Upmetrics AI Assistant: Simplifying Business Planning through AI-Powered Insights. Learn How

- AI ASSISTANTS

Upmetrics AI Your go-to AI-powered business assistant

AI Writing Assist Write, translate, and refine your text with AI

AI Financial Assist Automated forecasts and AI recommendations

- TOP FEATURES

AI Business Plan Generator Create business plans faster with AI

Financial Forecasting Make accurate financial forecasts faster

Strategic Planning Develop actionable strategic plans on-the-go

AI Pitch Deck Generator Use AI to generate your investor deck

See how it works →

AI-powered business planning software

Very useful business plan software connected to AI. Saved a lot of time, money and energy. Their team is highly skilled and always here to help.

- Julien López

- BY USE CASE

Starting & Launching a Business Plan your business for launch and success

Validate Your Business Idea Discover the potential of your business idea

Secure Funding, Loans, Grants Create plans that get you funded

Business Consultant & Advisors Plan seamlessly with your team members and clients

Business Schools & Educators Simplify business plan education for students

Students & Learners Your e-tutor for business planning

- Sample Plans

- WHY UPMETRICS?

Reviews See why customers love Upmetrics

Customer Success Stories Read our customer success stories

Blogs Latest business planning tips and strategies

Strategic Planning Templates Ready-to-use strategic plan templates

Business Plan Course A step-by-step business planning course

Ebooks & Guides A free resource hub on business planning

Business Tools Free business tools to help you grow

- Sample Business Plans

- Transportation, Logistics & Travel

Airline Business Plan

Launching an airline is challenging. Even harder is running it successfully. Starting with a new airline business and progressing to established market players requires ongoing learning and adaptability.

Anyone can start a new business, but you need a detailed business plan when it comes to raising funding, applying for loans, and scaling it like a pro!

Need help writing a business plan for your airline business? You’re at the right place. Our airline business plan template will help you get started.

Free Business Plan Template

Download our free business plan template now and pave the way to success. Let’s turn your vision into an actionable strategy!

- Fill in the blanks – Outline

- Financial Tables

How to Write An Airline Business Plan?

Writing an airline business plan is a crucial step toward the success of your business. Here are the key steps to consider when writing a business plan:

1. Executive Summary

An executive summary is the first section planned to offer an overview of the entire business plan. However, it is written after the entire business plan is ready and summarizes each section of your plan.

Here are a few key components to include in your executive summary:

Introduce your Business:

Start your executive summary by briefly introducing your business to your readers.

Market Opportunity:

Airline services:.

Highlight the airline services you offer your clients. The USPs and differentiators you offer are always a plus.

Marketing & Sales Strategies:

Financial highlights:, call to action:.

Ensure your executive summary is clear, concise, easy to understand, and jargon-free.

Say goodbye to boring templates

Build your business plan faster and easier with AI

Plans starting from $7/month

2. Business Overview

The business overview section of your business plan offers detailed information about your company. The details you add will depend on how important they are to your business. Yet, business name, location, business history, and future goals are some of the foundational elements you must consider adding to this section:

Business Description:

Describe your business in this section by providing all the basic information:

Describe what kind of airline company you run and the name of it. You may specialize in one of the following airline businesses:

- Full-service carriers

- Low-cost carriers

- Regional airlines

- Charter airlines

- Cargo airlines

- Describe the legal structure of your airline company, whether it is a sole proprietorship, LLC, partnership, or others.

- Explain where your business is located and why you selected the place.

Mission Statement:

Business history:.

If you’re an established airline service provider, briefly describe your business history, like—when it was founded, how it evolved over time, etc.

Future Goals

This section should provide a thorough understanding of your business, its history, and its future plans. Keep this section engaging, precise, and to the point.

3. Market Analysis

The market analysis section of your business plan should offer a thorough understanding of the industry with the target market, competitors, and growth opportunities. You should include the following components in this section.

Target market:

Start this section by describing your target market. Define your ideal customer and explain what types of services they prefer. Creating a buyer persona will help you easily define your target market to your readers.

Market size and growth potential:

Describe your market size and growth potential and whether you will target a niche or a much broader market.

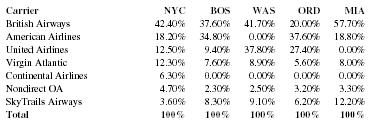

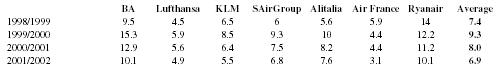

Competitive Analysis:

Market trends:.

Analyze emerging trends in the industry, such as technology disruptions, changes in customer behavior or preferences, etc. Explain how your business will cope with all the trends.

Regulatory Environment:

Here are a few tips for writing the market analysis section of your airline business plan:

- Conduct market research, industry reports, and surveys to gather data.

- Provide specific and detailed information whenever possible.

- Illustrate your points with charts and graphs.

- Write your business plan keeping your target audience in mind.

4. Airline Services

The product and services section should describe the specific services and products that will be offered to customers. To write this section should include the following:

Describe your services:

Mention the airline services your business will offer. This list may include services like,

- Passenger flight

- Baggage handling

- In-flight services

- Seating options

- Loyalty programs

- Special assistance

Quality measures

: This section should explain how you maintain quality standards and consistently provide the highest quality service.

Additional Services

In short, this section of your airline plan must be informative, precise, and client-focused. By providing a clear and compelling description of your offerings, you can help potential investors and readers understand the value of your business.

5. Sales And Marketing Strategies

Writing the sales and marketing strategies section means a list of strategies you will use to attract and retain your clients. Here are some key elements to include in your sales & marketing plan:

Unique Selling Proposition (USP):

Define your business’s USPs depending on the market you serve, the equipment you use, and your unique services. Identifying USPs will help you plan your marketing strategies.

Pricing Strategy:

Marketing strategies:, sales strategies:, customer retention:.

Overall, this section of your airline company business plan should focus on customer acquisition and retention.

Have a specific, realistic, and data-driven approach while planning sales and marketing strategies for your airline business, and be prepared to adapt or make strategic changes in your strategies based on feedback and results.

6. Operations Plan

The operations plan section of your business plan should outline the processes and procedures involved in your business operations, such as staffing requirements and operational processes. Here are a few components to add to your operations plan:

Staffing & Training:

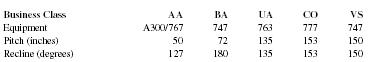

Operational process:, equipment & software:.

Include the list of equipment and software required for the airline, such as aircraft, baggage handling systems, flight operations systems, revenue management systems, etc.

Adding these components to your operations plan will help you lay out your business operations, which will eventually help you manage your business effectively.

7. Management Team

The management team section provides an overview of your airline business’s management team. This section should provide a detailed description of each manager’s experience and qualifications, as well as their responsibilities and roles.

Founders/CEO:

Key managers:.

Introduce your management and key members of your team, and explain their roles and responsibilities.

Organizational structure:

Compensation plan:, advisors/consultants:.

Mentioning advisors or consultants in your business plans adds credibility to your business idea.

This section should describe the key personnel for your airline business, highlighting how you have the perfect team to succeed.

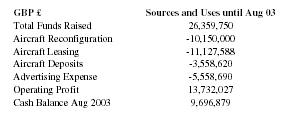

8. Financial Plan

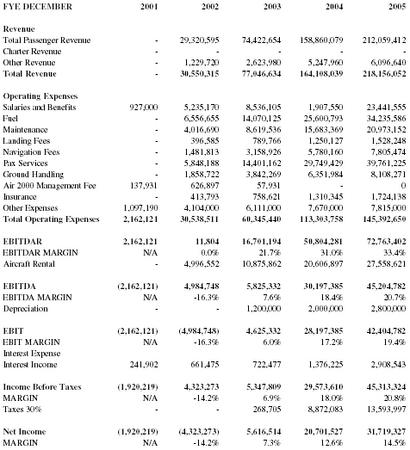

Your financial plan section should summarize your business’s financial projections for the first few years. Here are some key elements to include in your financial plan:

Profit & loss statement:

Cash flow statement:, balance sheet:, break-even point:.

