ist und sich anpasst, wenn sich die Bedürfnisse ändern. Mit der Plattform von Smartsheet ist es einfach, Arbeiten von überall zu planen, zu erfassen, zu verwalten und darüber zu berichten. So helfen Sie Ihrem Team, effektiver zu sein und mehr zu schaffen. Sie können über die Schlüsselmetriken Bericht erstatten und erhalten Echtzeit-Einblicke in laufende Arbeiten durch Rollup-Berichte, Dashboards und automatisierte Workflows, mit denen Ihr Team stets miteinander verbunden und informiert ist. Es ist erstaunlich, wie viel mehr Teams in der gleichen Zeit erledigen können, wenn sie ein klares Bild von der geleisteten Arbeit haben. Testen Sie Smartsheet gleich heute kostenlos.

Discover why over 90% of Fortune 100 companies trust Smartsheet to get work done.

- PRO Courses Guides New Tech Help Pro Expert Videos About wikiHow Pro Upgrade Sign In

- EDIT Edit this Article

- EXPLORE Tech Help Pro About Us Random Article Quizzes Request a New Article Community Dashboard This Or That Game Popular Categories Arts and Entertainment Artwork Books Movies Computers and Electronics Computers Phone Skills Technology Hacks Health Men's Health Mental Health Women's Health Relationships Dating Love Relationship Issues Hobbies and Crafts Crafts Drawing Games Education & Communication Communication Skills Personal Development Studying Personal Care and Style Fashion Hair Care Personal Hygiene Youth Personal Care School Stuff Dating All Categories Arts and Entertainment Finance and Business Home and Garden Relationship Quizzes Cars & Other Vehicles Food and Entertaining Personal Care and Style Sports and Fitness Computers and Electronics Health Pets and Animals Travel Education & Communication Hobbies and Crafts Philosophy and Religion Work World Family Life Holidays and Traditions Relationships Youth

- Browse Articles

- Learn Something New

- Quizzes Hot

- This Or That Game

- Train Your Brain

- Explore More

- Support wikiHow

- About wikiHow

- Log in / Sign up

- Finance and Business

- Running a Business

- Business Finances

How to Do a Cost Analysis

Last Updated: October 8, 2023 Approved

This article was co-authored by Dave Labowitz and by wikiHow staff writer, Jennifer Mueller, JD . Dave Labowitz is a Business Coach who helps pre-entrepreneurs, solopreneurs/entrepreneurs, and team leaders start, scale, and lead their businesses and teams. Before beginning his coaching career, Dave was a startup executive who spent over a decade building high-growth companies. Dave’s “path less traveled” life includes adventures such as dropping out of high school, co-authoring a book in the Smithsonian Institute, and getting his MBA at Pepperdine’s Graziadio Business School. There are 9 references cited in this article, which can be found at the bottom of the page. wikiHow marks an article as reader-approved once it receives enough positive feedback. This article has 22 testimonials from our readers, earning it our reader-approved status. This article has been viewed 744,732 times.

Cost analysis is one of four types of economic evaluation (the other three being cost-benefit analysis, cost-effectiveness analysis, and cost-utility analysis). Conducting a cost analysis, as the name implies, focuses on the costs of implementing a program without regard to the ultimate outcome. A cost analysis is an important first step before you engage in other types of economic evaluation to determine the suitability or feasibility of a potential project. [1] X Trustworthy Source Centers for Disease Control and Prevention Main public health institute for the US, run by the Dept. of Health and Human Services Go to source

Defining Your Purpose and Scope

- Programs that overlap to a significant degree may be lumped together, rather than evaluated separately. Go with what makes the most sense for the operations of your organization, avoiding duplication of efforts wherever possible.

- To determine whether programs should be separated, look at the services offered by each program, the resources needed to provide those services, and who those services are provided to. If two programs are the same in 2 out of 3 of those dimensions, they probably should be treated as one for the purposes of cost analysis.

- For example, if you're trying to decide whether to charge for a specific service, you would first determine how much that service costs you to provide. You would then do a longer term cost analysis to determine whether your organization can sustain a loss for providing that service.

- It's generally best to choose a time period for which you can acquire accurate revenue data, rather than estimates. This will help if you plan to use your cost analysis as a basis for further economic evaluation. [4] X Research source

- If you are conducting a cost analysis merely to set a budget or plan strategically for the future, you would typically conduct a cost analysis that extended organization-wide.

- On the other hand, a narrower or more specific purpose, such as determining whether to bill for a particular service (and how much), might require a narrower cost analysis that only addressed the costs of that particular service.

- For example, you may be interested in the cost to your clients of offering a particular service. You would look at costs from their perspective, taking into account the amount you bill (or plan to bill) for the service, transportation to your location, and other costs.

- If you're simply looking at the cost of the program to your organization, you'll look at your organizational expenses generally. You might also look at opportunity costs, such as whether offering one program means you will be unable to offer other programs.

Categorizing Costs

- You might also look at cost analyses conducted by similar organizations implementing similar programs or providing similar services.

- Direct costs are specific to the program or service you're evaluating in your cost analysis – they are not shared with any other programs.

- Overhead costs, such as utilities or rent, may be a direct cost if the program or service has its own location.

- Ultimately, when you calculate the costs of an individual program or service, you'll need to allocate these indirect costs

- Standard categories may include personnel costs, operational costs, and start-up costs. Within each category, identify which costs are direct and which are indirect.

Calculating Costs

- Use actual cost information as much as possible. It will increase the utility and reliability of your ultimate cost analysis. [11] X Trustworthy Source Centers for Disease Control and Prevention Main public health institute for the US, run by the Dept. of Health and Human Services Go to source

- For estimates, seek out reliable sources that can be applied as narrowly as possible. For example, if you need to estimate pay, use average rates for employees locally, not nationally.

- If you're doing a longer term cost analysis, compute direct costs first on a weekly or monthly basis, and then extend them out.

- When computing personnel costs, be sure to include the cost (or value) of any benefits offered to employees working on the program.

- For example, suppose you're allocating the salary of the director of human resources. Since they are responsible for personnel, it makes sense to divide their salary by the number of people on staff. If you have 10 employees total, 2 of whom are dedicated to the program or service you're evaluating, you can allocate 20 percent of the director's salary to the program for the purposes of your cost analysis.

- Calculating depreciation can be a complicated endeavor. If you don't have experience doing it, consider hiring an accountant. [14] X Research source

- For example, if you're doing the cost analysis of a program for a non-profit, hidden costs might include the estimated value of volunteer hours, donated materials, or donated space.

- Hidden costs might also include opportunity costs. For example, launching one program may affect your organization's ability to offer other programs.

- At a minimum, your cost analysis should provide your organization with the true cost of running a program or providing a particular service.

- Your cost analysis may also raise additional questions, indicating further analysis is necessary before an ultimate decision can be made.

