- Search Search Please fill out this field.

- Alternative Investments

- Private Equity & VC

How to Start Your Own Private Equity Fund

:max_bytes(150000):strip_icc():format(webp)/picture-53668-1413912494-5bfc2a95c9e77c005143c916.png)

Private equity firms have been a historically successful asset class and the field continues to grow as more would-be portfolio managers join the industry. Many investment bankers have made the switch from public to private equity because the latter has significantly outperformed the Standard & Poor's 500 Index over the last few decades, fueling greater demand for private equity funds from institutional and individual accredited investors . As demand continues to swell for alternative investments in the private equity space, new managers will need to emerge and provide investors with new opportunities to generate alpha.

Key Takeaways

- Private equity firms are growing thanks to their outperformance of the S&P 500.

- Starting a private equity fund means laying out a strategy, which means picking which sectors to target.

- A business plan and setting up the operations are also key steps, as well as picking a business structure and establishing a fee structure.

- Arguably the toughest step is raising capital, where fund managers will be expected to contribute 1% to 3% of the fund’s capital.

Today's many successful private equity firms include Blackstone Group, Apollo Global Management, TPG Capital, Goldman Sachs Capital Partners, and the Carlyle Group. However, most firms are small to midsize shops and can range from just two employees to several hundred workers. Here are several steps managers should follow to launch a private equity fund .

Define the Business Strategy

First, outline your business strategy and differentiate your financial plan from those of competitors and benchmarks. Establishing a business strategy requires significant research into a defined market or individual sector. Some funds focus on energy development, while others may focus on early-stage biotech companies. Ultimately, investors want to know more about your fund's goals.

As you articulate your investment strategy , consider whether you will have a geographic focus. Will the fund focus on one region of the United States? Will it focus on an industry in a certain country? Or will it emphasize a specific strategy in similar emerging markets? Meanwhile, there are several business focuses you could adopt. Will your fund aim to improve your portfolio companies' operational or strategic focus, or will this center entirely on cleaning up their balance sheets ?

Remember, private equity typically hinges on investment in companies that are not traded on the public market. It's critical that you determine the purpose of each investment. For example, is the aim of the investment to grow capital for mergers and acquisitions activity? Or is the goal to raise capital that will allow existing owners to sell their positions in the firm?

Business Plan, Operations Setup

The second step is to write a business plan, which calculates cash flow expectations, establishes your private equity fund's timeline, including the period to raise capital and exit from portfolio investments . Each fund typically has a life of 10 years, although ultimately timelines are up to the manager's discretion. A sound business plan contains a strategy on how the fund will grow over time, a marketing plan to target future investors, and an executive summary, which ties all of these sections and goals together.

Following the establishment of the business plan, set up an external team of consultants that includes independent accountants, attorneys and industry consultants who can provide insight into the industries of the companies in your portfolio. It's also wise to establish an advisory board and explore disaster recovery strategies in case of cyberattacks, steep market downturns, or other portfolio-related threats to the individual fund.

Another important step is to establish a firm and fund name. Additionally, the manager must decide on the roles and titles of the firm's leaders, such as the role of partner or portfolio manager. From there, establish the management team, including the CEO, CFO, chief information security officer, and chief compliance officer . First-time managers are more likely to raise more money if they are part of a team that spins out of a previously successful firm.

On the back end, it's essential to establish in-house operations. These tasks include the rent or purchase office space, furniture, technology requirements, and hiring staff. There are several things to consider when hiring staff, such as profit-sharing programs , bonus structures, compensation protocols, health insurance plans, and retirement plans.

Establish the Investment Vehicle

After early operations are in order, establish the fund’s legal structure. In the U.S., a fund typically assumes the structure of a limited partnership or a limited liability firm. As a founder of the fund, you will be a general partner, meaning that you will have the right to decide the investments that compose the fund.

Your investors will be limited partners who don't have the right to decide which companies are part of your fund. Limited partners are only accountable for losses tied to their individual investment, while general partners handle any additional losses within the fund and liabilities to the broader market.

Ultimately, your lawyer will draft a private placement memorandum and any other operating agreements such as a limited partnership agreement or articles of association .

Determine a Fee Structure

The fund manager should determine provisions related to management fees, carried interest and any hurdle rate for performance. Typically, private equity managers receive an annual management fee of 2% of committed capital from investors. So, for every $10 million the fundraises from investors, the manager will collect $200,000 in management fees annually. However, fund managers with less experience may receive a smaller management fee to attract new capital.

Carried interest is commonly set at 20% above an expected return level. Should the hurdle rate be 5% for the fund, you and your investors would split returns at a rate of 20 to 80. During this period, it is also important to establish compliance, risk and valuation guidelines for the fund.

Raise Capital

Next, you will want to have your offering memorandum, subscription agreement , partnership terms, custodial agreement , and due diligence questionnaires prepared. Also, marketing material will be needed prior to the process of raising capital. New managers will also want to ensure that they have obtained a proper severance letter from previous employers. A severance letter is important because employees require permission to boast about their previous experience and track record.

All of this leads ultimately leads you to the biggest challenge of starting a private equity fund, which is convincing others to invest in your fund. Firstly, prepare to invest your own fund. Fund managers who had had success during their careers will likely be expected to provide at least 2% to 3% of their money to the fund's total capital commitments . New managers with less capital can likely succeed with a commitment of 1% to 2% for their first fund.

In addition to your investment track record and investment strategy, your marketing strategy will be central to raising capital. Due to regulations on who can invest and the unregistered nature of private equity investments, the government says that only institutional investors and accredited investors can provide capital to these funds.

Institutional investors include insurance firms, sovereign wealth funds , financial institutions, pension programs , and university endowments. Accredited investors are limited to individuals who meet a specified annual income threshold for two years or maintain a net worth (less the value of their primary residence) of $1 million or more. Additional criteria for other groups that represent accredited investors are discussed in the Securities Act of 1933 .

Once a private equity fund has been established, portfolio managers have the capacity to begin building their portfolio. At this point, managers will start to select the companies and assets that fit their investment strategy.

The Bottom Line

Private equity investments have outperformed the broader U.S. markets over the last few decades. That has generated increased demand from investors seeking new ways to generate superior returns . The above steps can be used as a roadmap for establishing a successful fund.

Bain & Company. " Public vs. Private Equity Returns: Is PE Losing Its Advantage? "

United States Office of Government Ethics. " Capital Commitment ."

U.S. Securities and Exchange Commission. "' Accredited Investor' Net Worth Standard ."

:max_bytes(150000):strip_icc():format(webp)/Term-Definitions_Private-equity-673345d975244a9894e68d9b072a7969.png)

- Terms of Service

- Editorial Policy

- Privacy Policy

- Your Privacy Choices

- Search Search Please fill out this field.

- Building Your Business

- Becoming an Owner

- Business Plans

How To Write the Funding Request for Your Business Plan

What goes into the funding request, parts of the funding request, important points to remember when writing your request, frequently asked questions (faqs).

MoMo Productions / Getty Images

A business plan contains many sections, and if you plan to seek funding for your business, you will need to include the funding request section. The good news is that this section of your business plan is only needed if you plan to ask for outside business funding. If you're not seeking financial help, you can leave it out of your business plan. There are a variety of ways to fund your business without debt or investors. Below, we'll cover how to write the funding request section of your business plan.

Key Takeaways

- The funding request section of your business plan is required if you plan to seek funding from a lender or investors.