Determine and mention your business’s break-even point—the point at which your business costs and revenue will be equal.

Financing Needs:

Be realistic with your financial projections, and make sure you offer relevant information and evidence to support your estimates.

9. Appendix

The appendix section of your plan should include any additional information supporting your business plan’s main content, such as market research, legal documentation, financial statements, and other relevant information.

- Add a table of contents for the appendix section to help readers easily find specific information or sections.

- In addition to your financial statements, provide additional financial documents like tax returns, a list of assets within the business, credit history, and more. These statements must be the latest and offer financial projections for at least the first three or five years of business operations.

- Provide data derived from market research, including stats about the industry, user demographics, and industry trends.

- Include any legal documents such as permits, licenses, and contracts.

- Include any additional documentation related to your business plan, such as product brochures, marketing materials, operational procedures, etc.

Use clear headings and labels for each section of the appendix so that readers can easily find the necessary information.

Remember, the appendix section of your airline business plan should only include relevant and important information supporting your plan’s main content.

The Quickest Way to turn a Business Idea into a Business Plan

Fill-in-the-blanks and automatic financials make it easy.

This sample airline business plan will provide an idea for writing a successful airline plan, including all the essential components of your business.

After this, if you still need clarification about writing an investment-ready business plan to impress your audience, download our airline business plan pdf .

Related Posts

Travel Agency Business Plan

Taxi Business Plan

Business Plan Making Guide

10 AI Tools For Small Business

Frequently asked questions, why do you need an airline business plan.

A business plan is an essential tool for anyone looking to start or run a successful airline business. It helps to get clarity in your business, secures funding, and identifies potential challenges while starting and growing your business.

Overall, a well-written plan can help you make informed decisions, which can contribute to the long-term success of your airline company.

How to get funding for your airline business?

There are several ways to get funding for your airline business, but self-funding is one of the most efficient and speedy funding options. Other options for funding are:

- Bank loan – You may apply for a loan in government or private banks.

- Small Business Administration (SBA) loan – SBA loans and schemes are available at affordable interest rates, so check the eligibility criteria before applying for it.

- Crowdfunding – The process of supporting a project or business by getting a lot of people to invest in your business, usually online.

- Angel investors – Getting funds from angel investors is one of the most sought startup options.

Apart from all these options, there are small business grants available, check for the same in your location and you can apply for it.

Where to find business plan writers for your airline business?

There are many business plan writers available, but no one knows your business and ideas better than you, so we recommend you write your airline business plan and outline your vision as you have in your mind.

What is the easiest way to write your airline business plan?

A lot of research is necessary for writing a business plan, but you can write your plan most efficiently with the help of any airline business plan example and edit it as per your need. You can also quickly finish your plan in just a few hours or less with the help of our business plan software .

How do I write a good market analysis in an airline business plan?

Market analysis is one of the key components of your business plan that requires deep research and a thorough understanding of your industry. We can categorize the process of writing a good market analysis section into the following steps:

- Stating the objective of your market analysis—e.g., investor funding.

- Industry study—market size, growth potential, market trends, etc.

- Identifying target market—based on user behavior and demographics.

- Analyzing direct and indirect competitors.

- Calculating market share—understanding TAM, SAM, and SOM.

- Knowing regulations and restrictions

- Organizing data and writing the first draft.

Writing a marketing analysis section can be overwhelming, but using ChatGPT for market research can make things easier.

About the Author

Upmetrics Team

Upmetrics is the #1 business planning software that helps entrepreneurs and business owners create investment-ready business plans using AI. We regularly share business planning insights on our blog. Check out the Upmetrics blog for such interesting reads. Read more

Plan your business in the shortest time possible

No Risk – Cancel at Any Time – 15 Day Money Back Guarantee

Popular Templates

Create a great Business Plan with great price.

- 400+ Business plan templates & examples

- AI Assistance & step by step guidance

- 4.8 Star rating on Trustpilot

Streamline your business planning process with Upmetrics .

Need a business plan? Call now:

Talk to our experts:

- Business Plan for Investors

- Bank/SBA Business Plan

- Operational/Strategic Planning

- L1 Visa Business Plan

- E1 Treaty Trader Visa Business Plan

- E2 Treaty Investor Visa Business Plan

- EB1 Business Plan

- EB2 Visa Business Plan

- EB5 Business Plan

- Innovator Founder Visa Business Plan

- UK Start-Up Visa Business Plan

- UK Expansion Worker Visa Business Plan

- Manitoba MPNP Visa Business Plan

- Start-Up Visa Business Plan

- Nova Scotia NSNP Visa Business Plan

- British Columbia BC PNP Visa Business Plan

- Self-Employed Visa Business Plan

- OINP Entrepreneur Stream Business Plan

- LMIA Owner Operator Business Plan

- ICT Work Permit Business Plan

- LMIA Mobility Program – C11 Entrepreneur Business Plan

- USMCA (ex-NAFTA) Business Plan

Franchise Business Planning

- Landlord Business Plan

- Nonprofit Start-Up Business Plan

- USDA Business Plan

- Cannabis business plan

- eCommerce business plan

- Online Boutique Business Plan

- Mobile Application Business Plan

- Daycare business plan

- Restaurant business plan

- Food Delivery Business Plan

- Real Estate Business Plan

- Business Continuity Plan

- Buy Side Due Diligence Services

- ICO whitepaper

- ICO consulting services

- Confidential Information Memorandum

- Private Placement Memorandum

- Feasibility study

- Fractional CFO

- How it works

- Business Plan Examples

Airline Business Plan Sample

Published Feb.01, 2021

Updated Apr.19, 2024

By: Jakub Babkins

Average rating 4.8 / 5. Vote count: 6

No votes so far! Be the first to rate this post.

Table of Content

Do you want to start an airline company?

An airline business provides air transport to passengers on a national and international level. The business is undoubtedly much more profitable than other usual businesses. However, it comes at the cost of a difficult startup.

Starting an airline business is an inevitably expensive venture. The costs of jets, the salaries of qualified and experienced pilots, salaries of the crew, charges paid to the airport, payments to government and travel agents combined make a huge cost.

Therefore, if you are exploring how to build an airline business plan, you must first make sure that you will be able to manage a large team and expenses. To start this business, the first step would be creating a business plan. In this blog, we’re providing a business plan for airlines written for the startup, Bruce Airlines.

Executive Summary

2.1 the business.

Bruce Airlines will be a registered and licensed aviation business startup headquartered in Charlotte. The business will be owned by Bruce Greg, former COO of Aer Lingus.

2.2 Management of Airline company

Managing an airline company demands a lot of experience and expertise. Because the slightest mistake of anyone can lead to huge money and even life losses. In this airline business plan executive summary pdf we’ll be providing all details about Bruce Airlines. So you would have complete knowledge of what to include in your starting up airline business plan.

To manage an airline company, you’ll be needed to employ aviation attorneys, schedule coordinators, aviation technicians, flight attendants, pilots, and administrative staff.

To ensure the smooth running of business’ operations, Bruce Airlines will offer just 45 destinations across the globe in the initial phase.

2.3 Customers of Airline company

The customers of our airline will mainly be businesspersons and officers who need to travel internationally. Moreover, the general public and tourists will also be our target customers.

2.4 Business Target

Our target is to cover the startup expenses within two years of the launch. Moreover, we also aim at earning a net profit margin of $27k per month by the end of the second year and $49k per month by the end of the third year.