Community Q&A

You Might Also Like

- ↑ https://www.cdc.gov/dhdsp/pubs/docs/CB_January_2013.pdf

- ↑ https://www.bridgespan.org/insights/library/pay-what-it-takes/nonprofit-cost-analysis-introduction

- ↑ https://www.universalclass.com/articles/business/basic-methods-and-calculations-of-financial-and-cost-analysis.htm

- ↑ https://www.bridgespan.org/insights/library/pay-what-it-takes/nonprofit-cost-analysis-introduction/step-3-allocate-indirect-costs

- ↑ https://www.bridgespan.org/insights/library/pay-what-it-takes/nonprofit-cost-analysis-introduction/step-4-allocate-indirect-costs

- ↑ https://www.bridgespan.org/insights/library/pay-what-it-takes/nonprofit-cost-analysis-introduction/step-2-gather-financial-data

- ↑ https://2012-2017.usaid.gov/sites/default/files/documents/1868/300mad.pdf

- ↑ https://www.investopedia.com/ask/answers/021815/what-are-different-ways-calculate-depreciation.asp

- ↑ https://www.bridgespan.org/insights/library/pay-what-it-takes/nonprofit-cost-analysis-introduction/step-6-apply-this-knowledge

About This Article

To do a cost analysis, start by calculating the direct costs for your program, which include things like salaries, supplies, and materials. If you're doing a long-term cost analysis, break the costs up into weeks or months. Next, calculate the indirect costs, which are costs that are shared across multiple programs or services. You'll also want to include the depreciation of your company's assets that will be used, as well as any hidden costs that may appear. To learn how to calculate direct and indirect costs, keep reading! Did this summary help you? Yes No

- Send fan mail to authors

Reader Success Stories

Rashid kawawa A.

Jul 18, 2023

Did this article help you?

Jul 2, 2019

Monica Grigor

Sep 19, 2016

Sam McElroy

Jun 6, 2016

Michelle Stone

Aug 31, 2016

Featured Articles

Trending Articles

Watch Articles

- Terms of Use

- Privacy Policy

- Do Not Sell or Share My Info

- Not Selling Info

Get all the best how-tos!

Sign up for wikiHow's weekly email newsletter

- Contact sales

Start free trial

Cost-Benefit Analysis: A Quick Guide with Examples and Templates

When managing a project, many key decisions are required. Project managers strive to control costs while getting the highest return on investment and other benefits for their business or organization. A cost-benefit analysis (CBA) is just what they need to help them do that. Before we explain how to do a cost-benefit analysis, let’s briefly define what it is.

What Is a Cost-Benefit Analysis?

A cost-benefit analysis (CBA) is a process that’s used to estimate the costs and benefits of projects or investments to determine their profitability for an organization. A CBA is a versatile method that’s often used for business administration, project management and public policy decisions. An effective CBA evaluates the following costs and benefits:

- Direct costs

- Indirect costs

- Intangible costs

- Opportunity costs

- Costs of potential risks

- Total benefits

- Net benefits

These project costs and benefits are then assigned a monetary value and used to determine the cost-benefit ratio. However, a cost-benefit analysis might also involve other calculations such as return on investment (ROI), internal rate of return (IRR), net present value (NPV) and the payback period (PBP).

The Purpose of Cost-Benefit Analysis

The purpose of cost-benefit analysis is to have a systemic approach to figure out the pluses and minuses of various business or project proposals. The cost-benefit analysis gives you options and offers the best project budgeting approach to achieve your goal while saving on investment costs.

Get your free

Cost Benefit Analysis Template

Use this free Cost Benefit Analysis Template for Excel to manage your projects better.

When to Do a Cost-Benefit Analysis

Cost-benefit analysis is a technique that helps decision-makers choose the best investment opportunities in different scenarios. Here are some of the most common applications for a cost-benefit analysis in project management.

Cost Benefit Analysis & Feasibility Studies

A feasibility study determines whether a project or business initiative is feasible by determining whether it meets technical, economic, legal and market criteria.

Cost Benefit Analysis & Business Requirements Documents

A cost-benefit analysis should be included in a business requirements document , a document that explains what a project entails and what it requires for its successful completion.

Cost Benefit Analysis & Government Projects

Government projects also require conducting a cost-benefit analysis. However, in these types of projects, decision-makers must not only focus on financial gain, but rather think about the impact projects have on the communities and external stakeholders who might benefit from them.