- You'll want to include information on the business, your current financial situation, how the money will be used, and more.

- Tailor each funding request to the specific funding source, and make sure you ask for enough money to keep your business going.

The funding request section provides information on your future financial plans, such as when and how much money you might need. You will also include the possible sources you could consider for securing your funds, such as loans or crowdfunding. Later, you can update this section when you need outside funding again for business growth.

An Outline of the Business

Yes, you've done this already in past sections, but you want to give potential lenders and investors a recap of your business. In some cases, you might simply share the funding request section so you need to have your business details such as what you provide, information about your target market, your structure (i.e. LLC), owners' and members' information (for partnerships and corporations), and any successes you've had to date in your business.

Current Financial Situation

Again, you've provided some financial information in the financial data section , but it doesn't hurt to summarize. If you're submitting just the funding request, you'll need this information to help financial sources understand your money situation.

Provide financial details such as income and cash flow statements, and balance sheets in your funding request section.

Offer your projected financial information as well. If you're asking for a loan for which you'll be offering collateral, include information about the asset. If the business had debt, outline your plan for paying it off. Finally, share how you'll pay the loan or what sort of return on investment (ROI) investors can expect by investing in your business.

How Much Money Do You Need Now and in the Future?

Indicate what type of funding you're asking for such as a loan or investment. Outline what you need now and what you might need in the future as far as five years out.

How Will the Funds Be Used?

Detail how you'll be using the money, whether it's for inventory, paying a debt, buying equipment, hiring help, and more. If you plan to use the money for several things, highlight each and how much money will go to each.

Most financial sources would rather invest in things that grow a thriving business than things that pay for debt or overhead expenses.

Current and Future Financial Plans

Current and future financial plans include items such as loan repayment schedules or plans to sell the business. If you're getting a loan, outline your plans for repayment (although most lenders will have their own schedules). If you have plans to sell the business, let the lender know that and how it will affect them. Other issues to consider are relocation (if you move) or a buyout. Finally, let investors know how they can exit the deal, such as cashing out (and how long before they can do that).

You're asking for money, so you need to always be professional and know your business inside and out. Here are some other things to keep in mind:

- Tailor your funding request to each financial source : Lenders and investors need different information, such as loan repayment versus ROI, so create different reports for each.

- Keep your funding sources in mind : Each resource will have different questions and concerns. Do a little research so you can address them in your report.

- Ask for enough to keep your business going : Don't be stingy, as you don't want your business to fail from a lack of money. At the same time, don't be greedy, asking for more than you need.

How do you request funding for a nonprofit?

Most nonprofits seek funding in the form of grants. Write a grant proposal that includes information on the project or organization, preliminary budget needs, and more. Be sure to format it with a cover letter, proposal summary, the introduction of the organization, problem statement, objectives, methods, evaluation, future funding needs, and the budget.

What are three methods of funding?

Grants and scholarships, equity financing, and debt financing are the main three methods of funding for small businesses . Grants and scholarships do not need to be repaid and are often best for nonprofit organizations. Equity financing is when you receive money in exchange for ownership and profits. Debt financing is when you borrow money that needs to be repaid.

Want to read more content like this? Sign up for The Balance’s newsletter for daily insights, analysis, and financial tips, all delivered straight to your inbox every morning!

Small Business Administration. " Fund Your Business ."

Congressional Research Service. " How To Develop and Write a Grant Proposal ."

Library of Congress Research Guides. " Types of Financing ."

Investment Company Business Plan Template

Written by Dave Lavinsky

Investment Company Business Plan

Over the past 20+ years, we have helped over 1,000 entrepreneurs and business owners create business plans to start and grow their investment companies. On this page, we will first give you some background information with regards to the importance of business planning. We will then go through an investment company business plan template step-by-step so you can create your plan today.

Download our Ultimate Business Plan Template here >

What is an Investment Company Business Plan?

A business plan provides a snapshot of your investment company as it stands today, and lays out your growth plan for the next five years. It explains your business goals and your strategy for reaching them. It also includes market research to support your plans.

Why You Need a Business Plan for an Investment Company

If you’re looking to start an investment company, or grow your existing investment company, you need a business plan. A business plan will help you raise funding, if needed, and plan out the growth of your investment company in order to improve your chances of success. Your business plan is a living document that should be updated annually as your company grows and changes.

Sources of Funding for Investment Companies

With regards to funding, the main sources of funding for an investment company are bank loans and angel investors. With regards to bank loans, banks will want to review your business plan and gain confidence that you will be able to repay your loan and interest. To acquire this confidence, the loan officer will not only want to confirm that your financials are reasonable, but they will also want to see a professional plan. Such a plan will give them the confidence that you can successfully and professionally operate a business. Investors, grants, personal investments, and bank loans are the most common funding paths for investment companies.

Finish Your Business Plan Today!

How to write a business plan for an investment company.

If you want to start an investment company or expand your current one, you need a business plan. Below we detail what you should include in each section of your own business plan:

Executive Summary

Your executive summary provides an introduction to your business plan, but it is normally the last section you write because it provides a summary of each key section of your plan.

The goal of your Executive Summary is to quickly engage the reader. Explain to them the type of investment company you are operating and the status. For example, are you a startup, do you have an investment company that you would like to grow, or are you operating investment companies in multiple markets?

Next, provide an overview of each of the subsequent sections of your business plan. For example, give a brief overview of the investment company industry. Discuss the type of investment company you are operating. Detail your direct competitors. Give an overview of your target customers. Provide a snapshot of your marketing plan. Identify the key members of your team. And offer an overview of your financial plan.

Company Analysis

In your company analysis, you will detail the type of investment company you are operating.

For example, you might operate one of the following types of investment companies:

- Closed-End Funds Investment Company : this type of investment company issues a fixed number of shares through a single IPO to raise capital for its initial investments.

- Mutual Funds (Open-End Funds) Investment Company: this type of investment company is a diversified portfolio of pooled investor money that can issue an unlimited number of shares.

- Unit Investment Trusts (UITs) Investment Company: this type of investment company offers a fixed portfolio, generally of stocks and bonds, as redeemable units to investors for a specific period of time.

In addition to explaining the type of investment company you will operate, the Company Analysis section of your business plan needs to provide background on the business.

Include answers to question such as:

- When and why did you start the business?

- What milestones have you achieved to date? Milestones could include the number of investments made, number of client positive reviews, reaching X amount of clients invested for, etc.

- Your legal structure. Are you incorporated as an S-Corp? An LLC? A sole proprietorship? Explain your legal structure here.

Industry Analysis

In your industry analysis, you need to provide an overview of the investment industry.

While this may seem unnecessary, it serves multiple purposes.

First, researching the investment industry educates you. It helps you understand the market in which you are operating.

Secondly, market research can improve your strategy, particularly if your research identifies market trends.

The third reason for market research is to prove to readers that you are an expert in your industry. By conducting the research and presenting it in your plan, you achieve just that.

The following questions should be answered in the industry analysis section of your business plan:

- How big is the investment industry (in dollars)?

- Is the market declining or increasing?

- Who are the key competitors in the market?

- Who are the key suppliers in the market?

- What trends are affecting the industry?

- What is the industry’s growth forecast over the next 5 – 10 years?

- What is the relevant market size? That is, how big is the potential market for your investment company? You can extrapolate such a figure by assessing the size of the market in the entire country and then applying that figure to your local population.

Customer Analysis

The customer analysis section of your business plan must detail the customers you serve and/or expect to serve.