Company Summary

3.1 company owner.

Bruce Greg completed his pilot training at American Airlines Cadet Academy at the age of 21. After that, he did an MBA from Harvard University and joined Aer Lingus as a company manager. He served at several managerial posts and eventually became the company’s, Chief Operating Officer. He served as COO for six years and then decided to launch his own airline.

3.2 Why the airline company is being started

Bruce has always been associated with the airline business. He decided to launch his own airline to be an entrepreneur and earn the most by utilizing his skills and experience.

3.3 How the airline company will be started

Step1: Creating A Business Plan

The first step before starting an airline company is to create a business plan for airlines company. Bruce studied several examples of business plans for airlines and developed his start an airline business plan himself. We are providing the business plan he created in this sample business plan airline company.

Step2: Acquiring Required Licenses & Permits

Step3: Establish Headquarter, Values & Services

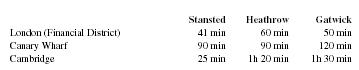

Bruce Airlines will be headquartered in Charlotte. The company will come into contact with airports and the government to negotiate the fee for hangars and for scheduling flights and routes. Meanwhile, the company will define its services, values, and customer care policies to get recognized.

Step4: Hire The Staff

To run an airline company, you need to hire a large staff. Due to the responsible and delicate nature of work, Bruce decided to recruit staff after rigorous testing and interviewing. The list of staff he’ll hire will be given in the upcoming sections along with their job descriptions and salaries.

Step5: Promote & Market

To attract customers amid huge competition, it is essential to develop an effective marketing strategy. And to come in contact with stakeholders who can indirectly promote your company.

Step6: Establish Online Presence

In this era, it is really important to establish a strong website presence. Bruce decided to launch a website that provides electronic ticketing and flight booking system to facilitate his customers.

Like all other airlines, Bruce Airlines will also be offering four travel classes. The services and luxuries associated with each class are listed here. If you want to build your own airline you can take help from this business plan template airlines.

- Economy Travel Class: This will be our basic class consisting of normal quality seats, foods, and extras for those looking for economical travel. The leg space, seat width, and screen size will be a lot lesser than all other classes. However, it will be adequate for a short flight.

- Wider and Comfortable Seats

- Quality foods and refreshments

- 16-inch entertainment screen

- Extra things including hot towels, toothbrushes, headsets, etc.

- Extra Comfortable Seats (More width, inclination)

- High-quality foods and refreshments

- 20-inch entertaining screen

- Extra things including eye masks, headsets, towels, and others.

- High priority check-in security

- High priority baggage handling

- Mini-Suites with privacy doors and noise-dampening curtains

- Storage compartments

- 26-inch entertainment screen

- Personal wardrobe

- Comfortable seat that reclines into super-comfy bedding with temperature control

- Finest foods and drinks made by world-renowned chefs

- Amenity kit including toothbrushes, face creams, lip balms, ear-plugs, and other things.

Marketing Analysis of Airline Company

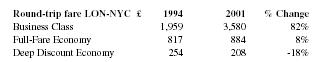

Marketing analysis is a very important part of airlines business plan template. It analyzes the target market and target customers. Moreover, it also explains how much price you should set to meet your financial goals while attracting more customers than your competitors.

In this starting an airline business plan we are providing the marketing analysis done for Bruce Airlines. Here we have analyzed the global market trends for this business and the general groups of people that can be considered as potential customers.

If you are looking for how to write a business plan for an airline you can take help from airline business models pdf.

5.1 Market Trends

According to IBISWorld, more than 22k global airline businesses are running in the United States, employing more than 2.5 million masses. According to the same source, the business holds a huge market size of $686 billion.

Despite that the industry is already quite large, still, It is expected to grow more in the coming years. The growth is forecasted based on the surge in travel activities and expansion in the middle-class population in the coming years.

5.2 Marketing Segmentation

5.2.1 Business Persons

This group of our customers comprises of businessmen and women who need to travel to several countries as part of their business. This group is expected to avail of our first class and business class travel tickets. As this category usually arrange business trips and meetings, therefore, we expect this group to avail our services in groups.

5.2.2 Foreign Officers

Our second target group comprises high officials who need to travel on regular basis to meet their job responsibilities. This group is also expected to avail of our first class and business class travel tickets.

5.2.3 Tourists

Our third target group will comprise tourists who board airplanes frequently to reach out to remote locations. This category is expected to travel mostly in economy and premium economy class.

5.2.4 General Public

Lastly, general people who have to travel far-off places on an urgent basis will also be our target customers. This group is expected to avail mostly our economy class service.

5.3 Business Target

- To earn a profit margin of $49k per month by the end of the third year

- To achieve an average rating above 4.77 by the end of the second year

- To achieve a CSAT score above 92 by the end of the first six months

- To increase our travel destinations from 45 to 55 within three years of our launch

5.4 Product Pricing

Our prices will lie within the same ranges as that of our competitors. However, we will offer several discounts in the startup phase.

Marketing Strategy

Bruce Airlines will come up with several competitive aspects to get ahead of its competitors. In this airline marketing strategy pdf we’re providing the marketing strategy of Bruce Airlines. So that you can have help in making your own airline marketing business plan.

6.1 Competitive Analysis

We expect to get popularity among our customers due to the following competitive aspects.

- Electronic booking and ticketing facility

- Additional amenities

- Discounted rates in the first two months

- Dedicated flight attendants

- Highly customer care oriented policies

6.2 Sales Strategy

To advertise our startup, we’ll

- Promote our services through travel agent companies , social media campaigns, and Google Local ads services.

- Offer a 30% discount on the economy, premium economy, and business class tickets for the first two months of our launch.

- By launching our frequent-flyer program for privileged and loyal customers.

- By making our website SEO and by investing in artificially intelligent chatbots.

6.3 Sales Monthly

6.4 Sales Yearly

6.5 Sales Forecast

Personnel plan

An airline company needs a lot of staff to manage operations. Therefore you should make a detailed list of required employees with their job descriptions as you write a business plan for an airline.

7.1 Company Staff

Bruce will be the CEO himself. The staff he’ll hire is listed below:

- 1 Chief Operating Officer

- 5 Pilots with ATP certifications

- 9 Flight Attendants

- 2 Airline Operations Agents

- 3 Avionics Technicians

- 3 Airline Station Agents

- 1 Aviation Attorney

- 2 Sales Executives

- 1 Social Media Manager

- 6 Security Officers

- General Cabin Crew

7.2 Average Salary of Employees

Financial plan.

The airline company is not like other usual businesses. Starting and running an airline business is extremely expensive due to the high costs involved in

- Purchasing Airplanes

- Recruiting highly qualified pilots

- The fee paid to the government and airports

- The fee paid to travel agents

- Frequent loss due to empty seats

- Salaries of a large workforce

- Maintenance costs

- Money spent on marketing and advertisement

Therefore due to the high costs involved in airline operations, you need to be very much careful in managing your finances. Your financial plan for this business must draw a trajectory to earn targeted profits despite these huge expenses.

As Bruce had all the knowledge to create a financial plan, he carried out this task himself. In the case of your startup, if you are not a professional financial analyst, you must hire the services of one. To get a rough idea of what to expect from your professional financial plan writer , we are providing the financial plan of Bruce Airlines in this starting airline company business plan.

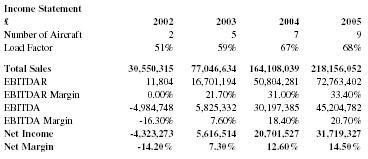

8.1 Important Assumptions

8.2 break-even analysis.

8.3 Projected Profit and Loss

8.3.1 profit monthly.

8.3.2 Profit Yearly

8.3.3 Gross Margin Monthly

8.3.4 Gross Margin Yearly

8.4 Projected Cash Flow

8.5 Projected Balance Sheet

8.6 business ratios.