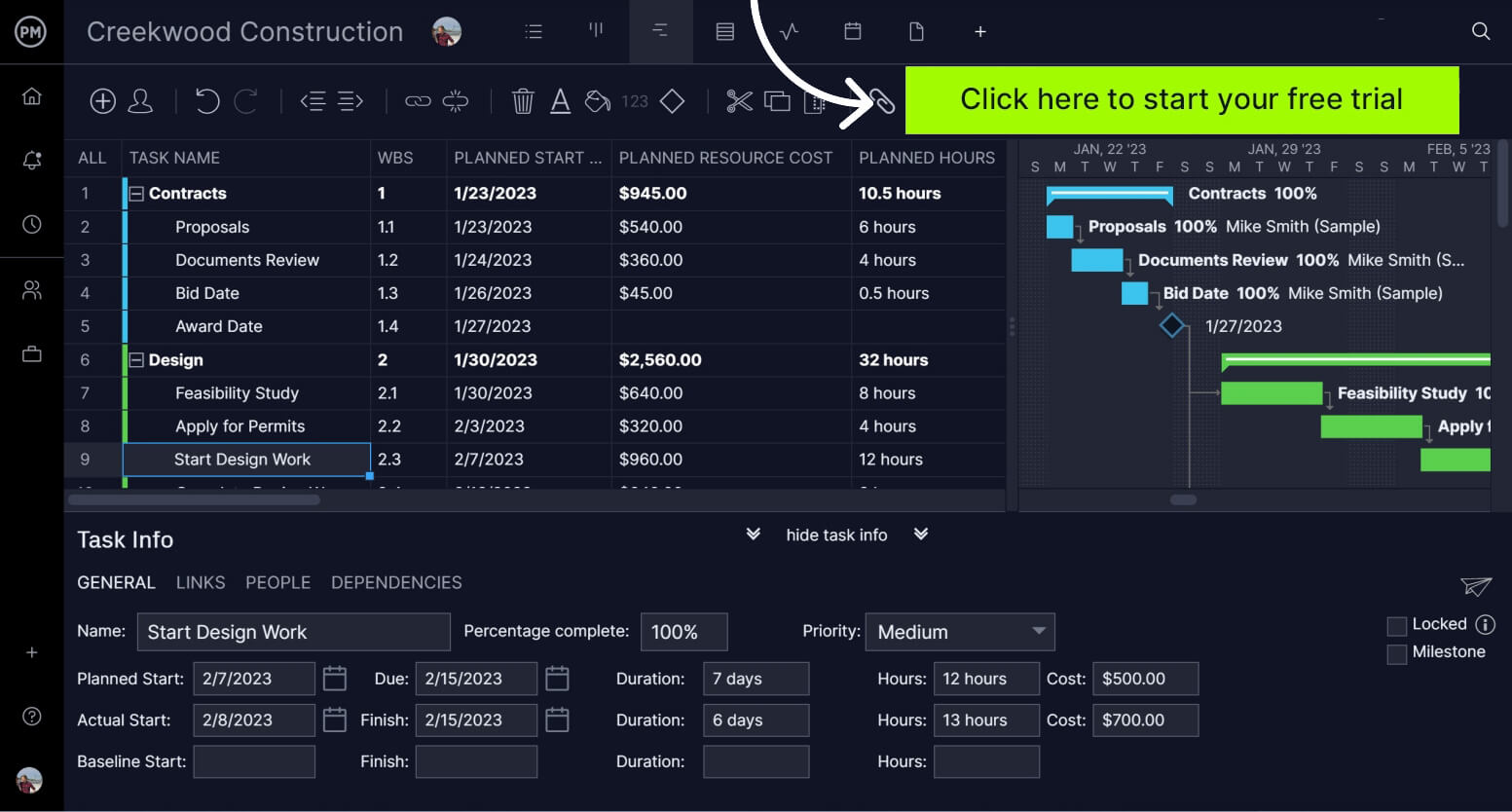

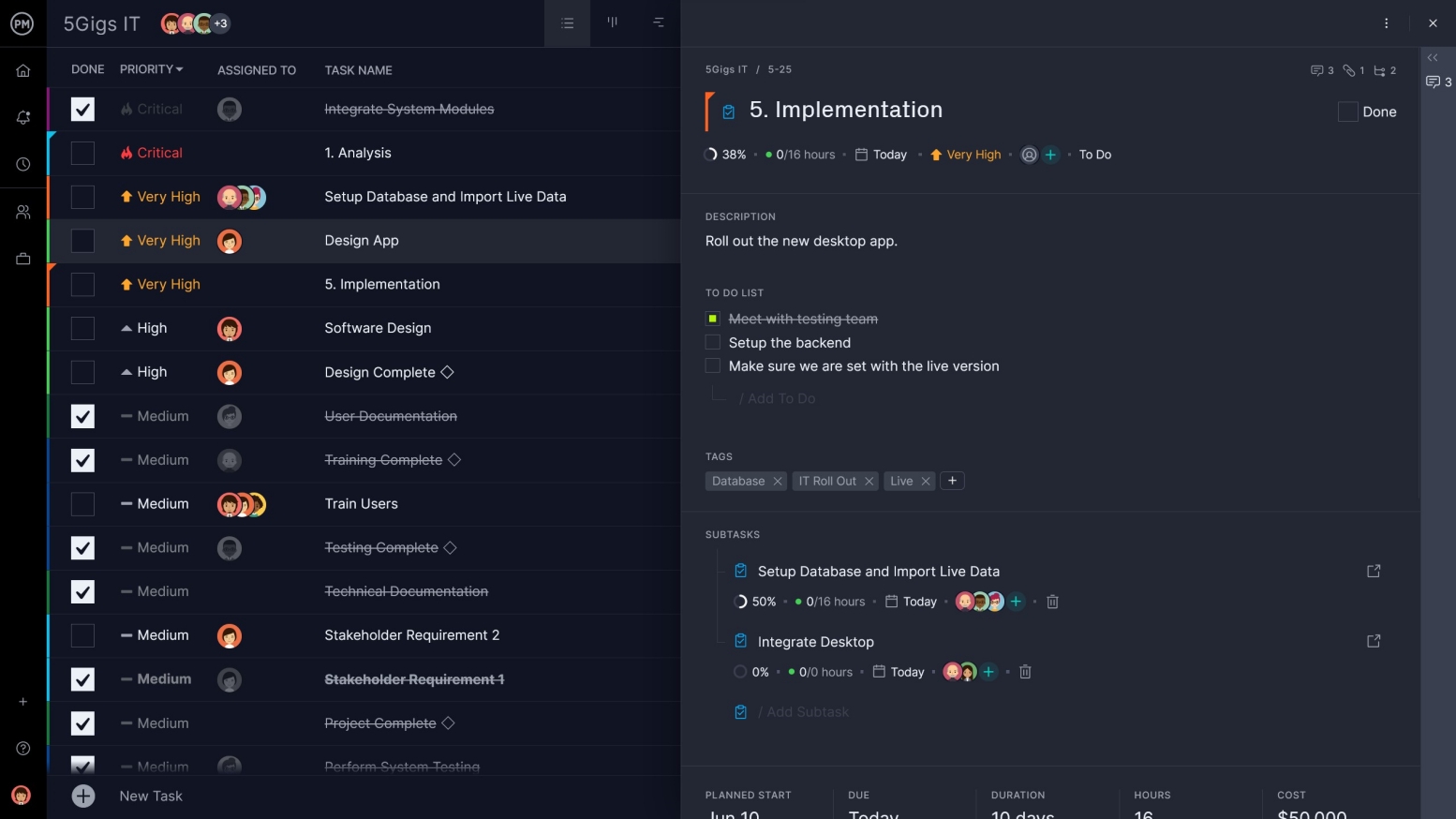

Keeping track of project costs is easier with project management software. For example, ProjectManager has a sheet view, which is exactly like a Gantt but without a visual timeline. You can switch back and forth from the Gantt to the sheet view when you want to just look at your costs in a spreadsheet. You can add as many columns as you like and filter the sheet to capture only the relevant data. Keeping track of your costs and benefits is what makes a successful project. Get started for free today.

How to Do a Cost-Benefit Analysis

According to the Economist , CBA has been around for a long time. In 1772, Benjamin Franklin wrote of its use. But the concept of CBA as we know it dates to Jules Dupuit, a French engineer, who outlined the process in an article in 1848.

Since then, the CBA process has greatly evolved. Let’s go through this checklist to learn how to do a basic cost-benefit analysis using the cost-benefit ratio and present value formulas:

1. What Are the Project Goals and Objectives?

Create a business case for your project and state its goals and objectives.

2. Review Historical Data

Before you can know if a project proposal might be valuable, you need to compare it to similar past projects to see which is the best path forward. Check their success metrics such as their return on investment, internal rate of return, payback period and benefit-cost ratio.

3. Who Are the Stakeholders?

List all stakeholders in the project. They’re the ones affected by the costs and benefits. Describe which of them are decision-makers.

4. What Are the Project Costs and Benefits?

Estimate the future value of your project costs and benefits and think about all the non-financial benefits that a project proposal might bring

The process can be greatly improved with project management software. ProjectManager has one-click reporting that lets you can create eight different project reports. Get data on project status, variance and more. Reports can be easily shared as PDFs or printed out for stakeholders. Filter any report to display only the data you need at the time.

5. Define a Project Timeframe

Look over the costs and benefits of the project, assign them a monetary value and map them over a relevant time period. It’s important to understand that the cost-benefit ratio formula factors in the number of periods in which the project is expected to generate benefits.