The following are examples of customer segments: companies or employees in specific industries, couples with double income, families with kids, small business owners, etc.

As you can imagine, the customer segment(s) you choose will have a great impact on the type of investment company you operate. Clearly, couples with families and double income would respond to different marketing promotions than corporations, for example.

Try to break out your target customers in terms of their demographic and psychographic profiles. With regards to demographics, include a discussion of the ages, genders, locations and income levels of the customers you seek to serve.

Psychographic profiles explain the wants and needs of your target customers. The more you can understand and define these needs, the better you will do in attracting and retaining your customers.

Finish Your Investment Company Business Plan in 1 Day!

Don’t you wish there was a faster, easier way to finish your business plan?

With Growthink’s Ultimate Business Plan Template you can finish your plan in just 8 hours or less!

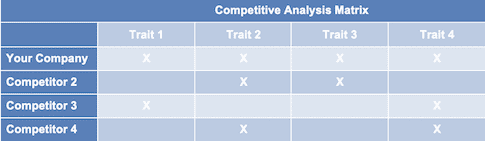

Competitive Analysis

Your competitive analysis should identify the indirect and direct competitors your business faces and then focus on the latter.

Direct competitors are other investment companies.

Indirect competitors are other options that customers have to purchase from that aren’t direct competitors. This includes robo investors and advisors, company 401Ks, etc. You need to mention such competition as well.

With regards to direct competition, you want to describe the other investment companies with which you compete. Most likely, your direct competitors will be investment companies located very close to your location.

For each such competitor, provide an overview of their businesses and document their strengths and weaknesses. Unless you once worked at your competitors’ businesses, it will be impossible to know everything about them. But you should be able to find out key things about them such as:

- What types of clients do they serve?

- What type of investment company are they and what certifications do they have?

- What is their pricing (premium, low, etc.)?

- What are they good at?

- What are their weaknesses?

With regards to the last two questions, think about your answers from the customers’ perspective. And don’t be afraid to ask your competitors’ customers what they like most and least about them.

The final part of your competitive analysis section is to document your areas of competitive advantage. For example:

- Will you provide better investment strategies?

- Will you provide services that your competitors don’t offer?

- Will you provide better customer service?

- Will you offer better pricing?

Think about ways you will outperform your competition and document them in this section of your plan.

Marketing Plan

Traditionally, a marketing plan includes the four P’s: Product, Price, Place, and Promotion. For an investment company, your marketing plan should include the following:

Product : In the product section, you should reiterate the type of company that you documented in your Company Analysis. Then, detail the specific products you will be offering. For example, in addition to an investment company, will you provide insurance products, website and app accessibility, quarterly or annual investment reviews, and any other services?

Price : Document the prices you will offer and how they compare to your competitors. Essentially in the product and price sub-sections of your marketing plan, you are presenting the services you offer and their prices.

Place : Place refers to the location of your company. Document your location and mention how the location will impact your success. For example, is your investment company located in a busy retail district, a business district, a standalone office, etc. Discuss how your location might be the ideal location for your customers.

Promotions : The final part of your investment company marketing plan is the promotions section. Here you will document how you will drive customers to your location(s). The following are some promotional methods you might consider:

- Advertising in local papers and magazines

- Commercials and billboards

- Reaching out to websites

- Social media marketing

- Local radio advertising

Operations Plan

While the earlier sections of your business plan explained your goals, your operations plan describes how you will meet them. Your operations plan should have two distinct sections as follows.

Everyday short-term processes include all of the tasks involved in running your investment company, including researching the stock market, keeping abreast of all investment industry knowledge, updating clients on any new activity, answering client phone calls and emails, networking to attract potential new clients.

Long-term goals are the milestones you hope to achieve. These could include the dates when you expect to land your Xth client, or when you hope to reach $X in revenue. It could also be when you expect to expand your investment business to a new city.

Management Team

To demonstrate your investment company’s ability to succeed, a strong management team is essential. Highlight your key players’ backgrounds, emphasizing those skills and experiences that prove their ability to grow a company.

Ideally you and/or your team members have direct experience in managing investment companies. If so, highlight this experience and expertise. But also highlight any experience that you think will help your business succeed.

If your team is lacking, consider assembling an advisory board. An advisory board would include 2 to 8 individuals who would act like mentors to your business. They would help answer questions and provide strategic guidance. If needed, look for advisory board members with experience in managing an investment company or successfully advised clients who have achieved a successful net worth.

Financial Plan

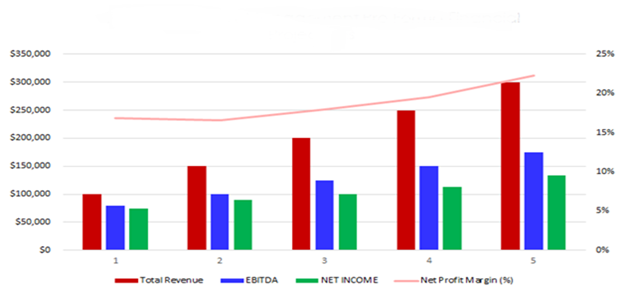

Your financial plan should include your 5-year financial statement broken out both monthly or quarterly for the first year and then annually. Your financial statements include your income statement, balance sheet and cash flow statements.

Income Statement : an income statement is more commonly called a Profit and Loss statement or P&L. It shows your revenues and then subtracts your costs to show whether you turned a profit or not.

In developing your income statement, you need to devise assumptions. For example, will you take on one new client at a time or multiple new clients? And will sales grow by 2% or 10% per year? As you can imagine, your choice of assumptions will greatly impact the financial forecasts for your business. As much as possible, conduct research to try to root your assumptions in reality.

Balance Sheets : Balance sheets show your assets and liabilities. While balance sheets can include much information, try to simplify them to the key items you need to know about. For instance, if you spend $50,000 on building out your investment company, this will not give you immediate profits. Rather it is an asset that will hopefully help you generate profits for years to come. Likewise, if a bank writes you a check for $50,000, you don’t need to pay it back immediately. Rather, that is a liability you will pay back over time.

In developing your Income Statement and Balance Sheets be sure to include several of the key costs needed in starting or growing an investment company:

- Cost of investor licensing..

- Cost of equipment and supplies

- Payroll or salaries paid to staff

- Business insurance

- Taxes and permits

- Legal expenses

Attach your full financial projections in the appendix of your plan along with any supporting documents that make your plan more compelling. For example, you might include your office location lease or list of clients that you have acquired.

Putting together a business plan for your investment company is a worthwhile endeavor. If you follow the template above, by the time you are done, you will truly be an expert. You will really understand the investment industry, your competition, and your customers. You will have developed a marketing plan and will really understand what it takes to launch and grow a successful investment company.

Investment Company Business Plan FAQs

What is the easiest way to complete my investment company business plan.

Growthink's Ultimate Business Plan Template allows you to quickly and easily complete your Investment Company Business Plan.

What is the Goal of a Business Plan's Executive Summary?

The goal of your Executive Summary is to quickly engage the reader. Explain to them the type of investment company you are operating and the status; for example, are you a startup, do you have an investment company that you would like to grow, or are you operating a chain of investment companies?

Don’t you wish there was a faster, easier way to finish your Investment Company business plan?

OR, Let Us Develop Your Plan For You

Since 1999, Growthink has developed business plans for thousands of companies who have gone on to achieve tremendous success. Click here to hire someone to write a business plan for you from Growthink’s team.