All tables in PDF Download Airline Business Plan Sample in pdf Professional OGS capital writers specialized also in themes such as drop shipping business plan , import and export business plan , logistics business plan , airmall business plan and helicopter business plan .

OGSCapital’s team has assisted thousands of entrepreneurs with top-rate business plan development, consultancy and analysis. They’ve helped thousands of SME owners secure more than $1.5 billion in funding, and they can do the same for you.

How to Start a Plumbing Business in 2024: A Detailed Guide

Vegetable Farming Business Plan

Trading Business Plan

How To Write A Textile Manufacturing Business Plan

Start a Vending Machine Business in 2024: A Detailed Guide

Oil and Gas Business Plan

Any questions? Get in Touch!

We have been mentioned in the press:

Leave a Reply Cancel reply

Your email address will not be published. Required fields are marked *

Save my name, email, and website in this browser for the next time I comment.

Search the site:

Airline Business Plan: Writing Effective Airline Business Plans

To write a successful airline business plan , you must take several important trends in the airline industry and broader economy into account. What affect will these important trends have on the new airline?

- Continuing volatility in oil and other commodity markets

- A decline in personal disposable income as the economy slows

- Anxiety over flying and travel restrictions as a result of terrorist attacks and war

- Recent financial hardships and bankruptcies of major airline companies

Important Airline Business Plan Questions to Answer

To write a convincing aviation business plan and successfully launch your new airline, you must have confident answers to the following questions:

- What is the market demand for your new airline business?

- How will you prove the feasibility of your new airline?

- What kind of financing will you need, and how much?

- What types of investors will you seek capital from?

- What relevant past experience does your management team have, which you can leverage in your business plan?

- What strategic partnerships will you forge?

- What is your marketing plan and how will you grow your airline’s customer base?

- What are your airline’s future financial projections?

- What is your new airline’s “unfair competitive advantage” and how will you create barriers to entry?

How to Finish Your Airline Business Plan in 1 Day!

Don’t you wish there was a faster, easier way to finish your business plan?

With Growthink’s Ultimate Business Plan Template you can finish your plan in just 8 hours or less!

Click here to finish your business plan today.

OR, Let Us Develop Your Plan For You

Since 1999, Growthink has developed business plans for thousands of companies who have gone on to achieve tremendous success.

Click here to see how a Growthink business plan consultant can create your business plan for you.

Airline Business Plan FAQs

What is the easiest way to complete my airline business plan.

Growthink's Ultimate Business Plan Template allows you to quickly and easily complete your Airline Business Plan.

What is the Goal of a Business Plan's Executive Summary?

The goal of your Executive Summary is to quickly engage the reader. Explain to them the type of airline you are operating and the status; for example, are you a startup, do you have an airline that you would like to grow, or are you operating a chain of airlines?

Other Helpful Business Plan Articles & Templates

How to Create an Airline Business Plan

Blog > how to create an airline business plan, table of content, introduction, executive summary, market analysis, business description, business structure and organization, marketing and sales strategy, fleet and operations, financial projections, funding and investment, risk analysis and mitigation, regulatory and legal compliance, sustainability and environmental, our other categories.

- Company Valuation

- Pitch Deck Essentials

- Raising Capital

- Startup Guide

- Uncategorized

Reading Time : 14 Min

Business plan 101.

The airline industry has experienced exponential growth and transformative changes over the years, making it an attractive sector for entrepreneurs seeking to launch their own airlines. However, navigating this competitive landscape requires a well-crafted and comprehensive airline business plan. In this guide, we will walk you through the essential steps and key components of creating an effective airline business plan that will lay the foundation for your success in the aviation industry. As a trusted startup consultant service provider, Stellar Business Plans is here to support you in turning your aviation dreams into reality.

An executive summary serves as the snapshot of your entire airline business plan . It succinctly outlines your airline’s vision, goals, financial projections, and growth strategies. This section sets the tone for the rest of the plan, capturing the attention of potential investors and stakeholders.

Example: “Skyline Airways is a visionary airline committed to redefining air travel by providing unparalleled luxury and convenience to business and leisure travelers. Our strategic expansion plans and commitment to customer satisfaction make us a strong contender in the aviation industry. This executive summary outlines the key components of our business plan, showcasing the promising potential of Skyline Airways.”

Stellar Business Tip: Keep your executive summary concise yet impactful. Highlight the unique selling points of your airline and emphasize how it addresses the pain points of customers.

Understanding the dynamics of the airline industry is crucial for making informed decisions. Conduct an in-depth market analysis, including market trends, target customer segments, and competitor landscape. Utilize relevant statistics and data to present a comprehensive overview.

Example: “The global airline industry is projected to witness substantial growth in the coming years, driven by increasing disposable incomes, growing tourism, and expanding business travel. According to the International Air Transport Association (IATA), global air passenger numbers are expected to double in the next two decades, reaching 8.2 billion by 2037.”

Stellar Business Tip: Leverage market research and industry reports to substantiate your claims. Show that your airline’s strategies are well-aligned with market opportunities.

This section delves into the core aspects of your airline, including your mission, unique selling proposition (USP), and the services you will offer. Introduce your airline’s history and highlight significant milestones that demonstrate your readiness for success.

Example: “FlyRight Airlines was founded with a vision to revolutionize the travel experience for passengers through exceptional customer service and innovative technology. Our commitment to punctuality, safety, and personalized service sets us apart from competitors. As an industry-disruptor, FlyRight Airlines has been recognized with the prestigious ‘Best Customer Service’ award for three consecutive years.”

Stellar Business Tip: Showcase your airline’s achievements and accolades to build credibility and confidence among potential investors and partners.

Outline the legal structure of your airline and discuss the management team’s roles and expertise. Provide an organizational chart to showcase the hierarchy and responsibilities of key personnel.

Example: “SkyJet Airways is registered as a private corporation in accordance with aviation regulations. Our management team comprises seasoned professionals with extensive experience in the aviation and hospitality industries. John Smith, our CEO, brings over 20 years of leadership experience in major airlines, ensuring efficient operations and strategic decision-making.”

Stellar Business Tip: Highlight the expertise of key team members and their significant contributions to the success of your airline.

Develop a robust marketing and sales strategy to attract and retain customers. Utilize data-driven insights and statistics to demonstrate the effectiveness of your marketing initiatives.

Example: “SkyGlide Airlines’ marketing strategy focuses on digital channels, social media, and influencer partnerships to reach our target audience effectively. Our market research indicates that millennial travelers heavily influence travel decisions, and thus, we invest significantly in social media marketing and user-generated content to create brand loyalty.”

Stellar Business Tip: Showcase your understanding of your target market’s preferences and how your marketing efforts align with their expectations.

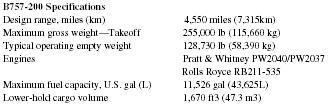

Detail your fleet composition and specifications, including aircraft types and capacities. Discuss aircraft maintenance and safety procedures, emphasizing your commitment to ensuring a reliable and secure airline.

Example: “AirWings Fleet consists of modern and fuel-efficient aircraft, including Airbus A320neo and Boeing 787 Dreamliner, ensuring a comfortable and eco-friendly flying experience. Our partnership with leading maintenance providers guarantees the highest standards of safety and reliability, with regular maintenance checks and adherence to regulatory guidelines.”

Stellar Business Tip: Focus on the safety and comfort features of your fleet to instill confidence in your airline’s operations.

Create comprehensive financial projections based on market research and sound assumptions. Utilize charts and tables to present revenue forecasts, cost structures, and projected profitability.

Example: “Our financial projections anticipate steady growth, with projected revenue of $100 million in the first year, reaching $500 million by the fifth year. This growth will be supported by a robust marketing strategy, optimized operational costs, and an expanding customer base.”