6. What Is the Rate of Return?

As explained above, the rate of return is used to calculate the present values of your project’s costs and benefits, which are needed to find the cost-benefit ratio.

Free Cost-Benefit Analysis Template

Use this Excel template to put what you’ve learned into practice. This free cost-benefit analysis template helps you identify quanitative costs and benefits, as well as qualitative costs and benefits, so you can appreciate the full impact of your project. Download yours today.

What Is the Cost-Benefit Ratio?

The cost-benefit ratio, or benefit-cost ratio, is the mathematical relation between the costs and financial benefits of a project. The cost-benefit ratio compares the present value of the estimated costs and benefits of a project or investment.

Cost-Benefit Ratio Formula

This is a simplified version of the cost-benefit ratio formula.

Cost-Benefit Ratio= Sum of Present Value Benefits / Sum of Present Value Costs

Here’s how you should interpret the result of the cost-benefit ratio formula.

- If the result is less than 1: The benefit-cost ratio is negative, therefore the project isn’t a good investment as its expected costs exceed the benefits.

- If the result is greater than 1: The cost-benefit ratio is positive, which means the project will generate financial benefits for the organization and it’s a good investment. The larger the number, the most benefits it’ll generate.

Present Value Formula

The present value of a project’s benefits and costs is calculated with the present value formula (PV).

PV = FV/(1+r)^n

- FV: Future value

- r= Rate of return

- n= Number of periods

We’ll apply these formulas in the cost-benefit analysis example below. Our free cost-benefit analysis template can help you gather the information you need for the cost-benefit ratio analysis.

Cost-Benefit Analysis Example

Now let’s put the formulas reviewed above into practice. For our cost-benefit analysis example, we’ll think about a residential construction project, the renovation of an apartment complex. After using project cost estimation methods and evaluating past-project data, the apartment management company concludes that:

- The project costs are $65,000. They’re paid upfront, so it’s not necessary to calculate their present value

- The project is expected to generate $100,000 in profit for the next 3 years

- The rate of return based on inflation data is 2%

Next, we’ll need to calculate the present value of the benefits expected to be earned in the future using the present value formula:

PV= ($100,000 / (1 + 0.02)^1) + ($100,000 / (1 + 0.02)^2) + ($100,000 / (1 + 0.02)^3)=$288,000

Now we need to use this cost value to find the cost-benefit ratio. Here’s how it would be calculated in this case:

Cost-Benefit Ratio: 288,000/65,000= 4.43

Since we obtained a positive benefit-cost ratio, we can conclude that the project will be profitable for this company. This result implies that the project will generate about $4,43 dollars per each $1 spent to cover expenses .

This is a simple cost-benefit analysis that relies on the cost-benefit ratio to establish the profitability of this project. In other scenarios, you might also need to calculate the return on investment (ROI), internal rate of return (IRR), net present value (NPV) and the payback period (PBP). In addition, it’s advisable to conduct a sensitivity analysis to evaluate different scenarios and how those affect your cost-benefit analysis.

Capture all the costs and benefits with project management software. But unlike many apps with inferior to-do lists, ProjectManager has a list view that is dynamic. It adds priority and customized tags you can assign team members to own each item. Our online tool automatically tracks the percentage complete for each item in real time. All the data you collect in our list view is visible throughout the tool. Regardless of the view, they all update live and they’re ready for you to utilize.

How Accurate Is Cost-Benefit Analysis?

How accurate is CBA? The short answer is it’s as accurate as the data you put into the process. The more accurate your estimates, the more accurate your results.

Some inaccuracies are caused by the following:

- Relying too heavily on data collected from past projects, especially when those projects differ in function, size, etc., from the one you’re working on

- Using subjective impressions when you’re making your assessment

- Improperly using heuristics (problem-solving employing a practical method that is not guaranteed) to get the cost of intangibles

- Confirmation bias or only using data that backs up what you want to find

Cost-Benefit Analysis Limitations

Cost-benefit analysis is best suited to smaller to mid-sized projects that don’t take too long to complete. In these cases, the analysis can help decision-makers optimize the benefit-cost ratio of their projects.

However, large projects that go on for a long time can be problematic in terms of CBA. There are outside factors, such as inflation, interest rates, etc., that impact the accuracy of the analysis. In those cases, calculating the net present value, time value of money, discount rates and other metrics can be complicated for most project managers .

There are other methods that complement CBA in assessing larger projects, such as NPV and IRR. Overall, though, the use of CBA is a crucial step in determining if any project is worth pursuing.

Templates to Help With Your Cost-Benefit Analysis

As you work to calculate the cost-benefit analysis of your project, you can get help from some of the free project management templates we offer on our site. We have dozens of free templates that assist every phase of the project life cycle. For cost-benefit analysis, use these three.

RACI Matrix Template

One of the steps when executing a cost-benefit analysis includes identifying project stakeholders. You need to list those stakeholders, but our free RACI matrix template takes that one step further by outlining who needs to know what. RACI is an acronym for responsible, accountable, consulted and informed. By filling out this template, you’ll organize your team and stakeholders and keep everyone on the same page.

Project Budget Template

You can’t do a cost-benefit analysis without outlining all your expenses first. That’s where our free project budget template comes in. It helps you capture all the expenses related to your project from labor costs, consultant fees, the price of raw materials, software licenses and travel. There’s even space to capture other line items, such as telephone charges, rental space, office equipment, admin and insurance. A thorough budget makes for a more accurate cost analysis.

Project Risk Register Template

You have your stakeholders identified and your budget outlined, but there’s always the unknown to consider. You can’t leave that up to chance: you must manage risk, which is why our free project risk register is so essential. Use it to outline inherent project risks. There are places to list the description of the risk, its impact, the level of risk and who’s responsible for it. By maintaining a risk register, you can control the project variables and make a better cost-benefit analysis.

Make Any Project Profitable With ProjectManager

No matter how great your return on investment might be on paper, a lot of that value can evaporate with poor execution of your project. ProjectManager is award-winning project management software with the tools you need to realize the potential of your project. First, you need an airtight plan.