Other Helpful Business Plan Articles & Templates

How To Write a Hedge Fund Business Plan + Template

Creating a business plan is essential for any business, but it can be beneficial for hedge fund s that want to improve their strategy or raise funding.

A well-crafted business plan outlines the vision for your company and the step-by-step roadmap of how you will accomplish it. To create an effective business plan, you must first understand the components essential to its success.

This article provides an overview of the critical elements that every hedge fund owner should include in their business plan.

Download the Ultimate Business Plan Template

What is a Hedge Fund Business Plan?

A hedge fund business plan is a formal written document describing your company’s business strategy and feasibility. It documents the reasons you will be successful, areas of competitive advantage, and your team members.

Your business plan is a critical document that will convince investors, fund partners, and lenders (if needed) that you are positioned to become a successful venture.

Why Create a Hedge Fund Business Plan?

A hedge fund business plan is required for banks and investors. The document is a clear and concise guide to your business idea and the steps to make it profitable.

Entrepreneurs can also use this as a roadmap when starting their new company or venture. Especially if they are inexperienced in starting a business.

Writing an Effective Hedge Fund Business Plan

The following are the critical components of a successful business plan:

Executive Summary

The executive summary of a hedge fund business plan is a one- to two-page overview of your entire business plan. It should summarize the main points you will present in full in the rest of your business plan.

- Start with a one-line description of your hedge fund

- Provide a summary of the key points in each section of your business plan, which includes information about your company’s management team, industry analysis, competitive analysis, and financial forecast, among others.

Company Description

This section should include a brief history of your company. Include a short description of how your company started and provide a timeline of milestones your company has achieved.

You may not have a long company history if you are just starting your hedge fund . Instead, you can include information about your professional experience in this industry and how and why you conceived your new venture. If you have worked for a similar firm or been involved in an entrepreneurial venture before starting your hedge fund , mention this.

You will also include information about your chosen hedge fund business model and how, if applicable, it is different from other companies in your industry.

Industry Analysis

The industry or market analysis is a crucial component of a hedge fund business plan. Conduct thorough market research to determine industry trends and document the size of your market.

Questions to answer include:

- Which industry are you targeting?

- How big is the market?

- What trends are happening in the industry right now (and, if applicable, how do these trends support your company’s success)?

You should also include sources for your information, such as published research reports and expert opinions.

Customer Analysis

This section should include a list of your target audience(s) with demographic and psychographic profiles (e.g., age, gender, income level, profession, job titles, interests). You will need to provide a profile of each customer segment separately, including their needs and wants.

For example, a hedge fund’s customers may include accredited investors, family offices, and financial institutions.

You can include information about how your customers decide to buy from you, and what keeps them buying from you.

Develop a strategy for targeting those customers who are most likely to buy from you, as well as those that might be influenced to buy your services with the right marketing.

Competitive Analysis

The competitive analysis helps you determine how your product or service will differ from competitors and what your unique selling proposition (USP) might be that will set you apart in this industry.

For each competitor, list their strengths and weaknesses. Next, determine your areas of competitive differentiation or advantage; that is, in what ways are you different from and ideally better than your competitors.

Marketing Plan

This part of the business plan is where you determine and document your marketing plan. Lay out your plan, including the following 4 Ps.

- Product/Service : Detail your product/service offerings here. Document their features and benefits.

- Price : Document your pricing strategy here. In addition to stating the prices for your products/services, mention how your pricing compares to your competition.

- Place : Where will your customers find you? What channels of distribution (e.g., partnerships) will you use to reach them if applicable?

- Promotion : How will you reach your target customers? For example, you may use social media, write blog posts, create an email marketing campaign, use pay-per-click advertising, or launch a direct mail campaign. Additional advanced promotions strategies include retaining a PR firm and attending relevant conferences and networking events.

Operations Plan

This part of your hedge fund business plan should include the following information:

- How will you deliver your service to clients? For example, will you meet in person or over Zoom only?

- What infrastructure, equipment, and resources are needed to operate successfully? How can you meet those requirements within budget constraints?

You also need to include your company’s business policies in the operations plan. You will want to establish policies related to everything from customer service to pricing to the overall brand image you are trying to present.

Most importantly, in your Operations Plan, you will outline the milestones your company hopes to achieve within the next five years. Create a chart showing the key milestones you plan to achieve each quarter for the next four quarters and each year for the following four years.

Examples of milestones for a hedge fund include reaching $X in sales, hiring X team members, or $X managed.

Management Team

List your team members, including their names and titles, as well as their expertise and experience relevant to your firm . Include brief biographies for each team member.

Particularly if you are seeking funding, the goal of this section is to convince investors and lenders that your team has the expertise and experience to execute your plan. If you are missing key team members, document the roles and responsibilities you plan to hire for in the future.

Financial Plan

Include a summary of your complete and detailed financial plan (your full financial projections go in the Appendix).

This section includes the following three financial statements:

Income Statement

Your income statement should include:

- Revenue : how much revenue you generate.

- Cost of Goods Sold : These are your direct costs associated with generating revenue. Your COG includes labor costs and the cost of any equipment and supplies used to deliver the product/service offering.

- Net Income (or loss) : Once expenses and revenue are totaled and deducted from each other, this is the net income or loss

Sample Income Statement for a Startup Hedge Fund

Balance sheet.

Include a balance sheet that shows your assets, liabilities, and equity. Your balance sheet should include:

- Assets : Everything you own (including cash).

- Liabilities : This is what you owe against your company’s assets, such as accounts payable or loans.

- Equity : The worth of your business after all liabilities and assets are totaled and deducted from each other.

Sample Balance Sheet for a Startup Hedge Fund

Cash flow statement.

Include a cash flow statement showing how much cash comes in, how much cash goes out and a net cash flow for each year. The cash flow statement should include:

- Cash Flow From Operations

- Cash Flow From Investments

- Cash Flow From Financing

Below is a sample of a projected cash flow statement for a startup hedge fund business.

Sample Cash Flow Statement for a Startup Hedge Fund

You will also want to include an appendix section which will include:

- Your complete financial projections

- A complete list of your company’s business policies and procedures related to the rest of the business plan (marketing, operations, etc.)

- Any other documentation which supports what you included in the body of your business plan.

Build a Successful Hedge Fund

Writing a good business plan gives you the advantage of being fully prepared to launch and grow your hedge fund . It not only outlines your vision but also provides the process to accomplish it.

Now that you know what to include in your hedge fund business plan, it’s time to get started writing.

Finish Your Hedge Fund Business Plan in 1 Day!

Wish there was a faster, easier way to finish your Hedge Fund business plan? With our Ultimate Business Plan Template you can finish your plan in just 8 hours or less! Finish your hedge fund business plan today!

Hedge Fund Business Plan Template

Written by Dave Lavinsky

Hedge Fund Business Plan

You’ve come to the right place to create your Hedge Fund business plan.

We have helped over 1,000 entrepreneurs and business owners create business plans and many have used them to start or grow their Hedge Fund companies.

Below is a template to help you create each section of your Hedge Fund business plan.

Executive Summary

Business overview.

LeadingEdge Capital is a startup hedge fund company located in Boston, Massachusetts. The company was founded by Robert Wilkens and Stuart Rosenberg, proven strategists of high value investments in their former employment roles as hedge fund managers. Robert Wilkens was a hedge fund manager for fifteen years, building the portfolios of his clients to over 45M within that time. Stuart Rosenberg, a hedge fund manager for thirteen years, built his clients portfolios to over 25M within the years of his employment.