Stellar Business Tip: Provide a clear breakdown of revenue streams and cost drivers to demonstrate your financial stability and growth potential.

Explain the initial investment required to launch and operate your airline. Showcase your budget for start-up costs and capital expenditures, providing clarity to potential investors about the financial requirements.

Example: “AirSprint Airways requires an initial investment of $50 million, which will cover aircraft acquisition, staff training, marketing campaigns, and administrative expenses. We are seeking strategic investors who share our vision of transforming air travel and are committed to long-term partnerships.”

Stellar Business Tip: Clearly articulate your funding needs and explain how the investment will be utilized to drive the growth of your airline.

Identify potential risks in the airline industry and outline your risk mitigation strategies. Present contingency plans to assure stakeholders of your preparedness for challenges.

Example: “SkyWings Airlines has conducted a comprehensive risk analysis, identifying potential risks such as fuel price volatility, geopolitical tensions, and regulatory changes. Our risk mitigation strategies include hedging fuel costs, diversifying routes, and maintaining strong relationships with aviation authorities to navigate regulatory changes smoothly.”

Stellar Business Tip: Address potential risks proactively and demonstrate your airline’s ability to adapt to unforeseen circumstances.

Discuss the licensing and certification requirements necessary for operating an airline. Show how your airline will comply with aviation authorities and regulations.

Example: “AviaJet is committed to maintaining the highest standards of safety and compliance with all aviation regulations. We are currently in the process of obtaining an Air Operator’s Certificate (AOC) and expect to launch operations after receiving all necessary approvals from the Civil Aviation Authority.”

Stellar Business Tip: Emphasize your commitment to adhering to all legal and regulatory requirements to gain trust from investors and passengers.

Impact Promote sustainability initiatives and demonstrate your commitment to reducing the airline industry’s environmental impact. Showcase your airline’s dedication to adopting eco-friendly practices.

Example: “EcoFlight Airlines is dedicated to minimizing our carbon footprint and preserving the environment. We are investing in modern, fuel-efficient aircraft, adopting sustainable inflight practices, and exploring alternative fuels to achieve carbon neutrality by 2030.”

Stellar Business Tip: Highlight your airline’s commitment to sustainability, as it aligns with the growing eco-consciousness of travelers.

Creating an airline business plan requires careful planning, extensive research, and a clear vision of your airline’s future. By following this comprehensive guide, you are equipped to build a solid foundation for your airline’s success. Stellar Business Plans is here to provide you with expert guidance and support in crafting an impressive business plan that will impress investors and stakeholders. Together, we can embark on a journey to make your airline a soaring success. Get ready to take flight with Stellar Business Plans!

Start Your Journey With Us

To know us more.

Updated On : September 2, 2023

Total shares:, average rating :, related posts.

How to Write a Business Plan for a Loan

How to create an effective amazon fba business plan, how to create an agricultural business plan, how to create an advertising agency business plan, how to create an accounting business plan, how to create 3d printing business plan, how to create mcdonalds restaurant business plan, how to create a bbq restaurant business plan, how to create airbnb business plan, how to create a gym business plan: complete guide.

How to Write a Strong Executive Summary?

13 Reasons why you need a Solid Business Plan

How useful was this post?

Click on a star to rate it!

Average rating 4 / 5. Vote count: 34

No votes so far! Be the first to rate this post.

WhatsApp us

StartupBoeing

Prepare for takeoff.

Starting an airline is tough. Running a profitable airline is even tougher. From startup airlines to established industry leaders, the process involves constant learning and adaptation.

Few businesses have as many variables and challenges as airlines. They are capital-intensive. Competition is fierce. Airlines are fossil fuel dependent and often at the mercy of fuel price volatility. Operations are labor intensive and subject to government control and political influence. And a lot depends on the weather.

But the intrepid entrepreneur is not alone. The StartupBoeing team assists entrepreneurs in launching new airlines. From concept through launch, StartupBoeing offers guidance, review, analysis, data, resources, contacts, and referrals to qualified startup airlines.

For further questions or dialogue, please e-mail us at [email protected] .

Market Analysis

Entrepreneurs who are considering a startup airline launch are wise to study the commercial aviation market. Three comprehensive publications are very useful in providing a detailed analysis of traffic growth, regional trends, and airplane requirements. They are produced by Boeing and highly regarded throughout the industry.

Commercial Market Outlook World Air Cargo Forecast Current Aircraft Finance Market Outlook

Operating Environment

Startup airlines must be aware of and operate within a framework of regulations, standards and guidelines. Included here is basic information on some of the primary international agreements and programs that shape the operating environment for commercial aviation.

Learn about the " Freedoms of the Air ," a set of international rights that allow a country's airlines to enter the airspace of another country or land there.

Find out more about ETOPS , or Extended Operations, a collaborative industry/government program allowing airplanes to fly routes with longer diversion times.

Business Planning

Successful startup airlines begin with a sound business plan. This detailed planning document typically includes:

- Analysis of the market and competition

- Brand positioning

- Description of the business and opportunity

- Details about the operation

- Management team biographies

- Discussion of risks and obstacles

- Pro forma financial statements/projections

- Capitalization plan

- Brand development

- Implementation strategy.

The business plan is the fundamental starting point for working effectively with theStartupBoeing consulting team. StartupBoeing provides free review services of the business plan and corresponding financials. We offer constructive suggestions, question assumptions, and challenge the entrepreneur to prove the concept just as prospective investors might. For entrepreneurs requiring assistance in preparing the plan itself, StartupBoeing can suggest advisors worldwide who specialize in such services.

The Structural Plan

The Airline Planning Roadmap (PDF) offers a conceptual sense of the necessary steps in launching an airline from idea through launch.

Business Plan Questions (PDF) provides a list of important questions to consider when writing the business plan.

Brand Foundation Overview (PDF) provides a list of steps to take to position your emerging brand based on your market analysis and a need to differentiate from existing competitors.

Structuring the Plan

The Airline Business Plan Outline (PDF) is a tool for capturing many of the important elements for successfully starting and operating an airline. While it is not a comprehensive structure for all airline concepts, it can serve as a starting framework for a business plan.

Airplane Selection

Target markets and frequencies are determined through traffic analysis and route/schedule planning. The startup airline is now positioned to select the appropriate airplane. Included here is basic airplane data a startup-airline can use to make a preliminary aircraft selection and complete a compelling business plan.

Interactive Aircraft Comparator

In-Production Airplanes

Out of production airplanes, passenger airplanes.

- 727 (727-100/-100C/-200)

- 737 (737-200/-200C)

- 737 (737-300/-400/-500)

- 737 (737-600/-700/-800/-900ER)

- 747 (747-100/-200/-300/SP)

- 747 (747-400/-400ER)

- 757 (757-200/-300)

- 767 (767-200/-200ER/-300/-300ER/-400ER)

- 777 (777-200/-200ER/-200LR/-300/-300ER)

Freighter Airplanes

- 707-320C Freighter

- 727-100/-200 Freighter

- 737-200/-300 Freighter

- 747-200F/-200SF/-100SF

- 747 Freighter (747-400/-400ER)

- 757-200 Freighter

- DC-8 Freighter

- DC-9 Freighter

- DC-10 Freighter

- MD-11 Freighter

Boeing Converted Freighters

- 747-400 BCF

Airplane Support

Visit Boeing Support and Services to learn more about Boeing global customer support, including spares & logistics support, maintenance and engineering services, fleet enhancements and modifications, and flight operations support.

The Boeing Airport Compatibility Group assists the aviation community to address their airport-related issues regarding our airplanes, providing Boeing and McDonnell Douglas commercial airplane product information needed to promote the continued and timely development of the world's airports.