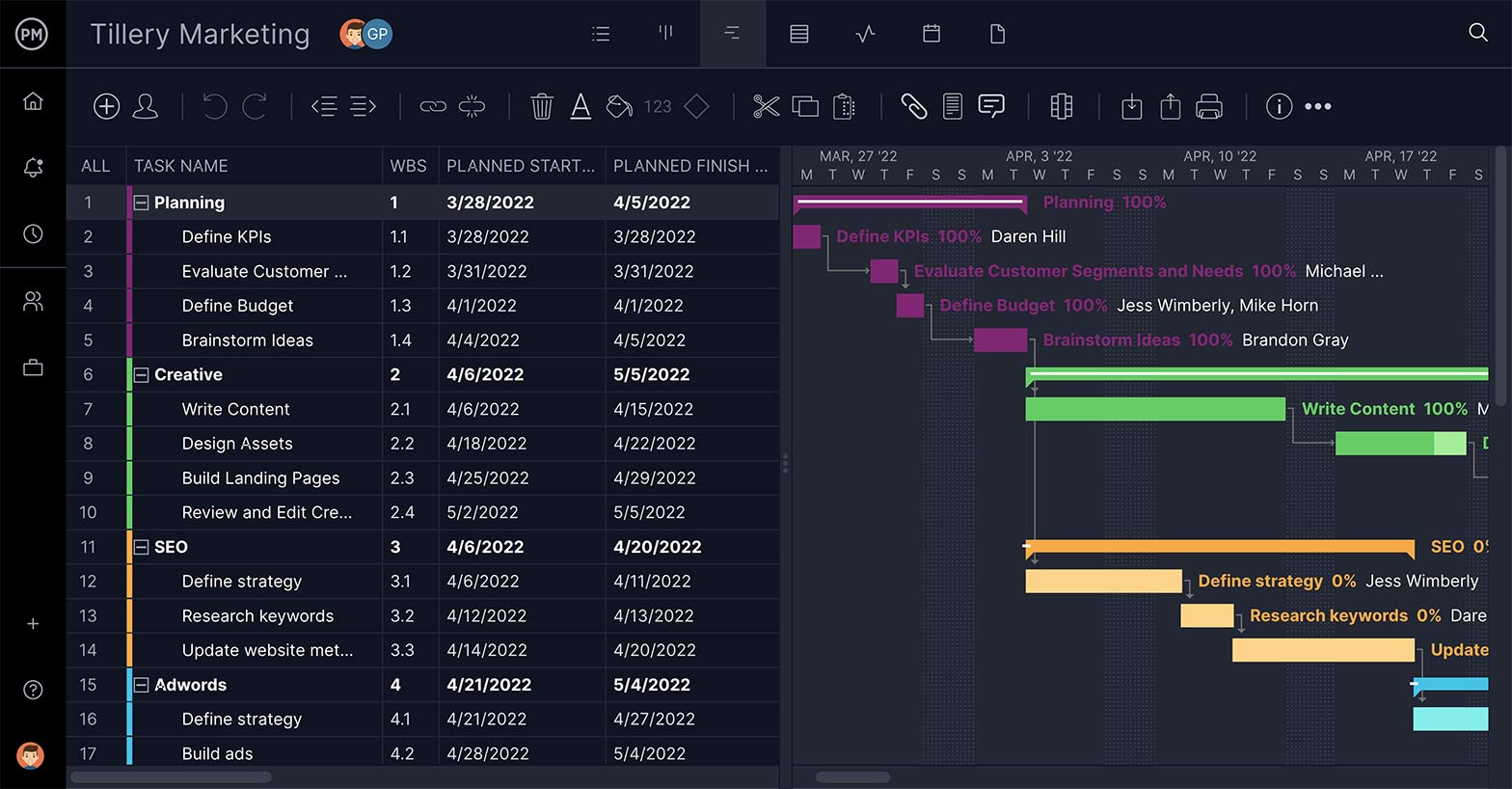

Planning on Gantt Charts

Our online Gantt charts have features to plan your projects and organize your tasks, so they lead to a successful final deliverable. If things change, and they will, the Gantt is easy to edit, so you can pivot quickly.

Resource Management Tools

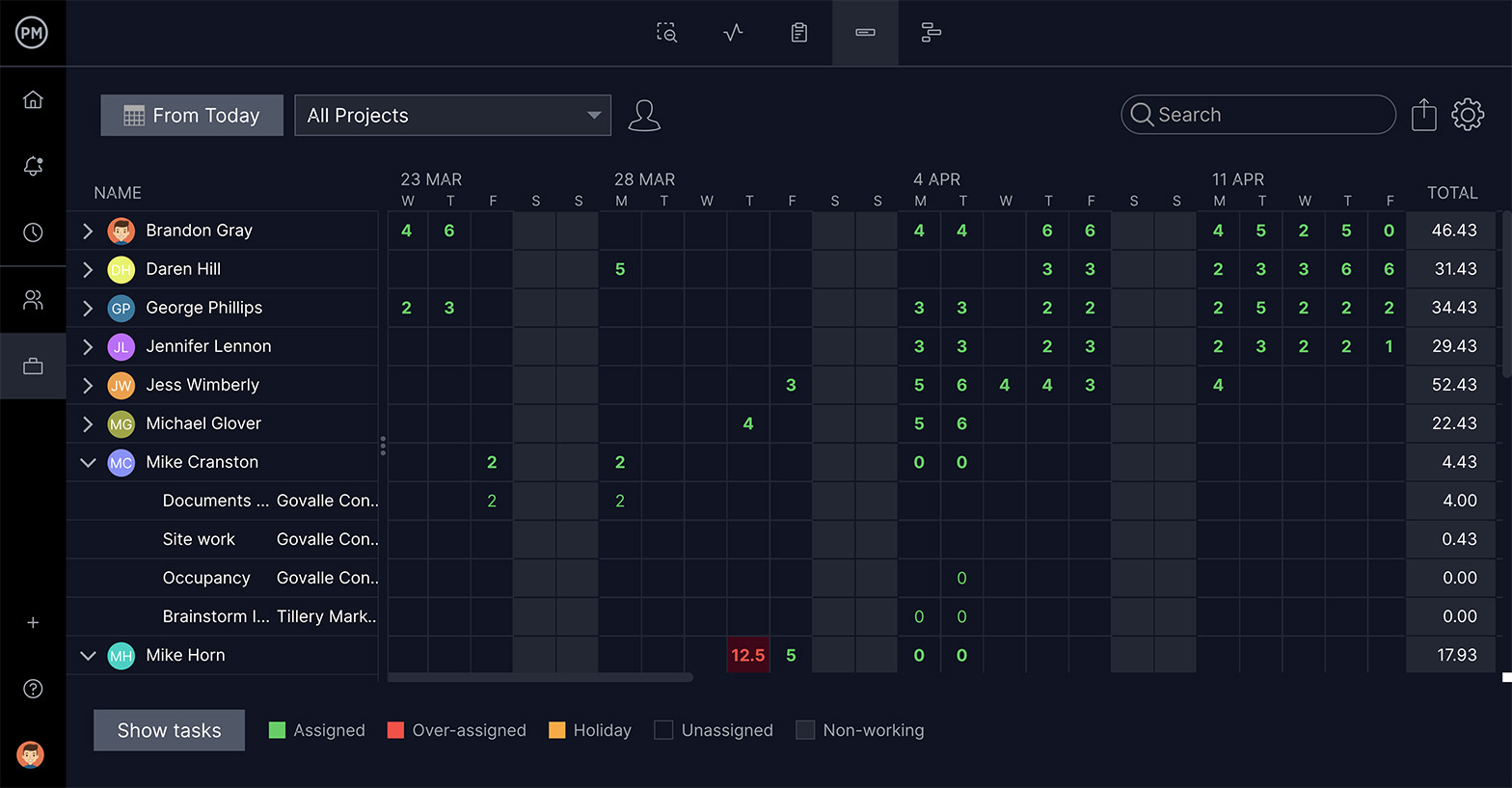

Another snag that can waylay a project is your resources. ProjectManager has resource management tools that track your materials, supplies and your most valuable resource: the project team. If they’re overworked, morale erodes and production suffers.