With the breakup of the ownership in their former employment, Robert and Stuart have determined this is the right and best time to open their own hedge fund company. Located in Boston, Massachusetts, a geographic area housing an abundance of serious investors, the new partners believe their former clients will support and invest in the new hedge fund. Toward that end, Robert and Stuart are starting to contract with those clients before the launch of LeadingEdge Capital.

Product Offering

The following are the services that LeadingEdge Capital will provide:

- Proven strategies for significant investment returns

- Deep and thorough market analysis using proprietary tech tools

- Unique client evaluation tools to assess risk appetite

- Thorough market analysis and reports

- Fund evaluation and administration

- Advanced technologies to monitor risk

- Data analysis to support profitable trading opportunities

- Day to day fund management

Customer Focus

LeadingEdge Capital will target all former clients of the prior employer. They will target investors from the Boston area and surrounding region. They will target risk-averse investors in the region. They will target clients at events, through networking opportunities, and industry associations. They will lead and speak at industry and investor events. They will educate potential investors via a unique set of educational video presentations at their website.

Management Team

LeadingEdge Capital will be co-owned and operated by Robert Wilkens and Stuart Rosenberg. They have recruited former associates from their prior employment to join their launch. This includes Mark Tompkins, who will act as the third-party fund administrator, Terry Camden, the independent certified public accountant, Tami Watson, the custodian, and Larry Lawson, the on-call attorney for LeadingEdge Capital.

Robert Wilkens holds a master’s degree in business administration from Harvard University. He is known as a brilliant strategic fund manager and has a wide circle of investors who rely on his capabilities to assess risk and manage the growth of their funds. Stuart Rosenberg is particularly gifted as a leader who can assist risk-averse investors with trust-building tools he built into a proprietary client app. The app helps investors see and track daily market activities and it ties global and national events to those activities to inform the client of a full-picture reason for the fund’s daily performance.

The remaining team members consist of: Mark Tompkins, who will act as the third-party fund administrator, Terry Camden, an independent certified public accountant, Tami Watson, the hedge fund custodian, and Larry Lawson, the on-call attorney for LeadingEdge Capital.

Success Factors

LeadingEdge Capital will be able to achieve success by offering the following competitive advantages:

- Friendly, knowledgeable, and highly-qualified team of LeadingEdge Capital

- Comprehensive menu of services, including educational webinars for new investors

- Proprietary app that assists managers and investors in making key decisions

- Compelling data analysis program to support profitable trading opportunities

- LeadingEdge Capital will offer discounted rates for “anchor investors” during the first six months of the establishment process. This is limited to 100 investors and includes on-going low percentage rates overall for the first-in investor pool.

Financial Highlights

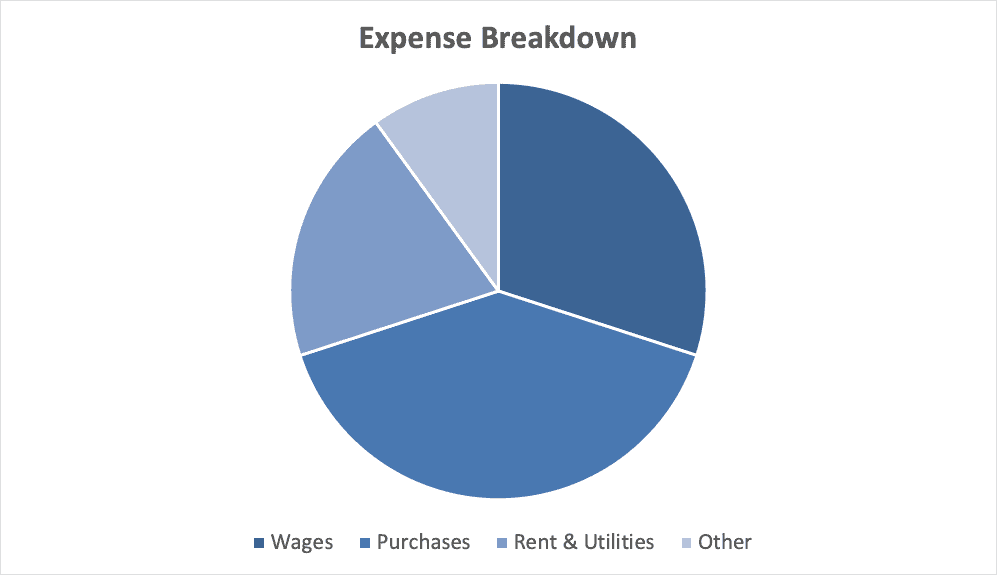

LeadingEdge Capital is seeking $200,000 in debt financing to launch its LeadingEdge Capital. The funding will be dedicated toward securing the midtown Boston office space and purchasing office equipment and supplies. Funding will also be dedicated towards three months of overhead costs to include payroll of the staff, rent, and marketing costs for the marketing and networking fees and costs. The breakout of the funding is below:

- Office space build-out: $20,000

- Office equipment, supplies, and materials: $10,000

- Three months of overhead expenses (payroll, rent, utilities): $150,000

- Marketing costs: $10,000

- Working capital: $10,000

The following graph outlines the financial projections for LeadingEdge Capital.

Company Overview

Who is leadingedge capital.

LeadingEdge Capital is a newly established full-service hedge fund company in Boston, Massachusetts. LeadingEdge Capital will be the most reliable, cost-effective, and efficient choice for investors in Boston and the surrounding communities. LeadingEdge Capital will provide a comprehensive menu of educational, investing, managing and assessment services for any client to utilize. Their full-service approach includes a comprehensive proprietary app and unique tools that are exclusive to LeadingEdge Capital.

LeadingEdge Capital is projecting at least one hundred clients within the first year of business. The team of professionals are highly qualified and experienced in hedge funds and all the permutations and regulations, and have strategic methods to find and evaluate new opportunities. LeadingEdge Capital provides an high-value investment process that will build their clients’ portfolios extensively through years of the best customer service from LeadingEdge Capital.

LeadingEdge Capital History

LeadingEdge Capital is a startup hedge fund company founded by Robert Wilkens and Stuart Rosenberg, proven strategists of high value investments in their former employment roles as hedge fund managers. Robert Wilkens was a hedge fund manager for fifteen years, building the portfolios of his clients to over 45M within that time. Stuart Rosenberg, a hedge fund manager for thirteen years, built his clients portfolios to over 25M within the years of his employment.

Since incorporation, LeadingEdge Capital has achieved the following milestones:

- Registered LeadingEdge Capital, LLC to transact business in the state of Massachusetts.

- Has a contract in place at a midtown Boston office building with 10,000 square foot space for offices and client waiting areas.

- Reached out to numerous former clients to engage them with the new LeadingEdge Capital hedge fund.

- Began recruiting a staff of managers, associated professionals and office personnel to work at LeadingEdge Capital.

LeadingEdge Capital Services

The following will be the services LeadingEdge Capital will provide:

Industry Analysis

The hedge fund investment industry is expected to grow during the next five years to over $123 billion. The growth will be driven by more investors seeking the resilient hedge fund market. The growth will also be driven by continued hedge fund interest driven by consumers who want to learn about the process and are eager for education. The growth will be driven by a greater use of technology to provide lower-risk options for investment that continually bring returns. Costs will likely be reduced as hedge fund managers lower fees to accommodate early entry investors. Costs will also likely be reduced as hedge fund managers continue to have increased access to retail investors.