Boeing provides a variety of documents that provide Airplane Characteristics data for General Airport Planning . Sections within each document include airplane description, airplane performance, ground maneuvering, terminal servicing, operating conditions, and pavement data.

Learn more about the pallets and containers used to carry cargo on-board large Boeing aircraft, including specific designations, dimensions, descriptions and visuals.

View a glossary of airplane terms .

Airplane Sourcing

Selecting the optimal airplane based on market, network plan, traffic estimates, interior layout, economics, and performance requirements is a good start. But now the airline entrepreneur must source the airplane. Decisions must be made about lease-versus-buy and new-versus-used. Airplane availability may be a challenge. Such factors may drive the airplane selection or even change the business model.

An important first step in sourcing the airplane is to consider financing options . The two most common methods of financing airplanes are direct purchase and operating lease.

New Airplanes

Depending on current production line availability, financing, business plan, and desired launch date, a startup airline may consider purchasing a new production airplane.

Leasing New or Used Airplanes

Boeing works with major airplane leasing companies worldwide. StartupBoeing is able to match qualified startup airlines with Boeing's leasing partners.

Lease Rates

Boeing does not regularly track airplane market lease rates. However, a range of lease rates can be provided to qualified startup airlines.

Through Boeing Commercial Aircraft Customer Finance, qualified startup airlines can be matched with third party sellers/lessors of used airplanes.

Third Party Used Airplanes

Through Boeing's internal Trading Floor, qualified startup airlines can be matched with third party sellers/lessors of used airplanes. Other sources of used airplane availability include:

Operating Your Airline

Boeing offers startup airlines the industry’s largest portfolio of commercial aviation support and services essential for running a successful airline. Through Boeing Global Services startup operators have access to everything from training and interior modifications to aircraft maintenance and high-tech enhancements.

The following solutions are available to suit your specific startup plans and requirements.

Maintenance & Parts Solutions

Boeing’s Maintenance and Part solutions help you to manage maintenance, modification, repair, overhaul and upgrades of your fleet while simplifying your supply chain. One of the services most applicable to a new airline is Global Fleet Care.

Boeing’s Global Fleet Care gives you the most comprehensive maintenance program available.

Global Fleet Care can:

- Help a new entrant operator conserve startup maintenance program capital

- Provide a competitive hourly maintenance rate that reduces airline staffing requirements.

- Include initial parts provisioning

- Supply engineering services

- Provide 24/7 Customer Support and Airplane Health Monitoring

Flight Operations Solutions

Boeing’s Flight Operations Solutions provide full flight operations support that is scalable to grow as your airline expands and your operational complexity increases. From pilot training to start of operations and beyond, our suite of products will provide the highest quality tools for your crews to deliver an efficient flight operation.

Services most applicable to a new airline:

- Flight Planning

- Charts and Navigation

- Electronic Flight Bag (EFB)

- Pilot training and Simulator

- Performance Planning

Boeing Aviation Consultants

Boeing’s staff of experienced airline and consulting professionals can advise and assist with all activities associated with a new entrant airline.

Boeing’s Consultants can:

- Assist with securing an Air Operator Certificate (AOC) as well as other regulatory requirement filings

- Design and structure an efficient operations organization

- Advise in the development and regulatory approval of a maintenance program

- Design a parts optimization program

- Assist with route analysis and payload improvements

- Develop a fuel efficiency program

- Select Information Technology elements that are appropriate for the size of operation

- Prepare an airline for eventual transition to ‘smart’ airplanes

Once an airline is up and running, Boeing’s Aviation Consultants can also provide periodic, detailed operations analysis that can assist with optimizing your maintenance and fuel efficiency programs, as well as provide crew management solutions for best scheduling and utilization of crewmembers.

When you are ready to start your airline, Boeing is ready to help you every step of the way.

Boeing offers startup airlines a comprehensive array of tools and services for running a successful airline. Everything from training to interior design to financing to maintenance to high-tech enhancements and more. Available resources include:

- Aviation Partners Boeing : Fuel saving and performance enhancing Blended Winglets for a number of current production Boeing airplanes and out-of-production models

- Boeing Business Jets : Private, Business, and Government VIP configured Boeing production airplanes

- Boeing Support and Services : Customer Support, Material Management, Maintenance Services, Fleet Enhancement, Flight Operations

- Fuel Conservation Services : Optimizing your operations to maximize airplane fuel efficiency

- Jeppesen : Aviation Training, Charts & Navigation Services, Flight Planning and Custom Services

- Training & Flight Services : Maintenance and Flight Crew Training

Becoming a Customer

Whether you are starting a new airline with Boeing aircraft, adding your first Boeing aircraft to your existing fleet, or you are new to maintaining Boeing aircraft, we have the products, services, and information resources needed to get you off the ground and keep you flying.

Relationship

Creating a business relationship with Boeing can provide access to:

- Boeing expertise

- Support services needed for the introduction, operation and maintenance of your aircraft

What do you need?

If you are a Maintenance Repair and Overhaul (MRO) or repair station, please see the Intellectual Property Management - Licensing Questionnaire .

In order to obtain Boeing goods and services, it will be necessary to enter into an agreement with Boeing and set-up an account. To begin the account set-up process, complete and submit a Boeing Customer Questionnaire . This questionnaire must be completed and submitted electronically.

Upon receipt of the completed questionnaire and based upon the information you submit, Boeing will:

- Start the process of establishing an account so your company can do business with Boeing.

- Assign your company a Boeing customer code which will identify your company within Boeing for future business transactions.

- Identify you as the owner, operator, or lessee of the aircraft.

- Supplemental Agreement for Electronic Access (SA-EA)

- Supplemental Agreement for Electronic Enabling (SA-eE)

- Provide you with certain documents at no charge when the CSGTA and its supplements are signed and appropriate insurance is obtained.

Access to Boeing Part Page

Boeing Material Services offers the advantage of buying from the original equipment manufacturer (OEM).

Boeing also provides customers with access to the aftermarket for a wider breadth of resources to locate hard-to-find parts. From single transactions to supply chain management, Boeing provides you with the right part, at the right place, at the right time. For more access information, please contact [email protected] .

Intellectual Property Management - Licensing Questionnaire

Aircraft owner/operators and third-party service providers have particular needs for OEM products and services as they support the industry. These products and services may require the use of information that is created during the development and certification of Boeing products. Comments from the industry have helped us to establish a set of Intellectual Property licensing standards that address specific requirements and establish a fair and consistent fee structure for the use of the information developed.

Take the Intellectual Property Management - Licensing Questionnaire .

Customer Services General Terms Agreement (CSGTA)

The Customer Services General Terms Agreement (CSGTA) incorporates articles applicable to various Boeing products and services into a blanket-type agreement so that, once in place, only unique terms and conditions need to be negotiated when a customer requires a specific product or service. The benefits of this approach are:

- Faster responses to requests from customers for products and services.

- A reduction in resources and effort needed to implement and manage all Customer Support related agreements for both customer and Boeing.

Some examples of the products and services covered by the CSGTA are lease of parts and tools, purchase of spare parts and standards, retrofit kit changes, repair, modification, technical assistance/consulting, training services and technical data.

Two Supplemental Agreements are associated with the CSGTA. The Supplemental Agreement to the CSGTA for Electronic Access (SA-EA) incorporates articles specific to granting you electronic access to Boeing goods and services, specifically technical data available on MyBoeingFleet.com. The Supplemental Agreement to the CSGTA for Electronic Enabling (SA-eE) incorporates articles specific to software licensing.

Part 125 Airplane Operating Certificate (AOC)

To apply for a part 125 AOC you will need to provide certain documents to your regulatory agency such as the Maintenance Planning Document (MPD), Quick Reference Handbook (QRH), and Aircraft Flight Manual (AFM). Our business operations group will help you get access to these documents on a temporary basis to help you with your AOC application.