The workload page on ProjectManager is color-coded to show who is working on what and gives you the tools to reassign to keep the workload balanced and the team productive.

Real-Time Cost Tracking

The surest way to kill any project is for it to bleed money. ProjectManager lets you set a budget for your project from the start. This figure is then reflected in reports and in the charts and graphs of the real-time dashboard , so you’re always aware of how costs are impacting your project. ProjectManager has the features you need to lead your project to profitability.

Cost benefits analysis is a data-driven process and requires project management software robust enough to digest and distribute the information. ProjectManager is online project management software with tools, such as a real-time dashboard, that can collect, filter and share your results in easy-to-understand graphs and charts. Try it today with this free 30-day trial.

Deliver your projects on time and on budget

Start planning your projects.

10 Cost-Benefit Analysis Examples

Cost-benefit analysis refers to an assessment of the benefits of a particular course of action, weighed against the costs incurred.

This type of analysis is useful for identifying the best path forward among a range of possible options, each with their own pros and cons. It is most commonly used in economics.

Cost-benefit analysis has two main applications:

- Determining the soundness of a decision.

- Providing a basis for comparing alternative decisions (see: opportunity cost analysis ).

A simple example of a cost-benefit analysis would involve an investor weighing up whether to buy real estate or stocks. Each has its own strengths and weaknesses, and they would need to consider their own context to determine which has the greatest cost-benefit (i.e. benefits per dollar).

Definition of Cost Benefit Analysis

Cost-benefit analysis (or benefit-cost analysis) is a systematic approach to deciding between alternatives based on their costs and benefits.

It may be used to compare completed or potential courses of action. It is often used to evaluate business or policy decisions, economic transactions, project investments, and so on.

Cost-benefit analysis identifies and places monetary values on the costs of programs.

Furthermore, it requires weighing those costs against the monetary value of program benefits (Riegg Cellini & Edwin Kee, 2015).

Often, this is achieved through calculating the benefit-cost ratio of a particular course of action, calculated as follows:

Benefit-Cost Ratio (BCR) = Present Value of Expected Benefits / Present Value of Expected Costs

This formula helps to determine whether the benefits outweigh the costs. A BCR greater than 1 indicates that the project’s benefits are expected to be greater than its costs, and vice versa.

Cost-benefit analysis proceeds by a ten-step process (Boardman et al., 2011; Riegg Cellini & Edwin Kee, 2015):

- Analysis Framework Setting: Decide on the type of analysis to be undertaken, such as a cost-benefit analysis or a cost-effectiveness analysis.

- Stakeholder Identification: Recognize whose costs and benefits should be accounted for. Considerations include which stakeholders are affected and who should have standing in the program or policy.

- Costs and Benefits Categorization: Identify and categorize all costs and benefits associated with the program or policy.

- Lifetime Costs and Benefits Projection: Project how costs and benefits will evolve over the lifespan of the program, if applicable.

- Cost Monetization: Assign a monetary value to all or most costs to facilitate comparisons.

- Benefit Quantification: Quantify benefits in terms of monetary units. The goal is to assign a dollar value to every major output or benefit, taking into consideration varying beneficiary groups and program objectives.

- Discounting Costs and Benefits: Discount future costs and benefits to their present values to account for the time value of money.

- Net Present Value Calculation: Compute the net present value (NPV) which represents the difference between the present value of cash inflows and the present value of cash outflows.

- Sensitivity Analysis: Test the sensitivity of the analysis to specific assumptions, determining how different values of an independent variable impact the particular dependent variable under consideration.

- Recommendation Generation: Based on the results of the cost-benefit analysis, make a suitable recommendation. If the program has a positive net present value, especially after a worst-case sensitivity analysis, the policy should be implemented as it would increase social welfare. Conversely, a program with a negative net present value should be rejected (Riegg Cellini & Edwin Kee, 2015).

The concept of cost-benefit analysis and its fundamental formulas are quite simple, but actually carrying out a cost-benefit analysis can be extremely challenging.

10 Examples of Cost Benefit Analysis

1. investment decisions.

A company is trying to decide between two alternative investments, so it decides to conduct a cost-benefit analysis to compare the two.

- Total costs of the first alternative: $100,000

- Total benefits of the first alternative: $120,000

- Total costs of the second alternative: $150,000

- Total benefits of the second alternative: $200,000

The basic formula to use to decide between the two alternatives is the following:

Benefit-Cost Ratio = Expected Benefits / Total Costs

- Benefit-Cost Ratio of the first alternative: 120,000/100,000=6/5

- Benefit-Cost Ratio of the second alternative: 200,000/150,000=4/3

The Benefit-Cost Ratio of the second alternative is larger than that of the first, so the second investment will be more profitable for the company.

2. Real Estate Development Options

A construction company needs to compare two potential real estate development projects. The company doesn’t have the resources to engage in both, so it has to choose.

Each project has a different number of housing units that need to be constructed, how many of those will be sold and how many will be rented also differs. The rental prices, construction costs, sale prices, personnel costs, durations, and financing costs of each project also differ.

A cost-benefit analysis will have to take account of each relevant parameter to estimate how much each project will cost in total and how profitable each will be. The two projects can then be compared based on the cost-benefit ratio of each (Castle, 2018).

3. Weighing whether to Buy new Equipment

A company wants to decide whether to make a new equipment purchase. The company wants to know whether this new purchase might save money in the long term, so it conducts a cost-benefit analysis.

- Total costs of the new equipment: $100,000

- Annual benefits of the new equipment: $25,000

So the company will make a profit after the fourth year. The company then has to decide whether this is worth it.

4. Whether to Hire more Workers

A company decides to conduct a cost-benefit analysis of hiring 10 new workers.

- Total costs: $200,000

- Total benefits: $250,000

The company can generate an extra $50,000 each year, so they should go through with the decision and hire 10 new workers.

5. Public Infrastructure Decisions

A city council is deciding between building a new public park or a community center. A cost-benefit analysis is carried out for each option:

- Total costs of the public park: $500,000 Estimated societal benefits of the park (increased property value, improved health, etc.): $700,000

- Total costs of the community center: $750,000 Estimated societal benefits of the community center (education, community cohesion, etc.): $900,000

- Benefit-Cost Ratio of the public park: 700,000/500,000=7/5 Benefit-Cost Ratio of the community center: 900,000/750,000=6/5

The public park has a higher Benefit-Cost Ratio and could therefore be a more favorable option, despite the community center having higher absolute benefits.

6. Healthcare Investment

A hospital is considering investing in new MRI technology or in a specialized heart disease treatment program.