Customer Analysis

Demographic profile of target market, customer segmentation.

LeadingEdge Capital will primarily target the following customer profiles:

- Former clients at prior employment

- Potential investors at networking events, industry relationships

- Potential Risk-averse investors who can rely on technology at LeadingEdge Capital

- Potential investors who are seeking self-education via webinars

- Potential investors who choose technology as a main driver for decision-making

Competitive Analysis

Direct and indirect competitors.

LeadingEdge Capital will face competition from other companies with similar business profiles. A description of each competitor company is below.

One Star Capital Partners

One Star Capital Partners has been in business in the Boston area for over seventy-five years. The current partners are the children and grandchildren of the original founders of the hedge fund business. The investor portfolio of One Star Capital Partners is a combined 210B, which has been produced via the past several years of wealth-building and wealth-creation for their clients. The company has experienced a loss of clients during the past five years, however, as the descendents of the original partners have been engaged in litigation regarding the ownership percentages of the privately-held company. This has led to some discouragement from clients and organizational changes that are difficult to understand or explain.

The promise of One Star Capital Partners is to build wealth through secure investor commitments that total as much or more than the previous years. The company has led investors toward a global macro investing environment which didn’t prove to be compatible with the event-driven model of prior years. This shift created a net loss of investors during the past five years, although forward-looking statements have recently been made during investor phone calls.

AlphaDrive & Company

With a golfer’s nomenclature and several clients directed into the golf, tennis and soccer investment categories, AlphaDrive & Company are becoming an established hedge fund after the introduction of the company in 2020. The hedge fund is fairly small, with a combined portfolio of all managers standing at 20M in 2023, the fund promises to expand and increase opportunities for investors to explore all sectors of the sports arena, finding attractive potential for earnings among their clientele. One of the unique aspects of this company is that it was founded by two famous golf celebrities and those relationships allow investors to enter the pro am golf tournaments throughout the world. Similar relationships and capabilities allow sports enthusiasts to meet their “favorite” athletes to join in activities as a result of investing with AlphaDrive & Company.

Howard & Howard Capital

Howard & Howard is a Boston-based hedge fund that was established in 2005. It is owned and operated by a father-son investment team. The company focuses on real estate conglomerates, REITS, distressed properties, and other lucrative real estate opportunities that are ripe for investment. The hedge fund represents those who believe their best returns will always come from land or the acquisition of real estate and are willing to invest significant sums of money in appropriate low-risk, high-return ventures. Robert Howard is the president of Howard & Howard Capital, while his son, Thomas Howard is the vice president of the company. Their office building is situated on the harborside of Boston, amid brick-lined walkways and older buildings indicative of early Boston. This feature attracts the potential investors who appreciate the heritage and value of land, especially land that is situated in the Massachusetts region. Investment opportunities include major retail outlets, farm and ranch land, undeveloped residential areas, and other land-based opportunities.

Competitive Advantage

LeadingEdge Capital will be able to offer the following advantages over their competition:

Marketing Plan

Brand & value proposition.

LeadingEdge Capital will offer the unique value proposition to its clientele:

- Highly-qualified team of skilled employees who are able to provide a comprehensive set of select investment opportunities to current and potential investors.

- Educational webinars via the website for “introductory” investors

- Discounted rates for “anchor investors” for first 6 months of business

Promotions Strategy

The promotions strategy for LeadingEdge Capital is as follows:

Word of Mouth/Referrals

LeadingEdge Capital has built up an extensive list of potential years from prior years of the former hedge fund that employed the founders of LeadingEdge. The former employer is now defunct, which indicates a wide swatch of investors who require a new, fresh set of opportunities to be garnered by the well-known and personable staff of LeadingEdge Capital. Having produced multiple opportunities and millions of dollars of profit with the former hedge fund managers, the former clients are eager to get in on the “anchor investor” program and start earning returns on investments once again.

Professional Associations and Networking

The owners of LeadingEdge Capital will continue extensively networking, attending and speaking at engagements that include current and potential investors. The company has plans to attend national conferences and exhibit at trade shows, where introductory materials can be offered to new investors just entering the market.

Website/SEO Marketing

LeadingEdge Capital will fully utilize their website. The website will be well-organized, informative, and list all the services that LeadingEdge Capital provides. The website will also list their contact information and testimonials from current and former clients. The website will have SEO marketing tactics embedded so that anytime someone types in the Google or Bing search engine “hedge fund company” or “hedge fund company near me”, LeadingEdge Capital will be listed at the top of the search results.

The pricing of LeadingEdge Capital will be moderate and on par with competitors so customers feel they receive excellent value when purchasing their services.

Operations Plan

The following will be the operations plan for LeadingEdge Capital. Operation Functions:

- Robert Wilkens will be the co-owner and President of the company. He will oversee and manage client relations, investor recruitments and forward-looking opportunities.

- Stuart Rosenberg will be the co-owner and Vice President of the company. He will oversee the technological research and development for the company.

- Mark Tompkins will be the third-party fund administrator.

- Terry Camden will be the independent certified public accountant assisting the company

- Tami Watson will be the Custodian of LeadingEdge Capital, assisting the company

- Larry Lawson will be the on-call Attorney for LeadingEdge Capital.

Milestones:

LeadingEdge Capital will have the following milestones completed in the next six months.

- 5/1/202X – Finalize contract to lease office space

- 5/15/202X – Finalize personnel and staff employment contracts for the LeadingEdge Capital

- 6/1/202X – Finalize contracts for LeadingEdge Capital clients

- 6/15/202X – Begin networking at industry events

- 6/22/202X – Begin moving into LeadingEdge Capital office

- 7/1/202X – LeadingEdge Capital opens its office for business

Financial Plan

Key revenue & costs.

The revenue drivers for LeadingEdge Capital are the investment fees they will charge to the investor clients for their services.

The cost drivers will be the overhead costs required in order to staff LeadingEdge Capital. The expenses will be the payroll cost, rent, utilities, office supplies, and marketing materials.

Funding Requirements and Use of Funds

LeadingEdge Capital is seeking $200,000 in debt financing to launch its hedge fund company. The funding will be dedicated toward securing the office space and purchasing office equipment and supplies. Funding will also be dedicated toward three months of overhead costs to include payroll of the staff, rent, and marketing costs for the events and association memberships. The breakout of the funding is below:

Key Assumptions

The following outlines the key assumptions required in order to achieve the revenue and cost numbers in the financials and in order to pay off the startup business loan.

- Number of Clients Per Month: 175

- Average Fees per Month: $125,000

- Office Lease per Year: $100,000

Financial Projections

Income statement, balance sheet, cash flow statement, hedge fund business plan faqs, what is a hedge fund business plan.

A hedge fund business plan is a plan to start and/or grow your hedge fund business. Among other things, it outlines your business concept, identifies your target customers, presents your marketing plan and details your financial projections.

You can easily complete your Hedge Fund business plan using our Hedge Fund Business Plan Template here .

What are the Main Types of Hedge Fund Businesses?

There are a number of different kinds of hedge fund businesses , some examples include: Global Macro, Event-driven, Relative value, and Directional.

How Do You Get Funding for Your Hedge Fund Business Plan?

Hedge Fund businesses are often funded through small business loans. Personal savings, credit card financing and angel investors are also popular forms of funding.

What are the Steps To Start a Hedge Fund Business?

Starting a hedge fund business can be an exciting endeavor. Having a clear roadmap of the steps to start a business will help you stay focused on your goals and get started faster.