MyBoeingFleet (MBF)

MyBoeingFleet is Boeing's secure internet portal, providing authorized customers with access to the industry's most comprehensive range of support products and services for Boeing commercial aircraft.

Aircraft owners and operators - as well as maintenance providers, leasing companies, regulatory agencies and other third party service providers - use MyBoeingFleet to order parts, collaborate with Boeing experts, and obtain essential information such as drawings, documentation, manuals, and operational data and procedures.

Owner/operators and licensed maintenance providers can also access productivity solutions such as Maintenance Performance Toolbox and Airplane Health Management.

Frequently Asked Questions

I want to start an airline. how can the startupboeing site help.

The StartupBoeing site is filled with information that will be useful in starting an airline. In starting an airline, there are specific steps that should be followed, and they are laid out in order to help you along your journey.

- Step 1: Market Analysis

- Step 2: Operating Environment

- Step 3: Business Planning

- Step 4: Airplane Selection

- Step 5: Airplane Sourcing

How can we obtain Boeing aircraft performance data for our planned operations?

The StartupBoeing team has found that this usually is not the first question to ask when starting an airline. The market opportunity and business plan will help shape what aircraft to fly. Once an understanding of the market opportunity and competitive environment are established, the StartupBoeing team can assist in providing suggestions for aircraft and ultimately performance data to fit the market opportunity.

Can Boeing lease me an aircraft?

Boeing generally does not lease aircraft. Aircraft leasing is usually done by third parties not associated with Boeing. To help you find these leased aircraft, Boeing has provided links to these parties found in the Airplane Sourcing section.

I want to buy a used aircraft from Boeing. How much does it cost?

Boeing generally does not sell used aircraft. Used aircraft are usually sold by third parties not associated with Boeing. To help you find these used aircraft, Boeing has provided links to these parties found in the Airplane Sourcing section.

Where can I find information on Boeing airplanes?

Information on passenger and freighter airplanes, along with information on cargo hold sizes can be found in the Airplane Selection section.

Where can I find a definition of aircraft terms?

A glossary of aircraft terms can be found here .

Where can I find airplane market data?

The Boeing Current Market Outlook (CMO) and World Air Cargo Forecast can be found in the Market Analysis section.

Where can I find information on business planning?

Information on business plans can be found in the Business Planning section.

Where can I find information about regulatory requirements?

Information about regulatory requirements can be found in the Operating Environment section.

Airline Company Business Plan [Sample Template]

By: Author Joy Nwokoro

Home » Business ideas » Aviation Industry » Airline

An airline company is a business that provides air transportation services for passengers and cargo. Its primary function is to use airplanes to carry people and goods between various destinations, both domestically and internationally.

The airline industry is a crucial part of the global transportation network and it plays a significant role in facilitating travel, trade, and economic growth.

The airline industry is highly competitive and subject to various economic, political, and environmental factors that can significantly impact its operations and financial performance. As a result, successful airline companies must be adaptive, innovative, and customer-oriented to thrive in this dynamic sector.

Steps on How to Write an Airline Company Business Plan

Executive summary.

Fly Mario® Airline Company, Inc. is a dynamic and customer-focused airline based in Dallas/Fort Worth, Texas, Texas, committed to providing safe, reliable, and convenient air transportation services. With a mission to connect people and places, we aim to be the preferred choice for both domestic and international travel, setting new standards of excellence in the airline industry.

Dallas/Fort Worth, Texas, as a major hub for business and tourism, presents significant opportunities for growth. With its diverse population and strong economic foundations, the city demands reliable air travel options, and Fly Mario® Airline Company, Inc. is poised to capture a substantial share of this market.

Fly Mario® Airline Company, Inc. was established in 2015, and since then, we have grown steadily to become one of the leading airlines in the region. Our modern fleet of state-of-the-art aircraft, combined with a highly trained and professional crew, ensures that our passengers experience unparalleled comfort and security throughout their journey.

Company Profile

A. our products and services.

Fly Mario® Airline Company, Inc. has an extensive route network, connecting major cities and popular tourist destinations in the United States and beyond. Our strategic partnerships with international carriers enable us to offer seamless travel options to our customers.

At Fly Mario®, customer satisfaction is our top priority. We are committed to providing exceptional service that exceeds expectations. From easy online booking to hassle-free check-ins and inflight amenities, we focus on every detail to make our passengers’ experience truly memorable.

b. Nature of the Business

Our airline company will operate with a business-to-consumer and business-to-business model.

c. The Industry

Fly Mario® Airline Company, Inc. will operate in the transportation industry (specifically within the aviation or airline industry).

d. Mission Statement

At Fly Mario® Airline Company, Inc., our mission is to connect people and places, providing safe, reliable, and exceptional air travel experiences. We are committed to exceeding our passengers’ expectations by delivering unparalleled service, convenience, and comfort.

With a customer-centric approach and a passion for innovation, we aim to be the preferred choice for domestic and international travelers.

e. Vision Statement

Our vision at Fly Mario® Airline Company, Inc. is to be a leading global airline, admired for our commitment to safety, excellence, and sustainability. We aspire to expand our route network, offering seamless connections to major destinations worldwide.

Through strategic alliances, cutting-edge technology, and an unwavering focus on customer satisfaction, we aim to set new industry standards while upholding our core values of integrity, responsibility, and respect.

f. Our Tagline (Slogan)

Fly Mario® Airline Company, Inc. – “Where Dreams Take Flight with Fly Mario®”

g. Legal Structure of the Business (LLC, C Corp, S Corp, LLP)

Fly Mario® Airline Company, Inc. will be formed as a Limited Liability Company (LLC).

h. Our Organizational Structure

- Chief Executive Officer (President)

- Logistics and Operations Manager

- Human Resources and Amin Manager

- Maintenance Engineer

- Air Hostess

- Sales and Marketing Manager

- Accountants (Cashiers)

- Customer Services Executive/Front Desk Officer

i. Ownership/Shareholder Structure and Board Members

- Solomon Stephen (Owner and Chairman/Chief Executive Officer) 52 Percent Shares

- Jude Justin (Board Member) 18 Percent Shares

- Chris Fox (Board Member) 10 Percent Shares

- Merrick Baseman (Board Member) 10 Percent Shares

- Kate Hanson (Board Member and Secretary) 10 Percent Shares.

SWOT Analysis

A. strength.

- Fly Mario® has established a recognizable and trusted brand identity, known for its commitment to customer satisfaction and quality service.

- The airline has a wide range of domestic and international routes, providing passengers with numerous travel options and convenient connections.

- Fly Mario® prioritizes customer needs and consistently delivers exceptional experiences, earning customer loyalty and positive word-of-mouth.

- The airline operates a modern fleet of fuel-efficient aircraft equipped with the latest technology, ensuring safety, reliability, and environmental sustainability.

- Fly Mario® has forged strategic alliances with other airlines and travel partners, enabling access to additional destinations and offering seamless travel experiences.

- The airline employs a highly trained and motivated workforce, including experienced pilots, cabin crew, and ground staff, contributing to operational excellence.

b. Weakness

- In certain markets, Fly Mario® faces strong competition from well-established airlines, limiting its market share in specific regions.

- High operating costs, such as fuel expenses, maintenance, and airport fees, can impact profitability, especially during periods of economic downturn or rising fuel prices.

- The airline industry is influenced by various external factors, such as weather conditions, geopolitical events, and economic fluctuations, which can disrupt operations and revenue.

c. Opportunities

- Fly Mario® can explore new markets and routes to tap into emerging travel trends and growing demand in untapped regions.

- Investing in more fuel-efficient and advanced aircraft can lead to cost savings and a reduced environmental footprint, aligning with sustainability goals.