- Total costs of the MRI technology: $2,000,000 Estimated patient benefits of MRI technology: $2,500,000

- Total costs of the heart disease program: $1,500,000 Estimated patient benefits of heart disease program: $2,200,000

- Benefit-Cost Ratio of MRI technology: 2,500,000/2,000,000=5/4 Benefit-Cost Ratio of the heart disease program: 2,200,000/1,500,000=44/30

Despite the heart disease program having a lower absolute benefit, it has a higher Benefit-Cost Ratio and might be a better investment for the hospital.

7. Education Policy Choices

A school district is deciding between implementing a new online learning system or hiring additional teaching staff. A cost-benefit analysis helps in decision making:

- Total costs of online learning system: $300,000 Estimated benefits of online learning system (increased learning efficiency , accessibility, etc.): $450,000

- Total costs of hiring additional staff: $400,000 Estimated benefits of additional staff (improved student-teacher ratio, individual attention, etc.): $550,000

- Benefit-Cost Ratio of online learning system: 450,000/300,000=3/2 Benefit-Cost Ratio of additional staff: 550,000/400,000=11/8

Despite the additional staff providing higher absolute benefits, the online learning system has a higher Benefit-Cost Ratio, making it a more efficient investment.

8. Software Upgrade Decision

A tech company is weighing the costs and benefits of upgrading their existing software versus purchasing a new one.

- Total costs of upgrading existing software: $10,000 Estimated benefits of upgrading existing software: $20,000

- Total costs of purchasing new software: $25,000 Estimated benefits of new software: $40,000

- Benefit-Cost Ratio of upgrading existing software: 20,000/10,000=2/1 Benefit-Cost Ratio of new software: 40,000/25,000=8/5

Upgrading the existing software has a higher Benefit-Cost Ratio, indicating it might be a more cost-effective choice for the company.

9. Environmental Policy

A government is considering investing in a renewable energy project or continuing to support fossil fuel-based energy production. A cost-benefit analysis is needed:

- Total costs of renewable energy project: $1,000,000

- Estimated societal benefits of renewable energy (lower pollution, sustainability, etc.): $1,300,000

Total costs of fossil fuel support: $800,000 Estimated societal benefits of fossil fuel support (job retention, immediate energy supply): $900

10. Whether to add a New Service

A software company is planning to speed up its delivery dates. But doing so would require hiring three additional coders, which requires investments like buying new furniture, and computers, and leasing additional workspace (Castle, 2018).

- Assume that the yearly revenue is $100,000 but it will increase by 50% as the capacity increases.

- Assume that each coder earns $10 per hour.

A cost-benefit analysis will have to take the following costs and benefits into account:

- Rental cost per year: $15,000

- Furniture costs: $10,000

- Hiring costs per year: $23,040

- Hardware & software costs: $10,000

- Downtime costs: $10,000

- 10% annual revenue increase: $50,000

Summing up the costs, we can see that they amount to more than $68,000, so the costs of the project would be larger than their benefits.

Cost-Benefit Analysis vs Cost-Effectiveness Analysis

In economics, cost-benefit analysis is related to cost-effectiveness analysis:

- Cost-effectiveness analysis: this compares the relative costs and outcomes (instead of benefits) of different decisions. It aims to be more holistic.

- Cost-benefit analysis: this tends to assign a monetary value to a course of action to identify the best course to pursue (Bleichrodt & Quiggin, 1999).

Riegg Cellini and Edwin Kee (2015) define the two as follows:

“Cost-effectiveness analysis is a technique that relates the costs of a program to its key outcomes or benefits. Cost-benefit analysis takes that process one step further, attempting to compare costs with the dollar value of all (or most) of a program’s many benefits. These seemingly straightforward analyses can be applied anytime before, after, or during a program implementation, and they can greatly assist decision makers in assessing a program’s efficiency.

For a General List of Analysis Examples, See Here

Cost-benefit analysis is an essential part of doing business as it helps businesses to identify the most efficient and productive ways to dedicate resources and time in order to achieve optimal outcomes for both the company and the client. By calculating the benefit-cost ratio, we can directly compare two options.

However, it’s important to note that a cost-effectiveness analysis may provide a more holistic overview that considers outcomes (such as human impact) rather than just costs.

Bleichrodt, H., & Quiggin, J. (1999). Life-cycle preferences over consumption and health: When is cost-effectiveness analysis equivalent to cost–benefit analysis? Journal of Health Economics , 18 (6), 681–708. https://doi.org/10.1016/S0167-6296(99)00014-4

Boardman, A., Greenberg, D., Vining, A., & Weimer, D. (2011). Cost-Benefit Analysis: Concepts and Practice, 4th edition .

Castle, K. (2018, February 13). Cost Benefit Analysis Example and Steps (CBA Example). Projectcubicle . https://www.projectcubicle.com/cost-benefit-analysis-example/

Riegg Cellini, S., & Edwin Kee, J. (2015). Cost-Effectiveness and Cost-Benefit Analysis. In Handbook of Practical Program Evaluation (pp. 636–672). John Wiley & Sons, Ltd. https://doi.org/10.1002/9781119171386.ch24

Chris Drew (PhD)

Dr. Chris Drew is the founder of the Helpful Professor. He holds a PhD in education and has published over 20 articles in scholarly journals. He is the former editor of the Journal of Learning Development in Higher Education. [Image Descriptor: Photo of Chris]

- Chris Drew (PhD) https://helpfulprofessor.com/author/chris-drew-phd/ 15 Top Stakeholders in Education

- Chris Drew (PhD) https://helpfulprofessor.com/author/chris-drew-phd/ The Six Principles of Andragogy (Malcolm Knowles)

- Chris Drew (PhD) https://helpfulprofessor.com/author/chris-drew-phd/ What are Pedagogical Skills? - 15 Examples

- Chris Drew (PhD) https://helpfulprofessor.com/author/chris-drew-phd/ 44 Maslow’s Hierarchy of Needs Examples

Leave a Comment Cancel Reply

Your email address will not be published. Required fields are marked *

- school Campus Bookshelves

- menu_book Bookshelves

- perm_media Learning Objects

- login Login

- how_to_reg Request Instructor Account

- hub Instructor Commons

Margin Size

- Download Page (PDF)

- Download Full Book (PDF)

- Periodic Table

- Physics Constants

- Scientific Calculator

- Reference & Cite

- Tools expand_more

- Readability

selected template will load here

This action is not available.