1. Develop A Hedge Fund Business Plan - The first step in starting a business is to create a detailed hedge fund business plan that outlines all aspects of the venture. This should include potential market size and target customers, the services or products you will offer, pricing strategies and a detailed financial forecast.

2. Choose Your Legal Structure - It's important to select an appropriate legal entity for your hedge fund business. This could be a limited liability company (LLC), corporation, partnership, or sole proprietorship. Each type has its own benefits and drawbacks so it’s important to do research and choose wisely so that your hedge fund business is in compliance with local laws.

3. Register Your Hedge Fund Business - Once you have chosen a legal structure, the next step is to register your hedge fund business with the government or state where you’re operating from. This includes obtaining licenses and permits as required by federal, state, and local laws.

4. Identify Financing Options - It’s likely that you’ll need some capital to start your hedge fund business, so take some time to identify what financing options are available such as bank loans, investor funding, grants, or crowdfunding platforms.

5. Choose a Location - Whether you plan on operating out of a physical location or not, you should always have an idea of where you’ll be based should it become necessary in the future as well as what kind of space would be suitable for your operations.

6. Hire Employees - There are several ways to find qualified employees including job boards like LinkedIn or Indeed as well as hiring agencies if needed – depending on what type of employees you need it might also be more effective to reach out directly through networking events.

7. Acquire Necessary Hedge Fund Equipment & Supplies - In order to start your hedge fund business, you'll need to purchase all of the necessary equipment and supplies to run a successful operation.

8. Market & Promote Your Business - Once you have all the necessary pieces in place, it’s time to start promoting and marketing your hedge fund business. This includes creating a website, utilizing social media platforms like Facebook or Twitter, and having an effective Search Engine Optimization (SEO) strategy. You should also consider traditional marketing techniques such as radio or print advertising.

Learn more about how to start a successful hedge fund business:

- How to Start a Hedge Fund Business

Everything that you need to know to start your own business. From business ideas to researching the competition.

Practical and real-world advice on how to run your business — from managing employees to keeping the books

Our best expert advice on how to grow your business — from attracting new customers to keeping existing customers happy and having the capital to do it.

Entrepreneurs and industry leaders share their best advice on how to take your company to the next level.

- Business Ideas

- Human Resources

- Business Financing

- Growth Studio

- Ask the Board

Looking for your local chamber?

Interested in partnering with us?

Run » business financing, a practical guide to funding your small business with business loans and beyond.

Here’s a detailed guide on how to fund your business, whether you’re just beginning or you have a few years under your belt.

Whether you’re just starting your business or growing an existing one, there are a multitude of options for small business funding to help meet the needs of your unique situation. To help you understand how to fund a small business, this guide will detail startup necessities, outline funding options, and walk through what to consider when selecting a funding option.

Startup necessities

You should go into seeking funding for a new business armed with some information. First, decide what’s on your "need" list and what’s on your "it can wait" list. Pose the question this way: What is the bare minimum required you need to get your venture off the ground?

At the same time, you can’t skimp on the necessities. This will, of course, be a major investment. So, if — when thinking through your new business venture — you put something on the "it can wait" list, check with other areas that may be affected if that area doesn’t get funded.

Here are some common business expenses and the questions surrounding them to consider before trying to secure funding:

- Payroll — How many employees do you have, what are you paying them, and how many employees will you have in the next six months? Startup and small businesses don’t always stay small, so think about how many people you will need to start, but also how many you may need before you start making a profit. Also, consider how you’re going to pay yourself. As the founder of the small business, you need to live, too.

- Insurance — Is your business prepared if disaster strikes? Will you be offering health insurance to your employees ?

- Licensing, permits, and taxes — Doing business costs money and you want to make sure you won’t be running into any legal trouble. How much capital do you need to cover licenses, permits, and taxes?

- Rent and utilities — If you’re moving your business into a physical space, make sure you can afford your lease and utility costs to keep things running. Make sure you clearly understand the terms of a commercial lease before signing a contract.

- Equipment — Do you need computers, phones, machinery, or other forms of equipment? Is renting or leasing equipment a possibility? Can you get equipment used? How much personal protective equipment (PPE) do you need to buy to protect worker and/or customer health?

- Inventory and upcoming orders — Do you have enough raw product to make your business continue to operate? If you don’t, should you be investing in more?

- Advertising and website — You have to let people know you exist, and this doesn’t happen without advertising and a good website. Perhaps you will buy social media ads , rent billboards, put an ad in a local magazine, or optimize your site for the best search engine results. All of this costs money.

- All the extras — Will you or your employees need to travel? Are there consultants in your field you should pay for some advice? Will you need a lawyer on retainer or to handle any sort of small business matter such as obtaining a copyright or trademark?

[Read more: How to Sell Products and Services on Social Media ]

Types of small business funding

There is no "right" way to fund your business, whether you’re looking for startup funding or to maintain or grow your existing business. Some types of funding work better for different stages of your business, and sometimes the right answer might be a combination of funding types.

Here are some common ways to fund your business:

Traditional loans

If you are a new business, you might not have a credit history. In that case, traditional lenders will look at your personal credit when deciding whether to give you a loan. Your credit history is the track record of how promptly you pay your bills and is used to determine how risky it is to lend to you. Traditional lenders, like banks, are cautious with their money. If your credit score is below 680, there may not be many options for you in the traditional lending arena. On the other hand, if your business is more established (two or more years in operation) and you have good credit and at least $100,000 a year in revenue, you’ll probably find very good interest rates from a traditional lender.

Online lenders

If your credit score isn’t up to par or you don’t have much time in business, you might look at popular online lenders for a loan. According to a recent Small Business Credit Survey by the Federal Reserve , 22% of the businesses surveyed applied for funds through online lenders.

Personal loans

If you have a new business but your personal credit score is high, you might consider taking out a personal loan for funding. Be aware, though, that if your business fails, this will seriously impact your personal credit.

Microlenders

As the name suggests, a microloan is a very small loan , typically of less than $50,000 given out by individuals rather than traditional lending institutions. These loans may also be offered through government organizations such as the Small Business Administration (SBA) or nonprofits. If you don’t need to borrow a lot of money, this could be a good direction.

Self-funding

You might be surprised by what you can do on a limited budget. Bootstrapping your own business can pay off down the road if you want to apply for a loan because it shows perseverance and dedication. The big question is whether you can afford to invest your own money and if it’s enough to accomplish your goals.

Are you involved in your local entrepreneurial community? It can be a good place to find people willing to invest in your business and ideas . Diligently research any investors and venture capitalists and work to come to an agreement on a term sheet about your business arrangement.

Crowdfunding

Crowdfunding will require you to pitch your business idea online through popular sites such as Kickstarter or Indiegogo to get upfront pledges to fund the business or product. However, you have to know how to market yourself and be savvy with web content for these options to work.

Friends and family

This can be a risky way to fund a business, but if you treat the situation professionally, it might work out. Friends or family helping to fund your business should earn interest or equity in the company and should be given monthly payments. Paperwork should still be drawn up.

Invoice factoring

When a business sells its outstanding invoices to a factoring company, it is called invoice factoring . An invoice factoring company quickly repays the business a percentage of what the invoice is worth, usually between 75% and 90%. Once the full invoice is paid, the factoring company pays your business the remainder of the invoice while subtracting its factoring charge and a factoring fee. This isn’t a loan, but it can help companies cover cash flow issues. Because it isn’t a loan, whether a factoring company will work with your small business or not is not as dependent on your credit score, but rather on the credit scores of your clients who the company will be depending on to pay in a timely fashion.