- Introducing additional ancillary services, such as in-flight entertainment, premium seat options, and travel packages, can enhance revenue generation.

- Embracing cutting-edge technology for ticketing, reservation systems, and customer interactions can streamline operations and improve the overall passenger experience.

i. How Big is the Industry?

The airline industry is indeed a big and significant sector in the transportation industry. As a matter of fact, the global airline industry generated hundreds of billions of dollars in annual revenue, making it one of the most revenue-intensive industries worldwide.

ii. Is the Industry Growing or Declining?

The airline industry is a growing industry. As a matter of fact, the demand for airline services has been steadily increasing in recent years. However, it is important to note that the airline industry is highly dynamic and can experience fluctuations based on various factors, including global economic conditions, geopolitical events, and health crises.

iii. What are the Future Trends in the Industry?

Airlines were expected to prioritize sustainability and environmental responsibility. This included investing in more fuel-efficient aircraft, exploring alternative fuels, and implementing eco-friendly practices to reduce their carbon footprint.

The industry embraced digital technologies to enhance passenger experience. This included mobile check-ins, personalized offers, in-flight Wi-Fi, and the use of artificial intelligence (AI) and data analytics to improve operations and customer service.

Post the COVID-19 pandemic, health and safety became a top priority. Airlines were anticipated to continue implementing stringent hygiene protocols, touchless check-ins, and enhanced cleaning measures to ensure passenger safety. The pandemic accelerated the adoption of remote work, leading to potential changes in business travel patterns.

The industry was exploring the use of hybrid and electric-powered aircraft to reduce emissions and fuel consumption, potentially leading to more sustainable aviation. Blockchain was gaining attention in the industry for its potential to streamline processes related to ticketing, baggage handling, and loyalty programs.

iv. Are There Existing Niches in the Industry?

Yes, there are existing niches when it comes to the airline business and some of them are:

- Commercial airline (passenger airline)

- Jet charter

- Air ambulance

- Cargo airline.

v. Can You Sell a Franchise of Your Business in the Future?

Fly Mario® Airline Company, Inc. has no plans to sell franchises in the near future.

- The airline industry is fiercely competitive, with both established carriers and new entrants vying for market share, potentially leading to price wars and reduced profit margins.

- Fluctuations in fuel prices can significantly impact operational costs, affecting the airline’s profitability.

- Evolving aviation regulations and policies can impose compliance challenges and increase operating expenses.

- Unforeseen events, such as pandemics, natural disasters, or political crises, can disrupt travel demand and operations on a global scale.

i. Who are the Major Competitors?

- American Airlines

- Delta Air Lines

- United Airlines

- Southwest Airlines

- Alaska Airlines

- JetBlue Airways

- Spirit Airlines

- Frontier Airlines

- Allegiant Air

- Hawaiian Airlines

- Sun Country Airlines

- Virgin America

- SkyWest Airlines

- Mesa Airlines

- Republic Airways

- Endeavor Air

- ExpressJet Airlines

- Piedmont Airlines

- PSA Airlines

ii. Is There a Franchise for Airline Business?

No, there are no franchise opportunities for the airline business because of the nature of the business.

iii. Are There Policies, Regulations, or Zoning Laws Affecting Airline Business?

Yes, there are various policies, regulations, and zoning laws that affect the airline business in the United States of America. These rules are put in place to ensure safety, fairness, and efficient operations within the aviation industry.

Federal Aviation Administration (FAA) is the primary regulatory body responsible for overseeing civil aviation in the United States. They establish and enforce safety standards for aircraft, pilots, and maintenance procedures. Airlines must comply with these regulations to operate legally and ensure the safety of their operations.

Airport Zoning Laws regulate land use around airports to ensure that developments near airfields do not interfere with flight operations. Zoning laws may restrict the height of buildings, noise levels, and other factors that could affect aircraft safety and efficiency.

Transportation Security Administration (TSA) Regulations is responsible for security in transportation systems, including aviation. They implement and enforce security measures at airports, such as passenger screening, baggage checks, and the screening of cargo to prevent threats to aviation security.

Airlines are subject to various environmental regulations aimed at reducing their impact on the environment, including emissions standards, noise restrictions, and fuel efficiency requirements. Federal Aviation Act provides the legal framework for aviation regulation in the U.S., defining the roles and responsibilities of various agencies and entities in the aviation industry.

The Department of Transportation (DOT) plays a significant role in regulating and overseeing various aspects of the airline industry, including consumer protection, airline competition, and enforcement of aviation-related laws.

Marketing Plan

A. who is your target audience.

i. Age Range

The target audience at Fly Mario® Airline Company, Inc. spans various age groups, with a primary focus on adults between the ages of 25 to 60. This demographic includes working professionals, business travelers, and leisure travelers seeking quality air travel experiences.

ii. Level of Education

The target audience comprises individuals with diverse educational backgrounds, ranging from high school graduates to those with advanced degrees.

iii. Income Level

Fly Mario® Airline Company, Inc. caters to a diverse income level audience. While it offers affordable and competitive ticket pricing to attract budget-conscious travelers, it also provides premium services and amenities for high-income passengers seeking luxury and convenience during their travels.

iv. Ethnicity: Fly Mario® Airline Company, Inc. aims to be inclusive and welcoming to passengers of all ethnic backgrounds.

v. Language

The airline’s services are available in multiple languages to accommodate passengers from different linguistic backgrounds.

It ensures that essential communication, including in-flight announcements and customer service interactions, is available in commonly spoken languages, making the flying experience more accessible and enjoyable for all passengers.

vi. Geographical Location

As a global airline, Fly Mario® Airline Company, Inc. operates across a wide geographical area, serving both domestic and international destinations.

vii. Lifestyle

The target audience for Fly Mario® Airline Company, Inc. encompasses a diverse range of lifestyles. It caters to business travelers seeking efficiency and convenience, families looking for a pleasant travel experience, leisure travelers desiring adventure and exploration, and individuals who value comfort and relaxation during their journeys.

b. Advertising and Promotion Strategies

- Content marketing

- Deliberately Brand All Our Trucks

- Email marketing

- Events and sponsorships

- Pay-per-click (PPC) advertising

- Referral marketing

- Search engine optimization (SEO).

i. Traditional Marketing Strategies

- Broadcast Marketing -Television & Radio Channels.

- Marketing through Direct Mail.

- Print Media Marketing – Newspapers & Magazines.

- Out-of-home (OOH) advertising – Public transit like Buses and Trains, Billboards, Street shows, and Cabs.

- Leverage direct sales, direct mail (postcards, brochures, letters, fliers), tradeshows, print advertising (magazines, newspapers, coupon books, billboards), referral (also known as word-of-mouth marketing), radio, and television.

ii. Digital Marketing Strategies

- Affiliate Marketing

- Content Marketing.

- Email Marketing.

- Influencer Marketing.

- Mobile Marketing.

- Social Media Marketing Platforms.

- Search Engine Optimization (SEO) Marketing.

iii. Social Media Marketing Plan

- Create a personalized experience for our customers.

- Create an efficient content marketing strategy.

- Create a community for our target market and potential target market.

- Create profiles on relevant social media channels.

- Gear up our profiles with a diverse content strategy.

- Start using chatbots.

- Run cross-channel campaigns.

- Use brand advocates.

c. Pricing Strategy

At Fly Mario® Airline Company, Inc., our pricing strategy is designed to offer a balance between affordability and value, ensuring that passengers have access to a range of ticket options while maintaining a high standard of service. Our approach considers various factors to remain competitive in the market and appeal to a diverse customer base. Key elements of our pricing strategy include:

- Dynamic Pricing

- Fare Classes

- Bundled Services

- Loyalty Programs

- Promotions and Special Offers