10.12: Assignment- Cost Variance Analysis

- Last updated

- Save as PDF

- Page ID 45948

- Lumen Learning

\( \newcommand{\vecs}[1]{\overset { \scriptstyle \rightharpoonup} {\mathbf{#1}} } \)

\( \newcommand{\vecd}[1]{\overset{-\!-\!\rightharpoonup}{\vphantom{a}\smash {#1}}} \)

\( \newcommand{\id}{\mathrm{id}}\) \( \newcommand{\Span}{\mathrm{span}}\)

( \newcommand{\kernel}{\mathrm{null}\,}\) \( \newcommand{\range}{\mathrm{range}\,}\)

\( \newcommand{\RealPart}{\mathrm{Re}}\) \( \newcommand{\ImaginaryPart}{\mathrm{Im}}\)

\( \newcommand{\Argument}{\mathrm{Arg}}\) \( \newcommand{\norm}[1]{\| #1 \|}\)

\( \newcommand{\inner}[2]{\langle #1, #2 \rangle}\)

\( \newcommand{\Span}{\mathrm{span}}\)

\( \newcommand{\id}{\mathrm{id}}\)

\( \newcommand{\kernel}{\mathrm{null}\,}\)

\( \newcommand{\range}{\mathrm{range}\,}\)

\( \newcommand{\RealPart}{\mathrm{Re}}\)

\( \newcommand{\ImaginaryPart}{\mathrm{Im}}\)

\( \newcommand{\Argument}{\mathrm{Arg}}\)

\( \newcommand{\norm}[1]{\| #1 \|}\)

\( \newcommand{\Span}{\mathrm{span}}\) \( \newcommand{\AA}{\unicode[.8,0]{x212B}}\)

\( \newcommand{\vectorA}[1]{\vec{#1}} % arrow\)

\( \newcommand{\vectorAt}[1]{\vec{\text{#1}}} % arrow\)

\( \newcommand{\vectorB}[1]{\overset { \scriptstyle \rightharpoonup} {\mathbf{#1}} } \)

\( \newcommand{\vectorC}[1]{\textbf{#1}} \)

\( \newcommand{\vectorD}[1]{\overrightarrow{#1}} \)

\( \newcommand{\vectorDt}[1]{\overrightarrow{\text{#1}}} \)

\( \newcommand{\vectE}[1]{\overset{-\!-\!\rightharpoonup}{\vphantom{a}\smash{\mathbf {#1}}}} \)

Read the following scenario and complete the questions below.

The entire poultry industry is working hard to keep up with demand, but egg production is falling behind. According to the USDA’s Economic Research Service, the price of eggs in the U.S. is expected to rise more than 35 percent in 2018. The cause of this egg price increases? An uptick in foreign demand for US eggs is partly to blame. When the avian influenza devastated Europe this past year, egg suppliers in the U.S. stepped in to help fill the demand in these countries. Another problem arose in late 2017 where some egg supplies were contaminated with a dangerous insecticide, affecting countries including Germany, France and Belgium. With millions of eggs being pulled from the shelves in Europe, US exports of eggs rose 663 percent between 2016 and 2017. Domestic demand has increased as well. In the United States, 2017 saw a 20-year record in egg consumption at 275.2 eggs per person per year. When you multiply that by 325 million Americans, that’s a lot of eggs.

Now, consider the commercial use of eggs in the production of grocery items such as bread, ice cream, pasta, cakes and waffles. Let’s focus on the Sara Lee® All Butter Pound Cake® found in the freezer section of your local grocery store. The first ingredient listed on the package is, you guessed it – eggs. The pound cake sells for around $3.97 at the grocery store. However, with the price of eggs on the rise, it is likely that $3.97 price may change.

- Which of Sara Lee’s variances will be affected by the increase in egg prices? Why?

- Will the increase in egg prices result in favorable or unfavorable variances for Sara Lee? Why?

- What is Sara Lee® likely to do to its standards based on this increase in price and which standards will be impacted?

- What, if anything, can Sara Lee® do to mitigate the impact of the rising cost of eggs on its manufacturing costs?

This assignment is available for download as a Word Document .

- Product overview

- All features

- App integrations

CAPABILITIES

- project icon Project management

- Project views

- Custom fields

- Status updates

- goal icon Goals and reporting

- Reporting dashboards

- workflow icon Workflows and automation

- portfolio icon Resource management

- Time tracking

- my-task icon Admin and security

- Admin console

- asana-intelligence icon Asana Intelligence

- list icon Personal

- premium icon Starter

- briefcase icon Advanced

- Goal management

- Organizational planning

- Campaign management

- Creative production

- Content calendars

- Marketing strategic planning

Resource planning

- Project intake

- Product launches

- Employee onboarding

- View all uses arrow-right icon

- Project plans

- Team goals & objectives

- Team continuity

- Meeting agenda

- View all templates arrow-right icon

- Work management resources Discover best practices, watch webinars, get insights

- What's new Learn about the latest and greatest from Asana

- Customer stories See how the world's best organizations drive work innovation with Asana

- Help Center Get lots of tips, tricks, and advice to get the most from Asana

- Asana Academy Sign up for interactive courses and webinars to learn Asana

- Developers Learn more about building apps on the Asana platform

- Community programs Connect with and learn from Asana customers around the world

- Events Find out about upcoming events near you

- Partners Learn more about our partner programs

- Support Need help? Contact the Asana support team

- Asana for nonprofits Get more information on our nonprofit discount program, and apply.

Featured Reads

- Project planning |

- Project cost management: Definition, st ...

Project cost management: Definition, steps, and benefits

Cost management is the process of planning, budgeting, and reporting project spend in order to keep teams on budget and overall costs reasonable. In this article, we'll go over the four functions of cost management and explain exactly how to use them to improve your project's bottom line.

What is cost management?

Cost management is the process of estimating, budgeting, and controlling project costs. The cost management process begins during the planning phase and continues throughout the duration of the project as managers continuously review, monitor, and adjust expenditures to ensure the project doesn't go over the approved budget.

Why is cost management important?

Have you ever wondered what happens when a project goes significantly over budget? The consequences can be severe—from strained relationships with clients to financial losses. Let's consider an example:

A small software development team was tasked with creating a custom application for a client. Midway through, they realized the project was quickly exceeding the initial budget. They faced a common dilemma: continue as planned and absorb the extra costs or re-evaluate their approach.

By implementing rigorous cost management strategies, the team was able to identify areas where expenses were ballooning. They streamlined their project management processes, prioritized essential features, and renegotiated terms with subcontractors. This approach not only brought the project back within budget but also improved their working relationship with the client, who appreciated their transparency and commitment to delivering value.

This scenario highlights how effective cost management can transform a potentially disastrous situation into a success story.

How to create a cost management plan

Cost management is a continuous, fluid process. However, there are four main elements or functions that can be found in any cost management plan:

Cost estimating

Cost budgeting, cost control.

Because new expenses can appear and project scope can be adjusted, cost managers need to be prepared to perform all four functions at any time throughout the project life cycle. Your workflow will vary according to the project’s needs.

Here, we'll break down each of the four elements in greater detail and explain what is required from the cost manager at each stage.

![cost analysis assignment [Inline Illustration] cost management (infographic)](https://assets.asana.biz/transform/817309ee-ddc4-405a-90ce-3090369ac44d/inline-project-planning-cost-management-1-2x?io=transform:fill,width:2560&format=webp)

The very first step in any cost management process is resource planning, which is when the cost manager reviews the project's scope and specs to figure out what resources the project will require.