Small business grants to consider

Many government entities, corporations, and nonprofits offer money for people to launch or grow small businesses. Some small business grants are open to any small business while others are targeted to specific demographics, like businesses owned by minorities , women , or veterans. The website Grants.gov also serves as the largest database for federal grant opportunities.

Government grants

Government grants are available for small businesses at the federal, state, and local levels for a variety of different business types and circumstances. A few examples of government grants include:

- U.S. Department of Commerce Minority Business Development Agency (MBDA): MDBA loans and targeted grants are designed to help minority-owned businesses grow.

- Farmers Market Promotion Program: Businesses in the agricultural sector can benefit from the Farmers Market Promotion Program , which aims to increase applicable marketplaces and manufacturer-to-consumer products. These businesses can receive educational resources, training, and financial support.

- Small Business Innovation Research Program (SBIR): The SBIR Program provides grants to small businesses with the ability to perform federal research for the potential to curate profit-oriented goods and services.

There is no "right" way to fund your business, whether you’re looking for startup funding or to maintain or grow your existing business.

General small business grants

Nonprofit and larger corporations offer grant opportunities and other funding options to small businesses based on their eligibility and industry. Here are a few general small business grants to consider:

- Business Warrior: Business Warrior’s mission is to provide small businesses with direct access to capital at low-interest rates and with short approval times.

- GoFundMe Small Business Relief Fund: GoFundMe assists qualifying small businesses that were negatively impacted by the COVID-19 pandemic by matching $500 grants to those that raise the same amount in a GoFundMe campaign.

- Dream Big Awards: The U.S. Chamber of Commerce’s annual Dream Big Awards seek to recognize small businesses across the country that have helped to grow the overall economy. Small businesses can submit their application for the chance to win a $25,000 grand prize during the Chamber’s Big Week for Small Business.

Industry-specific grants

Businesses with a specific niche or operating in a specialized industry can benefit from industry-specific grants. These grants aren’t open to all small businesses and you must carefully consider the requirements and eligibility guidelines before applying. A couple of examples of industry-specific grants include:

- Etsy Emergency Relief Fund: Etsy sellers may be eligible for relief funding thanks to CERF+, a nonprofit organization that provides support and preparation resources to artists during emergencies and disasters. This program grants up to $2,500 to Etsy sellers who have been through a natural disaster.

- Jobber Grants Program: This program is meant for businesses in the home service field, such as landscaping or pool servicing. The Jobber Grants Program provides grants between $2,500 and $15,000.

Diversity business grants

Diversity business grants are programs that seek to elevate minorities and other underrepresented communities by providing financial resources, mentorships, and networking opportunities. Here are some examples of diversity business grants:

- Amazon’s Black Business Accelerator Program: The Black Business Accelerator Program is designed to benefit Black sellers on Amazon. It offers advice, resources, mentorship opportunities, and financial and promotional support. Eligible sellers receive access to cash grant opportunities, advertising credits, money towards startup costs, and more.

- Amber Grant Foundation: Founded in 1998, the Amber Grant Foundation seeks to support women entrepreneurs by awarding a $10,000 grant each month and a $25,000 grant each December. Grant winners are chosen based on the applicant’s story and vision for their business.

- Black Founder Startup Grant: Backed by the SoGal Foundation, this program awards up to $10,000 in grants to Black and multiracial women and nonbinary entrepreneurs. The Black Founder Startup Grant program accepts applications year-round.

Ways to make your business attractive to investors and lenders

Write a business plan.

Writing a robust business plan is a good way to present your small business to banks and potential investors. It should include your personal story and be able to convey your passion for your small business.

The business plan will require you to do a fair amount of market research and convey that you understand the industry you are entering and the direction in which you want to take your business. Back up your financial projections with data. A business plan should also include a clear business model as well as a marketing plan.

[Read more: How to Write a Business Plan ]

Build your credit score

Before you apply for funding from a traditional lender or even some online lenders, it is crucial you know your business credit score as well as your personal credit score. If they aren’t up to snuff, take steps to raise them such as by paying down debt or removing any incorrect derogatory items. You can even take it one step further by opening a business credit card. When you use the card each month and pay off the balance by the due date, you’re building your business credit, which increases your credit score. This is especially helpful if you’re a new business owner looking to build a credit score quickly.

Crunch the numbers

At the end of the day, investors take a chance on businesses they hope can make them a return on their investment. Creditors, on the other hand, may want to see how your business is profiting financially before they provide you with a loan. To instill confidence in investors and creditors, it’s important to crunch the numbers in your business.

Crunching the numbers means displaying your business’s financial track record including where the business currently stands in terms of cash flow and the level of debt you've accumulated. If your business is new, lay out a clear plan of how you’re going to complete your financial goals and when investors can expect to see a return on investment in your business.

Craft a narrative

Investors are used to hearing pitches from hopeful business owners filled with hard data, metrics, and business analytics. While these details are critical to any successful pitch, they’re not the only factors that can sway an investor in favor of your business. Investors are humans, too, and are interested in the story behind the business you are pitching.

Come up with a strong narrative that will explain how you came up with your business idea, what drives you in your business, the impact you intend your business to have on the world, and more. The more compelling the narrative, the greater the chance investors will feel compelled to take a chance on your business.

Create a clear investment structure

Before investing in your business, investors want to know you have a clear layout of the investment structure. For example, legal ramifications, including possible liability exposure, can play a factor in their decision on whether or not to invest. Would the investor be a shareholder or partner? If so, would they be able to make business decisions alongside the business owner?

It’s also important to create a stockholder’s agreement that lays out each owner’s rights and obligations, including if the owner wants to sell, if the business shuts down, and other issues. Once you have a clear investment structure, it’s time to negotiate all the details with your investors.

[Read more: Best Tips From Famous Investors ]

Selecting a route to fund your business

Answering questions about your business and how you plan to use the financing is a good way to know which direction to take to fund your business. You should be able to answer the following:

- How much money do you need, and what do you need it for?

- How much debt can you afford to take on?

- What is your preferred method of borrowing money?

- Are there any changes you need to make to be eligible for that type of funding?

- Do you have a good personal credit score?

- How long have you been in business?

- What are your revenues?

- Do you have any collateral?

- Do your story and business idea seem like something you could take to an investor?

- Have you established a solid enough business plan to talk to an investor or a traditional bank?

The goal of any type of funding should be to benefit your business, not saddle you with debt. So, it’s wise to choose a funding type that best fits your financial needs and will help you reach your business goals.

CO— aims to bring you inspiration from leading respected experts. However, before making any business decision, you should consult a professional who can advise you based on your individual situation.

Follow us on Instagram for more expert tips & business owners’ stories.

Applications are open for the CO—100! Now is your chance to join an exclusive group of outstanding small businesses. Share your story with us — apply today .

CO—is committed to helping you start, run and grow your small business. Learn more about the benefits of small business membership in the U.S. Chamber of Commerce, here .

Subscribe to our newsletter, Midnight Oil

Expert business advice, news, and trends, delivered weekly

By signing up you agree to the CO— Privacy Policy. You can opt out anytime.

For more finance tips

A guide to understanding credit card processing, what are fifo and lifo, what is ai price optimization.

By continuing on our website, you agree to our use of cookies for statistical and personalisation purposes. Know More

Welcome to CO—